UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File No. 001-32500

TRX GOLD Corporation

(Translation of registrant’s name into English)

277 Lakeshore Road East, Suite 403

Oakville, Ontario Canada L6J 1H9

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under the cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒ TRX Gold Corp.

Explanatory Note

(the “Company”) is furnishing this Form 6-K to provide its financial information for the three and nine months ended May 31, 2024 and 2023, and to incorporate such financial information into the Company’s registration statements referenced below.

Exhibits 99.1 and 99.2 attached hereto are hereby incorporated by reference into the Company’s Registration Statements on Form F-3 (Registration Statement File number 333-255526) and on Form S-8 (Registration Statement File number 333-234078) to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed.

Exhibits

The following exhibits are filed as part of this Form 6-K.

| Exhibit No. | Document |

| 99.1 | Unaudited financial statements for the three and nine months ended May 31, 2024 and 2023 |

| 99.2 | Management’s Discussion & Analysis for the three and nine months ended May 31, 2024 |

| 101.INS | Inline XBRL Instance Document (the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document). |

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document |

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| 104. | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TRX Gold Corporation | ||

| (Registrant) | ||

| By: | /s/ Michael P. Leonard | |

| Michael P. Leonard, | ||

| Chief Financial Officer | ||

Date: July 15, 2024

Exhibit 99.1

TRX Gold Corporation TRX GOLD Corporation

Interim Condensed Consolidated

Financial Statements

(Unaudited)

For the three and nine months ended

May 31, 2024 and 2023

TRX Gold Corporation

Interim Condensed Consolidated Statements of Financial Position

(Unaudited)

(Expressed in Thousands of US Dollars)

| Note | May 31, 2024 | August 31, 2023 | ||||||||||

| Assets | ||||||||||||

| Current assets | ||||||||||||

| Cash | $ | 7,666 | $ | 7,629 | ||||||||

| Amounts receivable | 4 | 1,599 | 3,140 | |||||||||

| Prepayments and other assets | 5 | 1,008 | 1,463 | |||||||||

| Inventories | 6 | 6,502 | 4,961 | |||||||||

| Total current assets | 16,775 | 17,193 | ||||||||||

| Other long-term assets | 4 | 3,335 | 2,948 | |||||||||

| Mineral property, plant and equipment | 7 | 72,504 | 64,059 | |||||||||

| Total assets | $ | 92,614 | $ | 84,200 | ||||||||

| Liabilities | ||||||||||||

| Current liabilities | ||||||||||||

| Amounts payable and accrued liabilities | 15 | $ | 14,454 | $ | 11,571 | |||||||

| Income tax payable | 604 | 1,081 | ||||||||||

| Current portion of deferred revenue | 8 | 2,497 | 1,549 | |||||||||

| Current portion of lease liabilities | 47 | 65 | ||||||||||

| Derivative financial instrument liabilities | 9 | 4,221 | 3,544 | |||||||||

| Total current liabilities | 21,823 | 17,810 | ||||||||||

| Lease liabilities | 15 | 36 | ||||||||||

| Deferred revenue | 8 | - | 178 | |||||||||

| Deferred income tax liability | 10 | 7,314 | 4,287 | |||||||||

| Provision for reclamation | 913 | 833 | ||||||||||

| Total liabilities | 30,065 | 23,144 | ||||||||||

| Equity | ||||||||||||

| Share capital | 165,662 | 164,816 | ||||||||||

| Share-based payments reserve | 12 | 9,228 | 8,807 | |||||||||

| Warrants reserve | 13 | 1,700 | 1,700 | |||||||||

| Accumulated deficit | (123,948 | ) | (121,423 | ) | ||||||||

| Equity attributable to shareholders | 52,642 | 53,900 | ||||||||||

| Non-controlling interest | 14 | 9,907 | 7,156 | |||||||||

| Total equity | 62,549 | 61,056 | ||||||||||

| Total equity and liabilities | $ | 92,614 | $ | 84,200 | ||||||||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

TRX Gold Corporation

Interim Condensed Consolidated Statements of (Loss) Income and Comprehensive (Loss) Income

(Unaudited)

(Expressed in Thousands of US Dollars, except per share amounts)

| Three months ended May 31, |

Nine months ended May 31, |

|||||||||||||||||||

| Note | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||

| Revenue | 18 | $ | 10,148 | $ | 9,317 | $ | 27,536 | $ | 29,133 | |||||||||||

| Cost of sales | ||||||||||||||||||||

| Production costs | (4,484 | ) | (4,384 | ) | (12,673 | ) | (12,030 | ) | ||||||||||||

| Royalty | (777 | ) | (674 | ) | (2,075 | ) | (2,128 | ) | ||||||||||||

| Depreciation | (534 | ) | (376 | ) | (1,446 | ) | (863 | ) | ||||||||||||

| Total cost of sales | (5,795 | ) | (5,434 | ) | (16,194 | ) | (15,021 | ) | ||||||||||||

| Gross profit | 4,353 | 3,883 | 11,342 | 14,112 | ||||||||||||||||

| General and administrative expenses | 16 | (1,383 | ) | (1,634 | ) | (5,361 | ) | (5,506 | ) | |||||||||||

| Change in fair value of derivative financial instruments | 9 | (2,724 | ) | (730 | ) | (925 | ) | 1,670 | ||||||||||||

| Foreign exchange gains | 123 | 153 | 185 | 211 | ||||||||||||||||

| Interest and other expenses | (311 | ) | (327 | ) | (1,229 | ) | (1,368 | ) | ||||||||||||

| Income before tax | 58 | 1,345 | 4,012 | 9,119 | ||||||||||||||||

| Income tax expense | 10 | (1,714 | ) | (1,719 | ) | (3,786 | ) | (4,383 | ) | |||||||||||

| Net (loss) income and comprehensive (loss) income | $ | (1,656 | ) | $ | (374 | ) | $ | 226 | $ | 4,736 | ||||||||||

| Net (loss) income and comprehensive (loss) income attributable to: | ||||||||||||||||||||

| Shareholders | $ | (2,639 | ) | $ | (1,264 | ) | $ | (2,525 | ) | $ | 849 | |||||||||

| Non-controlling interest | 983 | 890 | 2,751 | 3,887 | ||||||||||||||||

| Net (loss) income and comprehensive (loss) income | $ | (1,656 | ) | $ | (374 | ) | $ | 226 | $ | 4,736 | ||||||||||

| (Loss) earnings per share attributable to shareholders: | ||||||||||||||||||||

| Basic and diluted (loss) earnings per share | 11 | $ | (0.01 | ) | $ | (0.00 | ) | $ | (0.01 | ) | $ | 0.00 | ||||||||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

TRX Gold Corporation

Interim Condensed Consolidated Statements of Changes in Equity

(Unaudited)

(Expressed in Thousands of US Dollars, except share amounts)

| Share Capital | Reserves | |||||||||||||||||||||||||||||||

| Number of Shares | Amount | Share-based payments | Warrants | Accumulated deficit | Shareholders' equity | Non-controlling interests | Total equity | |||||||||||||||||||||||||

| Balance at August 31, 2022 | 276,146,184 | $ | 163,946 | $ | 6,825 | $ | 1,700 | $ | (123,673 | ) | $ | 48,798 | $ | 2,361 | $ | 51,159 | ||||||||||||||||

| Shares issued for share-based payments | 810,469 | 509 | (514 | ) | - | - | (5 | ) | - | (5 | ) | |||||||||||||||||||||

| Share-based compensation expense (Note 12) | - | - | 2,138 | - | - | 2,138 | - | 2,138 | ||||||||||||||||||||||||

| Shares issued for cash, net of share issuance costs | 200,000 | 105 | - | - | - | 105 | - | 105 | ||||||||||||||||||||||||

| Shares issued for cashless exercise of options | 155,619 | 90 | (90 | ) | - | - | - | - | - | |||||||||||||||||||||||

| Witholding tax impact on restricted share units ("RSUs") | - | - | 87 | - | - | 87 | - | 87 | ||||||||||||||||||||||||

| Net income for the period | - | - | - | - | 849 | 849 | 3,887 | 4,736 | ||||||||||||||||||||||||

| Balance at May 31, 2023 | 277,312,272 | $ | 164,650 | $ | 8,446 | $ | 1,700 | $ | (122,824 | ) | $ | 51,972 | $ | 6,248 | $ | 58,220 | ||||||||||||||||

| Shares issued for share-based payments | 313,045 | 166 | (165 | ) | - | - | 1 | - | 1 | |||||||||||||||||||||||

| Share-based compensation expense | - | - | 559 | - | - | 559 | - | 559 | ||||||||||||||||||||||||

| Witholding tax impact on RSUs | - | - | (33 | ) | - | - | (33 | ) | - | (33 | ) | |||||||||||||||||||||

| Net income for the period | - | - | - | - | 1,401 | 1,401 | 908 | 2,309 | ||||||||||||||||||||||||

| Balance at August 31, 2023 | 277,625,317 | $ | 164,816 | $ | 8,807 | $ | 1,700 | $ | (121,423 | ) | $ | 53,900 | $ | 7,156 | $ | 61,056 | ||||||||||||||||

| Shares issued for share-based payments (Note 12) | 1,948,110 | 846 | (836 | ) | - | - | 10 | - | 10 | |||||||||||||||||||||||

| Share-based compensation expense (Note 12) | - | - | 1,695 | - | - | 1,695 | - | 1,695 | ||||||||||||||||||||||||

| Witholding tax impact on share-based payments | - | - | (438 | ) | - | - | (438 | ) | - | (438 | ) | |||||||||||||||||||||

| Net loss for the period | - | - | - | - | (2,525 | ) | (2,525 | ) | 2,751 | 226 | ||||||||||||||||||||||

| Balance at May 31, 2024 | 279,573,427 | $ | 165,662 | $ | 9,228 | $ | 1,700 | $ | (123,948 | ) | $ | 52,642 | $ | 9,907 | $ | 62,549 | ||||||||||||||||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

