UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2024

_______________________________

Arbutus Biopharma Corporation

(Exact name of registrant as specified in its charter)

_______________________________

| British Columbia, Canada | 001-34949 | 98-0597776 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

701 Veterans Circle

Warminster, Pennsylvania 18974

(Address of Principal Executive Offices) (Zip Code)

(267) 469-0914

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, without par value | ABUS | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On August 1, 2024, Arbutus Biopharma Corporation (the “Company”) issued a press release announcing its financial results for the second quarter ended June 30, 2024 and certain other information. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

On August 1, 2024, the Company posted an updated corporate presentation on its website at www.arbutusbio.com. A copy of the presentation is filed herewith as Exhibit 99.2 and is incorporated by reference herein.

(d) Exhibits.

| Exhibit Number | Description | |||

| 99.1 | Press release dated August 1, 2024 | |||

| 99.2 | Corporate Presentation dated August 1, 2024 | |||

| 104 | Cover page interactive data file (formatted as inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Arbutus Biopharma Corporation | ||

| Date: August 1, 2024 | By: | /s/ David C. Hastings |

| David C. Hastings | ||

| Chief Financial Officer | ||

EXHIBIT 99.1

Arbutus Reports Second Quarter 2024 Financial Results and Provides Corporate Update

End-of-treatment data presented at the EASL Congress from two Phase 2a clinical trials supports advancing imdusiran as a potential cornerstone in a HBV functional cure treatment regimen

IM-PROVE I clinical trial demonstrated undetectable HBsAg in 33% of patients who were treated with 48 weeks of imdusiran and 24 weeks of IFN and in 67% of these patients with baseline HBsAg less than 1000 IU/mL

Prioritizing imdusiran Phase 2b clinical development; eliminating HBV discovery efforts resulting in a reduction in workforce by 40% and extension of expected cash runway into the fourth quarter of 2026

Conference Call and Webcast Today at 8:45 AM ET

WARMINSTER, Pa., Aug. 01, 2024 (GLOBE NEWSWIRE) -- Arbutus Biopharma Corporation (Nasdaq: ABUS) (“Arbutus” or the “Company”), a clinical-stage biopharmaceutical company leveraging its extensive virology expertise to develop a functional cure for people with chronic hepatitis B virus (cHBV) infection, today reports second quarter 2024 financial results and provides a corporate update.

“At the EASL Congress we reported impressive imdusiran data. I’m particularly excited that in the IM-PROVE I clinical trial we saw undetectable HBsAg in 67% of those patients with baseline HBsAg less than 1000 IU/mL who were treated with 48 weeks of imdusiran and 24 weeks of IFN,” said Michael J. McElhaugh, Interim President and Chief Executive Officer of Arbutus Biopharma. “In addition, these patients stopped all therapy and in early follow-up have maintained undetectable HBsAg and HBV DNA, a precursor to a functional cure. With these encouraging data, we continue to be optimistic about imdusiran as a potential cornerstone therapeutic in a treatment regimen to functionally cure cHBV.”

Mr. McElhaugh continued, “We intend to focus our existing resources on conducting a Phase 2b clinical trial with imdusiran, assuming continued positive data. This has the potential to create a true inflection point for both Arbutus and HBV patients. To ensure we have the resources to conduct such a program, we have made the difficult decision to discontinue our HBV research efforts and reduce our headcount leading to a projected cash runway into the fourth quarter of 2026. I want to express my sincere gratitude to those impacted by the workforce reduction for their invaluable contributions to our mission and their dedication to helping HBV patients.”

Clinical Development Update

Imdusiran (AB-729, RNAi Therapeutic)

AB-101 (Oral PD-L1 Inhibitor)

Corporate Updates

LNP Litigation Update

Arbutus continues to protect and defend its intellectual property, which is the subject of the on-going lawsuits against Moderna and Pfizer/BioNTech. The Company is seeking fair compensation for Moderna’s and Pfizer/BioNTech’s use of its patented LNP technology that was developed with great effort and at a great expense, without which Moderna’s and Pfizer/BioNTech’s COVID-19 vaccines would not have been successful.

Financial Results

Cash, Cash Equivalents and Investments

As of June 30, 2024, the Company had cash, cash equivalents and investments in marketable securities of $148.5 million compared to $132.3 million as of December 31, 2023. During the six months ended June 30, 2024, the Company used $33.8 million in operating activities, which was offset by $44.1 million of net proceeds from the issuance of common shares under its “at-the-market” offering program (ATM Program). The Company expects its 2024 cash burn to range from $63 million to $67 million. With the organizational changes announced today, the Company believes its cash, cash equivalents and investments in marketable securities will be sufficient to fund its operations into the fourth quarter of 2026.

Revenue

Total revenue was $1.7 million for the three months ended June 30, 2024 compared to $4.7 million for the same period in 2023. The decrease of $3.0 million was due primarily to: i) a decrease in license revenue recognized under our licensing agreement with Qilu Pharmaceutical; and ii) a decrease in license royalty revenue from Alnylam due to lower sales of ONPATTRO in 2024 compared to 2023.

Operating Expenses

Research and development expenses were $15.6 million for the three months ended June 30, 2024 compared to $17.7 million for the same period in 2023. The decrease of $2.1 million was due primarily to the discontinuation of the Company’s coronavirus and AB-161 programs in September 2023 as part of its efforts to focus on its lead HBV product candidates, partially offset by an increase in clinical expenses for the Company’s AB-101 Phase 1a/1b clinical trial and its multiple imdusiran Phase 2a clinical trials. General and administrative expenses were $7.5 million for the three months ended June 30, 2024 compared to $6.0 million for the same period in 2023. The increase of $1.5 million was due primarily to higher litigation costs, partially offset by a decrease in compensation-related expenses.

Net Loss

For the three months ended June 30, 2024, the Company’s net loss was $19.8 million, or a loss of $0.11 per basic and diluted common share, as compared to a net loss of $17.1 million, or a loss of $0.10 per basic and diluted common share, for the three months ended June 30, 2023.

Outstanding Shares

As of June 30, 2024, the Company had approximately 188.7 million common shares issued and outstanding. In addition, the Company had approximately 20.5 million stock options and unvested restricted stock units outstanding as of June 30, 2024. Roivant Sciences Ltd. owned approximately 21% of our outstanding common shares as of June 30, 2024.

