UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 22, 2025

______________________________

Shenandoah Telecommunications Company

(Exact name of registrant as specified in its charter)

______________________________

| Virginia | 0-9881 | 54-1162807 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

500 Shentel Way

P.O. Box 459

Edinburg, VA 22824

(Address of principal executive offices) (Zip Code)

(540) 984-4141

(Registrant’s telephone number, including area code)

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock (No Par Value) | SHEN | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Principal Accounting Officer

On April 22, 2025, Tracy L. Willis was appointed principal accounting officer of Shenandoah Telecommunications Company (the “Company”).

Ms. Willis, age 60, joined the Company as Vice President and Chief Accounting Officer on December 16, 2024. Prior to joining Shentel, Ms. Willis worked for The Walt Disney Company where she spent the last 35 years in progressive accounting and finance leadership positions including Vice President, Segment Controller of Parks and Resorts, Vice President, Senior Controller for The Walt Disney Company and most recently as Vice President, Senior Controller of Finance Transformation. Tracy is a CPA and graduate of the University of Delaware. There will be no changes to Ms. Willis’ compensation in connection with her appointment as principal accounting officer other than her entry into the Severance Agreement, as discussed below.

There is no family relationship between Ms. Willis and any director or other executive officer of the Company. No arrangement or understanding exists between Ms. Willis and any other person pursuant to which she was selected as an officer of the Company. Since the beginning of the Company’s last fiscal year through the date hereof, there have been no transactions with the Company, and there are currently no proposed transactions with the Company, in which the amount involved exceeds $120,000 and in which Ms. Willis had or will have a direct or indirect material interest within the meaning of Item 404(a) of Regulation S-K.

Severance Agreement

In connection with her appointment as principal accounting officer, Shentel Management Company, an affiliate of the Company, will enter into a severance agreement with Ms. Willis, which provides for certain payments in the event of certain terminations of employment (the “Severance Agreement”).

The terms of the Severance Agreement with Ms. Willis are substantially the same as the terms of the form of severance agreement previously described in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on February 11, 2020, which description is incorporated herein by reference. The description of the Severance Agreement with Ms. Willis does not purport to be complete and is qualified in its entirety by reference to the full text of the form of severance agreement, a copy of which was included as Exhibit 10.19 to the Company’s Annual Report on Form 10-K filed with the SEC on February 20, 2025, and is incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On April 22, 2025, the Company held its annual shareholder meeting. At the annual meeting, the following proposals were submitted to a vote of the Company’s shareholders:

Proposal 1 – Election of Directors

The following Director nominees were elected.

Victor C. Barnes, James F. DiMola and Christopher E. French will serve a three (3) year term expiring at the Company’s annual meeting of shareholders in 2028. Michael A. Rhymes will serve a two (2) year term expiring at the Company’s annual meeting of shareholders in 2027. Matthew S. DeNichilo will serve a one (1) year term expiring at the Company’s annual meeting of shareholders in 2026.

| Votes For | Votes Against | Abstentions | Broker Non-Votes | |

| Victor C. Barnes | 36,927,727 | 219,474 | 49,050 | 7,971,781 |

| James F. DiMola | 33,806,785 | 3,344,859 | 44,607 | 7,971,781 |

| Christopher E. French | 36,685,153 | 479,383 | 31,715 | 7,971,781 |

| Michael A. Rhymes | 36,974,454 | 168,110 | 53,687 | 7,971,781 |

| Matthew S. DeNichilo | 36,944,014 | 196,781 | 55,456 | 7,971,781 |

Proposal 2 – Ratification of Selection of Independent Registered Public Accounting Firm

The Company’s shareholders ratified the appointment of RSM US LLP, as set forth below:

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 44,944,952 | 147,392 | 75,688 | - |

Proposal 3 - Non-Binding Vote on Named Executive Officer Compensation

The Company’s shareholders approved, on a non-binding basis, the compensation paid to the Company’s named executive officers, as set forth below:

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 36,383,019 | 716,777 | 96,455 | 7,971,781 |

Item 7.01. Regulation FD Disclosure.

