UNITED STATES

| ☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024 |

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________________ to ____________________ |

| ☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

||

|

Common Shares, no par value

|

IMCC

|

Nasdaq Capital Market

|

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

|

Non-accelerated filer ☒

|

Emerging growth company ☒

|

|

U.S. GAAP ☐

|

International Financial Reporting Standards as issued By the International Accounting Standards Board ☒

|

Other ☐

|

If this is an annual report, indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| 5 | ||

| 7 | ||

| 12 | ||

|

12 | ||

|

12 | ||

|

12 | ||

|

A. |

Reserved. |

12 |

|

B. |

Capitalization and Indebtedness |

12 |

|

C. |

Reasons for the Offer and Use of Proceeds

|

13 |

|

D. |

Risk Factors |

13 |

|

41 | ||

|

A. |

History and Development of the Company

|

41 |

|

B. |

Business Overview |

47 |

|

C. |

Organizational Structure |

65 |

|

D. |

Property, Plants and Equipment |

65 |

|

66 | ||

| 66 | ||

|

A. |

Operating Results |

66 |

|

B. |

Liquidity and capital resources

|

66 |

|

C. |

Research and development, patents and

licenses, etc |

66 |

|

D. |

Trend Information |

67 |

|

E. |

Critical Accounting Estimates |

67 |

|

80 | ||

|

A. |

Directors and Senior Management |

80 |

|

B. |

Compensation |

83 |

|

C. |

Board Practices |

95 |

|

D. |

Employees |

102 |

|

E. |

Share Ownership |

103 |

|

F. |

Disclosure of a registrant’s action

to recover erroneously awarded compensation |

103 |

|

103 | ||

|

A. |

Major Shareholders |

103 |

|

B. |

Related Party Transactions |

105 |

|

C. |

Interests of Experts and Counsel

|

107 |

|

107 | ||

|

A. |

Consolidated Statements and Other Financial

Information |

107 |

|

B. |

Significant Changes |

113 |

|

114 | ||

|

A. |

Offer and Listing Details |

114 |

|

B. |

Plan of Distribution |

114 |

|

C. |

Markets |

114 |

|

D. |

Selling Shareholders |

114 |

|

E. |

Dilution |

114 |

|

F. |

Expenses of the Issue |

114 |

|

114 | ||

|

A. |

Share Capital |

114 |

|

B. |

Memorandum and Articles of Association

|

114 |

|

C. |

Material Contracts |

119 |

|

D. |

Exchange Controls |

119 |

|

E. |

Taxation |

120 |

|

F. |

Dividends and Paying Agents |

127 |

|

G. |

Statement by Experts |

127 |

|

H. |

Documents on Display |

127 |

|

I. |

Subsidiary Information |

128 |

|

J. |

Annual Report to Security Holders

|

128 |

|

128 | ||

|

128 | ||

|

128 | ||

|

128 | ||

|

129 | ||

|

A. |

Disclosure Controls and Procedures

|

129 |

|

B. |

Management’s Annual Report on Internal

Control Over Financial Reporting |

129 |

|

C. |

Attestation Report of Registered Public

Accounting Firm |

129 |

|

D. |

Changes in Internal Controls Over Financial

Reporting |

129 |

|

130 | ||

|

130 | ||

|

130 | ||

|

131 | ||

|

131 | ||

|

132 | ||

|

132 | ||

|

133 | ||

|

133 | ||

|

133 | ||

|

133 | ||

|

Risk Management and Strategy |

133 | |

|

Governance |

134 | |

|

135 | ||

|

135 | ||

|

136 |

|

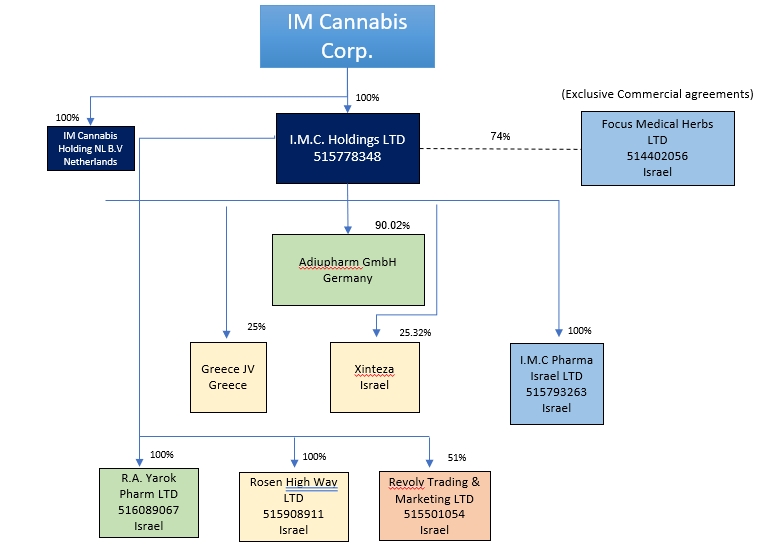

|

|

Legal

Entity |

Jurisdiction

|

Relationship

with the Company |

|

I.M.C.

Holdings Ltd. (“IMC Holdings”) |

Israel

|

Wholly-owned

subsidiary |

|

I.M.C.

Pharma Ltd. (“IMC Pharma”) |

Israel

|

Wholly-owned

subsidiary of IMC Holdings |

|

Focus

Medical Herbs Ltd.(1) (“Focus”)

|

Israel

|

Private

company over which IMC Holdings exercises “de facto control” under IFRS 10 |

|

R.A.

Yarok Pharm Ltd. (“Pharm Yarok”) |

Israel

|

Wholly-owned

subsidiary of IMC Holdings |

|

Rosen

High Way Ltd. (“Rosen High Way”) |

Israel

|

Wholly-owned

subsidiary of IMC Holdings |

|

Revoly Trading and Marketing Ltd. d/b/a Vironna Pharm (“Vironna”)

|

Israel

|

Subsidiary

of IMC Holdings |

|

Adjupharm GmbH (“Adjupharm”)

|

Germany |

Subsidiary of IMC

Holdings |

|

Xinteza API Ltd (“Xinteza”)

|

Israel |

Subsidiary of IMC

Holdings |

|

Shiran Societe Anonyme

(“Greece”) |

Greece |

Subsidiary of IMC

Holdings |

|

IM Cannabis Holding

NL B.V Netherlands (“IMC Holdings NL”) |

Netherlands |

Wholly-owned subsidiary

of IMC Holdings |

|

Oranim Plus Pharm Ltd. (“Oranim Plus”) 2)

|

Israel

|

Former

subsidiary of IMC Holdings |

|

Trichome Financial

Corp. (3) |

Canada |

Former wholly-owned

subsidiary |

|

I.M.C

Farms Israel Ltd. (“IMC Farms”).

(4) |

Israel

|

Wholly-owned

subsidiary of IMC Holdings |

|

IMCC

Medical Herbs Ltd. (“IMCC Medical Herbs”)(5)

|

Israel

|

Wholly-owned

subsidiary of IMC Holdings |

|

High Way Shinua Ltd.

(“High Way Shinua”)(6)

|

Israel |

Subsidiary of IMC

Holdings |

|

|

(1) |

Effective February 26, 2024, IMC Holdings exercised its option to acquire a 74% ownership stake in Focus. |

|

|

(2) |

Effective April 16, 2024, IMC Holdings no longer holds shares in Oranim Plus. For more information, please see “Item

4B. History and Development of the Company Important Events in the Development of the Business in Fiscal 2024 to the date of this Annual

