|

FY2024 20-F |

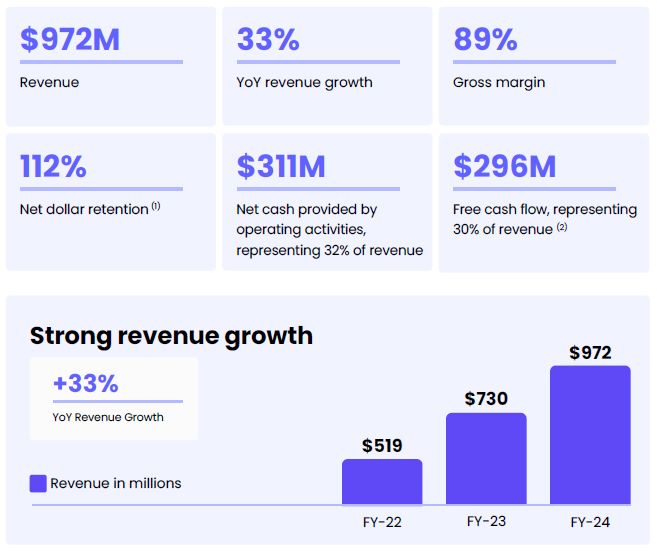

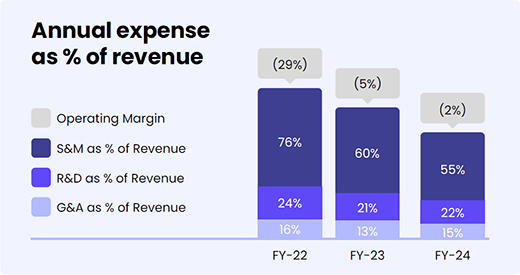

Financial Highlights

| (1) | For definition of Net Dollar Retention, see “Part 4 - Operating and Financial Review and Prospects - Key Business Metrics”. |

| (2) | Non-GAAP measures. See “Part 4 - Operating and Financial Review and Prospects - Non-GAAP Financial Measures”. |

2

|

FY2024 20-F |

| (1) | as of December 31, 2024. |

3

|

FY2024 20-F |

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose. The Gartner content described herein (the “Gartner Content”) represents research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. (“Gartner”), and is not a representation of fact. Gartner Content speaks as of its original publication date (and not as of the date of this 20-F), and the opinions expressed in the Gartner Content are subject to change without notice.

4

|

FY2024 20-F |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2024 |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-40461

monday.com Ltd.

(Exact name of Registrant as specified in its charter)

ISRAEL

(Jurisdiction of incorporation or organization)

6 Yitzhak Sadeh Street, Tel Aviv, 6777506 Israel

(Address of principal executive offices)

Shiran Nawi, Adv.

Chief People and Legal Officer

Telephone: +972(55) 939-7720

monday.com Ltd.

6 Yitzhak Sadeh Street

Tel Aviv, 6777506 Israel

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

5

|

FY2024 20-F |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Ordinary shares, no par value per share |

MNDY | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As of December 31, 2024, the registrant had outstanding 50,773,337 ordinary shares, no par value per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ |

| Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

6

|

FY2024 20-F |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

7

|

FY2024 20-F |

Table of contents

Table of contents 8

|

FY2024 20-F |

Cross Reference Table Form 20-F

| 1 | Identity of Directors, Senior Management and Advisers | N/A |

| 2 | Offer Statistics and Expected Timetable | N/A |

| 3 | Key Information | |

| 3.B. | Capitalization and Indebtedness | N/A |

| 3.C. | Reasons for the Offer and Use of Proceeds | N/A |

| 3.D. | Risk Factors | 87-148 |

| 4 | Information on the Company | |

| 4.A. | History and Development of the Company | 149 |

| 4.B. | Business Overview | 15-41 |

| 4.C. | Organizational Structure | 41 |

| 4.D. | Property, Plants and Equipment | 37 |

| 4A | Unresolved Staff Comments | N/A |

| 5 | Operating and Financial Review and Prospects | |

| 5.A. | Operating Results | 56-64 |

| 5.B. | Liquidity and Capital Resources | 64-66 |

| 5.C. | Research and Development, Patents and Licenses, etc. | 66 |

| 5.D. | Trend Information | 66-67 |

| 5.E. | Critical Accounting Estimates | 67-69 |

| 6 | Directors, Senior Management and Employees | |

| 6.A. | Directors and Senior Management | 42-46 |

| 6.B. | Compensation | 151-156 |

| 6.C. | Board Practices | 156-165 |

| 6.D. | Employees | 166 |

| 6.E. | Share Ownership | 47-49 |

| 6.F. | Disclosure of a Registrant’s Action to Recover Erroneously Awarded Compensation | N/A |

Cross Reference Table Form 20-F 9

|

FY2024 20-F |

| 7 | Major Shareholders and Related Party Transactions | |

| 7.A. | Major Shareholders | 47-49 |

| 7.B. | Related Party Transactions | 49-51 |

| 7.C. | Interest of Experts and Counsel | N/A |

| 8 | Financial Information | |

| 8.A. | Consolidated Statements and Other Financial Information | 173-221 |

| 8.B. | Significant Changes | 74 |

| 9 | The Offer and Listing | |

| 9.A. | Offer and Listing Details | N/A |

| 9.B. | Plan of Distribution | N/A |

| 9.C. | Markets | N/A |

| 9.D. | Selling Shareholders | N/A |

| 9.E. | Dilution | N/A |

| 9.F. | Expenses of the Issue | N/A |

| 10 | Additional Information | |

| 10.A. | Share Capital | 149 |

| 10.B. | Memorandum and Articles of Association | 149 |

| 10.C. | Material Contracts | 166 |

| 10.D. | Exchange Controls | 166 |

| 10.E. | Taxation | 74-86 |

| 10.F. | Dividends and Paying Agents | N/A |

| 10.G. | Statement by Experts | N/A |

| 10.H. | Documents on Display | 166 |

| 10.I. | Subsidiary Information | N/A |

| 10.J. | Annual Report to Security Holders | N/A |

| 11 | Quantitative and Qualitative Disclosures About Market Risk | 69-71 |

| 12 | Description of Securities Other than Equity Securities | N/A |

| 13 | Defaults, Dividends Arrearages and Delinquencies | N/A |

Cross Reference Table Form 20-F 10

|

FY2024 20-F |

| 14 | Material Modifications to the Rights of Security Holders and Use of Proceeds | N/A |

| 15 | Controls and Procedures | 72-73 |

| 16A | Audit Committee Financial Expert | 159-160 |

| 16B | Code of Ethics | 167 |

| 16C | Principal Accountant Fees and Services | 73 |

| 16D | Exemptions from the Listing Standards for Audit Committees | N/A |

| 16E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 167 |

| 16F | Change in Registrant’s Certifying Accountant | N/A |

| 16G | Corporate Governance | 167-169 |

| 16H | Mine Safety Disclosure | N/A |

| 16I | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | N/A |

| 16J | Insider Trading Policies | 168 |

| 16K | Cybersecurity | 168-169 |

| 17 | Financial Statements | N/A |

| 18 | Financial Statements | 173-221 |

| 19 | Exhibits | 170-173 |

Cross Reference Table Form 20-F 11

|

FY2024 20-F |

Introduction

In this annual report, references to “we,” “us,” “our,” “our business,” “the Company,” “monday.com” and similar references refer to monday.com Ltd. and, where appropriate, its consolidated subsidiaries.

This annual report contains estimates, projections and other information concerning our industry and our business, as well as data regarding market research, estimates and forecasts prepared by our management. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those discussed under the headings “Special Note Regarding Forward-Looking Statements” and “Part 6 - Risk Factors” in this annual report.

