UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 22, 2024

_______________________________

TPI Composites, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 001-37839 | 20-1590775 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

9200 E. Pima Center Parkway, Suite 250

Scottsdale, Arizona 85258

(Address of Principal Executive Offices) (Zip Code)

(480) 305-8910

(Registrant's telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 | TPIC | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On February 22, 2024, TPI Composites, Inc. (the Company) issued a press release announcing its financial results for the three months and full year ended December 31, 2023. A copy of the Company’s press release is furnished herewith as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein. The Company also posted a presentation to its website at www.tpicomposites.com under the tab “Investors” providing information regarding its results of operations and financial condition for the three months and full year ended December 31, 2023. The information contained in the presentation is incorporated by reference herein. The presentation is being furnished herewith as Exhibit 99.2 to this current report on Form 8-K. The Company’s website and the information contained therein is not part of this disclosure.

The information in Item 2.02 of this current report on Form 8-K (including Exhibits 99.1 and 99.2) is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in Item 2.02 of this current report on Form 8-K (including Exhibits 99.1 and 99.2) shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

(d) Exhibits

| 99.1 | Press Release dated February 22, 2024 | |||

| 99.2 | Presentation dated February 22, 2024 | |||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| TPI Composites, Inc. | ||

| Date: February 22, 2024 | By: | /s/ Ryan Miller |

| Ryan Miller | ||

| Chief Financial Officer | ||

EXHIBIT 99.1

TPI Composites, Inc. Announces Fourth Quarter and Full Year 2023 Earnings Results; Enhanced Liquidity Position and Projects Improved Profitability for the Second Half of 2024

SCOTTSDALE, Ariz., Feb. 22, 2024 (GLOBE NEWSWIRE) -- TPI Composites, Inc. (Nasdaq: TPIC), today reported financial results for the fourth quarter and full year ended December 31, 2023.

“Once again, we demonstrated our ability to navigate a challenging macro environment and finished 2023 with $161 million of unrestricted cash, resulting from a significant improvement in working capital. Throughout the year, we took advantage of the opportunity to strengthen our strategic position ahead of the wind market’s anticipated recovery and improve our liquidity,” said Bill Siwek, President and CEO of TPI Composites. “Our recently announced refinancing of Oaktree’s Series A Preferred Stock holdings provides TPI with approximately $190 million of improved liquidity through the life of the loan, permanently reduced future obligations by up to $90 million and gives us greater financial flexibility to execute on our strategic initiatives in 2024 and beyond.”

“In the fourth quarter, we deepened our relationships with our customers as evidenced by the recent contract expansions and extensions with GE Vernova in Mexico and Nordex in Türkiye. We are encouraged by the improved financial results and business outlooks from our customers. While we anticipate 2024 to be a transitional year for us, we do expect to have improved financial performance during 2024 compared to 2023 with profitability improving significantly in the second half of 2024 compared to the first half of 2024. We believe volume will begin to accelerate at the end of 2024 and into 2025 and position us for Adjusted EBITDA levels north of $100 million on an annualized basis beginning in 2025.”

“Our team at TPI did a tremendous job implementing our quality improvement initiatives over the back half of last year and we remain focused on operational execution and meeting our customers’ needs. While we continue to see some near-term challenges for the industry, we believe we are in excellent position to deliver for our customers and shareholders.”

Fourth Quarter 2023 Results and Recent Business Highlights

| KPIs from continuing operations |

4Q’23 | 4Q’22 | FY’23 | FY’22 | ||

| Sets1 | 602 | 649 | 2,584 | 2,441 | ||

| Estimated megawatts2 | 2,632 | 2,828 | 11,382 | 10,736 | ||

| Utilization3 | 87% | 71% | 82% | 80% | ||

| Dedicated manufacturing lines4 | 37 | 36 | 37 | 36 | ||

| Manufacturing lines installed5 | 37 | 36 | 37 | 36 | ||

|

1. Number of wind blade sets (which consist of three wind blades) produced worldwide during the period. 2. Estimated megawatts of energy capacity to be generated by wind blade sets produced during the period. 3. Utilization represents the percentage of wind blades invoiced during the period compared to the total potential wind blade capacity of manufacturing lines installed during the period. 4. Number of wind blade manufacturing lines that are dedicated to our customers under long-term supply agreements at the end of the period. 5. Number of wind blade manufacturing lines installed and either in operation, startup or transition during the period. |

||||||

Fourth Quarter 2023 Financial Results from Continuing Operations

Net sales for the three months ended December 31, 2023, decreased 26.2% to $297.0 million as compared to $402.3 million in the same period in 2022, due to the following:

Net income attributable to common stockholders was $11.6 million for the three months ended December 31, 2023, compared to a loss of $41.9 million in the same period in 2022. During the three months ended December 31, 2023, we recorded a gain on extinguishment of $82.6 million associated with the refinancing of our Series A Preferred Stock into a Senior Secured Term Loan. Net income attributable to common stockholders includes $11.7 million of Series A Preferred Stock dividends for the three months ended December 31, 2023. Net loss attributable to common stockholders includes $15.2 million of Series A Preferred Stock dividends for the three months ended December 31, 2022.

Net income per common share was $0.27 for the three months ended December 31, 2023, compared to a net loss per common share of $1.00 for the same period in 2022.