On April 22, 2025, following the formal portion of the Annual Meeting, Mr. Christopher French, Chairman of the Board, President and CEO, Mr. James Volk, Senior Vice President of Finance and CFO, and Mr. Edward McKay, Executive Vice President and COO, provided a brief presentation on the Company. The presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description |

| 99.1 | Presentation Materials from the Annual Meeting, dated April 22, 2025 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| SHENANDOAH TELECOMMUNICATIONS COMPANY | |

| Dated: April 23, 2025 | /s/ Derek C. Rieger |

| Derek C. Rieger | |

| Vice President – Legal and General Counsel | |

Exhibit 99.1

2025 Shareholder Meeting April 22, 2025

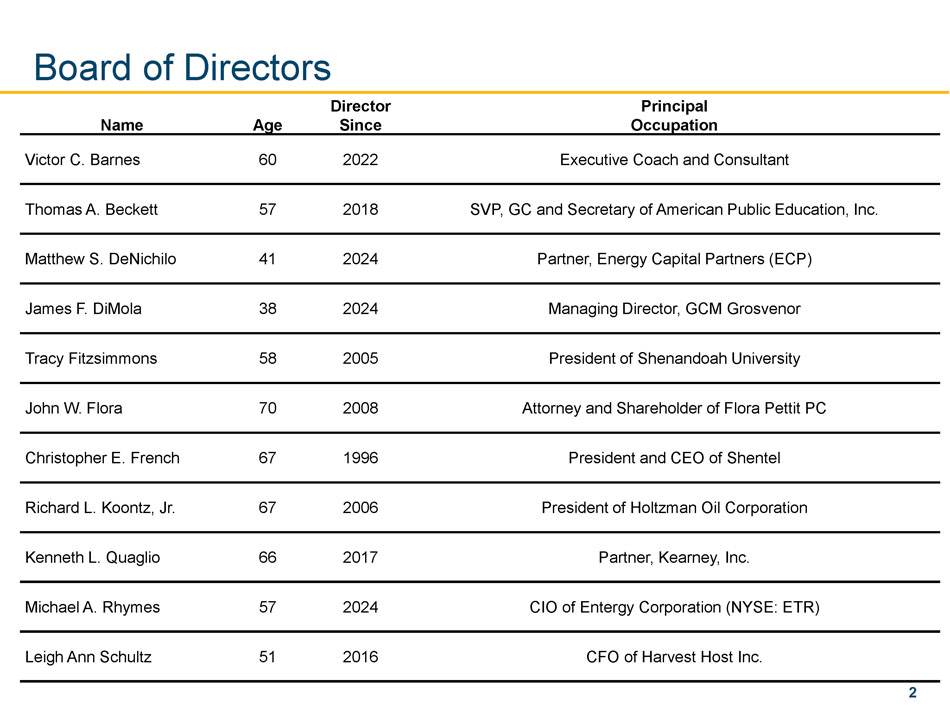

2 Principal Occupation Director Since Age Name Executive Coach and Consultant 2022 60 Victor C. Barnes SVP, GC and Secretary of American Public Education, Inc. 2018 57 Thomas A. Beckett Partner, Energy Capital Partners (ECP) 2024 41 Matthew S. DeNichilo Managing Director, GCM Grosvenor 2024 38 James F. DiMola President of Shenandoah University 2005 58 Tracy Fitzsimmons Attorney and Shareholder of Flora Pettit PC 2008 70 John W. Flora President and CEO of Shentel 1996 67 Christopher E. French President of Holtzman Oil Corporation 2006 67 Richard L. Koontz, Jr. Partner, Kearney, Inc. 2017 66 Kenneth L. Quaglio CIO of Entergy Corporation (NYSE: ETR) 2024 57 Michael A. Rhymes CFO of Harvest Host Inc. 2016 51 Leigh Ann Schultz Board of Directors 3 Proposals Election of directors 1.

