UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For: May 16, 2023

MAG Silver Corp.

(SEC File No. 0-50437)

#770 – 800 West Pender Street, Vancouver BC, V6C 2V6, CANADA

Address of Principal Executive Office

| The registrant files annual reports under cover: Form 20-F ☐ Form 40-F ☒ |

| Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐ |

| Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐ |

| Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: Yes ☐ No ☒ |

| If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. |

|

Exhibits |

|

| 99.1 | Notice of Meeting |

| 99.2 | Management Information Circular |

| 99.3 | Proxy |

| 99.4 | Voting Instruction Form |

| Date: May 16, 2023 | MAG Silver Corp. | |

| “George Paspalas” | ||

| GEORGE PASPALAS | ||

| President & CEO |

Exhibit 99.1

How to Obtain Paper Copies of the Proxy Materials Securityholders may request to receive paper copies of the current meeting materials by mail at no cost. Requests for paper copies may be made using your Control Number as it appears on your enclosed Voting Instruction Form or Proxy. To ensure you receive the materials in advance of the voting deadline and meeting date, all requests must be received no later than June 16, 2023. If you do request the current materials, please note that another Voting Instruction Form/Proxy will not be sent; please retain your current one for voting purposes. For Holders with a 15 digit Control Number: For Holders with a 16 digit Control Number: Request materials by calling Toll Free, within North America - 1 - 866 - 962 - 0498 or direct, from Outside of North America - (514) 982 - 8716 and entering your control number as indicated on your Voting Instruction Form or Proxy. To obtain paper copies of the materials after the meeting date, please contact 1 - 866 - 630 - 1399. Request materials by calling Toll Free, within North America - 1 - 877 - 907 - 7643 or direct, from Outside of North America - 1 - 303 - 562 - 9305 (English) or 1 - 303 - 562 - 9306 (French) and entering your control number as indicated on your Voting Instruction Form. To obtain paper copies of the materials after the meeting date, please contact 1 - 866 - 630 - 1399. 01X0IA Fold Fold Have questions about this notice? Call the Toll Free Number below or scan the QR code to find out more . Toll Free 1 - 866 - 964 - 0492 www.computershare.com/ noticeandaccess Notice of Availability of Proxy Materials for MAG SILVER CORP. Annual General and Special Meeting Meeting Date and Location : When: June 26, 2023 9:00 am (Pacific Time) Where: Online at https://meetnow.global/MYW6SYQ You are receiving this notice to advise that the proxy materials for the above noted securityholders’ meeting are available on the Internet. This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We remind you to access and review all of the important information contained in the information circular and other proxy materials before voting. The information circular and other relevant materials are available at: https://magsilver.com/investors/annual - general - meeting/ OR www.sedar.com Voting PLEASE NOTE – YOU CANNOT VOTE BY RETURNING THIS NOTICE.

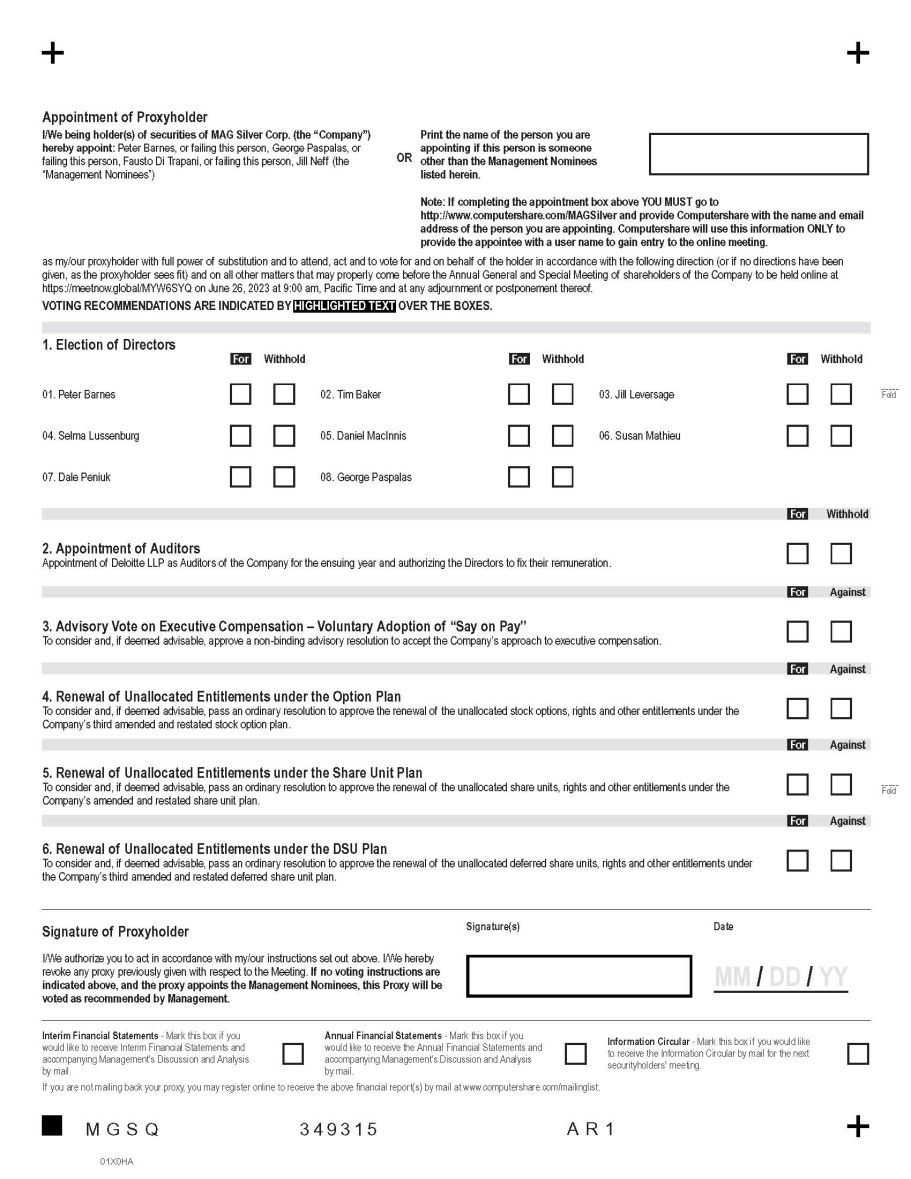

To vote your securities you must vote using the methods reflected on your enclosed Voting Instruction Form or Proxy. PLEASE VIEW THE INFORMATION CIRCULAR PRIOR TO VOTING 01X0JA Fold Fold Securityholder Meeting Notice The resolutions to be voted on at the meeting are listed below along with the Sections within the Information Circular where disclosure regarding the matter can be found. 1. Election of Directors - Election of Directors 2. Appointment of Auditors - Appointment and Remuneration of Auditor 3. Advisory Vote on Executive Compensation – Voluntary Adoption of “Say on Pay” - Advisory Vote on Executive Compensation – Voluntary Adoption of “Say on Pay” 4. Renewal of Unallocated Entitlements under the Option Plan - Renewal of Unallocated Entitlements under the Option Plan 5. Renewal of Unallocated Entitlements under the Share Unit Plan - Renewal of Unallocated Entitlements under the Share Unit Plan 6. Renewal of Unallocated Entitlements under the DSU Plan - Renewal of Unallocated Entitlements under the DSU Plan Annual Financial statement delivery • No Annual Report (or Annual Financial Statements) is (are) included in this mailing

Exhibit 99.2

THIS PAGE INTENTIONALLY LEFT BLANK

|

MAG SILVER CORP.

Suite 770, 800 W. Pender St., Vancouver, BC, Canada V6C 2V6 Tel: 604-630-1399 Fax: 604-681-0894 www.magsilver.com

|

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders:

The mining industry faced a number of challenges in 2022, including the continued effects of the COVID-19 pandemic, global cost inflation and ongoing global and regional supply constraints. Despite these challenges, 2022 marked a breakthrough year for MAG, with the long-anticipated connection of the Juanicipio plant to the national electrical grid and the commencement of commissioning of what is arguably one of the most promising silver assets globally. Commissioning and ramp up of the plant at Juanicipio is going smoothly, with throughput consistently increasing and the metallurgical performance beginning to align with our expectations. We were very pleased with the shipment of Juanicipio’s first commercial concentrates in March 2023, ushering in the next chapter for Juanicipio as it graduates to a low-cost, Tier-1 silver producer.

