|

TAT TECHNOLOGIES LTD.

(Registrant)

|

|||

|

|

By:

|

/s/ Ehud Ben-Yair | |

|

Ehud Ben-Yair

|

|||

|

Chief Financial Officer

|

|||

| 1. |

Approval of the renewal and amendment of the Company’s Compensation Policy for an additional three (3) years;

|

| 2. |

Approval of the amendments to the compensation terms of the Company's President and Chief Executive Officer, Mr. Igal Zamir;

|

| 3. |

Approval of the grant of a one-time special bonus for the Company's Chief Financial Officer, Mr. Ehud Ben Yair;

|

| 4. |

Approval of the grant of Options to purchase shares of the Company to Mr. Amos Malka, the active chairman of the board of directors of the Company;

|

| 5. |

Approval of the amended and restated Company's 2022 Stock Option Plan; and

|

| 6. |

Approval of an increase in the authorized share capital of the Company and the corresponding amendment of the Articles of Association of the Company to reflect this change.

|

|

By the Order of the Board of Directors,

|

|

|

/s/ Ehud Ben-Yair, CFO

Dated: February 11, 2025 |

| 1. |

Approval of the renewal and amendment of the Company’s Compensation Policy for an additional three (3) years;

|

| 2. |

Approval of the amendments to the compensation terms of the Company's President and Chief Executive Officer, Mr. Igal Zamir;

|

| 3. |

Approval of the grant of a one-time special bonus for the Company's Chief Financial Officer, Mr. Ehud Ben Yair;

|

| 4. |

Approval of the grant of Options to purchase Shares of the Company to Mr. Amos Malka, the active chairman of the board of directors of the Company;

|

| 5. |

Approval of the amended and restated Company's 2022 Stock Option Plan; and

|

| 6. |

Approval of an increase in the authorized share capital of the Company and the corresponding amendment of the Articles of Association of the Company to reflect this change.

|

|

Name

|

Number of

Ordinary Shares Beneficially Owned (1) |

Percentage of

Ownership (2)

|

|

FIMI Funds (3)

|

2,905,202

|

26.55%

|

|

Meitav Dash (4)

|

1,558,254

|

14.25%

|

|

Y.D.More Investments (5)

|

1,213,859

|

10.99%

|

|

|

a) |

Shift from Base Salary to Fixed Compensation structure - we have updated the compensation terminology to reflect total employment cost rather than base salary only, providing a more comprehensive

view of the compensation package.

|

|

|

b) |

Section 5.3 - Updated compensation caps and thresholds - revised figures for executives' compensation limits, as presented in Section 5.3 of the Compensation Policy as follows (maximum annual Fixed Compensation):

|

|

Executive Level

|

Maximum

|

|

Active Chairman

|

NIS 600K (for 35% of a full time position and a proportion of this amount to a different percentage of services).

|

|

CEO

|

US$ 470 K (for a full time position).

|

|

Other Executives

|

(1) In Israel - NIS 1,095 K (for a full time position); and (2) Outside of Israel - with respect to a Chief Executive Officer and or Presidents and or General Manager of a subsidiary of the

Company and Executives outside of Israel - US$ 410 K (for a full time position).

|

|

|

c) |

Section 5.5 - Variable Compensation Table - We updated the ratios between Fixed and Variable compensation components in alignment with the shift from Base Salary to Fixed Compensation structure

mentioned above and revised ratios as detailed below:

|

|

Executive Level

|

Variable Compensation

|

|

|

Cash incenstive compensation

|

Long term equity based compensation

|

|

|

Active Chairman

|

Up to 3 monthly Fixed Compensation or the equivalent thereof.

|

Up to 13 monthly Fixed Compensation or the equivalent thereof.

|

|

CEO

|

Up to 6.7 monthly Fixed Compensation or the equivalent thereof.

|

Up to 18.3 monthly Fixed Compensation or the equivalent thereof.

|

|

Other Executives

|

Up to 6 monthly Fixed Compensation or the equivalent thereof.

|

Up to 15.4 monthly Fixed Compensation or the equivalent thereof.

|

|

|

d) |

Section 9.1 - Relocation - We added specific parameters for the global relocation expense reimbursement as presented in Section 9.1 of the Compensation Policy.

|

|

Name and Principal Position(2)

|

Base Salary

|

Benefits and

Perquisites(3) |

Variable Compensation(4)

|

Equity-Based Compensation(5)

|

Total

|

|

Igal Zamir, CEO and President

|

339

|

129.76

|

254.12

|

20.49

|

743.37

|

| (I) |

First Proposed Resolution – Grant of 200,000 Options to purchase shares of the Company:

|

|

|

a) |

150,000 Options will be granted after receiving the required approvals and signing of a new employment agreement as part of Mr. Zamir relocation.

|

|

|

b) |

50,000 Options will be granted in August 2025.

|

| (II) |

Second Proposed Resolution – Grant of one-time a special bonus equivalent to two monthly salaries:

|

|

|

a) |

As mentioned above, Mr. Zamir has led a comprehensive restructuring of the Company’s organizational framework and business operations, while successfully negotiating and securing several large-scale strategic agreements. The transformative

initiatives he spearheaded have resulted in record-breaking performance and a significant increase in shareholder value.

|

|

|

b) |

The benefit inherent in the proposed changes is expected to enhance the motivation of the CEO to further promote the Company’s business activities for the benefit of the Company and its shareholders.

|

|

|

c) |

The high value of the Options is directly attributable to the strategy implemented by Mr. Zamir within the Company.

|

|

|

d) |

Mr. Zamir's current compensation is well below the compensation offered to CEO in similar size and value US companies (as presented by a comparative analysis detailed below), and therefore the compensation amendments are more than

reasonable and appropriate, aligned with market conditions, and intended to promote the Company’s goals, work plan, and policies, and align with the interests of the Company and its shareholders. For the purpose of reviewing the proposed

decisions, attached is a copy of the comparative analysis conducted by Pay Governance LLC (independent firm that serves as a trusted advisor on executive compensation matters to board and compensation committees) of the terms of office and

employment of the CEO and CFO in comparison to other CEOs and CFOs at companies comparable to the Company, attached hereto as Appendix B.

|

|

|

e) |

The proposed one-time special bonus and proposed Options grants are in exception to the Company's current compensation policy of the Company. Nevertheless, after taking into account the proposed compensation amendments, they are still well

below the median bonus and Options offered to CEO's in similar size companies in the US (as presented by the comparative analysis noted above).

|

|

|

f) |

The one-time special bonus serves as an important retention tool for a key executive who has demonstrated consistent performance since joining TAT in 2016.

|

|

|

g) |

The cost of the two-month salary bonus is justified given the significant financial benefits achieved through the fundraising effort and overall Company performance.

|

|

|

h) |

The proposed compensation, including the compensation that deviates from the compensation policy, is appropriate, reasonable, and in the best interest of the Company, and it does not have an adverse effect on labor relations within the

Company.

|

| (I) |

"RESOLVED, TO APPROVE THE GRANT OF 200,000 OPTIONS FOR ORDINARY SHARES OF THE COMPANY TO MR. IGAL ZAMIR, AS AN EXCEPTION TO THE COMPENSATION POLICY OF THE COMPANY, IN ACCORDANCE WITH THE TERMS DETAILED

ABOVE."

|

| (II) |

"RESOLVED, TO APPROVE THE PROPOSED TWO-MONTH SALARY ONE-TIME SPECIAL BONUS TO MR. IGAL ZAMIR, AS AN EXCEPTION TO THE COMPENSATION POLICY OF THE COMPANY, IN ACCORDANCE WITH THE TERMS DETAILED ABOVE."

