Document

INVITATION TO OUR VIRTUAL AGSM

April 1, 2024

Fellow shareholders:

On behalf of the Board of Directors and management of Alamos Gold Inc. (the “Company”), I would like to invite you to attend the annual general and special meeting of shareholders that will be held on Thursday, May 23, 2024, at 4:00 p.m. (Toronto time). To permit a greater number of shareholders to participate, we have once again made the decision to hold a virtual meeting, as set out in further detail in the accompanying notice and management information circular.

The enclosed management information circular contains important information about the meeting, voting, the nominated directors, our governance practices and how we compensate our executives and directors, among other things. It also describes the Board of Directors role and responsibilities. In addition to these items, we will discuss, at the meeting, highlights of our 2023 performance and our plans for the future.

Your participation in the affairs of the Company is important to us. You should exercise your vote, either online at the meeting, by completing and returning your proxy form, by telephone or online in advance of the meeting.

Best regards,

John A. McCluskey

President and Chief Executive Officer You are invited to attend the annual general and special meeting of shareholders (the “Meeting”) of Alamos Gold Inc. (the “Company” or “Alamos”), where you will be asked to:

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

|

|

|

|

|

|

| Meeting Information |

| Date: |

Thursday, May 23, 2024 |

| Time: |

4:00 p.m., Toronto time |

| Live Webcast: |

https://web.lumiconnect.com/425475736 |

|

|

1.receive and consider the consolidated financial statements of the Company for its financial year ended December 31, 2023, and the auditors’ report thereon;

2.elect nine (9) directors who will serve until the next annual meeting of shareholders;

3.re-appoint auditors that will serve until the next annual meeting of shareholders and authorize the directors to set their remuneration;

4.to approve an amendment to the Company’s articles of incorporation to increase the permitted size of the Board of Directors from ten (10) to twelve (12) directors; and

5.consider and, if deemed appropriate, to pass, with or without variation, a non-binding advisory resolution on the Company’s approach to executive compensation.

Shareholders will also transact such other business as may properly be brought before the Meeting (or adjournment thereof).

The Meeting will be held as a completely virtual meeting, which will be conducted via live webcast, where all shareholders, regardless of geographic location and equity ownership, will have an equal opportunity to participate in the Meeting and engage with directors of the Company (the “Directors”) and management. Shareholders will not be able to attend the Meeting in person. Registered shareholders and duly appointed proxyholders will be able to attend, participate in and vote at the Meeting online at https://web.lumiconnect.com/425475736.

The accompanying Management Information Circular provides information relating to the matters to be dealt with at the Meeting and forms part of this notice. The Board of Directors of the Company has fixed the close of business on April 10, 2024, as the record date for determining the shareholders who are entitled to receive notice of, and to vote at, the Meeting and any postponement or adjournment thereof. Alamos has prepared a list, as of the close of business on the record date, of the holders of Alamos common shares. A holder of record of common shares of Alamos whose name appears on such list is entitled to vote the shares shown opposite such holder’s name on such list at the Meeting.

This year, Alamos is using “notice-and-access” to deliver meeting materials to shareholders. Our meeting materials can be viewed online on our website at www.alamosgold.com, under our profile on SEDAR+ at www.sedarplus.ca, our profile on EDGAR at www.sec.gov/edgar, at http://www.envisionreports.com/ALAMOSGOLD2024 or at https://web.lumiconnect.com/425475736 (fifteen (15) minutes prior to the meeting start time).

The notice-and-access notification will also provide instructions on how to vote at the Meeting and how to receive paper copies of the meeting materials.

DATED at Toronto, Ontario, this 1st day of April, 2024.

By Order of the Board of Directors,

Nils F. Engelstad

Senior Vice President, General Counsel

TABLE OF CONTENTS

Management Information Circular PAGE - v

MEETING AND VOTING INFORMATION

Management Information Circular PAGE - vi This Management Information Circular (the “Circular”) is furnished in connection with the solicitation of proxies by the management of Alamos Gold Inc. (the “Company” or “Alamos”) for use at the annual general and special meeting of the shareholders of the Company (the “Meeting”) (and at any adjournment thereof) to be held as a virtual meeting, which will be conducted via live webcast on Thursday, May 23, 2024, at 4:00 p.m., Toronto time. The information set out in this Circular is given as at April 1, 2024, unless otherwise indicated. All dollar amounts referenced in this Circular are in United States Dollars (“USD$”), unless otherwise specified. The exchange rate as at December 31, 2023, was Canadian Dollar (“CAD$”) 1.00 = USD$0.7561, and the average exchange rate for 2023 was CAD$1.00 = USD$0.7409.

Record Date for Voting at the Meeting

The Board of Directors (the “Board”) has set the close of business on April 10, 2024, as the record date (the “Record Date”) for determining which shareholders shall be entitled to receive notice of and to vote at the Meeting. Only shareholders of record as of the Record Date shall be entitled to receive notice of and to vote at the Meeting, unless after the Record Date, a shareholder transfers his or her common shares of the Company (the “Common Shares”) and the transferee (the “Transferee”), upon establishing that the Transferee owns such Common Shares, requests in writing, at least 10 days prior to the Meeting or any adjournments thereof, that the Transferee may have his or her name included on the list of shareholders entitled to vote at the Meeting, in which case the Transferee is entitled to vote such shares at the Meeting. Such written request by the Transferee shall be sent to the Company’s Senior Vice President, General Counsel at the following email: notice@alamosgold.com.

Notice and Access

This year, the Company is using the “notice-and-access” system for the delivery of the Circular and 2023 annual report to both beneficial and registered shareholders, which includes the Company’s management’s discussion and analysis and annual audited consolidated financial statements for the fiscal year ended December 31, 2023 (collectively, the “Meeting Materials”).

Under notice-and-access, you will still receive a proxy or voting instruction form enabling you to vote at the Meeting. However, instead of a paper copy of the Circular, you receive a notice document which contains information about how to access the Meeting Materials electronically. One benefit of the notice-and-access system is that it reduces the environmental impact of producing and distributing paper copies of documents in large quantities.

The Circular and form of proxy (or voting instruction form, as applicable) provide additional information concerning the matters to be dealt with at the Meeting. You should access and review all information contained in the Circular before voting.

Our Meeting Materials can be viewed online on our website at www.alamosgold.com, under our profile on SEDAR+ at www.sedarplus.ca, our profile on EDGAR at www.sec.gov/edgar, or at http://www.envisionreports.com/ALAMOSGOLD2024.

How We Will Solicit Proxies

The Company will bear the expense of this solicitation. It is expected the solicitation will be made primarily by mail, but regular employees or representatives of the Company (none of whom shall receive any extra compensation for these activities) may also solicit by telephone, electronically and in person and arrange for intermediaries to send this Circular and the form of proxy to their principals at the expense of the Company.

|

|

|

|

|

|

| 2024 Management Information Circular |

1 | ALAMOS GOLD INC. |

The contents and the sending of this Circular have been approved by the Board.

How to Vote in Advance of the Meeting

Advance voting must be received by 4:00 p.m. (Toronto time) on May 21, 2024.

|

|

|

|

|

|

| By proxy (proxy form) |

| 🌐 |

Go to www.investorvote.com, or by scanning the QR code with a smartphone on the proxy form or voting information form (as applicable). |

( |

Call 1-866-732-VOTE (1-866-732-8683) Toll Free in Canada and the United States) or direct at 1-312-588-4290 from a touch tone telephone and follow the instructions. |

* |

Complete, sign, and date your form of proxy or voting instructions, and return it in the envelope provided. |

How to Attend the Meeting

|

|

|

|

|

|

|

|

|

| ¶ |

|

|

Date: |

Thursday, May 23, 2024 |

|

Time: |

4:00 p.m., Toronto time |

|

Location: |

https://web.lumiconnect.com/425475736 |

|

Registration: |

Voting at the Meeting will only be available for registered shareholders and duly appointed proxyholders |

