Document

ALGONQUIN POWER & UTILITIES CORP.

ANNUAL INFORMATION FORM

For the year ended December 31, 2024

March 7, 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

CORPORATE STRUCTURE |

|

|

1.1 |

Name, Address and Incorporation |

|

|

1.2 |

Intercorporate Relationships |

|

2. |

GENERAL DEVELOPMENT OF THE BUSINESS |

|

|

2.1 |

Three Year History |

|

|

|

2.1.1 |

Fiscal 2022 |

|

|

|

2.1.2 |

Fiscal 2023 |

|

|

|

2.1.3 |

Fiscal 2024 |

|

|

|

2.1.4 |

Fiscal 2025 |

|

3. |

DESCRIPTION OF THE BUSINESS |

|

|

3.1 |

Regulated Services Group |

|

|

|

3.1.1 |

Description of Operations |

|

|

|

3.1.2 |

Specialized Skill and Knowledge |

|

|

|

3.1.3 |

Competitive Conditions |

|

|

|

3.1.4 |

Cycles and Seasonality |

|

|

3.2 |

Hydro Group |

|

|

|

3.2.1 |

Description of Operations |

|

|

|

3.2.2 |

Specialized Skill and Knowledge |

|

|

|

3.2.3 |

Competitive Conditions |

|

|

|

3.2.4 |

Cycles and Seasonality |

|

|

3.3 |

Corporate Development Activities |

|

|

3.4 |

Principal Revenue Sources |

|

|

3.5 |

Environmental Protection |

|

|

3.6 |

Employees |

|

|

3.7 |

Foreign Operations |

|

|

3.8 |

Economic Dependence |

|

|

3.9 |

Social and Environmental Policies and Commitment to Sustainability |

|

|

3.10 |

Credit Ratings |

|

4. |

ENTERPRISE RISK FACTORS |

|

|

4.1 |

Risk Factors Relating to Operations |

|

|

4.2 |

Risk Factors Relating to Regulatory Environment |

|

|

4.3 |

Risk Factors Relating to Financing and Financial Reporting |

|

|

4.4 |

Risk Factors Relating to Strategic Planning and Execution |

|

5. |

DIVIDENDS |

|

|

5.1 |

Common Shares |

|

|

5.2 |

Preferred Shares |

|

|

5.3 |

Dividend Reinvestment Plan |

|

6. |

DESCRIPTION OF CAPITAL STRUCTURE |

|

|

6.1 |

Common Shares |

|

|

6.2 |

Preferred Shares |

|

TABLE OF CONTENTS

(continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.3 |

Subordinated Notes |

|

|

6.4 |

Equity Units |

|

|

6.5 |

Shareholders’ Rights Plan |

|

7. |

MARKET FOR SECURITIES |

|

|

7.1 |

Trading Price and Volume |

|

|

|

7.1.1 |

Common Shares |

|

|

|

7.1.2 |

Preferred Shares |

|

|

|

7.1.3 |

2019 Subordinated Notes |

|

|

7.2 |

Prior Sales |

|

|

7.3 |

Escrowed Securities and Securities Subject to Contractual Restrictions on Transfer |

|

8. |

DIRECTORS AND OFFICERS |

|

|

8.1 |

Name, Occupation and Security Holdings |

|

|

8.2 |

Audit & Finance Committee |

|

|

|

8.2.1 |

Audit & Finance Committee Charter |

|

|

|

8.2.2 |

Relevant Education and Experience |

|

|

|

8.2.3 |

Pre-Approval Policies and Procedures |

|

|

8.3 |

Corporate Governance, Risk, and Human Resources and Compensation Committees |

|

|

8.4 |

Cease Trade Orders, Bankruptcies, Penalties or Sanctions |

|

|

8.5 |

Conflicts of Interest |

|

9. |

LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

63 |

|

9.1 |

Legal Proceedings |

|

|

9.2 |

Regulatory Actions |

|

10. |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

|

11. |

TRANSFER AGENTS AND REGISTRARS |

|

12. |

MATERIAL CONTRACTS |

|

13. |

EXPERTS |

|

14. |

ADDITIONAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

Caution Concerning Forward-Looking Statements and Forward-Looking Information

This document may contain statements that constitute “forward-looking information” within the meaning of applicable securities laws in each of the provinces and territories of Canada and the respective policies, regulations and rules under such laws or “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking information”). The words “aims”, “anticipates”, “believes”, “budget”, “could”, “estimates”, “expects”, “forecasts”, “intends”, “may”, “might”, “plans”, “projects”, “pursue”, “schedule”, “seeks”, “should”, “strives”, “targets”, “will”, “would” (and grammatical variations of such terms) and similar expressions are often intended to identify forward-looking information, although not all forward-looking information contains these identifying words. Specific forward-looking information in this document includes, but is not limited to, statements relating to: expected future investments and growth, results of operations, performance, business prospects and opportunities of the Corporation; the expected expiry of the Cooperation Agreement (as such term is defined herein); the anticipated impact of the Renewables Sale on the Corporation; the anticipated impact of the sale of the Corporation’s interest in Atlantica on the Corporation; expectations regarding earnings and cash flows; share price appreciation; expectations regarding the use of proceeds from the Renewables Sale and financings; expectations regarding credit ratings and the maintenance thereof and equity credit from rating agencies; statements relating to renewable energy credits expected to be generated and sold; expectations regarding U.S. federal grants; statements regarding the Corporation’s sustainability and environmental, social and governance goals, including its net-zero by 2050 target; expected management changes; expectations and plans with respect to current and planned projects; expectations with respect to revenues pursuant to Offtake Contracts; financing plans; asset sales; sources of funding, including adequacy and availability of credit facilities, cash flows from operations and capital markets financing; anticipated customer benefits; potential acquisitions, dispositions, projects, initiatives or other transactions; expectations regarding the Corporation’s corporate development activities and the results thereof; expectations regarding future capital investments and development pipeline, including expected timing, investment plans, sources of funds and impacts; expectations regarding the outcome of legal claims and disputes; strategy and goals; expected demand for power; expected capacity of and energy sales from existing facilities; joint ventures; environmental liabilities; dividends to shareholders, including the sustainability thereof and the Corporation’s ability to achieve its targeted annual dividend payout ratio; the Reinvestment Plan; the future impact on the Corporation of actual or proposed laws, regulations and rules; the expected impact of changes in customer usage on the Regulated Services Group’s revenue; accounting estimates; the implementation of new technology systems and infrastructure, including the expected timing thereof; financing costs; the expected impact of tariffs imposed by the U.S. and Canada; and currency exchange rates. All forward-looking information is given pursuant to the “safe harbour” provisions of applicable securities legislation.

The forecasts and projections that make up the forward-looking information contained herein are based on certain factors or assumptions which include, but are not limited to: the receipt of applicable regulatory approvals and requested rate decisions; the absence of material adverse regulatory decisions being received and the expectation of regulatory stability; the absence of any material equipment breakdown or failure; availability of financing (including tax equity financing and self-monetization transactions for U.S. federal tax credits) on commercially reasonable terms and the stability of credit ratings of AQN and its subsidiaries; the absence of unexpected material liabilities or uninsured losses; the continued availability of commodity supplies and stability of commodity prices; the absence of interest rate increases or significant currency exchange rate fluctuations; the absence of significant operational, financial or supply chain disruptions or liability, including relating to additional import controls and tariffs; the continued ability to maintain systems and facilities to ensure their continued performance; the absence of a severe and prolonged downturn in general economic, credit, social or market conditions; the successful and timely development and construction of new projects; the absence of capital project or financing cost overruns; sufficient liquidity and capital resources; the continuation of long-term weather patterns and trends; the absence of significant counterparty defaults; the continued competitiveness of electricity pricing when compared with alternative sources of energy; the realization of the anticipated benefits of the Corporation’s dispositions, acquisitions and joint ventures; the absence of a change in applicable laws, political conditions, public policies and directions by governments materially negatively affecting the Corporation; the ability to obtain and maintain licenses and permits; maintenance of adequate insurance coverage; the absence of material fluctuations in market energy prices; the absence of material disputes with taxation authorities or changes to applicable tax laws; continued maintenance of information technology infrastructure and the absence of a material breach of cybersecurity; the successful implementation of new information technology systems and infrastructure; favourable relations with external stakeholders; favourable labour relations; that the Corporation will be able to successfully integrate newly acquired entities, and the absence of any material adverse changes to such entities prior to closing; the absence of undisclosed liabilities of entities being acquired; the absence of any significant indemnification claims arising from the Renewables Sale; the absence of any reputational harm to the Corporation as a result of the Renewables Sale; the absence of adverse reactions or changes in business relationships or relationships with employees following the Renewables Sale; and the ability of the Corporation to realize the anticipated benefits from the Renewables Sale and the sale of its interest in Atlantica.

