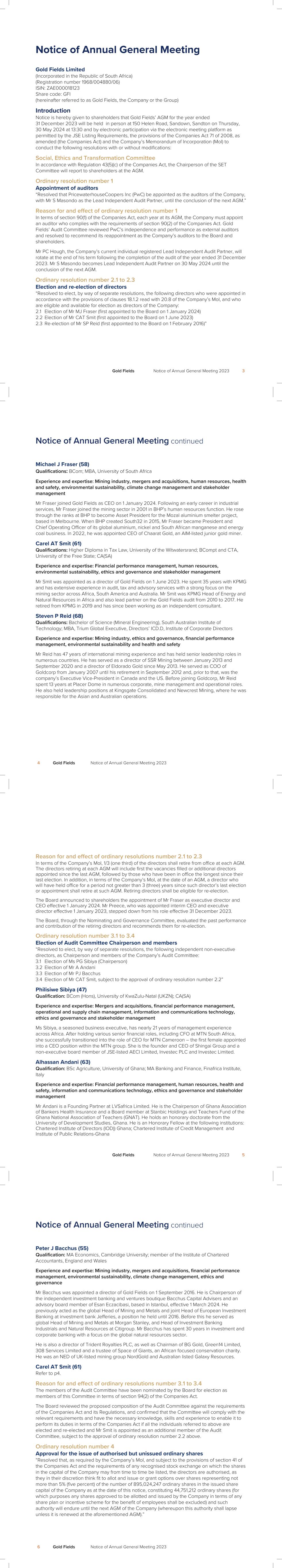

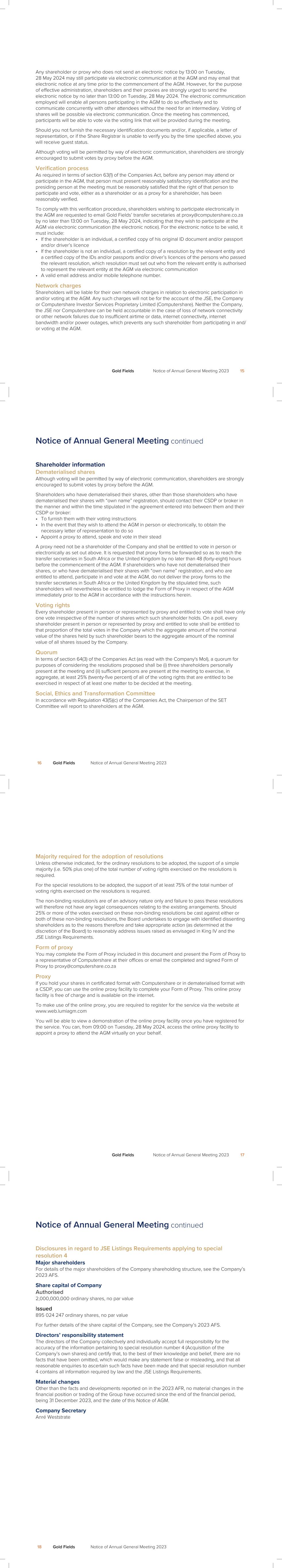

Gold Fields Limited Notice of Annual General Meeting for the year ended 31 December 2023 Dear shareholder I have pleasure in inviting you to attend the hybrid Annual General Meeting (AGM) of the Company, which will be held in person and by electronic participation at Gold Fields’ corporate office at 150 Helen Road, Sandown, Sandton, at 13:30 on Thursday, 30 May 2024. Virtual access to the AGM – with full voice integration – will be offered, allowing shareholders who cannot attend in person the opportunity to view the proceedings, speak and ask questions in real time and cast their votes on the shareholder resolutions. In addition, shareholders who are unable to attend the AGM in person may submit a Form of Proxy. The following documents are enclosed: • Notice of AGM setting out the resolutions to be proposed at the meeting • A Form of Proxy Gold Fields supports the use of electronic communication and, as such, the 2023 Integrated Annual Report (IAR) will be published in electronic format only. Should you wish to receive a printed copy of the 2023 IAR, kindly email your request to Gold Fields’ Company Secretary at anre.weststrate@goldfields.com. The 2023 IAR, the full consolidated audited Annual Financial Statements (AFS) of the Company and its subsidiaries (included in the Annual Financial Report (AFR)), the Governance and Remuneration Report, the Independent Auditors’ Report, and the Directors’ Report will be published on our website, www.goldfields.com on or about 28 March 2024. Environmental, social and governance (ESG) related matters will be included in the IAR, Climate Change Report and Report to Stakeholders, which will also be published on our website on or about 28 March 2024. I look forward to welcoming you at the meeting. Yunus Suleman Chairperson 28 March 2024 Board of Directors Yunus Suleman (66) Independent non-executive Chairperson Appointed in September 2016 Chairperson of the Nominating and Governance Committee Standing invitee to Audit; Risk; Safety, Health and Sustainable Development (SHSD); Capital Projects, Control and Review (CAPRO); Remuneration; and Social, Ethics and Transformation (SET) Committees Member of the Strategy and Investment Committee Skills: Mergers and acquisitions, financial performance management, ethics and governance and stakeholder management Steven Reid (68) Lead Independent Director (LID) Appointed in February 2016 Chairperson of the Remuneration Committee Standing invitee to Audit, Risk, CAPRO, and SET Committees Member of Nominating and Governance, SHSD, and Strategy and Investment Committees Skills: Mining industry, ethics and governance, financial performance management, health and safety, environmental performance Alhassan Andani (63) Independent non-executive director (NED) Appointed in August 2016 Chairperson of the CAPRO Committee Member of the Audit, Remuneration, SET, and Strategy and Investment Committees Skills: Financial performance management, human resources, health and safety, information and communications technology, ethics and governance and stakeholder management Peter Bacchus (55) Independent NED Appointed in September 2016 Chairperson of the Risk Committee and Strategy and Investment Committee Member of the Audit, CAPRO, and Remuneration Committees Skills: Mining industry, mergers and acquisitions, financial performance management, environmental sustainability, climate change management, ethics and governance Cristina Bitar (54) Independent NED Appointed in May 2022 Member of the Risk, SHSD, Remuneration, and SET Committees Skills: Mergers and acquisitions, human resources, ethics and governance and stakeholder management Terence Goodlace (65) Independent NED Appointed in July 2016 Chairperson of the SHSD Committee Member of the Risk, CAPRO, and Nominating and Governance Committees Skills: Mining industry, mergers and acquisitions, financial performance management, operational and supply chain management, health and safety, environmental sustainability, climate change management and ethics and governance For a more detailed view of directors’ skills and expertise, refer to the Governance and Remuneration Report. Gold Fields Notice of Annual General Meeting 2023 1 Board of Directors continued Jacqueline McGill (56) Independent NED Appointed in November 2021 Chairperson of the SET Committee Member of the SHSD, CAPRO, Remuneration, and Nominating and Governance Committees Skills: Mining industry, human resources, operational and supply chain management, health and safety, environmental sustainability, climate change management, ethics and governance and stakeholder management Philisiwe Sibiya (47) Independent NED Appointed in March 2021 Chairperson of the Audit Committee Member of the Risk, SET, and Nominating and Governance Committees Skills: Mergers and acquisitions, financial performance management, operational and supply chain management, information and communications technology, ethics and governance and stakeholder management Carel Smit (61) Independent NED Appointed in June 2023 Member of the Audit, CAPRO, Risk, and Strategy and Investment Committees Skills: Financial performance management, human resources, environmental sustainability, ethics and governance and stakeholder management Michael Fraser (58) Chief Executive Officer (CEO) Appointed in January 2024 Member of the SET Committee Skills: Mining industry, mergers and acquisitions, human resources, health and safety, environmental sustainability, climate change management, ethics and governance and stakeholder management Paul Schmidt (56) Chief Financial Officer (CFO) Appointed in August 2009 Skills: Mining industry, mergers and acquisitions, financial performance management, operational and supply chain management, information and communications technology, ethics and governance and stakeholder management For a more detailed view of directors’ skills and expertise, refer to the Governance and Remuneration Report. 2 Gold Fields Notice of Annual General Meeting 2023

