UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File No. 001-38145

Fury Gold Mines Limited

(Translation of registrant's name into English)

401

Bay Street, 16th Floor, Toronto, Ontario, Canada, M5H 2Y4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F ☒ Form 40-F ☐

SUBMITTED HEREWITH

| Exhibits | |

| 99.1 | Condensed Interim Consolidated Financial Statements |

| 99.2 | Management’s Discussion And Analysis |

| 99.3 | CEO certification of interim filings |

| 99.4 | CFO certification of interim filings |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: November 13, 2025

Fury Gold Mines Limited

/s/ Phil van Staden

Phil van Staden

Chief Financial Officer

Exhibit 99.1

(An exploration company)

CONDENSED INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2025

Fury Gold Mines Limited

Condensed Interim Consolidated Statements of Financial Position

(Expressed in thousands of Canadian dollars - Unaudited)

| At September 30 | At December 31 | |||||||||

| Note | 2025 | 2024 | ||||||||

| Assets | ||||||||||

| Current assets: | ||||||||||

| Cash | $ | 6,127 | $ | 4,912 | ||||||

| Marketable securities | 5 | 2,356 | 2,358 | |||||||

| Other investment | 2,063 | 2,063 | ||||||||

| Accounts receivable | 314 | 54 | ||||||||

| Prepaid expenses and deposits | 640 | 522 | ||||||||

| 11,500 | 9,909 | |||||||||

| Non-current assets: | ||||||||||

| Restricted cash | 144 | 144 | ||||||||

| Prepaid expenses and deposits | 73 | 77 | ||||||||

| Property and equipment | 222 | 326 | ||||||||

| Mineral property interests | 4,6 | 50,176 | 45,200 | |||||||

| Investments in associates | 7 | 24,514 | 29,456 | |||||||

| 75,129 | 75,203 | |||||||||

| Total assets | $ | 86,629 | $ | 85,112 | ||||||

| Liabilities and Equity | ||||||||||

| Current liabilities: | ||||||||||

| Accounts payable and accrued liabilities | $ | 1,042 | $ | 855 | ||||||

| Deferred government grant | 8 | 47 | - | |||||||

| Lease liability | - | 65 | ||||||||

| Flow-through share premium liability | 9 | 206 | 944 | |||||||

| 1,295 | 1,864 | |||||||||

| Non-current liabilities: | ||||||||||

| Provision for site reclamation and closure | 4,696 | 5,045 | ||||||||

| Total liabilities | $ | 5,991 | $ | 6,909 | ||||||

| Equity: | ||||||||||

| Share capital | 12 | $ | 324,223 | $ | 312,723 | |||||

| Share option and warrant reserve | 13 | 23,312 | 22,684 | |||||||

| Accumulated other comprehensive loss | (18 | ) | (12 | ) | ||||||

| Deficit | (266,879 | ) | (257,192 | ) | ||||||

| Total equity | $ | 80,638 | $ | 78,203 | ||||||

| Total liabilities and equity | $ | 86,629 | $ | 85,112 | ||||||

Commitments (notes 7, 17); Subsequent events (note 18)

Approved on behalf of the Board of Directors:

| “Forrester A. Clark” | “Steve Cook” | ||

| Chief Executive Officer | Director |

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

| Fury Gold Mines Limited |

|

Fury Gold Mines Limited

Condensed Interim Consolidated Statements of Loss and Comprehensive Loss

(Expressed in thousands of Canadian dollars, except per share amounts - Unaudited)

| Three months ended September 30 |

Nine months ended September 30 |

|||||||||||||||||

| Note | 2025 | 2024 (Note 3) |

2025 | 2024 (Note 3) |

||||||||||||||

| Operating expenses: | ||||||||||||||||||

| Exploration and evaluation | 10 | $ | 4,295 | $ | 2,318 | $ | 9,489 | $ | 4,794 | |||||||||

| Fees, salaries and other employee benefits | 485 | 412 | 1,547 | 1,517 | ||||||||||||||

| Insurance | 114 | 124 | 372 | 420 | ||||||||||||||

| Legal and professional | 310 | 138 | 896 | 602 | ||||||||||||||

| Marketing and investor relations | 198 | 138 | 615 | 464 | ||||||||||||||

| Office and administration | 51 | 98 | 219 | 280 | ||||||||||||||

| Regulatory and compliance | 71 | 36 | 262 | 170 | ||||||||||||||

| 5,524 | 3,264 | 13,400 | 8,247 | |||||||||||||||

| Other (income) expenses, net: | ||||||||||||||||||

| Accretion on provision for site reclamation and closure | 36 | 39 | 111 | 111 | ||||||||||||||

| Amortization of flow-through share premium | 9 | (194 | ) | (678 | ) | (1,142 | ) | (1,407 | ) | |||||||||

| Foreign exchange loss | 3 | 2 | 4 | 11 | ||||||||||||||

| Interest expense | - | 6 | 2 | 24 | ||||||||||||||

| Interest income | (53 | ) | (75 | ) | (132 | ) | (240 | ) | ||||||||||

| Net loss from associates | 7 | 1,847 | 1,668 | 3,634 | 3,624 | |||||||||||||

| Net gain on investments | 7 | (1,854 | ) | (1,780 | ) | (5,232 | ) | (2,538 | ) | |||||||||

| Net (gain) loss on marketable securities | 5 | (320 | ) | 421 | (668 | ) | (191 | ) | ||||||||||

| Other income | 11 | (126 | ) | - | (144 | ) | (566 | ) | ||||||||||

| (661 | ) | (397 | ) | (3,567 | ) | (1,172 | ) | |||||||||||

| Loss before taxes | 4,863 | 2,867 | 9,833 | 7,075 | ||||||||||||||

| Tax recovery | (164 | ) | (194 | ) | (146 | ) | (194 | ) | ||||||||||

| Net loss for the period | 4,699 | 2,673 | 9,687 | 6,881 | ||||||||||||||

| Other comprehensive loss, net of tax | ||||||||||||||||||

| Unrealized currency loss on translation of foreign operations |

2 | - | 6 | 2 | ||||||||||||||

| Total comprehensive loss for the period | $ | 4,701 | $ | 2,673 | $ | 9,693 | $ | 6,883 | ||||||||||

| Loss per share: | ||||||||||||||||||

| Basic and diluted loss per share | 16 | $ | 0.03 | $ | 0.02 | $ | 0.06 | $ | 0.05 | |||||||||

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

| Fury Gold Mines Limited |

|

Fury Gold Mines Limited

Condensed Interim Consolidated Statements of Equity

(Expressed in thousands of Canadian dollars, except share amounts - Unaudited)

| Number of common shares |

Share capital |

Share option and warrant reserve |

Accumulated other comprehensive loss |

Deficit | Total | |||||||||||||||||||

| Balance at December 31, 2023 | 145,744,795 | $ | 310,277 | $ | 21,660 | $ | (9 | ) | $ | (149,054 | ) | $ | 182,874 | |||||||||||

| Total comprehensive loss (note 3) | - | - | - | (2 | ) | (6,881 | ) | (6,883 | ) | |||||||||||||||

| Shares issued pursuant to offering, net of share issue costs and flow-through premium liability (note 9) | 5,320,000 | 2,537 | - | - | - | 2,537 | ||||||||||||||||||

| Share-based compensation (note 13) | 441,278 | - | 995 | - | - | 995 | ||||||||||||||||||

| Balance at September 30, 2024 | 151,506,073 | $ | 312,814 | $ | 22,655 | $ | (11 | ) | $ | (155,935 | ) | $ | 179,523 | |||||||||||

| Balance at December 31, 2024 | 151,556,273 | $ | 312,723 | $ | 22,684 | $ | (12 | ) | $ | (257,192 | ) | $ | 78,203 | |||||||||||

| Total comprehensive loss | - | - | - | (6 | ) | (9,687 | ) | (9,693 | ) | |||||||||||||||

| Shares and warrants exchanged in QPM Acquisition (note 4) | 8,394,045 | 4,503 | 30 | - | - | 4,533 | ||||||||||||||||||

| Shares and warrants issued pursuant to private placement, net of share issue costs (note 13) | 7,168,000 | 3,571 | 906 | - | - | 4,477 | ||||||||||||||||||

| Shares issued pursuant to offering, net of share issue costs and flow-through premium liability (note 9) | 3,999,701 | 2,457 | - | - | - | 2,457 | ||||||||||||||||||

| Share options exercised (note 13) | 231,000 | 190 | (64 | ) | - | - | 126 | |||||||||||||||||

| Share-based compensation (note 13) | 382,027 | 779 | (244 | ) | - | - | 535 | |||||||||||||||||

| Balance at September 30, 2025 | 171,731,046 | $ | 324,223 | $ | 23,312 | $ | (18 | ) | $ | (266,879 | ) | $ | 80,638 | |||||||||||

