|

Exhibit Number

|

Description of Exhibits

|

|

|

|

|

RADWARE LTD.

|

|||

|

Date: April 24, 2025

|

By:

|

/s/ Gadi Meroz

|

|

|

Gadi Meroz

|

|||

|

Vice President & General Counsel

|

|||

|

|

1. |

To approve grants of equity-based awards to, and modifications in the structure of the annual bonus of, the President and Chief Executive Officer of the Company; and

|

|

|

2. |

Transact such other business as may properly come before the Meeting or any postponement or adjournment thereof.

|

|

|

By Order of the Board of Directors

/s/ Roy Zisapel

ROY ZISAPEL

President and Chief Executive Officer

|

|

|

• |

“Articles of Association” is to our Amended and Restated Articles of Association;

|

|

|

• |

"Companies Law" or the "Israeli Companies Law" are to the Israeli Companies Law, 5759-1999, as amended, and the regulations promulgated thereunder;

|

|

|

• |

“dollars,” “$,” or “US$” are to U.S. dollars;

|

|

|

• |

“including” or “include,” shall be deemed to be followed by the phrase “without limitation”;

|

|

|

• |

“Nasdaq” is to the Nasdaq Stock Market LLC

|

|

|

• |

"NIS" or "shekel" are to New Israeli Shekels;

|

|

|

• |

"ordinary shares" or “shares” are to our ordinary shares, NIS 0.05 par value per share;

|

|

|

• |

the "SEC" are to the United States Securities and Exchange Commission;

|

|

|

• |

“2022 Annual Report” is to the annual report on Form 20-F we filed with the SEC on March 30, 2023

|

|

|

• |

"2023 Annual Report" is to the annual report on Form 20-F we filed with the SEC on March 25, 2024.

|

|

|

• |

"2024 Annual Report" is to the annual report on Form 20-F we filed with the SEC on March 28, 2025.

|

|

|

1. |

To approve grants of equity-based awards to, and modifications in the structure of the annual bonus of, the President and Chief Executive Officer of the Company.

|

|

|

< |

By Internet — You can vote over the Internet at www.proxyvote.com by following the instructions therein or, if you received your

proxy materials by mail, by following the instructions on the proxy card. You will need to enter your control number, which is a 16-digit number located in a box on your proxy card that is included with your proxy materials.

|

|

|

< |

By Telephone — You may vote and submit your proxy by calling toll-free 1-800-690-6903 in the United States and providing your

control number, which is a 16-digit number located in a box on your proxy card that is included with your proxy materials.

|

|

|

< |

By Mail — If you received your proxy materials by mail or if you requested paper copies of the proxy materials, you can vote by

mail by marking, dating, signing and returning the proxy card in the postage-paid envelope.

|

|

Name

|

Number of ordinary shares*

|

Percentage of outstanding ordinary

shares**

|

||||||

|

Senvest Management, LLC (1)

|

4,115,597

|

9.6

|

%

|

|||||

|

Nava Zisapel (2)

|

2,897,926

|

6.8

|

%

|

|||||

|

Morgan Stanley (3)

|

2,481,276

|

5.8

|

%

|

|||||

|

Artisan Partners (4)

|

2,360,703

|

5.5

|

%

|

|||||

|

Legal & General Investment Management Limited (5)

|

2,235,702

|

5.2

|

%

|

|||||

|

Roy Zisapel (6)

|

2,162,244

|

5.1

|

%

|

|||||

|

All directors and executive officers as a group consisting of 14 persons, including Roy Zisapel (7) (8)

|

3,083,401

|

7.1

|

%

|

|||||

|

|

• |

Revenue of $274.9 million, up 5% year-over-year

|

|

|

• |

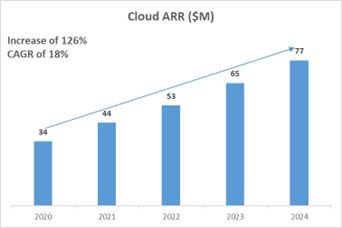

Cloud ARR (cloud annual recuring revenue) of $77.3 million, up 19% year-over-year

