|

|

|

FORM 20-F

|

|

Israel

|

|

2 HaMa’ayan Street

Modi’in 7177871, Israel |

|

(Jurisdiction of incorporation or organization)

|

|

(Address of principal executive offices)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

American Depositary Shares, each representing 600 ordinary shares, par value NIS 0.10 per share

|

|

Nasdaq Capital Market

|

|

|

|

|

|

Ordinary shares, par value NIS 0.10 per share

|

|

Nasdaq Capital Market*

|

|

|

|

|

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

Non-accelerated filer ☒

|

Emerging growth company ☐

|

|

U.S. GAAP ☐

|

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒

|

Other ☐

|

|

TABLE OF CONTENTS |

|

|

|

|

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 30 | |

| 60 | |

| 60 | |

| 71 | |

| 88 | |

| 91 | |

| 92 | |

| 93 | |

| 103 | |

| 104 | |

| 105 | |

| 105 | |

| 105 | |

| 106 | |

| 106 | |

| 106 | |

| 107 | |

| 107 | |

| 107 | |

| 107 | |

| 107 | |

| 108 | |

| 108 | |

| 109 | |

| 109 | |

| 110 | |

| 110 | |

| 110 | |

| 113 |

|

|

• |

the clinical development, commercialization and market acceptance of our therapeutic

candidates, including the degree and pace of market uptake of APHEXDA for the mobilization of hematopoietic stem cells for autologous

transplantation in multiple myeloma patients; |

|

|

• |

the initiation, timing, progress and results of our preclinical studies, clinical

trials and other therapeutic candidate development efforts; |

|

|

• |

our ability to advance our therapeutic candidates into clinical trials or to successfully

complete our preclinical studies or clinical trials; |

|

|

• |

whether the clinical trial results for APHEXDA will be predictive of real-world results;

|

|

|

• |

our receipt of regulatory approvals for our therapeutic candidates, and the timing

of other regulatory filings and approvals; |

|

|

|

|

|

|

• |

whether access to APHEXDA is achieved in a commercially viable manner and whether

APHEXDA receives adequate reimbursement from third-party payors; |

|

|

|

|

|

|

• |

our ability to establish, manage, and maintain corporate collaborations, as well as

the ability of our collaborators to execute on their development and commercialization plans; |

|

|

• |

our ability to integrate new therapeutic candidates and new personnel, as well as

new collaborations; |

|

|

• |

the interpretation of the properties and characteristics of our therapeutic candidates

and of the results obtained with our therapeutic candidates in preclinical studies or clinical trials; |

|

|

• |

the implementation of our business model and strategic plans for our business and

therapeutic candidates; |

|

|

• |

the scope of protection that we are able to establish and maintain for intellectual

property rights covering our therapeutic candidates and our ability to operate our business without infringing the intellectual property

rights of others; |

|

|

• |

estimates of our expenses, future revenues, capital requirements and our need for

and ability to access sufficient additional financing; |

|

|

• |

risks related to changes in healthcare laws, rules and regulations in the United States

or elsewhere; |

|

|

• |

competitive companies, technologies and our industry; |

|

|

• |

our ability to maintain the listing of our ADSs on Nasdaq; |

|

|

• |

statements as to the impact of the political and security situation in Israel on our

business, including the impact of Israel’s war with Hamas and other militant groups, which may exacerbate the magnitude of the factors

discussed above; and |

|

|

• |

those factors referred to in “Item 3.D. Risk Factors,” “Item 4.

Information on the Company,” and “Item 5. Operating and Financial Review and Prospects”, as well as in this Annual Report

on Form 20-F generally. |

|

|

• |

We have incurred significant losses since inception and expect to incur additional losses in the future

and may never be profitable. |

|

|

• |

We cannot assure investors that our existing cash and investment balances will be sufficient to meet our

future capital requirements. |

|

|

• |

If we default under our secured loan agreement with BlackRock EMEA Venture and Growth Lending (previously

Kreos Capital VII Aggregator SCSP), or BlackRock, all or a portion of our assets could be subject to forfeiture. |

|

|

• |

Management has concluded that there is substantial doubt about our ability to continue as a going concern,

which could prevent us from obtaining new financing on reasonable terms or at all. |

|

|

• |

We have earned limited commercialization revenues to date. We may never achieve profitability. |

|

|

• |

APHEXDA, or any other therapeutic candidate that may receive marketing approval in

the future, may fail to achieve the degree of market acceptance by physicians, patients, third-party payors and others in the medical

community necessary for commercial success and the market opportunity for APHEXDA or any other therapeutic candidate may be smaller than

our estimates. |

|

|

• |

If we or our collaborators are unable to obtain and/or maintain U.S. and/or foreign

regulatory approval for our therapeutic candidates, in a timely manner or at all, we will be unable to commercialize our therapeutic candidates.

|

|

|

• |

We and our collaborators may not obtain additional marketing approvals for motixafortide

in other indications or initial approval for any other therapeutic candidates we may develop in the future. |

|

|

• |

Clinical trials involve a lengthy and expensive process with an uncertain outcome,

and results of earlier studies and trials may not be predictive of future trial results. |

|

|

• |

Even if we obtain regulatory approvals, our therapeutic candidates will be subject

to ongoing regulatory review and if we fail to comply with continuing U.S. and applicable foreign regulations, we could lose those approvals

and our business would be seriously harmed. |

|

|

• |

We generally rely on third parties to conduct our preclinical studies and clinical

trials and to provide other services, and those third parties may not perform satisfactorily, including by failing to meet established

deadlines for the completion of such services. |

|

|

• |

We recently entered into and may in the future rely on out-licensing arrangements

for late-stage development, marketing or commercialization of our therapeutic candidates. |

|

|

• |

If we cannot meet requirements under our in-license agreements, we could lose the

rights to our therapeutic candidates, which could have a material adverse effect on our business. |

|

|

• |

We have partnered with and may seek to partner with third-party collaborators with

respect to the development and commercialization of motixafortide, and we may not succeed in establishing and maintaining collaborative

relationships, which may significantly limit our ability to develop and commercialize our therapeutic candidates successfully, if at all.

|

|

|

• |

If competitors develop and market therapeutics that are more effective, safer or less

expensive than our current or future therapeutic candidates, our prospects will be negatively impacted. |

|

|

• |

APHEXDA, or any other therapeutic candidate that we or our licensees are able to commercialize,

may become subject to unfavorable pricing regulations, third-party payor reimbursement practices or healthcare reform initiatives, any

of which could harm our business. |

|

|

• |

We rely upon third-party manufacturers to produce therapeutic supplies for the clinical

trials, and commercialization, of APHEXDA. If we manufacture any therapeutic candidates in the future, we will be required to incur significant

costs and devote significant efforts to establish and maintain manufacturing capabilities. |

|

|

• |

Healthcare reforms and related reductions in pharmaceutical pricing, reimbursement and coverage by government

authorities and third-party payors may adversely affect our business. |

|

|

• |

If third-party payors do not adequately reimburse customers for any of our therapeutic candidates that

are approved for marketing, they might not be purchased or used, and our revenues and profits will not develop or increase. |

|

|

• |

Our business has a substantial risk of clinical trial and product liability claims. If we are unable to

obtain and maintain appropriate levels of insurance, a claim could adversely affect our business. |

|

|

• |

Significant disruptions of our information technology systems or breaches of our data security could adversely

affect our business. |

|

|

• |

We deal with hazardous materials and must comply with environmental, health and safety laws and regulations,

which can be expensive and restrict how we do business. |

|

|

• |

We are currently party to, and may in the future, become subject to litigation or claims arising in or

outside the ordinary course of business that could negatively affect our business operations and financial condition. |

|

|

• |

Our access to most of the intellectual property associated with our therapeutic candidates

results from in-license agreements with biotechnology companies and a university, the termination of which would prevent us from commercializing

the associated therapeutic candidates. |

|

|

• |

Our business, operating results and growth rates may be adversely affected by current or future unfavorable

economic and market conditions and adverse developments with respect to financial institutions and associated liquidity risk. |

|

|

• |

The market prices of our ordinary shares and ADSs are subject to fluctuation, which could result in substantial

losses by our investors. |

|

|

• |

Future sales of our ordinary shares or ADSs could reduce the market price of our ordinary shares and ADSs.

