UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2025

Commission File No. 001-41769

Foremost Clean Energy Ltd.

(Translation of registrant’s name into English)

750 West Pender Street, Suite 250

Vancouver, BC, V6C 2T7

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F ☒ Form 40-F ☐

The information contained in this Report on Form 6-K is hereby incorporated by reference into our Registration Statement on Form F-3 (File No. 333-289277).

| Exhibit No. | Exhibit | |

| 99.1 | Notice and Access Notification to Shareholders | |

| 99.2 | Notice of Meeting and Management Information Circular | |

| 99.3 | Financial Statement Request Form | |

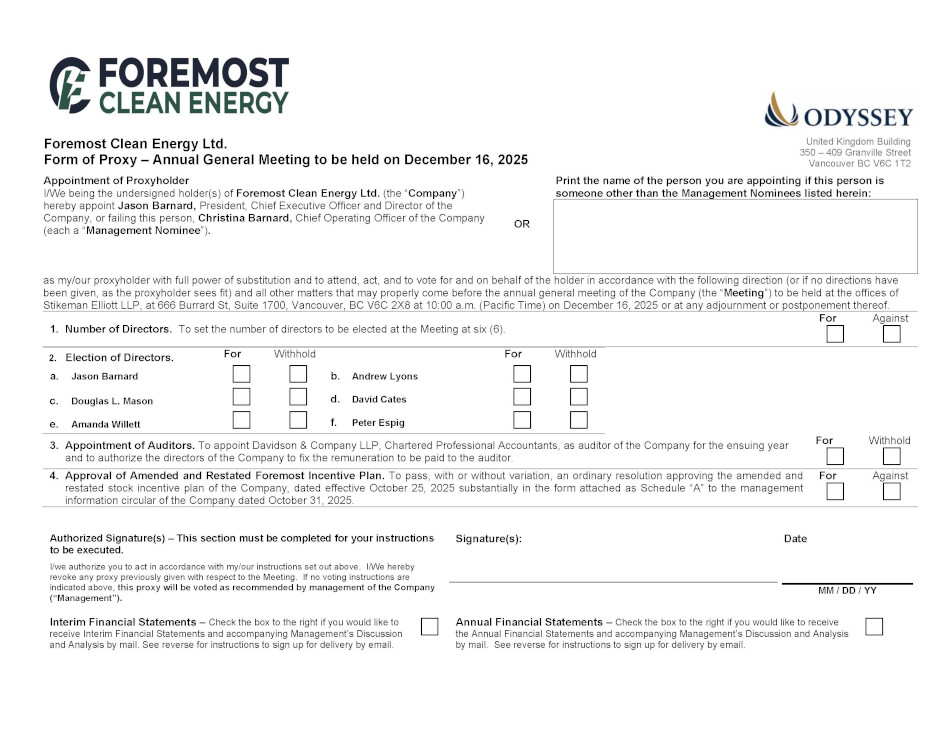

| 99.4 | Form of Proxy |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FOREMOST CLEAN ENERGY LTD. | ||

| Date: December 3, 2025 | By: | /s/ Jason Barnard |

| Name: | Jason Barnard | |

| Title: | Chief Executive Officer | |

Exhibit 99.1

Notice of Availability of Proxy Materials

for Foremost Clean Energy Ltd. Annual General Meeting of Shareholder

Meeting Date and Time: December 16, 2025, at 10:00 a.m. (Pacific Time)

Location: The offices of Stikeman Elliott LLP, at 666 Burrard St Suite 1700, Vancouver, BC V6C 2X8

Notice is hereby given that the Annual General Meeting (the “Meeting”) of holders (“Shareholders”) of common shares (“Foremost Shares”) of Foremost Clean Energy Ltd. (“Foremost” or the “Company”) will be held on December 16, 2025 at 10:00 a.m. (Pacific Time).

The record date for the determination of Shareholders entitled to receive notice of and to vote at the Meeting is October 31, 2025 (the "Record Date"). Only Shareholders of record as at the Record Date are entitled to receive notice of and to attend and vote at the Meeting or any adjournment thereof, unless after that date a Shareholder of record transfers their Foremost Shares and the transferee, upon producing properly endorsed certificates evidencing such Foremost Shares or otherwise establishing that they own such Foremost Shares, requests at least ten (10) days prior to the Meeting that the transferee's name be included in the list of Shareholders entitled to vote, in which case such transferee is entitled to vote such Foremost Shares at the Meeting.

Please be advised that the proxy materials for the above noted securityholder meeting are available for viewing and downloading online. This document provides an overview of these materials, but you are reminded to access and review the information circular and other proxy materials available online prior to voting. These materials are available at:

https://foremostcleanenergy.com/investors/shareholder-meeting.html

OR

www.sedarplus.ca

Obtaining Paper Copies of the Proxy Materials

Securityholders may request to receive paper copies of the proxy materials related to the above referenced meeting by mail at no cost. Requests for paper copies must be received by December 6, 2025 in order to receive the paper copy in advance of the meeting. Shareholders may request to receive a paper copy of the Materials for up to one year from the date the Materials were filed on www.sedar.com.

For more information regarding notice-and-access or to obtain a paper copy of the Materials you may contact our transfer agent, Odyssey Trust Company, via www.odysseycontact.com or by phone at 1-888-290-1175 (toll-free within North America) or 1-587-885-0960 (direct from outside North America).

Notice of Meeting

The resolutions to be voted on at the meeting, described in detail in the Management Information Circular under the heading “Particulars of Matters to be Acted Upon”, are as follows:

| 1. | to fix the number of directors to be elected at the Meeting at six (6); |

| 2. | to elect six (6) directors of the Company to hold office until the next annual meeting of the Shareholders; |

| 3. | to appoint Davidson & Company LLP, Chartered Professional Accountants, as auditor of the Company for the ensuing year and to authorize the directors of the Company to fix the remuneration to be paid to the auditor; |

| 4. | to pass, with or without variation, an ordinary resolution approving the amended and restated stock incentive plan of the Company, dated effective October 25, 2025 substantially in the form attached as Schedule “A” to the management information circular of the Company dated October 31, 2025; and |

| 5. | to transact such other business as may be properly brought before the Meeting and any adjournment thereof |

Voting

To vote your securities, please refer to the instructions on the enclosed Proxy or Voting Instruction Form. Your Proxy or Voting Instruction Form must be received by December 12, 2025 at 10:00 a.m. (Pacific Time)

Stratification

The Issuer is providing paper copies of its Management Information Circular only to those registered shareholders and beneficial shareholders that have previously requested to receive paper materials.

Annual Financial Statements

The Issuer is providing paper copies or emailing electronic copies of its annual financial statements to registered shareholders and beneficial shareholders that have opted to receive annual financial statements and have indicated a preference for either delivery method.

Exhibit 99.2

NOTICE OF MEETING

AND

MANAGEMENT INFORMATION CIRCULAR

FOR THE

ANNUAL GENERAL MEETING

OF SHAREHOLDERS

OF

FOREMOST CLEAN ENERGY LTD.

TO BE HELD ON TUESDAY, DECEMBER 16, 2025

DATED:

October 31, 2025

NOTICE OF MEETING

Foremost Clean Energy Ltd.

250-750 West Pender Street

Vancouver, BC V6C 2T7

Tel: 1 604 330-8067

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual General Meeting (the "Meeting") of the holders of common shares (the "Shareholders") of FOREMOST CLEAN ENERGY LTD. (the "Company" or "Foremost") will be held on Tuesday, December 16, 2025, at 10:00 a.m. (Pacific Time) at the offices of Stikeman Elliott LLP, at 666 Burrard St Suite 1700, Vancouver, BC V6C 2X8, for the following purposes:

| 1. | to receive the audited financial statements of the Company for the year ended March 31, 2025, and the report of the auditor thereon; |

| 2. | to fix the number of directors to be elected at the Meeting at six (6); |

| 3. | to elect six (6) directors of the Company to hold office until the next annual meeting of the Shareholders; |

| 4. | to appoint Davidson and Company LLP, Chartered Professional Accountants, as auditor of the Company for the ensuing year and to authorize the directors of the Company to fix the remuneration to be paid to the auditor; |

| 5. | to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution approving the amended and restated stock incentive plan of the Company dated effective October 25, 2025 (the "Amended and Restated Foremost Incentive Plan"), as more particularly described in the accompanying management information circular of the Company dated October 31, 2025 (the "Circular"); and |

| 6. | to transact such other business as may be properly brought before the Meeting and any adjournment thereof. |

The accompanying Circular provides additional information relating to the matters to be dealt with at the Meeting. Shareholders are advised to review the Circular before voting.