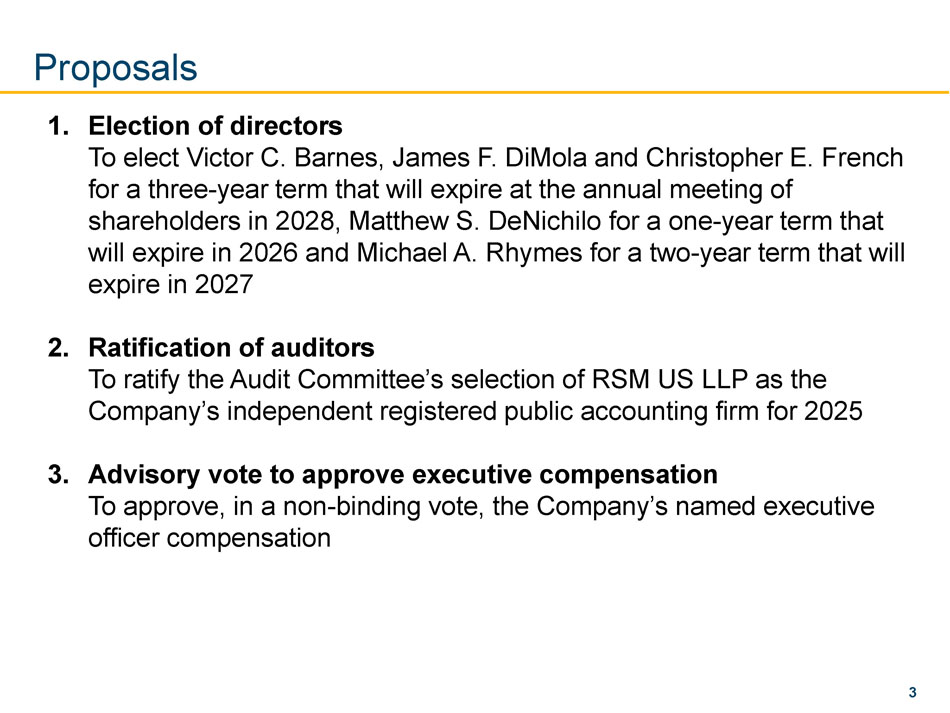

To elect Victor C. Barnes, James F. DiMola and Christopher E. French for a three - year term that will expire at the annual meeting of shareholders in 2028, Matthew S. DeNichilo for a one - year term that will expire in 2026 and Michael A. Rhymes for a two - year term that will expire in 2027 Ratification of auditors 2. To ratify the Audit Committee’s selection of RSM US LLP as the Company’s independent registered public accounting firm for 2025 Advisory vote to approve executive compensation 3.

To approve, in a non - binding vote, the Company’s named executive officer compensation 4 This presentation includes “forward - looking statements” within the meaning of Section 27 A of the Securities Act and Section 21 E of the Securities Exchange Act of 1934 , as amended, regarding our business strategy, our prospects and our financial position . These statements can be identified by the use of forward - looking terminology such as “believes,” “estimates,” “expects,” “intends,” “may,” “will,” “should,” “could” or “anticipates” or the negative or other variation of these similar words, or by discussions of strategy or risks and uncertainties . These statements are based on current expectations of future events . If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from the Company’s expectations and projections . Important risks, uncertainties, and other factors that could cause actual results to differ materially from such forward - looking statements can be found in the Company’s SEC filings, which are available online at www . sec . gov, www . shentel . com or on request from the Company . The Company does not undertake any obligation to update any forward - looking statements as a result of new information or future events or developments .