|

|

|

• |

Raising additional capital by issuing securities may cause dilution to existing shareholders. |

|

|

• |

If we fail to comply with the continued listing requirements of the Nasdaq, our ADSs may be delisted and

the price of our ADSs and our ability to access the capital markets could be negatively impacted. |

|

|

• |

We conduct a substantial part of our operations in Israel and therefore our results may be adversely affected

by political, economic and military instability in Israel and its region. |

|

|

|

|

|

|

• |

Provisions of Israeli law may delay, prevent or otherwise impede a merger with, or an acquisition of, our

company, which could prevent a change of control, even when the terms of such a transaction are favorable to us and our shareholders.

|

|

|

• |

It may be difficult to enforce a U.S. judgment against us and our officers and directors in Israel or the

United States, or to serve process on our officers and directors. |

|

|

• |

Your rights and responsibilities as a shareholder will be governed by Israeli law, which may differ in

some respects from the rights and responsibilities of shareholders of U.S. companies. |

|

|

• |

the advantages of the treatment compared

to competitive therapies; |

|

• |

the number of competitors approved for similar

uses; |

|

• |

the relative promotional effort and marketing

success of us as compared with our competitors; |

|

• |

how the product is positioned in physician

treatment guidelines and pathways; |

|

• |

the prevalence and severity of any side

effects; |

|

• |

the efficacy and safety of the product;

|

|

• |

our ability to offer the product for sale

at competitive reimbursement; |

|

• |

the product’s tolerability, convenience

and ease of administration compared to alternative treatments; |

|

• |

the willingness of the target patient population

to try, and of physicians to prescribe, the product; |

|

• |

limitations or warnings, including use restrictions,

contained in the product’s approved labeling; |

|

• |

the strength of sales, marketing and distribution

support; |

|

• |

the timing of market introduction of our

approved products as well as competitive products; |

|

• |

adverse publicity about the product or favorable

publicity about competitive products; |

|

• |

potential product liability claims;

|

|

• |

changes in the standard of care for the

targeted indications of the product; and |

|

• |

availability and amount of coverage and

reimbursement from government payors, managed care plans and other third-party payors. |

|

• |

regulatory authorities may withdraw their

approval of the product or seize the product; |

|

• |

we, or any of our collaborators, may be

required to recall the product, change the way the product is administered or conduct additional clinical trials; |

|

• |

additional restrictions may be imposed on

the marketing of, or the manufacturing processes for, the particular product; |

|

• |

we, or any of our collaborators, may be

subject to fines, injunctions or the imposition of civil or criminal penalties; |

|

• |

regulatory authorities may require the addition

of labeling or warning statements, such as a “black box” warning or a contraindication; |

|

• |

we, or any of our collaborators, may be

required to create a Medication Guide outlining the risks of the previously unidentified side effects for distribution to physicians,

health care professionals and patients; |

|

• |

we could be sued and held liable for harm

caused to patients; |

|

• |

physicians and patients may stop using our

product; and |

|

• |

our reputation may suffer. |

|

• |

delays in securing clinical investigators

or trial sites for the clinical trials; |

|

• |

delays in obtaining institutional review

board and other regulatory approvals to commence a clinical trial; |

|

• |

slower-than-anticipated patient recruitment

and enrollment; |

|

• |

negative or inconclusive results from clinical

trials; |

|

• |

unforeseen safety issues; |

|

• |

uncertain dosing issues; |

|

• |

an inability to monitor patients adequately

during or after treatment; and |

|

• |

problems with investigator or patient compliance

with the trial protocols. |

|

• |

restrictions on such product, manufacturer

or manufacturing process; |

|

• |

warning letters from the FDA or other regulatory

authorities; |

|

• |

withdrawal of the product from the market;

|

|

• |

suspension or withdrawal of regulatory approvals;

|

|

• |

refusal to approve pending applications

or supplements to approved applications that we or our licensees submit; |

|

• |

voluntary or mandatory recall; |

|

• |

fines; |

|

• |

refusal to permit the import or export of

our products; |

|

• |

product seizure or detentions; |

|

• |

injunctions or the imposition of civil or

criminal penalties; or |

|

• |

adverse publicity. |

|

• |

we have limited control over the amount

and timing of resources that a licensee devotes to our therapeutic candidate; |

|

• |

a licensee may experience financial difficulties;

|

|

• |

a licensee may fail to secure adequate commercial

supplies of our therapeutic candidate upon marketing approval, if at all; |

|

• |

our future revenues depend heavily on the

efforts of a licensee; |

|

• |

business combinations or significant changes

in a licensee’s business strategy may adversely affect the licensee’s willingness or ability to complete its obligations under

any arrangement with us; |

|

• |

a licensee could move forward with a competing

therapeutic candidate developed either independently or in collaboration with others, including our competitors; and |

|

• |

out-licensing arrangements are often terminated

or allowed to expire, which would delay the development and may increase the development costs of our therapeutic candidates. |

|

• |

a collaboration partner may shift its priorities

and resources away from our therapeutic candidates due to a change in business strategies, or a merger, acquisition, sale or downsizing;

|

|

• |

a collaboration partner may seek to renegotiate

or terminate their relationships with us due to unsatisfactory clinical results, manufacturing issues, a change in business strategy,

a change of control or other reasons; |

|

• |

a collaboration partner may cease development

in therapeutic areas which are the subject of our strategic collaboration; |

|

• |

a collaboration partner may not devote sufficient

capital or resources towards our therapeutic candidates; |

|

• |

a collaboration partner may change the success

criteria for a therapeutic candidate, thereby delaying or ceasing development of such candidate; |

|

• |

a significant delay in initiation of certain

development activities by a collaboration partner will also delay payment of milestones tied to such activities, thereby impacting our

ability to fund our own activities; |

|

• |

a collaboration partner could develop a

product that competes, either directly or indirectly, with our therapeutic candidate; |

|

• |

a collaboration partner with commercialization

obligations may not commit sufficient financial or human resources to the marketing, distribution or sale of a product; |

|

• |

a collaboration partner with manufacturing

responsibilities may encounter regulatory, resource or quality issues and be unable to meet demand requirements; |

|

• |

a partner may exercise a contractual right

to terminate a strategic alliance; |

|

• |

a dispute may arise between us and a partner

concerning the research, development or commercialization of a therapeutic candidate resulting in a delay in milestones, royalty payments

or termination of an alliance and possibly resulting in costly litigation or arbitration which may divert management attention and resources;

and |

|

• |

a partner may use our products or technology

in such a way as to invite litigation from a third party. |

|

• |

reliance on the third party for regulatory

compliance and quality assurance; |

|

• |

limitations on supply availability resulting

from capacity and scheduling constraints of the third parties; |

|

• |

impact on our reputation in the marketplace

if manufacturers of our products, once commercialized, fail to meet customer demands; |

|

• |

the possible breach of the manufacturing

agreement by the third party because of factors beyond our control; and |

|

• |

the possible termination or nonrenewal of

the agreement by the third party, based on its own business priorities, at a time that is costly or inconvenient for us. |

|

• |

a covered benefit under its health plan;

|

|

• |

safe, effective and medically necessary;

|

|

• |

appropriate for the specific patient;

|

|

• |

cost-effective; and |

|

• |

neither experimental nor investigational.

