Salient Features Media Release Poor safety start in Q1 2023 The safety of our people remains our overriding priority. Tragically, in Q1 2023, we had a fatal incident at our Tarkwa mine in Ghana, where a sub-contractor was killed in a workshop accident. Furthermore, two contractors died after a vehicle accident at the Galiano Gold-managed Asanko joint venture (JV), also in Ghana. On behalf of Gold Fields, I would like to extend our deepest condolences to the families of those affected and reiterate our commitment to continuously strengthening our safety systems, standards, and behaviours. Solid operational performance Group attributable equivalent gold production was 577koz, largely flat year on year (YoY) (down 4% quarter on quarter (QoQ)). Group production remains on track to deliver the FY 2023 guidance provided in February 2023. Group AISC for the quarter was US$1,152/oz, also largely flat YoY and up 8% QoQ. AIC for the Group was US$1,343/oz, 2% higher YoY (up 3% QoQ) due to higher capital expenditure at the Salares Norte project. Net debt at the end of the quarter was US$875m, compared to US$704m at the end of December 2022, primarily driven by the payment of the final dividend of US$215m and a non-controlling interest holders dividend of US$3m. The Group generated free cash flow of US$83m in Q1 2023. The balance sheet remains in a very strong position, with net debt to EBITDA at the end of the quarter of 0.36x, compared to 0.29x at the end of Q4 2022. Q1 2023 operational performance The Australian region produced 243koz, down 6% YoY (down 12% QoQ) at AIC of A$1,812/oz (US$1,239/oz) (up 6% YoY and up 16% QoQ) and AISC of A$1,658/oz (US$1,134/oz) (up 3% YoY and up 19% QoQ). South Africa reported Q1 2023 production of 88koz, 13% higher YoY (up 16% QoQ) at AIC of R751,830/kg (US$1,317/oz) (up 7% YoY and down 7% QoQ) and AISC of R751,830/kg (US$1,317/oz) (up 12% YoY and down 1% QoQ). Our mines in Ghana produced 193koz (including 45% of Asanko), down 8% YoY (down 3% QoQ), at AIC of US$1,193/oz (down 2% YoY and down 8% QoQ) and AISC of US$1,169/oz (down 1% YoY and down 8% QoQ). Production at Cerro Corona in Peru was 75koz (gold equivalent), 34% higher YoY, mainly due to lower gold and copper grades mined in the March 2022 quarter in line with the mining plan (up 6% QoQ) at AIC of US$853 per gold equivalent ounce (down 15% YoY and down 15% QoQ) and AISC of US$777 per gold equivalent ounce (down 19% YoY and down 13% QoQ). Update on Salares Norte The Salares Norte project continued to make positive progress during the March quarter. Total construction progress at the end of March was 90.3% compared to 85.7% at the end of Q4 2022. The project is fully staffed with the camp at full capacity. In addition to completing construction, the focus at the project includes dealing with punch list items to ensure successful commissioning. Total project progress was 90.4% as at the end of March 2023 compared to 86.7% at the end of December 2022. Total spend for the March quarter was US$115m, comprising of US$92m in capital expenditure, US$10m in exploration expenditure and a US$13m investment in working capital. 577,000 ounces of attributable production US$1,152 per ounce of all-in sustaining cost US$1,343 per ounce of all-in cost JOHANNESBURG, 04 May 2023: Gold Fields Limited (JSE and NYSE: GFI) is pleased to provide an operational update for the quarter ended 31 March 2023. Detailed financial and operational results are provided on a six-monthly basis i.e. at the end of June and December. Total tonnes mined for the March quarter increased by 14% to 8.9Mt (including 420kt of ore containing 97koz of gold) from 7.8Mt for the December quarter (including 422kt of ore containing 79koz of gold). As a result, there were 176koz on stockpile at the end of March. As guided in February 2023, first production is expected during Q4 2023, with a quick ramp-up in 2024. The project capex remains on track to meet revised guidance of US$1,020m. Outlook and 2023 guidance unchanged Gold Fields remains on track to meet the original production and cost guidance provided in February 2023. Attributable gold equivalent production (excluding Asanko) is expected to be between 2.25Moz – 2.30Moz (2022 comparable was 2.32Moz). AISC is expected to be between US$1,300/oz – US$1,340/oz, with AIC expected to be US$1,480/oz – US$1,520/oz. The exchange rates used for our 2023 guidance are: R/US$17.00 and US$/A$0.70. Integrated reporting At the end of March, we released a suite of reports under the umbrella of the 2022 Integrated Annual Report (IAR). These include the IAR itself, the Annual Financial Report (including our Governance Report), the Mineral Resource and Reserve supplement and the Climate Change Report, produced in line with the recommendations of the Task Force on Climate-related Financial Disclosure (TCFD). This was followed up in early May with the 2022 Report to Stakeholders and the GRI Content Index. Operational update for the quarter ended 31 March 2023

Environmental, social and governance (ESG) highlights In December 2021, we took a significant step by committing to a range of 2030 ESG targets, which we started implementing during 2022. The table below lists our six ESG priorities, the respective 2030 targets and how we performed against these targets during 2022. As part of our market presentation, we will highlight our progress against these priorities. Our ESG priorities, 2030 targets and 2022 performance Priority Category 2030 targets 2022 performance Comment Safety, health, well-being and the environment Fatalities 0 1 Read more in the safety section Serious injuries 0 5 Serious environmental incidents 0 0 Fourth consecutive year of zero serious environmental incidents Gender diversity Female representation 30% of total workforce 23% On track to meet 2030 target Stakeholder value creation Total value creation for host communities 30% of total value creation 27% On track to meet 2030 target New legacy programmes for host communities 6 0 On track to meet 2030 target Decarbonisation Reduce absolute emissions from 2016 baseline (Scope 1 and 2) 50% 18% Achieved through energy efficiency initiatives and renewable energy projects as two major projects were commissioned in 2022 Reduce net emissions from 2016 baseline (Scope 1 and 2) 30% +1% Increased net emissions in 2022. The impact of the new renewable projects will be felt in 2023 Tailings management Global Industry Standard on Tailings Management Conform by 2025 On track Priority facilities to comply by August 2023, the remainder by 2025 Reduce the number of active upstream-raised tailings storage facilities (TSFs) 3 5 Working towards the transition of Tarkwa TSFs 1 and 2 from upstream to downstream-raised facilities by end-2024 Water stewardship Water recycled or reused 80% of total water used 75% of total water used On track to meet 2030 targets Reduce freshwater use from 2018 baseline 45% 41% Underpinned by a strong commitment to sound corporate governance, compliance and ethics 2 Gold Fields Operational update for the quarter ended 31 March 2022

Gold Fields partners with Osisko to develop the Windfall Project On 2 May, we announced a partnership with Osisko Mining to develop and mine the world class underground Windfall Project in Québec, Canada, now known as the Windfall Mining Group. Under executed and implemented transaction agreements, Gold Fields, through a 100% held Canadian subsidiary, has acquired a 50% interest in the feasibility stage Windfall Project (including exploration potential) on the following key terms: • Cash payment of C$300m (c.US$220m) paid on signing; • Cash payment of C$300m payable on issuance of key permits by the Deputy Minister of Québec’s Ministère de l’Environnement, de la Lutte contre les changements climatiques, de la Faune et des Parcs (MELCCFP) to the Partnership authorising the construction and operation of the Windfall Project; and • 50/50 co-share of interim and construction capital expenditures. In addition, we have also acquired a 50% up-front vested interest in Osisko’s highly prospective Urban Barry and Quévillon district exploration camps, totalling approximately 2,400km2 (Exploration Properties), which will be co-explored and co-developed under the Partnership. In exchange, Gold Fields will fund the first C$75m in regional exploration on those Exploration Properties over the first seven years of the Partnership. Delivering on our strategy Our strategy is made of three pillars, as communicated towards the end of 2021 and reaffirmed to the market earlier this year, namely: • Pillar 1: Maximise the potential of our current assets through people and innovation • Pillar 2: Build on our leading commitment to ESG • Pillar 3: Grow the value and quality of our portfolio of assets Our progress against pillar 1 continued during Q1 with the asset optimisation programme kicking off at St Ives and then moving on to Tarkwa. We expect to provide more detail on this work later in 2023. In addition, during the quarter, Gold Fields and AngloGold Ashanti announced an agreement on the key terms of a proposed joint venture between Gold Fields’ Tarkwa and AngloGold Ashanti’s neighbouring Iduapriem mines in Ghana. Initial engagement with the government occurred in March, with formal negotiations expected to commence later in May 2023. This is a good example of a value accretive transaction that is focused on maximising the potential at one of our cornerstone assets. As highlighted above, we continue to make good progress on our six ESG priorities and are on track to meet our 2030 targets. As previously communicated, Gold Fields will continue to look at value accretive inorganic opportunities to bolster our pipeline. These options will include greenfields targets, development projects or bolt-on acquisitions of producing assets. The recently announced partnership with Osisko Mining and the joint venture with AngloGold Ashanti in Ghana demonstrates our commitment to growing the value and quality of our portfolio of assets. Further, adding in Salares Norte, which is expected to come into production at the end of this year, strengthens Gold Fields’ future production profile and enhances its position on the cost curve. Martin Preece Interim Chief Executive Officer 04 May 2023 3