Safe Harbor Statement 5 Use of Non - GAAP Financial Measures Included in this presentation are certain non - GAAP financial measures that are not determined in accordance with U.S. generally accepted accounting principles. These financial performance measures are not indicative of cash provided or used by operating activities and exclude the effects of certain operating, capital and financing costs and may differ from comparable information provided by other companies, and they should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with U.S. generally accepted accounting principles. Management believes these measures facilitate comparisons of our operating performance from period to period and comparisons of our operating performance to that of our peers and other companies by excluding certain differences. Shentel utilizes these financial performance measures to facilitate internal comparisons of our historical operating performance, which are used by management for business planning purposes, and also to facilitate comparisons of our performance relative to that of our competitors. In addition, we believe these measures are widely used by investors and financial analysts as measures of our financial performance over time, and to compare our financial performance with that of other companies in our industry.

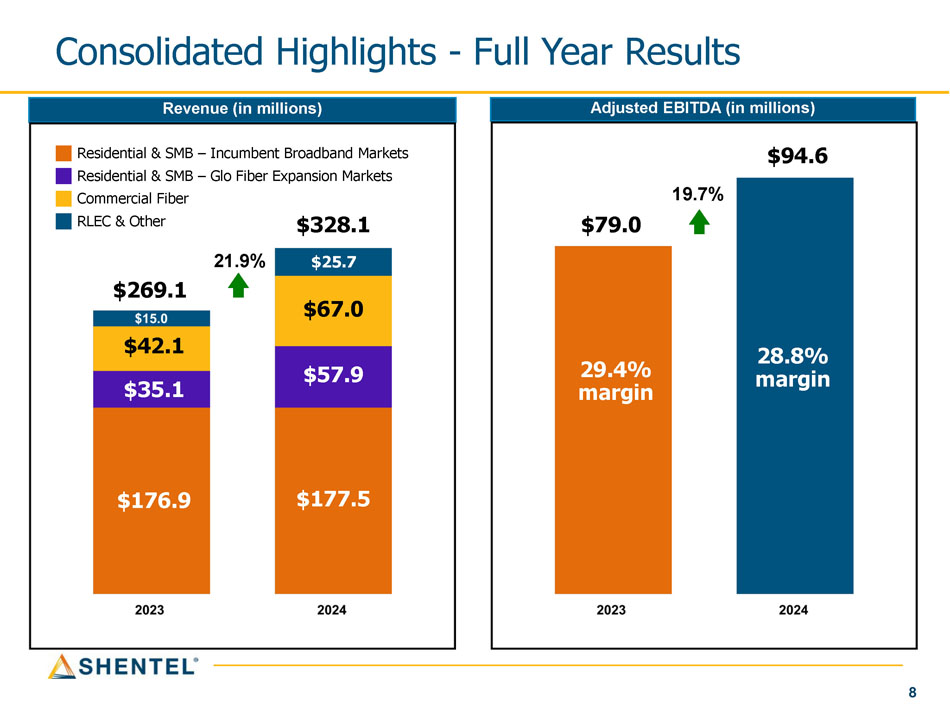

Jim Volk SVP of Finance and CFO 7 Acquisitions and Dispositions Update • Closed on the sale of our Tower portfolio and business on March 28, 2024 • Closed on the acquisition of Horizon Telcom on April 1, 2024 • Completed integration of Horizon’ s six core back - office systems in nine months from closing • Upsized Horizon annual run - rate synergy savings to $13.8 million o Realized $4.5 million in 2024 o Expect to realize an additional $8.5 million in 2025 o Expect to realize remaining $0.8 million in 1Q26 8 Consolidated Highlights - Full Year Results Adjusted EBITDA (in millions) Revenue (in millions) 29.4% margin 28.8% margin 21.9% 19.7% $177.5 $57.9 $67.0 $42.1 $35.1 $176.9 $269.1 $328.1 29.4% margin 28.8% margin $79.0 $94.6 Residential & SMB – Incumbent Broadband Markets Residential & SMB – Glo Fiber Expansion Markets Commercial Fiber RLEC & Other $25.7

9 Glo Fiber Revenue (in millions) $57.9 135% CAGR $35.1 $18.3 $8.3 $1.9 2024 2023 2021 2022 2020 Glo Fiber Data RGUs 65,140 99% CAGR 41,710 24,286 11,377 4,158 2024 2023 2021 2022 2020 Glo Fiber Fueling Consolidated Revenue Growth 2024 includes 1,831 acquired Horizon RGUs and 9 months of Horizon Glo revenues 10 Consolidated Highlights Adjusted EBITDA (in millions) Revenue (in millions) 9% CAGR 18% CAGR Consolidated revenue includes elimination of intercompany activity.

