SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 40-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended August 31, 2024 | Commission File Number 001-32500 |

TRX GOLD CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

Alberta, Canada Z4

(Jurisdiction of Incorporation or Organization)

| Primary Standard Industrial Classification Code Number | I.R.S. Employer Identification Number | |

| 1041 | N/A |

277 Lakeshore Road East, Suite 403

Oakville, Ontario

Canada L6J 1H9

844-364-1830

(Address of Principal Executive Offices)

National Registered Agents, Inc.

1015 15th Street N.W., Suite 1000

Washington, D.C. 20005

202-572-3133

(Name, address (including zip code) and telephone number (including area code) and of agent for service in the United States

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares | TRX | NYSE American |

Securities registered or to be registered pursuant to Section 12(g) of the Act: NONE

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: NONE

For annual reports, indicate by check mark the information filed with this Form:

☒ Annual information form ☒ Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 280,190,736 (as of August 31, 2024).

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 2.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging Growth Company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

EXPLANATORY NOTE

TRX Gold Corporation ("we", "us", "our", the "Company", or “Registrant”) is a Canadian corporation that is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this annual report on Form 40-F ("Annual Report") pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), in accordance with disclosure requirements in effect in Canada, which are different from those of the United States.

FORWARD LOOKING STATEMENTS

This Annual Report, including the Exhibits incorporated by reference into Annual Report, contains "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and U.S. securities legislation. These forward-looking statements reflect our current view about future plans, intentions or expectations and include, in particular, statements about our plans, strategies and prospects and may be identified by terminology such as “may,” “will,” “should,” “expect,” “scheduled,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “aim,” “potential,” or “continue” or the negative of those terms or other comparable terminology. These forward-looking statements are subject to risks, uncertainties and assumptions about us. Although we believe that our plans, intentions and expectations are reasonable, we may not achieve our plans, intentions or expectations.

Important factors that could cause actual results to differ materially from the forward-looking statements we make in this Annual Report are set forth under the caption “Risk Factors” in our Annual Information Form filed as Exhibit 99.1. We undertake no obligation to update any of the forward-looking statements after the date of this Annual Report to conform those statements to reflect the occurrence of unanticipated events, except as required by applicable law. You should read this Annual Report with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all our forward-looking statements by these cautionary statements.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Company is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this Annual Report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company prepares its financial statements, which are filed with this Annual Report, in accordance with the International Financial Reporting Standards issued by the International Accounting Standards Board. Therefore, they are not comparable in all respects to the financial statements of United States companies that are prepared in accordance with United States generally accepted accounting principles.

MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

Unless otherwise indicated, all mineral resource and mineral reserve estimates included in the documents incorporated by reference into this Annual Report have been prepared in accordance with Canadian National Instrument 43-101 ("NI 43-101") and the Canadian Institute of Mining and Metallurgy Classification System. NI 43-101 is a rule developed by the Canadian securities administrators, which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ from the requirements of the United States Securities and Exchange Commission (the "SEC" or “Commission”). Accordingly, mineral resource and mineral reserve estimates, and other scientific and technical information, contained in the documents incorporated by reference into this Annual Report may not be comparable to similar information disclosed by companies that have mining operations and report information pursuant SEC regulations.

RESOURCE AND RESERVE ESTIMATES

The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves (“CIM Standards”), adopted by the CIM Council, as amended.

Until recently, the CIM Standards differed significantly from standards in the United States. The SEC adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical disclosure requirements for mining registrants that were included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding definitions under the CIM Standards, as required under NI 43-101.

United States investors are cautioned that while the above terms are “substantially similar” to the corresponding CIM Definition Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

United States investors are also cautioned that while the SEC now recognizes “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any “indicated mineral resources” or “inferred mineral resources” that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. In accordance with Canadian securities laws, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances permitted under NI 43-101.

Accordingly, information contained in this Annual Report on Form 40-F and the documents incorporated by reference herein containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

PRINCIPAL DOCUMENTS

The following documents are part of, and are hereby incorporated by reference in, this Annual Report on Form 40-F (“Annual Report”):

| A. | Annual Information Form |

Annual Information Form or the fiscal year ended August 31, 2024, see Exhibit 99.1 to this Annual Report.

| B. | Audited Annual Financial Statements |

Audited Consolidated Financial Statements for the fiscal year ended August 31, 2024, and notes thereto, together with the report of the independent registered public accounting firm thereon, see Exhibit 99.2 of this Annual Report.

| C. | Management's Discussion and Analysis |

Management's Discussion and Analysis of Financial Condition and Results of Operations for the fiscal year ended August 31, 2024, see Exhibit 99.3 of this Annual Report; and

| D. | Technical Report |

NI 43-101 Technical Report: Updated Mineral Resource Estimate for the Buckreef Gold Mine Project, Tanzania, East Africa dated May 15, 2020, see Exhibit 99.4 of this Annual Report.

CONTROLS AND PROCEDURES

| A. | Certifications |

The required certifications for the Principal Executive Officer and Principal Financial Officer are attached as Exhibits 99.5, 99.6, 99.7 and 99.8 to this Annual Report.

| B. | Disclosure Controls and Procedures. |

The Company’s Chief Executive Officer (“CEO”) (principal executive officer) and Chief Financial Officer (“CFO”) (principal financial officer) evaluated the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), as of the end of the period covered by this Annual Report. Based on the evaluation, these officers concluded that as of the end of the period covered by this Annual Report, the Company’s disclosure controls and procedures were not effective to ensure that the information required to be disclosed by the Company in reports it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time period specified in the rules and forms of the SEC. These disclosure controls and procedures include controls and procedures designed to ensure that such information is accumulated and communicated to the Company’s management, including the Company’s principal executive officer and principal financial officer, to allow timely decisions regarding required disclosure. The conclusion that the disclosure controls and procedures were not effective was due to the presence of material weaknesses in internal control over financial reporting as identified below under the heading “Management’s Annual Report on Internal Control Over Financial Reporting.”

Management anticipates that such disclosure controls and procedures will not be effective until the material weaknesses are remediated. The Company intends to remediate the material weaknesses discussed in Section C. below.

Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, if any, within the Company have been detected.

| C. | Management's Annual Report on Internal Control Over Financial Reporting. |

Management of the Company is responsible for establishing and maintaining adequate internal controls over financial reporting (“ICFR”) for the Company as defined in Rule 13a-15(f) under the Securities and Exchange Act of 1934. The Company’s management, including the Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) have conducted an evaluation of the design and effectiveness of the Company’s ICFR as of August 31, 2024. In making this assessment, the Company’s management used the criteria established in Internal Control – Integrated Framework, issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO 2013”). This evaluation included review of the documentation of controls, evaluation of the design and operating effectiveness of controls, and a conclusion on this evaluation. Based on this evaluation, management concluded that ICFR were not effective for the year ended August 31, 2024, due to a material weakness relating to its information technology general controls (“ITGC”). The Company relies on a third-party service provider that manages its enterprise resource planning (“ERP”) software. As at August 31, 2024, the vendor did not have an assurance audit report to confirm the appropriate ITGCs were in place. As a result, the Company was unable to assess the internal controls related to security, availability, processing integrity and confidentiality surrounding the ERP. The Company did not have appropriate controls to monitor the vendor’s control environment and ITGCs as per the criteria established in the COSO 2013 Framework.

