|

|

MONDAY.COM LTD.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Shiran Nawi

|

|

|

|

|

Name: Shiran Nawi

|

|

|

|

|

Title: Chief People and Legal Officer

|

|

| Exhibit |

Description

|

| 99.2 |

| 99.3 |

|

●

|

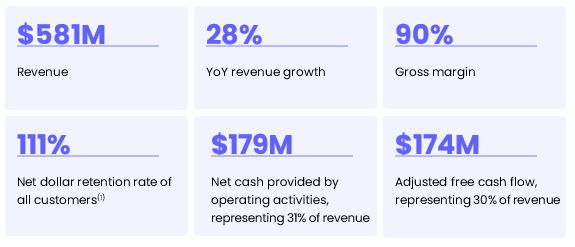

Revenue was $299.0 million, an increase of 27% year-over-year.

|

|

●

|

GAAP operating loss was $11.6 million compared to GAAP operating income of $1.8 million in the second quarter of 2024; GAAP operating margin was

negative 4% compared to 1% in the second quarter of 2024.

|

|

●

|

Non-GAAP operating income was $45.1 million compared to $38.4 million in the second quarter of 2024; non-GAAP operating margin was 15%, compared to 16%

in the second quarter of 2024.

|

|

●

|

GAAP basic and diluted net income per share was $0.03, compared to GAAP basic and diluted net income per share of $0.29 and $0.27, respectively, in the

second quarter of 2024; non-GAAP basic and diluted net income per share was $1.13 and $1.09, respectively, compared to non-GAAP basic and diluted net income per share of $0.99 and $0.94, respectively, in the second quarter of 2024.

|

|

●

|

Net cash provided by operating activities was $66.8 million, with $64.1 million of adjusted free cash flow, compared to net cash provided by operating

activities of $55.8 million and $50.8 million of adjusted free cash flow in the second quarter of 2024.

|

|

Three months ended June 30,

|

Six months ended June 30,

|

|||||||||||||||

|

2025

|

2024

|

2025

|

2024

|

|||||||||||||

|

(unaudited)

|

(unaudited)

|

|||||||||||||||

|

Revenue

|

$

|

299,014

|

$

|

236,106

|

$

|

581,264

|

$

|

453,019

|

||||||||

|

Cost of revenue

|

31,173

|

23,763

|

59,978

|

47,217

|

||||||||||||

|

Gross profit

|

267,841

|

212,343

|

521,286

|

405,802

|

||||||||||||

|

Operating expenses:

|

||||||||||||||||

|

Research and development

|

87,039

|

50,445

|

156,424

|

94,868

|

||||||||||||

|

Sales and marketing

|

152,590

|

131,471

|

294,310

|

259,612

|

||||||||||||

|

General and administrative

|

39,763

|

28,633

|

72,307

|

54,550

|

||||||||||||

|

Total operating expenses

|

279,392

|

210,549

|

523,041

|

409,030

|

||||||||||||

|

Operating income (loss)

|

(11,551

|

)

|

1,794

|

(1,755

|

)

|

(3,228

|

)

|

|||||||||

|

Financial income, net

|

14,102

|

14,850

|

31,749

|

27,689

|

||||||||||||

|

Income before income taxes

|

2,551

|

16,644

|

29,994

|

24,461

|

||||||||||||

|

Income tax expense

|

(978

|

)

|

(2,329

|

)

|

(996

|

)

|

(3,068

|

)

|

||||||||

|

Net income

|

$

|

1,573

|

$

|

14,315

|

$

|

28,998

|

$

|

21,393

|

||||||||

|

Net income per share attributable to ordinary shareholders, basic

|

$

|

0.03

|

$

|

0.29

|

$

|

0.57

|

$

|

0.43

|

||||||||

|

Net income per share attributable to ordinary shareholders, diluted

|

$

|

0.03

|

$

|

0.27

|

$

|

0.55

|

$

|

0.41

|

||||||||

|

Weighted-average ordinary shares used in calculating net income per ordinary share, basic

|

51,385,862

|

49,680,114

|

51,196,507

|

49,442,327

|

||||||||||||

|

Weighted-average ordinary shares used in calculating net income per ordinary share, diluted

|

53,271,524

|

52,209,431

|

53,149,561

|

52,106,369

|

||||||||||||

|

June 30,

|

December 31,

|

|||||||

|

2025

|

2024

|

|||||||

|

ASSETS

|

(unaudited)

|

(audited)

|

||||||

|

CURRENT ASSETS:

|

||||||||

|

Cash and cash equivalents

|

$

|

1,590,515

|

$

|

1,411,602

|

||||

|

Marketable securities

|

60,102

|

50,004

|

||||||

|

Accounts receivable, net

|

36,196

|

25,804

|

||||||

|

Prepaid expenses and other current assets

|

87,237

|

44,836

|

||||||

|

Total current assets

|

1,774,050

|

1,532,246

|

||||||

|

LONG-TERM ASSETS:

|

||||||||

|

Property and equipment, net

|

47,232

|

41,576

|

||||||

|

Operating lease right-of-use assets

|

109,612

|

94,703

|

||||||

|

Other long-term assets

|

33,077

|

16,983

|

||||||

|

Total long-term assets

|

189,921

|

153,262

|

||||||

|

Total assets

|

$

|

1,963,971

|

$

|

1,685,508

|

||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

CURRENT LIABILITIES:

|

||||||||

|

Accounts payable

|

$

|

41,859

|

$

|

35,611

|

||||

|

Accrued expenses and other current liabilities

|

198,429

|

171,040

|

||||||

|

Deferred revenue, current

|

402,794

|

339,951

|

||||||

|

Operating lease liabilities, current

|

29,828

|

29,013

|

||||||

|

Total current liabilities

|

672,910

|

575,615

|

||||||

|

LONG-TERM LIABILITIES:

|

||||||||

|

Operating lease liabilities, non-current

|

96,384

|

77,023

|

||||||

|

Deferred revenue, non-current

|

2,299

|

2,639

|

||||||

|

Total long-term liabilities

|

98,683

|

79,662

|

||||||

|

Total liabilities

|

771,593

|

655,277

|

||||||

|

SHAREHOLDERS' EQUITY:

|

||||||||

|

Other comprehensive income

|

22,984

|

3,189

|

||||||

|

Share capital and additional paid-in capital

|

1,692,428

|

1,579,074

|

||||||

|

Accumulated deficit

|

(523,034

|

)

|

(552,032

|

)

