UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 2054

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2025

Commission File Number: 001-35165

BRAINSWAY

LTD.

(Translation of registrant's name into English)

16

Hartum Street RAD Tower, 14th Floor

Har HaHotzvim

Jerusalem, 9777516, Israel

(+972-2) 582-4030

(Address and telephone number of Registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

This Form 6-K is incorporated by reference into the Company's Registration Statement on Form S-8 filed with the Securities and Exchange Commission on April 22, 2019 (Registration No. 333- 230979) and the Company's Registration Statements on Form F-3 filed with the Securities and Exchange Commission on July 22, 2024 (Registration No. 333-280934) and on April 22, 2025 (Registration No. 333-286672).

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BRAINSWAY LTD. | |

| (Registrant) | |

| Date: August 21, 2025 | |

| /s/ Hadar Levy | |

| Hadar Levy | |

| Chief Executive Officer |

Exhibit 99.1

BrainsWay Targets Expansion of its Total Addressable Market through a Strategic Investment in Neuromodulation Systems Developer, Neurolief Ltd.

This investment marks BrainsWay’s entrance into the market for mental health therapies that can be administered outside of a clinic, including at home

Neurolief’s breakthrough Proliv™Rx device is pending Premarket Approval from the U.S. FDA, and if granted, will become the first FDA-cleared medical device for MDD treatment that can be delivered outside of the clinic

BURLINGTON, Mass. and JERUSALEM, Israel, August 21, 2025 -- BrainsWay Ltd. (NASDAQ & TASE: BWAY) (“BrainsWay” or the “Company”), a global leader in advanced noninvasive neurostimulation treatments for mental health disorders, today announced it has closed an initial strategic investment by means of a $5 million convertible loan to, along with an option to acquire, Neurolief Ltd. (“Neurolief”), developer of the world’s first wearable, non-invasive, multi-channel brain neuromodulation platform that is designed for use at home. Neurolief’s technology has demonstrated positive clinical outcomes and includes a proprietary therapy for treatment-resistant major depressive disorder (MDD) and migraine. The Agreement also includes additional possible milestone-based funding.

“We are very excited with this strategic investment in Neurolief. Upon an FDA approval, we believe this technology will significantly expand our addressable market, enabling care for patients who cannot easily access clinics and empowering medical professionals to extend treatment beyond traditional settings. This aligns with our strategic goal of accelerating access to and awareness of innovative mental health treatments, especially offerings that we believe are complementary to mental health professionals using our Deep TMS therapy,” said Hadar Levy, BrainsWay’s Chief Executive Officer. “The BrainsWay team has rapidly expanded sales of the Deep TMS™ system, supported by scaling of our commercial platform and customer network. We are excited by the opportunity to leverage our platform and explore potential synergies between our two companies, as Neurolief brings its at-home neuromodulation systems to the market through mental health professionals.”

Neurolief is a pioneering neuromodulation company dedicated to developing innovative solutions for mental health and neurological disorders. Neurolief's Relivion®MG therapy is currently approved in the U.S., Europe and Japan for the treatment of migraine, and it is awaiting Premarket Approval from the U.S. FDA for its ProlivTMRx therapy addressing Major Depressive Disorder (MDD) in treatment resistant patients. If approved, Neurolief will be the first medical device company to offer an FDA-cleared MDD treatment that can be delivered outside of the clinic.

MDD is a leading cause of disability globally, with millions of people affected. The situation is especially dire for those patients who fail to respond to traditional treatments, facing prolonged suffering, higher healthcare costs, and a heightened risk of comorbid conditions such as substance abuse and suicide. Despite the global impact of MDD, there is a critical gap in accessible, effective therapies, particularly for these patients. Proliv™Rx is designed to bridge this gap by offering a revolutionary, non-invasive brain neuromodulation therapy that can be administered at a mental health clinic or a patient’s home.

“This strategic investment by BrainsWay is a strong validation of our science, our team, and our vision,” stated Scott Drees, Neurolief's Chief Executive Officer. “This partnership enhances our ability to reach the patients who need our therapy most. BrainsWay’s market presence, deep expertise, and established commercial platform can complement our innovation and momentum. Together, we aim to reshape the treatment landscape for depression and expand access to evidence-based, effective care.”

Beyond the initial $5 million convertible loan, the agreement provides for potential additional milestone-based funding to Neurolief, including a second tranche of up to a $6 million convertible loan upon FDA approval of Neurolief’s Proliv Rx system for MDD treatment, and a third tranche consisting of up to a $5 million equity investment upon Neurolief achieving an agreed-upon revenue milestone. BrainsWay has also been granted a “call option” to acquire all outstanding equity interests in Neurolief during clearly defined exercise windows, at a price based on the greater of a specified enterprise value or a revenue multiple, with the values varying depending on timing of exercise.

Through this multi-phased transaction, BrainsWay aims to expand its long-term total addressable market.

About BrainsWay

BrainsWay is a global leader in advanced noninvasive neurostimulation treatments for mental health disorders. The Company is boldly advancing neuroscience with its proprietary Deep Transcranial Magnetic Stimulation (Deep TMS™) platform technology to improve health and transform lives. BrainsWay is the first and only TMS company to obtain three FDA-cleared indications backed by pivotal clinical studies demonstrating clinically proven efficacy. Current indications include major depressive disorder (including reduction of anxiety symptoms, commonly referred to as anxious depression), obsessive-compulsive disorder, and smoking addiction. The Company is dedicated to leading through superior science and building on its unparalleled body of clinical evidence. Additional clinical trials of Deep TMS in various psychiatric, neurological, and addiction disorders are underway. Founded in 2003, with operations in the United States and Israel, BrainsWay is committed to increasing global awareness of and broad access to Deep TMS. For the latest news and information about BrainsWay, please visit www.brainsway.com.

About Neurolief

Neurolief is a pioneering neuromodulation company committed to developing breakthrough therapies for mental health and neurological disorders. The company has developed the world’s first wearable, non-invasive, multi-channel brain neuromodulation system, that is designed for use at home, engineered to simultaneously stimulate key neural pathways in the head in order to modulate brain regions involved in regulation of mood and pain. Neurolief's technology is currently FDA-cleared and CE-marked for the treatment of migraine, and the company is actively seeking regulatory approvals for Proliv™Rx, its flagship product for the treatment of Major Depressive Disorder. If granted, Neurolief will be the first medical device company to offer an FDA-approved MDD treatment that can be delivered outside of the clinic. Learn more at: www.neurolief.com This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-Looking Statement

Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “targets,” “believes,” “hopes,” “potential” or similar words, and also includes any financial guidance and projections contained herein. These forward-looking statements and their implications are based on the current expectations of the management of the Company only and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. In addition, historical results or conclusions from scientific research and clinical studies – especially preliminary data which remains subject to peer-review – do not guarantee that future results would suggest similar conclusions or that historical results referred to herein would be interpreted similarly in light of additional research or otherwise. The following factors, among others, could cause actual results to differ materially from those described in the forward-looking statements: the failure to realize anticipated synergies and other benefits of the proposed transaction; the failure of our investments in management services organizations and/or other clinic-related entities to produce profitable returns; inadequacy of financial resources to meet future capital requirements; changes in technology and market requirements; delays or obstacles in launching and/or successfully completing planned studies and clinical trials; failure to obtain approvals by regulatory agencies on the Company’s anticipated timeframe, or at all; inability to retain or attract key employees whose knowledge is essential to the development of Deep TMS products; unforeseen difficulties with Deep TMS products and processes, and/or inability to develop necessary enhancements; unexpected costs related to Deep TMS products; failure to obtain and maintain adequate protection of the Company’s intellectual property, including intellectual property licensed to the Company; the potential for product liability; changes in legislation and applicable rules and regulations; unfavorable market perception and acceptance of Deep TMS technology; inadequate or delays in reimbursement from third-party payers, including insurance companies and Medicare; inability to commercialize Deep TMS, including internationally, by the Company or through third-party distributors; product development by competitors; inability to timely develop and introduce new technologies, products and applications, which could cause the actual results or performance of the Company to differ materially from those contemplated in such forward-looking statements.