|

|

|

• |

Subscription revenue CAGR for the last six years was 21%

|

|

|

• |

Non-GAAP operating income nearly tripled year-over-year to $26.8 million

|

|

|

• |

Positive cash flow from operations of $71.6 million

|

|

Year

|

Salary

|

Bonus (including Sales Commissions)

|

Equity-Based Compensation (1)

|

All Other Compensation (2)

|

Total

|

|

(US$ In Thousands)

|

|||||

|

2024

|

450

|

465

|

2,489

|

155

|

3,559

|

|

2023

|

450

|

0

|

2,451

|

139

|

3,040

|

|

2022

|

452

|

382

|

2,327

|

140

|

3,301

|

| (1) |

Amounts reported in this column represent the grant date fair value in accordance with accounting guidance for share-based compensation. For a discussion of the assumptions used in reaching this valuation, see the notes to our

consolidated financial statements included in the applicable annual report.

|

| (2) |

Amounts reported in this column include benefits and perquisites, including those mandated by applicable law.

|

|

|

• |

Annual Recurring Revenues (ARR): Achievement (including overachievement) of the ARR target set in the annual budget of the Company approved by the Board of Directors for the applicable year (the

"Annual Budget") will entitle our CEO to up to 25% of the annual bonus;

|

|

|

• |

Bookings: Achievement (including overachievement) of the "bookings" target set in the Annual Budget (bookings is generally defined in our budget to mean funds that

are expected to be received from customers based on contracts or firm accepted orders for services and/or products recorded in our ERP system) will entitle our CEO to up to 40% of the annual bonus;

|

|

|

• |

Adjusted EBITDA: Achievement (including overachievement) of the EBITDA target (adjusted to exclude share based compensation) set in the Annual Budget will entitle our CEO to up to 25% of the

annual bonus; and

|

|

|

• |

Overall Performance: Achievement and performance of individual key non-financial performance indicators (KPIs) set by our Compensation Committee will entitle our CEO to up to 10% of the annual

bonus.

|

|

Corporate Goal

|

Performance

|

||

|

Threshold (50% payout)

|

Target (100% payout)

|

Maximum (150% payout)

|

|

|

ARR

(consolidated)

|

95% of Target

|

100% of 2024 Annual Target

|

108% of 2024

Annual Target

|

|

Booking

(consolidated)

|

95% of Target

|

100% of 2024 Annual Target

|

108% of 2024

Annual Target

|

|

EBITDA

(consolidated)

|

90% of Target

|

100% of 2024 Annual Target

|

108% of 2024

Annual Target

|

|

Board Discretion

|

|||

|

|

• |

For the 2022 Grants: 64,350 RSUs (which vest over a period of three years) and 128,700 PSOs (with an exercise price of $23.31 and which generally vest only if our

closing share price on Nasdaq exceeds 120% of the exercise price for at least 20 consecutive trading days at any time during the three-year period following the grant date). In light of the performance criteria for the 2022 Grants for the

PSUs and PSOs, our CEO did not vest in or otherwise earn any of the PSUs or PSOs under this grant.

|

|

|

• |

For the 2023 Grants: 75,949 RSUs (which vest over a period of three years) and 151,899 PSOs (with an exercise price of $19.75 and which generally vest only if our

closing share price on Nasdaq exceeds 120% of the exercise price for at least 20 consecutive trading days at any time during the three-year period following the grant date). In light of the performance criteria (including the measurement

period) for the 2023 Grants, none of the PSUs or PSOs have vested or otherwise been earned as of yet.

|

|

|

• |

For the 2024 Grants: 89,928 RSUs (which vest over a period of three years) and 179,856 PSOs (with an exercise price of $16.68 and which generally vest only if our

closing share price on Nasdaq exceeds 120% of the exercise price for at least 20 consecutive trading days at any time during the three-year period following the grant date). In light of the performance criteria (including the measurement

period) for the 2024 Grants, none of the PSUs have vested or otherwise been earned and two thirds of the PSOs have not vested and have not been otherwise earned as of yet.