TRX Gold Corporation

Interim Condensed Consolidated Statements of Cash Flows

(Unaudited)

(Expressed in Thousands of US Dollars)

| Nine months ended May 31, |

||||||||||

| Note | 2024 | 2023 | ||||||||

| Operating | ||||||||||

| Net income | $ | 226 | $ | 4,736 | ||||||

| Adjustments for items not involving cash: | ||||||||||

| Non-cash items | 20 | 7,972 | 4,218 | |||||||

| Changes in non-cash working capital: | ||||||||||

| Decrease in amounts receivable | 1,316 | 1,628 | ||||||||

| Increase in inventories | (1,229 | ) | (544 | ) | ||||||

| Decrease (increase) in prepayments and other assets | 455 | (1,567 | ) | |||||||

| Increase in amounts payable and accrued liabilities | 1,005 | 5,321 | ||||||||

| (Decrease) increase in income tax payable | (463 | ) | 788 | |||||||

| Cash provided by operating activities | $ | 9,282 | $ | 14,580 | ||||||

| Investing | ||||||||||

| Purchase of mineral property, plant and equipment | $ | (8,378 | ) | $ | (14,650 | ) | ||||

| Increase in other long-term assets | (387 | ) | (1,114 | ) | ||||||

| Cash used in investing activities | $ | (8,765 | ) | $ | (15,764 | ) | ||||

| Financing | ||||||||||

| Proceeds from issuance of shares and warrants | $ | - | $ | 110 | ||||||

| Issuance costs paid | - | (5 | ) | |||||||

| Withholding taxes on settlement of share-based payments | (438 | ) | (94 | ) | ||||||

| Lease payments | (42 | ) | (97 | ) | ||||||

| Cash used in financing activities | $ | (480 | ) | $ | (86 | ) | ||||

| Net increase (decrease) in cash | $ | 37 | $ | (1,270 | ) | |||||

| Cash at beginning of the period | 7,629 | 8,476 | ||||||||

| Cash at end of the period | $ | 7,666 | $ | 7,206 | ||||||

| Taxes paid in cash | $ | 1,218 | $ | 43 | ||||||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 1. | Nature of operations |

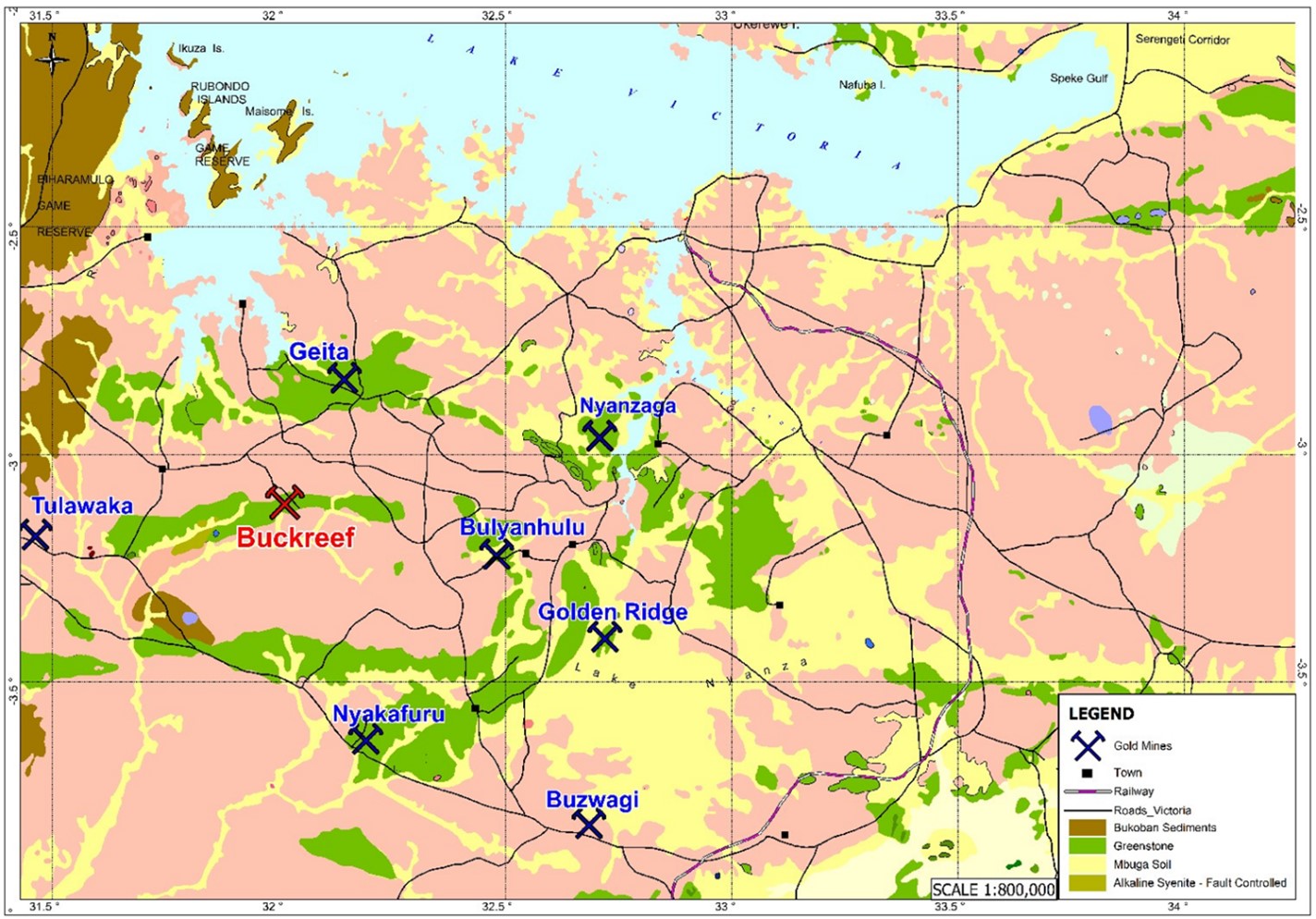

TRX Gold Corporation (“TRX Gold” or the “Company”) is incorporated in the Province of Alberta on July 5, 1990 under the Business Corporations Act (Alberta). The Company’s principal business activity is the exploration, development and production of mineral property interests in the United Republic of Tanzania (“Tanzania”).

The Company’s registered office is 400 3rd Avenue SW, Suite 3700, Calgary, Alberta, T2P 4H2, Canada and the Company’s principal place of business is 277 Lakeshore Road E, Suite 403, Oakville, Ontario, L6J 6J3, Canada.

The Company’s common shares are listed on the Toronto Stock Exchange in Canada (TSX: TRX) and NYSE American in the United States of America (NYSE American: TRX).

The Company is primarily focused on development and mining operations, exploring, and evaluating its mineral properties. The business of exploring and mining for minerals involves a high degree of risk. The underlying value of the mineral properties is dependent upon the existence and economic recovery of mineral resources and reserves, the ability to generate or raise capital to complete the development of the properties, government policies and regulations, and upon future profitable production or, alternatively, upon the Company’s ability to dispose of its interest on an advantageous basis; all of which are uncertain.

| 2. | Basis of preparation |

| a) | Statement of compliance |

The Company’s interim condensed consolidated financial statements have been prepared in accordance with International Accounting Standards (“IAS”) 34, Interim Financial Reporting, as issued by the International Accounting Standards Board (“IASB”). The interim condensed consolidated financial statements do not include all disclosures required by International Financial Reporting Standards (“IFRS”) for annual financial statements and should be read in conjunction with the Company’s consolidated financial statements for the year ended August 31, 2023.

These interim condensed consolidated financial statements were approved by the Board of Directors of the Company on July 11, 2024.

| b) | Basis of presentation and measurement |

These interim condensed consolidated financial statements have been prepared on a going concern basis under the historical cost basis, except for certain financial assets and liabilities which are measured at fair value as disclosed in Note 17. All amounts in these interim condensed consolidated financial statements are presented in U.S. dollars with all amounts rounded to the nearest thousand, except for share and per share data, or as otherwise noted. Reference herein of $ or USD is to U.S. dollars and C$ or CAD is to Canadian dollars.