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

| Fury Gold Mines Limited |

|

Fury Gold Mines Limited

Condensed Interim Consolidated Statements of Cash Flows

(Expressed in thousands of Canadian dollars - Unaudited)

| Three months ended September 30 |

Nine months ended September 30 |

|||||||||||||||||

| Note | 2025 | 2024 (Note 3) |

2025 | 2024 (Note 3) |

||||||||||||||

| Operating activities: | ||||||||||||||||||

| Loss for the year | $ | (4,699 | ) | $ | (2,673 | ) | $ | (9,687 | ) | $ | (6,881 | ) | ||||||

| Adjusted for: | ||||||||||||||||||

| Interest income | (53 | ) | (75 | ) | (132 | ) | (240 | ) | ||||||||||

| Government grant received | 8 | - | - | 83 | - | |||||||||||||

| Items not involving cash: | ||||||||||||||||||

| Accretion of provision for site reclamation and closure | 36 | 39 | 111 | 111 | ||||||||||||||

| Amortization of flow-through share premium | 9 | (194 | ) | (678 | ) | (1,142 | ) | (1,407 | ) | |||||||||

| Depreciation | 43 | 69 | 151 | 227 | ||||||||||||||

| Interest expense | - | 6 | 2 | 24 | ||||||||||||||

| Net loss from associates | 7 | 1,847 | 1,668 | 3,634 | 3,624 | |||||||||||||

| Net gain on investments | 7 | (1,854 | ) | (1,780 | ) | (5,232 | ) | (2,538 | ) | |||||||||

| Net (gain) loss on marketable securities | 5 | (320 | ) | 421 | (668 | ) | (191 | ) | ||||||||||

| Share-based compensation | 13 | 164 | 179 | 535 | 831 | |||||||||||||

| Changes in non-cash working capital | 15 | (473 | ) | (524 | ) | (222 | ) | (67 | ) | |||||||||

| Cash used in operating activities | (5,503 | ) | (3,348 | ) | (12,567 | ) | (6,507 | ) | ||||||||||

| Investing activities: | ||||||||||||||||||

| Acquisition of mineral interests, inclusive of transaction fees | 4 | - | - | (904 | ) | (3,030 | ) | |||||||||||

| Interest income | 53 | 75 | 132 | 240 | ||||||||||||||

| Proceeds from disposition of investment in associate, net of transaction costs |

7 | 2,914 | - | 6,539 | 3,820 | |||||||||||||

| Proceeds from disposition of marketable securities, net of transaction costs |

5 | 57 | 237 | 670 | 481 | |||||||||||||

| Marketable securities additions | 5 | - | - | - | (1,300 | ) | ||||||||||||

| Other investments additions | - | (2,063 | ) | - | (2,063 | ) | ||||||||||||

| Property and equipment additions | - | (35 | ) | (47 | ) | (35 | ) | |||||||||||

| Cash provided by (used in) investing activities | 3,024 | (1,786 | ) | 6,390 | (1,887 | ) | ||||||||||||

| Financing activities: | ||||||||||||||||||

| Lease payments | - | (48 | ) | (62 | ) | (142 | ) | |||||||||||

| Proceeds from financing, net of share issue costs | 12 | - | - | 4,477 | - | |||||||||||||

| Proceeds from issuance of flow-through shares, net of issuance costs |

12 | - | (4 | ) | 2,857 | 4,560 | ||||||||||||

| Proceeds from exercise of options | 13 | 41 | - | 126 | - | |||||||||||||

| Cash provided by financing activities | 41 | (52 | ) | 7,398 | 4,418 | |||||||||||||

| Effect of foreign exchange on cash | (2 | ) | - | (6 | ) | (2 | ) | |||||||||||

| Increase (decrease) in cash | (2,440 | ) | (5,186 | ) | 1,215 | (3,977 | ) | |||||||||||

| Cash, beginning of period | 8,567 | 8,522 | 4,912 | 7,313 | ||||||||||||||

| Cash, end of period | $ | 6,127 | $ | 3,336 | $ | 6,127 | $ | 3,336 | ||||||||||

Supplemental cash flow information (note 15)

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

| Fury Gold Mines Limited |

|

Note 1: Nature of operations

Fury Gold Mines Limited (the “Company” or “Fury Gold”) was incorporated on June 9, 2008, under the Business Corporations Act (British Columbia) and is listed on the Toronto Stock Exchange and the NYSE-American, with its common shares trading under the symbol FURY. The Company’s registered and records office is at 1500-1055 West Georgia Street Vancouver, BC, V6E 4N7 and the mailing address is 401 Bay Street, 16th Floor, Toronto, Ontario, M5H 2Y4.

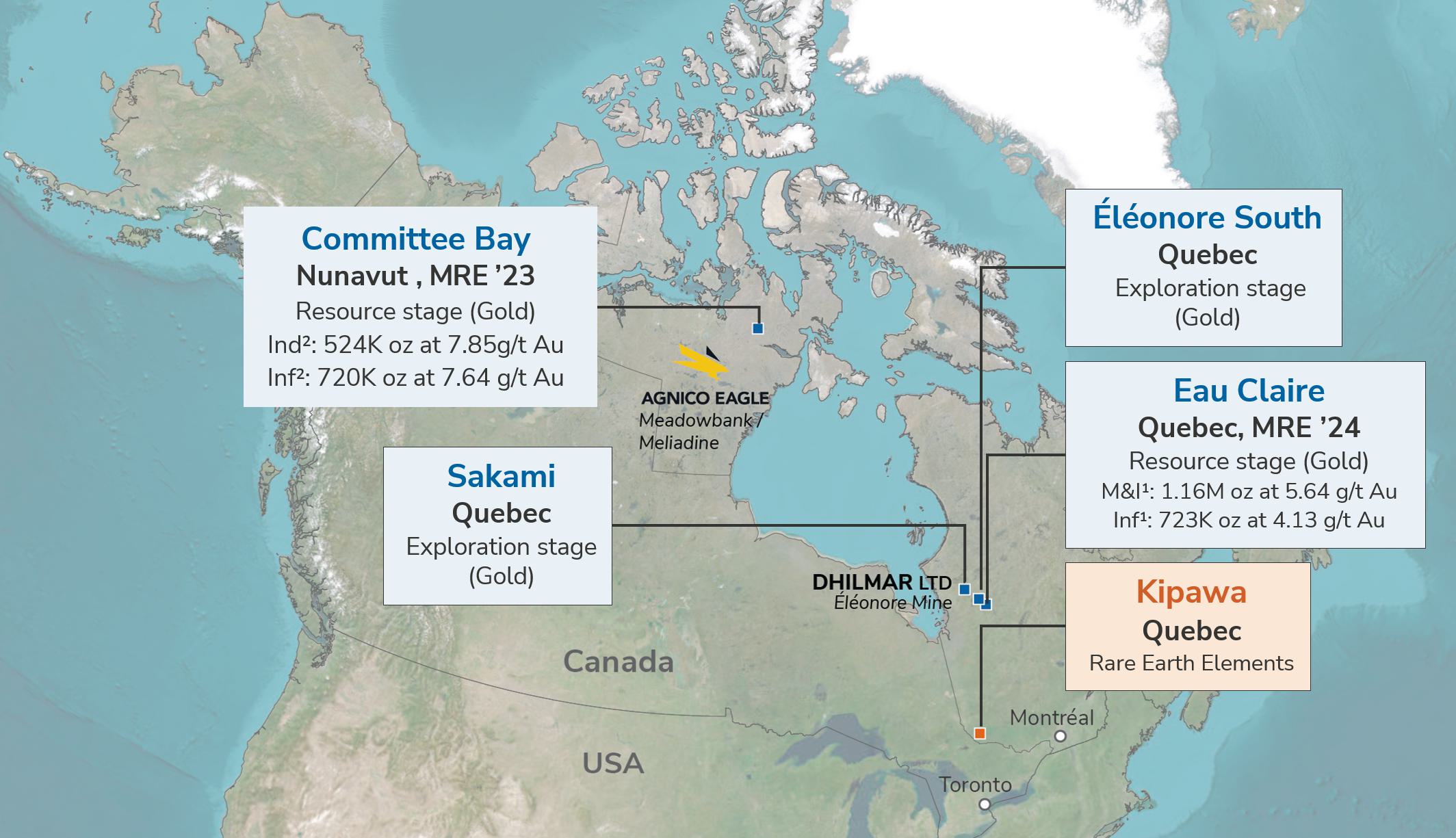

The Company’s principal business activity is the acquisition and exploration of resource projects in Canada. At September 30, 2025, the Company had three principal projects: Committee Bay in Nunavut, and Eau Claire and Éléonore South in Quebec, which the Company now owns 100% after acquiring the 49.978% interest previously held by Newmont Corporation (“Newmont”) in February 2024. Additionally, at September 30, 2025, the Company holds a 12.92% common share interest in Dolly Varden Silver Corporation (“Dolly Varden”) which owns the Kitsault project in British Columbia, and a 25% interest in Universal Mineral Services Limited (“UMS”), a private shared-services provider (note 7).