|

|

|

• |

Annual Recurring Revenues (ARR): Achievement (including overachievement) of the ARR target set in the annual budget of the Company approved by the Board of Directors

for the applicable year (the "Annual Budget") will entitle our CEO to between 10% and 20% of the annual bonus;

|

|

|

• |

Cloud ARR: Achievement (including overachievement) of the ARR from cloud-based subscriptions (Cloud ARR) target set in the Annual Budget will entitle our CEO to

between 25% and 40% of the annual bonus;

|

|

|

• |

Bookings: Achievement (including overachievement) of the "bookings" target set in the Annual Budget (bookings is generally defined in our budget to mean funds that

are expected to be received from customers based on contracts or firm accepted orders for services and/or products recorded in our ERP system) will entitle our CEO to between 20% and 40% of the annual bonus;

|

|

|

• |

Adjusted EBITDA: Achievement (including overachievement) of the EBITDA target (adjusted to exclude share based compensation) set in the Annual Budget will entitle our

CEO to between 15% and 40% of the annual bonus; and

|

|

|

• |

Overall Performance: Achievement and performance of individual key performance indicators (KPIs) set by our Compensation Committee will entitle our CEO to up to 10% of

the annual bonus.

|

|

|

• |

Allocation and Number: The allocation and actual number of PSUs1, PSUs2 and PSOs to be granted on each Grant Date will be as follows:

|

|

|

o |

The PSUs1 will represent 55% of the Total Grant Value for each of the 2025, 2026 and 2027 Grants, with the actual number of PSUs1 granted each year to be determined based on a valuation methodology generally

used for such awards (e.g., Monte Carlo method) as of the applicable Grant Date;

|

|

|

o |

The PSUs2 will represent 30% of the Total Grant Value for each of the 2025, 2026 and 2027 Grants, with the actual number of PSUs2 granted each year to be determined based on the closing price of our ordinary shares on the Nasdaq on the

applicable Grant Date; provided however that (i) no grant shall be made in the applicable year if, as of the applicable Grant Date, the average of the Company’s closing share price on Nasdaq for the

30 consecutive trading days prior to the Grant Date is less than $15 (as adjusted for any share splits or similar events) and (ii) in no event shall the number of PSUs2 in any applicable Grant Date exceed 83,333 PSUs2 (as adjusted for any

share splits or similar events) (the “PSUs2 Cap Limitations”); and

|

|

|

o |

The PSOs will represent 15% of the Total Grant Value for each of the 2025, 2026 and 2027 Grants, with the actual number of PSOs granted each year to be determined based on the closing price of our ordinary

shares on the Nasdaq on the applicable Grant Date (using a Black-Scholes valuation method) as of the applicable Grant Date.

|

|

|

• |

PSOs – Exercise Price: The PSOs will have an exercise price equal to the closing price of our ordinary shares on the Nasdaq on the applicable Grant Date.

|

|

|

• |

Vesting (including Eligibility/Performance Criteria) – PSUs1:1

|

|

|

o |

General: The vesting of the PSUs1 will be dependent upon the performance of our relative total shareholder return (TSR), as measured by our Company’s share price, relative to the performance of the companies

in the Nasdaq CTA Cybersecurity Index (as such index may change from time to time), of which Radware is a member.

|

|

A10 Networks

|

Crowdstrike

|

Netscout

|

Science Applications

|

|

Akamai Technologies

|

Cyberark

|

Okta

|

Sentinelone

|

|

Blackberry

|

F5

|

ONESPAN

|

Tenable

|

|

Booz Allen Hamltn

|

Fortinet

|

Open Text

|

Thales

|

|

Broadcom

|

Gen Digital

|

Palo Alto

|

Trend Micro

|

|

Check Point Software

|

Infosys

|

Qualys

|

Varonis

|

|

Cisco Systems

|

Leidos

|

Rapid7

|

Zscaler

|

|

Cloudflare

|

NCC Group

|

RUBRIK

|

|

Radware TSR Percentile Rank

|

Payout

(% of Target)*

|

|

< 30th Percentile

|

0%

|

|

30th Percentile

|

50% (Threshold)

|

|

55th Percentile

|

100% (Target) **

|

|

75th Percentile

|

150% (Maximum)

|

|

> 75th Percentile

|

150%

|

|

* Subject to linear interpolation

|

|

|

** Payout will not exceed 100% of target if our Company’s absolute TSR performance is negative during the measured performance period, irrespective of our Company’s percentile ranking.