Special note regarding forward-looking statements

In addition to historical facts, this annual report contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (“Securities Act”), Section 21E of the U.S. Securities Exchange Act of 1934, as amended (“Exchange Act”), and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties and include information about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” or the negative of these terms or similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to:

| • | our ability to effectively manage the scope and complexity of our business following years of rapid growth and our ability to maintain profitability; |

| • | foreign currency exchange rate fluctuations; |

| • | the fact that we continue to derive a majority of revenues from monday work management; |

| • | fluctuations in operating results; |

Introduction 12

|

FY2024 20-F |

| • | real or perceived errors, failures, vulnerabilities or bugs in our platform, products, or third-party applications offered on our app marketplace or interruptions or performance problems in the technology or infrastructure underlying our platform; |

| • | risks related to artificial intelligence (“AI” ) and machine learning (“ML”); |

| • | our ability to attract customers, grow our retention rates and expand usage within organizations, including cross-selling and upselling; |

| • | risks related to our subscription-based business model; |

| • | our sales efforts may require considerable time and expense and the use of differing sales strategies may extend our sales cycles; |

| • | changes in sizes or types of business that purchase our platform and products; |

| • | our ability to offer high quality customer support and consistent sales strategies; |

| • | maintenance of corporate culture; |

| • | risks related to international operations and compliance with laws and regulations applicable to our global operations; |

| • | risks related to acquisitions, strategic investments, partnerships, or alliances; |

| • | risks associated with environmental and social responsibility and climate change; |

| • | our dependence on key employees and ability to attract and retain highly skilled employees; |

| • | our ability to raise additional capital or generate cash flows necessary to grow our business; |

| • | uncertain global economic conditions and inflation; |

| • | changes and competition in the market and software categories in which we participate; |

| • | our ability to introduce new products, features, integrations, capabilities, and enhancements; |

| • | the ability of our platform to interoperate with a variety of software applications; |

| • | our reliance on third-party application stores to distribute our mobile application; |

| • | our successful strategic relationships with, and our dependence on third parties; |

| • | our reliance on traditional web search engines to direct traffic to our website; |

| • | interruption or delays in service from third parties or our inability to plan and manage interruptions; |

Introduction 13

|

FY2024 20-F |

| • | risks related to security disruptions, unauthorized system access; |

| • | evolving privacy protection and data security laws, regulations, industry standards, policies, contractual obligations, and cross-border data transfer or localization restrictions; |

| • | new legislation and regulatory obligations regulating AI; |

| • | changes in tax law and regulations or if we were to be classified as a passive foreign investment company; |

| • | our ability to maintain, protect or enforce our intellectual property rights or intellectual property infringement claims; |

| • | risks related to our use of open-source software; |

| • | risks related to our founder share that provides certain veto rights; |

| • | risks related to our status as a foreign private issuer incorporated and located in Israel, including risks related to the ongoing war between Israel and Hamas and escalations thereof; |

| • | our expectation not to pay dividends for the foreseeable future; |

| • | risks related to our Digital Lift Initiative and the monday.com Foundation; |

| • | risks related to legal and regulatory matters; and |

| • | other statements described in this annual report under “Part 1 - Who We Are,” “Part 4 - Operating and Financial Review and Prospects” and “Part 6 - Risk Factors,” as updated by subsequent reports filed with the U.S. Securities and Exchange Commission (“SEC”). |

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. The estimates and forward-looking statements contained in this annual report speak only as of the date of this annual report. Except as required by applicable law, we undertake no obligation to publicly update or revise any estimates or forward-looking statements whether as a result of new information, future events or otherwise, or to reflect the occurrence of unanticipated events.

This annual report includes websites or references to additional company reports. These are intended to provide inactive, textual references only. The information on websites and contained in those reports is not part of this report and not incorporated by reference in this report. In addition, historical, current, and forward-looking environmental and social-related statements may be based on standards for measuring progress that are still developing and on controls and processes that continue to evolve. While certain matters discussed in this annual report may be significant, any significance should not be taken, or otherwise assumed, as necessarily rising to the level of materiality used for purposes of complying with the Company’s public company reporting obligations pursuant to the U.S. federal securities laws and regulations, even if the report uses the words “material” or “materiality.”

Introduction 14

|

FY2024 20-F |

Part - 1 Who we are

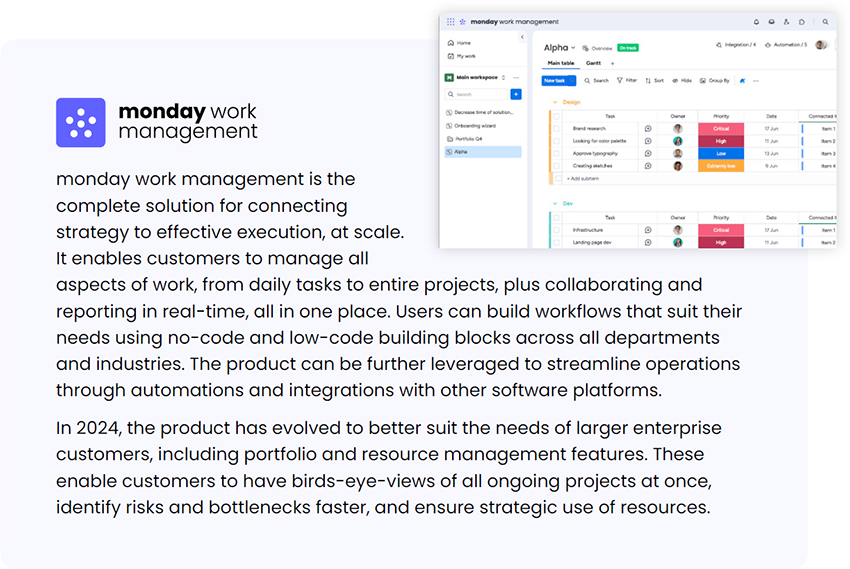

monday.com is a platform that runs the core of all work. The platform democratizes the power of software so organizations can easily build software applications and work management tools that fit their needs. We call our platform a “Work OS” (Work Operating System), and we believe that we are pioneering a new category of software that will change the way people work and businesses operate, giving them one place to manage every part of their work.

Our cloud-based platform is a no-code and low-code framework that consists of modular building blocks that are simple enough for anyone to use, yet powerful enough to drive core business within any organization. Our platform also integrates with other systems and applications, creating a new connective layer for organizations that links departments and bridges information silos. On top of our platform, we have built a product suite to address the needs of specific industries and use cases — including monday work management, monday CRM, monday dev, and monday service. We also offer independent products that can be used without the platform, including WorkCanvas, a digital whiteboard, and WorkForms, which allows users to create personalized forms or surveys and gain organizational insights. Additionally, we have begun incorporating AI capabilities throughout the entire platform.

By using our platform and products, our customers can simplify and accelerate their digital transformation, enhance organizational agility, create a unifying workspace across departments, and increase operational efficiency and productivity. As of December 31, 2024, we served nearly 245,000 customers across over 200 industries in more than 200 countries and territories.

Part 1 - Who we are 15

|

FY2024 20-F |

Part 1 - Who we are 16

|

FY2024 20-F |

Our growth strategies

We intend to drive the growth of our business by executing the following strategies:

Evolve the Work OS platform

We have a strong history of technological innovation, as we regularly release new building blocks and make frequent updates to our platform for performance and scale. We have also begun to incorporate AI capabilities throughout the platform.

Our unique product architecture enables us to improve our platform and build superior products rapidly and efficiently. We intend to continue making significant investments in research and development and hiring top technical talent to enable new use cases, serve more verticals, and increase enterprise-grade features on our platform.

Augment our vision with a versatile suite of Work OS-based, interoperable products

We have built products on top of our platform that run the core of work for organizations of all sizes, allowing customers to adapt the software on their own and scale with their business. We customize the user experience across the customer lifecycle, from initial discovery through marketing campaigns to onboarding with pre-designed workflows, templates, automations, and integrations. We prioritize the creation of new products that can work in harmony as they share a common code base. We do this by focusing on customer demand and go-to-market. Our product suite includes four products:

| • | monday work management: manages workflows, projects, and portfolios to fuel team collaboration and productivity at scale |

| • | monday CRM: tracks and manages all aspects of the sales cycle |

| • | monday dev: builds agile product and software development workflows |

| • | monday service: creates seamless connection between service desks and their data |

The AI capabilities introduced throughout the platform enable customers to leverage AI directly in all of their workflows. There are two additional, independent products based on specific customer needs: WorkForms, which allows users to create personalized forms or surveys and gain organizational insights, and WorkCanvas, a digital whiteboard for real-time, unstructured collaboration.