Note 2: Basis of presentation

Statement of compliance

These unaudited condensed interim consolidated financial statements (the “interim financial statements”) have been prepared in accordance with IAS 34 Interim Financial Reporting as issued by the International Accounting Standards Board (“IASB”). Certain disclosures included in the Company’s annual consolidated financial statements (the “consolidated financial statements”) prepared in accordance with IFRS® Accounting Standards as issued by the IASB have been condensed or omitted herein. Accordingly, these unaudited interim financial statements should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2024. These interim financial statements were approved and authorized for issuance by the Board of Directors of the Company on November 13, 2025.

Basis of preparation and consolidation

These interim financial statements include the accounts of the Company and its subsidiaries. Subsidiaries are entities controlled by the Company. Control exists when the Company has power over an investee, when the Company is exposed, or has rights, to variable returns from the investee, and when the Company has the ability to affect those returns through its power over the investee. Subsidiaries are included in the consolidated financial results of the Company from the effective date of acquisition up to the effective date of disposition or loss of control. The Company’s interim results are not necessarily indicative of its results for a full year.

The subsidiaries (with a beneficial interest of 100%) of the Company as at September 30, 2025, were as follows:

| Subsidiary | Place of incorporation |

Functional currency |

| Eastmain Mines Inc. (“Eastmain Mines”) (a) | Canada | CAD |

| Eastmain Resources Inc. (“Eastmain”) | ON, Canada | CAD |

| Fury Gold USA Limited (“Fury Gold USA”) (b) | Delaware, U.S.A. | USD |

| North Country Gold Corp. (“North Country”) | BC, Canada | CAD |

| Quebec Precious Metals Corporation (“QPM”) (a) (c) | Canada | CAD |

(a) The entity is incorporated federally in Canada.

(b) Fury Gold USA provided certain administrative services with respect to employee benefits for US resident personnel.

(c) QPM’s results are included from April 28, 2025, which was the acquisition date. See note 4 for details.

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

Investments in associates

These interim financial statements also include the following investments in associates:

| Associates | Ownership interest | Location | Classification and accounting method |

| Dolly Varden | 12.92% | BC, Canada | Associate; equity method |

| UMS | 25.00% | BC, Canada | Associate; equity method |

These interim financial statements have been prepared on a historical cost basis except for certain financial instruments that have been measured at fair value (note 17). All amounts are expressed in thousands of Canadian dollars unless otherwise noted. Reference to US$ are to United States dollars. All intercompany balances and transactions have been eliminated.

Segmented information

The Company’s operating segments are reviewed by the CEO, who is the chief operating decision maker (“CODM”) to make decisions about resources to be allocated to the segments and to assess their performance. The Company operates two reportable operating segments, a focus on the acquisition, exploration, and development of mineral resource properties within Quebec and Nunavut, as well as an administrative and corporate segment. The information contained in note 10 is the information used by the CODM to assess where to deploy resources and capital.

Critical accounting estimates, judgments, and policies

The preparation of financial statements in accordance with IFRS Accounting Standards as issued by the IASB requires management to select accounting policies and make estimates and judgments that may have a significant impact on consolidated financial statements. Estimates are continuously evaluated and are based on management’s experience and expectations of future events that are believed to be reasonable under the circumstances. Actual outcomes may differ from these estimates.

In preparing the Company’s interim financial statements for the three and nine months ended September 30, 2025, the Company applied the material accounting policy information and critical accounting estimates and judgments disclosed in notes 3 and 5, respectively, of its consolidated financial statements for the year ended December 31, 2024.

Application of new and revised accounting standards

On August 14, 2023, the IASB issued “Lack of Exchangeability (Amendments to IAS 21)” with amendments to clarify the accounting when there is a lack of exchangeability. The amendments to IAS 21 are effective for annual periods beginning on or after January 1, 2025, with earlier application permitted. The adoption of the new standard did not have an impact on the financial statements of the Company.

New and not yet effective accounting standards

On May 30, 2024, the IASB issued “Amendments to the Classification and Measurement of Financial Instruments (Amendments to IFRS 9 and IFRS 7)” to address matters identified during the post-implementation review of the classification and measurement requirements in IFRS 9 Financial Instruments and related requirements in IFRS 7 Financial Instruments: Disclosures. The amendments are effective for reporting periods beginning on or after January 1, 2026. Early application is permitted. The Company is currently evaluating the impact of the new standard on its financial statements.

On April 9, 2024, the IASB issued a new standard, called IFRS 18 Presentation and Disclosure in Financial Statements, which applies to an annual reporting period beginning on or after January 1, 2027, with earlier application permitted. IFRS 18 includes requirements for all entities applying IFRS Accounting Standards as issued by the IASB for the presentation and disclosure of information in financial statements. The Company is currently evaluating the impact of the new standard on its financial statements.

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

Note 3: Revision of prior period financial statements

In preparing the consolidated financial statements for the year ended December 31, 2024, the Company identified errors in its previously issued unaudited condensed interim consolidated financial statements for the periods ended March 31, 2024 and September 30, 2024. The errors resulted in a misstatement of gain/loss on investments and investments in associates relating to the Company’s investment in Dolly Varden, specifically an understatement of dilution gains on the consolidated statement of (earnings) loss and comprehensive (income) loss, as well as an understatement of investment in associate on the statement of financial position. The impact of the revisions to the periods presented in this report are as follows:

| As reported | Adjustment | Revised | ||||||||||

| Revised Statement of Financial Position as of March 31, 2024 | ||||||||||||

| Investment in associates | 32,638 | 220 | 32,858 | |||||||||

| Total assets | 188,023 | 220 | 188,243 | |||||||||

| Deficit | (149,988 | ) | 220 | 149,768 | ||||||||

| Total equity | 182,356 | 220 | 182,576 | |||||||||

| Revised Consolidated Statement of Loss and Comprehensive Loss for the three months ended March 31, 2024 | ||||||||||||

| Gain on investments | (537 | ) | (220 | ) | (757 | ) | ||||||

| Net loss | 934 | (220 | ) | 714 | ||||||||

| Total comprehensive loss | 935 | (220 | ) | 715 | ||||||||

| Revised Consolidated Statement of Loss and Comprehensive Loss for the six months ended June 30, 2024 | ||||||||||||

| Gain on investments | (537 | ) | (220 | ) | (757 | ) | ||||||

| Net loss | 4,428 | (220 | ) | 4,208 | ||||||||

| Total comprehensive loss | 4,430 | (220 | ) | 4,210 | ||||||||

| Revised Statement of Financial Position as of September 30, 2024 |

||||||||||||

| Investment in associates | 29,341 | 2,000 | 31,341 | |||||||||

| Total assets | 184,099 | 2,000 | 186,099 | |||||||||

| Deficit | (157,932 | ) | 2,000 | (155,932 | ) | |||||||

| Total equity | 177,526 | 2,000 | 179,526 | |||||||||

| Revised Consolidated Statement of Loss and Comprehensive Loss for the three months ended September 30, 2024 | ||||||||||||

| Gain on investments | - | (1,780 | ) | (1,780 | ) | |||||||

| Net loss | 4,453 | (1,780 | ) | 2,673 | ||||||||

| Total comprehensive loss | 4,453 | (1,780 | ) | 2,673 | ||||||||

| Revised Consolidated Statement of Loss and Comprehensive Loss for the nine months ended September 30, 2024 | ||||||||||||

| Gain on investments | (538 | ) | (2,000 | ) | (2,538 | ) | ||||||

| Net loss | 8,881 | (2,000 | ) | 6,881 | ||||||||

| Total comprehensive loss | 8,883 | (2,000 | ) | 6,883 | ||||||||

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

Note 4: Acquisition of Quebec Precious Metals Corporation

On April 28, 2025, the Company acquired all of the issued and outstanding common shares of Quebec Precious Metals Corporation (the “QPM Shares”). Former shareholders of QPM received 0.0741 of a common share of the Company for each QPM Share held (the “Exchange Ratio”). As a result, the Company issued an aggregate 8,394,045 Fury Gold shares at a fair value of C$0.54 per share, for an aggregate fair value of $4,533 (the “QPM Acquisition”).

Share options and share purchase warrants of QPM that were outstanding as at the time of completion were exchanged for Fury Shares on substantially the same terms and conditions, with the number of Fury Gold shares issuable on exercise and the exercise price adjusted in accordance with the Exchange Ratio (note 13). The fair value of these replacement awards is not included in purchase price consideration in accordance with IFRS 2 Share-based Payment (note 13).

On April 22, 2025, the Company entered into a contingent capital contribution agreement with QPM for a contribution amount of $750. Upon completion of the QPM Acquisition, the contingent capital contribution formed part of the consideration. Additionally, the Company incurred transaction costs of $199 comprised of due diligence costs, legal and listing fees. Transaction costs are allocated as part of the consideration according to the Company’s accounting policy.

