| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM 6-K |

| REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 |

| UNDER THE SECURITIES EXCHANGE ACT OF 1934 |

| For the month of September, 2025 |

| Commission File Number: 001-40086 |

| AlphaTON Capital Corp |

| (Translation of registrant's name into English) |

| Clarence Thomas Building, P.O. Box 4649, Road Town, Tortola, British Virgin Islands, VG1110 |

| (Address of principal executive office) |

| Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. | |

| Form 20-F [ X ] | Form 40-F [ ] |

INCORPORATION BY REFERENCE

This report on Form 6-K (including any exhibits attached hereto) shall be deemed to be incorporated by reference into the registration statements on Form S-8 (File No. 333-275842 and 333-289199) and Form F-3, as amended (File No. 333-286961) of AlphaTON Capital Corp (including any prospectuses forming a part of each such registration statement) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

Name Change

On August 11, 2025, AlphaTON Capital Corp (the “Company”, “we” or “us”) amended and restated its Memorandum of Association and Articles of Association (the “A&R Charter”) to change the Company’s name from “Portage Biotech Inc.” to “AlphaTON Capital Corp”. The CUSIP number for the Company’s ordinary shares (“ordinary shares”) has not changed as a result of the name change and will remain G7185A136.

Effective as of September 4, 2025, the Nasdaq trading symbol for the ordinary shares will be changed from “PRTG” to “ATON”. Each of the foregoing changes have been delivered to The Nasdaq Stock Market LLC.

The foregoing description of the A&R Charter is not complete and is qualified in its entirety by reference to the full text of the A&R Charter, which is attached hereto as Exhibit 3.1.

Business Description

We have two primary lines of business. On September 2, 2025, we entered into agreements related to the Offering (as defined below) of approximately $38.2 million and the Loan (as defined below) of $35 million to be able to enter into the digital asset industry with a focus on The Open Network (TON) token. Since 2019, we have been engaged in researching and developing immune oncology treatments.

Digital Asset Business

The Company's entry into the digital asset industry seeks to capitalize on the current change in regulation relating to, and the growing investor and consumer appetite for, digital assets; in particular The Open Network (TON) token. We believe that there is a current unique opportunity to invest in TON token by means of direct acquisition and long-term holding as a core treasury asset. This opportunity is founded on the increasing adoption of decentralized networks, the technological advancements underlying TON, and the expanding use cases for blockchain-based assets.

TON token is an especially compelling digital asset because it is currently the exclusive blockchain partner for the Telegram app, which is one of the top 10 most popular apps globally, hosting over 1 billion monthly active users. This partnership positions TON at the center of a vast and active user base, providing significant potential for ecosystem growth, adoption, and utility. The scalable architecture of TON, combined with its active developer community and integration with a major global platform like Telegram, enhances its prospects for broad adoption and long-term value creation.

Our objective through holding TON token is to provide shareholders with exposure to the potential appreciation of TON token and to participate in the development of the TON ecosystem. To achieve this, our general strategy for deploying our working capital is to immediately allocate 99% of our net cash proceeds from the Offering to the purchase of TON token (other than the $4 million allocated to our legacy business), with the remaining 1% reserved for operational expenses and liquidity needs. We will acquire TON token through transactions on digital asset exchanges and through over-the-counter (OTC) arrangements, and direct purchases from qualified sellers, as appropriate. Our initial capital will be deployed immediately upon availability, ensuring prompt exposure to TON token. Notwithstanding our objective, our acquisition of TON token may be influenced by market liquidity, regulatory considerations, or operational factors. We may also maintain a small portion of our capital in cash or cash equivalents to manage ongoing operational expenses.

In addition to our initial deployment, we plan to continue to raise funds to grow our treasury through private investment in public equity (PIPE) transactions, at-the-market (ATM) offerings, public offerings and other financings. These ongoing capital-raising efforts will support the continued accumulation of TON token as part of our yield-bearing treasury strategy.

For the TON token that we acquire, we will design and use liquidity management strategies for our cryptocurrency holdings, including staking protocols and yield optimization, as applicable. We intend to design and implement diversified digital asset portfolio allocation models as prudent in relation to our TON holdings so that we can manage risk and respond to evolving market conditions. We will conduct a regular review of emerging decentralized finance (“DeFi”) protocols and yield-generating opportunities for TON with institutional safeguards so as to enhance returns while maintaining appropriate risk controls and compliance with applicable regulations.

Immune-Oncology Treatment Research and Development

In our immune-oncology activities, we have been seeking to advance treatments that we believe will be first-in-class therapies that target known checkpoint resistance pathways to improve long-term treatment response and quality of life in patients with invasive cancers.

We attempt to source and develop early-to mid-stage treatments that we believe will be first-in-class therapies for a variety of cancers, by funding, implementing viable, cost- effective product development strategies, clinical counsel/trial design, shared services, financial and project management to enable efficient, turnkey execution of commercially informed development plans. Our drug development focuses on product candidates or technologies based on biology addressing known resistance pathways/mechanisms of current checkpoint inhibitors with established scientific rationales.

At this time, we have limited capital to fund our immune-oncology business activities. We have been exploring different funding alternatives. We expect to utilize approximately $4 million of the net proceeds of the Offering for our legacy business. However, there is no assurance that there will be sufficient capital available for our immune-oncology activities, or available on satisfactory terms, to enable us to continue our immune-oncology business.

We are also exploring strategic alternatives for our immune-oncology business activities, which may include finding a partner for one or more of our assets, a sale of all or a portion of our immune-oncology assets, a sale of some of our research subsidiaries, corporate restructurings both in and out of court for all or some of our research subsidiaries, further financing efforts directed specifically for the immune-oncology business or other strategic actions.

Private Placement

On September 2, 2025, the Company entered into with certain institutional and accredited investors (the “Cash Investors”) a securities purchase agreement (the “Cash Purchase Agreement”) pursuant to which the Company agreed to sell and issue to the Cash Investors in a private placement offering (the “Cash Offering”) ordinary shares (the “Cash Shares”) and pre-funded warrants to purchase ordinary shares (“Cash Pre-Funded Warrants”). In the Cash Offering, the Cash Investors tendered U.S. dollars to the Company as consideration for the Cash Shares and the Cash Pre-Funded Warrants.

The Company also entered into with certain institutional and accredited investors (the “Crypto Investors” and together with the Cash Investors, the “Investors”) a securities purchase agreement (the “Crypto Purchase Agreement” and together with the Cash Purchase Agreement, the “Purchase Agreements”) pursuant to which the Company agreed to sell and issue to the Crypto Investors in a private placement offering (the “Crypto Offering” and together with the Cash Offering, the “Offering”) ordinary shares (the “Crypto Shares”, and collectively with the Cash Shares, the “Shares”) and pre-funded warrants to purchase ordinary shares (“Crypto Pre-Funded Warrants, and collectively with the Cash Pre-Funded Warrants, the “Pre-Funded Warrants”). In the Crypto Offering, the Crypto Investors tendered various forms of cryptocurrency as consideration for the Crypto Shares and the Crypto Pre-Funded Warrants.

Pursuant to the Purchase Agreements, the Company agreed to offer and sell in the Offering an aggregate of about 6.7 million Shares (or Pre-Funded Warrants with such ordinary shares issuable under the Pre-Funded Warrants, the “Pre-Funded Warrant Shares”) at a purchase price of $5.73 per ordinary share (less $0.001 per Pre-Funded Warrant). Each Pre-Funded Warrant will be exercisable for one Pre-Funded Warrant Share at an exercise price of $0.001 per Pre-Funded Warrant Share, will be immediately exercisable and will expire once exercised in full.

In connection with the Offering, the Company entered into side letters (each a “Side Letter”) with certain investors who contributed TON or other forms of cryptocurrency as consideration. The side letters granted an irrevocable right and option to certain investors to require the Company to repurchase all ordinary shares received by the investors in exchange for the consideration initially provided by the investors. The option expires after one year.

Chardan Capital Market LLC (“Chardan”) acted as placement agent for the Offering. The Company has agreed to pay Chardan a cash placement fee equal to 7.0% of the aggregate gross proceeds of the Offering. In addition, the Company has agreed to pay Chardan a fee equal to 3.0% of the aggregate gross proceeds of the Offering. The Company has agreed to reimburse the placement agent for customary placement expenses in its capacity as placement agent for the Offering up to a specified amount. Chardan is also entitled to certain tail fees in connection with certain future financings and has an exclusive right to serve as the Company’s sole book running manager in future financings for a specified period of time. The full text of the form of placement agent agreement will be filed as an exhibit at a later date.

