|

|

|

|

|

KENON HOLDINGS LTD.

|

|

|

|

|

|

|

Date: November 19, 2025

|

By:

|

/s/ Robert L. Rosen

|

|

|

Name:

|

Robert L. Rosen

|

|

|

Title:

|

Chief Executive Officer

|

| 1. |

Executive Summary1

|

|

For the

|

For the

|

||||||||||||||||||||||||

|

Nine Months Ended

|

Three Months Ended

|

||||||||||||||||||||||||

|

September 30

|

September 30

|

||||||||||||||||||||||||

|

2025

|

2024

|

%

|

2025

|

2024

|

%

|

||||||||||||||||||||

| Consolidated |

EBITDA after proportionate

Consolidation

|

1,255

|

980

|

28

|

%

|

522

|

407

|

28

|

%

|

||||||||||||||||

|

|

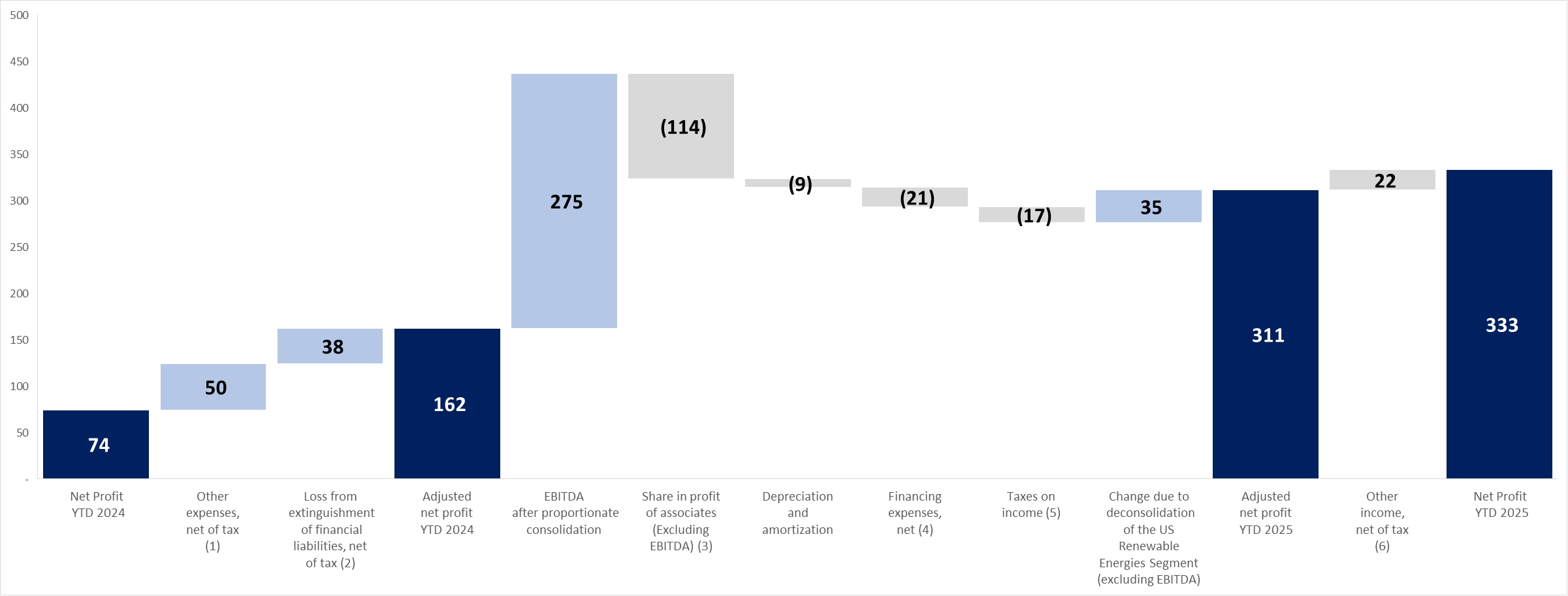

Net income |

333

|

74

|

350

|

%

|

236

|

86

|

174

|

%

|

||||||||||||||||

|

|

Adjusted net income

|

311

|

162

|

92

|

%

|

201

|

122

|

65

|

%

|

||||||||||||||||

|

|

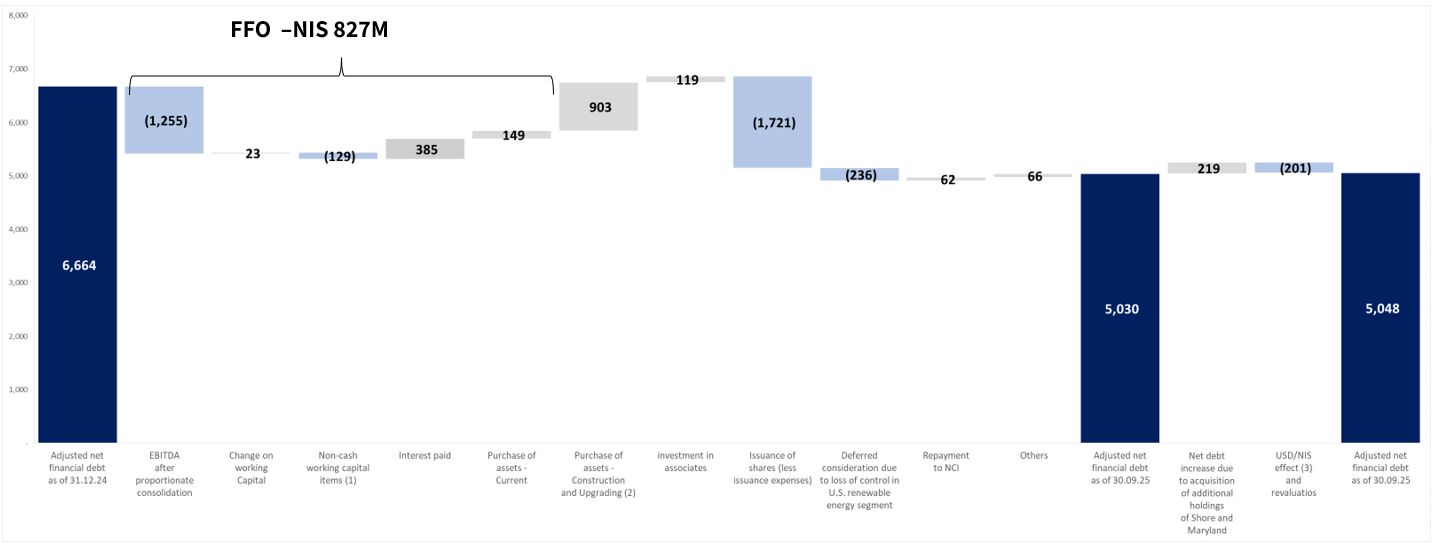

FFO

|

827 |

564

|

46 |

%

|

437

|

244

|

79

|

%

|

||||||||||||||||

|

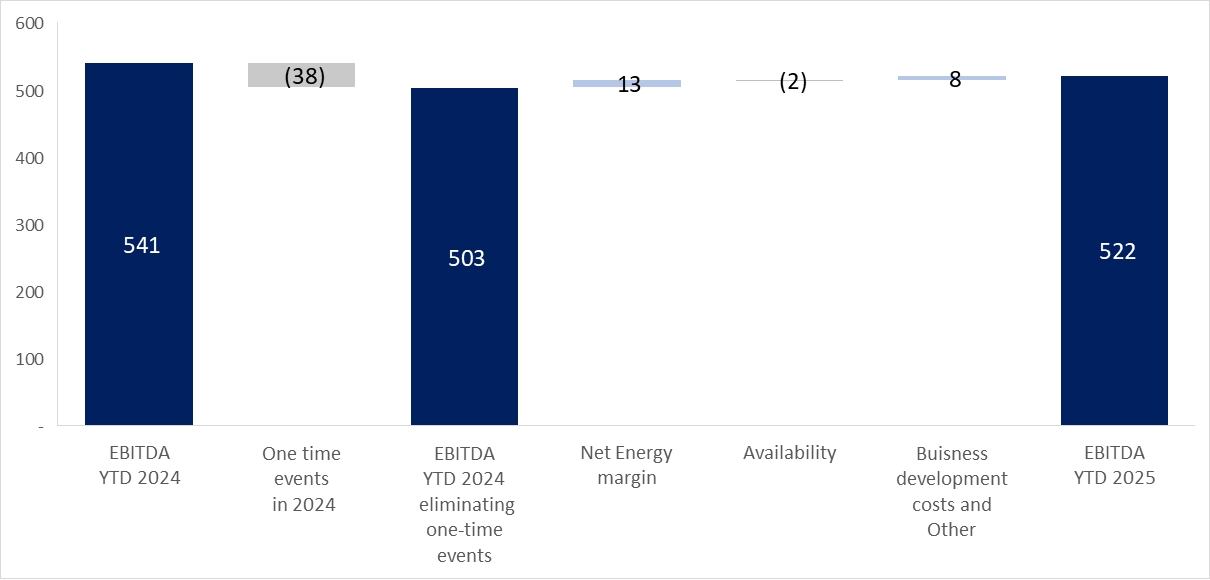

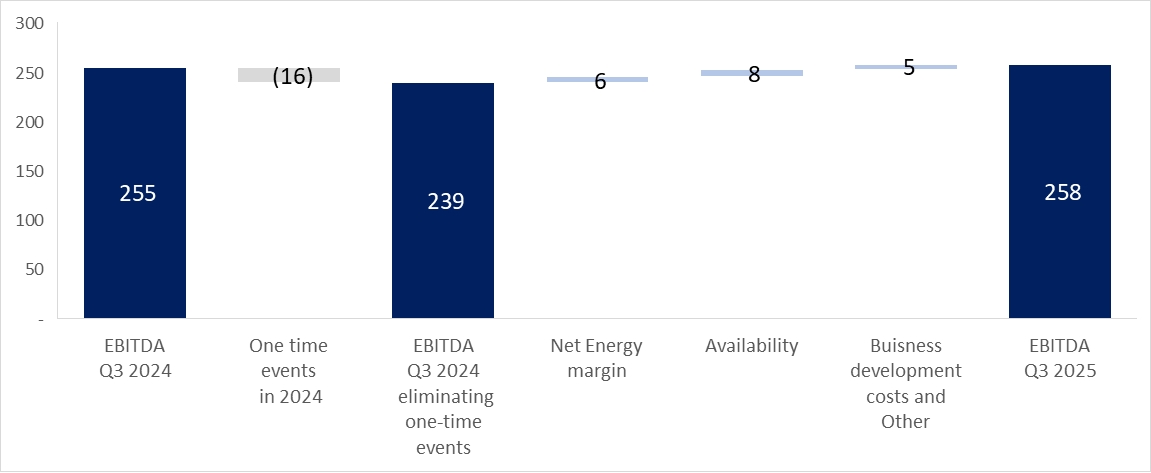

Israel

|

