| Algonquin Power & Utilities Corp. | ||

| Exhibit | Description | ||||

| Unaudited Financial Statements for the quarter ended June 30, 2024 | |||||

| Management's Discussion & Analysis for quarter ended June 30, 2024 | |||||

| Certification of Chief Executive Officer | |||||

| Certification of Chief Financial Officer | |||||

| Earnings Press Release for the quarter ended June 30, 2024 | |||||

| Q3 2024 Common Share & Preferred Share Dividend Press Release | |||||

| ALGONQUIN POWER & UTILITIES CORP. | |||||

| (registrant) | |||||

| Date: August 9, 2024 | By: /s/ Darren Myers |

||||

| Name: Darren Myers | |||||

| Title: Chief Financial Officer | |||||

| Three months ended | Six months ended | ||||||||||||||||||||||

| (thousands of U.S. dollars, except per share amounts) | June 30 | June 30 | |||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Revenue | |||||||||||||||||||||||

| Regulated electricity distribution | $ | 304,262 | $ | 328,242 | $ | 610,117 | $ | 644,215 | |||||||||||||||

| Regulated natural gas distribution | 94,264 | 109,539 | 328,217 | 380,677 | |||||||||||||||||||

| Regulated water reclamation and distribution | 92,786 | 95,861 | 177,809 | 183,282 | |||||||||||||||||||

| Non-regulated energy sales | 78,661 | 71,694 | 163,237 | 150,410 | |||||||||||||||||||

| Other revenue | 28,653 | 22,535 | 56,346 | 47,914 | |||||||||||||||||||

| 598,626 | 627,871 | 1,335,726 | 1,406,498 | ||||||||||||||||||||

| Expenses | |||||||||||||||||||||||

| Operating expenses | 265,868 | 267,174 | 527,653 | 505,294 | |||||||||||||||||||

| Regulated electricity purchased | 81,747 | 98,337 | 179,701 | 223,917 | |||||||||||||||||||

| Regulated natural gas purchased | 22,909 | 36,180 | 118,878 | 173,881 | |||||||||||||||||||

| Regulated water purchased | 4,279 | 3,857 | 8,160 | 7,726 | |||||||||||||||||||

| Non-regulated energy purchased | 690 | 3,782 | 4,228 | 11,588 | |||||||||||||||||||

| Depreciation and amortization | 136,912 | 118,448 | 266,452 | 240,089 | |||||||||||||||||||

| Loss on foreign exchange | 4,284 | 6,379 | 16,141 | 7,815 | |||||||||||||||||||

| 516,689 | 534,157 | 1,121,213 | 1,170,310 | ||||||||||||||||||||

| Operating income | 81,937 | 93,714 | 214,513 | 236,188 | |||||||||||||||||||

Interest expense (note 7) |

(105,787) | (89,663) | (208,311) | (171,581) | |||||||||||||||||||

Income (loss) from long-term investments (note 6) |

192,611 | (286,546) | 38,158 | (75,585) | |||||||||||||||||||

Other income (note 5) |

6,030 | 8,850 | 12,729 | 17,901 | |||||||||||||||||||

Other net losses (note 16) |

(17,061) | (40,367) | (27,662) | (43,829) | |||||||||||||||||||

Pension and other post-employment non-service costs (note 8) |

(3,975) | (5,306) | (7,413) | (10,267) | |||||||||||||||||||

Gain on derivative financial instruments (note 21(b)(iv)) |

58 | 1,039 | 191 | 3,205 | |||||||||||||||||||

Earnings (loss) before income taxes |

153,813 | (318,279) | 22,205 | (43,968) | |||||||||||||||||||

Income tax recovery (expense) (note 15) |

|||||||||||||||||||||||

| Current | 46,681 | (6,300) | 41,577 | (12,800) | |||||||||||||||||||

| Deferred | (41,453) | 62,258 | (25,046) | 44,057 | |||||||||||||||||||

| 5,228 | 55,958 | 16,531 | 31,257 | ||||||||||||||||||||

| Net earnings (loss) | 159,041 | (262,321) | 38,736 | (12,711) | |||||||||||||||||||

Net effect of non-controlling interests (note 14) |

|||||||||||||||||||||||

| Non-controlling interests | 41,725 | 15,439 | 72,884 | 42,018 | |||||||||||||||||||

| Non-controlling interests held by related party | — | (6,349) | — | (12,399) | |||||||||||||||||||

| $ | 41,725 | $ | 9,090 | $ | 72,884 | $ | 29,619 | ||||||||||||||||

| Net earnings (loss) attributable to shareholders of Algonquin Power & Utilities Corp. | $ | 200,766 | $ | (253,231) | $ | 111,620 | $ | 16,908 | |||||||||||||||

Series A Shares and Series D Shares dividend (note 12) |

2,705 | 2,080 | 5,117 | 4,172 | |||||||||||||||||||

| Net earnings (loss) attributable to common shareholders of Algonquin Power & Utilities Corp. | $ | 198,061 | $ | (255,311) | $ | 106,503 | $ | 12,736 | |||||||||||||||

Basic and diluted net earnings (loss) per share (note 17) |

$ | 0.28 | $ | (0.37) | $ | 0.15 | $ | 0.02 | |||||||||||||||

| Three months ended | Six months ended | ||||||||||||||||||||||

| (thousands of U.S. dollars) | June 30 | June 30 | |||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Net earnings (loss) | $ | 159,041 | $ | (262,321) | $ | 38,736 | $ | (12,711) | |||||||||||||||

| Other comprehensive income (loss) ("OCI"): | |||||||||||||||||||||||

Foreign currency translation adjustment, net of tax expense of $1,310 and $3,190 (2023 - tax recovery $3,418 and $3,038), respectively (notes 21(b)(iii) and 21(b)(iv)) |

10,933 | 130 | 4,416 | 15,555 | |||||||||||||||||||

Change in fair value of cash flow hedges, net of tax expense of $2,165 and $6,995 (2023 - tax expense of $3,737 and recovery of $178), respectively (note 21(b)(ii)) |

29,190 | 36,421 | 38,652 | 54,286 | |||||||||||||||||||

Change in pension and other post-employment benefits, net of tax recovery of $394 and $1,768 (2023 - tax recovery of $281 and $445), respectively |

(1,143) | (823) | (5,174) | (1,303) | |||||||||||||||||||

| OCI, net of tax | 38,980 | 35,728 | 37,894 | 68,538 | |||||||||||||||||||

| Comprehensive income (loss) | 198,021 | (226,593) | 76,630 | 55,827 | |||||||||||||||||||

| Comprehensive loss attributable to the non-controlling interests | (42,049) | (8,693) | (73,906) | (29,407) | |||||||||||||||||||

| Comprehensive income (loss) attributable to shareholders of Algonquin Power & Utilities Corp. | $ | 240,070 | $ | (217,900) | $ | 150,536 | $ | 85,234 | |||||||||||||||

| (thousands of U.S. dollars) | June 30, | December 31, | |||||||||

| 2024 | 2023 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 131,633 | $ | 56,142 | |||||||

Trade and other receivables, net (note 4) |

426,879 | 524,194 | |||||||||

| Fuel and natural gas in storage | 49,696 | 48,982 | |||||||||

| Supplies and consumables inventory | 185,637 | 178,150 | |||||||||

Regulatory assets (note 5) |

185,938 | 142,970 | |||||||||

| Prepaid expenses | 67,703 | 81,926 | |||||||||

Derivative instruments (note 21) |

28,016 | 10,920 | |||||||||

Other assets |

129,134 | 23,061 | |||||||||

| 1,204,636 | 1,066,345 | ||||||||||

Property, plant and equipment, net |

13,199,200 | 12,517,450 | |||||||||

Intangible assets, net |

90,405 | 93,938 | |||||||||

Goodwill |

1,317,440 | 1,324,062 | |||||||||

Regulatory assets (note 5) |

1,124,523 | 1,184,713 | |||||||||

Long-term investments (note 6) |

|||||||||||

| Investments carried at fair value | 1,128,171 | 1,115,729 | |||||||||

| Other long-term investments | 411,985 | 641,920 | |||||||||

Derivative instruments (note 21) |

88,817 | 72,328 | |||||||||

Deferred income taxes |

161,279 | 158,483 | |||||||||

Other assets |

139,918 | 198,993 | |||||||||

| $ | 18,866,374 | $ | 18,373,961 | ||||||||

| (thousands of U.S. dollars) | June 30, | December 31, | |||||||||

| 2024 | 2023 | ||||||||||

| LIABILITIES AND EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 138,154 | $ | 210,412 | |||||||

| Accrued liabilities | 552,164 | 554,875 | |||||||||

Dividends payable (note 12) |

83,267 | 74,916 | |||||||||

Regulatory liabilities (note 5) |

88,449 | 99,850 | |||||||||

Long-term debt (note 7) |

158,278 | 621,856 | |||||||||

Other long-term liabilities (note 9) |

185,314 | 80,458 | |||||||||

Derivative instruments (note 21) |

23,413 | 34,915 | |||||||||

| Other liabilities | 12,107 | 7,898 | |||||||||

| 1,241,146 | 1,685,180 | ||||||||||

Long-term debt (note 7) |

8,134,371 | 7,894,174 | |||||||||

Regulatory liabilities (note 5) |

562,715 | 634,446 | |||||||||

Deferred income taxes |

634,053 | 578,902 | |||||||||

Derivative instruments (note 21) |

106,644 | 75,961 | |||||||||

Pension and other post-employment benefits obligation |

99,185 | 96,653 | |||||||||

Other long-term liabilities (note 9) |

392,493 | 465,874 | |||||||||

| 9,929,461 | 9,746,010 | ||||||||||

Redeemable non-controlling interests |

|||||||||||

| Redeemable non-controlling interest, held by related party | — | 308,350 | |||||||||

| Redeemable non-controlling interests | 9,263 | 10,013 | |||||||||

| 9,263 | 318,363 | ||||||||||

| Equity: | |||||||||||

| Preferred shares | 184,299 | 184,299 | |||||||||

Common shares (note 10(a)) |

7,389,116 | 6,229,994 | |||||||||

| Additional paid-in capital | 827 | 7,254 | |||||||||

| Deficit | (1,331,947) | (1,279,696) | |||||||||

Accumulated other comprehensive loss (“AOCI”) (note 11) |

(63,370) | (102,286) | |||||||||

| Total equity attributable to shareholders of Algonquin Power & Utilities Corp. | 6,178,925 | 5,039,565 | |||||||||