Although no other matters are contemplated, the Meeting may also consider the transaction of such other business, and any permitted amendment to or variation of any matter identified in this Notice, as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. Accompanying this Notice and Circular is a form of proxy or voting instruction form and financial statement request form.

The board of directors of the Company (the "Foremost Board") has fixed the close of business on October 31, 2025, as the record date (the "Record Date") for determining Shareholders entitled to receive notice of, and to vote at, the Meeting. Only Shareholders of record at the close of business on the Record Date will be entitled to vote at the Meeting.

Registered Shareholders unable to attend the Meeting in person and who wish to ensure that their common shares (the "Foremost Shares") will be voted at the Meeting are requested to complete, date and sign a form of proxy and deliver it in accordance with the instructions set out in the form of proxy and in the Circular no later than December 12, 2025, at 10:00 a.m. (Pacific Time), the cut-off time for the deposit of proxies prior to the Meeting, or the day that is two (2) business days immediately preceding the date of any adjourned or postponed Meeting. Shareholders who beneficially own Foremost Shares that are registered in the name of an intermediary such as a bank, trust company, securities broker or other intermediary, or in the name of a depository of which the intermediary is a participant who receive these materials through their broker or other intermediary are requested to follow the instructions for voting provided by their broker or intermediary, which may include the completion and delivery of a voting instruction form.

(

To ensure Shareholders and proxyholders are able to access the Meeting location, the Company requests that Shareholders and proxyholders who are planning to attend the Meeting pre-register. Pre-registration will enable the Company to make the necessary arrangements and provide specific access instructions. To pre-register for attendance, please contact the Meeting Coordinator via email to harpreet.bajaj@foremostcleanenergy.com.

DATED at Vancouver, British Columbia, this 31st day of October, 2025.

| BY ORDER OF THE BOARD | |

| /s/ "Jason Barnard" | |

Jason Barnard

President, Chief Executive Officer and Director

(

MANAGEMENT INFORMATION CIRCULAR

As at October 31, 2025

TABLE OF CONTENTS

| NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS | I | |

| INTRODUCTION | 1 | |

| Attendance | 1 | |

| Date | 1 | |

| Notice and Access | 1 | |

| GENERAL PROXY INFORMATION | 2 | |

| Notice-and-Access | 2 | |

| Management Solicitation of Proxies | 3 | |

| Appointment of Proxy | 3 | |

| Voting by Proxy and Exercise of Discretion by Management Proxyholders | 4 | |

| Advice to Non-Registered Shareholders | 4 | |

| Revocation of Proxies | 5 | |

| Notice to Shareholders in the United States | 5 | |

| VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES | 6 | |

| Record Date | 6 | |

| Voting Rights | 6 | |

| Principal Holders of Foremost Shares | 6 | |

| Quorum | 6 | |

| Required Votes | 6 | |

| PARTICULARS OF MATTERS TO BE ACTED UPON | 7 | |

| PRESENTATION OF FOREMOST FINANCIAL STATEMENTS | 7 | |

| APPROVAL OF FIXING THE NUMBER OF DIRECTORS | 8 | |

| APPROVAL OF THE ELECTION OF DIRECTORS | 8 | |

| APPROVAL OF THE APPOINTMENT OF AUDITOR | 11 | |

| APPROVAL OF THE AMENDMENT TO THE FOREMOST INCENTIVE PLAN | 12 | |

| Amendments Requiring Shareholder Approval at the Meeting | 12 | |

| OTHER MATTERS TO BE ACTED ON | 14 | |

| STATEMENT OF EXECUTIVE COMPENSATION | 14 | |

| Definitions | 14 | |

| Compensation Discussion and Analysis | 15 | |

| Director Compensation | 24 | |

| Additional Compensation Disclosure | 27 | |

| Employment, Consulting and Management Agreements | 28 | |

| Foremost Incentive Plan | 29 | |

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 38 |

(

| AUDIT COMMITTEE | 38 | |

| Foremost Audit Committee Charter | 38 | |

| Composition of Audit Committee | 39 | |

| Relevant Education and Experience | 39 | |

| Audit Committee Oversight | 40 | |

| Reliance on Certain Exemptions | 40 | |

| Pre-approval Policies and Procedures | 40 | |

| External Auditor Service Fees (By Category) | 40 | |

| CORPORATE GOVERNANCE | 41 | |

| General | 41 | |

| Board of Directors | 41 | |

| Directorships | 42 | |

| Director Attendance | 43 | |

| Orientation and Continuing Education | 43 | |

| Position Descriptions | 44 | |

| Ethical Business Conduct | 44 | |

| Nomination of Directors | 44 | |

| Director Compensation | 45 | |

| Other Board Committees | 46 | |

| Assessments | 46 | |

| OTHER INFORMATION | 46 | |

| Indebtedness of Directors and Executive Officers | 46 | |

| Interest of Certain Persons or Companies in Matters to be Acted Upon | 47 | |

| Interest of Informed Persons in Material Transactions | 47 | |

| Additional Information | 47 | |

| APPROVAL OF THE BOARD OF DIRECTORS | 48 |

SCHEDULES

| Schedule "A" | - | Foremost Incentive Plan, as amended |

| Schedule "B" | - | Foremost Audit Committee Charter |

(

INTRODUCTION

This management information circular and accompanying form of proxy are furnished in connection with the solicitation of proxies by the management of Foremost Clean Energy Ltd. ("Foremost" or the "Company") for use at the annual general meeting of holders of common shares (the "Foremost Shares") of the Company (the "Shareholders") to be held on Tuesday, December 16, 2025, at 10:00 a.m. (Pacific Time) at the offices of Stikeman Elliott LLP, at 666 Burrard St Suite 1700, Vancouver, BC V6C 2X8, and any adjournment(s) or postponement(s) thereof, for the purposes set forth in the Notice of the Meeting.

Attendance

To ensure Shareholders and proxyholders are able to access the Meeting location, the Company requests that Shareholders and proxyholders who are planning to attend the Meeting in person pre-register. Pre-registration will enable the Company to make the necessary arrangements and provide specific access instructions.

To pre-register for attendance, please contact the Meeting Coordinator via email at harpreet.bajaj@foremostcleanenergy.com.

Date

The information contained in this Circular is accurate as at October 31, 2025, except as otherwise stated and except that information in documents incorporated by reference is given as of the dates noted therein.

Notice and Access

The Company is not mailing physical copies of the Circular or related materials in connection with the Meeting to registered Shareholders or Non-Registered Shareholders through its reliance on the "Notice and Access" provisions set out in NI 54-101. Shareholders will still receive a notice and access notification setting forth the notice of the Meeting and matters to be voted on and a copy of the form of proxy or voting instruction form, as applicable, and instructions for how to obtain an electronic copy of the Circular. Shareholders may also request to receive a paper copy of the Circular from the Company. For more information on Notice and Access, see the heading "General Proxy Information - Notice and Access".

GENERAL PROXY INFORMATION

Notice-and-Access

Notice-and-Access means provisions concerning the delivery of proxy-related materials to shareholders found in Section 9.1.1. of NI 51-102 in the case of registered Shareholders, and Section 2.7.1 of NI 54-101 in the case of Non-Registered Shareholders, which allow an issuer to deliver an information circular forming part of proxy-related materials to shareholders via certain specified electronic means provided that the conditions of NI 51-102 and NI 54-101 are met (collectively, the "Notice-and-Access Provisions").