Any forward-looking statement in this press release speaks only as of the date of this press release. The Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable securities laws. More detailed information about the risks and uncertainties affecting the Company is contained under the heading “Risk Factors” in the Company’s filings with the U.S. Securities and Exchange Commission.

Contacts:

BrainsWay:

Ido Marom

Chief Financial Officer

Ido.Marom@BrainsWay.com

Investors:

Brian Ritchie

LifeSci Advisors

britchie@lifesciadvisors.com

Exhibit 99.2

INVESTMENT AGREEMENT

THIS INVESTMENT AGREEMENT (the “Agreement”) is made and entered into effective as of the 18th day of August, 2025, by and among Neurolief Ltd., a company organized under the laws of the State of Israel having its principal offices at 12 Giborei Israel, Netanya, Israel, 4250412 (the “Company”) and Brainsway Ltd., a company organized under the laws of the State of Israel having its principal offices at 16 Hartum Street, RAD Tower, Jerusalem, 9777516, Israel (the “Investor”), and together with the Company, the “Parties” and each, a “Party”).

RECITALS:

WHEREAS, the Board of Directors of the Company (the “Board”) has determined that it is in the best interests of the Company to raise additional capital in an aggregate amount of up to $16M, to be extended in up to three installments (each: an “Installment”), the first two of which, by means of convertible loans all as further provided herein; and

WHEREAS, the Investor wishes to effectuate the initial investment in the Company of the first Installment, by way of a convertible loan, in the principal amount of US$5,000,000 in consideration of the grant of the rights in this Agreement to the Investor, upon and subject to the terms and conditions hereof; and

WHEREAS, subject to the satisfaction of certain milestones, the Investor undertakes to make certain additional investments in the Company in an aggregate amount of up to $11M, in two further Installments, on the terms and subject to the conditions provided herein; and

WHEREAS, as a further material inducement for the Investor’s undertakings herein, the Investor wishes to be granted certain rights (such rights, collectively, the “Call Option”) to acquire all of the outstanding equity interests of the Company, subject to the terms and conditions of this Agreement and the Call Option Agreement (as defined herein). The Company acknowledges and agrees that such Call Option is a significant factor in the Investor’s decision to enter into this Agreement and provide financing to the Company and the Investor acknowledges and agrees that the grant of the Call Option to it by the Company is a valuable economic right afforded to the Investor by the Company in order to receive such financing; and

WHEREAS, as a further material inducement for the Investor’s undertakings herein, in order to grant the Investor certain governance rights prior to the conversion of the Principal Amount (as defined herein), the Company has agreed to create and issue to the Investor, at the Closing, one (1) share of a newly designated class of Special Shares (the “Special Share”), which shall carry no economic rights but shall entitle the holder to appoint director(s) to the Board of Directors, to certain special consent rights, and the right to receive its nominal value upon liquidation of the Company, all as set forth in the Amended Articles; and

WHEREAS, the Company is a party: (i) to that certain Second Amended and Restated Convertible Bridge Loan Agreement dated on or around February 2025 in an aggregate principal amount of approximately $4.895M (plus an additional approximately $89,579 deemed convertible loans thereunder from the Company’s CFO and CEO in in lieu of deferred salary through September 30, 2024 the “First Company CLA Salary Deferral”) (collectively: the “First Company CLA”); and (ii) that certain Convertible Bridge Loan Agreement dated on or around February 2025 in an aggregate principal amount not to exceed $3.776M (which amount includes approximately $87,499 (the “Second Company Salary CLA Deferral”) deemed convertible loans thereunder from the Company’s CFO and CEO in in lieu of deferred salary from October 1, 2024 through Closing) (collectively, the “Second Company CLA”, and together with the First Company CLA, the “Existing Company CLAs”; all lenders which are parties to the Existing Company CLAs shall herein be collectively referred to as the “Existing Company CLA Lenders”); WHEREAS, at the Closing (and contingent thereupon), the First Company CLA (but without any interest accrued thereon which shall be forgiven) shall be converted into such number of Series B-2 Preferred Shares of the Company as reflected in the Capitalization Table (as defined below) (it being clarified that all of such shares underlying the foregoing conversion shall be included in the Fully Diluted Basis (as defined below) for purposes of calculation of the Conversion Price (as defined below) which shall have the rights, privileges and preferences as set forth in the Amended Articles (as defined below) (the “First Company CLA Conversion”).

WHEREAS, (i) pursuant to the Existing Company CLA Amendments (defined below) up to $3.776M of principal amount (including the Second Company CLA Salary Deferral) shall rank pari passu with Loan Amount, including with respect to creditor and repayment rights, and upon conversion (as further reflected in the Capitalization Table on a pro-forma basis following the Closing), and (ii) any amount of principal actually advanced under the Second Company CLA by the Closing Date, in excess of $3.776M (if any) (the “Second Company CLA Surplus Subordinated Amount”), shall be treated as follows: (i) any and all shares of the Company underlying the conversion of the Second Company CLA Surplus Subordinated Amount shall be included in the Fully Diluted Basis (as defined below) for purposes of calculation of the Conversion Price (as defined below) (it being clarified however, that nothing in the foregoing shall be deemed to imply the actual conversion thereof, which conversion terms (including timing) shall be determined according to the terms of the Second Company CLA, as amended), all as further reflected in the Capitalization Table (as defined below), and (ii) any repayment thereof shall be subordinate and subject to the prior and full repayment of the Loan Amount as further provided in the Existing Company CLA Amendments (as defined below);

NOW, THEREFORE, in consideration of the foregoing recitals and the mutual promises, representations, warranties and covenants hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, hereby agree as follows:

| 1. | Agreement to Make and Accept the Convertible Loan and Subsequent Investments. |

1.1. Convertible Loan. Subject to and in accordance with the terms and conditions of this Agreement, at the Closing (as defined below), the Investor shall provide to the Company, and the Company shall accept from the Investor, a convertible loan in the principal amount of US$5,000,000 (the “Initial Principal Amount”).

|

|

1.2. Interest. The Initial Principal Amount will bear interest on the outstanding balance at a simple rate per annum equal to the minimal rate permitted by Section 3(j)(“yud”) of the Israeli Income Tax Ordinance, 5721-1961 (and any rules and regulations promulgated thereof) (the “Interest”). The Initial Principal Amount, and all Interest accrued thereon and the VAT payable on such Interest, are collectively referred to as the “Initial Loan Amount”.

1.3. Repayment. Unless previously converted or repaid pursuant to the terms of this Agreement, the outstanding Initial Loan Amount shall become due and payable to the Investor on the date that is the three-year anniversary of the Closing Date (the “Maturity Date”); provided that it shall not be a breach of this Agreement as long as the Company completes the repayment of the Initial Loan Amount in full within 1 (one) year following the Maturity Date (the “Repayment Grace Period”), and further provided, that the Investor may, at the request of the Company and subject to its sole discretion, defer the Maturity Date to the Call Option Termination Date (as defined in the Call Option Agreement), by giving the Company notice in writing at any time prior to the Maturity Date. At any time prior to the Maturity Date (as and if deferred), the Investor will inform the Company by written notice if upon the Maturity Date, if it elects for the outstanding Initial Loan Amount to be repaid, or alternatively to have the Initial Principal Amount converted into shares as provided herein (in which case the accrued Interest thereon shall be deemed waived by the Investor and therefore shall be neither converted nor repaid); provided, however that in the event that no such written notice is timely given, then the Investor shall be deemed to have elected the outstanding Loan Amount to be repaid in accordance with the provisions of this Agreement. If it elects it to be repaid, the Company may obtain additional debt or equity financing to repay the outstanding Initial Loan Amount, without any restriction on the part of the Investor, and the Call Option shall expire immediately upon the repayment in full of the outstanding Loan Amount to the Investor.