|

|

• |

announcements of technological innovations

or new products by us or others; |

|

• |

announcements by us of significant acquisitions,

strategic partnerships, in-licensing, out-licensing, joint ventures or capital commitments; |

|

• |

expiration or terminations of licenses,

research contracts or other collaboration agreements; |

|

• |

public concern as to the safety of drugs

we, our licensees or others develop; |

|

• |

general market conditions; |

|

• |

the volatility of market prices for shares

of biotechnology companies generally; |

|

• |

success of research and development projects;

|

|

• |

departure of key personnel; |

|

• |

developments concerning intellectual property

rights or regulatory approvals; |

|

• |

variations in our and our competitors’

results of operations; |

|

• |

changes in earnings estimates or recommendations

by securities analysts, if our ordinary shares or ADSs are covered by analysts; |

|

• |

statements about the Company made in the

financial media or by bloggers on the Internet; |

|

• |

statements made about drug pricing and other

industry-related issues by government officials; |

|

• |

changes in government regulations or patent

decisions; |

|

• |

developments by our licensees; and

|

|

• |

general market conditions and other factors,

including factors unrelated to our operating performance. |

|

• |

the failure to obtain regulatory approval,

in a timely manner or at all, or achieve commercial success of our therapeutic candidates; |

|

• |

our success in effecting out-licensing arrangements

with third parties; |

|

• |

our success in establishing other out-licensing

or co-development arrangements; |

|

• |

the success of our licensees in selling

products that utilize our technologies; |

|

• |

the results of our preclinical studies and

clinical trials for our earlier stage therapeutic candidates, and any decisions to initiate clinical trials if supported by the preclinical

results; |

|

• |

the costs, timing and outcome of regulatory

review of our therapeutic candidates that progress to clinical trials; |

|

• |

the costs of establishing or acquiring specialty

sales, marketing and distribution capabilities, if any of our therapeutic candidates are approved, and we decide to commercialize them

ourselves; |

|

• |

the costs of preparing, filing and prosecuting

patent applications, maintaining and enforcing our issued patents and defending intellectual property-related claims; |

|

• |

the extent to which we acquire or invest

in businesses, products or technologies and other strategic relationships; and |

|

• |

the costs of financing unanticipated working

capital requirements and responding to competitive pressures. |

|

• |

Revenue sharing payments. These are payments to be made to licensors with respect

to revenue we receive from sub-licensing to third parties for further development and commercialization of our drug products. These payments

are generally fixed at a percentage of the total revenues we earn from these sublicenses. |

|

• |

Milestone payments. These payments are generally linked to the successful achievement

of milestones in the development and approval of drugs, such Phases 1, 2 and 3 of clinical trials and approvals of NDAs, and achievement

of sales milestones. |

|

• |

Royalty payments. To the extent we elect to complete the development, licensing and

marketing of a therapeutic candidate, we are generally required to pay our licensors royalties on the sales of the end drug product. These

royalty payments are generally based on the net revenue from these sales. In certain instances, the rate of the royalty payments decreases

upon the expiration of the drug’s underlying patent and its transition into a generic drug. |

|

• |

Additional payments. In addition to the above payments, certain of our in-license

agreements provide for a one-time or periodic payment that is not linked to milestones. Periodic payments may be paid until the commercialization

of the product, either by direct sales or sublicenses to third parties. Other agreements provide for the continuation of these payments

even following the commercialization of the licensed drug product. |

|

• |

The motixafortide drug product composition of matter and methods of manufacturing thereof are covered by

a granted U.S. patent and patent applications pending in the USA (two applications received notice of allowance). Israel, Europe, Japan,

Canada, Australia, China, India, Mexico, Brazil, Hong-Kong and Korea. The patents, if granted, will expire in December 2041, not including

any applicable patent term extension, which may add an additional term of up to five years for the U.S. patents. We also have an exclusive

license to a patent family that covers motixafortide combined with a PD1 antagonist for the treatment of cancer. Patents of this family

have been granted in the U.S., Israel, Australia, China, India, Mexico and Hong Kong; and member patent applications are pending in Australia,

Hong Kong, Europe, China, Canada, India, Israel and Brazil. The granted U.S. patent and patents to issue in the future based on pending

patent applications in this family will expire in 2036, not including any applicable patent term extension. In addition, we have an exclusive

license to nineteen other patent families pending or granted worldwide directed to methods of synthesis of motixafortide and methods of

use of motixafortide either alone or in combination with other drugs for the treatment of certain types of cancer and other indications.

Furthermore, we have Orphan Drug status for AML, pancreatic cancer and stem cell mobilization, as well as data exclusivity protection

afforded to motixafortide as an NCE. |

|

• |

With respect to BL-5010, we have an exclusive license to a patent family directed

to a novel applicator uniquely configured for applying the BL-5010 composition to targeted skin tissue safely and effectively. Patents

in this family have been granted in the U.S., Europe, Israel, Japan, China, Australia and New Zealand. The patents will expire in 2033-2034.

|

|

|

• |

preclinical laboratory tests, animal studies and formulation development; |

|

|

• |

submission to the FDA of an Investigational New Drug, or IND, application to conduct human clinical testing; |

|

|

• |

adequate and well controlled clinical trials to determine the safety and efficacy of the drug for each indication as well as to establish

the exposure levels; |

|

|

• |

submission to the FDA of an application for marketing approval; |

|

|

• |

satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the drug is manufactured; and

|

|

|

• |

FDA review and approval of the drug and drug labeling for marketing. |

|

|

• |

Consistent rules for conducting clinical trials throughout the EU; |

|

|

• |

Making information on the authorization, conduct and results of each clinical trial carried out in the EU publicly available;

|

|

|

• |

Harmonized electronic submission and assessment process for clinical trials conducted in multiple member states; |

|

|

• |

Improved collaboration, information sharing and decision-making between and within member states; |

|

|

• |

Increased transparency of information on clinical trials; and |

|

|

• |

Higher standards of safety for all participants in EU clinical trials. |

|

|

• |

the federal Anti-Kickback Statute, which prohibits, among other

things, persons and entities from knowingly and willfully soliciting, offering, receiving or providing remuneration (including any kickback,

bribe or rebate), directly or indirectly, in cash or in kind, to induce or reward either the referral of an individual for, or the purchase,

lease or order of, any good or service, for which payment may be made, in whole or in part, under a federal healthcare program such as

Medicare and Medicaid; |

|

|

• |

the federal civil and criminal false claims laws, including

the civil False Claims Act, and civil monetary penalties laws, which prohibit individuals or entities from, among other things, knowingly

presenting, or causing to be presented, to the federal government, claims for payment that are false or fraudulent or making a false statement

to avoid, decrease or conceal an obligation to pay money to the federal government; |

|

|

• |

the federal Health Insurance Portability and Accountability

Act of 1996, or HIPAA, which created additional federal criminal laws that prohibit, among other things, knowingly and willingly executing,

or attempting to execute, a scheme or making false statements in connection with the delivery of or payment for health care benefits,

items, or services; |

|

|

• |

HIPAA, as amended by the Health Information Technology for

Economic and Clinical Health Act and its implementing regulations, which also imposes obligations, including mandatory contractual terms,

with respect to safeguarding the privacy, security and transmission of individually identifiable health information on covered entities

and their business associates that associates that perform certain functions or activities that involve the use or disclosure of protected

health information on their behalf; |

|

|

• |

the Foreign Corrupt Practices Act, or FCPA, which prohibits

companies and their intermediaries from making, or offering or promising to make improper payments to non-U.S. officials for the purpose

of obtaining or retaining business or otherwise seeking favorable treatment; |

|

|

• |

the federal transparency requirements known as the federal

Physician Payments Sunshine Act, under the Patient Protection and Affordable Care Act, as amended by the Health Care Education Reconciliation