Juanicipio (MAG 44%; Fresnillo plc (“Fresnillo”) 56% and Project Operator) is our cornerstone asset. During 2021 and 2022, we achieved several important milestones by processing mineralized material from the Juanicipio underground through Fresnillo's adjacent Fresnillo and Saucito processing plants. These accomplishments have allowed us to:

| i. | Mitigate metallurgical risks before commissioning the Juanicipio processing facility in 2023. |

| ii. | Optimize the reagent mix and flotation process through the Saucito processing plant, which resembles the Juanicipio plant in terms of flowsheet design. |

| iii. | Confirm the consistency of the Valdecañas Bonanza Zone. |

| iv. | Generate incremental operating cash flow to offset the need for cash injections from MAG and Fresnillo. |

Despite Juanicipio generating cash from this “side-stream” processing, legislative changes and the associated requirements to internalize contractor workforces, and to bring forward sustaining capital not expected to be required until later in the mine life, continued to strain Juanicipio’s working capital as it awaited the electrical connection. This resulted in the joint venture partners recently contributing approximately US$75 million to Juanicipio (MAG’s share US$33 million) allowing it to continue development underground and purchase productive equipment to comply with the legislative changes. Thanks to our supportive shareholders, MAG was able to raise US$42 million via a short form MJDS prospectus offering, maintaining the Company’s balance sheet integrity and allowing it to remain debt free and in a great position through to the commercial production milestone expected later this year.

While we celebrate the success of Juanicipio ramping up and becoming a mining complex, we remain very enthusiastic in the greenfield potential at Juanicipio and believe there is substantially more exploration potential yet to be discovered, as only 5% of the Juanicipio joint venture property has been explored. We are currently securing exploration permits to test two other upwelling zones that appear similar to Valdecañas.

At the Deer Trail Project in Utah, while still an early-stage exploration project, we are excited about the significant potential of the project. We continued advancing the drill program, which has returned some very encouraging mineralized intercepts in Phase I and Phase II of drilling. Notably, the discovery of the Carissa Zone at Deer Trail continues to support our “hub and spoke” thesis, with follow-up drilling planned for 2023.

MAG also concluded the acquisition of Gatling Exploration Inc. (“Gatling”) in 2022. The integration of Gatling into our management team and business has been seamless, and we are looking forward to exploring more of the Larder Project area within this prolific jurisdiction using some different geological thought processes, aiming to make a high-grade discovery. MAG remains well capitalized with the recently concluded flow-through financing and will be commencing a drilling program at the Larder Project this summer.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

Throughout the year, we maintained focus on caring – one of MAG’s core values – continuing to prioritize the health and safety of our employees, contractors and nearby communities. Our inaugural Sustainability Report was published in 2022, underscoring MAG’s fundamental commitment to transparency with its stakeholders while providing a comprehensive overview of the Company's ESG commitments, practices, and performance.

As we continue to look at Board refreshment, we are very conscious of the skills and experience required as we transition to a producer, whilst maintaining our commitment to gender and other aspects of diversity in candidate selection.

We also take great pride in our talented and experienced leadership team, which we consider one of MAG's greatest assets. With over 200 years of combined experience in the mining industry, our strengthened leadership team is well-equipped to execute our strategy of science-based exploration while maintaining strong oversight of our cornerstone asset, Juanicipio, and extracting the best value for our shareholders and stakeholders alike.

Despite the industry-wide and MAG specific challenges faced in 2022, we remained focused on value creation and advancing key objectives to deliver on our strategy of fostering and growing a portfolio that delivers leading returns for our shareholders. We are encouraged by our progress throughout 2022, and we look forward to reporting further progress in the months and years ahead.

On behalf of our Board of Directors and the entire MAG team, we thank you for your continued support.

Sincerely,

| “Peter Barnes” | & | “George Paspalas” |

| Board Chair President | Chief Executive Officer |

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING

NOTICE IS HEREBY GIVEN that the annual general and special meeting (the “Meeting”) of shareholders of MAG Silver Corp. (the “Company” or “MAG”) will be held at 9:00 a.m. (Pacific time) on Monday, June 26, 2023 for the following purposes:

| · | to receive the report of the directors of the Company; |

| · | to receive the audited financial statements of the Company for the financial year ended December 31, 2022 and accompanying report of the auditor; |

| · | to elect the eight (8) nominees of the Company standing for election as directors of the Company to hold office for the ensuing year; |

| · | to appoint Deloitte LLP, an independent registered public accounting firm, as the auditor of the Company for the ensuing year and to authorize the directors to fix their remuneration; |

| · | to consider and, if deemed advisable, approve a non-binding advisory resolution to accept the Company’s approach to executive compensation; |

| · | to consider and, if deemed advisable, pass an ordinary resolution to approve the renewal of the unallocated stock options, rights and other entitlements under the Company’s third amended and restated stock option plan; |

| · | to consider and, if deemed advisable, pass an ordinary resolution to approve the renewal of the unallocated share units, rights and other entitlements under the Company’s amended and restated share unit plan; |

| · | to consider and, if deemed advisable, pass an ordinary resolution to approve the renewal of the unallocated deferred share units, rights and other entitlements under the Company’s third amended and restated deferred share unit plan; and |

| · | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

The details of all matters proposed to be put before shareholders at the Meeting are set forth in the management information circular dated May 8, 2023 accompanying this Notice of Meeting (the “Information Circular”). At the Meeting, shareholders will be asked to approve each of the foregoing items.

The Company will hold the Meeting in a virtual only format, via live audiocast. The virtual format provides all shareholders an equal opportunity to attend the Meeting regardless of their geographic location or particular constraints or circumstances they may be facing. At the Meeting, all shareholders in attendance will have the opportunity to participate, ask questions and vote in real-time, provided they comply with the applicable procedures set out in this Information Circular.

The directors of the Company have fixed May 8, 2023 as the record date for the Meeting (the “Record Date”). Only shareholders of record at the close of business on the Record Date are entitled to vote at the Meeting or any adjournment thereof.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

Registered shareholders and duly appointed proxyholders can attend the Meeting online at https://meetnow.global/MYW6SYQ where they can participate, vote, or submit questions during the Meeting’s live audiocast.

If you are a registered shareholder of the Company and are unable to attend the Meeting, please exercise your right to vote by completing and returning the accompanying form of proxy and deposit it with Computershare Investor Services Inc., 3rd Floor, 510 Burrard Street, Vancouver, British Columbia, Canada V6C 3B9 by 9:00 a.m. (Pacific time) on Thursday, June 22, 2023 or at least 48 hours (excluding Saturdays, Sundays and holidays) before the time that the Meeting is to be reconvened after any adjournment of the Meeting. The deadline for the deposit of proxies may be waived or extended by the Chair of the Meeting at the Chair’s discretion without notice.

The Company will use notice-and-access procedures adopted by the Canadian Securities Administrators to deliver this Notice of Meeting and the Information Circular. Shareholders will receive a form of proxy or voting instruction form and the notice-and-access notification with instructions on how to access the Information Circular electronically. The Information Circular will be available on the Company’s website for one full year at https://magsilver.com/investors/annual-general-meeting/, and will also be filed under the Company’s profile on SEDAR at www.sedar.com. Shareholders who wish to receive more information about notice-and-access or to receive paper copies of the Information Circular or other proxy-related materials, including the annual financial statements for the financial year ended December 31, 2022 and the accompanying management’s discussion and analysis, may contact 1-866-630-1399.

If you are a non-registered shareholder of the Company and received this Notice of Meeting and accompanying materials through a broker, a financial institution, a participant, a trustee or administrator of a self-administered retirement savings plan, retirement income fund, education savings plan or other similar self-administered savings or investment plan registered under the Income Tax Act (Canada), or a nominee of any of the foregoing that holds your security on your behalf (the “Intermediary”), please complete and return the materials in accordance with the instructions provided to you by your Intermediary.

DATED at Vancouver, British Columbia May 8, 2023.