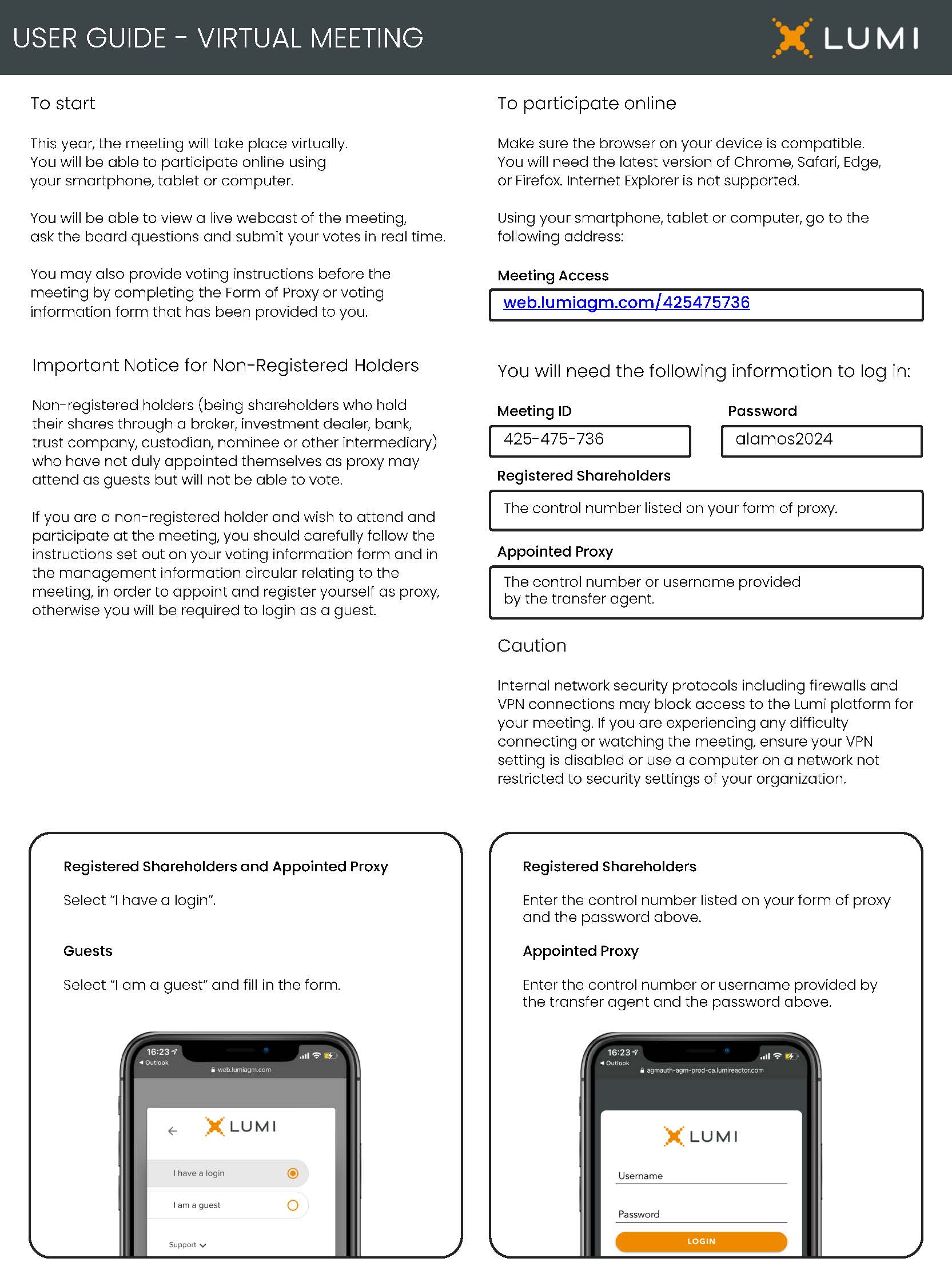

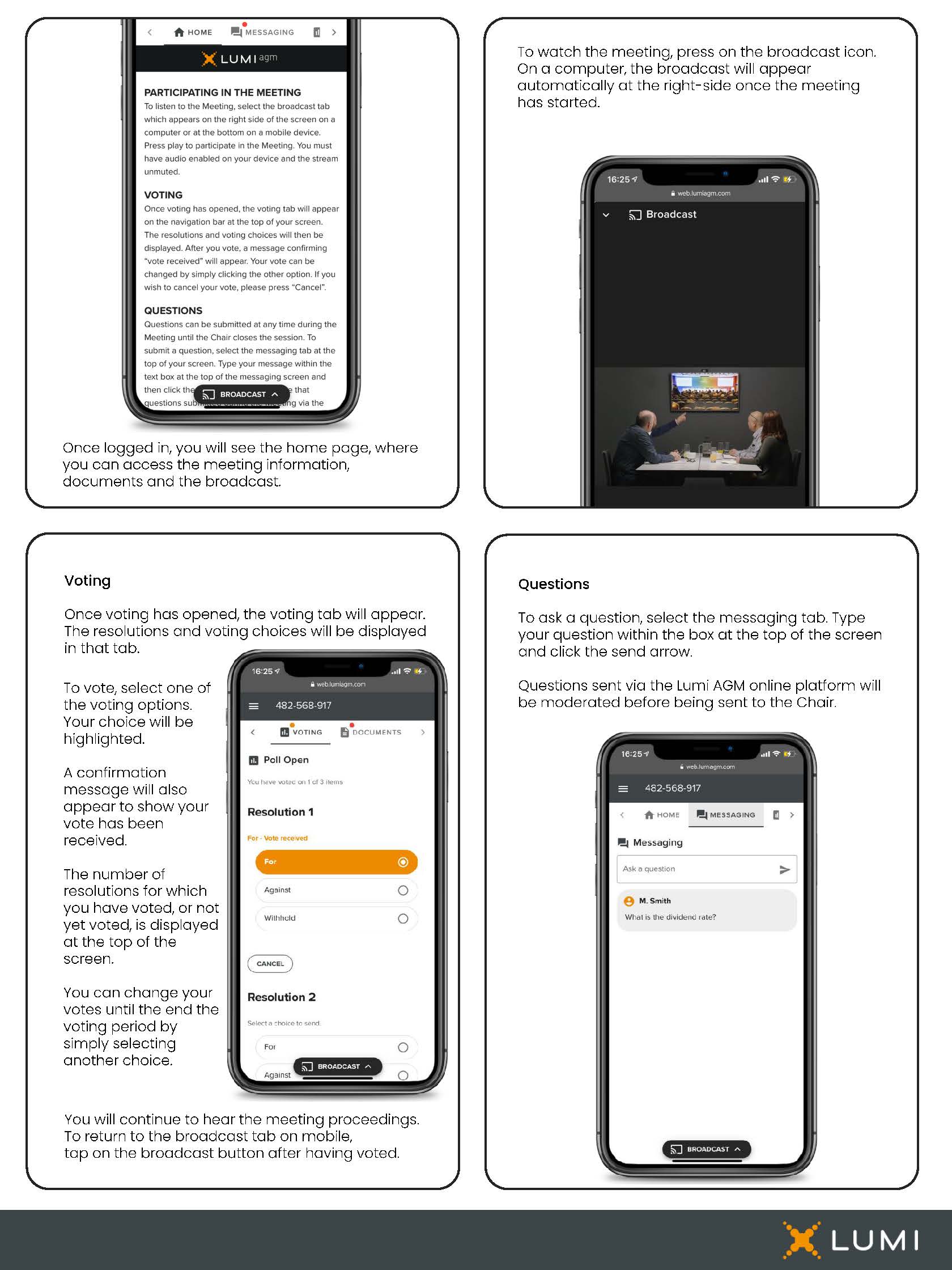

Shareholders will not be able to attend the Meeting in person. Shareholders and duly appointed proxyholders can attend the Meeting online by going to https://web.lumiconnect.com/425475736, which will open fifteen (15) minutes prior to the Meeting on May 23, 2024, at 4:00 p.m. Registered shareholders and duly appointed proxyholders can participate in the Meeting by clicking “I have a login”, entering a Username and Password, and accepting the terms and conditions before the start of the Meeting.

Registered shareholders must use the 15-digit control number located on the form of proxy or in the email notification received as the Username, and the Password is “alamos2024”. Computershare Trust Company of Canada (“Computershare”) will provide duly appointed proxyholders with a Username after the voting deadline has passed. Beneficial shareholders who have not appointed themselves may attend the Meeting by clicking “I am a guest” and completing the online form.

Voting at the meeting will only be available for registered shareholders and duly appointed proxyholders.

|

|

|

It is important that shareholders accessing the Meeting online, using a smartphone, tablet or computer, have the latest version of Chrome, Safari, Edge or Firefox and remain connected to the internet at all times during the Meeting in order to vote when balloting commences. In order to participate online, shareholders must have a valid 15-digit control number, and proxyholders must have received an email from Computershare containing a Username. |

|

|

|

|

|

|

| 2024 Management Information Circular |

2 | ALAMOS GOLD INC. |

How to Participate at the Meeting

|

|

|

|

|

|

| In person via Internet Webcast |

: |

Registered shareholders have the ability to vote at the Meeting by going to https://web.lumiconnect.com/425475736 prior to the start of the Meeting to log in, enter the 15-digit control number and follow the instructions.

Voting via Internet Webcast will only be available for registered shareholders and duly appointed proxyholders.

Registered shareholders and duly appointed proxyholders have the ability to ask questions during the meeting. See Schedule “B” for more information on how to ask questions. You can also direct your questions prior to the meeting to Scott K. Parsons, Senior Vice President, Investor Relations sparsons@alamosgold.com.

|

The Meeting will be hosted online by way of a live webcast. A summary of the information shareholders will need to attend the online Meeting is provided below. The Meeting will begin at 4:00 p.m. (Toronto time) on Thursday, May 23, 2024. Registered shareholders that have a 15-digit control number, along with duly appointed proxyholders who were assigned a Username (see details under the heading “Appointment and Revocation of Proxies”), will be able to vote and submit questions during the Meeting. To do so, please go to https://web.lumiconnect.com/425475736 prior to the start of the Meeting to login. Click on “I have a login” and enter your 15-digit control number or Username along with the password “alamos2024” and accept the terms and conditions. Beneficial Shareholders who do not have a 15-digit control number or Username will only be able to attend as a guest by clicking “I am a guest” which allows them to listen to the Meeting; however, they will not be able to vote or submit questions.

United States beneficial shareholders must first obtain a valid legal proxy from their broker, bank or other agent and then register in advance to attend and vote in the Meeting. Such beneficial shareholders should follow the instructions from their broker or bank included with these proxy materials or contact their broker or bank to request a legal proxy form. After first obtaining a valid legal proxy from their broker, bank or other agent, the beneficial shareholder may register to attend the Meeting by submitting a copy of their legal proxy to Computershare. Requests for registration should be directed to: Computershare, 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1 or email at uslegalproxy@computershare.com. Requests for registration must be labeled as “Legal Proxy” and be received no later than 4:00 p.m. (Toronto time) on May 21, 2024. Please note that you MUST also register your appointment at http://www.computershare.com/alamosgold.

If you are using a 15-digit control number to login to the online Meeting and you accept the terms and conditions, you will be revoking any and all previously submitted proxies. However, in such a case, you will be provided the opportunity to vote by ballot on the matters put forth at the Meeting. If you DO NOT wish to revoke all previously submitted proxies, do not accept the terms and conditions, in which case you can only enter the Meeting as a guest.

Appointment and Revocation of Proxies

The persons named in the accompanying form of proxy are designated as proxyholders by management of the Company. A SHAREHOLDER WISHING TO APPOINT SOME OTHER PERSON (WHO NEED NOT BE A SHAREHOLDER) TO REPRESENT HIM OR HER AT THE MEETING MAY DO SO by submitting your proxy to Computershare by 4:00 p.m. (Toronto Time) on May 21, 2024. You MUST also go to http://www.computershare.com/alamosgold and provide Computershare with the name and email address of such appointed person, by 4:00 p.m. (Toronto time) on May 21, 2024, so that Computershare may provide the proxyholder with a Username via email.

Any registered shareholder who has returned a proxy may revoke it at any time before it has been exercised. In addition to revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing, including a proxy bearing a later date, executed by the registered shareholder or by an attorney authorized in writing or, if the registered shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized.

|

|

|

|

|

|

| 2024 Management Information Circular |

3 | ALAMOS GOLD INC. |

The instrument revoking the proxy must be emailed to the Company at notice@alamosgold.com at any time up to and including the last business day preceding the date of the Meeting or any adjournment thereof duly authorized. Only registered shareholders have the right to revoke a proxy. Beneficial shareholders who wish to change their vote must, at least seven (7) days before the Meeting, arrange for their respective intermediaries to revoke the proxy on their behalf.

Provisions Relating to Voting of Proxies

The Common Shares represented by proxy will be voted or withheld from voting by the designated proxyholder in accordance with the instructions of the shareholder appointing him or her on any ballot that may be called for and, if the shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. If there are no instructions provided by the shareholder, those Common Shares will be voted in favour of all proposals set out in this Circular. The proxy gives the person named in it the discretion to vote as they see fit on any amendments or variations to matters identified in the Notice of Meeting, or any other matters which may properly come before the Meeting. At the time of printing of this Circular, the management of the Company knows of no other matters which may come before the Meeting other than those referred to in the Notice of Meeting.

Advice to Beneficial Shareholders of Common Shares

The information set forth in this section is significant to many shareholders as a substantial number of shareholders do not hold Common Shares in their own names. Beneficial shareholders should note that only proxies deposited by shareholders whose names appear on the records of the Company as the registered holders of Common Shares can be recognized and acted upon at the Meeting. If Common Shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases, those Common Shares will not be registered in the shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the name of the shareholder’s broker or an agent of that broker. In Canada, most of such Common Shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms). Common Shares held by brokers or their agents or nominees can only be voted (for, withhold or against resolutions) upon the instructions of the beneficial shareholders. Therefore, beneficial shareholders should ensure that instructions respecting the voting of their Common Shares are communicated to the appropriate person well in advance of the Meeting.

Applicable regulatory policies require intermediaries/brokers to seek voting instructions from beneficial shareholders in advance of shareholders’ meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by beneficial shareholders in order to ensure that their Common Shares are voted at the Meeting. The form of voting supplied to a beneficial shareholder by its broker (or the agent of the broker) is similar to the form of proxy provided to registered shareholders by the Company. However, its purpose is limited to instructing the registered shareholder (the broker or agent of the broker) how to vote on behalf of the beneficial shareholder. Most brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”) in Canada. Broadridge typically mails a voting instruction form to the beneficial shareholders, and asks beneficial shareholders to return the voting instruction forms to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions to the Company’s tabulation agent respecting the voting of shares to be presented at the Meeting. A beneficial shareholder receiving a voting instruction form cannot use that form to vote Common Shares directly at the Meeting. The voting instruction form must be returned to Broadridge well in advance of the Meeting to have the Common Shares voted.

Beneficial and Registered Shareholders

•If you would like paper copies of the Meeting Materials, you should first determine whether you are (i) a beneficial holder of the Common Shares, as are most of our shareholders, or (ii) a registered shareholder.

•You are a beneficial shareholder (also known as a non-registered shareholder) if you beneficially own Common Shares that are held in the name of an intermediary such as a depository, bank, trust company, securities broker, trustee, clearing agency (such as CDS Clearing and Depository Services Inc. or “CDS”) or another intermediary. For example, you are a non-registered shareholder if your Common Shares are held in a brokerage account of any type.

|

|

|

|

|

|

| 2024 Management Information Circular |

4 | ALAMOS GOLD INC. |

You are a registered shareholder if you hold a paper share certificate, and your name appears directly on your share certificate.

How to obtain paper copies of the Meeting Materials

Beneficial shareholders may request that paper copies of the Meeting Materials be mailed to them at no cost. Requests may be made up to one year from the date that the Circular was filed on SEDAR+. To request materials before the Meeting go to www.proxyvote.com, and enter the 16-digit control number located on your voting instruction form and follow the instructions provided. Alternatively, you may submit a request by calling 1-877-907-7643. If you are a Non-Objecting Beneficial Owner, you may also request that paper copies of the Meeting Materials be mailed to you at no cost by calling 1-877-907-7643. Requests should be received by May 13, 2024. (i.e., at least ten (10) calendar days in advance of the date and time set out in your voting instruction form as a voting deadline) if you would like to receive the Meeting Materials in advance of the voting deadline and Meeting date.

If you hold a paper share certificate or DRS Advice or Statement (“DRS”) and your name appears directly on your share certificate or DRS, you are a registered shareholder, and you may request that paper copies of the Meeting Materials be mailed to you at no cost by calling 1-866-962-0498. Requests should be received by May 13, 2024. (i.e., at least ten calendar days in advance of the date and time set out in your proxy form as a voting deadline). Requests by registered shareholders may be made up to one year from the date that the Circular was filed on SEDAR+ by calling the Assistant Corporate Secretary of the Company at 1-866-788-8801.

How many shareholders are needed to reach a quorum at the Meeting?

We need to have at least two people present at the meeting in person (or by proxy) representing not less than 25% of the total number of votes entitled to vote at the Meeting. On April 1, 2024, 396,994,884 Common Shares were issued and outstanding, each share carrying the right to one vote. The Company is authorized to issue an unlimited number of Common Shares without par value. Only shareholders of record on the close of business on April 10, 2024, who either personally attend the Meeting or who complete and deliver a proxy in the manner and subject to the provisions set out under the headings “Record Date for Voting at the Meeting” and “Appointment and Revocation of Proxies” will be entitled to have his or her shares voted at the Meeting or any adjournment thereof.

Does any shareholder own 10% or more of Alamos’ Common Shares?

To the knowledge of the Directors and senior officers of the Company, as at the date of this Circular, there are no persons or companies beneficially owning or controlling or directing, directly or indirectly, shares carrying ten percent (10%) or more of the voting rights attached to all outstanding shares of the Company, except as follows:

|

|

|

|

|

|

|

|

|

| Name and Address |

Number of Shares |

Percentage of Outstanding Common Shares |

Van Eck Associates Corporation, 666 Third Avenue, New York, NY 10017, USA |

44,769,035(1) |

11.38% |

(1)According to the last Schedule 13G report filed on EDGAR, dated February 14, 2023, this company owned or exercised control or direction over the number of Common Shares of the Company indicated.

|

|

|

|

|

|

| 2024 Management Information Circular |

5 | ALAMOS GOLD INC. |

BUSINESS OF THE MEETING

1. Receiving the Consolidated Financial Statements of Alamos Gold Inc.

The consolidated financial statements of the Company for the fiscal year ended December 31, 2023, together with the auditors’ report thereon, are mailed to the Company’s registered and beneficial shareholders who requested them. The 2023 consolidated financial statements of the Company are available on the Alamos website at www.alamosgold.com and on both the System for Electronic Document Analysis and Retrieval + (SEDAR+) at www.sedarplus.ca, our profile on Electronic Data Gathering, Analysis, and Retrieval (EDGAR) at www.sec.gov/edgar, or http://www.envisionreports.com/ALAMOSGOLD2024.

2. Election of Directors

At the Meeting, shareholders will be asked to elect nine (9) directors. Each director elected will hold office until the conclusion of the next annual meeting of shareholders of the Company at which a director is elected, unless the director’s office is earlier vacated in accordance with the articles of the Company or the provisions of the Business Corporations Act (Ontario).

All the nominated directors are independent, except for John McCluskey, the Company’s President and Chief Executive Officer (“CEO”) (see “Director Independence”, on page

64, below). As such, the majority (89%) of director nominees are independent.

You can vote “for” all of these directors, vote “for” some of them and “withh0ld” others, or “withh0ld” all of them.