|

|

Name and Principal Position(2)

|

Base Salary

|

Benefits and

Perquisites(3) |

Variable Compensation(4)

|

Equity-Based Compensation(5)

|

Total

|

|

Ehud Ben-Yair, CFO

|

324

|

27.6

|

154

|

95.57

|

601.17

|

|

|

a) |

The benefit inherent in the proposed resolution is expected to enhance the motivation of the CFO to further promote the Company’s business activities for the benefit of the Company and its shareholders. For the purpose of reviewing the

proposed decisions, attached as Appendix B is a copy of the comparative analysis conducted by Pay Governance LLC (independent firm that serves as a trusted advisor on executive compensation matters to

board and compensation committees) of the terms of office and employment of the CEO and CFO in comparison to other CEOs and CFOs at companies comparable to the Company.

|

|

|

b) |

The grant of the bonus to Mr. Ehud Ben-Yair, the Chief Financial Officer of the Company, is reasonable and appropriate, aligned with market conditions, and intended to promote the Company’s goals, work plan, and policies, while aligning

the interests of the Company’s CFO with those of its shareholders.

|

|

|

c) |

The one-time special bonus serves as an important retention tool for a key executive who has demonstrated consistent performance since joining TAT in 2018.

|

|

|

d) |

The cost of the two-month salary bonus is justified given the significant financial benefits achieved through the fundraising effort and overall Company performance.

|

|

|

e) |

The proposed one-time special bonus is in exception to the current compensation policy of the Company.

|

|

|

f) |

The proposed one-time special bonus is appropriate, reasonable, and in the best interest of the Company, and it does not have an adverse effect on labor relations within the Company.

|

|

By the Order of the Board of Directors,

|

|

/s/ Ehud Ben-Yair, CFO

Dated: February 11, 2025

|

| I. |

OVERVIEW

|

| 1. |

Definitions

|

|

Company

|

TAT TECHNOLOGIES LTD.

|

|

Law

|

The Israeli Companies Law 5759-1999 and any regulations promulgated under it, as amended from time to time.

|

|

Amendment 20

|

Amendment to the Law which was entered into effect on December 12, 2012.

|

|

Compensation Committee

|

A committee appointed in accordance with section 118A of the Law.

|

|

Office Holder

|

Director, CEO, any person filling any of these positions in a company, even if he holds a different title, and any other excutive subordinate to the CEO, all as defined in section 1 of

the Law.

|

|

Executive

|

Office Holder, excluding a director.

|

|

Terms of Office and Employment

|

Terms of office or employment of an Executive or a Director, including the grant of an exemption, an undertaking to indemnify, indemnification or insurance, separation package, and any

other benefit, payment or undertaking to provide such payment, granted in light of such office or employment, all as defined in section 1 of the Law.

|

|

Total Cash Compensation

|

The total annual cash compensation of an Executive, which shall include the total amount of: (i) the annual base salary; and (ii) the On Target Cash Plan.

|

|

Equity Value

|

The annual total equity value will be calculated on a linear basis, based on the equity value (valued using the same methodology used in the financial statements of the Company on the

date of approval of the Equity Based Components by the Company's Board of Directors) divided by the number of vesting years.

|

|

Total Compesation

|

The Total Cash Compensation and the annual Equity Value.

|

|

Base Salary

Additional Benefits

|

Monthly gross salary and/or monthly management fees, including related benefits, paid to the officer in consideration for their work.

Shell includes, inter alia, social benefits as prescribed by law (pension savings, contributions towards severance pay, contributions towards training fund, vacation pay, sick leave,

recreation pay, etc.) and related benefits, such as company vehicle/vehicle maintenance, telephone expenses, gifts on public holidays, etc., not take into account Relocation expenses.

;

|

|

Fixed Compensation

|

Base Salary and Additional Benefits

|

| 2. |

General

|

|

|

2.1. |

This compensation policy ("the Policy"), was formulated during an internal process conducted at the Company in compliance with the provision of Amendment 20, and is based on the Company's will to

properly balance between its will to reward Office Holders for their achievements and the need to ensure that the Total Compensation is in line with the Company's benefit and overall strategy over time.

|

|

|

2.2. |

The purpose of the Policy is to set guidelines for the compensation manner of the Company's Officer Holders. The Company's management and its Board of Directors deem all of the Office Holders of the Company as partners in the Company's

success and consequently, derived a comprehensive view with respect to the Company's Office Holders' Compensation. This document presents the indices that derived from the principles of the formulated Policy, as specified hereunder.

|

|

|

2.3. |

It is hereby clarified that no statement in this document is intended to vest any right to the Office Holders to whom the principles of the Policy apply, or to any other third party, and not necessarily will use be made of all of the

components and ranges presented in this Policy.

|

|

|

2.4. |

The indices presented in the Policy are intended to prescribe an adequately broad framework that shall enable the Compensation Committee and Board of Directors of the Company to formulate a personal Compensation Plan for each office

Holder or a particular compensation component according to individual circumstances (including unique circumstances) and according to the Company's needs, in a manner that is congruent with the Company's benefit and the Company's overall

strategy over time.

|

|

|

2.5. |

The Policy is intended to align between the importance of incentivizing Executives to reach personal targets and the need to assure that the overall compensation meets our Company's long term strategic performance and financial

objectives. The policy provides our Compensation Committee and our Board of Directors with adequate measures and flexibility, to tailor each of our Executive's compensation package based, among others, on geography, tasks, role,

seniority, and capability.

|

|

|

2.6. |

The Policy shall provide the Board of Directors with guidelines for exercising discretion under the Company’s equity plans.

|

|

|

2.7. |

For the avoidance of doubt, it is clarified that in case of any amendment made to provisions of the Law and any other relevant rules and regulations in a manner that will facilitate the Company regarding its actions related to Officer

compensation, the Company may be entitled to follow these provisions even if they contradict the principles of this Compensation Policy.

|

|

|

2.8. |

This Compensation Policy does not derogate from any agreements or compensation terms approved prior to the approval of this Compensation Policy. It is hereby clarified that if the Company shall acquire another company or new activity,

then the compensation terms of mangers of such acquired company or activity that become, after the acquisition Office Holders in the Company, shall not change for a period of six (6) months after the acquisition (even if their

compensation terms exceed the limitations on compensation set forth in this Policy). During such six-month period, the Company will make reasonable efforts to revise their compensation terms in accordance with applicable law.

Notwithstanding the foregoing, if the compensation terms of such mangers exceed the limitations on compensation set forth in this Policy, and the Company cannot amend such compensation after making reasonable efforts to do so, then the

compensation of such managers of the acquired entity may not be amended in accordance with the terms of the Policy.

|

| 3. |

Principles of the Policy

|

|

|

3.1. |

The Policy shall guide the Company’s management, Compensation Committee and Board of Directors with regard to the Office Holders' compensation.

|

|

|

3.2. |

The Policy shall be reviewed from time to time by the Compensation Committee and the Board of Directors, to ensure its compliance with applicable laws and regulations as well as market practices, and its conformity with the Company’s

targets and strategy. As part of this review, the Board of Directors will analyze the appropriateness of the Policy in advancing achievement of its goals, considering the implementation of the Policy by the Company during previous years.

|

|

|

3.3. |

Any proposed amendment to the Policy shall be brought up to the approval of the Shareholders of the Company and the Policy as a whole shall be re-approved by the Shareholders of the Company at least once every three years, or as

otherwise required by Law. However, to the extent permitted by law, if the shareholders shall oppose approving the Policy, the Compensation Committee and Board of Directors shall be able to approve the Policy, after having held another

discussion of the Policy and after having determined, on the basis of detailed reasoning, that, notwithstanding the opposition of the shareholders, the adoption of the Policy is for the benefit of the Company.