MAG SILVER CORP.

| by: | “George Paspalas” |

| George Paspalas | |

| President and Chief Executive Officer |

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

Table of Contents

| Page | |

| LETTER TO SHAREHOLDERS | iii |

| NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING | v |

| MANAGEMENT INFORMATION CIRCULAR | 3 |

| PROXIES AND VOTING RIGHTS | 3 |

| Appointment of Proxies | 6 |

| Revocation of Proxies | 8 |

| Voting and Exercise of Discretion by Proxyholders | 9 |

| RECORD DATE, VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF | 9 |

| RECEIPT OF DIRECTORS’ REPORT AND FINANCIAL STATEMENTS | 9 |

| PARTICULARS OF MATTERS TO BE ACTED UPON | 10 |

| 1. Election of Directors | 10 |

| 2. Appointment and Remuneration of Auditor | 10 |

| 3. Advisory Vote on Executive Compensation – Voluntary Adoption of “Say on Pay” | 12 |

| 4. Renewal of Unallocated Entitlements under the Option Plan | 12 |

| 5. Renewal of Unallocated Entitlements under the Share Unit Plan | 13 |

| 6. Renewal of Unallocated Entitlements under the DSU Plan | 14 |

| Other Business | 15 |

| About the Director Nominees | 16 |

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 25 |

| CORPORATE GOVERNANCE | 26 |

| Governance Highlights | 26 |

| Board of Directors | 27 |

| Board Composition and Independence | 27 |

| Board Mandate | 27 |

| Other Mandates and Position Descriptions | 28 |

| Board Committees | 28 |

| Board Meetings | 30 |

| Nomination of Directors | 31 |

| Board and Committee Assessments | 32 |

| Board Skills and Experience | 32 |

| Diversity, Equity and Inclusion | 33 |

| Board Refreshment and Director Tenure | 35 |

| Orientation and Continuing Education | 35 |

| Ethical Business Conduct | 37 |

| Succession Planning | 37 |

| Shareholder Engagement | 38 |

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

| Director Compensation and Share Ownership | 39 |

| Share-Based Awards | 39 |

| Director Share Ownership Requirement | 40 |

| Director Compensation Table | 41 |

| STATEMENT OF EXECUTIVE COMPENSATION | 42 |

| Named Executive Officers | 44 |

| Compensation Governance | 44 |

| Compensation Risk Management | 45 |

| Senior Management Share Ownership Requirement | 46 |

| Compensation Discussion and Analysis | 49 |

| Performance Graph | 58 |

| Incentive Plan Awards | 67 |

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY INCENTIVE PLANS | 70 |

| Equity Compensation Plan Information | 70 |

| Termination and Change of Control Benefits | 70 |

| INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS AND OTHERS | 73 |

| MANAGEMENT CONTRACTS | 73 |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 73 |

| INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON | 74 |

| ADDITIONAL INFORMATION | 74 |

| APPROVAL OF THE BOARD OF DIRECTORS | 75 |

| EXHIBIT A – BLACKLINED OPTION PLAN | 83 |

| EXHIBIT B – BLACKLINED SHARE UNIT PLAN | 99 |

| EXHIBIT C – BLACKLINED DSU PLAN | 115 |

| EXHIBIT D – BOARD MANDATE | 133 |

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

|

MAG SILVER CORP. Suite 770, 800 W. Pender St., Vancouver, BC, Canada V6C 2V6 Tel: 604-630-1399 Fax: 604-681-0894 www.magsilver.com

|

MANAGEMENT INFORMATION CIRCULAR

Dated: May 8, 2023

This Management Information Circular (“Information Circular”) accompanies the Notice (the “Notice of Meeting”) of Annual General and Special Meeting (the “Meeting”) of the shareholders (the “Shareholders”) of MAG Silver Corp. (the “Company” or “MAG”) to be held virtually on Monday, June 26, 2023 (the “Meeting Date”) at the time and for the purposes set out in the accompanying Notice of Meeting. This Information Circular is furnished in connection with the solicitation of proxies by management of the Company for use at the Meeting and at any adjournment or postponement of the Meeting.

In this Information Circular, unless otherwise indicated, all dollar amounts “$” are expressed in Canadian dollars. Unless otherwise stated, the information contained in this Information Circular is as of May 8, 2023.

PROXIES AND VOTING RIGHTS

General

The solicitation of proxies is being made on behalf of management. It is expected that solicitations of proxies will be made primarily through the use of the notice-and-access procedures detailed below under the heading “Notice-and-Access”, however, proxies may also be solicited by telephone or other personal contact by directors, officers and employees of the Company without special compensation. The Company may reimburse Shareholders’ nominees or agents (including brokers holding shares on behalf of clients) for the costs incurred in obtaining authorization to execute forms of proxies from their principals. The Company has engaged Kingsdale Advisors (“Kingsdale”) as their strategic shareholder advisor and proxy solicitation agent for the meeting. Kingsdale will provide the following services in connection with the Meeting: review and analysis of the Information Circular, recommending corporate governance best practices where applicable, liaising with proxy advisory firms, developing and implementing Shareholder proxies, and the solicitation of proxies including contacting Shareholders by telephone. Shareholders needing assistance completing a form of proxy or voting instruction form should contact Kingsdale toll free in North America at 1-866-481-2532. The estimated cost to the Company of such service is $32,500 plus charges for any telephone calls. The costs of solicitation will be borne by the Company.

Only a Shareholder whose name appears on the certificate(s) representing its shares (a “Registered Shareholder”) or its duly appointed proxy nominee is permitted to vote at the Meeting. A Shareholder is a non-registered shareholder (a “Non-Registered Shareholder”) if its shares are registered in the name of an intermediary, such as an investment dealer, brokerage firm, bank, trust company, trustee, custodian, administrators of self-administered RRSPs, RRIFs, RESPs and similar plans or other nominee, or a clearing agency in which the intermediary participates (each, an “Intermediary”). Accordingly, most Shareholders of the Company are “Non-Registered Shareholders” because the shares they own are not registered in their names but are instead registered in the name of the Intermediary through which they purchased the shares. More particularly, a person is a Non-Registered Shareholder in respect of shares which are held on behalf of that person, but which are registered either: (a) in the name of an Intermediary that the Non-Registered Shareholder deals with in respect of the shares; or (b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited (“CDS”)) of which the Intermediary is a participant. In Canada, the vast majority of such shares are registered under the name of CDS, which acts as nominee for many Canadian brokerage firms. Common shares in the capital of the Company (“Common Shares”) so held by brokers or their nominees can only be voted (for or against resolutions) upon the instructions of the Non-Registered Shareholder. Without specific instructions, Intermediaries are prohibited from voting shares held for Non-Registered Shareholders.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

Notice-and-Access

The Company intends to deliver the Notice of Meeting, the Information Circular and the related form of proxy or voting instruction form (collectively, the “Meeting Materials”) to Shareholders using the notice-and-access procedures (“Notice-and-Access”) set out in National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101"). The Company will post the Meeting Materials on its website at https://magsilver.com/investors/annual-general-meeting/¸ where the Meeting Materials will remain for one full year. The Meeting Materials will also be available under the Company’s profile on SEDAR at www.sedar.com.

The Company will continue to arrange delivery of paper copies of this Information Circular and other proxy-related materials to those Registered Shareholders and Non-Registered Shareholders who previously elected to receive paper copies of such materials. All other Shareholders will receive a notice package (the “Notice Package”) which will contain information on how to obtain electronic and paper copies of this Information Circular and other proxy-related materials in advance of the Meeting as well as how to vote.

The Company will not use procedures known as “stratification” in relation to the use of Notice-and-Access, meaning that both Registered Shareholders and Non-Registered Shareholders will be mailed a Notice Package. If the Company or its agent has sent the Notice Package directly to a Non-Registered Shareholder, such Non-Registered Shareholder’s name and address and information about its holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding the securities on such Non-Registered Shareholder’s behalf.

Non-Registered Shareholders who have not objected to their Intermediary disclosing certain information about them to the Company are referred to as “NOBOs”, whereas Non-Registered Shareholders who have objected to their Intermediary disclosing ownership information about them to the Company are referred to as “OBOs”. In accordance NI 54-101, the Company has elected to send the Notice Package indirectly to the NOBOs and to the OBOs through their Intermediaries, the cost of which will be borne by the Company.