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 3. | Material accounting policies, judgements and estimates |

The accounting policies, judgements and estimates applied in these interim condensed consolidated financial statements are consistent with those set out in Notes 3 and 4 of the Company’s annual consolidated financial statements for the year ended August 31, 2023, except as described below:

Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice Statement 2)

In February 2021, the IASB issued amendments to IAS 1, Presentation of Financial Statements, and IFRS Practice Statement 2, Making Materiality Judgements, requiring that an entity discloses its material accounting policies, instead of its significant accounting policies. Accounting policy information is material if, when considered together with other information included in an entity’s financial statements, it can reasonably be expected to influence decisions that the primary users of general purpose financial statements make on the basis of those financial statements. Accounting policy information may be material because of the nature of the related transactions, other events or conditions, even if the amounts are immaterial. Accounting policy information that relates to immaterial transactions, events or conditions is immaterial and need not be disclosed. The IASB has also developed guidance and examples to explain and demonstrate the application of the ‘four-step materiality process’ described in IFRS Practice Statement 2.

The amendments to IAS 1 and IFRS Practice Statement 2 were adopted on September 1, 2023 and did not have a material impact on the Company’s interim condensed consolidated financial statements.

Definition of Accounting Estimates (Amendments to IAS 8)

In February 2021, the IASB issued amendments to IAS 8, Accounting policies, changes in accounting estimates and errors. The amendments replace the definition of a change in accounting estimates with a definition of accounting estimates. Under the new definition, accounting estimates are “monetary amounts in financial statements that are subject to measurement uncertainty”. Entities develop accounting estimates if accounting policies require items in financial statements to be measured in a way that involves measurement uncertainty. The amendments clarify that a change in accounting estimate that results from new information or new developments is not the correction of an error and effects of a change in an input or a measurement technique used to develop an accounting estimate are changes in accounting estimates if they do not result from the correction of prior period errors.

The amendments to IAS 8 were adopted on September 1, 2023 and did not have a material impact on the Company’s interim condensed consolidated financial statements.

Deferred Tax related to Assets and Liabilities arising from a Single Transaction (Amendments to IAS 12)

In May 2021, the IASB issued amendments to IAS 12, Income Taxes. The amendments to IAS 12 narrow the scope of the initial recognition exemption so that it no longer applies to transactions which give rise to equal amounts of taxable and deductible temporary differences. The Company is to recognize a deferred tax asset and deferred tax liability for temporary differences arising on initial recognition for certain transactions, including leases and reclamation provisions.

The amendments to IAS 12 were adopted on September 1, 2023 and did not have a material impact on the Company’s interim condensed consolidated financial statements.

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

Presentation and Disclosure in Financial Statements (IFRS 18)

In April 2024, the IASB issued IFRS 18, Presentation and Disclosure in Financial Statements to replace IAS 1, Presentation of Financial Statement. IFRS 18 aims to achieve comparability of the financial performance of similar entities and will impact the presentation of primary financial statements and notes, including the statement of earnings where companies will be required to present separate categories of income and expense for operating, investing, and financing activities with prescribed subtotals for each new category. The standard will also require management-defined performance measures to be explained and included in a separate note within the consolidated financial statements.

IFRS 18 is effective for annual reporting periods beginning on or after January 1, 2027, with early adoption permitted. The Company is currently assessing the impact of the new standard.

| 4. | Amounts receivable |

| Schedule of amounts receivables | ||||||||

| May 31, 2024 | August 31, 2023 | |||||||

| Receivable from precious metal sales | $ | - | $ | 488 | ||||

| Sales tax receivable(1) | 4,910 | 5,554 | ||||||

| Other | 24 | 46 | ||||||

| Other receivable | 4,934 | 6,088 | ||||||

| Less: Long-term portion | (3,335 | ) | (2,948 | ) | ||||

| Total amounts receivable | $ | 1,599 | $ | 3,140 |

| (1) | Sales tax receivables consist of harmonized services tax and value added tax (“VAT”) due from Canadian and Tanzanian tax authorities, respectively. Tanzanian tax regulations allow for VAT receivable to be refunded or set-off against other taxes due to the Tanzania Revenue Authority ("TRA"). The Company has historically experienced delays in receiving payment or confirmation of offset against other taxes. The Company is in communication with the TRA and there is an expectation for either cash payments or offsetting of VAT receivable against other taxes in the future. VAT which the Company does not expect to recover within the next 12 months has been classified as long-term assets. |

The Company held no collateral for any receivables. During the three and nine months ended May 31, 2024, $nil0 and $nil0, respectively (2023 – $nil0 and $0.2 million, respectively) of VAT was written-off. During the three and nine months ended May 31, 2024, the Company recovered VAT refunds from the TRA of $0.5 million and $3.1 million, respectively (2023 – $nil0 and $nil0, respectively).

| 5. | Prepayments and other assets |

| Schedule of prepayments and other assets | ||||||||

| May 31, 2024 | August 31, 2023 | |||||||

| Prepaid expenses | $ | 301 | $ | 796 | ||||

| Deferred financing costs(1) | 707 | 667 | ||||||

| Total prepayments and other assets | $ | 1,008 | $ | 1,463 |

| (1) | Consists of $0.5 million in commitment fees paid with respect to a share purchase agreement whereby the Company, at its sole discretion, has the right to sell up to $10 million of its common shares over a 36-month period and $0.2 million in deferred financing costs related to an At-the-Market Offering Agreement entered on May 12, 2023. |

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 6. | Inventories |

| May 31, 2024 | August 31, 2023 | |||||||

| Ore stockpile | $ | 4,821 | $ | 3,361 | ||||

| Gold in circuit | 807 | 689 | ||||||

| Gold doré | 80 | 52 | ||||||

| Total precious metals inventories | 5,708 | 4,102 | ||||||

| Supplies | 794 | 859 | ||||||

| Total inventories | $ | 6,502 | $ | 4,961 |

| 7. | Mineral property, plant and equipment |

| Schedule of mineral property, plant and equipment | ||||||||||||||||||||||||

| Exploration

and evaluation expenditures(1) |

Mineral

properties |

Processing

plant and related infrastructure |

Machinery

and equipment(2) |

Other(3) | Total | |||||||||||||||||||

| Cost | ||||||||||||||||||||||||

| As at August 31, 2023 | $ | 1,864 | $ | 41,202 | $ | 23,063 | $ | 1,624 | $ | 351 | $ | 68,104 | ||||||||||||

| Additions | 288 | 3,792 | 6,051 | 108 | 13 | 10,252 | ||||||||||||||||||

| As at May 31, 2024 | $ | 2,152 | $ | 44,994 | $ | 29,114 | $ | 1,732 | $ | 364 | $ | 78,356 | ||||||||||||

| Accumulated depreciation | ||||||||||||||||||||||||

| As at August 31, 2023 | $ | - | $ | 899 | $ | 2,138 | $ | 828 | $ | 180 | $ | 4,045 | ||||||||||||

| Depreciation | - | 1,368 | 210 | 171 | 58 | 1,807 | ||||||||||||||||||

| As at May 31, 2024 | $ | - | $ | 2,267 | $ | 2,348 | $ | 999 | $ | 238 | $ | 5,852 | ||||||||||||

| Net book value | ||||||||||||||||||||||||

| As at August 31, 2023 | $ | 1,864 | $ | 40,303 | $ | 20,925 | $ | 796 | $ | 171 | $ | 64,059 | ||||||||||||

| As at May 31, 2024 | $ | 2,152 | $ | 42,727 | $ | 26,766 | $ | 733 | $ | 126 | $ | 72,504 |

| (1) | Represents exploration and evaluation expenditures related to the Eastern Porphyry and Anfield deposits on the Buckreef property. |

| (2) | Includes automotive, computer equipment and software. |

| (3) | Includes leasehold improvements and right-of-use assets. |

| 8. | Deferred revenue |

On August 11, 2022, the Company entered into a $5.0 million prepaid Gold Doré Purchase Agreement (“Agreement”) with OCIM Metals and Mining S.A. The Agreement requires funds to be made available to the Company in two tranches. During the three months ended November 30, 2023, the Company fully settled $2.5 million drawn on the first tranche of the Agreement. On July 11, 2023, the Company drew $1.0 million from the second tranche of the Agreement in exchange for delivering 46.4 ounces of gold per month, commencing October 2023, for a total of 603 ounces of gold over 13 months. On September 26, 2023, the Company drew an additional $0.5 million from the second tranche of the Agreement in exchange for delivering 23.5 ounces of gold per month, commencing December 2023, for a total of 305.4 ounces of gold over 13 months. On November 29, 2023, the Company drew an additional $1.0 million from the second tranche of the Agreement in exchange for delivering 44.1 ounces of gold per month, commencing February 2024, for a total of 573.2 ounces of gold over 13 months.