Part 1 - Who we are 17

|

FY2024 20-F |

Grow and invest in our ecosystem strategy

Our ability to innovate is amplified by our app marketplace, where external developers, channel partners, global system integrators, and customers are expanding our building blocks and creating new applications that fit a variety of use cases. Marketplace vendors can choose to monetize their apps through third-party payment systems directly from within the platform. We believe investing in our ecosystem will expand our addressable market, as we will be able to serve more customers in new verticals and in regulated industries with greater security requirements.

Provide more value to and increase the number of large accounts

We are constantly adding tools and services to drive adoption and expansion to customers of all sizes while continuing to expand our focus on the needs of larger enterprise accounts — including a dedicated Product Alignment Team that builds with feedback from our enterprise-level customers. We will also continue to reach out to and expand our partner ecosystem, to deepen and broaden product adoption and scale.

Scale our go-to-market

Continue to scale our self-serve funnel complemented by expanding sales-led motion. We continue to ensure that customers can easily and independently get up and running on our products built on the platform. This is accomplished through a self-serve funnel where virtually any user can sign up and immediately gain value, regardless of their technical skills. Simultaneously, our sales team has undergone training for a more sales-led go-to-market strategy that will come in full force in 2025.

Drive growth by acquiring new customers. To drive new customer growth, we intend to continue investing in sales, marketing, and our partner ecosystem, with a focus on delivering complete products and tailored features for specific use cases, both top-down and bottom-up selling to engage both business users and decision-makers, paid and organic customer outreach, and more account-based marketing outreach efforts.

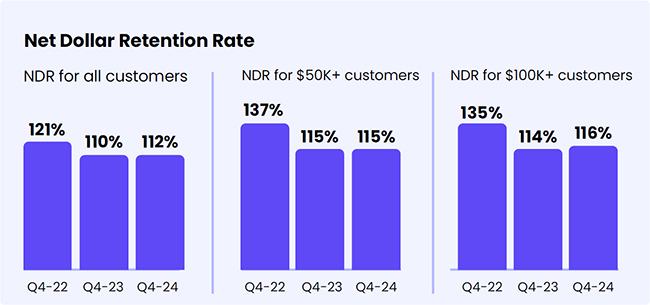

Drive increased adoption and expansion within our existing customer base. As our customers realize the benefits of our platform and products, they typically add more users and add additional products to their account as they expand to additional departments. As a result, our overall Net Dollar Retention Rate was 112% for the three months ended December 31, 2024, 110% for the three months ended December 31, 2023, and 121% for the three months ended December 31, 2022. We plan to continue investing in ways to expand within our existing customer base through the development of additional products. For the definition of Net Dollar Retention Rate, see “Part 4 - Operating and Financial Review and Prospects – Key Business Metrics.”

Part 1 - Who we are 18

|

FY2024 20-F |

Expand our global footprint. We will continue investing in local advertising channels, partnerships, events, and localizing our platform to address existing and new regions. We believe there is an opportunity to increase our global presence even further over time.

Our success by numbers

We have experienced rapid growth since launching our platform in 2014. Our revenue was $972.0 million, $729.7 million and $519.0 million for the years ended December 31, 2024, 2023, and 2022, respectively, representing an increase of 33%, 41%, and 68%, respectively, over the prior year. Additionally, we had net income of $32.4 million and net losses of $1.9 million and $136.9 million, for the years ended December 31, 2024, 2023, and 2022, respectively. We had net cash provided by operating activities of $311.1 million, $215.4 million and $27.1 million in the years ended December 31, 2024, 2023 and 2022, respectively, with free cash flow of $295.8 million, $204.9 million and $8.1 million for the years ended December 31, 2024, 2023 and 2022, respectively. Free cash flow is a non-GAAP financial measure. For additional information and a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure, see “Part 4 - Operating and Financial Review and Prospects - Non-GAAP Financial Measures.”

Industry trends

We believe we are at the center of generational shifts in technology and the way people work that create significant opportunities for our business, including the following trends:

AI is everywhere

In the past few years, to our estimation based on IDC data, the tech industry transitioned from novel AI use cases (like suggesting email copy) to more complex features. To our estimation, based on IDC data, companies that leverage AI with a collaborative culture will have the opportunity to better leverage creativity and critical thinking at all levels in delivering better results both for teams and for customers alike. As a new and rapidly evolving technology, adoption of AI by employees is a challenge. Companies that make AI accessible and intuitive have the advantage. According to the monday.com World of Work report, millennials have a higher likelihood of adopting AI than their gen Z counterparts, likely due to fears of AI replacing jobs. To win in this challenge, business leaders must introduce AI as a tool to enhance performance, not as a means to cut down on headcount.

Organizations are digitizing their work

Organizations are digitizing the workflows previously run in physical environments and reengineering their existing digital processes to gain more speed and efficiency. Flexible and adaptable software will determine the success of these digital transformation efforts and how businesses will compete in the digital era.

Part 1 - Who we are 19

|

FY2024 20-F |

Based on data from International Data Corporation (“IDC”), we forecast global digital transformation spending to reach nearly $4 trillion in 2027 with annual growth rate (“CAGR”) of 16.2% over the 2022-2027 period.

Enterprise work management: The key to scaling success

In 2025 and beyond, enterprise work management will be a cornerstone of business success as companies realize that seamless execution at scale is essential for growth. With hybrid teams spread across offices and remote locations, orchestrating workflows across departments, time zones, and geographies is no longer optional — it’s vital. Businesses that master this alignment will drive innovation and agility and stay ahead in an increasingly digital-first world.

Unified platforms are the future of enterprise tech

Platforms will reign supreme as businesses consolidate their tech stacks into unified systems for greater efficiency and strategic advantage. With all company data in one place, decision-making becomes faster and smarter, unlocking insights that fuel growth. Companies looking to achieve a complete AI transformation will find it more effective to implement an AI platform as an integrated platform essential for unlocking its full potential across all aspects of the business. In a data-driven world, a holistic platform isn’t just nice to have—it’s necessary when building a unique competitive edge.

Our opportunity

Rise of the Work Operating System

Organizations have historically run their businesses completely dependent on pre-packaged software that require significant implementation and maintenance costs. As a result, organizations were forced to manage and run their businesses to fit the software they were provided with, instead of in a way that fits their needs. These rigid frameworks limited their ability to work efficiently and agilely, grow their businesses, and have a complete perspective of their data.

Work OS is our vision for democratizing the power of software. The monday.com Work OS platform allows users, teams, and organizations to create their own software applications and work management tools to suit their specific and ever-growing needs and scale. We have also introduced and will continue to introduce AI capabilities throughout the platform to maximize its power. We designed our platform so that everything can be changed by our customers. This flexibility allows them to evolve as their company scales. We then took those building blocks ourselves and combined them into building new best-in-class, out-of-the-box, interoperable products. With continued adoption, monday.com becomes the unified platform to run the core of all work, by acting as a connective layer across all of an organization’s applications and departments.

Part 1 - Who we are 20

|

FY2024 20-F |

The monday.com Work OS platform is broadly applicable for any organization or team across a growing number of use cases. Using data from IDC, we estimate that our total addressable market was $101 billion in 2023 and will grow to $150 billion in 2026, representing a four-year CAGR of 14%.

We calculate these figures by summing the sizes of the following markets, which correspond to the most common use cases on our platform: project and portfolio management ($6 billion), collaborative applications ($39 billion), CRM applications ($30 billion), DevOps software tools ($17 billion) and IT service, operations and request management applications ($9 billion).

Because our platform serves many different verticals, we believe we have the ability to grow our market opportunity rapidly and expect to add more verticals over time.