Shareholders who wish to receive more information about Notice-and-Access or to receive paper copies of the Information Circular or other proxy-related materials, including the annual financial statements for the financial year ended December 31, 2022 and the accompanying management’s discussion and analysis, may contact 1-866-630-1399. Requested materials will be sent to the requesting Shareholders at no cost to them within three (3) business days of their request, if such requests are made before the Meeting or any postponement or adjournment thereof.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

How to Vote

The Company will hold the Meeting in a virtual only format, via live audiocast. All shareholders who attend the Meeting will have the opportunity to participate, ask questions and vote in real-time, provided they comply with the applicable procedures set out in this Information Circular.

| Registered Shareholders | Non-Registered Shareholders |

| Common Shares held in own name and represented by a physical certificate or DRS. | Common Shares held with a broker, bank or other intermediary. |

| Attending the Meeting Virtually | Attending the Meeting Virtually |

|

1. Log into https://meetnow.global/MYW6SYQ on the Meeting Date 2. Click “Join Meeting Now” and enter your control number (provided by Computershare) before the start of the Meeting. 3. Vote shares via the same link above.

|

1. Enter you name in the blank space on the VIF or form of proxy provided to you and return the same to your broker (or broker’s agent) 2. Register with Computershare: www.computershare.com/appointee 3. Log into https://meetnow.global/MYW6SYQ on the Meeting Date 4. click “Join Meeting Now” and enter your control number (provided by Computershare) before the start of the Meeting. 5. Enter your control number before the start of the meeting. 6. Vote shares via the same link above |

TECHNICAL DIFFICULTIES?

If you experience technical difficulties during the check-in process or during the meeting, please call:

1-888-724-2416 (Toll free in North America) or

+1 781-575-2748 (Outside North America, long distance charges will apply)

It is recommended that shareholders or guests log in at least one hour before the meeting begins to allow sufficient time to check in and complete any procedures. The Meeting will begin promptly at 9:00 am (Pacific time) on June 26, 2023, unless it is postponed or adjourned. The latest version of Chrome, Safari, Edge or Firefox will be required to access the Meeting. Internet Explorer is not supported.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

| Registered Shareholders | Non-Registered Shareholders | ||

| Not Attending the Meeting | Not Attending the Meeting | ||

| Return your completed, signed and dated proxy in one of the following ways: |

Submit your VIF or form of proxy following the instructions set out on the form well in advance of the Meeting in one of the following ways:

|

||

| Internet | You may vote over the internet by going to www.investorvote.com. You will need to enter your control number (located on the bottom left corner of the first page of the form of proxy) to identify yourself as a Shareholder on the voting website. | ||

| Telephone | 1-866-732-8683 | Dial the applicable number listed on the voting instruction form. | |

|

Complete, sign and return the enclosed form of proxy by email to:

Computershare Investor Service Inc. 100 University Ave, 8th Floor Toronto, Ontario M5J 2Y1

|

Complete, sign and return the enclosed form of proxy by email to:

Computershare Investor Service Inc. 100 University Ave, 8th Floor Toronto, Ontario M5J 2Y1

|

||

|

Shareholders needing assistance completing and returning a proxy or voting instruction form may call Kingsdale Advisors toll free at 1-866-481-2532 toll-free within Canada or the United States) or 1-416-867-2272 (for calls outside Canada and the United States) or by e-mail at contactus@kingsdaleadvisors.com.

|

|||

Appointment of Proxies

Registered Shareholders

The persons named in the accompanying form of proxy are nominees of the Company’s management. A Shareholder has the right to appoint a person (who need not be a Shareholder) to attend and act for and on the Shareholder’s behalf at the Meeting other than the persons designated as proxyholders in the accompanying form of proxy. To exercise this right, the Shareholder must either:

| (a) | insert the name of the Shareholder’s nominee in the blank space provided; or |

| (b) | complete another proper form of proxy. |

In either case, to be valid, a proxy must be dated and signed by the Shareholder or by the Shareholder’s attorney authorized in writing. In the case of a corporation, the proxy must be signed by a duly authorized officer of, or attorney for, the corporation.

The completed proxy, together with the power of attorney or other authority, if any, under which the proxy was signed, or a notarially certified copy of the power of attorney or other authority, must be delivered to Computershare Investor Services Inc. (“Computershare”), 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1, or by telephone, internet or facsimile (in accordance with the instructions provided in the form of proxy delivered herewith), by 9:00 a.m. (Pacific time) on Thursday, June 22, 2023 or at least 48 hours (excluding Saturdays, Sundays and holidays) before the time that the Meeting is to be reconvened after any adjournment of the Meeting. The deadline for the deposit of proxies may be waived or extended by the Chair of the Meeting at the Chair’s discretion without notice. If a Shareholder who has submitted a proxy attends the Meeting via the audiocast and has accepted the terms and conditions when entering the Meeting online, any votes cast by such Shareholder on a ballot will be counted and the submitted proxy will be disregarded.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

Shareholders who wish to appoint a third-party proxyholder to represent them at the online Meeting must submit their proxy or voting instruction form (as applicable) prior to registering their proxyholder. Registering the proxyholder is an additional step once a Shareholder has submitted their proxy/voting instruction form. Failure to register a duly appointed proxyholder will result in the proxyholder not receiving a control number to participate in the online Meeting. To register a proxyholder, Shareholders MUST visit www.computershare.com/magsilver by 9:00 a.m. (Pacific time) on Thursday, June 22, 2023 and provide Computershare with their proxyholder’s contact information, so that Computershare may provide the proxyholder with a control number via email.

Without a control number, proxyholders will not be able to participate online at the Meeting.

Non-Registered Shareholders

Only Registered Shareholders or duly appointed proxyholders for Registered Shareholders are permitted to vote at the Meeting. Non-Registered Shareholders (whether NOBOs or OBOs) are advised that only proxies from Shareholders of record can be recognized and voted at the Meeting.

The Intermediary holding shares on behalf of a Non-Registered Shareholder is required to forward the Notice Materials Package and relevant voting instruction form to such Non-Registered Shareholder (unless such Non-Registered Shareholder has waived its right to receive the Meeting Materials) and to seek such Non-Registered Shareholder’s instructions as how to vote its shares in respect of each of the matters described in this Information Circular to be voted on at the Meeting. Each Intermediary has its own procedures which should be carefully followed by Non-Registered Shareholders to ensure that their Common Shares are voted by the Intermediary on their behalf at the Meeting. The instructions for voting will be set out in the form of proxy or voting instruction form provided by the Intermediary. Non-Registered Shareholders should contact their Intermediary and carefully follow the voting instructions provided by such Intermediary. Alternatively, Non-Registered Shareholders who wish to vote their Common Shares at the Meeting may do so by appointing themselves as the proxy nominee by writing their own name in the space provided on the form of proxy or voting instruction form provided to them by the Intermediary and following the Intermediary’s instructions for return of the executed form of proxy or voting instruction form. Shareholders who have appointed someone to vote at the virtual Meeting MUST visit www.computershare.com/magsilver by 9:00 a.m. (Pacific time) on Thursday, June 22, 2023 and provide Computershare with their appointee’s contact information, so that Computershare may provide the proxyholder with a control number via email.

All references to Shareholders in this Information Circular and the accompanying Notice of Meeting and form of proxy are to Shareholders of record unless specifically stated otherwise.

The Company may also use Broadridge Financial Services’ (“Broadridge”) QuickVote™ service to assist Non-Registered Shareholders with voting their shares. Non-Registered Shareholders may be contacted by Kingsdale to conveniently obtain voting instructions directly over the telephone. Broadridge then tabulates the results of all the instructions received and then provides appropriate instructions respecting the shares to be represented at the Meeting.

Voting at the Meeting will only be available for Registered Shareholders and duly appointed proxyholders. Non-Registered Shareholders who have not appointed themselves may attend the Meeting by clicking “Guest” and completing the online form. Non-Registered Shareholders who do not have a control number will only be able to attend as a guest, which allows them to listen to the Meeting; however, will not be able to vote or submit questions.

To attend and vote at the virtual Meeting, you must first obtain a valid legal proxy from your broker, bank or other agent and then register in advance to attend the Meeting. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a legal proxy form. After first obtaining a valid legal proxy from your broker, bank, or other agent, to then register to attend the Meeting, you must submit a copy of your legal proxy to Computershare. Requests for registration should be directed to: Computershare, 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

Requests for registration must be labeled as “Legal Proxy” and be received by 9:00 a.m. (Pacific time) on Thursday, June 22, 2023, or at least 48 hours (excluding Saturdays, Sundays and holidays) before the time that the Meeting is to be reconvened after any adjournment of the Meeting. You will receive confirmation of your registration by email after we receive your registration materials. You may attend the Meeting and vote your shares at https://meetnow.global/MYW6SYQ during the Meeting. Please note that you are required to register your appointment at www.computershare.com/appointee.