EBITDA

|

522

|

541

|

(4

|

)%

|

258

|

255

|

1

|

%

|

||||||||||||||||

|

|

FFO | 394 |

375

|

(5

|

)%

|

208

|

144

|

44 |

%

|

||||||||||||||||

|

|

|

||||||||||||||||||||||||

|

U.S.

|

EBITDA after proportionate

Consolidation

|

750

|

452

|

66

|

%

|

270

|

157

|

72

|

%

|

||||||||||||||||

|

|

FFO

|

482

|

228

|

111

|

%

|

240

|

84

|

186

|

%

|

||||||||||||||||

|

|

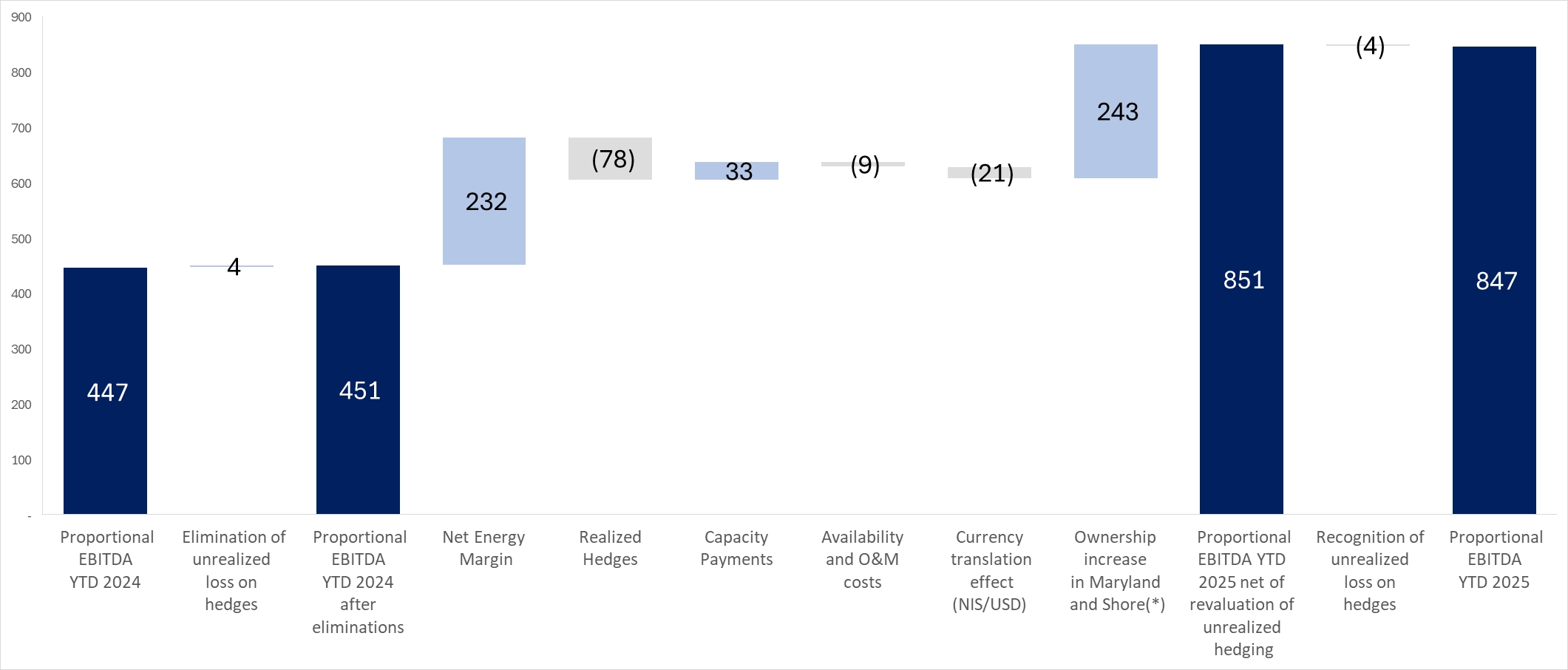

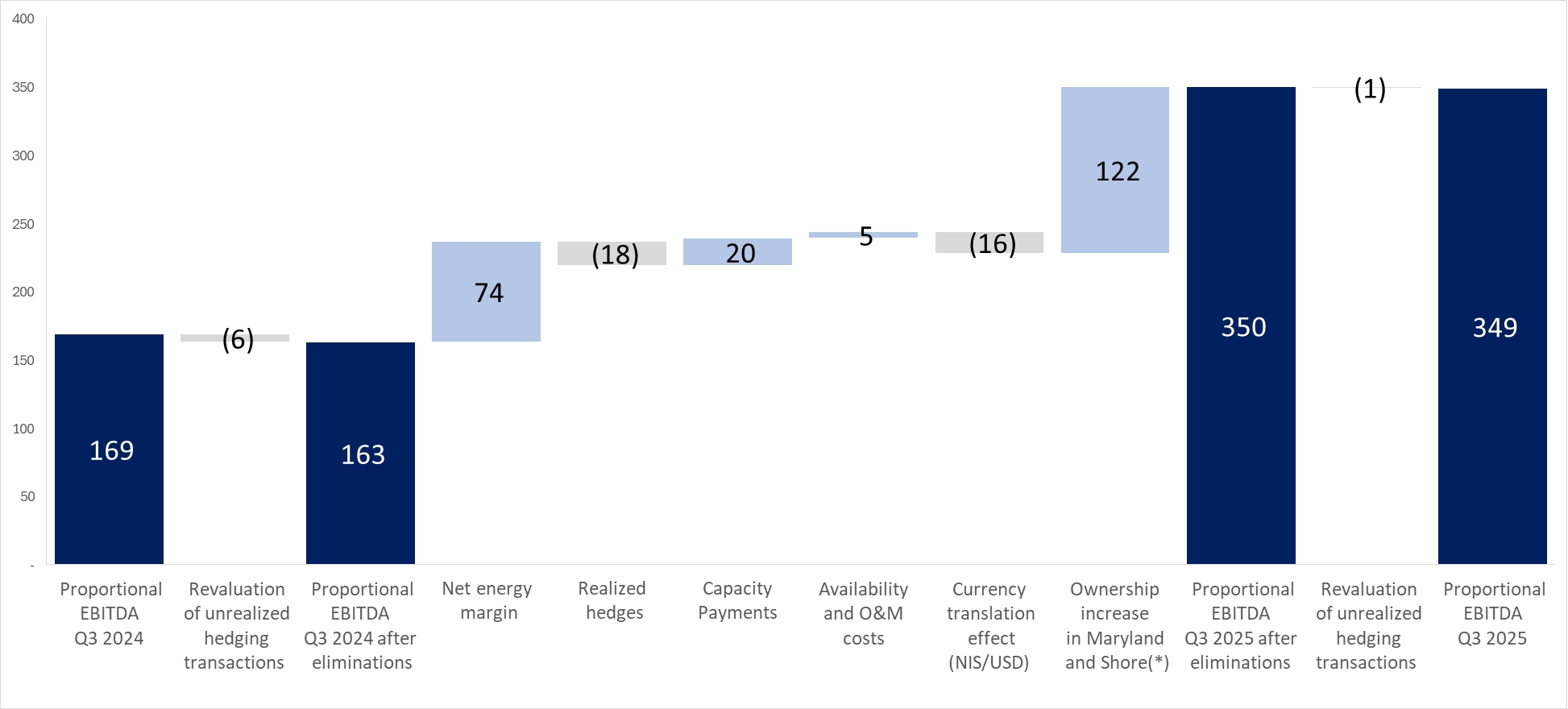

EBITDA after proportionate

consolidation – energy

Transition

|

847

|

447

|

89

|

%

|

349

|

169

|

107

|

%

|

||||||||||||||||

|

|

EBITDA after proportionate

consolidation – renewable

Energies

|

80

|

84

|

(5

|

)%

|

21

|

21

|

(0

|

)%

|

||||||||||||||||

|

|

* |

EBITDA, EBITDA after proportionate consolidation, adjusted net income and FFO are not recognized in accordance with IFRS – for definitions and the manner of their calculation – see Sections 4B and 4G below. In addition, for additional

details – see Sections 6C and 7C, below.