|

|

|

o |

“Double-trigger” Vesting: Vesting of PSUs1 would accelerate upon a Change of Control of the Company or similar Transaction (such terms to be defined in Mr. Zisapel’s grant agreement) that is followed by

termination of Mr. Zisapel’s employment within 12 months thereof, either (i) by the Company, other than for Cause (such term to be defined in Mr. Zisapel’s grant agreement and include, among other things, material and willful violation or

breach of the Employment Agreement), or (ii) by Mr. Zisapel, for Good Reason (such term to be defined in Mr. Zisapel’s grant agreement and include, among other things, material and willful violation or breach of the Employment Agreement),

except that (i) the actual pay-out level will be based on the extent to which our Company’s share price meets the various performance levels (threshold level through maximum level) relative to the companies in the Nasdaq CTA Cybersecurity

Index from the Grant Date of the relevant PSUs1 until the date of the Change of Control or similar Transaction, and (ii) for the sake of clarity, the acceleration, if any, shall be only with respect to the portion of PSUs1 that the

measurement period therefor has commenced prior to the Change of Control or similar Transaction. By way of example of the foregoing, if Mr. Zisapel is entitled to receive (subject to vesting and

pay-out) a grant (on-target) of 200,000 PSUs1 with respect to the 2025 Grants and 180,000 PSUs1 with respect to the 2026 Grants, a Change of Control (that is followed by termination without Cause) occurs on March 31, 2026, the TSR measured

from the Grant Date of the 2025 Grants through March 31, 2026 (instead of the three-year measurement period) is at the 55th percentile and the TSR measured from the Grant Date of the 2026 Grants through March 31, 2026 (instead of

the three-year measurement period) is at the 30th percentile, then all of the 200,000 PSUs1 made as part of the 2025 Grants will become fully earned and vested and half of the 180,000 PSUs1 made as part of the 2026 Grants will

become fully earned and vested (whereas all of the 2027 Grants will expire upon the Change of Control).

|

|

|

• |

Vesting – PSUs2:

|

|

|

o |

General: The PSUs2 will vest within three years following the applicable Grant Date, in three equal annual installments.

|

|

|

o |

“Double-trigger” Vesting: Vesting of PSUs2 would accelerate upon a Change of Control of the Company or similar Transaction that is followed by termination of Mr. Zisapel’s employment within 12 months thereof,

either (i) by the Company, other than for Cause, or (ii) by Mr. Zisapel, for Good Reason, but only with respect to the portion of unvested PSUs2 to be vested within 12 months following the year in which the Change of Control of the Company

or similar Transaction occurred, with the balance being forfeited. By way of example of the foregoing, if Mr. Zisapel receives a grant of 60,000 PSUs2 with respect to the 2025 Grants (which means the three-year vesting period thereof will

end on January 1, 2028), and a Change of Control (that is followed by termination without Cause) occurs on March 31, 2026, then 20,000 PSOs will be fully vested by January 1, 2026, and the 20,000 unvested PSUs2 that are scheduled to vest by

January 1, 2027 will be accelerated (but not the 20,000 PSUs2 that are scheduled to vest on January 1, 2028, which will be forfeited).

|

|

|

• |

Vesting (including Eligibility/Performance Criteria) – PSOs:

|

|

|

o |

General: The PSOs will vest over a three-year period following the applicable Grant Date in three equal annual installments. However, they would be earned only if the Company’s closing share price on Nasdaq

exceeds 120% of the price on the applicable Grant Date (i.e., 120% of the appliable exercise price) for at least 20 consecutive trading days at any time during the three-year period following the applicable Grant Date (the “Price

Milestone”).

|

|

|

o |

“Double-trigger” Vesting: Vesting of PSOs that were earned but remain unvested would accelerate upon a Change of Control of the Company or similar Transaction that is followed by termination of Mr. Zisapel’s

employment within 12 months thereof, either (i) by the Company, other than for Cause, or (ii) by Mr. Zisapel, for Good Reason, but only with respect to the portion of unvested PSOs to be vested within 12 months following the year in which

the Change of Control of the Company or similar Transaction occurred, with the balance being forfeited. By way of example of the foregoing, if Mr. Zisapel receives a grant of 75,000 PSOs with

respect to the 2025 Grants (which means the three-year vesting period thereof will end on January 1, 2028), the Price Milestone is achieved during 2025, and a Change of Control (that is followed by termination without Cause) occurs on March