The Company believes that the ability to participate in the Meeting in a meaningful way, including asking questions, is imperative, particularly in light of the decision to hold this year’s Meeting virtually. Registered Shareholders, Non-Registered Shareholders who have duly appointed themselves as proxyholders, and third-party proxyholders accessing the Meeting (other than those who attend as “guests”) will have an opportunity to ask questions at the Meeting in writing by sending a message to the Chair of the Meeting online through the Summit platform. Shareholders will have substantially the same opportunity to ask questions on matters of business before the Meeting as in past years when the annual meeting of shareholders was held in person. Questions properly brought before the Meeting will pertain to the formal business of the Meeting. To ensure fairness for all, the Chair of the Meeting will decide and announce the order of questions to be responded to, and the amount of time allocated to each question. The Chair can edit or reject questions considered inappropriate.

Shareholders needing assistance completing and returning a proxy or voting instruction form may call Kingsdale Advisors toll free at 1-866-481-2532.

Revocation of Proxies

A Shareholder who has given a proxy may revoke it at any time before the proxy is exercised:

| (a) | by an instrument in writing that is: |

| o | signed by the Shareholder, the Shareholder’s legal personal representative or trustee in bankruptcy or, where the Shareholder is a corporation, a duly authorized representative of the corporation; and |

| o | delivered to Computershare Investor Services Inc., 3rd Floor, 510 Burrard Street, Vancouver, British Columbia, Canada V6C 3B9 or to the registered office of the Company located at Suite 2600 – 595 Burrard Street, Vancouver, British Columbia, Canada V7X 1L3 at any time up to and including the last business day preceding the day of the Meeting or any adjournment of the Meeting; |

| (b) | by sending another proxy form with a later date to Computershare before 9:00 a.m. (Pacific time) on June 22, 2023, or at least 48 hours (excluding Saturdays, Sundays and holidays) before any adjourned or postponed Meeting; |

| (c) | by attending the online Meeting and accepting the online terms and conditions; or |

| (d) | in any other manner provided by law. |

A revocation of a proxy does not affect any matter on which a vote has been taken prior to the revocation.

If you are using a control number to login to the online Meeting and you accept the terms and conditions, you will be revoking any and all previously submitted proxies. However, in such a case, you will be provided the opportunity to vote by ballot on the matters put forth at the Meeting. If you DO NOT wish to revoke all previously submitted proxies, do not accept the terms and conditions, in which case you can only enter the Meeting as a guest.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

Voting and Exercise of Discretion by Proxyholders

A Shareholder may indicate the manner in which the persons named in the accompanying form of proxy are to vote with respect to a matter to be acted upon at the Meeting by marking the appropriate space. If the instructions as to voting indicated in the proxy are certain, the shares represented by the proxy will be voted or withheld from voting in accordance with the instructions given in the proxy on any ballot that may be called for.

If the Shareholder specifies a choice in the proxy with respect to a matter to be acted upon, then the shares represented will be voted or withheld from the vote on that matter accordingly. If no choice is specified in the proxy with respect to a matter to be acted upon, it is intended that the proxyholder named by management in the accompanying form of proxy will vote the shares represented by the proxy in favour of each matter identified in the proxy and for the nominees of the Company’s Board (as defined below) for directors and auditor.

The accompanying form of proxy also confers discretionary authority upon the named proxyholder with respect to amendments or variations to the matters identified in the accompanying Notice of Meeting and with respect to any other matters which may properly come before the Meeting. As of the date of this Information Circular, management of the Company is not aware of any such amendments or variations, or any other matters that will be presented for action at the Meeting other than those referred to in the accompanying Notice of Meeting. If, however, other matters that are not now known to management properly come before the Meeting, then the persons named in the accompanying form of proxy intend to vote on them in accordance with their best judgment.

RECORD DATE, VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The authorized capital of the Company consists of an unlimited number of Common Shares. As of the Record Date (as defined herein) and the date hereof, the Company had 102,894,098 Common Shares issued and outstanding.

In accordance with applicable laws, the board of directors of the Company (the “Board”) has provided notice of and fixed the record date as of May 8, 2023 (the “Record Date”) for the purposes of determining Shareholders entitled to receive notice of, and to vote at, the Meeting, and has obtained a list of all persons who are Registered Shareholders at the close of business on the Record Date and the number of Common Shares registered in the name of each Registered Shareholder on that date. Each Registered Shareholder as at the close of business on the Record Date will be entitled to receive notice of the Meeting and will be entitled to one vote at the Meeting for each Common Share registered in his or her name as it appears on the list.

To the knowledge of the directors and executive officers of the Company, as at the Record Date, no Shareholder beneficially owns, directly or indirectly, or exercises control or direction over, Common Shares carrying 10% or more of the voting rights attached to all outstanding voting securities of the Company.

RECEIPT OF DIRECTORS’ REPORT AND FINANCIAL STATEMENTS

The directors’ report and the consolidated financial statements of the Company for the financial year ended December 31, 2022 and accompanying auditor’s report will be presented at the Meeting and have been previously filed under the Company’s profile on SEDAR at www.sedar.com.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

PARTICULARS OF MATTERS TO BE ACTED UPON

| 1. | Election of Directors |

The Board currently consists of eight members. The term of office of each of these directors expires at the Meeting. Management proposes to nominate the eight persons named in the table beginning on page 17 of this Information Circular for election as directors of the Company and to hold office until the next annual general meeting of the Company or until his or her successor is duly elected or appointed, unless the office is earlier vacated in accordance with the Articles of the Company or the Business Corporations Act (British Columbia) or he or she becomes disqualified to act as a director.

Advance Notice of Director Nominations

A notice of meeting and record date was filed on SEDAR on April 13, 2023, being the first public announcement of the date of the Meeting. Pursuant to the Advance Notice Policy of the Company, originally adopted by the Board in 2012 and most recently re-approved on March 24, 2023, notice of any additional director nominations for the Meeting must be received by the Company in the form prescribed in, and in compliance with, the Advance Notice Policy, no later than the close of business on May 17, 2023. A copy of the Company’s Advance Notice Policy may be obtained under the Company’s profile on SEDAR at www.sedar.com and is also available on the Company’s website at www.magsilver.com/corporate/governance.

Majority Voting for Directors

The Board adopted a Majority Voting Policy in 2013, which is reviewed and, if needed, amended on an annual basis. The Majority Voting Policy was last reviewed on March 24, 2023, and no amendments were made. This policy provides that any nominee for election as a director who has more votes withheld than votes for his or her election at the Meeting must immediately tender his or her resignation to the Board following the Meeting. This policy applies only to uncontested elections. The Governance and Nomination Committee of the Board shall consider any resignation tendered pursuant to the policy and within 90 days after the Shareholders’ Meeting, determine whether or not it should be accepted. The Board shall accept the resignation absent exceptional circumstances. The resignation will be effective when accepted by the Board. A director who tenders a resignation pursuant to this policy shall recuse themselves from any meeting of the Board or the Governance and Nomination Committee and not participate in any deliberations on whether to accept such subject director(s) resignation. The Board will disclose its decision via press release as soon as practicable following receipt of the resignation and provide a copy to the Toronto Stock Exchange (the “TSX”). If the Board determines not to accept a resignation, the news release must fully state the reasons for that decision. If a resignation is accepted, the Board may leave the resultant vacancy unfilled until the next annual meeting of the Shareholders, appoint a new director to fill any vacancy created by the resignation or call a special meeting of the Shareholders to consider the election of a nominee. A copy of the Company’s Majority Voting Policy is available on the Company website at www.magsilver.com/corporate/governance, or will be provided to any Shareholder without charge by request to the Corporate Secretary of the Company at Suite 770, 800 West Pender Street, Vancouver, British Columbia, V6C 2V6.