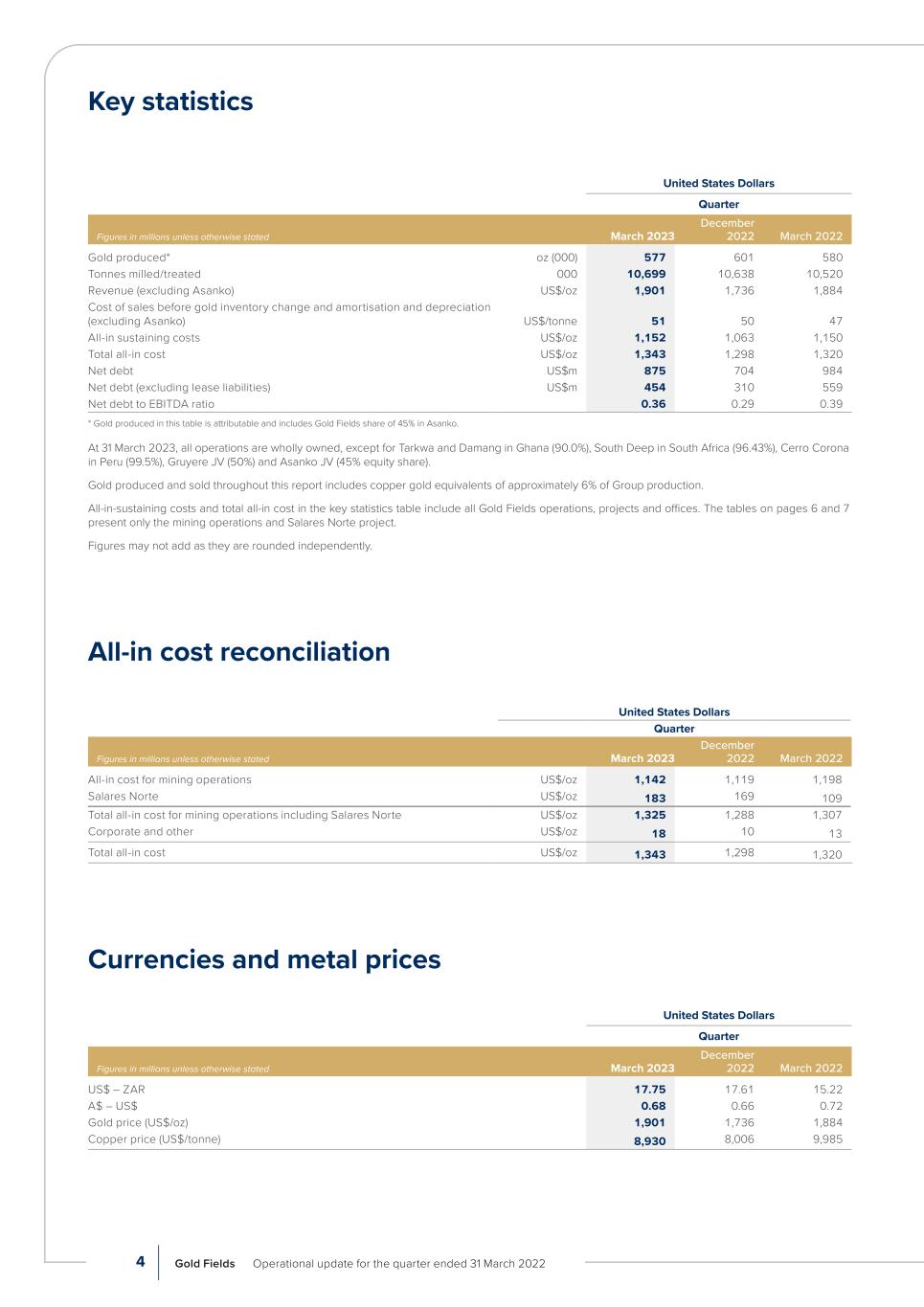

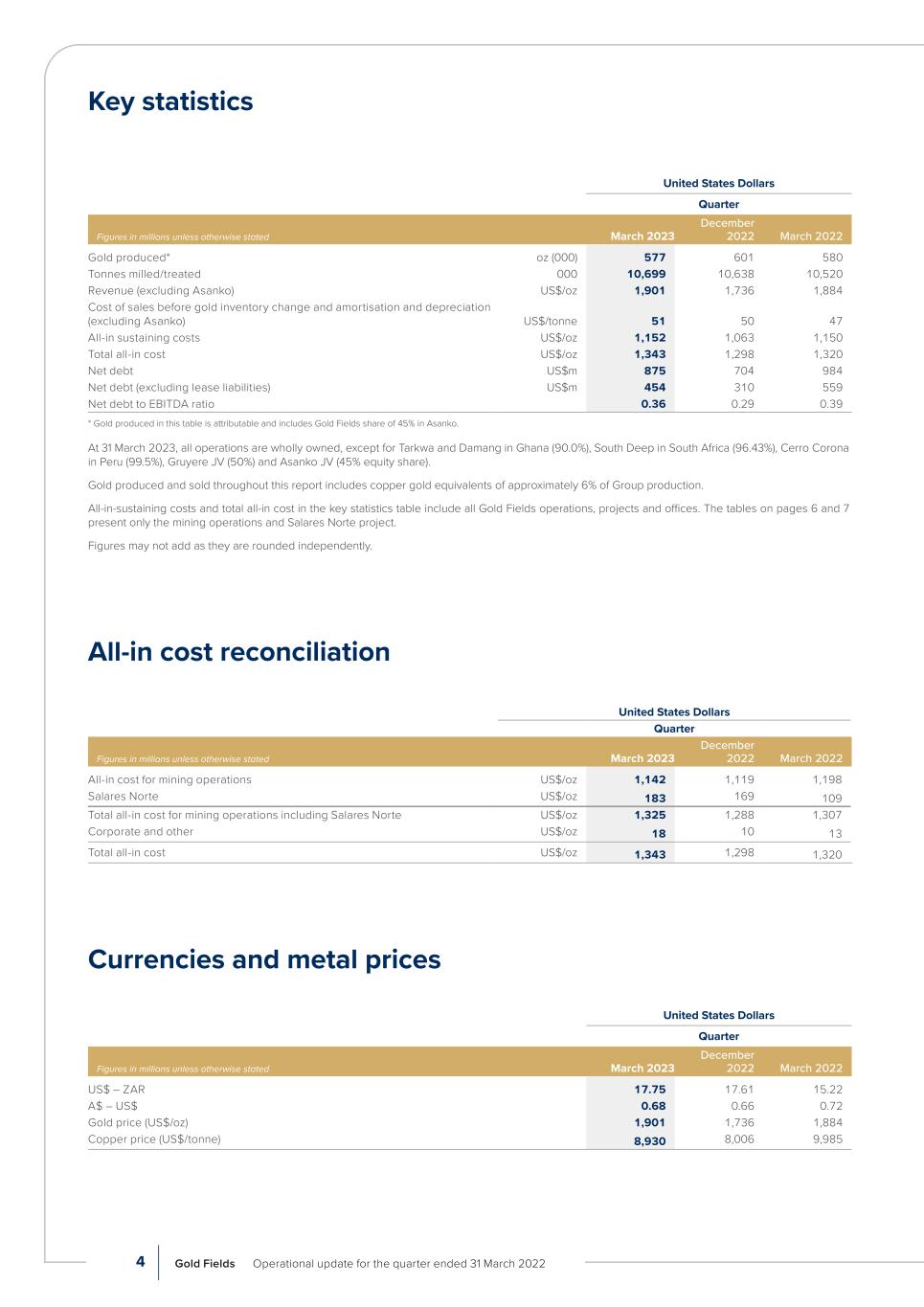

Key statistics United States Dollars Quarter Figures in millions unless otherwise stated March 2023 December 2022 March 2022 Gold produced* oz (000) 577 601 580 Tonnes milled/treated 000 10,699 10,638 10,520 Revenue (excluding Asanko) US$/oz 1,901 1,736 1,884 Cost of sales before gold inventory change and amortisation and depreciation (excluding Asanko) US$/tonne 51 50 47 All-in sustaining costs US$/oz 1,152 1,063 1,150 Total all-in cost US$/oz 1,343 1,298 1,320 Net debt US$m 875 704 984 Net debt (excluding lease liabilities) US$m 454 310 559 Net debt to EBITDA ratio 0.36 0.29 0.39 * Gold produced in this table is attributable and includes Gold Fields share of 45% in Asanko. At 31 March 2023, all operations are wholly owned, except for Tarkwa and Damang in Ghana (90.0%), South Deep in South Africa (96.43%), Cerro Corona in Peru (99.5%), Gruyere JV (50%) and Asanko JV (45% equity share). Gold produced and sold throughout this report includes copper gold equivalents of approximately 6% of Group production. All-in-sustaining costs and total all-in cost in the key statistics table include all Gold Fields operations, projects and offices. The tables on pages 6 and 7 present only the mining operations and Salares Norte project. Figures may not add as they are rounded independently. All-in cost reconciliation United States Dollars Quarter Figures in millions unless otherwise stated March 2023 December 2022 March 2022 All-in cost for mining operations US$/oz 1,142 1,119 1,198 Salares Norte US$/oz 183 169 109 Total all-in cost for mining operations including Salares Norte US$/oz 1,325 1,288 1,307 Corporate and other US$/oz 18 10 13 Total all-in cost US$/oz 1,343 1,298 1,320 Currencies and metal prices United States Dollars Quarter Figures in millions unless otherwise stated March 2023 December 2022 March 2022 US$ – ZAR 17.75 17.61 15.22 A$ – US$ 0.68 0.66 0.72 Gold price (US$/oz) 1,901 1,736 1,884 Copper price (US$/tonne) 8,930 8,006 9,985 4 Gold Fields Operational update for the quarter ended 31 March 2022

STOCK DATA FOR THE THREE MONTHS ENDED 31 MARCH 2023 Number of shares in issue JSE LIMITED – (GFI) – at end March 2023 893,527,657 Range – Quarter ZAR163.82 – ZAR243.42 – average for the period 892,649,602 Average volume – Quarter 3,598,531 shares/day Free float 100 per cent NYSE – (GFI) ADR ratio 1:1 Range – Quarter US$9.05 – US$13.50 Bloomberg/Reuters GFISJ/GFLJ.J Average volume – Quarter 5,697,296 shares/day 5

Salient features and cost benchmarks United States Dollars Australian Dollars Figures are in millions unless otherwise stated Total Mine Operations and projects including Equity- Accounted Joint Venture Total Mine Operations and projects excluding Equity- Accounted Joint Venture Australia Region Australia Region Australia Australia Total Gruyere 50% Granny Smith St Ives Agnew Total Gruyere 50% Granny Smith St Ives Agnew Operating results Ore milled/treated (000 tonnes) Mar 2023 10,699 9,994 2,949 1,234 407 990 318 2,949 1,234 407 990 318 Dec 2022 10,638 9,955 2,698 1,066 396 917 319 2,698 1,066 396 917 319 Mar 2022 10,520 9,853 2,772 1,071 389 1,021 292 2,772 1,071 389 1,021 292 Yield (grams per tonne) Mar 2023 1.7 1.8 2.6 1.0 4.6 2.9 4.7 2.6 1.0 4.6 2.9 4.7 Dec 2022 1.8 1.9 3.2 1.1 6.0 3.5 5.9 3.2 1.1 6.0 3.5 5.9 Mar 2022 1.8 1.8 2.9 1.0 5.3 2.9 6.7 2.9 1.0 5.3 2.9 6.7 Gold produced (000 managed equivalent ounces) Mar 2023 598.8 584.1 242.8 41.3 60.8 92.7 48.0 242.8 41.3 60.8 92.7 48.0 Dec 2022 622.7 607.3 276.2 37.1 76.6 101.9 60.6 276.2 37.1 76.6 101.9 60.6 Mar 2022 602.0 582.9 258.4 35.6 65.9 93.9 63.0 258.4 35.6 65.9 93.9 63.0 Gold produced (000 attributable equivalent ounces) Mar 2023 577.5 562.8 242.8 41.3 60.8 92.7 48.0 242.8 41.3 60.8 92.7 48.0 Dec 2022 601.2 585.8 276.2 37.1 76.6 101.9 60.6 276.2 37.1 76.6 101.9 60.6 Mar 2022 579.9 560.8 258.4 35.6 65.9 93.9 63.0 258.4 35.6 65.9 93.9 63.0 Gold sold (000 managed equivalent ounces) Mar 2023 610.2 594.3 248.6 41.8 60.9 98.0 47.8 248.6 41.8 60.9 98.0 47.8 Dec 2022 612.7 597.3 270.3 37.1 76.1 96.9 60.2 270.3 37.1 76.1 96.9 60.2 Mar 2022 602.4 583.5 255.3 35.1 59.7 95.9 64.5 255.3 35.1 59.7 95.9 64.5 Cost of sales before amortisation and depreciation (million) Mar 2023 (474.0) (458.0) (199.8) (30.7) (50.5) (73.0) (45.5) (292.1) (44.9) (73.9) (106.8) (66.6) Dec 2022 (438.0) (423.2) (166.0) (24.1) (46.6) (50.8) (44.5) (255.4) (36.8) (71.5) (79.1) (68.0) Mar 2022 (477.2) (452.8) (198.3) (23.7) (46.1) (79.4) (49.0) (273.9) (32.7) (63.7) (109.7) (67.7) Cost of sales before gold inventory change and amortisation and depreciation (dollar per tonne) Mar 2023 49 51 72 22 131 84 152 105 33 192 122 222 Dec 2022 48 50 74 28 118 84 142 112 43 180 127 216 Mar 2022 46 47 69 25 136 63 162 95 34 188 87 223 Sustaining capital (million) Mar 2023 (160.9) (158.7) (48.5) (8.0) (14.2) (14.4) (11.9) (70.9) (11.7) (20.8) (21.1) (17.4) Dec 2022 (156.5) (154.3) (50.0) (7.6) (20.9) (10.5) (11.1) (77.2) (11.7) (31.2) (17.2) (17.1) Mar 2022 (161.0) (160.5) (66.0) (9.1) (13.3) (28.1) (15.5) (91.2) (12.6) (18.3) (38.8) (21.5) Non-sustaining capital (million) Mar 2023 (87.5) (86.3) (19.5) — (7.7) (4.2) (7.6) (28.5) — (11.3) (6.2) (11.1) Dec 2022 (108.1) (107.7) (23.0) — (10.1) (4.8) (8.1) (34.8) — (15.3) (7.2) (12.3) Mar 2022 (89.8) (89.2) (16.0) — (7.3) (0.2) (8.6) (22.2) — (10.1) (0.2) (11.8) Total capital expenditure (million) Mar 2023 (248.4) (245.0) (68.0) (8.0) (21.9) (18.6) (19.5) (99.4) (11.7) (32.1) (27.3) (28.5) Dec 2022 (264.6) (262.0) (73.0) (7.6) (31.0) (15.3) (19.2) (112.0) (11.7) (46.5) (24.4) (29.4) Mar 2022 (250.8) (249.7) (82.0) (9.1) (20.6) (28.3) (24.1) (113.4) (12.6) (28.4) (39.0) (33.3) All-in-sustaining costs (dollar per ounce) Mar 2023 1,135 1,131 1,134 1,061 1,200 999 1,390 1,658 1,552 1,756 1,461 2,032 Dec 2022 1,052 1,048 903 986 982 713 1,060 1,389 1,508 1,494 1,116 1,622 Mar 2022 1,136 1,122 1,161 1,088 1,133 1,217 1,142 1,604 1,503 1,565 1,681 1,577 Total all-in-cost (dollar per ounce) Mar 2023 1,325 1,323 1,239 1,077 1,340 1,079 1,580 1,812 1,575 1,960 1,578 2,311 Dec 2022 1,288 1,289 1,020 989 1,140 807 1,228 1,565 1,513 1,734 1,257 1,878 Mar 2022 1,307 1,295 1,241 1,088 1,279 1,244 1,285 1,714 1,503 1,767 1,718 1,775 Average exchange rates were US$1 = R17.75, US$1 = R17.61 and US$1 = R15.22 for the March 2023, December 2022 and March 2022 quarters, respectively. The Australian/US Dollar exchange rates were A$1 = US$0.68, A$1 = US$0.66 and A$1 = US$0.72 for March 2023, December 2022 and March 2022 quarters, respectively. Figures may not add as they are rounded independently. 6 Gold Fields Operational update for the quarter ended 31 March 2022

