Important Disclosure This presentation is intended to provide general

information only and is not, and should not be considered, as an offer to purchase or sell the Company’s securities, or a proposal to receive such offers. In addition, this presentation is not an offer to the public of the Company’s

securities. By attending or viewing this presentation, each attendee (“Attendee”) agrees that he or she (i) has read this disclaimer, (ii) is bound by the restrictions set out herein, (iii) is permitted, in accordance with all applicable

laws, to receive such information, (iv) is solely responsible for his or her own assessment of the business and financial position of the Company and (v) will conduct his or her own analysis and be solely responsible for forming the

Attendee's view of the potential future performance of the Company’s business. The information in this presentation is provided for convenience only. It does not contain comprehensive information, but merely summary information in a

condensed form. This presentation does not and is not intended to replace a careful inspection of the Company's Financial Statements and other public filings, as reported or will be reported to the Israeli Securities Authority and the

Securities and Exchange Commission (the "Company's Reports"). In case of any inconsistencies between the information provided in this presentation and the Company's Reports, the latter will prevail. The information in this presentation is

not a basis and should not be used as a basis for making any decisions in relation to the Company, including any decision to purchase securities of the Company. Any such decision should be based on the Company's Reports and following the

receipt of appropriate professional advice. The information provided in this presentation is not, and should not be considered to be, a recommendation or an opinion of any kind in relation to an investment in the Company, whether legal,

financial, tax, economic or otherwise. This presentation does not replace the need for a potential investor to collect and analyze further independent information for their due consideration. Every potential investor must obtain their own

independent advice and guidance, in connection with a potential investment in the Company, including tax advice which takes into account the investor’s own tax position. This presentation includes projections, guidance, forecasts,

estimates, assessments and other information pertaining to future events and/or matters, whose materialization is uncertain and is beyond the Company’s control, and which constitute forward looking statements (within the meaning of

Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Israeli Securities Law, 5728-1968). Many of the forward-looking statements contained in this presentation can

be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others. Forward-looking statements include, but are not limited

to, expectations and evaluations relating to the Company’s business targets and strategy, the success of trials and the integration of the Company’s technology in various systems and industries, the advantages of the Company’s existing

and future products, timetables regarding completion of the Company’s developments and the expected commencement of production, sales and distribution of the Company’s products and technology, the Company’s intentions in relation to

various industries, the Company’s intentions in relation to the creation of collaborations and engagements in licensing agreements, production and distribution in various countries, and other statements regarding our intent, belief or

current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results

may differ materially from those expressed or implied in the forward-looking statements due to of various factors, including, but not limited to: our expectations regarding general market conditions, including as a result of the COVID-19

pandemic and other global economic trends; changes in consumer tastes and preferences; fluctuations in inflation, interest rate and exchange rates in the global economic environment over the world; the availability of qualified personnel

and the ability to retain such personnel; changes in commodity costs, labor, distribution and other operating costs; our ability to implement our growth strategy; changes in government regulation and tax matters; other factors that may

affect our financial condition, liquidity and results of operations; general economic, political, demographic and business conditions in Israel, including ongoing military conflicts in the region; the success of operating initiatives,