|

||||

|

Total shareholders’ equity

|

1,192,378

|

1,030,231

|

||||||

|

Total liabilities and shareholders’ equity

|

$

|

1,963,971

|

$

|

1,685,508

|

||||

|

Three months ended June 30,

|

Six months ended June 30,

|

|||||||||||||||

|

2025

|

2024

|

2025

|

2024

|

|||||||||||||

|

unaudited

|

unaudited

|

|||||||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||||||||||

|

Net income

|

$

|

1,573

|

$

|

14,315

|

$

|

28,998

|

$

|

21,393

|

||||||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||||||||||

|

Depreciation and amortization

|

3,375

|

2,920

|

6,625

|

5,453

|

||||||||||||

|

Share-based compensation

|

56,645

|

36,623

|

87,603

|

63,166

|

||||||||||||

|

Amortization of discount and accretion of interest on marketable securities

|

580

|

—

|

(95

|

)

|

—

|

|||||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||||||

|

Accounts receivable, net

|

(9,760

|

)

|

(1,292

|

)

|

(10,392

|

)

|

(1,691

|

)

|

||||||||

|

Prepaid expenses and other assets

|

(16,987

|

)

|

(17,306

|

)

|

(26,757

|

)

|

(15,199

|

)

|

||||||||

|

Accounts payable

|

10,068

|

9,625

|

6,224

|

21,668

|

||||||||||||

|

Accrued expenses and other liabilities, net

|

2,941

|

(3,636

|

)

|

24,098

|

2,710

|

|||||||||||

|

Deferred revenue

|

18,402

|

14,545

|

62,503

|

50,249

|

||||||||||||

|

Net cash provided by operating activities

|

66,837

|

55,794

|

178,807

|

147,749

|

||||||||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||||||||||

|

Purchase of property and equipment

|

(5,884

|

)

|

(4,504

|

)

|

(9,571

|

)

|

(5,964

|

)

|

||||||||

|

Purchase of marketable securities

|

—

|

—

|

(10,049

|

)

|

—

|

|||||||||||

|

Capitalized software development costs

|

(924

|

)

|

(469

|

)

|

(1,703

|

)

|

(1,070

|

)

|

||||||||

|

Net cash used in investing activities

|

(6,808

|

)

|

(4,973

|

)

|

(21,323

|

)

|

(7,034

|

)

|

||||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||||||||

|

Proceeds from exercise of share options and employee share purchase plan

|

12,365

|

10,616

|

26,501

|

19,324

|

||||||||||||

|

Receipt (repayment) of tax advance relating to exercises of share options and RSUs, net

|

(9,484

|

)

|

4,261

|

(5,072

|

)

|

14,075

|

||||||||||

|

Net cash provided by financing activities

|

2,881

|

14,877

|

21,429

|

33,399

|

||||||||||||

|

INCREASE IN CASH, AND CASH EQUIVALENTS

|

62,910

|

65,698

|

178,913

|

174,114

|

||||||||||||

|

CASH AND CASH EQUIVALENTS - Beginning of period

|

1,527,605

|

1,224,544

|

1,411,602

|

1,116,128

|

||||||||||||

|

CASH AND CASH EQUIVALENTS - End of period

|

$

|

1,590,515

|

$

|

1,290,242

|

$

|

1,590,515

|

$

|

1,290,242

|

||||||||

|

Three months ended June 30,

|

Six months ended June 30,

|

|||||||||||||||

|

2025

|

2024

|

2025

|

2024

|

|||||||||||||

|

(unaudited)

|

(unaudited)

|

|||||||||||||||

|

Reconciliation of gross profit and gross margin

|

||||||||||||||||

|

GAAP gross profit

|

$

|

267,841

|

$

|

212,343

|

$

|

521,286

|

$

|

405,802

|

||||||||

|

Share-based compensation

|

2,272

|

1,872

|

3,406

|

3,116

|

||||||||||||

|

Non-GAAP gross profit

|

$

|

270,113

|

$

|

214,215

|

$

|

524,692

|

$

|

408,918

|

||||||||

|

GAAP gross margin

|

90

|

%

|

90

|

%

|

90

|

%

|

90

|

%

|

||||||||

|

Non-GAAP gross margin

|

90

|

%

|

91

|

%

|

90

|

%

|

90

|

%

|

||||||||

|

Reconciliation of operating expenses

|

||||||||||||||||

|

GAAP research and development

|

$

|

87,039

|

$

|

50,445

|

$

|

156,424

|

$

|

94,868

|

||||||||

|

Share-based compensation

|

(27,806

|

)

|

(13,567

|

)

|

(43,347

|

)

|

(23,193

|

)

|

||||||||

|

Non-GAAP research and development

|

$

|

59,233

|

$

|

36,878

|

$

|

113,077

|

$

|

71,675

|

||||||||

|

GAAP sales and marketing

|

$

|

152,590

|

$

|

131,471

|

$

|

294,310

|

$

|

259,612

|

||||||||

|

Share-based compensation

|

(13,367

|

)

|

(10,733

|

)

|

(19,205

|

)

|

(18,068

|

)

|

||||||||

|

Non-GAAP sales and marketing

|

$

|

139,223

|

$

|

120,738

|

$

|

275,105

|

$

|

241,544

|

||||||||

|

GAAP general and administrative

|

$

|

39,763

|

$

|

28,633

|

$

|

72,307

|

$

|

54,550

|

||||||||

|

Share-based compensation

|

(13,200

|

)

|

(10,451

|

)

|

(21,645

|

)

|

(18,789

|

)

|

||||||||

|

Non-GAAP general and administrative

|

$

|

26,563

|

$

|

18,182

|

$

|

50,662

|

$

|

35,761

|

||||||||

|

Reconciliation of operating income (loss)

|

||||||||||||||||

|

GAAP operating income (loss)

|

$

|

(11,551

|

)

|

$

|

1,794

|

$

|

(1,755

|

)

|

$

|

(3,228

|

)

|

|||||

|

Share-based compensation

|

56,645

|

36,623

|

87,603

|

63,166

|

||||||||||||

|

Non-GAAP operating income

|

$

|

45,094

|

$

|

38,417

|

$

|

85,848

|

$

|

59,938

|

||||||||

|

GAAP operating margin

|

(4

|

)%

|

1

|

%

|

(0

|

)%

|

(1

|

)%

|

||||||||

|

Non-GAAP operating margin

|

15

|

%

|

16

|

%

|

15

|

%

|

13

|

%

|

||||||||

|

Reconciliation of net income

|

||||||||||||||||

|

GAAP net income

|

$

|

1,573

|

$

|

14,315

|

$

|

28,998

|

$

|

21,393

|

||||||||

|

Share-based compensation

|

56,645

|

36,623

|

87,603

|

63,166

|

||||||||||||

|

Tax expense (benefit) related to share-based compensation(1)

