UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 11, 2023

_______________________________

BROADWIND, INC.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 001-34278 | 88-0409160 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

3240 South Central Avenue

Cicero, Illinois 60804

(Address of Principal Executive Offices) (Zip Code)

(708) 780-4800

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | BWEN | The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On May 11, 2023, Broadwind, Inc. (the “Company”) issued a press release announcing its financial results as of and for the quarter ended March 31, 2023. The press release is incorporated herein by reference and is attached hereto as Exhibit 99.1.

The information contained in, or incorporated into, this Item 2.02 of this Current Report on Form 8-K (this “Report”), including Exhibit 99.1, is furnished under Item 2.02 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act regardless of any general incorporation language in such filings.

Please refer to Exhibit 99.1 for a discussion of certain forward-looking statements included therein and the risks and uncertainties related thereto.

An Investor Presentation dated May 11, 2023 is incorporated herein by reference and attached hereto as Exhibit 99.2.

The information contained in, or incorporated into, this Item 7.01 of this Report, including Exhibit 99.2 attached hereto, is furnished under Item 7.01 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act or the Exchange Act regardless of any general incorporation language in such filings.

This Report shall not be deemed an admission as to the materiality of any information in this Report that is being disclosed pursuant to Regulation FD.

Please refer to Exhibit 99.2 for a discussion of certain forward-looking statements included therein and the risks and uncertainties related thereto.

(d) Exhibits

| EXHIBIT NUMBER | DESCRIPTION | |||

| 99.1 | Press Release dated May 11, 2023 | |||

| 99.2 | Investor Presentation dated May 11, 2023 | |||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BROADWIND, INC. | ||

| Date: May 11, 2023 | By: | /s/ Eric B. Blashford |

| Eric B. Blashford | ||

| President and Chief Executive Officer (Principal Executive Officer) |

||

EXHIBIT 99.1

Broadwind Announces First Quarter 2023 Results

CICERO, Ill., May 11, 2023 (GLOBE NEWSWIRE) -- Broadwind, Inc. (Nasdaq: BWEN, “Broadwind” or the “Company”), a diversified precision manufacturer of specialized components and solutions serving global markets, today announced results for the first quarter 2023.

FIRST QUARTER 2023 RESULTS

(As compared to the first quarter 2022)

FULL-YEAR 2023 FINANCIAL GUIDANCE

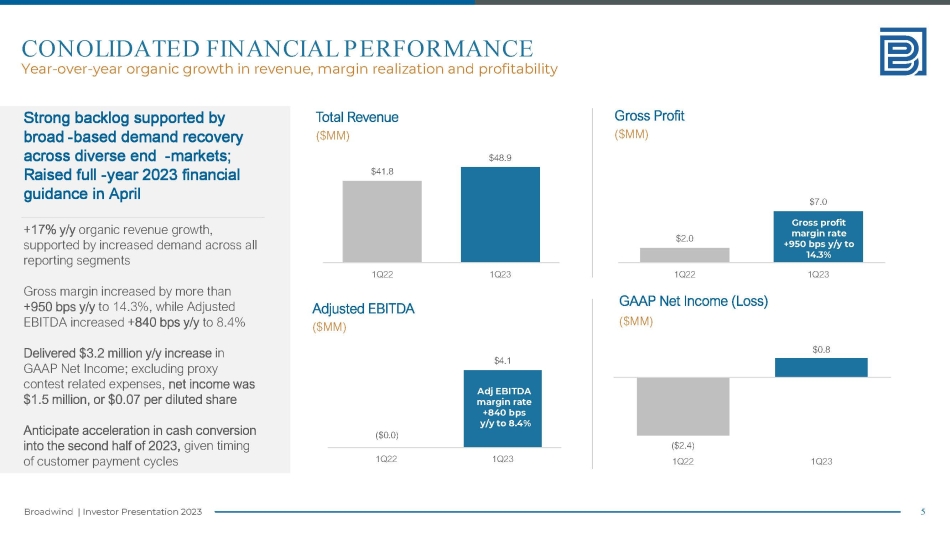

For the three months ended March 31, 2023, Broadwind reported total revenue of $48.9 million, an increase of 17% when compared to the prior-year period. The Company reported GAAP net income of $0.8 million, or $0.04 per diluted share, in the first quarter 2023, compared to a net loss of ($2.4) million, or ($0.12) per basic share, in the first quarter 2022. After excluding proxy contest-related expenses, the Company had net income of $1.5 million, or $0.07 per diluted share in the first quarter 2023. The Company reported adjusted EBITDA, a non-GAAP measure, of $4.1 million in the first quarter 2023, an increase of $4.1 million when compared to the prior-year period.

First quarter results benefited from a combination of sustained demand strength and strong operational execution across the Company’s diverse end-markets, with each reporting segment generating year-over-year growth in both revenue and operating income. Total gross margin increased 950 basis points on a year-over-year basis to a record 14.3%, primarily driven by improved sales mix, continued price discipline, benefits derived from advanced manufacturing credits associated with the Inflation Reduction Act (the “IRA”), and consistent asset optimization. Total backlog increased by $170.7 million on a year-over-year basis to $287.8 million, supported by growth across the Heavy Fabrications, Gearing and Industrial Solutions segments.

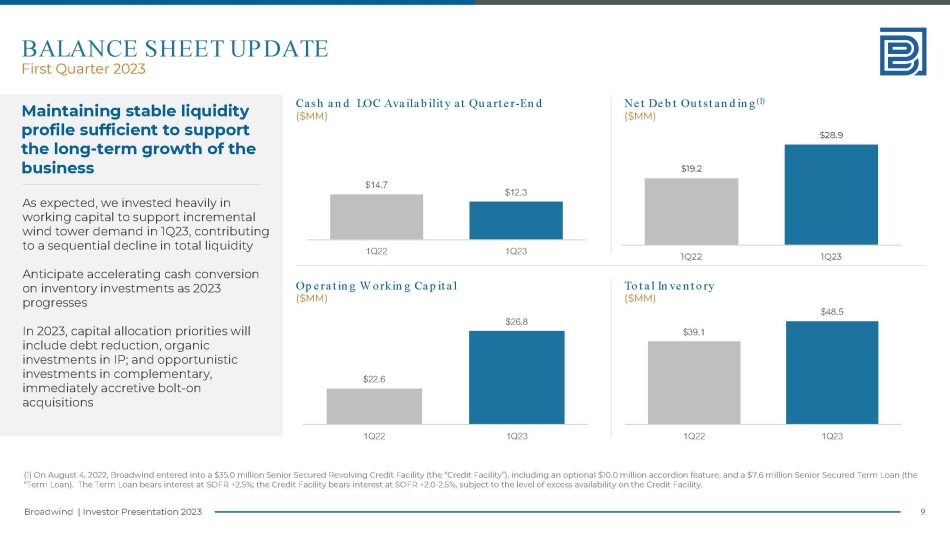

As of March 31, 2023, Broadwind had total cash on hand and availability under the Company’s credit facility of $12.3 million, down from $40.1 million at the end of the fourth quarter 2022. During the first quarter of 2023, the Company invested heavily in working capital to support incremental wind tower demand, contributing to a sequential decline in total liquidity, as expected.

BUSINESS UPDATE

Broadwind has continued to demonstrate strong operational excellence and commercial execution, consistent with a multi-year focus on building a market-leading precision manufacturing platform. Broadwind remains focused on organic growth within both existing and adjacent markets; further revenue mix diversification beyond its core wind business; improved asset optimization; ratable growth in orders and backlog; and disciplined capital management to support the requirements of the business.

MANAGEMENT COMMENTARY

“Our first quarter results demonstrate a strong start to the year, as sustained demand across our diverse end-markets, improved margin realization, and consistent operational execution contributed to significant year-over-year growth in volume and profitability,” stated Eric Blashford, President and CEO of Broadwind. “We delivered first quarter non-GAAP adjusted EBITDA of $4.1 million, ahead of our preliminary first quarter guided range of $3.0 to $4.0 million, while non-GAAP adjusted EBITDA margin increased by more than 800 basis points versus the prior-year period. We generated net income of $0.8 million in the first quarter, or $0.04 per diluted share, and currently expect to deliver positive net income for the full-year 2023.”

“Early into 2023, we’ve announced several significant new business wins, including $175 million in new tower orders received in late 2022, followed by a record $8 million order for our proprietary mobile PRS and related accessories in April,” continued Blashford. “These new orders reflect positive business momentum within our legacy wind business, together with significant traction within new, higher-margin adjacent markets that leverage our unique intellectual property, consistent with our long-term focus on driving profitable growth across a broader continuum of addressable energy transition and clean tech opportunities. As we further expand our product and service capabilities, we expect to drive improved asset utilization and unit economics, consistent with our focus on driving profitable growth through the cycle.”

“Our backlog remains near a record-high entering the second quarter 2023,” continued Blashford. “As before, assuming full utilization of our wind tower manufacturing facilities, we believe the IRA could provide up to an estimated $30 million in incremental annual gross profit in future years.”

“As of March 31, 2023, we had over $12 million of available cash and liquidity,” continued Blashford. “For the final nine months of 2023, we expect to generate positive free cash flow, given a normalization in working capital levels and total anticipated capital expenditures of approximately $6 million for the full-year 2023.”

“Entering the second quarter, we remain on-pace to achieve our full-year 2023 guidance,” stated Blashford. “At a strategic level, we remain focused on organic commercial growth, improved asset optimization, margin expansion and sustained profitability. Our first quarter results demonstrate focused execution on these priorities, while creating a strong foundation for long-term value creation.”

SEGMENT RESULTS

Heavy Fabrications Segment

Broadwind provides large, complex and precision fabrications to customers in a broad range of industrial markets. Key products include wind towers, PRS units and other industrial fabrications, including mining and material handling components and other frames/structures.

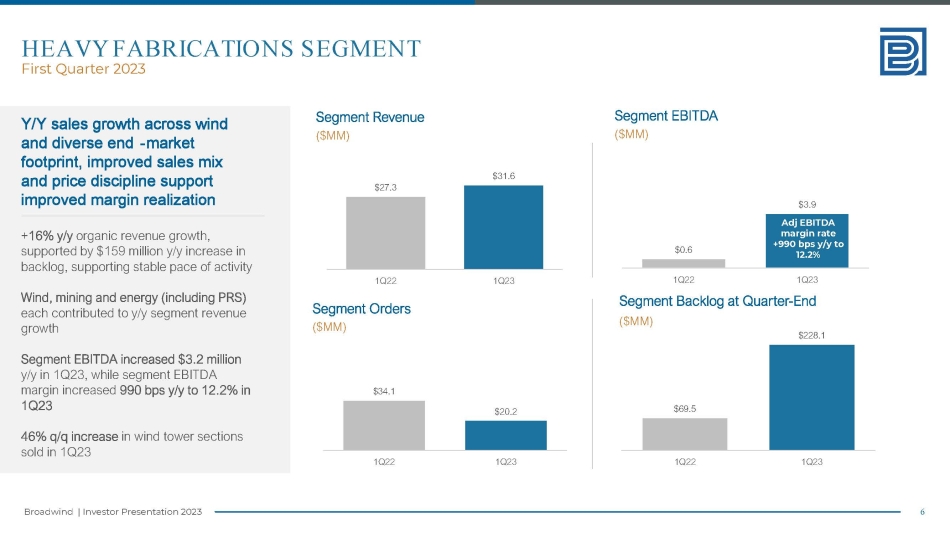

Heavy Fabrications segment sales increased 16% to $31.6 million in the first quarter 2023 as compared to the prior-year period primarily driven by increased raw material content and less customer supplied materials on tower sections sold, as well as improved industrial fabrication volumes primarily driven by increased demand for our PRS units. The segment reported operating income of $2.8 million in the first quarter 2023, as compared to an operating loss of ($0.5) million in the prior-year period. Segment non-GAAP adjusted EBITDA was $3.9 million in the first quarter 2023, as compared to $0.6 million in the prior-year period.

