| Algonquin Power & Utilities Corp. | ||

| Exhibit | Description | ||||

| Unaudited Financial Statements for the quarter ended March 31, 2024 | |||||

| Management's Discussion & Analysis for quarter ended March 31, 2024 | |||||

| Certification of Chief Executive Officer | |||||

| Certification of Chief Financial Officer | |||||

| Earnings Press Release for the quarter ended March 31, 2024 | |||||

| Q2 2024 Common Share & Preferred Share Dividend Press Release | |||||

| ALGONQUIN POWER & UTILITIES CORP. | |||||

| (registrant) | |||||

| Date: May 10, 2024 | By: /s/ Darren Myers |

||||

| Name: Darren Myers | |||||

| Title: Chief Financial Officer | |||||

| Three months ended | |||||||||||

| (thousands of U.S. dollars, except per share amounts) | March 31 | ||||||||||

| 2024 | 2023 | ||||||||||

| Revenue | |||||||||||

| Regulated electricity distribution | $ | 305,855 | $ | 315,973 | |||||||

| Regulated natural gas distribution | 233,953 | 271,138 | |||||||||

| Regulated water reclamation and distribution | 85,023 | 87,421 | |||||||||

| Non-regulated energy sales | 84,576 | 78,716 | |||||||||

| Other revenue | 27,693 | 25,379 | |||||||||

| 737,100 | 778,627 | ||||||||||

| Expenses | |||||||||||

| Operating expenses | 261,785 | 238,120 | |||||||||

| Regulated electricity purchased | 97,954 | 125,580 | |||||||||

| Regulated natural gas purchased | 95,969 | 137,701 | |||||||||

| Regulated water purchased | 3,881 | 3,869 | |||||||||

| Non-regulated energy purchased | 3,538 | 7,806 | |||||||||

| Depreciation and amortization | 129,540 | 121,641 | |||||||||

| Loss on foreign exchange | 11,857 | 1,436 | |||||||||

| 604,524 | 636,153 | ||||||||||

| Operating income | 132,576 | 142,474 | |||||||||

Interest expense (note 7) |

(102,524) | (81,918) | |||||||||

Income (loss) from long-term investments (note 6) |

(154,997) | 210,513 | |||||||||

Other income (note 5) |

7,243 | 9,499 | |||||||||

Other net losses (note 16) |

(10,601) | (3,462) | |||||||||

Pension and other post-employment non-service costs (note 8) |

(3,438) | (4,961) | |||||||||

Gain on derivative financial instruments (note 21(b)(iv)) |

133 | 2,166 | |||||||||

| Earnings (Loss) before income taxes | (131,608) | 274,311 | |||||||||

Income tax recovery (expense) (note 15) |

|||||||||||

| Current | (5,104) | (6,500) | |||||||||

| Deferred | 16,407 | (18,201) | |||||||||

| 11,303 | (24,701) | ||||||||||

| Net earnings (loss) | (120,305) | 249,610 | |||||||||

Net effect of non-controlling interests (note 14) |

|||||||||||

| Non-controlling interests | 31,159 | 26,579 | |||||||||

| Non-controlling interests held by related party | — | (6,050) | |||||||||

| $ | 31,159 | $ | 20,529 | ||||||||

| Net earnings (loss) attributable to shareholders of Algonquin Power & Utilities Corp. | $ | (89,146) | $ | 270,139 | |||||||

Series A Shares and Series D Shares dividend (note 12) |

2,412 | 2,092 | |||||||||

| Net earnings (loss) attributable to common shareholders of Algonquin Power & Utilities Corp. | $ | (91,558) | $ | 268,047 | |||||||

Basic and diluted net earnings (loss) per share (note 17) |

$ | (0.13) | $ | 0.39 | |||||||

| Three months ended | |||||||||||

| (thousands of U.S. dollars) | March 31 | ||||||||||

| 2024 | 2023 | ||||||||||

| Net earnings (loss) | $ | (120,305) | $ | 249,610 | |||||||

| Other comprehensive income (loss) ("OCI"): | |||||||||||

Foreign currency translation adjustment, net of tax expense of $1,880 (2023 - tax expense $380), (notes 21(b)(iii) and 21(b)(iv)) |

(8,295) | 15,425 | |||||||||

Change in fair value of cash flow hedges, net of tax expense of $4,830 (2023 - tax recovery of $3,915), (note 21(b)(ii)) |

9,462 | 17,865 | |||||||||

Change in pension and other post-employment benefits, net of tax recovery of $1,374 (2023 - tax recovery of $164) |

(4,031) | (480) | |||||||||

| OCI, net of tax | (2,864) | 32,810 | |||||||||

| Comprehensive income (loss) | (123,169) | 282,420 | |||||||||

| Comprehensive loss attributable to the non-controlling interests | (31,857) | (20,714) | |||||||||

| Comprehensive income (loss) attributable to shareholders of Algonquin Power & Utilities Corp. | $ | (91,312) | $ | 303,134 | |||||||

| (thousands of U.S. dollars) | March 31, | December 31, | |||||||||

| 2024 | 2023 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 86,265 | $ | 56,142 | |||||||

Trade and other receivables, net (note 4) |

534,083 | 524,194 | |||||||||

| Fuel and natural gas in storage | 46,353 | 48,982 | |||||||||

| Supplies and consumables inventory | 184,503 | 178,150 | |||||||||

Regulatory assets (note 5) |

198,887 | 142,970 | |||||||||

| Prepaid expenses | 85,617 | 81,926 | |||||||||

Derivative instruments (note 21) |

15,982 | 10,920 | |||||||||

Other assets |

18,932 | 23,061 | |||||||||

| 1,170,622 | 1,066,345 | ||||||||||

Property, plant and equipment, net |

12,697,704 | 12,517,450 | |||||||||

Intangible assets, net |

88,298 | 93,938 | |||||||||

Goodwill |

1,315,942 | 1,324,062 | |||||||||

Regulatory assets (note 5) |

1,035,183 | 1,184,713 | |||||||||

Long-term investments (note 6) |

|||||||||||

| Investments carried at fair value | 955,738 | 1,115,729 | |||||||||

| Other long-term investments | 565,690 | 641,920 | |||||||||

Derivative instruments (note 21) |

96,639 | 72,328 | |||||||||

Deferred income taxes |

178,127 | 158,483 | |||||||||

Other assets |

203,836 | 198,993 | |||||||||

| $ | 18,307,779 | $ | 18,373,961 | ||||||||

| (thousands of U.S. dollars) | March 31, | December 31, | |||||||||

| 2024 | 2023 | ||||||||||

| LIABILITIES AND EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 175,102 | $ | 210,412 | |||||||

| Accrued liabilities | 523,677 | 554,875 | |||||||||

Dividends payable (note 12) |

74,848 | 74,916 | |||||||||

Regulatory liabilities (note 5) |

94,153 | 99,850 | |||||||||

Long-term debt (note 7) |

240,395 | 621,856 | |||||||||

Other long-term liabilities (note 9) |

52,861 | 80,458 | |||||||||

Derivative instruments (note 21) |

26,991 | 34,915 | |||||||||

| Other liabilities | 7,973 | 7,898 | |||||||||

| 1,196,000 | 1,685,180 | ||||||||||

Long-term debt (note 7) |

8,849,283 | 7,894,174 | |||||||||

Regulatory liabilities (note 5) |

562,227 | 634,446 | |||||||||

Deferred income taxes |

586,884 | 578,902 | |||||||||

Derivative instruments (note 21) |

102,529 | 75,961 | |||||||||

Pension and other post-employment benefits obligation |

102,296 | 96,653 | |||||||||

Other long-term liabilities (note 9) |

464,120 | 465,874 | |||||||||

| 10,667,339 | 9,746,010 | ||||||||||

Redeemable non-controlling interests |

|||||||||||

| Redeemable non-controlling interest, held by related party | — | 308,350 | |||||||||

| Redeemable non-controlling interests | 9,638 | 10,013 | |||||||||

| 9,638 | 318,363 | ||||||||||

| Equity: | |||||||||||

| Preferred shares | 184,299 | 184,299 | |||||||||

Common shares (note 10(a)) |

6,235,552 | 6,229,994 | |||||||||

| Additional paid-in capital | 1,394 | 7,254 | |||||||||

| Deficit | (1,446,333) | (1,279,696) | |||||||||

Accumulated other comprehensive loss (“AOCI”) (note 11) |

(104,452) | (102,286) | |||||||||

| Total equity attributable to shareholders of Algonquin Power & Utilities Corp. | 4,870,460 | 5,039,565 | |||||||||

Non-controlling interests |

|||||||||||

| Non-controlling interests - tax equity partnership units | 1,212,885 | 1,196,720 | |||||||||

| Other non-controlling interests | 354,094 | 347,338 | |||||||||

| Non-controlling interest, held by related party | (2,637) | 40,785 | |||||||||

| 1,564,342 | 1,584,843 | ||||||||||

| Total equity | 6,434,802 | 6,624,408 | |||||||||

Commitments and contingencies (note 19) |

|||||||||||

Subsequent events (notes 7(d), 10(c), 13(d), 19(a)) |

|||||||||||

| $ | 18,307,779 | $ | 18,373,961 | ||||||||

|

(thousands of U.S. dollars)

For the three months ended March 31, 2024

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. Shareholders | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common shares |

Preferred shares |

Additional paid-in capital |

Deficit | AOCI | Non- controlling interests |

Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2023 | $ | 6,229,994 | $ | 184,299 | $ | 7,254 | $ | (1,279,696) | $ | (102,286) | $ | 1,584,843 | $ | 6,624,408 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | (89,146) | — | (31,159) | (120,305) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Effect of redeemable non-controlling interests not included in equity (note 14) | — | — | — | — | — | 331 | 331 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OCI | — | — | — | — | (2,166) | (698) | (2,864) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared and distributions to non-controlling interests | — | — | — | (77,912) | — | (49,720) | (127,632) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Contributions received from non-controlling interests, net of cost | — | — | — | — | — | 64,545 | 64,545 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common shares issued under employee share purchase plan | 1,278 | — | — | — | — | — | 1,278 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | 9,466 | — | — | — | 9,466 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common shares issued pursuant to share-based awards | 4,280 | — | (5,783) | 421 | — | — | (1,082) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Acquisition of non-controlling interest | — | — | (9,543) | — | — | (3,800) | (13,343) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | $ | 6,235,552 | $ | 184,299 | $ | 1,394 | $ | (1,446,333) | $ | (104,452) | $ | 1,564,342 | $ | 6,434,802 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