|

78

|

(1,620

|

)

|

78

|

(3,525

|

)

|

||||||||||

|

Non-GAAP net income

|

$

|

58,296

|

$

|

49,318

|

$

|

116,679

|

$

|

81,034

|

||||||||

|

Reconciliation of weighted average number of shares outstanding

|

||||||||||||||||

|

Weighted-average ordinary shares used in calculating GAAP and Non-GAAP net income per ordinary share, basic

|

51,385,862

|

49,680,114

|

51,196,507

|

49,442,327

|

||||||||||||

|

Effect of dilutive shares

|

1,885,662

|

2,529,317

|

1,953,054

|

2,664,042

|

||||||||||||

|

Weighted-average ordinary shares used in calculating GAAP and Non-GAAP net income per ordinary share, diluted

|

53,271,524

|

52,209,431

|

53,149,561

|

52,106,369

|

||||||||||||

|

GAAP net income per share, basic

|

$

|

0.03

|

$

|

0.29

|

$

|

0.57

|

$

|

0.43

|

||||||||

|

GAAP net income per share, diluted

|

$

|

0.03

|

$

|

0.27

|

$

|

0.55

|

$

|

0.41

|

||||||||

|

Non-GAAP net income per share, basic

|

$

|

1.13

|

$

|

0.99

|

$

|

2.28

|

$

|

1.64

|

||||||||

|

Non-GAAP net income per share, diluted

|

$

|

1.09

|

$

|

0.94

|

$

|

2.20

|

$

|

1.56

|

||||||||

| (1) |

The tax benefit related to share-based compensation was excluded in calculating non-GAAP net income and non-GAAP net income per basic and diluted share. The Company believes that excluding the

tax benefit enables investors to see the full effect that excluding share-based compensation expenses had on the operating results.

|

|

Three months ended June 30,

|

Six months ended June 30,

|

|||||||||||||||

|

2025

|

2024

|

2025

|

2024

|

|||||||||||||

|

(unaudited)

|

(unaudited)

|

|||||||||||||||

|

Net cash provided by operating activities

|

$

|

66,837

|

$

|

55,794

|

$

|

178,807

|

$

|

147,749

|

||||||||

|

Purchase of property and equipment

|

(5,884

|

)

|

(4,504

|

)

|

(9,571

|

)

|

(5,964

|

)

|

||||||||

|

Capitalized software development costs

|

(924

|

)

|

(469

|

)

|

(1,703

|

)

|

(1,070

|

)

|

||||||||

|

Purchase of property and equipment related to build-out and expansion of our corporate headquarters

|

4,064

|

—

|

6,092

|

—

|

||||||||||||

|

Adjusted free cash flow

|

$

|

64,093

|

$

|

50,821

|

173,625

|

140,715

|

||||||||||

|

Adjusted free cash flow margin

|

21

|

%

|

22

|

%

|

30

|

%

|

31

|

%

|

||||||||

Page |

|

F - 2 |

|

F - 3 |

|

F - 4 |

|

F - 5 |

|

F - 6 |

|

F - 7 – F - 24 |

|

June 30,

|

December 31,

|

|||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

(audited)

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS:

|

||||||||

|

Cash and cash equivalents

|

$

|

1,590,515

|

$

|

1,411,602

|

||||

|

Marketable securities

|

60,102

|

50,004

|

||||||

|

Accounts receivable - net of allowance for credit losses of $354 and $296 as of June 30, 2025 (unaudited) and December 31, 2024, respectively

|

36,196

|

25,804

|

||||||

|

Prepaid expenses and other current assets

|

87,237

|

44,836

|

||||||

|

Total current assets

|

1,774,050

|

1,532,246

|

||||||

|

|

||||||||

|

Property and equipment, net

|

47,232

|

41,576

|

||||||

|

Operating lease right-of-use assets

|

109,612

|

94,703

|

||||||

|

Other long-term assets

|

33,077

|

16,983

|

||||||

|

Total long-term assets

|

189,921

|

153,262

|

||||||

|

Total assets

|

$

|

1,963,971

|

$

|

1,685,508

|

||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

CURRENT LIABILITIES:

|

||||||||

|

Accounts payable

|

$

|

41,859

|

$

|

35,611

|

||||

|

Accrued expenses and other current liabilities

|

198,429

|

171,040

|

||||||

|

Deferred revenue, current

|

402,794

|

339,951

|

||||||

|

Operating lease liabilities, current

|

29,828

|

29,013

|

||||||

|

Total current liabilities

|

672,910

|

575,615

|

||||||

|

Operating lease liabilities, non-current

|

96,384

|

77,023

|

||||||

|

Deferred revenue, non-current

|

2,299

|

2,639

|

||||||

|

Total long-term liabilities

|

98,683

|

79,662

|

||||||

|

Total liabilities

|

771,593

|

655,277

|

||||||

|

COMMITMENTS AND CONTINGENCIES (NOTE 9)

|

||||||||

|

SHAREHOLDERS' EQUITY:

|

||||||||

|

Ordinary shares, no par value – Authorized: 99,999,999 shares as of June 30, 2025 (unaudited) and December 31, 2024; Issued and Outstanding: 51,551,462 and 50,773,337 as of June 30, 2025 (unaudited) and December 31,2024, respectively

|

-

|

-

|

||||||

|

Founders’ shares no par value: Authorized: 1 share as of June 30, 2025 (unaudited), and December 31, 2024; Issued and Outstanding: 1 share as of June 30,2025 (unaudited), and December 31, 2024

|

||||||||

|

Additional paid-in capital

|

1,692,428

|

1,579,074

|

||||||

|

Accumulated other comprehensive income

|

22,984

|

3,189

|

||||||

|

Accumulated deficit

|

(523,034

|

)

|

(552,032

|

)

|

||||

|

Total shareholders’ equity

|

1,192,378

|

1,030,231

|

||||||

|

Total liabilities and shareholders’ equity

|

$

|

1,963,971

|

$

|

1,685,508

|

||||

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Revenue

|

$

|

581,264

|

$

|

453,019

|

||||

|

Cost of revenue

|

59,978

|

47,217

|

||||||

|

Gross profit

|

521,286

|

405,802

|

||||||

|

OPERATING EXPENSES

|

||||||||

|

Research and development

|

156,424

|

94,868

|

||||||

|

Sales and marketing

|

294,310

|

259,612

|

||||||

|

General and administrative

|

72,307

|

54,550

|

||||||

|

Total operating expenses

|

523,041

|

409,030

|

||||||

|

Operating loss

|

(1,755

|

)

|

(3,228

|

)

