UNITED STATES

| ☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Ordinary shares, par value NIS 0.01 per share

|

CYBR

|

The Nasdaq Stock Market LLC

|

|

Large accelerated filer ☒

|

Accelerated filer ☐

|

Non-accelerated filer ☐

|

|

Emerging growth company ☐

|

|

U.S. GAAP ☒

|

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐

|

Other ☐

|

| 1 | ||

| 1 | ||

|

| ||

| 2 | ||

|

| ||

| 2 | ||

|

| ||

| 2 | ||

|

| ||

| 27 | ||

|

| ||

| 44 | ||

|

| ||

| 44 | ||

|

| ||

| 63 | ||

|

| ||

| 83 | ||

|

| ||

| 85 | ||

|

| ||

| 86 | ||

|

| ||

| 86 | ||

|

| ||

| 96 | ||

|

| ||

| 97 | ||

|

| ||

|

| ||

| 98 | ||

|

| ||

| 98 | ||

| 98 | ||

|

| ||

| 99 | ||

|

| ||

| 99 | ||

|

| ||

| 99 | ||

|

| ||

| 100 | ||

|

| ||

| 100 | ||

|

| ||

| 100 | ||

|

| ||

| 100 | ||

|

| ||

| 100 | ||

|

| ||

| 100 | ||

|

| ||

| 101 | ||

|

| ||

| 101 | ||

|

| ||

|

| ||

| 102 | ||

|

| ||

| 102 | ||

|

| ||

| 102 | ||

|

|

• |

the rapidly evolving security market, increasingly changing cyber threat landscape and our ability to adapt our solutions to the

information security market changes and demands; |

|

|

• |

our ability to acquire new customers and maintain and expand our revenues from existing customers; |

|

|

• |

real or perceived security vulnerabilities and gaps in our solutions or services or the failure of our customers or third parties

to correctly implement, manage and maintain our solutions; |

|

|

• |

our IT network systems, or those of our third-party providers, may be compromised by cyberattacks or other security incidents, or

by a critical system disruption or failure; |

|

|

• |

intense competition within the information security market; |

|

|

• |

failure to fully execute, integrate, or realize the benefits expected from strategic alliances, partnerships, and acquisitions;

|

|

|

• |

our ability to effectively execute our sales and marketing strategies, and expand, train and retain our sales personnel; |

|

|

• |

risks related to our compliance with privacy, data protection and artificial intelligence (AI) laws and regulations; |

|

|

• |

our ability to hire, upskill, retain and motivate qualified personnel; |

|

|

• |

risks related to AI technology; |

|

|

• |

our reliance on third-party cloud providers for our operations and software-as-a-service (SaaS) solutions; |

|

|

• |

our ability to main successful relationships with channel partners, or if our channel partners fail to perform; |

|

|

• |

fluctuation in our quarterly results of operations; |

|

|

• |

risks related to sales made to government entities; |

|

|

• |

economic uncertainties or downturns; |

|

|

• |

our history of incurring net losses, our ability to generate sufficient revenue to achieve and sustain profitability and our ability

to generate cash flow from operating activities; |

|

|

• |

regulatory and geopolitical risks associated with our global sales and operations; |

|

|

• |

risks related to intellectual property; |

|

|

• |

fluctuations in currency exchange rates; |

|

|

• |

the ability of our solutions to help customers achieve and maintain compliance with government regulations or industry standards;

|

|

|

• |

our ability to protect our proprietary technology and intellectual property rights; |

|

|

• |

risks related to using third-party software, such as open-source software and other intellectual property; |

|

|

• |

risks related to share price volatility or activist shareholders; |

|

|

• |

any failure to retain our “foreign private issuer” status or the risk that we may be classified, for U.S. federal income

tax purposes, as a “passive foreign investment company”; |

|

|

• |

risks related to issuance of ordinary shares or securities convertible into ordinary shares and dilution, leading to a decline in

the marketplace of our ordinary shares; |

|

|

• |

changes in tax laws; |

|

|

• |

our expectation to not pay dividends on our ordinary shares for the foreseeable future; and |

|

|

• |

risks related to our incorporation and location in Israel, including the ongoing war between Israel and Hamas and conflict in the

region. |

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

| ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

|

|

A. |

[Reserved] |

|

|

B. |

Capitalization and Indebtedness |

|

|

C. |

Reasons for the Offer and Use of Proceeds |

|

|

D. |

Risk Factors |

|

|

• |

Privileged Access Management (PAM), including Endpoint Privilege Management, such as Delinea and BeyondTrust; |

|

|

• |

Access Management, such as Okta and Microsoft; |

|

|

• |

Secrets Management, such as Hashi Corporation; |

|

|

• |

Machine Identity, such as KeyFactor; and |

|

|

• |

Identity Governance and Administration, such as SailPoint and Saviynt. |

|

|

• |

failure to fully comply with various global data privacy and data protection laws; |

|

|

• |

fluctuations in exchange rates between the U.S. dollar and foreign currencies in markets where we do business; |

|

|

• |

social, economic and political instability, war, civil disturbance or acts of terrorism, conflicts (including the conflicts in the

Middle East, for example between Israel and Hamas), security concerns, and any pandemics or epidemics; |

|

|

• |

noncompliance with the U.S. Federal requirements which mandate management and auditor reports on the effectiveness of our internal

control over financial reporting (such as the Sarbanes-Oxley Act); |

|

|

• |

greater difficulty in enforcing contracts and managing collections, as well as longer collection periods; |

|

|

• |

noncompliance with certain anti-bribery laws or unfair or corrupt business practices in certain geographies; |

|

|

• |

certain of our activities and solutions are subject to U.S., European Union, Israeli, and possibly other export and trade control

and economic sanctions laws and regulations, which have and may additionally prohibit or restrict our ability to engage in business with

certain countries and customers or distribute or implement our solutions in certain countries. If the applicable requirements related

to export and trade controls change or expand, including as a result of future relationships between the U.S. and various other countries,

if we change the encryption functionality in our solutions, or if we develop other solutions, or export solutions from/to certain jurisdictions,

we may fail to comply with such regulations or may need to satisfy additional requirements or obtain specific licenses to continue to

export our solutions in the same global scope; |

|

|

• |

changes in tax regulations and uncertain tax obligations and effective tax rates may impact our financial results or result in changes

in the valuation of our deferred tax assets and liabilities; |

|

|

• |

new and developing laws and regulations, and compliance with, and uncertainty regarding, laws and regulations that apply or may in

the future apply to our business; |

|

|

• |

reduced or uncertain protection of intellectual property rights in some countries; and |

|

|

• |

management communication and integration problems resulting from cultural and geographic dispersion. |

|

|

• |

actual or anticipated fluctuations in our results of operations and the results of other similar companies; |

|

|

• |

variance in our financial performance from the expectations of market analysts; |

|

|

• |

announcements by us or our competitors of significant business developments, changes in service provider relationships, acquisitions

or expansion plans; |

|

|

• |

changes in the prices of our solutions or in our pricing models; |

|

|

• |

our involvement in litigation; |

|

|

• |

our sale of ordinary shares or other securities in the future; |

|

|

• |

market conditions in our industry; |

|

|

• |

speculation in the press or the investment community; |

|

|

• |

the trading volume of our ordinary shares; |

|

|

• |

changes in the estimation of the future size and growth rate of our markets; |

|

|

• |

any merger and acquisition activities; and |

|

|

• |

general economic and market conditions. |

| ITEM 4. |

INFORMATION ON THE COMPANY |

|

|

A. |

History and Development of the Company |

|

|

B. |

Business Overview |

|

|

• |

Strengthening our Identity Security leadership position by delivering ongoing

innovation. We intend to extend our leadership position by enhancing our solutions, including utilization of AI, introducing new

functionality and developing new offerings to address additional human and machine identity security use cases. Our strategy includes

both internal development and an active mergers and acquisition program in which we acquire or invest in complementary businesses or technologies.

|

|

|

• |

Deepening and expanding relationships and influence with the C-Suite.