Notice of Annual General Meeting Gold Fields Limited (Incorporated in the Republic of South Africa) (Registration number 1968/004880/06) ISIN: ZAE000018123 Share code: GFI (hereinafter referred to as Gold Fields, the Company or the Group) Introduction Notice is hereby given to shareholders that Gold Fields’ AGM for the year ended 31 December 2023 will be held in person at 150 Helen Road, Sandown, Sandton on Thursday, 30 May 2024 at 13:30 and by electronic participation via the electronic meeting platform as permitted by the JSE Listing Requirements, the provisions of the Companies Act 71 of 2008, as amended (the Companies Act) and the Company’s Memorandum of Incorporation (MoI) to conduct the following resolutions with or without modifications: Social, Ethics and Transformation Committee In accordance with Regulation 43(5)(c) of the Companies Act, the Chairperson of the SET Committee will report to shareholders at the AGM. Ordinary resolution number 1 Appointment of auditors “Resolved that PricewaterhouseCoopers Inc (PwC) be appointed as the auditors of the Company, with Mr S Masondo as the Lead Independent Audit Partner, until the conclusion of the next AGM.” Reason for and effect of ordinary resolution number 1 In terms of section 90(1) of the Companies Act, each year at its AGM, the Company must appoint an auditor who complies with the requirements of section 90(2) of the Companies Act. Gold Fields’ Audit Committee reviewed PwC’s independence and performance as external auditors and resolved to recommend its reappointment as the Company’s auditors to the Board and shareholders. Mr PC Hough, the Company’s current individual registered Lead Independent Audit Partner, will rotate at the end of his term following the completion of the audit of the year ended 31 December 2023. Mr S Masondo becomes Lead Independent Audit Partner on 30 May 2024 until the conclusion of the next AGM. Ordinary resolution number 2.1 to 2.3 Election and re-election of directors “Resolved to elect, by way of separate resolutions, the following directors who were appointed in accordance with the provisions of clauses 18.1.2 read with 20.8 of the Company’s MoI, and who are eligible and available for election as directors of the Company: 2.1 Election of Mr MJ Fraser (first appointed to the Board on 1 January 2024) 2.2 Election of Mr CAT Smit (first appointed to the Board on 1 June 2023) 2.3 Re-election of Mr SP Reid (first appointed to the Board on 1 February 2016)” Gold Fields Notice of Annual General Meeting 2023 3 Notice of Annual General Meeting continued Michael J Fraser (58) Qualifications: BCom; MBA, University of South Africa Experience and expertise: Mining industry, mergers and acquisitions, human resources, health and safety, environmental sustainability, climate change management and stakeholder management Mr Fraser joined Gold Fields as CEO on 1 January 2024. Following an early career in industrial services, Mr Fraser joined the mining sector in 2001 in BHP’s human resources function. He rose through the ranks at BHP to become Asset President for the Mozal aluminium smelter project, based in Melbourne. When BHP created South32 in 2015, Mr Fraser became President and Chief Operating Officer of its global aluminium, nickel and South African manganese and energy coal business. In 2022, he was appointed CEO of Chaarat Gold, an AIM-listed junior gold miner. Carel AT Smit (61) Qualifications: Higher Diploma in Tax Law, University of the Witwatersrand; BCompt and CTA, University of the Free State; CA(SA) Experience and expertise: Financial performance management, human resources, environmental sustainability, ethics and governance and stakeholder management Mr Smit was appointed as a director of Gold Fields on 1 June 2023. He spent 35 years with KPMG and has extensive experience in audit, tax and advisory services with a strong focus on the mining sector across Africa, South America and Australia. Mr Smit was KPMG Head of Energy and Natural Resources in Africa and also lead partner on the Gold Fields audit from 2010 to 2017. He retired from KPMG in 2019 and has since been working as an independent consultant. Steven P Reid (68) Qualifications: Bachelor of Science (Mineral Engineering), South Australian Institute of Technology; MBA, Trium Global Executive, Directors’ ICD.D, Institute of Corporate Directors Experience and expertise: Mining industry, ethics and governance, financial performance management, environmental sustainability and health and safety Mr Reid has 47 years of international mining experience and has held senior leadership roles in numerous countries. He has served as a director of SSR Mining between January 2013 and September 2020 and a director of Eldorado Gold since May 2013. He served as COO of Goldcorp from January 2007 until his retirement in September 2012 and, prior to that, was the company’s Executive Vice-President in Canada and the US. Before joining Goldcorp, Mr Reid spent 13 years at Placer Dome in numerous corporate, mine management and operational roles. He also held leadership positions at Kingsgate Consolidated and Newcrest Mining, where he was responsible for the Asian and Australian operations. 4 Gold Fields Notice of Annual General Meeting 2023 Reason for and effect of ordinary resolutions number 2.1 to 2.3 In terms of the Company’s MoI, 1/3 (one third) of the directors shall retire from office at each AGM. The directors retiring at each AGM will include first the vacancies filled or additional directors appointed since the last AGM, followed by those who have been in office the longest since their last election. In addition, in terms of the Company’s MoI, at the date of an AGM, a director who will have held office for a period not greater than 3 (three) years since such director’s last election or appointment shall retire at such AGM. Retiring directors shall be eligible for re-election. The Board announced to shareholders the appointment of Mr Fraser as executive director and CEO effective 1 January 2024. Mr Preece, who was appointed interim CEO and executive director effective 1 January 2023, stepped down from his role effective 31 December 2023. The Board, through the Nominating and Governance Committee, evaluated the past performance and contribution of the retiring directors and recommends them for re-election. Ordinary resolution number 3.1 to 3.4 Election of Audit Committee Chairperson and members “Resolved to elect, by way of separate resolutions, the following independent non-executive directors, as Chairperson and members of the Company’s Audit Committee: 3.1 Election of Ms PG Sibiya (Chairperson) 3.2 Election of Mr A Andani 3.3 Election of Mr PJ Bacchus 3.4 Election of Mr CAT Smit, subject to the approval of ordinary resolution number 2.2” Philisiwe Sibiya (47) Qualification: BCom (Hons), University of KwaZulu-Natal (UKZN); CA(SA) Experience and expertise: Mergers and acquisitions, financial performance management, operational and supply chain management, information and communications technology, ethics and governance and stakeholder management Ms Sibiya, a seasoned business executive, has nearly 21 years of management experience across Africa. After holding various senior financial roles, including CFO at MTN South Africa, she successfully transitioned into the role of CEO for MTN Cameroon – the first female appointed into a CEO position within the MTN group. She is the founder and CEO of Shingai Group and a non-executive board member of JSE-listed AECI Limited, Investec PLC and Investec Limited. Alhassan Andani (63) Qualification: BSc Agriculture, University of Ghana; MA Banking and Finance, Finafrica Institute, Italy Experience and expertise: Financial performance management, human resources, health and safety, information and communications technology, ethics and governance and stakeholder management Mr Andani is a Founding Partner at LVSafrica Limited. He is the Chairperson of Ghana Association of Bankers Health Insurance and a Board member at Stanbic Holdings and Teachers Fund of the Ghana National Association of Teachers (GNAT). He holds an honorary doctorate from the University of Development Studies, Ghana. He is an Honorary Fellow at the following institutions: Chartered Institute of Directors (IOD)) Ghana; Chartered Institute of Credit Management and Institute of Public Relations-Ghana Gold Fields Notice of Annual General Meeting 2023 5 Notice of Annual General Meeting continued Peter J Bacchus (55) Qualification: MA Economics, Cambridge University; member of the Institute of Chartered Accountants, England and Wales Experience and expertise: Mining industry, mergers and acquisitions, financial performance management, environmental sustainability, climate change management, ethics and governance Mr Bacchus was appointed a director of Gold Fields on 1 September 2016. He is Chairperson of the independent investment banking and ventures boutique Bacchus Capital Advisers and an advisory board member of Esan Eczacibasi, based in Istanbul, effective 1 March 2024. He previously acted as the global Head of Mining and Metals and joint Head of European Investment Banking at investment bank Jefferies, a position he held until 2016. Before this he served as global Head of Mining and Metals at Morgan Stanley, and Head of Investment Banking Industrials and Natural Resources at Citigroup. Mr Bacchus has spent 30 years in investment and corporate banking with a focus on the global natural resources sector. He is also a director of Trident Royalties PLC, as well as Chairman of BG Gold, Green14 Limited, 308 Services Limited and a trustee of Space of Giants, an African focused conservation charity. He was an NED of UK-listed mining group NordGold and Australian listed Galaxy Resources. Carel AT Smit (61) Refer to p4. Reason for and effect of ordinary resolutions number 3.1 to 3.4 The members of the Audit Committee have been nominated by the Board for election as members of this Committee in terms of section 94(2) of the Companies Act. The Board reviewed the proposed composition of the Audit Committee against the requirements of the Companies Act and its Regulations, and confirmed that the Committee will comply with the relevant requirements and have the necessary knowledge, skills and experience to enable it to perform its duties in terms of the Companies Act if all the individuals referred to above are elected and re-elected and Mr Smit is appointed as an additional member of the Audit Committee, subject to the approval of ordinary resolution number 2.2 above. Ordinary resolution number 4 Approval for the issue of authorised but unissued ordinary shares “Resolved that, as required by the Company’s MoI, and subject to the provisions of section 41 of the Companies Act and the requirements of any recognised stock exchange on which the shares in the capital of the Company may from time to time be listed, the directors are authorised, as they in their discretion think fit to allot and issue or grant options over shares representing not more than 5% (five percent) of the number of 895,024,247 ordinary shares in the issued share capital of the Company as at the date of this notice, constituting 44,751,212 ordinary shares (for which purposes any shares approved to be allotted and issued by the Company in terms of any share plan or incentive scheme for the benefit of employees shall be excluded) and such authority will endure until the next AGM of the Company (whereupon this authority shall lapse unless it is renewed at the aforementioned AGM).” 6 Gold Fields Notice of Annual General Meeting 2023