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF LOSS (in thousands, except share and per share data) | |||||||||||||||

| Three Months Ended March 31, | Six Months Ended June 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenue | |||||||||||||||

| Collaborations and licenses | $ | 1,155 | $ | 3,885 | $ | 2,094 | $ | 9,394 | |||||||

| Non-cash royalty revenue | 571 | 766 | 1,164 | 1,944 | |||||||||||

| Total revenue | 1,726 | 4,651 | 3,258 | 11,338 | |||||||||||

| Operating expenses | |||||||||||||||

| Research and development | 15,551 | 17,692 | 30,954 | 35,967 | |||||||||||

| General and administrative | 7,547 | 5,980 | 12,859 | 11,532 | |||||||||||

| Change in fair value of contingent consideration | 211 | (636 | ) | 391 | (363 | ) | |||||||||

| Total operating expenses | 23,309 | 23,036 | 44,204 | 47,136 | |||||||||||

| Loss from operations | (21,583 | ) | (18,385 | ) | (40,946 | ) | (35,798 | ) | |||||||

| Other income | |||||||||||||||

| Interest income | 1,829 | 1,461 | 3,374 | 2,729 | |||||||||||

| Interest expense | (34 | ) | (171 | ) | (78 | ) | (369 | ) | |||||||

| Foreign exchange gain | (8 | ) | 1 | (21 | ) | 5 | |||||||||

| Total other income | 1,787 | 1,291 | 3,275 | 2,365 | |||||||||||

| Net loss | $ | (19,796 | ) | $ | (17,094 | ) | $ | (37,671 | ) | $ | (33,433 | ) | |||

| Loss per share | |||||||||||||||

| Basic and diluted | $ | (0.11 | ) | $ | (0.10 | ) | $ | (0.21 | ) | $ | (0.20 | ) | |||

| Weighted average number of common shares | |||||||||||||||

| Basic and diluted | 188,041,489 | 166,063,284 | 181,842,519 | 163,855,661 | |||||||||||

| Comprehensive loss | |||||||||||||||

| Unrealized gain on available-for-sale securities | 63 | 166 | 113 | 1,020 | |||||||||||

| Comprehensive loss | $ | (19,733 | ) | $ | (16,928 | ) | $ | (37,558 | ) | $ | (32,413 | ) | |||

| UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) | |||||||

| June 30, 2024 | December 31, 2023 |

||||||

| Cash, cash equivalents and marketable securities, current | $ | 141,986 | $ | 126,003 | |||

| Accounts receivable and other current assets | 6,234 | 6,024 | |||||

| Total current assets | 148,220 | 132,027 | |||||

| Property and equipment, net of accumulated depreciation | 4,059 | 4,674 | |||||

| Investments in marketable securities, non-current | 6,527 | 6,284 | |||||

| Right of use asset | 1,237 | 1,416 | |||||

| Total assets | $ | 160,043 | $ | 144,401 | |||

| Accounts payable and accrued liabilities | $ | 11,108 | $ | 10,271 | |||

| Deferred license revenue, current | 11,034 | 11,791 | |||||

| Lease liability, current | 453 | 425 | |||||

| Total current liabilities | 22,595 | 22,487 | |||||

| Liability related to sale of future royalties | 5,859 | 6,953 | |||||

| Contingent consideration | 7,991 | 7,600 | |||||

| Lease liability, non-current | 1,144 | 1,343 | |||||

| Total stockholders’ equity | 122,454 | 106,018 | |||||

| Total liabilities and stockholders’ equity | $ | 160,043 | $ | 144,401 | |||

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) | |||||||

| Six Months Ended June 30, | |||||||

| 2024 |

2023 |

||||||

| Net loss | $ | (37,671 | ) | $ | (33,433 | ) | |

| Non-cash items | 3,973 | 2,911 | |||||

| Change in deferred license revenue | (757 | ) | (7,128 | ) | |||

| Other changes in working capital | 656 | (9,210 | ) | ||||

| Net cash used in operating activities | (33,799 | ) | (46,860 | ) | |||

| Net cash provided by investing activities | 21,523 | 18,119 | |||||

| Issuance of common shares pursuant to the Open Market Sale Agreement | 44,124 | 24,604 | |||||

| Cash provided by other financing activities | 4,676 | 555 | |||||

| Net cash provided by financing activities | 48,800 | 25,159 | |||||

| Effect of foreign exchange rate changes on cash and cash equivalents | (21 | ) | 3 | ||||

| Increase/(decrease) in cash and cash equivalents | 36,503 | (3,579 | ) | ||||

| Cash and cash equivalents, beginning of period | 26,285 | 30,776 | |||||

| Cash and cash equivalents, end of period | 62,788 | 27,197 | |||||

| Investments in marketable securities | 85,725 | 136,344 | |||||

| Cash, cash equivalents and marketable securities, end of period | $ | 148,513 | $ | 163,541 | |||

Conference Call and Webcast Today

Arbutus will hold a conference call and webcast today, Thursday, August 1, 2024, at 8:45 AM Eastern Time to provide a corporate update. To dial-in for the conference call by phone, please register using the following link: Registration Link. A live webcast of the conference call can be accessed through the Investors section of Arbutus' website at www.arbutusbio.com.

An archived webcast will be available on the Arbutus website after the event.

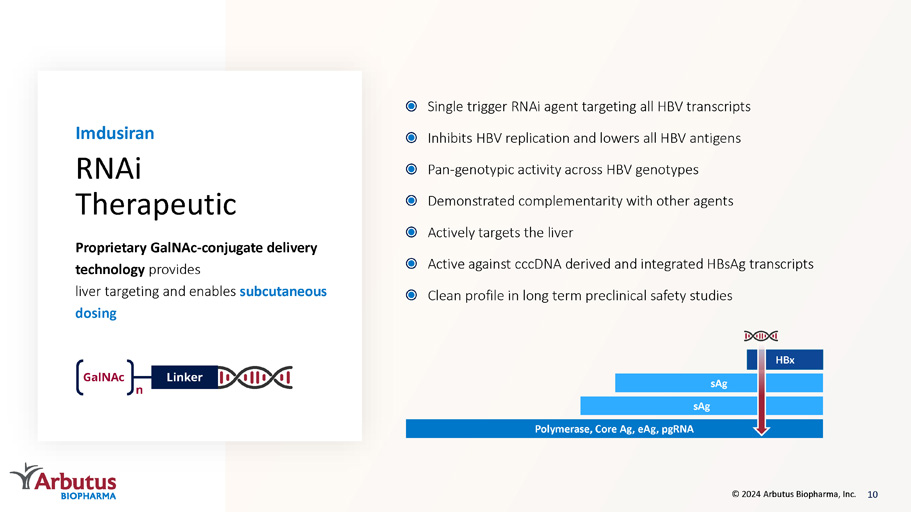

About Imdusiran (AB-729)