The net proceeds to the Company from the Offering are expected to be approximately $38.2 million, after deducting Chardan’s placement agent fees and before estimated expenses. The Offering is expected to close (“Closing”) on or about September 5, 2025 (the “Closing Date”), subject to the satisfaction of customary closing conditions. The Company intends to use $4 million of the net proceeds from the Offering to fund the Company’s legacy business operations and for working capital and general corporate purposes relating to the business operations and 99% of the balance of the net proceeds shall be used fund the acquisition of cryptocurrency and the establishment of the Company’s cryptocurrency treasury operations. None of the proceeds from the Offering will be used: (a) for the redemption of any ordinary shares or ordinary shares equivalents, or (b) in violation of FCPA or OFAC regulations.

In connection with the Offering, the Company also entered into a Registration Rights Agreement with the Investors. Pursuant to the terms of the Registration Rights Agreement, the Company will register for resale the Shares on a registration statement (the “Resale Registration Statement”). The Company will, as promptly as reasonably practicable and in any event no later than fifteen (15) days after the Closing Date (the “Filing Deadline”), prepare and file with the SEC the Resale Registration Statement; provided however that the Company will use commercially reasonable efforts to effect such filing within ten (10) days after the Closing Date. The Company will use its reasonable efforts to have the Resale Registration Statement declared effective by the Securities and Exchange Commission (the “SEC”) at the earliest possible date but no later than the earlier of: (a) the thirtieth (30th) calendar day following the initial filing date of the Resale Registration Statement (or in, the event of a “full review” by the SEC, the sixtieth (60th) calendar day following the filing date) and (b) the fifth (5th) business day after the date the Company is notified by the SEC that the Resale Registration Statement will not be “reviewed” or will not be subject to further review. Failure by the Company to meet the filing deadlines and other requirements set forth in the Registration Rights Agreement will subject the Company to certain damages.

Pursuant to the terms of the Purchase Agreement, the Company will not, subject to certain exceptions, until 30 days after the effective date of the Resale Registration Statement (the “Restricted Period”), (i) issue ordinary shares or ordinary shares equivalents, (ii) effect a reverse stock split, recapitalization, share consolidation, reclassification or similar transaction affecting the outstanding ordinary shares or (iii) file with the SEC a registration statement under the Securities Act of 1933, as amended (the “Securities Act”), relating to any ordinary shares or ordinary shares equivalents, except pursuant to the terms of the Registration Rights Agreement and any other registration rights from other agreements entered into in connection with the Offering, with such exceptions including the filing of related prospectus supplement(s) or registration statement(s) with respect to the ATM Agreement (as defined below) and the filing of a registration statement on Form S-8 to register the offer and sale of securities on an equity incentive plan or employee stock purchase plan.

Each Pre-Funded Warrant will be exercisable at any time and from time to time on or after the original issue date. Holders of the Pre-Funded Warrants will not have the right to exercise any portion of its Pre- Funded Warrant if such holder, together with its affiliates, would beneficially own in excess of 4.99% or 9.99% (at the initial election of the holder) of the number of ordinary shares of the Company outstanding immediately after giving effect to such exercise (the “Beneficial Ownership Limitation”); provided, however, that a holder may increase or decrease such Beneficial Ownership Limitation up to, and no higher than, 19.99%, by giving 61 days’ notice to the Company. As more fully described in the Pre-Funded Warrants, if a Fundamental Transaction (as defined in the Pre-Funded Warrants) occurs, then the successor entity will succeed to, and be substituted for the Company, and may exercise every right and power that the Company may exercise and will assume all of the Company’s obligations under the Pre-Funded Warrants with the same effect as if such successor entity had been named in the Pre-Funded Warrant itself. If holders of Ordinary Shares are given a choice as to the securities, cash or property to be received in such a Fundamental Transaction, then the holder shall be given the same choice as to the consideration it would receive upon any exercise of the Pre-Funded Warrants following such a Fundamental Transaction.

The Shares and the Pre-Funded Warrants are being sold and issued without registration under the Securities Act in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act as transactions not involving a public offering and Rule 506 promulgated under the Securities Act as sales to accredited investors.

The foregoing descriptions of the Cash Purchase Agreement, the Cryptocurrency Purchase Agreement, the Registration Rights Agreement, the Pre-Funded Warrants, and the Side Letters are not complete and are qualified in their entirety by reference to the full text of the form of Cash Purchase Agreement, form of Cryptocurrency Purchase Agreement, the form of Registration Rights Agreement, the form of Pre-Funded Warrant and form of Side Letter, which are attached hereto as Exhibit 10.1, 10.2, 10.3, 10.4 and 10.5, respectively.

Master Loan Agreement

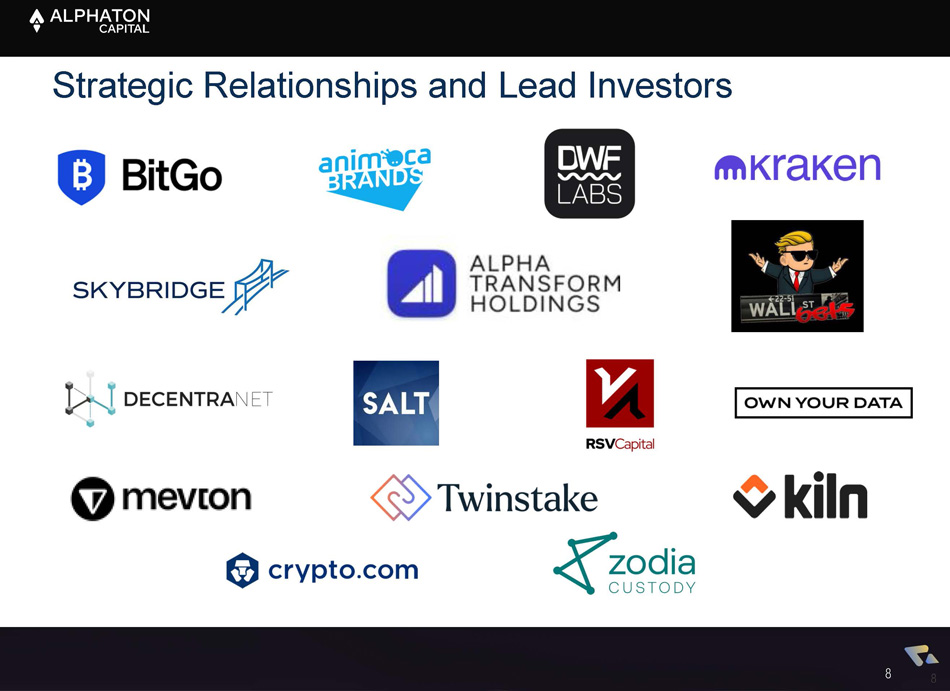

On August 28, 2025, the Company entered into a master loan agreement (the “Master Loan Agreement”) with BitGo Prime, LLC (“BitGo”). Pursuant to the Master Loan Agreement, the Company will receive at the closing of the Offering a loan for $35,000,000 at an interest rate of 15.75% per annum with a 2.00% origination fee paid upfront (the “Loan”). The Company has pledged as collateral 28,000,000 of TON to be held at BitGo. The Loan shall only be used to purchase liquid TON that will be delivered to BitGo and such purchase liquid TON will also be pledged as collateral for the Loan. The Loan must be repaid within six months of the origination of the Loan, unless provided for otherwise or amended. The Loan is subject to an initial margin requirement of 250%, with a margin call triggered if the collateral value falls to 200%, and liquidation permitted if the collateral value drops to 150%, unless the Company posts additional collateral in either liquid TON or USD. In the event of default, BitGo has the right to instruct the collateral custodian to accelerate the lockup of the TON held at BitGo, enabling BitGo to liquidate the collateral in the market to recover the principal and accrued interest in full on the Loan.

The Master Loan Agreement can be terminated upon the occurrence of certain termination events specified in the Master Loan Agreement, such as the Company’s assets minus liabilities being less than $40 million as of the end of any calendar month. Upon notice of a termination event, any remaining balance is due and payable within one business day.

The Master Loan Agreement contains representations and warranties and affirmative and negative covenants customary for financings of this type, as well as customary events of default.

The foregoing description of the Master Loan Agreement is not complete and is qualified in their entirety by reference to the full text of the Master Loan Agreement, which is attached hereto as Exhibit 10.6.

Resignation of Directors and Election of Directors

On August 3, 2025, Justin Stebbing, and Jean-Christophe Renondin resigned from the Company’s Board of Directors (the “Board”). The resignations of Dr. Stebbing and Dr. Renondin were not due to any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

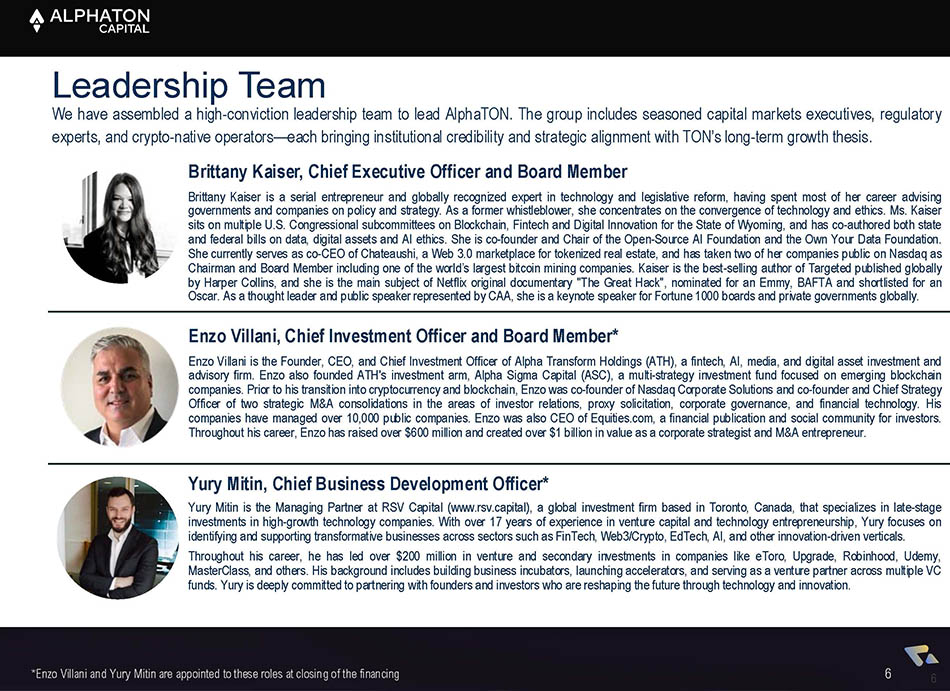

On August 3, 2025, the Board appointed Brittany Kaiser to the Board.

On September 3, 2025, Gregory Bailey and James Mellon provided notice of their resignation from the Board effective as of the Closing of the Offering. The resignations of Dr. Bailey and Mr. Mellon are not due to any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

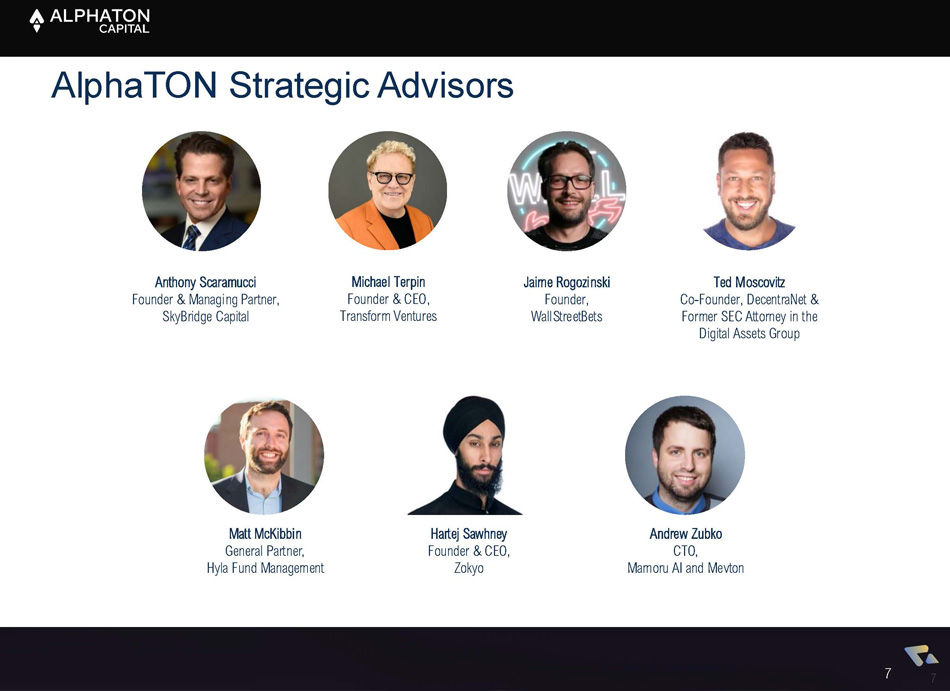

On August 3, 2025, the Board appointed Messrs. Michael Terpin and Fiorenzo Villani to the Board, subject to and effective upon the Closing of the Offering. Additionally, Mr. Villani will serve as Executive Chairman of the Board.

As disclosed below, the Company will enter into, upon and on the date of the Closing, the Asset Management Agreement with Alpha Sigma Capital Advisors, LLC (“Alpha”). Mr. Villani is the Chief Executive Officer and Chief Investment Officer of Alpha. Under the terms of the Asset Management Agreement, Alpha will be entitled to an asset-based fee of 1% per annum on the assets under management. As disclosed below, Mr. Villani is entitled to compensation under the CIO Agreement (as defined below). Additionally, the Company will enter into, upon and on the date of the Closing, a simple agreement for future equity with Alpha AI, a corporation affiliated with Alpha, (the “SAFE”) pursuant to which the Company will invest ($250,000 in cash and $250,000 in TON token) with the right to future equity in Alpha AI. In addition, under this agreement, Alpha AI will receive (for the benefit of Mr. Villani) in connection with the Closing $250,000 in cash, $250,000 worth of TON tokens and ordinary shares equal to 2.5% of the issued and outstanding ordinary shares of the Company after giving effect to the number of issued and outstanding ordinary shares of the Company as of immediately after the Closing. Mr. Villani is the majority shareholder of Alpha AI.

The foregoing description of the SAFE is not complete and is qualified in their entirety by reference to the full text of the SAFE, which is attached hereto as Exhibit 10.7.

Resignation of Chief Executive Officer and Appointment of Chief Executive Officer

On August 3, 2025, Mr. Alexander Pickett resigned from his position as interim Chief Executive Officer of the Company. Mr. Pickett continues to serve on the Board.

On August 3, 2025, the Board appointed Ms. Brittany Kaiser as Chief Executive Officer of the Company. Ms. Kaiser, 37, is a serial entrepreneur and globally recognized expert in technology and legislative reform, having spent most of her career advising governments and companies on policy and strategy. As a former whistleblower, she concentrates on the convergence of technology and ethics. Ms. Kaiser has served on multiple U.S. Congressional subcommittees on Blockchain, Fintech and Digital Innovation for the State of Wyoming, and has co-authored both state and federal bills on data, digital assets and AI ethics as co-founder and Director of the Own Your Data Foundation. Ms. Kaiser has taken two of her companies public on Nasdaq as chairperson including one of the world’s largest bitcoin mining companies Gryphon Digital Mining, Inc. (Nasdaq:GRYP). Ms. Kaiser is the best-selling author of Targeted published globally by Harper Collins, and she is the main subject of Netflix original documentary “The Great Hack”, nominated for an Emmy, BAFTA and shortlisted for an Oscar. As a renowned thought leader and public speaker represented by CAA, she is a regular keynote speaker and trainer for Fortune 1000 boards and private governments globally. Ms. Kaiser previously served as chairperson and continues to serve on the board of directors of Gryphon Digital Mining, Inc. since February 4, 2020. Ms. Kaiser also serves as President and director of Own Your Data Foundation, a non-profit foundation implementing digital intelligence education programs since August 2019; and co-founder of Digital Asset Trade Association, an advocacy group for distributed ledger technology since February 2018. Prior to that, Ms. Kaiser served as business development director at SCL USA, a provider of consumer research, targeted advertising and other data-related services from March 2017 to January 2018 and SCL Group Ltd. (UK) from February 2015 to March 2017. Ms. Kaiser graduated from Middlesex University School of Law in 2015.

In connection with Ms. Kaiser’s appointment as Chief Executive Officer, the Company entered into an Independent Contractor Agreement on August 4, 2024, as amended on August 19, 2025, with Own Your Own Data, LLC (“Own Your Own Data”) through which the Company will engage Brittany Kaiser as Chief Executive Officer (the “Kaiser Contractor Agreement”) for a term of five (5) years. Pursuant to the Kaiser Contractor Agreement, Own Your Own Data (for the benefit of Ms. Kaiser) is entitled to an annual base salary of $500,000 in cash and $500,000 to be paid in TON tokens. Own Your Own Data (for the benefit of Ms. Kaiser) will also be eligible to receive an annual performance bonus target of 200% of base compensation (both cash and TON) based on performance metrics, with threshold (50%) and maximum overperformance (400%) payout features. Ms. Kaiser will personally be eligible for an annual equity performance bonus ranging from $1,500,000 to $6,000,000 based on performance metrics. Ms. Kaiser will also be personally granted annual equity grants under the Company’s equity incentive plan of $1,500,000 worth of restricted shares units (the “RSUs”) of ordinary shares of the Company. The RSUs will vest 20% over five years. Own Your Own Data (for the benefit of Ms. Kaiser) will also participate in a to be established Company long-term incentive plan with a target value of $2,000,000 annually, based on 5-year cycles of measuring total shareholder return, revenue growth, and EBITDA margins. Additionally, Own Your Own Data shall be responsible for its own benefits, insurance and tax obligations, provided, however, that the Company will contribute a stipend towards certain benefits. Additionally, in connection with certain qualifying equity raises, Own Your Own Data (for the benefit of Ms. Kaiser) would receive a bonus paid in the form of ordinary shares equal to 1.25-1.5% of the issued and outstanding ordinary shares of the Company after giving effect to the number of issued and outstanding ordinary shares of the Company as of immediately after the Closing, $250,000 in cash and $250,000 worth of TON tokens. In addition, Ms. Kaiser shall personally receive $500,000 in stock options under the Company’s equity incentive plan at an exercise price equal to the last closing price of the ordinary shares the day before the Closing of the Offering, with 25% vesting immediately and 75% vesting in equal monthly installments over the subsequent 6-month period. Own Your Own Data is also entitled to certain additional benefits as described more fully in the Kaiser Contractor Agreement. In the event Own Your Own Data (for the benefit of Ms. Kaiser) is terminated without cause or Own Your Own Data (for the benefit of Ms. Kaiser) terminates its service for Good Reason (as defined in the Kaiser Contractor Agreement), Own Your Own Data (for the benefit of Ms. Kaiser) will be entitled to: (i) an amount equal to 24 months of Consultant’s then-current base fee, (ii) two times Own Your Own Data’s target bonus, (iii) a pro-rated portion of the current year bonus based on actual performance, (iv) continuation of health and welfare stipends for 24 months, (v) accelerated vesting of all equity awards that would have vested in 24 months following termination, and (vi) executive outplacement services valued at up to $50,000.

On August 20, 2025, the Company entered into an independent contractor agreement with Ralph Matthew McKibbin (the “McKibbin Agreement”), pursuant to which Mr. McKibbin will provide development advisory services to the Company. Mr. McKibbin is entitled to an equity grant in options at a strike price equal to the fair market value on the date of the grant of 0.25% of the issued and outstanding ordinary shares of the Company after giving effect to the number of issued and outstanding ordinary shares of the Company as of immediately after the Closing. 50% of the options will vest immediately and the remaining 50% shall vest in equal installments over a 12-month period. Due to the relationship between Ms. Kaiser and Mr. McKibbin, the McKibbin Agreement is a related party transaction for Ms. Kaiser.

The foregoing descriptions of the Kaiser Contractor Agreement, amendment to the Kaiser Contractor Agreement, and McKibbin Agreement are not complete and are qualified in their entirety by reference to the full text of the Kaiser Contractor Agreement, amendment to the Kaiser Contractor Agreement and McKibbin Agreement, which are attached hereto as Exhibit 10.8, 10.9 and 10.10, respectively.

Appointment of Executive Officers

The Board appointed Mr. Yuri Mitin to serve as the Company’s Chief Business Development Officer, subject to and effective upon the Closing of the Offering.

In connection with Mr. Mitin’s appointment as Chief Business Development Officer, the Company entered into an Independent Contractor Agreement on August 20, 2025 with Red Shark Ventures, LLC (“RSV”), an entity solely owned by Mr. Mitin, through which the Company will engage Mr. Mitin as Chief Business Development Officer of the Company (the “CBDO Agreement”) for a term of five (5) years. Pursuant to the CBDO Agreement, RSV (for the benefit of Mr. Mitin) is entitled to an annual base salary of $300,000 in cash and $300,000 to be paid in TON tokens. RSV (for the benefit of Mr. Mitin) will also be eligible to receive an annual performance bonus target of 200% of base compensation (both cash and TON) based on performance metrics, with threshold (50%) and maximum overperformance (400%) payout features. RSV will also be eligible for an annual equity performance bonus ranging from $300,000 to $1,200,000 based on performance metrics. RSV (for the benefit of Mr. Mitin) will also be granted annual equity grants under the Company’s equity incentive plan of $300,000 worth of RSUs of ordinary shares of the Company. The RSUs will vest 20% over five years. RSV (for the benefit of Mr. Mitin) will also participate in a to be established Company long-term incentive plan with a target value of $1,200,000 annually, based on 5-year cycles of measuring total shareholder return, revenue growth, and EBITDA margins. Additionally, RSV shall be responsible for its own benefits, insurance and tax obligations, provided, however, that the Company will contribute a stipend towards certain benefits. Additionally, in connection with certain qualifying equity raises, RSV (for the benefit of Mr. Mitin) would receive a bonus paid in ordinary shares equal to 0.75-1.0% of the issued and outstanding ordinary shares of the Company after giving effect to the number of issued and outstanding ordinary shares of the Company as of immediately after the Closing, $250,000 in cash, $250,000 worth of TON tokens, $500,000 in stock options under the Company’s equity incentive plan at an exercise price equal to the last closing price of the common shares the day before the Closing of the Offering, with 25% vesting immediately and 75% vesting in equal monthly installments over the subsequent 6-month period. RSV is also entitled to certain additional benefits as described more fully in the CBDO Agreement. In the event RSV (for the benefit of Mr. Mitin) is terminated without cause or RSV (for the benefit of Mr. Mitin) terminates its service for Good Reason (as defined in the CBDO Agreement), RSV (for the benefit of Mr. Mitin) will be entitled to: (i) an amount equal to 24 months of Consultant’s then-current base fee, (ii) two times RSV’s target bonus, (iii) a pro-rated portion of the current year bonus based on actual performance, (iv) continuation of health and welfare stipends for 24 months, (v) accelerated vesting of all equity awards that would have vested in 24 months following termination, and (vi) executive outplacement services valued at up to $50,000.

Additionally, the Board appointed Mr. Villani to serve as the Company’s Chief Investment Officer, subject to and effective upon the Closing of the Offering.

In connection with Mr. Villani’s appointment, the Company entered into an Independent Contractor Agreement on August 20, 2025, as amended on August 20, 2025, through which the Company will engage Mr. Villani as Executive Director and Chief Investment Officer of the Company (the “CIO Agreement”) for a term of five (5), effective on the Closing Date. Pursuant to the CIO Agreement, Alpha (for the benefit of Mr. Villani) is entitled to an annual base salary of $300,000 in cash and $300,000 to be paid in TON tokens. Alpha (for the benefit of Mr. Villani) will also be eligible to receive an annual performance bonus target of 200% of base compensation (both cash and TON) based on performance metrics, with threshold (50%) and maximum overperformance (400%) payout features. RSV will also be eligible for an annual equity performance bonus ranging from $300,000 to $1,200,000 based on performance metrics. Mr. Villani will personally be granted annual equity grants under the Company’s equity incentive plan of $300,000 worth of RSUs of ordinary shares of the Company. The RSUs will vest 20% over five years. Alpha (for the benefit of Mr. Villani) will also participate in a to be established Company long-term incentive plan with a target value of $1,200,000 annually, based on 5-year cycles of measuring total shareholder return, revenue growth, and EBITDA margins. Additionally, the Consultant shall be responsible for its own benefits, insurance and tax obligations, provided, however, that the Company will contribute a stipend towards certain benefits. Mr. Villani will personally receive a bonus paid of $500,000 in stock options under the Company’s equity incentive plan at an exercise price equal to the last closing price the day before the Closing of the Offering, with 25% vesting immediately and 75% vesting in equal monthly installments over the subsequent 6-month period. Alpha is also entitled to certain additional benefits as described more fully in the CIO Agreement. In the event the Consultant (for the benefit of Mr. Villani) is terminated without cause or Alpha (for the benefit of Mr. Villani) terminates its service for Good Reason (as defined in the CIO Agreement), Alpha (for the benefit of Mr. Villani) will be entitled to: (i) an amount equal to 24 months of Consultant’s then-current base fee, (ii) two times Alpha’s target bonus, (iii) a pro-rated portion of the current year bonus based on actual performance, (iv) continuation of health and welfare stipends for 24 months, (v) accelerated vesting of all equity awards that would have vested in 24 months following termination, and (vi) executive outplacement services valued at up to $50,000.

Additionally, Alpha (for the benefit of Mr. Villani) will receive at Closing a bonus paid in the form of ordinary shares equal to 2.5% of the issued and outstanding ordinary shares of the Company after giving effect to the number of issued and outstanding ordinary shares of the Company as of immediately after the Closing, $250,000 in cash, $250,000 worth of TON tokens. In the event Alpha (for the benefit of Mr. Villani) is terminated without cause or the Consultant (for the benefit of Mr. Villani) terminates its service for Good Reason (as defined in the CIO Agreement), the Consultant (for the benefit of Mr. Villani) will be entitled to: (i) an amount equal to 24 months of Consultant’s then-current base fee, (ii) two times Alpha’s target bonus, (iii) a pro-rated portion of the current year bonus based on actual performance, (iv) continuation of health and welfare stipends for 24 months, (v) accelerated vesting of all equity awards that would have vested in 24 months following termination, and (vi) executive outplacement services valued at up to $50,000.

The foregoing descriptions of the CBDO Agreement, CIO Agreement and amendment to the CIO Agreement are not complete and are qualified in their entirety by reference to the full text of the CBDO Agreement, CIO Agreement and amendment to the CIO Agreement, which are attached hereto as Exhibit 10.11, 10.12, and 10.13, respectively.

Asset Management Agreement

Additionally, the Company will enter into, upon and on the date of the Closing (the “AMA Effective Date”), an Asset Management Agreement (the “Asset Management Agreement”) with Alpha Sigma Capital, LLC (the “Asset Manager”). Pursuant to the Asset Management Agreement, the Asset Manager shall provide discretionary investment management services with respect to, among other assets (including without limitation certain subsequently raised funds), certain of the Company’s net proceeds from the Offering (the “Account Assets”) in accordance with the terms of the Asset Management Agreement.

Under the Asset Management Agreement, the Company shall pay the Asset Manager an asset-based fee (the “Asset-based Fee”) equal to 1.0% per annum of the assets under management.

The Asset Management Agreement will, unless terminated earlier in accordance with its terms, remain in effect until the first (1st) anniversary of the AMA Effective Date and shall continue for successive one year renewal periods thereafter. After the first anniversary of the AMA Effective Date, the Asset Management Agreement may be terminated upon at least ninety (90) days notice by the Company upon a determination by the Board or by the Asset Manager for any reason. Additionally, the Asset Management Agreement may be terminated for cause (i) by the Company upon at least thirty (30) days prior written notice to the Asset Manager or (ii) by the Asset Manager upon at least sixty (60) days prior written notice to the Company.

In the event the Asset Management Agreement is terminated by the Company upon the Board’s determination, the Company will pay to the Asset Manager an early termination fee equal to the present value of the amount equal to (1) the remaining time left in the current term multiplied by (2) the Asset-based Fee for the prior one-year term at the time of termination.

Mr. Enzo Villani is the Chief Executive Officer and Chief Investment Officer of Asset Manager.

Additionally, as part of the Offering, the Company entered into a treasury management agreement (the “DWF AMA”) with DWF MaaS Limited (“DWF”), pursuant to which the Company would appoint DWF to manage $25 million and implement the TON treasury strategy for the Company. Within two months, the Company will transfer to DWF an additional $50 million with no less than $25 million transferred each month. DWF is entitled to retain 100% of all profits earned until the balance with DWF reaches $150 million at which point 10% of the profits will then be shared with the Company. In consideration for the services provided, the Company shall issue 160,000 ordinary shares on the Closing to DWF, which shares shall vest linearly over a period of three (3) years from the date of issue to DWF.

The foregoing descriptions of the Asset Management Agreement and DWF AMA are not complete and are qualified in their entirety by reference to the full text of the Asset Management Agreement and DWF AMA, which are attached hereto as Exhibit 10.14 and 10.15, respectively.

Termination of Prior ATM Agreement

As previously disclosed, on June 27, 2025, the Company entered into an At The Market Offering Agreement (the “Rodman ATM Agreement”) with Rodman & Renshaw LLC (“Rodman”) as the sales agent.

On August 1, 2025, the Company and Rodman mutually agreed to immediately terminate the Rodman ATM Agreement. The Company is not subject to any termination penalties relating to the Rodman ATM Agreement. The Company will not offer or sell any additional ordinary shares under the Rodman ATM Agreement and no additional offers or sales will be made under the prospectus supplement filed on June 27, 2025.

Entrance into New ATM Agreement

On July 31, 2025, the Company entered into an At The Market Offering Agreement (the “ATM Agreement”), with Chardan, which will serve as the sales agent (the “Agent”), pursuant to which the Company may offer and sell, from time to time through or to the Agent, as sales agent and/or principal, ordinary shares of the Company (the “ATM Shares”).

The offer and sale of the ATM Shares, if any, will be made pursuant to a shelf registration statement on Form F-3 and the related base prospectus (File No. 333-286961) as declared effective by the Company with the Securities and Exchange Commission (the “SEC”), on May 14, 2025, and a related prospectus supplement to be filed by the Company with the SEC (the “ATM Prospectus”) or pursuant to another registration statement filed for the purpose of an at-the-market offering.

Subject to an effective registration statement on Form F-3 pursuant to which offers and sales under the ATM Agreement will be made, the ATM Shares may be offered and sold (A) in privately negotiated transactions with the Company's consent, (B) as block transactions; or (C) by any other method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act, including sales made directly on the Nasdaq Capital Market, sales made into any other existing trading market in the United States for the ordinary shares, and sales made to or through a market maker other than on an exchange. The Agent is not required to sell any number or dollar amount of the ATM Shares but will act as a sales agent and use its commercially reasonable efforts consistent with its normal trading and sales practices and applicable law and regulations to sell on the Company's behalf all of the ATM Shares requested to be sold by the Company. The offering of the ATM Shares pursuant to the ATM Agreement and the ATM Prospectus will terminate upon the termination of the ATM Agreement as permitted therein.

The Company will pay to the Agent a fixed cash commission rate equal to 3.0% of the gross sales price of any ATM Shares sold under the ATM Agreement and has agreed to provide the Agent with customary indemnification and contribution rights. The Company will also reimburse the Agent for certain specified expenses in connection with entering into the ATM Agreement.

The ATM Agreement also contains customary representations and warranties and conditions to the sale of the ATM Shares pursuant thereto.

The foregoing description of the ATM Agreement is not complete and is qualified in its entirety by reference to the full text of the ATM Agreement, which is attached hereto as Exhibit 1.1.

Amendment to Share Subscription Agreement

On August 29, 2025, the Company entered into an amendment (the “Amendment”) to the Subscription Agreement, dated June 5, 2025, by and between the Company and Compedica Holdings Limited (“Compedica”). Pursuant to the terms of the Amendment provides for, among other things, removing certain sections of the Subscription Agreement that require the Company to subscribe for shares of Compedica and provide Compedica with the right to a Board observer under certain circumstances. The Company also agreed to register certain shares held by Compedica on the resale registration statement to be filed in connection with the Offering. The Company agreed to reimburse Compedica for certain expenses related to the Subscription Agreement and Amendment.

The foregoing description of the Amendment is not complete and is qualified in its entirety by reference to the full text of the Amendment, which is attached hereto as Exhibit 10.15.

Risk Factors

As part of the Company entering a new line of business the Company is supplementing the risk factors set forth in Item 3 “Key Information – Risk Factors” on the Annual Report on Form 20-F.

RISKS RELATED TO OUR PROPOSED INVESTMENT IN TON

We intend to use substantially all of the net proceeds from the Offering to purchase TON token, the price of which has been, and will likely continue to be, highly volatile.

We intend to use substantially all of the net proceeds from the Offering to purchase TON token, the native digital asset of The Open Network (TON) blockchain. TON token is a highly volatile asset that has traded between $2.74 and $6.90 per TON in the 12 months ended July 31, 2025, per reports by Forbes. More recently, during July 2025, TON has traded between $2.78 and $3.59 per TON token. Such volatility may continue or increase in the future, and there can be no assurance that the market for TON token will become more stable or liquid. In addition, TON token does not pay interest, but staking rewards can be earned on TON. The ability to generate a return on investment from the net proceeds of the Offering will depend on whether there is appreciation in the value of TON token following our purchases.

Our TON token holdings will be less liquid than our existing cash and cash equivalents and may not be able to serve as a source of liquidity for us to the same extent as cash and cash equivalents.

Historically, the crypto markets, including the market for TON token, have been characterized by significant volatility in price, limited liquidity and trading volumes compared to sovereign currencies markets, relative anonymity, a developing regulatory landscape, potential susceptibility to market abuse and manipulation, compliance and internal control failures at exchanges, and various other risks inherent in its entirely electronic, virtual form and decentralized network. During times of market instability, we may not be able to sell our TON token at favorable prices. Further, any TON token we hold with our custodians and transact with our trade execution partners does not enjoy the same protections as are available to cash or securities deposited with or transacted by institutions subject to regulation by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation. Additionally, we may be unable to enter into term loans or other capital raising transactions collateralized by our unencumbered TON token or otherwise generate funds using our TON holdings, including in particular during times of market instability or when the price of TON token has declined significantly. If we are unable to enter into additional capital raising transactions using TON token as collateral, or otherwise generate funds using our TON holdings, or if we are ever forced to sell our TON token at a significant loss, in order to meet our working capital requirements, our business and financial condition could be negatively impacted.

There are unique risks associated with staking TON.

We plan to participate in the TON staking process to earn staking rewards. Staking TON typically requires locking up tokens for a specified period, in TON’s case, approximately 18-36 hours, during which they may not be readily accessible or liquid. This lock-up period could limit our ability to use our TON holdings to meet liquidity needs or respond to market opportunities or adverse events.

A unique risk associated with staking is the possibility of “slashing,” where a portion of staked TON may be forfeited as a penalty for validator misbehavior, network errors, or other protocol violations. If we stake TON directly or through third-party validators, we may be exposed to slashing risk, which could result in a partial or total loss of staked TON. Although our business is insured against these losses by our institutional custodians, the rules and enforcement of slashing penalties are subject to change by the TON network and may be unpredictable.

Additionally, the technical complexity of staking, including the need to maintain secure validator infrastructure or rely on third-party staking services, introduces operational and cybersecurity risks. Any failure in the staking process, whether due to technical error, malicious attack, or mismanagement by a third-party staking provider, could result in loss of rewards, slashing penalties, or loss of principal.

The TON ecosystem faces risks from demand fluctuations and technical issues specific to the network.

The value and utility of TON token are closely tied to the continued development and adoption of The Open Network (TON) ecosystem. A general loss of interest in the TON ecosystem, the emergence of superior competing blockchain platforms, or a decline in developer or user activity could significantly reduce demand for TON token and negatively impact its price. Technical issues, such as network outages, bugs, or security vulnerabilities in the TON protocol, could also undermine confidence in the network and the value of TON token. The TON ecosystem is still developing, and its long-term viability depends on continued innovation, user adoption, and the ability to attract and retain developers and users. Any setbacks in the development or adoption of the TON network, or negative publicity regarding its security or governance, could materially and adversely affect the value of TON token.

We may be limited in the amount of TON assets that we will be able to acquire, which may limit our operations and revenues.

Telegram has issued new guidelines for TON-focused public company deal structures, as they seek to control the movement of locked TON assets and can ultimately approve the transfer of TON locked assets into or out of custody. Telegram has requested that all TON-focused public company transactions are approximately 75% cash and 25% TON in capital raises. Telegram is seeking this limitation, in their opinion, to limit TON vehicles from experiencing investor sell pressure events or engaging in other TON strategies that could cause a cashing out of their locked assets or engaging in other disruptive practices to the TON ecosystem. TON is indicating that it prefers to have TON holders holding their TON assets for longer term investment strategies. The guidelines imposed by Telegram may limit our ability to generate the growth and income that we believe is an opportunity with holding TON assets, and investors may not achieve the return that is comparable to other crypto currency transactions that are available in the market. As a result, investors may seek to invest in other crypto currency focused companies with the result that the liquidity and price of our shares would be adversely affected.

The value and adoption of TON are at risk due to potential changes in interest in the Telegram app or platform.

The value and adoption of TON are closely linked to the continued popularity and growth of the Telegram messaging platform, which serves as a primary gateway for user engagement and ecosystem development for TON. If Telegram’s user base no longer creates demand for TON token due to Telegram no longer offering exclusive blockchain partnership with TON, or Telegram discontinues its use of, or integration with TON, then the vibrancy of its ecosystem could be materially and adversely affected. A reduction in Telegram’s usage of TON could directly impact the utility and perceived value of TON token, leading to price declines and reduced liquidity. This may cause a loss in the value of an investment in our company.

There is a risk of a hack or exploit of the TON blockchain.

The TON blockchain, like all decentralized networks, is subject to the risk of technical vulnerabilities, bugs, or malicious attacks. A successful hack or exploit of the TON blockchain could result in the theft or loss of TON tokens, disruption of network operations, or loss of confidence in the security and reliability of the network. Such an event could have a material adverse effect on the value of TON token, the willingness of users and developers to participate in the ecosystem, and the overall viability of TON token as a treasury asset. The evolving nature of blockchain technology means that new vulnerabilities may be discovered, and the effectiveness of security measures cannot be guaranteed.

There are risks associated with being a public treasury company for TON.

As a public company whose principal asset is TON token, we will be subject to risks associated with the concentration of our assets in a single digital asset. Our business model may be unfamiliar to investors, analysts, and other market participants, which could result in increased costs of director and officer liability insurance or the potential inability to obtain such coverage on acceptable terms in the future. The lack of precedent for public companies holding significant digital asset treasuries may also result in increased scrutiny from regulators, auditors, and other stakeholders.

We may be subject to regulatory developments related to crypto assets and crypto asset markets, which could adversely affect our business, financial condition, and results of operations.

As TON token and other digital assets are relatively novel and the application of state and federal securities laws and other laws and regulations to digital assets is unclear in certain respects, it is possible that regulators in the United States or foreign countries may interpret or apply existing laws and regulations in a manner that adversely affects the price of TON token. The U.S. federal government, states, regulatory agencies, and foreign countries may also enact new laws and regulations, or pursue regulatory, legislative, enforcement or judicial actions, that could materially impact the price of TON token or the ability of individuals or institutions such as us to own or transfer TON token.

If TON token is determined to constitute a security for purposes of the federal securities laws, the additional regulatory restrictions imposed by such a determination could adversely affect the market price of TON token and in turn adversely affect the market price of our common stock. Moreover, the risks of us engaging in a TON treasury strategy could create complications due to the lack of experience that third parties have with companies engaging in such a strategy, such as increased costs of director and officer liability insurance or the potential inability to obtain such coverage on acceptable terms in the future.

Regulatory change reclassifying TON token as a security could lead to our falling within the definition of “investment company” under the Investment Company Act of 1940, as amended, or the 1940 Act, and could adversely affect the market price of TON and the market price of our common stock.

Under Sections 3(a)(1)(A) and (C) of the 1940 Act, a company generally will be deemed to be an “investment company” for purposes of the 1940 Act if (1) it is, or holds itself out as being, engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities or (2) it is engaged, or proposes to engage, in the business of investing, reinvesting, owning, holding or trading in securities and it owns or proposes to acquire investment securities having a value exceeding 40% of the value of its total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis.

While the SEC has not stated a view as to whether TON token is or is not a “security” for purposes of the federal securities laws, a determination by the SEC or a court of competent jurisdiction that TON token is a security could lead to our meeting the definition of “investment company” under the 1940 Act, if the portion of our assets that consists of investments in TON token exceeds the 40% limit prescribed in the 1940 Act, which would subject us to significant additional regulatory requirements that could have a material adverse effect on our business and operations and may also require us to change the manner in which we conduct our business.

We intend to monitor our assets and income in order to conduct our business activities in a manner such that we do not fall within the definition of “investment company” under the 1940 Act or would qualify under one of the exemptions or exclusions provided by the 1940 Act and corresponding SEC rules. If TON token is determined to be a security for purposes of the federal securities laws, we would take steps to reduce our holdings of TON token as a percentage of our total assets. These steps may include, among others, selling TON token that we might otherwise hold for the long term and deploying our cash in assets that are not considered to be investment securities under the 1940 Act, in which case we may be forced to sell our TON token at unattractive prices. We may also seek to acquire additional assets that are not considered to be investment securities under the 1940 Act, and we may need to incur debt, issue additional equity or enter into other financing arrangements that are not otherwise attractive to our business. Any of these actions could have a material adverse effect on our results of operations and financial condition. Moreover, we can make no assurance that we would successfully be able to take the necessary steps to avoid meeting the definition of “investment company” under the 1940 Act and becoming subject to its requirements. If TON token is determined to constitute a security for purposes of the federal securities laws, and if we are not able to come within an available exemption or exclusion under the 1940 Act, then we would have to register as an investment company and require us to change the manner in which we conduct our business. In addition, such a determination could adversely affect the market price of TON and in turn adversely affect the market price of our common stock.

We believe that we are not subject to legal and regulatory obligations that apply to investment companies such as mutual funds and exchange-traded funds, or to obligations applicable to investment advisers.

Mutual funds, exchange-traded funds and their directors and management are subject to extensive regulation as “investment companies” and “investment advisers” under U.S. federal and state law; this regulation is intended for the benefit and protection of investors. We do not currently comply with and do not intend to voluntarily comply with these laws and regulations. This means, among other things, that the execution of or changes to our TON strategy, our use of leverage, the manner in which our TON token is custodied, our ability to engage in transactions with affiliated parties and our operating and investment activities generally are not subject to the extensive legal and regulatory requirements and prohibitions that apply to investment companies and investment advisers. Consequently, our board of directors has broad discretion over the investment, leverage and cash management policies it authorizes, whether in respect of our TON holdings or other activities we may pursue, and has the power to change our current policies, including our strategy of acquiring and holding TON token.

If we or our third-party service providers experience a security breach or cyberattack and unauthorized parties obtain access to our TON token, or if our private keys are lost or destroyed, or other similar circumstances or events occur, we may lose some or all of our TON token and our financial condition and results of operations could be materially adversely affected.

We expect that substantially all of the TON token we acquire will be held in custody accounts at institutional-grade digital asset custodians. Security breaches and cyberattacks are of particular concern with respect to digital assets, including TON token. TON token and other blockchain-based cryptocurrencies and the entities that provide services to participants in the TON ecosystem have been, and may in the future be, subject to security breaches, cyberattacks, or other malicious activities. A successful security breach or cyberattack could result in:

| ● |

a partial or total loss of our TON token in a manner that may not be covered by insurance or the liability provisions of the custody agreements with the custodians who hold our TON token; |

|

| ● | harm to our reputation and brand; | |

| ● | improper disclosure of data and violations of applicable data privacy and other laws; or | |

| ● |

significant regulatory scrutiny, investigations, fines, penalties, and other legal, regulatory, contractual and financial exposure. |

Further, any actual or perceived data security breach or cybersecurity attack directed at other companies with digital assets or companies that operate digital asset networks, regardless of whether we are directly impacted, could lead to a general loss of confidence in the broader TON ecosystem or in the use of the TON network to conduct financial transactions, which could negatively impact us.

Attacks upon systems across a variety of industries, including industries related to TON, are increasing in frequency, persistence, and sophistication, and, in many cases, are being conducted by sophisticated, well-funded and organized groups and individuals, including state actors. The techniques used to obtain unauthorized, improper or illegal access to systems and information (including personal data and digital assets), disable or degrade services, or sabotage systems are constantly evolving, may be difficult to detect quickly, and often are not recognized or detected until after they have been launched against a target. These attacks may occur on our systems or those of our third-party service providers or partners. We may experience breaches of our security measures due to human error, malfeasance, insider threats, system errors or vulnerabilities or other irregularities. In particular, we expect that unauthorized parties will attempt to gain access to our systems and facilities, as well as those of our partners and third-party service providers, through various means, such as hacking, social engineering, phishing and fraud. Threats can come from a variety of sources, including criminal hackers, hacktivists, state-sponsored intrusions, industrial espionage, and insiders. In addition, certain types of attacks could harm us even if our systems are left undisturbed. For example, certain threats are designed to remain dormant or undetectable, sometimes for extended periods of time, or until launched against a target and we may not be able to implement adequate preventative measures. Further, there has been an increase in such activities due to the increase in work-from-home arrangements. The risk of cyberattacks could also be increased by cyberwarfare in connection with the ongoing Russia-Ukraine and Israel-Hamas conflicts, or other future conflicts, including potential proliferation of malware into systems unrelated to such conflicts. Any future breach of our operations or those of others in the TON industry, including third-party services on which we rely, could materially and adversely affect our financial condition and results of operations.

We will incur a debt obligation of $35,000,000 and may in the future incur significant additional or alternative debt, and our governing documents contain no limit on the amount of debt we may incur.

Subject to market conditions and availability, we may enter into debt facilities from time to time. On August 30, 2025, we entered into a credit facility with BitGo Prime LLC (“BitGo”), which is also affiliated with our crypto currency custodian. The BitGo credit facility is for $35 million, due six months from disbursement, bearing an annual interest rate of 15.75%, payable monthly, accruing daily. At the closing of the Offering, we will take down the full $35 million from the credit facility. There is a 2% origination fee to be paid at the making of the loan. The credit facility will be secured by 28 million of TON that we deposited with BitGo Trust. The use of proceeds of the credit facility is for the acquisition of TON.

The BitGo credit facility represents a significant leverage of our assets, and future borrowing may represent a similar or even greater amount of leverage, depending on our available investment opportunities, our available capital, our ability to obtain and access financing arrangements and our estimate of the stability of our asset portfolio and our cash flow. Our governing documents contain no limit on the amount of debt we may incur, and we may significantly increase the amount of leverage we utilize at any time without approval of our shareholders. The amount of leverage on individual assets may vary, with leverage on some assets substantially higher than others. Leverage can enhance our potential returns but can also exacerbate our losses.

Incurring substantial debt, as we are doing with the BitGo credit facility, could subject us to many risks that, if realized, would materially and adversely affect us, including the risk that:

| | our cash flow from operations may be insufficient to make required payments of principal of and interest on the debt or we may fail to comply with covenants contained in our debt instruments, which would likely result in (1) acceleration of outstanding debt (and any other debt arrangements containing a cross default or cross acceleration provision) that we may be unable to repay from internal funds or to refinance on favorable terms, or at all, (2) our inability to borrow additional funds, even if we are current in payments on borrowings and/or (3) the loss of some or all of our assets to foreclosures or forced sales; | |

| | if we are in default under our debt instruments that are collateralized, we will likely lose our collateral, which would have a material adverse impact on our ability to carry on our business as a result of the loss of assets; |

| | our debt may increase our vulnerability to adverse economic, market and industry conditions with no assurance that our investment yields will increase to match our higher financing costs; |

| | we may be required to dedicate a substantial portion of our cash flow from operations to payments on our debt, thereby reducing funds available for operations, future business opportunities, distributions to our shareholders or other purposes; and |

| | we may not be able to refinance maturing debts. |

We cannot be sure that our leverage strategies will be successful.

A failure to comply with restrictive covenants in our financing arrangements would have a material adverse effect on us, and any future financings may require us to provide additional collateral or pay down debt.

We are subject to various restrictive covenants contained in our credit facility with BitGo, and we may be subject to additional covenants in connection with future financing arrangements. Our BitGo facility requires us to maintain compliance with various financial covenants, including specified financial ratios. Financing arrangements that we may enter into in the future may contain similar or more extensive and restrictive covenants and may also require collateralization. These covenants may limit our flexibility to pursue certain of our investment and operational strategies, certain investments, or incur additional debt. If we fail to meet or satisfy any of these covenants, we may be in default under the agreements governing the applicable arrangements, and our lenders could elect to accelerate our obligation to repurchase certain assets, declare outstanding amounts due and payable, terminate their commitments, require the posting of additional collateral or enforce their rights against existing collateral. We may also be subject to cross default and acceleration rights and, with respect to collateralized debt, the posting of additional collateral or foreclosure upon default.

Several investors in the Offering have the right for the Company to return all the ordinary shares purchased for the number of TON and any digital currency transferred as consideration for the ordinary shares. The loss of assets may adversely impact our ability to comply with the Master Loan Agreement covenants and impact our value and our ability to generate income.

In the Offering, the Company granted several investors an option to return their TON and other digital assets transferred as the consideration for purchasing ordinary shares of the Company. The put option is available for up to twelve months after the Closing. The put option protects the investor for its value of the contributed digital asset, while the company bears the corresponding risk of the loss of the investment. Any loss of digital assets resulting from the put option may adversely impact the Company’s ability to satisfy its covenants under the Master Loan Agreement. The exercise of the put option and loss of the investment may adversely affect the Company’s assets and the ability to generate income.

Press Release

On September 3, 2025, the Company issued a press release. A copy of the press release is attached hereto as Exhibit 99.1.

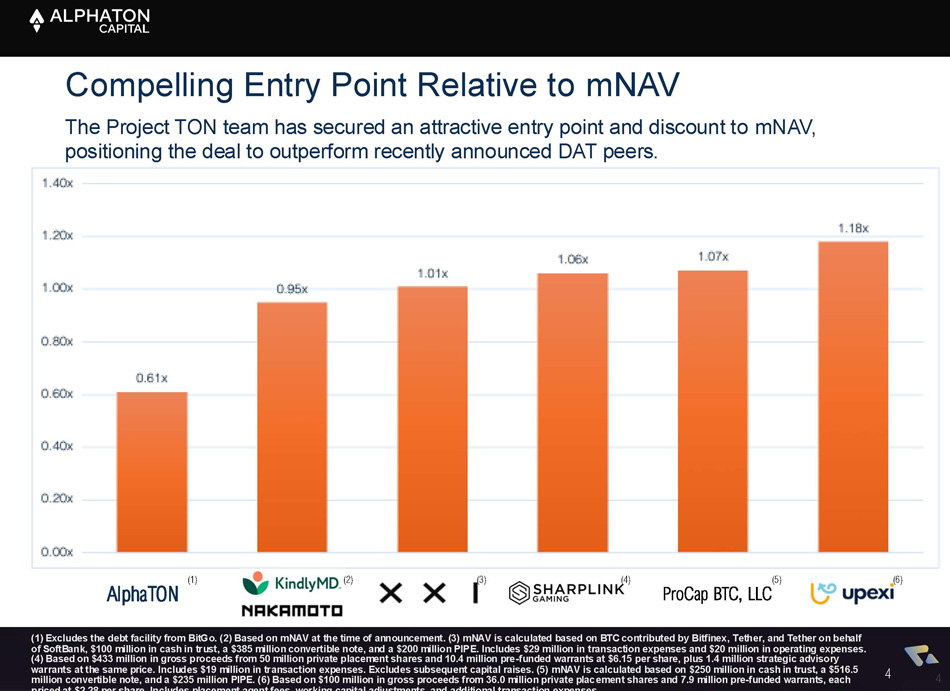

Investor Presentation

On September 3, 2025, the Company furnished an investor presentation. A copy of the investor presentation is attached hereto as Exhibit 99.2.

EXHIBITS

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 3, 2025

ALPHATON CAPITAL CORP

| By: | /s/ Andrea Park |

| Andrea Park | |

| Chief Financial Officer | |

Exhibit 1.1

AT THE MARKET OFFERING AGREEMENT

July 31, 2025

Chardan Capital Markets, LLC

1 Penn Plaza, Suite 4800

New York, NY 10119

Ladies and Gentlemen:

Portage Biotech Inc, a corporation organized under the laws of the British Virgin Islands (the “Company”), confirms its agreement (this “Agreement”) with Chardan Capital Markets LLC and its successors and permitted assigns (the “Manager”) as follows:

1. Definitions. The terms that follow, when used in this Agreement and any Terms Agreement, shall have the meanings indicated.

“Accountants” shall have the meaning ascribed to such term in Section 4(m).

“Act” shall mean the Securities Act of 1933, as amended, and the rules and regulations of the Commission promulgated thereunder.

“Action” shall have the meaning ascribed to such term in Section 3(p).

“Affiliate” shall have the meaning ascribed to such term in Section 3(o).

“Applicable Time” shall mean, with respect to any Shares, the time of sale of such Shares pursuant to this Agreement or any relevant Terms Agreement.

“Base Prospectus” shall mean the base prospectus contained in the Registration Statement at the Execution Time.

“BHCA” shall have the meaning ascribed to such term in Section 3(qq).

“Board” shall have the meaning ascribed to such term in Section 2(b)(iii).

“Broker Fee” shall have the meaning ascribed to such term in Section 2(b)(v).

“Business Day” shall mean any day other than Saturday, Sunday or other day on which commercial banks in The City of New York are authorized or required by law to remain closed; provided, however, that, for purposes of clarity, commercial banks shall not be deemed to be authorized or required by law to remain closed due to “stay at home”, “shelter-in-place”, “non-essential employee” or any other similar orders or restrictions or the closure of any physical branch locations at the direction of any governmental authority so long as the electronic funds transfer systems (including for wire transfers) of commercial banks in The City of New York generally are open for use by customers on such day.

“Commission” shall mean the United States Securities and Exchange Commission.

“Company BVI Counsel” shall have the meaning ascribed to such term in Section 4(l).

“Company Counsel” shall have the meaning ascribed to such term in Section 4(l).

“DTC” shall have the meaning ascribed to such term in Section 2(b)(vii).

“Distribution” shall have the meaning ascribed to such term in Section 2(b)(ix).

“Effective Date” shall mean each date and time that the Registration Statement and any post-effective amendment or amendments thereto became or becomes effective.

“Environmental Laws” shall have the meaning ascribed to such term in Section 3(s).

“Evaluation Date” shall have the meaning ascribed to such term in Section 3(y).

“Exchange Act” shall mean the Securities Exchange Act of 1934, as amended, and the rules and regulations of the Commission promulgated thereunder.

“Execution Time” shall mean the date and time that this Agreement is executed and delivered by the parties hereto.

“Federal Reserve” shall have the meaning ascribed to such term in Section 3(qq).

“FINRA” shall have the meaning ascribed to such term in Section 3(e).

“Free Writing Prospectus” shall mean a free writing prospectus, as defined in Rule 405.

“Hazardous Materials” shall have the meaning ascribed to such term in Section 3(s).

“IFRS” shall have the meaning ascribed to such term in Section 3(m).

“Incorporated Documents” shall mean the documents or portions thereof filed with the Commission on or prior to the Effective Date that are incorporated by reference in the Registration Statement or the Prospectus and any documents or portions thereof filed with the Commission after the Effective Date that are deemed to be incorporated by reference in the Registration Statement or the Prospectus.

“Indebtedness” shall have the meaning ascribed to such term in Section 3(ee).

“Intellectual Property Rights” shall have the meaning ascribed to such term in Section 3(v).

“Issuer Free Writing Prospectus” shall mean an issuer free writing prospectus, as defined in Rule 433.

“IT Systems and Data” shall have the meaning ascribed to such term in Section 3(mm).

“Liens” shall have the meaning ascribed to such term in Section 3(a).

“Losses” shall have the meaning ascribed to such term in Section 7(d).

“Material Adverse Effect” shall have the meaning ascribed to such term in Section 3(b).

“Material Permits” shall have the meaning ascribed to such term in Section 3(t).

“Maximum Amount” shall have the meaning ascribed to such term in Section 2.

“Money Laundering Laws” shall have the meaning ascribed to such term in Section 3(rr).

“Net Proceeds” shall have the meaning ascribed to such term in Section 2(b)(v).

“Ordinary Shares” means the ordinary shares, no par value per share, of the Company, and any other class of securities into which such securities may hereafter be reclassified or changed.

“Ordinary Share Equivalents” shall have the meaning ascribed to such term in Section 3(g).

“Permitted Free Writing Prospectus” shall have the meaning ascribed to such term in Section 4(g).

“Person” shall have the meaning ascribed to such term in Section 3(e).

“Placement” shall have the meaning ascribed to such term in Section 2(c).

“Proceeding” shall have the meaning ascribed to such term in Section 3(b).

“Prospectus” shall mean the Base Prospectus, as supplemented by the most recently filed Prospectus Supplement (if any).

“Prospectus Supplement” shall mean each prospectus supplement relating to the Shares prepared and filed pursuant to Rule 424(b) from time to time.

“Record Date” shall have the meaning ascribed to such term in Section 2(b)(ix).

“Registration Statement” shall mean the shelf registration statement (File Number 333-286961) on Form F-3, including exhibits and financial statements filed with or incorporated by reference into such registration statement and any prospectus supplement relating to the Shares that is filed with the Commission pursuant to Rule 424(b) and deemed part of such registration statement pursuant to Rule 430B, as amended on each Effective Date and, in the event any post- effective amendment thereto becomes effective, shall also mean such registration statement as so amended.

“Representation Date” shall have the meaning ascribed to such term in Section 4(k).

“Required Approvals” shall have the meaning ascribed to such term in Section 3(e).

“Rule 158”, “Rule 164”, “Rule 172”, “Rule 173”, “Rule 405”, “Rule 415”, “Rule 424”, “Rule 430B” and “Rule 433” refer to such rules under the Act.

“Sales Notice” shall have the meaning ascribed to such term in Section 2(b)(i).

“SEC Reports” shall have the meaning ascribed to such term in Section 3(m).

“Settlement Date” shall have the meaning ascribed to such term in Section 2(b)(vii).

“Shares” shall have the meaning ascribed to such term in Section 2.

“Subsidiary” shall have the meaning ascribed to such term in Section 3(a).

“Terms Agreement” shall have the meaning ascribed to such term in Section 2(a).

“Time of Delivery” shall have the meaning ascribed to such term in Section 2(c).

“Trading Day” means a day on which the Trading Market is open for trading.

“Trading Market” means any of the following markets or exchanges on which the Ordinary Shares are listed or quoted for trading on the date in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market or the New York Stock Exchange (or any successors to any of the foregoing).

All references in this Agreement to financial statements and schedules and other information that is “contained,” “included” or “stated in the Registration Statement or the Prospectus (and all other references of like import) shall be deemed to mean and include all such financial statements and schedules and other information which is or is deemed to be incorporated by reference in or otherwise deemed under the Act to be a part of or included in the Registration Statement or the Prospectus, as the case may be, as of any specified date; and all references in this Agreement to amendments or supplements to the Registration Statement or the Prospectus shall be deemed to mean and include, without limitation, the filing of any Incorporated Document to be a part of or included in the Registration Statement or the Prospectus, as the case may be, as of any specified date.

2. Sale and Delivery of Shares. The Company proposes to issue and sell through or to the Manager, as sales agent and/or principal, from time to time during the term of this Agreement and on the terms set forth herein, up to such number of Ordinary Shares of the Company (the “Shares”), that does not exceed (a) the number or dollar amount of Ordinary Shares registered on the Prospectus Supplement, pursuant to which the offering is being made, (b) the number of authorized but unissued Ordinary Shares (less the number of Ordinary Shares issuable upon exercise, conversion or exchange of any outstanding securities of the Company or otherwise reserved from the Company’s authorized shares), or (c) the number or dollar amount of Ordinary Shares that would cause the Company or the offering of the Shares to not satisfy the eligibility and transaction requirements for use of Form F-3, including, if applicable, General Instruction I.B.5 of Registration Statement on Form F-3 (the lesser of (a), (b) and (c), the “Maximum Amount”). Notwithstanding anything to the contrary contained herein, the parties hereto agree that compliance with the limitations set forth in this Section 2 on the number and aggregate sales price of Shares issued and sold under this Agreement shall be the sole responsibility of the Company and that the Manager shall have no obligation in connection with such compliance.