31, 2026, then 25,000 PSOs will be fully vested by January 1, 2026, and the 25,000 unvested PSOs that are scheduled to vest by January 1, 2027 will be accelerated (but not the 25,000 PSOs that are scheduled to vest on January 1, 2028, which

will be forfeited).

|

|

|

• |

Exercise Period: 62 months following the applicable Grant Date.

|

|

|

• |

“Clawback” Conditions: The proposed equity-based compensation terms for Mr. Zisapel would be subject to a potential repayment obligation to our Company or cancellation

(as applicable), under certain circumstances, as described in our Compensation Policy and Compensation Recovery Policy.

|

|

|

• |

Hedging/Pledging Restrictions: Consistent with our Insider Trading Policy, and to ensure that the equity portion of Mr. Zisapel’s compensation package serves solely to

motivate him to create value for our shareholders, he will be prohibited from creating “short” positions or engaging in other hedging activity with respect to our ordinary shares. For a similar reason, Mr. Zisapel will generally be

prohibited from pledging the equity to be granted to him pursuant to this Proposal 1 as collateral for a loan that may be received by him.

|

|

|

• |

Discretion: While the Compensation Committee currently intends to follow the PSU design in subsequent years, it will re-assess and may adjust the reference index and

payout curve based on future circumstances (subject to any required corporate approvals under Israeli law).

|

|

|

• |

Other Terms: All other terms and conditions in connection with the above (i) equity-based grants shall be as set forth in the Company’s Key Employee Stock Option Plan

1997, as amended (or any other successor plan adopted by the Company prior to the applicable Grant Date) and the award agreements approved by our Compensation Committee and Board of Directors, and (ii) annual bonus shall be as set forth in

the bonus plan approved by our Compensation Committee and Board of Directors for other senior employees, including, in each case, entitlement in the case of cessation of service, disability and death.

|

|

|

✔ |

The Importance of Mr. Zisapel’s Services to the Company. This element is

demonstrated by Mr. Zisapel playing a key role in most aspects of our operations, starting from formulating our strategic vision, driving our on-going shift into our cloud-based and subscription offering model and leading our M&A

activities.

|

|

|

✔ |

Retention Risks. The market for CEO talent is competitive. Mr. Zisapel has

decades of leadership experience, as well as in depth knowledge of our business, our history and the security industry. Furthermore, as a global company, our executive pay programs are designed to compete in a global labor market.

|

|

|

✔ |

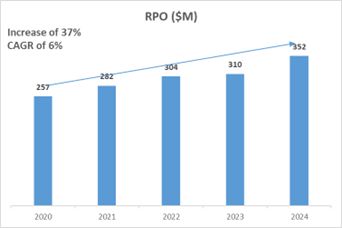

The Contribution of Mr. Zisapel to Our Business and Success. To illustrate Mr.

Zisapel's contribution to our success, the below charts indicate our Company’s growth in the past several years and the shareholder value created in that period:

|

|

|

|

|

|

|

|

|

|

|

|

✔ |

The Risks to Our Business if We Were to Lose the Services of Mr. Zisapel. For the reasons stated above, Mr. Zisapel is vital

to our business and our ability to deliver future shareholder value. Radware must be able to provide Mr. Zisapel with competitive compensation if we expect to maintain his continued service as our CEO.

|

|

|

✔ |

Feedback from Shareholders. Our Compensation Committee and Board of Directors

considered, among other things, that, at our annual meeting of shareholders held in October 2024, the shareholders did not approve the then proposed equity-based grants. Moreover, in response to the feedback from our shareholders, our