1.4. Issuance of Special Share. Subject to the Closing taking place, the Company shall issue to the Investor the Special Share. The Special Share shall have such rights, preferences and privileges as set forth in the Amended Articles.

1.5. Use of Proceeds. The Company will use the Initial Principal Amount substantially in accordance with the budget following the Closing attached hereto as Exhibit A (the “Budget”), as may be amended from time to time Board subject to the procedures set forth in the Amended Articles.

1.6. [Reserved].

1.7. Subordination and Amendment of Existing Company CLAs. A condition to Closing shall be that Existing Company CLA Lenders, constituting the requisite majority necessary to effectuate an amendment to the Existing Company CLAs, execute and deliver an amendment to each of the Existing Company CLAs in substantially the form as set forth in Schedule 2.2.1.8(A) and (B)) (the “Existing Company CLAs Amendments”) confirming, inter alia, (i) effectuation of the First Company CLA Conversion immediately prior to the Closing (and contingent thereupon), (ii) that any payments with respect to the Second Company CLA Surplus Subordinated Amount (if any) shall be subordinated to the full repayment of the Loan Amount (as defined below), that the maturity date under the Second Company CLA shall be the Maturity Date under this Agreement, that interest accrued on the Second Company CLA with respect to the period commencing on the Closing Date and onwards, shall accrue at the same rate as provided in Section 1.2 of this Agreement (it being clarified that any interest accrued on the Second Company CLA during the period commencing on the respective dates of funding of all amounts constituting the Second Company CLA through the Closing Date shall remain unchanged as set forth in the Existing Company CLAs Amendment), and that the Event of Default under the Second Company CLA shall be substantially identical to the corresponding provisions of this Agreement.

|

|

1.8. Additional Future Investments. Subject to the Closing having occurred, and contingent upon the Company meeting certain milestones described below, the Investor undertakes to provide additional funding at two subsequent closings (the “Second Closing” and the “Third Closing”, each of which may be referred to as a “Subsequent Closing” and collectively the “Subsequent Closings”), as further provided in this Section 1.8.

1.8.1. Second Investment. At the Second Closing, and (in addition to the conditions set forth in Section 2.4), conditioned upon FDA Approval (defined below) (the “Second Investment Milestone”), the Investor shall provide to the Company, a convertible loan in the principal amount of up to US$6,000,000, as specified in the Company’s Investment Request (as defined below, where the exact portion of the Second Principal Amount to be provided shall be determined by the Board (such principal amount actually extended to the Company by the Investor per the Company’s request, shall be referred to herein: the “Second Principal Amount”). The Second Principal Amount will bear Interest on the outstanding balance from the date of its disbursement to the Company, at the same rate as set forth in Section 1.2 above per annum. The Second Principal Amount, and all Interest and VAT accrued thereon, are collectively referred to as the “Second Loan Amount”, and collectively with the Initial Loan Amount, which is outstanding, the “Loan Amount”. The Second Principal Amount and the Initial Principal Amount are collectively referred to as the “Principal Amount”. Unless previously converted or repaid pursuant to the terms of this Agreement, the Second Loan Amount shall become due and payable to the Investor on the Maturity Date (as and if deferred in accordance with Section 1.3, and subject to the Repayment Grace Period set forth therein). At any time prior to the Maturity Date, the Investor will inform the Company by written notice if upon the Maturity Date, it elects for the outstanding Second Loan Amount to be repaid, or alternatively to have the Second Principal Amount converted into shares as provided herein (in which case the accrued Interest thereon shall be deemed waived by the Investor and therefore shall be neither converted nor repaid); provided, however that in the event that no such written notice is timely given, then the Investor shall be deemed to have elected the outstanding Loan Amount to be repaid in accordance with the provisions of this Agreement. If it elects it to be repaid, the Company may obtain additional debt or equity financing to repay the outstanding Second Loan Amount, without any restriction on the part of the Investor, and the Call Option shall expire as of immediately upon the repayment in full of the outstanding Loan Amount to the Investor. “FDA Approval” means: receipt by the Company of an Approval Order from the U.S. Food and Drug Administration (the “FDA”) for the Proliv Rx neurostimulation system for depression, which shall include approval as an adjunctive tool for management or treatment, or use for medication resistant or treatment-refractory depression, for use at home, and may include post approval obligations provided that it does not include any condition that would prevent commercial sale of the product in the United States.

1.8.2. Third Investment. Subject to the Second Closing having occurred and the investment of the Second Principal Amount, at the Third Closing, and (in addition to the conditions set forth in Section 2.4), conditioned upon Company having achieved twelve month revenues of US$10,000,000, calculated on a trailing 12-month basis based on a reviewed (by the Company’s auditors, in accordance with US GAAP) statement(s) of the Company’s revenues for the applicable 12 calendar month period (the “Third Investment Milestone”), the Investor shall (subject to satisfaction of the conditions to a Subsequent Closing set forth in Section 2.4 below) pay to the Company the Third Investment Amount, in consideration for which the Company shall allot to the Investor Series S-3 Preferred Shares of the Company (the Preferred S-3 Shares, and together with the Preferred S-1 Shares and Preferred S-2 Shares, as defined below, the “Preferred S Shares”), which shall have the rights, preferences and privileges set forth in Amended Articles, for the aggregate purchase price specified in the Company’s Investment Request, such amount not to exceed US$5,000,000 (the “Third Investment Amount”) (where the exact portion of the Third Investment Amount to be provided shall be determined by the Board). The price per share of the Preferred S-3 Shares (the “Third Investment PPS”) shall reflect a pre-money Company valuation, as of the Closing Date, on a Fully Diluted Basis, of $55,000,000, assuming the investment and conversion of the Principal Amount and the Second Company CLA; and the number of Preferred S-3 Shares to be issued and allotted to Investor (the “Third Closing Shares”)) shall be the result obtained by dividing the Third Investment Amount by the Third Investment PPS; all as further reflected in the Capitalization Table. The current Capitalization Table simulation assumes the investment of the maximum Principal Amount (i.e., $11M) prior to investment of the Third Investment Amount, in which case, the Third Investment PPS shall be $2.82 (and if and to the extent the Second Principal Amount actually invested is lower than $6M, at the request of the Company, then the Capitalization Table shall be adjusted accordingly so to reflect the actual Principal Amount that was invested).

|

|

1.8.3. The amounts actually called by the Company in respect of the Second Principal Amount and the Third Investment Amount shall each be determined by the Board in its reasonable discretion, considering the Company’s capital needs, business plan, and other relevant factors.

1.8.4. In order to minimize the potential for any dispute regarding the determination of the Company’s revenues for the purpose of determining the Third Investment Milestone, the Parties agree to the following:

| 1.8.4.1. | the Company’s revenues will be calculated in accordance with US GAAP, as consistently applied by the Company in accordance with past practice; |

| 1.8.4.2. | upon decision of the Board, following the date upon which the Company first generates revenues in any calendar quarter of at least $250,000, the Company’s quarterly financial statements which shall be delivered to the Investor and the other entitled shareholders pursuant to the IRA (as defined below) on a quarterly basis shall be financial statements reviewed by the Company’s auditors (“Quarterly Reviewed FS”). |

| 1.8.4.3. | upon Investor’s receipt of any Quarterly Reviewed FS from the Company, the Investor shall have the right, to be exercised within 14 business days following the delivery date thereof, to review, inter alia, the Company’s revenues with the Company’s CFO and ensure that they are reflected in accordance with the abovementioned accounting principles; |

|

|

| 1.8.4.4. | revenues of the Company as set forth in any Quarterly Reviewed FS which were (i) approved by the Board, with the affirmative vote or written consent of a director appointed by the Investor, or (ii) not subject to any outstanding contest that was previously raised by the Investor pursuant to the procedure set forth in Section 1.8.4.3 shall have the presumption of being correct for purposes of determining whether the Third Investment Milestone has been achieved, unless such revenues has been adjusted in the course of the preparation of the Audited Financial Statements of the Company, in which case the revenues as adjusted shall have the presumption of being correct for purposes of determining whether the Third Investment Milestone has been achieved. |

1.8.5. The Company shall provide the Investor with written notice promptly upon it becoming aware of the achievement of each of the Second Investment Milestone and the Third Investment Milestone (each, a “Milestone” and a “Milestone Notice”, respectively), together with the documentary evidence reasonably necessary to demonstrate that the applicable Milestone has been reached. Together with such notice, or in a separate notice to be given no later than 30 days after the date when the applicable Milestone was reached, the Company may issue a request (“Investment Request”) for the Second Principal Amount or the Third Investment Amount, as the case may be.

