UNITED STATES

| ☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024 |

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Title of each Class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Ordinary shares, par value NIS 0.001 per share

|

|

NYAX

|

|

The Nasdaq Stock Market LLC

|

|

Large Accelerated Filer ☐

|

Accelerated Filer ☒

|

Non-accelerated Filer ☐

|

|

|

|

Emerging Growth Company ☒

|

|

Page

| |||

|

- v - | |||

| 1 | |||

| 3 | |||

| 3 | |||

| 3 | |||

| 3 | |||

|

|

A. |

[Reserved]

|

3 |

|

|

B. |

Capitalization and Indebtedness

|

3 |

|

|

C. |

Reasons for the Offer and Use of Proceeds

|

3 |

|

|

D. |

Risk Factors

|

3 |

| 37 | |||

|

|

A. |

History and Development of the Company

|

37 |

|

|

B. |

Business Overview

|

37 |

|

|

C. |

Organizational Structure

|

55 |

|

|

D. |

Property, Plants and Equipment

|

56 |

| 56 | |||

| 56 | |||

|

|

A. |

Operating Results

|

56 |

|

|

B. |

Liquidity and Capital Resources

|

68 |

|

|

C. |

Research and Development, Patents and Licenses, etc. |

70 |

|

|

D. |

Trend Information

|

70 |

|

|

E. |

Critical Accounting Estimates

|

70 |

| 70 | |||

|

|

A. |

Directors and Senior Management

|

70 |

|

|

B. |

Compensation

|

73 |

|

|

C. |

Board Practices

|

76 |

|

|

D. |

Employees

|

87 |

|

|

E. |

Share Ownership

|

87 |

|

|

F. |

Disclosure of a Registrant’s Action to Recover Erroneously

Awarded Compensation |

87 |

| 87 | |||

|

|

A. |

Major Shareholders

|

87 |

|

|

B. |

Related Party Transactions

|

89 |

|

|

C. |

Interests of Experts and Counsel

|

91 |

| 91 | |||

|

|

A. |

Consolidated Statements and Other Financial Information

|

91 |

|

|

B. |

Significant Changes

|

92 |

| 92 | |||

|

|

A. |

Offering and Listing Details

|

92 |

|

|

B. |

Plan of Distribution

|

92 |

|

|

C. |

Markets

|

92 |

|

|

D. |

Selling Shareholders

|

92 |

|

|

E. |

Dilution

|

92 |

|

|

F. |

Expenses of the Issue

|

92 |

| 92 | |||

|

|

A. |

Share Capital

|

92 |

|

|

B. |

Memorandum and Articles of Association

|

92 |

|

|

C. |

Material Contracts

|

92 |

|

|

D. |

Exchange Controls

|

92 |

|

|

E. |

Taxation

|

93 |

|

|

F. |

Dividends and Paying Agents

|

102 |

|

|

G. |

Statement by Experts

|

102 |

|

|

H. |

Documents on Display

|

102 |

|

|

I. |

Subsidiary Information

|

102 |

|

|

J. |

Annual Report to Security Holders

|

102 |

| 102 | |||

| 103 | |||

|

|

A. |

Debt Securities

|

103 |

|

|

B. |

Warrants and Rights

|

103 |

|

|

C. |

Other Securities

|

103 |

|

|

D. |

American Depositary Shares

|

103 |

| 103 | |||

| 104 | |||

| 104 | |||

| 104 | |||

|

|

A. |

Disclosure Controls and Procedures

|

104 |

|

|

B. |

Management’s Annual Report on Internal Control Over Financial

Reporting |

104 |

|

|

C. |

Attestation Report of the Registered Public Accounting Firm

|

104 |

|

|

D. |

Changes in Internal Control Over Financial Reporting |

104 |

| 104 | ||

| 104 | ||

| 104 | ||

| 105 | ||

| 105 | ||

| 105 | ||

| 105 | ||

| 106 | ||

| 106 | ||

| 106 | ||

| 106 | ||

| 106 | ||

| 108 | ||

| 108 | ||

| 108 | ||

| 108 | ||

| 110 | ||

| F - 1 | ||

|

|

• |

our expectations regarding general market conditions and global economic trends;

|

|

|

• |

impact of the conflict in Israel on our operations and financial results;

|

|

|

• |

fluctuations in inflation, interest rates and exchange rates in the global economic

environment over the world; |

|

|

• |

our ability to implement our growth strategy; |

|

|

• |

the success of operating initiatives, including advertising and promotional efforts

and new product and concept development by us and our competitors; |

|

|

• |

our ability to compete and conduct our business in the future; |

|

|

• |

changes in consumer tastes and preferences; |

|

|

• |

the availability of qualified personnel and the ability to retain such personnel;

|

|

|

• |

changes in commodity costs, labor, distribution and other operating costs;

|

|

|

• |

changes in government regulation and tax matters; |

|

|

• |

other factors that may affect our financial condition, liquidity and results of

operations; and |

|

|

• |

other risk factors discussed under “Item 3. Key Information—D. Risk

Factors.” |

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

|

ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

|

ITEM 3. |

KEY INFORMATION |

| A. |

[Reserved] |

|

B. |

Capitalization and Indebtedness |

| C. |

Reasons for the Offer and Use of Proceeds |

| D. |

Risk Factors |

|

|

• |

unfavorable conditions in our industry or the global economy or reductions in spending

on point of sale, or POS, technology could limit our ability to grow our business and negatively affect our results of operations;

|

|

|

• |

we operate in a competitive business environment and a failure to compete effectively

may adversely affect our financial condition, results of operations and cash flows in the future; |

|

|

• |

we procure some of our key components from a single or limited number of suppliers.

Therefore, we are exposed to risks of shortages, price fluctuations, tariffs and delays in delivery of such components; |

|

|

• |

we have a limited operating history at our current scale, and our prospects and

future revenues are subject to a number of uncertainties, which limits our ability to predict them accurately; |

|

|

• |

we have a history of annual net losses and there are therefore risks related to

our ability to maintain profitability; |

|

|

• |

if we are unable to attract customers, maintain or grow our retention rates and

expand usage with existing customers, our revenue growth and any future profitability could be harmed; |

|

|

• |

we may be unable to successfully develop and expand our platform, which could limit

our ability to grow and maintain our competitive position and adversely affect our financial condition, results of operations and cash

flow; |

|

|

• |

we rely on processing service providers, credit card networks, banks and other entities

in the payment transfer system to process payments, and if they fail or no longer agree to provide their services or we fail to comply

with our obligations under those relationships, our customer relationships could be adversely affected, and we could lose business;

|

|

|

• |

any failure to offer high-quality customer support may adversely affect our relationships

with our customers and could adversely affect our business, financial condition and results of operations; |

|

|

• |

the termination of our existing relationships with commercial communications services

providers could force us to adapt our products to a new vendor; |

|

|

• |

Israel is currently at war, and the duration, scope and effects of the war are unknown;

|

|

|

• |

any past or future acquisitions, strategic investments, entries into new businesses,

joint ventures, divestitures and other transactions could fail to achieve strategic objectives, disrupt our ongoing operations or result

in operating difficulties, liabilities and expenses, harm our business and negatively impact our results of operations; |

|

|

• |

failure to maintain and enhance our brand recognition in a cost-effective manner

could harm our business, financial condition and results of operations; |

|

|

• |

information security failures or interruptions of our or our third-party partners’

or service providers’ information technology systems could adversely affect our business, financial condition and results of operations;

|

|

|

• |

operational failures, including within data transfer, could harm our reputation,

ability to retain customers and recruit new customers, as well as our business results; |

|

|

• |

our business is subject to complex and evolving regulations and oversight related

to privacy and data protection; |

|

|

• |

we are subject to substantial governmental and commercial regulations across our

areas of activity. Any failure to comply with applicable regulations or standards may lead to significant regulatory consequences and

could have an adverse effect on our business, financial condition or results of operations; |

|

|

• |

our business could suffer if we are unable to obtain, maintain, protect, defend

or enforce our intellectual property or other proprietary rights, or if others claim that we have infringed upon, misappropriated or otherwise

violated their intellectual property rights; |

|

|

• |

we rely on our key personnel and have not developed a succession plan for our senior

management; if our key personnel leave us, our results and product development could be harmed; and |

|

|

• |

we are controlled by our founding shareholders, who may make decisions with which

other shareholders may disagree. |

|

|

• |

the transaction may not advance our business strategy; |

|

|

• |

we may not be able to secure required regulatory approvals or otherwise satisfy

closing conditions for a proposed transaction in a timely manner, or at all; |

|

|

• |

the transaction may subject us to additional regulatory burdens, such as antitrust

and competition filings, that affect our business in potentially unanticipated and significantly negative ways; |

|

|

• |

we may not realize a satisfactory return or increase our revenue; |

|

|

• |

we may experience difficulty, and may not be successful in, integrating technologies,