Report”. |

|

|

(3) |

Discontinued operations. Please see note 25 in the 2024 Annual Financial Statements |

|

|

(4) |

On January 8, 2025, the Israeli Companies Registrar approved the liquidation of IMC Farms, which will be

completed within 100 days from the date of approval. |

|

|

(5) |

On January 13, 2025, the Israeli Companies Registrar approved the liquidation status of IMCC Medical Herbs,

stating that the liquidation will be completed within 100 days from the date of approval. |

|

|

(6) |

On December 14, 2023, Israeli Companies Registrar approved the liquidation status of High Way Shinua, which

liquidation was completed on March 23, 2024. |

|

|

• |

the Company’s business objectives and milestones and the anticipated timing of execution; |

|

|

• |

the performance of the Company’s business, strategies and operations; |

|

|

• |

the Company’s intentions to expand the business, operations and potential activities of the Company; |

|

|

• |

the Company’s plans to expand its sales channels, distribution, delivery and storage capacity, and reach to medical cannabis

patients; |

|

|

• |

the competitive conditions of the cannabis industry and the growth of medical or adult-use recreational cannabis markets in the jurisdictions

in which the Company operates; |

|

|

• |

the competitive conditions of the industry, including the Company’s ability to maintain or grow its market share and maintain

its competitive advantages; |

|

|

• |

statements relating to the Company’s commitment to responsible growth and compliance with the strictest regulatory environments;

|

|

|

• |

the Company’s focus on providing premium cannabis products to medical patients in the jurisdictions in which the Company conducts

business and any other jurisdiction in which the Company may conduct business in the future; |

|

|

• |

the Company’s plans to amplify its commercial and brand power to become a global high-quality cannabis player; |

|

|

• |

the Company’s primary goal of sustainably increasing revenue in its core markets; |

|

|

• |

the demand and momentum in the Company’s Israeli and Germany operations; |

|

|

• |

how the Company intends to position its brands; |

|

|

• |

the efficiencies and synergies of the Company as a global organization with domestic expertise in Israel and Germany; |

|

|

• |

expectations that providing high-quality, reliable supply to the Company’s customers and patients will lead to recurring sales;

|

|

|

• |

expectations related to the Company’s introduction of new Stock Keeping Units (“SKUs”);

|

|

|

• |

anticipated cost savings from the reorganization of the Company and the completion thereof upon the timelines disclosed herein;

|

|

|

• |

geographic diversification and brand recognition and the growth of the Company’s brands in the jurisdictions that the Company

operates in or may expand to; |

|

|

• |

expectations related to the Company’s ability to address the ongoing needs and preferences of medical cannabis patients;

|

|

|

• |

the Company’s retail presence, distribution capabilities and data-driven insights; |

|

|

• |

the future impact of the Regulations Amendment (as defined herein) regarding the transition reform from licenses to prescriptions

for medical treatment of cannabis; |

|

|

• |

the Company’s continued partnerships with third party suppliers and partners and the benefits thereof; |

|

|

• |

the Company’s ability to achieve profitability in 2025; |

|

|

• |

the number of patients in Israel licensed by the Israeli Ministry of Health (“MOH”)

to consume medical cannabis; |

|

|

• |

expectations relating to the number of patients paying out-of-pocket for medical cannabis products in Germany; |

|

|

• |

the anticipated decriminalization or legalization of adult-use recreational cannabis in Israel and Germany; |

|

|

• |

expectations related to the demand and the ability of the Company to source premium and ultra-premium cannabis products exclusively

and competition in this product segment; |

|

|

• |

the anticipated impact of inflation and liquidity on the Company’s performance; |

|

|

• |

expectations with respect to the Company’s operating budget and the assumptions related thereto; |

|

|

• |

expectations relating to the Company as a going concern and its ability to conduct business under the ordinary course of operations;

|

|

|

• |

expectations related to the collection of the payment awarded in Test Kits Appeal, and the potential outcome of the Test Kits Appeal

(as defined herein); |

|

|

• |

the continued listing of the common shares in the capital of the Company (“Common Shares”)

on the Nasdaq Stock Market (“Nasdaq”) and Canadian Securities Exchange (“CSE”);

|

|

|

• |

cannabis licensing in the jurisdictions in which the Company operates; |

|

|

• |

the renewal and/or extension of the Company’s licenses; |

|

|

• |

the Company’s anticipated operating cash requirements and future financing needs; |

|

|

• |

the Company’s expectations regarding its revenue, expenses, profit margins and operations; |

|

|

• |

the expected increase in revenue and margins in its Israeli medical cannabis market activities arising from its acquisitions;

|

|

|

• |

future opportunities for the Company in Israel, particularly in the retail and distribution segments of the cannabis market;

|

|

|

• |

future expansion and growth opportunities for the Company in Germany and Europe and the timing of such; and |

|

|

• |

contractual obligations and commitments. |

|

|

• |

the Company has the ability to achieve its business objectives and milestones under the stated timelines; |

|

|

• |

the Company will succeed in carrying out its business, strategies and operations; |

|

|

• |

the Company will realize upon its intentions to expand the business, operations and potential activities of the Company; |

|

|

• |

the Company will expand its sales channels, distribution, delivery and storage capacity, and reach to medical cannabis patients;

|

|

|

• |

the competitive conditions of the cannabis industry and the growth of medical or adult-use recreational cannabis in the jurisdictions

in which the Company operates; |

|

|

• |

the competitive conditions of the industry will be favorable to the Company, and the Company has the ability to maintain or grow

its market share and maintain its competitive advantages; |

|

|

• |

the Company will commit to responsible growth and compliance with the strictest regulatory environments; |

|

|

• |

the Company will remain focused on providing premium cannabis products to medical patients in the jurisdictions in which the Company

conducts business and any other jurisdiction in which the Company may conduct business in the future; |

|

|

• |

the Company has the ability to amplify its commercial and brand power to become a global high-quality cannabis player; |

|

|

• |

the Company will maintain its primary goal of sustainably increasing revenue in its core markets; |

|

|

• |

the demand and momentum in the Company’s Israeli and Germany operations will be favorable to the Company; |

|

|

• |

the Company will carry out its plans to position its brands as stated; |

|

|

• |

the Company has the ability to realize upon the stated efficiencies and synergies the Company as a global organization with domestic

expertise in Israel and Germany; |

|

|

• |

providing a high-quality, reliable supply to the Company’s customers and patients will lead to recurring sales; |

|

|

• |

the Company will introduce new SKUs; |

|

|

• |

the Company will realize the anticipated cost savings from the reorganization; |

|

|

• |

the Company has the ability to achieve geographic diversification and brand recognition and the growth of the Company’s brands

in the jurisdictions that the Company operates in or may expand to; |

|

|

• |

the Company’s has the ability to address the ongoing needs and preferences of medical cannabis patients; |

|

|

• |

the Company has the ability to realize upon its retail presence, distribution capabilities and data-driven insights; |

|

|

• |

the future impact of the Regulations Amendment will be favorable to the Company; |

|

|

• |

the Company will maintain its partnerships with third parties, suppliers and partners; |

|

|

• |

the Company has the ability to achieve profitability in 2025; |

|

|

• |

the accuracy of number of patients in Israel licensed by the MOH to consume medical cannabis; |

|

|

• |

the accuracy of the number of patients paying out-of-pocket medical cannabis products in Germany; |

|

|

• |

the anticipated decriminalization or legalization of adult-use recreational cannabis in Israel and Germany will occur; |

|

|

• |

the Company has the ability to source premium and ultra-premium cannabis products exclusively and competition in this product segment;

|

|

|

• |

the anticipated impact of inflation and liquidity on the Company’s performance will be as forecasted; |

|

|

• |

the accuracy with respect to the Company’s operating budget and the assumptions related thereto; |

|

|

• |

the Company will remain as going concern; |

|

|

• |

a favorable outcome with respect to the collection of the awards in successful judgements, and the success of other ongoing claims

the Company is involved in; |

|

|

• |

the Company’s Common Shares will remain listed on the Nasdaq and CSE; |

|

|

• |

the Company’s ability to maintain cannabis licensing in the jurisdictions in which the Company operates; |

|

|

• |

the Company has the ability to obtain the renewal and/or extension of the Company’s licenses; |

|

|

• |

the Company has the ability to meet operating cash requirements and future financing needs; |

|

|

• |

the Company will meet or surpass its expectations regarding its revenue, expenses, profit margins and operations; |

|

|

• |

the Company will have the ability to collect the payment awarded in Test Kits Appeal; |

|

|

• |

the Company will increase its revenue and margins in its Israeli medical cannabis market activities arising from its acquisitions;

|

|

|

• |

the Company has the ability to capitalize on future opportunities for the Company in Israel, particularly in the retail and distribution

segments of the cannabis market; |

|

|

• |

the Company will carry out its future expansion and growth opportunities for the Company in Germany and Europe and the timing of

such; and |

|

|

• |

the Company will fulfill its contractual obligations and commitments. |

|

|

• |

the Company’s inability to achieve its business objectives and milestones under the stated timelines; |

|

|

• |

the Company inability to carry out its business, strategies and operations; |

|

|

• |

the Company’s inability to realize upon its intentions to expand the business, operations and potential activities of the Company;

|

|

|

• |

the Company will not expand its sales channels, distribution, delivery and storage capacity, and reach to medical cannabis patients;

|

|

|

• |

the competitive conditions of the cannabis industry and the growth of medical or adult-use recreational cannabis markets will be

unfavorable to the Company in the jurisdictions in which the Company operates; |

|

|

• |

the competitive conditions of the industry will be unfavorable to the Company, and the Company’s inability to maintain or grow

its market share and maintain its competitive advantages; |

|

|

• |

the Company will not commit to responsible growth and compliance with the strictest regulatory environments; |