Compensation Committee and Board of Directors made several changes in the proposed equity-based compensation (compared to the one proposed in the annual meeting held last year), including the following:

|

|

|

o |

Eliminated the time-based RSUs component (such that the proposed equity-based grants are only PSUs and PSOs linked to performance);

|

|

|

o |

Imposed “safety valves” in case of decrease in our share price through the introduction of the PSU2s Cap Limitations, as described above; and

|

|

|

o |

Narrowed and clarified the “double-trigger” vesting acceleration with respect to PSUs and PSOs in connection with change of control transactions, from full acceleration of all unvested equity to vesting of

only the equity otherwise scheduled to vest within the 12 months following the year in which the Change of Control of the Company or similar Transaction occurred, as described above.

|

|

|

✔ |

The Effective Freeze on Mr. Zisapel's Compensation. Our Compensation Committee

and Board of Directors considered the fact that:

|

|

|

o |

Mr. Zisapel's salary has not been modified since July 2022; and

|

|

|

o |

Mr. Zisapel's annual bonus amount has not been modified since July 2022.

|

|

|

✔ |

The Compensation Levels of other Senior Managers in our Industry.

|

|

|

o |

In evaluating Mr. Zisapel's compensation, our Compensation Committee and Board of Directors reviewed, with the assistance of one of the Big Four global accounting firms’ Valuation and Business consulting

departments (Benchmarking Firm), benchmark information relating to the compensation of chief executive officers of other comparable companies.

|

|

|

o |

In particular, the Benchmarking Firm assisted the Compensation Committee in developing a peer group of high-tech companies traded in public markets and in market capitalization ranges that we may compete with

for executive talent and/or investor capital.

|

|

|

o |

As part of the peer group selection process, our Compensation Committee evaluated, with the assistance of the Benchmarking Firm, several criteria, including global companies from a variety of technology

industries:

|

|

ADEIA

|

IONQ

|

UPLAND SOFTWARE

|

|

AVEPOINT

|

ONESPAN

|

VARONIS SYSTEMS

|

|

BANDWIDTH

|

RACKSPACE TECHNOLOGY

|

VERITONE

|

|

C3.AI

|

RAPID7

|

WEAVE COMMUNICATIONS

|

|

COUCHBASE

|

RED VIOLET

|

YEXT

|

|

CS DISCO

|

SOLARWINDS CORP

|

ZOOMINFO TECHNOLOGIES

|

|

EXODUS MOVEMENT

|

TENABLE HOLDINGS

|

|

|

FASTLY

|

TERADATA CORP

|

|

|

|

✔ |

Performance-Based and Retention Incentives.

|

|

|

o |

The proposed CEO equity-based compensation, together with his other existing compensation terms, provides strong alignment between executive pay and shareholder interests and incorporates governance best

practices. The proposed equity-based grants together with the existing annual bonus program contain inherent incentives to reward for performance and the structure of the equity-based grants also includes important retention incentives. In

particular, if Proposal 1 is approved, the entire cash bonus and equity compensation received by Mr. Zisapel is not guaranteed and is rather tied to his continued employment as well as our share price (through the proposed equity-based

grants) and operating results (through the annual cash bonus), assuring a strong correlation between pay and performance:

|

|

|

• |

The milestones and criteria of the annual bonus are tied to thresholds and targets set in the Company’s annual budget and roadmap, which, based on past experience, are not easily achieved. For example, in 2022, 2023 and 2024, Mr. Zisapel received 64%, 0% and 77% of the maximum annual bonus for that year, respectively.

|

|

|

• |

Similarly, vesting of (i) the PSUs1 is tied to the performance of our TSR relative to the performance of the companies in the Nasdaq CTA Cybersecurity Index and (ii) PSUs2 and PSOs are tied to the performance

of our share price, which, based on past experience, is not easily achieved.

|

|

|

✔ |

Use of Shares & Dilution.

|

|

|

o |

General: While our Compensation Committee and Board of Directors manage our equity incentive plans to monitor, among other things, long-term shareholder dilution, burn rate and equity-based compensation

expense, we do so while maintaining our ability to attract, reward and retain key talent in a hypercompetitive market and do not target any specific dilution level. Instead, we examine a number of factors including equity grant levels, pay

mix between cash and equity, and total compensation as compared to global technology companies in which we compete for business and executive talent to ensure our practices are competitive and successful in attracting, retaining and

motivating the talent needed to successfully run our business and create shareholder value.