2020 - 2023 include Tower segment results and exclude Horizon results 2024 includes 9 months of Horizon results and exclude Tower segment results 11 Consolidated Financial Highlights Net Income (Loss) Attributable to Common Shareholder Per Diluted Share Net Income (Loss) Attributable to Common Shareholders 2022 2023 2022 2023 $1 ($32) $7 $222 $8 $190 2023 2024 Discontinued Operations Continuing Operations ($0.59) $0.14 $0.02 $4.13 $0.16 $3.54 2023 2024 Discontinued Operations Continuing Operations 12 Regular Dividend History (per Share, Split Adjusted) $0.35 $0.30 $0.25 $0.20 $0.15 $0.10 $0.05 $0.00

Ed McKay EVP and COO 14 Integrated Fiber and Broadband Network

15 211,120 212,050 215,763 239,041 250,000 75,189 147,479 233,872 346,299 550,000 286,309 359,529 449,635 585,340 800,000+ 2021 2022 2023 2024 2026 Projected Incumbent Broadband Markets Glo Fiber Expansion Markets Broadband Network: Rapidly Becoming Fiber - Dominant Broadband Data Homes and Businesses Passed 1 6 Glo Fiber Data Net Additions 21,599 17,424 52% CAGR 12,909 7,219 4,032 2024 2023 2021 2022 2020 Glo Fiber Passings Released to Sales 96,877 38% CAGR 86,393 72,290 46,537 26,899 2024 2023 2021 2022 2020 Accelerating Pace of Construction and Sales 2024 includes 9 months of Horizon net additions and passings constructed and released to sales, but excludes acquired RGUs and passings