Remediation of Material Weaknesses:

The control deficiency described immediately above was concluded on by management during the year ended August 31, 2024. The Company has prioritized the remediation of the material weakness and is working with its vendor to resolve the issue.

During the year ended August 31, 2024, the Company continued to strengthen its internal controls and is committed to ensuring that such controls are designed and operating effectively. The Company is implementing process and control improvements, and management made the following changes during the year to improve the internal control framework, including the following:

| · | Continued working with a third-party service provider to implement and test the design and operating effectiveness of key controls developed in the prior year period. Based on this work, the Company concluded that the majority of internal control deficiencies previously identified have been substantially remediated, except for the material weakness described above. |

| · | Continued to build an experienced team at Buckreef Gold Company Limited, the Company’s operating subsidiary, including hiring a new site Supply Chain Superintendent and adding additional headcount to enhance controls over the procurement process, document management, segregation of duties and optimization of the Company’s financial reporting close process. |

It is the Company’s intention to remediate the material weakness by working closely with its vendor and, if required, designing and implementing additional compensating controls over ITGCs over the course of fiscal 2025.

| D. | Attestation Report of the Independent Registered Public Accounting Firm. |

See Exhibit 99.2 of this Annual Report.

| E. | Changes in Internal Control Over Financial Reporting. |

During the year ended August 31, 2024, there were no changes in the Company’s internal control over financial reporting that have materially affected, or are reasonable likely to materially affect, its internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

The Company was not required by Rule 104 of Regulation BTR to send any notices to any of its directors or executive officers during the fiscal year ended August 31, 2024.

AUDIT COMMITTEE FINANCIAL EXPERT

Following are the members of the Audit Committee:

| Norman Betts (Chair) | Independent | Financial expert | ||||

| Shubo Rakhit | Independent | Financially literate | ||||

| Richard Steinberg | Independent | Financially literate |

The Company’s Board of Directors has determined that Mr. Norman Betts, Chair of the Audit Committee, is an audit committee financial expert within the meaning of paragraph 8(b) of General Instruction B of Form 40-F.

An Audit Committee Financial Expert must possess five attributes: (i) an understanding of IFRS and financial statements; (ii) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (iii) experience preparing auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities; (iv) an understanding of internal controls and procedures for financial reporting; and (v) an understanding of audit committee functions. Mr. Betts is an Associate Professor, Faculty of Business Administration, University of New Brunswick and a Fellow Chartered Accountant. The Company believes that all three members of the Audit Committee (Messrs. Betts, Rakhit and Steinberg) are independent within the meaning of United States and Canadian securities regulations and applicable stock exchange requirements.

CODE OF ETHICS

The Company has a Code of Ethics and Business Conduct that applies to the Company’s directors, officers, employees and consultants. In addition, the Company has a Code of Ethical Conduct for Financial Managers that applies to its principal executive officer, principal financial officer, principal accounting officer, controller and other persons performing similar functions. A copy of the Company’s Code of Ethics and Business Conduct and Code of Ethical Conduct for Financial Managers can be found on its website at www.trxgold.com and is filed as Exhibit 99.9. The Company undertakes to provide to any person without charge, upon request, a copy of such code of ethics by contacting Corporate Secretary, TRX Gold Corp., at www.trxgold.com.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The Company’s independent auditor for the fiscal years ended August 31, 2024 and 2023 was Dale Matheson Carr-Hilton Labonte LLP, Chartered Professional Accountants.

The following summarizes the significant professional services rendered by Dale Matheson Carr-Hilton Labonte LLP for the year ended ended August 31, 2024 and 2023.

| Financial Year Ending August 31 | Audit Fees | Audit Related Fees | Tax Fees | All Other Fees |

| 2024 | C$279,000 | Nil | Nil | Nil |

| 2023 | C$293,000 | Nil | Nil | Nil |

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

The Company’s Audit Committee pre-approves all services provided by its independent auditors. All services and fees described above were reviewed and pre-approved by the Audit Committee.

OFF BALANCE ARRANGEMENTS

The Company has no off-balance sheet arrangements. See Management's Discussion and Analysis of Financial Condition and Results of Operations for the fiscal year ended August 31, 2024, for an analysis of material cash requirements from known contractual and other obligations.

MINE SAFETY DISCLOSURE

The Company does not operate any mines in the United States and has no mine safety incidents to report for the year ended August 31, 2024.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS.

None

UNDERTAKING

Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company has previously filed with the SEC an Appointment of Agent for Service of Process and Undertaking on Form F-X with respect to the class of securities in relation to which the obligation to file this Form 40-F arises. Any change to the name or address of the Company's agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Company.

EXHIBITS

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant hereby certifies that it meets all of the requirements for filing this Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

| Date: November 29, 2024 | TRX GOLD CORPORATION | ||

| By: | /s/ Stephen Mullowney | ||

| Stephen Mullowney, Chief Executive Officer | |||

| (Principal Executive Officer”) | |||

8

Exhibit 99.1

ANNUAL INFORMATION FORM

(for the year ended August 31, 2024)

November 29, 2024

TABLE OF CONTENTS

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | iii |

| Glossary of Technical Terms | iv |

| Corporate Structure | 1 |

| Intercorporate Relationships | 2 |

| General Development of the Business Over the Last Three Years | 2 |

| Description of the Business | 5 |

| General | 5 |

| Risk Factors | 8 |

| Risks Relating to the Company | 8 |

| Risks Relating to the Market | 14 |

| Risks relating to the Securities of the Company | 16 |

| Mineral Projects | 18 |

| Buckreef Gold Mine Project | 18 |

| Introduction | 19 |

| Location, Property Description and Ownership | 19 |

| Geology and Mineralization | 20 |

| Exploration, Drilling, Sampling and QA/QC | 20 |

| Mineral Processing and Metallurgical Testing | 21 |

| Mineral Resource Estimation | 21 |

| Exploration Targets | 22 |

| Mineral Reserves | 22 |

| Interpretations and Conclusions | 23 |

| Recommendations | 24 |

| Dividends And Distributions | 24 |

| Description Of Capital Structure | 24 |

| Common Shares | 24 |

| Omnibus Plan | 25 |

| Options | 25 |

| Restricted Share Units | 25 |

| Deferred Share Units | 26 |

| Performance Share Units | 26 |

| Constraints on Ownership – Canada | 26 |

| Market For Securities | 27 |

| Prior Sales | 28 |

| Escrowed Securities And Securities Subject To Contractual Restriction On Transfer | 28 |