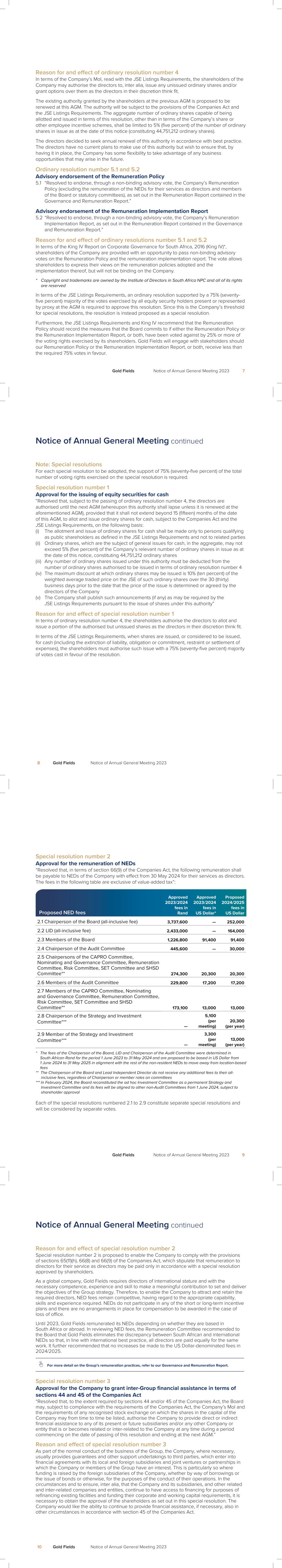

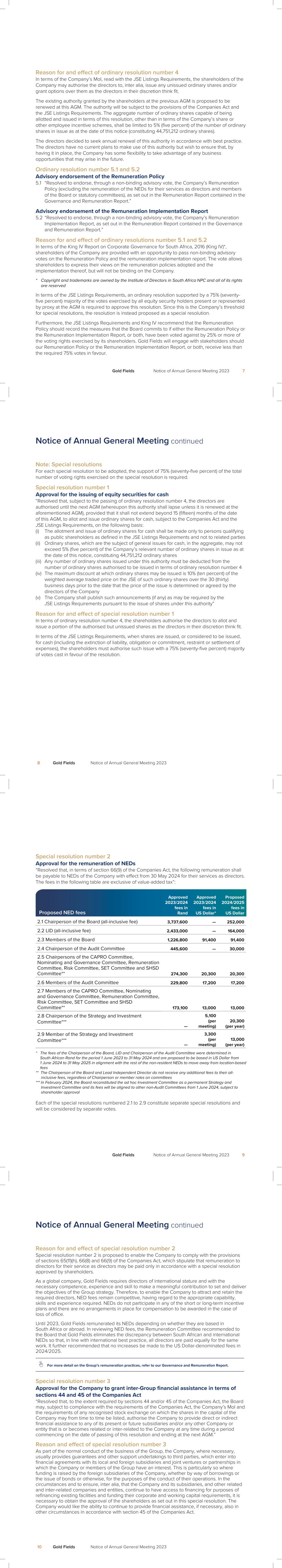

Reason for and effect of ordinary resolution number 4 In terms of the Company’s MoI, read with the JSE Listings Requirements, the shareholders of the Company may authorise the directors to, inter alia, issue any unissued ordinary shares and/or grant options over them as the directors in their discretion think fit. The existing authority granted by the shareholders at the previous AGM is proposed to be renewed at this AGM. The authority will be subject to the provisions of the Companies Act and the JSE Listings Requirements. The aggregate number of ordinary shares capable of being allotted and issued in terms of this resolution, other than in terms of the Company’s share or other employee incentive schemes, shall be limited to 5% (five percent) of the number of ordinary shares in issue as at the date of this notice (constituting 44,751,212 ordinary shares). The directors decided to seek annual renewal of this authority in accordance with best practice. The directors have no current plans to make use of this authority but wish to ensure that, by having it in place, the Company has some flexibility to take advantage of any business opportunities that may arise in the future. Ordinary resolution number 5.1 and 5.2 Advisory endorsement of the Remuneration Policy 5.1 “Resolved to endorse, through a non-binding advisory vote, the Company’s Remuneration Policy (excluding the remuneration of the NEDs for their services as directors and members of the Board or statutory committees), as set out in the Remuneration Report contained in the Governance and Remuneration Report.” Advisory endorsement of the Remuneration Implementation Report 5.2 “Resolved to endorse, through a non-binding advisory vote, the Company’s Remuneration Implementation Report, as set out in the Remuneration Report contained in the Governance and Remuneration Report.” Reason for and effect of ordinary resolutions number 5.1 and 5.2 In terms of the King IV Report on Corporate Governance for South Africa, 2016 (King IV)*, shareholders of the Company are provided with an opportunity to pass non-binding advisory votes on the Remuneration Policy and the remuneration implementation report. The vote allows shareholders to express their views on the remuneration policies adopted and the implementation thereof, but will not be binding on the Company. * Copyright and trademarks are owned by the Institute of Directors in South Africa NPC and all of its rights are reserved In terms of the JSE Listings Requirements, an ordinary resolution supported by a 75% (seventy- five percent) majority of the votes exercised by all equity security holders present or represented by proxy at the AGM is required to approve this resolution. Since this is the Company’s threshold for special resolutions, the resolution is instead proposed as a special resolution. Furthermore, the JSE Listings Requirements and King IV recommend that the Remuneration Policy should record the measures that the Board commits to if either the Remuneration Policy or the Remuneration Implementation Report, or both, have been voted against by 25% or more of the voting rights exercised by its shareholders. Gold Fields will engage with stakeholders should our Remuneration Policy or the Remuneration Implementation Report, or both, receive less than the required 75% votes in favour. Gold Fields Notice of Annual General Meeting 2023 7 Notice of Annual General Meeting continued Note: Special resolutions For each special resolution to be adopted, the support of 75% (seventy-five percent) of the total number of voting rights exercised on the special resolution is required. Special resolution number 1 Approval for the issuing of equity securities for cash “Resolved that, subject to the passing of ordinary resolution number 4, the directors are authorised until the next AGM (whereupon this authority shall lapse unless it is renewed at the aforementioned AGM), provided that it shall not extend beyond 15 (fifteen) months of the date of this AGM, to allot and issue ordinary shares for cash, subject to the Companies Act and the JSE Listings Requirements, on the following basis: (i) The allotment and issue of ordinary shares for cash shall be made only to persons qualifying as public shareholders as defined in the JSE Listings Requirements and not to related parties (ii) Ordinary shares, which are the subject of general issues for cash, in the aggregate, may not exceed 5% (five percent) of the Company’s relevant number of ordinary shares in issue as at the date of this notice, constituting 44,751,212 ordinary shares (iii) Any number of ordinary shares issued under this authority must be deducted from the number of ordinary shares authorised to be issued in terms of ordinary resolution number 4 (iv) The maximum discount at which ordinary shares may be issued is 10% (ten percent) of the weighted average traded price on the JSE of such ordinary shares over the 30 (thirty) business days prior to the date that the price of the issue is determined or agreed by the directors of the Company (v) The Company shall publish such announcements (if any) as may be required by the JSE Listings Requirements pursuant to the issue of shares under this authority” Reason for and effect of special resolution number 1 In terms of ordinary resolution number 4, the shareholders authorise the directors to allot and issue a portion of the authorised but unissued shares as the directors in their discretion think fit. In terms of the JSE Listings Requirements, when shares are issued, or considered to be issued, for cash (including the extinction of liability, obligation or commitment, restraint or settlement of expenses), the shareholders must authorise such issue with a 75% (seventy-five percent) majority of votes cast in favour of the resolution. 