The following pages set out information about the nominees for election as directors. There are no contracts, arrangements or understandings between any director or executive officer or any other person pursuant to which any of the nominees have been nominated for election as a director of the Company.

Each of the nominated directors is eligible to serve as a director and has expressed his/her willingness to do so.

To learn more about how our Board operates, see our “Statement of Corporate Governance Practices” on page

63.

Unless otherwise instructed, the named proxyholders will vote for all the nominated directors listed below. If any proposed nominee is unable to serve as a director, the individuals named in the enclosed form of proxy reserve the right to nominate and vote for another nominee in their discretion.

|

|

|

|

|

|

| 2024 Management Information Circular |

6 | ALAMOS GOLD INC. |

|

|

|

|

|

|

|

|

Securities Held

Shares: 25,000

DSUs: 102,831

|

Elaine Ellingham, MBA, M.Sc., P.Geo.

Toronto, Ontario, Canada

|

|

Elaine Ellingham is a geologist with over 30 years of experience in mineral exploration, corporate development, investor relations and senior management for mining companies. She also spent eight years with the Toronto Stock Exchange, from 1997 to 2005, in a number of capacities including National Leader of Mining. She has held senior management roles at IAMGOLD Inc., Richmont Mines Inc. and currently serves as CEO of Omai Gold Mines Corp. For fifteen years, she consulted to international mining companies and private equity funds, evaluating and executing corporate transactions and assisting in going-public transactions. Her former Directorships include Wallbridge Mining Company Ltd, Aurania Resources Ltd and Richmont Mines Inc, acquired by Alamos in 2017. She is currently a director of Almaden Minerals Ltd. and Omai Gold Mines Corp. Ms. Ellingham holds a Master of Science degree and a Master of Business Administration from the University of Toronto, and is a Professional Geoscientist. Ms. Ellingham has been a Director of Alamos since May 7, 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

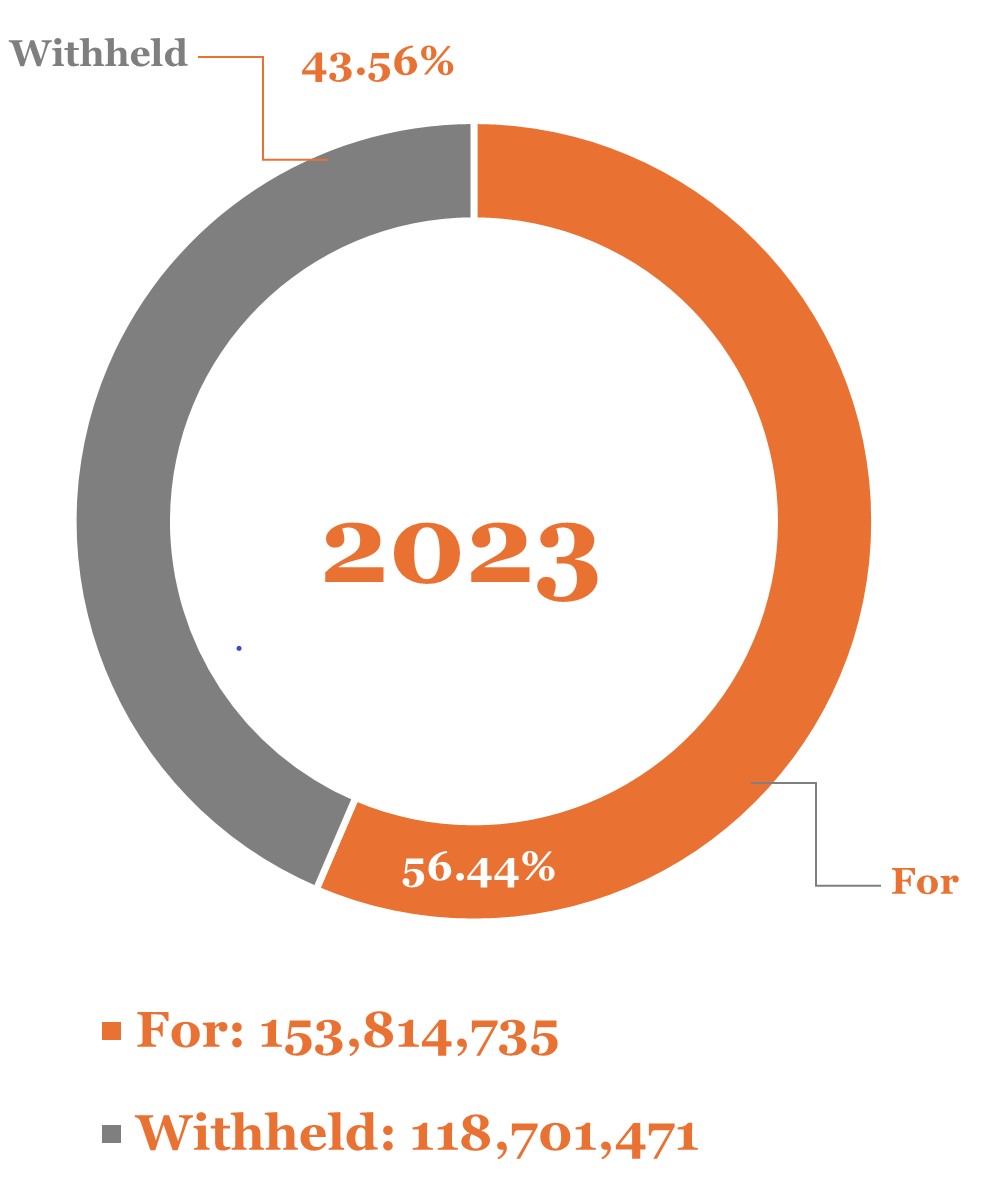

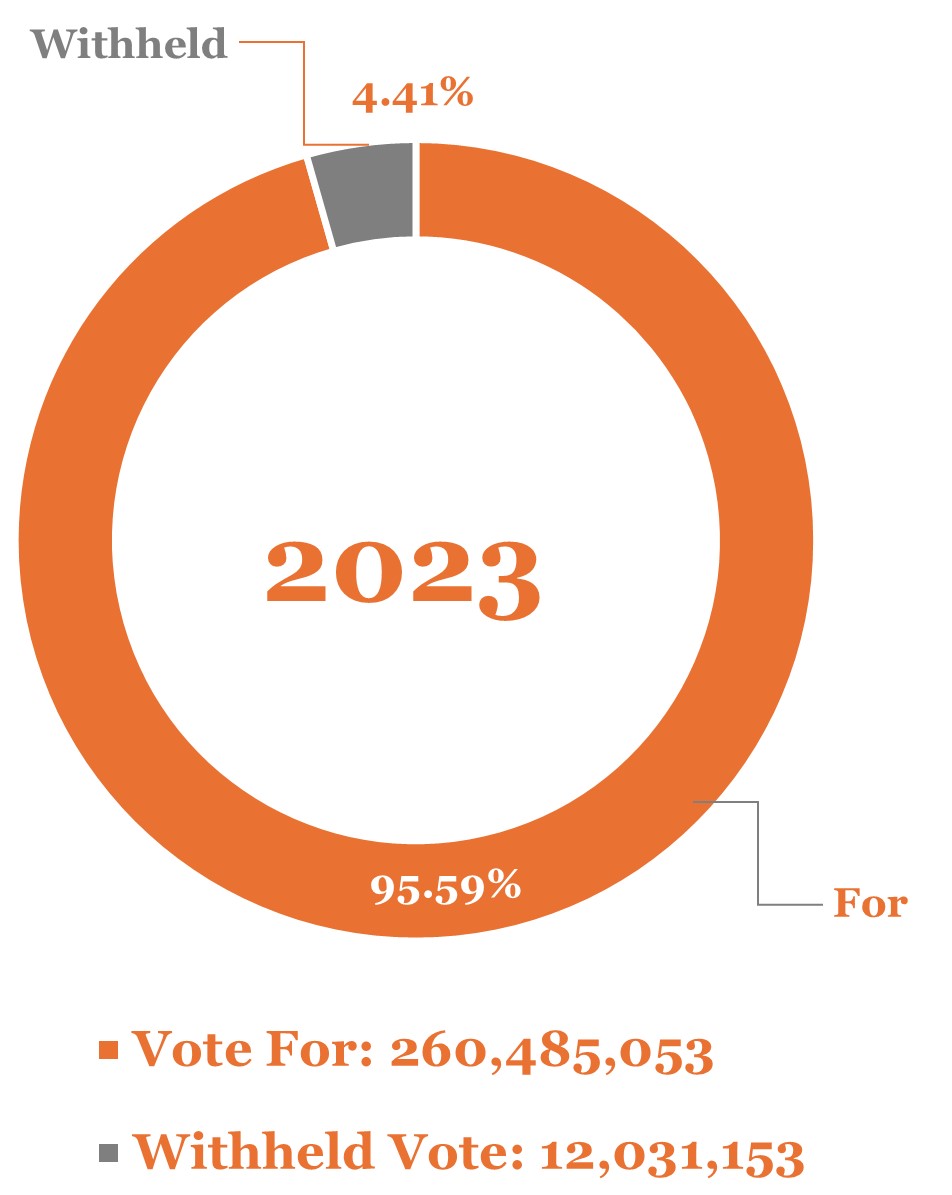

| 2023 ANNUAL MEETING VOTING RESULTS |

Independent Director Since May 7, 2018 |

|

Age

65

|

|

|

|

|

|

|

|

| Areas of Expertise |

|

Other Public Boards |

•Strategy and Leadership |

|

•Almaden Minerals Ltd. |

•Operations |

|

•Omai Gold Mines Corp. |

•Exploration |

|

|

•Metals and Mining |

|

|

•Finance |

|

|

•Human Resources |

|

|

•International Business |

|

|

•ESG and Legal |

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE |

|

2023 Meeting Attendance |

2023 Meeting Attended (%) |

| Board |

7 of 7 |

100 |

| Audit Committee |

2 of 2(1) |

100 |

| Human Resources Committee |

7 of 7 |

100 |

Technical and Sustainability Committee |

5 of 5 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

| OWNERSHIP UNDER THE GUIDELINES |

| Ownership requirement |

Total ownership value |

Meets ownership requirement |

| 5x Base Salary/Retainer |

CAD$2,518,271 |

Yes |

(1) Ms. Ellingham became a member of the Audit Committee effective May 25, 2023, and therefore only attended meetings following that date.

|

|

|

|

|

|

| 2024 Management Information Circular |

7 | ALAMOS GOLD INC. |

|

|

|

|

|

|

|

|

Securities Held

Shares: -

DSUs: 171,144

|

David Fleck, B.A., MBA, ICD.D

Toronto, Ontario, Canada

|

|

Mr. Fleck has more than 30 years of capital markets experience. Beginning his career in corporate finance, Mr. Fleck ultimately rose to the positions of Co-Head Equity Products and Executive Managing Director of the BMO Financial Group. Mr. Fleck was subsequently appointed President of Mapleridge Capital Corp., and then President and Chief Executive Officer of Macquarie Capital Markets Ltd. He is a former Partner and Senior Vice President of Delaney Capital Management and is currently Co-President of Forthlane Partners. Mr. Fleck holds a B.A. in Economics from the University of Western Ontario, an MBA from INSEAD School of Business and has completed the Directors Education Program at Rotman School of Business, University of Toronto and has received the ICD.D certification from the Institute of Corporate Directors. Mr. Fleck has been a Director of Alamos since July 2, 2015, before which he was a director of a predecessor to the Company since March 10, 2014.

