UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 2, 2024

_______________________________

TPI Composites, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 001-37839 | 20-1590775 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

9200 E. Pima Center Parkway, Suite 250

Scottsdale, Arizona 85258

(Address of Principal Executive Offices) (Zip Code)

(480) 305-8910

(Registrant's telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 | TPIC | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On May 2, 2024, TPI Composites, Inc. (the Company) issued a press release announcing its financial results for the three months ended March 31, 2024. A copy of the Company’s press release is furnished herewith as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein. The Company also posted a presentation to its website at www.tpicomposites.com under the tab “Investors” providing information regarding its results of operations and financial condition for the three months ended March 31, 2024. The information contained in the presentation is incorporated by reference herein. The presentation is being furnished herewith as Exhibit 99.2 to this current report on Form 8-K. The Company’s website and the information contained therein is not part of this disclosure.

The information in Item 2.02 of this current report on Form 8-K (including Exhibits 99.1 and 99.2) is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in Item 2.02 of this current report on Form 8-K (including Exhibits 99.1 and 99.2) shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

(d) Exhibits

99.1 – Press Release dated May 2, 2024

99.2 – Presentation dated May 2, 2024

104 – Cover page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| TPI Composites, Inc. | ||

| Date: May 2, 2024 | By: | /s/ Ryan Miller |

| Ryan Miller | ||

| Chief Financial Officer | ||

EXHIBIT 99.1

TPI Composites, Inc. Announces First Quarter 2024 Earnings Results – Results In-line with Company Expectations; Reiterate Full Year 2024 Financial Guidance

SCOTTSDALE, Ariz., May 02, 2024 (GLOBE NEWSWIRE) -- TPI Composites, Inc. (Nasdaq: TPIC), today reported financial results for the first quarter ended March 31, 2024.

“As expected, sales and adjusted EBITDA for the first quarter of 2024 were impacted by the timing of production line startups and transitions. As our customers prepare for an expected multi-year global wind market growth environment, we are excited to partner with them and align our factories to support their next generation blade models. Activity on these startups and transitions is progressing well and we remain confident 2024 will be a tale of two halves, as we are projecting a return to mid-single digit adjusted EBITDA margins and positive free cash flow in the second half of 2024,” said Bill Siwek, President and CEO of TPI Composites. “We ended the quarter with $117 million of cash and with the completion of the Oaktree strategic refinancing last quarter, we have ample liquidity to navigate current market conditions and ultimately expand to meet our customers’ growing needs.”

“In addition to demand driven by climate change and the need for energy security, several government policy initiatives aimed at enabling and expanding the use of renewable energy are having a positive impact on OEM backlogs and give us confidence in the wind industry’s short- and long-term growth trajectory. We remain focused on improving our operations every day and strengthening our strategic position in the market, which we expect will set us up nicely for the anticipated recovery in the wind industry.”

First Quarter 2024 Results and Recent Business Highlights

| KPIs from continuing operations |

1Q’24 | 1Q’23 | |||||

| Sets1 | 488 | 655 | |||||

| Estimated megawatts2 | 2,050 | 2,948 | |||||

| Utilization3 | 67% | 84% | |||||

| Dedicated manufacturing lines4 | 36 | 37 | |||||

| Manufacturing lines installed5 | 36 | 37 | |||||

| Wind Blade ASP (in $ thousands)6 | $183 | $195 | |||||

First Quarter 2024 Financial Results from Continuing Operations

Net sales for the three months ended March 31, 2024, decreased 26.0% to $299.1 million as compared to $404.1 million in the same period in 2023 due to the following:

Net loss from continuing operations attributable to common stockholders was $61.8 million for the three months ended March 31, 2024, compared to a loss of $30.3 million in the same period in 2023. The decrease was primarily driven by lower sales, startup and transition costs, and changes in estimate for pre-existing warranty claims, partially offset by favorable foreign currency fluctuations.

The net loss from continuing operations per common share was $1.31 the three months ended March 31, 2024, compared to a net loss per common share of $0.72 for the same period in 2023.

Adjusted EBITDA was a loss of $23.0 million for the three months ended March 31, 2024, as compared to adjusted EBITDA of $8.4 million during the same period in 2023. Adjusted EBITDA margin decreased to a loss of 7.7% as compared to an adjusted EBITDA margin of 2.1% during the same period in 2023. The decrease was primarily driven by lower sales, startup and transition costs, and changes in estimate for pre-existing warranty claims, partially offset by favorable foreign currency fluctuations.