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

On May 6, 2024, the Company amended the terms of the Agreement to allow for additional prepayments and drew an additional $1.0 million in exchange for delivering 40.85 ounces of gold per month, commencing June 2024, for a total of 490.2 ounces of gold over 12 months.

| Schedule of deferred revenue liability | ||||

| Amount | ||||

| As at August 31, 2023 | $ | 1,727 | ||

| Drawdown | 2,500 | |||

| Accretion of deferred revenue | 360 | |||

| Revenue recognized | (2,090 | ) | ||

| As at May 31, 2024 | $ | 2,497 |

| Schedule of deferred revenue | ||||||||

| May 31, 2024 | August 31, 2023 | |||||||

| Current portion of deferred revenue | $ | 2,497 | $ | 1,549 | ||||

| Non-current portion of deferred revenue | - | 178 | ||||||

| Balance at end of period | $ | 2,497 | $ | 1,727 |

| 9. | Derivative financial instrument liabilities |

| Schedule of derivative financial instrument liabilities | ||||||||

| May 31, 2024 | August 31, 2023 | |||||||

| Derivative warrant liabilities | $ | 4,221 | $ | 3,544 | ||||

| Total derivative financial instrument liabilities | $ | 4,221 | $ | 3,544 |

| a) | Derivative warrant liabilities |

| Schedule of derivative warrant liabilities | ||||

| Amount | ||||

| As at August 31, 2023 | $ | 3,544 | ||

| Change in fair value | 677 | |||

| As at May 31, 2024 | $ | 4,221 |

Derivative warrant liabilities of $4.2 million will only be settled by issuing equity of the Company. For the three and nine months ended May 31, 2024 fair value changes amounted to a loss of $2.5 million and $0.7 million, respectively (2023 – loss of $0.7 million and gain of $1.7 million, respectively).

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

Fair values of derivative warrant liabilities were calculated using the Black-Scholes Option Pricing Model with the following assumptions:

| Schedule of assumptions fair value of derivative warrant liabilities | ||||||||

| May 31, 2024 | August 31, 2023 | |||||||

| Share price | 0.48 | $ | 0.39 | |||||

| Risk-free interest rate | 4.70% - 4.92% | 4.43% - 4.66% | ||||||

| Dividend yield | 0% | 0% | ||||||

| Expected volatility | 48% - 49% | 52% | ||||||

| Remaining term (in years) | 1.7 – 2.7 | 2.5 – 3.4 | ||||||

The fair value is classified as Level 3 as expected volatilities are determined using adjusted historical volatilities and were therefore not an observable input.

Sensitivity analysis

If expected volatility, the significant unobservable input, had been higher or lower by 10% and all other variables were held constant, net income and net assets for the three and nine months ended May 31, 2024 would increase or decrease by:

| Schedule of net loss and net assets | ||||||||

| May 31, 2024 | ||||||||

| 10% change in expected volatilities | Increase | Decrease | ||||||

| (Loss) income | $ | (851 | ) | $ | 848 | |||

| b) | Gold zero-cost collars |

In December 2023, the Company entered into a series of gold zero-cost collar contracts for 600 gold ounces per month for a total of 3,000 gold ounces to be settled from January 2024 to May 2024, at a maximum and minimum gold price of $2,150 and $1,850 per gold ounce, respectively.

During the three and nine months ended May 31, 2024, gold zero-cost collar contracts for a total of nil and 1,200 gold ounces, respectively (2023 – 3,600 gold ounces and 3,600 gold ounces, respectively) expired unexercised and 1,800 gold ounces and 1,800 gold ounces, respectively (2023 – $nil and $nil, respectively) were exercised. As at May 31, 2024, no gold zero-cost collar contracts were outstanding.

For the three and nine months ended May 31, 2024, realized losses on exercised contracts amounted to $0.2 million and $0.2 million, respectively (2023 - $nil 0and $nil0, respectively).

| 10. | Income tax |

Income tax expense is recognized based on management’s estimate of the weighted average annual income tax rate expected for the full financial year. The maximum amount of tax losses that a business can utilize in Tanzania is 70% of its taxable profit for the current year. The remaining 30% of taxable profit is subject to a statutory tax rate of 30%. As a result, Buckreef’s current income tax is calculated at an effective tax rate of 9% until Buckreef’s tax loss carryforwards are fully utilized. Tax losses in Tanzania can only be utilized by the entity to which the tax losses relate to.

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

The carrying value of Buckreef’s Mineral Property, Plant and Equipment is higher than their tax written down values due to historical mining incentives in Tanzania and accelerated depreciation for tax purposes. The taxable temporary difference between the carrying value of Mineral Property, Plant and Equipment and its tax basis in excess of available tax loss carryforwards resulted in a deferred tax liability.

For the three months ended May 31, 2024, the Company recorded income tax expense of $1.7 million, comprised of current income tax expense of $0.4 million and deferred income tax expense of $1.3 million (2023 – $1.7 million income tax expense comprised of current income tax expense of $0.3 million and deferred income tax expense of $1.4 million). For the nine months ended May 31, 2024, the Company recorded income tax expense of $3.8 million, comprised of current income tax expense of $0.8 million and deferred income tax expense of $3.0 million (2023 – $4.4 million income tax expense comprised of current income tax expense of $0.8 million and deferred income tax expense of $3.6 million).

| 11. | (Loss) earnings per share |

| Schedule of (loss) earning per share | ||||||||||||||||

| Three months ended May 31, | Nine months ended May 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Net (loss) income attributable to shareholders | $ | (2,639 | ) | $ | (1,264 | ) | $ | (2,525 | ) | $ | 849 | |||||

| Weighted average number of common shares for purposes of basic EPS(1) | 290,792,725 | 284,205,392 | 289,148,445 | 281,536,777 | ||||||||||||

| Effect of dilutive stock options, warrants, RSUs and share awards | - | - | - | 4,056,778 | ||||||||||||

| Weighted average number of common shares for purposes of diluted EPS(1) | 290,792,725 | 284,205,392 | 289,148,445 | 285,593,555 | ||||||||||||

| (1) | The weighted average number of common shares for basic and diluted EPS include 10.0 million gross number of vested, but unissued, common shares relating to common share awards. |

For the nine months ended May 31, 2024, the weighted average number of common shares for diluted EPS excluded 15.4 million stock options, 2.3 million RSUs, and 36.2 million warrants that were anti-dilutive for the period (2023 – 7.4 million stock options and 42.0 million warrants).

| 12. | Share-based payments reserve |

Share-based compensation expense for the three and nine months ended May 31, 2024 totalled $0.3 million and $1.7 million, respectively (2023 – $0.5 million and $2.1 million, respectively).

As at May 31, 2024, the Company had 5,392,420 (August 31, 2023 – 3,617,450) share awards available for issuance under the Omnibus Equity Incentive Plan.

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

| a) | Stock options |

Canadian Dollars denominated stock options

| Schedule of continuity of outstanding stock options | |||

| Number of stock options |

Weighted average exercise price per share |

||

| Balance – May 31, 2024 and August 31, 2023 | 4,986,000 | CAD $0.41 |

Options to purchase common shares carry exercise prices and terms to maturity as follows:

| Schedule of options to purchase common shares carry exercise prices and terms to maturity | ||||||||||||||

| Remaining | ||||||||||||||

| Number of options | Expiry | contractual | ||||||||||||

| Exercise price | Outstanding | Exercisable | Date | life (years) | ||||||||||

| C$0.35 | 100,000 | 100,000 | January 2, 2027 | 2.6 | ||||||||||

| C$0.40 | 2,259,000 | 2,259,000 | October 11, 2026 | 2.4 | ||||||||||

| C$0.40 | 95,000 | 95,000 | October 6, 2024 | 0.4 | ||||||||||

| C$0.43 | 2,065,000 | 2,065,000 | September 29, 2026 | 2.3 | ||||||||||

| C$0.43 | 467,000 | 467,000 | October 6, 2024 | 0.4 | ||||||||||

| C$0.41(1) | 4,986,000 | 4,986,000 | 2.1(1) | |||||||||||

| (1) | Total represents weighted average. |

US Dollars denominated stock options

| Schedule of outstanding stock options | |||

| Number of stock options |

Weighted average exercise price per share |

||

| Balance – May 31, 2024 and August 31, 2023 | 10,450,000 | $0.49 |

Options to purchase common shares carry exercise prices and terms to maturity as follows:

| Schedule of options to purchase common shares exercise prices | ||||||||||||||

| Remaining | ||||||||||||||

| Number of options | Expiry | contractual | ||||||||||||

| Exercise price | Outstanding | Exercisable | Date | life (years) | ||||||||||

| USD $0.50 | 7,375,000 | 2,950,000 | August 17, 2027 | 3.2 | ||||||||||

| USD $0.45 | 3,075,000 | 615,000 | August 28, 2028 | 4.2 | ||||||||||

| USD $0.49(1) | 10,450,000 | 3,565,000 | 3.5(1) | |||||||||||

| (1) | Total represents weighted average. |

For the three and nine months ended May 31, 2024, share-based compensation expense related to stock options totalled $0.2 million and $0.5 million, respectively (2023 – $0.2 million and $0.4 million, respectively).

