SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

| For the Month of: March, 2024 | Commission File Number: 001-32562 |

STANTEC INC.

(Name of Registrant)

300-10220 103 Avenue NW

Edmonton, Alberta

Canada T5J 0K4

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form 40-F ☒ Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SIGNATURES

| STANTEC INC. | ||

| Date: March 27, 2024 | By: /s/ Theresa B.Y. Jang | |

| Name: Theresa B. Y. Jang | ||

| Title: Executive Vice President and CFO |

EXHIBIT INDEX

Notice of Annual General Meeting and of Availability of Proxy Materials Notice is hereby given that Stantec Inc. (“Stantec” or the “Company”) will hold its annual general meeting: When: Thursday, May 9, 2024 10:30 AM (MDT) Where: Virtual meeting via live audio webcast online at https://web.lumiagm.com/281567372 Meeting ID: 281 - 567 - 372 Password: stantec2024 (case sensitive) The meeting will be held to address the following business: Business of the Meeting For more information 1 Receive Stantec’s financial statements for the year ended December 31, 2023, together with the auditor’s report on those statements Page 12 of the Circular and Stantec’s 2023 Annual Report 2 Elect each of the directors of Stantec to hold office until the end of the next annual meeting or until their successors are appointed Pages 12 and 14 of the Circular 3 Appoint the auditor of Stantec and authorize the directors to fix the auditor’s remuneration Page 13 of the Circular 4 Consider a nonbinding advisory resolution on Stantec’s approach to executive compensation Page 13 of the Circular 5 Transact any other business as may properly be brought before the meeting The board has fixed the close of business on March 15, 2024, as the record date for the determination of shareholders entitled to notice of and to vote at the meeting. Only shareholders of record on that date are entitled to vote on the matters listed in this Notice. Notice - and - Access As permitted by Canadian securities regulators, Stantec is using the “notice - and - access” mechanism for delivery of its Management Information Circular (“Circular”) for our annual general meeting to both registered and beneficial shareholders. This means that our Circular is being posted online for you to access, rather than being mailed out. This Notice includes information on how to access our Circular online and how to request a paper copy. Notice - and - access gives shareholders more choice, substantially reduces our printing and mailing costs, and is environmentally friendly as it reduces paper and energy consumption. WHERE YOU CAN ACCESS THE CIRCULAR On our website: stantec.com under Investors // Financial Reports & Filings On our profile on SEDAR+: sedarplus.ca On our profile on EDGAR: sec.gov/edgar It is very important that you read the Circular carefully before voting your shares. Voting Please note that you cannot vote by returning this Notice. Enclosed with this Notice, you will find a form of proxy or a voting instruction form that you can use to vote your shares of Stantec. You may vote your shares online, by phone or mail. Please refer to the instructions on your separate proxy or voting instruction form on how to vote using these methods. Exhibit 99.1 Notice of Annual General Meeting and of Availability of Proxy Materials March 15, 2024 Stantec Inc.

Registered shareholders: Computershare must receive your proxy form, or you must have voted by Internet or telephone before 10:30 AM (MDT) on Tuesday, May 7, 2024. Beneficial shareholders: Your intermediary must receive your voting instructions with sufficient time for your vote to be processed by Computershare before 10:30 AM (MDT) on Tuesday, May 7, 2024. Please refer to your voting instruction form for more information. How to request a paper copy of the Circular Upon request, Stantec will provide a paper copy of the Circular to any shareholder, free of charge, for a period of one year from the date the Circular is filed on SEDAR+. Here is how you can request a paper copy: Before the meeting If your request is made before the date of the meeting, the Circular will be sent to you within three business days of receipt of your request. To ensure receipt of the paper copy in advance of the voting deadline and meeting date, we estimate that your request must be received no later than 10:30 AM (MDT) on Monday, April 29, 2024 (this factors the three - business day period for processing requests as well as typical mailing times). Registered Shareholders Beneficial Shareholders Call the fulfillment service line at 1 - 866 - 962 - 0498. Please note Call the fulfillment service line at 1 - 877 - 907 - 7643. Please note that you will be asked to provide the 15 - digit control number that you will be asked to provide the 16 - digit control number indicated on your form of proxy. indicated on your voting instruction form. After the meeting If the request is made on or after May 9, 2024, the Circular will be sent to you within ten calendar days of receiving your request. Call 1 - 844 - 916 - 0609 for a copy of the Circular. Please note that you will not receive another form of proxy or voting instruction form; please retain your current one to vote your shares. If you have any questions regarding this Notice, notice - and - access, or the meeting, please call • Computershare Trust Company of Canada at 1 - 800 - 564 - 6253 (if you are a registered shareholder) or • Broadridge Financial Solutions, Inc. at 1 - 844 - 916 - 0609 (if you are a beneficial shareholder) By order of the board of directors, Paul J. D. Alpern Senior Vice President, Secretary and General Counsel March 15, 2024 Notice of Annual General Meeting and of Availability of Proxy Materials March 15, 2024 Stantec Inc.

Management Information Circular M A RC H 1 5 , 2 0 2 4 Exhibit 99.2

This page intentionally left blank.

Table of Contents Invitation to Shareholders Notice of Meeting General Information About Voting Business of the Meeting 1 Financial Statements 2 Election of Directors 3 Appointment of Auditor 4 Nonbinding Advisory Vote on Executive Compensation Nominees for Election to the Board of Directors Description of Nominees Additional Information about Directors Director Compensation Components of Compensation Director Equity Ownership Directors’ Total Compensation for 2023 Statement Of Corporate Governance Practices Composition of Our Board Director Competencies Matrix Board of Directors Information Role and Duties of the Board of Directors Serving on Our Board Committee Reports Audit and Risk Committee Corporate Governance and Compensation Committee Sustainability and Safety Committee Sustainability Shareholder Engagement Executive Compensation Overview Performance and Compensation Summary Compensation Discussion and Analysis 2023 Compensation Details Employment Agreements Additional Information Schedule A Overview of Stantec's Long - Term Incentive Plan 3 4 6 7 12 12 12 13 13 14 14 21 23 23 25 27 28 29 32 33 33 35 39 39 41 43 45 46 47 47 49 65 67 70 72 72 Invitation to Shareholders Dear Fellow Shareholder: The Stantec board of directors and management team invite you to attend the annual general meeting of shareholders of Stantec Inc. Details of the meeting follow: Date : Time : Place : Thursday, May 9, 2024 10:30 AM (MDT) Virtual Meeting via live audio webcast online at https://web.lumiagm.com/281567372 Meeting ID: 281 - 567 - 372 Password: stantec2024 (case sensitive) This year, Stantec will hold a virtual - only meeting. Using virtual meeting capabilities, you or your proxyholder will be able to engage in real time voting and interact with the board and management. To maximize accessibility and create an interactive and inclusive environment, Stantec enables Q&A technology for all participants at the meeting, allowing a real - time exchange with our board and management. We use an industry - leading platform (Lumi) to facilitate access to our meeting and broadcast the meeting live. Having held our meetings this way for the past three years, shareholder feedback has been positive, meetings have been engaging, and environmental impacts have been minimized. We include detailed information about how to access the meeting in the accompanying Management Information Circular and on our website at stantec.com. Investors are also welcomed to contact us at ir@stantec.com if they have any questions about access to or participation at the meeting. As a shareholder, you have the right to vote your shares on all matters that come before the meeting. Your vote is important and we facilitate voting by allowing you to vote by proxy at any time prior to the meeting. We encourage you to do so and have enabled voting online, by phone, or by mail. You can also vote by attending the virtual meeting by logging in online at https://web.lumiagm.com/281567372. Please refer to the instructions in the section titled How to Attend the Virtual Meeting beginning on page 8 in the accompanying Circular for further details. The Circular provides details about all matters that come before the meeting, such as information about our director nominees and their compensation, our auditor, our corporate governance practices, and our executive compensation program. Further information regarding the meeting, along with a virtual meeting guide and all of our meeting materials are available on our website at stantec.com and under our profile on SEDAR+ at sedarplus.ca and on EDGAR at sec.gov. Please return your voting instructions as soon as possible to ensure that your vote is recorded. Thank you for your continuing support. Sincerely, Douglas K. Ammerman, Chair Board of Directors 2024 Management Information Circular March 15, 2024 3 Stantec Inc. Gordon A. Johnston, P.Eng.

President & CEO Notice of Annual General Meeting and of Availability of Proxy Materials Notice is hereby given that Stantec Inc. (“Stantec” or the “Company”) will hold its annual general meeting: When: Thursday, May 9, 2024 10:30 AM (MDT) Where: Virtual meeting via live audio webcast online at https://web.lumiagm.com/281567372 Meeting ID: 281 - 567 - 372 Password: stantec2024 (case sensitive) The meeting will be held to address the following business: Business of the Meeting For more information 1 Receive Stantec’s financial statements for the year ended December 31, 2023, together with the auditor’s report on those statements Page 12 of the Circular and Stantec’s 2023 Annual Report 2 Elect each of the directors of Stantec to hold office until the end of the next annual meeting or until their successors are appointed Pages 12 and 14 of the Circular 3 Appoint the auditor of Stantec and authorize the directors to fix the auditor’s remuneration Page 13 of the Circular 4 Consider a nonbinding advisory resolution on Stantec’s approach to executive compensation Page 13 of the Circular 5 Transact any other business as may properly be brought before the meeting The board has fixed the close of business on March 15, 2024, as the record date for the determination of shareholders entitled to notice of and to vote at the meeting. Only shareholders of record on that date are entitled to vote on the matters listed in this Notice. Notice - and - Access As permitted by Canadian securities regulators, Stantec is using the “notice - and - access” mechanism for delivery of its Management Information Circular (“Circular”) for our annual general meeting to both registered and beneficial shareholders. This means that our Circular is being posted online for you to access, rather than being mailed out. This Notice includes information on how to access our Circular online and how to request a paper copy. Notice - and - access gives shareholders more choice, substantially reduces our printing and mailing costs, and is environmentally friendly as it reduces paper and energy consumption. WHERE YOU CAN ACCESS THE CIRCULAR On our website: stantec.com under Investors // Financial Reports & Filings On our profile on SEDAR+: sedarplus.ca On our profile on EDGAR: sec.gov/edgar It is very important that you read the Circular carefully before voting your shares. Voting Please note that you cannot vote by returning this Notice. Enclosed with this Notice, you will find a form of proxy or a voting instruction form that you can use to vote your shares of Stantec. You may vote your shares online, by phone or mail. Please refer to the instructions on your separate proxy or voting instruction form on how to vote using these methods. 2024 Management Information Circular March 15, 2024 4 Stantec Inc.

Registered shareholders: Computershare must receive your proxy form, or you must have voted by Internet or telephone before 10:30 AM (MDT) on Tuesday, May 7, 2024. Beneficial shareholders: Your intermediary must receive your voting instructions with sufficient time for your vote to be processed by Computershare before 10:30 AM (MDT) on Tuesday, May 7, 2024. Please refer to your voting instruction form for more information. How to request a paper copy of the Circular Upon request, Stantec will provide a paper copy of the Circular to any shareholder, free of charge, for a period of one year from the date the Circular is filed on SEDAR+. Here is how you can request a paper copy: Before the meeting If your request is made before the date of the meeting, the Circular will be sent to you within three business days of receipt of your request. To ensure receipt of the paper copy in advance of the voting deadline and meeting date, we estimate that your request must be received no later than 10:30 AM (MDT) on Monday, April 29, 2024 (this factors the three - business day period for processing requests as well as typical mailing times). Registered Shareholders Beneficial Shareholders Call the fulfillment service line at 1 - 866 - 962 - 0498. Please note Call the fulfillment service line at 1 - 877 - 907 - 7643. Please note that you will be asked to provide the 15 - digit control number that you will be asked to provide the 16 - digit control number indicated on your form of proxy. indicated on your voting instruction form. After the meeting If the request is made on or after May 9, 2024, the Circular will be sent to you within ten calendar days of receiving your request. Call 1 - 844 - 916 - 0609 for a copy of the Circular. Please note that you will not receive another form of proxy or voting instruction form; please retain your current one to vote your shares. If you have any questions regarding this Notice, notice - and - access, or the meeting, please call • Computershare Trust Company of Canada at 1 - 800 - 564 - 6253 (if you are a registered shareholder) or • Broadridge Financial Solutions, Inc. at 1 - 844 - 916 - 0609 (if you are a beneficial shareholder) By order of the board of directors, Paul J. D. Alpern Senior Vice President, Secretary and General Counsel March 15, 2024 2024 Management Information Circular March 15, 2024 5 Stantec Inc.

2024 Management Information Circular March 15, 2024 6 Stantec Inc. General Information You have received this Circular because you owned common shares of Stantec Inc. as of the close of business on March 15, 2024 (the "Record Date") and are entitled to notice of and vote at our annual general meeting of shareholders on Thursday, May 9, 2024 (or a reconvened meeting if the meeting is postponed or adjourned). This Circular and other securityholder materials are being sent to both registered and beneficial owners of Stantec’s common shares. If you are a beneficial shareholder, and Stantec’s agent has sent these materials directly to you, your name, address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf. Please note that we are holding a virtual only meeting to facilitate ease of participation by shareholders. Management is soliciting your proxy for the meeting, and the costs for doing so (including costs to mail materials to our beneficial shareholders via their intermediaries) are borne by Stantec. In addition to soliciting proxies by mail, Stantec may also solicit proxies via telephone, email, or in person. If determined advisable, Stantec may retain an agency to solicit proxies for Stantec in Canada and the United States. All costs associated with the solicitation of proxies by or on behalf of the Company will be borne by Stantec. In this Circular, unless otherwise noted or the context otherwise requires, references to “we”, “us”, “our”, “Stantec” or the “Company” refer to Stantec Inc. “You”, “your” and “shareholder” refer to holders of Stantec’s common shares. The “board of directors” or “board” refer to the board of directors of Stantec Inc. You will find additional information regarding our business in our Annual Information Form for the fiscal year ended December 31, 2023, as well as our audited consolidated financial statements and accompanying management’s discussion and analysis for the year ended December 31, 2023. Copies of these documents along with our other public documents are available on our website at stantec.com, on the System for Electronic Document Analysis and Retrieval (“SEDAR+”) at sedarplus.ca and on the Electronic Data Gathering, Analysis, and Retrieval (“EDGAR”) system at sec.gov. Unless stated otherwise, the information provided in this Circular is given as of March 15, 2024, and all dollar amounts are expressed in Canadian dollars. Notice - and - Access As permitted by Canadian securities regulators, Stantec is utilizing notice - and - access to deliver this Circular to both registered and beneficial shareholders. “Notice - and - access” is a set of rules that allows issuers to post electronic versions of proxy - related materials online, via SEDAR+ and one other website, rather than mailing paper copies of such materials to shareholders. Under notice - and - access, shareholders still receive a proxy form or voting instruction form enabling them to vote at the meeting. However, instead of receiving a paper copy of the meeting materials, shareholders receive a notice which contains information on how they may access the materials online and how to request a paper copy. The use of notice - and - access directly benefits Stantec by substantially reducing our printing and mailing costs and is more environmentally friendly. Shares eligible to vote As of March 15, 2024, the Company had 114,066,995 common shares issued and outstanding. Each share carries the right to one vote on each matter that comes before the meeting. Principal shareholders To the knowledge of the Company, Stantec does not have any shareholders that beneficially own, directly or indirectly, or exercise control or direction over 10% or more of Stantec’s common shares.

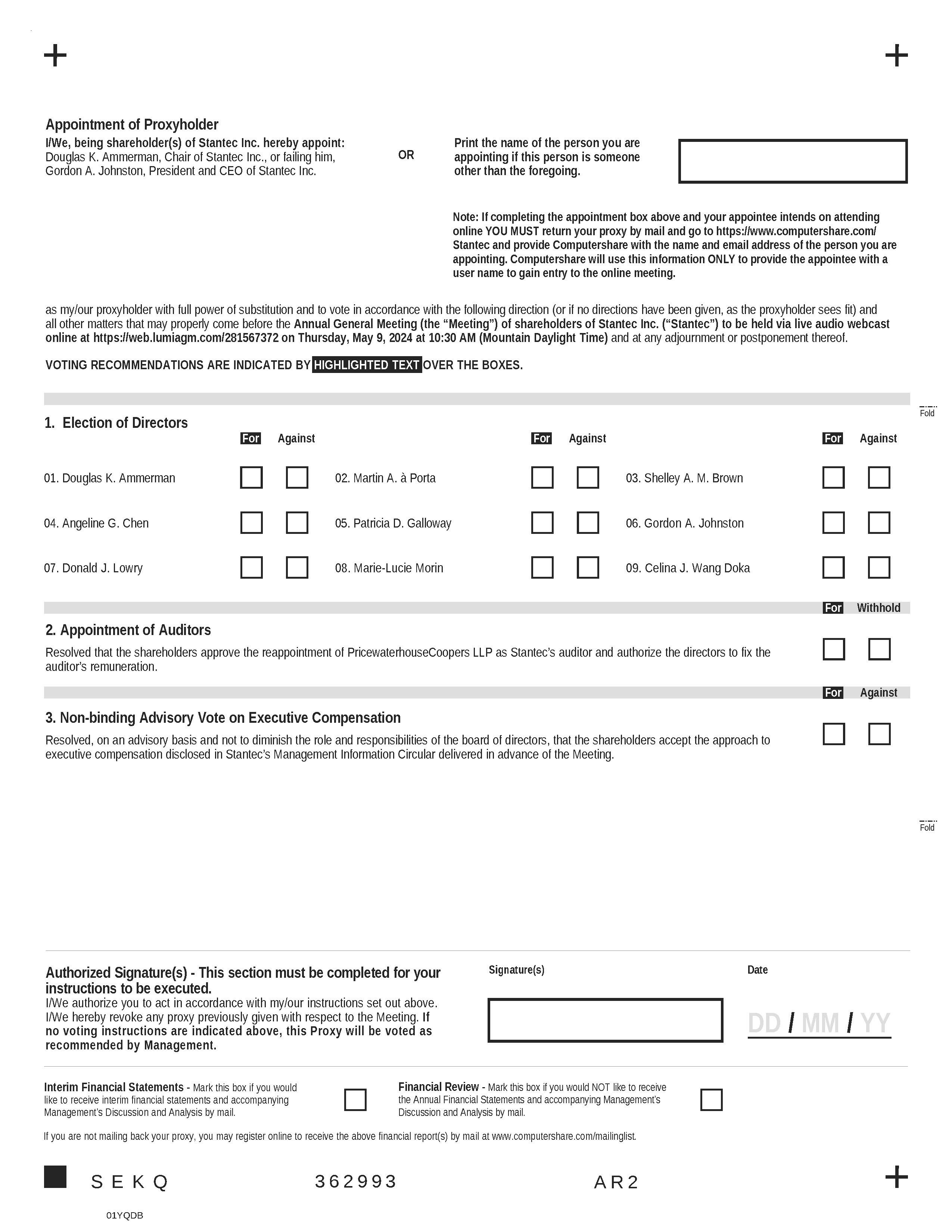

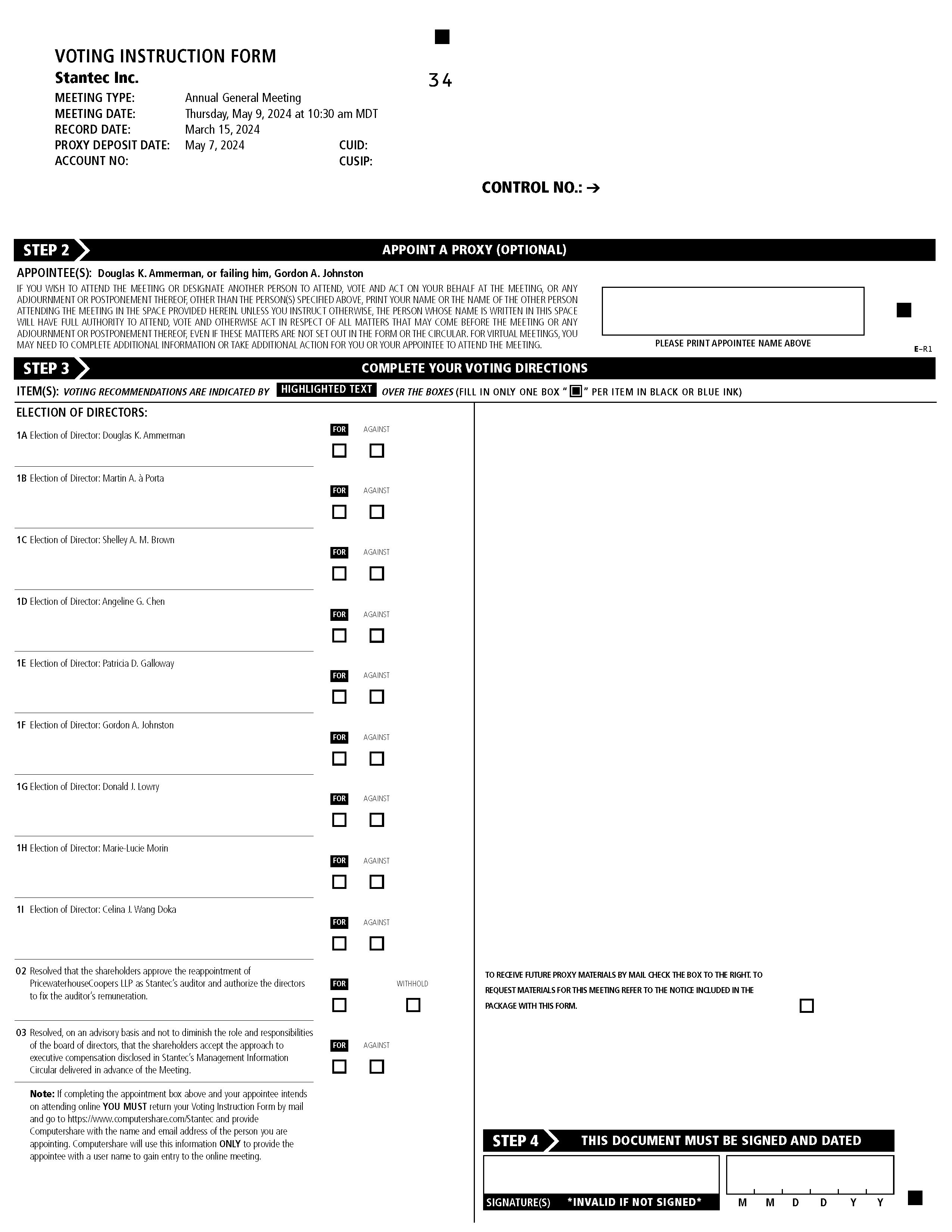

About Voting Who can Vote You are entitled to vote at the meeting if you held common shares of Stantec at the close of business on March 15, 2024. Shareholders will vote on three items of business and any other matters that may properly come before the meeting. A simple majority of votes (50% plus one vote) cast at the meeting in person or by proxy is required to approve each matter to be considered at the meeting. How to Vote Your Shares in Advance Voting your shares in advance of the meeting is the easiest way to vote. The voting process is different depending on whether you are a registered or non - registered (beneficial) shareholder. You are a registered shareholder if your shares are held in your name. You are a beneficial shareholder if your shares are held in the name of your nominee (usually a bank, trust company, securities dealer or other financial institution) and you are the beneficial owner of the shares. If you are not sure whether you are a registered shareholder, please contact Stantec’s transfer agent, Computershare Trust Company of Canada ("Computershare"), at 1 - 800 - 564 - 6253 (North America) or 1 - 514 - 982 - 7555 (International). How to Vote in Advance – Registered Shareholders As a registered shareholder, you have received a form of proxy. Voting by proxy means that you appoint a person or entity (your proxyholder) to attend the meeting and vote your shares in accordance with your instructions. Your proxyholder does not need to be a shareholder, but this person or company must attend the meeting and vote on your behalf. Please refer to the section titled Appointing a Proxyholder to Vote at the Meeting below. If you do not appoint your own proxyholder, Douglas K. Ammerman and Gordon A. Johnston, the Stantec representatives named on the proxy form will act as your proxyholder and will vote your shares according to your instructions. Your proxyholder will have discretion to vote on amendments or variations to the business of the meeting or any other matters to be voted on at the meeting. How to Vote by Proxy as a Registered Shareholder Internet Visit the website shown on your proxy form. Refer to your holder account number and control number on your proxy form and follow the online instructions. Phone Call the toll - free telephone number shown on your proxy form. Refer to your holder account number and control number on your proxy form and follow the instructions. Please note: you cannot appoint anyone other than the Stantec representatives named on your proxy form if you vote by telephone. Mail Complete, sign, and date the proxy form following the instructions provided; return it by mail using the envelope provided. How to Vote in Advance – Beneficial Shareholders As a beneficial shareholder, you have received a voting instruction form from your intermediary. Please follow the instructions on your voting instruction form and send your voting instructions to your nominee who will vote for you. If you are a beneficial shareholder, you will likely have an earlier deadline for the return of your voting instruction form, so please be sure to send the form early, to allow enough time for your nominee to receive your voting instructions and then send them to Stantec’s transfer agent, Computershare, before the proxy cut - off. Most nominees delegate responsibility for obtaining voting instructions from their clients to Broadridge Financial Solutions, Inc. (“Broadridge”). Broadridge usually mails a scannable voting instruction form that can be completed via phone, mail, or over the Internet at proxyvote.com. Your voting instruction form provides you with the right to appoint a person or company (your proxyholder) to attend the meeting and vote your shares for you. 2024 Management Information Circular March 15, 2024 7 Stantec Inc.

How to Vote in Advance – Employees Holding Shares Under the Employee Stock Purchase Plan (“ESPP”) If you hold shares through Stantec’s ESPP in Canada, you can direct Manulife Financial, the plan trustee to vote your employee shares as you instruct. Follow the instructions on your proxy form: How to Vote by Proxy as an Employee Shareholder Holding Shares Under the ESPP Internet Visit the website shown on your proxy form. Refer to your holder account number and control number on your proxy form and follow the online instructions. Phone Call the toll - free telephone number shown on your proxy form. Refer to your holder account number and control number on your proxy form and follow the instructions. Please note: you cannot appoint anyone other than the Stantec representatives named on your proxy form if you vote by telephone. Mail Complete, sign, and date the proxy form following the instructions provided; return it by mail using the envelope provided. If you hold shares through Stantec’s ESPP in the United States, you will receive a voting instruction form that will contain instructions on how to vote your shares. Your employee shares will be voted for or against or will be withheld from voting only in accordance with your instructions. If your proxy form or voting instruction form is not received according to the procedures above, your employee shares will not be voted at the meeting. Send your Voting Instructions Right Away Take some time to read this Circular and then vote your shares. Regardless of which method you choose to vote, we must receive your voting instructions by 10:30 AM (Mountain Daylight Time) on May 7, 2024 to ensure your shares are voted at the meeting. If you are a non - registered (beneficial) shareholder, you will need to allow enough time for your nominee (or their representative) to receive your voting instructions and then submit them to Stantec’s transfer agent, Computershare. If the meeting is postponed or adjourned, you must send your voting instructions at least 48 hours (not including Saturdays, Sundays and holidays) before the time the meeting is reconvened. How to Attend the Virtual Meeting Use your smartphone, tablet or computer to attend our virtual meeting. You can attend the meeting as a guest or participate in the meeting online as described below. Virtual Meeting Checklist Make sure you have the following to access the meeting online: 1. The latest version of Chrome, Safari, Edge or Firefox as your Internet browser 2. The Stantec meeting ID: 281 - 567 - 372 3. The meeting password: stantec2024 (case sensitive) 4. Your user name and/or control number (see below) 2024 Management Information Circular March 15, 2024 8 Stantec Inc.

Attending as a Guest Attending the meeting as a guest means you can listen to the meeting, ask questions and engage with management, members of the board, and other shareholders. However, as a guest attendee, you are not able to vote at the meeting. How to log in You should log in at least 30 minutes before the start of the meeting Go to https://web.lumiagm.com/281567372 on your smartphone, tablet or computer. Click “Login” and enter the password: stantec2024 (case sensitive). Click “Guest” and complete the online form. Voting your Shares in Real Time Registered shareholders and duly appointed proxyholders can vote at the meeting, ask questions, and engage with management, members of the board, and other shareholders. How to log in You or your proxyholder should log in at least 30 minutes before the start of the meeting Go to https://web.lumiagm.com/281567372 on your smartphone, tablet or computer. Click “Login” and enter the password: stantec2024 (case sensitive). If you are a registered shareholder, enter the 15 - digit control number on your proxy form as your username. If you are a registered shareholder and you appointed someone else to be your proxyholder (a third party proxyholder), or if you are a non - registered (beneficial) shareholder and you appointed yourself or someone else as your proxyholder, that person will receive an email notification from Computershare with a control number that will also serve as their user name (see below). If you are a registered, beneficial or employee shareholder and you are appointing someone other than the Stantec representatives named in your proxy form or voting instruction form to attend the meeting as your proxyholder, you must register them with Computershare at https://www.computershare.com/Stantec. Detailed instructions for appointing a third - party proxyholder to vote at the meeting are provided below. Appointing a Proxyholder to Vote at the Meeting As a shareholder, you have the right to appoint a person or entity (your proxyholder) to attend the meeting and vote your shares for you. You may appoint someone else other than Douglas K. Ammerman and Gordon A. Johnston to represent you at the meeting . Your proxyholder does not need to be a shareholder, but this person or company must attend the meeting and vote on your behalf. 2024 Management Information Circular March 15, 2024 9 Stantec Inc.

Registered Shareholders and Employees Holding Shares Under the ESPP If you want to appoint someone other than the Stantec representatives named in your proxy form to attend the meeting and vote your shares for you, print the name of the person or company you are appointing in the space provided on the proxy form in your package of materials. Follow the instructions for submitting your form of proxy to Computershare. After you submit your proxy form to Computershare, you MUST register your proxyholder with Computershare. Go to https://www.computershare.com/Stantec by 10:30 AM (MDT) on May 7, 2024 to register your proxyholder and provide the contact information required. Computershare needs this information so they can confirm their registration and send an email notification with a control number. Your proxyholder needs the control number in order to participate in the meeting and vote your shares. Your proxyholder should receive an email notification after 10:30 AM (MDT) on May 7, 2024. Your proxyholder must vote your shares according to your instructions, but will have discretion to vote on amendments or variations to the business of the meeting or any other matters to be voted on at the meeting. Beneficial Shareholders If you want to participate in the meeting and vote your shares in real time, print your name in the space provided on your voting instruction form to instruct your nominee to appoint yourself as proxyholder. After you submit your voting instruction form to your nominee, you MUST register yourself as a third - party proxyholder. Go to https://www.computershare.com/Stantec by 10:30 AM (MDT) on May 7, 2024 to register yourself and provide your contact information. Computershare requires this information so they can confirm the registration and send you an email notification with a control number. You need the control number in order to participate in the meeting and vote your shares. You should receive your email notification after 10:30 AM (MDT) on May 7, 2024. If you are a beneficial shareholder located in the United States and wish to participate or vote at the meeting, or, if permitted, appoint a third party as your proxyholder, you must follow the instructions provided in the voting instruction form to obtain a valid legal proxy from your intermediary. After obtaining a valid legal proxy from your intermediary, you must then submit such legal proxy to Computershare. Requests for registration from beneficial shareholders located in the United States that wish to vote at the meeting or, if permitted, appoint third parties as their proxyholders must be sent by email or by courier to: uslegalproxy@computershare.com (if by email); or Computershare Trust Company of Canada, Attention: Proxy Department, 8th Floor, 100 University Avenue, Toronto, ON M5J 2Y1, Canada (if by courier), and in both cases, must be labeled “Legal Proxy” and received no later than the voting deadline of 10:30 AM (MDT) on May 7, 2024. Once you log in to the meeting, remember to stay connected to the Internet so you can vote when the balloting begins. Participating and Voting at the Meeting Participating and voting at the meeting is made easy through Lumi's end - to - end virtual meeting platform. Once guests, shareholders, or their proxyholders enter the virtual meeting room, the meeting room technology provides immediate, onscreen feedback. Meeting participants can submit questions and make comments at any time during the meeting via the Q&A section within the platform. When the meeting starts, polling for matters to be voted on at the meeting will open and appear automatically, allowing participants to enter a response and receive a vote confirmation instantly. Participants can change their selection at any time while polls are open and the vote confirmation will update. The chair of the meeting will advise meeting participants before polls close. Additional time will be allowed for guests, shareholders and proxyholders to ask questions and engage with management and the board. 2024 Management Information Circular March 15, 2024 10 Stantec Inc.

Stantec has selected Lumi's virtual meeting platform because of its known simplicity. Accessibility and engagement are important, and so the meeting room has been designed to be intuitive for all shareholders, irrespective of digital literacy. Lumi offers live chat and technical support on the day of the meeting. In addition, shareholders are welcomed to contact Stantec at ir@stantec.com before the meeting for additional assistance. For more information, guests, shareholders and their proxyholders can access our Virtual Meeting Guide at stantec.com under the Investors // Events & Presentations page. Changing Your Vote Registered Shareholders and Employees Holding Shares Under the ESPP If you are a registered shareholder and have voted by proxy, you may revoke your proxy in one of several ways: • By providing new voting instructions on a proxy form with a later date or at a later time if you are voting by telephone or on the Internet. Any new voting instructions must be received by Computershare before 10:30 AM (MDT) on May 7, 2024, or, if the meeting is adjourned or postponed, by 10:30 AM (MDT) on the business day before the date of the reconvened meeting. • By delivering a revocation of proxy to the registered office of Stantec (to the attention of our corporate secretary at Suite 300, 10220 – 103 Avenue NW, Edmonton, Alberta, T5J 0K4) any time before 10:30AM (MDT) on May 8, 2024, or, if the meeting is adjourned or postponed, before 10:30 AM (MDT) on the business day before the date of the reconvened meeting. You may also revoke your proxy in any other manner permitted by law. Beneficial Shareholders If you are a beneficial shareholder, you may revoke your voting instructions by contacting the person who serves your account. However, you are subject to the same time constraints as noted above for registered shareholders. If you are an employee shareholder and have voted by submitting your proxy, you may revoke it by providing new voting instructions with a later date or at a later time if you are voting by telephone or on the Internet. However, any new voting instructions will take effect only if received by 10:30 AM (MDT) on May 7, 2024, or, if the meeting is adjourned or postponed, by 10:30 AM (MDT) on the second - last business day before the reconvened meeting. Matters You Will Be Voting On You will be voting on • The election of Stantec’s directors • The appointment of Stantec’s auditor • A nonbinding advisory vote on Stantec’s approach to executive compensation. Please see the Business of the Meeting section of this Circular for more information. Other Business As of March 15, 2024, no director or executive officer of the Company was aware of any variation, amendment, or other matter to be presented for a vote at the meeting. Confidentiality of Your Vote Under normal conditions, your vote will be kept confidential because the Company’s transfer agent tabulates proxies and votes. However, confidentiality may be lost if a question arises about a proxy’s validity, revocation, or any other like matter. Loss of confidentiality may also occur if the board decides that disclosure is in the best interest of the Company or its shareholders. 2024 Management Information Circular March 15, 2024 11 Stantec Inc.

2024 Management Information Circular March 15, 2024 12 Stantec Inc. Business of the Meeting 1 Financial Statements Our audited consolidated financial statements for the year ended December 31, 2023, will be placed before the meeting. Our financial statements are contained in our 2023 Annual Report, available on our website at stantec.com and on SEDAR+ at sedarplus.ca. Our Form 40 - F is available on EDGAR at sec.gov. If you want a free copy of any of these documents, please contact our corporate secretary at Suite 300, 10220 – 103 Avenue NW, Edmonton, Alberta, T5J 0K4. 2 Election of Directors Nine directors will stand for election at the meeting. All of the nominated directors currently serve on the Company's board. The Nominees for Election to the Board of Directors section of this Circular provides information on each nominees' experience, background, and key competencies. We believe that each person nominated is well qualified to be a director of Stantec. If any nominee is unable to serve as a director for any reason arising before the meeting, the person named in your proxy has the discretion to vote for another nominee at the meeting. Each director elected at the meeting will hold office until the next annual meeting of shareholders or until his or her successor is duly elected or appointed. The following persons listed in the Nominees for Election to the Board of Directors section of this Circular will be presented for election at the meeting as management’s nominees: Donald J. Lowry Angeline G. Chen Douglas K. Ammerman Marie - Lucie Morin Patricia D. Galloway Martin A. à Porta Celina J. Wang Doka Gordon A. Johnston Shelley A. M. Brown Because of our 15 - year director term limit, Mr. Gomes will not stand for re - election at the meeting. Though information relating to Mr. Gomes's service on the board does not appear in the section that presents the nominees for election to the board, information concerning him appears in the sections of this Circular that pertain to the members of the board as of December 31, 2023, and up to the meeting date. Majority Voting Requirement for Directors Stantec is governed by the Canada Business Corporations Act (the "CBCA"). In accordance with the CBCA, shareholders can vote "for" or "against" each nominee director, and each nominee director must receive a majority of "for" votes to be elected. If a nominee director does not receive a majority of "for" votes, they may not be appointed to the board except in limited circumstances where it is necessary to ensure the board has the requisite number of resident Canadians or independent directors. Incumbent directors who fail to receive majority support are permitted to remain in office for a maximum of 90 days after the meeting until their successor is appointed or elected. We recommend that you vote FOR the election of the nominees listed above. Unless otherwise instructed, the management representatives designated in the enclosed proxy intend to vote FOR the election of each of the nominees.

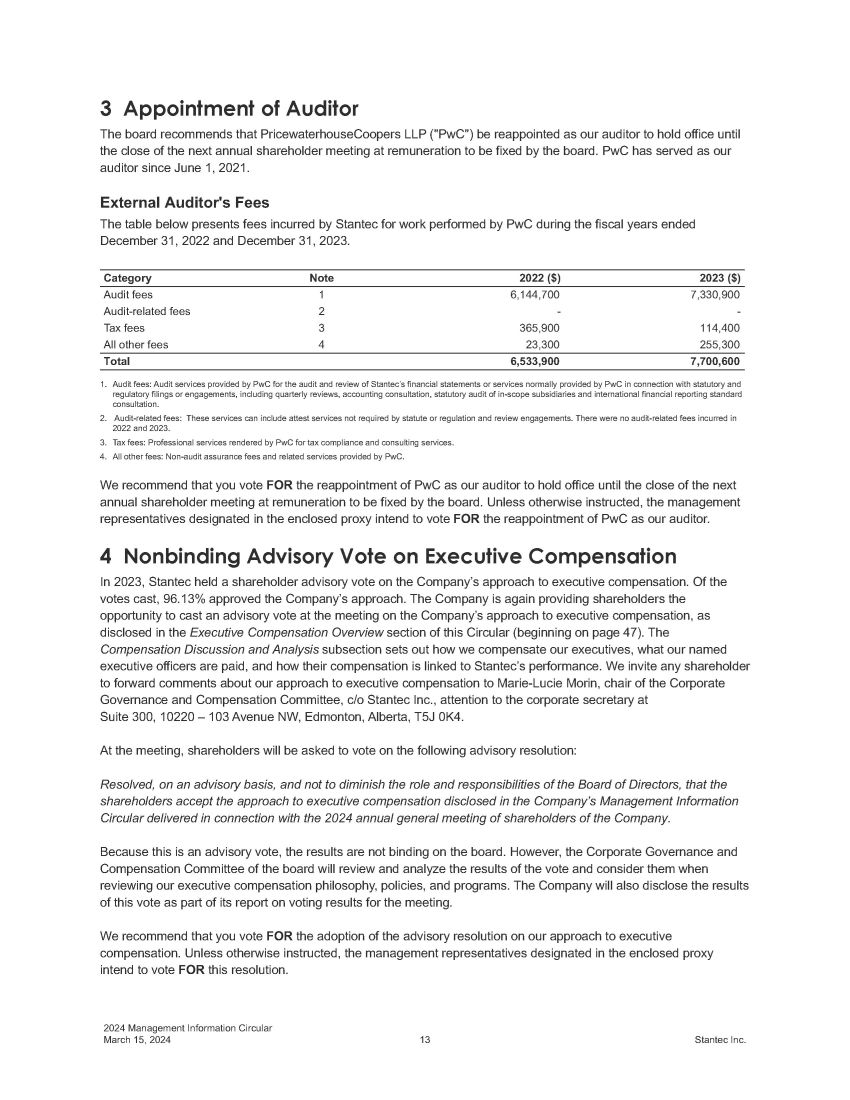

2024 Management Information Circular March 15, 2024 13 Stantec Inc. 3 Appointment of Auditor The board recommends that PricewaterhouseCoopers LLP ("PwC") be reappointed as our auditor to hold office until the close of the next annual shareholder meeting at remuneration to be fixed by the board. PwC has served as our auditor since June 1, 2021. External Auditor's Fees The table below presents fees incurred by Stantec for work performed by PwC during the fiscal years ended December 31, 2022 and December 31, 2023. 2023 ($) 2022 ($) Note Category 7,330,900 6,144,700 1 Audit fees - - 2 Audit - related fees 114,400 365,900 3 Tax fees 255,300 23,300 4 All other fees 7,700,600 6,533,900 Total 1. Audit fees : Audit services provided by PwC for the audit and review of Stantec’s financial statements or services normally provided by PwC in connection with statutory and regulatory filings or engagements, including quarterly reviews, accounting consultation, statutory audit of in - scope subsidiaries and international financial reporting standard consultation . 2. Audit - related fees : These services can include attest services not required by statute or regulation and review engagements . There were no audit - related fees incurred in 2022 and 2023 . 3. Tax fees : Professional services rendered by PwC for tax compliance and consulting services . 4. All other fees : Non - audit assurance fees and related services provided by PwC . We recommend that you vote FOR the reappointment of PwC as our auditor to hold office until the close of the next annual shareholder meeting at remuneration to be fixed by the board. Unless otherwise instructed, the management representatives designated in the enclosed proxy intend to vote FOR the reappointment of PwC as our auditor. 4 Nonbinding Advisory Vote on Executive Compensation In 2023, Stantec held a shareholder advisory vote on the Company’s approach to executive compensation. Of the votes cast, 96.13% approved the Company’s approach. The Company is again providing shareholders the opportunity to cast an advisory vote at the meeting on the Company’s approach to executive compensation, as disclosed in the Executive Compensation Overview section of this Circular (beginning on page 47 ). The Compensation Discussion and Analysis subsection sets out how we compensate our executives, what our named executive officers are paid, and how their compensation is linked to Stantec’s performance. We invite any shareholder to forward comments about our approach to executive compensation to Marie - Lucie Morin, chair of the Corporate Governance and Compensation Committee, c/o Stantec Inc., attention to the corporate secretary at Suite 300, 10220 – 103 Avenue NW, Edmonton, Alberta, T5J 0K4. At the meeting, shareholders will be asked to vote on the following advisory resolution: Resolved, on an advisory basis, and not to diminish the role and responsibilities of the Board of Directors, that the shareholders accept the approach to executive compensation disclosed in the Company’s Management Information Circular delivered in connection with the 2024 annual general meeting of shareholders of the Company. Because this is an advisory vote, the results are not binding on the board. However, the Corporate Governance and Compensation Committee of the board will review and analyze the results of the vote and consider them when reviewing our executive compensation philosophy, policies, and programs. The Company will also disclose the results of this vote as part of its report on voting results for the meeting. We recommend that you vote FOR the adoption of the advisory resolution on our approach to executive compensation. Unless otherwise instructed, the management representatives designated in the enclosed proxy intend to vote FOR this resolution.

Nominees for Election to the Board of Directors Description of Nominees The following tables give information as of December 31, 2023, about the nominees for election to the board, including their background and key qualifications relevant to serving on our board. All nominees are current directors of Stantec. Douglas Ammerman is a retired partner of KPMG LLP. Mr. Ammerman was with KPMG for almost 30 years, and, during that time, he served as a national practice partner, as the managing partner of the Orange County office, and as a member of KPMG’s nominating committee for its board of directors. He holds a master’s degree in business taxation from the University of Southern California, as well as a Bachelor of Arts degree with an accounting emphasis from California State University at Fullerton. Mr. Ammerman is past president and director emeritus of the Pacific Club and served in the Reagan Administration as Special Assistant to the Secretary of Interior. Douglas K. Ammerman Corporate Director Laguna Beach, California, United States Age: 72 Director since 2011 Independent Director Key Qualifications • Public accounting • Public company board experience • Professional services management 100% 6 of 6 Board and Committee Attendance During 2023 Board of Directors (chair) 100% 4 of 4 Audit and Risk 100% 5 of 5 Corporate Governance and Compensation 100% 6 of 6 Sustainability and Safety Audit (chair) Other Public Board Directorships (1) Fidelity National Financial, Inc. (NYSE – FNF) Audit (chair) Audit (chair) Audit (chair) Dun & Bradstreet Holdings, Inc. (NYSE – DNB) F&G Annuities & Life, Inc. (NYSE – FG) Cannae Holdings, Inc. (NYSE – CNNE) Total Equity at Risk (Common Shares and Deferred Share Units) Value at Risk $10,500,791 (1) Mr. Ammerman's other public board directorships are related to each other, resulting in synergies and overlap that substantially mitigate overboarding concerns. See page 37 of this Circular for more information. 2024 Management Information Circular March 15, 2024 14 Stantec Inc.

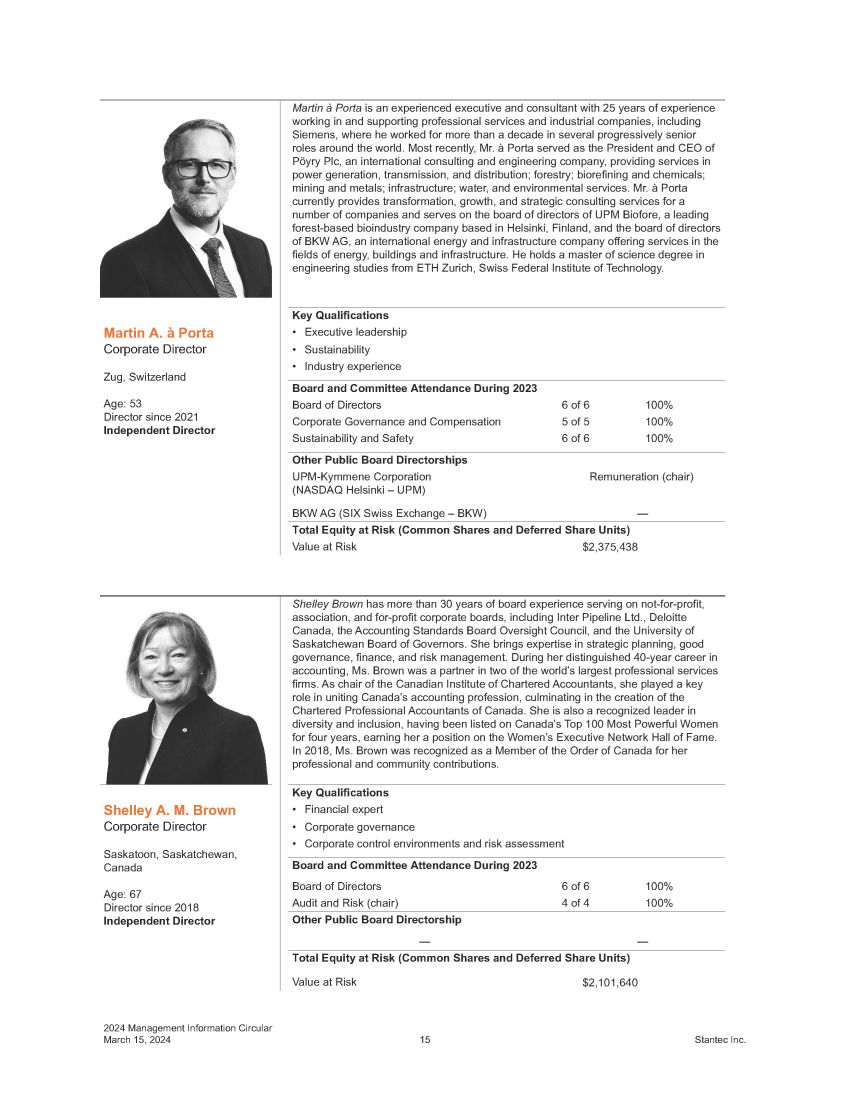

Martin à Porta is an experienced executive and consultant with 25 years of experience working in and supporting professional services and industrial companies, including Siemens, where he worked for more than a decade in several progressively senior roles around the world. Most recently, Mr. à Porta served as the President and CEO of Pöyry Plc, an international consulting and engineering company, providing services in power generation, transmission, and distribution; forestry; biorefining and chemicals; mining and metals; infrastructure; water, and environmental services. Mr. à Porta currently provides transformation, growth, and strategic consulting services for a number of companies and serves on the board of directors of UPM Biofore, a leading forest - based bioindustry company based in Helsinki, Finland, and the board of directors of BKW AG, an international energy and infrastructure company offering services in the fields of energy, buildings and infrastructure. He holds a master of science degree in engineering studies from ETH Zurich, Swiss Federal Institute of Technology. Martin A. à Porta Corporate Director Zug, Switzerland Age: 53 Director since 2021 Independent Director Key Qualifications • Executive leadership • Sustainability • Industry experience Board and Committee Attendance During 2023 100% 6 of 6 Board of Directors 100% 5 of 5 Corporate Governance and Compensation 100% 6 of 6 Sustainability and Safety Other Public Board Directorships Remuneration (chair) UPM - Kymmene Corporation (NASDAQ Helsinki – UPM) BKW AG (SIX Swiss Exchange – BKW) — Total Equity at Risk (Common Shares and Deferred Share Units) Value at Risk $2,375,438 Shelley Brown has more than 30 years of board experience serving on not - for - profit, association, and for - profit corporate boards, including Inter Pipeline Ltd., Deloitte Canada, the Accounting Standards Board Oversight Council, and the University of Saskatchewan Board of Governors. She brings expertise in strategic planning, good governance, finance, and risk management. During her distinguished 40 - year career in accounting, Ms. Brown was a partner in two of the world’s largest professional services firms. As chair of the Canadian Institute of Chartered Accountants, she played a key role in uniting Canada’s accounting profession, culminating in the creation of the Chartered Professional Accountants of Canada. She is also a recognized leader in diversity and inclusion, having been listed on Canada’s Top 100 Most Powerful Women for four years, earning her a position on the Women’s Executive Network Hall of Fame. In 2018, Ms. Brown was recognized as a Member of the Order of Canada for her professional and community contributions. Shelley A. M. Brown Corporate Director Saskatoon, Saskatchewan, Canada Age: 67 Director since 2018 Independent Director Key Qualifications • Financial expert • Corporate governance t • Corporate control environments and risk assessmen Board and Committee Attendance During 2023 100% 6 of 6 Board of Directors 100% 4 of 4 Audit and Risk (chair) Other Public Board Directorship — — Total Equity at Risk (Common Shares and Deferred Share Units) Value at Risk $2,101,640 2024 Management Information Circular March 15, 2024 15 Stantec Inc.

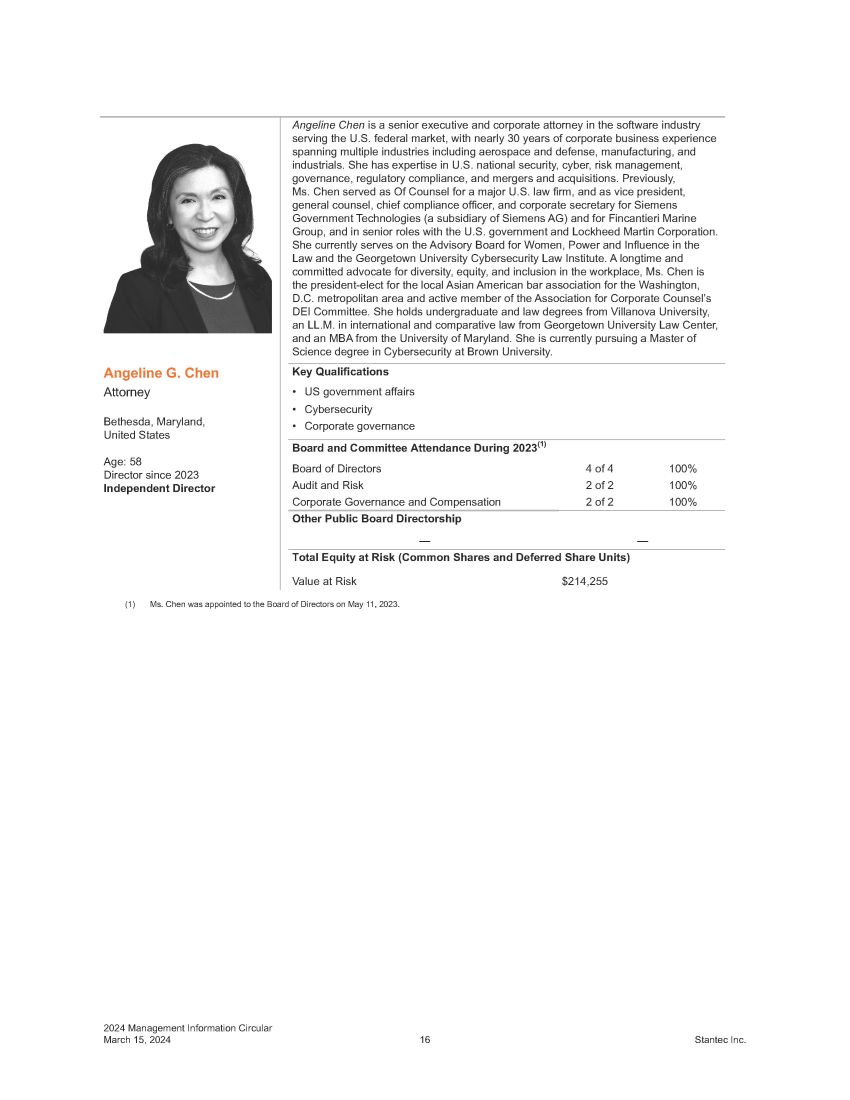

Angeline Chen is a senior executive and corporate attorney in the software industry serving the U.S. federal market, with nearly 30 years of corporate business experience spanning multiple industries including aerospace and defense, manufacturing, and industrials. She has expertise in U.S. national security, cyber, risk management, governance, regulatory compliance, and mergers and acquisitions. Previously, Ms. Chen served as Of Counsel for a major U.S. law firm, and as vice president, general counsel, chief compliance officer, and corporate secretary for Siemens Government Technologies (a subsidiary of Siemens AG) and for Fincantieri Marine Group, and in senior roles with the U.S. government and Lockheed Martin Corporation. She currently serves on the Advisory Board for Women, Power and Influence in the Law and the Georgetown University Cybersecurity Law Institute. A longtime and committed advocate for diversity, equity, and inclusion in the workplace, Ms. Chen is the president - elect for the local Asian American bar association for the Washington, D.C. metropolitan area and active member of the Association for Corporate Counsel’s DEI Committee. She holds undergraduate and law degrees from Villanova University, an LL.M. in international and comparative law from Georgetown University Law Center, and an MBA from the University of Maryland. She is currently pursuing a Master of Science degree in Cybersecurity at Brown University. Angeline G. Chen Attorney Bethesda, Maryland, United States Age: 58 Director since 2023 Key Qualifications • US government affairs • Cybersecurity • Corporate governance Board and Committee Attendance During 2023 (1) Board of Directors 4 of 4 100% 100% 2 of 2 Audit and Risk Independent Director 100% 2 of 2 Corporate Governance and Compensation Other Public Board Directorship — — Total Equity at Risk (Common Shares and Deferred Share Units) Value at Risk $214,255 (1) Ms. Chen was appointed to the Board of Directors on May 11, 2023. 2024 Management Information Circular March 15, 2024 16 Stantec Inc.

Patricia D. Galloway Corporate Director Cle Elum, Washington, United States Patricia Galloway has served in several executive positions and has over 30 years of experience in corporate risk management. Dr. Galloway is chair of Pegasus Global Holdings, Inc.® (Pegasus - Global), a firm that performs risk management, management, and strategic consulting business services. From July to December 2018, Dr. Galloway served on the board of SCANA Corporation as chair of the Special Litigation Committee. Her service ended with the merger of SCANA and Dominion Energy, Inc. From 2008 to 2018, Dr. Galloway served as chief executive officer of Pegasus - Global. She also served on the U.S. National Science Board from 2006 to 2012. Prior to that, from 1981 to 2008, Dr. Galloway held various positions with The Nielsen - Wurster Group, Inc., including chief executive officer and principal, and president and chief financial officer. Dr. Galloway was the first woman President of the American Society of Civil Engineers. She served as a director of the American Arbitration Association from 2010 to 2020 and currently acts as an arbitrator on construction and energy litigation cases. Dr. Galloway holds a Bachelor of Science degree in civil engineering from Purdue University, a Certificate in Dispute Resolution from the Pepperdine Law School - Straus Institute, a Ph.D. in Infrastructure Systems Engineering (Civil) from Kochi University of Technology (Japan), and an MBA from the New York Institute of Technology. In addition, Dr. Galloway is a National Association of Corporate Directors (NACD) certified board member and has obtained a Climate Leadership Certificate from Diligent. Dr. Galloway also holds a Certificate in Cybersecurity Oversight from NACD and a Cyber Risk and Strategy Certification from Diligent. Age: 66 Director since 2020 Independent Director Key Qualifications • Corporate governance • Corporate risk management • International megaproject delivery and execution Board and Committee Attendance During 2023 83% 5 of 6 Board of Directors 100% 5 of 5 Corporate Governance and Compensation 100% 6 of 6 Sustainability and Safety Other Public Board Directorship Granite Construction Inc. (NYSE – GVA) Nominating and Corporate Governance (chair); Compensation Total Equity at Risk (Common Shares and Deferred Share Units) Value at Risk $1,405,037 2024 Management Information Circular March 15, 2024 17 Stantec Inc.

Gord Johnston is the current president & CEO of Stantec. He has over 35 years of private and public sector experience in the design and project management of infrastructure projects throughout North America and abroad. Mr. Johnston has held increasingly senior roles since joining Stantec in 1990, including serving as the Water business line leader, as executive vice president of the Infrastructure business operating unit, and as an active participant in Stantec’s acquisition sourcing and integration efforts. He earned Bachelor of Science and Master of Engineering degrees in civil engineering from the University of Alberta, and is a registered professional engineer, certified project management professional, and Envision Sustainability Professional. Gordon (Gord) A. Johnston President and CEO of Stantec Inc. Edmonton, Alberta, Canada Age: 58 Director since 2018 Non - Independent Director Key Qualifications • Engineering industry experience • Managing and leading growth • Strategic planning and execution Board and Committee Attendance During 2023 Board of Directors 6 of 6 100% Other Public Board Directorship — — Total Equity at Risk (Common Shares, PSUs and RSUs) Value at Risk $28,713,190 2024 Management Information Circular March 15, 2024 18 Stantec Inc.

Don Lowry has more than 30 years of industry experience in the utilities, telecommunications, and power generation sectors. From January 1998 until March 2013, Mr. Lowry served as president & CEO of EPCOR Utilities Inc. For 12 years, Mr. Lowry served as chair of Capital Power Corporation, a publicly traded company formed when EPCOR spun off its generation business in July 2009. Following his retirement in April 2021, Capital Power Corporation honored Mr. Lowry with the title of Chair Emeritus in appreciation of his distinguished service. Mr. Lowry was also the chair of Canadian Oilsands Limited until February 2016, when the company was acquired. In 2011, he was named Alberta Business Person of the Year by Alberta Venture magazine and, in January 2014, was named Alberta Resource Person of the Year for 2014 by the Alberta Chamber of Resources. Mr. Lowry holds a Bachelor of Commerce (honors) and Master of Business Administration degrees from the University of Manitoba and is a graduate of the Harvard Advanced Management Program and the Banff School of Management. He obtained his Institute of Corporate Directors designation (ICD.D) in January 2016 from the Rotman School of Business. In 2020, Mr. Lowry was recognized by the Institute of Corporate Directors as an “F.ICD Fellow”, which is the highest honor a director can receive in Canada. Donald (Don) J. Lowry, ICD.D, F.ICD Corporate Director Edmonton, Alberta, Canada Age: 72 Director since 2013 Independent Director Key Qualifications • Strategic growth, oversight and insight • Corporate governance and executive compensation • Capital markets and risk management Board and Committee Attendance During 2023 100% 6 of 6 Board of Directors 100% 4 of 4 Audit and Risk 100% 6 of 6 Sustainability and Safety (chair) Other Public Board Directorship — — Total Equity at Risk (Common Shares and Deferred Share Units) Value at Risk $8,422,988 2024 Management Information Circular March 15, 2024 19 Stantec Inc.

Marie - Lucie Morin was Executive Director at the World Bank from 2010 to 2013. Previously Ms. Morin pursued a 30 - year career in Federal Public Service. She was appointed National Security Advisor to the Prime Minister and Associate Secretary to the Cabinet in 2008, having served as Deputy Minister for International Trade and Associate Deputy Minister of Foreign Affairs. Earlier in her career with the Department of Foreign Affairs and International Trade, Ms. Morin completed assignments in San Francisco, Jakarta, London, and Moscow. In 1997 she was appointed Ambassador to Norway with accreditation to Iceland. Ms. Morin served as advisor for the Canada Transport Act Review which tabled its report to Parliament in 2015. Ms. Morin was named Chevalier de la Légion d'honneur in 2012, was sworn into the Queen's Privy Council in 2015 and became a member of the Order of Canada in 2016. Ms. Morin presently serves on corporate and not - for - profit boards; she is a member of the National Security and Intelligence Review Agency (NSIRA). Marie - Lucie Morin, P.C., C.M. Corporate Director Ottawa, Ontario, Canada Age: 66 Director since 2016 Independent Director Key Qualifications • International business and government affairs • Strategic planning and execution • Corporate governance Board and Committee Attendance During 2023 100% 6 of 6 Board of Directors 100% 1 of 1 Audit and Risk (1) 100% 5 of 5 Corporate Governance and Compensation (chair) Other Public Board Directorships Chorus Aviation Inc. (TSX – CHR) Sun Life Financial Inc. (TSX, NYSE – SLF) Governance, Safety and Sustainability (chair); Human Resources and Compensation Management Resources; Risk Total Equity at Risk (Common Shares and Deferred Share Units) Value at Risk $3,455,613 (1) Because of the unexpected death of Mr. Richard Bradeen (a board member at the time), Ms. Morin served on the Audit and Risk Committee for the first quarter of 2023. 2024 Management Information Circular March 15, 2024 20 Stantec Inc.

Celina Wang Doka is a retired audit partner of KPMG LLP. Throughout her 39 years with KPMG, she provided accounting and auditing services for a wide variety of public and private clients, specializing in the real estate, investment management, civil engineering, medical device, life sciences, pharmaceutical and title insurance industries. She led KPMG’s Building, Construction and Real Estate practice in the firm’s Orange County office, served on KPMG’s Partnership Audit Committee, and co - led the Orange County Chapter of KPMG’s Network of Women. Ms. Doka holds a Bachelor of Arts degree in Business Economics from the University of California, Los Angeles. She is currently the Immediate Past President of the Board of Directors of Human Options, a non - profit organization focused on ending the cycle of domestic violence, and formerly chaired the Advisory Board for the University of California at Irvine’s Paul Merage School of Business, Program for Real Estate Management. Celina J. Wang Doka Corporate Director Newport Beach, California, United States Key Qualifications • Public accounting • Financial expert • Real estate management practice Board and Committee Attendance During 2023 (1) 100% 5 of 5 Board of Directors 100% 3 of 3 Audit and Risk 100% 5 of 5 Sustainability and Safety Audit Other Public Board Directorship F&G Annuities & Life, Inc. (NYSE – FG) Age: 63 Director since 2023 Independent Director Total Equity at Risk (Common Shares and Deferred Share Units) Value at Risk $306,340 (1) Celina Wang Doka was appointed to the Board of Directors on March 1, 2023. Additional Information about Directors Information below pertains to director voting results at the 2023 Annual General Meeting and our directors' attendance in 2023. Director Voting Results from Our 2023 Annual General Meeting A summary of the voting results from our 2023 annual general meeting follows: 2024 Management Information Circular March 15, 2024 21 Stantec Inc.

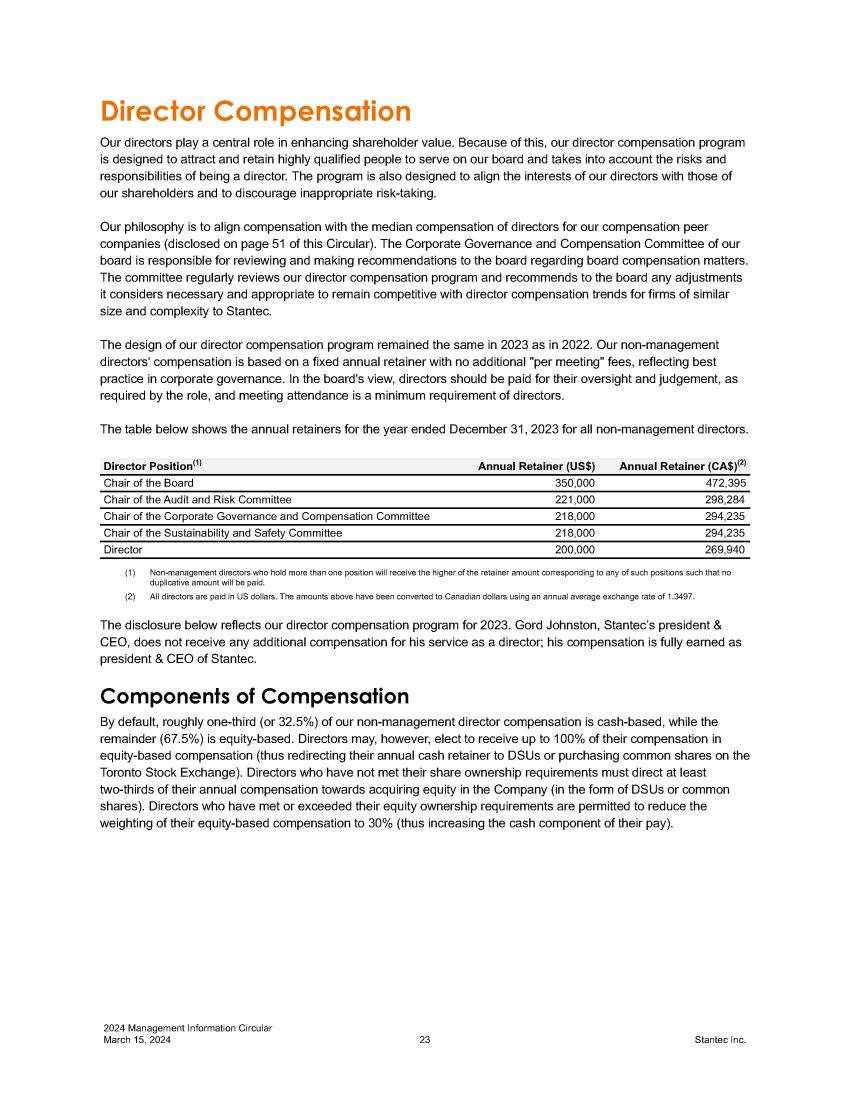

% Against Votes Against % For Votes For Director 5.13 4,252,705 94.87 78,579,717 Douglas Ammerman 0.36 297,809 99.64 82,534,613 Martin à Porta 0.28 235,564 99.72 82,596,858 Shelley Brown 0.32 261,218 99.68 82,571,204 Angeline Chen 0.58 481,213 99.42 82,351,209 Patricia Galloway 0.91 757,155 99.09 82,075,267 Bob Gomes 0.55 457,822 99.45 82,374,600 Gord Johnston 0.61 503,326 99.39 82,329,096 Don Lowry 0.89 741,317 99.11 82,091,105 Marie - Lucie Morin 0.38 317,725 99.62 82,514,697 Celina Wang Doka Director Attendances The number and percentage of board and committee meetings each director attended in 2023 follows: Director Board Meetings Attended Committee Meetings Attended Total Meetings Attended 100 % 21 of 21 100 % 15 of 15 100 % 6 of 6 Douglas Ammerman 100 % 17 of 17 100 % 11 of 11 100 % 6 of 6 Martin à Porta 100 % 10 of 10 100 % 4 of 4 100 % 6 of 6 Shelley Brown 100 % 8 of 8 100 % 4 of 4 100 % 4 of 4 Angeline Chen (1) 94 % 16 of 17 100 % 11 of 11 83 % 5 of 6 Patricia Galloway 100 % 12 of 12 100 % 6 of 6 100 % 6 of 6 Bob Gomes 100 % 6 of 6 — % — 100 % 6 of 6 Gord Johnston 100 % 16 of 16 100 % 10 of 10 100 % 6 of 6 Don Lowry 100 % 12 of 12 100 % 6 of 6 100 % 6 of 6 Marie - Lucie Morin 100 % 13 of 13 100 % 8 of 8 100 % 5 of 5 Celina Wang Doka (2) (1) Ms. Chen joined the board on May 11, 2023; therefore, Ms. Chen's attendance record reflects meetings held in the remainder of the year. (2) Ms. Wang Doka joined the board on March 1, 2023; therefore, Ms. Wang Doka's attendance record reflects meetings held in the remainder of the year. Director Independence The board has determined that all director nominees, except Mr. Johnston, are independent within the meaning of applicable Canadian securities laws. Mr. Johnston, as president & CEO of Stantec, is not considered independent. Reason for Non - Independence Non - Independent Independent Director Nominee Douglas Ammerman Martin à Porta Shelley Brown Angeline Chen Patricia Galloway President & CEO of the Company Gord Johnston Don Lowry Marie - Lucie Morin Celina Wang Doka Overlapping Board Memberships The table below indicates which directors serve on the same board and committees of another reporting issuer. Our view is that these interlocking directorships do not adversely impact the effectiveness of these directors on our board. Company Director Interlocking Committee Memberships F&G Annuities & Life, Inc. (NYSE – FG) Douglas Ammerman Celina Wang Doka Audit Committee (chair) Audit Committee (member) 2024 Management Information Circular March 15, 2024 22 Stantec Inc.

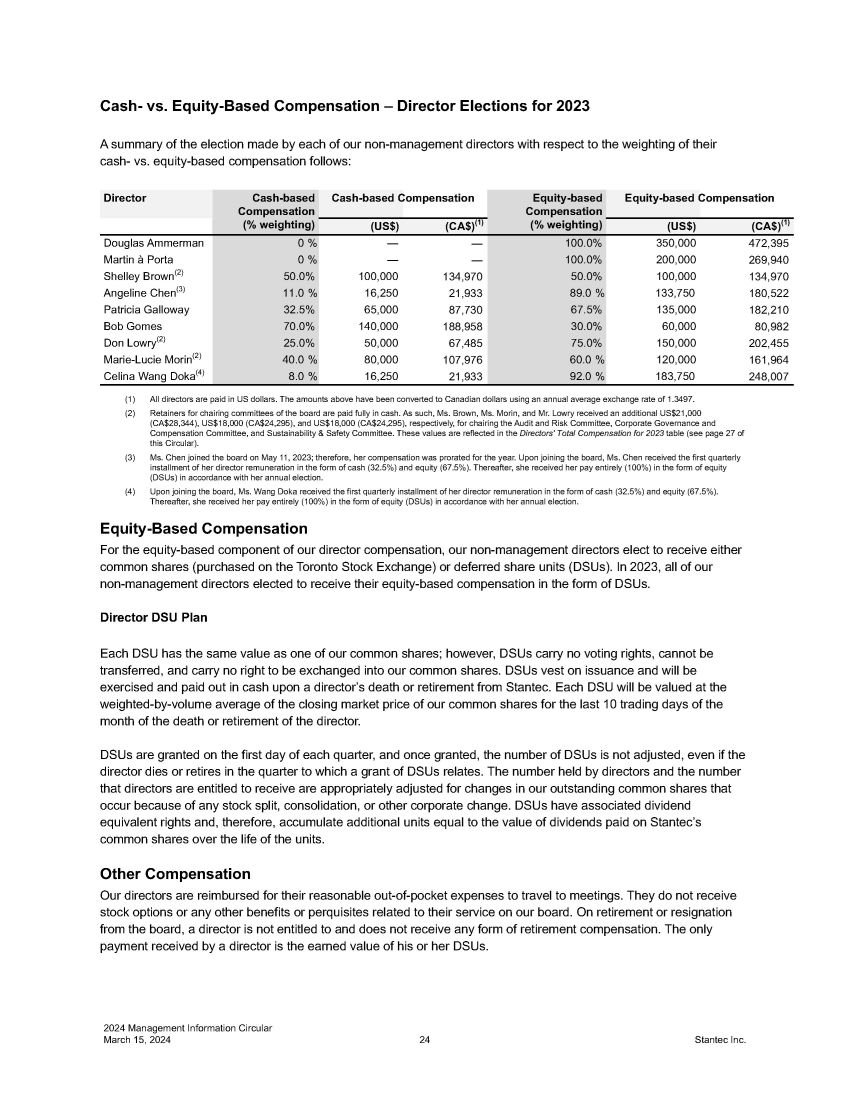

2024 Management Information Circular March 15, 2024 23 Stantec Inc. Director Compensation Our directors play a central role in enhancing shareholder value. Because of this, our director compensation program is designed to attract and retain highly qualified people to serve on our board and takes into account the risks and responsibilities of being a director. The program is also designed to align the interests of our directors with those of our shareholders and to discourage inappropriate risk - taking. Our philosophy is to align compensation with the median compensation of directors for our compensation peer companies (disclosed on page 51 of this Circular). The Corporate Governance and Compensation Committee of our board is responsible for reviewing and making recommendations to the board regarding board compensation matters. The committee regularly reviews our director compensation program and recommends to the board any adjustments it considers necessary and appropriate to remain competitive with director compensation trends for firms of similar size and complexity to Stantec. The design of our director compensation program remained the same in 2023 as in 2022. Our non - management directors' compensation is based on a fixed annual retainer with no additional "per meeting" fees, reflecting best practice in corporate governance. In the board's view, directors should be paid for their oversight and judgement, as required by the role, and meeting attendance is a minimum requirement of directors. The table below shows the annual retainers for the year ended December 31, 2023 for all non - management directors. Annual Retainer (CA$) (2) Annual Retainer (US$) Director Position (1) 472,395 350,000 Chair of the Board 298,284 221,000 Chair of the Audit and Risk Committee 294,235 218,000 Chair of the Corporate Governance and Compensation Committee 294,235 218,000 Chair of the Sustainability and Safety Committee 269,940 200,000 Director (1) Non - management directors who hold more than one position will receive the higher of the retainer amount corresponding to any of such positions such that no duplicative amount will be paid. (2) All directors are paid in US dollars. The amounts above have been converted to Canadian dollars using an annual average exchange rate of 1.3497. The disclosure below reflects our director compensation program for 2023. Gord Johnston, Stantec’s president & CEO, does not receive any additional compensation for his service as a director; his compensation is fully earned as president & CEO of Stantec. Components of Compensation By default, roughly one - third (or 32.5%) of our non - management director compensation is cash - based, while the remainder (67.5%) is equity - based. Directors may, however, elect to receive up to 100% of their compensation in equity - based compensation (thus redirecting their annual cash retainer to DSUs or purchasing common shares on the Toronto Stock Exchange). Directors who have not met their share ownership requirements must direct at least two - thirds of their annual compensation towards acquiring equity in the Company (in the form of DSUs or common shares). Directors who have met or exceeded their equity ownership requirements are permitted to reduce the weighting of their equity - based compensation to 30% (thus increasing the cash component of their pay).

2024 Management Information Circular March 15, 2024 24 Stantec Inc. Cash - vs. Equity - Based Compensation – Director Elections for 2023 A summary of the election made by each of our non - management directors with respect to the weighting of their cash - vs. equity - based compensation follows: Compensation Equity - based Equity - based Compensation ( % weighting) ompensation Cash - based C Cash - based Compensation ( % weighting) Director (CA$) (1) (US$) (CA$) (1) (US$) 472,395 350,000 100.0% — — 0 % Douglas Ammerman 269,940 200,000 100.0% — — 0 % Martin à Porta 134,970 100,000 50.0% 134,970 100,000 50.0% Shelley Brown (2) 180,522 133,750 89.0 % 21,933 16,250 11.0 % Angeline Chen (3) 182,210 135,000 67.5% 87,730 65,000 32.5% Patricia Galloway 80,982 60,000 30.0% 188,958 140,000 70.0% Bob Gomes 202,455 150,000 75.0% 67,485 50,000 25.0% Don Lowry (2) 161,964 120,000 60.0 % 107,976 80,000 40.0 % Marie - Lucie Morin (2) 248,007 183,750 92.0 % 21,933 16,250 8.0 % Celina Wang Doka (4) (1) All directors are paid in US dollars. The amounts above have been converted to Canadian dollars using an annual average exchange rate of 1.3497. (2) Retainers for chairing committees of the board are paid fully in cash. As such, Ms. Brown, Ms. Morin, and Mr. Lowry received an additional US$21,000 (CA$28,344), US$18,000 (CA$24,295), and US$18,000 (CA$24,295), respectively, for chairing the Audit and Risk Committee, Corporate Governance and Compensation Committee, and Sustainability & Safety Committee. These values are reflected in the Directors' Total Compensation for 2023 table (see page 27 of this Circular). (3) Ms. Chen joined the board on May 11, 2023; therefore, her compensation was prorated for the year. Upon joining the board, Ms. Chen received the first quarterly installment of her director remuneration in the form of cash (32.5%) and equity (67.5%). Thereafter, she received her pay entirely (100%) in the form of equity (DSUs) in accordance with her annual election. (4) Upon joining the board, Ms. Wang Doka received the first quarterly installment of her director remuneration in the form of cash (32.5%) and equity (67.5%). Thereafter, she received her pay entirely (100%) in the form of equity (DSUs) in accordance with her annual election. Equity - Based Compensation For the equity - based component of our director compensation, our non - management directors elect to receive either common shares (purchased on the Toronto Stock Exchange) or deferred share units (DSUs). In 2023, all of our non - management directors elected to receive their equity - based compensation in the form of DSUs. Director DSU Plan Each DSU has the same value as one of our common shares; however, DSUs carry no voting rights, cannot be transferred, and carry no right to be exchanged into our common shares. DSUs vest on issuance and will be exercised and paid out in cash upon a director’s death or retirement from Stantec. Each DSU will be valued at the weighted - by - volume average of the closing market price of our common shares for the last 10 trading days of the month of the death or retirement of the director. DSUs are granted on the first day of each quarter, and once granted, the number of DSUs is not adjusted, even if the director dies or retires in the quarter to which a grant of DSUs relates. The number held by directors and the number that directors are entitled to receive are appropriately adjusted for changes in our outstanding common shares that occur because of any stock split, consolidation, or other corporate change. DSUs have associated dividend equivalent rights and, therefore, accumulate additional units equal to the value of dividends paid on Stantec’s common shares over the life of the units. Other Compensation Our directors are reimbursed for their reasonable out - of - pocket expenses to travel to meetings. They do not receive stock options or any other benefits or perquisites related to their service on our board. On retirement or resignation from the board, a director is not entitled to and does not receive any form of retirement compensation. The only payment received by a director is the earned value of his or her DSUs.

2024 Management Information Circular March 15, 2024 25 Stantec Inc. Director Equity Ownership To align the interests of our directors with those of our shareholders, each non - management director is required to own a certain value in Stantec common shares or DSUs. In accordance with Stantec’s Director Equity Ownership Policy, each non - management director is required to hold at least $750,000 in equity within five years of his or her appointment to the board. The chair of the board is required to hold at least $1,500,000 in equity. Directors may not purchase financial instruments to hedge or offset a decrease in the market value of shares held for the purpose of Stantec’s Director Equity Ownership Policy. As the president & CEO of Stantec, Gord Johnston is required to comply with the CEO Share Ownership Policy (disclosed on page 62 of this Circular). The following table provides information about the number and value of common shares and DSUs owned by our non - management director nominees on December 31, 2023. The value of each Stantec common share is based on the closing price of $106.38 on December 31, 2023. The value of each DSU is $102.76 (the volume - weighted average trading price of Stantec shares for the last 10 trading days up to and including December 31, 2023). Meeting Total Value of Value of Total DSUs Value of Number of Director (1) Requirement? Stantec Shares DSUs Held Stantec Shares Stantec Shares Owned, ($) Owned, Owned, Controlled, or Controlled, or Controlled, or Directed, and Directed ($) Directed DSUs (Total at Risk)($) Yes 10,500,791 7,026,420 68,377 3,474,371 32,660 Douglas Ammerman Yes 2,375,438 1,269,086 12,350 1,106,352 10,400 Martin à Porta Yes 2,101,640 1,564,315 15,223 537,325 5,051 Shelley Brown In Progress (2) 214,255 214,255 2,085 — — Angeline Chen Yes 1,405,037 1,405,037 13,673 — — Patricia Galloway Yes 8,422,988 6,050,714 58,882 2,372,274 22,300 Don Lowry Yes 3,455,613 3,455,613 33,628 — — Marie - Lucie Morin In Progress (3) 306,430 306,430 2,982 — — Celina Wang Doka (1) As the president & CEO, Gord Johnston is required to comply with the CEO Share Ownership Requirement (see page 62 of this Circular). (2) Ms. Chen, appointed to the board on May 11, 2023, has until May 11, 2028 to meet the equity ownership requirements of the Director Equity Ownership Policy. (3) Ms. Wang Doka, appointed to the board on March 1, 2023, has until March 1, 2028 to meet the equity ownership requirements of the Director Equity Ownership Policy.

2024 Management Information Circular March 15, 2024 26 Stantec Inc. Incentive Plan Awards — Value Vested or Earned during the Year The following table summarizes the value of all share - based compensation earned by each non - management director during the fiscal year ended December 31, 2023. Non - Equity Incentive Plan Compensation Value Earned during the Year ($) Share - Based Awards — Value Vested during the Year ($) (1) Option - Based Awards — Value Vested during the Year ($) Name — 521,734 — Douglas Ammerman — 277,807 — Martin à Porta — 145,786 — Shelley Brown — 180,884 — Angeline Chen — 191,580 — Patricia Galloway — 98,561 — Bob Gomes — 246,099 — Don Lowry — 186,627 — Marie - Lucie Morin — 248,831 — Celina Wang Doka (1) Represents the value of DSUs that have vested during the year. DSUs vest upon issuance but do not pay out until a director's death or retirement from the board. The value of DSUs is based on the grant date fair value of the share units. DSUs are paid quarterly. The amounts shown in this column include dividend equivalent rights earned during 2023 on each director's total DSU holdings. Outstanding Share - Based Awards for Directors Listed below are the total outstanding share - based awards held by each of our non - management directors as of December 31, 2023. Market or Payout Number of Shares or Market or Payout Value of Number of Shares or Director (1) Value of Vested Share - Based Awards Not Units of Shares That Have Vested (#) (2) Share - Based Awards That Have Not Vested ($) Units of Shares That Have Not Vested (#) Paid Out or Distributed ($) (3) 7,026,420 68,377 — — Douglas Ammerman 1,269,086 12,350 — — Martin à Porta 1,564,315 15,223 — — Shelley Brown 214,255 2,085 — — Angeline Chen 1,405,037 13,673 — — Patricia Galloway 2,436,645 23,712 — — Bob Gomes 6,050,714 58,882 — — Don Lowry 3,455,613 33,628 — — Marie - Lucie Morin 306,430 2,982 — — Celina Wang Doka (1) Our non - management directors do not receive any form of option - based awards. (2) Represents DSUs held by each director. (3) The volume weighted average price of Stantec shares for the last 10 trading days of 2023 ($102.76) was used to calculate the aggregate value. The number of DSUs has been rounded down to the closest whole unit for this table; however, payout value is calculated using the unrounded number.

2024 Management Information Circular March 15, 2024 27 Stantec Inc. Directors’ Total Compensation for 2023 The table below summarizes our non - management directors’ compensation for the fiscal year ended December 31, 2023: Director Cash Fees Equity - based Option - based Non - equity Pension All Other Total ($) Earned Awards ($) (2) Awards ($) Incentive Plan Value ($) Compensation ($) (1) Compensation ($) ($) (3) 521,734 49,339 — — — 472,395 — Douglas Ammerman 277,807 7,867 — — — 269,940 — Martin à Porta 309,100 10,816 — — — 134,970 163,314 Shelley Brown 202,817 362 — — — 180,522 21,933 Angeline Chen 279,310 9,370 — — — 182,210 87,730 Patricia Galloway 287,519 17,579 — — — 80,982 188,958 Bob Gomes 337,879 43,644 — — — 202,455 91,780 Don Lowry 318,898 24,663 — — — 161,964 132,271 Marie - Lucie Morin 270,764 824 — — — 248,007 21,933 Celina Wang Doka (1) Annual cash retainers are paid in US dollars. The amounts above have been converted to Canadian dollars using an annual average exchange rate of 1.3497. (2) Directors’ DSUs granted in the 2023 calendar year are valued using the fair value at the grant date for each of the four allotments issued in 2023. (3) Represents the value of dividend equivalent rights earned on each director's total DSU holdings in 2023.

2024 Management Information Circular March 15, 2024 28 Stantec Inc. Statement of Corporate Governance Practices One core value at Stantec is We Do What is Right. We embrace the highest standards of personal and professional integrity. Our ideals are those shared by all good companies — sound governance, transparent accounting, and long - term shareholder value. These high standards reflect not only the legal and regulatory requirements of corporate governance but also existing and emerging practices. Information about the corporate governance practices that support our board’s mandate is provided below. The policies and position descriptions noted — including our Code of Business Conduct and our Corporate Governance Guidelines — are available on our website at stantec.com, or you may contact us for a free copy of the policies or guidelines. The Code of Business Conduct is available on SEDAR+ at sedarplus.ca and EDGAR at sec.gov. Ethical Business Conduct The board has adopted a comprehensive Code of Business Conduct (the “Code”) that provides a framework for our directors, officers, and employees to support ethical decision making and to protect the Company’s reputation and the integrity of its services. All Stantec employees must certify at least annually that they have read and understand the Code. The Corporate Governance and Compensation Committee reviews the Code at least annually to ensure it complies with all legal requirements and aligns with best practices. If amendments are needed, recommendations are made to the board for approval. The board believes that providing a forum for employees to raise concerns about ethical conduct and treating all complaints seriously fosters a culture of ethical conduct at Stantec. Our Code outlines procedures for reporting and investigating observations and concerns raised by Stantec employees. We closely monitor compliance with our Code. Officers, employees, stakeholders, and members of the public can report concerns regarding breaches of the Code through our Integrity Hotline, which is managed by an independent third party. Complaints can be submitted by telephone, online, or mail. All complaints are kept confidential, and requests for anonymity are respected to the extent possible. Copies of all complaints are reviewed by the chairs of the Audit and Risk Committee and the Sustainability and Safety Committee. A quarterly report, presented to both committees, summarizes the status of any active investigations of complaints and the resolution of all complaints made through the Integrity Hotline. The board believes that having directors exercise independent judgment when considering transactions and agreements is vital. At any board meeting, if a director or executive officer has a material interest in a matter being considered, he or she will not be present for discussions relating to the matter and will not participate in any vote on the matter. Timely Communication Stantec is committed to providing timely, accurate, and balanced disclosure of material information consistent with legal and regulatory requirements. Materiality to us means that an event or information would reasonably be expected to have a significant effect on the price or value of Stantec’s shares. The Company will disclose both positive and negative information — in keeping with the rules of the TSX and NYSE and applicable securities laws — on a timely basis, except when confidentiality issues require a delay. The Company has established a Disclosure Committee to support the CEO and CFO in identifying material information, to determine how and when to disclose it, and to ensure that all material disclosures comply with relevant securities legislation. The Disclosure Committee meets to review and evaluate other disclosures and potential disclosures before the release of our regular quarterly and annual disclosure documents and when requested by the CEO or CFO.