United States Dollars South African Rand United States Dollars Figures are in millions unless otherwise stated South Africa Region Ghana Region South American Region Chile Peru South Deep South Deep Total Damang Tarkwa Asanko* 45% Total Salares Norte Project Cerro Corona Operating results Ore milled/treated (000 tonnes) Mar 2023 742 742 5,322 1,182 3,435 705 1,687 — 1,687 Dec 2022 739 739 5,522 1,224 3,615 683 1,678 — 1,678 Mar 2022 734 734 5,286 1,171 3,447 667 1,729 — 1,729 Yield (grams per tonne) Mar 2023 3.7 3.7 1.1 1.0 1.3 0.6 1.4 — 1.4 Dec 2022 3.2 3.2 1.1 1.1 1.2 0.7 1.3 — 1.3 Mar 2022 3.3 3.3 1.2 1.6 1.2 0.9 1.0 — 1.0 Gold produced (000 managed equivalent ounces) Mar 2023 87.9 2,734 193.0 39.5 138.8 14.7 75.1 — 75.1 Dec 2022 76.1 2,368 199.6 44.7 139.6 15.3 70.7 — 70.7 Mar 2022 78.0 2,425 209.5 62.0 128.5 19.1 56.1 — 56.1 Gold produced (000 attributable equivalent ounces) Mar 2023 84.8 2,636 175.2 35.5 124.9 14.7 74.7 — 74.7 Dec 2022 73.4 2,283 181.2 40.2 125.7 15.3 70.4 — 70.4 Mar 2022 75.2 2,338 190.5 55.8 115.7 19.1 55.8 — 55.8 Gold sold (000 managed equivalent ounces) Mar 2023 87.1 2,708 197.7 40.5 141.4 15.8 76.8 — 76.8 Dec 2022 76.1 2,367 196.1 43.6 137.1 15.4 70.2 — 70.2 Mar 2022 78.0 2,425 209.3 62.0 128.5 18.9 59.8 — 59.8 Cost of sales before amortisation and depreciation (million) Mar 2023 (93.1) (1,651.7) (142.4) (43.3) (83.1) (16.0) (38.8) 6.2 (45.0) Dec 2022 (74.6) (1,322.4) (160.5) (43.5) (102.2) (14.8) (36.9) 5.2 (42.0) Mar 2022 (81.3) (1,237.6) (151.2) (37.1) (89.7) (24.4) (46.4) — (46.4) Cost of sales before gold inventory change and amortisation and depreciation (dollar per tonne) Mar 2023 106 1,888 34 43 33 21 32 — 31 Dec 2022 104 1,849 31 35 33 19 36 — 36 Mar 2022 110 1,679 32 47 25 39 27 — 27 Sustaining capital (million) Mar 2023 (18.6) (329.3) (59.8) (1.8) (55.8) (2.2) (34.0) (30.6) (3.4) Dec 2022 (21.0) (375.7) (65.4) (8.0) (55.3) (2.1) (20.1) (10.7) (9.4) Mar 2022 (23.4) (356.4) (68.7) (10.9) (57.2) (0.5) (2.9) — (2.9) Non-sustaining capital (million) Mar 2023 — — (1.2) — — (1.2) (66.8) (61.7) (5.1) Dec 2022 (5.6) (98.1) (3.0) (2.6) — (0.4) (76.5) (70.0) (6.5) Mar 2022 (5.3) (81.2) (3.2) (2.6) — (0.6) (65.2) (63.0) (2.2) Total capital expenditure (million) Mar 2023 (18.6) (329.3) (61.0) (1.8) (55.8) (3.4) (100.8) (92.3) (8.5) Dec 2022 (26.6) (473.8) (68.4) (10.6) (55.3) (2.5) (96.6) (80.7) (15.9) Mar 2022 (28.7) (437.6) (71.9) (13.5) (57.2) (1.1) (68.1) (63.0) (5.1) All-in-sustaining costs (dollar per ounce) Mar 2023 1,317 751,830 1,169 1,263 1,131 1,268 583# — (230) Dec 2022 1,341 763,157 1,265 1,296 1,260 1,217 — — 136 Mar 2022 1,373 671,829 1,181 891 1,269 1,538 — — (129) Total all-in-cost (dollar per ounce) Mar 2023 1,317 751,830 1,193 1,329 1,131 1,394 2,516# — (86) Dec 2022 1,415 804,575 1,293 1,420 1,260 1,227 — — 325 Mar 2022 1,441 705,316 1,213 967 1,269 1,639 — — (27) Average exchange rates were US$1 = R17.75, US$1 = R17.61 and US$1 = R15.22 for the March 2023, December 2022 and March 2022 quarters, respectively. The Australian/US Dollar exchange rates were A$1 = US$0.68, A$1 = US$0.66 and A$1 = US$0.72 for March 2023, December 2022 and March 2022 quarters, respectively. Figures may not add as they are rounded independently. * Equity-accounted JV. # Includes all-in cost with no gold sold for Salares Norte as the project is still under construction. 7