Gearing Segment

Broadwind provides custom gearboxes, loose gearing and heat treat services to a broad set of customers in diverse markets, including oil & gas production, surface and underground mining, wind energy, steel, material handling and other infrastructure markets.

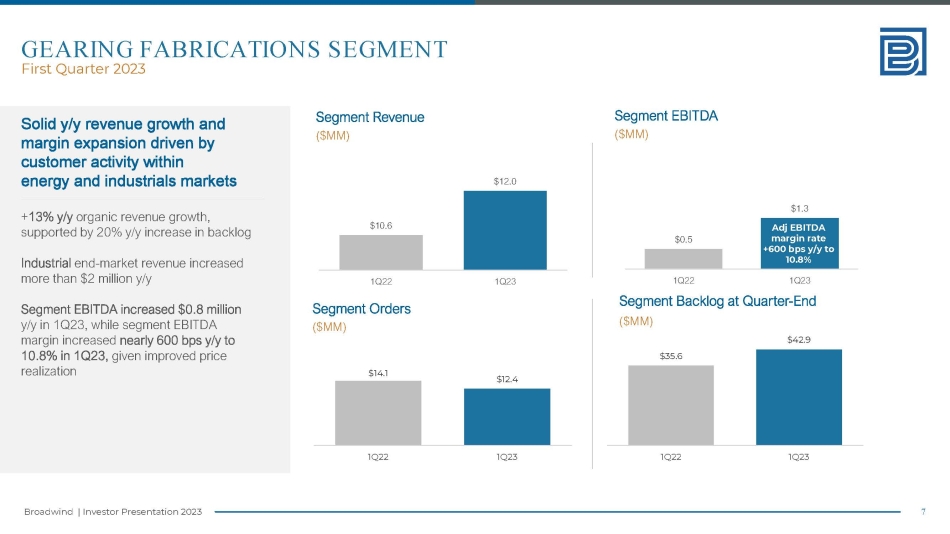

Gearing segment sales increased by 13% to $12.0 million in the first quarter 2023, as compared to the prior-year period, primarily driven by increased demand from industrial customers. The segment reported operating income of $0.6 million in the first quarter 2023, compared to an operating loss of ($0.1) million in the prior-year period. The segment reported non-GAAP adjusted EBITDA of $1.3 million in the first quarter 2023, versus $0.5 million in the prior-year period.

Industrial Solutions Segment

Broadwind provides supply chain solutions, light fabrication, inventory management, kitting and assembly services, primarily serving the combined cycle natural gas turbine market as well as other clean technology markets.

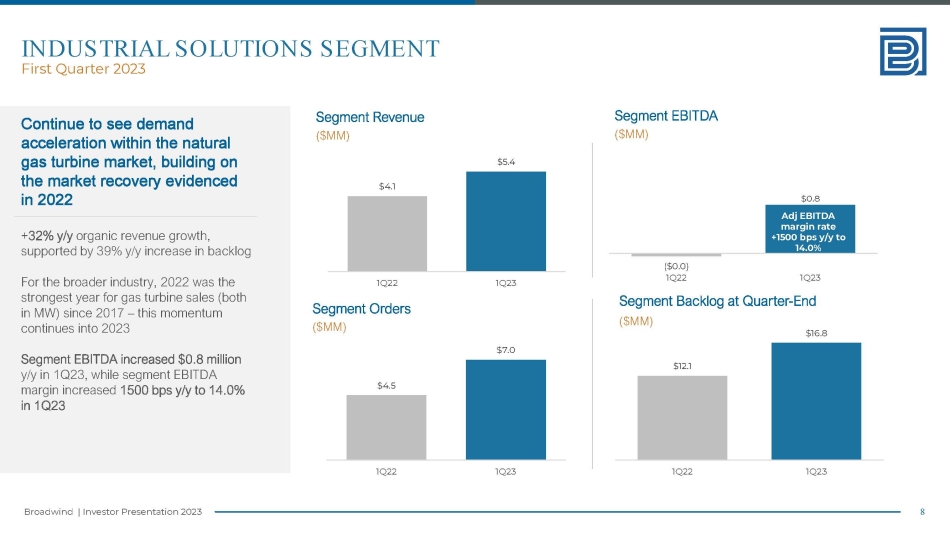

Industrial Solutions segment sales increased 33% to $5.4 million in the first quarter 2023, as compared to the prior-year period, primarily driven by increased demand for natural gas turbine content, as industry gas turbine unit sales reached multi-year highs. The segment reported operating income of $0.6 million in the first quarter 2023, compared to an operating loss of ($0.2) million in the prior-year period. The segment reported non-GAAP adjusted EBITDA of $0.8 million in the first quarter 2023, as compared to ($0.0) million in the prior-year period.

FINANCIAL GUIDANCE

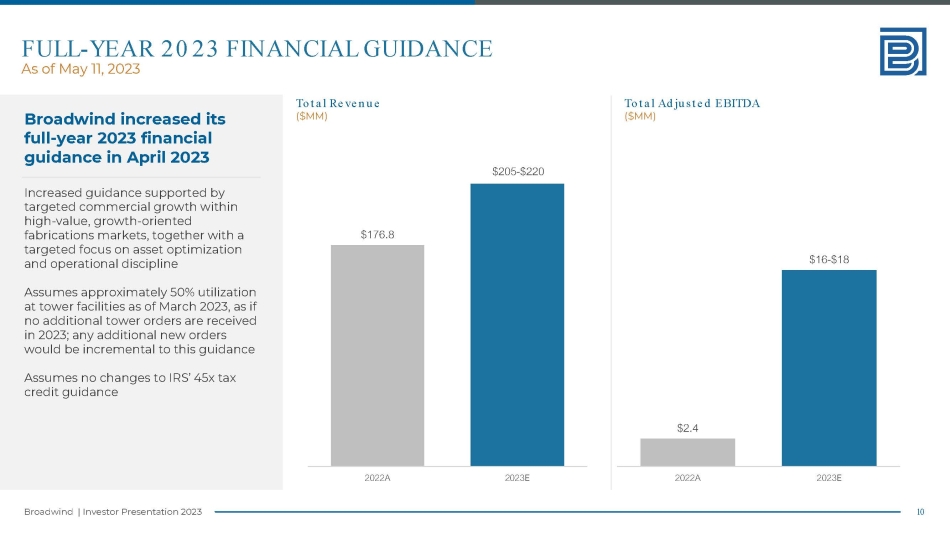

The following financial guidance for the full year 2023 reflects the Company’s current expectations and beliefs. All guidance is current as of the time provided and is subject to change.

| $ in Millions | Previous Full-Year 2023 Guidance | New Full-Year 2023 Guidance | ||||||||

| Low | High | Low | High | |||||||

| Revenue | $200 | $220 | $205 | $220 | ||||||

| Non-GAAP Adjusted EBITDA | $14 | $16 | $16 | $18 | ||||||

FIRST QUARTER 2023 CONFERENCE CALL

Broadwind will host a conference call today at 11:00 A.M. ET to review the Company’s financial results, discuss recent events and conduct a question-and-answer session.

A webcast of the conference call and accompanying presentation materials will be available in the Investor Relations section of the Company’s corporate website at https://investors.bwen.com/investors. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download, and install any necessary audio software.

To participate in the live teleconference:

| Domestic Live Call: | 1-877-407-9716 |

| International Live Call: | 1-201-493-6779 |

To listen to a replay of the teleconference, which will be available through May 18, 2023:

| Domestic Call Replay: | 1-844-512-2921 |

| International Call Replay: | 1-412-317-6671 |

| Access Code: | 13737950 |

ABOUT BROADWIND

Broadwind (NASDAQ: BWEN) is a precision manufacturer of structures, equipment and components for clean tech and other specialized applications. With facilities throughout the U.S., our talented team is committed to helping customers maximize performance of their investments—quicker, easier and smarter. Find out more at www.bwen.com.

NON-GAAP FINANCIAL MEASURES

The Company provides non-GAAP adjusted EBITDA (earnings before interest, income taxes, depreciation, amortization, share-based compensation and other stock payments, restructuring costs, impairment charges, proxy contest-related expenses and other non-cash gains and losses) as supplemental information regarding the Company’s business performance. The Company’s management uses this supplemental information when it internally evaluates its performance, reviews financial trends and makes operating and strategic decisions. The Company believes that this non-GAAP financial measure is useful to investors because it provides investors with a better understanding of the Company’s past financial performance and future results, which allows investors to evaluate the Company’s performance using the same methodology and information as used by the Company’s management. The Company's definition of adjusted EBITDA may be different from similar non-GAAP financial measures used by other companies and/or analysts.

FORWARD-LOOKING STATEMENTS

This release contains “forward-looking statements”—that is, statements related to future, not past, events—as defined in Section 21E of the Securities Exchange Act of 1934, as amended, that reflect our current expectations regarding our future growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities, as well as assumptions made by, and information currently available to, our management. Forward-looking statements include any statement that does not directly relate to a current or historical fact. We have tried to identify forward-looking statements by using words such as “anticipate,” “believe,” “expect,” “intend,” “will,” “should,” “may,” “plan” and similar expressions, but these words are not the exclusive means of identifying forward looking statements. Our forward-looking statements may include or relate to our beliefs, expectations, plans and/or assumptions with respect to the following: (i) the impact of global health concerns on the economies and financial markets and the demand for our products; (ii) state, local and federal regulatory frameworks affecting the industries in which we compete, including the wind energy industry, and the related extension, continuation or renewal of federal tax incentives and grants, including the advanced manufacturing tax credits (which remain subject to further technical guidance and regulations), and state renewable portfolio standards as well as new or continuing tariffs on steel or other products imported into the United States; (iii) our customer relationships and our substantial dependency on a few significant customers and our efforts to diversify our customer base and sector focus and leverage relationships across business units; (iv) the economic and operational stability of our significant customers and suppliers, including their respective supply chains, and the ability to source alternative suppliers as necessary; (v) our ability to continue to grow our business organically and through acquisitions; (vi) the production, sales, collections, customer deposits and revenues generated by new customer orders and our ability to realize the resulting cash flows; (vii) information technology failures, network disruptions, cybersecurity attacks or breaches in data security; (viii) the sufficiency of our liquidity and alternate sources of funding, if necessary; (ix) our ability to realize revenue from customer orders and backlog; (x) our ability to operate our business efficiently, comply with our debt obligations, manage capital expenditures and costs effectively, and generate cash flow; (xi) the economy and the potential impact it may have on our business, including our customers; (xii) the state of the wind energy market and other energy and industrial markets generally and the impact of competition and economic volatility in those markets; (xiii) the effects of market disruptions and regular market volatility, including fluctuations in the price of oil, gas and other commodities; (xiv) competition from new or existing industry participants including, in particular, increased competition from foreign tower manufacturers; (xv) the effects of the change of administrations in the U.S. federal government; (xvi) our ability to successfully integrate and operate acquired companies and to identify, negotiate and execute future acquisitions; (xvii) the potential loss of tax benefits if we experience an “ownership change” under Section 382 of the Internal Revenue Code of 1986, as amended; (xviii) the limited trading market for our securities and the volatility of market price for our securities; and (xix) the impact of future sales of our common stock or securities convertible into our common stock on our stock price. These statements are based on information currently available to us and are subject to various risks, uncertainties and other factors that could cause our actual growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities to differ materially from those expressed in, or implied by, these statements including, but not limited to, those set forth under the caption “Risk Factors” in Part I, Item 1A of our most recently filed Form 10-K and our other filings with the Securities and Exchange Commission (the “SEC”). We are under no duty to update any of these statements. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties or other factors that could cause our current beliefs, expectations, plans and/or assumptions to change. Accordingly, forward-looking statements should not be relied upon as a predictor of actual results.