The Board recommends a vote FOR each of the nominated directors.

| 2. | Appointment and Remuneration of Auditor |

The Board recommends the re-appointment of Deloitte LLP as MAG Silver’s auditor to hold office until the close of the next annual meeting of Shareholders and to authorize the directors to fix their remuneration for the ensuing year.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

A number of mechanisms are in place that strengthen auditor independence, without impeding audit quality and efficiency, including:

| · | Auditor Engagement Partner Rotation: The rotation of the Company’s lead engagement and concurring partners at Deloitte LLP is intended to mitigate the risk of over familiarity and self-interest of such persons, and to promote objectivity. The lead engagement and concurring partners are subject to a 5-year rotation requirement, followed by a 2-year period of absence from the consolidated audit. The rotation of a new lead engagement partner for the Company commenced on January 1, 2023 for the audit of the financial years ending December 31, 2023 and onwards, which rotation must not extend beyond January 1, 2028. |

| · | Regular Assessments: Annual assessments of the auditor are conducted by the Audit Committee to ensure, among other things, the ongoing quality, independence and effectiveness of the auditor. In addition, the Audit Committee and the Board have recently decided to undertake a comprehensive assessment of the auditor. Included in this assessment is a determination as to whether there is any threat of institutional familiarity that could impact the independence of the auditor and prevent the engagement team from exercising appropriate professional skepticism. The Audit Committee and the Board will conduct this comprehensive assessment every 5 years concurrent with the audit partner rotation. |

The fees paid to the auditor for years ended December 31, 2022 and 2021 are as follows:

| Year Ended December 31, 2022 (C$) | Year Ended December 31, 2021 (C$) | |

| Audit Fees | 389,000 | 333,882 |

| Audit-Related Fees | 4,073 | 0 |

| Tax Fees | 93,787 | 100,870 |

| All Other Fees | 0 | 0 |

| Total | 486,860 | 434,752 |

The nature of the services provided by Deloitte LLP under each of the categories indicated in the table is described below.

Audit Fees

Audit fees are those incurred for professional services rendered by Deloitte LLP for the audit of the Company’s annual consolidated financial statements, for the quarterly interim reviews of the Company’s unaudited consolidated financial statements, and for services that are normally provided by Deloitte LLP in connection with regulatory filings.

Audit-Related Fees

The fees in 2022 include amounts with respect to the Company’s Canadian Public Accountability Board fees that are remitted by Deloitte LLP on behalf of the Company.

Tax Fees

Tax fees are those incurred for professional services rendered by Deloitte LLP for tax compliance, including the review of tax returns, tax planning and advisory services relating to common forms of domestic and international taxation, continued tax planning and advisory services on potential restructuring and spin-out projects, and services related to the Company’s transfer pricing report.

The Board recommends a vote FOR the appointment of Deloitte LLP The Board conducts an annual advisory vote by its Shareholders on the Company’s executive compensation (commonly referred to as “say on pay”).

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

| 3. | Advisory Vote on Executive Compensation – Voluntary Adoption of “Say on Pay” |

The advisory vote provides Shareholders the opportunity to advise the Board on their view on the Company’s executive compensation programs as presented in the Statement of Executive Compensation of this Information Circular, by voting on the following resolution:

“IT IS RESOLVED, on an advisory basis, and not to diminish the role and responsibilities of the board of directors of MAG Silver Corp., the shareholders accept the approach to the executive compensation program as disclosed in the management information circular of MAG Silver Corp., dated May 8, 2023.”

The results of MAG’s “say on pay” vote at the previous three annual general meetings are set out below:

| Year | Percentage of Votes in Favour |

| 2022 | 96.91% |

| 2021 | 98.51% |

| 2020 | 94.85% |

As this is an advisory vote, the results will not be binding on the Board. The Board retains sole authority and remains fully responsible for the Company’s compensation decisions and is not relieved of these responsibilities as a result of the advisory vote by Shareholders. However, the Board believes that it is essential for the Shareholders to be well informed of the Company’s approach to executive compensation and considers this advisory vote to be an important part of the ongoing process of engagement between the Shareholders and the Board.

Following each annual general meeting, all voting results, including the results of the “say on pay” vote, will be publicly filed under the Company’s profile on the SEDAR website (www.sedar.com).

The Board recommends a vote FOR the advisory resolution

to accept our approach to executive compensation

| 4. | Renewal of Unallocated Entitlements under the Option Plan |

The Board adopted the Company’s second amended and restated stock option plan on May 13, 2014, which plan was amended and restated a third time on May 10, 2017 (the “Option Plan”). On May 8, 2023, the Board approved, among other amendments of a “housekeeping” nature, certain amendments thereto to: (i) remove the provisions governing options granted to U.S. option holders in accordance with the terms of section 422 of the U.S. Internal Revenue Code of 1986, as amended (each such option, an “ISO”), as the Company’s ability to grant ISOs expired March 30, 2017 in accordance with the terms of the Option Plan and no further ISOs remain outstanding; and (ii) align the meaning of the term “insider” with the meaning given to such term in the TSX Company Manual. Pursuant to the terms of the Option Plan, the Company is not required to seek shareholder approval to adopt amendments of such nature. The full text of the Option Plan, marked to illustrate these recent amendments, is attached hereto as Exhibit A. The maximum number of Common Shares available for issuance under the Option Plan is 5% of the Company’s issued and outstanding Common Shares on a non-diluted basis at any time, provided that: (a) the number of Common Shares issued or issuable under all of the Company’s share compensation arrangements (excluding the DSU Plan (as defined herein)), shall not exceed 5% on a non-diluted basis; and (b) the number of Common Shares issued or issuable under all share compensation arrangements (including the DSU Plan) shall not exceed 6% on a non-diluted basis. As at May 8, 2023, there were a total of 3,601,293 Common Shares reserved for issuance under the Option Plan, with 1,222,355 stock options (“Options”) issued and outstanding (with the underlying Common Shares representing approximately 1.19% of Common Shares), leaving an additional 2,378,938 Options available for grant (with the underlying Common Shares representing approximately 2.31% of Common Shares).

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

Pursuant to the rules and policies of the TSX, unallocated Options, rights or other entitlements under a TSX-listed issuer’s security-based compensation arrangement that does not have a fixed maximum number of securities issuable (such as the Option Plan) must be approved by a majority of the Company’s directors and shareholders every three years. Shareholders last approved the unallocated Options under the Option Plan at the Company’s annual meeting held in June 2020. If the Shareholders approve the unallocated Options at the Meeting, the Company will next be required to seek similar approval from the Shareholders no later than June 26, 2026.

The resolution to approve the unallocated entitlements under the Option Plan which will be presented at the Meeting and, if approved, adopted with or without variation (the “Option Plan Resolution”) is required to be approved by a majority of the votes cast by Shareholders present or represented by proxy at the Meeting. The text of the Option Plan Resolution is as follows:

“IT IS RESOLVED THAT:

| (a) | all unallocated options, rights and entitlements under the third amended and restated stock option plan of MAG Silver Corp. be and are hereby authorized and approved; |

| (b) | MAG Silver Corp.’s ability to grant options under such option plan until June 26, 2026 (or such date that is three years after the date of the meeting at which shareholder approval is being sought or any adjournment or postponement thereof), be and is hereby authorized and approved; and |

| (c) | any one director or officer of MAG Silver Corp. is hereby authorized and directed to perform all such acts, deeds and things and execute all such documents and other instruments as may be required to give effect to the intent of this resolution.” |

If the Option Plan Resolution is not approved at the Meeting, then after that date, the Company will not have the ability to grant further Options under the Option Plan. Allocated Options will continue to exist unchanged, but the Board will neither be able to grant new Options, nor be able to re-allocate outstanding Options that have been terminated, cancelled or that have expired unexercised.

The Board recommends a vote FOR the Option Plan Resolution

| 5. | Renewal of Unallocated Entitlements under the Share Unit Plan |

The Board adopted the Company’s amended and restated share unit plan on May 13, 2014, further amending the share unit plan on May 10, 2017 (the “Share Unit Plan”). On May 8, 2023, the Board approved, among other amendments of a “housekeeping” nature, certain amendments thereto to ensure continued compliance with U.S. tax legislation and regulations. Pursuant to the terms of the Share Unit Plan, the Company is not required to seek shareholder approval to adopt amendments of such nature. The full text of the Share Unit Plan, marked to illustrate these recent amendments, is attached hereto as Exhibit B.

The maximum number of Common Shares available for issuance under the Share Unit Plan is 1.5% of the Company’s issued and outstanding Common Shares on a non-diluted basis at any time, provided that: (a) the number of Common Shares issued or issuable under all of the Company’s share compensation arrangements (excluding the DSU Plan), shall not exceed 5% on a non-diluted basis; and (b) the number of Common Shares issued or issuable under all share compensation arrangements (including the DSU Plan) shall not exceed 6% on a non-diluted basis. As at May 8, 2023, there were a total of 1,543,411 Common Shares reserved for issuance under the Share Unit Plan, with 485,394 share units issued and outstanding (with the underlying Common Shares representing approximately 0.47% of Common Shares), leaving an additional 1,058,017 share units available for grant (with the underlying Common Shares representing approximately 1.03% of Common Shares).

