|

Oded Har-Even, Esq.

Sullivan & Worcester LLP 1633 Broadway New York, NY 10019 Tel: 212.660.3000 |

Reut Alfiah, Adv.

Sullivan & Worcester Tel-Aviv

(Har-Even & Co.)

28 HaArba’a St. HaArba’a Towers,

North Tower, 35th Floor

Tel-Aviv, Israel 6473925

T +972.74.758.0480

|

|

Title of class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

||

|

Ordinary Shares, no par value

|

SATX

|

NYSE American LLC

|

|

Warrants to purchase ordinary shares

|

|

(Title of Class)

|

|

None

|

|

(Title of Class)

|

|

Large Accelerated filer ☐

|

Accelerated filer ☐

|

Non-accelerated filer ☒

Emerging growth company ☒

|

|

U.S. GAAP ☐

|

International Financial Reporting Standards as issued by the

International Accounting Standards Board ☒

|

Other ☐ |

|

PART I |

6 | |

|

6 | ||

|

6 | ||

|

6 | ||

| 49 | ||

| 70 | ||

| 71 | ||

| 89 | ||

| 110 | ||

| 113 | ||

| 114 | ||

| 115 | ||

| 130 | ||

| 130 | ||

|

PART II |

131 | |

| 131 | ||

| 131 | ||

| 131 | ||

| 131 | ||

| 131 | ||

| 132 | ||

| 132 | ||

| 132 | ||

| 132 | ||

| 133 | ||

| 133 | ||

| 133 | ||

| 133 | ||

| 134 | ||

| 134 | ||

|

PART III |

135 | |

| 135 | ||

| 135 | ||

| 136 |

|

|

• |

Our performance following the Business Combination; |

|

|

• |

Unpredictability in the satellite communications industry; |

|

|

• |

The regulatory environment and changes in laws, regulations or policies in the jurisdictions in which we operate; |

|

|

• |

Competition in the satellite communications industry, and the failure to introduce new technologies and products in a timely manner

to compete successfully against competitors; |

|

|

• |

Failure by us to adjust our supply chain volume due to changing market conditions or failure to estimate its customers’

demand; |

|

|

• |

Disruptions in relationships with any one of our key customers; |

|

|

• |

Disruptions in relationships with any one of our third-party manufacturers or suppliers; |

|

|

• |

Any difficulty selling our products if customers do not design its products into their product offerings; |

|

|

• |

Our dependence on winning selection processes and gaining market acceptance of its technologies and products; |

|

|

• |

Even if we succeed in winning selection processes for its technologies and products, we may not generate timely or sufficient net

sales or margins from those wins; |

|

|

• |

Our ability to execute its strategies, manage growth and maintain its corporate culture as it grows; |

|

|

• |

Sustained yield problems or other delays in the manufacturing process of products; |

|

|

• |

Changes in the need for capital and the availability of financing and capital to fund these needs; |

|

|

• |

Our estimates of our total addressable market and the demand for and pricing of its products and services; |

|

|

• |

Our ability to maintain effective internal control over financial reporting; |

|

|

• |

Our ability to retain key personnel and to replace such personnel on a timely basis or on acceptable terms; |

|

|

• |

Exchange rate fluctuations; |

|

|

• |

Changes in interest rates or rates of inflation; |

|

|

• |

Legal, regulatory and other proceedings; |

|

|

• |

Changes in applicable laws or regulations, or the application thereof on us; |

|

|

• |

The results of future financing efforts; |

|

|

• |

Our ability to maintain continued listing standards with the NYSE American LLC: |

|

|

• |

General market, political and economic conditions in the countries in which we operate including those related to recent unrest and

actual or potential armed conflict in Israel and other parts of the Middle East, such as the Israel-Hamas war; |

|

|

• |

Some or all of the expected benefits of the transaction between the Company and MDA will not be achieved; and |

|

|

• |

The other matters described in the section titled “Risk Factors”. |

| A. |

[Reserved] |

| B. |

Capitalization and Indebtedness |

| C. |

Reasons for the Offer and Use of Proceeds |

| D. |

Risk Factors |

|

|

• |

SatixFy has limited capital currently

available and will need to raise additional capital in the future to fund its operations and develop its technology and chips and satellite

communications systems. If SatixFy fails to raise sufficient capital or is unable to do so on favorable or acceptable terms, it might

not be able to make the necessary investments in technology development, its operating results may be harmed, it may have to seek protection

under insolvency laws and may be unable to continue its operations. |

|

|

• |

SatixFy is an early stage company with a history of losses, has generated less revenues than its prior projections, and has not demonstrated

a sustained ability to generate predictable revenues or cash flows. If SatixFy does not generate revenue as expected, its financial condition

will be materially and adversely affected. |

|

|

• |

SatixFy may face increased risks and costs associated with volatility in labor or component prices or as a result of supply chain

or procurement disruptions, which may adversely affect its operations. |

|

|

• |

Obtaining customer contracts may require SatixFy to participate in lengthy competitive selection processes that require it to incur

significant costs. |

|

|

• |

Some of SatixFy’s customers may require its chips and satellite communications systems to undergo a demonstration process that

does not assure future sales or customer contracts. |

|

|

• |

SatixFy generates a significant percentage of its revenue from certain key customers and anticipates this concentration will continue

for the foreseeable future, and the loss of one or more of its key customers could negatively affect its business and operating results.

|

|

|

• |

SatixFy may not be able to continue to develop its technology or develop new technologies for its existing and new satellite communications

systems. |

|

|

• |

Deterioration of the financial conditions of SatixFy’s customers could adversely affect its operating results. |

|

|

• |

SatixFy operates in a highly competitive industry and may be unsuccessful in effectively competing in the future. |

|

|

• |

SatixFy has incurred net losses in each year since inception and may not be able to continue to raise sufficient capital or achieve

or sustain profitability. |

|

|

• |

SatixFy may not be able to generate sufficient cash to service its indebtedness. |

|

|

• |

SatixFy’s estimates, including market opportunity estimates and growth forecasts, are subject to inherent challenges in measurement

and significant uncertainty, and real or perceived inaccuracies in those metrics and estimates may harm its reputation and negatively

affect its business. |

|

|

• |

SatixFy’s results of operations may vary significantly from its expectations or guidance. |

|

|

• |

SatixFy may not be able to comply with its contracts with customers, and non-compliance may harm its operations and expose it to

potential third-party claims for damages. |

|

|

• |

Loss of key employees and the inability to continuously recruit and retain qualified employees could hurt SatixFy’s competitive

position. |

|

|

• |

SatixFy relies on third parties for manufacturing of its products. SatixFy does not have long-term supply contracts with its foundry

or most of its third-party manufacturing vendors, and they may not allocate sufficient capacity to SatixFy at reasonable prices to meet

future demands for its solutions. |

|

|

• |

SatixFy’s business is subject to a wide range of laws and regulations, many of which are continuously evolving, and failure

to comply with such laws and regulations could harm its business, financial condition and operating results. |

|

|

• |

SatixFy is subject to risks from its international operations. |

|

|

• |

SatixFy relies on its intellectual property and proprietary rights and may be unable to adequately obtain, maintain, enforce, defend

or protect its intellectual property and proprietary rights, including against unauthorized use by third parties. |

|

|

• |

SatixFy relies on the availability of third-party licenses of intellectual property, and if it fails to comply with its obligations

under such agreements or is unable to extend its existing third- party licenses or enter into new third-party licenses on reasonable terms

or at all, it could have a material adverse effect on its business, operating results and financial condition. |

|

|

• |

Defects, errors or other performance problems in SatixFy’s software or hardware, or the third-party software or hardware on

which it relies, could harm SatixFy’s reputation, result in significant costs to SatixFy, impair its ability to sell its systems

and subject it to substantial liability. |

|

|

• |

SatixFy is subject to complex and evolving laws, regulations, rules, standards and contractual obligations regarding data privacy

and cybersecurity, which can increase the cost of doing business, compliance risks and potential liability. |

|

|

• |

Changes in SatixFy’s effective tax rate may adversely impact its results of operations. |

|

|

• |

Exchange rate fluctuations between the U.S. dollar, the British pound, the Euro and other foreign currencies may negatively affect