8 Gold Fields Notice of Annual General Meeting 2023 Special resolution number 2 Approval for the remuneration of NEDs “Resolved that, in terms of section 66(9) of the Companies Act, the following remuneration shall be payable to NEDs of the Company with effect from 30 May 2024 for their services as directors. The fees in the following table are exclusive of value-added tax”: Proposed NED fees Approved 2023/2024 fees in Rand Approved 2023/2024 fees in US Dollar* Proposed 2024/2025 fees in US Dollar 2.1 Chairperson of the Board (all-inclusive fee) 3,737,600 — 252,000 2.2 LID (all-inclusive fee) 2,433,000 — 164,000 2.3 Members of the Board 1,226,800 91,400 91,400 2.4 Chairperson of the Audit Committee 445,600 — 30,000 2.5 Chairpersons of the CAPRO Committee, Nominating and Governance Committee, Remuneration Committee, Risk Committee, SET Committee and SHSD Committee** 274,300 20,300 20,300 2.6 Members of the Audit Committee 229,800 17,200 17,200 2.7 Members of the CAPRO Committee, Nominating and Governance Committee, Remuneration Committee, Risk Committee, SET Committee and SHSD Committee** 173,100 13,000 13,000 2.8 Chairperson of the Strategy and Investment Committee*** — 5,100 (per meeting) 20,300 (per year) 2.9 Member of the Strategy and Investment Committee*** — 3,300 (per meeting) 13,000 (per year) * The fees of the Chairperson of the Board, LID and Chairperson of the Audit Committee were determined in South African Rand for the period 1 June 2023 to 31 May 2024 and are proposed to be based in US Dollar from 1 June 2024 to 31 May 2025 in alignment with the rest of the non-resident NEDs to move away from location-based fees ** The Chairperson of the Board and Lead Independent Director do not receive any additional fees to their all- inclusive fees, regardless of Chairperson or member roles on committees *** In February 2024, the Board reconstituted the ad hoc Investment Committee as a permanent Strategy and Investment Committee and its fees will be aligned to other non-Audit Committees from 1 June 2024, subject to shareholder approval Each of the special resolutions numbered 2.1 to 2.9 constitute separate special resolutions and will be considered by separate votes. Gold Fields Notice of Annual General Meeting 2023 9 Notice of Annual General Meeting continued Reason for and effect of special resolution number 2 Special resolution number 2 is proposed to enable the Company to comply with the provisions of sections 65(11)(h), 66(8) and 66(9) of the Companies Act, which stipulate that remuneration to directors for their service as directors may be paid only in accordance with a special resolution approved by shareholders. As a global company, Gold Fields requires directors of international stature and with the necessary competence, experience and skill to make a meaningful contribution to set and deliver the objectives of the Group strategy. Therefore, to enable the Company to attract and retain the required directors, NED fees remain competitive, having regard to the appropriate capability, skills and experience required. NEDs do not participate in any of the short or long-term incentive plans and there are no arrangements in place for compensation to be awarded in the case of loss of office. Until 2023, Gold Fields remunerated its NEDs depending on whether they are based in South Africa or abroad. In reviewing NED fees, the Remuneration Committee recommended to the Board that Gold Fields eliminates the discrepancy between South African and international NEDs so that, in line with international best practice, all directors are paid equally for the same work. It further recommended that no increases be made to the US Dollar-denominated fees in 2024/2025. For more detail on the Group’s remuneration practices, refer to our Governance and Remuneration Report. Special resolution number 3 Approval for the Company to grant inter-Group financial assistance in terms of sections 44 and 45 of the Companies Act “Resolved that, to the extent required by sections 44 and/or 45 of the Companies Act, the Board may, subject to compliance with the requirements of the Companies Act, the Company’s MoI and the requirements of any recognised stock exchange on which the shares in the capital of the Company may from time to time be listed, authorise the Company to provide direct or indirect financial assistance to any of its present or future subsidiaries and/or any other Company or entity that is or becomes related or inter-related to the Company at any time during a period commencing on the date of passing of this resolution and ending at the next AGM.” Reason and effect of special resolution number 3 As part of the normal conduct of the business of the Group, the Company, where necessary, usually provides guarantees and other support undertakings to third parties, which enter into financial agreements with its local and foreign subsidiaries and joint ventures or partnerships in which the Company or members of the Group have an interest. This is particularly so where funding is raised by the foreign subsidiaries of the Company, whether by way of borrowings or the issue of bonds or otherwise, for the purposes of the conduct of their operations. In the circumstances and to ensure, inter alia, that the Company and its subsidiaries, and other related and inter-related companies and entities, continue to have access to financing for purposes of refinancing existing facilities and funding their corporate and working capital requirements, it is necessary to obtain the approval of the shareholders as set out in this special resolution. The Company would like the ability to continue to provide financial assistance, if necessary, also in other circumstances in accordance with section 45 of the Companies Act. 10 Gold Fields Notice of Annual General Meeting 2023

