UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 17, 2025

Predictive Oncology Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

001-36790 |

33-1007393 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

91 43rd Street, Suite 110

Pittsburgh, PA 15201

(Address of principal executive offices) (Zip Code)

(412) 432-1500

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common stock, par value $0.01 per share | POAI | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Predictive Oncology Inc. (the “Company”) has scheduled a conference call and webcast at 9:00 a.m. Eastern Time on November 17, 2025, to discuss the Company’s financial results for the third quarter ended September 30, 2025 and provide an update on its digital asset strategy. A presentation will be made available on the Company’s investor relations page. A copy of the presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information included in this Item 7.01, including Exhibit 99.1 hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Exchange Act or Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Presentation dated November 17, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Predictive Oncology Inc. | ||

| Date: November 17, 2025 | By: | /s/ Josh Blacher |

| Josh Blacher | ||

| Chief Financial Officer | ||

Exhibit 99.1

1 This presentation contains “forward - looking statements” as defined by the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. This presentation also includes express and implied forward - looking statements regarding the Company’s current expectations, estimates, opinions and beliefs that are not historical facts. Such forward - looking statements may be identified by words such as “believes,” “expects,” “endeavors,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “should” and “objective” and the negative and variations of such words and similar words. These statements are made on the basis of current knowledge and, by their nature, involve numerous assumptions and uncertainties. The Company cannot guarantee the accuracy, completeness, or reliability of statements made by third parties in this presentation, nor can it assure that any expectations, forecasts, or outcomes expressed by third parties will materialize. Nothing set forth herein should be regarded as a representation, warranty or prediction that we will achieve or are likely to achieve any particular future result. Actual results may differ materially from those indicated in the forward - looking statements because the realization of those results is subject to many risks and uncertainties, including, without limitation, the risk of failing to realize the anticipated benefits of the Company’s proposed digital asset treasury strategy, economic conditions, fluctuations in the market price of ATH and other digital assets, the impact of the evolving regulatory environment on the Company’s business, the ability of the Company to execute on its digital asset treasury strategy and implications for shareholders and for the Company’s core business, the ability of the Aethir ecosystem to perform in a manner consistent with projections, receipt of shareholder approval for the exercise of the pre - funded warrants issued in connection with the private placement pursuant to which the Company issued pre - funded warrants in exchange for locked and unlocked ATH, the risks related to the success of our collaboration arrangements, commercialization activities and product sales levels by our collaboration partners, and the other risks, uncertainties, and other factors described under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in the documents we file with the U.S. Securities and Exchange Commission. Forward - looking statements contained in this presentation are made as of the date of this presentation, and the Company undertakes no duty to update such information except as required under applicable law. Safe Harbor Statement 2 Third Quarter 2025 Financial Results and Update on Digital Asset Strategy November 17, 2025

3 Via Video Recording Third Quarter 2025 Financial Results and Strategic Update Predictive Oncology Inc. Speakers: Raymond Vennare (Chief Executive Officer) Josh Blacher (Chief Financial Officer) Thomas McLaughlin (Chief Investment Officer) Kyle Okamoto (Crypto Advisory Board Member) Agenda Subject Presenter Introduction and Opening Remarks Company Update Financial Update Investment Overview Market and Utility Overview R. Vennare R. Vennare J. Blacher T. McLaughlin K. Okamoto November 17, 2025 4 Company Update Raymond Vennare (Chief Executive Officer)

5 Company Update & Strategic Path Forward Rationale, Investment Strategy and Market Execution Rationale • Predictive Oncology partners with DNA Holdings Venture to initiate a digital asset treasury strategy • Focused on the Aethir ecosystem and its native token (ATH) • Aethir operates one of the world’s largest decentralized GPU networks with +200 locations in 93 countries Investment Strategy • Citigroup estimates that AI infrastructure spending will reach $2.8 trillion globally by 2029 • Aethir enables Predictive Oncology to directly benefit from this exponential growth Market Execution • Alignment with Aethir network provides direct access to advanced computing power on a global scale • Blueprint for decentralized digital currencies to converge and mutually benefit November 17, 2025 6 Financial Update Josh Blacher (Chief Financial Officer)

7 Investment Overview Thomas McLaughlin Chief Investment Officer 8 Investment Overview Overview of Assets and Plan for Action Objectives • Allocate the assets on the balance sheet to drive the best risk - adjusted returns for Predictive Oncology • Will be achieved through a combination of 4 different allocation methods (shown right) Composition of Assets Available • $44.5m Net Cash to Purchase ATH (of $50.8m gross proceeds received in connection with the PIPE) • $145.9m of ATH Tokens* Infrastructure, Custody and Internal Processes • Governance oversight through DNA Holdings Venture, the Company’s asset manager • Multiple Signatories on Movement and Execution * As of November 10, 2025 at 4PM EST, per Coinbase Exchange November 17, 2025 Utilizing ATH on the Balance Sheet 1. Passive ATH staking in AI/gaming pools 2. Active staking for Aethir Cloud Hosts, to share rewards from AI bookings 3. Book GPUs (using ATH) to sell for cash 4.