|

|

• |

the Company’s inability to remain focused on providing premium cannabis products to medical patients in the jurisdictions in

which the Company conducts business and any other jurisdiction in which the Company may conduct business in the future; |

|

|

• |

the Company inability to amplify its commercial and brand power to become a global high-quality cannabis player; |

|

|

• |

the Company will not maintain its primary goal of sustainably increasing revenue in its core markets; |

|

|

• |

the demand and momentum in the Company’s Israeli and Germany operations will be unfavorable to the Company; |

|

|

• |

the Company will not carry out its plans to position its brands as stated; |

|

|

• |

the Company’s inability to realize upon the stated efficiencies and synergies of the Company as a global organization with

domestic expertise in Israel and Germany; |

|

|

• |

providing a high-quality, reliable supply to the Company’s customers and patients will not lead to recurring sales; |

|

|

• |

the Company will not introduce new SKUs; |

|

|

• |

the Company’s inability to realize upon the anticipated cost savings from the reorganization; |

|

|

• |

the Company’s inability to achieve geographic diversification and brand recognition and the growth of the Company’s brands

in the jurisdictions that the Company operates in or may expand to; |

|

|

• |

the Company’s inability to address the ongoing needs and preferences of medical cannabis patients; |

|

|

• |

the Company’s inability to realize upon its retail presence, distribution capabilities and data-driven insights; |

|

|

• |

the future impact of the Regulations Amendment will be unfavorable to the Company; |

|

|

• |

the Company will not maintain its partnerships with third party suppliers and partners; |

|

|

• |

the Company’s inability to achieve profitability in 2025; |

|

|

• |

the inaccuracy of number of patients in Israel licensed by the MOH to consume medical cannabis; |

|

|

• |

the inaccuracy of the number of patients paying out-of-pocket for medical cannabis products in Germany; |

|

|

• |

the anticipated decriminalization or legalization of adult-use recreational cannabis in Israel and Germany will not occur;

|

|

|

• |

the Company’s ability to source premium and ultra-premium cannabis products exclusively and competition in this product segment;

|

|

|

• |

the anticipated impact of inflation and liquidity on the Company’s performance will not be as forecasted; |

|

|

• |

the inaccuracy with respect to the Company’s operating budget and the assumptions related thereto; |

|

|

• |

the Company will not remain as going concern; |

|

|

• |

an unfavorable outcome of legal proceedings the Company is involved in; |

|

|

• |

an unfavorable outcome with respect to the collection of the award pursuant to the Test Kits Appeal and the Company being unsuccessful

in other ongoing claims the Company is involved in; |

|

|

• |

the Company’s Common Shares will not remain listed on the Nasdaq and CSE; |

|

|

• |

the Company’s inability to maintain cannabis licensing in the jurisdictions in which the Company operates; |

|

|

• |

the Company’s inability to obtain the renewal and/or extension of the Company’s licenses; |

|

|

• |

the Company’s inability to meet operating cash requirements and future financing needs; |

|

|

• |

the Company will not meet or surpass its expectations regarding its revenue, expenses, profit margins and operations; |

|

|

• |

the Company will not increase its revenue and margins in its Israeli medical cannabis market activities arising from its acquisitions;

|

|

|

• |

the Company’s ability to capitalize on future opportunities for the Company in Israel, particularly in the retail and distribution

segments of the cannabis market; |

|

|

• |

the Company will not carry out its future expansion and growth opportunities for the Company in Germany and Europe and the timing

of such; and |

|

|

• |

the Company will not fulfill its contractual obligations and commitments. |

| 1) |

the Company receiving economic benefits from Focus (and the terms of the Commercial Agreements (as defined herein) cannot be changed

without the approval of the Company); |

| 2) |

the Company having the option to purchase the divested 74% interest in Focus held by Oren Shuster, the Chief Executive Officer, director

and a promoter of the Company, and Rafael Gabay, a former consultant director, a former consultant and a promoter of the Company;

|

| 3) |

Messrs. Shuster and Gabay each being a director of Focus (while Mr. Shuster concurrently being a director, officer and substantial

shareholder of the Company and Mr. Gabay concurrently being a substantial shareholder of the Company); and |

| 4) |

the Company providing management and support activities to Focus through the Services Agreement (as defined herein). |

|

|

● |

diversion of management time and focus from operating our business to addressing acquisition integration challenges; |

|

|

● |

coordination of research and development and sales and marketing functions; |

|

|

● |

retention of employees from the acquired company; |

|

|

● |

cultural challenges associated with integrating employees from the acquired company into our organization; |

|

|

● |

integration of the acquired company's accounting, management information, human resources, and other administrative systems;

|

|

|

● |

the need to implement or improve controls, procedures, and policies at a business that prior to the acquisition may have lacked effective

controls, procedures, and policies; |

|

|

● |

potential write-offs of intangible assets or other assets acquired in transactions that may have an adverse effect on our operating

results in a given period; |

|

|

● |

liability for activities of the acquired company before the acquisition, including patent and trademark infringement claims, violations

of laws, commercial disputes, tax liabilities, and other known and unknown liabilities; and |

|

|

● |

litigation or other claims in connection with the acquired company, including claims from terminated employees, consumers, former

stockholders, or other third parties. |

|

|

• |

$1,560 (NIS 4 million) will be extended as a loan with a six-month grace period, after which repayment

will be made in 31 monthly installments commencing September 10, 2025. The principal loan will not require a personal guarantee and will

bear an interest at a rate of prime plus+2.9% to be paid monthly, commencing April 20, 2025. |

|

|

• |

The remaining $390 (NIS 1 million) will be extended as a credit line from March 19, 2025, to March 12, 2026. |

|

|

• |

We began working with a new processing facility to improve gross margin and enhance business flexibility. |

|

|

• |

Reducing shipping and distribution costs through efficiency measures, service provider replacements, and outsourcing. |

|

|

• |

Streamlining operations by reducing headcount and closing the trading house to optimize costs. |

|

|

• |

Addressing higher costs and operational challenges due to flight disruptions caused by the Iron Swords War. |

|

|

• |

$1,560 (NIS 4 million) will be extended as a loan with a six-month grace period, after which repayment

will be made in 31 monthly installments commencing September 10, 2025. The principal loan will not require a personal guarantee and will

bear an interest at a rate of prime plus+2.9to be paid monthly, comencing April 20, 2025. |

|

|

• |

The remaining $390 (NIS 1 million) will be extended as a credit line from March 19, 2025, to March 12, 2026. |

|

|

- |

Shai Shemesh, resigned as Chief Financial Officer of the Company and Itay Vago, was appointed as Chief Financial Officer of the Company

to fill the vacancy created by Shai Shemesh’s resignation. |

|

|

- |

Rinat Efrima, resigned as Chief Executive Officer of IMC Holdings and Eyal Fisher was appointed as the General Manager of IMC Holdings

to fill the vacancy created by Ms. Efrima’s resignation. Mr. Fisher previously held the position of Sales Director of IMC Holdings

prior to his appointment as General Manager. |

|

|

- |

Yael Harrosh resigned as Chief Legal and Operations Officer of the Company and Michal Lebovitz was appointed on April 14, 2023 as

General Counsel of the Company to fill the vacancy created by Mr. Harrosh’s resignation. |

|

|

- |

The Craft Collection – IMC brand’s premium product line with indoor-grown, hand-dried

and hand-trimmed high-THC cannabis flowers. The Craft Collection includes exotic and unique cannabis strains such as Sup.S. |

|

|

- |

The Top-Shelf Collection – IMC’s premium product line, which offers indoor-grown,

high-THC cannabis flowers with strains such as Lemon Rocket, Diesel Drift, Tropicana Gold, Lucy Dreamz, Santa Cruz, Or’enoz, and

Banjo. Inspired by the 1970’s cannabis culture in America, the Top-Shelf Collection targets the growing segment of medical patients

who are cannabis culture enthusiasts. |

|

|

- |

The Signature Collection –IMC brand’s high-quality product line with greenhouse-grown

or indoor grown, high-THC cannabis flowers. The Signature Collection currently includes well known proprietary cannabis dried flowers

such as Chemchew, Rockabye, FLO OG, Roma T15, Roma T20, Karma lada, Sydney, MOTORBRTH and B.F LMO, all an indoor-grown flowers.