Imdusiran is an RNA interference (RNAi) therapeutic specifically designed to reduce all HBV viral proteins and antigens including hepatitis B surface antigen, which is thought to be a key prerequisite to enable reawakening of a patient’s immune system to respond to the virus. Imdusiran targets hepatocytes using Arbutus’ novel covalently conjugated N-Acetylgalactosamine (GalNAc) delivery technology enabling subcutaneous delivery. Clinical data generated thus far has shown single and multiple doses of imdusiran to be generally safe and well-tolerated, while also providing meaningful reductions in hepatitis B surface antigen and hepatitis B DNA. Imdusiran is currently in multiple Phase 2a clinical trials.

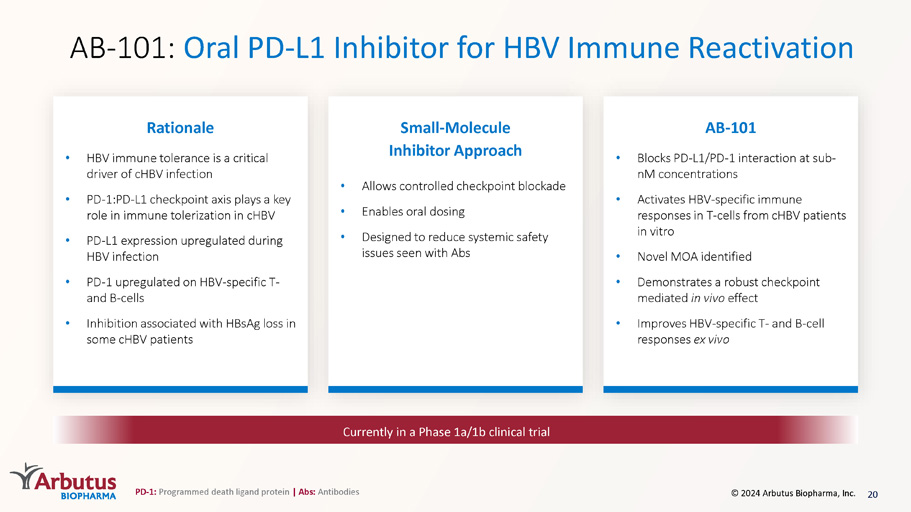

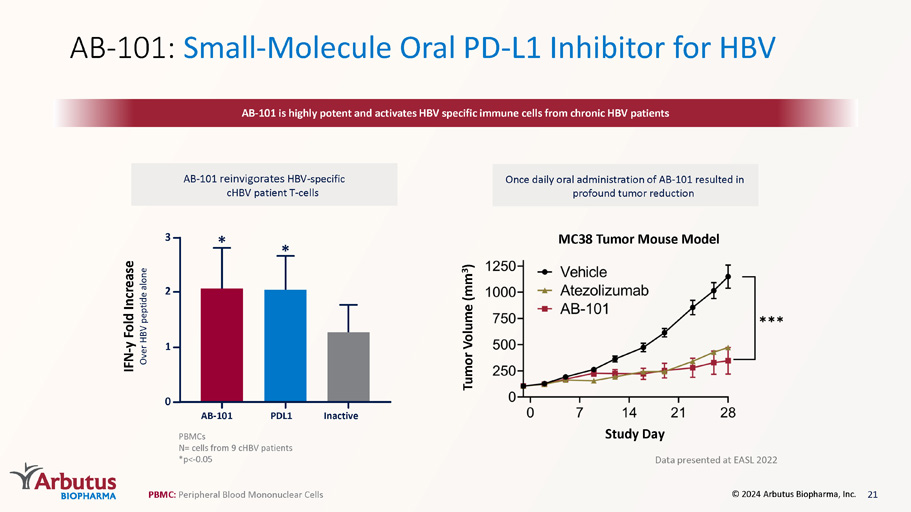

About AB-101

AB-101 is our oral PD-L1 inhibitor candidate that we believe will allow for controlled checkpoint blockade while minimizing the systemic safety issues typically seen with checkpoint antibody therapies. Immune checkpoints such as PD-1/PD-L1 play an important role in the induction and maintenance of immune tolerance and in T-cell activation. Preclinical data generated thus far indicates that AB-101 mediates re-activation of exhausted HBV-specific T-cells from cHBV patients. We believe AB-101, when used in combination with other approved and investigational agents, could potentially lead to a functional cure in patients chronically infected with HBV. AB-101 is currently being evaluated in a Phase 1a/1b clinical trial.

About HBV

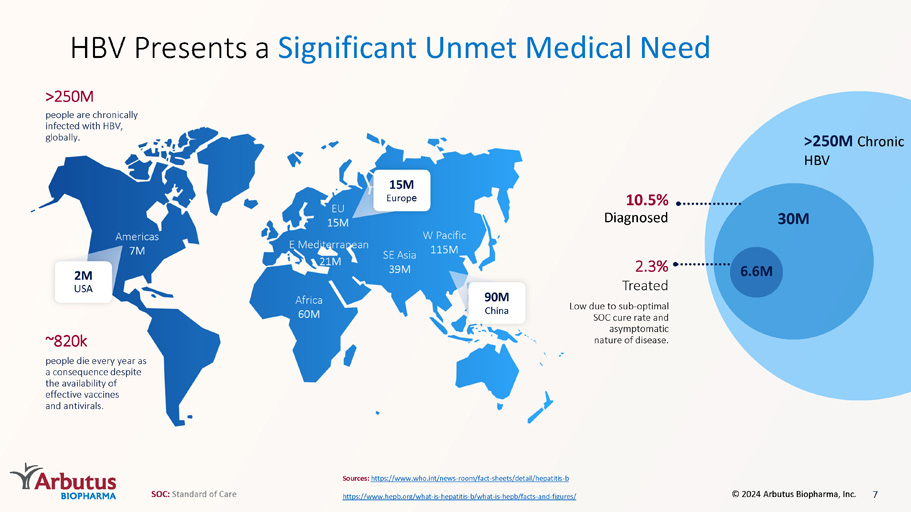

Hepatitis B is a potentially life-threatening liver infection caused by the hepatitis B virus (HBV). HBV can cause chronic infection which leads to a higher risk of death from cirrhosis and liver cancer. Chronic HBV infection represents a significant unmet medical need. The World Health Organization estimates that over 250 million people worldwide suffer from chronic HBV infection, while other estimates indicate that approximately 2.4 million people in the United States suffer from chronic HBV infection. Approximately 820,000 people die every year from complications related to chronic HBV infection despite the availability of effective vaccines and current treatment options.