2024 Guidance

Guidance for the full year ending December 31, 2024:

| Guidance | Full Year 2024 |

| Net Sales from Continuing Operations | $1.3 billion - $1.4 billion |

| Adjusted EBITDA Margin % from Continuing Operations | 1% - 3% |

| Utilization % | 75% to 80% (based on 34 lines installed) |

| Capital Expenditures | $25 - $30 million |

Conference Call and Webcast Information

TPI Composites will host an investor conference call this afternoon, Thursday, May 2nd, at 5:00 pm ET. Interested parties are invited to listen to the conference call which can be accessed live over the phone by dialing 1-844-825-9789, or for international callers, 1-412-317-5180. A replay will be available two hours after the call and can be accessed by dialing 1-844-512-2921, or for international callers, 1-412-317-6671. The passcode for the live call and the replay is 10187861. The replay will be available until May 16, 2024. Interested investors and other parties may also listen to a simultaneous webcast of the conference call by logging onto the Investors section of the Company’s website at www.tpicomposites.com. The online replay will be available for a limited time beginning immediately following the call.

About TPI Composites, Inc.

TPI Composites, Inc. is a global company focused on innovative and sustainable solutions to decarbonize and electrify the world. TPI delivers high-quality, cost-effective composite solutions through long-term relationships with leading OEMs in the wind and automotive markets. TPI is headquartered in Scottsdale, Arizona and operates factories in the U.S., Mexico, Türkiye and India. TPI operates additional engineering development centers in Denmark and Germany and global service training centers in the U.S. and Spain.

Forward-Looking Statements

This release contains forward-looking statements which are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements, among other things, concerning: growth of the wind energy and electric vehicle markets and our addressable markets for our products and services; effects on our financial statements and our financial outlook; our business strategy, including anticipated trends and developments in and management plans for our business and the wind industry and other markets in which we operate; competition; future financial results, operating results, revenues, gross margin, operating expenses, profitability, products, projected costs, warranties, our ability to improve our operating margins, and capital expenditures. These forward-looking statements are often characterized by the use of words such as “estimate,” “expect,” “anticipate,” “project,” “plan,” “intend,” “seek,” “believe,” “forecast,” “foresee,” “likely,” “may,” “should,” “goal,” “target,” “might,” “will,” “could,” “predict,” “continue” and the negative or plural of these words and other comparable terminology. Forward-looking statements are only predictions based on our current expectations and our projections about future events. You should not place undue reliance on these forward-looking statements. We undertake no obligation to update any of these forward-looking statements for any reason. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from those expressed or implied by these statements. These factors include, but are not limited to, the matters discussed in “Risk Factors,” in our Annual Report on Form 10-K and other reports that we will file with the SEC.

Non-GAAP Definitions

This press release includes unaudited non-GAAP financial measures, including EBITDA, adjusted EBITDA, net cash (debt) and free cash flow. We define EBITDA as net income (loss) plus interest expense (including losses on the extinguishment of debt and net of interest income), income taxes and depreciation and amortization. We define adjusted EBITDA as EBITDA plus any share-based compensation expense, any foreign currency income or losses, any gains or losses on the sale of assets and asset impairments and any restructuring charges. We define net cash (debt) as the total unrestricted cash and cash equivalents less the total principal amount of debt outstanding. We define free cash flow as net cash flow from operating activities less capital expenditures. We present non-GAAP measures when we believe that the additional information is useful and meaningful to investors. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non-GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP.

We provide forward-looking statements in the form of guidance in our quarterly earnings releases and during our quarterly earnings conference calls. This guidance is provided on a non-GAAP basis and cannot be reconciled to the closest GAAP measures without unreasonable effort because of the unpredictability of the amounts and timing of events affecting the items we exclude from non-GAAP measures. For example, stock-based compensation is unpredictable for our performance-based awards, which can fluctuate significantly based on current expectations of future achievement of performance-based targets. Amortization of intangible assets and restructuring costs are all impacted by the timing and size of potential future actions, which are difficult to predict. In addition, from time to time, we exclude certain items that occur infrequently, which are also inherently difficult to predict and estimate. It is also difficult to predict the tax effect of the items we exclude and to estimate certain discrete tax items, like the resolution of tax audits or changes to tax laws. As such, the costs that are being excluded from non-GAAP guidance are difficult to predict and a reconciliation or a range of results could lead to disclosure that would be imprecise or potentially misleading. Material changes to any one of the exclusions could have a significant effect on our guidance and future GAAP results. See Table Four for a reconciliation of certain non-GAAP financial measures to the comparable GAAP measures.

