UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2025

Commission File Number: 001-41421

Alvotech

(Translation of registrant's name into English)

9, Rue de Bitbourg,

L-1273 Luxembourg,

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Incorporation by Reference

This Report on Form 6-K (this “Report”) of Alvotech (the “Company”), including Exhibits 99.1, 99.2, 99.3, 99.4, 99.5 and Exhibit 99.6, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, unless expressly set forth by specific reference in such a filing.

Press Releases and Announcements

On May 16, 2025, the Company issued a press release announcing the outcome of an offering directed solely the general public in Sweden of Swedish Depository Receipts in connection with its listing on Nasdaq Stockholm. A copy of this press release is furnished herewith as Exhibit 99.1. The prospectus for this offering with an invitation to acquire Swedish Depository Receipts in Alvotech, directly solely to the general public in Sweden, is furnished here as Exhibit 99.2.

On May 16, 2025, the Company also announced that according to a form filed with the Luxembourg Commission de Surveillance du Secteur Financier (CSSF) regarding transactions of managers and closely associated persons, Richard Davis, Deputy Chairman of the Board of Directors of Alvotech, had reported the acquisition of 19,988 shares in Alvotech at USD 10.18 per share. A copy of the form is furnished herewith as Exhibit 99.3.

On May 19, 2025, the Company issued a press release announcing the first day of trading of its Swedish Depository Receipts. On the same day, the Company issued a press release announcing that Alvotech has appointed DNB Carnegie as liquidity provider for Swedish Depository Receipts listed on the Nasdaq Stockholm market. Copies of the Press Releases are furnished herewith as Exhibit 99.4 and Exhibit 99.5, respectively.

On May 23, 2025, the Company announced that according to a form filed with the Luxembourg Commission de Surveillance du Secteur Financier (CSSF) regarding transactions of managers and closely associated persons, Alvogen Lux Holdings S.ár.l., the second largest shareholder in Alvotech, had reported the acquisition of 95,000 shares in Alvotech at ISK 1,260 per share. A copy of the form is furnished herewith as Exhibit 99.6.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Alvotech | ||

| (Registrant) | ||

| Date: May 27, 2025 | /s/ Tanya Zharov | |

| Tanya Zharov | ||

| General Counsel |

EXHIBIT 99.1

Alvotech Announces the Outcome of the Offering in Connection with the Company’s Listing on Nasdaq Stockholm

Not to be released, published, distributed or circulated in any jurisdiction in which it would be unlawful to do so. This press release is for information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities.

REYKJAVIK, ICELAND AND STOCKHOLM, SWEDEN (May 16, 2025) — Alvotech (NASDAQ: ALVO, the “Company”), a global biotech company specializing in the development and manufacture of biosimilar medicines for patients worldwide, today announces the outcome of the offering of Swedish Depository Receipts (“SDRs”), equity share equivalents, in connection with the Company’s listing on Nasdaq Stockholm (the “Offering”). The Offering attracted strong interest from the general public in Sweden and was multiple times oversubscribed. This will result in more than 3,000 new shareholders for Alvotech. Trading on Nasdaq Stockholm commences on Monday, May 19, 2025.

The Offering in brief

Background of the Offering

Alvotech’s board of directors and executive management team have identified the expansion of its R&D capability as a strategic priority to support Alvotech’s expected growth trajectory. The Company also intends to increase its access to experienced life-science R&D professionals living outside Iceland. The Company recently announced the acquisition of Xbrane Biopharma AB’s (“Xbrane”) R&D operations at the Karolinska life-science hub in Sweden. The integration of much of Xbrane’s workforce of seasoned biosimilar developers will further expand Alvotech’s scientific and innovation capabilities, enable the Company to access a broader talent pool and help to establish a strong presence in the Swedish life-science sector, supporting growth. The shareholders of Xbrane approved the transaction at the extraordinary general meeting held on April 14, 2025, and subsequent Foreign Direct Investment approval was received on May 13, 2025. Closing of the transaction is expected to take place early in June 2025.

A listing on Nasdaq Stockholm is expected to further strengthen Alvotech’s recognition in the Nordic and European markets, improving access to regional capital, and attracting a broader base of institutional and retail investors, based in Sweden, and beyond. Additionally, Alvotech has identified strong investor demand for opportunities to invest in European biotech, biopharma and biosimilar stocks among Nordic and international institutional investors.

It is the intention of the Company to enter into an agreement with a market maker (liquidity provider) to promote further liquidity in the SDRs.

Free SDR conversion period

The Company will offer shareholders who have been owners of the Company prior to the Offering a free conversion period with an opportunity to convert their unrestricted Shares into SDRs. During a period of one year from, and including, the first day of trading in SDRs on Nasdaq Stockholm, the conversion fees charged by Euroclear Sweden and DNB Bank ASA, Sweden Branch, as issuer of the SDRs, for converting Shares to SDRs will be paid by Alvotech. For the avoidance of doubt, potential additional fees and costs charged by the shareholders’ own custodian, brokerage firm or bank will be borne by the shareholders. For information on how to convert please refer to sdr@dnb.se.

Advisors

DNB Carnegie Investment Bank AB (publ) (formerly Carnegie Investment Bank AB (publ) and DNB Markets, a part of DNB Bank ASA, Sweden Branch) is acting as financial advisor in relation to the Offering. Cirio Advokatbyrå AB and Westerberg & Partners are legal advisors to the Company as to Swedish law, Arendt & Medernach SA is legal advisor to the Company as to Luxembourg law, BBA//Fjeldco is legal advisor to the Company as to Icelandic law and Cooley LLP is legal advisor to the Company as to U.S. law. Linklaters Advokatbyrå is legal advisor to the financial advisors as to Swedish law and Linklaters LLP is legal advisor to the financial advisors as to US law.

About Alvotech

Alvotech is a biotech company, founded by Róbert Wessman, focused solely on the development and manufacture of biosimilar medicines for patients worldwide. Alvotech seeks to be a global leader in the biosimilar space by delivering high-quality, cost-effective products and services, enabled by a fully integrated approach and broad in-house capabilities. Two biosimilars, to Humira® (adalimumab) and Stelara® (ustekinumab), are already approved and marketed in multiple global markets. The current development pipeline includes nine disclosed biosimilar candidates aimed at treating autoimmune disorders, eye disorders, osteoporosis, respiratory disease, and cancer. Alvotech has formed a network of strategic commercial partnerships to provide global reach and leverage local expertise in markets that include the United States, Europe, Japan, China, and other Asian countries and large parts of South America, Africa and the Middle East. Alvotech’s commercial partners include Teva Pharmaceuticals, a U.S. affiliate of Teva Pharmaceutical Industries Ltd. (U.S.), STADA Arzneimittel AG (EU), Fuji Pharma Co., Ltd (Japan), Advanz Pharma (EEA, U.K., Switzerland, Canada, Australia and New Zealand), Dr. Reddy’s (EEA, U.K. and U.S.), Biogaran (France), Cipla/Cipla Gulf/Cipla Med Pro (Australia, New Zealand, South Africa/Africa), JAMP Pharma Corporation (Canada), Yangtze River Pharmaceutical (Group) Co., Ltd. (China), DKSH (Taiwan, Hong Kong, Cambodia, Malaysia, Singapore, Indonesia, India, Bangladesh and Pakistan), YAS Holding LLC (Middle East and North Africa), Abdi Ibrahim (Turkey), Kamada Ltd. (Israel), Mega Labs, Stein, Libbs, Tuteur and Saval (Latin America) and Lotus Pharmaceuticals Co., Ltd. (Thailand, Vietnam, Philippines, and South Korea). Each commercial partnership covers a unique set of products and territories. Except as specifically set forth therein, Alvotech disclaims responsibility for the content of periodic filings, disclosures and other reports made available by its partners. For more information, please visit https://www.alvotech.com. None of the information on the Alvotech website shall be deemed part of this press release.

For more information, please visit our investor portal, and our website or follow us on social media on LinkedIn, Facebook, Instagram, and YouTube.

Important information

This announcement is not, and does not form part of, an offer to sell or buy any securities.

This communication is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States or in any jurisdiction other than Sweden, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. The SDRs (and underlying shares) have not been, and will not be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. The SDRs were being offered and sold in the Offering outside of the United States in an overseas directed offering in accordance with Regulation S.

This announcement is not a prospectus for the purposes of Regulation (EU) 2017/1129 (the "Prospectus Regulation") and has not been approved by any regulatory authority in any jurisdiction. A prospectus in connection with the Offering has been prepared and published by the Company on the Company’s website. The Offering was only directed to the public in Sweden.

This press release does not identify or suggest, or purport to identify or suggest, the risks (direct or indirect) that may be associated with an investment in the Company. Any investment decision to acquire or subscribe for securities in connection with the Offering must be made on the basis of all publicly available information relating to the Company and the Company’s securities.

DNB Carnegie Investment Bank AB (publ) (formerly Carnegie Investment Bank AB (publ) and DNB Markets, a part of DNB Bank ASA, Sweden Branch) is acting for Alvotech in connection with the Offering and for no one else. DNB Carnegie Investment Bank AB (publ) (formerly Carnegie Investment Bank AB (publ) and DNB Markets, a part of DNB Bank ASA, Sweden Branch) will not be responsible to anyone other than Alvotech for providing the protections afforded to its clients nor for giving advice in relation to the Offering or any other matter referred to herein.