We have developed deep relationships with our customers. Through our innovation, we are a platform company today, and to fully execute

against our platform strategy, we intend to build deeper relationships across the C-suite and in the board room. We are increasing our

marketing and program investments across executive engagement, strategic sales initiatives, curated thought leadership content and experiences

delivered through our Customer Experience Centers. |

|

|

• |

Extending our GTM reach. We market and sell our solutions through a high-touch

hybrid model that includes direct and indirect sales. We leverage our sophisticated marketing capabilities, such as account-based and

inbound marketing, GTM plays, and our CyberArk IMPACT and IMPACT World Tour conferences, to drive demand and generate pipeline. We plan

to expand our sales reach by adding new direct sales capacity, expanding our indirect channels by deepening our relationships with existing

partners and by adding new partners, including value-added resellers, system integrators, managed security service providers, distributors,

and C3 Alliance partners. We are also expanding our routes

to market to include cloud provider marketplaces. We will leverage this elite ecosystem to further extend our reach and strengthen our

offerings. |

|

|

• |

Growing our customer base. The global threat landscape, digitalization

of the enterprise, cloud migration and the broad security skills shortage are contributing to the need for Identity Security solutions.

We believe that every organization, regardless of size or vertical, needs Identity Security. We plan to pursue new customers in the enterprise

and corporate segments of the market with our sales and partner teams, as well as through our brand awareness and lead generation campaigns.

|

|

|

• |

Expanding our relationships with existing customers. As of December 31,

2024, we had more than 9,700 customers. We work diligently to develop and continually strengthen relationships with our customers. Our

Customer Success team will focus on expanding these relationships by growing the number of users who access our solutions and cross-selling

additional solutions. |

|

|

• |

Driving strong adoption of our solutions and retaining our customer base.

An important part of our overall strategy, particularly for our SaaS and self-hosted subscription customers, is delivering fast time to

value from our solutions. The Venafi and Zilla Security acquisitions have expanded our core capabilities and portfolio, positioning us

to address the growing demand for machine identity security and modern IGA solutions, differentiate us from our competitors, and drive

innovation and market adoption. We will continue to deliver high levels of customer service and support and invest in our Customer Success

team to help ensure that our customers are up and running quickly and derive benefit from our software, which we believe will result in

higher customer retention rates. |

|

|

• |

Attracting, developing and retaining our employee base. A key pillar of

our growth strategy is attracting, developing and retaining our employees. Our people are one of our most valuable assets, and our culture

is a key business differentiator for CyberArk. We value belonging and inclusion, which allows for the exchange of ideas, creates a strong

community, and helps ensure our employees feel valued and respected. |

|

|

• |

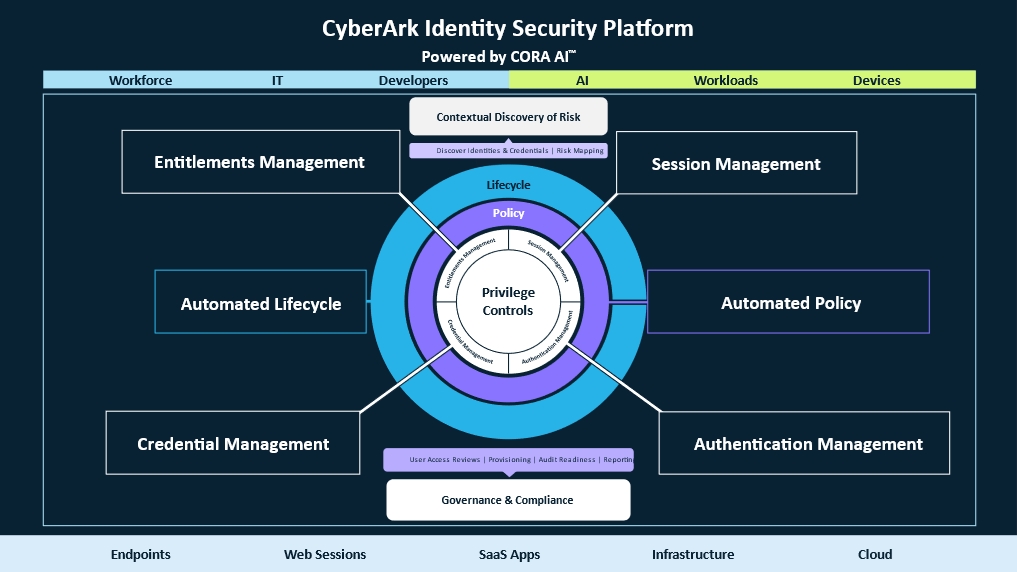

Workforce Users: This segment includes employees accessing endpoints, applications, and data for daily tasks. The risk profile varies

depending on the sensitivity of resources accessed. For example, application administrators managing SaaS platforms represent a higher

risk due to their elevated permissions within critical systems. |

|

|

• |

IT Professionals: The IT group encompasses roles that have evolved from traditional infrastructure management to include cloud administrators

and DevOps engineers. With the ability to configure cloud environments and modify workloads, IT professionals present a higher level of

complexity and potential impact on enterprise security. |

|

|

• |

Developers: Developers hold powerful access to code repositories, workloads, and applications. Their capability to alter code, combined

with persistent cloud access, poses significant risks, particularly in dynamic DevOps environments where rapid changes demand continuous

security vigilance. |

|

|

• |

Machine Identities: Spanning AI, workloads and devices, machine identities require secure communication using secrets, certificates,

and tokens. As their numbers multiply, managing the complexity of their interactions and privileges becomes increasingly challenging.

|

|

|

• |

Privileged Access Manager. CyberArk Privileged Access Manager and CyberArk Privilege Cloud

include risk-based credential security and session management to protect against attacks involving privileged access. CyberArk’s

self-hosted Privileged Access Manager solution can be deployed in a self-hosted data center or in a hybrid cloud or a public cloud environment.

CyberArk Privileged Cloud is a SaaS solution. |

|

|

• |

Remote Access. CyberArk Remote Access is a SaaS solution that integrates with Privileged Access

Manager or Privilege Cloud to provide fast, easy and secure privileged access to third-party vendors who need access to critical internal

systems via CyberArk, without the need to use passwords. By not requiring VPNs or agents, Remote Access removes operational overhead for

administrators, makes it easier and quicker to deploy and improves organizational security. |

|

|

• |

Secure Infrastructure Access. CyberArk Secure Infrastructure Access is a SaaS solution that

provisions just-in-time (JIT), privileged access to infrastructure. The solution leverages attribute-based access control and full session

isolation to drive measurable risk reduction. Secure Infrastructure Access allows organizations to unify controls for JIT and standing

privileged access across public cloud and on-premises systems, enabling operational efficiencies while progressing towards Zero Standing