Book GPUs (using ATH) to earn other Decentralized Physical Infrastructure Network (DePIN) tokens and sell for cash 9 Investment Overview ATH Tokens on the Balance Sheet Token Balance Composition • Company currently holds 5.7bn ATH tokens on its balance sheet as of 11/10/2025 • Based on current values this puts the company’s mNAV at ~0.76x 1 • 3.74bn ATH tokens are set to unlock through 12/12/2028 (as shown in chart on right) Accumulation of Tokens Since Transaction • 927.9m additional tokens have been accumulated through 11/10/2025, using $25m cash (of the $44.5m from the PIPE), at an average acquisition price of $0.027 2 November 17, 2025 (1) mNAV based on fully diluted share count of 21,840,605 as of 11/11/2025; Enterprise value calculated as of close on 11/10/2025. (2) In connection with the PIPE, Predictive Oncology entered into an agreement with the Aethir Foundation pursuant to which it agreed that for each ATH token purchased by the Company on the open market, the Aethir Foundation would grant the Company an additional 20% of the tokens purchased.

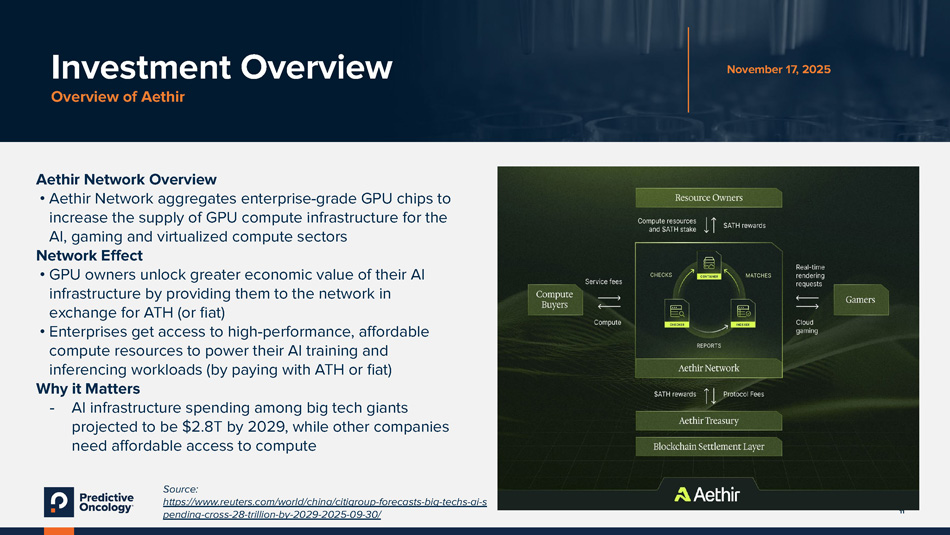

10 Investment Overview Summary of Objectives Summary of Objectives • FY’26 Goal is to achieve a high single digit % return on digital assets • Leverage multiple strategies to deploy ATH to drive revenue for the company • First objective is to drive a baseline of cash flow to the company • Ultimate objective to create a strong sustained business model that is positively valued by the public market in comparison to competitors based on revenue and profitability metrics November 17, 2025 11 Investment Overview Overview of Aethir Aethir Network Overview • Aethir Network aggregates enterprise - grade GPU chips to increase the supply of GPU compute infrastructure for the AI, gaming and virtualized compute sectors Network Effect • GPU owners unlock greater economic value of their AI infrastructure by providing them to the network in exchange for ATH (or fiat) • Enterprises get access to high - performance, affordable compute resources to power their AI training and inferencing workloads (by paying with ATH or fiat) Why it Matters - AI infrastructure spending among big tech giants projected to be $2.8T by 2029, while other companies need affordable access to compute November 17, 2025 Source: https://www.reuters.com/world/china/citigroup - forecasts - big - techs - ai - s pending - cross - 28 - trillion - by - 2029 - 2025 - 09 - 30/ 12 Leveraging ATH Strategic Compute Reserve - Maximize Utility Kyle Okamoto Predictive Oncology Crypto Advisory Board Member

