UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 30, 2024

______________________________

Shenandoah Telecommunications Company

(Exact name of registrant as specified in its charter)

______________________________

| Virginia | 0-9881 | 54-1162807 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

500 Shentel Way

P.O. Box 459

Edinburg, VA 22824

(Address of principal executive offices) (Zip Code)

(540) 984-4141

(Registrant’s telephone number, including area code)

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock (No Par Value) | SHEN | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Shareholder Approval of 2024 Equity Incentive Plan

On April 30, 2024, Shenandoah Telecommunications Company (the “Company”) held its Annual Meeting of Shareholders (the “Annual Meeting”). At the Annual Meeting, the Company’s shareholders approved the Company’s 2024 Equity Incentive Plan (the “2024 Plan”) which had been previously approved by the Company’s Board of Directors (the “Board”) subject to shareholder approval.

The material terms of the 2024 Plan are described under “Proposal No. 5 – Shareholder Approval of Company’s 2024 Equity Incentive Plan” in the Company’s Definitive Proxy Statement on Schedule 14A, filed with the Securities and Exchange Commission (the “SEC”) on March 14, 2024, as amended by the Company’s supplements thereto, filed with the SEC on March 28, 2024 and April 5, 2024 (collectively, the “Proxy Statement”). Such description of the 2024 Plan is incorporated by reference herein. A copy of the 2024 Plan is attached as Exhibit 10.1 to this Current Report on Form 8-K.

Appointment of New Directors

On April 30, 2024, following the Annual Meeting and the effectiveness of the Board Size Amendment and the Bylaw Amendment (as defined below), the Board increased the size of the Board from 8 to 10 and appointed (i) James F. DiMola to serve as a Class 3 Director for a term expiring at the Company’s 2025 Annual Meeting of Shareholders (the “2025 Annual Meeting”) or until his successor has been elected and qualified, or until his earlier resignation, removal from office, death or incapacity and (ii) Matthew S. DeNichilo to serve as a Class 1 Director for a term expiring at the 2025 Annual Meeting or until his successor has been elected and qualified, or until his earlier resignation, removal from office, death or incapacity. The Board appointed Mr. DiMola to serve on the Company’s Nominating and Corporate Governance Committee and appointed Mr. DeNichilo to serve on the Company’s Audit Committee.

Mr. DiMola was appointed to the Board pursuant to the Investor Rights Agreement, dated April 1, 2024 (the “Investor Rights Agreement”), between the Company and an investment fund managed by affiliates of GCM Grosvenor (“GCM Grosvenor”). Mr. DiMola serves as a Managing Director at GCM Grosvenor. The material terms of the Investor Rights Agreement were disclosed in the Company’s Current Report on Form 8-K, filed with the SEC on April 1, 2024 (the “Horizon Closing Form 8-K”), which also attached a copy of the Investor Rights Agreement as Exhibit 10.2. Such description in the Horizon Closing Form 8-K and the copy of the Investor Rights Agreement attached thereto are incorporated by reference herein.

Mr. DeNichilo was appointed to the Board pursuant to the terms of the Investment Agreement, dated October 24, 2023 (the “Investment Agreement”), among the Company, Shentel Broadband Holding Inc., a wholly-owned subsidiary of the Company, ECP Fiber Holdings, LP, a Delaware limited partnership (“ECP Investor”), and Hill City Holdings, LP, a Delaware limited partnership affiliated with ECP Investor (“Hill City”). Mr. DeNichilo serves as a Partner at Energy Capital Partners, which is affiliated with ECP Investor and Hill City. The material terms of the Investment Agreement were disclosed in the Company’s Current Report on Form 8-K, filed with the SEC on October 26, 2023 (the “Horizon Signing Form 8-K”), which also attached a copy of the Investment Agreement as Exhibit 2.2. Such description in the Horizon Signing Form 8-K and the copy of the Investment Agreement attached thereto are incorporated by reference herein.

Other than as set forth in the Investor Rights Agreement and the Investment Agreement, respectively, there are no arrangements or understandings between either of Mr. DiMola and Mr. DeNichilo and the Company required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Mr. DiMola and Mr. DeNichilo will receive compensation for their service on the Board in accordance with the Company’s standard policies, as described under “Director Compensation” in the Proxy Statement.

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On April 30, 2024, at the Annual Meeting, the Company’s shareholders approved an amendment to the Company’s Amended and Restated Articles of Incorporation to increase the maximum size of the Board, from nine (9) to thirteen (13) directors (the “Board Size Amendment”). Following shareholder approval, the Company filed Articles of Amendment to the Company’s Articles of Incorporation with the State Corporation Commission of the Commonwealth of Virginia (the “SCC”) reflecting the Board Size Amendment. The Board Size Amendment became effective upon the issuance of a Certificate of Amendment by the SCC to the Company on April 30, 2024.

In connection with the effectiveness of the Board Size Amendment, the Board adopted amended and restated bylaws of the Company (the “Bylaws”) to provide that the Board shall fix the number of directors by resolution from time to time within the range specified in the Board Size Amendment (the “Bylaw Amendment”).

The foregoing summary of the Board Size Amendment and Bylaw Amendment is qualified in its entirety by reference to the full text of the Articles of Amendment and Bylaws, copies of which are attached hereto as Exhibits 3.1 and 3.2, respectively, and incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On April 30, 2024, at the Annual Meeting, the following proposals were submitted to a vote of the Company’s shareholders:

Proposal 1 – Election of Directors

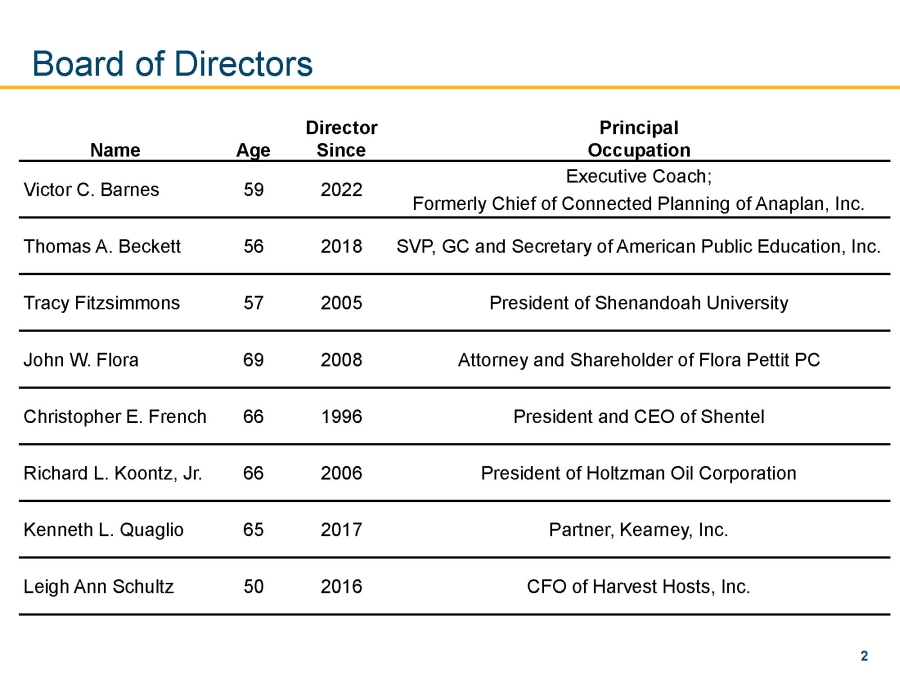

The following Director nominees were elected. All individuals elected as a Director will serve a three (3) year term expiring at the Company’s annual meeting of shareholders in 2027.

| Votes For | Votes Against | Abstentions | Broker Non-Votes | |

| Thomas A. Beckett | 37,798,122 | 3,597,139 | 206,430 | 3,197,821 |

| Richard L. Koontz, Jr. | 40,136,768 | 1,304,524 | 160,399 | 3,197,821 |

| Leigh Ann Schultz | 40,559,354 | 829,111 | 213,226 | 3,197,821 |

Proposal 2 – Ratification of Selection of Independent Registered Public Accounting Firm

The Company’s shareholders ratified the appointment of RSM US LLP, as set forth below:

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 43,916,149 | 265,908 | 617,455 | - |

Proposal 3 - Non-Binding Vote on Named Executive Officer Compensation

The Company’s shareholders approved, on a non-binding basis, the compensation paid to the Company’s named executive officers, as set forth below:

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 39,371,962 | 1,755,631 | 474,098 | 3,197,821 |

Proposal 4 - An Amendment to the Company’s Amended and Restated Articles of Incorporation to Increase the Maximum Size of the Board

The Company’s shareholders approved the Board Size Amendment with the affirmative vote of more than two-thirds of the Company’s outstanding common stock entitled to vote at the Annual Meeting, as set forth below:

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 43,102,737 | 1,465,237 | 231,538 | - |

Proposal 5 - A Vote to Approve the Company’s 2024 Equity Incentive Plan

The Company’s shareholders approved the 2024 Plan, as set forth below:

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 39,442,567 | 1,735,220 | 423,904 | 3,197,821 |