Alvotech forward-looking statements

Certain statements in this communication may be considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements generally relate to future events or the future financial operating performance of Alvotech and may include, for example, Alvotech’s expectations regarding the Offering, including the timing of the settlement of the Offering; the expected benefits of the listing of SDRs on Nasdaq Stockholm; competitive advantages, business prospects and opportunities including pipeline product development; future plans and intentions, results, level of activities, performance, goals or achievements or other future events; regulatory submissions, review and interactions; the potential approval and commercial launch of its product candidates; the timing of regulatory approval, and market launches. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential”, “aim” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Alvotech and its management, are inherently uncertain and are inherently subject to risks, variability, and contingencies, many of which are beyond Alvotech’s control. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) the ability to close the acquisition of Xbrane’s R&D operations and a biosimilar candidate, which is subject to approval of regulatory agencies and funding; (2) the ability to list Swedish Depository Receipts and maintain stock exchange listing standards; (3) changes in applicable laws or regulations; (4) the possibility that Alvotech may be adversely affected by economic, business, and/or competitive factors; (5) Alvotech’s estimates of expenses and profitability; (6) Alvotech’s ability to develop, manufacture and commercialize the products and product candidates in its pipeline; (7) actions of regulatory authorities, which may affect the initiation, timing and progress of clinical studies or future regulatory approvals or marketing authorizations; (8) the ability of Alvotech or its partners to respond to inspection findings and resolve deficiencies to the satisfaction of the regulators; (9) the ability of Alvotech or its partners to enroll and retain patients in clinical studies; (10) the ability of Alvotech or its partners to gain approval from regulators for planned clinical studies, study plans or sites; (11) the ability of Alvotech’s partners to conduct, supervise and monitor existing and potential future clinical studies, which may impact development timelines and plans; (12) Alvotech’s ability to obtain and maintain regulatory approval or authorizations of its products, including the timing or likelihood of expansion into additional markets or geographies; (13) the success of Alvotech’s current and future collaborations, joint ventures, partnerships or licensing arrangements; (14) Alvotech’s ability, and that of its commercial partners, to execute their commercialization strategy for approved products; (15) Alvotech’s ability to manufacture sufficient commercial supply of its approved products; (16) the outcome of ongoing and future litigation regarding Alvotech’s products and product candidates; (17) the impact of worsening macroeconomic conditions, including tariffs on Alvotech’s products in the U.S. or other markets, rising inflation and interest rates and general adverse market conditions, including the impact of conflicts in Ukraine, the Middle East and other global geopolitical tension, on the Company’s business, financial position, strategy and anticipated milestones; and (18) other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in documents that Alvotech may from time to time file or furnish with the SEC or identified in the prospectus filed with the Swedish Financial Supervisory Authority (Sw. Finansinspektionen). There may be additional risks that Alvotech does not presently know or that Alvotech currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Alvotech does not undertake any duty to update these forward-looking statements or to inform the recipient of any matters of which it becomes aware of which may affect any matter referred to in this communication. Alvotech expressly disclaims any and all liability for any loss or damage (whether foreseeable or not) suffered or incurred by any person or entity as a result of anything contained or omitted from this communication. The recipient agrees that it shall not seek to sue or otherwise hold Alvotech or any of its directors, officers, employees, affiliates, agents, advisors, or representatives liable in any respect for the provision of this communication, the information contained in this communication, or the omission of any information from this communication.

ALVOTECH INVESTOR RELATIONS AND GLOBAL COMMUNICATIONS

Benedikt Stefansson, VP

alvotech.ir@alvotech.com

Exhibit 99.2

Invitation to acquire Swedish Depository Receipts in Alvotech IMPORTANT INFORMATION This prospectus (the “ Prospectus ”) has been prepared by Alvotech, a public limited liability company ( société anonyme ) governed by the laws of the Grand Duchy of Luxembourg and registered with the Luxembourg Trade and Companies Register ( Registre du Commerce et des Sociétés de Luxembourg ) under number B 258884 (“ Alvotech ” or the “ Company ”, together with its subsidiaries the “ Group ”), by reason of the admission to trading of all 324 , 801 , 040 issued ordinary shares (the “ Shares ” or “ Underlying shares ”) in the Company on the regulated market Nasdaq Stockholm in the form of Swedish Depository Receipts (“ SDRs ”), and the Company's offering to the public in Sweden to acquire SDRs (the “ Offering ”) . Alvotech has appointed DNB Bank ASA, Sweden Branch (“ DNB ”) as the issuer of the SDRs . DNB Markets, a part of DNB Bank ASA, Sweden branch (“ DNB Markets ”) and Carnegie Investment Bank AB (“ Carnegie ”) are acting as financial advisors in relation to the Offering (together the “ Financial Advisors ”) . Any dispute arising from the Offering, this Prospectus and related legal matters shall be exclusively governed and construed in accordance with Swedish law and settled exclusively by Swedish courts, whereby the Stockholm District Court (Sw . Stockholms tingsrätt ) shall be the court of first instance . The Prospectus has been prepared as a simplified prospectus in accordance with Article 14 of Regulation (EU) 2017 / 1129 of the European Parliament and of the Council of 14 June 2017 on the Prospectus to be published when securities are offered to the public or admitted to trading on a regulated market (together with the related delegated and implementing regulations and supplements) (the “ Prospectus Regulation ”) . The Swedish Financial Supervisory Authority (the “ SFSA ”), which is the competent authority, has approved the Prospectus in accordance with Article 20 of the Prospectus Regulation . The SFSA only approves the Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation . Such approval should not be considered as an endorsement of the Company or the quality of the securities that are subject to the Prospectus . Every investor is advised to carry out their own assessment whether it is appropriate to invest in Alvotech . The Prospectus is valid for a maximum of 12 months after the SFSA's approval, which was received on 8 May 2025 , provided that Alvotech complies with its obligation under the Prospectus Regulation, and, if required, provide supplements to this Prospectus in the event of changing material facts, factual errors or material misstatements occur which may affect the assessment of the securities . Offering restrictions The Offering is not directed to the general public in any other country than Sweden . Nor is the Offering directed to such persons whose participation requires additional prospectuses, registrations or measures other than those prescribed by Swedish law . No measures have been taken or will be taken in any other jurisdiction than Sweden, that would allow any offer of any securities to the public, or holding and distribution of the Prospectus or any other documents pertaining to the Company or its securities in such jurisdiction . Application to acquire SDRs that violates such rules may be deemed invalid . Persons into whose possession the Prospectus comes are required by the Company and the Financial Advisors to inform themselves about and to observe such restrictions . Neither the Company nor the Financial Advisors accept any legal responsibility for any violation by any person, whether or not a prospective investor, of any such restrictions . The SDRs (including the Underlying shares) under the Offering have not been and will not be registered under the United States Securities Act of 1933 , as amended (the “ US Securities Act ”) or the securities legislation of any other state or other jurisdiction in the United States, and are being offered and sold outside the United States in offshore transactions as part of an overseas directed offering in reliance on Regulation S promulgated under the US Securities Act (“ Regulation S ”) in accordance with the local laws and customary practices and documentation of Sweden and solely directed to the public in Sweden . The SDRs may not be offered, sold or otherwise transferred, directly or indirectly, in or into the United States except under an available exemption from, or by a transaction not subject to, the registration requirements under the US Securities Act and in compliance with the securities legislation in the relevant state or any other jurisdiction of the United States . The SDRs in the Offering have not been recommended, approved or rejected by any US federal or state securities commission or regulatory authority . Furthermore, neither of the aforementioned authorities have confirmed the accuracy or determined the adequacy of the Prospectus . Any representation to the contrary is a criminal offence in the United States . Financial information Except when expressly stated, no information in the Prospectus has been reviewed or audited by an auditor. Certain financial information presented in the Prospectus has been rounded off in order to make the information more easily accessible to the reader. Consequently, the figures in some columns do not correspond exactly to the totals shown. Financial amounts are presented in US dollars (“ USD ”) or Swedish krona (“ SEK ”) unless otherwise stated. Forward - looking statements Statements in this Prospectus relating to future status or circumstances, including statements regarding future performance, growth and other trend projections as well as benefits of the Offering, are forward - looking statements . Forward - looking statements may generally, but not always, be identified by the use of words such as “believe”, “expect”, “anticipate”, “intend”, “may”, “plan”, “estimate”, “will”, “should”, “could”, “aim” or “might”, or, in each case, their negative, or similar expressions, and other variations of such terms or comparable terminology . By their nature, forward - looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future . There can be no assurance that actual results will not differ materially from those expressed or implied by these forward - looking statements due to many factors, many of which are outside the control of Alvotech . Any such forward - looking statements speak only as of the date which they were made and Alvotech has no obligation (and undertakes no such obligation) to update or revise any of them, whether as a result of new information, future events or otherwise, except as required by applicable laws and regulations . Industry and market information This Prospectus contains industry and market information attributable to Alvotech's operations and the market in which it operates . Such information is based on Alvotech's analysis of several different sources, including industry publications and reports . Industry publications or reports usually state that the information in them has been obtained from sources that are deemed to be reliable, but that the accuracy and completeness of the information cannot be guaranteed . Alvotech has not independently verified and therefore cannot guarantee the accuracy of the industry and market information contained in this Prospectus and which has been taken from or derived from these industry publications or reports .

TABLE OF CONTENTS Summary...................................................................................................................... ... ..........................................3 Swedish summary ............................................................................................................................. ... .....................9 Glossary of terms ............................................................................................................................. ... ....................15 Risk Factors ............................................................................................................................. ... ............................17 Invitation to acquire SDRs in Alvotech ......................................................................................................................27 Background and reasons ............................................................................................................................. ... .........28 Terms and conditions ............................................................................................................................. ... ..............30 Market overview ............................................................................................................................. ... ......................37 Business Overview ............................................................................................................................. ... ..................45 Historical financial information.................................................................................................................. ... ...........62 Capitalization, indebtedness and other financial information ...................................................................................67 Board of directors and executive management.........................................................................................................72 Corporate governance ............................................................................................................................. ... .............76 The Underlying shares, Share capital and Ownership structure ................................................................................82 Legal considerations and other information .............................................................................................................92 Addresses ............................................................................................................................. ... ...............................96 Summary of the Offering the lower of either the volume - weighted average price of the Company’s share on Nasdaq Iceland Main Market during the application period of the Offering, or the last closing price of the Company’s share on Nasdaq Iceland Main Market during the application period of the Offering, with a discount of ten (10)% and converted to SEK based on the exchange rate published by the Swedish Central Bank (Sw. Riksbanken ) on the last day of the application period. The Offering Price will not exceed SEK 90 per SDR Price per SDR: 9 May 2025 – 16 May 2025 Application period: 19 May 2025 First day of trading: 21 May 2025 Settlement date: Financial calendar 25 June 2025 Annual General Meeting: 13 August 2025 Interim financial report January – June 2025: 2025: 12 November 2025 Interim financial report January – September Other information ALVO SDB Ticker SDR: SE0025011463 ISIN code SDR:

Invitation to acquire Swedish Depository Receipts in Alvotech 3 Summary Introduction and warnings This summary should be read as an introduction to the Prospectus . Any decision to invest in the securities should be based on a consideration of the Prospectus as a whole by the investor . The investor may lose all or part of the invested capital . Where a claim relating to the information contained in this Prospectus is brought before a court, the plaintiff investor might, under national law, have to bear the costs of translating this Prospectus before the legal proceedings are initiated . Civil liability attaches only to those persons who have prepared the summary, including any translation thereof, but only where the summary is misleading, inaccurate or inconsistent, when read together with other parts of the Prospectus, or where it does not provide, when read together with the other parts of the Prospectus, key information in order to aid investors when considering whether to invest in such securities . Introduction and warnings Issuer: Alvotech Company reg. no: B258884 Legislation of incorporation: Luxembourg Domicile: 9, rue de Bitbourg, L - 1273, Luxembourg, Grand Duchy of Luxembourg Website: http://www.alvotech.com/ Telephone number: +354 422 4500 Legal entity identifier (LEI): 222100DCZBOWV5DZ8372 ISIN code SDRs: SE0025011463 The issuer The Swedish Financial Supervisory Authority (Sw. Finansinspektionen ) (the “SFSA”) is the competent authority and responsible for approving this Prospectus under the Prospectus Regulation (EU) 2017/1129. The SFSA's visiting address is Sveavägen 44, SE - 111 34 Stockholm, Sweden and postal address is P.O. Box 7821, SE - 103 97 Stockholm, Sweden, phone number +46 (0)8 408 980 00, website www.fi.se . The Prospectus was approved by the SFSA on 8 May 2025. Competent authority Key information regarding the issuer Who is the issuer of the securities? The registered name of the Company is Alvotech . Alvotech is a public limited liability company ( société anonyme ) governed by the laws of the Grand Duchy of Luxembourg . Alvotech was incorporated on 23 August 2021 , for an unlimited duration and registered with the Luxembourg Trade and Companies' Register ( Registre du Commerce et des Sociétés de Luxembourg ) under the number B 258884 . The Company's LEI code is 222100 DCZBOWV 5 DZ 8372 . The issuer of the SDRs is DNB Bank ASA, Sweden Branch (“DNB”) registered with the Swedish Companies Registration Office (Sw . Bolagsverket ) . DNB is a branch to the Norwegian public limited liability company DNB Bank ASA incorporated under and governed by the laws of Norway on 18 February 2004 with a Swedish Branch . The company registration number of DNB is 516406 - 0161 and its LEI code is 549300 GKF 60 RYRRQ 1414 . DNB's registered address is Regeringsgatan 59 , SE - 105 88 , Stockholm, Sweden with its registered office in Stockholm . DNB is authorized by the SFSA to conduct investment business . The issuer's domicile and legal form Alvotech is a vertically integrated biotech company focused exclusively on the development and manufacturing of biosimilar medicines for patients worldwide . Its platform, talent base, and strategic partnerships are dedicated to expanding access to more affordable biologic therapies by targeting originator biologics approaching patent expiration . The Company's purpose is to improve the health and quality of life for patients globally by improving access to proven treatments for a broad range of diseases . Alvotech views both the discovery of novel therapies and the expansion of access to existing biologics as essential to the broader purpose of the pharmaceutical industry . The Company believes that the availability of safe, high - quality, and affordable biosimilars is critical to the long - term sustainability of global healthcare systems and to the continued advancement of medical innovation . By generating significant cost savings, The issuer's principal activities 4 Invitation to acquire Swedish Depository Receipts in Alvotech biosimilars enable healthcare providers to treat more patients while preserving resources for investment in next - generation therapies.

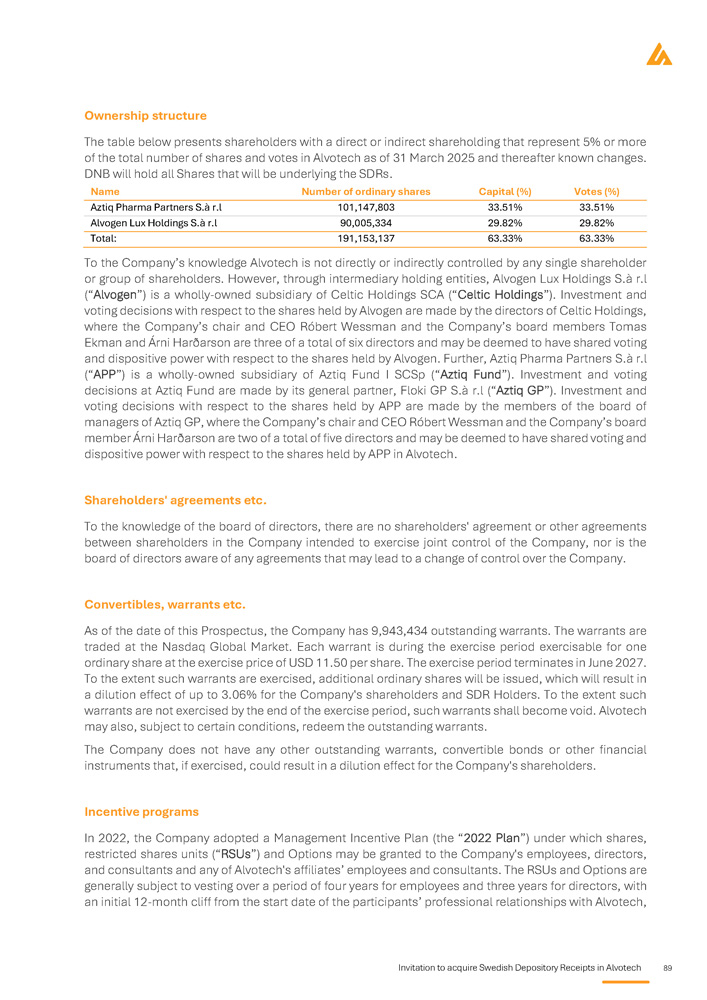

The table below presents shareholders with a direct or indirect shareholding that represent 5% or more of the total number of shares and votes in Alvotech as of 31 March 2025 and thereafter known changes. DNB will hold all shares that will be underlying the SDRs. Name Number of Ordinary shares Capital and votes (%) Aztiq Pharma Partners S.à r.l 101,147,803 33.51% Alvogen Lux Holdings S . à r . l 90 , 005 , 334 29 . 82 % To the Company’s knowledge Alvotech is not directly or indirectly controlled by any single shareholder or group of shareholders . However, through intermediary holding entities, Alvogen Lux Holdings S . à r . l (“Alvogen”) is a wholly - owned subsidiary of Celtic Holdings SCA (“Celtic Holdings”) . Investment and voting decisions with respect to the shares held by Alvogen are made by the directors of Celtic Holdings, where the Company’s chair and CEO Róbert Wessman and the Company’s board members Tomas Ekman and Árni Harðarson are three of a total of six directors and may be deemed to have shared voting and dispositive power with respect to the shares held by Alvogen . Further, Aztiq Pharma Partners S . à r . l (“APP”) is a wholly - owned subsidiary of Aztiq Fund I SCSp (“Aztiq Fund”) . Investment and voting decisions at Aztiq Fund are made by its general partner, Floki GP S . à r . l (“Aztiq GP”) . Investment and voting decisions with respect to the shares held by APP are made by the members of the board of managers of Aztiq GP, where the Company’s chair and CEO Róbert Wessman and the Company’s board member Árni Harðarson are two of a total of five directors and may be deemed to have shared voting and dispositive power with respect to the shares held by APP in Alvotech . The issuer's major share - holders Alvotech's board of directors is comprised of Róbert Wessman (chair), Richard Davies (Deputy chair), Árni Harðarson, Lisa Graver, Ann Merchant, Tomas Ekman, Linda McGoldrick, Faysal Kalmoua and Hjörleifur Pálsson. The executive management team is comprised of Róbert Wessman, CEO, Faysal Kalmoua, COO, Tanya Zharov, General Counsel, Joseph E. McClellan, Chief Scientific Officer and Joel Morales, CFO. Board of directors and Executive Management The independent registered public accounting firm, Deloitte Audit, Société à responsabilité limitée , with registered office at 20 Boulevard de Kockelscheuer, L - 1821, Luxembourg, Grand Duchy of Luxembourg is the independent auditor ( réviseur d'entreprises agréé ) of Alvotech. Ludovic Mosca is responsible for the audit of Alvotech on behalf of Deloitte Audit, Société à responsabilité limitée , and is a chartered accountant ( expert - comptable ) of Luxembourg and is a member of the Institut des Réviseurs d'Entreprises (IRE).