|

|

|

- |

The Full Spectrum Extracts – IMC brand’s full spectrum, strain-specific cannabis

extracts, includes high-THC Roma® T20 oil and OIL GLTO 33. |

|

|

- |

Roma® Product Portfolio – IMC’s Roma portfolio also includes oils. IMC’s

Roma® strain is a high-THC medical cannabis flower that offers a therapeutic continuum and is known for its strength and longevity

of effect. |

|

|

- |

WAGNERS™ – this brand launched in Israel in Q1 2022, with indoor-grown cannabis

imported from Canada. The WAGNERS™ brand was the first international premium, indoor-grown brand introduced to the Israel cannabis

market, at a competitive price point. The WAGNERS™ brand includes Cherry Jam, Rainforest Crunch, Tiki Rain, Pink Buba and Silverback#4.

|

|

|

- |

BLKMKT™ – this is the Company’s second Canadian brand. It is a super-premium

product line with indoor-grown, hand-dried and hand-trimmed high-THC cannabis flowers. The BLKMKT™ includes BLK MLK, YA HEMI, PURPLE

RAIN, JEALOUSY, Hemi GLTO, RAINBOW P, GUVA BOBA, Sunsets.rudel, Park fire OG and Upside down C. |

|

|

- |

LOT420 – this brand launched in Israel in

Q2 2023, with super-premium indoor-grown cannabis imported from Canada with high-THC. The

LOT420 brand includes GLTO 33, Apps and Bans and O.C. The Company ceased selling Atomic APP.

|

|

|

- |

The PICO collection (minis) - Under the BLKMKT™ and LOT420 brands, the Company launched

a new type of product (small flowers) in 2023, which is a super-premium indoor-grown cannabis imported from Canada with high-THC. The

PICO collection includes the following products: PICO PURPLE RAIN, PICO YA HEMI, PICO JEALOUSY, Pico upside Down, PICO RAIN BOW, Pico

California love, PICO BLK MLK and PICO Bacio Glto. |

|

|

- |

Flower – In Q2 2024, the Company launched a super-premium indoor-grown cannabis imported

from Canada with high-THC. The Flower brand includes cannabis strains California Love and Face Sherb. |

|

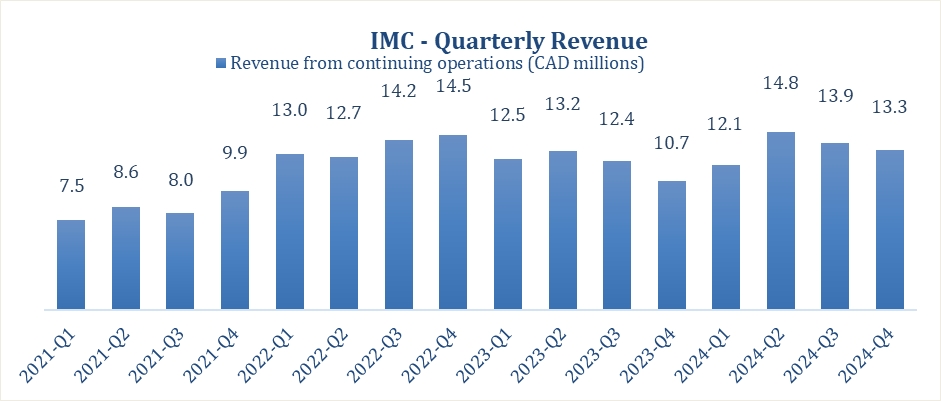

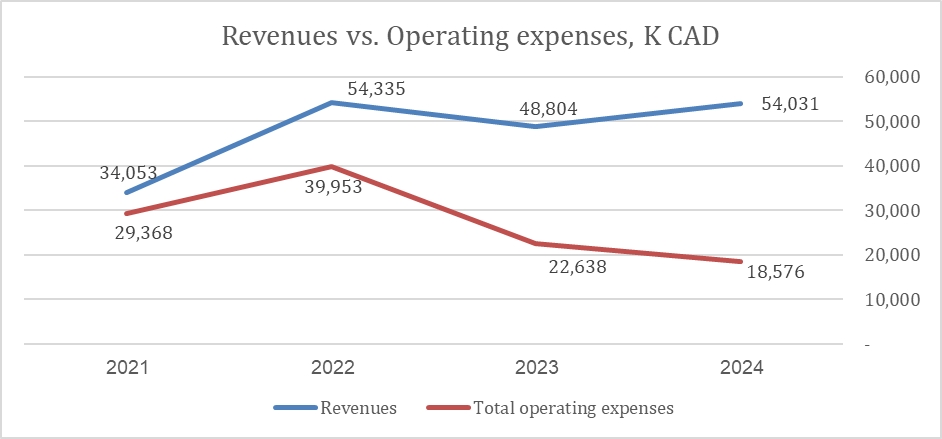

Revenues

from Continuing operations - By Product Type | ||||

|

Financial Year |

Medical Cannabis Products |

Adult-Use Recreational Cannabis Products |

Other Products |

Total |

|

2024 |

$51,355 |

- |

$2,696 |

$54,031 |

|

2023 |

$44,246 |

- |

$4,558 |

$48,804 |

|

2022 |

$48,384 |

- |

$5,951 |

$54,335 |

|

Revenues from Continuing operations - by geographic market

| |||

|

Financial Year |

Israel |

Germany |

Total |

|

2024 |

$38,523 |

$15,508 |

$54,031 |

|

2023 |

$43,316 |

$5,488 |

$48,804 |

|

2022 |

$50,500 |

$3,835 |

$54,335 |

|

|

1. |

Change in the prescription process: patients with a wide range of diseases and medical conditions from Oncology to Parkinsons will

no longer be required to obtain a license to receive medical cannabis. Patients will receive a prescription similar to those for other

prescription medications. Pain and PTSD are not included in the April 2024 Regulatory Reform yet. |

|

|

2. |

Medical cannabis will now be prescribed through the HMO's, Israel's public healthcare system: until the April 2024 Regulatory Reform,

cannabis could not be prescribed through the HMO's which cover the majority of the Israeli population. |

|

|

3. |

The number of prescribing physicians is expected to increase: as of today, HMO physicians, who are dully trained and certified within

their field of expertise, can prescribe medical cannabis as a first line treatment, as opposed to a last resort, based on medical discretion

for the approved indications. |

|

|

4. |

The cost for prescription is anticipated to be reduced: the Ministry of Health limited the cost for a medical cannabis prescription.

|

|

Level 1 |

- |

quoted prices (unadjusted) in active markets for identical assets or liabilities.

|

|

Level 2 |

- |

inputs other than quoted prices included within Level 1 that are observable directly

or indirectly. |

|

Level 3 |

- |

inputs that are not based on observable market data (valuation techniques that use

inputs that are not based on observable market data).

|

|

Name |

Position(s) with the

Company |

Other Directorships

|

Date of Initial Appointment

|

|

Oren Shuster(4)

|

CEO, Executive Chairman, and Director

|

IMC Holdings; Focus; Pharm Yarok; Rosen High Way; IMC Pharma; IMC Farms; Ewave Group Ltd (“Ewave”) and its subsidiaries |

October 11, 2019 |

|

Moti Marcus(2)(3)(4)

|

Director |

Nil |

September 12, 2022 |

|

Einat Zakariya(2)(3)(4)

|

Director |

Nil |

September 12, 2022 |

|

Brian Schinderle(2)(3)

|

Director |

Nil |

February 22, 2021 |

|

Shmulik Arbel |

Director |

Delta Capita Group, London, Canada Global

|

September 9, 2024 |

|

Uri Birenberg |

CFO |

Nil |

October 10, 2023 |

|

Eyal Fisher |

CEO of IMC Holdings and each of the Israeli

Subsidiaries |

Nil |

March 8, 2023 |

|

Michal Lebovitz Nissimov |

General Counsel |

Nil |

April 14, 2023 |

|

Richard Balla |

CEO of Adjupharm, a wholly owned subsidiary

of the Company |

Nil |

October 11, 2019 |

|

|

(1) |

Information furnished by the respective individual. |

|

|

(2) |

Member of the Audit Committee. |

|

|

(3) |

Member of Compensation Committee. |

|

|

(4) |

Member of the Governance and Nomination Committee. |

|

|

(1) |

Oren Shuster, CEO, Executive Chairman and a director of the Company. |

|

|

(2) |

Uri Birenberg, CFO of the Company. |

|

|

(3) |

Eyal Fisher, CEO of the IMC Holdings and each of the Israeli Subsidiaries; |

|

|

(4) |

Richard Balla, CEO of Adjupharm, a wholly owned subsidiary of the Company; and |

|

|

(5) |

Michal Lebovitz Nissimov, Company's General Counsel and secretary |

|

|

1. |

base salary; |

|

|

2. |

cash bonuses; and/or |

|

|

3. |

long-term incentives. |

| 1. |

Base Salary |

| 2. |

Cash Bonuses |

| 3. |

Long Term Incentives |

|

|

(a) |

the maximum number of RSUs available for grant to any one person under the RSU Plan and any other Securities Based Compensation Arrangements

of the Company in a 12-month period is 5% of the total number of Common Shares then outstanding on a non-diluted basis; and |

|

|

(b) |

the maximum number of Common Shares issuable to insiders of the Company (as a group) under the RSU Plan, together with any other

