UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2025

Commission File No. 001-38145

Fury Gold Mines Limited

(Translation of registrant's name into English)

401 Bay Street, 16th

Floor, Toronto, Ontario, Canada, M5H 2Y4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F ☒ Form 40-F ☐

| - |

Exhibits 99.1 to 99.3 included with this report are hereby incorporated by reference into the Registrant’s registration statement on Form F-10 (File no. 333-272658) (the “Registration Statement”), and to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SUBMITTED HEREWITH

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: March 31, 2025

Fury Gold Mines Limited

Phil van Staden

Chief Financial Officer

|

Exhibit 99.1

FURY GOLD MINES LIMITED |

| ANNUAL INFORMATION FORM |

|

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2024 DATED MARCH 31, 2025 |

| - A- |

TABLE OF CONTENTS

| INTRODUCTORY NOTES | 4 |

| Cautionary Note Regarding Forward-Looking Statements | 4 |

| Cautionary Note to United States Investors Regarding Presentation of Mineral Resource Estimates | 6 |

| Resource Category (Classification) Definitions | 7 |

| CORPORATE STRUCTURE | 8 |

| Name, Address and Incorporation | 8 |

| 2022 to 2024 Unification of the Éléonore South Gold Project | 9 |

| Inter-corporate Relationships | 10 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 11 |

| Business of Fury Gold | 11 |

| Three-Year History Fury Gold’s Business | 11 |

| Eau Claire Exploration Program | 11 |

| Completion of Sale of Homestake Ridge Project to Dolly Varden and Investor Rights Agreement | 11 |

| 2022 Partial Sale of Dolly Varden Shareholdings | 12 |

| Eau Claire Exploration Program | 12 |

| Corporate developments | 13 |

| Eau Claire Exploration Program | 14 |

| Éléonore South Exploration Program | 14 |

| Committee Bay Exploration 2024 Program | 15 |

| 2024 Partial Sale of Dolly Varden Shareholdings | 16 |

| BUSINESS DESCRIPTION | 17 |

| General | 17 |

| Specialized Skill and Knowledge | 17 |

| Competitive Conditions | 18 |

| Cyclical and Seasonal | 18 |

| Intangible Properties | 18 |

| Environmental Protection | 18 |

| Employees | 18 |

| Social and Environmental Policies | 18 |

| Indigenous and Local Community Engagement | 19 |

| THE COMPANY’S MINERAL PROJECTS | 20 |

| Summary of Three Material Mineral Properties | 20 |

| Eau Claire Project | 21 |

| Property Description and Location | 21 |

| Accessibility, Climate, Local Resources, Infrastructure and Physiography | 22 |

| Geology and Mineralization | 23 |

| Mineral Resources | 24 |

| Sample Preparation, Analyses and Security | 25 |

| Sampling, Analysis and Data Verification | 25 |

| Mineral Processing and Metallurgical Testing | 26 |

| 2024 Mineral Resource Estimate | 27 |

| Combined Mineral Resource Estimate for the Eau Claire Project, May 10, 2024 | 28 |

| Conclusions | 30 |

| Recommendations | 30 |

| Regional Exploration: | 32 |

| Committee Bay Project | 33 |

| Description and Location | 33 |

| Access, Climate, Local Resources, Infrastructure and Physiography | 33 |

| Geology, Mineralization and Deposit Types | 34 |

| History | 34 |

| - A- |

| Sampling, Analyses and Data Verification | 35 |

| Committee Bay RAB Drilling QA/QC Disclosure | 35 |

| Committee Bay Diamond Drilling QA/QC Disclosure | 35 |

| Committee Bay Grabs QA/QC Disclosure: | 35 |

| Mineral Processing and Metallurgical Testing | 36 |

| 2023 Committee Bay Mineral Resource Estimates | 37 |

| Exploration Program Recommendations | 39 |

| 2015 through 2021 Committee Bay Exploration by Fury | 40 |

| 2018 Committee Bay Exploration Program | 40 |

| 2019 Committee Bay Exploration Program | 41 |

| 2021 Committee Bay Project Drill and Exploration Program | 41 |

| 2022 and 2023 Committee Bay Project Exploration Program | 42 |

| 2024 Committee Bay Project Exploration Program | 42 |

| 2023 Committee Bay Mineral Resource Estimate and Technical Report | 43 |

| Éléonore South Property, Québec, Canada | 43 |

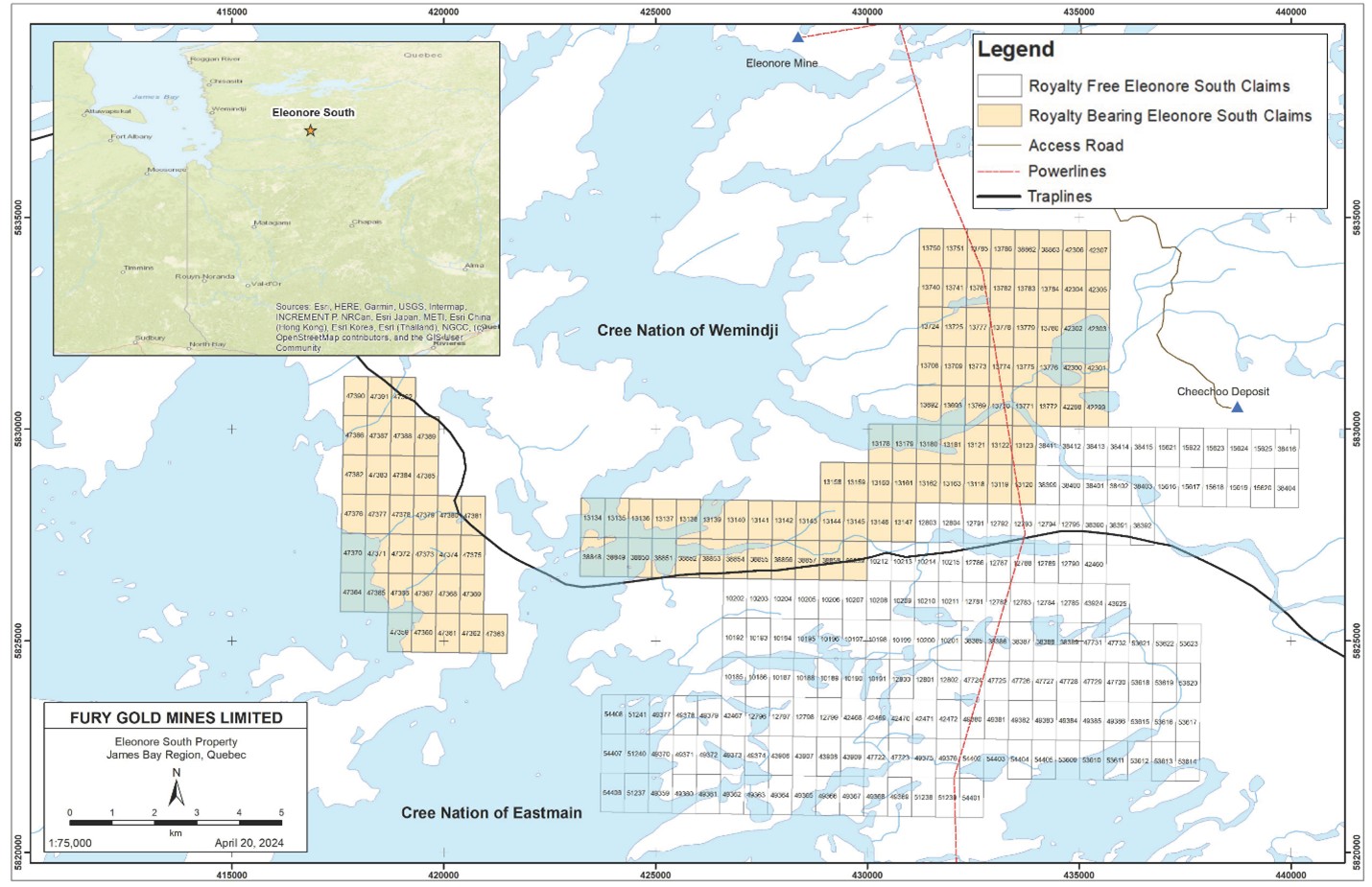

| Access, Climate, Local Resources, Infrastructure and Physiography | 45 |

| Geology, Mineralization and Deposit Types | 45 |

| History | 46 |

| Sampling, Analyses and Data Verification | 50 |

| Mineral Processing and Metallurgical Testing | 51 |

| Mineral Resource Estimates | 51 |

| 2024 Éléonore South Exploration Program | 51 |

| Biochemical Sampling | 52 |

| Drilling | 52 |

| Conclusion | 52 |

| Recommendations | 52 |

| 2024 Éléonore South project Exploration | 53 |

| RISK FACTORS | 54 |

| Exploration Activities May Not Be Successful | 54 |

| Commodity Price Fluctuations and Cycles | 55 |

| Additional Funding Requirements and Shareholder Equity Dilution | 56 |

| Negative Cash Flow | 56 |

| Indirect Economic Interest in the Homestake Ridge Project | 56 |

| Price Volatility of Publicly Traded Securities | 56 |

| Mineral Resource Estimates | 57 |

| Inflation | 57 |

| Property Commitments | 57 |

| Environmental Regulatory, Health & Safety Risks | 57 |

| Relationships with Local Communities and Indigenous Organizations | 58 |

| Environmental Protection | 58 |

| Climate Change | 59 |

| Changes in Government Mining, Permitting, Environmental Regulation | 59 |

| Competitive Conditions | 60 |

| Local Community Uncertainties | 60 |

| Acquisitions May Not Be Successfully Integrated | 60 |

| Changes in the Market Price of Common Shares | 60 |

| Properties May Be Subject to Defects in Title | 61 |

| Reliance on Contractors and Experts | 61 |

| Qualified and Experienced Employees, Management, and Board Members | 61 |

| Legal and Litigation Risks | 61 |

| Risks Relating to Statutory and Regulatory Compliance | 61 |

| Under-insured or Uninsurable Insurance Risks | 62 |

| Limited Business History and No History of Earnings | 62 |

| Claims by Investors Outside of Canada | 62 |

| No-Dividends Policy | 63 |

| - A- |

| Disclosure and Internal Controls | 63 |

| Cybersecurity Risks | 64 |

| Social Media Risks | 64 |

| Liabilities relating to Past Issuances of Flow-Through Shares | 64 |

| DESCRIPTION OF CAPITAL STRUCTURE | 65 |

| Attributes of Common Shares | 65 |

| MARKET FOR SECURITIES | 65 |

| Trading Price and Volume | 65 |

| Prior Sales | 66 |

| DIRECTORS AND EXECUTIVE OFFICERS | 66 |

| Name, Principal Occupation and Province or State of Residence | 66 |

| Management Security Holdings | 68 |

| Management History of Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 68 |