Privileges and zero trust initiatives. |

|

|

• |

Endpoint Privilege Manager. CyberArk Endpoint Privilege Manager is a SaaS solution that secures

privileges on the endpoint (Windows servers, Windows desktops and Mac desktops) and helps contain attacks early in their lifecycle. It

enables revocation of local administrator rights, while minimizing impact on user productivity, by seamlessly elevating privileges for

authorized applications or tasks. Application control, with automatic policy creation, allows organizations to prevent malicious applications

from executing, and runs unknown applications in a restricted mode. This, combined with credential theft protection, helps prevent malware

such as ransomware from gaining a foothold and designed to contain attacks on the endpoint. |

|

|

• |

Secure Desktop. CyberArk Secure Desktop is a solution that lets businesses protect access

to endpoints and enforce the principle of least privilege without complicating IT operations or hindering user productivity. The unified

endpoint multifactor authentication and privilege management solution helps organizations strengthen access security, optimize user experiences,

and eliminate the manually intensive, error-prone administrative processes that can lead to overprovisioning and privilege abuse.

|

|

|

• |

Adaptive MFA. Adaptive MFA enforces risk-aware and strong identity assurance controls within

an organization. These controls include a broad range of built-in authentication factors such as passwordless authenticators like Windows

Hello and Apple TouchID, high assurance authenticators like USB security keys, and our patented Zero Sign-on certificate-based authentication.

|

|

|

• |

Single Sign-On. SSO facilitates secure access to many different applications, systems, and

resources while only requiring a single authentication. Our SSO capability offers a modern identity provider supporting popular SSO protocols

to any system or app that supports SAML, WS-Fed, OIDC and OAuth2, as well as an extensive application catalogue with out-of-the-box integration

for thousands of applications. |

|

|

• |

Secure Web Sessions. Secure Web Sessions records, audits and protects end-user activity within

designated web applications. The solution uses a browser extension on an end-user’s endpoint to monitor and segregate web apps that

are accessed through SSO and deemed sensitive by business application owners, enterprise IT and security administrators. |

|

|

• |

Workforce Password Management. CyberArk Workforce Password Management is an enterprise-focused

password manager providing a user-friendly solution to store data from business applications -like website URLs, usernames, passwords

and notes, in a centralized vault and securely share it with other users in the organization. |

|

|

• |

Application Gateway. With the CyberArk Identity Application Gateway service, customers can

enable secure remote access and expand SSO benefits to on-premises web apps, like SharePoint and SAP, without the complexity of installing

and maintaining VPNs. |

|

|

• |

Identity Lifecycle Management. This module enables CyberArk Identity customers to automate

the joiner, mover, and leaver processes within the organization. This automation is critical to ensure that privileges do not accumulate,

and a user’s access is turned off as soon as the individual changes roles or leaves the organization. |

|

|

• |

Directory Services. Allows customers to use identity where they control it. In other words,

we do not force our customers to synchronize their on-premises Active Directory implementation with our cloud. Our cloud architecture

can work seamlessly with existing directories, such as Active Directory, LDAP-based directories, and other federated directories. CyberArk

Identity also provides its own highly scalable and flexible directory for customers who choose to use it. |

|

|

• |

Customer Identity offers authentication and authorization services, MFA, directory, and user

management to enable organizations to provide customers and partners with easy and secure access to websites and applications.

|

|

|

• |

Secure Browser. The CyberArk Secure Browser is a hardened and purpose-built technology that

further extends the CyberArk Identity Security Platform to the web browser. It provides enhanced security, privacy and productivity across

the enterprise, while delivering a familiar and customized user experience. The CyberArk Secure Browser minimizes the risk of unauthorized

access by helping to prevent the malicious use of compromised identities, endpoints, and credentials both at and beyond the login stage.

It provides secure access to sensitive data for the complete workforce across the complete identity journey. By providing a centralized,

consistent and secure launchpad to every resource and application across the enterprise, it can help safeguard the most sensitive and

valuable resources while increasing productivity and privacy. |

|

|

• |

Secrets Manager Credential Providers. Credential Providers can be used to provide and manage

the credentials used by third-party solutions such as security tools, RPA, and IT management software, and can also support internally

developed applications built on traditional monolithic application architectures. Credential Providers works with CyberArk’s on-premises

and SaaS-based solutions. |

|

|

• |

Conjur Enterprise and Conjur Cloud. For cloud-native applications built using DevOps methodologies,

Conjur Enterprise and Conjur Cloud provide a secrets management solution tailored specifically to the unique requirements of these environments

delivered either on-premises or in the cloud. We also provide an open-source version to better meet the needs of the developer community.

|

|

|

• |

Secrets Hub. CyberArk Secrets Hub enables security teams to have centralized visibility and

management across secrets in native vaults, such as AWS Secrets Manager and Azure Key Vault, without impacting developer workflows.

|

|

|

• |

Venafi TLS Protect. Venafi TLS Protect allows security teams, application owners and developers

to effectively keep up with the rapid growth of transport layer security (TLS) machine identities to prevent outages, while also improving

security by minimizing risks introduced by humans and manual processes. TLS Protect identifies all TLS keys and certificates, continually

validates that they are installed and operating properly and automates the TLS machine identity lifecycle. |

|

|

• |

Venafi TLS Protect for Kubernetes. Venafi TLS Protect for Kubernetes helps organizations easily

and reliably manage their machine identity security infrastructure in complex multicloud and multicluster environments. It provides

the enterprise with discovery, observability, control and consistency of cloud native machine identities (e.g., TLS, mTLS, SPIFFE) to

improve application reliability and reduce development and operational costs. |

|

|

• |

Venafi Zero Touch PKI. Venafi Zero Touch PKI is a SaaS-based service with effortless

onboarding provided by Venafi experts. A modern PKI is built to customer specifications, leveraging the certificate authorities, roots and

intermediaries needed by a customer’s business. Each customized PKI is designed with current best practices for design, deployment

and security in mind, so that the PKI leverages the latest capabilities and protocols. |

|

|

• |

Venafi SSH Protect. Venafi SSH Protect discovers SSH host and authorized keys throughout

a customer’s infrastructure and adds them to a continually updated inventory. In this database, the type of key, location

of all copies, public and private components, algorithm and key sizes are routinely assessed and tracked. |

|

|

• |

Venafi Firefly. Venafi Firefly is a workload identity issuer to give cloud security and information

security teams superior governance, compliance and consistency for authenticating all types of workloads across clouds, platforms and

application environments. Firefly bootstraps ephemeral trust anchors for issuing validated short-lived identities in the environment in

which the workload is running. This provides a developer-friendly, enterprise-scale trust root system with security governance, providing

consistent and compliant workload authentication. |

|

|

• |

Venafi CodeSign Protect. Venafi CodeSign Protect secures

enterprise code signing processes by providing centralized and secure key storage along with role-based policy enforcement. Providing

code signing-as-a-service reduces the burden on development teams by integrating with the tools and processes they already use.