| Item 7.01. | Regulation FD Disclosure. |

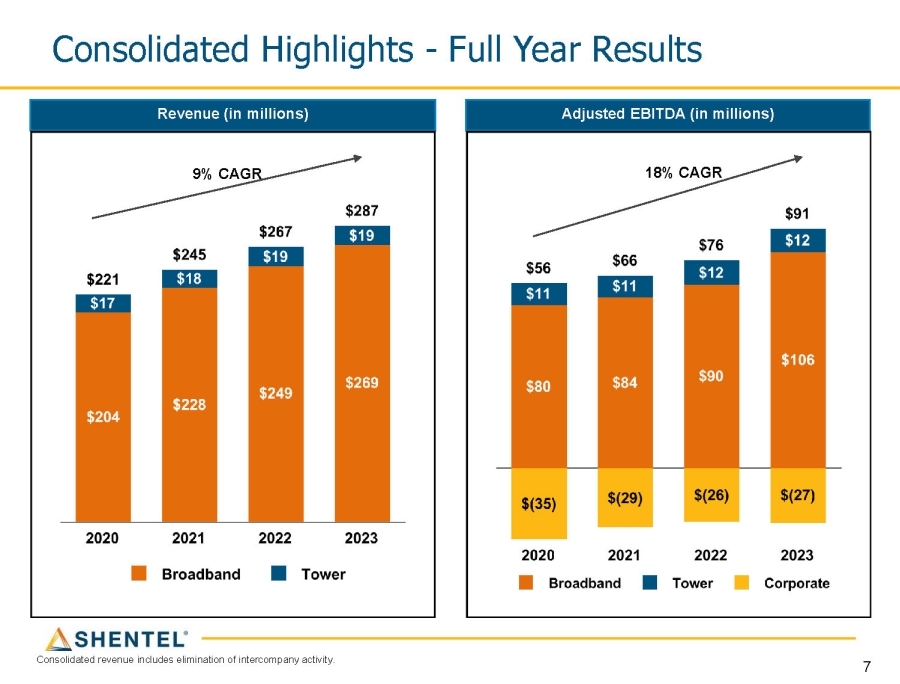

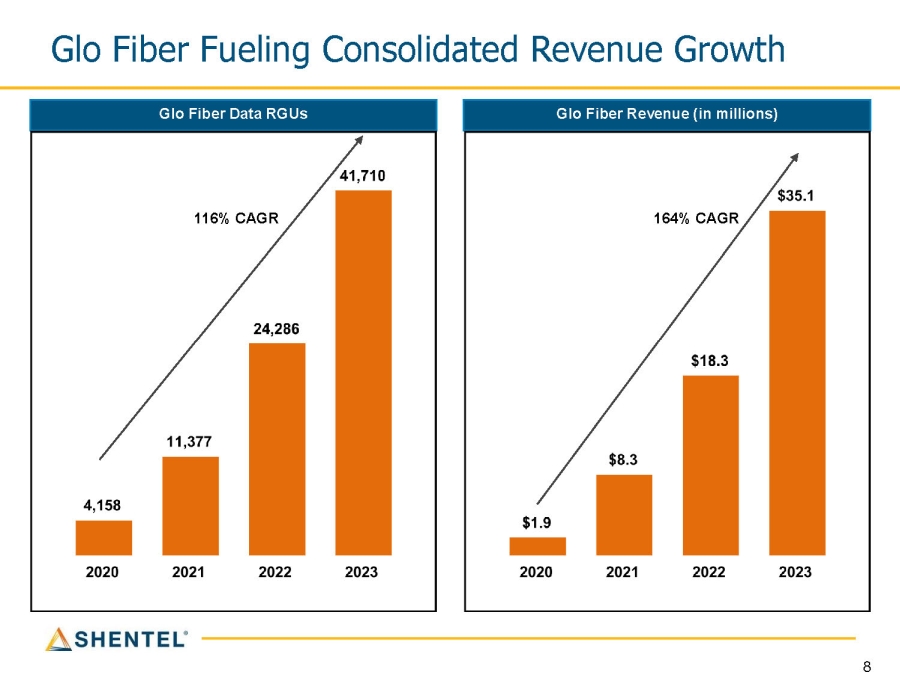

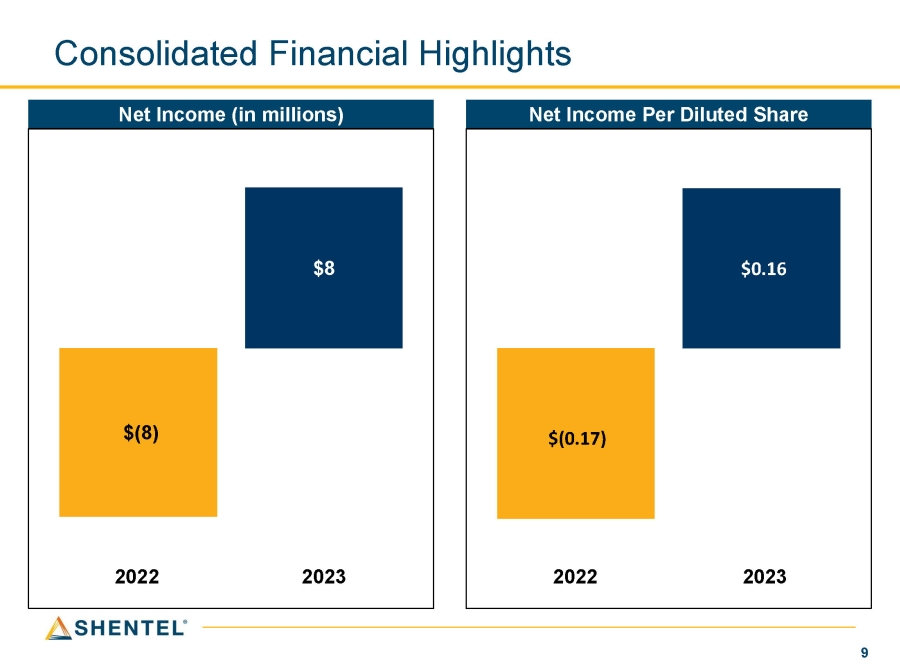

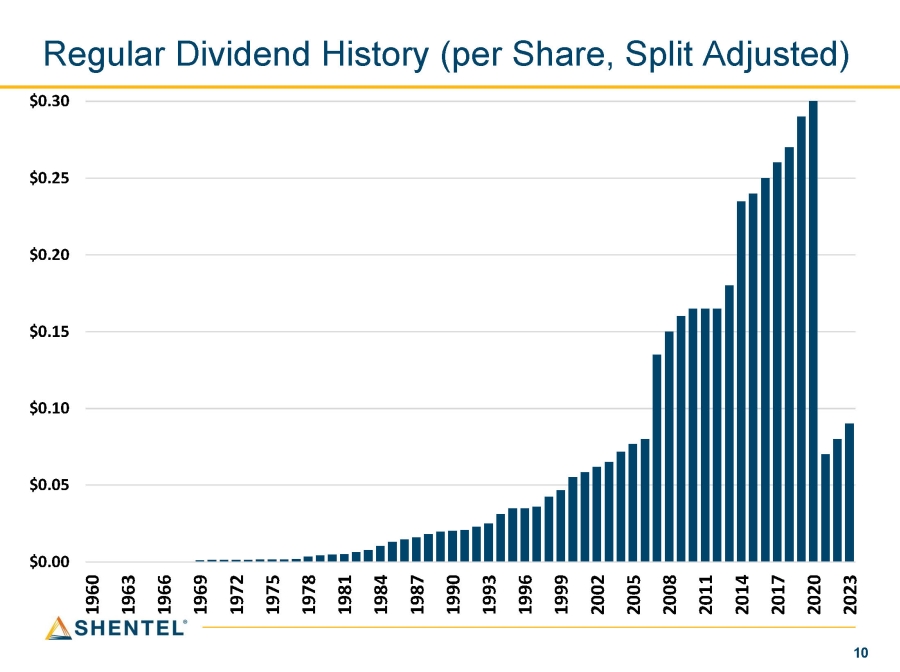

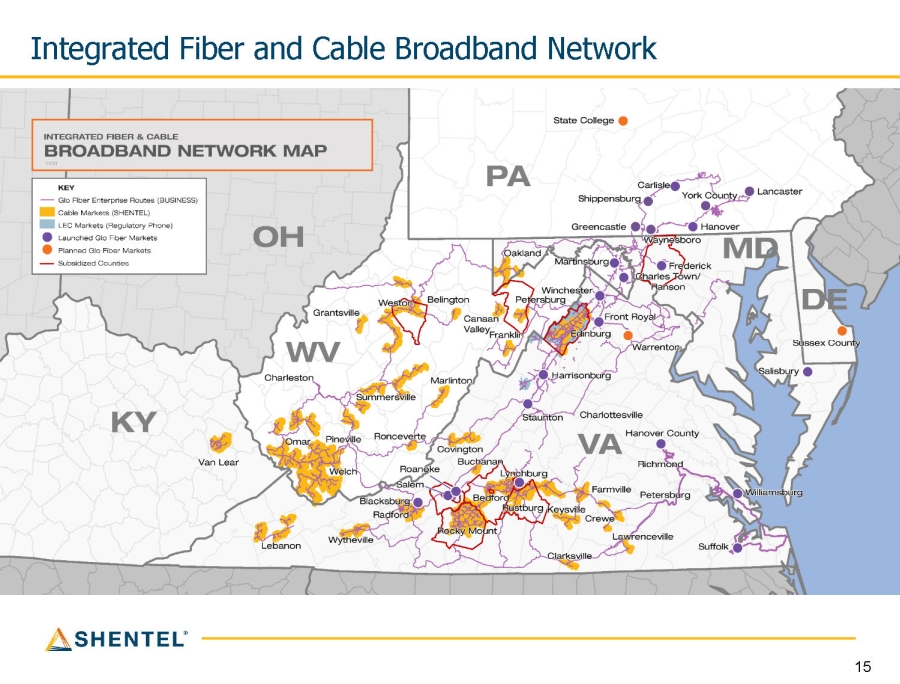

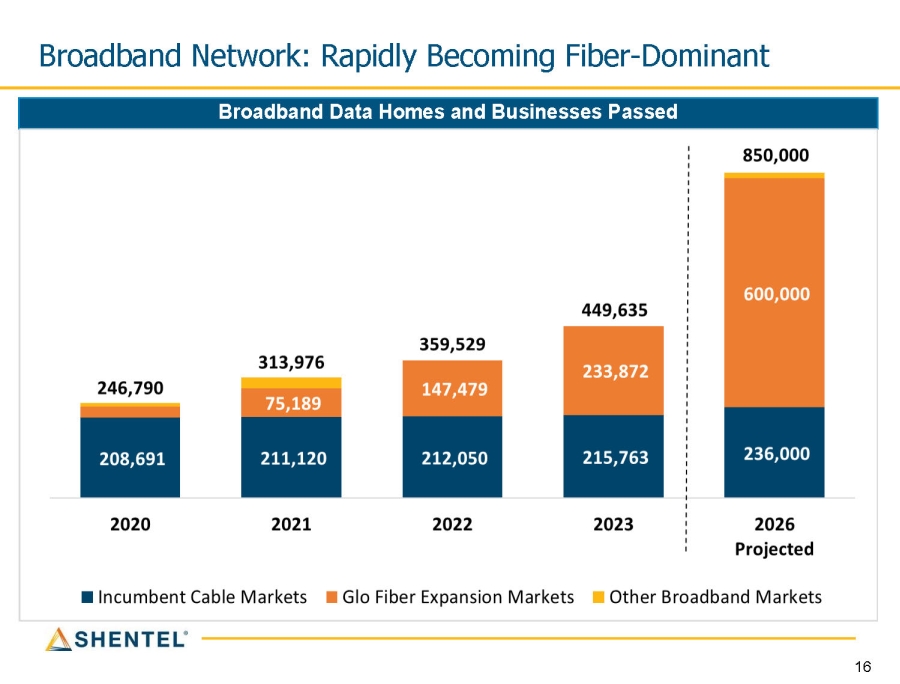

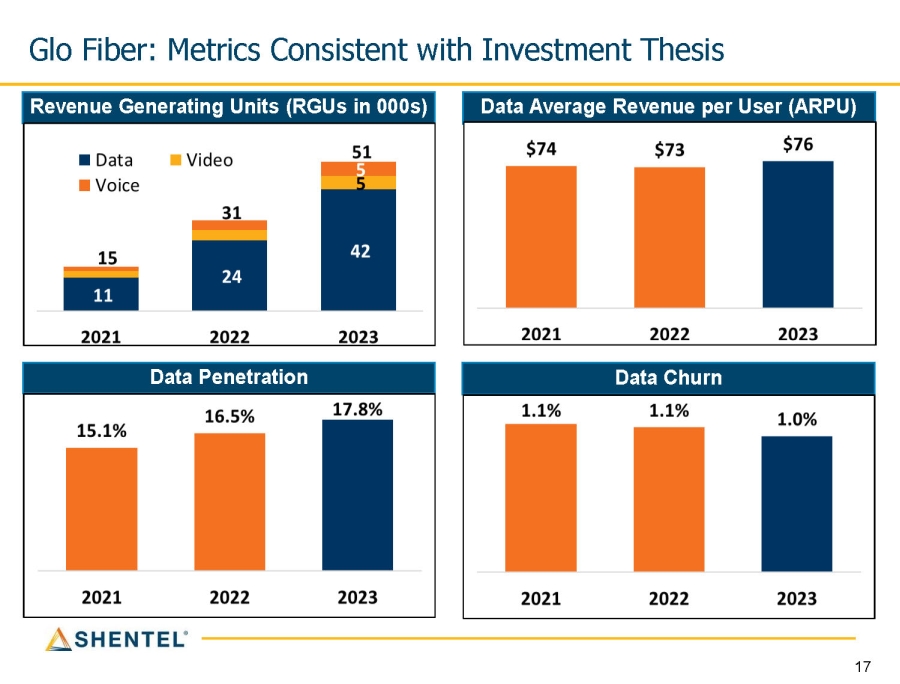

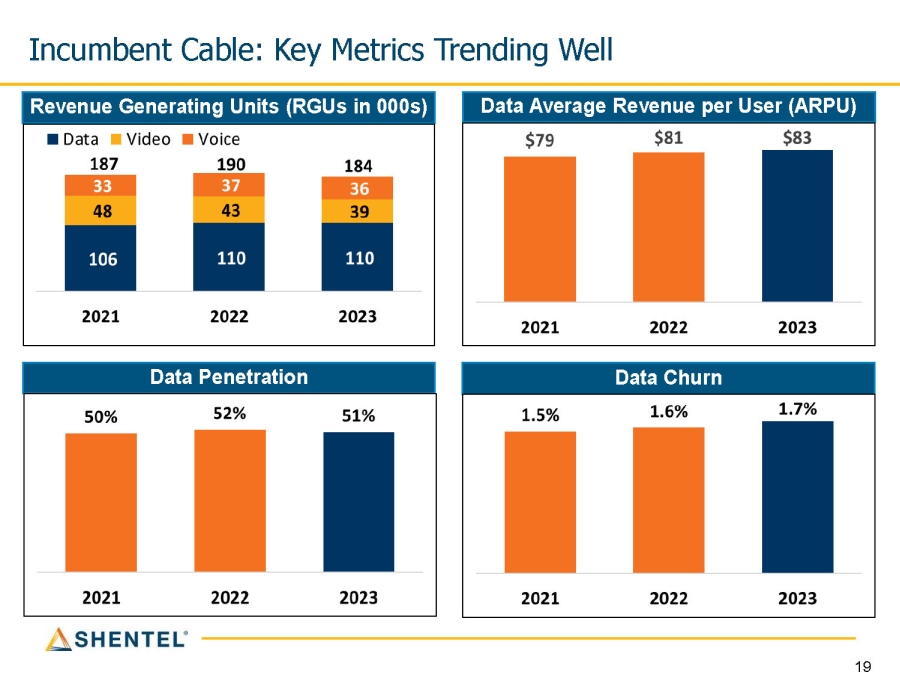

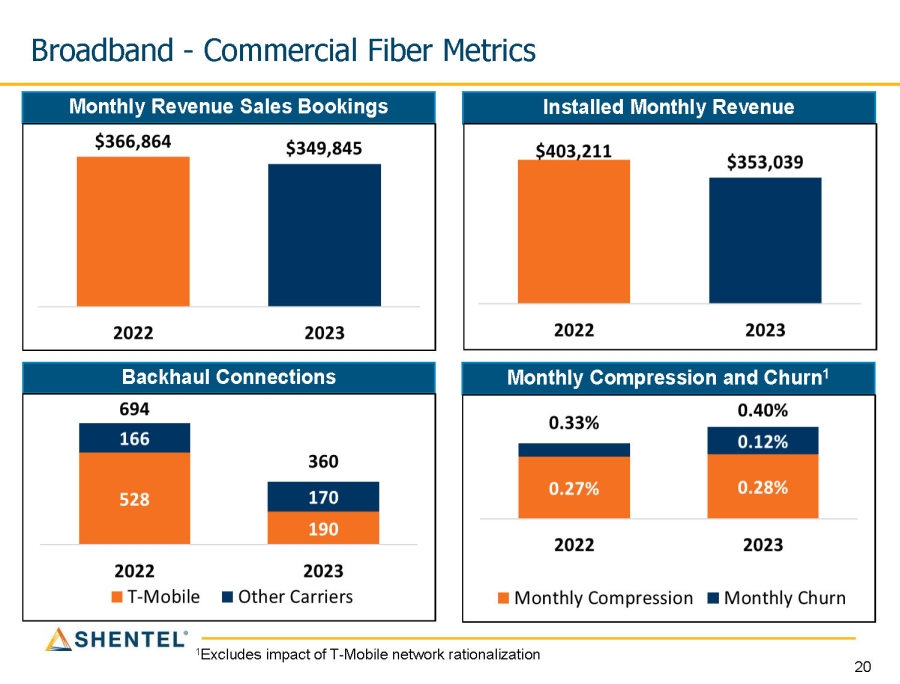

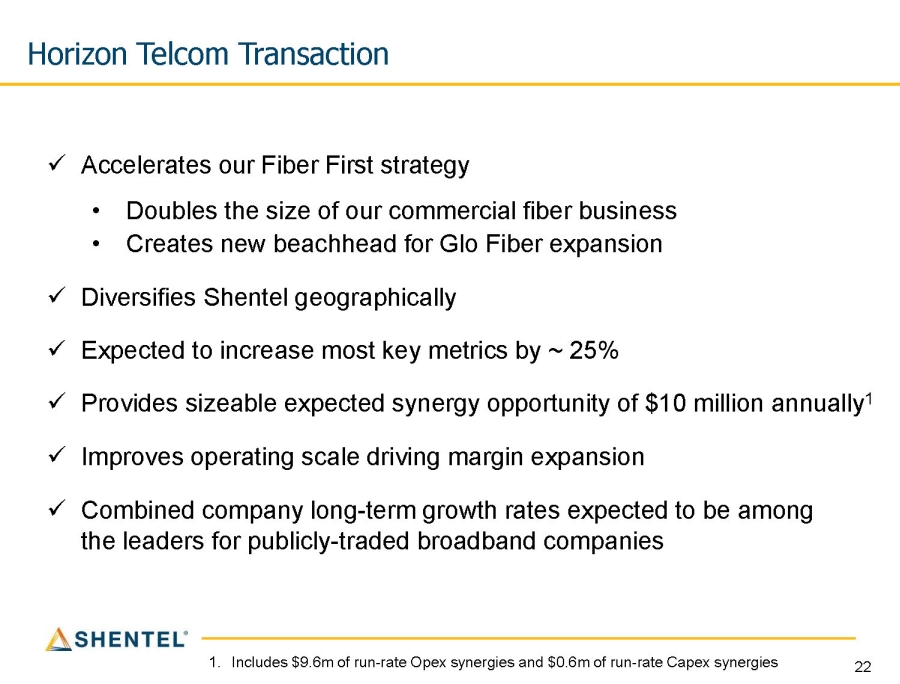

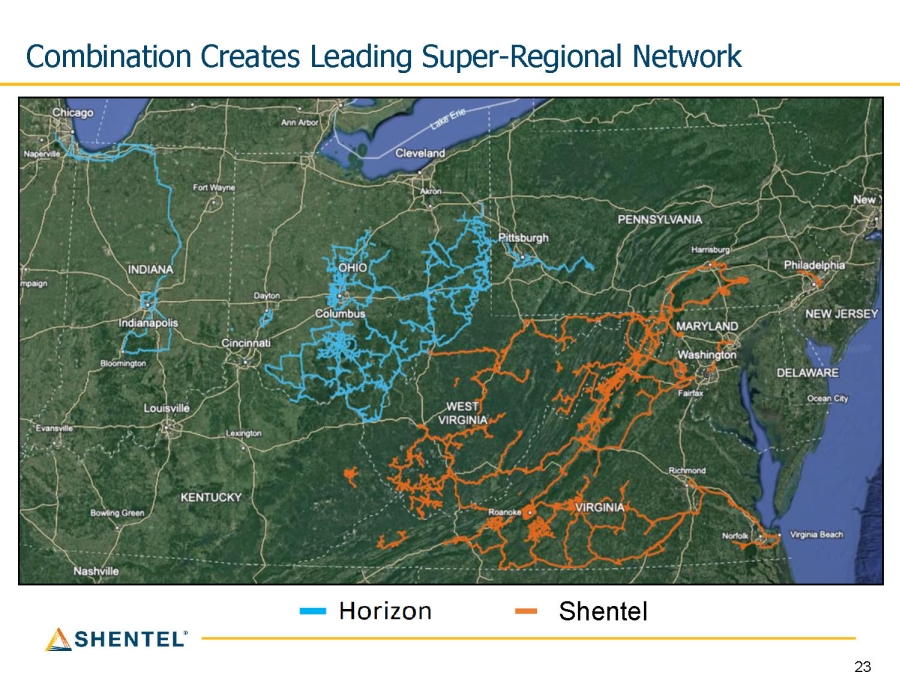

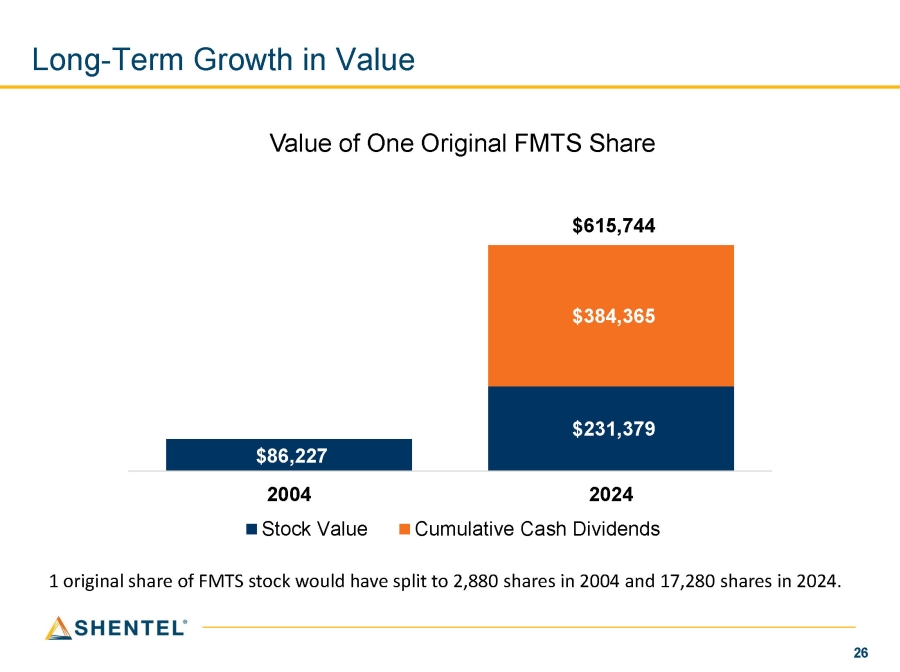

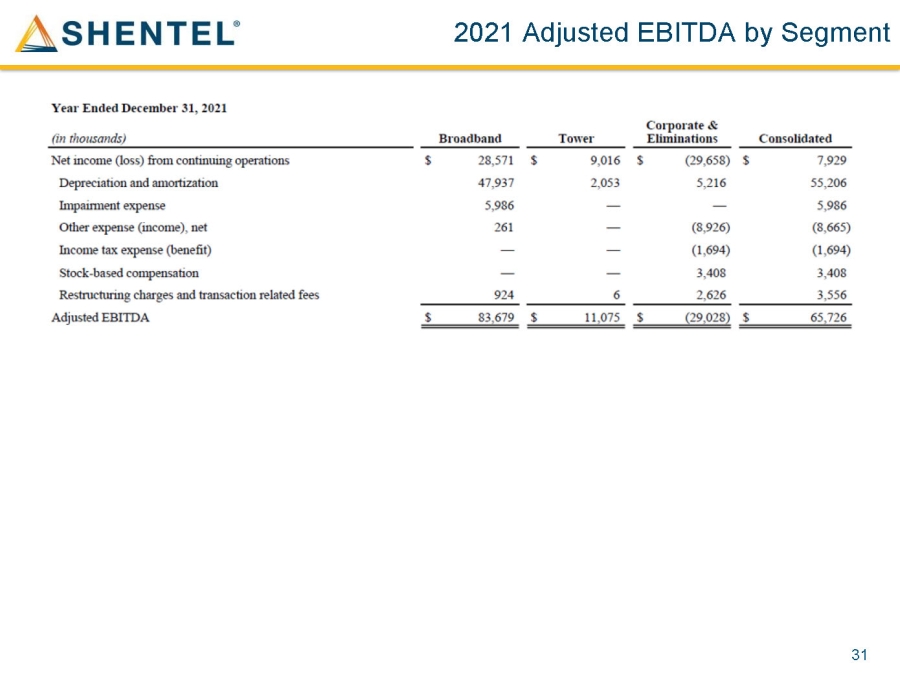

On April 30, 2024, following the formal portion of the Annual Meeting, Mr. Christopher French, Chairman of the Board, President and CEO, Mr. James Volk, Senior Vice President of Finance and CFO, and Mr. Edward McKay, Executive Vice President and COO, provided a brief presentation on the Company. The presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. | Description |

| 3.1 | Articles of Amendment to Amended and Restated Articles of Incorporation of Shenandoah Telecommunications Company, effective April 30, 2024 |

| 3.2 | Amended and Restated Bylaws of Shenandoah Telecommunications Company, effective April 30, 2024 |

| 10.1 | Shenandoah Telecommunications Company 2024 Equity Incentive Plan, effective April 30, 2024 |

| 99.1 | Presentation Materials from the Annual Meeting, dated April 30, 2024 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| SHENANDOAH TELECOMMUNICATIONS COMPANY | |

| Dated: May 1, 2024 | /s/ Derek C. Rieger |

| Derek C. Rieger | |

| Vice President – Legal and General Counsel | |

Exhibit 3.1

ARTICLES OF AMENDMENT

TO THE

AMENDED AND RESTATED ARTICLES OF INCORPORATION

OF

SHENANDOAH TELECOMMUNICATIONS COMPANY

The undersigned, on behalf of the corporation set forth below, pursuant to Title 13.1, Chapter 9, Article 11 of the Code of Virginia, states as follows:

I.

The name of the corporation is Shenandoah Telecommunications Company (the “Corporation”).

II.

Article VI of the articles of incorporation of the Corporation is hereby amended in its entirety to read as follows:

The authorized number of directors of this Corporation shall be not less than seven (7) and not more than thirteen (13). The number of directors within this range shall be fixed in accordance with the Corporation’s Bylaws, as may be amended from time to time. When the number of directors is changed the Board of Directors shall determine the class or classes to which the increased or decreased number of directors shall be apportioned; provided that the directors in each class shall be as nearly equal in number as possible. No decrease in the number of directors shall have the effect of shortening the term of any incumbent director.

III.

The amendment was adopted by the board of directors of the Corporation on February 13, 2024, was submitted to the shareholders in accordance with Title 13.1, Chapter 9, Article 11 of the Code of Virginia, and was duly approved by the shareholders in the manner required by Title 13.1, Chapter 9 of the Code of Virginia and by the articles of incorporation of the Corporation on April 30, 2024.