|

||||

|

Financial income, net

|

31,749

|

27,689

|

||||||

|

Income before income taxes

|

29,994

|

24,461

|

||||||

|

Income tax expense

|

(996

|

)

|

(3,068

|

)

|

||||

|

Net income

|

$

|

28,998

|

$

|

21,393

|

||||

|

Net income per share attributable to ordinary shareholders, basic

|

$

|

0.57

|

$

|

0.43

|

||||

|

Net income per share attributable to ordinary shareholders, diluted

|

$

|

0.55

|

$

|

0.41

|

||||

|

Weighted-average ordinary shares used in calculating net income per ordinary share, basic

|

51,196,507

|

49,442,327

|

||||||

|

Weighted-average ordinary shares used in calculating net income per ordinary share, diluted

|

53,149,561

|

52,106,369

|

||||||

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Net Income

|

$

|

28,998

|

$

|

21,393

|

||||

|

Other comprehensive income (loss):

|

||||||||

|

Change in unrealized gains on marketable securities

|

||||||||

|

Unrealized losses arising during the period, net of tax

|

(46

|

)

|

-

|

|||||

|

Losses (gains) reclassified into earnings, net of tax

|

-

|

-

|

||||||

|

Change in unrealized gains (losses) on cash flow hedges

|

||||||||

|

Unrealized gains (losses) arising during the period, net of tax

|

24,004

|

(5,480

|

)

|

|||||

|

gains reclassified into earnings, net of tax

|

(4,163

|

)

|

(1,667

|

)

|

||||

|

Net current-period other comprehensive income (loss)

|

19,795

|

(7,147

|

)

|

|||||

|

Comprehensive income

|

$

|

48,793

|

$

|

14,246

|

||||

|

Number of Founders’

Shares

|

Number of Ordinary

shares

|

Additional Paid-in-

Capital

|

Accumulated Other

Comprehensive Income

(*)

|

Accumulated Deficit

|

Shareholders’ equity

|

|||||||||||||||||||

|

Balance as of January 1, 2025

|

1

|

50,773,337

|

$

|

1,579,074

|

$

|

3,189

|

$

|

(552,032

|

)

|

$

|

1,030,231

|

|||||||||||||

|

Exercise of options

|

-

|

415,101

|

16,134

|

-

|

-

|

16,134

|

||||||||||||||||||

|

Issuance of ordinary shares upon vesting of restricted share units

|

-

|

325,163

|

-

|

-

|

-

|

-

|

||||||||||||||||||

|

Issuance of ordinary shares under employee share purchase plan

|

-

|

37,861

|

8,562

|

-

|

-

|

8,562

|

||||||||||||||||||

|

Share-based compensation

|

-

|

-

|

88,658

|

-

|

-

|

88,658

|

||||||||||||||||||

|

Other comprehensive income

|

-

|

-

|

-

|

19,795

|

-

|

19,795

|

||||||||||||||||||

|

Net income

|

-

|

-

|

-

|

-

|

28,998

|

28,998

|

||||||||||||||||||

|

Balance as of June 30, 2025 (unaudited)

|

1

|

51,551,462

|

$

|

1,692,428

|

$

|

22,984

|

$

|

(523,034

|

)

|

$

|

1,192,378

|

|||||||||||||

|

Balance as of January 1, 2024

|

1

|

48,923,903

|

$

|

1,388,108

|

$

|

9,804

|

$

|

(584,404

|

)

|

$

|

813,508

|

|||||||||||||

|

Exercise of options

|

-

|

671,366

|

12,573

|

-

|

-

|

12,573

|

||||||||||||||||||

|

Issuance of ordinary shares upon vesting of restricted share units

|

-

|

223,678

|

-

|

-

|

-

|

-

|

||||||||||||||||||

|

Issuance of ordinary shares under employee share purchase plan

|

-

|

39,840

|

5,981

|

-

|

-

|

5,981

|

||||||||||||||||||

|

Share-based compensation

|

-

|

-

|

63,814

|

-

|

-

|

63,814

|

||||||||||||||||||

|

Other comprehensive loss

|

-

|

-

|

-

|

(7,147

|

)

|

-

|

(7,147

|

)

|

||||||||||||||||

|

Net income

|

-

|

-

|

-

|

-

|

21,393

|

21,393

|

||||||||||||||||||

|

Balance as of June 30, 2024 (unaudited)

|

1

|

49,858,787

|

$

|

1,470,476

|

$

|

2,657

|

$

|

(563,011

|

)

|

$

|

910,122

|

|||||||||||||

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net income

|

$

|

28,998

|

$

|

21,393

|

||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation and amortization

|

6,625

|

5,453

|

||||||

|

Share-based compensation

|

87,603

|

63,166

|

||||||

|

Amortization of discount and accretion of interest on marketable securities

|

(95

|

)

|

-

|

|||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable, net

|

(10,392

|

)

|

(1,691

|

)

|

||||

|

Prepaid expenses and other assets

|

(26,757

|

)

|

(15,199

|

)

|

||||

|

Accounts payable

|

6,224

|

21,668

|

||||||

|

Accrued expenses and other liabilities

|

24,098

|

2,710

|

||||||

|

Deferred revenue

|

62,503

|

50,249

|

||||||

|

Net cash provided by operating activities

|

178,807

|

147,749

|

||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||

|

Purchase of property and equipment

|

(9,571

|

)

|

(5,964

|

)

|

||||

|

Capitalized software development costs

|

(1,703

|

)

|

(1,070

|

)

|

||||

|

Purchase of marketable securities

|

(10,049

|

)

|

-

|

|||||

|

Net cash used in investing activities

|

(21,323

|

)

|

(7,034

|

)

|

||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Proceeds from exercise of share options and employee share purchase plan

|

26,501

|

19,324

|

||||||

|

Receipt (repayment)of tax advance relating to exercises of share options and RSUs, net

|

(5,072

|

)

|

14,075

|

|||||

|

Net cash provided by financing activities

|

21,429

|

33,399

|

||||||

|

|

||||||||

|

INCREASE IN CASH, AND CASH EQUIVALENTS

|

178,913

|

174,114

|

||||||

|

CASH AND CASH EQUIVALENTS - Beginning of period

|

1,411,602

|

1,116,128

|

||||||

|

CASH AND CASH EQUIVALENTS - End of period

|

$

|

1,590,515

|

$

|

1,290,242

|

||||

|

NON-CASH INVESTING AND FINANCING ACTIVITIES:

|

||||||||

|

Non-cash purchases of property and equipment

|

$

|

-

|

$

|

212

|

||||

|

Capitalized share-based compensation costs

|

$

|

1,055

|

$

|

648

|

||||

|

Right-of-use asset recognized with corresponding lease liability

|

$

|

27,111

|

$

|

8,753

|

||||

|

NOTE 1:-

|

ORGANIZATION AND DESCRIPTION OF BUSINESS

|

|

NOTE 2:-

|

BASIS OF PRESENTATION and SIGNIFICANT ACCOUNTING POLICIES

|

|

|

a.

