UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of April 2024

Commission File Number 001-11444

| MAGNA INTERNATIONAL INC. |

| (Exact Name of Registrant as specified in its Charter) |

| 337 Magna Drive, Aurora, Ontario, Canada L4G 7K1 |

| (Address of principal executive office) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒ Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SIGNATURES

|

Date: April 2, 2024 |

MAGNA INTERNATIONAL INC. (Registrant)

|

||

| By: | /s/ “Bassem Shakeel” |

|

|

|

Bassem A. Shakeel, Vice-President, Associate General Counsel and Corporate Secretary |

|||

EXHIBITS

Exhibit 99

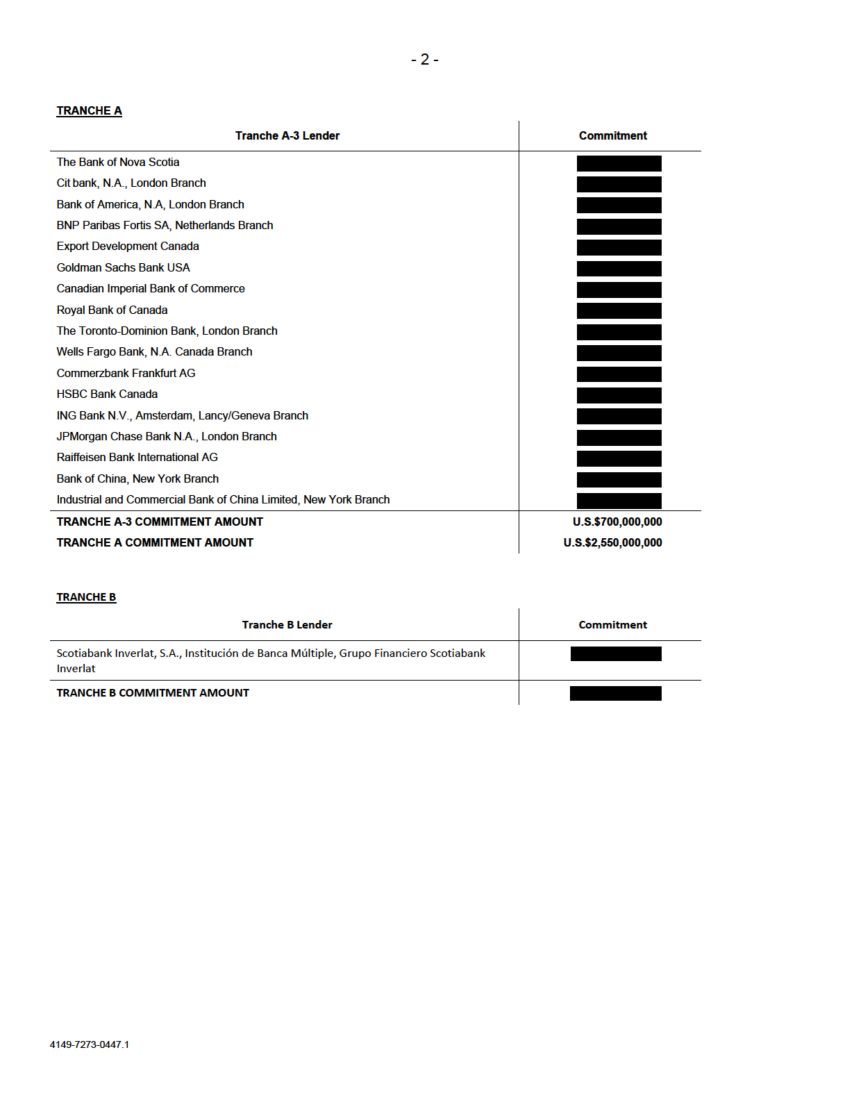

SEVENTH AMENDMENT TO CREDIT AGREEMENT among MAGNA INTERNATIONAL INC., AND THE OTHER BORROWERS IDENTIFIED HEREIN as Borrowers - and - THE FINANCIAL INSTITUTIONS IDENTIFIED HEREIN as Lenders - and - THE BANK OF NOVA SCOTIA, CITIGROUP N.A., MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED, BNP PARIBAS SECURITIES CORP. and EXPORT DEVELOPMENT CANADA as Co - Lead Arrangers and Co - Bookrunners - and - THE BANK OF NOVA SCOTIA as Administrative Agent - and - THE BANK OF NOVA SCOTIA as European Agent - and - CITIBANK, N.A. CANADIAN BRANCH, BANK OF AMERICA, N.A., BNP PARIBAS SECURITIES CORP, and EXPORT DEVELOPMENT CANADA as Co - Syndication Agents - and - CANADIAN IMPERIAL BANK OF COMMERCE, ROYAL BANK OF CANADA, and THE TORONTO - DOMINION BANK as Documentation Agents - and - 4140 - 6823 - 4062.6 COMMERZBANK AG, NEW YORK BRANCH, ING BANK N.V., AMSTERDAM, LANCY/GENEVA BRANCH, JPMORGAN CHASE BANK, N.A., HSBC BANK CANADA, and WELLS FARGO Bank, N.A., CANADIAN BRANCH as Senior Managing Agents - and - RAIFFEISEN BANK INTERNATIONAL AG, BANK OF CHINA, NEW YORK BRANCH, INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED, NEW YORK BRANCH, GOLDMAN SACHS BANK USA, and INDUSTRIAL AND COMMERCIAL BANK OF CHINA (CANADA) as Co - Agents 4140 - 6823 - 4062.6 DATED as of March 28, 2024

4140 - 6823 - 4062.6 SEVENTH AMENDMENT TO CREDIT AGREEMENT made as of the 28th day of March, 2024 . A M O N G : MAGNA INTERNATIONAL INC. and the other Borrowers indicated on the signature pages hereto (hereinafter referred to as the “ Borrowers ”), - and - THE FINANCIAL INSTITUTIONS indicated on the signature pages hereto (hereinafter referred to as the “ Lenders ”), - and - THE BANK OF NOVA SCOTIA , as administrative agent of the Lenders (hereinafter referred to as the “ Administrative Agent ”), - and - THE BANK OF NOVA SCOTIA, as European funding agent of the Lenders to the European Borrowers (hereinafter referred to as the “ European Agent ”and collectively with the Administrative Agent and the European Agent, the “ Agents ”), - WHEREAS the Borrowers, the Agents, Citicorp International Limited, as Asian agent (the “ Asian Agent ”), and certain of the Lenders are parties to a credit agreement dated as of July 8 , 2011 (as amended on June 20 , 2013 , May 16 , 2014 , May 3 , 2018 , April 28 , 2021 , May 18 , 2022 and April 27 , 2023 the “ Credit Agreement ”) ; AND WHEREAS the Asian Agent has resigned; AND WHEREAS the parties hereto wish to further amend certain terms and conditions of the Credit Agreement; NOW THEREFORE THIS AGREEMENT WITNESSES THAT in consideration of the covenants and agreements contained herein and for other good and valuable consideration, the parties hereto agree to amend the Credit Agreement as provided herein :

4140 - 6823 - 4062.6 - 2 - 1. General In this amendment to the Credit Agreement (the “ Amending Agreement ”) (including the recitals) unless otherwise defined herein or the context otherwise requires, all capitalized terms shall have the respective meanings specified in the Credit Agreement. 2. To be Read with Credit Agreement This Amending Agreement is an amendment to the Credit Agreement. Unless the context of this Amending Agreement otherwise requires, the Credit Agreement and this Amending Agreement shall be read together and shall have effect as if the provisions of the Credit Agreement and this Amending Agreement were contained in one agreement. The term “Agreement” when used in the Credit Agreement means the Credit Agreement as amended, supplemented or modified from time to time. 3. Amendments to Credit Agreement (a) Effective as of the date of this Amending Agreement, the Credit Agreement is hereby amended by deleting the stricken text (indicated textually in the same manner as the following example: stricken text ) and by adding the bold underline text (indicated textually in the same manner in the following example: underline text ) as set forth on the pages of the Credit Agreement and all schedules and attached hereto all as set forth on Exhibit A to this Amending Agreement. For clarity, all changes reflected in the attached Exhibit A are inclusive of deletions and additions applicable in each of amending agreements entered into by the parties to the Credit Agreement prior to the date hereof and consequently all such amending agreements are superseded by the terms of this Amending Agreement. (b) Schedules A and F to the Credit Agreement are hereby deleted in their entirety and replaced by Schedules A and F to this Amending Agreement. 4. Representations and Warranties In order to induce the Administrative Agent and the Lenders to enter into this Amending Agreement, each of the Borrowers represents and warrants to the Administrative Agent and the Lenders as follows, which representations and warranties shall survive the execution and delivery hereof: (a) the representations and warranties set out in Article 7 of the Credit Agreement shall be true and correct in all material respects on the date of this Amending Agreement as if made on and as of such date, except that if any such representation and warranty is specifically given in respect of a particular date or particular period of time and relates to such date or period of time, then such representation and warranty shall be true and correct in all material respects as at such date or for such period of time; (b) all necessary action, corporate or otherwise, has been taken to authorize the execution, delivery and performance of this Amending Agreement by each Borrower. Each Borrower has duly executed and delivered this Amending Agreement.

This Amending Agreement is a legal, valid and binding obligation of each Borrower enforceable against it by the Agents and the Lenders in accordance with its terms, except to the extent that the enforceability thereof may - 3 - be limited by applicable bankruptcy, insolvency, moratorium, reorganization and other laws of general application limiting the enforcement of creditor’s rights generally and the fact that the courts may deny the granting or enforcement of equitable remedies; and (c) as of the date hereof and after giving full force and effect to the amendments to the Credit Agreement provided for in this Amending Agreement, no Default or Event of Default exists. 5. Borrowers As of the date of this Amending Agreement, the Borrowers (broken out by Canadian Borrowers, US Borrowers, European Borrowers and Mexican Borrowers) are set forth on Schedule X to this Amending Agreement. 6. Confirmation of Magna Guarantee Magna hereby acknowledges, confirms and agrees that, notwithstanding this Amending Agreement (i) the Magna Guarantee continues in full force and effect, and constitutes a legal, valid and binding obligation of Magna enforceable against it in accordance with its terms, and (ii) the Magna Guarantee is hereby ratified and confirmed. 7. Conditions Precedent This Amending Agreement shall not be effective until satisfaction of the following terms, each to the satisfaction of the Administrative Agent and the Lenders, acting reasonably: (a) this Amending Agreement shall be executed and delivered by the Borrowers, the Agents and the Lenders; (b) the Agents shall have received the following in form and substance satisfactory to the Lenders: (i) an Officers’ Certificate of Magna attaching: (A) copies of the articles and the by - laws of Magna and that such documents are in full force and effect, unamended; and (B) incumbency of officers and directors of Magna, who have executed this Amending Agreement (such certificate to include sample signatures); (c) receipt by the Administrative Agent on behalf of the extending Lenders of a fee equal to on their respective Commitment; receipt by the Administrative Agent on behalf of the applicable Lenders increasing their Commitments of a fee equal to 10 bps on their respective increased Commitment; (d) (e) the Administrative Agent and each Lender shall have received all such other documents, instruments and agreements as may reasonably be required by it. 4140 - 6823 - 4062.6 4140 - 6823 - 4062.6 - 4 - 8.