SatixFy’s future revenues. |

|

|

• |

Managing a public company and compliance with regulatory requirements may divert the attention of SatixFy’s senior management

from the day-to-day management of its business. |

|

|

• |

An active trading market for SatixFy’s equity securities may not develop or may not be sustained to provide adequate liquidity.

|

|

|

• |

The selling shareholders listed in the Registration Statement may be incentivized to sell them under the Registration Statement depending

on the market price of our securities, and sales of a significant number of our securities by such selling shareholders could materially

adversely affect the trading prices of our securities. |

|

|

• |

Investors’ rights and responsibilities as SatixFy’s shareholders will be governed by Israeli law, which differs in some

respects from the rights and responsibilities of shareholders of non- Israeli companies. |

|

|

• |

The market price of SatixFy’s equity securities may be volatile, and your investment could suffer or decline in value.

|

|

|

• |

SatixFy is an “emerging growth company” and avails itself of the reduced disclosure requirements applicable to emerging

growth companies, which could make its equity securities less attractive to investors. |

|

|

• |

SatixFy may lose its foreign private issuer status in the future, which could result in significant additional costs and expenses.

|

|

|

• |

Future sales or other issuances of our securities could depress the market price for our securities. |

|

|

• |

Failure to meet NYSE’s continued listing requirements could result in the delisting of our Ordinary Shares, negatively impact

the price of our Ordinary Shares and negatively impact our ability to raise additional capital. |

|

|

• |

the effects of catastrophic and other disruptive events at our customers’ operational sites or targeted markets including,

but not limited to, natural disasters, telecommunications failures, geopolitical instability caused by international conflict, including

the Russia-Ukraine and Israel-Hamas wars, cyber-attacks, terrorist attacks, pandemics, epidemics or other outbreaks of infectious disease,

and breaches of security or loss of critical data; |

|

|

• |

increased costs associated with potential disruptions to our or our customers’ supply chain and other manufacturing and production

operations; |

|

|

• |

the deterioration of our customers’ financial condition; |

|

|

• |

delays and project cancellations as a result of design flaws in the chips and communications systems developed by us or our customers;

|

|

|

• |

the inability of our customers to dedicate the resources necessary to promote and commercialize their products; |

|

|

• |

the inability of our customers to adapt to changing technological demands resulting in their products becoming obsolete; and

|

|

|

• |

the failure of our satellite communications systems or our customers’ products to achieve market success and gain market acceptance.

|

|

|

• |

our ability to anticipate the needs of the market for new generations of satellite communications digital chip technology;

|

|

|

• |

our ability to continue funding and to maintain our current research and development activities, particularly the development of

enhancements to our chips and systems; |

|

|

• |

our ability to successfully integrate our advanced technologies and system design architectures into satellite communications systems

that are compatible with our customers’ infrastructure; |

|

|

• |

our ability to develop and introduce timely, qualified

and on-budget new satellite communications systems or chips that meet the market’s technological requirements; |

|

|

• |

our ability to establish close working relationships with our customers and to have them integrate our satellite communications systems

in their design of new communications systems; |

|

|

• |

our ability to maintain intellectual properties rights, whether proprietary or third-party, that are necessary to our research and

development activities, such as chip development software; |

|

|

• |

our ability to gain access to the proprietary waveforms that potential customers utilize; and |

|

|

• |

our ability to obtain funding for continuing our technology and product development. |

|

|

• |

our ability to timely introduce to the market our current chips and satellite communications systems; |

|

|

• |

our ability to develop new chips and satellite communications systems that respond to customer requirements; |

|

|

• |

changes in cost estimates and cost overruns associated with our development projects; |

|

|

• |

changes in demand for, and market conditions of, our chips and satellite communications systems; |

|

|

• |

the ability of third-party foundries and other third-party suppliers to manufacture, assemble and test our chips and satellite communications

systems in a timely and cost-effective manner; |

|

|

• |

the discovery of defects or errors in our hardware or software after delivery to customers; |

|

|

• |

our ability to achieve cost savings and improve yields and margins on our new and existing products; |

|

|

• |

our ability to utilize our capacity efficiently or to adjust such capacity in response to customer demand; |

|

|

• |

our ability to realize the expected benefits of any acquisitions or strategic investments; |

|

|

• |

business, political, geopolitical and macroeconomic changes, including the Russia-Ukraine and Israel-Hamas wars. trade disputes,

the imposition of tariffs or sanctions, inflation trends and downturns in the semiconductor and the satellite communications industries

and the overall global economy; and |

|

|

• |

changes in consumer confidence caused by many factors, including changes in interest rates, credit markets, expectations for inflation,

unemployment levels, and energy or other commodity prices. |

|

|

• |

hire and retain qualified professionals; |

|

|

• |

continue to develop leaders for key business units and functions; and |

|

|

• |

train and motivate our employee base. |

|

|

• |

negative economic developments in economies around the world and the instability of governments; |

|

|

• |

social and political instability in Israel, including the Israel-Hamas war, and in the other countries in which we operate;

|

|

|

• |

pandemics or national and international environmental, nuclear or other disasters, which may adversely affect our workforce, as well

as our local suppliers and customers; |

|

|

• |

adverse changes in governmental policies, especially those affecting trade and investment; |

|

|

• |

foreign currency exchange, in particular with respect to the U.S. dollar, the Euro, the British pound sterling, the Israeli Shekel,

and transfer restrictions, in particular in Russia and China; |

|

|

• |

global and local economic, social and political conditions and uncertainty; |

|

|

• |

formal or informal imposition of export, import or doing-business regulations, including trade sanctions, tariffs and other related

restrictions; |

|

|

• |

compliance with laws and regulations that differ among jurisdictions, including those covering taxes, intellectual property ownership

and infringement, export control regulations, anti- corruption and anti-bribery, antitrust and competition, data privacy, cybersecurity

and environment, health and safety; |

|

|

• |

labor market conditions and workers’ rights affecting our operations; and |

|

|

• |

occurrences of geopolitical crises such as terrorist activity, armed conflict, civil or military unrest or political instability,

which may disrupt our operations — for example, conflicts in Asia implicating the global semi-conductor supply-chain, such as conflicts

between Taiwan and China, the war between Russia and Ukraine, the war between Israel and Hamas, the tense relations between the U.S. and

China, could lead to regional and/or global instability, as well as adversely affect supply chains as well as commodity and other financial

markets or economic conditions. The U.S., European Union (the “EU”), the United Kingdom, Switzerland and other countries have

imposed, and may further impose, financial and economic sanctions and export controls targeting certain Russian entities and/or individuals,

and we, or our customers, may face restrictions on engaging with certain businesses due to any current or impending sanctions and laws,

which could adversely affect our business; and |

|

|

• |

threats that our operations or property could be subject to nationalization and expropriation. |

|

|

• |

changes in our overall profitability and the amount of profit determined to be earned and taxed in jurisdictions with differing statutory

tax rates; |

|

|

• |

the resolution of issues arising from tax audits with various tax authorities; |

|

|

• |

the impact of transfer pricing policies; |

|

|

• |

changes in the valuation of either our gross deferred tax assets or gross deferred tax liabilities; |

|

|

• |

changes in expenses not deductible for tax purposes; |

|

|

• |

changes in available tax credits; and |

|

|

• |

changes in tax laws or the interpretation of such tax laws, and changes in generally accepted accounting principles. |

|

|

• |

the book-building process undertaken by underwriters that helps to inform efficient price discovery with respect to opening trades

of newly listed securities; |

|

|

• |

underwriter support to help stabilize, maintain or affect the public price of the new issue immediately after listing; and

|

|

|

• |

underwriter due diligence review of the offering and potential liability for material misstatements or omissions of fact in a prospectus

used in connection with the securities being offered or for statements made by its securities analysts or other personnel. |

|

|

• |

a limited availability of market quotations for the warrants; |

|

|

• |

reduced liquidity for the warrants; |

|

|

• |

a determination that our warrants are a “penny stock” which will require brokers trading in our warrants to adhere to

