| ☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Singapore (Jurisdiction of incorporation or organization) |

(Company Registration No. 201406588W)

4911 (Primary Standard Industrial Classification Code Number) 1 Temasek Avenue #37-02B Millenia Tower Singapore 039192 +65 6351 1780 |

Not Applicable (I.R.S. Employer Identification No.) |

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

||

|

Ordinary Shares, no par value

|

KEN

|

The New York Stock Exchange

|

|

Large accelerated filer ☐

|

Accelerated filer ☒

|

Non-accelerated filer ☐

|

Emerging growth company ☐

|

|

U.S. GAAP ☐

|

International Financial Reporting Standards as issued by the International

|

Other ☐

|

|

Accounting Standards Board ☒

|

| 1 | |||

| 1 | |||

| 1 | |||

| 1 | |||

| 1 | |||

| 1 | |||

| 1 | |||

| 1 | |||

| 1 | |||

| 1 | |||

| 1 | |||

| 1 | |||

| 34 | |||

| 34 | |||

| 34 | |||

| 104 | |||

| 104 | |||

| 104 | |||

| 104 | |||

| 121 | |||

| 125 | |||

| 140 | |||

| 140 | |||

| 143 | |||

| 143 | |||

| 143 | |||

| 143 | |||

| 146 | |||

| 146 | |||

| 146 | |||

| 149 | |||

| 150 | |||

| 150 | |||

| 151 | |||

|

|

151 | ||

| 151 | |||

| 151 | |||

| 151 | |||

| 151 | |||

| 151 | |||

| 151 | |||

| 151 | |||

| 152 | |||

| 152 | |||

| 152 | |||

| 152 | |||

| 152 | |||

| 152 | |||

| 164 | |||

| 171 | |||

| 171 | |||

| 171 | |||

| 171 | |||

| 171 | |||

| 171 | |||

| 171 | |||

| 171 | |||

| 172 | |||

| 172 | |||

| 172 | |||

| 172 | |||

| 172 | |||

| 172 | ||

| 172 | ||

| 172 | ||

| 173 | ||

| 173 | ||

| 173 | ||

| 173 | ||

| 174 | ||

| 174 | ||

| 175 | ||

| 175 | ||

| 175 | ||

| 175 | ||

| 176 | ||

| 176 | ||

| 176 | ||

| 176 | ||

| 177 |

|

|

• |

“Ansonia” means Ansonia Holdings

Singapore B.V., which owns approximately 62% of the outstanding shares of Kenon; |

|

|

• |

“Chery” means Chery Automobile Co. Ltd., a supplier to and shareholder of Qoros; |

|

|

• |

“CPV” means CPV Power Holdings LP, Competitive Power Ventures Inc. and CPV Renewable Energy Company Inc.), a business

engaged in the development, construction and management of power plants running conventional energy (powered by natural gas) and renewable

energy in the United States, which was acquired in January 2021 by CPV Group LP, an entity in which OPC holds an indirect interest of

approximately 70.5%. |

|

|

• |

“CPV Renewables” is CPV Renewable Power LLC, a limited liability company through which CPV’s renewable energy activity

is held and which is 66.7% owned by CPV Group; |

|

|

• |

“CPV Group” means CPV Group LP and its investees; |

|

|

• |

“IC Power” means IC Power Ltd., formerly IC Power Pte. Ltd, a Singaporean company and a wholly-owned subsidiary of Kenon;

|

|

|

• |

“Inkia” means Inkia Energy Limited,

a Bermuda corporation, which was a wholly-owned subsidiary of IC Power. In December 2017, Inkia sold all of its Latin American and Caribbean

businesses and has since been wound up; |

|

|

• |

“Inkia Business” means Inkia’s Latin American and Caribbean power generation and distribution businesses, which

were sold in December 2017; |

|

|

• |

“Majority Qoros Shareholder” means the China-based investor related to Shenzhen Baoneng Investment Group Co., Ltd. (“Baoneng

Group”) that holds 63% of Qoros; |

|

|

• |

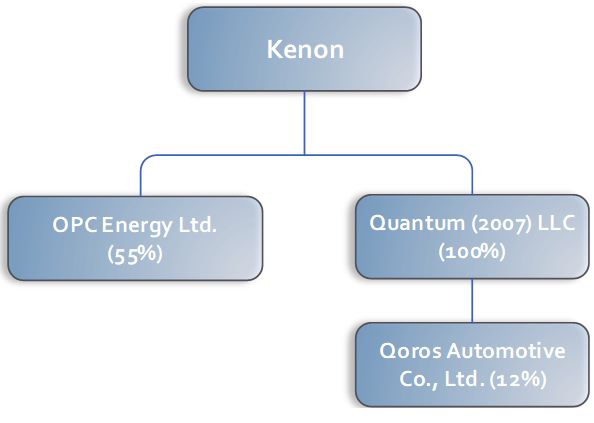

“OPC” means OPC Energy Ltd., an owner, developer and operator of power generation facilities in the Israeli and United

States power markets, in which Kenon has an approximately 55% interest; |

|

|

• |

“our businesses” shall refer to each of our subsidiaries and associated companies, collectively, as the context may require;

|

|

|

• |

Qoros Automotive Co., Ltd. (“Qoros”), a Chinese company, in which Kenon, through its 100%-owned subsidiary Quantum (as

defined below), has a 12% interest; |

|

|

• |

“Quantum” means Quantum (2007) LLC, a Delaware limited liability company, a wholly-owned subsidiary of Kenon, which is

the direct owner of our interest in Qoros; |

|

|

• |

“Spin-off” shall refer to (i) Israel Corporation Ltd.’s (“IC”) January 7, 2015 contribution to Kenon

of its interests in IC Power, Qoros, ZIM and other entities, and (ii) IC’s January 9, 2015 distribution of Kenon’s issued

and outstanding ordinary shares, via a dividend-in-kind, to IC’s shareholders; |

|

|

• |

“Tower” means Tower Semiconductor Ltd., an Israeli specialty foundry semiconductor manufacturer, listed on the NASDAQ

stock exchange and the Tel Aviv Stock Exchange (the “TASE”), in which Kenon used to hold an interest until June 30, 2015;

and |

|

|

• |

“ZIM” means ZIM Integrated Shipping Services, Ltd., an Israeli global container shipping company, in which Kenon had

and sold an approximately 21% interest in 2024, and as a result Kenon no longer holds any shares in ZIM. |

|

|

• |

“availability factor” refers to the number of hours that a generation facility is available to produce electricity divided

by the total number of hours in a year; |

|

|

• |

“BCM” means a billion cubic meters of natural gas, a unit of energy, specifically natural gas production and distribution;

|

|

|

• |

“Black Start” facility is one that can start its own power without support from the grid in the event of a major system

collapse or a system-wide blackout; |

|

|

• |

“carbon capture” technology refers to a set of chemical processes that are designed to capture CO2 from the exhaust gas

stream of a fossil fuel power generation or industrial process, often referred to as point source carbon capture technology; the primary

goal of this technology is to reduce the release of CO2 into the atmosphere; |

|

|

• |

“COD” means the commercial operation date of a development project; |

|

|

• |

“distribution” refers to the transfer of electricity from the transmission lines at grid supply points and its delivery

to consumers at lower voltages through a distribution system; |

|

|

• |

“EA” means Israeli Electricity Authority; |

|

|

• |

“EPC” means engineering, procurement and construction; |

|

|

• |

“Energean” means Energean Israel Ltd which holds 100% interest in Karish Reservoir. |

|

|

• |

“firm capacity” means the amount of energy available for production that, pursuant to applicable regulations, must be

guaranteed to be available at a given time for injection to a certain power grid; |

|

|

• |

“Gat Partnership” means Alon Energy Centers—Gat Limited Partnership, a limited partnership that holds interests

in the Gat Power Plant; |

|

|

• |

“GW” means gigawatt; |

|

|

• |

“GWh” means gigawatt per hour (one GWh is equal to 1,000 MWh); |

|

|

• |

“Hadera” is an Israeli corporation, in which OPC Israel has a 100% interest; |

|

|

• |

“Hadera Energy Center” means Hadera’s boilers and a steam turbine. The Hadera Energy Center currently serves as