About Arbutus

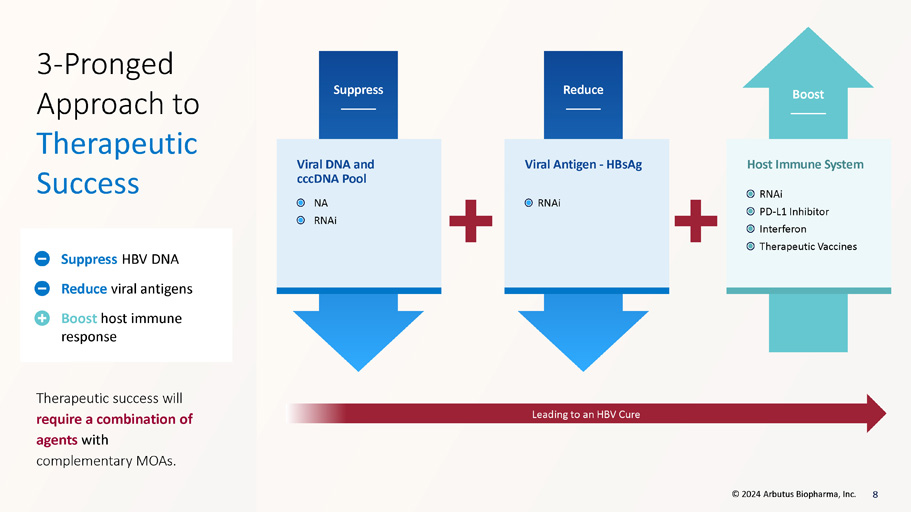

Arbutus Biopharma Corporation (Nasdaq: ABUS) is a clinical-stage biopharmaceutical company leveraging its extensive virology expertise to develop novel therapeutics with distinct mechanisms of action, which can potentially be combined to provide a functional cure for patients with chronic hepatitis B virus (cHBV). We believe the key to success in developing a functional cure involves suppressing HBV DNA, reducing surface antigen, and boosting HBV-specific immune responses. Our pipeline of internally developed, proprietary compounds includes an RNAi therapeutic, imdusiran (AB-729), and an oral PD-L1 inhibitor, AB-101. Imdusiran has generated meaningful clinical data demonstrating an impact on both surface antigen reduction and reawakening of the HBV-specific immune response. Imdusiran is currently in two Phase 2a combination clinical trials. AB-101 is currently being evaluated in a Phase 1a/1b clinical trial. For more information, visit www.arbutusbio.com.

Forward-Looking Statements and Information

This press release contains forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and forward-looking information within the meaning of Canadian securities laws (collectively, forward-looking statements). Forward-looking statements in this press release include statements about our future development plans for our product candidates; the expected cost, timing and results of our clinical development plans and clinical trials with respect to our product candidates; our expectations with respect to the release of data from our clinical trials and the expected timing thereof; our expectations and goals for our collaborations with third parties and any potential benefits related thereto; our expectations regarding our organizational changes; the potential for our product candidates to achieve success in clinical trials; our expectations regarding our pending litigation matters; and our expected financial condition, including our anticipated net cash burn, the anticipated duration of cash runways and timing regarding needs for additional capital.

With respect to the forward-looking statements contained in this press release, Arbutus has made numerous assumptions regarding, among other things: the effectiveness and timeliness of preclinical studies and clinical trials, and the usefulness of the data; the timeliness of regulatory approvals; the continued demand for Arbutus’ assets; and the stability of economic and market conditions. While Arbutus considers these assumptions to be reasonable, these assumptions are inherently subject to significant business, economic, competitive, market and social uncertainties and contingencies, including uncertainties and contingencies related to patent litigation matters.

Additionally, there are known and unknown risk factors which could cause Arbutus’ actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements contained herein. Known risk factors include, among others: anticipated pre-clinical studies and clinical trials may be more costly or take longer to complete than anticipated, and may never be initiated or completed, or may not generate results that warrant future development of the tested product candidate; Arbutus may elect to change its strategy regarding its product candidates and clinical development activities; Arbutus may not receive the necessary regulatory approvals for the clinical development of Arbutus’ products; economic and market conditions may worsen; Arbutus may not realize the anticipated benefits from the organizational changes; Arbutus may incur additional unexpected expenses in connection with the organizational changes; Arbutus may experience additional employee turnover as a result of the organizational changes; uncertainties associated with litigation generally and patent litigation specifically; and Arbutus and its collaborators may never realize the expected benefits of the collaborations; market shifts may require a change in strategic focus.

A more complete discussion of the risks and uncertainties facing Arbutus appears in Arbutus’ Annual Report on Form 10-K, Arbutus’ Quarterly Reports on Form 10-Q and Arbutus’ continuous and periodic disclosure filings, which are available at www.sedar.com and at www.sec.gov. All forward-looking statements herein are qualified in their entirety by this cautionary statement, and Arbutus disclaims any obligation to revise or update any such forward-looking statements or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments, except as required by law.

Contact Information

Investors and Media

Lisa M. Caperelli

Vice President, Investor Relations

Phone: 215-206-1822

Email: lcaperelli@arbutusbio.com

Exhibit 99.2

NASDAQ: ABUS www.arbutusbio.com August 1, 2024 Corporate Presentation © 2024 Arbutus Biopharma, Inc.