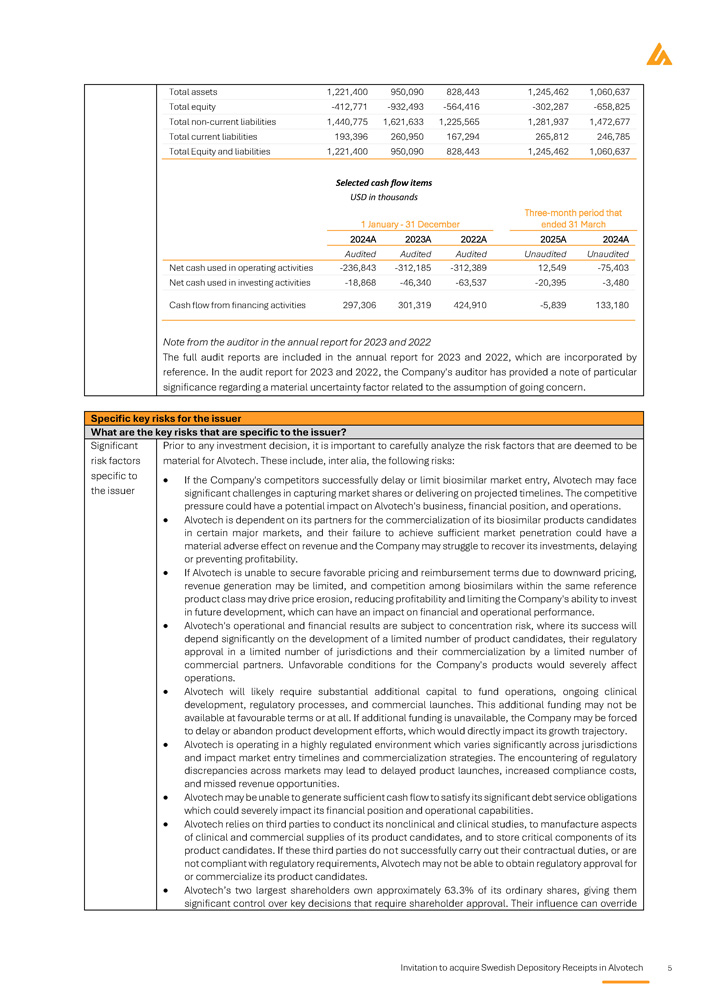

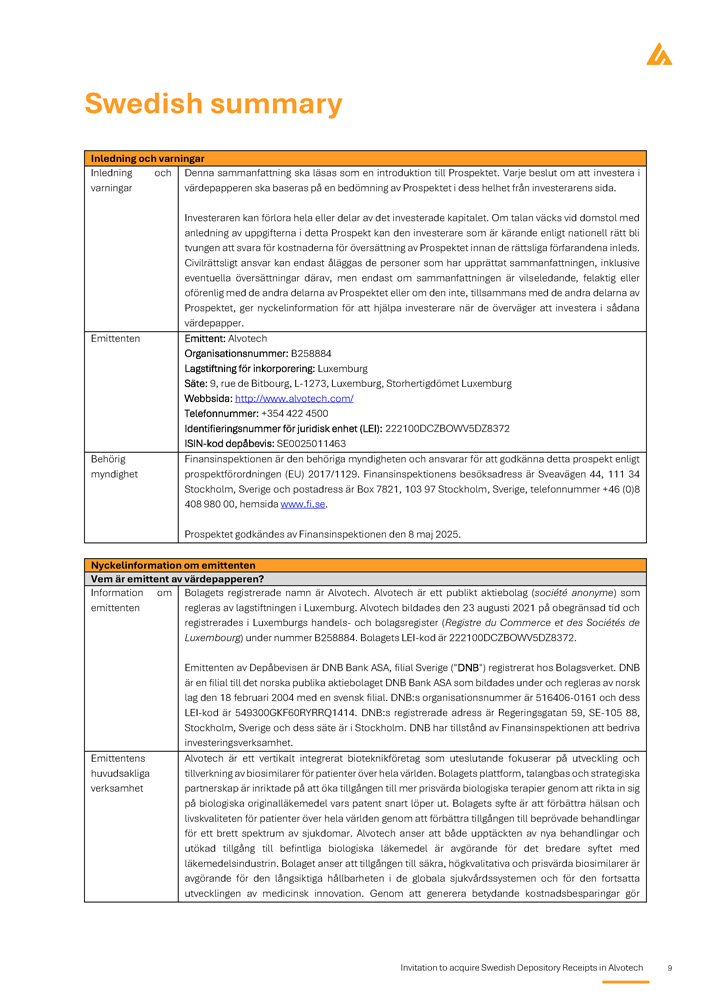

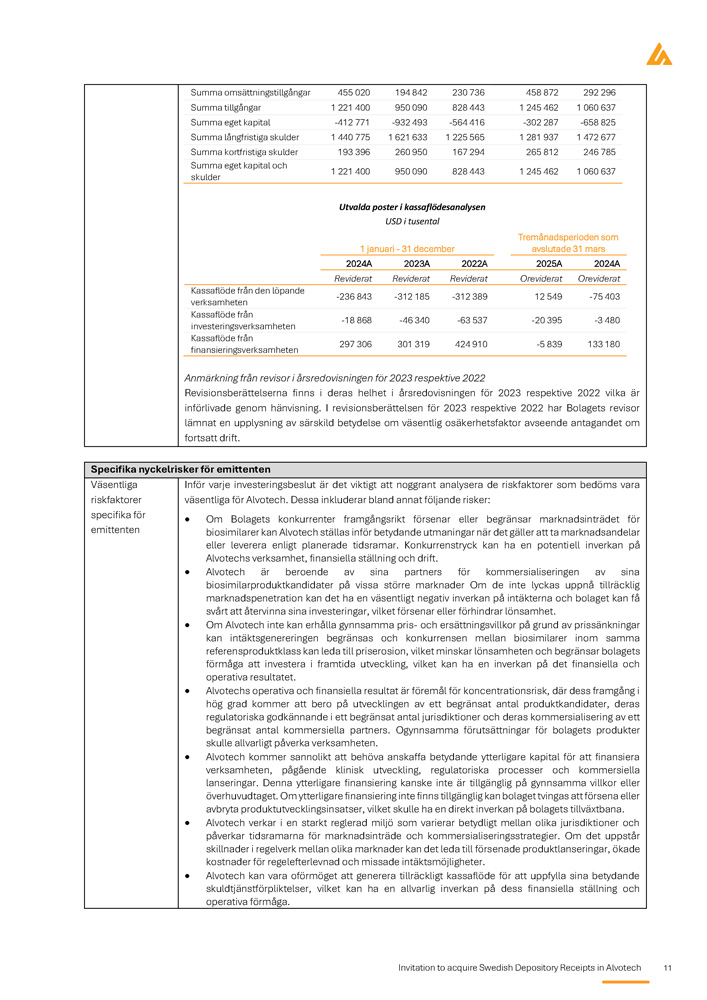

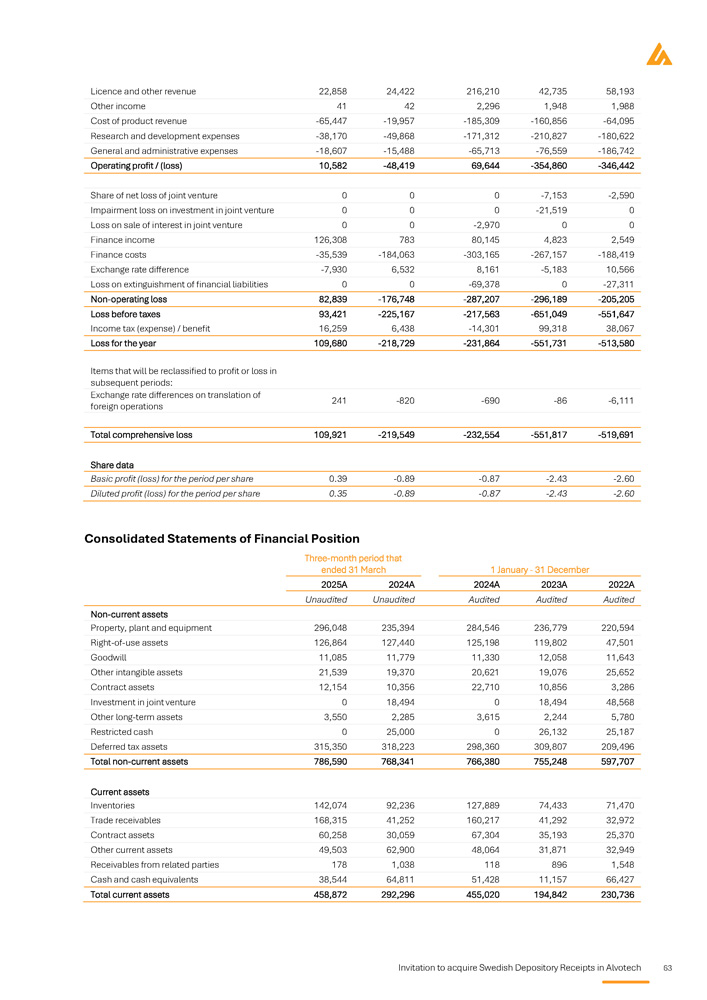

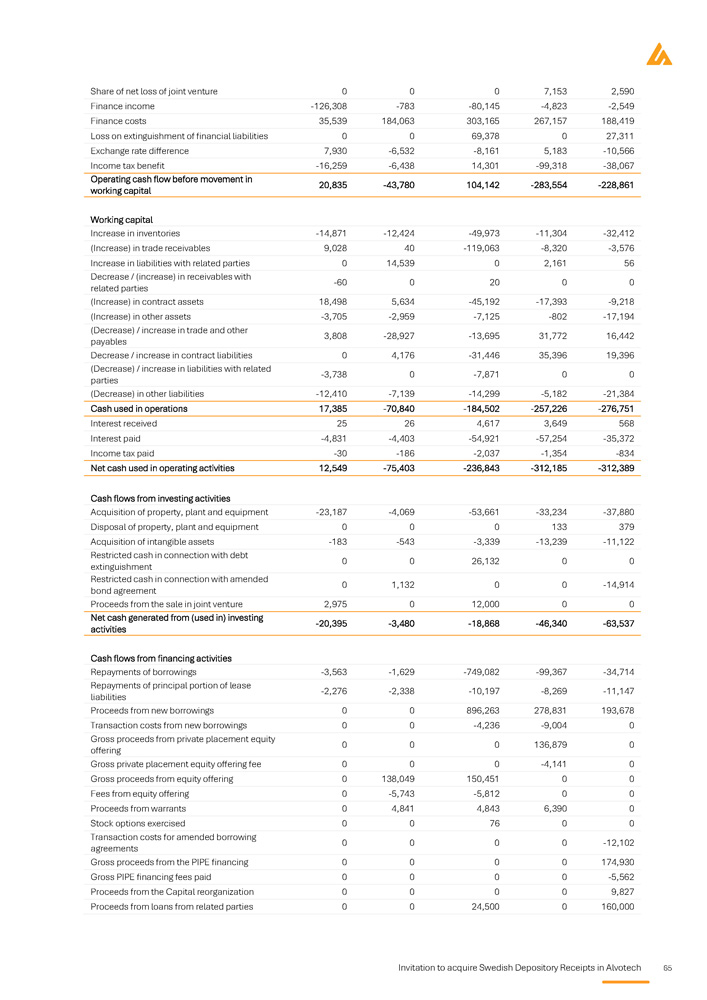

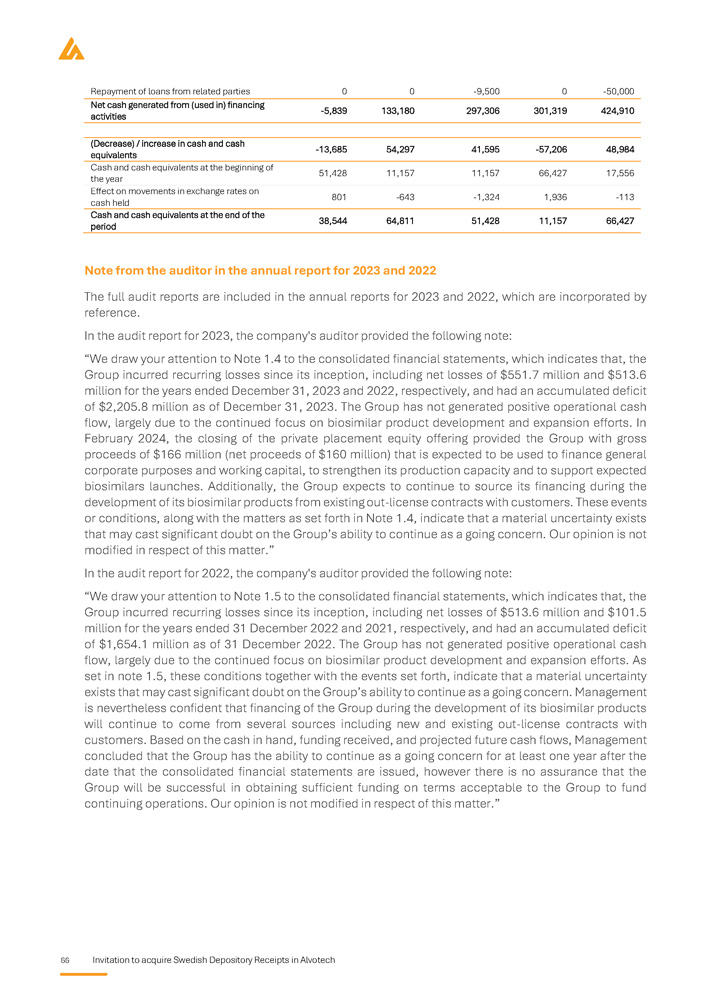

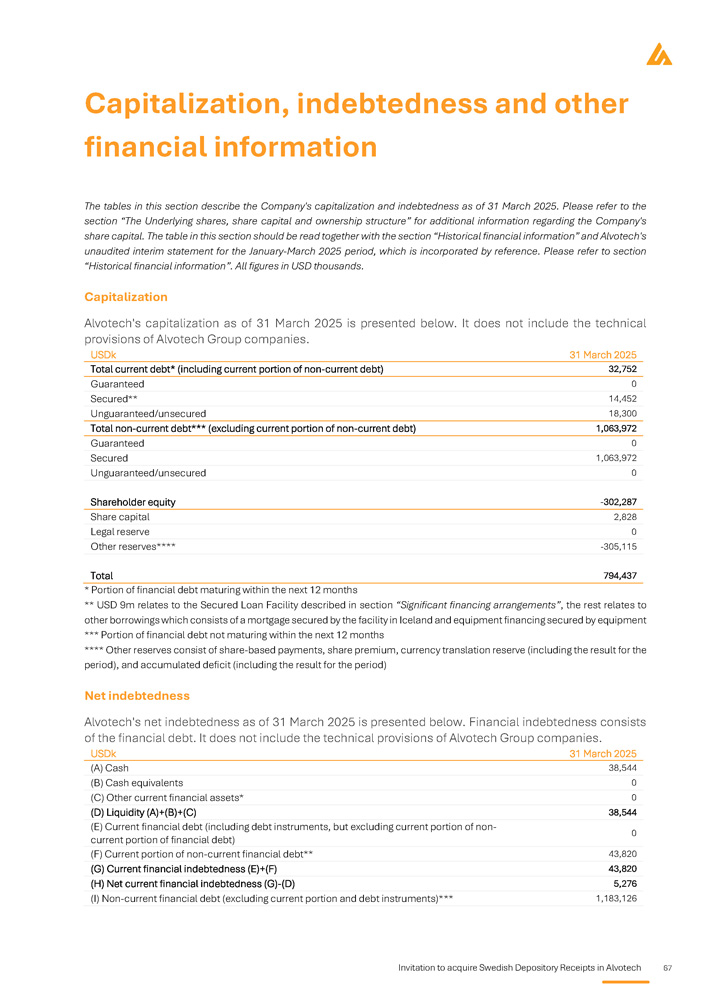

Auditors Key financial information regarding the issuer What is the key financial information regarding the issuer? Selected statement of Profit and Loss items Summary of key financial information USD in thousands, except for per share amounts Three - month period that ended 31 March 1 January - 31 December 2025A 2022A 2023A 2024A Unaudited Audited Audited Audited 132,806 85,017 93,382 491,978 Total revenue 10,582 - 346,442 - 354,860 69,644 Operating profit / (loss) 109,921 - 519,691 - 551,817 - 232,554 Total comprehensive loss 0.39 - 2.60 - 2.43 - 0.87 Basic profit / (loss) for the period per share 0.35 - 2.60 - 2.43 - 0.87 Diluted profit / (loss) for the period per share Selected balance sheet items USD in thousands Three - month period ended 31 March 1 January - 31 December 2025A 2022A 2023A 2024A Unaudited Audited Audited Audited 786,590 597,707 755,248 766,380 Total non - current assets 458,872 230,736 194,842 455,020 Total current assets Invitation to acquire Swedish Depository Receipts in Alvotech 5 1,245,462 828,443 950,090 1,221,400 Total assets - 302,287 - 564,416 - 932,493 - 412,771 Total equity 1,281,937 1,225,565 1,621,633 1,440,775 Total non - current liabilities 265,812 167,294 260,950 193,396 Total current liabilities period March orporated of . 1,245,462 Three - month ended 31 2025A Unaudited 12,549 - 20,395 - 5,839 , which are inc provided a note n of going concern 828,443 ember 2022A Audited - 312,389 - 63,537 424,910 r 2023 and 2022 ny's auditor has the assumptio 950,090 ash flow items thousands uary - 31 Dec 2023A Audited - 312,185 - 46,340 301,319 3 and 2022 l report fo , the Compa tor related to 1,221,400 Selected c USD in 1 Jan 2024A Audited ies - 236,843 ies - 18,868 s 297,306 ual report for 202 ded in the annua r 2023 and 2022 al uncertainty fac Total Equity and liabilities Net cash used in operating activit Net cash used in investing activit Cash flow from financing activitie Note from the auditor in the ann The full audit reports are inclu reference . In the audit report fo significance regarding a materi Specific key risks for the issuer What are the key risks that are specific to the issuer? Prior to any investment decision, it is important to carefully analyze the risk factors that are deemed to be Significant material for Alvotech. These include, inter alia, the following risks: risk factors If the Company's competitors successfully delay or limit biosimilar market entry, Alvotech may face significant challenges in capturing market shares or delivering on projected timelines . The competitive pressure could have a potential impact on Alvotech's business, financial position, and operations . Alvotech is dependent on its partners for the commercialization of its biosimilar products candidates in certain major markets, and their failure to achieve sufficient market penetration could have a material adverse effect on revenue and the Company may struggle to recover its investments, delaying or preventing profitability . If Alvotech is unable to secure favorable pricing and reimbursement terms due to downward pricing, revenue generation may be limited, and competition among biosimilars within the same reference product class may drive price erosion, reducing profitability and limiting the Company's ability to invest in future development, which can have an impact on financial and operational performance . Alvotech's operational and financial results are subject to concentration risk, where its success will depend significantly on the development of a limited number of product candidates, their regulatory approval in a limited number of jurisdictions and their commercialization by a limited number of commercial partners . Unfavorable conditions for the Company's products would severely affect operations . Alvotech will likely require substantial additional capital to fund operations, ongoing clinical development, regulatory processes, and commercial launches . This additional funding may not be available at favourable terms or at all . If additional funding is unavailable, the Company may be forced to delay or abandon product development efforts, which would directly impact its growth trajectory . Alvotech is operating in a highly regulated environment which varies significantly across jurisdictions and impact market entry timelines and commercialization strategies . The encountering of regulatory discrepancies across markets may lead to delayed product launches, increased compliance costs, and missed revenue opportunities . Alvotech may be unable to generate sufficient cash flow to satisfy its significant debt service obligations which could severely impact its financial position and operational capabilities . Alvotech relies on third parties to conduct its nonclinical and clinical studies, to manufacture aspects of clinical and commercial supplies of its product candidates, and to store critical components of its product candidates . If these third parties do not successfully carry out their contractual duties, or are not compliant with regulatory requirements, Alvotech may not be able to obtain regulatory approval for or commercialize its product candidates . Alvotech’s two largest shareholders own approximately 63 . 3 % of its ordinary shares, giving them significant control over key decisions that require shareholder approval . Their influence can override specific to the issuer 6 Invitation to acquire Swedish Depository Receipts in Alvotech the views of other shareholders on board appointments, major corporate transactions, and other important decisions.