Adjusted EBITDA for the three months ended December 31, 2023, was a loss of $28.1 million as compared to a gain of $21.2 million during the same period in 2022. Adjusted EBITDA margin decreased to a loss of 9.4% for the three months ended December 31, 2023, as compared to a positive margin of 5.3% during the same period in 2022. The decrease in adjusted EBITDA for the three months ended December 31, 2023, as compared to the same period in 2022, was primarily driven by the volume reduction, increased costs related to quality initiatives, and higher startup and transition costs.

Full Year 2023 Financial Results

Net sales for the year ended December 31, 2023, decreased 4.4% to $1,455.2 million as compared to $1,522.7 million in 2022, due to the following:

Net loss attributable to common stockholders was $172.3 million for the year ended December 31, 2023, compared to a net loss of $114.5 million in 2022. The net loss attributable to common stockholders includes a $82.6 million gain associated with the refinancing of our Series A Preferred Stock into a Senior Secured Term Loan for the year ended December 31, 2023. The net loss attributable to common stockholders includes $58.5 million and $58.9 million of Series A Preferred Stock dividends for the years ended December 31, 2023 and 2022, respectively.

The net loss per common share was $4.04 for the year ended December 31, 2023, compared to a net loss per common share of $2.73 in 2022.

Adjusted EBITDA for the year ended December 31, 2023, totaled a loss of $85.9 million compared to income of $37.9 million in 2022. This decrease was primarily due to the warranty campaign we announced in the second quarter, credit losses and charges related to the bankruptcy of Proterra, higher inspection and repair costs, diverting Field Services technicians to warranty related effort and away from revenue generation work, and lower sales, partially offset by higher average blade selling prices.

On December 31, 2023, we had unrestricted cash and cash equivalents of $161.1 million. Net cash used in operating activities for the year ended December 31, 2023, was $81.0 million compared to $62.3 million in 2022. Net cash used in investing activities was $23.3 million for the year ended December 31, 2023, as compared to $18.8 million in 2022.

Capital expenditures were $36.1 million for the year ended December 31, 2023, as compared to $18.8 million in 2022. Our capital expenditures primarily relate to machinery and equipment and expansion and improvements to our existing facilities. In 2023, we also made investments in wind turbines to power one of our facilities in Türkiye.

2024 Guidance

Guidance for the full year ending December 31, 2024:

| Guidance | Full Year 2024 |

| Net Sales from Continuing Operations | $1.3 billion - $1.4 billion |

| Adjusted EBITDA Margin % from Continuing Operations | 1% - 3% |

| Utilization % | 75% to 80% (based on 36 lines installed) |

| Capital Expenditures | $25 - $30 million |

Conference Call and Webcast Information

TPI Composites will host an investor conference call this afternoon, Thursday, February 22nd, at 5:00 pm ET. Interested parties are invited to listen to the conference call which can be accessed live over the phone by dialing 1-844-825-9789, or for international callers, 1-412-317-5180. A replay will be available two hours after the call and can be accessed by dialing 1-844-512-2921, or for international callers, 1-412-317-6671. The passcode for the live call and the replay is 10185683. The replay will be available until March 7, 2024. Interested investors and other parties may also listen to a simultaneous webcast of the conference call by logging onto the Investors section of the Company’s website at www.tpicomposites.com. The online replay will be available for a limited time beginning immediately following the call.

About TPI Composites, Inc.

TPI Composites, Inc. is a global company focused on innovative and sustainable solutions to decarbonize and electrify the world. TPI delivers high-quality, cost-effective composite solutions through long-term relationships with leading OEMs in the wind and automotive markets. TPI is headquartered in Scottsdale, Arizona and operates factories in the U.S., Mexico, Türkiye and India. TPI operates additional engineering development centers in Denmark and Germany and global service training centers in the U.S. and Spain.

Forward-Looking Statements

This release contains forward-looking statements which are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements, among other things, concerning: growth of the wind energy and electric vehicle markets and our addressable markets for our products and services; effects on our financial statements and our financial outlook; our business strategy, including anticipated trends and developments in and management plans for our business and the wind industry and other markets in which we operate; competition; future financial results, operating results, revenues, gross margin, operating expenses, profitability, products, projected costs, warranties, our ability to improve our operating margins, and capital expenditures. These forward-looking statements are often characterized by the use of words such as “estimate,” “expect,” “anticipate,” “project,” “plan,” “intend,” “seek,” “believe,” “forecast,” “foresee,” “likely,” “may,” “should,” “goal,” “target,” “might,” “will,” “could,” “predict,” “continue” and the negative or plural of these words and other comparable terminology. Forward-looking statements are only predictions based on our current expectations and our projections about future events. You should not place undue reliance on these forward-looking statements. We undertake no obligation to update any of these forward-looking statements for any reason. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from those expressed or implied by these statements. These factors include, but are not limited to, the matters discussed in “Risk Factors,” in our Annual Report on Form 10-K and other reports that we will file with the SEC.

Non-GAAP Definitions

This press release includes unaudited non-GAAP financial measures, including EBITDA, adjusted EBITDA, net cash (debt) and free cash flow. We define EBITDA, a non-GAAP financial measure, as net income or loss from continuing operations plus interest expense net, income taxes, depreciation and amortization, preferred stock dividends and accretion less gain on extinguishment on series A preferred stock. We define adjusted EBITDA as EBITDA plus any share-based compensation expense, plus or minus any foreign currency losses or income, plus or minus any losses or gains from the sale of assets and asset impairments, plus any restructuring charges. We define net cash (debt) as the total unrestricted cash and cash equivalents less the total principal amount of debt outstanding. We define free cash flow as net cash flow from operating activities less capital expenditures. We present non-GAAP measures when we believe that the additional information is useful and meaningful to investors. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non-GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP.

