Document

ALAMOS GOLD INC.

Management’s Discussion and Analysis

(in United States dollars, unless otherwise stated)

For the Three Months ended March 31, 2024

ALAMOS GOLD INC.

For the Three months ended March 31, 2024

Table of Contents

|

|

|

|

|

|

Overview of the Business |

|

Highlight Summary |

|

First Quarter 2024 Highlights |

|

Environment, Social and Governance Summary Performance |

|

Business Developments |

|

|

|

Outlook and Strategy |

|

Young-Davidson Mine ("Young-Davidson") |

|

Island Gold Mine ("Island Gold") |

|

Mulatos Mine ("Mulatos") |

|

First Quarter 2024 Development Activities |

|

First Quarter 2024 Exploration Activities |

|

Key External Performance Drivers |

|

Summarized Financial and Operating Results |

|

Review of First Quarter Financial Results |

|

|

|

Consolidated Expenses and Other |

|

Consolidated Income Tax Expense |

|

Financial Condition |

|

Liquidity and Capital Resources |

|

Outstanding Share Data |

|

Related Party Transactions |

|

Off-Balance Sheet Arrangements |

|

Financial Instruments |

|

Summary of Quarterly Financial and Operating Results |

|

Non-GAAP Measures and Additional GAAP Measures |

|

Accounting Estimates, Policies and Changes |

|

Internal Control over Financial Reporting |

|

Changes in Internal Control over Financial Reporting |

|

Disclosure Controls |

|

Limitations of Controls and Procedures |

|

|

|

Cautionary Note to United States Investors |

|

Cautionary Note Regarding Forward-Looking Statements |

|

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

This Management’s Discussion and Analysis (“MD&A”), dated April 24, 2024, relates to the financial condition and results of the consolidated operations of Alamos Gold Inc. (“Alamos” or the “Company”), and should be read in conjunction with the Company’s consolidated financial statements for the years ended December 31, 2023 and unaudited condensed consolidated interim financial statements for the three months ended March 31, 2024 and notes thereto. The financial statements have been prepared in accordance with the IAS 34, Interim Financial Reporting ("IAS 34") as issued by the International Accounting Standards Board (“IFRS” or “GAAP”). All results are presented in United States dollars (“US dollars” or “$”), unless otherwise stated.

Statements are subject to the risks and uncertainties identified in the Cautionary Note Regarding Forward-Looking Statements section of this document. United States investors are also advised to refer to the section entitled Cautionary Note to United States Investors on page 35.

Overview of the Business

Alamos is a Canadian-based intermediate gold producer with diversified North American production from the Young-Davidson and Island Gold mines in Northern Ontario, Canada and the Mulatos District in Sonora State, Mexico. In addition, Alamos has a strong portfolio of growth projects, including the Phase 3+ Expansion at Island Gold, and the Lynn Lake project in Manitoba, Canada. Alamos employs more than 1,900 people and is committed to the highest standards of sustainable development and ethical business practices.

The Company’s common shares are listed on the Toronto Stock Exchange (TSX: AGI) and the New York Stock Exchange (NYSE: AGI). Further information about Alamos can be found in the Company’s regulatory filings, including the Company's Annual Information Form, available on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov, and on the Company’s website at www.alamosgold.com.

3

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Highlight Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

| Financial Results (in millions) |

|

|

|

|

| Operating revenues |

|

|

$277.6 |

|

$251.5 |

|

Cost of sales (1) |

|

|

$173.6 |

|

$155.2 |

|

| Earnings from operations |

|

|

$81.4 |

|

$75.0 |

|

| Earnings before income taxes |

|

|

$75.6 |

|

$72.2 |

|

| Net earnings |

|

|

$42.1 |

|

$48.4 |

|

Adjusted net earnings (2) |

|

|

$51.2 |

|

$45.4 |

|

|

Earnings before interest, taxes, depreciation and

amortization (2)

|

|

|

$125.7 |

|

$119.9 |

|

Cash provided by operations before working capital and taxes paid (2) |

|

|

$134.9 |

|

$127.2 |

|

| Cash provided by operating activities |

|

|

$108.9 |

|

$94.3 |

|

Capital expenditures (sustaining) (2) |

|

|

$26.5 |

|

$26.9 |

|

Capital expenditures (growth) (2) |

|

|

$51.6 |

|

$52.0 |

|

| Capital expenditures (capitalized exploration) |

|

|

$6.4 |

|

$4.9 |

|

Free cash flow (2) |

|

|

$24.4 |

|

$10.5 |

|

| Operating Results |

|

|

|

|

| Gold production (ounces) |

|

|

135,700 |

|

128,400 |

|

|

|

|

|

|

| Gold sales (ounces) |

|

|

132,849 |

|

132,668 |

|

|

|

|

|

|

| Per Ounce Data |

|

|

|

|

| Average realized gold price |

|

|

$2,069 |

|

$1,896 |

|

| Average spot gold price (London PM Fix) |

|

|

$2,070 |

|

$1,890 |

|

|

Cost of sales per ounce of gold sold

(includes amortization) (1)

|

|

|

$1,307 |

|

$1,170 |

|

Total cash costs per ounce of gold sold (2) |

|

|

$910 |

|

$821 |

|

All-in sustaining costs per ounce of gold sold (2) |

|

|

$1,265 |

|

$1,176 |

|

| Share Data |

|

|

|

|

| Earnings per share, basic and diluted |

|

|

$0.11 |

|

$0.12 |

|

Adjusted earnings per share, basic (2) |

|

|

$0.13 |

|

$0.12 |

|

|

|

|

|

|

| Weighted average common shares outstanding (basic) (000’s) |

|

|

396,817 |

|

393,960 |

|

|

|

|

|

|

| Financial Position (in millions) |

|

|

|

|

| Cash and cash equivalents |

|

|

$240.2 |

|

$224.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Cost of sales includes mining and processing costs, royalties, and amortization expense.

(2)Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this MD&A for a description and calculation of these measures.

4

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

| Gold production (ounces) |

|

|

|

|

| Young-Davidson |

|

|

40,100 |

|

45,000 |

|

| Island Gold |

|

|

33,400 |

|

32,900 |

|

|

|

|

|

|

|

|

|

|

|

Mulatos District (7) |

|

|

62,200 |

|

50,500 |

|

| Gold sales (ounces) |

|

|

|

|

| Young-Davidson |

|

|

39,810 |

|

45,676 |

|

| Island Gold |

|

|

34,130 |

|

33,727 |

|

|

|

|

|

|

|

|

|

|

|

| Mulatos District |

|

|

58,909 |

|

53,265 |

|

Cost of sales (in millions) (1) |

|

|

|

|

| Young-Davidson |

|

|

$65.4 |

|

$61.9 |

|

| Island Gold |

|

|

$33.4 |

|

$30.9 |

|

|

|

|

|

|

|

|

|

|

|

| Mulatos District |

|

|

$74.8 |

|

$62.4 |

|

Cost of sales per ounce of gold sold (includes amortization) (1) |

|

|

|

| Young-Davidson |

|

|

$1,643 |

|

$1,355 |

|

| Island Gold |

|

|

$979 |

|

$916 |

|

|

|

|

|

|

|

|

|

|

|

| Mulatos District |

|

|

$1,270 |

|

$1,172 |

|

Total cash costs per ounce of gold sold (2) |

|

|

|

| Young-Davidson |

|

|

$1,188 |

|

$941 |

|

| Island Gold |

|

|

$706 |

|

$629 |

|

|

|

|

|

|

|

|

|

|

|

| Mulatos District |

|

|

$840 |

|

$839 |

|

Mine-site all-in sustaining costs per ounce of gold sold (2),(3) |

|

|

|

| Young-Davidson |

|

|

$1,482 |

|

$1,233 |

|

| Island Gold |

|

|

$1,105 |

|

$970 |

|

| Mulatos District |

|

|

$905 |

|

$914 |

|

|

|

|

|

|

Capital expenditures (sustaining, growth, and capitalized exploration) (in millions) (2) |

|

Young-Davidson (4) |

|

|

$20.2 |

|

$17.4 |

|

Island Gold (5) |

|

|

$54.6 |

|

$57.0 |

|

Mulatos District (6) |

|

|

$3.9 |

|

$5.7 |

|

| Other |

|

|

$5.8 |

|

$3.7 |

|

(1)Cost of sales includes mining and processing costs, royalties, and amortization expense.