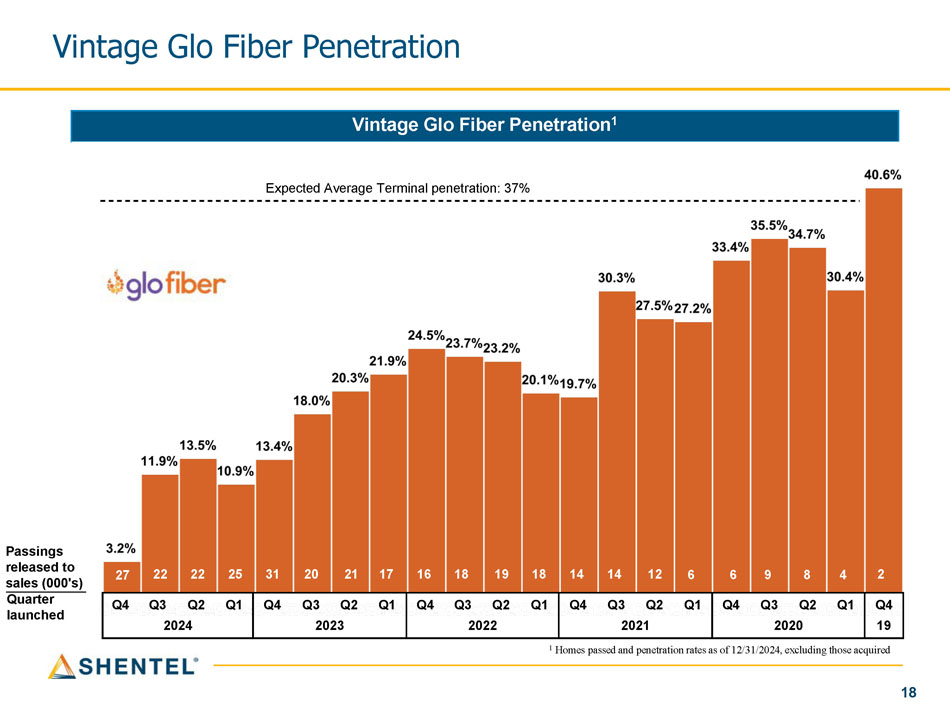

17 Glo Fiber: Metrics Consistent with Investment Thesis Revenue Generating Units (RGUs in 000s) Data Penetration 24 42 65 6 7 31 51 78 2022 2023 2024 Data Video Voice Data Average Revenue per User (ARPU) $81 $76 $73 2024 2023 2022 16.5% 17.8% 18.8% 2022 2023 2024 Data Churn 1.0% 1.0% 1.1% 2024 2023 2022 Vintage Glo Fiber Penetration Vintage Glo Fiber Penetration 1 launched Expected Average Terminal penetration: 37% 6 9 8 4 2 Passings released to sales (000's) Quarter Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 19 2020 2021 2022 2023 2024 22 22 25 31 20 21 17 16 18 19 18 14 14 12 6 27 1 Homes passed and penetration rates as of 12/31/2024, excluding those acquired 18

19 Incumbent Broadband 1 : Key Metrics Trending Well Revenue Generating Units (RGUs in 000s) 183 38 36 37 34 39 43 111 110 110 2024 2023 2022 Data Video 190 Voice 184 Data Average Revenue per User (ARPU) $85 $83 $81 2024 2023 2022 Data Penetration 47% 51% 52% 2024 2023 2022 Data Churn 1.6% 1.7% 1.6% 2024 2023 2022 1. Consists of Incumbent Cable Markets and Incumbent Telephone Markets with FTTH passings 20 - 10% - 5% 0% 5% 10% 15% Source: Public filings for year - end 2024 broadband customers versus year - end 2023, excluding fixed or mobile wireless Excludes Shentel customers added as part of Horizon acquisition Leader in Broadband Customer Growth among Public Peers

21 Commercial Fiber Metrics Monthly Compression and Churn 2 Installed MRR and MAR 1 MRR & MAR Sales Bookings MRR/MAR Backlog 1. MRR = Monthly Recurring Revenue; MAR = Monthly Amortized Revenue 2.

Excludes impact of T - Mobile network rationalization 22 Investing for a Fiber - First Future Capex Spending 1 $175 - $190 $35 - $40 $40 - $50 $250 - $280 $299.8 $253.2 1 Net of government grant reimbursements $182.2 $193.7 $175 - $190 $35 - $40 $40 - $50 $57.0 $74.5 $30.3 Incumbent Broadband Markets Commercial Fiber Glo Fiber Expansion Markets 23 Capital Intensity 1 expected to decline sharply at the end of construction phase 20% - 25% 15% - 25% 20% - 30% 15% - 25% 94% 519% 33% 30% 91% 334% 45% 37% 2 2 2 Capital Intensity 1 1 Capital Intensity = Gross CapEx Less Government Subsidies / Revenue 2 Includes government - subsidized builds in 2023 and 2024.