The Company concluded that the QPM Acquisition did not constitute a business combination and accounted for it as an asset acquisition. A summary of the Company's consideration paid, assets acquired, and liabilities assumed from QPM as at acquisition date is as follows:

| Purchase price | ||||

| Cash consideration | $ | 750 | ||

| Fair value of common shares issued | 4,533 | |||

| Transaction costs | 199 | |||

| Total | $ | 5,482 | ||

| Net assets acquired | ||||

| Cash | $ | 547 | ||

| Other receivables and assets | 164 | |||

| Mineral property interests | 5,436 | |||

| Accounts payable and other liabilities | (600 | ) | ||

| Deferred government grant | (65 | ) | ||

| Total | $ | 5,482 | ||

QPM holds a land package covering approximately 70,900 hectares in the Eeyou Istchee James Bay territory, Quebec, near Newmont Corporation’s Éléonore gold mine. QPM’s focus has been on advancing its Sakami gold project and its newly discovered, drill-ready Ninaaskuwin lithium showing on the Elmer East project. In addition, QPM holds a 68% interest in the Kipawa rare earths project located near Temiscaming, Quebec.

Note 5: Marketable securities

The marketable securities held by the Company were as follows:

| Total | ||||

| Balance at December 31, 2023 | $ | 1,166 | ||

| Additions | 1,300 | |||

| Sale of marketable securities | (481 | ) | ||

| Realized loss on disposition | (60 | ) | ||

| Unrealized net gain | 433 | |||

| Balance at December 31, 2024 | $ | 2,358 | ||

| Sale of marketable securities | (670 | ) | ||

| Realized gain on disposition | 58 | |||

| Unrealized net gain | 610 | |||

| Balance at September 30, 2025 | $ | 2,356 | ||

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

Note 6: Mineral property interests

The Company’s principal resource properties are located in Canada. A summary of the carrying amounts is as follows:

| Quebec | Nunavut | Total | ||||||||||

| Balance at December 31, 2023 | $ | 122,978 | $ | 19,661 | $ | 142,639 | ||||||

| Additions(a) | 3,030 | - | 3,030 | |||||||||

| Change in estimate of provision for site reclamation and closure | (23 | ) | 427 | 404 | ||||||||

| Impairment(b) | (88,885 | ) | (11,988 | ) | (100,873 | ) | ||||||

| Balance at December 31, 2024 | $ | 37,100 | $ | 8,100 | $ | 45,200 | ||||||

| Additions (note 4) | 5,436 | - | 5,436 | |||||||||

| Change in estimate of provision for site reclamation and closure | (546 | ) | 86 | (460 | ) | |||||||

| Balance at September 30, 2025 | $ | 41,990 | $ | 8,186 | $ | 50,176 | ||||||

(a) On February 29, 2024, the Company, and its joint operation partner Newmont, through their respective subsidiaries, closed a transaction whereby the Company acquired 100% control of the joint operation interests, the Éléonore South project, consolidating these properties into the Company’s portfolio at which time the joint venture operation was dissolved. The 49.978% that Newmont held was acquired by the Company for $3,000 while incurring $30 in transaction costs. As part of the same transaction, the Company also acquired a 10.9% interest in Sirios, as disclosed in note 5.

(b) The Company’s market capitalization has historically been below the carrying value of its mineral properties over the last few years, and, for this reason, the Company engaged a third-party valuation specialist to conduct a review to determine a more reflective carrying value. As a result, the report recommended an impairment charge to these properties, to better align with the market capitalization value as at December 31, 2024.

Note 7: Investments in associates

| (a) | Acquisition of investments in associates |

| (i) | On February 25, 2022, the Company completed the sale of Homestake Resources Corporation to Dolly Varden for cash proceeds of $5,000 and 76,504,590 common shares of Dolly Varden. The Company’s resulting interest in Dolly Varden represented approximately 35.3% of the issued and outstanding common shares of Dolly Varden on February 25, 2022, which has been accounted for using the equity method. The Company recognized a gain of $48,390, net of transaction costs of $589, on the date of disposition. On October 13, 2022, the Company completed the sale of 17,000,000 common shares of Dolly Varden for total gross proceeds of $6,800. During the year ended December 31, 2024, the Company sold an aggregate 8,450,000 shares of Dolly Varden for net proceeds of $7,042. The Company’s investment was also diluted through financing rounds by Dolly Varden in which the Company did not participate. As a result, the Company had a gain on investments of $4,109 consisting of a realized gain on disposal of $2,026 and a gain on dilution of $2,083 for the year ended December 31, 2024. On April 2, 2025, Dolly Varden announced a four for one Common Share Consolidation which took effect on April 7, 2025. The impact of this was that the Company’s 51,054,590 Common Shares was consolidated into 12,763,648 Common Shares. On May 8, 2025, the Company completed the sale of 1,000,000 common shares of Dolly Varden for total gross proceeds of $3,625. On September 17, 2025, the Company completed the sale of 500,000 common shares of Dolly Varden for total gross proceeds of $2,914. During the three and nine months ended September 30, 2025, there has been a dilution gain on investments of $34 and $2,002 respectively (three and nine months ended September 30, 2024 – $1,780 and $2,000, respectively), as well as a realized gain of $1,820 and $3,230 respectively (three and nine months ended September 30, 2024 – $nil and $538, respectively). |

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

| (ii) | On April 1, 2022, the Company purchased a 25% share interest in UMS, a private shared-services provider, for nominal consideration. The Company funded, in addition to its nominal investment in UMS, a cash deposit of $150 which is held by UMS for the purposes of general working capital, and which will be returned to the Company upon termination of the UMS Canada arrangement, net of any residual unfulfilled obligations. UMS is the private company through which its shareholders, including Fury Gold, share geological, financial, and transactional advisory services as well as administrative services on a full, cost recovery basis. |

| (b) | Summarized financial information of the Company’s investments in associates: |

The carrying amounts of the Company’s investments in associates were as follows:

| Dolly Varden | UMS | Total | ||||||||||

| Carrying amount at December 31, 2023 | $ | 36,126 | $ | 122 | $ | 36,248 | ||||||

| Company’s share of net loss of associates | (3,837 | ) | (21 | ) | (3,858 | ) | ||||||

| Disposition | (5,017 | ) | - | (5,017 | ) | |||||||

| Dilution gain | 2,083 | - | 2,083 | |||||||||

| Carrying amount at December 31, 2024 | $ | 29,355 | $ | 101 | $ | 29,456 | ||||||

| Company’s share of net loss of associates | (3,632 | ) | (2 | ) | (3,634 | ) | ||||||

| Disposition | (3,310 | ) | - | (3,310 | ) | |||||||

| Dilution gain | 2,002 | - | 2,002 | |||||||||

| Carrying amount at September 30, 2025 | $ | 24,415 | $ | 99 | $ | 24,514 | ||||||

The quoted fair market value of the Company’s equity interest in Dolly Varden at September 30, 2025 was $78,733 (September 30, 2024 - $58,920) based on the closing share price on the TSX Venture Exchange on that date.

For the three months ended September 30, 2025, the Company’s equity share of net loss (income) of the Company’s associates on a 100% basis were as follows:

| Three months ended September 30, 2025 | Dolly Varden | UMS | Total | |||||||||

| Cost recoveries | $ | - | $ | (869 | ) | $ | (869 | ) | ||||

| Exploration and evaluation | 15,163 | 418 | 15,581 | |||||||||

| Marketing | 361 | - | 361 | |||||||||

| Share-based compensation | 529 | - | 529 | |||||||||

| Administrative and other | (2,288 | ) | 447 | (1,841 | ) | |||||||

| Net loss (income) of associate, 100% | 13,765 | (4 | ) | 13,761 | ||||||||

| Average equity interest for the period | 13.43 | % | 25 | % | ||||||||

| Company’s share of net loss (income) of associates | $ | 1,848 | $ | (1 | ) | $ | 1,847 | |||||

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

For the three months ended September 30, 2024, the Company’s equity share of net loss of the Company’s associates on a 100% basis were as follows:

| Three months ended September 30, 2024 | Dolly Varden | UMS | Total | |||||||||

| Cost recoveries | $ | - | $ | (1,016 | ) | $ | (1,016 | ) | ||||

| Exploration and evaluation | 9,269 | 481 | 9,750 | |||||||||

| Marketing | 561 | 20 | 581 | |||||||||

| Share-based compensation | 555 | - | 555 | |||||||||

| Administrative and other | (1,399 | ) | 557 | (842 | ) | |||||||

| Net loss of associate, 100% | 8,986 | 42 | 9,028 | |||||||||

| Average equity interest for the period | 18.44 | % | 25 | % | ||||||||

| Company’s share of net loss of associates | $ | 1,657 | $ | 11 | $ | 1,668 | ||||||

For the nine months ended September 30, 2025, the Company’s equity share of net loss of the Company’s associates on a 100% basis were as follows:

| Nine months ended September 30, 2025 | Dolly Varden | UMS | Total | |||||||||

| Cost recoveries | $ | - | $ | (2,119 | ) | $ | (2,119 | ) | ||||

| Exploration and evaluation | 23,416 | 757 | 24,173 | |||||||||

| Marketing | 1,414 | - | 1,414 | |||||||||

| Share-based compensation | 1,662 | - | 1,662 | |||||||||

| Administrative and other | (1,097 | ) | 1,371 | 274 | ||||||||

| Net loss of associate, 100% | 25,395 | 9 | 25,404 | |||||||||

| Average equity interest for the period | 14.30 | % | 25 | % | ||||||||

| Company’s share of net loss of associates | $ | 3,632 | $ | 2 | $ | 3,634 | ||||||