more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our Warrants; and

|

|

|

• |

the risk that market makers that initially make a market in our unexchanged warrants eventually cease to do so. |

|

|

• |

the rescheduling, increase, reduction or cancellation of significant customer orders; |

|

|

• |

the timing of customer qualification of our products and commencement of volume sales by our customers of systems that include our

products; |

|

|

• |

the timing and amount of research and development and sales and marketing expenditures; |

|

|

• |

the rate at which our present and future customers and end users adopt our technologies in our target end markets; |

|

|

• |

the timing and success of the introduction of new products and technologies by us and our competitors, and the acceptance of our

new products by our customers; |

|

|

• |

our ability to anticipate changing customer product requirements; |

|

|

• |

our gain or loss of one or more key customers; |

|

|

• |

the availability, cost and quality of materials and components that we purchase from third-party vendors and any problems or delays

in the manufacturing, testing or delivery of our products; |

|

|

• |

the availability of production capacity at our third-party facilities or other third-party subcontractors and other interruptions

in the supply chain, including as a result of materials shortages, bankruptcies or other causes; |

|

|

• |

supply constraints for and changes in the cost of the other components incorporated into our customers’ products; |

|

|

• |

our ability to reduce the manufacturing costs of our products; |

|

|

• |

fluctuations in manufacturing yields; |

|

|

• |

the changes in our product mix or customer mix; |

|

|

• |

the timing of expenses related to the acquisition of technologies or businesses; |

|

|

• |

product rates of return or price concessions in excess of those expected or forecasted; |

|

|

• |

the emergence of new industry standards; |

|

|

• |

product obsolescence; |

|

|

• |

unexpected inventory write-downs or write-offs; |

|

|

• |

costs associated with litigation over intellectual property rights and other litigation; |

|

|

• |

the length and unpredictability of the purchasing and budgeting cycles of our customers; |

|

|

• |

loss of key personnel or the inability to attract qualified engineers; |

|

|

• |

the quality of our products and any remediation costs; |

|

|

• |

adverse changes in economic conditions in the various markets where we or our customers have operations; |

|

|

• |

the general industry conditions and seasonal patterns in our target end markets, particularly the satellite communications market;

|

|

|

• |

other conditions affecting the timing of customer orders or our ability to fill orders of customers subject to export control or

economic sanctions; and |

|

|

• |

geopolitical events, such as war, threat of war or terrorist actions, including the current wars between Russia-Ukraine and Israel-Hamas,

or the occurrence of pandemics, epidemics or other outbreaks of disease, including the COVID-19 pandemic, or natural disasters, and the

impact of these events on the factors set forth above. |

|

|

• |

the Israeli Companies Law regulates mergers and requires that a tender offer be effected when one or more shareholders propose to

purchase shares that would result in it or them owning more than a specified percentage of shares in a company; |

|

|

• |

the Israeli Companies Law requires special approvals for certain transactions involving directors, officers or significant shareholders

and regulates other matters that may be relevant to these types of transactions; |

|

|

• |

the Israeli Companies Law does not provide for shareholder action by written consent for public companies, thereby requiring all

shareholder actions to be taken at a general meeting of shareholders; |

|

|

• |

our amended and restated articles of association divide our directors into three classes, each of which is elected once every three

years; |

|

|

• |

an amendment to our amended and restated articles of association generally requires, in addition to the approval of our board of

directors, a vote of the holders of a majority of our outstanding ordinary shares entitled to vote present and voting on the matter at

a general meeting of shareholders (referred to as simple majority), and the amendment of a limited number of provisions, such as the provision

empowering our board of directors to determine the size of the board, the provision dividing our directors into three classes, the provision

that sets forth the procedures and the requirements that must be met in order for a shareholder to require the Company to include a matter

on the agenda for a general meeting of the shareholders, the provisions relating to the election and removal of members of our board of

directors and empowering our board of directors to fill vacancies on the board, requires, in addition to the approval of our board of

directors, a vote of the holders of 66-2⁄3% of our outstanding ordinary shares entitled to vote at a general meeting; |

|

|

• |

our amended and restated articles of association do not permit a director to be removed except by a vote of the holders of at least

66-2⁄3% of our outstanding shares entitled to vote at a general meeting of shareholders; and |

|

|

• |

our amended and restated articles of association provide that director vacancies may be filled by our board of directors. |

|

|

• |

sales of a significant number of our securities, including those which we plan to register in connection with the Equity Line of

Credit and by the selling securityholders under our resale registration statement on Form F-1 (Registration No. 333-268510), or that we

may in the future register for sale or for resale on behalf of our securityholders, could materially adversely affect the trading prices

of our securities; |

|

|

• |

the realization of any of the risk factors presented in this Annual Report; |

|

|

• |

actual or anticipated differences in our estimates, or in the estimates of analysts, for our revenues, earnings, results of operations,

level of indebtedness, liquidity or financial condition; |

|

|

• |

failure to comply with the requirements of the NYSE; |

|

|

• |

failure to comply with the Sarbanes-Oxley Act or other laws or regulations; |

|

|

• |

variance in our financial performance from the expectations of market analysts; |

|

|

• |

announcements by us or our competitors of significant business developments, changes in service provider relationships, acquisitions

or expansion plans; |

|

|

• |

changes in the prices of our products and services; |

|

|

• |

commencement of, or involvement in, litigation involving us; |

|

|

• |

future issuances, sales, repurchases or anticipated issuances, sales, resales or repurchases, of our securities including due to

the expiration of contractual lock-up agreements; |

|

|

• |

publication of research reports about us; |

|

|

• |

failure of securities analysts to initiate or maintain coverage of us, changes in financial estimates by any securities analysts

who follow us or our failure to meet these estimates or the expectations of investors; |

|

|

• |

new laws, regulations, subsidies, or credits or new interpretations of existing laws applicable to us; |

|

|

• |

market conditions in our industry; |

|

|

• |

changes in key personnel; |

|

|

• |

speculation in the press or investment community; |

|

|

• |

changes in the estimation of the future size and growth rate of our markets; |

|

|

• |

broad disruptions in the financial markets, including sudden disruptions in the credit markets; |

|

|

• |

actual, potential or perceived control, accounting or reporting problems; |

|

|

• |

changes in accounting principles, policies and guidelines; and |

|

|

• |

other events or factors, including those resulting from infectious diseases, health epidemics and pandemics, natural disasters, war,

including the current wars between Russia-Ukraine and Israel-Hamas, acts of terrorism or responses to these events. |

|

|

• |

the last day of the fiscal year during which our total annual revenue equals or exceeds $1.235 billion (subject to adjustment for

inflation); |

|

|

• |

the last day of the fiscal year following the fifth anniversary of our initial registered offering; |

|

|

• |

the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; or |

|

|

• |

the date on which we are deemed to be a “large accelerated filer” under the Exchange Act. |