Act, or collectively the ACA, which requires certain manufacturers of drugs, devices, biologics and medical supplies for which payment

is available under Medicare, Medicaid, or the Children’s Health Insurance Program, with specific exceptions, to report annually

to the Centers for Medicare & Medicaid Services, or CMS, within HHS, information related to payments and other transfers of value

to certain healthcare providers and teaching hospitals and information regarding ownership and investment interests held by physicians

and their immediate family members; and |

|

|

• |

analogous state and foreign laws and regulations, such as state

anti-kickback and false claims laws, which may apply to healthcare items or services that are reimbursed by non-governmental third-party

payors, including private insurers. |

|

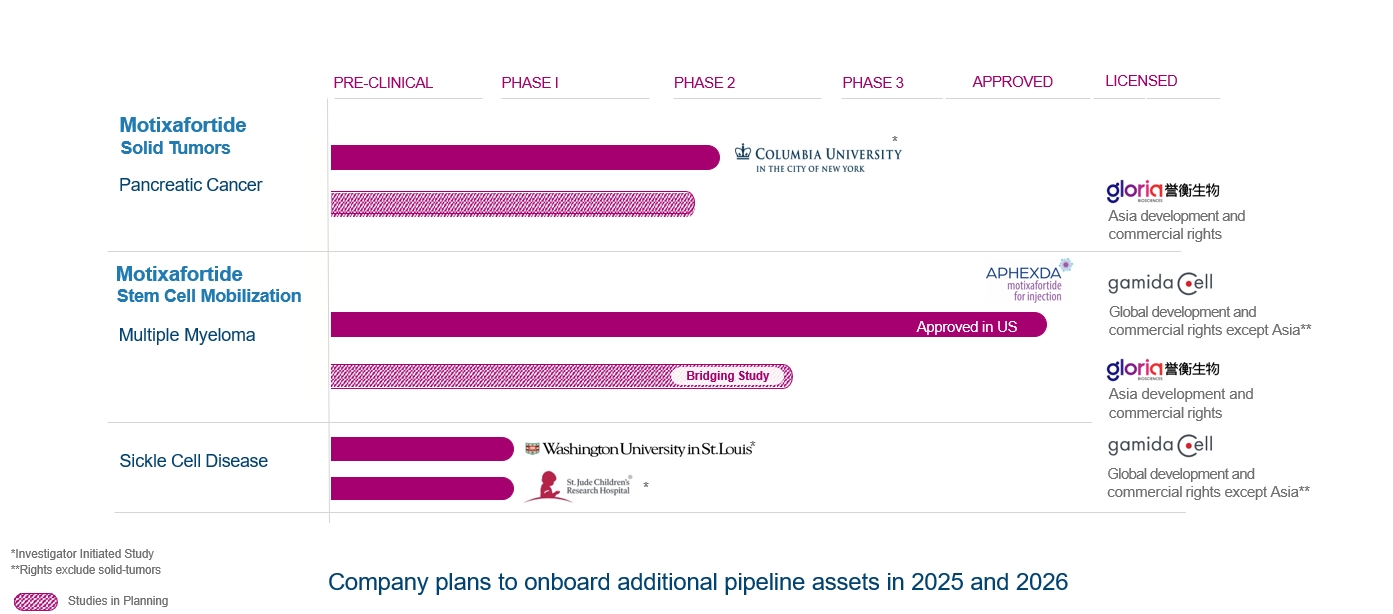

Project |

Status |

Expected Near Term Milestones |

||

|

motixafortide |

1. |

FDA approval received on September 8, 2023 for stem-cell mobilization

in multiple myeloma patients. |

1. |

Out-licensed to Ayrmid in November 2024; five-year long-term

follow-up of GENESIS patients ongoing |

|

2. |

Reported data from single-arm pilot phase of the investigator-initiated

Phase 2 combination trial in first-line PDAC. Of 11 patients with metastatic pancreatic cancer enrolled, 7 patients (64%) experienced

partial response (PR), of which 6 (55%) were confirmed PRs with one patient experiencing resolution of the hepatic (liver) metastatic

lesion. 3 patients (27%) experienced stable disease, resulting in a disease control rate of 91%. Based on these encouraging results, study

was substantially revised to a multi-institution, randomized Phase 2b trial of 108 patients |

2. |

First patient dosed in February 2024. Interim data expected

in 2026 and full enrollment projected for 2027* | |

|

3. |

Phase 1 study for gene therapies in SCD (with Washington University

School of Medicine in St. Louis)** |

3. |

First patient dosed in December 2023 and initial data from

the study released in November 2024. Final data planned in 2025* | |

|

4. |

Phase 1 study for gene therapies in SCD (with St. Jude Children’s

Research Hospital, Inc.)** |

4. |

First patient dosed in February 2025, with data planned in

2025/2026* | |

|

5. |

IND approved in China for initiation of pivotal bridging study

in SCM under license agreement with Gloria |

5. |

Initiation of the study is currently delayed*** |

|

|

6. |

Phase 2b randomized study in first-line PDAC in China under

license agreement with Gloria |

6. |

IND submission and protocol finalization is currently delayed***

| |

|

|

* |

These studies are investigator-initiated studies; therefore, the timelines are ultimately controlled by the independent investigators

and are subject to change. |

|

** |

Study to be continued under

the Ayrmid License Agreement |

|

|

*** |

Under the Gloria License Agreement, Gloria is late in the payment of $2.4 million to

us for the achievement of a specific milestone under the Gloria License Agreement and for certain product supply, which was due during

2024. In addition, the planned studies of motixafortide in China under the Gloria License Agreement are currently not advancing according

to schedule and it is unclear when such studies will be initiated, if at all. There can be no assurance that Gloria will meet its payment

obligations or any other obligations under the Gloria License Agreement. |

|

|

• |

the number of sites included in the clinical trials; |

|

|

• |

the length of time required to enroll suitable patients; |

|

|

|

|

|

|

• |

the number of patients that participate, and are eligible to participate, in the clinical

trials; |

|

|

• |

the duration of patient follow-up; |

|

|

|

|

|

|

• |

whether the patients require hospitalization or can be treated on an outpatient basis;

|

|

|

• |

the development stage of the therapeutic candidate; and |

|

|

• |

the efficacy and safety profile of the therapeutic candidate. |

|

|

• |

identify the contract with a customer; |

|

|

• |

identify the performance obligations in the contract; |

|

|

• |

determine the transaction price; |

|

|

• |

allocate the transaction price to the performance obligations in the contract; and

|

|

|

• |

recognize revenue when (or as) the entity satisfies a performance obligation.