|

Unaudited Interim Condensed Consolidated Financial Information

|

F - 7

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 2:-

|

BASIS OF PRESENTATION and SIGNIFICANT ACCOUNTING POLICIES (cont.)

|

F - 8

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 2:-

|

BASIS OF PRESENTATION and SIGNIFICANT ACCOUNTING POLICIES (cont.)

|

|

b.

|

Use of estimates

|

|

c.

|

Accounting pronouncements not yet effective

|

F - 9

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 3:-

|

REVENUE RECOGNITION

|

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Beginning balance

|

$

|

20,522

|

$

|

3,675

|

||||

|

Capitalization of deferred contract costs

|

34,787

|

10,187

|

||||||

|

Amortization

|

(9,090

|

)

|

(1,825

|

)

|

||||

|

Ending balance

|

$

|

46,219

|

$

|

12,037

|

||||

|

June 30,

2025

|

December 31,

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Deferred contract costs, current

|

$

|

20,160

|

$

|

10,409

|

||||

|

Deferred contract costs, noncurrent

|

26,059

|

10,113

|

||||||

|

Total deferred contract costs

|

$

|

46,219

|

$

|

20,522

|

||||

F - 10

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 3:-

|

REVENUE RECOGNITION (cont.)

|

|

NOTE 4:-

|

CASH, CASH EQUIVALENTS AND MARKETABLE SECURITIES

|

|

June 30,

|

December 31,

|

|||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Cash and cash equivalents:

|

||||||||

|

Cash

|

$

|

73,804

|

$

|

98,392

|

||||

|

Bank deposits

|

182,327

|

21,936

|

||||||

|

Money market funds

|

1,334,384

|

1,291,274

|

||||||

|

Total cash and cash equivalents

|

1,590,515

|

1,411,602

|

||||||

|

Marketable securities:

|

||||||||

|

U.S. Treasury bills

|

60,102

|

50,004

|

||||||

|

Total marketable securities

|

60,102

|

50,004

|

||||||

|

Total cash and cash equivalents and marketable securities

|

$

|

1,650,617

|

$

|

1,461,606

|

||||

|

June 30, 2025

|

||||||||||||||||

|

(Unaudited)

|

||||||||||||||||

|

Amortized cost

|

Gross unrealized gains

|

Gross unrealized losses

|

Fair value

|

|||||||||||||

|

Contractual maturity:

|

||||||||||||||||

|

Within one year

|

$

|

59,941

|

$

|

161

|

$

|

-

|

$

|

60,102

|

||||||||

|

After one year through five years

|

-

|

-

|

-

|

-

|

||||||||||||

|

Total

|

$

|

59,941

|

$

|

161

|

$

|

-

|

$

|

60,102

|

||||||||

F - 11

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 4:-

|

CASH, CASH EQUIVALENTS AND MARKETABLE SECURITIES (cont.)

|

|

December 31, 2024

|

||||||||||||||||

|

Amortized cost

|

Gross unrealized gains

|

Gross unrealized losses

|

Fair value

|

|||||||||||||

|

Contractual maturity:

|

||||||||||||||||

|

Within one year

|

$

|

49,797

|

$

|

207

|

$

|

-

|

$

|

50,004

|

||||||||

|

After one year through five years

|

-

|

-

|

-

|

-

|

||||||||||||

|

Total

|

$

|

49,797

|

$

|

207

|

$

|

-

|

$

|

50,004

|

||||||||

|

NOTE 5:-

|

PREPAID EXPENSES AND OTHER CURRENT ASSETS

|

|

June 30,

|

December 31,

|

|||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Prepaid expenses

|

$

|

23,526

|

$

|

15,944

|

||||

|

Related parties’ receivable

|

81

|

1,587

|

||||||

|

Government institutions

|

12,408

|

7,376

|

||||||

|

Derivative instruments

|

22,825

|

2,984

|

||||||

|

Interest receivable

|

5,010

|

4,864

|

||||||

|

Short-term vendor deposits

|

436

|

335

|

||||||

|

Deferred contract costs

|

20,160

|

10,409

|

||||||

|

Other current assets

|

2,791

|

1,337

|

||||||

|

Total prepaid expenses and other current assets

|

$

|

87,237

|

$

|

44,836

|

||||

|

NOTE 6:-

|

ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

|

|

June 30,

|

December 31,

|

|||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Accrued employee compensation and benefits

|

$

|

108,845

|

$

|

95,960

|

||||

|

Accrued expenses

|

67,598

|

56,528

|

||||||

|

Advances from customers

|

5,826

|

3,431

|

||||||

|

Income and indirect taxes payable

|

16,160

|

15,121

|

||||||

|

Total

|

$

|

198,429

|

$

|

171,040

|

||||

F - 12

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 7:-

|

FAIR VALUE MEASUREMENTS

|

|

As of June 30,

|

As of December 31,

|

|||||||||||||||||||||||

|

2025

|

2024

|

|||||||||||||||||||||||

|

Level 1

|

Level 2

|

Total

|

Level 1

|

Level 2

|

Total

|

|||||||||||||||||||

|

(Unaudited)

|

||||||||||||||||||||||||

|

Cash equivalents:

|

||||||||||||||||||||||||

|

Money market funds

|

$

|

1,334,384

|

$

|

-

|

$

|

1,334,384

|

$

|

1,291,274

|

$

|

-

|

$

|

1,291,274

|

||||||||||||

|

Marketable securities:

|

||||||||||||||||||||||||

|

U.S. Treasury bills

|

60,102

|

-

|

60,102

|

50,004

|

-

|

50,004

|

||||||||||||||||||

|

Foreign currency derivative contracts:

|

||||||||||||||||||||||||

|

Foreign exchange contracts

|

-

|

22,825

|

22,825

|

-

|

2,984

|

2,984

|

||||||||||||||||||

|

Total

|

$

|

1,394,486

|

$

|

22,825

|

$

|

1,417,311

|

$

|

1,341,278

|

$

|

2,984

|

$

|

1,344,262

|

||||||||||||

|

NOTE 8:-

|

DERIVATIVES AND HEDGING

|

F - 13

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 8:-

|

DERIVATIVES AND HEDGING (cont.)