|

|

|

3.4. |

The compensation of each Office Holder shall be subject to mandatory or customary deductions and withholdings, in accordance with the applicable local laws.

|

| II. |

Executive Compensation

|

| 4. |

When examining and approving Executives’ Terms of Office and Employment, the Compensation Committee and Board members shall review the following factors and shall include them in their considerations and reasoning:

|

|

|

4.1. |

Executive’s education, skills, expertise, professional experience and specific achievements.

|

|

|

4.2. |

Executive’s role and scope of responsibilities and in accordance with the location in which such Executive is placed.

|

|

|

4.3. |

Executive’s previous compensation.

|

|

|

4.4. |

The Company’s performance and general market conditions.

|

|

|

4.5. |

The ratio between Executives' compensation, including all components of the Executives' Terms of Office and Employment, and the salary of the Company’s employees, in particular with regard to the average and median ratios, and the

effect of such ratio on work relations inside the Company, as defined by the Law.

|

|

|

4.6. |

Comparative information, as applicable, as to former Executives in the same position or similar positions, as to other positions with similar scopes of responsibilities inside the Company, and as to Executives in peer companies. The

peer group for the purpose detailed below shall include not less than 4 public companies listed on the Tel Aviv Stock Exchange ("TASE") similar in parameters such as total revenues, market cap,

industry and number of employees. The comparative information, as applicable, shall address the base salary, target cash incentives and equity and will rely, as much as possible, on reputable industry surveys.

|

|

|

4.7. |

The compensation of each Executive shall be composed of, some or all, of the following components:

|

|

|

a) |

Fixed components, which shall include, among others: base salary and benefits as may be customary under local customs.

|

| b) |

Variable components, which may include: cash incentives and equity based compensation.

|

| c) |

Separation package;

|

|

|

d) |

Directors & Officers (D&O) Insurance, indemnification and exemption; and

|

| e) |

Other components, which may include: change in control, relocation benefits, special bonus, etc.

|

| 4.8. |

Our philosophy is that our Executives’ compensation mix shall comprise of, some or all, of the following components: annual base salary, performance-based cash incentives and long-term equity based compensation, all in accordance with

the position and responsibilities of each Executive, and taking into account the purposes of each component, as presented in the following table:

|

|

Compensation Component

|

|

Purpose

|

|

Compensation Objective Achieved

|

|

Annual base salary

|

|

Provide annual cash income based on the level of responsibility, individual qualities, past performance inside the Company, past experience inside and outside the Company.

|

|

• Individual role, scope and capability based compensation

• Market competitiveness in attracting Executives.

|

|

Performance-based cash

incentive compensation

|

|

Motivate and incentivize individual towards reaching Company, department and individual's periodical and long-term goals and targets.

|

|

• Reward periodical accomplishments

• Align Executive’ objectives with Company, department and individual's objectives

• Market competitiveness in attracting Executives

|

|

Long-term equity-based

Compensation

|

|

Align the interests of the individual with the Shareholders of the Company, by creating a correlation between the Company’s success and the value of the individual holdings

|

|

• Company performance based compensation

• Reward long-term objectives

• Align individual's objectives with shareholders’ objectives

|

| 4.9. |

The compensation package shall be reviewed with each Executive at least once a year, or as may be required from time to time.

|

|

|

5. |

Fixed compensation

|

|

|

5.1. |

The Fixed Compensation shall be determined in accordance with the criterias and considerations as detailed in Section 4 above and shall be approved by the Compensation

Committee.

|

| 5.2. |

The Fixed Compensation shall not be automatically linked.

|

| 5.3. |

The annual Fixed Compensation for an Office

|

|

Executive Level

|

Maximum

|

|

Active Chairman

|

NIS 600K (for 35% of a full time position and a proportion of this amount to a different percentage of services).

|

|

CEO

|

US$ 470 K (for a full time position)).

|

|

Other Executives

|

(1) In Israel - NIS 1,095 K (for a full time position); and (2) Outside of Israel - with respect to a Chief

Executive Officer and or Presidents of a subsidiary and or General Manager of the Company and Executives outside of Israel - US$ 410 K (for a full time position).

|

|

|

5.4. |

In the event an Office Holder provides services to the Company as an independent contractor or via a management company controlled by said Office Holder, and get paid through the issuance of an invoice, then the provisions of the

Policy shall apply to him/her mutatis mutandis and for all purposes in this policy, the base salary for such an Office Holder shall be extracted from actual payment based on normal rate of

employment cost.

|

| 5.5. |

In order to ensure allignment of all components of the Total Compensation, the appropriate ratio between the Fixed compensation of Office Holders' and their Variable Compensation, in terms of full time position for a given year, are

as detailed below:

|

|

|

Variable Compensation

|

|

|

Executive Level

|

Cash incenstive compensation

|

Long term equity based compensation

|

|

Active

Chairman

|

Up to 3 monthly Fixed Compensation or the

equivalent thereof.

|

Up to 13 monthly Fixed Compensation or the equivalent thereof.

|

|

CEO

|

Up to 6.7 monthly Fixed Compensation or the equivalent thereof.

|

Up to 18.3 monthly Fixed Compensation or the equivalent thereof.

|

|

Directors

|

NONE.

|

See section 12 below

|

|

Other

Executives

|

Up to 6 monthly Fixed Compensation or the equivalent thereof.

|

Up to 15.4 monthly Fixed Compensation or the equivalent thereof.

|

|

|

5.6. |

Benefits:

|

| 5.6.1. |

Benefits granted to Executives shall include any mandatory benefit under applicable law, as well as, part or all, of the following components:

|

|

|

5.6.2. |

Pension plan/ Executive insurance as customary.

|

| 5.6.3. |

Benefits which may be offered as part of the general employee benefits package (such as: pension fund, study fund) in accordance with the local practice of the Company.

|

| 5.6.4. |

An Executive will be entitled to sick days and other special vacation days (such as recreation days), as required under local standards and practices.

|

| 5.6.5. |

An Executive will be entitled to vacation days, in correlation with the Executive’s seniority and position in the Company (generally up to 30 days annualy), and subject to the minimum vacation days requirements per country of

employment as well as the local national holidays.

|

| 5.6.6. |

Reasonable expenses, including vehicle, daily newspaper, cellphone and meals.

|

| 6. |

Variable Components

|

|

|

6.1. |

When determining the variable components as part of an Executive's compensation package, the contribution of the Executive to the achievement of the Company’s goals, revenues, profitability and other key performance indicators ("Targets") shall be considered, taking into account Company and department’s long term perspective and the Executive’s position.

|

| 6.2. |

Variable compensation components shall be comprised of (i) cash components which shall be mostly based on measurable criteria or non-measurable targets; and (ii) equity components, all taking into consideration periodical and a long

term perspective.

|

|

|

6.3. |

The Board of Directors shall have the absolute discretion to reduce or cancel any cash incentive.

|

| 6.4. |

Variable Cash Incentive Plan

|

|

|

6.4.1. |

The Compensation Committee and Board of Directors may adopt, from time to time, a Cash Incentive Plan, which will set forth for each Executive targets which form such Executive's on target Cash payment (which shall be referred to as

the “On Target Cash Plan”) and the rules or formula for calculation of the On Target Cash Plan payment once actual achievements are known.

|

| 6.4.2. |

The Compensation committee and Board of Directors may include, inter- alia, in the On Target Cash Plan predetermined thresholds and caps, to corelate an Executive’s On Target Cash Plan payments with actual achievements.

|

| 6.4.3. |

The annual On Target Cash Plan actual payment for the Active Chairman, the CEO and other Executives in a given year shall be capped as determined by our Board of Directors, but in no event shall exceed the ratio set forth in the table

in clause 5.5 above.