Forward - Looking Statements This presentation contains forward - looking statements within the meaning of the U . S . Private Securities Litigation Reform Act of 1995 and Canadian securities laws . All statements that are not historical facts are hereby identified as forward - looking statements for this purpose and include, among others, statements relating to : the potential market opportunity for HBV ; Arbutus’ ability to meet a significant unmet medical need ; the sufficiency of Arbutus’ cash and cash equivalents for the anticipated durations ; the expected cost, timing and results of Arbutus’ clinical development plans and clinical trials, including its clinical collaborations with third parties ; the potential for Arbutus’ product candidates to achieve their desired or anticipated outcomes ; Arbutus’ expectations regarding the timing and clinical development of Arbutus’ product candidates, including its articulated clinical objectives ; the timeline to a combination cure for HBV ; Arbutus’ expectations regarding its technology licensed to third parties ; the expected timing and payments associated with strategic and/or licensing agreements ; the patent infringement lawsuits ; and other statements relating to Arbutus’ future operations, future financial performance, future financial condition, prospects or other future events . With respect to the forward - looking statements contained in this presentation, Arbutus has made numerous assumptions regarding, among other things : the timely receipt of expected payments ; the effectiveness and timeliness of pre - clinical studies and clinical trials, and the usefulness of the data ; the timeliness of regulatory approvals ; the continued demand for Arbutus’ assets ; and the stability of economic and market conditions . While Arbutus considers these assumptions to be reasonable, these assumptions are inherently subject to significant business, economic, competitive, market and social uncertainties, and contingencies including uncertainties and contingencies related to patent litigation matters . Forward - looking statements herein involve known and unknown risks, uncertainties and other factors that may cause the actual results, events or developments to be materially different from any future results, events or developments expressed or implied by such forward - looking statements . Such factors include, among others : anticipated pre - clinical and clinical trials may be more costly or take longer to complete than anticipated, and may never be initiated or completed, or may not generate results that warrant future development of the tested drug candidate ; changes in Arbutus’ strategy regarding its product candidates and clinical development activities ; Arbutus may not receive the necessary regulatory approvals for the clinical development of Arbutus' products ; economic and market conditions may worsen ; uncertainties associated with litigation generally and patent litigation specifically ; market shifts may require a change in strategic focus ; and the parties may never realize the expected benefits of the collaborations . A more complete discussion of the risks and uncertainties facing Arbutus appears in Arbutus' Annual Report on Form 10 - K, Quarterly Report on Form 10 - Q and Arbutus' periodic disclosure filings, which are available at www . sec . gov and at www . sedar . com . All forward - looking statements herein are qualified in their entirety by this cautionary statement, and Arbutus disclaims any obligation to revise or update any such forward - looking statements or to publicly announce the result of any revisions to any of the forward - looking statements contained herein to reflect future results, events or developments, except as required by law . 2 © 2024 Arbutus Biopharma, Inc.

Our Strategy for Value Creation Leverage the proven track record of success established with our team's expertise in understanding and treating viral infections by discovering and developing a differentiated pipeline of therapies targeting chronic HBV. Develop a combination therapy that includes antivirals and immunologics to provide a finite duration treatment for people with cHBV that results ≥20% functional cure rate. HBV: Hepatitis B Virus | cHBV: chronic HB V 3 © 2024 Arbutus Biopharma, Inc.

Investment Highlights Strong financial position Indications with significant unmet medical need & large market opportunities Patented LNP technology Portfolio of internally discovered assets with distinct MOAs Lead HBV compound – imdusiran (AB - 729) RNAi therapeutic in multiple Phase 2a combination clinical trials Team with virology expertise and proven track record Focused on developing a functional cure for HBV Cash runway into Q4 2026 Data shows imdusiran is generally safe and well - tolerated and has shown meaningful suppression of HBsAg while on - or off - treatment RNAi therapeutic PD - L1 inhibitor Receiving licensing royalties arising from Alnylam’s Onpattro ® and seeking damages from patent litigation suits filed against Moderna & Pfizer/BioNTech for COVID - 19 vaccine sales Discovered, developed & commercialized multiple drugs MOA: Mechanism of Action | PD - L1: Programmed death - ligand 1 | HBsAg: Hepatitis B surface antigen 4 © 2024 Arbutus Biopharma, Inc.

Pipeline AB - 101 cHBV NA: Nucleoside Analogue 5 Imdusiran (AB - 729) cHBV RNAi Therapeutic PD - L1 Inhibitor AB - 101 - 001 single - / multiple - ascending dose © 2024 Arbutus Biopharma, Inc. Phase 1 Phase 2 Phase 3 Marketed IM - PROVE I Combo trial (imdusiran + Peg - IFN α - 2a + NA) IM - PROVE II Combo trial (imdusiran + vaccine + NA +/ - nivolumab)

HBV Overview Life - threatening liver infection caused by hepatitis B virus (HBV) Transmitted through body fluids and from mother to child Long - term chronic infection ( cHBV ) leads to higher risk of cirrhosis and/or liver cancer Cause & Symptoms Diagnosis HBsAg detection Additional biomarkers necessary to determine stage of disease Treatments NA therapy – lifelong daily therapy, aimed at reducing HBV DNA and risk of cirrhosis and/or HCC Peg - IFN α – administered weekly; poorly tolerated over 48 weeks of treatment <5% of patients achieve functional cure Rationale Need for finite and more efficacious HBV treatments that further improve long - term outcomes and increase functional cure rate Combination therapy with different MOAs will be required to reduce HBsAg, suppress HBV DNA, and boost immune system Sources for all data on slide: 1 Hepatitis B Fact Sheet, WHO https://www.who.int/news - room/fact - sheets/detail/hepatitis - b ; Hep B Foundation link https://www.hepb.org/what - is - hepatitis - b/what - is - hepb/facts - and - figures/ ; Kowdley et al. Hepatology (2012) Prevalence of Chronic Hepatitis B Among Foreign - Born Persons Living in the US by Country of Origin 2 Pegasys , PEG - Intron, Baraclude and Viread Package Inserts HBsAg : HBV Surface Antigen | HCC: Hepatocellular carcinoma 6 © 2024 Arbutus Biopharma, Inc.

Africa 60M E Mediterranean 21M SE Asia 39M W Pacific 115M EU 15M Americas 7M ~820k people die every year as a consequence despite the availability of effective vaccines and antivirals. people are chronically infected with HBV, globally. >250M >250M Chronic HBV Sources: https://www.who.int/news - room/fact - sheets/detail/hepatitis - b https://www.hepb.org/what - is - hepatitis - b/what - is - hepb/facts - and - figures/ HBV Presents a Significant Unmet Medical Need 30M 6.6M 2.3% Treated Low due to sub - optimal SOC cure rate and asymptomatic nature of disease. 10.5% Diagnosed 2M USA 15M Europ e 90M China 7 SOC: Standard of Care © 2024 Arbutus Biopharma, Inc.

