UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From _______to ________

Commission File Number: 001-38106

PLYMOUTH INDUSTRIAL REIT, INC.

(Exact name of registrant as specified in its charter)

| Maryland | 27-5466153 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 20 Custom House Street, 11th Floor, Boston, MA 02110 | (617) 340-3814 | |

| (Address of principal executive offices) | (Registrant’s telephone number) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | PLYM | New York Stock Exchange |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☑ Accelerated filer ☐ Non-accelerated Filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ☐ No ☑

As of November 5, 2024, the Registrant had outstanding 45,389,186 shares of common stock.

Plymouth Industrial REIT, Inc.

INDEX TO QUARTERLY REPORT ON FORM 10-Q

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

PLYMOUTH INDUSTRIAL REIT, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

UNAUDITED

(In thousands, except share and per share amounts)

| September 30, 2024 |

December 31, 2023 |

|||||||

| Assets | ||||||||

| Real estate properties | $ | 1,393,892 | $ | 1,567,866 | ||||

| Less: accumulated depreciation | (246,652 | ) | (268,046 | ) | ||||

| Real estate properties, net | 1,147,240 | 1,299,820 | ||||||

| Real estate assets held for sale, net | 199,548 | — | ||||||

| Cash | 21,383 | 14,493 | ||||||

| Cash held in escrow | 4,780 | 4,716 | ||||||

| Restricted cash | 7,393 | 6,995 | ||||||

| Deferred lease intangibles, net | 44,458 | 51,474 | ||||||

| Other assets | 49,256 | 42,734 | ||||||

| Interest rate swaps | 13,237 | 21,667 | ||||||

| Forward contract asset | 9,116 | — | ||||||

| Total assets | $ | 1,496,411 | $ | 1,441,899 | ||||

| Liabilities, Redeemable Non-controlling Interest and Equity | ||||||||

| Liabilities: | ||||||||

| Secured debt, net | $ | 176,717 | $ | 266,887 | ||||

| Unsecured debt, net | 448,465 | 447,990 | ||||||

| Borrowings under line of credit | 196,400 | 155,400 | ||||||

| Accounts payable, accrued expenses and other liabilities | 83,397 | 73,904 | ||||||

| Real estate liabilities held for sale, net | 67,982 | — | ||||||

| Warrant liability | 73,335 | — | ||||||

| Deferred lease intangibles, net | 5,095 | 6,044 | ||||||

| Financing lease liability | 2,290 | 2,271 | ||||||

| Interest rate swaps | 1,085 | 1,161 | ||||||

| Total liabilities | 1,054,766 | 953,657 | ||||||

| Commitments and contingencies (Note 12) | ||||||||

| Redeemable non-controlling interest - Series C Preferred Units, 500,000 units authorized, (aggregate liquidation preference of $82,229 and $0 at September 30, 2024 and December 31, 2023, respectively) | 426 | — | ||||||

| Equity: | ||||||||

| Common stock, $0.01 par value: 900,000,000 shares authorized; 45,390,436 and 45,250,184 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | 454 | 452 | ||||||

| Additional paid in capital | 614,716 | 644,938 | ||||||

| Accumulated deficit | (190,675 | ) | (182,606 | ) | ||||

| Accumulated other comprehensive income | 11,969 | 20,233 | ||||||

| Total stockholders' equity | 436,464 | 483,017 | ||||||

| Non-controlling interest | 4,755 | 5,225 | ||||||

| Total equity | 441,219 | 488,242 | ||||||

| Total liabilities, redeemable non-controlling interest and equity | $ | 1,496,411 | $ | 1,441,899 | ||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

PLYMOUTH INDUSTRIAL REIT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

UNAUDITED

(In thousands, except share and per share amounts)

| For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Rental revenue | $ | 51,432 | $ | 49,736 | $ | 150,271 | $ | 149,006 | ||||||||

| Management fee revenue and other income | 439 | 29 | 514 | 58 | ||||||||||||

| Total revenues | 51,871 | 49,765 | 150,785 | 149,064 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Property | 17,374 | 15,754 | 47,585 | 47,398 | ||||||||||||

| Depreciation and amortization | 21,010 | 22,881 | 64,725 | 70,098 | ||||||||||||

| General and administrative | 3,582 | 3,297 | 10,826 | 10,586 | ||||||||||||

| Total operating expenses | 41,966 | 41,932 | 123,136 | 128,082 | ||||||||||||

| Other income (expense): | ||||||||||||||||

| Interest expense | (10,359 | ) | (9,473 | ) | (29,368 | ) | (28,592 | ) | ||||||||

| Loss on extinguishment of debt | — | (72 | ) | — | (72 | ) | ||||||||||

| Gain (loss) on sale of real estate | (234 | ) | 12,112 | 8,645 | 12,112 | |||||||||||

| Loss on financing transaction | (14,657 | ) | — | (14,657 | ) | — | ||||||||||

| Total other income (expense) | (25,250 | ) | 2,567 | (35,380 | ) | (16,552 | ) | |||||||||

| Net income (loss) | (15,345 | ) | 10,400 | (7,731 | ) | 4,430 | ||||||||||

| Less: Net income (loss) attributable to non-controlling interest | (170 | ) | 114 | (88 | ) | 46 | ||||||||||

| Less: Net income (loss) attributable to redeemable non-controlling interest - Series C Preferred Units | 426 | — | 426 | — | ||||||||||||

| Net income (loss) attributable to Plymouth Industrial REIT, Inc. | (15,601 | ) | 10,286 | (8,069 | ) | 4,384 | ||||||||||

| Less: Preferred Stock dividends | — | 677 | — | 2,509 | ||||||||||||

| Less: Loss on extinguishment/redemption of Series A Preferred Stock | — | 2,021 | — | 2,023 | ||||||||||||

| Less: Amount allocated to participating securities | 89 | 83 | 277 | 253 | ||||||||||||

| Net income (loss) attributable to common stockholders | $ | (15,690 | ) | $ | 7,505 | $ | (8,346 | ) | $ | (401 | ) | |||||

| Net income (loss) per share attributable to common stockholders — basic | $ | (0.35 | ) | $ | 0.17 | $ | (0.19 | ) | $ | (0.01 | ) | |||||

| Net income (loss) per share attributable to common stockholders — diluted | $ | (0.35 | ) | $ | 0.17 | $ | (0.19 | ) | $ | (0.01 | ) | |||||

| Weighted-average common shares outstanding — basic | 45,009,273 | 44,056,855 | 44,979,140 | 43,108,039 | ||||||||||||

| Weighted-average common shares outstanding — diluted | 45,009,273 | 44,139,603 | 44,979,140 | 43,108,039 | ||||||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

PLYMOUTH INDUSTRIAL REIT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

UNAUDITED

(In thousands, except share and per share amounts)

| For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Net income (loss) | $ | (15,345 | ) | $ | 10,400 | $ | (7,731 | ) | $ | 4,430 | ||||||

| Other comprehensive income (loss): | ||||||||||||||||

| Unrealized gain (loss) on interest rate swaps | (13,171 | ) | 2,935 | (8,354 | ) | 4,000 | ||||||||||

| Other comprehensive income (loss) | (13,171 | ) | 2,935 | (8,354 | ) | 4,000 | ||||||||||

| Comprehensive income (loss) | (28,516 | ) | 13,335 | (16,085 | ) | 8,430 | ||||||||||

| Less: Net income (loss) attributable to non-controlling interest | (170 | ) | 114 | (88 | ) | 46 | ||||||||||

| Less: Net income (loss) attributable to redeemable non-controlling interest - Series C Preferred Units | 426 | — | 426 | — | ||||||||||||

| Less: Other comprehensive income (loss) attributable to non-controlling interest | (142 | ) | 32 | (90 | ) | 44 | ||||||||||

| Comprehensive income (loss) attributable to Plymouth Industrial REIT, Inc. | $ | (28,630 | ) | $ | 13,189 | $ | (16,333 | ) | $ | 8,340 | ||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