The forward-looking information contained herein is subject to risks, uncertainties and other factors that could cause actual results to differ materially from historical results or results anticipated by the forward-looking information. Factors which could cause results or events to differ materially from current expectations include, but are not limited to: changes in general economic, credit, social or market conditions; changes in customer energy usage patterns and energy demand; reductions in the liquidity of energy markets; global climate change; the incurrence of environmental liabilities; natural disasters, diseases, pandemics, public health emergencies and other force majeure events and the collateral consequences thereof, including the disruption of economic activity, volatility in capital and credit markets and legislative and regulatory responses; critical equipment breakdown or failure; supply chain disruptions; the impact of existing import controls and tariffs and the imposition of additional import controls or tariffs; the failure of information technology infrastructure and other cybersecurity measures to protect against data, privacy and cybersecurity breaches; failure to successfully implement, and cost overruns and delays in connection with, new information technology systems and infrastructure; physical security breach; the loss of key personnel and/or labour disruptions; seasonal fluctuations and variability in weather conditions and natural resource availability; reductions in demand for electricity, water and natural gas due to developments in technology; reliance on transmission systems owned and operated by third parties; issues arising with respect to land use rights and access to the Corporation’s facilities; terrorist attacks; fluctuations in commodity and energy prices; capital expenditures; reliance on subsidiaries; the incurrence of an uninsured loss; a credit rating downgrade; an increase in financing costs or limits on access to credit and capital markets; inflation; increases and fluctuations in interest rates and failure to manage exposure to credit and financial instrument risk; currency exchange rate fluctuations; restricted financial flexibility due to covenants in existing credit agreements; an inability to refinance maturing debt on favourable terms; disputes with taxation authorities or changes to applicable tax laws; requirement for greater than expected contributions to post-employment benefit plans; default by a counterparty; inaccurate assumptions, judgments and/or estimates with respect to asset retirement obligations; failure to maintain required regulatory authorizations; changes in, or failure to comply with, applicable laws and regulations; failure of compliance programs; failure to dispose of assets (at all or at a competitive price) to fund the Corporation’s operations and strategic objectives; delays and cost overruns in the design and construction of projects; loss of key customers; a third party joint venture partner acting in a manner contrary to the Corporation’s interests; facilities being condemned or otherwise taken by governmental entities; increased external stakeholder activism adverse to the Corporation’s interests; fluctuations in the price and liquidity of the Common Shares and the Corporation’s other securities; the failure to implement the Corporation’s strategic objectives or achieve expected benefits relating to acquisitions, dispositions or other initiatives, including with respect to the Renewables Sale and the sale of the Corporation’s interest in Atlantica; and risks related to the Renewables Sale and its impact on the Corporation’s remaining business, including the possibility of adverse reactions or changes in business relationships or relationships with employees resulting from the Renewables Sale. Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Some of these and other factors are discussed in more detail under the heading “Enterprise Risk Factors” in this AIF and under the heading “Enterprise Risk Management” in the Corporation’s management discussion and analysis for the three and twelve months ended December 31, 2024 (which may be found on SEDAR+ at www.sedarplus.com and on EDGAR at www.sec.gov/edgar) (the “MD&A”).

Forward-looking information contained herein is provided for the purposes of assisting the reader in understanding the Corporation and its business, operations, risks, financial performance, financial position and cash flows as at and for the periods indicated and to present information about management’s current expectations and plans relating to the future, and the reader is cautioned that such information may not be appropriate for other purposes. Forward-looking information contained herein is made as of the date of this document and based on the plans, beliefs, estimates, projections, expectations, opinions and assumptions of management on the date hereof. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. While subsequent events and developments may cause the Corporation’s views to change, the Corporation disclaims any obligation to update any forward-looking information or to explain any material difference between subsequent actual events and such forward-looking information, except to the extent required by applicable law. All forward-looking information contained herein is qualified by these cautionary statements.

Explanatory Notes

All information contained in this AIF is presented as at December 31, 2024, unless otherwise specified. In this AIF, all dollar figures are in U.S. dollars, unless otherwise indicated.

The term “rate base” is used in this document. Rate base is a measure specific to rate-regulated utilities that is not intended to represent any financial measure as defined by U.S. GAAP. The measure is used by the regulatory authorities in the jurisdictions where the Corporation’s rate-regulated subsidiaries operate. The calculation of this measure may not be comparable to similarly titled measures used by other companies.

1.CORPORATE STRUCTURE

1.1Name, Address and Incorporation

Algonquin Power & Utilities Corp. (“AQN”) was originally incorporated under the Canada Business Corporations Act on August 1, 1988 as Traduction Militech Translation Inc. Pursuant to articles of amendment dated August 20, 1990 and January 24, 2007, the Corporation amended its articles to change its name to Société Hydrogenique Incorporée – Hydrogenics Corporation and Hydrogenics Corporation – Corporation Hydrogenique, respectively. Pursuant to a certificate and articles of arrangement dated October 27, 2009, the Corporation, among other things, created a new class of common shares, transferred its existing operations to a newly formed independent corporation, exchanged new common shares for all of the trust units of Algonquin Power Co. (“APCo”) and changed its name to Algonquin Power & Utilities Corp. AQN amended its articles on November 2, 2012, January 1, 2013, February 27, 2014, October 16, 2018, May 21, 2019 and January 14, 2022 to provide for the creation of series of preferred shares of the Corporation. See “Description of Capital Structure – Preferred Shares”. On June 10, 2016, the Corporation amended its articles to provide for a minimum of three directors and a maximum of 20 directors and to provide that the registered office of the Corporation be situated anywhere within the Province of Ontario. The head and registered office of AQN is located at Suite 100, 354 Davis Road, Oakville, Ontario L6J 2X1.

Unless the context indicates otherwise, references in this AIF to the “Corporation” refer collectively to AQN, its direct and indirect subsidiary entities and partnership interests held by AQN and its subsidiary entities.

1.2Intercorporate Relationships

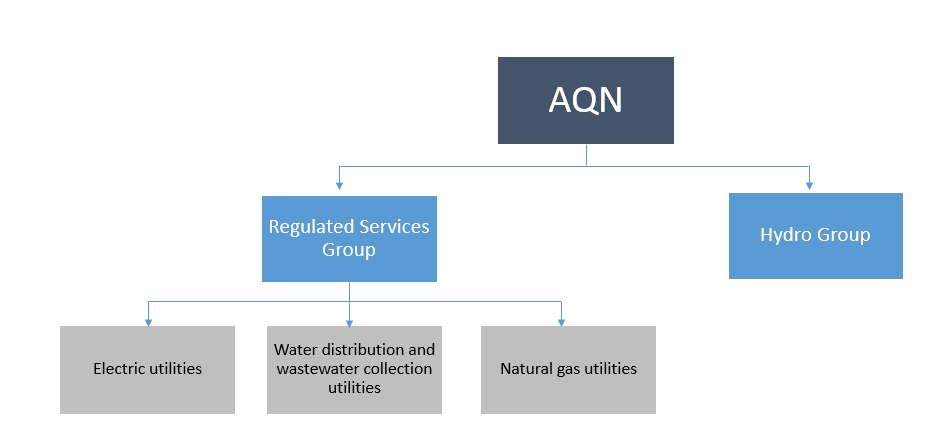

Most of the Corporation’s business is conducted through subsidiary entities, including those entities which hold project assets. The following chart depicts, in summary form, the Corporation’s key operating business units as of the date of this AIF.