1.8.6. The Investor shall have 10 business days following the delivery of each Milestone Notice (as applicable with respect to each Milestone, the “Review Period”) to review such Milestone Notice and any additional information and documents received from the Company and to either: (a) inform the Company of its position as to the attainment of the Milestone by the Company, or (b) request additional information and documents from the Company as may be reasonably required for the Investor in order to confirm the satisfaction of the Milestone. If such additional information has been requested by the Investor, the Review Period shall be extended for 10 additional business days following the delivery to the Investor of all such additional information and documentation. In case the Investor does not agree that the Company has achieved such Milestone (the “Dispute”), the Investor shall inform the Company in writing, within the Review Period, of its conclusion which such written notice shall include the reason for such Dispute (the “Objection Notice”) and the Investor and the Company will promptly commence discussions to resolve such Dispute. If the Investor does not deliver an Objection Notice within the applicable Review Period (as extended, if and as applicable), then the Investor shall be deemed to have agreed with the Milestone Notice. If within 3 business days following the commencement of such discussions, the Investor and the Company have not resolved such Dispute, then either the Investor or the Company may submit for resolution of the Dispute to an independent expert consultant (the “Expert”). The Expert shall be appointed by mutual agreement of the Company’s chairman and the Investor’s Chief Executive Officer and shall serve as an arbitrator to resolve the items in Dispute. If the Parties cannot agree on the appointment of the Expert within 5 business days, the appointment shall be an individual recommended by the Company’s US regulatory counsel for the Second Investment Milestone, and the Company’s auditor for the Third Investment Milestone (in each case with meeting the necessary requirements and qualifications set forth in this Section 1.8.6). The Expert shall hold the relevant expertise and experience. Accordingly, the Parties contemplate the appointment of an independent regulatory consultant with at least seven (7) years’ direct experience in FDA medical-device submissions (including De Novo and PMA pathways) and who has no current or former association with the Company in case of dispute regarding completion of the Second Investment Milestone, or appointment of an accounting firm associated with one of the “Big 4” international accounting firms, that has no current or former association with the Company or the Investor in case of dispute regarding completion of the Third Investment Milestone. The Expert will provide its final determination within 14 days after the date of its appointment in case of the Second Investment Milestone or 30 days after the date of its appointment in case of the Third Investment Milestone. This provision for arbitration shall be specifically enforceable by the Parties, and the determination of the Expert in accordance with the provisions hereof shall be final and binding upon the Company and the Investor with no right of appeal therefrom (save for manifest error) This arbitration clause shall be treated as an arbitration contract between the parties for all intents and purposes and the provisions of the Israeli Arbitration Law of 1968 shall be applied to the arbitration proceedings and the Expert, unless the parties expressly agree to the contrary. The Expert shall not be bound by procedural rules. The costs of the Expert and any legal expenses borne in connection therewith shall be borne by the Party against whom the Dispute is determined.

|

|

1.8.7. Subject to the satisfaction of the conditions to the Subsequent Closings pursuant to Section 2.4 below, upon completion of the Review Period (and, if applicable, the Expert determination under Section 1.8.6), each of the Subsequent Closings shall take place as follows: (A) If no Objection Notice is delivered during the Review Period (as extended), the applicable Subsequent Closing shall take place within 7 business days after the expiration of the Review Period (as and if extended in accordance with Section 1.8.6 above); and (B) If a Dispute is raised and referred to an Expert, then, upon and subject to receipt of the Expert’s final determination that the applicable Milestone was achieved, the applicable Subsequent Closing shall take place within 7 business days after such determination.

1.8.8. If, notwithstanding the satisfaction of all the conditions to the applicable Subsequent Closing, the Investor fails to duly comply with its obligations herein and fund the Second Principal Amount or the Third Investment Amount by the applicable date designated therefor according to this Agreement (each, a “Default”), the Company shall immediately notify the Investor of such Default and in the event that such Default is not remedied within 21 days from the date of delivery of the notice by the Company, then the Investor shall constitute a “Defaulting Investor” (a “Defaulting Investor”) for the purpose of this Agreement, the Amended Articles and the Call Option Agreement. In case the Investor is a Defaulting Investor, and as a sole and exclusive remedy for the Company, the following provisions shall apply: (a) the Investor’s Call Option and the right of the Investor to appoint any director to the Company’s (or any of its subsidiaries) Board of Directors pursuant to the Amended Articles, shall be automatically extinguished and of no further force and effect; (b) so long as the Second Company CLA remains outstanding and is not converted, the outstanding Principal Amount shall remain outstanding (and shall not be converted without the Company’s prior consent), shall become due and repayable by the later date of: (i) the Maturity Date plus the Repayment Grace Period (i.e., the fourth year anniversary of the Closing Date), or (ii) 12 months from the date upon which the Investor is as a Defaulting Investor; and may be prepaid at any time. In such case, the rights, privileges and preferences of the Special Share pertaining to the Investor (including its veto rights) shall be automatically amended as specified in the Amended Articles in reference to a case of a Defaulting Investor; (c) upon conversion of the Second Company CLA into shares of the Company an amount equal to the greater of $5,000,0000 or 50% of the outstanding Principal Amount (if any) (without any accrued interest which shall be deemed waived (i.e., neither converted nor paid) shall be automatically and concurrently converted into Conversion Shares (as defined below) based on the applicable a Conversion Price (which shall be the First Conversion Price (defined below) if Default is with respect to the Second Principal Amount, and the Second Conversion Price (defined below) if Default is with respect to the Third Principal Amount), and shall have such rights, privileges and preferences as specified in the Amended Articles, specifically in reference to a case of a Defaulting Investor, and following such conversion, any portion of the outstanding Principal Amount not so converted and the Interest accrued thereupon, shall remain outstanding under the terms of this Section 1.8.8 and may be converted at any time at the option of the Investor at the Third Investment PPS (without any accrued interest which shall be deemed waived (i.e., neither converted nor paid); and (d) any other provisions in the Amended Articles relating to a Defaulting Investor shall apply.

|

|

1.8.9. Nothing in this Section 1.8 (other than in case of Default) shall supersede or limit the Investor’s Call Option rights set forth in Section 4. The Call Option may be exercised (subject to its own terms) during the Call Option Period (as defined in the Call Option Agreement) regardless of whether the Second Closing or Third Closing has occurred, except as otherwise expressly stated in this Agreement or the Call Option Agreement (e.g., Non-Exercise Period or if the Investor has elected not to invest despite the satisfaction of the applicable Milestone due to the occurrence of a Material Adverse Change as per Section 2.4.6.2).

| 2. | Closing, Delivery and Payment. |

2.1. Closing. The closing of the payment and receipt of the Initial Principal Amount and the grant of the Call Option (the “Closing”) shall take place via an electronic closing through exchange of separate counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument, on or around the date which is 14 days following the date hereof or at such other time as the Company and the Investor mutually agree (the date of the closing being herein referred to as the “Closing Date”).