|

| 6.4.4. |

The CEO, Active Chairman and other Executives' individual On Target Cash Plan may be composed based on the mix of (i) the Company Target (as defined below); (ii) Personal Target; and (iii) Personal Evaluation. The weight to be assigned

to each of the components per each of the executives shall be as set forth in the table below.

|

|

Active Chairman

|

CEO

|

Other Executives

|

|

|

Company Target

|

100%

|

75% - 100%

|

50% - 100%

|

|

Personal Target

|

NONE

|

NONE

|

0% - 30%

|

|

Personal Evaluation

|

NONE

|

0% - 25%

|

0% - 20%

|

| 6.4.5. |

Without derogating from the foregoing, the annual bonus may be conditional on financial or other threshold conditions in accordance with a list of measurable targets that will be determined by the board of directors of the Company from

time to time, such as sales turnover, gross profit, operating profit, pre-tax profit, net profit and relevant operating targets, as determined for the Other Executives, such as compliance with budgetary targets, level of inventory,

collections and profitability targets, and so forth (If such threshold condition is determined), failure to meet the lower threshold for the distribution of an annual bonus will mean that an annual bonus will not be earned (the "Annual Bonus Threshold").

|

| 6.4.6. |

Notwithstanding the foregoing, the board of directors may, in exceptional cases, following the recommendation of the CEO of the Company, approve the grant of a partial bonus, notwithstanding that the Annual Bonus Threshold has not been

met in an amount of up to 3 salaries. This will be under special circumstances in which, in light of the efforts of the Executive and his great investment in his position in the previous year, it is decided that it is appropriate to award

the Executive with the bonus in the framework of the Executive’s compensation, notwithstanding the failure to meet the Annual Bonus Threshold so as to incentivize him and compensate him in respect of his investment in the Company.

|

| 6.4.7. |

Personal evaluation: the Company's CEO shall present his personal evaluation of Executive reporting to the CEO to the Company's Compensation Committee and to the Board of Directos. This evaluation shall relate, inter alia, to

nonfinancial indices, including the Executive's long term contribution and his/her long term performance. The CEO's personal evaluation shall be presented to the Compensation Committee and to the Board of Directors by the Chairman of the

Board, according to the evaluation principles set above with relation to all other Executives.

|

| 6.4.8. |

It is hereby clarified that the aggregate weight to be assigned to all five of the aforesaid categories in a cash incentives formula shall be 100% and in no event shall exceed the ratio set forth in the table in clause 5.5

above.

|

| 6.4.9. |

In the event that the Company's strategic targets shall be amended by the Board of Directors during a particular year and/or there is a change to the Executive’s responsibilities and/or scope of employment - the Board of Directors

shall have the authorization to determine whether, and in which manner, such amendment shall apply to the On Target Cash Plan.

|

| 6.4.10. |

The Board of Directors will be authorized to define certain events as exceptional and extra-ordinary to the Company’s ordinary course of business, in which case the compensation committee will have the ability to adjust their impact

when calculating any of the Company’s targets and Personal Targets. It shall be noted that Company’s Targets and/or Personal Targets impacted by this section with respect to the Active Chairman and CEO, shall be brought for the approval

of the General Meeting in accordance with the Law.

|

| 6.4.11. |

The entitlement to the On Target Cash Plan in respect of a particular year shall be conferred on an Executive where such Executive rendered services or was employed with the Company for a period of at least 6 months during that

particular year - and the amount thereof shall be relative to the period of employment with the Company during that particular year.

|

| 6.4.12. |

In the event of termination of the relationship following "Cause" as defined below, such Executive shall not be entitled to any payments in accordance with his/her On Target Cash Plan which have not yet been paid prior to the date of

said termination, unless otherwise determined by the Board of Directors.

|

| 6.4.13. |

For the avoidance of doubt, it is hereby clarified that payments under the On Target Cash Plan shall not be deemed to be a salary, for all intents and purposes, and it shall not confer any social rights.

|

| 6.4.14. |

The Company will include in its year-end filings (i.e. Annual 20F), with respect to the Active Chairman and the CEO, an explanation as to how their On Target Cash Plan was calculated, including: their predetermined Company Targets,

Personal Targets and Personal Evaluation for that particular year; the mix and weights; and the extent of achieving them.

|

|

|

6.5. |

Equity Based Compensation

|

|

|

6.5.1. |

The Company may grant its Executives, from time to time, equity based compensation, which may include any type of equity, including, without limitation, any type of shares, options, restricted share units (RSUs), share appreciation

rights, restricted shares or other shares based awards (“Equity Based Components”), either under the Company's existing Stock Option Plan or future equity

plan (as may be adopted by the Company), and subject to any applicable law.

|

| 6.5.2. |

The amount of equity based compensation granted via RSUs units and restricted shares, will not exceed the amount of 25% of the equity based compensation or the maximum Annual Value equal to the cost of three (3) Base Salaries of the

officer to which the equity based compensation was granted.

|

| 6.5.3. |

The Company believes that it is not in its best interest to limit the exercise value of Equity Based Components.

|

| 6.5.4. |

Equity Based Components for Executives shall be in accordance with and subject to the terms of our existing or future equity plan and shall vest in installments throughout a period which shall not be shorter than 3 years with at least

a 1 year cliff taking into account adequate incentives in a long term perspective.

|

| 6.5.5. |

The total yearly Equity Value granted shall not exceed with respect to the Active Chairman, the CEO and each other Executive, at the time of approval by the Board of Directors the appropriate ratio set forth in clause 5.5 above.

|

| 6.5.6. |

The total yearly Equity Value granted to any non-executive Directors (determined based on generally accepted accounting principles applicable to the Company) shall not exceed (based on accepted valuation methods), 50% of the total

value of the fixed directors’ compensation, incuding per meeting compensation, per vesting annum.

|

| 6.5.7. |

The maximum dilution as a result of grant of the equity based compensation to Executives shall not exceed 15%.

|

| 6.5.8. |

The Board may determine a mechanism of acceleration of vesting:

|

| 6.5.9. |

A full acceleration will be permitted in the event of death, disability, medical reasons or a change in control of the Company followed by the delisting of the Company's shares;

|

| 6.5.10. |

An acceleration of the next unvested period will be permitted in the event of change in control of the Company following a resignation or termination of employment of the officer (except in the case of Termination for Cause).

|

| 6.5.11. |

The exercise price of the options granted shall be determined by the Company and shall not be less than the higher of (a) 5% above the average closing price of the Company's share in the 30 trading days preceding the date of the Board

of Directors' approval of the equity grant; (b) 5% above the share price on the date of the Board of Directors' approval of the equity grant.

|

| 6.5.12. |

In the event of the termination of the employer – employee relationship or rendering services to the Company's group during the relevant year, the grantee shall be entitled to the options which were allocated in his/her regard, where

the date of entitlement in respect of the said options occurred prior to the date of the actual termination, and to exercise them into shares of the Company up until the earlier of: (1) 90 days from the date of the actual termination; (2)

the expiration of their exercise period. The grantee shall be entitled to count the shares which were allocated for him only if the date of entitlement in respect thereof occurred prior to the date of the actual termination.

|

| 6.5.13. |

In the event of the termination of the relationship following Cause– and even if the date of entitlement to the options has fallen due, in whole or in part, and they have not yet been exercised into shares, the options which have not

yet been exercised prior to the expiration of the exercise period shall expire.

|

| 6.5.14. |

For the avoidance of doubt, it is hereby clarified that the annual equity compensation shall not be deemed to be a salary, for all intents and purposes, and it shall not confer any social rights.

|

| 7. |

Separation Package

|

| 7.1. |

The following criteria shall be taken into consideration when determining Separation Package: the duration of employment of the Active Chairman or the Executive, the terms of employment, the Company’s performance during such term, the