|

| 1 |

The Executive Summary below is presented solely for convenience and it is not a substitute for reading the full detail (including with reference to the matters referred to in the Summary) as stated in this report

with all its parts (including warnings relating to “forward‑looking” information as it is defined in the Securities Law, 1968 (“the Securities Law”), definitions or explanations with respect to the indices for measurement of the results and

including the information included by means of reference, as applicable). This Summary includes estimates, plans and assessment of the Company, which constitute “forward‑looking” information regarding which there is no certainty they will

materialize and the readers are directed to the detail presented in this report below.

|

| 1. |

Executive Summary (Cont.)

|

|

Israel

|

Hadera 2 project – on August 10, 2025, the government of Israel approved National Infrastructures Plan 20B (NIP 20B) regarding construction of an additional power

plant in Hadera. For details – see Section 6A(2) below.

|

|

|

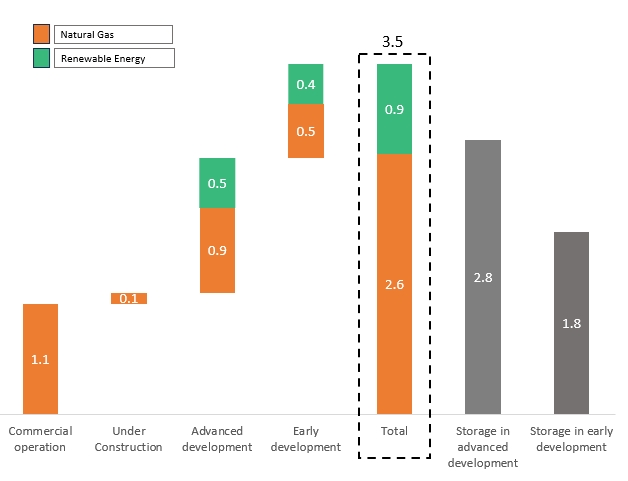

Continuing increase in

the portfolio of projects under development in the area of renewable energy – in addition to the Ramat Beka project, as at the approval date of the report the portfolio of projects in the renewable energy area

with integrated storage is estimated at a cumulative about 0.4 gigawatts and 1.8 gigawatts per hour. For details see Section 6A(2) below.

|

||

|

Corporate financing in Israel – in July 2025, OPC Israel signed an additional bank financing agreement, in the aggregate amount of about NIS 400 million, on terms

similar to those of the agreements it signed in 2024 and in the beginning of 2025, which is for refinancing long‑term debt in OPC Israel and the Company’s share is mainly for repayment of its debentures. For details – see Note 7A(1) to the

Interim Statements.

|

||

|

Hearing regarding update of the structure of the electricity tariff for consumers of Israel Electric Company – in September 2025, the Electricity Authority

published a hearing regarding update of the structure of the electricity tariff, which provides, among other things, that assuming a shekel/dollar exchange rate in 2026 of 3.4 will be 28.55 agurot and the tariff will be for three‑years

(2026–2028) and during the period it will be linked to the relevant price indices. For details – see Section 3.2E below.

|

||

|

Performance of upgrading and planned maintenance work at the Rotem power plant in the fourth quarter – in October 2025, the Rotem power plant was shut down for

purposes of upgrading and planned maintenance work. For details – see Section 4C below.

|

||

|

U.S.

|

Financial closing and start of construction of the Basin Ranch power plant in Texas (a combined cycle power plant with a capacity of about 1.35 gigawatts) at an

estimated total construction cost of $1.8 – $2.0 billion –for details – see Section 6B(2) below.

|

|

|

Signing of a transaction for acquisition of the remaining rights (30%) in the Basin Ranch power plant for an aggregate consideration of about $371 million –

completion of the transaction (if ultimately completed) is expected no later than February 2026. Upon and subject to completion of the transaction, the project will be consolidated in the Company’s financial statements. For details – see

Section 6B(2) below and Note 6B to the Interim Statements.

|

||

|

Signing of a transaction for acquisition of the remaining rights (11%) in the Shore power plant in the Energy Transition area (a combined cycle power plant with a

capacity of 725 megawatts in PJM) in exchange for an immaterial amount – upon and subject to its completion, which is expected to take place in the upcoming months, CPV’s rate of holdings will be 100% and control of the power plant will

be achieved – this being as part of the CPV Group’s strategy to increase the holdings and attain control of the active power plants running on natural gas. For details – see Section 10B below and Note 6A to the Interim Statements.

|

| 1. |

Executive Summary (Cont.)

|

|

U.S. (Cont.)

|

Change of the financing terms for the Fairview power plant – in October 2025, a transaction was completed for revision of the financing terms such that the margin

was updated to 2.5% (in place of 3%) and a dividend was distributed to the partners, in the aggregate amount of about $ 217 million (the CPV Group’s share – about $54 million).

|

|

|

Signing of an investment agreement with the tax partner in the Rouges Wind project (a wind project under construction with a capacity of about 114 megawatts) – in

August 2025, a binding investment agreement was signed with a tax partner for investment in the project the aggregate amount of about $163 million. For details – see Section 6B(1) below.

|

||

|

Capacity auctions in the PJM market for the period June 2026 through May 2028 – in July 2025, the results of a capacity auction for the period from June 1, 2026

through May 31, 2027 were published at a price of $329 for MW/day, which reflects the ceiling for the price range and which was approved by the FERC for two capacity auctions from June 2026 and up to May 2028. For details – see Section 3.3M

below.

|

||

|

The “One Big Beautiful Bill” and change of the tax benefit arrangements in the energy area, particularly renewable energies, and update of the U.S. income tax

guidelines regarding the Safe Harbor rules – for details – see Section 3.1C below.

|

||

|

Group headquarters

|

Raising of capital – in August 2025, the Company completed raising of capital from classified investors, in the amount of NIS 900 million (gross). The proceeds of

the issuance are intended mainly for purposes of continued growth and development of the Company’s business. For details – see Note 7D to the Interim Statements.

|

|

|

Early partial repayment of the debentures (Series B) – on September 30, 2025, the Company made an early partial repayment of the debentures (Series B), in the

total amount of about NIS 302 million. For details – see Note 7A(5) to the Interim Statements.

|

| 1. |

Executive Summary (Cont.)

|

|

|

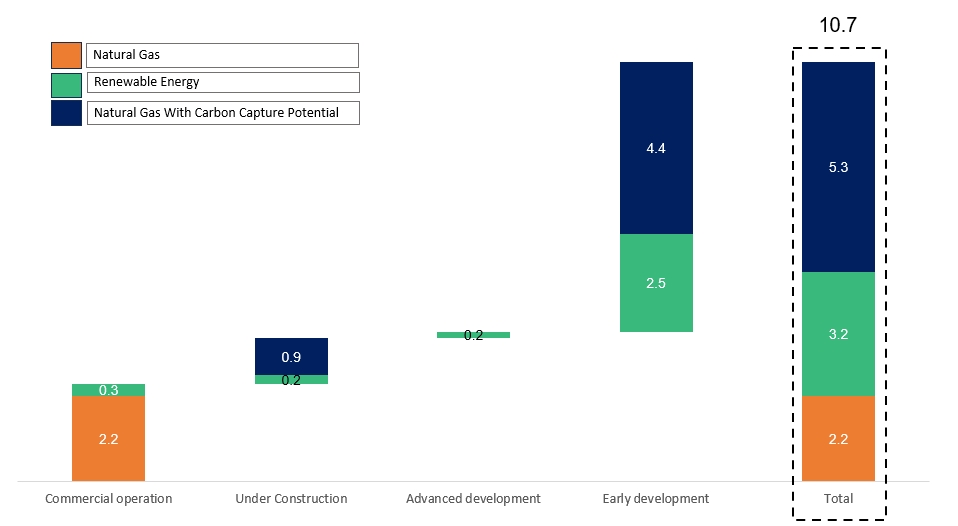

(1) |

The projects are presented in accordance with the relative share of the CPV Group in each project.

|

|

|

(2) |

The Basin Ranch (under construction) and Shore (active) power plants are presented in accordance with the rate of ownership of the CPV Group as at the approval date of the report (70% and 89%, respectively). For details regarding

transactions for acquisition of the remaining partners in the two projects, which as at the approval date of the report had not yet been completed – see Section 10 below and Note 6 to the Interim Statements.

|

|

|

(3) |

The Mason Road project (in the early development stage), the sale of which had been completed as at the approval date of the report, is not presented in the above chart. For details – see Section 6B(3) below and Note 10C(1) to the Interim

Statements.

|

| 1. |

Executive Summary (Cont.)

|

|

|

(1) |

For details regarding examination of a possible increase in the capacity and scope of the storage in the Ramat Beka project (in the advanced development stage) – see Section 6A(2) below.

|

|

|

(2) |

At this preliminary stage, not including a project covered by an agreement with Migdal, as detailed in Section 6A(2) below.

|

| 2. |

Brief description of the areas of activity

|

| 3. |

Main Developments in the Business Environment

|

|

|

3.1 |

General

|

|

|

A. |

Macro‑economic environment (particularly inflation and interest) – for details regarding the business and macro‑economic environment in which the Group companies operate, significant changes that occurred in 2024 and the impact

thereof on the Group’s activities – see Section 3.1A to the Report of the Board of Directors for 2024.

|

|

Dollar/shekel exchange rate *

|

2025

|

2024

|

Change

|

|||||||||

|

At the end of the previous year

|

3.647

|

3.627

|

0.6

|

%

|

||||||||

|

On September 30

|

3.306

|

3.710

|

(10.9

|

)%

|

||||||||

|

On June 30

|

3.372

|

3.759

|

(10.3

|

)%

|

||||||||

|

Average January – September

|

3.519

|

3.701

|

(4.9

|

)%

|

||||||||

|

Average July – September

|

3.364

|

3.714

|

(9.4

|

)%

|

||||||||

|

|

* |

The dollar/shekel exchange rate shortly before the approval date of the report (on November 14, 2025) is 3.235.