|

|

|

• |

the progress and costs of our preclinical studies, clinical trials and other research

and development activities; |

|

|

• |

the scope, prioritization and number of our clinical trials and other research and

development programs; |

|

|

• |

the amount of revenues we receive, if any, under our collaboration or licensing arrangements;

|

|

|

|

|

|

|

• |

the costs of the development and expansion of our operational infrastructure;

|

|

|

• |

the costs and timing of obtaining regulatory approval of our therapeutic candidates;

|

|

|

• |

our success in effecting out-licensing arrangements with third parties; |

|

|

• |

the ability of our collaborators and licensees to achieve development milestones,

marketing approval and other events or developments under our collaboration and out-licensing agreements; |

|

|

• |

the costs of filing, prosecuting, enforcing and defending patent claims and other

intellectual property rights; |

|

|

• |

the costs and timing of securing manufacturing arrangements for clinical or commercial

production; |

|

|

• |

the costs of establishing sales and marketing capabilities or contracting with third

parties to provide these capabilities for us; |

|

|

• |

the costs of acquiring or undertaking development and commercialization efforts for

any future therapeutic candidates; |

|

|

• |

the magnitude of our general and administrative expenses; |

|

|

• |

interest and principal payments on the loan from BlackRock; |

|

|

• |

any cost that we may incur under current and future licensing arrangements relating

to our therapeutic candidates; and |

|

|

• |

market conditions. |

|

Name |

|

Age |

|

Position(s) |

|

|

|

|

|

|

|

Philip A. Serlin, CPA, MBA |

|

64 |

|

Chief Executive Officer |

|

Mali Zeevi, CPA |

|

49 |

|

Chief Financial Officer |

|

Ella Sorani, Ph.D. |

|

57 |

|

Chief Development Officer |

|

Aharon Schwartz, Ph.D. (1) |

|

82 |

|

Chairman of the Board of Directors, Class III Director |

|

Rami Dar, MBA (1)(2)(3)(4) |

|

68 |

|

Class I Director |

|

B.J. Bormann, Ph.D. (1)(3) |

|

66 |

|

Class II Director |

|

Raphael Hofstein, Ph.D. (1)(2)(3) |

|

75 |

|

Class II Director |

|

Avraham Molcho, M.D. (1)(2)(3) |

|

67 |

|

Class I Director |

|

Sandra Panem, Ph.D. (1)(4) |

|

78 |

|

Class III Director |

|

Shaoyu Yan, Ph.D. |

|

60 |

|

Class III Director |

|

Gal Cohen (1) |

|

52 |

|

Class I Director |

|

(1) |

Independent director under applicable Nasdaq Capital Market, as affirmatively determined by our board of

directors. | |

|

|

| |

|

(2) |

A member of our audit committee. | |

|

|

| |

|

(3) |

A member of our compensation committee. | |

|

|

| |

|

(4) |

A member of our investment monitoring committee |

|

|

Salaries, fees,

commissions

and bonuses |

Pension,

retirement,

options and

other similar benefits |

||||||

|

|

(in thousands of U.S. dollars) |

|||||||

|

All directors and senior management as a group, consisting of 13 persons |

1,912 |

899 |

||||||

|

Name and Position |

Salary |

Social Benefits(1)

|

Bonuses(2)

|

Value of

Share-Based

Compensation(3)

|

All Other

Compensation(4)

|

Total |

||||||||||||||||||

|

|

(in thousands of U.S. dollars) |

|||||||||||||||||||||||

|

Philip A. Serlin

Chief Executive Officer |

296 |

109 |

74 |

265 |

20 |

764 |

||||||||||||||||||

|

Mali Zeevi

Chief Financial Officer |

195 |

59 |

49 |

32 |

22 |

357 |

||||||||||||||||||

|

Ella Sorani

Chief Development Officer |

221 |

54 |

- |

32 |

20 |

328 |

||||||||||||||||||

|

Holly W. May

Former President of BioLineRx USA, Inc.* |

440 |

61 |

226 |

- |

220 |

947 |

||||||||||||||||||

|

(1) |

“Social Benefits” include payments to the National Insurance Institute,

advanced education funds, managers’ insurance and pension funds, vacation pay and recuperation pay as mandated by Israeli law.

|

|

(2) |

With the exception of Ms. May, does not include annual bonuses for 2024, which remain

subject to the approval of the Company’s compensation committee and board of directors. | |

|

(3) |

Consists of amounts recognized as share-based compensation expense on the Company’s

statement of comprehensive loss for the year ended December 31, 2024. |

|

(4) |

“All Other Compensation” includes automobile-related expenses pursuant to the Company’s

automobile leasing program, telephone, basic health insurance and holiday presents, as well as termination benefits to Ms. May.

|

|

|

• |

the Class I directors, consisting of Dr. Avraham Molcho, Mr. Rami Dar and Gal Cohen, will hold office until our annual general meeting

of shareholders to be held in 2027; |

|

|

• |

the Class II directors, consisting of Dr. B.J. Bormann and Dr. Raphael Hofstein, will hold office until our annual general meeting

of shareholders to be held in 2025; and |

|

|

• |

the Class III directors, consisting of Dr. Sandra Panem, Dr. Aharon Schwartz and Dr. Shaoyu Yan, will hold office until our annual

general meeting of shareholders to be held in 2026. |

|

|

• |

oversight of the company’s independent registered public accounting firm and

recommending the engagement, compensation or termination of engagement of our independent registered public accounting firm to our board

of directors in accordance with Israeli law; |

|

|

• |

recommending the engagement or termination of the office of our internal auditor;

and |

|

|

• |

reviewing and pre-approving the terms of audit and non-audit services provided by

our independent auditors. |

|

|

• |

to make recommendations to the board of directors for its approval of (i) a compensation

policy for office holders, (ii) once every three years whether to extend the then current compensation policy (approval of either a new

compensation policy or the continuation of an existing compensation policy must, in any case, occur every three years); and (iii) periodic

updates to the compensation policy which may be required from time to time. In addition, the compensation committee is required

to periodically examine the implementation of the compensation policy; and |

|

|

• |

to approve transactions relating to terms of office and employment of company office

holders that require the approval of the compensation committee pursuant to the Companies Law (including determining whether the compensation

terms of a candidate for chief executive officer of the company need not be brought to approval of the shareholders). |

|

|

• |

the majority of the votes voted in favor includes at least a majority of all the votes

of shareholders who are not controlling shareholders of the company and shareholders who do not have a personal interest in the compensation

policy, present and voting on the matter (excluding abstentions); or |

|

|

• |

the total of opposing votes from among the shareholders who are non-controlling shareholders

and shareholders who do not have a personal interest in the matter does not exceed 2% of all the voting rights in the company. |

|

|

• |

a person (or a relative of a person) who holds more than 5% of the company’s

shares; |

|

|

• |

a person (or a relative of a person) who has the power to appoint a director or the

general manager of the company; |

|

|

• |

an executive officer or director of the company (or a relative thereof); or

|

|

|

• |

a member of the company’s independent accounting firm. |

|

|

• |

information on the advisability of a given action brought for his or her approval

or performed by virtue of his or her position; and |

|

|

• |

all other important information pertaining to these actions. |

|

|

• |

refrain from any act involving a conflict of interest between the performance of his

or her duties in the company and his or her other duties or personal affairs; |

|

|

• |

refrain from any activity that is competitive with the business of the company;

|

|

|

• |

refrain from exploiting any business opportunity of the company for the purpose of

gaining a personal advantage for himself or herself or others; and |

|

|

• |

disclose to the company any information or documents relating to the company’s

affairs which the office holder received as a result of his or her position as an office holder. |

|

|

• |

a transaction other than in the ordinary course of business; |

|

|

• |

a transaction that is not on market terms; or |

|

|

• |

a transaction that may have a material impact on the company’s profitability, assets or liabilities.

