UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For: November 12, 2024

MAG Silver Corp.

(SEC File Number: 001-33574)

#770 – 800 West Pender Street, Vancouver

BC, V6C 2V6, CANADA

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

| Date: November 12, 2024 | MAG Silver Corp. | |

"George Paspalas" |

||

George Paspalas |

||

President & CEO |

Exhibit 99.1

|

MAG SILVER CORP.

Unaudited Condensed Interim Consolidated Financial Statements (expressed in thousands of US dollars)

For the three and nine months ended September 30, 2024

Dated: November 8, 2024 |

|

VANCOUVER OFFICE Suite 770 800 W. Pender Street Vancouver, BC V6C 2V6 |

604 630 1399 phone 866 630 1399 toll free 604 681 0894 fax |

TSX: MAG NYSE American : MAG info@magsilver.com

|

| MAG SILVER CORP. | ||||||||||||||||||

| Condensed Interim Consolidated Statements of Income and Comprehensive Income | ||||||||||||||||||

| For the three and nine months ended September 30, 2024 and 2023 | ||||||||||||||||||

| (In thousands of US dollars, except for shares and per share amounts - Unaudited) | ||||||||||||||||||

| For the three months ended | For the nine months ended | |||||||||||||||||

| September 30, | September 30, | September 30, | September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||

| Note | $ | $ | $ | $ | ||||||||||||||

| Income from equity accounted investment in Juanicipio | 5 | 25,552 | 13,692 | 69,919 | 44,030 | |||||||||||||

| General and administrative expenses | 3 | (3,529 | ) | (4,094 | ) | (11,052 | ) | (10,599 | ) | |||||||||

| General exploration and business development | (138 | ) | (468 | ) | (590 | ) | (610 | ) | ||||||||||

| Operating income | 21,885 | 9,130 | 58,277 | 32,821 | ||||||||||||||

| Interest income | 1,336 | 663 | 3,091 | 1,868 | ||||||||||||||

| Other income | 8 | 533 | 269 | 1,720 | 629 | |||||||||||||

| Financing costs | (211 | ) | - | (553 | ) | - | ||||||||||||

| Foreign exchange loss | (41 | ) | (192 | ) | (144 | ) | (204 | ) | ||||||||||

| Income before income tax | 23,502 | 9,870 | 62,391 | 35,114 | ||||||||||||||

| Deferred income tax expense | (1,210 | ) | (1,008 | ) | (3,590 | ) | (2,149 | ) | ||||||||||

| Net income | 22,292 | 8,862 | 58,801 | 32,965 | ||||||||||||||

| Other comprehensive income | ||||||||||||||||||

| Items that will not be reclassified subsequently to profit or loss: | ||||||||||||||||||

| Unrealized gain (loss) on equity securities | 1 | (2 | ) | 1 | (4 | ) | ||||||||||||

| Total comprehensive income | 22,293 | 8,860 | 58,802 | 32,961 | ||||||||||||||

| Basic earnings per share | 0.22 | 0.09 | 0.57 | 0.32 | ||||||||||||||

| Diluted earnings per share | 0.22 | 0.09 | 0.57 | 0.32 | ||||||||||||||

| Weighted average number of shares outstanding | 7 | |||||||||||||||||

| Basic | 103,184,518 | 102,945,350 | 103,104,001 | 102,329,945 | ||||||||||||||

| Diluted | 104,158,011 | 103,501,006 | 104,067,728 | 102,934,823 | ||||||||||||||

See accompanying notes to the condensed interim consolidated financial statements

|

|

| MAG SILVER CORP. | ||||||||||||

| Condensed Interim Consolidated Statements of Financial Position | ||||||||||||

| As at September 30, 2024 and December 31, 2023 | ||||||||||||

| (In thousands of US dollars, unless otherwise stated - Unaudited) | ||||||||||||

| Note | September 30, 2024 | December 31, 2023 | ||||||||||

| $ | $ | |||||||||||

| Assets | ||||||||||||

| Current assets | ||||||||||||

| Cash | 113,491 | 68,707 | ||||||||||

| Accounts receivable | 4 | 1,675 | 1,559 | |||||||||

| Prepaid expenses | 2,094 | 1,787 | ||||||||||

| 117,260 | 72,053 | |||||||||||

| Non-current assets | ||||||||||||

| Investment in Juanicipio | 5 | 394,928 | 394,622 | |||||||||

| Exploration and evaluation assets | 6 | 74,519 | 52,637 | |||||||||

| Deferred financing fees | 653 | 909 | ||||||||||

| Property and equipment | 236 | 301 | ||||||||||

| Investments | 8 | 8 | ||||||||||

| 470,344 | 448,477 | |||||||||||

| Total assets | 587,604 | 520,530 | ||||||||||

| Liabilities | ||||||||||||

| Current liabilities | ||||||||||||

| Trade and other payables | 3,314 | 2,668 | ||||||||||

| Lease obligation | 40 | 154 | ||||||||||

| Flow-through share premium liability | 8 | 249 | 1,969 | |||||||||

| 3,603 | 4,791 | |||||||||||

| Non-current liabilities | ||||||||||||

| Deferred income taxes | 12,088 | 8,498 | ||||||||||

| Provision for reclamation | 484 | 484 | ||||||||||

| Total liabilities | 16,175 | 13,773 | ||||||||||

| Equity | ||||||||||||

| Share capital | 618,649 | 614,364 | ||||||||||

| Equity reserve | 22,349 | 20,764 | ||||||||||

| Accumulated other comprehensive income | 782 | 781 | ||||||||||

| Deficit | (70,351 | ) | (129,152 | ) | ||||||||

| Total equity | 571,429 | 506,757 | ||||||||||

| Total liabilities and equity | 587,604 | 520,530 | ||||||||||

See accompanying notes to the condensed interim consolidated financial statements

|

|

| MAG SILVER CORP. | ||||||||||||||||||||

| Condensed Interim Consolidated Statements of Cash Flows | ||||||||||||||||||||

| For the three and nine months ended September 30, 2024 and 2023 | ||||||||||||||||||||

| (In thousands of US dollars, unless otherwise stated - Unaudited) | ||||||||||||||||||||

| For the three months ended | For the nine months ended | |||||||||||||||||||

| September 30, | September 30, | September 30, | September 30, | |||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| Note | $ | $ | $ | $ | ||||||||||||||||

| OPERATING ACTIVITIES | ||||||||||||||||||||

| Net income | 22,292 | 8,862 | 58,801 | 32,965 | ||||||||||||||||

| Items not involving cash: | ||||||||||||||||||||

| Amortization of flow-through premium liability | 8 | (533 | ) | (269 | ) | (1,720 | ) | (629 | ) | |||||||||||

| Depreciation and amortization | 3 | 100 | 133 | 394 | 201 | |||||||||||||||

| Deferred income tax expense | 1,210 | 1,008 | 3,590 | 2,149 | ||||||||||||||||

| Amortization of deferred financing fees | 86 | - | 256 | - | ||||||||||||||||

| Income from equity accounted investment in Juanicipio | 5 | (25,552 | ) | (13,692 | ) | (69,919 | ) | (44,030 | ) | |||||||||||

| Share-based compensation expense | 3,7 | 991 | 822 | 3,010 | 2,597 | |||||||||||||||

| Unrealized foreign exchange gain | 146 | 129 | (44 | ) | 102 | |||||||||||||||

| Movements in non-cash working capital | ||||||||||||||||||||

| Accounts receivable | (584 | ) | 281 | (824 | ) | 229 | ||||||||||||||

| Prepaid expenses | (401 | ) | 642 | (307 | ) | (104 | ) | |||||||||||||

| Trade and other payables | 364 | 783 | (31 | ) | 288 | |||||||||||||||

| Net cash used in operating activities | (1,881 | ) | (1,301 | ) | (6,794 | ) | (6,232 | ) | ||||||||||||

| INVESTING ACTIVITIES | ||||||||||||||||||||

| Exploration and evaluation expenditures | 6 | (5,392 | ) | (3,811 | ) | (17,025 | ) | (10,053 | ) | |||||||||||

| Acquisition of exploration property | 6 | - | - | (3,802 | ) | - | ||||||||||||||

| Investment in Juanicipio | 5 | - | (53 | ) | - | (25,376 | ) | |||||||||||||

| Receipt of principal on loans to Juanicipio | 5 | 21,934 | 8,800 | 65,235 | 8,800 | |||||||||||||||

| Receipt of interest on loans to Juanicipio | 5 | 715 | 2,495 | 4,692 | 5,789 | |||||||||||||||

| Purchase of equipment | - | (19 | ) | - | (19 | ) | ||||||||||||||

| Net cash from / (used in) investing activities | 17,257 | 7,412 | 49,100 | (20,859 | ) | |||||||||||||||

| FINANCING ACTIVITIES | ||||||||||||||||||||

| Issuance of common shares upon exercise of stock options | 7 | 961 | - | 2,548 | 225 | |||||||||||||||