PLYMOUTH INDUSTRIAL REIT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN PREFERRED STOCK,

REDEEMABLE NON-CONTROLLING INTEREST AND EQUITY

UNAUDITED

(In thousands, except share and per share amounts)

| Preferred Stock | Redeemable Non-controlling Interest |

Common Stock, $0.01 Par Value |

Additional Paid in |

Accumulated | Accumulated Other Comprehensive |

Stockholders’ | Non- controlling |

Total | |||||||||||||||||||||||||

| Shares | Amount | Amount | Shares | Amount | Capital | Deficit | Income | Equity | Interest | Equity | |||||||||||||||||||||||

| Balance, January 1, 2024 | — | $ | — | $ | — | 42,250,184 | $ | 452 | $ | 644,938 | $ | (182,606 | ) | $ | 20,233 | $ | 483,017 | $ | 5,225 | $ | 488,242 | ||||||||||||

| Net proceeds from common stock | — | — | — | — | — | (245 | ) | — | — | (245 | ) | — | (245 | ) | |||||||||||||||||||

| Stock based compensation | — | — | — | — | — | 914 | — | — | 914 | — | 914 | ||||||||||||||||||||||

| Restricted shares issued (forfeited) | — | — | — | 131,892 | 1 | (1 | ) | — | — | — | — | — | |||||||||||||||||||||

| Dividends and distributions | — | — | — | — | — | (10,904 | ) | — | — | (10,904 | ) | (118 | ) | (11,022 | ) | ||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | — | — | 5,626 | 5,626 | 61 | 5,687 | ||||||||||||||||||||||

| Reallocation of non-controlling interest | — | — | — | — | — | (51 | ) | — | — | (51 | ) | 51 | — | ||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | — | 6,218 | — | 6,218 | 68 | 6,286 | ||||||||||||||||||||||

| Balance, March 31, 2024 | — | $ | — | $ | — | - | 45,382,076 | $ | 453 | $ | 634,651 | $ | (176,388 | ) | $ | 25,859 | $ | 484,575 | $ | 5,287 | $ | 489,862 | |||||||||||

| Net proceeds from common stock | — | — | — | — | — | (65 | ) | — | — | (65 | ) | — | (65 | ) | |||||||||||||||||||

| Stock based compensation | — | — | — | — | — | 1,111 | — | — | 1,111 | — | 1,111 | ||||||||||||||||||||||

| Restricted shares issued (forfeited) | — | — | — | 14,210 | 1 | (1 | ) | — | — | — | — | — | |||||||||||||||||||||

| Dividends and distributions | — | — | — | — | — | (10,928 | ) | — | — | (10,928 | ) | (118 | ) | (11,046 | ) | ||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | — | — | (861 | ) | (861 | ) | (9 | ) | (870 | ) | ||||||||||||||||||

| Reallocation of non-controlling interest | — | — | — | — | — | 42 | — | — | 42 | (42 | ) | — | |||||||||||||||||||||

| Net income (loss) | — | — | — | - | — | — | — | 1,314 | — | 1,314 | 14 | 1,328 | |||||||||||||||||||||

| Balance, June 30, 2024 | — | $ | — | $ | — | 45,396,286 | $ | 454 | $ | 624,810 | $ | (175,074 | ) | $ | 24,998 | $ | 475,188 | $ | 5,132 | $ | 480,320 | ||||||||||||

| Net proceeds from common stock | — | — | — | — | — | (207 | ) | — | — | (207 | ) | — | (207 | ) | |||||||||||||||||||

| Stock based compensation | — | — | — | — | — | 1,093 | — | — | 1,093 | — | 1,093 | ||||||||||||||||||||||

| Restricted shares issued (forfeited) | — | — | — | (5,850 | ) | — | — | — | — | — | — | — | |||||||||||||||||||||

| Dividends and distributions | — | — | — | — | — | (10,927 | ) | — | — | (10,927 | ) | (118 | ) | (11,045 | ) | ||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | — | — | (13,029 | ) | (13,029 | ) | (142 | ) | (13,171 | ) | ||||||||||||||||||

| Reallocation of non-controlling interest | — | — | — | — | — | (53 | ) | — | — | (53 | ) | 53 | — | ||||||||||||||||||||

| Net income (loss) | — | — | 426 | - | — | — | — | (15,601 | ) | — | (15,601 | ) | (170 | ) | (15,771 | ) | |||||||||||||||||

| Balance, September 30, 2024 | — | $ | — | $ | 426 | 45,390,436 | $ | 454 | $ | 614,716 | $ | (190,675 | ) | $ | 11,969 | $ | 436,464 | $ | 4,755 | $ | 441,219 | ||||||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

PLYMOUTH INDUSTRIAL REIT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN PREFERRED STOCK,

REDEEMABLE NON-CONTROLLING INTEREST AND EQUITY

UNAUDITED

(In thousands, except share and per share amounts)

| Preferred Stock | Redeemable Non-controlling Interest |

Common Stock, $0.01 Par Value |

Additional Paid in |

Accumulated | Accumulated Other Comprehensive |

Stockholders’ | Non- controlling |

Total | |||||||||||||||||||||||||

| Shares | Amount | Amount | Shares | Amount | Capital | Deficit | Income | Equity | Interest | Equity | |||||||||||||||||||||||

| Balance, January 1, 2023 | 1,955,513 | $ | 46,844 | $ | — | 42,849,489 | $ | 428 | $ | 635,068 | $ | (194,243 | ) | $ | 29,739 | $ | 470,992 | $ | 5,389 | $ | 476,381 | ||||||||||||

| Repurchase and extinguishment of Series A Preferred Stock | (1,730 | ) | (41 | ) | — | — | — | — | (2 | ) | — | (2 | ) | — | (2 | ) | |||||||||||||||||

| Net proceeds from common stock | — | — | — | — | — | (137 | ) | — | — | (137 | ) | — | (137 | ) | |||||||||||||||||||

| Stock based compensation | — | — | — | — | — | 585 | — | — | 585 | — | 585 | ||||||||||||||||||||||

| Restricted shares issued (forfeited) | — | — | — | 181,375 | 2 | (2 | ) | — | — | — | — | — | |||||||||||||||||||||

| Dividends and distributions | — | — | — | — | — | (10,598 | ) | — | — | (10,598 | ) | (110 | ) | (10,708 | ) | ||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | — | — | (6,989 | ) | (6,989 | ) | (81 | ) | (7,070 | ) | ||||||||||||||||||

| Reallocation of non-controlling interest | — | — | — | — | — | 26 | — | — | 26 | (26 | ) | — | |||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | — | (3,298 | ) | — | (3,298 | ) | (38 | ) | (3,336 | ) | ||||||||||||||||||

| Balance, March 31, 2023 | 1,953,783 | $ | 46,803 | - | $ | — | 43,030,864 | $ | 430 | $ | 624,942 | $ | (197,543 | ) | $ | 22,750 | $ | 450,579 | $ | 5,134 | $ | 455,713 | |||||||||||

| Net proceeds from common stock | — | — | — | 70,000 | 1 | 1,384 | — | — | 1,385 | — | 1,385 | ||||||||||||||||||||||

| Stock based compensation | — | — | — | — | — | 716 | — | — | 716 | — | 716 | ||||||||||||||||||||||