Executive’s contribution to achieving the Company’s goals and revenues and the retirement’s circumstances.

|

| 7.2. |

Other than payments required under any applicable law, local practices, transfer or release of pension funds, manager's insurance policies, etc. - the maximum Separation Package of each Executive, CEO or the Active Chairman shall not

exceed the value of 25% the Total Compensation of such an Executive, CEO or Active Chairman, respectively.

|

|

|

8. |

Notice Period in Termination

|

|

|

9. |

Others

|

| 9.1. |

Relocation– additional compensation pursuant to local practices and law may be granted to an Executive under relocation circumstances. Such benefits shall include reimbursement for out of pocket

one time payments and other ongoing expenses, such as housing allowance, schooling allowance, car or transportation allowance, home leave visit, health insurance for executive and family, etc, all as reasonable and customary for the

relocated country and in accordance with the Company's relocation practices, as shall be approved by the Compensation Committee and Board of Directors. Our Compensation Committee and our Board of Directors may approve, from time to

time, fair and reasonable global relocation expense reimbursement to Executive in amoun up to $135,000 annually. This reimbursement constitutes a final and

comprehensive global relocation expense allowance that covers all of the Executives relocation expenses. Any request for relocation reimbursement of additional expenses from the Company will be subject to special approval.

|

| 9.2. |

Special Bonus - Our Compensation Committee and our Board of Directors may approve, from time to time, with respect to any Executive, if they deem required under special circumstances or in case

of an exceptional contribution to the Company, including, among others, in cases of retention or attraction of a new Executive or consummation of an acquisition by or of the Company or the sale or spin off of any material asset of the

Company, the grant of a onetime cash incentive, of up to three monthly salaries or the equivalent thereof.

|

| 10. |

Clawback Policy

|

| 10.1. |

In the event of a restatement of the Company’s financial results, we shall seek reimbursement from our Office Holders of any payment made due to erroneous restated data, with regards to each Office Holder’s Terms of Office and

Employment that would not otherwise have been paid. The reimbursement shall be limited to such payments made during the 3-years period preceding the date of restatement. The above shall not apply in case of restatements that reflect the

adoption of new accounting standards, transactions that require retroactive restatement (e.g., discontinued operations), reclassifications of prior year financial information to conform to the current year presentation, or discretionary

accounting changes.

|

| 10.2. |

Our Compensation Committee and Board of Directors shall be authorized to seek recovery to the extent that (i) to do so would be unreasonable or impracticable; or (ii) there is low likelihood of success under governing law versus the

cost and effort involved.

|

| III. |

Director Remuneration:

|

| 11. |

Cash Compensation:

|

| 11.1. |

The Company’s non-executive directors may be entitled to receive an annual cash fee and a participation fee for each meeting in accordance with the amounts set forth in the Companies Regulations

(Rules Regarding Compensation and Expense Reimbursement of External Directors) -2000 ("the Compensation Regulations"), and taking into account their definition as "expert director" according to the

Compensation Regulations.

|

| 11.2. |

The Company’s directors may be reimbursed for their reasonable expenses incurred in connection with attending meetings of the Board of Directors and of any Committees of the Board of Directors, all in accordance with the Compensation

Regulations.

|

| 12. |

Equity Based Compensation:

|

| 13. |

Active Chairman Compensation:

|

| IV. |

Indemnification & Insurance

|

| 14. |

The Office Holders shall be entitled to a directors and officers indemnification up to the maximum amount permitted by law, D&O insurance as shall be approved at the Board of Director's discretion, all in accordance with any

applicable law and the Company’s articles of association.

|

| 15. |

With respect to the D&O policy-

|

| 15.1. |

The D&O insurance may provide group insurance to the Company and its affiliates (only in respect of D&Os serving as such on behalf of the Company) and alongside the Company's D&O Insurance it is possible that D&Os of

the affiliates may also be insured. In the event the D&O insurance shall provide such group insurance, the annual premium shall be relatively divided between the different companies based on the decision of the Company's management

taking into account the recommendation of the Company's external insurance advisors.

|

| 15.2. |

The limits of liability shall not exceed USD 35 million.

|

| 15.3. |

The deductible shall not exceed USD 3,500,000.

|

| 15.4. |

The annual premium for the D&O policy shall be in accordance with market conditions. The Company shall retain the assistance of the Company's external isurance advisors in determining market conditions.

|

| 15.5. |

Any purchase of D&O insurance or its renewal during the term of this Policy shall not be brought to additional approval of the General Meeting provided that the Compensation Committee has approved that the purchased D&O

insurance meets the conditions detailed above.

|

|

|

16. |

Each of our Office Holders shall be entitled to the same indemnification terms and insurance policy coverage, all as may be approved from time to time.

|

TAT Technologies Ltd.

Executive Compensation Pay Analysis

January 30, 2025

| Presented by: | Patrick Haggerty, Partner |

| Pay Governance LLC Cell: 973-943-3339 patrick.haggerty@paygovernance.com |

©2025 Pay Governance LLC. All rights reserved. Proprietary and Confidential. For Pay Governance LLC client use only.

B - 2

|

|

Executive Summary |

Executive Summary

Background

| • | TAT Technologies Ltd. requested this study following the completion of relocating the company’s headquarters to the US and the fact that almost all TAT executives live and work in the US. TAT needs the flexibility to offer fair and competitive US-based compensation packages. Pay Governance independently developed a peer group of publicly-traded companies to serve as a framework of reference for competitive pay and design information |

|

|

— | Publicly-disclosed data from the peers were be analyzed to understand competitive pay practices |

Objective

| • | Identify roughly 15-20 companies that are broadly representative of (i) TAT’s industry and revenue size and of (ii) the types of companies that might operate in TAT’s labor market for executive and outside director talent |

| • | Provide market data for future pay decisions and specifically understand gap in pay for TAT’s CEO and CFO compared to competitive market compensation data |

Highlights of Potential Peer Group and Pay Analysis

| • | All peer companies are located in the US |

| • | Primary focus was on Aerospace & Defense (A&D) companies, but we needed to include other similar industries to ensure adequate sample size of 15-20 companies |

| • | Limited peer group to companies with similar revenue, roughly .25x to 3x TAT’s last 12-month revenue |

| • | Survey data is also provided as a secondary market reference point |

| • | For TAT’s CEO and CFO roles, current pay levels are well below US market median |

|

|

— | Salary – TAT’s CEO and CFO are well below market median |

|

|

— | Target Bonus – TAT’s CEO and CFO are well below market median |

|

|

— | Long-Term Incentive (LTI) Value – TAT’s CEO and CFO are well below market median |

| ©2025 Pay Governance LLC. |

|

B - 3 |

|

|

Peer Group |

Peer Group Screening Criteria for TAT

Major US Exchanges Screen #1

| • | Screen #1: narrows the universe of potential peers to publicly-traded companies listed on major US exchanges |

| • | Screen #2: isolates the peer universe to companies in the Capital Goods Industry |

| • | Screen #3: ensures we identify similar-sized companies in terms of revenue, roughly .25x to 3x TAT’s last 12-month revenue |

| • | Screen #4: primary focus was on A&D companies, but we needed to include other similar industries to ensure adequate sample size of 15-20 companies |

| • | Other Factors: focused on growing companies while excluded companies with non-founder CEOs (if pay was unique) and companies with relatively high or low market caps |

| ©2025 Pay Governance LLC. |

|

B - 4 |

| Peer Group |

Peer Group for TAT

|

|

● | The peer group is based on screening criteria outlined on previous page |

|

|

● | Our approach to develop the peer group uses standard practices while considering TAT’s industry, size, and expected growth |