|

|

|

• |

PAM, including Endpoint Privilege Management, such as Delinea and BeyondTrust; |

|

|

• |

Access Management, such as Okta and Microsoft; |

|

|

• |

Secrets Management, such as Hashi Corporation; |

|

|

• |

Machine Identity, such as Keyfactor; and |

|

|

• |

Identity Governance and Administration, such as SailPoint and Saviynt. |

|

|

• |

the breadth and completeness of a security solution; |

|

|

• |

reliability and effectiveness in protecting, detecting and responding to cyberattacks; |

|

|

• |

analytics and accountability at an individual user level; |

|

|

• |

the ability of customers to achieve and maintain compliance with compliance standards and audit requirements; |

|

|

• |

strength of sale and marketing efforts, including advisory firms and channel partner relationships; |

|

|

• |

global reach and customer base; |

|

|

• |

scalability and ease of integration with an organization’s existing IT infrastructure and security investments; |

|

|

• |

brand awareness and reputation; |

|

|

• |

innovation, including AI and generative AI capabilities, and thought leadership; |

|

|

• |

quality of customer support and professional services; |

|

|

• |

the speed at which a solution can be deployed and implemented; and |

|

|

• |

the price of a solution, including bundled or free offerings, and cost of maintenance and professional services. |

|

|

C. |

Organizational Structure |

|

Name of Subsidiary |

Place of Incorporation |

|

CyberArk Software, Inc. |

Delaware, United States |

|

Cyber-Ark Software (UK) Limited |

United Kingdom |

|

CyberArk Software (Singapore) Pte. Ltd. |

Singapore |

|

CyberArk Software (DACH) GmbH |

Germany |

|

CyberArk Software Italy S.r.l. |

Italy |

|

CyberArk Software (France) SARL |

France |

|

CyberArk Software (Netherlands) B.V. |

Netherlands |

|

CyberArk Software (Australia) Pty Ltd |

Australia |

|

CyberArk Software (Japan) K.K. |

Japan |

|

CyberArk Software Canada Inc. |

Canada |

|

CyberArk USA Engineering, GP, LLC |

Delaware, United States |

|

CyberArk Software (Spain), S.L. |

Spain |

|

CyberArk Software (India) Private Limited |

India |

|

C3M India Private Limited |

India |

|

CyberArk Turkey Siber Güvenlik Yazılımı Anonim Şirketi |

Turkey |

|

Venafi, Inc. |

Delaware, United States |

|

Venafi Ltd. |

United Kingdom |

|

Venafi EOOD |

Bulgaria |

|

Zilla Security, Inc. |

Delaware, United States |

|

|

D. |

Property, Plant and Equipment |

| ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

|

Year ended December 31, |

||||||||||||

|

2022 |

2023 |

2024 |

||||||||||

|

($ in millions) |

||||||||||||

|

Total ARR (as of period-end) |

$ |

570 |

$ |

774 |

$ |

1,169 |

||||||

|

Subscription Portion of ARR (as of period-end)

|

$ |

364 |

$ |

582 |

$ |

977 |

||||||

|

Recurring revenues |

$ |

498 |

$ |

680 |

$ |

930 |

||||||

|

Deferred revenue (as of period-end) |

$ |

408 |

$ |

481 |

$ |

692 |

||||||

|

RPO (as of period-end) |

$ |

713 |

$ |

972 |

$ |

1,386 |

||||||

|

Net cash provided by operating activities

|

$ |

50 |

$ |

56 |

$ |

232 |

||||||

|

|

A. |

Operating Results |

|

|

• |

Subscription Revenues. Subscription revenues include SaaS and self-hosted subscription revenues,

as well as maintenance and support services associated with self-hosted subscriptions. Subscription revenues are generated primarily from

sales of our PAM (Privilege Cloud and self-hosted), EPM, Secrets Manager, Machine Identity Management, Remote Access, Workforce and Customer

Access, Secure Cloud Access and Identity Management. We see an increasing percentage of our business coming from our SaaS solutions, which

have ratable revenue recognition, increasing our total deferred revenue that will be recognized over time. Our SaaS and self-hosted subscriptions

represented 73% of our total revenues in 2024, and we expect our subscription revenues to continue to grow in the near and long term.

Sale of our IT, Workforce and Developer solutions are licensed per user through standard and enterprise packages. The enterprise packages

include more features and functionality than the standard packages. EPM is licensed by target system (workstations and servers). For Machine

Identity Security, we have four solution packages, which combine our secrets management and Venafi machine identity management capabilities

to secure machines licensed per machine and credential. The first is our core secrets management capabilities that secure secrets of all

application types, DevOps and automation tools. The second is securing certificates and PKI for automated management and renewal of certificates,

which offers an easy way to adopt PKI as a service. The third solution is Securing Certificates within cloud service providers, which

introduces a combination of what was Venafi technology and CyberArk technology for securing secrets. The fourth is for securing Kubernetes

applications. |

|

|

• |

Perpetual License Revenues. Perpetual license revenues are generated primarily from sales

of our PAM. We are seeing a single digit percentage of our business coming from perpetual licenses, which have upfront revenue recognition.

We expect revenues from perpetual licenses to continue to decrease as a percentage of total revenue as we continue to operate as a subscription

company. |

|

|

• |

Maintenance and Professional Services Revenues. Maintenance revenues are generated from maintenance

and support contracts purchased by our customers who bought perpetual licenses in order to gain access to the latest software enhancements

and updates on an if-and-when available basis and to telephone and email technical support. With the continued decline of new perpetual

licenses and related new maintenance contracts, we are expecting our total maintenance revenues to decline in the near and long term in

absolute dollars. We also offer advanced services, including professional services and technical account management, for consulting, deployment

and training of our customers to fully leverage the use of our solutions. We increasingly leverage partners to provide services around

implementation and ongoing management of our solutions and we are shifting our service delivery team toward higher value services that

are often recurring in nature, like technical account management. |

|

Year ended December 31, |

||||||||||||||||||||||||

|

2022 |

2023 |

2024 |

||||||||||||||||||||||

|

Amount |

% of Revenues |

Amount |

% of Revenues |

Amount |

% of Revenues |

|||||||||||||||||||

|

($ in thousands) |

||||||||||||||||||||||||

|

United States |

$ |

312,816 |

52.9 |

% |

$ |

393,355 |

52.3 |

% |

$ |

503,359 |

50.3 |

% | ||||||||||||

|

EMEA |

178,344 |

30.1 |

225,738 |

30.0 |

311,595 |

31.1 |

||||||||||||||||||

|

Rest of World |

100,550 |

17.0 |

132,795 |

17.7 |

185,788 |

18.6 |

||||||||||||||||||

|

Total revenues |

$ |

591,710 |

100.0 |

% |

$ |

751,888 |

100.0 |

% |

$ |

1,000,742 |

100.0 |

% | ||||||||||||

|

|

• |

Cost of Subscription Revenues. The cost of subscription revenues consists primarily of personnel

costs related to our customer support and cloud operations. Personnel costs consist primarily of salaries, benefits, bonuses and share-based

compensation. The cost of subscription revenues also includes cloud infrastructure costs, amortization of intangible assets and depreciation

of internal use software capitalization. As our business grows, including the expansion of our SaaS offerings, we expect the absolute

cost of subscription revenues to increase. In addition, amortization of acquired intangible assets included in cost of subscription revenue

is expected to increase due to our recent acquisitions of Venafi and Zilla. |

|

|

• |

Cost of Perpetual License Revenues. The cost of perpetual license revenues consists primarily

of appliance expenses and allocated personnel costs to support delivery and operations related to perpetual licenses. Personnel costs

consist primarily of salaries, benefits, bonuses and share-based compensation. With perpetual licenses now making up a smaller part of

our overall revenues, we expect the absolute cost of perpetual license revenues and the cost of perpetual license revenues as a percentage

of total revenues to decrease. |

|

|

• |

Cost of Maintenance and Professional Services Revenues. The cost of maintenance related to

perpetual license contracts and professional services revenues primarily consists of allocated personnel costs for our global customer

support, customer success and professional services organization. Personnel costs consist primarily of salaries, benefits, bonuses, share-based

compensation and subcontractors’ fees. We anticipate the absolute dollars associated with generating professional services revenues

to increase due to our expanding customer base and ongoing investment in our services teams, aimed at delivering exceptional customer