This control may delay or block changes, potentially restricting the Company’s growth and financial flexibility. Key information regarding the securities What are the main features of the securities? One (1) Swedish depository receipt (“SDR”) (ISIN code SE0025011463) represents one (1) Underlying share in Alvotech (ISIN code LU2458332611). The Underlying shares in Alvotech have a nominal value of USD 0.01. The Underlying shares have been created under, and are governed by, the laws of the Grand Duchy of Luxembourg. The SDRs are issued in SEK. The SDRs will be created under, and will be governed by, Swedish law. All the Underlying shares are, and when issued the SDRs will be, freely transferable and fully paid for. Information about the securities subject to admission to trading The Underlying shares Each Underlying share entitles the holder to one ( 1 ) vote at the general meeting of shareholders . Neither Luxembourg law nor Alvotech's Articles of Association contain any restrictions as to the voting of ordinary shares by non - Luxembourg residents . Under Luxembourg Companies Law, existing shareholders benefit from a preferential subscription right on the issuance of ordinary shares for cash consideration . All shares in Alvotech give equal rights to dividend and to Alvotech's assets and possible surpluses in the event of liquidation . Dividend and other distributions are paid to shareholders or their nominees that are included in the share register or the register of shareholders on the relevant dividend record date . Alvotech is responsible for keeping the register of the shareholders . Such register shall contain the name of each shareholder, residence or elected domicile and the number of Shares held . Every transfer and devolution of a share shall be entered in the register of the shareholders . All Shares of Alvotech are either registered in the name of shareholders of record with the Company Dz s transfer agent Computershare or are shares in global form existing as book - entry securities that are deposited with, or on behalf of, The Depository Trust Company (DTC), as the central securities depository for shares traded on the Nasdaq Global Market in the United States and Nasdaq CSD for shares traded on the Nasdaq Iceland Main Market . The ISIN code for Alvotech's Underlying shares is LU 2458332611 . The SDRs The issuer of the SDRs is DNB . Alvotech has entered into a custodian agreement with DNB pursuant to which DNB will hold ordinary shares in the Company as custodian and issue one ( 1 ) SDR for each deposited ordinary share in accordance with the General Terms and Conditions for Swedish Depository Receipts in Alvotech (the “SDR General Terms and Conditions”) . Underlying shares are deposited on behalf of an owner of SDRs or such owner's nominee (the “SDR Holder”) in a custody account held by and in the name of DNB . The SDRs in Alvotech shall be registered in the central securities depository and settlement register maintained by Euroclear Sweden in accordance with the Swedish Central Securities Depositories and Financial Instruments Accounts Act (Sw . lag (SFS 1998 : 1479 ) om värdepapperscentraler och kontoföring av finansiella instrument ) and Euroclear Sweden Rules for Issuers and Issuer Agents . An SDR Holder will not have equivalent rights as shareholders of Underlying shares in Alvotech in all respects . As DNB will be the shareholder of record for the Underlying shares represented by the SDRs, the formal shareholder rights will rest with DNB . The SDR Holders' rights will derive from the SDR General Terms and Conditions and applicable rules and regulations . DNB and the Company shall continuously establish arrangements as can be reasonably expected, practically possible and in accordance with applicable laws, regulations, VPC Rules and market practice, such that the SDR Holders may have the opportunity to indirectly exercise shareholder rights with respect to Alvotech . Rights associated with the securities From the annual net profits of Alvotech, at least 5 % shall each year be allocated to the reserve required by applicable law (the “Legal Reserve”) . That allocation to the Legal Reserve will cease to be required as soon and as long as the Legal Reserve amounts to 10 % of the amount of the share capital of Alvotech . The Legal Reserve is not available for distribution . Alvotech do not anticipate paying any cash dividends in the foreseeable future . The Company intend to retain all available funds and any future earnings to fund the development and expansion of its business and product candidates .