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned corporation has caused these Articles of Amendment to be executed by its duly authorized officer as of April 30, 2024.

| SHENANDOAH TELECOMMUNICATIONS COMPANY, a Virginia corporation | ||

| By: | /s/ Christopher E. French | |

| Name: | Christopher E. French | |

| Title: | President and Chief Executive Officer | |

| SCC ID: | 02140531 | |

Exhibit 3.2

SHENANDOAH TELECOMMUNICATIONS COMPANY

Edinburg, Virginia

AMENDED AND RESTATED BYLAWS

(Amended effective as of April 30, 2024)

ARTICLE I

MEETINGS OF SHAREHOLDERS

SECTION 1. Places of Meetings - All meetings of the shareholders shall be held at the principal executive offices of the company in Edinburg, Virginia, or at such other place or places, if any, as may from time to time be fixed by the Board of Directors.

SECTION 2. Annual Meetings -

(a) The annual meeting of shareholders shall be held on such date and at such time as may be fixed by the Board of Directors and stated in the notice of meeting. The annual meeting shall be held for the purpose of electing directors and for the transaction of only such other business as is properly brought before the meeting in accordance with these Bylaws. To be properly brought before an annual meeting, nominations and other business must be: (i) specified in the notice of the annual meeting (or any supplement thereto) given by or at the direction of the Board of Directors; (ii) otherwise properly brought before the annual meeting by or at the direction of the Board of Directors; or (iii) otherwise properly brought before the annual meeting by a shareholder in accordance with these Bylaws. For nominations of persons for election to the Board of Directors or proposals of other business to be properly brought by a shareholder before an annual meeting, a shareholder must (x) be a shareholder of record at the time of giving of notice of such annual meeting by or at the direction of the Board of Directors, at the time the shareholder provides the notice required by these Bylaws and at the time of the annual meeting, (y) be entitled to vote at such annual meeting and (z) comply with the procedures set forth in these Bylaws as to such nomination or business. The immediately preceding sentence shall be the exclusive means for a shareholder to make nominations or other business proposals (other than matters properly brought under Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and included in the company’s notice of meeting) before an annual meeting of shareholders.

(b) For nominations or other business to be properly brought before an annual meeting by a shareholder, the shareholder must have given timely notice thereof in writing to the secretary in proper form (including, in the case of nominations, the completed and signed questionnaire, representation and agreement required by Section 9 of Article I of these Bylaws) and timely updates and supplements thereof in writing to the secretary, and any such other business must constitute a proper matter for shareholder action under