Common Shares issuable under any other Securities Based Compensation Arrangements, shall not exceed at any time or within any 12-month

period, 10% of the issued and outstanding Common Shares on a non-diluted basis at the time of grant. |

|

|

(a) |

increase the number of Common Shares which may be issued pursuant to the RSU Plan, other than by virtue of a change in Common Shares,

whether by reason of a stock dividend, consolidation, subdivision or reclassification which adjustment may be made by the Board or Compensation

Committee for the number of Common Shares available under the RSU Plan and the number of Common Shares subject to RSUs; |

|

|

(b) |

amend the definition of “Participant” under the RSU Plan which would have the potential of narrowing, broadening or increasing

insider participation; |

|

|

(c) |

amendments to cancel and reissue RSUs; |

|

|

(d) |

amendments to the list of amendments to the RSU Plan or RSUs requiring requisite regulatory and shareholder approval and those subject

to requisite regulatory approval (where required) but not subject to shareholder approval; |

|

|

(e) |

amendments that extend the term of an RSU; |

|

|

(f) |

amendments to the participation limits including: the maximum number of shares issuable under the RSU Plan, limitations on grants

of RSUs to any one person in a 12-month period, grants within a one-year period to insiders, and the number of shares issuable to a person

providing investor relations activities in any 12-month period; and |

|

|

(g) |

amendments to the RSU Plan that would permit RSUs, or any other right or interest of a RSU Participant under the RSU Plan, to be

assigned or transferred, other than for normal estate settlement purposes. |

|

|

(a) |

amendments of a housekeeping nature. |

|

|

(b) |

amendments to the vesting provisions of a RSU or the RSU Plan. |

|

|

(c) |

amendments to the definitions, other than such definitions noted above. |

|

|

(d) |

amendments to reflect changes to applicable securities laws; and |

|

|

(e) |

amendments to ensure that the RSUs granted under the RSU Plan will comply with any provisions respecting income tax and other laws

in force in any country or jurisdiction of which a RSU Participant to whom a RSU has been granted may from time to time be a resident,

citizen or otherwise subject to tax therein. |

|

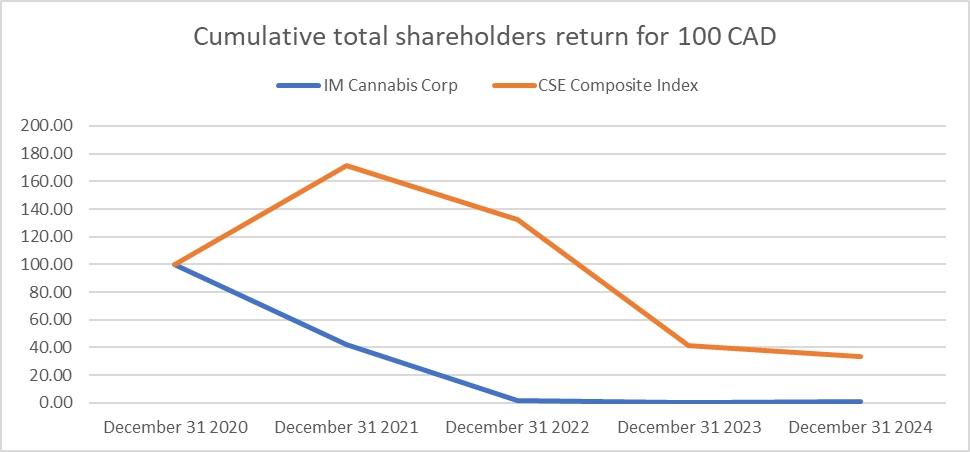

December 31, 2020

|

December 31, 2021

|

December 31, 2022

|

December 31, 2023

|

December 31, 2024

| |

|

IM Cannabis Corp.

|

$100.00 |

$42.03 |

$1.29 |

$0.46 |

$0.54 |

|

CSE Composite Index

|

$100.00 |

$171.57 |

$132.1 |

$41.3 |

$33.71 |

|

|

1. |

Einat Zakariya (Chair); |

|

|

2. |

Brian Schinderle; and |

|

|

3. |

Moti Marcus, |

| • |

Salary Benchmarking for Management Positions – Conducting a comparative analysis of

executive salary levels based on a tailored sample of companies. This includes the CEO and senior management positions, with a breakdown

of base salary, bonuses, and equity compensation. |

| • |

Compensation Analysis for International Operations – Assessing salary levels for executives

in Adjupharm, using MERCER and Accumulate market data. This includes benchmarking compensation components such as base salary, bonuses,

and equity grants. |

| • |

Equity Grant Policy Review – Evaluating the Company’s equity compensation strategy

for Board members and executives, including grant methods, frequency, and valuation. |

| • |

Equity Compensation Policy Development – Establishing an equity-based compensation framework,

including: |

|

|

o |

Defining a capital compensation strategy. |

|

|

o |

Structuring an allocation model for existing and new employees, from the CEO and Board members downward. |

|

|

o |

Setting guidelines for equity content and reallocation policies. |

|

|

o |

Developing a multi-year allocation plan; and |

|

|

o |

Supporting Compensation Committee approval processes. |

|

Name and Principal Position

|

Year |

Salary

($)(1)

|

Share-Based Awards

($) |

Option-Based Awards

($)(2)

|

Non-Equity Incentive

Plan Compensation

($) |

Pension Value

($) |

All Other

Compensation ($) |

Total

Compensation ($) | |

|

Annual Incentive Plans

|

Long-Term Incentive

Plans | ||||||||

|

Oren Shuster(3)

CEO,

Executive Chairman and Director |

2024 |

484,697 |

Nil |

45,591 |

Nil |

Nil |

Nil |

Nil |

530,288 |

|

2023 |

476,266 |

Nil |

331,802 |

Nil |

Nil |

Nil |

Nil |

818,068 | |

|

2022 |

506,244 |

Nil |

1,110,057 |

Nil |

Nil |

Nil |

Nil |

1,616,301 | |

|

Uri Birenberg(4)

CFO

|

2024 |

330,238 |

Nil |

Nil |

Nil |

Nil |

Nil |

26,064 |

356,302 |

|

2023 |

73,558 |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

73,558 | |

|

2022 |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil | |

|

Eyal Fisher(5)

CEO of the IMC Holdings

and each of the Israeli Subsidiaries |

2024 |

262,198

|

Nil |

628 |

Nil |

Nil |

Nil |

34,966 |

297,164 |

|

2023 |

216,998 |

Nil |

1,693

|

Nil |

Nil |

Nil |

Nil |

216,998 | |

|

2022 |

215,586 |

Nil |

4,381 |

Nil |

Nil |

Nil |

Nil |

217,279 | |

|

Richard Balla

CEO

of Adjupharm |

2024 |

193,608 |

Nil |

Nil |

88,908 |

Nil |

Nil |

31,035 |

313,551 |

|

2023 |

175,385 |

Nil |

Nil |

87,692 |

Nil |

Nil |

30,895 |

293,972 | |

|

2022 |

164,186 |

Nil |

37 |

Nil |

Nil |

Nil |

29,066 |

193,289 | |

|

Michal Lebovitz Nissimov

General Counsel and

secretary(6) |

2024 |

192,877 |

Nil |

828 |

Nil |

Nil |

Nil |

Nil |

193,705 |

|

2023 |

119,088 |

Nil |

1,099 |

Nil |

Nil |

Nil |

Nil |

120,187 | |

|

Marc Lustig,

former Executive Chairman(7)

|

2024 |

22,400 |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

22,400 |

|

2023 |

129,920 |

79,959 |

Nil |

Nil |

Nil |

Nil |

Nil |

209,879 | |

| (1) |

Each of Messrs. Shuster, Birenberg, Fisher, and Mrs. Lebovitz Nissimov received their compensation in NIS and Mr. Balla received

his compensation in Euros. All salaries were converted to CDN pursuant to the average Bank of Canada rate for the applicable fiscal year.

|

| (2) |

The Company used the Black-Scholes pricing model as the methodology to calculate the grant date fair value, and relied on the following

the key assumptions and estimates for each calculation under the following assumptions: (i) risk free interest rate of 0.42% to 4.21%

(ii) expected dividend yield of 0%; (iii) expected volatility of 76.28% to 82.31%; and (iv) a term of 2 to 10 years. The Black-Scholes

pricing model was used to estimate the fair value as it is the most accepted methodology. |

| (3) |

Oren Shuster, through Ewave, a company in which he controls, entered into a consulting agreement with the Company pursuant to which

he is paid NIS 108,350 plus VAT per month (approximately $40,390 plus tax per month) in consideration of his CEO services provided to

the Company. Mr. Shuster did not earn consideration for his role as Chairman and nor as a director of the Company during the fiscal years

ended December 31, 2024, 2023 and 2022. |

| (4) |

Mr. Birenberg was appointed as CFO of the Company effective October 10, 2023. |

| (5) |

Mr. Fisher was appointed as CEO of the IMC Holdings and each of the Israeli Subsidiaries effective March 15, 2023. |

| (6) |

Michal Lebovitz Nissimov was appointed as Company General Counsel and Secretary effective April 14, 2023. |

| (7) |

50,065300,393 Common Shares and 23,020 Warrants are held by Marc Lustig directly and 105,040 Common Shares and 495,74282,624 Warrants

are held indirectly through L5 Capital, a privately held entity of which Mr. Lustig owns and controls 100% of the outstanding voting rights.