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.1 |

General (Cont.)

|

|

|

A. |

(Cont.)

|

|

Israeli

|

U.S.

|

Bank of Israel

|

Federal

|

|||||||||||||

|

CPI

|

CPI

|

interest rate

|

interest rate

|

|||||||||||||

|

On November 14, 2025

|

117.8

|

324.8

|

4.5

|

%

|

3.75%–4.00

|

%

|

||||||||||

|

On September 30, 2025

|

118.5

|

324.0

|

4.5

|

%

|

4.00%–4.25

|

%

|

||||||||||

|

On June 30, 2025

|

116.9

|

321.2

|

4.5

|

%

|

4.25%–4.50

|

%

|

||||||||||

|

On December 31, 2024

|

115.1

|

315.5

|

4.5

|

%

|

4.25%–4.50

|

%

|

||||||||||

|

On September 30, 2024

|

115.2

|

314.8

|

4.5

|

%

|

4.75%–5.00

|

%

|

||||||||||

|

On June 30, 2024

|

113.4

|

314.1

|

4.5

|

%

|

5.25%–5.50

|

%

|

||||||||||

|

On December 31, 2023

|

111.3

|

307.1

|

4.75

|

%

|

5.25%–5.50

|

%

|

||||||||||

|

Change in the first nine months of 2025

|

3.0

|

%

|

2.7

|

%

|

0

|

%

|

(0.25

|

)%

|

||||||||

|

Change in the first nine months of 2024

|

3.5

|

%

|

2.5

|

%

|

(0.25

|

)%

|

(0.5

|

)%

|

||||||||

|

Change in the third quarter of 2025

|

1.4

|

%

|

0.9

|

%

|

0

|

%

|

(0.25

|

)%

|

||||||||

|

Change in the third quarter of 2024

|

1.6

|

%

|

0.2

|

%

|

0

|

%

|

(0.5

|

)%

|

||||||||

|

|

B. |

Domestic and geopolitical instability in the defense (security) situation in Israel – further to that stated in Section 6.1.1 of Part A of the Periodic Report for 2024, during of the period of the report, the security instability in

Israel increased with a rekindling of the fighting, including calling up of military reserves and missiles from the Yemenite terrorist organizations.

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.1 |

General (Cont.)

|

|

|

B. |

(Cont.)

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.1 |

General (Cont.)

|

|

|

C. |

Changes in government policies (including with respect to tariffs) and passage of the One Big Beautiful Bill in the U.S. – further to that stated in Section 3.1C of the Report of the Board of Directors for 2024, the policy changes

against the background of entry into office of the Trump administration have created and are continuing to create uncertainty along with opportunities in the energy sector in the U.S.

|

| 2 |

That stated in this Section above constitutes “forward‑looking” information, as it is defined in the Securities Law, which is based solely on the Company’s estimates as at the approval date of the report,

which are subject to uncertainty and changes that are not under the Company’s control. The policies (present or additional) of the U.S. government could have a negative impact on advancement and/or benefits with respect to renewable energy

projects (particularly, renewable energies) and the costs of equipment, services and shipping for the projects and power plants in the U.S. In addition, such changes could have macro impacts on the Company’s activity markets.

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.1 |

General (Cont.)

|

|

|

C. |

(Cont.)

|

| 3 |

That stated above regarding the absence of a negative impact of the

new legislation on the list of projects in the advanced development stage, and relating to the demand for renewable energies and an increase in prices (and scope), a decline in the equipment prices and/or reduction of the impacts of the Law on renewable energy projects, constitutes “forward‑looking” information as it is defined in the Securities Law, which is based on the estimates of the CPV Group as at the approval date of the report and on an assumption regarding high demand for renewable

energies on the part ofsignificant consumers, and regarding which there is no certainty they will be realized or the manner of their

realization. As at the approval date of the report, the manner of the impact of the new legislation on the renewable energy sector in the U.S. has not yet been fully clarified and assimilated at this stage. Therefore, as part of the

process of internalizing the legislation (including updates, if any, or changes in other regulations) there could be changes in the sector the results of which will be different than the said estimates, including changes that could have

a significant negative impact on the activities, including on projects of the CPV Group in the area. As at the approval date of the report, the estimates described with reference to the impacts of the legislation on the CPV Group are

not final and the CPV Group is continuing to examine these impacts. Accordingly, the said estimates are subject to changes (including due to specific circumstances of the projects on the list of the awaiting projects of the CPV Group).

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.2 |

Activities in Israel

|

|

|

D. |

Update of the electricity tariffs – in January 2025, a decision of the Electricity Authority entered into effect regarding update of the tariff for 2025 for consumers of electricity from the Electric Company. Pursuant to the

decision, the weighted‑average generation component was updated to 29.39 agurot per kilowatt hour – a decline of about 2.2% in the weighted‑average generation component with reference to the generation component in effect at the end of 2024,

this being mainly as a result of a decrease in the Electric Company’s generation cost due to a reduction in the use of coal and a forecasted decline in the Electric Company’s natural‑gas price. In addition, there was a non‑recurring

recognition of surplus receipts from sale of the Eshkol power plant, which led to a reduction in the generation component.

|

|

Period

|

2025

|

2024

|

Change

|

|||||||||

|

January–September average

|

29.39

|

30.11

|

(2.4

|

)%

|

||||||||

|

July–September average

|

29.39

|

30.07

|

(2.2

|

)%

|

||||||||

| 4 |

That stated regarding the impact of changes in the generation component on the Company’s results, is subject to changes, among other things, as a result of determination of the periodic generation component and/or the manner of its

application between the hourly demand hours’ brackets, operational factors and/or existence of one or more of the risk factors to which the Company is exposed, as stated in Section 19.2 of Part A of the Periodic Report for 2024. For

additional details regarding the generation component – see section 7.2.3 of Part A of the Periodic Report for 2024.

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.2 |

Activities in Israel (Cont.)

|

|

|

E. |

Hearing regarding update of the tariff structure for electricity for consumers of Israel Electric Company – further to that stated in the Public Announcement regarding a proposal for changes in the tariff structure described in

Section 7.2.3 of Part A of the Periodic Report for 2024, on September 30, 2025, the Electricity Authority published a hearing regarding the matter of “Update of the Tariff Structure for Electricity for Consumers of Israel Electric Company”.

As part of the Hearing, the Electricity Authority is proposing to partially apply the change proposed in the Public Announcement and, among other things, that: (1) update of the tariff will be made every quarter automatically; (2) the pricing

will be updated for the network sector and for the supply sector; and (3) the structure of the generation component will change such that starting from January 1, 2026 the generation component will be split into a fixed component and a

variable component based on the tariff costs for 2025 (without assimilation of the MCP price5 and pricing of the external costs of the emissions at this stage). The split up of the components is intended, among other things, to

prepare the market for separation between the components to the extent it will be decided at a later stage that the variable component will be based on the MCP price. Regarding the tariffs for the starting point of each of the two components,

a linkage and advancement mechanism was provided that conforms to the costs that compose it and their characteristics. The tariff will be a three‑year tariff (2026–2028), where during the period the tariff will be linked to relevant indices

and prices, as stated. In addition, the Electricity Authority notes that it intends to determine a tariff update mechanism in respect of differences in the tariff and between the actual costs in a cumulative scope of more than NIS 1 billion

for Israel Electric Company and NIS 0.5 billion for the System Operator, in accordance with the mechanism.

|

| 5 |

Marginal Clearing Price, that is, the marginal cost computed at the half‑hour level by the System Operator. In the original Public Announcement, SMP was the subject while at the present time the System Operator is taking action to update

the methodology, where the new methodology is called MCP.

|

| 6 |

The Company’s estimates with respect to the impact of the Hearing is

“forward‑looking” information as it is defined in the Securities Law, which is based on the Company’s preliminary estimates regarding the arrangements included in the Hearing for which there is no certainty of their realization.

Ultimately, the impacts could be different due to, among other things, the market conditions, changes impacting the components of the proposed tariffs, regulator changes/factors that impact the electricity market and/or final arrangements that will be determined, should they enter into effect, which do not depend on the Company.