| Company Name | Sector |

| AerSale Corporation | Aerospace and Defense |

| American Superconductor Corporation | Electrical Components |

| Butler National Corporation | Aerospace and Defense |

| Byrna Technologies Inc. | Aerospace and Defense |

| CPI Aerostructures, Inc. | Aerospace and Defense |

| FuelCell Energy, Inc. | Electrical Components |

| Innovative Solutions and Support, Inc. | Aerospace and Defense |

| Intuitive Machines, Inc. | Aerospace and Defense |

| Loar Holdings Inc. | Aerospace and Defense |

| LSI Industries Inc. | Electrical Components |

| Luxfer Holdings PLC | Industrial Machinery |

| Perma-Pipe International Holdings, Inc. | Industrial Machinery |

| Redwire Corporation | Aerospace and Defense |

| Taylor Devices, Inc. | Industrial Machinery |

| The Eastern Company | Industrial Machinery |

| Thermon Group Holdings, Inc. | Electrical Components |

| Ultralife Corporation | Electrical Components |

| ©2025 Pay Governance LLC. |  |

B - 5 |

| Peer Group |

Peer Group – Business Descriptions

| Business Description |

| AerSale Corporation provides aftermarket commercial aircraft, engines, and its parts to passenger and cargo airlines, leasing companies, original equipment manufacturers, and government and defense contractors, as well as maintenance, repair, and overhaul (MRO) service providers worldwide. |

| American Superconductor Corporation, together with its subsidiaries, provides megawatt-scale power resiliency solutions worldwide. |

| Butler National Corporation, together with its subsidiaries, designs, engineers, manufactures, sells, integrates, installs, repairs, modifies, overhauls, services, and distributes a portfolio of aerostructures, aircraft components, avionics, accessories, subassemblies, and systems in North America, Europe, the Middle East, Asia, and internationally. |

| Byrna Technologies Inc., a less- lethal self- defense technology company, engages in the development, manufacture, and sale of less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada. |

| CPI Aerostructures, Inc. engages in the contract production of structural aircraft parts for fixed wing aircraft and helicopters in the commercial and defense markets. |

| FuelCell Energy, Inc., together with its subsidiaries, manufactures and sells stationary fuel cell and electrolysis platforms that decarbonize power and produce hydrogen. |

| Innovative Solutions and Support, Inc., a systems integrator, designs, develops, manufactures, sells, and services flight guidance, autothrottles, and cockpit display systems. |

| Intuitive Machines, Inc. designs, manufactures, and operates space products and services in the United States. |

| Loar Holdings Inc., through its subsidiaries, designs, manufactures, and markets aerospace and defense components for aircraft, and aerospace and defense systems. |

| LSI Industries Inc. produces and sells non-residential lighting and retail display solutions in the United States, Canada, Mexico, and Latin America. |

| Luxfer Holdings PLC, together with its subsidiaries, designs, manufactures, and supplies high-performance materials, components, and high-pressure gas containment devices for defense and first response, healthcare, transportation, and general industrial applications. |

| Perma-Pipe International Holdings, Inc., together with its subsidiaries, engineers, designs, manufactures, and sells specialty piping and leak detection systems. |

| Redwire Corporation provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally. |

| Taylor Devices, Inc. engages in design, development, manufacture, and marketing of shock absorption, rate control, and energy storage devices for use in machinery, equipment, and structures in the United States, Asia, and internationally. |

| The Eastern Company designs, manufactures, and sells engineered solutions to industrial markets in the United States and internationally. |

| Thermon Group Holdings, Inc. provides engineered industrial process heating solutions for process industries in the United States and Latin America, Canada, Europe, the Middle East, Africa, and the Asia-Pacific. |

| Ultralife Corporation, together with its subsidiaries, designs, manufactures, installs, and maintains power, and communication and electronics systems worldwide. |

| ©2025 Pay Governance LLC. |  |

B - 6 |

| Executive Pay Analysis |

Executive Pay Analysis - Introduction

Methodology

|

|

● | To develop competitive market data for the CEO and CFO, we used two sources of data: |

|

|

— | Peer group proxy statements “peer analysis” |

|

|

— | Survey data “survey analysis” |

Definitions Used For Proxy and Survey Analysis

|

|

● | Salary: represents the full year salary reported in US dollars |

|

|

● | Target bonus: represents the annual target bonus. This value represents the amount that would be paid for achieving target or budgeted performance. Typically, bonus plans also have a threshold and maximum level of performance and payout. For example, for an executive with a target bonus equal to 50% of salary: |

|

|

— | Threshold payout equals 25% of salary (0.5x target) |

|

|

— | Target payout equals 50% of salary |

|

|

— | Maximum payout equals 100% of salary (2x target) |

|

|

● | Long-term incentive (LTI) value: represents the annual grant date value of equity granted to an executive. For example, assume market LTI value equals $100,000 and company wants to grant 50% of value in restricted stock units (RSUs) and 50% of value in stock options; stock price is $10.00 |

|

|

— | RSUs: $100,000 x 50% = $50,000 divided by $10 = 5,000 RSUs |

|

|

— | Options: $100,000 x 50% = $50,000 divided by ($10 x 40% Black-Scholes factor for example) = 12,500 Options |

|

|

— | Each year, assuming the $100,000 LTI market value doesn’t change, the executive would receive a new RSU and Option grant based on the grant date stock price. US-based executives typically receive a LTI grant each year except for unique situations such as one-time large special grants or new hire grants with expressed purpose to cover future grants |

| ©2025 Pay Governance LLC. |  |

B - 7 |

| Executive Pay Analysis |

Market Executive Pay Analysis

Chief Executive Officer

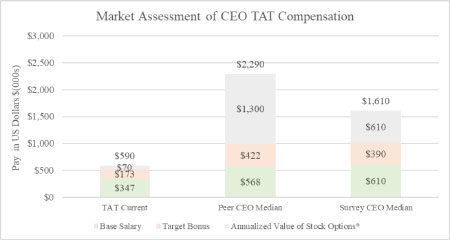

| ● | Base salary, target bonus, and annualized value of stock options for TAT are below median of Peer CEOs and Survey CEOs |

| ● | From a total compensation perspective, TAT CEO’s value of $590,000 is below Peer CEO median of $2,290,000 and below Survey CEO median of $1,610,000 |

Chief Financial Officer

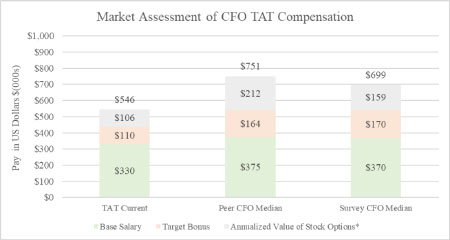

| ● | Base salary, target bonus, and annualized value of stock options for TAT are below median of Peer CFOs and Survey CFOs |

| ● | From a total compensation perspective, TAT CFO’s value of $546,000 is below Peer CFO median of $751,000 and below Survey CFO median of $699,000 |

* For TAT executives, value based on most recent stock option granted using a Black-Scholes value estimated to be 40% of exercise price. Each grant date value was divided by four to reflect vesting period and duration of time needed to lapse before next grant

| ©2025 Pay Governance LLC. |  |

B - 8 |

Appendix

| ©2025 Pay Governance LLC. |  |

B - 9 |

|

Appendix A |

Survey Data |

Summary of Survey Data Participants

|

|

• | Used Willis Towers Watson’s 2024 General Industry Executive Survey Report — United States |

|

|

― | Due to insufficient data for A&D companies, used an “All Industries” cut of data |

|

|

― | To ensure appropriate size to TAT, used the survey regression tool to reflect TAT’s revenue size |

|

|

― | When regression tool was not available due to sample size or lack of correlation of pay to revenue, we used tabular data provide by survey based on companies that approximate TAT’s revenue |

|

|

• | Survey matches |

|

Executive |

TAT Title |

Survey Match |

| Zamir, Igal | CEO & President | Chief Executive Officer |

|

Ben-Yair, Ehud |

Chief Financial Officer |

Top Finance Executive |

| ©2025 Pay Governance LLC. |

|

B - 10 |

| 1. |

[Amended 1998, 2013] In these Articles the words standing in the first column of the table next hereinafter contained shall bear the meanings set opposite them respectively in the second column

thereof, if not inconsistent with the subject or context:

|

|

Words

|

Meanings

|

|

The Company

|

The above-named Company.