Non-controlling interests |

|||||||||||

| Non-controlling interests - tax equity partnership units | 1,156,628 | 1,196,720 | |||||||||

| Other non-controlling interests | 358,670 | 347,338 | |||||||||

| Non-controlling interest, held by related party | (7,719) | 40,785 | |||||||||

| 1,507,579 | 1,584,843 | ||||||||||

| Total equity | 7,686,504 | 6,624,408 | |||||||||

Commitments and contingencies (note 19) |

|||||||||||

Subsequent events (note 3(a), 7(f)) |

|||||||||||

| $ | 18,866,374 | $ | 18,373,961 | ||||||||

|

(thousands of U.S. dollars)

For the three months ended June 30, 2024

|

|||||||||||||||||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. Shareholders | |||||||||||||||||||||||||||||||||||||||||

| Common shares |

Preferred shares |

Additional paid-in capital |

Deficit | AOCI | Non- controlling interests |

Total | |||||||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | $ | 6,235,552 | $ | 184,299 | $ | (384) | $ | (1,446,333) | $ | (104,452) | $ | 1,566,120 | $ | 6,434,802 | |||||||||||||||||||||||||||

Net earnings (loss) |

— | — | — | 200,766 | — | (41,725) | 159,041 | ||||||||||||||||||||||||||||||||||

Effect of redeemable non-controlling interests not included in equity (note 14) |

— | — | — | — | — | 331 | 331 | ||||||||||||||||||||||||||||||||||

| OCI | — | — | — | — | 41,082 | (2,102) | 38,980 | ||||||||||||||||||||||||||||||||||

| Dividends declared and distributions to non-controlling interests | — | — | — | (86,445) | — | (17,359) | (103,804) | ||||||||||||||||||||||||||||||||||

Contributions received from non-controlling interests, net of cost |

— | — | — | — | — | 2,314 | 2,314 | ||||||||||||||||||||||||||||||||||

Common shares issued upon public offering (note 10(a)) |

1,150,000 | — | — | — | — | — | 1,150,000 | ||||||||||||||||||||||||||||||||||

| Common shares issued under employee share purchase plan | 1,038 | — | — | — | — | — | 1,038 | ||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | 1,211 | — | — | — | 1,211 | ||||||||||||||||||||||||||||||||||

| Common shares issued pursuant to share-based awards | 2,526 | — | — | 65 | — | — | 2,591 | ||||||||||||||||||||||||||||||||||

| Balance, June 30, 2024 | $ | 7,389,116 | $ | 184,299 | $ | 827 | $ | (1,331,947) | $ | (63,370) | $ | 1,507,579 | $ | 7,686,504 | |||||||||||||||||||||||||||

|

(thousands of U.S. dollars)

For the three months ended June 30, 2023

|

|||||||||||||||||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. Shareholders | |||||||||||||||||||||||||||||||||||||||||

| Common shares |

Preferred shares |

Additional paid-in capital |

Deficit | AOCI | Non- controlling interests |

Total | |||||||||||||||||||||||||||||||||||

| Balance, March 31, 2023 | $ | 6,223,301 | $ | 184,299 | $ | 776 | $ | (805,515) | $ | (127,068) | $ | 1,580,027 | $ | 7,055,820 | |||||||||||||||||||||||||||

| Net loss | — | — | — | (253,231) | — | (9,090) | (262,321) | ||||||||||||||||||||||||||||||||||

Redeemable non-controlling interests not included in equity (note 14) |

— | — | — | — | — | (6,018) | (6,018) | ||||||||||||||||||||||||||||||||||

| OCI | — | — | — | — | 35,331 | 397 | 35,728 | ||||||||||||||||||||||||||||||||||

| Dividends declared and distributions to non-controlling interests | — | — | — | (77,449) | — | (14,104) | (91,553) | ||||||||||||||||||||||||||||||||||

| Common shares issued upon conversion of convertible debentures | 11 | — | — | — | — | — | 11 | ||||||||||||||||||||||||||||||||||

Contributions received from non-controlling interests, net of cost |

— | — | — | — | — | 98,851 | 98,851 | ||||||||||||||||||||||||||||||||||

| Issuance of common shares under employee share purchase plan | 1,405 | — | — | — | — | — | 1,405 | ||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | 3,602 | — | — | — | 3,602 | ||||||||||||||||||||||||||||||||||

| Common shares issued pursuant to share-based awards | 53 | — | (99) | (13) | — | — | (59) | ||||||||||||||||||||||||||||||||||

| Balance, June 30, 2023 | $ | 6,224,770 | $ | 184,299 | $ | 4,279 | $ | (1,136,208) | $ | (91,737) | $ | 1,650,063 | $ | 6,835,466 | |||||||||||||||||||||||||||

|

(thousands of U.S. dollars)

For the six months ended June 30, 2024

|

|||||||||||||||||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. Shareholders | |||||||||||||||||||||||||||||||||||||||||

| Common shares |

Preferred shares |

Additional paid-in capital |

Deficit | AOCI | Non- controlling interests |

Total | |||||||||||||||||||||||||||||||||||

| Balance, December 31, 2023 | $ | 6,229,994 | $ | 184,299 | $ | 7,254 | $ | (1,279,696) | $ | (102,286) | $ | 1,584,843 | $ | 6,624,408 | |||||||||||||||||||||||||||

Net earnings (loss) |

— | — | — | 111,620 | — | (72,884) | 38,736 | ||||||||||||||||||||||||||||||||||

| Effect of redeemable non-controlling interests not included in equity (note 14) | — | — | — | — | — | 662 | 662 | ||||||||||||||||||||||||||||||||||

| OCI | — | — | — | — | 38,916 | (1,022) | 37,894 | ||||||||||||||||||||||||||||||||||

| Dividends declared and distributions to non-controlling interests | — | — | — | (164,357) | — | (67,079) | (231,436) | ||||||||||||||||||||||||||||||||||

Contributions received from non-controlling interests, net of cost |

— | — | — | — | — | 66,859 | 66,859 | ||||||||||||||||||||||||||||||||||

Common shares issued upon public offering (note 10(a)) |

1,150,000 | — | — | — | — | — | 1,150,000 | ||||||||||||||||||||||||||||||||||

| Common shares issued under employee share purchase plan | 2,316 | — | — | — | — | — | 2,316 | ||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | 6,453 | — | — | — | 6,453 | ||||||||||||||||||||||||||||||||||

| Common shares issued pursuant to share-based awards | 6,806 | — | (5,783) | 486 | — | — | 1,509 | ||||||||||||||||||||||||||||||||||

Non-controlling interest assumed on asset acquisition |

— | — | (7,097) | — | — | (3,800) | (10,897) | ||||||||||||||||||||||||||||||||||

| Balance, June 30, 2024 | $ | 7,389,116 | $ | 184,299 | $ | 827 | $ | (1,331,947) | $ | (63,370) | $ | 1,507,579 | $ | 7,686,504 | |||||||||||||||||||||||||||

|

(thousands of U.S. dollars)

For the six months ended June 30, 2023

|

|||||||||||||||||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. Shareholders | |||||||||||||||||||||||||||||||||||||||||

| Common shares |

Preferred shares |

Additional paid-in capital |

Deficit | AOCI | Non- controlling interests |

Total | |||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | 6,183,943 | $ | 184,299 | $ | 9,413 | $ | (997,945) | $ | (160,063) | $ | 1,616,792 | $ | 6,836,439 | |||||||||||||||||||||||||||

Net earnings (loss) |

— | — | 16,908 | — | (29,619) | (12,711) | |||||||||||||||||||||||||||||||||||

| Redeemable non-controlling interests not included in equity (note 14) | — | — | — | — | — | (11,737) | (11,737) | ||||||||||||||||||||||||||||||||||

| OCI | — | — | — | — | 68,326 | 212 | 68,538 | ||||||||||||||||||||||||||||||||||

| Dividends declared and distributions to non-controlling interests | — | — | — | (124,451) | — | (33,518) | (157,969) | ||||||||||||||||||||||||||||||||||

| Dividends and issuance of shares under dividend reinvestment plan | 30,482 | — | — | (30,482) | — | — | — | ||||||||||||||||||||||||||||||||||