We provide forward-looking statements in the form of guidance in our quarterly earnings releases and during our quarterly earnings conference calls. This guidance is provided on a non-GAAP basis and cannot be reconciled to the closest GAAP measures without unreasonable effort because of the unpredictability of the amounts and timing of events affecting the items we exclude from non-GAAP measures. For example, stock-based compensation is unpredictable for our performance-based awards, which can fluctuate significantly based on current expectations of future achievement of performance-based targets. Amortization of intangible assets and restructuring costs are all impacted by the timing and size of potential future actions, which are difficult to predict. In addition, from time to time, we exclude certain items that occur infrequently, which are also inherently difficult to predict and estimate. It is also difficult to predict the tax effect of the items we exclude and to estimate certain discrete tax items, like the resolution of tax audits or changes to tax laws. As such, the costs that are being excluded from non-GAAP guidance are difficult to predict and a reconciliation or a range of results could lead to disclosure that would be imprecise or potentially misleading. Material changes to any one of the exclusions could have a significant effect on our guidance and future GAAP results. See the Reconciliation of Non-GAAP Measures for a reconciliation of certain non-GAAP financial measures to the comparable GAAP measures.

Investor Relations

480-315-8742

Investors@TPIComposites.com

| TPI COMPOSITES, INC. AND SUBSIDIARIES | |||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||||||

| (UNAUDITED) | |||||||||||||||

| Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||

| (in thousands, except per share data) | 2023 | 2022 | 2023 | 2022 | |||||||||||

| Net sales | $ | 296,986 | $ | 402,276 | $ | 1,455,183 | $ | 1,522,741 | |||||||

| Cost of sales | 317,107 | 383,060 | 1,520,974 | 1,482,428 | |||||||||||

| Startup and transition costs | 11,583 | 3,251 | 21,757 | 25,668 | |||||||||||

| Total cost of goods sold | 328,690 | 386,311 | 1,542,731 | 1,508,096 | |||||||||||

| Gross profit (loss) | (31,704 | ) | 15,965 | (87,548 | ) | 14,645 | |||||||||

| General and administrative expenses | 6,623 | 9,771 | 49,133 | 32,349 | |||||||||||

| Loss on sale of assets and asset impairments | 6,593 | 3,700 | 21,862 | 9,842 | |||||||||||

| Restructuring charges, net | 1,560 | 653 | 5,050 | 263 | |||||||||||

| Income (loss) from continuing operations | (46,480 | ) | 1,841 | (163,593 | ) | (27,809 | ) | ||||||||

| Other income (expense): | |||||||||||||||

| Interest expense, net | (6,078 | ) | (2,157 | ) | (12,112 | ) | (5,029 | ) | |||||||

| Foreign currency income (loss) | (1,884 | ) | (9,735 | ) | (5,162 | ) | 4,571 | ||||||||

| Miscellaneous income | 430 | 1,333 | 1,976 | 2,330 | |||||||||||

| Total other income (expense) | (7,532 | ) | (10,559 | ) | (15,298 | ) | 1,872 | ||||||||

| Loss before income taxes | (54,012 | ) | (8,718 | ) | (178,891 | ) | (25,937 | ) | |||||||

| Income tax provision | (5,357 | ) | (17,935 | ) | (17,562 | ) | (29,613 | ) | |||||||

| Net loss from continuing operations | (59,369 | ) | (26,653 | ) | (196,453 | ) | (55,550 | ) | |||||||

| Preferred stock dividends and accretion | (11,651 | ) | (15,245 | ) | (58,453 | ) | (58,903 | ) | |||||||

| Gain on extinguishment of Series A Preferred Stock | 82,620 | — | 82,620 | — | |||||||||||

| Net income (loss) from continuing operations attributable to common stockholders | 11,600 | (41,898 | ) | (172,286 | ) | (114,453 | ) | ||||||||

| Net income (loss) from discontinued operations | 1,769 | (15,875 | ) | (5,326 | ) | (9,755 | ) | ||||||||

| Net income (loss) attributable to common stockholders | $ | 13,369 | $ | (57,773 | ) | $ | (177,612 | ) | $ | (124,208 | ) | ||||

| Weighted-average common shares outstanding: | |||||||||||||||

| Basic | 43,334 | 41,983 | 42,671 | 41,959 | |||||||||||

| Diluted | 43,420 | 41,983 | 42,671 | 41,959 | |||||||||||

| Net income (loss) from continuing operations per common share: | |||||||||||||||

| Basic | $ | 0.27 | $ | (1.00 | ) | $ | (4.04 | ) | $ | (2.73 | ) | ||||

| Diluted | $ | 0.27 | $ | (1.00 | ) | $ | (4.04 | ) | $ | (2.73 | ) | ||||

| Net income (loss) from discontinued operations per common share: | |||||||||||||||

| Basic | $ | 0.04 | $ | (0.38 | ) | $ | (0.12 | ) | $ | (0.23 | ) | ||||

| Diluted | $ | 0.04 | $ | (0.38 | ) | $ | (0.12 | ) | $ | (0.23 | ) | ||||

| Net income (loss) per common share: | |||||||||||||||

| Basic | $ | 0.31 | $ | (1.38 | ) | $ | (4.16 | ) | $ | (2.96 | ) | ||||

| Diluted | $ | 0.31 | $ | (1.38 | ) | $ | (4.16 | ) | $ | (2.96 | ) | ||||

| Non-GAAP Measures (unaudited): | |||||||||||||||

| EBITDA | $ | (38,863 | ) | $ | 2,881 | $ | (127,910 | ) | $ | 17,864 | |||||

| Adjusted EBITDA | $ | (28,053 | ) | $ | 21,151 | $ | (85,920 | ) | $ | 37,857 | |||||