|

|

|

• |

Executive officers other than the Chief Executive

Officer. The compensation of an office holder in a public company who is neither a director nor the chief executive officer

generally requires approval by the (i) compensation committee; and (ii) the board of directors. Approval of terms of office and

employment for such officers which do not comply with the compensation policy may nonetheless be approved, in special circumstances, subject

to two cumulative conditions: (i) the compensation committee and thereafter the board of directors, approved the terms after having taken

into account the various considerations and mandatory requirements set forth in the Companies Law with respect a compensation policy,

and (ii) the shareholders of the company have approved the terms by the Special Majority for Compensation . However, if the shareholders

do not approve a compensation arrangement with an executive officer that is inconsistent with the company’s compensation policy,

a company’s compensation committee and board of directors, may, in special circumstances approve the compensation despite shareholder

objection, provided that the compensation committee and thereafter the board of directors have determined to approve the compensation

based on detailed reasoning, after each having re- discussed the terms of compensation, and after examining the objection of the shareholders.

|

|

|

• |

Chief Executive Officer. The compensation

of a chief executive officer in a public company generally requires approval by the (i) compensation committee; (ii) the board of directors;

and (iii) the shareholders of the company by the Special Majority for Compensation. Approval of the compensation terms of a chief executive

officer which do not comply with the compensation policy may nonetheless be approved, in special circumstances, subject to two cumulative

conditions: (i) the compensation committee and thereafter the board of directors, approved the terms after having taken into account the

various considerations and mandatory requirements set forth in the Companies Law with respect to a compensation policy and (ii) the shareholders

of the company have approved the terms by means of the Special Majority for Compensation . However, a company’s compensation committee

and board of directors, may, in special circumstances approve the compensation of a chief executive officer (who is not a director) that

is not approved by shareholders despite shareholder objection, provided that the company’s compensation committee and thereafter

the board of directors have determined to approve the compensation, based on detailed reasoning, after each having re-discussed the terms

of office and employment, and after examining the objection of the shareholders. In addition, the compensation committee may exempt from

shareholder approval the compensation terms of a candidate for the office of chief executive officer where such officer has no prior business

relationship with the controlling shareholder or the company, if it has found, based on detailed reasons, that bringing the compensation

to the approval of the shareholders would impede the employment of such candidate by the company, provided that the terms of office and

employment are in accordance with the company’s compensation policy. |

|

|

• |

Directors. The compensation of a director

(who is not the chief executive officer) of a public company generally requires approval by the (i) compensation committee; (ii) the board

of directors; and (iii) unless exempted under regulations promulgated under the Companies Law, the shareholders of the company. Approval

of terms of the compensation of directors of a company which do not comply with the compensation policy may nonetheless be approved, in

special circumstances, subject to two cumulative conditions: (i) the compensation committee and thereafter the board of directors, approved

the terms after having taken into account the various considerations and mandatory requirements set forth in the Companies Law with respect

to a compensation policy and (ii) the shareholders of the company have approved the terms by means of the Special Majority for Compensation.

|

|

|

• |

at least a majority of the shares held by shareholders who have no personal interest in the matter who

are present and voting at the meeting must be voted in favor of approving the transaction, excluding abstentions; or |

|

|

• |

the shares voted by shareholders who have no personal interest in the matter who are present and vote against

the transaction represent no more than 2% of the voting rights in the company. |

|

|

• |

an amendment to the articles of association; |

|

|

• |

an increase in the company’s authorized share capital; |

|

|

• |

a merger; and |

|

|

• |

the approval of related party transactions and acts of office holders that require shareholder approval

under the Companies Law. |

|

|

• |

monetary liability imposed on him or her in favor of another person pursuant to a

judgment, including a settlement or arbitrator’s award approved by a court. However, if an undertaking to indemnify an office holder

with respect to such liability is provided in advance, then such an undertaking must be limited to events which, in the opinion of the

board of directors, can be foreseen based on the company’s activities when the undertaking to indemnify is given, and to an amount

or according to criteria determined by the board of directors as reasonable under the circumstances, and such undertaking shall detail

the abovementioned foreseen events and amount or criteria; |

|

|

• |

reasonable litigation expenses, including attorneys’ fees, incurred by the office

holder (i) as a result of an investigation or proceeding instituted against him or her by an authority authorized to conduct such investigation

or proceeding, provided that (1) no indictment was filed against such office holder as a result of such investigation or proceeding; and

(2) no financial liability was imposed upon him or her as a substitute for the criminal proceeding as a result of such investigation or

proceeding or, if such financial liability (such as a criminal penalty) was imposed, it was imposed with respect to an offense that does

not require proof of criminal intent and (ii) in connection with a monetary sanction; |

|

|

• |

a monetary liability imposed on an office holder in favor of an injured party at an Administrative Procedure

(as defined below) pursuant to Section 52(54)(a)(1)(a) of the Israeli Securities Law; |

|

|

• |

expenses incurred by an office holder or certain compensation payments made to an injured party that were

instituted against an office holder in connection with an Administrative Procedure under the Israeli Securities Law, including reasonable

litigation expenses and reasonable attorneys’ fees; and |

|

|

• |

reasonable litigation expenses, including attorneys’ fees, incurred by the office

holder or imposed by a court in proceedings instituted against him or her by the company, on its behalf or by a third party or in connection

with criminal proceedings in which the office holder was acquitted or as a result of a conviction for an offense that does not require

proof of criminal intent. |

|

|

• |

a breach of duty of loyalty to the company, provided that the office holder acted in good faith and had

a reasonable basis to believe that the act would not prejudice the company; |

|

|

• |

a breach of duty of care to the company or to a third party, including a breach arising out of the negligent

(but not intentional or reckless) conduct of the office holder; |

|

|

• |

a financial liability imposed on the office holder in favor of a third party; |

|

|

• |

a monetary liability imposed on the office holder in favor of an injured party in an Administrative Procedure

pursuant to Section 52(54)(a)(1)(a) of the Israeli Securities Law; and |

|

|

• |

expenses, including reasonable litigation expenses and reasonable attorneys’ fees, incurred by an

office holder in connection with an Administrative Procedure instituted against him or her pursuant to certain provisions of the Israeli

Securities Law. |

|

|

• |

a breach of duty of loyalty, except for indemnification and insurance for a breach of the duty of loyalty

to the company to the extent that the office holder acted in good faith and had a reasonable basis to believe that the act would not prejudice

the company; |

|

|

• |

a breach of duty of care committed intentionally or recklessly, excluding a breach arising out of the negligent

conduct of the office holder; |

|

|

• |

an act or omission committed with intent to derive illegal personal benefit; or |

|

|

• |

a fine, monetary sanction or forfeit levied against the office holder. |

|

|

December 31, |

|||||||||||

|

|

2022 |

2023 |

2024 |

|||||||||

|

|

||||||||||||

|

Management and administration |

12 |

12 |

8 |

|||||||||

|

Research and development |

29 |

29 |

19 |

|||||||||

|

Commercialization and business development |

8 |

38 |

1 |

|||||||||

|

Total |

49 |

79 |

28 |

|||||||||

|

|

● |

each of our directors and senior management; |

|

|

● |

all of our directors and senior management as a group; and |

|

|

● |

each person (or group of affiliated persons) known by us to be the beneficial owner

of 5% or more of the outstanding ordinary shares. |

|

|

Number of |

|||||||

|

|

Ordinary Shares |

|||||||

|

|

Beneficially |

Percent of |

||||||

|

|

Held |

Class |

||||||

|

|

||||||||

|

5% or Greater Shareholder |

||||||||

|

Hong Seng Technology Limited(1)

|

102,437,055 |

4.6 |

% | |||||

|

Intracoastal Capital LLC(2)

|

102,236,115 |

4.6 |

% | |||||

|

Directors |

||||||||

|

|

||||||||

|

Aharon Schwartz(3)

|

6,071,400 |

* |

||||||

|

B.J. Bormann(4) |

2,366,400 |

* |

||||||

|

Rami Dar(5) |

1,917,600 |

* |

||||||

|

Raphael Hofstein(6)

|

2,366,400 |

* |

||||||

|

Avraham Molcho(7)

|

2,366,400 |

* |

||||||

|

Sandra Panem(8) |

2,366,400 |

* |

||||||

|

Shaoyu Yan |

- |

|||||||

|

Gal Cohen (9) |

342,600 |

* |

||||||

|

|

||||||||

|

Executive officers |

||||||||

|

|

||||||||

|

Philip A. Serlin(10)

|

16,166,400 |

* |

||||||

|

Mali Zeevi(11) |

4,279,200 |

* |

||||||

|

Ella Sorani(12) |

4,176,000 |

* |

||||||

|

All directors and executive officers as a group (11 persons)(13)

|

42,418,800 |

1.1 |

% | |||||

|

(1) |

Based on Schedule 13D filed with the SEC on October 26, 2023. According to the Schedule