Suppress Reduce Boost Viral DNA and cccDNA Pool Viral Antigen - HBsAg Host Immune System Leading to an HBV Cure 3 - Pronged Approach to Therapeutic Success Therapeutic success will require a combination of agents with complementary MOAs. Suppress HBV DNA Reduce viral antigens Boost host immune response 8 NA RNAi RNAi RNAi PD - L1 Inhibitor Interferon Therapeutic Vaccines © 2024 Arbutus Biopharma, Inc.

RNAi Therapeutic 9 © 2024 Arbutus Biopharma, Inc.

Proprietary GalNAc - conjugate delivery technology provides liver targeting and enables subcutaneous dosing Single trigger RNAi agent targeting all HBV transcripts Inhibits HBV replication and lowers all HBV antigens Pan - genotypic activity across HBV genotypes Demonstrated complementarity with other agents Actively targets the liver Active against cccDNA derived and integrated HBsAg transcripts Clean profile in long term preclinical safety studies RNAi Therapeutic Imdusiran GalNAc n Linker Polymerase, Core Ag, eAg , pgRNA sAg sAg HBx 10 © 2024 Arbutus Biopharma, Inc.

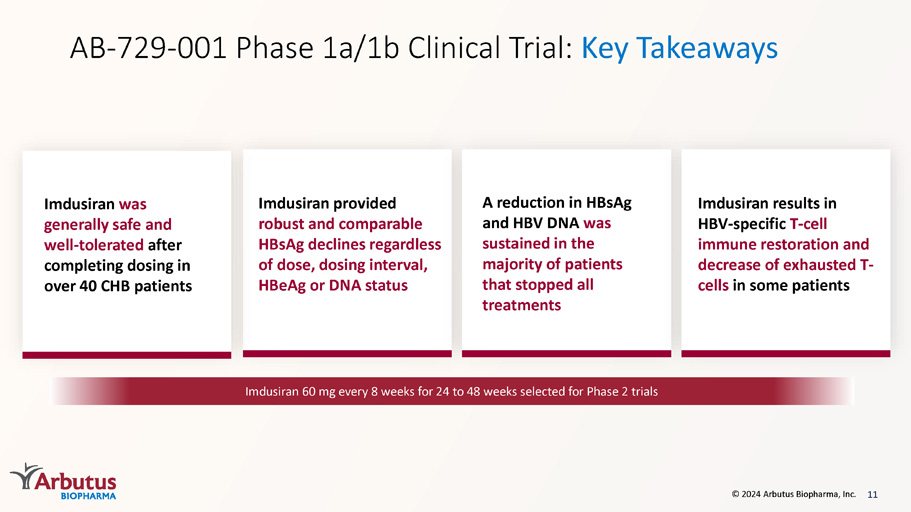

AB - 729 - 001 Phase 1a/1b Clinical Trial: Key Takeaways Imdusiran provided robust and comparable HBsAg declines regardless of dose, dosing interval, HBeAg or DNA status A reduction in HBsAg and HBV DNA was sustained in the majority of patients that stopped all treatments Imdusiran was generally safe and well - tolerated after completing dosing in over 40 CHB patients Imdusiran results in HBV - specific T - cell immune restoration and decrease of exhausted T - cells in some patients 11 © 2024 Arbutus Biopharma, Inc.

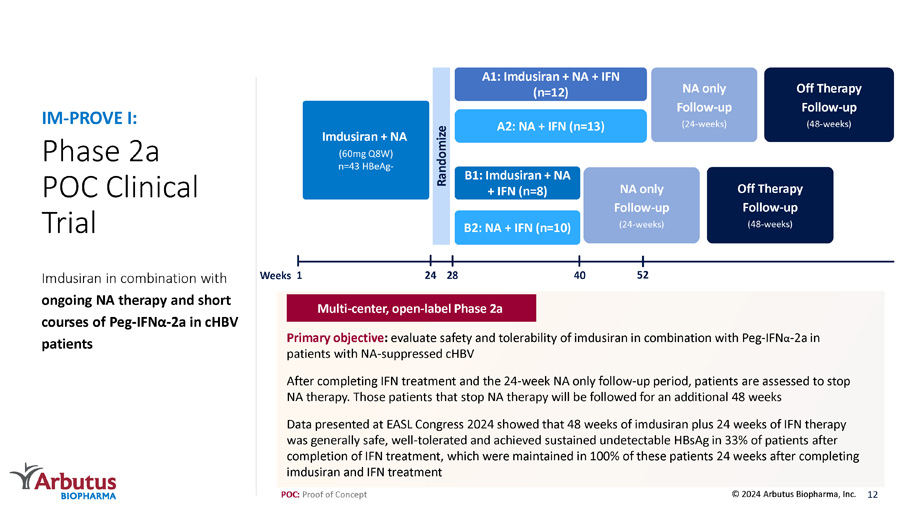

Imdusiran 60 mg every 8 weeks for 24 to 48 weeks selected for Phase 2 trials Phase 2a POC Clinical Trial Imdusiran in combination with ongoing NA therapy and short courses of Peg - IFN α - 2 a in cHBV patients IM - PROVE I: POC: Proof of Concept Primary objective : evaluate safety and tolerability of imdusiran in combination with Peg - IFN α - 2a in patients with NA - suppressed cHBV After completing IFN treatment and the 24 - week NA only follow - up period, patients are assessed to stop NA therapy. Those patients that stop NA therapy will be followed for an additional 48 weeks Data presented at EASL Congress 2024 showed that 48 weeks of imdusiran plus 24 weeks of IFN therapy was generally safe, well - tolerated and achieved sustained undetectable HBsAg in 33% of patients after completion of IFN treatment, which were maintained in 100% of these patients 24 weeks after completing imdusiran and IFN treatment Multi - center, open - label Phase 2a 12 © 2024 Arbutus Biopharma, Inc. Weeks NA only Follow - up (24 - weeks) A1: Imdusiran + NA + IFN (n=12) A2: NA + IFN (n=13) B1: Imdusiran + NA + IFN (n=8) B2: NA + IFN (n=10) Imdusiran + NA (60mg Q8W) n=43 HBeAg - Randomize NA only Follow - up (24 - weeks) 1 52 28 24 40 Off Therapy Follow - up (48 - weeks) Off Therapy Follow - up (48 - weeks)