back-up for the Hadera power plant’s supply for steam; |

|

|

• |

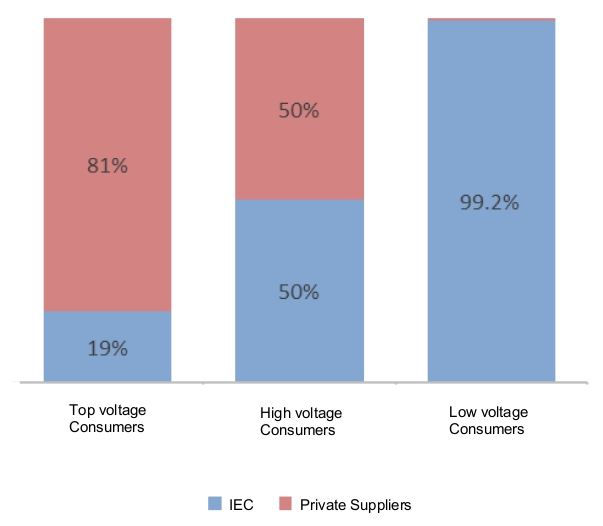

the “IEC” means Israel Electric Corporation; |

|

|

• |

“ILA” means The Israel Lands Authority; |

|

|

• |

“Infinya” means Infinya Ltd. (formerly Hadera Paper Ltd.), an Israeli corporation; |

|

|

• |

“INGL” means Israel National Gas Lines Ltd., a government company holding a license for the transmission of high-pressure

gas; |

|

|

• |

“installed capacity” means the intended full-load sustained output of energy that a generation unit is designed to produce

(also referred to as name-plate capacity); |

|

|

• |

“IPP” means independent power producer, excluding co-generators and generators for self-consumption; |

|

|

• |

“Kallpa” means Kallpa Generación SA, a company within the Inkia Business. Kallpa was owned by Inkia until December

2017; |

|

|

• |

“Karish Reservoir” refers to the Karish and Tanin natural gas fields situated in the Mediterranean Sea offshore Israel

and are owned and operated by Energean; |

|

|

• |

“Gat Power Plant” or “Gat” means a combined-cycle power plant powered by conventional energy with installed

capacity of 75 MW located in the Kiryat Gat area, which began commercial operation in November 2019; |

|

|

• |

“kWh” means kilowatt per hour; |

|

|

• |

“Minimum Price” means the minimum price of gas in USD set forth in gas purchase agreements between Tamar Group and each

of Hadera and Rotem based on a natural gas price formula described in the agreements that may be affected by generation component tariff;

|

|

|

• |

“MW” means megawatt (one MW is equal to 1,000 kilowatts or kW); |

|

|

• |

“MWdc” means megawatts, direct current; |

|

|

• |

“MWh” means megawatt per hour; |

|

|

• |

“Noga” or the "System Operator” means Noga – Independent System Operator Ltd, which acts as the System Operator

in Israel; |

|

|

• |

“capacity” or “installed capacity” means, with respect to each asset, 100% of the capacity of such asset,

regardless of OPC’s ownership interest in the entity that owns such asset; |

|

|

• |

“OPC Israel” or OPC Holdings Israel Ltd., is an Israeli corporation which owns and operates OPC’s businesses in

Israel, in which OPC holds an 80% interest; |

|

|

• |

“OPC Partnerships Activity Gat Ltd.” is a privately-held company, which indirectly holds an interest through existing

partnerships in the Gat Power Plant; |

|

|

• |

“OPC Power” means OPC Power Ventures LP; |

|

|

• |

“PPA” means power purchase agreement; |

|

|

• |

“Rotem” means O.P.C. Rotem Ltd., an Israeli corporation, in which OPC Israel has an 100% interest; |

|

|

• |

“Sorek 2” means OPC Sorek 2 Ltd.; |

|

|

• |

the “System Operator” has the meaning as defined in Section 1 of the Israeli Electricity Sector Regulations (Private

Conventional Electricity Producer), 2005 entrusted by the Israeli government to manage and operate Israeli electrical grid; currently

Noga acts as the System Operator; |

|

|

• |

“Tamar” means Tamar reservoir, a gas field located 90 km west of Haifa, Israel with estimated reserves of natural gas

of approximately 13.17 tcf or approximately 373 BCM; the gas field is owned and operated by the Tamar Group consisting of Isramco Negev

2 Limited Partnership, Chevron Mediterranean Ltd., Tamar Investment 1 RSC Limited, Tamar Investment 2 RSC Limited, Dor Gas Exploration

Limited Partnership, Everest Infrastructure Limited Partnership and Tamar Petroleum Ltd. (the “Tamar Group”); |

|

|

• |

“tcf” means trillion cubic feet, a volume measurement of natural gas; |

|

|

• |

“Title V” refers to a United States federal program designed to standardize air quality permits and the permitting process

for major sources of emissions across the country. which requires the Environmental Protection Agency (“EPA”) to establish

a national, operating permit program; |

|

|

• |

“transmission” refers to the bulk transfer of electricity from generating facilities to the distribution system at load

center station in which the electricity is stabilized by means of the transmission grid; |

|

|

• |

“Zomet” means Zomet Energy Ltd., an Israeli corporation in which OPC has a 100% interest; |

|

|

• |

“Veridis” means Veridis Power Plants Ltd which owns 20% of OPC Israel; OPC and Veridis are party to a shareholders’

agreement which governs the relationship between OPC and Veridis in OPC Israel; and |

|

|

• |

the “War” refers to a deadly attack by the Hamas terrorist organization on communities in the Gaza Strip in the southern

part of Israel on October 7, 2023 and the military actions that followed. |

|

|

• |

our goals and strategies; |

|

|

• |

the strategies, business plans and funding requirements of our businesses; |

|

|

• |

expected trends and projections in the industries and markets

in which our businesses operate; |

|

|

• |

our tax status and treatment and expected status and treatment under relevant regulations; |

|

|

• |

our share repurchase plan; |

|

|

• |

our treasury activities; |

|

|

• |

statements relating to litigation and arbitration; and |

|

|

• |

critical accounting estimates and the expected effect of new accounting standards on Kenon; |

|

|

• |

with respect to OPC: |

|

|

• |

OPC’s and CPV’s strategy; |

|

|

• |

the expected cost and timing of commencement and completion of construction and development projects and projects under development,

as well as the anticipated installed capacities and expected performance of such projects, including the required license and approvals

for the development of and financing for projects; |

|

|

• |

expected macroeconomic trends in Israel and the US, including the expected growth in energy demand; |

|

|

• |

potential new projects and existing projects; |

|

|

• |

gas supply agreements; |

|

|

• |

dividend policy; |

|

|

• |

expected trends in energy consumption; |

|

|

• |

regulatory developments; |

|

|

• |

anticipated capital expenditures, and the expected sources of funding for capital expenditures; |

|

|

• |

projections for growth and expected trends in the electricity market in Israel and the US; and |

|

|

• |

the impact of the War; |

|

|

• |

with respect to Qoros: |

|

|

• |

statements relating to the agreement to sell Kenon’s remaining interest in Qoros to the Majority Qoros Shareholder; and

|

|

|

• |

statements with respect to the litigation and arbitration relating to Qoros. |

| ITEM 1. |

Identity of Directors, Senior Management and Advisers |

| A. |

Directors and Senior Management |

| B. |

Advisers |

| C. |

Auditors |

| ITEM 2. |

Offer Statistics and Expected Timetable |

| A. |

Offer Statistics |

| B. |

Methods and Expected Timetable |

| ITEM 3. |

Key Information |

| A. |

Reserved |

| B. |

Capitalization and Indebtedness |

| C. |

Reasons for the Offer and Use of Proceeds |

| D. |

Risk Factors |

|

|

• |

minimum equity; |

|

|

• |

debt service coverage ratio; |

|

|

• |

limits on the incurrence of liens or the pledging of certain assets; |

|

|

• |

limits on the incurrence of debt; |

|

|

• |

limits on the ability to enter into transactions with affiliates, including us; |