Mr. Lustig resigned from his role as a director effective June 5, 2024. |

|

Option-based

Awards |

Share-based

Awards | ||||||

|

Name

|

Number

of securities underlying unexercised Options

(#)(1)

|

Option

exercise price

($)

|

Option

expiration date |

Value

of unexercised

in-the-money Options ($)(2)

|

Number

of shares or units of shares that have not vested

(#)

|

Market

or payout value of share-based awards that have not vested(4)

($)

|

Market or payout value

of vested share-based awards not paid out or distributed

($) |

|

Oren Shuster |

21,875 |

3.00 |

October 4, 2026 |

5,469 |

Nil |

Nil |

Nil |

|

Uri Birenberg |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

|

Eyal Fisher |

167 |

3.00 |

October 4, 2026 |

42 |

Nil |

Nil |

Nil |

|

Richard Balla |

1,500 |

16.00 |

July 30, 2029 |

Nil |

Nil |

Nil |

Nil |

|

Michal Lebovitz Nissimov |

500 |

3.00 |

October 4, 2026 |

125 |

Nil |

Nil |

Nil |

| (1) |

Each Option entitles the holder to purchase one Common Share. |

| (2) |

As of December 31, 2024, the closing price of the Common Shares, was $3.25 per Common Share. |

|

Name

|

Option-based

awards – Value vested during the year

($)(1)

|

Share-based

awards – Value vested during the year ($) |

Non-equity

incentive plan compensation – Value earned during the year

($)

|

|

Oren Shuster |

1,821 |

Nil |

Nil |

|

Uri Birenberg |

Nil |

Nil |

Nil |

|

Richard Balla |

Nil |

Nil |

Nil |

|

Eyal Fisher |

14 |

Nil |

Nil |

|

Michal Lebovitz Nissimov |

42 |

Nil |

Nil |

|

|

(1) |

As of December 31, 2024, the closing price of the Common Shares was $3.25 per Common Share. |

|

Name(1)

|

Fees earned

($)(2) |

Share-based awards

($) |

Option-based awards ($)(3) |

Non-equity incentive

plan compensation ($) |

Pension value ($) |

All other compensation ($) |

Total

($) |

|

Brian Schinderle(4)

|

70,700 |

Nil |

4,015 |

Nil |

Nil |

Nil |

74,715 |

|

Moti Marcus(5)

|

80,200 |

Nil |

6,809 |

Nil |

Nil |

Nil |

87,009 |

|

Einat Zakariya(8)

|

74,200 |

Nil |

6,809 |

Nil |

Nil |

Nil |

81,009 |

|

Shmulik Arbel |

19,035 |

Nil |

Nil |

Nil |

Nil |

106,244(6)

|

125,279 |

|

Marc Lustig(7)

|

22,400 |

Nil |

Nil |

Nil |

Nil |

Nil |

22,400 |

| (1) |

Each of Mr. Marcus Ms. Zakariya and Mr. Arbel received their compensation in NIS and Mr. Schinderle received his compensation in

USD. All salaries were converted to CDN pursuant to the average Bank of Canada rate for the applicable fiscal year. L5 Capital received

their fees in CDN. |

| (2) |

Other than with respect to Mr. Lustig, each director was entitled to a $13,750 payment per quarter for their role as a director of

the Company. For each Audit Committee meeting, the Chair received a $1,500 payment and each other member received a $1,000 payment and

for each of the Compensation Committee and Governance and Nomination Committee meetings, the Chair received a $1,200 payment and each

other member received a $700 payment. |

| (3) |

The Company used the Black-Scholes pricing model as the methodology to calculate the grant date fair value and relied on the following

key assumptions and estimates for each calculation under the following assumptions: (i) risk free interest rate of 3.23% (ii) expected

dividend yield of 0%; (iii) expected volatility of 128.1% to 137.34%; and (iv) a term of 2 years. The Black-Scholes pricing model was

used to estimate the fair value as it is the most accepted methodology. |

| (4) |

Mr. Schinderle receives compensation through Solidum Capital Advisors LLC. |

| (5) |

Mr. Marcus receives compensation through Marcus Management Services Ltd. |

| (6) |

Mr. Arbel received additional compensation for his services as an adviser to the Company. This compensation was received in NIS and

converted to CDN pursuant to the average Bank of Canada rate for the applicable fiscal year. |

| (7) |

Mr. Lustig resigned from his role as a director effective June 5, 2024. Mr. Lustig did not earn consideration for his role as a director

of the Company; however, Mr. Lustig, through L5 Capital, entered into a consulting agreement with the Company pursuant to which he was

paid $5,250 per month in consideration of his Executive Chairman services provided to the Company. Mr. Lustig resigned as Executive Chairman

effective June 5, 2024. |

|

Option-based

Awards |

Share-based

Awards | ||||||

|

Name

|

Number

of securities underlying unexercised Options (1)

(#)

|

Option

exercise price

($)

|

Option

expiration date |

Value

of

unexercised

in-the-money Options(2) ($)

|

Number

of shares or units of shares that have not vested

(#)

|

Market

or payout value of share-based awards that have not vested

($)

|

Market or payout value

of vested share-based awards not paid out or distributed

($) |

|

Brian Schinderle |

1,500 |

3.00 |

October 4, 2026 |

4,875 |

Nil |

Nil |

Nil |

|

Moti Marcus |

1,500 |

3.00 |

October 4, 2026 |

4,875 |

Nil |

Nil |

Nil |

|

Einat Zakariya |

1,500 |

3.00 |

October 4, 2026 |

4,875 |

Nil |

Nil |

Nil |

|

Shmulik Arbel |

Nil |

N/A |

N/A |

Nil |

Nil |

N/A |

N/A |

|

Marc Lustig |

Nil |

N/A |

N/A |

Nil |

Nil |

N/A |

N/A |

|

|

(1) |

Each Option entitles the holder to purchase one Common Share. |

|

|

(2) |

The closing price of the Common Shares as at December 31, 2024 was $3.25 per Common Share. |

|

Name

|

Option-based

awards – Value vested during the year(1)

($)

|

Share-based

awards – Value vested during the year ($) |

Non-equity

incentive plan compensation – Value earned during the year

($)

|

|

Brian Schinderle |

1,625 |

Nil |

Nil |

|

Moti Marcus |

1,625 |

Nil |

Nil |

|

Einat Zakariya |

1,625 |

Nil |

Nil |

|

|

(1) |

The closing price of the Common Shares as of December 31, 2024 was $3.25 per Common Share. |

|

Name of Director |

Board |

Audit Committee |

Compensation Committee |

Governance and Nomination Committee |

|

Oren Shuster |

14/14 |

N/A |

N/A |

N/A |

|

Marc Lustig(1)

|

7/14 |

N/A |

N/A |

N/A |

|

Moti Marcus |

14/14 |

6/6 |

1/1 |

N/A |

|

Einat Zakariya |

14/14 |

6/6 |

1/1 |

N/A |

|

Brian Schinderle |

14/14 |

6/6 |

1/1 |

N/A |

|

Shmulik Arbel(2)

|

2/14 |

N/A |

N/A |

N/A |

|

|

(1) |

Marc Lustig resigned as Executive Chairman and a director effective June 5, 2024. |

|

|

(2) |

Shmulik Arbel was appointed to the Board effective September 9, 2024. |

|

|

(a) |

overseeing that the day-to-day business affairs of the Company are appropriately managed and taking steps to maintain and enhance