13 Global AI Infra Demand is Here…Now Massive Compute Demand Creating Unprecedented Opportunity Key Statistics : 䙘 $2.8 Trillion: Projected AI infrastructure spending by 2029 ( Citigroup ) 䙘 200 Gigawatts: Global power capacity needed by 2030 ( Bain & Company ) 䙘 10x: Supply/demand gap in AI compute ( Bloomberg Intelligence) 䙘 $490 Billion: AI CapEx of 5 hyperscalers by 2026 ( Reuters ) November 17, 2025 “Based on the trends we are seeing of how people are using AI and how much of it they would like to use, we believe the risk to OpenAI of not having enough computing power is more significant … Building a strategic national reserve of computing power makes a lot of sense . ” - Sam Altman, OpenAI Predictive Oncology Strategy: 1. Establish Strategic Compute Reserve – done 2. Stimulate supply – Aim to monetize ATH via staking and providing staking loans to Cloud Hosts - in - progress 3. Satisfy demand – Seek to convert ATH to GPUs to generate fiat revenue by renting GPUs to enterprise clients on the Aethir network - in - progress 4. Grow Reserve – Strive to generate additional ATH via rewards & on - market purchases (receiving an additional 20% Aethir Foundation grant) - in - progress Sources: https://www.reuters.com/world/china/citigroup - forecasts - big - techs - ai - spending - cross - 28 - trillion - by - 2029 - 2025 - 09 - 30/ , https://www.bain.com/insights/how - can - we - meet - ais - insatiable - demand - for - compute - power - technology - report - 2025/ , https://www.bloomberg.com/professional/insights/artificial - intelligence/?type=article 14 Utilizing ATH to Satisfy Enterprise Demand Transactional Workflow Example Strategic Compute Reserve: 1.

Lend ATH (for Cloud Host stake) to earn more ATH 2. Rent GPUs w/ ATH 3. Sell GPUs to enterprise clients (generating positive - margin fiat revenue) 4.

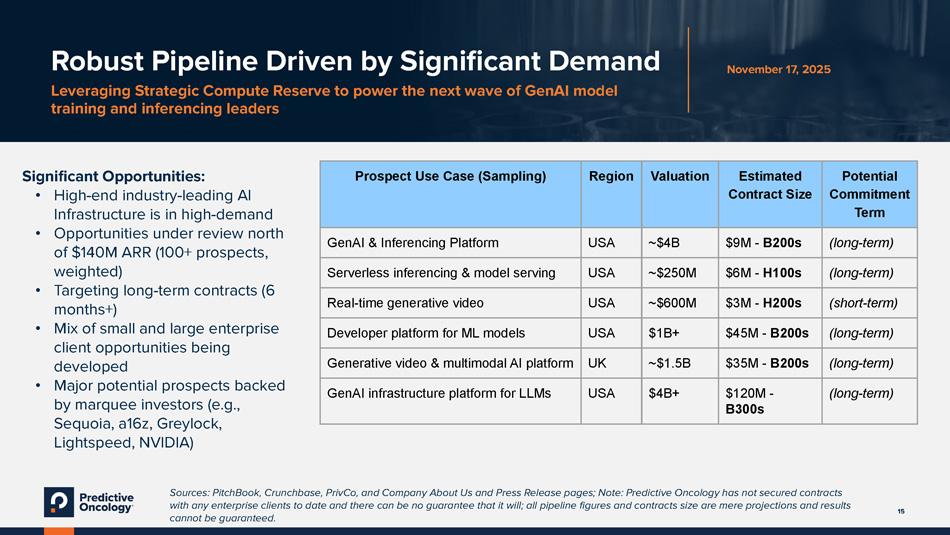

Use portion of fiat revenue to purchase more ATH, receive +20% Foundation Grant November 17, 2025 15 Robust Pipeline Driven by Significant Demand Leveraging Strategic Compute Reserve to power the next wave of GenAI model training and inferencing leaders November 17, 2025 Potential Commitment Term Estimated Contract Size Valuation Region Prospect Use Case (Sampling) (long - term) $9M - B200s ~$4B USA GenAI & Inferencing Platform (long - term) $6M - H100s ~$250M USA Serverless inferencing & model serving (short - term) $3M - H200s ~$600M USA Real - time generative video (long - term) $45M - B200s $1B+ USA Developer platform for ML models (long - term) $35M - B200s ~$1.5B UK Generative video & multimodal AI platform (long - term) $120M - B300s $4B+ USA GenAI infrastructure platform for LLMs Significant Opportunities: • High - end industry - leading AI Infrastructure is in high - demand • Opportunities under review north of $140M ARR (100+ prospects, weighted) • Targeting long - term contracts (6 months+) • Mix of small and large enterprise client opportunities being developed • Major potential prospects backed by marquee investors (e.g., Sequoia, a16z, Greylock, Lightspeed, NVIDIA) Sources: PitchBook, Crunchbase, PrivCo, and Company About Us and Press Release pages; Note: Predictive Oncology has not secured contracts with any enterprise clients to date and there can be no guarantee that it will; all pipeline figures and contracts size are mere projections and results cannot be guaranteed.

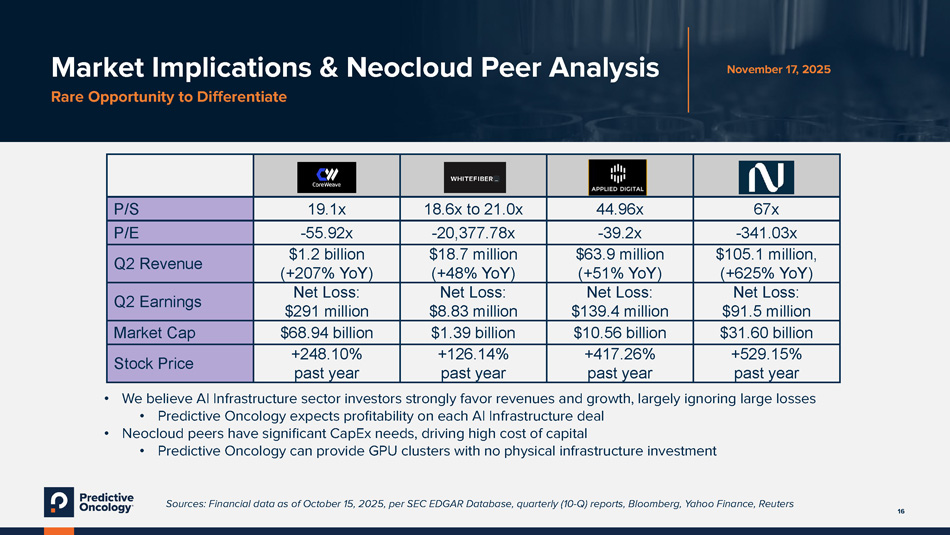

16 Market Implications & Neocloud Peer Analysis Rare Opportunity to Differentiate • We believe AI Infrastructure sector investors strongly favor revenues and growth, largely ignoring large losses • Predictive Oncology expects profitability on each AI Infrastructure deal • Neocloud peers have significant CapEx needs, driving high cost of capital • Predictive Oncology can provide GPU clusters with no physical infrastructure investment 67x 44.96x 18.6x to 21.0x 19.1x P/S - 341.03x - 39.2x - 20,377.78x - 55.92x P/E $105.1 million, (+625% YoY) $63.9 million (+51% YoY) $18.7 million (+48% YoY) $1.2 billion (+207% YoY) Q2 Revenue Net Loss: $91.5 million Net Loss: $139.4 million Net Loss: $8.83 million Net Loss: $291 million Q2 Earnings $31.60 billion $10.56 billion $1.39 billion $68.94 billion Market Cap +529.15% past year +417.26% past year +126.14% past year +248.10% past year Stock Price November 17, 2025 Sources: Financial data as of October 15, 2025, per SEC EDGAR Database, quarterly (10 - Q) reports, Bloomberg, Yahoo Finance, Reuters 17 Coming soon Expanding our mission Powering the next era of AI innovation • Strategic Compute Reserve Acceleration: We expect to leverage ATH tokens to activate global AI Infrastructure, turning capital into scalable, revenue - producing compute power • Expanding Inventory: We anticipate delivering NVIDIA B300 clusters to enable major enterprise deals — accelerating our cash flow and growth • New Business Lines: We expect to expand active digital asset management strategies to enhance our new business • Brand & Ticker Update: Update image to reflect our expanded focus on AI infrastructure and digital asset utility November 17, 2025

18 Closing Remarks Raymond Vennare (Chief Executive Officer)