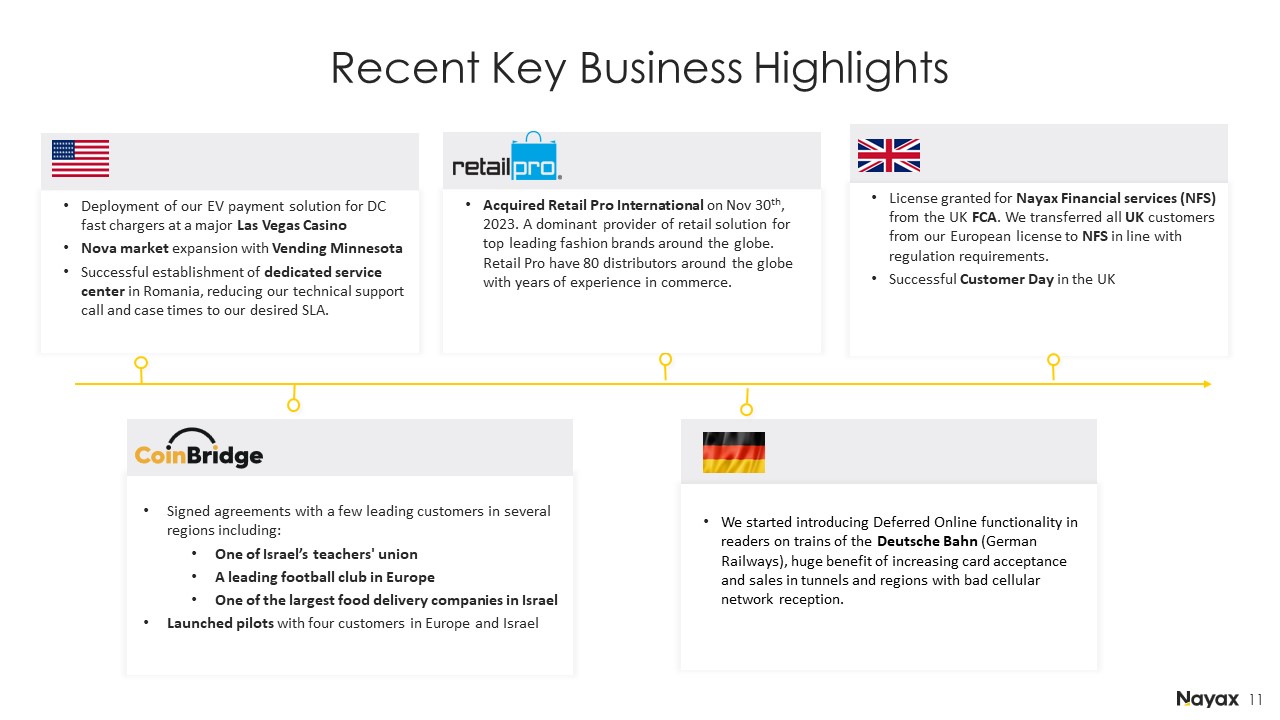

including advertising and promotional efforts and new product and concept development by us and our competitors; factors relating to the acquisition of Retail Pro International, including but not limited to the financing for and payment

of the acquisition and our ability to effectively and efficiently integrate the acquired business into our existing business; and other risk factors discussed under “Risk Factors” in our annual report on Form 20-F filed with the SEC on

February 28, 2024 (our “Annual Report"). The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. These statements are only estimates based upon our current expectations and projections about

future events. There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by

the forward-looking statements. In particular, you should consider the risks provided under “Risk Factors” in our Annual Report. You should not rely upon forward-looking statements as predictions of future events. Although we believe that

the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be

achieved or will occur. Each forward-looking statement speaks only as of the date of the particular statement. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason, to

conform these statements to actual results or to changes in our expectations. In addition, the presentation includes data published by various bodies, and data provided to the Company in the framework of cooperation engagements,

concerning the industry, competitive position and the markets in which the Company operates, whose content was not independently verified by the Company, such that the Company is not responsible for the accuracy or completeness of such

date or whether the data is up-to-date, and Company takes no responsibility for any reliance on the data. Management estimates contained in this presentation are derived from publicly available information released by independent

industry analysts and other third-party sources, as well as data from the Company's internal research, and are based on assumptions made by the Company upon reviewing such data, and the Company's experience in, and knowledge of, such

industry and markets, which the Company believes to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which the Company operates and the Company's future performance are

necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties

and by the Company. Industry publications, research, surveys and studies generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information

is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this presentation. In addition to various