Our platform

With the monday.com Work OS platform, organizations can build software applications and work management tools to fit their needs. Our no-code and low-code platform consists of modular building blocks that are simple enough for anyone to assemble, yet powerful enough to build solutions that drive the core business of any organization in any vertical. On top of the platform, we have built a suite of products, for the work management, CRM, software development, and service verticals, to address the needs of specific industries and use cases. Additionally, we have two independent products that can be used without the platform, to provide users with a digital whiteboard (WorkCanvas) and forms for data collection (WorkForms).

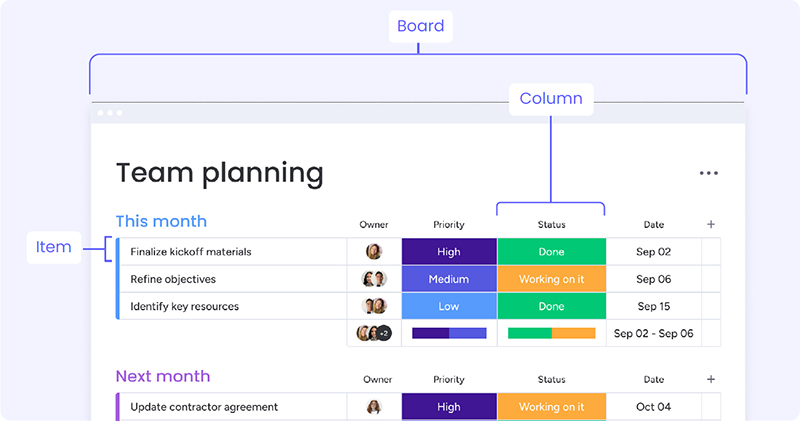

Users use boards to hold any information and processes they have, within items and columns. Our schemaless database infrastructure is completely flexible, allowing users to easily define the way they capture and present data. They use views to manipulate and consume that board information in different ways. Users can create forms to capture data from anyone, including non-monday.com users.

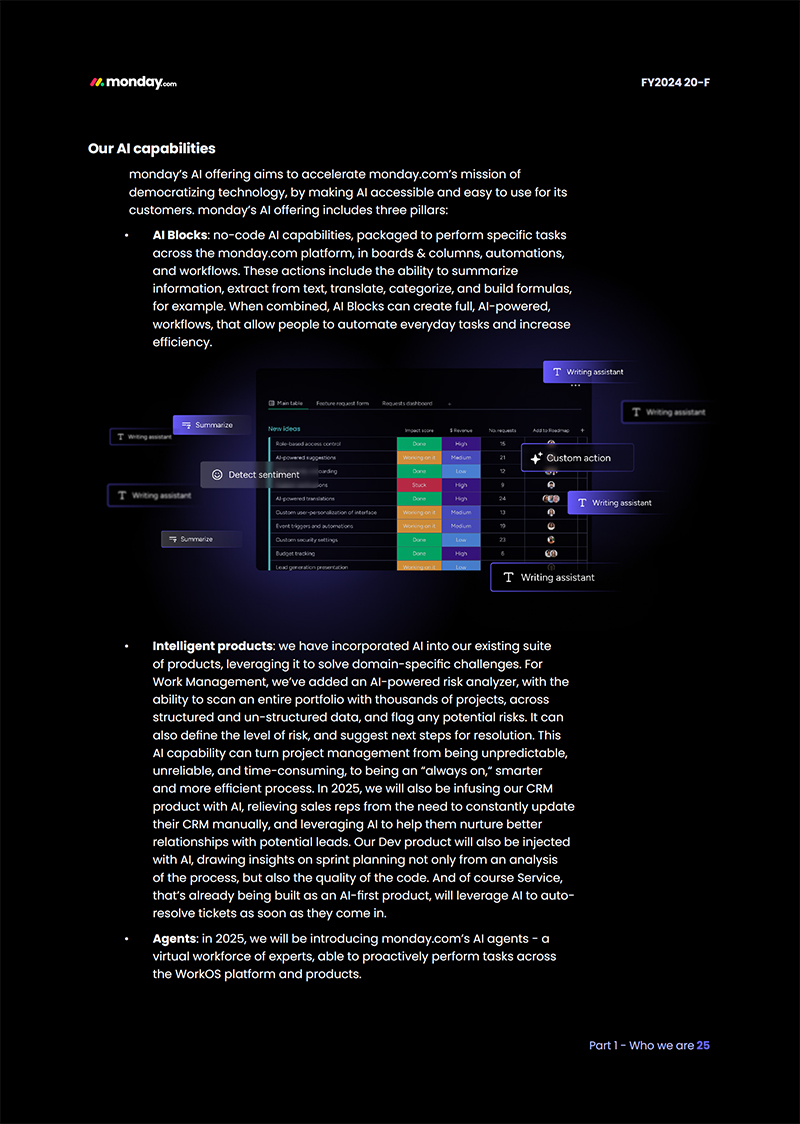

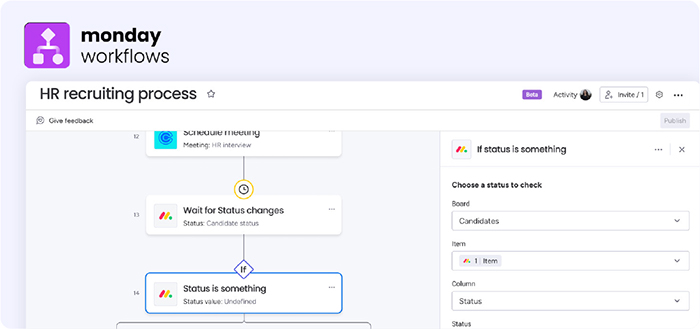

Integrations pull data from other applications into the board, export data to other systems, and synchronize data across applications. Automations eliminate repetitive manual processes, saving time and reducing human error. monday workflows optimizes customers’ automations and allows them to manage more complex workflows across teams and products. AI capabilities allow users to automate task generation, build formulas, compose emails, and generate content.

Part 1 - Who we are 21

|

FY2024 20-F |

Users build dashboards that pull data across many boards so stakeholders can get a complete high-level view of anything they may want. Users can access a variety of monday.com “stores” to further customize any kind of building block: for example, the column store allows customers to add new data types to any board, including location, formulas, numbers, text, and dates. The views store provides different types of interactive interfaces, including calendar, location, and timeline views. The dashboard widget store includes many widgets such as graphs, lists, and numbers for use in any dashboard layout customers want to create.

With monday workdocs, users can collaborate on documents in real-time and embed monday.com dashboards, images, videos, and more. Users can organize their boards, dashboards, and workdocs using workspaces.

Upon discovering our platform, customers enroll in a 14-day free trial of our Pro plan for the product that fits their needs, after which they are prompted to either continue with our Free plan for small teams (limited to two users) or pay for one of our four paid subscription plans.

Our products

Thanks to the flexibility of our infrastructure, we are building end-to-end products on top of the monday.com platform. Each product is tailored to a specific business need and empowers our customers to run the core of their work on monday.com. By the end of 2024, our product suite included:

Part 1 - Who we are 22

|

FY2024 20-F |

Part 1 - Who we are 23

|

FY2024 20-F |

We have two additional products, with differentiated pricing, designed to complement our platform:

Our app marketplace

We expanded the scope of our building blocks by extending our platform to external developers through a no-code and low-code framework and app marketplace. Our framework and flexible application programming interface, “monday_code,” allow customers, partners, and external developers to easily create their own building blocks and apps, either for private use or public availability on the app marketplace, while working with any of our products. Developers and app builders can also distribute their building blocks and solutions through our app marketplace. Marketplace vendors can choose to monetize their apps through third-party payment systems, or a payment processing system directly from within the platform. As of December 31, 2024, we had 649 apps in the marketplace and 445 apps with native monetization.

Part 1 - Who we are 24

|

FY2024 20-F |

Key benefits to our customers

Our platform enables customers to:

Democratize the power of software to all users: As a no-code and low-code platform, the possibilities for customization and the level of control our platform offers are virtually endless.