| Directors And Officers | 28 |

| Conflicts of Interest | 30 |

| Audit Committee | 30 |

| Reliance on Certain Exemptions | 31 |

| Audit Committee Oversite | 31 |

| Pre-Approval Policies and Procedures | 31 |

| External Auditor Service Fees | 32 |

| Promoters | 32 |

| Legal Proceedings And Regulatory Actions | 32 |

| Legal Proceedings | 32 |

| Regulatory Actions | 32 |

| Interest Of Management And Others In Material Transactions | 32 |

| Transfer Agents and Registrars | 33 |

| Material Contracts | 33 |

| Interests Of Experts | 34 |

| Additional Information | 34 |

| SCHEDULE “A” | 35 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Information Form (“Annual Report”) contains forward-looking statements. These forward-looking statements reflect our current view about future plans, intentions or expectations and include, in particular, statements about our plans, strategies and prospects and may be identified by terminology such as “may,” “will,” “should,” “expect,” “scheduled,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “aim,” “potential,” or “continue” or the negative of those terms or other comparable terminology. These forward-looking statements are subject to risks, uncertainties and assumptions about us. Although we believe that our plans, intentions and expectations are reasonable, we may not achieve our plans, intentions or expectations.

Important factors that could cause actual results to differ materially from the forward-looking statements we make in this Annual Report set forth under the caption “Risk Factors”. We undertake no obligation to update any of the forward-looking statements after the date of this Annual Report to conform those statements to reflect the occurrence of unanticipated events, except as required by applicable law. You should read this Annual Report with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all our forward-looking statements by these cautionary statements.

In this Annual Report, “we,” “us,” “our,” “the Company,” and “TRX” refer to TRX Gold Corporation and its subsidiaries, unless the context otherwise requires. Unless otherwise stated, all dollar amounts in this Annual Report refer to U.S. dollars.

The disclosure contained in this Annual Report of a scientific or technical nature relating to the Company’s Buckreef Project has been summarized or extracted from the technical report entitled “The National Instrument 43-101 Independent Technical Report, Updated Mineral Resource Estimate for the Buckreef Gold Mine Project, Tanzania, East Africa For TRX Gold” with an effective date (the “Effective Date”) of May 15, 2020 (the “2020 Technical Report”). The 2020 Technical Report was prepared by or under the supervision Mr. Wenceslaus Kutekwatekwa (Mining Engineer, Mining and Project Management Consultant) BSc Hons (Mining Eng.), MBA, FSAIMM, of Virimai Projects, and, Dr Frank Crundwell, MBA, PhD, a Consulting Engineer, each of whom is an independent Qualified Person as such term is defined in NI 43-101. The information contained herein is subject to all of the assumptions, qualifications and procedures set out in the 2020 Technical Report and reference should be made to the full details of the 2020 Technical Report which has been filed with the applicable regulatory authorities and is available on the Company’s profile at www.sedarplus.ca. The Company did not complete any new work that would warrant reporting material changes in the previously reported Mineral Resource (“MRE”) and Mineral Reserve statements during the period ended May 31, 2024. The MRE and economic analysis was previously conducted under the 2003 CIM Code for the Valuation of Mineral Properties which may be different than the November 2019 guidelines.

Glossary of Technical Terms

| Assay | To analyze the proportions of metals in an ore. |

| Au | The elemental letters for gold. |

| CIM | Canadian Institute of Mining, Metallurgy and Petroleum. |

| Diamond drilling | A form of core drilling which uses a rotary drill with a diamond drill bit attached in order to create precisely measured holes from which rock samples, ‘core’ are extracted. |

| Dyke | A tabular igneous intrusion that cuts across (discordant) the bedding orfoliation of the country rock. |

| Fault | A planar fracture or discontinuity in a volume of rock, across which there has been displacement of one rock mass against the other. |

| Feasibility study | A feasibility study is a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable modifying factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a pre-feasibility study. |

| Fracture | A general term for any surface within a mass across which there is no cohesion, e.g. a ‘crack’, fault or joint. |

| Grade | The relative quantity or percentage of ore-mineral content in an orebody. |

| Indicated Mineral Resource | Indicated mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve. |

| Inferred Mineral Resource | Inferred mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a mineral reserve. |

| Kilometres or km | Metric measurement of distance equal to 1,000 metres (or 0.6214 miles). |

| Processing plant | A facility for processing ore to recover minerals. |

| Mineral Reserve | Mineral reserve is an estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of a Qualified Person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

| Measured Mineral Resource | Measured mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve. |

| Mineralization | The ‘deposition’ of economically important metals in the formation of ore bodies or "lodes”. |

| NI 43-101 | National Instrument 43-101, “Standards of Disclosure for Mineral Projects”, as adopted by the Canadian Securities Administrators, as the same may be amended or replaced from time to time, and shall include any successor regulation or legislation. |

| Ore | A mineral or an aggregate of minerals from which a valuable constituent, especially a metal, can be profitably mined or extracted. |

| Porphyry | An igneous rock of any composition that contains conspicuous phenocrysts in a fine-grained ground mass. |

| Pre-feasibility Study (preliminary feasibility study) | A pre-feasibility study is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the modifying factors and the evaluation of any other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the Mineral Resource may be converted to a Mineral Reserve at the time of reporting. A pre-feasibility study is at a lower confidence level than a feasibility study. |

| Probable Mineral Reserve | Probable mineral reserve is the economically mineable part of an indicated and, in some cases, a measured mineral resource. |

| Proven Mineral Reserve | Proven mineral reserve is the economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource. The term should be restricted to that part of the deposit where production planning is taking place and for which any variation in the estimate would not significantly affect potential economic viability. |

| Qualified Person | An individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the technical report; and is a member or licensee in good standing of a professional association. |

| STAMICO | State Mining Corporation of Tanzania. |

| Ton | Imperial measurement of weight equivalent to 2,000 pounds (sometimes called a “short ton”). |

| Tonne | Metric measurement of weight equivalent to 1,000 kilograms (or 2,204.6 pounds). |

| Veins | An epigenetic mineral filling of a fault or fracture in a host rock; a mineral deposit of this form and origin. |

TRX GOLD CORPORATION

All information in this Annual Information Form (“Annual Report”) is as of August 31, 2024, unless otherwise indicated.

Corporate Structure

The Company was originally incorporated under the corporate name “424547 Alberta Ltd.” on July 5, 1990, under the Business Corporations Act (Alberta).