Dividend policy Where will the securities be traded? Invitation to acquire Swedish Depository Receipts in Alvotech 7 The Underlying shares are traded on the Nasdaq Global Market in the United States and on the Nasdaq Iceland Main Market under the ticker ALVO . The board of directors of Alvotech intends to apply for listing of the Company ’ s 324 , 801 , 040 issued ordinary shares on Nasdaq Stockholm in the form of SDRs, with each SDR representing one Underlying share in Alvotech . Nasdaq Stockholm has on 30 April 2025 assessed that Alvotech fulfils the applicable listing requirements . Nasdaq Stockholm will approve an application for admission to trading of the Company’s SDRs on Nasdaq Stockholm, provided that certain customary conditions are met, including that Alvotech submits such an application for admission to trading on Nasdaq Stockholm and that the distribution requirement for the Company’s SDRs are met no later than on the date of the first day of trading in the SDRs . Expected first day of trading in the SDRs on Nasdaq Stockholm is 19 May 2025 . Admission to trading Which key risks that are specific to the securities? The most significant risks related to Alvotech's SDRs include the following: No assurance can be given that a trading market will develop for the SDRs and, if a market does develop, the SDRs may be subject to greater volatility than the Underlying shares. Holders of SDRs will have similar but not identical rights to those of shareholders holding ordinary shares in Alvotech. Significant risk factors specific to the securities Key information regarding the Offering Under which conditions and timetable can I invest in this security? The Offering The Offering comprises of a maximum of 441 , 600 SDRs where each SDR is represented by one existing Underlying share . The Offering is directed to the general public in Sweden . Offering Price The final price per SDR in the Offering (the “Offering Price”) will be the lower of either the volume - weighted average price of the Company’s share on Nasdaq Iceland Main Market during the application period of the Offering, or the last closing price of the Company’s share on Nasdaq Iceland Main Market during the application period of the Offering, with a discount of ten ( 10 ) % and converted to SEK based on the exchange rate published by the Swedish Central Bank (Sw . Riksbanken ) on the last day of the application period . The Offering Price will not exceed SEK 90 per SDR . No commission or brokerage fee is charged . The final Offering Price will be determined by the board of directors in consultation with the Financial Advisors and is expected to be announced through a press release on 16 May 2025 . Allotment Decisions on allotment of SDRs in the Offering will be made by Alvotech in consultation with the Financial Advisors, whereby the target is to achieve a broad distribution of the SDRs among the general public in order to enable regular and liquid trading in the SDRs on Nasdaq Stockholm . The allotment does not depend on when the application is submitted during the application period . In the event of oversubscription, allotment may not take place or take place with a lower number of SDRs than the application refers to, whereby allotment may take place in whole or in part through a random selection . Allotment to persons who receive SDRs under the Offering will primarily be made so that a certain number of SDRs are allotted per application . Any additional allocation will be made in a certain, equal percentage of the excess number of SDRs requested in the application . Announcement of the outcome of the Offering The final outcome of the Offering is expected to be announced through a press release that will be available on Alvotech’s website www . alvotech . com on or about 16 May 2025 . Terms and conditions regarding the Offering Application period: 9 May 2025 – 16 May 2025 First day of trading: 19 May 2025 Settlement date: 21 May 2025 Expected timetable for the Offering Alvotech's costs related to the Offering and the listing on Nasdaq Stockholm are expected to amount to approximately SEK 25 million. Such costs primarily relate to costs for advisors and listing costs.

Costs relating to the Offering Why is this Prospectus being produced? 8 Invitation to acquire Swedish Depository Receipts in Alvotech Alvotech’s board of directors and executive management team have identified the expansion of its research and development (“R&D”) capability as a strategic priority to support Alvotech’s expected growth trajectory . The Company also wants to increase access to experienced life - science R&D professionals outside Iceland . The Company’s recently announced acquisition of Xbrane’s R&D operations at the Karolinska life - science hub in Sweden and the integration of much of its workforce of seasoned biosimilars developers will further expand Alvotech’s scientific and innovation capabilities, enable the Company to access a broad talent pool and help to establish a strong presence in the Swedish life - science sector, supporting further growth . The shareholders of Xbrane approved the transaction at the extraordinary general meeting held on 14 April 2025 , but closing of the acquisition is subject to FDI approval . Such regulatory approval is expected in May 2025 . Alvotech has been listed on the Nasdaq Global Market and Nasdaq Iceland Main Market since 2022 . The board of directors and executive management believe that now is an opportune time to broaden the Company’s investor base and increase its visibility among Nordic and European investors by listing SDRs on Nasdaq Stockholm . The Offering is not being made to raise capital for the Company but solely for the purpose of achieving a sufficient distribution of the SDRs to fulfil the listing requirements of Nasdaq Stockholm . The Offering is expected to provide Alvotech with gross proceeds of approximately SEK 30 million before deduction of transaction costs of approximately SEK 25 million . Consequently, Alvotech expects to receive net proceeds of SEK 5 million . The Company considers the net proceeds to be insignificant with respect to the Company’s operations and therefore do not allocate the proceeds to any specific use other than for general corporate purposes . A listing on Nasdaq Stockholm is thus expected to further strengthen Alvotech’s recognition in the Nordic and European markets, improving access to regional capital, and attracting a broader base of institutional and retail investors, both based in Sweden, and beyond . Additionally, Alvotech has identified strong investor demand for opportunities to invest in European biotech, biopharma and biosimilar stocks among Nordic and international institutional investors . Background and reasons DNB Markets and Carnegie are acting as financial advisors to the Company in connection with the Offering and admission to trading of the SDRs on Nasdaq Stockholm . DNB Markets and Carnegie (and its affiliated) have provided, and may provide in the future, various banking, financial, investment and commercial services as well as other services to Alvotech for which they have received, or may receive, compensation . DNB Markets and Carnegie may, in the securities business, come to trade with or take positions in securities which are directly or indirectly linked to the Company .

Material conflicts of interest Invitation to acquire Swedish Depository Receipts in Alvotech 9 Swedish summary Inledning och varningar Denna sammanfattning ska läsas som en introduktion till Prospektet . Varje beslut om att investera i värdepapperen ska baseras på en bedömning av Prospektet i dess helhet från investerarens sida . Investeraren kan förlora hela eller delar av det investerade kapitalet . Om talan väcks vid domstol med anledning av uppgifterna i detta Prospekt kan den investerare som är kärande enligt nationell rätt bli tvungen att svara för kostnaderna för översättning av Prospektet innan de rättsliga förfarandena inleds . Civilrättsligt ansvar kan endast åläggas de personer som har upprättat sammanfattningen, inklusive eventuella översättningar därav, men endast om sammanfattningen är vilseledande, felaktig eller oförenlig med de andra delarna av Prospektet eller om den inte, tillsammans med de andra delarna av Prospektet, ger nyckelinformation för att hjälpa investerare när de överväger att investera i sådana värdepapper . Inledning och varningar Emittent: Alvotech Organisationsnummer: B258884 Lagstiftning för inkorporering: Luxemburg Säte: 9, rue de Bitbourg, L - 1273, Luxemburg, Storhertigdömet Luxemburg Webbsida: http://www.alvotech.com/ Telefonnummer: +354 422 4500 Identifieringsnummer för juridisk enhet (LEI): 222100DCZBOWV5DZ8372 ISIN - kod depåbevis: SE0025011463 Emittenten Finansinspektionen är den behöriga myndigheten och ansvarar för att godkänna detta prospekt enligt prospektförordningen (EU) 2017/1129. Finansinspektionens besöksadress är Sveavägen 44, 111 34 Stockholm, Sverige och postadress är Box 7821, 103 97 Stockholm, Sverige, telefonnummer +46 (0)8 408 980 00, hemsida www.fi.se . Prospektet godkändes av Finansinspektionen den 8 maj 2025. Behörig myndighet Nyckelinformation om emittenten Vem är emittent av värdepapperen? Bolagets registrerade namn är Alvotech . Alvotech är ett publikt aktiebolag ( société anonyme ) som regleras av lagstiftningen i Luxemburg . Alvotech bildades den 23 augusti 2021 på obegränsad tid och registrerades i Luxemburgs handels - och bolagsregister ( Registre du Commerce et des Sociétés de Luxembourg ) under nummer B 258884 . Bolagets LEI - kod är 222100 DCZBOWV 5 DZ 8372 . Emittenten av Depåbevisen är DNB Bank ASA, filial Sverige ("DNB") registrerat hos Bolagsverket . DNB är en filial till det norska publika aktiebolaget DNB Bank ASA som bildades under och regleras av norsk lag den 18 februari 2004 med en svensk filial . DNB : s organisationsnummer är 516406 - 0161 och dess LEI - kod är 549300 GKF 60 RYRRQ 1414 . DNB : s registrerade adress är Regeringsgatan 59 , SE - 105 88 , Stockholm, Sverige och dess säte är i Stockholm . DNB har tillstånd av Finansinspektionen att bedriva investeringsverksamhet . Information om emittenten Alvotech är ett vertikalt integrerat bioteknikföretag som uteslutande fokuserar på utveckling och tillverkning av biosimilarer för patienter över hela världen . Bolagets plattform, talangbas och strategiska partnerskap är inriktade på att öka tillgången till mer prisvärda biologiska terapier genom att rikta in sig på biologiska originalläkemedel vars patent snart löper ut . Bolagets syfte är att förbättra hälsan och livskvaliteten för patienter över hela världen genom att förbättra tillgången till beprövade behandlingar för ett brett spektrum av sjukdomar . Alvotech anser att både upptäckten av nya behandlingar och utökad tillgång till befintliga biologiska läkemedel är avgörande för det bredare syftet med läkemedelsindustrin . Bolaget anser att tillgången till säkra, högkvalitativa och prisvärda biosimilarer är avgörande för den långsiktiga hållbarheten i de globala sjukvårdssystemen och för den fortsatta utvecklingen av medicinsk innovation . Genom att generera betydande kostnadsbesparingar gör Emittentens huvudsakliga verksamhet 10 Invitation to acquire Swedish Depository Receipts in Alvotech biosimilarer det möjligt för vårdgivare att behandla fler patienter samtidigt som resurser frigörs för investeringar i nästa generations behandlingar.