Incumbent Broadband Markets 2 Commercial Fiber 2 Glo Fiber Expansion Markets 2

24 Giving Back to the Communities We Serve Chris French President and CEO

27 Questions & Answers

2025 Shareholder Meeting April 22, 2025

29 Appendix

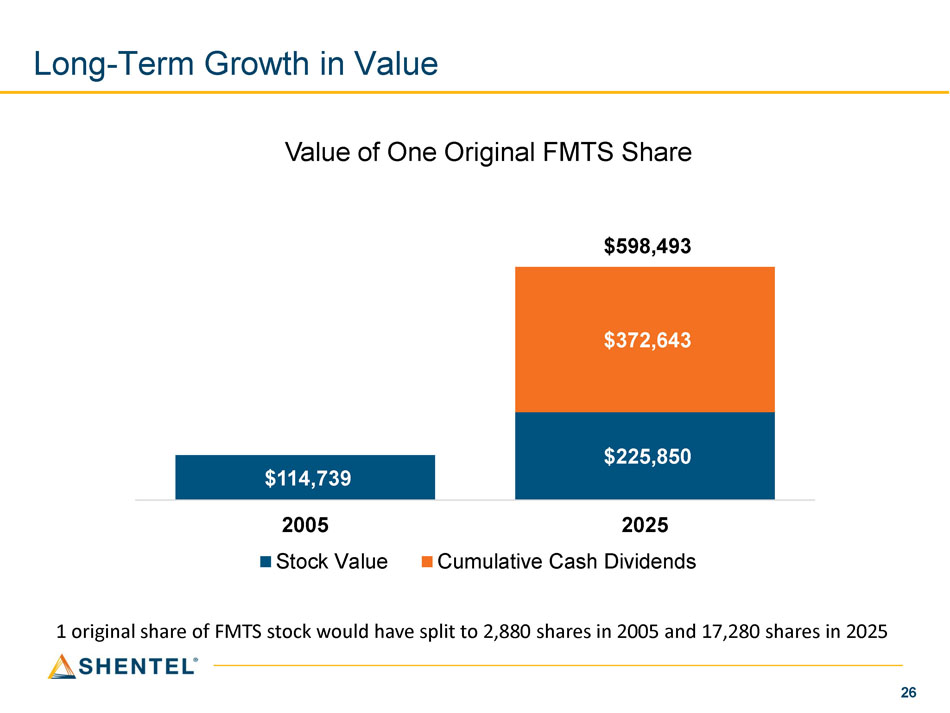

1 original share of FMTS stock would have split to 2,880 shares in 2005 and 17,280 shares in 2025 26 Long - Term Growth in Value $114,739 $225,850 $372,643 $598,493 2005 Stock Value 2025 Cumulative Cash Dividends Value of One Original FMTS Share 30 2020 Year Ended December 31, (in thousands) 2021 2022 2023 2024 $ 1,576 $ 7,929 $ (8,379) $ 8,038 $ (28,357) Net income (loss) from continuing operations 48,703 55,206 68,899 65,471 98,453 Depreciation and amortization - 5,986 5,241 2,552 382 Impairment expense - - - - 15,897 Interest expense (3,187) (8,665) 1,348 (1,387) (6,461) Other expense (income), net (990) (1,694) (927) 2,973 (9,670) Income tax expense (benefit) 5,907 3,408 8,528 10,033 9,837 Stock - based compensation 2,915 3,556 1,251 2,915 14,509 Restructuring charges and other $ 55,798 $ 65,726 $ 75,961 $ 90,595 $ 94,590 Adjusted EBITDA Adjusted EBITDA - Full Year Results 2020, 2021, 2022 and 2023 amounts include results from Shentel's Tower business, which was sold on March 31, 2024.

31 Broadband - Average Revenue per User (ARPU) Residential and SMB ARPU Year Ended December 31, 2023 2024 Residential and SMB Revenue: $ 139,102 $ 164,984 Broadband Data 108,822 112,852 Incumbent Broadband Markets 30,280 52,132 Glo Fiber Expansion Markets 56,924 58,029 Video 12,203 12,765 Voice 3,753 (386) Discounts, adjustments and other $ 211,982 $ 235,392 Total Residential & SMB Revenue Average RGUs: 142,598 164,320 Broadband Data 109,591 110,888 Incumbent Broadband Markets 33,007 53,432 Glo Fiber Expansion Markets 44,876 41,491 Video 40,372 43,402 Voice ARPU: (1) $ 81.27 $ 83.67 Broadband Data $ 82.75 $ 84.81 Incumbent Broadband Markets $ 76.45 $ 81.30 Glo Fiber Expansion Markets $ 105.71 $ 116.55 Video $ 25.19 $ 24.51 Voice * Average Revenue Per User calculation = (Residential & SMB Revenue * 1,000) / average revenue generating units / 12 months