the Articles of Incorporation, these Bylaws and applicable law. To be timely, a shareholder’s notice shall be delivered to the secretary at the principal executive offices of the company not later than the close of business on the one hundred twentieth (120th) day nor earlier than the close of business on the one hundred fiftieth (150th) day prior to the first (1st) anniversary of the preceding year’s annual meeting; provided, however, that in the event that the date of the annual meeting is more than thirty (30) days before or more than seventy (70) days after such anniversary date, notice by the shareholder must be so delivered not earlier than the close of business on the one hundred fiftieth (150th) day prior to such annual meeting and not later than the close of business on the later of the one hundred twentieth (120th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement of the date of such meeting is first made by the company. In no event shall any adjournment or postponement of an annual meeting or the public announcement thereof commence a new time period (or extend any time period) for the giving of a shareholder’s notice as described above. In addition, to be timely, a shareholder’s notice shall be further updated and supplemented so that the information provided or required to be provided in such notice shall be true and correct as of the record date for the meeting and as of the date that is ten (10) business days prior to the meeting or any adjournment or postponement thereof, and such update and supplement shall be delivered to the secretary at the principal executive offices of the company not later than five (5) business days after the record date for the meeting in the case of the update and supplement required to be made as of the record date, and not later than eight (8) business days prior to the date of the meeting or any adjournment or postponement thereof in the case of the update and supplement required to be made as of ten (10) business days prior to the meeting or any adjournment or postponement thereof; provided, however, that no such update or supplement shall cure a notice that did not fully comply with this Bylaw on the date that such notice was delivered to the company, nor shall a shareholder be permitted to amend, update or submit a new nomination or proposal of other business, including by changing or adding nominees or proposals proposed to be brought before a meeting, after the time first required for the giving of the shareholder’s notice under this Section 2(b) of Article I of these Bylaws. If a shareholder who has given timely notice as required by these Bylaws to make a nomination or bring other business before any such meeting intends to authorize another person to act for such shareholder as a proxy to make the nomination or present the proposal at such meeting, the shareholder shall give notice of such authorization in writing to the secretary at the principal executive offices of the company not less than five (5) business days before the date of the meeting, including the name and contact information for such person.