(2)Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this MD&A for a description and calculation of these measures.

(3)For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(4)Includes capitalized exploration at Young-Davidson of $1.0 million for the three months ended March 31, 2024 ($1.4 million for the three months ended March 31, 2023).

(5)Includes capitalized exploration at Island Gold of $3.5 million for the three months ended March 31, 2024 ($2.4 million for the three months ended March 31, 2023).

(6)Includes capitalized exploration at Mulatos District of $1.9 million for the three months ended March, 2024 ($1.1 million for the three months ended March 31, 2023).

(7)The Mulatos District includes the Mulatos pit and La Yaqui Grande.

5

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

First Quarter 2024 Highlights

Operational and Financial Highlights

•Produced 135,700 ounces of gold, exceeding quarterly guidance and representing a 6% increase from the first quarter of 2023. This was driven by another strong performance from the Mulatos District, including record quarterly production from La Yaqui Grande

•Sold 132,849 ounces of gold at an average realized price of $2,069 per ounce, generating record quarterly revenue of $277.6 million, a 10% increase from the first quarter of 2023

•Total cash costs1 were $910 per ounce, all-in sustaining costs ("AISC"1) were $1,265 per ounce, and cost of sales were $1,307 per ounce. As previously guided, costs were above full year guidance in the first quarter, with AISC also impacted by an increase in share-based compensation reflecting the Company's higher share price in the quarter. Costs are expected to decrease through the remainder of the year to be consistent with full year guidance

•Strong ongoing free cash flow1 generation of $24.4 million, while funding the Phase 3+ Expansion at Island Gold, and net of $45.3 million of cash tax payments in Mexico

•Cash flow from operating activities of $108.9 million (including $134.9 million, or $0.34 per share before changes in working capital1)

•Realized adjusted net earnings1 for the first quarter of $51.2 million, or $0.13 per share1. Adjusted net earnings includes adjustments for net unrealized foreign exchange losses recorded within deferred taxes and foreign exchange of $4.5 million, and other adjustments, net of taxes totaling $4.6 million. Reported net earnings were $42.1 million, or $0.11 per share

•Cash and cash equivalents increased 7% from the end of 2023 to $240.2 million, with no debt and $16.3 million in equity securities

•Paid dividends of $9.8 million, or $0.025 per share for the quarter

•Reported year-end 2023 Mineral Reserves of 10.7 million ounces of gold, a 2% increase from 2022, with grades also increasing 1%. This marked the fifth consecutive year Mineral Reserves have grown for a combined increase of 10% with grades also increasing 9% over that time frame. Additionally, Measured and Indicated Mineral Resources increased 12% to 4.4 million ounces, with grades increasing 9%, and Inferred Mineral Resources increased 3% to 7.3 million ounces, at 1% higher grades

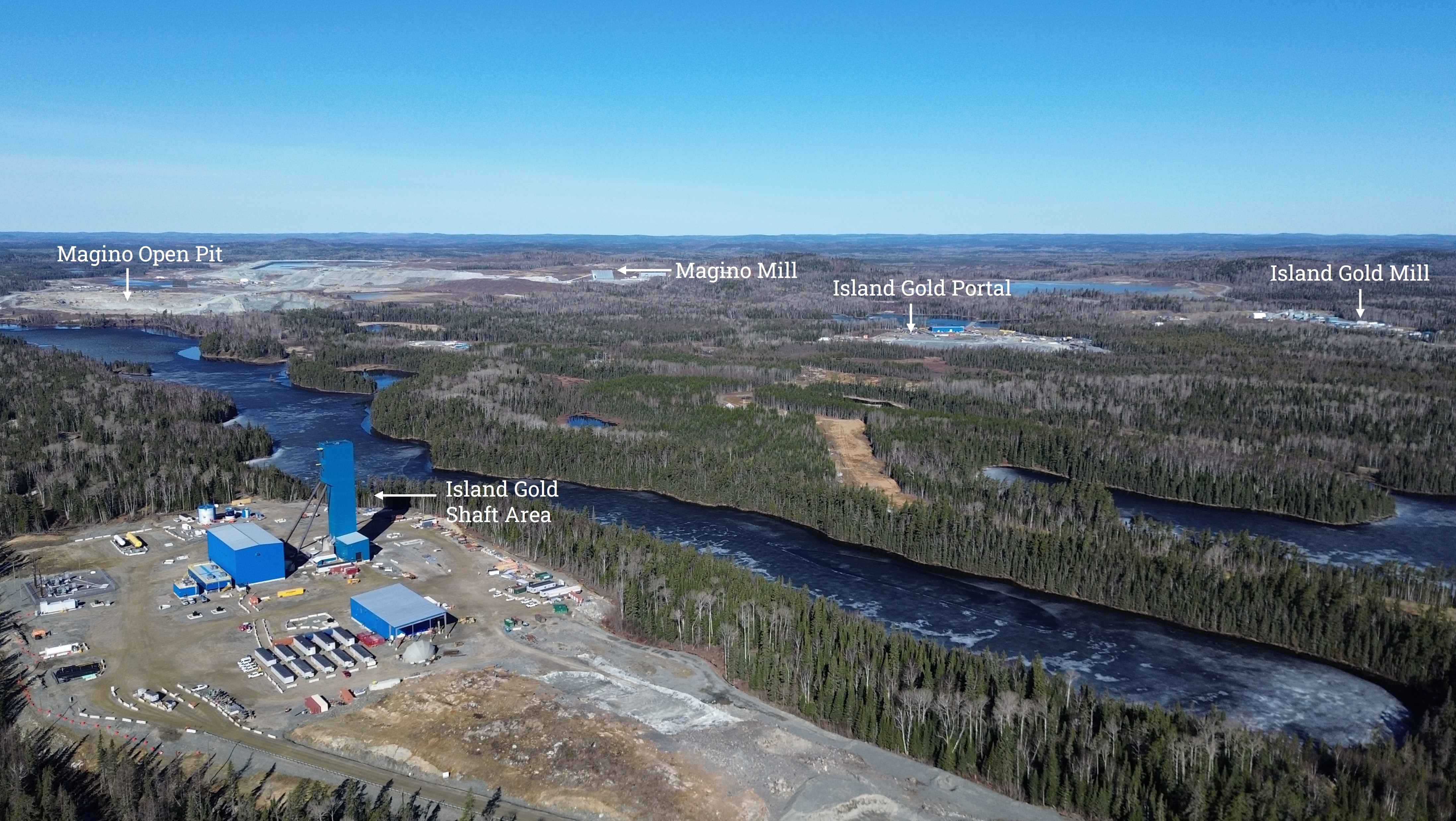

•Announced a definitive agreement to acquire Argonaut Gold Inc. ("Argonaut") and its Magino mine, located adjacent to the Company's Island Gold mine in Ontario, Canada. The integration of the two operations is expected to create one of the largest and lowest cost gold mines in Canada and unlock significant value with pre-tax synergies expected to total $515 million2 through the use of shared infrastructure

•On April 4, 2024, announced the closing of the previously announced non-brokered private placement for common shares of Argonaut, representing approximately 13.8% of Argonaut's outstanding common shares for CAD $50 million

•Completed the acquisition of Orford Mining Corporation ("Orford") on April 3, 2024, through which the Company consolidated its existing ownership of Orford shares and added the highly prospective Qiqavik Gold Project, located in Quebec, Canada

(1) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this MD&A for a description and calculation of these measures.