IR CONTACT

Noel Ryan, IRC

BWEN@val-adv.com

BROADWIND, INC. AND SUBSIDIARIES

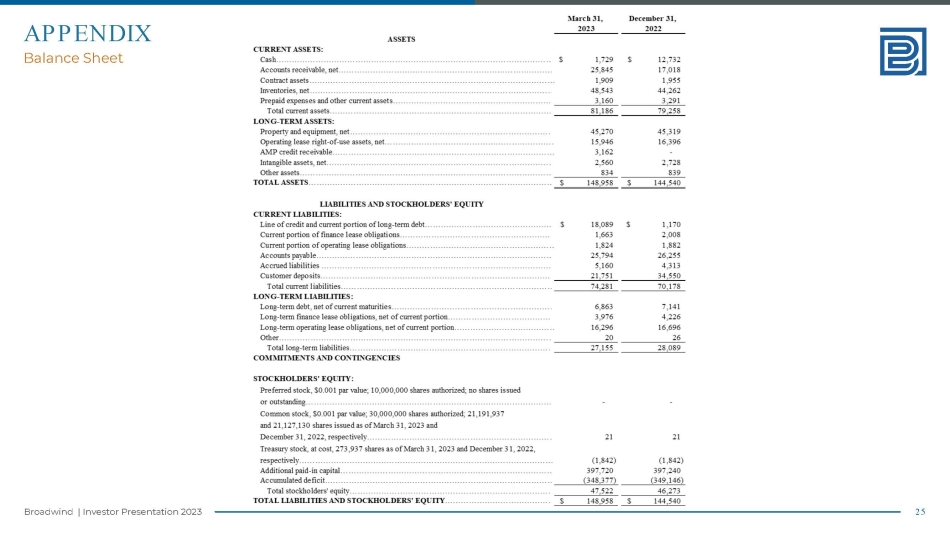

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS)

(UNAUDITED)

| March 31, | December 31, | |||||||||

| 2023 | 2022 | |||||||||

| ASSETS | ||||||||||

| CURRENT ASSETS: | ||||||||||

| Cash | $ | 1,729 | $ | 12,732 | ||||||

| Accounts receivable, net | 25,845 | 17,018 | ||||||||

| Contract assets | 1,909 | 1,955 | ||||||||

| Inventories, net | 48,543 | 44,262 | ||||||||

| Prepaid expenses and other current assets | 3,160 | 3,291 | ||||||||

| Total current assets | 81,186 | 79,258 | ||||||||

| LONG-TERM ASSETS: | ||||||||||

| Property and equipment, net | 45,270 | 45,319 | ||||||||

| Operating lease right-of-use assets, net | 15,946 | 16,396 | ||||||||

| AMP credit receivable | 3,162 | - | ||||||||

| Intangible assets, net | 2,560 | 2,728 | ||||||||

| Other assets | 834 | 839 | ||||||||

| TOTAL ASSETS | $ | 148,958 | $ | 144,540 | ||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||

| CURRENT LIABILITIES: | ||||||||||

| Line of credit and current portion of long-term debt | $ | 18,089 | $ | 1,170 | ||||||

| Current portion of finance lease obligations | 1,663 | 2,008 | ||||||||

| Current portion of operating lease obligations | 1,824 | 1,882 | ||||||||

| Accounts payable | 25,794 | 26,255 | ||||||||

| Accrued liabilities | 5,160 | 4,313 | ||||||||

| Customer deposits | 21,751 | 34,550 | ||||||||

| Total current liabilities | 74,281 | 70,178 | ||||||||

| LONG-TERM LIABILITIES: | ||||||||||

| Long-term debt, net of current maturities | 6,863 | 7,141 | ||||||||

| Long-term finance lease obligations, net of current portion | 3,976 | 4,226 | ||||||||

| Long-term operating lease obligations, net of current portion | 16,296 | 16,696 | ||||||||

| Other | 20 | 26 | ||||||||

| Total long-term liabilities | 27,155 | 28,089 | ||||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||||

| STOCKHOLDERS' EQUITY: | ||||||||||

| Preferred stock, $0.001 par value; 10,000,000 shares authorized; no shares issued | ||||||||||

| or outstanding | - | - | ||||||||

| Common stock, $0.001 par value; 30,000,000 shares authorized; 21,191,937 | ||||||||||

| and 21,127,130 shares issued as of March 31, 2023 and | ||||||||||

| December 31, 2022, respectively | 21 | 21 | ||||||||

| Treasury stock, at cost, 273,937 shares as of March 31, 2023 and December 31, 2022, | ||||||||||

| respectively | (1,842 | ) | (1,842 | ) | ||||||

| Additional paid-in capital | 397,720 | 397,240 | ||||||||

| Accumulated deficit | (348,377 | ) | (349,146 | ) | ||||||

| Total stockholders' equity | 47,522 | 46,273 | ||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 148,958 | $ | 144,540 | ||||||

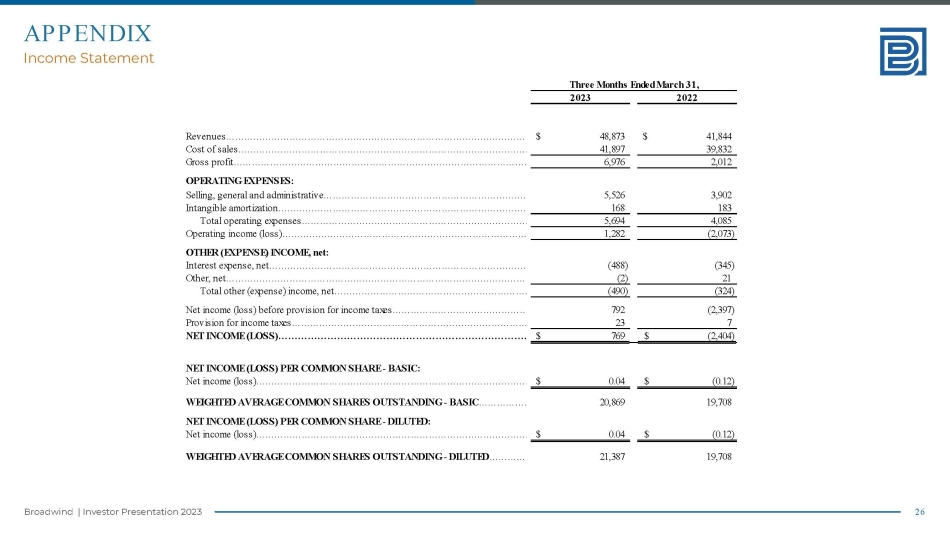

BROADWIND, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| Three Months Ended March 31, | |||||||||

| 2023 | 2022 | ||||||||

| Revenues | $ | 48,873 | $ | 41,844 | |||||

| Cost of sales | 41,897 | 39,832 | |||||||

| Gross profit | 6,976 | 2,012 | |||||||

| OPERATING EXPENSES: | |||||||||

| Selling, general and administrative | 5,526 | 3,902 | |||||||

| Intangible amortization | 168 | 183 | |||||||

| Total operating expenses | 5,694 | 4,085 | |||||||

| Operating income (loss) | 1,282 | (2,073 | ) | ||||||

| OTHER (EXPENSE) INCOME, net: | |||||||||

| Interest expense, net | (488 | ) | (345 | ) | |||||

| Other, net | (2 | ) | 21 | ||||||

| Total other (expense) income, net | (490 | ) | (324 | ) | |||||

| Net income (loss) before provision for income taxes | 792 | (2,397 | ) | ||||||

| Provision for income taxes | 23 | 7 | |||||||

| NET INCOME (LOSS) | $ | 769 | $ | (2,404 | ) | ||||

| NET INCOME (LOSS) PER COMMON SHARE - BASIC: | |||||||||

| Net income (loss) | $ | 0.04 | $ | (0.12 | ) | ||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING - BASIC | 20,869 | 19,708 | |||||||

| NET INCOME (LOSS) PER COMMON SHARE - DILUTED: | |||||||||

| Net income (loss) | $ | 0.04 | $ | (0.12 | ) | ||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING - DILUTED | 21,387 | 19,708 | |||||||

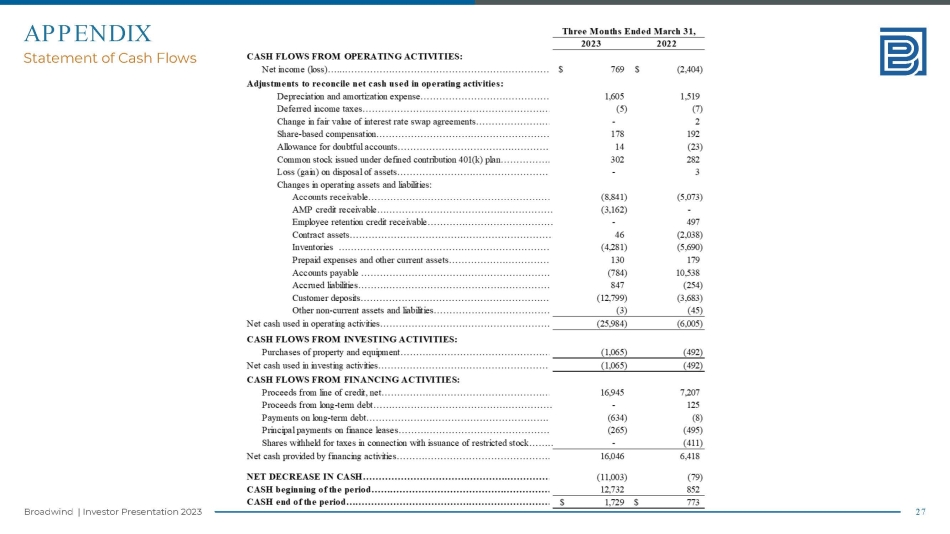

BROADWIND, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

(UNAUDITED)

| Three Months Ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net income (loss) | $ | 769 | $ | (2,404 | ) | |||

| Adjustments to reconcile net cash used in operating activities: | ||||||||

| Depreciation and amortization expense | 1,605 | 1,519 | ||||||

| Deferred income taxes | (5 | ) | (7 | ) | ||||

| Change in fair value of interest rate swap agreements | - | 2 | ||||||

| Share-based compensation | 178 | 192 | ||||||

| Allowance for doubtful accounts | 14 | (23 | ) | |||||

| Common stock issued under defined contribution 401(k) plan | 302 | 282 | ||||||

| Loss (gain) on disposal of assets | - | 3 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (8,841 | ) | (5,073 | ) | ||||

| AMP credit receivable | (3,162 | ) | - | |||||

| Employee retention credit receivable | - | 497 | ||||||

| Contract assets | 46 | (2,038 | ) | |||||

| Inventories | (4,281 | ) | (5,690 | ) | ||||

| Prepaid expenses and other current assets | 130 | 179 | ||||||

| Accounts payable | (784 | ) | 10,538 | |||||

| Accrued liabilities | 847 | (254 | ) | |||||

| Customer deposits | (12,799 | ) | (3,683 | ) | ||||

| Other non-current assets and liabilities | (3 | ) | (45 | ) | ||||

| Net cash used in operating activities | (25,984 | ) | (6,005 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchases of property and equipment | (1,065 | ) | (492 | ) | ||||

| Net cash used in investing activities | (1,065 | ) | (492 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from line of credit, net | 16,945 | 7,207 | ||||||

| Proceeds from long-term debt | - | 125 | ||||||

| Payments on long-term debt | (634 | ) | (8 | ) | ||||

| Principal payments on finance leases | (265 | ) | (495 | ) | ||||

| Shares withheld for taxes in connection with issuance of restricted stock | - | (411 | ) | |||||

| Net cash provided by financing activities | 16,046 | 6,418 | ||||||

| NET DECREASE IN CASH | (11,003 | ) | (79 | ) | ||||

| CASH beginning of the period | 12,732 | 852 | ||||||

| CASH end of the period | $ | 1,729 | $ | 773 | ||||

BROADWIND, INC. AND SUBSIDIARIES

SELECTED SEGMENT FINANCIAL INFORMATION

(IN THOUSANDS)