Increase efficiency: Our platform helps our customers digitize their business operations and re-engineer existing digital processes to make them more efficient. By consolidating many software tools into one cross-departmental platform, we enable our customers to increase their organizational agility, speed, and efficiency.

Create a unified workspace: By serving as a connective layer, our multi-product platform brings organizations, applications, and data into a unified workspace. This enables our customers to make complete, data-driven decisions, eliminate silos across the organization, and centralize all tools in one place.

Make data-driven decisions: By working with data that can be tracked, measured, and analyzed, our customers can gain new insights and work more effectively. This allows them to implement more data-driven decision-making and work more effectively.

Increase productivity and deep working: We believe our platform greatly reduces the reliance upon meetings, communications, and emails. This gives employees significant time back to their days and unlocks greater potential. Additionally, our platform automates repetitive, manual, and error-prone work, which frees up time and energy to focus on more impactful work.

Enhance company culture: Our platform helps foster a culture of inclusion, ownership, and clarity. By empowering everyone to think more holistically and have access to greater information, our platform helps promote better idea-sharing and brainstorming within an organization.

Part 1 - Who we are 26

|

FY2024 20-F |

The components of our platform

The key components of the platform include:

Boards: capture data and manage processes. Our boards are at the core of our platform, as they are the starting point upon which all functionality on our platform is built. Each board has the infrastructure of a schemaless database with an easy-to-use interface, which users can easily customize, populate, and build applications upon.

Items: customized to fit any use case. An item is a row within a board that can represent virtually anything a user chooses, including an entity, workstream, or campaign. Users populate items with actions, steps, leads, contacts, or other elements of a workstream.

Columns: represent data in a tailored way. Each item has a number of columns associated with it. Users add columns to identify owners of an item or workstream, track the status of an item, rate specific items, and add files related to the item, along with many more options. Users can also customize columns to fit virtually any use case.

Views: visualize and tailor a board’s contents for any need. Users can view and work with their data with multiple board view options. Each view is built for a different set of workflow needs.

monday workdocs: collaborate on a powerful doc that empowers users to turn words into actions. monday workdocs enables users to work simultaneously on the same shareable documents. Users can tag each other and embed boards and dashboards to collaborate within the context of their workflows and processes. They can co-edit, comment, and drag and drop text in real-time without disrupting other users working on the doc.

Part 1 - Who we are 27

|

FY2024 20-F |

WorkForms: capture data from others, including non-monday.com users. Users can create and collect data with intuitive, web-based, and easily shareable forms. Each submission generates a new item within the board, with all of the data supplied by the recipient automatically populated in the relevant columns.

Automations: save time and minimize human error by automating repetitive processes. Automations can be triggered when certain actions occur or thresholds are reached. They include automatically sending notifications, creating items, assigning ownerships and due dates, and moving items to other boards. Users can automate work using our predefined automation recipes or create their own.

Integrations: connect with external tools to share data and automate actions across tools. Integrations allow our users to connect with external tools to share data and automate actions across tools. Currently, our integration center includes integrations to other tools and growing, such as Gmail, Outlook, Jira, Salesforce, Google Drive, Dropbox, Stripe, Slack, GitHub, and Zendesk. Users can find additional integrations in our app marketplace or build their own using the monday.com API.

monday workflows: simplify the entire workflow creation process by utilizing drag-and-drop blocks. The monday workflows add-on optimizes customers’ automations and allows them to manage more complex workflows across organizations, departments, and monday.com products. This includes a workflows and connections center, robust workflow capabilities, and an AI prompt to workflow feature. monday workflows is also open to third-party developers.

Part 1 - Who we are 28

|

FY2024 20-F |

Dashboards: a high-level view of everything happening across an organization. Users can create dashboards with summaries and reports from data across multiple boards to track progress across their monday.com account. These dashboards help visualize everything happening across their organization to enable data-driven decision-making.

Dashboard widgets: track all data on a single pane of glass. Users can select any dashboard widget according to the data they want to display to build a dashboard, with different visualizations of the data they want to track, all on one screen. Dashboard widgets allow users to immediately get the full picture of their organization, from the drill-down or high-level insights.

Workspaces: keep work organized as work scales. Users can organize and centralize boards and dashboards using workspaces, which are defined by any category the user chooses. In large organizations, for example, workspaces can represent an entire department or a team working on a cross-company project.

My Work: centralize all assigned items in a single place. My Work allows users to view and manage all the items that are assigned to them without needing to go into individual boards. Users can customize the data on their My Work to get an instant overview of everything they are working on.

|

Mobile application

Mobile capabilities have become a key requirement for users as more work is done outside the office, including in industries where operational mobility is critical to success, such as construction or real estate. We have invested in our mobile development to ensure the high performance of our platform on smartphones and tablets. Our native mobile application is built for both iOS and Android and is designed to support mobile-first customer use cases. Our mobile application’s robust functionalities differ from the desktop version, as we designed it to be more compact and thumb- friendly, creating an easy-to-use, on-the-go experience. |

Part 1 - Who we are 29

|

FY2024 20-F |

Our technology and in-house tools

Extensible technology platform

monday.com is a cloud-based, proprietary software-as-a-service platform that is built to be fully resilient and fault-tolerant while staying agile, flexible, and fast. To accomplish this, we utilize multiple data centers across multiple geographical regions of Amazon Web Services (“AWS”) and Google Cloud Platform.

Our mission has always been to empower our customers to build anything on top of the monday.com platform. Every day, our customers’ use cases are getting more and more complex and impressive, with increasing amounts of data. As they scale, our platform needs to scale with them. So to make sure that anything our customers build performs with speed and reliability, we have upgraded our core infrastructure through a flagship initiative called mondayDB (monday database).

In 2024, we released mondayDB 2.0, which supports boards with up to 10x more items and 25x more dashboards.

mondayDB 2.0’s redefined data infrastructure enables organizations to achieve their business goals, with key capabilities, including major performance improvements that improve users’ experience with improved speed across all boards, and elasticity at scale, which supports their unique needs and adapts to the way they work best as they add users, data tables, and query volume.

Our in-house business intelligence tool, BigBrain, supports our data-driven culture by providing every monday.com employee easy access to the company’s core data that is required for their job. We believe this allows our employees to work efficiently and provides them the ability to do their jobs in the best way possible.

BigBrain collects and processes data from over 1.5 billion events per workday from multiple separate sources and aggregates it into one place that every employee can access. This enables our team to analyze and make informed decisions based on transparent data, in real-time. BigBrain includes various tools such as a landing page generator, AI brain for monday-related content search and activities, account data insights, an AB test tool, and media buying statistics tracking, all of which were built by our in-house team. BigBrain also aligns our team around key performance indicators (“KPIs”) and metrics. We proactively connect employees to the business status via an internal app we developed which is updated daily with high-level KPIs and strategically distributed data dashboards powered by BigBrain throughout our offices.

Part 1 - Who we are 30

|

FY2024 20-F |

We believe BigBrain supports our core product by paving the way for quick-to-market, efficient and high quality execution. It also aligns with our values of transparency and trust within the monday.com culture.

Our customers

We have a large customer base that consists of nearly 245,000 customers as of December 31, 2024. In 2024, we strategically emphasized growing our mid-market customer base. Our customers span thousands of use cases and range from teams of all sizes, though we are investing more in up-market growth in 2024. As of December 31, 2024, we had 3,201 enterprise customers, with more than $50,000 in ARR. Since inception, we have been focused on ensuring that any user can easily adopt our platform on their own regardless of his or her technical skills. Because of our easy-to-use interface, customers across industries use our platform, with a majority of customers working in traditionally non-tech industries, such as real estate, banking, journalism, and construction, alongside customers from traditionally tech industries, such as IT management, software development, and e-commerce.

Research and development

Builders

Our research and development (“R&D”) group, together with our product and product design groups, which we also refer to as our “builders group,” consists of autonomous, multidisciplinary teams of engineers, analysts, designers, and product managers, each with high talent density and its own product mission.