IT or business enterprise systems, culture or management or other personnel of the acquired business; |

|

|

• |

we may incur significant acquisition costs and transition costs, including in connection

with the assumption of ongoing expenses of the acquired business; |

|

|

• |

we may not realize the expected benefits or synergies from the transaction in the

expected time period, or at all – for example, we expect opportunities to deliver additional revenue and costs synergies, as well

as accretion to net income, with the acquisition of Retail Pro and VMT, which may or may not be realized in a timely manner or at all;

|

|

|

• |

we may be unable to retain key personnel; |

|

|

• |

acquired businesses or businesses that we invest in may not have adequate controls,

processes and procedures to ensure compliance with laws and regulations, including with respect to data privacy and security, and our

due diligence process may not identify compliance issues or other liabilities – moreover, acquired businesses’ technology

may add complexity, resource constraints and failures that make it difficult and time consuming to achieve such adequate controls, processes

and procedures; |

|

|

• |

we may fail to identify or assess the magnitude of certain liabilities, shortcomings

or other circumstances prior to acquiring or investing in a business, which could result in additional financial, legal or regulatory

exposure, which may subject us to additional controls, policies, procedures, liabilities, litigation, costs of compliance or remediation

or to other adverse effects on our business, operating results or financial condition; |

|

|

• |

we may have difficulty entering into new product areas, market verticals or geographic

territories; |

|

|

• |

we may be unable to retain the customers, vendors and partners of acquired businesses;

|

|

|

• |

there may be lawsuits or regulatory actions resulting from the transaction. For

example, during 2023, the Israeli Competition Authority (the “ICA”) requested from us certain documents and other information

related mainly to our acquisition of OTI. We cooperated fully and transparently with the ICA throughout its investigative process, and,

on February 3, 2025, we entered into a consent decree (the “Consent Decree”) with the ICA to settle allegations of anticompetitive

practices and failing to obtain necessary ICA consent in connection with the acquisition. Pursuant to the Consent Decree, we and Yair

Nechmad, our CEO and Chairman, agreed to pay a sum of NIS 2,500,000 (approximately $701,000) and NIS 240,000 (approximately $67,300),

respectively, to the Israeli State Treasury, and we agreed to provide up to 6,500 OTI POS kits, comprised of the Telebox hardware units

paired with Uno 8/Uno Plus card readers, over a period of five years, to third parties who may sell, distribute, and market the OTI POS

kits under their own brands in the Israeli market. The Consent Decree is subject to public commentary and will become effective upon approval

by the Israeli Competition Court; |

|

|

• |

there may be risks associated with undetected security weaknesses, cyber-attacks

or security breaches at companies that we acquire or with which we may combine or partner; |

|

|

• |

there may be local and foreign regulations applicable to the international activities

of our business and the businesses we acquire; and |

|

|

• |

acquisitions could result in dilutive issuances of equity securities or the incurrence

of debt – for example, the acquisition of Retail Pro was financed through bank financing, which increased our debt burden, consideration

for the acquisition of VMT included an earn-out in the amount of up to approximately $5.3 million payable primarily in our ordinary shares

and consideration for the acquisition of Roseman Engineering included 19,722 of our ordinary shares. |

|

|

• |

cease selling or using solutions or services that incorporate the intellectual property

rights that we allegedly infringe, misappropriate, dilute or violate; |

|

|

• |

make payment of substantial royalty or license fees, lost profits or other damages;

|

|

|

• |

make substantial payments for legal fees, settlement payments or other costs or

damages; |

|

|

• |

discontinue some or all of the features, integrations and capabilities available

through our solutions; |

|

|

• |

indemnify our products’ users or third-party service providers; |

|

|

• |

obtain a license, which may not be available on reasonable terms or at all, to sell

or use the relevant technology; or |

|

|

• |

redesign or rebrand our allegedly infringing solutions to avoid infringement, misappropriation,

dilution or violation of third-party intellectual property rights, which could be costly, time-consuming or impossible. |

|

|

• |

actual or anticipated changes or fluctuations in our and our competitors’

results of operations; |

|

|

• |

the guidance we may provide to analysts and investors from time to time, and any

changes in, or our failure to perform in line with, such guidance; |

|

|

• |

announcements by us or our competitors of new offerings or new or terminated contracts,

commercial relationships or capital commitments; |

|

|

• |

industry or financial analyst or investor reaction to our press releases, other

public announcements, and filings with the U.S. Securities and Exchange Commission (the “SEC”); |

|

|

• |

rumors and market speculation involving us or other companies in our industry;

|

|

|

• |

future sales or expected future sales of our ordinary shares; |

|

|

• |

investor perceptions of us and the industries in which we operate; |

|

|

• |

price and volume fluctuations in the overall stock market from time to time;

|

|

|

• |

our shares generally trade at low volumes, which may increase the volatility of

our share price; |

|

|

• |

changes in operating performance and stock market valuations of other technology

companies generally, or those in our industry in particular; |

|

|

• |

failure of industry or financial analysts to maintain coverage of us, the issuance

of new or updated reports or recommendations by any analysts who follow our company, or our failure to meet the expectations of investors;

|

|

|

• |

actual or anticipated developments in our business or our competitors’ businesses

or the competitive landscape generally; |

|

|

• |

litigation involving us, other companies in our industry or both, or investigations

or sanctions by regulators regarding our operations or those of our competitors; |

|

|

• |

developments or disputes concerning our intellectual property or other proprietary

rights or our solutions, or third-party intellectual or other proprietary rights; |

|

|

• |

announced or completed acquisitions of businesses or technologies, or other strategic

transactions by us or our competitors; |

|

|

• |

actual or perceived breaches of, or failures relating to, privacy, data protection

or data security; |

|

|

• |

new laws or regulations, including new interpretations of existing laws or regulations

applicable to our business, increased enforcement efforts in our industry, or specific enforcement actions against us; |

|

|

• |

actual or anticipated changes in our management or our board of directors;

|

|

|

• |

general economic conditions and slow or negative growth of our target markets; and

|

|

|

• |

other events or factors, including those resulting from war such as the current

conflicts in Israel and Ukraine, incidents of terrorism or responses to these events. |

|

|

• |

the level of demand for our integrated POS devices; |

|

|

• |

our ability to grow or maintain our retention rates, expand usage within our customer

base, and sell our solutions to existing and future customers; |

|

|

• |

geopolitical uncertainty, including as a result of the current conflicts in Israel

and Ukraine, tensions between U.S. and China, and uncertainty as to regional economic conditions; |

|

|

• |

costs and timing of expenses related to hiring additional personnel, technologies

or intellectual property, including potentially significant amortization costs and possible write-downs; |

|

|

• |

the impact of market volatility and economic downturns caused by natural disasters

and health epidemics, such as the COVID-19 pandemic; |

|

|

• |

supply chain constraints and increases in component prices; |

|

|

• |

the timing and success of new features, integrations, capabilities and enhancements

by us to our platform or by our competitors to their products or any other change in the competitive landscape of our market; |

|

|

• |

errors in our forecasting of the demand for our products, which could lead to lower

revenue, increased costs or both; |

|

|

• |

the amount and timing of operating expenses and capital expenditures that we may

incur to maintain and expand our business and operations and to remain competitive; |

|

|

• |

security breaches, technical difficulties, disruptions or outages on our platform

resulting in service level agreement credits; |

|

|

• |

changes in the legislative or regulatory environment; |

|

|

• |

legal and regulatory compliance costs in new and existing markets; |

|

|

• |

pricing pressure as a result of competition or otherwise; and |

|

|

• |

fluctuations in foreign currency exchange rates. |

|

|

• |

we are not required to engage an auditor to report on our internal controls over

financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

|

|

• |

we are not required to comply with any requirement that may be adopted by the PCAOB

regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit

and the financial statements (i.e., an auditor discussion and analysis); and |

|

|

• |

we are not required to disclose certain executive compensation related items such

as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation

to median employee compensation. |

|

|

• |

Human Resources:

nearly 10% of our Israeli employees and managers were initially called to active reserve duty; it is possible that the war will require

additional reserve duty call-ups and more of our employees and managers or their family members will be called to active reserve duty,

which would prevent them from working or effectively performing their tasks for us. |

|

|

• |

Macro-economic effects:

the war has led, and may continue to lead, to negative domestic macro-economic effects in Israel that could materially impact our business

and operations, such as inflation, depreciation of the Shekel, bearish capital markets, reduced availability of credit and financing sources

and decline in growth. |

|

|

• |

Trade curtailment:

the war may lead to interruptions and curtailment of trade between Israel and its trading partners, which could result in reductions in

the demand for our offerings or disruptions in the supply of components required for our products. Certain countries and organizations

may impose trade or other trade or financial sanctions on Israel, which could impact our ability to conduct our business.