(UNAUDITED)

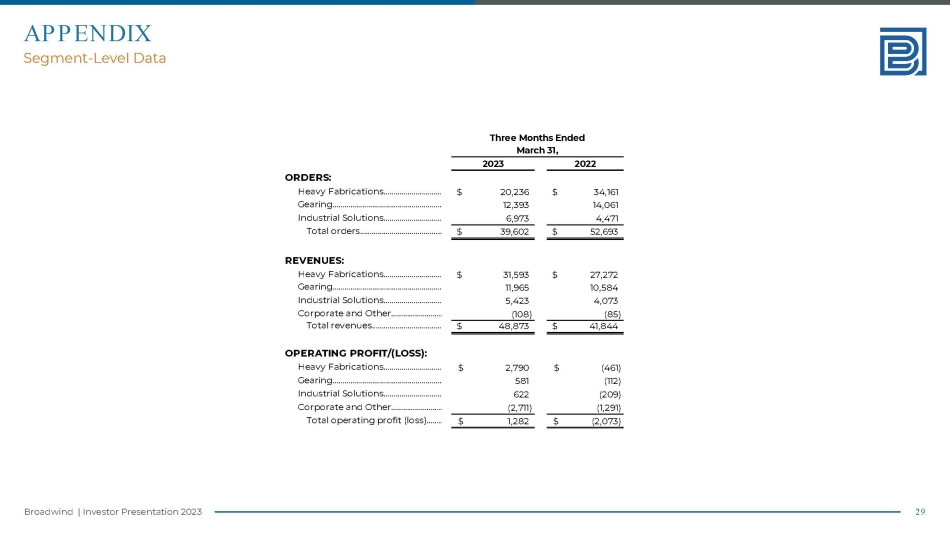

| Three Months Ended | ||||||||||

| March 31, | ||||||||||

| 2023 | 2022 | |||||||||

| ORDERS: | ||||||||||

| Heavy Fabrications | $ | 20,236 | $ | 34,161 | ||||||

| Gearing | 12,393 | 14,061 | ||||||||

| Industrial Solutions | 6,973 | 4,471 | ||||||||

| Total orders | $ | 39,602 | $ | 52,693 | ||||||

| REVENUES: | ||||||||||

| Heavy Fabrications | $ | 31,593 | $ | 27,272 | ||||||

| Gearing | 11,965 | 10,584 | ||||||||

| Industrial Solutions | 5,423 | 4,073 | ||||||||

| Corporate and Other | (108 | ) | (85 | ) | ||||||

| Total revenues | $ | 48,873 | $ | 41,844 | ||||||

| OPERATING PROFIT/(LOSS): | ||||||||||

| Heavy Fabrications | $ | 2,790 | $ | (461 | ) | |||||

| Gearing | 581 | (112 | ) | |||||||

| Industrial Solutions | 622 | (209 | ) | |||||||

| Corporate and Other | (2,711 | ) | (1,291 | ) | ||||||

| Total operating profit (loss) | $ | 1,282 | $ | (2,073 | ) | |||||

BROADWIND, INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(IN THOUSANDS)

(UNAUDITED)

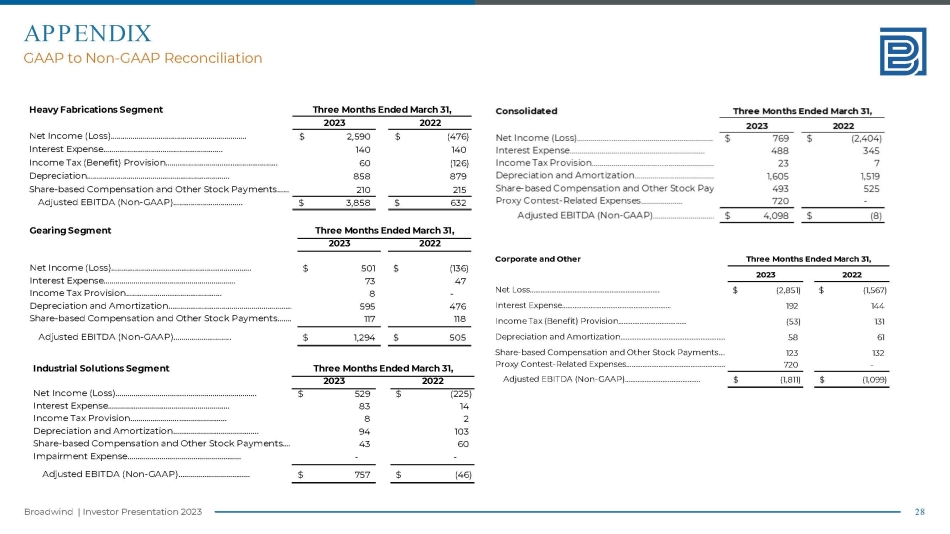

| Consolidated | Three Months Ended March 31, | ||||||||

| 2023 | 2022 | ||||||||

| Net Income (Loss) | $ | 769 | $ | (2,404 | ) | ||||

| Interest Expense | 488 | 345 | |||||||

| Income Tax Provision | 23 | 7 | |||||||

| Depreciation and Amortization | 1,605 | 1,519 | |||||||

| Share-based Compensation and Other Stock Payments | 493 | 525 | |||||||

| Proxy Contest-Related Expenses | 720 | - | |||||||

| Adjusted EBITDA (Non-GAAP) | $ | 4,098 | $ | (8 | ) | ||||

| Heavy Fabrications Segment | Three Months Ended March 31, | |||||||

| 2023 | 2022 | |||||||

| Net Income (Loss) | $ | 2,590 | $ | (476 | ) | |||

| Interest Expense | 140 | 140 | ||||||

| Income Tax (Benefit) Provision | 60 | (126 | ) | |||||

| Depreciation | 858 | 879 | ||||||

| Share-based Compensation and Other Stock Payments | 210 | 215 | ||||||

| Adjusted EBITDA (Non-GAAP) | $ | 3,858 | $ | 632 | ||||

| Gearing Segment | Three Months Ended March 31, | |||||||

| 2023 | 2022 | |||||||

| Net Income (Loss) | $ | 501 | $ | (136 | ) | |||

| Interest Expense | 73 | 47 | ||||||

| Income Tax Provision | 8 | - | ||||||

| Depreciation and Amortization | 595 | 476 | ||||||

| Share-based Compensation and Other Stock Payments | 117 | 118 | ||||||

| Adjusted EBITDA (Non-GAAP) | $ | 1,294 | $ | 505 | ||||

| Industrial Solutions Segment | Three Months Ended March 31, | |||||||

| 2023 | 2022 | |||||||

| Net Income (Loss) | $ | 529 | $ | (225 | ) | |||

| Interest Expense | 83 | 14 | ||||||

| Income Tax Provision | 8 | 2 | ||||||

| Depreciation and Amortization | 94 | 103 | ||||||

| Share-based Compensation and Other Stock Payments | 43 | 60 | ||||||

| Adjusted EBITDA (Non-GAAP) | $ | 757 | $ | (46 | ) | |||

| Corporate and Other | Three Months Ended March 31, | ||||||||

| 2023 | 2022 | ||||||||

| Net Loss | $ | (2,851 | ) | $ | (1,567 | ) | |||

| Interest Expense | 192 | 144 | |||||||

| Income Tax (Benefit) Provision | (53 | ) | 131 | ||||||

| Depreciation and Amortization | 58 | 61 | |||||||

| Share-based Compensation and Other Stock Payments | 123 | 132 | |||||||

| Proxy Contest-Related Expenses | 720 | - | |||||||

| Adjusted EBITDA (Non-GAAP) | $ | (1,811 | ) | $ | (1,099 | ) | |||

EXHIBIT 99.2

1 Broadwind | Investor Presentation 2023 First Quarter 2023 Conference Call Presentation May 11, 2023 2 Broadwind | Investor Presentation 2023 SAFE HARBOR STATEMENT This document contains “forward - looking statements” — that is, statements related to future, not past, events — as defined in Section 21 E of the Securities Exchange Act of 1934 , as amended, that reflect our current expectations regarding our future growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities, as well as assumptions made by, and information currently available to, our management . Forward - looking statements include any statement that does not directly relate to a current or historical fact . We have tried to identify forward - looking statements by using words such as “anticipate,” “believe,” “expect,” “intend,” “will,” “should,” “may,” “plan” and similar expressions, but these words are not the exclusive means of identifying forward looking statements . Our forward - looking statements may include or relate to our beliefs, expectations, plans and/or assumptions with respect to the following : ( i ) the impact of global health concerns on the economies and financial markets and the demand for our products ; (ii) state, local and federal regulatory frameworks affecting the industries in which we compete, including the wind energy industry, and the related extension, continuation or renewal of federal tax incentives and grants, including the advanced manufacturing tax credits (which remain subject to further technical guidance and regulations), and state renewable portfolio standards as well as new or continuing tariffs on steel or other products imported into the United States ; (iii) our customer relationships and our substantial dependency on a few significant customers and our efforts to diversify our customer base and sector focus and leverage relationships across business units ; (iv) the economic and operational stability of our significant customers and suppliers, including their respective supply chains, and the ability to source alternative suppliers as necessary ; (v) our ability to continue to grow our business organically and through acquisitions ; (vi) the production, sales, collections, customer deposits and revenues generated by new customer orders and our ability to realize the resulting cash flows ; (vii) information technology failures, network disruptions, cybersecurity attacks or breaches in data security ; (viii) the sufficiency of our liquidity and alternate sources of funding, if necessary ; (ix) our ability to realize revenue from customer orders and backlog ; (x) our ability to operate our business efficiently, comply with our debt obligations, manage capital expenditures and costs effectively, and generate cash flow ; (xi) the economy and the potential impact it may have on our business, including our customers ; (xii) the state of the wind energy market and other energy and industrial markets generally and the impact of competition and economic volatility in those markets ; (xiii) the effects of market disruptions and regular market volatility, including fluctuations in the price of oil, gas and other commodities ; (xiv) competition from new or existing industry participants including, in particular, increased competition from foreign tower manufacturers ; (xv) the effects of the change of administrations in the U . S . federal government ; (xvi) our ability to successfully integrate and operate acquired companies and to identify, negotiate and execute future acquisitions ; (xvii) the potential loss of tax benefits if we experience an “ownership change” under Section 382 of the Internal Revenue Code of 1986 , as amended ; (xviii) the limited trading market for our securities and the volatility of market price for our securities ; and (xix) the impact of future sales of our common stock or securities convertible into our common stock on our stock price . These statements are based on information currently available to us and are subject to various risks, uncertainties and other factors that could cause our actual growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities to differ materially from those expressed in, or implied by, these statements including, but not limited to, those set forth under the caption “Risk Factors” in Part I, Item 1 A of our most recently filed Form 10 - K and our other filings with the Securities and Exchange Commission (the “SEC”) . We are under no duty to update any of these statements . You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties or other factors that could cause our current beliefs, expectations, plans and/or assumptions to change . Accordingly, forward - looking statements should not be relied upon as a predictor of actual results .