|

|

(c) To be in proper form, a shareholder’s notice shall set forth, as applicable: (i) as to each person, if any, whom the shareholder proposes to nominate for election as a director (A) all information relating to such person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors in a contested election pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder, or is otherwise required pursuant to and in accordance with Regulation 14A of the Exchange Act, (B) a description of all arrangements, understandings or relationships between such person and the shareholder, the beneficial owner, if any, on whose behalf the nomination is made and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder, including a description of all direct and indirect compensation and other material monetary agreements, arrangements or understandings during the past three years, and any other material relationships, between or among such shareholder, the beneficial owner, if any, or their respective affiliates and associates, or others acting in concert therewith, on the one hand, and each proposed nominee, and his or her respective affiliates and associates, or others acting in concert therewith, on the other hand, including, without limitation, all information that would be required to be disclosed pursuant to Rule 404 promulgated under Regulation S-K if the shareholder making the nomination and any beneficial owner on whose behalf the nomination is made, if any, or any affiliate or associate thereof or person acting in concert therewith, were the “registrant” for purposes of such rule and the nominee were a director or executive officer of such registrant, and (C) (I) such person’s written consent to be named in a proxy statement as a nominee and to serve as a director if elected and (II) a written certification from such person that, if elected, he or she intends to serve as a director for the entire term of such office; (ii) as to any other business that the shareholder proposes to bring before the meeting, (A) a brief description of the business desired to be brought before the meeting, (B) the text of the proposal or business (including the text of any resolutions proposed for consideration and, in the event that such business includes a proposal to amend these Bylaws, the text of the proposed amendment), (C) the reasons for conducting such business at the meeting and any material interest in such business of such shareholder, the beneficial owner, if any, on whose behalf the proposal is made and any of their respective affiliates and associates or others acting in concert therewith, and (D) a description of all agreements, arrangements and understandings between such shareholder or the beneficial owner, if any, and any other person or persons (including their names) in connection with the proposal of such business by such shareholder or beneficial owner; and (iii) as to the shareholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made (A) the name and address of such shareholder, as they appear on the company’s books, of such beneficial owner, if any, and of their respective affiliates or associates or others acting in concert therewith, (B) (I) the class and number of shares of capital stock or other securities of the company which are directly or indirectly owned beneficially and of record by such shareholder, such beneficial owner, if any, or their respective affiliates or associates or others acting in concert therewith, (II) the names of and number of shares of capital stock or other securities of the company held by any broker, bank or other custodian or nominee on behalf of such shareholder, such beneficial owner, if any, or their respective affiliates or associates or others acting in concert therewith, and (III) any economic interest of the shareholder, the beneficial owner, if any, or their respective affiliates or associates or others acting in concert therewith in any indebtedness of the company or its subsidiaries, (C) any option, warrant, convertible security, stock appreciation right or similar right with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any class of shares of capital stock of the company or with a value derived in whole or in part from the value of any class of shares of the company’s capital stock, or any derivative or synthetic arrangement having the characteristics of a long position in any class of shares of the company’s capital stock, or any contract, derivative, swap or other transaction or series of transactions designed to produce economic benefits and risks that correspond substantially to the ownership of any class of shares of the company’s capital stock, including due to the fact that the value of such contract, derivative, swap or other transaction or series of transactions is determined by reference to the price, value or volatility of any class of shares of the company’s capital stock, whether or not such instrument, contract or right shall be subject to settlement in the underlying class of shares of the company’s capital stock, through the delivery of cash or other property or otherwise, and without regard to whether the shareholder, the beneficial owner, if any, or any affiliates or associates or others acting in concert therewith may have entered into any transactions that hedge or mitigate the economic effect of such instrument, contract or right or any other direct or indirect opportunity to profit or share in any profit derived from any increase or decrease in the value of shares of the company’s capital stock (any of the foregoing, a “Derivative Instrument”) directly or indirectly owned beneficially by such shareholder, the beneficial owner, if any, or any affiliates or associates or others acting in concert therewith, (D) any proxy (other than a revocable proxy given in response to a solicitation made pursuant to, and in accordance with, Section 14(a) of the Exchange Act by way of a solicitation statement filed on Schedule 14A), contract, arrangement or understanding pursuant to which such shareholder, beneficial owner, if any, or affiliates or associates or others acting in concert therewith has a right to vote any class of shares of the company’s capital stock, (E) any agreement, arrangement, understanding or otherwise, including any repurchase or similar so-called “stock borrowing” agreement or arrangement, engaged in, directly or indirectly, by such shareholder, the purpose or effect of which is to mitigate loss, reduce the economic risk (of ownership or otherwise) of any class of shares of the company’s capital stock by, manage the risk of share price changes for or increase or decrease the voting power of, such shareholder, the beneficial owner, if any, or any affiliates or associates or others acting in concert therewith with respect to any class of the shares of the company’s capital stock, or which provides, directly or indirectly, the opportunity to profit or share in any profit derived from any decrease in the price or value of any class of shares of the company’s capital stock (any of the foregoing, “Short Interests”), (F) any rights to dividends or other distributions on the shares of the company’s capital stock owned beneficially by such shareholder, the beneficial owner, if any, or any affiliates or associates or others acting in concert therewith that are separated or separable from the underlying shares of the company’s capital stock, (G) any performance-related fees (other than an asset-based fee) to which such shareholder, the beneficial owner, if any, or any affiliates or associates or others acting in concert therewith may be entitled based on any increase or decrease in the value of shares of the company’s capital stock or Derivative Instruments, (H) any significant equity interests or any Derivative Instruments or Short Interests in any principal competitor of the company held by such shareholder, the beneficial owner, if any, or any affiliates or associates or others acting in concert therewith, (I) any direct or indirect interest of such shareholder, the beneficial owner, if any, or any affiliates or associates or others acting in concert therewith in any contract with the company, any affiliate of the company or any principal competitor or principal counter-party of the company (including, in any such case, any employment agreement or consulting agreement), (J) a representation that the shareholder is a holder of record of stock of the company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to propose such business or nomination, (K) a representation regarding whether the shareholder or the beneficial owner, if any, or any of their respective affiliates or associates or others acting in concert therewith intends, or is part of a group which intends, (x) to deliver a proxy statement and/or form of proxy to any holders of the company’s outstanding capital stock with respect to such proposal or (y) in the case of any nomination, to solicit proxies in support of director nominees other than the company’s nominees in accordance with Rule 14a-19 promulgated under the Exchange Act, and if so in each of clauses (x) and (y), naming the participants (as defined in Item 4 of Schedule 14A under the Exchange Act) in any such proxy solicitation, and (L) any other information relating to such shareholder and beneficial owner, if any, or their respective affiliates or associates or others acting in concert therewith that would be required to be disclosed in a proxy statement and form of proxy or other filings required to be made in connection with solicitations of proxies for, as applicable, the proposal and/or for the election of directors in a contested election pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder. The company may require any proposed nominee to furnish such other information as it may reasonably require to determine the eligibility of such proposed nominee to serve as a director of the company under applicable law, the Articles of Incorporation or these Bylaws, or the independence of such nominee.

|

|

(d) Notwithstanding anything in the second sentence of paragraph (b) of this Section 2 to the contrary, in the event that the number of directors to be elected to the Board of Directors at an annual meeting is increased and there is no public announcement by the company naming the nominees for the additional directorships at least one hundred (100) days prior to the first

|

|

(1st) anniversary of the preceding year’s annual meeting, a shareholder’s notice required by this Section 2 shall also be considered timely, but only with respect to nominees for the additional directorships, if it shall be delivered to the secretary at the principal executive offices of the company not later than the close of business on the tenth (10th) day following the day on which a public announcement that the number of directors to be elected to the Board of Directors at an annual meeting has been increased is first made by the company.

(e) In addition to the other requirements of Sections 2 and 3 of this Article I, (i) no shareholder, beneficial owner, if any, or any of their respective affiliates, associates or others acting in concert therewith or any other participant shall solicit proxies in support of any nominees other than the nominees of the Board of Directors in connection with any meeting of shareholders unless such shareholder, beneficial owner, if any, and their respective affiliates, associates and other persons acting in concert therewith or any other participants to such solicitation have complied with Rule 14a-19 promulgated under the Exchange Act in connection with the solicitation of such proxies, and (ii) if such shareholder, beneficial owner, if any, or any of their respective affiliates, associates or others acting in concert therewith or any other participant (A) provides notice pursuant to Rule 14a-19(b) promulgated under the Exchange Act or includes the information required by Rule 14a-19(b) in a preliminary or definitive proxy statement previously filed by such person (it being understood that such notice or filing shall be in addition to any notice required by these Bylaws, including pursuant to this Section 2 and Section 3 of Article I, as applicable) and (B) subsequently fails to comply with any of the requirements of Rule 14a-19 promulgated under the Exchange Act, then the company shall disregard any proxies or votes solicited for such shareholder’s nominee and any such nomination shall be disregarded. Upon request by the company, if any shareholder, beneficial owner, if any, or their respective affiliates, associates or others acting in concert therewith provides notice pursuant to Rule 14a-19(b) promulgated under the Exchange Act or includes the information required by Rule 14a-19(b) in a preliminary or definitive proxy statement previously filed by such person, such shareholder or other applicable person shall deliver to the company, no later than seven (7) business days prior to the applicable meeting, reasonable evidence that it has met the requirements of Rule 14a-19 promulgated under the Exchange Act. In no event may a shareholder nominate a greater number of director candidates than are subject to election by the shareholders at the applicable meeting. Any shareholder directly or indirectly soliciting proxies from other shareholders must use a proxy card color other than white, which shall be reserved for the exclusive use by the Board of Directors.

(f) For purposes of Section 2 and Section 3 of this Article I, “public announcement” shall mean disclosure in a press release reported by the Dow Jones News Service, Associated Press or other national news service or in a document publicly filed by the company with the Securities and Exchange Commission pursuant to Section 13, 14 or 14(d) of the Exchange Act and the rules and regulations promulgated thereunder. In addition to the other requirements set forth in these Bylaws (including Section 2, Section 3 and Section 9 of this Article I), a shareholder shall also comply with all applicable requirements of state and federal law, including the Exchange Act and the rules and regulations thereunder (including Rule 14a-19), with respect to any nomination, proposal of other business or other matters set forth in these Bylaws. Nothing in these Bylaws shall be deemed to affect any rights of shareholders to request inclusion of proposals in the company’s proxy statement pursuant to Rule 14a-8 under the Exchange Act.

|

|

SECTION 3. Special Meetings -

(a) Special meetings of the shareholders may be called only by the Chairman of the Board of Directors, the president or the Board of Directors by the vote of a majority of the directors in office. At any special meeting of the shareholders, only such business shall be conducted or considered, as shall have been properly brought before the meeting pursuant to the company’s notice of meeting. To be properly brought before a special meeting, proposals of business must be (i) specified in the company’s notice of meeting (or any supplement thereto) given by or at the direction of the Board of Directors or (ii) otherwise properly brought before the special meeting, by or at the direction of the Board of Directors. Nominations of persons for election to the Board of Directors may be made at a special meeting of shareholders at which directors are to be elected pursuant to the company’s notice of meeting (A) by or at the direction of the Board of Directors or (B) provided that the Board of Directors has determined that directors shall be elected at such meeting, by any shareholder of the company who complies with the procedures set forth in these Bylaws as to such nomination. The immediately preceding sentence shall be the exclusive means for a shareholder to make nominations before a special meeting of shareholders.