| Issuance of common shares, net of share issue costs | 7 | - | 136 | - | 39,541 | |||||||||||||||

| Issuance of flow-through shares, net of share issue costs | 7 | - | - | - | 16,208 | |||||||||||||||

| Payment of lease obligation principal | (37 | ) | (33 | ) | (114 | ) | (94 | ) | ||||||||||||

| Net cash from financing activities | 924 | 103 | 2,434 | 55,880 | ||||||||||||||||

| Effect of exchange rate changes on cash | (146 | ) | (359 | ) | 44 | (225 | ) | |||||||||||||

| Increase in cash during the period | 16,154 | 5,855 | 44,784 | 28,564 | ||||||||||||||||

| Cash, beginning of period | 97,337 | 52,664 | 68,707 | 29,955 | ||||||||||||||||

| Cash, end of period | 113,491 | 58,519 | 113,491 | 58,519 | ||||||||||||||||

See accompanying notes to the condensed interim consolidated financial statements

|

|

| MAG SILVER CORP. | ||||||||||||||||||||||||||||

| Condensed Interim Consolidated Statements of Changes in Equity | ||||||||||||||||||||||||||||

| For the nine months ended September 30, 2024 and 2023 | ||||||||||||||||||||||||||||

| (In thousands of US dollars, except shares - Unaudited) | ||||||||||||||||||||||||||||

|

Common shares without par value |

||||||||||||||||||||||||||||

| Notes | Number of Shares | Amount | Equity reserve | Accumulated other comprehensive income (loss) | Deficit | Total equity | ||||||||||||||||||||||

| # | $ | $ | $ | $ | $ | |||||||||||||||||||||||

| Balance, January 1, 2023 | 98,956,808 | 559,933 | 18,790 | 784 | (177,811 | ) | 401,696 | |||||||||||||||||||||

| Stock options exercised | 28,787 | 397 | (90 | ) | - | - | 307 | |||||||||||||||||||||

| Restricted and performance share units converted | 112,605 | 1,215 | (1,215 | ) | - | - | - | |||||||||||||||||||||

| Shares issued for cash, net of flow-through share premium liability | 3,874,450 | 56,761 | - | - | - | 56,761 | ||||||||||||||||||||||

| Share issue costs | - | (3,942 | ) | - | - | - | (3,942 | ) | ||||||||||||||||||||

| Share-based compensation | - | - | 3,279 | - | - | 3,279 | ||||||||||||||||||||||

| Other comprehensive loss | - | - | - | (3 | ) | - | (3 | ) | ||||||||||||||||||||

| Net income | - | - | - | - | 48,659 | 48,659 | ||||||||||||||||||||||

| Balance, December 31, 2023 | 102,972,650 | 614,364 | 20,764 | 781 | (129,152 | ) | 506,757 | |||||||||||||||||||||

| Stock options exercised | 7 | 255,403 | 3,379 | (831 | ) | - | - | 2,548 | ||||||||||||||||||||

| Restricted and performance share units converted | 7 | 28,902 | 410 | (410 | ) | - | - | - | ||||||||||||||||||||

| Deferred share units converted | 7 | 50,000 | 496 | (496 | ) | - | ||||||||||||||||||||||

| Share-based compensation | 7 | - | - | 3,322 | - | - | 3,322 | |||||||||||||||||||||

| Other comprehensive income | - | - | - | 1 | - | 1 | ||||||||||||||||||||||

| Net income | - | - | - | - | 58,801 | 58,801 | ||||||||||||||||||||||

| Balance, September 30, 2024 | 103,306,955 | 618,649 | 22,349 | 782 | (70,351 | ) | 571,429 | |||||||||||||||||||||

| Balance, January 1, 2023 | 98,956,808 | 559,933 | 18,790 | 784 | (177,811 | ) | 401,696 | |||||||||||||||||||||

| Stock options exercised | 21,346 | 292 | (67 | ) | - | - | 225 | |||||||||||||||||||||

| Restricted and performance share units converted | 96,009 | 994 | (994 | ) | - | - | - | |||||||||||||||||||||

| Shares issued for cash, net of flow-through share premium liability | 3,874,450 | 56,761 | - | - | - | 56,761 | ||||||||||||||||||||||

| Share issue costs | - | (3,942 | ) | - | - | - | (3,942 | ) | ||||||||||||||||||||

| Share-based compensation | - | - | 2,869 | - | - | 2,869 | ||||||||||||||||||||||

| Other comprehensive loss | - | - | - | (4 | ) | - | (4 | ) | ||||||||||||||||||||

| Net income | - | - | - | - | 32,965 | 32,965 | ||||||||||||||||||||||

| Balance, September 30, 2023 | 102,948,613 | 614,038 | 20,598 | 780 | (144,846 | ) | 490,570 | |||||||||||||||||||||

See accompanying notes to the condensed interim consolidated financial statements

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

| 1. | NATURE OF OPERATIONS |

MAG Silver Corp. (the “Company” or “MAG”) is a growth-oriented Canadian mining and exploration company focused on advancing high-grade, district scale precious metals projects in the Americas. MAG is the ultimate parent company of its consolidated group, was incorporated on April 21, 1999, and is governed by the Business Corporations Act of the Province of British Columbia (“BCABC"). MAG’s shares are listed on both the Toronto Stock Exchange in Canada and the NYSE American, LLC in the United States of America.

The Company’s principal asset is a 44% interest in the Juanicipio Mine (Note 5 “Investment in Juanicipio”) located in Zacatecas, Mexico, which achieved commercial production at its 4,000 tonnes per day (“tpd”) processing facility on June 1, 2023.

Address of registered office of the Company:

3500 – 1133 Melville Street

Vancouver, British Columbia,

Canada V6E 4E5

Head office and principal place of business:

770 – 800 West Pender Street

Vancouver, British Columbia,

Canada V6C 2V6

| 2. | MATERIAL ACCOUNTING POLICY INFORMATION |

| (a) | Statement of compliance |

These condensed unaudited interim consolidated financial statements (“Interim Financial Statements”) are prepared under IAS 34 Interim Financial Reporting (“IAS 34”) in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). They do not include all of the information required for full annual IFRS financial statements and therefore should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2023.

The accounting policies applied in the preparation of the Interim Financial Statements are consistent with those applied and disclosed in the Company’s audited consolidated financial statements for the year ended December 31, 2023.

These Interim Financial Statements have been prepared on a historical cost basis except for the revaluation of certain financial instruments, which are stated at their fair value.

These Interim Financial Statements were authorized for issuance by the Board of Directors of the Company on November 8, 2024.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

| (b) | Significant accounting judgments and estimates |

The Company makes certain significant judgments and estimates in the process of applying the Company’s accounting policies. Management believes the judgments and estimates used in these Interim Financial Statements are reasonable; however, actual results could differ from those estimates and could impact future results of operations and cash flows. The areas involving significant judgments and estimates have been set out in Note 5 of the Company’s audited consolidated financial statements for the year ended December 31, 2023.

| 3. | GENERAL AND ADMINISTRATIVE EXPENSES |

| For the three months ended | For the nine months ended | |||||||||||||||

| September 30, | September 30, | September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Accounting and audit | 182 | 277 | 670 | 606 | ||||||||||||

| Compensation and consulting fees | 1,268 | 1,727 | 3,406 | 3,949 | ||||||||||||

| Depreciation and amortization | 100 | 133 | 394 | 201 | ||||||||||||

| Filing and transfer agent fees | 28 | 62 | 256 | 342 | ||||||||||||

| General office expenses | 255 | 171 | 622 | 561 | ||||||||||||

| Insurance | 302 | 334 | 974 | 1,162 | ||||||||||||

| Juanicipio oversight costs | 214 | 332 | 741 | 332 | ||||||||||||

| Legal | 46 | 110 | 397 | 344 | ||||||||||||

| Share-based compensation expense (see Note 7) | 991 | 822 | 3,010 | 2,597 | ||||||||||||

| Shareholder relations | 98 | 87 | 350 | 276 | ||||||||||||

| Travel | 45 | 39 | 232 | 229 | ||||||||||||

| 3,529 | 4,094 | 11,052 | 10,599 | |||||||||||||

| 4. | ACCOUNTS RECEIVABLE |

| September 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| $ | $ | |||||||

| Receivable from Minera Juanicipio (Notes 5 & 13) | 114 | 855 | ||||||

| Value added tax (“IVA” and “GST”) | 1,084 | 700 | ||||||

| Other receivables | 477 | 4 | ||||||

| 1,675 | 1,559 | |||||||

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

| 5. | INVESTMENT IN JUANICIPIO |

Minera Juanicipio, S.A. de C.V. (“Minera Juanicipio”) was created for the purpose of holding the Juanicipio property, and is held 56% by Fresnillo plc (“Fresnillo”) and 44% by the Company. On December 27, 2021, the Company and Fresnillo created Equipos Chaparral, S.A. de C.V. (“Equipos Chaparral”) in the same ownership proportions. Equipos Chaparral owns the processing facility and mining equipment which is leased to Minera Juanicipio. Minera Juanicipio and Equipos Chaparral are collectively referred to herein as “Juanicipio,” or, the “Juanicipio Mine”.