| Dividends and distributions | — | — | — | — | — | (10,625 | ) | — | — | (10,625 | ) | (110 | ) | (10,735 | ) | ||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | — | — | 8,042 | 8,042 | 93 | 8,135 | ||||||||||||||||||||||

| Reallocation of non-controlling interest | — | — | — | — | — | (3 | ) | — | — | (3 | ) | 3 | — | ||||||||||||||||||||

| Net income (loss) | — | — | - | — | — | — | — | (2,604 | ) | — | (2,604 | ) | (30 | ) | (2,634 | ) | |||||||||||||||||

| Balance, June 30, 2023 | 1,953,783 | $ | 46,803 | $ | — | 43,100,864 | $ | 431 | $ | 616,414 | $ | (200,147 | ) | $ | 30,792 | $ | 447,490 | $ | 5,090 | $ | 452,580 | ||||||||||||

| Redemption of Series A Preferred Stock | (1,953,783 | ) | (46,803 | ) | — | — | — | (19 | ) | (2,021 | ) | — | (2,040 | ) | — | (2,040 | ) | ||||||||||||||||

| Net proceeds from common stock | — | — | — | 2,130,600 | 21 | 48,249 | — | — | 48,270 | — | 48,270 | ||||||||||||||||||||||

| Stock based compensation | — | — | — | — | — | 827 | — | — | 827 | — | 827 | ||||||||||||||||||||||

| Restricted shares issued (forfeited) | — | — | — | 18,720 | — | — | — | — | — | — | — | ||||||||||||||||||||||

| Dividends and distributions | — | — | — | — | — | (10,870 | ) | — | — | (10,870 | ) | (110 | ) | (10,980 | ) | ||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | — | — | 2,903 | 2,903 | 32 | 2,935 | ||||||||||||||||||||||

| Reallocation of non-controlling interest | — | — | — | — | — | (255 | ) | — | — | (255 | ) | 255 | — | ||||||||||||||||||||

| Net income (loss) | — | — | - | — | — | — | — | 10,286 | — | 10,286 | 114 | 10,400 | |||||||||||||||||||||

| Balance, September 30, 2023 | — | $ | — | $ | — | 45,250,184 | $ | 452 | $ | 654,346 | $ | (191,882 | ) | $ | 33,695 | $ | 496,611 | $ | 5,381 | $ | 501,992 | ||||||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

PLYMOUTH INDUSTRIAL REIT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

UNAUDITED

(In thousands)

| For the Nine Months Ended September 30, |

||||||||

| 2024 | 2023 | |||||||

| Operating activities | ||||||||

| Net income (loss) | $ | (7,731 | ) | $ | 4,430 | |||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 64,725 | 70,098 | ||||||

| Straight line rent adjustment | 1,012 | (1,833 | ) | |||||

| Intangible amortization in rental revenue, net | (910 | ) | (1,820 | ) | ||||

| Loss on extinguishment of debt | — | 72 | ||||||

| Amortization of debt related costs | 1,346 | 1,708 | ||||||

| Stock based compensation | 3,118 | 2,128 | ||||||

| Loss on financing transaction | 14,657 | — | ||||||

| (Gain) loss on sale of real estate | (8,645 | ) | (12,112 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Other assets | (9,392 | ) | 588 | |||||

| Deferred leasing costs | (3,915 | ) | (4,400 | ) | ||||

| Accounts payable, accrued expenses and other liabilities | (220 | ) | 4,400 | |||||

| Net cash provided by operating activities | 54,045 | 63,259 | ||||||

| Investing activities | ||||||||

| Acquisition of real estate properties | (101,387 | ) | — | |||||

| Real estate improvements | (16,497 | ) | (26,542 | ) | ||||

| Proceeds from sale of real estate | 8,439 | 18,231 | ||||||

| Net investment in sales-type lease | 21,244 | — | ||||||

| Net cash used in investing activities | (88,201 | ) | (8,311 | ) | ||||

| Financing activities | ||||||||

| (Payment) proceeds from issuance of common stock, net | (517 | ) | 49,499 | |||||

| Repayment of secured debt | (23,366 | ) | (12,352 | ) | ||||

| Proceeds from line of credit facility | 132,991 | 27,500 | ||||||

| Repayment of line of credit facility | (91,991 | ) | (40,000 | ) | ||||

| Repurchase of Series A Preferred Stock | — | (43 | ) | |||||

| Redemption of Series A Preferred Stock | — | (48,824 | ) | |||||

| Proceeds from financing transaction, net | 58,670 | — | ||||||

| Financing transaction issuance costs | (1,937 | ) | — | |||||

| Debt issuance costs | (28 | ) | (27 | ) | ||||

| Dividends and distributions paid | (32,314 | ) | (31,642 | ) | ||||

| Net cash provided by (used in) financing activities | 41,508 | (55,889 | ) | |||||

| Net increase (decrease) in cash, cash held in escrow, and restricted cash | 7,352 | (941 | ) | |||||

| Cash, cash held in escrow, and restricted cash at beginning of period | 26,204 | 31,213 | ||||||

| Cash, cash held in escrow, and restricted cash at end of period | $ | 33,556 | $ | 30,272 | ||||

| Supplemental Cash Flow Disclosures: | ||||||||

| Cash paid for interest | $ | 28,672 | $ | 27,450 | ||||

| Supplemental Non-cash Financing and Investing Activities: | ||||||||

| Dividends declared included in accounts payable, accrued expenses and other liabilities | $ | 11,006 | $ | 10,205 | ||||

| Distribution payable to non-controlling interest holder | $ | 118 | $ | 110 | ||||

| Financing transaction costs included in accounts payable, accrued expenses and other liabilities | $ | 7,171 | $ | — | ||||

| Real estate improvements included in accounts payable, accrued expenses and other liabilities | $ | 3,608 | $ | 3,981 | ||||

| Deferred leasing costs included in accounts payable, accrued expenses and other liabilities | $ | 646 | $ | 1,605 | ||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

1. Nature of the Business and Basis of Presentation

Business

Plymouth Industrial REIT, Inc., (the “Company,” “we” or the “REIT”) is a Maryland corporation formed on March 7, 2011. The Company is structured as an umbrella partnership REIT, commonly called an UPREIT, and owns substantially all of its assets and conducts substantially all of its business through its operating partnership subsidiary, Plymouth Industrial Operating Partnership, L.P., a Delaware limited partnership (the “Operating Partnership”). The Company, as general partner of the Operating Partnership, controls the Operating Partnership and consolidates the assets, liabilities, and results of operations of the Operating Partnership. As of September 30, 2024 and December 31, 2023, the Company owned a 98.9% equity interest in the Operating Partnership.

The Company is a real estate investment trust focused on the acquisition, ownership and management of single and multi-tenant industrial properties, including distribution centers, warehouses, light industrial and small bay industrial properties, located in primary and secondary markets within the main industrial, distribution and logistics corridors of the United States. As of September 30, 2024, the Company, through its subsidiaries, owned 158 industrial properties comprising 223 buildings with an aggregate of approximately 34.9 million square feet, and our regional property management office building located in Columbus, Ohio totaling approximately 17,260 square feet.

2. Summary of Significant Accounting Policies

The accounting policies underlying the accompanying unaudited condensed consolidated financial statements are those set forth in the Company's audited financial statements for the years ended December 31, 2023 and 2022. Additional information regarding the Company’s significant accounting policies related to the accompanying interim condensed consolidated financial statements is as follows:

Basis of Presentation

The Company’s interim condensed consolidated financial statements include the accounts of the Company, the Operating Partnership and their subsidiaries. The interim condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). All significant intercompany transactions have been eliminated in consolidation. These interim condensed consolidated financial statements include adjustments of a normal and recurring nature considered necessary by management to fairly state the Company's financial position and results of operations. These interim condensed consolidated financial statements may not be indicative of financial results for the full year. These interim condensed consolidated financial statements and notes thereto should be read in conjunction with the Company's audited consolidated financial statements and the notes thereto for the years ended December 31, 2023 and 2022 included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 as filed with the United States Securities and Exchange Commission on February 22, 2024.