|

|

|

|

|

|

|

|

|

|

|

|

|

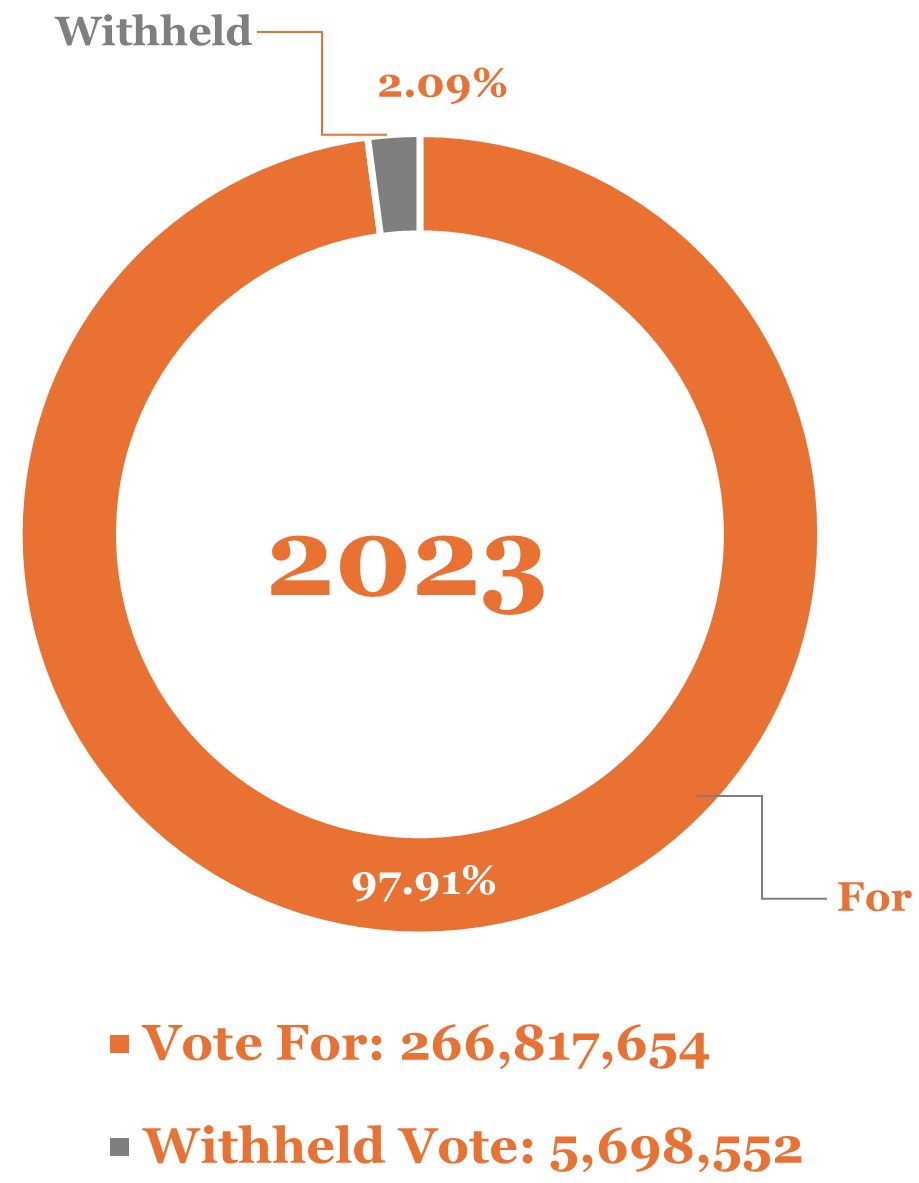

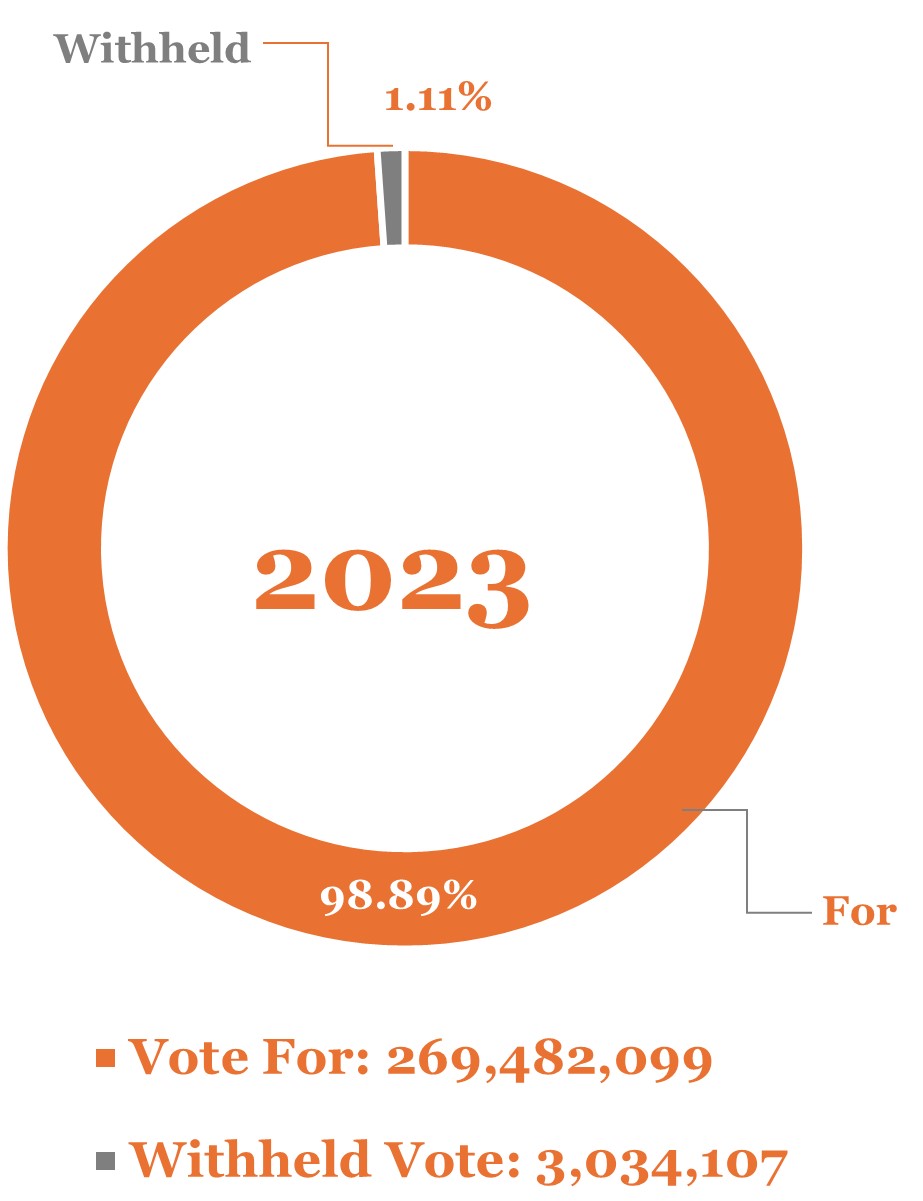

| ANNUAL MEETING VOTING RESULTS |

Independent Director Since March 10, 2014 |

|

Age

64

|

|

|

|

|

|

|

|

| Areas of Expertise |

|

Other Public Boards |

•Strategy and Leadership |

|

•N/A |

•Metals and Mining |

|

|

•Finance |

|

|

•Human Resources |

|

|

•Accounting |

|

|

•International Business |

|

|

•ESG and Legal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE |

|

2023 Meeting Attendance |

2023 Meeting Attended (%) |

| Board |

7 of 7 |

100 |

| Audit Committee |

5 of 5 |

100 |

| Corporate Governance and Nominating Committee (Chair) |

7 of 7 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

| OWNERSHIP UNDER THE GUIDELINES |

| Ownership requirement |

Total ownership value |

Meets ownership requirement |

| 5x Base Salary/Retainer |

CAD$3,371,537 |

Yes |

|

|

|

|

|

|

| 2024 Management Information Circular |

8 | ALAMOS GOLD INC. |

|

|

|

|

|

|

|

|

Securities Held

Shares: 16,500

DSUs: 164,173

|

David Gower, M.Sc., P.Geo.

Oakville, Ontario, Canada

|

|

Mr. Gower has been involved in the mineral industry for over 30 years, including positions with Falconbridge Limited and Noranda Inc. (now Glencore Canada Corporation). While at Falconbridge, he was General Manager of Global Nickel and PGM Exploration and a member of the senior operating team that approved capital budgets for new mining projects. Mr. Gower has been involved in numerous discoveries and mine development projects, including brown field discoveries at Raglan, Matagami, and Sudbury, Canada and green field discoveries in Brazil and at Kabanga in Tanzania. Since 2006, Mr. Gower has also been an executive of a number of junior mineral exploration companies focused in South America and Europe with advanced projects in Spain, Brazil, Bolivia and Chile. Mr. Gower serves as CEO and Director of Emerita Resources Corp. and a Director of Lithium Ionic Corp. He is the former CEO and Director of Halcones Precious Metals Corp and Nobel Resources Corp. Mr. Gower has a Bachelor of Science degree in Geology from Saint Francis Xavier University and a Master of Science degree in Earth Sciences from Memorial University. Mr. Gower has been a Director of Alamos since July 2, 2015, before which he was a director of a predecessor to the Company since May 19, 2009.