Juanicipio is governed by a shareholders’ agreement and by corporate by-laws. All costs relating to Juanicipio are required to be shared by the Company and Fresnillo pro-rata based on their ownership interests in Juanicipio, and if either party does not fund pro-rata, their ownership interest will be diluted in accordance with the shareholders’ agreement and by-laws.

Fresnillo is the operator of Juanicipio, and with its affiliates, beneficially owns 9,314,877 common shares of the Company as at September 30, 2024, as publicly reported by Fresnillo.

The Company has recorded its Investment in Juanicipio using the equity method of accounting. The recorded value of the investment includes the carrying value of the deferred exploration, mineral and surface rights, Juanicipio costs incurred by the Company, the required net cash investments to establish and maintain its 44% interest in Juanicipio, and the Company’s 44% share of income (loss) from Juanicipio.

Changes during the period of the Company’s investment relating to its interest in Juanicipio are detailed as follows:

| Nine months ended | Year ended | |||||||

| September 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| $ | $ | |||||||

| Balance, beginning of period | 394,622 | 338,316 | ||||||

| Juanicipio oversight expenditures incurred 100% by MAG | - | 384 | ||||||

| Amortization of Juanicipio's oversight expenditures incurred 100% by MAG | (394 | ) | (305 | ) | ||||

| Cash contributions and advances to Juanicipio (3) | - | 24,992 | ||||||

| Loan repayments from Juanicipio (2) | (65,235 | ) | (25,714 | ) | ||||

| Total for the period | (65,628 | ) | (642 | ) | ||||

| Income from equity accounted Investment in Juanicipio | 69,919 | 65,099 | ||||||

| Interest earned, reclassified to accounts receivable (1) | (3,985 | ) | (8,150 | ) | ||||

| Balance, end of period | 394,928 | 394,622 | ||||||

(1) A portion of the Investment in Juanicipio is in the form of interest bearing shareholder loans. For the nine months ended September 30, 2024, the Company earned interest amounting to $3,985 (year ended December 31, 2023: $8,150) while $4,692 of interest payments were received from Juanicipio (year ended December 31, 2023: $7,639).

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

(2) During the nine months ended September 30, 2024, no loans to Juanicipio were converted into equity (year ended December 31, 2023: $7,251). As at September 30, 2024, the Company has advanced, net of aggregate repayments, $29,179 as shareholder loans to Juanicipio (December 31, 2023: $94,414).

(3) During the nine months ended September 30, 2024, no cash contributions and advances were made to Juanicipio (year ended December 31, 2023: $24,992 cash contributions and advances, with $22,726 in the form of loans and $2,276 in the form of equity).

A summary of financial information of Juanicipio (on a 100% basis reflecting adjustments made by the Company, including adjustments for differences in accounting policies) is as follows:

Juanicipio Statements of Income

| For the three months ended | For the nine months ended | |||||||||||||||

| September 30, | September 30, | September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Sales | 176,393 | 125,046 | 467,161 | 311,303 | ||||||||||||

| Cost of sales: | ||||||||||||||||

| Production cost | (38,596 | ) | (43,782 | ) | (115,248 | ) | (125,731 | ) | ||||||||

| Depreciation and amortization | (23,440 | ) | (21,646 | ) | (67,934 | ) | (47,001 | ) | ||||||||

| (62,036 | ) | (65,428 | ) | (183,183 | ) | (172,732 | ) | |||||||||

| Gross profit | 114,357 | 59,618 | 283,978 | 138,571 | ||||||||||||

| Consulting and administrative expenses | (2,497 | ) | (3,458 | ) | (10,969 | ) | (9,115 | ) | ||||||||

| Extraordinary mining and other duties | (2,810 | ) | (1,635 | ) | (6,975 | ) | (3,532 | ) | ||||||||

| 109,050 | 54,525 | 266,034 | 125,924 | |||||||||||||

| Exchange gains (losses) and other | 1,961 | 420 | 1,360 | (2,414 | ) | |||||||||||

| Interest expense | (1,839 | ) | (5,214 | ) | (9,058 | ) | (13,915 | ) | ||||||||

| Income tax expense | (52,937 | ) | (23,824 | ) | (108,485 | ) | (23,441 | ) | ||||||||

| Net income | 56,235 | 25,907 | 149,850 | 86,154 | ||||||||||||

| MAG's 44% portion of net income | 24,743 | 11,399 | 65,934 | 37,908 | ||||||||||||

| Interest on Juanicipio loans - MAG's 44% | 809 | 2,293 | 3,985 | 6,122 | ||||||||||||

| MAG's 44% equity income | 25,552 | 13,692 | 69,919 | 44,030 | ||||||||||||

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

Juanicipio Statements of Financial Position

| September 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| $ | $ | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | 96,782 | 42,913 | ||||||

| Value added tax and other receivables | 1,159 | 3,162 | ||||||

| Income tax receivable | 1,529 | 3,758 | ||||||

| Concentrate sales receivable | 98,068 | 56,532 | ||||||

| Inventories | ||||||||

| Stockpiles | 3,553 | 2,417 | ||||||

| Metal concentrates | 3,224 | 2,361 | ||||||

| Materials and supplies | 18,566 | 18,414 | ||||||

| Prepaids and other assets | 3,405 | 5,501 | ||||||

| 226,286 | 135,058 | |||||||

| Non-current assets | ||||||||

| Right-of-use assets | 996 | 1,590 | ||||||

| Mineral interests, plant and equipment | 759,590 | 794,512 | ||||||

| Deferred tax assets | 8,600 | 24,336 | ||||||

| 769,186 | 820,438 | |||||||

| Total assets | 995,473 | 955,496 | ||||||

| Liabilities | ||||||||

| Current liabilities | ||||||||

| Payables | 13,574 | 22,167 | ||||||

| Interest and other payables to shareholders | 4,774 | 12,160 | ||||||

| Taxes payable | 20,705 | 14,395 | ||||||

| 39,052 | 48,722 | |||||||

| Non-current liabilities | ||||||||

| Lease obligation | 1,012 | 1,597 | ||||||

| Provisions | ||||||||

| Reserves for retirement and pension | 107 | 112 | ||||||

| Reclamation and closure | 3,601 | 3,605 | ||||||

| Deferred tax liabilities | 58,100 | 9,439 | ||||||

| 62,820 | 14,753 | |||||||

| Total liabilities | 101,872 | 63,475 | ||||||

| Equity | ||||||||

| Shareholders' equity including shareholder advances | 893,601 | 892,021 | ||||||

| Total equity | 893,601 | 892,021 | ||||||

| Total liabilities and equity | 995,473 | 955,496 | ||||||

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

Juanicipio Statements of Cash Flows

| For the three months ended | For the nine months ended | |||||||||||||||

| September 30, | September 30, | September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Operating activities | ||||||||||||||||

| Net income | 56,235 | 25,907 | 149,850 | 86,154 | ||||||||||||

| Items not involving cash | ||||||||||||||||

| Depreciation and amortization | 23,440 | 21,646 | 67,934 | 47,001 | ||||||||||||

| Income tax expense | 52,937 | 23,824 | 108,485 | 23,441 | ||||||||||||

| Interest incurred on loans | 1,839 | 5,214 | 9,058 | 13,915 | ||||||||||||

| Other | (600 | ) | 942 | (775 | ) | 2,553 | ||||||||||

| Income tax payments | (7,348 | ) | (21,257 | ) | (36,806 | ) | (77,053 | ) | ||||||||

| Change in other operating working capital | (16,667 | ) | 996 | (52,624 | ) | (35,094 | ) | |||||||||

| Net cash from operating activities | 109,836 | 57,271 | 245,123 | 60,918 | ||||||||||||

| Investing activities | ||||||||||||||||

| Capital expenditures including plant, mine development and exploration | (13,631 | ) | (16,954 | ) | (33,694 | ) | (62,368 | ) | ||||||||

| Other | 975 | 430 | 2,765 | 716 | ||||||||||||

| Net cash used in investing activities | (12,656 | ) | (16,524 | ) | (30,929 | ) | (61,653 | ) | ||||||||

| Financing activities | ||||||||||||||||

| Loans and other capital provided by shareholders | - | - | - | 56,800 | ||||||||||||

| Repayments of loans to shareholders | (49,853 | ) | (20,000 | ) | (148,270 | ) | (20,000 | ) | ||||||||

| Interest paid to shareholders | (1,627 | ) | (5,670 | ) | (10,665 | ) | (13,157 | ) | ||||||||

| Payment of lease obligations | (232 | ) | (174 | ) | (789 | ) | (552 | ) | ||||||||

| Net cash (used in) from financing activities | (51,712 | ) | (25,843 | ) | (159,724 | ) | 23,091 | |||||||||

| Effect of exchange rate changes on cash and cash equivalents | (108 | ) | (9 | ) | (601 | ) | (25 | ) | ||||||||

| Increase in cash and cash equivalents during the period | 45,360 | 14,895 | 53,869 | 22,331 | ||||||||||||

| Cash and cash equivalents, beginning of period | 51,422 | 8,539 | 42,913 | 1,102 | ||||||||||||

| Cash and cash equivalents, end of period | 96,782 | 23,434 | 96,782 | 23,433 | ||||||||||||