experiences. |

|

Year ended December 31, |

||||||||||||||||||||||||

|

2022 |

2023 |

2024 |

||||||||||||||||||||||

|

Amount |

% of Revenues |

Amount |

% of Revenues |

Amount |

% of Revenues |

|||||||||||||||||||

|

($ in thousands) |

||||||||||||||||||||||||

|

Revenues: |

||||||||||||||||||||||||

|

Subscription

|

$ |

280,649 |

47.4 |

% |

$ |

472,023 |

62.8 |

% |

$ |

733,275 |

73.3 |

% | ||||||||||||

|

Perpetual license

|

49,964 |

8.5 |

21,037 |

2.8 |

14,449 |

1.4 |

||||||||||||||||||

|

Maintenance and professional services |

261,097 |

44.1 |

258,828 |

34.4 |

253,018 |

25.3 |

||||||||||||||||||

|

Total revenues

|

591,710 |

100.0 |

751,888 |

100.0 |

1,000,742 |

100.0 |

||||||||||||||||||

|

Cost of revenues: |

||||||||||||||||||||||||

|

Subscription

|

46,249 |

7.8 |

74,623 |

9.9 |

115,852 |

11.6 |

||||||||||||||||||

|

Perpetual license

|

2,893 |

0.5 |

1,873 |

0.2 |

1,594 |

0.2 |

||||||||||||||||||

|

Maintenance and professional services |

76,904 |

13.0 |

79,635 |

10.6 |

90,931 |

9.1 |

||||||||||||||||||

|

Total cost of revenues

|

126,046 |

21.3 |

156,131 |

20.7 |

208,377 |

20.8 |

||||||||||||||||||

|

Gross profit

|

465,664 |

78.7 |

595,757 |

79.3 |

792,365 |

79.2 |

||||||||||||||||||

|

Operating expenses: |

||||||||||||||||||||||||

|

Research and development

|

190,321 |

32.2 |

211,445 |

28.1 |

243,058 |

24.3 |

||||||||||||||||||

|

Sales and marketing

|

345,273 |

58.4 |

405,983 |

54.0 |

480,977 |

48.1 |

||||||||||||||||||

|

General and administrative

|

82,520 |

13.9 |

94,801 |

12.6 |

141,134 |

14.1 |

||||||||||||||||||

|

Total operating expenses

|

618,114 |

104.5 |

712,229 |

94.7 |

865,169 |

86.5 |

||||||||||||||||||

|

Operating loss

|

(152,450 |

) |

(25.8 |

) |

(116,472 |

) |

(15.5 |

) |

(72,804 |

) |

(7.3 |

) | ||||||||||||

|

Financial income, net

|

15,432 |

2.6 |

53,214 |

7.1 |

56,838 |

5.7 |

||||||||||||||||||

|

Loss before taxes on income

|

(137,018 |

) |

(23.2 |

) |

(63,258 |

) |

(8.4 |

) |

(15,966 |

) |

(1.6 |

) | ||||||||||||

|

Tax benefit (taxes on income)

|

6,650 |

1.1 |

(3,246 |

) |

(0.4 |

) |

(77,495 |

) |

(7.7 |

) | ||||||||||||||

|

Net loss

|

$ |

(130,368 |

) |

(22.0 |

)% |

$ |

(66,504 |

) |

(8.8 |

)% |

$ |

(93,461 |

) |

(9.3 |

)% | |||||||||

|

Year ended December 31, |

||||||||||||||||||||||||

|

2023 |

2024 |

Change |

||||||||||||||||||||||

|

Amount |

% of Revenues |

Amount |

% of Revenues |

Amount |

% |

|||||||||||||||||||

|

($ in thousands) |

||||||||||||||||||||||||

|

Revenues: |

||||||||||||||||||||||||

|

Subscription |

$ |

472,023 |

62.8 |

% |

$ |

733,275 |

73.3 |

% |

$ |

261,252 |

55.3 |

% | ||||||||||||

|

Perpetual license |

21,037 |

2.8 |

14,449 |

1.4 |

(6,588 |

) |

(31.3 |

) | ||||||||||||||||

|

Maintenance and professional services |

258,828 |

34.4 |

253,018 |

25.3 |

(5,810 |

) |

(2.2 |

) | ||||||||||||||||

|

Total revenues |

$ |

751,888 |

100.0 |

% |

$ |

1,000,742 |

100.0 |

% |

$ |

248,854 |

33.1 |

% | ||||||||||||

|

Year ended December 31, |

||||||||||||||||||||||||

|

2023 |

2024 |

Change |

||||||||||||||||||||||

|

Amount |

% of Revenues |

Amount |

% of Revenues |

Amount |

% |

|||||||||||||||||||

|

($ in thousands) |

||||||||||||||||||||||||

|

Cost of revenues: |

||||||||||||||||||||||||

|

Subscription |

$ |

74,623 |

9.9 |

% |

$ |

115,852 |

11.6 |

% |

$ |

41,229 |

55.2 |

% | ||||||||||||

|

Perpetual license |

1,873 |

0.2 |

1,594 |

0.2 |

(279 |

) |

(14.9 |

) | ||||||||||||||||

|

Maintenance and professional services

|

79,635 |

10.6 |

90,931 |

9.1 |

11,296 |

14.2 |

||||||||||||||||||

|

Total cost of revenues |

$ |

156,131 |

20.7 |

% |

$ |

208,377 |

20.8 |

% |

$ |

52,246 |

33.5 |

% | ||||||||||||

|

Gross profit |

$ |

595,757 |

79.3 |

% |

$ |

792,365 |

79.2 |

% |

$ |

196,608 |

33.0 |

% | ||||||||||||

|

Year ended December 31, |

||||||||||||||||||||||||

|

2023 |

2024 |

Change |

||||||||||||||||||||||

|

Amount |

% of Revenues |

Amount |

% of Revenues |

Amount |

% |

|||||||||||||||||||

|

($ in thousands) |

||||||||||||||||||||||||

|

Operating expenses: |

||||||||||||||||||||||||

|

Research and development |

$ |

211,445 |

28.1 |

% |

$ |

243,058 |

24.3 |

% |

$ |

31,613 |

15.0 |

% | ||||||||||||

|

Sales and marketing |

405,983 |

54.0 |

480,977 |

48.1 |

74,994 |

18.5 |

||||||||||||||||||

|

General and administrative |

94,801 |

12.6 |

141,134 |

14.1 |

46,333 |

48.9 |

||||||||||||||||||

|

Total operating expenses |

$ |

712,229 |

94.7 |

% |

$ |

865,169 |

86.5 |

% |

$ |

152,940 |

21.5 |

% | ||||||||||||

|

Year Ended December 31, |

||||||||

|

2023 |

2024 |

|||||||

|

($ in thousands) |

||||||||

|

Net cash provided by operating activities

|

$ |

56,204 |

$ |

231,887 |

||||

|

Net cash used in investing activities

|

(85,828 |

) |

(346,262 |

) | ||||

|

Net cash provided by financing activities

|

38,084 |

288,806 |

||||||

|

Total |

Less than 1 year |

1 – 3 years |

3 – 5 years |

More than 5 years |

||||||||||||||||

|

($ in thousands) |

||||||||||||||||||||

|

Operating lease obligations(1) |

$ |

30,874 |

$ |

11,240 |

$ |

12,677 |

$ |

6,950 |

$ |

7 |

||||||||||

|

Uncertain tax obligations(2) |

19,973 |

— |

— |

— |

— |

|||||||||||||||

|

Severance pay(3) |

9,115 |

— |

— |

— |

— |

|||||||||||||||

|

Non-cancellable purchase obligations(4)

|

175,436 |

58,035 |

117,401 |

— |

— |

|||||||||||||||

|

Total |

$ |

235,398 |

$ |

69,275 |

$ |

130,078 |

$ |

6,950 |

$ |

7 |

||||||||||

| (1) |

Operating lease obligations consist of our contractual rental expenses under operating leases of facilities and certain motor vehicles.

|

| (2) |

Consists of accruals for certain income tax positions under ASC 740 that are paid

upon settlement, and for which we are unable to reasonably estimate the ultimate amount and timing of settlement. See Note 15(j) to our

consolidated financial statements included elsewhere in this annual report for further information regarding our liability under ASC 740.