|

|

• |

limits on the ability to pay dividends to shareholders, including us; |

|

|

• |

limits on the ability to sell assets; and |

|

|

• |

other non-financial covenants and limitations and various reporting obligations. |

|

|

• |

Transaction Risk—exists where sales or purchases are denominated in overseas currencies

and the exchange rate changes after our entry into a purchase or sale commitment but prior to the completion of the underlying transaction

itself; |

|

|

• |

Translation Risk—exists where the currency in which the results of a business are reported

differs from the underlying currency in which the business’ operations are transacted; |

|

|

• |

Economic Risk—exists where the manufacturing cost base of a business is denominated

in a currency different from the currency of the market into which the business’ products are sold; and |

|

|

• |

Reinvestment Risk—exists where our ability to reinvest earnings from operations in

one country to fund the capital needs of operations in other countries becomes limited. |

|

|

• |

economic volatility; |

|

|

• |

unfavorable changes in laws or regulations; |

|

|

• |

fluctuations in revenues, operating margins and/or other financial measures due to currency exchange rate fluctuations and restrictions

on currency and earnings repatriation; |

|

|

• |

unfavorable changes in regulated electricity tariffs; |

|

|

• |

import or export restrictions or other trade protection measures and/or licensing requirements; |

|

|

• |

costs and risks associated with managing a number of operations across a number of countries; |

|

|

• |

issues related to occupational safety, work hazard, and adherence to local labor laws and regulations; |

|

|

• |

adverse tax developments; |

|

|

• |

geopolitical events such as military actions; |

|

|

• |

changes in the general political, social and/or economic conditions in the countries where we operate; and |

|

|

• |

the presence of corruption in certain countries. |

| ITEM 4. |

Information on the Company |

| A. |

History and Development of the Company |

| B. |

Business Overview |

|

|

• |

Israel (through OPC Israel,

which is 80% owned by OPC, with the remaining 20% held by Veridis): through this segment, OPC is engaged in the generation and supply

of electricity and energy to private customers and to Noga (the System Operator in Israel) and the development, construction and operation

of power plants and energy generation facilities using natural gas and renewable energy in Israel. |

|

|

• |

U.S. Renewable Energies (through CPV Group, which is 70.5% owned by OPC): through

this segment, OPC (through CPV) is engaged in the initiation, development, construction and operation of power plants using renewable

energy in the United States (solar and wind) and supply of electricity from renewable sources to customers; and |

|

|

• |

Energy Transition in the U.S. (through CPV Group, which is 70.5% owned by OPC): through

this segment, OPC (through CPV Group) is engaged mainly in the operation of conventional energy power plants in the United States. All

active power plants in this segment are held by CPV Group through associates (which are not consolidated in OPC’s or our financial

statements). |

|

Power plant/ energy generation facilities |

Capacity(1) (MW) |

OPC Israel Ownership Interest |

Location |

Type of project / technology |

Year of commercial operation |

||||||||

|

Rotem |

466 |

100 |

% |

Mishor Rotem |

Natural gas, combined cycle |

2013 |

|||||||

|

Hadera(2)

|

144 |

100 |

% |

Hadera |

Natural–gas—cogeneration |

2020 |

|||||||

|

Zomet |

396 |

100 |

% |

Plugot Intersection |

Natural gas, open-cycle |

2023 |

|||||||

|

Gat |

75 |

100 |

% |

Kiryat Gat industrial park |

Natural gas, combined cycle |

2019 (acquired in 2023) |

|||||||

|

Energy generation facilities on the consumers’ premises |

29 |

100 |

% |

On consumers' premises across Israel |

Natural gas and renewable energy (solar) |

2024-2025 |

|||||||

| (1) |

As stipulated in the relevant generation license. |

| (2) |

Hadera owns the Hadera Energy Center (boilers and turbines located at the premises of Infinya), which serves as back-up for steam

generated by the Hadera power plant. |

|

As of December 31, 2024 |

As of December 31, 2023 |

|||||||||||||||||||||||

|

Entity |

Installed Capacity (MW) |

Net

energy generated (GWh)(1) |

Availability

factor (%)(2) |

Installed Capacity (MW) |

Net

energy generated (GWh)(1) |

Availability

factor (%)(2) |

||||||||||||||||||

|

Rotem |

466 |

3,332 |

95.1 |

% |

466 |

3,514 |

98.5 |

% | ||||||||||||||||

|

Hadera |

144 |

943 |

92.6 |

% |

144 |

939 |

90.7 |

% | ||||||||||||||||

|

Zomet(3)

|

396 |

428 |

83.6 |

% |

396 |

283 |

88.0 |

|||||||||||||||||

|

Gat |

87 |

397 |

64.4 |

% |

87 |

433 |

94.4 |

|||||||||||||||||

|

OPC Total

|

1,081 |

(4) |

5,100 |

1,081 |

4,085 |

|||||||||||||||||||

| (1) |

The net generation is the gross production capacity during the year, less energy consumed by the power plant for its own use.

|

| (2) |

The availability factor is the period during which the power plant was available for electricity generation, including scheduled

and non-scheduled maintenance work. |

| (3) |

The commercial operation date of Zomet was June 2023. Zomet is a peaker plant. |

| (4) |

Excludes energy generation facilities on the premises of customers. |

|

Power plants / energy generation facilities |

Capacity (MW) |

Status |

Location | |||

|

Sorek 2

|

Approximately 87 MW |

Under construction |

On the premises of the Sorek B seawater desalination facility

| |||

|

Energy generation facilities on the consumers’ premises

|

Aggregate capacity of approximately 79 MW, of which approximately

28 MW(1) are in various development and construction stages

|

Various stages of development/construction |

On consumers’ premises across Israel | |||

|

The Ramat Beka Solar Project |

Approximately 500 MW with an estimated storage capacity of up to approximately 2,760 MWh |

Advanced development |

Neot Hovav Local Industrial Council | |||

|

Solar and storage projects |

An estimated aggregate capacity of approximately 215 MW and approximately 1100 MWh |

Initial development |

Kibbutzim/Moshavim | |||

|

Intel |

450 MW- 650 MW |

Initial development |

Intel’s facilities in Kiryat Gat |

| (1) |

Each facility - with a capacity of up to 16 MW. Following the outbreak of the War, OPC served force majeure notices to consumers.

The War and its effects may have an adverse effect regarding the compliance with the expected commercial operation dates, and the projects’

expected costs. In addition, delays in the completion of the projects, which are not justified in accordance with the relevant agreements,

may impact the cost of the project and may cause an increase in costs and/or constitute failure to comply with undertakings to third parties

and lead to the instigation of proceedings and/or the demand of remedies. |

|

Plant |

Location |

CPV Ownership Interest |

Field/ technology |

Installed Capacity (MW) |

Year of commercial operation | |||||

|

Energy Transition Projects – Natural

Gas Fired | ||||||||||

|

CPV Fairview, LLC (“Fairview”) |

Pennsylvania |

25% |

Conventional gas-fired, combined cycle |

1,050 |

2019 | |||||

|

CPV Towantic, LLC (“Towantic”) |

Connecticut |

26% |

Conventional gas-fired (dual fuel / two fuels), combined cycle

|

805 |

2018 | |||||

|

CPV Maryland, LLC (“Maryland”) |

Maryland |

75%(1)

|

Conventional gas-fired, combined cycle |

745 |

2017 | |||||

|

CPV Shore Holdings, LLC (“Shore”) |

New Jersey |

68.8%(1)(2)

|

Conventional gas-fired, combined cycle |

725 |

2016 | |||||

|

CPV Valley Holdings, LLC (“Valley”) |

New York |

50% |

Conventional gas-fired, dual-fuel, combined cycle |

720 |

2018 | |||||

|

CPV Three Rivers LLC (“Three Rivers”) |

Illinois |

10% |

Natural gas, combined cycle |

1,258 |

2023 | |||||

|

Renewable Energy Projects

(held by CPV Renewables)(3) | ||||||||||

|

CPV Keenan II Renewable Energy Company, LLC (“Keenan II”)