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

| 6. | EXPLORATION AND EVALUATION ASSETS |

| (a) | In 2018, the Company entered into an option agreement with a private group, whereby the Company has the right to earn 100% ownership interest in a company which owns the Deer Trail Project in Utah. The Company paid $150 upon signing the agreement, $150 in each of 2020 and 2021, and $200 in each of 2022 and 2023. To earn 100% interest in the property, the Company must make remaining cash payments totaling $1,150 over the next 5 years (with option to accelerate if desired) and fund a cumulative of $30,000 of eligible exploration expenditures by 2028 (criteria met: as of September 30, 2024, the Company has incurred $34,147 of eligible exploration expenditures on the property). As at September 30, 2024, the Company has also bonded and recorded a $484 reclamation liability for the project. Other than the reclamation liability, the balance of cash payments are optional at the Company’s discretion. Upon the Company’s 100% earn-in, the vendors will retain a 2% net smelter returns (“NSR”) royalty. |

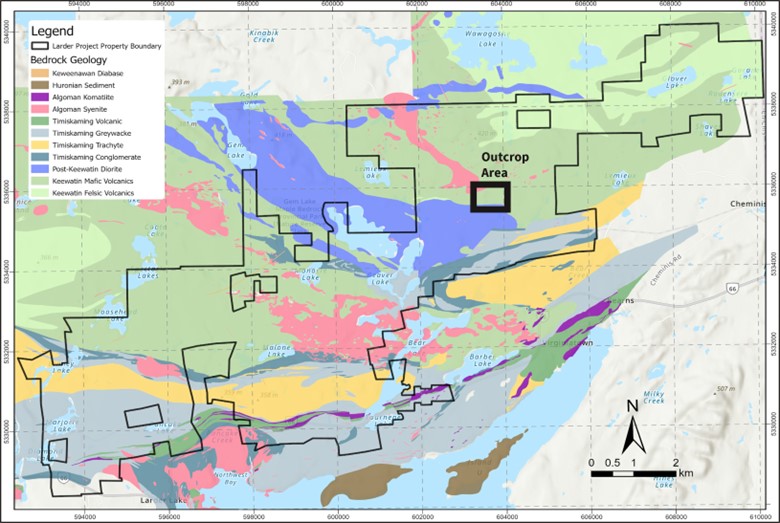

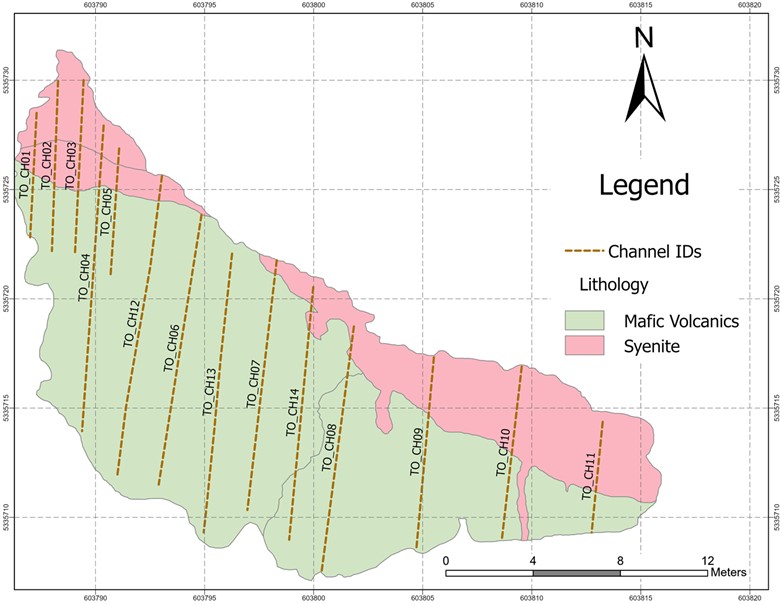

| (b) | In 2022, through the acquisition of Gatling Exploration Inc. (“Gatling”) the Company acquired 100% of the Larder Project in Ontario. During the nine months ended September 30, 2024, the Company incurred a total of $14,048 in exploration and evaluation expenditures, which includes $3,802 in acquisition of exploration property mainly relating to the purchase of 100% ownership of the Goldstake property (“Goldstake”), contiguous to Gatling’s existing land holdings. |

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

During the three and nine months ended September 30, 2024 and year ended December 31, 2023, the Company has incurred the following exploration and evaluation expenditures on these projects:

| Three months ended | Nine months ended | Year ended | ||||||||||

| September 30, | September 30, | December 31, | ||||||||||

| 2024 | 2024 | 2023 | ||||||||||

| $ | $ | $ | ||||||||||

| Deer Trail Project | ||||||||||||

| Option and other payments | - | - | 275 | |||||||||

| Total acquisition costs | - | - | 275 | |||||||||

| Drilling and geotechnical | 2,149 | 6,838 | 5,854 | |||||||||

| Camp and site costs | 67 | 367 | 875 | |||||||||

| Land taxes and government fees | 214 | 218 | 213 | |||||||||

| Legal, community and other consultation costs | 115 | 272 | 343 | |||||||||

| Travel | 49 | 139 | 190 | |||||||||

| Total for the period | 2,594 | 7,834 | 7,750 | |||||||||

| Balance, beginning of period | 32,555 | 27,315 | 19,565 | |||||||||

| Total Deer Trail Project cost | 35,149 | 35,149 | 27,315 | |||||||||

| Larder Project | ||||||||||||

| Acquisition of exploration property | - | 3,802 | - | |||||||||

| Total acquisition costs | - | 3,802 | - | |||||||||

| Drilling and geotechnical | 2,672 | 8,237 | 6,357 | |||||||||

| Camp and site costs | 323 | 1,456 | 772 | |||||||||

| Land taxes and government fees | 19 | 39 | 43 | |||||||||

| Legal, community and other consultation costs | 131 | 386 | 347 | |||||||||

| Travel | 58 | 128 | 109 | |||||||||

| Total for the period | 3,203 | 14,048 | 7,628 | |||||||||

| Balance, beginning of period | 36,167 | 25,322 | 17,694 | |||||||||

| Total Larder Project cost | 39,370 | 39,370 | 25,322 | |||||||||

| Total Exploration and Evaluation Assets | 74,519 | 74,519 | 52,637 |

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

| 7. | SHARE CAPITAL |

| (a) | Public offerings |

On February 7, 2023, the Company closed a $42,558 bought deal public offering and issued 2,905,000 common shares, at a price of $14.65 per common share.

On February 16, 2023, the Company closed a $17,133 (C$23,024) bought deal private placement and issued 969,450 common shares on a “flow-through” basis” (as defined in the Income Tax Act (Canada)) (the Flow-Through Shares”), at a price of $17.67 (C$23.75) per Flow-Through Share. The premium paid by investors on the flow-through shares was calculated as $3.08 per share. Accordingly, $2,986 was recorded as flow-through share premium liability (Note 8).

The aggregate gross proceeds from the combined bought deal public offering and bought deal private placement amounted to $59,691. The Company paid commissions to underwriters of $3,010 and legal and filing fees totalling $932 yielding net proceeds of $55,749.

| (b) | Notice of Intention to Make a Normal Course Issuer Bid (“NCIB”) |

On May 15, 2024, MAG announced that the Toronto Stock Exchange (“TSX”) had accepted the Company’s Notice of Intention to make a NCIB. Under the NCIB, the Company may purchase for cancellation up to an aggregate of 8,643,374 common shares of the Company, representing approximately 10% of the public float (as defined in the rules and policies of the TSX) of the common shares as of May 8, 2024. The Company’s purchases in the United States will be subject to a limit of 5,148,977 common shares, being 5% of the public float of the common shares as of May 8, 2024. The NCIB commenced on May 17, 2024 and will terminate on May 16, 2025, or earlier if the maximum number of common shares under the NCIB have been purchased or if the NCIB has been terminated by the Company. As at September 30, 2024 the Company has not repurchased any common shares. In addition, the Company entered into an automatic share purchase plan with its designated broker to allow for the purchase of common shares at times which the Company ordinarily would not be active in the market due to trading blackout periods, insider trading rules or otherwise.

| (c) | Stock options |

The Company may enter into Incentive Stock Option Agreements in accordance with the Company’s Stock Option Plan (the “Plan”). On June 26, 2023, the Shareholders re-approved the Plan. The maximum number of common shares that may be issuable under the Plan is set at 5% of the number of issued and outstanding common shares on a non-diluted basis at any time, provided that the number of common shares issued or issuable under the combined Plan and Share Unit Plan (Note 7(d)) shall not exceed 5% of the issued and outstanding common shares of the Company on a non-diluted basis. Options granted under the Plan have a maximum term of 5 years.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

The following table summarizes the Company’s stock options activity, excluding the Gatling replacement options, for the period:

| Stock options activity | Weighted average exercise price (C$/option) |

|||||||

| Outstanding, January 1, 2023 | 1,012,794 | 17.56 | ||||||

| Granted | 236,928 | 16.42 | ||||||

| Expired | (20,000 | ) | 19.41 | |||||

| Forfeited | (13,564 | ) | 18.35 | |||||

| Exercised for cash | (28,787 | ) | 14.34 | |||||

| Outstanding, December 31, 2023 | 1,187,371 | 17.37 | ||||||

| Granted | 273,507 | 14.64 | ||||||

| Expired | (7,791 | ) | 21.36 | |||||

| Exercised for cash | (255,403 | ) | 14.24 | |||||

| Exercised cashless | (86,747 | ) | 13.64 | |||||

| Outstanding, September 30, 2024 | 1,110,937 | 17.68 | ||||||

During the three months ended September 30, 2024, the Company recorded a share-based compensation expense of $242 (September 30, 2023: $225) and capitalized $41 (September 30, 2023: $37) to exploration and evaluation assets relating to stock options to employees and consultants.