|

|

June 30,

|

December 31,

|

||||||||

|

Balance sheet line item

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

|||||||||

|

Derivatives designated as hedging instruments:

|

|||||||||

|

Foreign exchange contracts

|

Prepaid expenses and other current assets

|

$

|

22,825

|

$

|

2,984

|

||||

|

22,825

|

2,984

|

||||||||

|

Derivatives not designated as hedging instruments:

|

|||||||||

|

-

|

-

|

||||||||

|

Total

|

$

|

22,825

|

$

|

2,984

|

|||||

|

Gain (Loss) Recognized

in Other Comprehensive

Income on Effective-

Portion of Derivative, net

|

Realized gains on Derivative Reclassified from Accumulated Other Comprehensive Income (*)

|

Amount Excluded from Effectiveness Testing Recognized in Income (Loss)

|

||||||||||||||||||||||

|

Six months ended June 30

|

Six months ended June 30

|

Six months ended June 30

|

||||||||||||||||||||||

|

2025

|

2024

|

2025

|

2024

|

2025

|

2024

|

|||||||||||||||||||

|

(Unaudited)

|

||||||||||||||||||||||||

|

Derivatives designated as hedging instruments:

|

||||||||||||||||||||||||

|

Foreign exchange contracts

|

$

|

24,004

|

$

|

(5,480

|

)

|

$

|

4,163

|

$

|

1,667

|

$

|

(182

|

)

|

$

|

-

|

||||||||||

|

24,004

|

(5,480

|

)

|

4,163

|

1,667

|

(182

|

)

|

-

|

|||||||||||||||||

|

Derivatives not designated as hedging instruments:

|

||||||||||||||||||||||||

|

Foreign exchange contracts

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||||

|

Total

|

$

|

24,004

|

$

|

(5,480

|

)

|

$

|

4,163

|

$

|

1,667

|

$

|

(182

|

)

|

$

|

-

|

||||||||||

F - 14

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 8:-

|

DERIVATIVES AND HEDGING (cont.)

|

|

June 30,

2025

|

December 31,

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Derivatives designated as hedging instruments:

|

||||||||

|

Foreign exchange contracts:

|

||||||||

|

NIS

|

$

|

274,259

|

$

|

209,487

|

||||

|

Total

|

$

|

274,259

|

$

|

209,487

|

||||

|

NOTE 9:-

|

LEASES

|

|

Amount (*)

|

||||

|

The remainder of 2025

|

$

|

16,047

|

||

|

2026

|

25,101

|

|||

|

2027

|

21,049

|

|||

|

2028

|

21,119

|

|||

|

2029

|

19,665

|

|||

|

Thereafter

|

37,948

|

|||

|

Total undiscounted cash flows

|

$

|

140,929

|

||

|

Less: Imputed interest

|

$

|

(14,717

|

)

|

|

|

Present value of lease liabilities

|

$

|

126,212

|

||

F - 15

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 9:-

|

LEASES (cont.)

|

|

June 30,

2025

|

December 31,

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Weighted-average remaining lease term

|

5.9 years

|

5.2 years

|

||||||

|

Weighted-average discount rate

|

3.9

|

%

|

4.2

|

%

|

||||

|

NOTE 10:-

|

COMMITMENTS AND CONTINGENCIES

|

|

a.

|

Guarantees

|

|

b.

|

Indemnifications

|

F - 16

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 10:-

|

COMMITMENTS AND CONTINGENCIES (cont.)

|

|

c.

|

Legal Contingencies

|

|

d.

|

Other Commitments

|

|

Amount

|

||||

|

The remainder of 2025

|

$

|

18,361

|

||

|

2026

|

34,762

|

|||

|

2027

|

17,710

|

|||

|

2028

|

-

|

|||

|

Total contractual obligations

|

$

|

70,833

|

||

F - 17

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 11:-

|

FINANCIAL INCOME, NET

|

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Financial expenses:

|

||||||||

|

Bank charges and other

|

$

|

278

|

$

|

274

|

||||

|

Exchange rate expense, net

|

-

|

1,309

|

||||||

|

Total financial expenses

|

278

|

1,583

|

||||||

|

Financial income:

|

||||||||

|

Exchange rate income, net

|

556

|

-

|

||||||

|

Interest income on deposits, money market funds and marketable securities

|

30,158

|

29,272

|

||||||

|

Accretion of discount on marketable securities

|

1,313

|

-

|

||||||

|

Total financial income

|

32,027

|

29,272

|

||||||

|

Financial income, net

|

$

|

31,749

|

$

|

27,689

|

||||

|

NOTE 12:-

|

RELATED PARTIES

|

|

NOTE 13:-

|

SHAREHOLDERS’ EQUITY

|

|

a.

|

Ordinary shares

|

|

June 30,

2025

|

December 31,

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Ordinary shares

|

51,551,462

|

50,773,337

|

||||||

|

Outstanding share options and RSUs

|

3,032,942

|

3,164,395

|

||||||

|

Shares available for future grants under the 2021 plan

|

10,871,688

|

8,941,243

|

||||||

|

Shares available for future grants under the 2024 Foundation plan

|

14,410

|

15,000

|

||||||

|

Shares subject to the employee share purchase plan

|

1,118,576

|

1,156,437

|

||||||

|

Total

|

66,589,078

|

64,050,412

|

||||||

F - 18

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 13:-

|

SHAREHOLDERS’ EQUITY (cont.)

|

|

b.

|

Share-based compensation

|

|

Number of Options

|

Weighted-Average Exercise Price

|

Weighted Average Remaining Contractual life

|

Aggregate Intrinsic Value

|

|||||||||||||

|

(Unaudited)

|

||||||||||||||||

|

Outstanding — January 1, 2025 (*)

|

1,768,230

|

$

|

62.90

|

6.04

|

$

|

305,379

|

||||||||||

|

Granted (*)

|

42,897

|

$

|

0.87

|

|||||||||||||

|

Exercised

|

(415,101

|

)

|

$

|

38.74

|

||||||||||||

|

Expired and forfeited

|

(34,323

|

)

|

$

|

54.03

|

||||||||||||

|

Outstanding — June 30, 2025

|

1,361,703

|

$

|

68.54

|

5.68

|

$

|

334,903

|

||||||||||

|

Exercisable — June 30, 2025 (*)

|

1,134,484

|

$

|

64.20

|

5.34

|

$

|

283,937

|

||||||||||

F - 19

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 13:-

|

SHAREHOLDERS’ EQUITY (cont.)