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

| b) | Restricted Share Units |

The following table sets out activity with respect to outstanding RSUs:

| Schedule of restricted stock outstanding | ||||

| Number of RSUs |

||||

| Balance – August 31, 2023 | 3,473,077 | |||

| Granted | 57,432 | |||

| Vested | (1,203,333 | ) | ||

| Balance – May 31, 2024 | 2,327,176 | |||

For the three and nine months ended May 31, 2024, share-based payment expenses related to RSUs totalled $0.1 million and $0.8 million, respectively (2023 – $0.1 million and $0.4 million, respectively).

| 13. | Warrants reserve |

| Schedule of warrants reserve | |||

| Number of warrants |

Weighted average exercise price per share |

Weighted average remaining contractual life (years) |

|

| Balance – August 31, 2023 | 38,968,037 | $0.68 | 2.8 |

| Warrants expired | (2,777,268) | $1.50 | |

| Balance – May 31, 2024 | 36,190,769 | $0.62 | 2.2 |

As at May 31, 2024, the following warrants were outstanding:

| Schedule of warrants outstanding | ||||||||||

| Number of Warrants |

Exercise price |

Expiry date | ||||||||

| Private placement financing warrants - February 11, 2021 | 16,461,539 | $0.80 | February 11, 2026 | |||||||

| Private placement financing broker warrants - February 11, 2021 | 1,152,307 | $0.80 | February 11, 2026 | |||||||

| Private placement financing warrants – January 26, 2022 | 17,948,718 | $0.44 | January 26, 2027 | |||||||

| Private placement financing placement agent warrants – January 26, 2022 | 628,205 | $0.44 | January 26, 2027 | |||||||

| Balance – May 31, 2024 | 36,190,769 | $0.62 | (1) | |||||||

| (1) | Total represents weighted average. |

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 14. | Non-controlling interest |

Summarized financial information for Buckreef is disclosed below:

| Schedule of summarized financial information | ||||||||||||||||

| Three months ended May 31, |

Nine months ended May 31, |

|||||||||||||||

| Income Statement | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenue | $ | 9,938 | $ | 9,317 | $ | 27,325 | $ | 29,133 | ||||||||

| Depreciation | 534 | 376 | 1,446 | 863 | ||||||||||||

| Accretion expense | 146 | 101 | 443 | 472 | ||||||||||||

| Income tax expense | 1,714 | 1,719 | 3,786 | 4,383 | ||||||||||||

| Comprehensive income for the period | 2,184 | 1,979 | 6,113 | 8,638 | ||||||||||||

| Statement of Financial Position | May 31, 2024 | August 31, 2023 | ||||||

| Current assets | $ | 10,441 | $ | 11,238 | ||||

| Non-current assets | 73,702 | 64,762 | ||||||

| Current liabilities | (15,741 | ) | (12,113 | ) | ||||

| Non-current liabilities | (8,228 | ) | (5,301 | ) | ||||

| Advances from parent, net | (31,404 | ) | (36,049 | ) | ||||

| Nine months ended May 31, |

||||||||

| Statement of Cash Flows | 2024 | 2023 | ||||||

| Cash provided by operating activities | $ | 13,178 | $ | 17,785 | ||||

| Cash used in investing activities | (8,760 | ) | (15,170 | ) | ||||

| Cash used in financing activities | (4,807 | ) | (1,128 | ) | ||||

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 15. | Related party transactions |

Related parties include the Board of Directors and officers, extended relatives and enterprises that are controlled by these individuals as well as certain consultants performing similar functions.

Remuneration of Directors and key management personnel of the Company was as follows:

| Schedule of related parties compensation | ||||||||||||||||

| Three months ended May 31, |

Nine months ended May 31, |

|||||||||||||||

| Directors and key management personnel | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Remuneration(1) | $ | 429 | $ | 438 | $ | 1,293 | $ | 1,414 | ||||||||

| Share-based compensation expense | 185 | 410 | 1,173 | 1,682 | ||||||||||||

| Total directors and key management personnel | $ | 614 | $ | 848 | $ | 2,466 | $ | 3,096 | ||||||||

| (1) | Remuneration includes salaries and benefits for certain key management personnel and director fees. Certain members of the board of directors have employment or service contracts with the Company. Directors are entitled to director fees and share-based compensation for their services and officers are entitled to cash remuneration and share-based compensation for their employment services. |

As at May 31, 2024, included in amounts payable is $nil 0 of board fees (August 31, 2023 – $0.4 million) due to related parties with no specific terms of repayment.

During the three and nine months ended May 31, 2024, $0.2 million and $0.5 million for stock options granted to key management personnel was expensed, respectively (2023 – $0.2 million and $0.4 million, respectively) and $nil 0 and $0.4 million for RSUs granted to directors and key management personnel was expensed, respectively (2023 – $nil 0 and $0.2 million, respectively).

During the three and nine months ended May 31, 2024, $nil 0 and $0.2 million related to common share awards granted to key management personnel was expensed, respectively (2023 – $0.2 million and $1.1 million, respectively).

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 16. | General and administrative expenses |

| Schedule of general and administrative expense | ||||||||||||||||

| Three months ended May 31, |

Nine months ended May 31, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Directors’ fees (Note 15) | $ | 67 | $ | 92 | $ | 196 | $ | 306 | ||||||||

| Insurance | 84 | 69 | 255 | 268 | ||||||||||||

| Office and general | 80 | 47 | 225 | 107 | ||||||||||||

| Shareholder information | 71 | 61 | 368 | 375 | ||||||||||||

| Professional fees | 93 | 94 | 338 | 331 | ||||||||||||

| Salaries and benefits (Note 15) | 534 | 540 | 1,788 | 1,638 | ||||||||||||

| Consulting | 98 | 115 | 454 | 292 | ||||||||||||

| Share-based compensation expense (Notes 12 and 15) | 280 | 541 | 1,493 | 1,939 | ||||||||||||

| Travel and accommodation | 55 | 47 | 168 | 150 | ||||||||||||

| Depreciation | 14 | 21 | 46 | 79 | ||||||||||||

| Other | 7 | 7 | 30 | 21 | ||||||||||||

| Total general and administrative expenses | $ | 1,383 | $ | 1,634 | $ | 5,361 | $ | 5,506 | ||||||||

| 17. | Financial instruments |

Fair value of financial instruments

The following table sets out the classification of the Company’s financial instruments as at May 31, 2024 and August 31, 2023:

| Schedule of financial instruments | ||||||||

| May 31, 2024 | August 31, 2023 | |||||||

| Financial Assets | ||||||||

| Measured at amortized cost | ||||||||

| Amounts receivable | $ | 1,599 | $ | 3,140 | ||||

| Measured at fair value through profit or loss | ||||||||

| Cash | 7,666 | 7,629 | ||||||

| Financial Liabilities | ||||||||

| Measured at amortized cost | ||||||||

| Amounts payables and accrued liabilities | 14,454 | 11,571 | ||||||

| Measured at fair value through profit or loss | ||||||||

| Derivative financial instrument liabilities | 4,221 | 3,544 | ||||||

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

Fair value estimates are made at a specific point in time based on relevant market information and information about financial instruments. These estimates are subject to and involve uncertainties and matters of significant judgment, and therefore cannot be determined with precision. Changes in assumptions could significantly affect the estimates.

The Company classifies its financial instruments carried at fair value according to a three-level hierarchy that reflects the significance of the inputs used in making the fair value measurements. The three levels of fair value hierarchy, giving the highest priority to Level 1 inputs and the lowest priority to Level 3 inputs, are as follows:

| · | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities; |

| · | Level 2 – Inputs other than quoted prices that are observable for assets and liabilities, either directly or indirectly; and |

| · | Level 3 – Inputs for assets or liabilities that are not based on observable market data. |

As at May 31, 2024 and August 31, 2023, cash was classified as Level 1 and derivative warrant liabilities (Note 9) were classified as Level 3 under the fair value hierarchy.

| 18. | Segmented information |

Operating segments

The Company’s Chief Operating Decision Maker, its Chief Executive Officer, reviews the operating results, assesses the performance and makes capital allocation decisions of the Company viewed as a single operating segment engaged in mineral exploration and development in Tanzania. All amounts disclosed in the interim condensed consolidated financial statements represent this single reporting segment. The Company’s corporate division only earns interest revenue that is considered incidental to the activities of the Company and does not meet the definition of an operating segment as defined in IFRS 8, Operating Segments.

Geographic segments

The Company is in the business of mineral exploration and production in Tanzania. Information regarding the Company’s geographic locations are as follows:

| Schedule of revenue |

Three months ended May 31, |

Nine Months Ended May 31, |

||||||||||||||

| Revenue | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Tanzania | $ | 10,148 | $ | 9,317 | $ | 27,536 | $ | 29,133 | ||||||||

| Total revenue | $ | 10,148 | $ | 9,317 | $ | 27,536 | $ | 29,133 | ||||||||

During the three and nine months ended May 31, 2024, the Company generated 93% and 92%, respectively (2023 – 92% and 95%, respectively) of its revenue from one (2023 – one) customer totalling $9.5 million and $25.4 million, respectively (2023 – $8.6 million and $27.6 million, respectively).

|

|

TRX Gold Corporation

Notes to the Interim Condensed Consolidated Financial Statements

For the three and nine months ended May 31, 2024 and 2023

(Unaudited)

(Expressed in Thousands of US dollars, except for share and per share amounts)

| Schedule of non-current assets | ||||||||

| Non-current assets | May 31, 2024 | August 31, 2023 | ||||||

| Canada | $ | 42 | $ | 55 | ||||

| Tanzania | 75,797 | 66,952 | ||||||

| Total non-current assets | $ | 75,839 | $ | 67,007 | ||||

| 19. | Commitments and contingencies |

Commitments:

In order to maintain its existing mining and exploration licenses, the Company is required to pay annual license fees. As at May 31, 2024 and August 31, 2023, these licenses remained in good standing and the Company is up to date on its license payments.