2.2. Deliveries and Transactions at the Closing. At the Closing, the following transactions shall occur, which transactions shall be deemed to take place simultaneously and no transaction shall be deemed to have been completed or any document delivered until all such transactions have been completed and all required documents delivered:

2.2.1. The Company shall deliver to the Investor the following documents:

2.2.1.1. Shareholders Resolutions. Duly executed resolutions of the shareholders of the Company (which may be in the form of a written resolution or minutes of a general meeting and in any event shall include the requisite approvals as required under the Current Articles), substantially in the form attached as Schedule 2.2.1.1 hereto, pursuant to which the shareholders of the Company shall have, inter alia, approved all transactions contemplated hereby and taken all necessary corporate actions related to such transactions, including but not limited to:

2.2.1.1.1. As of immediately prior to the Closing: (A) increasing and modifying the authorized share capital of the Company to create and authorize the Special Share for the issuance to the Investor, and the creation of the Preferred S Shares, (B) approving the replacement, no later than immediately prior to the Closing, of the Current Articles (as defined below) with the Amended and Restated Articles of Association, in the form attached hereto as Schedule 2.2.1.1.1 (the “Amended Articles”); (C) approving the execution, delivery and performance by the Company of this Agreement, the Existing Company CLA Amendments (and all transaction contemplated thereby, including without limitation, the First Company CLA Conversion), the IRA and all documents, agreements, certificates, and instruments furnished pursuant or ancillary hereto or thereto (collectively with the Amended Articles, the “Ancillary Documents”, and collectively with this Agreement, the “Transaction Documents”); and (D) changing the composition of the Board as of the Closing and each Subsequent Closing; and

|

|

2.2.1.1.2. [Reserved].

2.2.1.1.3. [Reserved].

2.2.1.2. Board Resolutions. Duly executed unanimous resolutions of the Board (which may be in the form of a written resolution or minutes of the board of directors), substantially in the form attached as Schedule 2.2.1.2 hereto, pursuant to which the Board shall have, inter alia, approved all transactions contemplated hereby and taken all necessary corporate actions related to such transactions, including but not limited to, (A) approving the execution, delivery and performance by the Company of this Agreement and each Ancillary Document requiring such, (B) approving the issuance of the Special Share to the Investor, and (C) approving the issuance to the Investor of the Conversion Shares upon conversion of the Principal Amount, and the Third Closing Shares at the Third Closing (the “Aggregate Shares”, and together with the Call Option, and the Ordinary Shares which may be issued upon conversion of the Aggregate Shares, collectively, the “Securities”).

2.2.1.3. Share Certificate. Validly executed share certificate evidencing the registration of the Special Share in the name of the Investor, in the form attached hereto as Schedule 2.2.1.3 in the name of the Investor.

2.2.1.4. Shareholders Register. A copy, duly certified by an officer of the Company and dated as of the Closing, of the Company's shareholders register, in the form of Schedule 2.2.1.4 attached hereto (the “Shareholders Register”), which shall also reflect the registration by the Company of the issuance of the Special Share to the Investor.

2.2.1.5. Waivers; Confirmation of Holdings. Unless included in the shareholders resolutions, the Company shall deliver to the Investor a written consent in the form attached hereto as Schedule 2.2.1.5, signed by the Preferred B Majority (as defined under the Amended Articles) pursuant to which (i) any and all preemptive rights, rights of first refusal, or any other rights by virtue of which such shareholder (or any permitted transferee or assignee) may be entitled to purchase or receive securities of the Company (“Participation Rights”) with respect to the transactions contemplated by this Agreement, including the issuance of any Shares upon the conversion of the Principal Amount, have been waived or excluded; and (ii) any and all anti-dilution rights to which such shareholder (or any permitted transferee or assignee) may be entitled under the Current Articles or under any other instrument have been waived or excluded; and (iii) with respect to the holders of at least 85% of the Company’s issued and outstanding share capital on a Fully-Diluted Basis, represents that its shareholdings as set forth in the Capitalization Table accurately reflects its holdings of the securities of the Company, both prior to and following the Closing, on a Fully-Diluted Basis (where confirmation to this effect in the Call Option Agreement shall satisfy this condition).

|

|

2.2.1.6. Compliance Certificate. A certificate, duly executed by the Chief Executive Officer of the Company, dated as of the Closing, in the form attached hereto as Schedule 2.2.1.6 (the “Compliance Certificate”).

2.2.1.7. Existing Company CLA Amendments. The Company shall deliver to the Investor the Existing Company CLA Amendments, in the form attached hereto as Schedule 2.2.1.8, duly executed by the requisite majority of lenders under the Existing Company CLAs necessary in order to effectuate the Existing Company CLA Amendments and the conversion of the First Company CLA.

2.2.2. Payment of Initial Principal Amount. The Investor shall cause the transfer to the Company of the Initial Principal Amount by wire transfer in accordance with written instructions of the Company attached hereto as Schedule 2.2.2.

2.2.3. Investors' Rights Agreement. The Amended and Restated Investors' Rights Agreement attached hereto as Schedule 2.2.3 (the “Investors' Rights Agreement” or “IRA”) shall have been executed by each of the Company, the Investor and the other existing shareholders necessary in order to effectuate the Investors’ Rights Agreement.

2.2.4. Indemnification Agreements. The Company shall have executed the indemnification agreements with each of the Company’s directors (including the director designated by the Investor), in the form attached hereto as Schedule 2.2.4.

2.2.5. Call Option Agreement. The Call Option Agreement (as defined in Section 4 below) shall have been executed by the Company, shareholders of the Company holding at least 85% of the Company’s issued and outstanding shares, including the holders of a majority of each class of shares of the Company, and the Investor.

2.3. Transactions and Deliveries at Subsequent Closings.

2.3.1. At the Second Closing, the following transactions shall occur, which transactions shall be deemed to take place simultaneously and no transaction shall be deemed to have been completed or any document delivered until all such transactions have been completed and all required documents delivered: The Company shall (i) if and to the extent legally required with respect to any shares newly issued following the Closing and prior to the Second Closing, deliver to the Investor a waiver of Participation Rights in the same or substantially similar form as provided at the Closing, as applicable to the Second Closing with respect to any shares or convertible securities, options or warrants issued following the Closing, (ii) deliver to the Investor an Officer Certificate duly executed by the CEO of the Company confirming to the Investor that no Material Adverse Change (as defined below) shall have occurred and remains outstanding prior to such date, substantially in the form attached hereto as Schedule 2.3.1 (the “Officer Certificate”). The Investor shall cause the transfer to the Company of the Second Principal Amount by wire transfer in accordance with written instructions of the Company.

|

|

“Material Adverse Change” shall mean (i) as of the Closing and each Subsequent Closing, any change, event or effect that is materially adverse to the business, results of operations, assets, liabilities, or financial condition of the Company, taken as a whole, or that prevents or could reasonably be expected to prevent the consummation of the transactions contemplated by this Agreement or performance by any the Company of any material obligations under this Agreement; and (ii) as of the Second Closing or Third Closing, respectively, any adverse change (a “R&W Material Adverse Change”) to any of the Company’s representations and warranties constituting MAC Representations (as defined below) which meets the materiality criteria specified therein, and remains outstanding as of the Second Closing or Third Closing (as applicable), and, if curable, was not rectified by the Company within 30 days of notice thereof. The “MAC Representations’” mean: (x) with respect to each of the Second Closing and the Third Closing: (x) (a) 5.14 (Intellectual Property) – in the context of any patent infringement claim against the Company, which has been accepted, is subject to ongoing settlement negotiations with the Company, or where such claim has been filed against the Company in any court or arbitration forum, and (b) 5.16 (Litigation) - in the context of any outstanding claim in the amount of at least $2.5M, that is accepted, is subject to ongoing settlement negotiations with the Company, or where such claim has been filed against the Company in any court or arbitration forum ; and (y) with respect to the Third Closing – also 5.20 (Regulatory Matters) – in the context of: revocation, suspension or withdrawal of the FDA Approval below, even if such failure of a MAC Representation does not, in and of itself, meet the criteria set forth in clause (i) of this definition; provided, however, that any effect to the extent resulting or arising from any of the following shall not be considered when determining whether a Material Adverse Change under clause (i) shall have occurred: (a) any change or development in general economic conditions in the industries or markets or countries in which the Company operates, (b) any change in financing, banking or securities markets generally, (c) any act of god (including earthquakes, fires, floods and natural catastrophes) or act of war, armed hostilities or terrorism, change in political environment or any worsening thereof or actions taken in response thereto, and (d) any changes in law or the interpretation thereof; provided that any of the foregoing effects stated in clauses (a) through (d) shall be excluded only to the extent they do not have a disproportionate effect on the Company compared to other similarly situated companies in the same industry or market.