The Articles of 424547 Alberta Ltd. were amended on August 13, 1991, as follows:

| · | the name of the Company was changed to “Tan Range Exploration Corporation”; |

| · | the restriction on the transfer of shares was removed; and |

| · | a new paragraph regarding the appointment of additional directors was added as follows: |

| “(b) | The Directors, may, between annual general meetings, appoint one or more additional directors of the Company to serve until the next annual general meeting, but the number of additional Directors shall not at any time exceed one-third (1/3) of the number of Directors who held office at the expiration of the last annual meeting of the corporation.” |

The Company was registered in the Province of British Columbia as an extra-provincial company under the Company Act (British Columbia) on August 5, 1994.

The Articles of the Company were further amended on February 15, 1996, as follows:

| · | the provisions of the Articles authorizing the issue of Class “B” Voting shares, Class “C” Non-Voting shares and Class “D” Preferred shares were deleted; |

| · | Class “A” voting shares were redesignated as common shares; and |

| · | a provision was added to allow meetings of shareholders to be held outside Alberta in either of the cities of Vancouver, British Columbia or Toronto, Ontario. |

The Articles of the Company were further amended on February 28, 2006, to change the name of the Company to “Tanzanian Royalty Exploration Corporation”.

The Articles of the Company were further amended on February 29, 2008 as follows:

| · | Pursuant to Section 173(1)(l) of the Business Corporations Act (Alberta), Item 5 of the Articles of the Company was amended by changing the maximum number of directors from 9 to 11. |

The Articles of the Company were further amended on April 17, 2019, to change the name of the Company to “Tanzanian Gold Corporation”.

The Articles of the Company were further amended on May 24, 2022, to change the name of the Company to its present name of “TRX Gold Corporation”.

The Articles of the Company were further amended on February 23, 2023, to allow for meetings of shareholders to be held in any location or manner as determined by the board.

The Company is also registered in the Province of British Columbia as an extra-provincial company under the Business Corporations Act (British Columbia). The principal executive office of the Company is located at 277 Lakeshore Road East, Suite 403, Oakville, Ontario, L6J 1H9. The Company’s website address is www.trxgold.com.

Intercorporate Relationships

The Company has the following seven subsidiaries:

| Name of Subsidiary | Jurisdiction of Incorporation | Percentage &Type of Securities Owned or Controlled by Company | |

| Voting Securities Held | Non-Voting Securities | ||

| Itetemia Mining Company Limited | United Republic of Tanzania | 90%(1) common shares | N/A |

| Lunguya Mining Company Ltd. | United Republic of Tanzania | 60%(2) common shares | N/A |

| Tancan Mining Company Limited | United Republic of Tanzania | 100% common shares | N/A |

| TRX Gold Tanzania Limited | United Republic of Tanzania | 100% common shares | N/A |

| Buckreef Gold Company Limited (BGCL) | United Republic of Tanzania | 55%(3) common shares | N/A |

| Northwest Basemetals Company Limited | United Republic of Tanzania | 75%(4) common shares | N/A |

| BGCL/AGC Joint Venture (6) | United Republic of Tanzania | 40%(5) common shares | N/A |

(1) The remaining 10% interest is held by STAMICO.

(2) The remaining 40% interest is held by Northern Mining and Consultancy Company Ltd.

(3) The remaining 45% interest is held by STAMICO.

(4) The remaining interest is held 15% by STAMICO and 10% by Songshan Mining Company.

(5) The remaining interest is held 60% by Allied Gold Corp. of United Arab Emirates.

(6) Joint venture letter of intent signed and subject to final approval.

General Development of the Business Over the Last Three Years

2022 Developments

Completion of Buckreef Gold Mine 360 tonne per day Processing Plant Construction

Buckreef Gold successfully completed construction of Phase 1 of the 1,000+ tpd processing plant and operated at 360 tpd nameplate capacity beginning in Q2 2022. The expanded processing plant construction was completed in line with the scheduled completion date of September/October 2021 at a capital cost of $1.6 million, within guidance. Following commissioning of the 360 tpd processing plant, the Company poured 8,874 ounces in 2022, a record annual production output for the Company.

Completion of Buckreef Gold Mine 1,000+ tonne per day Processing Plant Construction

During September 2022, Buckreef Gold announced successful commissioning of the expanded 1,000+ tpd mill circuit, which was completed on time and on budget (capital cost of US$4.0 million). The processing plant ramped up throughput and reached nameplate capacity of 1,000+ tpd at the end of October 2022.

Prepaid Gold Purchase Agreement

On September 1 2022, the Company announced that its operating subsidiary, Buckreef Gold Company Limited, has entered into a pre-paid gold purchase agreement with a contract price totaling $5 million with OCIM Metals & Mining SA. The total contract price can be made available to Buckreef Gold in tranches with a $2.5 million upfront tranche and further tranches to be drawn over the next 18 months at Buckreef Gold’s option. Tranche 1 in this non-dilutive financing includes a 6-month grace period and a repayment period over the following 12 months as quarterly deliveries of a pre-determined quantity of gold.

Closed Registered Direct Offering

On January 26 2022, the Company closed a registered direct offering with a single institutional investor for the purchase and sale of 17,948,718 of the Company’s common shares at a purchase price of $0.39 per share. The Company also issued to the investor warrants to purchase up to an aggregate of 17,948,718 common shares. The warrants have an exercise price of $0.44, will be exercisable at any time and will expire five years after issuance.

Closed Equity Line of Credit Purchase Agreement

On January 13 2022, the Company closed a purchase agreement with Lincoln Park. Under the terms of the purchase agreement, TRX Gold, in its sole discretion, has the right from time to time over a 36-month period to sell up to $10 million of its shares to Lincoln Park, subject to certain conditions. TRX Gold controls the timing and amount of any sales to Lincoln Park, and Lincoln Park is obligated to make purchases in accordance with the purchase agreement. Any common shares that are sold to Lincoln Park will occur at a purchase price that is based on prevailing market prices at the time of each sale and with no upper limits to the price Lincoln Park may pay to purchase common shares.

Company Name Change

The Company announced a name change from “Tanzanian Gold Corporation” to “TRX Gold Corporation” which was approved by way of special resolution at the Company’s annual general and special meeting of shareholders held on February 25, 2022. The name change better reflects the great strides that the Company has made over the last 18 months as evidenced by the record operating and financial results achieved in 2022.

2022 Other Developments

The Company ramped up its exploration programs and drilled over 22,000 meters in 2022. Buckreef Gold announced an extension of the Buckreef Main zone by an additional 300 meters in the northeast extension, and exploration also commenced south of the Buckreef Main zone and in the Anfield zone. The Company received an extension the Buckreef Gold Special Mining License renewal date period by 5 years from 2027 to 2032. The focus on employees and upgrading of talent across the organization continued in 2022, and the Company implemented a new finance system. The Company also completed the land compensation process that was commenced in 2021.