|

|

|

• |

Shipping costs:

the global shipping industry is experiencing disruptions due to various factors, including the rerouting of shipping away from the Suez

Canal due to attacks by Houthi militants from Yemen on commercial shipping vessels in the Gulf of Aden and the Red Sea, which has caused

a substantial increase in rates for some shipping routes. This and other factors have caused a worldwide increase in shipping rates, which

has impacted the Company. |

|

|

• |

Decrease in Israeli demand:

we have noticed an immaterial decrease in demand in Israel for our products and services compared to our global demand, due to reduction

in mobility and gatherings in public spaces, such as for leisure and entertainment activities during the war. |

|

|

• |

Concern about transacting business with Israeli companies:

we have received inquiries related to the war from customers concerned about

our operations in Israel. While we do not believe that any significant orders have been withdrawn or delayed as a result of such inquiries,

we cannot rule out the possibility that customers or business partners may stop doing business with us in the future, nor can we predict

the impact this might have on us. |

|

|

• |

Damage to infrastructure:

Terror, drone and missile attacks may lead to infrastructure damage, such as to various of our facilities located in Israel, including

communications networks, computer infrastructure and other cyber assets, which may lead to interruptions in our operations. Although the

Israeli government may cover the reinstatement value of certain damages that are caused by terrorist attacks or acts of war, we cannot

be sure that such government coverage will be available to us or, if available, will sufficiently cover our damages. |

|

|

• |

Reputation and international relations:

as a result of the war, public opinion in the international community towards Israel, Israeli companies and Israeli industries has deteriorated,

and may be further negatively affected in the future. In January 2024 the International Court of Justice, or ICJ, issued an interim ruling

in a case filed by South Africa against Israel alleging genocide amid and in connection with the war in Gaza. On November 21, 2024, the

International Criminal Court, or ICC, issued arrest warrants to Israeli Prime Minister Benjamin Netanyahu and former Israeli Minister

of Defense Yoav Gallant based on allegations of war crimes including using starvation as a method of warfare, murder and other inhumane

acts. It is hard to anticipate if and how such sentiments and other political developments will impact our clients, backlog of orders

or financial results; however, it is possible that a limited number of customers will hold, delay or cancel existing or future orders

as a result of the war and a shift in international relations and politics. |

|

|

• |

the Companies Law regulates the methods and processes by which mergers may be consummated

and requires tender offers to be effected for acquisitions of shares above specified thresholds in a company; |

|

|

• |

the Companies Law requires special approvals for certain transactions involving

directors, officers or significant shareholders and regulates other matters that may be relevant to these types of transactions;

|

|

|

• |

the Companies Law does not provide for shareholder action by written consent for

public companies, thereby requiring all shareholder actions to be taken at a general meeting of shareholders; |

|

|

• |

our amended and restated articles of association provide that director vacancies

may be filled by our board of directors; |

|

|

• |

our amended and restated articles of association require a vote of the holders of

our outstanding ordinary shares entitled to vote present and voting on the subject matter at a general meeting of shareholders for the

removal of directors (other than external directors regarding whom special rules apply); |

|

|

• |

We have undertaken in certain of our financing agreements not to have a change-of-control

without the lender’s approval; and |

|

|

• |

Some of our European licenses may be cancelled or suspended, or we may be subject

to other sanctions for breaches of such licenses, if holders of our shares cross certain prescribed ownership thresholds without the prior

approvals of the relevant regulators. |

| ITEM 4. |

INFORMATION ON THE COMPANY |

|

A. |

History and Development of the Company |

| B. |

Business Overview |

|

|

• |

$4.87 billion of transaction value; |

|

|

• |

approximately 2.38 billion transactions; and |

|

|

• |

approximately 1,260,000 managed and connected devices across more than 120 countries

on every inhabited continent. |

|

|

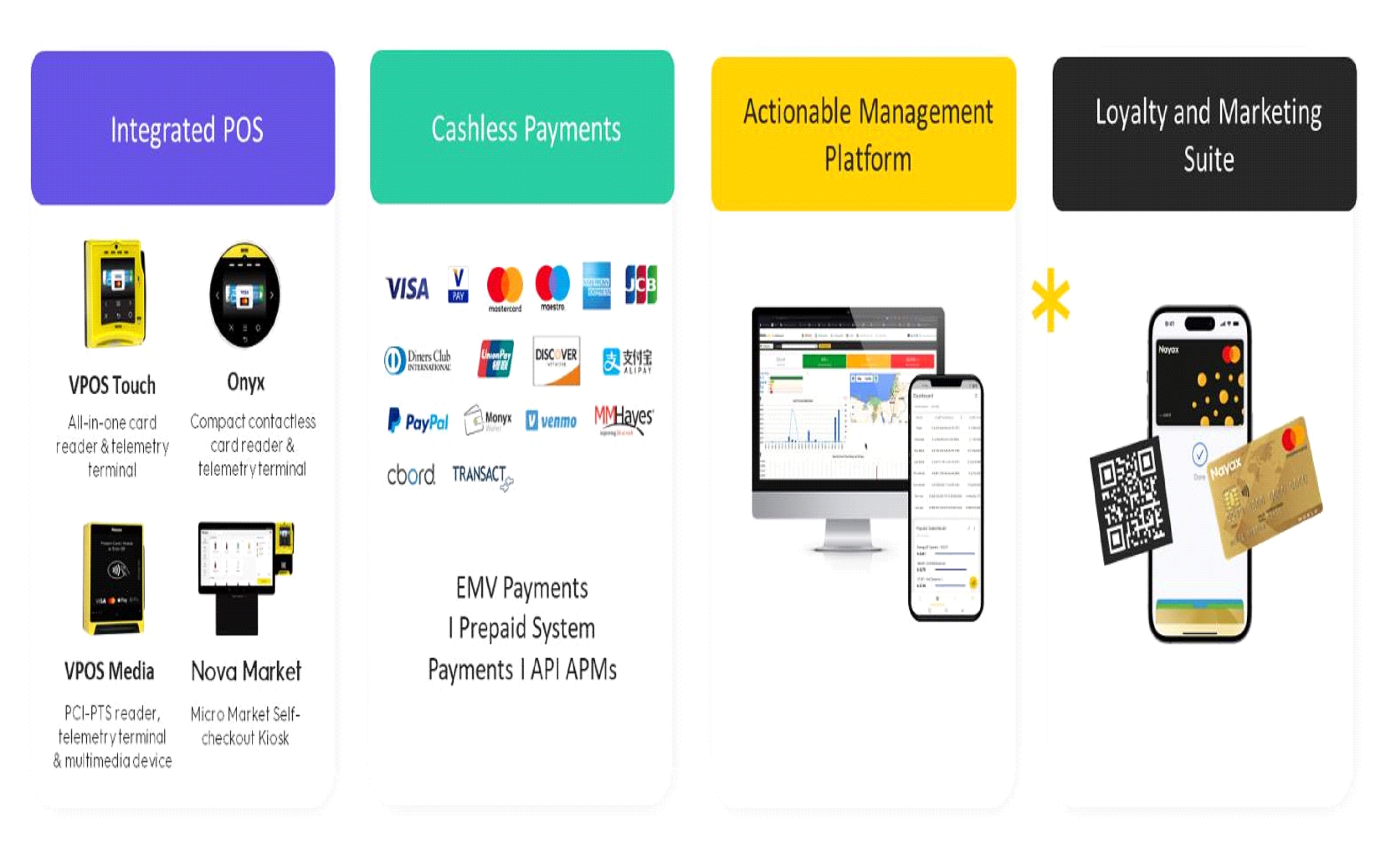

• |

Remote Monitoring and Administration:

Our system offers comprehensive 24/7 remote monitoring and administration, featuring real-time error detection and alerts, remote price

adjustments, software updates, inventory management, promotion oversight, employee monitoring, and energy consumption control, without

requiring onsite technical support or maintenance. |

|

|

• |

Inventory Management:

Our inventory management system empowers customers to oversee stock availability, control costs, and transfer inventory across various

sites. With dynamic resupply routing, customers can streamline their supply chains, minimize waste, and cut operational costs.

|

|

|

• |

Reporting and Analytics:

Our platform collects and synthesizes data from all Nayax POS devices a business owns, delivering real-time insights into sales, cash

levels, and inventory status through automated reports, supported by powerful business intelligence tools and customizable dashboards

for data-driven decision-making. |

|

|

• |

Product Management:

We enable customers to create and manage product catalogs with customizable parameters and offer dynamic pricing tools, including multiple

price lists, currencies, and special pricing options. |

|

|

• |

Employee Management:

Our customers can manage roles, set permissions, and control access levels across POS devices and activities, organized by hierarchies

like global offices or regions. Automated self-service retailers can also track employee visits, inventory refills, and cash collections

to reduce fraud. |

|

|

• |

Loyalty:

Customers can design loyalty programs with attributes like price rules, cards, points, and wallets. Our platform simplifies campaign creation

with built-in templates and provides analytic tools to track performance and strengthen brand loyalty. |

|

|

• |

Promotions:

Customers can set up promotions such as punch cards, discounts, cashback, bonus credit, and happy hours, which we believe helps encourage

repeat visits and strengthens consumer loyalty. |

|

|

• |

Engagement Solutions:

We provide omni-channel marketing tools that bridge online and in-store consumer experiences, enabling businesses to target advertising,

enhance engagement, maximize conversions, grow revenue, and attract returning consumers. |

|

|

• |

Marketing Solutions:

We empower customers to execute marketing campaigns across social media, SMS, and email channels, leveraging their own data to maximize

impact and improve outcomes. |

|

|

• |

Universal Redemption Capability:

Customers can convert points, rewards, miles, vouchers, gift cards, and other digital assets into real currency, spendable at any merchant

worldwide that accepts major credit cards. |

|

|

• |

Seamless Integration:

Brands can incorporate CoinBridge into their existing mobile applications through a straightforward Software Development Kit, requiring

no changes to point-of-sale systems or merchant infrastructures. |

|

|

• |

Real-Time Transaction Processing:

Instant verification and approval of transactions enable customers to redeem loyalty assets effortlessly through a simple ‘Tap &

Go’ experience. |

|

|

• |

Comprehensive Data Analytics:

CoinBridge provides brands with detailed transaction data and consumer behavior insights, enabling personalized marketing strategies,

improved customer retention, and optimized business operations. |

|

|

• |

Enhanced Customer Engagement:

Flexible redemption options and a user-friendly payment experience increase customer satisfaction and loyalty, allowing consumers to utilize

rewards in ways that align with their spending habits. |

|

|

• |

Secure and Compliant Infrastructure:

Operating under stringent security protocols and complying with global financial regulations, CoinBridge ensures safe and reliable transactions

for both brands and consumers. |

|

|

• |

Single, Integrated, End-to-End Platform: We

offer a comprehensive, integrated end-to-end platform that reduces the need for customers to manage multiple vendors and systems. Customers

benefit from a 360-degree, omni-channel platform that centralizes reporting and operational tracking in one location. |

|

|

• |

Global Footprint:

Our global presence allows us to offer solutions that span multiple regions and geographies, saving our enterprise customers and SMEs

from the hassle of engaging additional local providers. Our extensive network of original equipment manufacturer, or OEM, partners pre-installs

our products in machines like vending machines, EV chargers, and arcade games, facilitating quick and efficient deployment across the

globe. Our local offices span across large regions such as the United States, the United Kingdom, Germany, Australia, Canada, China, Brazil

and Japan. We also have more than 80 distributors in multiple countries to provide local support in different languages for their local

customers. |

|

|

• |

Increased Sales:

Our solutions provide diverse payment options, improved consumer experience, and dynamic pricing capabilities, helping our customers increase

sales by responding nimbly to changing market conditions and making payments more convenient. |

|

|

• |

Reduced Costs:

Our solutions optimize operating costs by enabling better overhead management and employee efficiency. Remote diagnostics and software

updates eliminate third-party troubleshooting, while our customer service platform improves customer experience and reduces the cost of

ownership and maintenance. We streamline operations with 24/7 monitoring of connected devices, employees, and business activities, while

minimizing downtime through automated issue detection and resolution. |

|

|

• |

Enhanced Customer Engagement:

Our platform helps businesses attract and retain consumers with data-driven marketing, branded loyalty programs, and mobile solutions.

Retailers gain access to valuable consumer insights and advanced analytics, enabling them to build direct relationships and foster loyalty.

Our omni-channel marketing engine allows businesses to tailor personalized recommendations and deals, while our loyalty programs track

every transaction, helping consumers earn rewards with each purchase. |

|

|

• |

Diverse Payment Options:

Our platform provides seamless, Europay, MasterCard, and Visa-, or EMV-, certified payment processing in approximately 120 countries and

approximately 50 currencies and supports more than 80 payment methods, including most major credit and debit cards, mobile wallets, prepaid

cards, and QR-based payments, allowing consumers to pay using their preferred local method. Available methods vary by country and region.

|

|

|

• |

Advanced Loyalty Benefits:

Our platform includes loyalty features such as discounts, gifts, and special offers, providing consumers with immediate rewards at checkout

that enhance the purchasing experience and encourage repeat engagement. |

|

|

• |

Enhanced Consumer Experience:

Our platform elevates the consumer experience with features such as mobile app feedback and ratings, while our integrated solutions streamline

traditionally complex processes like instant refunds for a smoother shopping journey. |

|

|

• |

Automated Self-Service:

Solutions for the automated self-service retail market vary widely, from standalone payment, telemetry, or business intelligence products

to integrated offerings that combine telemetry, payments, and operational management tools. Our competitors include Cantaloupe, Inc.,

CPI, Ingenico, 365 Retail, traditional cash payment vendors, and many others. We believe our competitive advantage lies in providing customers

around the globe with comprehensive and scalable end-to-end POS solutions, including cashless payment capabilities, remote operation and

management services, and payment processing. Despite our extensive industry knowledge and experience, we recognize the strength of our

competition and acknowledge that past success does not guarantee future performance. |

|

|

• |

Attended Retail:

Our competition includes large, established vendors and smaller startups, spanning payment processors, POS providers, and peer-to-peer

payment platforms. We aim to expand our market share by cross-selling to our broad automated self-service customer base and offering integrated

solutions for their attended retail operations. Our competitive edge lies in providing a unified payment ecosystem that seamlessly

integrates attended and self-service commerce, enhancing efficiency and consistency across hybrid retail environments. Leveraging our

expertise in SME automation, we bring advanced tools like loyalty programs, real-time monitoring, and dynamic pricing to smaller retailers,

helping them expand margins and compete effectively in an increasingly tech-fueled and omnichannel retail landscape. |

|

|

• |

Large Enterprise:

Our proven ability to secure large accounts spans multiple industries and regions, with notable recent wins including Café+Co, Primo

Water, Canteen, FiveStar, MOL Group, Synergy Energy—Western Australia’s largest energy retailer and generator—and Turkey’s

Düzey, part of Koç Holding. |

|

|

• |

SMEs:

Our automated and scalable go-to-market platform effectively reaches SMEs via digital channels, distributors, and OEM partnerships. SMEs

represent a significant share of our revenue, and we view this channel as integral to our future growth strategy, driven by our strong

track record in this space. |

|

|

• |

Geographic Expansion:

Nayax uses M&A to accelerate regional expansion, helping us enter new markets faster, acquire strategic customers, mitigate regulatory

challenges, and expand our product reach. We target unattended market leaders with profitable operations, at least 10,000 connected devices,

and strong growth potential. Examples include our acquisitions of a leading Brazilian technology

provider for the automated self-service industry, which significantly advanced our expansion into Latin America and extended our service

offerings across Brazil; and Retail Pro, a global retail POS software leader, which brought 130,000 POS licenses and a significant, global

distribution network. |

|

|

• |

Distribution Channel Consolidation:

Nayax leverages M&A to consolidate distribution channels to secure direct access to strategic customers, reduce costs and increase

efficiency in key markets, enhance operational control, and replace poorly performing distributors. We focus on unattended market leaders

with profitable operations, at least 10,000 connected devices, and a core TAM of at least 500,000 devices. Examples include InOne Technology,

rebranded as Nayax LLC, a North American distributor now responsible for more than 35% of Nayax’s global revenue, and VendCheck,

rebranded as Nayax Australia to enhance marketing, sales, and support while offering expanded solutions and innovations to the Australian

market. |

|

|

• |

Technological Advancement: Nayax pursues M&A to accelerate technological

innovation and prowess in strategic growth verticals such as EV charging, retail kiosks, and mass transit. Acquisitions allow us to fill

technology gaps, deliver value-added revenue, and integrate complementary solutions into our platform. We target market-leading or disruptive

technologies that can be integrated within 12–18 months. Examples include Weezmo, which we acquired in early 2021 to enhance our

portfolio of marketing tools for retailers; Tigapo, in which we acquired a majority stake in 2021 to expand our platform offering for

US amusement operators; OTI, which we acquired in 2022 to strengthen our smart payment solutions for automated self-service machines;

and Roseman Engineering, which we acquired in 2024 to strengthen our energy sector offerings with advanced fleet management, cloud management,

and AVI (Automatic Vehicle Identification) tools. |

|

|

• |

Automated Self-Service:

We design and develop our integrated POS devices and software for automated self-service customers in-house. We rely upon a limited number

of manufacturing subcontractors, who purchase all necessary components and supply us with POS devices as a finished product, with certain

exceptions. We place manufacturing orders as necessary to fulfill purchases by our customers, adjusting production volumes dynamically

based upon our needs. |

|

|

• |

Attended Retail:

Nayax currently partners with four suppliers to procure standard, off-the-shelf hardware for our attended retail customers. Although we

customize color schemes, branding, and packaging to reflect our marketing strategy, we do not make any major modifications to the underlying

hardware to maximize scalability and reliability. We work with multiple suppliers, each specializing in different product categories,

to minimize our risks from supply chain disruptions or dependency on a single source. |

|

|

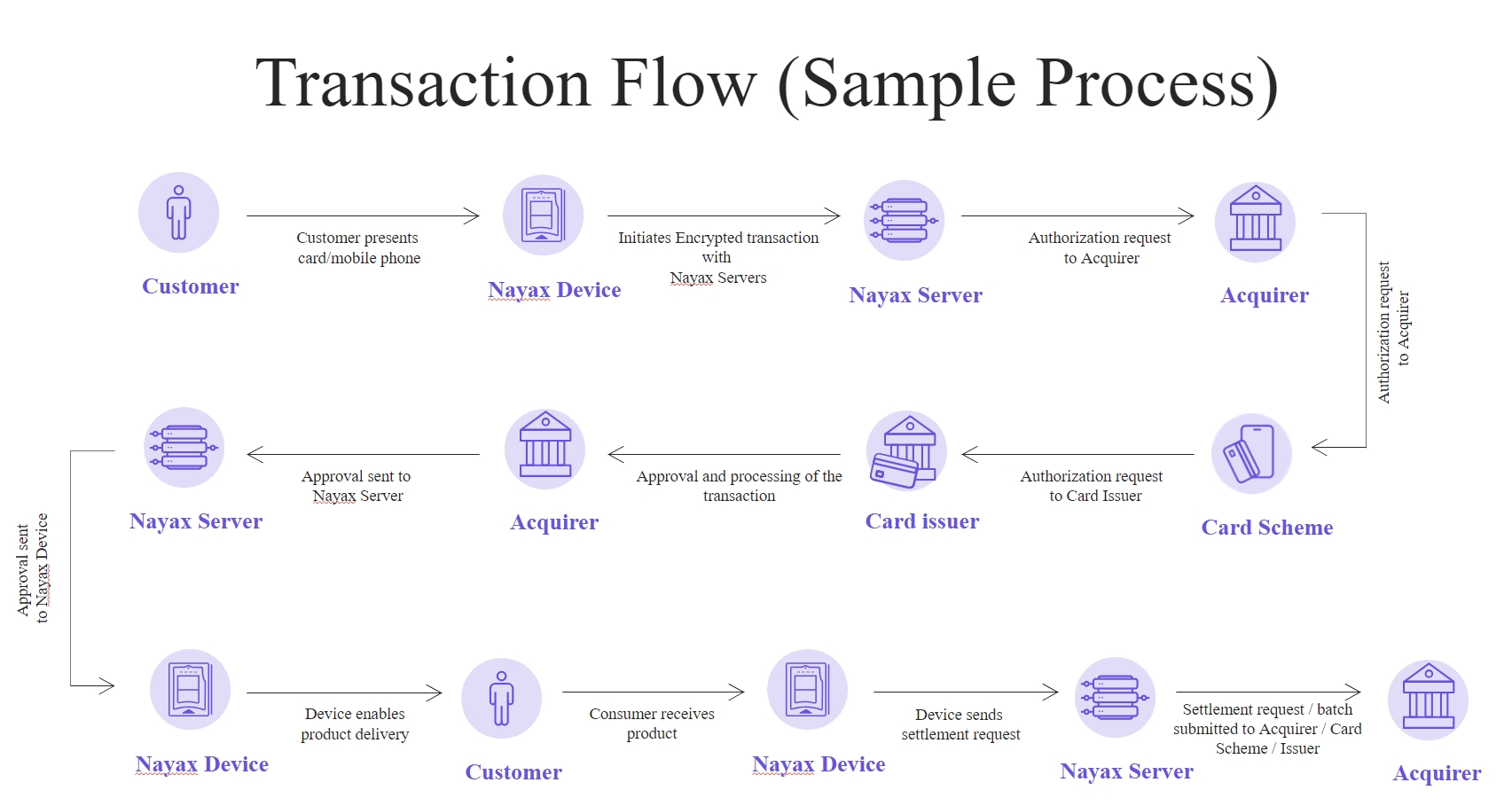

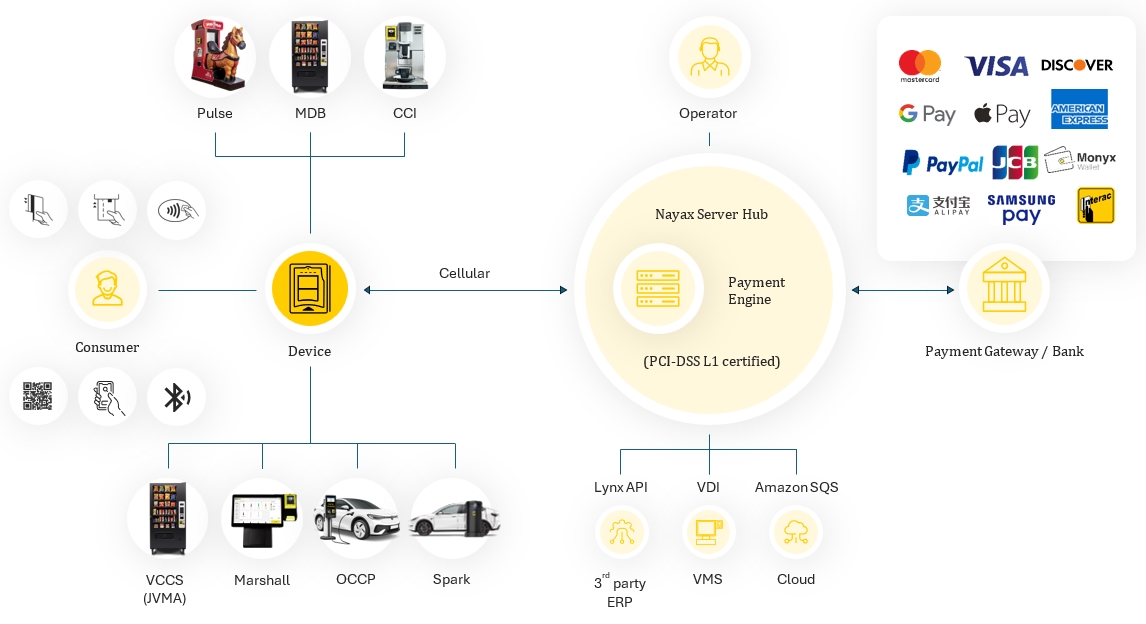

• |

Marshall, a simple serial protocol designed to connect our integrated POS devices

to PC-based machines; |

|

|

• |

LYNX, which provides input / output data to third-party systems; and |

|

|

• |

Cortina, a collection of API methods which allows a third-party payment gateway

to process payments via Nayax systems as depicted in the following diagram: |

|

|

• |

Patents:

We own four issued U.S. patents, five issued Israeli patents, two issued European patents, and four patents issued in other jurisdictions.