During the nine months ended September 30, 2024, the Company recorded a share-based compensation expense of $770 (September 30, 2023: $963) and capitalized $126 (September 30, 2023: $115) to exploration and evaluation assets relating to stock options to employees and consultants.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

The following table summarizes the Company’s stock options outstanding and exercisable as at September 30, 2024.

| Exercise price | Number | Number | Weighted avg. remaining | |||||||

| (C$/option) | Outstanding | Exercisable | contractual life (years) | |||||||

| 14.64 | 273,507 | - | 4.51 | |||||||

| 14.98 | 115,813 | 115,813 | 0.41 | |||||||

| 16.09 | 6,021 | 2,007 | 3.50 | |||||||

| 16.43 | 213,841 | 65,139 | 3.50 | |||||||

| 17.02 | 100,000 | 66,666 | 2.63 | |||||||

| 20.20 | 109,799 | 73,194 | 2.52 | |||||||

| 21.26 | 50,000 | 33,333 | 2.17 | |||||||

| 21.29 | 9,191 | 6,127 | 2.52 | |||||||

| 21.57 | 182,765 | 182,765 | 1.19 | |||||||

| 23.53 | 50,000 | 50,000 | 1.30 | |||||||

| 14.64 - 23.53 | 1,110,937 | 595,044 | 2.70 | |||||||

The Company determined the fair value of the options using the Black-Scholes option pricing model with the following weighted average assumptions:

| Nine month ended | Year ended | |||||||

| September 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Risk-free interest rate | 3.91 | % | 3.53 | % | ||||

| Expected volatility | 48 | % | 57 | % | ||||

| Expected dividend yield | nil | nil | ||||||

| Expected life (years) | 3 | 3 |

In 2022, the Company issued 43,675 replacement stock options pursuant to the Gatling acquisition, of which all replacement stock options expired unexercised by August 12, 2024.

| (d) | Restricted and performance share units |

On June 26, 2023, the Shareholders re-approved a share unit plan (the “Share Unit Plan”) for the benefit of the Company’s officers, employees and consultants. The Share Unit Plan provides for the issuance of common shares from treasury, in the form of restricted share units (“RSUs”) and performance share units (“PSUs”). The maximum number of common shares that may be issuable under the Share Unit Plan is set at 1.5% of the number of issued and outstanding common shares on a non-diluted basis, provided that the number of common shares issued or issuable under the combined Share Unit Plan and Stock Option Plan (Note 7(b)) shall not exceed 5% of the issued and outstanding common shares on a non-diluted basis. RSUs and PSUs granted under the Share Unit Plan have a term of 5 years unless otherwise specified by the Board, and each unit entitles the participant to receive one common share of the Company subject to vesting criteria, and in the case of PSUs, performance criteria which may also impact the number of PSUs to vest between 0-200%. PSUs for which the performance targets are not achieved during the performance period are automatically forfeited and cancelled.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

The following table summarizes the Company’s RSUs activity for the period:

| RSU activity | Weighted average fair value (C$/RSU) |

|||||||

| Outstanding, January 1, 2023 | 101,059 | 18.47 | ||||||

| Granted | 56,425 | 16.42 | ||||||

| Forfeited | (4,244 | ) | 17.07 | |||||

| Exercised | (54,985 | ) | 17.19 | |||||

| Outstanding, December 31, 2023 | 98,255 | 17.82 | ||||||

| Granted | 94,842 | 14.64 | ||||||

| Exercised | (17,741 | ) | 15.26 | |||||

| Outstanding, September 30, 2024 | 175,356 | 16.17 | ||||||

During the three months ended September 30, 2024, the Company recorded share-based compensation expense of $182 (September 30, 2023: $83) and capitalized $37 (September 30, 2023: $20) to exploration and evaluation assets relating to RSUs to employees and consultants.

During the nine months ended September 30, 2024, the Company recorded share-based compensation expense of $487 (September 30, 2023: $570) and capitalized $104 (September 30, 2023: $61) to exploration and evaluation assets relating to RSUs to employees and consultants.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

The following table summarizes the Company’s PSUs activity for the period:

| PSU activity | Weighted average fair value (C$/PSU) |

|||||||

| Outstanding, January 1, 2023 | 231,255 | 17.91 | ||||||

| Granted | 156,861 | 16.42 | ||||||

| Forfeited | (43,047 | ) | 19.71 | |||||

| Exercised | (57,620 | ) | 13.17 | |||||

| Outstanding, December 31, 2023 | 287,449 | 17.78 | ||||||

| Granted | 137,191 | 14.64 | ||||||

| Exercised | (11,161 | ) | 20.75 | |||||

| Outstanding, September 30, 2024 | 413,479 | 16.66 | ||||||

During the three months ended September 30, 2024, the Company recorded share-based compensation expense of $358 (September 30, 2023: $299) and capitalized $30 (September 30, 2023: $35) to exploration and evaluation assets relating to PSUs to employees and consultants.

During the nine months ended September 30, 2024, the Company recorded share-based compensation expense of $968 (September 30, 2023: $415) and capitalized $82 (September 30, 2023: $97) to exploration and evaluation assets relating to PSUs to employees and consultants.

| (e) | Deferred share units |

On June 26, 2023, the Shareholders re-approved a Deferred Share Unit Plan (the “DSU Plan”) for the benefit of the Company’s non-executive directors. The DSU Plan provides for the issuance of common shares from treasury, on conversion of Deferred Share Units (“DSUs”) granted. Directors may also elect to receive all or a portion of their annual retainer in the form of DSUs. DSUs may be settled in cash or in common shares issued from treasury, as determined by the Board at the time of the grant. The maximum number of common shares that may be issuable under the DSU Plan is set at 1.0% of the number of issued and outstanding common shares on a non-diluted basis.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

The following table summarizes the Company’s DSUs activity for the period:

| DSU activity | Weighted average fair value (C$/DSU) |

|||||||

| Outstanding, January 1, 2023 | 420,115 | 14.80 | ||||||

| Granted | 78,474 | 14.81 | ||||||

| Outstanding, December 31, 2023 | 498,589 | 14.80 | ||||||

| Granted | 66,368 | 16.00 | ||||||

| Exercised | (50,000 | ) | 12.26 | |||||

| Outstanding, September 30, 2024 | 514,957 | 15.20 | ||||||

During the three months ended September 30, 2024, the Company recorded share-based compensation expense of $210 (September 30, 2023: $215) relating to DSUs to directors. Furthermore, 13,286 DSUs were granted under the plan and 1,044 DSUs were granted to directors who elected to receive a portion of their annual retainer in DSUs rather than in cash (September 30, 2023: 18,690 and 2,002 respectively).

During the nine months ended September 30, 2024, the Company recorded share-based compensation expense of $785 (September 30, 2023: $649) relating to DSUs to directors. Furthermore, 63,083 DSUs were granted under the plan and 3,285 DSUs were granted to directors who elected to receive a portion of their annual retainer in DSUs rather than in cash (September 30, 2023: 51,849 and 5,554 respectively).

| (f) | Diluted earnings per share |

| Three months ended | Nine months ended | |||||||||||||||

| September 30, | September 30, | September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Net income | 22,292 | 8,862 | 58,801 | 32,965 | ||||||||||||

| Basic weighted average number of shares outstanding | 103,184,518 | 102,945,350 | 103,104,001 | 102,329,945 | ||||||||||||

| Effect of dilutive common share equivalents: | ||||||||||||||||

| Stock options | 102,349 | 23,723 | 111,766 | 64,957 | ||||||||||||

| Restricted and performance share units | 356,187 | 54,415 | 337,004 | 62,403 | ||||||||||||

| Deferred share units | 514,957 | 477,518 | 514,957 | 477,518 | ||||||||||||

| Diluted weighted average number of shares outstanding | 104,158,011 | 103,501,006 | 104,067,728 | 102,934,823 | ||||||||||||

| Diluted earnings per share | $ | 0.21 | $ | 0.09 | $ | 0.57 | $ | 0.32 |

For the three months ended September 30, 2024, there are 1,008,588 anti-dilutive stock options (September 30, 2023: 752,170) and 232,648 anti-dilutive restricted and performance share units (September 30, 2023: 383,673).