On September 23, 2022, the Tanzanian Government published Regulation 6(2) of the Mining (State Participation) Regulations 2022 providing that any person holding a mining license or special mining license shall, within ninety days of these Regulations, give notice to the Mining Commission to initiate negotiations for a joint venture arrangement to enable the Tanzanian Government to acquire a shareholding in the venture. The Company engaged Tanzanian legal counsel to assess the impacts of the Regulation on the Buckreef Gold operations. The Company believes it is already in compliance with the requirements of the Regulation through its Joint Venture Agreement for Re-Development of Buckreef Gold Mine dated October 25, 2011 with the State Mining Corporation (STAMICO). The Company prepared with Tanzanian legal counsel and sent a notice to the Mining Commission, to meet the ninety-day notice requirement, outlining our compliance with the Regulation.

2023 Developments

Declared Commercial Production on Buckreef Gold Mine 1,000+ tonne per day Processing Plant

During September 2022, Buckreef Gold announced successful commissioning of the expanded 1,000+ tpd mill circuit, which was completed on time and on budget (capital cost of US$4.0 million). The processing plant ramped up throughput and reached nameplate capacity of 1,000+ tpd at the end of October 2022 and commercial production was declared effective in November 2022. Following commissioning of the 1,000+ tpd processing plant, the Company poured 20,759 ounces in fiscal 2023, a record annual production output for the Company.

Commenced Expansion of Buckreef Gold Mine Processing Plant to 2,000 tonnes per day

During 2023, the Company used cash flow from operations to order an additional 1,000 tpd ball mill to advance the short-term objective of increasing Buckreef Gold’s current average annual throughput by 75-100% through the addition of this new mill. In October 2023, the ball mill arrived on site and earthworks have commenced. The expanded plant has a targeted completion date in the second half of fiscal 2024 and is expected to benefit production in Q4 2024 and beyond.

Achieved Suphide Gold Recovery of 88.7% from Existing Processing Plant

During the year, the Company successfully processed 6,500 tonnes of sulphide ore through Buckreef Gold’s existing milling facility, achieving an indicative gold recovery of 88.7%. This is a significant achievement as approximately 90% of Buckreef Gold’s 2 million+ ounce gold mineral resource is held in sulphide material, thus unlocking the significant economic potential of the project. This bulk sample test indicates that the Company can process sulphide ore through its existing processing plant, thus minimizing capex for future plant expansions.

Extended Gold Mineralization of the Buckreef Main Zone and Reported Positive drilling Results from the Anfield and Eastern Porphyry Zones

During the year, the Company drilled 11,171 meters of exploration, infill and sterilization drilling, excluding grade control drilling. Buckreef Gold announced positive near surface drilling results from the Anfield and Eastern Porphyry Zones which are in close proximity to the Buckreef Main Zone and present an opportunity to host future mineral resources outside of the Buckreef Main Zone. Buckreef Gold also announced an extension of the Buckreef Main Zone South by an additional 200 meters, increasing the strike length of the Buckreef Main Zone deposit, or known gold mineralization, to over 2.0 kilometers.

Closed At the Market Offering

On May 12, 2023, the Company announced that it entered into an At The Market Offering Agreement with H.C. Wainwright & Co., LLC as Lead Agent and Roth Capital Partners, LLC as Co-Agent, pursuant to which the Company, at its discretion, may offer and sell, from time to time, common shares having an aggregate offering price of up to $10 million. To date, no shares have been sold under the At The Market Offering Agreement.

Announced the Appointment of Shubo Rakhit as Chairman of TRX Gold Board of Directors

Subsequent to year end, the Company announced the appointment of Shubo Rakhit as Chairman of the TRX Gold Board following the passing of its founder and Chairman James E. Sinclair, at the age of 82. Mr. Sinclair founded TRX Gold and had been Chairman and Director since 2000. Mr. Rakhit has had a prominent career as a highly respected strategist and sought after trusted advisor. His 30+ year career has included senior positions at several global and Canadian investment banks and advisory firms including CIBC, Bank of Nova Scotia, Bank of America Securities, KPMG Corporate Finance and Echelon Wealth Partners. Mr. Rakhit’s distinguished career includes leading over $90 billion of M&A transactions, and over $100 billion of global capital markets issuance, including many well-known transformational transactions and complex capital solutions, that have also encompassed mining companies. The strength of his relationships is characterized by authenticity and trust that will assist the Company in broadening its access to capital markets and its strategic direction at a time of rapid growth for the organization.

2024 Developments

Completed Expansion of Buckreef Gold Mine Processing Plant to 2,000 tonnes per day

During Q4 2024, the Company announced successful completion of the expanded processing plant to 2,000 tpd of nameplate processing capacity, which was completed on time and on budget (capital cost of approximately US$6.0 million). The processing plant was fully commissioned in September 2024 and has been consistently achieving, on average, 1,938 tpd of mill throughput following full plant commissioning, reaching a maximum of 2,016 tpd, a 149% increase over Q3 2024. Following completion of the expanded plant, Q4 2024 production increased to 5,767 ounces from Q3 2024 (4,628 ounces), a 25% increase over the prior quarter, as the increase in processing plant throughput more than offset the impact of lower head grade. This expansion marks Buckreef Gold’s third successful expansion project aimed at increasing annual gold production in a de-risked, self-funded and phased approach. Moreover, through this latest expansion, the project is expected to benefit from greater economies of scale, resulting from higher processing plant throughput and higher overhead cost absorption.

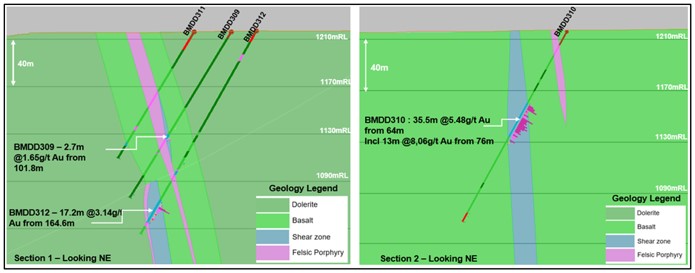

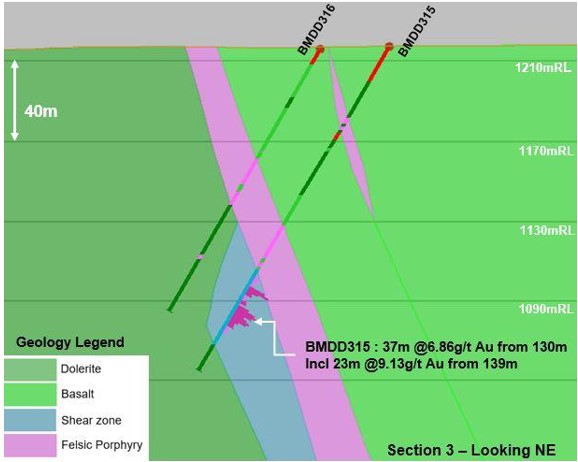

Best Drill Hole Results in History of Buckreef Gold – Announcement of Stamford Bridge Zone

Subsequent to August 31, 2024, the Company announced its two best drill results ever, on a gram x tonne x meters (“gtm”) basis, intersecting 37 meters (“m”) @ 6.86 g/t Au (253.82 gtm) from 130 m (hole BMDD315) and 35.5 m @ 5.48 g/t Au (194.54 gtm) from 64 m. These drill hole results are approximately 200-250 m east of the Buckreef Main Zone, host to Buckreef Gold’s 2M+ ounce Au Mineral Resource1 and where current operations are ongoing in the Main Pit.