We also have several active patents applications in various jurisdictions. |

|

|

• |

Domain Names:

We own eight registered website domains. |

|

|

• |

Trademarks:

We maintain trademarks and service marks on or in connection with our proprietary technology and services, including both unregistered

common law marks and issued trademark registrations, in jurisdictions including Israel, the United States, Japan, Australia, the European

Union, the United Kingdom, China and Mexico, and others. |

|

|

• |

Ownership:

We empower employees to take responsibility for their decisions and outcomes, fostering accountability, entrepreneurial thinking, and

meaningful results for our customers. |

|

|

• |

Listen:

We listen closely to our customers and each other, uncovering opportunities to innovate, building stronger relationships, and deliver

solutions that solve customer pain points. |

|

|

• |

Act:

We encourage employees of all levels to be decisive, challenge the status quo, and take calculated risks to better serve our customers

and meet their needs quickly and effectively. |

|

|

• |

Honesty:

We place honesty and integrity at the heart of every action we take, sustaining collaboration within our team and forging lasting, trust-based

partnerships with our customers. |

|

|

• |

We acquired VMT, a leading technology provider for the automated self-service industry

in Brazil. This strategic acquisition marks a significant step in our expansion into the Latin American market by enabling us to leverage

VMT’s established position serving thousands of retailers in diverse industries in hundreds of cities across Brazil. |

|

|

• |

We acquired Roseman Engineering, a Tel-Aviv based fuel and electric vehicle management

software solution provider that allows managers of gas stations to track fuel station income, reduce expenses and increase operational

efficiencies. This acquisition complements our existing offerings utilized by EV charging station operators worldwide. |

|

|

• |

We launched EV CloudPay, a cloud-based payments solution to facilitate payments

at EV charging stations. EV CloudPay is a single cloud-based kiosk that facilitates the payments for multiple chargers (without having

to download and use multiple mobile apps), enabling a seamless experience for charging station operators and customers. |

|

|

• |

Our VPOS Touch card reader was designated Best Payment System from The Vendies,

an annual UK-based vending industry award. VPOS Touch helps operators stay on top of their business via telemetry technology that communicates

with a vending management system and app. VPOS Touch won the same award for Best Payment System in 2021 and won the Payment System of

the Year award from The Vendies in 2016, 2017 and 2018. |

|

|

• |

We opened a new Technical Support Center for the U.S. market aimed at enhancing

our customer support quality, reducing call times and increasing customer satisfaction. We have also worked to automate several onboarding

processes, with the goal of enabling us to continue to scale without compromising on support responsiveness. |

|

|

• |

We entered into a collaboration agreement with DKV Mobility, a B2B platform for

on-the-road payment solutions that will further expand our payments acceptance across Europe. DKV Mobility offers access to the largest

energy-agnostic acceptance network in Europe, including tens of thousands of fuel service stations and hundreds of thousands of public

and semi-public EV charging stations. |

|

|

• |

We entered into a strategic partnership with Slovakia’s ASO Vending, the country’s

largest vending machine operator. This partnership will include the installation of thousands of Nayax card readers on vending machines

throughout the country, more than doubling Nayax’s active devices in Slovakia. |

|

|

• |

We entered into a strategic partnership with Ayden to globally expand its EV charging

and automated self-service payments infrastructure. This partnership introduces the world’s first global omnichannel payment service

provider solution for EV charging, integrating our payment and loyalty platform into Adyen’s international platform. Additionally,

this global partnership enables us to expand into new regions, such as Latin America and APAC, while reducing operational costs.

|

|

|

• |

We entered into a strategic partnership with A2Z Cust2Mate Solutions Corp. to integrate

our automated self-service mobile payment system with A2Z Cust2Mate’s cart platform for small retails stores. This collaboration

will enable customers to complete their shopping journey directly from their smart cart, eliminating the need for checkout lines, with

a seamless “pick-and-go” experience. |

|

|

• |

We launched the Energy EV Kiosk, a payment processing solution for EV charging stations.

The Energy EV Kiosk enables a seamless and fast payment experience for drivers charging their vehicles using credit cards, debit cards

or mobile wallets without the need for individual payment devices on each charger. |

| C. |

Organizational Structure |

|

Company |

Country of Incorporation

|

Percentage Ownership and Voting Interest |

Main Activities

| |||

|

Nayax LLC |

USA (Maryland) |

100% |

Sale of the Company’s products and

services | |||

|

Nayax Europe UAB |

Lithuania |

100% |

Processing transactions on behalf of the

Company’s customers in Europe | |||

|

Nayax AU PTY Ltd. |

Australia |

100% |

Sale of the Company’s products and

services | |||

|

Nayax (UK) Limited |

UK |

100% |

Sale of the Company’s products and

services |

| D. |

Property, Plants and Equipment |

| ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

| ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

| A. |

Operating Results |

|

|

• |

Software and ongoing services,

including SaaS solutions; |

|

|

• |

Payment processing fees;

and |

|

|

• |

Hardware sales and other one-time revenues,

such as professional services. |

|

Year ended December 31,

|

||||||||||||

|

2024 |

2023 |

2022 |

||||||||||

|

SaaS Revenue ($millions)

|

88.5 |

58.9 |

45.3 |

|||||||||

|

YoY Growth

|

50 |

% |

30 |

% |

30.9 |

% | ||||||

|

Payment Processing Fees ($millions) |

133.8 |

92.1 |

59.5 |

|||||||||

|

YoY Growth

|

45 |

% |

55 |

% |

63 |

% | ||||||

|

Year ended December 31,

|

||||||||||||||||||||||||

|

2024 |

2023 |

2022 |

||||||||||||||||||||||

|

Revenue

($ millions) |

Rate of

total income |

Revenue

($ millions) |

Rate of

total income |

Revenue

($ millions) |

Rate of

total income |

|||||||||||||||||||

|

SaaS Revenue and Payment Processing Fees |

222.3 |

70.8 |

% |

151.1 |

64.1 |

% |

104.8 |

60.4 |

% | |||||||||||||||

|

Revenue from sale of integrated POS devices |

91.7 |

29.2 |

% |

84.4 |

35.9 |

% |

68.7 |

39.6 |

% | |||||||||||||||

|

Year ended December 31,

|

||||||||||||

|

2024 |

2023 |

2022 |

||||||||||

|

Net revenue retention

|

129 |

% |

144 |

% |

131 |

% | ||||||

|

|

• |

Global Economic Growth:

Slower economic expansion may lead businesses to scale back or delay investments in our integrated POS devices and services. Consumers

could also reduce discretionary spending in response to slower growth, reducing our overall transaction volumes. |

|

|

• |

Supply Chain Disruptions:

Component shortages, or anticipated or unanticipated logistical disturbances could disrupt our ability to manufacture and fulfill orders

on time, increasing the cost of essential components and shipping or impacting our ability to meet contractual commitments.

|

|

|

• |

Interest Rates:

Rising interest rates could increase borrowing costs for our customers, limiting their ability to invest in new locations, upgrade payment

infrastructure, or adopt our integrated POS solutions at the same pace. |

|

|

• |

Inflation:

Volatility in component prices has already affected production costs for our integrated POS devices, and prolonged inflation may further

strain margins. While general inflation has not yet significantly impacted customer demand for our solutions, persistent cost increases

could require adjustments in pricing or supply chain strategies to maintain affordability and competitiveness. |

|

|

• |

Tariffs:

Elevated tariffs on essential imported materials, including steel and aluminum, could lead to higher manufacturing expenses for our integrated

POS devices, potentially reducing our profit margins. Suppliers also may attempt to renegotiate or terminate contracts if tariffs unexpectedly

raise their operating costs or disrupt their own supply chains. |

|

|

• |

SaaS Subscriptions:

We charge monthly fees per billable device for access to our telemetry and management software, with pricing based on a tiered subscription

model. Customers can choose from multiple plans, each offering different levels of functionality and support, ensuring flexibility for

businesses of all sizes. Revenue is recognized over the subscription period once service begins. |

|

|

• |

Payment Processing Fees:

We charge a transaction fee for payments processed through our platform, typically calculated as a percentage of the total transaction

amount. We recognize revenue from Payment Processing Fees as gross revenue because we are responsible for facilitating, managing, and

ensuring the completion of the transaction. We recognize fees paid to our acquiring partners as cost of revenues because they are direct

expenses incurred to deliver that service. |

|

|

• |

Hardware Revenue:

We generate one-time revenue from the sale of integrated POS hardware. Although we believe that businesses can optimize their sales performance,

cost efficiency, and customer experience by deploying our integrated POS devices in conjunction with our SaaS solutions and payment processing

infrastructure, our hardware supports multiple functionalities and can be purchased as a standalone product. We recognize revenue from

hardware sales when control of the device transfers to the customer, as each sale is a distinct performance obligation separate from any

related services. |

|

|

• |

Hardware-Related Costs includes

all expenses associated with the production, sale, and distribution of our integrated POS devices, including hardware component costs,

shipping and handling expenses, external manufacturing services, salary-based and share-based compensation for employees, quality control,

and infrastructure costs related to testing and production oversight. |

|

|

• |

Payment Processing-Related Costs

includes interchange and flat fees paid to processing agencies, including merchant acquirers and card networks, for payment processing

services. |

|

|

• |

SaaS-Related Costs

includes all expenses associated with developing or maintaining our SaaS platform and device communication network, expenses related to

our Tier 1 customer support team, and relevant employee-related costs, including salary-based and share-based compensation.

|

|

Year ended December 31,

|

||||||||||||

|

2024 |

2023 |

2022 |

||||||||||

|

U.S. Dollars in thousands

|

||||||||||||

|

Interest income on cash and bank deposits |

3,110 |

1,685 |

- |

|||||||||

|

Financial income in respect of change in fair value options

|

148 |

- |

423 |

|||||||||

|

Financial income in respect of shareholders and related companies

|

150 |

24 |

15 |

|||||||||

|

Financial income in respect of finance sub-lease |

- |

17 |

- |

|||||||||

|

Financial income in respect of exchange rate differences

|

- |

767 |

- |

|||||||||

|

3,408 |

2,493 |

438 |

||||||||||

|

Year ended December 31,

|

||||||||||||

|

2024 |

2023 |

2022 |

||||||||||

|

U.S. Dollars in thousands

|

||||||||||||

|

Interest expense on bank loans and bank fees |

(6,181 |

) |

(3,389 |

) |

(993 |

) | ||||||

|

Financial expenses in respect of change in fair value options

|

- |

(310 |

) |

- |

||||||||

|

Financial expenses in respect of loans from others |

(197 |

) |

(591 |

) |

(70 |

) | ||||||

|

Financial expenses in respect of other liabilities |

(1,552 |

) |

(161 |

) |

(167 |

) | ||||||

|

Financial expenses in respect of leases liabilities |

(333 |

) |

(330 |

) |

(260 |

) | ||||||

|

Financial Expenses in respect of exchange rate differences

|

(2,634 |

) |

- |

(1,968 |

) | |||||||

|

(10,897 |

) |

(4,781 |

) |

(3,458 |

) | |||||||

|

As of December 31,

|

||||||||||||

|

2024 |

2023 |

2022 |

||||||||||

|

Number of customers

|

95,060 |

72,252 |

47,385 |

|||||||||

|

YoY growth

|

32 |

% |

52 |

% |

60 |

% | ||||||

|

As of December 31,

|

||||||||||||

|

2024 |

2023 |

2022 |

||||||||||

|

Number of managed and connected devices (in thousands)

|

1,260 |

1,044 |

725 |

|||||||||

|

YoY growth

|

21 |

% |

44 |

% |

40 |

% | ||||||

|

Year ended December 31,

|

||||||||||||

|

2024 |

2023 |

2022 |

||||||||||

|

Number of transactions (in millions) |

2,378 |

1,841 |

1,304 |

|||||||||

|

YoY growth

|

29 |

% |

41 |

% |

64 |

% | ||||||

|

Year ended December 31,

|

||||||||||||

|

2024 |

2023 |

2022 |

||||||||||

|

In USD thousands

|

||||||||||||

|

Loss for the period

|

(5,631 |

) |

(15,887 |

) |

(37,509 |

) | ||||||

|

Finance expenses,

net |

7,489 |

2,288 |

3,020 |

|||||||||

|

Tax expenses

|

1,247 |

1,215 |

451 |

|||||||||

|

Depreciation and amortization

|

21,370 |

12,505 |

9,028 |

|||||||||

|

EBITDA

|

24,475 |

121 |

(25,010 |

) | ||||||||

|

Share-based payment

costs |

7,187 |

6,027 |

8,747 |

|||||||||

|

employment benefit

cost(1)

|

541 |

- |

- |

|||||||||

|

Non-recurring issuance

and acquisition costs(2) |

2,023 |

444 |

1,790 |

|||||||||

|

Share of loss of equity

method investee |

1,270 |

1,555 |

1,794 |

|||||||||

|

Adjusted EBITDA

|

35,496 |

8,147 |

(12,679 |

) | ||||||||

|

|

(1) |

Consists of other compensation arrangements provided to the shareholders of VMT.

|

|

|

(2) |

Consists primarily of (i) expenses incurred in connection with our listing on Nasdaq,

(ii) professional fees and other expenses incurred in connection with our acquisitions, (iii) fees and expenses, other than underwriter

discount and commissions, incurred in connection with our March 2024 underwritten public offering of 3,130,435 ordinary shares, (iv) settlement

arrangement and legal expenses incurred in connection with and throughout the ICA’s investigative process related to our acquisition

of OTI. |

|

Year ended December 31, |

||||||||

|

2024 |

2023 |

|||||||

|

In USD thousands |

||||||||

|

Revenues |

314,013 |

235,491 |

||||||

|

Cost of revenues |

172,479 |

147,198 |

||||||

|

Gross Profit |

141,534 |

88,293 |

||||||

|

Research and development expenses |

25,374 |

21,928 |

||||||

|

Selling, administrative and general expenses |

98,196 |

70,320 |

||||||

|

Depreciation and amortization in respect of technology and capitalized development costs |

11,566 |

6,430 |

||||||

|

Other expenses |

2,023 |

444 |

||||||

|

Share of loss of equity method investee |

1,270 |

1,555 |

||||||

|

Profit (Loss) from ordinary operations |

3,105 |

(12,384 |

) | |||||

|

Financial Income |

3,408 |

2,493 |

||||||

|

Financial Expense |

(10,897 |

) |

(4,781 |

)