Expenses The Borrowers shall pay all reasonable fees and expenses incurred by the Agents and the Lenders in connection with the preparation, negotiation, completion, execution, delivery and review of this Amending Agreement. 9. Continuance of the Loan Documents and the Credit Agreement The Loan Documents and the Credit Agreement, as changed, altered, amended or modified by this Amending Agreement, shall be and continue in full force and effect and is hereby confirmed and the rights and obligations of all parties thereunder shall not be affected or prejudiced in any manner except as specifically provided for in this Amending Agreement. 10. Counterparts This Amending Agreement may be executed in any number of separate counterparts, each of which shall be deemed an original and all of said counterparts taken together shall be deemed to constitute one and the same agreement. 11. Governing Law This Amending Agreement shall be construed and interpreted in accordance with the laws of the Province of Ontario and the laws of Canada applicable therein and each of the parties hereto irrevocably attorns in accordance with the provisions of Section 1.08 of the Credit Agreement. 12. Severability If any term or provision of this Amending Agreement or the application thereof to any party or circumstance shall be held to be invalid, illegal or unenforceable in any respect by a court of competent jurisdiction, the validity, legality and enforceability of the remaining terms and provisions of this Amending Agreement shall not in any way be affected or impaired thereby, and the affected term or provision shall be modified to the minimum extent permitted by law so as most fully to achieve the intention of this Amending Agreement. [Remainder of page intentionally left blank]

Do c uS i gn En v elop e ID: E9E 8 2F5A - 2D0C - 4920 - 817D - CF677271CAEA S - 1 IN WITNESS WHEREOF this Agreement has been executed by the parties hereto as of the date first written above . Per : \ lrq1 H • _ - fr - e - '? rJ re - - r Per : Title : V { L£ - f t lls. ; i: fl .:1 J Name : 6ci s.ew - - , s;._ / . G:,J,Uel Title : V,le · - f \ f - /A5fo cA f;e,,, / o,y - _J eor go ,/;Jf . vret,,1 MAGNA TREASURY SERVICES LP, by its general partner, MAGNA TREASURY :::v•: : 1t= - - = - TitIe : v , · ((,. - .Prrs ;' k,,t Cl > - 4 Tre . -- sv r - e - Per : N_ame : O c , s5 , S i - .. f - ee_ / , Title: Vi< - e - - Prt>s< f - A - - >>uGc.if G / Covf'S(f {, \ ,,....J 0i r f o 'rv1 - k:> S'e urr fi'I 1 MAGNA INTERNAJ],PNAL O AMERICA, INC. Per : Name : Po.vi ,&f'I? Title : l/1 (.6 - fff ic,t.i;; · t - <lJlr - ,) /rt' "1 .S'vre - t' Per : Name : \ VI s.se M flc,, i4 - e - ) Title: 1/1 (£ - .P s1t)€,J·1 _ ,4 c;sa C11,1 - }e lic,1ern; / Coc 1 r5e} c, ncl C.b: - fi) ,'71 if' Sevre 1vi / Seventh Amendment lo Credit Agreement (Magna)

DocuSign Envelope ID: E9E82F5A - 2D0C - 4920 - 817D - CF677271CAEA S - 2 MAGNA INTERNATIONAL INVE Z TM NTS S.A. ;J /) Per· Per: f V'tttA, lS [7rbV..p J, / / t : -- c • Name : /J n::n.,. (]0. - u>/,hJC Hie , 0 u - ,._ C t'"';'""_" ' Name : rr,,, .,1ve,U 1 .i 8F4886 f; t, .l(" Title : /) 1 i Per: Per: Name: \ Jc.5<;erA 5 K l l . . Title: i Jj te - f 1 tS. , t , 't SS'O c.. q C rc,n / "' ct! Cb , ror0· - ff i - evfY'1vi0 - J - ·Jf) ')e. Seventh Amendment to Credit Agreement (Magna)

S - 3 THE BANK OF NOVA SCOTIA, as Administrative Agent Per: Name: Agnes Podbielski Title: Director Per: Name: Melody Quintal Title: Associate Seventh Amendment to Credit Agreement (Magna)

S - 4 Title: Associate THE BANK OF NOVA SCOTIA, as European Agent Per: Name: Agnes Podbielski Title: Director Per: Name: Melody Quintal Seventh Amendment to Credit Agreement (Magna)

S - 5 Title: Per: Name: Title: Andrew Pryor Associate Director THE BANK OF NOVA SCOTIA, as Tranche A - 1 Lender Per: Name: Anuj Dhawan Seventh Amendment to Credit Agreement (Magna) Managing Director & Head S - 6 Title: Per: Name: Title: Andrew Pryor Associate Director THE BANK OF NOVA SCOTIA, as Tranche A - 2 Lender Per: Name: Anuj Dhawan Seventh Amendment to Credit Agreement (Magna) Managing Director & Head

S - 7 Name: Title: Andrew Pryor Associate Director THE BANK OF NOVA SCOTIA, as Tranche A - 3 Lender Per: Name: Anuj Dhawan Title: Managing Director & Head Per: Seventh Amendment to Credit Agreement (Magna)

S - 8 SCOTIABANK INVERLAT, S.A., INSTITUCION DE BANCA MULTIPLE, GRUPO FINANCIERO SCOTIABANK INVERLAT, as Tranche B Lender Per: me: Fabiola Palacio Vaca itle: Attorney - in - Fact Per : Name 6 : is Michel Lugo P i na Title: Attorney - in - Fact Seventh Amendment to Credit Agreement (Magna)

S - 9 CITIBANK, N.A., CANADIAN BRANCH, as Tranche A - 1 Lender Per: Name: Daljeet Lamba Title: Managing Director Per: Name: Title: Seventh Amendment to Credit Agreement (Magna)

S - 10 CITIBANK N.A., as Tranche A - 2 Lender Per: Name: Richard Rivera Title: Vice Presdent Seventh Amendment to Credit Agreement (Magna)

S - 11 CITIBANK, N.A., as Tranche A - 3 Lender Per: Name: Richard Rivera Title: Vice President Seventh Amendment to Credit Agreement (Magna)

S - 12 Title: BANK OF AMERICA, N.A., CANADA BRANCH, as Tranche A - 1 Lender Per: Name: Adrian Plummer Per: Name: Title: Director Seventh Amendment to Credit Agreement (Magna)

S - 13 BANK OF AMERICA, N.A., as Tranche A - 2 Lender Per: Name: Erika Murphy Title: Vice President Per: Name: Title: Seventh Amendment to Credit Agreement (Magna)

S - 14 BANK OF AMERICA, N.A., LONDON BRANCH, as Tranche A - 3 Lender Per: - C' • r Nam ௭ itsky Title : Director Per: Name: Title : Seventh Amendment to Credit Agreement (Magna)

S - 15 BNP PARIBAS, as Tranche A - 1 Lender Seventh Amendment to Credit Agreement (Magna)

S - 16 BNP PARIBAS, as Tranche A - 2 Lender Seventh Amendment to Credit Agreement (Magna)

S - 17 BNP PARIBAS SA, NETHERLANDS BRANCH, as Tranche A - 3 Lender P e r : Name : Title: Per: Name: Title : Qj_g i tal ly signed by 189440 Date: 2024.03.25 14 :46 :29 + 01'00' Seventh Amendment to Credit Agreement (Magna)

Seventh Amendment to Credit Agreement (Magna) S - 18 EXPORT DEVELOPMENT CANADA, as Tranche A - 1 Lender Per: ,4 Name: Camille Poirier Title: Financing Manager Per: D ;t, Nfune:ciylan Thompson Title: Senior Associate Seventh Amendment to Credit Agreement (Magna) S - 19 EXPORT DEVELOPMENT CANADA, as Tranche A - 2 Lender Per: /J& - t/U4/4, Name:Camille Poirier Title : Financing Manager Per : Name: Title:

Seventh Amendment to Credit Agreement (Magna) S - 20 EXPORT DEVELOPMENT CANADA, as Tranche A - 3 Lender Per: /Jo Name:Camille Poirier Title : Financing Manager Per : Name: Title:

S - 21 Seventh Amendment to Credit Agreement (Magna) CANADIAN IMPERIAL BANK OF COMMERCE, as Tranche A - 1 Lender . . Name : Natasa \ /uJcic Title : Director Per: Per: Name : Stephen Reddinef Title : Manag i ng D i rector z - ---- < - .