|

|

|

|

|

|

|

|

|

|

|

|

|

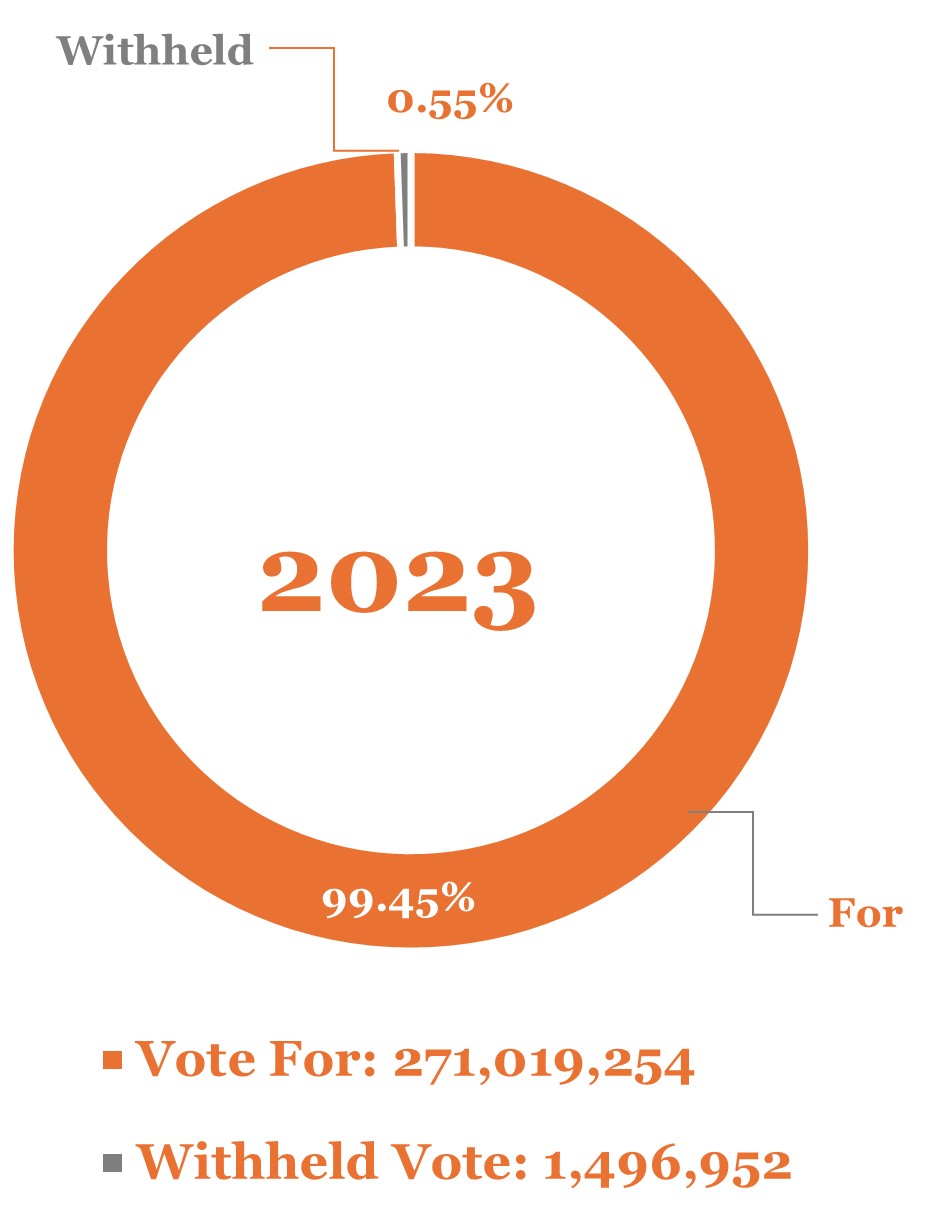

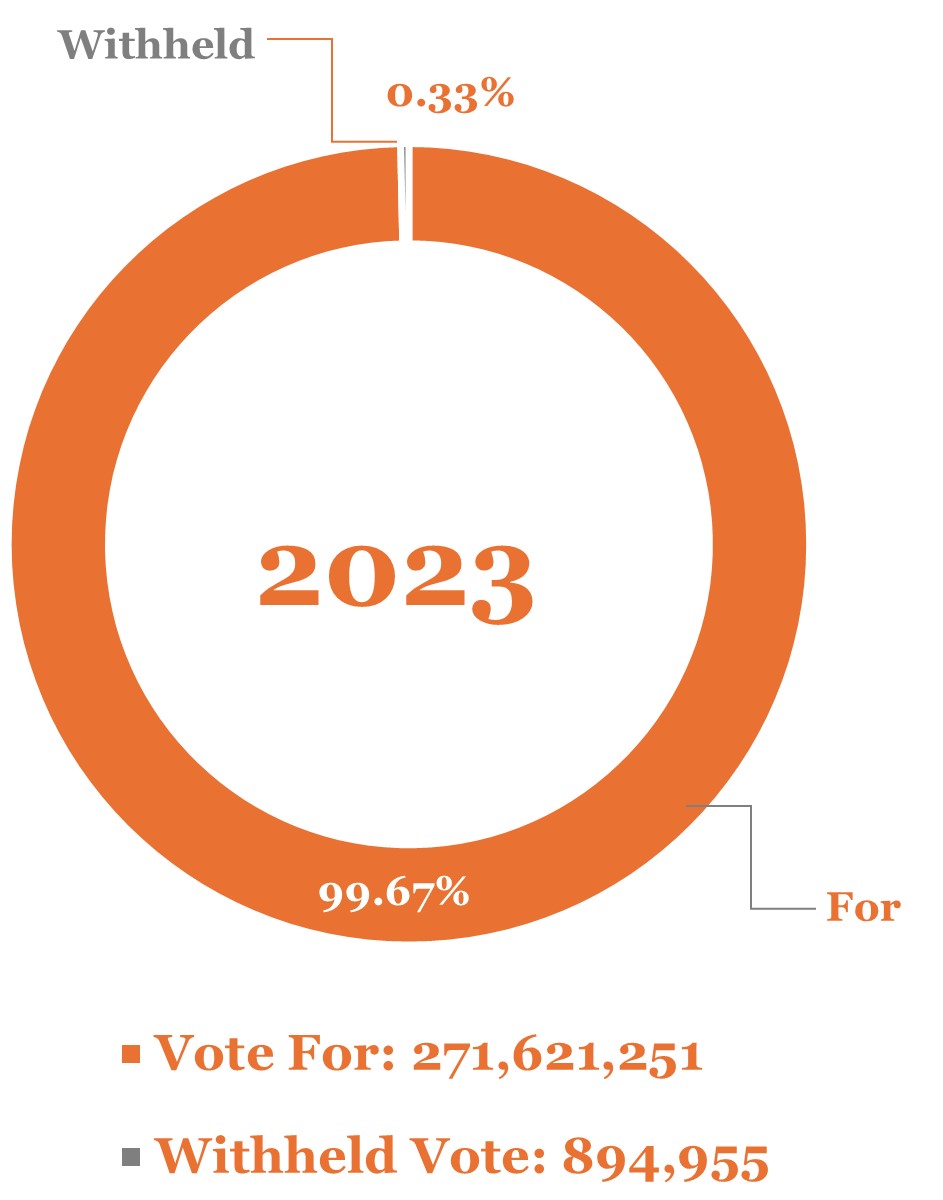

| ANNUAL MEETING VOTING RESULTS |

Independent Director Since

May 19, 2009

|

|

Age

65

|

|

|

|

|

|

|

|

| Areas of Expertise |

|

Other Public Boards |

•Strategy and Leadership |

|

•Emerita Resources Corp. |

•Operations |

|

•Lithium Ionic Corp. |

•Exploration |

|

|

•Metals and Mining |

|

|

•Human Resources |

|

|

•International Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE |

|

2023 Meeting Attendance |

2023 Meeting Attended (%) |

| Board |

7 of 7 |

100 |

| Human Resources Committee |

7 of 7 |

100 |

| Technical and Sustainability Committee (Chair) |

5 of 5 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

| OWNERSHIP UNDER THE GUIDELINES |

| Ownership requirement |

Total ownership value |

Meets ownership requirement |

| 5x Base Salary/Retainer |

CAD$3,559,258 |

Yes |

|

|

|

|

|

|

| 2024 Management Information Circular |

9 | ALAMOS GOLD INC. |

|

|

|

|

|

|

|

|

Securities Held

Shares: 9,500

DSUs: 159,064

|

Claire Kennedy, B.A.Sc., LL.D. (Hons.), ICD.D, P.Eng

Toronto, Ontario Canada

|

Ms. Kennedy is a lawyer and Senior Advisor, Clients and Industries in the Toronto office of Bennett Jones LLP. In addition, Ms. Kennedy is Lead Director of the Bank of Canada, Chair of Neo Performance Materials Inc. (and director since November 2017) and Director of Constellation Software Inc. She is a member of the Dean's Advisory Committee at Rotman School of Management, a past member of the Dean's Council at Queen’s University School of Law, past Chair of the Governing Council of the University of Toronto and formerly a Director of Neo Material Technologies Inc. Ms. Kennedy holds a Bachelor of Applied Science degree in chemical engineering from the University of Toronto, a law degree from Queen’s University, and has completed the University of Chicago’s Booth School of Business Advanced Management Program. She was a partner of Bennett Jones LLP until July 2019 when she became Senior Advisor. She also holds the ICD.D designation from the Institute of Corporate Directors, is a licensed Professional Engineer in Ontario, and was awarded an honorary LL.D. by the University of Toronto. Ms. Kennedy has been a Director of Alamos since November 10, 2015. |

|

|

|

|

|

|

|

|

|

|

|

|

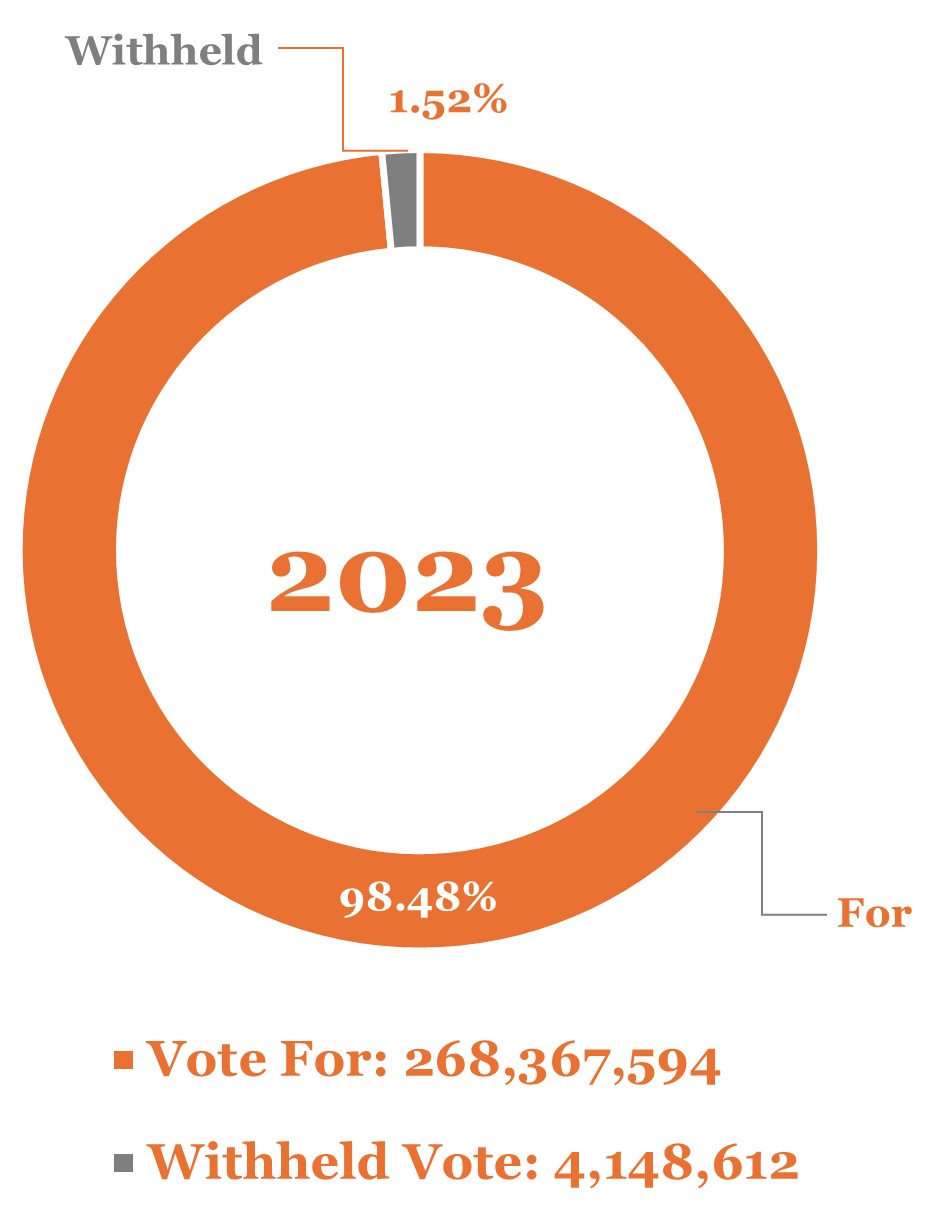

| ANNUAL MEETING VOTING RESULTS |

Independent Director Since November 10, 2015 |

|

Age

57

|

|

|

|

|

|

|

|

| Areas of Expertise |

|

Other Public Boards |

•Strategy and Leadership |

|

•Neo Performance Materials Inc. |

•Metals and Mining |

|

•Constellation Software Inc. |

•Finance |

|

|

•Government Affairs/Public Policy/Indigenous Relations |

|

•Human Resources |

|

|

•Accounting |

|

|

•International Business |

|

|

•ESG and Legal |

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE |

|

2023 Meeting Attendance |

2023 Meeting Attended (%) |

| Board |

7 of 7 |

100 |

| Audit Committee (Chair) |

5 of 5 |

100 |

| Corporate Governance and Nominating Committee |

7 of 7 |

100 |

| Public Affairs Committee |

4 of 4 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

| OWNERSHIP UNDER THE GUIDELINES |

| Ownership requirement |

Total ownership value |

Meets ownership requirement |

| 5x Base Salary/Retainer |

CAD$3,320,711 |

Yes |

|

|

|

|

|

|

| 2024 Management Information Circular |

10 | ALAMOS GOLD INC. |

|

|

|

|

|

|

|

|

Securities Held

Shares: 976,728(1)

Options: 1,365,594

PSUs: 318,978

RSUs: 159,490

|

John A. McCluskey

Toronto, Ontario, Canada

|

Mr. McCluskey began his career with Glamis Gold Ltd. in 1983. He went on to hold senior executive positions in a number of public companies in the resource sector. In 1996, he founded Grayd Resource Corporation, where he was CEO. In 1996, he also co-founded Alamos Minerals with mining hall of famer Chester Millar. Mr. McCluskey has been the President and Chief Executive Officer of Alamos since 2003, when the company merged with National Gold Corp. Mr. McCluskey was named Ontario’s 2012 Ernst & Young Entrepreneur of The Year, based on a judging panel’s assessment of financial performance, vision, leadership, innovation, personal integrity and influence, social responsibility and entrepreneurial spirit. In addition, he is the recipient of the 2018 Murray Pezim Award for perseverance and success in financing mineral exploration and the 2023 Viola R. MacMillan Award given to an individual or organization demonstrating leadership in management and financing for the exploration and development of mineral resources. Mr. McCluskey is currently a Director of Orford Mining Corporation and a Director of the World Gold Council. In addition, Mr. Cluskey is a former Director of AuRico Metals Inc. and New Pacific Metals Corp. Mr. McCluskey has been a Director of Alamos since July 2, 2015, before which he was a director of a predecessor to the Company since July 1996. Mr. McCluskey is the President and CEO of Alamos Gold Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

| ANNUAL MEETING VOTING RESULTS |

Non-Independent Director Since

July 1996

|

Age

64

|

|

|

|

|

|

|

|

| Areas of Expertise |

|

Other Public Boards |

•Strategy and Leadership |

|

•Orford Mining Corporation |

•Operations |

|

|

•Exploration |

|

|

•Metals and Mining |

|

|

•Finance |

|

|

•Government Affairs/Public Policy/Indigenous Relations |

|

•Human Resources |

|

|

•International Business |

|

|

•ESG and Legal |

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE |

|

2023 Meeting Attendance |

2023 Meeting Attended (%) |

| Board |

7 of 7 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

| OWNERSHIP UNDER THE GUIDELINES |

| Ownership requirement |

Total ownership value(1) |

Meets ownership requirement |

| 3x Base Salary/Retainer |

CAD$28,667,361 |

Yes |

(1)Of this amount, 219,941 Common Shares are held by Mr. McCluskey's spouse, 86,568 Common Shares are held by No. 369 Sail View Ventures Ltd., a corporation wholly-owned by Mr. McCluskey and his spouse, and a total of 670,219 Common Shares are held directly by Mr. McCluskey.

|

|

|

|

|

|

| 2024 Management Information Circular |

11 | ALAMOS GOLD INC. |

|

|

|

|

|

|

|

|

Securities Held

Shares: 2,603

DSUs: 82,105

|

Monique Mercier, LL.B., M.Phil. (Oxon), Ad. E.

Montreal, Québec, Canada

|

|

Monique Mercier is a Corporate Director and Senior Advisor at Bennett Jones LLP. She retired in December 2018 from TELUS Corporation, where she was Executive Vice-President, Corporate Affairs, Chief Legal and Governance Officer since 2014. Ms. Mercier has been a senior executive in the telecom, health and information industry for most of her career, including two decades at TELUS and Emergis, where she led a number of corporate functions, including human resources, government and media relations, regulatory and sustainability. She is a graduate from the University of Montreal and Oxford University, where she was awarded the Commonwealth Scholarship. She is currently a Director of TMX Group Limited, Innergex Renewable Energy Inc., iA Financial Corporation Inc., and the Thoracic Surgery Research Foundation of Montreal. Ms. Mercier was formerly a Director of the Bank of Canada, Stornoway Diamond Corporation and the Canadian Cancer Research Society. She has received numerous awards, including the 2018 Lifetime Achievement Award at the annual Canadian General Counsel Awards ceremony. Ms. Mercier has been Director of Alamos since May 2, 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

| ANNUAL MEETING VOTING RESULTS |

Independent Director Since May 2, 2019 |

|

Age

67

|

|

|

|

|

|

|

|

| Areas of Expertise |

|

Other Public Boards |

•Strategy and Leadership |

|

•Innergex Renewable Energy Inc. |

•Metals and Mining |

|

•iA Financial Corporation Inc. |

•Finance |

|

•TMX Group Limited |

•Government Affairs/Public Policy/Indigenous Relations |

|

•Human Resources |

|

|

•International Business |

|

|

•ESG and Legal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE |

|

2023 Meeting Attendance |

2023 Meeting Attended (%) |

| Board |

7 of 7 |

100 |

| Human Resources Committee (Chair) |

7 of 7 |

100 |

| Corporate Governance and Nominating Committee |

7 of 7 |

100 |

| Public Affairs Committee |

4 of 4 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

| OWNERSHIP UNDER THE GUIDELINES |

| Ownership requirement |

Total ownership value |

Meets ownership requirement |

| 5x Base Salary/Retainer |

CAD$1,668,748 |

Yes |

|

|

|

|

|

|

| 2024 Management Information Circular |

12 | ALAMOS GOLD INC. |

|

|

|

|

|

|

|

|

Securities Held

Shares: 30,000

DSUs: 263,816

|

Paul J. Murphy, B.Comm., FCPA, FCA

Toronto, Ontario, Canada

|

|

Mr. Murphy was a Partner and National Mining Leader of PricewaterhouseCoopers LLP from 2004 to April 2010 and Partner of PricewaterhouseCoopers LLP since 1981. Throughout his career, Mr. Murphy has worked primarily in the resource sector, with a client list that included major international oil and gas and mining companies. His professional experience includes financial reporting controls, operational effectiveness, International Financial Reporting Standards, SEC reporting issues, financing, valuation, and taxation as they pertain to the mining sector. Mr. Murphy was the Chief Financial Officer of GPM Metals Inc. from May 2012 to August 2018, Chief Financial Officer and Executive Vice-President, Finance, Guyana Goldfields Inc. from April 2010 until February 2019, Director of Continental Gold Inc. from 2010 until March 2020, and Chief Financial Officer of G2 Goldfields Inc. from March 2020 to June 2021. Mr. Murphy obtained a Bachelor of Commerce degree from Queen’s University and obtained his Chartered Accountant (now known as a Chartered Professional Accountant) designation in 1975 and has been recognized as a Fellow of the Institute of Chartered Professional Accountants. Mr. Murphy is currently a Director of Generation Mining Limited and Collective Mining Ltd. and has been a Director of Alamos since July 2, 2015, before which he was a director of a predecessor to the Company since February 18, 2010.