Contributions received from non-controlling interests, net of cost |

— | — | — | — | — | 107,933 | 107,933 | ||||||||||||||||||||||||||||||||||

| Common shares issued upon conversion of convertible debentures | 11 | — | — | — | — | — | 11 | ||||||||||||||||||||||||||||||||||

| Issuance of common shares under employee share purchase plan | 3,113 | — | — | — | — | — | 3,113 | ||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | 4,695 | — | — | — | 4,695 | ||||||||||||||||||||||||||||||||||

| Common shares issued pursuant to share-based awards |

7,221 | — | (9,829) | (238) | — | — | (2,846) | ||||||||||||||||||||||||||||||||||

| Balance, June 30, 2023 | $ | 6,224,770 | $ | 184,299 | $ | 4,279 | $ | (1,136,208) | $ | (91,737) | $ | 1,650,063 | $ | 6,835,466 | |||||||||||||||||||||||||||

| (thousands of U.S. dollars) | Three months ended June 30 | Six months ended June 30 | |||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Cash provided by (used in): | |||||||||||||||||||||||

| Operating activities | |||||||||||||||||||||||

Net earnings (loss) |

$ | 159,041 | $ | (262,321) | $ | 38,736 | $ | (12,711) | |||||||||||||||

| Adjustments and items not affecting cash: | |||||||||||||||||||||||

| Depreciation and amortization | 136,912 | 118,448 | 266,452 | 240,089 | |||||||||||||||||||

| Deferred taxes | 41,453 | (62,258) | 25,046 | (44,057) | |||||||||||||||||||

Initial value and changes in derivative financial instruments net of amortization |

(1,255) | (4,882) | (3,000) | (9,851) | |||||||||||||||||||

| Share-based compensation | 5,172 | 3,199 | 10,282 | 3,895 | |||||||||||||||||||

| Cost of equity funds used for construction purposes | (281) | (568) | (1,150) | (1,226) | |||||||||||||||||||

| Change in value of investments carried at fair value | (172,904) | 311,410 | (14,572) | 132,026 | |||||||||||||||||||

Pension and post-employment expense in excess of (lower than) contributions |

(1,553) | 2,176 | 2,429 | 119 | |||||||||||||||||||

| Distributions received from equity investments, net of income | 9,799 | 5,588 | 34,269 | 3,554 | |||||||||||||||||||

Other (note 16(c)) |

(10,736) | 38,232 | (7,556) | 36,195 | |||||||||||||||||||

Net change in non-cash operating items (note 20) |

70,553 | 112,380 | 16,010 | (53,356) | |||||||||||||||||||

| 236,201 | 261,404 | 366,946 | 294,677 | ||||||||||||||||||||

| Financing activities | |||||||||||||||||||||||

| Increase in long-term debt | 468,230 | 224,664 | 2,383,349 | 654,648 | |||||||||||||||||||

| Repayments of long-term debt | (1,250,081) | (194,403) | (2,751,033) | (398,179) | |||||||||||||||||||

| Net change in commercial paper | (192,699) | (1,187) | (448,720) | 91,613 | |||||||||||||||||||

| Issuance of common shares, net of costs | 1,151,038 | 1,405 | 1,152,316 | 3,113 | |||||||||||||||||||

| Cash dividends on common shares | (77,075) | (75,493) | (150,738) | (171,386) | |||||||||||||||||||

| Dividends on preferred shares | (2,705) | (2,080) | (5,117) | (4,172) | |||||||||||||||||||

Contributions from non-controlling interests and redeemable non-controlling interests (note 3) |

— | 98,955 | 60,545 | 98,955 | |||||||||||||||||||

| Production-based cash contributions from non-controlling interest | 2,313 | — | 6,315 | 9,082 | |||||||||||||||||||

Distributions to non-controlling interests, related party |

— | (244) | — | (12,300) | |||||||||||||||||||

| Distributions to non-controlling interests | (18,636) | (20,746) | (25,450) | (33,084) | |||||||||||||||||||

| Shares surrendered to fund withholding taxes on exercised share options | (1,481) | — | (2,451) | (568) | |||||||||||||||||||

| Acquisition of non-controlling interest | — | — | (10,059) | — | |||||||||||||||||||

| Increase in other long-term liabilities | 2,738 | 6,695 | 9,370 | 11,125 | |||||||||||||||||||

| Decrease in other long-term liabilities | (21,991) | (255) | (44,279) | (20,329) | |||||||||||||||||||

| 59,651 | 37,311 | 174,048 | 228,518 | ||||||||||||||||||||

| Investing activities | |||||||||||||||||||||||

| Additions to property, plant and equipment and intangible assets | (204,336) | (245,209) | (416,882) | (414,958) | |||||||||||||||||||

| Increase in long-term investments | (62,288) | (41,774) | (78,181) | (89,379) | |||||||||||||||||||

Divestiture of operating entity |

11,827 | — | 29,548 | — | |||||||||||||||||||

| Increase in other assets | (1,719) | (130) | (2,650) | (1,980) | |||||||||||||||||||

| Decrease in long-term investments | — | 11,749 | — | 11,749 | |||||||||||||||||||

| (256,516) | (275,364) | (468,165) | (494,568) | ||||||||||||||||||||

| Effect of exchange rate differences on cash and restricted cash | 151 | 369 | (1,512) | 872 | |||||||||||||||||||

Increase in cash, cash equivalents and restricted cash |

39,487 | 23,720 | 71,317 | 29,499 | |||||||||||||||||||

Cash, cash equivalents and restricted cash, beginning of period |

107,969 | 106,964 | 76,139 | 101,185 | |||||||||||||||||||

| Cash, cash equivalents and restricted cash, end of period | $ | 147,456 | $ | 130,684 | $ | 147,456 | $ | 130,684 | |||||||||||||||

| Algonquin Power & Utilities Corp. Unaudited Interim Condensed Consolidated Statements of Cash Flows (continued) | |||||||||||||||||||||||

| (thousands of U.S. dollars) | Three months ended June 30 | Six months ended June 30 | |||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Supplemental disclosure of cash flow information: | |||||||||||||||||||||||

Cash paid during the period for interest expense |

$ | 96,783 | $ | 75,489 | $ | 206,412 | $ | 178,201 | |||||||||||||||

Cash paid (received) during the period for income taxes - net (note 15) |

$ | (52,118) | $ | 2,097 | $ | (49,454) | $ | 4,138 | |||||||||||||||

Cash received during the period for distributions from equity investments |

$ | 27,081 | $ | 28,331 | $ | 53,469 | $ | 56,611 | |||||||||||||||

| Non-cash financing and investing activities: | |||||||||||||||||||||||

| Property, plant and equipment acquisitions in accruals | $ | 124,001 | $ | 145,594 | $ | 124,001 | $ | 145,594 | |||||||||||||||

| Issuance of common shares under dividend reinvestment plan and share-based compensation plans | $ | 3,564 | $ | 1,458 | $ | 9,122 | $ | 40,816 | |||||||||||||||

Property, plant and equipment, intangible assets and accrued liabilities in exchange of notes receivable |

$ | 141,171 | $ | — | $ | 160,916 | $ | — | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Shady Oaks II | |||||

| Working capital | $ | (1,189) | |||

| Property, plant and equipment | 260,090 | ||||

Long-term debt (note 7(f)) |

(163,735) | ||||

| Asset retirement obligation | (674) | ||||

| Derivative | (23,493) | ||||

| Deferred tax liability | (11,375) | ||||

| Total net assets acquired | 59,624 | ||||

Less: cash and cash equivalents |

1,922 | ||||

| Net assets acquired, net of cash and cash equivalents | $ | 57,702 | |||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| New Market Solar | |||||

| Working capital | $ | (7,614) | |||

| Property, plant and equipment | 193,782 | ||||

| Asset retirement obligation | (1,135) | ||||

| Deferred tax liability | (2,091) | ||||

| Total net assets acquired | 182,942 | ||||

Less: cash and cash equivalents |

434 | ||||

| Net assets acquired, net of cash and cash equivalents | $ | 182,508 | |||

| Sandy Ridge II | |||||

| Working capital | $ | 3,526 | |||

| Property, plant and equipment | 206,927 | ||||

| Long-term debt | (162,341) | ||||

| Asset retirement obligation | (456) | ||||

| Deferred tax liability | (3,517) | ||||

| Total net assets acquired | 44,139 | ||||

Less: cash and cash equivalents |

— | ||||

| Net assets acquired, net of cash and cash equivalents | $ | 44,139 | |||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Utility | State, Province or Country | Regulatory Proceeding Type | Details | ||||||||

| BELCO | Bermuda | General Rate Case ("GRC") | On September 30, 2021, filed its revenue allowance application in which it requested a $34,800 increase for 2022 and a $6,100 increase for 2023. On March 18, 2022, the Regulatory Authority ("RA") approved an annual increase of $22,800, for a revenue allowance of $224,100 for 2022 and $226,200 for 2023. The RA authorized a 7.16% rate of return, comprised of a 62% equity and an 8.92% return on equity ("ROE"). In April 2022, BELCO filed an appeal in the Supreme Court of Bermuda challenging the decisions made by the RA through the recent Retail Tariff Review. On February 23, 2024, the Bermuda Supreme Court issued an order denying the BELCO appeal. |

||||||||

BELCO |

Bermuda |

GRC |

On October 17, 2023, filed its revenue allowance application in which it requested a $59,100 increase for 2024 and 2025 based on a weighted average cost of capital of 10.13%. On May 30, 2024, the RA issued a final order authorizing a revenue increase of $33,600 in 2024 and 2025 based on a weighted average cost of capital of 7.79%. New base rates became effective August 1, 2024. |

||||||||

| Empire Electric | Arkansas | GRC |

On February 14, 2023, filed an application seeking an increase in revenues of $7,300 based on an ROE of 10.25% and an equity ratio of 56% to be phased in over three years. On December 7, 2023, the Arkansas Public Service Commission issued an order approving the settlement agreement authorizing a revenue increase of $5,300. New rates became effective January 1, 2024. |

||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| June 30, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Regulatory assets | |||||||||||