| Potential Conflicts of Interest | 69 |

| Audit Committee | 69 |

| Audit Committee Charter | 69 |

| Composition of the Audit Committee | 69 |

| Relevant Education and Experience of Audit Committee Members | 69 |

| Pre-Approval Policies and Procedures | 70 |

| External Auditor Service Fees | 70 |

| Other Board Committees | 70 |

| No Legal Proceedings | 71 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 71 |

| SHARED SERVICES PROVIDER | 71 |

| UNIVERSAL MINERAL SERVICES LTD. (“UMS”) | 71 |

| TRANSFER AGENT AND REGISTRAR | 71 |

| AUDITOR | 72 |

| MATERIAL CONTRACTS | 72 |

| INTERESTS OF EXPERTS | 72 |

| ADDITIONAL INFORMATION | 73 |

| - A- |

INTRODUCTORY NOTES

In this Annual Information Form (the “AIF”) the “Company”, “Fury Gold”, “we”, “us” or “our” refers to Fury Gold Mines Limited, together with, as the context requires, its subsidiaries or its predecessors.

This AIF is dated March 31, 2025. Except as otherwise indicated, all information contained herein is as at December 31, 2024. In this AIF, unless otherwise indicated, all dollar amounts and references to “C$” or “$” are to Canadian dollars and references to “US$” are to U.S. dollars. All dollar amounts are expressed in thousands of Canadian dollars unless otherwise indicated.

All financial figures are in 000s except for exploration program recommendations.

Cautionary Note Regarding Forward-Looking Statements

Certain statements made in this AIF contain forward-looking information within the meaning of applicable Canadian and United States securities laws (“forward-looking statements”). These forward-looking statements are presented for the purpose of assisting the Company’s securityholders and prospective investors in understanding management’s intentions and views regarding future outcomes and are inherently uncertain and should not be heavily relied upon. When used in this AIF, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”, “expect”, and similar expressions, as they relate to the Company, identify such forward-looking statements. Specific forward-looking statements in this AIF include:

| · | the Company’s exploration and financing plans, |

| · | the ability of the Company to realize the objectives of the Company’s planned exploration programs; |

| · | the results of the Company’s exploration programs and the likelihood of discovering or expanding resources; |

| · | the Company’s estimated mineral resources; |

| · | the future price of minerals, especially gold and other precious metals; |

| · | the Company’s future capital expenditures and requirements, and sources and timing of additional financing; |

| · | the Company’s plans to complete the acquisition of Quebec Precious Metals Corporation; |

| · | the potential for resource expansion and ultimately mine development of the Company’s Eau Claire Project, |

| · | permitting timelines and possible delays; |

| · | local indigenous and other affected communities engagement; |

| · | government regulation of mining operations; |

| · | environmental and climate-related risks; |

| · | the possible impairment of mining interests; |

| · | any objectives, expectations, intentions, plans, results, levels of activity, goals or achievements; |

| · | the liquidity of the common shares in the capital of the Company; and |

| · | other events or conditions that may occur in the future. |

The forward-looking statements contained in this AIF represent the Company’s views as of the date hereof. The assumptions related to these plans, estimates, projections, beliefs and opinions may change without notice and in unanticipated ways. Many assumptions may prove to be incorrect, including:

| - A- |

| · | the Company’s budgeting plans, expected costs, assumptions regarding capital and commodity market conditions and other factors upon which the Company has based its expenditure and funding expectations; |

| · | the Company will be able to raise additional capital to proceed with its exploration, development and operations plans and attracting finance for precious metal exploration will be possible; |

| · | the Company’s ability to obtain or renew the licenses, permits and regulatory approvals necessary for its planned exploration and securing support of locally affected communities; |

| · | the Company’s exploration plans will not be adversely impacted by declines in prices of precious metals and consequent impairment of the Company’s ability to finance its operations |

| · | that operations and financial markets will not in the long term be adversely impacted by wars, pandemics or other natural or man-made disasters; |

| · | the Company’s ability to complete and successfully integrate acquisitions, including its acquisition of Quebec Precious Metals Corporation; |

| · | the Company’s plan of operations will not be adversely impacted by climate change, extreme weather events, water scarcity, and seismic events, and the Company’s strategies to deal with these issues will be effective; |

| · | the Company’s expectations regarding the future demand for, and supply and price of, precious metals; |

| · | the Company’s ability to recruit and retain qualified personnel to pursue its business operations; |

| · | the Company’s mineral resource estimates, and the assumptions upon which they are based, are reasonably accurate; |

| · | the Company will be able to comply with current and future environmental, safety and other regulatory requirements and to obtain and maintain local community support. |

Inherent in the forward-looking statements are known and unknown risks, uncertainties and other factors beyond the Company’s ability to control or predict, that may cause the actual results, performance or achievements of the Company, or developments in the Company’s business or in its industry, to adversely differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements. Some of the risks and other factors (some of which are beyond the Company’s control) which could cause results to differ materially from those expressed in the forward-looking statements and information contained in this AIF include, but are not limited to:

| · | fluctuations in the current and projected prices for gold, other precious and base metals and other commodities (such as natural gas, fuel oil and electricity) which are needed to explore for and ultimately produce these metals; |

| · | the Company does not earn any revenues from its business and has history of losses and negative cash flows from operations, each of which is expected to continue in the future; |

| · | the Company may not be able to secure additional financings, including equity financings, to continue the planned exploration of its mineral properties; |

| · | the Company’s exploration programs are inherently risky as they involve uncertain geology and risk exploration failure and may overrun on costs and not be successful in achieving the targeted objectives or result in the discovery of new resources or the expansion of existing resources |

| · | the Company’s plan of operations involves risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, potential unintended releases of contaminants, industrial accidents, unusual or unexpected geological or structural formations, pressures, cave-ins and flooding); |

| · | the speculative nature of mineral exploration and development; the estimation of mineral resources, the Company’s ability to obtain funding, including the Company’s ability to complete future equity financings; |

| - A- |

| · | the shareholders of Quebec Precious Metals Corporation may not approve the acquisition by the Company; |

| · | environmental risks and remediation measures, including evolving environmental regulations and legislation; |

| · | changes in laws and regulations impacting exploration and mining activities; |

| · | the Company’s mineral properties being subject to prior unregistered agreements, transfers or claims and other defects in title; |

| · | legal and litigation risks; |

| · | statutory and regulatory compliance; |

| · | insurance and uninsurable risks; |

| · | the continuation of our management team and our ability to secure the specialized skill and knowledge necessary to operate in the mining industry |

| · | the Company’s limited business history and history of losses and negative cash, which will continue into the foreseeable future; |

| · | our inability to pay dividends, volatility in the Company’s share price, the continuation of our management team and our ability to secure the specialized skill and knowledge necessary to operate in the mining industry; relations with and claims by local communities and non-governmental organizations, including relations with and claims by indigenous populations; |

| · | the effectiveness of the Company’s internal control over financial reporting; |

| · | cybersecurity risks and other reputational risks; |

| · | general business, economic, competitive, political and social uncertainties; |

| · | the effects of climate change, extreme weather events, water scarcity, and seismic events, and the effectiveness of strategies to deal with these issues; |

| · | and public health crises such as the COVID-19 pandemic and other uninsurable risks. |

While intended to list the primary risks we see, no list can be exhaustive of the risk and other adverse factors that may affect any of the Company’s forward-looking statements. Some of these risks and other factors are discussed in more detail in the section entitled “Risk Factors” in this AIF. Investors and others should carefully consider these risks and other factors and not place heavy reliance on the forward-looking statements.

The Company only updates its forward-looking statements, to the extent required by applicable securities laws.

Cautionary Note to United States Investors Regarding Presentation of Mineral Resource Estimates

This AIF uses the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource”, which are Canadian mining terms as defined in, and required to be disclosed in accordance with, National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on mineral resources and mineral reserves (“CIM Definition Standards”), adopted by the CIM Council, as amended. Mining disclosure under U.S. securities law was previously required to comply with SEC Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Exchange Act of 1934, as amended. The SEC has adopted rules to replace SEC Industry Guide 7 with new mining disclosure rules under sub-part 1300 of Regulation S-K of the U.S. Securities Act (“Regulation S-K 1300”) which became mandatory for U.S. reporting companies beginning with the first fiscal year commencing on or after January 1, 2021. Under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards. Readers are cautioned that despite efforts to harmonize U.S. mining disclosure rules with NI 43-101 and other international requirements, there are differences between the terms and definitions used in Regulation S-K 1300 and mining terms defined by CIM and used in NI 43 101, and there is no assurance that any mineral reserves or mineral resources that an owner or operator may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the owner or operator prepared the reserve or resource estimates under the standards of Regulation S-K 1300.

| - A- |

As a “foreign private issuer” under United States securities laws, the Company was previously eligible to file its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system. Consequently, the Company was not required to provide disclosure on its mineral properties under US Regulation S-K 1300 but rather provided disclosure under Canadian NI 43-101 and the Canadian Institute of Mining and Metallurgy (CIM) Standards. The Company is presently not able to file its SEC annual report on Form 40-F for the year ended December 31, 2024 using Canadian standards due to the non-affiliate market capitalization of its public share float having a market value less than US$75 million. Consequently, the Company will file its annual report with the SEC on Form 20-F for the year ended December 31, 2024 (the “2024 Form 20-F”) will include disclosure on the Company’s material properties in accordance with the requirements of Regulation S-K 1300 which as noted above may materially differ from the requirements of NI 43-101 and the CIM Definition Standards.