| TPI COMPOSITES, INC. AND SUBSIDIARIES | ||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | ||||||

| (UNAUDITED) | ||||||

| December 31, | ||||||

| (in thousands) | 2023 | 2022 | ||||

| Assets | ||||||

| Current assets: | ||||||

| Cash and cash equivalents | $ | 161,059 | $ | 133,546 | ||

| Restricted cash | 10,838 | 9,854 | ||||

| Accounts receivable | 138,029 | 184,809 | ||||

| Contract assets | 112,237 | 215,939 | ||||

| Prepaid expenses | 17,621 | 29,119 | ||||

| Other current assets | 34,564 | 26,052 | ||||

| Inventories | 9,420 | 10,661 | ||||

| Assets held for sale | 17,787 | — | ||||

| Current assets of discontinued operations | 1,520 | 35,182 | ||||

| Total current assets | 503,075 | 645,162 | ||||

| Noncurrent assets: | ||||||

| Property, plant, and equipment, net | 128,808 | 136,841 | ||||

| Operating lease right of use assets | 136,124 | 152,312 | ||||

| Other noncurrent assets | 36,073 | 27,861 | ||||

| Total assets | $ | 804,080 | $ | 962,176 | ||

| Liabilities, Mezzanine Equity and Stockholders' Equity | ||||||

| Current liabilities: | ||||||

| Accounts payable and accrued expenses | $ | 227,723 | $ | 280,499 | ||

| Accrued warranty | 37,483 | 22,347 | ||||

| Current maturities of long-term debt | 70,465 | 59,975 | ||||

| Current operating lease liabilities | 22,017 | 22,220 | ||||

| Contract liabilities | 24,021 | 17,100 | ||||

| Liabilities held for sale | 1,897 | - | ||||

| Current liabilities of discontinued operations | 2,815 | 54,440 | ||||

| Total current liabilities | 386,421 | 456,581 | ||||

| Noncurrent liabilities: | ||||||

| Long-term debt, net of current maturities | 414,728 | 1,198 | ||||

| Noncurrent operating lease liabilities | 117,133 | 133,363 | ||||

| Other noncurrent liabilities | 8,102 | 10,670 | ||||

| Total liabilities | 926,384 | 601,812 | ||||

| Total mezzanine equity | — | 309,877 | ||||

| Total stockholders' (deficit) equity | (122,304 | ) | 50,487 | |||

| Total liabilities, mezzanine equity and stockholders' equity | $ | 804,080 | $ | 962,176 | ||

| Non-GAAP Measure (unaudited): | ||||||

| Net cash (debt) | $ | (323,218 | ) | $ | 82,042 | |

| TPI COMPOSITES, INC. AND SUBSIDIARIES | |||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||||||

| (UNAUDITED) | |||||||||||||||

| Three Months Ended December 31, |

Year Ended December 31, |

||||||||||||||

| (in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||

| Net cash provided by (used in) operating activities | $ | 4,936 | $ | 22,823 | $ | (80,972 | ) | $ | (62,272 | ) | |||||

| Net cash used in investing activities | (20,291 | ) | (7,340 | ) | (23,301 | ) | (18,832 | ) | |||||||

| Net cash provided by (used in) financing activities | 12,965 | (1,732 | ) | 121,994 | (14,597 | ) | |||||||||

| Impact of foreign exchange rates on cash, cash equivalents and restricted cash | 1,323 | 359 | 2,023 | (3,448 | ) | ||||||||||

| Cash, cash equivalents and restricted cash, beginning of period | 173,880 | 138,959 | 153,069 | 252,218 | |||||||||||

| Cash, cash equivalents and restricted cash, end of period | $ | 172,813 | $ | 153,069 | $ | 172,813 | $ | 153,069 | |||||||

| Non-GAAP Measure (unaudited): | |||||||||||||||

| Free cash flow | $ | (15,355 | ) | $ | 15,483 | $ | (117,109 | ) | $ | (81,104 | ) | ||||

| TPI COMPOSITES, INC. AND SUBSIDIARIES | |||||||||||||||

| RECONCILIATION OF NON-GAAP MEASURES | |||||||||||||||

| (UNAUDITED) | |||||||||||||||

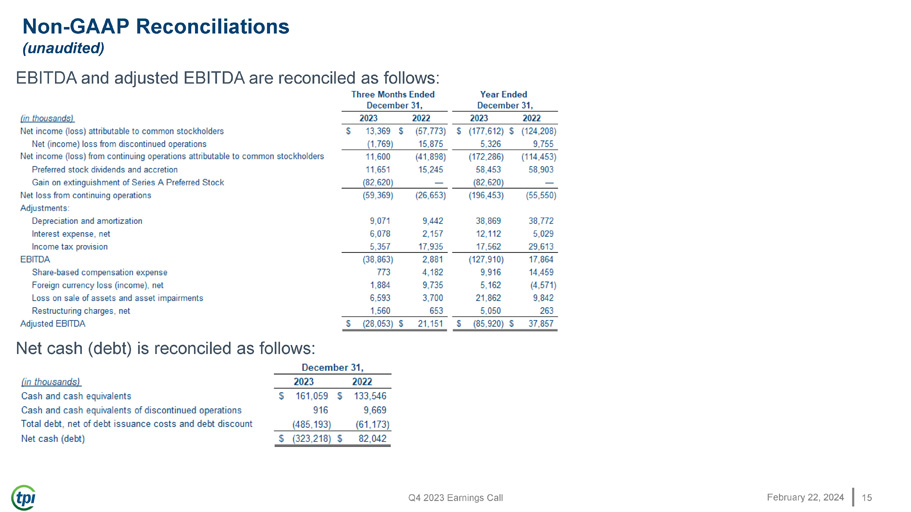

| EBITDA and adjusted EBITDA are reconciled as follows: | Three Months Ended December 31, |