(2) Synergies are pre-tax and undiscounted. On a discounted basis, this represents an after-tax net present value of $250 million

6

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Environment, Social and Governance Summary Performance

Health and Safety

•Total recordable injury frequency rate1 ("TRIFR") of 1.79 in the first quarter of 2024, an increase from 1.45 in the fourth quarter of 2023

•Lost time injury frequency rate1 ("LTIFR") of nil, a decrease from 0.10 in the fourth quarter of 2023

•La Yaqui Grande Mine celebrated four million hours without a lost time injury

•Alamos’ Home Safe Every Day safety leadership training was implemented at the Island Gold Mine, where it will be delivered to all employees as part of the site’s safety training. This program is now available at all Alamos operations

•During the first quarter of 2024, Alamos had 18 recordable injuries across its sites and zero lost time injuries

Alamos strives to maintain a safe, healthy working environment for all, with a strong safety culture where everyone is continually reminded of the importance of keeping themselves and their colleagues healthy and injury-free. The Company’s overarching commitment is to have all employees and contractors return Home Safe Every Day.

Environment

•Zero significant environmental incidents and zero reportable spills in the first quarter of 2024

•One externally reportable non-compliance in the first quarter that resulted in a fine. At Young-Davidson, environmental testing of treated mine water determined a toxicity failure for Daphnia magna (water fleas), resulting in an environmental penalty of $14,000. The investigation determined the cause of the failure to be algae build-up in the mine water discharge pond and remediation measures were taken. Water treatment and discharge were not impacted and the mine has been in full compliance subsequent to the event

•Finalized a fish habitat compensation project for Davidson Creek at Young-Davidson

•Reclamation work underway at Mulatos focused on the closed Cerro Pelon, El Victor and San Carlos pits

The Company is committed to preserving the long-term health and viability of the natural environment that surrounds its operations and projects. This includes investing in new initiatives to reduce our environmental footprint with the goal of minimizing the environmental impacts of our activities and offsetting any impacts that cannot be fully mitigated or rehabilitated.

Community

Ongoing donations, medical support and infrastructure investments were provided to local communities, including:

•Various sponsorships to support local youth sports teams and community events, and donations to local charities and organizations around the Company's mines

•Partnered with a local foundation (Fundación Vamos Juntos a Ganar) to organize an entrepreneurship workshop for residents of Matarachi to increase their capacity for opening or improving local businesses

•Provided ongoing health services to local community members around the Mulatos Mine. During the quarter, free dental services, vaccinations, and Pap tests were provided to residents

•Upgraded public lighting in Matarachi with the installation of 96 solar street lights throughout the town

•Completed the annual Mi Matarachi evaluation and planning meeting with residents of Matarachi, working together to develop actions that promote education, health and infrastructure that improve the quality of life for residents

The Company believes that excellence in sustainability provides a net benefit to all stakeholders. The Company continues to engage with local communities to understand local challenges and priorities. Ongoing investments in local infrastructure, health care, education, cultural and community programs remain a focus of the Company.

Governance and Disclosure

•Completed annual fieldwork and assurance of Alamos’ compliance with the World Gold Council’s Responsible Gold Mining Principles (RGMPs). Alamos will publish its 2023 RGMP Report in the second quarter of 2024

•Prepared Alamos’ inaugural Modern Slavery Report in accordance with Canada’s Fighting Against Forced Labour and Child Labour in Supply Chains Act. Alamos will publish its 2023 Modern Slavery Report in May 2024

The Company maintains the highest standards of corporate governance to ensure that corporate decision-making reflects its values, including the Company’s commitment to sustainable development.

(1) Frequency rate is calculated as incidents per 200,000 hours worked.

7

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

2024 Business Developments

Acquisition of Argonaut

On March 27, 2024, the Company announced it had entered into a definitive agreement whereby Alamos will acquire all of the issued and outstanding shares of Argonaut pursuant to a court approved plan of arrangement (the "Transaction"). As part of the Transaction, Alamos will acquire Argonaut’s Magino mine, located adjacent to its Island Gold mine in Ontario, Canada. The integration of the two operations is expected to create one of the largest and lowest cost gold mines in Canada. Through the use of shared infrastructure, Alamos expects to unlock significant value with immediate and long-term synergies expected to total approximately US$515 million1. The addition of Magino is expected to increase Alamos’ combined gold production to over 600,000 ounces per year, with longer term production potential of over 900,000 ounces per year. The combination materially enhances Alamos’ position as a leading, Canadian focused, intermediate producer, with growing production and declining costs.

Concurrently with the Transaction, Argonaut’s assets in the United States and Mexico will be spun out to its existing shareholders as a newly created junior gold producer (“SpinCo”). SpinCo will own the Florida Canyon mine in the United States, as well as the El Castillo Complex, the La Colorada operation, and the Cerro del Gallo project, located in Mexico.

Under the terms of the Agreement, each Argonaut common share outstanding will be exchanged for 0.0185 Alamos common shares and 1 share of SpinCo2 (the “Exchange Ratio”). The Exchange Ratio implies estimated total consideration of C$0.40 per Argonaut common share, or US$325 million based on Alamos' share price on March 26, 2024. This represented a 34% premium based on Argonaut’s and Alamos’ closing prices on March 26, 2024 on the Toronto Stock Exchange (“TSX”). Total consideration includes C$0.34 of Alamos common shares, based on the closing price of Alamos common shares on the TSX on March 26, 2024, and SpinCo common shares with an estimated value of C$0.063. Alamos expects to issue approximately 20.3 million common shares as part of the Transaction, representing an equity value of approximately US$276 million on a fully diluted in-the-money basis at the time of announcement, and an enterprise value of US$516 million.

Upon completion of the Transaction, existing Alamos and Argonaut shareholders will own approximately 95% and 5% of the pro forma company, respectively.

Transaction Highlights

•Creation of one of Canada’s largest, lowest cost and most profitable gold mines – combined Magino and Island Gold mines are expected to produce approximately 280,000 ounces in 20244, and increase to over 400,000 ounces per year at first quartile costs, following the completion of the Phase 3+ Expansion in 2026. The two deposits contain Mineral Reserves of 4.1 million ounces, and total Mineral Reserves and Resources of 11.5 million ounces supporting a mine life of more than 19 years, with significant exploration upside5

•Immediate value creation – the combination of Island Gold and Magino is expected to unlock pre-tax synergies of approximately US$515 million1 over the life of mine. This includes operating synergies of US$375 million, through the use of the larger centralized mill and tailings facility at Magino, and capital savings of US$140 million with the mill and tailings expansions at Island Gold no longer required

•Enhances position as a leading intermediate gold producer – combined near-term gold production is expected to increase approximately 25% to over 600,000 ounces per year4, with longer term growth potential to over 900,000 ounces per year, at declining costs

•Leading Canadian exposure supporting a low political risk profile – with 88% of the combined Company’s net asset value6 supported by its Canadian assets, solidifying Alamos’ position as the third largest gold producer in Canada

•Longer-term upside potential – significant further upside potential at both Magino and Island Gold through an expansion of a single optimized milling complex at Magino

•Stronger financial capacity – to complete the ramp up and optimization of the Magino mine, unlocking the full potential of the operation. Stronger overall cash flow generation to support portfolio of organic growth projects, including the Phase 3+ Expansion at Island Gold, and Lynn Lake

On April 4, 2024, the Company announced the closing of the previously announced Private Placement, pursuant to which Alamos subscribed for 174,825,175 common shares of Argonaut, representing approximately 13.8% of Argonaut’s total outstanding common shares after giving effect to the Private Placement. The shares were acquired at a price of CAD $0.286 per share, for total gross proceeds to Argonaut of CAD $50,000,000.