Securitized costs, net (a) |

$ | 296,918 | $ | — | |||||||

| Rate adjustment mechanism | 201,051 | 192,880 | |||||||||

| Deferred capitalized costs | 147,536 | 124,517 | |||||||||

| Fuel and commodity cost adjustments | 101,805 | 326,418 | |||||||||

| Income taxes | 99,847 | 101,939 | |||||||||

Wildfire mitigation and vegetation management (b) |

130,564 | 64,146 | |||||||||

| Pension and post-employment benefits | 62,736 | 68,822 | |||||||||

| Environmental remediation | 60,365 | 66,779 | |||||||||

| Clean energy and other customer programs | 31,676 | 37,214 | |||||||||

| Debt premium | 15,880 | 18,995 | |||||||||

| Retired generating plant | 14,509 | 183,732 | |||||||||

| Asset retirement obligation | 13,916 | 26,620 | |||||||||

| Cost of removal | 11,084 | 11,084 | |||||||||

| Rate review costs | 9,014 | 8,815 | |||||||||

| Long-term maintenance contract | 3,948 | 4,932 | |||||||||

| Other | 109,612 | 90,790 | |||||||||

| Total regulatory assets | $ | 1,310,461 | $ | 1,327,683 | |||||||

| Less: current regulatory assets | (185,938) | (142,970) | |||||||||

| Non-current regulatory assets | $ | 1,124,523 | $ | 1,184,713 | |||||||

| Regulatory liabilities | |||||||||||

| Income taxes | $ | 273,064 | $ | 290,121 | |||||||

| Cost of removal | 188,840 | 185,786 | |||||||||

| Pension and post-employment benefits | 111,556 | 104,636 | |||||||||

| Fuel and commodity cost adjustments | 42,491 | 42,850 | |||||||||

| Clean energy and other customer programs | 9,746 | 12,730 | |||||||||

| Rate adjustment mechanism | 1,119 | 2,078 | |||||||||

| Other | 24,348 | 96,095 | |||||||||

| Total regulatory liabilities | $ | 651,164 | $ | 734,296 | |||||||

| Less: current regulatory liabilities | (88,449) | (99,850) | |||||||||

| Non-current regulatory liabilities | $ | 562,715 | $ | 634,446 | |||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| June 30, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Long-term investments carried at fair value |

|||||||||||

Atlantica (a) |

$ | 1,074,736 | $ | 1,052,703 | |||||||

| Atlantica Yield Energy Solutions Canada Inc. | 51,530 | 61,064 | |||||||||

| Other | 1,905 | 1,962 | |||||||||

| $ | 1,128,171 | $ | 1,115,729 | ||||||||

| Other long-term investments | |||||||||||

Equity-method investees (b) |

$ | 352,983 | $ | 456,393 | |||||||

Development loans receivable from equity-method investees (b) |

31,444 | 158,110 | |||||||||

| Other | 27,558 | 27,417 | |||||||||

| $ | 411,985 | $ | 641,920 | ||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 30 | June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Fair value gain (loss) on investments carried at fair value | |||||||||||||||||||||||

| Atlantica | $ | 169,902 | $ | (299,653) | $ | 22,034 | $ | (120,449) | |||||||||||||||

| Atlantica Yield Energy Solutions Canada Inc. | 2,966 | (11,763) | (7,596) | (11,567) | |||||||||||||||||||

| Other | 36 | 6 | 134 | (10) | |||||||||||||||||||

| $ | 172,904 | $ | (311,410) | $ | 14,572 | $ | (132,026) | ||||||||||||||||

| Dividend and interest income from investments carried at fair value | |||||||||||||||||||||||

| Atlantica | $ | 21,788 | $ | 21,788 | $ | 43,577 | $ | 43,577 | |||||||||||||||

| Atlantica Yield Energy Solutions Canada Inc. | 4,984 | 4,821 | 8,875 | 10,678 | |||||||||||||||||||

| Other | 9 | 7 | 26 | 17 | |||||||||||||||||||

| $ | 26,781 | $ | 26,616 | $ | 52,478 | $ | 54,272 | ||||||||||||||||

| Other long-term investments | |||||||||||||||||||||||

Equity method loss (c) |

(9,108) | (2,434) | (33,375) | (153) | |||||||||||||||||||

| Interest and other income | 2,034 | 682 | 4,483 | 2,322 | |||||||||||||||||||

| $ | (7,074) | $ | (1,752) | $ | (28,892) | $ | 2,169 | ||||||||||||||||

Income (loss) from long-term investments |

$ | 192,611 | $ | (286,546) | $ | 38,158 | $ | (75,585) | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| June 30, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Total assets | $ | 2,590,705 | $ | 3,235,474 | |||||||

| Total liabilities | 1,395,474 | 1,962,115 | |||||||||

| Net assets | $ | 1,195,231 | $ | 1,273,359 | |||||||

| AQN's ownership interest in the entities | 310,885 | 388,993 | |||||||||

|

Difference between investment carrying amount and underlying

equity in net assets(a)

|

42,098 | 67,400 | |||||||||

| AQN's investment carrying amount for the entities | $ | 352,983 | $ | 456,393 | |||||||

| Six months ended | |||||||||||

| June 30 | |||||||||||

| 2024 | 2023 | ||||||||||

| Revenue | $ | 67,675 | $ | 49,467 | |||||||

Net gain (loss) |

(38,136) | 1,836 | |||||||||

Other comprehensive income (loss) (a) |

27,731 | (2,807) | |||||||||

Net loss attributable to AQN |

$ | (33,375) | $ | (153) | |||||||

Other comprehensive income (loss) attributable to AQN (a) |

$ | 12,182 | $ | (2,076) | |||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| June 30, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| AQN's maximum exposure in regards to VIEs | |||||||||||

| Carrying amount | $ | 90,471 | $ | 179,728 | |||||||

| Development loans receivable | 31,444 | 158,110 | |||||||||

Indirect guarantees of debt on behalf of VIEs |

405,119 | 740,866 | |||||||||

Other indirect guarantees and commitments on behalf of VIEs |

141,860 | 303,641 | |||||||||

| $ | 668,894 | $ | 1,382,345 | ||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Borrowing type | Weighted average coupon | Maturity | Par value | June 30, | December 31, | ||||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||||||||

Senior unsecured revolving credit facilities (a) |

— | 2024-2028 | N/A | $ | 668,876 | $ | 1,624,186 | ||||||||||||||||||||||

|

Senior unsecured bank credit

facilities and delayed draw term

facility (b)

|

— | 2024-2031 | N/A | 789,216 | 786,962 | ||||||||||||||||||||||||

| Commercial paper | — | 2025 | N/A | 33,000 | 481,720 | ||||||||||||||||||||||||

| U.S. dollar borrowings | |||||||||||||||||||||||||||||

|

Senior unsecured notes

(Green Equity Units) (c)

|

5.37 | % | 2026 | $ | 1,140,787 | 1,135,137 | 1,144,897 | ||||||||||||||||||||||

Senior unsecured notes (d) |

4.25 | % | 2027-2047 | $ | 2,195,000 | 2,181,669 | 1,406,278 | ||||||||||||||||||||||

| Senior unsecured utility notes | 6.30 | % | 2025-2035 | $ | 137,000 | 146,623 | 147,589 | ||||||||||||||||||||||

Senior secured utility bonds (e) |

4.82 | % | 2026-2044 | $ | 861,681 | 850,773 | 551,166 | ||||||||||||||||||||||

Construction loan (f) |

6.57 | % | 2024 | $ | 163,735 | 163,735 | — | ||||||||||||||||||||||

| Canadian dollar borrowings | |||||||||||||||||||||||||||||

| Senior unsecured notes | 3.68 | % | 2027-2050 | C$ | 1,200,000 | 873,025 | 904,604 | ||||||||||||||||||||||

| Senior secured project notes | 10.21 | % | 2027 | C$ | 15,097 | 11,030 | 12,738 | ||||||||||||||||||||||

| Chilean Unidad de Fomento borrowings | |||||||||||||||||||||||||||||

| Senior unsecured utility bonds | 3.82 | % | 2028-2040 | CLF | 1,463 | 64,026 | 70,967 | ||||||||||||||||||||||

| $ | 6,917,110 | $ | 7,131,107 | ||||||||||||||||||||||||||

| Subordinated borrowings | |||||||||||||||||||||||||||||

| Subordinated unsecured notes | 5.25 | % | 2082 | C$ | 400,000 | $ | 288,459 | $ | 298,382 | ||||||||||||||||||||

| Subordinated unsecured notes | 5.21 | % | 2079-2082 | $ | 1,100,000 | 1,087,080 | 1,086,541 | ||||||||||||||||||||||

| $ | 1,375,539 | $ | 1,384,923 | ||||||||||||||||||||||||||

| $ | 8,292,649 | $ | 8,516,030 | ||||||||||||||||||||||||||

| Less: current portion | (158,278) | (621,856) | |||||||||||||||||||||||||||

| $ | 8,134,371 | $ | 7,894,174 | ||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| June 30, | December 31, | |||||||||||||

| 2024 | 2023 | |||||||||||||

| Revolving and term credit facilities | $ | 4,589,200 | $ | 4,562,000 | ||||||||||

| Funds drawn on facilities/commercial paper issued | (1,491,100) | (2,892,900) | ||||||||||||

| Letters of credit issued | (461,900) | (469,100) | ||||||||||||

| Liquidity available under the facilities | 2,636,200 | 1,200,000 | ||||||||||||

| Undrawn portion of uncommitted letter of credit facilities | (254,600) | (254,100) | ||||||||||||

| Cash on hand | 131,633 | 56,142 | ||||||||||||

| Total liquidity and capital reserves | $ | 2,513,233 | $ | 1,002,042 | ||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 30 | June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Long-term debt | $ | 73,169 | $ | 65,046 | $ | 139,881 | $ | 128,814 | |||||||||||||||

| Commercial paper, credit facility draws and related fees | 39,299 | 27,714 | 82,412 | 52,140 | |||||||||||||||||||

| Accretion of fair value adjustments | (5,094) | (824) | (10,956) | (4,223) | |||||||||||||||||||

| Capitalized interest and AFUDC capitalized on regulated property | (2,269) | (4,420) | (5,661) | (8,304) | |||||||||||||||||||

| Other | 682 | 2,147 | 2,635 | 3,154 | |||||||||||||||||||

| $ | 105,787 | $ | 89,663 | $ | 208,311 | $ | 171,581 | ||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Pension benefits | |||||||||||||||||||||||

| Three months ended June 30 | Six months ended June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Service cost | $ | 2,969 | $ | 3,166 | $ | 6,053 | $ | 6,093 | |||||||||||||||

| Non-service costs | |||||||||||||||||||||||

| Interest cost | 8,061 | 7,906 | 16,494 | 16,299 | |||||||||||||||||||

| Expected return on plan assets | (8,603) | (7,947) | (17,300) | (16,263) | |||||||||||||||||||