Consolidation

We consolidate all entities that are wholly owned and those in which we own less than 100% but control, as well as any Variable Interest Entities (“VIEs”) in which we are the primary beneficiary. We evaluate our ability to control an entity and whether the entity is a VIE and we are the primary beneficiary through consideration of the substantive terms of the arrangement to identify which enterprise has the power to direct the activities of a VIE that most significantly impacts the entity’s economic performance and the obligation to absorb losses of the entity or the right to receive benefits from the entity. Investments in entities in which we do not control but over which we have the ability to exercise significant influence over operating and financial policies are presented under the equity method. Investments in entities that we do not control and over which we do not exercise significant influence are carried at the lower of cost or fair value, as appropriate. Our ability to correctly assess our influence and/or control over an entity affects the presentation of these investments in our condensed consolidated financial statements.

Consolidated VIEs are those for which the Company is considered to be the primary beneficiary of a VIE. The primary beneficiary is the entity that has a controlling financial interest in the VIE, which is defined by the entity having both of the following characteristics: (1) the power to direct the activities that, when taken together, most significantly impact the VIE’s performance and (2) the obligation to absorb losses or the right to receive the returns from the VIE that could potentially be significant to the VIE. The Company has determined that the Operating Partnership is a VIE and the Company is the primary beneficiary. The Company's only significant asset is its investment in the Operating Partnership, and, therefore, substantially all of the Company’s assets and liabilities are the assets and liabilities of the Operating Partnership.

Risks and Uncertainties

The state of the overall economy can significantly impact the Company’s operational performance and thus impact its financial position. Should the Company experience a significant decline in operational performance, it may adversely affect the Company’s ability to make distributions to its stockholders, service debt, or meet other financial obligations.

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Management makes significant estimates regarding the allocation of tangible and intangible assets and liabilities for real estate acquisitions, impairments of long-lived assets, stock-based compensation, preferred unit forward contract asset and its warrant liability. These estimates and assumptions are based on management’s best estimates and judgment. Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors, including the then-current economic environment. Management adjusts such estimates when facts and circumstances dictate. As future events and their effects cannot be determined with precision, actual results could differ materially from those estimates and assumptions.

Cash Equivalents and Restricted Cash

The Company considers all highly liquid investments with a maturity of three months or less when purchased to be cash equivalents. The Company maintains cash and restricted cash, which includes tenant security deposits and cash collateral for its borrowings discussed in Note 5, and cash held in escrow for real estate tax, insurance, tenant capital improvements and leasing commissions, in bank deposit accounts, which at times may exceed federally insured limits. As of September 30, 2024, the Company has not realized any losses in such cash accounts and believes it mitigates its risk of loss by depositing its cash and restricted cash in highly rated financial institutions or within accounts that are below the federally insured limits.

The following table presents a reconciliation of cash, cash held in escrow, and restricted cash reported within our condensed consolidated balance sheets to amounts reported within our condensed consolidated statements of cash flows:

Summary of significant accounting policies - schedule of cash, cash equivalents and restricted cash

| September 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Cash | $ | 21,383 | $ | 14,493 | ||||

| Cash held in escrow | 4,780 | 4,716 | ||||||

| Restricted cash | 7,393 | 6,995 | ||||||

| Cash, cash held in escrow, and restricted cash | $ | 33,556 | $ | 26,204 | ||||

Debt Issuance Costs

Debt issuance costs other than those associated with the revolving line of credit facility are reflected as a reduction to the respective loan amounts in the form of a debt discount. Amortization of this expense is included in interest expense in the condensed consolidated statements of operations.

Debt issuance costs amounted to $6,815 and $6,787 at September 30, 2024 and December 31, 2023, respectively, and related accumulated amortization amounted to $4,363 and $3,603 at September 30, 2024 and December 31, 2023, respectively. At September 30, 2024 and December 31, 2023, the Company classified net unamortized debt issuance costs of $773 and $1,469, respectively, related to borrowings under the revolving line of credit facility to other assets in the condensed consolidated balance sheets.

Derivative Instruments and Hedging Activities

We record all derivatives on the accompanying condensed consolidated balance sheets at fair value. The accounting for changes in the fair value of derivatives depends on the intended use of the derivative, whether we have elected to designate a derivative in a hedging relationship and apply hedge accounting, and whether the hedging relationship has satisfied the criteria necessary to apply hedge accounting. Derivatives designated and qualifying as a hedge of the exposure to changes in the fair value of an asset, liability, or firm commitment attributable to a particular risk, such as interest rate risk, are considered fair value hedges. Derivatives designated and qualifying as a hedge of the exposure to variability in expected future cash flows, or other types of forecasted transactions, are considered cash flow hedges. Hedge accounting generally provides for the matching of the timing of gain or loss recognition on the hedging instrument with the recognition of the changes in the fair value of the hedged asset or liability that are attributable to the hedged risk in a fair value hedge or the earnings effect of the hedged forecasted transactions in a cash flow hedge. We may enter into derivative contracts that are intended to economically hedge certain of its risks, even though hedge accounting does not apply, or we elect not to apply hedge accounting.

In accordance with fair value measurement guidance, we made an accounting policy election to measure the credit risk of our derivative financial instruments that are subject to master netting arrangements on a net basis by the counterparty portfolio. Credit risk is the risk of failure of the counterparty to perform under the terms of the contract. We minimize the credit risk in our derivative financial instruments by entering into transactions with various high-quality counterparties. Our exposure to credit risk at any point is generally limited to amounts recorded as assets on the accompanying condensed consolidated balance sheets.

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

The Company follows the two-class method when computing net earnings (loss) per common share, as the Company has issued shares that meet the definition of participating securities. The two-class method determines net earnings (loss) per share for each class of common and participating securities according to dividends declared or accumulated and participation rights in undistributed earnings. The two-class method requires income available to common stockholders for the period to be allocated between common and participating securities based upon their respective rights to receive dividends as if all income for the period had been distributed. See Note 10 for details.

Fair Value of Financial Instruments

The Company applies various valuation approaches in determining the fair value of its financial assets and liabilities within a hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that observable inputs be used when available. Observable inputs are inputs that market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s assumptions about the inputs that market participants would use in pricing the asset or liability and are developed based on the best information available in the circumstances. The fair value hierarchy is broken down into three levels based on the source of inputs as follows:

Level 1 — Quoted prices for identical instruments in active markets.

Level 2 — Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 — Significant inputs to the valuation model are unobservable.

The availability of observable inputs can vary among the various types of financial assets and liabilities. To the extent that the valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for financial statement disclosure purposes, the level in the fair value hierarchy within which the fair value measurement is categorized is based on the lowest level input that is significant to the overall fair value measurement. Level 3 inputs are applied in determining the fair value of our debt, interest rate swaps and performance stock units discussed in Notes 5, 6, and 9, respectively, in determining the fair value of the forward contract for preferred units discussed in Note 9, and in determining the fair value of warrants to purchase partnership units in Note 11.

Financial instruments, including cash, restricted cash, cash held in escrow, accounts receivable, accounts payable, accrued expenses and other current liabilities, are considered Level 1 in fair value hierarchy. The amounts reported on the condensed consolidated balance sheets for these financial instruments approximate their fair value due to their relatively short maturities and prevailing interest rates. Derivative financial instruments are considered Level 2 in the fair value hierarchy as discussed in Note 6.