|

|

|

|

|

|

|

|

|

|

|

|

|

| ANNUAL MEETING VOTING RESULTS |

Independent Director Since February 18, 2010 |

|

Age

73

|

|

|

|

|

|

|

|

| Areas of Expertise |

|

Other Public Boards |

•Strategy and Leadership |

|

•Generation Mining Limited |

•Operations |

|

•Collective Mining Ltd. |

•Metals and Mining |

|

•Finance |

|

|

•Government Affairs/Public Policy/Indigenous Relations |

|

•Human Resources |

|

|

•Accounting |

|

|

•International Business |

|

|

•ESG and Legal |

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE |

|

2023 Meeting Attendance |

2023 Meeting Attended (%) |

| Board |

7 of 7 |

100 |

| Audit Committee |

5 of 5 |

100 |

| Corporate Governance and Nominating Committee |

7 of 7 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

| OWNERSHIP UNDER THE GUIDELINES |

| Ownership requirement |

Total ownership value |

Meets ownership requirement |

| 4x Base Salary/Retainer |

CAD$5,788,175 |

Yes |

|

|

|

|

|

|

| 2024 Management Information Circular |

13 | ALAMOS GOLD INC. |

|

|

|

|

|

|

|

|

Securities Held

Shares: 64,600

DSUs: 133,830

|

J. Robert S. Prichard, OC, O.Ont

Toronto, Ontario, Canada

|

|

J. Robert S. Prichard is a lawyer and Corporate Director. At present, he serves as non-executive Chairman of Torys LLP, Director of Onex Corporation, Wittington Investments and Chair VIA, HFR (crown corporation). He is the former Chair of the BMO Financial Group, Director of George Weston Limited and Barrick Gold Corporation and Chair of the Hospital for Sick Children. He is also President Emeritus of the University of Toronto. Mr. Prichard taught law at the University of Toronto, Yale University and Harvard University and served as Dean of Law from 1984-1990 and President from 1990-2000 at the University of Toronto. He subsequently served as President and CEO of Torstar Corporation from 2002-2009 and then President and CEO of Metrolinx before serving as Chair of Metrolinx from 2010-2018. He is an Officer of the Order of Canada, a Member of the Order of Ontario, a Fellow of the Royal Society of Canada and a Fellow of the Institute of Corporate Directors. He attended Swarthmore College, the University of Chicago (MBA), the University of Toronto (LLB) and Yale University (LLM). Mr. Prichard has been a Director of Alamos since May 2, 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

| ANNUAL MEETING VOTING RESULTS |

Independent Director Since May 2, 2019 |

|

Age

75

|

|

|

|

|

|

|

|

| Areas of Expertise |

|

Other Public Boards |

•Strategy and Leadership |

|

•Onex Corporation |

•Metals and Mining |

|

|

•Finance |

|

|

•Government Affairs/Public Policy/Indigenous Relations |

|

•Human Resources |

|

|

•Accounting |

|

|

•International Business |

|

|

•ESG and Legal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE |

|

2023 Meeting Attendance |

2023 Meeting Attended (%) |

| Board |

7 of 7 |

100 |

| Human Resources Committee |

7 of 7 |

100 |

| Corporate Governance and Nominating Committee |

7 of 7 |

100 |

| Public Affairs Committee (Chair) |

4 of 4 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

| OWNERSHIP UNDER THE GUIDELINES |

| Ownership requirement |

Total ownership value |

Meets ownership requirement |

| 5x Base Salary/Retainer |

CAD$3,909,071 |

Yes |

|

|

|

|

|

|

| 2024 Management Information Circular |

14 | ALAMOS GOLD INC. |

|

|

|

|

|

|

|

|

Securities Held

Shares: -

DSUs: 15,427

|

Shaun Usmar, B.Sc., MBA.

Toronto, Ontario, Canada

|

|

Mr. Usmar is an international mining executive with 30 years of experience working around the globe in operational, financial and executive leadership roles in some of the world's largest and fastest growing mining companies. Mr. Usmar is the founder of Triple Flag Precious Metals Corp. and is currently the CEO and a Director. Previously, Mr. Usmar served as Senior Executive Vice President and Chief Financial Officer of Barrick Gold Corporation from 2014 to 2016. He joined Xstrata in 2002 as a senior executive member of the management team that grew the company into one of the world's largest diversified miners at the time of its acquisition by Glencore in 2013. His roles at Xstrata included General Manager of Business Development in London, Chief Financial Officer of Xstrata's global Ferro-Alloys business in South Africa, and Chief Financial Officer of Xstrata's global Nickel business in Canada. Prior to joining Xstrata, Mr. Usmar worked at BHP Billiton in Corporate Finance in London, and started his career in mining in operations in the steel and aluminum industries as a production engineer. Mr. Usmar serves as Chair of Make- A-Wish Canada and Chairs the Audit Committee of the World Gold Council. He holds a Bachelor of Science Engineering in Metallurgy and Materials from the University of Witwatersrand in South Africa, and an MBA from the Kellogg Graduate School of Management at Northwestern University, both with distinction. Mr. Usmar has been a Director of Alamos since May 25, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

| ANNUAL MEETING VOTING RESULTS |

Independent Director Since May 25, 2023 |

|

Age

54

|

|

|

|

|

|

|

|

| Areas of Expertise |

|

Other Public Boards |

•Strategy and Leadership |

|

•Triple Flag Precious Metals Corp. |

•Operations |

|

|

•Metals and Mining |

|

|

•Finance |

|

|

•Human Resources |

|

|

•Accounting |

|

|

•International Business |

|

|

•ESG and Legal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE ATTENDANCE |

|

2023 Meeting Attendance |

2023 Meeting Attended (%) |

| Board |

3 of 3(1) |

100 |

| Technical and Sustainability Committee |

3 of 3(2) |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

| OWNERSHIP UNDER THE GUIDELINES |

| Ownership requirement |

Total ownership value |

Meets ownership requirement |

| 5x Base Salary/Retainer |

$303,912 |

No(3) |

(1)Mr. Usmar became a Director of the Company effective May 25, 2023, and therefore only attended meetings following that date.

(2)Mr. Usmar became a member of the Technical and Sustainability Committee effective May 25, 2023, and therefore only attended meetings following that date.

(3)Mr. Usmar became a Director of the Company effective May 25, 2023, and therefore is expected to achieve the Minimum Equity Ownership Requirements of the Company by the date that is the three year anniversary of the date he became a Director (May 25, 2026).

|

|

|

|

|

|

| 2024 Management Information Circular |

15 | ALAMOS GOLD INC. |

The information as to province of residence and principal occupation has been furnished by the respective Directors individually, and the information as to shares beneficially owned or over which a Director exercises control or direction, not being within the knowledge of the Company, has been furnished by the respective Directors individually as at April 1, 2024, as reported on the SEDI website at www.sedi.ca. Equity Ownership value based on number of outstanding vested or not vested units as at April 1, 2024, multiplied by the closing price of the Common Shares on the TSX at April 1, 2024, of CAD$19.70. For full details see the Company’s Minimum Equity Ownership Requirements (page

52).

Our Policy on Majority Voting

The Board believes that each of its members should carry the confidence and support of its shareholders. To this end, the Board has adopted a Majority Voting Policy. If, at any meeting for the election of Directors, a Director receives more “withheld” votes than “for” votes, the Director must promptly tender his resignation to the Board to take effect on acceptance by the Board. The Board will promptly accept the resignation unless the Corporate Governance and Nominating Committee (“CGNC”) of the Board determines that there are extraordinary circumstances relating to the composition of the Board or the voting results that should delay the acceptance of the resignation or justify rejecting it. Within 90 days of the relevant shareholders’ meeting, the Board will make a final decision and announce such decision, including any reasons for not accepting a resignation, by way of press release. If the Board accepts the resignation, it may appoint a new director to fill the vacancy. Any Director who tenders his or her resignation will not participate in the deliberations of the CGNC or the Board regarding such matters. In the event any Director fails to tender his or her resignation in accordance with this policy, the Board will not re-nominate such Director.

Cease Trade Orders, Bankruptcies and Penalties and Sanctions

Except as described below, no proposed Director is, as at the date of this Circular, or was within ten (10) years before the date of this Circular, a director, chief executive officer or chief financial officer of any company (including the Company), that: (i) was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than thirty (30) consecutive days, that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or (ii) was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than thirty (30) consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

On January 15, 2020, Kew Media Group Inc. (“Kew”) was subject to a cease trade order issued by the Ontario Securities Commission due to Kew’s auditor’s withdrawal of audit reports as a result of misrepresentations by Kew’s former Chief Financial Officer. David Fleck resigned from the board of directors of Kew in late February 2020.

Except as described below, no proposed Director; (i) is, as at the date of this Circular, or has been within the ten (10) years before the date of this Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or (ii) has, within the ten (10) years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed Director.

On February 28, 2020, a receiver was appointed over the assets, undertakings and properties of Kew. David Fleck resigned from the board of directors of Kew in late February 2020.

No proposed Director has been subject to: (i) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (ii) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed Director.

|

|

|

|

|

|

| 2024 Management Information Circular |

16 | ALAMOS GOLD INC. |

3. Appointment of Auditor

The Board unanimously recommends that shareholders vote in favour of KPMG LLP, Chartered Accountants and Licensed Public Accountants, of 333 Bay Street, Suite 4600, Toronto, Ontario, Canada M5H 2S5, as auditor of the Company for the ensuing year, until the close of the next annual meeting of shareholders at remuneration to be fixed by the Directors. Unless instructed otherwise, the persons named in the accompanying proxy intend to vote “FOR” the Appointment of KPMG LLP as Auditor.

The persons named in the enclosed form of proxy will vote for the appointment of KPMG LLP, Chartered Accountants and Licensed Public Accountants, of 333 Bay Street, Suite 4600, Toronto, Ontario, Canada M5H 2S5, as auditor of the Company for the ensuing year, until the close of the next annual meeting of shareholders at remuneration to be fixed by the Directors.

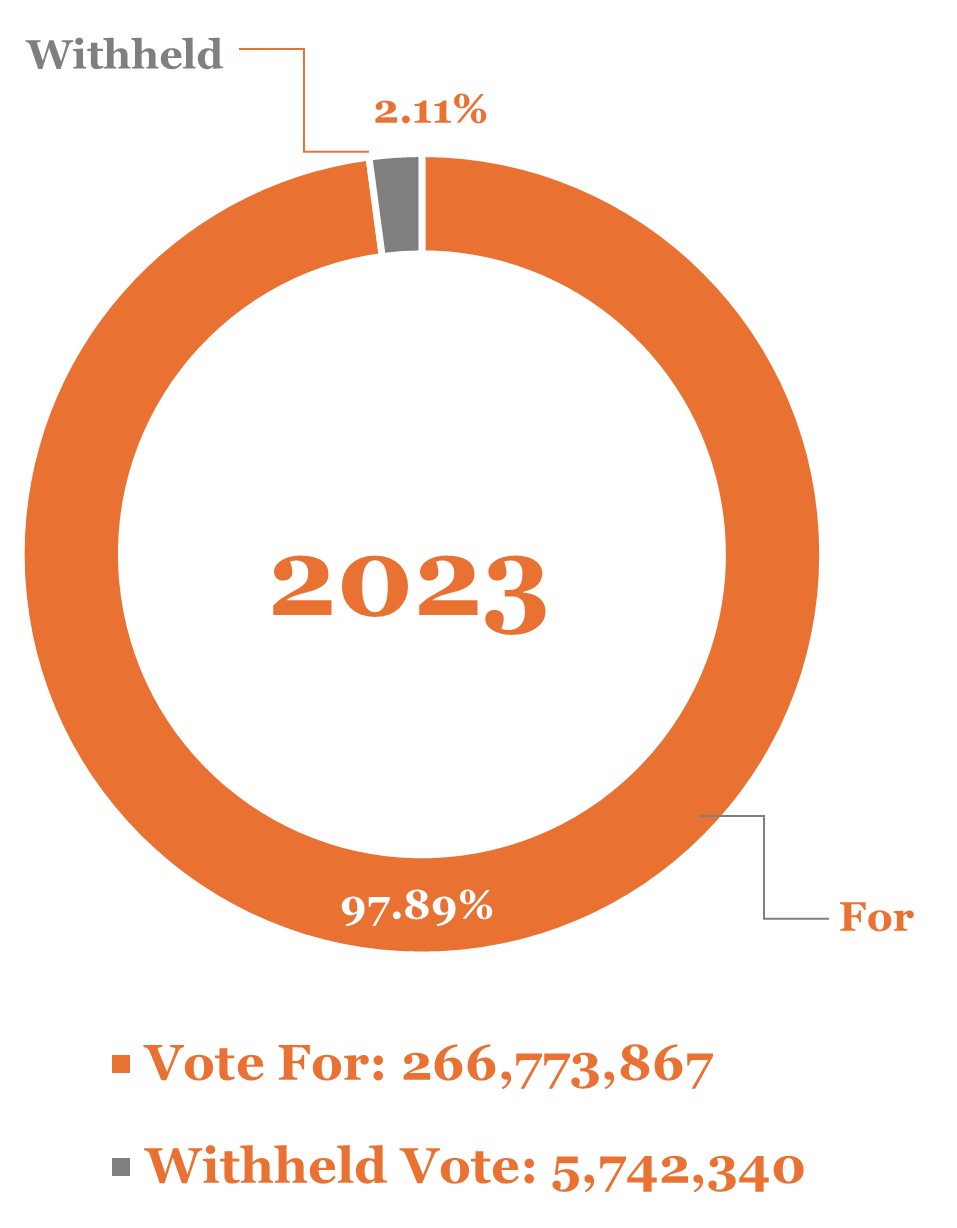

We most recently held a vote on the appointment of our Auditor, KPMG LLP, at our May 25, 2023, Annual General Meeting of Shareholders. The Appointment of Auditor Resolution was supported with 97.52% of the votes cast (298,021,076 shares) on the resolution in favour of re-appointment of KPMG LLP as Auditor and 2.48% of the votes cast (7,571,999 shares) withheld.