Amortization of net actuarial gains |

(321) | (71) | (712) | (195) | |||||||||||||||||||

| Amortization of prior service credits | (359) | (373) | (719) | (746) | |||||||||||||||||||

| Impact of regulatory accounts | 4,384 | 4,588 | 8,755 | 8,683 | |||||||||||||||||||

| $ | 3,162 | $ | 4,103 | $ | 6,518 | $ | 7,778 | ||||||||||||||||

| Net benefit cost | $ | 6,131 | $ | 7,269 | $ | 12,571 | $ | 13,871 | |||||||||||||||

| OPEB | |||||||||||||||||||||||

| Three months ended June 30 | Six months ended June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Service cost | $ | 780 | $ | 902 | $ | 1,560 | $ | 1,891 | |||||||||||||||

| Non-service costs | |||||||||||||||||||||||

| Interest cost | 2,674 | 2,891 | 5,327 | 6,329 | |||||||||||||||||||

| Expected return on plan assets | (2,644) | (2,331) | (5,288) | (5,077) | |||||||||||||||||||

Amortization of net actuarial gains |

(867) | (561) | (2,466) | (1,122) | |||||||||||||||||||

| Amortization of prior service credits | (213) | (213) | (426) | (426) | |||||||||||||||||||

| Impact of regulatory accounts | 1,863 | 1,417 | 3,748 | 2,785 | |||||||||||||||||||

| $ | 813 | $ | 1,203 | $ | 895 | $ | 2,489 | ||||||||||||||||

| Net benefit cost | $ | 1,593 | $ | 2,105 | $ | 2,455 | $ | 4,380 | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| June 30, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Asset retirement obligations | $ | 120,722 | $ | 115,611 | |||||||

| Advances in aid of construction | 84,220 | 88,135 | |||||||||

Contingent liability (note 19(a)) |

172,283 | 66,000 | |||||||||

| Deferred credits and contingent consideration | 43,859 | 40,945 | |||||||||

| Environmental remediation obligation | 37,676 | 40,772 | |||||||||

| Customer deposits | 35,636 | 36,294 | |||||||||

| Lease liabilities | 20,024 | 20,493 | |||||||||

| Unamortized investment tax credits | 17,068 | 17,255 | |||||||||

| Contingent development support obligations | 7,681 | 12,666 | |||||||||

| Hook-up fees | 7,510 | 7,425 | |||||||||

Contract adjustment payments (a) |

— | 39,590 | |||||||||

Note payable to related party (note 3(c)) |

— | 25,808 | |||||||||

| Other | 31,128 | 35,338 | |||||||||

| $ | 577,807 | $ | 546,332 | ||||||||

| Less: current portion | (185,314) | (80,458) | |||||||||

| $ | 392,493 | $ | 465,874 | ||||||||

| Six months ended | ||||||||||||||

| June 30 | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Common shares, beginning of period | 689,271,039 | 683,614,803 | ||||||||||||

Settlement of Purchase Contracts |

76,909,700 | — | ||||||||||||

Exercise of share-based awards |

749,522 | 772,591 | ||||||||||||

Dividend reinvestment plan |

— | 4,370,289 | ||||||||||||

Conversion of convertible debentures |

— | 1,415 | ||||||||||||

| Common shares, end of period | 766,930,261 | 688,759,098 | ||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Foreign currency cumulative translation | Unrealized gain (loss) on cash flow hedges | Pension and post-employment actuarial changes | Total | ||||||||||||||||||||

| Balance, January 1, 2023 | $ | (98,467) | $ | (97,809) | $ | 36,213 | $ | (160,063) | |||||||||||||||

| OCI | (3,788) | 57,351 | 8,395 | 61,958 | |||||||||||||||||||

Amounts reclassified from AOCI to the unaudited interim condensed consolidated statements of operations |

(1,598) | 2,136 | (3,702) | (3,164) | |||||||||||||||||||

| Net current period OCI | $ | (5,386) | $ | 59,487 | $ | 4,693 | $ | 58,794 | |||||||||||||||

| OCI attributable to the non-controlling interests | (1,017) | — | — | (1,017) | |||||||||||||||||||

| Net current period OCI attributable to shareholders of AQN | (6,403) | 59,487 | 4,693 | 57,777 | |||||||||||||||||||

| Balance, December 31, 2023 | $ | (104,870) | $ | (38,322) | $ | 40,906 | $ | (102,286) | |||||||||||||||

| OCI | 4,690 | 45,698 | — | 50,388 | |||||||||||||||||||

Amounts reclassified from AOCI to the unaudited interim condensed consolidated statements of operations |

(274) | (7,046) | (5,174) | (12,494) | |||||||||||||||||||

| Net current period OCI | $ | 4,416 | $ | 38,652 | $ | (5,174) | $ | 37,894 | |||||||||||||||

| OCI attributable to the non-controlling interests | 1,022 | — | — | 1,022 | |||||||||||||||||||

| Net current period OCI attributable to shareholders of AQN | $ | 5,438 | $ | 38,652 | $ | (5,174) | $ | 38,916 | |||||||||||||||

| Balance, June 30, 2024 | $ | (99,432) | $ | 330 | $ | 35,732 | $ | (63,370) | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended June 30 | |||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||

| Dividend | Dividend per share | Dividend | Dividend per share | ||||||||||||||||||||

| Common shares | $ | 83,740 | $ | 0.1085 | $ | 75,379 | $ | 0.1085 | |||||||||||||||

| Series A preferred shares | C$ | 1,973 | C$ | 0.4110 | C$ | 1,549 | C$ | 0.3226 | |||||||||||||||

| Series D preferred shares | C$ | 1,713 | C$ | 0.4283 | C$ | 1,273 | C$ | 0.3182 | |||||||||||||||

| Six months ended June 30 | |||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||

| Dividend | Dividend per share | Dividend | Dividend per share | ||||||||||||||||||||

| Common shares | $ | 159,207 | $ | 0.2170 | $ | 150,765 | $ | 0.2170 | |||||||||||||||

| Series A preferred shares | C$ | 3,946 | C$ | 0.8220 | C$ | 3,097 | C$ | 0.6453 | |||||||||||||||

| Series D preferred shares | C$ | 2,986 | C$ | 0.7465 | C$ | 2,546 | C$ | 0.6364 | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 30 | June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| HLBV and other adjustments attributable to: | |||||||||||||||||||||||

| Non-controlling interests - tax equity partnership units | $ | 49,121 | $ | 25,172 | $ | 89,328 | $ | 59,743 | |||||||||||||||

| Non-controlling interests - redeemable tax equity partnership units | 331 | 331 | 662 | 662 | |||||||||||||||||||

Other net earnings attributable to: |

|||||||||||||||||||||||

| Non-controlling interests | (7,727) | (10,064) | (17,106) | (18,387) | |||||||||||||||||||

| $ | 41,725 | $ | 15,439 | $ | 72,884 | $ | 42,018 | ||||||||||||||||

| Redeemable non-controlling interest, held by related party | — | (6,349) | — | (12,399) | |||||||||||||||||||

Net effect of non-controlling interests |

$ | 41,725 | $ | 9,090 | $ | 72,884 | $ | 29,619 | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 30 | June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Expected income tax (recovery) expense at Canadian statutory rate | $ | 40,622 | $ | (84,596) | $ | 5,746 | $ | (11,903) | |||||||||||||||

| Increase (decrease) resulting from: | |||||||||||||||||||||||

| Effect of differences in tax rates on transactions in and within foreign jurisdictions and change in tax rates | (2,702) | (5,560) | (3,863) | (16,718) | |||||||||||||||||||

| Adjustments from investments carried at fair value | (24,817) | 40,357 | (4,734) | 11,092 | |||||||||||||||||||

| Change in valuation allowance | (10,058) | 676 | (13,846) | (791) | |||||||||||||||||||

| Non-controlling interests share of income | 10,468 | 2,201 | 16,470 | 12,393 | |||||||||||||||||||

| Tax credits | (17,160) | (8,095) | (20,463) | (20,505) | |||||||||||||||||||

| Amortization and settlement of excess deferred income tax | (1,794) | (2,456) | (3,305) | (6,207) | |||||||||||||||||||

Foreign exchange difference and other |

213 | 1,515 | 7,464 | 1,382 | |||||||||||||||||||

Income tax recovery |

$ | (5,228) | $ | (55,958) | $ | (16,531) | $ | (31,257) | |||||||||||||||

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 30 | June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Beginning balance | $ | 95,554 | $ | 97,396 | $ | 97,344 | $ | 107,583 | |||||||||||||||