an effective senior management team reporting to the CEO; |

|

|

(b) |

recommending to the Board the Company’s financial and operating goals and objectives and, following approval by the Board thereof,

consistently striving to achieve such goals and objectives; |

|

|

(c) |

formulating, and presenting to the Board for approval, long-term business plans, strategies and policies having the objective of

maximizing the Company’s long-term success and the creation of shareholder value; |

|

|

(d) |

together with other senior management, as are appropriate, developing and recommending to the Board annual business plans and budgets

that support the Company’s long term business plans and strategies; |

|

|

(e) |

developing and implementing, with senior management of the Company, plans, strategies, budgets and policies necessary to achieve

the goals and objectives of the Company; |

|

|

(f) |

supervising, maintaining and deploying the Company’s resources – human, financial or otherwise – with the purpose

and objective of achieving the Company’s operating goals and objectives; |

|

|

(g) |

keeping the Board informed in a timely and candid manner of the progress of the Company towards the achievement of its strategic

and operational goals and objectives and of all material deviations from the goals, objectives, plans, strategies, budgets or policies

established by the Board; |

|

|

(h) |

overseeing, evaluating and taking steps to enhance, where necessary, the integrity and reliability of the Company’s internal

controls, including its management information systems and financial reporting, and establishing, maintaining, designing and evaluating

disclosure controls and procedures for the Company; |

|

|

(i) |

identifying and managing business risks faced by the Company, including overseeing the design and implementation of appropriate systems

and procedures to effectively monitor, manage and mitigate such risks; |

|

|

(j) |

ensuring that the Board has regular exposure to the Company’s senior management and overseeing the development and succession

of the Company’s senior management team; |

|

|

(k) |

evaluating the performance of senior management of the Company and making recommendations with respect to their compensation;

|

|

|

(l) |

maintaining a positive and ethical work climate that is conducive to attracting, retaining and motivating a diverse group of top-quality

employees at all levels; |

|

|

(m) |

serving as the Company’s principal spokesperson and ensuring that information communicated to the public fairly portrays the

position of the Company and that timely and continuous disclosure obligations of the Company are met; |

|

|

(n) |

representing the Company in a such a way so as to enhance and maintain the Company’s reputation and to promote positive relationships

with shareholders, suppliers, contractors, clients, service providers, strategic partners, creditors, financial institutions, local communities,

all levels of government and the media; and |

|

|

(o) |

fulfilling all other responsibilities as assigned by the Board, in the manner expected by the Board. |

|

Name

|

Independence(1)

|

Financial

Literacy(2) |

|

Moti Marcus (Chair)

|

Independent

|

Financially literate

|

|

Brian Schinderle

|

Independent

|

Financially literate

|

|

Einat Zakariya

|

Independent

|

Financially literate

|

|

|

1. |

Within the meaning of subsection 1.4 of NI 52-110 and as determined under Exchange Act Rule 10A-3 and Rule 5605(a)(2) of the

Nasdaq Stock Market Rules. |

|

|

2. |

Within the meaning of subsection 1.6 of NI 52-110, Item 407(d)(5)(ii)-(iii) of Regulation S-K under the Exchange Act) and Rule 5605(c)(2)(A)

of the Nasdaq Stock Market Rules. |

|

|

(i) |

matters of governance; and |

|

|

(ii) |

the nomination of directors to the Board. |

|

|

1. |

Einat Zakariya (Chair); |

|

|

2. |

Oren Shuster; and |

|

|

3. |

Moti Marcus. |

|

Year |

Full Time |

Part Time |

Total | |||

|

Fiscal 2022 |

153 |

- |

153 | |||

|

Fiscal 2023 |

95 |

- |

95 | |||

|

Fiscal 2024 |

55 |

- |

55 |

|

Year |

Israel |

Germany |

Canada |

Total | ||||

|

Fiscal 2022 |

126 |

27 |

- |

153 | ||||

|

Fiscal 2023 |

77 |

18 |

- |

95 | ||||

|

Fiscal 2024 |

35 |

20 |

- |

55 |

|

|

• |

each person, or group of affiliated persons, known by us to beneficially own five percent (5%) or more of any class of our shares;

|

|

|

• |

each of our Named Executive Officers; |

|

|

• |

each of our directors; and |

|

|

• |

all of our directors and executive officers as a group. |

|

Name of Beneficial Holder

|

Number of Common Shares

Beneficially Held |

Number of Common Shares

Underlying Options |

Option Exercise Price ($) |

Option Expiration Date

|

Restricted Share Units

|

Debentures |

Warrants |

Total Convertible Securities

|

Percentage of Common

Shares Beneficially Held Undiluted |

Percentage of Common

Shares Beneficially Held Partially Diluted |

|

Oren Shuster(1)

|

616,831 |

21,875 |

3.00 |

October 4, 2026 |

Nil |

46,512 |

346,811 |

415,198(1)

|

19.9% |

33.45% |

|

Marc Lustig(2)

|

155,106 |

Nil |

Nil |

Nil |

Nil |

Nil |

105,643 |

105,643 |

5.02% |

8.45% |

|

Moti Marcus |

Nil |

1,500 |

3.00 |

October 4, 2026 |

Nil |

Nil |

Nil |

1,500 |

Nil |

0.04% |

|

Einat Zakariya |

10,200 |

1,500 |

3.00 |

October 4, 2026 |

Nil |

Nil |

Nil |

1,500 |

0.33% |

0.38% |

|

Brian Schinderle |

Nil |

1,500 |

3.00 |

October 4, 2026 |

Nil |

Nil |

Nil |

1,500 |

Nil |

0.04% |

|

Uri Birenberg |

Nil |

Nil |

N/A |

N/A |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

|

Michal Lebovitz Nissimov |

Nil |

500 |

3.00 |

October 4, 2026 |

Nil |

Nil |

Nil |

500 |

Nil |

0.00% |

|

Richard Balla |

625 |

1,500 |

24 |

July 30, 2029 |

Nil |

Nil |

Nil |

1,500 |

0.00% |

0.00% |

|

Rafael Gabay(3)

|

389,707 |

1,500 |

3.00 |

October 4, 2026 |

Nil |

46,396 |

244,637 |

292,533 |

12.63% |

12.68% |

|

Shmulik Arbel |

54,859 |

Nil |

Nil |

Nil |

Nil |

Nil |

48,349 |

48,349 |

1.78% |

3.34% |

| (1) |

616,806 Common Shares and 348,811 Warrants are held by Oren Shuster directly and 25 Common Shares are held indirectly through Ewave,

a privately-held entity of which Mr. Shuster owns and controls 50% of the outstanding voting rights. Mr. Shuster also holds 39,536 convertible

debentures. |

|

|

(2) |

50,065 Common Shares and 23,020 Warrants are held by Marc Lustig directly and 105,040 Common Shares and 82,624 Warrants are held

indirectly through L5 Capital, a privately held entity of which Mr. Lustig owns and controls 100% of the outstanding voting rights.

|

|

|

(3) |

389,682 Common Shares and 244,637 Warrants are held by Rafael Gabay directly and 25 Common Shares are held indirectly by Ewave, a

privately-held entity of which Mr. Gabay owns and controls 50% of the outstanding voting rights. Mr. Gabay also holds 46,396 convertible

debentures. |

|

|

• |

On April 2, 2019, IMC Holdings and Focus entered into an agreement (the "Focus Agreement")

pursuant to which IMC Holdings acquired an option to purchase, at its sole discretion and in compliance with Israeli cannabis regulation,

all of the ordinary shares held by Messrs. Shuster and Gabay held in Focus at a price equal to NIS 765.67 per ordinary share until April

2029. On November 30, 2023, IMC Holdings sent a request letter to IMCA to approve IMC Holding’s exercise of the option and on February

26, 2024, IMCA's approval was obtained. Effective February 26, 2024, IMC Holdings acquired 74% of the ordinary shares of Focus.

|

|

|

• |

The Company is a party to indemnification agreements with certain directors and officers of the Company and Trichome to cover certain

tax liabilities, interest and penalties arising from the Company’s acquisition of all of issued and outstanding securities of Trichome

and certain of its subsidiaries. |

|

|

• |

On August 5, 2022, the Company sold Sublime to a group of purchasers that included current and former members of the Sublime management

team for aggregate proceeds of $100,000 less working capital adjustments, for a final net purchase price of $89,000. The transaction constituted

a “related party transaction” within the meaning of MI 61-101, however pursuant to Sections 5.5(a) and 5.7(1)(a) of MI 61-101,

the transaction was exempt from the formal valuation and minority shareholder approval requirements of such instrument. |

|

|

• |

On August 19, 2022, the Company announced a non-brokered private placement offering of Common Shares (the “2022

Private Placement”) for aggregate gross proceeds of up to US$5,000 led by the Company’s management and executive team.