In order to rely on Notice-and-Access Provisions to deliver the Circular and related materials through the Company's website, the Company must send a notice and access notification (the "Notice-and-Access Notification") to Shareholders, including Non-Registered Shareholders, indicating that the Circular and proxy-related materials have been posted on the website and explaining how a Shareholder can access them or obtain from the Company a paper copy of the Circular. The Notice-and-Access Notification has been delivered to Shareholders by the Company along with the applicable voting document (a form of proxy in the case of registered Shareholders or a voting information form (a "VIF") in the case of Non-Registered Shareholders). This Circular has been posted in full on the Company's website at https://www.foremostcleanenergy.com/investors/shareholder-meeting.html and is also available for viewing under the Company's SEDAR+ profile at www.sedarplus.ca.

In order to use Notice-and-Access Provisions, a reporting issuer must set the record date for notice of the meeting to be on a date that is at least thirty (30) days prior to the meeting in order to ensure there is sufficient time for the circular to be posted on the applicable website and other materials to be delivered to shareholders. The Company will not rely upon the use of stratification. Stratification occurs when a reporting issuer using the Notice-and-Access Provisions selectively provides to certain shareholders a paper copy of its information circular with the notice. In relation to the Meeting, all Shareholders will receive the required documentation under the Notice-and-Access Provisions and all documents required to vote in respect of all matters to be voted on at the Meeting. No Shareholder will receive a paper copy of the Circular from the Company or any Intermediary (as defined herein) unless such Shareholder specifically requests the same.

This Circular is available for review at https://www.foremostcleanenergy.com/investors/shareholder-meeting.html, being the website address to the Company's annual general meeting page. Any Shareholder who wishes to obtain a paper copy of the Circular should contact the Company, at Suite 250, 750 West Pender Street, Vancouver, British Columbia, V6C 2T7, by phone at 604-330-8067 or through email at harpreet.bajaj@foremostcleanenergy.com. A Shareholder may also use the number noted above to obtain additional information about Notice-and-Access Provisions. Please note that, due to ongoing labour disruptions at Canada Post, there may be delays or a failure to deliver requested paper copies of meeting materials in time for the proxy return deadline. Additionally, registered Shareholders are encourage to deposit their forms of proxies with the transfer agent of the Company (the "Transfer Agent"), Odyssey Trust Company, via the internet, as shown in the proxy, by the proxy deadline on December 12, 2025, at 10:00 a.m. (Pacific Time) or the day that is two (2) business days immediately preceding the date of any adjourned or postponed Meeting. Non-Registered Shareholders are encouraged to contact their intermediaries/brokers on how to properly submit their VIF in light of the potential Canada Post mail service disruptions. To ensure that a paper copy of the Circular can be delivered to a requesting Shareholder in time for them to review the Circular and return a proxy or VIF prior to the proxy deadline, it is strongly suggested such Shareholder's request is received by the Company by no later than December 6, 2025.

Management Solicitation of Proxies

It is expected that the solicitation of proxies by the management of the Company will be conducted primarily by mail and may be supplemented by telephone or other personal contact to be made without special compensation by the directors, officers and employees of the Company. The Company does not reimburse Shareholders, nominees or agents for costs incurred in obtaining authorization from their principals to execute forms of proxy, except that the Company has requested brokers and nominees who hold stock in their respective names to furnish this proxy material to their customers, and the Company will reimburse such brokers and nominees for their related out-of-pocket expenses. No solicitation will be made by specifically engaged employees or soliciting agents. The cost of solicitation will be borne by the Company. This Circular does not constitute the solicitation of a proxy by anyone in any jurisdiction in which such solicitation is not authorized, or in which the person making such solicitation is not qualified to do so, or to anyone to whom it is unlawful to make such an offer of solicitation.

No person has been authorized to give any information or to make any representation other than as contained in this Circular in connection with the solicitation of proxies. If given or made, such information or representations must not be relied upon as having been authorized by the Company. The delivery of this Circular shall not create, under any circumstances, any implication that there has been no change in the information set forth herein since the date of this Circular.

Appointment of Proxy

Only registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting. A registered Shareholder is entitled to one (1) vote for each Foremost Share that such registered Shareholder holds on the Record Date. Please read and follow the instructions on the proxy carefully and return by 10:00 a.m. (Pacific Time), on December 12, 2025, or the day that is two (2) business days immediately preceding the date of any adjourned or postponed Meeting. The Company may refuse to recognize any instrument of proxy deposited in writing or by the internet received later than 48 hours (excluding Saturdays, Sundays and statutory holidays in British Columbia) prior to the Meeting or any adjournment(s) or postponement(s) thereof.

The purpose of a proxy is to designate persons who will vote the proxy on a registered Shareholder's behalf in accordance with the instructions given by the registered Shareholder in the proxy. The persons whose names are printed on the enclosed proxy form are officers and/or directors of the Company (the "Management Proxyholders").

A registered Shareholder has the right to appoint a person or company to attend and act for or on behalf of that registered Shareholder at the Meeting, other than the Management Proxyholders named in the enclosed proxy form. A proxyholder need not be a Shareholder.

Such right may be exercised by striking out the printed names and inserting the name of such other person and, if desired, an alternate to such person, in the blank space provided in the proxy form. Such registered Shareholder should notify the nominee of the appointment, obtain the nominee's consent to act as proxy, and should provide instruction to the nominee on how the registered Shareholder's Foremost Shares should be voted. The nominee should bring personal identification to the Meeting.

Those registered Shareholders desiring to be represented at the Meeting by proxy must deposit their respective forms of proxy with the Transfer Agent of the Company, Odyssey Trust Company, at 350 – 409 Granville Street, Vancouver, BC V6C 1T2, Attention: Proxy Department, by mail or via the internet by December 12, 2025, at 10:00 a.m. (Pacific Time) or the day that is two (2) business days immediately preceding the date of any adjourned or postponed Meeting. The deadline for deposit of proxies may be waived or extended by the Chairman of the Meeting at their discretion, without notice. Considering the ongoing Canada Post labour disruptions, the Company encourages that registered Shareholders deposit their respective forms of proxy with the Transfer Agent via the internet, as shown in the proxy, to ensure their vote is received by the proxy voting deadline.

Voting by Proxy and Exercise of Discretion by Management Proxyholders

Foremost Shares represented by a properly executed proxy will be voted or be withheld from voting on each matter referred to in the Notice of Meeting in accordance with the instructions of the registered Shareholder on any ballot that may be called for, and if the registered Shareholder specifies a choice with respect to any matter to be acted upon, the Foremost Shares will be voted accordingly.

If a registered Shareholder does not specify a choice and the registered Shareholder has appointed the Management Proxyholders as proxyholder, the Management Proxyholders will vote FOR the matters specified in the Notice of Meeting and FOR all other matters proposed by management at the Meeting.

The form of proxy also provides discretionary authority to the person named therein as proxyholder with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. As of the date of this Circular, management of the Company knows of no such amendments, variations or other matters to come before the Meeting.

Advice to Non-Registered Shareholders

The information in this section is significant to many Shareholders, as a substantial number of Shareholders do not hold their Foremost Shares in their own name.

Only registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Most Shareholders are "Non-Registered Shareholders" because the Foremost Shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which Foremost Shares were purchased. More particularly, a person is not a registered Shareholder in respect of Foremost Shares which are held on behalf of that person (the "Non-Registered Shareholder") but which are registered either: (a) in the name of an intermediary (an "Intermediary") that the Non-Registered Shareholders deals with in respect of the Foremost Shares (Intermediaries include, among others: banks, trust companies, securities dealers or brokers and trustees or administrators or self-administered RRSPs, RRIFs, RESPs and similar plans); or (b) in the name of a clearing agency (such as CDS Clearing and Depositary Services Inc. or CDS & Co. ("CDS")) of which the Intermediary is a participant. In Canada, the vast majority of such shares are registered under the name of CDS, which acts as nominee for many Canadian brokerage firms. Foremost Shares held by brokers or their nominees can only be voted upon the instructions of the Non-Registered Shareholders. Without specific voting instructions, brokers and their nominees are prohibited from voting Foremost Shares held for Non-Registered Shareholders. Therefore, Non-Registered Shareholders should ensure that instructions respecting the voting of their Foremost Shares are communicated to the appropriate person or that the Foremost Shares are duly registered in their name.