Charged to income tax expense (recovery) |

(10,058) | 676 | (13,846) | (791) | |||||||||||||||||||

| Charged (reduction) to OCI | (5,507) | (6,418) | (3,509) | (15,138) | |||||||||||||||||||

| Ending balance | $ | 79,989 | $ | 91,654 | $ | 79,989 | $ | 91,654 | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 30 | June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

Renewable energy business sale costs (a) |

5,323 | 5,390 | 11,232 | 5,390 | |||||||||||||||||||

Kentucky termination costs (b) |

— | 43,808 | — | 46,527 | |||||||||||||||||||

Acquisition-related settlement payment |

— | (11,983) | — | (11,983) | |||||||||||||||||||

Other (c) |

11,738 | 3,152 | 16,430 | 3,895 | |||||||||||||||||||

| $ | 17,061 | $ | 40,367 | $ | 27,662 | $ | 43,829 | ||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 30 | June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Net earnings (loss) attributable to shareholders of AQN | 200,766 | (253,231) | $ | 111,620 | $ | 16,908 | |||||||||||||||||

Series A preferred share dividend |

1,448 | 1,142 | 2,203 | 2,290 | |||||||||||||||||||

Series D preferred share dividend |

1,257 | 938 | 2,914 | 1,882 | |||||||||||||||||||

| Net earnings (loss) attributable to common shareholders of AQN – basic and diluted | $ | 198,061 | $ | (255,311) | $ | 106,503 | $ | 12,736 | |||||||||||||||

| Weighted average number of shares | |||||||||||||||||||||||

| Basic | 701,593,792 | 687,847,010 | 695,700,444 | 688,277,615 | |||||||||||||||||||

| Effect of dilutive securities | 2,360,493 | — | 2,039,030 | 2,838,682 | |||||||||||||||||||

| Diluted | 703,954,285 | 687,847,010 | 697,739,474 | 691,116,297 | |||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended June 30, 2024 | |||||||||||||||||||||||

| Regulated Services Group | Renewable Energy Group | Corporate | Total | ||||||||||||||||||||

Revenue (1)(2) |

$ | 491,312 | $ | 78,661 | $ | — | $ | 569,973 | |||||||||||||||

| Other revenue | 13,940 | 14,518 | 195 | 28,653 | |||||||||||||||||||

| Fuel, power and water purchased | 108,934 | 691 | — | 109,625 | |||||||||||||||||||

| Net revenue | 396,318 | 92,488 | 195 | 489,001 | |||||||||||||||||||

Operating expenses (3) |

215,708 | 47,758 | 2,402 | 265,868 | |||||||||||||||||||

| Depreciation and amortization | 100,120 | 36,553 | 239 | 136,912 | |||||||||||||||||||

| Loss on foreign exchange | — | — | 4,284 | 4,284 | |||||||||||||||||||

Operating income |

80,490 | 8,177 | (6,730) | 81,937 | |||||||||||||||||||

| Interest expense | (49,476) | (18,624) | (37,687) | (105,787) | |||||||||||||||||||

Income from long-term investments and other income |

7,456 | 17,667 | 173,518 | 198,641 | |||||||||||||||||||

| Other expenses | (8,537) | (7,886) | (4,555) | (20,978) | |||||||||||||||||||

| Earnings (loss) before income taxes | $ | 29,933 | $ | (666) | $ | 124,546 | $ | 153,813 | |||||||||||||||

Capital expenditures (4) |

$ | 167,834 | $ | 36,502 | $ | — | $ | 204,336 | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended June 30, 2023 | |||||||||||||||||||||||

| Regulated Services Group | Renewable Energy Group | Corporate | Total | ||||||||||||||||||||

Revenue (1)(2) |

$ | 533,642 | $ | 71,694 | $ | — | $ | 605,336 | |||||||||||||||

| Other revenue | 12,791 | 9,380 | 364 | 22,535 | |||||||||||||||||||

| Fuel, power and water purchased | 138,374 | 3,782 | — | 142,156 | |||||||||||||||||||

| Net revenue | 408,059 | 77,292 | 364 | 485,715 | |||||||||||||||||||

Operating expenses (3) |

228,847 | 38,367 | (40) | 267,174 | |||||||||||||||||||

| Depreciation and amortization | 84,754 | 33,291 | 403 | 118,448 | |||||||||||||||||||

| Gain on foreign exchange | — | — | 6,379 | 6,379 | |||||||||||||||||||

Operating income |

94,458 | 5,634 | (6,378) | 93,714 | |||||||||||||||||||

| Interest expense | (42,724) | (16,420) | (30,519) | (89,663) | |||||||||||||||||||

Income (loss) from long-term investments and other income |

9,332 | 22,842 | (309,870) | (277,696) | |||||||||||||||||||

| Other expenses | (41,010) | (1,197) | (2,427) | (44,634) | |||||||||||||||||||

| Earnings (loss) before income taxes | $ | 20,056 | $ | 10,859 | $ | (349,194) | $ | (318,279) | |||||||||||||||

Capital expenditures (4) |

$ | 225,505 | $ | 19,704 | $ | — | $ | 245,209 | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Six months ended June 30, 2024 | |||||||||||||||||||||||

| Regulated Services Group | Renewable Energy Group | Corporate | Total | ||||||||||||||||||||

Revenue (1)(2) |

$ | 1,116,143 | $ | 163,237 | $ | — | $ | 1,279,380 | |||||||||||||||

| Other revenue | 25,689 | 30,052 | 605 | 56,346 | |||||||||||||||||||

| Fuel, power and water purchased | 306,738 | 4,229 | — | 310,967 | |||||||||||||||||||

| Net revenue | 835,094 | 189,060 | 605 | 1,024,759 | |||||||||||||||||||

Operating expenses (3) |

423,239 | 101,353 | 3,061 | 527,653 | |||||||||||||||||||

| Depreciation and amortization | 192,140 | 73,812 | 500 | 266,452 | |||||||||||||||||||

Loss on foreign exchange |

— | — | 16,141 | 16,141 | |||||||||||||||||||

| Operating income (loss) | 219,715 | 13,895 | (19,097) | 214,513 | |||||||||||||||||||

| Interest expense | (98,186) | (38,419) | (71,706) | (208,311) | |||||||||||||||||||

Income from long-term investments and other income |

15,377 | 19,689 | 15,821 | 50,887 | |||||||||||||||||||

| Other expenses | (12,228) | (9,198) | (13,458) | (34,884) | |||||||||||||||||||

| Earnings (loss) before income taxes | $ | 124,678 | $ | (14,033) | $ | (88,440) | $ | 22,205 | |||||||||||||||

Capital expenditures (4) |

351,048 | 65,834 | — | 416,882 | |||||||||||||||||||

| June 30, 2024 | |||||||||||||||||||||||

| Property, plant and equipment | $ | 9,051,366 | $ | 4,120,034 | $ | 27,800 | $ | 13,199,200 | |||||||||||||||

| Investments carried at fair value | 1,905 | 1,126,266 | — | 1,128,171 | |||||||||||||||||||

| Equity-method investees | 39,012 | 313,971 | — | 352,983 | |||||||||||||||||||

| Total assets | 12,690,910 | 5,809,815 | 365,649 | 18,866,374 | |||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Six months ended June 30, 2023 | |||||||||||||||||||||||

| Regulated Services Group | Renewable Energy Group | Corporate | Total | ||||||||||||||||||||

Revenue (1)(2) |

$ | 1,208,174 | $ | 150,410 | $ | — | $ | 1,358,584 | |||||||||||||||

| Other revenue | 26,438 | 20,751 | 725 | 47,914 | |||||||||||||||||||

| Fuel, power and water purchased | 405,524 | 11,588 | — | 417,112 | |||||||||||||||||||

| Net revenue | 829,088 | 159,573 | 725 | 989,386 | |||||||||||||||||||

Operating expenses (3) |

425,699 | 78,796 | 799 | 505,294 | |||||||||||||||||||

| Depreciation and amortization | 170,611 | 68,836 | 642 | 240,089 | |||||||||||||||||||

Loss on foreign exchange |

— | — | 7,815 | 7,815 | |||||||||||||||||||

| Operating income (loss) | 232,778 | 11,941 | (8,531) | 236,188 | |||||||||||||||||||

| Interest expense | (81,202) | (31,315) | (59,064) | (171,581) | |||||||||||||||||||

Income (loss) from long-term investments and other income |

19,660 | 52,584 | (129,928) | (57,684) | |||||||||||||||||||

| Other expenses | (45,259) | (1,197) | (4,435) | (50,891) | |||||||||||||||||||

| Earnings (loss) before income taxes | $ | 125,977 | $ | 32,013 | $ | (201,958) | $ | (43,968) | |||||||||||||||

Capital expenditures (4) |

372,886 | 42,072 | — | 414,958 | |||||||||||||||||||

| December 31, 2023 | |||||||||||||||||||||||

| Property, plant and equipment | $ | 8,945,637 | $ | 3,539,069 | $ | 32,744 | $ | 12,517,450 | |||||||||||||||

| Investments carried at fair value | 1,962 | 1,113,767 | — | 1,115,729 | |||||||||||||||||||

| Equity-method investees | 112,180 | 343,712 | 501 | 456,393 | |||||||||||||||||||

| Total assets | 12,658,955 | 5,367,011 | 347,995 | 18,373,961 | |||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended June 30 | Six months ended June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Revenue | |||||||||||||||||||||||

| United States | $ | 467,747 | $ | 503,777 | $ | 1,069,326 | $ | 1,144,201 | |||||||||||||||

| Canada | 37,391 | 37,788 | 87,886 | 90,916 | |||||||||||||||||||

| Other regions | 93,488 | 86,306 | 178,514 | 171,381 | |||||||||||||||||||

| $ | 598,626 | $ | 627,871 | $ | 1,335,726 | $ | 1,406,498 | ||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Thereafter | Total | |||||||||||||||||