Investor Relations

480-315-8742

Investors@TPIComposites.com

| TPI COMPOSITES, INC. AND SUBSIDIARIES | |||||||

| TABLE ONE - CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||

| (UNAUDITED) | |||||||

| Three Months Ended March 31, |

|||||||

| (in thousands, except per share data) | 2024 | 2023 | |||||

| Net sales | $ | 299,062 | $ | 404,066 | |||

| Cost of sales | 307,084 | 399,381 | |||||

| Startup and transition costs | 22,229 | 1,980 | |||||

| Total cost of goods sold | 329,313 | 401,361 | |||||

| Gross profit (loss) | (30,251 | ) | 2,705 | ||||

| General and administrative expenses | 6,699 | 7,034 | |||||

| Loss on sale of assets and asset impairments | 1,830 | 3,593 | |||||

| Restructuring charges, net | 182 | 75 | |||||

| Loss from continuing operations | (38,962 | ) | (7,997 | ) | |||

| Other income (expense): | |||||||

| Interest expense, net | (21,385 | ) | (2,528 | ) | |||

| Foreign currency loss | (640 | ) | (1,214 | ) | |||

| Miscellaneous income | 2,479 | 453 | |||||

| Total other expense | (19,546 | ) | (3,289 | ) | |||

| Loss before income taxes | (58,508 | ) | (11,286 | ) | |||

| Income tax provision | (3,289 | ) | (3,860 | ) | |||

| Net loss from continuing operations | (61,797 | ) | (15,146 | ) | |||

| Preferred stock dividends and accretion | - | (15,173 | ) | ||||

| Net loss from continuing operations attributable to common stockholders | (61,797 | ) | (30,319 | ) | |||

| Net income (loss) from discontinued operations | 329 | (6,981 | ) | ||||

| Net loss attributable to common stockholders | $ | (61,468 | ) | $ | (37,300 | ) | |

| Weighted-average shares of common stock outstanding: | |||||||

| Basic | 47,204 | 42,284 | |||||

| Diluted | 47,204 | 42,284 | |||||

| Net loss from continuing operations per common share: | |||||||

| Basic | $ | (1.31 | ) | $ | (0.72 | ) | |

| Diluted | $ | (1.31 | ) | $ | (0.72 | ) | |

| Net income (loss) from discontinued operations per common share: | |||||||

| Basic | $ | 0.01 | $ | (0.16 | ) | ||

| Diluted | $ | 0.01 | $ | (0.16 | ) | ||

| Net loss per common share: | |||||||

| Basic | $ | (1.30 | ) | $ | (0.88 | ) | |

| Diluted | $ | (1.30 | ) | $ | (0.88 | ) | |

| Non-GAAP Measures (unaudited): | |||||||

| EBITDA | $ | (28,223 | ) | $ | 964 | ||

| Adjusted EBITDA | $ | (22,982 | ) | $ | 8,399 | ||

| TPI COMPOSITES, INC. AND SUBSIDIARIES | |||||||

| TABLE TWO - CONDENSED CONSOLIDATED BALANCE SHEETS | |||||||

| (UNAUDITED) | |||||||

| March 31, | December 31, | ||||||

| (in thousands) | 2024 | 2023 | |||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 116,850 | $ | 161,059 | |||