(thousands of U.S. dollars)

For the three months ended March 31, 2023

|

|||||||||||||||||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. Shareholders | |||||||||||||||||||||||||||||||||||||||||

| Common shares |

Preferred shares |

Additional paid-in capital |

Deficit | AOCI | Non- controlling interests |

Total | |||||||||||||||||||||||||||||||||||

Balance, December 31, 2022 |

$ | 6,183,943 | $ | 184,299 | $ | 9,413 | $ | (997,945) | $ | (160,063) | $ | 1,616,792 | $ | 6,836,439 | |||||||||||||||||||||||||||

| Net earnings | — | — | — | 270,139 | — | (20,529) | 249,610 | ||||||||||||||||||||||||||||||||||

| Effect of redeemable non-controlling interests not included in equity (note 14) | — | — | — | — | — | (5,719) | (5,719) | ||||||||||||||||||||||||||||||||||

| OCI | — | — | — | — | 32,995 | (185) | 32,810 | ||||||||||||||||||||||||||||||||||

| Dividends declared and distributions to non-controlling interests | — | — | — | (47,002) | — | (19,414) | (66,416) | ||||||||||||||||||||||||||||||||||

| Dividends and issuance of shares under dividend reinvestment plan | 30,482 | — | — | (30,482) | — | — | — | ||||||||||||||||||||||||||||||||||

| Contributions received from non-controlling interests, net of cost | — | — | — | — | — | 9,082 | 9,082 | ||||||||||||||||||||||||||||||||||

| Common shares issued under employee share purchase plan | 1,708 | — | — | — | — | — | 1,708 | ||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | 1,093 | — | — | — | 1,093 | ||||||||||||||||||||||||||||||||||

| Common shares issued pursuant to share-based awards |

7,168 | — | (9,730) | (225) | — | — | (2,787) | ||||||||||||||||||||||||||||||||||

| Balance, March 31, 2023 | $ | 6,223,301 | $ | 184,299 | $ | 776 | $ | (805,515) | $ | (127,068) | $ | 1,580,027 | $ | 7,055,820 | |||||||||||||||||||||||||||

| (thousands of U.S. dollars) | Three months ended March 31 | ||||||||||

| 2024 | 2023 | ||||||||||

| Cash provided by (used in): | |||||||||||

| Operating activities | |||||||||||

Net earnings (loss) |

$ | (120,305) | $ | 249,610 | |||||||

| Adjustments and items not affecting cash: | |||||||||||

| Depreciation and amortization | 129,540 | 121,641 | |||||||||

| Deferred taxes | (16,407) | 18,201 | |||||||||

Initial value and changes in derivative financial instruments net of amortization |

(1,745) | (4,969) | |||||||||

| Share-based compensation | 5,110 | 696 | |||||||||

| Cost of equity funds used for construction purposes | (869) | (658) | |||||||||

| Change in value of investments carried at fair value | 158,332 | (179,384) | |||||||||

Pension and post-employment expense in excess of (lower than) contributions |

3,982 | (2,057) | |||||||||

| Distributions received from equity investments, net of income | 24,470 | (2,034) | |||||||||

Other (notes 16(c)) |

3,180 | (2,037) | |||||||||

Net change in non-cash operating items (note 20) |

(54,543) | (164,791) | |||||||||

| 130,745 | 34,218 | ||||||||||

| Financing activities | |||||||||||

| Increase in long-term debt | 2,040,119 | 429,984 | |||||||||

| Repayments of long-term debt | (1,625,952) | (203,776) | |||||||||

| Net change in commercial paper | (256,021) | 92,800 | |||||||||

| Issuance of common shares, net of costs | 1,278 | 1,708 | |||||||||

| Cash dividends on common shares | (73,663) | (95,893) | |||||||||

| Dividends on preferred shares | (2,412) | (2,092) | |||||||||

Contributions from non-controlling interests and redeemable non-controlling interests (note 3) |

60,545 | — | |||||||||

| Production-based cash contributions from non-controlling interest | 4,002 | 9,082 | |||||||||

Distributions to non-controlling interests, related party |

— | (12,056) | |||||||||

| Distributions to non-controlling interests | (6,814) | (12,338) | |||||||||

| Payments upon settlement of derivatives | — | (945) | |||||||||

| Shares surrendered to fund withholding taxes on exercised share options | (970) | (568) | |||||||||

| Acquisition of non-controlling interest | (10,059) | — | |||||||||

| Increase in other long-term liabilities | 6,632 | 4,430 | |||||||||

| Decrease in other long-term liabilities | (22,288) | (20,074) | |||||||||

| 114,397 | 190,262 | ||||||||||

| Investing activities | |||||||||||

| Additions to property, plant and equipment and intangible assets | (212,546) | (169,749) | |||||||||

| Increase in long-term investments | (15,893) | (47,605) | |||||||||

Divestiture of operating entity (note 3(c)) |

17,721 | — | |||||||||

Increase in other assets |

(931) | (1,850) | |||||||||

| (211,649) | (219,204) | ||||||||||

| Effect of exchange rate differences on cash and restricted cash | (1,663) | 503 | |||||||||

Increase in cash, cash equivalents and restricted cash |

31,830 | 5,779 | |||||||||

Cash, cash equivalents and restricted cash, beginning of period |

76,139 | 101,185 | |||||||||

| Cash, cash equivalents and restricted cash, end of period | $ | 107,969 | $ | 106,964 | |||||||

| Algonquin Power & Utilities Corp. Unaudited Interim Condensed Consolidated Statements of Cash Flows (continued) | |||||||||||

| (thousands of U.S. dollars) | Three months ended March 31 | ||||||||||

| 2024 | 2023 | ||||||||||

| Supplemental disclosure of cash flow information: | |||||||||||

Cash paid during the period for interest expense |

$ | 109,629 | $ | 102,712 | |||||||

Cash paid during the period for income taxes |

$ | 2,664 | $ | 2,041 | |||||||

Cash received during the period for distributions from equity investments |

$ | 26,388 | $ | 28,281 | |||||||

| Non-cash financing and investing activities: | |||||||||||

| Property, plant and equipment acquisitions in accruals | $ | 50,702 | $ | 99,587 | |||||||

| Issuance of common shares under dividend reinvestment plan and share-based compensation plans | $ | 5,558 | $ | 39,358 | |||||||

| Property, plant and equipment, intangible assets and accrued liabilities in exchange of note receivable | $ | 19,745 | $ | — | |||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

Sandy Ridge II |

|||||

| Working capital | $ | 3,526 | |||

| Property, plant and equipment | 196,461 | ||||

| Long-term debt | (162,341) | ||||

| Asset retirement obligation | (456) | ||||

| Deferred tax liability | (639) | ||||

| Total net assets acquired | 36,551 | ||||

| Cash and cash equivalents | — | ||||

| Net assets acquired, net of cash and cash equivalents | $ | 36,551 | |||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Utility | State, Province or Country | Regulatory Proceeding Type | Details | ||||||||

| BELCO | Bermuda | General Rate Case ("GRC") | On September 30, 2021, BELCO filed its revenue allowance application in which it requested a $34,800 increase for 2022 and a $6,100 increase for 2023. On March 18, 2022, the Regulatory Authority ("RA") approved an annual increase of $22,800, for a revenue allowance of $224,100 for 2022 and $226,200 for 2023. The RA authorized a 7.16% rate of return, comprised of a 62% equity and an 8.92% return on equity. In April 2022, BELCO filed an appeal in the Supreme Court of Bermuda challenging the decisions made by the RA through the recent Retail Tariff Review. On February 23, 2024, the Bermuda Supreme Court issued an order denying the BELCO appeal. |

||||||||

| Empire Electric | Arkansas | General rate review | On December 7, 2023, the Arkansas Public Service Commission issued an order approving the settlement agreement authorizing a revenue increase of $5,300. New rates became effective January 1, 2024. |

||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| March 31, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Regulatory assets | |||||||||||

Securitized costs, net (a) |

$ | 299,517 | $ | — | |||||||

| Rate adjustment mechanism | 182,760 | 192,880 | |||||||||

| Deferred capitalized costs | 135,365 | 124,517 | |||||||||

| Fuel and commodity cost adjustments | 118,998 | 326,418 | |||||||||

| Income taxes | 100,455 | 101,939 | |||||||||

| Wildfire mitigation and vegetation management | 68,598 | 64,146 | |||||||||

| Pension and post-employment benefits | 67,846 | 68,822 | |||||||||

| Environmental remediation | 62,799 | 66,779 | |||||||||

| Clean energy and other customer programs | 31,174 | 37,214 | |||||||||

| Debt premium | 17,437 | 18,995 | |||||||||

| Retired generating plant | 16,281 | 183,732 | |||||||||

| Asset retirement obligation | 11,780 | 26,620 | |||||||||

| Cost of removal | 11,084 | 11,084 | |||||||||

| Rate review costs | 9,426 | 8,815 | |||||||||

| Long-term maintenance contract | 4,440 | 4,932 | |||||||||

| Other | 96,110 | 90,790 | |||||||||

| Total regulatory assets | $ | 1,234,070 | $ | 1,327,683 | |||||||

| Less: current regulatory assets | (198,887) | (142,970) | |||||||||

| Non-current regulatory assets | $ | 1,035,183 | $ | 1,184,713 | |||||||

| Regulatory liabilities | |||||||||||

| Income taxes | $ | 275,427 | $ | 290,121 | |||||||

| Cost of removal | 187,160 | 185,786 | |||||||||

| Pension and post-employment benefits | 112,071 | 104,636 | |||||||||

| Fuel and commodity cost adjustments | 43,023 | 42,850 | |||||||||

| Clean energy and other customer programs | 12,926 | 12,730 | |||||||||

| Rate adjustment mechanism | 3,178 | 2,078 | |||||||||

| Other | 22,595 | 96,095 | |||||||||

| Total regulatory liabilities | $ | 656,380 | $ | 734,296 | |||||||

| Less: current regulatory liabilities | (94,153) | (99,850) | |||||||||

| Non-current regulatory liabilities | $ | 562,227 | $ | 634,446 | |||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| March 31, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Long-term investments carried at fair value |