Contingencies:

The Company is involved in litigation and disputes arising in the normal course of operations. Management is of the opinion that the outcome of any potential litigation will not have a material adverse impact on the Company’s financial position or results of operations. Accordingly, no provisions for the settlement of outstanding litigation and potential claims have been accrued as at May 31, 2024 and August 31, 2023.

| 20. | Non-cash items |

| Schedule of non-cash items | ||||||||

| Nine months ended May 31, |

||||||||

| 2024 | 2023 | |||||||

| Depreciation | $ | 1,493 | $ | 942 | ||||

| Change in fair value of derivative financial instruments (Note 9) | 677 | (1,670 | ) | |||||

| Share-based compensation expense (Note 12) | 1,705 | 2,113 | ||||||

| Accretion of provision for reclamation | 81 | 105 | ||||||

| Deferred income tax expense (Note 10) | 3,027 | 3,552 | ||||||

| Accretion of lease liabilities | 3 | 8 | ||||||

| Deferred revenue (Note 8) | 410 | (1,485 | ) | |||||

| Accretion of deferred revenue (Note 8) | 360 | 364 | ||||||

| Foreign exchange losses | 216 | 41 | ||||||

| VAT written-off (Note 4) | - | 233 | ||||||

| Other expenses | - | 15 | ||||||

| Total non-cash items | $ | 7,972 | $ | 4,218 | ||||

19

Exhibit 99.2

TRX GOLD CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the three and nine month periods ended May 31, 2024

|

Management’s Discussion May 31, 2024 |

The following Management’s Discussion and Analysis (“MD&A”) of the financial condition and results of operations for TRX Gold Corporation (“TRX Gold” or the “Company”) should be read in conjunction with the Company’s unaudited interim consolidated financial statements for the three and nine months ended May 31, 2024, as well as the Company’s audited consolidated financial statements included in the Company’s Annual Report on Form 40-F and Annual Information Form for the year ended August 31, 2023. The financial statements and related notes of TRX Gold have been prepared in accordance with International Financial Reporting Standards (“IFRS”). Additional information, including our press releases, has been filed electronically on SEDAR+ and is available online under the Company’s profile at www.sedarplus.ca and on our website at www.TRXGold.com.

This MD&A reports our activities through July 12, 2024, unless otherwise indicated. References to the 3rd quarter of 2024 or Q3 2024, and references to the 3rd quarter of 2023 or Q3 2023 mean the three months ended May 31, 2024, and May 31, 2023, respectively. Unless otherwise noted, all references to currency in this MD&A refer to US dollars. Unless clearly otherwise referenced to a specific table, numbers referenced refer to numbered Endnotes on page 42.

Disclosure and Cautionary Statement Regarding Forward Looking Information

This MD&A contains certain forward-looking statements and forward-looking information, including without limitation statements about TRX Gold’s future business, operations and production capabilities. All statements, other than statements of historical fact, included herein are forward-looking statements and forward-looking information that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Although TRX Gold believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance. The actual achievements of TRX Gold or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors. These risks, uncertainties and factors include general business, legal, economic, competitive, political, regulatory and social uncertainties; actual results of exploration activities and economic evaluations; fluctuations in currency exchange rates; changes in costs; future prices of gold and other minerals; mining method, production profile and mine plan; delays in exploration, development and construction activities; changes in government legislation and regulation; the ability to obtain financing on acceptable terms and in a timely manner or at all; contests over title to properties; employee relations and shortages of skilled personnel and contractors; and the speculative nature of, and the risks involved in, the exploration, development and mining business.

Mr. William van Breugel, P.Eng, BASc (Hons), technical advisor to TRX Gold Corporation, is the Company’s Qualified Person under National Instrument 43-101 “Standards of Disclosure for Mineral Projects” (“NI 43-101”) and has reviewed and assumes responsibility for the scientific and technical content in this MD&A.

|

|

|

Management’s Discussion May 31, 2024 |

The disclosure contained in this MD&A of a scientific or technical nature relating to the Company’s Buckreef Project has been summarized or extracted from the technical report entitled “The National Instrument 43-101 Independent Technical Report, Updated Mineral Resource Estimate for the Buckreef Gold Mine Project, Tanzania, East Africa for TRX Gold” with an effective date (the “Effective Date”) of May 15, 2020 (the “2020 Technical Report”). The 2020 Technical Report was prepared by or under the supervision Mr. Wenceslaus Kutekwatekwa (Mining Engineer, Mining and Project Management Consultant) BSc Hons (Mining Eng.), MBA, FSAIMM, of Virimai Projects, and, Dr Frank Crundwell, MBA, PhD, a Consulting Engineer, each of whom is an independent Qualified Person as such term is defined in NI 43-101. The information contained herein is subject to all of the assumptions, qualifications and procedures set out in the 2020 Technical Report and reference should be made to the full details of the 2020 Technical Report which has been filed with the applicable regulatory authorities and is available on the Company’s profile at www.sedarplus.ca. The Company did not complete any new work that would warrant reporting material changes in the previously reported Mineral Resource (“MRE”) and Mineral Reserve statements during the period ended May 31, 2024. The MRE and economic analysis was previously conducted under the 2003 CIM Code for the Valuation of Mineral Properties which may be different than the November 2019 guidelines.

Certain information presented in this MD&A may constitute “forward-looking statements” and “forward looking information” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and under securities legislation applicable in Canada, respectively. Such forward-looking statements and information are based on numerous assumptions, and involve known and unknown risks, uncertainties, and other factors, including risks inherent in mineral exploration and development, which may cause the actual results, performance, or achievements of the Company to be materially different from any projected future results, performance, or achievements expressed or implied by such forward-looking statements and information. Investors are referred to our description of the risk factors affecting the Company, as contained in our U.S. Securities and Exchange Commission (“SEC”) filings, including our Annual Report on Form 40-F and Report of Foreign Private Issuer on Form 6-K, and our Annual Information Form also posted on SEDAR+, for more information concerning these risks, uncertainties, and other factors.

TRX Gold Corporation

TRX Gold is rapidly advancing the Buckreef Gold Project. Anchored by a Mineral Resource published in May 20201, the project currently hosts an NI 43-101 Measured and Indicated Mineral Resource (“M&I Resource”) of 35.88 million tonnes (“MT”) at 1.77 grams per tonne (“g/t”) gold containing 2,036,280 ounces (“oz”) of gold and an Inferred Mineral Resource of 17.8 MT at 1.11 g/t gold for 635,540 oz of gold. The leadership team is focused on creating both near-term and long-term shareholder value by increasing gold production to generate positive cash flow. The positive cash flow will be utilized for exploratory drilling with the goal of increasing the current mineral resource base and advancing the larger project development which represents 90% of current mineral resources. TRX Gold’s actions are led by the highest environmental, social and corporate governance (“ESG”) standards, evidenced by the relationships and programs that the Company has developed during its nearly two decades of presence in the Geita Region, Tanzania. Please refer to the Company’s Updated Mineral Resources Estimate for Buckreef Gold Project, dated May 15, 20201 and filed under the Company’s profile on SEDAR+ and with the SEC on June 23, 2020 (the “2020 Technical Report”) for more information.

______________________

1 See Cautionary Statement

|

|

|

Management’s Discussion May 31, 2024 |

Highlights – Third Quarter and Year to Date 2024

During Q3 2024 the Company continued to use cash flow generated from mining operations to fund additional growth at Buckreef Gold. During Q3 2024, the Company recorded: (i) production of 4,628 ounces of gold, (ii) revenue of $10.1 million, (iii) gross profit of $4.4 million, (iv) operating cashflow of $3.1 million, and (v) Adjusted EBITDA1 of $3.9 million. The Company reinvested $3.3 million during the quarter to continue to advance construction on the project aimed at expanding annual processing plant throughput by 75-100%. During Q3 2024, the Company began commissioning of the additional 1,000 tonnes per day (“tpd”) capacity milling circuit. Following final commissioning (expected in early Q4 2024), the expanded milling circuit will have 2,000 tpd of nameplate processing capacity, which is expected to significantly benefit plant throughput, gold recovery and gold production. During Q3 2024 the Company completed construction of the new crushing circuit as part of the plant expansion project to 2,000 tpd. The expanded crushing system is now operational and has been fully commissioned. Subsequent to Q3 2024, the Company began to realize the benefits of the expanded crushing and milling circuit. Following wet commissioning in June 2024, plant mill throughput has increased to an average of 1,750 tpd, reaching a maximum of 1,873 tpd. This reflects a 116% increase in throughput relative to Q3 2024, on average, while undergoing wet commissioning. Once the additional carbon-in-leach (“CIL”) tanks are completed and fully commissioned (expected in early Q4 2024), it is expected that the expanded processing plant will begin to achieve 2,000 tpd of processing capacity. These positive results continue to demonstrate the growth potential at Buckreef Gold and reflect successful execution of the Company’s sustainable business plan where cash flow from operations funds value creating activities.

