UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For: March 19, 2024

MAG Silver Corp.

(SEC File Number: 001-33574)

#770 – 800 West Pender Street, Vancouver BC, V6C 2V6, CANADA

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

|

Exhibits |

|

|

Consolidated Financial Statements for the year ended December 31, 2023 |

|

|

Management Discussion and Analysis for the year ended December 31, 2023 |

|

Date: March 19, 2024 |

MAG Silver Corp. |

|

|

"Jill Neff" |

||

|

Jill Neff |

||

|

Corporate Secretary |

Exhibit 99.1

|

MAG SILVER CORP.

Consolidated Financial Statements (expressed in thousands of US dollars)

For the year ended December 31, 2023

Dated: March 18, 2024 |

A copy of this report will be provided to any shareholder who requests it.

|

VANCOUVER OFFICE Suite 770 800 W. Pender Street Vancouver, BC V6C 2V6 |

604 630 1399 phone 866 630 1399 toll free 604 681 0894 fax |

TSX: MAG NYSE American : MAG info@magsilver.com |

Management’s Responsibility for the Financial Statements

The preparation and presentation of the accompanying consolidated financial statements and management’s discussion and analysis (“MD&A”) for MAG Silver Corp. (the “Company”) are the responsibility of management and have been approved by the Board of Directors.

The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). Financial statements, by nature, are not precise since they include certain amounts based upon estimates and judgments. When alternative methods exist, management has chosen those it deems to be the most appropriate in the circumstances.

Management, under the supervision, and with the participation of, the Chief Executive Officer and the Chief Financial Officer, have a process in place to evaluate disclosure controls and procedures and internal control over financial reporting as required by Canadian and U.S. securities regulations. We, as Chief Executive Officer and Chief Financial Officer, certify our annual filings with the Canadian Securities Administrators, as required in Canada by National Instrument 52-109 – Certification of Disclosure, and in the United States with the U.S. Securities and Exchange Commission as required by the Securities Exchange Act of 1934, as amended.

The Board of Directors is responsible for ensuring that management fulfills its responsibilities for financial reporting and is ultimately responsible for reviewing and approving the consolidated financial statements. The Board of Directors carries out this responsibility principally through its Audit Committee, which is independent from management.

The Audit Committee is appointed by the Board of Directors and reviews the consolidated financial statements and MD&A, considers the report of the external auditors, assesses the adequacy of our internal controls, including management’s assessment described in the accompanying Management Report on Internal Control over Financial Reporting, examines and approves the fees and expenses for the audit services, and recommends the independent auditors to the Board of Directors for the appointment by the shareholders. The independent auditors have full and free access to the Audit Committee and meet with it to discuss their audit work, our internal control over financial reporting and financial reporting matters. The Audit Committee reports its findings to the Board of Directors for consideration when approving the consolidated financial statements for issuance to the shareholders and management’s assessment of the internal control over financial reporting.

Management’s Report on Internal Control over Financial Reporting

Management of MAG Silver Corp. (“MAG” or “the Company”) is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)) is a process designed by, or caused to be designed under the supervision of the President and Chief Executive Officer, and the Chief Financial Officer, and effected by the Board of Directors, management and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with IFRS. It includes those policies and procedures that

|

i. |

pertain to the maintenance of records that accurately and fairly reflect, in reasonable detail, the transactions and dispositions of assets of MAG; |

|

ii. |

provide reasonable assurance that transactions are recorded as necessary to permit preparation of consolidated financial statements in accordance with IFRS, and that MAG’s receipts and expenditures are made only in accordance with authorizations of management and MAG’s directors; and |

|

iii. |

provided reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of MAG’s assets that could have a material effect on the Company’s consolidated financial statements. |

Due to its inherent limitations, internal control over financial reporting may not prevent or detect misstatements on a timely basis. Also, projections of any evaluation of the effectiveness of internal control over financial reporting to future years are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management, under the supervision of the President and Chief Executive Officer, and the Chief Financial Officer, assessed the effectiveness of MAG’s internal control over financial reporting as of December 31, 2023, based on the criteria set forth in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this assessment, management concluded that, as of December 31, 2023, MAG’s internal control over financial reporting was effective.

The effectiveness of MAG’s internal control over financial reporting, as of December 31, 2023, has been audited by Deloitte LLP, Independent Registered Public Accounting Firm, who also audited the Company’s consolidated financial statements as at and for the year ended December 31, 2023, as stated in their reports

| /s/ “George Paspalas” | /s/ “Fausto Di-Trapani” |

| George Paspalas | Fausto Di-Trapani |

| President and Chief Executive Officer | Chief Financial Officer |

March 18, 2024

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Directors of MAG Silver Corp.

Opinion on the Financial Statements

We have audited the accompanying consolidated statements of financial position of MAG Silver Corp. and subsidiaries (the "Company") as of December 31, 2023 and 2022, the related consolidated statements of income and comprehensive income, changes in equity, and cash flows, for each of the two years in the year ended December 31, 2023, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2023 and 2022, and its financial performance and its cash flows for each of the two years in the year ended December 31, 2023, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company's internal control over financial reporting as of December 31, 2023, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated March 18, 2024, expressed an unqualified opinion on the Company's internal control over financial reporting.

Basis for Opinion

These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matter

The critical audit matter communicated below is a matter arising from the current-year audit of the financial statements that was communicated or required to be communicated to the audit committee and that (1) relates to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

Accounting for Investment in Juanicipio — Refer to Notes 3c and 9 to the financial statements

Critical Audit Matter Description

The Company has a 44% ownership in the Juanicipio Mine (“Juanicipio”) where the remaining 56% interest is held by Fresnillo plc, who is also the operator. The Company has accounted for its interest in Juanicipio under the equity method which requires that the Company’s investment is initially recognized at cost and subsequently increased or decreased to reflect additional contributions or distributions, the Company’s share of earnings and losses of Juanicipio, and any impairment losses after the initial recognition date.

We identified the accounting for the investment in Juanicipio as a critical audit matter because of the significance to the Company’s financial statements, and the judgments made by management when assessing the results of Juanicipio’s operations and the accounting judgments made by the operator of Juanicipio. This required an increased extent of effort, including the need to involve the auditor of Juanicipio and senior members of the engagement team.

How the Critical Audit Matter Was Addressed in the Audit

Our audit procedures related to accounting for the investment in Juanicipio included the following, among others:

|

● |

Tested the effectiveness of controls related to the accounting for the Company’s investment in Juanicipio, which includes management’s receipt and review of Juanicipio financial information; |

|

● |

Tested contributions and distributions related to the investment in Juanicipio; |

|

● |

Evaluated significant judgments and estimates at the underlying investment in Juanicipio through oversight of the auditors of Juanicipio by; |

|

– |

Obtaining and assessing information from the auditors of Juanicipio to understand significant judgments and estimates, significant findings or issues identified by such auditor, actions taken to address them and conclusions reached; |

|

● |

Agreed the underlying information of the investment in Juanicipio to the audited financial information of Juanicipio; and |

|

● |

Performed procedures to evaluate subsequent events related to the investment in Juanicipio and to assess their impact, if any, on the financial information, up to the date of our auditor’s report on the Company’s financial statements. |

/s/ Deloitte LLP

Chartered Professional Accountants

Vancouver, Canada

March 18, 2024

We have served as the Company's auditor since 1999.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Directors of MAG Silver Corp.