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.2 |

Activities in Israel (Cont.)

|

|

|

F. |

Update off the decision regarding regulation of conventional generation units – further to that stated in Section 7.3.4 of Part A of the Periodic Report for 2024, on March 26, 2025, the Electricity Authority published a decision –

“Update of the Decision regarding Regulation of Conventional Generation Units” (“the Decision”). As part of the Decision, the Electricity Authority increased the quota to four additional generation units and extended the validity of the

decision up to the end of June 2027. The availability tariff determined runs from 3.05 agurot to 3.31 agurot based on the date of the financial closing. In addition, an incentive of 0.5 agurot was provided for the first unit that reaches a

financial closing – this being only for units located in the northern part of Gush Dan (central Israel), as well as an incentive of 0.75% of the availability tariff for every month of acceleration of the commercial operation prior to

December 31, 2029. It is noted that the Company is taking action such that the Hadera 2 project, which has reached the advanced development stages, will operate (subject to its construction and completion) under this regulation, as detailed

in Section 6A(2) below.

|

|

|

G. |

Regulation for undertakings in transactions for sale of availability in high‑voltage solar generation facilities with integrated storage – further to the hearing described in Section 7.3.5 of Part A of the Periodic Report for 2024,

on May 20, 2025, the Electricity Authority published a decision regarding a bilateral regulation for generation and storage facilities connected to or integrated in the transmission network. The regulation will apply from January 1, 2026 to

renewable energy generation facilities with integrated storage (it was provided that the facility must with a storage capacity to installed generation capacity ratio that does not exceed 7), which will receive tariff approval up to June 1,

2027 or for a quota of up to 2,000 megawatts.

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.2 |

Activities in Israel (Cont.)

|

|

|

H. |

Revised hearing regarding a temporary mechanism for acquisition of availability certificates by virtual suppliers from the System Operator (“the Revised Hearing”) – further to the publication of the Electricity Authority on June 26,

2025 with respect to a hearing regarding integration of existing private conventional generators that are connected to the transmission network in the bilateral regulation (“the Original Hearing”)7, on September 29, 2025 the

Electricity Authority published a hearing revising the Original Hearing. As part of the Revised Hearing, the Electricity Authority is proposing to provide a mechanism that will permit virtual suppliers that will win in competitive processes

for determination of tariffs for acquisition of availability certificates from the System Operator that will be published by the Electricity Authority, to acquire capacity directly from the System Operator (instead of the expired original

proposal to acquire from generators having conventional generation units for which an availability tariff was determined based on the relevant regulation, and that are not permitted to designate the supplier or to sell energy to a private

supplier or yard consumer, such as Zomet). Pursuant to the Revised Hearing, the mechanism will apply temporarily until the conditions in the market are ready for maintenance of a decentralized availability market based on bilateral

transactions between generators and suppliers in accordance with the right of the winning suppliers to acquire capacity from the System Operator at the winning tariff in the process, which will be valid for them only up to December 31, 2029,

and thereafter the suppliers will be required to acquire capacity in the bilateral availability market. In the Company’s estimation, as at the approval date of the report, the Revised Hearing (if it is recorded in an agreement and subject to

the final arrangements) could have a positive impact on the Group’s activities in Israel8.

|

|

|

I. |

Decision regarding determination of the value of the land of the Eshkol site – assessment of the Electricity Authority – as part of the Electricity Authority’s decision on July 24, 2025, it was determined that the value of the land

of the Eshkol site that will be recognized by Israel Electric Company in the framework of sale of the site will be NIS 1,740 million. As part of update of the electricity tariff for 2025, the amount of NIS 508 million was recognized by the

Electricity Authority. Recognition of the rest of the amount, totaling NIS 1,232 million, plus interest and linkage differences, will be spread out by Israel Electric Company in the framework of the updated tariff over the next 3 years. It is

noted that this amount will be included in a three‑year tariff update mechanism in respect of tariff differences and between actual costs as detailed in Section 3.2E above.

|

|

|

J. |

Continued increase of activities in the market for supply to household customers and small businesses – further to that stated in Section 7.6.5 of Part A of the Periodic Report for 2024, as part of diversification of the mix of the

customers of OPC Israel and further to the undertaking with Partner Communications Ltd. in 2024, in the period of the report an agreement was signed with an additional large retail company.

|

| 7 |

For details – see Section 3.2G of the Report of the Company’s Board of Directors for the second quarter of 2025 published on August 13, 2025 (Reference No.: 2025-01-059955).

|

| 8 |

That stated constitutes “forward‑looking” information as it is defined in the Securities Law, which is based solely on the Company’s estimates pursuant to the Revised Hearing as at the approval date of the

report. Ultimately, the impacts could be different – this being as a result of the final arrangements, market conditions and/or the manner of implementation of the arrangements as will be determined (if ultimately determined).

|

|

|

3.3 |

Activities in the U.S.

|

|

|

K. |

Electricity and natural gas prices

|

|

For the

|

For the

|

|||||||||||||||||||||||

|

Nine Months Ended

|

Three Months Ended

|

|||||||||||||||||||||||

|

Region

|

September 30

|

September 30

|

||||||||||||||||||||||

|

(Power Plant)

|

2025

|

2024

|

Change

|

2025

|

2024

|

Change

|

||||||||||||||||||

|

PJM West (Shore, Maryland)

|

47.66

|

33.52

|

42

|

%

|

46.82

|

37.10

|

26

|

%

|

||||||||||||||||

|

New York Zone G (Valley)

|

60.41

|

34.74

|

74

|

%

|

51.88

|

35.36

|

47

|

%

|

||||||||||||||||

|

Mass Hub (Towantic)

|

64.31

|

37.10

|

73

|

%

|

50.20

|

38.08

|

32

|

%

|

||||||||||||||||

|

PJM AEP Dayton (Fairview)

|

43.98

|

30.14

|

46

|

%

|

43.51

|

32.21

|

35

|

%

|

||||||||||||||||

|

PJM ComEd (Three Rivers)

|

36.40

|

25.87

|

41

|

%

|

42.77

|

29.00

|

48

|

%

|

||||||||||||||||

|

ERCOT West Hub (Basin Ranch)**

|

33.53

|

30.20

|

11

|

%

|

37.69

|

28.87

|

31

|

%

|

||||||||||||||||

|

|

* |

Based on Day‑Ahead prices as published by the relevant ISO.

|

|

|

** |

As at the approval date of the report, the Basin Ranch project is under construction.

|

| 9 |

That stated constitutes merely a general estimate that could be subject to changes due to projects characteristics or factors and events that are not under the control of the CPV Group.

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.3 |

Activities in the U.S. (Cont.)

|

|

|

K. |

Electricity and natural gas prices (Cont.)

|

|

For the nine months ended

|

For the three months ended

|

|||||||||||||||||||||||

|

Region

|

September 30

|

September 30

|

||||||||||||||||||||||

|

(Power Plant)

|

2025

|

2024

|

Change

|

2025

|

2024

|

Change

|

||||||||||||||||||

|

Texas Eastern M‑3 (Shore, Valley – 70%)

|

3.70

|

1.98

|

87

|

%

|

2.27

|

1.50

|

51

|

%

|

||||||||||||||||

|

Transco Zone 5 North (Maryland)

|

3.67

|

2.55

|

44

|

%

|

2.34

|

1.77

|

32

|

%

|

||||||||||||||||

|

Dominion South Pt (Valley – 30%)

|

2.72

|

1.57

|

73

|

%

|

2.13

|

1.41

|

51

|

%

|

||||||||||||||||

|

Algonquin City Gate (Towantic)

|

5.85

|

2.56

|

129

|

%

|

2.96

|

1.75

|

69

|

%

|

||||||||||||||||

|

Texas Eastern M‑3 and Texas

|

||||||||||||||||||||||||

|

Eastern M‑2 (Fairview)**

|

2.81

|

1.62

|

73

|

%

|

2.27

|

1.41

|

61

|

%

|

||||||||||||||||

|

Chicago City Gate (Three Rivers)

|

3.21

|

2.09

|

54

|

%

|

2.77

|

1.78

|

56

|

%

|

||||||||||||||||

|

Waha (Basin Ranch)***

|

1.09

|

(0.15

|

)

|

827

|

%

|

0.44

|

(1.00

|

)

|

144

|

%

|

||||||||||||||

|

|

* |

Source: The Day‑Ahead prices at gas Midpoints as reported in Platt’s Gas Daily. It is clarified that the actual gas prices of the power plants of the CPV Group could be significantly different.

|

|

|

** |

Commencing from the third quarter of 2025, Fairview has started acquiring natural gas that is priced based on the Texas Eastern M‑3 transmission region. The above table presents Fairview’s combined gas price, which constitutes the gas

price up to June 2025 based on the Texas Eastern M‑2 transmission region, and starting from July 2025 the gas price based on the Texas Eastern M‑3 transmission region. For additional details – see Appendix A below.

|

|

|

*** |

As at the approval date of the report, the Basin Ranch project is under construction.