Payment of these obligations would result from settlements with tax authorities. Due to the difficulty in determining the timing of resolution

of audits, these obligations are only presented in their total amount. |

| (3) |

Severance pay relates to accrued severance obligations mainly to our Israeli employees

as required under Israeli labor laws. These obligations are payable only upon the termination, retirement or death of the respective employee

and may be reduced if the employee’s termination is voluntary. These obligations are partially funded through accounts maintained

with financial institutions and recognized as an asset on our balance sheet. As of December 31, 2024, $3.2 million is unfunded. See Note

2(l) to our consolidated financial statements included elsewhere in this annual report for further information. |

| (4) |

Consists of agreements related to the receipt of cloud infrastructure services and subscription-based cloud services. |

|

|

C. |

Research and Development, Patents and Licenses, etc. |

|

|

D. |

Trend Information |

|

|

E. |

Critical Accounting Estimates |

|

|

• |

the expenditures are approved by the relevant Israeli government ministry, determined by the field of research; |

|

|

• |

the research and development is for the promotion or development of the company; and |

|

|

• |

the research and development is carried out by or on behalf of the company seeking the deduction. |

|

|

• |

amortization of the cost of purchased know-how, patents and rights to use a patent and know-how which are used for the development

or promotion of the Industrial Enterprise, over an eight-year period commencing on the year in which such rights were first exercised;

|

|

|

• |

under limited conditions, an election to file consolidated tax returns together with Israeli Industrial Companies controlled by it;

and |

|

|

• |

expenses related to a public offering of shares in a stock exchange are deductible in equal amounts over three years commencing on

the year of offering. |

| ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

|

|

A. |

Directors and Senior Management |

|

Name |

Age |

Position |

|

Senior Management |

||

|

Ehud (Udi) Mokady (4) |

56 |

Executive Chairman of the Board and Founder |

|

Matthew Cohen |

49 |

Chief Executive Officer and Director |

|

Erica Smith |

52 |

Chief Financial Officer |

|

Eduarda Camacho |

53 |

Chief Operating Officer |

|

Donna Rahav |

46 |

Chief Legal Officer |

|

Omer Grossman |

45 |

Chief Information Officer |

|

Peretz Regev |

46 |

Chief Product Officer |

|

Directors |

||

|

Gadi Tirosh (1)(3)(4)(5) |

58 |

Lead Independent Director |

|

Ron Gutler (1)(2)(4)(5) |

67 |

Director |

|

Kim Perdikou (1)(2)(3)(5) |

67 |

Director |

|

Amnon Shoshani (3)(5) |

61 |

Director |

|

François Auque (2)(5) |

68 |

Director |

|

Avril England (3)(4)(5) |

56 |

Director |

|

Mary Yang (4)(5) |

56 |

Director |

| (1) |

Member of our compensation committee. |

| (2) |

Member of our audit committee. |

| (3) |

Member of our nominating, environmental, sustainability and governance committee. |

| (4) |

Member of our strategy committee. |

| (5) |

Independent director under the rules of Nasdaq. |

|

|

B. |

Compensation |

|

Information Regarding the Covered Executive (1) |

||||||||||||||||

|

Name and Principal Position (2) |

Base Salary |

Benefits and

Perquisites (3) |

Variable

Compensation (4) |

Equity-Based

Compensation (5) |

||||||||||||

| Matthew Cohen, CEO |

$ |

481,000 |

$ |

208,643 |

$ |

649,350 |

$ |

10,550,362 |

||||||||

|

Ehud (Udi) Mokady, Executive Chairman of the Board and Founder |

270,000 |

385,278 |

364,500 |

8,644,102 |

||||||||||||

|

Joshua Siegel, Former CFO (6) |

389,793 |

94,697 |

414,100 |

6,022,593 |

||||||||||||

|

Eduarda Camacho, Chief Operating Officer |

391,026 |

357,808 |

540,000 |

2,941,686 |

||||||||||||

|

Peretz Regev, Chief Product Officer |

373,698 |

123,824 |

281,800 |

3,006,509 |

||||||||||||

| (1) |

All amounts reported in the table are in terms of cost to our Company, as recorded in our financial statements for the year ended

December 31, 2024. |

| (2) |

Other than our Executive Chairman of the Board, all current officers listed in the table are full-time employees. Cash compensation

amounts denominated in currencies other than the U.S. dollar were converted into U.S. dollars at the average conversion rate for the year

ended December 31, 2024. |

| (3) |

Amounts reported in this column include benefits and perquisites, including those mandated by applicable law. Such benefits and perquisites

may include, to the extent applicable to each executive, payments, contributions and/or allocations for savings funds, pension, severance,

vacation, car or car allowance, medical insurances and benefits, risk insurances (such as life, disability and accident insurances), convalescence

pay, payments for Medicare and social security, tax gross-up payments and other benefits and perquisites consistent with our guidelines,

regardless of whether such amounts have actually been paid to the executive. |

| (4) |

Amounts reported in this column refer to Variable Compensation, such as incentives and earned or paid bonuses as recorded in our

financial statements for the year ended December 31, 2024. |

| (5) |

Amounts reported in this column represent the expense recorded in our financial statements for the year ended December 31, 2024 with

respect to equity-based compensation, reflecting also equity awards made in previous years which have vested during the current year.

Assumptions and key variables used in the calculation of such amounts are described in Note 14 to our audited consolidated financial statements,

which are included in this annual report. |

| (6) |

Joshua Siegel stepped down as CFO on January 1, 2025, and Erica Smith became CFO, effective January 1, 2025. |

|

RSUs |

Business PSUs |

Relative TSR PSUs | ||

|

2023 |

Percentage |

50% |

30% |

20% |

|

Amount |

29,100 |

17,460 |

11,640 | |

|

2024 |

Percentage |

50% |

30% |

20% |

|

Amount |

24,000 |

14,400 |

9,600 | |

|

2025 |

Percentage |

50% |

30% |

20% |

|

Amount |

16,900 |

10,140 |

6,760 |

|

RSUs |

Business PSUs |

Relative TSR PSUs |

|

Percentage |

50% |

30% |

20% |

|

Amount |

12,000 |

7,200 |

4,800 |

|

Year of Grant |

Performance Targets |

Performance Criteria Achievement Rate (Weighted Average) |

Earning Rate |

|

2024 Business PSUs |

• Annual recurring revenue

• Operating Margin |

129.5% |

165% |

|

Year of Grant |

Percentile Rate |

Earning Rate |

|

2022 |

92.54% |

200.0% |

|

Number of PSUs Granted (on Target) |

Number of PSUs Earned | ||

|

2024 Business PSUs |

Executive Chairman |

7,200 |

11,890 |

|

CEO |

14,400 |

23,780 | |

|

2022 rTSR PSUs |

Executive Chairman |

12,300 |

24,600 |

|

CEO |

3,140 |

6,280 |

|

|

C. |

Board Practices |

|

|

• |

providing leadership to the Board if circumstances arise in which the role of the Executive Chairman of the Board may be, or may