8

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Acquisition of Orford

On April 3, 2024, the Company completed the acquisition of all of the issued and outstanding shares of Orford by way of a court-approved plan of arrangement (the “Orford Agreement"). The acquisition consolidated Alamos’ existing ownership of Orford shares through which the Company has added the highly prospective Qiqavik Gold Project, located in Quebec, Canada. Under the terms of the Orford Agreement, Orford shareholders received 0.005588 of the Company's common shares for each Orford share with a total of 908,689 Alamos shares issued as consideration.

2023 Year-End Mineral Reserve and Resource Update

On February 20, 2024, the Company reported its updated Mineral Reserves and Resources as of December 31, 2023. Highlights include the following:

•Global Proven and Probable Mineral Reserves increased 2% to 10.7 million ounces of gold (202 million tonnes (“mt”) grading 1.65 grams per tonne of gold (“g/t Au”)), with grades increasing 1%, reflecting higher grade additions at Island Gold and Puerto Del Aire (“PDA”) and growth at Lynn Lake. Mineral Reserve additions more than replaced depletion at a rate of 132%

◦Island Gold’s Mineral Reserves increased 18% to 1.7 million ounces (5.2 mt grading 10.30 g/t Au), marking the 11th consecutive year of growth

◦Puerto Del Aire’s ("PDA") Mineral Reserves increased 33% to 1.0 million ounces (5.4 mt grading 5.61 g/t Au) with a 16% increase in grades

◦Lynn Lake’s Mineral Reserves increased 13% to 2.3 million ounces (47.6 mt grading 1.52 g/t Au)

•Island Gold’s Mineral Reserves and Resources increased 16% to 6.1 million ounces driven by significant high-grade additions near existing infrastructure within the main zone and recently defined zones in hanging wall and footwall

•PDA Mineral Reserves and Resources increased 26% to 1.2 million ounces. A development plan incorporating the larger and higher-grade Mineral Reserve is expected to be completed later this quarter

•Global Measured and Indicated Mineral Resources increased 12% to 4.4 million ounces (108 mt grading 1.27 g/t Au), with grades increasing 9% reflecting higher-grade additions at Island Gold and growth at Young-Davidson

•Global Inferred Mineral Resources increased 3% to 7.3 million ounces (128 mt grading 1.77 g/t Au), reflecting increases at Island Gold and Lynn Lake

(1) Synergies are pre-tax and undiscounted. On a discounted basis, this represents an after-tax net present value of $250 million

(2) Shares issued in SpinCo as part of the Exchange Ratio do not reflect a planned 10:1 share consolidation upon SpinCo going public

(3) Based on consensus analyst estimates for the underlying assets and comparable peer market multiples

(4) Based on the midpoint of Alamos’ and Argonaut’s 2024 production guidance

(5) Island Gold mine life based on 2023 Mineral Reserves and Resources assuming Phase 3+ Expansion Study Mineral Resource conversion rate. See Mineral Reserve & Resource estimates and associated footnotes in press release dated February 20, 2024. Magino’s mine life based on 2022 Feasibility study

(6) Based on consensus analyst net asset value estimates for mining assets

9

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Outlook and Strategy

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 Guidance (4) |

|

|

|

Young-Davidson |

Island Gold |

Mulatos |

|

|

Lynn Lake |

|

Total |

|

|

Gold production (000's ounces) |

180 - 195 |

145 - 160 |

160 - 170 |

|

|

|

|

485 - 525 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales, including amortization (in millions)(3) |

|

|

|

|

|

|

|

$620 |

|

|

Cost of sales, including amortization ($ per ounce)(3) |

|

|

|

|

|

|

|

$1,225 |

|

|

Total cash costs ($ per ounce)(1) |

$950 - $1,000 |

$550 - $600 |

$925 - $975 |

|

|

— |

|

$825 - $875 |

|

|

All-in sustaining costs ($ per ounce)(1) |

|

|

|

|

|

|

|

$1,125 - $1,175 |

|

|

Mine-site all-in sustaining costs ($ per ounce)(1)(2) |

$1,175 - $1,225 |

$875 - $925 |

$1,000 - $1,050 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures (in millions) |

|

|

|

|

|

|

|

|

|

|

Sustaining capital(1) |

$40 - $45 |

$50 - $55 |

$3 - $5 |

|

|

— |

|

$93 - $105 |

|

|

Growth capital(1) |

$20 - $25 |

$210 - $230 |

$2 - $5 |

|

|

— |

|

$232 - $260 |

|

|

Total Sustaining and Growth Capital (1) - producing mines |

$60 - $70 |

$260 - $285 |

$5 - $10 |

|

|

— |

|

$325 - $365 |

|

|

| Growth capital - development projects |

|

|

|

|

|

$25 |

|

$25 |

|

|

Capitalized exploration(1) |

$10 |

$13 |

$9 |

|

|

$9 |

|

$41 |

|

|

Total capital expenditures and capitalized exploration(1) |

$70 - $80 |

$273 - $298 |

$14 - $19 |

|

|

$34 |

|

$391 - $431 |

|

|

(1)Refer to the "Non-GAAP Measures and Additional GAAP" disclosure at the end of this MD&A for a description of these measures.

(2)For the purposes of calculating mine-site all-in sustaining costs at individual mine sites, the Company does not include an allocation of corporate and administrative and share based compensation expenses to the mine sites.

(3)Cost of sales includes mining and processing costs, royalties, and amortization expense, and is calculated based on the mid-point of total cash cost guidance.

(4)2024 Guidance does not reflect the proposed acquisition of the Magino Mine and will be updated following close of the transaction

The Company’s objective is to operate a sustainable business model that supports growing returns to all stakeholders over the long-term, through growing production, expanding margins, and increasing profitability. This includes a balanced approach to capital allocation focused on generating strong ongoing free cash flow while re-investing in high-return internal growth opportunities, and supporting higher returns to shareholders.

Following a record operational and financial performance in 2023, the Company continued to deliver across multiple fronts in the first quarter of 2024. Production of 135,700 ounces exceeded quarterly guidance, reflecting another strong performance from Mulatos driven by record quarterly production from La Yaqui Grande. Costs were in line with quarterly guidance and expected to decrease through the rest of the year to be consistent with annual guidance. With the strong operational performance, and higher gold prices, the Company generated record quarterly revenues, and solid ongoing free cash flow of $24.4 million while funding the Phase 3+ Expansion at Island Gold, and net of $45.3 million of cash tax payments in Mexico.

The Phase 3+ Expansion remains on track for completion during the first half of 2026 and will be a key driver of the Company's growing production base and declining cost profile over the next several years. Work on the expansion continues to advance with shaft sinking well underway and reaching a depth of 185 metres by the end of March.

Additionally, the Company continued to demonstrate its long-term track record of value creation through exploration and M&A during the quarter. Global Mineral Reserves increased to 10.7 million ounces of gold (202 mt grading 1.65 g/t Au), a 2% increase from 2022, with a further 1% increase in grades. This marked the fifth consecutive year of growth in Mineral Reserves for a combined increase of 10% over that time frame. Grades have also increased 9% over the same timeframe as Mineral Reserves continue to grow both in size and quality. The increase in 2023 was driven by higher-grade additions at Island Gold and PDA, as well as growth at Lynn Lake.

The acquisition of Argonaut's Magino mine is expected to unlock significant value given its proximity to Island Gold. The integration of the two operations is expected to create one of the largest and lowest cost gold mines in Canada and drive pre-tax synergies of approximately $515 million through the use of shared infrastructure. This includes immediate capital savings with the mill and tailings expansions at Island Gold no longer required, and significant ongoing operating savings through the use of the larger and more efficient Magino mill. This not only de-risks the Phase 3+ Expansion, but also creates opportunities for further expansions of the combined Island Gold and Magino operations. The addition of Magino is expected to increase company-wide gold production to over 600,000 ounces per year with longer term production potential of over 900,000 ounces per year. The transaction is expected to close in July 2024.