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.3 |

Activities in the U.S. (Cont.)

|

|

|

K. |

Electricity and natural gas prices (Cont.)

|

|

|

|

Set forth below are the average Spark Spread margins for each of the main markets in which the power plants of the CPV Group are operating (the prices are denominated in dollars per megawatt/hour)*:

|

|

For the

|

For the

|

|||||||||||||||||||||||

|

Nine Months Ended

|

Three Months Ended

|

|||||||||||||||||||||||

|

September 30

|

September 30

|

|||||||||||||||||||||||

|

Power Plant10

|

2025

|

2024

|

Change

|

2025

|

2024

|

Change

|

||||||||||||||||||

|

Shore

|

22.13

|

19.86

|

11

|

%

|

31.16

|

26.75

|

17

|

%

|

||||||||||||||||

|

Maryland

|

22.34

|

15.93

|

40

|

%

|

30.67

|

24.89

|

23

|

%

|

||||||||||||||||

|

Valley

|

36.91

|

21.93

|

68

|

%

|

36.51

|

25.20

|

45

|

%

|

||||||||||||||||

|

Towantic

|

26.29

|

20.46

|

29

|

%

|

30.96

|

26.71

|

16

|

%

|

||||||||||||||||

|

Fairview

|

25.72

|

19.61

|

31

|

%

|

28.76

|

23.05

|

25

|

%

|

||||||||||||||||

|

Three Rivers

|

15.54

|

12.29

|

26

|

%

|

24.77

|

17.43

|

42

|

%

|

||||||||||||||||

|

Basin Ranch**

|

26.45

|

31.18

|

(15

|

)%

|

34.83

|

35.37

|

(2

|

)%

|

||||||||||||||||

|

|

* |

Based on electricity prices as shown in the above table, with assuming a thermal conversion ratio (heat rate) of 6.9 MMBtu/MWh for Maryland, Shore and Valley, and a thermal conversion ratio of 6.5 MMBtu/MWh for Three Rivers, Fairview,

Towantic and Basin Ranch. It is clarified that the actual energy margins of the power plants of the CPV Group could be significantly different due to, among other things, the existence of Power Basis and a different breakdown in the scope of

the electricity sold in the peak and off‑peak hours in CPV’s power plants and that shown above (which was calculated in the above table based on the assumption of generation in all the hours of the 24‑hour period).

|

|

|

** |

As at the approval date of the report, the Basin Ranch project was under construction.

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.3 |

Activities in the U.S. (Cont.)

|

|

|

K. |

Electricity and natural gas prices (Cont.)

|

|

|

3.3 |

Activities in the U.S. (Cont.)

|

|

|

L. |

Tax on carbon emissions (RGGI)

|

|

Average for the

|

Average for the

|

|||||||||||||||||||||||

|

Nine Months Ended

|

Three Months Ended

|

|||||||||||||||||||||||

|

September 30

|

September 30

|

|||||||||||||||||||||||

|

2025

|

2024

|

Change

|

2025

|

2024

|

Change

|

|||||||||||||||||||

|

Price of carbon emission tax in the RGGI

tenders ($ per short ton / 2,000 pounds)*

|

19.81

|

17.30

|

15

|

%

|

19.63

|

21.03

|

(7

|

)%

|

||||||||||||||||

|

Cost of the carbon emission tax (in terms

of gas cost) ($ per MMBtu)**

|

1.18

|

1.03

|

15

|

%

|

1.17

|

1.25

|

(7

|

)%

|

||||||||||||||||

|

|

* |

The prices of the carbon emissions tax are presented under the assumption that the price of the tender that is held prior to a certain quarter represents the price of the carbon emissions tax for the subsequent quarter. For example, the

tender held in December 2024 will represent the price for the first quarter of 2025. It is noted that the actual price of the carbon emissions tax could be different than the tender prices as a result of transactions made in the secondary

market.

|

|

|

** |

The cost of the carbon emissions tax (in terms of gas cost) is calculated under the assumption of emissions of carbon dioxide with a reference (ratio) of 119 lbs./MMBtu. It is noted that the actual carbon dioxide emissions ratio varies

between the different power plants, and in the estimation of the CPV Group a ratio of 119 lbs./MMBtu is a representative ratio for power plants running on natural gas.

|

|

|

3.3 |

Activities in the U.S. (Cont.)

|

|

|

M. |

Capacity revenues

|

|

Sub-Region

|

CPV Plants

|

2026/2027

|

2025/2026

|

2024/2025

|

2023/2024

|

|

PJM RTO

|

|

329.17

|

269.92

|

28.92

|

34.13

|

|

PJM COMED

|

Three Rivers

|

329.17

|

269.92

|

28.92

|

34.13

|

|

PJM MAAC

|

Fairview, Maryland,

Maple Hill

|

329.17

|

269.92

|

49.49

|

49.49

|

|

PJM EMAAC

|

Shore

|

329.17

|

269.92

|

54.95

|

49.49

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.3 |

Activities in the U.S. (Cont.)

|

|

|

M. |

Capacity revenues (Cont.)

|

| 11 |

That stated in this Section regarding the estimation of the CPV Group constitutes “forward‑looking” information as it is defined in the Securities Law, with respect to which there is no certainty it will

materialize. Ultimately, the revenues of the CPV Group from availability could be different (even significantly) as a result of, among other things, regulatory changes (including appeal or other processes in the PJM market or relating to

other authorities), operating factors, changes in the business environment and/or existence of one or more of the risk factors the CPV Group is exposed to.

|

| 3. |

Main Developments in the Business Environment (Cont.)

|

|

|

3.3 |

Activities in the U.S. (Cont.)

|

|

|

M. |

Capacity revenues (Cont.)

|

|

|

3.3 |

Activities in the U.S. (Cont.)

|

|

|

M. |

Capacity revenues (Cont.)

|

|

Sub-Area

|

CPV

Plants

|

Winter

2025/2026

|

Summer

2025

|

Winter 2024/2025

|

Summer

2024

|

|

NYISO

Rest of the Market

|

–

|

89.83

|

153.26

|

66.30

|

168.91

|

|

Lower Hudson Valley

|

Valley

|

89.83

|

153.26

|

66.30

|

168.91

|

|

|

3.3 |

Activities in the U.S. (Cont.)

|

|

|

M. |

Capacity revenues (Cont.)

|

|

Sub-Region

|

CPV Power Plants

|

2027/2028

|

2026/2027

|

2025/2026

|

|

ISO-NE

Rest of the Market

|

Towantic

|

117.70

|

85.15

|

85.15

|

|

|

3.3 |

Activities in the U.S. (Cont.)

|

|

|

N. |

The ERCOT market in Texas (Basin Ranch project under construction)

|

| 4. |

Analysis of the results of operations for the nine months ended September 30, 2025 (in millions of NIS)

|

|

|

A. |

Statement of income

|

|

For the Nine Months Ended

|

||||||||

|

Section

|

September 30

|

|||||||

|

*2025

|

2024

|

|||||||

|

Revenues from sales and provision of services (1)

|

2,256

|

2,190

|

||||||

|

Cost of sales and provision of services (without depreciation and amortization) (2)

|

(1,643

|

)

|

(1,493

|

)

|

||||

|

Depreciation and amortization

|

(180

|

)

|

(245

|

)

|

||||

|

Gross profit

|

433

|

452

|

||||||

|

Share in earnings of associated companies

|

423

|

150

|

||||||

|

Compensation for loss of income

|

–

|

44

|

||||||

|

Administrative and general expenses

|

(295

|

)

|

(191

|

)

|

||||

|

Business development expenses

|

(10

|

)

|

(33

|

)

|

||||

|

Other income (expenses), net

|

19

|

(50

|

)

|

|||||

|

Operating income

|

570

|

372

|

||||||

|

Financing expenses, net

|

(163

|

)

|

(200

|

)

|

||||

|

Loss from settlement of financial liabilities

|

–

|

(49

|

)

|

|||||

|

Income before taxes on income

|

407

|

123

|

||||||

|

Taxes on income expenses

|

(74

|

)

|

(49

|

)

|

||||

|

Net income for the period**

|

333

|

74

|

||||||

|

Attributable to:

|

||||||||

|

The Company’s shareholders

|

254

|

83

|

||||||

|

Holders of non‑controlling interests

|

79

|

(9

|

)

|

|||||

|

|

* |

Commencing from November 2024, as a result of loss of discontinuance of consolidation of CPV Renewable and transition to the equity method of accounting, the Company has discontinued consolidation in the consolidated financial statements

of the results of the renewable energy segment in the U.S.

|

|

|

** |

For an analysis of the change in the net income and a definition and analysis of the change in the adjusted net income – see Section 4G below.

|

| 4. |

Analysis of the results of operations for the nine months ended September 30, 2025 (in millions of NIS) (Cont.)

|

|

|

A. |

Statement of income (Cont.)

|

| (1) | Changes in revenues: |

|

Revenues

|

For the

|

Board’s Explanations

|

|||||||

|

Nine Months

|

|||||||||

|

Ended

|

|||||||||

|

September 30

|

|||||||||

|

2025

|

2024

|

||||||||

|

Revenues in Israel

|

|||||||||

|

Revenues from sale of energy to private customers

|

986

|

1,121

|

A decrease, in the amount of about NIS 92 million, stemming from a decline in the consumption of customers compared

with the corresponding period last year, among other things in light of the “Nation as a Lioness” mission and an additional decline, of about NIS 40 million, stemming from a decrease in the tariff for the generation component compared with

the corresponding period last year.

|

||||||

|

Revenues from sale of energy to the System Operator and to other suppliers

|

158

|

146

|

|||||||

|

Revenues in respect of capacity payments

|

110

|

127

|

Most of the decrease compared with the corresponding period last year stems from a decline in the availability of the Zomet power plant offset by an

increase in the availability of the Gat power plant. For additional details – see Section 4C below.

|

||||||

|

Revenues from sale of energy at cogeneration tariff

|

56

|

42

|

Most of the increase stems from maintenance work at the Hadera power plant in the corresponding period last year.

|

||||||

|

Revenues from sale of steam

|

44

|

44

|

|||||||

|

Other revenues

|

2

|

23

|

Most of the decrease derives from discontinuance of the consolidation of Gnrgy at the end of second quarter of 2024.

|

||||||

|

Total revenues from sale of energy and others in Israel (without infrastructure services)

|

1,356

|

1,503

|

|||||||

|

Revenues from private customers in respect of infrastructure services

|

433

|

332

|

The increase stems mainly from an average increase in the tariffs, at the rate of about 40%.