13D, includes 170,728 ADS, representing 102,437,055 ordinary shares held by Hong Seng Technology Limited. Lepu (Hong Kong) Co.,

Limited holds 66.67% equity interest of Hong Seng Technology Limited. Lepu Holdings Limited holds 99.5% equity interest of Lepu

(Hong Kong) Co., Limited. Lepu Medical (Europe) Cooperatief U.A. holds 100% equity interest of Lepu Holdings Limited. Lepu Medical

Technology (Beijing) Co., Ltd. holds 99.95% equity interest of Lepu Medical (Europe) Cooperatief U.A. Lepu Medical Technology (Beijing)

Co., Ltd. is a company publicly listed on Shenzhen Stock Exchange in the PRC (300003.SZ). |

|

(2) |

Based on Schedule 13G filed with the SEC on January 10, 2025.

According to the Schedule 13G, includes (i) 3,125 ADSs representing 1,875,000 ordinary shares and (ii) 45,394 ADSs representing 27,236,115

ordinary shares issuable upon exercise of a warrant issued in January 2025. Mitchell P. Kopin and Daniel B. Asher, each of whom

are managers of Intracoastal Capital LLC, or Intracoastal, have shared voting control and investment discretion over the securities reported

herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined

under Section 13(d) of the Exchange Act) of the securities reported herein that are held by Intracoastal. The warrant is subject to a

beneficial ownership limitation of 4.99%, which such limitation restricts the shareholder from exercising that portion of the warrant

that would result in the shareholder and its affiliates owning, after exercise, a number of shares in excess of the beneficial ownership

limitation. The principal business office of Intracoastal is 245 Palm Trail, Delray Beach, FL 33483. |

|

(3) |

Includes 3,705,000 ordinary shares and 2,366,400 ordinary shares issuable upon exercise

of outstanding options currently exercisable or exercisable within 60 days of March 26, 2025. Does not include 1,937,400 ordinary shares

issuable upon exercise of outstanding options that are not exercisable within 60 days of March 26, 2025. |

|

(4) |

Includes 2,366,400 ordinary shares issuable upon exercise of outstanding options currently exercisable

or exercisable within 60 days of March 26, 2025. Does not include 1,937,400 ordinary shares issuable upon exercise of outstanding options

that are not exercisable within 60 days of March 26, 2025. |

|

(5) |

Includes 1,917,600 ordinary shares issuable upon exercise of outstanding options currently

exercisable or exercisable within 60 days of March 26, 2025. Does not include 1,937,400 ordinary shares issuable upon exercise of outstanding

options that are not exercisable within 60 days of March 26, 2025. |

|

(6) |

Includes 2,366,400 ordinary shares issuable upon exercise of

outstanding options currently exercisable or exercisable within 60 days of March 26, 2025. Does not include 1,937,400 ordinary shares

issuable upon exercise of outstanding options that are not exercisable within 60 days of March 26, 2025. |

|

(7) |

Includes 2,366,400 ordinary

shares issuable upon exercise of outstanding options currently exercisable or exercisable within 60 days of March 26, 2025. Does

not include 1,937,400 ordinary shares issuable upon exercise of outstanding options that are not exercisable within 60 days of March 26,

2025. |

|

(8) |

Includes 2,366,400 ordinary shares issuable upon exercise of outstanding options currently exercisable

or exercisable within 60 days of March 26, 2025. Does not include 1,937,400 ordinary shares issuable upon exercise of outstanding options

that are not exercisable within 60 days of March 26, 2025. |

|

(9) |

Includes 342,600 ordinary shares issuable upon exercise of outstanding

options currently exercisable or exercisable within 60 days of March 26, 2025. Does not include 1,712,400 ordinary shares issuable upon

exercise of outstanding options that are not exercisable within 60 days of March 26, 2025. |

|

(10) |

Includes 171,600 ordinary shares and 15,994,800 ordinary

shares issuable upon exercise of outstanding options and PSUs currently exercisable or exercisable within 60 days of March 26,

2025. Does not include 6,006,000 ordinary shares issuable upon exercise of outstanding options and PSUs that are not exercisable within

60 days of March 26, 2025. |

|

(11) |

Includes 329,400 ordinary shares and 3,949,800 ordinary shares issuable upon exercise of outstanding options

and PSUs currently exercisable or exercisable within 60 days of March 26, 2025. Does not include 1,441,200 ordinary shares issuable upon

exercise of outstanding options and PSUs that are not exercisable within 60 days of March 26, 2025. |

|

(12) |

Includes 66,600 ordinary shares and 4,109,400 ordinary shares issuable upon exercise of outstanding options

and PSUs currently exercisable or exercisable within 60 days of March 26, 2025. Does not include 1,441,200 ordinary shares issuable upon

exercise of outstanding options and PSUs that are not exercisable within 60 days of March 26, 2025. |

|

(13) |

See footnotes (3)-(12) for certain information regarding beneficial ownership.

|

|

• |

amendments to our Articles of Association; |

|

• |

appointment, termination or the terms of service of our auditors; |

|

• |

appointment of external directors (if applicable); |

|

• |

approval of certain related party transactions; |

|

• |

increases or reductions of our authorized share capital; |

|

• |

a merger; and |

|

• |

the exercise of our board of directors’ powers by a general meeting, if our

board of directors is unable to exercise its powers and the exercise of any of its powers is required for our proper management.

|

|

|

• |

the excess distribution or gain would be allocated ratably over the Non-Electing U.S.