For the nine months ended September 30, 2024, the Company’s equity share of net loss of the Company’s associates on a 100% basis were as follows:

| Nine months ended September 30, 2024 | Dolly Varden | UMS | Total | |||||||||

| Cost recoveries | $ | - | $ | (2,797 | ) | $ | (2,797 | ) | ||||

| Exploration and evaluation | 16,502 | 1,014 | 17,516 | |||||||||

| Marketing | 1,245 | 131 | 1,376 | |||||||||

| Share-based compensation | 2,049 | - | 2,049 | |||||||||

| Administrative and other | (660 | ) | 1,780 | 1,120 | ||||||||

| Net loss of associate, 100% | 19,136 | 128 | 19,264 | |||||||||

| Average equity interest for the period | 18.91 | % | 25 | % | ||||||||

| Company’s share of net loss of associates | $ | 3,618 | $ | 32 | $ | 3,650 | ||||||

The Company’s equity share of net assets of associates at September 30, 2025, is as follows:

| Dolly Varden | UMS | |||||||

| Current assets | $ | 37,075 | $ | 838 | ||||

| Non-current assets | 152,630 | 1,859 | ||||||

| Current liabilities | (7,864 | ) | (1,196 | ) | ||||

| Non-current liabilities | - | (1,109 | ) | |||||

| Net assets, 100% | 181,841 | 392 | ||||||

| Company’s equity share of net assets of associate | $ | 24,415 | $ | 99 | ||||

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

| (c) | Services rendered and balances with UMS |

| Three months ended September 30 |

Nine months ended September 30 |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Exploration and evaluation costs | $ | 187 | $ | 50 | $ | 260 | $ | 160 | ||||||||

| General and administration | 48 | 52 | 180 | 244 | ||||||||||||

| Total transactions for the period | $ | 235 | $ | 102 | $ | 440 | $ | 404 | ||||||||

The outstanding balance owing at September 30, 2025, was $42 (December 31, 2024 – $90) which is included in accounts payable and accrued liabilities.

As part of the UMS arrangement, the Company is contractually obliged to pay certain rental expenses in respect of a ten-year office lease entered into by UMS on July 1, 2021. As at September 30, 2025, the Company expects to incur approximately $81 in respect of its share of future rental expense of UMS.

The Company issues share options to certain UMS employees, including key management personnel of the Company (note 13). The Company recognized a share-based compensation expense of $2 and $9 for the three and nine months ended September 30, 2025, in respect of share options issued to UMS employees (September 30, 2024 - $1 expense and $3 recovery) which is included within employee benefits and exploration and evaluation costs.

Note 8: Deferred government grant

On April 28, 2025, as part of the QPM acquisition (note 4), the Company inherited a grant entitlement from the Government of Quebec’s Minister of Natural Resources and Forestry (the “Minister”) for expenditures to be made by the Company for geometallurgical studies on the Elmer East property (the “Program”). The Program will fund up to 50% of the qualifying exploration expenses incurred by the Company up to a maximum grant of $268. On May 30, 2025, the Company received a progress payment for fiscal year 2025-2026 of $83. As at September 30, 2025, the Company has unspent funding of $47 relating to the progress payment, which will require the Company to incur $94 in qualifying expenses under the Program before March 31, 2026. The Company is obligated to reimburse the Minister, upon expiry of the Program, for any unapplied grant funding plus interest thereon.

On May 30, 2025, the Company, through its subsidiary, North Country Gold, was approved by the Government of Nunavut’s Minister of the Department of Community Services a contribution of up to $250 from its Discover, Invest, Grow Program in support of the Company’s exploration activities in the Three Bluffs Gold deposit and the Raven Gold Prospect. Expenses eligible must be incurred between May 30, 2025 to March 31, 2026. The Company received initial payment of $125 in August 2025. The remaining balance is payable upon approval of the expenditure report which must be submitted by March 31, 2026. The Company is obligated to return the initial payment if the Company is unable to prove sufficient spending on approved expenditures equalling to or exceeding the advance provided. As at September 30, 2025, the Company incurred $125 in eligible expenditures and, as a result, fully recognized the initial grant amount received.

Note 9: Flow-through share premium liability

Flow-through shares are issued at a premium, calculated as the difference between the price of a flow-through share and the price of a common share at that date. Tax deductions generated by eligible expenditures are passed through to the shareholders of the flow-through shares once the eligible expenditures are incurred and renounced.

On June 19, 2025, the Company completed an offering (note 12) and raised $3,080 through the issuance of 3,999,701 common shares designated as flow-through shares. The flow-through proceeds will be used for the Company’s mineral exploration activities. The Company is committed to incur the full exploration expenditures of $3,080 before December 31, 2026.

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

On June 13, 2024, the Company completed an offering (note 12) and raised $5,001 through the issuance of 5,320,000 common shares designated as flow-through shares. The flow-through proceeds will be used for mineral exploration in Quebec. The exploration expenditures of $5,001 was fully incurred as of April 30, 2025.

The flow-through share funding and expenditures along with the corresponding impact on the flow-through share premium liability were as follows:

| Flow-through funding (expenditures) |

Flow-through premium liability |

|||||||

| Balance at December 31, 2023 | $ | 1,223 | $ | 544 | ||||

| Flow-through eligible expenditures | (1,223 | ) | (544 | ) | ||||

| Flow-through funds raised | 5,001 | 2,022 | ||||||

| Flow-through eligible expenditures | (2,666 | ) | (1,078 | ) | ||||

| Balance at December 31, 2024 | $ | 2,335 | $ | 944 | ||||

| Flow-through eligible expenditures | (2,335 | ) | (944 | ) | ||||

| Flow-through funds raised | 3,080 | 400 | ||||||

| Flow-through eligible expenditures | (1,497 | ) | (194 | ) | ||||

| Balance at September 30, 2025 | $ | 1,583 | $ | 206 | ||||

Note 10: Segmented information - Exploration and evaluation costs

For the three months ended September 30, 2025, the Company’s exploration and evaluation costs were as follows:

| Quebec | Nunavut | Total | ||||||||||

| Assaying | $ | 392 | $ | 157 | $ | 549 | ||||||

| Exploration drilling | 330 | 490 | 820 | |||||||||

| Camp cost, equipment and field supplies | 294 | 176 | 470 | |||||||||

| Geological consulting services | 1 | 205 | 206 | |||||||||

| Permitting, environmental and community costs | 32 | 55 | 87 | |||||||||

| Expediting and mobilization | 4 | 52 | 56 | |||||||||

| Salaries and wages | 349 | 431 | 780 | |||||||||

| Fuel and consumables | 74 | 18 | 92 | |||||||||

| Aircraft and travel | 343 | 872 | 1,215 | |||||||||

| Share-based compensation | 5 | 15 | 20 | |||||||||

| Total for the three months ended September 30, 2025 | $ | 1,824 | $ | 2,471 | $ | 4,295 | ||||||

For the three months ended September 30, 2024, the Company’s exploration and evaluation costs were as follows:

| Quebec | Nunavut | Total | ||||||||||

| Assaying | $ | 449 | $ | 61 | $ | 510 | ||||||

| Exploration drilling | 376 | - | 376 | |||||||||

| Camp cost, equipment and field supplies | 181 | 60 | 241 | |||||||||

| Geological consulting services | - | 40 | 40 | |||||||||

| Permitting, environmental and community costs | 38 | 79 | 117 | |||||||||

| Expediting and mobilization | - | 23 | 23 | |||||||||

| Salaries and wages | 341 | 51 | 392 | |||||||||

| Fuel and consumables | 73 | 10 | 83 | |||||||||

| Aircraft and travel | 315 | 205 | 520 | |||||||||

| Share-based compensation | 7 | 9 | 16 | |||||||||

| Total for the three months ended September 30, 2024 | $ | 1,780 | $ | 538 | $ | 2,318 | ||||||

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

For the nine months ended September 30, 2025, the Company’s exploration and evaluation costs were as follows:

| Quebec | Nunavut | Total | ||||||||||

| Assaying | $ | 854 | $ | 179 | $ | 1,033 | ||||||

| Exploration drilling | 1,049 | 570 | 1,619 | |||||||||

| Camp cost, equipment and field supplies | 667 | 291 | 958 | |||||||||

| Geological consulting services | 41 | 213 | 254 | |||||||||

| Permitting, environmental and community costs | 189 | 157 | 346 | |||||||||

| Expediting and mobilization | 6 | 117 | 123 | |||||||||

| Salaries and wages | 1,017 | 473 | 1,490 | |||||||||

| Fuel and consumables | 461 | 898 | 1,359 | |||||||||

| Aircraft and travel | 1,152 | 1,047 | 2,199 | |||||||||

| Share-based compensation | 82 | 26 | 108 | |||||||||

| Total for the nine months ended September 30, 2025 | $ | 5,518 | $ | 3,971 | $ | 9,489 | ||||||