- z S - 22 CANADIAN IMPERIAL BANK OF COMMERCE, as Tranche A - 2 Lender Per: Name: Natasha Vujcic Title: Director Per: Name: Stephen Redding Title: Managing Director Seventh Amendment to Credit Agreement (Magna)

S - 23 CANADIAN IMPERIAL BANK OF COMMERCE, as Tranche A - 3 Lender Per: Name: Natasha Vujcic Title: Director Per: Name: Stephen Redding Title: Managing Director Seventh Amendment to Credit Agreement (Magna)

Seventh Amendment to Credit Agreement (Magna) S - 24 ROYAL BANK OF CANADA , as Tranche A - 1 Lender , -- 7 _ / Pe r : Name: T i tle: C h r is Cowan Autho r i z ed Signatory Pe r : Name: T i tle:

S - 25 ROYAL BANK OF CANADA, as Tranche A - 2 Lender Per: Name: Title: Per: Name: Title: Chris Cowan Authorized Signatory Seventh Amendment to Credit Agreement (Magna)

S - 26 Title: Per: Name: Title: ROYAL BANK OF CANADA, as Tranche A - 3 Lender Per: Name: Chris Cowan Seventh Amendment to Credit Agreement (Magna) Authorized Signatory S - 27 Title: THE TORONTO - DOMINION BANK, as Tranche A - 1 Lender Per: Name: Tim Thomas Title: Managing Director Per: Name: Aman Cheema Vice President Seventh Amendment to Credit Agreement (Magna)

S - 28 THE TORONTO - DOMINION BANK, NEW YORK BRANCH, as Tranche A - 2 Lender Per: Name: Title: Per: Name: Title: Tyrone Nicholson Authorized Signatory Seventh Amendment to Credit Agreement (Magna)

S - 29 THE TORONTO - DOMINION BANK, as Tranche A - 3 Lender Per: Name: Philip Bates Title: Managing Director, Head of European Credit Origination Per: Name: Title: Seventh Amendment to Credit Agreement (Magna)

S - 30 Seventh Amendment to Credit Agreement (Magna) WELLS FARGO BANK, N.A., CANADIAN BRANCH as Tranche A - 1 Lender Per: /;;ew,, &,. ., Nam 6: S £ ..8H'e.. - ,M Title: P Rce?"o..Z Per: Name: Title:

S - 31 Seventh Amendment to Credit Agreement (Magna) WELLS FARGO BANK, N . A., CANADIAN BRANCH, as Tranche A - 2 Lender Per: Name ?se,; N Title: D11t£er - .e Per : Name: Title:

S - 32 WELLS FARGO BANK, N.A., CANADIAN BRANCH, as Tranche A - 3 Lender Per: Cew . &e:4., Nam f: .S Seventh Amendment to Credit Agreement (Magna) .&eN'.. - w Title: Po treroR Per: Name: Title:

DocuSign E nve l ope I D : EC83 1 273 - 7203 - 4D80 - BF43 - 65253CDAC187 S - 33 COMMERZBANK AG, NEW YORK BRANCH, as Tranche A - 1 Lender Per: f1:/fJc - 5?2 => Seventh Amendment to Credit Agreement (Magna) Per:

DocuSign Enve l ope I D : EC83 1 273 - 7203 - 4D80 - BF43 - 65253CDAC187 S - 34 COMMERZBANK AG, NEW YORK BRANCH, as Tranche A - 2 Lender O ::db: u Per: Nam n W fl , J 3 4 Seventh Amendment to Credit Agreement (Magna) Title: f - "1 !l,ru/, /" Per: Name: J, Title: Ifie S - 35 COMMERZBANK AG, as Tranche A - Per: Name: Title: Sebastian Ott l> 1 rL€ cro P - ' Seventh Amendment to Credit Agreement (Magna) Per: - s = > J < 4 C f < \ C - L rl'lb· _ • / - 1 '.

m . e· . · • Gabri,,J 5id ' 'P. r • Vf S - 36 Title: Title: Per: Name: James Sanders Managing Director, Global Banking HSBC BANK CANADA, as Tranche A - 1 Lender Per: Name: Anthony Reid Seventh Amendment to Credit Agreement (Magna) Vice President

S - 37 Title: Title: Per: Name: James Sanders Managing Director, Global Banking HSBC BANK CANADA, as Tranche A - 2 Lender Per: Name: Anthony Reid Seventh Amendment to Credit Agreement (Magna) Vice President S - 38 Title: Title: Per: Name: James Sanders Managing Director, Global Banking HSBC BANK CANADA, as Tranche A - 3 Lender Per: Name: Anthony Reid Seventh Amendment to Credit Agreement (Magna) Vice President

S - 39 ING BANK N.V., AMSTERDAM, LANCY/GENEVA BRANCH, as Tranche A - 1 Lender Per: Name: Title: Per: Name: Title: GREGORY JACQUES B LAMBILLON Digitally signed by GREGORY JACQUES B LAMBILLON Date: 2024.03.22 17:27:33 +01'00' HENDRIK EGBERINK Seventh Amendment to Credit Agreement (Magna) HERMEN BRAM Digitally signed by HERMEN BRAM HENDRIK EGBERINK Date: 2024.03.22 17:40:50 +01'00' S - 40 ING BANK N.V., AMSTERDAM, LANCY/GENEVA BRANCH, as Tranche A - 2 Lender Per: Name: Title: Per: Name: Title: GREGORY JACQUES B Digitally signed by GREGORY JACQUES B LAMBILLON Date: 2024.03.22 LAMBILLON 17:28:10 +01'00' HENDRIK EGBERINK Seventh Amendment to Credit Agreement (Magna) Digitally signed by HERMEN BRAM HERMEN BRAM HENDRIK EGBERINK Date: 2024.03.22 17:41:43 +01'00'

S - 41 ING BANK N.V., AMSTERDAM, LANCY/GENEVA BRANCH, as Tranche A - 3 Lender Per: Name: Title: Per: Name: Title: GREGORY JACQUES B LAMBILLON Digitally signed by GREGORY JACQUES B LAMBILLON Date: 2024.03.22 17:28:50 +01'00' HERMEN BRAM HENDRIK EGBERINK Seventh Amendment to Credit Agreement (Magna) Digitally signed by HERMEN BRAM HENDRIK EGBERINK Date: 2024.03.22 17:42:34 +01'00' S - 42 Seventh Amendment to Credit Agreement (Magna) JPMORGAN CHASE BANK, N.A., TORONTO BRANCH, as Tranche A - 1 Lender

S - 43 JPMORGAN CHASE BANK , N . A., as Tranche A - 2 Lender Per : Name : Marlon Mathews Title: E x ecutive Director Seventh Amendment lo Credit Agreement (Magna)

S - 44 JPMORGAN CHASE BANK N . A., as Tranche A - 3 Lender Per : Name: Marlon Mathews Title : Executive Director Seventh Amendment to Credit Agreement (Magna)

S - 45 Seventh Amendment to Credit Agreement (Magna) RAIFFEISEN BANK INTERNATIONAL AG, as TrancheA - 1 ,1;,:; ;J ' Per: v Name: Nikolaus Somo9yi Title: o/ " - Per: P Name / Title : JOHAN AIGNfR DIRECTOR S - 46 Seventh Amendment to Credit Agreement (Magna) RAIFFEISEN BANK INTERNATIONAL AG, as TrancheA - ;,, •r .1,1 · Per: V l/ N_ame: Nikolaus Somogyi Per: Title: !(O UI i l e: f JOHA:; ; : Gtt R DIRECTOR

S - 47 Seventh Amendment to Credit Agreement (Magna) RAIFFEISEN BANK INTERNATIONAL AG, as Tranche A - 3 £ _ Per: VVA. N T i a t l m e : e • · N" 1 k o I aus S omogy, • ffQ , 41:1 / L JOHANNA IGNER DIRECTOR Per Name Title:

S - 48 BANK OF CHINA, NEW YORK BRANCH, as Tranche A - 1 Lender Seventh Amendment to Credit Agreement (Magna)

S - 49 BANK OF CHINA, NEW YORK BRANCH, as Tranche A - 2 Lender Seventh Amendment to Credit Agreement (Magna)

S - 50 BANK OF CHINA, NEW YORK BRANCH, as Tranche A - 3 Lender Seventh Amendment to Credit Agreement (Magna)

S - 51 Per: INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED, NEW YORK BRANCH, as Tranche A - 1 Lender Digitally signed by: Xuan Zhang Date: 2024.03.22 Name: Yuanyuan Peng Title: Executive Director Per: 10:15:09 - 05'00' Name: Xuan Zhang Title: Assistant Vice President Digitally signed by Yuanyuan Peng Date 2024.03.22 10 38 48 - 05 00' Seventh Amendment to Credit Agreement (Magna)

S - 52 Per: Title: Name: Xuan Zhang INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED, NEW YORK BRANCH, as Tranche A - 2 Lender Digitally signed by: Xuan Zhang Date: 2024.03.22 Per: Title: Executive Director Name: Yuanyuan Peng 10:15:24 - 05'00' Assistant Vice President Digitally signed by Yuanyuan Peng Date 2024.03.22 11 21 28 - 05'00' Seventh Amendment to Credit Agreement (Magna)

S - 53 Per: Title: Name: Xuan Zhang INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED, NEW YORK BRANCH, as Tranche A - 3 Lender Digitally signed by: Xuan Zhang Date: 2024.03.22 Per: Name: Yuanyuan Peng Title: Executive Director 10:15:33 - 05'00' Assistant Vice President Digitally signed by Yuanyuan Peng Date 2024.03.22 11 21 46 - 05'00' Seventh Amendment to Credit Agreement (Magna)

S - 54 INDUSTRIAL AND COMMERCIAL BANK OF CHINA (CANADA), as Tranche A - 1 Lender Per: Name: Harry Han Title: Regional Head, Eastern Canada Per: Name: Sherry Cao Title: Director, Corporate Banking Toronto Seventh Amendment to Credit Agreement (Magna)

S - 55 GOLDMAN SACHS BANK USA, as Tranche A - 1 Lender Per: Name: Jonathan Dworkin Title: Authorized Signatory Per: Name: Title: Seventh Amendment to Credit Agreement (Magna)

S - 56 GOLDMAN SACHS BANK USA, as Tranche A - 2 Lender Per: Name: Jonathan Dworkin Title: Authorized Signatory Per: Name: Title: Seventh Amendment to Credit Agreement (Magna)

S - 57 GOLDMAN SACHS BANK USA, as Tranche A - 3 Lender Per: Name: Jonathan Dworkin Title: Authorized Signatory Per: Name: Title: Seventh Amendment to Credit Agreement (Magna)