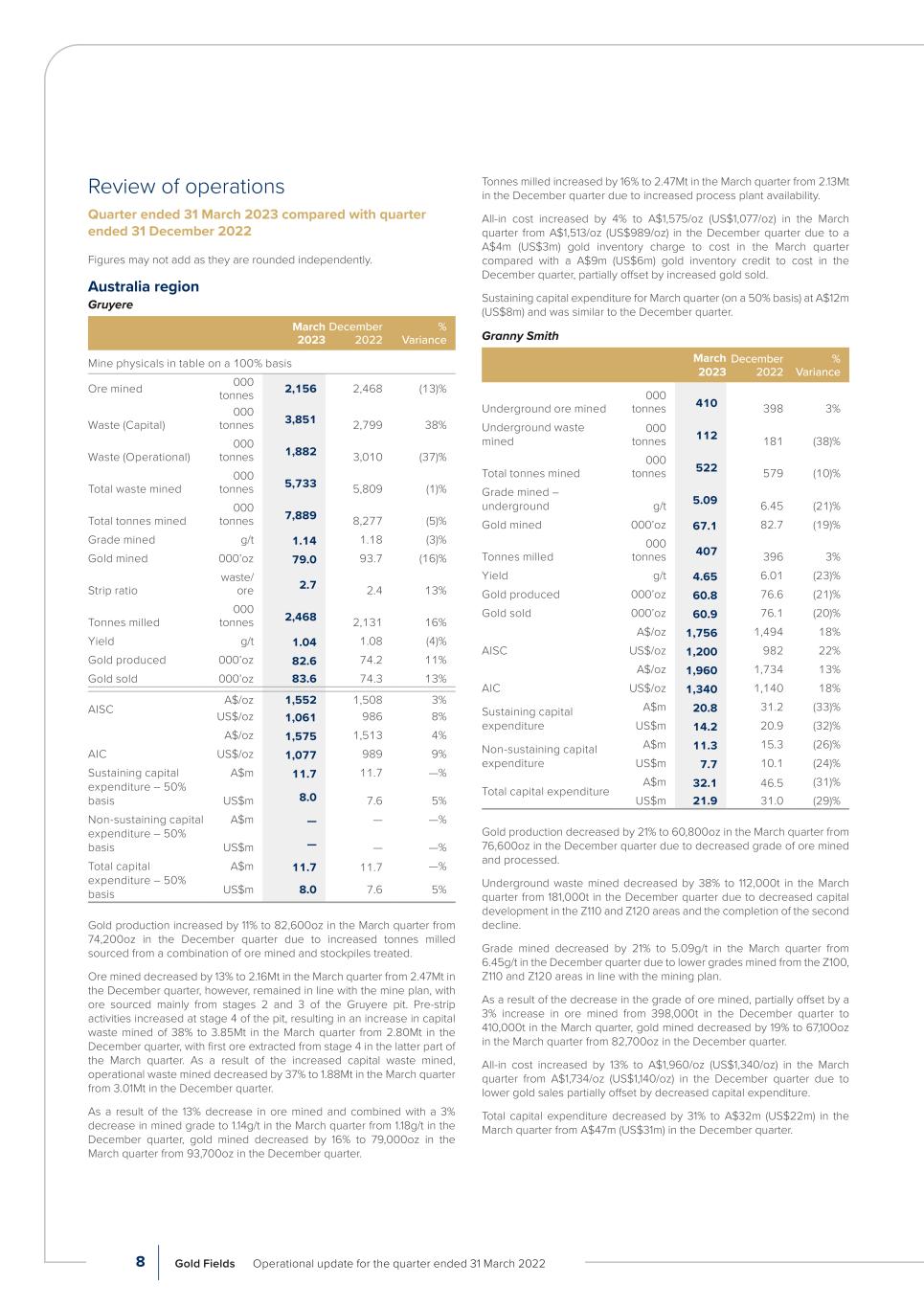

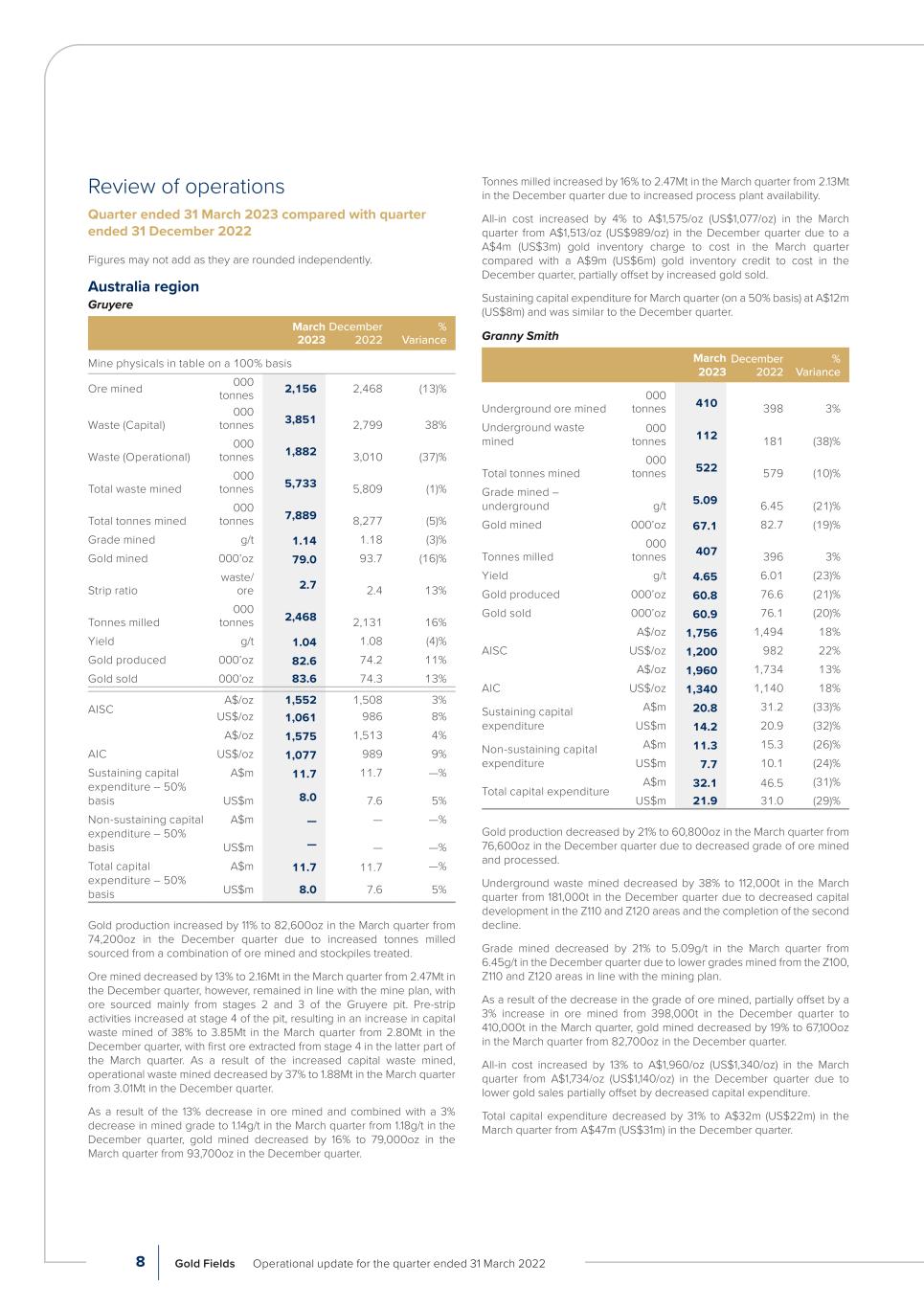

Review of operations Quarter ended 31 March 2023 compared with quarter ended 31 December 2022 Figures may not add as they are rounded independently. Australia region Gruyere March 2023 December 2022 % Variance Mine physicals in table on a 100% basis Ore mined 000 tonnes 2,156 2,468 (13)% Waste (Capital) 000 tonnes 3,851 2,799 38% Waste (Operational) 000 tonnes 1,882 3,010 (37)% Total waste mined 000 tonnes 5,733 5,809 (1)% Total tonnes mined 000 tonnes 7,889 8,277 (5)% Grade mined g/t 1.14 1.18 (3)% Gold mined 000’oz 79.0 93.7 (16)% Strip ratio waste/ ore 2.7 2.4 13% Tonnes milled 000 tonnes 2,468 2,131 16% Yield g/t 1.04 1.08 (4)% Gold produced 000’oz 82.6 74.2 11% Gold sold 000’oz 83.6 74.3 13% AISC A$/oz 1,552 1,508 3% US$/oz 1,061 986 8% AIC A$/oz 1,575 1,513 4% US$/oz 1,077 989 9% Sustaining capital expenditure – 50% basis A$m 11.7 11.7 —% US$m 8.0 7.6 5% Non-sustaining capital expenditure – 50% basis A$m — — —% US$m — — —% Total capital expenditure – 50% basis A$m 11.7 11.7 —% US$m 8.0 7.6 5% Gold production increased by 11% to 82,600oz in the March quarter from 74,200oz in the December quarter due to increased tonnes milled sourced from a combination of ore mined and stockpiles treated. Ore mined decreased by 13% to 2.16Mt in the March quarter from 2.47Mt in the December quarter, however, remained in line with the mine plan, with ore sourced mainly from stages 2 and 3 of the Gruyere pit. Pre-strip activities increased at stage 4 of the pit, resulting in an increase in capital waste mined of 38% to 3.85Mt in the March quarter from 2.80Mt in the December quarter, with first ore extracted from stage 4 in the latter part of the March quarter. As a result of the increased capital waste mined, operational waste mined decreased by 37% to 1.88Mt in the March quarter from 3.01Mt in the December quarter. As a result of the 13% decrease in ore mined and combined with a 3% decrease in mined grade to 1.14g/t in the March quarter from 1.18g/t in the December quarter, gold mined decreased by 16% to 79,000oz in the March quarter from 93,700oz in the December quarter. Tonnes milled increased by 16% to 2.47Mt in the March quarter from 2.13Mt in the December quarter due to increased process plant availability. All-in cost increased by 4% to A$1,575/oz (US$1,077/oz) in the March quarter from A$1,513/oz (US$989/oz) in the December quarter due to a A$4m (US$3m) gold inventory charge to cost in the March quarter compared with a A$9m (US$6m) gold inventory credit to cost in the December quarter, partially offset by increased gold sold. Sustaining capital expenditure for March quarter (on a 50% basis) at A$12m (US$8m) and was similar to the December quarter. Granny Smith March 2023 December 2022 % Variance Underground ore mined 000 tonnes 410 398 3% Underground waste mined 000 tonnes 112 181 (38)% Total tonnes mined 000 tonnes 522 579 (10)% Grade mined – underground g/t 5.09 6.45 (21)% Gold mined 000’oz 67.1 82.7 (19)% Tonnes milled 000 tonnes 407 396 3% Yield g/t 4.65 6.01 (23)% Gold produced 000’oz 60.8 76.6 (21)% Gold sold 000’oz 60.9 76.1 (20)% AISC A$/oz 1,756 1,494 18% US$/oz 1,200 982 22% AIC A$/oz 1,960 1,734 13% US$/oz 1,340 1,140 18% Sustaining capital expenditure A$m 20.8 31.2 (33)% US$m 14.2 20.9 (32)% Non-sustaining capital expenditure A$m 11.3 15.3 (26)% US$m 7.7 10.1 (24)% Total capital expenditure A$m 32.1 46.5 (31)% US$m 21.9 31.0 (29)% Gold production decreased by 21% to 60,800oz in the March quarter from 76,600oz in the December quarter due to decreased grade of ore mined and processed. Underground waste mined decreased by 38% to 112,000t in the March quarter from 181,000t in the December quarter due to decreased capital development in the Z110 and Z120 areas and the completion of the second decline. Grade mined decreased by 21% to 5.09g/t in the March quarter from 6.45g/t in the December quarter due to lower grades mined from the Z100, Z110 and Z120 areas in line with the mining plan. As a result of the decrease in the grade of ore mined, partially offset by a 3% increase in ore mined from 398,000t in the December quarter to 410,000t in the March quarter, gold mined decreased by 19% to 67,100oz in the March quarter from 82,700oz in the December quarter. All-in cost increased by 13% to A$1,960/oz (US$1,340/oz) in the March quarter from A$1,734/oz (US$1,140/oz) in the December quarter due to lower gold sales partially offset by decreased capital expenditure. Total capital expenditure decreased by 31% to A$32m (US$22m) in the March quarter from A$47m (US$31m) in the December quarter. 8 Gold Fields Operational update for the quarter ended 31 March 2022

Sustaining capital expenditure decreased by 33% to A$21m (US$14m) in the March quarter from A$31m (US$21m) in the December quarter following lower capital development in the Z110 and Z120 areas. Non-sustaining capital expenditure decreased by 26% to A$11m (US$8m) in the March quarter from A$15m (US$10m) in the December quarter following the completion of the second decline in 2022 and reduced development in the Z135 area. St Ives March 2023 December 2022 % Variance Underground Ore mined 000 tonnes 449 497 (10)% Waste mined 000 tonnes 149 154 (3)% Total tonnes mined 000 tonnes 598 651 (8)% Grade mined g/t 4.88 5.47 (11)% Gold mined 000’oz 70.6 87.3 (19)% Surface —% Ore mined 000 tonnes 1,077 792 36% Surface waste (Capital) 000 tonnes 362 — —% Surface waste (Operational) 000 tonnes 671 1,935 (65)% Total waste mined 000 tonnes 1,033 1,033 —% Total tonnes mined 000 tonnes 2,110 2,110 —% Grade mined g/t 1.78 1.59 12% Gold mined 000’oz 61.6 40.4 52% Strip ratio waste/ ore 1.1 2.4 (54)% Total (Underground and Surface) Total ore mined 000 tonnes 1,526 1,288 18% Total grade mined g/t 2.69 3.08 (13)% Total tonnes mined 000 tonnes 2,708 2,761 (2)% Total gold mined 000’oz 132.2 127.7 4% Tonnes milled 000 tonnes 990 917 8% Yield – underground g/t 4.27 5.23 (18)% Yield – surface g/t 1.75 1.39 26% Yield – combined g/t 2.91 3.45 (16)% Gold produced 000’oz 92.7 101.9 (9)% Gold sold 000’oz 98.0 96.9 1% AISC A$/oz 1,461 1,116 31% US$/oz 999 713 40% AIC A$/oz 1,578 1,257 26% US$/oz 1,079 807 34% Sustaining capital expenditure A$m 21.1 17.2 23% US$m 14.4 10.5 37% Non-sustaining capital expenditure A$m 6.2 7.2 (14)% US$m 4.2 4.8 (13)% Total capital expenditure A$m 27.3 24.4 12% US$m 18.6 15.3 22% Gold production decreased by 9% to 92,700oz in the March quarter from 101,900oz in the December quarter due to lower tonnes and grades mined from underground sources, partially offset by increased ore processed. At the underground operations, ore mined decreased by 10% to 449,000t in the March quarter from 497,000t in the December quarter due to a delay in the power upgrade at Invincible, with expected completion in May as well as delays in the ventilation upgrade due to the incident at Hamlet late in 2022. The plan is to re-commence raise boring in May with expected completion of this work in early Q4. Grade mined from underground operations decreased by 11% to 4.88g/t in the March quarter from 5.47g/t in the December quarter associated with lower grade stopes sequenced in the upper levels of Invincible mine. As a result of the decreased ore mined at lower grades, gold mined decreased by 19% to 70,600oz in the March quarter from 87,300oz in the December quarter. At Neptune open pit stage 7, ore mined increased by 36% to 1,077,000t in the March quarter from 792,000t in the December quarter and grade mined increased by 12% to 1.78g/t in the March quarter from 1.59g/t in the December quarter. Resultant gold mined increased by 52% to 61,600oz in the March quarter from 40,400oz in the December quarter. Operational waste mined decreased by 65% to 0.67Mt in the March quarter from 1.94Mt in the December quarter. Mining activities are scheduled to be concluded at Neptune in the June quarter. Pre-strip activities commenced at the Swiftsure open pit, with 362,000t of capital waste moved during the March quarter (December quarter – nil). The Swiftsure open pit is a small but high-grade open pit that will come into production in the second half of 2023. All-in cost increased by 26% to A$1,578/oz (US$1,079/oz) in the March quarter from A$1,257/oz (US$807/oz) in the December quarter due to increased cost of sales before amortisation and depreciation and higher capital expenditure, partially offset by higher gold sold. The increase in cost of sales before amortisation and depreciation is mainly due to a lower gold inventory credit to cost in the March quarter of A$14m (US$10m) compared with a gold inventory credit to cost of A$38m (US$26m) in the December quarter. Total capital expenditure increased by 12% to A$27m (US$19m) in the March quarter from A$24m (US$15m) in the December quarter. Sustaining capital expenditure increased by 23% to A$21m (US$14m) in the March quarter from A$17m (US$11m) in the December due to the commencement of pre-stripping at the Swiftsure open pit. Non-sustaining capital decreased by 14% to A$6m (US$4m) in the March quarter from A$7m (US$5m) in the December quarter due to timing of infrastructure expenditure at the Invincible Deep underground mine. 9

Agnew March 2023 December 2022 % Variance Underground ore mined 000 tonnes 253 313 (19)% Underground waste mined 000 tonnes 203 193 5% Total tonnes mined 000 tonnes 456 506 (10)% Grade mined – underground g/t 5.79 6.26 (8)% Gold mined 000’oz 47.2 63.1 (25)% Surface Ore mined 000 tonnes 63 3 2000% Surface waste (Capital) 000 tonnes 1,130 625 81% Surface waste (Operational) 000 tonnes 454 — —% Total waste mined 000 tonnes 1,584 1,033 53% Total tonnes mined 000 tonnes 1,647 2,110 (22)% Grade mined g/t 2.2 0.6 267% Gold mined 000’oz 4.4 0.1 4300% Strip ratio waste/ ore 25.3 234.3 (89)% Total (Underground and Surface) Total ore mined 000 tonnes 316 316 —% Total grade mined g/t 5.1 6.2 (18)% Total tonnes mined 000 tonnes 2,103 2,616 (20)% Total gold mined 000’oz 51.6 63.2 (18)% Tonnes milled 000 tonnes 318.4 319.2 —% Yield – underground g/t 5.2 5.9 (12)% Yield – surface g/t 2.1 — —% Yield – combined g/t 4.7 5.9 (20)% Gold produced 000’oz 48.0 60.6 (21)% Gold sold 000’oz 47.8 60.2 (21)% AISC A$/oz 2,032 1,622 25% US$/oz 1,390 1,060 31% AIC A$/oz 2,311 1,878 23% US$/oz 1,580 1,228 29% Sustaining capital expenditure A$m 17.4 17.1 2% US$m 11.9 11.1 7% Non-sustaining capital expenditure A$m 11.1 12.3 (10)% US$m 7.6 8.1 (6)% Total capital expenditure A$m 28.5 29.4 (3)% US$m 19.5 19.2 2% Gold production decreased by 21% to 48,000oz in the March quarter from 60,600oz in the December quarter due to decreased grade of ore mined and processed. Underground ore mined decreased by 19% to 253,000t in the March quarter from 313,000t in the December quarter due to unfavourable ground conditions causing sequencing delays in the Kath orebody at Waroonga. Overall grade mined decreased by 8% to 5.79g/t in the March quarter from 6.26g/t in the December quarter with lower grade ore mined from New Holland, in line with the mining plan. As a result of the 19% decrease in ore mined and 8% decrease in grade, gold mined from underground operations decreased by 25% to 47,200oz in the March quarter from 63,100oz in the December quarter. Pre-strip activities at the Barren Lands open pit concluded during the March quarter, with capital waste increasing by 81% to 1.13Mt from 0.63Mt in the December quarter. Ore tonnes mined of 63,000t at an average grade of 2.17g/t for 4,4Koz in the March quarter compared with ore tonnes mined of 3,000t at an average grade of 0.61g/t for 0.1Koz in the December quarter. The Barren Lands open pit will provide the gateway to the Barren Lands and Redeemer Underground Complex. The project also enables access to new underground exploration platforms. All-in cost increased by 23% to A$2,311/oz (US$1,580oz) in the March quarter from A$1,878/oz (US$1,228/oz) in the December quarter primarily due to the 21% decrease in gold sold. Total capital expenditure in the March quarter was similar to the December quarter at A$29 million (US$20m). Sustaining capital expenditure at A$17m (US$12m) for the March quarter was similar to sustaining capital expenditure in the December quarter. Non-sustaining capital expenditure decreased by 10% to A$11m (US$8m) in the March quarter from A$12m (US$8m) in the December quarter with the completion of the Agnew crushing circuit upgrade. 10 Gold Fields Operational update for the quarter ended 31 March 2022