The following table outlines the Corporation’s significant subsidiaries and excludes certain other subsidiaries. The assets and revenues of the excluded subsidiaries did not individually exceed 10%, or in the aggregate exceed 20%, of the total consolidated assets or total consolidated revenues of the Corporation as at December 31, 2024. The voting securities of each subsidiary are held in the form of common shares, share quotas or partnership interests in the case of partnerships and their foreign equivalents.

|

|

|

|

|

|

|

|

|

|

|

|

| Significant Subsidiaries |

Description |

Jurisdiction of Incorporation or Formation |

Ownership of Voting Securities |

| REGULATED SERVICES GROUP |

| Liberty Utilities (Canada) Corp. |

|

Canada |

100% |

Liberty Utilities Co. (“Liberty Utilities”) |

|

Delaware |

100% |

| Liberty Utilities (CalPeco Electric) LLC |

Owner of the CalPeco Electric System |

California |

100% |

| Liberty Utilities (Granite State Electric) Corp. |

Owner of the Granite State Electric System |

New Hampshire |

100% |

| Liberty Utilities (EnergyNorth Natural Gas) Corp. |

Owner of the EnergyNorth Gas System |

New Hampshire |

100% |

| Liberty Utilities (Litchfield Park Water & Sewer) Corp. |

Owner of the Litchfield Park Water System |

Arizona |

100% |

| Liberty Utilities (Midstates Natural Gas) Corp. |

Owner of the Midstates Gas Systems |

Missouri |

100% |

| Liberty Utilities (Peach State Natural Gas) Corp. |

Owner of the Peach State Gas System |

Georgia |

100% |

| Liberty Utilities (New England Natural Gas Company) Corp. |

Owner of the New England Gas System |

Delaware |

100% |

| Liberty Utilities (New York Water) Corp. |

Owner of the New York Water System |

New York |

100% |

| Liberty Utilities (St. Lawrence Gas) Corp. |

Owner of the St. Lawrence Gas System |

New York |

100% |

The Empire District Electric Company (“Empire”) |

Owner of, among other things, electric distribution, generation and transmission utility system serving locations in Missouri, Kansas, Oklahoma and Arkansas |

Kansas |

100% |

| Neosho Ridge Wind, LLC |

Owner of the Neosho Ridge Wind Facility |

Delaware |

100%1 |

| North Fork Ridge Wind, LLC |

Owner of the North Fork Ridge Wind Facility |

Delaware |

100%1 |

| Kings Point Wind, LLC |

Owner of the Kings Point Wind Facility |

Delaware |

100%1 |

The Empire District Gas Company (“EDG”) |

Operator of a natural gas distribution utility in Missouri |

Kansas |

100% |

Liberty Utilities (Canada) LP (“Liberty Utilities Canada”) |

|

Ontario |

100% |

Liberty Utilities (Gas New Brunswick) LP |

Owner of the New Brunswick Gas System |

New Brunswick |

100% |

Bermuda Electric Light Company Limited (“BELCO”) |

Owner of an electric distribution, transmission and generation system in Bermuda |

Bermuda |

100% |

Suralis S.A. (“Suralis”) (previously known as Empresa de Servicios Sanitarios de Los Lagos S.A. ) |

Owner of a water and wastewater system in Chile |

Chile |

64% |

1 The Corporation directly or indirectly holds 100% of the managing interests, with 100% of the tax equity interests directly or indirectly held by third-party partners.

2.GENERAL DEVELOPMENT OF THE BUSINESS

The Corporation owns and operates a diversified portfolio of regulated generation, distribution, and transmission assets, as well as hydroelectric generation assets. Through its activities, the Corporation aims to drive growth in earnings and cash flows to support a sustainable dividend and share price appreciation. On January 8, 2025, the Corporation completed the sale of its renewable energy business (excluding hydro) to a wholly-owned subsidiary of LS Power (“LS Buyer”) by way of an acquisition of 100% of the issued and outstanding trust units of APCo (the “Renewables Sale”).

One of AQN’s financial objectives is to maintain a BBB investment grade credit rating. In an effort to realize that objective, AQN monitors and strives to adhere to various targets communicated by rating agencies related to their assessments of financial and business risk at AQN. These targets currently include expectations that AQN satisfies specific leverage targets. Since completing the Renewables Sale and the sale of its interest in Atlantica, AQN expects to generate nearly all of its revenue from the Regulated Services Group.

AQN’s operations are organized across two business units consisting of: the Regulated Services Group, which primarily owns and operates a portfolio of regulated electric, water distribution and wastewater collection and natural gas utility systems and transmission operations in the United States, Canada, Bermuda and Chile; and the Hydro Group, which consists of hydroelectric generation facilities located in Canada that were not sold as part of the Renewables Sale. Additionally, the Corporation has a corporate function, the Corporate Group, consisting of corporate and shared services that primarily support the Regulated Services Group and the Hydro Group, in addition to holding certain ancillary investments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Regulated Services Group |

|

Hydro Group |

|

Corporate Group |

|

|

|

Electric Utilities

Water and Wastewater Utilities

Natural Gas Utilities

Electric and Natural Gas Transmission

Energy Generation and Storage

|

|

Hydro Power Generation

|

|

Corporate and Shared Services |

Regulated Services Group

The Regulated Services Group primarily operates a diversified portfolio of regulated utility systems located in the United States, Canada, Bermuda and Chile serving approximately 1,265,000 customer connections as of December 31, 2024. The Regulated Services Group seeks to provide safe, high-quality and reliable services to its customers and to deliver stable and predictable earnings to the Corporation. The Regulated Services Group seeks to deliver long-term growth within its service territories, including through the pursuit of capital investment opportunities and other initiatives.

Hydro Group

The Hydro Group generates and sells electrical energy produced by its 14 hydroelectric generating facilities located in the Canadian provinces of Alberta, Ontario, New Brunswick and Quebec, with a combined gross generating capacity of approximately 115 MW and a net generating capacity of approximately 111 MW.

Corporate Group

The Corporate Group includes the Corporation’s corporate and shared services that primarily support the Regulated Services Group and the Hydro Group, in addition to holding certain ancillary investments.

2.1Three Year History

The following is a description of the general development of the business of the Corporation over the last three fiscal years.

2.1.1Fiscal 2022

Corporate

(i)Offering of Subordinated Notes

On January 18, 2022, AQN completed an underwritten offering of (i) C$400 million aggregate principal amount of 5.25% fixed-to-fixed reset rate junior subordinated notes series 2022-A (the “2022-A Subordinated Notes”) due January 18, 2082 and (ii) $750 million aggregate principal amount of 4.75% fixed-to-fixed reset rate junior subordinated notes series 2022-B (the “2022-B Subordinated Notes”) due January 18, 2082 (collectively, the “2022 Subordinated Note Offerings”). Upon the occurrence of certain bankruptcy-related events in respect of AQN, the 2022-A Subordinated Notes automatically convert into preferred shares, Series H of AQN (the “Series H Shares”) and the 2022-B Subordinated Notes automatically convert into preferred shares, Series I of AQN (the “Series I Shares”).

See “Description of Capital Structure – Subordinated Notes” for more detail on the 2022-A Subordinated Notes and the 2022-B Subordinated Notes and see “Description of Capital Structure – Preferred Shares” for more detail on the Series H Shares and Series I Shares.

(ii)At-the-Market Equity Program

On August 15, 2022, AQN re-established its at-the-market equity program, which allowed AQN to issue up to $500 million (or the equivalent in Canadian dollars) of Common Shares from treasury to the public from time to time, at AQN’s discretion, at the prevailing market price when issued on the TSX, the NYSE or on any other existing trading market for the Common Shares in Canada or the United States. The at-the-market equity program terminated in accordance with its terms on December 19, 2023.

(iii)Management Change

On August 30, 2022, AQN announced that Arthur Kacprzak was stepping down as Chief Financial Officer and announced the appointment of Darren Myers to such role.

(iv)Completion of Asset Recycling Transaction

On December 29, 2022, the Corporation closed the sale of ownership interests in a portfolio of operating wind facilities in the United States and Canada to InfraRed Capital Partners, an international infrastructure investment manager that is part of SLC Management, the institutional alternatives and traditional asset management business of Sun Life Financial Inc. (the “2022 Asset Recycling Transaction”). The 2022 Asset Recycling Transaction consisted of the sale of (1) a 49% ownership interest in three operating wind facilities in the United States totaling 551 MW of installed capacity; and (2) an 80% ownership interest in an operating 175 MW wind facility in Saskatchewan. Total cash proceeds to the Corporation from the 2022 Asset Recycling Transaction were approximately $277.5 million for the U.S. facilities and approximately C$108.6 million for the Saskatchewan facility (in each case subject to certain post-closing adjustments).

Regulated Services Group

(i)Acquisition of Liberty New York Water (formerly New York American Water Corporation, Inc.)

Effective January 1, 2022, the Regulated Services Group closed the acquisition of New York American Water Company, Inc. (subsequently renamed Liberty Utilities (New York Water) Corp.) (“Liberty New York Water”) for a purchase price of approximately $609 million. Liberty New York Water is a regulated water and wastewater utility serving over 127,000 customer connections across eight counties in southeastern New York. Operations include approximately 1,270 miles of water mains and distribution lines with 98% of customers in Nassau County on Long Island. The purchase price for the acquisition of Liberty New York Water was funded through drawings on a $1.1 billion senior unsecured delayed draw non-revolving term credit facility of Liberty Utilities entered into on December 20, 2021 (the “Regulated Services Delayed Draw Term Facility”). The Regulated Services Delayed Draw Term Facility was subsequently repaid on its maturity date, October 25, 2024.