|||||||||||

| Atlantica | $ | 904,835 | $ | 1,052,703 | |||||||

| Atlantica Yield Energy Solutions Canada Inc. | 49,050 | 61,064 | |||||||||

| Other | 1,853 | 1,962 | |||||||||

| $ | 955,738 | $ | 1,115,729 | ||||||||

| Other long-term investments | |||||||||||

| Equity-method investees (a) | $ | 442,906 | $ | 456,393 | |||||||

| Development loans receivable from equity-method investees (a) | 94,696 | 158,110 | |||||||||

| Other | 28,088 | 27,417 | |||||||||

| $ | 565,690 | $ | 641,920 | ||||||||

| Three months ended | ||||||||||||||

| March 31 | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Fair value gain (loss) on investments carried at fair value | ||||||||||||||

| Atlantica | $ | (147,868) | $ | 179,204 | ||||||||||

| Atlantica Yield Energy Solutions Canada Inc. | (10,562) | 196 | ||||||||||||

| Other | 98 | (16) | ||||||||||||

| $ | (158,332) | $ | 179,384 | |||||||||||

| Dividend and interest income from investments carried at fair value | ||||||||||||||

| Atlantica | $ | 21,789 | $ | 21,789 | ||||||||||

| Atlantica Yield Energy Solutions Canada Inc. | 3,891 | 5,857 | ||||||||||||

| Other | 17 | 10 | ||||||||||||

| $ | 25,697 | $ | 27,656 | |||||||||||

| Other long-term investments | ||||||||||||||

Equity method gain (loss) (b) |

(24,266) | 2,281 | ||||||||||||

| Interest and other income | 1,904 | 1,192 | ||||||||||||

| $ | (22,362) | $ | 3,473 | |||||||||||

Income (loss) from long-term investments |

$ | (154,997) | $ | 210,513 | ||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| March 31, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Total assets | $ | 2,713,684 | $ | 3,235,474 | |||||||

| Total liabilities | 1,426,641 | 1,962,115 | |||||||||

| Net assets | $ | 1,287,043 | $ | 1,273,359 | |||||||

| AQN's ownership interest in the entities | 393,951 | 388,993 | |||||||||

|

Difference between investment carrying amount and underlying

equity in net assets(a)

|

48,955 | 67,400 | |||||||||

| AQN's investment carrying amount for the entities | $ | 442,906 | $ | 456,393 | |||||||

| Three months ended | |||||||||||

| March 31 | |||||||||||

| 2024 | 2023 | ||||||||||

| Revenue | $ | 12,635 | $ | 26,146 | |||||||

Net gain (loss) |

(45,332) | 5,541 | |||||||||

Other comprehensive income (loss) (a) |

9,672 | (10,653) | |||||||||

Net gain (loss) attributable to AQN |

$ | (24,266) | $ | 2,281 | |||||||

Other comprehensive income (loss) attributable to AQN (a) |

$ | 2,758 | $ | (4,368) | |||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| March 31, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| AQN's maximum exposure in regards to VIEs | |||||||||||

| Carrying amount | $ | 173,966 | $ | 179,728 | |||||||

| Development loans receivable | 94,696 | 158,110 | |||||||||

Indirect guarantees of debt on behalf of VIEs |

587,579 | 740,866 | |||||||||

Other indirect guarantees and commitments on behalf of VIEs |

270,797 | 303,641 | |||||||||

| $ | 1,127,038 | $ | 1,382,345 | ||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Borrowing type | Weighted average coupon | Maturity | Par value | March 31, | December 31, | ||||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||||||||

| Senior unsecured revolving credit facilities (a) | — | 2024-2028 | N/A | $ | 1,049,564 | $ | 1,624,186 | ||||||||||||||||||||||

| Senior unsecured bank credit facilities and delayed draw term facility (b) |

— | 2024-2031 | N/A | 1,082,243 | 786,962 | ||||||||||||||||||||||||

| Commercial paper | — | 2024 | N/A | 225,699 | 481,720 | ||||||||||||||||||||||||

| U.S. dollar borrowings | |||||||||||||||||||||||||||||

| Senior unsecured notes (Green Equity Units) (c) |

5.37 | % | 2026 | $ | 1,150,000 | 1,143,402 | 1,144,897 | ||||||||||||||||||||||

| Senior unsecured notes (d) | 4.23 | % | 2024-2047 | $ | 2,265,000 | 2,250,398 | 1,406,278 | ||||||||||||||||||||||

| Senior unsecured utility notes | 6.30 | % | 2025-2035 | $ | 137,000 | 147,173 | 147,589 | ||||||||||||||||||||||

| Senior secured utility bonds (e) | 4.82 | % | 2026-2044 | $ | 861,684 | 852,589 | 551,166 | ||||||||||||||||||||||

| Canadian dollar borrowings | |||||||||||||||||||||||||||||

| Senior unsecured notes | 3.68 | % | 2027-2050 | C$ | 1,200,000 | 881,710 | 904,604 | ||||||||||||||||||||||

| Senior secured project notes | 10.21 | % | 2027 | C$ | 15,983 | 11,796 | 12,738 | ||||||||||||||||||||||

| Chilean Unidad de Fomento borrowings | |||||||||||||||||||||||||||||

| Senior unsecured utility bonds | 3.90 | % | 2028-2040 | CLF | 1,521 | 66,743 | 70,967 | ||||||||||||||||||||||

| $ | 7,711,317 | $ | 7,131,107 | ||||||||||||||||||||||||||

| Subordinated borrowings | |||||||||||||||||||||||||||||

| Subordinated unsecured notes | 5.25 | % | 2082 | C$ | 400,000 | 291,389 | $ | 298,382 | |||||||||||||||||||||

| Subordinated unsecured notes | 5.21 | % | 2079-2082 | $ | 1,100,000 | 1,086,972 | 1,086,541 | ||||||||||||||||||||||

| $ | 1,378,361 | $ | 1,384,923 | ||||||||||||||||||||||||||

| $ | 9,089,678 | $ | 8,516,030 | ||||||||||||||||||||||||||

| Less: current portion | (240,395) | (621,856) | |||||||||||||||||||||||||||

| $ | 8,849,283 | $ | 7,894,174 | ||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| March 31, | December 31, | |||||||||||||

| 2024 | 2023 | |||||||||||||

| Revolving and term credit facilities | $ | 4,882,900 | $ | 4,562,000 | ||||||||||

| Funds drawn on facilities/commercial paper issued | (2,358,100) | (2,892,900) | ||||||||||||

| Letters of credit issued | (461,400) | (469,100) | ||||||||||||

| Liquidity available under the facilities | $ | 2,063,400 | 1,200,000 | |||||||||||

| Undrawn portion of uncommitted letter of credit facilities | (254,900) | (254,100) | ||||||||||||

| Cash on hand | 86,265 | 56,142 | ||||||||||||

| Total liquidity and capital reserves | $ | 1,894,765 | $ | 1,002,042 | ||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | ||||||||||||||

| March 31 | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Long-term debt | $ | 66,712 | $ | 62,112 | ||||||||||

| Commercial paper, credit facility draws and related fees | 43,113 | 24,909 | ||||||||||||

| Accretion of fair value adjustments | (5,862) | (3,349) | ||||||||||||

| Capitalized interest and AFUDC capitalized on regulated property | (3,392) | (3,675) | ||||||||||||

| Other | 1,953 | 1,921 | ||||||||||||

| $ | 102,524 | $ | 81,918 | |||||||||||

| Pension benefits | OPEB | ||||||||||||||||||||||

| Three months ended March 31, | Three months ended March 31, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Service cost | $ | 3,084 | $ | 2,927 | $ | 780 | $ | 989 | |||||||||||||||

| Non-service costs | |||||||||||||||||||||||

| Interest cost | 8,433 | 8,393 | 2,653 | 3,438 | |||||||||||||||||||

| Expected return on plan assets | (8,697) | (8,316) | (2,644) | (2,746) | |||||||||||||||||||

| Amortization of net actuarial loss | (391) | (124) | (1,599) | (561) | |||||||||||||||||||

| Amortization of prior service credits | (360) | (373) | (213) | (213) | |||||||||||||||||||

| Impact of regulatory accounts | 4,371 | 4,095 | 1,885 | 1,368 | |||||||||||||||||||

| $ | 3,356 | $ | 3,675 | $ | 82 | $ | 1,286 | ||||||||||||||||

| Net benefit cost | $ | 6,440 | $ | 6,602 | $ | 862 | $ | 2,275 | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| March 31, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Contract adjustment payments | $ | 19,342 | $ | 39,590 | |||||||

| Asset retirement obligations | 116,010 | 115,611 | |||||||||

| Advances in aid of construction | 84,983 | 88,135 | |||||||||

| Environmental remediation obligation | 39,146 | 40,772 | |||||||||

| Customer deposits | 36,104 | 36,294 | |||||||||

| Unamortized investment tax credits | 17,162 | 17,255 | |||||||||

| Deferred credits and contingent consideration | 42,211 | 40,945 | |||||||||

| Hook-up fees | 7,499 | 7,425 | |||||||||

| Lease liabilities | 20,672 | 20,493 | |||||||||

| Contingent development support obligations | 10,788 | 12,666 | |||||||||

| Note payable to related party | 25,808 | 25,808 | |||||||||

| Contingent liability | 66,000 | 66,000 | |||||||||

| Other | 31,256 | 35,338 | |||||||||

| $ | 516,981 | $ | 546,332 | ||||||||

| Less: current portion | (52,861) | (80,458) | |||||||||

| $ | 464,120 | $ | 465,874 | ||||||||

| Three months ended | ||||||||||||||

| March 31 | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Common shares, beginning of period | 689,271,039 | 683,614,803 | ||||||||||||