|

Oklahoma |

66.7%(4)

|

Wind |

152 |

2010 | |||||

|

CPV Mountain Wind Holdings, LLC (“Mountain Wind”)

|

Maine |

66.7%(5)

|

Wind |

82 (in aggregate) |

Various between 2008 and 2017 | |||||

|

CPV Maple Hill Solar LLC (“Maple Hill”) |

Pennsylvania |

66.7%

(subject to the tax equity partner’s share) (6) |

Solar |

126 MWdc |

Second half of 2023 | |||||

|

CPV Stagecoach Solar, LLC (“Stagecoach”) |

Georgia |

66.7%

(subject to the tax equity partner’s share)(7) |

Solar |

102 MWdc |

First half of

2024 | |||||

| (1) |

In October 2024, CPV Group completed the acquisition of an additional 25% interest in Maryland and entered into agreements for the

acquisition of an additional 31% interest in Shore and additional 25% in Maryland were signed These acquisitions were completed in the

fourth quarter of 2024, as a result of which as of December 31, 2024, CPV Group held approximately 68.8% in Shore and approximately 75%

in Maryland. |

| (2) |

During the first quarter of 2025, CPV entered into a purchase agreement to acquire an additional 20% interest in Shore, and now holds

approximately 90% of Shore. |

| (3) |

On August 16, 2024, subsidiaries of CPV entered into agreements with Harrison Street, a U.S. private equity fund (the “Investor”)

in the field of infrastructure, pursuant to which the Investor would invest a total $300 million in CPV Renewables for 33.33% of the equity

interests in CPV Renewables, which holds 100% in CPV’s renewable projects under construction and in development. |

| (4) |

Represents CPV’s holding in the project after giving effect to the sale of 33.33% of the equity interests in CPV Renewables

to the Investor. |

| (5) |

Represents CPV’s holding in the project after giving effect to the sale of 33.33% of the equity interests in CPV Renewables

to the Investor. |

| (6) |

Represents CPV’s holding in the project after giving effect to the Investor’s investment in CPV Renewables. In addition,

in May 2023, the CPV Group entered into an agreement with a “tax equity partner” for an investment in the project. The tax

equity partner completed its $82 million investment on December 15, 2023. The agreement gives the tax equity partner the option to sell

its equity to CPV Group for a specified amount. |

| (7) |

Represents CPV’s holding in the project after giving effect to the sale of 33.33% of the equity interests in CPV Renewables

to the Investor. In addition, on May 13, 2024, the CPV Group entered into an agreement with a “tax equity partner” for an

investment in the project of approximately $52 million, which was completed after the project reached commercial operation in the second

quarter of 2024. According to the agreement and as of the project’s completion date, the tax equity partner funded an investment

of approximately $43 million, with approximately $9 million to be funded over the term of the agreement as a function of the project’s

production pursuant to the agreement. The agreement gives the CPV Group the option to acquire the tax equity partner's share in the project

within a certain period and in accordance with the agreement. |

|

2024 |

2023 |

|||||||||||||||||||||||

|

Net Electricity

generation (GWh)(1) |

Actual Generation(2)

(%) |

Actual Availability Percentage (%) |

Net Electricity

generation (GWh)(1) |

Actual Generation (%)(2)

|

Actual Availability Percentage (%) |

|||||||||||||||||||

|

Energy Transition Projects |

||||||||||||||||||||||||

|

Shore |

3,612 |

56.9 |

% |

92.4 |

% |

4,000 |

63.3 |

% |

83.4 |

% | ||||||||||||||

|

Maryland |

3,628 |

56.3 |

% |

90.3 |

% |

4,162 |

64.5 |

% |

93.0 |

% | ||||||||||||||

|

Valley |

5,002 |

82.1 |

% |

89.1 |

% |

4,392 |

72.3 |

% |

77.6 |

% | ||||||||||||||

|

Fairview |

7,610 |

82.1 |

% |

88.5 |

% |

7,213 |

81.1 |

% |

84.2 |

% | ||||||||||||||

|

Towantic |

5,593 |

77.7 |

% |

89.9 |

% |

5,551 |

77.5 |

% |

91.2 |

% | ||||||||||||||

|

Three Rivers |

6,366 |

59.9 |

% |

76.9 |

% |

2,814 |

64.0 |

74.8 |

||||||||||||||||

|

Renewable Energy Projects |

||||||||||||||||||||||||

|

Keenan II |

261 |

19.5 |

% |

95.8 |

% |

271 |

20.4 |

% |

93.6 |

% | ||||||||||||||

|

Mountain Wind |

197 |

27.5 |

% |

91.7 |

% |

140 |

22.0 |

79.6 |

||||||||||||||||

|

Maple Hill(3)

|

164 |

18.7 |

% |

93.4 |

% |

4.9 |

6.6 |

99.8 |

||||||||||||||||

|

Stagecoach(4)

|

136 |

25.7 |

% |

98.1 |

% |

— |

— |

— |

||||||||||||||||

| (1) |

The net electricity generation is the gross generation during the period less the electricity consumed for the self-use of the power

plants. |

| (2) |

The actual generation percentage is the electricity produced by the power plants relative to the maximum amount of generation capacity

during the period and is affected by ordinary course maintenance activities at the power plants, which are scheduled at fixed intervals.

Such maintenance activities typically last for approximately 30–50 days and reduce the power plants’ generation and availability

until such maintenance has been completed. The actual capacity percentage (availability percentage) for the Shore, Valley and Fairview

plants improved in 2024 compared with 2023 as these plants had outages in 2023. Maryland’s decrease in 2024 compared with 2023 was

mainly due to maintenance outages taken 2024. CPV Group’s projects may be under planned and unplanned maintenance (or experience

production limitations or technical failures) from time to time, including as occurred in 2024. In 2025, in addition to immaterial planned

tests, a major planned maintenance is expected at Towantic. |

| (3) |

The Maple Hill project commenced commercial operations in December 2023. |

| (4) |

The Stagecoach project commenced commercial operations in April 2024. The Stagecoach project entered into a PPA with a utility company

for the supply of all the electricity to be produced for a period of up to 30 years from the project’s commercial operation date,

at market prices, for the sale to a global company of 100% of the project’s Solar Renewable Energy Credits (“RECs”),

as well as a hedge covering the entire electricity price of the quantity that is produced and sold to the utility company, at a fixed

price, for a period of 20 years from the date of commercial operation of the project. |

|

Project |

Location |

Type of project/ technology |

Planned Capacity (MW) |

Year of construction start |

Projected date of commercial operation |

Expected

construction cost for 100% of the project | |||||||

|

CPV Backbone Solar, LLC (“Backbone”)(1)

|

Maryland |

Solar |

179 MWdc |

June 2023 |

Second half of 2025 |

Approximately $304 million | |||||||

|

CPV Rogue's Wind, LLC ("Rogue's Wind") |

Pennsylvania |

Wind Turbines |

114 MWdc |

August 2024(2)

|

First half of 2026 |

Approximately $365 million | |||||||

| (1) |

The Backbone project has signed a connection agreement and electricity supply agreement with the global e–commerce company

for a period of 10 years from the start of the commercial operation, for supply of 90% of the electricity expected to be generated by

the project in the period, and the sale of solar renewable energy certificates (“SREC”), for a period up to 2035. The balance

of the project’s capacity (10%) will be used for supply to customers, retail supply of electricity of the CPV Group or for sale

in the market. |

| (2) |

In August 2024, a work commencement order for the construction of Rogue’s Wind project was issued. On the same date, an engineering,

procurement and construction (EPC) agreement and equipment purchase agreement were signed and a project financing agreement was signed.