These small and agile teams are empowered to make independent decisions, move quickly, and are able to execute at a faster pace, launching a new version of monday.com almost every day while meeting high quality assurance standards. Our builders group works in a closed loop of customer feedback, testing, and data to remain connected to our users to keep our product aligned with their needs.

We invest substantial resources in R&D to improve and scale our product. The builders group is a lean and efficient organization within monday.com with a highly significant impact on our revenue. As of December 31, 2024, we had 629 employees in our builders group.

CIO Team

As our organization scales, we aim to centralize our efforts to help our departments streamline business processes and work more efficiently. Our CIO team, led by the Chief Information Officer, oversees the management of our main information systems and data infrastructures, in order to enable data-driven decision-making and optimize business operations. Our CIO team is comprised of several domains, such as BigBrain, data analysis and infrastructure.

Part 1 - Who we are 31

|

FY2024 20-F |

Security Team

Our security efforts are guided and monitored by our VP Chief Information and Security Officer (CISO), as well as our dedicated global security teams, composed of the following specialized domains: Platform security (application security & Data security); IT security; Governance, risk, and compliance (GRC); Cloud security and our in-house SOC team.

CRO Team

Customers are and have always been at the core of our business. To better serve them, all our client facing teams operate as a consolidated organization, under the CRO (Chief Revenue Officer) organization.

We engage our customers directly and indirectly, through our partners and sales teams. This alignment ensures that from the moment a customer begins using monday.com and throughout their growth trajectory, their experience is seamless.

Sales

Our account executives and account managers focus on acquiring new customers and expanding existing accounts, respectively. As part of our combined flywheel and top-down approach, our account managers are actively monitoring customers’ usage patterns and engaging with them to add more users and expand to other products and use cases within the platform, as they expand across different departments. Our sales teams specialize by region and customer size.

Our product suite provides us with an additional entry point into our sales flywheel. Because all products are built on top of the platform, customers can easily adopt additional products as they grow their accounts and use cases. As adoption of our products grows, we have been able to increase the footprint of monday.com across accounts.

As we are employing a sales-led-growth strategy, the sales function has increased its geographical footprint for more boots-on-the-ground sales efforts. This strategy also includes more face to face interaction between our sales team and customers/prospects, such as at regional events.

Our partners

Our global partner ecosystem was built to extend our reach, add product value, and position monday.com and its partners as leaders in the market. We are also leveraging partners for growth, to shift some of the business from being monday-led to partner-led, particularly as it pertains to onboarding and training. For example, our Latin American market was mostly partner-led until monday staff more recently planted roots in the region.

Our broad ecosystem includes leading enterprise software companies and emerging startups, global systems integrators, and channel partners. As of December 31, 2024, we have 272 channel partners in 50 countries and territories.

Part 1 - Who we are 32

|

FY2024 20-F |

With a wide array of vertical and industry expertise, our partners do more than just sell our products, they also provide professional services and extend our products with partner-led solutions and applications.

We have 46 listed and partner-built solutions on the monday.com platform, across accounting, construction, HR management and other verticals. In addition, our partners built, listed, and started monetizing 78 applications on the monday.com marketplace, such as resource management, time tracking, and portfolio management.

Professional services provided by partners enable larger deals and demonstrate the power of our company. Our partners are uniquely situated to help potential customers implement our products. Customers can find a partner that fits their specific needs based on geographical location and desired verticals through our services marketplace and partner directory.

We have partnered with some of the world’s leading tech companies, such as Amazon AWS, as well as with a broad set of independent software vendors, in order to increase in scope, deepen our products, and strengthen our ability to serve as the connective layer across organizations.

We also have regional partnerships in order to strengthen our ability to move upmarket and work together to help customers achieve digital transformation with deep, enterprise-grade solutions built on top of our platform.

Customer Success

Our customer success teams are focused on upselling, and also specialize in driving value for monday.com customers by maximizing impact and adoption of use cases on the platform. Customer success augments our sales teams by ensuring that our customers fulfill their business objectives through leveraging their expertise of the platform and gathering extensive knowledge on the needs of our diverse customer base. Through their relationship-building efforts, they are able to drive long-term loyalty. In 2024, as part of our regional expansions, the customer success function also leverages more face-to-face interactions to support relationship-building. They also play a key role in the flywheel sales motion, supporting account expansion.

Customer Experience

Our customer experience team, along with our newly released AI bots, provides 24/7 support to our customers. We offer support to every account and every user, with extended service to enterprise customers. All customers receive an extensive self-service knowledge base, on-demand webinars and demonstrations, and access to the monday.com community, a place to connect with thousands of monday. com users to learn and share ideas. Our extended service includes priority support and specialized onboarding services, along with additional services.

Part 1 - Who we are 33

|

FY2024 20-F |

Marketing

As a multi-product company, we utilize our marketing efforts to expand brand awareness, grow lead generation, and strengthen relationships with both existing and potential customers.

In order to expand our brand awareness, we invest in organic marketing, online brand advertising, out-of-home campaigns, and are constantly testing new channels.

We target potential customers on the team and managerial levels with both a bottom-up and top-down marketing approach, casting a wide net of performance-based marketing, like acquisition and media-buying, across several digital and offline channels to help bring in new customers.

Our B2B marketing enables our client-facing teams to deliver value and impact to current and potential customers, as well as our partner ecosystem. We are focused on delivering a tailored and valuable experience to all accounts with product-specific or industry-specific offerings. Our multidisciplinary marketing approach allows us to continue expanding upmarket, deliver value to customers in over 200 industries, and bring leads ranging from small businesses to Fortune 500 companies.

Our competition

We are creating a new category of software, the Work OS, that seeks to change the way people work and businesses operate. As a result, we compete across multiple different markets. Our competitors include the following:

| • | companies that primarily offer project and work management solutions, including the application of processes, methods, skills, and knowledge to achieve specific objectives. This includes companies such as Asana, Inc., Smartsheet Inc., Notion Labs, Inc., Atlassian Corporation PLC (Trello), ClickUp and Freshworks Inc. |

| • | companies that primarily offer customer relationship management solutions. This includes companies such as SugarCRM, HubSpot, Pipedrive, and Zoho Corp. |

| • | companies that primarily offer software development tools. This includes companies such as Atlassian Corporation PLC (Jira). |

| • | companies that primarily offer enterprise service management tools. This includes companies such as Freshworks Inc. (Freshservice), and Atlassian Corporation PLC (Jira Service Management). |

In the future, we will likely face increased competition from companies providing similar platforms to our platform. Our principal competitive factor is our open and modular infrastructure, leading in flexibility and adaptability and our ability to scale our vertical and horizontal offerings as we continue to rapidly build end-to-end products. We believe that our ability to compete successfully depends primarily on the following factors:

Part 1 - Who we are 34

|

FY2024 20-F |

| • | our ability to introduce new and improve on existing features, products, and services in response to competition, user sentiment, online, market and industry trends, and the ever-evolving technological landscape; |

| • | our ability to continue to increase social and technological acceptance of our products; |

| • | continued growth in the digitization of the workplace; |

| • | our ability to maintain the value and reputation of monday.com as a solution; and |

| • | the scale, growth, and engagement of our community relative to those of our competitors. |

Intellectual property

Our intellectual property is valuable and important to our business. To establish and protect our proprietary rights, including our proprietary technology, software, know-how, and brand, we rely upon a combination of patents, designs, copyright, trade secret, domain names and trademark rights, and contractual restrictions such as confidentiality agreements, licenses, and intellectual property assignment agreements. Although we take great efforts to establish and protect our proprietary rights, we believe that factors such as the technological and creative skills of our personnel, creation of new modules, features and functionality, and frequent enhancements to our platform, are more essential to establishing and maintaining our technology leadership position.