South Africa region South Deep March 2023 December 2022 % Variance Ore mined 000 tonnes 336 400 (16)% Waste mined 000 tonnes 68 57 19% Total tonnes 000 tonnes 404 457 (12)% Grade mined – underground reef g/t 5.56 6.19 (10)% Grade mined – underground total g/t 4.62 5.42 (15)% Gold mined kg 1,869 2,472 (24)% 000’oz 60.1 79.5 (24)% Development m 2,972 2,790 7% Secondary support m 2,649 2,471 7% Backfill m3 98,675 98,070 1% Ore milled – underground reef 000 tonnes 384 424 (9)% Ore milled – underground waste 000 tonnes 54 63 (14)% Total underground tonnes milled 000 tonnes 438 487 (10)% Ore milled – surface 000 tonnes 304 252 21% Total tonnes milled 000 tonnes 742 739 —% Yield – underground reef g/t 7.1 5.5 29% Surface yield g/t 0.1 0.2 (50)% Total yield g/t 3.68 3.20 15% Gold produced kg 2,734 2,368 15% 000’oz 87.9 76.1 16% Gold sold kg 2,708 2,367 14% 000’oz 87.1 76.1 14% AISC R/kg 751,830 763,157 (1)% US$/oz 1,317 1,341 (2)% AIC R/kg 751,830 804,575 (7)% US$/oz 1,317 1,415 (7)% Sustaining capital expenditure Rm 329.3 375.7 (12)% US$m 18.6 21.0 (11)% Non-sustaining capital expenditure Rm — 98.1 (100)% US$m — 5.6 (100)% Total capital expenditure Rm 329.3 473.8 (30)% US$m 18.6 26.6 (30)% Gold production increased by 15% to 2,734kg (87,900oz) in the March quarter from 2,368g (76,100oz) in the December quarter, mainly due to more shifts worked in the March quarter as well as ore phasing. Grade mined decreased by 10% to 5.56 g/t in the March quarter from 6.19 g/t in the December quarter, mainly due to a gravity fall of ground incident in the 100 2B West Cut 3 Main Access Drive compounded by an unexpected holing of the hanging wall into the footwall at the 2 West Main Ramp. The fall of ground area is expected to be rehabilitated by Q3 2023 and the 2 West Main Ramp was rehabilitated in April 2023. Reef yield increased by 29% to 7.06g/t in the March quarter from 5.45g/t in the December quarter due to ore phasing and stockpile movements which led to Gold in Process (GIP) drawdown amounting to 605kg. The GIP drawdown was mainly due to poor ground conditions as detailed above rendering some stopes unavailable and the associated impact on long-hole stoping tonnes. Total underground tonnes processed decreased by 10% to 438kt in the March quarter from 487kt in the December quarter due to lower tonnes broken as explained above as well as intermittent fleet reliability. Surface tonnes processed increased by 21% to 304kt in the March quarter from 252kt in the December quarter in line with the business plan. Surface yield decreased by 50% from 0.2g/t in the December quarter to 0.1g/t in the March quarter due to the depletion of the higher-grade clean up surface material, which was processed in December 2022. Total development increased by 7% to 2,972m in the March quarter from 2,790m in the December quarter as fewer shifts were worked in the December quarter due to the planned maintenance shutdown. Secondary support installed increased by 7% to 2,649m in the March quarter from 2,471m in the December quarter in line with increased development and destress performance. Backfill increased by 1% to 98,675m3 in the March quarter from 98,070m3 in the December quarter. All-in cost decreased by 7% to R751,830/kg (US$1,317/oz) in the March quarter from R804,575/kg (US$1,415/oz) in the December quarter, mainly due to an increase in gold sold and lower capital expenditure, partially offset by higher cost of sales before amortisation and depreciation. The higher cost of sales before amortisation and depreciation is mainly due to a gold inventory charge to cost of R250m (US$14m) in the March quarter compared to a gold inventory credit to cost of R44m (US$3m) in the December quarter. Total capital expenditure decreased by 30% to R329m (US$19m) in the March quarter from R474m (US$27m) in the December quarter. Sustaining capital expenditure decreased by 12% to R329m (US$19m) in the March quarter from R376m (US$21m) in the December quarter, mainly due to lower spend on surface infrastructure and equipment. Non-sustaining capital expenditure decreased by 100% to R0m (US$0m) in the March quarter from R98m (US$6m) in the December quarter due to the inclusion of new mine development and related infrastructure in sustaining capital from 2023. 11

Ghana Region Damang March 2023 December 2022 % Variance Ore mined 000 tonnes 828 821 1% Waste (Capital) 000 tonnes — 1,383 (100)% Waste (Operational) 000 tonnes 3,372 2,027 66% Total waste mined 000 tonnes 3,372 3,410 (1)% Total tonnes mined 000 tonnes 4,200 4,231 (1)% Strip ratio waste/ ore 4.1 4.2 (2)% Grade mined g/t 1.09 1.15 (5)% Gold mined 000’oz 29.0 30.5 (5)% Tonnes milled 000 tonnes 1,182 1,224 (3)% Yield g/t 1.04 1.13 (8)% Gold produced 000’oz 39.5 44.7 (12)% Gold sold 000’oz 40.5 43.6 (7)% AISC US$/oz 1,263 1,296 (3)% AIC US$/oz 1,329 1,420 (6)% Sustaining capital expenditure US$m 1.8 8.0 (78)% Non-sustaining expenditure US$m — 2.6 (100)% Total capital expenditure US$m 1.8 10.6 (83)% Gold production decreased by 12% to 39,500oz in the March quarter from 44,700oz in the December quarter due to lower yield. Yield decreased by 8% to 1.04g/t in the March quarter from 1.13g/t in the December quarter due to lower tonnes and grade fed in the March quarter in line with the plan. Total tonnes mined decreased by 1% to 4.20Mt in the March quarter from 4.23Mt in the December quarter. Ore tonnes mined increased by 1% to 0.83Mt in the March quarter from 0.82Mt in the December quarter. Total tonnes and ore tonnes mined were in line with the mining schedule. Mined grade decreased by 5% to 1.09g/t in the March quarter from 1.15g/t in the December quarter due to the completion of mining at Damang Pit Cut Back (DPCB) in the December 2022 quarter and transitioning through the smaller ore polygons with lower grades in the Huni pit. Operational waste tonnes mined at Huni pit increased by 66% to 3.4Mt in the March quarter from 2.0Mt in the December quarter due to improved mining fleet capacity. No capital waste tonnes were mined at Huni pit due to the completion of capital waste mining in the December quarter. All-in cost decreased by 6% to US$1,329/oz in the March quarter from US$1,420/oz in the December quarter, mainly due to lower capital expenditure, partially offset by lower gold sold. Total capital expenditure decreased by 83% to US$2m in the March quarter from US$11m in the December quarter. Sustaining capital expenditure decreased by 78% to US$2m in the March quarter from US$8m in the December quarter due to no capital waste stripping in the March quarter. Non-sustaining capital expenditure decreased to nil in the March quarter from US$3m in the December quarter due to reclassifying the TSF raise from growth to sustaining capital going forward. Tarkwa March 2023 December 2022 % Variance Ore mined 000 tonnes 4,879 3,812 28% Waste (Capital) 000 tonnes 8,678 10,179 (15)% Waste (Operational) 000 tonnes 7,859 7,521 4% Total waste mined 000 tonnes 16,537 17,700 (7)% Total tonnes mined 000 tonnes 21,416 21,512 —% Strip ratio waste/ ore 3.4 4.6 (26)% Grade mined g/t 1.18 1.26 (6)% Gold mined 000’oz 184.5 154.9 19% Tonnes milled 000 tonnes 3,435 3,615 (5)% Yield g/t 1.26 1.20 5% Gold produced 000’oz 138.8 139.6 (1)% Gold sold 000’oz 141.4 137.1 3% AISC US$/oz 1,131 1,260 (10)% AIC US$/oz 1,131 1,260 (10)% Sustaining capital expenditure US$m 55.8 55.3 1% Non-sustaining expenditure US$m — — —% Total capital expenditure US$m 55.8 55.3 1% Gold production decreased by 1% to 138,800oz in the March quarter from 139,600oz in the December quarter due to lower tonnes milled. Yield increased by 5% to 1.26g/t in the March quarter from 1.20g/t in the December quarter due to higher feed grade. In the March quarter, 0.30Mt stockpiles at 1.16g/t were processed compared with 0.13Mt stockpiles at 1.12g/t in the December quarter, while ex-pit ore processed for the March quarter was 3.1Mt at 1.32g/t compared with 3.5Mt at 1.26g/t in the December quarter. Total tonnes mined, including capital waste stripping, decreased marginally to 21.4Mt in the March quarter from 21.5Mt in the December quarter. Ore mined increased by 28% to 4.9Mt in the March quarter from 3.8Mt in the December quarter in line with the mining plan with more exposed ore available during the March quarter. Operational waste increased by 4% to 7.9Mt in the March quarter from 7.5Mt in the December quarter, while capital waste decreased by 15% to 8.7Mt in the March quarter from 10.2Mt in the December quarter in line with the mining plan. Strip ratio decreased by 26% to 3.4 in the March quarter from 4.6 in the December quarter due to higher ore tonnes mined. Gold mined increased by 19% to 184.5koz in the March quarter from 154.9koz in the December quarter due to higher ore tonnes mined. All-in cost decreased by 10% to US$1,131/oz in the March quarter from US$1,260/oz in the December quarter due to lower cost of sales before amortisation and depreciation and higher ounces sold. Capital expenditure increased by 1% to US$56m in the March quarter from US$55m in the December quarter due to the timing of expenditure. 12 Gold Fields Operational update for the quarter ended 31 March 2022