Dividend reinvestment plan |

— | 4,370,289 | ||||||||||||

Exercise of share-based awards (b) |

365,832 | 606,960 | ||||||||||||

| Common shares, end of period | 689,636,871 | 688,592,052 | ||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Foreign currency cumulative translation | Unrealized gain (loss) on cash flow hedges | Pension and post-employment actuarial changes | Total | ||||||||||||||||||||

| Balance, January 1, 2023 | $ | (98,467) | $ | (97,809) | $ | 36,213 | $ | (160,063) | |||||||||||||||

| OCI | (3,788) | 57,351 | 8,395 | 61,958 | |||||||||||||||||||

Amounts reclassified from AOCI to the unaudited interim condensed consolidated statements of operations |

(1,598) | 2,136 | (3,702) | (3,164) | |||||||||||||||||||

| Net current period OCI | $ | (5,386) | $ | 59,487 | $ | 4,693 | $ | 58,794 | |||||||||||||||

| OCI attributable to the non-controlling interests | (1,017) | — | — | (1,017) | |||||||||||||||||||

| Net current period OCI attributable to shareholders of AQN | (6,403) | 59,487 | 4,693 | 57,777 | |||||||||||||||||||

| Balance, December 31, 2023 | $ | (104,870) | $ | (38,322) | $ | 40,906 | $ | (102,286) | |||||||||||||||

| OCI | (9,013) | 15,927 | — | 6,914 | |||||||||||||||||||

Amounts reclassified from AOCI to the unaudited interim condensed consolidated statements of operations |

718 | (6,465) | (4,031) | (9,778) | |||||||||||||||||||

| Net current period OCI | $ | (8,295) | $ | 9,462 | $ | (4,031) | $ | (2,864) | |||||||||||||||

| OCI attributable to the non-controlling interests | 698 | — | — | 698 | |||||||||||||||||||

| Net current period OCI attributable to shareholders of AQN | $ | (7,597) | $ | 9,462 | $ | (4,031) | $ | (2,166) | |||||||||||||||

| Balance, March 31, 2024 | $ | (112,467) | $ | (28,860) | $ | 36,875 | $ | (104,452) | |||||||||||||||

| Three months ended March 31, | |||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||

| Dividend | Dividend per share | Dividend | Dividend per share | ||||||||||||||||||||

| Common shares | $ | 75,467 | $ | 0.1085 | $ | 75,386 | $ | 0.1085 | |||||||||||||||

| Series A preferred shares | C$ | 1,973 | C$ | 0.4110 | C$ | 1,549 | C$ | 0.3226 | |||||||||||||||

| Series D preferred shares | C$ | 1,273 | C$ | 0.3182 | C$ | 1,273 | C$ | 0.3182 | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | ||||||||||||||

| March 31 | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| HLBV and other adjustments attributable to: | ||||||||||||||

| Non-controlling interests - tax equity partnership units | $ | 40,208 | $ | 34,571 | ||||||||||

| Non-controlling interests - redeemable tax equity partnership units | 331 | 331 | ||||||||||||

Other net earnings attributable to: |

||||||||||||||

| Non-controlling interests | (9,380) | (8,323) | ||||||||||||

| $ | 31,159 | $ | 26,579 | |||||||||||

| Redeemable non-controlling interest, held by related party | — | (6,050) | ||||||||||||

Net effect of non-controlling interests |

$ | 31,159 | $ | 20,529 | ||||||||||

| Three months ended | ||||||||||||||

| March 31 | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Expected income tax (recovery) expense at Canadian statutory rate | $ | (34,876) | $ | 72,692 | ||||||||||

| Increase (decrease) resulting from: | ||||||||||||||

| Effect of differences in tax rates on transactions in and within foreign jurisdictions and change in tax rates | (1,161) | (11,158) | ||||||||||||

| Adjustments from investments carried at fair value | 20,083 | (29,265) | ||||||||||||

| Change in valuation allowance | (3,788) | (1,467) | ||||||||||||

| Non-controlling interests share of income | 6,002 | 10,192 | ||||||||||||

| Tax credits | (3,303) | (12,410) | ||||||||||||

| Amortization and settlement of excess deferred income tax | (1,511) | (3,751) | ||||||||||||

Foreign exchange difference and other |

7,251 | (132) | ||||||||||||

| Income tax (recovery) expense | $ | (11,303) | $ | 24,701 | ||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | ||||||||||||||

| March 31 | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Beginning balance | $ | 97,344 | $ | 107,583 | ||||||||||

Charged to income tax expense (recovery) |

(3,788) | (1,467) | ||||||||||||

| Charged (reduction) to OCI | 1,998 | (8,720) | ||||||||||||

| Ending balance | $ | 95,554 | $ | 97,396 | ||||||||||

| Three months ended | ||||||||||||||

| March 31 | ||||||||||||||

| 2024 | 2023 | |||||||||||||

Renewable energy business sale costs (a) |

5,909 | — | ||||||||||||

Kentucky termination costs (b) |

— | 2,752 | ||||||||||||

Other (c) |

4,692 | 710 | ||||||||||||

| $ | 10,601 | $ | 3,462 | |||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | ||||||||||||||

| March 31 | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Net earnings (loss) attributable to shareholders of AQN | $ | (89,146) | $ | 270,139 | ||||||||||

Series A preferred share dividend |

1,466 | 1,148 | ||||||||||||

Series D preferred share dividend |

946 | 944 | ||||||||||||

| Net earnings (loss) attributable to common shareholders of AQN – basic and diluted | $ | (91,558) | $ | 268,047 | ||||||||||

| Weighted average number of shares | ||||||||||||||

| Basic | 689,564,036 | 687,693,510 | ||||||||||||

| Effect of dilutive securities | — | 2,454,187 | ||||||||||||

| Diluted | 689,564,036 | 690,147,697 | ||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended March 31, 2024 | |||||||||||||||||||||||

| Regulated Services Group | Renewable Energy Group | Corporate | Total | ||||||||||||||||||||

Revenue (1)(2) |

$ | 624,831 | $ | 84,576 | $ | — | $ | 709,407 | |||||||||||||||

| Other revenue | 11,749 | 15,534 | 410 | 27,693 | |||||||||||||||||||

| Fuel, power and water purchased | 197,804 | 3,538 | — | 201,342 | |||||||||||||||||||

| Net revenue | 438,776 | 96,572 | 410 | 535,758 | |||||||||||||||||||

Operating expenses (3) |

207,531 | 53,595 | 659 | 261,785 | |||||||||||||||||||

| Depreciation and amortization | 92,020 | 37,259 | 261 | 129,540 | |||||||||||||||||||

| Loss on foreign exchange | — | — | 11,857 | 11,857 | |||||||||||||||||||

| Operating income (loss) | 139,225 | 5,718 | (12,367) | 132,576 | |||||||||||||||||||

| Interest expense | (48,710) | (19,795) | (34,019) | (102,524) | |||||||||||||||||||

Income (loss) from long-term investments and other income |

7,921 | 2,022 | (157,697) | (147,754) | |||||||||||||||||||

| Other expenses | (3,691) | (1,312) | (8,903) | (13,906) | |||||||||||||||||||

| Earnings (loss) before income taxes | $ | 94,745 | $ | (13,367) | $ | (212,986) | $ | (131,608) | |||||||||||||||

| Property, plant and equipment | $ | 8,981,554 | $ | 3,687,945 | $ | 28,205 | $ | 12,697,704 | |||||||||||||||

| Investments carried at fair value | 1,853 | 953,885 | — | 955,738 | |||||||||||||||||||

| Equity-method investees | 112,042 | 330,858 | 6 | 442,906 | |||||||||||||||||||

| Total assets | 12,603,339 | 5,308,641 | 395,799 | 18,307,779 | |||||||||||||||||||

| Capital expenditures | $ | 183,214 | $ | 29,332 | $ | — | $ | 212,546 | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended March 31, 2023 | |||||||||||||||||||||||

| Regulated Services Group | Renewable Energy Group | Corporate | Total | ||||||||||||||||||||

Revenue (1)(2) |

$ | 674,532 | $ | 78,716 | $ | — | $ | 753,248 | |||||||||||||||

| Other revenue | 13,647 | 11,371 | 361 | 25,379 | |||||||||||||||||||

| Fuel, power and water purchased | 267,150 | 7,806 | — | 274,956 | |||||||||||||||||||

| Net revenue | 421,029 | 82,281 | 361 | 503,671 | |||||||||||||||||||

Operating expenses (3) |

196,852 | 40,429 | 839 | 238,120 | |||||||||||||||||||

| Depreciation and amortization | 85,857 | 35,545 | 239 | 121,641 | |||||||||||||||||||

| Loss on foreign exchange | — | — | 1,436 | 1,436 | |||||||||||||||||||

| Operating income (loss) | 138,320 | 6,307 | (2,153) | 142,474 | |||||||||||||||||||

| Interest expense | (38,478) | (14,895) | (28,545) | (81,918) | |||||||||||||||||||

Income from long-term investments and other income |

10,328 | 29,742 | 179,942 | 220,012 | |||||||||||||||||||

| Other expenses | (4,249) | — | (2,008) | (6,257) | |||||||||||||||||||

| Earnings before income taxes | $ | 105,921 | $ | 21,154 | $ | 147,236 | $ | 274,311 | |||||||||||||||

| Capital expenditures | $ | 147,381 | $ | 22,368 | $ | — | $ | 169,749 | |||||||||||||||

| December 31, 2023 | |||||||||||||||||||||||

| Property, plant and equipment | $ | 8,945,637 | $ | 3,539,069 | $ | 32,744 | $ | 12,517,450 | |||||||||||||||

| Investments carried at fair value | 1,962 | 1,113,767 | — | 1,115,729 | |||||||||||||||||||

| Equity-method investees | 112,180 | 343,712 | 501 | 456,393 | |||||||||||||||||||

| Total assets | $ | 12,658,955 | $ | 5,367,011 | $ | 347,995 | $ | 18,373,961 | |||||||||||||||

| Three months ended March 31 | |||||||||||

| 2024 | 2023 | ||||||||||

| Revenue | |||||||||||

| United States | $ | 626,906 | $ | 640,424 | |||||||

| Canada | 50,495 | 53,128 | |||||||||

| Other regions | 59,699 | 85,075 | |||||||||

| $ | 737,100 | $ | 778,627 | ||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Thereafter | Total | |||||||||||||||||