Additionally, the Company continues to invest in its longer-term portfolio of growth projects with the acquisition of Orford, adding the highly prospective Qiqavik Gold Project, located in Quebec, Canada.

The Company provided three-year production and operating guidance in January 2024 (excluding Magino), which outlined growing production at declining costs over the next three years. Refer to the Company’s January 10, 2024 guidance press release for a summary of the key assumptions and related risks associated with the comprehensive 2024 guidance and three-year production, cost and capital outlook.

10

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Gold production in 2024 is expected to range between 485,000 and 525,000 ounces. Total cash costs and AISC are expected to be consistent with 2023.

Production is expected to be slightly higher during the first half of 2024, reflecting higher grades at La Yaqui Grande and stronger rates of production through residual leaching at Mulatos. Second quarter gold production is expected to be between 123,000 and 133,000 ounces with costs decreasing slightly from the first quarter driven by lower costs at both Island Gold and Young-Davidson. Consistent with annual guidance, costs are expected to decrease through the remainder of the year reflecting a declining contribution of higher cost production from residual leaching at Mulatos.

Production is expected to increase 7% by 2026 to between 520,000 and 560,000 ounces, with AISC decreasing 11% to between $975 and $1,075 per ounce reflecting low-cost production growth from Island Gold with the completion of the Phase 3+ Expansion. The three year guidance excludes the higher grade PDA project which represents potential production upside at Mulatos as early as 2026. This upside is expected to be outlined in a development plan for PDA to be released during the second quarter of 2024. Looking beyond 2026, the Lynn Lake project is expected to support further potential growth as early as the end of 2027.

The majority of capital spending in 2024 remains focused on advancing the Phase 3+ Expansion at Island Gold. Following the closing of the acquisition of Argonaut in July, the Company will revise its 2024 capital guidance to reflect the addition of Magino and lower planned capital spending on the mill and tailings expansions at Island Gold.

Other areas of focus in 2024 include a larger capital budget for Lynn Lake and increased capitalized exploration. Spending at Lynn Lake will be focused on upgrades to site access and infrastructure, including early work on the power line upgrade, in advance of a construction decision anticipated in 2025. Additionally, a portion of the 2024 exploration program will be focused on converting Mineral Resources at the Burnt Timber and Linkwood satellite deposits into a smaller, higher quality Mineral Reserve. A study incorporating these deposits into the Lynn Lake project is expected to be competed in the fourth quarter of 2024, and represents potential production and economic upside to the 2023 Feasibility Study.

Given the strong profitability of the Mulatos operation in 2023, the Company expects to pay significantly higher cash tax payments in Mexico in 2024. This included $45.3 million of cash tax payments made in the first quarter, the majority of which related to the 2023 year-end tax payment. Cash tax payments in Mexico are expected to decrease to approximately $10 million in the second quarter and remain at similar levels through the remainder of the year. The Company expects stronger company-wide free cash flow starting in the second quarter of 2024 given lower cash tax burden and an expected decrease in costs.

The global exploration budget for 2024 is $62 million, a 19% increase from $52 million spent in 2023. The increase reflects expanded budgets across all key assets following up on broad-based exploration success in 2023. Island Gold and the Mulatos District account for approximately 60% of the total budget with $19 million planned for each asset. This is followed by $12 million at Young-Davidson, $9 million at Lynn Lake and $2 million at Golden Arrow.

The Company's liquidity position remains strong, ending the quarter with $240.2 million of cash and cash equivalents, $16.3 million in equity securities, and no debt. Additionally, the Company has a $500 million undrawn credit facility, providing total liquidity of $756.5 million. Combined with strong ongoing cash flow generation, the Company remains well positioned to internally fund its organic growth initiatives including the Phase 3+ Expansion, optimization of the Magino mill, and development of PDA and Lynn Lake.

11

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Young-Davidson

The Young-Davidson mine is located near the town of Matachewan in Northern Ontario, Canada. The property consists of contiguous mineral leases and claims totaling 5,720 ha and is situated on the site of two past producing mines that produced over one million ounces of gold between 1934 and 1957. The Young-Davidson mine declared commercial production in 2013.

Young-Davidson Financial and Operational Review

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

| Gold production (ounces) |

|

|

40,100 |

|

45,000 |

|

| Gold sales (ounces) |

|

|

39,810 |

|

45,676 |

|

| Financial Review (in millions) |

|

|

|

|

| Operating Revenues |

|

|

$82.7 |

|

$86.3 |

|

Cost of sales (1) |

|

|

$65.4 |

|

$61.9 |

|

| Earnings from operations |

|

|

$16.8 |

|

$24.0 |

|

|

|

|

|

|

| Cash provided by operating activities |

|

|

$34.8 |

|

$33.7 |

|

Capital expenditures (sustaining) (2) |

|

|

$11.6 |

|

$13.2 |

|

Capital expenditures (growth) (2) |

|

|

$7.6 |

|

$2.8 |

|

Capital expenditures (capitalized exploration) (2) |

|

|

$1.0 |

|

$1.4 |

|

|

|

|

|

|

Mine-site free cash flow (2) |

|

|

$14.6 |

|

$16.3 |

|

|

|

|

|

|

Cost of sales, including amortization per ounce of gold sold (1) |

|

|

$1,643 |

|

$1,355 |

|

Total cash costs per ounce of gold sold (2) |

|

|

$1,188 |

|

$941 |

|

Mine-site all-in sustaining costs per ounce of gold sold (2),(3) |

|

|

$1,482 |

|

$1,233 |

|

| Underground Operations |

|

|

|

|

| Tonnes of ore mined |

|

|

667,062 |

|

720,927 |

|

| Tonnes of ore mined per day |

|

|

7,330 |

|

8,010 |

|

Average grade of gold (4) |

|

|

1.94 |

|

2.22 |

|

| Metres developed |

|

|

1,914 |

|

2,695 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mill Operations |

|

|

|

|

| Tonnes of ore processed |

|

|

665,778 |

|

701,954 |

|

| Tonnes of ore processed per day |

|

|

7,316 |

|

7,799 |

|

Average grade of gold (4) |

|

|

1.94 |

|

2.22 |

|

| Contained ounces milled |

|

|

41,609 |

|

50,212 |

|

| Average recovery rate |

|

|

89.4 |

% |

90.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Cost of sales includes mining and processing costs, royalties and amortization.

(2)Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this MD&A for a description and calculation of these measures.

(3)For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(4)Grams per tonne of gold ("g/t Au").

Operational review

Young-Davidson produced 40,100 ounces of gold in the first quarter, an 11% decrease compared to the prior year period. Underground mining rates averaged 7,330 tpd in the first quarter, lower than the prior year period reflecting temporary downtime to replace the head ropes in the Northgate shaft, which had previously been scheduled in the second quarter. Additionally, delays in receiving two production scoops also impacted mining rates earlier in the quarter. Following the completion of the head rope change and receipt of two new hybrid production scoops, mining rates returned to design capacity of 8,000 tpd in March and are expected to remain at similar rates through the rest of the year. Milling rates averaged 7,316 tpd in the quarter, as a result of the lower underground mining rates.

Grades mined averaged 1.94 g/t Au in the quarter, a 13% decrease from the prior year period, and below the range of full year guidance, due to mine sequencing. Given the lower mining rates, higher grade stopes that had been planned for March were deferred into April. Grades mined are expected to increase to within the range of annual guidance in the second quarter and through the remainder of the year. Mill recoveries averaged 89% in the quarter, at the low end of the range of annual guidance.

Financial Review

First quarter revenues of $82.7 million were 4% lower than the prior year period, resulting from lower ounces sold, partially offset by a higher realized gold price.