Key highlights for Q3 2024 and Year to Date 2024 include:

| · | During Q3 2024, the Company poured 4,628 ounces of gold, recognizing revenue of $10.1 million, gross profit of $4.4 million (43%), operating cashflow of $3.1 million and Adjusted EBITDA2 of $3.9 million. The increase in revenue, gross profit and Adjusted EBITDA1 compared to the prior year comparative period is primarily related to an increase in average realized price, partially offset by slightly lower gold production and lower ounces of gold sold. During the period, the Company sold 4,515 ounces of gold (Q3 2023: 4,810 ounces) at an average realized price (net)1 of $2,270 per ounce (Q3 2023: $1,959 per ounce). |

| · | Year to date, the Company poured and sold 13,622 and 13,361 ounces of gold respectively, resulting in revenue of $27.5 million, gross profit of $11.3 million (41%), operating cash flow of $9.3 million and Adjusted EBITDA1 of $9.1 million. |

| · | During Q3 2024 the Company began commissioning of the new 1,000 tpd capacity milling circuit at Buckreef Gold. Following final commissioning (expected in early Q4 2024), the expanded milling circuit will have 2,000 tpd of nameplate processing capacity, which is expected to significantly benefit plant throughput, gold recovery and gold production beginning in Q4 2024 and into fiscal 2025 (“F2025”). |

| · | As part of an initial phase of the plant expansion project to 2,000 tpd, during Q3 2024 the Company completed construction of the new crushing circuit. The expanded crushing system is now operational and has been fully commissioned. The crushing circuit has been consistently averaging 2,000 tpd of crushed material, reaching a maximum of 2,470 tpd. The new crushing circuit is expected to produce a finely crushed ore ‘product’ suitable for the existing and future ball mills. It is expected that the new crushing circuit will help drive increased throughput and recovery percentages and will provide capacity for increased production. It is also expected to improve options for material handling, provide equipment redundancy to eliminate or reduce plant downtime, and improve grind size allowing for more efficient, cost-effective processing of sulphide ore. |

______________________

Numerical annotations throughout the text of the remainder of this document refer to the endnotes found on page 42.

|

|

|

Management’s Discussion May 31, 2024 |

Commissioning Begins at Newly Expanded 2,000 TPD Plant

| · | During Q3 2024 the Company began commissioning of the additional 1,000 tpd capacity milling circuit at Buckreef Gold. Over the past few months, technical teams onsite have been working diligently to complete the final phase of the mill expansion, including finalizing the installation and optimization of the new crushing circuit. Following final commissioning (expected in early Q4 2024), the expanded milling circuit will have 2,000 tpd of nameplate processing capacity, which is expected to significantly benefit plant throughput, gold recovery and gold production beginning in Q4 2024 and into fiscal 2025 (“F2025”). |

| · | The newly expanded processing plant is now operational and is currently undergoing wet commissioning. During this commissioning phase, the expanded processing plant has been consistently achieving, on average, 1,750 tpd of mill throughput, reaching a maximum of 1,873 tpd, a 116% increase over Q3 2024, and is ramping up towards final commissioning. The Company is currently finalizing some minor welding work on the CIL tanks, and some ancillary electrical work on the agitators and intertank screens. Once the additional CIL tanks are completed and fully commissioned, it is expected that the expanded processing plant will begin to achieve 2,000 tpd of processing capacity. Final commissioning is expected early in Q4 2024. |

| · | As part of an initial phase of the plant expansion project to 2,000 tpd, during Q3 2024 the Company completed construction of the new crushing circuit. The expanded crushing system is now operational and has been fully commissioned. The crushing circuit has been consistently achieving an average of 2,000 tpd of crushed material, reaching a maximum of 2,470 tpd. The new crushing plant, combined with the old crushing circuit, is rated to process 3,600 to 4,800 tpd of ore at full capacity with new equipment comprising: run-of-mine (“ROM”) bin, apron feeder, conveyors, vibrating grizzly, primary jaw crusher and secondary and tertiary cone crushers. The crushing plant configuration is designed to produce a finely crushed ore ‘product’ suitable for the existing and future ball mills to improve grind size for a more efficient, cost-effective processing of sulphide ore. This new circuit is also expected to help drive increased throughput, recovery percentages and it continues to demonstrate the Company’s overall design philosophy of simplicity, redundancy, and durability (Figures 3a, b and c). |

| · | The total capital cost of the full mill expansion was budgeted to be approximately $6.0 million, of which approximately $5.5 million has been incurred to date. The expansion to 2,000 tpd was completed on time and on budget, and is the Company’s third successful mill expansion over the last 24 months. |

| · | Operating cash flow from the expanded 2,000+ tpd processing plant will be predominantly reinvested in the Company with a focus on value enhancing activities, including: (i) enhancements to the 2,000+ tpd processing plant (and other site upgrades), (ii) exploration and drilling with a focus on potential mineral resource expansion at Buckreef Main (northeast and south), Buckreef West, Anfield, Eastern Porphyry extension; (iii) additional capital programs focused on further plant expansions and production growth; and (iv) enhanced CSR/ESG programs. |

Operational and Financial Details – Third Quarter and Year to Date 2024

Mining and Processing

| · | During the three and nine months ended May 31, 2024, Buckreef Gold regretfully reported one LTI at site. The accident occurred in March 2024, and the employee has since made a full recovery. For the three and nine months ended May 31, 2024, including contractors, Buckreef Gold recorded a safety incident frequency rate of 1 (per million hours). Buckreef Gold had previously achieved, for a second time, 1 million hours lost time injury free work until this incident. The Company’s two main contractors, FEMA Builders Limited (“FEMA”) and STAMICO, recorded a safety incident frequency rate of 0 (per million hours). |

|

|

|

Management’s Discussion May 31, 2024 |

| · | During Q3 2024, Buckreef Gold poured 4,628 ounces of gold (Q3 2023: 4,764 ounces) and sold 4,515 ounces of gold (Q3 2023: 4,810 ounces). The slight decrease in gold production in Q3 2024 compared to the prior year period is mainly attributable to a lower average recovery of 79% (Q3 2023: 90%), partially offset by higher mill throughput of 809 tpd (Q3 2023: 740 tpd) and a higher average head grade of 2.52 g/t (Q3 2023: 2.00). The lower average recovery in Q3 2024 was mainly due to a higher proportion of blended material processed in Q3 2024 (22% oxide / 78% sulphide) compared to the prior year period where the mill processed 100% oxide material at a higher average recovery. For the nine months ended May 31, 2024, the Company produced 13,622 ounces of gold and sold 13,361 ounces of gold, a 14% decrease in gold production compared to the prior year period due to lower mill throughput and a lower average recovery. It is expected that the new crushing and milling circuit will produce a finely crushed ore ‘product’ that will help drive increased throughput and recovery percentages and will provide capacity for increased production. Subsequent to Q3 2024, the Company began to realize the benefits of the expanded crushing and milling circuit. Following wet commissioning in June 2024, plant mill throughput has increased to an average of 1,750 tpd, reaching a maximum of 1,873 tpd. This reflects a 116% increase in throughput relative to Q3 2024, on average, while undergoing wet commissioning. |

| · | The Company is continuing its variable metallurgical work with SGS (South Africa) to determine gold recoveries and strategies across the deposit and at different depths. This work continues to progress with additional work focusing on grind size characteristics of the ore. Following initial metallurgical test work findings (2021) and results from a recent bulk sample (2023) from sulphide ore, the average recovery of 80% during the nine months ended May 31, 2024 is within the anticipated range of initial test-work gold recoveries for sulphide ore (refer to press release dated 6/9/2021) based on the grind size and retention time realized during the first nine months of F2024. Recoveries are expected to stay within the 80% – 82% range for the sulphide ore with the grind size being maintained at 80% passing 75 microns (p80 of 75µ). This grind size was realized during the nine months ended May 31, 2024. Although increasing retention times to those similar to the recent ‘bulk sample’ test (refer to press release dated 6/15/2023) would be expected to increase gold recovery, the Company will, for the remainder of 2024, focus on mill throughput to maximize gold production. In addition, the commissioning of the new crushing circuit with the capacity to process 3,600 to 4,800 tpd is designed to provide a steady and finer feed to the milling section thus improving the grindability and increasing consistent throughput to the mill. Additional anticipated benefits of the new crusher include providing a consistent mill feed with less wear and tear on the ball mills, and therefore reducing maintenance intervals. Upon final commissioning, the additional 1,000 tpd ball mill is also expected to improve grindability and gold recovery. |

| · | Total ore tonnes mined in Q3 2024 of 105 kt were in line with the prior year period (Q3 2023: 99 kt), however waste tonnes mined decreased to 677 kt (Q3 2023: 875 kt) as drilling and blasting activities were negatively impacted by contractor blast hole drill rig availability. This coincided with mining operations accessing a higher proportion of the harder transitional and sulphide material (compared to the prior year period, which was mainly softer oxide material). During Q3 2024 waste to ore tonnes, contributed to a strip ratio in of 6.5 (waste:ore tonnes) compared to the prior year period (8.8 waste:ore tonnes). In late Q3 2024, blast hole drill rig availability returned to planned levels and mining activity is planned to ramp up over Q4 2024. During the nine months ended May 31, 2024, mining activity provided access to a higher proportion of ore tonnes to waste tonnes compared to the prior year period, contributing to an improved strip ratio of 5.4 (waste:ore tonnes) (2023: 6.8 waste:ore tonnes). |