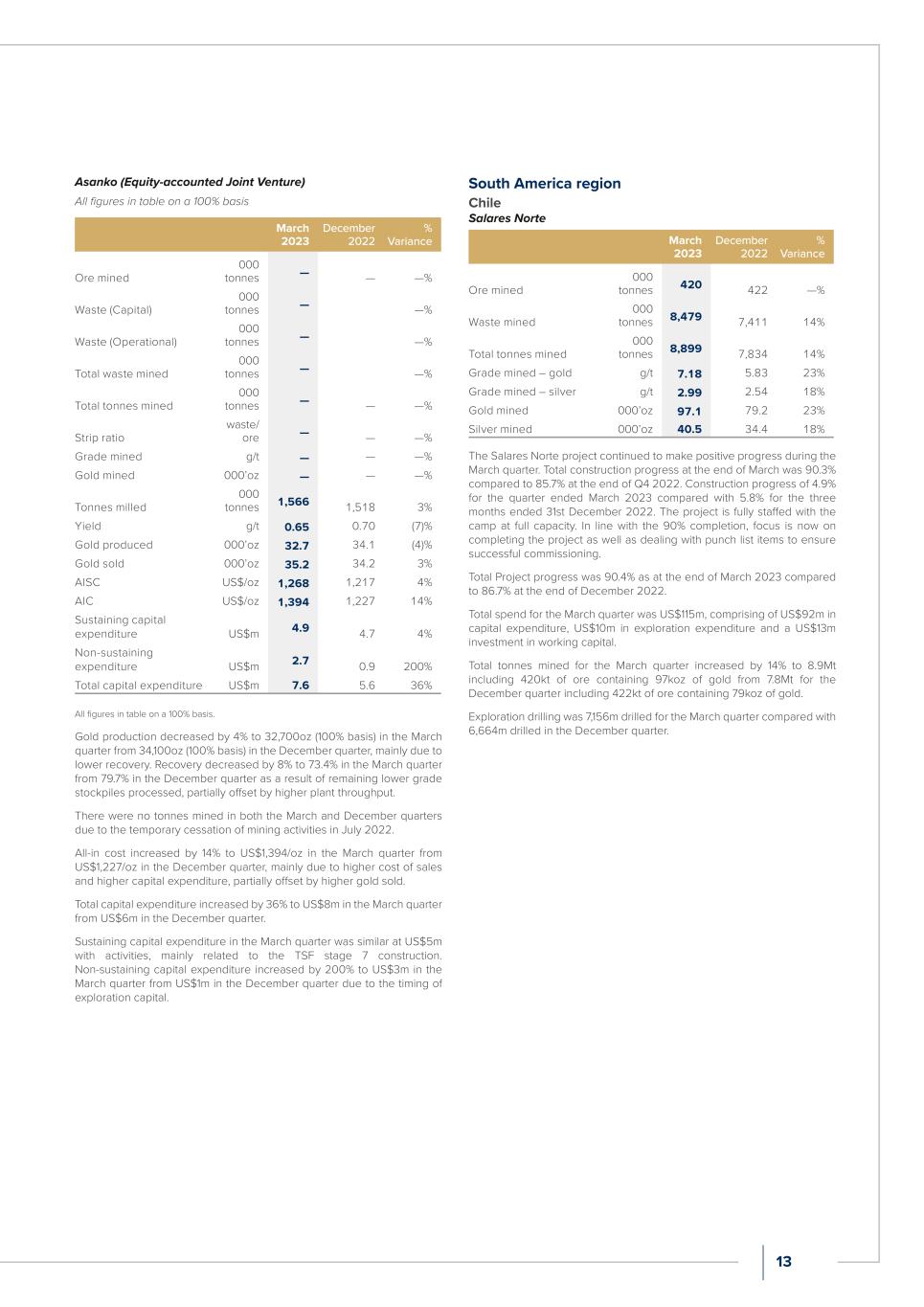

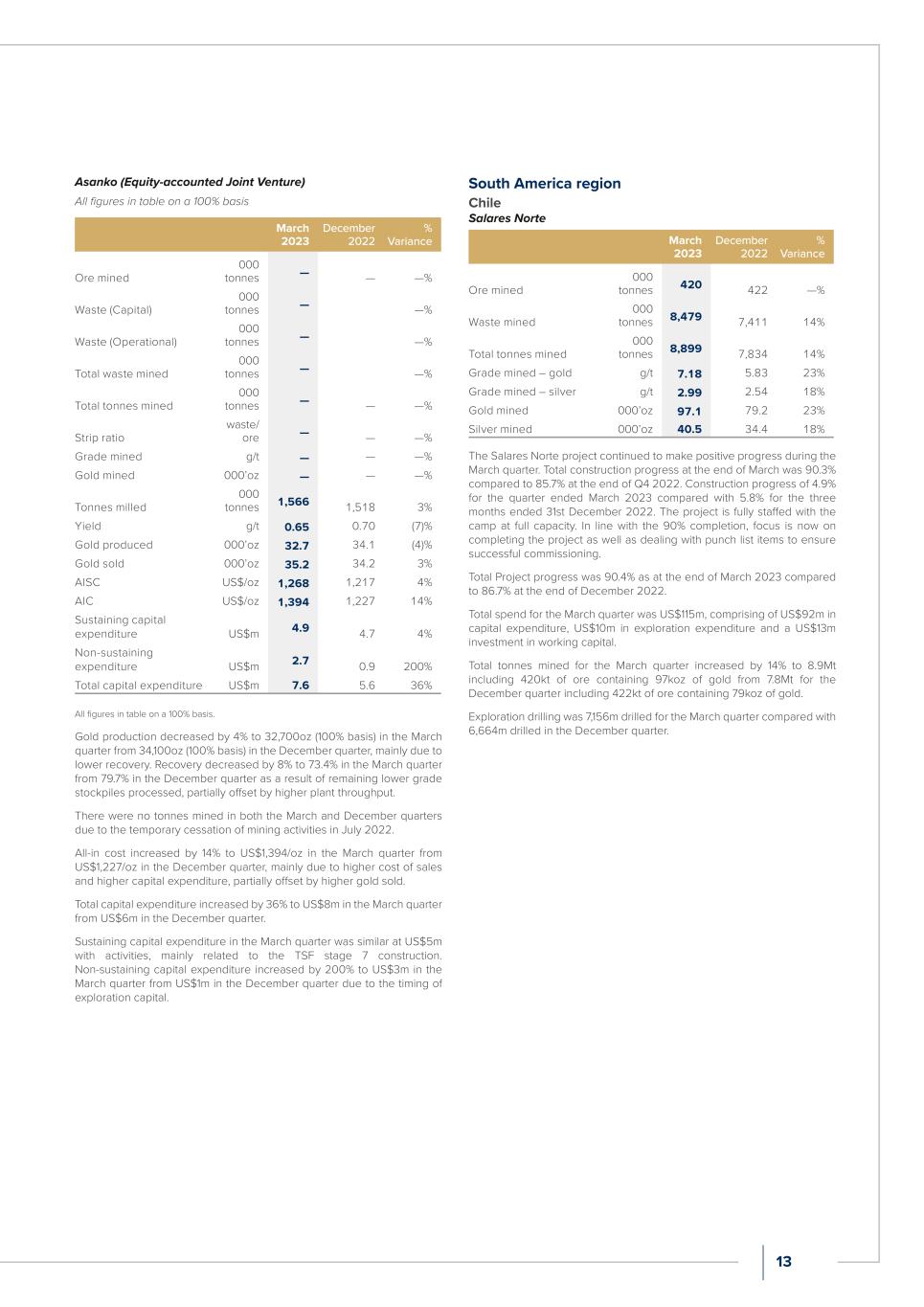

Asanko (Equity-accounted Joint Venture) All figures in table on a 100% basis March 2023 December 2022 % Variance Ore mined 000 tonnes — — —% Waste (Capital) 000 tonnes — —% Waste (Operational) 000 tonnes — —% Total waste mined 000 tonnes — —% Total tonnes mined 000 tonnes — — —% Strip ratio waste/ ore — — —% Grade mined g/t — — —% Gold mined 000’oz — — —% Tonnes milled 000 tonnes 1,566 1,518 3% Yield g/t 0.65 0.70 (7)% Gold produced 000’oz 32.7 34.1 (4)% Gold sold 000’oz 35.2 34.2 3% AISC US$/oz 1,268 1,217 4% AIC US$/oz 1,394 1,227 14% Sustaining capital expenditure US$m 4.9 4.7 4% Non-sustaining expenditure US$m 2.7 0.9 200% Total capital expenditure US$m 7.6 5.6 36% All figures in table on a 100% basis. Gold production decreased by 4% to 32,700oz (100% basis) in the March quarter from 34,100oz (100% basis) in the December quarter, mainly due to lower recovery. Recovery decreased by 8% to 73.4% in the March quarter from 79.7% in the December quarter as a result of remaining lower grade stockpiles processed, partially offset by higher plant throughput. There were no tonnes mined in both the March and December quarters due to the temporary cessation of mining activities in July 2022. All-in cost increased by 14% to US$1,394/oz in the March quarter from US$1,227/oz in the December quarter, mainly due to higher cost of sales and higher capital expenditure, partially offset by higher gold sold. Total capital expenditure increased by 36% to US$8m in the March quarter from US$6m in the December quarter. Sustaining capital expenditure in the March quarter was similar at US$5m with activities, mainly related to the TSF stage 7 construction. Non-sustaining capital expenditure increased by 200% to US$3m in the March quarter from US$1m in the December quarter due to the timing of exploration capital. South America region Chile Salares Norte March 2023 December 2022 % Variance Ore mined 000 tonnes 420 422 —% Waste mined 000 tonnes 8,479 7,411 14% Total tonnes mined 000 tonnes 8,899 7,834 14% Grade mined – gold g/t 7.18 5.83 23% Grade mined – silver g/t 2.99 2.54 18% Gold mined 000’oz 97.1 79.2 23% Silver mined 000’oz 40.5 34.4 18% The Salares Norte project continued to make positive progress during the March quarter. Total construction progress at the end of March was 90.3% compared to 85.7% at the end of Q4 2022. Construction progress of 4.9% for the quarter ended March 2023 compared with 5.8% for the three months ended 31st December 2022. The project is fully staffed with the camp at full capacity. In line with the 90% completion, focus is now on completing the project as well as dealing with punch list items to ensure successful commissioning. Total Project progress was 90.4% as at the end of March 2023 compared to 86.7% at the end of December 2022. Total spend for the March quarter was US$115m, comprising of US$92m in capital expenditure, US$10m in exploration expenditure and a US$13m investment in working capital. Total tonnes mined for the March quarter increased by 14% to 8.9Mt including 420kt of ore containing 97koz of gold from 7.8Mt for the December quarter including 422kt of ore containing 79koz of gold. Exploration drilling was 7,156m drilled for the March quarter compared with 6,664m drilled in the December quarter. 13