|

|

|

o |

Burn Rate & Dilution Levels: Below is a summary analysis of certain burn rate and dilution metrics considered by our Compensation Committee and Board of Directors:

|

|

|

|

Burn Rate

|

|

|

|

The following table sets forth information regarding award grants, the burn rate for each of the last three years, and the average burn rate over the last three years. The burn rate

has been calculated as the quotient of (i) the sum of all options and RSUs granted in such year, divided by (ii) the weighted average number of ordinary shares outstanding at the end of such year.

|

|

Year Ended December 31,

|

3-Year

Average

|

|||

|

2024

|

2023

|

2022

|

||

|

Options and RSUs granted*

|

1,627,986

|

1,593,790

|

1,667,983

|

|

|

Weighted average shares outstanding

|

41,982,851

|

42,871,770

|

44,943,168

|

|

|

Burn rate

|

3.9%

|

3.7%

|

3.7%

|

3.8%

|

|

|

|

* Options and RSUs granted, excluding PSUs that have not been granted or earned as of such dates.

|

|

|

|

Overhang

|

|

|

|

“Overhang” was analyzed to measure the potential dilutive effect of all outstanding equity awards and shares available for future grants.

|

|

As of December 31,

|

|||

|

2024

|

2023

|

2022

|

|

|

Issued Overhang*

|

10.1%

|

10.7%

|

9.5%

|

|

Total Overhang**

|

14.4%

|

13.5%

|

11.3%

|

|

|

|

* “Issued Overhang” was computed as (A) the total number of equity awards outstanding, excluding PSUs that have not been granted or earned as of such dates, divided by (B) total

ordinary shares outstanding plus the figure in clause A.

|

|

|

|

** “Total Overhang” was computed as (A) the total number of equity awards outstanding plus shares available to be granted under the Company’s equity-incentive plans, divided

by (B) total ordinary shares outstanding plus the figure in clause A.

|

|

|

✔ |

ISS Policy: Our Compensation Committee and Board of Directors considered the voting guidelines of U.S. proxy advisory firm Institutional Shareholder Services Inc. (“ISS”). In particular, according to ISS’

Israel Proxy Voting Guidelines, ISS (i) supports a general guideline for Israeli companies to maintain dilution level of below 10% and (ii) may support a proposal if the three-year average burn rate is equal to or below 1% and the total

potential dilution from outstanding and proposed plans does not exceed 15%.

|

|

|

o |

To that end, our Compensation Committee and Board of Directors believed that this ISS guideline is intended to apply broadly to all Israeli companies (regardless of their industry) and fails to recognize

company size, industry practices, and the need for companies like Radware to compete globally for executive talent.

|

|

|

o |

Moreover, our Compensation Committee and Board of Directors noted that, per the ISS’ U.S. Proxy Voting Guidelines (including FAQ regarding Equity Compensation Plans), which is applicable to some of the U.S.

domestic peers of Radware, the targeted three-year average burn rate benchmark for companies in GICS 4510 (Software & Services) was (i) 6.40% for Russel 3000 companies and (ii) 9.06% for Non-Russel 3000, significantly higher than the

average burn rate of Radware presented above. These U.S. domestic peers of Radware, with which we compete for key talent on a worldwide basis, have a competitive advantage over Radware in the marketplace for talent if Radware is limited to

the more restrictive equity compensation practices set forth in ISS’ Israel Proxy Voting Guidelines versus what is permissible under ISS’ U.S. Proxy Voting Guidelines.

|

|

|

✔ |

Our Compensation Policy. Our Compensation Committee and Board of Directors

considered our Compensation Policy and other elements of compensation payable to Mr. Zisapel, including other factors set forth in the Companies Law. In reaching their decision, our Compensation Committee and Board of Directors believed

that the proposed compensation package to our CEO, taken as a whole, creates the optimal balance between various elements, including the retention needs of our Company and introducing performance-based metrics designed to incentivize for

creating shareholder value in the long-term. In particular, the combination of the proposed grant of PSU and performance-based share options balances absolute and relative TSR performance, which aligns with our compensation philosophy and

is in direct response to feedback from some of our shareholders and their advisors.

|

|

|

✔ |

Disinterested Vote. Our Compensation Committee and Board of Directors

considered that the proposed compensation described above is the result of a careful deliberation process, was approved solely by disinterested directors and, as required by Israeli law, will be subject to approval by a special majority of

disinterested shareholders (see under “Required Vote” below).

|

|

Dated: April 24, 2025

|

By Order of the Board of Directors

/s/Roy Zisapel

ROY ZISAPEL

President and Chief Executive Officer

|

|

|

|

RADWARE LTD.