For more detail on the New York Water System, see “Description of the Business – Regulated Services Group – Description of Operations – Water Distribution and Wastewater Collection Systems” below.

(ii)Regulated Services Group Credit Facilities

On April 29, 2022, the Regulated Services Group entered into a $1.0 billion senior unsecured revolving credit facility and a $500.0 million senior unsecured revolving credit facility (the “Short-Term Regulated Services Credit Facility”). The Short Term Regulated Services Credit Facility subsequently terminated on its maturity date, October 25, 2024.

2.1.2Fiscal 2023

Corporate

(i)Sustainability Linked Loan and Bilateral Credit Facility

On March 31, 2023, the Corporation completed an amendment and restatement of its senior unsecured revolving credit facility entered into as of July 12, 2019, which increased the borrowing capacity from $500 million to $1 billion and included sustainability-linked performance targets. The Corporation also entered into a new $75 million uncommitted bilateral credit facility on March 31, 2023.

(ii)Completion of Strategic Review and Management Changes

On May 11, 2023, the Corporation announced that the Board had initiated a strategic review of its renewable energy business. To oversee the strategic review process, the Board formed a Strategic Review Committee, comprised of directors Christopher Huskilson (Chair), Amee Chande and Dan Goldberg. On August 10, 2023, the Corporation announced that it was pursing a sale of its renewable energy business. Concurrently, the Corporation also announced that Arun Banskota was stepping down as President and Chief Executive Officer and as a member of the Board and announced the appointment of Christopher Huskilson as Interim Chief Executive Officer. Mr. Huskilson was subsequently appointed Chief Executive Officer on May 10, 2024.

See “Three Year History – Fiscal 2025 – Corporate – Completion of Renewables Sale” for more detail on the Renewables Sale.

(iii)Redemption of Series C Preferred Shares

During the year ended December 31, 2023, 100 Series C Shares of AQN that had previously been issued in exchange for 100 Class B limited partnership units of St. Leon Wind Energy LP (“St. Leon LP”) were redeemed for $14.5 million. As a result of the redemption, no Series C Shares of AQN remained outstanding. AQN subsequently sold all of its interest in St. Leon LP as part of the Renewables Sale.

(iv)Redemption of 6.875% Fixed-to-Floating Subordinated Notes – Series 2018-A due 2078

On November 6, 2023, AQN redeemed all $287,500,000 aggregate principal amount of its outstanding 6.875% Fixed-to-Floating Subordinated Notes – Series 2018-A due October 17, 2078 at a redemption price equal to 100% of the aggregate principal amount plus accrued and unpaid interest thereon.

Regulated Services Group

(i)Termination of Kentucky Power Transaction

On April 17, 2023, Liberty Utilities, American Electric Power Company, Inc. and AEP Transmission Company, LLC mutually agreed to terminate the agreement entered into on October 26, 2021 for Liberty Utilities to acquire Kentucky Power Company and AEP Kentucky Transmission Company.

2.1.3Fiscal 2024

Corporate

(i)Director Changes and Cooperation Agreement

On February 2, 2024, the Corporation announced that the Board had appointed David Levenson as a director.

Subsequently, on April 18, 2024, the Corporation announced that the Board intended to nominate Brett Carter and Christopher Lopez for election to the Board at the Corporation’s 2024 annual meeting of shareholders (the “2024 Annual Meeting”). In connection with the announcement, the Corporation announced that it had entered into a cooperation agreement with Starboard Value LP and certain of its affiliates (collectively, “Starboard”) dated April 18, 2024 (the “Cooperation Agreement”), pursuant to which Starboard agreed to withdraw its previously-announced director nominations for election to the Board and to support the Corporation’s nominees for election at the 2024 Annual Meeting, including Messrs. Carter and Lopez. In addition, Starboard and the Corporation agreed to, among other things, customary standstill, voting and other provisions related to the composition of the Board and committees of the Board.

Pursuant to the Cooperation Agreement the Corporation also agreed that it would not, following the 2024 Annual Meeting, increase the size of its Board to more than nine directors without Starboard’s prior consent. The Cooperation Agreement is currently expected to expire on March 21, 2025.

(ii)Successful Remarketing of Equity Units and Subsequent Settlement of Purchase Contracts

On March 28, 2024, the Corporation successfully remarketed its $1.15 billion aggregate principal amount of 1.18% Senior Notes due June 15, 2026 (the “Notes”). The Notes were originally issued in June 2021, together with the related purchase contracts (the “Purchase Contracts”), as a component of the Corporation’s corporate units (the “Equity Units”). In connection with the remarketing, the interest rate on the Notes was reset to 5.365%, with the maturity date remaining as June 15, 2026. The proceeds from the remarketing of the Notes were used to purchase a portfolio of treasury securities maturing on June 13, 2024. Subsequently, on June 17, 2024, all outstanding Purchase Contracts were settled. In connection with the settlement of the Purchase Contracts, holders of Equity Units received, following payment of $50.00 for each Purchase Contract, 3.3439 Common Shares for each Purchase Contract held. The payment obligation of holders was satisfied with the proceeds of the treasury portfolio purchased in connection with the remarketing of the Notes. In aggregate, the Corporation received $1.15 billion in exchange for the issuance of approximately 76.9 million Common Shares upon settlement of the Purchase Contracts.

See “Description of Capital Structure – Equity Units” for additional details on the Equity Units.

(iii)Sale of Interest in Atlantica

On May 28, 2024, the Corporation entered into a support agreement with Atlantica and a private limited company controlled by Energy Capital Partners (“Bidco”) pursuant to which the Corporation and its subsidiary, Liberty (AY Holdings) B.V., which held approximately 42.2% of the shares of Atlantica, agreed to cause such shares to be voted in favour of a transaction agreement separately announced by Atlantica and Bidco on May 28, 2024 pursuant to which Bidco agreed to acquire Atlantica. Subsequently, on December 12, 2024, Bidco completed the acquisition of Atlantica, including the 42.2% equity interest in Atlantica held by Liberty (AY Holdings) B.V. The Corporation received total proceeds of approximately $1.1 billion in connection with the sale.

(iv)Final Deployment of Integrated Customer Solution Technology Platform

In the second quarter of 2024, the Corporation completed the final deployment of its integrated customer solution technology platform, which includes customer billing, enterprise resource planning systems and asset management systems.

(v)Agreement to Sell Renewable Energy Business

On August 9, 2024, the Corporation entered into a securities purchase agreement with LS Buyer (the “Renewables Securities Purchase Agreement”) in respect of the Renewables Sale. See “Three Year History – Fiscal 2025 – Corporate – Completion of Renewables Sale” for more detail on the Renewables Sale and the Renewables Securities Purchase Agreement.

Regulated Services Group

(i)Offering of Senior Unsecured Notes

On January 12, 2024, Liberty Utilities completed an offering of $500 million aggregate principal amount of 5.577% senior notes due January 31, 2029 (the “2029 Notes”) and $350 million aggregate principal amount of 5.869% senior notes due January 31, 2034 (the “2034 Notes”, and together with the 2029 Notes, the “Senior Notes”). The Senior Notes are unsecured and unsubordinated obligations of Liberty Utilities and rank equally with all of Liberty Utilities' existing and future unsecured and unsubordinated indebtedness and senior in right of payment to any existing and future Liberty Utilities subordinated indebtedness.

(ii)Offering of Securitized Utility Tariff Bonds

On January 30, 2024, Empire District Bondco, LLC, a wholly owned subsidiary of Empire, completed an offering of approximately $180.5 million of aggregate principal amount of 4.943% Securitized Utility Tariff Bonds with a maturity date of January 1, 2035 and $125 million aggregate principal amount of 5.091% Securitized Utility Tariff Bonds with a maturity date of January 1, 2039, to recover previously incurred qualified extraordinary costs associated with the February 2021 extreme winter storm conditions experienced in Texas and parts of the central U.S. and energy transition costs related to the retirement of the Asbury generating plant. The principal asset securing these bonds is the securitized utility tariff property.

2.1.4Fiscal 2025

Corporate

(i)Completion of Renewables Sale

On January 8, 2025, the Corporation completed the Renewables Sale. Pursuant to the Renewables Securities Purchase Agreement, LS Buyer acquired the Corporation’s renewable energy business (excluding hydro) by way of an acquisition of 100% of the issued and outstanding trust units of APCo for proceeds of approximately $2.1 billion, after subtracting taxes, transaction fees and other preliminary closing adjustments, including an adjustment for estimated remaining completion costs for in-construction assets. Approximately $1.95 billion of such proceeds were received upon the closing of the transaction and approximately $150 million of such proceeds are currently expected to be received at a later date in 2025 upon monetization of tax attributes on certain in-construction projects. Additionally, the Corporation can receive up to $220 million in cash pursuant to an earn out agreement relating to certain wind assets (the “Earn Out Agreement”).