Power purchase (1) |

$ | 39,135 | $ | 23,831 | $ | 12,336 | $ | 12,582 | $ | 12,831 | $ | 126,584 | $ | 227,299 | |||||||||

Natural gas supply and service agreements (2) |

100,564 | 68,744 | 40,143 | 32,318 | 27,990 | 148,145 | 417,904 | ||||||||||||||||

| Service agreements | 74,529 | 64,078 | 54,958 | 54,775 | 52,675 | 252,692 | 553,707 | ||||||||||||||||

| Capital projects | 4,936 | — | — | — | — | — | 4,936 | ||||||||||||||||

| Land easements and others | 16,171 | 15,422 | 15,646 | 15,813 | 16,049 | 540,000 | 619,101 | ||||||||||||||||

| Total | $ | 235,335 | $ | 172,075 | $ | 123,083 | $ | 115,488 | $ | 109,545 | $ | 1,067,421 | $ | 1,822,947 | |||||||||

| Three months ended | ||||||||||||||

| March 31 | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Accounts receivable | $ | (9,889) | $ | 13,763 | ||||||||||

| Fuel and natural gas in storage | 2,629 | 32,494 | ||||||||||||

| Supplies and consumables inventory | (6,353) | (10,776) | ||||||||||||

| Income taxes recoverable | 2,091 | 549 | ||||||||||||

| Prepaid expenses | (2,332) | (7,048) | ||||||||||||

| Accounts payable | 22,692 | (53,220) | ||||||||||||

| Accrued liabilities | (31,198) | (126,165) | ||||||||||||

| Current income tax liability | — | 3,602 | ||||||||||||

| Asset retirements and environmental obligations | (849) | (1,069) | ||||||||||||

| Net regulatory assets and liabilities | (31,334) | (16,921) | ||||||||||||

| $ | (54,543) | $ | (164,791) | |||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| March 31, 2024 | Carrying amount |

Fair value |

Level 1 | Level 2 | Level 3 | ||||||||||||||||||||||||

| Long-term investments carried at fair value | $ | 955,738 | $ | 955,738 | $ | 906,688 | $ | — | $ | 49,050 | |||||||||||||||||||

| Development loans and other receivables | 94,695 | 104,133 | — | 104,134 | — | ||||||||||||||||||||||||

| Derivative instruments: | |||||||||||||||||||||||||||||

| Interest rate swaps designated as a hedge | 100,276 | 100,276 | — | 100,276 | — | ||||||||||||||||||||||||

| Interest rate cap not designated as hedge | 964 | 964 | — | 964 | — | ||||||||||||||||||||||||

| Congestion revenue rights not designated as hedge | 9,145 | 9,145 | — | — | 9,145 | ||||||||||||||||||||||||

| Cross-currency swap designated as a net investment hedge | 2,217 | 2,217 | — | 2,217 | — | ||||||||||||||||||||||||

| Commodity contracts for regulatory operations | 19 | 19 | — | 19 | — | ||||||||||||||||||||||||

| Total derivative instruments | 112,621 | 112,621 | — | 103,476 | 9,145 | ||||||||||||||||||||||||

| Total financial assets | $ | 1,163,054 | $ | 1,172,492 | $ | 906,688 | $ | 207,610 | $ | 58,195 | |||||||||||||||||||

| Long-term debt | $ | 9,089,678 | $ | 7,868,470 | $ | 2,192,654 | $ | 5,675,816 | $ | — | |||||||||||||||||||

| Notes payable to related party | 25,808 | 15,246 | — | 15,246 | — | ||||||||||||||||||||||||

| Convertible debentures | 231 | 276 | 276 | — | — | ||||||||||||||||||||||||

| Derivative instruments: | |||||||||||||||||||||||||||||

| Energy contracts designated as a cash flow hedge | 74,492 | 74,492 | — | — | 74,492 | ||||||||||||||||||||||||

| Energy contracts not designated as hedge | 6,676 | 6,676 | — | — | 6,676 | ||||||||||||||||||||||||

| Cross-currency swap designated as a net investment hedge | 21,233 | 21,233 | — | 21,233 | — | ||||||||||||||||||||||||

| Cross-currency swap designated as a cash flow hedge | 13,932 | 13,932 | — | 13,932 | — | ||||||||||||||||||||||||

Interest rate swaps designated as a hedge |

11,955 | 11,955 | — | 11,955 | — | ||||||||||||||||||||||||

| Commodity contracts for regulated operations | 1,232 | 1,232 | — | 1,232 | — | ||||||||||||||||||||||||

| Total derivative instruments | 129,520 | 129,520 | — | 48,352 | 81,168 | ||||||||||||||||||||||||

| Total financial liabilities | $ | 9,245,237 | $ | 8,013,512 | $ | 2,192,930 | $ | 5,739,414 | $ | 81,168 | |||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| December 31, 2023 | Carrying amount |

Fair value |

Level 1 | Level 2 | Level 3 | ||||||||||||||||||||||||

| Long-term investments carried at fair value | $ | 1,115,729 | $ | 1,115,729 | $ | 1,054,665 | $ | — | $ | 61,064 | |||||||||||||||||||

| Development loans and other receivables | 158,110 | 155,735 | — | 155,735 | — | ||||||||||||||||||||||||

| Derivative instruments: | |||||||||||||||||||||||||||||

| Interest rate swap designated as a hedge | 72,936 | 72,936 | — | 72,936 | — | ||||||||||||||||||||||||

Interest rate cap not designated as a hedge |

1,854 | 1,854 | — | 1,854 | — | ||||||||||||||||||||||||

| Congestion revenue rights not designated as hedge |

8,458 | 8,458 | — | — | 8,458 | ||||||||||||||||||||||||

| Total derivative instruments | 83,248 | 83,248 | — | 74,790 | 8,458 | ||||||||||||||||||||||||

| Total financial assets | $ | 1,357,087 | $ | 1,354,712 | $ | 1,054,665 | $ | 230,525 | $ | 69,522 | |||||||||||||||||||

| Long-term debt | $ | 8,516,030 | $ | 7,423,318 | $ | 2,532,608 | $ | 4,890,710 | — | ||||||||||||||||||||

| Notes payable to related party | 25,808 | 15,320 | — | 15,320 | — | ||||||||||||||||||||||||

| Convertible debentures | 230 | 276 | 276 | — | — | ||||||||||||||||||||||||

| Derivative instruments: | |||||||||||||||||||||||||||||

| Energy contracts designated as a cash flow hedge | 68,070 | 68,070 | — | — | 68,070 | ||||||||||||||||||||||||

| Energy contracts not designated as hedge | 5,593 | 5,593 | — | — | 5,593 | ||||||||||||||||||||||||

| Cross-currency swap designated as a net investment hedge | 10,533 | 10,533 | — | 10,533 | — | ||||||||||||||||||||||||

| Currency forward contract designated as hedge | 6,779 | 6,779 | — | 6,779 | — | ||||||||||||||||||||||||

| Interest rate swaps designated as a hedge | 11,790 | 11,790 | — | 11,790 | — | ||||||||||||||||||||||||

| Cross-currency swap designated as a cash flow hedge | 5,547 | 5,547 | — | 5,547 | — | ||||||||||||||||||||||||

| Commodity contracts for regulated operations | 2,564 | 2,564 | — | 2,564 | — | ||||||||||||||||||||||||

| Total derivative instruments | 110,876 | 110,876 | — | 37,213 | 73,663 | ||||||||||||||||||||||||

| Total financial liabilities | $ | 8,652,944 | $ | 7,549,790 | $ | 2,532,884 | $ | 4,943,243 | $ | 73,663 | |||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Notional quantity (MW-hrs) |

Expiry | Receive average prices (per MW-hr) |

Pay floating price (per MW-hr) |

|||||||||||||||||

| 3,381,054 | September 2030 | $24.54 | Illinois Hub | |||||||||||||||||

| 315,110 | December 2028 | $29.17 | PJM Western HUB | |||||||||||||||||

| 1,343,841 | December 2027 | $21.32 | NI HUB | |||||||||||||||||

| 1,220,525 | December 2027 | $36.46 | ERCORT North HUB | |||||||||||||||||

| Derivative | Notional quantity |

Expiry |

Hedged item |

||||||||

Forward-starting interest rate swap |

$ | 350,000 | July 2029 |

$350,000 subordinated unsecured notes |

|||||||

Cross-currency interest rate swap |

C$ | 400,000 | January 2032 |

C$400,000 subordinated unsecured notes |

|||||||

Forward-starting interest rate swap |

$ | 750,000 | April 2032 |

$750,000 subordinated unsecured notes |

|||||||

| Forward-starting interest rate swap | $ | 575,000 | June 2026 | First $575,000 of the $1,150,000 senior unsecured notes issuance |

|||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | ||||||||||||||

| March 31 | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Effective portion of cash flow hedge | $ | 15,927 | $ | 22,486 | ||||||||||

| Amortization of cash flow hedge | (539) | (3,487) | ||||||||||||

| Amounts reclassified from AOCI | (5,926) | (1,134) | ||||||||||||

| OCI attributable to shareholders of AQN | $ | 9,462 | $ | 17,865 | ||||||||||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