| ||||

|

Loss before taxes on income

|

(4,384 |

) |

(14,672 |

) | ||||

|

Tax expenses |

(1,247 |

) |

(1,215 |

) | ||||

|

Loss for the year

|

(5,631 |

) |

(15,887 |

) | ||||

|

Year ended December 31, |

||||||||

|

2024 |

2023 |

|||||||

|

In USD thousands |

||||||||

|

Revenue from the sale of integrated POS devices |

91,677 |

84,406 |

||||||

|

Recurring revenue |

222,336 |

151,085 |

||||||

|

Total revenue |

314,013 |

235,491 |

||||||

|

Year ended December 31, |

||||||||

|

2024 |

2023 |

|||||||

|

In USD thousands |

||||||||

|

Cost of integrated POS devices sales

|

64,106 |

68,433 |

||||||

|

Cost of recurring revenue |

108,373 |

78,765 |

||||||

|

Total cost of revenue

|

172,479 |

147,198 |

||||||

|

Year ended December 31, |

||||||||

|

2024 |

2023 |

|||||||

|

In USD thousands |

||||||||

|

United States |

123,033 |

83,528 |

||||||

|

Europe (excluding United Kingdom) |

76,000 |

72,887 |

||||||

|

United Kingdom |

38,688 |

26,391 |

||||||

|

Australia |

27,521 |

22,484 |

||||||

|

Israel |

16,967 |

13,095 |

||||||

|

Rest of the World |

31,804 |

17,106 |

||||||

|

Total |

314,013 |

235,491 |

||||||

|

Year ended December 31, |

||||||||

|

2024 |

2023 |

|||||||

|

(in USD thousands) |

||||||||

|

Net cash generated from (used in): |

||||||||

|

Net cash generated from operating activities |

42,902 |

8,798 |

||||||

|

Net cash flows used in investing activities |

(45,906 |

) |

(36,831 |

) | ||||

|

Net cash flows generated from financing activities |

50,844 |

31,551 |

||||||

|

Increase in cash and cash equivalents

|

47,840 |

3,518 |

||||||

|

B. |

Liquidity and Capital Resources |

| C. |

Research and Development, Patents and Licenses, etc. |

| D. |

Trend Information |

| E. |

Critical Accounting Estimates |

| ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

| A. |

Directors and Senior Management |

|

Name |

Position(s) |

Age | ||

|

Directors |

| |||

|

Yair Nechmad |

Co-Founder, Chairman and Chief Executive Officer |

62 | ||

|

David Ben-Avi |

Co-Founder, Chief Technology Officer and Director |

51 | ||

|

Rina Shafir |

Director |

61 | ||

|

Vered Raz Avayo |

Director |

55 | ||

|

Nir Dor |

Director |

61 | ||

|

Reuven Ben Menachem |

Director |

64 | ||

|

Eran Havshush |

Director |

49 | ||

|

Executive Officers |

|

|||

|

Sagit Manor |

Chief Financial Officer |

52 | ||

|

Oren Tepper |

Chief Commercial Officer |

53 | ||

|

Keren Sharir |

President and Chief Marketing Officer |

45 | ||

|

Tami Erel |

Chief Business Operations Officer |

49 | ||

|

Gal Omer |

Chief Legal Officer |

42 | ||

|

Oded Frenkel |

Chief Customer Officer |

44 | ||

|

Moshe Shmaryahu |

Chief Information Officer |

57 | ||

|

Yaron Aharon |

Chief Operating Officer |

58 | ||

|

Aaron Greenberg |

Chief Strategy Officer |

30 | ||

|

Erez Aminpour |

Chief Product Officer |

42 | ||

|

Eden Zafrani |

Chief Human Resources Officer |

43 |

| B. |

Compensation |

|

Remuneration for services(1)

|

||||||||||||||||||||||||||||||

|

Name |

Position |

Scope of employment |

Salary |

Bonus |

Share-based payment |

Management fees |

Consulting fees |

Total |

||||||||||||||||||||||

|

In thousands |

||||||||||||||||||||||||||||||

|

Yair Nechmad |

Co-Founder, Chairman and Chief Executive Officer |

100 |

% |

$ |

483 |

— |

$ |

811 |

— |

— |

$ |

1,294 |

||||||||||||||||||

|

David Ben-Avi |

Co-Founder, Chief Technology Officer and Director |

100 |

% |

$ |

483 |

— |

$ |

811 |

— |

— |

$ |

1,294 |

||||||||||||||||||

|

Sagit Manor |

Chief Financial Officer |

100 |

% |

$ |

317 |

73 |

$ |

243 |

— |

— |

$ |

633 |

||||||||||||||||||

|

Carly Furman |

General Manager, North America |

100 |

% |

$ |

508 |

— |

$ |

80 |

— |

— |

$ |

588 |

||||||||||||||||||

|

Keren Sharir |

President and Chief Marketing Officer |

100 |

% |

$ |

277 |

32 |

$ |

92 |

— |

— |

$ |

400 |

||||||||||||||||||

| (1) |

In accordance with Israeli law and practice, all amounts reported in the above table

are in terms of cost to our Company, as recorded in our audited consolidated financial statements. All of the executive officers listed

in the above table are full-time employees, except for Yair Nechmad and David Ben-Avi, whose compensation was paid under services agreements

we have with them. See “—Services Agreements with our Founders.” |

| C. |

Board Practices |

|

|

• |

such majority includes at least a majority of the shares held by all shareholders

who are not controlling shareholders and do not have a personal interest in the election of the external director (other than a personal

interest not deriving from a relationship with a controlling shareholder) that are voted at the meeting, excluding abstentions; or

|

|

|

• |

the total number of shares voted by non-controlling shareholders and by shareholders

who do not have a personal interest in the election of the external director against the election of the external director does not exceed

2% of the aggregate voting rights in the company. |

|

|

• |

an employment relationship; |

|

|

• |

a business or professional relationship even if not maintained on a regular basis

(excluding insignificant relationships); |

|

|

• |

control; and |

|

|

• |

service as an office holder, excluding service as a director in a private company

prior to the initial public offering of its shares if such director was appointed as a director of the private company in order to serve

as an external director following the initial public offering. |

|

|

• |

he or she meets the qualifications for being appointed as an external director,

except for the requirement (i) that the director be an Israeli resident (which does not apply to companies such as ours whose securities

have been offered outside of Israel or are listed for trading outside of Israel) and (ii) for accounting and financial expertise or professional

qualifications; and |

|

|

• |

he or she has not served as a director of the company for a period exceeding nine

consecutive years. For this purpose, a break of less than two years in his or her service as a director shall not be deemed to interrupt

the continuity of the service. |

|

|

• |

retaining and terminating our independent auditors, subject to ratification by the

board of directors, and in the case of retention, to ratification by the shareholders; |

|

|

• |

pre-approving audit and non-audit services to be provided by the independent auditors

and related fees and terms; |

|

|

• |

overseeing the accounting and financial reporting processes of the Company and audits

of our financial statements, the effectiveness of our internal control over financial reporting and making such reports as may be required

of an audit committee under the rules and regulations promulgated under the Exchange Act; |

|

|

• |

reviewing with management and our independent auditor our annual and interim financial

statements prior to publication or filing (or submission, as the case may be) to the SEC; |

|

|

• |

recommending to the board of directors the retention and termination of the internal

auditor and the internal auditor’s engagement fees and terms, in accordance with the Companies Law, approving the yearly or periodic

work plan proposed by the internal auditor and examining whether the internal auditor was afforded all required resources to perform its

role; |

|

|

• |

reviewing with our general counsel and/or external counsel, as deemed necessary,

legal and regulatory matters that could have a material impact on the financial statements; |

|

|

• |

identifying irregularities in our business administration by, among other things,

consulting with the internal auditor or with the independent auditor, and suggesting corrective measures to the board of directors;

|

|

|

• |

reviewing policies and procedures with respect to transactions between the Company

and officers and directors (other than transactions related to the compensation or terms of service of the officers and directors), or

affiliates of officers or directors, or transactions that are not in the ordinary course of the Company’s business and deciding

whether to approve such acts and transactions if so required under the Companies Law; and |

|

|

• |

establishing procedures for the handling of employees’ complaints as to the

management of our business and the protection to be provided to such employees. |

|

|

• |

recommending to the board of directors the approval of the compensation policy for

office holders and, once every three years, regarding any extensions to a compensation policy that was adopted for a period of more than

three years; |

|

|

• |

monitoring the implementation of the compensation policy and periodically making

recommendations to the board of directors with respect to any amendments or updates of the compensation policy; |

|

|

• |

resolving whether or not to approve arrangements with respect to the terms of office

and employment of office holders; and |

|

|

• |

exempting, under certain circumstances, transactions with our chief executive officer

from the approval of our shareholders. |

|

|

• |

from time to time, reviewing the implementation of our compensation policy in accordance

with the requirements of the Companies Law as well as other compensation policies, incentive-based compensation plans and equity-based

compensation plans (insofar as these relate to office holders in the Company), and overseeing the development and implementation of such

policies and recommending to our board of directors any amendments or modifications the committee deems appropriate, including as required

under the Companies Law; |

|

|

• |

reviewing and approving the employment terms of our office holders, including granting

of options and other incentive awards and reviewing and approving corporate goals and objectives relevant to the compensation of our executive

officers, including evaluating their performance in light of such goals and objectives; and |

|

|

• |

approving and exempting certain transactions regarding office holders’ compensation

pursuant to the Companies Law. |

|

|

• |

such majority includes at least a majority of the shares held by shareholders who

are not controlling shareholders and shareholders who do not have a personal interest in such compensation policy which voted at the meeting,

disregarding abstentions; or |

|

|

• |

the total number of shares of non-controlling shareholders and shareholders who

do not have a personal interest in the compensation policy and who vote against the policy, does not exceed 2% of the aggregate voting

rights in the company. |

|

|

• |

the education, skills, experience, expertise and accomplishments of the relevant

office holder; |

|

|

• |

the office holder’s position and responsibilities; |

|

|

• |

prior compensation agreements with the office holder; |

|

|

• |

the ratio between the cost of the terms of employment of an office holder and the