(ii)Management Changes

On January 14, 2025, the Corporation announced that Darren Myers will resign as Chief Financial Officer following the reporting of the Corporation’s fourth quarter 2024 results.

On January 31, 2025, the Corporation announced that Roderick West will join the Corporation as Chief Executive Officer. Mr. West’s appointment as Chief Executive Officer will be effective as of 12:00 p.m. (Eastern time) on March 7, 2025. Chris Huskilson will step down as Chief Executive Officer and will continue in his role as a director of the Corporation.

On February 14, 2025, the Corporation announced that Brian Chin, the Corporation’s Vice President, Investor Relations, will be appointed as Interim Chief Financial Officer, effective as of 12:00 p.m. (Eastern time) on March 7, 2025.

3.DESCRIPTION OF THE BUSINESS

The Corporation’s operating groups consist of the Regulated Services Group and the Hydro Group.

3.1Regulated Services Group

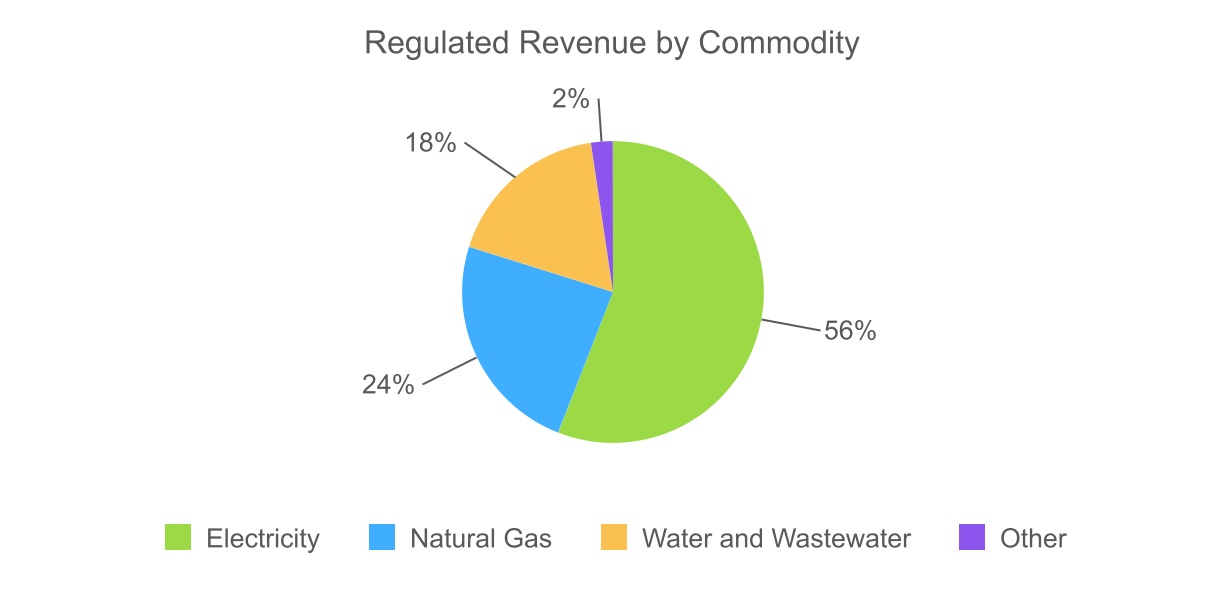

The Regulated Services Group primarily operates a diversified portfolio of regulated utility systems located in the United States, Canada, Bermuda and Chile, serving approximately 1,265,000 customer connections as at December 31, 2024.

The Regulated Services Group’s regulated electrical distribution utility systems and related transmission and generation assets are located in the U.S. states of Arkansas, California, Kansas, Missouri, Nevada, New Hampshire, and Oklahoma, as well as in Bermuda, which together served approximately 310,000 electric customer connections as at December 31, 2024. The group also owns and operates generating assets with a gross capacity of approximately 2.0 GW and has investments in generating assets with approximately 0.3 GW of net generation capacity.

The Regulated Services Group’s regulated water distribution and wastewater utility systems are located in the U.S. states of Arizona, Arkansas, California, Illinois, Missouri, New York and Texas, as well as in Chile, which together served approximately 577,000 customer connections as at December 31, 2024.

The Regulated Services Group’s regulated natural gas distribution utility systems are located in the U.S. states of Georgia, Illinois, Iowa, Massachusetts, Missouri, New Hampshire and New York, and in the Canadian province of New Brunswick, which together served approximately 378,000 natural gas customer connections as at December 31, 2024.

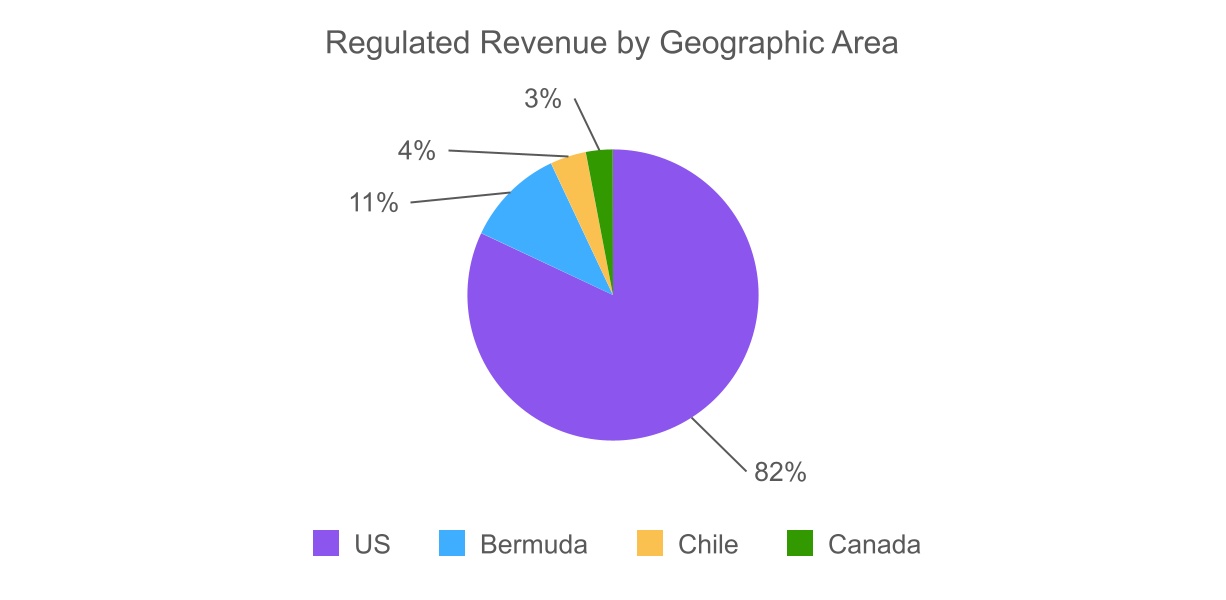

Below is a breakdown of revenue for the Regulated Services Group by geographic area for the twelve months ended December 31, 2024.

|

|

|

|

|

|

| Geographic Area |

% of Total Revenue |

| United States |

82.091% |

| Canada |

2.453% |

| Bermuda |

11.242% |

| Chile |

4.214% |

3.1.1Description of Operations

Electric Distribution Systems

(i)Method of Providing Services and Distribution Methods

Electric distribution is the final stage in the delivery system of providing electricity to end users. An electric distribution utility sources and distributes electricity to its customers through a network of buried or overhead lines. The electricity is sourced from power generation facilities. The electricity is transported from the source(s) of generation at high voltages through transmission lines and is then reduced through transformers to lower voltages at substations. The electricity from the substations is then delivered through distribution lines to the customers where the voltage is again lowered through a transformer for use by the customer.

The rates charged for electric distribution service are comprised of a fixed charge that recovers customer related costs, such as meter readings, and a variable rate component that recovers the cost of generation (except in New Hampshire), transmission and distribution. Other revenues are comprised of fees for other services such as establishing a connection, late fee, reconnections, and energy efficiency programs.

The electric utilities located in Arkansas, California, Kansas, Missouri, New Hampshire and Oklahoma are subject to state and federal regulation and rates charged by these utilities must be reviewed and approved by their respective state regulatory authorities and FERC in limited circumstances. Similarly, the electric utility in Bermuda, BELCO, is subject to regulation by the RAB and its rates must be approved by the RAB.