There is no assurance any mineral resources that the Company may report as “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43- 101 would be the same had the Company prepared the resource estimates under the standards adopted under the Regulation S-K 1300. However, the Company’s mineral resources presented in this AIF are consistent with the Company’s estimates of mineral resources prepared under Regulation S-K 1300 that will be include in the Company’s 2024 Form 20-F. United States investors are also cautioned that while the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves.

The Company has no mineral reserves which require that the estimated resources be demonstrated to be economic in at least a pre-feasibility study. Accordingly, investors are cautioned not to assume that any “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” that the Company reports are or will be economically or legally mineable. Although in Canada, “inferred mineral resources” are subject to an expectation that there must be a reasonable probability of upgrading a majority of an inferred resource into a measured or indicated category, inferred resources have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. In accordance with Canadian securities laws, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

Accordingly, information contained in this AIF describing the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

See the heading “Resource Category (Classification) Definitions” below for a description of certain of the mining terms used in this AIF.

Resource Category (Classification) Definitions

The discussion of mineral deposit classifications in this AIF adheres to the CIM Definition Standards developed by the CIM. Estimated mineral resources fall into two broad categories dependent on whether the economic viability of them has been established and these are “mineral resources” (potential for economic viability) and “mineral reserves” (viable economic production is feasible). Resources are sub-divided into categories depending on the confidence level of the estimate based on level of detail of sampling and geological understanding of the deposit. The categories, from lowest confidence to highest confidence, are inferred mineral resource, indicated mineral resource and measured mineral resource. Reserves are similarly sub-divided by order of confidence into probable (lowest) and proven (highest). The Company at this time has not classified any of its mineral deposits as mineral reserves. These classifications can be more particularly described as follows:

| - A- |

A “mineral resource” is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. The Company has no projects for which mineral reserves are claimed.

An “inferred mineral resource” is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. It has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

An “indicated mineral resource” is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. It has a lower level of confidence than that applying to a measured mineral resource and may only be converted to a probable mineral reserve.

A “measured mineral resource” is that part of a mineral resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of modifying factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. It has a higher level of confidence than that applying to either an indicated mineral resource or an inferred mineral resource. It may be converted to a proven mineral reserve or to a probable mineral reserve.

A “mineral reserve” is the economically mineable part of a measured and/or indicated mineral resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at Pre-Feasibility or Feasibility level as appropriate that include application of modifying factors, which are considerations used to convert mineral resources to mineral reserves and include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which mineral reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a mineral reserve must be demonstrated by a pre-feasibility study or feasibility study.

A “probable mineral reserve” is the economically mineable part of an indicated, and in some circumstances, a measured mineral resource. The confidence in the modifying factors applying to a probable mineral reserve is lower than that applying to a proven mineral reserve. The Company has not determined that any of its properties contain any probable mineral reserves.

A “proven mineral reserve” is the economically mineable part of a measured mineral resource. A proven mineral reserve implies a high degree of confidence in the modifying factors. The Company has not determined that any of its properties contain any proven mineral reserves.

CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated under the Business Corporations Act (British Columbia) (the “BCBCA”) on June 9, 2008, under the name Georgetown Capital Corp. The Company was a Capital Pool Company under the policies of the TSX Venture Exchange (the “TSXV”) and, accordingly, on February 23, 2011, the Company completed a qualifying transaction (the “Qualifying Transaction”) with Full Metal Minerals USA Inc., a wholly owned subsidiary of Full Metals Minerals Ltd. Pursuant to the Qualifying Transaction, the Common Shares began trading on the TSXV. On October 15, 2013, the Company changed its name to Auryn Resources Inc. On November 1, 2016, the Company completed its graduation to the TSX and the Common Shares began trading on the TSX. In connection with the Company’s graduation to the TSX, the Common Shares were voluntarily delisted from the TSXV. On July 17, 2017, the Common Shares also commenced trading on the NYSE American.

| - A- |

Fury Gold is a reporting issuer in all of the provinces and territories of Canada. In addition, the Common Shares are registered under Section 12(b) of the U.S. Exchange Act by virtue of being listed on the NYSE American. The Company’s legal registered and records office is in care of its attorneys at 1500-1055 West Georgia Street, Vancouver, BC, V6E 4N7, and its head office is located at 401 Bay Street, 16th Floor, Toronto, ON M5H 2Y4.

2020 Merger and Reorganization

On October 9, 2020, the Company acquired all of the then-issued and outstanding shares of Eastmain Resources Inc. (“Eastmain”) while distributing (or “spinning out”) shares of two subsidiaries to its shareholders (“Spinco Transactions”) in accordance with the terms and conditions of the arrangement agreement dated August 10, 2020 (the “2020 Arrangement Agreement”). The Spinco Transactions resulted in the divestment of the Company’s South American exploration assets to focus on Canadian mineral projects. On October 5, 2020, the Eastmain Transaction and the Spinco Transactions (as defined herein) received the approval of both the Company’s and Eastmain’s shareholders, and on October 7, 2020, the British Columbia Supreme Court and the Ontario Superior Court of Justice approved the Reorganization Arrangement and the Eastmain Arrangement, respectively, and both courts issued final orders approving the Eastmain Transaction and the Spinco Transactions. In accordance with the terms of the 2020 Arrangement Agreement, the Company changed its name to “Fury Gold Mines Limited” pursuant to a certificate of change of name dated October 8, 2020.

Immediately following the closing of the Transaction, the Company’s ticker symbol for the Common Shares was changed to “FURY” effective October 12, 2020 on the NYSE American and October 13, 2020 on the TSX. Eastmain’s shares were delisted from the TSX and removed from the OTCQB after the end of trading on October 9, 2020. Immediately following the closing of the Eastmain Arrangement, Eastmain became and remains a wholly-owned subsidiary of Fury Gold.

2022 Sale of Homestake Mineral Project to Dolly Varden Silver Corporation for Dolly Varden Shares

On February 25, 2022, the Company announced the completion of the sale of the Homestake Ridge project to Dolly Varden Silver Corporation (“Dolly Varden”), a publicly traded corporation listed on the TSX Venture Exchange. Pursuant to the Homestake Purchase Agreement entered into on December 6, 2021, Dolly Varden acquired 100% of Homestake Resource Corporation from Fury in exchange for a $5 million cash payment and the issuance of 76,504,590 common shares of Dolly Varden. On October 13, 2022, the Company reduced its holdings to 59,504,590 by selling 17 million common shares, representing 22.2% of the Company’s interest in Dolly Varden, for gross proceeds of $6.8 million, and resulting in the Company’s interest in Dolly Varden being reduced to 25.8%. Following further dilutive equity financings completed by Dolly Varden on December 22, 2022 and November 2, 2023, Fury Gold held 59,504,590 common shares, representing a 22.03% interest in Dolly Varden as at December 31, 2023. The Company's interest in Dolly Varden was further reduced by 5,450,000 shares in a March 2024 private sale, and by 3,000,000 shares in an October 2024 private sale, resulting in in the Company’s interest being 16.11% in Dolly Varden as at December 31, 2024.

2022 to 2024 Unification of the Éléonore South Gold Project

On September 12, 2022, the Company and its joint venture partner Newmont Corporation (“Newmont”), through their respective subsidiaries, completed the acquisition of the remaining approximately 23.77% participating interest of Azimut Exploration Inc. in the Éléonore South Joint Venture (“ESJV”), on a pro-rata basis. Following the completion of the transaction, the 100% ESJV participating interests were then held 50.022% by the Company and 49.978% by Newmont with Fury remaining the operator under an amended and restated joint operating agreement.

| - A- |

On February 29, 2024, the Company completed the purchase of Newmont’s 49.978% interest in the Éléonore South Gold Project in Quebec (“Éléonore South”) for $3,000,000. As a result of the consolidation, Fury Gold is the 100% owner of Éléonore South. The Company also acquired Newmont’s 30,392,372 common shares or 10.98% of Sirios Resources Inc. (“Sirios”) as part of the transaction for an additional $1,300,000. Sirios shares have been acquired for investment purposes, and Fury will evaluate its investment in Sirios on an ongoing basis with respect to any possible additional purchases or dispositions. In March 2024, the Company sold 1,514,000 common shares of Sirios, resulting in the Company’s interest in Sirios being reduced to 10.4%. Following further dilutive equity financings completed by Sirios in 2024, the Company’s holding interest in Sirios as at December 31, 2024 was less than 9.9%.