Notes to the Unaudited Interim Condensed Consolidated Financial Statements | ||

| March 31, 2024 and 2023 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Three months ended | |||||||||||

| March 31 | |||||||||||

| 2024 | 2023 | ||||||||||

| Unrealized gain (loss) on derivative financial instruments: | |||||||||||

| Energy derivative contracts | $ | (696) | $ | (22) | |||||||

| Commodity contracts | (890) | 1,128 | |||||||||

| $ | (1,586) | $ | 1,106 | ||||||||

| Realized gain (loss) on derivative financial instruments: | |||||||||||

| Energy derivative contracts | 104 | (2,293) | |||||||||

| $ | 104 | $ | (2,293) | ||||||||

| Loss on derivative financial instruments not accounted for as hedges | (1,482) | (1,187) | |||||||||

| Amortization of AOCI gains frozen as a result of hedge dedesignation | 981 | 997 | |||||||||

| $ | (501) | $ | (190) | ||||||||

Unaudited interim condensed consolidated statements of operations classification: |

|||||||||||

| Gain on derivative financial instruments | $ | 133 | $ | 2,166 | |||||||

Renewable energy sales |

(634) | (2,356) | |||||||||

| $ | (501) | $ | (190) | ||||||||

Management Discussion & Analysis

Management Discussion & Analysis | Explanatory Notes | |||||

| Caution Concerning Forward-Looking Statements and Forward-Looking Information | |||||

| Caution Concerning Non-GAAP Measures | |||||

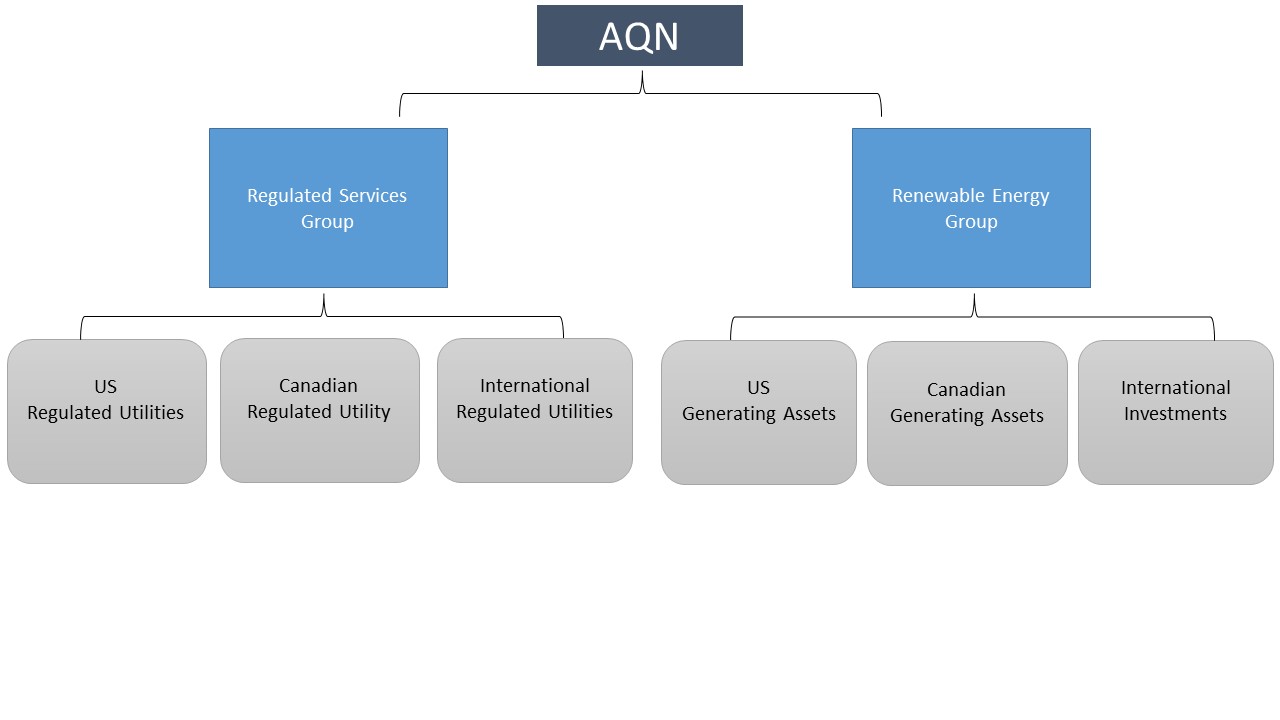

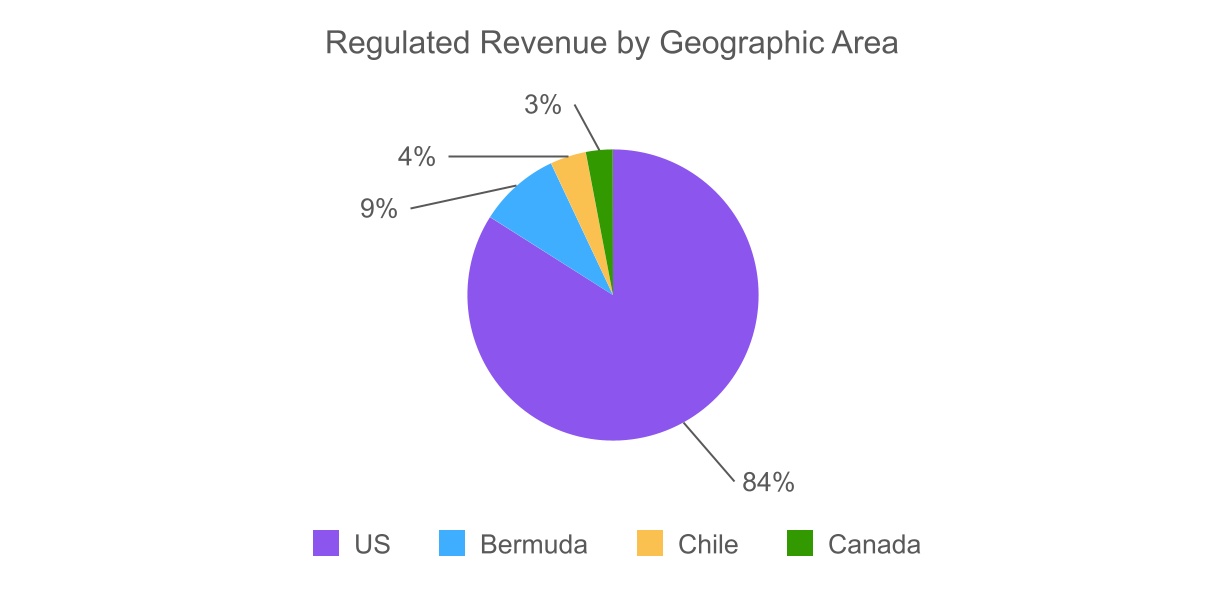

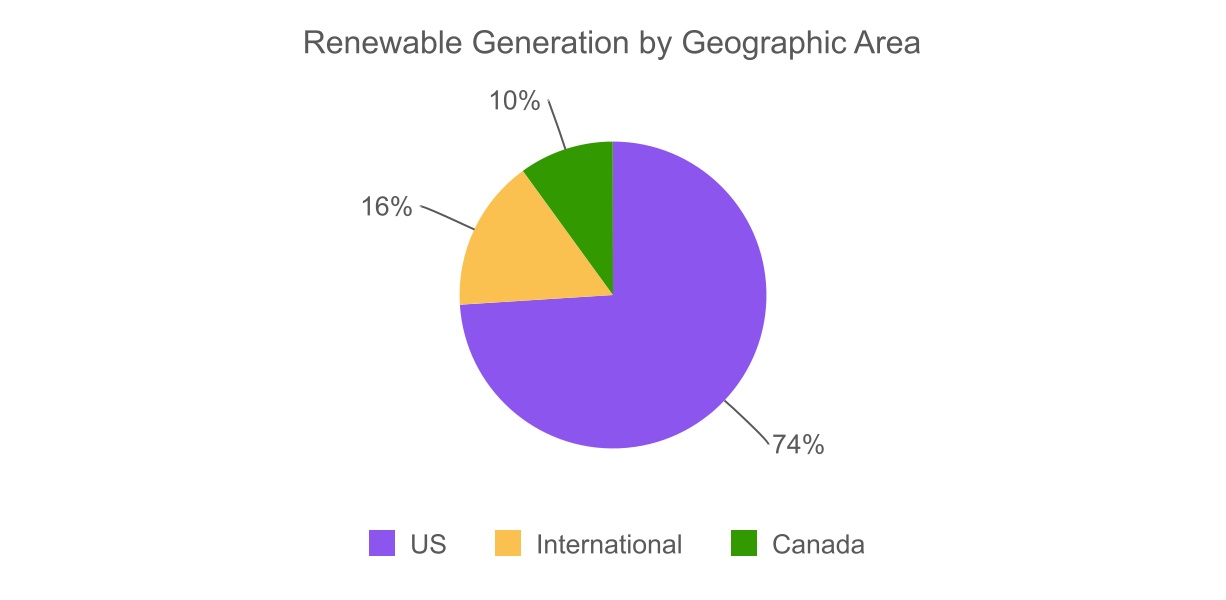

| Overview and Business Strategy | |||||

| Significant Updates | |||||

| 2024 First Quarter Results From Operations | |||||

| 2024 First Quarter Net Earnings Summary | |||||

| 2024 First Quarter Adjusted EBITDA Summary | |||||

| Regulated Services Group | |||||

| Renewable Energy Group | |||||

| AQN: Corporate and Other Expenses | |||||

| Non-GAAP Financial Measures | |||||

| Summary of Property, Plant and Equipment Expenditures | |||||

| Liquidity and Capital Reserves | |||||

| Share-Based Compensation Plans | |||||

| Related Party Transactions | |||||

| Enterprise Risk Management | |||||

| Quarterly Financial Information | |||||

| Disclosure Controls and Procedures | |||||

| Critical Accounting Estimates and Policies | |||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 1 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 2 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 3 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 5 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 7 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

| (all dollar amounts in $ millions except per share information) | Three months ended March 31 |

||||||||||||||||

| 2024 | 2023 | Change | |||||||||||||||

| Net earnings (loss) attributable to shareholders | $(89.1) | $270.1 | (133)% | ||||||||||||||

Adjusted Net Earnings1 |

$95.6 | $119.9 | (20)% | ||||||||||||||

Adjusted EBITDA1 |

$344.3 | $341.0 | 1% | ||||||||||||||

| Net earnings (loss) per common share | $(0.13) | $0.39 | (133)% | ||||||||||||||