IM - PROVE I: Imdusiran with Short Courses of IFN Leads to Undetectable HBsAg and Sustained HBsAg Loss Cohort A2: IDR x 4 + NA + IFN x 24W (N = 13) Cohort A1: IDR x 6 + NA + IFN x 24W (N = 12) Achieved HBsAg ≤ LLOQ (0.05 IU/mL) 3/13 (23%) 6/12 (50%) Anytime during treatment 3/13 (23%) 4/12 (33.3%) EOT (W52) 7/25 (28%) 2/3 4/4 Next Assay negative 2/13 (15.4%) 4/12 (33.3%) 24 weeks post - EOT (NA therapy only) 6/25 (24%) 2/2 2*/4 (*1 subject pending testing) Next Assay negative 3/13 (23%) 9/12 (75%) Discontinued NA therapy W: week; EOT: end - of - treatment; Next Assay LLOD=0.005 IU/mL Number of Patients with Undetectable HBsAg at Key Timepoints Data presented at EASL 2024 Key Findings: 33% of patients in Cohort A1 reached and maintained undetectable HBsAg for 24 weeks after completing imdusiran and IFN treatment Undetectable HBsAg was achieved in 67% of those patients in Cohort A1 with HBsAg less than 1000 IU/mL at baseline Patients with sustained HBsAg loss had corresponding high anti - HBs levels (43.8 to >1000 mIU/mL) Imdusiran and 24 weeks of IFN was generally safe and well - tolerated – No related - SAEs and no AEs leading to discontinuation All 6 undetectable patients (plus an additional 15 from all 4 Cohorts, n=21 total) discontinued NA therapy after the 24 weeks post - EOT visit – 2/6 undetectable patients have reached 12 weeks off all therapy remain undetectable – 1 patient in Cohort B2 achieved functional cure during the NA discontinuation period 13 Functional Cure: undetectable HBV DNA and HBsAg with or without anti - HBs that is maintained for six months after discontinuing all therapy. © 2024 Arbutus Biopharma, Inc.

IM - PROVE I: Imdusiran with 24 Weeks of IFN Reduces HBsAg Levels to Undetectable in 6 patients Data presented at EASL 2024 14 © 2024 Arbutus Biopharma, Inc.

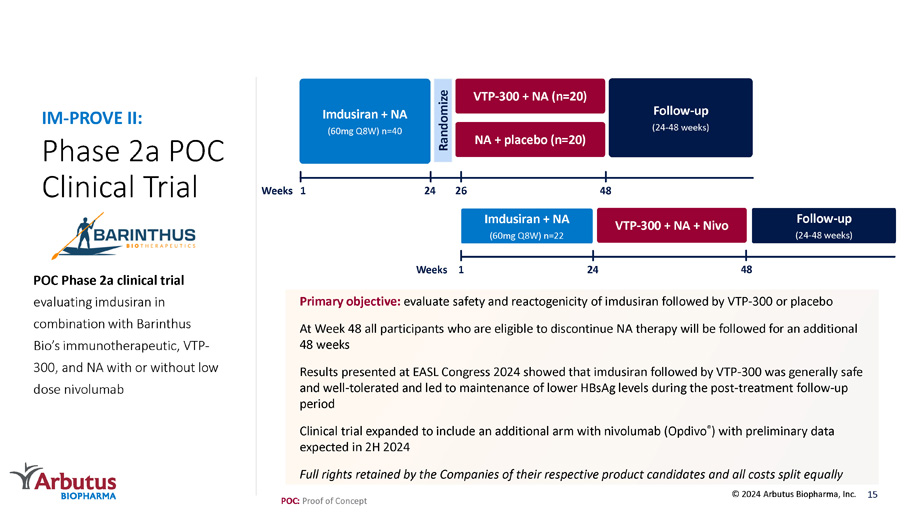

Phase 2a POC Clinical Trial POC Phase 2a clinical trial evaluating imdusiran in combination with Barinthus Bio’s immunotherapeutic, VTP - 300, and NA with or without low dose nivolumab IM - PROVE II: Primary objective: evaluate safety and reactogenicity of imdusiran followed by VTP - 300 or placebo At Week 48 all participants who are eligible to discontinue NA therapy will be followed for an additional 48 weeks Results presented at EASL Congress 2024 showed that imdusiran followed by VTP - 300 was generally safe and well - tolerated and led to maintenance of lower HBsAg levels during the post - treatment follow - up period Clinical trial expanded to include an additional arm with nivolumab ( Opdivo ® ) with preliminary data expected in 2H 2024 Full rights retained by the Companies of their respective product candidates and all costs split equally 15 Follow - up (24 - 48 weeks) VTP - 300 + NA (n=20) NA + placebo (n=20) 1 Imdusiran + NA (60mg Q8W) n=40 Randomize Weeks Imdusiran + NA (60mg Q8W) n=22 24 VTP - 300 + NA + Nivo 1 48 26 24 Weeks 48 Follow - up (24 - 48 weeks) © 2024 Arbutus Biopharma, Inc.

POC: Proof of Concept IM - PROVE II: Imdusiran and VTP - 300 Achieve Statistical Significance in Lowering HBsAg Levels 16 © 2024 Arbutus Biopharma, Inc.