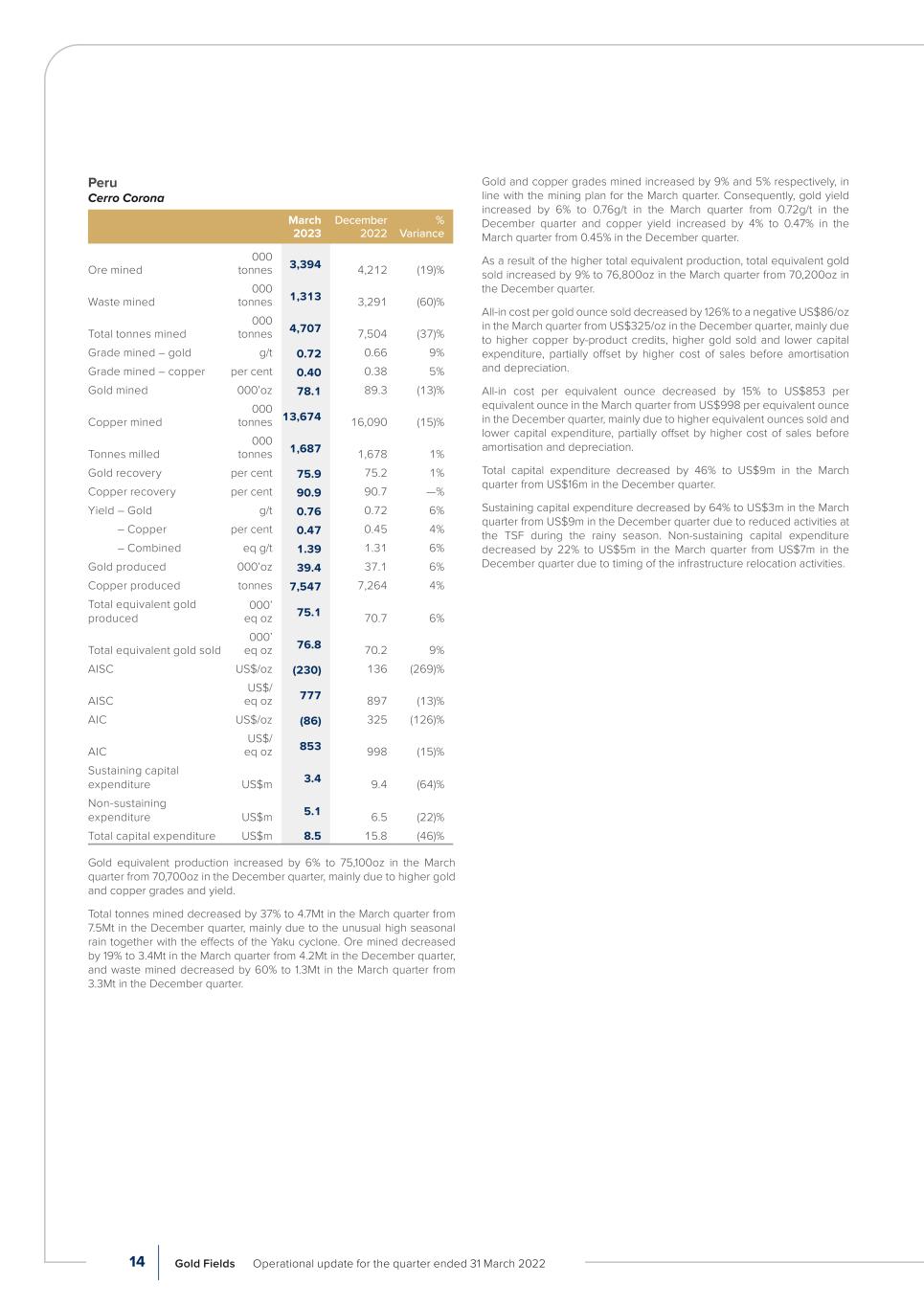

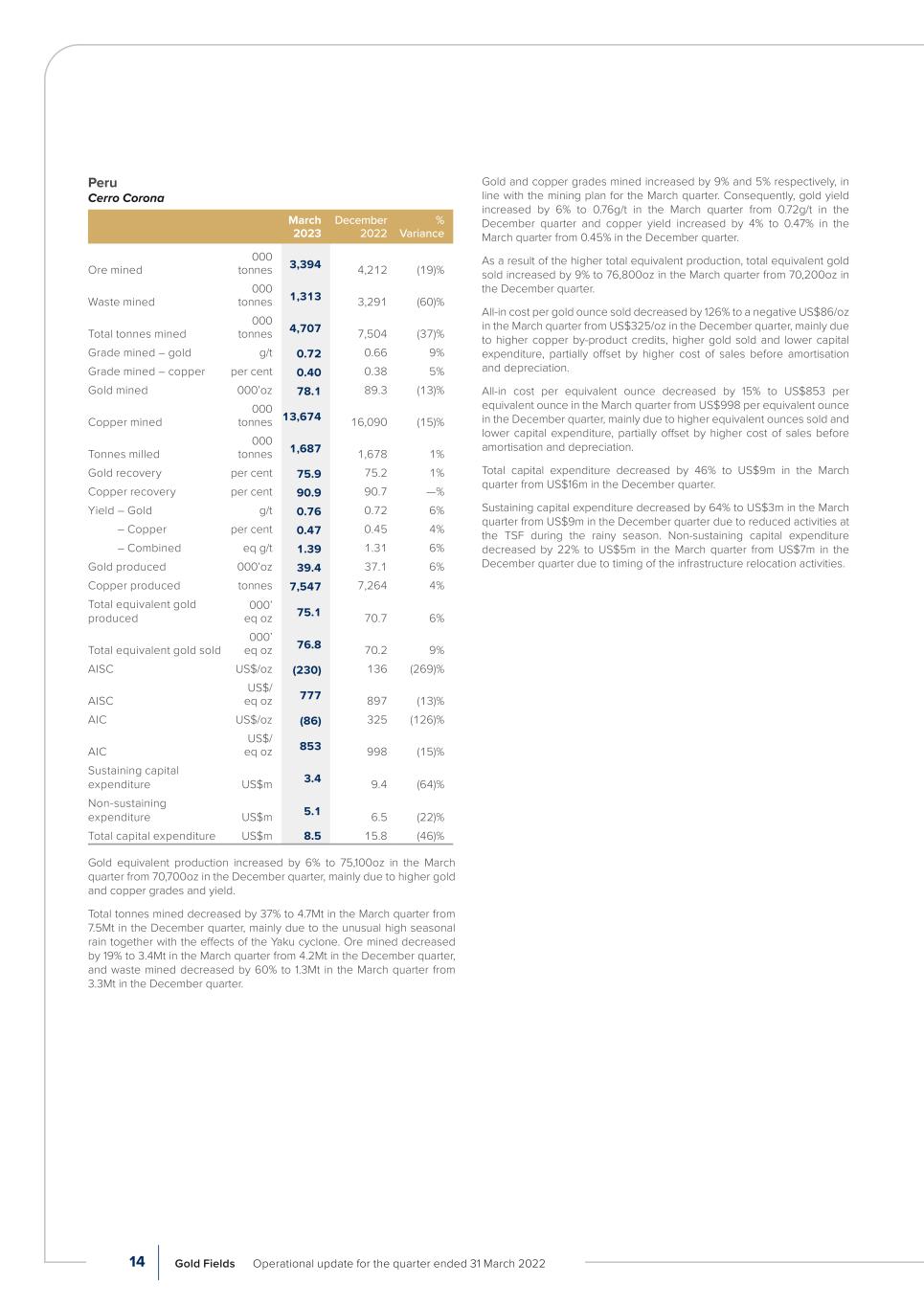

Peru Cerro Corona March 2023 December 2022 % Variance Ore mined 000 tonnes 3,394 4,212 (19)% Waste mined 000 tonnes 1,313 3,291 (60)% Total tonnes mined 000 tonnes 4,707 7,504 (37)% Grade mined – gold g/t 0.72 0.66 9% Grade mined – copper per cent 0.40 0.38 5% Gold mined 000’oz 78.1 89.3 (13)% Copper mined 000 tonnes 13,674 16,090 (15)% Tonnes milled 000 tonnes 1,687 1,678 1% Gold recovery per cent 75.9 75.2 1% Copper recovery per cent 90.9 90.7 —% Yield – Gold g/t 0.76 0.72 6% – Copper per cent 0.47 0.45 4% – Combined eq g/t 1.39 1.31 6% Gold produced 000’oz 39.4 37.1 6% Copper produced tonnes 7,547 7,264 4% Total equivalent gold produced 000’ eq oz 75.1 70.7 6% Total equivalent gold sold 000’ eq oz 76.8 70.2 9% AISC US$/oz (230) 136 (269)% AISC US$/ eq oz 777 897 (13)% AIC US$/oz (86) 325 (126)% AIC US$/ eq oz 853 998 (15)% Sustaining capital expenditure US$m 3.4 9.4 (64)% Non-sustaining expenditure US$m 5.1 6.5 (22)% Total capital expenditure US$m 8.5 15.8 (46)% Gold equivalent production increased by 6% to 75,100oz in the March quarter from 70,700oz in the December quarter, mainly due to higher gold and copper grades and yield. Total tonnes mined decreased by 37% to 4.7Mt in the March quarter from 7.5Mt in the December quarter, mainly due to the unusual high seasonal rain together with the effects of the Yaku cyclone. Ore mined decreased by 19% to 3.4Mt in the March quarter from 4.2Mt in the December quarter, and waste mined decreased by 60% to 1.3Mt in the March quarter from 3.3Mt in the December quarter. Gold and copper grades mined increased by 9% and 5% respectively, in line with the mining plan for the March quarter. Consequently, gold yield increased by 6% to 0.76g/t in the March quarter from 0.72g/t in the December quarter and copper yield increased by 4% to 0.47% in the March quarter from 0.45% in the December quarter. As a result of the higher total equivalent production, total equivalent gold sold increased by 9% to 76,800oz in the March quarter from 70,200oz in the December quarter. All-in cost per gold ounce sold decreased by 126% to a negative US$86/oz in the March quarter from US$325/oz in the December quarter, mainly due to higher copper by-product credits, higher gold sold and lower capital expenditure, partially offset by higher cost of sales before amortisation and depreciation. All-in cost per equivalent ounce decreased by 15% to US$853 per equivalent ounce in the March quarter from US$998 per equivalent ounce in the December quarter, mainly due to higher equivalent ounces sold and lower capital expenditure, partially offset by higher cost of sales before amortisation and depreciation. Total capital expenditure decreased by 46% to US$9m in the March quarter from US$16m in the December quarter. Sustaining capital expenditure decreased by 64% to US$3m in the March quarter from US$9m in the December quarter due to reduced activities at the TSF during the rainy season. Non-sustaining capital expenditure decreased by 22% to US$5m in the March quarter from US$7m in the December quarter due to timing of the infrastructure relocation activities. 14 Gold Fields Operational update for the quarter ended 31 March 2022

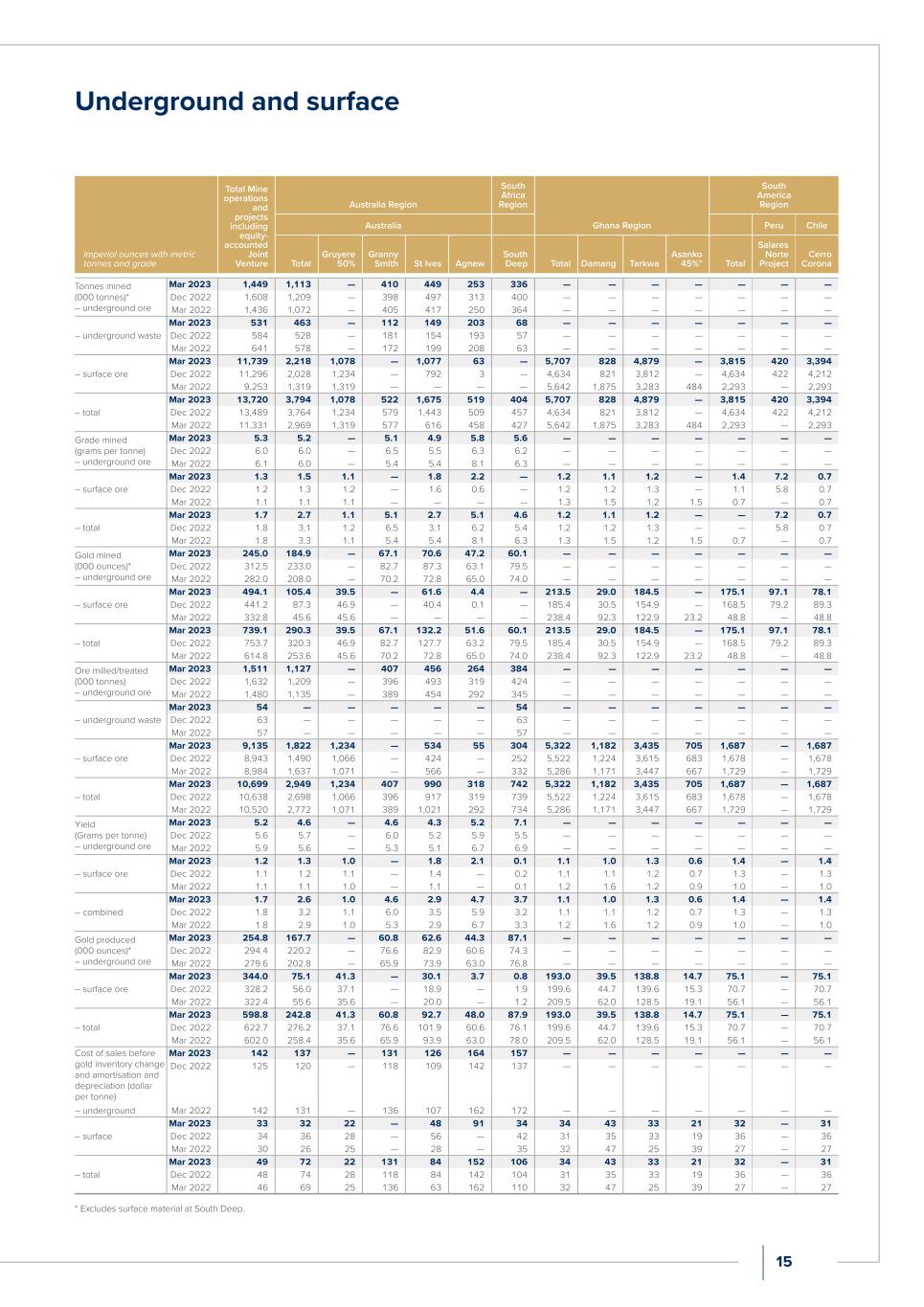

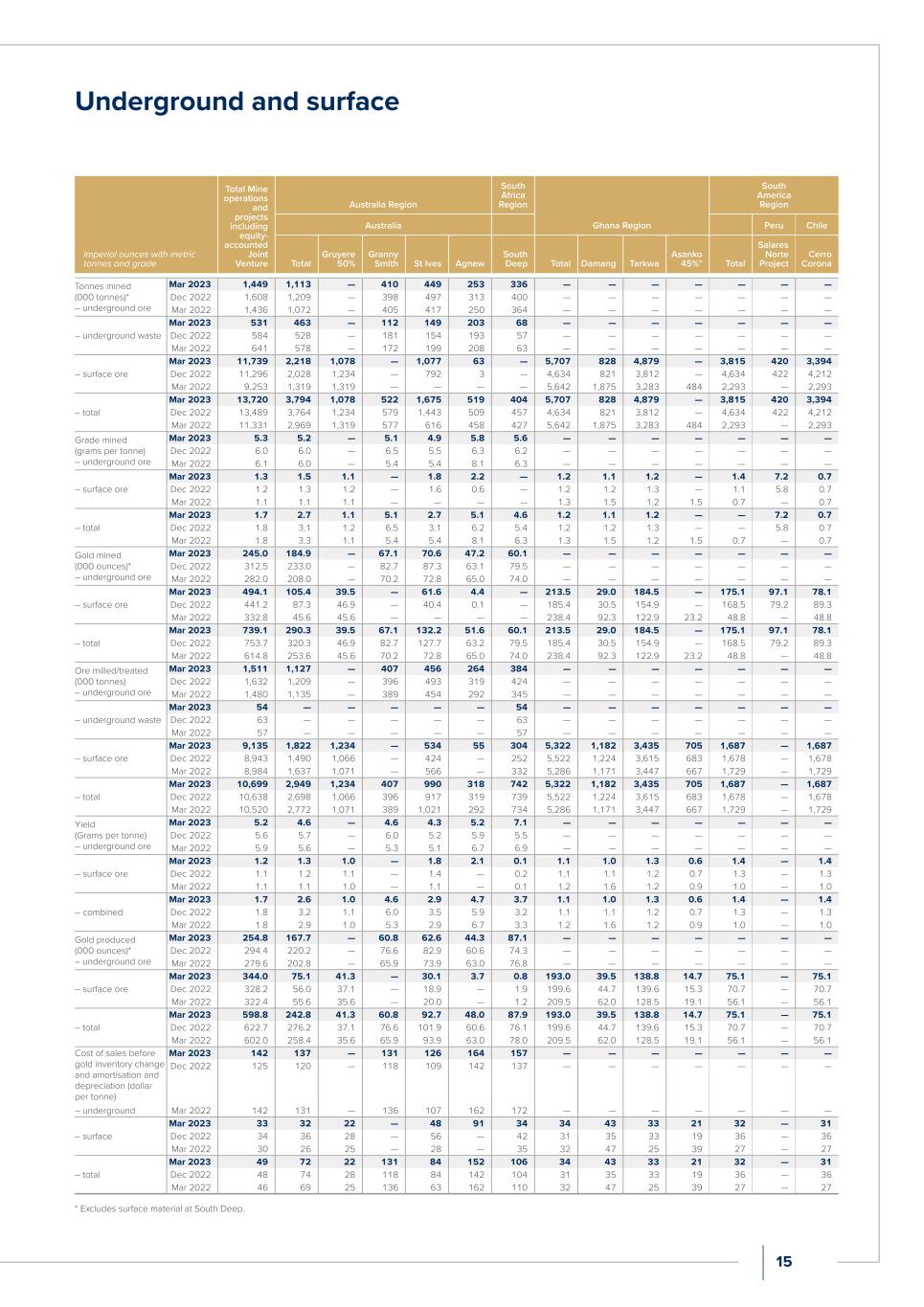

Underground and surface Imperial ounces with metric tonnes and grade Total Mine operations and projects including equity- accounted Joint Venture Australia Region South Africa Region Ghana Region South America Region Australia Peru Chile Total Gruyere 50% Granny Smith St Ives Agnew South Deep Total Damang Tarkwa Asanko 45%* Total Salares Norte Project Cerro Corona Tonnes mined (000 tonnes)* – underground ore Mar 2023 1,449 1,113 — 410 449 253 336 — — — — — — — Dec 2022 1,608 1,209 — 398 497 313 400 — — — — — — — Mar 2022 1,436 1,072 — 405 417 250 364 — — — — — — — – underground waste Mar 2023 531 463 — 112 149 203 68 — — — — — — — Dec 2022 584 528 — 181 154 193 57 — — — — — — — Mar 2022 641 578 — 172 199 208 63 — — — — — — — – surface ore Mar 2023 11,739 2,218 1,078 — 1,077 63 — 5,707 828 4,879 — 3,815 420 3,394 Dec 2022 11,296 2,028 1,234 — 792 3 — 4,634 821 3,812 — 4,634 422 4,212 Mar 2022 9,253 1,319 1,319 — — — — 5,642 1,875 3,283 484 2,293 — 2,293 – total Mar 2023 13,720 3,794 1,078 522 1,675 519 404 5,707 828 4,879 — 3,815 420 3,394 Dec 2022 13,489 3,764 1,234 579 1,443 509 457 4,634 821 3,812 — 4,634 422 4,212 Mar 2022 11,331 2,969 1,319 577 616 458 427 5,642 1,875 3,283 484 2,293 — 2,293 Grade mined (grams per tonne) – underground ore Mar 2023 5.3 5.2 — 5.1 4.9 5.8 5.6 — — — — — — — Dec 2022 6.0 6.0 — 6.5 5.5 6.3 6.2 — — — — — — — Mar 2022 6.1 6.0 — 5.4 5.4 8.1 6.3 — — — — — — — – surface ore Mar 2023 1.3 1.5 1.1 — 1.8 2.2 — 1.2 1.1 1.2 — 1.4 7.2 0.7 Dec 2022 1.2 1.3 1.2 — 1.6 0.6 — 1.2 1.2 1.3 — 1.1 5.8 0.7 Mar 2022 1.1 1.1 1.1 — — — — 1.3 1.5 1.2 1.5 0.7 — 0.7 – total Mar 2023 1.7 2.7 1.1 5.1 2.7 5.1 4.6 1.2 1.1 1.2 — — 7.2 0.7 Dec 2022 1.8 3.1 1.2 6.5 3.1 6.2 5.4 1.2 1.2 1.3 — — 5.8 0.7 Mar 2022 1.8 3.3 1.1 5.4 5.4 8.1 6.3 1.3 1.5 1.2 1.5 0.7 — 0.7 Gold mined (000 ounces)* – underground ore Mar 2023 245.0 184.9 — 67.1 70.6 47.2 60.1 — — — — — — — Dec 2022 312.5 233.0 — 82.7 87.3 63.1 79.5 — — — — — — — Mar 2022 282.0 208.0 — 70.2 72.8 65.0 74.0 — — — — — — — – surface ore Mar 2023 494.1 105.4 39.5 — 61.6 4.4 — 213.5 29.0 184.5 — 175.1 97.1 78.1 Dec 2022 441.2 87.3 46.9 — 40.4 0.1 — 185.4 30.5 154.9 — 168.5 79.2 89.3 Mar 2022 332.8 45.6 45.6 — — — — 238.4 92.3 122.9 23.2 48.8 — 48.8 – total Mar 2023 739.1 290.3 39.5 67.1 132.2 51.6 60.1 213.5 29.0 184.5 — 175.1 97.1 78.1 Dec 2022 753.7 320.3 46.9 82.7 127.7 63.2 79.5 185.4 30.5 154.9 — 168.5 79.2 89.3 Mar 2022 614.8 253.6 45.6 70.2 72.8 65.0 74.0 238.4 92.3 122.9 23.2 48.8 — 48.8 Ore milled/treated (000 tonnes) – underground ore Mar 2023 1,511 1,127 — 407 456 264 384 — — — — — — — Dec 2022 1,632 1,209 — 396 493 319 424 — — — — — — — Mar 2022 1,480 1,135 — 389 454 292 345 — — — — — — — – underground waste Mar 2023 54 — — — — — 54 — — — — — — — Dec 2022 63 — — — — — 63 — — — — — — — Mar 2022 57 — — — — — 57 — — — — — — — – surface ore Mar 2023 9,135 1,822 1,234 — 534 55 304 5,322 1,182 3,435 705 1,687 — 1,687 Dec 2022 8,943 1,490 1,066 — 424 — 252 5,522 1,224 3,615 683 1,678 — 1,678 Mar 2022 8,984 1,637 1,071 — 566 — 332 5,286 1,171 3,447 667 1,729 — 1,729 – total Mar 2023 10,699 2,949 1,234 407 990 318 742 5,322 1,182 3,435 705 1,687 — 1,687 Dec 2022 10,638 2,698 1,066 396 917 319 739 5,522 1,224 3,615 683 1,678 — 1,678 Mar 2022 10,520 2,772 1,071 389 1,021 292 734 5,286 1,171 3,447 667 1,729 — 1,729 Yield (Grams per tonne) – underground ore Mar 2023 5.2 4.6 — 4.6 4.3 5.2 7.1 — — — — — — — Dec 2022 5.6 5.7 — 6.0 5.2 5.9 5.5 — — — — — — — Mar 2022 5.9 5.6 — 5.3 5.1 6.7 6.9 — — — — — — — – surface ore Mar 2023 1.2 1.3 1.0 — 1.8 2.1 0.1 1.1 1.0 1.3 0.6 1.4 — 1.4 Dec 2022 1.1 1.2 1.1 — 1.4 — 0.2 1.1 1.1 1.2 0.7 1.3 — 1.3 Mar 2022 1.1 1.1 1.0 — 1.1 — 0.1 1.2 1.6 1.2 0.9 1.0 — 1.0 – combined Mar 2023 1.7 2.6 1.0 4.6 2.9 4.7 3.7 1.1 1.0 1.3 0.6 1.4 — 1.4 Dec 2022 1.8 3.2 1.1 6.0 3.5 5.9 3.2 1.1 1.1 1.2 0.7 1.3 — 1.3 Mar 2022 1.8 2.9 1.0 5.3 2.9 6.7 3.3 1.2 1.6 1.2 0.9 1.0 — 1.0 Gold produced (000 ounces)* – underground ore Mar 2023 254.8 167.7 — 60.8 62.6 44.3 87.1 — — — — — — — Dec 2022 294.4 220.2 — 76.6 82.9 60.6 74.3 — — — — — — — Mar 2022 279.6 202.8 — 65.9 73.9 63.0 76.8 — — — — — — — – surface ore Mar 2023 344.0 75.1 41.3 — 30.1 3.7 0.8 193.0 39.5 138.8 14.7 75.1 — 75.1 Dec 2022 328.2 56.0 37.1 — 18.9 — 1.9 199.6 44.7 139.6 15.3 70.7 — 70.7 Mar 2022 322.4 55.6 35.6 — 20.0 — 1.2 209.5 62.0 128.5 19.1 56.1 — 56.1 – total Mar 2023 598.8 242.8 41.3 60.8 92.7 48.0 87.9 193.0 39.5 138.8 14.7 75.1 — 75.1 Dec 2022 622.7 276.2 37.1 76.6 101.9 60.6 76.1 199.6 44.7 139.6 15.3 70.7 — 70.7 Mar 2022 602.0 258.4 35.6 65.9 93.9 63.0 78.0 209.5 62.0 128.5 19.1 56.1 — 56.1 Cost of sales before gold inventory change and amortisation and depreciation (dollar per tonne) – underground Mar 2023 142 137 — 131 126 164 157 — — — — — — — Dec 2022 125 120 — 118 109 142 137 — — — — — — — Mar 2022 142 131 — 136 107 162 172 — — — — — — — – surface Mar 2023 33 32 22 — 48 91 34 34 43 33 21 32 — 31 Dec 2022 34 36 28 — 56 — 42 31 35 33 19 36 — 36 Mar 2022 30 26 25 — 28 — 35 32 47 25 39 27 — 27 – total Mar 2023 49 72 22 131 84 152 106 34 43 33 21 32 — 31 Dec 2022 48 74 28 118 84 142 104 31 35 33 19 36 — 36 Mar 2022 46 69 25 136 63 162 110 32 47 25 39 27 — 27 * Excludes surface material at South Deep. 15

Forward-looking statements This announcement contains forward-looking statements within the meaning of the “safe harbour” provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this announcement may be forward-looking statements. Forward-looking statements may be identified by the use of words such as “aim”, “anticipate”, “will”, “would”, “expect”, “may”, “could” “believe”, “target”, “estimate”, “project” and words of similar meaning. These forward-looking statements, including among others, those relating to Gold Fields’ future business prospects, financial positions, production and operational guidance, climate and ESG-related statements, targets and metrics, are necessary estimates reflecting the best judgement of the senior management of Gold Fields and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances and should be considered in light of various important factors, including those set forth in Gold Fields’ Integrated Annual Report 2022 filed with the Johannesburg Stock Exchange and annual report on Form 20-F filed with the United States Securities and Exchange Commission on 30 March 2023. Readers are cautioned not to place undue reliance on such statements. These forward-looking statements speak only as of the date they are made. Gold Fields undertakes no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this announcement or to reflect the occurrence of unanticipated events. These forward-looking statements have not been reviewed or reported on by the Company’s external auditors. 16 Gold Fields Operational update for the quarter ended 31 March 2022

Administration and corporate information Corporate secretary Anre Weststrate Tel: +27 11 562 9719 Mobile: +27 83 635 5961 email: anre.weststrate@goldfields.com Registered office Johannesburg Gold Fields Limited 150 Helen Road Sandown Sandton 2196 Postnet Suite 252 Private Bag X30500 Houghton 2041 Tel: +27 11 562 9700 Fax: +27 11 562 9829 Office of the United Kingdom secretaries London St James’s Corporate Services Limited Second Floor 107 Cheapside London EC2V 6DN United Kingdom Tel: +44 (0) 20 7796 8644 email:general@corpserv.co.uk American depository receipts transfer agent Shareholder correspondence should be mailed to: BNY Mellon P O Box 505000 Louisville, KY 40233 – 5000 Overnight correspondence should be sent to: BNY Mellon 462 South 4th Street, Suite 1600 Louisville, KY40202 email: shrrelations@cpushareownerservices.com Phone numbers Tel: 866 247 3871 Domestic Tel: 201 680 6825 Foreign Sponsor J.P. Morgan Equities South Africa Proprietary Limited 1 Fricker Road Illovo, Johannesburg 2196 South Africa Investor enquiries Avishkar Nagaser Tel: +27 11 562 9775 Mobile: +27 82 312 8692 email: avishkar.nagaser@goldfields.com Thomas Mengel Tel: +27 11 562 9849 Mobile: +27 72 493 5170 email: thomas.mengel@goldfields.com Media enquiries Sven Lunsche Tel: +27 11 562 9763 Mobile: +27 83 260 9279 email: sven.lunsche@goldfields.com Transfer secretaries South Africa Computershare Investor Services (Proprietary) Limited Rosebank Towers 15 Biermann Avenue Rosebank Johannesburg 2196 PO Box 61051 Marshalltown 2107 Tel: +27 11 370 5000 Fax: +27 11 688 5248 United Kingdom Link Group 10th Floor, Central Square 29 Wellington Street Leeds LSI 4 DL England Tel: 0371 664 0300 If you are outside the United Kingdom please call + (0) 371 664 0300 Calls are charged at the standard geographic rate and will vary by provider. Calls outside the United Kingdom will be charged at the applicable international rate. Lines are open between 09:00 – 17:30, Monday to Friday excluding public holidays in England and Wales. email: shareholderenquiries@linkgroup.co.uk Website www.goldfields.com Listings JSE / NYSE / GFI YGH Suleman† (Chairperson) M Preece• (Interim Chief Executive Officer) PA Schmidt• (Chief Financial Officer) A Andani#† PJ Bacchus*† MC Bitar@† TP Goodlace† JE McGill^ PG Sibiya† SP Reid^† ^ Australian * British @Chilean # Ghanaian † Independent Director • Non-independent Director 17

G O LD FIELD S LIM ITED C LIM ATE C H A N G E REPO RT 2022