Investor’s holding period for the ordinary shares or ADSs; |

|

|

• |

the amount allocated to the current taxable year and any year prior to us becoming

a PFIC would be taxed as ordinary income; and |

|

|

• |

the amount allocated to each of the other taxable years would be subject to tax at

the highest rate of tax in effect for the applicable class of taxpayer for that year, and an interest charge for the deemed deferral benefit

would be imposed with respect to the resulting tax attributable to each such other taxable year. |

|

|

• |

taxes and other governmental charges; |

|

|

• |

any applicable transfer or registration fees; |

|

|

• |

certain cable, telex and facsimile transmission charges as provided in the deposit

agreement; |

|

|

• |

any expenses incurred in the conversion of foreign currency; |

|

|

• |

a fee of $5.00 or less per 100 ADSs (or a portion thereof) for the execution and delivery

of ADRs and the surrender of ADRs, including if the deposit agreement terminates; |

|

|

• |

a fee of $.01 or less per ADS (or portion thereof) for any cash distribution made

pursuant to the deposit agreement; |

|

|

• |

a fee for the distribution of securities pursuant to the deposit agreement;

|

|

|

• |

in addition to any fee charged for a cash distribution, a fee of $.01 or less per

ADS (or portion thereof) per annum for depositary services; |

|

|

• |

a fee for the distribution of proceeds of rights that the Depositary sells pursuant

to the deposit agreement; and |

|

|

• |

any other charges payable by the Depositary, any of the Depositary’s agents,

or the agents of the Depositary’s agents in connection with the servicing of ordinary shares or other Deposited Securities.

|

|

a. |

Disclosure Controls and Procedures

|

|

b. |

Management’s Annual Report on Internal

Control over Financial Reporting |

|

c. |

Attestation Report of Registered Public Accounting

Firm |

|

d. |

Changes in Internal Control over Financial

Reporting |

|

|

Year Ended December 31, |

|||||||

|

|

2023 |

2024 |

||||||

|

Services Rendered |

(in thousands of U.S. dollars) |

|||||||

|

|

||||||||

|

Audit Fees(1) |

130 |

160 |

||||||

|

Audit-Related Fees(2)

|

17 |

40 |

||||||

|

Tax Fees(3) |

52 |

41 |

||||||

|

Total |

199 |

211 |

||||||

|

(1) |

Audit fees consist of services that would normally be provided in connection with statutory and regulatory

filings or engagements, including services that generally only the independent accountant can reasonably provide. | |

|

|

| |

|

(2) |

Audit-related services relate to reports to the IIA and work regarding a public listing or offering.

| |

|

|

| |

|

(3) |

Tax fees relate to tax reports for BioLineRx USA, Inc., tax compliance, planning

and advice. |

|

|

• |

Distribution of periodic reports to shareholders.

Under Israeli law, a public company whose shares are traded on the TASE, is not required to distribute periodic reports directly to shareholders

and the generally accepted business practice in Israel is not to distribute such reports to shareholders but to make such reports publicly

available through a public website. We will only mail such reports to shareholders upon request. In addition, we make our audited financial

statements available to our shareholders at our offices. |

|

|

• |

Quorum. While the Nasdaq Rules require that

the quorum for purposes of any meeting of the holders of a listed company’s common voting stock, as specified in the company’s

bylaws, be no less than 33 1/3% of the company’s outstanding common voting stock, as permitted under the Companies Law, our Articles

of Association provide that a quorum of two or more shareholders holding at least 25% of the voting rights in person or by proxy is required

for commencement of business at a general meeting (and, with respect to an adjourned meeting, a quorum consists of any number of shareholders

present in person or by proxy). |

|

|

• |

Nomination of Directors. We follow Israeli

corporate governance practices instead of the requirements of the Nasdaq Rules with regard to the nomination committee and director nomination

procedures. Israeli law and practice does not require director nominations to be made by a nominating committee of our board of

directors consisting solely of independent directors, as required under the Nasdaq Rules. In accordance with Israeli law and practice,

directors are recommended by our board of directors for election by our shareholders (other than directors elected by our board of directors

to fill a vacancy), and certain of our shareholders may nominate candidates for election as directors by the general meeting of shareholders

in accordance with the Companies Law and our Articles of Association. |

|

|

• |

Compensation of Officers. We follow Israeli

law and practice with respect to the approval of officer compensation, pursuant to which transactions with office holders regarding their

terms of office and employment generally require the approval of the compensation committee, the board of directors and under certain

circumstances (such as if the officer is a director or controlling shareholder) the shareholders, either in accordance with our compensation

policy or, in special circumstances in deviation therefrom, taking into account certain considerations set forth in the Companies Law.

See “Item 6.C— Directors, Senior Management and Employees — Board Practices — Compensation Committee” for

information regarding the Compensation Committee, and “Item 6.C — Directors, Senior Management and Employees — Approval

of Related Party Transactions under Israeli Law” for information regarding the approvals required with respect to approval of terms

of office and employment of office holders, pursuant to the Companies Law. |

|

|

• |

Approval of Related Party Transactions.

We follow Israeli law and practice with respect to the approval of interested party acts and transactions, as set forth in sections 268

to 275 of the Companies Law, and the regulations promulgated thereunder, which generally require the approval of the audit committee,

the board of directors and, under certain circumstances (such as if the transaction is with a controlling shareholder or another party

in which the controlling shareholder has a personal interest) the shareholders, as may be applicable, for specified transactions. See

“Item 6.C— Directors, Senior Management and Employees —Board Practices — Approval of Related Party Transactions

under Israeli Law” for information regarding the approvals required with respect to approval of related party transactions pursuant

to the Companies Law. |

|

|

• |

Shareholder Approval. We intend to seek shareholder

approval for all corporate actions requiring such approval in accordance with the requirements of the Companies Law, which are different

or in addition to the requirements for seeking shareholder approval under Nasdaq Listing Rule 5635, rather than seeking approval for corporation

actions in accordance with such listing rules. |

|

|

• |

Equity Compensation Plans. We do not necessarily

seek shareholder approval for the establishment of, and amendments to, stock option or equity compensation plans (as set forth in Nasdaq

Listing Rule 5635(c)), as such matters are not subject to shareholder approval under Israeli law and practice. However, any equity-based

compensation arrangement with a director or the chief executive officer or the material amendment of such an arrangement must be approved

by our Compensation Committee, board of directors and shareholders, in that order. |

109

|

Exhibit

Number

|

|

Exhibit Description

|

|

101

|

The following financial information from BioLineRx Ltd.’s Annual Report on Form 20-F for the fiscal year ended December 31, 2023 formatted in Inline XBRL (Extensible Business Reporting Language): (i) Consolidated Statements of Financial Position at December 31, 2023 and 2022; (ii) Consolidated Statements of Comprehensive Loss for the years ended December 31, 2023, 2022 and 2021; (iii) Statements of Changes in Equity for the years ended December 31, 2023, 2022 and 2021; (iv) Consolidated Cash Flow Statements for the years ended December 31, 2023, 2022 and 2021; and (v) Notes to the Consolidated Financial Statements.

|

|

*

|

Filed herewith.

|

|

†

|

Portions of this exhibit have been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request.

|

|

(1)

|

Incorporated by reference to the Registrant’s Annual Report on Form 20-F filed on February 23, 2021.

|

|

(2)

|

Incorporated by reference to Exhibit 1 of the Registration Statement on Form F-6EF (No. 333-218969) filed by the Bank of New York Mellon on June 26, 2017 with respect to the Registrant’s American Depositary Shares.

|

|

(3)

|

Incorporated by reference to the Registrant’s Annual Report on Form 20-F filed on March 23, 2017.

|

|

(4)

|

Incorporated by reference to the Registrant’s Registration Statement on Form 20-F (No. 001-35223) filed on July 1, 2011.

|

|

(5)

|

Incorporated by reference to the Registrant’s Annual Report on Form 20-F filed on March 10, 2016.

|

|

(6)

|

Incorporated by reference to the Registrant’s Annual Report on Form 20-F/A filed on May 31, 2016.

|

|

(7)

|

Incorporated by reference to the Registrant’s Form 6-K filed on October 3, 2018.

|

|

(8)

|

Incorporated by reference to the Registrant’s Form 6-K filed on May 27, 2022.

|

|

(9)

|

Incorporated by reference to the Registrant’s Annual Report on Form 20-F filed on March 12, 2020.

|

|

(10)

|

Incorporated by reference to the Registrant’s Annual Report on Form 20-F filed on March 23, 2015.

|

|

(11)

|

Incorporated by reference to the Registrant’s Annual Report on Form 20-F/A filed on September 22, 2015.

|

|

(12)

|