|

|

|

• |

operates within a hybrid model that utilizes natural gas and renewable energies in order to secure optimal and reliable supply of

electricity, while promoting a green and clean energy future. OPC promotes the energy transition (power generation that will transition

to low carbon emission energy production) through a set of energy generation solutions, both through efficient, continuous, reliable conventional

means (natural gas) and through renewable sources (solar, wind and storage); |

|

|

• |

is active throughout the value chain in the field of energy, from the initiation, construction and development stages of projects,

to the operational stage to the supply stage, while working to achieve optimal utilization; and |

|

|

• |

works to expand its activity and enhance its position by further promotion of projects in the field of energy in Israel and the United

States. OPC is working to continue initiating, developing and operating projects to generate electricity using a range of leading technologies

that support energy transition, and enhancing the inherent synergy of the energy generation and supply activities. |

|

Power plants / energy generation facilities

|

Status |

Capacity (MW) |

Location |

Technology |

Expected commercial operation date |

Main customer/ consumer |

||||||

|

Sorek 2 |

Under construction |

Approximately 87

|

On the premises of the Sorek B seawater desalination facility |

Natural gas—Cogeneration |

First half of 2025 |

Onsite consumers and the System Operator | ||||||

|

Energy generation facilities on consumers’ premises |

Various stages of development/construction |

Total agreements with an aggregate capacity of approximately 79 MW, of which approximately

28 MW are in various construction and development stages (of which 16 MW have completed the construction work and have not yet commenced

commercial operation) |

On the premises of consumers throughout Israel |

Natural gas, renewable energy (solar) and storage |

Gradually in accordance with the development stages of each project |

Onsite consumers and the System Operator |

|

Power plant/ energy

generation facilities |

Status |

Location |

Technology |

Additional details | ||||

|

The Ramat Beka Solar Project |

Advanced Development |

Neot Hovav Local Industrial Council |

Photovoltaic with integrated storage |

In May 2023 and June 2024, OPC power plants won two tenders of Israeli land authority for planning and

construction of facilities for generation of electricity using renewable energy using photovoltaic technology with storage, on a number

of adjacent sites. OPC estimates the proximity of the sites on which it won two of the tenders constitutes a significant unique advantage

for it would be expected to permit physical project consecutiveness, allow for savings on central (joint) costs, increase the certainty

with respect to the feasibility and characteristics of the projects and advance the conditions required for ultimate execution and connection

to the transmission network in the framework of an overall plan having a significant scope. Subject to advancement of appropriate development

processes, it will be possible to act in order to advance a consolidated project having about 500 megawatts per hour plus storage capacity

estimated at about 2,760 megawatts per hour, and an estimated cost of about NIS 4.0 – 4.2 billion, on a cumulative basis. For the

sites of the two tenders. Subject to completion of all the transactions, development processes, planning and licensing along with receipt

of the required approvals, the start of the construction stage is expected to be in 2026–2027. In September 2024, OPC’s subsidiary

completed a payment to the ILA of approximately NIS 178 million (approximately $48 million), which constitutes 20% of the total consideration

in respect of the two plots of land in the additional tender. To the best of OPC’s knowledge, government authorization was received

for advancement of the plan to the State National Infrastructures Board. | ||||

|

Solar and storage projects |

Initial development |

Kibbutzim/Moshavim |

Photovoltaic in combination with storage |

OPC entered into agreements with interest holders in land (rural settlements – moshavim and kibbutzim)

who hold interest in land of potential sites for combined storage solar projects. OPC entered into agreements for the construction of

solar facilities with estimated aggregate capacity of approximately 215 MW and approximately 1,100 MWh. | ||||

|

Intel |

Initial development |

Gat |

Conventional |

On March 3, 2024, OPC Power Plants signed a non-binding memorandum of understanding with Intel Electronics

(“Intel”), an OPC existing customer, pursuant to which OPC Israel will construct and operate a power plant, which will supply

electricity to Intel’s facilities, including expansion of the facilities currently being constructed, for a period of 20 years from

the operation date. |

|

|

• |

Developing and operating renewable energy projects by developing and constructing new

renewable projects focused in markets where renewable demand outstrips supply and optimizing the performance and returns of CPV’s

operating renewable platform. |

|

|

• |

Energy Transition and Low Carbon Projects for dispatchable electricity generation: for example,

by continued operation of the CPV Group’s efficient natural gas power plants to supply electricity and supporting the reliability

of the grid, reaching construction phase of Basin Ranch natural gas power plant and continuing to develop Low Carbon Projects to support

the expected increase in demand while maintaining grid reliability, and identifying opportunities to increase CPV Group's holdings in

certain power plants. |

|

|

• |

Vertical integration by growing retail electric sales to commercial and industrial customers

interested in reducing their carbon footprint by supplying from the CPV Group’s projects or the market, and developing and implementing

ESG goals consistent with the CPV Group’s business strategy to drive alignment between financial goals and company values.

|

|

Project |

Location |

Installed Capacity (MW) |

CPV ownership interest |

Year of commercial operation |

Type of project/ technology / client |

Regulated market | ||||||||

|

Fairview |

Pennsylvania |

1,050 |

25% |

2019 |

Gas-fired, combined cycle |

PJM MAAC | ||||||||

|

Towantic

|

Connecticut |

805 |

26% |

2018 |

Gas-fired (with dual fuel), Combined cycle |

ISO-NE CT | ||||||||

|

Maryland

|

Maryland |

745 |

75%(1)

|

2017 |

Gas-fired, Combined cycle |

PJM SW MAAC | ||||||||

|

Shore

|

New Jersey |

725 |

68.8%(1)(2)

|

2016 |

Gas-fired, Combined cycle |

PJM EMAAC | ||||||||

|

Valley

|

New York |

720 |

50% |

2018 |

Gas-fired, Combined cycle |

NYISO Zone G | ||||||||

|

Three Rivers

|

Illinois |

1,258 |

10% |

2023(3)

|

|

Natural gas, combined cycle |

PJM |

|

Keenan II

|

Oklahoma |

152 |

66.7%(5)

|

2010 |

Wind |

SPP (Long-term PPA) | ||||||||

|

Mountain Wind(6)

|

Maine |

82 |

66.7% |

Between 2008 and 2017 |

Wind (4 wind power plants) |

ISO-NE market | ||||||||

|

Maple Hill

|

Pennsylvania |

126 MWdc |

66.7%(7) (subject to tax equity partner’s share) |

Second half of 2023 |

Solar |

PJM MAAC + PA SRECs | ||||||||

|

Stagecoach

|

Georgia |

102 MWdc |

66.7%(8) (subject to tax equity partner’s share) |

First half of 2024 |

Solar |

SERC |

| (1) |

In October 2024, CPV Group completed the acquisition of an additional 25% interest in Maryland and entered into agreements for the

acquisition of an additional 31% interest in Shore and additional 25% in Maryland were signed These acquisitions were completed in the

fourth quarter of 2024, as a result of which, as of December 31, 2024, CPV Group held approximately 68.8% in Shore and approximately 75%

in Maryland. |

| (2) |

During the first quarter of 2025, CPV entered into a purchase agreement to acquire an additional 20% interest in Shore, and now holds

approximately 90% of Shore. |

| (3) |

Three Rivers power plant, which commenced commercial operation in July 2023, is entitled to receive capacity payments from June 2023.

|

| (4) |

On August 16, 2024, subsidiaries of CPV entered into agreements with Harrison Street, a U.S. private equity fund in the field of

infrastructure, pursuant to which the Investor would invest a total $300 million in CPV Renewables for 33.33% of the equity interests

in CPV Renewables, which holds 100% in CPV’s renewable projects under construction and in development. |

| (5) |

Represents CPV’s holding in the project after giving effect to the sale of 33.33% of the equity interests in CPV Renewables

to the Investor. |

| (6) |

Represents CPV’s holding in the project after giving effect to the sale of 33.33% of the equity interests in CPV Renewables

to the Investor. |

| (7) |

Represents CPV’s holding in the project after giving effect to the Investor’s investment in CPV Renewables. In addition,

in May 2023, the CPV Group entered into an agreement with a “tax equity partner” for an investment in the project. The tax

equity partner completed its $82 million investment on December 15, 2023. The agreement gives the tax equity partner the option to sell

its equity to CPV Group for a specified amount. |

| (8) |

Represents CPV’s holding in the project after giving effect to the sale of 33.33% of the equity interests in CPV Renewables

to the Investor. In addition, on May 13, 2024, the CPV Group entered into an agreement with a “tax equity partner” for an

investment in the project of approximately $52 million, which was completed after the project reached commercial operation in the second

quarter of 2024. According to the agreement and as of the project’s completion date, the tax equity partner funded an investment

of approximately $43 million, with approximately $9 million to be funded over the term of the agreement as a function of the project’s

production pursuant to the agreement. The agreement gives the CPV Group the option to acquire the tax equity partner's share in the project

within a certain period and in accordance with the agreement. |

|

Project |

Location |

Planned Capacity (MW) |

CPV Ownership Interest |

Year of

construction start |

Projected date of commercial operation |

Type of

project/ technology |

Tax Equity |

Expected construction cost for 100% of the project | ||||||||

|

CPV Backbone Solar, LLC (“Backbone”) |

Maryland |

179 MWdc |

66.7% (subject to the tax equity partner’s share) |

June 2023 |

Second half of 2025 |

Solar |

Approximately $116 million(1)

|

Approximately $315 million(2)

| ||||||||

|

CPV Rogue's Wind, LLC ("Rogue's

Wind") |

Pennsylvania |

114 MWdc |

66.7% |

|

August 2024(2) |

First half of 2026 |

Wind Turbines |

Approximately $163 million(4)

|

Approximately $365 million |

| (1) |

The project is located on a former coal mine and, therefore, it is expected to be entitled to higher tax benefits of 40% in accordance

with The Inflation Reduction Act of 2022 (the “IRA”). |

| (2) |

Excludes development fees but includes financing costs under the financing agreement. CPV Group intends to provide the project with

solar panels through its existing master agreement for the purchase of solar panels. The total cost of such project is expected to be

approximately $330 million, approximately 40% of which is expected to be financed by a tax equity partner such that the net investment

cost for CPV Group is estimated to be approximately $150 million. In addition, CPV Group is working to obtain a short term revolving financing

facility for part of the remainder of the project cost. Customary collateral with a value of approximately $17 million is expected to

be provided for purposes of the agreement covering connection to the network (grid) and the PPA as well as additional development expenses

in the project. Construction of the project commenced in June 2023 and commercial operation in PJM is expected to be reached in the third

quarter of 2025. |

| (3) |

In August 2024, a work commencement order for the construction of Rogue’s Wind project was issued. On the same date, an engineering,

procurement and construction (EPC) agreement and equipment purchase agreement were signed and a project financing agreement was signed.

|

| (4) |

The project is located on a former coal mine and, therefore, it is expected to be entitled to enlarged tax benefits of 40% in accordance

with the IRA. The CPV Group intends to sign an agreement with a tax equity partner in respect of about 40% of the cost of the project

and use of the tax credits that are available to the project (subject to the relevant regulatory guidelines). |

|

Advanced |

Preliminary |

|||||||||||

|

Renewable energy |

Development |

development |

Total |

|||||||||

|

PJM market |

||||||||||||

|

Solar |

40 |

1,330 |

1,370 |

|||||||||

|

Wind |

150 |

– |

150 |

|||||||||

|

Total PJM market (1) |

190 |

1,330 |

1,520 |

|||||||||

|

Other markets |

||||||||||||

|

Solar |

760 |

1,330 |

2,090 |

|||||||||

|

Wind |

300 |

900 |

1,200 |

|||||||||

|

Total other markets |

1,060 |

2,230 |

3,290 |

|||||||||

|

Total renewable energy |

1,250 |

3,560 |

4,810 |

|||||||||

|

Share of the CPV Group (66.67%) |

830 |

2,370 |

3,200 |

|||||||||

|

|

(1) |

Delays in the processes for connection to the network in the PJM market: The increasing demand for renewable energies in the PJM,

MISO and SPP electricity markets have led to an increase in the requests for connection to the network and requests for connection studies

of projects to the network. These requests place a strain on the system and could slow down the connection approval process, and could

impact the projects’ rate of advancement. In January 2023, a reform was implemented in the PJM market to manage the process of requesting

network connections, designed to address the backlog of connection requests handled by the PJM. As part of the new protocol, PJM will

prepare a three-stage connection study process that applies to parties requesting connection in the relevant framework with respect to

times. In 2024, particularly in December, interim results were published with respect to certain connection studies (Transition Cycle#1).

The CPV Group believes that the process of the network connection agreements caused a delay in the development of certain projects in

the PJM market, considering factors such as the costs required for network upgrades and their position in the connection process.

|

|

Natural gas projects |

Advanced |

Preliminary |

||||||||||

|

with carbon capture potential* |

development |

development |

Total |

|||||||||

|

Development projects |

1,350 |

(1) |

5,000 |

(2) |

6,350 |

|||||||

|

Share of the CPV Group

|

950 |

3,940 |

4,890 |

|||||||||

|

|

(1) |

In the third quarter of 2024, the Basin Ranch project (a natural gas project with an estimated capacity of approximately 1.35 GW

located in the state of Texas with future carbon capture potential, which is held at the rate of 70% by the CPV Group and 30% by a partner

(“Basin Ranch”)), which was chosen by TEF (Texas Energy Fund) to advance to the due diligence stage for receipt of a subsidized

loan in the amount of approximately $1 billion having a term of about 20 years bearing fixed interest of 3% – subject to the condition

that construction begins before 2025. The CPV Group estimates the total construction cost of the power plant project (100%) to be in the

range of approximately $1.8 – $2 billion, and, subject to completion of the relevant development processes, particularly receipt

of permits (including environmental), completion of the material undertakings and signing of the loan agreement, decision to start construction

of the project is expected in 2025. The CPV Group is in the process of capital raising required for construction of the project. There

is no certainty as to the structure, manner or amount of such fundraising (if it is agreed and completed), which has not yet been finally

determined. |

|

|

(2) |

In February 2025, the Federal Energy Regulatory Commission (the “FERC”) approved the PJM’s “Reliability Resource

Initiative” (RRI), the purpose of which is to handle the expected deficiency in available capacity by accelerating connection of

up to 50 projects for generation of electricity that meet certain criteria. Qualifying projects will be advanced to the next connection

round, Transition Cycle#2, which permits projects to potentially connect up to approximately 14 months earlier. PJM noted that selection

of the project as part of the RRI will be made by means of a weighted average point method that will focus on the size of the project,

the availability and the date of the commercial operation applications, and selection of the projects is expected to end in the second

quarter of 2025. Projects that are selected for RRI will be required to comply with fixed timetables for construction and participation

in PJM’s availability tenders for a minimum commitment period of ten years from the commercial operation date. The CPV Group has

indicated that it intends to submit a request for the Oregon project (which is currently in the initial development stage) to be part

of this accelerated connection process. |

|

Project |

State |

MW(1)

|

Development Stage |

|

Basin Ranch |

TX |

1,350 |

Advanced |

|

Shay |

WV |

2,100 |

Early |

|

Oregon |

OH |

1,450 |

Early |

|

Mason Road |

MI |

1,452 |

Early |

|

Total |

6,352 |

|

|

(1) |

MW is presented based on operation as a natural gas power plant assuming operation of the power plants without carbon capture component.

|

|

|

• |

Gas Supply: a base

contract for purchase and transmission of natural gas which provides for supply of natural gas at a quantity of up to 180,000

MMBtu per day at a price that is linked to market prices set forth in the agreement. Pursuant to the agreement, the gas supplier is responsible

for transport of natural gas to the designated supply point and is permitted to transport ethane in lieu of natural gas for up to 25%

of the agreed supply quantity. The agreement is valid up to May 31, 2025. |

|

|

• |

Maintenance: a maintenance agreement (MA) with

its original equipment manufacturer, for the provision of maintenance services for the combustion turbines. In consideration for the maintenance

services, Fairview pays a fixed and a variable amount as of the date stipulated in the agreement. The MA period is 25 years beginning

in 2016 or ends earlier when specific milestones are reached on the basis of usage and wear and tear. |

|

|

• |

Operation: an agreement for operation and maintenance

of the facility. The initial period of the agreement is three years from the completion date of construction of the facility and

includes an extension/renewal clause for a period of one year, unless one of the parties gives notice of termination of the agreement

in accordance with its provisions. The agreement is currently under the automatic annual one-year renewal option. |

|

|

• |

Hedging: a hedge agreement on electricity

margins of the Revenue Put Option (“RPO”). The RPO is intended to provide CPV a minimum margin for the term of the agreement.

Calculation of the amount for the minimum margin is determined for each contractual year, with the actual netting dates taking place every

three months in respect of the respective partial amount and an annual adjustment is made to calculate the total annual margin for the

year. The RPO has an annual exercise price that covers an exercise period of a fiscal year. To calculate the gross margin pursuant to

the agreement, specific parameters are taken into account, such as utilization, heat rate, the expected generation levels, forward prices

for electricity and gas, gas transmission costs and other specific project costs. The RPO expires on May 31, 2025. |

|

|

• |

Gas Supply & Transmission: |

|

|

• |

an agreement for the guaranteed gas transmission of 2,500 MMBtu per day, at the

AFT 1 Tariff. On June 1, 2024, the agreement was extended to March 31, 2027. The agreement renews automatically for periods of one year

each time, unless one of the parties terminates the agreement. |

|

|

• |

an agreement for the supply of gas, pursuant to which up to 125,000 MMBtu per day will

be supplied at a price linked to market prices. The agreement has an initial term, which commenced on April 1, 2023, and ends on March

31, 2025. On March 26, 2024, the parties agreed to extend the delivery period through March 31, 2027. |

|

|

• |

Maintenance: a services agreement with

its original equipment manufacturer, for the provision of maintenance services for the combustion turbines. In consideration for the maintenance

services, Towantic pays a fixed and a variable amount as of the date stipulated in the agreement. The agreement term is 20 years,

beginning in 2016 or ends earlier when specific milestones are reached on the basis of usage and wear and tear. |

|

|

• |

Operation: an agreement for operation and maintenance

of the facility, which commenced in May 2018. The consideration includes a fixed and variable amount, a performance-based bonus,

and reimbursement for employment expenses, including payroll costs and taxes, subcontractor costs and other costs. In July 2021, the agreement

was extended for the three years ending January 1, 2025 with one year renewal options. The agreement includes an extension/renewal clause

for a period of one year, unless one of the parties gives a termination notice in accordance with that provided in the agreement.

|

|

|

• |

Gas Supply: an agreement for the supply of

firm natural gas, pursuant to which up to 132,000 MMBtu per day will be supplied at a price linked to market prices. The term of

the agreement commenced on November 1, 2024 and is effective until October 31, 2025. |

|

|

• |

Gas Transmission: a natural gas transmission

agreement for guaranteed capacity of up to 132,000 MMBtu/d. The term of the agreement term is 20 years from May 31, 2016,

with an option for Maryland to extend it by an additional 5 years. |

|

|

• |

Maintenance: a services agreement with

its original equipment manufacturer for the provision of maintenance services for the combustion turbines. In consideration for the maintenance

services, Maryland pays a fixed and a variable amount as of the date stipulated in the agreement. The agreement period is 20 years beginning

in 2014 or ends earlier when specific milestones are reached on the basis of usage and wear and tear. |

|

|

• |

Operation: an agreement for operation and maintenance of

the facility. The consideration includes fixed annual management fees, a performance-based bonus, and reimbursement of employment expenses,

payroll costs and taxes, subcontractor costs and other costs. In March 2021, the agreement was extended to continue until July 23, 2028

and may be renewed for one-year periods, unless one of the parties gives a termination notice in accordance with agreement. |

|

|

• |

Engineering, Procurement and Construction Agreement. Maryland signed an Engineering,

Procurement and Construction Agreement dated October 31, 2022, for the construction of a Black Start facility in the event of grid power

outages around the Maryland’s site which commenced operation during 2024. The total contract cost is approximately $30 million to

be paid in accordance with a progress payment schedule incorporated into the agreement. Most of the consideration is financed through

a financing agreement entered into by Maryland. |

|

|

• |

Gas Supply: an agreement for supply of natural

gas. Pursuant to the agreement, the gas supplier supplies 120,000 MMBtu of gas per day at a price linked to the market price. The

agreement is effective through October 31, 2026. |

|

|

• |

Gas Transmission: two agreements with interstate

pipeline companies for the use of two different pipeline systems, one of which was operational since 2015 and the second of

which became operational in late 2021. Pursuant to the agreements, natural gas connection and transmission services are provided to Shore

by means of a pipeline the start of which is an existing interstate pipe and allows for gas to reach the facility’s connection point.

The period of the gas transmission agreements are 15 years (until April 2030) for one interconnection, with an option to extend the

agreement twice by ten years, and 20 years (until September 2041) for the other interconnection, with an option to extend annually.

|

|

|

• |

Maintenance: an amended services agreement with

its original equipment manufacturer for the provision of maintenance services for the turbines. In consideration for the maintenance services,

Shore pays a fixed and a variable amount as of the date stipulated in the agreement. The agreement period is 20 years beginning in 2014

or ends earlier when specific milestones are reached on the basis of usage and wear and tear. |

|

|

• |

Operation: an agreement for operation of the

facility. The consideration includes fixed annual management fees, a performance-based bonus and reimbursement of employment expenses,

including, payroll and taxes, subcontractor costs and other costs as provided in the agreement. The agreement is currently under

the automatic annual one year renewal option unless one of the parties gives a termination notice. |

|

|

• |

Gas Supply: an agreement for the supply of

natural gas of up to 127,200 MMBtu of natural gas per day at a price linked to the market price. Pursuant to the agreement,

the supplier is responsible for transmission of natural gas to the designated supply point and the agreement is effective through October

31, 2025. |

|

|

• |

Gas Transmission: an agreement with an interstate

pipeline company for the licensing, construction, operating and maintenance of a pipeline and measurement and regulating facilities,

from the interstate pipeline system for transmission of natural gas up to the facility. The supplier provides 127,200 MMBtu per day of

firm natural gas delivery at an agreed price during a period ending March 31, 2033, with an option to extend by up to three additional

five-year periods. Valley signed an additional agreement for provision of transmission services (firm) of 35,000 MMBtu per day, for a

period of 15 years ending on March 31, 2033, which can deliver gas from a different location into the firm transportation agreement

referenced above. |

|

|

• |

Maintenance: an agreement with its original

equipment manufacturer for maintenance services for the fire turbines. The consideration includes fixed and variable amounts.

The agreement period is the earlier of: (i) 132,800 equivalent base load hours; or (ii) 29 years from 2015. |

|

|

• |

Operation: an operation and maintenance agreement with

one of the partners in the project. The consideration includes fixed annual management fees, an operation bonus, and reimbursement of

certain costs set out in the agreement. The period of the agreement is five years from the completion date of construction of the facility,

and the agreement may be renewed for additional three-year periods unless one of the parties gives a termination notice in accordance

with the agreement. The agreement is currently under the automatic three year renewal option pursuant to which the agreement automatically

extends for three-year terms unless one of the parties elects otherwise. |

|

|

• |

Gas Supply: two agreements for the supply of

natural gas. The agreements supply 139,500 MMBtu in natural gas per day to the facility, from the operation date of the facility

for a period of five years, and a reduced quantity of 25,000 MMBtu per day from the fifth year of operation of the facility and up to

the tenth year. The price of natural gas delivered under these agreements is linked to the day-ahead electricity prices in the PJM market.

The agreements include an obligation to purchase such fixed volume of natural gas, with a right to resell surplus gas. |

|

|

• |

GSPA. Three Rivers entered into a Contract for Sale and Purchase of Natural Gas (the

“GSPA”) on December 15, 2022. The GSPA requires the supplier to provide gas supply of up to 200,000 MMBtu/day at a price indexed

to market. The agreement had an initial term until January 31, 2023. The agreement is automatically renewed month-to-month unless one

of the parties elects to terminate. |

|

|

• |

Gas Interconnection: two connection agreements

for transmission of gas: |

|

|

• |

One agreement is an interconnection agreement with an interstate pipeline company for transmission of natural gas. The agreement

sets forth the responsibility of the parties in connection with the design, construction, ownership, operation and management of a pipeline

as well as the connection and pressure equipment. Based on the agreement, Three Rivers bears the costs of all of the facilities.

|

|

|

• |

The second agreement is an additional interconnection agreement with an interstate pipeline company for transmission of natural gas.

As part of the agreement, the counterparty is responsible for the design and construction to connect to the existing pipeline. The counterparty

to the agreement remains the owner of these facilities and operates them, and Three Rivers bears the construction and development costs.

|

|

|

• |

Gas Transmission: an agreement for transmission

of gas with an interstate pipeline company and its Canadian affiliate, for firm transmission of natural gas from Alberta,

Canada to the facility. The agreements include capacity of 36.2 MMcf per day, at agreed prices. The term of the agreement is 11 years

from the signing date of the agreement on November 1, 2020; the counterparty may extend the agreement for an additional year by means

of prior notice of 12 months. |

|

|

• |

Maintenance: a services agreement with

its original equipment manufacturer for the provision of maintenance services for the combustion turbines. In consideration for the maintenance

services, Three Rivers pays a fixed and a variable payment. The agreement period is 25 years beginning in 2020 or ends earlier when

specific milestones are reached on the basis of usage and wear and tear. |

|

|

• |

Operation: an agreement for operation and maintenance

of the facility. The consideration includes fixed annual management fees, a performance-based bonus, and reimbursement of employment

expenses, payroll costs and taxes, subcontractor costs and other costs. The agreement period commenced during the construction period,

and will continue for approximately 3 years from the construction completion date of the facility, which occurred in June 2023.

|

|

|

• |

Equity Purchase Agreement: an agreement for

the purchase of 100% of the outstanding equity interests in Keenan. As a result of the acquisition in April 2021, CPV holds all of the

rights to Keenan. |

|

|

• |

PPA: a wind power energy agreement for

sale of renewable energy. Pursuant to the agreement, the purchaser is to receive all of the electricity generated by the wind farm, credits,

RECs, similar rights or other environmental allotments. The consideration includes a fixed payment. The period of the agreement is 20 years,

ending in 2030. The purchaser is permitted, with proper notice, to extend the agreement for another five-year period, and to acquire an

option to purchase the project at the end of the agreement period or renewal period at its fair market value, as defined in the agreement

and pursuant to the terms and conditions stipulated therein. |

|

|

• |

O&M Agreement: an agreement for the operation and maintenance of the wind farm

which commenced in February 2016. The consideration includes fixed annual management fees and the agreement lasts for 15 years from the

commencement date. |

|

|

• |

Operation: a master services agreement and

an operations agreement with its original equipment manufacturer for the operation, maintenance and repair of the wind turbines.

The consideration includes fixed annual fees, performance-based bonus (or liquidated damages) and reimbursement of expenses for additional

work. The agreement expires in February 2031. |

|

|

• |

Maintenance: a master services agreement for

the management and maintenance of the four wind facilities (Saddleback Ridge, Canton Mountain, Beaver Ridge, Spruce Mountain)

entered into by Mountain Wind. Staff is shared between the four projects. At all projects except for Beaver Ridge, the services agreement

applies only to work outside the scope of the turbine services which is performed by the original equipment manufacturers. At Beaver Ridge,

where there is no agreement with the original equipment manufacturer, the agreement also covers the direct maintenance of the wind turbines.

The agreement commenced on April 5, 2023 and has an initial two year term. |

|

|

• |

Services Agreements and Operation Agreements: a

master service agreement and an operation agreement with its original equipment

manufacturer for the operation, maintenance, and repair of the wind turbines is entered by each of Mountain Wind Project with the exception

of Beaver Ridge; maintenance at Beaver Ridge is performed under an agreement by a third-party provider. The agreements for Saddleback

Ridge and Canton Mountain were entered into in 2016 and both have 20 year terms with a sunset date of September 16, 2035. The agreement

for Spruce Mountain was entered into in December 2023 and has an 8-year term. The Beaver Ridge agreement was entered in April 2023 and

has a 2-year term. |

|

|

• |

Other contracts: The projects have entered into contracts to sell 100% of the electricity

and RECs, under separate contracts (PPAs) with local utility companies and councils, generally for a period of the next 15 to 20 years

from the acquisition of the projects by CPV, with most of the capacity sold under separate contracts for the next 12 years from the acquisition

of the projects by CPV (the periods of the contracts may change according to termination clauses in each agreement). |

|

|

• |

Tax Equity

Partner. In May 2023, CPV entered into an investment agreement with a tax equity partner for approximately $78 million in the Maple

Hill project. In consideration for its investment in the project corporation, the tax equity partner is expected to receive most of the

project’s tax benefits, including ITC at a higher rate of 40% (in accordance with the IRA), and participation in the distributable

free cash flow from the project (at single digit rates and on a gradual basis as set out in the investment agreement). In addition, the

tax equity partner is entitled to participate in the project’s loss for tax purposes; in the first few years, the tax equity partner’s

share in such taxable income or loss for tax purposes is high. At the end of 6 years from the COD, the tax equity partner’s share

in such taxable income decreases significantly, and CPV has the option to acquire the tax equity partner’s share in the project

corporation within a certain period and in accordance with terms of the agreement. The agreement includes a guarantee provided by CPV,

and an undertaking to indemnify the tax equity partner in connection with certain matters. Furthermore, the tax equity partner has certain

veto rights, among other things, in respect of the creation of liens on the Maple Hill project corporation’s assets or the entry

of the Maple Hill project corporation into additional material agreements. Some of the tax equity partner’s investment was made

available upon the completion of the construction work, and the remaining amount was made available on the commercial operation date.

In December 2023, the terms and conditions for the commercial operation of the project were met in accordance with the investment agreement

with the tax equity partner, and the tax equity partner completed its entire investment in the project in a total aggregate amount of

approximately $82 million. |

|

|

• |

Maintenance. An operating and maintenance agreement with

a third-party service provider for services related to the ongoing operation and maintenance of the Maple Hill solar power generation

facility. The agreement has an initial term of three years, commencing on the date that the service provider actually begins providing

services, which occurred in November 2023 and is automatically renewed for 2 one-year terms unless one of the parties provides notice

on non-renewal in accordance with the agreement. |

|

|

• |

SREC. An agreement with an international

energy company for the sale of 100% of the SRECs generated in the project through 2027 to an international energy company. CPV provided

collateral for its obligations under the agreement, which include delivery of SRECs generated by the project. |

|

|

• |

Virtual PPA. An agreement with

a third party for the sale of 48% of the total generated electricity, where the electricity price calculation is based on financial netting

between the parties for 10 years from the commercial date of operation. In accordance with the agreement, a net calculation will be made

of the difference between the variable price that Maple Hill receives from the system operator and which is published (the spot price)

and the fixed price set with a third party. CPV provided collateral for its obligations under the agreement, which include making certain

payments to the other party as part of the settlement of the virtual PPAs. The agreement includes an option to transition to a physical

PPA with a fixed price on fulfillment of certain terms and conditions, which have yet to be met. |

|

|

• |

Energy Sale Agreement (non-firm). In March 2022, Stagecoach entered into an agreement

to sell 100% of non-firm energy to a utility company. The utility company is to receive all of the energy and ancillary services produced

by Stagecoach. The agreement excludes tax attributes arising from the ownership of the solar project and any environmental attributes

generated by Stagecoach. The consideration is based on the hourly avoided energy rate for each hour of generation up to a maximum energy

output as defined in the agreement. The agreement is for a period of 30 years from the commercial operation date of Stagecoach. The agreement