Imdusiran led to declines of - 1.8 log10 by Week 26, 95% of subjects had HBsAg <100 at time of VTP - 300 or placebo dosing More subjects maintained HBsAg thresholds of <100 IU/mL and <10 IU/mL when administered VTP - 300 vs placebo At 24 weeks post - EOT (Week 72, N=11), there was a significant difference in HBsAg levels between groups, which may reflect the d elayed effect of VTP - 300 on HBsAg levels observed in other trials Data presented at EASL 2024 Subject number Cohort A: VTP - 300 (N=20) Cohort B: placebo (N=20) N=19* N=19* N=5 N=6 N=19 BSL=baseline; WK=week; EOT=end of treatment; * 2 subjects did not reach timepoint by datacut ; # N=2 and † N=1 subject censored after Week 60 visit due to NA restart HBsAg Thresholds Achieved by Visit EOT EOT 1 1 † # * p < 0.05 Mean [SE] Log 10 HBsAg Level by Visit Log 10 HBsAg (IU/mL) * by ANCOVA EOT † NA d/c assessment imdusiran doses VTP - 300 doses # N=2 and † N=1 subject censored after Week 60 visit due to NA restart # IM - PROVE II: More patients Treated with Imdusiran and VTP - 300 stopped NA treatment 17 © 2024 Arbutus Biopharma, Inc. 84% of patients in Group A/VTP - 300 met NA discontinuation criteria and stopped treatment after W48 • More Group A/VTP - 300 subjects (50%) have maintained HBV DNA <LLOQ off NA therapy than placebo subjects (37.5%) • Group A/VTP - 300 subjects have maintained lower HBsAg levels after NA discontinuation – 1 Group A/VTP - 300 subject reached HBsAg <LLOQ at Week 72, another has >1.5 log 10 HBsAg decline between Week 60 and 68 Data presented at EASL 2024 Imdusiran and VTP - 300 was generally safe and well - tolerated when administered sequentially • No SAEs, Grade 3 or 4 adverse events (AEs) or treatment discontinuations due to AEs • Most common treatment - related AEs in 2 or more patients (all Grade 1 or 2): – Imdusiran: injection site - related (bruising and/or swelling in 2 subjects), ALT increased in 2 subjects – VTP - 300: injection site - related (redness, pain and/or injection reaction in 2 subjects) ‡ only subjects who remained off NA therapy included Group A ‡ (N=14) Group B ‡ (N=8) 14% 50% 7% 29% 50% 25% 25% 50% 50% 63% 37% 36% 36% 28% 37% 50% 13% Time off of NA therapy HBV DNA <LLOQ most recent visit HBsAg level (IU/mL) at most recent visit Strategic Collaboration Exclusive Licensing* and Strategic Partnership Develop, manufacture and commercialize imdusiran in mainland China, Hong Kong, Macau and Taiwan Imdusiran Upfront payment (received in 2022) $40M Equity investment (received in 2022) $15M Commercialization and milestone payments Up to $245M Tiered royalties on annual sales Double - digit up to low twenties % *ABUS retains the non - exclusive right to develop and manufacture in the Qilu territory for exploiting AB - 729 in the rest of the world Deal economics for Arbutus: Qilu Pharmaceutical: One of the leading pharmaceutical companies in China, provides development, manufacturing, and commercialization expertise to this partnership China 18 © 2024 Arbutus Biopharma, Inc.

Oral PD - L1 Inhibitor 19 © 2024 Arbutus Biopharma, Inc.

AB - 101: Oral PD - L1 Inhibitor for HBV Immune Reactivation PD - 1: Programmed death ligand protein | Abs: Antibodies Currently in a Phase 1a/1b clinical trial Rationale • HBV immune tolerance is a critical driver of cHBV infection • PD - 1:PD - L1 checkpoint axis plays a key role in immune tolerization in cHBV • PD - L1 expression upregulated during HBV infection • PD - 1 upregulated on HBV - specific T - and B - cells • Inhibition associated with HBsAg loss in some cHBV patients AB - 101 • Blocks PD - L1/PD - 1 interaction at sub - nM concentrations • Activates HBV - specific immune responses in T - cells from cHBV patients in vitro • Novel MOA identified • Demonstrates a robust checkpoint mediated in vivo effect • Improves HBV - specific T - and B - cell responses ex vivo Small - Molecule Inhibitor Approach • Allows controlled checkpoint blockade • Enables oral dosing • Designed to reduce systemic safety issues seen with Abs 20 © 2024 Arbutus Biopharma, Inc.

AB - 101: Small - Molecule Oral PD - L1 Inhibitor for HBV AB - 101 is highly potent and activates HBV specific immune cells from chronic HBV patients AB - 101 reinvigorates HBV - specific cHBV patient T - cells PBMCs N= cells from 9 cHBV patients *p< - 0.05 PBMC: P eripheral Blood Mononuclear Cells PDL1 * Inactive AB - 101 * 0 3 2 1 IFN - y Fold Increase Over HBV peptide alone 21 © 2024 Arbutus Biopharma, Inc.

Once daily oral administration of AB - 101 resulted in profound tumor reduction Study Day MC38 Tumor Mouse Model Tumor Volume (mm 3 ) Data presented at EASL 2022 22 © 2024 Arbutus Biopharma, Inc. Part 1: SAD (n=8/cohort – 6:2) 1C: Dose 3 1B: Dose 2 1A: Dose 1 Part 2: MAD (n=10/cohort – 8:2) 2A: Do se ≤ dose tested in Part 1; interval TBD 2B: Dose/interval TBD 3A: Dose ≤ dose tested in Part 2; interval TBD x 28d 3B: Dose/interval TBD x 28d 3C: Dose/interval TBD x 28d AB - 101 - 001: Phase 1a/1b Clinical Trial with AB - 101 Parts 1 & 2 – Healthy Subjects Part 3 – cHBV Patients (n=12/cohort – 10:2) Virally suppressed Additional optional dose panels may be used. Dosing initiated with preliminary data from MAD portion expected in 2H 2024 . * Preliminary data shows AB - 101 is well tolerated and binds to the receptor target. In the 25mg cohort, all 5 evaluable subjects showed evidence of receptor occupancy between 50 - 100%. 1D: Dose 4 * LNP Litigation: Update Moderna - Trial date April 21, 2025* • Markman Hearing occurred February 8, 2024 – judge heard arguments on claim construction.

– Court provided ruling on April 3 and agreed with Arbutus’s position on the majority of the claims • Next Steps – Expert reports / depositions 80% to Genevant Arbutus owns 16% of Genevant 20% to Arbutus Royalties/litigation related damages *Above referenced date is included in the 2/27/2024 Court's Scheduling Order Extension and is subject to change. Pfizer • Lawsuit ongoing • Date for claim construction hearing has not been set 23 © 2024 Arbutus Biopharma, Inc.

2024 Key Milestones *Consists of cash, cash equivalents and marketable securities 24 Anticipated Timing 2024 Milestone 1H IM - PROVE I Phase 2a (imdusiran + IFN): End - of - treatment data 1H IM - PROVE II Phase 2a (imdusiran + VTP - 300): End - of - treatment data 1H AB - 101 - 001: Preliminary data from healthy subject cohorts 2H AB - 729 - 202 Phase 2a (imdusiran + VTP - 300 + nivolumab): End - of - treatment data 2H AB - 101 - 001: Preliminary data from multiple - ascending dose healthy subject cohorts © 2024 Arbutus Biopharma, Inc. Cash balance * of $ 148.5M as of June 30, 2024, cash runway into Q4 2026; 2024 cash burn between $63M and $67M Thank You 25 © 2024 Arbutus Biopharma, Inc.