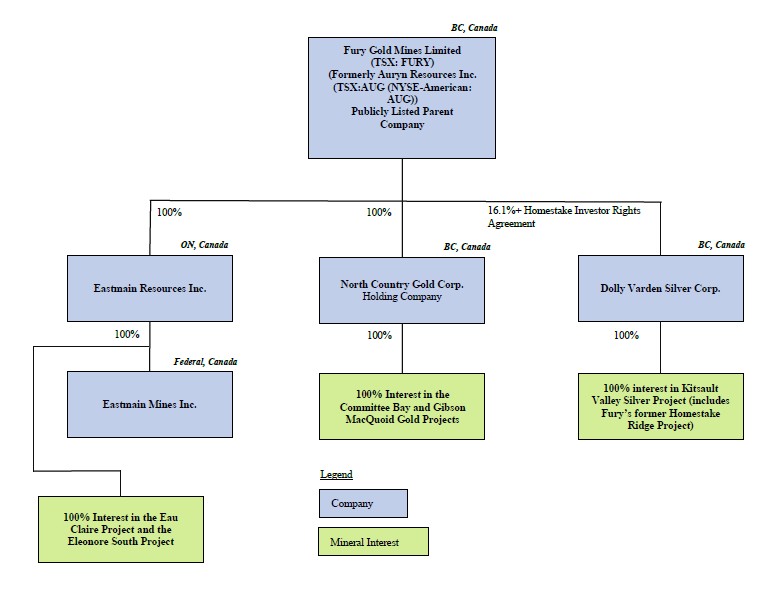

Inter-corporate Relationships

Fury Gold conducts its business through a number of wholly-owned subsidiaries The following diagram depicts the Company’s corporate structure as of December 31, 2024, and its material subsidiaries, including the name, jurisdiction of incorporation and proportion of ownership in each:

Not reflected in the above organization chart is the Company’s non-material interest in a shared service provider entity, Universal Mineral Services Ltd (“UMS”). Fury owns 25% of UMS with three other junior resource explores each owning 25%. Also not shown is a pending acquisition of 100% of Quebec Precious Metals Corporation for $5.1 million which is expected to complete in late April 2025.

| - A- |

GENERAL DEVELOPMENT OF THE BUSINESS

Business of Fury Gold

Fury Gold Mines is a Canadian-focused high-grade gold exploration company strategically positioned in two prolific mining regions: the Eeyou Istchee James Bay Region of Quebec and the Kitikmeot Region in Nunavut. Fury Gold has a portfolio of mineral properties, including the Eau Claire property located in the Eeyou Istchee James Bay Region of Northern Quebec (the “Eau Claire Project”), the Committee Bay gold project located in the Kitikmeot Region of Nunavut (the “Committee Bay Project”) and the Éléonore South property also located in the Eeyou Istchee James Bay Region of Northern Quebec (“Éléonore South Project”) which was determined to have become material as of March, 31, 2025.

Three-Year History Fury Gold’s Business

2022

Eau Claire Exploration Program

In October 2022, the Company completed the initial drilling program at Eau Claire and the Percival prospect, completing a total of approximately 52,700m from 2020-2022, with the final 17,700m completed in 2022. Additionally, the company completed a B-horizon soil sampling program at Lac Clarkie, a property adjacent to the Eau Claire project.

Changes to Management and the Board

On March 9, 2022, the Company announced the appointment of Bryan Atkinson, P.Geo, to Senior Vice President (SVP), Exploration and Michael Henrichsen, P.Geo, to Chief Geological Officer, effective immediately. The Company also announced that Salisha Ilyas, Vice President of Investor Relations, has resigned to pursue other opportunities.

On May 24, 2022, the Company announced that the Company’s Board Chair, Ivan Bebek was retiring from the Board, effective June 29, 2022 and would be an advisor.

Financing

On April 14, 2022, the Company completed a non-brokered private placement with two placees, who include a Canadian corporate investor and a US institutional investor, for a private placement sale of 13.75 million common shares of the Company at a price of $0.80 per share for gross proceeds of $11,000.

Completion of Sale of Homestake Ridge Project to Dolly Varden and Investor Rights Agreement

On February 25, 2022, the Company completed the sale of the Homestake Ridge Project to Dolly Varden. Pursuant to the agreement entered into on December 6, 2021 (“Homestake Purchase Agreement”), Dolly Varden purchased 100% of the shares of the Company’s subsidiary, Homestake Resource Corporation for a $5 million cash payment and the issuance of 76,504,590 common shares of Dolly Varden (the “Homestake Transaction. As a result of the sale, the Company has an indirect economic interest in the Homestake Ridge Project through its ownership of shares of Dolly Varden but does not have legal control over either Dolly Varden or the Homestake Ridge Project.

In connection with the Homestake Transaction, Dolly Varden and Fury Gold entered into an investor rights agreement (the "Homestake Investor Rights Agreement") pursuant to which Fury Gold has the following rights, and is subject to the following obligations:

| (i) | Fury Gold will have the right to appoint two nominees to the Dolly Varden board so long as Fury Gold owns greater than 20% of the Dolly Varden common shares outstanding. Should Fury Gold own less than 20% but greater than 10% of the Dolly Varden shares outstanding, Fury Gold shall have the right to appoint one nominee to the Dolly Varden board. Tim Clark, the Chief Executive Officer of Fury Gold, and Michael Henrichsen, the Chief Geological Officer of Fury Gold, joined the Dolly Varden Board upon closing of the Homestake Transaction. As Fury Gold now owns less than 20% but greater than 10% of the Dolly Varden shares outstanding, only Mr. Clark remains a director. |

| - A- |

| (ii) | Fury Gold will have the right to appoint one member to Dolly Varden’s technical committee for the purpose of providing non-binding advice and recommendations to the Dolly Varden board for so long as Fury Gold is entitled to appoint one nominee to the Dolly Varden board. |

| (iii) | Fury will have pre-emptive rights to maintain its ownership percentage in Dolly Varden for so long as Fury Gold owns more than 10% of the outstanding Dolly Varden common shares, subject to certain carve-outs and top-up rights. |

| (iv) | Fury Gold will not sell the Dolly Varden Shares during the one-year hold period following closing and will provide to Dolly Varden the right to direct the sale of any DV Shares proposed to be sold by Fury Gold after the expiry of the initial one-year hold period. |

| (v) | Fury Gold will for the initial two year period following closing, and subject to Fury Gold continuing to hold at least 10% of Dolly Varden’s outstanding shares, vote its shares in accordance with Dolly Varden management’s recommendations at each meeting of the shareholders of Dolly Varden, subject to exceptions for certain excluded matters, including special resolutions, minority shareholder votes required pursuant to Multilateral Instrument 61-101 and matters that would materially and adversely impact Fury Gold disproportionately. |

| (vi) | Fury Gold will not for the initial three-year period following Closing, and subject to Fury Gold continuing to hold at least 10% of Dolly Varden’s outstanding shares, acquire additional securities of Dolly Varden, solicit proxies separately from any Dolly Varden board approved proxy circular or otherwise seek to control management, the board or the policies of Dolly Varden. |

2022 Partial Sale of Dolly Varden Shareholdings

On October 3, 2022, the Company announced that it had entered into a non-brokered sale agreement to sell 17 million common shares of Dolly Varden at $0.40 per share, representing approximately 7.4% of the outstanding common shares of Dolly Varden. The gross proceeds received by the Company upon the close of the transaction on October 13, 2022, was $6.8 million. At December 31, 2022, and 2023, the Company held a 23.5% and 22.03% interest, respectively, in Dolly Varden.

2023

Eau Claire Exploration Program

On February 13, 2023, Fury Gold provided an update on targeting the wholly owned Lac Clarkie project immediately to the east of its 100% owned Eau Claire project in the Eeyou Istchee Territory in the James Bay region of Quebec. The Company has defined a total of eight gold targets through the completion of a B-horizon soil sampling program (Figure 1). Six of the targets lie along the Cannard Deformation Zone, which hosts numerous gold occurrences along its >100 kilometre (km) mapped extent, including Fury’s Eau Claire Deposit and Percival Property. Fury is working to prioritize these newly defined targets for follow-up in 2023 with the aim of advancing a number of these targets.

In April 2023, Fury Gold commenced a drilling program at the Eau Claire Deposit, comprising of 10,000 to 15,000 metres (m), with the goals of i) continuing expansion of the high-grade Eau Claire resource; ii) following up on the 2022 success at the Percival Prospect 14 km to the east of Eau Claire; and iii) advancing several early-stage exploration targets along the Cannard Deformation Zone to the drill ready stage.

On July 10, 2023, the Company announced its 2023 summer exploration program and the restart of all exploration activities, which had been interrupted since June 5, 2023, due to a governmental emergency fire evacuation order.

| - A- |

On August 3, 2023, Fury announced results for the first three 2023 core drill holes at the high-grade Eau Claire gold project. The 2023 drill program focused on the continued expansion of the Hinge Target located immediately west of the Eau Claire Deposit. Drilling at the Hinge Target continues to return multiple stacked zones of gold mineralization from each drill hole, including 5.0m of 3.6 g/t Au within a broader interval of 14.0m of 2.37 g/t Au. Additional drill intercepts include 6.5m of 2.66 g/t Au, 6.0m of 2.77 g/t Au and 1.0m of 10.35 g/t Au.

On October 3, 2023, the Company reported the results for an additional two infill core drill holes from the Hinge Target at the Eau Claire Project. The 2023 drill program continues to focus on infill drilling at the Hinge Target located immediately west of the Eau Claire Deposit. Every hole completed at the Hinge Target to date has intercepted two corridors of stacked gold-bearing quartz tourmaline veins and alteration, including 3.5m of 5.73 g/t gold and 11.27 g/t Tellurium and 7.43g/t gold over 2.5m within a broader interval of 4.65g/t gold and 8.72 g/t Tellurium over 4.5m. Drill holes 23EC-065 and 23EC-068 represent the continuation of a series of infill drill holes designed to tighten up the spacing of the 2022 Hinge Target drilling to a nominal spacing of 60-80m. The stacked intercepts through these new holes continue to exhibit the overall strength of the mineralized system within the Hinge Target.