Applicable Canadian securities regulatory policies require intermediaries/brokers to seek voting instructions from Non-Registered Shareholders in advance of the shareholders' meeting. Every intermediary has its own mailing procedures and provides its own return instructions to clients. In either case, the purpose of this procedure is to permit a Non-Registered Shareholder to direct the voting of Foremost Shares that they beneficially own. Non-Registered Shareholders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or proxy authorization form is to be delivered. Additionally, Non-Registered Shareholders are encouraged to contact their intermediaries/brokers on how to properly submit their proxy, proxy authorization form or VIF in light of the potential Canada Post mail service disruptions.

In Canada, the majority of brokers and intermediaries now delegate responsibility for obtaining voting instructions from Non-Registered Shareholders to Broadridge. Broadridge typically supplies a VIF and asks Non-Registered Shareholders to return the completed forms to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Foremost Shares to be represented at the Meeting. A Non-Registered Shareholder receiving such a form from Broadridge cannot use that form to vote Foremost Shares directly at the Meeting. The form must be returned to Broadridge well in advance of the Meeting in order to have the Foremost Shares voted.

A Non-Registered Shareholder who wishes to attend the Meeting and vote in person may write the name of the Non-Registered Shareholder in the place provided for that purpose on the VIF. A Non-Registered Shareholder also has the right to appoint a person or company other than the persons designated in the form of proxy, who need not be a Shareholder, to attend the Meeting and act on behalf of the Non-Registered Shareholder. Unless prohibited by law, the person whose name is written in the space provided in the VIF will be appointed as proxy holder for the Non-Registered Shareholder and will have full authority to present matters to the Meeting and vote on all matters that are presented at the Meeting, even if those matters are not set out in the VIF or this Circular. A Non-Registered Shareholder should consult a legal advisor if the Non-Registered Shareholder wishes to modify the authority of the person to be appointed as proxy holder in any way.

Revocation of Proxies

A registered Shareholder who has submitted a proxy may revoke it at any time prior to the exercise thereof by: (i) completing and signing a proxy bearing a later date and delivering such proxy to the Transfer Agent by 10:00

a.m. (Pacific Time) on December 15, 2025, or the last business day prior to the day the Meeting is reconvened if it is adjourned; (ii) sending a signed written statement (or have your lawyer sign a statement with your written authorization) to: Corporate Secretary, Foremost Clean Energy Ltd., Email: harpreet.bajaj@foremostcleanenergy.com prior to 5:00 p.m. (Pacific Time) December 15, 2025, or the last business day prior to the day the Meeting is reconvened if it is adjourned; (iii) providing a signed written statement, at the Meeting, to the chair of the Meeting prior to the vote being taken; or (iv) any other manner permitted by law.

If you have followed the instructions for attending and voting at the Meeting, voting at the Meeting will revoke any previous proxy.

A beneficial Shareholder who has changed their mind should contact their broker or nominee for further information regarding changing their voting instructions.

Notice to Shareholders in the United States

The solicitation of proxies involves securities of an issuer located in Canada and is being effected in accordance with the corporate laws of the Province of British Columbia, Canada, and securities laws of the provinces of Canada. The proxy solicitation rules under the U.S. Securities Exchange Act of 1934 (the "Exchange Act") are not applicable to the Company or this solicitation. This solicitation has been prepared in accordance with the disclosure requirements of the securities laws of the provinces of Canada. Shareholders should be aware that disclosure requirements under the securities laws of the provinces of Canada differ from the disclosure requirements under United States securities laws.

The enforcement by Shareholders of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the Business Corporations Act (British Columbia), some of its directors and its executive officers are residents of Canada and a substantial portion of its assets and the assets of such persons are located outside the United States. Shareholders may not be able to sue a foreign company or its officers or directors in a foreign court for violations of United States federal securities laws. It may be difficult to compel a foreign company and its officers and directors to subject themselves to a judgement by a United States court.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

Record Date

The board of directors of the Company (the "Foremost Board") has fixed October 31, 2025, as the Record Date for determining the persons entitled to receive the Notice of Meeting. Only Shareholders of record as at the Record Date are entitled to receive notice of and to attend and vote at the Meeting or any adjournment(s) or postponement(s) thereof. In addition, persons who are Non-Registered Shareholders as at the Record Date will be entitled to exercise their voting rights in accordance with the procedures established under NI 54-101. See "Proxies and Voting Rights – Advice to Non-Registered Shareholders".

Voting Rights

The authorized share capital of the Company consists of an unlimited number of common shares, being the Foremost Shares. As at the Record Date, there are 14,435,380 Foremost Shares issued and outstanding. Each Shareholder, as of the Record Date, is entitled to one (1) vote for each Foremost Share registered in their name. No group of Shareholders has the right to elect a specified number of directors, nor are there cumulative or similar voting rights attached to the Foremost Shares.

Principal Holders of Foremost Shares

To the knowledge of the directors and executive officers of the Company, no person or company beneficially owns, controls or directs, directly or indirectly, voting securities carrying ten percent (10%) or more of the voting rights attached to any class of outstanding voting securities of the Company as at the Record Date, other than as set out in the table below:

| Name of Shareholder | Number of Foremost Shares Owned | Percentage of Outstanding Foremost Shares |

| Denison Mines Corp. | 2,462,410 | 17.06% |

Quorum

Pursuant to the articles of the Company, a quorum for a meeting of the Shareholders is constituted when (i) at least two (2) persons entitled to vote at the meeting are present and (ii) not less than 5% of the outstanding Foremost Shares which may be voted at the Meeting are represented in person or by proxy or by a duly authorized representative of a Shareholder.

Required Votes

The following table summarizes the matters to be considered at the Meeting, the available voting options for each matter, and the level of approval required to pass each resolution:

| Matter | Voting Options | Required Vote |

| Number of Directors | For / Against |

At least a majority (50% + 1) of votes cast by Shareholders present in person or represented by proxy at the Meeting.

|

| Election of Directors | For / Withhold |

Each nominee for election as a director will be elected by a plurality of votes cast by Shareholders present in person or represented by proxy at the Meeting.

|

| Appointment of Auditors | For / Withhold |

The auditor will be appointed by a plurality of votes cast by Shareholders present in person or represented by proxy at the Meeting.

|

| Amendment to the Foremost Incentive Plan |

For / Against

|

Approval requires a majority (50% + 1) of votes cast by Shareholders present in person or represented by proxy at the Meeting. |

PARTICULARS OF MATTERS TO BE ACTED UPON

MANAGEMENT OF THE COMPANY KNOWS OF NO OTHER MATTERS TO COME BEFORE THE MEETING OTHER THAN THOSE REFERRED TO IN THE NOTICE OF MEETING. HOWEVER, IF ANY OTHER MATTERS THAT ARE NOT KNOWN TO MANAGEMENT SHOULD PROPERLY COME BEFORE THE MEETING, THE ACCOMPANYING FORM OF PROXY CONFERS DISCRETIONARY AUTHORITY UPON THE PERSONS NAMED THEREIN TO VOTE ON SUCH MATTERS IN ACCORDANCE WITH THEIR BEST JUDGMENT.

Additional details regarding each of the matters to be acted upon at the Meeting is set forth below.

PRESENTATION OF FOREMOST FINANCIAL STATEMENTS

The audited financial statements of the Company for the year ended March 31, 2025, together with the auditors' report thereon and the notes thereto (the "Foremost Annual Financial Statements") will be presented to Shareholders at the Meeting.

A copy of the Foremost Annual Financial Statements together with the related MD&A were previously delivered to the Shareholders to the extent such Shareholder has requested a copy. Copies of the Foremost Annual Financial Statements and associated MD&A may also be obtained by a Shareholder upon request without charge from the Company, at Suite 250, 750 West Pender Street, Vancouver, BC V6C 2T7 or via email to harpreet.bajaj@foremostcleanenergy.com These documents are also available under the Company's profile on SEDAR+ at www.sedarplus.ca.