4140 - 6823 - 4062.6 EXHIBIT A CREDIT AGREEMENT among MAGNA INTERNATIONAL INC., MAGNA TREASURY SERVICES LP, MAGNA INTERNATIONAL OF AMERICA, INC., MAGNA INTERNATIONAL INVESTMENTS S.A., MAGNA INTERNACIONAL DE MEXICO, S.A. de C.V., MAGNA INTERNATIONAL (HONG KONG) LIMITED,MAGNA TECHNOLOGY AND TOOLING SYSTEMS (TIANJIN) CO., LTD,MAGNA AUTOMOTIVE TECHNOLOGY AND SERVICE (SHANGHAI) CO., LTD.,GUANGDONG MAGNA AUTOMOTIVE MIRRORS CO., LTD.,MAGNA AUTOMOTIVE MIRRORS (SHANGHAI) CO., LTD.,COSMA AUTOMOTIVE (SHANGHAI) CO., LTD.,MAGNA CLOSURES (KUNSHAN) CO., LTD.,MAGNA (FUZHOU) AUTOMOTIVE SEATING CO., LTD.,MAGNA ELECTRONICS (ZHANGJIAGANG) CO., LTD.,MAGNA AUTOMOTIVE PARTS (SUZHOU) CO., LTD.,MAGNA STEYR AUTOMOTIVE TECHNOLOGY (SHANGHAI) LTD.MAGNA MIRRORS (TAICANG) AUTOMOTIVE TECHNOLOGY CO., LTD., andMAGNA POWERTRAIN (TIANJIN) CO., LTD. as Borrowers - and - THE FINANCIAL INSTITUTIONS IDENTIFIED HEREIN as Lenders - and - THE BANK OF NOVA SCOTIA, CITIGROUP GLOBAL MARKETS INC. MERRILL LYNCH BofA SECURITIES , PIERCE, FENNER & SMITH INCORPORATED INC. BNP PARIBAS SECURITIES CORP., and EXPORT DEVELOPMENT CANADA as Co - Lead Arrangers and Co - Bookrunners - and - THE BANK OF NOVA SCOTIA as Administrative Agent - and - THE BANK OF NOVA SCOTIA as European Agent and CITICORP INTERNATIONAL LIMITED as Asian Agent - and - CITIBANK, N.A.

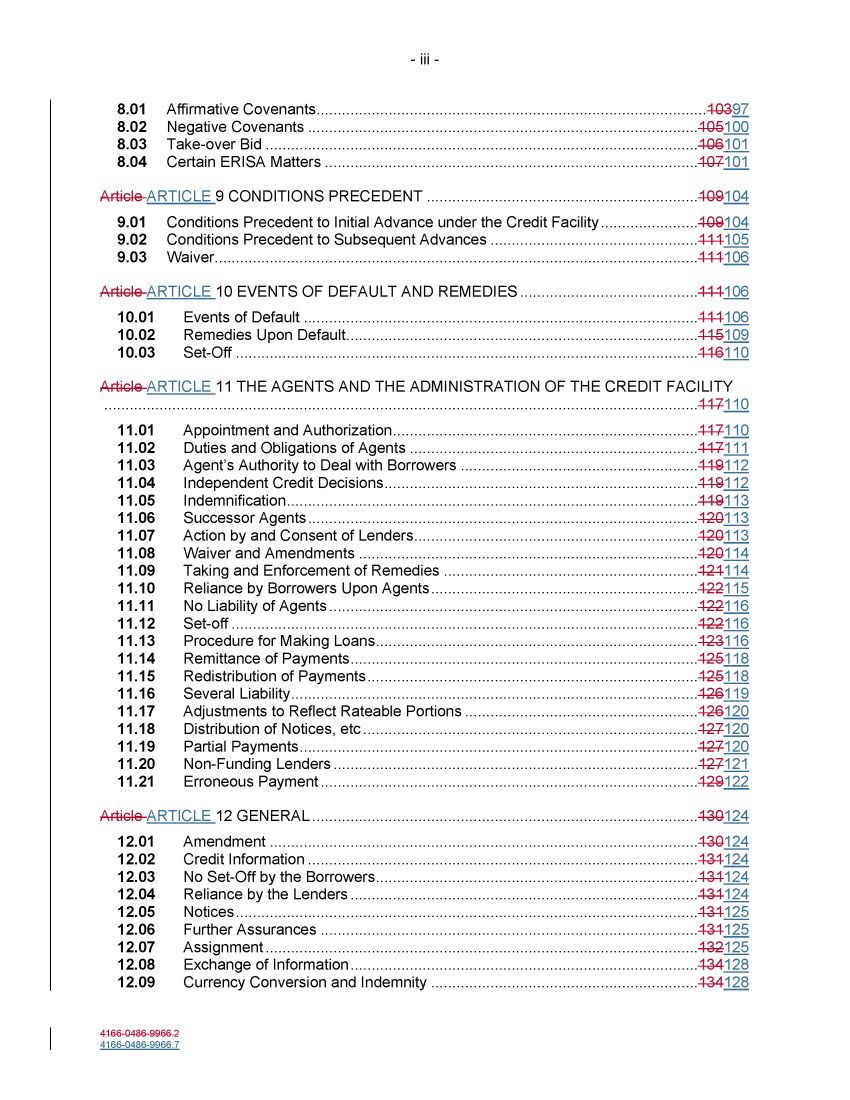

CANADIAN BRANCH, BANK OF AMERICA, N.A., BNP PARIBAS SECURITIES CORP., and EXPORT DEVELOPMENT CANADA as Co - Syndication Agents 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - ii - - and - CANADIAN IMPERIAL BANK OF COMMERCE, ROYAL BANK OF CANADA, and THE TORONTO - DOMINION BANK as Documentation Agents - and - COMMERZBANK AG, NEW YORK BRANCH, ING BANK N.V., AMSTERDAM, LANCY/GENEVA BRANCH, BANK OF MONTREAL JP MORGAN CHASE BANK, N.A., HSBC BANK CANADA, and WELLS FARGO BANK, N.A., CANADIAN BRANCH as Senior Managing Agents - and - RAIFFEISEN BANK INTERNATIONAL AG, BANK OF CHINA, NEW YORK BRANCH , INDUSTRIAL AND COMMERCE BANK OF CHINA LIMITED, NEW YORK BRANCH, and GOLDMAN SACHS BANK USA and INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED, NEW YORK BRANCH as Co - Agents DATED as of July 8, 2011 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 TABLE OF CONTENTS Article ARTICLE 1 INTERPRETATION .......................................................................................

6 4 1. Definitions .................................................................................................................... 6 4 2. Gender and Number ....................................................................................................37 3. Certificate of the Lenders as to Rates, etc...................................................................37 4. Interest Act...................................................................................................................37 5. Invalidity, etc. ........................................................................................................... 37 38 6. Headings, etc...............................................................................................................38 7. Governing Law.............................................................................................................38 8. Submission to Jurisdiction ...........................................................................................38 9. References .............................................................................................................. 38 39 10. Currency ......................................................................................................................39 11. This Agreement to Govern...........................................................................................39 12. Determination of Amount of Loans .......................................................................... 39 40 13. Computation of Time Periods ......................................................................................40 14. Actions on Days Other Than Banking Days ................................................................40 15. Time of the Essence ....................................................................................................40 16. Consents and Approvals..............................................................................................40 17. Obligations of Borrowers .............................................................................................40 18. Designated Lending Affiliates ......................................................................................40 18. [Intentionally Deleted] ..................................................................................................40 19. No Other Duties, Etc................................................................................................ 40 41 20. Interest Rates ..............................................................................................................41 21. Incorporation of Schedules ..........................................................................................41 Article ARTICLE 2 CREDIT FACILITY ........................................................................................42 1. Establishment of Credit Facility ...................................................................................42 2. Revolving Nature of Credit Facility ..............................................................................47 3. Voluntary Reduction in Commitment Amounts ........................................................ 48 47 4. Oral Instructions...........................................................................................................48 5. Payments Against Credit Facility .................................................................................48 6. Extension of Final Repayment Date ........................................................................ 49 48 7. Effect of Benchmark Transition Event .........................................................................50 Article ARTICLE 3 GENERAL PROVISIONS RELATING TO CREDIT FACILITY ................. 52 51 1. Advances ................................................................................................................. 52 51 2. Borrowers’ Obligations with Respect to Borrowing Notices..................................... 54 53 3. Lenders’ Obligations with Respect to Loans............................................................ 54 53 4. Payments Generally ................................................................................................ 54 53 5. Disturbance of Markets............................................................................................ 55 54 6. Selection of Interest Periods........................................................... and BA Periods57 55 7. Rollover and Conversion ......................................................................................... 58 55 8. The Canadian Swingline Facility.............................................................................. 59 58 9. The U.S. Swingline Facility ...................................................................................... 61 60 10. The European Swingline Facility ............................................................................. 64 62 11. The Mexican Swingline Facility................................................................................ 66 64 12. Change in Circumstances........................................................................................ 67 65 13. Illegality................................................................................................................... . 70 68 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - ii - 14.

Indemnities .............................................................................................................. 70 69 15. Mandatory Repayment - Currency Excess .............................................................. 73 71 16. U.S. Evidence of Indebtedness ............................................................................... 75 73 17. Canadian, European , and Mexican and Asian Evidence of Indebtedness ............. 75 73 18. Payments Free and Clear of Taxes ......................................................................... 75 74 19. Conditions Relating to Freely Convertible Currencies ............................................. 79 77 20. [Intentionally Deleted] ..................................................................................................78 3.20 Asian Facility Agreements ...........................................................................................79 Article 4 BANKERS’ ACCEPTANCES ........................................................................................80 4.01 Procedure Relating to Bankers’ Acceptances .............................................................80 3.21 CORRA Benchmark Replacement Setting ..................................................................78 ARTICLE 4 [INTENTIONALLY DELETED] .................................................................................80 2. BA Rate Loans.............................................................................................................84 3. Power of Attorney ........................................................................................................84 Article ARTICLE 5 LETTERS OF CREDIT.............................................................................. 86 80 1. Procedures Relating to Letters of Credit.................................................................. 86 80 2. Reimbursement ....................................................................................................... 87 81 3. Lenders Not Liable................................................................................................... 87 81 4. Fees......................................................................................................................... 89 83 5. Overdue Amounts.................................................................................................... 89 83 6. Acceleration ............................................................................................................. 90 84 7. Conflict..................................................................................................................... 90 84 8. Letters of Credit Subject to an Order ....................................................................... 91 85 9. Refund of Overpayments......................................................................................... 91 85 10. Renewal of a Letter of Credit ................................................................................... 92 86 11. Indemnities .............................................................................................................. 92 86 12. [Intentionally Deleted] ..................................................................................................87 12. Asian Facility Agreements ...........................................................................................93 13. Affiliates ................................................................................................................... 93 87 Article ARTICLE 6 INTEREST AND FEES ............................................................................. 93 87 1. Interest Rates .......................................................................................................... 93 87 2. Calculation and Payment of Interest........................................................................ 94 88 3. General Interest Rules............................................................................................. 96 90 4. Facility Fee/Commitment Fee.................................................................................. 97 91 5. Payment of Costs and Expenses............................................................................. 97 92 6. [INTENTIONALLY DELETED] .....................................................................................93 7. Compensation for Losses ............................................................................................93 6.06 Adjustment of Fees Paid in Advance...........................................................................98 Article ARTICLE 7 REPRESENTATIONS AND WARRANTIES ............................................. 99 93 1. Representations and Warranties ............................................................................. 99 93 2. Survival of Representations and Warranties ......................................................... 103 97 Article ARTICLE 8 COVENANTS.......................................................................................... 103 97 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - iii - 1.

Affirmative Covenants............................................................................................ 103 97 2. Negative Covenants ............................................................................................ 105 100 3. Take - over Bid ...................................................................................................... 106 101 4. Certain ERISA Matters ........................................................................................ 107 101 Article ARTICLE 9 CONDITIONS PRECEDENT ................................................................ 109 104 1. Conditions Precedent to Initial Advance under the Credit Facility ....................... 109 104 2. Conditions Precedent to Subsequent Advances ................................................. 111 105 3. Waiver.................................................................................................................. 111 106 Article ARTICLE 10 EVENTS OF DEFAULT AND REMEDIES .......................................... 111 106 1. Events of Default ............................................................................................. 111 106 2. Remedies Upon Default................................................................................... 115 109 3. Set - Off ............................................................................................................. 116 110 Article ARTICLE 11 THE AGENTS AND THE ADMINISTRATION OF THE CREDIT FACILITY ............................................................................................................................. ... ............ 117 110 1. Appointment and Authorization........................................................................ 117 110 2. Duties and Obligations of Agents .................................................................... 117 111 3. Agent’s Authority to Deal with Borrowers ........................................................ 119 112 4. Independent Credit Decisions.......................................................................... 119 112 5. Indemnification................................................................................................. 119 113 6. Successor Agents ............................................................................................ 120 113 7. Action by and Consent of Lenders................................................................... 120 113 8. Waiver and Amendments ................................................................................ 120 114 9. Taking and Enforcement of Remedies ............................................................ 121 114 10. Reliance by Borrowers Upon Agents............................................................... 122 115 11. No Liability of Agents ....................................................................................... 122 116 12. Set - off .............................................................................................................. 122 116 13. Procedure for Making Loans............................................................................ 123 116 14. Remittance of Payments.................................................................................. 125 118 15. Redistribution of Payments.............................................................................. 125 118 16. Several Liability................................................................................................ 126 119 17. Adjustments to Reflect Rateable Portions ....................................................... 126 120 18. Distribution of Notices, etc ............................................................................... 127 120 19. Partial Payments.............................................................................................. 127 120 20. Non - Funding Lenders ...................................................................................... 127 121 21. Erroneous Payment ......................................................................................... 129 122 Article ARTICLE 12 GENERAL ........................................................................................... 130 124 1. Amendment ..................................................................................................... 130 124 2. Credit Information ............................................................................................ 131 124 3. No Set - Off by the Borrowers............................................................................ 131 124 4. Reliance by the Lenders .................................................................................. 131 124 5. Notices ............................................................................................................. 131 125 6. Further Assurances ......................................................................................... 131 125 7. Assignment ...................................................................................................... 132 125 8. Exchange of Information.................................................................................. 134 128 9. Currency Conversion and Indemnity ............................................................... 134 128 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - iv - 10.

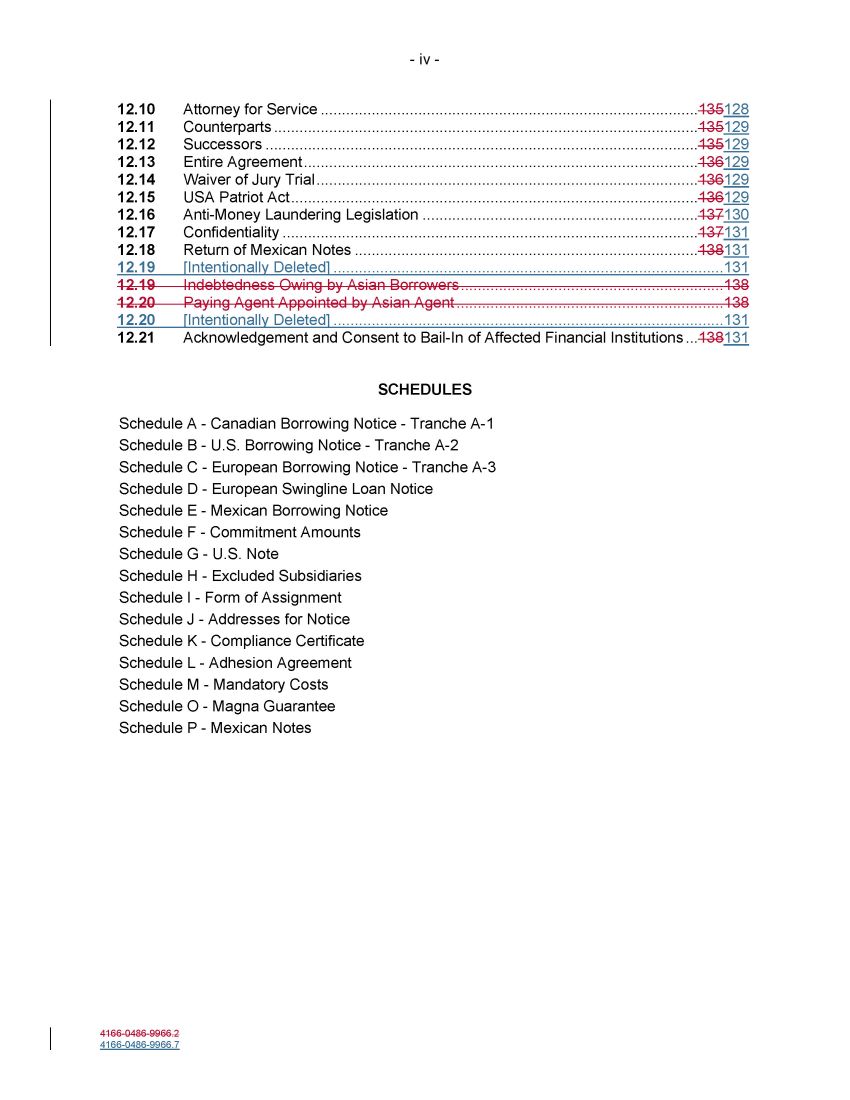

Attorney for Service ......................................................................................... 135 128 11. Counterparts .................................................................................................... 135 129 12. Successors ...................................................................................................... 135 129 13. Entire Agreement............................................................................................. 136 129 14. Waiver of Jury Trial .......................................................................................... 136 129 15. USA Patriot Act................................................................................................ 136 129 16. Anti - Money Laundering Legislation ................................................................. 137 130 17. Confidentiality .................................................................................................. 137 131 18. Return of Mexican Notes ................................................................................. 138 131 19. [Intentionally Deleted] ............................................................................................131 19. Indebtedness Owing by Asian Borrowers..............................................................138 20. Paying Agent Appointed by Asian Agent ...............................................................138 20. [Intentionally Deleted] ............................................................................................131 21. Acknowledgement and Consent to Bail - In of Affected Financial Institutions ... 138 131 SCHEDULES Schedule A - Canadian Borrowing Notice - Tranche A - 1 Schedule B - U.S. Borrowing Notice - Tranche A - 2 Schedule C - European Borrowing Notice - Tranche A - 3 Schedule D - European Swingline Loan Notice Schedule E - Mexican Borrowing Notice Schedule F - Commitment Amounts Schedule G - U.S. Note Schedule H - Excluded Subsidiaries Schedule I - Form of Assignment Schedule J - Addresses for Notice Schedule K - Compliance Certificate Schedule L - Adhesion Agreement Schedule M - Mandatory Costs Schedule O - Magna Guarantee Schedule P - Mexican Notes 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 CREDIT AGREEMENT THIS AGREEMENT is made as of the 8 th day of July, 2011.

AMONG: MAGNA INTERNATIONAL INC. , a corporation amalgamated under the laws of the Province of Ontario (herein called “ Magna ”) - and - MAGNA TREASURY SERVICES LP, a limited partnership formed under the laws of the Province of Ontario (herein called “ Magna LP ”) - and - MAGNA INTERNATIONAL OF AMERICA, INC. , a corporation incorporated under the laws of the State of Delaware (herein called the “ Magna America ”) - and - MAGNA INTERNATIONAL INVESTMENTS S.A. , a Swiss branch of a Luxembourg corporation (herein called “ Magna Europe ”) - and - MAGNA INTERNACIONAL DE MEXICO, S.A. de C.V. , a corporation incorporated under the laws of Mexico (herein called “ Magna Mexico ”) - and - MAGNA INTERNATIONAL (HONG KONG) LIMITED , a company incorporated under the laws of Hong Kong (herein called “ Magna Hong Kong ”) and MAGNA TECHNOLOGY AND TOOLING SYSTEMS (TIANJIN) CO., LTD.

, a company incorporated under the laws of The Peoples Republic of China 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - 2 - (herein called “ Tianjin ”) and MAGNA AUTOMOTIVE TECHNOLOGY AND SERVICE (SHANGHAI) CO., LTD. , a company incorporated under the laws of The Peoples Republic of China (herein called “ Shanghai ”) and GUANGDONG MAGNA AUTOMOTIVE MIRRORS CO., LTD. , a company incorporated under the laws of The Peoples Republic of China (herein called “Guangdong”) and MAGNA AUTOMOTIVE MIRRORS (SHANGHAI) CO., LTD. , a company incorporated under the laws of The Peoples Republic of China (herein called “Magna Shanghai”) and COSMA AUTOMOTIVE (SHANGHAI) CO., LTD. , a company incorporated under the laws of The Peoples Republic of China (herein called “ Cosma ”) and MAGNA CLOSURES (KUNSHAN) CO., LTD. , a company incorporated under the laws of The Peoples Republic of China (herein called “ Kunshan ”) and MAGNA (FUZHOU) AUTOMOTIVE SEATING CO., LTD.

, a company incorporated under the laws of The Peoples Republic of China (herein called “ Fuzhou ”) and 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - 3 - MAGNA ELECTRONICS (ZHANGJIAGANG) CO., LTD. , a company incorporated under the laws of The Peoples Republic of China (herein called “Magna Zhangjagang”) and MAGNA AUTOMOTIVE PARTS (SUZHOU) CO., LTD. , a company incorporated under the laws of The Peoples Republic of China (herein called “ Magna Suzhou ”) and MAGNA STEYR AUTOMOTIVE TECHNOLOGY (SHANGHAI) LTD. , a company incorporated under the laws of The Peoples Republic of China (herein called “ Magna Steyr ”) and MAGNA MIRRORS (TAICANG) AUTOMOTIVE TECHNOLOGY CO., LTD. , a company incorporated under the laws of The Peoples Republic of China (herein called “Magna Taicang”) and MAGNA POWERTRAIN (TIANJIN) CO., LTD.

, a company incorporated under the laws of The Peoples Republic of China (herein called “Magna Tianjin”) and THE BANK OF NOVA SCOTIA, CITIBANK, N.A., CANADIAN BRANCH, BANK OF AMERICA, N.A., CANADA BRANCH, BNP PARIBAS, EXPORT DEVELOPMENT CANADA, CANADIAN IMPERIAL BANK OF COMMERCE, ROYAL BANK OF CANADA, THE TORONTO - DOMINION BANK, BANK OF MONTREAL, SANTANDER BANK, N.A., COMMERZBANK AG, NEW YORK BRANCH, HSBC BANK CANADA, ING BANK N.V., AMSTERDAM, LANCY/GENEVA BRANCH, 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - 4 - JPMORGAN CHASE BANK, N.A., TORONTO BRANCH , WELLS FARGO BANK, N.A. BRANCH, GOLDMAN SACHS BANK USA , RAIFFEISEN BANK INTERNATIONAL AG, BANK OF CHINA, NEW YORK BRANCH and INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED, NEW YORK BRANCH and other financial institutions to whom any of the foregoing or their permitted assigns may from time to time assign an undivided interest in the Loan Documents and who agree to be bound by the terms hereof as a Tranche A - 1 Lender or who otherwise become a Tranche A - 1 Lender pursuant to the terms hereof (herein, in their capacities as lenders to the Canadian Borrowers under Tranche A - 1, collectively called the “ Tranche A - 1 Lenders ” and individually called a “ Tranche A - 1 Lender ”) - and - THE BANK OF NOVA SCOTIA, CITIBANK N.A., BANK OF AMERICA, N.A., CANADA BRANCH, BNP PARIBAS, EXPORT DEVELOPMENT CANADA, CANADA BRANCH, CIBC INC., ROYAL BANK OF CANADA, TORONTO - DOMINION (TEXAS) LLC, BANK OF MONTREAL, CHICAGO BRANCH, SANTANDER BANK, N.A., COMMERZBANK AG, NEW YORK BRANCH, HSBC BANK CANADA, ING BANK N.V., AMSTERDAM, LANCY/GENEVA BRANCH, JPMORGAN CHASE BANK, N.A. , WELLS FARGO BANK, N.A. BRANCH, GOLDMAN SACHS BANK USA , RAIFFEISEN BANK INTERNATIONAL AG, BANK OF CHINA, NEW YORK BRANCH and INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED, NEW YORK BRANCH and other financial institutions to whom any of the foregoing or their permitted assigns may from time to time assign an undivided interest in the Loan Documents and who agree to be bound by the terms hereof as a Tranche A - 2 Lender or who otherwise become a Tranche A - 2 Lender pursuant to the terms hereof (herein, in their capacities as lenders to the U.S.

Borrowers under Tranche A - 2, collectively called the “ Tranche A - 2 Lenders ” and individually called a “ Tranche A - 2 Lender ”) 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - 5 - THE BANK OF NOVA SCOTIA, CITIBANK, N.A. , LONDON BRANCH , BANK OF AMERICA, N.A., LONDON BRANCH, BNP PARIBAS SA, NETHERLANDS BRANCH, EXPORT DEVELOPMENT CANADA, LONDON BRANCH, CANADIAN IMPERIAL BANK OF COMMERCE, ROYAL BANK OF CANADA, THE TORONTO - DOMINION BANK, BMO LONDON BRANCH, SANTANDER BANK, N.A., COMMERZBANK AG, HSBC BANK CANADA, ING BANK N.V., AMSTERDAM, LANCY/GENEVA BRANCH, JPMORGAN CHASE BANK N.A., LONDON BRANCH , WELLS FARGO BANK, N.A. BRANCH, GOLDMAN SACHS BANK USA , RAIFFEISEN BANK INTERNATIONAL AG, BANK OF CHINA, NEW YORK BRANCH and INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED, NEW YORK BRANCH and other financial institutions to whom any of the foregoing or their permitted assigns may from time to time assign an undivided interest in the Loan Documents and who agree to be bound by the terms hereof as a Tranche A - 3 Lender pursuant to the terms hereof (herein, in their capacities as lenders to the European Borrowers under Tranche A - 3, collectively called the “ Tranche A - 3 Lenders ” and individually called a “ Tranche A - 3 Lender ”) - and - SCOTIABANK INVERLAT S.A., INSTITUCION DE BANCA MÚLTIPLE, GRUPO FINANCIERO SCOTIABANK INVERLAT and other financial institutions to whom the foregoing or its permitted assigns may from time to time assign an undivided interest in the Loan Documents and who agree to be bound by the terms hereof as a Tranche B Lender or who otherwise become a Tranche B Lender pursuant to the terms hereof (herein, in their capacities as lenders to the Mexican Borrowers under Tranche B, collectively called the “ Tranche B Lenders ” and individually called a “ Tranche B Lender ”) - and - 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - 6 - THE BANK OF NOVA SCOTIA, BANK OF AMERICA, N.A., and CITIBANK N.A., HONG KONG BRANCH and other financial institutions to whom any of the foregoing or their permitted assigns may from time to time assign an undivided interest in the Loan Documents and who agree to be bound by the terms hereof as a Tranche C Lender or who otherwise become a Tranche C Lender pursuant to the terms hereof (herein, in their capacities as lenders to the Asian Borrowers under Tranche C, collectively called the “ Tranche C Lenders ” and individually called a “ Tranche C Lender ”) and THE BANK OF NOVA SCOTIA (herein, in its capacity as administrative agent of the Lenders, called the “ Administrative Agent ”) - and - THE BANK OF NOVA SCOTIA (herein, in its capacity as European funding agent of the Lenders to the European Borrowers, called the “ European Agent ”) and CITICORP INTERNATIONAL LIMITED (herein, in its capacity as Asian funding agent of the Lenders to the Asian Borrowers, called the “ Asian Agent ”) RECITALS: WHEREAS the Borrowers, the Agents and the Lenders have agreed to enter into this Agreement on the terms contained herein.

NOW THEREFORE THIS CREDIT AGREEMENT WITNESSES that, in consideration of the covenants and agreements herein contained, the parties hereto agree as follows: ARTICLE 1 INTERPRETATION 1.01 Definitions For the purposes of this Agreement: 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - 7 - "Acceptance Fee" means , in respect of each Bankers' Acceptance Loan, a fee calculated on the basis of a 365 or 366 day year at a rate per annum for the actual number of days in the relevant BA Period equal to the Applicable Margin as at the date of issuance of such Bankers ' Acceptance, subject to adjustment pursuant to Section 6.06 , multiplied by the aggregate face amount of the applicable Bankers' Acceptance; "Adhesion Agreement" means an ag r eement substant i a ll y i n the fo r m of Schedu l e L attached he r eto ; "Adjusted Daily Compounded CORRA" means, for purposes of any calculation, the rate per annum equal to (a) Da i ly Compounded CORRA for such calculation, plus (b) the Daily Compounded CORRA Adjustment: provided that if Adjusted Daily Compounded CORRA as so determined shall be less than the Floor, then Adjusted Da i ly Compounded CORRA shall be deemed to be the Floor : "Adjusted Term CORRA" means, for purposes of any calculation, the rate per annum equal to (a) Term CORRA for such calculation, plus (b) the Term CORRA Adjustment: provided that if Ad j usted Term CORRA as so determ i ned shall ever be less than the Floor, then Adjusted Term CORRA shall be deemed to be the Floor : 4166 Q486 9966 . 2 4 1 66 - 0 4 86 - 99 66 . 7 " Adjusted Term SOFR " mean w ith r es ( i ) Te r m SOFR plus ii of th r ee - month , and sha ll be less than e for one - month , or s i x - months p r ovide a I J US e erm SOFR shall be deemed to be the F l oor; tenor , the pe r annum rate e ua l to the sum of fo r erm OFR "Administrative Agent" means The Bank of Nova Scotia , and includes i ts successo r s and any replacement admin i strative agent; "Advance" means any util i zation ( of any natu r e or kind ) of the C r edit Fa cility by a Bo r ro w e r ( other than by w ay of Rollover or Convers i on of a Loan al r eady outstanding ) , i nclud i ng , w ithout lim i tation , w hether by w ay of , in the case of a Canadian Bor r o w er , advance of a P r ime Rate L oan, Base Rate Canada Loan o r SOFR L oan, EURIBOR Loan or issuance of a Bankers' Acceptance (including BA Rate Loans) . a Term CORRA Loan . a Daily Compounded CORRA Loan o r Letter of C r ed i t or, in the case of a U . S. Bo r ro w e r, advance of a U.S.

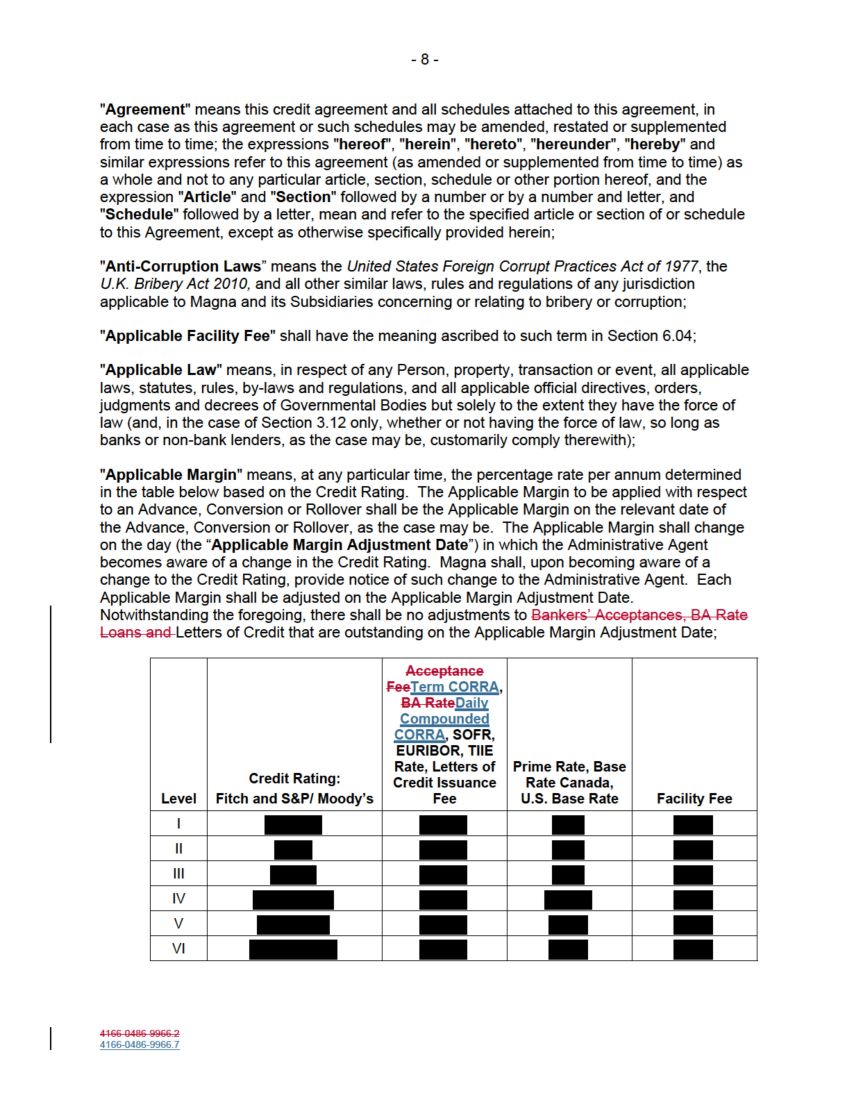

Base Rate Loan or SOFR Loan, EURIBOR Loan or i ssuance of a Le tte r of Credit or , in the case of a European Bor r o w er , advance of a SOFR Loan , EURIBOR Loan or a Eu r opean S w i ngline Loan o r issuance of a Letter of C r ed i t or, in the case of a Mex i can Bo r ro w e r, advance of a SOFR Loan o r a Peso Loan or i ssuance of a Letter of C r ed i t or, in the case of an Asian Borrower, an advance as provided for in accordance with the terms set forth in an Asian Facility Agreement ; "Affected Financial Institution" means ( a ) any EEA F i nancial Inst i tution or ( b ) any UK F i nanc i a l Institut i on ; "Affiliate" means , in respect of any co r po r at i on , any Person w h i ch, di r ectly o r ind i rec tly , cont r ols o r is cont r olled by or i s under common contro l w ith the co r poration ; and for the pu r pose of th i s definition, "control" ( i nclud i ng , w i th co r re l ative meanings , the te r ms "controlled by" and "under common control with" ) means the po w er to d i rec t , o r cause to be directed, the management and po li c i es of a co r poration w hethe r through the o w nersh i p of vot i ng sha r es or by contract ; "Agents" means , collect i ve l y, the Admin i st r at i ve Agent , and the Eu r opean Agent and the Asian Agent and " Agent " means any of the m ; - 8 - " Agreement " means th i s c r ed i t agreement and all schedules attached to this agreement, in each case as this agreement or such schedules may be amended, restated or s u pp l emen t ed f r om time to time; the expressions " hereof ', " herein "," hereto "," hereunder " , " hereby " and s i m i l a r expressions re f er to this agreement ( as amended or supplemented from time to time ) as a w hole and not to any particular article, section, schedu l e or other port i on hereo f , and the ex pr ess i on " Arti c le " and " Se c tion " f o ll o w ed by a number or by a number and l e tt e r, and " S c hedule " f ollo w ed by a l etter, mean and re f er to the specified article or section of or schedu l e to this Agreement , except as o t he rw i se specifically p r ov i ded here i n ; " Anti - Corruption Laws " means the United States Fore i gn Co r rupt P r act i ces Act of 1977 , the U.K. Bribery Act 2010 , and all other s i m i l a r la w s , rules and regulations of any jurisdiction a pp licab l e to Magna and i ts Subs i d i a r ies concerning o r r ela t i ng to bribery or corruption; " Appli c able Fa c ility Fee " shall have the meaning ascr i bed to such te r m in Sec t i on 6 . 04 ; " Appli c able Law " means, i n respect of any Person , p r o p erty , transaction or event, all a p plicab l e l a w s, statu t es , ru l es , b y - l a w s and regulations, and all applicable official di r ec t i ves , orders, judgments and dec r ees of Governmental Bodies but so l e l y to the extent they have the force o f l a w ( and, in the case of Section 3. 1 2 only, w hethe r o r not having the f o r ce of l a w, so long as banks or non - bank lenders, as the case may be , customarily comp l y t he r e w i th ); " Appli c able M a rgin " means , at any particular time, the percentage rate per annum determined i n the table be l o w based on the Credit Rating. The Applicable M arg i n to be applied w i th respect to an Advance, Conversion or Rollover shall be the Applicable M arg i n on the relevant date of the Advance , Conve r s i on o r R ollover , as the case may be . The A p plicab l e Ma r g i n shall change on the day ( the " Appli c able Margin Adjustment Date ") in w hich the Adm i nis t r ative Agent becomes a w are o f a change in the C r ed i t Rating. Magna shall, upon becom i ng a w are o f a change to the Credit Rating, p r ov i de not i ce of such change to the Adm i nis t r ative Agent. E ach App li cab l e Margin shall be adjusted on the A pp licab l e Margin Adjustment Date. No tw i t hstand i ng the foregoing, the r e sha ll be no adjustments to Bankers' Acceptances, BA Rate Loans and Letters of Credit tha t are outstanding on the Applicable M arg i n Adjustment Date; - - - 4166 Q486 9966 . 2 4 1 66 - 0 4 86 - 99 66 . 7 F ac ili ty F e e Prim e R at e , B a se R a t e C a n a da , U.S.

B a se R at e Cr e dit R at ing: Fi tc h and S&P / M oo d y' s Le v el Acceptance f'.ee Term CORRA , 8A Rate Oaily Comeounded CORRA , SOFR , EURIBOR , TIIE Ra t e , L e tters of Cr e dit Issu a n c e F e e 1111 1111 1111 1111 1111 1111 - - 1111 1111 - - - - 1111 II 111 I V V V I - 9 - " Applicable Margin Adjustment Date " has the meaning set forth in the definition of Applicable Margin; " Asian Agent " means Citicorp International Limited, and includes its successors and any replacement Asian Agent; " Asian Borrowers " means, collectively, Magna Hong Kong, Tianjin, Magna Shanghai, Shanghai, Guangdong, Magna Taicang, Cosma, Kunshan, Fuzhou, Magna Zhangjagang, Magna Suzhou, Magna Steyr, Magna Tianjin and each other Person that becomes a Borrower under Tranche C from time to time after the Closing Date pursuant to an Asian Facility Agreement and by executing this Agreement or an Adhesion Agreement and " Asian Borrower " means any one of them; " Asian Facility Agreements " means, collectively, the agreements entered into from time to time among the Administrative Agent, the Asian Agent, the Tranche C Lenders and an Asian Borrower establishing the terms applicable to the ability of such Asian Borrower to obtain credit pursuant to Tranche C (including without limitation the PRC Supplement), as each such agreement may be amended, restated, supplemented or replaced from time to time and " Asian Facility Agreement " means any one of them; “ Available Tenor ” means, as of any date of determination and with respect to the then - current Benchmark, as applicable, (x) if such Benchmark is a term rate, any tenor for such Benchmark (or component thereof) that is or may be used for determining the length of an interest period pursuant to this Agreement or (y) otherwise, any payment period for interest calculated with reference to such Benchmark (or component thereof) that is or may be used for determining any frequency of making payments of interest calculated with reference to such Benchmark, in each case, as of such date and not including, for the avoidance of doubt, any tenor for such Benchmark that is then - removed from the definition of “Interest Period” pursuant to Section 2.07(d); " Bail - In Action ” means the exercise of any Write - Down and Conversion Powers by the applicable Resolution Authority in respect of any liability of an Affected Financial Institution; " Bail - In Legislation ” means, (a) with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law, rule, regulation or requirement for such EEA Member Country from time to time which is described in the EU Bail - In Legislation Schedule, and (b) with respect to the United Kingdom, Part I of the United Kingdom Banking Act 2009 (as amended from time to time) and any other law, regulation or rule applicable in the United Kingdom relating to the resolution of unsound or failing banks, investment firms or other financial institutions or their affiliates (other than through liquidation, administration or other insolvency proceedings); " BA Period " means, with respect to a Bankers’ Acceptance, the duration thereof as selected by a Canadian Borrower in the applicable Borrowing Notice, in each case commencing on the date the Bankers’ Acceptance is accepted and expiring on a Banking Day not less than one (1) month nor more than three (3) months thereafter (or, subject to availability, a duration of less than 1 month with a maximum of 10 BA Periods at any time of less than 1 month); " BA Rate " means the BA Schedule I Rate or the BA Schedule II Rate, as the case may be; " BA Rate Loan " shall have the meaning ascribed thereto in Section 4.02; 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - 10 - " BA Schedule I Rate " means, with respect to an issue of Bankers’ Acceptances with the same Maturity Date to be accepted by a Schedule I Lender hereunder, the discount rate per annum, calculated on the basis of a year of 365 days, (i) equal to, as determined by the Administrative Agent, the arithmetic average (rounded upwards to the nearest multiple of 0.01%) of the discount rates of the Schedule I Reference Lenders that appear on the Refinitiv Screen CDOR Page for the Schedule I Reference Lenders at or about 10:20 a.m. (Toronto time) on the date of issue and acceptance of such Bankers’ Acceptances, for bankers’ acceptances having a comparable face value and an identical Maturity Date to the face value and Maturity Date of such issue of Bankers’ Acceptances or (ii) if such rate does not appear on such page for all Schedule I Reference Lenders, equal to the arithmetic average of the rates per annum for Canadian dollar bankers’ acceptances having such term for the Administrative Agent which are quoted to the Administrative Agent as of such time by three major Canadian banks chosen by the Administrative Agent, provided that the Administrative Agent shall act in good faith in order to obtain representative quotes; " BA Schedule II Rate " means, with respect to an issue of Bankers’ Acceptances with the same Maturity Date to be accepted by a Non Schedule I Lender hereunder, the lesser of (i) the discount rate per annum, calculated on the basis of a year of 365 days, determined by the Administrative Agent as being the arithmetic average (rounded upwards to the nearest multiple of 0.01%) of the discount rates of the Schedule II Reference Lenders determined in accordance with their normal practices at or about 10:20 a.m. (Toronto time) on the date of issue and acceptance of such Bankers’ Acceptances, for bankers’ acceptances having a comparable face value and an identical Maturity Date to the face value and Maturity Date of such issue of Bankers’ Acceptances and (ii) the BA Schedule I Rate with respect to an issue of Bankers’ Acceptances with the same Maturity Date to be accepted by a Schedule I Lender hereunder plus 0.10% per annum; " Bankers’ Acceptance " means any draft issued by a Canadian Borrower and accepted by a Tranche A 1 Lender in accordance with the provisions of Article 4 and includes, among other things, a depository bill under the Depository Bills and Notes Act (Canada) and a bill of exchange under the Bills of Exchange Act (Canada); " Bankers’ Acceptance Loan " means, at any particular time, any Loan which at such time is outstanding by way of Bankers’ Acceptances or BA Rate Loans and, for greater certainty, refers to the aggregate face amount of all Bankers’ Acceptances accepted and BA Rate Loans made in respect of a single Borrowing Notice, and " Bankers’ Acceptance Loans " means, at any time, all Bankers’ Acceptance Loans at such time; " Banking Day " means (i) for all purposes other than in respect of a SOFR Loan or EURIBOR Loan or an Advance, a Conversion or a Rollover to a Borrower, a day on which banks are generally open for business and on which dealings in foreign currency and exchange between banks may be carried on in Toronto, Ontario and Montreal, Quebec and, in the case of an Advance, a Conversion or a Rollover in currencies other than Canadian dollars, New York, New York and (ii) in respect of an Advance, a Conversion or a Rollover (other than a SOFR Loan or EURIBOR Loan) to a U.S.

Borrower, a day on which banks are generally open for business and on which dealings in foreign currency and exchange between banks may be carried on in New York, New York and (iii) in respect of a EURIBOR Loan (other than a EURIBOR Loan to a European Borrower), a day on which banks are generally open for business and on which dealings in foreign currency and exchange between banks may be carried on in Toronto, Ontario, in New York, New York and in London, England and (iv) in respect of an Advance, a Conversion or a Rollover to a European Borrower (other than a European Swingline Loan), a 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - 11 - day on which banks are generally open for business and on which dealings in foreign currency and exchange between banks may be carried out in London, England and (v) in respect of a European Swingline Loan, a day on which banks are generally open for business in Vienna, Austria and which is a TARGET Day and (vii) in respect of an Advance, a Conversion or a Rollover (other than a SOFR Loan) to a Mexican Borrower, a day on which banks are generally open for business and on which dealings in foreign currency and exchange between banks may be carried on in Mexico City, Mexico and, in the case of a SOFR Loan to a Mexican Borrower, the day on which banks are generally open for business and on which dealings in foreign currency and exchange between banks may be carried on in Mexico City, Mexico and London, England , and (viii) in respect of an Advance, a Conversion or a Rollover to an Asian Borrower, as provided for in the applicable Asian Facility Agreement . In addition to the provisions stated above in this definition, any Advance, a Conversion or a Rollover denominated in Euros shall be made on a TARGET Day only; " Base Rate Canada " means, at any particular time, the greater of (a) the annual rate of interest, designated as the “Base Rate Canada”, which the Administrative Agent establishes at its principal office in Toronto as the reference rate of interest in order to determine interest rates it will charge at such time for loans in U.S. dollars made to its customers in Canada, such rate to be adjusted automatically and without the necessity of any notice to the Canadian Borrowers upon each change to such rate and (b) the Federal Funds Rate at such time plus ½ of 1% per annum; " Base Rate Canada Loan " means, at any particular time, any Loan which is outstanding at such time and in respect of which interest is to be calculated based on the Base Rate Canada and " Base Rate Canada Loans " means, at any particular time, all Base Rate Canada Loans at such time; “ Benchmark ” means, initially, the Term SOFR Reference Rate; provided that if a Benchmark Transition Event has occurred with respect to the Term SOFR Reference Rate or the then - current Benchmark, then “Benchmark” means the applicable Benchmark Replacement to the extent that such Benchmark Replacement has replaced such prior benchmark rate pursuant to Section 2.07(d); “ Benchmark Replacement ” means, (a) the alternate benchmark rate that has been selected by the Agent and Magna giving due consideration to (i) any selection or recommendation of a replacement benchmark rate or the mechanism for determining such a rate by the Relevant Governmental Body or (ii) any evolving or then - prevailing market convention for determining a benchmark rate as a replacement to the then - current Benchmark for Dollar - denominated syndicated credit facilities at such time, and (b) the related Benchmark Replacement Adjustment; provided that, if such Benchmark Replacement as so determined would be less than the Floor, such Benchmark Replacement will be deemed to be the Floor for the purposes of this Agreement and the other Loan Documents; “ Benchmark Replacement Adjustment ” means, with respect to any replacement of the then - current Benchmark with an Unadjusted Benchmark Replacement, the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by the Agent and Magna giving due consideration to (a) any selection or recommendation of a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body or (b) any evolving or then - prevailing market convention for determining a spread adjustment, or 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - 12 - method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for Dollar - denominated syndicated credit facilities; “ Benchmark Replacement Date ” means the earliest to occur of the following events with respect to the then - current Benchmark: (a) in the case of clause (a) or (b) of the definition of “Benchmark Transition Event”, the later of (i) the date of the public statement or publication of information referenced therein and (ii) the date on which the administrator of such Benchmark (or the published component used in the calculation thereof) permanently or indefinitely ceases to provide all Available Tenors of such Benchmark (or such component thereof); or (b) in the case of clause (c) of the definition of “Benchmark Transition Event”, the first (1st) date on which such Benchmark (or the published component used in the calculation thereof) has been determined and announced by or on behalf of the administrator of such Benchmark (or such component thereof) or the regulatory supervisor for the administrator of such Benchmark (or such component thereof) to be no longer representative or not to comply with the International Organization of Securities Commissions (IOSCO) Principles for Financial Benchmarks ; provided, that such non - representativeness or non - compliance will be determined by reference to the most recent statement or publication referenced in such clause (c) and even if any Available Tenor of such Benchmark (or such component thereof) continues to be provided on such date.

For the avoidance of doubt, the “Benchmark Replacement Date” will be deemed to have occurred in the case of clause (a) or (b) with respect to any Benchmark upon the occurrence of the applicable event or events set forth therein with respect to all then - current Available Tenors of such Benchmark (or the published component used in the calculation thereof); “ Benchmark Transition Event ” means the occurrence of one or more of the following events with respect to the then - current Benchmark: (a) a public statement or publication of information by or on behalf of the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that such administrator has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); (b) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof), the Federal Reserve Board, the Federal Reserve Bank of New York, an insolvency official with jurisdiction over the administrator for such Benchmark (or such component), a resolution authority with jurisdiction over the administrator for such Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for such Benchmark (or such component), which states that the administrator of such Benchmark (or such component) has ceased or will cease to provide all Available 4166 - 0486 - 9966.2 4166 - 0486 - 9966.7 - 13 - Tenors of such Benchmark (or such component thereof) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); or (c) a public statement or publication of information by or on behalf of the administrator of such Benchmark (or the published component used in the calculation thereof) or the regulatory supervisor for the administrator of such Benchmark (or such component thereof) announcing that all Available Tenors of such Benchmark (or such component thereof) are no longer, or as of a specified future date will no longer be, representative or do not, or as a specified future date will not , comply with the International Organization of Securities Commissions (IOSCO) Principles for Financial Benchmarks . For the avoidance of doubt, a “Benchmark Transition Event” will be deemed to have occurred with respect to any Benchmark if a public statement or publication of information set forth above has occurred with respect to each then - current Available Tenor of such Benchmark (or the published component used in the calculation thereof); “ Benchmark Unavailability Period ” means the period (if any) (a) beginning at the time that a Benchmark Replacement Date has occurred if, at such time, no Benchmark Replacement has replaced the then - current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 2.07, and (b) ending at the time that a Benchmark Replacement has replaced the then - current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 2.07; " Borrowers " means, collectively, the Canadian Borrowers, the U.S. Borrowers, the European Borrowers, the Mexican Borrowers , the Asian Borrowers and any other borrower designated and that has become party to this Agreement pursuant to Section 2.01(k) or (l) and " Borrower " means any of them; " Borrowers’ Counsel " means, collectively, Osler, Hoskin & Harcourt LLP of Toronto, Ontario, Baker & McKenzie of Zurich, Switzerland, Allen & Overy of Hong Kong and Goodrich, Riquelme y Asociados, Mexico City, Mexico and/or such other counsel not unacceptable to the Lenders acting reasonably as Magna may designate to the Administrative Agent in writing from time to time; " Borrowing Date " means any Banking Day on which an Advance, Conversion or Rollover is made; " Borrowing Notice " means, in respect of an Advance to a Canadian Borrower under Tranche A - 1, a notice substantially in the form of Schedule A hereto and, in respect of an Advance to a Mexican Borrower under Tranche B, a notice substantially in the form of Schedule E hereto and, in respect of an Advance to a U.S.