12

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Cost of sales of $65.4 million in the first quarter were 6% higher than the prior year period, reflecting inflationary pressures on unit costs. Underground mining costs were CAD $62 per tonne in the first quarter, reflecting the lower tonnes mined.

Total cash costs and mine-site AISC were $1,188 per ounce and $1,482 per ounce, respectively in the first quarter. Both metrics were higher than the prior year period and annual guidance, resulting from the temporary downtime for the hoist rope changeover as well as lower grades. Costs are expected to decrease through the remainder of the year to be consistent with annual guidance, reflecting higher grades and mining rates.

Capital expenditures in the first quarter included $11.6 million of sustaining capital and $7.6 million of growth capital. Additionally, $1.0 million was invested in capitalized exploration in the quarter. Capital expenditures, inclusive of capitalized exploration, totaled $20.2 million in the first quarter, a 16% increase from the prior year period driven by timing of payments.

Young-Davidson continues to demonstrate operational and financial consistency with mine-site free cash flow of $14.6 million in the first quarter, and stronger free cash flow expected through the remainder of the year. Young-Davidson has generated over $100 million in mine-site free cash flow for three consecutive years. The operation is well positioned to generate similar free cash flow in 2024 and over the long-term, with a 15 year Mineral Reserve life.

13

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Island Gold

The Island Gold mine is a high grade, low cost underground mining operation located just east of the town of Dubreuilville, Ontario, Canada, 83km northeast of Wawa. Alamos holds 100% of all mining titles related to the Island Gold property, which comprises approximately 55,277 ha. The mine began production in October 2007.

Island Gold Financial and Operational Review

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

2023 |

| Gold production (ounces) |

|

|

33,400 |

|

32,900 |

|

| Gold sales (ounces) |

|

|

34,130 |

|

33,727 |

|

| Financial Review (in millions) |

|

|

|

|

| Operating Revenues |

|

|

$71.0 |

|

$63.9 |

|

Cost of sales (1) |

|

|

$33.4 |

|

$30.9 |

|

| Earnings from operations |

|

|

$36.9 |

|

$32.6 |

|

|

|

|

|

|

| Cash provided by operating activities |

|

|

$40.9 |

|

$36.5 |

|

Capital expenditures (sustaining) (2) |

|

|

$13.5 |

|

$11.4 |

|

Capital expenditures (growth) (2) |

|

|

$37.6 |

|

$43.2 |

|

Capital expenditures (capitalized exploration) (2) |

|

|

$3.5 |

|

$2.4 |

|

Mine-site free cash flow (2) |

|

|

($13.7) |

|

($20.5) |

|

Cost of sales, including amortization per ounce of gold sold (1) |

|

|

$979 |

|

$916 |

|

Total cash costs per ounce of gold sold (2) |

|

|

$706 |

|

$629 |

|

Mine-site all-in sustaining costs per ounce of gold sold (2),(3) |

|

|

$1,105 |

|

$970 |

|

| Underground Operations |

|

|

|

|

| Tonnes of ore mined |

|

|

106,737 |

|

108,396 |

|

| Tonnes of ore mined per day ("tpd") |

|

|

1,173 |

|

1,204 |

|

Average grade of gold (4) |

|

|

10.53 |

|

9.56 |

|

| Metres developed |

|

|

1,787 |

|

2,103 |

|

|

|

|

|

|

|

|

|

|

|

| Mill Operations |

|

|

|

|

| Tonnes of ore processed |

|

|

107,215 |

|

107,507 |

|

| Tonnes of ore processed per day |

|

|

1,178 |

|

1,195 |

|

Average grade of gold (4) |

|

|

10.63 |

|

9.57 |

|

| Contained ounces milled |

|

|

36,651 |

|

33,082 |

|

| Average recovery rate |

|

|

97.3 |

% |

97.0 |

% |

|

|

|

|

|

(1)Cost of sales includes mining and processing costs, royalties, and amortization.

(2)Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this MD&A for a description and calculation of these measures.

(3)For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(4)Grams per tonne of gold ("g/t Au").

Operational review

Island Gold produced 33,400 ounces in the first quarter of 2024, consistent with the prior year period. Underground mining rates averaged 1,173 tpd in the first quarter, a 3% decrease from the prior year period and slightly below annual guidance of 1,200 tpd. Grades mined averaged 10.53 g/t Au in the quarter, consistent with annual guidance and 10% higher than in the prior year period.

Mill throughput averaged 1,178 tpd for the quarter, slightly lower than the prior year period reflecting mining rates in the quarter. Mill recoveries averaged 97% in the first quarter, consistent with guidance.

Financial Review

Revenues of $71.0 million in the first quarter were 11% higher than the prior year period, primarily driven by the higher realized gold price.

Cost of sales of $33.4 million in the first quarter was 8% higher than the prior year period, driven by inflationary pressures on mining and processing costs, driven mainly by labour and certain consumables.

14

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Total cash costs of $706 per ounce and mine-site AISC of $1,105 per ounce in the first quarter were both higher than the prior year period, reflecting inflationary pressures. Costs are expected to decrease through the remainder of the year to be consistent with annual guidance.

Total capital expenditures were $54.6 million in the first quarter, including $37.6 million of growth capital and $3.5 million of capitalized exploration. Growth capital spending remained focused on the Phase 3+ Expansion shaft site infrastructure and shaft sinking, with the shaft reaching a depth of 185 metres by the end of the quarter. Additionally, capital spending was focused on lateral development and other surface infrastructure. Certain other capital activities planned for 2024 have been deferred as a result of the planned acquisition of Argonaut.

Mine-site free cash flow was negative $13.7 million for the first quarter given the significant capital investment related to the Phase 3+ Expansion. At current gold prices, Island Gold is expected to continue funding the majority of the Phase 3+ Expansion capital. The operation is expected to generate significant free cash flow from 2026 onward with the completion of the expansion.

15

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Mulatos District

The Mulatos District (Mulatos and La Yaqui Grande mines) is located within the Salamandra Concessions in the Sierra Madre Occidental mountain range in the State of Sonora, Mexico. The Company controls a total of 28,972 hectares of mineral concessions within the Mulatos District. The Mulatos mine achieved commercial production in 2006, with La Yaqui Grande commencing operations in June 2022.