(b) In the event a special meeting of shareholders is called for the purpose of electing one or more directors to the Board of Directors, any shareholder may nominate a person or persons (as the case may be) for election to such position(s) to be elected as specified in the notice of such meeting, provided that the shareholder must (i) have given timely notice thereof in writing to the secretary at the principal executive offices of the company in proper form (including the completed and signed questionnaire, representation and agreement required by Section 9 of Article I of these Bylaws) and timely updates and supplements thereof in writing to the secretary and (ii) (x) be a shareholder of record at the time of giving of notice of such special meeting by or at the direction of the Board of Directors, at the time the shareholder provides the notice required by these Bylaws and at the time of the special meeting, (y) be entitled to vote at such special meeting and (z) comply with the procedures set forth in these Bylaws as to such nomination. In order to be timely, a shareholder’s notice shall be delivered to the secretary at the principal executive offices of the company not earlier than the close of business on the one hundred fiftieth (150th) day prior to the date of such special meeting and not later than the close of business on the later of the one hundred twentieth (120th) day prior to the date of such special meeting or, if the first public announcement of the date of such special meeting is less than one hundred thirty (130) days prior to the date of such special meeting, the tenth (10th) day following the day on which such first public announcement is made. In no event shall any adjournment or postponement of a special meeting or the public announcement thereof commence a new time period for the giving of a shareholder’s notice as described above. In addition, to be timely, a shareholder’s notice shall further be updated and supplemented so that the information provided or required to be provided in such notice shall be true and correct as of the record date for the meeting and as of the date that is ten (10) business days prior to the meeting or any adjournment or postponement thereof, and such update and supplement shall be delivered to the secretary at the principal executive offices of the company not later than five (5) business days after the record date for the meeting in the case of the update and supplement required to be made as of the record date, and not later than eight (8) business days prior to the date of the meeting or any adjournment or postponement thereof in the case of the update and supplement required to be made as of ten (10) business days prior to the meeting or any adjournment or postponement thereof; provided, however, that no such update or supplement shall cure a notice that did not fully comply with this Bylaw on the date that such notice was delivered to the company, nor shall a shareholder be permitted to amend, update or submit a new nomination, including by changing or adding nominees proposed to be brought before a meeting, after the time first required for the giving of the shareholder’s notice under this Section 3(b) of Article I of these Bylaws.

|

|

(c) To be in proper form, a shareholder’s notice of a nomination of a person or persons for election as a director at a special meeting must include all information that would be required by Section 2 of Article I of these Bylaws with respect to each person who the shareholder proposes to nominate for election as a director, the shareholder giving the notice and the beneficial owner, if any, on whose behalf the nomination is made and their respective affiliates and associates or others acting in concert therewith, as if such notice were given with respect to an annual meeting of shareholders, and such shareholder must otherwise comply with all applicable provisions set forth in Section 2 with respect to any such nomination or the solicitation of proxies with respect thereto.

SECTION 4. Notice of Meetings - Written notice stating the place, if any, date and time of a shareholders’ meeting; the record date for determining the shareholders entitled to vote at such meeting, if such date is different from the record date for determining shareholders entitled to notice of the meeting; and the means of remote communications, if any, by which shareholders and proxy holders may be deemed to be present and vote at such meeting, shall be given not less than ten (10) nor more than sixty (60) days (unless a longer notice period is required by applicable law) before the date of the meeting, except as hereinafter provided, either personally or by mail, electronic transmission or in any other manner permitted by law, by or at the direction of the president, the secretary, or the director or directors calling the meeting, to each shareholder of record entitled to vote at such meeting as of the record date for determining the shareholders entitled to notice of such meeting. Except in the case of a special meeting, the purpose of a meeting is not required to be set forth in the notice of such meeting. Notice shall be deemed to be given (i) if sent by mail, when deposited in the United States mail, addressed to the shareholder at the address as it appears on the company’s record of shareholders, with postage thereon prepaid; (ii) if sent by electronic mail, when directed to an electronic mail address at which the shareholder has consented to receive notice; (iii) if sent by facsimile transmission, when directed to a facsimile number at which the shareholder has consented to receive notice; or (iv) if delivered personally or sent by any other method, when actually received by the shareholder.

|

|

SECTION 5. Quorum - Any number of shareholders together holding a majority of the votes entitled to be cast at the meeting in respect to the business to be transacted, who shall be present in person or represented by proxy at any meeting duly called, shall constitute a quorum for the transaction of business, except where by law a greater interest is required. If less than a quorum shall be in attendance at the time for which a meeting shall have been called, the meeting may be adjourned from time to time by the chairman of the meeting or by a majority of the votes cast by shareholders present or represented by proxy without notice other than by announcement at the meeting until a quorum shall attend.

SECTION 6. Voting -

(a) At any meeting of the shareholders, each common shareholder shall have one (1) vote for each share of common stock standing in such shareholder’s name on the books of the company on the record date for such meeting. A shareholder may vote his, her or its shares when present at a meeting of the shareholders or by proxy.

(b) If a quorum exists, action on a matter, other than the election of directors, by a voting group is approved if the votes cast within the voting group favoring the action exceed the votes cast opposing the action, unless the Articles of Incorporation, these Bylaws or applicable law requires a greater number of affirmative votes. For purposes of the preceding sentence, an abstention or an election by a shareholder not to vote on the action because of the failure to receive voting instructions from the beneficial owner of the shares shall not be considered a vote cast. With respect to the election of directors, a nominee for director shall be elected to the Board of Directors if a quorum is present and if the votes cast “for” such nominee’s election exceed the “withhold” or “against” votes cast against such nominee’s election; provided, however, that directors shall be elected by a plurality of the votes cast at any meeting of shareholders for which as of the date of the notice of such meeting the number of nominees competing for election exceeds the number of directorships available for election at such meeting.

(c) A shareholder, or the shareholder’s agent or attorney-in-fact, may appoint a proxy to vote or otherwise act for the shareholder by signing an appointment form or by an electronic transmission. An electronic transmission shall contain or be accompanied by information from which the recipient can determine the date of the transmission and that the transmission was authorized by the sender or the sender’s agent or attorney-in-fact. Unless required by statute or determined by the Board of Directors or the chairman of the meeting to be advisable, the vote on any question need not be by ballot. On a vote by ballot, each ballot shall be signed by the shareholder voting or by such shareholder’s proxy, if there be such proxy; provided, however, that if authorized by the Board of Directors, any shareholder vote to be taken by written ballot may be satisfied by a ballot submitted by electronic transmission by the shareholder or the shareholder’s proxy, provided that any such electronic transmission shall either set forth or be submitted with information from which it can be determined that the electronic transmission was authorized by the shareholder or the shareholder’s proxy.

|

|

SECTION 7. Waiver of Notice - A shareholder may waive any notice required by applicable law, the Articles of Incorporation or these Bylaws before or after the date and time stated in the notice of the meeting. The waiver shall be in writing, be signed by the shareholder entitled to the notice, and be delivered to the secretary for filing in the minutes or corporate records. A shareholder’s attendance at a meeting (i) waives objection to lack of notice or defective notice of the meeting, unless the shareholder at the beginning of the meeting objects to holding the meeting or transacting business at the meeting, and (ii) waives objection to consideration of a particular matter at the meeting that is not within the purpose or purposes described in the meeting notice, unless the shareholder objects to considering the matter when it is presented.

SECTION 8. Organization - At all meetings of the shareholders, the Chairman of the Board of Directors or, in the Chairman’s absence, the president or, in the president’s absence, such other person selected by the Board of Directors, shall act as chairman of the meeting. In the absence of the foregoing persons, a majority of the shares present and entitled to vote at such meeting may appoint any person to act as chairman of the meeting. The secretary of the company or, in the secretary’s absence, an assistant secretary, shall act as secretary at each meeting of the shareholders. In the event that neither the secretary nor any assistant secretary is present, the chairman of the meeting may appoint any person to act as secretary of the meeting. The Board of Directors may adopt such rules, regulations and procedures for the conduct of any meeting of shareholders as it shall deem necessary, appropriate or convenient. Except to the extent inconsistent with such rules, regulations and procedures as adopted by the Board of Directors, the chairman of any meeting of shareholders shall have the right and authority to prescribe such rules, regulations and procedures and to do all such acts and things as, in the judgment of such person, are necessary, appropriate or convenient for the proper conduct of the meeting. Such rules, regulations and procedures, whether adopted by the Board of Directors or prescribed by the chairman of the meeting, may include, without limitation, the following: (a) the establishment of an agenda or order of business for the meeting; (b) rules, regulations and procedures for maintaining order at the meeting and the safety of those present; (c) limitations on attendance at or participation in the meeting to shareholders of record, their duly authorized and constituted proxies or such other persons as the chairman of the meeting shall permit; (d) restrictions on entry to the meeting after the time fixed for the commencement thereof; and (e) limitations on the time allotted to questions or comments by participants. The chairman of the meeting shall have the power to recess or adjourn any meeting. Except as otherwise provided by law, and without limiting the power of the Board of Directors, the chairman of the meeting shall have the power to determine whether a nomination or any other business proposed to be brought before the meeting was made or proposed, as the case may be, in accordance with these Bylaws and, if any proposed nomination or other business is not in compliance with these Bylaws, to declare that no action shall be taken on such nomination or other proposal, and such nomination or other proposal shall be disregarded notwithstanding the fact that proxies or votes may have been received with respect to such nomination or other proposal.

|

|

SECTION 9. Submission of Questionnaire, Representation and Agreement - To be eligible to be a nominee for election or reelection as a director of the company by a shareholder, a person must deliver (no later than the time required for delivery of notice of the nomination under Section 2(b) or Section 3(b) of Article I of these Bylaws, as applicable) to the secretary at the principal executive offices of the company a signed and completed written questionnaire with respect to the background and qualification of such person and the background of any other person or entity on whose behalf the nomination is being made (which questionnaire shall be provided by the secretary upon the written request of a shareholder of record), and a written representation and agreement (in the form provided by the secretary upon the written request of a shareholder of record) that such person (a) is not and will not become a party to (i) any agreement, arrangement or understanding with, and has not given any commitment or assurance to, any person or entity as to how such person, if elected as a director of the company, will act or vote on any issue or question (a “Voting Commitment”) that has not been disclosed to the company or (ii) any Voting Commitment that could limit or interfere with such person’s ability to comply, if elected as a director of the company, with such person’s fiduciary duties under applicable law, (b) is not and will not become a party to any agreement, arrangement or understanding with any person or entity other than the company with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director of the company that has not been disclosed therein and (c) in such person’s individual capacity and on behalf of any person or entity on whose behalf the nomination is being made, would be in compliance, if elected as a director of the company, and will comply with all applicable corporate governance, conflict of interest, resignation, confidentiality and stock ownership and trading policies and guidelines of the company publicly disclosed from time to time.