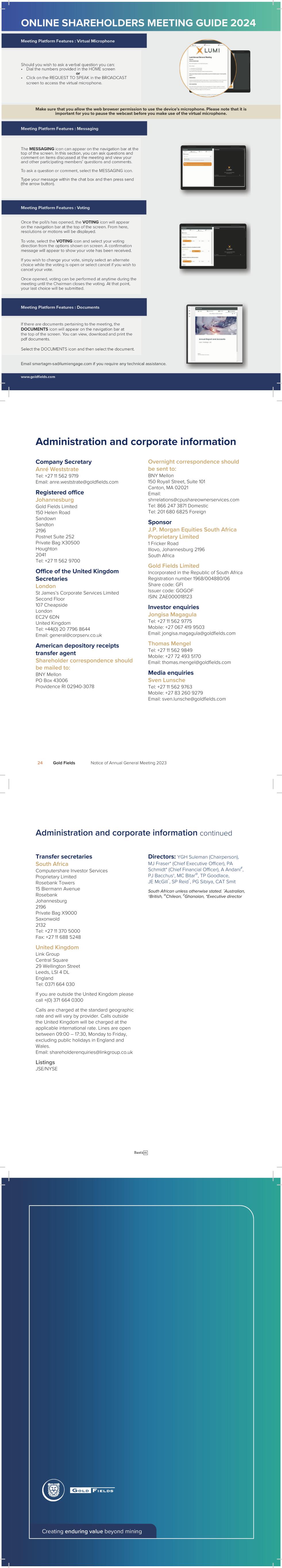

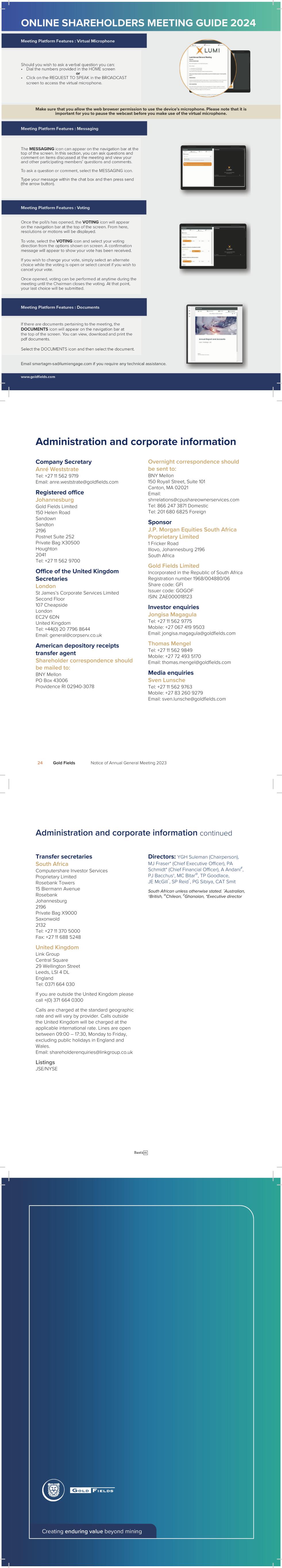

Furthermore, it may be necessary for the Company to provide financial assistance to any of its present or future subsidiaries, and/or to any related or inter-related Company or corporation and/ or to a member of a related or inter-related corporation to subscribe for options or securities of the Company or another Company related or inter-related to it. Both sections 44 and 45 of the Companies Act, which govern financial assistance, provide, inter alia, that the particular financial assistance must be provided only pursuant to a special resolution of shareholders, adopted within the previous 2 (two) years, which approved such assistance either for the specific recipient, or generally for a category of potential recipients, and the specific recipient falls within that category and the Board is satisfied that: (i) immediately after providing the financial assistance, the Company would satisfy the solvency and liquidity test (as contemplated in the Companies Act) and (ii) the terms under which the financial assistance is proposed to be given are fair and reasonable to the Company. It is therefore imperative that the Company obtains the approval of shareholders in terms of special resolution number 4 so that it can effectively organise its internal financial administration. Special resolution number 4 Acquisition of the Company’s own shares “Resolved that the Company or any subsidiary of the Company is hereby authorised by way of a general approval, from time to time, to acquire ordinary shares in the capital of the Company in accordance with the Companies Act, the Company’s MoI and the JSE Listings Requirements provided that: (i) The number of its own ordinary shares acquired by the Company in any one financial year shall not exceed 10% (ten percent) of the ordinary shares in issue at the date on which this resolution is passed. For details of our shareholding structure, see the relevant section in the AFR (ii) This authority shall lapse on the earlier of the date of the next AGM of the Company or the date 15 (fifteen) months after the date on which this resolution is passed (iii) The Board has resolved to authorise the acquisition and that the Company and its subsidiaries (the Group) will satisfy the solvency and liquidity test immediately after the acquisition and that, since the test was done there have been no material changes to the Group’s financial position (iv) The acquisition must be effected through the order book operated by the JSE trading system and done without any prior understanding or arrangement between the Company and the counterparty (v) The Company only appoints one agent to effect any acquisition(s) on its behalf (vi) The price paid per ordinary share may not be greater than 10% (ten percent) above the weighted average of the market value of the ordinary shares for the 5 (five) business days immediately preceding the date on which an acquisition is made (vii) The number of shares acquired by subsidiaries of the Company shall not exceed 10% (ten percent) in the aggregate of the number of issued shares in the Company at the relevant times (viii) The acquisition of shares by the Company or its subsidiaries may not be effected during a prohibited period, as defined in the JSE Listings Requirements, unless the Company has a repurchase programme in place where the dates and quantities of securities to be traded during the relevant period are fixed (not subject to any variation) and has been submitted to the JSE in writing prior to the commencement of the prohibited period. The Company must instruct an independent third party, which makes its investment decisions in relation to the Company’s securities independently of, and uninfluenced by the Company, prior to the commencement of the prohibited period to execute the repurchase programme submitted to the JSE (ix) An announcement containing full details of such acquisitions of shares will be published as soon as the Company and/or its subsidiaries have acquired shares constituting, on a cumulative basis, 3% (three percent) of the number of shares in issue at the date of the AGM at which this special resolution is considered and, if approved, passed and for each 3% (three percent) in aggregate of the initial number acquired thereafter” Gold Fields Notice of Annual General Meeting 2023 11 Notice of Annual General Meeting continued Reason for and effect of special resolution number 4 Special resolution number 4 is sought to allow the Group by way of a general authority to acquire its own issued shares (reducing the total number of ordinary shares of the Company in issue in the case of an acquisition by the Company of its own shares). At present, the directors have no specific intention with regard to the utilisation of this authority, which will only be used if the circumstances are appropriate. Any decision by the directors to use the general authority to acquire shares of the Company will be taken with regard to the prevailing market conditions and other factors. The directors, having considered the effect of a maximum repurchase under the general authority, are of the opinion that: (i) The Group will be able to pay its debts in the ordinary course of business for a period of 12 (twelve) months after the date of this notice (ii) The assets of the Group will exceed the liabilities of the Company and its subsidiaries for a period of 12 (twelve) months after the date of this notice, recognised and measured in accordance with the accounting policies used in the latest audited Group AFS (iii) The ordinary share capital and reserves of the Company and its subsidiaries will be adequate for the purposes of the business of the Company and its subsidiaries for the period of 12 (twelve) months after the date of this notice (iv) The working capital of the Company and its subsidiaries will be adequate for the purposes of the business of the Company and its subsidiaries for the period of 12 (twelve) months after the date of this notice. In terms of the Companies Act, this acknowledgement by the directors is valid for a set period only and the directors’ minds would need to be applied again if the buyback was implemented after this period Anré Weststrate Company Secretary Johannesburg 28 March 2024 12 Gold Fields Notice of Annual General Meeting 2023 Record dates, proxies and voting For use at the Annual General Meeting of the Company (the AGM) to be held on Thursday, 30 May 2024 at 13:30 South African Standard Time at 150 Helen Road, Sandown, Sandton, Johannesburg or at any adjourned or postponed date and time determined in accordance with section 64(4) and 64(11)(a)(i) of the Companies Act No 71 of 2008, as amended (Companies Act). In terms of section 59(1)(a) and (b) of the Companies Act, Gold Fields’ Board of Directors (Board) set the following record dates for the purposes of determining which shareholders are entitled to receive notice, participate in and vote: Record date to receive the Notice of AGM Friday, 22 March 2024 Last date to trade to be eligible to participate in and vote at the AGM Tuesday, 21 May 2024 Record date to be eligible to participate in and vote at the AGM Friday, 24 May 2024 Last date for lodging forms of proxy with transfer secretaries, at 13:00 Tuesday, 28 May 2024 Date of hybrid AGM at 13:30 Thursday, 30 May 2024 Results of AGM to be released on JSE Stock Exchange News Service Thursday, 30 May 2024 Gold Fields’ 2023 Governance and Remuneration Report, AFS and IAR were published on the Company’s website on 28 March 2024 and can be accessed at www.goldfields.com/integrated-annual-reports.php A complete set of the consolidated audited AFS, together with the Directors’ Report, Independent Auditor’s Report and Audit Committee Chairperson’s Report, are included in the Company’s 2023 AFR. Note This Notice of AGM is only available in English. Electronic copies of this document may be obtained from the Gold Fields website at www.goldfields.com. If you have disposed of your Gold Fields shares, this Notice of AGM should be handed to the purchaser of such shares or to the Central Securities Depositary Participant (CSDP), broker, banker or other agent through whom such disposal was affected. Gold Fields Notice of Annual General Meeting 2023 13 Notice of Annual General Meeting continued Options available in attending and participating at the Annual General Meeting Below we detail important information on how you can attend and participate in the in-person and virtual (hybrid) AGM. Virtual meeting attendance You can attend the AGM virtually by accessing the virtual AGM platform (see below) through your computer or mobile device. This platform will allow you to vote on the resolutions in real time and pose verbal and written questions to the Chairperson and directors. The virtual AGM platform is a live webcast of the AGM. Should you not be able to attend the AGM virtually, you can either: (i) Complete the Form of Proxy included in this document (ii) Access the iProxy system through your computer or mobile device to appoint a proxy to vote on your behalf at the virtual AGM or (iii) Use your mobile device to appoint a proxy to vote on your behalf at the virtual AGM In-person meeting attendance In terms of section 63(1) of the Companies Act, before any person may attend or participate in the AGM, meeting participants (including proxies) will be required to provide reasonably satisfactory identification before being entitled to participate in or vote at the AGM. Forms of identification that will be accepted include original and valid identity documents, driver’s licences and passports. This is described in more detail below under the heading verification process. Attending the AGM virtually Shareholders or their proxy who wish to attend, participate in and vote at the AGM virtually should access the meeting through the link below and by following the relevant prompts: https://web.lumiagm.com Once https://web.lumiagm.com is entered into the web browser, the user will be prompted to enter the meeting identity (ID) followed by a requirement to enter the username and password. The meeting ID for the virtual AGM is 135841783. To log in, all users must be in possession of their username and password both of which can be requested from proxy@computershare.co.za or smartagm-sa@lumiengage.com after registering to attend the AGM via https://smartagm.co.za. Detailed guidance to shareholders on how to register for the virtual AGM can be found in the detailed meeting guidance section on p22 and 23 of this Notice of AGM. Should you wish to attend and participate in the AGM virtually, you are required to deliver written notice accompanied by the relevant verification documentation (as set out on p21 of this Notice of AGM) to Gold Fields’ transfer secretaries (Share Registrar) by no later than 13:00 on Wednesday, 29 May 2024. This is necessary for the Share Registrar to verify you and for Lumi to assign you a username and password. 14 Gold Fields Notice of Annual General Meeting 2023

Any shareholder or proxy who does not send an electronic notice by 13:00 on Tuesday, 28 May 2024 may still participate via electronic communication at the AGM and may email that electronic notice at any time prior to the commencement of the AGM. However, for the purpose of effective administration, shareholders and their proxies are strongly urged to send the electronic notice by no later than 13:00 on Tuesday, 28 May 2024. The electronic communication employed will enable all persons participating in the AGM to do so effectively and to communicate concurrently with other attendees without the need for an intermediary. Voting of shares will be possible via electronic communication. Once the meeting has commenced, participants will be able to vote via the voting link that will be provided during the meeting. Should you not furnish the necessary identification documents and/or, if applicable, a letter of representation, or if the Share Registrar is unable to verify you by the time specified above, you will receive guest status. Although voting will be permitted by way of electronic communication, shareholders are strongly encouraged to submit votes by proxy before the AGM. Verification process As required in terms of section 63(1) of the Companies Act, before any person may attend or participate in the AGM, that person must present reasonably satisfactory identification and the presiding person at the meeting must be reasonably satisfied that the right of that person to participate and vote, either as a shareholder or as a proxy for a shareholder, has been reasonably verified. To comply with this verification procedure, shareholders wishing to participate electronically in the AGM are requested to email Gold Fields’ transfer secretaries at proxy@computershare.co.za by no later than 13:00 on Tuesday, 28 May 2024, indicating that they wish to participate at the AGM via electronic communication (the electronic notice). For the electronic notice to be valid, it must include: • If the shareholder is an individual, a certified copy of his original ID document and/or passport and/or driver’s licence • If the shareholder is not an individual, a certified copy of a resolution by the relevant entity and a certified copy of the IDs and/or passports and/or driver’s licences of the persons who passed the relevant resolution, which resolution must set out who from the relevant entity is authorised to represent the relevant entity at the AGM via electronic communication • A valid email address and/or mobile telephone number. Network charges Shareholders will be liable for their own network charges in relation to electronic participation in and/or voting at the AGM. Any such charges will not be for the account of the JSE, the Company or Computershare Investor Services Proprietary Limited (Computershare). Neither the Company, the JSE nor Computershare can be held accountable in the case of loss of network connectivity or other network failures due to insufficient airtime or data, internet connectivity, internet bandwidth and/or power outages, which prevents any such shareholder from participating in and/ or voting at the AGM. Gold Fields Notice of Annual General Meeting 2023 15 Notice of Annual General Meeting continued Shareholder information Dematerialised shares Although voting will be permitted by way of electronic communication, shareholders are strongly encouraged to submit votes by proxy before the AGM. Shareholders who have dematerialised their shares, other than those shareholders who have dematerialised their shares with “own name” registration, should contact their CSDP or broker in the manner and within the time stipulated in the agreement entered into between them and their CSDP or broker: • To furnish them with their voting instructions • In the event that they wish to attend the AGM in person or electronically, to obtain the necessary letter of representation to do so • Appoint a proxy to attend, speak and vote in their stead A proxy need not be a shareholder of the Company and shall be entitled to vote in person or electronically as set out above. It is requested that proxy forms be forwarded so as to reach the transfer secretaries in South Africa or the United Kingdom by no later than 48 (forty-eight) hours before the commencement of the AGM. If shareholders who have not dematerialised their shares, or who have dematerialised their shares with “own name” registration, and who are entitled to attend, participate in and vote at the AGM, do not deliver the proxy forms to the transfer secretaries in South Africa or the United Kingdom by the stipulated time, such shareholders will nevertheless be entitled to lodge the Form of Proxy in respect of the AGM immediately prior to the AGM in accordance with the instructions herein. Voting rights Every shareholder present in person or represented by proxy and entitled to vote shall have only one vote irrespective of the number of shares which such shareholder holds. On a poll, every shareholder present in person or represented by proxy and entitled to vote shall be entitled to that proportion of the total votes in the Company which the aggregate amount of the nominal value of the shares held by such shareholder bears to the aggregate amount of the nominal value of all shares issued by the Company. Quorum In terms of section 64(3) of the Companies Act (as read with the Company's MoI), a quorum for purposes of considering the resolutions proposed shall be (i) three shareholders personally present at the meeting and (ii) sufficient persons are present at the meeting to exercise, in aggregate, at least 25% (twenty-five percent) of all of the voting rights that are entitled to be exercised in respect of at least one matter to be decided at the meeting. Social, Ethics and Transformation Committee In accordance with Regulation 43(5)(c) of the Companies Act, the Chairperson of the SET Committee will report to shareholders at the AGM. 16 Gold Fields Notice of Annual General Meeting 2023 Majority required for the adoption of resolutions Unless otherwise indicated, for the ordinary resolutions to be adopted, the support of a simple majority (i.e. 50% plus one) of the total number of voting rights exercised on the resolutions is required. For the special resolutions to be adopted, the support of at least 75% of the total number of voting rights exercised on the resolutions is required. The non-binding resolution/s are of an advisory nature only and failure to pass these resolutions will therefore not have any legal consequences relating to the existing arrangements. Should 25% or more of the votes exercised on these non-binding resolutions be cast against either or both of these non-binding resolutions, the Board undertakes to engage with identified dissenting shareholders as to the reasons therefore and take appropriate action (as determined at the discretion of the Board) to reasonably address issues raised as envisaged in King IV and the JSE Listings Requirements. Form of proxy You may complete the Form of Proxy included in this document and present the Form of Proxy to a representative of Computershare at their offices or email the completed and signed Form of Proxy to proxy@computershare.co.za Proxy If you hold your shares in certificated format with Computershare or in dematerialised format with a CSDP, you can use the online proxy facility to complete your Form of Proxy. This online proxy facility is free of charge and is available on the internet. To make use of the online proxy, you are required to register for the service via the website at www.web.lumiagm.com You will be able to view a demonstration of the online proxy facility once you have registered for the service. You can, from 09:00 on Tuesday, 28 May 2024, access the online proxy facility to appoint a proxy to attend the AGM virtually on your behalf. Gold Fields Notice of Annual General Meeting 2023 17 Notice of Annual General Meeting continued Disclosures in regard to JSE Listings Requirements applying to special resolution 4 Major shareholders For details of the major shareholders of the Company shareholding structure, see the Company’s 2023 AFS. Share capital of Company Authorised 2,000,000,000 ordinary shares, no par value Issued 895 024 247 ordinary shares, no par value For further details of the share capital of the Company, see the Company’s 2023 AFS. Directors’ responsibility statement The directors of the Company collectively and individually accept full responsibility for the accuracy of the information pertaining to special resolution number 4 (Acquisition of the Company’s own shares) and certify that, to the best of their knowledge and belief, there are no facts that have been omitted, which would make any statement false or misleading, and that all reasonable enquiries to ascertain such facts have been made and that special resolution number 4 contains all information required by law and the JSE Listings Requirements. Material changes Other than the facts and developments reported on in the 2023 AFR, no material changes in the financial position or trading of the Group have occurred since the end of the financial period, being 31 December 2023, and the date of this Notice of AGM. Company Secretary Anré Weststrate 18 Gold Fields Notice of Annual General Meeting 2023

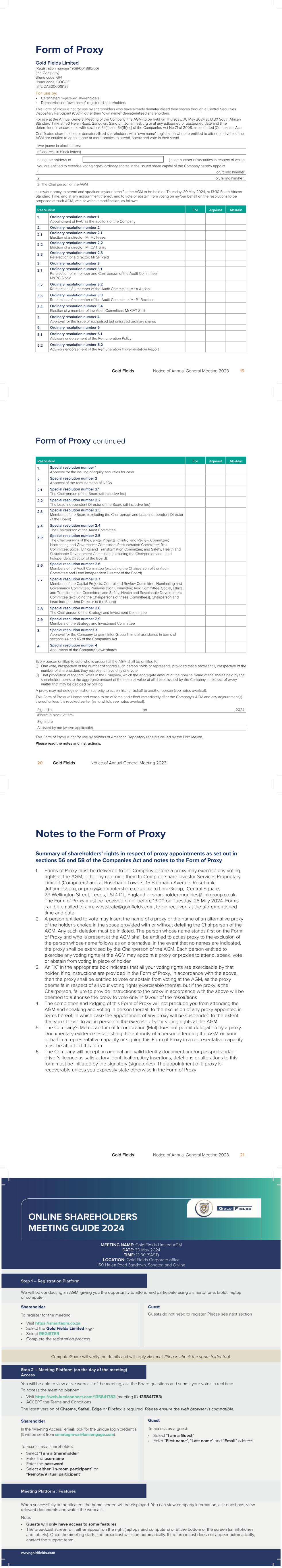

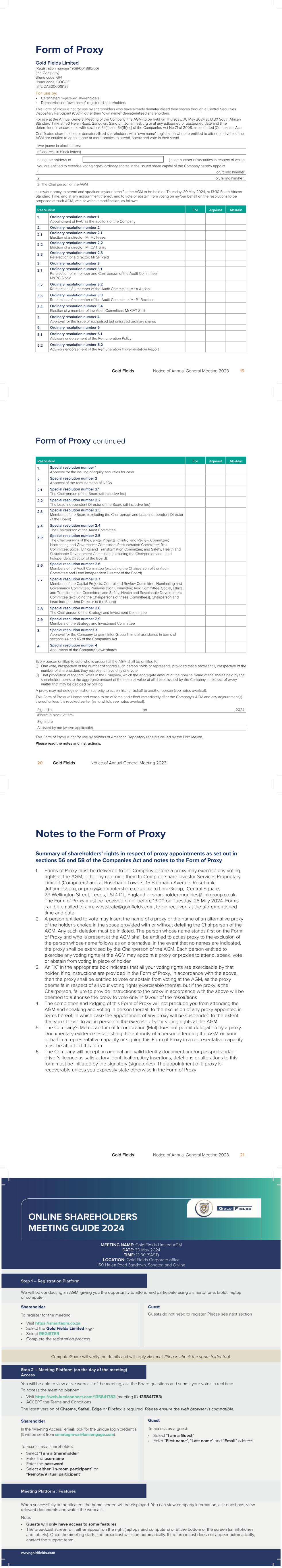

Form of Proxy Gold Fields Limited (Registration number 1968/004880/06) (the Company) Share code: GFI Issuer code: GOGOF ISIN: ZAE000018123 For use by: • Certificated registered shareholders • Dematerialised “own name” registered shareholders This Form of Proxy is not for use by shareholders who have already dematerialised their shares through a Central Securities Depositary Participant (CSDP) other than “own name” dematerialised shareholders. For use at the Annual General Meeting of the Company (the AGM) to be held on Thursday, 30 May 2024 at 13:30 South African Standard Time at 150 Helen Road, Sandown, Sandton, Johannesburg or at any adjourned or postponed date and time determined in accordance with sections 64(4) and 64(11)(a)(i) of the Companies Act No 71 of 2008, as amended (Companies Act). Certificated shareholders or dematerialised shareholders with “own name” registration who are entitled to attend and vote at the AGM are entitled to appoint one or more proxies to attend, speak and vote in their stead. I/we (name in block letters) of (address in block letters) being the holder/s of (insert number of securities in respect of which you are entitled to exercise voting rights) ordinary shares in the issued share capital of the Company hereby appoint 1. or, failing him/her 2. or, failing him/her, 3. The Chairperson of the AGM as my/our proxy to attend and speak on my/our behalf at the AGM to be held on Thursday, 30 May 2024, at 13:30 South African Standard Time, and at any adjournment thereof, and to vote or abstain from voting on my/our behalf on the resolutions to be proposed at such AGM, with or without modification, as follows: 2. Ordinary resolution number 2 2.1 Ordinary resolution number 2.1 Election of a director: Mr MJ Fraser 2.2 Ordinary resolution number 2.2 Election of a director: Mr CAT Smit 2.3 Ordinary resolution number 2.3 Re-election of a director: Mr SP Reid 3. Ordinary resolution number 3 3.1 Ordinary resolution number 3.1 Re-election of a member and Chairperson of the Audit Committee: Ms PG Sibiya 3.2 Ordinary resolution number 3.2 Re-election of a member of the Audit Committee: Mr A Andani 3.3 Ordinary resolution number 3.3 Re-election of a member of the Audit Committee: Mr PJ Bacchus 3.4 Ordinary resolution number 3.4 Election of a member of the Audit Committee: Mr CAT Smit 4. Ordinary resolution number 4 Approval for the issue of authorised but unissued ordinary shares 5. Ordinary resolution number 5 5.1 Ordinary resolution number 5.1 Advisory endorsement of the Remuneration Policy 5.2 Ordinary resolution number 5.2 Advisory endorsement of the Remuneration Implementation Report Resolution For Against Abstain 1. Ordinary resolution number 1 Appointment of PwC as the auditors of the Company Gold Fields Notice of Annual General Meeting 2023 19 Form of Proxy continued Resolution For Against Abstain 1. Special resolution number 1 Approval for the issuing of equity securities for cash 2. Special resolution number 2 Approval of the remuneration of NEDs 2.1 Special resolution number 2.1 The Chairperson of the Board (all-inclusive fee) 2.2 Special resolution number 2.2 The Lead Independent Director of the Board (all-inclusive fee) 2.3 Special resolution number 2.3 Members of the Board (excluding the Chairperson and Lead Independent Director of the Board) 2.4 Special resolution number 2.4 The Chairperson of the Audit Committee 2.5 Special resolution number 2.5 The Chairpersons of the Capital Projects, Control and Review Committee; Nominating and Governance Committee; Remuneration Committee; Risk Committee; Social, Ethics and Transformation Committee; and Safety, Health and Sustainable Development Committee (excluding the Chairperson and Lead Independent Director of the Board); 2.6 Special resolution number 2.6 Members of the Audit Committee (excluding the Chairperson of the Audit Committee and Lead Independent Director of the Board) 2.7 Special resolution number 2.7 Members of the Capital Projects, Control and Review Committee; Nominating and Governance Committee; Remuneration Committee; Risk Committee; Social, Ethics and Transformation Committee; and Safety, Health and Sustainable Development Committee (excluding the Chairpersons of these Committees), Chairperson and Lead Independent Director of the Board) 2.8 Special resolution number 2.8 The Chairperson of the Strategy and Investment Committee 2.9 Special resolution number 2.9 Members of the Strategy and Investment Committee 3. Special resolution number 3 Approval for the Company to grant inter-Group financial assistance in terms of sections 44 and 45 of the Companies Act 4. Special resolution number 4 Acquisition of the Company’s own shares Every person entitled to vote who is present at the AGM shall be entitled to: (i) One vote, irrespective of the number of shares such person holds or represents, provided that a proxy shall, irrespective of the number of shareholders they represent, have only one vote (ii) That proportion of the total votes in the Company, which the aggregate amount of the nominal value of the shares held by the shareholder bears to the aggregate amount of the nominal value of all shares issued by the Company in respect of every matter that may be decided by polling A proxy may not delegate his/her authority to act on his/her behalf to another person (see notes overleaf). This Form of Proxy will lapse and cease to be of force and effect immediately after the Company’s AGM and any adjournment(s) thereof unless it is revoked earlier (as to which, see notes overleaf). Signed at on 2024 (Name in block letters) Signature Assisted by me (where applicable) This Form of Proxy is not for use by holders of American Depository receipts issued by the BNY Mellon. Please read the notes and instructions. 20 Gold Fields Notice of Annual General Meeting 2023 Notes to the Form of Proxy Summary of shareholders’ rights in respect of proxy appointments as set out in sections 56 and 58 of the Companies Act and notes to the Form of Proxy 1. Forms of Proxy must be delivered to the Company before a proxy may exercise any voting rights at the AGM, either by returning them to Computershare Investor Services Proprietary Limited (Computershare) at Rosebank Towers, 15 Biermann Avenue, Rosebank, Johannesburg, or proxy@computershare.co.za; or to Link Group, Central Square, 29 Wellington Street, Leeds, LSI 4 DL, England or shareholderenquiries@linkgroup.co.uk. The Form of Proxy must be received on or before 13:00 on Tuesday, 28 May 2024. Forms can be emailed to anre.weststrate@goldfields.com, to be received at the aforementioned time and date 2. A person entitled to vote may insert the name of a proxy or the name of an alternative proxy of the holder’s choice in the space provided with or without deleting the Chairperson of the AGM. Any such deletion must be initiated. The person whose name stands first on the Form of Proxy and who is present at the AGM shall be entitled to act as proxy to the exclusion of the person whose name follows as an alternative. In the event that no names are indicated, the proxy shall be exercised by the Chairperson of the AGM. Each person entitled to exercise any voting rights at the AGM may appoint a proxy or proxies to attend, speak, vote or abstain from voting in place of holder 3. An “X” in the appropriate box indicates that all your voting rights are exercisable by that holder. If no instructions are provided in the Form of Proxy, in accordance with the above, then the proxy shall be entitled to vote or abstain from voting at the AGM, as the proxy deems fit in respect of all your voting rights exercisable thereat, but if the proxy is the Chairperson, failure to provide instructions to the proxy in accordance with the above will be deemed to authorise the proxy to vote only in favour of the resolutions 4. The completion and lodging of this Form of Proxy will not preclude you from attending the AGM and speaking and voting in person thereat, to the exclusion of any proxy appointed in terms hereof, in which case the appointment of any proxy will be suspended to the extent that you choose to act in person in the exercise of your voting rights at the AGM 5. The Company’s Memorandum of Incorporation (MoI) does not permit delegation by a proxy. Documentary evidence establishing the authority of a person attending the AGM on your behalf in a representative capacity or signing this Form of Proxy in a representative capacity must be attached this form 6. The Company will accept an original and valid identity document and/or passport and/or driver’s licence as satisfactory identification. Any insertions, deletions or alterations to this form must be initiated by the signatory (signatories). The appointment of a proxy is recoverable unless you expressly state otherwise in the Form of Proxy Gold Fields Notice of Annual General Meeting 2023 21

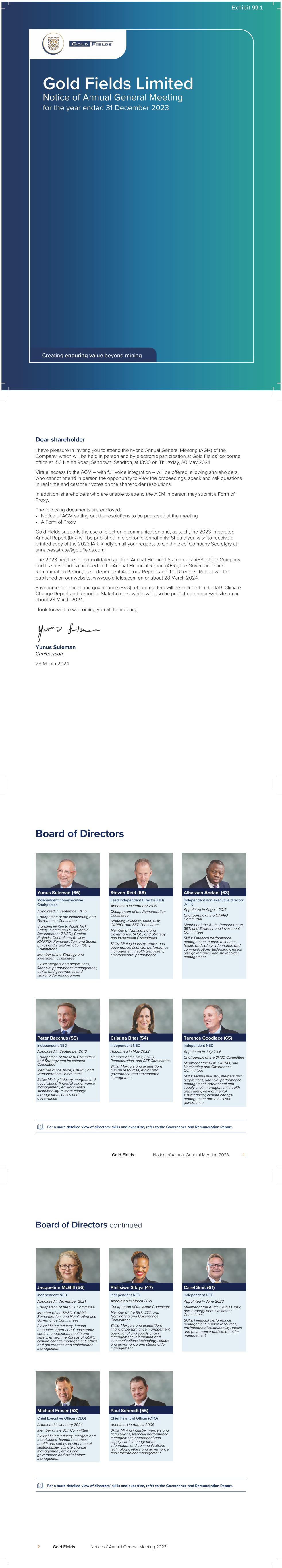

Administration and corporate information Company Secretary Anré Weststrate Tel: +27 11 562 9719 Email: anre.weststrate@goldfields.com Registered office Johannesburg Gold Fields Limited 150 Helen Road Sandown Sandton 2196 Postnet Suite 252 Private Bag X30500 Houghton 2041 Tel: +27 11 562 9700 Office of the United Kingdom Secretaries London St James’s Corporate Services Limited Second Floor 107 Cheapside London EC2V 6DN United Kingdom Tel: +44(0) 20 7796 8644 Email: general@corpserv.co.uk American depository receipts transfer agent Shareholder correspondence should be mailed to: BNY Mellon PO Box 43006 Providence RI 02940-3078 Overnight correspondence should be sent to: BNY Mellon 150 Royall Street, Suite 101 Canton, MA 02021 Email: shrrelations@cpushareownerservices.com Tel: 866 247 3871 Domestic Tel: 201 680 6825 Foreign Sponsor J.P. Morgan Equities South Africa Proprietary Limited 1 Fricker Road Illovo, Johannesburg 2196 South Africa Gold Fields Limited Incorporated in the Republic of South Africa Registration number 1968/004880/06 Share code: GFI Issuer code: GOGOF ISIN: ZAE000018123 Investor enquiries Jongisa Magagula Tel: +27 11 562 9775 Mobile: +27 067 419 9503 Email: jongisa.magagula@goldfields.com Thomas Mengel Tel: +27 11 562 9849 Mobile: +27 72 493 5170 Email: thomas.mengel@goldfields.com Media enquiries Sven Lunsche Tel: +27 11 562 9763 Mobile: +27 83 260 9279 Email: sven.lunsche@goldfields.com 24 Gold Fields Notice of Annual General Meeting 2023 Administration and corporate information continued Transfer secretaries South Africa Computershare Investor Services Proprietary Limited Rosebank Towers 15 Biermann Avenue Rosebank Johannesburg 2196 Private Bag X9000 Saxonwold 2132 Tel: +27 11 370 5000 Fax: +27 11 688 5248 United Kingdom Link Group Central Square 29 Wellington Street Leeds, LSI 4 DL England Tel: 0371 664 030 If you are outside the United Kingdom please call +(0) 371 664 0300 Calls are charged at the standard geographic rate and will vary by provider. Calls outside the United Kingdom will be charged at the applicable international rate. Lines are open between 09:00 – 17:30, Monday to Friday, excluding public holidays in England and Wales. Email: shareholderenquiries@linkgroup.co.uk Listings JSE/NYSE Directors: YGH Suleman (Chairperson), MJ Fraser* (Chief Executive Officer), PA Schmidt* (Chief Financial Officer), A Andani#, PJ Bacchus†, MC Bitar@, TP Goodlace, JE McGill^, SP Reid^, PG Sibiya, CAT Smit South African unless otherwise stated. ˆAustralian, †British, @Chilean, #Ghanaian, *Executive director