For the nine months ended September 30, 2024, there are 999,171 anti-dilutive stock options (September 30, 2023: 515,242) and 251,831 anti-dilutive restricted and performance share units (September 30, 2023: 375,684).

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

| 8. | FLOW-THROUGH PREMIUM LIABILITY |

As at September 30, 2024, the Company has a flow-through share premium liability of $249 (December 31, 2023: $1,969) in relation to the flow-through share financing completed on February 16, 2023 (see Note 7(a) for full details of the financing). Flow-through shares are issued at a premium, and in the Company’s case, considering the separate offerings for flow-through shares and standard public offering for common shares both made on January 25, 2023, this premium has been calculated as the difference between the pricing of a flow-through share and that of a common share from the public offering made on the same date. Tax deductions generated by the eligible expenditures are passed through to the shareholders of the flow-through shares once the eligible expenditures are incurred and renounced. Below is a summary of the flow-through financing and the related flow-through share premium liability generated.

| Shares issued | Flow-through share price |

Premium per flow through share price |

Flow-through premium liability |

|||||||||||||

| $ | $ | $ | ||||||||||||||

| February 2023 Financing | 969,450 | 17.67 | 3.08 | 2,986 | ||||||||||||

The following table is a continuity of the flow-through share funding and expenditures along with the corresponding impact on the flow-through share premium liability:

| Flow-through funding and expenditures |

Flow-through premium liability |

|||||||

| $ | $ | |||||||

| Balance at January 1, 2023 | - | - | ||||||

| Flow-through funds raised | 17,133 | 2,986 | ||||||

| Flow-through eligible expenditures | (5,835 | ) | (1,017 | ) | ||||

| Balance at December 31, 2023 | 11,298 | 1,969 | ||||||

| Flow-through eligible expenditures | (9,869 | ) | (1,720 | ) | ||||

| Balance at September 30, 2024 | 1,428 | 249 |

The Company renounced the entirety of tax deductions from incurred and not yet incurred eligible spend to its shareholders of flow-through shares as at December 31, 2023.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

| 9. | DEBT FACILITY |

In October 2023 the Company entered into a $40,000 senior secured revolving credit facility with the Bank of Montreal (the “Credit Facility”). The Credit Facility bears interest on a sliding scale of SOFR or the Lender’s Base Rate on US Dollar commercial loans plus an applicable margin on a sliding scale of between 200 and 400 basis points based on the Company’s leverage ratio. Interest incurred on drawn amounts is to be paid quarterly. Commitment fees on the undrawn portion of the facility are calculated on a similar sliding scale of between 50 and 75 basis points, and are also to be paid on a quarterly basis. The term of the facility is 34 months, maturing on August 4, 2026, at which date any drawn amount is required to be paid back in full. All debts, liabilities and obligations under the facility are guaranteed by the Company's material subsidiaries and secured by assets of the Company. The facility includes a number of customary covenants (liquidity, leverage, tangible net worth) and conditions including limitations on acquisitions and investments (excluding exploration and capital expenditures) funded using cash with no limitations when equity is used as a funding source. As at September 30, 2024, the Company is in compliance with all applicable covenants.

As of September 30, 2024, the Company has not drawn down any funds from its Credit Facility, and as a result expensed $50 and $149 of commitment fees for the three and nine months ended September 30, 2024, respectively.

| 10. | CAPITAL RISK MANAGEMENT |

The Company’s objectives in managing its liquidity and capital are to safeguard the Company’s ability to continue as a going concern and to provide financial capacity to meet its strategic objectives. The capital structure of the Company consists of its equity (comprised of share capital, equity reserve, accumulated other comprehensive income and deficit), its undrawn Credit Facility (see Note 9) and lease obligation, net of cash and investments in equity securities as follows:

| September 30, | December 31, | ||||||||

| 2024 | 2023 | ||||||||

| $ | $ | ||||||||

| Equity | 571,429 | 506,757 | |||||||

| Lease obligation | 40 | 154 | |||||||

| Cash | (113,491 | ) | (68,707 | ) | |||||

| Investments | (8 | ) | (8 | ) | |||||

| Total | 457,970 | 438,196 |

The Company manages the capital structure and makes adjustments to it in light of changes in economic conditions and the risk characteristics of the underlying assets. To maintain or adjust the capital structure, the Company may attempt to issue new shares, issue debt and/or acquire or dispose of assets.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

As at September 30, 2024, the Company does not have any long-term debt outstanding, is in compliance with all applicable Credit Facility covenants, and is not subject to any other externally imposed capital requirements.

| 11. | FINANCIAL RISK MANAGEMENT |

The Company’s operations consist of the acquisition, exploration and advancement of mineral projects in the Americas. The Company examines the various financial risks to which it is exposed and assesses the impact and likelihood of occurrence. These risks may include credit risk, liquidity risk, currency risk, interest rate risk and other price risks. Where material, these risks are reviewed and monitored by the Board of Directors.

| (a) | Market risk |

The Company conducts the majority of its business through its equity interest in its associates, Juanicipio (Note 5). Juanicipio is exposed to commodity price risk, specifically to the prices of silver, gold, and to a lesser extent, lead and zinc. Currently, Juanicipio produces and sells concentrates containing these metals which are each subject to market price fluctuations which will affect its profitability and its ability to generate cash flow. Juanicipio does not hedge any of the commodities produced and does not have any such positions outstanding at September 30, 2024.

| (b) | Credit risk |

Counterparty credit risk is the risk that the financial benefits of contracts with a specific counterparty will be lost if a counterparty defaults on its obligations under the contract. This includes any cash amounts owed to the Company by those counterparties, less any amounts owed to the counterparty by the Company where a legal right of set-off exists and also includes the fair values of contracts with individual counterparties which are recorded in the financial statements.

| (i) | Trade credit risk |

Juanicipio, in which the Company has a 44% interest, has revenue from its operations as described in Note 5. Juanicipio sells and receives payment for its concentrates at market terms, under an offtake agreement with Met-Mex Peñoles, S.A. de C.V. (“Met-Mex”), a related party to Fresnillo. The Company believes Juanicipio is not exposed to significant trade credit risk.

| (ii) | Cash |

In order to manage credit and liquidity risk, the Company’s practice is to invest only in highly rated investment grade instruments backed by Canadian commercial banks, and in the case of its Mexican and US operations, the Company maintains minimal cash in its US and Mexican subsidiaries.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

The Company’s maximum exposure to credit risk is the carrying value of its cash, accounts receivable and loans receivable from Juanicipio which is classified as an Investment in Juanicipio in the consolidated statements of financial position, as follows:

| September 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| $ | $ | |||||||

| Cash | 113,491 | 68,707 | ||||||

| Accounts receivable (Note 4) | 1,675 | 1,559 | ||||||

| Juanicipio loans (Notes 5 & 14) | 29,179 | 94,414 | ||||||

| 144,345 | 164,680 |

| (c) | Liquidity risk |

The Company has a planning and budgeting process in place to help determine the funds required to support the Company's normal operating requirements, its exploration and mineral projects advancement plans, and its various optional property and other commitments (Notes 5, 6, 8 and 15). The annual budget is approved by the Board of Directors. The Company ensures that there are sufficient cash balances to meet its short-term business requirements.

To increase its flexibility with regards to access to capital, in October 2023 the Company entered into a $40,000 Credit Facility (see Note 9 for full details of the debt facility).

The Company estimates it has the ability to fund the next 12 months of corporate and exploration expenses with its liquidity position, and the Company 's overall liquidity risk has not changed significantly from December 31, 2023. Future liquidity may therefore depend upon the Company’s ability to repatriate capital from Juanicipio, arrange additional debt or additional equity financing.

| (d) | Currency risk |

The Company is exposed to the financial risks related to the fluctuation of foreign exchange rates, both in the Mexican peso and C$, relative to the US$. The Company does not use any derivative instruments to reduce its exposure to fluctuations in foreign exchange rates.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

Exposure to currency risk

As at September 30, 2024, the Company is exposed to currency risk through the following assets and liabilities denominated in currencies other than the functional currency of the applicable entity:

| Mexican peso | Canadian dollar | |||||||

| (in US$ equivalent) | $ | $ | ||||||

| Cash | 8 | 5,047 | ||||||

| Accounts receivable | 385 | 33 | ||||||

| Prepaid expenses | 6 | 1,680 | ||||||

| Investments | - | 8 | ||||||

| Accounts payable | (28 | ) | (2,821 | ) | ||||

| Lease obligations | - | (40 | ) | |||||

| Net (liabilities) assets exposure | 371 | 3,908 |

Mexican peso relative to the US$

Although the majority of operating expenses in Mexico are both determined and denominated in US$, an appreciation in the Mexican peso relative to the US$ will increase the Company’s cost of operations in Mexico (reported in US$) related to those operating costs denominated and determined in Mexican pesos. Alternatively, a depreciation in the Mexican peso relative to the US$ will decrease the Company’s cost of operations in Mexico (reported in US$) related to those operating costs denominated and determined in Mexican pesos.