2.3.2. At the Third Closing, the following transactions shall occur, which transactions shall be deemed to take place simultaneously and no transaction shall be deemed to have been completed or any document delivered until all such transactions have been completed and all required documents delivered: The Company shall (i) issue and allot the Third Closing Shares and the Conversion Shares; (ii) deliver to the Investor a validly executed share certificate covering the Third Closing Shares and the Conversion Shares; (iii) register the allotment of the portion of the Third Closing Shares purchased by the Investor, and the Conversion Shares issued upon conversion of the Principal Amount, in its Shareholders Register and deliver a copy thereof to the Investor; (iv) deliver to the Investor an Officer Certificate in the same form as provided at the Second Closing, as applicable to the Third Closing; and (v) the Investor shall transfer the Third Investment Amount, for the Third Closing Shares being purchased to the Company by wire transfer in accordance with written instructions of the Company. Promptly following the Third Closing, the Company shall file the applicable reports with the Israeli Companies Registrar regarding the issuance of the Third Closing Shares.

2.4. Conditions to the Closing and the Subsequent Closings of the Investor. The obligations of the Investor to transfer the Investor’s Initial Principal Amount at the Closing, and to transfer the Investor Second Principal Amount, and the Third Investment Amount, as applicable, at the Subsequent Closings, are subject to the fulfilment at or before the Closing, and the applicable Subsequent Closing (where indicated), of the following conditions precedent, any one or more of which may be waived in whole or in part by the Investor:

|

|

2.4.1. Representations and Warranties. The representations and warranties made by the Company in this Agreement shall have been true and correct when made, and shall be true and correct in all material respects as of the Closing Date.

2.4.2. Covenants. All covenants, agreements, and conditions contained in this Agreement to be performed or complied with by the Company prior to or at the Closing or the applicable Subsequent Closing, shall have been performed or complied with by the Company.

2.4.3. Consents, etc. The Company shall have secured all permits, consents and authorizations that shall be necessary or required lawfully to consummate this Agreement and to issue the Special Share, the Third Closing Shares, and the other securities herein contemplated to the Investor.

2.4.4. Delivery of Documents. All of the documents to be delivered by the Company at the Closing pursuant to this Section 2 shall have been delivered to the Investor. All other applicable actions and transactions set forth in this Section 2 shall have been completed on or prior to the Closing, and prior to each Subsequent Closing, as applicable.

2.4.5. Proceedings and Documents. All corporate and other proceedings in connection with the transactions contemplated by this Agreement shall be reasonably satisfactory in substance and form to the Investor, and the Investor shall have received all such counterpart originals or certified or other copies of such documents as the Investor or its counsel may reasonably request.

2.4.6. No Material Adverse Change.

| 2.4.6.1. | As of the Closing and as of each Subsequent Closing, (i) there shall have been no Material Adverse Change as of such closing following the date of this Agreement and (ii) the Investor shall have received the Company's written confirmation thereof in the Officer Certificate. In the event the Investor claims that the condition set forth in Section 2.4.6 has not been satisfied (notwithstanding the Officer Certificate provided pursuant to Section 2.4.6.1(ii) was provided by the Company (as evidenced by the applicable Officer Certificate), the Investor shall promptly provide notice to the Company within 5 business days of the delivery of such Officer Certificate of its refusal to fund at the Subsequent Closing (as applicable) with a written explanation substantiating the basis for such refusal. |

| 2.4.6.2. | If the Subsequent Closing is not consummated by reason of non- satisfaction of the condition set forth in this Section 2.4.6, the Call Option shall immediately and automatically be deemed extinguished and of no further force and effect as of the date of the applicable Officer's Certificate, the Investor shall not be entitled to make any further investments under this Agreement, and the Company shall at any time be entitled to repay the outstanding Loan Amount. |

|

|

2.4.7. Updating Disclosure Schedule. At least ten (10) business days prior to each Subsequent Closing, the Company shall deliver to the Investor an updated Schedule of Exceptions solely referencing and updating matters that require disclosure in order not to render any representation or warranty in the MAC Representations untrue or incorrect as of the date of such Subsequent Closing. For the avoidance of doubt, the provision of such updated disclosures shall not, in and of itself, preclude the Investor from claiming, in its reasonable discretion, that any matter disclosed therein constitutes or gives rise to an R&W Material Adverse Change.

2.4.8. Milestones. The respective Milestone for such Subsequent Closing shall have been achieved, as determined under this Agreement.

2.4.9. No Injunction. No injunction, judgment, order, decree, statute, law, ordinance, rule or regulation, entered, enacted, promulgated, enforced or issued by any court or other authority of competent jurisdiction or other similar legal restraint or prohibition preventing, enjoining, restraining, prohibiting or making illegal the consummation of the Agreement or any of the transactions contemplated by the Agreement, shall be in effect.

2.5. Conditions to the Closing and the Subsequent Closings of the Company. The obligations of the Company to accept the Principal Loan Amount and the Third Investment Amount and issue the securities contemplated herein to the Investor at the Closing and the Subsequent Closings, as applicable, are subject to the fulfilment at or before the Closing, and the applicable Subsequent Closing, of the following conditions precedent, any one or more of which may be waived in whole or in part by the Company:

2.5.1. Representations and Warranties. The representations and warranties made by the Investor in this Agreement shall have been true and correct when made, and shall be true and correct in all respects as of the Closing, and as of the Subsequent Closing(s).

2.5.2. Payment. The Investor shall pay to the Company the Initial Principal Amount, the Second Principal Amount or the Third Investment Amount, as applicable. For avoidance of doubt, it is clarified that if the Investor is in Default in respect of the Second Closing, and such Default is not fully remedied as set forth in Section 1.8.7, then the Investor shall not be entitled to invest the Third Investment Amount and purchase the Third Investment Shares at the Third Closing. Furthermore, it is clarified that a condition of the Company for the consummation of the Third Closing is the occurrence of the Second Closing, such that, in no event will Investor be entitled to invest the Third Investment Amount, if the Second Closing was not consummated (regardless of the reasoning therefor) and the Second Principal Amount not extended to the Company at the Second Closing.

2.5.3. Performance. The Investor shall have performed and complied with all other agreements, obligations and conditions contained in this Agreement that are required to be performed or complied with by it prior to or at the Closing or the applicable Subsequent Closing, including the execution of each Ancillary Document requiring its execution.

|

|

2.5.4. No Injunction. No injunction, judgment, order, decree, statute, law, ordinance, rule or regulation, entered, enacted, promulgated, enforced or issued by any court or other authority of competent jurisdiction or other similar legal restraint or prohibition preventing, enjoining, restraining, prohibiting or making illegal the consummation of the Agreement or any of the transactions contemplated by the Agreement, shall be in effect.

| 3. | Conversion. |

3.1. Definitions. As used herein:

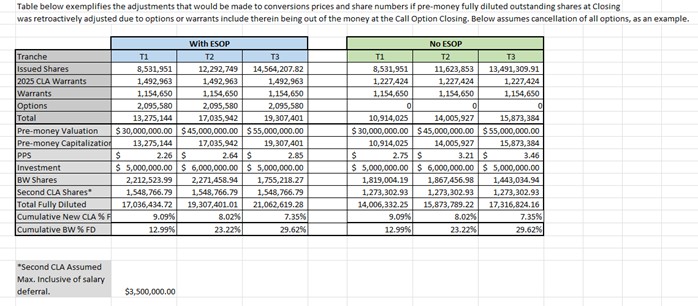

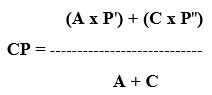

3.1.1. “Conversion Price” means, (A) in respect of the Initial Principal Amount, a price per share of US$2.26 (subject to appropriate adjustment in the event of any share dividend, share split, combination or other similar recapitalization with respect to the applicable Conversion Shares) reflecting a pre-money valuation of US$30,000,000 (thirty million USD) as of the Closing on a Fully Diluted Basis (the “First Conversion Price”); and (B) in respect of the Second Principal Amount a price per share of US$2.64 (subject to appropriate adjustment in the event of any share dividend, share split, combination or other similar recapitalization with respect to the applicable Conversion Shares) reflecting a pre-money valuation of US$45,000,000 (forty five million USD) as of the Closing, on a Fully Diluted Basis (the “Second Conversion Price”), assuming the conversion of the Initial Principal Amount and the Second Company CLA; in each case as further reflected in the Capitalization Table.