| Restricted cash | 12,035 | 10,838 | |||||

| Accounts receivable | 125,870 | 138,029 | |||||

| Contract assets | 93,149 | 112,237 | |||||

| Prepaid expenses | 18,536 | 17,621 | |||||

| Other current assets | 41,003 | 34,564 | |||||

| Inventories | 13,679 | 9,420 | |||||

| Assets held for sale | 22,253 | 17,787 | |||||

| Current assets of discontinued operations | 1,036 | 1,520 | |||||

| Total current assets | 444,411 | 503,075 | |||||

| Noncurrent assets: | |||||||

| Property, plant and equipment, net | 126,379 | 128,808 | |||||

| Operating lease right of use assets | 135,858 | 136,124 | |||||

| Other noncurrent assets | 39,205 | 36,073 | |||||

| Total assets | $ | 745,853 | $ | 804,080 | |||

| Liabilities and Stockholders' Deficit | |||||||

| Current liabilities: | |||||||

| Accounts payable and accrued expenses | $ | 220,300 | $ | 227,723 | |||

| Accrued warranty | 37,500 | 37,483 | |||||

| Current maturities of long-term debt | 78,576 | 70,465 | |||||

| Current operating lease liabilities | 22,373 | 22,017 | |||||

| Contract liabilities | 10,234 | 24,021 | |||||

| Liabilities held for sale | 2,834 | 1,897 | |||||

| Current liabilities of discontinued operations | 1,950 | 2,815 | |||||

| Total current liabilities | 373,767 | 386,421 | |||||

| Noncurrent liabilities: | |||||||

| Long-term debt, net of current maturities | 431,038 | 414,728 | |||||

| Noncurrent operating lease liabilities | 116,755 | 117,133 | |||||

| Other noncurrent liabilities | 8,360 | 8,102 | |||||

| Total liabilities | 929,920 | 926,384 | |||||

| Total stockholders’ deficit | (184,067 | ) | (122,304 | ) | |||

| Total liabilities and stockholders’ deficit | $ | 745,853 | $ | 804,080 | |||

| TPI COMPOSITES, INC. AND SUBSIDIARIES | ||||||||

| TABLE THREE - CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||

| (UNAUDITED) | ||||||||

| Three Months Ended March 31, |

||||||||

| (in thousands) | 2024 | 2023 | ||||||

| Net cash used in operating activities | $ | (39,004 | ) | $ | (83,861 | ) | ||

| Net cash used in investing activities | (8,285 | ) | (3,275 | ) | ||||

| Net cash provided by financing activities | 3,880 | 107,746 | ||||||

| Impact of foreign exchange rates on cash, cash equivalents and restricted cash | 333 | 730 | ||||||

| Cash, cash equivalents and restricted cash, beginning of period | 172,813 | 153,069 | ||||||

| Cash, cash equivalents and restricted cash, end of period | $ | 129,737 | $ | 174,409 | ||||

| Non-GAAP Measure (unaudited): | ||||||||

| Free cash flow | $ | (47,289 | ) | $ | (87,136 | ) | ||

| TPI COMPOSITES, INC. AND SUBSIDIARIES | |||||||

| TABLE FOUR - RECONCILIATION OF NON-GAAP MEASURES | |||||||

| (UNAUDITED) | |||||||

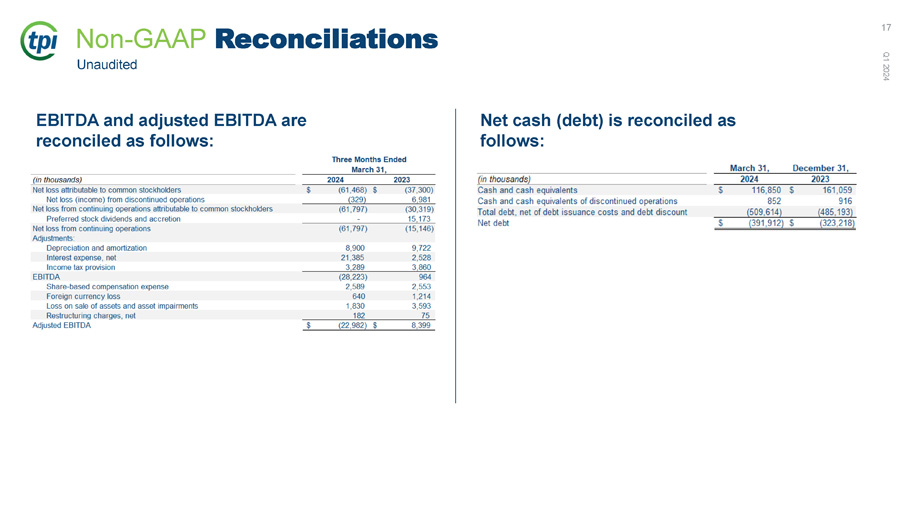

| EBITDA and adjusted EBITDA are reconciled as follows: | Three Months Ended March 31, |

||||||

| (in thousands) | 2024 | 2023 | |||||

| Net loss attributable to common stockholders | $ | (61,468 | ) | $ | (37,300 | ) | |

| Net loss (income) from discontinued operations | (329 | ) | 6,981 | ||||

| Net loss from continuing operations attributable to common stockholders | (61,797 | ) | (30,319 | ) | |||