On November 28, 2023, the Company reported additional results from the 2023 infill drilling program at the Hinge Target at the Eau Claire Project. Drilling continues to intercept multiple zones of gold mineralization, including 5.5m of 4.52 g/t gold and 3.0m of 3.34 g/t gold from 23-EC-069; 1.0m of 20.20 g/t gold and 3.5m of 3.51 g/t gold from 23EC-070; 1.0m of 19.55 g/t gold from 23EC-066; and 3.5m of 3.82 g/t gold from 23EC-067.

Changes to Management and the Board

On February 22, 2023, the Company announced that its Board of Directors has appointed Brian Christie as an Independent Director, effective immediately. Mr. Christie most recently served as Vice President, Investor Relations at Agnico Eagle Mines Limited, prior to which Mr. Christie worked for over 17 years as a precious and base metals mining analyst and brings with him extensive experience in the capital markets and the mining industry. On May 15, 2023, the Company announced the appointment of Mr. Christie as Board Chair, replacing Mr. Jeffrey Mason, who was appointed Board Chair on January 11, 2023 and continues to serve as independent Director of Fury Gold. The Company also announced that Michael Henrichsen, Chief Geological Officer, resigned from his role to pursue other interests.

On June 23, 2023, Phil van Staden, having previously served as the Company’s Corporate Controller since 2020, was appointed Interim Chief Financial Officer of the Company and brings over 15 years of diverse international experience in various accounting roles and industries throughout South Africa and Canada. He holds B. Commerce and B. Commerce Honours degrees, respectively, from the University of Pretoria and the University of South Africa. Mr. van Staden, took over from Dr. Lynsey Sherry, who had been the Chief Financial Officer since November 2020. Mr. van Staden was appointed (permanent) Chief Financial Officer effective January 1, 2024.

On September 5, 2023 Fury announced that it had appointed Ms. Isabelle Cadieux as an Independent Director, and she served until her resignation from the Board on March 24, 2025.

Financings

In March 2023, the Company closed a bought-deal private placement of 6,076,500 Common Shares of the Company that qualify as “flow-through shares” (the “FT Shares”) at a price of C$1.44 per FT Share for aggregate gross proceeds of approximately $8.750 million. The proceeds from the March 2023 Offering are being used to incur “flow-through mining expenditures” in connection with the exploration of the Company’s Eau Claire and ESJV projects. As at December 31, 2023, the Company had approximately $544,000 available to incur flow-through mining expenditures before December 31, 2024.

Corporate developments

On October 12, 2023, the Company filed a short form base shelf prospectus (the "Shelf Prospectus") with the securities commissions or similar regulatory authorities in all of the provinces and territories of Canada and has filed a corresponding registration statement on Form F-10 with the United States Securities and Exchange Commission. As a result of the completion of these filings, the Company is permitted to publicly offer up to $75 million of common shares, subscription receipts, warrants, and units or any combination thereof to investors in Canada and the United States during the 25-month period from October 12, 2023, that the Shelf Prospectus is effective.

| - A- |

2024

Eau Claire Exploration Program

On January 17, 2024, the Company reported results from the 2023 drilling program at the Hinge Target at the Eau Claire Project. Highlights from the seven drill holes include 31.77 g/t gold over 3.50m from 23EC-077; 65.0 g/t gold over 0.50m and 14.25 g/t gold over 1.0m from 23EC-074; 2.56 g/t gold over 7.50m from 23EC-068; and 3.41 g/t gold over 6.50m and 5.0 g/t gold over 3.50m from 23EC-075.

On February 6, 2024, the Company announced the final set of results from the 12,000m 2023 drilling program at the Hinge Target, part of the high-grade Eau Claire Project. Highlights from these last five drill holes include 17.62 g/t gold over 3.50m, including 29.80 g/t gold over 2m, and 22.20 g/t gold over 0.50m from 23EC-079; and 5.49 g/t gold over 3.50m from 23-EC-078. The reported intercepts from drill hole 23EC-082 of 17.62 g/t gold over 3.50m is within 135m of surface and is completely open to surface and to the west, above the rest of the Hinge Target.

On March 13, 2024, Fury Gold announced the results for the five remaining 2023 core drill holes from the Percival

Prospect located 14 kilometers east of the Eau Claire Project. Highlights from the drill holes include 15.0 m of 0.88 g/t Au including 3.0 m of 2.81 g/t Au from 23KP-016; 18.0m of 0.50 g/t Au from 23KP-014; and 14.50m of 1.05 g/t Au including 1.0m of 10.70 g/t Au from 23KP-013.

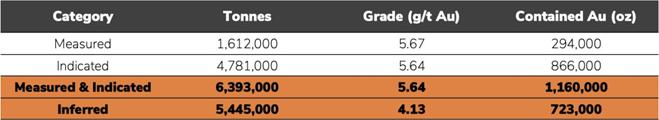

On May 14, 2024, the Company announced an updated Mineral Resource Estimate for the high-grade Eau Claire deposit as well as a Maiden Mineral Resource Estimate for the Percival deposit. The Eau Claire project now contains a combined mineral resource of 1.16Moz gold (Au) at a grade of 5.64 g/t Au in the Measured and Indicated category as well as an additional 723koz gold at a grade of 4.13 g/t Au in the Inferred Category. The 2024 updated Mineral Resource Estimate indicates an increase in the Measured and Indicated category by 307koz (a 36.0% increase) and adds 223koz Au (a 44.6% increase) to the Inferred category.

On June 19, 2024, the Company commenced a 3,500m drill program at the Serendipity Project at Eau Claire, focusing on three target areas.

On June 28, 2024, the Company announced the filing of a Technical Report for the Increased Mineral Resource Estimate for the high-grade Eau Claire deposit as well as a Maiden Mineral Resource Estimate for the Percival deposit located in the Eeyou Istchee Territory of the James Bay region of Quebec. The Eau Claire project now contains a combined mineral resource of 1.16Moz gold (Au) at a grade of 5.64 g/t Au in the Measured and Indicated category as well as an additional 723koz gold at a grade of 4.13 g/t Au in the Inferred Category. Gold mineralization remains open for expansion in all directions at both the Eau Claire and Percival deposits through additional drilling. The authors of this report are further described below.

On September 9, 2024, the Company announced results from the diamond drilling program at the greenfield Serendipity Prospect on its wholly owned Eau Claire project in the Eeyou Istchee Territory in the James Bay region of Quebec. The Serendipity Prospect lies within the same prospective geological setting as the Company’s Percival Deposit. In total 3,871 metres (m) were drilled in 10 holes across five distinct targets at Serendipity. Drill hole 24SD-009 targeted a biogeochemical anomaly overlying the easterly extension of the structure controlling the mineralization at Serendipity and intercepted 12.16 g/t gold over 3.0 m (Figures 1 and 2, Table 1). Drill hole 24SD-002 targeted a biogeochemical anomaly at the hinge of an interpreted fold within volcanic stratigraphy and intercepted 5.27 g/t gold over 1.0 m. The two noted intercepts above are separated by over 2 kilometres (km) indicating the potential for a large mineralizing system at Serendipity. The Company is in the process of planning follow-up drilling at Serendipity for 2025.

| - A- |

Éléonore South Exploration Program

On March 5, 2024, Fury Gold announced that is has identified a robust geochemical gold anomaly within the same sedimentary rock package that hosts Newmont’s Éléonore Mine at the Éléonore South gold project located in the Eeyou Istchee Territory in the James Bay region of Quebec. The orientation level biogeochemical sampling survey was designed to target an interpreted fold nose within the Low Formation sediments in an area where conventional soil or till sampling was not possible due to the ground conditions. The targeted area exhibited similar geological, geophysical, and structural characteristics to those present at the nearby Éléonore Mine. The identified anomaly is up to 200x the background value in gold and outlines the folded sedimentary package

On March 20, 2024, the Company announced a drilling program at its owned Éléonore South gold project located in the Eeyou Istchee Territory in the James Bay region of Quebec, in early April 2024, comprising of 2,000 metres (m) focusing on the Moni showing trend. Previous drilling intercepted up to; 53.25 m of 4.22 g/t gold (Au); 6.0 m of 49.50 g/t Au including 1.0 m of 294 g/t Au and 23.8 m of 3.08 g/t Au including 1.5 m of 27.80 g/t Au, several of which remain open.

On June 4, 2024, Fury announced the results of its spring 2024 diamond drilling program and the summer 2024 exploration plans for the project. The 2,331.4 metres (m) drilling program was completed with seven diamond drill holes testing 2.3 kilometres (km) of strike along the JT – Moni Trend. The drilling targeted 100 to 125 m downdip extensions from historical drilling. All seven drill holes intercepted anomalous gold mineralization including 137.5 m of 0.44 g/t gold and 18.7 m of 0.97 g/t from drill hole 24ES-161, 115.5 m of 0.50 g/t gold from drill hole 24ES-162 and, 28.0 m of 0.47 g/t gold from drill hole 24ES-160. During the summer of 2024, Fury plans to complete the biogeochemical sampling grid where a robust geochemical gold anomaly within the same sedimentary rock package that hosts Newmont’s Éléonore Mine has been identified. The completion of the biogeochemical grid will allow Fury to finalize drill targeting.

On October 7, 2024, the Company announced the discovery of high-grade lithium outcrop on the western claim block of its 100% owned Éléonore South project in the Eeyou Istchee Territory in the James Bay region of Quebec. The outcrop sampling program targeted the historical Fliszar showing lepidolite bearing pegmatite as well as new rock exposures over an area of approximately 1000 x 500 metres (m) resulting in the collection of 34 samples. Seven samples returned high-grade values above 1.75% lithium oxide (Li2O) with a peak value of 4.67% Li2O. The Company’s focus remains on the gold prospectivity of the Éléonore South project. However, the announced lithium results provide additional exploration targets as the overall project is advanced.