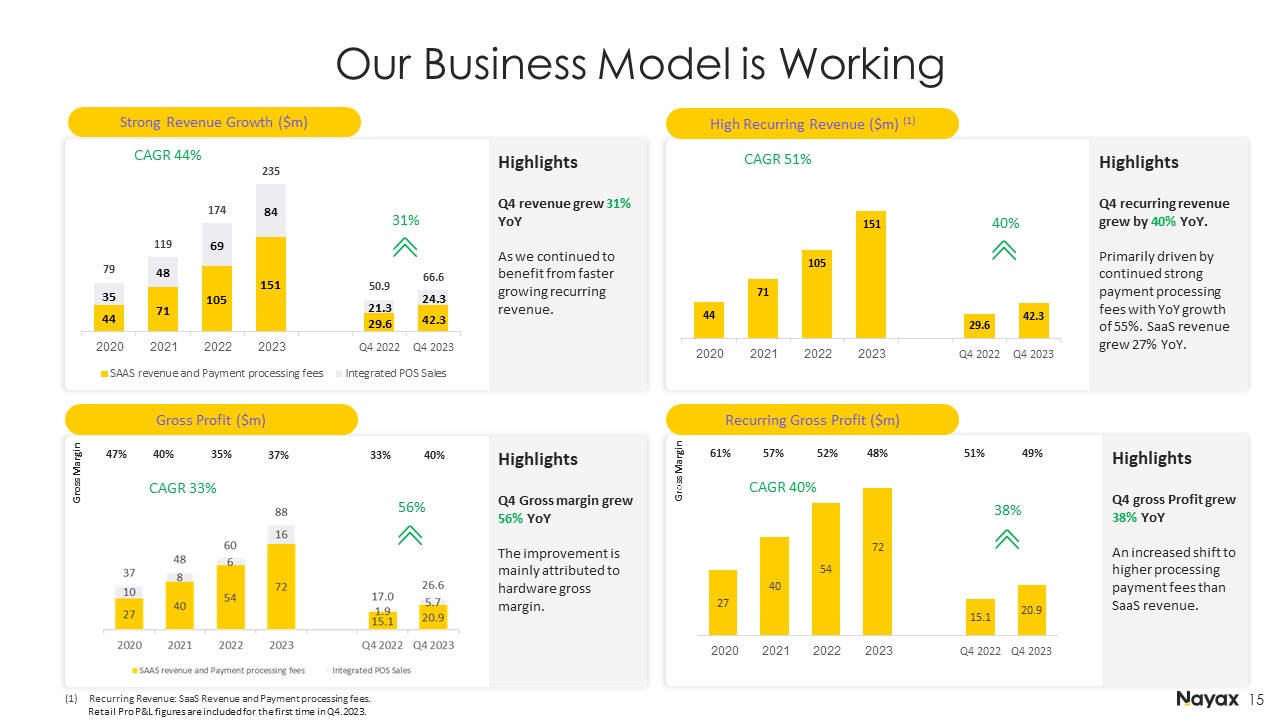

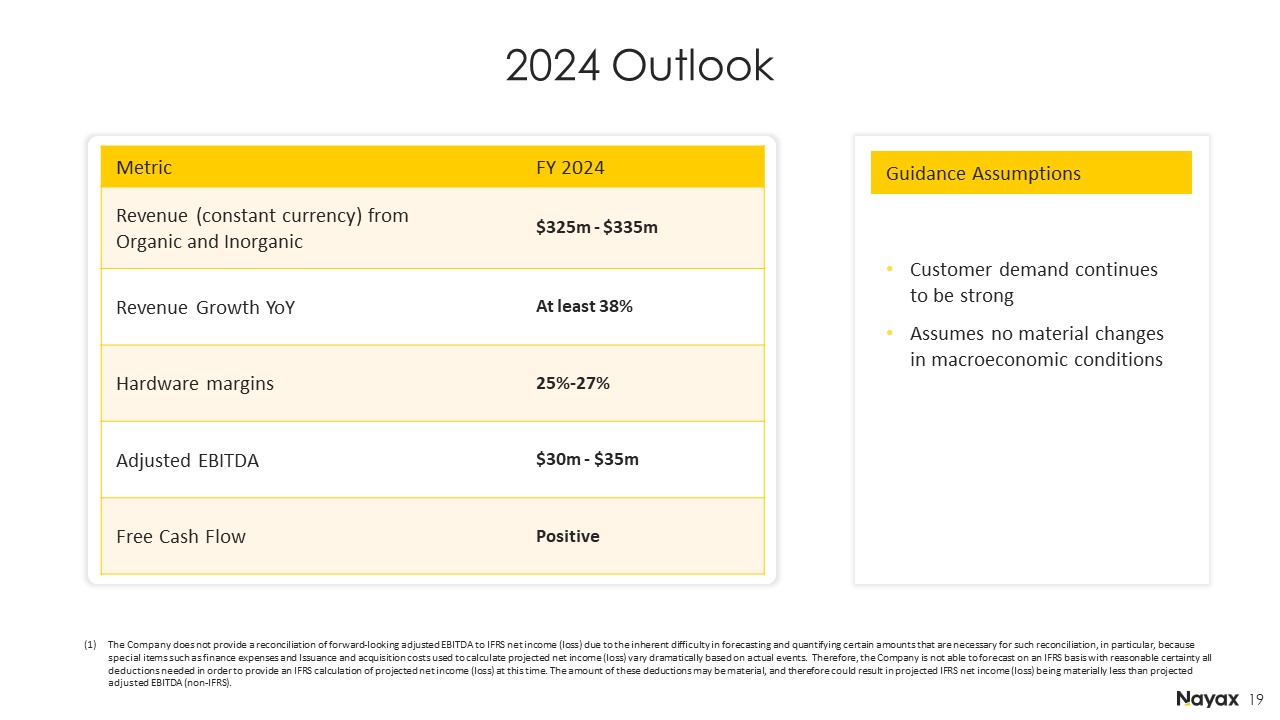

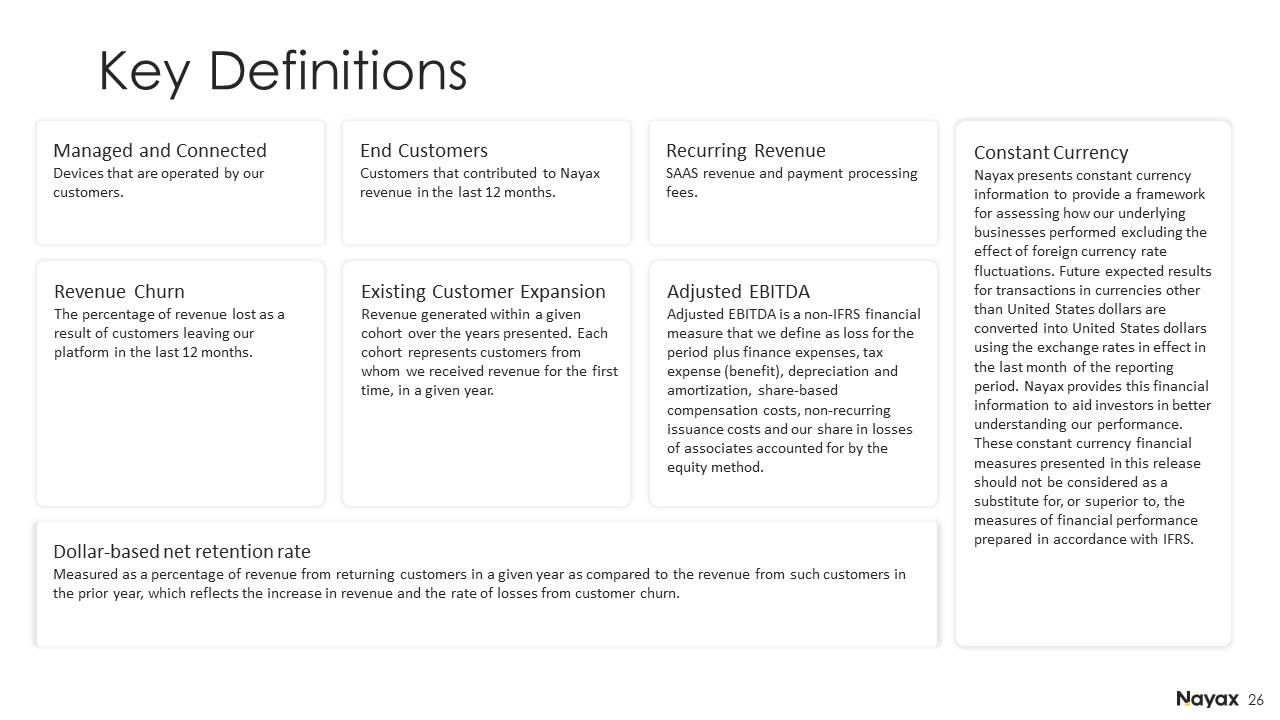

operational metrics and financial measures in accordance with accounting principles generally accepted under International Financial Reporting Standards, or IFRS, this presentation contains Adjusted EBITDA, a non-IFRS financial measure,

as a measure to evaluate our past results and future prospects. Please refer to the Appendix for a definition of Adjusted EBITDA and for a reconciliation of Adjusted EBITDA to net income (loss). The Company does not provide a

reconciliation of forward-looking Adjusted EBITDA to IFRS net income (loss), due to the inherent difficulty in forecasting, and quantifying certain amounts that are necessary for such reconciliation, in particular, because special items

such as, finance expenses and Issuance and acquisition costs, used to calculate projected net income (loss) vary dramatically based on actual events. Therefore, the Company is not able to forecast on an IFRS basis with reasonable

certainty all deductions needed in order to provide an IFRS calculation of projected net income (loss) at this time. The amount of these deductions may be material, and therefore could result in projected IFRS net income (loss) being

materially less than projected Adjusted EBITDA (non-IFRS). The Company does not confirm or undertake that the information appearing in this presentation is complete or accurate. The Company, its employees, officers and its shareholders

will not be responsible for damages and/or losses which may arise as a result of the use of the information contained in this presentation. The Company is not responsible for any changes to the economic, financial or legal situation

relating to the Company and its business. The Company does not undertake to update and/or change forecasts and/or evaluations included in the presentation in order that they will reflect events and/or circumstances which apply after the

date of the presentation’s preparations. No persons have been authorized to make any representations regarding the information contained in this presentation, and if given or made, such representations should not be considered as

authorized. The content of this presentation does not bind the Company or its managers and they have the right to change any item described in the presentation relating to the Company, at their sole discretion. The Company and its

licensors have proprietary rights to trademarks used in this Presentation. Solely for convenience, trademarks and trade names referred to in this Presentation may appear without the “®” or “™” symbols, but the lack of such references is

not intended to indicate, in any way, that the Company will not assert, to the fullest extent possible under applicable law, its rights or the rights of the applicable licensor to these trademarks and trade names. This Presentation also

contains trademarks, trade names and service marks of other companies, which are the property of their respective owners and are used for reference purposes only. Such use of other parties’ trademarks, trade names or service marks should

not be construed to imply, a relationship with, or an endorsement or sponsorship of the Company by any other party.