| A. |

History and Development of the Company |

| B. |

Business Overview |

|

|

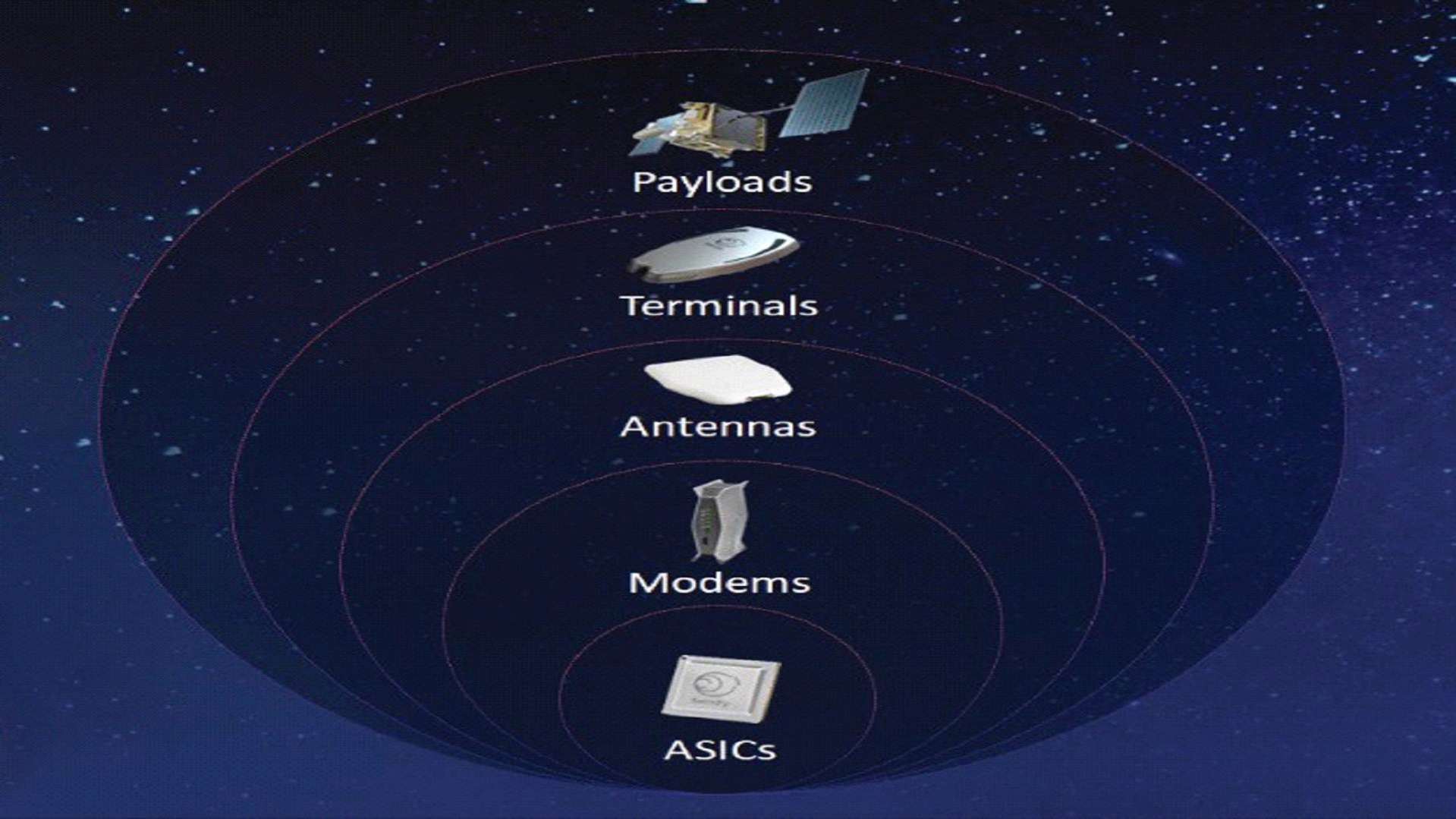

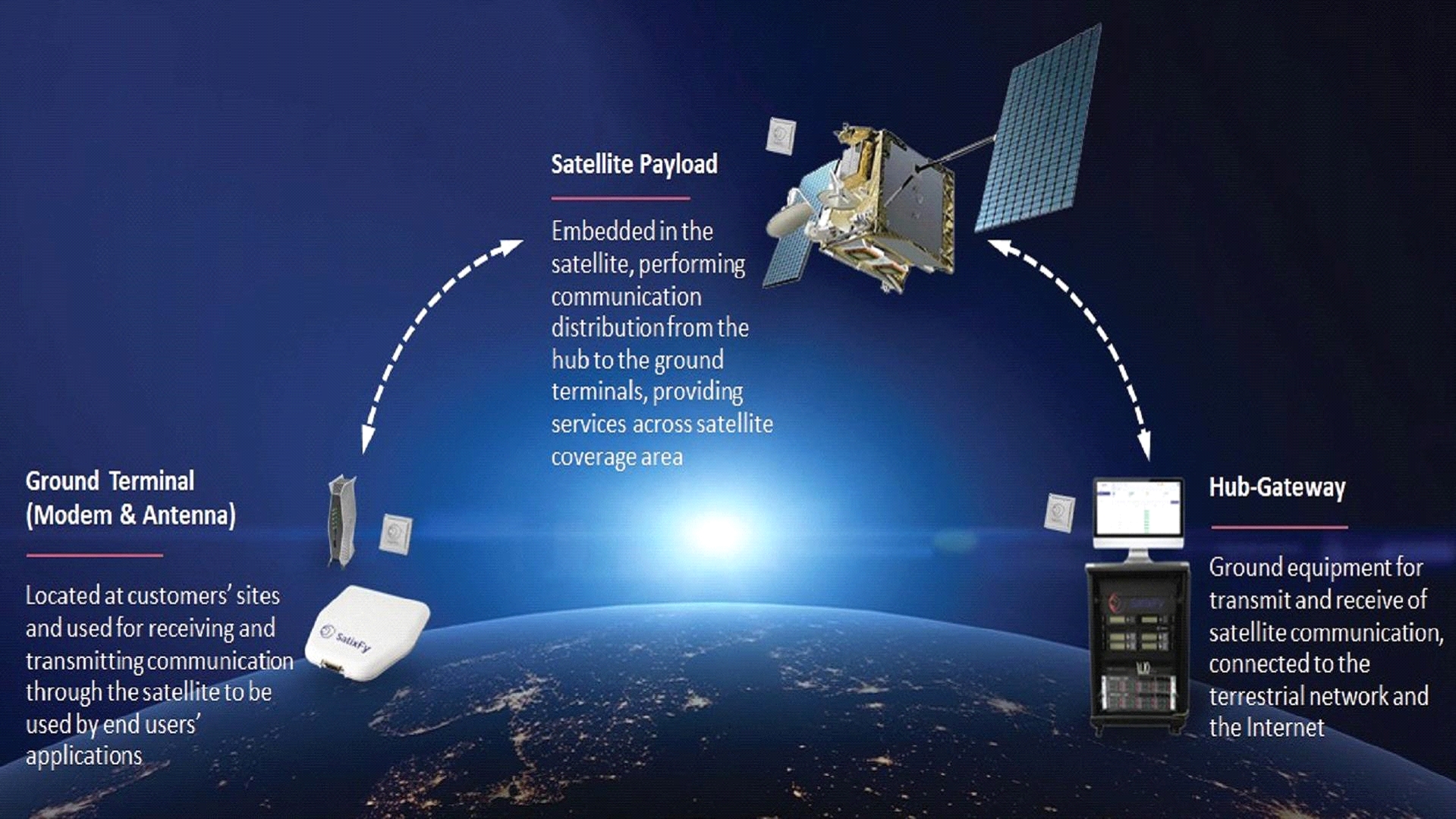

• |

The satellite payload, which is the system

integrated to the satellite platform that provides in-space data receiving, processing and transmitting capabilities. |

|

|

• |

The user terminal, which is the system on

the ground (or aircraft, in the case of IFC), comprised of an antenna and modem, that digitally links to the satellite payload and provides

data receiving, processing and transmitting capabilities. |

|

|

• |

The hub, which is the system that enables

the network operator to control and manage its communication network and the interaction between the satellite payload and the ground

terminal. |

|

|

• |

Modems. We have developed our modems based on our proprietary SX-3000 and SX-3099 Very Small

Aperture Terminal (“VSAT”) chips, a part of our ASIC technology and one of the base building blocks for all our terminal products.