| Preferred stock dividends and accretion | - | 15,173 | |||||

| Net loss from continuing operations | (61,797 | ) | (15,146 | ) | |||

| Adjustments: | |||||||

| Depreciation and amortization | 8,900 | 9,722 | |||||

| Interest expense, net | 21,385 | 2,528 | |||||

| Income tax provision | 3,289 | 3,860 | |||||

| EBITDA | (28,223 | ) | 964 | ||||

| Share-based compensation expense | 2,589 | 2,553 | |||||

| Foreign currency loss | 640 | 1,214 | |||||

| Loss on sale of assets and asset impairments | 1,830 | 3,593 | |||||

| Restructuring charges, net | 182 | 75 | |||||

| Adjusted EBITDA | $ | (22,982 | ) | $ | 8,399 | ||

| Net debt is reconciled as follows: | March 31, | December 31, | |||||

| (in thousands) | 2024 | 2023 | |||||

| Cash and cash equivalents | $ | 116,850 | $ | 161,059 | |||

| Cash and cash equivalents of discontinued operations | 852 | 916 | |||||

| Total debt, net of debt issuance costs and debt discount | (509,614 | ) | (485,193 | ) | |||

| Net debt | $ | (391,912 | ) | $ | (323,218 | ) | |

| Free cash flow is reconciled as follows: | Three Months Ended March 31, |

||||||

| (in thousands) | 2024 | 2023 | |||||

| Net cash used in operating activities | $ | (39,004 | ) | $ | (83,861 | ) | |

| Capital expenditures | (8,285 | ) | (3,275 | ) | |||

| Free cash flow | $ | (47,289 | ) | $ | (87,136 | ) | |

Exhibit 99.2

Q1 2024 Earnings Call May 2, 2024

Legal Disclaimer This presentation contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). All statements other than statements of historical facts contained in this presentation, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward - looking statements. In many cases, you can identify forward - looking statements by terms such as “may,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. Forward - looking statements contained in this release include, but are not limited to, statements about: i. competition from other wind blade and wind blade turbine manufacturers; ii. the discovery of defects in our products and our ability to estimate the future cost of warranty campaigns; iii. the current status of the wind energy market and our addressable market; iv. our ability to absorb or mitigate the impact of price increases in resin, carbon reinforcements (or fiber), other raw materials and related logistics costs that we use to produce our products; v. our ability to absorb or mitigate the impact of wage inflation in the countries in which we operate; vi. our ability to procure adequate supplies of raw materials and components to fulfill our wind blade volume commitments to our customers; vii. the potential impact of the increasing prevalence of auction - based tenders in the wind energy market and increased competition from solar energy on our gross margins and overall financial performance; viii. our future financial performance, including our net sales, cost of goods sold, gross profit or gross margin, operating expenses, ability to generate positive cash flow and ability to achieve or maintain profitability; ix. changes in domestic or international government or regulatory policy, including without limitation, changes in trade policy and energy policy; x. changes in global economic trends and uncertainty, geopolitical risks, and demand or supply disruptions from global events; xi. changes in macroeconomic and market conditions, including the potential impact of any pandemic, risk of recession, rising interest rates and inflation, supply chain constraints, commodity prices and exchange rates, and the impact of such changes on our business and results of operations; xii. the sufficiency of our cash and cash equivalents to meet our liquidity needs; xiii. the increasing cost and availability of additional capital, should such capital be needed; xiv. our ability to attract and retain customers for our products, and to optimize product pricing; xv. our ability to effectively manage our growth strategy and future expenses, including our startup and transition costs; xvi. our ability to successfully expand in our existing wind energy markets and into new international wind energy markets, including our ability to expand our field service inspection and repair services business; xvii. our ability to keep up with