Mulatos District Financial and Operational Review

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Gold production (ounces) |

|

|

62,200 |

|

50,500 |

|

| Gold sales (ounces) |

|

|

58,909 |

|

53,265 |

|

Financial Review (in millions) |

|

|

|

|

| Operating Revenues |

|

|

$123.9 |

|

$101.3 |

|

Cost of sales (1) |

|

|

$74.8 |

|

$62.4 |

|

| Earnings from operations |

|

|

$45.8 |

|

$36.6 |

|

|

|

|

|

|

| Cash provided by operating activities |

|

|

$53.6 |

|

$42.5 |

|

|

|

|

|

|

Capital expenditures (sustaining) (2) |

|

|

$1.4 |

|

$2.3 |

|

|

|

|

|

|

Capital expenditures (growth) (2) |

|

|

$0.6 |

|

$2.3 |

|

Capital expenditures (capitalized exploration) (2) |

|

|

$1.9 |

|

$1.1 |

|

Mine-site free cash flow (2) |

|

|

$49.7 |

|

$36.8 |

|

|

|

|

|

|

|

|

|

|

|

Cost of sales, including amortization per ounce of gold sold (1) |

|

|

$1,270 |

|

$1,172 |

|

|

|

|

|

|

|

|

|

|

|

Total cash costs per ounce of gold sold (2) |

|

|

$840 |

|

$839 |

|

|

|

|

|

|

|

|

|

|

|

Mine site all-in sustaining costs per ounce of gold sold (2),(3) |

|

|

$905 |

|

$914 |

|

| La Yaqui Grande Mine |

|

|

|

|

Open Pit Operations |

|

|

|

|

Tonnes of ore mined - open pit (4) |

|

|

986,214 |

|

1,032,944 |

|

Total waste mined - open pit (6) |

|

|

4,076,910 |

|

5,830,815 |

|

| Total tonnes mined - open pit |

|

|

5,063,125 |

|

6,863,759 |

|

| Waste-to-ore ratio (operating) |

|

|

4.13 |

|

5.64 |

|

Crushing and Heap Leach Operations |

|

|

|

|

| Tonnes of ore stacked |

|

|

981,740 |

|

1,019,634 |

|

Average grade of gold processed (5) |

|

|

1.31 |

|

1.55 |

|

| Contained ounces stacked |

|

|

41,398 |

|

50,922 |

|

| Average recovery rate |

|

|

120.8 |

% |

75.0 |

% |

| Ore crushed per day (tonnes) |

|

|

10,800 |

|

11,329 |

|

| Mulatos Mine |

|

|

|

|

Open Pit Operations |

|

|

|

|

Tonnes of ore mined - open pit (4) |

|

|

— |

|

1,001,785 |

|

Total waste mined - open pit (6) |

|

|

— |

|

611,755 |

|

| Total tonnes mined - open pit |

|

|

— |

|

1,613,539 |

|

| Waste-to-ore ratio (operating) |

|

|

— |

|

0.61 |

|

Crushing and Heap Leach Operations |

|

|

|

|

| Tonnes of ore stacked |

|

|

— |

|

1,229,076 |

|

Average grade of gold processed (5) |

|

|

— |

|

0.92 |

|

| Contained ounces stacked |

|

|

— |

|

36,541 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average recovery rate |

|

|

— |

|

33 |

% |

| Ore crushed per day (tonnes) |

|

|

— |

|

13,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Cost of sales includes mining and processing costs, royalties, and amortization expense.

(2)Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this MD&A for a description and calculation of these measures.

(3)For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(4)Includes ore stockpiled during the quarter.

(5)Grams per tonne of gold ("g/t Au").

(6)Total waste mined includes operating waste and capitalized stripping.

16

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Mulatos District Operational Review

The Mulatos District produced 62,200 ounces in the first quarter, 23% higher than the prior year period, reflecting a record quarter from La Yaqui Grande.

La Yaqui Grande produced 50,000 ounces in the first quarter, exceeding expectations, and an increase of 30% compared to the prior year period. Recovery rates averaged 121%, well above annual guidance, benefiting from the recovery of higher grade ore stacked in the latter part of 2023. Grades stacked averaged 1.31 g/t Au in the quarter, in line with guidance. Stacking rates of 10,800 tpd in the first quarter were above annual guidance, but are expected to average 10,000 tpd for the remainder of the year.

Mulatos produced 12,200 ounces in the first quarter following commencement of residual leaching in December 2023. The operation is expected to benefit from ongoing gold production at decreasing rates in 2024.

Financial Review (Mulatos District)

Revenues of $123.9 million in the first quarter were 22% higher than the prior year period, reflecting higher realized gold prices and higher ounces sold.

Cost of sales of $74.8 million in the first quarter were 20% higher than in the prior year period due to the significant increase in ounces sold. On a per ounce basis, cost of sales were slightly lower than the prior year period reflecting the greater contribution of low-cost ounces at La Yaqui Grande.

Total cash costs of $840 per ounce and mine-site AISC of $905 per ounce in the first quarter were lower than the prior year period and below annual guidance due to the greater contribution of low-cost production from La Yaqui Grande, offset in part by ongoing inflationary pressures. Both total cash costs and mine-site AISC are expected to increase through the remainder of the year to be consistent with annual guidance reflecting lower rates of production due to lower grades at La Yaqui Grande.

Capital expenditures totaled $3.9 million in the first quarter, including sustaining capital of $1.4 million, and $1.9 million of capitalized exploration focused on drilling at PDA.

The Mulatos District generated mine-site free cash flow of $49.7 million for the first quarter, net of $45.3 million of cash tax payments primarily related to 2023 income and mining taxes payable given the increased profitability of the operation. The Company expects cash tax payments to decrease to approximately $10 million per quarter for the remainder of the year, related to the 2024 tax year. The 35% increase in mine-site free cash flow as compared to the prior year period was driven by record production from La Yaqui Grande, partially offset by higher cash tax payments.

17

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

First Quarter 2024 Development Activities

Island Gold (Ontario, Canada)

Phase 3+ Expansion

On June 28, 2022, the Company reported results of the Phase 3+ Expansion Study (“P3+ Expansion Study”) conducted on its Island Gold mine, located in Ontario, Canada.

The Phase 3+ Expansion to 2,400 tpd from the current rate of 1,200 tpd will involve various infrastructure investments. These include the installation of a shaft, paste plant, expansion of the mill as well as accelerated development to support the higher mining rates. Following the completion of the expansion in 2026, the operation will transition from trucking ore and waste up the ramp to skipping ore and waste to surface through the new shaft infrastructure, driving production higher and costs significantly lower.

With the acquisition of Argonaut's Magino mine expected to close in July, the expansion of the Island Gold mill and tailings facility will no longer be required providing immediate capital savings. Starting in 2025, ore from Island Gold is expected to be processed through the larger and more cost effective Magino mill, providing significant ongoing operating synergies.

Construction of the Phase 3+ Expansion continued through the first quarter of 2024 with progress summarized below:

•Completed the mechanical and electrical outfitting for hoist house and headframe

•Shaft sinking advanced to a depth of 185 metres ("m") by the end of the first quarter with sinking rates increasing to 2.5 m per day in March

•Paste plant detailed engineering 85% complete; issuance of long lead time equipment procurement packages is ongoing with construction activities expected to begin in the second half of 2024

•Advanced lateral development to support higher mining rates with the Phase 3+ Expansion

The Phase 3+ Expansion remains on schedule to be completed during the first half of 2026. During the first quarter of 2024, the Company spent $37.6 million on the Phase 3+ Expansion and capital development. As of March 31, 2024, 57% of the total initial growth capital of $756 million has been spent and committed on the project. Capital spending is tracking well for work completed to date; however, continuing labour cost pressures may impact future project costs. Following the expected closing of the Magino acquisition in July 2024, the Company will provide updated capital estimates to reflect upgrades to the Magino mill and with the Island Gold mill expansion no longer required. Progress on the Expansion is detailed as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in US$M)

Growth capital (including indirects and contingency) |

P3+ 2400

Study1

|

Spent to date2 |

Committed to date |

% of Spent & Committed |

|

| Shaft & Shaft Surface Complex |

229 |

|

156 |

|

52 |

|

91 |

% |

|

Mill Expansion 4 |

76 |

|

11 |

|

7 |

|

24 |

% |

|

| Paste Plant |

52 |

|

4 |

|

24 |

|

54 |

% |

|

| Power Upgrade |

24 |

|

11 |

|

4 |

|

63 |

% |

|

| Effluent Treatment Plant |

16 |

|

— |

|

— |

|

— |

|

|

| General Indirect Costs |

64 |

|

38 |

|

6 |

|

69 |

% |

|

Contingency3 |

55 |

|

— |

|

— |

|

|

|

| Total Growth Capital |

$516 |

$220 |

$93 |

61 |

% |

|

|

|

|

|

|

|

| Underground Equipment & Infrastructure |

79 |

|

34 |

|

— |

|

43 |

% |

|

| Accelerated Capital Development |

162 |

|

82 |

|

— |

|

51 |

% |

|

| Total Growth Capital (including Accelerated Spend) |

$756 |

$336 |

$93 |

57 |

% |

|

1.Phase 3+ 2400 Study is as of January 2022. Phase 3+ capital estimate based on USD/CAD exchange $0.78:1. Spent to date based on average USD/CAD of $0.75:1 since the start of 2022. Committed to date based on the spot USD/CAD rate as at March 31, 2024 of $0.75:1.