|

|

Companies Ordinance

|

The Companies Ordinance (new version) 1983 ("The Companies Ordinance ") as amended and as amended from time to time including any law or

statute replacing it.

|

|

The Companies Law or The Israeli Companies Law

|

The Israeli Companies Law 5759-1999 ("The Companies Law") as amended and as amended from time to time including any law or statute replacing

it.

|

|

|

|

|

The Statutes

|

The Companies Ordinance and/or The Companies Law and/or The Securities Law and/or every other Law for the time being in force and affecting the

Company.

|

|

These Articles

|

These Articles of Association or as shall be altered from time to time by the General Meeting of the shareholders of the Company.

|

|

The Office

|

The registered office for the time being of the Company.

|

|

The Seal

|

The rubber stamp of the Company.

|

|

The Securities Law

|

The Israeli Securities Law 5728-1968 ("The Securities Law") as amended from time to time including any law or statute replacing it.

|

|

Month

|

Gregorian month.

|

|

The Record Date

|

The record date as determined pursuant to the provision of Article 55(a) of these Articles

|

|

Writing

|

Printing, lithography, photography, and any other mode or modes of representing or reproducing words in a visible form.

|

|

Special Resolution

|

In accordance with the Companies Ordinance, decision of 75% of the General Meeting of the shareholders of the Company.

|

| 2. |

[Amended 2013] The Company may engage in any lawful occupation.

|

| 3. |

[Amended 2013] The liability of the shareholders is limited, as determined in the Companies Law. For this purpose, each shareholder is responsible for repayment of the nominal value of shares. In

the event that the Company issued shares in exchange for lower nominal value, the responsibility of each shareholder will be limited to the repayment of the amortized amount of the consideration for each share assigned to him as aforesaid.

|

| 4. |

The Company is a non-private company; consequently:

|

|

|

(a) |

No limitations will apply to the transfer of its shares;

|

|

|

(b) | The number of shareholders is unlimited; |

|

|

(c) | The company may issue to the public shares, debentures or any other securities. |

| 5. |

[Amended 1993, 1998, 2005, 2018, 2024, 2025] The share capital of the company shall consist of 15,000,000 (Fifteen Million) Ordinary Shares of no per value of each, all ranking pari-passu.

|

| 6. |

Subject to these Articles or to the terms of any resolution creating new shares, the unissued shares from time to time shall be under the control of the Board of Directors, who shall have the power to allot shares or otherwise dispose of

them to such persons, on such terms and conditions, and either at par or at a premium, or, subject to the provisions of the Statues, at a discount, and at such times, as the Board of Directors may think fit, and the power to give to any

person the option to acquire from the Company any shares, either at par or at a premium, or, subject as aforesaid, at a discount, during such time and for such consideration as the Board of Directors may think fit.

|

| 7. |

If two or more persons are registered as joint holders of any share, any one of such persons may give effectual receipts for any dividends or other moneys in respect of such share.

|

| 8. |

No person shall be recognized by the Company as holding any share upon any trust, and the Company shall not be bound by or required to recognize any equitable, contingent, future, or partial interest in any share or any right whatsoever

in respect of any share other than an absolute right to the entirety thereof in the registered holder.

|

| 9. |

[Amended 2013] Every member shall be entitled without payment to receive after allotment or registration of transfer (unless the conditions of issue provide for a longer interval) one certificate

under the Seal for all the shares registered in his name, specifying the number and denoting numbers of the shares in respect of which it is issued and the amount paid up thereon. Provided that in the case of joint holders the Company shall

not be bound to issue more than one certificate to all the joint holders, and delivery of such certificate to one of them shall be sufficient delivery to all. Every certificate shall be signed by one Director and countersigned by the

Secretary or some other person nominated by the Directors for the purpose.

|

| 10. |

If any share certificate shall be defaced, worn out, destroyed or lost, it may be renewed on such evidence being produced, and such indemnity (if any) being given as the Directors shall require and (in case of defacement or wearing out)

on delivery up of the old certificate, and in any case on payment of such sum not exceeding NIS 5 (Five New Israeli Shekels) as the Directors may from time to time require.

|

|

|

11. |

[Deleted 2013]

|

|

|

12. |

[Deleted 2013]

|

|

|

13. |

[Deleted 2013]

|

| 14. |

[Amended 2013] No member shall be entitled to receive any dividend or to exercise any privileges as a member until he shall have paid all calls for the time being due and payable on every share

held by him, whether alone or jointly with any other person, together with interest and expenses (if any). The shareholders who are entitled to a dividend shall be the holders of shares on the date of the resolution regarding the dividend

or on a later date if a later date is prescribed in such resolution.

|

|

|

(a) |

If under the conditions of the issuance of shares there is no fixed date for the payments due therefor, the Directors may from time to time make such calls upon the members in respect of all moneys then unpaid on shares possessed by them

and every member will pay the sum demanded of him at the place and time appointed by the Directors, provided that fourteen days notice as to the place and date of payment was served on him. The Directors may revoke or postpone any call.

|

|

|

(b) |

A call shall be deemed to have been made at the time when the Resolution of the Directors authorizing such call was passed.

|

|

|

(c) |

The joint holders of a share shall be jointly and severally liable for the payment of all calls and installments in respect thereof.

|

|

|

(d) |

If before or on the day appointed for payment thereof, a call or installment payable in respect of a share is not paid, the holder or allottee of the share shall pay interest on the amount of the call or Installment at such rate not

exceeding the debitory rate prevailing at the largest Israeli commercial bank on the day appointed for the payment referred to, as the Directors shall fix, from the day appointed for payment thereof to the time of actual payment, but the

Directors may waive payment of such interest wholly or in part.

|

|

|

(a) |

Any sum which by the terms of allotment of a share is made payable upon allotment or at any fixed date, whether on account of the amount of the share or by way of premium, shall for all purposes of these Articles be deemed to be a call

duly made, and payable on the date fixed for payment, and in case of non-payment the provisions of these Articles as to payment of interest and expenses, forfeiture and the like, and all other relevant provisions of these Articles shall

apply as if such sum were a call duly made and notified as hereby provided;

|

|

|

(b) |

The Directors may at the time of allotment of shares make arrangements on the issue of shares for a difference between the holders of such shares in the amount of calls to be paid and in the time of payment of such call.

|

| 17. |

The Directors may, if they think fit, receive from any member willing to advance the same, all or any part of the monies due upon his shares beyond the sums actually called up thereon; and upon the moneys so paid in advance, or so much

thereof as exceeds the amount for the time being called up on the shares in respect of which such advance has been made, the Directors may pay or allow such interest as may be agreed by them and the Company.

|

| 18. |

No transfer of shares shall be registered unless a proper writing or instrument of transfer (in any customary form or any other form satisfactory to the Board of Directors) has been submitted to the Company (or its transfer agent),

together with the share certificate(s) and such other evidence of title as the Board of Directors may reasonably require. Until the transferee has been registered in the Register of Members in respect of the shares so transferred, the

Company may continue to regard the transferor as the owner thereof.