market changes and innovations; xviii. our ability to successfully open new manufacturing facilities and expand existing facilities on time and on budget; xix. the impact of the pace of new product and wind blade model introductions on our business and our results of operations; xx. our ability to identify and execute a strategic alternative to enable the growth of our automotive business; xxi. our ability to maintain, protect and enhance our intellectual property; xxii. our ability to comply with existing, modified, or new laws and regulations applying to our business, including the imposition of new taxes, duties, or similar assessments on our products; xxiii. the attraction and retention of qualified associates and key personnel; xxiv. our ability to maintain good working relationships with our associates, and avoid labor disruptions, strikes and other disputes with labor unions that represent certain of our associates; and xxv. the potential impact of one or more of our customers becoming bankrupt or insolvent or experiencing other financial problems. These forward - looking statements are only predictions. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to materially differ from any future results, levels of activity, performance or achievements expressed or implied by these forward - looking statements. Because forward - looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward - looking statements as guarantees of future events. Further information on the factors, risks and uncertainties that could affect our financial results and the forward - looking statements in this presentation are included in our filings with the Securities and Exchange Commission and will be included in subsequent periodic and current reports we make with the Securities and Exchange Commission from time to time, including in our Annual Report on Form 10 - K for the year ended December 31, 2023, filed with the Securities and Exchange Commission. The forward - looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward - looking statements at some point in the future, we undertake no obligation to update any forward - looking statement to reflect events or developments after the date on which the statement is made or to reflect the occurrence of unanticipated events except to the extent required by applicable law. You should, therefore, not rely on these forward - looking statements as representing our views as of any date after the date of this presentation. Our forward - looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments we may make. This presentation includes unaudited non - GAAP financial measures including EBITDA, adjusted EBITDA, net cash (debt) and free cash flow. We define EBITDA, a non - GAAP financial measure, as net income or loss from continuing operations plus interest expense net, income taxes, depreciation and amortization, preferred stock dividends and accretion less gain on extinguishment on series A preferred stock. We define adjusted EBITDA as EBITDA plus any share - based compensation expense, plus or minus any foreign currency losses or income, plus or minus any losses or gains from the sale of assets and asset impairments, plus any restructuring charges. We define net cash (debt) as total unrestricted cash and cash equivalents less the total principal amount of debt outstanding. We define free cash flow as net cash flow from operating activities less capital expenditures. We present non - GAAP measures when we believe that the additional information is useful and meaningful to investors. Non - GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non - GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. See the Appendix for the reconciliations of certain non - GAAP financial measures to the comparable GAAP measures. This presentation also contains estimates and other information concerning our industry that are based on industry publications, surveys and forecasts. This information involves a number of assumptions and limitations, and we have not independently verified the accuracy or completeness of the information Q1 2024 2 Agenda ⎮ 2023 Sustainability Report ⎮ Q1 2024 Highlights and Business Update ⎮ Q1 2024 Financial Highlights and 2024 Guidance ⎮ Wrap Up ⎮ Q&A 3 Q1 2024