|

||||||

|

Total revenues in Israel

|

1,789

|

1,835

|

|||||||

|

Revenues in the U.S.

|

|||||||||

|

Revenues from sale of electricity from renewable energy

|

–

|

164

|

The decrease derives mainly from discontinuance of consolidation of the renewable energies segment in November 2024, and transition to the equity

method of accounting. For additional details – see Note 23E to the annual financial statements.

|

||||||

|

Revenues from sale of electricity (retail) activities and others

|

467

|

191

|

The increase stems mainly from an increase in the scope of the retail activities.

|

||||||

|

Total revenues in the U.S.

|

467

|

355

|

|||||||

|

Total revenues

|

2,256

|

2,190

|

|||||||

| 4. |

Analysis of the results of operations for the nine months ended September 30, 2025 (in millions of NIS) (Cont.)

|

|

|

A. |

Statement of income (Cont.)

|

|

|

(2) |

Changes in the cost of sales and provision of services (not including depreciation and amortization):

|

|

Cost of Sales and

Services

|

For the

Nine Months

|

Board’s Explanations

|

|||||||

|

Ended

|

|||||||||

|

September 30

|

|||||||||

|

2025

|

2024

|

||||||||

|

Cost of sales in Israel

|

|||||||||

|

Natural gas and diesel oil

|

502

|

495

|

|||||||

|

Expenses in respect of acquisition of energy

|

136

|

280

|

Most of the decrease stems from a decline in customer consumption compared with the corresponding period last year due to, among other things, the

“Nation as a Lioness” mission, as well as maintenance work performed at the Rotem, Hadera and Gat power plants in the corresponding period last year.

|

||||||

|

Cost of transmission of gas

|

38

|

41

|

|||||||

|

Salaries and related expenses

|

33

|

33

|

|||||||

|

Operating expenses

|

88

|

87

|

|||||||

|

Other expenses

|

–

|

18

|

Most of the decrease stems from discontinuance of the consolidation of Gnrgy at the end of the second quarter of 2024.

|

||||||

|

Total cost of sales in Israel without infrastructure services

|

797

|

954

|

|||||||

|

Expenses in respect of infrastructure services

|

433

|

332

|

For details – see the explanation of the change in the revenues in respect of infrastructure services.

|

||||||

|

Total cost of sales in Israel

|

1,230

|

1,286

|

|||||||

|

Cost of sales and services in the U.S.

|

|||||||||

|

Cost of sales in respect of sale of electricity from renewable energy

|

–

|

53

|

The decrease stems from discontinuance of consolidation of the renewable energies segment in November 2024 and transition to the equity method of

accounting. For additional details – see Note 23E to the annual financial statements.

|

||||||

|

Cost of sales in respect of sale of electricity (Retail) and others

|

413

|

154

|

The increase stems mainly from an increase in the scope of the retail activities.

|

||||||

|

Total cost of sales and provision of services in the U.S.

|

413

|

207

|

|||||||

|

Total cost of sales and provision of services

|

1,643

|

1,493

|

|||||||

| 4. |

Analysis of the results of operations for the nine months ended September 30, 2025 (in millions of NIS) (Cont.)

|

|

|

B. |

EBITDA, FFO and net cash flows after debt service

|

|

|

1. |

EBITDA indices

|

|

|

2. |

“FFO” (funds from operations) – with respect to active projects – cash flows from current operating activities for the period (including changes in working capital) and less investments in property, plant and equipment and periodic

maintenance costs that are not included in the operating activities and less net interest payments. With respect to the rest of the Group’s activities – cash flows from current operating activities for the period (including changes in working

capital) and less net interest payments (to the extent they do not relate to projects under construction). It is clarified that investments in property, plant and equipment (under construction and/or in development) including the net interest

payments in respect thereof, are not included in FFO.

|

|

|

3. |

“Net cash flows after service of project debt” – the “FFO” less/plus payment of principal in respect of financial debt and/or taking out of project debt and non‑project debt (loans and/or debentures), and after adjustments for a

change in other credit from banks and a change in cash, including cash restricted for debt service and deposits (including to secure transactions hedging electricity margins).

|

| 14 |

It is clarified that the compensation for loss of income is included in EBITDA in the consolidated statements.

|

| 4. |

Analysis of the results of operations for the nine months ended September 30, 2025 (in millions of NIS) (Cont.)

|

|

|

B. |

EBITDA, FFO and net cash flows after debt service (Cont.)

|

|

For the

Nine Months Ended

|

||||||||

|

September 30

|

||||||||

|

2025

|

2024

|

|||||||

|

Revenues from sales and provision of services

|

2,256

|

2,190

|

||||||

|

Cost of sales (without depreciation and amortization)

|

(1,643

|

)

|

(1,493

|

)

|

||||

|

Share in income of associated companies

|

423

|

150

|

||||||

|

Compensation for lost revenues

|

–

|

44

|

||||||

|

Administrative and general expenses (without depreciation and amortization)

|

(282

|

)

|

(179

|

)

|

||||

|

Business development expenses

|

(10

|

)

|

(33

|

)

|

||||

|

Consolidated EBITDA

|

744

|

679

|

||||||

|

Elimination of the share in income of associated companies

|

(423

|

)

|

(150

|

)

|

||||

|

Plus – Group’s share of the EBITDA after proportionate consolidation of

|

||||||||

|

associated companies in the Energy Transition segment (1)

|

854

|

451

|

||||||

|

Plus – Group’s share of the EBITDA after proportionate consolidation of

|

||||||||

|

activities in the renewable energies segment in the U.S. (2)*

|

80

|

–

|

||||||

|

EBITDA after proportionate consolidation

|

1,255

|

980

|

||||||

|

|

* |

Due to completion of an investment transaction in the area of renewable energies in the U.S. in November 2024, starting from this date the data of this segment is calculated on the basis of a proportionate consolidation (instead of a full

consolidation up to that time) where the share of the CPV Group is about 66.7%.

|

| 15 |

It is noted that other companies might define EBITDA and FFO indices differently.

|

| 4. |

Analysis of the results of operations for the nine months ended September 30, 2025 (in millions of NIS) (Cont.)

|

|

|

B. |

EBITDA, FFO and net cash flows after debt service (Cont.)

|

|

|

(1) |

Calculation of the Group’s share in the EBITDA after proportionate consolidation, FFO and net cash flows after service of project debt of associated companies in the Energy Transition segment (in millions of NIS):

|

|

For the nine months ended September 30, 2025

|

Fairview

|

Towantic

|

Maryland

|

Shore (1)

|

|

Valley

|

Three

Rivers

|

Total

|

||||||||||||||||||||

|

Rate of holdings of the CPV Group

|

25%

|

|

26%

|

|

75%

|

|

89%

|

|

50%

|

|

10%

|

|

||||||||||||||||

|

Revenues from sales of energy

|

231

|

230

|

553

|

370

|

431

|

71

|

1,886

|

|||||||||||||||||||||

|

Cost of natural gas

|

106

|

140

|

240

|

195

|

169

|

38

|

888

|

|||||||||||||||||||||

|

Carbon emissions tax (RGGI)

|

–

|

29

|

89

|

57

|

60

|

–

|

235

|

|||||||||||||||||||||

|

Cost of sales – other expenses (without depreciation and amortization)

|

1

|

3

|

12

|

10

|

7

|

1

|

34

|

|||||||||||||||||||||

|

Gain (loss) on realization of transactions hedging the electricity margins

|

5

|

(9

|

)

|

(10

|

)

|

20

|

(16

|

)

|

7

|

(3

|

)

|

|||||||||||||||||

|

Net energy margin

|

129

|

49

|

202

|

128

|

179

|

39

|

726

|

|||||||||||||||||||||

|

Revenues from capacity payments

|

31

|

58

|

65

|

76

|

45

|

12

|

287

|

|||||||||||||||||||||

|

Other income

|

3

|

12

|

18

|

11

|

2

|

2

|

48

|

|||||||||||||||||||||

|

Gross profit

|

163

|

119

|

285

|

215

|

226

|

53

|

1,061

|

|||||||||||||||||||||

|

Fixed costs (without depreciation and amortization)

|

9

|

14

|

40

|

49

|

48

|

11

|

171

|

|||||||||||||||||||||

|

Administrative and general expenses (without depreciation and amortization)

|

4

|

4

|

8

|

9

|

6

|

1

|

32

|

|||||||||||||||||||||

|

Loss from revaluation of unrealized hedging transactions

|

(1

|

)

|

(1

|

)

|

–

|

–

|

–

|

(2

|

)

|

(4

|

)

|

|||||||||||||||||

|

Group’s share in EBITDA after proportionate consolidation in the Energy Transition segment

|

149

|

100

|

237

|

157

|

172

|

39

|

854

|

|||||||||||||||||||||

|

Group’s share in FFO

|

112

|

47

|

181

|

36

|

125

|

24

|

525

|

|||||||||||||||||||||

|

Group’s share in net cash flows after service service of project debt (3)

|

64

|

51

|

74

|

(2)(243 |

)

|

17

|

9

|

(28

|

)

|

|||||||||||||||||||

|

|

(1) |

At the Shore power plant – gas transmission costs (totaling in the period of the report of about NIS 35 million) are classified in accordance with IFRS 16 as depreciation expenses and, accordingly, are not included in the EBITDA.