SECTION 10. Inspectors - For all meetings of the shareholders, the company shall appoint one or more inspectors to act at such shareholders’ meeting in connection with determining voting results. Each inspector shall verify in writing that the inspector will faithfully execute the duties of inspector with strict impartiality and according to the best of the inspector’s ability. An inspector may be an officer or employee of the company. An inspector may appoint or retain other persons to assist the inspector in the performance of the inspector’s duties, and may rely on information provided by such persons and other persons, including those appointed to count votes, unless the inspectors believe reliance is unwarranted. The inspectors shall ascertain the number of shares outstanding and the voting power of each; determine the shares represented at a meeting; determine the validity of proxy appointments and ballots; count all votes; and make a written report of the results.

ARTICLE II

DIRECTORS

SECTION 1. Powers - All corporate powers shall be exercised by or under the authority of the Board of Directors, and the business and affairs of the company managed under the direction, and subject to the oversight, of the Board of Directors.

SECTION 2. Number and Qualification - Subject to the limitations set forth in the Articles of Incorporation, the number of directors shall be fixed from time to time by resolution of the Board of Directors. Directors need not be shareholders. No person shall be a member of the Board of Directors after the end of the term of such member’s class (as provided in Article VI of the Articles of Incorporation) in which such member reaches the age of seventy-two (72).

|

|

SECTION 3. Election of Directors; Vacancies; Resignations - At each annual meeting of shareholders (or any meeting held in lieu of the annual meeting for that purpose) the successors to the class of directors whose term shall then expire shall be elected to hold office for a term expiring at the third (3rd) proceeding annual meeting and until their successors shall be elected and qualified. Any vacancy occurring in the Board of Directors, including a vacancy resulting from an increase in the number of directors, shall be filled in accordance with the Articles of Incorporation. A director may resign at any time by delivering a written notice of resignation to the Board of Directors, the Chairman of the Board of Directors or the secretary.

SECTION 4. Meetings of Directors - Meetings of the Board of Directors shall be held at places within or without the Commonwealth of Virginia and at times fixed by resolution of the Board of Directors, or upon call of the Chairman of the Board of Directors or president; and the secretary or officer performing the secretary’s duties shall give at least forty-eight (48) hours’ notice in writing or twenty-four (24) hours’ notice by electronic transmission, telephone or in person of all meetings of the Board of Directors, provided that notice need not be given of regular meetings held at dates, times and places fixed by resolution of the Board of Directors. Neither the business to be transacted at, nor the purpose of, any meeting of the Board of Directors need be specified in the notice or waiver of notice of such meeting. Unless otherwise determined by the Board of Directors, any or all directors may participate in any meeting of the Board of Directors or any committee thereof, or conduct such meeting, through the use of any means of communication by which all directors participating may simultaneously hear each other during the meeting. A director participating in a meeting by this means is deemed to be present in person at the meeting. The secretary or officer performing the secretary’s duties shall call special meetings of the Board of Directors whenever requested in writing to do so by two (2) or more directors, such request to specify the purpose of the meeting.

SECTION 5. Quorum - A quorum at any meeting of the Board of Directors shall consist of a majority of the number of directors set forth in these Bylaws. If a quorum is present when a vote is taken, the vote of a majority of directors present is the act of the Board of Directors unless the Articles of Incorporation, these Bylaws or applicable law require the vote of a greater number of directors.

SECTION 6. Consent in Lieu of Meeting - Any action required or permitted to be taken by the Board of Directors may be taken without a meeting if each director signs a consent describing the action to be taken and delivers it to the secretary.

SECTION 7. Waiver of Notice - A director may waive any notice of a meeting of the Board of Directors or any committee thereof that is required by applicable law, the Articles of Incorporation or these Bylaws before or after the date and time stated in the notice of such meeting, and such waiver shall be equivalent to the giving of such notice. The waiver shall be in writing, signed by the director entitled to the notice and delivered to the secretary for filing by the company with the minutes of the meeting or corporate records. Notwithstanding the foregoing, a director’s attendance at or participation in a meeting of the Board of Directors or any committee waives any required notice to the director of the meeting unless the director at the beginning of the meeting or promptly upon the director’s arrival objects to holding the meeting or transacting business at the meeting and does not after objecting vote for or assent to action taken at the meeting.

|

|

SECTION 8. Chairman and Vice Chairman of the Board of Directors - The Chairman of the Board of Directors shall preside over the meetings of the Board of Directors at which he shall be present and shall in general oversee all of the business and affairs of the Board of Directors. In the absence of the Chairman of the Board of Directors, the Vice Chairman of the Board of Directors shall preside at such meetings at which he shall be present. The Chairman of the Board of Directors and the Vice Chairman of the Board of Directors shall be appointed by the Board of Directors by the vote of a majority of the directors in office and shall serve in such capacities until a successor is designated or until his or her earlier resignation, removal from office, death or incapacity. The positions of Chairman of the Board of Directors and Vice Chairman of the Board of Directors shall not be officer positions of the company.

SECTION 9. Compensation - The Board of Directors shall have the authority to fix the compensation of directors without regard to any compensation received by them as officers, directors or employees of the company or its subsidiaries.

ARTICLE III

COMMITTEES

SECTION 1. Designation of Committees -

(a) The Board of Directors may designate an Executive Committee which shall consist of at least three (3) directors, one of whom shall be the Chairman of the Board of Directors. The members of the Executive Committee shall serve until their successors are designated by the Board of Directors or until removed or until the Executive Committee is dissolved by the Board of Directors. All vacancies which may occur in the Executive Committee shall be filled by the Board of Directors. The Board of Directors shall have the power at any time to change the membership of or to dissolve the Executive Committee.

(b) In addition to the Executive Committee, the Board of Directors may designate any other committee which shall consist of at least two (2) directors. The members of any such other committee shall serve until their successors are designated by the Board of Directors or until removed or until such committee is dissolved by the Board of Directors. Unless otherwise provided by the Board of Directors in the resolutions establishing such committee, all vacancies which may occur in any such other committee shall be filled by the Board of Directors. The Board of Directors shall have the power at any time to change the membership of or to dissolve any such other committee.

SECTION 2. Powers of Committees -

(a) The Executive Committee, when the Board of Directors is not in session, shall have and may exercise all of the authority of the Board of Directors. The Executive Committee shall report at the next regular or special meeting of the Board of Directors all action which the Executive Committee may have taken since the last regular or special meeting of the Board of Directors.

|

|

(b) Any other committee designated by the Board of Directors may exercise the authority of the Board of Directors to the extent specified by the Board of Directors, the Articles of Incorporation or these Bylaws.

(c) Notwithstanding Sections 2(a) and (b) of this Article III, neither the Executive Committee nor any other committee may approve or propose to shareholders action that is required to be approved by shareholders; fill vacancies on the Board of Directors; amend the Articles of Incorporation; adopt new Bylaws or amend or repeal these Bylaws; approve a plan of merger not requiring shareholder approval; authorize or approve a distribution, except according to a formula or method, or within limits, prescribed by the Board of Directors; or authorize or approve the issuance or sale or contract for sale of shares, or determine the designation and rights, preferences, and limitations of a class or series of shares, except that the Board of Directors may (i) authorize a committee to do so subject to such limits, if any, as may be prescribed by the Board of Directors, and (ii) authorize a senior executive officer of the company to do so subject to such limits, if any, as may be prescribed by the Board of Directors or pursuant to applicable law.

SECTION 3. Meetings of Committees - Meetings of a committee shall be held at such places and at such dates and times as fixed by resolution of such committee, or upon call of the chairman of such committee. At least forty-eight (48) hours’ notice in writing or twenty-four (24) hours’ notice by electronic transmission, telephone or in person shall be given of all meetings of a committee, provided that notice need not be given of regular meetings held at times and places fixed by resolution of the committee. Neither the business to be transacted at, nor the purpose of, any meeting of a committee need be specified in the notice or waiver of notice of such meeting. A majority of the members of a committee shall constitute a quorum for the transaction of business. If a quorum is present when a vote is taken, the vote of a majority of members present is the act of the committee unless the Articles of Incorporation, these Bylaws or applicable law require the vote of a greater number of members. Any action required or permitted to be taken by a committee may be taken without a meeting if each member on the committee signs a consent describing the action to be taken and delivers it to the secretary.

ARTICLE IV

OFFICERS

SECTION 1. Required Officers - The officers of the company shall include a president, a secretary, a treasurer and such other officers as may be appointed as provided in Section 2 of this Article IV. The president, secretary and treasurer shall be elected by the Board of Directors.

SECTION 2. Other Officers - Other officers, including one or more vice presidents, assistant secretaries and assistant treasurers, may from time to time be appointed by the Board of Directors or the president.

|

|

SECTION 3. Eligibility of Officers - No person shall be an officer of the company after the end of the calendar year in which he reaches the age of seventy-two (72). Any two or more offices may be held by the same person.

SECTION 4. Term of Office; Removal and Resignation of Officers - All officers shall hold office for any term specified by the Board of Directors or the president (if such officer was appointed by the president), unless earlier removed by the Board of Directors or the president. The Board of Directors shall have the authority to remove any officer (whether such officer was appointed by the Board of Directors or the president) at any time, with or without cause, and the president shall have the authority to remove any officer appointed by the president at any time, with or without cause. Any officer may resign at any time by giving notice to the Board of Directors or the president. Any such resignation shall take effect at the time specified in the resignation notice or, if no time is specified, upon delivery of the notice; and unless otherwise specified in the notice, acceptance of such resignation shall not be necessary to make it effective.

SECTION 5. Vacancies - If the office of any officer becomes vacant by reason of death, resignation, removal, disqualification or otherwise, the vacancy may be filled in the manner set forth in Section 1 (for the president, secretary and treasurer) or Section 2 (for other officers) of this Article IV.

SECTION 6. Duties - The officers of the company shall have such duties as generally pertain to their offices, respectively, as well as such powers and duties as are hereinafter provided and as from time to time shall be conferred by the Board of Directors or the president. The Board of Directors may require any officer to give such bond for the faithful performance of his duties as it may see fit.

SECTION 7. Duties of the President - In the absence of the Chairman of the Board of Directors and the Vice Chairman of the Board of Directors, the president shall preside at all meetings of the Board of Directors, if a director, and shareholders. The president shall be the chief executive officer to whom all other officers shall report. The president shall have the overall supervision of the affairs of the company, including the day-to-day responsibilities for the operation of the company and have direct charge of the employees thereof and such other duties as may be delegated to him by the Board of Directors or the Executive Committee. Presidents of all subsidiaries of the company shall report to the president of the company.