On November 12, 2024, the Company announced the finalization of drill targeting at the Éléonore South gold project in the Eeyou Istchee Territory in the James Bay Region of Quebec. Drilling will target robust geochemical gold anomalies within the same sedimentary rock package that hosts Newmont’s Éléonore Mine. The completed biogeochemical sampling survey covered an interpreted fold nose within the Low Formation sediments where an orientation level study identified a large-scale gold anomaly in a similar geological, geophysical, and structural setting to that of the nearby Éléonore Mine. Six priority drill targets across over 3 kilometres (km) of prospective folded sedimentary stratigraphy have been identified. These six targets encompass multi point gold anomalies above the 90th percentile of the data and correlate with moderate pathfinder elemental anomalies, most notably arsenic which is associated with gold mineralization at the Éléonore Mine. The Company intends to mobilize crews in Q1 2025 for an initial fully funded 3,000 – 5,000 metre (m) diamond drilling program.

On November 20, 2024, the Company announced that it has finalized drill targeting after completing a surficial geochemical survey at the Éléonore South gold project located in the Eeyou Istchee Territory in the James Bay region of Quebec. Six priority drill targets across over 3 kilometres (km) of prospective folded sedimentary stratigraphy have been identified. These six targets encompass multi point gold anomalies above the 90th percentile of the data and correlate with moderate pathfinder elemental anomalies, most notably arsenic, which is associated with gold mineralization at the Éléonore Mine.

| - A- |

Committee Bay Exploration 2024 Program

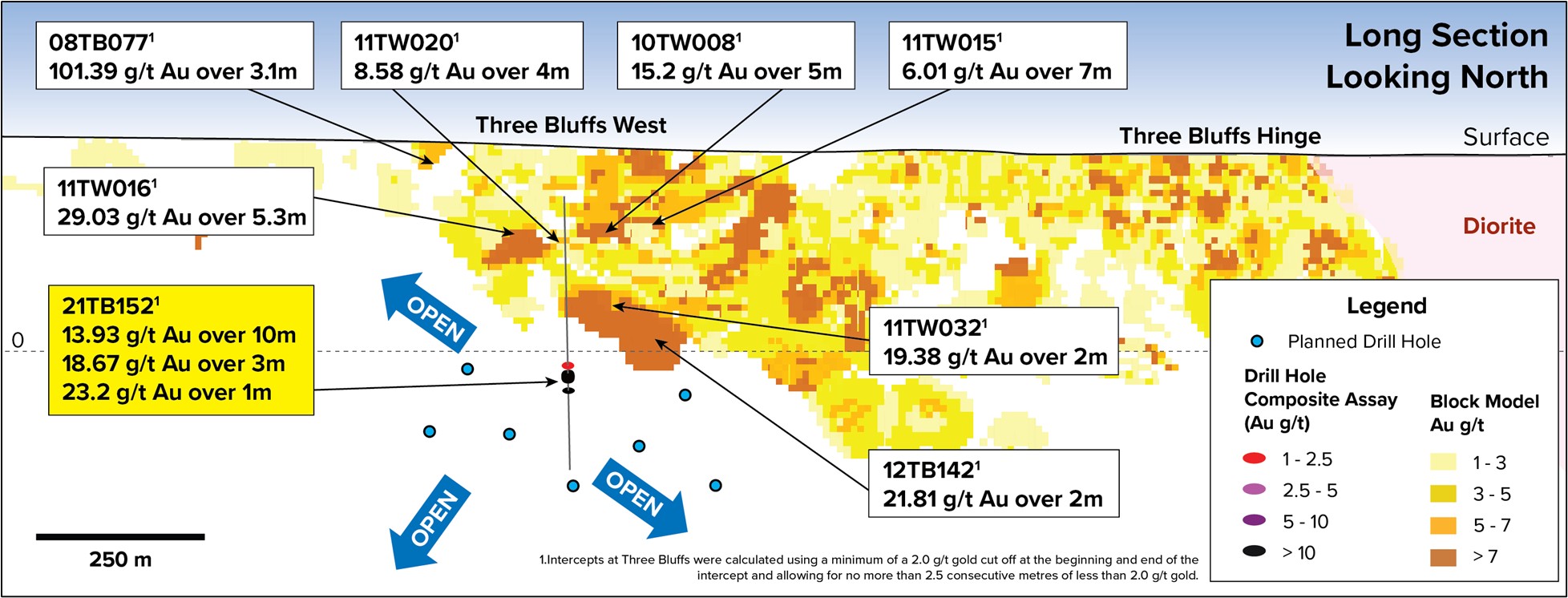

On October 24, 2024, the Company announced the results from the summer exploration program at its 100% Committee Bay project in the Kitikmeot Region of Nunavut. The 2024 exploration program defined three drill ready shear zone hosted targets advanced through a combination of till sampling, rock sampling and geological mapping:

| § | Three Bluffs Shear, where drilling in 2021 intercepted 13.93 g/t Au over 10 metres (m) (see news release dated December 1, 2021); |

| § | Raven Shear where 7 rock samples have averaged 16.12 g/t gold; and |

| § | Burro West where a 300 by 300 m discrete >90th percentile gold in till anomaly has been defined with a peak value of 50 ppb gold. |

Changes to Management and the Board

On January 10, 2024, the Company announced the appointment of Phil van Staden, the current Interim CFO of the Company, to the position of Chief Financial Officer effective as of January 1, 2024.

On June 27, 2024, as a result of the voting at its Annual General Meeting (“AGM”) of Shareholders held on June 26, 2024, the Company confirmed that each director nominee listed in the Company’s management information circular dated May 14, 2024, in connection with the AGM were re-elected as directors of the Company and that Deloitte LLP was re-appointed as the Company’s auditor. Mr. Mason did not stand for re-election as a director in 2024.

Financing

On June 13, 2024, the Company closed the $5 million financing announced on May 23, 2024. The Company issued 5,320,000 common shares of the Company that qualify as “flow-through shares” as defined under subsection 66(15) of the Income Tax Act (Canada) and section 359.1 of the Taxation Act (Québec) (the “FT Shares”) at a price of C$0.94 per FT Share for total gross proceeds to the Company of C$5,001.

2024 Partial Sale of Dolly Varden Shareholdings

On March 14, 2024, the Company announced that it had sold 5.45 million common shares of Dolly Varden at $0.735 per share, for gross proceeds of $4,006, lowering its holdings to 19.99% and decreasing its right to one director on Dolly Varden under its Investors Rights Agreement, to which notice have been given. On October 4, 2024 the Company sold another 3 million common shares of Dolly Varden for gross proceeds of $3,356, lowering its interest to 16.11% as at December 31, 2024.

Corporate Developments

On February 29, 2024, the Company, and its joint operation partner Newmont Corporation (“Newmont”), through their respective subsidiaries, closed a transaction whereby the Company acquired 100% control of the joint operation interests, the Éléonore South project, consolidating these properties into the Company’s portfolio at which time the joint venture operation was dissolved. The 49.978% that Newmont held was acquired by the Company for $3,000 while incurring $22, in transaction costs. As part of the transaction, the Company acquired 30,392,372 shares of Sirios Resources Inc. from Newmont which represented a 10.98% share at the time. The Company has sold a portion of the Sirios shares to retain under 9.9% which is the insider reporting threshold in Canada.

2025

The Company entered into an arrangement agreement with Quebec Precious Metals Corporation (“QPM”) on February 25, 2025 (the “Original Arrangement Agreement”). Under the terms of the Arrangement Agreement, Fury Gold has agreed to acquire QPM pursuant to a statutory plan of arrangement (the “Arrangement”) under Section 192 of the Canada Business Corporations Act (the “CBCA”) whereby Fury Gold will acquire all of the issued and outstanding shares of QPM on the basis of 0.0741 of one common share of Fury Gold for each share of QPM (the “Exchange Ratio”) as consideration for the acquisition. On March 6, 2025, Fury and QPM amended and restated the Original Arrangement Agreement in order to address certain technical matters related to QPM’s share capital (the “Amended and Restated Arrangement Agreement”). The Amended and Restated Arrangement Agreement was further amended by an amendment agreement dated March 19, 2025 (the “Amendment Agreement” and together with the Amended and Restated Arrangement Agreement, the “Arrangement Agreement”). In addition, each outstanding option and warrant of QPM will become exercisable to purchase shares of Fury following closing in accordance with the Exchange Ratio. Fury anticipates that approximately 8,385,030 common shares of Fury will be issued on closing of the Arrangement and that an additional 879,277 common shares will be issuable upon exercise of QPM options and warrants after closing. Fury Gold has obtained the approval of the Toronto Stock Exchange and NYSE American for the completion of the acquisition and related share issuances. Closing remains subject to the approval of the shareholders of QPM, the receipt of a final court order approving the Arrangement under the CBCA and satisfaction of other customary conditions to closing. Closing is anticipated to occur by April 30, 2025 if the required shareholder and court approvals are obtained.

| - A- |

QPM’s main asset is the Sakami gold project located in Eeyou Istchee James Bay territory in Québec, Canada (the “Sakami Project”). QPM’s other assets include the Cheechoo-Eleonore Trend gold project which is adjacent to the northwest to the Sakami Project, and the Elmer East gold and lithium project located in Eeyou Istchee James Bay territory in Québec, Canada. QPM also holds a 68% interest in the Kippawa rare earths project and a 100% interest in the Zeus heavy rare earths project, both of which are located in the Témiscamingue region of Québec, Canada.

BUSINESS DESCRIPTION

General

Fury Gold Mines is a Canadian-focused high-grade gold exploration company strategically positioned in two prolific mining regions: the Eeyou Istchee James Bay Region of Quebec and the Kitikmeot Region in Nunavut.