1Q23 PERFORMANCE SUMMARY

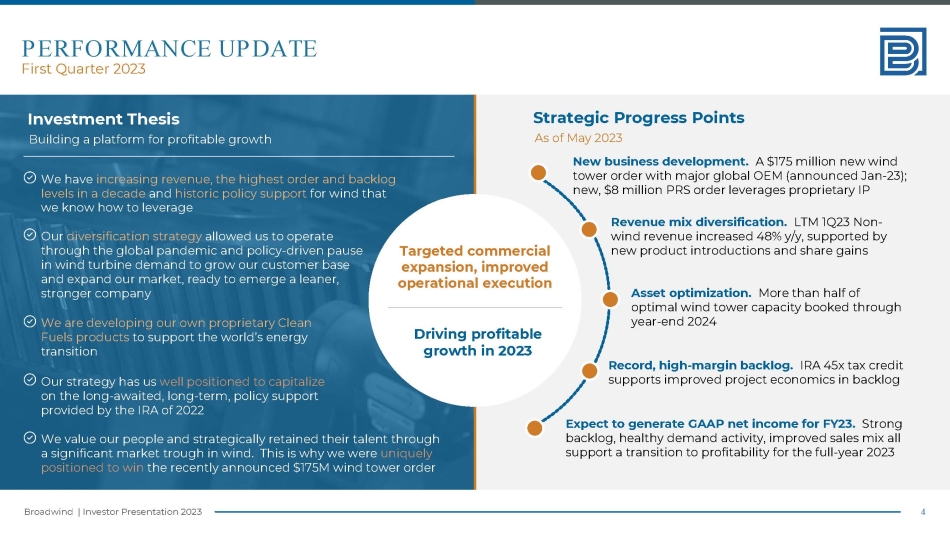

4 Broadwind | Investor Presentation 2023 PERFORMANCE UPDATE Targeted commercial expansion, improved operational execution Driving profitable growth in 2023 Strategic Progress Points As of May 2023 New business development. A $175 million new wind tower order with major global OEM (announced Jan - 23); new, $8 million PRS order leverages proprietary IP Revenue mix diversification. LTM 1Q23 Non - wind revenue increased 48% y/y, supported by new product introductions and share gains Asset optimization. More than half of optimal wind tower capacity booked through year - end 2024 Record, high - margin backlog. IRA 45x tax credit supports improved project economics in backlog Expect to generate GAAP net income for FY23. Strong backlog, healthy demand activity, improved sales mix all support a transition to profitability for the full - year 2023 We have increasing revenue, the highest order and backlog levels in a decade and historic policy support for wind that we know how to leverage Our diversification strategy allowed us to operate through the global pandemic and policy - driven pause in wind turbine demand to grow our customer base and expand our market, ready to emerge a leaner, stronger company We are developing our own proprietary Clean Fuels products to support the world’s energy transition Our strategy has us well positioned to capitalize on the long - awaited, long - term, policy support provided by the IRA of 2022 We value our people and strategically retained their talent through a significant market trough in wind.

This is why we were uniquely positioned to win the recently announced $175M wind tower order Investment Thesis Building a platform for profitable growth First Quarter 2023 5 Broadwind | Investor Presentation 2023 Year - over - year organic growth in revenue, margin realization and profitability CONOLIDATED FINANCIAL PERFORMANCE Strong backlog supported by broad - based demand recovery across diverse end - markets; R aised full - year 2023 financial guidance in April +17% y/y organic revenue growth, supported by increased demand across all reporting segments Gross margin increased by more than +950 bps y/y to 14.3%, while Adjusted EBITDA increased +840 bps y/y to 8.4% Delivered $3.2 million y/y increase in GAAP Net Income; excluding proxy contest related expenses, net income was $1.5 million, or $0.07 per diluted share Anticipate acceleration in cash conversion into the second half of 2023, given timing of customer payment cycles Total Revenue ($MM) Gross Profit ($MM) Adjusted EBITDA ($MM) GAAP Net Income (Loss) ($MM) $41.8 $48.9 1Q22 1Q23 $2.0 $7.0 1Q22 1Q23 ($0.0) Gross profit margin rate +950 bps y/y to 14.3% $4.1 1Q22 1Q23 Adj EBITDA margin rate +840 bps y/y to 8.4% ($2.4) $0.8 1Q22 1Q23 6 Broadwind | Investor Presentation 2023 First Quarter 2023 HEAVY FABRICATIONS SEGMENT Y/Y sales growth across wind and diverse end - market footprint, improved sales mix and price discipline support improved margin realization +16% y/y organic revenue growth, supported by $159 million y/y increase in backlog, supporting stable pace of activity Wind, mining and energy (including PRS) each contributed to y/y segment revenue growth Segment EBITDA increased $3.2 million y/y in 1Q23, while segment EBITDA margin increased 990 bps y/y to 12.2% in 1Q23 46% q/q increase in wind tower sections sold in 1Q23 Segment Revenue ($MM) Segment EBITDA ($MM) Segment Orders ($MM) Segment Backlog at Quarter - End ($MM) $27.3 $31.6 1Q22 1Q23 $0.6 $3.9 1Q22 1Q23 Adj EBITDA margin rate +990 bps y/y to 12.2% $34.1 $20.2 1Q22 1Q23 $69.5 $228.1 1Q22 1Q23

7 Broadwind | Investor Presentation 2023 First Quarter 2023 GEARING FABRICATIONS SEGMENT Solid y/y revenue growth and margin expansion driven by customer activity within energy and industrials markets +13% y/y organic revenue growth, supported by 20% y/y increase in backlog Industrial end - market revenue increased more than $2 million y/y Segment EBITDA increased $0.8 million y/y in 1Q23, while segment EBITDA margin increased nearly 600 bps y/y to 10.8% in 1Q23, given improved price realization Segment Revenue ($MM) Segment EBITDA ($MM) Segment Orders ($MM) Segment Backlog at Quarter - End ($MM) $10.6 $12.0 1Q22 1Q23 $0.5 $1.3 1Q22 1Q23 $14.1 $12.4 1Q22 1Q23 $35.6 $42.9 1Q22 1Q23 Adj EBITDA margin rate +600 bps y/y to 10.8% 8 Broadwind | Investor Presentation 2023 First Quarter 2023 INDUSTRIAL SOLUTIONS SEGMENT Continue to see demand acceleration within the natural gas turbine market, building on the market recovery evidenced in 2022 +32% y/y organic revenue growth, supported by 39% y/y increase in backlog For the broader industry, 2022 was the strongest year for gas turbine sales (both in MW) since 2017 – this momentum continues into 2023 Segment EBITDA increased $0.8 million y/y in 1Q23, while segment EBITDA margin increased 1500 bps y/y to 14.0% in 1Q23 Segment Revenue ($MM) Segment EBITDA ($MM) Segment Orders ($MM) Segment Backlog at Quarter - End ($MM) $4.1 $5.4 1Q22 1Q23 ($0.0) $0.8 1Q22 1Q23 $4.5 $7.0 1Q22 1Q23 $12.1 $16.8 1Q22 1Q23 Adj EBITDA margin rate +1500 bps y/y to 14.0%

9 Broadwind | Investor Presentation 2023 (1) On August 4, 2022, Broadwind entered into a $35.0 million Senior Secured Revolving Credit Facility (the “Credit Facility”), including an optional $10.0 mi ll ion accordion feature, and a $7.6 million Senior Secured Term Loan (the “Term Loan). The Term Loan bears interest at SOFR +2.5%; the Credit Facility bears interest at SOFR +2.0 - 2.5%, subject to the l evel of excess availability on the Credit Facility. Maintaining stable liquidity profile sufficient to support the long - term growth of the business As expected, we invested heavily in working capital to support incremental wind tower demand in 1Q23, contributing to a sequential decline in total liquidity Anticipate accelerating cash conversion on inventory investments as 2023 progresses In 2023, capital allocation priorities will include debt reduction, organic investments in IP; and opportunistic investments in complementary, immediately accretive bolt - on acquisitions Cash and LOC Availability at Quarter - End ($MM) Net Debt Outstanding (1) ($MM) Operating Working Capital ($MM) Total Inventory ($MM) First Quarter 2023 BALANCE SHEET UPDATE $19.2 $28.9 1Q22 1Q23 $22.6 $26.8 1Q22 1Q23 $39.1 $48.5 1Q22 1Q23 $14.7 $12.3 1Q22 1Q23 10 Broadwind | Investor Presentation 2023 Broadwind increased its full - year 2023 financial guidance in April 2023 Increased guidance supported by targeted commercial growth within high - value, growth - oriented fabrications markets, together with a targeted focus on asset optimization and operational discipline Assumes approximately 50% utilization at tower facilities as of March 2023, as if no additional tower orders are received in 2023; any additional new orders would be incremental to this guidance Assumes no changes to IRS’ 45x tax credit guidance Total Revenue ($MM) Total Adjusted EBITDA ($MM) As of May 11, 2023 FULL - YEAR 2023 FINANCIAL GUIDANCE $176.8 $205 - $220 2022A 2023E $2.4 $16 - $18 2022A 2023E