For the fiscal year ended December 31, 2023, KPMG LLP was paid the following fees:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year-End(1) |

Audit Fees(2) |

Audit Related Fees(3) |

Tax Fees(4) |

All Other Fees(5) |

| 2023 |

$1,151,378 |

|

$35,202 |

|

$44,917 |

|

$Nil |

(1)All fees are in USD$.

(2)Fees charged for the annual financial statement audit and quarterly reviews.

(3)Fees charged for assurance and related services reasonably related to the performance of an audit, and not included under “Audit Fees”.

(4)Fees charged for tax compliance, tax advice, and tax planning services.

(5)Fees for services other than disclosed in any other column.

4. Amendment Resolution to Articles of Incorporation to increase the size of the Board

In 2023, the CGNC of the Board commenced a process to evaluate the Company’s process for orderly board renewal and succession planning, ultimately deciding as an initial step to implement term limits for existing and new directors (see “Statement of Corporate Governance Practices” on page

63).

In order to ensure an orderly transition to director term limits, including adequate overlap of existing and new directors for the purpose of board skills composition, institutional knowledge continuity, and the need for multi-year committee leadership transitions, the Board has determined that it would be in the best interest of the Company to increase the permitted size of the Board of Directors from the current range of three (3) to ten (10) directors to a range of three (3) to twelve (12) directors.

BE IT RESOLVED THAT:

1.On the recommendation of the Board, the maximum size of the Board is hereby increased from ten (10) to twelve (12).

The Board unanimously recommends that shareholders vote in favour of the Articles Amendment Resolution. Unless instructed otherwise, the persons named in the accompanying proxy intend to vote “FOR” the Articles Amendment Resolution.”

|

|

|

|

|

|

| 2024 Management Information Circular |

17 | ALAMOS GOLD INC. |

5. Advisory Resolution on Approach to Executive Compensation - “Say on Pay”

The Company believes that its compensation objectives and approach to executive compensation align the interests of management with the long-term interests of shareholders and are appropriate. Details of the Company’s approach to executive compensation are disclosed in the “Report on Executive Compensation” set forth immediately below.

As part of our dialogue with shareholders about executive compensation, we are proposing a “say on pay” advisory resolution (the “Say on Pay Resolution”) for this year’s Meeting.

As the Say on Pay Resolution is an advisory vote, the results are not binding upon the Board. However, the Board, the Human Resources Committee (“HRC”) and the CGNC of the Board will take the results of the vote into account when considering future compensation policies, procedures and decisions.

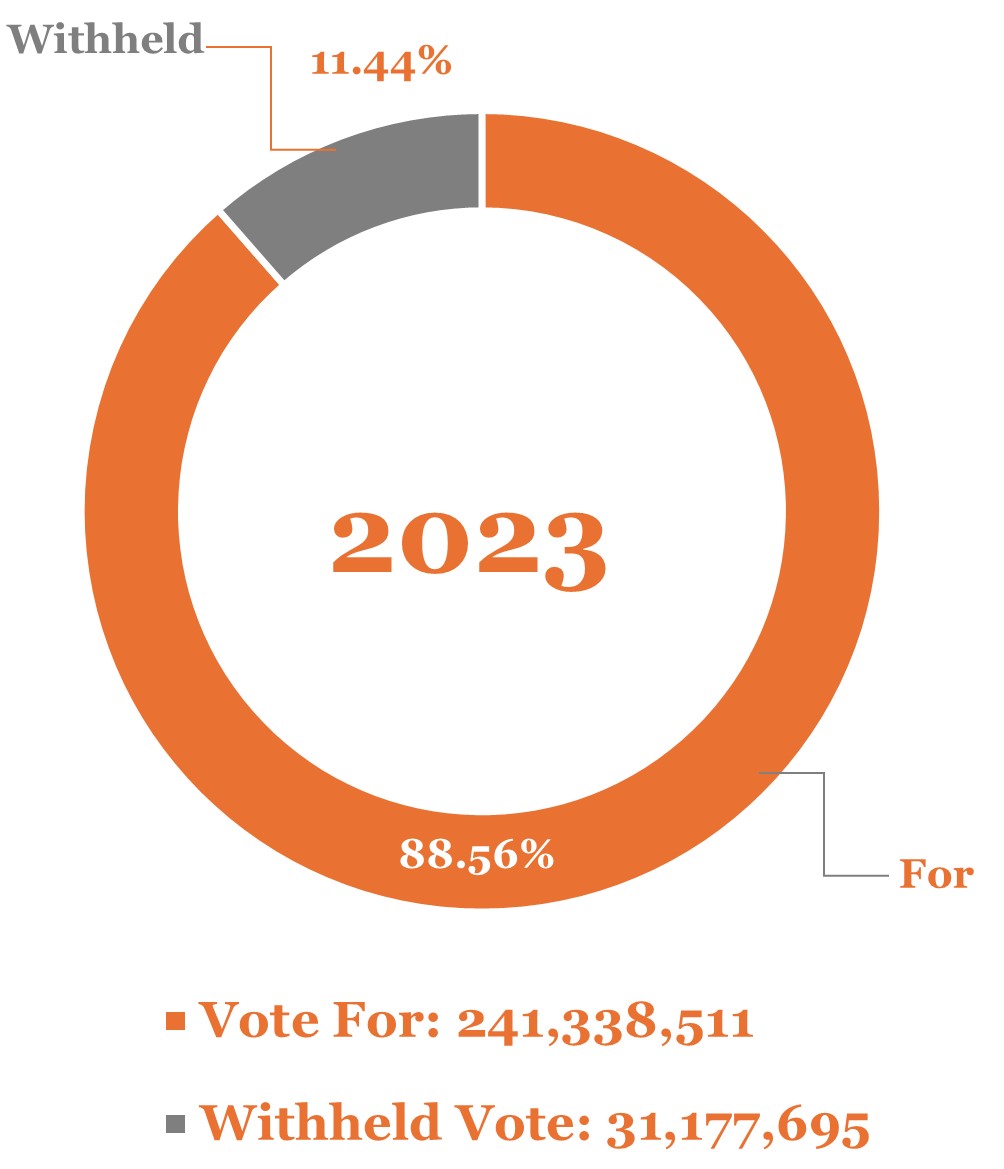

We most recently held an advisory vote on executive compensation at our May 25, 2023, Annual General Meeting of Shareholders. The Say on Pay Resolution was supported by the majority (97.99%) of the votes cast (266,951,742 shares) and 2.01% of the votes cast (5,479,277 shares) against.

Prior to voting on the Say on Pay Resolution, the Board urges shareholders to read the Report on Executive Compensation section of the Circular as it explains the objectives and principles used in designing an executive compensation program for Alamos’ Named Executive Officers (“NEOs”). Shareholders with questions about our executive compensation programs are encouraged to contact Nils F. Engelstad, Senior Vice President, General Counsel, by email at notice@alamosgold.com.

“BE IT RESOLVED THAT:

1.On an advisory basis and not to diminish the role and responsibilities of the Board, that shareholders accept the approach to executive compensation disclosed in this Circular provided in advance of the Meeting.

The Board unanimously recommends that shareholders vote in favour of the Say on Pay Resolution. Unless instructed otherwise, the persons named in the accompanying proxy intend to vote “FOR” the Say on Pay Resolution.”

Other Business

2024 Shareholder Proposals

The Business Corporations Act (Ontario) (“OBCA”) permits certain eligible shareholders to submit shareholder proposals to the Company, which may be included in a management proxy circular relating to an annual meeting of shareholders. No proposals were received prior to the notice requirements outlined in the OBCA.

Shareholder Nominations for Directors

Shareholders may at any time submit to the Board the names of individuals for consideration as directors. The CGNC will consider such submissions when assessing the diversity, skills and experience required on the Board to enhance overall board composition and oversight capabilities and making recommendations for individuals to be nominated for election as directors.

Holders of shares representing in the aggregate not less than 5% of the’ outstanding shares may nominate individuals to serve as directors and have their nominations included in the Company’s proxy circular for its annual meeting by submitting a shareholder proposal in compliance with and subject to the provisions of the OBCA. No such shareholder proposal was received this year.

Advance Notice Requirements

The Company’s By-Laws (“By-Laws”) contain an advance notice requirement for director nominations. These requirements are intended to provide a transparent, structured and fair process with a view to providing

|

|

|

|

|

|

| 2024 Management Information Circular |

18 | ALAMOS GOLD INC. |

shareholders an opportunity to submit their proxy voting instructions on an informed basis. Shareholders who wish to nominate candidates for election as directors must provide timely notice in writing to the Corporate Secretary of the Company and include the information set out in the Company’s By-Laws. A copy of the By-Laws of the Company is available through the Company’s website at www.alamosgold.com, www.sedarplus.ca or www.sec.gov/edgar.

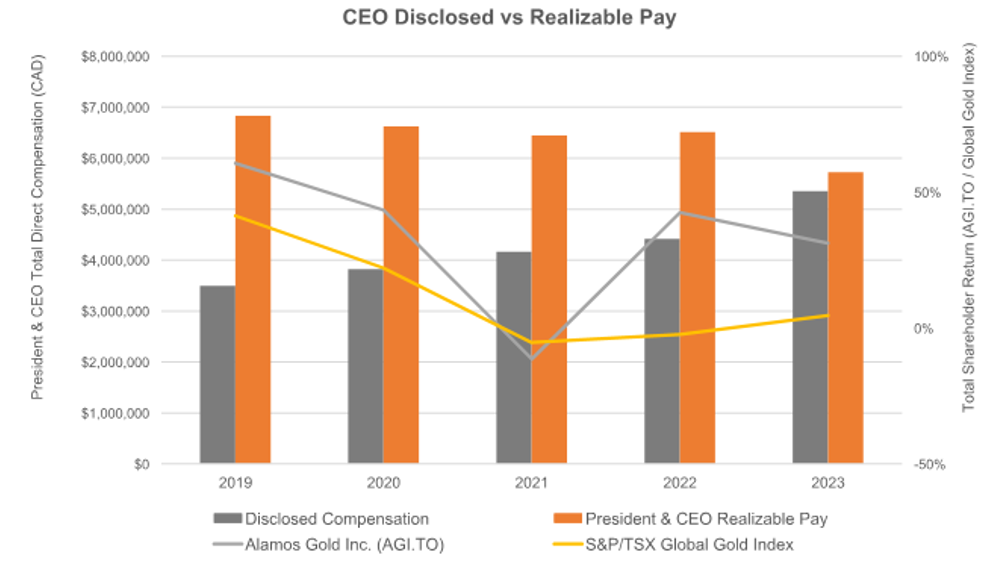

REPORT ON EXECUTIVE COMPENSATION

As at December 31, 2023, the end of the most recently completed financial year of the Company, the six (6) Named Executive Officers (“NEOs”) of the Company were: John A. McCluskey, President and Chief Executive Officer, Gregory Fisher, Chief Financial Officer, James Porter, Former Chief Financial Officer, Luc Guimond, Chief Operating Officer, Nils F. Engelstad, Senior Vice President, General Counsel, and Christopher Bostwick, Senior Vice President, Technical Services.

Compensation Discussion and Analysis

The Alamos executive compensation program is designed to achieve the following objectives:

•Attract, retain, and motivate executives of the highest quality;

•Align the interests of the CEO and senior executives with the Company’s shareholders;

•Create incentives to achieve established corporate and individual performance objectives in the short and long-term;

•Properly reflect the respective duties and responsibilities of the senior executives; and

•Create incentives relating to risk management and regulatory compliance.

These objectives are embedded in the charter of the HRC and reflect the Company’s pay-for-performance philosophy for compensation of its executives. Each of the elements of the Company’s compensation program (base salary, annual non-equity incentive and long-term equity incentive) is designed to achieve one or more of these objectives, both in the near and long-term.

Compensation for the NEOs and the balance of the executive officers consists of a base salary, annual non-equity incentive, and annual long-term incentives in the form of stock options, restricted and performance share unit grants. The HRC reviews and recommends base salary levels to the Board, based on several factors, to enable the Company to attract, motivate and retain high quality executives who are critical to the Company’s long-term success. Annual incentive compensation is linked to achievement of annual corporate objectives in the case of the President and CEO and in the case of all other executives, individual and corporate objectives, thereby aligning interests of the executives with the short and long-term objectives of the Company and those of the Company’s shareholders. Long-term equity incentive compensation is intended to align the interests of executive officers with the longer-term interests of shareholders.