We produce modem modules designed to bring the fastest performance available today in a compact form factor and with low power. All of

our modems are designed for easy integration with our customers’ hardware, and software solutions and are available for a variety

of applications. Our modems are designed to natively support the entire DVB-RCS2 / DVB-S2X industry standards as well as a complete SDR

for any other waveform, to ensure maximum flexibility and relevance to our customer base. These industry standards are intended to ensure

that systems that utilize them perform with better efficiency, more throughput and better network reliability. We were directly involved

in writing the DVB-S2X standard which is based in part on our technology and patents. |

|

|

• |

Antennas. We offer a line of advanced ESMA products based on our proprietary BEAT and PRIME

ASIC chip technologies for both ground and Aero/IFC terminal connectivity. |

|

|

• |

Cutting-Edge Chips. We believe we are positioned to be a leading provider of satellite communications

systems for the next generation of satellites. Our modem chips have the ability to split data for retransmission and combine received

data from nearby satellites or ground hubs efficiently and quickly. Our chip technology enables us to develop communications systems that

are high performing, low weight, energy efficient and sized to be compatible for a wide array of applications and satellite technologies.

|

|

|

• |

Advanced Antennas and Modems. Our technology in the field of multibeam management, transmission

and beamforming and hopping, based on our advanced chips, introduces a new and advanced generation of flat electronic antennas that will

be critical to enabling user terminals to track multiple LEO satellites at a time. Our ESMA chips enable efficiency, modularity and scalability

to support multibeam and high data rates. We are designing efficient and innovative digital interfaces for our modems to enable them to

handle numerous transmission and reception beams, which will be necessary for LEO satellite networks. |

|

|

• |

Tailor Made. We have the ability to design and present customers with customized solutions

using our whole family of highly flexible chips and modules that integrate with their planned or existing systems, and which can be tailored

to meet their requirements. We believe that providing optimized cost-effective solutions, in an era when satellite technology is rapidly

evolving, is important for positioning us at the technological forefront of the market and securing relationships with leading communications

providers. |

|

|

• |

End-to-End Solutions. Our development team manages the entire product development life cycle,

beginning with the characterization stage, through to the design and third-party manufacture of the chips, integration of the chips within

communications systems, testing of the systems and culminating with delivery and the provision of operational support to the customer.

The solutions we provide enable customers to enjoy an efficient and continuous process for the development of their systems with a single

supplier and single point of contact throughout the entire development and implementation process. We develop the chips, design the systems

that integrate the chips, write the software needed to operate the chips and manage integration of the various components into a single,

cohesive satellite communications systems that fits our customers’ needs. |

|

|

• |

Superior Technology Leading to Superior Performance. We believe we are a technology and product

leader in the growing satellite communications industry, as evidenced by our innovative technologies such as the digital beamforming and

the beam-hopping chip technology. Our chips are designed to power our satellite communications systems, which in turn enhance satellite

communications capabilities, including on-board processing capabilities driven by channel switching and flexibility. |

|

|

• |

Tailor-Made Innovation of Next-Generation Satellite Communications Technology. Our SDR modem

and antenna chips are designed to be tailored and optimized to meet the technical requirements of our customers in their respective end

markets without the traditional expense of developing bespoke chips each time. This is a significant differentiator from, and combined

with the over $243 million we have invested in research and development, creates significant barriers to entry for, our competitors. Our

communications systems are also capable of being tailored to our customers’ needs, while promoting efficiency through a common chip

set across the entire satellite communications value chain. In many cases, our close relationships with our customers in the design stage

and our deep engineering expertise, position us in a limited group of satellite communications system developers capable of providing

the necessary solutions to our customers. We believe these close working relationships, coupled with our proprietary technology and experience,

help our customers achieve higher throughput capacity and better integration of all key components of the satellite communications system,

while providing advantages in terms of lower weight and power consumption. We believe our solution enables overall lower systems costs

relative to our principal competitors. |

|

|

• |

Silicon Enabled SWaP-C. The use of silicon-based technologies in our satellite communications

chips and systems is key to achieving the industry’s goal of producing systems that are smaller in size and lower in weight, power

consumption and cost. |

|

|

• |

Higher Reliability, Lower Maintenance and Faster Installation. The use of silicon in our

antenna systems makes them more reliable than the mechanical antennas available in the market due to fewer moving parts, fewer failure

points and faster installation time of our antennas. We have designed our antenna systems to be easier to install and require less maintenance

than systems using mechanical elements with complex packaging. |

|

|

• |

End-to-End Capabilities Promoting Long-term Customer Relationships. We often cover the entire

life cycle of the systems we deliver to our customers, from defining specifications according to our customers’ requirements, to

designing or redesigning the chips, to oversight of the assembly of the final product and the subsequent delivery of custom-tailored products

to the customer. We believe that our participation in serving the entire life cycle of the customer’s satellite communications system

promotes long-term customer relationships, as once our tailor-made systems are integrated in a customer’s satellite constellation

or the ground communications infrastructure, the costs of switching to a different provider of satellite communications systems could

often be substantial. |

|

|

• |

Proven Management Team. Our founders and executive management team have extensive experience

in effectively guiding companies through various industry cycles and technology transitions. We have recently strengthened our leadership

with the joining of Mr. Nir Barkan as a Chief Executive Officer as of June 1, 2023 and the addition of Itzik Ben Bassat as our Chief Operating

Officer as of February 12, 2023. Mr. Nir brings extensive experience of leading high tech technologies and products companies, including

Curvalux, Orbit and Texas Instruments. Mr. Yoav Leibovitch, our Executive Chairman of the Board, has vast experience in leading the financial

strategizing and investor relations of public companies. Our management team provides us with steady, reliable leadership, uniquely capable

of identifying strong investments, executing through change, and maintaining stability during market uncertainty. |

|

|

• |

Strengthen our Technology Leadership. We believe that our success thus far is largely attributable

to our digital silicon chip design expertise. We aim to leverage our design expertise to continue developing high-performing chips and

systems that are smaller, lighter, have lower power consumption and a lower cost, while continuing to invest in research and development

to maintain our technology leadership in this market. |

|

|

• |

Capitalize on LEO and IFC Market Opportunities. The satellite communications market presents

significant opportunities for innovative solutions. The introduction of the new LEO satellite constellations creates the need for smaller

satellite communications systems that can handle higher speeds, larger capacity and operate with lower power consumption. Our modem and

antenna chips, as well as our satellite payload, user terminal and hub systems were developed to meet the new technological needs of the

LEO satellite constellations. New opportunities in the Aero/IFC market are emerging as the demand for “home-like” broadband

connectivity on commercial flights increases, creating the need for IFC systems that can deliver fast and reliable connectivity. By developing

our chips and systems to meet new market opportunities, we intend to expand the deployment of our next generation chips and systems.

|

|

|

• |

Leverage and Expand our Existing Customer Base. We intend to continue to develop long-term,

collaborative relationships with top tier customers who are regarded as leaders in their respective markets. We intend to continue to

focus on sales to these customers and build on our relationships with them to define and enhance our product roadmap and expand our scope

of business with them. Engaging with market leaders will also enable us to participate in emerging technology trends and new industry

standards. |

|

|

• |

Attract and Retain Top Talent. We are committed to recruiting and retaining talented professionals

with proven expertise in the design, development, marketing and sales of satellite communications chips and systems. We believe we have

assembled a high-quality global multinational team in all the areas of expertise required for a leading satellite communications company.

We believe that our ability to attract the best engineers is a critical component of our future growth and success. |

|

|

• |

Expand our Global Presence. We intend to continue strengthening our relationships with our

existing customers, while also planning for increased demand as our brand recognition grows. We intend to continue expanding our presence

worldwide as we grow in our market to serve the needs of clients in additional geographies and tap into talent pools from international

markets. |

|

|

• |

Vertical Integration- As part of our go-to-market strategy, we are working on vertical integration with leading market players. For

example, In August 2023, we announced a $60 million transaction with MDA Ltd. (“MDA”) (TSX: MDA), a leading provider of advanced

technology and services to the rapidly expanding global space industry. The MDA Agreement establishes cooperation between the companies

to utilize our digital payload chip-based technology to advanced digital satellite payloads, which the parties believe to be unparalleled

in today’s market, and is expected to open up our solutions to broader markets as well as new customers. The MDA Agreement is an

example of our strategy towards vertical integration for the space payload business. |

| D. |

Organizational Structure |

|

Year Ended December 31 |

||||||||

|

2023 |

2022 |

|||||||

|

(U.S.$ in thousands, except percentages) |

||||||||

|

Revenues |

$ |

10,730 |

$ |

10,626 |

||||

|

Gross profit |

$ |

4,792 |

$ |

6,128 |

||||

|

Gross margin |

45 |

% |

58 |

% | ||||

|

Net loss |

$ |

(29,715 |

) |

$ |

(397,789 |

)(*) | ||

| A. |

Results of Operations |

|

|

Year Ended

December 31, |

|||||||||||||||

|

|

2023

|

2022

|

Change

|

% |

||||||||||||

|

|

(U.S.$ in thousands,

except percentages) |

|||||||||||||||

|

Revenues:

|

||||||||||||||||

|

Development services and preproduction |

$ |

8,249 |

$ |

10,081 |

$ |

(1,832 |

) |

(18 |

)% | |||||||

|

Sale of products |

2,481 |

545 |

1,936 |

355 |

% | |||||||||||

|

Total revenues |

$ |

10,730 |

$ |

10,626 |

$ |

104 |

1 |

% | ||||||||

|

Cost of sales and

services: |

||||||||||||||||

|

Development services and preproduction |

4,930 |

4,166 |

764 |

18 |

% | |||||||||||

|

Sale of products |

1,008 |

332 |

676 |

204 |

% | |||||||||||

|

Total cost of sales and services |

5,938 |

4,498 |

1,440 |

32 |

% | |||||||||||

|

|

||||||||||||||||

|

Gross profit |

$ |

4,792 |

$ |

6,128 |

$ |

(1,336 |

) |

(22 |

)% | |||||||

|

Research and development expenses |

29,126 |

16,842 |

12,284 |

73 |

% | |||||||||||

|

Selling and marketing expenses |

2,866 |

2,335 |

531 |

23 |

% | |||||||||||

|

General and administrative expenses |

14,561 |

9,249 |

5,312 |

57 |

% | |||||||||||

|

Loss from operations |

$ |

(41,761 |

) |

$ |

(22,298 |

) |

$ |

19,463 |

87 |

% | ||||||

|

Finance Income |

83 |

17 |

66 |

388 |

% | |||||||||||

|

Finance Expenses |

(12,129 |

) |

(9,919 |

) |

2,210 |

22 |

% | |||||||||

|

Derivatives Revaluation |

(17,217 |

) |

(37,377 |

) |

(20,160 |

) |

(54 |

%) | ||||||||

|

Other Income |

41,657 |

5,474 |

36,183 |

661 |

% | |||||||||||

|

Listing Expenses |

- |

(333,326 |

) |

(333,326 |

) |

(100 |

)% | |||||||||

|

Share in the loss of a company accounted by equity

method, net |

(226 |

) |

(360 |

) |

(134 |

) |

(37 |

)% | ||||||||

|

|

||||||||||||||||

|

Loss before income taxes

|

$ |

(29,593 |

) |

$ |

(397,789 |

) |

$ |

(368,196 |

) |

(93 |

)% | |||||

|

Tax expenses |

(122 |

) |

- |

122 |

100 |

% | ||||||||||

|

Loss for the period (1) |

$ |

(29,715 |

) |

$ |

(397,789 |

) |

$ |

(368,074 |

) |

(93 |

)% | |||||

|

|

(1) |

Net loss for the year ended December 31, 2022 reflects the impact of a $333 million non-recurring, listing expense, of which $318

million was a non-cash expense due to the application of IFRS 2 (Share-based Payments) and a $37.4 million non-cash finance expense reflecting

the revaluation of a derivative contract relating to the transactions under the Forward Purchase Agreement. Neither of the aforementioned

non-cash expenses had any impact on our income tax expense or benefit for the year ended December 31, 2022 or on our deferred tax assets

or liabilities as of that date. See 25 to our consolidated financial statements included elsewhere in this Annual Report for more information.

|

| B. |

Liquidity and Capital Resources |

|

For the year ended December 31 (in thousands of USD) |

||||||||

|

2023

|

2022

|

|||||||

|

Cash Flow Data: |

||||||||

|

Net cash used in operating activities |

(24,635 |

) |

(31,480 |

) | ||||

|

Net cash used in investing activities |

17,341 |

(582 |

) | |||||

|

Net cash provided by financing activities |

9,114 |

40,523 |

||||||

|

Increase (decrease) in cash and cash equivalents

|

1,820 |

8,461 |

||||||

|

Cash and cash equivalents balance at the beginning

of the year |

11,934 |

3,854 |

||||||

|

Effect of changes in foreign exchange rates on cash

and cash equivalents |

225 |

(381 |

) | |||||

|

Cash and cash equivalents balance at the end of the

period |

13,979 |

11,934 |

||||||

| C. |

Research and Development, Patents and Licenses |

| D. |

Trend Information |

| E. |

Critical Accounting Policies and Estimates |

|

|

• |

the product is technically and commercially feasible; |

|

|

• |

we intend to complete the product so that it will be available for use or sale; |

|

|

• |

we have the ability to use or sell the product; |

|

|

• |

we have the technical, financial and other resources to complete the development and to use or sell the product; |

|

|

• |

we can demonstrate the probability that the product will generate future economic benefits; and |

|

|

• |

we are able to reliably measure the expenditure attributable to the product during its development. |

| A. |

Directors and Senior Management |

|

Name |

Age |

Position | ||

|

Yoav Leibovitch(8)

|

66 |

Executive Chairman of the Board of Directors | ||

|

Nir Barkan |

45 |

Acting Chief Executive Officer | ||

|

Oren Harari |

49 |

Interim Chief Financial Officer | ||

|

Doron Rainish |

68 |

Chief Technology Officer | ||

|

Divaydeep Sikri |

45 |

Vice President and Chief Engineer | ||

|

Stephane Zohar |

57 |

Executive Vice President — VLSI | ||

|

Itzik Ben Bassat |

55 |

Chief Operating Officer | ||

|

Mary P. Cotton((1)2)((3)(4)(

(7) |

66 |

Director | ||

|

Yair Shamir(6) |

78 |

Director | ||

|

David L. Willetts(7)

|

68 |

Director | ||

|

Richard C. Davis(8)

|

58 |

Director | ||

|

Moshe Eisenberg(1)(2)(3)(4)(5)

|

57 |

Director | ||

|

Yoram Stettiner(1)(2)((3)(4)(5)

|

66 |

Director |

|

Executive Officers |

| (1) |

Member of the Compensation Committee |

| (2) |

Member of the Audit Committee |

| (3) |

Independent Director (as defined under Israeli law) |

| (4) |

Independent Director (as defined under NYSE American LLC Company Guide Manual Section 803(A)(2), or NYSE American Section 803(A)(2))

|

| (5) |

External director, if required under the Companies law |

| (6) |

Class I directors hold office until the annual general

meeting to be held in 2026 and until their successors shall have been elected and qualified |

| (7) |

Class II directors hold office until the annual general

meeting to be held in 2024 and until their successors shall have been elected and qualified |

| (8) |

Class III directors hold office until the annual general

meeting to be held in 2025 and until their successors shall have been elected and qualified |

| B. |

Compensation |

|

Name and Position of

Director or Officer |

Base Salary or

Other Payment (1) |

Value of

Social Benefits (2) |

Bonuses |

Value of

Equity- Based Compensation

Granted (3) |

All Other

Compensation (4) |

Total |

||||||||||||||||||

|

Yoav Leibovitch |

1,200,000 |

0 |

1,000,000 |

38,309 |

0 |

2,238,309 |

||||||||||||||||||

|

Nir Barkan |

207,356 |

60,073 |

195,768 |

128,875 |

0 |

592,072 |

||||||||||||||||||

|

Oren Harari |

229,942 |

64,384 |

191,538 |

73,590 |

0 |

559,454 |

||||||||||||||||||

|

Itzik Ben Bassat |

220,223 |

61,663 |

110,284 |

279,516 |

0 |

671,686 |

||||||||||||||||||

|

Simona Gat (5) |

605,000 |

0 |

38,309 |

38,309 |

0 |

643,309 |

||||||||||||||||||

|

|

(1) |

“Base Salary or Other Payment” means the aggregate yearly gross monthly salaries or other payments with respect to the

Company’s executive officers and members of the board of directors for the year 2023. |

|

|

(2) |

“Social Benefits” include benefits and perquisites, including those mandated by applicable law. Such benefits and perquisites

may include, to the extent applicable to the relevant officers, payments, contributions and/or allocations for savings funds (e.g., Managers’

Life Insurance Policy), education funds (referred to in Hebrew as "keren hishtalmut"), pension, severance, vacation, car or car allowance,

rent for relocated officers, medical insurances and benefits, risk insurance (e.g., life, disability, accident), telephone, convalescence

pay, payments for social security, tax gross-up payments and other benefits and perquisites. |

|

|

(3) |

Represents the equity-based compensation expenses recorded in the Company's consolidated financial statements for the year ended