Subsequent to August 31, 2024, the Company announced the discovery of a promising new gold mineralization shear zone, named the “Stamford Bridge Zone”, where results are beginning to form what may become a potential 1-kilometer “bridge” between the Buckreef Gold Main Zone, where current operations are ongoing, with links to the parallel, high-priority, gold mineralization zone known as the Eastern Porphyry, and the prospective Anfield Zone to the southeast.

Metallurgical Study Results – Higher Gold Recoveries Attainable at Buckreef Gold

Subsequent to August 31, 2024, the Company announced completion of the ongoing metallurgical variability study at Buckreef Gold, with results confirming excellent gold recovery rates for the processing of sulphide ore. Results demonstrate that a finer grind size leads to higher recovery rates, and the Company is currently in the process of developing finer grinding initiatives to achieve higher gold recoveries. This is positive for both near term production potential and future Mineral Resource development as the Company continues to focus on development of other high-priority gold zones, such as Stamford Bridge, Anfield and Eastern Porphyry.

Buckreef Gold Procurement of Heavy Mining Equipment

During Q4 2024, the Company entered into a finance lease agreement for fifteen pieces of heavy equipment, including six excavators, one dozer, one motor grader, one backhoe, one compactor, and three loaders. Half of this fleet will replace rented equipment currently operating in the plant, while the remaining equipment will be utilized in site development projects, roadway construction, and maintenance. Additionally, this equipment is capable of supporting and supplementing, when necessary, the contract mining fleet at the site. Subsequent to August 31, 2024, the Company also entered into a purchase agreement to procure a fleet of eight haul trucks to expand haulage capability and capacity. The Company intends to use two of the newly procured owner-operated fleet within the plant, while the remainder will be used to haul materials for the site development crew. As is customary with Buckreef Gold, all equipment must have a dual purpose, thus these trucks are also capable of providing transport services to a contractor-owned mining fleet, as necessary. The Company is currently exploring all opportunities to utilize site equipment to its fullest capacity, with a focus on reducing mining costs.

Description of the Business

General

The Company’s main area of interest has been in the exploration and development of gold properties, with a primary focus on exploring for and developing gold properties in the United Republic of Tanzania (“Tanzania”). Tanzania remains the focus of the Company’s exploration and development activities. The Company’s primary asset is its interest in the Buckreef Gold Project, a joint venture that is 55% owned by one of the Company’s subsidiaries (TRX Gold Tanzania Limited) and 45% is owned by the State Mining Corporation (“STAMICO”), a Governmental agency of Tanzania.

TRX Gold is rapidly advancing the Buckreef Gold Project. Anchored by a Mineral Resource published in May 2020, the project currently hosts an NI 43-101 Measured and Indicated Mineral Resource (“M&I Resource”) of 35.88 million tonnes (“MT”) at 1.77 grams per tonne (“g/t”) gold containing 2,036,280 ounces (“oz”) of gold and an Inferred Mineral Resource of 17.8 MT at 1.11 g/t gold for 635,540 oz of gold. The leadership team is focused on creating both near-term and long-term shareholder value by increasing gold production to generate positive cash flow. The positive cash flow will be utilized for exploratory drilling with the goal of increasing the current mineral resource base and advancing the larger project development which represents 90% of current mineral resources. TRX Gold’s actions are guided by the highest environmental, social and corporate governance (“ESG”) standards, evidenced by the relationships and programs that the Company has developed during its nearly two decades of presence in the Geita Region, Tanzania. Please refer to the Company’s Updated Mineral Resources Estimate for Buckreef Gold Project, dated May 15, 2020 and filed under the Company’s profile on SEDAR+ and with the SEC on June 23, 2020 (the “2020 Technical Report”) for more information.

The Company’s Buckreef Gold Project produced 19,389 ounces in fiscal 2024, in line with revised full year production guidance, and sold approximately 19,075 ounces of gold. This compares to production of approximately 20,759 ounces of gold and sales of 20,864 ounces of gold in fiscal 2023. The slight decrease in production compared to the prior year period was mainly due a lower average recovery of 79% (2023: 90%) and lower average head grade of 2.19 g/t (2023: 2.38 g/t), partially offset by higher mill throughput of 973 tpd (2023: 852 tpd) following completion of the 2,000 tpd processing plant in Q4 2024.

For fiscal 2024, the Company recognized record full year revenue of $41.2 million, cost of sales of $23.2 million, generating gross profit of $17.9 million, gross profit margin of 44%, net income of $3.5 million, and Adjusted EBITDA[1] of $15.3 million. For fiscal 2023, the Company recognized revenue of $38.3 million, cost of sales of $20.1 million, gross profit of $18.2 million, net income of $7.0 million, and Adjusted EBITDA1 of $13.9 million. Gross profit, operating cashflow and Adjusted EBITDA1 were in line with the prior comparative period, and mainly reflects an increase in revenue, primarily related to an increase in average realized price, partially offset by an increase in cost of sales related to higher mining costs, processing costs and royalties. Mining costs were higher than the prior year comparative period ($3.32) primarily due to an increase in drilling and blasting cost, as mining activity accessed a higher proportion of sulphide ore compared to the prior year period which was mainly oxide ore and transitional material. Processing costs increased as a result of higher tonnes processed following commissioning of the 2,000 tpd processing plant in Q4 2024, which led to an increase in consumables, reagents, fuel and power consumption. Royalties were higher due to the impact of the 7.3% statutory royalty rate on higher full year revenue as a result of increase in average realized price (2024: $2,179 per ounce, 2023: $1,845 per ounce), partially offset by lower gold production and lower ounces of gold sold (2024: 19,075 ounces of gold sold, 2023: 20,864 ounces).