Fury Gold has a portfolio of mineral properties of which three are considered material at this time: the Eau Claire property located in the Eeyou Istchee James Bay Region of Northern Quebec (the “Eau Claire Project”), the Committee Bay gold project located in the Kitikmeot Region of Nunavut (the “Committee Bay Project”) and the Éléonore South property also located in the Eeyou Istchee James Bay Region of Northern Quebec (“Éléonore South Project”) which was determined to have become material as of March, 31, 2025.

Since 2016, the Company has been actively exploring its mineral projects with the goal of identifying new areas of significant mineralization. As discussed in relevant project sections below, the majority of this work has taken place away from the known deposit areas in the form of regional exploration and prospect drilling at satellite targets. Though this work has yet to lead to the discovery of any new material mineral deposits, it has strengthened the Company’s understanding of the geological systems and provided new evidence with respect to the projects’ continued perspectivity. The Company expects to continue its exploration on the Eau Claire Project and Éléonore South project through 2025 as discussed under the heading “General Development of the Business – Recent Developments”.

The Company has not yet determined whether any of its mineral property interests contain economically recoverable mineral reserves. The Company’s continuing operations and the underlying value of the Company’s mineral property interests are entirely dependent upon the existence of economically recoverable mineral reserves, the ability of the Company to obtain the necessary financing to complete the exploration of its mineral property interests, obtaining the necessary mining permits, and on future profitable production or the proceeds from the disposition of the exploration and evaluation assets. See “Risk Factors” for further information.

Specialized Skill and Knowledge

Most aspects of the Company’s business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, mining, metallurgy, engineering, environment issues, permitting, social issues, capital markets, financing and accounting. While competition in the resource mining industry can make it difficult to locate and retain competent employees in such fields, the Company has been successful in finding and retaining personnel for the majority of its key processes. See “Risk Factors – Specialized Skill and Knowledge”.

| - A- |

In addition, Fury Gold’s technical and management teams have a track record of successfully monetizing assets for all stakeholders and local communities in which it operates. Fury Gold conducts itself to the highest standards of corporate governance and sustainability.

Competitive Conditions

The mineral exploration industry is competitive and Fury Gold will be required to compete for the acquisition of project opportunities. As a result of this competition Fury Gold may not be able to acquire or retain prospective mineral projects, technical experts that can find, develop and mine such mineral properties and interests, workers to operate its mineral properties, and capital to finance exploration, development and future operations. The Company competes with other mining companies, some of which have greater financial resources and technical facilities, for the acquisition of mineral property interests, the recruitment and retention of qualified employees and for necessary investment capital with which to fund its operations and projects. See “Risk Factors – Competitive Conditions”.

Cyclical and Seasonal

The Company’s mineral exploration activities may be subject to seasonality due to adverse weather conditions affecting exploration including, without limitation, incremental weather, frozen ground and restricted access due to snow, ice or other weather-related factors. Further, the mining business, and particularly the precious metals industry, including the gold industry, is subject to metal price cycles. Moreover, the mining and mineral exploration business is subject to global economic cycles effecting, among other things, the marketability and price of gold products in the global marketplace. See “Risk Factors – Commodity Price Fluctuations and Cycles”.

Intangible Properties

The Company’s intangible property, including its mineral and surface rights, is described elsewhere in this AIF. The Company’s business is not materially affected by intangibles such as business or commercial licenses, patents and trademarks or other intellectual property.

Environmental Protection

Exploration activities are subject to numerous and often stringent environmental laws and regulations. Compliance with such laws and regulations increases the costs of and delays planning, designing, drilling and developing the Company’s properties. To the best of management’s knowledge, the Company is in compliance in all material respects with all environmental laws and regulations applicable to its exploration and drilling activities. Fury Gold is committed to meeting or surpassing all applicable environmental legislation, regulations, permit and license requirements, and to continuously improving its environmental performance and practices. The Company embraces safe, socially and environmentally responsible and sustainable work practices during all activities. Fury Gold seeks to utilize innovative technologies and techniques to reduce its environmental footprint across all of the Company’s projects. This includes awarding drill contracts to an EcoLogo certified contractor at Eau Claire, the use of Rotary Air Blast (RAB) drilling at the Committee Bay Project, which reduces water usage, footprint and time on the ground, and the use of drone imagery to allow targeted ground-based follow up of outcrop. Current costs associated with compliance are considered to be normal. See “Risk Factors – Environmental Regulatory, Health & Safety Risks and “Risk Factors – Environmental Protection”.

Employees

As at December 31, 2024, the Company had approximately 9 equivalent full-time employees located primarily in Canada. The Company shares certain technical and administrative functions provided by Vancouver-based Universal Mineral Services Ltd on a full-cost recovery basis (See “Agreement with Universal Mineral Services Ltd.). The Company also relies on consultants and contractors to carry on many of its business activities and, in particular, to supervise and carry out mineral exploration and drilling on its mineral properties. No management functions of Fury Gold are performed to any substantial degree by a person other than the directors or executive officers of Fury Gold.

| - A- |

Social and Environmental Policies

Building and maintaining good corporate citizenship is an important component of Fury Gold’s business practices. The Company has adopted several social and environmental policies and codes of conduct that are essential to its operations. The Company’s operating practices are governed by the principles set out in its Code of Business Conduct and Ethics, Diversity Policy, Insider Trading Policy, Indigenous Relations Policy, Disclosure Policy and Whistle-Blower Policy.

Fury Gold endeavours to contribute to the communities in which it operates by focusing on activities that can make a meaningful, positive and lasting difference to the lives of those affected by its presence. Fury Gold prioritizes creating mutually beneficial and long-term partnerships with the communities where it operates, respecting their interests as our own. Fury Gold establishes constructive local partnerships to contribute to local priorities and interests and to have communities benefit both socially and economically from its activities. The Company seeks opportunities to maximize employment and procurement for local communities through the provision of suitable training opportunities and resources.

Fury Gold endeavours to engage in open and transparent dialogue with governments, local communities, Indigenous peoples, organizations and individuals on the basis of respect, fairness and meaningful consultation and participation.

Further information regarding Fury Gold’s corporate governance policies and charters can be found on its website at www.furygoldmines.com/about -us/governance.

Indigenous and Local Community Engagement

Fury Gold respects and engages meaningfully with Indigenous and local communities at all of its operations. The Company is committed to working constructively with local communities, government agencies and Indigenous groups to ensure that exploration work is conducted in a culturally and environmentally sensitive manner. The Company’s engagement with Indigenous and local communities is governed by the principles set out in its Indigenous and Community Relations Committee Charter. Moreover, Fury Gold is committed to:

| · | sharing information about its projects and operations, providing meaningful opportunities for input and dialogue and involving local and Indigenous communities in archaeological work, environmental assessments and related studies; |

| · | making meaningful efforts to reach agreements with local and Indigenous groups on the preferred method of participation and engagement processes; |

| · | exploring opportunities for local and Indigenous communities to benefit from its projects and activities, which may include employment, contracting, training, community benefits and agreements, as appropriate to the type and stage of activity being undertaken; and |

| · | engaging in candid and respectful dialogue with a view to resolving or minimizing any disagreements and ensuring full communication in respect of any unresolved issues. |

Fury Gold is committed to responsible mineral exploration. The Company is dedicated to collaborating with Indigenous peoples and communities to establish and maintain effective, lasting, and mutually beneficial relationships. To achieve this commitment, we strive for relationships based on transparency, mutual respect, and trust. Accordingly, Fury implemented an Indigenous Relations Policy in 2024, which can be found on the Company’s website at www.furygoldmines.com/about-us/governance.

Cultural Awareness

In 2021, employees and the board of directors participated in a multi-module accredited in-house learning program aimed at developing Indigenous cultural competency. This program is provided to any new board members as part of the director onboarding process. In 2024, employees and the board of directors completed additional cultural awareness training which focused on the Indigenous communities in the regions of its projects in Quebec.

| - A- |

Fury, in partnership with the Cree Hunters Economic Security Board and 15 other mining and exploration companies, contributed to a voluntary fund totalling C$750,000 for the Reconstruction Initiative Forest Fires Fund 2023. This initiative aimed to support the rebuilding of cabins destroyed by the 2023 wildfires in the Eeyou Istchee James Bay territory of Quebec.

Ecologo Certificate

During the year ended December 31, 2024, the Company received its Ecologo certification for mineral exploration. Ecologo is the first comprehensive certification for mineral exploration companies and their service providers that features third-party certification of environmental, social and economic practices in Quebec.

Additionally, during the first quarter of 2022, the Company undertook a qualitative environmental, social and governance (“ESG”) assessment with Digbee, a technology company which provides qualitative assessment tools to mining companies to track their ESG achievements. Fury Gold received an overall score of BB with a range of CC to A broken down into a corporate score of BB with a range of B to A and a project score of BB with a range of CC to A for both the Eau Claire and Committee Bay projects. These results are considered strong for an exploration company and the Company is continually evaluating and implementing initiatives to improve future scores. Fury Gold conducted a second annual Digbee ESG Certification in 2024, and achieved an overarching score of BBB with a range of CC to AA as of June 2024. A corporate score of A with a range of BB to A was obtained, which is considered to be strong for an Exploration company. The Eau Claire project achieved a score of BB with a range of CC to AA. The Company continues to evaluate and implement initiatives to improve future scores.

During 2023 and 2024, the Company’s subsidiary Eastmain entered into a Services Agreement with Stajune Ventures Inc., a business entity of the Cree Nation of Eastmain, which provided for the local First Nation personnel to provide services for the summer exploration activities at the Eau Claire project during those years.

Fury Gold’s Indigenous and Community Relations Committee Charter can be viewed on its website at www.furygoldmines.com/about -us/governance.