3.1.2. “Conversion Shares” means (i) with respect to the Initial Principal Amount – Series S-1 Preferred Shares of the Company (“Preferred S-1 Shares”), and (ii) with respect to the Second Principal Amount – Series S-2 Preferred Shares of the Company (“Preferred S-2 Shares”), in each case having the respective rights, preferences and privileges as set forth in the Amended Articles.

3.1.3. “Exit Event” means a Deemed Liquidation (as defined in the Amended Articles) or an IPO (as defined in the Articles), excluding an acquisition of the Company by the Investor (or any of its affiliates) (i.e., through the exercise of the Call Option or otherwise).

3.1.4. “Fully Diluted Basis” means, the total number of shares of the Company’s outstanding share capital (on an as-converted basis, assuming the implementation of all applicable anti-dilution protections and rights) plus all shares issuable upon the exercise of outstanding options, warrants, or other convertible securities (including the shares issuable upon conversion of the First Company CLAs, but not the Second Company CLAs), whether or not such options, warrants, or other rights are vested or exercisable; all as of the Closing Date, as reflected in the Capitalization Table.

3.2. Conversion upon the Third Investment. To the extent that any part of the Loan Amount has not been repaid or converted pursuant to the terms of this Agreement, in the event of the Third Closing, the entire outstanding balance of the Principal Amount (without any accrued Interest, which, in such event, shall then be deemed waived (i.e. neither converted nor payable) concurrently with the conversion and shall convert into Conversion Shares at the applicable Conversion Price simultaneously with the Third Closing.

|

|

3.3. Conversion upon Exercise of Call Option. To the extent that any part of the Loan Amount has not been repaid or converted pursuant to the terms of this Agreement, in the event that the Investor elects to exercise the Call Option (as defined in Section 4.1), the entire outstanding balance of the Principal Amount (without any accrued Interest, which, in such event, shall then be deemed waived (i.e. neither converted nor payable concurrently with the conversion) shall convert into Conversion Shares at the applicable Conversion Price with effect as of immediately prior to the consummation of the transactions contemplated by the Call Option Agreement (as defined in Section 4.1).

3.4. Optional Conversion. Unless previously converted or repaid, and unless otherwise expressly indicated otherwise under this Agreement (e.g., in the event Investor is a Defaulting Investor), the Investor shall at any time be entitled, upon providing the Company with written notice, to immediately convert the entire then outstanding Principal Amount (without any accrued Interest, which, in such event, shall then be deemed waived (i.e. neither converted nor payable) concurrently with the conversion)into Conversion Shares at the applicable Conversion Price. Upon receiving the written instructions of the Investor in accordance with the provisions of this Section 3.5, the Company shall take all the necessary steps required to effectuate the conversion as described herein, and filing the necessary documents to the Israeli Registrar of Companies, all within fourteen (14) days upon receiving Investor’s notice.

3.5. Conversion upon an Exit Event. Unless previously converted or repaid, in the event of the consummation of an Exit Event, immediately prior to the closing of the Exit Event, the entire outstanding Principal Amount (without any accrued Interest, which, in such event, shall then be deemed waived (i.e., neither converted nor payable) concurrently with the conversion) shall be automatically converted, at the applicable Conversion Price, into Conversion Shares. Upon receiving the written instructions of the Investor in accordance with the provisions of this Section 3.5, instructing the Company to convert the entire Principal Amount into Conversion Shares, then the Company shall take all the necessary steps required to effectuate the conversion as described herein, and filing the necessary documents to the Israeli Registrar of Companies, all within fourteen (14) days upon receiving the Investor’s notice.

3.6. Automatic Conversion – Defaulting Investor. The outstanding Principal Amount (if any) (without any accrued interest which shall be deemed waived (i.e., neither converted nor paid) shall be automatically converted in accordance with and subject to the provisions of Section 1.8.7.

3.7. Notice. For as long as the Loan Amount has not been converted or repaid, the Company shall deliver prior written notice to the Investor of any contemplated Exit Event, as promptly as possible, but in any event at least thirty (30) days prior to the closing of such transaction.

3.8. Automatic Conversion of Second Company CLAs. Immediately prior to, but subject to, the conversion of the outstanding Principal Amount by the Investor, the Second Company CLAs shall be converted according to the terms set forth in the Existing Company CLA Amendments and consistent with this Agreement.

|

|

4. Investor’s Call Option

4.1. Grant of Call Option. A condition to the Closing shall be the execution and delivery, effective as of the Closing, of the definitive Call Option Agreement (in the form attached hereto as Exhibit C (the “Call Option Agreement”)) to purchase all of the Option Purchased Securities (as defined therein directly or indirectly through an affiliate of the Investor, free and clear of any encumbrances, all subject to and in accordance with the terms of the Call Option Agreement.

4.2. [Reserved]

5. Warranties of the Company. The Company hereby represents and warrants to the Investor, and acknowledges that the Investor is entering into this Agreement in reliance thereon, that, except as set forth on the Schedule of Exceptions attached as Schedule 5 to this Agreement, which exceptions shall explicitly reference the representations hereunder to which they relate thereby qualifying only such Company representation or such other Company representations which are readily apparent to be relevant, and shall be deemed to be representations and warranties as if made hereunder, the following representations are true and complete on the date hereof and shall remain true and complete as of the date of the Closing (except to the extent such representations and warranties refer to a specific date, in which case the Company makes such representations and warranties as of such date), it being noted that, with the exception of the representations in Sections 5.1, 5.3, 5.5, 5.6 and 5.8, the representations in this Section 5 shall be read as if made also with respect to each Subsidiary (as defined below).

5.1. Organization. The Company is a private company, duly organized and validly existing under the laws of the State of Israel, and has full corporate power and authority to own, lease and operate its properties and assets and to conduct its business as now being conducted and as proposed to be conducted. A true and correct copy of the Articles of Association of the Company in effect prior to the Closing and prior to the adoption of the Amended Articles (the “Current Articles”) was delivered to counsel to the Investor. The Company has not taken any action or failed to take any action, which action or failure would preclude or prevent the Company from conducting its business after the Closing in the manner heretofore conducted.

5.2. General Compliance with Instruments and Law. The Company is not in violation or default (a) under the Current Articles, or (b) under any material contract, note, indenture, mortgage, lease, purchase order or other instrument, document or agreement to which the Company is a party, or (c) with respect to any law, statute, ordinance, regulation, order, writ, injunction, decree, or judgment of any court or any governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign (any of the foregoing, a “Law”). The Company has not received notice regarding any violation of, conflict with, or failure to comply with, any Law. Without derogating from the generality of the foregoing, the Company is not registered under the status and has not been declared by the Registrar as a “violating company” within the meaning of Section 362A of the Israeli Companies Law, and it has not received any notice or warning (in writing or otherwise) concerning any intention of the Registrar to register and/or declare the Company as a “violating company”.