The following tables summarize the Company’s forward contract asset, warrant liability and interest rate swaps that are accounted for at fair value on a recurring basis as of September 30, 2024 and December 31, 2023.

Summary of significant accounting policies - schedule of fair value on a recurring basis

| Balance Sheet Line Item | Fair Value as

of September 30, 2024 |

Level 1 | Level 2 | Level 3 | ||||||||||||

| Forward contract asset | $ | 9,116 | $ | — | $ | — | $ | 9,116 | ||||||||

| Interest rate swaps - Asset | $ | 13,237 | $ | — | $ | 13,237 | $ | — | ||||||||

| Interest rate swaps - Liability | $ | (1,085 | ) | $ | — | $ | (1,085 | ) | $ | — | ||||||

| Warrant liability | $ | (73,335 | ) | $ | — | $ | — | $ | (73,335 | ) | ||||||

| Balance Sheet Line Item | Fair Value as

of December 31, 2023 |

Level 1 | Level 2 | Level 3 | ||||||||||||

| Forward contract asset | $ | — | $ | — | $ | — | $ | — | ||||||||

| Interest rate swaps - Asset | $ | 21,667 | $ | — | $ | 21,667 | $ | — | ||||||||

| Interest rate swaps - Liability | $ | (1,161 | ) | $ | — | $ | (1,161 | ) | $ | — | ||||||

| Warrant liability | $ | — | $ | — | $ | — | $ | — | ||||||||

Leases

For leases in which we are the lessee, a right of use asset and lease liability is recorded on the condensed consolidated balance sheets equal to the present value of the fixed lease payments of the corresponding lease. To determine our operating right of use asset and lease liability, we estimate an appropriate incremental borrowing rate on a fully-collateralized basis for the terms of the leases by utilizing a market-based approach. Since the terms under our ground leases are significantly longer than the terms of borrowings available to us on a fully collateralized basis, the estimate of this rate requires significant judgment, and considers factors such as market-based pricing on longer duration financing instruments.

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

Redeemable Non-Controlling Interest – Preferred Units

The Company applies the guidance enumerated in ASC 480, when determining the classification and measurement of preferred units. Preferred units subject to mandatory redemption, if any, is classified as a liability and is measured at fair value. The Company classifies conditionally redeemable preferred units, which includes preferred units that features redemption rights that are either within the control of the holder or subject to redemption upon the occurrence of uncertain events not solely within the Company’s control, as mezzanine equity. The Company subsequently measures mezzanine equity based on whether the instrument is currently redeemable or whether or not it is probable the instrument will become redeemable. Upon determination that the instrument is probable of redemption, the Company will adjust the carrying value to the redemption value. If redemption is not probable, the Company will not adjust the carrying value of the instrument recorded as mezzanine equity other than to reflect dividends accrued and not yet paid, but which will be payable under the redemption feature.

Revenue Recognition

Minimum rental revenue from real estate operations is recognized on a straight-line basis. The straight-line rent calculation on leases includes the effects of rent concessions and scheduled rent increases, and the calculated straight-line rent income is recognized over the term of the individual leases. In accordance with ASC 842, we assess the collectability of lease receivables (including future minimum rental payments) both at commencement and throughout the lease term. If our assessment of collectability changes during the lease term, any difference between the revenue that would have been received under the straight-line method and the lease payments that have been collected will be recognized as a current period adjustment to rental revenue. Rental revenue associated with leases where collectability has been deemed less than probable is recognized on a cash basis in accordance with ASC 842.

Segments

The Company has one reportable segment, industrial properties. These properties have similar economic characteristics and meet the other criteria that permit the properties to be aggregated into one reportable segment.

The Company grants stock-based compensation awards to our employees and directors typically in the form of restricted shares of common stock, and performance stock units for certain executive officers and key employees. The Company measures stock-based compensation expense based on the fair value of the awards on the grant date and recognizes the expense ratably over the applicable vesting period. Forfeitures of unvested shares are recognized in the period in which the forfeiture occurs.

Warrants

The Company accounts for warrants as either derivative liabilities or as equity instruments depending on the specific terms of the warrant agreement. Warrants that are not considered indexed to the Company’s own stock are required to be accounted for as a liability. Liability-classified financial instruments are measured at fair value on the issuance date and at the end of each reporting period. Any change in the fair value of the financial instrument after the issuance date is recorded in the condensed consolidated financial statements through earnings.

Recent Accounting Announcements

In November 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2023-07, "Improvements to Reportable Segment Disclosures" ("ASU 2023-07"). ASU 2023-07 requires disclosure of significant segment expenses that are regularly provided to the chief operating decision maker and included within the segment measure of profit or loss. ASU 2023-07 will be applied retrospectively and is effective for annual reporting periods in fiscal years beginning after December 15, 2023, and interim reporting periods in fiscal years beginning after December 31, 2024. We are currently evaluating ASU 2023-07 to determine its impact on our disclosures.

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

3. Real Estate Properties, Net

Real estate properties, net consisted of the following at September 30, 2024 and December 31, 2023:

Real estate properties - schedule of real estate properties

| September 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Land | $ | 177,155 | $ | 226,020 | ||||

| Buildings and improvements | 1,087,628 | 1,203,355 | ||||||

| Site improvements | 114,993 | 130,638 | ||||||

| Construction in progress | 14,116 | 7,853 | ||||||

| Real estate properties at cost | 1,393,892 | 1,567,866 | ||||||

| Less: accumulated depreciation | (246,652 | ) | (268,046 | ) | ||||

| Real estate properties, net | $ | 1,147,240 | $ | 1,299,820 | ||||

Depreciation expense was $16,258 and $16,943 for the three months ended September 30, 2024 and 2023, respectively, and $50,502 and $50,705 for the nine months ended September 30, 2024 and 2023, respectively.

Acquisition of Properties

The Company made the following acquisitions of properties during the nine months ended September 30, 2024:

Real estate properties - schedule of real estate acquisitions

| Location | Date Acquired | Square Feet | Properties | Purchase Price (1) | ||||||||

| Memphis, TN | July 18, 2024 | 1,625,241 | 4 | $ | 100,500 | |||||||

| Total | 1,625,241 | 4 | $ | 100,500 | ||||||||

________________

| (1) | Purchase price does not include capitalized acquisition costs. |

The allocation of the aggregate purchase price in accordance with FASB, ASU 2017-01 (Topic 805) “Business Combinations,” of the assets and liabilities acquired at their relative fair values as of their acquisition date, is as follows:

Real estate properties - schedule of recognized identified assets acquired and liabilities assumed

| Nine Months Ended September 30, 2024 |

||||||||

| Purchase price allocation | Purchase Price |

Weighted Average Amortization Period (years) of Intangibles at Acquisition |

||||||

| Total Purchase Price | ||||||||

| Purchase price | $ | 100,500 | N/A | |||||

| Acquisition costs | 887 | N/A | ||||||

| Total | $ | 101,387 | ||||||

| Allocation of Purchase Price | ||||||||

| Land | $ | 14,465 | N/A | |||||

| Building | 73,213 | N/A | ||||||

| Site improvements | 3,494 | N/A | ||||||

| Total real estate properties | 91,172 | |||||||

| Deferred Lease Intangibles | ||||||||

| Tenant relationships | 1,711 | 5.4 | ||||||

| Leasing commissions | 1,026 | 5.3 | ||||||

| Above market lease value | 710 | 6.7 | ||||||

| Below market lease value | (1,443 | ) | 6.1 | |||||

| Lease in place value | 8,211 | 4.4 | ||||||

| Net deferred lease intangibles | 10,215 | |||||||

| Totals | $ | 101,387 | ||||||

All acquisitions completed during the nine months ended September 30, 2024 were considered asset acquisitions under ASC 805.

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

Sale of Real Estate

During the nine months ended September 30, 2024, the Company sold a single, 221,911 square foot property located in Kansas City, MO for approximately $9,150, recognizing a net gain of $849. During the nine months ended September 30, 2023, the Company sold a single, 306,000 square foot property located in Chicago, IL for approximately $19,926, recognizing a net gain of $12,112.

Real Estate Properties Held for Sale

On August 26, 2024, the Operating Partnership, Isosceles JV Investments, LLC, an affiliate of Sixth Street Partners, LLC (the “Investor”), and Isosceles JV, LLC, an affiliate of Sixth Street Partners, LLC (the “Joint Venture”), entered into a Limited Liability Company Interest Contribution Agreement (the “Contribution Agreement”), pursuant to which the Operating Partnership will contribute (the “Contribution”) 100% of its equity interests in directly and indirectly wholly-owned subsidiaries owning 34 properties located in and around the Chicago metropolitan statistical area (each, a “Chicago Property” and, collectively the “Chicago Properties”) to the Joint Venture, which will be owned 35% by Plymouth Chicago Portfolio, LLC, a wholly-owned subsidiary of the Operating Partnership, and 65% by the Investor. The aggregate purchase price for the Chicago Properties is $356,000, which includes the assumption by the Joint Venture of $56,898 of debt held by the Company that is currently outstanding with Transamerica Life Insurance Company (“Transamerica”) and secured by certain Chicago Properties. An additional $10,506 of debt held by the Company that is currently outstanding with Midland National Life Insurance Mortgage and secured by a single Chicago Property is also expected to be paid in full by the Company upon the close of the Contribution (refer to “Note 5 – Indebtedness”). The closing of the Contribution is scheduled to take place on the day that is 12 business days following the satisfaction or waiver of all of the condition’s precedent to the closing, including, without limitation, obtaining new financing and refinancing existing indebtedness secured by the Chicago Properties. The Contribution closing is anticipated to occur in the fourth quarter of 2024, however it is contingent on the satisfaction of the closing conditions, which cannot be assured.

As of September 30, 2024, due to the pending contribution of the Chicago Properties, the carrying amount of the Chicago Properties were classified as "Real estate assets held for sale, net" and "Real estate liabilities held for sale, net" on the condensed consolidated balance sheets. Upon classifying the Chicago Properties as "Real estate assets held for sale, net" and "Real estate liabilities held for sale, net", the Chicago Properties were recorded at the lower of the carrying value or fair value less costs to sell and the Company ceased recognizing depreciation on the Chicago Properties. The Company determined that the disposition is not considered discontinued operations as it does not represent a strategic shift that has or will have a material impact on the Company's operations and financial results.

Real estate assets and liabilities held for sale, net consisted of the following at September 30, 2024. The Company did not classify any properties as held for sale as of December 31, 2023.

Real estate properties - schedule of real estate assets and liabilities held for sale

| September 30, | ||||

| Assets | 2024 | |||

| Land | $ | 60,359 | ||

| Buildings and improvements | 173,355 | |||

| Site improvements | 16,965 | |||

| Construction in progress | 3,789 | |||

| 254,468 | ||||

| Less: accumulated depreciation | (61,994 | ) | ||

| Real estate properties held for sale, net | $ | 192,474 | ||

| Deferred lease intangibles, net | 7,074 | |||

| Real estate assets held for sale, net | 199,548 | |||

| Liabilities | September 30, 2024 |

|||

| Secured debt, net | $ | 66,951 | ||

| Deferred lease intangibles, net | 1,031 | |||

| Real estate liabilities held for sale, net | $ | 67,982 | ||

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

4. Leases

As a Lessor

Operating Leases

We lease our properties to tenants under agreements that are typically classified as operating leases. We recognize the total minimum lease payments provided for under the leases on a straight-line basis over the applicable lease term. Many of our leases have triple-net provisions or modified gross lease expense reimbursement provisions, which entitle us to recover certain operating expenses, such as common area maintenance, insurance, real estate taxes and utilities from our tenants. The recovery of such operating expenses is recognized in rental revenue in the condensed consolidated statements of operations. Some of our tenants’ leases are subject to rent increases based on increases in the Consumer Price Index (“CPI”).

The Company includes accounts receivable and straight-line rent receivables within other assets in the condensed consolidated balance sheets. For the nine months ended September 30, 2024 and 2023, rental revenue was derived from various tenants. As such, future receipts are dependent upon the financial strength of the lessees and their ability to perform under the lease agreements.

Rental revenue is comprised of the following:

Leases - schedule of rental revenue components

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Income from leases | $ | 37,808 | $ | 36,783 | $ | 112,020 | $ | 109,163 | ||||||||

| Straight-line rent adjustments | 17 | 216 | (1,012 | ) | 1,833 | |||||||||||

| Tenant recoveries | 13,104 | 12,320 | 37,722 | 36,190 | ||||||||||||

| Amortization of above market leases | (151 | ) | (158 | ) | (420 | ) | (494 | ) | ||||||||

| Amortization of below market leases | 450 | 575 | 1,330 | 2,314 | ||||||||||||

| Total | $ | 51,228 | $ | 49,736 | $ | 149,640 | $ | 149,006 | ||||||||

Tenant recoveries included within rental revenue for the nine months ended September 30, 2024 and 2023 are variable in nature.

Sales Type Leases

During the quarter ended March 31, 2024, the tenant occupying a single-tenant industrial property located in Columbus, Ohio, provided notice of its intention to exercise its option to purchase the property at a fixed price of $21,480. As a result, we reclassified the respective real estate property to net investment in sales-type lease totaling $21,480 in our condensed consolidated balance sheets, effective as of the date of tenant notice, in the following amounts: (i) $19,605 from Real estate properties, (ii) $8,094 from Accumulated depreciation, (iii) $877 from net Deferred lease intangible assets, and (iv) $1,062 from Other assets. Further, we recognized a Gain on sale of real estate of $8,030 related to this transaction. On August 30, 2024, we completed the sale of the property and recognized selling costs of $234.

Earnings from our Net investment in sales-type leases are included in Rental revenue in the condensed consolidated statements of operations and totaled $204 and $0 for the three months ended September 30, 2024 and 2023, respectively, and $631 and $0 for the nine months ended September 30, 2024 and 2023, respectively. Prior to this reclassification to Net investment in sales-type lease, earnings from this lease were recognized in Rental revenue in the condensed consolidated statements of operations.

Net investment in sales-type leases are assessed for credit loss allowances. No such allowances were recorded as of September 30, 2024 or December 31, 2023.

As a Lessee

Operating Leases

As of September 30, 2024, we are the lessee under four office space operating leases and a single ground operating sublease. The office lease agreements do not contain residual value guarantees or an option to renew. The ground sublease agreement does not contain residual value guarantees and includes multiple options to extend the sublease between nineteen and twenty years for each respective option. The operating leases have remaining lease terms ranging from 0.3 to 31.3 years, which includes the exercise of a single twenty-year renewal option pertaining to the ground sublease. The Company's condensed consolidated balance sheets include the total operating right-of-use assets within other assets, and lease liabilities within accounts payable, accrued expenses and other liabilities. Total operating right-of-use assets and lease liabilities were approximately $4,420 and $5,216, respectively, as of September 30, 2024 and $4,829 and $5,789, respectively, as of December 31, 2023. The operating lease liability as of September 30, 2024 represents a weighted-average incremental borrowing rate of 4.1% over the weighted-average remaining lease term of 8.0 years. The incremental borrowing rate is our estimated borrowing rate on a fully-collateralized basis for the term of the respective leases.

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

The following table summarizes the operating lease expense recognized during the three and nine months ended September 30, 2024 and 2023 included in the Company’s condensed consolidated statements of operations.

Leases - schedule of lease costs

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Operating lease expense included in general and administrative expense attributable to office leases | $ | 177 | $ | 195 | $ | 599 | $ | 577 | ||||||||

| Operating lease expense included in property expense attributable to ground sublease | 21 | 9 | 39 | 27 | ||||||||||||

| Non-cash adjustment due to straight-line rent adjustments | 44 | 36 | 131 | 105 | ||||||||||||

| Cash paid for amounts included in the measurement of lease liabilities (operating cash flows) | $ | 242 | $ | 240 | $ | 769 | $ | 709 | ||||||||

The following table summarizes the maturity analysis of our operating leases, which is discounted by our incremental borrowing rate to calculate the lease liability as included in accounts payable, accrued expenses and other liabilities in the Company’s condensed consolidated balance sheets for the operating leases in which we are the lessee:

Leases - schedule of lessee future minimum rental commitments under non-cancellable leases

| October 1, 2024 – December 31, 2024 | $ | 325 | ||

| 2025 | 965 | |||

| 2026 | 876 | |||

| 2027 | 894 | |||

| 2028 | 865 | |||

| Thereafter | 2,658 | |||

| Total minimum operating lease payments | $ | 6,583 | ||

| Less imputed interest | (1,367 | ) | ||

| Total operating lease liability | $ | 5,216 |

Financing Leases

As of September 30, 2024, we have a single finance lease in which we are the sublessee for a ground lease. The Company includes the financing lease right of use asset in the amount of $825 and $845 as of September 30, 2024 and December 31, 2023, respectively, within real estate properties and the corresponding liability within financing lease liability in the condensed consolidated balance sheets. The ground sublease agreement does not contain a residual value guarantee and includes multiple options to extend the sublease between nineteen and twenty years for each respective option. The lease has a remaining lease term of approximately 31.3 years, which includes the exercise of a single twenty-year renewal option. The financing lease liability in the amount of $2,290 and $2,271 as of September 30, 2024 and December 31, 2023, respectively, represents a weighted-average incremental borrowing rate of 7.8% over the weighted-average remaining lease term, which, as of September 30, 2024, was 31.3 years. The incremental borrowing rate is our estimated borrowing rate on a fully-collateralized basis for the term of the respective lease.

The following table summarizes the financing lease expense recognized during the three and nine months ended September 30, 2024 and 2023 included in the Company’s condensed consolidated statements of operations.

Leases - schedule of finance lease expense

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Depreciation/amortization of financing lease right-of-use assets | $ | 7 | $ | 7 | $ | 21 | $ | 20 | ||||||||

| Interest expense for financing lease liability | 45 | 45 | 135 | 134 | ||||||||||||

| Total financing lease cost | $ | 52 | $ | 52 | $ | 156 | $ | 154 | ||||||||

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

The following table summarizes the maturity analysis of our financing lease:

Leases - schedule of finance lease, liability, fiscal year maturity

| October 1, 2024 – December 31, 2024 | $ | 39 | ||

| 2025 | 170 | |||

| 2026 | 170 | |||

| 2027 | 170 | |||

| 2028 | 170 | |||

| Thereafter | 6,195 | |||

| Total minimum financing lease payments | $ | 6,914 | ||

| Less imputed interest | (4,624 | ) | ||

| Total financing lease liability | $ | 2,290 |

5. Indebtedness

The following table sets forth a summary of the Company’s borrowings outstanding under its respective secured debt, unsecured line of credit and unsecured debt as of September 30, 2024 and December 31, 2023.

Indebtedness - schedule of secured and unsecured debt outstanding

| Outstanding Balance at | Interest rate at | |||||||||||

| Debt | September 30, 2024 |

December 31, 2023 |

September 30, 2024 |

Final Maturity Date |

||||||||

| Secured debt: | ||||||||||||

| Ohio National Life Mortgage(4) | — | 18,409 | 4.14% | August 1, 2024 | ||||||||

| Allianz Loan | 60,383 | 61,260 | 4.07% | April 10, 2026 | ||||||||

| Nationwide Loan | 14,712 | 14,948 | 2.97% | October 1, 2027 | ||||||||

| Lincoln Life Gateway Mortgage | 28,800 | 28,800 | 3.43% | January 1, 2028 | ||||||||

| Minnesota Life Memphis Industrial Loan | 54,079 | 54,956 | 3.15% | January 1, 2028 | ||||||||

| Midland National Life Insurance Mortgage(5) | 10,506 | 10,665 | 3.50% | March 10, 2028 | ||||||||

| Minnesota Life Loan | 19,220 | 19,569 | 3.78% | May 1, 2028 | ||||||||

| Transamerica Loan(5) | 56,898 | 59,357 | 4.35% | August 1, 2028 | ||||||||

| Total secured debt | $ | 244,598 | $ | 267,964 | ||||||||

| Unamortized debt issuance costs, net | (916 | ) | (1,174 | ) | ||||||||

| Unamortized premium/(discount), net | (14 | ) | 97 | |||||||||

| Total secured debt, net | $ | 243,668 | $ | 266,887 | ||||||||

| Unsecured debt: | ||||||||||||

| $100m KeyBank Term Loan | 100,000 | 100,000 | 3.00%(1)(2) | August 11, 2026 | ||||||||

| $200m KeyBank Term Loan | 200,000 | 200,000 | 3.03%(1)(2) | February 11, 2027 | ||||||||

| $150m KeyBank Term Loan | 150,000 | 150,000 | 4.40%(1)(2) | May 2, 2027 | ||||||||

| Total unsecured debt | $ | 450,000 | $ | 450,000 | ||||||||

| Unamortized debt issuance costs, net | (1,535 | ) | (2,010 | ) | ||||||||

| Total unsecured debt, net | $ | 448,465 | $ | 447,990 | ||||||||

| Borrowings under line of credit: | ||||||||||||

| KeyBank unsecured line of credit | 196,400 | 155,400 | 6.41%(1)(3) | August 11, 2025 | ||||||||

| Total borrowings under line of credit | $ | 196,400 | $ | 155,400 | ||||||||

_______________

| (1) | For the month of September 2024, the one-month term SOFR for our unsecured debt was 5.195% and the one-month term SOFR for our borrowings under line of credit was at a weighted average of 4.980%. The spread over the applicable rate for the $100m, $150m, and $200m KeyBank Term Loans and KeyBank unsecured line of credit is based on the Company’s total leverage ratio plus the 0.1% SOFR index adjustment. |

| (2) | The one-month term SOFR for the $100m, $150m and $200m KeyBank Term Loans was swapped to a fixed rate of 1.504%, 2.904%, and 1.527%, respectively. |

| (3) | $100 million of the outstanding borrowings under the KeyBank unsecured line of credit was swapped to a fixed USD-SOFR rate at a weighted average of 4.754%. |

| (4) | On August 1, 2024, the Company repaid in full, the outstanding principal and interest balance of approximately $18.1 million on the Ohio National Life Mortgage using proceeds from the KeyBank unsecured line of credit. |

| (5) | As of September 30, 2024, the Midland National Life Insurance Mortgage and the Transamerica Loan were reclassified to Real estate liabilities held for sale, net on our condensed consolidated balance sheets. |

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

Financial Covenant Considerations

The Company is in compliance with all respective financial covenants for its secured and unsecured debt and unsecured revolving line of credit as of September 30, 2024.