Shareholders and proxyholders will be given an opportunity to discuss the Company's financial results with management. Shareholder approval is not required, and no formal action will be taken at the Meeting to approve the Foremost Annual Financial Statements.

APPROVAL OF FIXING THE NUMBER OF DIRECTORS

At the Meeting, it will be proposed that six (6) directors be elected to hold office until the next annual general meeting or until their successors are elected or appointed. Shareholders will be asked to consider and, if deemed advisable, to approve an ordinary resolution, the text of which is as follows:

"BE IT RESOLVED, as an ordinary resolution of Shareholders, that the number of directors to be elected at the Meeting, to hold office until the close of the next annual meeting of Shareholders or until their successors are duly elected or appointed pursuant to the constating documents of the Company, unless their offices are earlier vacated in accordance with the provisions of the Business Corporations Act (British Columbia) or the Company's constating documents, be and is hereby fixed at six (6)."

For the foregoing resolution to be passed, it must be approved by a simple majority of the votes cast by Shareholders in person or represented by proxy in respect of the resolution at the Meeting.

Management believes the passing of the above resolution is in the best interests of the Company and recommends Shareholders vote FOR the ordinary resolution fixing the number of directors to be elected at the Meeting at six (6). Unless directed to the contrary, it is the intention of the Management Proxyholders, if named as proxy, to vote FOR the ordinary resolution fixing the number of directors to be elected at the Meeting at six (6).

APPROVAL OF THE ELECTION OF DIRECTORS

The directors of the Company are elected annually and hold office until the next annual general meeting of Shareholders or until their successors are elected or until such director's earlier death, resignation or removal.

Management of the Company is nominating the six (6) persons named in the table below for election by Shareholders as directors of the Company.

The following table sets out, for each person proposed to be nominated for election as a director: their name; all major offices and positions currently held with the Company and any of its significant affiliates; their principal occupation, business or employment during the five (5) preceding years; the period of time during which they have served as a director of the Company; and the number of securities of the Company beneficially owned, or controlled or directed, directly or indirectly by each proposed director as of the Record Date:

|

Name, Province of Residence and Present Office Held |

Principal Occupation for the past five (5) years (1) |

Periods During Which Nominee Has Served as a Director of Foremost |

Number of Securities Beneficially Owned, or Controlled or Directed, Directly or Indirectly (2) |

|

Jason Barnard British Columbia, Canada

President, Chief Executive Officer and Director |

President, Chief Executive Officer and Director of Foremost since 2022

President and CEO and Director of Rio Grande Resources since February 2025

|

September 8, 2022 - present |

918,474(3) |

|

Name, Province of Residence and Present Office Held |

Principal Occupation for the past five (5) years (1) |

Periods During Which Nominee Has Served as a Director of Foremost |

Number of Securities Beneficially Owned, or Controlled or Directed, Directly or Indirectly (2) |

| Self-employed as a private investor since 2004 |

|

|

|

|

Peter Espig British Columbia, Canada

Director |

President, CEO and Director of Nicola Mining Inc since November 2013

Director at ESGold since May 2025

|

October 27, 2025 - present |

13,674(4) |

|

Andrew Lyons (6) British Columbia, Canada

Director

|

CEO and President of Lakestone Gold Corp. since April 2020 |

December 10, 2021 - present |

92,959(5) |

|

Douglas L. Mason (6)(7)(8) British Columbia, Canada

Chairman and Director

|

Chairman and CEO of Magnus Goldcorp Inc. since November 2013 Director of Naturally Splendid Enterprises Ltd. from 2015 to 2019, and CEO from 2017 to 2019 |

December 4, 2023 - present |

93,056(9) |

|

David Cates (7)(8) Ontario, Canada

Director

|

President and CEO of Denison Mines Corp., since 2015 |

October 4, 2024 - present |

107,377(10) |

|

Amanda Willett (6)(7)(8) British Columbia, Canada

Director

|

Vice President Legal and Corporate Secretary of Denison Mines Corp., since 2020 |

December 20, 2024 - present |

53,488(11) |

Notes:

| (1) | The information in the table above as to the principal occupation and business or employment of the director nominees has been furnished by each nominee and is not within the knowledge of, nor independently verified by, management of the Company. |

| (2) | The information as to the number of Foremost Shares beneficially owned, controlled or directed, directly or indirectly, is not within the knowledge of management of the Company and has been furnished by the respective director nominees, or obtained from information available to the Company through SEDI and/or in reports provided by the transfer agent of the Company. The totals reflect the Foremost Shares currently held and the Foremost Shares issuable upon the exercise of Foremost Options and/or warrants of the Company. |

| (3) | Consists of 31,970 Foremost Shares held directly by Mr. Barnard, 38,640 Foremost Shares owned by Claimbank Exploration Ltd. (“Claimbank”), 60,313 Foremost Shares owned by Ora Nutraceuticals, Inc. (“Ora”), 54,078 Foremost Shares issuable upon exercise of stock options at $6.01 or $2.51 per Foremost Share, and 164,573 RSUs. Mr. Barnard is the sole owner of each entity and has sole control over the Foremost Shares held by Claimbank and Ora. The Foremost Options and RSUs are held directly by Mr. Barnard. Additionally, this includes Mr. Barnard’s spouse, Ms. Barnard’s indirect holdings of 179,939 Foremost Shares through 1374646 B.C. LTD and direct holdings of 275,447 Foremost Shares and 26,899 Foremost Shares issuable to Ms. Barnard upon exercise of Foremost Options at $6.01 or $2.51 per Foremost Share and 86,615 RSUs. |

| (4) | Consists of 13,647 RSUs. |

| (5) | Consists of 10,500 Foremost Shares, 39,089 Foremost Shares issuable upon exercise of Foremost Options at exercise prices of $8.20, $6.01 or $2.51, and 43,070 RSUs. |

| (6) | Member of the Foremost CG&N Committee. |

| (7) | Member of the Foremost Audit Committee. |

| (8) | Member of the Foremost Compensation Committee. |

| (9) | Consists of 19,056 Foremost Shares owned by Mr. Mason, 8,000 Foremost Shares owned by Waterfront Capital Partners Inc. (“Waterfront Capital”), 20,000 Foremost Shares issuable upon exercise of options at $4.98, and 46,000 RSUs. Mr. Mason is the sole owner of Waterfront Capital and has the sole voting over the Foremost Shares held by Waterfront Capital. |

| (10) | Consists of 43,000 Foremost Shares, 6,815 Foremost Shares issuable upon exercise of Foremost Options at $2.51, 20,000 Foremost Shares issuable upon exercise of Foremost Share purchase warrants at $4.00 and 37,562 RSUs and. |

| (11) | Consists of 2,500 Foremost Shares and 9,200 Foremost Shares issuable upon exercise of Foremost Options at $1.38, 2,500 Foremost Shares issuable upon exercise of Foremost Share purchase warrants at $4.00 and 39,288 RSUs. |

Cease Trade Orders

To the knowledge of the management of the Company, no proposed nominee for election as a director of the Company:

| (a) | is, at the date of this Circular, or has been within ten (10) years before the date of this Circular, a director, chief executive officer or chief financial officer of any company (including the Company) that, |

| (i) | was subject to a cease trade order, an order similar to a cease trade order, or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than thirty (30) consecutive days (an "Order") that was issued while the proposed director was acting in the capacity as a director, chief executive officer or chief financial officer; or |

| (ii) | was subject to an Order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer, |

| (b) | is, at the date of this Circular, or has been within ten (10) years before the date of this Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, |

| (c) | has, within the ten (10) years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director, or |

| (d) | has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority or has been subject to any other penalties or sanctions imposed by a court or regulatory body that would be likely to be considered important to a reasonable shareholder in deciding whether to vote for a proposed director. |

Nomination of Alternative Directors

Pursuant to the advance notice provisions (the "Advance Notice Provisions") in the constating documents of the Company, advance notice must be provided to the Company in circumstances where nomination of persons for election to the Foremost Board are made by Shareholders of the Company. The Advance Notice Provisions set a deadline by which Shareholders must submit nominations (a "Notice") to the Company for the election of directors prior to any annual meeting of Shareholders. The Advance Notice Provisions also set forth the information that a Shareholder must include in the Notice to the Company and establish the form in which the Shareholder must submit the Notice for the Notice to be in proper written form.