At Buckreef, the Company expects fiscal 2025 gold production to be to be higher than F2024 levels, reflecting a full year of operations from the expanded 2,000 tpd processing plant, partially offset by a waste stripping campaign required to access high grade ore blocks to deliver consistent higher grade ore feed to the mill. To maintain prudent capital management and an ability to fund the plant expansion to 2,000 tpd, the Company proactively deferred a portion of waste stripping originally scheduled for F2024, which limited access to certain high grade ore blocks as scheduled in the initial mine sequence. Following commissioning of the 2,000 tpd plant in Q4 2024, the Company has scheduled a waste stripping campaign in F2025 to access the originally scheduled ore blocks. It is expected that the updated mine sequence will begin to access these high grade ore blocks in the second half of F2025 benefiting production starting in Q3 and Q4 2025. As a result, gold production is expected to be lower in H1 2025 and higher production is expected in H2 2025. Cash cost per ounce are expected to be in line with F2024 levels, mainly due to the impact of higher gold production, offset by waste stripping costs in the Buckreef Main Zone. Cash cost per ounce is expected to be slightly higher in H1 2025 and lower in H2 2025 as the mine sequence begins to access higher grade ore blocks in H2 2025. “Total cash costs” per ounce is a non-GAAP financial performance measure. 1

Specialized Skill and Knowledge

A majority of aspects of our business requires specialized skills and knowledge, certain of which are in high demand and in limited supply. Such skills and knowledge include the areas of permitting, engineering, geology, metallurgy, logistical planning, implementation of exploration programs, mine construction and development, mine operation, as well as legal compliance, finance and accounting. We have highly qualified management personnel and staff, an active recruitment program, and believe that persons having the necessary skills are generally available. We have found that we can locate and retain competent employees and consultants in such fields. We do not anticipate having significant difficulty in recruiting other personnel as needed. Training programs are in place for workers that are recruited locally.

Competitive Conditions

The gold exploration and mining business is a competitive business. We compete with numerous other companies and individuals in the search for and the acquisition of quality properties, mineral claims, permits, concessions and other mineral interests, as well as recruiting and retaining qualified employees.

Permits

1 Non-GAAP measures are more fully described in the Company's MD&A for the year ended August 31, 2024 under “Non-IFRS Performance Measures”, available on SEDAR+ at www.sedarplus.ca.

Exploration and ore processing activities on the Company’s properties require permits from local authorities. The state owns title to all mineral resources in Tanzania. All permits conferring rights to explore and extract mineral resources are granted by the Minister of Energy and Minerals, (“MEM”) in terms of the Tanzania 2010 Mining Act. The Mining Act serves as the legal framework governing mining in Tanzania. Special Mining Licenses (SML) are granted for large scale mining operations and are valid for the estimated mine life determined in the Bankable Feasibility Study (BFS). Holders of special mining licenses may enter into a Mining Development Agreement (MDA) with the Government which is subject to review every five years and at the renewal of the mineral right.

The Company was granted an extension to the renewal date for the (renewable) Special Mining License at Buckreef Gold extending the SML renewal period for Buckreef Gold by an additional 5 years from 2027 to 2032. Under the Tanzania 2010 Mining Act, a SML confers on the holder the exclusive right to carry out mining operations and to prospect (within the SML) for minerals as specified in the license. The duration of the Special Mining License covers the estimate life of mine, with specified renewals over that period.

Business Cycles

The mining business is subject to mineral price and investment climate cycles. The marketability of minerals is also affected by worldwide economic and demand cycles. It is difficult to assess if the current commodity prices are long-term trends, and there is uncertainty as to the recovery, or otherwise, of the world economy. If global economic conditions weaken and commodity prices decline as a consequence, a continuing period of lower prices could significantly affect the economic potential of the Company’s projects. See “Risk Factors”.

Economic Dependence and Components

The Company's business is not dependent on any contract to sell a major part of its products or to purchase a major part of its requirements for goods, services or raw materials, or on any franchise or license or other agreement to use a patent, formula, trade secret, process or trade name upon which its business depends. It is not expected that the Company's business will be affected in the current financial year by the renegotiation, amendment or termination of contracts or subcontracts.

Employees

As at August 31, 2024, the Company had 153 full-time employees, inclusive of executives operating in Canada, 358 contract miners and project contractors, and 134 part-time/casual employees working in the Republic of Tanzania.

Foreign Operations

Our principal operations and assets are located in the Tanzania, Africa. Our operations are exposed to various levels of political, economic and other risks and uncertainties. These risks and uncertainties include, but are not limited to, government regulations (or changes to such regulations) with respect to restrictions on production, export controls, income taxes, royalties, excise and other taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, local ownership requirements and land claims of local people, regional and national instability and security, mine safety, and sanctions. The effect of these factors cannot be accurately predicted. See “Risk Factors”.

Bankruptcy and Similar Procedures

There are no bankruptcy, receivership or similar proceedings against the Company, nor is the Company aware of any such pending or threatened proceedings. There have not been any voluntary bankruptcy, receivership or similar proceedings by the Company within the three most recently completed financial years or proposed for the current financial year.

Social and Environmental Policies

The Company respects its employees, the environment and the communities in which we operate. The Company acknowledges that its activities can impact the environment, thus it is our intention to act responsibly by demonstrating stewardship to the environment. The Company believes that environmental stewardship is both a matter of "doing the right thing" and a sound business practice that will create value for our shareholders.

TRX commits to the following principles to ensure environmental stewardship:

| · | comply with applicable legal requirements; |

| · | work to reduce or avoid potential environmental impacts through effective management, the wise use of resources, pollution prevention and other appropriate mitigative measures, including; |

| o | reducing the Company’s carbon footprint by maximising grid power using hydroelectric and natural gas, minimizing diesel usage; |

| o | recycling all water used in operations with no water discharge from operations; and |

| · | ensure that employees and contractors are aware of environmental policies, understand the policies, are aware of their roles and responsibilities, and have the appropriate training to do their work, including; |

| o | all sites and suppliers certified by the International Cyanide Management Code. |

The Company is committed to exploring for, building, operating and closing mines in an environmental, socially and financially responsible manner.

Risk Factors

Risks Relating to the Company

The Company’s exploration and development activities are highly speculative and involve substantial risks.

Except for the Buckreef Gold Project which has high exploration potential, all of the other Company’s exploration prospects on the Company’s SML are in the exploration stage and no mineral reserves have been established. The Company’s exploration work may not result in the discovery of mineable deposits of ore in a commercially economical manner. There may be limited availability of water, which is essential to milling operations, and interruptions may be caused by adverse weather conditions. The Company’s future operations, if any, are subject to a variety of existing laws and regulations relating to exploration and development, permitting procedures, safety precautions, property reclamation, employee health and safety, air quality standards, pollution and other environmental protection controls.

The Company has uninsurable risks.

The Company’s business is capital intensive and subject to a number of risks and hazards, including environmental pollution, accidents or spills, industrial and transportation accidents, labour disputes, changes in the regulatory environment, natural phenomena (such as inclement weather conditions, earthquakes, pit wall failures and cave-ins) and encountering unusual or unexpected geological conditions. Many of the foregoing risks and hazards could result in damage to, or destruction of the Company’s mineral properties or future processing facilities, personal injury or death, environmental damage, delays in or interruption of or cessation of their exploration or development activities, delay in or inability to receive regulatory approvals to transport their products, or costs, monetary losses and potential legal liability and adverse governmental action. The Company may be subject to liability or sustain loss for certain risks and hazards against which they do not or cannot insure or which it may reasonably elect not to insure. This lack of insurance coverage could result in material economic harm to the Company.

The Company depends on key personnel.

The senior officers of the Company will be critical to its success as will recruiting qualified personnel as the Company grows. The number of persons skilled in the acquisition, exploration and development of mining properties is limited and competition, worldwide, for such persons is intense. As the Company’s business activity grows, it will require additional key financial, administrative, regulatory, and mining personnel as well as additional operations staff. If the Company is not successful in attracting and training qualified personnel, the efficiency of its operations could be affected, which could have an adverse impact on future cash flows, earnings, results of operations and the financial condition of the Company.

Certain Company directors or officers may have a conflict of interest.

Directors and officers of the Company are or may become directors or officers of other reporting companies or have significant shareholdings in other mineral resource companies and, to the extent that such other companies may participate in ventures in which the Company may participate, the directors and officers of the Company may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. The Company and its directors and officers will attempt to minimize such conflicts. In the event that such a conflict of interest arises at a meeting of the directors of the Company, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In appropriate cases the Company may establish a special committee of independent directors to review a matter in which one or more directors, or officers, may have a conflict. In determining whether or not the Company will participate in a particular program and the interest therein to be acquired by it, the directors will primarily consider the potential benefits to the Company, the degree of risk to which the Company may be exposed and its financial position at that time.

The Company has a limited property portfolio.

Currently, the Company holds an interest in the Buckreef Gold Project, the Company’s principal property. As a result, unless the Company develops its other properties or acquires additional property interests, any adverse developments affecting the Buckreef Gold Project could have a material adverse effect upon the Company and would materially and adversely affect the potential future mineral resource production, profitability, financial performance and results of operations of the Company.

The Company is subject to growth-related risks.

The Company may be subject to growth-related risks including capacity constraints and pressure on its internal systems and controls, as well as on its employee base. The ability of the Company to manage growth effectively will require it to continue to implement and improve its operational and financial systems and to expand, train and manage its employee base. The inability of the Company to deal with this growth may have a material adverse effect on the Company’s business, financial condition, results of operations and prospects.

Foreign corrupt practices legislation.

The Company is subject to the Foreign Corrupt Practices Act (the “FCPA”), the Corruption of Foreign Public Officials Act (Canada) (“CFPOA”), the U. S. Foreign Corrupt Practices Act of 1977, as amended, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by persons and issuers as defined by the statutes, for the purpose of obtaining or retaining business. It is the Company’s policy to implement safeguards to discourage these practices by its employees; however, its existing safeguards and any future improvements may prove to be less than effective, and the Company’s employees, consultants, sales agents or distributors may engage in conduct for which the Company might be held responsible. Any such violation could result in substantial fines, sanctions, civil and/or criminal penalties, curtailment of operations in certain jurisdictions, and might adversely affect the Company’s business, results of operations or financial condition. In addition, actual or alleged violations could damage the Company’s reputation and ability to do business. Furthermore, detecting, investigating, and resolving actual or alleged violations is expensive and could consume significant time and attention of management.

Security breaches and other disruptions could compromise the Company’s information and expose it to liability, which would cause its business and reputation to suffer.

In the ordinary course of the Company’s business, it collects and stores sensitive data, including intellectual property, its proprietary business information and that of its business partners, and personally identifiable information of its employees in its data centers and on its networks. The secure processing, maintenance and transmission of this information is critical to the Company’s operations and business strategy. Despite its security measures, the information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. Any such breach could compromise the Company’s networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, potential liability under laws that protect the privacy of personal information, and potential regulatory penalties, disrupt the Company’s operations and damage its reputation, and cause a loss of confidence in the Company, which could adversely affect its business and competitive position.

The Company may be characterized as a passive foreign investment company.

The Company may be characterized as a passive foreign investment company (“PFIC”). If the Company is determined to be a PFIC, its U.S. shareholders may suffer adverse tax consequences. Under the PFIC rules, for any taxable year that the Company’s passive income or its assets that produce passive income exceed specified levels, the Company will be characterized as a PFIC for U.S. federal income tax purposes. This characterization could result in adverse U.S. tax consequences for the Company’s U.S. shareholders, which may include having certain distributions on its common shares and gains realized on the sale of its common shares treated as ordinary income, rather than as capital gains income, and having potentially punitive interest charges apply to the proceeds of sales of the Company’s common shares and certain distributions.

Certain elections may be made to reduce or eliminate the adverse impact of the PFIC rules for holders of the Company’s common shares, but these elections may be detrimental to the shareholder under certain circumstances. The PFIC rules are extremely complex and U.S. investors are urged to consult independent tax advisers regarding the potential consequences to them of the Company’s classification as a PFIC. See “Certain United States Federal Income Tax Considerations.”

The exploration for and development of mineral deposits involves significant risks.

Mineral exploration is highly speculative in nature. There is no assurance that exploration efforts will be successful. Even when mineralization is discovered, it may take several years until production is possible, during which time the economic feasibility of production may change. Substantial expenditures are required to establish proven and probable mineral reserves through drilling. Because of these uncertainties, no assurance can be given that exploration programs will result in the establishment or expansion of mineral resources or mineral reserves. There is no certainty that the exploration expenditures made by the Company towards the search and evaluation of mineral deposits will result in discoveries or development of mineral reserves. Mining operations generally involve a high degree of risk. The Company’s operations are subject to the hazards and risks normally encountered in mineral exploration and development, including environmental hazards, explosions, and unusual or unexpected geological formations or pressures. Such risks could result in damage to, or destruction of, mineral properties, personal injury, environmental damage, delays in mining, monetary losses and possible legal liability.

Mining exploration, development and operating activities are inherently hazardous. The Company’s exploration activities may be interrupted by mining accidents such as cave-ins, rock falls, rock bursts, pit wall failures, fires or flooding. In addition, exploration activities may be reduced if unfavorable weather conditions, ground conditions or seismic activity are encountered, ore grades are lower than expected, the physical or metallurgical characteristics of the ore are less amenable than expected to mining or treatment, dilution increases or electrical power is interrupted. Occurrences of this nature and other accidents, adverse conditions or operational problems in future years may result in the Company’s failure to achieve current or future exploration and production estimates.

The Company cannot accurately predict whether commercial quantities of ores as estimated or projected in the pre-feasibility study will continue to be established as commercial production continues.