|

|

Number of Units

|

Weighted-Average Fair Value

|

|||||||

|

(Unaudited)

|

||||||||

|

Balance at January 1, 2025 (*)

|

1,396,165

|

$

|

177.72

|

|||||

|

Granted (*)

|

696,448

|

$

|

269.61

|

|||||

|

Vested

|

(325,163

|

)

|

$

|

175.71

|

||||

|

Canceled

|

(96,211

|

)

|

$

|

176.79

|

||||

|

Balance at June 30, 2025 (*)

|

1,671,239

|

$

|

216.46

|

|||||

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

Cost of revenues

|

$

|

3,406

|

$

|

3,116

|

||||

|

Research and development

|

43,347

|

23,193

|

||||||

|

Sales and marketing

|

19,205

|

18,068

|

||||||

|

General and administrative

|

21,645

|

18,789

|

||||||

|

Share-based compensation, net of amounts capitalized

|

$

|

87,603

|

$

|

63,166

|

||||

|

Capitalized share-based compensation expense

|

1,055

|

648

|

||||||

|

Total share-based compensation

|

$

|

88,658

|

$

|

63,814

|

||||

F - 20

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 13:-

|

SHAREHOLDERS’ EQUITY (cont.)

|

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Risk-free interest rate

|

3.74%-4.1%

|

|

4.03%-4.77%

|

|

||||

|

Expected dividend yield

|

0%

|

|

0%

|

|

||||

|

Expected term (in years)

|

2-7

|

5-7

|

||||||

|

Expected volatility

|

57.02%-59.32%

|

|

57.81%

|

|

||||

|

c.

|

Employee Share Purchase Plan

|

F - 21

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 14:-

|

EARNINGS PER SHARE

|

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

Numerator:

|

(Unaudited)

|

|||||||

|

Net income attributable to ordinary shareholders, basic and diluted

|

$

|

28,998

|

$

|

21,393

|

||||

|

Denominator:

|

||||||||

|

Weighted-average ordinary shares outstanding, basic

|

51,196,507

|

49,442,327

|

||||||

|

Dilutive effect

|

||||||||

|

Employee stock options, RSUs and PSUs

|

1,953,054

|

2,664,042

|

||||||

|

Weighted average ordinary shares outstanding, diluted

|

53,149,561

|

52,106,369

|

||||||

|

Net income per share attributable to ordinary shareholders, basic

|

$

|

0.57

|

$

|

0.43

|

||||

|

Net income per share attributable to ordinary shareholders, diluted

|

$

|

0.55

|

$

|

0.41

|

||||

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Options

|

-

|

248,083

|

||||||

|

RSUs

|

29,176

|

90,105

|

||||||

|

Total

|

29,176

|

338,188

|

||||||

F - 22

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 15:-

|

SEGMENT REPORTING

|

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

Total revenues

|

$

|

581,264

|

453,019

|

|||||

|

Share-based compensation

|

(87,603

|

)

|

(63,166

|

)

|

||||

|

Tax benefit (expense) related to share-based compensation

|

(78

|

)

|

3,525

|

|||||

|

Other segment items (*)

|

(464,585

|

)

|

(371,985

|

)

|

||||

|

Net income

|

$

|

28,998

|

$

|

21,393

|

||||

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

United States

|

$

|

293,324

|

$

|

242,075

|

||||

|

EMEA

|

124,902

|

98,445

|

||||||

|

United Kingdom

|

62,300

|

46,865

|

||||||

|

Rest of the world

|

100,738

|

65,634

|

||||||

|

Total

|

$

|

581,264

|

$

|

453,019

|

||||

F - 23

|

MONDAY.COM AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

NOTE 15:-

|

SEGMENT REPORTING (cont.)

|

|

As of

June 30,

2025

|

As of

December 31,

2024

|

|||||||

|

(Unaudited)

|

||||||||

|

Israel

|

$

|

94,257

|

$

|

72,613

|

||||

|

United States

|

13,467

|

17,895

|

||||||

|

United Kingdom

|

46,953

|

43,030

|

||||||

|

Rest of the world

|

2,168

|

2,741

|

||||||

|

Total

|

$

|

156,845

|

$

|

136,279

|

||||

|

H1 2025

|

|

|

• |

our ability to effectively manage the scope and complexity of our business following years of rapid growth and our ability to maintain profitability;

|

|

|

• |

foreign currency exchange rate fluctuations;

|

|

|

• |

the fact that we continue to derive a majority of revenues from monday work management;

|

|

|

• |

fluctuations in operating results;

|

|

|

• |

real or perceived errors, failures, vulnerabilities or bugs in our platform, products, or third-party applications offered on our app marketplace or interruptions or performance problems in the technology or

infrastructure underlying our platform;

|

|

|

• |

risks related to artificial intelligence (“AI”) or machine learning (“ML”);

|

|

|

• |

our ability to attract customers, grow our retention rates and expand usage within organizations, including cross selling and upselling;

|

|

|

• |

risks related to our subscription-based business model;

|

|

|

• |

our sales efforts may require considerable time and expense and the use of differing sales strategies

and may extend our sales cycles;

|

|

|

• |

changes in sizes or types of business that purchase our platform and products;

|

|

|

• |

our ability to offer high-quality customer support and consistent sales strategies;

|

|

|

• |

maintenance of corporate culture;

|

|

|

• |

risks related to international operations and compliance with laws and regulations applicable to our global operations;

|

|

|

• |

risks related to acquisitions, strategic investments, partnerships, or alliances;

|

|

H1 2025

|

|

|

• |

risks associated with environmental and social responsibility and climate change;

|

|

|

• |

our dependence on key employees and ability to attract and retain highly skilled employees;

|

|

|

• |

our ability to raise additional capital or generate cash flows necessary to grow our business;

|

|

|

• |

uncertain global economic conditions and inflation;

|

|

|

• |

changes and competition in the market and software categories in which we participate;

|

|

|

• |

our ability to introduce new products, features, integrations, capabilities, and enhancements;

|

|

|

• |

the ability of our platform to interoperate with a variety of software applications;

|

|

|

• |

our reliance on third-party application stores to distribute our mobile application;

|

|

|

• |

our successful strategic relationships with, and our dependence on third parties;

|

|

|

• |

our reliance on traditional web search engines to direct traffic to our website;

|

|

|

• |

interruption or delays in service from third parties or our inability to plan and manage interruptions;

|

|

|

• |

risks related to security disruptions, unauthorized system access;

|

|

|

• |

evolving privacy protection and data security laws, regulations, industry standards, policies, contractual obligations, and cross-border data transfer or localization restrictions;

|

|

|

• |

new legislation and regulatory obligations regulating AI;

|

|

|

• |

changes in tax law and regulations or if we were to be classified as a passive foreign investment company;

|

|

|

• |

our ability to maintain, protect or enforce our intellectual property rights or risks related to

intellectual property infringement claims;

|

|

|

• |

risks related to our use of open-source software;

|

|

|

• |

risks related to our founder share that provides certain veto rights

|

|

|

• |

risks related to our status as a foreign private issuer incorporated and located in Israel, including risks related to the ongoing war between Israel and Hamas and escalations thereof;

|

|

|

• |

our expectation not to pay dividends for the foreseeable future;

|

|

|

• |

risks related to our Digital Lift Initiative and the monday.com Foundation; and

|

|

|

• |

risks related to legal and regulatory matters.