In the case of an annual meeting of Shareholders, a Notice must be provided to the Company not less than thirty (30) days and not more than sixty-five (65) days prior to the date of such meeting (except that, if the meeting is to be held on a date that is less than fifty (50) days after the date that the notice was provided, the notice by the nominating Shareholder shall be made not less than the close of business on the 10th day after the notice of the meeting is provided). The Advance Notice Provisions are available for viewing in the articles of the Company available under the Company's profile on SEDAR+, at www.sedarplus.ca.

As at the date of this Circular, the Company has not received a Notice in compliance with the Advance Notice Provisions and, as such management's nominees for election as directors set forth herein shall be the only nominees eligible to stand for election at the Meeting.

Management recommends Shareholders vote FOR the election of each of the nominees listed above as directors of the Company for the ensuing year. Unless directed to the contrary, it is the intention of the Management Proxyholders named in the enclosed instrument of proxy to vote proxies FOR each of the nominees.

APPROVAL OF THE APPOINTMENT OF AUDITOR

Shareholders will be asked to vote for the appointment of Davidson and Company LLP, Chartered Professional Accountants, as auditor of the Company to hold office until the next annual meeting of Shareholders, or until a successor is appointed, and to authorize the directors of the Company to fix the remuneration of the auditor.

Dismissal of Independent Registered Public Accountants

On March 25, 2025, the Audit Committee dismissed MNP LLP, Chartered Professional Accountants as the Company's independent registered public accounting firm. The reports of MNP on the Company's consolidated financial statements for the fiscal year ended March 31, 2024 did not contain any adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal year ended March 31, 2024 and through the date of MNP's dismissal, there were (i) no "disagreements" between the Company and MNP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to the satisfaction of MNP would have caused MNP to make reference to the subject matter of the disagreement in connection with its reports on the Company's consolidated financial statements for such years, and (ii) no "reportable events", as such terms are defined in section 4.11 of NI 51-102.

Engagement of New Independent Registered Public Accountant

On March 25, 2025, the Audit Committee appointed Davidson and Company LLP, Chartered Professional Accountants, as the Company's independent registered public accounting firm for the fiscal year ended March 31, 2025.

During the fiscal year ended March 31, 2025, neither the Company nor anyone on its behalf has consulted with Davidson and Company LLP, Chartered Professional Accountants, with respect to either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's consolidated financial statements, and neither a written report nor oral advice was provided to the Company that Davidson and Company LLP, Chartered Professional Accountants, concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a "disagreement" or a "reportable event" as such terms are defined in section 4.11 of NI 51-102.

Management recommends Shareholders vote FOR the appointment of Davidson and Company LLP, Chartered Professional Accountants, as auditor of the Company for the ensuing year and authorize the Foremost Board to fix the auditor's remuneration. Unless directed to the contrary, it is the intention of the Management Proxyholders named in the enclosed instrument of proxy to vote proxies FOR the appointment of Davidson and Company LLP, Chartered Professional Accountants, as auditors of the Company until the close of its next annual meeting and to authorize the Foremost Board to fix the auditor's remuneration.

APPROVAL OF THE AMENDMENT TO THE FOREMOST INCENTIVE PLAN

Amendments Requiring Shareholder Approval at the Meeting

On October 25, 2025, the Foremost Board approved, subject to Shareholder approval at the Meeting, the following principal amendment to the Foremost Incentive Plan (the "Foremost Incentive Plan Amendments"), such that among other things, the Foremost Incentive Plan Amendments:

| (a) | converted the Foremost Incentive Plan from a “fixed number” plan restricting the maximum aggregate number of Foremost Shares issuable pursuant to outstanding options ("Foremost Options" or "Options"), restricted share units ("RSUs"), performance share units ("PSUs") and/or deferred share units ("DSUs", together with the Foremost Options, RSUs and PSUs, the "Foremost Awards" or "Awards") to be no more than 1,500,000 Foremost Shares, to a “rolling” or “evergreen” plan, pursuant to which the aggregate number of Foremost Shares that may be issued pursuant to the outstanding Awards is equal to 15% of the issued and outstanding Foremost Shares at the time of grant, calculated on non-diluted basis; |

| (b) | implemented a 5% annual burn rate cap such that the maximum aggregate number of Foremost Shares that may be issued pursuant to outstanding Foremost Awards granted under the Foremost Incentive Plan within any twelve-month period shall be equal to 5% of the issued and outstanding Foremost Shares at the time of grant, calculated on a non-diluted basis; |

| (c) | provided that, upon the termination of a participant’s position with the Company without cause within 12 month following the completion of a transaction resulting in a Change in Control (as defined herein) of the Company, any unvested PSUs held by a participant shall vest based on adjustment factors determined by the plan administrator, replacing the provision under the unamended Foremost Incentive Plan where all unvested PSUs shall vest immediately under the same circumstances; and |

| (d) | modified the treatment of Awards upon voluntary resignation by a participant, such that any vested Options may be exercised at any time during the period ending on the earlier of (A) the original expiry date of such Options or (B) the date that is 90 days after the termination date of the participant, replacing the current provision under the Foremost Incentive Plan that results in the forfeiture or cancellation of any Awards that have not been exercised, surrendered or settled as of the termination date. |

The proposed Foremost Incentive Plan Amendments are to advance the interests of the Company by enhancing the ability of the Company to attract, motivate and retain employees, officers, directors and consultants, reward such persons for their sustained contributions and encourage such persons to take into account the long-term performance of the Company.

A summary of the material terms of the Foremost Incentive Plan, including the proposed Foremost Incentive Plan Amendments described above, is set out under the heading "Statement of Executive Compensation – Foremost Incentive Plan." The summary is qualified in its entirety by the full text of the amended and restated Foremost Incentive Plan (the "Amended and Restated Foremost Incentive Plan") reflecting the Foremost Incentive Plan Amendments attached to this Circular as Schedule "A".

At the Meeting, Shareholders will be asked to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution approving the Foremost Incentive Plan Amendments. The text of the ordinary resolution which management intends to place before the Meeting (the "Foremost Incentive Plan Amendment Resolution") is as follows:

"BE IT RESOLVED, as an ordinary resolution of Shareholders, that:

| (1) | the amended and restated stock incentive plan of the Company (the ‘Amended and Restated Foremost Incentive Plan’), substantially in the form attached hereto as Schedule 'A', and the reservation for issuance thereunder of up to 15% of the aggregate number of common shares of the Company pursuant to the Amended and Restated Foremost Incentive Plan as are issued and outstanding from time to time, be and is hereby authorized and approved; |

| (2) | the board of directors of the Company be and is hereby authorized in its absolute discretion to administer the Amended and Restated Foremost Incentive Plan, in accordance with its terms and conditions, and to further amend or modify the Amended and Restated Foremost Incentive Plan in accordance with the terms thereof; and |

| (3) | any one director or officer of the Company be and is hereby authorized and directed to do all such acts and things and to execute and deliver, under the corporate seal of the Company or otherwise, all such deeds, documents, instruments and assurances as in his or her opinion may be necessary or desirable to give effect to the foregoing resolutions, including, without limitation, making any changes to the Amended and Restated Foremost Incentive Plan required by the CSE or applicable securities regulatory authorities and to complete all transactions in connection with the administration of the Amended and Restated Foremost Incentive Plan." |

For the foregoing Foremost Incentive Plan Amendment Resolution to be passed, it must be approved by a simple majority of the votes cast by Shareholders in person or represented by proxy at the Meeting. If the Foremost Incentive Plan Amendment Resolution is not approved at the Meeting, the Company will be permitted to issue no more than 1,500,000 Foremost Shares pursuant to Foremost Awards granted under the current Foremost Incentive Plan, of which 518,772 Foremost Shares remain available for future issuances as of the Record Date. This remaining pool may be insufficient to support the Company's ongoing efforts to attract, motivate, and retain employees, officers, directors, and consultants through equity-based incentives beyond the near term. If the Foremost Incentive Plan Amendment Resolution is not approved at the Meeting, the Company’s ability to use equity compensation as a tool to attract and retain skilled personnel and align the interests of such individual with the long-term performance of the Company will be significantly constrained.