be perceived to be, in conflict with the interests of the Company, and responding to any reported conflicts of interest, or potential

conflicts of interest, arising for any director; |

|

|

• |

presiding as chairman of meetings of the Board at which the Executive Chairman of the Board is not present, including executive sessions

of the independent members of the Board of directors; |

|

|

• |

serving as a liaison between the CEO and the independent members of the Board of directors; |

|

|

• |

providing feedback on Board meeting agendas, information and ongoing training provided to the Board, and requiring changes to the

same; |

|

|

• |

approving meeting schedules to ensure there is sufficient time for discussion of all agenda items; |

|

|

• |

having the authority to call meetings of the independent members of the Board; |

|

|

• |

being available for consultation and direct communication with shareholders, as appropriate; |

|

|

• |

recommending that the Board of directors retain consultants or advisers that report directly to the Board; |

|

|

• |

conferring with the Executive Chairman of the Board or CEO on important Board of directors matters and key issues and tasks facing

the Company, and ensuring the Board of directors focuses on the same; |

|

|

• |

presiding over the Board’s annual self-assessment process and the independent directors’ evaluation of the effectiveness

of the Executive Chairman of the Board, CEO, and management; and |

|

|

• |

performing such other duties as the Board of directors may, from time to time, delegate to assist the Board of directors in the fulfillment

of its duties. |

|

|

• |

overseeing our accounting and financial reporting process and the audits of our financial statements, the effectiveness of our internal

control over financial reporting and making such reports as may be required of an audit committee under the rules and regulations promulgated

under the Exchange Act; |

|

|

• |

retaining and terminating our independent registered public accounting firm subject to the approval of our Board of directors and,

in the case of retention, of our shareholders and recommending the terms of audit and non-audit services provided by the independent registered

public accounting firm for pre-approval by our Board of directors and related fees and terms; |

|

|

• |

establishing systems of internal control over financial reporting, including communication and implementation thereof and the assessment

of the internal controls in accordance with the Sarbanes-Oxley Act, and any attestation by the independent registered public accounting

firm; |

|

|

• |

determining whether there are deficiencies in the business management practices of our Company, including in consultation with our

Head of Internal Audit or the independent registered public accounting firm, and making recommendations to the Board of directors to improve

such practices; |

|

|

• |

determining whether to approve certain related party transactions (see “Item 6.C. Board Practices —Approval of Related

Party Transactions under Israeli Law”); |

|

|

• |

recommending to the Board of directors the retention and termination of our Head of Internal Audit, and determining the Head of Internal

Audit’s remuneration, in accordance with the Companies Law; |

|

|

• |

approving the work plan proposed by the Head of Internal Audit and reviewing and discussing the work of the internal auditor on a

quarterly basis; |

|

|

• |

reviewing our cybersecurity risks and controls with senior management, keeping our Board of directors informed of key issues related

to cybersecurity; |

|

|

• |

establishing procedures for the handling of employees’ complaints as to the deficiencies in the management of our business

and the protection to be provided to such employees; |

|

|

• |

conducting or authorizing investigations into any matters within the scope of its responsibilities as it deems appropriate; and

|

|

|

• |

performing such other duties consistent with the audit committee charter, our governing documents, stock exchange rules and applicable

law that may be requested by the Board of directors from time to time, including discussing with management policies and practices that

govern the process by which the Company undertakes risk assessment and management in sensitive areas. |

|

|

• |

recommending to the board of directors for its approval a compensation policy and subsequently reviewing it from time to time, assessing

its implementation and recommending periodic updates, whether a new compensation policy should be adopted or an existing compensation

policy should continue in effect; |

|

|

• |

reviewing, evaluating, and making recommendations regarding the terms of office, compensation, and benefits for our office holders,

including the non-employee directors, taking into account our compensation policy; |

|

|

• |

exempting certain compensation arrangements from the requirement to obtain shareholder approval under the Companies Law (including

with respect to the CEO); and |

|

|

• |

reviewing and granting equity-based awards pursuant to our equity incentive plans to the extent such authority is delegated to the

compensation committee by our Board of directors and the reserving of additional shares for issuance thereunder. |

|

|

• |

overseeing and assisting our Board of directors in reviewing and recommending nominees for election as directors and as members of

the committees of the board of directors; |

|

|

• |

establishing procedures for, and administering the performance of the members of our Board of directors and its committees;

|

|

|

• |

evaluating and making recommendations to our Board of directors regarding the termination of membership of directors; |

|

|

• |

reviewing, evaluating, and making recommendations regarding management succession and development; |

|

|

• |

reviewing and making recommendations to our Board of directors regarding board member qualifications, composition and structure and

the nature and duties of the committees and qualifications of committee members; |

|

|

• |

establishing and maintaining effective corporate governance principles and practices, including, but not limited to, developing and

recommending to our Board of directors a set of corporate governance guidelines applicable to our Company; and |

|

|

• |

providing oversight of the Company’s efforts with regard to ESG matters, disclosure and strategy, as well as coordinating,

as necessary, with other committees of the board of directors and the Company’s ESG committee and steering committee, which are

comprised of key Company employees and management. |

|

|

• |

a person (or a relative of a person) who holds more than 5% of the company’s outstanding shares or voting rights; |

|

|

• |

a person (or a relative of a person) who has the power to appoint a director or the general manager of the company; |

|

|

• |

an office holder (including a director) of the company (or a relative thereof); or |

|

|

• |

a member of the company’s independent accounting firm, or anyone on his or her behalf. |

|

|

• |

information on the advisability of a given action brought for his or her approval or performed by virtue of his or her position;

and |

|

|

• |

all other important information pertaining to any such action. |

|

|

• |

refrain from any conflict of interest between the performance of his or her duties to the company and his or her duties or personal

affairs; |

|

|

• |

refrain from any action which competes with the company’s business; |

|

|

• |

refrain from exploiting any business opportunity of the company in order to receive a personal gain for himself or herself or others;

and |

|

|

• |

disclose to the company any information or documents relating to the company’s affairs which the office holder received as

a result of his or her position as an office holder. |

|

|

• |

a transaction other than in the ordinary course of business; |

|

|

• |

a transaction that is not on market terms; or |

|

|

• |

a transaction that may have a material impact on a company’s profitability, assets or liabilities. |

|

|

• |

an amendment to the company’s articles of association; |

|

|

• |

an increase of the company’s authorized share capital; |

|

|

• |

a merger; or |

|

|

• |

the approval of related party transactions and acts of office holders that require shareholder approval. |

|

|

• |

a monetary liability incurred by or imposed on him or her in favor of another person pursuant to a judgment, including a settlement

or arbitrator’s award approved by a court. However, if an undertaking to indemnify an office holder with respect to such liability

is provided in advance, then such undertaking must be limited to certain events which, in the opinion of the board of directors, can be

foreseen based on the company’s activities when the undertaking to indemnify is given, and to an amount or according to criteria

determined by the board of directors as reasonable under the circumstances, and such undertaking shall detail the foreseen events and

described above amount or criteria; |

|

|

• |

reasonable litigation expenses, including reasonable attorneys’ fees, incurred by the office holder (1) as a result of an investigation

or proceeding instituted against him or her by an authority authorized to conduct such investigation or proceeding, provided that (i)

no indictment was filed against such office holder as a result of such investigation or proceeding; and (ii) no financial liability was

imposed upon him or her as a substitute for the criminal proceeding as a result of such investigation or proceeding or, if such financial

liability was imposed, it was imposed with respect to an offense that does not require proof of criminal intent; or (2) in connection