SECTION 8. Duties of the Secretary - The secretary shall record the proceedings of all meetings of shareholders, the Board of Directors and any committees of the Board of Directors; keep or supervise the keeping of records of the ownership of shares of common stock; have custody of the Corporate seal and all deeds, leases and contracts to which the company is a party; and, on behalf of the company, make reports as from time to time are required by law, except tax returns. In the absence of the secretary, an assistant secretary or a secretary pro tempore shall perform the secretary’s duties.

|

|

SECTION 9. Duties of the Treasurer - The treasurer shall be the chief financial officer and shall coordinate the financial and accounting affairs of the company and its subsidiaries. The treasurer shall have custody of all securities held by the company and of all funds which may come into his hands. The treasurer shall keep appropriate records and accounts of all moneys of the company received or disbursed and shall deposit all moneys and securities in the name of and to the credit of the company in such banks and depositories as the directors shall from time to time designate. The treasurer may endorse for deposit for collection all checks, notes, et cetera, payable to the company or its order, and may accept drafts on behalf of the company. The treasurer shall also file or supervise the filing of all tax returns required by law. The treasurer may affix his signature to coupons on any bonds of the company by any form or facsimile, whether engraved, printed, lithographed or otherwise.

SECTION 10. Other Duties of Officers - Any officer of the company shall have, to the extent prescribed by the Board of Directors or the president, the power to sign bonds, deed and contracts of the company and, in addition to the duties prescribed in these Bylaws and by law, such other duties as from time to time shall be prescribed by the Board of Directors or the president.

ARTICLE V

CAPITAL STOCK

SECTION 1. Certificates for Shares - The shares of stock of the company shall be represented by certificates, or shall be uncertificated shares that may be evidenced by a book-entry system maintained by the registrar of such stock, or a combination of both. To the extent that shares are represented by certificates, such certificates whenever authorized by the Board of Directors shall be in such form as prescribed by the Board of Directors and shall bear the seal of the company and the signature of at least two (2) of the president, the treasurer and the secretary, or such other officers designated by the Board of Directors to sign such certificates.

Transfer agents and/or registrars for the stock of the company may be appointed by the Board of Directors and may be required to countersign stock certificates.

Any or all of the signatures on a stock certificate may be a facsimile.

In the event that any officer whose signature shall have been used on a stock certificate shall for any reason cease to be an officer of the company and such certificate shall not then have been delivered by the company, the Board of Directors may nevertheless adopt such certificate, and it may then be issued and delivered as though such person had not ceased to be an officer of the company.

SECTION 2. Lost, Destroyed and Mutilated Certificates - Holders of the stock of the company shall immediately notify the company of any loss, destruction or mutilation of the certificate therefor; and the Board of Directors may in its discretion cause one or more new certificates for the same number of shares in the aggregate to be issued to such shareholder upon the surrender of the mutilated certificate or upon satisfactory proof of such loss or destruction, and the deposit of a bond in such form and amount and with corporate surety.

|

|

SECTION 3. Transfer of Stock - Transfer of shares of stock of the company shall be transferable or assignable only on the books of the company upon authorization by the registered holder thereof, or by such holder’s attorney thereunto authorized by a power of attorney duly executed and filed with the secretary or a transfer agent for such stock, if any, and if such shares are represented by a certificate, upon surrender of the certificate or certificates for such shares properly endorsed or accompanied by a duly executed stock transfer power (or by proper evidence of succession, assignment or authority to transfer). The company will recognize, however, the exclusive rights of the person registered on its books as the owner of shares to receive dividends and to vote as such owner. It shall be the duty of each shareholder to notify the company of such shareholder’s mailing address or any change thereto.

SECTION 4. Fixing Record Date - For the purpose of determining shareholders entitled to notice of or to vote at any meeting of shareholders or any adjournment thereof, or entitled to receive payment of any dividend or distribution, or in order to make a determination of shareholders for any other proper purpose, the Board of Directors may fix in advance a date as the record date for any such determination of shareholders, such date in any case to be not more than seventy (70) days prior to the date on which the particular action, requiring such determination of shareholders, is to be taken. If no record date is fixed for the determination of shareholders entitled to notice of or to vote at a meeting of shareholders, or shareholders entitled to receive payment of a dividend or distribution, the date on which notices of the meeting are mailed or the date on which the resolution of the Board of Directors declaring such dividend or distribution is adopted, as the case may be, shall be the record date for such determination of shareholders. When a determination of shareholders entitled to vote at any meeting of shareholders has been made as provided in this Section, such determination shall apply to any adjournment thereof unless the Board of Directors fixes a new record date, which it shall do if the meeting is adjourned to a date more than one hundred twenty (120) days after the date fixed for the original meeting.

ARTICLE VI

MISCELLANEOUS PROVISIONS

SECTION 1. Seal - The seal of the company shall bear the words, “Shenandoah Telecommunications Company Seal”, with such device or devices as the Board of Directors may determine.

SECTION 2. Fiscal Year - The fiscal year shall end on the last day in December of each year.

SECTION 3. Examination of Books - The Board of Directors shall, subject to the laws of the Commonwealth of Virginia, have power to determine from time to time whether and to what extent and under what conditions and limitations the accounts, records and books (except the stock and transfer books) of the company, or any of them, shall be open to the inspection of the shareholders.

The stock and transfer books of the company shall be at all times during business hours open to the inspection of the registered shareholders in person.

|

|

SECTION 4. Amendment of Bylaws - These Bylaws may be amended, altered or repealed by the Board of Directors by the vote of a majority of the directors in office. The shareholders shall have the power to rescind, alter, amend, or repeal any Bylaws and to enact Bylaws which, if expressly provided, may not be amended, altered or repealed by the Board of Directors.

SECTION 5. Voting of Stock Held - Unless otherwise provided by the Board of Directors, the president or the secretary may from time to time appoint an attorney or attorneys or agent or agents of the company, in the name and on behalf of the company, to cast the votes which the company may be entitled to cast as a shareholder or otherwise in any other corporation, any of whose stock or securities may be held by the company, at meetings of the holders of the stock or other securities of any other corporations, or to consent in writing to any action by any such other corporations, and may instruct the person or persons so appointed as to the manner of casting such votes or giving such consent, and may execute or cause to be executed on behalf of the company and under its corporate seal, or otherwise, such written proxies, consents, waivers, or other instruments as may be necessary or proper in the premises; or the president, the secretary or another officer of the company may attend any meeting of the holders of stock or other securities of any such other corporation and thereat vote or exercise any or all other powers of the company as the holder of such stock or other securities of such other corporation.

SECTION 6. Control Share Statute - Article 14.1 of Title 13.1 of the Code of Virginia (Control Share Acquisitions) shall not apply to acquisitions of shares of capital stock of the company.

SECTION 7. Exclusive Forum - Unless the company consents in writing to the selection of an alternative forum (an “Alternative Forum Consent”), the United States District Court for the Western District of Virginia, Harrisonburg Division, or in the event that court lacks jurisdiction to hear such action, the Circuit Court of the County of Shenandoah, Virginia, shall be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the company, (ii) any action asserting a claim of breach of duty owed by any current or former director, officer, employee, shareholder or agent of the company to the company or the company’s shareholders, including a claim alleging the aiding and abetting of such a breach of duty, (iii) any action asserting a claim arising pursuant to any provision of the Virginia Stock Corporation Act, the Articles of Incorporation or these Bylaws (in each case, as may be amended from time to time), (iv) any action or proceeding to interpret, apply, enforce or determine the validity of the Articles of Incorporation or these Bylaws (in each case, as may be amended from time to time), including any right, obligation, or remedy thereunder or (v) any action asserting a claim governed by the internal affairs doctrine or asserting one or more “internal corporate claims,” as that term is defined in subsection C of Section 13.1-624 of the Virginia Stock Corporation Act, in each case to the extent not addressed in clauses (i), (ii), (iii), or (iv), in all cases to the fullest extent permitted by law and subject to one of the courts having personal jurisdiction over the indispensable parties named as defendants.

|

|

Any person or entity purchasing or otherwise acquiring or holding any interest in shares of capital stock of the company shall be deemed to have notice of and consented to the provisions of this Section 7 of Article VI. If any action the subject matter of which is within the scope of this Section 7 of Article VI is filed in a court other than a court located within the Commonwealth of Virginia (a “Foreign Action”) by or in the name of any shareholder (including any beneficial owner), such shareholder shall be deemed to have consented to (i) the personal jurisdiction of the state and federal courts located within the Commonwealth of Virginia in connection with any action brought in any such court to enforce the provisions of this Section 7 of Article VI and (ii) having service of process made upon such shareholder in any such action by service upon such shareholder’s counsel in the Foreign Action as agent for such shareholder. Failure to enforce the provisions of this Section 7 of Article VI would cause the company irreparable harm and the company shall be entitled to equitable relief, including injunctive relief and specific performance to enforce the provisions of this Section 7 of Article VI.

If any provision of this Section 7 of Article VI shall be held to be invalid, illegal or unenforceable as applied to any person or entity or circumstance for any reason whatsoever, then, to the fullest extent permitted by law, the validity, legality and enforceability of such provision in any other circumstance and of the remaining provisions of Section 7 of Article VI (including, without limitation, each portion of any sentence of this Section 7 of Article VI containing any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) and the application of such provision to other persons or entities or circumstances shall not in any way be affected or impaired thereby. The existence of any prior Alternative Forum Consent shall not act as a waiver of the company’s ongoing consent right as set forth in this Section 7 of Article VI with respect to any current or future actions or proceedings. To the extent that the United States District Court for the Western District of Virginia, Harrisonburg Division, and the Circuit Court of the County of Shenandoah, Virginia, do not have personal jurisdiction over the indispensable parties named as defendants, such parties must be given a reasonable opportunity to consent to such jurisdiction before any action or proceeding may be brought or maintained in any other court.

* * * *

18

Exhibit 10.1

SHENANDOAH TELECOMMUNICATIONS COMPANY

2024 EQUITY INCENTIVE PLAN

(as of April 30, 2024)

1. Purposes of this Plan. The purpose of this Plan is to: (i) attract and retain the best available personnel for positions of substantial responsibility, (ii) provide additional incentive to Employees, Directors and Consultants, and (iii) promote the success of the Company's business by offering these individuals an opportunity to acquire a proprietary interest in the success of the Company, or to increase this interest, by permitting them to receive Shares of the Company. This Plan permits the grant of Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance Stock Units, Performance Shares, and Other Stock-Based Awards.

| 2. | Definitions. As used in this Plan, the following definitions apply: |

(a) "Administrator" means the Board or any of its Committees that are administering this Plan, in accordance with Section 4 of this Plan.

(b) "Affiliate" means a corporation or other entity that, directly or through one or more intermediaries, controls, is controlled by or is under common control with, the Company.