Management of the Company has reviewed the Foremost Incentive Plan Amendment Resolution, concluded that it is fair and reasonable to the Shareholders and in the best interest of the Company, and recommends Shareholders vote FOR the Foremost Incentive Plan Amendment Resolutions. Unless directed to the contrary, it is the intention of the Management Proxyholders named in the enclosed instrument of proxy to vote proxies FOR the approval of the Amended and Restated Foremost Incentive Plan.

OTHER MATTERS TO BE ACTED ON

Management of the Company is not aware of any other matters to come before the Meeting other than as set forth in the Notice of Meeting that accompanies this Circular. If any other matter properly comes before the Meeting, it is the intention of the persons named in the enclosed proxy form to vote the shares represented thereby in accordance with their best judgment on such subject matter.

STATEMENT OF EXECUTIVE COMPENSATION

Definitions

For the purposes of this Statement of Executive Compensation, the below terms are defined as follows:

| (a) | "company" includes other types of business organizations such as partnerships, trusts and other unincorporated business entities; |

| (b) | "compensation securities" includes stock options, convertible securities, exchangeable securities and similar instruments including stock appreciation rights, deferred share units, and restricted stock units granted or issued by the Company or one of its subsidiaries for services provided or to be provided, directly or indirectly, to the Company or any of its subsidiaries; |

| (c) | "named executive officer" or "NEO" means each of the following individuals: |

| (i) | each individual who, in respect of the company, during any part of the most recently completed financial year, served as CEO including an individual performing functions similar to a CEO; |

| (ii) | each individual who, in respect of the company, during any part of the most recently completed financial year, served as CFO including an individual performing functions similar to a CFO; |

| (iii) | in respect of the company and its subsidiaries, each of the three highly compensated executive officers of the Company, other than the individuals identified in paragraphs (a) and (b), at the end of the most recently completed financial year whose total compensation was more than $150,000 for that financial year; |

| (iv) | each individual who would be a named executive officer under paragraph (c) but for the fact that the individual was not an executive officer of the company, and was not acting in a similar capacity, at the end of that financial year; |

| (d) | "non-executive director" or "NED" refers to a member of the Foremost Board who, not being an employee of the company, provides independent oversight and strategic direction, focusing on policy-making, planning, and ensuring that the Company's operations align with stakeholder interests rather than day-to-day management. |

| (e) | "plan" includes any plan, contract, authorization, or arrangement, whether or not set out in any formal document, where cash, compensation, securities, or any other property may be received, whether for one or more persons. |

Compensation Discussion and Analysis

The following discussion describes the significant elements of Foremost's executive compensation program, with particular emphasis on the process for determining compensation payable to Foremost's NEOs. This summary provides insight into executive compensation as a key aspect of the overall stewardship and governance of the Company and will help investors understand how decisions about executive compensation are made.

For the financial year ended March 31, 2025, Foremost had the following NEOs: Jason Barnard (President and Chief Executive Officer), Dong Shim (Chief Financial Officer), Sead Hamzagic (former Chief Financial Officer), and Christina Barnard (Chief Operating Officer).

Objectives of the Company's Compensation Program

Foremost strives to improve Shareholder value through sustainable corporate performance. The Company recognizes that its employees and, in particular, the leaders within the organization have a significant impact on Foremost's success.

Foremost's compensation practices are based on a pay-for-performance philosophy in which assessment of performance is based on the Company's financial and operational performance as well as individual contributions.

In determining NEO compensation, the Foremost Board and Foremost Compensation Committee, which consists of only independent directors, strives to:

| (a) | retain an executive critical to the success of the Company and the enhancement of shareholder value; |

| (b) | attract and motivate executives who are instrumental to the success of the Company and the enhancement of shareholder value; |

| (c) | align employee interests with the business objectives of Foremost; |

| (d) | align compensation with Foremost's corporate strategy and financial interests as well as the long-term interests of Shareholders and the communities in which it operates; and balancing the interests of management and Shareholders; and |

| (e) | be viewed as fair and reasonable to Shareholders, in scale with local market and similar positions in comparable companies. |

Managing Risks

Foremost has a series of governance and operational controls to mitigate risks stemming from its compensation structure, including the establishment of the Foremost Compensation Committee which, amongst other matters, is responsible for considering the appropriateness of remuneration in light of performance outcomes and market conditions. The Foremost Compensation Committee meets as required, but not less than once each year and reports to the Foremost Board. Additional risk management initiatives currently employed by the Company are as follows:

| · | all Foremost Compensation Committee members are independent directors; | |

| · | discretion is used in adjusting any bonus payments up or down as the Foremost Compensation Committee deems appropriate and recommends; | |

| · | a capped bonus plan design was established; | |

| · | executives and non-employee directors are subject to share ownership guidelines; and | |

| · | a clawback policy was adopted, which allows certain incentive compensation paid by the Company to an executive to be clawed back if such compensation was based on the achievement of financial results that were a result of erroneous data or material noncompliance of the Company with any financial reporting requirements. |

All of Foremost's executives, employees and directors are subject to Foremost's insider trading policy, which prohibits trading in Foremost's securities while in possession of undisclosed material information about Foremost. Under this policy, such individuals are also prohibited from active trading or short-term speculation involving Foremost's securities, including short sales, puts and calls. Furthermore, Foremost permits executives to trade in its securities only during prescribed trading windows.

Compensation Oversight / Decision Making

At the beginning of each year, the Foremost Board reviews the Company's performance and the analysis and recommendations from (i) the Foremost Compensation Committee in respect of NEO compensation and (ii) the CEO in respect of compensation for the COO and their direct staff and all staff under their supervision. As applicable, the Foremost Compensation Committee and CEO provides to the Foremost Board (i) their assessment of the competitiveness of base salaries within Foremost's peer group, (ii) their recommendations for annual performance incentives for the Company's executives, based on the prior year's performance of such executives and the Company as a whole, and (iii) their recommendations regarding base salaries, long term incentive awards and annual performance objectives for the current fiscal year.

The Foremost Compensation Committee reviews all of Foremost's policies and programs relating to executive compensation and makes recommendations to the Foremost Board, as follows:

| Establishing objectives to measure performance |

The objectives of the CEO are reviewed by the Foremost Compensation Committee and recommended to the Foremost Board for ultimate approval. The Foremost Compensation Committee reviews and approves the annual objectives of the other NEOs, except for the COO and direct staff of the CEO and employees under the CEOs supervision.

|

| Evaluating Performance |

The performance of the CEO is reviewed by the Foremost Compensation Committee. The CEO is responsible for evaluating the performance of their direct reports and makes recommendations for their awards, including equity, to the Foremost Compensation Committee for review and approval.

|

|

Determining compensation packages

|

The CEO's base salary and bonus awards are reviewed by the Foremost Compensation Committee prior to recommendation to the Foremost Board for ultimate approval. The base salaries and bonuses of the other NEOs are reviewed and approved by the Foremost Compensation Committee. The Foremost Board approves all equity-based grants. |

Foremost Compensation Committee

The Foremost Compensation Committee is a sub-committee of the Foremost Board, consisting of David Cates (Chairman), Amanda Willett and Douglas Mason, each of whom satisfy the "independence" requirements of Rule 10A-3 under the Exchange Act and NASDAQ Listing Rule 5605(c)(2).