|

| 19. |

The Directors may refuse, without giving any reasons therefor, to register any transfer of shares where the Company has a lien on the share, constituting the subject matter of the transfer, but fully paid-up shares may be transferred

freely and such transfers do not require the approval of the Directors.

|

| 20. |

[Amended 1998] The Transfer Records and the Register of Members and Debenture Holders (if any) and Debenture Stock Holders (if any) and other securities (if any) of the Company may be closed

during such time as the Directors may deem fit, not exceeding in the aggregate, thirty days in each year. To avoid any doubts, the determination of a Record Date shall not constitute nor be deemed as a closing of the above records or

registers.

|

| 21. |

In the case of the death of a member, or a holder of a debenture, the survivor or survivors, where the deceased was a joint holder, and the executors and/or administrators and/or the legal heirs of the deceased where he was a sole or

only surviving holder, shall be the only persons recognized by the Company as having any title to his shares or his debentures, but nothing herein contained shall release the estate of a deceased joint holder form any liability in respect

of any share or any debenture jointly held by him.

|

| 22. |

Any person who becomes entitled to a share or a debenture in consequence of the death or bankruptcy of any member, may, upon producing such evidence of title as the Directors shall require, with the consent of the Directors, be

registered himself as holder of the share or the debenture or, subject to the provisions as to transfers herein contained, transfer the same to some other person.

|

| 23. |

A person entitled to a share or a debenture by transmission shall be entitled to receive, and may give a discharge for, any dividends or interest or other moneys payable in respect of the share or debenture, but he shall not be entitled

in respect of it to receive notices of, or to attend or vote at meetings of the Company, or, save as aforesaid, to exercise any of the rights or privileges of a member or a holder of a debenture unless and until he shall become a member in

respect of the share or a holder of the debenture.

|

| 24. |

If any member fails to pay the whole or any part of any call or installment of a call on or before the day appointed for the payment thereof, the Directors may at any time thereafter, during such time as the call or installment or any

part thereof remains unpaid, serve a notice on him, or on the person entitled to the share by transmission requiring him to pay such call or installment, or such part thereof as remains unpaid, together with any expenses incurred by the

company by reason of such non-payment.

|

| 25. |

The notice shall name a further day (not earlier than the expiration of thirty days from the date of the notice) on or before which such call or installment, or such part as aforesaid, and all interest and expenses that have accrued by

reason of such non-payment, is to be made, and shall state that In the event of non-payment at or before the time and at the place appointed, the shares in respect of which such call was made will be liable to be forfeited.

|

| 26. |

If the requisitions of any such notice as aforesaid are not complied with, any share in respect of which such notice has been given may at any time thereafter, before the payment required by the notice has been made, be forfeited by a

resolution of the Directors to that effect. A forfeiture of shares shall include all dividends in respect of the shares not actually paid before the forfeiture, notwithstanding that they shall have been declared.

|

| 27. |

Notwithstanding any such forfeiture as aforesaid, the Directors may, at any time before the forfeited share has been otherwise disposed of, annul the forfeiture upon the terms of payment of all call and interest due upon and expenses

incurred in respect of the shares and upon such further terms (if any) as they shall see fit.

|

| 28. |

Every share which shall be forfeited shall thereupon become the property of the Company and may be either cancelled or sold or re-allotted or otherwise disposed of either to the person who was before forfeiture the holder thereof, or

entitled thereto, or to any other person, upon such terms and in such manner as the Directors shall think fit. [Amended 2013] Each Forfeited share that hasn’t been sold or canceled, will become

dormant Share, as defined in the Israeli Companies law, and will not confer any rights, so long that such shares is owned by the Company.

|

| 29. |

A member whose shares have been forfeited shall, notwithstanding, be liable to pay to the Company all calls made and not paid on such shares at the time of forfeiture, and interest thereon to the date of payment, in the same manner in

all respects as if the shares had not been forfeited and to satisfy all (if any) the claims and demands which the Company might have enforced in respect of the shares at the time of forfeiture, without any deduction or allowance for the

value of the shares at the time of forfeiture.

|

| 30. |

The forfeiture of a share shall involve the extinction at the time of forfeiture of all interest in and all claims and demands against the Company in respect of the share, and all other rights and liabilities incidental to the share as

between the member whose share is forfeited and the Company, except only such of those rights and liabilities as are by these Articles expressly saved, or as are by the Statutes given or imposed in the case of past members.

|

| 31. |

A sworn declaration in writing that the declarant is a Director of the Company, and that a share has been duly forfeited in pursuance of these Articles and stating the date upon which it was forfeited, shall, as against all persons

claiming to be entitled to the share adversely to the forfeiture thereof, be conclusive evidence of the facts therein stated, and such declaration, together with the receipt of the Company for the consideration (if any) given for the share

on the sale or disposition thereof, and a certificate of proprietorship of the share under the Seal delivered to the person to whom the same is sold or disposed of, shall constitute a good title to the share, and such person shall be

registered as the holder of the share and shall be discharged from all calls made prior to such sale or disposition, and shall not be bound to see to the application of the purchase money (if any) nor shall his title to the share be

affected by any act, omission or irregularity relating to or connected with the proceedings in reference to the forfeiture, sale, re-allotment or disposal of the share.

|

| 32. |

The Company shall have a first and paramount lien upon all shares (which are not fully paid up) registered in the name of any member, either alone or jointly with any other person, for his debts, liabilities and engagements, whether

solely or jointly with any other person, to or with the Company, whether the period for the payment, fulfillment or discharge thereof shall have actually arrived or not, and such lien shall extend to all dividends from time to time declared

in respect of such shares; but the Directors may at any time declare any share to be exempt wholly or partially from the provisions of this Article.

|

| 33. |

The Directors may sell the shares subject to any such lien at such time or times and in such manner as they shall think fit, but no sale shall be made until such time as the moneys in respect of which such lien exists, or some part

thereof, are or is presently payable, or the liability or engagement in respect of which such lien exists is liable to be presently fulfilled or discharged, and until a demand and notice in writing stating the amount due or specifying the

liability or engagement and demanding payment or fulfillment or discharge thereof and giving notice of intention to sell in default shall have been served on such member, or the persons (if any) entitled by transmission to the shares, and

default in payment, fulfillment or discharge shall have been made by him or them for fourteen days after such notice.

|

| 34. |

The net proceeds of such sale shall be applied in or towards satisfaction of the amount due to the Company, or of the liability or engagement, as the case may be, and the balance (if any) shall be paid to the member or the person (if

any) entitled by transmission to the shares so sold.

|

| 35. |

Upon any such sale (i.e., following forfeiture or foreclosing on a lien for and the bona fide use of the powers granted with respect thereto) the Directors may enter the purchaser's name in the Register as holder of the shares and the

purchaser shall not be bound to see to the application of the purchase money, nor shall his title to the shares be affected by any irregularity or invalidity in the proceedings in reference to the sale.

|

|

|

(a) |

The Company may, subject to the provisions of the Statutes, with respect to fully paid up shares, issue warrants (hereinafter called "share warrants"), stating that the bearer is entitled to the shares therein specified and may provide

by coupons or otherwise for the payment of dividends on the shares included in such warrants. The Directors may determine and from time to time vary, the conditions upon which share warrants shall be issued, and in particular the conditions

upon which a new share warrant or coupon will be issued in the place of one worn out, defaced, lost or destroyed, or upon which a share warrant may be surrendered, and the name of the bearer entered in the Register in respect of the shares

therein specified. The bearer of a share warrant shall be subject to the conditions for the time being in force, whether made before or after the issue of such share warrant.

|

|

|

|

No new share warrant or coupon shall be issued in the place of one which has been lost or destroyed unless it shall have been established to the satisfaction of the

Directors that the same has been lost or destroyed.

|

|

|

(b) |