An appreciation/depreciation in the Mexican peso against the US$ will also result in a gain/loss before tax and deferred tax to the extent that the Company holds net monetary assets (liabilities) in pesos. Specifically, the Company's foreign currency exposure is comprised of peso denominated cash, prepaids and value added taxes receivable, net of trade and other payables. The carrying amount of the Company’s peso denominated net monetary assets at September 30, 2024 is 7.3 million pesos (December 31, 2023: 564 thousand pesos net monetary assets). A 10% appreciation or depreciation in the peso against the US$ would have an immaterial effect on the Company’s income (loss) before tax.

Mexican peso relative to the US$ - Investment in Juanicipio

The Company conducts the majority of its business through its equity interest in its associates (Note 5). The Company accounts for this investment using the equity method and recognizes the Company's 44% share of earnings and losses of Juanicipio. Juanicipio also has a US$ functional currency and is exposed to the same currency risks noted above for the Company.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

An appreciation/depreciation in the Mexican peso against the US$ will also result in a gain/loss after tax and deferred taxes (Note 5) in Juanicipio to the extent that it holds net monetary assets (liabilities) in pesos, comprised of peso denominated cash, value added taxes receivable, net of trade and other payables. The carrying amount of Juanicipio’s net peso denominated monetary liabilities at September 30, 2024 is 686 million pesos (December 31, 2023: 545 million pesos net monetary liabilities). A 10% appreciation in the peso against the US$ would result in a loss before tax at September 30, 2024 of $3,881 (December 31, 2023: $3,584 loss) in Juanicipio, of which the Company would record its 44% share being $1,708 loss from equity investment in Juanicipio (December 31, 2023: $1,577 loss), while a 10% depreciation in the peso relative to the US$ would result in an equivalent gain.

C$ relative to the US$

The Company is exposed to gains and losses from fluctuations in the C$ relative to the US$.

As general and administrative overheads in Canada are predominantly denominated in C$, an appreciation in the C$ relative to the US$ will increase the Company’s overhead costs as reported in US$. Alternatively, a depreciation in the C$ relative to the US$ will decrease the Company’s overhead costs as reported in US$.

An appreciation/depreciation in the C$ against the US$ will result in a gain/loss to the extent that MAG, the parent entity, and the Larder Project holds net monetary assets (liabilities) in C$. The carrying amount of the Company’s net Canadian dollar denominated monetary assets at September 30, 2024 is C$5.3 million (December 31, 2023: C$1.4 million net monetary assets). A 10% appreciation or depreciation in the C$ against the US$ would have a $528 (December 31, 2023: $160) effect on the Company’s income (loss) before tax.

| (e) | Interest rate risk |

The Company’s interest income earned on cash is exposed to interest rate risk. A decrease in interest rates would result in lower relative interest income and an increase in interest rates would result in higher relative interest income.

The Company’s Credit Facility is based on variable interest rate, where it will bear interest on a sliding scale of SOFR or the Lender’s Base Rate on US Dollar commercial loans plus an applicable margin on a sliding scale of between 200 and 400 basis points based on the Company’s leverage ratio. As of September 30, 2024, the Company has not drawn down any funds from its Credit Facility.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

| 12. | FINANCIAL INSTRUMENTS AND FAIR VALUE DISCLOSURES |

The Company’s financial instruments include cash, accounts receivable, investments, and trade and other payables. The carrying values of cash, accounts receivable, and trade and other payables reported in the consolidated statement of financial position approximate their respective fair values due to the relatively short-term nature of these instruments.

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy establishes three levels to classify the inputs to valuation techniques used to measure fair value as described below:

Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical assets or liabilities.

Level 2: Observable inputs other than quoted prices in Level 1 such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3: Unobservable inputs which are supported by little or no market activity.

The Company’s financial assets or liabilities as measured in accordance with the fair value hierarchy described above are:

| As at September 30, 2024 | Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| $ | $ | $ | $ | ||||||||||||||

| Investments | 8 | - | - | 8 | |||||||||||||

| As at December 31, 2023 | Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| $ | $ | $ | $ | ||||||||||||||

| Investments | 8 | - | - | 8 |

There were no transfers between levels 1, 2 and 3 during the nine months ended September 30, 2024 or during the year ended December 31, 2023.

| 13. | SEGMENTED INFORMATION |

The Company operates in one operating segment, being the exploration and advancement of mineral projects in North America. The Company’s principal asset, its 44% ownership in the Juanicipio Mine, is located in Mexico, and the Company also has other exploration properties in North America. The Company’s executive and head office is located in Canada.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

| 14. | RELATED PARTY TRANSACTIONS |

The Company does not have offices or direct personnel in Mexico, but rather is party to a Field Services Agreement, whereby it has contracted administrative and exploration services in Mexico with Minera Cascabel, S.A. de C.V. (“Cascabel”) and IMDEX Inc. (“IMDEX”). Dr. Peter Megaw, the Company’s former Chief Exploration Officer (“CXO”), is a principal of both IMDEX and Cascabel, and was remunerated by the Company through fees to IMDEX.

On May 21, 2024, Dr. Megaw stepped down as CXO and will continue to provide technical advice in a consulting role and as such will no longer be providing key management personnel services as defined under IAS 24. Accordingly, Dr. Megaw is no longer considered a related party. Related party transactions incurred by the Company with Cascabel and IMDEX will only be included up until the date of his retirement from executive duties.

During the three and nine months ended September 30, 2024 (expenses incurred up to May 21, 2024) and 2023, the Company incurred expenses with Cascabel and IMDEX as follows:

| Three months ended | Nine months ended | |||||||||||||||

| September 30, | September 30, | September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Fees related to Dr. Megaw: | ||||||||||||||||

| Exploration and marketing services | - | 53 | 69 | 190 | ||||||||||||

| Travel and expenses | - | 5 | 11 | 34 | ||||||||||||

| Other fees to Cascabel and IMDEX: | ||||||||||||||||

| Administration for Mexican subsidiaries | - | 11 | 22 | 38 | ||||||||||||

| Field exploration services | - | 40 | 66 | 118 | ||||||||||||

| Share-based payments (Note 7) | - | 121 | 129 | 356 | ||||||||||||

| - | 230 | 297 | 736 |

All transactions are incurred in the normal course of business and are negotiated on arm’s length terms between the parties for all services rendered. A portion of the expenditures are incurred on the Company’s behalf and are charged to the Company on a “cost + 10%” basis. The services provided do not include drilling and assay work which are contracted out independently from Cascabel and IMDEX.

Any amounts due to related parties arising from the above transactions are unsecured, non-interest bearing and are due upon receipt of invoices.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

The details of the Company’s significant subsidiary and controlling ownership interests are as follows:

| Name | Country of | Principal | MAG's effective interest | |||||||||||||

| Incorporation | Project | 2024 (%) | 2023(%) | |||||||||||||

| Minera Los Lagartos, S.A. de C.V. | Mexico | Juanicipio (44%) |

100% | 100% | ||||||||||||

Balances and transactions between the Company and its subsidiaries have been eliminated on consolidation and are not disclosed in this note.

As at September 30, 2024, Fresnillo and the Company have advanced, net of aggregate repayments, $66,316 as shareholder loans (MAG’s 44% share $29,179) to Juanicipio, bearing interest at 1 and 6 months SOFR + 2%. Interest recorded by the Company for the nine months ended September 30, 2024 totalling $3,985 (nine months ended September 30, 2023: $6,122) has been included in MAG’s income from equity accounted investment in Juanicipio.

During the three and nine months ended September 30, 2024 and 2023, compensation of key management personnel (including directors) was as follows:

| Three months ended | Nine months ended | |||||||||||||||

| September 30, | September 30, | September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Salaries and other short term employee benefits | 442 | 376 | 2,297 | 1,581 | ||||||||||||

| Share-based compensation (non-cash) (Note 7) | 730 | 605 | 2,254 | 1,963 | ||||||||||||

| 1,172 | 981 | 4,551 | 3,544 |

Key management personnel are those persons having authority and responsibility for planning, directing and controlling the activities of the Company, directly or indirectly, and consists of its directors, the Chief Executive Officer, the Chief Financial Officer, the Chief Sustainability Officer, and effective January 1, 2024 onwards, the Chief Development Officer.

|

|

MAG SILVER CORP.