5.3. Authorization and Approvals Related to the Transaction; No Breach.

|

|

5.3.1. Authorization and Approvals Related to the Transaction. The Company has full power and authority to execute and deliver the Transaction Documents and to consummate the transactions and to perform its obligations contemplated thereby. All corporate action on the part of the Company, its shareholders and directors necessary for the authorization, execution, delivery, and performance of all of the Company's obligations under the Transaction Documents and for the authorization, issuance and allotment of the Securities has been taken or will be taken prior to the Closing and each Subsequent Closing as applicable. The Transaction Documents, when executed and delivered by or on behalf of the Company, shall be duly and validly authorized, executed and delivered by the Company, and shall constitute the valid and legally binding obligations of the Company, legally enforceable against the Company in accordance with their respective terms, except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

5.3.2. No Breach. The execution, delivery and performance by the Company of the Transaction Documents shall not conflict with, or result in a breach, violation or default (or event which with the giving of notice or lapse of time, or both, would become a default) of, any of the terms, conditions and provisions of: (i) the Current Articles or the Amended Articles, (ii) any judgment, order, injunction, decree, or ruling of any court or Governmental Entity (as defined below), domestic or foreign, (iii) any agreement, contract, lease, license or commitment to which the Company is a party or by which it is bound, or to which any of its properties is subject, nor shall it result in the imposition of any Lien (as defined below) upon such assets, (iv) any Law applicable to the Company. Such execution, delivery, compliance and consummation, will not (a) give to others any rights, including rights of prior notice, termination, cancellation or acceleration, in or with respect to any material agreement, contract or commitment referred to in this paragraph, or (b) otherwise require the prior notice to, or consent or approval of, any person or entity (including without limitation any Governmental Entity), which prior notice, consent or approval has not heretofore been delivered or obtained. “Governmental Entity”, or “Government Entity” means any supra-national, national, federal, provincial, state, regional, municipal or local government (including any sub-division, ministry, tribunal, court, body, bureau, agency, public or other authority or instrumentality, department, administrative agency, commission or other authority thereof) or private body exercising any regulatory, taxing, customs, importing or quasi-governmental authority, including but not limited to state-owned or state-controlled entities or enterprises, in each case having jurisdiction or authority.

5.4. Corporate Records. The minute books of the Company contain accurate and complete copies, in all material respects, of the minutes of every meeting (and all written consents in lieu of meetings) of the Company's shareholders and the Board (and any committee thereof). There are no applications or filing outstanding which would reasonably be expected to adversely affect such documents or the corporate status of the Company (except where such applications or filings can be remediated with minimal cost and effort). No material resolutions (including, for the avoidance of any doubt, resolutions regarding the grant of options, issuance of shares or any other securities) have been passed, enacted, consented to or adopted by the Board (or any committee thereof) or shareholders of the Company, except for those contained in such minute books. The corporate records of the Company have been maintained in accordance with all applicable statutory requirements.

|

|

5.5. Subsidiaries. Except as set forth in Section 5.5 of the Schedule of Exceptions, the Company does not own or control any equity security or other interest of any other corporation, limited partnership or other business entity (“Subsidiary”). Each Subsidiary listed in Section 5.5 of the Schedule of Exceptions (A) is duly organized and validly existing under the Laws of the state of its incorporation, is active and has paid all is fees, and has full corporate power and authority to own, lease and operate its properties and assets and to conduct its business as now being conducted and as proposed to be conducted; and (B) is a wholly-owned (directly or indirectly) subsidiary of the Company and no third party, directly or indirectly, owns or has any rights with respect to, any equity security or other interest whatsoever in any of the Subsidiaries. The Company is not a participant in any joint venture, partnership or similar arrangement.

5.6. Capitalization.

5.6.1. Share Capital.

5.6.1.1. Immediately prior to the Closing, the authorized share capital of the Company shall consist of NIS 200,000 divided into: (a) 13,800,000 Ordinary Shares, par value NIS 0.01 each - (i) 2,318,094 of which shall be issued and outstanding; (ii) 1,500,220 of which have been reserved for issuance to employees, consultants, officers, or directors of the Company pursuant to the ESOP and 595,360 of which shall be available for future issuances of options thereunder; (b) 1,400,000 Series A Shares, par value NIS 0.01 each, 1,060,179 of which are issued and outstanding, and 100,000 Series A-1 Shares, par value NIS 0.01 each, 41,849 of which are issued and outstanding; (c) 2,500,000 Series B Shares, par value NIS 0.01 each, 1,363,540 of which are issued and outstanding, and (d) 2,200,000 Series B-1 Shares, par value NIS 0.01 each, 2,128,133 of which are issued and outstanding.

5.6.1.2. Simultaneous with the Closing and as of immediately thereafter, the authorized share capital of the Company shall consist of NIS 391,648 divided into: (a) 21,062,619 Ordinary Shares, par value NIS 0.01 each: (i) 2,488,454 of which shall be issued and outstanding; (ii) 1,500,220 of which have been reserved for issuance to employees, consultants, officers, or directors of the Company pursuant to the ESOP and 595,360 of which shall be available for future issuances of options thereunder; (b) 1,400,000 Series A Shares, par value NIS 0.01 each, 948,581 of which are issued and outstanding; (c) 100,000 Series A-1 Shares, par value NIS 0.01 each, 41,849 of which are issued and outstanding; (d) 2,500,000 Series B Shares, par value NIS 0.01 each, 1,363,540 of which are issued and outstanding; (e) 2,200,000 Series B-1 Shares, par value NIS 0.01 each, 2,069,371 of which are issued and outstanding; (f) 1,621,000 Series B-2 Shares, par value NIS 0.01 each, 1,620,156 of which are issued and outstanding; (g) 1,000,000 Series B-3 Preferred Shares par value NIS 0.01 each, none of which are issued and outstanding; (h) 3,042,000 Series B-4 Preferred Shares par value NIS 0.01 each, none of which are issued and outstanding; (i) 2,212,524 Series S-1 Preferred Shares par value NIS 0.01 each none of which are issued and outstanding; (j) 2,271,458 Series S-2 Preferred Shares par value NIS 0.01 each none of which are issued and outstanding; (k) 1,755,219 Series S-3 Preferred Shares par value NIS 0.01 each none of which are issued and outstanding; and (f) one Special Share, par value NIS 0.01, which is issued and outstanding.

|

|

5.6.2. Exhibit B attached hereto (the “Capitalization Table”) accurately and completely reflects the Company's capitalization on a Fully Diluted Basis, setting forth the number and class or series of shares held by each of the Company's shareholders (all of which are the lawful owners, beneficially and of record, of all of the issued and outstanding share capital of the Company and of all rights thereto) and holders of options to purchase shares of the Company, and the number of reserved and granted or promised options, warrants, and all other rights to subscribe for, purchase or acquire from the Company any share capital of the Company, immediately prior to, and immediately following, the Closing assuming the investment of the entire Initial Principal Amount, Second Principal Amount and Third Investment Amount. All issued and outstanding shares were upon their issuance duly authorized and validly issued, fully paid up, non-assessable, and issued in accordance with applicable securities Laws and no party has any Lien on such shares or anti-dilution rights with respect to such prior issuances.

5.6.3. Simultaneously with the Closing, the number of ESOP Shares issuable under the ESOP shall be 2,095,850 of which 1,500,220 ESOP Shares will have been allocated under the Company’s ESOP Plan and of which 595,630 shall constitute Free ESOP Shares which remain free for future allocation thereunder and shall represent the Free ESOP Percentage. No employee, officer, director or consultant has options or any other securities that provide for accelerated vesting upon a change of control transaction or termination of employment or service or any other event. The Company has not adjusted or amended the exercise price of any share options previously awarded, whether through amendment, cancellation, replacement grant, re-pricing, or any other means. Schedule 5.6.3 of the Schedule of Exceptions sets forth for each outstanding or promised option or equity award: (i) the name of the holder thereof; (ii) the exercise price, (iii) the vesting commencement date and vesting schedule (and any acceleration terms, if any); (iii) whether each such option or award was granted and is subject to tax pursuant to Section 3(i) or Section 102 of the Israeli Income Tax Ordinance [New Version], 1961 (and specifying the subsection of Section 102) or tax regimes of other jurisdictions.