For the nine months ended September 30, 2024, the Company’s exploration and evaluation costs were as follows:

| Quebec | Nunavut | Total | ||||||||||

| Assaying | $ | 749 | $ | 80 | $ | 829 | ||||||

| Exploration drilling | 843 | - | 843 | |||||||||

| Camp cost, equipment and field supplies | 607 | 156 | 763 | |||||||||

| Geological consulting services | 7 | 48 | 55 | |||||||||

| Permitting, environmental and community costs | 75 | 165 | 240 | |||||||||

| Expediting and mobilization | - | 23 | 23 | |||||||||

| Salaries and wages | 1,000 | 57 | 1,057 | |||||||||

| Fuel and consumables | 182 | 10 | 192 | |||||||||

| Aircraft and travel | 450 | 205 | 655 | |||||||||

| Share-based compensation | 127 | 10 | 137 | |||||||||

| Total for the nine months ended September 30, 2024 | $ | 4,040 | $ | 754 | $ | 4,794 | ||||||

Note 11: Other income

| Three months ended September 30 |

Nine months ended September 30 |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Government grant income (note 8) | 126 | - | 144 | - | ||||||||||||

| Excess fuel resold | - | - | - | 566 | ||||||||||||

| Total transactions for the period | $ | 126 | $ | - | $ | 144 | $ | 566 | ||||||||

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

Note 12: Share capital

| (a) | Authorized |

Unlimited common shares without par value.

Unlimited preferred shares – nil issued and outstanding.

| (b) | Share issuances |

During the nine months ended September 30, 2025:

| i. | The Company issued 8,394,045 common shares as part of the QPM acquisition with a fair market value of $4,533 (note 4). Transaction costs incurred in respect of the acquisition were $199. |

| ii. | The Company closed a non-brokered private equity placement for gross proceeds of $4,306, consisting of 6,728,000 units at C$0.64 per unit. Each unit consisted of one common share of Fury Gold and one common share purchase warrant exercisable to purchase one Fury Gold common share at C$0.80 for a period of three years. Share issuance costs incurred in respect of the private placement were $123. |

| iii. | 156,000 shares were issued as a result of share options being exercised with a weighted average exercise price of C$0.55 for gross proceeds of $85. The amount of $43 attributed to these share options was transferred from the equity reserves and recorded against share capital. |

| iv. | 75,000 shares were issued as a result of share options being exercised with a weighted average exercise price of C$0.55 for gross proceeds of $41. The amount of $21 attributed to these share options was transferred from the equity reserves and recorded against share capital. |

| v. | During June 2025, the Company issued 3,999,701 flow-through shares for gross proceeds of $3,080 (“June 2025 Offering”). Share issuance costs related to the June 2025 Offering totaled $223, which included $183 in commissions and $40 in other issuance costs. A reconciliation of the impact of the June 2025 Offering on share capital is as follows: |

| Number of common shares |

Impact on share capital |

|||||||

| Flow-through shares issued at $0.77 per share | 3,999,701 | $ | 3,080 | |||||

| Cash share issue costs | - | (223 | ) | |||||

| Proceeds net of share issue costs | 3,999,701 | 2,857 | ||||||

| Less: flow-through share premium liability (note 9) | - | (400 | ) | |||||

| Total allocated to share capital | 3,999,701 | $ | 2,457 | |||||

| vi. | In connection with the June 2025 Offering, a certain shareholder of the Company exercised its existing participation rights and acquired 440,000 Fury Gold common shares at a price of C$0.67 per share for a gross proceed of $295. |

During the year ended December 31, 2024:

During June 2024, the Company issued 5,320,000 flow-through shares for gross proceeds of $5,001 (“June 2024 Offering”). Share issuance costs related to the June 2024 Offering totaled $533, which included $300 in commissions and $233 in other issuance costs. A reconciliation of the impact of the June 2024 Offering on share capital is as follows:

| Number of common shares |

Impact on share capital |

|||||||

| Flow-through shares issued at $0.94 per share | 5,320,000 | $ | 5,001 | |||||

| Cash share issue costs | - | (533 | ) | |||||

| Proceeds net of share issue costs | 5,320,000 | 4,468 | ||||||

| Less: flow-through share premium liability (note 9) | - | (2,022 | ) | |||||

| Total allocated to share capital | 5,320,000 | $ | 2,446 | |||||

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

Note 13: Share-based compensation and warrant reserve

| (a) | Share-based compensation expense |

The Company uses the fair value method of accounting for all share-based payments to directors, officers, employees, and other service providers. During the three and nine months ended September 30, 2025 and 2024, the Company recognized share-based compensation expense as follows:

| Three months ended September 30 |

Nine months ended September 30 |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Recognized in net loss and included in: | ||||||||||||||||

| Exploration and evaluation costs | $ | 20 | $ | 16 | $ | 108 | $ | 137 | ||||||||

| Fees, salaries and other employee benefits | 144 | 163 | 427 | 694 | ||||||||||||

| Total share-based compensation expense | $ | 164 | $ | 179 | $ | 535 | $ | 831 | ||||||||

During the three and nine months ended September 30, 2025, the Company granted nil and 140,000 share options, respectively, (three and nine months ended September 30, 2024 – nil and 245,000, respectively), to certain employees and consultants who provide defined on-going services to the Company, representative of employee service.

The weighted average fair value per option of these share options for the three and nine months ended September 30, 2025 was calculated as nil and C$0.38, respectively (three and nine months ended September 30, 2024 – nil and C$0.31, respectively), using the Black-Scholes option valuation model at the grant date with the following weighted average assumptions:

| Three months ended September 30 |

Nine months ended September 30 |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Risk-free interest rate | - | - | 2.99 | % | 3.45 | % | ||||||||||

| Expected dividend yield | - | - | Nil | Nil | ||||||||||||

| Share price volatility | - | - | 71 | % | 70 | % | ||||||||||

| Expected life in years | - | - | 5.0 | 5.0 | ||||||||||||

The risk-free interest rate assumption is based on the Government of Canada benchmark bond yields and treasury bills with a remaining term that approximates the expected life of the share-based options. The expected volatility assumption is based on the historical and implied volatility of the Company’s common shares. The expected forfeiture rate and the expected life in years are based on historical trends.

In connection with the QPM Acquisition, all outstanding and vested share options of QPM were exchanged for replacement share options of the Company, in amount and at exercise prices adjusted in accordance with the Exchange Ratio. As a result, 282,470 share options with a nominal fair value were granted and vested immediately.

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

The number of share options issued and outstanding and the weighted average exercise price were as follows:

|

Number of share options |

Weighted average exercise price (C$/option) |

|||||||

| Outstanding, December 31, 2023 | 9,951,602 | $ | 1.23 | |||||

| Granted | 245,000 | 0.56 | ||||||

| Expired | (472,937 | ) | 1.92 | |||||

| Forfeited | (1,502,487 | ) | 1.40 | |||||

| Outstanding, December 31, 2024 | 8,221,178 | $ | 1.14 | |||||

| Granted | 422,470 | 1.50 | ||||||

| Exercised | (231,000 | ) | 0.55 | |||||

| Expired | (253,144 | ) | 1.73 | |||||

| Forfeited | (50,000 | ) | 0.91 | |||||

| Outstanding, September 30, 2025 | 8,109,504 | $ | 1.17 | |||||

As at September 30, 2025, the number of share options outstanding was as follows:

| Options outstanding | Options exercisable | |||||||||||||||||||||||

| Exercise price ($/option) |

Number of shares |

Weighted average exercise price (C$/option) |

Weighted average remaining life (years) |

Number of shares |

Weighted average exercise price (C$/option) |

Weighted average remaining life (years) |

||||||||||||||||||

| C$0.53 – C$1.00 | 3,749,500 | 0.83 | 2.03 | 3,659,500 | 0.84 | 1.98 | ||||||||||||||||||

| C$1.00 – C$1.85 | 2,806,659 | 1.09 | 1.35 | 2,806,659 | 1.09 | 1.35 | ||||||||||||||||||

| C$2.05 – C$3.91 | 1,553,345 | 2.08 | 0.07 | 1,553,345 | 2.08 | 0.07 | ||||||||||||||||||

| 8,109,504 | 1.17 | 1.42 | 8,019,504 | 1.17 | 1.39 | |||||||||||||||||||

| (b) | Long-term incentive plan |

In addition to options, the Company also granted RSU’s to officers and employees.

On June 29, 2023, the Company adopted a Long-Term Incentive Plan (“LTI Plan”) which strives to accelerate and encourage additional share ownership by its employees, officers and directors. The LTI plan provides for the awarding of share options, performance share units, restricted share units and deferred share units. The LTI Plan limits the number of shares reserved for issuance under the LTI Plan, together with all other security-based compensation arrangements of the Company, to a maximum of 10% of the Common Shares issued and outstanding.

On January 9, 2025, the Company issued 590,000 DSU’s to directors and 1,142,500 RSU’s to officers and employees. The DSU’s and RSU’s were issued in accordance with the Company’s LTI plan, with a grant-date fair value of $0.55 per unit, one third vesting annually on anniversary.