(ii)Principal Markets and Regulatory Environments

The Regulated Services Group operates electrical distribution systems in the states of Arkansas, California, Kansas, Missouri, New Hampshire and Oklahoma, and in Bermuda under a cost-of-service methodology. The utilities use either a historical test year, adjusted pro forma for known and measurable changes in the establishment of their rates, or prospective test years based on expenses expected to be incurred in future periods. Pursuant to these methods, the revenue requirement upon which rates are based is determined by applying an approved return on rate base, and adding depreciation, operating expenses and administrative and general expenses.

Rate cases allow for a particular utility the opportunity to recover its appropriate operating costs and earn a reasonable rate of return on its capital investment as allowed by the regulatory authority under which the utility operates. Rates are approved by the agency to provide the utility the opportunity, but not the guarantee, to earn a reasonable return on its investment after recovering its prudently incurred operating expenses.

(iii)Selected Facilities

(1)CalPeco Electric System

The CalPeco Electric System provides electric distribution service to the Lake Tahoe basin and surrounding areas. The service territory, centered on a highly popular tourist destination, has a customer base spread throughout Alpine, El Dorado, Mono, Nevada, Placer, Plumas and Sierra counties in northeastern California. CalPeco Electric System’s connection base is primarily residential. Its commercial connections consist primarily of ski resorts, hotels, hospitals, schools and grocery stores. The CalPeco Electric System is regulated by the CPUC.

The CalPeco Electric System entered into a multi-year full services agreement with NV Energy that commenced in December 2020 and expires in December 2025. The full services agreement obligates NV Energy to supply the CalPeco Electric System with sufficient renewable power to, when combined with the output of the CalPeco Electric System’s Luning Solar Facility and Turquoise Solar Facility, balance the load requirements and use commercially reasonable efforts to satisfy the current California Renewables Portfolio Standard requirement for the term of the services agreement. This agreement lowers fixed rates for customers, while providing the CalPeco Electric System the opportunity to add renewable generation capacity. The CalPeco Electric System received approval from the CPUC to recover the costs it will incur under this agreement as well as costs incurred to acquire, own and operate the Luning Solar Facility and the Turquoise Solar Facility.

The CalPeco Electric System has also received approval from the CPUC to build a second solar generation facility (including a storage system).

(2)Granite State Electric System

The Granite State Electric System provides electric distribution service in southern and northwestern New Hampshire, centered around operating centers in Salem in the south and Lebanon in the northwest. The Granite State Electric System’s customer base includes a mixture of residential, commercial and industrial customers. The Granite State Electric System consists of approximately 2,219 circuit miles, 60 distribution circuits and 17 electric distribution substations.

The Granite State Electric System is regulated by the NHPUC and FERC. The Granite State Electric System is required to provide electric commodity supply for all customers who do not choose to take supply from a competitive supplier (“Energy Service”) in the New England power market and is allowed to fully recover its costs for the provision and administration of Energy Service under the Energy Service Adjustment Factor, as approved by the NHPUC. The Granite State Electric System must file with the NHPUC twice a year to adjust for market prices of power purchased. Additionally, the Granite State Electric System serves a “borderline” customer under a retail delivery service tariff approved by the NHPUC for which it charges distribution rates which are subject to FERC’s jurisdiction.

(3)Empire District Electric System

Based in Joplin, Missouri, Empire is a regulated utility providing electric distribution, generation and transmission services in parts of Missouri, Kansas, Oklahoma and Arkansas. The largest urban area served is the city of Joplin, Missouri, and its immediate vicinity. The vertically integrated regulated electricity operations of Empire represent approximately 28.8% and 26.5% of the Regulated Services Group’s operating revenues and assets, respectively. Empire’s customer base includes a mixture of residential, commercial, and industrial customers. Empire also operates a fibre optics business. Empire is subject to regulation by the MPSC, the KCC, the OCC, the APSC and FERC.

Empire has various owned generation located in Missouri, Kansas and Arkansas. Its facilities include, among others, the approximately 150 MW North Fork Ridge Wind Facility located in northwestern Jasper County and southwestern Barton County, Missouri; the approximately 150 MW Kings Point Wind Facility located in Barton County, southwestern Dade County, northeastern Jasper County, and northwestern Lawrence County, Missouri; Empire’s share of the approximately 430 MW jointly-owned State Line natural gas fired thermal generation facility, located in Joplin, Missouri; the approximately 250 MW Energy Center, a natural gas fired thermal generation facility located in Sarcoxie, Missouri; Empire’s share of the approximately 200 MW jointly-owned Iatan 1 and 2 coal-fired thermal generation facilities located in Weston, Missouri; the approximately 300 MW Neosho Ridge Wind Facility located in Neosho County, Kansas; the approximately 300 MW Riverton natural gas-fired thermal generation facility located in Riverton, Kansas; and Empire’s share of the approximately 50 MW jointly-owned Plum Point coal-fired thermal generation facility located in Osceola, Arkansas.

(4)BELCO Electric System

BELCO is the sole provider of electricity transmission, distribution, and retail services to all customers in Bermuda and is a bulk generator of electricity on the island. BELCO’s customer base includes a mixture of residential, commercial, and industrial customers. Its network includes approximately 1,000 km of high voltage distribution lines, approximately 600 km of low voltage overhead service lines, approximately 200 km of underground transmission cables and 34 substations.

BELCO has various owned reciprocating and gas turbine generation units with a combined capacity of approximately 140 MW. There is also a 10 MW Battery Energy Storage System.

BELCO is regulated by the RAB, the sole utility regulator in Bermuda. The Electricity Act 2016 brought changes to Bermuda’s electricity market which included the development of the first integrated resource plan, the encouragement of competitive electricity generation and a new retail tariff methodology.

Water Distribution and Wastewater Collection Systems

(i)Method of Providing Services and Distribution Methods

A water and/or wastewater utility company provides water distribution and/or wastewater collection and treatment services to its customers.

A water utility sources, treats and stores potable water and subsequently distributes it to its customers through a network of buried pipes (distribution mains). The raw water for human consumption is sourced from the ground and extracted through wells or from surface water such as lakes or rivers. The water is treated to potable water standards that are specified in federal and state regulations as administered and which are typically enforced by a federal, state or local agency.

Following treatment, the water is either pumped directly into the distribution system or pumped into storage reservoirs from which it is subsequently pumped into the distribution system. This system of wells, pumps, storage vessels and distribution infrastructure is owned and maintained by the private utility. The fees or rates charged for water are comprised of a fixed charge component plus a variable fee based on the volume of water used. Additional fees are typically charged for other services such as establishing a connection, late fees and reconnects.

A wastewater utility collects wastewater from its customers and transports it through a network of collection pipes, lift stations and manholes to a centralized facility where it is treated, rendering it suitable for discharge to the environment or for reuse, usually as irrigation. The wastewater is ultimately delivered to a treatment plant. Primary treatment at the plant consists of the screening out of larger solids, floating material and other foreign objects and, at some facilities, grit removal. These removed materials are hauled to a landfill. Secondary treatment at the plant consists of biological digestion of the organic and other impurities which is performed by beneficial bacteria in an oxygen enriched environment. Excess and spent bacteria are collected from the bottom of the tanks, digested and/or dewatered and the resulting solids are sent to landfill or to land application as a soil amendment. The treated water, referred to as “effluent”, is then used for irrigation or groundwater recharging or is discharged by permit into adjacent surface water. The standards to which this wastewater is treated are specified in each treatment facility’s operating permit and the wastewater is routinely tested to confirm its continuing compliance therewith. The effluent quality standards are based on federal, state or local regulations which are administered, and continuing compliance is enforced by the state agency to which federal enforcement powers are delegated.

(ii)Principal Markets and Regulatory Environments

The Regulated Services Group’s water and wastewater facilities are located in the United States in the states of Arizona, Arkansas, California, Illinois, Missouri, New York and Texas, and in Chile. The water and wastewater utilities are generally subject to regulation by the public utility commissions of the jurisdiction in which they operate. The respective public utility commissions have jurisdiction with respect to rate, service, accounting procedures, issuance of securities, acquisitions and other matters. These utilities generally operate under cost-of-service regulation as administered by these regulatory authorities. The utilities generally use a historic or forward-looking test year in the establishment of rates for the utility and pursuant to this method the determination of the rate of return on approved rate base, recovery of depreciation on plant, together with all reasonable and prudent operating costs, establishes the revenue requirement upon which each utility’s customer rates are determined.

Rate cases allow a particular utility the opportunity to recover appropriate operating costs and to earn a rate of return on its capital investment as allowed by the regulatory authority under which the facility operates. The Corporation monitors the rates of return on each of its water and wastewater utility investments to determine the appropriate time to file rate cases in order to pursue its goal of earning the regulatory approved rate of return on its investments in accordance with any legal requirements. Rates are approved by the authority to provide the utility the opportunity, but not the guarantee, to earn a reasonable return on its investment after recovering its prudently incurred operating expenses.

(iii)Selected Facilities

(1)Litchfield Park Water System

The Litchfield Park Water System is a regulated water and wastewater utility located in and around the cities of Avondale, Goodyear, Litchfield Park, and unincorporated Maricopa County, west of Phoenix, Arizona that has a service area that includes the City of Litchfield Park, sections of land located in the cities of Goodyear and Avondale as well as portions of unincorporated Maricopa County. Litchfield Park Water System’s operations consist of sixteen well sites, two reservoir sites, and approximately 500 km of water mains and distribution lines. Wastewater operations at the Litchfield Park Water System consist of two lift stations and approximately 400 km of collection mains to both the Palm Valley Water Reclamation Facility and the newly constructed Sarival Water Reclamation Facility. The Palm Valley Water Reclamation Facility has a permitted treatment capacity of 6.55 million gallons per day and the Sarival Water Reclamation Facility has a permitted treatment capacity of 4.5 million gallons per day. The Litchfield Park Water System’s customer base includes a mixture of residential, commercial, and industrial customers. The Litchfield Park Water System is regulated by the Arizona Corporation Commission and uses a historic test year in the establishment of rates for the utility. Pursuant to this method, the determination of the rate of return on approved rate base and recovery of depreciation on plant, together with all reasonable and prudent operating costs, establishes the revenue requirement upon which customer rates are determined. The Arizona Corporation Commission recently adopted a policy statement providing for formula rates, which is available for Arizona regulated utilities.

(2)Liberty Park Water and Liberty Apple Valley Water System

Liberty Utilities (Park Water) Corp. (“Liberty Park Water”) provides, owns and operates water systems in Los Angeles County, California. Liberty Park Water also wholly owns Liberty Utilities (Apple Valley Ranchos Water) Corp. (“Liberty Apple Valley Water”), which is a regulated utility providing water utility services to customers in and around the Town of Apple Valley, California. Liberty Park Water’s and Liberty Apple Valley Water’s customer base includes a mixture of residential, commercial, and industrial customers. The Liberty Park Water system consists of approximately 423 km of pipeline, 11 wells, eight booster pump stations, seven purchase water connections, and 6.9 million gallons of storage reservoirs and tank capacity. The Liberty Apple Valley Water system consists of approximately 777 km of pipeline, 25 wells, 8 booster pump stations, and 12 million gallons of storage reservoirs and tank capacity. Liberty Park Water and Liberty Apple Valley Water are regulated by the CPUC and use a forward-looking, multi-year rate plan.

(3)Suralis System

Suralis is a water and wastewater utility company located in Southern Chile. The utility operates 51 potable water production systems, 29 sewage plants, approximately 2,357 km of drinking water distribution networks and approximately 2,043 km of sewage networks covering 31 municipalities in the provinces of Valdivia, Ranco, Osorno, Llanquihue, Chiloé and Palena in the regions of Los Lagos and Los Ríos. The Corporation indirectly owns approximately 68.073% of the outstanding shares of Suralis. Suralis’ customer base includes a mixture of residential, commercial, and industrial customers. Suralis is regulated by the Superintendence of Sanitary Services of Chile and is also subject to the jurisdiction of the Chilean National Consumer Service (“SERNAC”), being Chile’s consumer protection agency.

(4)New York Water System

The New York Water System is a regulated water and wastewater utility serving customers across seven counties in southeastern New York. Operations include approximately 1,270 miles of water mains and distribution lines, 92 groundwater wells, 52 treatment stations and 41 tanks. Approximately 86% of the New York Water System’s customer base is residential, with 98% of customers located in Nassau County on Long Island.

The New York Water System is regulated by the New York State Public Service Commission. The New York Water System uses a forward-looking, multi-year rate plan and has a reconciliation mechanism designed to allow the Corporation to recover or refund, through a surcharge or credit, the annual difference between projections of revenues, production costs and property taxes and the actual amounts experienced by the New York Water System. The New York Water System also utilizes an infrastructure surcharge mechanism to recover water quality and system improvement investments, and a pension and other post-employment benefits tracker mechanism that tracks changes from authorized expenses.

Natural Gas Distribution Systems

(i)Method of Providing Services and Distribution Methods

Natural gas is a fossil fuel composed almost entirely of methane (a hydrocarbon gas) usually found in deep underground reservoirs formed by porous rock. In making its journey from the wellhead to the customer, natural gas may travel thousands of miles through interstate pipelines owned and operated by pipeline companies. Along the route, the natural gas may be stored underground in depleted oil and gas wells or other natural geological formations for use during seasonal periods of high demand. Interstate pipelines interconnect with other pipelines and other utility systems and offer system operators flexibility in moving the gas from point to point. The interstate pipeline companies are regulated by FERC. Typically, the distribution network operates pipelines (including transmission and distribution pipelines), gate stations, district regulator stations, peak shaving plants and natural gas meters. The Regulated Services Group is also active in the RNG sector. RNG is pipeline compatible gaseous fuel derived from biogenic or other renewable sources that has lower lifecycle emissions than geologic natural gas. RNG is a “drop in” fuel requiring no modification to company or customer equipment and provides a low to negative carbon lifecycle footprint. The Regulated Services Group has RNG projects in various stages of development across several gas distribution companies which are, or are expected to be, connected to the Regulated Services Group’s local infrastructure. The Regulated Services Group, through its gas distribution subsidiaries in New York and Georgia, has also entered into physical supply contracts for locally produced RNG which does not include the environmental attributes/credits associated with the RNG. The gas distribution utilities owned by the Regulated Services Group are subject to state or provincial regulation and rates charged by these facilities may be reviewed and altered by the state or provincial regulatory authorities from time to time.

(ii)Principal Markets and Regulatory Environments

The Regulated Services Group owns and operates natural gas distribution systems under cost-of-service regulation in the states of Georgia, Illinois, Iowa, Massachusetts, Missouri, New Hampshire and New York and the province of New Brunswick. In establishing rates, the natural gas utilities use either a historical test year that is adjusted on a pro forma basis for known and measurable changes or a prospective test year based on expenses expected to be incurred in a future period, which is the methodology utilized in New Brunswick and Illinois. Pursuant to either the historic or prospective rate making methodology, rates are determined by establishing the rate of return on approved rate base and recovery of depreciation on plant, together with all reasonable and prudent operating costs, thereby establishing the revenue requirement upon which each utility’s customer rates are determined.

Rate cases allow a particular utility the opportunity to recover its appropriate operating costs and earn a reasonable rate of return on its capital investment as allowed by the regulatory authority under which the facility operates. The Corporation monitors the rates of return on its utility investments to determine the appropriate times to file rate cases, with the goal of earning a reasonable rate of return on its investments in accordance with any legal requirements.

(iii)Selected Facilities

(1)EnergyNorth Gas System

The EnergyNorth Gas System is a regulated natural gas utility providing natural gas distribution services in 32 communities covering six counties in New Hampshire. Its franchise service area includes the communities of Nashua, Manchester, Concord, Keene, and Berlin. The EnergyNorth Gas System’s customer base includes a mixture of residential, commercial, industrial and transportation customers. The EnergyNorth Gas System operates and maintains approximately 2,410 km of underground distribution and transmission mains, approximately 70,484 service lines, and approximately 70 local and district regulator stations.

The EnergyNorth Gas System is regulated by the NHPUC. The EnergyNorth Gas System has a revenue per customer decoupling mechanism to recover lost distribution revenue associated with energy efficiency and to otherwise account for the effects of abnormal weather and economic conditions, and includes a real-time weather normalization adjustment. In addition, the EnergyNorth Gas System has a cost of gas adjustment mechanism that allows for monthly adjustments to account for commodity cost changes within certain tolerances. Subject to the satisfaction of certain criteria, New Hampshire natural gas utilities are allowed to procure RNG at quantities up to 5% of their total annual delivered volume through contracts with terms of up to 15 years, to recover prudently incurred costs of procuring RNG, and to recover the costs of and earn a return on qualified investments in RNG infrastructure.

(2)Empire District Gas System

EDG is engaged in the distribution of natural gas in Missouri, serving customers in northwest, north central and west central Missouri. EDG’s customer base includes a mixture of residential, commercial, industrial and transportation customers.

EDG is regulated by the MPSC. A PGA allows EDG to recover from its customers, subject to audit and final determination by regulators, the cost of purchased natural gas supplies and related carrying costs associated with EDG’s use of natural gas financial instruments to hedge the purchase price of natural gas. This PGA allows EDG to make rate changes periodically (up to four times) throughout the year in response to weather conditions and supply demands. Missouri law allows companies to include investments in RNG production, gathering and delivery infrastructure in rate base. It also includes the ability to include RNG in the supply portfolio as well as delivery to customers.