Notes to the Condensed Interim Consolidated Financial Statements

For the three and nine months ended September 30, 2024

(Expressed in thousands of US dollars unless otherwise stated - Unaudited)

| 15. | COMMITMENTS AND CONTINGENCIES |

The following table discloses the contractual obligations of the Company and its subsidiaries as at September 30, 2024 for committed exploration work and committed other obligations.

| Less than 1 | More than 5 | |||||||||||||||||||

| Total | year | 1-3 Years | 3-5 Years | years | ||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| Minera Juanicipio (1) | - | - | - | - | - | |||||||||||||||

| Financing and consulting contractual commitments | 546 | 302 | 244 | - | - | |||||||||||||||

| Office lease commitments | 2,156 | 157 | 393 | 417 | 1,189 | |||||||||||||||

| Total Obligations and Commitments | 2,702 | 459 | 637 | 417 | 1,189 | |||||||||||||||

| (1) | According to the operator, Fresnillo, contractual commitments including project development and for continuing operations and purchase orders issued for project capital, sustaining capital, and continuing operations total $22,982 (December 31, 2023: $13,779), with respect to Juanicipio on a 100% basis as at September 30, 2024. |

The concessions associated with the Larder Project are all in good standing with various underlying obligations or royalties ranging from nil-2% NSRs associated with various mineral claims, and various payments upon a production announcement.

The Company is obligated to a 2.5% NSR royalty on the Cinco de Mayo property.

The Company could be subject to various investigations, claims and legal and tax proceedings covering matters that arise in the ordinary course of business activities. Each of these matters would be subject to various uncertainties and it is possible that some matters may be resolved unfavourably to the Company. Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company is not aware of any such claims or investigations, and as such has not recorded any related provisions and does not expect such matters to result in a material impact on the results of operations, cash flows and financial position.

29

Exhibit 99.2

|

MAG SILVER CORP. Management’s Discussion & Analysis For the three and nine months ended September 30, 2024

Dated: November 8, 2024 |

|

|

|

VANCOUVER OFFICE Suite 770 800 W. Pender Street Vancouver, BC V6C 2V6 |

604 630 1399 phone 866 630 1399 toll free 604 681 0894 fax |

TSX: MAG NYSE American: MAG info@magsilver.com |

MAG SILVER CORP.

Management’s Discussion & Analysis

For the three and nine months ended September 30, 2024

(expressed in thousands of US dollars except as otherwise noted)

Table of Contents

| 1. | INTRODUCTION | 3 |

| 2. | DESCRIPTION OF BUSINESS | 4 |

| 3. | HIGHLIGHTS – SEPTEMBER 30, 2024 & SUBSEQUENT TO THE QUARTER END | 4 |

| 4. | RESULTS OF JUANICIPIO | 7 |

| 5. | DEER TRAIL PROJECT | 15 |

| 6. | LARDER PROJECT | 16 |

| 7. | OUTLOOK | 24 |

| 8. | SUMMARY OF QUARTERLY INFORMATION | 25 |

| 9. | REVIEW OF FINANCIAL RESULTS | 26 |

| 10. | FINANCIAL POSITION | 29 |

| 11. | CASH FLOWS | 31 |

| 12. | NON-IFRS MEASURES | 32 |

| 13. | LIQUIDITY AND CAPITAL RESOURCES | 38 |

| 14. | CONTRACTUAL OBLIGATIONS | 41 |

| 15. | SHARE CAPITAL INFORMATION | 42 |

| 16. | OTHER ITEMS | 42 |

| 17. | TREND INFORMATION | 43 |

| 18. | RISKS AND UNCERTAINTIES | 44 |

| 19. | OFF-BALANCE SHEET ARRANGEMENTS | 45 |

| 20. | RELATED PARTY TRANSACTIONS | 45 |

| 21. | CRITICAL ACCOUNTING JUDGMENTS, SIGNIFICANT ESTIMATES AND ASSUMPTIONS | 47 |

| 22. | CHANGES IN ACCOUNTING STANDARDS | 47 |

| 23. | CONTROLS AND PROCEDURES | 48 |

| 24. | ADDITIONAL INFORMATION | 49 |

| 25. | CAUTIONARY STATEMENTS | 49 |

|

|

MAG SILVER CORP.

Management’s Discussion & Analysis

For the three and nine months ended September 30, 2024

(expressed in thousands of US dollars except as otherwise noted)

1. INTRODUCTION

The following Management’s Discussion and Analysis (“MD&A”) focuses on the financial condition and results of operations of MAG Silver Corp. (“MAG”, “MAG Silver” or the “Company”) for the three and nine months ended September 30, 2024 (“Q3 2024”). It is prepared as of November 8, 2024 and should be read in conjunction with the unaudited condensed interim consolidated financial statements of the Company for the three and nine months ended September 30, 2024 (“Q3 2024 Financial Statements”) together with the notes thereto which are available on the Canadian Securities Administrator’s System for Electronic Data Analysis and Retrieval + (“SEDAR+”) at www.sedarplus.ca and on the U.S. Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

All dollar amounts referred to in this MD&A are expressed in thousands of United States dollars (“US$”) unless otherwise stated; references to C$ refer to thousands of Canadian dollars. The functional currency of the parent, its subsidiaries and its investment in Juanicipio (as defined herein), is the US$.

The common shares of the Company (“Common Shares”) trade on the Toronto Stock Exchange (the “TSX”) and on the NYSE American, LLC both under the ticker symbol MAG. MAG Silver is a reporting issuer in each of the provinces and territories of Canada and is a reporting “foreign issuer” in the United States of America.

Cautionary Statements and Risk Factors

This MD&A contains forward-looking statements (as defined herein) which should be read in conjunction with the risk factors described in section “Risks and Uncertainties” and the cautionary statements provided in section “Cautionary Statements – Cautionary Note Regarding Forward-Looking Statements” at the end of this MD&A.

Unless otherwise indicated, technical disclosure regarding the Company’s properties included or incorporated by reference herein, including use of the capitalized terms “Mineral Resources” and “Mineral Reserves”, has been prepared in accordance with the requirements of, and imports the meaning of such terms as defined in, National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”), as applicable, and should be read in conjunction with the cautionary statements provided in section “Cautionary Statements – Cautionary Note for United States Investors” and “Cautionary Statements – Cautionary Note to Investors Concerning Estimates of Mineral Resources” at the end of this MD&A.

Qualified Persons

Unless otherwise specifically noted herein, all scientific or technical information in this MD&A, including assay results, Mineral Reserve and Mineral Resource estimates, and mineralization, if applicable, is based upon information prepared by or under the supervision of, or has been approved by Gary Methven, P.Eng., Vice President, Technical Services and Lyle Hansen, P.Geo., Geotechnical Director; both are “Qualified Persons” for the purposes of NI 43-101.

|

|

MAG SILVER CORP.

Management’s Discussion & Analysis

For the three and nine months ended September 30, 2024

(expressed in thousands of US dollars except as otherwise noted)

2. DESCRIPTION OF BUSINESS

MAG Silver Corp. is a growth-oriented Canadian mining and exploration company focused on advancing high-grade, district scale precious metals projects in the Americas. MAG is a top-tier primary silver mining company through its (44%) investment in the 4,000 tonnes per day (“tpd”) Juanicipio mine (the “Juanicipio Mine” or “Juanicipio”), operated by Fresnillo plc (“Fresnillo”) (56%). The Juanicipio Mine is located in the Fresnillo Silver Trend in Mexico, the world’s premier silver mining camp, where in addition to mining and processing operations, an expanded exploration program is in place targeting multiple highly prospective targets. MAG is also executing multi-phase exploration programs at the 100% earn-in Deer Trail Project (as defined herein) in Utah and the 100% owned Larder Project (as defined herein), located in the historically prolific Abitibi region of Canada.

3. HIGHLIGHTS – SEPTEMBER 30, 2024 & SUBSEQUENT TO THE QUARTER END (ON A 100% BASIS UNLESS OTHERWISE NOTED)

Q3 2024

| ü | MAG reported net income of $22,292 ($0.22 per share) driven by income from Juanicipio (equity accounted) of $25,552, and adjusted EBITDA1 (as defined herein) of $55,720. |

| ü | A total of 332,290 tonnes of ore at a silver head grade of 481 grams per tonne (“g/t”) (equivalent silver head grade2 735 g/t) was processed at Juanicipio. |

| ü | Juanicipio achieved silver production and equivalent silver production2 of 4.9 and 7.1 million ounces, respectively. |

| ü | Juanicipio generated strong operating cash flow of $109,836 and free cash flow1 of $96,948. |

| ü | Building on the robust cost performance of the first half of 2024, Juanicipio continued to improve delivering negative cash cost1 of $0.12 per silver ounce sold ($8.38 per equivalent silver ounce sold3) and all-in sustaining cost1 of $3.28 per silver ounce sold ($10.83 per equivalent silver ounce sold3). |

__________________________

1 Adjusted EBITDA, cash cost per ounce, all-in sustaining cost per ounce and free cash flow are non-IFRS measures, please refer to “Non-IFRS Measures” section of this MD&A for a detailed reconciliation of these measures to the Q3 2024 Financial Statements.