Power purchase (1) |

$ | 60,458 | $ | 25,890 | $ | 12,434 | $ | 12,680 | $ | 12,894 | $ | 123,350 | $ | 247,706 | |||||||||

Natural gas supply and service agreements (2) |

97,983 | 71,485 | 51,892 | 45,828 | 40,147 | 198,234 | 505,569 | ||||||||||||||||

| Service agreements | 75,445 | 64,981 | 54,811 | 56,233 | 54,407 | 248,746 | 554,623 | ||||||||||||||||

| Capital projects | 4,399 | — | — | — | — | — | 4,399 | ||||||||||||||||

| Land easements and others | 16,330 | 16,725 | 16,984 | 17,170 | 17,420 | 597,528 | 682,157 | ||||||||||||||||

| Total | $ | 254,615 | $ | 179,081 | $ | 136,121 | $ | 131,911 | $ | 124,868 | $ | 1,167,858 | $ | 1,994,454 | |||||||||

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 30 | June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Accounts receivable | $ | 107,205 | $ | 21,450 | $ | 97,316 | $ | 35,213 | |||||||||||||||

| Fuel and natural gas in storage | (3,344) | (12,837) | (715) | 19,657 | |||||||||||||||||||

| Supplies and consumables inventory | (1,128) | (11,678) | (8,631) | (22,454) | |||||||||||||||||||

| Income taxes recoverable | 1,872 | 5,134 | 3,963 | 5,683 | |||||||||||||||||||

| Prepaid expenses | 21,102 | 13,231 | 18,770 | 6,183 | |||||||||||||||||||

Accounts payable, accrued liabilities and other |

(31,106) | 92,826 | (60,310) | (110,147) | |||||||||||||||||||

| Current income tax liability | 3,603 | (1,039) | 3,603 | 2,563 | |||||||||||||||||||

| Net regulatory assets and liabilities | (27,651) | 5,293 | (37,986) | 9,946 | |||||||||||||||||||

| $ | 70,553 | $ | 112,380 | $ | 16,010 | $ | (53,356) | ||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| June 30, 2024 | Carrying amount |

Fair value |

Level 1 | Level 2 | Level 3 | ||||||||||||||||||||||||

| Long-term investments carried at fair value | $ | 1,128,171 | $ | 1,128,171 | $ | 1,076,642 | $ | — | $ | 51,529 | |||||||||||||||||||

| Development loans and other receivables | 31,479 | 43,491 | — | 43,491 | — | ||||||||||||||||||||||||

| Derivative instruments: | |||||||||||||||||||||||||||||

| Interest rate swaps designated as a hedge | 95,723 | 95,723 | — | 95,723 | — | ||||||||||||||||||||||||

| Congestion revenue rights not designated as hedge | 10,971 | 10,971 | — | — | 10,971 | ||||||||||||||||||||||||

| Cross-currency swap designated as a net investment hedge | 10,064 | 10,064 | — | 10,064 | — | ||||||||||||||||||||||||

| Commodity contracts for regulatory operations | 75 | 75 | — | 75 | — | ||||||||||||||||||||||||

| Total derivative instruments | 116,833 | 116,833 | — | 105,862 | 10,971 | ||||||||||||||||||||||||

| Total financial assets | $ | 1,276,483 | $ | 1,288,495 | $ | 1,076,642 | $ | 149,353 | $ | 62,500 | |||||||||||||||||||

| Long-term debt | $ | 8,292,649 | $ | 8,783,756 | $ | 2,223,829 | $ | 6,559,927 | $ | — | |||||||||||||||||||

| Convertible debentures | 229 | 262 | 262 | — | — | ||||||||||||||||||||||||

| Derivative instruments: | |||||||||||||||||||||||||||||

| Energy contracts designated as a cash flow hedge | 85,630 | 85,630 | — | — | 85,630 | ||||||||||||||||||||||||

| Energy contracts not designated as hedge | 6,505 | 6,505 | — | — | 6,505 | ||||||||||||||||||||||||

| Cross-currency swap designated as a net investment hedge | 23,203 | 23,203 | — | 23,203 | — | ||||||||||||||||||||||||

| Cross-currency swap designated as a cash flow hedge | 13,783 | 13,783 | — | 13,783 | — | ||||||||||||||||||||||||

| Commodity contracts for regulated operations | 936 | 936 | — | 936 | — | ||||||||||||||||||||||||

| Total derivative instruments | 130,057 | 130,057 | — | 37,922 | 92,135 | ||||||||||||||||||||||||

| Total financial liabilities | $ | 8,422,935 | $ | 8,914,075 | $ | 2,224,091 | $ | 6,597,849 | $ | 92,135 | |||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| December 31, 2023 | Carrying amount |

Fair value |

Level 1 | Level 2 | Level 3 | ||||||||||||||||||||||||

| Long-term investments carried at fair value | $ | 1,115,729 | $ | 1,115,729 | $ | 1,054,665 | $ | — | $ | 61,064 | |||||||||||||||||||

| Development loans and other receivables | 158,110 | 155,735 | — | 155,735 | — | ||||||||||||||||||||||||

| Derivative instruments: | |||||||||||||||||||||||||||||

| Interest rate swap designated as a hedge | 72,936 | 72,936 | — | 72,936 | — | ||||||||||||||||||||||||

Interest rate cap not designated as a hedge |

1,854 | 1,854 | — | 1,854 | — | ||||||||||||||||||||||||

| Congestion revenue rights not designated as hedge |

8,458 | 8,458 | — | — | 8,458 | ||||||||||||||||||||||||

| Total derivative instruments | 83,248 | 83,248 | — | 74,790 | 8,458 | ||||||||||||||||||||||||

| Total financial assets | $ | 1,357,087 | $ | 1,354,712 | $ | 1,054,665 | $ | 230,525 | $ | 69,522 | |||||||||||||||||||

| Long-term debt | $ | 8,516,030 | $ | 7,423,318 | $ | 2,532,608 | $ | 4,890,710 | $ | — | |||||||||||||||||||

| Notes payable to related party | 25,808 | 15,320 | — | 15,320 | — | ||||||||||||||||||||||||

| Convertible debentures | 230 | 276 | 276 | — | — | ||||||||||||||||||||||||

| Derivative instruments: | |||||||||||||||||||||||||||||

| Energy contracts designated as a cash flow hedge | 68,070 | 68,070 | — | — | 68,070 | ||||||||||||||||||||||||

| Energy contracts not designated as hedge | 5,593 | 5,593 | — | — | 5,593 | ||||||||||||||||||||||||

| Cross-currency swap designated as a net investment hedge | 10,533 | 10,533 | — | 10,533 | — | ||||||||||||||||||||||||

| Currency forward contract designated as hedge | 6,779 | 6,779 | — | 6,779 | — | ||||||||||||||||||||||||

| Interest rate swaps designated as a hedge | 11,790 | 11,790 | — | 11,790 | — | ||||||||||||||||||||||||

| Cross-currency swap designated as a cash flow hedge | 5,547 | 5,547 | — | 5,547 | — | ||||||||||||||||||||||||

| Commodity contracts for regulated operations | 2,564 | 2,564 | — | 2,564 | — | ||||||||||||||||||||||||

| Total derivative instruments | 110,876 | 110,876 | — | 37,213 | 73,663 | ||||||||||||||||||||||||

| Total financial liabilities | $ | 8,652,944 | $ | 7,549,790 | $ | 2,532,884 | $ | 4,943,243 | $ | 73,663 | |||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Notional quantity (MW-hrs) |

Expiry | Receive average prices (per MW-hr) |

Pay floating price (per MW-hr) |

|||||||||||||||||

| 3,245,679 | September 2030 | $24.54 | Illinois Hub | |||||||||||||||||

| 287,686 | December 2028 | $29.14 | PJM Western HUB | |||||||||||||||||

| 1,220,001 | December 2027 | $21.31 | NI HUB | |||||||||||||||||

| 1,137,027 | December 2027 | $36.46 | ERCORT North HUB | |||||||||||||||||

| Derivative | Notional quantity |

Expiry |

Hedged item |

||||||||

Forward-starting interest rate swap |

$ | 350,000 | July 2029 |

$350,000 subordinated unsecured notes |

|||||||

Cross-currency interest rate swap |

C$ | 400,000 | January 2032 |

C$400,000 subordinated unsecured notes |

|||||||

Forward-starting interest rate swap |

$ | 750,000 | April 2032 |

$750,000 subordinated unsecured notes |

|||||||

| Forward-starting interest rate swap | $ | 575,000 | June 2026 | First $575,000 of the $1,150,000 senior unsecured notes issuance |

|||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 30 | June 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Effective portion of cash flow hedge | $ | 29,771 | $ | 29,949 | $ | 45,698 | $ | 52,435 | |||||||||||||||

| Amortization of cash flow hedge | (539) | (1,421) | (1,078) | (4,908) | |||||||||||||||||||

| Amounts reclassified from AOCI | (42) | 7,893 | (5,968) | 6,759 | |||||||||||||||||||

| OCI attributable to shareholders of AQN | $ | 29,190 | $ | 36,421 | $ | 38,652 | $ | 54,286 | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| June 30, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | Six months ended | |||||||||||||||||||

| June 30 | June 30 | |||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| Unrealized gain (loss) on derivative financial instruments: | ||||||||||||||||||||

| Energy derivative contracts | $ | 1,843 | 84 | $ | 1,147 | $ | 62 | |||||||||||||

| Commodity contracts | — | — | (890) | 1,128 | ||||||||||||||||

| $ | 1,843 | $ | 84 | $ | 257 | $ | 1,190 | |||||||||||||

Realized loss on derivative financial instruments: |

||||||||||||||||||||

| Energy derivative contracts | (1,887) | (1,537) | (1,783) | (3,830) | ||||||||||||||||

| $ | (1,887) | $ | (1,537) | $ | (1,783) | $ | (3,830) | |||||||||||||

| Loss on derivative financial instruments not accounted for as hedges | (44) | (1,453) | (1,526) | (2,640) | ||||||||||||||||

| Amortization of AOCI gains frozen as a result of hedge dedesignation | 17 | 997 | 999 | 1,994 | ||||||||||||||||

| $ | (27) | $ | (456) | $ | (527) | $ | (646) | |||||||||||||

Unaudited interim condensed consolidated statements of operations classification: |

||||||||||||||||||||

| Gain on derivative financial instruments | $ | 58 | $ | 1,039 | $ | 191 | $ | 3,205 | ||||||||||||

