UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2025

Predictive Oncology Inc.

(Exact name of registrant as specified in its charter)

Delaware |

001-36790 |

33-1007393 |

|

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

91 43rd Street, Suite 110

Pittsburgh, PA 15201

(Address of principal executive offices) (Zip Code)

(412) 432-1500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, par value $0.01 per share |

|

POAI |

|

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

Private Placement (Cash Offering)

Cash Securities Purchase Agreement

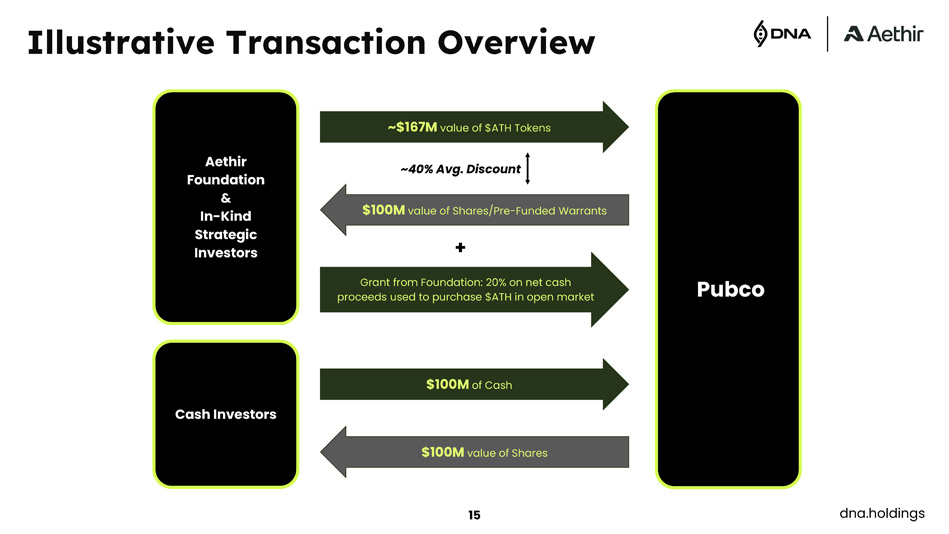

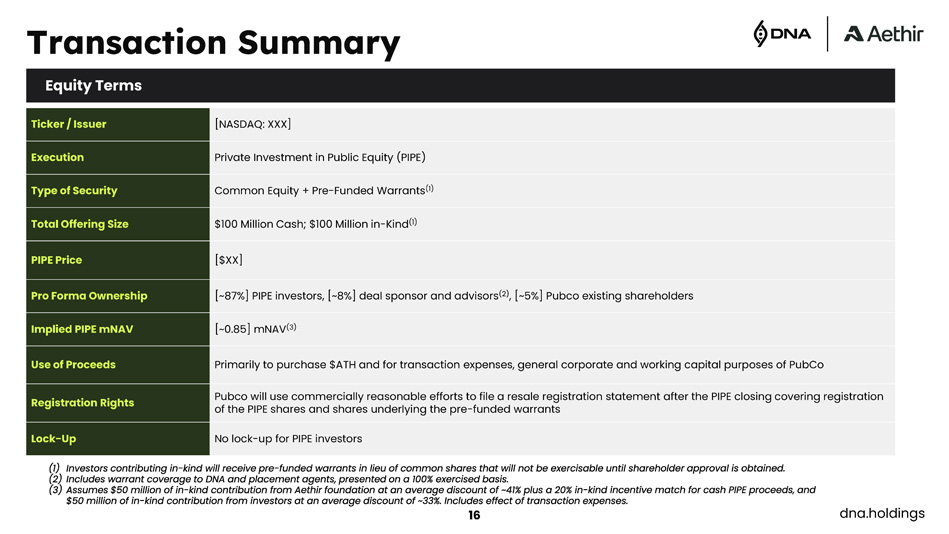

On September 29, 2025, Predictive Oncology Inc., a Delaware corporation (the “Company”), entered into a securities purchase agreement (the “Cash Securities Purchase Agreement”) with certain accredited investors (the “Cash Purchasers”) pursuant to which the Company agreed to sell and issue to the Cash Purchasers in a private placement (the “Cash Offering”) an aggregate of (i) approximately 55.2 million shares (the “Shares”) of common stock of the Company, par value $0.01 per share (the “Common Stock”), at a purchase price of $0.7751 per share (the “Cash Per Share Purchase Price”), and/or (ii) pre-funded warrants to purchase an aggregate of up to approximately 11.5 million shares of Common Stock (the “Cash Pre-Funded Warrants” and together with the Shares, the “Cash Securities”) to purchase shares of Common Stock (the “Cash Pre-Funded Warrant Shares”) at a purchase price per Cash Pre-Funded Warrant equal to the Cash Per Share Purchase Price minus the Cash Pre-Funded Warrant Exercise Price (as defined below), with such purchase price being pre-funded on the Closing Date (as defined below) other than the unfunded exercise price. In the Cash Offering, the Purchasers will tender U.S. dollars to the Company as consideration for the Cash Securities.

Cash Pre-Funded Warrants

The unfunded exercise price of each Cash Pre-Funded Warrant will be a fixed nominal amount of $0.01 per underlying Cash Pre-Funded Warrant Share (the “Cash Pre-Funded Warrant Exercise Price”) and will not be adjusted in connection with the reverse stock split. The exercise price and the number of shares of Common Stock issuable upon exercise of each Cash Pre-Funded Warrant is subject to appropriate adjustment in the event of certain stock dividends, stock splits, stock combinations or similar events affecting the Common Stock. The Cash Pre-Funded Warrants are exercisable in cash or by means of a cashless exercise, and will not expire until the date that such Cash Pre-Funded Warrants are fully exercised. The Cash Pre-Funded Warrants may not be exercised if the aggregate number of shares of Common Stock beneficially owned by the holder thereof (together with its affiliates) immediately following such exercise would exceed a specified beneficial ownership limitation; provided, however, that a holder may increase or decrease the beneficial ownership limitation by giving notice to the Company (61 days’ notice for increases), but not to any percentage in excess of 19.99%.

Private Placement (Cryptocurrency Offering)

Cryptocurrency Securities Purchase Agreement

On September 29, 2025, the Company, in a separate private placement transaction, entered into a securities purchase agreement (the “Cryptocurrency Securities Purchase Agreement” and, together with the Cash Securities Purchase Agreement, the “Securities Purchase Agreements”) with certain accredited investors (the “Cryptocurrency Purchasers” and, together with the Cash Purchasers, the “Purchasers”) pursuant to which the Company agreed to sell and issue to the Cryptocurrency Purchasers in a private placement (the “Cryptocurrency Offering” and, together with the Cash Offering, the “Private Placements”) pre-funded warrants (the “Cryptocurrency Pre-Funded Warrants” and, together with the Cash Pre-Funded Warrants, the “Pre-Funded Warrants” and, together with the Cash Securities, the “Securities”) to purchase an aggregate of up to approximately 223.6 million shares of Common Stock (the “Cryptocurrency Pre-Funded Warrant Shares” and, together with the Cash Pre-Funded Warrant Shares, the “Pre-Funded Warrant Shares”) at a purchase price per Cryptocurrency Pre-Funded Warrant equal to the Cash Per Share Purchase Price minus the Cryptocurrency Pre-Funded Warrant Exercise Price (as defined below), with such purchase price being pre-funded on the Closing Date (as defined below) other than the unfunded exercise price. In the Cryptocurrency Offering, the Purchasers will tender a combination of digital assets, including primarily Aethir tokens (“ATH”), to the Company as consideration for the Cryptocurrency Pre-Funded Warrants.

Cryptocurrency Pre-Funded Warrants

The unfunded exercise price of each Cryptocurrency Pre-Funded Warrant will be a fixed nominal amount of $0.01 per underlying Cryptocurrency Pre-Funded Warrant Share (the “Cryptocurrency Pre-Funded Warrant Exercise Price”) and will not be adjusted in connection with the reverse stock split. The Cryptocurrency Pre-Funded Warrants may not be exercised for Common Stock prior to the receipt of shareholder approval, which the Company is obligated to request promptly following the Closing Date.

The exercise price and the number of shares of Common Stock issuable upon exercise of each Cryptocurrency Pre-Funded Warrant is subject to appropriate adjustment in the event of certain stock dividends, stock splits, stock combinations, or similar events affecting the Common Stock. The Cryptocurrency Pre-Funded Warrants are exercisable in cash or by means of a cashless exercise and will not expire until the date that such Cryptocurrency Pre-Funded Warrants are fully exercised. The Cryptocurrency Pre-Funded Warrants may not be exercised if the aggregate number of shares of Common Stock beneficially owned by the holder thereof (together with its affiliates) immediately following such exercise would exceed a specified beneficial ownership limitation; provided, however, that a holder may increase or decrease the beneficial ownership limitation by giving notice to the Company (61 days’ notice for increases), but not to any percentage in excess of 19.99%.

Agreements and Disclosures Related to the Private Placements

Closing of Private Placements and Launch of Digital Asset Strategy

The closing of the Private Placements is expected to occur concurrently on or about October 2, 2025 (the “Closing Date”), subject to the satisfaction of certain customary closing conditions. The Securities Purchase Agreements contain customary representations, warranties and agreements by the Company, customary conditions to closing, indemnification obligations of the Company, other obligations of the parties and termination provisions.

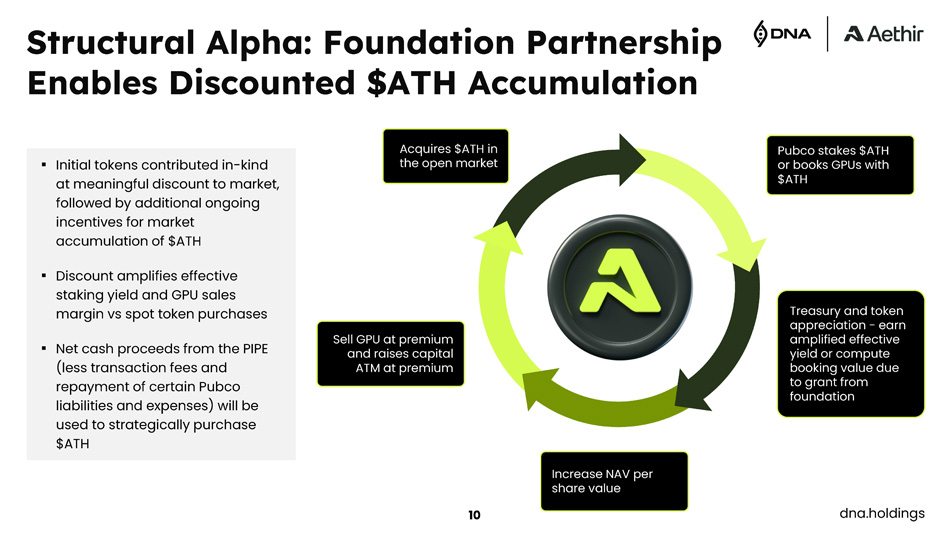

The Company has also decided to initiate its digital asset treasury strategy (the “Company’s Treasury Strategy”), effective upon closing of the Private Placements, pursuant to which the Company plans to pursue a number of strategic initiatives to acquire and manage digital assets, primarily ATH. The Company intends to use the net cash proceeds from the Private Placements primarily to purchase ATH, which, together with the contribution of the ATH from investors in the Cryptocurrency Offering, will establish the Company’s cryptocurrency treasury, as well as provide for working capital and general corporate purposes, and for the payment of transaction costs incurred in respect of the Private Placements.

Restrictions on the Sale of Equity Securities

Pursuant to the Securities Purchase Agreements, the Company has agreed to certain restrictions on the issuance and sale of the Company’s equity securities for a period beginning on the date of the Securities Purchase Agreements until the 180th day following the date on which the resale registration statement filed pursuant to the Registration Rights Agreement (as defined below) becomes effective, subject to certain customary exceptions, including, without limitation, issuances (i) contemplated by the Securities Purchase Agreements, (ii) pursuant to employee benefit plans or (iii) pursuant to any at-the-marketing offering sales agreement or similar agreement.

Securities Not Registered

The Securities to be issued pursuant to the Securities Purchase Agreements have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws, and will be issued pursuant to the exemption from registration provided under Section 4(a)(2) of the Securities Act and/or Rule 506 under Regulation D of the Securities Act and in reliance on similar exemptions under applicable state laws. The Company relied on this exemption from registration based in part on representations made by the Purchasers. The Securities may not be offered or sold in the United States absent registration under the Securities Act or an applicable exemption therefrom. Neither this Current Report on Form 8-K, nor any exhibit attached hereto, is an offer to sell or the solicitation of an offer to buy the Securities described herein.

Registration Rights Agreement

In connection with the Private Placements, the Company and the Purchasers entered into a Registration Rights Agreement, dated September 29, 2025 (the “Registration Rights Agreement”), providing for the registration for resale of the Shares, Pre-Funded Warrant Shares and the Strategic Advisor Warrant Shares (as defined below), and any securities issued or then issuable upon any share split, dividend or other distribution, recapitalization or similar event with respect to the foregoing (collectively, the “Registrable Securities”) on one or more registration statements (collectively, the “Resale Registration Statements”) to be filed with the Securities and Exchange Commission (the “Commission”) no later than the 15th calendar day following the Closing Date. The Company has agreed to use its best efforts to cause the Resale Registration Statements to be declared effective as promptly as possible, but in no event later than, in respect of the Cash Securities, the thirtieth calendar day following the filing date (or in the case of a full review by the Commission the sixtieth day thereafter), or in respect of the Resale Registration Statement to be filed for the Cryptocurrency Pre-Funded Warrant Shares, the fifth trading day following receipt of notice by the Commission that such Resale Registration Statement will not be reviewed or is no longer subject to further review, and to keep such Resale Registration Statements continuously effective from the date on which the Commission declares them to be effective (or the Resale Registration Statements go effective pursuant to their terms) until the date that all Registrable Securities covered by such Resale Registration Statements (i) have been sold, thereunder or pursuant to Rule 144, or (ii) may be sold without volume or manner-of-sale restrictions pursuant to Rule 144 and without the requirement for the Company to be in compliance with the current public information requirement under Rule 144.

The Company has granted the Purchasers customary indemnification rights in connection with the Registration Rights Agreement. The Purchasers have also granted the Company customary indemnification rights in connection with the Registration Rights Agreement.

Lock-up Agreements

In connection with the Private Placements, each director and certain officers of the Company will agree not to sell, pledge or otherwise dispose of any shares of our Common Stock or securities convertible thereinto or exercisable therefor for a period of ninety (90) days following the date on which the Resale Registration Statements are declared effective by the Commission, substantially in the form attached as Exhibit B to the Securities Purchase Agreement (each, a “Lock-Up Agreement”).

Side Letter

In connection with the Private Placements, on September 29, 2025, the Company entered into a side letter agreement (the “Side Letter”) with DCI Foundation, a Panama foundation company (“DCI”), supplementing the Cryptocurrency Securities Purchase Agreement. The Side Letter provides that DCI will be responsible if any digital assets contributed pursuant to the Cryptocurrency Securities Purchase Agreement that are subject to transfer restrictions (the “Locked Crypto”) are not released from such restrictions as expected or cannot be used by the Company due to issues attributable to DCI, and entitles the Company to seek equitable relief if DCI does not cure such failure within five business days of notice. The Side Letter further obligates DCI to deliver to the Company an additional twenty percent (20%) of the number of ATH tokens purchased by the Company on the open market, within thirty days of each such purchase. In addition, DCI makes certain representations regarding the ability of the Locked Crypto to generate yield and that the vesting provisions applicable to the Locked Crypto will not interfere with the Company’s Treasury Strategy, and the Side Letter further provides that DCI will have no claims against the Company in connection with any disputes relating to the valuation or contribution of Locked Crypto.

Engagement Agreement

H.C. Wainwright & Co., LLC (“Wainwright”) acted as the exclusive placement agent in connection with the Private Placements. Pursuant to that certain engagement agreement, dated as of May 14, 2024, by and between the Company and Wainwright, as amended on February 18, 2025 and June 1, 2025 (the “Engagement Agreement”), Wainwright is entitled to a cash fee of 5% of the gross cash proceeds paid by investors in the Private Placements, excluding any proceeds tendered to the Company in the form of digital assets. Additionally, the Company will issue to Wainwright (or its designees) warrants (the “Placement Agent Warrants”) to purchase up to approximately 3.3 million shares of Common Stock (the “Placement Agent Warrant Shares”) equal to 5% of the total Shares and Cash Pre-Funded Warrants sold pursuant to the Cash Securities Purchase Agreement. The Placement Agent Warrants will be exercisable for five years from the date of issuance at an exercise price equal to $0.7751 per share, which is equal to the Cash Per Share Purchase Price. The Company has agreed to reimburse Wainwright for its reasonable expenses in connection with the Private Placements.

The Placement Agent Warrants and the Placement Agent Warrant Shares to be issued upon exercise of the Placement Agent Warrants have not been registered under the Securities Act, or any state securities laws, and will be issued pursuant to the exemption from registration provided under Section 4(a)(2) of the Securities Act and/or Rule 506 under Regulation D of the Securities Act and in reliance on similar exemptions under applicable state laws.

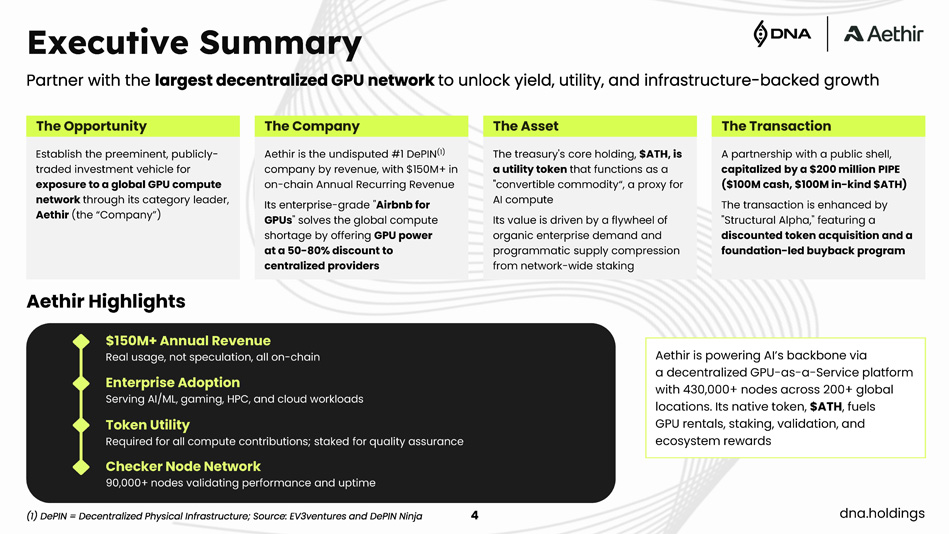

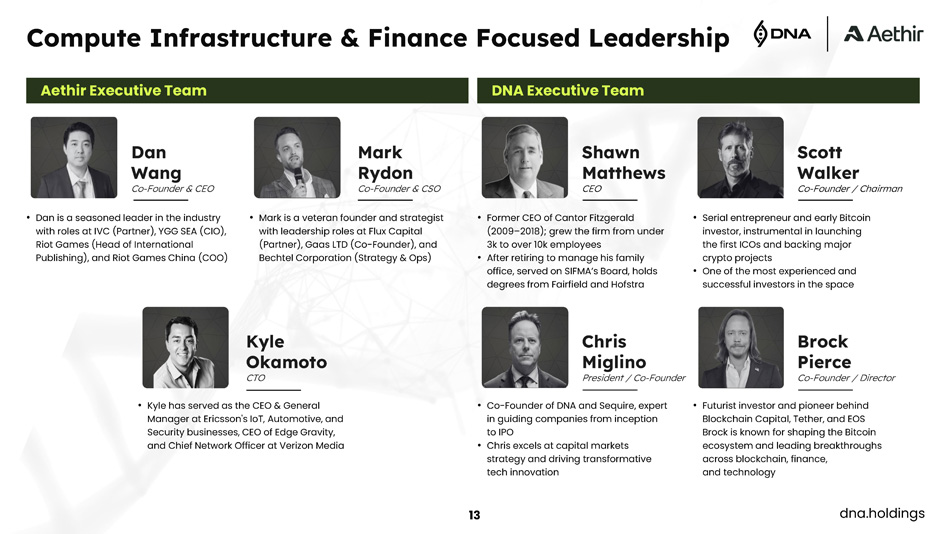

Strategic Advisor Agreements

In connection with the Company’s Treasury Strategy, the Company expects to enter into a Strategic Advisor Agreement (the “Strategic Advisor Agreement”) with DNA Holdings Venture, Inc. (“DNA”), pursuant to which the Company will engage DNA as a non-exclusive strategic advisor to provide financial advisory services related to digital asset strategies and business development initiatives for an initial term of three (3) years, subject to earlier termination for cause or by mutual agreement. DNA is also an investor in the Cash Offering.

As compensation for its services under the Strategic Advisor Agreement, the Company will issue DNA warrants (the “Strategic Advisor Warrants”) to purchase up to approximately 20.3 million shares of Common Stock (the “Strategic Advisor Warrant Shares”) equal to 7% of the total Shares and Pre-Funded Warrants sold pursuant to the Private Placements. The Strategic Advisor Warrants will be exercisable for five years from the date of issuance at an exercise price equal to $0.7751 per share, which is equal to the Cash Per Share Purchase Price. The Strategic Advisor Warrants will include a beneficial ownership limitation of 4.99% (or, at the election of DNA, 9.99%) of the outstanding Common Stock, and provide for cashless exercise and piggyback registration rights. The Strategic Advisor Agreement is expected to contain customary representations and warranties, confidentiality provisions, and limitations on liability. The Strategic Advisor Warrants and the Strategic Advisor Warrant Shares issuable upon exercise thereof are expected to be offered and sold in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation D promulgated thereunder, and applicable state securities laws.

Asset Management Agreement

In connection with the Company’s Treasury Strategy, the Company also expects to enter into an asset management agreement (the “Asset Management Agreement”) with DNA, as the asset manager (the “Asset Manager”), pursuant to which the Asset Manager will provide discretionary asset management services with respect to certain of the Company’s digital assets, including cryptocurrency and tokens (the “Account Assets”). The Account Assets will include, at the Company’s discretion, cash proceeds from securities offerings, ATH, stablecoin proceeds, and any additional assets designated by the Company, excluding assets attributable to the Company’s AI-driven drug development business.

As compensation for its services, the Asset Manager will be entitled to an asset-based management fee equal to 1.00% per annum of the Account Assets, calculated and paid quarterly in advance, as well as an incentive fee equal to 25% of any profits earned on the Account Assets in excess of 7%. The Company will be responsible for all reasonable and documented expenses related to the operation of the account holding the Account Assets, including custodial, banking, brokerage, transaction, and other related fees.

The initial term of the Asset Management Agreement will be ten years, with automatic one-year renewal periods unless terminated by either party in accordance with the Asset Management Agreement. The Asset Management Agreement may be terminated by the Company for cause, including fraud, gross negligence, willful misconduct, or material breach by the Asset Manager, or by the Asset Manager for cause or upon certain acts of insolvency, each as described in the Asset Management Agreement. While the Asset Manager would be the exclusive asset manager for the Company, the Asset Manager may nonetheless provide similar services to other clients, and the Asset Manager or its affiliates may engage in transactions for their own accounts. The Asset Management Agreement contains customary representations, warranties, confidentiality, indemnification and limitation of liability provisions, and is governed by the laws of the State of New York.

The foregoing descriptions of the Cash Securities Purchase Agreement, Cryptocurrency Securities Purchase Agreement, the Registration Rights Agreement, the Lock-Up Agreements, the Side Letter, the form of Strategic Advisor Agreement, the form of Asset Management Agreement, Cash Pre-Funded Warrant, Cryptocurrency Pre-Funded Warrant, Placement Agent Warrant and Strategic Advisor Warrant are not complete and are qualified in their entirety by reference to forms thereof filed as Exhibits 10.1, 10.2, 10.3, 10.4, 10.5, 10.6, 10.7, 4.1, 4.2, 4.3 and 4.4, respectively, to this Current Report on Form 8-K and are incorporated by reference herein.

On September 19, 2025, the Company’s stockholders approved a one-for-fifteen (1-for-15) reverse stock split of the Company’s outstanding Common Stock which will become effective at 12:01 a.m. on Tuesday, September 30, 2025. All share and price per share information included in this Current Report on Form 8-K is presented on a pre-split basis and the exercise price of $0.01 for the Pre-Funded Warrants will not be adjusted upon the reverse stock split.

Item 3.02. Unregistered Sales of Equity Securities.

The information contained in Item 1.01 of this Current Report on Form 8-K under the captions “Private Placement (Cash Offering)”, “Private Placement (Cryptocurrency Offering)”, “Engagement Agreement” and “Strategic Advisor Agreements” is hereby incorporated by reference into this Item 3.02.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Nancy Chung-Welch Resignation

On September 25, 2025, Nancy Chung-Welch, Ph.D. resigned from the Board of Directors (the “Board”), effective as of the Closing Date and subject to the successful closing of the Private Placements.

Ms. Chung-Welch’s resignation was not the result of any dispute or disagreement with the Company or the Company’s Board of Directors on any matter relating to the operations, policies or practices of the Company.

Shawn Matthews Appointment

On September 26, 2025, Shawn Matthews was appointed to the Board, effective as of the Closing Date and subject to the closing of the Private Placements, to serve for as long as DNA, directly or indirectly, holds at least 10% of the Common Stock and common stock equivalents purchased pursuant to the Securities Purchase Agreements, pursuant to the nomination right set forth in Section 4.20 of the Cryptocurrency Securities Purchase Agreement (the “Nomination Right”) or until DNA designates another individual to serve as a director pursuant to the Nomination Right. The information contained in response to Item 1.01 above is incorporated herein by reference.

Mr. Matthews will serve as a Class II director with a term expiring at the Company’s 2026 Annual Meeting of Stockholders and until his successor is duly elected and qualified, or until his earlier resignation or removal. Mr. Matthews, age 58, is the Chief Executive Officer of DNA, and founder and Chief Investment Officer of Hondius Capital Management, a global asset management firm he established in 2019. From 2009 to 2018, Mr. Matthews served as Chief Executive Officer and President of Cantor Fitzgerald & Co., where he oversaw more than 100 affiliated entities across a broad spectrum of financial services and fintech businesses. Mr. Matthews joined Cantor Fitzgerald in 2005 and held several senior roles, including Head of Capital Markets and Head of Mortgage Trading. Earlier in his career, Mr. Matthews held positions at Wertheim Schroder & Co., West Side Capital, and Alchemist Capital Management. Mr. Matthews holds a B.S. in Finance from Fairfield University and an MBA from Hofstra University.

Mr. Matthews will participate in the Company’s standard compensation program for non-employee directors, which includes quarterly and annual awards of common stock and cash, as described in the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission. Mr. Matthews has no family relationships with any director or executive officer of the Company. Other than with respect to Mr. Matthews’ role as the Chief Executive Officer of DNA in connection with the matters described in Item 1.01 above, there are no transactions in which Mr. Matthews has a material interest requiring disclosure under Item 404(a) of Regulation S-K.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

In connection with the Private Placements, the Board approved an amendment to Section 3.02 of the Company’s Second Amended and Restated Bylaws, as amended (the “Bylaws”). The amendment, which became effective as of September 26, 2025, modifies Section 3.02 of the Bylaws to provide that the exact number of directors shall continue to be determined from time to time solely by resolution adopted by the affirmative vote of a majority of the entire Board, but now expressly limits the number of directors serving on the Board to a maximum of seven.

Except as described herein and set forth in Amendment No. 2 to the Bylaws (the “Bylaws Amendment”), attached as Exhibit 3.1 to this Current Report on Form 8-K, the Bylaws remain unchanged and in full force and effect.

Prior to the Bylaws Amendment, Section 3.02 provided that the exact number of directors would be determined solely by resolution of the Board, without a specified maximum. The foregoing description of the Bylaws Amendment is qualified in its entirety by reference to the full text of the Bylaws Amendment, which is filed as Exhibit 3.1 hereto and incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On September 29, 2025, the Company issued a press release announcing the Private Placements and related transactions, including its adoption of a digital asset treasury strategy. The Company intends to continue to pursue its current lines of business in addition to the pursuit of its digital asset treasury strategy.

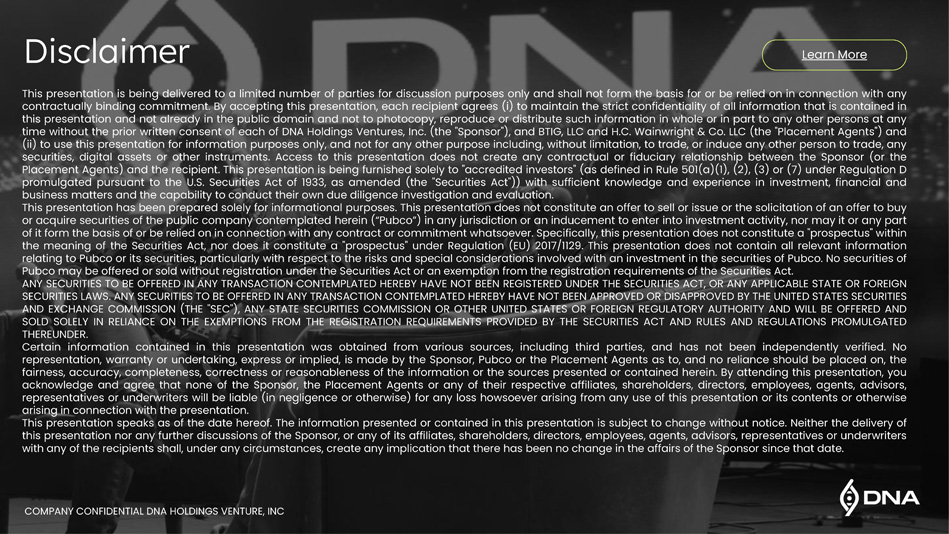

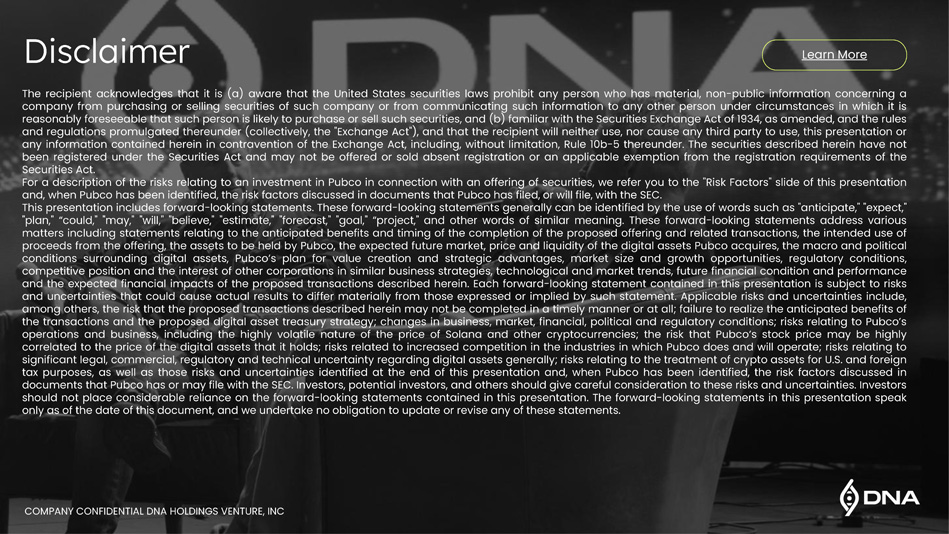

In connection with the Private Placements, the Company delivered an investor presentation to potential investors on a confidential basis.

The press release and investor presentation are attached as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K and are incorporated into this Item 7.01 by reference. The information in this Item 7.01, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01. Other Information.

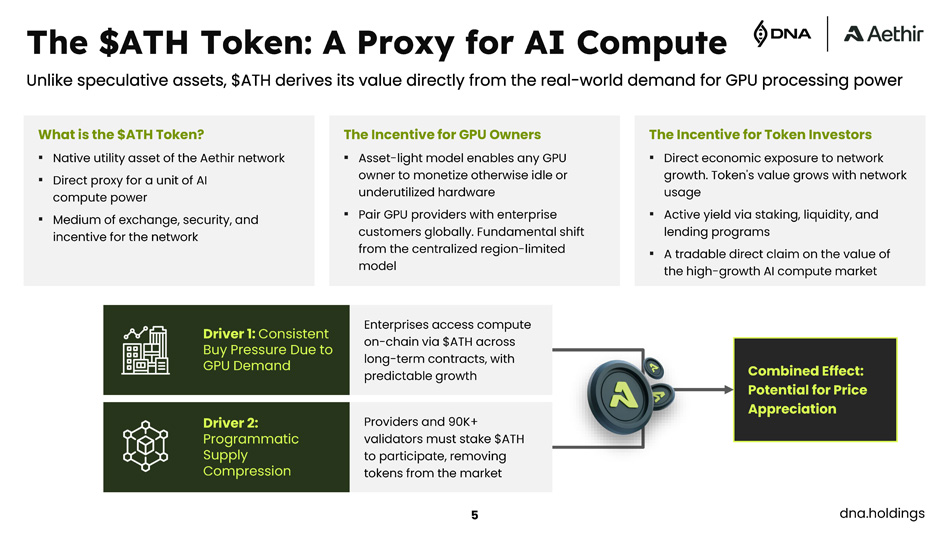

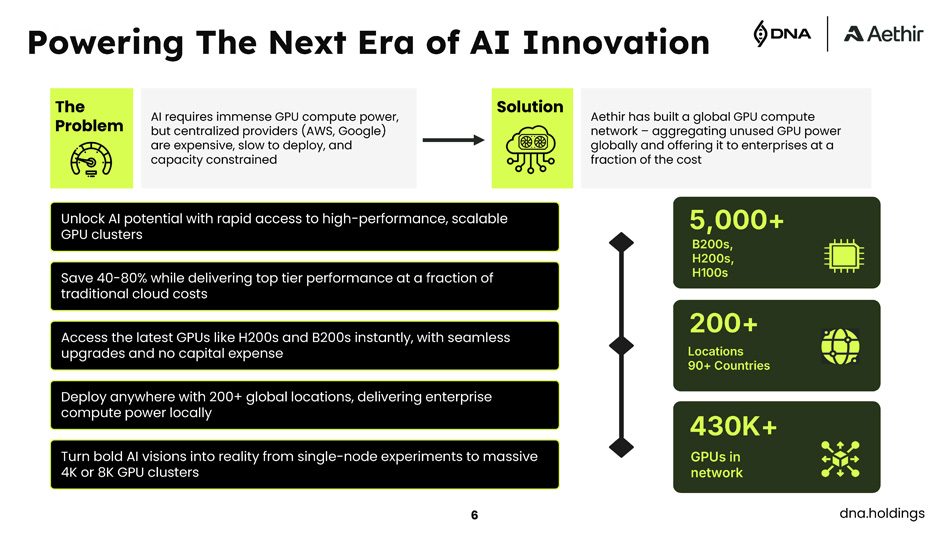

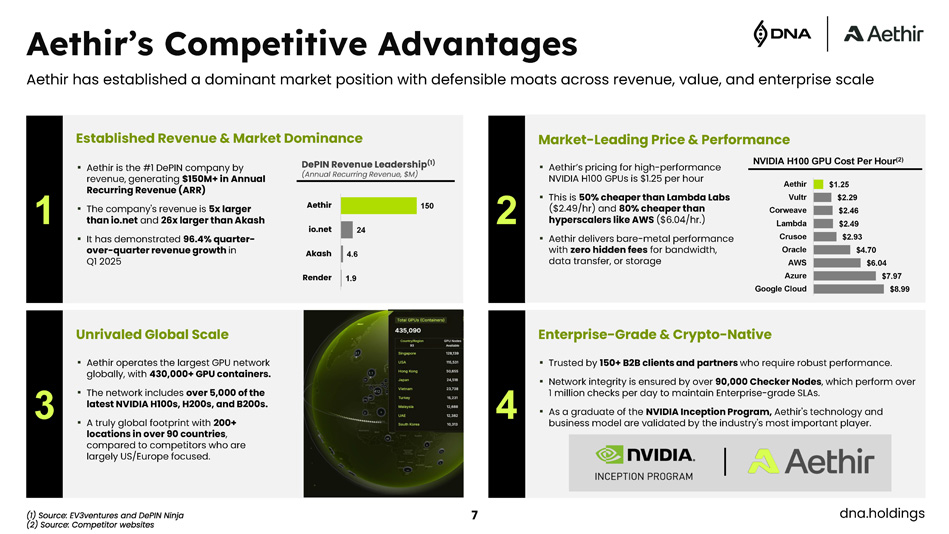

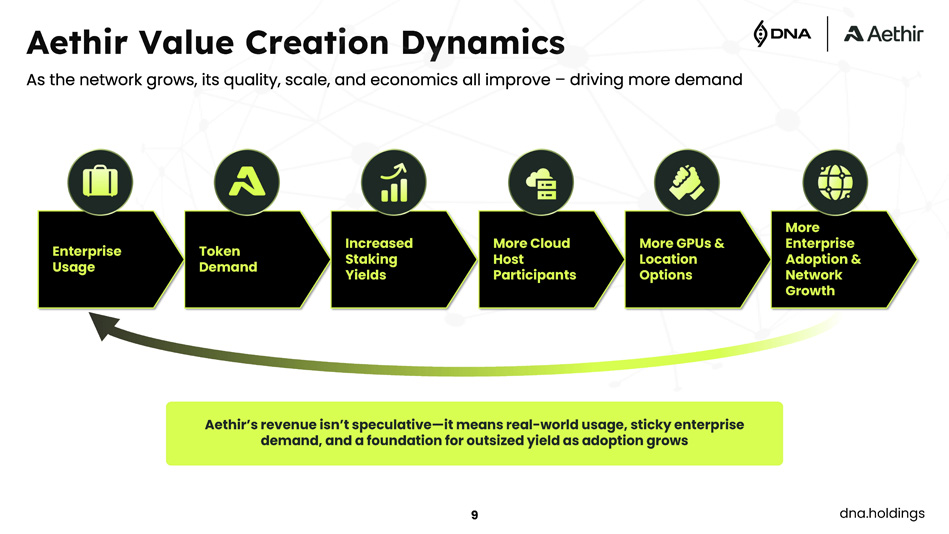

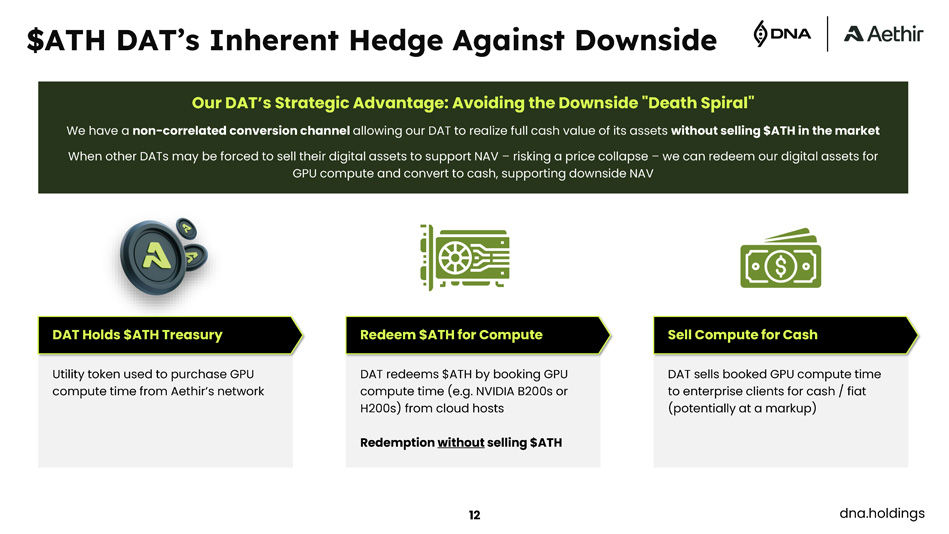

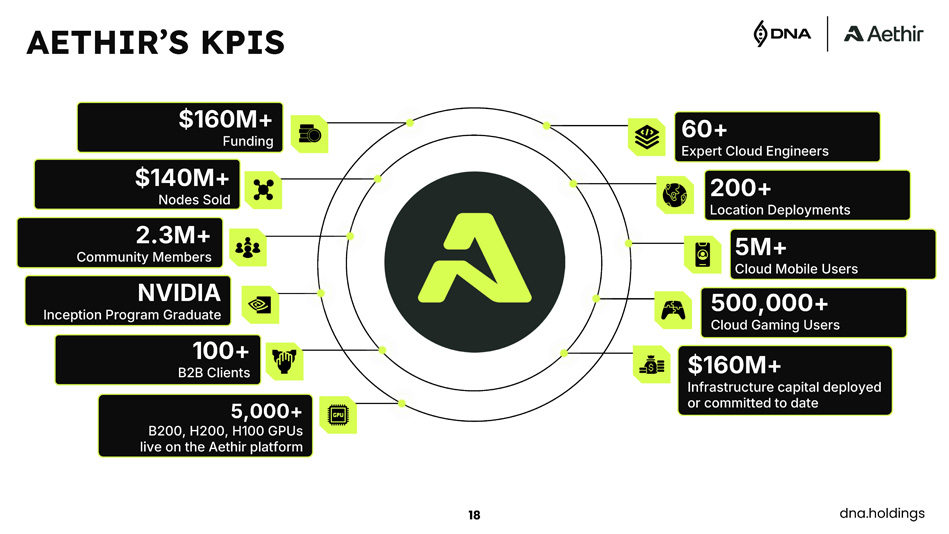

Upon the anticipated closing of the Private Placements on or about October 2, 2025 and the transactions contemplated thereby, the predominant business activity of the Company will be the Company’s digital asset treasury strategy, which is focused on the ATH token. Aethir is a leading decentralized physical infrastructure network developed by DCI that provides a decentralized graphics processing unit (“GPU”) network, which connects producers and consumers of GPU compute power at enterprise scale, supporting applications such as artificial intelligence computation, gaming and cloud workloads.

ATH, the native token of the Aethir network, is a utility token used for GPU rentals, staking, validation and the provision of ecosystem rewards on the Aethir network. ATH functions as a proxy for a unit of GPU compute power and serves as a medium of exchange and unit of incentives for participants in the Aethir network. Participants in the Aethir network can generate yield or other rewards by staking or lending ATH or by otherwise serving as a source of ATH liquidity. On September 26, 2025, the price of ATH was $0.0613, based on the price of ATH reported on the Coinbase exchange as of 4:00 p.m. ET on such date.

Pursuant to its Aethir digital asset treasury strategy, the Company intends to acquire additional ATH in the open market and to earn yield on its ATH treasury holdings by engaging in ATH staking and other activities. As a holder of ATH, the Company would accrue unrealized gains from any appreciation (or would be subject to unrealized losses from any depreciation) in the value of ATH tokens, which trade on various cryptocurrency exchanges. The Company’s digital asset treasury strategy will be overseen by a special committee to be constituted by the Board, as well as a new Chief Investment Officer expected to be appointed by the Board at the Closing Date, who will report to such committee, and will be implemented by DNA pursuant to the Asset Management Agreement and Strategic Advisor Agreement. DNA will be permitted to stake and/or lend ATH in the Company’s treasury.

In connection with the Private Placements and related transactions described herein, the Company is filing certain supplemental risk factors pertaining to its digital asset treasury business to revise and update disclosures contained in the Company’s prior public filings, including those discussed under the heading “Item 1A. Risk Factors” in (i) the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the Commission on March 31, 2025, (ii) the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, filed with the Commission on May 14, 2025, and (iii) the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2025, filed with the Commission on August 13, 2025. The supplemental updated risk factors are filed herewith as Exhibit 99.3 and are incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act. This Current Report on Form 8-K also includes express and implied forward-looking statements regarding the Company’s current expectations, estimates, opinions and beliefs that are not historical facts. Such forward-looking statements may be identified by words such as “believes,” “expects,” “endeavors,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “should” and “objective” and the negative and variations of such words and similar words. These statements are made on the basis of current knowledge and, by their nature, involve numerous assumptions and uncertainties. Nothing set forth herein should be regarded as a representation, warranty or prediction that we will achieve or are likely to achieve any particular future result. Actual results may differ materially from those indicated in the forward-looking statements because the realization of those results is subject to many risks and uncertainties, including the risk that the proposed transactions described herein may not be completed in a timely manner or at all; the failure to realize the anticipated benefits of the Private Placements and related transactions, including the Company’s proposed digital asset treasury strategy; economic conditions, fluctuations in the market price of ATH and other digital assets; the impact on the Company’s business of the evolving regulatory environment; the ability of the Company to execute on its digital asset treasury strategy; risks relating to significant legal, commercial, regulatory and technical uncertainty regarding digital assets generally as well as those risks and uncertainties identified under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, and Quarterly Report on Form 10-Q for the quarter ended June 30, 2025, and other information the Company has or may file with the Commission, including those disclosed under Item 8.01 of this Current Report on Form 8-K. Forward-looking statements contained in this Current Report on Form 8-K are made as of the date of this Current Report on Form 8-K, and the Company undertakes no duty to update such information except as required under applicable law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Predictive Oncology Inc. |

|

|

|

|

|

|

|

Date: September 29, 2025 |

By: |

/s/ Josh Blacher |

|

|

Josh Blacher |

|

|

Interim Chief Financial Officer |

|

|

|

Exhibit 3.1

AMENDMENT NO. 2

TO

THE SECOND AMENDED AND RESTATED BYLAWS

OF

PREDICTIVE ONCOLOGY INC.

The Second Amended and Restated Bylaws, as amended on September 9, 2022 (the “Bylaws”) of Predictive Oncology Inc., a Delaware corporation (the “Company”) are hereby amended pursuant to Section 6.06 of the Bylaws as follows:

| 1. | Section 3.02 of the Bylaws is hereby deleted in its entirety and replaced with the following: |

“Number, Election and Term of Office. The exact number of directors shall be determined from time to time solely by resolution adopted by the affirmative vote of a majority of the entire Board of Directors, provided that the number of directors serving on the Board of Directors at any time shall not exceed a maximum of seven directors. The Board of Directors shall be divided into three classes, as nearly equal in number as possible, designated: Class I, Class II and Class III (each, a “Class”). In the case of any increase or decrease, from time to time, in the number of directors, the number of directors in each class shall be apportioned as nearly equal as possible. Except as otherwise provided in the certificate of incorporation, each director shall serve for a term ending on the date of the third annual meeting of the Corporation’s stockholders following the annual meeting at which such director was elected; provided, however, that each director initially appointed to Class I shall serve for an initial term expiring at the Corporation’s first annual meeting of stockholders following the effectiveness of this provision; each director initially appointed to Class II shall serve for the initial term expiring at the Corporation’s second annual meeting of stockholders following the effectiveness of this provision; and each director initially appointed to Class III shall serve for an initial term expiring at the Corporation’s third annual meeting of stockholders following the effectiveness of this provision; provided further, that the term of each director shall continue until the election and qualification of a successor and be subject to such director’s earlier death, resignation or removal. Directors need not be stockholders.”

Except as expressly modified hereby, the Bylaws and all of the provisions contained therein shall remain in full force and effect.

CERTIFICATION

The undersigned hereby certifies that the foregoing Amendment No. 2 to the Bylaws of the Company was duly adopted by the Board of Directors of the Company at meeting of the Board of Directors of the Company on September 26, 2025.

/s/ Raymond Vennare__________

Raymond Vennare

Exhibit 4.1

NEITHER THIS SECURITY NOR THE SECURITIES FOR WHICH THIS SECURITY IS EXERCISABLE HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS. THIS SECURITY AND THE SECURITIES ISSUABLE UPON EXERCISE OF THIS SECURITY MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT WITH A REGISTERED BROKER DEALER OR OTHER LOAN WITH A FINANCIAL INSTITUTION THAT IS AN “ACCREDITED INVESTOR” AS DEFINED IN RULE 501(a) UNDER THE SECURITIES ACT OR OTHER LOAN SECURED BY SUCH SECURITIES.

FORM OF PRE-FUNDED COMMON STOCK PURCHASE WARRANT

PREDICTIVE ONCOLOGY, INC.

| Warrant Shares: [*] | Issue Date: [*], 2025 |

| Initial Exercise Date: [*], 2025 |

THIS PRE-FUNDED COMMON STOCK PURCHASE WARRANT (the “Warrant”) certifies that, for value received, __________ or its assigns (the “Holder”) is entitled, upon the terms and subject to the limitations on exercise and the conditions hereinafter set forth, at any time on or after the date hereof (the “Initial Exercise Date”) until this Warrant is exercised in full (the “Termination Date”), to subscribe for and purchase from Predictive Oncology, Inc., a Delaware corporation (the “Company”), up to [*] shares of common stock, par value $0.01 per share (the “Common Stock”), of the Company (as subject to adjustment hereunder, the “Warrant Shares”). The purchase price of one Warrant Share under this Warrant shall be equal to the Exercise Price, as defined in Section 2(b).

Section 1. Definitions. Capitalized terms used and not otherwise defined herein shall have the meanings set forth in that certain Securities Purchase Agreement (the “Purchase Agreement”), dated September [*], 2025, among the Company and the Holder.

Section 2. Exercise.

| a) | Exercise of Warrant. Exercise of the purchase rights represented by this Warrant may be made, in whole or in part, at any time or times on or after the Initial Exercise Date and, on or before the Termination Date by delivery to the Company of a duly executed PDF or DocuSign copy submitted by e-mail (or e-mail attachment) of the Notice of Exercise in the form annexed hereto as Exhibit A (the “Notice of Exercise”). Within the earlier of (i) one (1) Trading Day and (ii) the number of Trading Days comprising the Standard Settlement Period (as defined in Section 2(d)(i) herein) following the date of exercise as aforesaid, the Holder shall deliver the aggregate Exercise Price for the Warrant Shares specified in the applicable Notice of Exercise by wire transfer or cashier’s check drawn on a United States bank unless the cashless exercise procedure specified in Section 2(c) below is specified in the applicable Notice of Exercise. No ink-original Notice of Exercise shall be required, nor shall any medallion guarantee (or other type of guarantee or notarization) of any Notice of Exercise be required. Notwithstanding anything herein to the contrary, the Holder shall not be required to physically surrender this Warrant to the Company until the Holder has purchased all of the Warrant Shares available hereunder and the Warrant has been exercised in full, in which case, the Holder shall surrender this Warrant to the Company for cancellation within three (3) Trading Days of the date on which the final Notice of Exercise is delivered to the Company. Partial exercises of this Warrant resulting in purchases of a portion of the total number of Warrant Shares available hereunder shall have the effect of lowering the outstanding number of Warrant Shares purchasable hereunder in an amount equal to the applicable number of Warrant Shares purchased. The Holder and the Company shall maintain records showing the number of Warrant Shares purchased and the date of such purchases. The Company shall deliver any objection to any Notice of Exercise within one (1) Trading Day of receipt of such notice. The Holder and any assignee, by acceptance of this Warrant, acknowledge and agree that, by reason of the provisions of this paragraph, following the purchase of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at any given time may be less than the amount stated on the face hereof. |

For the avoidance of doubt, there is no circumstance that would require the Company to net cash settle the Warrants.

b) Exercise Price. The aggregate exercise price of this Warrant, except for a nominal exercise price of $0.01 per Warrant Share, was pre-funded to the Company on or prior to the Initial Exercise Date and, consequently, no additional consideration (other than the nominal exercise price of $0.01 per Warrant Share) shall be required to be paid by the Holder to any Person to effect any exercise of this Warrant. The Holder shall not be entitled to the return or refund of all, or any portion, of such pre-paid aggregate exercise price under any circumstance or for any reason whatsoever. The remaining unpaid exercise price per Warrant Share shall be $0.01, subject to adjustment hereunder (the “Exercise Price”).

c) Cashless Exercise. This Warrant may also be exercised, in whole or in part, at such time by means of a “cashless exercise” in which the Holder shall be entitled to receive a number of Warrant Shares equal to the quotient obtained by dividing [(A-B) (X)] by (A), where:

(A) = as applicable: (i) the VWAP on the Trading Day immediately preceding the date of the applicable Notice of Exercise if such Notice of Exercise is (1) both executed and delivered pursuant to Section 2(a) hereof on a day that is not a Trading Day or (2) both executed and delivered pursuant to Section 2(a) hereof on a Trading Day prior to the opening of “regular trading hours” (as defined in Rule 600(b) of Regulation NMS promulgated under the federal securities laws) on such Trading Day, (ii) at the option of the Holder, either (y) the VWAP on the Trading Day immediately preceding the date of the applicable Notice of Exercise or (z) the Bid Price of the Common Stock on the principal Trading Market as reported by Bloomberg L.P. (“Bloomberg”) as of the time of the Holder’s execution of the applicable Notice of Exercise if such Notice of Exercise is executed during “regular trading hours” on a Trading Day and is delivered within two (2) hours thereafter (including until two (2) hours after the close of “regular trading hours” on a Trading Day) pursuant to Section 2(a) hereof or (iii) the VWAP on the date of the applicable Notice of Exercise if the date of such Notice of Exercise is a Trading Day and such Notice of Exercise is both executed and delivered pursuant to Section 2(a) hereof after the close of “regular trading hours” on such Trading Day;

(B) = the Exercise Price of this Warrant, as adjusted hereunder, in effect on the date of exercise; and

(X) = the number of Warrant Shares that would be issuable upon exercise of this Warrant in accordance with the terms of this Warrant if such exercise were by means of a cash exercise rather than a cashless exercise.

If Warrant Shares are issued in such a cashless exercise, the parties acknowledge and agree that in accordance with Section 3(a)(9) of the Securities Act, the holding period of the Warrant Shares being issued may be tacked on to the holding period of this Warrant. The Company agrees not to take any position contrary to this Section 2(c).

“Bid Price” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed or quoted on a Trading Market, the bid price of the Common Stock for the time in question (or the nearest preceding date) on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg (based on a Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if the Common Stock is not then listed or quoted for trading on a Trading Market and if the Common Stock is then listed or quoted on OTCQB or OTCQX, the volume weighted average price of the Common Stock for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if the Common Stock is not then listed or quoted for trading on OTCQB or OTCQX and if prices for the Common Stock are then reported on The Pink Open Market (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of the Common Stock so reported, or (d) in all other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the holders of a majority in interest of the Warrants then outstanding and reasonably acceptable to the Company, the fees and expenses of which shall be paid by the Company.

“Trading Day” means any day on which the Trading Market is open for trading, including any day on which the Trading Market is open for trading for a period of time less than the customary time. If the Common Stock is not then listed or quoted on a Trading Market, Trading Day means a Business Day.

“VWAP” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date) on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg (based on a Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if the Common Stock is not then listed or quoted for trading on a Trading Market and if the Common Stock is then listed or quoted on OTCQB or OTCQX, the volume weighted average price of the Common Stock for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if the Common Stock is not then listed or quoted for trading on OTCQB or OTCQX and if prices for the Common Stock are then reported on The Pink Open Market (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of the Common Stock so reported, or (d) in all other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the holders of a majority in interest of the Warrants then outstanding and reasonably acceptable to the Company, the fees and expenses of which shall be paid by the Company.

| d) | Mechanics of Exercise. |

i. Delivery of Warrant Shares Upon Exercise. The Company shall cause the Warrant Shares purchased hereunder to be transmitted by the Transfer Agent to the Holder by crediting the account of the Holder’s or its designee’s balance account with The Depository Trust Company through its Deposit or Withdrawal at Custodian system (“DWAC”) if the Company is then a participant in such system and either (A) there is an effective registration statement permitting the issuance of the Warrant Shares to or resale of the Warrant Shares by the Holder or (B) the Warrant Shares are eligible for resale by the Holder without volume or manner-of-sale limitations pursuant to Rule 144 (assuming cashless exercise of the Warrants), and otherwise by physical delivery of a certificate, registered in the Company’s share register in the name of the Holder or its designee, for the number of Warrant Shares to which the Holder is entitled pursuant to such exercise to the address specified by the Holder in the Notice of Exercise by the date that is the earlier of (i) one (1) Trading Day after delivery of the aggregate Exercise Price to the Company (other than in the instance of a cashless exercise) and (ii) the number of Trading Days comprising the Standard Settlement Period after the delivery to the Company of the Notice of Exercise, provided that payment of the aggregate Exercise Price (other than in the instance of a cashless exercise) is received by the Company by such date (such date, the “Warrant Share Delivery Date”). Upon delivery of the Notice of Exercise, the Holder shall be deemed for all corporate purposes to have become the holder of record of the Warrant Shares with respect to which this Warrant has been exercised, irrespective of the date of delivery of the Warrant Shares, provided that payment of the aggregate Exercise Price (other than in the case of a cashless exercise) is received by the Warrant Share Delivery Date. If the Company fails for any reason to deliver to the Holder the Warrant Shares subject to a Notice of Exercise by the Warrant Share Delivery Date, the Company shall pay to the Holder, in cash, as liquidated damages and not as a penalty, for each $1,000 of Warrant Shares subject to such exercise (based on the VWAP of the Common Stock on the date of the applicable Notice of Exercise), $10 per Trading Day (increasing to $20 per Trading Day on the third Trading Day after such Warrant Share Delivery Date) for each Trading Day after such Warrant Share Delivery Date until such Warrant Shares are delivered or the Holder rescinds such exercise. The Company agrees to maintain a transfer agent that is a participant in the FAST program so long as this Warrant remains outstanding and exercisable. As used herein, “Standard Settlement Period” means the standard settlement period, expressed in a number of Trading Days, on the Company’s primary Trading Market with respect to the Common Stock as in effect on the date of delivery of the Notice of Exercise.

ii. Delivery of New Warrants Upon Exercise. If this Warrant shall have been exercised in part, the Company shall, at the request of a Holder and upon surrender of this Warrant certificate, at the time of delivery of the Warrant Shares, deliver to the Holder a new Warrant evidencing the rights of the Holder to purchase the unpurchased Warrant Shares called for by this Warrant, which new Warrant shall in all other respects be identical with this Warrant.

iii. Rescission Rights. If the Company fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares pursuant to Section 2(d)(i) by the Warrant Share Delivery Date, then the Holder will have the right to rescind such exercise.

iv. Compensation for Buy-In on Failure to Timely Deliver Warrant Shares Upon Exercise. In addition to any other rights available to the Holder, if the Company fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares in accordance with the provisions of Section 2(d)(i) above pursuant to an exercise on or before the Warrant Share Delivery Date (other than any such failure that is solely due to any action or inaction by the Holder with respect to such exercise), and if after such date the Holder is required by its broker to purchase (in an open market transaction or otherwise) or the Holder’s brokerage firm otherwise purchases, shares of Common Stock to deliver in satisfaction of a sale by the Holder of the Warrant Shares which the Holder anticipated receiving upon such exercise (a “Buy-In”), then the Company shall (A) pay in cash to the Holder the amount, if any, by which (x) the Holder’s total purchase price (including brokerage commissions, if any) for the Warrant Shares so purchased exceeds (y) the amount obtained by multiplying (1) the number of Warrant Shares that the Company was required to deliver to the Holder in connection with the exercise at issue times (2) the price at which the sell order giving rise to such purchase obligation was executed, and (B) at the option of the Holder, either reinstate the portion of the Warrant and equivalent number of Warrant Shares for which such exercise was not honored (in which case such exercise shall be deemed rescinded) or deliver to the Holder the number of shares of Common Stock that would have been issued had the Company timely complied with its exercise and delivery obligations hereunder. For example, if the Holder purchases shares of Common Stock having a total purchase price of $11,000 to cover a Buy-In with respect to an attempted exercise of Warrants with an aggregate sale price giving rise to such purchase obligation of $10,000, under clause (A) of the immediately preceding sentence the Company shall be required to pay the Holder $1,000. The Holder shall provide the Company written notice indicating the amounts payable to the Holder in respect of the Buy-In and, upon request of the Company, evidence of the amount of such loss. Nothing herein shall limit a Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver shares of Common Stock upon exercise of the Warrant as required pursuant to the terms hereof.

v. No Fractional Shares or Scrip. No fractional shares or scrip representing fractional shares shall be issued upon the exercise of this Warrant. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such exercise, the Company shall, at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Exercise Price or round up to the next whole share of Common Stock.

vi. Charges, Taxes and Expenses. The issuance and delivery of Warrant Shares shall be made without charge to the Holder for any issue or transfer tax or other incidental expense in respect of the issuance of such Warrant Shares, all of which taxes and expenses shall be paid by the Company, and such Warrant Shares shall be issued in the name of the Holder or in such name or names as may be directed by the Holder; provided, however, that, in the event that Warrant Shares are to be issued in a name other than the name of the Holder, this Warrant when surrendered for exercise shall be accompanied by the Assignment Form, attached hereto as Exhibit B, duly executed by the Holder and the Company may require, as a condition thereto, the payment of a sum sufficient to reimburse it for any transfer tax incidental thereto. The Company shall pay all Transfer Agent fees required for same-day processing of any Notice of Exercise and all fees to the Depository Trust Company (or another established clearing corporation performing similar functions) required for same-day electronic delivery of the Warrant Shares.

vii. Closing of Books. The Company will not close its stockholder books or records in any manner which prevents the timely exercise of this Warrant, pursuant to the terms hereof.

e) Holder’s Exercise Limitations. The Company shall not effect any exercise of this Warrant, and a Holder shall not have the right to exercise any portion of this Warrant, pursuant to Section 2 or otherwise, to the extent that after giving effect to such issuance after exercise as set forth on the applicable Notice of Exercise, the Holder (together with (i) the Holder’s Affiliates, (ii) any other Persons acting as a group together with the Holder or any of the Holder’s Affiliates, and (iii) any other Persons whose beneficial ownership of the shares of Common Stock would or could be aggregated with the Holder’s for purposes of Section 13(d) (such Persons, “Attribution Parties”)), would beneficially own in excess of the Beneficial Ownership Limitation (as defined below). For purposes of the foregoing sentence, the number of shares of Common Stock beneficially owned by the Holder and its Affiliates and Attribution Parties shall include the number of Warrant Shares issuable upon exercise of this Warrant with respect to which such determination is being made, but shall exclude the number of Warrant Shares which would be issuable upon (i) exercise of the remaining, nonexercised portion of this Warrant beneficially owned by the Holder or any of its Affiliates or Attribution Parties and (ii) exercise or conversion of the unexercised or nonconverted portion of any other securities of the Company (including, without limitation, any other Common Stock Equivalents) subject to a limitation on conversion or exercise analogous to the limitation contained herein beneficially owned by the Holder or any of its Affiliates or Attribution Parties. Except as set forth in the preceding sentence, for purposes of this Section 2(e), beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder, it being acknowledged by the Holder that the Company is not representing to the Holder that such calculation is in compliance with Section 13(d) of the Exchange Act and the Holder is solely responsible for any schedules required to be filed in accordance therewith. To the extent that the limitation contained in this Section 2(e) applies, the determination of whether this Warrant is exercisable (in relation to other securities owned by the Holder together with any Affiliates and Attribution Parties) and of which portion of this Warrant is exercisable shall be in the sole discretion of the Holder, and the submission of a Notice of Exercise shall be deemed to be the Holder’s determination of whether this Warrant is exercisable (in relation to other securities owned by the Holder together with any Affiliates and Attribution Parties) and of which portion of this Warrant is exercisable, in each case subject to the Beneficial Ownership Limitation, and the Company shall have no obligation to verify or confirm the accuracy of such determination and shall have no liability for exercises of the Warrants that are not in compliance with the Beneficial Ownership Limitation, except to the extent the Holder relies on the number of outstanding shares of Common Stock that was provided by the Company. In addition, a determination as to any group status as contemplated above shall be determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder, and the Company shall have no obligation to verify or confirm the accuracy of such determination and shall have no liability for exercises of the Warrants that are not in compliance with the Beneficial Ownership Limitation, except to the extent the Holder relies on the number of outstanding shares of Common Stock that was provided by the Company. For purposes of this Section 2(e), in determining the number of outstanding shares of Common Stock, a Holder may rely on the number of outstanding shares of Common Stock as reflected in (A) the Company’s most recent periodic or annual report filed with the Commission, as the case may be, (B) a more recent public announcement by the Company or (C) a more recent written notice by the Company or the Transfer Agent setting forth the number of shares of Common Stock outstanding. Upon the written or oral request of a Holder, the Company shall within one (1) Trading Day confirm orally and in writing to the Holder the number of shares of Common Stock then outstanding. In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Company, including this Warrant, by the Holder or its Affiliates or Attribution Parties since the date as of which such number of outstanding shares of Common Stock was reported. The “Beneficial Ownership Limitation” shall be [4.99%/9.99%/19.99%] of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of Warrant Shares issuable upon exercise of this Warrant. The Holder, upon notice to the Company, may increase or decrease the Beneficial Ownership Limitation provisions of this Section 2(e), provided that the Beneficial Ownership Limitation in no event exceeds [19.99]% of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of Warrant Shares upon exercise of this Warrant held by the Holder and the provisions of this Section 2(e) shall continue to apply, provided further that an Affiliate of the Company may suspend the Beneficial Ownership Limitation in its entirety if, and for so long as, such Beneficial Ownership Limitation is not required to be in effect to ensure compliance with applicable Nasdaq listing requirements with respect to stockholder approval. Any increase in the Beneficial Ownership Limitation will not be effective until the 61st day after such notice is delivered to the Company. The provisions of this paragraph shall not be construed and implemented in a manner otherwise than in strict conformity with the terms of this Section 2(e) to correct this paragraph (or any portion hereof) which may be defective or inconsistent with the intended Beneficial Ownership Limitation herein contained or to make changes or supplements necessary or desirable to properly give effect to such limitation. The limitations contained in this paragraph shall apply to a successor holder of this Warrant. If the Warrant is unexercisable as a result of the Holder’s Beneficial Ownership Limitation, no alternative consideration is owing to the Holder.

Section 3. Certain Adjustments.

a) Stock Dividends and Splits. If the Company, at any time while this Warrant is outstanding: (i) pays a stock dividend or otherwise makes a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of Common Stock (which, for avoidance of doubt, shall not include any Warrant Shares issued by the Company upon exercise of this Warrant), (ii) subdivides outstanding shares of Common Stock into a larger number of shares, (iii) combines (including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, or (iv) issues by reclassification of shares of the Common Stock any shares of capital stock of the Company, then in each case the Exercise Price shall be multiplied by a fraction of which the numerator shall be the number of shares of Common Stock (excluding treasury shares, if any) outstanding immediately before such event and of which the denominator shall be the number of shares of Common Stock outstanding immediately after such event, and the number of shares issuable upon exercise of this Warrant shall be proportionately adjusted such that the aggregate Exercise Price of this Warrant shall remain unchanged. Any adjustment made pursuant to this Section 3(a) shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination or re-classification.

b) Subsequent Rights Offerings. In addition to any adjustments pursuant to Section 3(a) above, if at any time the Company grants, issues or sells any Common Stock Equivalents or rights to purchase stock, warrants, securities or other property pro rata to the record holders of any class of shares of Common Stock (the “Purchase Rights”), then the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete exercise of this Warrant (without regard to any limitations on exercise hereof, including without limitation, the Beneficial Ownership Limitation) immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights (provided, however, that, to the extent that the Holder’s right to participate in any such Purchase Right would result in the Holder exceeding the Beneficial Ownership Limitation, then the Holder shall not be entitled to participate in such Purchase Right to such extent (or beneficial ownership of such shares of Common Stock as a result of such Purchase Right to such extent) and such Purchase Right to such extent shall be held in abeyance for the Holder until such time, if ever, as its right thereto would not result in the Holder exceeding the Beneficial Ownership Limitation).

c) Pro Rata Distributions. During such time as this Warrant is outstanding, if the Company shall declare or make any dividend or other distribution of its assets (or rights to acquire its assets) to holders of shares of Common Stock, by way of return of capital or otherwise (including, without limitation, any distribution of cash, stock or other securities, property or options by way of a dividend, spin off, reclassification, corporate rearrangement, scheme of arrangement or other similar transaction) (a “Distribution”), at any time after the issuance of this Warrant, then, in each such case, the Holder shall be entitled to participate in such Distribution to the same extent that the Holder would have participated therein if the Holder had held the number of shares of Common Stock acquirable upon complete exercise of this Warrant (without regard to any limitations on exercise hereof, including without limitation, the Beneficial Ownership Limitation) immediately before the date of which a record is taken for such Distribution, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the participation in such Distribution (provided, however, that, to the extent that the Holder's right to participate in any such Distribution would result in the Holder exceeding the Beneficial Ownership Limitation, then the Holder shall not be entitled to participate in such Distribution to such extent (or in the beneficial ownership of any shares of Common Stock as a result of such Distribution to such extent) and the portion of such Distribution shall be held in abeyance for the benefit of the Holder until such time, if ever, as its right thereto would not result in the Holder exceeding the Beneficial Ownership Limitation). To the extent that this Warrant has not been partially or completely exercised at the time of such Distribution, such portion of the Distribution shall be held in abeyance for the benefit of the Holder until the Holder has exercised this Warrant.

d) Fundamental Transaction. If, at any time while this Warrant is outstanding, (i) the Company, directly or indirectly, in one or more related transactions effects any merger or consolidation of the Company with or into another Person in which the Company is not the surviving entity (other than a reincorporation in a different state), (ii) the Company or any Subsidiary, directly or indirectly, effects any sale, lease, license, assignment, transfer, conveyance or other disposition of all or substantially all of the assets of the Company and its Subsidiaries, taken as a whole, in one or a series of related transactions, (iii) any, direct or indirect, purchase offer, tender offer or exchange offer (whether by the Company or another Person) is completed pursuant to which holders of Common Stock are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the holders of more than 50% of the outstanding shares of the aggregate voting power of all classes of equity of the Company, (iv) the Company, directly or indirectly, in one or more related transactions effects any reclassification, reorganization or recapitalization of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property, or (v) the Company, directly or indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off, merger or scheme of arrangement) with another Person or group of Persons whereby such other Person or group acquires more than 50% of the outstanding shares of the aggregate voting power of all classes of equity of the Company (each a “Fundamental Transaction”), then, upon any subsequent exercise of this Warrant, the Holder shall have the right to receive, for each Warrant Share that would have been issuable upon such exercise immediately prior to the occurrence of such Fundamental Transaction, at the option of the Holder (without regard to any limitation in Section 2(e) on the exercise of this Warrant), the number of shares of Common Stock of the successor or acquiring corporation or of the Company, if it is the surviving corporation, and any additional consideration (the “Alternate Consideration”) receivable as a result of such Fundamental Transaction by a holder of the number of shares of Common Stock for which this Warrant is exercisable immediately prior to such Fundamental Transaction (without regard to any limitation in Section 2(e) on the exercise of this Warrant). For purposes of any such exercise, the determination of the Exercise Price shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Fundamental Transaction, and the Company shall apportion the Exercise Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same choice as to the Alternate Consideration it receives upon any exercise of this Warrant following such Fundamental Transaction. The Company shall cause any successor entity in a Fundamental Transaction in which the Company is not the survivor (the “Successor Entity”) to assume in writing all of the obligations of the Company under this Warrant and the other Transaction Documents in accordance with the provisions of this Section 3(d) pursuant to written agreements in form and substance reasonably satisfactory to the Holder prior to such Fundamental Transaction and shall, at the option of the Holder, deliver to the Holder in exchange for this Warrant a security of the Successor Entity evidenced by a written instrument substantially similar in form and substance to this Warrant which is exercisable for a corresponding number of shares of capital stock of such Successor Entity (or its parent entity) equivalent to the shares of Common Stock acquirable and receivable upon exercise of this Warrant (without regard to any limitations on the exercise of this Warrant) prior to such Fundamental Transaction, and with an exercise price which applies the exercise price hereunder to such shares of capital stock (but taking into account the relative value of the shares of Common Stock pursuant to such Fundamental Transaction and the value of such shares of capital stock, such number of shares of capital stock and such exercise price being for the purpose of protecting the economic value of this Warrant immediately prior to the consummation of such Fundamental Transaction), and which is reasonably satisfactory in form and substance to the Holder. Upon the occurrence of any such Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such Fundamental Transaction, the provisions of this Warrant and the other Transaction Documents referring to the “Company” shall refer instead to the Successor Entity), and may exercise every right and power of the Company and shall assume all of the obligations of the Company under this Warrant and the other Transaction Documents with the same effect as if such Successor Entity had been named as the Company herein. For the avoidance of doubt, the Holder shall be entitled to the benefits of the provisions of this Section 3(e) regardless of (i) whether the Company has sufficient authorized shares of Common Stock for the issuance of Warrant Shares and/or (ii) whether a Fundamental Transaction occurs prior to the Initial Exercise Date.

e) [Reserved].

f) Calculations. All calculations under this Section 3 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. For purposes of this Section 3, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the number of shares of Common Stock (excluding treasury shares, if any) issued and outstanding.

g) Notice to Holder.

i. Adjustment to Exercise Price. Whenever the Exercise Price is adjusted pursuant to any provision of this Section 3, the Company shall promptly deliver to the Holder by email a notice setting forth the Exercise Price after such adjustment and any resulting adjustment to the number of Warrant Shares and setting forth a brief statement of the facts requiring such adjustment.

ii. Notice to Allow Exercise by Holder. If, while the Warrant is outstanding, (A) the Company declares a dividend (or any other distribution in whatever form) on the Common Stock, (B) the Company declares a special nonrecurring cash dividend on, or a redemption of, the shares of Common Stock, (C) the Company authorizes the granting to all holders of the shares of Common Stock rights or warrants to subscribe for or purchase any shares of capital stock of any class or of any rights, (D) the approval of any stockholders of the Company shall be required in connection with a Fundamental Transaction, or (E) the Company authorizes the voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Company, then, in each case, the Company shall cause to be delivered by email to the Holder at its last email address as it shall appear upon the Warrant Register of the Company, at least 10 calendar days prior to the applicable record or effective date hereinafter specified, a notice stating (x) the date on which a record is to be taken for the purpose of such dividend, distribution, redemption, rights or warrants, or if a record is not to be taken, the date as of which the holders of the Common Stock of record to be entitled to such dividend, distributions, redemption, rights or warrants are to be determined or (y) the date on which such reclassification, consolidation, merger, sale, transfer or share exchange is expected to become effective or close, and the date as of which it is expected that holders of the Common Stock of record shall be entitled to exchange their shares of Common Stock for securities, cash or other property deliverable upon such reclassification, consolidation, merger, sale, transfer or share exchange; provided that the failure to deliver such notice or any defect therein or in the delivery thereof shall not affect the validity of the corporate action required to be specified in such notice. To the extent that any notice provided in this Warrant constitutes, or contains, material, non-public information regarding the Company or any of the Subsidiaries, the Company shall simultaneously file such notice with the Commission pursuant to a Current Report on Form 8-K. The issuance of a press release or the filing of a Form 8-K or other suitable filing with the Commission shall satisfy this notice requirement. The Holder shall remain entitled to exercise this Warrant during the period commencing on the date of such notice to the effective date of the event triggering such notice except as may otherwise be expressly set forth herein.

Section 4. Transfer of Warrant.

a) Transferability. Subject to compliance with any applicable securities laws, the conditions set forth in Section 4(d) hereof, and the provisions of Section 4.1 of the Purchase Agreement, this Warrant and all rights hereunder (including, without limitation, any registration rights) are transferable, in whole or in part, upon surrender of this Warrant at the principal office of the Company or its designated agent, together with a written assignment of this Warrant substantially in the form attached hereto duly executed by the Holder or its agent or attorney and funds sufficient to pay any transfer taxes payable upon the making of such transfer. Upon such surrender and, if required, such payment, the Company shall execute and deliver a new Warrant or Warrants in the name of the assignee or assignees, as applicable, and in the denomination or denominations specified in such instrument of assignment, and shall issue to the assignor a new Warrant evidencing the portion of this Warrant not so assigned, and this Warrant shall promptly be cancelled. Notwithstanding anything herein to the contrary, the Holder shall not be required to physically surrender this Warrant to the Company unless the Holder has assigned this Warrant in full, in which case, the Holder shall surrender this Warrant to the Company within three (3) Trading Days of the date on which the Holder delivers an assignment form to the Company assigning this Warrant in full. The Warrant, if properly assigned in accordance herewith, may be exercised by a new holder for the purchase of Warrant Shares without having a new Warrant issued.

b) New Warrants. Subject to compliance with applicable securities laws, this Warrant may be divided or combined with other Warrants upon presentation hereof at the aforesaid office of the Company, together with a written notice specifying the names and denominations in which new Warrants are to be issued, signed by the Holder or its agent or attorney. Subject to compliance with Section 4(a), as to any transfer which may be involved in such division or combination, the Company shall execute and deliver a new Warrant or Warrants in exchange for the Warrant or Warrants to be divided or combined in accordance with such notice. All Warrants issued on transfers or exchanges shall be dated the initial Issue Date of this Warrant and shall be identical with this Warrant except as to the number of Warrant Shares issuable pursuant thereto.

c) Warrant Register. The Company shall register this Warrant, upon records to be maintained by the Company for that purpose (the “Warrant Register”), in the name of the record Holder hereof from time to time. The Company may deem and treat the registered Holder of this Warrant as the absolute owner hereof for the purpose of any exercise hereof or any distribution to the Holder, and for all other purposes, absent actual notice to the contrary.