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

As the Share Unit Plan does not have a fixed maximum number of securities issuable thereunder, it must be approved by a majority of the Company’s directors and shareholders every three years. Shareholders last approved the unallocated share units under the Share Unit Plan at the Company’s annual meeting held in June 2020. If the Shareholders approve the unallocated share units at the Meeting, the Company will next be required to seek similar approval from the Shareholders no later than June 26, 2026.

The resolution to approve the unallocated entitlements under the Share Unit Plan which will be presented at the Meeting and, if approved, adopted with or without variation (the “Share Unit Plan Resolution”) is required to be approved by a majority of the votes cast by Shareholders present or represented by proxy at the Meeting. The text of the Share Unit Plan Resolution is as follows:

“IT IS RESOLVED THAT:

| (a) | all unallocated restricted share units, performance share units, rights and entitlements under the amended and restated share unit plan of MAG Silver Corp. be and are hereby authorized and approved; |

| (b) | MAG Silver Corp.’s ability to grant share units under such share unit plan until June 26, 2026 (or such date that is three years after the date of the meeting at which shareholder approval is being sought or any adjournment or postponement thereof), be and is hereby authorized and approved; and |

| (c) | any one director or officer of MAG Silver Corp. is hereby authorized and directed to perform all such acts, deeds and things and execute all such documents and other instruments as may be required to give effect to the intent of this resolution.” |

If the Share Unit Plan Resolution is not approved at the Meeting, then after that date, the Company will not have the ability to grant further share units under the Share Unit Plan. Allocated share units will continue to exist unchanged, but the Board will neither be able to grant new share units, nor be able to re-allocate outstanding share units that have been terminated or cancelled.

The Board recommends a vote FOR the Share Unit Plan Resolution

| 6. | Renewal of Unallocated Entitlements under the DSU Plan |

The Board adopted the Company’s second amended and restated deferred share unit plan on May 13, 2014, further amending the plan on May 10, 2017 (the “DSU Plan”). On May 8, 2023, the Board adopted a third amended and restated version of the DSU Plan, which version included amendments of a “housekeeping” nature and amendments designed to clarify the deferred share unit (“DSU”) redemption procedures available to non-U.S. taxpayers. Pursuant to the terms of the DSU Plan, the Company is not required to seek shareholder approval to adopt amendments of such nature. The full text of the DSU Plan, marked to illustrate these recent amendments, is attached hereto as Exhibit C.

The maximum number of Common Shares available for issuance under the DSU Plan is 1% of the Company’s issued and outstanding Common Shares on a non-diluted basis at any time, provided that the number of Common Shares issued or issuable under all share compensation arrangements (including the DSU Plan) shall not exceed 6% on a non-diluted basis. As at May 8, 2023, there were a total of 1,028,941 Common Shares reserved for issuance under the DSU Plan, with 437,126 DSUs issued and outstanding (with the underlying Common Shares representing approximately 0.42% of Common Shares), leaving an additional 591,815 DSUs available for grant (with the underlying Common Shares representing approximately 0.58% of Common Shares).

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

As the DSU Plan does not have a fixed maximum number of securities issuable thereunder, it must be approved by a majority of the Company’s directors and shareholders every three years. Shareholders last approved the unallocated DSUs under the DSU Plan at the Company’s annual meeting held in June 2020. If the Shareholders approve the unallocated DSUs at the Meeting, the Company will next be required to seek similar approval from the Shareholders no later than June 26, 2026.

The resolution to approve the unallocated entitlements under the DSU Plan which will be presented at the Meeting and, if approved, adopted with or without variation (the “DSU Plan Resolution”) is required to be approved by a majority of the votes cast by Shareholders present or represented by proxy at the Meeting. The text of the DSU Plan Resolution is as follows:

“IT IS RESOLVED THAT:

| (a) | all unallocated deferred share units, rights and entitlements under the third amended and restated deferred share unit plan of MAG Silver Corp. be and are hereby authorized and approved; |

| (b) | MAG Silver Corp.’s ability to grant deferred share units under such deferred share unit plan until June 26, 2026 (or such date that is three years after the date of the meeting at which shareholder approval is being sought or any adjournment or postponement thereof), be and is hereby authorized and approved; and |

| (c) | any one director or officer of MAG Silver Corp. is hereby authorized and directed to perform all such acts, deeds and things and execute all such documents and other instruments as may be required to give effect to the intent of this resolution.” |

If the DSU Plan Resolution is not approved at the Meeting, then after that date, the Company will not have the ability to grant further DSUs under the DSU Plan. Allocated share units will continue to exist unchanged, but the Board will neither be able to grant new share units, nor be able to re-allocate outstanding DSUs that have been terminated or cancelled.

The Board recommends a vote FOR the DSU Plan Resolution

Other Business

Management knows of no other matter to come before the Meeting other than the matters referred to in the accompanying Notice of Meeting and this Information Circular.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

About the Director Nominees

Management proposes to nominate the eight persons named in the table below for election as directors of the Company. The following pages provide relevant information on each of the director nominees.

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

| Peter D Barnes, Acc.Dir., ICD.D | Independent Director (1)(2)(4) | |||||

|

Mr. Barnes is Chair of the Board of the Company (the “Board Chair”) and is a Fellow of the Chartered Professional Accountants of British Columbia. Mr. Barnes co-founded Wheaton Precious Metals (formerly, Silver Wheaton) in 2004, and served as their CEO from 2006 to 2011. Prior to that, he served as Executive Vice President and CFO of Goldcorp from 2005 to 2006. | |||||

| British Columbia, Canada | Skills and Qualifications | |||||

|

Director Since: October 5, 2012

Tenure: 10.5 years

Principal Occupation:

|

· Capital Markets

· Financial / Audit & Risk Management

· Governance

· International Experience

· Leadership & Strategy

|

|||||

| Board Meetings Attended | ||||||

| Board (Chair) | 8 of 8 | 100% | ||||

| 2022 Voting Results | Committee Meetings Attended | |||||

| For: 99.59% | Audit Committee | 4 of 4 | 100% | |||

| Withheld: 0.41% | Governance and Nominating Committee | 5 of 5 | 100% | |||

| Ownership Requirement: | Achievement? (7) | Common Shares | DSUs | Options | ||

| 3x Annual Retainer | Yes | 106,954 | 101,478 | 0 | ||

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

| Tim Baker, ICD.D | Independent Director (1)(3)(5)(6) | |||||

|

Mr. Baker has a B.Sc. in Geology from Edinburgh University and has substantial experience in operating international mines and projects. He was Executive Vice President and Chief Operating Officer of Kinross Gold before retiring in 2010. Prior to joining Kinross, Mr. Baker was with Placer Dome, where he held several key roles including Executive General Manager of Placer Dome Chile, Executive General Manager of Placer Dome Tanzania and Senior Vice President of the copper producing Compañia Minera Zaldivar. Mr. Baker is currently a director of Triple Flag Precious Metals and RCF Acquisition. He has previously been a director on the boards of Golden Star Resources (Chair of the Board), Sherritt International, Augusta Resources, Antofagasta PLC, Eldorado Gold, Rye Patch Gold (later Alio Gold) and Pacific Rim Mining. | |||||

| British Columbia, Canada | Skills and Qualifications | |||||

|

Age: 71

Director Since: March 31, 2021

Tenure: 2.0 years

Principal Occupation:

Other Public Directorships: Triple Flag Precious Metals Corp.