|

|

H1 2025

|

|

|

• |

“dollars” or “$” means United States dollars; and

|

|

|

• |

“NIS” means New Israeli Shekels.

|

|

H1 2025

|

|

|

• |

Revenue: Our revenue was $581.3 million and $453.0 million for

the six months ended June 30, 2025, and June 30, 2024, respectively.

|

|

|

• |

Year over Year Revenue Growth: Our revenue growth was 28% and

34% for the six months ended June 30, 2025, and June 30, 2024, respectively.

|

|

|

• |

Net Income: Our net income was $29.0 million and $21.4 million

for the six months ended June 30, 2025, and June 30, 2024, respectively.

|

|

|

• |

Net Cash Provided by Operating Activities: Our net cash

provided by operating activities was $178.8 million and $147.7 million for the six months ended June 30, 2025, and June 30, 2024, respectively.

|

|

|

• |

Adjusted free Cash Flow: Our adjusted free cash flow was

$173.6 million and $140.7 million for the six months ended June 30, 2025, and June 30, 2024, respectively.

|

|

H1 2025

|

|

H1 2025

|

|

H1 2025

|

|

H1 2025

|

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(in thousands)

|

||||||||

|

Revenue

|

$

|

581,264

|

$

|

453,019

|

||||

|

Cost of revenue (1)

|

59,978

|

47,217

|

||||||

|

Gross profit

|

521,286

|

405,802

|

||||||

|

Operating Expenses:

|

||||||||

|

Research and development (1)

|

156,424

|

94,868

|

||||||

|

Sales and marketing (1)

|

294,310

|

259,612

|

||||||

|

General and administrative (1)

|

72,307

|

54,550

|

||||||

|

Total operating expenses

|

523,041

|

409,030

|

||||||

|

Operating loss

|

(1,755

|

)

|

(3,228

|

)

|

||||

|

Financial income, net

|

31,749

|

27,689

|

||||||

|

Income before income taxes

|

29,994

|

24,461

|

||||||

|

Income tax expenses

|

(996

|

)

|

(3,068

|

)

|

||||

|

Net income

|

$

|

28,998

|

$

|

21,393

|

||||

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(in thousands)

|

||||||||

|

Cost of revenue

|

$

|

3,406

|

$

|

3,116

|

||||

|

Research and development

|

43,347

|

23,193

|

||||||

|

Sales and marketing

|

19,205

|

18,068

|

||||||

|

General and administrative

|

21,645

|

18,789

|

||||||

|

Total share-based compensation

|

$

|

87,603

|

$

|

63,166

|

||||

|

H1 2025

|

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

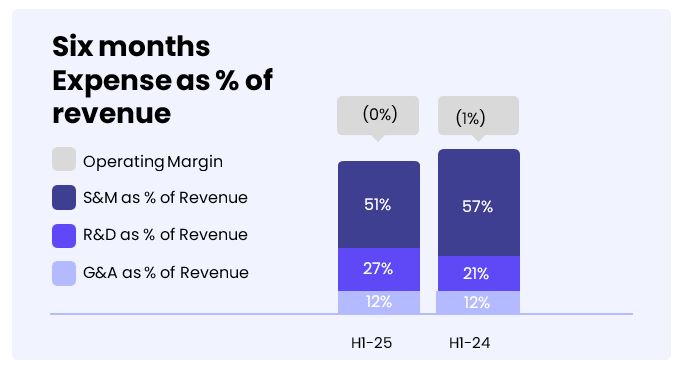

Revenue

|

100

|

%

|

100

|

%

|

||||

|

Cost of revenue

|

10

|

10

|

||||||

|

Gross profit

|

90

|

90

|

||||||

|

Operating Expenses:

|

||||||||

|

Research and development

|

27

|

21

|

||||||

|

Sales and marketing

|

51

|

57

|

||||||

|

General and administrative

|

12

|

12

|

||||||

|

Total operating expenses

|

90

|

90

|

||||||

|

Operating loss

|

(-

|

)

|

(1

|

)

|

||||

|

Financial income, net

|

5

|

6

|

||||||

|

Income before income taxes

|

5

|

5

|

||||||

|

Income tax expenses

|

(-

|

)

|

(1

|

)

|

||||

|

Net income

|

5

|

%

|

5

|

%

|

||||

|

Six months ended June 30,

|

||||||||||||||||

|

2025

|

2024

|

Change

|

%

|

|||||||||||||

|

(in thousands)

|

||||||||||||||||

|

Revenue

|

$

|

581,264

|

$

|

453,019

|

$

|

128,245

|

28

|

%

|

||||||||

|

Six months ended June 30,

|

||||||||||||||||

|

2025

|

2024

|

Change

|

% change

|

|||||||||||||

|

(in thousands)

|

||||||||||||||||

|

Cost of revenue

|

$

|

59,978

|

$

|

47,217

|

$

|

12,761

|

27

|

%

|

||||||||

|

Gross profit

|

90

|

%

|

90

|

%

|

||||||||||||

|

H1 2025

|

|

Six months ended June 30,

|

||||||||||||||||

|

2025

|

2024

|

Change

|

%

|

|||||||||||||

|

(in thousands)

|

||||||||||||||||

|

Research and development

|

$

|

156,424

|

$

|

94,868

|

$

|

61,556

|

65

|

%

|

||||||||

|

Sales and marketing

|

294,310

|

259,612

|

34,698

|

13

|

%

|

|||||||||||

|

General and administrative

|

72,307

|

54,550

|

17,757

|

33

|

%

|

|||||||||||

|

Total operating expenses

|

$

|

523,041

|

$

|

409,030

|

$

|

114,011

|

28

|

%

|

||||||||

|

H1 2025

|

|

Six months ended June 30,

|

||||||||||||||||

|

2025

|

2024

|

Change

|

%

|

|||||||||||||

|

(in thousands)

|

||||||||||||||||

|

Financial income, net

|

$

|

31,749

|

$

|

27,689

|

$

|

4,060

|

15

|

%

|

||||||||

|

Six months ended June 30,