with a monetary sanction or liability imposed on him or her in favor of an injured party in certain administrative proceedings;

|

|

|

• |

expenses incurred by an office holder in connection with administrative proceedings instituted against such office holder, or certain

compensation payments made to an injured party imposed on an office holder by administrative proceedings, including reasonable litigation

expenses and reasonable attorneys’ fees; and |

|

|

• |

reasonable litigation expenses, including attorneys’ fees, incurred by the office holder or imposed by a court in proceedings

instituted against him or her by the company, on its behalf, or by a third party, or in connection with criminal proceedings in which

the office holder was acquitted, or as a result of a conviction for an offense that does not require proof of criminal intent. |

|

|

• |

a breach of duty of care to the company or to a third party, to the extent such a breach arises out of the negligent conduct of the

office holder; |

|

|

• |

a breach of the duty of loyalty to the company, provided that the office holder acted in good faith and had a reasonable basis to

believe that the act would not harm the company; |

|

|

• |

a monetary liability imposed on the office holder in favor of a third party; |

|

|

• |

a monetary liability imposed on the office holder in favor of an injured party in certain administrative proceedings; and |

|

|

• |

expenses incurred by an office holder in connection with certain administrative proceedings, including reasonable litigation expenses

and reasonable attorneys’ fees. |

|

|

• |

a breach of the duty of loyalty, except for indemnification and insurance for a breach of the duty of loyalty to the company to the

extent that the office holder acted in good faith and had a reasonable basis to believe that the act would not prejudice the company;

|

|

|

• |

a breach of duty of care committed intentionally or recklessly, excluding a breach arising out of the negligent conduct of the office

holder; |

|

|

• |

an act or omission committed with intent to derive illegal personal benefit; or |

|

|

• |

a civil or criminal fine, monetary sanction or forfeit levied against the office holder. |

|

|

D. |

Employees |

|

As of December 31, |

||||||||||||

|

Department |

2022 |

2023 |

2024 |

|||||||||

|

Sales and marketing |

1,157 |

1,321 |

1,573 |

|||||||||

|

Research and development |

901 |

922 |

1,205 |

|||||||||

|

Services and support |

493 |

533 |

696 |

|||||||||

|

General and administrative |

217 |

242 |

319 |

|||||||||

|

Total |

2,768 |

3,018 |

3,793 |

|||||||||

|

|

E. |

Share Ownership |

|

Shares Beneficially Owned |

|||||||

|

Name of Beneficial Owner |

Number |

% |

|||||

|

Senior Management and Directors |

|||||||

|

Ehud (Udi) Mokady (1) |

* |

* |

|||||

|

Matthew Cohen |

* |

* |

|||||

|

Erica Smith |

* |

* |

|||||

|

Eduarda Camacho |

* |

* |

|||||

|

Donna Rahav |

* |

* |

|||||

|

Peretz Regev |

* |

* |

|||||

|

Omer Grossman |

* |

* |

|||||

|

Gadi Tirosh |

* |

* |

|||||

|

Ron Gutler |

* |

* |

|||||

|

Kim Perdikou |

* |

* |

|||||

|

Amnon Shoshani |

* |

* |

|||||

|

François Auque |

* |

* |

|||||

|

Avril England |

* |

* |

|||||

|

Mary Yang |

* |

* |

|||||

|

All senior management and directors as a group (14 persons)

|

* |

* |

|||||

|

|

(1) |

Mr. Mokady’s shares include 12,600 shares held in trust for family members over which Mr. Mokady is the beneficial owner.

|

|

|

A. |

Major Shareholders |

|

|

• |

each person or entity known by us to own beneficially 5% or more of our outstanding shares; |

|

|

• |

each of our directors and senior management individually; and |

|

|

• |

all of our senior management and directors as a group. |

|

|

B. |

Related Party Transactions |

|

|

C. |

Interests of Experts and Counsel |

|

|

B. |

Significant Changes |

|

|

A. |

Offer and Listing Details |

|

|

B. |

Plan of Distribution |

|

|

C. |

Markets |

|

|

D. |

Selling Shareholders |

|

|

E. |

Dilution |

|

|

F. |

Expenses of the Issue |

|

|

A. |

Share Capital |

|

|

B. |

Memorandum and Articles of Association |

|

|

C. |

Material Contracts |

|

|

• |

banks, financial institutions or insurance companies; |

|

|

• |

real estate investment trusts, regulated investment companies or grantor trusts; |

|

|

• |

brokers, dealers or traders in securities, commodities or currencies; |

|

|

• |

tax-exempt entities, accounts or organizations, including an “individual retirement account” or “Roth IRA”

as defined in Section 408 or 408A of the Code, respectively; |

|

|

• |

certain former citizens or long-term residents of the United States; |

|

|

• |

persons that receive our ordinary shares as compensation for the performance of services; |

|

|

• |

persons that hold our ordinary shares as part of a “hedging,” “integrated” or “conversion” transaction

or as a position in a “straddle” for United States federal income tax purposes; |

|

|

• |

persons subject to special tax accounting rules as a result of any item of gross income with respect to the ordinary shares being

taken into account in an applicable financial statement; |

|

|

• |

partnerships (including entities or arrangements classified as partnerships for United States federal income tax purposes) or other

pass-through entities or arrangements, or indirect holders that hold our ordinary shares through such an entity or arrangement;

|

|

|

• |

S corporations; |

|

|

• |

holders whose “functional currency” is not the U.S. dollar; or |

|

|

• |

holders that own directly, indirectly or through attribution 10.0% or more of the voting power or value of our shares. |

|

|

• |

a citizen or individual resident of the United States; |

|

|

• |

a corporation (or other entity treated as a corporation for United States federal income tax purposes) created or organized in or

under the laws of the United States or any state thereof, including the District of Columbia; |

|

|

• |

an estate the income of which is subject to United States federal income taxation regardless of its source; or |

|

|

• |

a trust if such trust has validly elected to be treated as a United States person for United States federal income tax purposes or

if (1) a court within the United States is able to exercise primary supervision over its administration and (2) one or more United States

persons have the authority to control all of the substantial decisions of such trust. |

|

|

• |

at least 75% of its gross income is “passive income”; or |

|

|

• |

at least 50% of the average quarterly value of its total gross assets (which may be measured in part by the market value of our ordinary

shares, which is subject to change) is attributable to assets that produce “passive income” or are held for the production

of passive income. |

|

|

F. |

Dividends and Paying Agents |

|

|

G. |

Statement by Experts |

|

|

H. |

Documents on Display |

|

|

I. |

Subsidiary Information |

|

|

J. |

Annual Report to Security Holders |

|

Period |

Change in Average Exchange Rate of the NIS Against the U.S. dollar (%) |

|||

|

2024 |

0.4 |

|||

|

2023 |

9.7 |

|||

|

2022 |

4.0 |

|||

|

|

• |

pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions

of our assets; |

|

|

• |

provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance

with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations

of our management and directors; and |

|

|

• |

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets

that could have a material effect on the financial statements. |

|

2023 |

2024 |

|||||||

|

($ in thousands) |

||||||||

|

Audit Fees |

$ |

1,010 |

$ |

1,575 |

||||

|

Tax Fees |

262 |

750 |

||||||

|

All Other Fees |

45 |

14 |

||||||

|

Total |

$ |

1,317 |

$ |

2,339 |

||||

| ITEM 16D. |

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

| ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

| ITEM 16F. |

CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT |

| ITEM 16G. |

CORPORATE GOVERNANCE |

| • |

risk assessments designed to help identify material cybersecurity risks to our critical systems and information;

|

| • |