We have developed a patent program and a strategy to identify and apply for patents for innovative aspects of our platform and technology. As of December 31, 2024, we had 31 U.S. patent-pending applications, two U.S. provisional patent applications, 106 granted U.S. patents, three allowed U.S. patents, two EU patent-pending applications, one allowed Israeli patent, one Israeli patent-pending application, one Chinese (CNIPA) granted patent and nine PCT applications relating to certain aspects of our technology.

We have trademark rights in our name, logo, and other brand elements, including trademark registrations for select marks in the United States and other jurisdictions around the world. We also have design registrations and applications in the United States and the European Union, as well as domain names for websites that we use. We intend to pursue additional trademark and design registration to the extent we believe it would be beneficial.

Legal proceedings

We have not been, and are not currently, a party to any material or pending litigation or regulatory proceedings that could have a material adverse effect on our business, operating results, financial condition, or cash flows. From time to time, we may be involved in legal or regulatory proceedings arising in the ordinary course of our business.

Part 1 - Who we are 35

|

FY2024 20-F |

monday.com ESG

The monday.com way

Our culture is why we win and is more than a catchphrase or a poster on a wall. It is what we do. It is how we act. Our culture is the ‘monday.com way.’

Transparency and trust. Radical transparency, data accessibility, and trust allow us to reduce complexity, ensure that we are all working towards the same goal, and increase accountability and ownership. Transparency is a tool that helps us harness our collective intelligence and eliminates politics and bureaucracy.

Customer-centricity. We have achieved leading benchmarks for customer service, answering tickets at faster-than-industry-average response times. We prioritize customer satisfaction over our potential short-term gains, and we believe that when our customers win, we win.

Product-first. We believe that a product should work for the customer and not the other way around. Every feature is designed to be intuitive and accessible, as evidenced by the fact that a majority of our customers work in traditionally non-tech industries.

Ownership and impact. We empower our employees to make their own decisions so that they can maximize their impact. We believe autonomy allows our employees to move faster, be more efficient and learn from their own mistakes.

Speed and execution. Speed is the key to success in everything we do. We constantly push ourselves to learn fast, gain first-mover advantage and deliver quickly. As we continue to scale, our ability to execute and adapt quickly will continue to give us a competitive edge.

Inclusivity. Diversity, belonging, and inclusion are rooted in the core of our company. We celebrate individuality together as a team. We have embedded inclusivity not only within the company’s values but also within the platform, providing a user experience open to everyone.

Privacy and security

We are committed to providing our customers with a highly secure and reliable environment, and to giving them peace of mind while they manage their data on the platform. By using top-of-the-line security tools and aligning with the strictest security and data protection measures available on the market, we meet the needs of all verticals, including those with stringent requirements such as health care and banking. We earn the trust of our customers by making data security our top priority.

In order to increase our customers’ privacy and security capabilities, we have recently released the Guardian add-on to enhance data protection and governance, streamline organization-wide access, and adhere to compliance requirements with an extra layer of protection. The add-on includes: Tenant-level encryption (TLE), Bring Your Own Key (BYOK), and Multiple SSOs capabilities.

Part 1 - Who we are 36

|

FY2024 20-F |

We conduct annual red team assessments on our defensive posture, applicative penetration tests, infrastructure attack simulations, manage a private bug bounty program, and assume breach simulations. These assessments and drills are performed and accompanied by leading industry standard offensive and defensive third-party security consulting companies, which use high-end sophisticated attack techniques to provide unique visibility into our potential security risks and vulnerabilities.

Our security strategy and controls are based on international standards and industry best practices, such as ISO 27001, ISO 27018, and OWASP Top 10, and are subject to independent annual SOC2 Audits. Additionally, our security strategy and controls include HIPAA-compliant features.

We have a dedicated privacy team that builds and executes our privacy program, which includes working with our legal teams to conduct product and feature reviews, privacy and impact assessments, and support for data protection and privacy-related requests. We monitor guidance from industry and regulatory bodies and update our product features and contractual commitments accordingly.

Our facilities

Our current corporate headquarters are located in Tel Aviv, Israel, where we lease approximately 230,000 square feet pursuant to an operating lease that is expected to expire in May 2031. We plan to expand our office space in Tel-Aviv by an additional 118,000 square feet by the end of 2025.

We also lease office space in New York City, Denver, São Paulo, London, Warsaw, Sydney, Melbourne, and Tokyo, and are planning to open office space in Paris and Munich by the end of 2025. We further intend to expand our global facilities and lease additional office space as we recruit more employees and enter new geographic markets. We believe that suitable additional or alternative space will be available as needed to accommodate any such growth. We are committed to ensuring that all new buildings, even though led by third-party developers, follow sustainable principles.

Our offices are designed to support our work culture, as well as each location’s local culture. When designing our global offices, we create a local identity that incorporates unique aspects of each location. We promote ownership and transparency with a completely open workspace and glass-walled conference rooms. There are no private offices, without exception. All of our meeting rooms are optimized for both online and face-to-face meetings to facilitate seamless collaboration between employees globally. We also strategically place hundreds of dashboards throughout the office to encourage transparency and data-driven decision-making. In every element of our office design, we are mindful of our environmental impact. Wherever possible in our offices, we implement smart energy and waste management systems.

Part 1 - Who we are 37

|

FY2024 20-F |

Our workforce

As of December 31, 2024, we had 2,508 employees worldwide. Provided below is a breakdown of employees by region:

| Region | Americas | Europe | APAC | IL |

| Employee count | 625 | 271 | 118 | 1,494 |

Diversity and inclusion

At monday.com, we are committed to building an equitable and inclusive workplace that empowers our employees to do their best work in service of our customers and communities. We recognize and value the competitive advantage that comes with having diverse teams, equitable employee experiences, and an inclusive workplace. We understand this is both the right thing to do and critical to our continued growth and success as a global organization.

We have nine Employee Resource Groups (ERGs) that are open to all employees and aim to create business impact through initiatives that support talent attraction, retention, professional and leadership development, as well as employee engagement. Through several key engagements with organizations, our ERGs create programming for their members and support our efforts to establish relationships with organizations with which we plan to create long term partnerships as we scale our inclusion efforts.

Looking ahead, our strategic priorities include enhancing our demographic data collection systems and processes, implementing inclusive leadership learning programs, and continuing to scale our programming through collaborating with our ERGs and external partners.

Part 1 - Who we are 38

|

FY2024 20-F |

|

Employee wellness

We work continuously around the globe to ensure our people’s physical and mental well-being. To promote physical health, we offer medical checkups throughout the year, physical fitness classes, a full in-office gym or gym passes, sports & interest-based internal communities, nutritionist services, and alternative medicine services. We also prioritize our employees’ mental health by offering in-office and confidential therapy sessions, free subscriptions to a meditation and sleep app, meditation rooms, and a daily mindfulness group. |

|

Learning and development

Through our learning and development programs, we work to continuously improve the performance of our workforce and invest in the career development of each employee. |

|

Management workshops

We believe that one of the best ways to retain and develop our talent is by ‘leading the leaders’. We conduct onboarding and ongoing sessions with our first-line and second-line managers to provide them with the tools they need to manage, mentor and develop their employees. The sessions also empower them to effectively deal with day-to-day managerial challenges and conflicts in order to create the best possible work environment. |

|

Talent development

We are committed to the personal and professional development of all our employees. We have several programs in place offering external learning resources tailored to each employee’s professional growth path. We offer multiple internal courses as well, including stock option education, employee knowledge sharing, and more. |

| An annual budget is reserved for each business unit within the Company to provide profession-specific education and training to their employees. We also have a comprehensive internal mobility program in place to empower employees to follow their interests and seek new career opportunities within monday.com. | |

|

Rewards program

Our rewards program is designed to recruit and retain top talent worldwide. We offer market-competitive compensation and benefits packages in an equitable way. We assess these programs on an ongoing basis in order to maintain our competitiveness within the industry and ensure intrinsic value for all of our employees. |

Part 1 - Who we are 39

|

FY2024 20-F |

monday for non-profits

We help nonprofits scale their impact by leveraging the power of monday.com’s Work OS.

By providing nonprofits with the platform and skills they need, they can be more effective and productive in their mission.