2023 Sustainability Report Q1 2024 4

2023 Sustainability Report 1 5 Q1 2024 0 250 500 2018 2019 2020 2021 2022 2023 Million Metric Tons of CO 2 Estimated CO 2 Reduction from Wind Blades Produced over Entire Product Life by Year Produced 0 1 2 3 2018 2019 2020 2021 2022 2023 Incidents per 200,000 hours worked Environment: x ~346 million metric tons of CO2 reduction for wind blades produced in 2023 x 18% decrease in market - based Scope 1 & 2 emissions from the prior year x Reduced total waste generated by 12% from the prior year x Invested in two wind turbines and expanded solar power in Türkiye x Advancing economically viable PPA’s in Mexico & India Associates: x Our Behavior - Based Safety program continued to yield safety results outperforming industry standards and our internal goals x Fully embraced IDEA (Inclusion, Diversity, Equity, and Awareness) and recognized with numerous awards for commitment to inclusion and diversity around the globe x Promote associate engagement through Global Values in Motion awards and engagement surveys (1) See 2023 Sustainability Report for more details Q1 2024 Highlights and Business Update Q1 2024 6

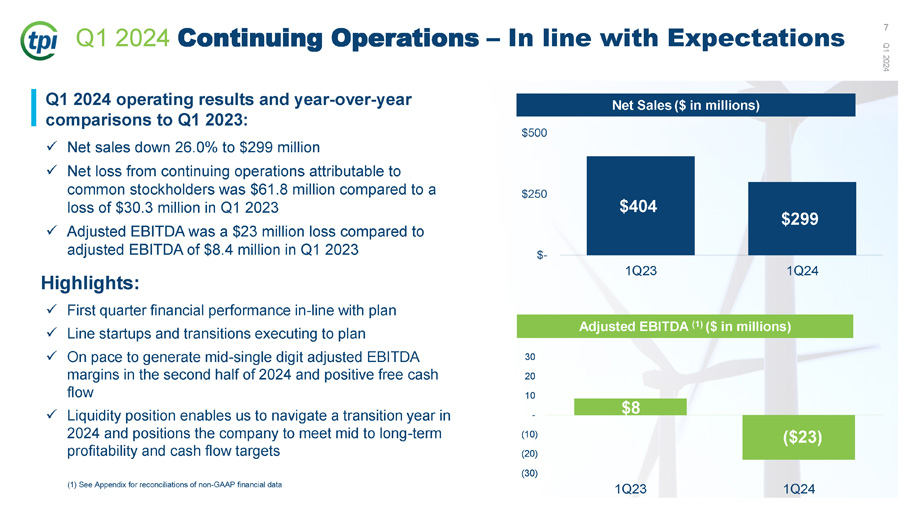

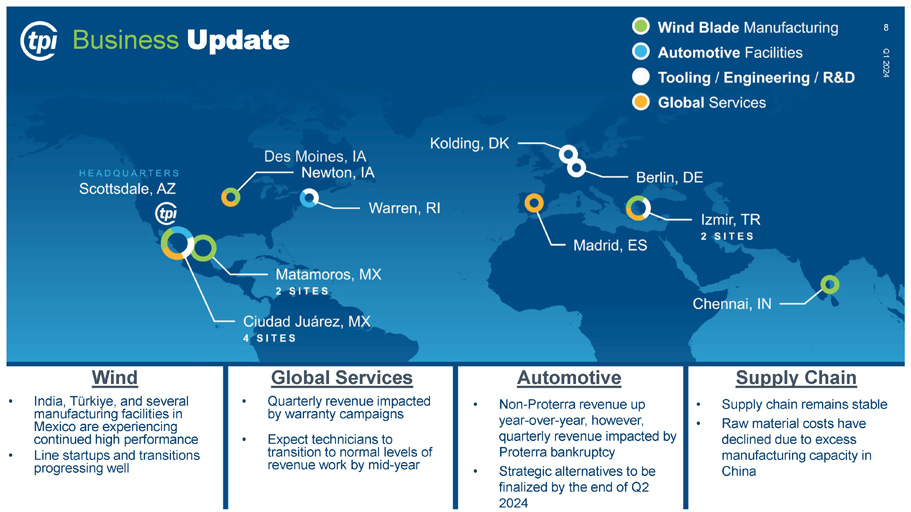

$404 $299 $ - $250 $500 1Q23 1Q24 $8 ($23) (10) (20) (30) - 30 20 10 1Q23 1Q24 Q1 2024 Continuing Operations – In line with Expectations Q1 2024 operating results and year - over - year comparisons to Q1 2023: x Net sales down 26.0% to $299 million x Net loss from continuing operations attributable to common stockholders was $61.8 million compared to a loss of $30.3 million in Q1 2023 x Adjusted EBITDA was a $23 million loss compared to adjusted EBITDA of $8.4 million in Q1 2023 Highlights: x First quarter financial performance in - line with plan x Line startups and transitions executing to plan x On pace to generate mid - single digit adjusted EBITDA margins in the second half of 2024 and positive free cash flow x Liquidity position enables us to navigate a transition year in 2024 and positions the company to meet mid to long - term profitability and cash flow targets (1) See Appendix for reconciliations of non - GAAP financial data Adjusted EBITDA (1) ($ in millions) Net Sales ($ in millions) Q1 2024 7 Wind • India, Türkiye, and several manufacturing facilities in Mexico are experiencing continued high performance • Line startups and transitions progressing well Global Services • Quarterly revenue impacted by warranty campaigns • Expect technicians to transition to normal levels of revenue work by mid - year Supply Chain • Supply chain remains stable • Raw material costs have declined due to excess manufacturing capacity in China 8 Q1 2024 Business Update Automotive • Non - Proterra revenue up year - over - year, however, quarterly revenue impacted by Proterra bankruptcy • Strategic alternatives to be finalized by the end of Q2 2024