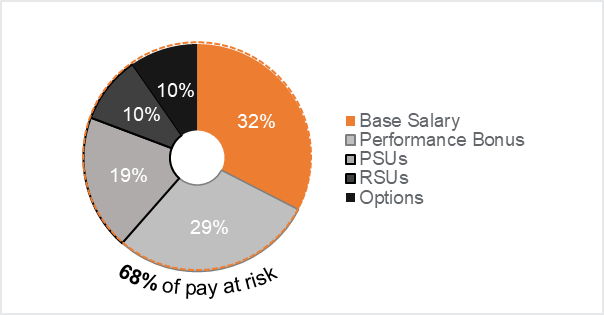

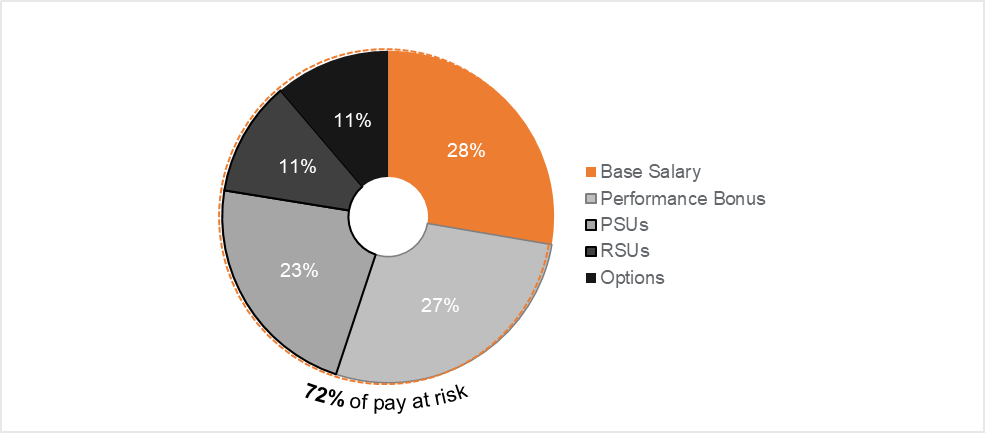

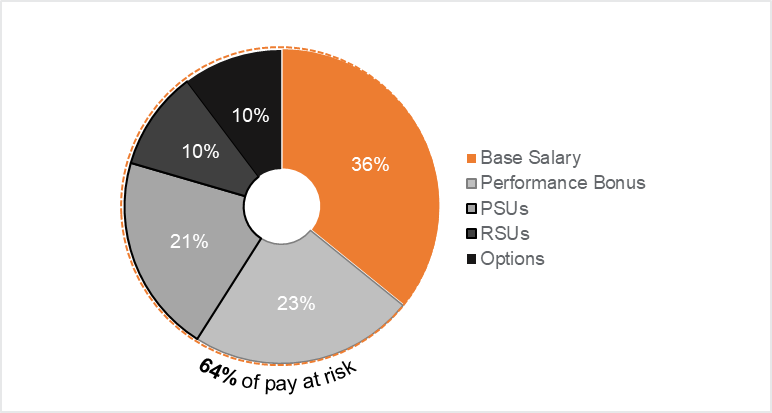

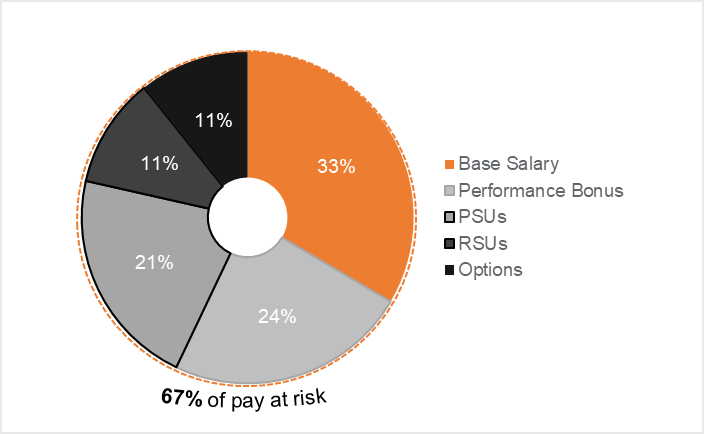

Overall, the Company’s compensation strategy is to target market position. Generally, when an executive is newly appointed, their total direct compensation is targeted below market median. Compensation is reviewed annually, and actual salary and awards are based on performance and other factors noted previously. The Company continues to place greater weighting on pay at risk, including annual non-equity incentives and long-term incentives.

Base salaries and long-term incentives for the 2023 fiscal year were reviewed in meetings of the HRC held on February 6, 2023, and February 17, 2023, and approved by the Board on February 24, 2023.

The Company’s performance and non-equity incentive achievement for executives for the 2023 year was reviewed by the HRC on February 5, 2024, and February 14, 2024, and approved by the Board on February 20, 2024.

Base salaries, annual non-equity incentive targets, and long-term incentive grants for the 2024 fiscal year were reviewed in the same HRC meetings, February 5, 2024, and February 14, 2024, and approved by the Board on February 20, 2024.

Key components of the Company’s compensation plan are discussed in greater detail below.

|

|

|

|

|

|

| 2024 Management Information Circular |

19 | ALAMOS GOLD INC. |

The HRC’s executive compensation decisions were informed by information and advice from the Company’s independent compensation advisor WTW (formerly, Willis Towers Watson), which provided compensation benchmarking analysis, market intelligence, analysis of company performance, and review and commentary on compensation recommendations.

Base Salary

Base salaries provide executive officers with remuneration based on the position and the required experience, qualifications, and skills to effectively perform the functions contained in the job description. Base salaries are also the determinant for other forms of compensation (annual non-equity incentive, long-term incentive, retirement plan, and benefits) to the extent these are paid or granted as a percentage of base salary. Base salaries are intended to be internally equitable and externally competitive, with the principal objectives being to retain and motivate existing executives and attract high caliber candidates. Salaries are reviewed annually based on performance and compared to base salaries for similar roles in peer group companies and/or the broader mining industry. The Company targets the median of its peer group; however, actual salaries reflect industry economics, Company performance, individual performance, years of experience at the executive level, and technical, management skills, leadership skills, and succession planning considerations. Annual adjustments to base salaries are assessed and recommended by the CEO to the HRC, and, in turn, recommended by the HRC to the Board for final approval. The CEO’s base salary adjustment is recommended by the HRC to the Board.

Annual Non-Equity Incentive

The HRC reviews annual non-equity incentives (“Bonus”) to be paid to the executive officers of the Company in respect of a financial year based on both individual and corporate performance, as recommended by the CEO. Each executive officer is responsible for presenting specific individual goals and objectives to the CEO for review and approval on an annual basis. Bonus targets are set based on peer group benchmarking, and an internal review for internal equity purposes. An annual bonus is provided as an element of total compensation to provide an incentive to achieve or exceed annual goals consistent with operating, financial and ESG metrics that can generally be improved on a year over year basis. The Company metrics are outlined in the table under “Corporate Metrics”. All executives other than the CEO, Chief Financial Officer (“CFO”) and Chief Operating Officer (“COO”) have a 50:50 weighting of their individual and corporate metrics. The CFO and COO have a weighting of 75:25 corporate metrics and individual goals, whereas the CEO is measured entirely on performance relative to corporate metrics. For 2024 performance year, the CEO’s non-equity incentive weighting will reflect 90:10 corporate metrics and individual goals.

While the calculation of the corporate performance component of the annual bonus awards is formulaic in nature, the Board retains discretion with respect to the amounts awarded.

Following a market review, Alamos determined that the upper end of the performance factor of 150% is behind market. As a result, for the 2024 performance year, the maximum achievable has been adjusted to 200%.

Details of the Plan

The annual bonus is structured to recognize individual and Company-wide performance. Goals are set as stretch goals, and achievement equates to a 100% target payout, while exceeding goals is recognized by a payout of up to 150% of target. Board discretion applies when awards are outside the stated award ranges. Individual goal recognition is determined in concert with overall corporate performance. Equally, the Board has the discretion to recognize goals that are not fully achieved but would be paid at a threshold level (below target). Target annual non-equity incentive payout targets are expressed as percentages of base salary and achievement as percentages of base earnings.

|

|

|

|

|

|

| 2024 Management Information Circular |

20 | ALAMOS GOLD INC. |

Overall bonus (corporate and individual metrics) for the NEOs were as follows:

|

|

|

|

|

|

|

|

|

| Name and Principal Position |

Target Bonus as a % of Base Salary |

Actual Bonus Paid as % of Base Earnings |

| John A. McCluskey, CEO |

125% |

150% |

| Gregory Fisher, CFO |

80% |

89% |

| Luc Guimond, Chief Operating Officer |

80% |

99% |

James Porter, Former CFO |

100% |

N/A% |

| Nils F. Engelstad, SVP, General Counsel |

55% |

65% |

| Christopher Bostwick, SVP, Technical Services |

60% |

71% |

James Porter resigned in 2023 and did not earn a bonus for the year. Gregory Fisher was promoted to CFO on May 1, 2023, resulting in a pro-rated bonus, which reflects the time in the position as Senior Vice President, Finance and CFO, respectively, in 2023.

Company Performance

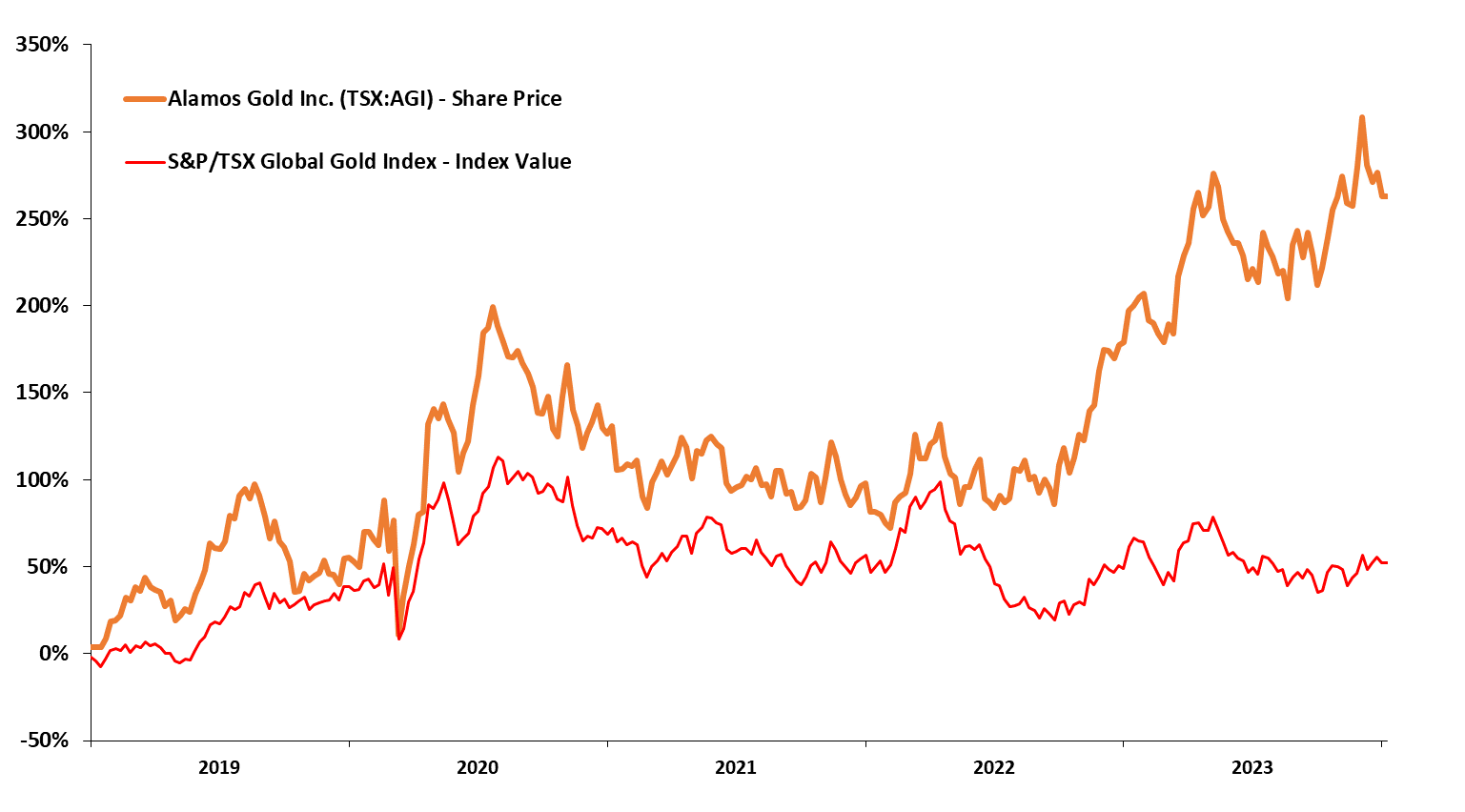

2023 Operating and Financial Highlights

•Produced a record 529,300 ounces of gold in 2023, achieving the top end of increased production guidance and representing a 15% increase from 2022

•The Mulatos District exceeded guidance, producing 212,800 ounces in 2023, a 58% increase from the prior year, reflecting a strong performance from La Yaqui Grande in its first full year of production. The higher margin ounces from La Yaqui Grande drove a significant increase in mine-site free cash flow(1) to $142.1 million

•Young-Davidson produced 185,100 ounces in 2023, meeting guidance and generating record mine-site free cash flow(1) of $117.6 million. This marked the third consecutive year mine-site free cash flow has exceeded $100 million, demonstrating the strong ongoing performance and consistency of the operation

•Island Gold produced 131,400 ounces in 2023, meeting guidance and continuing to self-fund the majority of $178.1 million of growth capital invested in the Phase 3+ Expansion during the year

•Total cash costs(1) of $850 per ounce, all-in sustaining costs (“AISC”(1)) of $1,160 per ounce, and cost of sales of $1,212 per ounce for the full year were in line with guidance

•Record financial performance with full year gold sales totaling 526,258 ounces at an average realized price of $1,944 per ounce for record revenue of $1.0 billion

•Record annual cash flow from operating activities of $472.7 million (including $518.9 million, or $1.31 per share before changes in working capital(1))

•Strong free cash flow(1) of $123.8 million in 2023 while funding the Phase 3+ Expansion at Island Gold

•Realized adjusted net earnings(1) of $208.4 million, or $0.53 per share(1) in 2023. Reported net earnings were $210.0 million, or $0.53 per share

•Cash and cash equivalents increased $95.0 million, or 73%, to $224.8 million at year end, with no debt and $13.0 million in equity securities

•Paid dividends of $39.4 million, or $0.10 per share for the full year