Adjusted Net Earnings per common share1 |

$0.14 | $0.17 | (18)% | ||||||||||||||

| 1 | See Caution Concerning Non-GAAP Measures. |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 10 |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

Key Financial Information |

Three months ended March 31 | ||||||||||

| (all dollar amounts in $ millions except per share information) | 2024 | 2023 | |||||||||

| Revenue | $ | 737.1 | $ | 778.6 | |||||||

| Net earnings (loss) attributable to shareholders | (89.1) | 270.1 | |||||||||

| Cash provided by operating activities | 130.7 | 34.2 | |||||||||

Adjusted Net Earnings1 |

95.6 | 119.9 | |||||||||

Adjusted EBITDA1 |

344.3 | 341.0 | |||||||||

Adjusted Funds from Operations1 |

189.2 | 208.1 | |||||||||

| Dividends declared to common shareholders | 75.5 | 75.4 | |||||||||

| Weighted average number of common shares outstanding | 689,564,036 | 687,693,510 | |||||||||

| Per share | |||||||||||

| Basic net earnings (loss) | $ | (0.13) | $ | 0.39 | |||||||

| Diluted net earnings (loss) | $ | (0.13) | $ | 0.39 | |||||||

Adjusted Net Earnings1 |

$ | 0.14 | $ | 0.17 | |||||||

| Dividends declared to common shareholders | $ | 0.11 | $ | 0.11 | |||||||

| 1 | See Caution Concerning Non-GAAP Measures. |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 12 |

||||

| (all dollar amounts in $ millions) | Three months ended March 31 | ||||

| Comparative Prior Period Revenue | $ | 778.6 | |||

| REGULATED SERVICES GROUP | |||||

| Existing Facilities | |||||

Electricity: Decrease is primarily due to lower pass through commodity costs. |

(20.8) | ||||

Natural Gas: Decrease is primarily due to lower pass through commodity costs. |

(40.4) | ||||

| Water: Increase is primarily due to higher consumption at the Suralis (Chile) Water System. | 2.7 | ||||

Other: Decrease is primarily due to lower activity in the non-regulated business in Bermuda. |

(4.5) | ||||

| (63.0) | |||||

| Rate Reviews | |||||

| Electricity: Increase is primarily due to the implementation of new rates at the CalPeco (CA), Empire (AR) and Granite State (NH) Electric Systems. | 13.3 | ||||

| Natural Gas: Increase is primarily due to the implementation of new rates at the EnergyNorth (NH), and St. Lawrence (NY) Gas Systems. |

3.1 | ||||

Water: Decrease is primarily due to one – time revenues in the first quarter of 2023 from a retroactive rate increase at the Park (CA) Water System, partially offset by the implementation of new rates at the Pine Bluff (AR) Water System. |

(1.2) | ||||

| 15.2 | |||||

| Foreign Exchange | (3.9) | ||||

| RENEWABLE ENERGY GROUP | |||||

| Existing Facilities | |||||

Hydro |

0.2 | ||||

Wind CA |

0.4 | ||||

| Wind U.S.: Increase is primarily due to higher availability income from the Maverick Creek Wind Facility. | 1.8 | ||||

Solar: Increase is primarily driven by favourable Renewable Energy Credit ("REC") revenue for the Great Bay Solar I and Great Bay Solar II Facilities. |

3.7 | ||||

Thermal & Renewable Natural Gas: Decrease is primarily due to the sale of the Windsor Locks Thermal Facility as of March 1, 2024. |

(3.3) | ||||

| Other: Increase is primarily due to higher portfolio optimization revenue. | 1.2 | ||||

| 4.0 | |||||

| New Facilities | |||||

Wind U.S: Increase is primarily driven by the Deerfield II Wind Facility and Sandy Ridge II Wind Facility. |

6.1 | ||||

| 6.1 | |||||

| Foreign Exchange | 0.1 | ||||

| Current Period Revenue | $ | 737.1 | |||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

| Change in net earnings (loss) attributable to shareholders | Three months ended | ||||

| March 31 | |||||

| (all dollar amounts in $ millions) | 2024 | ||||

| Net earnings attributable to shareholders – Prior Period Balance | $ | 270.1 | |||

Adjusted EBITDA1 |

3.3 | ||||

| Net earnings attributable to the non-controlling interest, exclusive of HLBV | 5.0 | ||||

| Income tax recovery | 36.0 | ||||

| Interest expense | (20.6) | ||||

| Other net losses | (7.1) | ||||

| Unrealized loss on energy derivatives included in revenue | (10.7) | ||||

| HLBV prior period adjustment within equity income | (8.5) | ||||

| Pension and post-employment non-service costs | 1.6 | ||||

| Change in value of investments carried at fair value | (337.7) | ||||

| Gain on derivative financial instruments | (2.1) | ||||

| Foreign exchange | (10.5) | ||||

| Depreciation and amortization | (7.9) | ||||

| Net loss attributable to shareholders – Current Period Balance | $ | (89.1) | |||

Change in Net Earnings (loss) ($) |

$ | (359.2) | |||

Change in Net Earnings (loss) (%) |

(133.0) | % | |||

| 1 | See Caution Concerning Non-GAAP Measures. |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 14 |

||||

Adjusted EBITDA1 by segment |

Three months ended March 31 | ||||||||||

| (all dollar amounts in $ millions) | 2024 | 2023 | |||||||||

Divisional Operating Profit for Regulated Services Group1 |

$ | 257.0 | $ | 245.7 | |||||||

Divisional Operating Profit for Renewable Energy Group1 |

86.3 | 95.2 | |||||||||

| Other Income & Expenses | 1.0 | 0.1 | |||||||||

Total AQN Adjusted EBITDA1 |

$ | 344.3 | $ | 341.0 | |||||||

Change in Adjusted EBITDA1 ($) |

$ | 3.3 | |||||||||

Change in Adjusted EBITDA1 (%) |

1.0 | % | |||||||||

| 1 | See Caution Concerning Non-GAAP Measures. |

||||

Change in Adjusted EBITDA1 Breakdown |

Three months ended March 31, 2024 | |||||||||||||

| (all dollar amounts in $ millions) | Regulated Services | Renewable Energy | Corporate | Total | ||||||||||

| Prior period balances | $ | 245.7 | $ | 95.2 | $ | 0.1 | $ | 341.0 | ||||||

| Existing Facilities and Investments | 2.1 | (15.3) | 0.9 | (12.3) | ||||||||||

| New Facilities and Investments | — | 5.7 | — | 5.7 | ||||||||||

| Rate Reviews | 10.8 | — | — | 10.8 | ||||||||||

| Foreign Exchange Impact | (1.6) | 0.7 | — | (0.9) | ||||||||||

| Total change during the period | $ | 11.3 | $ | (8.9) | $ | 0.9 | $ | 3.3 | ||||||

| Current Period Balances | $ | 257.0 | $ | 86.3 | $ | 1.0 | $ | 344.3 | ||||||

| 1 | See Caution Concerning Non-GAAP Measures. |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 15 |

||||

| Utility System Type | As at March 31 | ||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||

| (all dollar amounts in $ millions) | Assets | Net Utility Sales1 |

Total Customer Connections2 |

Assets | Net Utility Sales1 |

Total Customer Connections2 |

|||||||||||||||||

| Electricity | 5,163.2 | 208.0 | 310,000 | 5,020.2 | 190.4 | 308,000 | |||||||||||||||||

| Natural Gas | 1,833.3 | 138.0 | 377,000 | 1,720.1 | 133.4 | 375,000 | |||||||||||||||||

| Water and Wastewater | 1,664.8 | 81.1 | 571,000 | 1,580.8 | 83.6 | 570,000 | |||||||||||||||||

| Other | 320.2 | 11.7 | 352.1 | 13.6 | |||||||||||||||||||

| Total | $ | 8,981.5 | $ | 438.8 | 1,258,000 | $ | 8,673.2 | $ | 421.0 | 1,253,000 | |||||||||||||

| Accumulated Deferred Income Taxes Liability | $ | 773.7 | $ | 715.9 | |||||||||||||||||||

| 1 | Net Utility Sales for the three months ended March 31, 2024 and 2023. See Caution Concerning Non-GAAP Measures. |

||||

| 2 | Total Customer Connections represents the sum of all active and vacant customer connections. | ||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 16 |

||||

| Electric Distribution Systems | Three months ended March 31 | ||||||||||

| 2024 | 2023 | ||||||||||

| Average Active Electric Customer Connections For The Period | |||||||||||

| Residential | 263,100 | 262,400 | |||||||||

| Commercial and industrial | 42,900 | 42,500 | |||||||||

| Total Average Active Electric Customer Connections For The Period | 306,000 | 304,900 | |||||||||

| Customer Usage (GW-hrs) | |||||||||||

| Residential | 796.7 | 755.1 | |||||||||

| Commercial and industrial | 943.7 | 923.4 | |||||||||

| Total Customer Usage (GW-hrs) | 1,740.4 | 1,678.5 | |||||||||

| Natural Gas Distribution Systems | Three months ended March 31 | ||||||||||

| 2024 | 2023 | ||||||||||

| Average Active Natural Gas Customer Connections For The Period | |||||||||||

| Residential | 324,500 | 323,600 | |||||||||

| Commercial and industrial | 40,200 | 40,000 | |||||||||

| Total Average Active Natural Gas Customer Connections For The Period | 364,700 | 363,600 | |||||||||

| Customer Usage (MMBTU) | |||||||||||

| Residential | 10,274,000 | 10,031,000 | |||||||||

| Commercial and industrial | 8,718,000 | 8,714,000 | |||||||||

| Total Customer Usage (MMBTU) | 18,992,000 | 18,745,000 | |||||||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 17 |

||||

| Water and Wastewater Distribution Systems | Three months ended March 31 | ||||||||||