On January 31, 2024, the Company issued 273,542 RSU’s to an officer. The RSU’s were issued in accordance with the Company’s LTI plan, which vested on the same day and paid out as fully paid shares.

On January 9, 2024, the Company issued 1,318,623 RSU’s to directors, officers, and employees. The RSU’s were issued in accordance with the Company’s LTI plan, one third vesting annually on the anniversary and paid out as fully paid shares. The Company also approved 235,080 RSU’s to directors, which were fully vested and paid out as fully paid shares in 2024.

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

The number of RSU’s and DSU’s issued and outstanding and the weighted average grant date fair value were as follows:

| Number of RSU’s and DSU’s |

Weighted Average grant date fair value ($/ share) |

|||||||

| Outstanding, December 31, 2023 | - | $ | - | |||||

| Granted | 1,827,245 | 0.57 | ||||||

| Settled | (491,478 | ) | 0.59 | |||||

| Forfeited | (189,687 | ) | 0.57 | |||||

| Outstanding, December 31, 2024 | 1,146,080 | $ | 0.57 | |||||

| Granted | 1,732,500 | 0.55 | ||||||

| Settled | (382,027 | ) | 0.53 | |||||

| Forfeited | (289,597 | ) | 0.56 | |||||

| Outstanding, September 30, 2025 | 2,206,956 | $ | 0.56 | |||||

| (c) | Share purchase warrants |

In connection with the QPM Acquisition (note 4), all warrants of QPM became exercisable to acquire common shares of the Company, in amounts and at exercise prices adjusted in accordance with the Exchange Ratio. As a result, 596,808 warrants, each exercisable into one Fury Gold share, were granted at an exercise price of C$1.35 per share. The total fair value of the warrants issued was $30, calculated using a the Black-Scholes valuation model with the following inputs: (i) expected life – 2.12 years; (ii) expected volatility – 57%; (iii) expected dividend yield – 0%; (iv) risk-free interest rate – 2.56%; (v) share price – C$0.54.

In connection with a non-brokered private equity placement (note 13), the Company issued 6,728,000 warrants exercisable into one common share of the Company at a price of C$0.80 for a period of three years. The warrants were classified as equity instruments under IAS 32 and measured at a fair value of $949, calculated using a the Black-Scholes valuation model with the following inputs: (i) expected life – 3 years; (ii) expected volatility – 58%; (iii) expected dividend yield – 0%; (iv) risk-free interest rate – 2.7%; (v) share price – C$0.51.

The number of share purchase warrants outstanding at September 30, 2025 was as follows:

| Warrants outstanding |

Weighted average exercise price (C$/share) |

|||||||

| Outstanding, December 31, 2023 | 7,461,450 | $ | 1.20 | |||||

| Expired | (7,461,450 | ) | 1.20 | |||||

| Outstanding, December 31, 2024 | - | - | ||||||

| Issued | 7,324,808 | 0.84 | ||||||

| Outstanding, September 30, 2025 | 7,324,808 | $ | 0.84 | |||||

The following table reflects the share purchase warrants issued and outstanding as at September 30, 2025:

| Expiry date | Warrants outstanding |

Exercise price (C$/share) |

||||||

| May 31, 2027 | 274,170 | $ | 1.35 | |||||

| June 21, 2027 | 322,638 | 1.35 | ||||||

| May 26, 2028 | 6,728,000 | 0.80 | ||||||

| Total | 7,324,808 | $ | 0.84 | |||||

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

Note 14: Key management personnel

Key management personnel include Fury Gold’s board of directors and certain executive officers of the Company, including the CEO, Chief Financial Officer (“CFO”) and Senior Vice President, Exploration.

The remuneration of the Company’s key management personnel was as follows:

| Three months ended September 30 |

Nine months ended September 30 |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Short-term benefits provided to executives (a) | $ | 260 | $ | 209 | $ | 787 | $ | 642 | ||||||||

| Directors’ fees paid to non-executive directors | 60 | 39 | 191 | 123 | ||||||||||||

| Share-based payments | 151 | 160 | 443 | 704 | ||||||||||||

| Total | $ | 471 | $ | 408 | $ | 1,421 | $ | 1,469 | ||||||||

(a) Short-term employee benefits include salaries, bonuses payable within twelve months of the date of the consolidated statements of financial position, and other annual employee benefits.

Note 15: Supplemental cash flow information

The impact of changes in non-cash working capital was as follows:

| Three months ended September 30 |

Nine months ended September 30 |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Accounts receivable | $ | (94 | ) | $ | (60 | ) | $ | (260 | ) | $ | 137 | |||||

| Prepaid expenses and deposits | (121 | ) | (179 | ) | (114 | ) | 47 | |||||||||

| Accounts payable and accrued liabilities | (257 | ) | (285 | ) | 189 | (251 | ) | |||||||||

| Deferred government grant | (1 | ) | - | (37 | ) | - | ||||||||||

| Changes in non-cash working capital | $ | (473 | ) | $ | (524 | ) | $ | (222 | ) | $ | (67 | ) | ||||

Note 16: Loss per share

For the three and nine months ended September 30, 2025, and 2024, the weighted average number of shares outstanding and loss per share were as follows:

| Three months ended September 30 |

Nine months ended September 30 |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net loss | $ | 4,699 | $ | 2,673 | $ | 9,687 | $ | 6,881 | ||||||||

| Weighted average basic number of shares outstanding | 166,338,451 | 151,470,606 | 161,569,043 | 148,178,821 | ||||||||||||

| Basic loss per share | $ | 0.03 | $ | 0.02 | $ | 0.06 | $ | 0.05 | ||||||||

| Weighted average diluted number of shares outstanding | 166,338,451 | 151,470,606 | 161,569,043 | 148,178,821 | ||||||||||||

| Diluted loss per share | $ | 0.03 | $ | 0.02 | $ | 0.06 | $ | 0.05 | ||||||||

All of the outstanding share options and share purchase warrants at September 30, 2025 were anti-dilutive for the period then ended as the Company was in a loss position.

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

Note 17: Financial instruments

The Company’s financial instruments as at September 30, 2025, consisted of cash, marketable securities, accounts receivable, other investments, deposits, and accounts payable and accrued liabilities. The fair values of these financial instruments approximate their carrying values, unless otherwise noted.

| (a) | Financial assets and liabilities by categories |

| At September 30, 2025 | At December 31, 2024 | |||||||||||||||||||||||

| Amortized Cost |

FVTPL | Total | Amortized Cost |

FVTPL | Total | |||||||||||||||||||

| Cash | $ | 6,127 | $ | - | $ | 6,127 | $ | 4,912 | $ | - | $ | 4,912 | ||||||||||||

| Marketable securities | - | 2,356 | 2,356 | - | 2,358 | 2,358 | ||||||||||||||||||

| Other investments | - | 2,063 | 2,063 | - | 2,063 | 2,063 | ||||||||||||||||||

| Deposits | 36 | 36 | 191 | - | 191 | |||||||||||||||||||

| Accounts receivable | 314 | 314 | 54 | - | 54 | |||||||||||||||||||

| Total financial assets | $ | 6,477 | $ | 4,419 | $ | 10,896 | $ | 5,157 | $ | 4,421 | $ | 9,578 | ||||||||||||

| Accounts payable and accrued liabilities | (1,042 | ) | - | (1,042 | ) | 855 | - | 855 | ||||||||||||||||

| Deferred government grant | (47 | ) | (47 | ) | - | - | - | |||||||||||||||||

| Total financial liabilities | $ | (1,089 | ) | $ | - | $ | (1,089 | ) | $ | 855 | $ | - | $ | 855 | ||||||||||

| (b) | Financial assets and liabilities measured at fair value |

The categories of the fair value hierarchy that reflect the significance of inputs used in making fair value measurements are as follows:

Level 1 – fair values based on unadjusted quoted prices in active markets for identical assets or liabilities;

Level 2 – fair values based on inputs that are observable for the asset or liability, either directly or indirectly; and

Level 3 – fair values based on inputs for the asset or liability that are not based on observable market data.

The Company’s policy to determine when a transfer occurs between levels is to assess the impact at the date of the event or the change in circumstances that could result in a transfer. No transfers occurred between the levels during the year.

As at September 30, 2025, the Company’s financial instruments measured at fair value on a recurring basis were the Company’s marketable securities which were classified as Level 1, and other investments which were classified as Level 3. There were no financial assets or financial liabilities measured and recognized in the condensed interim consolidated statements of financial position at fair value that would be categorized as level 2 in the fair value hierarchy.

| (c) | Financial instruments and related risks |

The Company’s financial instruments are exposed to liquidity risk, credit risk and market risks, which include currency risk, interest rate risk and price risk. As at September 30, 2025, the primary risks were as follows:

Liquidity risk

Liquidity risk is the risk that the Company will encounter difficulty in meeting obligations associated with financial liabilities. The Company proactively manages its capital resources and has in place a budgeting and cash management process to help determine the funds required to ensure the Company has the appropriate liquidity to meet its current exploration plans and achieve its growth objectives. The Company ensures that there is sufficient liquidity available to meet its short-term business requirements, taking into account its anticipated cash outflows from exploration activities, and its holdings of cash and marketable securities. The Company monitors and adjusts, when required, these exploration programs as well as corporate administrative costs to ensure that adequate levels of working capital are maintained.