I tabellen nedan presenteras aktieägare med ett direkt eller indirekt aktieinnehav som representerar 5 % eller mer av det totala antalet aktier och röster i Alvotech per den 31 mars 2025 och därefter kända förändringar . DNB kommer att inneha samtliga aktier som kommer att ligga till grund för Depåbevisen . Namn Antal aktier Kapital och röster ( % ) Aztiq Pharma Partners S . à r . l 101 147 803 33 . 51 % Alvogen Lux Holdings S . à r . l 90 005 334 29 . 82 % Såvitt Bolaget känner till kontrolleras Alvotech inte direkt eller indirekt av någon enskild aktieägare eller grupp av aktieägare . Genom mellanliggande holdingbolag är dock Alvogen Lux Holdings S . à r . l (”Alvogen”) ett helägt dotterbolag till Celtic Holdings SCA (”Celtic Holdings”) . Investerings - och röstningsbeslut avseende de aktier som innehas av Alvogen fattas av styrelseledamöterna i Celtic Holdings, där bolagets styrelseordförande och VD Róbert Wessman och bolagets styrelseledamöter Tomas Ekman och Árni Harðarson är tre av totalt sex styrelseledamöter och kan anses ha delad rösträtt och bestämmanderätt avseende de aktier som innehas av Alvogen . Vidare är Aztiq Pharma Partners S . à r . l (”APP”) ett helägt dotterbolag till Aztiq Fund I SCSp (”Aztiq Fund”) . Investerings - och röstningsbeslut i Aztiq Fund fattas av dess general partner, Floki GP S . à r . l (”Aztiq GP”) . Investerings - och röstningsbeslut avseende de aktier som innehas av APP fattas av ledamöterna i styrelsen för Aztiq GP, där Bolagets styrelseordförande och VD Róbert Wessman och Bolagets styrelseledamot Árni Harðarson är två av totalt fem styrelseledamöter och kan anses ha delad rösträtt och bestämmanderätt avseende de aktier som innehas av APP i Alvotech . Emittentens större aktieägare Alvotechs styrelse består av Róbert Wessman (ordförande), Richard Davies (vice ordförande), Árni Harðarson, Lisa Graver, Ann Merchant, Tomas Ekman, Linda McGoldrick, Faysal Kalmoua och Hjörleifur Pálsson. Den verkställande ledningen består av Róbert Wessman (VD), Faysal Kalmoua (COO), Tanya Zharov (chefsjurist), Joseph E. McClellan (forskningschef) och Joel Morales (CFO). Styrelse och ledande befattnings - havare Det oberoende registrerade revisionsbolaget Deloitte Audit, Société à responsabilité limitée , med säte på 20 Boulevard de Kockelscheuer, L - 1821 , Luxemburg, Storhertigdömet Luxemburg, är Alvotechs oberoende revisor ( réviseur d'entreprises agréé ) . Ludovic Mosca är ansvarig för revisionen av Alvotech för Deloitte Audits, Société à responsabilité limitée , räkning och är auktoriserad revisor ( expert - comptable ) i Luxemburg och medlem av Institut des Réviseurs d'Entreprises (IRE) .

Revisor Finansiell nyckelinformation för emittenten Utvalda poster i resultaträkningen USD i tusental förutom aktiedata Tremånadsperioden som 1 januari - 31 december avslutade 31 mars 2024A 2023A 2022A 2025A 2024A Reviderat Reviderat Reviderat Oreviderat Oreviderat Summa intäkter 491 978 93 382 85 017 132 806 36 894 Rörelseresultat 69 644 - 354 860 - 346 442 10 582 - 48 419 Totalt resultat - 232 554 - 551 817 - 519 691 109 921 - 219 549 Resultat per aktie före - 0,87 - 2,43 - 2,60 0,39 - 0,89 utspädning Resultat per aktie efter - 0,87 - 2,43 - 2,60 0,35 - 0.89 utspädning Utvalda poster i balansräkningen USD i tusental Tremånadsperioden som 1 januari - 31 december avslutade 31 mars 2024A 2023A 2022A 2025A 2024A Reviderat Reviderat Reviderat Oreviderat Oreviderat Summa anläggningstillgångar 766 380 755 248 597 707 786 590 768 341 Finansiell nyckelinformatio n i sammandrag Invitation to acquire Swedish Depository Receipts in Alvotech 11 i 292 458 872 230 736 194 842 455 020 Summa omsättningstillgångar 1 060 1 245 462 828 443 950 090 1 221 400 Summa tillgångar - 658 - 302 287 - 564 416 - 932 493 - 412 771 Summa eget kapital 1 472 1 281 937 1 225 565 1 621 633 1 440 775 Summa långfristiga skulder 246 265 812 167 294 260 950 193 396 Summa kortfristiga skulder 1 060 erioden e 31 mars 2024A Oreviderat - 75 - 133 2022 Bolagets antagandet 1 245 462 Tremånadsp avslutad 2025A Oreviderat 12 549 - 20 395 - 5 839 23 respektive tive 2022 har tor avseende 828 443 desanalysen l mber 2022A Reviderat - 312 389 - 63 537 424 910 ktive 2022 isningen för 20 r 2023 respek osäkerhetsfak 950 090 oster i kassaflö USD i tusenta uari - 31 dece 2023A Reviderat - 312 185 - 46 340 301 319 ör 2023 respe et i årsredov rättelsen fö om väsentlig 1 221 400 Utvalda p 1 jan 2024A Reviderat - 236 843 - 18 868 297 306 dovisningen f deras helh I revisionsbe ild betydelse Summa eget kapital och skulder Kassaflöde från den löpande verksamheten Kassaflöde från investeringsverksamheten Kassaflöde från finansieringsverksamheten Anmärkning från revisor i årsre Revisionsberättelserna finns införlivade genom hänvisning. lämnat en upplysning av särsk fortsatt drift. Specifika nyckelrisker för emittenten Inför varje investeringsbeslut är det viktigt att noggrant analysera de riskfaktorer som bedöms vara Väsentliga väsentliga för Alvotech. Dessa inkluderar bland annat följande risker: riskfaktorer Om Bolagets konkurrenter framgångsrikt försenar eller begränsar marknadsinträdet för biosimilarer kan Alvotech ställas inför betydande utmaningar när det gäller att ta marknadsandelar eller leverera enligt planerade tidsramar . Konkurrenstryck kan ha en potentiell inverkan på Alvotechs verksamhet, finansiella ställning och drift . Alvotech är beroende av sina partners för kommersialiseringen av sina biosimilarproduktkandidater på vissa större marknader Om de inte lyckas uppnå tillräcklig marknadspenetration kan det ha en väsentligt negativ inverkan på intäkterna och bolaget kan få svårt att återvinna sina investeringar, vilket försenar eller förhindrar lönsamhet . Om Alvotech inte kan erhålla gynnsamma pris - och ersättningsvillkor på grund av prissänkningar kan intäktsgenereringen begränsas och konkurrensen mellan biosimilarer inom samma referensproduktklass kan leda till priserosion, vilket minskar lönsamheten och begränsar bolagets förmåga att investera i framtida utveckling, vilket kan ha en inverkan på det finansiella och operativa resultatet . Alvotechs operativa och finansiella resultat är föremål för koncentrationsrisk, där dess framgång i hög grad kommer att bero på utvecklingen av ett begränsat antal produktkandidater, deras regulatoriska godkännande i ett begränsat antal jurisdiktioner och deras kommersialisering av ett begränsat antal kommersiella partners . Ogynnsamma förutsättningar för bolagets produkter skulle allvarligt påverka verksamheten . Alvotech kommer sannolikt att behöva anskaffa betydande ytterligare kapital för att finansiera verksamheten, pågående klinisk utveckling, regulatoriska processer och kommersiella lanseringar . Denna ytterligare finansiering kanske inte är tillgänglig på gynnsamma villkor eller överhuvudtaget . Om ytterligare finansiering inte finns tillgänglig kan bolaget tvingas att försena eller avbryta produktutvecklingsinsatser, vilket skulle ha en direkt inverkan på bolagets tillväxtbana . Alvotech verkar i en starkt reglerad miljö som varierar betydligt mellan olika jurisdiktioner och påverkar tidsramarna för marknadsinträde och kommersialiseringsstrategier . Om det uppstår skillnader i regelverk mellan olika marknader kan det leda till försenade produktlanseringar, ökade kostnader för regelefterlevnad och missade intäktsmöjligheter . Alvotech kan vara oförmöget att generera tillräckligt kassaflöde för att uppfylla sina betydande skuldtjänstförpliktelser, vilket kan ha en allvarlig inverkan på dess finansiella ställning och operativa förmåga .

specifika för emittenten 12 Invitation to acquire Swedish Depository Receipts in Alvotech Alvotech är beroende av tredje part för att genomföra sina icke - kliniska och kliniska studier, för att tillverka delar av kliniska och kommersiella leveranser av sina produktkandidater och för att lagra kritiska komponenter i sina produktkandidater . Om dessa tredje parter inte framgångsrikt utför sina avtalsenliga skyldigheter, eller inte uppfyller regulatoriska krav, kan det hända att Alvotech inte kan erhålla regulatoriskt godkännande för eller kommersialisera sina produktkandidater . Alvotechs två största aktieägare äger cirka 63 , 3 % av Bolagets aktier, vilket ger dem betydande kontroll över viktiga beslut som kräver godkännande av aktieägarna . Deras inflytande kan åsidosätta andra aktieägares synpunkter om styrelseutnämningar, större företagstransaktioner och andra viktiga beslut . Denna kontroll kan försena eller blockera förändringar, vilket potentiellt kan begränsa bolagets tillväxt och finansiella flexibilitet . Nyckelinformation om värdepapperen Värdepapperens viktigaste egenskaper Ett ( 1 ) svenskt depåbevis ("Depåbevis") (ISIN - kod SE 0025011463 ) representerar en ( 1 ) Underliggande aktie i Alvotech (ISIN - kod LU 2458332611 ) . De Underliggande aktierna i Alvotech har ett nominellt värde om 0 , 01 USD . De Underliggande aktierna har skapats i enlighet med, och regleras av, lagarna i Luxemburg . Depåbevisen är utgivna i SEK . Depåbevisen kommer att skapas under, och kommer att regleras av, svensk lag . Alla Underliggande aktier är, och Depåbevisen kommer att vara när de emitteras, fritt överlåtbara och fullt betalda . Värdepapper som är föremål för upptagande till handel De Underliggande aktierna Varje Underliggande aktie berättigar innehavaren till en ( 1 ) röst vid bolagsstämma . Varken luxemburgsk lag eller Alvotechs bolagsordning innehåller några begränsningar avseende rösträtt för stamaktier för personer som inte är bosatta i Luxemburg . Enligt luxemburgsk aktiebolagslag har befintliga aktieägare företrädesrätt till teckning vid emission av stamaktier mot kontant vederlag . Samtliga aktier i Alvotech ger lika rätt till utdelning och till Alvotechs tillgångar och eventuella överskott i händelse av likvidation . Utdelning och andra värdeöverföringar betalas till aktieägare eller deras förvaltare som är införda i aktieboken eller aktieboken på den relevanta avstämningsdagen för utdelning . Alvotech är ansvarigt för att föra aktieboken . Sådan förteckning ska innehålla uppgift om varje aktieägares namn, hemvist eller säte samt antal innehavda aktier . Varje överlåtelse och upplåtelse av en aktie ska antecknas i aktieboken . Alla aktier i Alvotech är antingen registrerade i aktieägarnas namn hos Bolagets transferagent Computershare eller är aktier i global form som existerar som kontoförda värdepapper som är deponerade hos, eller på uppdrag av, The Depository Trust Company (DTC), som den centrala värdepapperscentralen för aktier som handlas på Nasdaq Global Market i USA och Nasdaq CSD för aktier som handlas på Nasdaq Iceland Main Market . ISIN - koden för Alvotechs Underliggande aktie är LU 2458332611 . Depåbevisen Emittent av Depåbevisen är DNB. Alvotech har ingått ett depåavtal med DNB enligt vilket DNB kommer att hålla stamaktier i Bolaget som depåbank och utfärda ett ( 1 ) Depåbevis för varje deponerad stamaktie i enlighet med Allmänna Villkor för svenska depåbevis i Alvotech ("Allmänna Villkor för Depåbevis") . Underliggande aktier deponeras för depåbevisinnehavares eller dennes förvaltares räkning ("Depåbevisinnehavaren") på en depå som hålls av och i DNB : s namn . Depåbevisen i Alvotech ska vara registrerade i det av Euroclear Sweden förda centrala värdepappersförvararings - och avvecklingsregistret i enlighet med lagen ( 1998 : 1479 ) om värdepapperscentraler och kontoföring av finansiella instrument och Euroclear Swedens Regler för emittenter och emissionsinstitut . En Depåbevisinnehavare kommer inte att ha motsvarande rättigheter som aktieägare av Underliggande aktier i Alvotech i alla avseenden . Eftersom DNB kommer att vara den registrerade aktieägaren för de Underliggande aktier som Depåbevisen representerar, kommer de formella aktieägarrättigheterna att tillkomma DNB . Depåbevisinnehavarnas rättigheter kommer att följa av Allmänna Villkor för Depåbevis och tillämpliga regler och föreskrifter . DNB och Bolaget ska löpande etablera arrangemang som rimligen kan förväntas så att Depåbevisinnehavarna kan ha möjlighet att indirekt utöva aktieägarrättigheter avseende Alvotech .