|

|

|

(2) |

The net cash flows after service of the project debt in Shore includes partial repayment of debt that was made as part of the refinancing made in February 2025. For additional details – see Section 9A(7) below.

|

|

|

(3) |

It is pointed out that the financing agreements of the CPV Group include arrangements for mechanisms of the “cash sweep” type, in the framework of which all or part of the free cash flows of the projects is designated for repayment of loan

principal on a current basis along with a predetermined minimum repayment schedule relating to every long‑term loan. Accordingly, there could be an acceleration of execution of repayments upon occurrence of certain events and there are also

restrictions on distributions to shareholders.

|

|

|

* |

For details regarding transactions for acquisition of additional holdings in the Shore and Maryland power plants in the fourth quarter of 2024 and the second quarter of 2025 – see Note 24C to the annual financial statements and Note 6A to

the Interim Statements. For additional details regarding signing of an agreement for acquisition of the balance of the rights in the Shore power plant after the date of the report – see Note 6A to the Interim Statements.

|

| 4. |

Analysis of the results of operations for the three months ended September 30, 2025 (in millions of NIS) (Cont.)

|

|

|

B. |

EBITDA, FFO and net cash flows after debt service (Cont.)

|

|

|

(1) |

Calculation of the Group’s share in the EBITDA after proportionate consolidation, FFO and net cash flows after service of project debt of associated companies in the Energy Transition segment (in millions of NIS): (Cont.)

|

|

|

|

|||||||||||||||||||||||||||

|

For the nine months ended September 30, 2024

|

Fairview

|

Towantic

|

Maryland

|

Shore (1)

|

|

Valley

|

Three

Rivers

|

Total

|

||||||||||||||||||||

|

Rate of holdings of the CPV Group

|

25%

|

|

26%

|

|

25%

|

|

38%

|

|

50%

|

|

10%

|

|

||||||||||||||||

|

Revenues from sales of energy

|

155

|

145

|

120

|

122

|

259

|

48

|

849

|

|||||||||||||||||||||

|

Cost of natural gas

|

66

|

59

|

48

|

57

|

95

|

28

|

353

|

|||||||||||||||||||||

|

Carbon emissions tax (RGGI)**

|

–

|

30

|

21

|

32

|

65

|

–

|

148

|

|||||||||||||||||||||

|

Cost of sales – other expenses (without depreciation and amortization)

|

2

|

3

|

5

|

5

|

5

|

2

|

22

|

|||||||||||||||||||||

|

Gain on realization of transactions hedgingthe electricity margins

|

18

|

(5

|

)

|

(1

|

)

|

7

|

45

|

12

|

76

|

|||||||||||||||||||

|

Net energy margin

|

105

|

48

|

45

|

35

|

139

|

30

|

402

|

|||||||||||||||||||||

|

Revenues from capacity payments

|

13

|

89

|

9

|

14

|

45

|

3

|

173

|

|||||||||||||||||||||

|

Other income

|

3

|

4

|

5

|

4

|

2

|

1

|

19

|

|||||||||||||||||||||

|

Gross profit

|

121

|

141

|

59

|

53

|

186

|

34

|

594

|

|||||||||||||||||||||

|

Fixed costs (without depreciation and amortization)

|

10

|

15

|

13

|

20

|

51

|

9

|

118

|

|||||||||||||||||||||

|

Administrative and general expenses (without depreciation and amortization)

|

4

|

3

|

3

|

4

|

6

|

1

|

21

|

|||||||||||||||||||||

|

Gain (loss) from revaluation of unrealized hedging transactions

|

7

|

(5

|

)

|

–

|

(6

|

)

|

–

|

–

|

(4

|

)

|

||||||||||||||||||

|

Group’s share in EBITDA after proportionate consolidation in theEnergy Transition segment

|

114

|

118

|

43

|

23

|

129

|

24

|

451

|

|||||||||||||||||||||

|

Group’s share in FFO

|

90

|

108

|

4

|

4

|

55

|

10

|

271

|

|||||||||||||||||||||

|

Group’s share in net cash flows after service of project debt

|

(2)270

|

|

38

|

2

|

4

|

1

|

10

|

325

|

||||||||||||||||||||

|

|

(1) |

At the Shore power plant – gas transport costs (totaling in the corresponding period last year about NIS 17 million)

are classified in accordance with IFRS 16 as depreciation expenses and, accordingly, are not included in the EBITDA.

|

|

|

(2) |

The net cash flows after debt service in Fairview includes taking out of additional financing for the project as part of the refinance in the third quarter of 2024, which was distributed as a dividend to the project’s partners (the share

of the CPV Group amounted to about NIS 246 million)).

|

| 4. |

Analysis of the results of operations for the nine months ended September 30, 2025 (in millions of NIS) (Cont.)

|

|

|

B. |

EBITDA, FFO and net cash flows after debt service (Cont.)

|

|

|

(2) |

Calculation of the Group’s share in EBITDA after proportionate consolidation of the renewable energies segment (in NIS millions):

|

|

For the nine months ended

|

||||

|

September 30, 2025

|

||||

|

Revenues

|

141

|

|||

|

Fixed costs (without depreciation and amortization)

|

(29

|

)

|

||

|

Administrative and general

|

(16

|

)

|

||

|

EBITDA from active projects

|

96

|

|||

|

Business development and other costs

|

(16

|

)

|

||

|

Share of the Group in EBITDA after proportionate

|

||||

|

consolidation in the renewable energies segment in

|

||||

|

the U.S.

|

80

|

|||

| 4. |

Analysis of the results of operations for the nine months ended September 30, 2025 (in millions of NIS) (Cont.)

|

|

|

B. |

EBITDA, FFO and net cash flows after debt service (Cont.)

|

|

|

(3) |

Set forth below is a breakdown of the EBITDA after proportionate consolidation data broken down by subsidiaries (on a consolidated basis) and the associated companies (on a proportionate basis, based on the rate of the holdings of the CPV

Group therein) as well as FFO and cash flows after service of project debt data (in NIS millions):

|

|

For the nine months ended

|

For the nine months ended

|

||||||||||||||||||||||||

|

Main projects in operation

|

Basis of

|

September 30, 2025

|

September 30, 2024

|

||||||||||||||||||||||

|

|

presentation

|

Net cash

|

Net cash

|

||||||||||||||||||||||

|

|

in the

|

EBITDA

|

flows

|

EBITDA

|

flows

|

||||||||||||||||||||

|

|

Company’s

|

after

|

after

|

after

|

after

|

||||||||||||||||||||

|

|

financial

|

proportionate

|

debt

|

proportionate

|

debt

|

||||||||||||||||||||

|

|

statements

|

consolidation

|

FFO

|

service

|

consolidation

|

FFO

|

service

|

||||||||||||||||||

|

|

|||||||||||||||||||||||||

|

Total operating projects in Israel and accompanying business activities (1) (3)

|

Consolidated

|

531

|

501

|

465

|

(2)564

|

|

|

485

|

424

|

||||||||||||||||

|

Business development costs,

headquarters in Israel and other costs (3)

|

Consolidated

|

(9

|

)

|

(107

|

)

|

(137

|

)

|

(23

|

)

|

(110

|

)

|

(45

|

)

|

||||||||||||

|

Total Israel (4)

|

522

|

394

|

328

|

541

|

375

|

379

|

|||||||||||||||||||

|

Total operating projects (5)

|

Associated

|

854

|

525

|

(28

|

)

|

451

|

271

|

325

|

|||||||||||||||||

|

Other costs

|

Consolidated

|

(7

|

)

|

(21

|

)

|

(21

|

)

|

(4

|

)

|

(2

|

)

|

(2

|

)

|

||||||||||||

|

Total energy transition in the U.S.

|

847

|

504

|

(49

|

)

|

447

|

269

|

323

|

||||||||||||||||||

|

Total operating projects (6)

|

Associated

|

96

|

64

|

11

|

104

|

59

|

6

|

||||||||||||||||||

|

Business development and other costs

|

Associated

|

(16

|

)

|

(27

|

)

|

(27

|

)

|

(20

|

)

|

(33

|

)

|

(33

|

)

|

||||||||||||

|

Total renewable energy in the U.S.

|

80

|

37

|

(16

|

)

|

84

|

26

|

(27

|

)

|

|||||||||||||||||

|

Total activities as part of the “others” segment (7)

|

Consolidated

|

(12

|

)

|

(19

|

)

|

(7

|

)

|

(18

|

)

|

(18

|

)

|

(18

|

)

|

||||||||||||

|

Headquarters in the United States (8) (9)

|

Consolidated

|

(165

|

)

|

(40

|

)

|

(40

|

)

|

(61

|

)

|

(49

|

)

|

(49

|

)

|

||||||||||||

|

Total United States

|

750

|

482

|

(112

|

)

|

452

|

228

|

229

|

||||||||||||||||||

|

Company headquarters (not allocated

|

|||||||||||||||||||||||||

|

to the segments) (4) (8)

|

Consolidated

|

(17

|

)

|

(49

|

)

|

(167

|

)

|

(13

|

)

|

(39

|

)

|

(35

|

)

|

||||||||||||

|

Total consolidated (10)

|

1,255

|

827

|

49 |

980

|

564

|

573

|

|||||||||||||||||||

|

|

(1) |

The accompanying business activities in Israel include mainly virtual supply activities through OPC Israel, and sale/purchase of natural gas, including with third parties through OPC Natural Gas.

|

|

|

(2) |