THE COMPANY’S MINERAL PROJECTS

Summary of Three Material Mineral Properties

At December 31, 2024, the Company’s three material mineral properties were the Eau Claire Project and the Éléonore South Project located in the Eeyou Istchee James Bay Region of Northern Quebec, and the Committee Bay Project located in the Kitikmeot Region of Nunavut, Canada. The Éléonore South Project has been determined to have become material effective March 31, 2025 as a result of the Company increasing its ownership interest to 100% and increasing exploration expenditures. As a consequence of being determined to be material, a Technical Report on Committee Bay described below authored by the Company’s Senior Project Geologist is being filed concurrently with this AIF.

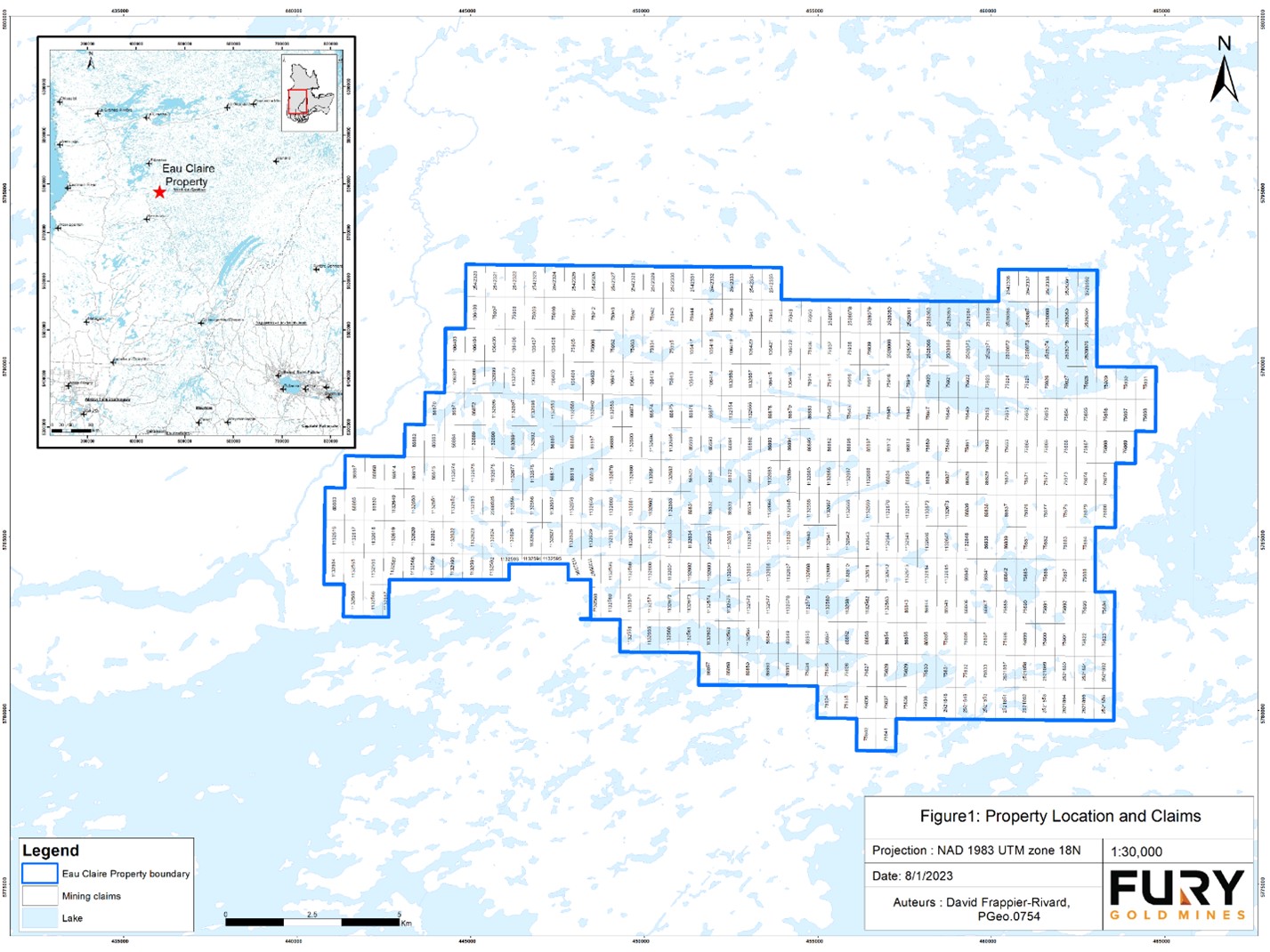

The Eau Claire Project is a resource stage project, 100% held and operated by Fury, comprised of 446 claims, totaling 23,284 hectares(ha). Located in 1:50,000 scale NTS map sheets 33B04 and 33B05, approximately 320 km northwest of the town of Chibougamau and 800 km north of Montreal in the Eeyou Istchee James Bay Region of Quebec. The centre of the property is located at approximately 75.78 degrees longitude west and 52.22 degrees latitude north.

The early exploration stage Éléonore South Project, 100% held and operated by Fury, comprises 282 claims, totaling 14,760 hectares (ha). Located in 1:50,000 scale NTS map sheets 33B12 and 33C09, approximately 200 km east of the Cree community of Wemindji, 330 km northwest of the town of Chibougamau and 800 km north of Montreal in the Eeyou Istchee James Bay Region of Quebec. The centre of the property is located at approximately 75.98 degrees longitude west and 52.58 degrees latitude north.

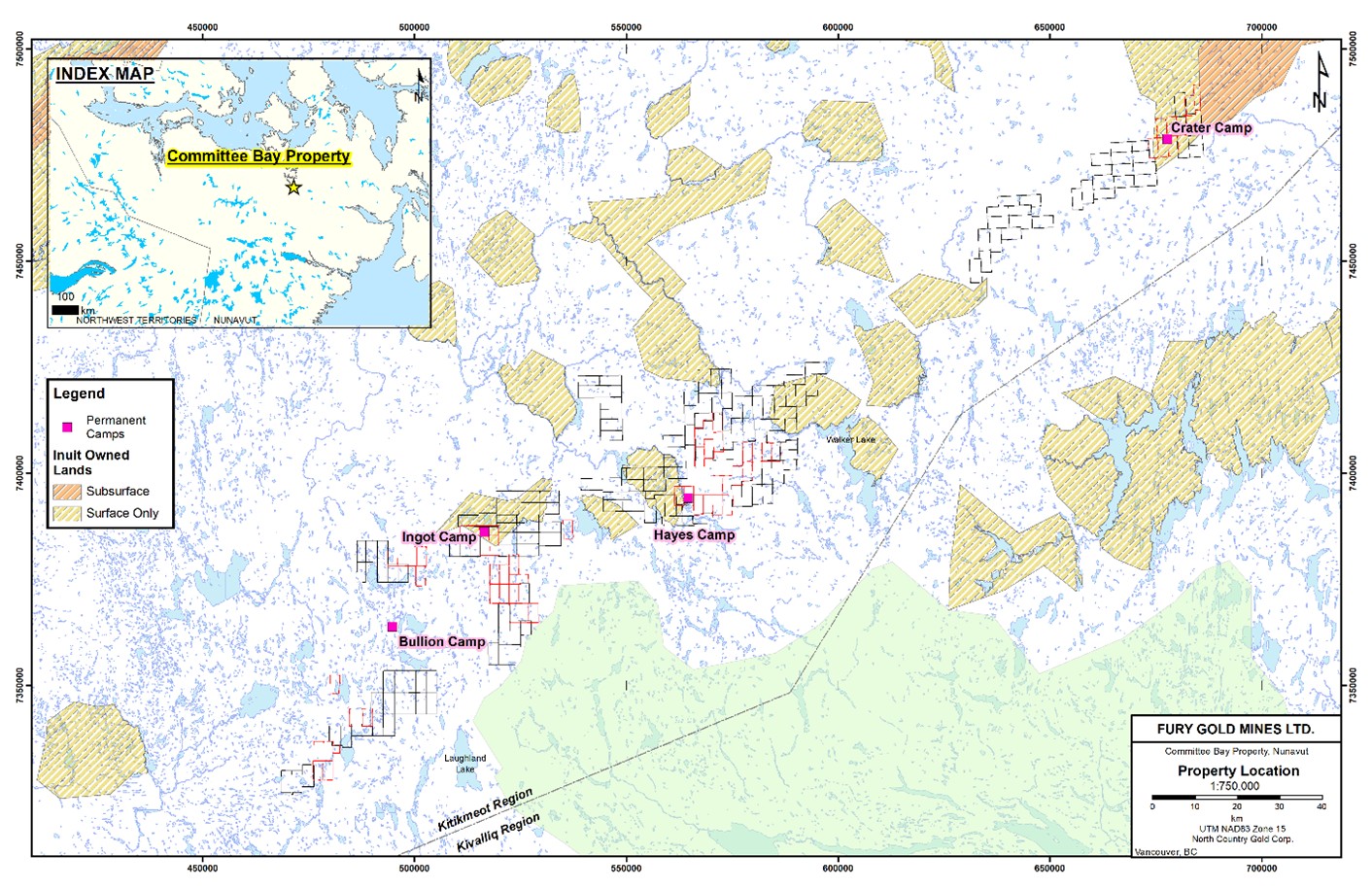

The Committee Bay Project, 100% held by Fury, is a resource stage project comprising 156 claims and 57 crown leases, totaling 254,623.05 hectares (ha). located in 1:250,000 scale NTS map sheets 56J, 56K, 59O and 56P, approximately 430 km northwest of the town of Rankin Inlet. The approximate centre of the Project is located at Universal Transverse Mercator (UTM) co-ordinates 7,400,000m N and 570,000m E (NAD 83, Zone 15N).

| - A- |

Eau Claire Project