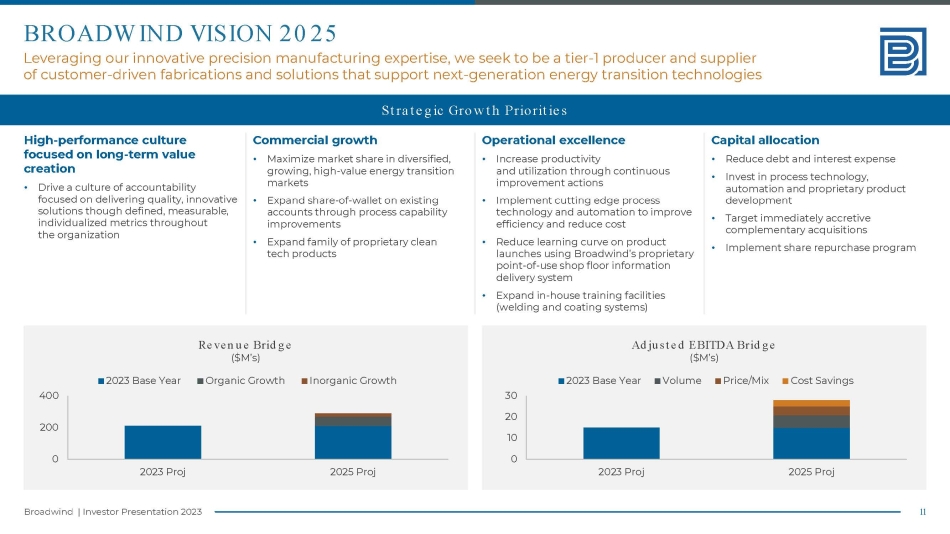

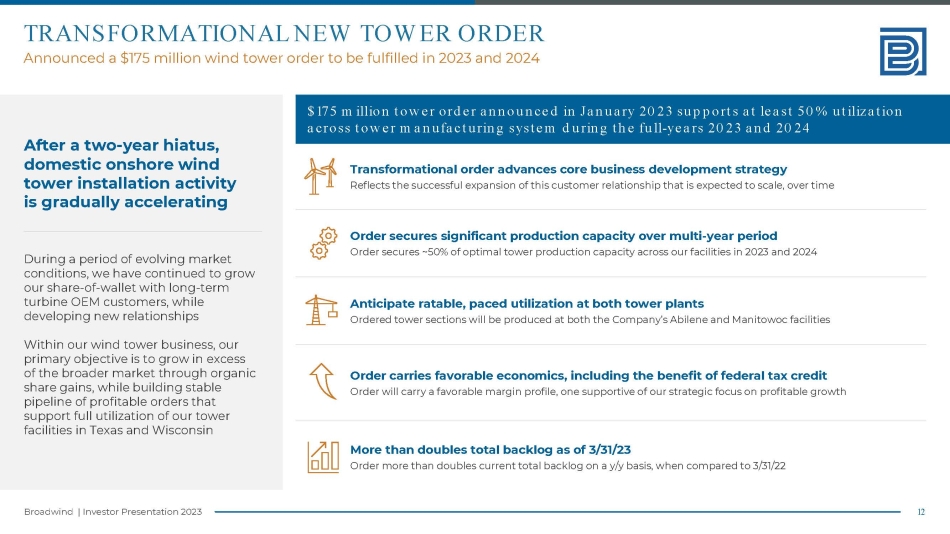

11 Broadwind | Investor Presentation 2023 BROADWIND VISION 2025 Leveraging our innovative precision manufacturing expertise, we seek to be a tier - 1 producer and supplier of customer - driven fabrications and solutions that support next - generation energy transition technologies Strategic Growth Priorities High - performance culture focused on long - term value creation • Drive a culture of accountability focused on delivering quality, innovative solutions though defined, measurable, individualized metrics throughout the organization Commercial growth • Maximize market share in diversified, growing, high - value energy transition markets • Expand share - of - wallet on existing accounts through process capability improvements • Expand family of proprietary clean tech products Operational excellence • Increase productivity and utilization through continuous improvement actions • Implement cutting edge process technology and automation to improve efficiency and reduce cost • Reduce learning curve on product launches using Broadwind’s proprietary point - of - use shop floor information delivery system • Expand in - house training facilities (welding and coating systems) Capital allocation • Reduce debt and interest expense • Invest in process technology, automation and proprietary product development • Target immediately accretive complementary acquisitions • Implement share repurchase program Revenue Bridge ($M’s) Adjusted EBITDA Bridge ($M’s) 0 200 400 2023 Proj 2025 Proj 2023 Base Year Organic Growth Inorganic Growth 0 10 20 30 2023 Proj 2025 Proj 2023 Base Year Volume Price/Mix Cost Savings 12 Broadwind | Investor Presentation 2023 TRANSFORMATIONAL NEW TOWER ORDER Announced a $175 million wind tower order to be fulfilled in 2023 and 2024 After a two - year hiatus, domestic onshore wind tower installation activity is gradually accelerating During a period of evolving market conditions, we have continued to grow our share - of - wallet with long - term turbine OEM customers, while developing new relationships Within our wind tower business, our primary objective is to grow in excess of the broader market through organic share gains, while building stable pipeline of profitable orders that support full utilization of our tower facilities in Texas and Wisconsin $175 million tower order announced in January 2023 supports at least 50% utilization across tower manufacturing system during the full - years 2023 and 2024 Transformational order advances core business development strategy Reflects the successful expansion of this customer relationship that is expected to scale, over time Order secures significant production capacity over multi - year period Order secures ~50% of optimal tower production capacity across our facilities in 2023 and 2024 Anticipate ratable, paced utilization at both tower plants Ordered tower sections will be produced at both the Company’s Abilene and Manitowoc facilities Order carries favorable economics, including the benefit of federal tax credit Order will carry a favorable margin profile, one supportive of our strategic focus on profitable growth More than doubles total backlog as of 3/31/23 Order more than doubles current total backlog on a y/y basis, when compared to 3/31/22

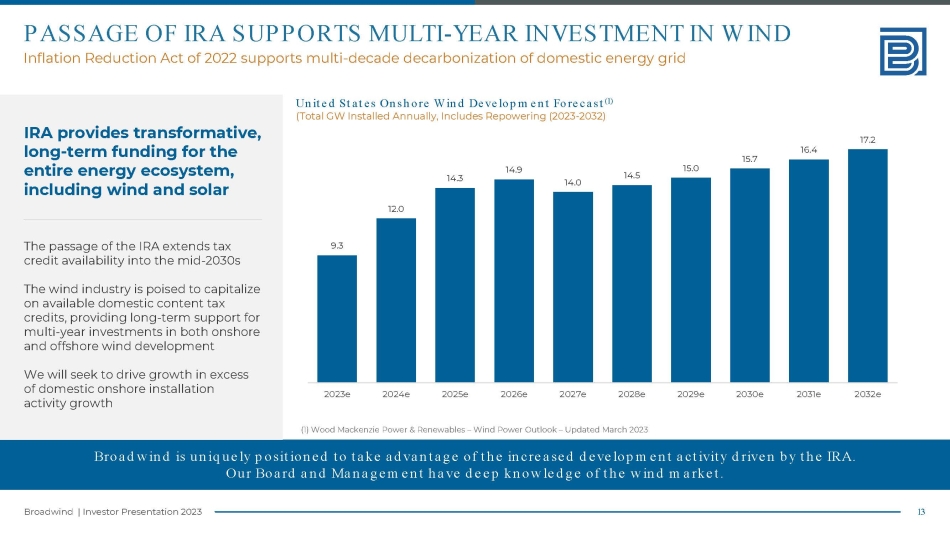

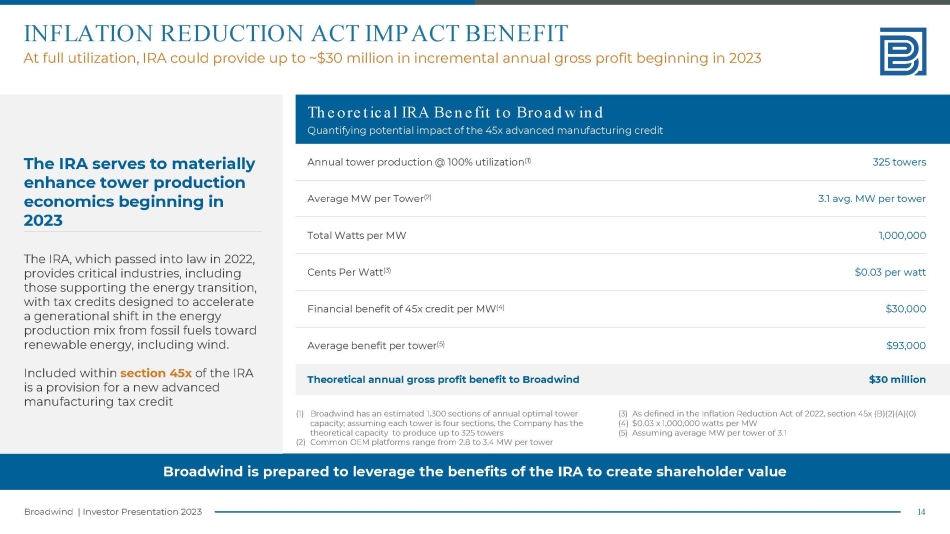

13 Broadwind | Investor Presentation 2023 PASSAGE OF IRA SUPPORTS MULTI - YEAR INVESTMENT IN WIND Inflation Reduction Act of 2022 supports multi - decade decarbonization of domestic energy grid Broadwind is uniquely positioned to take advantage of the increased development activity driven by the IRA. Our Board and Management have deep knowledge of the wind market. IRA provides transformative, long - term funding for the entire energy ecosystem, including wind and solar The passage of the IRA extends tax credit availability into the mid - 2030s The wind industry is poised to capitalize on available domestic content tax credits, providing long - term support for multi - year investments in both onshore and offshore wind development We will seek to drive growth in excess of domestic onshore installation activity growth United States Onshore Wind Development Forecast (1) (Total GW Installed Annually, Includes Repowering (2023 - 2032) (1) Wood Mackenzie Power & Renewables – Wind Power Outlook – Updated March 2023 9.3 12.0 14.3 14.9 14.0 14.5 15.0 15.7 16.4 17.2 2023e 2024e 2025e 2026e 2027e 2028e 2029e 2030e 2031e 2032e 14 Broadwind | Investor Presentation 2023 INFLATION REDUCTION ACT IMPACT BENEFIT At full utilization, IRA could provide up to ~$30 million in incremental annual gross profit beginning in 2023 Broadwind is prepared to leverage the benefits of the IRA to create shareholder value The IRA serves to materially enhance tower production economics beginning in 2023 The IRA, which passed into law in 2022, provides critical industries, including those supporting the energy transition, with tax credits designed to accelerate a generational shift in the energy production mix from fossil fuels toward renewable energy, including wind.

Included within section 45x of the IRA is a provision for a new advanced manufacturing tax credit Theoretical IRA Benefit to Broadwind Quantifying potential impact of the 45x advanced manufacturing credit Theoretical annual gross profit benefit to Broadwind $30 million Annual tower production @ 100% utilization (1) 325 towers Average MW per Tower (2) 3.1 avg. MW per tower Total Watts per MW 1,000,000 Cents Per Watt (3) $0.03 per watt Financial benefit of 45x credit per MW (4) $30,000 Average benefit per tower (5) $93,000 (1) Broadwind has an estimated 1,300 sections of annual optimal tower capacity; assuming each tower is four sections, the Company has the theoretical capacity to produce up to 325 towers (2) Common OEM platforms range from 2.8 to 3.4 MW per tower (3) As defined in the Inflation Reduction Act of 2022, section 45x (B)(2)(A)(0) (4) $0.03 x 1,000,000 watts per MW (5) Assuming average MW per tower of 3.1 16 Broadwind | Investor Presentation 2023 CORPORATE OVERVIEW We support the world’s energy transition as a leading independent producer of wind towers, gearing, custom fabrications, clean fuel processing systems and supply chain solutions Broadwind is a precision manufacturer of technologically advanced, high - value components and solutions for industrial clients.

APPENDIX

We are one of the leading independent wind tower manufacturers in the United States. Our most significant business serves the US domestic wind energy industry, with primary production facilities that are strategically located to meet our customers’ project needs. We also serve industrial customers in a diversified set of industrial markets including oil & gas, industrial, power generation, mining and construction. This strategic diversification allows us to leverage our manufacturing expertise to improve capacity utilization, expand our customer base and balance our exposure to the often volatile demand in the US wind energy industry.

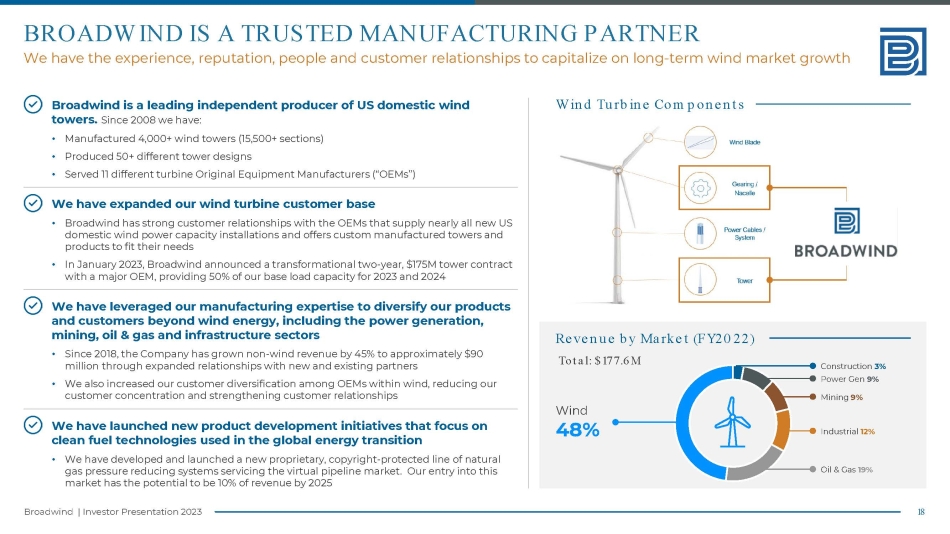

17 Broadwind | Investor Presentation 2023 What we do Precision manufacturing within wind sector and other diverse end - markets We provide large complex and precision fabrications to customers in a broad range of industrial markets, as well as proprietary clean fuel processing systems. Key products include wind towers, PRS units and industrial fabrications, which include components for mining, construction, marine, material handling and other applications Heavy Fabrications Segment 66% of 2022 Revenue We provide custom gearing, gearboxes and heat treat services to a broad set of customers in diverse markets, including oil and gas production, surface and underground mining, wind energy, steel, material handling and other infrastructure markets Gearing Segment 24% of 2022 Revenue We provide supply chain solutions, inventory management, kitting and assembly services, primarily serving the combined cycle natural gas turbine and solar power generation markets Industrial Solutions Segment 10% of 2022 Revenue Why we win Unique Value Proposition Proven engineering, product development and technical capabilities Expertise in manufacturing large, complex fabrications, gearing, and proprietary clean fuel processing systems Integrated design, sourcing, fabrication, machining, coating, assembly Stringent testing and quality capabilities Targeted, multi - industry focus Our manufacturing base Established Original Equipment Manufacturer (“OEM”) Relationships Our customer base Established OEM Relationships Manitowoc, WI Tower Manufacturing Industrial Fabrications Facility Abilene, TX Tower Manufacturing Industrial Fabrications Facility Cicero, IL Gear Manufacturing and Gearbox Repair Facility Pittsburgh, PA Gearbox Repair and Heat Treat Facility Sanford, NC Industrial Solutions and Gearbox Repair Facility OUR BUSINESS Building a platform sustained, profitable growth and long - term value creation 18 Broadwind | Investor Presentation 2023 BROADWIND IS A TRUSTED MANUFACTURING PARTNER We have the experience, reputation, people and customer relationships to capitalize on long - term wind market growth Broadwind is a leading independent producer of US domestic wind towers.

Since 2008 we have: • Manufactured 4,000+ wind towers (15,500+ sections) • Produced 50+ different tower designs • Served 11 different turbine Original Equipment Manufacturers (“OEMs”) We have expanded our wind turbine customer base • Broadwind has strong customer relationships with the OEMs that supply nearly all new US domestic wind power capacity installations and offers custom manufactured towers and products to fit their needs • In January 2023, Broadwind announced a transformational two - year, $175M tower contract with a major OEM, providing 50% of our base load capacity for 2023 and 2024 We have leveraged our manufacturing expertise to diversify our products and customers beyond wind energy, including the power generation, mining, oil & gas and infrastructure sectors • Since 2018, the Company has grown non - wind revenue by 45% to approximately $90 million through expanded relationships with new and existing partners • We also increased our customer diversification among OEMs within wind, reducing our customer concentration and strengthening customer relationships We have launched new product development initiatives that focus on clean fuel technologies used in the global energy transition • We have developed and launched a new proprietary, copyright - protected line of natural gas pressure reducing systems servicing the virtual pipeline market.

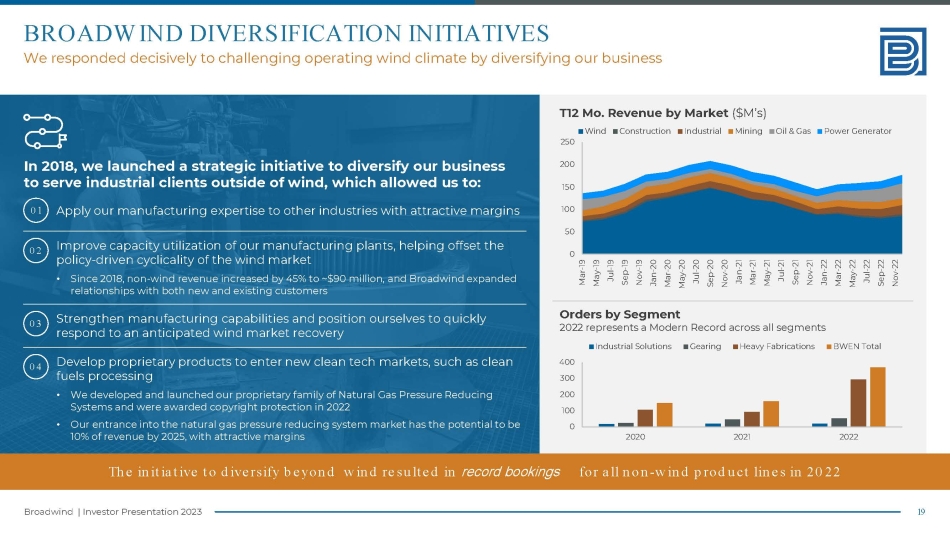

Our entry into this market has the potential to be 10% of revenue by 2025 Wind Turbine Components Revenue by Market (FY2022) Construction 3% Power Gen 9% Mining 9% Industrial 12% Oil & Gas 19% Wind 48% Total: $177.6M 19 Broadwind | Investor Presentation 2023 BROADWIND DIVERSIFICATION INITIATIVES We responded decisively to challenging operating wind climate by diversifying our business Source: Wood Mackenzie, [November 2022] T12 Mo. Revenue by Market ($M’s) In 2018, we launched a strategic initiative to diversify our business to serve industrial clients outside of wind, which allowed us to: The initiative to diversify beyond wind resulted in record bookings for all non - wind product lines in 2022 Apply our manufacturing expertise to other industries with attractive margins 01 Improve capacity utilization of our manufacturing plants, helping offset the policy - driven cyclicality of the wind market • Since 2018, non - wind revenue increased by 45% to ~$90 million, and Broadwind expanded relationships with both new and existing customers 02 Strengthen manufacturing capabilities and position ourselves to quickly respond to an anticipated wind market recovery 03 Develop proprietary products to enter new clean tech markets, such as clean fuels processing • We developed and launched our proprietary family of Natural Gas Pressure Reducing Systems and were awarded copyright protection in 2022 • Our entrance into the natural gas pressure reducing system market has the potential to be 10% of revenue by 2025, with attractive margins 04 0 50 100 150 200 250 Mar-19 May-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar-20 May-20 Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 Sep-21 Nov-21 Jan-22 Mar-22 May-22 Jul-22 Sep-22 Nov-22 Wind Construction Industrial Mining Oil & Gas Power Generator Orders by Segment 2022 represents a Modern Record across all segments 0 100 200 300 400 2020 2021 2022 Industrial Solutions Gearing Heavy Fabrications BWEN Total 20 Broadwind | Investor Presentation 2023 OUR EXPERIENCED, PROVEN MANAGEMENT TEAM Leadership Team with extensive experience in clean tech manufacturing Eric Blashford Chief Executive Officer Since 2020 Recent Experience • Interim CFO 2021 – Aug. 2022 • COO 2018 - 2020 • President, Broadwind Towers 2014 - 2019 Tom Ciccone Chief Financial Officer Since Aug. 2022 Recent Experience • Principal Accounting Officer 2021 - Aug. 2022 • Corporate Controller, Assistant Treasurer, Assistant Secretary since 2017 Hayes Kennedy Chief Human Resource Officer Since 2020 Recent Experience • Vice President of Human Resources, CHS (NASDAQ: CHSCP, CHSCO, CHSCN, CHSCM, CHSCL) • Senior HR roles at The Gavilon Group LLC and ConAgra Foods Daniel Schueller President, Heavy Fabrications Since 2019 Recent Experience • President, Brad Foote Gear Works (2010 - 2013, 2016 - 2019) • Manufacturing leadership experience at Bronto Skylift and Vactor Manufacturing Wayne Hanna President, Brad Foote Gear Works Since Aug. 2019 Recent Experience • Process Improvement consultant with Crowe LLP, • CEO of Cotta Transmission Company • 30+ years of manufacturing experience Gil Mayo President, Industrial Solutions Since 2017 Recent Experience • General Manager, Broadwind Heavy Fabrications (2015 - 2017) • Previous manufacturing leadership experience at Scott Fetzer Company

21 Broadwind | Investor Presentation 2023 OUR EXPERIENCED BOARD OF DIRECTORS Leadership Team with extensive experience in clean tech manufacturing Broadwind Board Experience • Independent Director • Chairman of Compensation Committee • Financial Expert • Served as Lead Director (2020 - 2021) Positions Held: • CEO - Grede Holdings LLC • CEO - Angelica Corp. • CEO, President - Sparton Corp. Public Board Experience: • Westell Technologies Inc. (2017 – Present) • Sparton Corp. (2009 - 2016) • VISHAY (2016 - 2018) Background: Manufacturing, Corporate Governance, Leadership, M&A and Business Turnaround, Operations, Risk Assessment and Management, Strategic Planning, Global Business, Public and Private Company Executive Leadership Eric Blashford Chief Executive Officer Director since 2020 BSBA, Accounting, University of Akron MBA, Kent State University Licensed CPA (non - practicing) Broadwind Board Experience • CEO since 2020 • COO 2018 - 2020 • Joined Broadwind in 2014, led turnaround of Heavy Fabrications Division Positions Held: • Group President - Heico Companies • Group President - Berkshire Hathaway / Scott Fetzer • VP / GM - Waltco Truck Equipment Company Background: Manufacturing, Product Development, Accounting, Finance, Corporate Governance, M&A, Business Turnarounds, Operations, Strategic Planning, Public and Private Company Executive Leadership Broadwind Board Experience • Independent Director • Chair of Governance/Nominating Committee • Member, Audit and Compensation Committees Positions Held • President of Operations – Navistar • EVP Corporate Strategy – Navistar • President Global Business – Navistar Public Board Experience • Allison Transmission Holdings (2022 - Present) Background: Manufacturing, Corporate Governance, Leadership, Engineering, Government/Regulatory and Public Policy, Operations, Strategy, Business Turnaround and Global Business, Business Development and Technology Philip J. Christman Director since 2018 BS, Mechanical Engineering, Indiana Institute of Technology MBA, Ball State University Cary B.

Wood Independent Chair (since 2021) Director since 2016 BS, Technology, Purdue University MBA, Finance, Loyola University - Chicago MS, Industrial Operations, Lawrence Technological University 22 Broadwind | Investor Presentation 2023 OUR EXPERIENCED BOARD OF DIRECTORS David P. Reiland Director since 2008 BS, Financial Management, California State University MBA, University of Southern California Certified Public Accountant (CPA) Broadwind Board Experience • Independent Director • Chairman of Audit Committee • Financial Expert • Member of Governance/Nominating Committee • Former Independent Chairman - Broadwind Positions Held: • President and CEO - Magnetek, Inc. • Director of Magnatek • Previously also CFO and Corporate Controller of Magnetek Background: Subject matter expert and background in Strategy Development and Execution, M&A and Divestitures; Operating and Financial Restructuring; SEC Reporting and SOX Compliance; Public and Private Capital Transactions Thomas A. Wagner Director since 2011 BS Engineering, Cornell University MS Mechanics, Rensselaer Polytechnic Institute Broadwind Board Experience • Independent Director • Member of Compensation and Governance/Nominating Committees Positions Held: • Founder - Wagner Werks • Chief Product Officer - Ogin , Inc., a wind - turbine design and supply company • Head of Engineering - Nordic Windpower USA • Chief Technology Officer - Gas Turbine Efficiency, PLC • Vice President, Technology - Hess Microgen • GM, Wind Technology - General Electric Background: Operations, Global business, Manufacturing, Engineering, Renewable Energy Business Development and Technology Mr. Reiland was employed by Magnetek, Inc., a developer and manufacturer of markets power and motion control systems, from 1986 until 2009 and served on its board until its acquisition by Columbus McKinnon Corp. in September 2015. Mr. Wagner has worked in the diversified energy industry for more than 45 years with assignments addressing Nuclear, Fossil and Renewable Power Generation. He has performed engineering design and lead large technical teams of several hundred engineers engaged in design and service functions that improved system reliability, reduced or eliminated environmental emissions and developed intellectual property.

23 Broadwind | Investor Presentation 2023 OUR EXPERIENCED BOARD OF DIRECTORS Sachin Shivaram Director since 2022 BA, Harvard University Mphil , University of Cambridge JD, Yale Law School; (licensed to practice law in WI) Broadwind Board Experience • Independent Director • Member of Audit and Governance/Nominating Committees Positions Held: • CEO - Wisconsin Aluminum Foundry • President - Sierra Aluminum and Samuel Pressure Vessel Group, both divisions of Samuel, Son & Co. • Director Mid - Continent, Tenaris • Director Rig Services and Distribution, Tenaris Background: Manufacturing, Corporate Governance, M&A, Operations, Risk Assessment and Management, Government/Regulatory and Public Policy, Marketing and Sales, Strategy, Business Development and Technology, Business Turnaround and Global Business Development Jeanette A. Press Director since 2023 BBA in Accounting, Loyola University Licensed CPA Broadwind Board Experience • Independent Director • Member of Audit and Governance/Nominating Committees Positions Held: • CFO, Controller, and Principal Accounting Officer of CMC Materials • Vice President Controller and Principal Accounting Officer of Univar Solutions • Vice President Controller and Principal Accounting Officer of USG Corp.

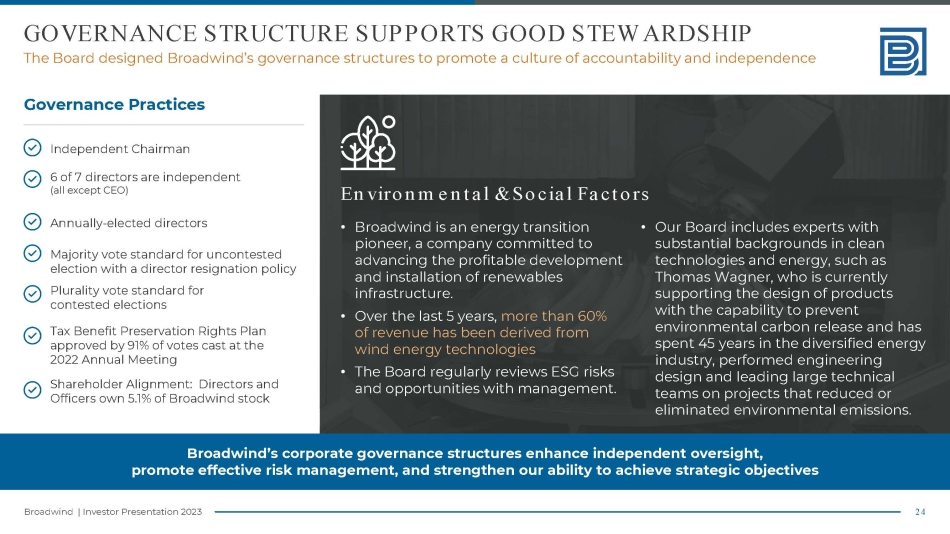

• Senior Manager Audit, KPMG LLP Background: Financial expert, SEC Reporting and SOX Compliance; Public and Private Capital Transactions, Manufacturing, M&A, Divestitures, Risk Assessment and Management and Operating and Financial Restructuring 15+ years of leadership experience in precision manufacturing in the areas of sales, business development and general management 24 Broadwind | Investor Presentation 2023 GOVERNANCE STRUCTURE SUPPORTS GOOD STEWARDSHIP The Board designed Broadwind’s governance structures to promote a culture of accountability and independence Broadwind’s corporate governance structures enhance independent oversight, promote effective risk management, and strengthen our ability to achieve strategic objectives Independent Chairman Governance Practices 6 of 7 directors are independent (all except CEO) Annually - elected directors Majority vote standard for uncontested election with a director resignation policy Plurality vote standard for contested elections Tax Benefit Preservation Rights Plan approved by 91% of votes cast at the 2022 Annual Meeting Shareholder Alignment: Directors and Officers own 5.1% of Broadwind stock Environmental & Social Factors • Broadwind is an energy transition pioneer, a company committed to advancing the profitable development and installation of renewables infrastructure. • Over the last 5 years, more than 60% of revenue has been derived from wind energy technologies • The Board regularly reviews ESG risks and opportunities with management. • Our Board includes experts with substantial backgrounds in clean technologies and energy, such as Thomas Wagner, who is currently supporting the design of products with the capability to prevent environmental carbon release and has spent 45 years in the diversified energy industry, performed engineering design and leading large technical teams on projects that reduced or eliminated environmental emissions.

25 Broadwind | Investor Presentation 2023 APPENDIX Balance Sheet 26 Broadwind | Investor Presentation 2023 APPENDIX Income Statement 2023 2022 Revenues……………………………………………………………………………………………………..

48,873$ 41,844$ Cost of sales………………………………………………………………………………………………………. 41,897 39,832 Gross profit……………………………………………………………………………………………. 6,976 2,012 OPERATING EXPENSES: Selling, general and administrative…………………………………………………………………...………. 5,526 3,902 Intangible amortization……………………………………………………………………………………..… 168 183 Total operating expenses………………………………………………………………………………. 5,694 4,085 Operating income (loss)………………………………………………………………………………………………1,282 (2,073) OTHER (EXPENSE) INCOME, net: Interest expense, net………………………………………………………………………………………. (488) (345) Other, net……………………………………………………………………………………………………… (2) 21 Total other (expense) income, net…………………………………………………………………………………………….(490) (324) Net income (loss) before provision for income taxes……………………………………………………….. 792 (2,397) Provision for income taxes………………………………………………………………………………. 23 7 NET INCOME (LOSS)…………………………………………………………………………………………………769$ (2,404)$ NET INCOME (LOSS) PER COMMON SHARE - BASIC: Net income (loss)……………………………………………………………………………………………………………………………0.04$ (0.12)$ WEIGHTED AVERAGE COMMON SHARES OUTSTANDING - BASIC………………………………………………..20,869 19,708 NET INCOME (LOSS) PER COMMON SHARE - DILUTED: Net income (loss)……………………………………………………………………………………………………………………………0.04$ (0.12)$ WEIGHTED AVERAGE COMMON SHARES OUTSTANDING - DILUTED……………………………………………….21,387 19,708 Three Months Ended March 31, 27 Broadwind | Investor Presentation 2023 APPENDIX Statement of Cash Flows

28 Broadwind | Investor Presentation 2023 APPENDIX GAAP to Non - GAAP Reconciliation Gearing Segment 2023 2022 Net Income (Loss)……………………...……………………...……………. 501$ (136)$ Interest Expense………………………...……………………………… 73 47 Income Tax Provision…………………...…………………… 8 - Depreciation and Amortization……………………………………………………………… 595 476 Share-based Compensation and Other Stock Payments……………………………………………………………… 117 118 Adjusted EBITDA (Non-GAAP)……………………….. 1,294$ 505$ Three Months Ended March 31, Heavy Fabrications Segment 2023 2022 Net Income (Loss)……………………...…………………………….……. 2,590$ (476)$ Interest Expense……………………………..……………………. 140 140 Income Tax (Benefit) Provision……..…………………...…………………… 60 (126) Depreciation……………………………………………………………… 858 879 Share-based Compensation and Other Stock Payments……………………………………………………………… 210 215 Adjusted EBITDA (Non-GAAP)…………………………….. 3,858$ 632$ Three Months Ended March 31, Industrial Solutions Segment 2023 2022 Net Income (Loss)……………………...……...……………………………. 529$ (225)$ Interest Expense……………………………………………………. 83 14 Income Tax Provision…………………...…………………… 8 2 Depreciation and Amortization……………………………………. 94 103 Share-based Compensation and Other Stock Payments………… 43 60 Impairment Expense………………………………………………… - - Adjusted EBITDA (Non-GAAP)……………………………… 757$ (46)$ Three Months Ended March 31, Corporate and Other 2023 2022 Net Loss………………………..……...……………………………. (2,851)$ (1,567)$ Interest Expense……………….…………………………………… 192 144 Income Tax (Benefit) Provision…………………..…………… (53) 131 Depreciation and Amortization……………………………………………………………… 58 61 Share-based Compensation and Other Stock Payments……………………………………………………………… 123 132 Proxy Contest-Related Expenses…………………………………...……………………. 720 - Adjusted EBITDA (Non-GAAP)……………………..…………….

(1,811)$ (1,099)$ Three Months Ended March 31, 29 Broadwind | Investor Presentation 2023 APPENDIX Segment - Level Data Three Months Ended 2023 2022 ORDERS: Heavy Fabrications……………………………………………………………… 20,236$ 34,161$ Gearing……………………………………………………………… 12,393 14,061 Industrial Solutions……………………………………………………………… 6,973 4,471 Total orders………………………………...……………… 39,602$ 52,693$ REVENUES: Heavy Fabrications……………………………………………………………… 31,593$ 27,272$ Gearing……………………………………………………………… 11,965 10,584 Industrial Solutions……………………………………………………………… 5,423 4,073 Corporate and Other…………………………………………………………… (108) (85) Total revenues…………………………………..…………………… 48,873$ 41,844$ OPERATING PROFIT/(LOSS): Heavy Fabrications……………………………………………………………… 2,790$ (461)$ Gearing……………………………………………………………… 581 (112) Industrial Solutions……………………………………………………………… 622 (209) Corporate and Other…………………………………………………………… (2,711) (1,291) Total operating profit (loss)…………………………………… 1,282$ (2,073)$ March 31, 30 Broadwind | Investor Presentation 2023 Please contact our investor relations team at Investor@BWEN.com IR CONTACT