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

As at September 30, 2025, the Company had unrestricted cash of $6,127 (December 31, 2024 – $4,912), working capital surplus of $10,205 (December 31, 2024 – $8,045), which the Company defines as current assets less current liabilities, and an accumulated deficit of $266,879 (December 31, 2024 – $257,192). During the three and nine months ended September 30, 2025, Fury Gold incurred a comprehensive loss of $4,701 and $9,693, respectively, (three and nine months ended September 30, 2024 – $2,673 and $6,883, respectively). The Company expects to incur future operating losses in relation to exploration activities. With no source of operating cash flow, there is no assurance that sufficient funding will be available to conduct further exploration of its mineral properties.

The Company’s contractual obligations are as follows:

| Within 1 year |

2 to 3 years |

Over 3 years |

At September 30, 2025 |

At December 31, 2024 |

||||||||||||||||

| Accounts payable and accrued liabilities | $ | 1,042 | $ | - | $ | - | $ | 1,042 | $ | 855 | ||||||||||

| Deferred government grant | 47 | - | - | 47 | - | |||||||||||||||

| Quebec flow-through expenditure requirements | 206 | - | - | 206 | 944 | |||||||||||||||

| Undiscounted lease payments | - | - | - | - | 65 | |||||||||||||||

| Total | $ | 1,295 | $ | - | $ | - | $ | 1,295 | $ | 1,864 | ||||||||||

The Company also makes certain payments arising on mineral claims and leases on an annual or bi-annual basis to ensure all the Company’s properties remain in good standing. The Company estimates that $477 of payments arising on mineral claims and leases will be payable during the year ended December 31, 2025.

Credit risk

The Company’s cash and accounts receivables are exposed to credit risk, which is the risk that the counterparties to the Company’s financial instruments will cause a loss to the Company by failing to pay their obligations. The amount of credit risk to which the Company is exposed is considered insignificant as the Company’s cash is held with highly rated financial institutions in interest-bearing accounts and the accounts receivable primarily consist of sales tax receivables.

Market risk

This is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market prices. The significant market risks to which the Company is exposed are as follows:

| i. | Currency risk |

The Company is exposed to currency risk by having balances and transactions in currencies that are different from the relevant functional currency (the Canadian dollar). The Company’s foreign currency exposure related to its financial assets and liabilities held in US dollars was as follows:

| At September 30, 2025 |

At December 31, 2024 |

|||||||

| Financial assets | ||||||||

| US$ bank accounts | $ | 12 | $ | 1 | ||||

| Financial liabilities | ||||||||

| Accounts payable | - | - | ||||||

| $ | 12 | $ | 1 | |||||

| Fury Gold Mines Limited |

|

| Notes to the Q3 2025 Condensed Interim Consolidated Financial Statements | |

(Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

A 10% increase or decrease in the US dollar to Canadian dollar exchange rate would not have a material impact on the Company’s net loss.

| ii. | Price risk |

The Company holds certain investments in marketable securities (note 5) which are measured at fair value, being the closing share price of each equity security at the date of the consolidated statements of financial position. The Company is exposed to changes in share prices which would result in gains and losses being recognized in the loss for the year. A 10% increase or decrease in the Company’s marketable securities share prices would not have a material impact on the Company’s net loss.

Note 18: Subsequent events

| - | On November 12, 2025 the Company closed a private placement of 1,494,253 units of the Company (the “Units”) at a price of $0.87 per Unit for gross proceeds of $1.3 million. The Units are comprised of one share, and one-half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant will entitle the holder to purchase one common share (a “Warrant Share”) at a price of $1.20 per Warrant Share for a period of 24 months from the date of the closing. |

| - | On October 14, 2025, the Company closed its previously announced brokered private placement of 9,915,000 flow-through units sold to charity purchasers (the “Charity FT Units”) at a price per Charity FT Unit of C$1.21; and 6,003,000 flow-through shares (the “FT Shares”) at a price per FT Share of C$1.00, for total aggregate gross proceeds of $18 million. The Charity FT Units are comprised of one “flow-through” share (each, a “Charity FT Share”), and one-half of one common share purchase warrant. Each Warrant will entitle the holder to purchase one non-flow through common share at a price of $1.20 per Warrant Share for a period of 24 months from the date of the closing. |

| - | On October 27, 2025 Benz Mining Corp (“Benz”) exercised their option to acquire the remaining 25% of the Eastmain Gold and Ruby Hill project from the Company. The additional 25% of the Eastmain Mine property was acquired by settling a cash payment of $750 and issuing common shares of Benz to the value of $250, while the acquisition of the remaining 25% of Ruby Hill was settled by a $100 cash payment. |

| Fury Gold Mines Limited | 23 |

| Notes

to the Q3 2025 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted - Unaudited) |

Exhibit 99.2

(An exploration company)

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2025

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2025

This Management’s Discussion and Analysis (the “MD&A”) for Fury Gold Mines Limited (“Fury Gold” or the “Company”) should be read in conjunction with the condensed interim consolidated financial statements of the Company and related notes thereto for the three and nine months ended September 30, 2025. The condensed interim consolidated financial statements have been prepared in accordance with International Accounting Standard 34 – Interim Financial Reporting (“IAS 34”) of the IFRS® Accounting Standards as issued by the International Accounting Standards Board (“IASB”) and interpretations issued by the IFRS Interpretations Committee (“IFRIC”). All dollar amounts presented are expressed in thousands of Canadian dollars unless otherwise stated. Amounts presented in this MD&A may be rounded. The effective date of this MD&A is November 13, 2025.

| Fury Gold Mines Limited Results of Operations for the Three and Nine Months Ended September 30, 2025 (Amounts expressed in thousands of Canadian dollars, unless otherwise noted) |

|

Section 1: Forward-looking statements and risk factors

1.1 Forward-looking statements

Certain statements made in this MD&A contain forward-looking information within the meaning of applicable Canadian and United States securities laws (“forward-looking statements”). These forward-looking statements are presented for the purpose of assisting the Company’s securityholders and prospective investors in understanding management’s views regarding those future outcomes and may not be appropriate for other purposes. When used in this MD&A, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”, “expect”, and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. Specific forward-looking statements in this MD&A include, but are not limited to: the Company’s exploration plans and objectives and the timing and costs of these plans; future capital expenditures and requirements, and sources and timing of additional financing; the timing, costs and success of the Company’s exploration activities, estimates of the Company’s mineral resources; the realization of mineral resource estimates; any objectives, expectations, intentions, plans, results, levels of activity, goals or achievements; capital expenditures; the Company’s plans for its marketable securities in Dolly Varden Silver Corporation and Sirios Resources Inc. and the realization of carrying values of these and any other securities held for resale. Additional factors include liabilities related to unused tax benefits or flow-through obligations; statements relating to the business, operations or prospects of the Company; and other events or conditions that may occur in the future.

The forward-looking statements contained in this MD&A represent the Company’s views only as of the date such statements were made and may change. Many assumptions are subject to risks and uncertainties, and so may prove to be incorrect, including the Company’s budget, including expected costs and the assumptions regarding market conditions and other factors upon which the Company has based its expenditure expectations; the Company’s ability to complete its planned exploration activities with its available working capital; the Company’s ability to raise additional capital to proceed with its exploration plans; the Company’s ability to obtain or renew the licences and permits necessary for exploration; the Company’s ability to obtain all necessary regulatory approvals, permits and licences for its planned exploration activities under governmental and other applicable regulatory regimes including the legally, mandated consultation process with affected First Nations; the Company’s ability to complete and successfully integrate acquisitions; the effects of climate change, extreme weather events, tariffs, water scarcity, and seismic events, and the effectiveness of strategies to deal with these issues; the Company’s expectations regarding the demand for, and supply and price of, precious metals; the Company’s ability to recruit and retain qualified personnel; the Company’s resource estimates, and the assumptions upon which they are based; the Company’s ability to comply with current and future environmental, safety and other regulatory requirements.

The foregoing is not an exhaustive list of the risks and other factors that may affect any of the Company’s forward-looking statements. Readers should refer to the risks discussed herein and in the Company’s Annual Information Form (the “Annual Information Form”) for the year ended December 31, 2024, subsequent disclosure filings with the Canadian Securities Administrators, the Company’s annual report on Form 20-F for the year ended December 31, 2024 filed with the United States Securities and Exchange Commission (the “SEC”) (the “2024 Form 20-F Annual Report”), and subsequent disclosure filings with the SEC, available on SEDAR+ at www.sedarplus.com and with the SEC at www.sec.gov, as applicable.

The Company does not undertake to update any forward-looking statements, except to the extent required by applicable securities laws.

Readers are cautioned not to place heavy reliance on forward looking statements.

Cautionary Note to United States Investors concerning Estimates of Measured, Indicated, and Inferred Resource Estimates: