UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2025

Commission File Number: 001-41923

EUPRAXIA PHARMACEUTICALS INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name)

201-2067 Cadboro Bay Road

Victoria, British Columbia, Canada V8R 5G4

Telephone: (250) 590-3968

(Address and telephone number of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒ Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

DOCUMENTS INCLUDED AS PART OF THIS REPORT

| Exhibit | ||

| 99.1 | Management Information Circular | |

| 99.2 | Notice of Annual General and Special Meting of Shareholders | |

| 99.3 | Form of Proxy |

SIGNATURES

| EUPRAXIA PHARMACEUTICALS INC. | ||

| Date: May 30, 2025 | By: | /s/ Alex Rothwell |

| Name: Alex Rothwell | ||

| Title: Chief Financial Officer | ||

Exhibit 99.1

EUPRAXIA PHARMACEUTICALS INC. NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS OF EUPRAXIA PHARMACEUTICALS INC.

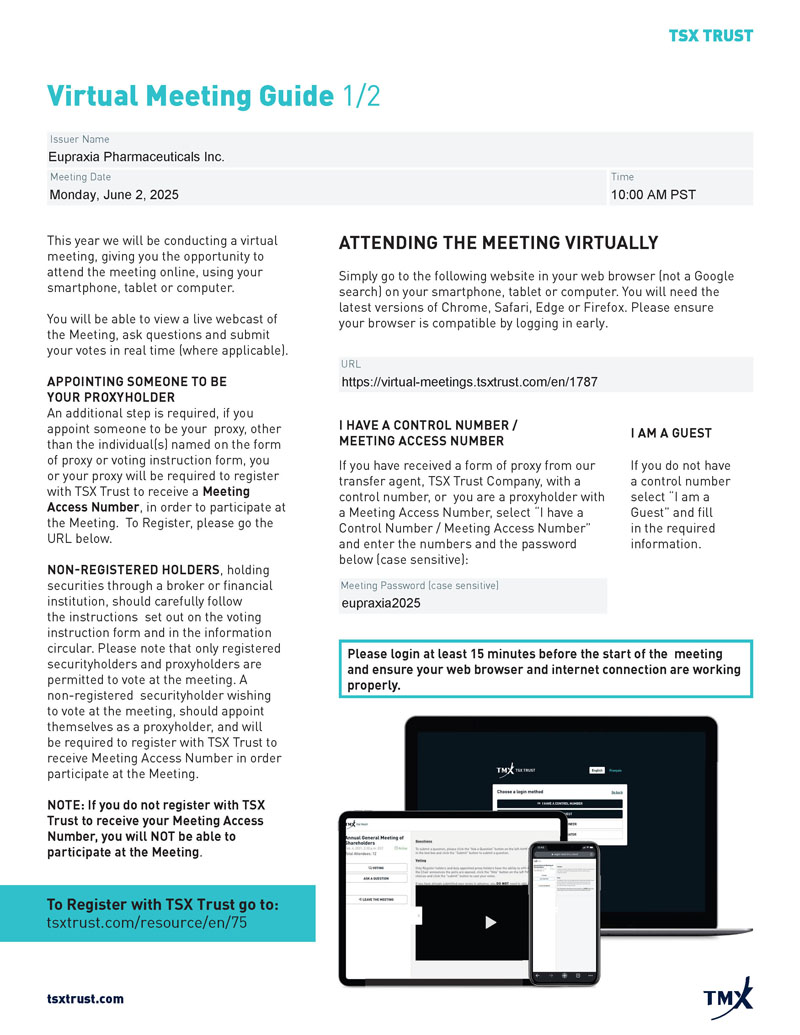

TO BE HELD ON JUNE 2, 2025 MANAGEMENT INFORMATION CIRCULAR DATED: APRIL 25, 2025 1 EUPRAXIA PHARMACEUTICALS INC. Suite 201, 2067 Cadboro Bay Road Victoria, British Columbia Canada V8R 5G4 NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS NOTICE IS HEREBY GIVEN that the annual general and special meeting (the “ Meeting ”) of the shareholders of Eupraxia Pharmaceuticals Inc . (the “ Company ” or “ Eupraxia ”) will be held at 10 : 00 a . m . (Vancouver time) on Monday, June 2 , 2025 via live webcast at https : //virtual - meetings . tsxtrust . com/en/ 1787 (control number provided from TSX Trust Company, case sensitive password : eupraxia 2025 ) . The following items of business will be covered at the Meeting : 1. to receive and consider the audited financial statements of the Company for the years ended December 31, 2024 and 2023, together with the auditor’s report thereon; 2. to set the number of directors for the ensuing year at seven; 3. 4. to elect the directors for the ensuing year ; to appoint an auditor for the ensuing year and authorize the directors to approve the remuneration to be paid to the auditor ; to consider, and if thought fit, to approve an ordinary resolution of disinterested shareholders approving the Company’s 2025 Omnibus Incentive Plan, as more particularly set out in the accompanying Management Information Circular ; to consider, and if thought fit, to approve an ordinary resolution of shareholders approving the re - pricing of certain stock options previously granted to certain non - executive employees, none of which are insiders of the Company, under the Company’s amended and restated stock option plan, as more particularly set out in the accompanying Management Information Circular ; and to transact such other business as may properly come before the Meeting . 5. 6. 7. Virtual only format The Company will hold the Meeting in a virtual - only format, which will be conducted via live audio and slideshow webcast at https : //virtual - meetings . tsxtrust . com/en/ 1787 . Eligible shareholders attending the Meeting may ask questions during the Meeting, as described in more detail in the Management Information Circular (the “Circular”) . Shareholders will not be able to attend the Meeting in person . You can find more information about voting and asking questions during the Meeting in the guide by TSX Trust Company attached as Schedule C to the Circular . Registered shareholders and duly appointed proxyholders will be able to attend, submit questions and vote at the Meeting online at https : //virtual - meetings . tsxtrust . com/en/ 1787 . Non - registered (beneficial) shareholders who have not duly appointed themselves as proxyholder will be able to attend the Meeting as guests, but guests will not be able to vote or ask questions at the Meeting .

You have the right to vote 2 You are entitled to receive notice of and vote at the Meeting, or any adjournment, if you are a registered holder of common shares in the capital of the Company (each, a “ Common Share ”) at the close of business on April 17 , 2025 . Your vote is important If you are a registered shareholder or duly appointed proxyholder, you are entitled to vote at the Meeting online at https : //virtual - meetings . tsxtrust . com/en/ 1787 (control number provided from TSX Trust Company, case sensitive password : eupraxia 2025 ) . If you are unable to attend the Meeting, you are requested to vote your Common Shares using the form of proxy or voting instruction form, as applicable, enclosed with the Circular . Registered shareholders should complete and sign the form of proxy and return it in the envelope provided . Alternative methods of voting by proxy are outlined in the Circular . If you are a non - registered shareholder, you should review the voting instruction form provided by your intermediary, which sets out the procedures to be followed for voting Common Shares held through intermediaries . Shareholders who wish to appoint a proxyholder other than the persons designated by us (including a non - registered shareholder who wishes to appoint themselves as proxyholder) must carefully follow the instructions on their form of proxy or voting instruction form, as applicable . These instructions include the additional step of registering such proxyholder with our transfer agent, TSX Trust Company, after submitting their form of proxy or voting instruction form, as applicable . Failure to register the proxyholder will result in the proxyholder not receiving a control number that is required for them to vote at the Meeting online and, consequently, only being able to attend the Meeting online as a guest . To register as a proxyholder, the shareholder or the proxyholder MUST contact TSX Trust Company by emailing tsxtrustproxyvoting@tmx . com , and complete the Request for Control Number form at https : //tsxtrust . com/resource/en/ 75 , so that TSX Trust Company may provide the proxyholder with a control number via email . Non - registered shareholders located in the United States must also provide TSX Trust Company with a duly completed legal proxy if they wish to vote at the Meeting or appoint a third - party as their proxyholder . Proxies must be received by our transfer agent, TSX Trust Company, by mail at 100 Adelaide Street West, Suite 301 , Toronto, Ontario, Canada, M 5 H 4 H 1 , Attention : Proxy Department ; by facsimile to 1416 - 595 - 9593 ; or online with your 12 - digit control number at www . voteproxyonline . com , by no later than 10 : 00 a . m . (Vancouver time) on May 29 , 2025 or two business days before the commencement of any adjournment(s) or postponement(s) of the Meeting . Shareholders can contact our transfer agent, TSX Trust Company, toll free at 1 - 866 - 600 - 5869 or by email at tsxtis@tmx . com , with questions regarding how to vote their Common Shares . DATED at Vancouver, British Columbia this 25 th day of April 2025 . ON BEHALF OF THE BOARD OF DIRECTORS Signed: James A. Helliwell James A.

Helliwell Chief Executive Officer and Director 3 EUPRAXIA PHARMACEUTICALS INC. Suite 201, 2067 Cadboro Bay Road Victoria, British Columbia Canada V8R 5G4 MANAGEMENT INFORMATION CIRCULAR as at April 25, 2025 GENERAL PROXY INFORMATION This Management Information Circular (the “Circular”) is furnished in connection with the solicitation of proxies by the management of Eupraxia Pharmaceuticals Inc . for use at the annual general and special meeting (the “Meeting”) of its shareholders to be held on Monday, June 2 , 2025 at the time and place and for the purposes set forth in the accompanying notice of the Meeting . In this Circular, references to the “ Company ”, “ Eupraxia ”, “ we ” and “ our ” refer to Eupraxia Pharmaceuticals Inc . “ Common Shares ” means common shares without par value in the capital of the Company . “ Non - Registered Holders ” or “ Beneficial Shareholders ” means shareholders who do not hold Common Shares in their own name and “ intermediaries ” refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders . All amounts are in U . S . dollars (“ $ ” or “US $ ”), unless otherwise stated The Company will hold the Meeting in a virtual - only format, which will be conducted via live audio and slideshow webcast at https : //virtual - meetings . tsxtrust . com/en/ 1787 (control number provided from TSX Trust Company, case sensitive password : eupraxia 2025 ) . Eligible shareholders attending the Meeting may ask questions during the Meeting, as described in more detail in this Circular . Shareholders will not be able to attend the Meeting in person . You can find more information about voting and asking questions during the Meeting in the guide by TSX Trust Company attached as Schedule C to this Circular . Solicitation of Proxies The solicitation of proxies will be primarily by mail, but proxies may be solicited personally or by telephone by directors, executive officers and regular employees of the Company . The Company will bear all costs of this solicitation . We have arranged for intermediaries to forward the meeting materials to beneficial owners of Common Shares held as of the Record Date (as defined herein) by those intermediaries and we may reimburse the intermediaries for their reasonable fees and disbursements in that regard . VOTING INFORMATION Shareholders who wish to appoint a proxyholder other than the person designated by the Company on the proxy form or voting instruction form (including a Non - Registered Holder who wishes to appoint themselves as proxyholder in order to attend and vote at the Meeting online) must carefully follow the instructions in this Circular and on their proxy form or voting instruction form . These instructions include the additional step of registering such proxyholder with our transfer agent, TSX Trust Company, after submitting their proxy form or voting instruction form . Failure to register the proxyholder will result in the proxyholder not receiving a control number that is required for them to vote at the Meeting and, consequently, only being able to attend the Meeting online as a guest .

4 The following information provides guidance on how to vote your Common Shares. Your vote is important As a shareholder of Eupraxia, it is very important that you read this information carefully and then vote your Common Shares, either by proxy or by attending the online Meeting. Voting by proxy means that you are giving the person or people named on your proxy form (each a “ proxyholder ”) the authority to vote your Common Shares for you at the Meeting or any adjournment or postponement thereof . A proxy form is included in this package . If you vote by proxy, the individuals who are named on the proxy form will vote your Common Shares for you, unless you appoint someone else to be your proxyholder . You have the right to appoint a person or company of your choice who need not be a shareholder to represent you at the Meeting other than the individuals designated in the enclosed proxy form . If you appoint someone else, he or she must attend the Meeting to vote your Common Shares . See “ Attending and voting at the virtual meeting ” or “ Voting by Proxy ” for additional information . If you are voting your Common Shares by proxy, our transfer agent, TSX Trust Company, or other agents we appoint must receive your signed proxy form by 10 : 00 a . m . (Vancouver time) on May 29 , 2025 or if the Meeting is adjourned or postponed, prior to 10 : 00 a . m . (Vancouver time) on the second business day preceding the day of the Meeting . Attending and voting at the virtual meeting The Company will hold the Meeting in a virtual - only format, which will be conducted via live audio and slideshow webcast at https : //virtual - meetings . tsxtrust . com/en/ 1787 . Eligible shareholders attending the Meeting may ask questions during the Meeting, as described in more detail in this Circular . Shareholders will not be able to attend the Meeting in person . Registered shareholders and duly appointed proxyholders will be able to attend, participate and vote at the Meeting online at https : //virtual - meetings . tsxtrust . com/en/ 1787 . Such persons may enter the Meeting by clicking “I have a control number” and entering a valid control number and the Password : eupraxia 2025 before the start of the Meeting . Registered shareholders : The control number located on the proxy form or in the email notification you received is your control number . If you are a registered shareholder and choose to vote online at the Meeting, you do not need to complete or return your proxy form . You can login to the Meeting and complete a ballot online during the Meeting . Duly appointed proxyholders : TSX Trust Company will provide the proxyholder with a control number by e - mail after the proxy voting deadline has passed and the proxyholder has been duly appointed AND registered as described in “ How can I appoint a third party as my proxyholder? ” below . Guests, including Non - Registered Holders who have not duly appointed themselves as proxyholder can login to the Meeting by clicking “I am a guest” and completing the online registration form . Guests will be able to listen to the Meeting but will not be able to vote or ask questions at the Meeting . If you attend the Meeting, it is important that you are connected to the internet at all times during the Meeting in order to vote when balloting commences . You should ensure you have a strong, preferably high - speed internet connection wherever you intend to participate in the Meeting . You will need the latest versions of Chrome, Safari, Edge or Firefox . Please do not use Internet Explorer .

Online check - in will begin 5 30 minutes prior to the Meeting on June 2 , 2025 at 9 : 30 a . m . (Vancouver time) . The Meeting will begin promptly at 10 : 00 a . m . (Vancouver time) on June 2 , 2025 , unless otherwise adjourned or postponed . You should allow ample time to ensure your web browser and internet connection are working properly and for online check - in procedures . For any technical difficulties experienced during the check - in process or during the Meeting, please refer to the TSX Trust Virtual Meeting Guide mailed to shareholders as well as the notice of the Meeting, this Circular and the form of proxy or voting instruction form, as applicable (collectively, the “ Meeting Materials ”) . Voting by Proxy Registered shareholders You are a registered shareholder if your name appears on your share certificate or on the register maintained by our transfer agent, TSX Trust Company . If you are a registered shareholder, you will receive a proxy form . Registered shareholders have three options to vote by proxy: On the Internet Go to www . voteproxyonline . com and follow the instructions on screen . You will need the 12 - digit control number listed on your proxy . You do not need to return your proxy form if you vote on the internet . By mail Complete, sign and date the accompanying proxy form and return it in the envelope we have provided . Please see “ Completing the Proxy Form ” on the enclosed form for more information . By fax Complete, sign and date the accompanying proxy form and send it by fax to 416 - 595 - 9593 . Please see “ Completing the Proxy Form ” on the enclosed form for more information . If you vote by proxy, the individuals named on the enclosed proxy form will vote your Common Shares for you unless you appoint someone else to be your proxyholder . You have the right to appoint a person or company of your choice who need not be a shareholder to represent you at the Meeting online other than the persons designated in the enclosed proxy form . See below under “ How can I appoint a third party as my proxyholder? ” for instructions . Changing your vote You may change a vote you made by proxy by: voting again online at www . voteproxyonline . com before 10 : 00 a . m . (Vancouver time) on May 29 , 2025 ; or completing a proxy form that is dated later than the proxy form you are changing and mailing it to TSX Trust Company so that it is received at the address indicated before 10 : 00 a . m . (Vancouver time) on May 29 , 2025 . You may revoke a vote you made by proxy by:

6 making a request in writing to the Chair of the Meeting by email at info@eupraxiapharma . com during the Meeting or any adjournment or postponement thereof, or before any vote in respect of which the proxy has been given or taken . The written request can be from you or your authorized attorney . If as a registered shareholder you login to the Meeting online using your control number and you accept the terms and conditions, you will be provided the opportunity to vote by online ballot on the matters put forth at the Meeting . If you vote by online ballot at the Meeting, you will be revoking any and all previously submitted proxies . If you do not vote by online ballot at the Meeting, your previously submitted proxies will not be revoked and will continue to be counted by TSX Trust Company in tabulating the vote with respect to the matters put forth at the Meeting . Non - Registered Holders You are a Non - Registered Holder if your Common Shares are registered either in the name of an intermediary (an “ Intermediary ”) that represents the Non - Registered Holder in respect of its shares or in the name of a depository (a “ Depository ”, such as CDS Clearing and Depository Services Inc . ) of which the Intermediary is a participant . We have distributed copies of the Meeting Materials to Intermediaries for onward distribution to non - objecting Non - Registered Holders and to Non - Registered Holders that are objecting beneficial owners . The Company does not intend to pay for intermediaries to forward the Meeting Materials to objecting Non - Registered Holders . Accordingly, objecting Non - Registered Holders will not receive the Meeting Materials unless their respective intermediaries assume the cost of forwarding such documents to them . Intermediaries are required to forward the Meeting Materials to non - objecting Non - Registered Holders unless a non - objecting Non - Registered Holder has waived the right to receive such materials . Intermediaries often use service companies to forward the Meeting Materials to Non - Registered Holders . Generally, Non - Registered Holders who have not waived the right to receive the Meeting Materials will receive a package from their Intermediary containing either : (a) a voting instruction form that must be properly completed and signed by the Non - Registered Holder and returned to the Intermediary in accordance with the instructions on the voting instruction form; or, less typically, (b) a proxy form that has already been stamped or signed by the Intermediary that is restricted as to the number of shares beneficially owned by the Non - Registered Holder but which otherwise has not been completed . In this case, the Non - Registered Holder who wishes to submit a proxy should properly complete the proxy form and deposit it with TSX Trust Company at the address set forth in the notice of Meeting . The purpose of these procedures is to permit Non - Registered Holders to direct the voting of Common Shares that they beneficially own . We do not have access to the names or holdings of all of our Non - Registered Holders . Should a Non - Registered Holder, who receives either a voting instruction form or a proxy form, wish to attend and vote at the Meeting online (or have another person attend and vote on behalf of the Non - Registered Holder), the Non - Registered Holder should follow the instructions contained on the voting instruction form or proxy form within the time periods specified and appoint themselves (or another person to vote on their behalf) . In either case, Non - Registered Holders should carefully follow the instructions of their Intermediaries and service companies . If you are a Non - Registered Holder and have not received a package containing a voting instruction form or proxy form, please contact your Intermediary .

See above 7 for additional information on how to log in to the Meeting online and see “ How can I appoint a third party as my proxyholder? ” below for additional information on how Non - Registered Holders can appoint themselves as proxyholder . Changing your vote A Non - Registered Holder may revoke a voting instruction form or proxy which has been given to an Intermediary by written notice to the Intermediary or by submitting a voting instruction form or proxy bearing a later date in accordance with the applicable instructions . In order to ensure that an Intermediary acts upon a revocation of a proxy or voting instruction form, the written notice should be received by the Intermediary well in advance of the Meeting . Completing the proxy form or voting instruction form You can choose to vote “For”, “Against” or “Withhold”, depending on the items listed on the proxy form. When you sign the proxy form, you authorize the directors and officers of the Company who are named in the proxy form to vote your Common Shares for you at the Meeting according to your instructions, unless you have appointed someone else to act as your proxy . If you return your proxy form and do not tell us how you want to vote your Common Shares, your vote will be counted : FOR the election of each of the directors nominated for election as listed in this Circular; FOR setting the number of directors for the ensuing year at seven; FOR the appointment of KPMG LLP, Chartered Professional Accountants as auditor of the Company and the authorization of the directors to fix the auditor’s remuneration; FOR the ordinary resolution approving the Company’s omnibus incentive plan; and FOR the ordinary resolution approving the re - pricing of certain stock options previously granted to certain non - executive employees, none of which are insiders of the Company. If you are appointing someone else to vote your Common Shares for you at the Meeting, write the name of the person voting for you in the space provided AND register such proxyholder with our transfer agent, TSX Trust Company, after submitting your proxy form . If you do not specify how you want your Common Shares voted, your proxyholder will vote your Common Shares as he or she sees fit on each item and on any other matter that may properly come before the Meeting . If you are an individual shareholder, you or your authorized attorney must sign the form. If you are a corporation or other legal entity, an authorized officer or attorney must sign the form. If you have questions on how to complete your proxy form, please contact TSX Trust Company – Investor Services at 1 - 866 - 600 - 5869. How can I appoint a third party as my proxyholder? The following applies to shareholders who wish to appoint another person of their choice to represent them at the Meeting (a “ third party proxyholder ”), other than the management proxyholders designated in the enclosed proxy form or voting instruction form accompanying this Circular . This includes Non - Registered Holders who wish to appoint themselves as proxyholder to attend, ask questions and vote online at the Meeting .

Shareholders who wish to appoint a third party proxyholder to represent them and vote their Common Shares at the Meeting MUST submit their proxy form or voting instruction form, as applicable, appointing that third party proxyholder, AND register that third party proxyholder online, as described below . Registering your third party proxyholder is an additional step that must be completed AFTER you have submitted your proxy form or voting instruction form . Failure to register your third party proxyholder will result in the third party proxyholder not receiving a Control Number, which is used as their online sign - in credentials and is required for them to vote at the Meeting . Step 1 – Submit your proxy form or voting instruction form : To appoint a third party proxyholder, insert that person’s name in the blank space provided in the proxy form or voting instruction form (if permitted) and follow the instructions for submitting such proxy form or voting instruction form prior to the proxy cut - off time . This must be completed before registering the proxyholder, which is an additional step to be completed once you have submitted your proxy form or voting instruction form . Step 2 – Register your proxyholder : To register as a third party proxyholder, the proxyholder must contact TSX Trust Company at tsxtrustproxyvoting@tmx . com to request a control number to be represented and voted at the Meeting by 10 : 00 a . m . (Vancouver time) on May 29 , 2025 and provide TSX Trust Company with the required proxyholder contact information so that TSX Trust Company may verify the appointment and provide the proxyholder with a Control Number via email . Without a Control Number, proxyholders will not be able to vote or ask questions at the Meeting . They will only be able to attend the Meeting online as a guest . It is the responsibility of shareholders to advise their proxyholder to contact TSX Trust Company to request a control number . Third party proxyholders can also download a form to request a control number at https : //www . tsxtrust . com/resource/en/ 75 . Make sure that the person you appoint as your third party proxyholder is aware that he or she has been appointed and attends the Meeting online . If you are a Non - Registered Holder and wish to vote online at the Meeting, you have to insert your own name in the blank space provided on the proxy form or voting instruction form sent to you by your Intermediary, follow the applicable instructions provided by your Intermediary, AND register yourself as your proxyholder, as described below . By doing so, you are instructing your Intermediary to appoint you as proxyholder . It is important that you comply with the signature and return instructions provided by your Intermediary . If yo u a r e a Non - Registered Holder located in the United States an d wish to vote at the Meeting, o r , if yo u a r e permitted to appoint a third party as you r proxyholder, in addition to the steps described abov e und e r “Attending an d voting at the virtual meeting” , yo u must obtain a valid legal p r o x y from you r Intermediary . You must follow the instructions from your Intermediary which are included with the legal proxy form a n d the voting information form sent to y o u . If y o u h a v e not received o n e , y o u must contact your Intermediary to request a legal proxy form or a legal proxy . After obtaining a valid legal proxy from your Intermediary, y o u must then submit such legal proxy to TSX Trust Company . Requests for registration from Non - Registered Holders located in the United States that wish to vote online at the Meeting or, if permitted to appoint a third party as their proxyholder, must b e deposited with TSX Trust Company by email at tsxtrustproxyvoting@tmx . com ; registered holders may also deposit their proxies b y e - mail to tsxtrustproxyvoting@tmx . com a n d in both cases, must b e labeled “Legal Proxy” a n d received n o later than the voting deadline of 10 : 00 a . m . (Vancouver time) o n Ma y 29 , 202 5 or, if the Meeting is adjourned or pos t p oned, by 10 : 00 a . m . (Vancouver time) on the last business d ay preceding the pre c ed i ng the day of the reconvened Meeting . The Chair of the Meeting has the discretion to accept proxies received after su c h deadline only at the Meeting . Notwithstanding the foregoing, the Chair of the Meeting will not be ab l e to accept su c h proxies at the Meeting for shareholders wishing to appoint another p e r son (who need not be a 8 9 shareholder) to represent them at the Meeting virtually, including in respect of Non - Registered holders who wish to appoint themselves as proxyholder.

Notice to Shareholders in the United States The solicitation of proxies and the matters to be voted on, as contemplated in this Circular, involve securities of an issuer located in Canada and are being effected in accordance with the corporate laws of the Province of British Columbia, Canada and securities laws of the provinces of Canada . As a “foreign private issuer” as defined under Rule 3 b - 4 under the United States Securities Exchange Act of 1934 , as amended (the “ 1934 Act ”), the proxy solicitation rules under the 1934 Act, including Regulation 14 A thereunder, are not applicable to the Company or this solicitation, and this solicitation has been prepared in accordance with the disclosure requirements of the securities laws of the provinces of Canada . Shareholders should be aware that disclosure requirements under the securities laws of the provinces of Canada differ from the disclosure requirements under United States securities laws . The enforcement by shareholders of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the Business Corporations Act (British Columbia), as amended, certain of its directors and its executive officers are residents of Canada and a substantial portion of its assets and the assets of such persons are located outside the United States . Shareholders may not be able to sue a foreign company or its executive officers or directors in a foreign court for violations of United States federal securities laws . It may be difficult to compel a foreign company and its executive officers and directors to subject themselves to a judgment by a United States court . The Company is listed on the Toronto Stock Exchange (the “ TSX ”) and on the Nasdaq Capital Market (the “ Nasdaq ”) . The Company does not follow Rule 5620 (c) of the rules of the Nasdaq Stock Market LLC (the “ Nasdaq Listing Rules ”) regarding minimum quorum for meetings of shareholders and instead follows its home country practice . The Nasdaq minimum quorum requirement under Rule 5620 (c) for a shareholder meeting is 33 - 1 / 3 % of the outstanding shares of a company’s common voting stock . In addition, a company listed on Nasdaq is required to state its quorum requirement in its by - laws . Under the Company’s articles, quorum for a meeting of the Company’s shareholders is at least one person who is, or who represents by proxy, one or more shareholders who, in the aggregate, hold at least 5 % of the issued shares of the Company entitled to be voted at the meeting . The Business Corporations Act (British Columbia) defers to the quorum requirements in a corporation’s articles . The primary market for the Company’s common shares in Canada is the TSX . The rules of the TSX do not contain quorum requirements . As a result, the Company’s quorum requirements in respect of shareholder meetings are not prohibited by the Business Corporations Act (British Columbia) or the rules of the TSX . VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES The board of directors of the Company (the “ Board ”) has fixed April 17 , 2025 as the record date (the “ Record Date ”) for determination of persons entitled to receive notice of and to vote at the Meeting . Only shareholders of record at the close of business on the Record Date who either attend the virtual Meeting or complete, sign and deliver a form of proxy in the manner and subject to the provisions described above will be entitled to vote or to have their Common Shares voted at the Meeting . The Common Shares of the Company are listed for trading on the TSX and the Nasdaq. As of the Record Date, there were 35,849,353 Common Shares issued and outstanding, each carrying the right to one vote. No group of shareholders has the right to elect a specified number of directors, nor are there cumulative or similar voting rights attached to the Common Shares.

10 To the knowledge of the directors and executive officers of the Company, no persons or corporations beneficially owned (as determined under applicable Canadian securities laws), directly or indirectly, or exercised control or direction over, Common Shares carrying 10 % or more of the voting rights attached to all outstanding Common Shares of the Company as at the Record Date . FINANCIAL STATEMENTS The audited financial statements of the Company for the years ended December 31 , 2024 and 2023 , report of the auditor and related management discussion and analysis, all of which may be obtained from SEDAR+ at www . sedarplus . ca , or from EDGAR at www . sec . gov, that will be placed before the Meeting have been filed with the securities commissions or similar regulatory authority in all provinces of Canada, other than Québec . VOTES NECESSARY TO PASS RESOLUTIONS Other than as described below, a simple majority of affirmative votes cast at the Meeting is required to pass the resolutions described herein . Pursuant to the rules of the TSX, the approval of the Omnibus Plan Resolution (as defined herein), requires disinterested shareholder approval . Disinterested shareholder approval is the approval by a majority of the votes cast on the ordinary resolution by all shareholders at the Meeting, excluding the votes attached to Common Shares beneficially owned by insiders (as defined under the rules of the TSX) of the Company and their associates (as defined under the rules of the TSX) . If there are more nominees for election as directors or appointment of the Company’s auditor than there are vacancies to fill, the nominees receiving the greatest number of votes will be elected or appointed, as the case may be, until all such vacancies have been filled . If the number of nominees for election or appointment is equal to the number of vacancies to be filled, all such nominees will be declared elected or appointed as directors by ballot in accordance with the Company’s Majority Voting Policy (as defined below) . PARTICULARS OF MATTERS TO BE ACTED UPON 1. Setting the Number of Directors – See heading “ Number of Directors ”. 2. Election of Directors – See heading “ Election of Directors ”. 3. Appointment of Auditor – See heading “ Appointment of Auditor ”. 4. Approval of Omnibus Incentive Plan – See heading “ Approval of Omnibus Incentive Plan” . 5. Approval of Option Re - Pricing – See heading “ Approval of Option Re - Pricing” . NUMBER OF DIRECTORS The Articles of the Company set out that the number of directors of the Company will be a minimum of three and a maximum of the most recently set of (i) the number of directors set by ordinary resolution (whether or not previous notice of the resolution was given) and (ii) the number of directors set in the event that the places of any retiring directors are not filled by an election at a meeting of shareholders . At the Meeting, the shareholders will be asked to pass an ordinary resolution setting the number of directors of the Company at seven . To be approved, the resolution must be passed by a majority of the votes cast by the holders of Common Shares at the Meeting . Management recommends a vote “for” in respect of the resolution setting the number of directors of the Company at seven .

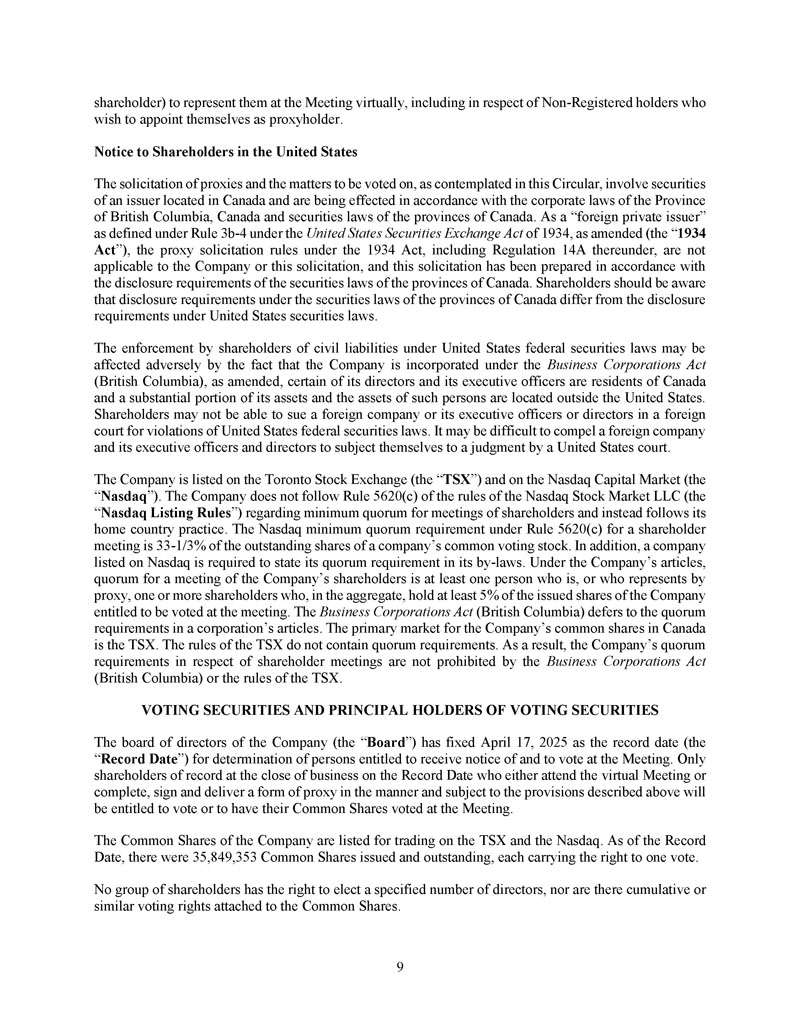

11 ELECTION OF DIRECTORS The term of office of each of the seven current directors will end at the conclusion of the Meeting . Unless a director’s office is vacated earlier in accordance with provisions of the Business Corporations Act (British Columbia), each of the seven directors elected at this Meeting will hold office until the conclusion of the next annual meeting of the Company, or if no director is then elected, until a successor is elected . Advance Notice Policy The Company has adopted an advance notice policy (the “ Advance Notice Policy ”) . Pursuant to the Advance Notice Policy, any additional director nominations for an annual general meeting must be received by the Company, not less than 30 days prior to the date of the annual meeting ; provided, however, that in the event that the annual meeting of shareholders is to be held on a date that is less than 50 days after the date on which the first public announcement of the date of the annual meeting was made, notice by the nomination shareholder may be made not later than the close of business on the tenth day following the notice date . If no nominations are received by May 3 , 2025 , being the date which is 30 days prior to the Meeting, management’s nominees for election as directors set forth below shall be the only nominees eligible to stand for election at the Meeting . The full text of the Advance Notice Policy is available on the Company’s website at https://eupraxiapharma.com/investors/governance . Majority Voting Policy The Company has adopted a majority voting policy (the “ Majority Voting Policy ”) . Pursuant to the Majority Voting Policy, shareholders vote, or withhold from voting, for the election of each individual director rather than for a fixed slate of directors . Further, in an uncontested election of directors, the number of shares “withheld” for any nominee exceeds the number of shares voted “for” the nominee, then, notwithstanding that such director was duly elected as a matter of corporate law, he or she shall, immediately upon receipt of the final scrutineer’s report on the ballot, tender his or her written resignation to the Chair of the Board . The Nominating and Corporate Governance Committee of the Company (the “ Nominating and Corporate Governance Committee ”) will consider such offer of resignation and will make a recommendation to the Board concerning the acceptance or rejection of the resignation . In its deliberations, the Nominating and Corporate Governance Committee will consider all factors deemed relevant . The Board will take formal action on the Nominating and Corporate Governance Committee’s recommendation no later than 90 days of the date of the applicable shareholders’ meeting and announce its decision by press release to the TSX . Absent exceptional circumstances, the Board will be expected to accept the resignation which will be effective on such date . If the Board declines to accept the resignation, it will include in the press release the reason or reasons for its decision . Management recommends a vote “for” the appointment of each of the following nominees as directors of the Company . The full text of the Majority Voting Policy is available on the Company’s website at https://eupraxiapharma.com/investors/governance . Nominees The following table sets out, among other things, the names of management’s seven nominees for election as directors, all major offices and positions with the Company each now holds, each nominee’s principal occupation, business or employment, the period of time during which each has been a director of the Company and the number of Common Shares of the Company beneficially owned by each, directly or indirectly, or over which each exercised control or direction, as at April 25 , 2025 :

12 Common Shares Beneficially Owned, Controlled or Directed (1) Date Appointed as a Director of the Company Principal Occupation or Business or Employment in the Past Five Years Name, Province of Residence and Position with Eupraxia 674,012 (5) July 23, 2012 Chief Executive Officer, Eupraxia Pharmaceuticals Inc. (July 2012 – Present) James A. Helliwell British Columbia, Canada Chief Executive Officer and Director 8,626 (6) January 14 , 2013 (as Director) and January 24 , 2013 (as Chairman) Chair of the Board, Founder and Chief Executive Officer, XYON Health Inc. (Jan 2019 – Present) Director, Alpha - 9 Oncology Inc. (May 2020 – 2024) Non - Executive Chair of the Board, Xenon Pharmaceuticals, Inc. (June 2022 – 2024) Executive Chair of the Board, Xenon Pharmaceuticals, Inc. (June 2021 – June 2022) Chief Executive Officer, Xenon Pharmaceuticals, Inc. (January 2003 – June 2021) Simon Pimstone (2)(3)(4) British Columbia, Canada Chairman of the Board and Director 13,930 (7) March 9, 2021 Chairman of the Board, ESSA Pharma Inc. (October 2010 – Present) Co - founder and Executive Chairman (September 2013 – February 2014) and Chairman of the Board (February 2014 – April 2019) and Chief Executive Officer (February 2017 – April 2019), Aurinia Pharmaceuticals Inc. Venture Partner, Lumira Ventures (March 2016 – Present) Richard M. Glickman (2)(4) British Columbia, Canada Director 340,346 (8) January 14, 2013 Chief Executive Officer, Discovery Parks Investments Ltd. and Nimbus Synergies Inc. (May 2017 – Present) Paul Geyer (3) British Columbia, Canada Director 1,212,466 (9) January 14, 2013 Director, AbCellera Biologics Inc. (November 2020 – Present) Director, XYON Health Inc. (June 2021 – Present) Director, Canada Pension Plan Investment Board (February 2017 – Present) Director, Aritzia Inc. (July 2019 – February 2025) Director, Manulife. (February 2025 – Present) John Montalbano (3)(4) British Columbia, Canada Director 224,865 (10) January 14, 2013 Orthopaedic Surgeon, Partner in OrthoArizona practice (2002 – Present) Michael Wilmink (2) Phoenix, Arizona Director 1,501,200 (11) October 31, 2024 Director, Centre for Aging and Brain Health Innovation (2021 – Present) Director, Bridgemarq Real Estate Services (2020 – Present) Director, Total Containment Inc. (March 2022 – Present) Joseph Freedman Toronto, Canada Director Notes: ( 1 ) The information as to principal occupation, business or employment (for the preceding five years for any new director) and Common Shares beneficially owned, controlled or directed is not within the knowledge of the management of the Company and has been furnished by the respective nominees themselves . Beneficial ownership is determined in accordance with applicable Canadian securities laws .

13 (10) (11) (2) Members of the Compensation Committee of the Company (the “ Compensation Committee ”), with Richard Glickman as chair. (3) Members of the Audit Committee of the Company (the “ Audit Committee ”), with John Montalbano as chair. (4) Members of the Nominating and Corporate Governance Committee, with Simon Pimstone as chair. (5) James Helliwell holds stock options (the “ Options ”) to acquire 1 , 244 , 250 Common Shares, Founders Warrants to acquire 100 , 500 Underlying Founder Warrants and 100 , 500 Common Shares, 2013 Warrants to acquire 150 , 000 Common Shares, and 30 , 000 Common Share purchase warrants (the “ 2022 Warrants ”) from the Company’s overnight marketed public offering of units consisting of Common Shares and 2022 Warrants that closed on April 20 , 2022 . “Founders Warrants”, “Underlying Founders Warrants” and “ 2013 Warrants” are defined in the Company’s long - form prospectus dated March 3 , 2021 (the “ Prospectus ”), which is available under the Company’s profile on SEDAR+ at www . sedarplus . ca . (6) Simon Pimstone holds Options to acquire 263 , 750 Common Shares, and Founders Warrants to acquire 125 , 000 Underlying Founder Warrants and 125 , 000 Common Shares . (7) Richard Glickman holds Options to acquire 240 , 000 Common Shares . Richard Glickman and his spouse each hold 3 , 125 common share purchase warrants that were distributed pursuant to the Prospectus and are listed on the TSX, with the terms of such warrants described in the Prospectus (each, an “ IPO Warrant ”) . (8) Common Shares are held through Paul Geyer’s holding company . Paul Geyer holds Options to acquire 206 , 250 Common Shares, Founders Warrants to acquire 25 , 000 Underlying Founder Warrants and 25 , 000 Common Shares, 12 , 500 IPO Warrants to acquire 12 , 500 Common Shares, and 2022 Warrants to acquire 48 , 725 Common Share . (9) John Montalbano holds Options to acquire 213 , 750 Common Shares, Founders Warrants to acquire 25 , 000 Underlying Founder Warrants and 25,000 Common Shares, IPO Warrants to acquire 21,875 Common Shares, and 2022 Warrants to acquire 243,900 Common Shares. Michael Wilmink holds Options to acquire 190,000 Common Shares, Founders Warrants to acquire 10,000 Underlying Founder Warrants and 10,000 Common Shares, and IPO Warrants to acquire 1,525 Common Shares. Joseph Freedman holds Options to acquire 135,000 Common Shares, common share purchase warrants to acquire 170,000 Common Shares, and 3,173,985 Series 1 Preferred Shares, convertible on a one - to - one basis into Common Shares for no additional consideration. None of the proposed nominees for election as a director of the Company are proposed for election pursuant to any arrangement or understanding between the nominee and any other person, except the directors and senior officers of the Company acting solely in such capacity . Further, the Board has reviewed the above proposed nominees for election as a director of the Company and has recommended that each proposed nominee be up for election as a director of the Company at the Meeting . Director Biographies James A. Helliwell, MD, Chief Executive Officer and Director Dr . Helliwell is the Co - founder and CEO of Eupraxia Pharmaceuticals . A board - certified Cardiac Anesthesiologist, he previously maintained a busy quaternary clinical and academic practice with a focus on cardiac transplantation and held a double tenure as President of the Anesthesiologists of BC . Dr . Helliwell’s experience in the operating room and ICU instilled an appreciation for the value of precision drug delivery to achieve successful patient outcomes . This led him to create Eupraxia Pharmaceuticals, a company developing precision medicines in areas of high unmet medical need . In 2021 , Eupraxia became the first biotech to successfully list exclusively on the Toronto Stock Exchange in almost 20 years . The company’s lead product candidate – a long - acting corticosteroid to treat osteoarthritis pain – is currently in Phase 2 clinical development . Dr . Helliwell has also applied precision delivery to the medical device space . As Co - founder and CEO of Accuro Technologies, he invented Arthrotap® – a medical device to improve the accuracy of intra - articular injections . After successfully transacting on Accuro, he moved on to serve as Chair of the Board for Guidestar Medical Devices – a company focused on precision medicines delivery for the epidural space . Simon Pimstone, MD, PhD, FRCPC (Chair), Chairman of the Board Dr Pimstone is founder and CEO of XYON Health Inc . , a privately held Canadian Company delivering innovative healthcare solutions for men and women with hair loss . He has also held various management, board, and advisory roles at companies including Xenon Pharmaceuticals (Nasdaq : XENE), Eupraxia Pharmaceuticals (TSX : EPRX), Alpha 9 Oncology and Kokua Pharmaceuticals .

14 In addition to these roles, Dr . Pimstone has served on the boards of several industry and healthcare associations . He was former chair of LifeSciences BC and the Providence Healthcare Research Trust, as well as being former vice - chair of BIOTECanada . He has also previously chaired the Canadian federal government State of Nation Report . Dr . Pimstone received his MD from the University of Cape Town (MBChB, 1991 ) and is an internal medicine specialist (FRCPC, UBC, 2001 ) . Prior to his specialization, he trained as a clinical research fellow with the Department of Medical Genetics at the University of British Columbia and obtained his PhD in cardiovascular genetics through the University of Amsterdam ( 1998 ) . Dr . Pimstone also serves as a consultant physician at the UBC Medical and Cardiology Clinic at UBC Hospital in Vancouver . Dr. Pimstone has received a number of awards and is widely published. Richard Glickman, L.L.D., Director Dr . Glickman was a co - founder, Chairman and Chief Executive Officer of Aspreva Pharmaceuticals Inc . ( “Aspreva” ) which was acquired by the Galenica Group for $ 915 million . Prior to establishing Aspreva, Dr . Glickman was the co - founder and Chief Executive Officer of StressGen Biotechnologies Corporation . Dr . Glickman currently serves as Chairman of the Board of Directors of Essa Pharma Inc and Engene Corporation, and as Director of Vida Pharmaceuticals . In addition, Dr . Glickman served as Chairman of the Board and CEO of Aurinia Pharmaceuticals Inc . , until his retirement in April 2019 . He has also been a Venture Partner at Lumira Ventures since March 2016 . Dr . Glickman has served on numerous biotechnology and community boards, including as a member of the Canadian federal government’s National Biotechnology Advisory Committee, Director of the Canadian Genetic Disease Network, Chairman of Life Sciences B . C . and a member of the B . C . Innovation Council . Dr . Glickman is the recipient of numerous awards including the Ernst and Young Entrepreneur of the Year, a recipient of both BC and Canada’s Top 40 under 40 award, the BC Lifesciences Leadership Award and the Corporate Leadership Award from the Lupus Foundation of America . Paul Geyer, P.Eng., Director Mr . Geyer is a Medtech Entrepreneur, angel investor and venture capitalist, and has sat on the Boards of several companies . Over the past 30 years Mr . Geyer founded or led three companies through their growth phase, in one case to exit and in another to a public company . These companies have grown to employ more than 350 people . Mr . Geyer is currently the CEO of Discovery Parks and Nimbus Synergies, a venture capital investment program focused on growing BC Digital Health companies that operate in the intersection between health, life sciences, and technology . He is an active mentor and angel investor in medical technology companies . In 1991 he founded Mitroflow, a tissue heart valve company . Mr . Geyer grew the company from nine employees to more than 125 employees, selling in 1999 for more than $ 50 million . In 2001 , Mr . Geyer founded Medical Ventures (Neovasc) where he is on the board and held the position of CEO until June 2008 and was responsible for raising over $ 40 million in equity financing and overseeing the acquisition of three other companies .

15 From 2009 to 2017 , Mr . Geyer was the first CEO of LightIntegra Technology which developed the ThromboLux, a point of care device to determine platelet quality for blood transfusions . Since 2008 , Mr . Geyer has focused on assisting entrepreneurs to build successful businesses, as a mentor or board member, and as a Fellow of Creative Destruction Labs . He has also worked on building the local community through his involvement as a board member of BCTech, LifeSciences BC, and Science World, Vancouver General Hospital & UBC Hospital Foundation, and Junior Achievement BC along with a number of non - profit community - based organizations . He also participates in a range of philanthropic endeavours . John Montalbano, CFA, Director John retired as CEO of RBC Global Asset Management in 2015 , at which point the company managed $ 370 billion in assets, placing it among the 50 largest asset managers worldwide . John currently serves as Director and Audit Chair for the following organizations : Canada Pension Plan Investment Board, AbCellera Inc . (NASDAQ), and Eupraxia Pharmaceuticals (TSX) . He also serves as Director forManulife and Chairs White Crane Capital, a Vancouver - based hedge fund . John’s past volunteer roles have included Chair of the UBC Board of Governors, Chair of St . Paul's Foundation, Chair of The Vancouver Police Foundation, Killam Trusts Trustee, Co - Founder of Take a Hike Youth at Risk Foundation, Chair of the Vancouver Public Library Capital Campaign and Director/Chair Investments for the Asia Pacific Foundation of Canada . He serves as a Director for the Rideau Hall Foundation, and Windmill Microlending . John holds a Chartered Financial Analyst designation, a Bachelor of Commerce degree with Honours from the University of British Columbia, and an Honorary Doctor of Letters degree from Emily Carr University of Art and Design . Michael Wilmink, MD, Director Dr . Wilmink is an Orthopaedic surgeon and partner in OrthoArizona where he is active in both the Operations Committee and Research Committee . Dr . Wilmink was an inventor of the muscle sparing anterior approach technique for hip replacements and currently lectures and teaches this technique to surgeons across the United States . In addition, Dr .

Wilmink is a surgeon designer for NextStep Arthropedix and has brought two FDA approved hip replacement systems to the market and a total knee system coming 16 to the clinical market in 2021 . Dr . Wilmink is active in the Phoenix medical community sitting on the boards of OASIS Surgical Hospital and the Gateway Outpatient Surgical Center . Michael completed his undergraduate education at University of California at Los Angeles in Physiological Sciences and was a scholarship All American Water Polo player . Dr . Wilmink completed his Medical Degree and Orthopaedic Surgical Residency at UBC . Outside of the medical world, Dr . Wilmink was elected to be a Phoenix Thunderbird and collaborates with business leaders in the community to run and operate the Waste Management Phoenix Open PGA Golf Tournament . Joseph Freedman, MBA, LLB, Director Mr . Freedman is a private equity investor and corporate director with more than 25 years industry experience including, most recently, 18 years at Brookfield Asset Management, one of the world’s leading private equity and alternative asset management firms . Over his career at Brookfield, M r . Freedman has held a nu m ber of positions, including Vice Chair of Private Equi t y , General Counsel a nd the Partner responsible for M&A transaction execution, fund formation a n d fund operations . Prior to joining Brookfield, he was a lawyer in the corporate finance group at a Toronto law firm, specializing in private equity transactions and public company mergers and acquisitions . Now retired from Brookfield, Mr . Freedman is a director of several private and public companies and non - profit organizations including the Centre for Aging and Brain Health Innovation (co - chair), Bridgemarq Real Estate Services (TSX : BRE) and Total Containment Inc . Mr . Freedman holds a joint MBA/LL . B from the Schulich School of Business at York University and Osgoode Hall Law School in Toronto . Cease Trade Orders and Bankruptcies No proposed director of the Company is, as of the date of this Circular, or has been, within the ten years prior to the date hereof, a director or chief executive officer or chief financial officer of any company (including the Company) that : (i) was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant issuer access to any exemption under securities legislation, that was in effect for a period or more than 30 consecutive days (an “ Order ”) that was issued while the director or executive officer was acting in the capacity as director, chief executive officer or chief financial officer of such issuer, or (ii) was subject to an Order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer . No proposed director of the Company is, at the date of this Circular, or has been within ten years before the date of this Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets .

Penalties and Sanctions 17 No proposed director of the Company has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority, or has been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director . Individual Bankruptcies No proposed director of the Company has, within the ten years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director . APPOINTMENT OF AUDITOR KPMG LLP, at its offices located at 777 Dunsmuir Street, Vancouver, BC V 7 Y 1 K 3 , will be nominated at the Meeting for reappointment as auditor of the Company at remuneration to be fixed by the directors . KPMG LLP was originally appointed as auditor of the Company on August 30 , 2023 . To be approved, the resolution must be passed by a majority of the votes cast by the holders of Common Shares at the Meeting . Management recommends a vote “for” in respect of the resolution approving the appointment of the auditor and authorizing the directors to fix the auditor’s remuneration . APPROVAL OF OMNIBUS INCENTIVE PLAN Under the recommendation of the Compensation Committee, on February 17 , 2025 , the Board approved the adoption of the 2025 Omnibus Incentive Plan (the “ Omnibus Plan ”), a copy of which is attached as Schedule B to the Circular . Pursuant to the rules and policies of the TSX, the adoption of the Omnibus Plan must be ratified and confirmed by the Company’s shareholders at the Meeting . If approved, the Company’s existing amended and restated stock option plan, adopted by the Board on March 9 , 2021 , and amended on May 3 , 2021 and October 27 , 2021 (the “ Existing Option Plan ”) will be replaced by the Omnibus Plan . The Existing Option Plan was last approved by shareholders at the annual general meeting of the Company held on June 6 , 2024 . The Existing Option Plan has been frozen, and if the Omnibus Plan is approved by shareholders at the Meeting, all future equity awards will be issued under the Omnibus Plan . Options granted under the Existing Option Plan will remain outstanding and governed by the terms of the Existing Option Plan . If the Omnibus Plan is not approved, the Existing Option Plan will remain in place and options may continue to be granted under the Existing Option Plan . A summary of the material provisions of the Existing Option Plan is set out under the heading “ Particulars of the Existing Stock Option Plan ” . The purpose of the Omnibus Plan is to attract, retain and reward those employees, directors and other individuals who are expected to contribute significantly to the success of the Company, to incentivize such individuals to perform at the highest level, to strengthen the mutuality of interests between such individuals and the Company’s shareholders and, in general, to further the best interests of the Company . The following is a description of the key terms of the Omnibus Plan, which is qualified in its entirety by reference to the full text of the Omnibus Plan . Capitalized terms used in this section and not otherwise defined have the meaning ascribed to them in the Omnibus Plan .

Summary of the Omnibus Plan 18 Types of Awards The Omnibus Plan provides for the grant of options, stock appreciation rights, restricted stock, restricted stock units, deferred stock units, performance awards, other stock - based awards and cash - based awards (each an “ Award ” and collectively, the “ Awards ”) . Plan Administration The Omnibus Plan is administered by the Compensation Committee . Subject to the terms of the Omnibus Plan and applicable law, and the rules of the TSX and the Nasdaq, as applicable, the Compensation Committee (or its delegate) will have the power and authority to, among other things, designate participants and determine the types of Awards to be granted, number of shares to be covered and the terms and conditions of those Awards . It will also have the authority to interpret and administer the Omnibus Plan and any instrument or agreement relating to the Omnibus Plan and to make any other determination and take any other action that the Compensation Committee deems necessary or desirable for the administration of the Omnibus Plan . Shares available for Awards The number of Common Shares available for issuance under the Omnibus Plan is a rolling maximum number equal to 18 . 5 % of the issued and outstanding Common Shares from time to time, provided that the number of Common Shares available for issuance under Incentive Stock Options (within the meaning of Section 422 of the Internal Revenue Code of 1986 ) may not exceed 6 , 594 , 575 . The Omnibus Plan is considered to be an “evergreen” plan as Common Shares covered by Awards which have been exercised or settled, as applicable, will be available for subsequent grant under the Omnibus Plan and the number of Awards that may be granted under the Omnibus Plan increases if the total number of issued and outstanding Common Shares increases . As at the date of this Circular, the Company has 35 , 849 , 353 Common Shares issued and outstanding, and 5 , 572 , 120 Common Shares issuable pursuant to Options granted under the Existing Option Plan (equal to approximately 15 . 54 % of the issued and outstanding Common Shares of the Company) . Currently, there are unallocated entitlements under the Existing Option Plan to purchase 1 , 060 , 010 Common Shares (equal to approximately 2 . 96 % of the issued and outstanding Common Shares of the Company) . The Omnibus Plan does not impose a limitation on the number of Awards that can be granted to any one person . Insider Participation The Omnibus Plan does not include limitations on insider participation. Eligible Participants Any director, employee or consultant of the Company, its subsidiaries or any of its affiliates will be eligible to participate in the Omnibus Plan, on approval by the Compensation Committee . Description of Awards A. Options The Compensation Committee will be permitted to grant stock options under the Omnibus Plan . The exercise price per share and terms of each option will be determined by the Compensation Committee ; provided, however, that the exercise price will not be less than the fair market value of a Common Share on the date that the option is granted .

An option will be exercisable only in 19 accordance with the terms and conditions established by the Compensation Committee in the Award agreement between the Company and the participant (the “ Award Agreement ”) . The Compensation Committee may, in its discretion, provide that an option may become vested and exercisable in whole or in part, in installments, cumulative or otherwise, for any period of time specified by the Compensation Committee and reflected in an Award Agreement . The Compensation Committee will fix the term of each option, not to exceed ten years . Other than for U . S . participants, if the term of an option would otherwise expire during a period of time during which an optionee cannot exercise or sell securities of the Company due to applicable policies of the Company in respect of insider trading (a “ Blackout Period ”), or within ten business days of the expiration thereof, then the term of such option will be extended to the tenth business day following the expiration of the Blackout Period . Stock Appreciation Rights (“ SARs ”) The Compensation Committee will be permitted to grant SARs under the Omnibus Plan . SARs may be granted to participants either alone (“ freestanding ”) or in addition to other Awards granted under the Omnibus Plan (“ tandem ”) . A freestanding SAR will not have a term of greater than ten years . In the case of any tandem SAR related to an option, the SAR will not be exercisable until the related option is exercisable and will terminate, and no longer be exercisable, upon the termination or exercise of the related option . A freestanding SAR will not have a grant price less than the fair market value of the share on the date of grant . Other than for U . S . participants, if the term of a SAR would otherwise expire during a Blackout Period, or within ten business days of the expiration thereof, then the term of such SAR will be extended to the tenth business day following the expiration of the Blackout Period . B. C. Restricted Stock and Restricted Stock Units The Compensation Committee will be permitted to grant awards of restricted stock and restricted stock units under the Omnibus Plan . Shares of restricted stock and restricted stock units will be subject to any restrictions that the Compensation Committee may impose, including any limitation on the right to receive any dividend or dividend equivalent . If deemed necessary, the Compensation Committee may require that, as a condition of any grant of restricted stock, the participant will deliver a signed stock power or other instruments of assignment, which would permit transfer to the Company of all or a portion of the shares subject to the award of restricted stock or restricted stock units in the event that the Award is forfeited . Deferred Stock Units The Compensation Committee is permitted to grant deferred stock units under the Omnibus Plan . Deferred stock units will be settled upon expiration of the deferral period by the Compensation Committee in the applicable Award Agreement (which, in the case of a Canadian participant, must be on the earlier of the cessation of service or death) . The Compensation Committee, in its discretion, may award dividend equivalents with respect to awards of deferred stock units . Performance Awards The Compensation Committee may grant a performance award to a participant payable upon the attainment of specific performance goals during the applicable performance period, as set forth in the Award Agreement for the performance award . Other Stock - Based and Cash - Based Awards D. E. F.

20 The Compensation Committee is authorized to grant to participants other awards that may be denominated or payable in, valued in whole or in part by reference to, or otherwise based on, or related to, Common Shares or factors that may influence the value of Common Shares . The Compensation Committee will determine the terms and conditions of such stock - based awards . The Compensation Committee is also permitted to grant cash - based awards to participants . In its discretion, the Compensation Committee will determine the number of cash - based awards to grant to a participant, the duration of the period during which, and any conditions under which, the cash incentive awards will be eligible to vest or will be forfeited, and any other terms and conditions applicable . Financial Assistance Solely to the extent permitted by applicable law and the applicable rules of the TSX and Nasdaq, the Compensation Committee has discretion to determine whether, to what extent and under what circumstances to provide loans (which may be on a recourse basis and will bear interest at the rate the Compensation Committee provides) to participants to exercise options or acquire Common Shares under the Omnibus Plan . Cashless Exercise If agreed to by the Compensation Committee, Options may be exercised in whole or in part at any time during the Option term, by giving written notice of exercise to the Company specifying the number of Common Shares to be purchased, and having the Company withhold Common Shares issuable upon exercise of such Option as payment in full or in part, for the exercise price of such Options . The number of Common Shares to be withheld as payment will be determined based on the fair market value of the Common Shares on the payment date, as determined by the Compensation Committee . Effect of Termination of Service on Awards The Compensation Committee may provide, by rule or regulation or in any Award Agreement, or may determine in any individual case, the circumstances in which Awards shall be exercised, vested, paid or forfeited in the event a participant ceases to provide service to the Company or any affiliate prior to the end of a performance period or exercise or settlement of such Award . Change in Control Unless otherwise provided in an Award Agreement, in the event of a change in control (as defined in the Omnibus Plan) a participant’s unvested Awards will be treated in accordance with one of the following methods as determined by the Compensation Committee : (a) Awards, whether or not vested, will be continued, assumed or have new rights substituted as determined by the Compensation Committee ; (b) the Compensation Committee, in its sole discretion, may provide for the purchase of any Awards by the Company or an affiliate for an amount of cash equal to the excess of the change in control price of the shares covered by such Awards, over the aggregate exercise price of such Awards ; or (c) if and to the extent that the approach chosen by the Compensation Committee results in an acceleration or potential acceleration of the exercise, vesting or settlement of an Award, the Compensation Committee may impose such conditions upon the exercise, vesting or settlement of such Award as it determines . Assignability/Transferability Awards granted under the Omnibus Plan may not be sold, pledged or otherwise transferred, other than following the death of a participant by will or the laws of descent . A participant’s beneficiary or estate may 21 exercise vested stock options during the applicable exercise period following the death of the participant, subject to the same conditions that would have applied to exercise by the participant.

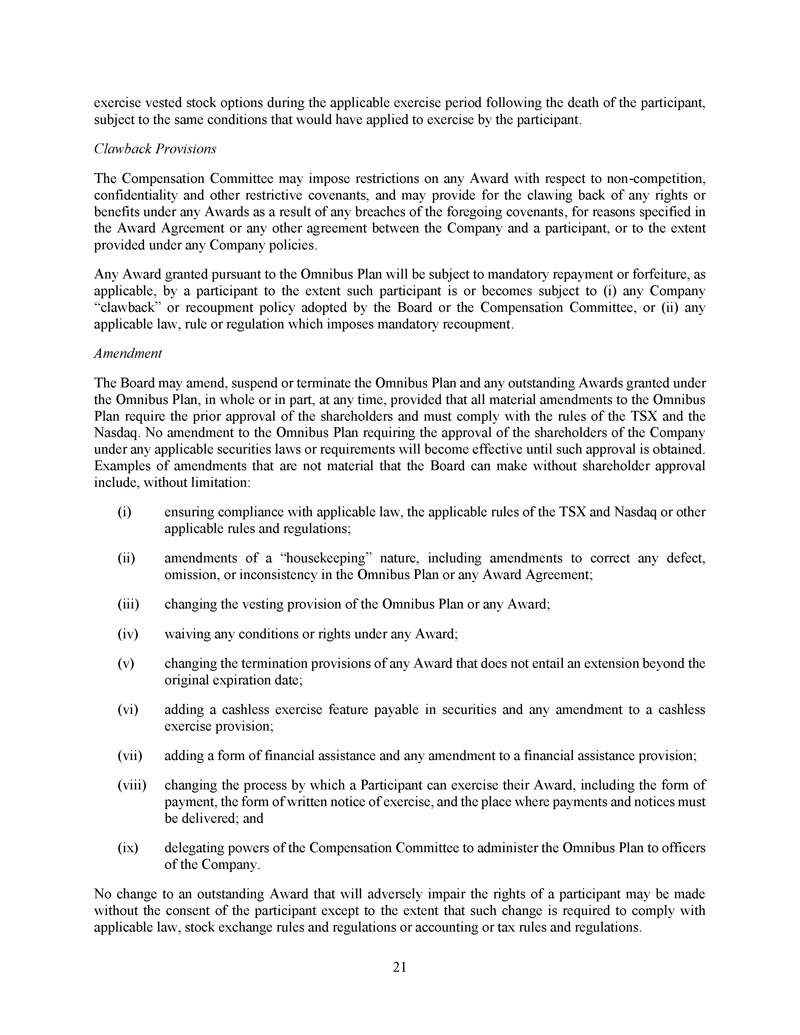

Clawback Provisions The Compensation Committee may impose restrictions on any Award with respect to non - competition, confidentiality and other restrictive covenants, and may provide for the clawing back of any rights or benefits under any Awards as a result of any breaches of the foregoing covenants, for reasons specified in the Award Agreement or any other agreement between the Company and a participant, or to the extent provided under any Company policies . Any Award granted pursuant to the Omnibus Plan will be subject to mandatory repayment or forfeiture, as applicable, by a participant to the extent such participant is or becomes subject to (i) any Company “clawback” or recoupment policy adopted by the Board or the Compensation Committee, or (ii) any applicable law, rule or regulation which imposes mandatory recoupment . Amendment The Board may amend, suspend or terminate the Omnibus Plan and any outstanding Awards granted under the Omnibus Plan, in whole or in part, at any time, provided that all material amendments to the Omnibus Plan require the prior approval of the shareholders and must comply with the rules of the TSX and the Nasdaq . No amendment to the Omnibus Plan requiring the approval of the shareholders of the Company under any applicable securities laws or requirements will become effective until such approval is obtained . Examples of amendments that are not material that the Board can make without shareholder approval include, without limitation : (i) ensuring compliance with applicable law, the applicable rules of the TSX and Nasdaq or other applicable rules and regulations; amendments of a “housekeeping” nature, including amendments to correct any defect, omission, or inconsistency in the Omnibus Plan or any Award Agreement; changing the vesting provision of the Omnibus Plan or any Award; (ii) (iii) (vi) (iv) waiving any conditions or rights under any Award; (v) changing the termination provisions of any Award that does not entail an extension beyond the original expiration date; adding a cashless exercise feature payable in securities and any amendment to a cashless exercise provision; (vii) (viii) adding a form of financial assistance and any amendment to a financial assistance provision ; changing the process by which a Participant can exercise their Award, including the form of payment, the form of written notice of exercise, and the place where payments and notices must be delivered ; and delegating powers of the Compensation Committee to administer the Omnibus Plan to officers of the Company . (ix) No change to an outstanding Award that will adversely impair the rights of a participant may be made without the consent of the participant except to the extent that such change is required to comply with applicable law, stock exchange rules and regulations or accounting or tax rules and regulations .

22 Approval of Unallocated Entitlements Pursuant to the rules and policies of the TSX, unallocated awards under a TSX - listed issuer’s security - based compensation arrangement that does not have a fixed maximum of securities (which will include the Omnibus Plan, if approved) must be approved by a majority of the issuer’s directors and by the issuer’s security holders every three years . If the shareholders of the Company approve the Omnibus Plan, the Company will be required to seek approval from the shareholders of all unallocated entitlements under the Omnibus Plan by no later than June 2 , 2028 . If the Omnibus Plan is not approved by the shareholders at the Meeting, Options will continue to exist unchanged, and the Company will be required to seek shareholder approval of all unallocated entitlements under the Existing Option Plan by no later than June 6 , 2027 . Disinterested Shareholder and TSX Approval The Omnibus Plan Resolution (as defined below) must be approved by a simple majority of the votes cast by disinterested shareholders of the Company at the Meeting . To be approved, the Omnibus Plan Resolution must be approved by a majority of the votes cast by all shareholders at a general meeting, excluding votes attaching to shares beneficially owned by (i) insiders to whom options may be issued under the Omnibus Plan ; and (ii) associates and affiliates of insiders to whom options may be issued under the Omnibus Plan, including direct and indirect issuances . The people who are allowed to vote are referred to as “disinterested shareholders” . The term “insider” is defined in the Securities Act (British Columbia) and includes, among other persons, directors and senior officers of a company and its subsidiaries and shareholders owning more than 10 % of the voting securities of a company . Accordingly, disinterested shareholders will be asked to consider and, if thought appropriate, to pass, with or without amendment, the Omnibus Plan Resolution set out below . In order to be effective, the Omnibus Plan Resolution must be approved by a majority of the votes cast in virtually at the Meeting or by proxy in respect thereof by the disinterested shareholders and approved by the TSX . 5 , 056 , 988 Common Shares will be excluded from voting on the Omnibus Plan Resolution, which represents 14 . 11 % of the issued and outstanding Common Shares of the Company as of the Record Date . The TSX has conditionally approved the Omnibus Plan, subject to receipt from the Company of, among other things, evidence of disinterested shareholder approval . Omnibus Plan Resolution At the Meeting, Shareholders will be asked to consider, and if thought fit, pass the following ordinary resolution (the “ Omnibus Plan Resolution ”) : “ BE IT RESOLVED AS AN ORDINARY RESOLUTION OF DISINTERESTED SHAREHOLDERS THAT: 1. the 2025 Omnibus Incentive Plan of the Company (the “ Omnibus Plan ”), in substantially the form described in, and a ppended as Sch e du l e B to the management information circular da t ed April 2 5 , 2025 , is he r eby ratified, confirmed and app r o v ed ; 2. the maximum number of common shares in the capital of the Company authorized and reserved for issuance under the Omnibus Plan will equal 18 . 5 % of the total number of issued and outstanding Common Shares, from time to time ; 3. the Company is authorized to grant awards under the Omnibus Plan until June 2 , 2027 , which is the date that is three ( 3 ) years from the date of the shareholder meeting at which shareholder approval is being sought ; and 23 4.

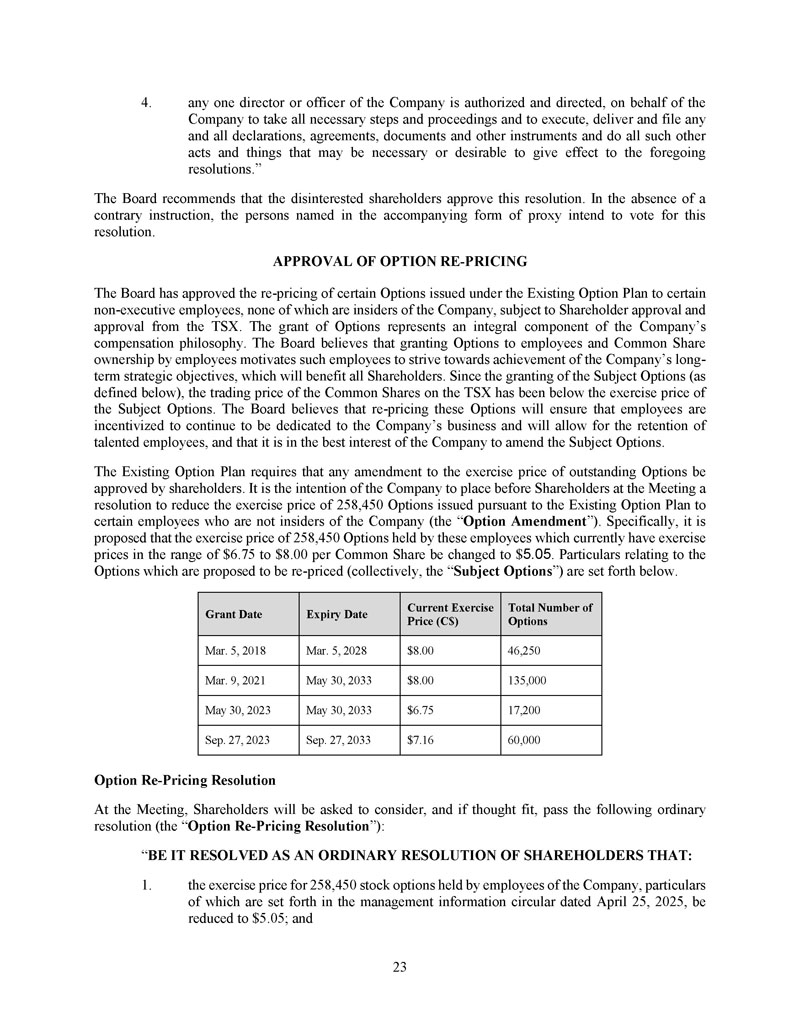

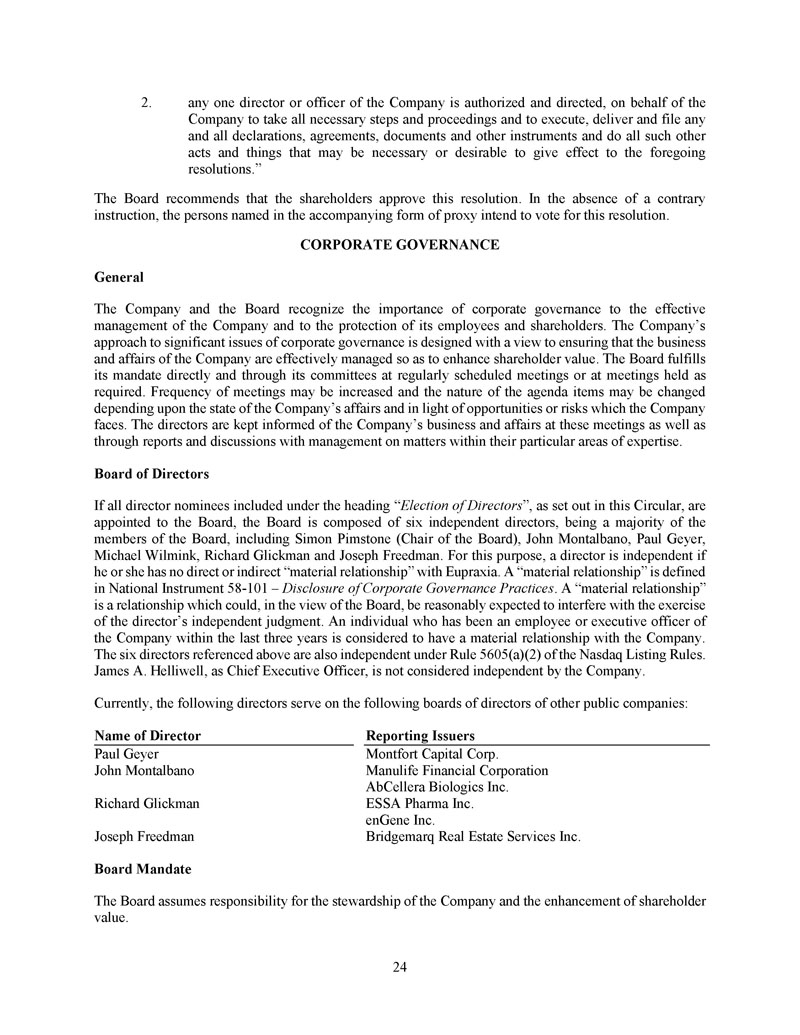

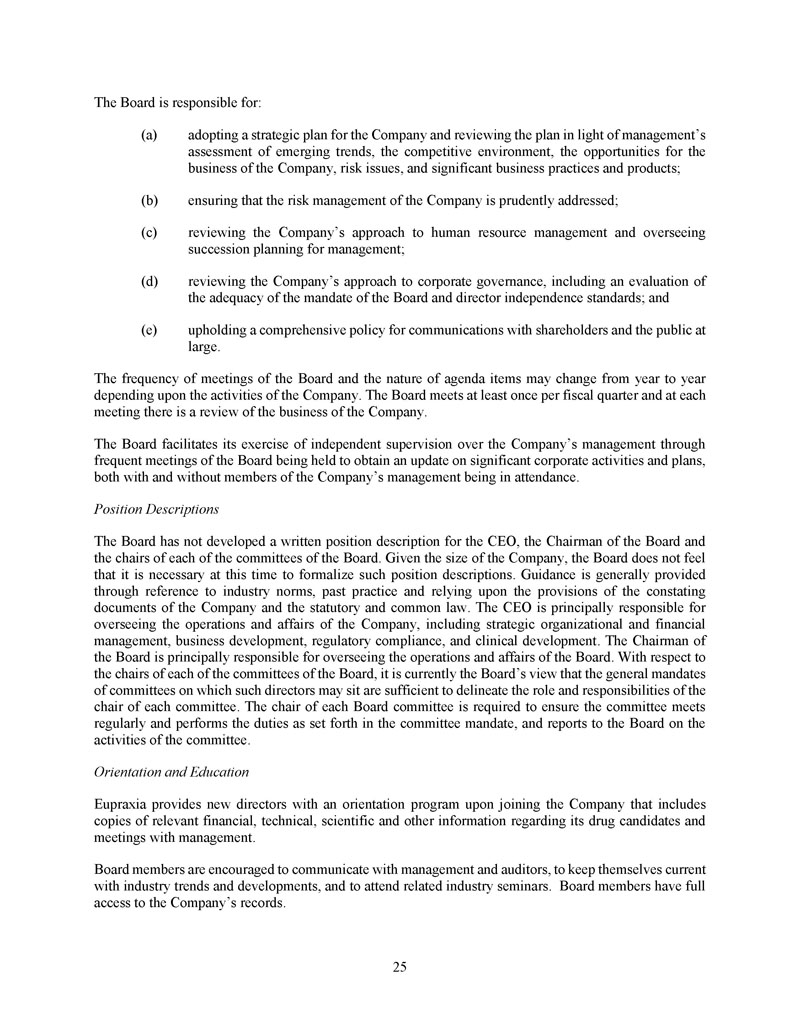

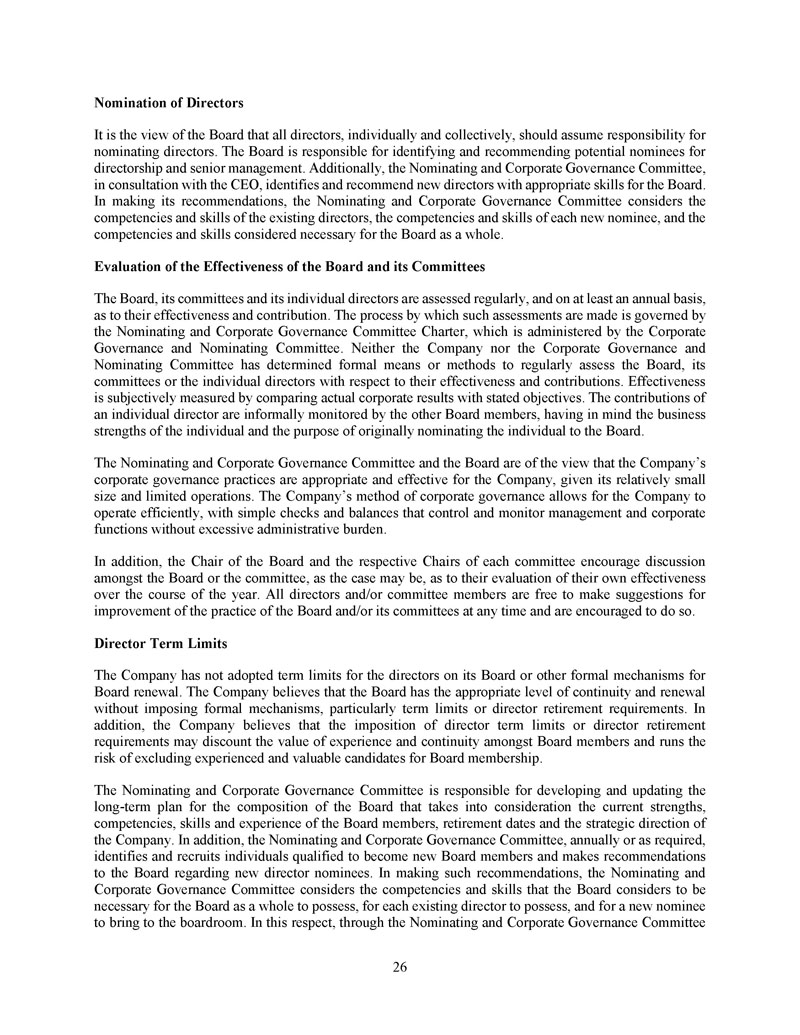

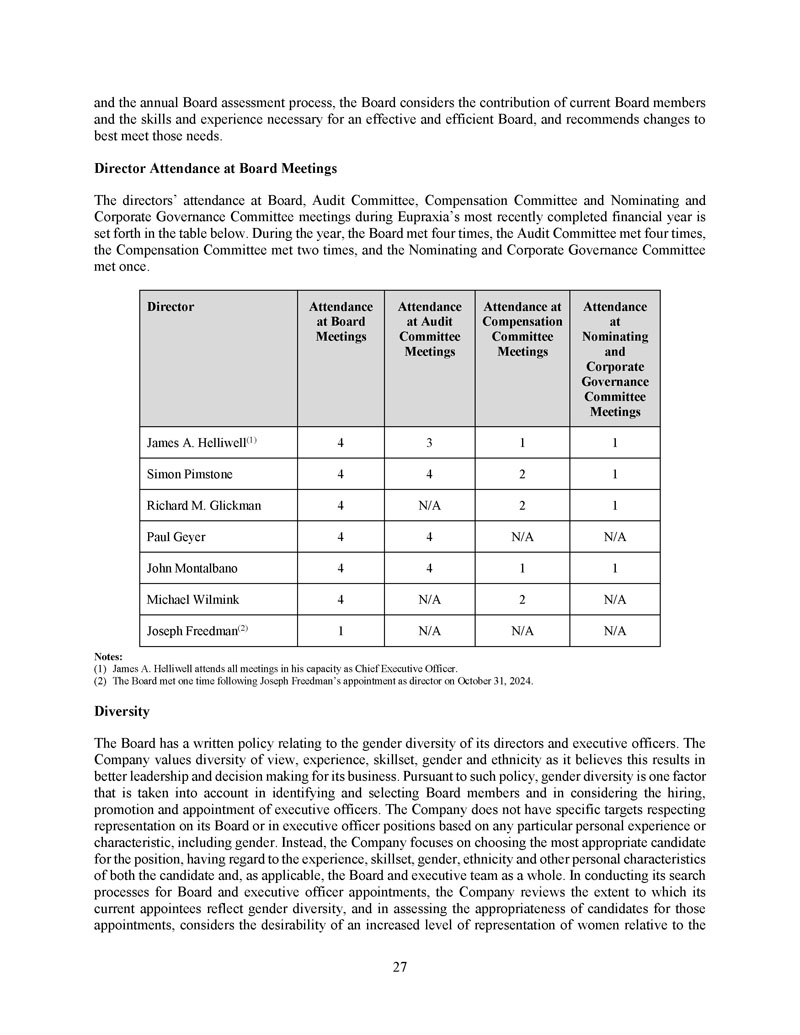

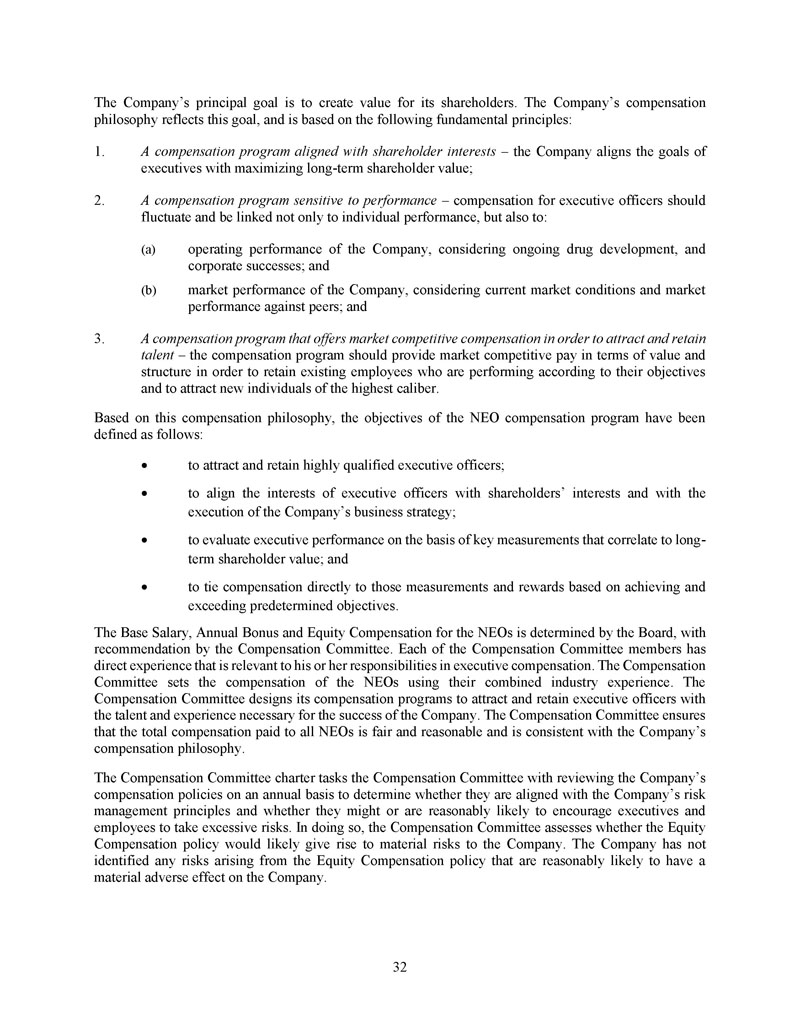

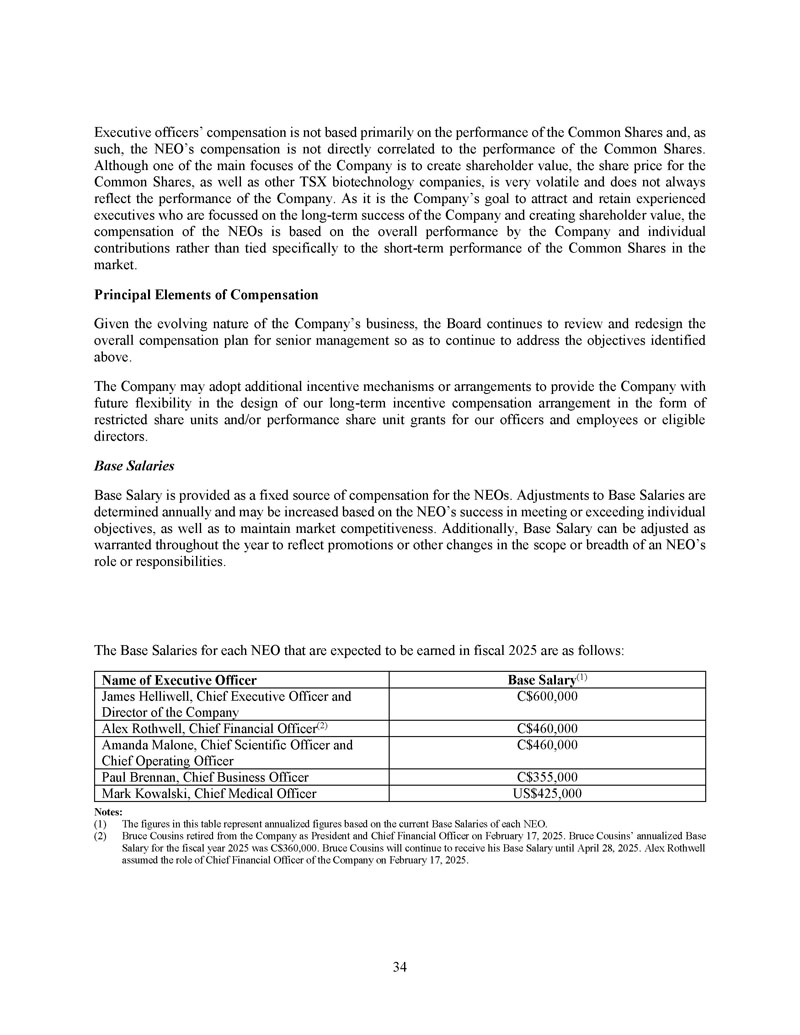

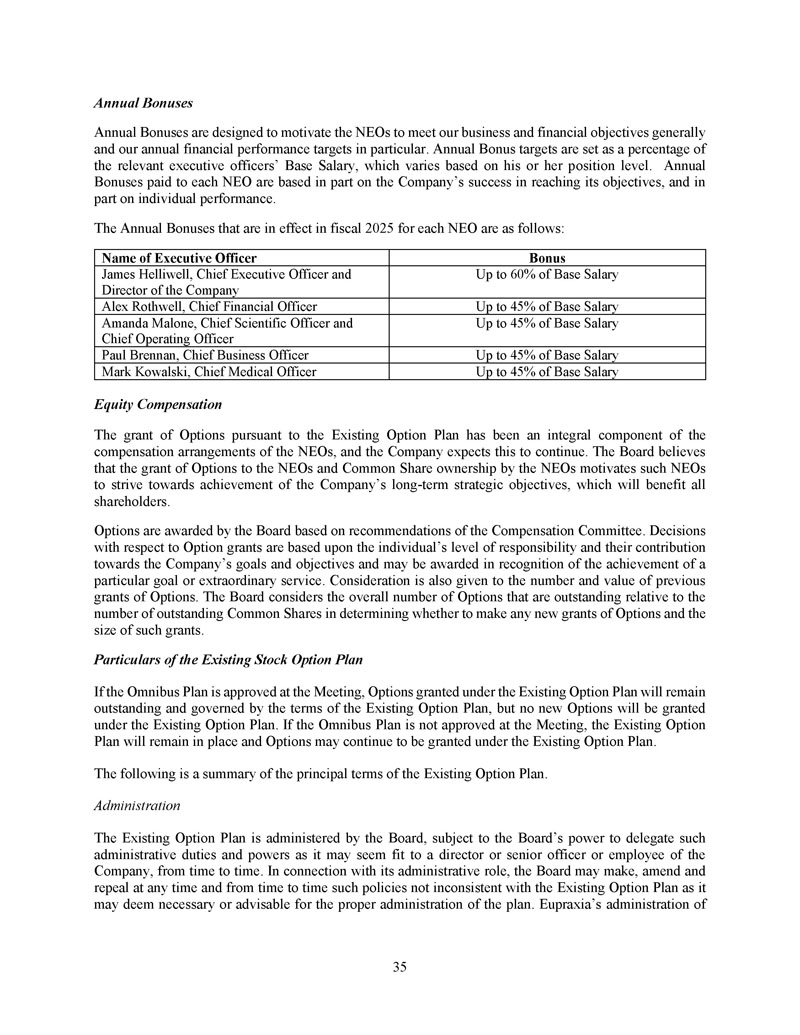

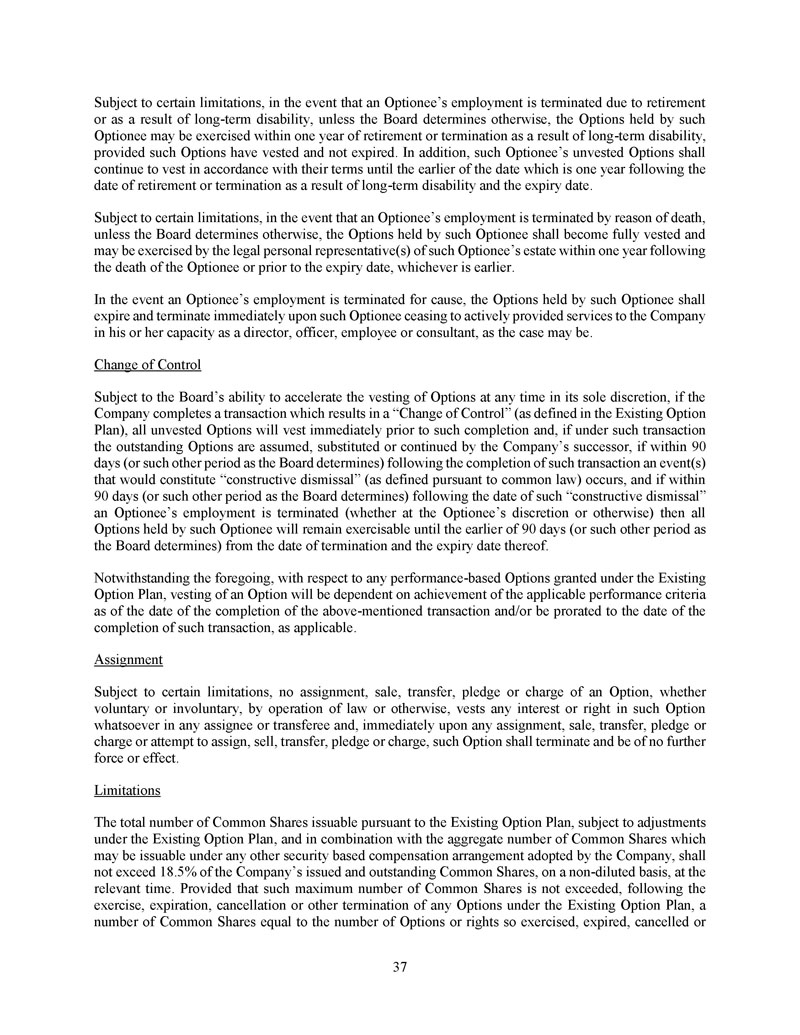

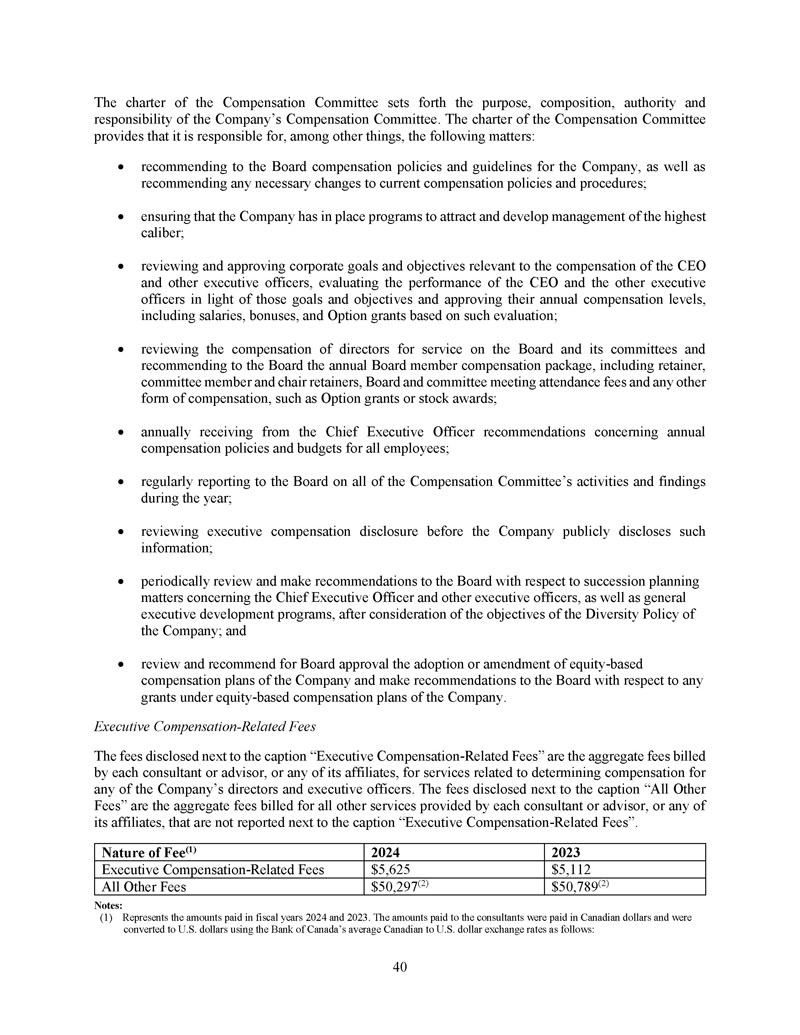

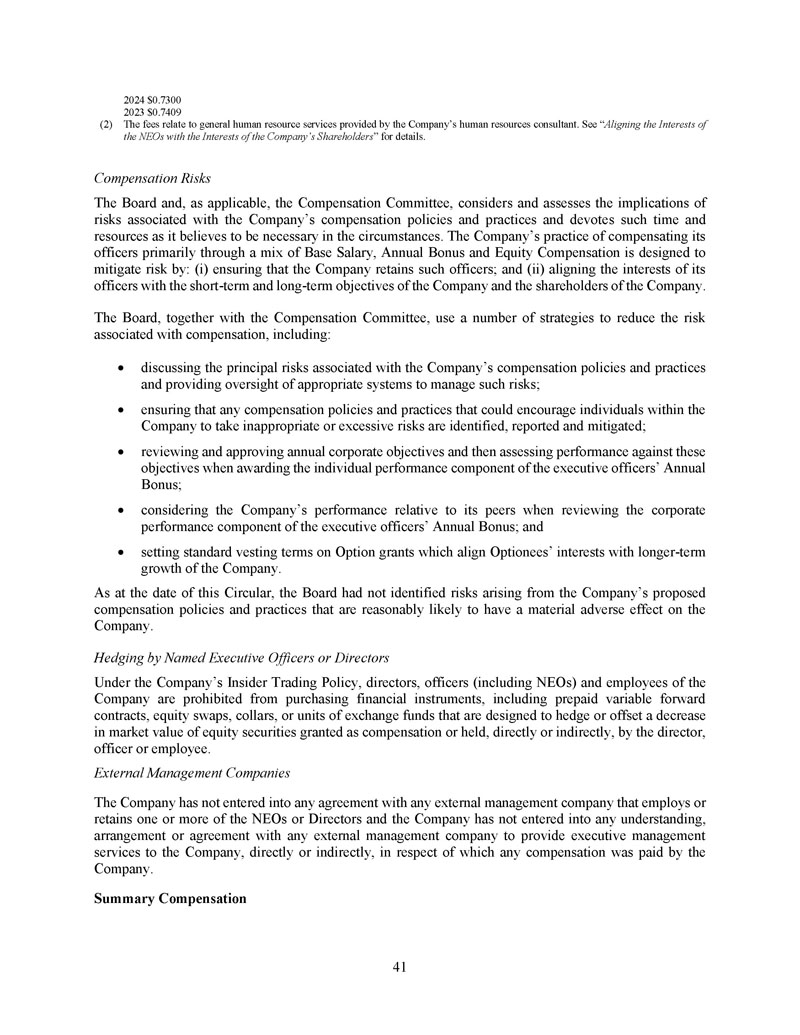

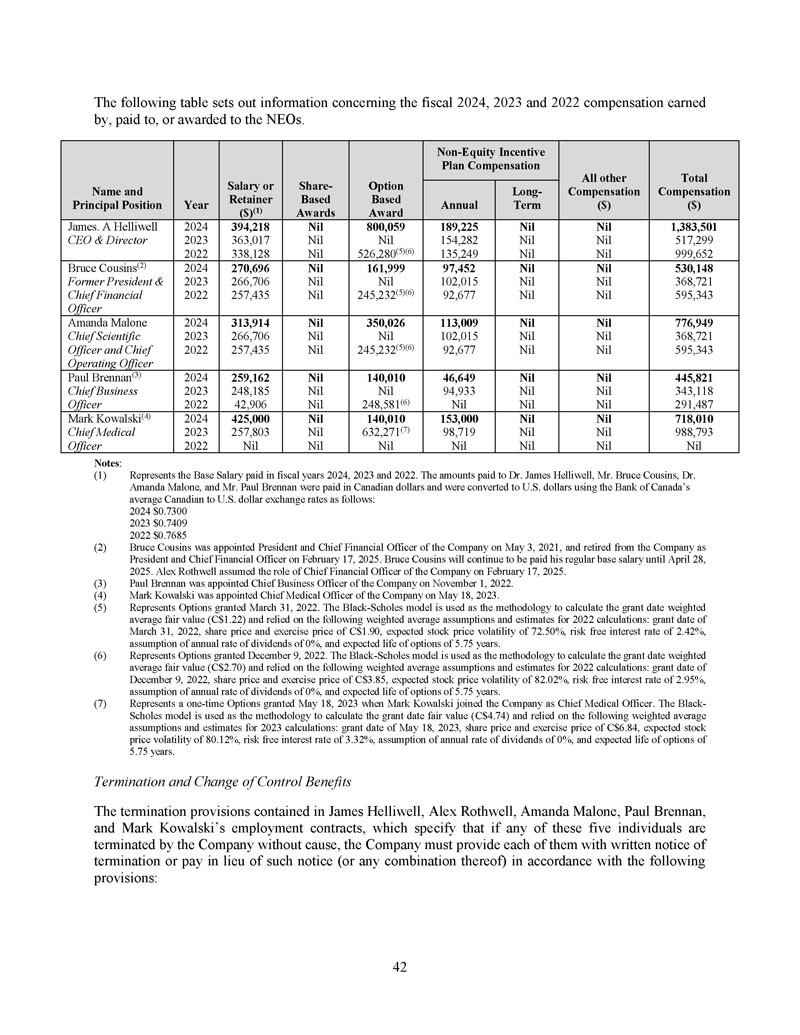

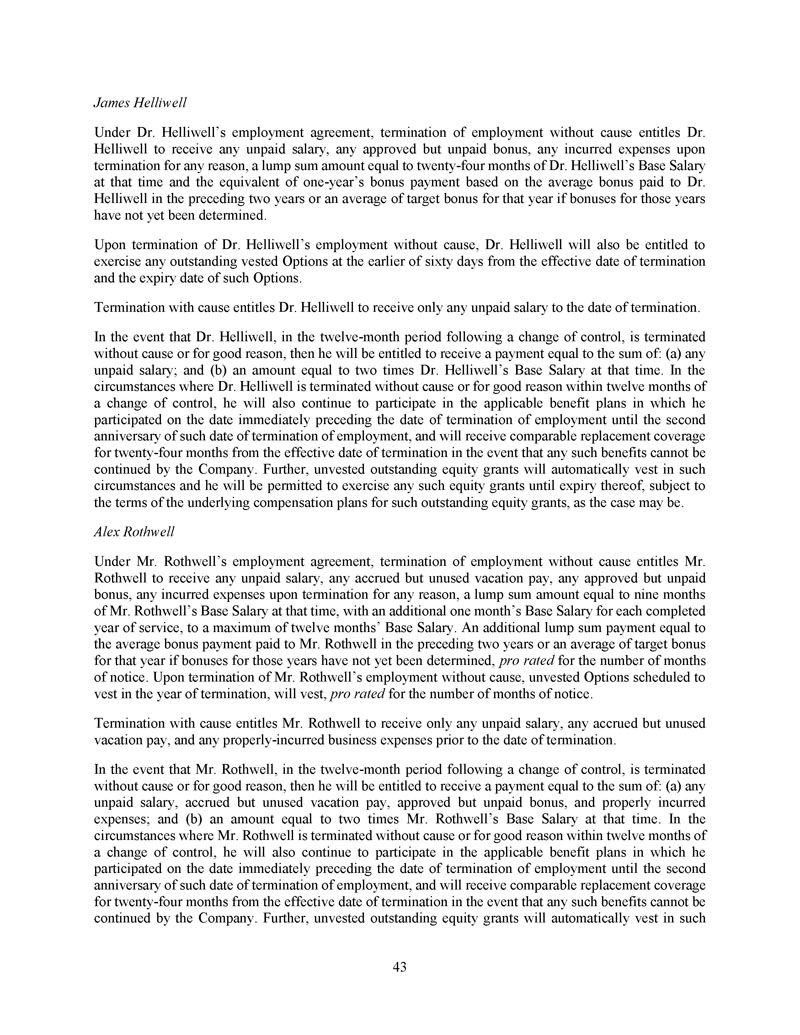

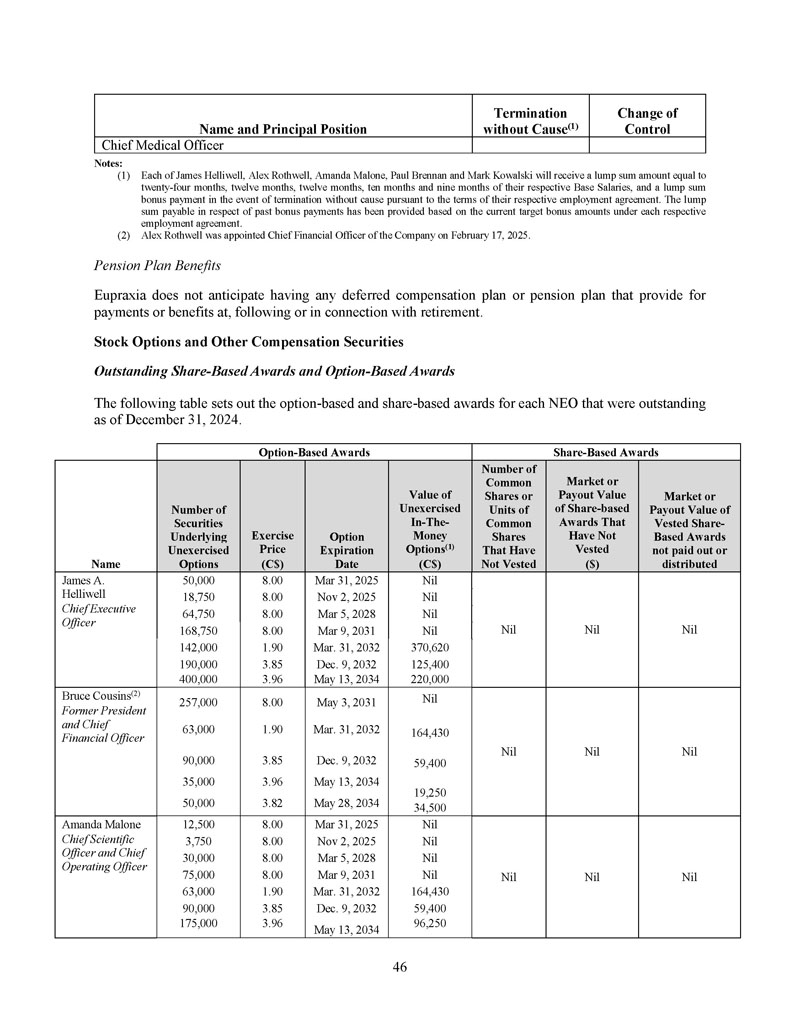

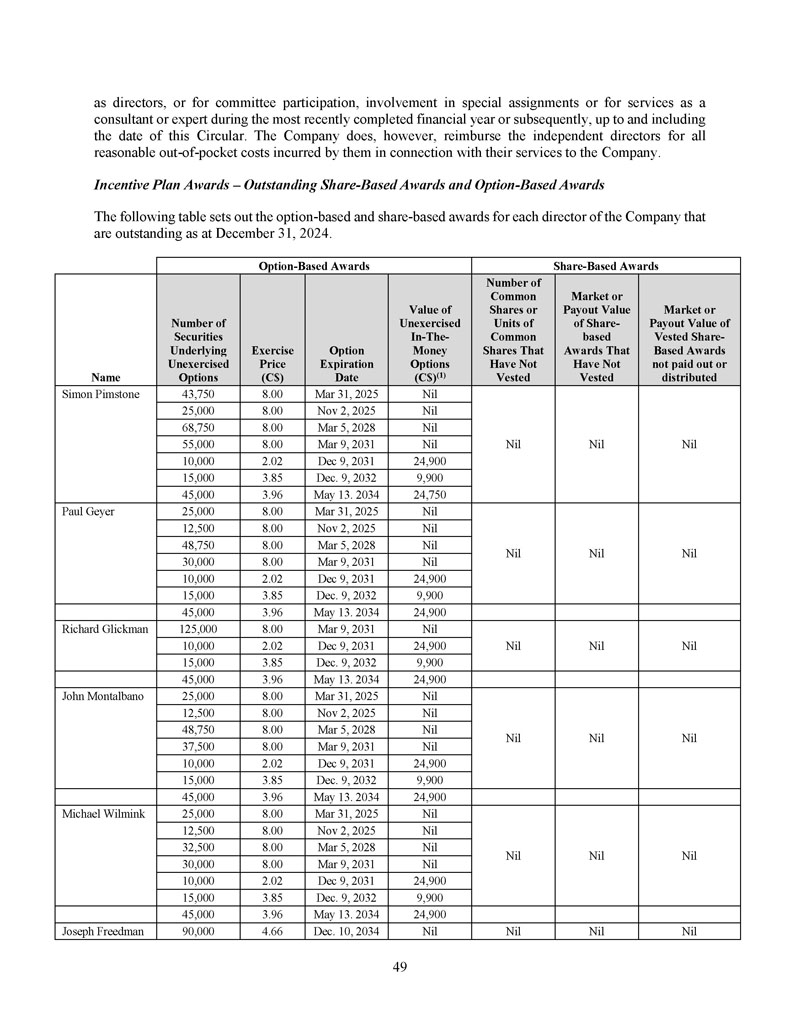

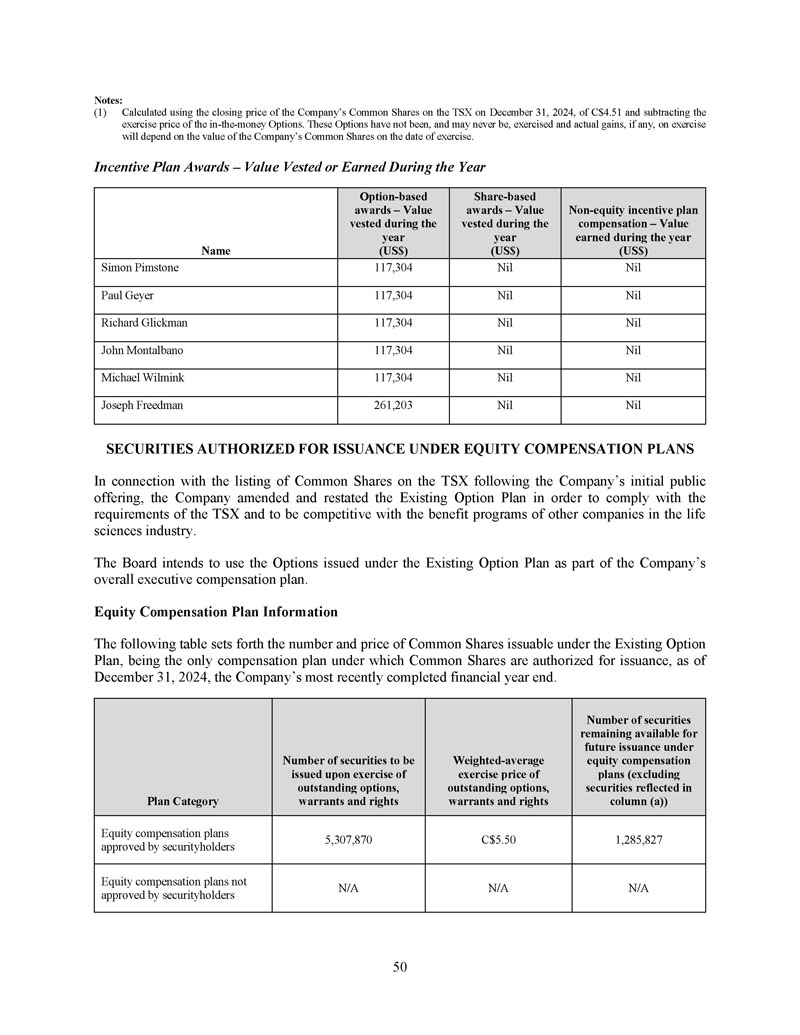

any one director or officer of the Company is authorized and directed, on behalf of the Company to take all necessary steps and proceedings and to execute, deliver and file any and all declarations, agreements, documents and other instruments and do all such other acts and things that may be necessary or desirable to give effect to the foregoing resolutions . ” The Board recommends that the disinterested shareholders approve this resolution . In the absence of a contrary instruction, the persons named in the accompanying form of proxy intend to vote for this resolution . APPROVAL OF OPTION RE - PRICING The Board has approved the re - pricing of certain Options issued under the Existing Option Plan to certain non - executive employees, none of which are insiders of the Company, subject to Shareholder approval and approval from the TSX . The grant of Options represents an integral component of the Company’s compensation philosophy . The Board believes that granting Options to employees and Common Share ownership by employees motivates such employees to strive towards achievement of the Company’s long - term strategic objectives, which will benefit all Shareholders . Since the granting of the Subject Options (as defined below), the trading price of the Common Shares on the TSX has been below the exercise price of the Subject Options . The Board believes that re - pricing these Options will ensure that employees are incentivized to continue to be dedicated to the Company’s business and will allow for the retention of talented employees, and that it is in the best interest of the Company to amend the Subject Options . The Existing Option Plan requires that any amendment to the exercise price of outstanding Options be approved by shareholders . It is the intention of the Company to place before Shareholders at the Meeting a resolution to reduce the exercise price of 258 , 450 Options issued pursuant to the Existing Option Plan to certain employees who are not insiders of the Company (the “ Option Amendment ”) . Specifically, it is proposed that the exercise price of 258 , 450 Options held by these employees which currently have exercise prices in the range of $ 6 . 75 to $ 8 . 00 per Common Share be changed to $ 5 . 05 . Particulars relating to the Options which are proposed to be re - priced (collectively, the “ Subject Options ”) are set forth below . Total Number of Options Current Exercise Price (C$) Expiry Date Grant Date 46,250 $8.00 Mar. 5, 2028 Mar. 5, 2018 135,000 $8.00 May 30, 2033 Mar. 9, 2021 17,200 $6.75 May 30, 2033 May 30, 2023 60,000 $7.16 Sep. 27, 2033 Sep. 27, 2023 Option Re - Pricing Resolution At the Meeting, Shareholders will be asked to consider, and if thought fit, pass the following ordinary resolution (the “ Option Re - Pricing Resolution ”): “ BE IT RESOLVED AS AN ORDINARY RESOLUTION OF SHAREHOLDERS THAT: 1. the exercise price for 258 , 450 stock options held by employees of the Company, particulars of which are set forth in the management information circular dated April 25 , 2025 , be reduced to $ 5 . 05 ; and 24 2.