22 RAOUL WALLENBERG ST.

TEL AVIV 6971917, ISRAEL

ATTN: GADI MEROZ

|

VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode above

Use the Internet to transmit your voting instructions and for electronic delivery of information up until

11:59 p.m. Eastern Time on May 28, 2025. Follow the instructions to obtain your records and to create an electronic voting instruction form.

|

|

|

|

|

|

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy

statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive

or access proxy materials electronically in future years.

|

|

|

|

|

|

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on May 28, 2025. Have your proxy card in hand

when you call and then follow the instructions.

|

|

|

|

|

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge,

51 Mercedes Way, Edgewood, NY 11717.

|

|

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

|

||||

|

|

V70957-S12777

|

|

KEEP THIS PORTION FOR YOUR RECORDS

|

|

|

DETACH AND RETURN THIS PORTION ONLY

|

||||

|

RADWARE LTD.

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

The Board of Directors recommends you vote FOR proposal 1:

|

|

|

|

|

||

|

|

|

|

|

For

|

Against

|

Abstain

|

|

|

|

1. |

To approve grants of equity-based awards to, and modifications in the structure of the annual bonus of, the President and Chief Executive Officer of the Company.

See "Important Instruction (Personal Interest)” below.

|

☐

|

☐

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT INSTRUCTION (PERSONAL INTEREST): By executing this proxy card, you are deemed to

certify that you ARE NOT a controlling shareholder and DO NOT have a personal interest in Proposal 1. In particular, every Radware shareholder voting by means of this proxy card, or via a voting instruction form,

internet voting or telephone, will be deemed to confirm that he/she/it IS NOT a controlling shareholder and DOES NOT have a personal interest in Proposal 1. If, however, you are unable to make the aforesaid confirmations for any reason

(or have questions about whether you have a personal interest), please contact the Company's General Counsel at telephone number: +972-72-391-7045; fax number: +972-3-766-8982 or email gadime@radware.com. If you hold your shares in "street

name" and you are unable to make the aforesaid confirmations for any reason, you should notify the representative managing your account, and such representative should then contact the above person on your behalf to notify Radware as

described in the preceding sentence.

|

|

|

|

|

|

|

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full

title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer.

|

|

|

|

||||

|

|

|

||||||

| Signature [PLEASE SIGN WITHIN BOX] | Date |

|

Signature (Joint Owners) | Date | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V70958-S12777

|

|

RADWARE LTD.

Extraordinary General Meeting of Shareholders

May 29, 2025

This proxy is solicited by the Board of Directors

The shareholder(s) hereby appoint(s) Guy Avidan and Gadi Meroz, or either of them, as proxies, each with the power to appoint his/her

substitute, and hereby authorize(s) them to represent and to vote, as designated on the reverse side of this ballot, all of the ordinary shares of RADWARE LTD. that the shareholder(s) is/are entitled to vote at the Extraordinary General

Meeting of Shareholders to be held at 8:00 AM (Eastern Time) on May 29, 2025, at the offices of Radware Inc., 575 Corporate Drive, Mahwah NJ 07430, and any adjournment or postponement thereof (the "Meeting").

This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy

will be voted in accordance with the Board of Directors' recommendations. The proxies are authorized in their discretion to vote upon such other business as may properly come before the meeting or any adjournment thereof.

IMPORTANT NOTE: BY EXECUTING THIS PROXY CARD ON THE REVERSE SIDE, THE UNDERSIGNED SHAREHOLDER IS CONFIRMING THAT HE, SHE

OR IT IS NOT A CONTROLLING SHAREHOLDERS AND DOES NOT HAVE A PERSONAL INTEREST IN THE APPROVAL OF PROPOSAL 1.

Continued and to be signed on reverse side

|