Year Ended December 31, |

|||||||||||||

| (in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||

| Net income (loss) attributable to common stockholders | $ | 13,369 | $ | (57,773 | ) | $ | (177,612 | ) | $ | (124,208 | ) | ||||

| Net (income) loss from discontinued operations | (1,769 | ) | 15,875 | 5,326 | 9,755 | ||||||||||

| Net income (loss) from continuing operations attributable to common stockholders | 11,600 | (41,898 | ) | (172,286 | ) | (114,453 | ) | ||||||||

| Preferred stock dividends and accretion | 11,651 | 15,245 | 58,453 | 58,903 | |||||||||||

| Gain on extinguishment of Series A Preferred Stock | (82,620 | ) | — | (82,620 | ) | — | |||||||||

| Net loss from continuing operations | (59,369 | ) | (26,653 | ) | (196,453 | ) | (55,550 | ) | |||||||

| Adjustments: | |||||||||||||||

| Depreciation and amortization | 9,071 | 9,442 | 38,869 | 38,772 | |||||||||||

| Interest expense, net | 6,078 | 2,157 | 12,112 | 5,029 | |||||||||||

| Income tax provision | 5,357 | 17,935 | 17,562 | 29,613 | |||||||||||

| EBITDA | (38,863 | ) | 2,881 | (127,910 | ) | 17,864 | |||||||||

| Share-based compensation expense | 773 | 4,182 | 9,916 | 14,459 | |||||||||||

| Foreign currency loss (income), net | 1,884 | 9,735 | 5,162 | (4,571 | ) | ||||||||||

| Loss on sale of assets and asset impairments | 6,593 | 3,700 | 21,862 | 9,842 | |||||||||||

| Restructuring charges, net | 1,560 | 653 | 5,050 | 263 | |||||||||||

| Adjusted EBITDA | $ | (28,053 | ) | $ | 21,151 | $ | (85,920 | ) | $ | 37,857 | |||||

| Free cash flow is reconciled as follows: | Three Months Ended December 31, |

Year Ended December 31, |

|||||||||||||

| (in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||

| Net cash provided by (used in) operating activities | $ | 4,936 | $ | 22,823 | $ | (80,972 | ) | $ | (62,272 | ) | |||||

| Capital expenditures | (20,291 | ) | (7,340 | ) | (36,137 | ) | (18,832 | ) | |||||||

| Free cash flow | $ | (15,355 | ) | $ | 15,483 | $ | (117,109 | ) | $ | (81,104 | ) | ||||

| Net cash is reconciled as follows: | December 31, | ||||||||||||||

| (in thousands) | 2023 | 2022 | |||||||||||||

| Cash and cash equivalents | $ | 161,059 | $ | 133,546 | |||||||||||

| Cash and cash equivalents of discontinued operations | 916 | 9,669 | |||||||||||||

| Total debt, net of debt issuance costs and debt discount | (485,193 | ) | (61,173 | ) | |||||||||||

| Net cash (debt) | $ | (323,218 | ) | $ | 82,042 | ||||||||||

Exhibit 99.2

Q4 2023 Earnings Call February 22, 2024

February 22, 2024 Q4 2023 Earnings Call Legal Disclaimer This presentation contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amende d, and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). All statements other than statements of historical facts contained in this presentation, including statements regarding our future results o f o perations and financial position, business strategy and plans and objectives of management for future operations, are forward - looking statements. In many cases, you can identify forward - looking statements by terms such as “may,” “should,” “expect s,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. Forward - looking statements contained in this release include, but are not limited to, statements about: i . competition from other wind blade and wind blade turbine manufacturers; ii. the discovery of defects in our products and our ability to estimate the future cost of warr ant y campaigns; iii. the current status of the wind energy market and our addressable market; iv. our ability to absorb or mitigate the impact of price increases in resin, carbon reinforcements (or fiber), other raw materials and related logistics cos ts that we use to produce our products; v. our ability to absorb or mitigate the impact of wage inflation in the countries in which we operate; vi. our ability to procure adequate supplies of raw materials and components to fulfill our wind blade v olu me commitments to our customers; vii. the potential impact of the increasing prevalence of auction - based tenders in the wind energy market and increased competition from solar energy on our gross margins and overall financial performance; vi ii. our future financial performance, including our net sales, cost of goods sold, gross profit or gross margin, operating expenses, ability to generate positive cash flow and ability to achieve or maintain profitability; ix. changes in d ome stic or international government or regulatory policy, including without limitation, changes in trade policy and energy policy; x. changes in global economic trends and uncertainty, geopolitical risks, and demand or supply disruptions from globa l e vents; xi. changes in macroeconomic and market conditions, including the potential impact of any pandemic, risk of recession, rising interest rates and inflation, supply chain constraints, commodity prices and exchange rates, and the imp act of such changes on our business and results of operations; xii. the sufficiency of our cash and cash equivalents to meet our liquidity needs; xiii. the increasing cost and availability of additional capital, should such capital be needed; xi v. our ability to attract and retain customers for our products, and to optimize product pricing; xv. our ability to effectively manage our growth strategy and future expenses, including our startup and transition costs; xvi. our ability to successfully exp and in our existing wind energy markets and into new international wind energy markets, including our ability to expand our field service inspection and repair services business; xvii. our ability to keep up with market changes and innova tio ns; xviii. our ability to successfully open new manufacturing facilities and expand existing facilities on time and on budget; xix. the impact of the pace of new product and wind blade model introductions on our business and our results of oper ati ons; xx. our ability to identify and execute a strategic alternative to enable the growth of our automotive business; xxi. our ability to maintain, protect and enhance our intellectual property; xxii. our ability to comply with exist ing , modified, or new laws and regulations applying to our business, including the imposition of new taxes, duties, or similar assessments on our products; xxiii. the attraction and retention of qualified associates and key personnel; xxiv. our ability to maintain good working relationships with our associates, and avoid labor disruptions, strikes and other disputes with labor unions that represent certain of our associates; and xxv. the potential impact of one or more of our customers becoming ba nkrupt or insolvent or experiencing other financial problems. These forward - looking statements are only predictions. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainti es and other important factors that may cause our actual results, levels of activity, performance or achievements to materially differ from any future results, levels of activity, performance or achievements expressed or implied by these forw ard - looking statements. Because forward - looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward - looking statements as guarantees of future events. Further information on the factors, risks and uncertainties that could affect our financial results and the forward - looking statements in this presentation are included in our filings with the Securities and Exchange Commission and will be i ncl uded in subsequent periodic and current reports we make with the Securities and Exchange Commission from time to time, including in our Annual Report on Form 10 - K for the year ended December 31, 2023, filed with the Securities and E xchange Commission. The forward - looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward - looking statements at some point in the future, we undertake no obligation to update any forward - looking statement to reflect events or developments after the date on which the statement is made or to reflect the occurrence of unanticipated events except to the extent required by applicable law. You should, therefore, not rely on these forward - looking s tatements as representing our views as of any date after the date of this presentation. Our forward - looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investme nts we may make. This presentation includes unaudited non - GAAP financial measures including EBITDA, adjusted EBITDA, net cash (debt) and free cas h flow. We define EBITDA, a non - GAAP financial measure, as net income or loss from continuing operations plus interest expense net, income taxes, depreciation and amortization, preferred stock dividends and accretion le ss gain on extinguishment on series A preferred stock. We define adjusted EBITDA as EBITDA plus any share - based compensation expense, plus or minus any foreign currency losses or income, plus or minus any losses or gains from the s ale of assets and asset impairments, plus any restructuring charges. We define net cash (debt) as total unrestricted cash and cash equivalents less the total principal amount of debt outstanding. We define free cash flow as net c ash flow from operating activities less capital expenditures. We present non - GAAP measures when we believe that the additional information is useful and meaningful to investors. Non - GAAP financial measures do not have any standardized meani ng and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non - GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation fr om, the financial measures reported in accordance with GAAP. See the Appendix for the reconciliations of certain non - GAAP financial measures to the comparable GAAP measures. This presentation also contains estimates and other information concerning our industry that are based on industry publicatio ns, surveys and forecasts. This information involves a number of assumptions and limitations, and we have not independently verified the accuracy or completeness of the information 2 Q4 2023 Earnings Call February 22, 2024 Agenda 3 • Q4 2023 Highlights and Business Update • Q4 2023 Financial Highlights and 2024 Guidance • Wrap Up • Q&A • Appendix – Non - GAAP Financial Information

February 22, 2024 Q4 2023 Highlights and Business Update 4

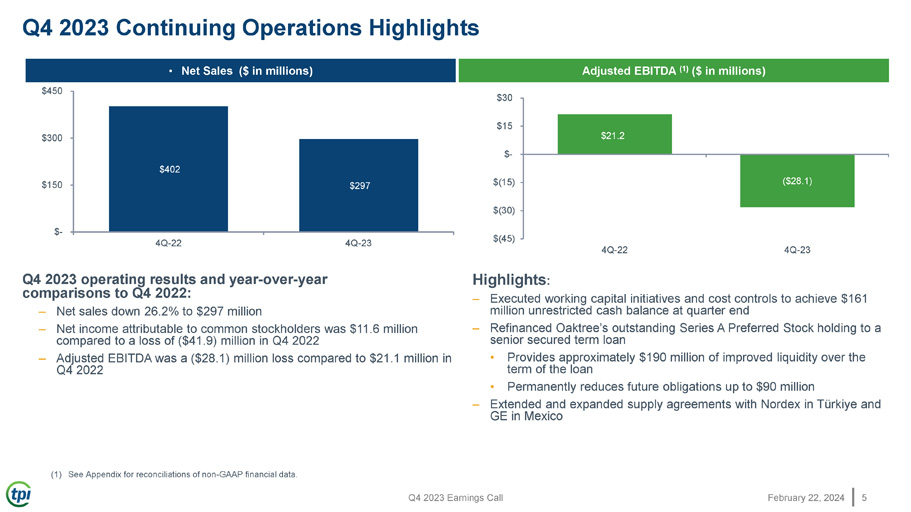

February 22, 2024 Q4 2023 Earnings Call Q4 2023 Continuing Operations Highlights 5 • Net Sales ($ in millions) Q4 2023 operating results and year - over - year comparisons to Q4 2022: – Net sales down 26.2% to $297 million – Net income attributable to common stockholders was $11.6 million compared to a loss of ($41.9) million in Q4 2022 – Adjusted EBITDA was a ($28.1) million loss compared to $21.1 million in Q4 2022 Highlights : – Executed working capital initiatives and cost controls to achieve $161 million unrestricted cash balance at quarter end – Refinanced Oaktree’s outstanding Series A Preferred Stock holding to a senior secured term loan • Provides approximately $190 million of improved liquidity over the term of the loan • Permanently reduces future obligations up to $90 million – Extended and expanded supply agreements with Nordex in Türkiye and GE in Mexico (1) See Appendix for reconciliations of non - GAAP financial data. $402 $297 $- $150 $300 $450 4Q-22 4Q-23 Adjusted EBITDA (1) ($ in millions) $21.2 ($28.1) $(45) $(30) $(15) $- $15 $30 4Q-22 4Q-23 February 22, 2024 Q4 2023 Earnings Call Business Update 6 • Global Operations • Global Service • Automotive • Supply Chain • Wind Market

February 22, 2024 Q4 2023 Financial Highlights and 2024 Guidance 7

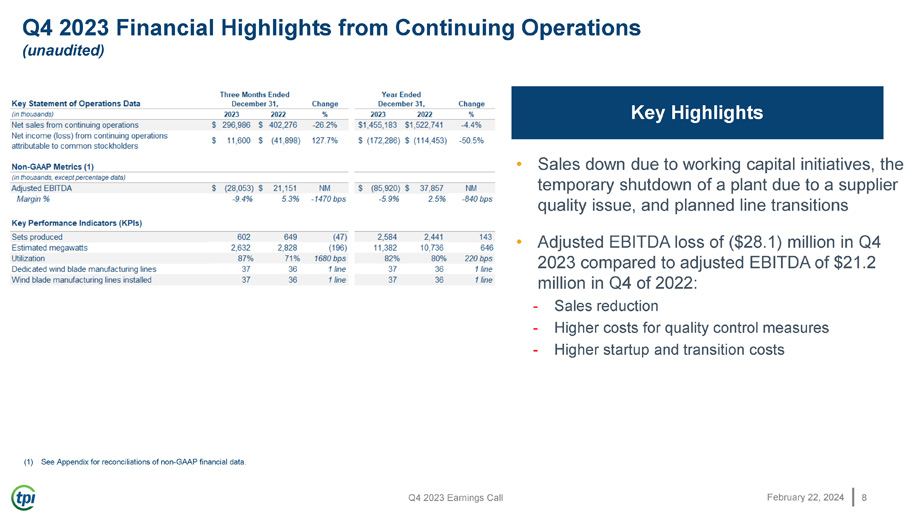

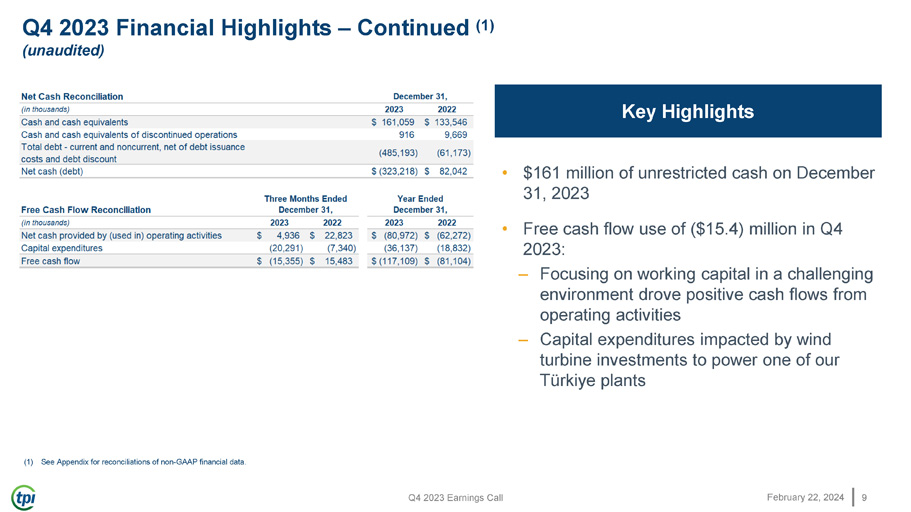

Q4 2023 Earnings Call February 22, 2024 Q4 2023 Financial Highlights from Continuing Operations (unaudited) 8 (1) See Appendix for reconciliations of non - GAAP financial data. Key Highlights • Sales down due to working capital initiatives, the temporary shutdown of a plant due to a supplier quality issue, and planned line transitions • Adjusted EBITDA loss of ($28.1) million in Q4 2023 compared to adjusted EBITDA of $21.2 million in Q4 of 2022: - Sales reduction - Higher costs for quality control measures - Higher startup and transition costs Q4 2023 Earnings Call February 22, 2024 Q4 2023 Financial Highlights – Continued (1) (unaudited) 9 Key Highlights • $161 million of unrestricted cash on December 31, 2023 • Free cash flow use of ($15.4) million in Q4 2023: – Focusing on working capital in a challenging environment drove positive cash flows from operating activities – Capital expenditures impacted by wind turbine investments to power one of our Türkiye plants (1) See Appendix for reconciliations of non - GAAP financial data.

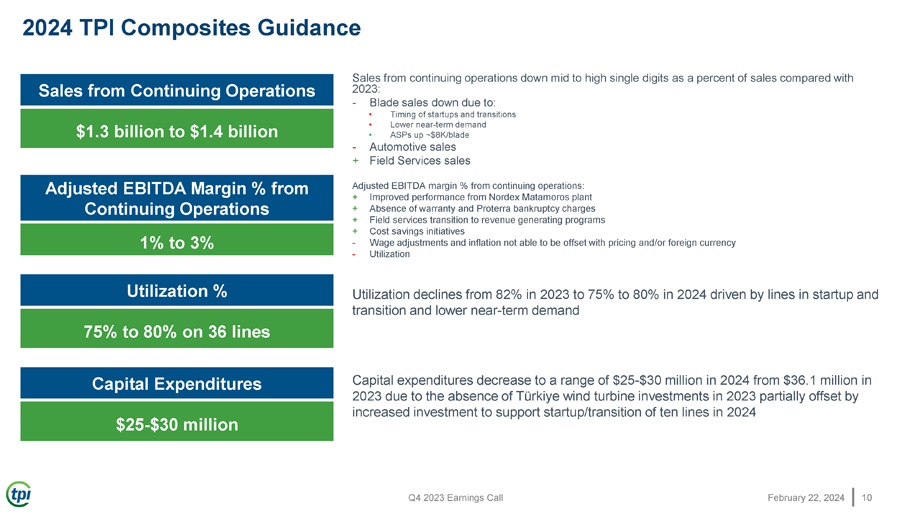

February 22, 2024 Q4 2023 Earnings Call 2024 TPI Composites Guidance 10 Sales from continuing operations down mid to high single digits as a percent of sales compared with 2023: - Blade sales down due to: • Timing of startups and transitions • Lower near - term demand • ASPs up ~$8K/blade - Automotive sales + Field Services sales Sales from Continuing Operations $1.3 billion to $1.4 billion Adjusted EBITDA Margin % from Continuing Operations 1% to 3% Capital Expenditures $25 - $30 million Adjusted EBITDA margin % from continuing operations: + Improved performance from Nordex Matamoros plant + Absence of warranty and Proterra bankruptcy charges + Field services transition to revenue generating programs + Cost savings initiatives - Wage adjustments and inflation not able to be offset with pricing and/or foreign currency - Utilization Capital expenditures decrease to a range of $25 - $30 million in 2024 from $36.1 million in 2023 due to the absence of Türkiye wind turbine investments in 2023 partially offset by increased investment to support startup/transition of ten lines in 2024 Utilization % 75% to 80% on 36 lines Utilization declines from 82% in 2023 to 75% to 80% in 2024 driven by lines in startup and transition and lower near - term demand February 22, 2024 Wrap Up 11

Q4 2023 Earnings Call February 22, 2024 Wrap Up 12 • Quality improvement initiatives have been successful • Focusing on what we can control as we manage cash flow and our business through short - term challenges • Remain very bullish on the energy transition • Positioned to capitalize on the significant growth the industry expects in the coming years • Return to positive Adjusted EBITDA in 2024 • Volume improves in second half of 2024 positioning us for Adjusted EBITDA levels north of $100 million in 2025 • Thanks to our associates for their commitment and dedication to TPI and our mission to decarbonize and electrify February 22, 2024 Q&A 13

February 22, 2024 Appendix – Non - GAAP Financial Information This presentation includes unaudited non - GAAP financial measures including EBITDA, adjusted EBITDA, net cash (debt) and free cash flow. We define EBITDA, a non - GAAP financial measure, as net income or loss from continuing operations plus interest expense net, income taxes, depreciation and amortization, preferred stock dividends and accretion less gain on extinguishment on series A preferred stock. We define adjusted EBITDA as EBITDA plus any share - based compensation expense, plus or minus any foreign currency losses or income, plus or minus any losses or gains from the sale of assets and asset impairments, plus any restructuring charges. . We define net cash (debt) as total unrestricted cash and cash equivalents less the total principal amount of debt outstanding. We define free cash flow as net cash flow from operating activities less capital expenditures. We present non - GAAP measures when we believe that the additional information is useful and meaningful to investors. Non - GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non - GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. We provide forward - looking statements in the form of guidance in our quarterly earnings releases and during our quarterly earnings conference calls. This guidance is provided on a non - GAAP basis and cannot be reconciled to the closest GAAP measures without unreasonable effort because of the unpredictability of the amounts and timing of events affecting the items we exclude from non - GAAP measures. For example, stock - based compensation is unpredictable for our performance - based awards, which can fluctuate significantly based on current expectations of future achievement of performance - based targets. Amortization of intangible assets and restructuring costs are all impacted by the timing and size of potential future actions, which are difficult to predict. In addition, from time to time, we exclude certain items th at occur infrequently, which are also inherently difficult to predict and estimate. It is also difficult to predict the tax effe ct of the items we exclude and to estimate certain discrete tax items, like the resolution of tax audits or changes to tax laws. As such, the costs that are being excluded from non - GAAP guidance are difficult to predict and a reconciliation or a range of results could lead to disclosure that would be imprecise or potentially misleading. Material changes to any one of the exclusions could have a significant effect on our guidance and future GAAP results. See below for a reconciliation of certain non - GAAP financial measures to the comparable GAAP measures. 14 Q4 2023 Earnings Call February 22, 2024 EBITDA and adjusted EBITDA are reconciled as follows: Net cash (debt) is reconciled as follows: Non - GAAP Reconciliations (unaudited) 15