2.Amount spent to date accounted for on an accrual basis, including working capital movements.

3.Contingency has been allocated to the various areas.

4.No further capital is expected to be incurred on the Island Gold mill expansion with the acquisition of Argonaut, expected to close in July 2024.

18

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Shaft site area - April 2024

Lynn Lake (Manitoba, Canada)

On August 2, 2023, the Company reported the results of an updated Feasibility Study ("2023 Study") conducted on the project which replaces the previous Feasibility Study completed in 2017 ("2017 Study"). The 2023 Study incorporates a 44% larger Mineral Reserve and 14% increase in milling rates to 8,000 tpd supporting a larger, longer-life, low-cost operation. The 2023 Study has been updated to reflect the current costing environment, as well as a significant amount of additional engineering, on-site geotechnical investigation work, and requirements outlined during the permitting process with the EIS granted in March 2023. Highlights of the study include:

•average annual gold production of 207,000 ounces over the first five years and 176,000 ounces over the initial 10 years

•low-cost profile: average mine-site all-in sustaining costs of $699 per ounce over the first 10-years and $814 per ounce over the life of mine

•44% larger Mineral Reserve totaling 2.3 million ounces grading 1.52 g/t Au (47.6 million tonnes ("mt"))

•17-year mine life, life of mine production of 2.2 million ounces

•After-tax net present value (“NPV”) (5%) of $428 million (base case gold price assumption of $1,675 per ounce and USD/CAD foreign exchange rate of $0.75:1); after-tax internal rate of return (“IRR”) of 17%

•After-tax NPV (5%) of $670 million, and an after-tax IRR of 22%, at current gold prices of approximately $1,950 per ounce

•Payback of less than four years at the base case gold price of $1,675 per ounce and less than three years at a $1,950 per ounce gold prices

Development spending (excluding exploration) was $3.6 million in the first quarter of 2024, primarily on detailed engineering, which is 80% complete. The focus in 2024 is on further de-risking and advancing the project ahead of an anticipated construction decision in 2025. This includes completion of detailed engineering, and commencement of early works, including road construction and power line upgrades. The majority of the $25 million capital budget in 2024 is spending included as initial capital in the 2023 Feasibility Study.

Kirazlı (Çanakkale, Türkiye)

On October 14, 2019, the Company suspended all construction activities on its Kirazlı project following the Turkish government's failure to grant a routine renewal of the Company’s mining licenses, despite the Company having met all legal and regulatory requirements for their renewal. In October 2020, the Turkish government refused the renewal of the Company’s Forestry Permit.

19

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

The Company had been granted approval of all permits required to construct Kirazlı including the Environmental Impact Assessment approval, Forestry Permit, and GSM (Business Opening and Operation) permit, and certain key permits for the nearby Ağı Dağı and Çamyurt Gold Mines. These permits were granted by the Turkish government after the project earned the support of the local communities and passed an extensive multi-year environmental review and community consultation process.

On April 20, 2021, the Company announced that its Netherlands wholly-owned subsidiaries Alamos Gold Holdings Coöperatief U.A, and Alamos Gold Holdings B.V. (the “Subsidiaries”) would be filing an investment treaty claim against the Republic of Türkiye for expropriation and unfair and inequitable treatment. The claim was filed under the Netherlands-Türkiye Bilateral Investment Treaty (the “Treaty”). Alamos Gold Holdings Coöperatief U.A. and Alamos Gold Holdings B.V. had their claim against the Republic of Türkiye registered on June 7, 2021 with the International Centre for Settlement of Investment Disputes (World Bank Group).

Bilateral investment treaties are agreements between countries to assist with the protection of investments. The Treaty establishes legal protections for investment between Türkiye and the Netherlands. The Subsidiaries directly own and control the Company’s Turkish assets. The Subsidiaries invoking their rights pursuant to the Treaty does not mean that they relinquish their rights to the Turkish project, or otherwise cease the Turkish operations. The Company will continue to work towards a constructive resolution with the Republic of Türkiye.

The Company incurred $1.4 million in the first quarter of 2024 related to ongoing care and maintenance and arbitration costs to progress the Treaty claim, which was expensed.

First Quarter 2024 Exploration Activities

Island Gold (Ontario, Canada)

The 2024 near mine exploration program will continue to focus on defining new Mineral Reserves and Resources in proximity to existing production horizons and underground infrastructure through both underground and surface exploration drilling.

As announced on February 13, 2024, the 2023 exploration program was successful with high-grade Mineral Reserves and Resources added across all categories to now total 6.1 million ounces, a 16% increase from the end of 2022. This included an 18% increase in Mineral Reserves to 1.7 million ounces (5.2 mt grading 10.30 g/t Au), a 146% increase in Measured and Indicated Mineral Resources to 0.7 million ounces (2.6 mt grading 8.73 g/t Au) and a 4% increase in Inferred Mineral Resources to 3.7 million ounces (7.9 mt grading 14.58 g/t Au).

The majority of these high-grade Mineral Reserve and Resource additions were in proximity to existing production horizons and infrastructure. This included additions within the main Island Gold structure as well as within the hanging wall and footwall. Given their proximity to existing infrastructure, these ounces are expected to be low cost to develop and could be incorporated into the mine plan and mined within the next several years, further increasing the value of the operation.

A total of $19 million has been budgeted for exploration at Island Gold in 2024, up from $14 million in 2023, with both a larger near mine and regional exploration program. This includes 41,000 m of underground exploration drilling, 12,500 m of near-mine surface exploration drilling, and 10,000 m of surface regional exploration drilling.

To support the underground exploration drilling program, 460 m of underground exploration drift development is planned to extend drill platforms on the 850 and 1025 m levels. In addition to the exploration budget, 32,000 m of underground delineation drilling has been planned and included in sustaining capital for Island Gold which will be focused on the conversion of the large Mineral Resource base to Mineral Reserves.

The 2024 regional exploration program will follow up on high-grade mineralization intersected at the Pine-Breccia and 88-60 targets, located 4 km and 7 km, respectively, from the Island Gold mine. Drilling will also be completed in proximity to the past-producing Cline and Edwards mines, as well as at the Island Gold North Shear target. Additionally, a comprehensive data compilation project is underway across the 40,000-hectare Manitou land package that was acquired in 2023 in support of future exploration targeting.

During the first quarter, 11,967 m of underground exploration drilling was completed in 45 holes, and 2,631 m of surface drilling was completed in two holes. Additionally, a total of 9,425 m of underground delineation drilling was completed in 37 holes, focused on in-fill drilling to convert Mineral Resources to Mineral Reserves. A total of 159 m of underground exploration drift development was also completed during the first quarter.

The regional exploration drilling program also commenced in the first quarter, with 565 m completed in one hole targeting mineralization in the North Shear, Webb Lake Stock, and up-plunge of Island West (C-zone).

Total exploration expenditures during the first quarter of 2024 were $4.2 million, of which $3.5 million was capitalized.

Young-Davidson (Ontario, Canada)

A total of $12 million has been budgeted for exploration at Young-Davidson in 2024, up from $8 million spent in 2023. This includes 21,600 m of underground exploration drilling, and 1,070 m of underground exploration development to extend drill platforms on multiple levels. The majority of the underground exploration drilling program will be focused on extending mineralization within the Young-Davidson syenite, which hosts the majority of Mineral Reserves and Resources.

20

|

|

|

|

|

|

|

|

|

2024 Management’s Discussion and Analysis |

Drilling will also test the hanging wall and footwall of the deposit where higher grades have been previously intersected.

The regional program has been expanded with 7,000 m of surface drilling planned in 2024, up from 5,000 m in 2023. The focus will be on testing multiple near-surface targets across the 5,900 hectare Young-Davidson Property that could potentially provide supplemental mill feed.