The first and second tranche of which closed on August 24, 2022, and October 5, 2022, respectively. Insiders of the Company, led by the

CEO and Director, and the Company’s former CFO, subscribed for 1,563,496 Common Shares for aggregate proceeds of US$782 in the first

tranche of the 2022 Private Placement, and the Executive Chairman of the Company, subscribed for 1,112,504 Common Shares for aggregate

proceeds of US$556 in the second tranche of the 2022 Private Placement. As a result of the participation by the CEO, CFO and Executive

Chairman, the 2022 Private Placement was considered a “related party transaction” pursuant to MI 61-101. The Company relied

on Sections 5.5(a) and 5.7(1)(a) of MI 61-101 for exemptions from the requirements to obtain a formal valuation and minority shareholder

approval, respectively, because the fair market value of the insiders’ participation in the 2022 Private Placement was below 25%

of the Company’s market capitalization for purposes of MI 61-101. |

|

|

• |

The Stalking Horse Purchase Agreement constituted a related party transaction as L5 Capital is an entity controlled by Marc Lustig,

who was a director of Trichome and the Executive Chairman of the Board. On March 8, 2023, the Company announced that the SISP approved

by the Court did not result in any bids for the going-concern business of Trichome; however, L5 Capital advised that it would not complete

the proposed transaction contemplated by the Stalking Horse Share Purchase Agreement. |

|

|

• |

On January 16, 2023, the Company closed of the first tranche of the LIFE Concurrent Offering comprised of an aggregate of 1,159,999

Units for aggregate gross proceeds of US$1,500. The LIFE Concurrent Offering was led by insiders of the Company. The units offered under

the LIFE Concurrent Offering were sold under similar terms as the Life Offering. |

|

|

• |

On January 20, 2023, the Company closed the second tranche of the LIFE Offering comprised of 102,152 Life Units for an aggregate

subscription price of approximately US$128. The second tranche of the LIFE Offering was comprised of a single subscription by the Executive

Chairman of the Company whose subscription price was satisfied by the settlement of approximately US$128 in debt owed by the Company to

him for certain consulting services previously rendered to the Company. |

|

|

• |

On February 16, 2023, the Company closed the fifth and final tranche of the LIFE Offering. Marc Lustig, the Executive Chairman of

the Company subscribed for 29,548 Life Units in the fifth tranche at an aggregate subscription price of US$37. Marc Lustig’s subscription

price was satisfied by the settlement of US$37 in debt owed by the Company to the director for certain consulting services previously

rendered by the director to the Company. The participation by Company’s insiders in each of the LIFE Concurrent Offering and LIFE

Offering constituted “related party transactions” pursuant to MI 61-101. The Company relied on Sections 5.5(a) and 5.7(1)(a)

of MI 61-101 for exemptions from the requirements to obtain a formal valuation and minority shareholder approval, respectively, because

the fair market value of the insiders’ participation in the LIFE Concurrent Offering and LIFE Offering, as applicable, was below

25% of the Company’s market capitalization for the purposes of MI 61-101. |

|

|

• |

Pursuant to the consulting agreement between the Company and L5 Capital, the Company issued 50,414 Common Shares as a result of the

vested RSUs according to the agreed vesting schedule. The Common Shares were issued on May 5, 2023. On July 24, 2023, an additional 4,585

Common Shares were issued as a result of the vested RSUs according to the agreed vesting schedule. |

|

|

• |

On October 12, 2023, Oren Shuster, the CEO, loaned an amount of NIS 500 (approximately $170) to IMC Holdings. The participation of

the Mr. Shuster constituted a “related party transaction”, as such term is defined in MI 61-101 and would require the Company

to receive minority shareholder approval for and obtain a formal valuation for the subject matter of, the transaction in accordance with

MI 61-101, prior to the completion of such transaction. However, in completing the loan, the Company has relied on exemptions from the

formal valuation and minority shareholder approval requirements of MI 61-101, in each case on the basis that the fair market value of

the CEO’s loan did not exceed 25% of the market capitalization of the Company, as determined in accordance with MI 61-101.

|

|

|

• |

On May 29, 2024, Mr. Shuster subscribed for an aggregate of $237,214 of May 2024 Debentures in the May 2024 Private Placement. Mr.

Shuster’s participation in the May 2024 Private Placement is a “related party transaction”. For more information, see

“Item 4B. Business Overview – Important Events in the Development of the Business in Fiscal

2024 to the date of this Annual Report”. |

|

|

• |

Mr. Oren Shuster, Mr. Shmulik Arbel, and Mr. Rafael Gabay, each participated in the November 2024 Offering. Mr. Shuster acquired

194,109,110 November 2024 Units, 110,576 Common Shares in connection with the November 2024 Debt Settlement, and 122,141152,701 Pre-Funded

November 2024 Warrants. Mr. Arbel acquired 48,348 Nov 2024 Units, and Mr. Gabay acquired 194,087 Nov 2024 Units. For more information,

see “Item 4B. Business Overview – Important Events in the Development of the Business in

Fiscal 2024 to the date of this Annual Report”. |

|

•

|

Effective October 4, 2024, the Company cancelled the October 2024 Cancelled Options,

which were previously granted to board members, officers, employees, advisors and consultants of the Issuer. For more information, see

“Item 4B. Business Overview – Important Events in the Development of the Business in Fiscal

2024 to the date of this Annual Report”. |

|

•

|

Effective October 4, 2024, the Company cancelled an aggregate of 142,784 October 2024

Subject Warrants to purchase Shares, which were previously granted to Mr. Shuster. Management reviewed the Company’s outstanding

warrants and determined that the October 2024 Subject Warrants at an exercise price of US$9.00 per Share, no longer represented a realistic

incentive to motivate Mr. Shuster. For more information, see “Item 4B. Business Overview –

Important Events in the Development of the Business in Fiscal 2024 to the date of this Annual Report”. |

|

•

|

On November 12, 2024, the Company completed a debt settlement (the “November

2024 Debt Settlement”) in the amount of US$560,000 with Mr. Shuster. Since October 2022, the Company, through its subsidiaries,

had borrowed more than US$8,000,000 (together, the “Loans”) from various groups. As

required by the lenders, Mr. Shuster, the Company's CEO and chairman of the Board personally guaranteed the Loans. The independent members

of the Board commissioned a valuation to determine the value of Mr. Shuster’s personal guarantees, which ascribes the benefit to

the Company to be approximately US$560,000 (the “Shuster Benefit”). To repay Mr. Shuster

in connection with the Shuster Benefit, and to preserve the Company’s cash for working capital, the issued Mr. Shuster 110,576 Common

Shares and 152,701 pre-funded Common Share purchase warrants (each, a “Pre-Funded November 2024

Warrant”) at a deemed price of C$2.88 For more information, see “Item 4B. Business Overview – Important Events

in the Development of the Business in Fiscal 2024 to the date of this Annual Report”. |

|

|

1. |

The contractual party of the company was not Stroakmont. The contract with Stroakmont was only concluded as a sham transaction to

cover up a contract with a company named Uniclaro GmbH (“Uniclaro”). Therefore, Stroakmont

is not the real purchaser rather than Uniclaro. |

|

|

2. |

The company allegedly placed an order with Uniclaro for a total of 4.3 million Clongene COVID-19 tests, of which Uniclaro claims

to have a payment claim against the company for a partial delivery of 380,400 Clongene COVID-19 tests in the total amount of EUR 942.

Uniclaro has assigned this alleged claim against the company to Stroakmont Trading GmbH, and Stroakmont Trading GmbH has precautionary

declared a set-off against the company’s claim. |

|

1. |

Adjupharm was not sentenced. Uniclaro's lawsuit for payment of approximately EUR 1,046

thousand in exchange for delivery of 300,000 Clungene tests was dismissed. |

|

2. |

Uniclaro is sentenced to pay Adjupharm approximately EUR 54 thousand plus interest

at 5 percentage points above the German basis rate since January 17, 2023. |

|

3. |

Uniclaro shall bear the procedural costs. |

|

|

1. |

under the age of 18 years; |

|

|

2. |

found by a court, in Canada or elsewhere, to be incapable of managing the individual’s own affairs, unless a court, in Canada

or elsewhere, subsequently finds otherwise; |

|

|

3. |

an undischarged bankrupt; or |

|

|

4. |

convicted in or out of the Province of British Columbia of an offence in connection with the promotion, formation or management of