The Foremost Compensation Committee is chartered to:

| (a) | make recommendations to the Foremost Board regarding corporate goals and objectives relevant to the compensation of the Company's CEO and other senior executive officers; |

| (b) | evaluate the performance of the CEO and other senior executive officers in light of those goals and objectives and make recommendations to the Foremost Board with respect to the compensation level of the CEO and other senior executive officers; |

| (c) | make recommendations to the Foremost Board with respect to the grant of Foremost Options under the Foremost Incentive Plan, as amended from time to time or other grants under equity-based plans; |

| (d) | recommend to the Foremost Board the cash and non-cash compensation policies for the non-executive directors; |

| (e) | make recommendations to the Foremost Board with respect to amendments to the Foremost Incentive Plan or other equity-based plans or implementing other equity-based plans; |

| (f) | assist the Foremost Board in evaluating potential candidates for senior executive officer positions with the Company; |

| (g) | review, discuss with management and approve the Company's disclosures regarding compensation for use in any of the Company's public disclosure documents; and |

| (h) | produce a compensation committee report on executive officer compensation as required by applicable securities laws. |

Foremost Compensation Program

The Foremost Board adopted a comprehensive compensation framework effective April 1, 2024 (the "Foremost Compensation Program" or the "Program"). The Program is designed to provide a competitive total compensation structure for the Company's directors, executive officers, and senior leadership team, and to align their interests with those of the Company's shareholders over the long term.

Pursuant to the Foremost Compensation Program, the Company (a) adjusted the formulation of the elements in the bonus plan and (b) introduced an executive share ownership policy (the "Share Ownership Policy"). For further particulars of the changes made pursuant to the Foremost Compensation Program, see "Share Ownership Policy" and "NEO Compensation Components" below.

No compensation consultant or advisor was retained during the fiscal year ended March 31, 2025 to assist the Board of Directors or the Foremost Compensation Committee in determining compensation for any of the Company's directors or executive officers.

The Foremost Compensation Program governs all aspects of compensation for the Company's NEOs, including base salary, annual bonuses, equity-based awards and related governance policies such as the Company's Share Ownership Policy.

Benchmarking

In developing the Program, the Foremost Board reviewed the competitive market analysis of Canadian and U.S.-listed mining companies prepared by Global Governance Advisors ("GGA"), an independent compensation consultancy firm, to ensure that the compensation framework reflects prevailing practices of the Company's peer group. The analysis focused on establishing a peer group consisting of companies of similar size and stage of development in the lithium, copper and uranium sectors. The peer selection criteria included:

| (a) | companies of a similar size to Foremost, with a market capitalization ranging from 0.25x to 4x; |

| (b) | consideration of the total asset size of peer companies; |

| (c) | companies that are in the pre-revenue exploration stage and primarily focus on lithium, copper, and uranium mining; |

| (d) | companies operating in geographic regions similar to Foremost, to account for geographic risk; |

| (e) | companies with a similar business strategy and scope of operations to Foremost; and |

| (f) | publicly traded companies listed on major North American exchanges. |

Based on the above criteria, the following peer companies were used for benchmarking purposes:

| Fortune Battery Metals Corp |

Lion Copper and Gold Corp

|

Northcliff Resources | Vision Lithium |

| Avalon Advanced Materials Inc |

Grid Metals Corp

|

Lithium South Development Corp | Peloton Minerals Corp |

| Electra Battery Materials |

International Lithium Corp.

|

New Age Metals Inc |

| FE Battery Metals Corp |

Kutcho Copper Corp

|

Nickel Creek Platinum Corp | |

| Generation Mining Ltd |

Lithium Bank Corp

|

North West Copper Corp |

At the time the peer group was established, Foremost’s relative market position was at the 54th percentile relative to market capitalization, 78th percentile relative to enterprise value and 39th percentile relative to total assets.

NEO Compensation Components

Under the Foremost Compensation Program, the compensation for NEOs consists of three (3) primary components: (a) base salary, (b) bonuses, and (c) stock-based awards, serving as long term-incentives.

Base Salaries

The Foremost Board approves the salary ranges, or fees paid to NEOs. The review for each NEO is based on assessment of factors such as current competitive market conditions and particular skills, including leadership ability and management effectiveness, experience, responsibility and proven or expected overall performance of the particular individual. The Foremost Board, using this information, together with budgetary guidelines and other internally generated planning and forecasting tools, performs an annual assessment of the compensation of all executive and employee compensation levels.

Pursuant to the Foremost Compensation Program and informed by the competitive market analysis provided by GGA, the Company adjusted certain executive base salaries for the 2024 fiscal year. The GGA analysis indicated that while the CEO's previous base salary was positioned near the median of mineral-specific peers, the Company's successful NASDAQ listing warranted a review against a broader market. The adjustments reflect a targeted, multi-year approach to align with competitive market practices while maintaining fiscal prudence.

The CEO's base salary was increased to $300,000 annually. This adjustment positions the salary competitively within the lower quartile of the broader peer group as the Company progresses towards full market alignment. The COO's base salary was increased to $250,000 annually. This adjustment brings the COO's salary to the market median (50th percentile) for the role, addressing a previously identified gap and ensuring the retention of key operational leadership.

The Foremost Board, using this market data together with budgetary guidelines, performs an annual assessment of all executive compensation levels.

Bonuses / Short Term Incentives.

A bonus structure with a balanced score-card approach was adopted pursuant to the Foremost Compensation Program. The balanced scorecard measures a both corporate and personal objectives that align with Foremost’s strategic initiatives. The performance metric includes appreciation of the Company's share price, financial health, and include strategic and individual performance measures. To ensure a pay-for-performance culture and affordability to Foremost, bonus payouts will only be made if minimum performance levels and progress review results that the Compensation Committee sets in the first quarter of the fiscal year are achieved. The CEO and COO’s target bonus opportunity is 60% and 40% of their base salary respectively.

The Foremost Board, upon recommendation of the Foremost Compensation Committee, approves the NEOs bonus awards, subject to the corporate performance results. Individual performance of the CEO is assessed by the Foremost Compensation Committee, and the CEO's direct report's individual performance is assessed by the CEO. The Foremost Compensation Committee considers the CEO's individual performance assessment and ultimately recommends to the Foremost Board for final approval, the NEOs final bonus awards.

Additionally, the Foremost Board has the discretion to award the annual bonus earned by the CEO using a mix of equity and cash where appropriate. The Foremost Board has the discretion to award up to 100% of the annual bonus in equity, as well as having accelerators allowing up to 150% of bonus for superior performance.

During Fiscal Year ended March 31, 2025 Compensation Committee reviewed the results achieved within the balanced scorecard and determined that the Company’s achieved the following results against each of the target objectives:

| · | stock performance, weighted 30% of the bonus opportunity, fell below the threshold level, resulting in 0% of the earned portion of the component weighting; |

| · | financing performance, weighted 30% of the bonus opportunity, met the target, resulting in 100% of the earned portion of the component weighting; |

| · | operational performance, weighted 20% of the bonus opportunity, fell between threshold and target levels, resulting in 66.7% of the earned portion of the component weighting; and |

| · | ESG performance, weighted 10% of the bonus opportunity, met the threshold level, resulting in 50% of the earned portion of the component weighting. |

Based on the results achieved, the balanced scorecard multiplier resulted in a bonus equal to 55% of the target bonus for the CEO and COO. Specifically, the CEO and the COO were awarded a bonus of $99,000 and $55,000 respectively.

Long Term Incentives.

As of the financial year ended March 31, 2025, the Company implemented the long-term incentive plan ("LTIP") for the CEO and the COO, which includes and Foremost Options and RSUs. Thereafter, the LTIP program became available for non-employee directors, officers and senior management personnel and consultants of the Company. LTIP is designed to enable the Company to attract and retain experienced and qualified individuals in those positions, and incentivize them to achieve certain Company objectives, by permitting such individuals to directly participate in an increase in per share value created for the Shareholders. The Foremost Incentive Plan is the Company's only equity compensation plan. The Foremost Incentive Plan is an important part of the Company's long-term incentive strategy for its executive officers. The Foremost Incentive Plan is intended to reinforce commitments to long-term growth in profitability and shareholder value.

Foremost Awards