RCF Acquisition Corp.

|

· Mine Development / Operations

· Executive Compensation

· Mineral Exploration

· Health & Safety

· International Experience

· Leadership & Strategy

|

|||||

| Board Meetings Attended | ||||||

| Board Meetings | 8 of 8 | 100% | ||||

| 2022 Voting Results | Committee Meetings Attended | |||||

| For: 99.10% | Compensation and Human Resources Committee (Chair) | 3 of 3 | 100% | |||

| Withheld: 0.9% | Health, Safety, Environment and Community Committee | 4 of 4 | 100% | |||

| Technical Committee | 5 of 5 | 100% | ||||

| Ownership Requirement | Achievement? (7) | Common Shares | DSUs | Options | ||

| 3x Annual Retainer | Yes | 8,100 | 19,258 | 0 | ||

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

| Jill D. Leversage, Acc.Dir. | Independent Director (1)(2)(3)(4) | |||||

|

Ms. Leversage has over 30 years of experience in the financial advisory and services sector. She began her finance career at Burns Fry Ltd. and has held senior level positions at both RBC Capital Markets and TD Securities. Ms. Leversage currently serves on a number of public and government related boards including Aurinia Pharmaceuticals, RE Royalties, Insurance Corporation of BC and the Vancouver Airport Authority. She is a former director of Catalyst Paper Corporation and CMAIO. Ms. Leversage is a Fellow in the Institute of Chartered Professional Accountants and was a Chartered Business Valuator (ret.) of the Canadian Institute of Chartered Business Valuators. | |||||

| British Columbia, Canada | Skills and Qualifications | |||||

|

Age: 66

Director Since: December 22, 2014

Tenure: 8.3 years

Principal Occupation:

Other Public Directorships: Aurinia Pharmaceuticals Inc.

|

· Capital Markets

· Financial / Audit & Risk Management

· Governance

· Leadership & Strategy

|

|||||

| Board Meetings Attended | ||||||

| Board Meetings | 8 of 8 | 100% | ||||

| 2022 Voting Results | Committee Meetings Attended | |||||

| For: 98.80% | Audit Committee | 4 of 4 | 100% | |||

| Withheld: 1.2% | Compensation and Human Resources Committee | 3 of 3 | 100% | |||

| Governance and Nomination Committee (Chair) | 5 of 5 | 100% | ||||

| Ownership Requirement | Achievement? (7) | Common Shares | DSUs | Options | ||

| 3x Annual Retainer | Yes | 14,300 | 116,027 | 0 | ||

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

| Selma Lussenburg, C.Dir., GCB.D | Independent Director (1)(4)(5) | |||||

|

Ms. Lussenburg is a business executive, former General Counsel, Corporate Secretary and current board director with over 35 years of business experience. She has held various senior executive positions encompassing a broad range of legal, governance, compliance, pension, safety and security, and operational responsibilities. Ms. Lussenburg currently serves on several other boards and committees, including Ontario Power Generation and the Muskoka Airport. Ms. Lussenburg is also a Canadian private sector member on the CUSMA 31.22 Advisory Committee on the resolution of private commercial disputes. She has served as General Counsel and Corporate Secretary for AT&T’s operations in Canada, for the Ontario Municipal Retirement System (OMERS), and most recently for Toronto Pearson International Airport. Ms. Lussenburg has an undergraduate law degree (University of Ottawa) and other degrees, including a Masters of International Law (Australian National University) and a post-graduate Certificate in Mining Law (York University). | |||||

| Ontario, Canada | Skills and Qualifications | |||||

|

Age: 67

Director Since: February 1, 2020

Tenure: 3.2 years

Principal Occupation:

Other Public Directorships: Ontario Power Generation Inc. |

· Governance · Health & Safety · International Experience · Leadership & Strategy · Legal · Environmental / Social · Executive Compensation

|

|||||

| Board Meetings Attended | ||||||

| Board Meetings | 8 of 8 | 100% | ||||

| 2022 Voting Results | Committee Meetings Attended | |||||

| For: 99.69% | Governance and Nomination Committee | 5 of 5 | 100% | |||

| Withheld: 0.31% | Health, Safety, Environment and Community Committee (Chair) | 4 of 4 | 100% | |||

| Ownership Requirement | Achievement? (7) | Common Shares | DSUs | Options | ||

| 3x Annual Retainer | Yes | 4,250 | 30,846 | 0 | ||

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

| Daniel T. MacInnis, Acc.Dir. | Independent Director (1)(5)(6) | |||||

|

Mr. MacInnis has over 40 years of experience in worldwide mineral exploration, including Mexico, and was President and CEO of the Company from 2005 to 2013. He has managed and directed multimillion dollar exploration programs for Noranda Exploration, Battle Mountain Gold/Hemlo Gold and Sargold Resources. Mr. MacInnis has extensive global experience in property acquisitions and joint venture negotiations and operation. A significant number of mineral discoveries have been made under his guidance. Discoveries include gold and base metal deposits in the U.S., Canada and Mexico. Mr. MacInnis is a graduate of Saint Francis Xavier University with a BSc. in Geology. He is also currently Chair of Group Eleven Resources. | |||||

| British Columbia, Canada | Skills and Qualifications | |||||

|

Age: 71

Director Since: February 1, 2005

Independent Director Since: January 1, 2019

Tenure: 18.2 years

Principal Occupation:

Other Public Directorships: Group Eleven Resources Corp.

|

· Environmental / Social · Capital Markets · Health & Safety · International Experience · Leadership & Strategy · Mineral Exploration · Executive Compensation

|

|||||

| Board Meetings Attended | ||||||

| Board Meetings | 8 of 8 | 100% | ||||

| 2022 Voting Results | Committee Meetings Attended | |||||

| For: 98.92 | Health, Safety, Environment and Community Committee | 4 of 4 | 100% | |||

| Withheld: 1.08% | Technical Committee | 5 of 5 | 100% | |||

| Ownership Requirement | Achievement? (7) | Common Shares | DSUs | Options | ||

| 3x Annual Retainer | Yes | 149,688 | 91,562 | 0 | ||

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

| Susan F. Mathieu, ICD.D | Independent Director (1)(5)(6) | |||||

|

Ms. Mathieu has more than 25 years of international mining experience through due diligence, exploration, project development, construction and operations. Her career spanned from mine site to corporate leadership roles in governance, environment, sustainability, community, health and safety, compliance and risk management programs and strategies. Ms. Mathieu commenced her career with Placer Dome and progressed to increasingly senior roles with Falconbridge, NovaGold Resources, Centerra Gold, BHP (formerly BHP Billiton), Golder Associates and NexGen Energy. Ms. Mathieu holds a BSc. (Honours) and MSc. in Biology (University of Saskatchewan), and an Executive MBA (Beedie School of Business, Simon Fraser University). | |||||

| Alberta, Canada | Skills and Qualifications | |||||

|

Age: 56

Director Since: January 13, 2021

Tenure: 2.2 years

Principal Occupation:

Other Public Directorships: N/A

|

· Mine Development / Operations · Environmental / Social · Health & Safety · International Experience

· Leadership & Strategy

|

|||||

| Board Meetings Attended | ||||||

| Board Meetings | 8 of 8 | 100% | ||||

| 2022 Voting Results | Committee Meetings Attended | |||||

| For: 99.77% | Health, Safety, Environment and Community Committee | 4 of 4 | 100% | |||

| Withheld: 0.23% | Technical Committee (Chair) | 5 of 5 | 100% | |||

| Ownership Requirement | Achievement? (7) | Common Shares | DSUs | Options | ||

| 3x Annual Retainer | Yes | 9,283 | 19,577 | 0 | ||

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

| Dale C. Peniuk | Independent Director (1)(2)(3) | |||||

|

Mr. Peniuk is a Chartered Professional Accountant (CPA, CA) and corporate director. Mr. Peniuk obtained his Bachelor of Commerce (Accounting and Management Information Systems) degree from the University of British Columbia in 1982 and his CA designation from the Institute of Chartered Accountants of British Columbia (now the Chartered Professional Accountants of British Columbia) in 1986, and spent more than 20 years with KPMG LLP (“KPMG”) and predecessor firms, the last 10 of which as an assurance partner with a focus on mining companies, including leading KPMG’s Vancouver office mining industry group. Mr. Peniuk currently serves on the Board and as Audit Committee Chair of Lundin Mining Corp., Argonaut Gold and Kuya Silver, and has been on the Board and Chair of the Audit Committee of numerous other Canadian public mining companies since 2006. | |||||

| British Columbia, Canada | Skills and Qualifications | |||||

|

Age: 63

Director Since: August 3, 2021

Tenure: 1.6 years

Principal Occupation:

Other Public Directorships: Lundin Mining Corp.

|

· Capital Markets · Financial / Audit & Risk Management · Governance · Executive Compensation · International Experience · Leadership & Strategy

|

|||||

| Board Meetings Attended | ||||||

| Board Meetings | 8 of 8 | 100% | ||||

| 2022 Voting Results | Committee Meetings Attended | |||||

| For: 98.05% | Audit Committee (Chair) | 4 of 4 | 100% | |||

| Withheld: 1.95% | Compensation and Human Resources Committee | 3 of 3 | 100% | |||

| Ownership Requirement | Achievement? (7) | Common Shares | DSUs | Options | ||

| 3x Annual Retainer | Yes | 1,000 | 18,492 | 0 | ||

-

|

MAG Silver Corp.

|

2023 Management Information Circular |

| George N. Paspalas, Acc.Dir. | President, CEO, Non-Independent Director (1) | |||||||

|