The monday.com Foundation

The monday.com Foundation (“Foundation“) is a philanthropic initiative focused on supporting communities across the world through technology, human capital and financial resources.

The Foundation was incorporated in Israel in 2024 as a Public Benefit Company (a nonprofit organization for public purposes). Upon its incorporation, various social impact initiatives that were part of monday.com’s philanthropic efforts were transferred into the Foundation, including the Emergency Response Team and Tech School.

|

The Emergency Response Team (“ERT“) partners with the humanitarian aid sector to enhance and scale its core disaster response operations and impact with the monday.com platform. The initiative is run by a team of humanitarian experts, and volunteers from monday.com and the greater ecosystem. |

monday for non-profits 40

|

FY2024 20-F |

|

Tech School is a program launched in 2023 that empowers youth from underserved communities with tech skills and innovation in order to close the digital gap. The initiative is run by an expert social impact team together with educational professionals, and supported by industry leaders and mentors. |

Organizational structure

The legal name of our company is monday.com Ltd., and we are organized under the laws of the State of Israel.

The following table sets forth our key subsidiaries, all of which are 100% owned directly by monday.com Ltd:

| Name of subsidiary | Place of incorporation |

| monday.com Inc. | Delaware, United States |

| monday.com Pty Ltd. | Australia |

| monday.com UK 2020 Ltd. | United Kingdom |

| monday.com Ltda. | Brazil |

| monday.com K.K. | Japan |

| monday.com Sp. Z O.O. | Poland |

| monday.com PTE. LTD. | Singapore |

| monday.com SAS | France |

| monday.com GmbH | Germany |

The monday.com Foundation 41

|

FY2024 20-F |

Part 2 - Directors and senior management

The following table sets forth the name and position of each of our executive officers and directors as of the date of this annual report:

| Name | Age | Position |

| Executive Officers and Employee Directors | ||

| Roy Mann(1) | 46 | Co-Founder, Co-Chief Executive Officer, Director |

| Eran Zinman | 41 | Co-Founder, Co-Chief Executive Officer, Director |

| Eliran Glazer | 53 | Chief Financial Officer |

| Daniel Lereya | 40 | Chief Product and Technology Officer |

| Shiran Nawi | 41 | Chief People and Legal Officer |

| Adi Dar | 53 | Chief Operating Officer |

| Non-Employee Directors | ||

| Jeff Horing | 61 | Independent Director, Chairperson of the Board of Directors |

| Aviad Eyal(1)(2) | 54 | Independent Director |

| Avishai Abrahami | 53 | Independent Director |

| Gili Iohan(2) | 49 | Independent Director |

| Ronen Faier(1)(2) | 54 | Independent Director |

| Petra Jenner | 60 | Independent Director |

| (1) | Serves as a member of our environmental, social and governance committee. |

| (2) | Serves as a member of our audit committee, compensation committee, and nominating committee. |

Part 2 - Directors and senior management 42

|

FY2024 20-F |

Executive officers

|

Roy Mann is our Co-Founder and has served as our Co-Chief Executive Officer since June 1, 2012. Mr. Mann has also served as a member of our board of directors since February 2012. Mr. Mann previously served as a senior technology leader at Wix.com Ltd. (Nasdaq: WIX), from 2010 to 2012. Mr. Mann is also the Co-Founder of and led the technology vision and operation at SaveAnAlien.com, from 2006 to 2010. Mr. Mann holds a B.A. in Computer Science from the Interdisciplinary Center Herzliya, Israel. | ||

|

Eran Zinman is our Co-Founder and has served as our Co-Chief Executive Officer since November 2020 after having served as our Chief Technology Officer between 2012 and 2020. Mr. Zinman has also served as a member of our board of directors since March 2018. Mr. Zinman previously served as the Research and Development Manager at the founding team of Conduit Mobile (now Como) at Conduit Ltd. from 2010 to 2012. Mr. Zinman is the Co-Founder of Othersay and served as its Chief Executive Officer from 2009 to 2010. Mr. Zinman holds a B.Sc. in Computer Science and Electrical Engineering from Tel Aviv University, Israel. | ||

|

Eliran Glazer has served as our Chief Financial Officer since March 2021. Mr. Glazer previously served as the Chief Financial Officer of Lightricks Ltd. from December 2019 to February 2021 and the Chief Financial Officer of Nex Markets from April 2012 to November 2018. Following the acquisition of Nex Markets by the CME Group, Mr. Glazer served as the Chief Financial Officer of Nex Markets, a CME Group Company from November 2018 to November 2019. Mr. Glazer holds a B.A. in Business and Accounting from The College of Management Academic Studies as well as an L.L.M. from Bar Ilan University and is a licensed certified public accountant. | ||

|

Daniel Lereya has served as our Chief Product and Technology Officer since 2023 and previously served as our Vice President of Research and Development since October 2016 and Vice President of Product since December 2020. Mr. Lereya previously served in numerous positions, including as a software team leader at International Business Machines Corp. (NYSE: IBM) from November 2012 to October 2016, and as a software engineer at SAP SE from February 2011 to October 2012. Mr. Lereya holds a B.Sc. in Computer Science and Economics from Tel Aviv University, Israel. | ||

Part 2 - Directors and senior management 43

|

FY2024 20-F |

|

Adi Dar has served as our Chief Operating Officer since 2024. In this role, Adi oversees our global Business Operations teams, including Customer Experience, IT, Security, Program Management, and Workplace Operations. Adi previously served as the CEO of ELOP, an electro-optics subsidiary of Elbit Systems (Nasdaq: ESLT). Prior to ELOP, he founded and led Elbit Systems' Intelligence and Cyber division. Adi is also the founder of Cyberbit, a leading cybersecurity company. Adi holds a Bachelor's degree in Industrial Engineering from Technion - Israel Institute of Technology and an MBA from Tel Aviv University, Israel. | ||

|

Shiran Nawi has served as our Chief People and Legal Officer since 2023 and previously served as our General Counsel since June 2018. Prior to joining monday.com, Ms. Nawi served as a senior legal counsel at Wix.com Ltd. (Nasdaq: WIX) from June 2014 to June 2018 and as an associate at Israeli, Ben-Zvi, Attorneys at Law, from July 2009 to April 2014. Ms. Nawi holds an L.L.B. and a Master of Business Taxation from The College of Management Academic Studies, Israel, and is a member of the Israel Bar Association. | ||

Directors

|

Jeff Horing has served as a member of our board of directors since May 20, 2017. Mr. Horing has been a Managing Director of Insight Partners, a private equity investment firm he co-founded, since 1995. Mr. Horing currently serves on the board of directors of nCino, Inc. (Nasdaq: NCNO) since February 2015 and previously served on the board of directors of WalkMe Ltd. (NYSE: WKME) until November 2024, Alteryx, Inc. (NYSE: AYX.) until March 2024 and JFrog Ltd. (Nasdaq: FROG) until December 2023. In addition, Mr. Horing currently serves on the board of directors of several privately held companies. Mr. Horing holds a B.S. and B.A. from the University of Pennsylvania’s Moore School of Engineering and the Wharton School, respectively, and an M.B.A. from the M.I.T. Sloan School of Management. | ||

Part 2 - Directors and senior management 44

|

FY2024 20-F |

|

Aviad Eyal has served as an independent director on our board of directors since June 2014. Mr. Eyal is the Co-Founder of Entrée Capital and has served as its Managing Partner since 2011. Prior to that, Mr. Eyal co-founded and built a number of successful startups over a span of 18 years. Mr. Eyal currently serves on the board of directors of several privately held companies, including Broadlume Inc. since 2019, BlueWhite Robotics Ltd. since 2019 and Rivery Ltd. since 2021. He has also served on the board of directors of Prospa Group Ltd. (ASX:PGL) since 2017. Mr. Eyal holds a B.Sc. Engineering degree from the University of Natal, South Africa. Mr. Eyal was selected to the Forbes Europe Midas list of top 25 VCs for the past five years. | ||

|