Renewable energy sales |

(85) | (1,495) | (718) | (3,851) | ||||||||||||||||

| $ | (27) | $ | (456) | $ | (527) | $ | (646) | |||||||||||||

Management Discussion & Analysis

Management Discussion & Analysis | Explanatory Notes | |||||

| Caution Concerning Forward-Looking Statements and Forward-Looking Information | |||||

| Caution Concerning Non-GAAP Measures | |||||

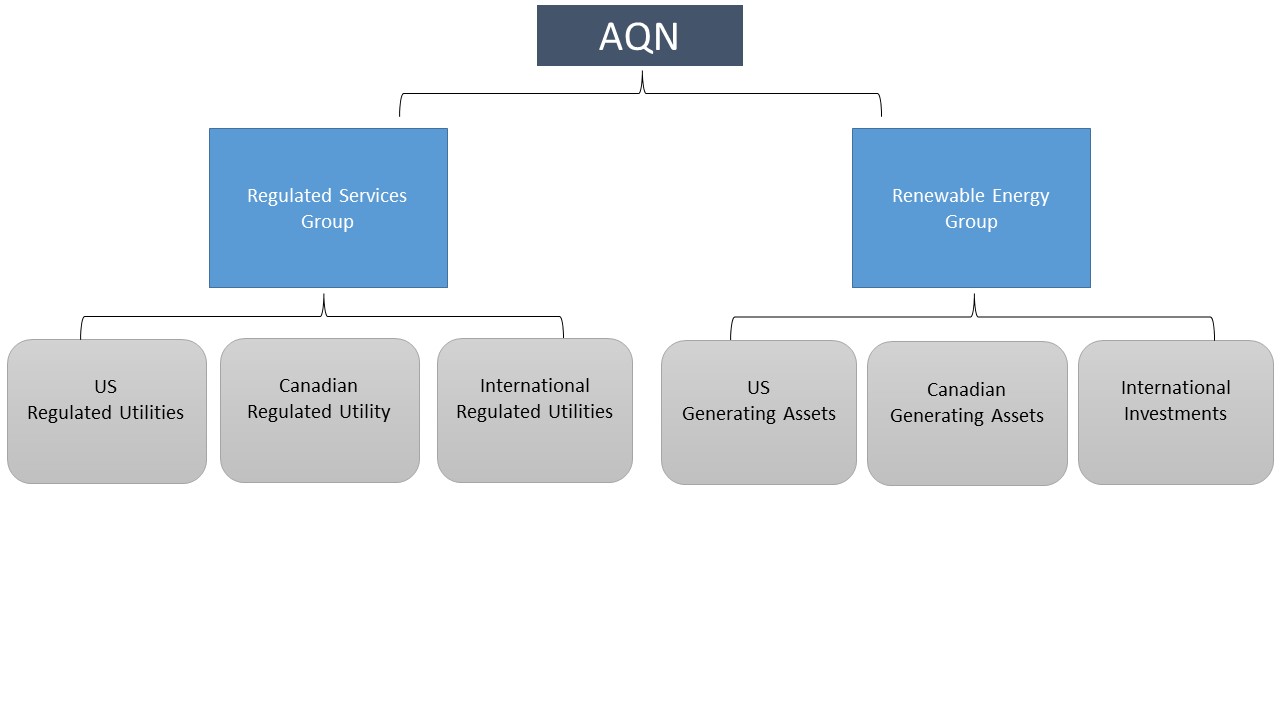

| Overview and Business Strategy | |||||

| Significant Updates | |||||

2024 Second Quarter Results From Operations |

|||||

2024 Year-to-Date Results From Operations |

|||||

2024 Second Quarter and Year-to-Date Net Earnings Summary |

|||||

2024 Second Quarter and Year-to-Date Adjusted EBITDA Summary |

|||||

| Regulated Services Group | |||||

| Renewable Energy Group | |||||

| AQN: Corporate and Other Expenses | |||||

| Non-GAAP Financial Measures | |||||

| Summary of Property, Plant and Equipment Expenditures | |||||

| Liquidity and Capital Reserves | |||||

| Share-Based Compensation Plans | |||||

| Related Party Transactions | |||||

| Enterprise Risk Management | |||||

| Quarterly Financial Information | |||||

| Disclosure Controls and Procedures | |||||

| Critical Accounting Estimates and Policies | |||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 1 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 2 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 3 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 5 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 7 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

| (all dollar amounts in $ millions except per share information) | Three months ended June 30 |

||||||||||||||||

| 2024 | 2023 | Change | |||||||||||||||

| Net earnings (loss) attributable to shareholders | $200.8 | $(253.2) | 179% | ||||||||||||||

Adjusted Net Earnings1 |

$65.2 | $56.2 | 16% | ||||||||||||||

Adjusted EBITDA1 |

$311.0 | $277.7 | 12% | ||||||||||||||

| Net earnings (loss) per common share | $0.28 | $(0.37) | 176% | ||||||||||||||

Adjusted Net Earnings per common share1 |

$0.09 | $0.08 | 13% | ||||||||||||||

| 1 | See Caution Concerning Non-GAAP Measures. |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 10 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

Key Financial Information |

Three months ended June 30 | ||||||||||

| (all dollar amounts in $ millions except per share information) | 2024 | 2023 | |||||||||

| Revenue | $ | 598.6 | $ | 627.9 | |||||||

| Net earnings (loss) attributable to shareholders | 200.8 | (253.2) | |||||||||

| Cash provided by operating activities | 236.2 | 261.4 | |||||||||

Adjusted Net Earnings1 |

65.2 | 56.2 | |||||||||

Adjusted EBITDA1 |

311.0 | 277.7 | |||||||||

Adjusted Funds from Operations1 |

167.9 | 150.2 | |||||||||

| Dividends declared to common shareholders | 83.7 | 75.4 | |||||||||

| Weighted average number of common shares outstanding | 701,593,792 | 687,847,010 | |||||||||

| Per share | |||||||||||

| Basic net earnings (loss) | $ | 0.28 | $ | (0.37) | |||||||

| Diluted net earnings (loss) | $ | 0.28 | $ | (0.37) | |||||||

Adjusted Net Earnings1 |

$ | 0.09 | $ | 0.08 | |||||||

| Dividends declared to common shareholders | $ | 0.11 | $ | 0.11 | |||||||

| 1 | See Caution Concerning Non-GAAP Measures. |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 12 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

| (all dollar amounts in $ millions) | Three months ended June 30 | ||||

| Comparative Prior Period Revenue | $ | 627.9 | |||

| REGULATED SERVICES GROUP | |||||

| Existing Facilities | |||||

Electricity: Decrease is primarily due to lower pass through costs. This is partially offset by higher revenues at the Empire Electric System (MO) to recover previously incurred costs that resulted from the extreme winter storm conditions experienced in Texas and parts of the central U.S. in the first quarter of 2021 and the retirement of the Asbury generating plant. |

(4.4) | ||||

Natural Gas: Decrease is primarily due to lower pass through commodity costs. |

(17.9) | ||||

Water: |

(1.3) | ||||

Other: |

0.3 | ||||

| (23.3) | |||||

| Rate Reviews | |||||

Electricity: Decrease is primarily due to one-time revenues in the second quarter of 2023 from a retroactive rate increase at the CalPeco (CA) Electric System. This is partially offset by the implementation of new rates at the Bermuda Electric Light Company ("BELCO") Electric System retroactive to the first quarter of 2024 as well as the implementation of new rates at the CalPeco (CA), Empire (AR), and Granite State (NH) Electric Systems. |

(18.4) | ||||

|

Natural Gas: Increase is primarily due to the implementation of new rates at the EnergyNorth (NH), and Peach State (GA) Gas Systems.

|

2.6 | ||||

Water: Increase is primarily due to the implementation of new rates at the Pine Bluff (AR) and Park (CA) Water Systems. |

1.6 | ||||

| (14.2) | |||||

| Foreign Exchange | (3.6) | ||||

| RENEWABLE ENERGY GROUP | |||||

| Existing Facilities | |||||

Hydro: |

(0.2) | ||||

Wind CA: Increase is primarily driven by higher production across the majority of the Canadian wind facilities. |

3.2 | ||||

Wind U.S.: Increase is primarily due to higher production across all U.S. wind facilities. |

4.4 | ||||

Solar: |

0.8 | ||||