Q1 2024 Financial Highlights and 2024 Guidance Q1 2024 9

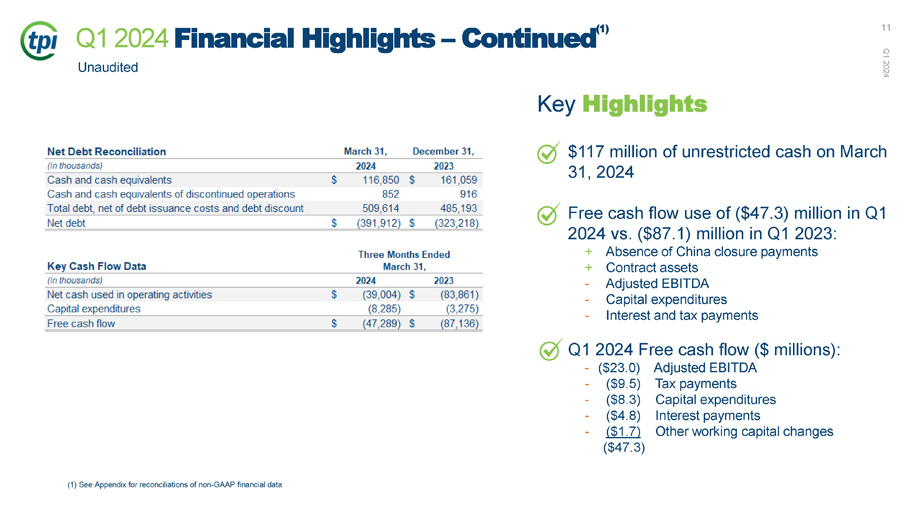

Key Highlights Sales down due to a decrease in the number of blades produced, lower market activity levels, and lower ASPs (mix), partially offset by foreign currency fluctuations and higher tooling sales. Adjusted EBITDA loss of $23 million in Q1 2024 compared to adjusted EBITDA of $8.3 million in Q1 2023: + Cost reduction initiatives + Favorable foreign currency fluctuations + Lower raw material costs - Sales reduction - Higher startup and transition costs - Changes in estimate for pre - existing warranty claims - Inflation impact on production expenses and wages Q1 2024 Financial Highlights from Continuing Operations (1) Unaudited (1) See Appendix for reconciliations of non - GAAP financial data Q1 2024 10 Key Highlights $117 million of unrestricted cash on March 31, 2024 Free cash flow use of ($47.3) million in Q1 2024 vs. ($87.1) million in Q1 2023: + Absence of China closure payments + Contract assets - Adjusted EBITDA - Capital expenditures - Interest and tax payments Q1 2024 Free cash flow ($ millions): Adjusted EBITDA ($23.0) - Tax payments ($9.5) - Capital expenditures ($8.3) - Interest payments ($4.8) - Other working capital changes ($1.7) - ($47.3) Q1 2024 Financial Highlights – Continued (1) Unaudited (1) See Appendix for reconciliations of non - GAAP financial data Q1 2024 11

Adjusted EBITDA Margin % from Continuing Operations 1% to 3% Capital Expenditures $25 million to $30 million Utilization Percentage 75% to 80% on 34 lines Sales from Continuing Operations $1.3 billion to $1.4 billion 2024 TPI Guidance 12 Q1 2024 Wrap Up Q1 2024 13

Q1 2024 14 Wrap Up Market: • Remain very bullish on the energy transition • Positioned to capitalize on the significant growth the industry expects in the coming years Operational: • Renewed focus on LEAN to drive waste reduction across the business • Quality improvement initiatives have been successful • Line startups and transitions progressing as planned Financial : • Volume, EBITDA and cash return to positive in second half of 2024 • Focus on balance sheet efficiency provides us confidence in our liquidity position to manage through short term challenges • End 2024 on run rate to achieve AEBITDA levels of $100+ million in 2025 People: • Thanks to our associates for their commitment and dedication to TPI and our mission to decarbonize and electrify the world This presentation includes unaudited non - GAAP financial measures including EBITDA, adjusted EBITDA, net cash (debt) and free cash flow.

Q&A Q1 2024 15

We define EBITDA, a non - GAAP financial measure, as net income or loss from continuing operations plus interest expense net, income taxes, depreciati on and amortization, preferred stock dividends and accretion less gain on extinguishment on series A preferred stock. We define adjusted EBITDA as EBITDA plus any share - based compensation expense, plus or minus any foreign currency losses or income, plus or minus any losses or gains from the sale of assets and asset impairments, plus any restructuring charges. . We define net cash (debt) as total unrestricted cash and cash equivalents less the total principal amount of debt outstanding. We define free cash flow as net cash flow from operating activities less capital expenditures. We present non - GAAP measures when we believe that the additional information is useful and meaningful to investors. Non - GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non - GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. We provide forward - looking statements in the form of guidance in our quarterly earnings releases and during our quarterly earnings conference calls. This guidance is provided on a non - GAAP basis and cannot be reconciled to the closest GAAP measures without unreasonable effort because of the unpredictability of the amounts and timing of events affecting the items we exclude from non - GAAP measures. For example, stock - based compensation is unpredictable for our performance - based awards, which can fluctuate significantly based on current expectations of future achievement of performance - based targets. Amortization of intangible assets and restructuring costs are all impacted by the timing and size of potential future actions, which are difficult to predict. In addition, from time to time, we exclude certain items that occur infrequently, which are also inherently difficult to predict and estimate. It is also difficult to predict the tax effect of the items we exclude and to estimate certain discrete tax items, like the resolution of tax audits or changes to tax laws. As such, the costs that are being excluded from non - GAAP guidance are difficult to predict and a reconciliation or a range of results could lead to disclosure that would be imprecise or potentially misleading. Material changes to any one of the exclusions could have a significant effect on our guidance and future GAAP results. See below for a reconciliation of certain non - GAAP financial measures to the comparable GAAP measures. Appendix – Non - GAAP Financial Information 16 Q1 2024 Non - GAAP Reconciliations Unaudited EBITDA and adjusted EBITDA are reconciled as follows: Net cash (debt) is reconciled as follows: Q1 2024 17