(3)Peach State Gas System

The Peach State Gas System is a regulated natural gas system providing natural gas distribution services in 15 communities covering eight counties in Georgia. The Peach State Gas System franchise service area includes the communities of Columbus, Gainesville, Waverly Hall, Oakwood, Hamilton and Manchester. The Peach State Gas System’s customer base primarily includes a mixture of residential, commercial, industrial and transportation customers. The Peach State Gas System operates and maintains approximately 2,238 km of underground distribution mains, approximately 109 km of transmission mains, approximately 66,765 service lines, and approximately 114 local and district regulator stations. In addition, the Peach State Gas System has a 50-year privatization agreement to operate and maintain the natural gas system at Fort Moore.

The Peach State Gas System is regulated by the Georgia Public Service Commission. The Peach State Gas System’s rates are reviewed and updated annually through a tariff provision called the Georgia Rate Adjustment Mechanism. Georgia allows recovery of natural gas costs (including commodity price, transportation, reservation and demand costs, hedging costs and storage costs).

Georgia also allows certain RNG investments to be included in rate base.

(4)New England Gas System

The New England Gas System is a regulated natural gas utility providing natural gas distribution services in eleven communities, including Fall River, North Attleborough, Blackstone and surrounding communities, located in the southeastern portion of Massachusetts. The New England Gas System operates approximately 1,099 km of underground distribution mains. The New England Gas System’s customer base includes a mixture of residential, commercial, and industrial customers.

The New England Gas System is regulated by the MDPU. The cost of natural gas is recoverable from customers through the Gas Adjustment Factor (“GAF”) when billed to “firm” natural gas customers included in approved tariffs by the MDPU. The GAF is adjusted twice annually and more frequently under certain circumstances.

(5)Midstates Gas Systems

The Midstates Gas Systems own regulated natural gas utilities providing natural gas distribution services to approximately 203 communities in the states of Illinois, Iowa and Missouri. The franchise service area includes the communities of Virden, Vandalia, Harrisburg and Metropolis in Illinois, Keokuk in Iowa, and Butler, Kirksville, Canton, Hannibal, Jackson, Sikeston, Malden and Caruthersville in Missouri. The Midstates Gas Systems’ customer base includes a mixture of residential, commercial, industrial and transportation customers. The Midstates Gas Systems operate and maintain approximately 4,611 km of underground distribution mains, 357 km of transmission mains, and approximately 620 local and district regulator stations.

The Midstates Gas Systems are regulated by the Illinois Commerce Commission, the Iowa Utilities Board and the MPSC. The regulators in Illinois, Iowa and Missouri allow recovery of natural gas costs (including commodity price, transportation, reservation and demand costs, hedging costs, and storage costs). The rate is adjusted monthly in Illinois and Iowa with an annual reconciliation. In Missouri, the rate is adjusted annually with allowance to file quarterly. In Missouri and Illinois, mechanisms exist to allow for the recovery of the revenue requirement approved by the regulator. In Missouri, the weather normalization adjustment mechanism allows for the adjustment in revenue due to weather and in Illinois, the volume balancing adjustment mechanism allows for the recovery of revenue due to variances in the volume of natural gas used.

(6)New Brunswick Gas System

The New Brunswick Gas System is regulated by the NB Energy Board and has a distribution network that includes approximately 1,250 km of underground distribution mains. The New Brunswick Gas System provides service to customers in 14 communities in New Brunswick. The NB Energy Board’s regulatory activities in the natural gas sector are primarily in relation to the New Brunswick Gas System which is the exclusive holder of the natural gas distribution franchise for the Province of New Brunswick, which expires in 2044 and is extendable for an additional 25-year period. The New Brunswick Gas System’s customer base includes a mixture of residential, commercial, and industrial customers.

For rate cases, the NB Energy Board can review all facets of the operations but primarily focuses on the approval of the previous calendar year’s regulatory financial statements, future test year budgets, establishing revenue requirements, rate design and other decisions such as community expansion plans, customer retention and incentive programs, load retention rate proposals, return on equity, debt structure and rate class reviews. The New Brunswick Gas System has a weather normalization adjustment for its small general service/residential rate customers.

(7)St. Lawrence Gas System

The St. Lawrence Gas System is a regulated natural gas utility operating approximately 777 km of underground distribution and transmission mains. It distributes natural gas to customers in more than 20 communities in northern New York State, including the Villages of Canton, Malone, Massena, Potsdam and the City of Ogdensburg located in St. Lawrence County, Franklin County and a portion of Lewis County. The St. Lawrence Gas System’s customer base includes a mixture of residential, commercial, industrial, and electric generation customers.

The St. Lawrence Gas System is regulated by the New York State Public Service Commission. In a traditional rate case filing, the filing includes historical operating results (test year) and a 12-month forecast for the period the rates will be in effect (rate year). More commonly, the St. Lawrence Gas System will endeavor to settle the rate case filing, in which case it is expected that there would be a multi-year plan in which the rate base and revenue requirement is adjusted for subsequent years within the plan. The St. Lawrence Gas System has a revenue decoupling mechanism which applies to residential and commercial customers within sales and transportation service types. This mechanism reconciles actual delivery service revenue to allowed delivery service revenues, which effectively adjusts the revenue for weather, energy efficiency and customer numbers.

Electric Transmission

(i)Method of Providing Services and Transmission Methods

Electric transmission is the bulk transportation of generated electricity over long distances from a generating site, such as a power plant, to an electrical substation. Transmission lines move large amounts of power at a high voltage level to a substation for voltage step-down and on to a lower voltage distribution network resulting in electricity delivered to homes and businesses. Transmission services obtained through FERC-governed OATT include network and point-to-point transmission service along with other ancillary services. Some examples of these types of services include spinning and non-spinning reserves, black-start capability, regulation and voltage support and system control and dispatch.

(ii)Principal Markets and Regulatory Environments

Empire’s transmission rates and services, electric wholesale sales of electric energy in interstate commerce, and its facilities are subject to the jurisdiction of FERC, under the Federal Power Act. Wholesale rate recovery of transmission costs, as with wholesale rate recovery of any other cost, is subject to FERC review.

The operations and rates of AQN’s transmission facility in New Brunswick are regulated by the NB Energy Board. It is entitled to recover the transmission revenue requirement, pursuant to the transmission tariff administered by New Brunswick Power Corporation. Any increase to its revenue requirement would result in an increase to the transmission rates under the OATT.

BELCO’s transmission rates are regulated by the RAB. BELCO’s transmission function and bulk generation functions are regulated under two licences held by BELCO: one for electricity transmission, distribution, and retail services and one for bulk generation.

(iii)Selected Facilities

(1)Empire Transmission Facilities

The Empire electric transmission facilities are located within a four-state area of Missouri, Kansas, Oklahoma and Arkansas and primarily consist of approximately 22 miles of 345 kV lines, approximately 404 miles of 161 kV lines, approximately 813 miles of 69 kV lines and approximately 18 miles of 34.5 kV lines.

Empire is a member of the SPP, which spans an area from the Canadian border in Montana and North Dakota in the north to parts of New Mexico, Texas and Louisiana in the south. The transmission facilities are offered for service under an OATT approved by FERC and administered by SPP. Service requests are placed in the SPP Open Access Same-Time Information System and are evaluated by SPP for available capacity which is provided subject to the SPP Tariff and SPP Market Rules on a non-discriminatory basis. Service requests can be either point-to-point or network service, where network service is used for serving electric load. Empire is subject to four different states’ regulatory bodies, the Midwest Reliability Organization regional entity for NERC compliance, SPP Market Rules and FERC.

3.1.2Specialized Skill and Knowledge

The Regulated Services Group requires specialized knowledge of its utility systems, including electrical, water and wastewater and natural gas. Upon acquiring a new utility system, the Regulated Services Group will typically retain the existing employees with such specialized skill and knowledge. In addition, the Regulated Services Group will add, when required, additional trained utility personnel at its corporate offices to support the expanded portfolio of utility assets. The Regulated Services Group has developed in-house regulatory expertise in order to interact with the state regulators in the various jurisdictions in which it operates. The Regulated Services Group believes that the relationship with regulators is unique to each jurisdiction and therefore is best delivered by local managers who work in the applicable service territory. The local regulatory teams and business representatives meet with regulatory agencies on a regular basis to review regulatory policies, service delivery results and strategies, operating results and rate making initiatives.

3.1.3Competitive Conditions