Opinion on Internal Control over Financial Reporting

We have audited the internal control over financial reporting of MAG Silver Corp. and subsidiaries (the “Company") as of December 31, 2023, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2023, based on criteria established in Internal Control - Integrated Framework (2013) issued by COSO.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated financial statements as of and for the year ended December 31, 2023, of the Company and our report dated March 18, 2024, expressed an unqualified opinion on those financial statements.

Basis for Opinion

The Company's management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management's Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

Definition and Limitations of Internal Control over Financial Reporting

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future years are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

/s/ Deloitte LLP

Chartered Professional Accountants

Vancouver, Canada

March 18, 2024

MAG SILVER CORP.

Consolidated Statements of Income and Comprehensive Income

For the years ended December 31, 2023 and 2022

(In thousands of US dollars, except for shares and per share amounts)

|

2023 |

2022 |

|||||||||||

|

Note |

$ | $ | ||||||||||

|

Income from equity accounted investment in Juanicipio |

9 | 65,099 | 40,767 | |||||||||

|

General and administrative expenses |

7 | (13,594 | ) | (12,352 | ) | |||||||

|

General exploration and business development |

(736 | ) | (193 | ) | ||||||||

|

Exploration and evaluation assets written down |

10 | - | (10,471 | ) | ||||||||

|

Operating income |

50,769 | 17,751 | ||||||||||

|

Interest income |

2,594 | 630 | ||||||||||

|

Other income |

12 | 1,017 | - | |||||||||

|

Foreign exchange loss |

(144 | ) | (366 | ) | ||||||||

|

Income before income tax |

54,236 | 18,015 | ||||||||||

|

Deferred income tax expense |

20 | (5,577 | ) | (371 | ) | |||||||

|

Net income |

48,659 | 17,644 | ||||||||||

|

Other comprehensive income |

||||||||||||

|

Items that will not be reclassified subsequently to profit or loss: |

||||||||||||

|

Unrealized loss on equity securities |

(3 | ) | (57 | ) | ||||||||

|

Deferred tax benefit |

- | 7 | ||||||||||

|

Total comprehensive income |

48,656 | 17,594 | ||||||||||

|

Basic earnings per share |

0.47 | 0.18 | ||||||||||

|

Diluted earnings per share |

0.47 | 0.18 | ||||||||||

|

Weighted average number of shares outstanding |

11 | |||||||||||

|

Basic |

102,486,986 | 98,420,906 | ||||||||||

|

Diluted |

102,631,964 | 98,557,615 | ||||||||||

See accompanying notes to the consolidated financial statements

MAG SILVER CORP.

Consolidated Statements of Financial Position

As at December 31, 2023 and 2022

(In thousands of US dollars, unless otherwise stated)

|

Note |

December 31, 2023 |

December 31, 2022 |

||||||||||

| $ | $ | |||||||||||

|

Assets |

||||||||||||

|

Current assets |

||||||||||||

|

Cash |

68,707 | 29,955 | ||||||||||

|

Accounts receivable |

8 | 1,559 | 708 | |||||||||

|

Prepaid expenses |

1,787 | 1,232 | ||||||||||

| 72,053 | 31,895 | |||||||||||

|

Non-current assets |

||||||||||||

|

Investment in Juanicipio |

9 | 394,622 | 338,316 | |||||||||

|

Exploration and evaluation assets |

10 | 52,637 | 37,259 | |||||||||

|

Deferred financing fees |

13 | 909 | - | |||||||||

|

Property and equipment |

301 | 348 | ||||||||||

|

Investments |

8 | 11 | ||||||||||

| 448,477 | 375,934 | |||||||||||

|

Total assets |

520,530 | 407,829 | ||||||||||

|

Liabilities |

||||||||||||

|

Current liabilities |

||||||||||||

|

Trade and other payables |

2,668 | 2,542 | ||||||||||

|

Current portion of lease obligation |

154 | 121 | ||||||||||

|

Flow-through share premium liability |

12 | 1,969 | - | |||||||||

| 4,791 | 2,663 | |||||||||||

|

Non-current liabilities |

||||||||||||

|

Lease obligation |

- | 140 | ||||||||||

|

Deferred income taxes |

20 | 8,498 | 2,921 | |||||||||

|

Provision for reclamation |

484 | 409 | ||||||||||

|

Total liabilities |

13,773 | 6,133 | ||||||||||

|

Equity |

||||||||||||

|

Share capital |

614,364 | 559,933 | ||||||||||

|

Equity reserve |

20,764 | 18,790 | ||||||||||

|

Accumulated other comprehensive income |

781 | 784 | ||||||||||

|

Deficit |

(129,152 | ) | (177,811 | ) | ||||||||

|

Total equity |

506,757 | 401,696 | ||||||||||

|

Total liabilities and equity |

520,530 | 407,829 | ||||||||||

See accompanying notes to the consolidated financial statements

MAG SILVER CORP.

Consolidated Statements of Cash Flows

For the years ended December 31, 2023 and 2022

(In thousands of US dollars, unless otherwise stated)

|

2023 |

2022 |

|||||||||||

|

Note |

$ | $ | ||||||||||

|

OPERATING ACTIVITIES |

||||||||||||

|

Net income |

48,659 | 17,644 | ||||||||||

|

Items not involving cash: |

||||||||||||

|

Amortization of flow-through premium liability |

12 | (1,017 | ) | - | ||||||||

|

Depreciation and amortization |

7 | 352 | 136 | |||||||||

|

Deferred income tax expense |

20 | 5,577 | 371 | |||||||||

|

Exploration and evaluation assets written down |

- | 10,471 | ||||||||||

|

Amortization of deferred financing fees |

13 | 84 | - | |||||||||

|

Income from equity accounted investment in Juanicipio |

9 | (65,099 | ) | (40,767 | ) | |||||||

|

Share-based payment expense |

11,7 | 3,279 | 3,250 | |||||||||

|

Unrealized foreign exchange loss (gain) |

71 | (232 | ) | |||||||||

|

Movements in non-cash working capital |

||||||||||||

|

Accounts receivable |

(340 | ) | 243 | |||||||||

|

Prepaid expenses |

(555 | ) | (705 | ) | ||||||||

|

Trade and other payables |

44 | 871 | ||||||||||

|

Net cash used in operating activities |

(8,945 | ) | (8,718 | ) | ||||||||

|

INVESTMENT ACTIVITIES |

||||||||||||

|

Exploration and evaluation expenditures |

10 | (15,220 | ) | (12,018 | ) | |||||||

|

Acquisition of Gatling Exploration, net of cash acquired |

6 | - | (2,653 | ) | ||||||||

|

Investment in Juanicipio |

9 | (25,376 | ) | (8,864 | ) | |||||||

|

Receipt of principal on loans to Juanicpio |

9 | 25,714 | - | |||||||||

|

Receipt of interest on loans to Juanicipio |

9 | 7,639 | 3,564 | |||||||||

|

Proceeds from disposition of equity securities |

- | 1,111 | ||||||||||

|

Purchase of equipment |

- | (35 | ) | |||||||||

|

Net cash used in investing activities |

(7,243 | ) | (18,895 | ) | ||||||||

|

FINANCING ACTIVITIES |

||||||||||||

|

Deferred financing fees (credit facility) |

(993 | ) | - | |||||||||

|

Issuance of common shares upon exercise of stock options |

11 | 307 | 1,037 | |||||||||

|

Issuance of common shares, net of share issue costs |

11 | 39,750 | - | |||||||||

|

Issuance of flow-through shares, net of share issue costs |

11 | 15,998 | - | |||||||||

|

Payment of lease obligation (principal) |

(107 | ) | (109 | ) | ||||||||

|

Net cash from financing activities |

54,955 | 928 | ||||||||||

|

Effect of exchange rate changes on cash |

(15 | ) | (108 | ) | ||||||||

|

Increase (decrease) in cash during the year |

38,752 | (26,793 | ) | |||||||||

|

Cash, beginning of year |

29,955 | 56,748 | ||||||||||

|

Cash, end of year |

68,707 | 29,955 | ||||||||||

See accompanying notes to the consolidated financial statements

MAG SILVER CORP.

Consolidated Statements of Changes in Equity

For the years ended December 31, 2023 and 2022

(In thousands of US dollars, except shares)

|

Common shares without par value |

Accumulated other comprehensive income (loss) |

|||||||||||||||||||||||||||

|

Notes |

Number of Shares |

Amount |

Equity reserve |

Deficit |

Total equity |

|||||||||||||||||||||||

|

# |

$ | $ | $ | $ | $ | |||||||||||||||||||||||

|

Balance, December 31, 2021 |

97,809,441 | 543,927 | 18,215 | 1,798 | (196,419 | ) | 367,521 | |||||||||||||||||||||

|

Stock options exercised |

100,678 | 1,399 | (362 | ) | - | - | 1,037 | |||||||||||||||||||||

|

Stock options exercised cashless |

24,247 | 432 | (432 | ) | - | - | - | |||||||||||||||||||||

|

Restricted and performance share units converted |

98,012 | 1,147 | (1,147 | ) | - | - | - | |||||||||||||||||||||

|

Deferred share units converted |

86,295 | 871 | (871 | ) | - | - | - | |||||||||||||||||||||

|

Shares issued on acquisition of Gatling Exploration |

774,643 | 11,212 | - | - | - | 11,212 | ||||||||||||||||||||||

|

Shares issued on settlement of Gatling Exploration liability |

63,492 | 945 | 85 | - | - | 1,030 | ||||||||||||||||||||||

|

Share-based payment |

- | - | 3,302 | - | - | 3,302 | ||||||||||||||||||||||

|

Transfer of gain on disposal of equity securities at FVOCI to deficit, net of tax |

- | - | - | (964 | ) | 964 | - | |||||||||||||||||||||

|

Other comprehensive income loss |

- | - | - | (50 | ) | - | (50 | ) | ||||||||||||||||||||

|

Net income |

- | - | - | - | 17,644 | 17,644 | ||||||||||||||||||||||

|

Balance, December 31, 2022 |

98,956,808 | 559,933 | 18,790 | 784 | (177,811 | ) | 401,696 | |||||||||||||||||||||

|

Stock options exercised |

11 | 28,787 | 397 | (90 | ) | - | - | 307 | ||||||||||||||||||||

|

Restricted and performance share units converted |

11 | 112,605 | 1,215 | (1,215 | ) | - | - | - | ||||||||||||||||||||

|

Shares issued for cash, net of flow-through share premium liability |

11 | 3,874,450 | 56,761 | - | - | - | 56,761 | |||||||||||||||||||||

|

Share issue costs |

11 | - | (3,942 | ) | - | - | - | (3,942 | ) | |||||||||||||||||||

|

Share-based payment |

11 | - | - | 3,279 | - | - | 3,279 | |||||||||||||||||||||

|

Other comprehensive loss |

- | - | (3 | ) | - | (3 | ) | |||||||||||||||||||||

|

Net income |

- | - | 48,659 | 48,659 | ||||||||||||||||||||||||

|

Balance, December 31, 2023 |

102,972,650 | 614,364 | 20,764 | 781 | (129,152 | ) | 506,757 | |||||||||||||||||||||

See accompanying notes to the consolidated financial statements

|

1. |

NATURE OF OPERATIONS |

MAG Silver Corp. (the “Company” or “MAG”) is a growth-oriented Canadian exploration company focused on advancing high-grade, district scale precious metals projects in the Americas. MAG is the ultimate parent company of its consolidated group, was incorporated on April 21, 1999, and is governed by the Business Corporations Act of the Province of British Columbia (“BCABC"). MAG’s shares are listed on both the Toronto Stock Exchange in Canada and the NYSE American, LLC in the United States of America.

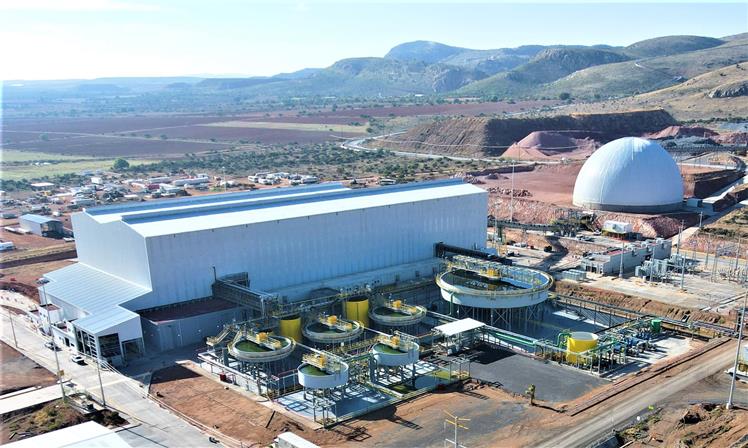

The Company’s principal asset is a 44% interest in the Juanicipio Mine (Note 9 “Investment in Juanicipio”) located in Zacatecas, Mexico, which achieved commercial production at its 4,000 tonnes per day (“tpd”) processing facility on June 1, 2023.

Address of registered office of the Company:

3500 – 1133 Melville Street

Vancouver, British Columbia,

Canada V6E 4E5

Head office and principal place of business:

770 – 800 West Pender Street

Vancouver, British Columbia,

Canada V6C 2V6

|

2. |

BASIS OF PRESENTATION |

|

(a) |

Statement of compliance |

These audited consolidated financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”).

These audited consolidated financial statements have been prepared on a historical cost basis except for the revaluation of certain financial instruments, which are stated at their fair value.

These audited consolidated financial statements were authorized for issuance by the Board of Directors of the Company on March 18, 2024.

|

(b) |

Principles of consolidation |

These audited consolidated financial statements include the accounts of the Company and its controlled subsidiaries. Control exists when the Company has power over the investee, is exposed or has rights to variable returns from its involvement with the investee, and has the ability to use its power over the investee to affect the amount of the investor’s returns. Subsidiaries and controlled entities are included in the consolidated financial results of the Company from the effective date that control is obtained up to the effective date of disposal or loss of control. The principal wholly-owned subsidiary as at December 31, 2023 and December 31, 2022 is Minera Los Lagartos, S.A. de C.V., a Mexican incorporated company. All intercompany balances, transactions, revenues and expenses have been eliminated upon consolidation.

These audited consolidated financial statements also include the Company’s 44% interest in each of Minera Juanicipio, S.A. de C.V. (“Minera Juanicipio”) and Equipos Chaparral, S.A. de C.V. (“Equipos Chaparral”) (Note 9, “Investment in Juanicipio”), which both associates (Note 3) are accounted for using the equity method.

Where necessary, adjustments have been made to the financial statements of the Company’s subsidiaries and associates prior to consolidation, to conform with the accounting policies used in their preparation to those used by the Company.

|

3. |

MATERIAL ACCOUNTING POLICY INFORMATION |

The accounting policies applied in the preparation of these audited consolidated financial statements have been applied consistently for all years presented except as disclosed in Note 4(a).

The significant judgements the Company made in applying its accounting policies and the key sources of estimation uncertainty arising in the preparation of these consolidated financial statements are discussed in Note 5.

|

(a) |

Foreign currencies |

|

(i) |

Foreign currency transactions |

Transactions in foreign currencies are recorded at the rates of exchange prevailing at the dates of the transactions. At each statement of financial position date, foreign currency denominated monetary assets and liabilities are translated using the period end foreign exchange rate whereas non-monetary assets and liabilities are translated using the historical rate on the date of the transaction. Non-monetary assets and liabilities that are stated at fair value in a foreign currency are translated using the rate on the date that the fair value was determined. All gains and losses on translation of these foreign currency transactions are included in the consolidated statements of income and comprehensive income.

|

(ii) |

Functional currency and presentation currency |

The functional currency of the parent, its subsidiaries, and its associates, including the Juanicipio Mine, is the United States dollar (“US$”).

The Company’s reporting and presentation currency is the US$.

|

(b) |

Inventories |

Inventories at Juanicipio include production inventory, and materials and supplies inventory.

All inventories at Juanicipio are measured at the lower of cost and net realizable value. Cost is determined using the weighted average cost method and includes all costs incurred, based on a normal production capacity, in bringing each product to its present location and condition. Net realizable value is the estimated selling price in the ordinary course of business less any further costs expected to be incurred to completion and estimated costs necessary to make the sale.

|

(i) |

Production inventories |

Production inventory consists of stockpiled ore, work-in-process, and concentrate.

The cost of production inventories includes:

|

● |

operating costs, which include employee costs, material costs and contractor expenses which are directly attributable to the extraction and processing of mineralized material; |

|

● |

amortization of property, plant and equipment used in the extraction and processing of mineralized material; and |

|

● |

related production overheads. |

The assumptions used in the valuation of inventories include estimates of the amount of recoverable metal in the stockpile and an assumption of the metal prices expected to be realized when the metal is recovered.

|

(ii) |

Materials and supplies inventory |

An allowance for obsolete and slow-moving inventories is determined by reference to specific items of inventory based on usage profile. A regular review is undertaken to determine the extent of such an allowance.

|

(c) |

Investments in associates |

The Company conducts the majority of its business through an equity interest in associates. An associate is an entity over which the Company has significant influence, and is neither a subsidiary nor a joint arrangement, and includes the Company’s 44% interest in each of Minera Juanicipio, S.A. de C.V. and Equipos Chaparral, S.A. de C.V., both Mexican incorporated companies (Note 9, “Investment in Juanicipio”). The Company has significant influence when it has the power to participate in the financial and operating policy decisions of the associate but does not have control or joint control over those policies.

The Company accounts for its investment in associates using the equity method. The Company aggregates its disclosures required under IFRS for interests in associates effectively involved in advancing the same business objective. Under the equity method, the Company’s investments in associates are initially recognized at cost and subsequently increased or decreased to reflect additional contributions or distributions and to recognize the Company's share of earnings and losses of the associate and for impairment losses after the initial recognition date. The Company's share of earnings and losses of associates are recognized in the consolidated statements of income and comprehensive income during the year. Intercompany interest on loans from the Company to its associates is recorded against its share of income from equity accounted investment, rather than as a separate line item in the consolidated statements of income and comprehensive income. Distributions received from an associate are accounted for as a reduction in the carrying amount of the Company’s investment.

Impairment

At the end of each reporting year, the Company assesses whether there is objective evidence that an investment in associate is impaired. The Company has performed an assessment for impairment indicators of its investments in associates as of December 31, 2023 and noted no impairment indicators. This assessment is generally made with reference to the timing of completing construction of the development project, future production, future silver, gold, lead and zinc prices, future capital requirements, future operating costs, exploration results achieved, and an assessment of the likely operating and estimated cash flow results to be achieved. When there is objective evidence that an investment in associate is impaired, the carrying amount of such investment is compared to its recoverable amount. If the recoverable amount of an investment in associate is less than its carrying amount, the carrying amount is reduced to its recoverable amount and an impairment loss, being the excess of carrying amount over the recoverable amount, is recognized in the consolidated statements of income and comprehensive income. When an impairment loss reverses in a subsequent year, the carrying amount of the investment in associate is increased to the revised estimate of recoverable amount to the extent that the increased carrying amount does not exceed the carrying amount that would have been determined had an impairment loss not been previously recognized. A reversal of an impairment loss is recognized in the consolidated statements of income and comprehensive income in the year the reversal occurs.

|

(d) |

Exploration and evaluation assets |

With respect to its exploration activities, the Company follows the practice of capitalizing all costs relating to the acquisition, exploration and evaluation of its mining rights. Option payments made by the Company are capitalized until the decision to exercise the option is made. If the option agreement is to exercise a purchase option in an underlying mineral property, the costs are capitalized and accounted for as an exploration and evaluation asset. If a mineable ore body is discovered, exploration and evaluation costs are reclassified to mining properties. At such time as commercial production commences, the capitalized costs will be depleted on a units-of-production method (“UOP”). If no mineable ore body is discovered, such costs are expensed or written-off in the period in which it is determined the property has no future economic value.

Exploration and evaluation expenditures include acquisition costs of rights to explore; topographical, geological, geochemical and geophysical studies; exploratory drilling; trenching and sampling; all costs incurred to obtain permits and other licenses required to conduct such activities, including legal, community, strategic and consulting fees; and activities involved in evaluating the technical feasibility and commercial viability of extracting mineral resources. This includes the costs incurred in determining the most appropriate mining/processing methods and developing feasibility studies. Expenditures incurred on a prospective property prior to the Company obtaining the right to explore it, are expensed in the year in which they are incurred.

When the technical feasibility and commercial viability of extracting a mineral resource are demonstrable, the underlying project enters the development phase and exploration and evaluation assets are reclassified to mine development costs. Key considerations in concluding a project has entered development phase include, but are not limited to, sufficient evidence of the probability of the existence of economically recoverable minerals has been obtained, the Board of Directors has approved development of the project and the Company has sufficient financing in place to proceed with development.

Impairment

Management reviews the carrying amount of exploration and evaluation assets for impairment when facts or circumstances suggest that the carrying amount is not recoverable. This review is generally made with reference to the timing of exploration work, work programs proposed, exploration results achieved by the Company and by others in the related area of interest, and an assessment of the likely results to be achieved from performance of further exploration. When the results of this review indicate that indicators of impairment exist, the Company estimates the recoverable amount of the deferred exploration costs and related mining rights by reference to the potential for success of further exploration activity and/or the likely proceeds to be received from sale or assignment of the rights. When the carrying amounts of exploration and evaluation assets are estimated to exceed their recoverable amounts, an impairment loss is recorded in the consolidated statements of income and comprehensive income. If conditions that gave rise to the impairment no longer exist, a reversal of impairment may be recognized in a subsequent year, with the carrying amount of the exploration and evaluation asset increased to the revised estimate of recoverable amount to the extent that the increased carrying amount does not exceed the carrying amount that would have been determined had an impairment loss not been previously recognized. A reversal of an impairment loss is recognized in the consolidated statements of income and comprehensive income in the year the reversal occurs.

|

(e) |

Property, plant and equipment and mine development costs |

Property, plant and equipment are recorded at cost less accumulated amortization and impairment losses. When parts of an item of equipment have different useful lives, they are accounted for as separate equipment items (major components).

Amortization is based on the depreciable amount, which is the cost of the asset, less its expected residual value.

Amortization of the 44% owned Juanicipio mine and plant is a component of the Company’s share of income (loss) from its equity investment in Juanicipio. With the exception of mobile equipment being amortized on a straight-line basis over its useful life, the majority of the Juanicipio mine and plant will be amortized over tonnes processed from proven and probable reserves, on a UOP basis, once each component enters commercial production.

The mine entered commercial production in January 2022 and the plant entered commercial production in June 2023. Upon both the mine and plant entering commercial production, the Company ceased capitalization of oversight expenditures associated with development of the Juanicipio Project and started to amortize such costs on a UOP basis.

Amortization on 100% owned and controlled assets is recognized in the consolidated statements of income and comprehensive income on a declining balance basis or straight-line basis over the estimated useful lives of each part of an item of property and equipment, based on how this most closely reflects the expected pattern of consumption of the future economic benefits embodied in the asset. Exploration assets that become a mineable ore body are reclassified to mineral properties.

The amortization rates for 100% owned and controlled assets are as follows:

| Building | 4% declining balance |

| Computer and office equipment | 30% declining balance |

| Exploration camp and equipment | 30% declining balance |

| Right-of-use asset |

straight-line over the earlier of the end of the lease term or useful life of the asset |

Amortization methods, useful lives and residual values are reviewed at the end of each reporting year and adjusted if appropriate.

|

(f) |

Provisions |

Provisions are liabilities that are uncertain in timing or amount. The Company records a provision when and only when:

(i) The Company has a present obligation (legal or constructive) as a result of a past event;

(ii) It is probable that an outflow of resources embodying economic benefits will be required to settle the obligation; and

(iii) A reliable estimate can be made of the amount of the obligation.

Constructive obligations are obligations that derive from the Company’s actions where:

(i) By an established pattern of past practice, published policies or a sufficiently specific current statement, the Company has indicated to other parties that it will accept certain responsibilities; and (ii) As a result, the Company has created a valid expectation on the part of those other parties that it will discharge those responsibilities.

Provisions are reviewed at the end of each reporting year and adjusted to reflect management’s current best estimate of the expenditure required to settle the present obligation at the end of the reporting year. If it is no longer probable that an outflow of resources embodying economic benefits will be required to settle the obligation, the provision is reversed. Provisions are reduced by actual expenditures for which the provision was originally recognized. Where discounting has been used, the carrying amount of a provision increases in each year to reflect the passage of time. This increase (accretion expense) is included in the consolidated statements of income and comprehensive income for the year.

Closure and reclamation

A provision for mine closure cost is made in respect of the estimated future costs of closure, restoration and for environmental rehabilitation costs (which include the dismantling and demolition of infrastructure, removal of residual materials and remediation of disturbed areas) based on a mine closure plan, in the accounting year when the related environmental disturbance occurs. The provision is discounted and the unwinding of the discount is included within finance costs. At the time of establishing the provision, a corresponding asset is capitalized where it gives rise to a future economic benefit and is depreciated over future production from the mine to which it relates. The provision is reviewed on an annual basis for changes in cost estimates, discount rates or life of operations. Changes to estimated future costs are recognized in the statement of financial position by adjusting the mine closure cost liability and the related asset originally recognized.

Decommissioning assets depreciate over the estimated production period of the mining and processing facilities. The depreciation and amortization charge is recognized in the consolidated statements of income and comprehensive income as part of production costs.

|

(g) |

Income taxes |

Income tax is comprised of current and deferred tax. Income tax is recognized in the consolidated statements of income and comprehensive income except to the extent that it relates to items recognized directly in equity, in which case the income tax is also recognized directly in equity.

Current tax is the expected tax payable on taxable income for the year of each entity in the consolidated group, using tax rates enacted or substantively enacted, at the end of the reporting year.

Deferred income taxes relate to the expected future tax consequences of unused tax losses and unused tax credits and differences between the carrying amount of statement of financial position items and their corresponding tax values. Deferred tax assets, if any, are recognized only to the extent that, in the opinion of management, it is probable that sufficient future taxable profit will be available to recover the asset. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of substantive enactment.

|

(h) |

Financial instruments |

Financial assets

Financial assets are classified as either financial assets at fair value through the consolidated statements of income and comprehensive income (“FVTPL”), fair value through other comprehensive income (“FVTOCI”) or amortized cost. The Company determines the classification of financial assets at initial recognition.

|

(i) |

Financial assets at FVTPL |

Financial assets carried at FVTPL are initially recorded at fair value and transaction costs are expensed in the consolidated statements of income and comprehensive income. Equity instruments that are held for trading and all equity derivative instruments are classified as FVTPL.

|

(ii) |

Financial assets at FVTOCI |

Equity instruments that are designated at FVTOCI are initially recorded at fair value plus transaction costs with all subsequent changes in fair value recognized in other comprehensive income (loss). For investments in equity instruments that are not held for trading, the Company can make an irrevocable election (on an instrument-by-instrument basis) at initial recognition to classify them as FVTOCI. On the disposal of the investment, the cumulative change in fair value in other comprehensive income (loss) is not recycled to the consolidated statements of income and comprehensive income but transferred only within equity.

|

(iii) |

Financial assets at amortized cost |

Financial assets are classified at amortized cost if the objective of the business model is to hold the financial asset for the collection of contractual cash flows, and the assets’ contractual cash flows are comprised solely of payments of principal and interest. The Company’s loans to Mineria Juanicipio, S.A. de C.V. and Equipos Chaparral, S.A. de C.V., and accounts receivable are recorded at amortized cost as they meet the required criteria. A provision is recorded based on the expected credit losses for the financial asset and reflects changes in the expected credit losses at each reporting year (see impairment below).

Impairment

IFRS 9 requires an ‘expected credit loss’ model to be applied which requires a loss allowance to be recognized based on expected credit losses. This applies to financial assets measured at amortized cost. The expected credit loss model requires an entity to account for expected credit losses and changes in those expected credit losses at each reporting date to reflect changes in initial recognition.

Financial liabilities

Financial liabilities are initially recorded at fair value and subsequently measured at amortized cost, unless they are required to be measured at FVTPL (such as derivatives) or the Company has elected to measure at FVTPL. The Company’s financial liabilities include trade and other payables which are classified at amortized cost.

|

(i) |

Debt |

Debt is initially recorded at fair value, net of transaction costs incurred. Debt is subsequently carried at amortized cost; any difference between the proceeds (net of transaction costs) and the redemption value is recognized in the consolidated statements of income and comprehensive income over the period of the debt using the effective interest method.

|

(j) |

Share capital |

The Company records proceeds from share issuances net of issue costs. The Company records proceeds from the exercise of stock options as share capital in the amount for which the option enabled the holder to purchase a share in the Company. Share capital issued for non-monetary consideration is recorded at the fair value of the non-monetary consideration received, or at the fair value of the shares issued if the fair value of the non-monetary consideration cannot be measured reliably, on the date of issue.

|

(k) |

Share-based compensation |

The fair value of equity-settled share-based compensation awards are estimated as of the date of the grant and recorded as share-based compensation expense in the consolidated statements of income and comprehensive income over their vesting periods, with a corresponding increase in equity. The amount recognized as an expense is adjusted to reflect the number of awards for which the related service and non-market vesting conditions are expected to be met. Market price performance conditions are included in the fair value estimate on the grant date with no subsequent adjustment to the actual number of awards that vest. Forfeiture rates are estimated on grant date, and adjusted for actual forfeitures at each reporting year. Changes to the estimated number of awards that will eventually vest are accounted for prospectively. Share based compensation awards with graded vesting schedules are accounted for as separate grants with different vesting periods and fair values.

The fair value of stock options is estimated using the Black-Scholes option valuation model. The fair value of restricted and deferred share units, is based on the fair market value of a common share equivalent on the date of grant. The fair value of performance share units awarded with market price conditions is determined using the Monte Carlo pricing model and the fair value of performance share units with non-market performance conditions is based on the fair market value of a common share equivalent on the date of grant.

|

(l) |

Revenue |

The Juanicipio Mine recognizes revenue for silver, gold, lead and zinc from concentrate sales, net of treatment and refining charges, when it satisfies the performance obligation of transferring control of the concentrate to the customer. This generally occurs as material is received at the customer’s plant, as the customer has the ability to direct the use of and obtain substantially all of the remaining benefits from the material and the customer has the risk of loss. The Juanicipio revenues are based on estimated metal quantities based on assay data and on a provisional price. The receivable is marked to market for changes in price differences each year prior to final settlement. The Juanicipio Mine also adjusts estimated metal quantities used in computing provisional revenues based on new information and assay data from the smelter/refinery as it is received (if any). MAG only includes in the transaction price the amount which is not highly likely to be subject to significant subsequent revenue reversal. A provisional payment is generally due by the 15th of the month following delivery of the concentrate to the customer. Final payment is due upon final settlement of price and quantity in accordance with the contractual terms of the sale.

|

(m) |

Income per common share |

Basic income per share is based on the weighted average number of common shares outstanding during the year.

Diluted income per share is computed using the weighted average number of common and potential common shares outstanding during the year. Common equivalent shares consist of the incremental common shares upon the assumed exercise of stock options and warrants, and upon the assumed conversion of deferred share units and units issued under the Company’s share unit plan, to the extent their inclusion is not anti-dilutive.

|

(n) |

Asset acquisitions |

Upon the acquisition of an asset or a group of assets and liabilities that does not constitute a business, the Company identifies and recognizes the individual identifiable assets acquired and liabilities assumed. The cost of the group is allocated to the individual identifiable assets and liabilities on the basis of their relative fair values at the date of purchase. Such a transaction or event does not give rise to goodwill.

|

4. |

CHANGES IN ACCOUNTING STANDARDS |

|

(a) |

Accounting standards adopted during the year |

During 2023, the Company adopted the following amendments to standards:

|

● |

Amendments to IAS 12, Income Taxes (effective January 1, 2023) clarify how companies should account for deferred tax related to assets and liabilities arising from a single transaction, such as leases and decommissioning obligations. The amendments narrow the scope of the initial recognition exemption so that it does not apply to transactions that give rise to equal and offsetting temporary differences. As a result, companies need to recognize a deferred tax asset and a deferred tax liability for temporary differences arising on initial recognition of the related asset and liability. The implementation of these amendments did not have a significant impact on the Company’s tax provision for its December 31, 2023 financial statements. |

|

● |

Amendments to IAS 12, International Tax Reform — Pillar Two Model Rules. The Company adopted amendments to IAS 12 Income taxes in response to the Organization for Economic Co-operation and Development's (OECD) Pillar Two model tax rules (also known as the Global Minimum Tax) adopted through amendments to IAS 12, International Tax Reform — Pillar Two Model Rules (effective January 1, 2023). The amendments provide that an entity has to disclose separately its current tax expense related to Global Minimum Tax as well as a mandatory temporary exception to the requirements regarding deferred tax assets and liabilities. The amendments also provide that in a year where the Global Minimum Tax legislation is enacted or substantively enacted, but not yet in effect, an entity discloses known or reasonably estimable information that helps users of financial statements understand the entity’s exposure to Global Minimum Tax arising from that legislation. The Company has applied the mandatory temporary exemption regarding deferred taxes. The adoption of these amendments did not have a material impact on these consolidated financial statements. |

|

(b) |

Accounting standards and amendments issued but not yet adopted |

The Company has not applied the following amendments to standards that have been issued but are not yet effective:

|

● |

Amendments to IAS 1, Presentation of Financial Statements. The amendments to IAS 1, clarifies the presentation of liabilities. The classification of liabilities as current or noncurrent is based on contractual rights that are in existence at the end of the reporting year and is affected by expectations about whether an entity will exercise its right to defer settlement. A liability not due over the next twelve months is classified as non-current even if management intends or expects to settle the liability within twelve months. The amendment also introduces a definition of ‘settlement’ to make clear that settlement refers to the transfer of cash, equity instruments, other assets, or services to the counterparty. The amendment issued in October 2022 also clarifies how conditions with which an entity must comply within twelve months after the reporting year affect the classification of a liability. Covenants to be complied with after the reporting date do not affect the classification of debt as current or non-current at the reporting date. The amendments are effective for annual reporting years beginning on or after January 1, 2024. The implementation of this amendment is not expected to have a material impact on the Company. |

|

5. |

SIGNIFICANT ACCOUNTING JUDGMENTS AND ESTIMATES |

|

(a) |

Significant judgements |

In preparing the consolidated financial statements, the Company makes judgments when applying its accounting policies. The judgments that have the most significant effect on the amounts recognized in the consolidated financial statements are outlined below.

|

(i) |

Equity investments |

In the normal course of operations, the Company may invest in equity investments for strategic reasons. In such circumstances, management considers whether the facts and circumstances pertaining to each investment result in the Company obtaining control, joint control or significant influence over the investee entity. In some cases, the determination of whether or not the Company has control, joint control or significant influence over the investee entities requires the application of significant management judgment to consider individually and collectively such factors as:

|

● |

The purpose and design of the investee entity. |

|

● |

The ability to exercise power, through substantive rights, over the activities of the investee entity that significantly affect its returns. |

|

● |

The size of the company’s equity ownership and voting rights, including potential voting rights. |

|

● |

The size and dispersion of other voting interests, including the existence of voting blocks. |

|

● |

Other investments in or relationships with the investee entity including, but not limited to, current or possible board representation, loans and other types of financial support, material transactions with the investee entity, interchange of managerial personnel or consulting positions. |

|

● |

Other relevant and pertinent factors. |

If the Company determines that it controls an investee entity, it consolidates the investee entity’s financial statements as further described in Note 3. If the Company determines that it has joint control (a joint venture) or significant influence (an associate) over an investee entity, then it uses the equity method of accounting to account for its investment in that investee entity as further described in Note 3. If, after careful consideration, it is determined that the Company neither has control, joint control nor significant influence over an investee entity, the Company accounts for the corresponding investment in equity interest as fair value through other comprehensive income investment as further described in Note 3.

|

(ii) |

Impairment of non-current assets |

Non-current assets are tested for impairment at the end of each reporting year if, in management’s judgement, there is an indicator of impairment. Management applies significant judgment in assessing whether indicators of impairment exist that would necessitate impairment testing. Internal and external factors, such as (i) changes in quantity of the recoverable resources and reserves; (ii) changes in metal prices, capital and operating costs and interest rates; and (iii) market capitalization of the Company compared to its net assets, are evaluated by management in determining whether there are any indicators of impairment. If there are indicators, management performs an impairment test on the major assets in this category.

In addition, the application of the Company’s accounting policy for exploration and evaluation expenditures requires judgment in determining whether it is probable that future economic benefits are likely, either from future exploitation or sale or where activities have not reached a stage which permits a reasonable assessment of the existence of reserves. The deferral policy requires management to make certain estimates and assumptions about future events or circumstances, in particular whether the technical feasibility and commercial viability of extracting a mineral resource is demonstrable. Estimates and assumptions made may change if new information becomes available. If, after an expenditure is capitalized, information becomes available suggesting that the recovery of expenditure is unlikely, the amount capitalized is written off in the consolidated statements of income and comprehensive income in the year when the new information becomes available.

As at December 31, 2023 and December 31, 2022, the Company did not have any indicators of impairment.

|

(iii) |

Commercial production |

The determination of the date on which a mine enters the commercial production stage is a significant judgement as capitalization of certain costs ceases and the recording of expenses commences. In determining commercial production and when the mine and processing facility are available for use in the manner intended by management, the following factors are considered:

|

● |

Operational commissioning of major mine and plant components is complete; |

|

● |

Intended operating results are being achieved consistently for a period of time (i.e. consistent level of throughput, sustained plant recovery levels, etc); |

|

● |

There are indicators that these operating results will be continued; and |

|

● |

Other factors are present, including one or more of the following: a significant portion of plant/mill capacity has been achieved; a significant portion of available funding is directed towards operating activities; a pre-determined, reasonable period of time has passed; or significant milestones for the development of the mining property have been achieved. |

Declaration of commercial production at Juanicipio

The Juanicipio mine and related mining infrastructure achieved commercial production on January 1, 2022. Following a successful commissioning period, the Juanicipio processing facility had been operating at approximately 85% of its nameplate of 4,000 tpd with silver recovery consistently above 88%. With all major construction activities completed and the Juanicipio mine, processing facility and other vital systems all operating in line with, or rapidly approaching design capacity, commercial production at the Juanicipio processing facility was declared effective June 1, 2023.

With the declaration of commercial production, Juanicipio began depreciating all assets related to processing and associated facilities. In addition, the Company commenced depreciating exploration expenditures at Juanicipio that were capitalized in accordance with the Company’s accounting policies as well as project oversight expenditures incurred by MAG (Note 9).

|

(b) |

Significant estimates |

The preparation of consolidated financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the amounts reported and disclosed. These estimates are based on management’s knowledge of the relevant facts and circumstances, having regard to previous experience, but actual results may differ materially from the amounts included in the consolidated financial statements. Information about assumptions and other sources of estimating uncertainty that have a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities within the next 12 months are outlined below.

|

(i) |

Revenue |

Revenue recorded at the Juanicipio Mine, which is reflected as a component in the Company’s consolidated statements of income and comprehensive income from its equity accounted investment in Juanicipio, is based on estimated metal quantities reflecting assay data and on provisional prices which will be trued up for final price and quantity in a later period.

|

(ii) |

Provision for reclamation |

Management assesses the closure and reclamation obligations on an annual basis or when new information becomes available. This assessment includes the estimation of the future rehabilitation costs required based on the existing laws and regulations in the jurisdiction the Company operates in, the timing of these expenditures, and the impact of changes in the inflation and discount rates. The actual future expenditures may differ from the amounts currently provided if the estimates made are significantly different than actual results or if there are significant changes in environmental and/or regulatory requirements in the future.

|

(iii) |

Contingent liabilities |

The Company is subject to various tax, legal and other disputes, the outcomes of which cannot be assessed with a high degree of certainty. A liability is recognized where, based on the Company’s legal views and advice, it is considered probable that an outflow of resources will be required to settle a present obligation that can be measured reliably. By their nature, these provisions will only be resolved when one or more future events occur or fail to occur, which will bring resolution to their underlying cases. The assessment of such provisions inherently involves the exercise of significant judgment of the potential outcome of future events.

|

(iv) |

Fair value measurement: share-based compensation |

The Company uses valuation techniques (Note 3(m)) in measuring the fair value of equity-settled share-based compensation awards, which requires the Company to make certain estimates, judgements, and assumptions in relation to the expected life, expected volatility, expected risk‐free rate, expected forfeiture rate, and expected future market conditions of the various equity based units, as applicable.

The fair value of stock options is estimated using the Black-Scholes option valuation model, and related required estimates, judgements, and assumptions include stock options expected life, expected volatility, expected risk‐free rate, and expected forfeiture rate. The fair value of performance share units awarded with market price conditions is determined using the Monte Carlo pricing model, projecting the performance of the Company and, if applicable, the relevant market index against which the Company’s performance is compared. In assessing the vesting of performance share units awarded with market price conditions the Company may be required to make certain estimates, judgements, and assumptions in relation with future market conditions. The fair value of performance share units with non-market performance conditions, restricted and deferred share units are based on the fair market value of a common share equivalent on the date of grant.

|

6. |

ACQUISITION OF GATLING EXPLORATION INC. |

On March 11, 2022, the Company entered into a Definitive Arrangement Agreement with Gatling Exploration Inc. (“Gatling”) to acquire all of the issued and outstanding common shares of Gatling with the issuance of common shares of the Company and the advancement of a Canadian dollar (“C$”) $3 million convertible note receivable. On May 20, 2022, the Company completed the acquisition of Gatling by way of a court-approved plan of arrangement under the BCABC (the “Transaction”), pursuant to which Gatling became a wholly-owned subsidiary of the Company and the Company thereby acquired a 100% interest in the Larder Project (the “Larder Project”). Under the terms of the Transaction, each former Gatling shareholder received 0.0170627 of a common share of the Company in exchange for each share of Gatling held immediately prior to the Transaction. Holders of options and warrants to acquire common shares of Gatling received replacement options and warrants, respectively, entitling the holders thereof to acquire common shares of the Company, based on, and subject to, the terms of such options and warrants of Gatling, as adjusted by the plan of arrangement.

MAG issued a total of 774,643 common shares to the shareholders of Gatling in connection with the Transaction. The Company also issued 43,675 replacement stock options and 53,508 replacement warrants (Note 11). A portion of the liabilities of Gatling related to change of control payments to Gatling executive management was settled by the issuance of 63,492 common shares of the Company.

The Company has determined that the Transaction did not meet the definition of business combination under IFRS 3, Business Combinations and accordingly, has been accounted for as an asset acquisition.

The purchase price allocation requires management to estimate the relative fair value of identifiable assets acquired and liabilities assumed.

The following tables summarize the fair value of the consideration given and the relative fair values of identified assets and liabilities recognized as a result of the Transaction.

|

Total shares issued on close: |

774,643 | |||

| $ | ||||

|

MAG share price – C$ |

18.54 | |||

|

USD exchange rate |

0.7807 | |||

|

MAG share price – US$ |

14.47 | |||

|

Value of shares on close of Transaction |

11,212 | |||

|

Value of convertible note receivable |

2,392 | |||

|

Value of replacement options and warrants |

85 | |||

|

Transaction costs |

350 | |||

|

Value of consideration paid |

14,039 | |||

|

Identified assets acquired and liabilities assumed |

$ | |||

|

Assets |

||||

|

Cash and cash equivalents |

89 | |||

|

Receivables, prepaids and deposits |

115 | |||

|

Exploration and evaluation assets |

15,187 | |||

|

Total Assets |

15,391 | |||

|

Liabilities |

||||

|

Accounts payable and accrued liabilities |

1,315 | |||

|

Lease liabilities |

37 | |||

|

Total Liabilities |

1,352 | |||

|

Net assets acquired |

14,039 |

|

7. |

GENERAL AND ADMINISTRATIVE EXPENSES |

|

For the year ended |

||||||||

|

December 31 |

December 31 |

|||||||

|

2023 |

2022 |

|||||||

| $ | $ | |||||||

|

Accounting and audit |

751 | 606 | ||||||

|

Compensation and consulting fees |

4,985 | 4,648 | ||||||

|

Depreciation and amortization |

352 | 136 | ||||||

|

Filing and transfer agent fees |

354 | 335 | ||||||

|

Amortization of deferred financing fees |

84 | - | ||||||

|

General office expenses |

847 | 530 | ||||||

|

Insurance |

1,466 | 2,024 | ||||||

|

Juanicipio oversight costs |

687 | - | ||||||

|

Legal |

433 | 244 | ||||||

|

Share-based compensation expense (see Note 11) |

2,894 | 3,250 | ||||||

|

Shareholder relations |

445 | 419 | ||||||

|

Travel |

296 | 160 | ||||||

| 13,594 | 12,352 | |||||||

|

8. |

ACCOUNTS RECEIVABLE |

|

December 31, |

December 31, |

|||||||

|

2023 |

2022 |

|||||||

| $ | $ | |||||||

|

Receivable from Minera Juanicipio (Notes 9 & 17) |

855 | 323 | ||||||

|

Value added tax (“IVA” and “GST”) |

700 | 382 | ||||||

|

Other receivables |

4 | 3 | ||||||

| 1,559 | 708 | |||||||

|

9. |

INVESTMENT IN JUANICIPIO |

Minera Juanicipio was created for the purpose of holding the Juanicipio property, and is held 56% by Fresnillo plc (“Fresnillo”) and 44% by the Company. On December 27, 2021, the Company and Fresnillo created Equipos Chaparral in the same ownership proportions. Equipos Chaparral owns the processing facility and mining equipment which is leased to Minera Juanicipio. Minera Juanicipio and Equipos Chaparral are collectively referred to herein as “Juanicipio,” or, the “Juanicipio Mine.”

Juanicipio is governed by a shareholders’ agreement and by corporate by-laws. All costs relating to Juanicipio are required to be shared by the Company and Fresnillo pro-rata based on their ownership interests in Juanicipio, and if either party does not fund pro-rata, their ownership interest will be diluted in accordance with the shareholders’ agreement and by-laws.

Fresnillo is the operator of Juanicipio, and with its affiliates, beneficially owns 9,314,877 common shares of the Company as at December 31, 2023, as publicly reported by Fresnillo.

The Company has recorded its Investment in Juanicipio using the equity method of accounting. The recorded value of the investment includes the carrying value of the deferred exploration, mineral and surface rights, Juanicipio costs incurred by the Company, the required net cash investments to establish and maintain its 44% interest in Juanicipio, and the Company’s 44% share of income (loss) from Juanicipio.

Changes during the year of the Company’s investment relating to its interest in Juanicipio are detailed as follows:

|

December 31, |

December 31, |

|||||||

|

2023 |

2022 |

|||||||

| $ | $ | |||||||

|

Balance, beginning of year |

338,316 | 291,084 | ||||||

|

Juanicipio oversight expenditures incurred 100% by MAG |

384 | 719 | ||||||

|

Amortization of Juanicipio's oversight expenditures incurred 100% by MAG |

(305 | ) | - | |||||

|

Cash contributions and advances to Juanicipio (3) |

24,992 | 8,140 | ||||||

|

Loan repayments from Juanicipio (2) |

(25,714 | ) | - | |||||

|

Total for the period |

(642 | ) | 8,859 | |||||

|

Income from equity accounted Investment in Juanicipio |

65,099 | 40,767 | ||||||

|

Interest earned, net of recontributions, reclassified to accounts receivable (1) |

(8,150 | ) | (2,394 | ) | ||||

|

Balance, end of year |

394,622 | 338,316 | ||||||

(1) A portion of the Investment in Juanicipio is in the form of interest bearing shareholder loans. For the year ended December 31, 2023, the Company earned interest, net of recontributions, amounting to $8,150 (year ended December 31, 2022: $2,394) while $7,639 of interest payments were received from Juanicipio (December 31, 2022: $3,564).

(2) During the year ended December 31, 2023, a $7,251 loan to Juanicipio was converted into equity (December 31, 2022: nil).

(3) Of the $24,992 cash contributions and advances made to Juanicipio during the year ended December 31, 2023, $22,726 was in the form of loans whereas $2,276 was in the form of equity (December 31, 2022: $8,140 in the form of loans).

A summary of financial information of Juanicipio (on a 100% basis reflecting adjustments made by the Company, including adjustments for differences in accounting policies) is as follows:

Juanicipio Statements of Income

|

For the year ended |

||||||||

|

December 31, |

December 31, |

|||||||

|

2023 |

2022 |

|||||||

| $ | $ | |||||||

|

Sales |

442,288 | 215,736 | ||||||

|

Cost of sales: |

||||||||

|

Production cost |

171,830 | 61,985 | ||||||

|

Depreciation and amortization |

68,475 | 20,913 | ||||||

|

Cost of sales |

240,305 | 82,898 | ||||||

|

Gross profit |

201,983 | 132,838 | ||||||

|

Consulting and administrative expenses |

(18,768 | ) | (8,436 | ) | ||||

|

Extraordinary mining and other duties |

(4,945 | ) | (349 | ) | ||||

| 178,270 | 124,053 | |||||||

|

Exchange losses and other |

(2,937 | ) | (5,160 | ) | ||||

|

Interest expense |

(18,524 | ) | (2,298 | ) | ||||

|