| 2024 | 2023 | ||||||||||

| Average Active Customer Connections For The Period | |||||||||||

| Wastewater customer connections | 55,700 | 55,200 | |||||||||

| Water distribution customer connections | 508,100 | 502,600 | |||||||||

| Total Average Active Customer Connections For The Period | 563,800 | 557,800 | |||||||||

| Gallons Provided (millions of gallons) | |||||||||||

| Wastewater treated | 898 | 795 | |||||||||

| Water provided | 8,589 | 8,507 | |||||||||

| Total Gallons Provided (millions of gallons) | 9,487 | 9,302 | |||||||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |||||

| Three months ended | |||||||||||

| March 31 | |||||||||||

| (all dollar amounts in $ millions) | 2024 | 2023 | |||||||||

| Revenue | |||||||||||

| Regulated electricity distribution | $ | 305.9 | $ | 316.0 | |||||||

| Less: Regulated electricity purchased | (97.9) | (125.6) | |||||||||

Net Utility Sales – electricity1 |

208.0 | 190.4 | |||||||||

| Regulated gas distribution | 234.0 | 271.1 | |||||||||

| Less: Regulated gas purchased | (96.0) | (137.7) | |||||||||

|

Net Utility Sales – natural gas1

|

138.0 | 133.4 | |||||||||

| Regulated water reclamation and distribution | 85.0 | 87.4 | |||||||||

| Less: Regulated water purchased | (3.9) | (3.8) | |||||||||

Net Utility Sales – water reclamation and distribution1 |

81.1 | 83.6 | |||||||||

Other revenue2 |

11.7 | 13.6 | |||||||||

Net Utility Sales1,3 |

438.8 | 421.0 | |||||||||

| Operating expenses | (207.5) | (196.9) | |||||||||

Income from long-term investments |

7.9 | 10.3 | |||||||||

HLBV4 |

17.8 | 11.3 | |||||||||

Divisional Operating Profit1,5 |

$ | 257.0 | $ | 245.7 | |||||||

| 1 | See Caution Concerning Non-GAAP Measures. |

||||

| 2 | See Note 18 in the unaudited interim condensed consolidated financial statements. |

||||

| 3 | This table contains a reconciliation of Net Utility Sales to revenue. The relevant sections of the table are derived from and should be read in conjunction with the unaudited interim condensed consolidated statement of operations and Note 18 in the unaudited interim condensed consolidated financial statements, "Segmented Information". This supplementary disclosure is intended to more fully explain disclosures related to Net Utility Sales and provides additional information related to the operating performance of the Regulated Services Group. Investors are cautioned that Net Utility Sales should not be construed as an alternative to revenue. |

||||

| 4 | HLBV income represents the value of net tax attributes monetized by the Regulated Services Group in the period at the Luning and Turquoise Solar Facilities and the Neosho Ridge, Kings Point and North Fork Ridge Wind Facilities. |

||||

| 5 | This table contains a reconciliation of Divisional Operating Profit to revenue for the Regulated Services Group. The relevant sections of the table are derived from and should be read in conjunction with the unaudited interim condensed consolidated statement of operations and Note 18 in the unaudited interim condensed consolidated financial statements, "Segmented Information". This supplementary disclosure is intended to more fully explain disclosures related to Divisional Operating Profit and provides additional information related to the operating performance of the Regulated Services Group. Investors are cautioned that Divisional Operating Profit should not be construed as an alternative to revenue. |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 19 |

||||

| (all dollar amounts in $ millions) | Three months ended March 31 | ||||

Prior Period Divisional Operating Profit1 |

$ | 245.7 | |||

| Existing Facilities | |||||

Electricity: Increase is primarily due to higher HLBV income of approximately $6.4 million at the Empire Electric System (MO, KS, AR, OK) as a result of increased wind resources. |

7.9 | ||||

Natural Gas: Decrease is primarily due to higher operating expenses at the Peach State Gas System. |

(1.7) | ||||

Water: Decrease is primarily due to higher recoverable operating expenses at the Park Water (CA) and Pine Bluff (AR) Water Systems. |

(1.1) | ||||

| Other: Decrease is primarily driven by lower interest income on regulatory asset accounts. | (3.0) | ||||

| 2.1 | |||||

| Rate Reviews | |||||

Electricity: Increase is primarily due to the implementation of new rates at the CalPeco (CA), Empire (OK) and Granite State (NH) Electric Systems. |

8.9 | ||||

Natural Gas: Increase is primarily due to the implementation of new rates at the EnergyNorth (NH) and St. Lawrence (NY) Gas Systems. |

3.1 | ||||

| Water: Decrease is primarily due to one - time revenues in the first quarter of 2023 from a retroactive rate increase at the Park (CA) Water System, partially offset by the implementation of new rates at the Pine Bluff (AR) Water System. | (1.2) | ||||

| 10.8 | |||||

| Foreign Exchange | (1.6) | ||||

Current Period Divisional Operating Profit1 |

$ | 257.0 | |||

| 1 | See Caution Concerning Non-GAAP Measures. |

||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 20 |

||||

| Utility | Jurisdiction | Regulatory Proceeding Type | Rate Request (millions) |

Current Status | ||||||||||||||||

| Completed Rate Reviews | ||||||||||||||||||||

| BELCO | Bermuda | General Rate Case ("GRC") |

$34.8 | On September 30, 2021, filed its revenue allowance application in which it requested a $34.8 million increase for 2022 and a $6.1 million increase for 2023. On March 18, 2022, the Regulatory Authority ("RA") approved an annual increase of $22.8 million, for a revenue allowance of $224.1 million for 2022 and $226.2 million for 2023. The RA authorized a 7.16% rate of return, comprised of a 62% equity and an 8.92% return on equity ("ROE"). In April 2022, BELCO filed an appeal in the Supreme Court of Bermuda challenging the decisions made by the RA through the recent Retail Tariff Review. On February 23, 2024, the Bermuda Supreme Court issued an order denying the BELCO appeal. |

||||||||||||||||

| Empire Electric | Arkansas | GRC | $7.3 | On February 14, 2023, filed an application seeking an increase in revenues of $7.3 million based on an ROE of 10.25% and an equity ratio of 56% to be phased in over three years. On December 7, 2023, the Arkansas Public Service Commission issued an order approving the settlement agreement authorizing a revenue increase of $5.3 million. New rates became effective January 1, 2024. |

||||||||||||||||

| Pending Rate Reviews | ||||||||||||||||||||

| Granite State Electric | New Hampshire | GRC | $15.5 | On May 5, 2023, filed an application seeking a permanent increase in revenues of $15.5 million based on an ROE of 10.35% and an equity ratio of 55%. Temporary rates of $5.5 million were implemented on July 1, 2023. On December 13, 2023, the Department of Energy ("DOE") filed a motion seeking to dismiss the case. An evidentiary hearing was held on January 23, 2024. The case has been stayed by the New Hampshire Public Utilities Commission ("NHPUC") until May 15, 2024 so that it may contemplate the motion and the Company's third-party review of its financial information. On April 2, 2024 the NHPUC directed the Company to cooperate with the DOE and all other parties to develop a mutually-agreeable scope of work for the third-party report, to be filed with the NHPUC no later than April 15, 2024. Because there was not agreement on the scope of work, the Company filed the third-party report which concluded that the accounting information included in the rate filing provides a sufficient basis for determining the Company’s revenue requirement and that 2023 accounting data provides a sufficient basis for inclusion in the Company’s regulatory filings. On April 24, 2024, the Company filed an updated revenue requirement, seeking an increase in revenues of $14.7 million. On April 30, 2024, the NHPUC rejected the scope of the third-party report that was submitted, ordered an independent audit facilitated by the DOE with a procedural schedule for the next phase of the proceeding due no later than May 20, 2024, and deferred a ruling on the DOE motion to dismiss. |

||||||||||||||||

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 21 |

||||

| Utility | Jurisdiction | Regulatory Proceeding Type | Rate Request (millions) |

Current Status | ||||||||||||||||

| New York Water | New York | GRC | $39.7 | On May 4, 2023, filed an application seeking an increase in revenues of $39.7 million based on an ROE of 10% and an equity ratio of 50%. | ||||||||||||||||

| EnergyNorth Gas | New Hampshire | GRC | $27.5 | On July 27, 2023, filed an application seeking an increase in revenues of $27.5 million based on an ROE of 10.35% and an equity ratio of 55%. Temporary rates of $8.7 million were approved by the Commission on October 31, 2023. The temporary rate increase is retroactive to October 1, 2023. On February 5, 2024, the Company requested that the NHPUC stay the case until April 12, 2024 so that the Company can provide the Commission with a third-party review of the financial information upon which the revenue requirement is predicated. On February 16, 2024, the Department of Energy filed a motion seeking to dismiss the case. On March 14, 2024 the Commission issued an order staying the case until June 7, 2024, so that it may contemplate the motion and so that the Company can provide the NHPUC with a third-party review of the financial information within the rate application. |

||||||||||||||||

| BELCO | Bermuda | GRC | $59.1 | On October 17, 2023, filed its revenue allowance application in which it requested a $59.1 million increase for 2024 and 2025 based on a weighted average cost of capital of 10.13%. |

||||||||||||||||

| Midstates Gas | Illinois | GRC | $5.3 | On December 20, 2023, filed an application seeking an increase in revenues of $5.3 million based on an ROE of 10.80% and an equity ratio of 54%. On April 24, 2024, Staff of the Illinois Commerce Commission filed testimony recommending a $0.6 million rate decrease. |

||||||||||||||||

| Rio Rico Water & Sewer, Bella Vista Water, Beardsley Water, Cordes Lakes Water | Arizona | GRC | $5.4 | On December 28, 2023, filed an application seeking an increase in revenues of $5.4 million based on an ROE of 10.95% and an equity ratio of 54%. | ||||||||||||||||

| Park Water | California | GRC | $9.3 | On January 2, 2024, filed an application seeking an increase in revenues of $9.3 million based on an ROE of 9.35% and an equity ratio of 57%. | ||||||||||||||||

| Apple Valley Water | California | GRC | $3.1 | On January 2, 2024, filed an application seeking an increase in revenues of $3.1 million based on an ROE of 9.35% and an equity ratio of 57%. | ||||||||||||||||