December 31, 2023, calculated in accordance with accounting guidance for equity-based compensation. For a discussion on the assumptions

used in reaching this valuation, see Note 18 to our consolidated financial statements included elsewhere in this Annual Report.

|

|

|

(4) |

“All Other Compensation” includes, among other things, car-related expenses (including tax gross-up), communication expenses,

basic health insurance, and holiday presents. |

|

|

(5) |

Ms. Gat resigned from her positions as President of SatixFy, the CEO and a director of Satixfy UK Limited, and a director of Satixfy

Bulgaria effective April 30, 3023. |

|

|

• |

information on the business advisability of a given action brought for the office holder’s approval or performed by virtue

of the office holder’s position; and |

|

|

• |

all other important information pertaining to such action. |

|

|

• |

refrain from any act involving a conflict of interest between the performance of the office holder’s duties in the company

and the office holder’s other duties or personal affairs; |

|

|

• |

refrain from any activity that is competitive with the business of the company; |

|

|

• |

refrain from exploiting any business opportunity of the company for the purpose of gaining a personal advantage for the office holder

or others; and |

|

|

• |

disclose to the company any information or documents relating to the company’s affairs which the office holder received as

a result of the office holder’s position. |

|

|

• |

an amendment to the company’s articles of association; |

|

|

• |

an increase of the company’s authorized share capital; |

|

|

• |

a merger; or |

|

|

• |

interested party transactions that require shareholder approval. |

| C. |

Board Practices |

|

|

• |

such majority includes at least a majority of the shares held by all shareholders who are not controlling shareholders and do not

have a personal interest in the election of the external director (other than a personal interest not deriving from a relationship with

a controlling shareholder) that are voted at the meeting, excluding abstentions, to which we refer as a disinterested majority; or

|

|

|

• |

the total number of shares voted by non-controlling shareholders and by shareholders who do not have a personal interest in the election

of the external director against the election of the external director does not exceed 2% of the aggregate voting rights in the company.

|

|

|

• |

his or her service for each such additional term is recommended by one or more shareholders holding at least 1% of the company’s

voting rights and is approved at a shareholders meeting by a disinterested majority, where the total number of shares held by non-controlling,

disinterested shareholders voting for such re-election exceeds 2% of the aggregate voting rights in the company, subject to additional

restrictions set forth in the Israeli Companies Law with respect to affiliations of external director nominees; |

|

|

• |

the external director proposed his or her own nomination, and such nomination was approved in accordance with the requirements described

in the paragraph above; or |

|

|

• |

his or her service for each such additional term is recommended by the board of directors and is approved at a meeting of shareholders

by the same majority required for the initial election of an external director (as described above). |

|

|

• |

an employment relationship; |

|

|

• |

a business or professional relationship even if not maintained on a regular basis (excluding insignificant relationships);

|

|

|

• |

control; and |

|

|

• |

service as an office holder, excluding service as a director in a private company prior to the initial public offering of its shares

if such director was appointed as a director of the private company in order to serve as an external director following the initial public

offering. |

|

|

• |

at least a majority of the shares of non-controlling shareholders or shareholders that do not have a personal interest in the approval

voted at the meeting are voted in favor (disregarding abstentions); or |

|

|

• |

the total number of shares of non-controlling shareholders and shareholders who do not have a personal interest in such appointment

voting against such appointment does not exceed 2% of the aggregate voting rights in the company. |

|

|

• |

he or she meets the qualifications for being appointed as an external director, except for the requirement (i) that the director

be an Israeli resident (which does not apply to companies such as ours whose securities have been offered outside of Israel or are listed

for trading outside of Israel) and (ii) for accounting and financial expertise or professional qualifications; and |

|

|

• |

he or she has not served as a director of the company for a period exceeding nine consecutive years. For this purpose, a break of

less than two years in his or her service as a director shall not be deemed to interrupt the continuity of the service. A majority of

our audit committee (each, as identified in the second paragraph under “— Listing Requirements”

below) are external directors under the Israeli Companies Law, thereby fulfilling the foregoing Israeli law requirement for the composition

of the audit committee. |

|

|

• |

retaining and terminating our independent auditors, subject to ratification by the board of directors and by the shareholders;

|

|

|

• |

pre-approving audit and non-audit services to be provided by the independent auditors and related fees and terms; |

|

|

• |

overseeing the accounting and financial reporting processes of our company; |

|

|

• |

managing audits of our financial statements; |

|

|

• |

preparing all reports as may be required of an audit committee under the rules and regulations promulgated under the Exchange Act;

|

|

|

• |

reviewing with management and our independent auditor our annual and quarterly financial statements prior to publication, filing,

or submission to the SEC; |

|

|

• |

recommending to the board of directors the retention and termination of the internal auditor, and the internal auditor’s engagement

fees and terms, in accordance with the Israeli Companies Law as well as approving the yearly or periodic work plan proposed by the internal

auditor; |

|

|

• |

reviewing with counsel, as deemed necessary, legal and regulatory matters that may have a material impact on the financial statements;

|

|

|

• |

identifying irregularities in our business administration, including by consulting with the internal auditor (if any) or with the

independent auditor, and suggesting corrective measures to the board of directors; |

|

|

• |

reviewing policies and procedures with respect to transactions (other than transactions related to the compensation or terms of services)

between the company and officers and directors, or affiliates of officers or directors, or transactions that are not in the ordinary course

of the Company’s business and deciding whether to approve such acts and transactions if so required under the Israeli Companies

Law; and |

|

|

• |

establishing procedures for the handling of employees’ complaints as to the management of our business and the protection to

be provided to such employees. |

|

|

• |

recommending to the board of directors with respect to the approval of the compensation policy for “office holders” (a

term used under the Israeli Companies Law, which essentially means directors and executive officers) and, once every three years, regarding

any extensions to a compensation policy that has been in effect for a period of more than three years; |

|

|

• |

reviewing the implementation of the compensation policy and periodically recommending to the board of directors with respect to any

amendments or updates of the compensation plan; |

|

|

• |

resolving whether or not to approve arrangements with respect to the terms of office and employment of office holders; and

|

|

|

• |

exempting, under certain circumstances, from the requirement of approval by the general meeting of shareholders, transactions with

a candidate to serve as the chief executive officer of SatixFy. |

|

|

• |

recommending to our board for its approval a compensation policy in accordance with the requirements of the Israeli Companies Law

as well as other compensation policies, incentive- based compensation plans and equity-based compensation plans, and overseeing the development

and implementation of such policies and recommending to our board of directors any amendments or modifications the committee deems appropriate,

including as required under the Israeli Companies Law; |

|

|

• |

reviewing and approving the granting of options and other incentive awards to our Chief Executive Officer and other executive officers,

including reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other

executive officers, including evaluating their performance in light of such goals and objectives; |

|

|

• |

approving and exempting certain transactions regarding office holders’ compensation pursuant to the Israeli Companies Law

|

|

|

• |

administer our clawback policy; and |

|

|

• |

administering our equity-based compensation plans, including without limitation, approving the adoption of such plans, amending and

interpreting such plans and the awards and agreements issued pursuant thereto, and making awards to eligible persons under the plans and

determining the terms of such awards. |

|

|

• |

such majority includes at least a majority of the shares held by shareholders who are not controlling shareholders and do not have

a personal interest in such compensation policy and who are present and voting (excluding abstentions); or |

|

|

• |

the total number of shares of non-controlling shareholders and shareholders who do not have a personal interest in the compensation

policy and who vote against the policy, does not exceed 2% of the company’s aggregate voting rights. |

|

|

• |

the education, skills, experience, expertise and accomplishments of the relevant office holder; |

|

|

• |

the office holder’s position, responsibilities and prior compensation agreements with him or her; |

|

|

• |

the ratio between the cost of the terms of employment of an office holder and the cost of the employment of other employees of the

company, including employees employed through contractors who provide services to the company, in particular the ratio between such cost,

the average and median salary of the employees of the company, as well as the impact of such disparities on the work relationships in

the company; |

|

|

• |

if the terms of employment include variable components — the possibility of reducing variable components at the discretion

of the board of directors and the possibility of setting a limit on the value of non-cash variable equity-based components; and

|

|

|

• |

if the terms of employment include severance compensation — the term of employment or office of the office holder, the terms

of his or her compensation during such period, the company’s performance during such period, his or her individual contribution

to the achievement of the company goals and the maximization of its profits and the circumstances under which he or she is leaving the

company. |

|

|

• |

with regard to variable components of compensation: |

|

|

• |

with the exception of office holders who report directly to the chief executive officer, provisions determining the variable components

on the basis of long-term performance and on measurable criteria; however, the company may determine that an immaterial part of the variable

components of the compensation package of an office holder shall be awarded based on non-measurable criteria, if such amount is not higher

than three monthly salaries per annum, while taking into account such office holder’s contribution to the company; and |

|

|

• |

the ratio between variable and fixed components, as well as the limit on the values of variable components at the time of their grant.