|

|

|

Management’s Discussion May 31, 2024 |

Fiscal 2024 Production and Cost Outlook

| · | Full year gold production guidance is being revised to approximately 20,000 ounces, a decrease from the originally estimated guidance range of 25,000 – 30,000 ounces, and total average cash cost1 is being revised to approximately $1,100 per ounce, an increase from the original range of $800 - $900 per ounce. F2024 full year gold production has been partially impacted by a delay in accessing the high-grade ore blocks as scheduled in the initial mine sequence. This is primarily due to a delay in timing of planned mining activities as drilling and blasting activities were negatively impacted by contractor blast hole drill rig availability in Q2 and Q3 2024, coupled with the impact of unusually heavy rainy season in Tanzania associated with the El Niño climatic conditions during the nine months ended May 31, 2024, which impacted load and haul operations from the pit. Drill rig availability has returned to planned levels and mining activity is planned to ramp up over Q4 2024 and into F2025. During this period, to maintain prudent capital management and an ability to fund the plant expansion to 2,000 tpd, the Company demonstrated operational flexibility by proactively deferring a portion of waste stripping originally scheduled for F2024, which also limited access to certain high grade ore blocks as scheduled in the initial mine sequence. It is expected that the updated mine sequence will access the originally scheduled ore blocks in early F2025 benefiting production early next fiscal year. The newly expanded processing facility is also expected to have an immediate and positive impact on current operations beginning in Q4 2024 and into F2025, by enhancing ore throughput, gold recovery and gold production from the 2,000 tpd processing plant. |

| · | Subsequent to Q3 2024, the Company began to realize the benefits of the expansion. Following commencement of the new mill, which started on June 21, 2024, plant mill throughput has increased to an average of 1,750 tpd, and reaching a maximum of 1,873 tpd. This reflects a 116% increase in throughput relative to Q3 2024, on average, while undergoing wet commissioning. Average weekly gold production has also increased to 616 ounces over this same period, an increase in weekly production of 60%, on average, from Q3 2024 production levels. This weekly production run rate is expected to continue over the remainder of July and August 2024, during final plant commissioning and ramp-up, to meet the Company’s revised F2024 production and cost guidance. |

Inventory

| · | As at May 31, 2024, the ROM pad stockpile contained 334,996 tonnes at an average grade of 1.12 g/t with an estimated 12,024 ounces of contained gold. A further stockpile of crushed mill feed of 752 tonnes at 2.68 g/t containing an estimated 65 ounces of gold has been accumulated between the crusher and mill. The fair market value of the ounces of gold on the ROM pad stockpile and crushed ore stockpile is approximately $28.4 million using the London PM Fix gold price of $2,348 per ounce as at May 31, 2024. Since year-end August 31, 2023, the Company added to the ROM pad stockpile (3,282 ounces) but drew down 355 ounces on the crushed ore stockpile to support mill feed. These fluctuations in ROM pad inventory are anticipated throughout the course of the year and are designed to ensure steady state processing. During the nine months ended May 31 2024, the Company processed stockpiled and mined material through the 1,000+ tpd processing plant (which includes 7 large CIL tanks) and consequently reported gold in circuit, reflecting a buildup of metal inventory in the CIL tanks. The Company reported 1,140 ounces of gold in circuit at May 31, 2024, which reflected an increase of 287 ounces from August 31, 2023, following gold elution and smelting activity during the year. |

Tailings Storage (TSF 2.2)

| · | During Q2 2024 the initial phase of TSF 2.2 construction was completed. Beginning in Q4 2024, the Company will begin construction of a river training project, in preparation for the placement of the final lift on TSF2.2 to its final approved elevation. This work will consist of minor clearing, box cutting, bulk excavation & compaction of the berm, slope finishing and installation of HDPE liner and final erosion control measures. This final phase of TSF 2.2 construction is planned for Q1 2025, which will provide further storage until the beginning of Q1 2026. Long term solutions are being pursued, including two sites for long term tailings deposition, as well as using thickened tails (dry stacking) with co-disposal with pit waste. |

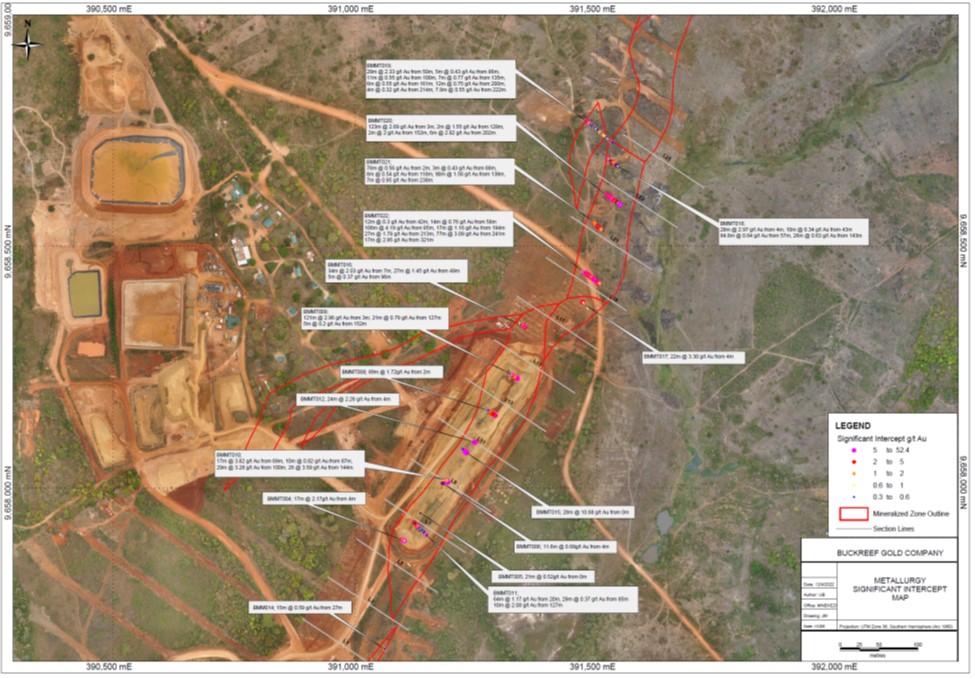

Exploration

| · | During the three and nine months ended May 31, 2024, the Company primarily focused on grade control drilling to support mining activity. Exploration drilling for F2024 is now expected to commence during the dry season, beginning in July 2024, and will focus on infill and expansion drilling at Eastern Porphyry, Buckreef West, inferred mineral resources and strike extensions, both to the NE and SW of the Main Zone – which, if successful, has the potential to increase tonnes to higher mineral resource categories. |

|

|

|

Management’s Discussion May 31, 2024 |

Larger Project

| · | The larger project, in which the ‘sulphide ore’ encompasses approximately 90+% of the Buckreef Main Zone’s Measured and Indicated Mineral Resources, is a key mid-to-long term value driver. Unlocking this value is an important business objective for the Company. The larger project will evaluate the options for a high return large scale operation. It is the goal of the Company to exceed the metrics outlined in the 2020 Technical Report, including annual production, strip ratios and key financial metrics. The Company continues to work with our principal consultants on advancing the larger project, including advanced metallurgical testing across the deposit and geotechnical studies for a deeper pit. Concurrent with this work, the Company has started assessing the construction and operation of a significantly larger processing facility. |

| · | Buckreef Gold has commenced the long-lead items for de-risking the larger project, including: (i) geotechnical characterization to determine the ultimate pit slopes of the 2-kilometre-long open pit. The field work was completed in early Q3 2023 with consultants SGS Canada Inc (“SGSC”) and Terrane Geoscience Inc; and (ii) the variability metallurgical study for the first 5 - 7 years of potential production of the larger project. To date a total of 19 metallurgical holes (2,367 meters) have been completed along the entire strike of the Buckreef Main deposit. These holes were shipped to SGS South Africa for metallurgical testing and are nearing completion. |

| · | The Company, in conjunction with Ausenco Engineering Canada Inc. (“Ausenco”), has identified potential locations for the larger processing plant, tailing storage facilities, potential dry stack tailings facility, waste rock piles and other associated infrastructure. All locations are subject to successful ‘sterilization drilling’, which commenced in Q2 2023, and ongoing planning. |

| · | During fiscal 2023 (“F2023”), the Company received significant assay results for the metallurgical testing program, the results of which demonstrate: (i) continuity of mineralization down dip and along strike of the deposit; and (ii) excellent width and grade of mineralization. As part of the upcoming metallurgical variability study, using core from this program, the Company plans to confirm the amenability of the sulphide material to be processed through the existing processing plant, using its relatively simple flowsheet. This study, in conjunction with the previously reported 6,500 tonne bulk sample results, is expected to have positive implications for potential plant expansions and a straightforward flow sheet similar to the existing processing plant. |

Environmental, Social and Corporate Governance

| · | The Company is committed to working to high ESG standards and is implementing several community programs, while continuing to develop a broader framework and policies. There were no reportable environmental or community related incidents during the three and nine months ended May 31, 2024. |