Rättigheter som sammanhänger med värde - papperen Invitation to acquire Swedish Depository Receipts in Alvotech 13 Av Alvotechs årliga nettovinst ska minst 5 % varje år avsättas till den reserv som krävs enligt tillämplig lag ("Reservfonden") . Denna avsättning till Reservfonden kommer att upphöra så snart och så länge som Reservfonden uppgår till 10 % av aktiekapitalet i Alvotech . Reservfonden är inte tillgänglig för utdelning . Alvotech förväntar sig inte att betala några kontantutdelningar under överskådlig framtid . Bolaget avser att behålla alla tillgängliga medel och eventuella framtida vinster för att finansiera utvecklingen och expansionen av dess verksamhet och produktkandidater . Utdelnings policy Var kommer värdepapperen att handlas? De Underliggande aktierna handlas på Nasdaq Global Market i USA och på Nasdaq Iceland Main Market under kortnamnet ALVO . Styrelsen i Alvotech avser att ansöka om notering av Bolagets 324 801 040 emitterade stamaktier på Nasdaq Stockholm i form av Depåbevis, där varje Depåbevis representerar en Underliggande aktie i Alvotech . Nasdaq Stockholm har den 30 april 2025 bedömt att Alvotech uppfyller gällande noteringskrav . Nasdaq Stockholm kommer att godkänna en ansökan om upptagande till handel av Bolagets Depåbevis på Nasdaq Stockholm, under förutsättning att vissa sedvanliga villkor uppfylls, däribland att Alvotech lämnar in en sådan ansökan om upptagande till handel på Nasdaq Stockholm och att spridningskravet för Bolagets Depåbevis uppnås senast första dagen för handel med Depåbevisen . Förväntad första dag för handel med Depåbevisen på Nasdaq Stockholm är den 19 maj 2025 . Upptagande till handel Vilka nyckelrisker är specifika för värdepapperen? De mest väsentliga riskerna relaterade till Alvotechs Depåbevis inkluderar följande : Ingen garanti kan lämnas för att en handelsmarknad kommer att utvecklas för Depåbevisen och, om en marknad utvecklas, kan Depåbevisen vara föremål för större volatilitet än de Underliggande aktierna . Innehavare av Depåbevis kommer att ha liknande men inte identiska rättigheter som aktieägare som innehar stamaktier i Alvotech . Väsentliga riskfaktorer specifika för värdepapperen Nyckelinformation om Erbjudandet På vilka villkor och enligt vilken tidsplan kan jag investera i detta värdepapper? Erbjudandet Erbjudandet omfattar högst 441 600 Depåbevis där varje Depåbevis representerar en (1) befintlig Underliggande aktie. Erbjudandet riktar sig till allmänheten i Sverige. Priset i Erbjudandet Det slutliga priset per Depåbevis i Erbjudandet ("Erbjudandepriset") kommer att vara det lägsta av antingen det volymvägda genomsnittspriset för Bolagets aktie på Nasdaq Iceland Main Market under anmälningsperioden för Erbjudandet, eller det sista stängningspriset för Bolagets aktie på Nasdaq Iceland Main Market under anmälningsperioden för Erbjudandet, med en rabatt om tio ( 10 ) % och omräknat till SEK baserat på den växelkurs som publiceras av Riksbanken den sista dagen i anmälningsperioden . Erbjudandepriset kommer inte att överstiga SEK 90 per Depåbevis . Inget courtage eller förmedlingsavgift tas ut . Det slutliga Erbjudandepriset kommer att fastställas av styrelsen i samråd med Financial Advisors och förväntas offentliggöras genom ett pressmeddelande den 16 maj 2025 . Tilldelning Beslut om tilldelning av Depåbevis i Erbjudandet kommer att fattas av Alvotech i samråd med Financial Advisors, varvid målet är att uppnå en bred spridning av Depåbevisen bland allmänheten för att möjliggöra en regelbunden och likvid handel i Depåbevisen på Nasdaq Stockholm . Tilldelningen är inte beroende av när ansökan lämnas in under anmälningsperioden . I händelse av överteckning kan tilldelning komma att utebli eller ske med ett lägre antal Depåbevis än vad anmälan avser, varvid tilldelning helt eller delvis kan komma att ske genom slumpmässigt urval . Tilldelning till personer som erhåller Depåbevis inom ramen för Erbjudandet kommer i första hand att ske så att ett visst antal Depåbevis tilldelas per ansökan . Eventuell ytterligare tilldelning kommer att ske med en viss, lika stor andel av det överskjutande antalet Depåbevis som begärts i ansökan . Offentliggörande av slutligt utfall Villkor och anvisningar avseende Erbjudan - det 14 Invitation to acquire Swedish Depository Receipts in Alvotech Det slutliga utfallet av Erbjudandet förväntas offentliggöras genom ett pressmeddelande som kommer att finnas tillgängligt på Alvotechs hemsida www.alvotech.com omkring den 16 maj 2025.

Anmälningsperiod: 9 maj 2025 - 16 maj 2025 Första dag för handel: 19 maj 2025 Likviddag: 21 maj 2025 Förväntad tidplan för Erbjudandet Alvotechs kostnader i samband med Erbjudandet och noteringen på Nasdaq Stockholm förväntas uppgå till cirka 25 MSEK. Sådana kostnader avser främst kostnader för rådgivare och noteringskostnader. Kostnader hänförliga till Erbjudandet Varför upprättas detta Prospekt? Alvotechs styrelse och ledningsgrupp har identifierat expansionen av sin forsknings - och utvecklingskapacitet ("FoU") som en strategisk prioritering för att stödja Alvotechs förväntade tillväxtbana . Bolaget vill också öka tillgången till erfaren personal inom forskning och utveckling inom life - science utanför Island . Bolagets nyligen offentliggjorda förvärv av Xbranes FoU - verksamhet vid Karolinska life - science hubben i Sverige och integrationen av en stor del av dess personalstyrka av erfarna biosimilarutvecklare kommer att ytterligare utöka Alvotechs vetenskapliga och innovationsförmåga, göra det möjligt för bolaget att få tillgång till en bred talangpool och bidra till att etablera en stark närvaro i den svenska life - science - sektorn, vilket stödjer ytterligare tillväxt . Aktieägarna i Xbrane godkände förvärvet vid den extra bolagsstämman som hölls den 14 april 2025 , men slutförandet av förvärvet är föremål för FDI - godkännande . Sådant godkännande förväntas erhållas i maj 2025 . Alvotech har varit noterat på Nasdaq Global Market och Nasdaq Iceland Main Market sedan 2022 . Styrelsen och ledningen anser att det nu är en lämplig tidpunkt att bredda Bolagets investerarbas och öka dess synlighet bland nordiska och europeiska investerare genom att notera Depåbevis på Nasdaq Stockholm . Erbjudandet genomförs inte för att anskaffa kapital till Bolaget utan endast i syfte att erhålla en spridning av Depåbevisen för att uppfylla noteringskraven på Nasdaq Stockholm . Erbjudandet förväntas tillföra Alvotech en bruttolikvid om cirka 30 miljoner SEK före avdrag för transaktionskostnader om cirka 25 miljoner SEK . Följaktligen förväntar sig Alvotech att erhålla en nettolikvid om cirka 5 miljoner SEK . Bolaget anser att nettolikviden är obetydlig i förhållande till Bolagets verksamhet och därför allokeras inte intäkterna till något specifikt ändamål annat än för allmänna bolagsändamål . En notering på Nasdaq Stockholm förväntas således ytterligare stärka Alvotechs erkännande på de nordiska och europeiska marknaderna, förbättra tillgången till regionalt kapital och attrahera en bredare bas av institutionella och privata investerare, både baserade i Sverige och utanför . Dessutom har Alvotech identifierat en stark efterfrågan på möjligheter att investera i europeiska bioteknik - , biopharma - och biosimilaraktier bland nordiska och internationella institutionella investerare . Bakgrund och motiv DNB Markets och Carnegie agerar som finansiella rådgivare till Bolaget i samband med Erbjudandet och upptagandet till handel av Depåbevisen på Nasdaq Stockholm. DNB Markets och Carnegie (och dess närstående) har tillhandahållit, och kan i framtiden komma att tillhandahålla, olika bank - , finans - , investerings - och kommersiella tjänster samt andra tjänster till Alvotech för vilka de har erhållit, eller kan komma att erhålla, ersättning. DNB Markets och Carnegie kan i värdepappersrörelsen komma att handla med eller ta positioner i värdepapper som är direkt eller indirekt kopplade till Bolaget.