|

|

|

• |

a condition under which the office holder will return to the company, according to conditions to be set forth in the compensation

policy, any amounts paid as part of his or her terms of employment, if such amounts were paid based on information later to be discovered

to be wrong, and such information was restated in the company’s financial statements; |

|

|

• |

the minimum holding or vesting period of variable equity-based components to be set in the terms of office or employment, as applicable,

while taking into consideration long-term incentives; and |

|

|

• |

a limit on retirement grants. |

|

|

• |

at least a majority of the shares of non-controlling shareholders or shareholders that do not have a personal interest in the approval

voted at the meeting are voted in favor (disregarding abstentions); or |

|

|

• |

the total number of shares of non-controlling shareholders and shareholders who do not have a personal interest in such appointment

voting against the inconsistent provisions of the compensation package does not exceed 2% of the aggregate voting rights in the company.

|

| D. |

Employees |

| E. |

Share Ownership |

| F. |

Disclosure of a Registrant’s Action to Recover Erroneously Awarded Compensation. |

| A. |

Major Shareholders |

|

|

• |

each person who is the beneficial owner of more than 5% of the outstanding shares of any series of our voting ordinary shares;

|

|

|

• |

each of our then-current executive officers and directors;

and |

|

|

• |

all executive officers and directors of the Company,

as a group. |

|

Number of

Shares Beneficially

Owned |

Percentage of

Outstanding

Shares |

|||||||

|

5% Holders (other than executive officers and directors):

|

||||||||

|

Endurance Antarctica Partners, LLC(1) |

9,438,942 |

10.8 |

% | |||||

|

FP Credit Partners II, L.P. |

5,936,409 |

7.1 |

% | |||||

|

Simona Gat(2)(3) |

17,590,279 |

20.7 |

% | |||||

|

Executive Officers and Directors(4) |

||||||||

|

Oren Harari |

139,275 |

* |

||||||

|

Nir Barkan |

367,442 |

* |

||||||

|

Itzik Ben Bassat |

125,000 |

* |

||||||

|

Mary P. Cotton |

— |

— |

||||||

|

Richard C. Davis(1) |

— |

— |

||||||

|

Moshe Eisenberg. |

— |

— |

||||||

|

Doron Rainish(5) |

1,224,098 |

1.5 |

% | |||||

|

Yair Shamir (6) |

— |

— |

||||||

|

Yoram Stettiner |

— |

— |

||||||

|

David L. Willetts(7) |

39,600 |

* |

||||||

|

Yoav Leibovitch(9) |

23,307,330 |

27.4 |

% | |||||

|

Divaydeep Sikry(10) |

108,016 |

* |

||||||

|

Stephane Zohar(11) |

143,069 |

* |

||||||

|

All Executive Officers and Directors as a Group |

43,044,109 |

49.3 |

% | |||||

|

* Less than 1%. |

||||||||

| (1) |

Consists of 5,673,846 SatixFy Ordinary Shares, including 500,000 Price Adjustment Shares, and 3,765,096 SatixFy Ordinary Shares underlying

the SatixFy Warrants. Richard C. Davis shares voting and investment control over shares held by the Sponsor by virtue of his shared control

of the Sponsor. By virtue of this relationship, Richard C. Davis may be deemed to share beneficial ownership of the securities held of

record of the Sponsor. Richard C. Davis has disclaimed beneficial ownership of the shares, except to the extent of his pecuniary interest

therein, if any. The business address for Endurance Antarctica Partners, LLC is 200 Park Avenue, 32nd Floor New York, NY 10166.

|

| (2) |

Ms. Gat resigned from her positions as President of SatixFy, the CEO and a director of Satixfy UK Limited, and a director of Satixfy

Bulgaria, effective April 30, 2023. |

| (3) |

Consists of 16,186,297 SatixFy Ordinary Shares held directly.

Ms. Simona Gat is one of SatixFy’s founders. Ms. Simona Gat’s holdings include 9,000,000 Price Adjustment Shares, and 1,403,981

SatixFy Ordinary Shares underlying options to acquire SatixFy Ordinary Shares exercisable within 60 days of March 28, 2024 |

| (4) |

The business address for each of the directors and officers of SatixFy is 2 Hamada St., Rehovot 670315, Israel. |

| (5) |

Consists of 1,153,679 SatixFy Ordinary Shares held directly and

179,513 SatixFy Ordinary Shares underlying options to acquire SatixFy Ordinary Shares exercisable within 60 days of March 28, 2024. And

10,586 vested RSUs. |

| (6) |

Mr. Yair Shamir is a director of CEL Catalyst Communications Limited and has the power to direct it to vote and dispose of the shares

and has shared voting and investment power over the shares. Mr. Yair Shamir disclaims any beneficial ownership of any shares owned by

CEL Catalyst Communications Limited other than to the extent of any pecuniary interest he may have therein, directly or indirectly.

|

| (7) |

Consists of 39,600 SatixFy Ordinary Shares underlying options to acquire SatixFy Ordinary Shares

exercisable within 60 days of March 28, 2024. |

| (8) |

Consists of 21,903,349 SatixFy Ordinary Shares held directly. Mr. Yoav Leibovitch is one of SatixFy’s

founders. Mr. Yoav Leibovitch’s holdings include 18,000,000 Price Adjustment Shares and 1,403,981 SatixFy Ordinary Shares underlying

options to acquire SatixFy Ordinary Shares exercisable within 60 days of March 28, 2024 |

| (9) |

Consists of 53,328 SatixFy Ordinary Shares underlying options to acquire SatixFy Ordinary Shares exercisable

within 60 days of March 28, 2024. And 54,688 vested RSUs |

| (10) |

Consists of 64,944 SatixFy Ordinary Shares underlying options to acquire SatixFy Ordinary Shares exercisable

within 60 days of March 28, 2024.and 54,688 vested RSUs |

|

|

B. |

Related Party Transactions |

| C. |

Interests of Experts and Counsel |

| A. |

Financial Statements and Other Financial Information |

| B. |

Significant Changes |

| A. |

Offer and Listing Details |

| B. |

Plan of Distribution |

| C. |

Markets |

| D. |

Selling Shareholders |

| E. |

Dilution |

| F. |

Expenses of the Issue |

| A. |

Share Capital |

| B. |

Memorandum and Articles of Association |

| C. |

Material Contracts |

| D. |

Exchange Controls |

| E. |

Taxation |

|

|

• |

Amortization of the cost of purchased patent, rights to use a patent, and know-how, which were purchased in good faith and are used

for the development or advancement of the Industrial Enterprise, over an eight-year period, commencing on the year in which such rights

were first exercised; |

|

|

• |

Under limited conditions, an election to file consolidated tax returns with controlled Israeli Industrial Companies; |

|

|

• |

Expenses related to a public offering are deductible in equal amounts over three years commencing on the year of the offering.

|

|

|

• |

The research and development expenditures are approved by the relevant Israeli government ministry, determined by the field of research;

|

|

|

• |

The research and development must be for the promotion of the company; and |

|

|

• |

The research and development is carried out by or on behalf of the company seeking such tax deduction. |

|

|

• |