Fair Value of Debt

The fair value of our debt and borrowings under our revolving line of credit was estimated using Level 3 inputs by calculating the present value of principal and interest payments, using discount rates that best reflect current market interest rates for financings with similar characteristics and credit quality, and assuming each loan is outstanding through its maturity.

The following table summarizes the aggregate principal outstanding under the Company’s indebtedness and the corresponding estimate of fair value as of September 30, 2024 and December 31, 2023:

Indebtedness - schedule of fair value of debt instruments

| September 30, 2024 | December 31, 2023 | |||||||||||||||

| Indebtedness | Principal Outstanding | Fair Value | Principal Outstanding | Fair Value | ||||||||||||

| Secured debt | $ | 244,598 | $ | 233,530 | $ | 267,964 | $ | 254,114 | ||||||||

| Unsecured debt | 450,000 | 450,000 | 450,000 | 455,229 | ||||||||||||

| Borrowings under revolving line of credit, net | 196,400 | 196,400 | 155,400 | 155,599 | ||||||||||||

| Total | 890,998 | $ | 879,930 | 873,364 | $ | 864,942 | ||||||||||

| Unamortized debt issuance cost, net | (2,451 | ) | (3,184 | ) | ||||||||||||

| Unamortized premium/(discount), net | (14 | ) | 97 | |||||||||||||

| Total carrying value | $ | 888,533 | $ | 870,277 | ||||||||||||

6. Derivative Financial Instruments

Risk Management Objective of Using Derivatives

The Company is exposed to certain risk arising from both its business operations and economic conditions. The Company principally manages its exposures to a wide variety of business and operational risks through management of its core business activities. The Company manages economic risks, including interest rate, liquidity, and credit risk primarily by managing the amount, sources, and duration of its assets and liabilities and the use of derivative financial instruments. Specifically, the Company enters into derivative financial instruments to manage exposures that arise from business activities that result in the receipt or payment of future known and uncertain cash amounts, the value of which are determined by interest rates. The Company’s derivative financial instruments are used to manage differences in the amount, timing, and duration of the Company’s known or expected cash receipts and its known or expected cash payments principally related to the Company’s borrowings.

Cash Flow Hedges of Interest Rate Risk

The Company’s objectives in using interest rate derivatives are to add stability to interest expense and to manage its exposure to interest rate movements. To accomplish this objective, the Company primarily uses interest rate swaps as part of its interest rate risk management strategy. Interest rate swaps designated as cash flow hedges involve the receipt of variable amounts from a counterparty in exchange for the Company making fixed-rate payments over the life of the agreements without exchange of the underlying notional amount. During the nine months ended September 30, 2024 and the year ended December 31, 2023, such derivatives were used to hedge the variable cash flows associated with existing variable-rate debt.

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

The following table sets forth a summary of our interest rate swaps as of September 30, 2024 and December 31, 2023.

Derivative financial instruments - schedule of interest rate derivatives

| Notional Value(1) | Fair Value(2) | ||||||||||||||||||||

| Interest Rate Swap Counterparty |

Trade Date |

Effective Date |

Maturity Date |

SOFR Interest Strike Rate |

September 30, 2024 |

December 31, 2023 |

September 30, 2024 |

December 31, 2023 |

|||||||||||||

| Capital One, N.A. | July 13, 2022 | July 1, 2022 | Feb. 11, 2027 | 1.527% | $ | 200,000 | $ | 200,000 | $ | 8,253 | $ | 12,539 | |||||||||

| JPMorgan Chase Bank, N.A. | July 13, 2022 | July 1, 2022 | Aug. 8, 2026 | 1.504% | $ | 100,000 | $ | 100,000 | $ | 3,477 | $ | 5,692 | |||||||||

| JPMorgan Chase Bank, N.A. | Aug. 19, 2022 | Sept. 1, 2022 | May 2, 2027 | 2.904% | $ | 75,000 | $ | 75,000 | $ | 754 | $ | 1,723 | |||||||||

| Wells Fargo Bank, N.A. | Aug. 19, 2022 | Sept. 1, 2022 | May 2, 2027 | 2.904% | $ | 37,500 | $ | 37,500 | $ | 377 | $ | 861 | |||||||||

| Capital One, N.A. | Aug. 19, 2022 | Sept. 1, 2022 | May 2, 2027 | 2.904% | $ | 37,500 | $ | 37,500 | $ | 376 | $ | 852 | |||||||||

| Wells Fargo Bank, N.A. | Nov. 10, 2023 | Nov. 10, 2023 | Nov. 1, 2025 | 4.750% | $ | 50,000 | $ | 50,000 | $ | (540 | ) | $ | (577 | ) | |||||||

| JPMorgan Chase Bank, N.A. | Nov. 10, 2023 | Nov. 10, 2023 | Nov. 1, 2025 | 4.758% | $ | 25,000 | $ | 25,000 | $ | (272 | ) | $ | (292 | ) | |||||||

| Capital One, N.A. | Nov. 10, 2023 | Nov. 10, 2023 | Nov. 1, 2025 | 4.758% | $ | 25,000 | $ | 25,000 | $ | (273 | ) | $ | (292 | ) | |||||||

_______________

| (1) | Represents the notional value of interest rate swaps effective as of September 30, 2024. |

| (2) | As of September 30, 2024, the fair value of five of the interest rate swaps were in an asset position of approximately $13.2 million and the remaining three interest rate swaps were in a liability position of approximately $1.1 million. |

For derivatives designated and that qualify as cash flow hedges of interest rate risk, the gain or loss on the derivative is recorded in accumulated other comprehensive income (“AOCI”) and subsequently reclassified into interest expense in the same period during which the hedged transaction affects earnings. Amounts reported in AOCI related to derivatives will be reclassified to interest expense as interest payments are made on the Company’s variable-rate debt. During the next twelve months, the Company estimates that an additional $10,653 will be reclassified as a decrease to interest expense.

The following table sets forth the impact of our interest rate swaps on our condensed consolidated financial statements for the three and nine months ended September 30, 2024 and 2023.

Derivative financial instruments - schedule of cash flow hedges included in accumulated other comprehensive income (loss)

| For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||||||

| Interest Rate Swaps in Cash Flow Hedging Relationships: | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Amount of unrealized gain (loss) recognized in AOCI on derivatives | $ | (13,171 | ) | $ | 2,935 | $ | (8,354 | ) | $ | 4,000 | ||||||

| Total interest expense presented in the condensed consolidated statements of operations in which the effects of cash flow hedges are recorded | $ | 3,958 | $ | 3,764 | $ | 11,860 | $ | 10,030 | ||||||||

Fair Value of Interest Rate Swaps

The Company’s valuation of the interest rate swaps is determined using widely accepted valuation techniques, including discounted cash flow analysis on the expected cash flows of each derivative. This analysis reflects the contractual terms of the derivatives, including the period to maturity, and uses observable market-based inputs, including interest rate curves.

The Company incorporates credit valuation adjustments to appropriately reflect both its own nonperformance risk and the respective counterparty’s nonperformance risk in the fair value measurements. In adjusting the fair value of its derivative contracts for the effect of nonperformance risk, the Company has considered the impact of netting and any applicable credit enhancements, such as collateral postings, thresholds, mutual puts, and guarantees.

Although the Company has determined that the majority of the inputs used to value its derivatives fall within Level 2 of the fair value hierarchy, the credit valuation adjustments associated with its derivatives utilize Level 3 inputs, such as estimates of current credit spreads to evaluate the likelihood of default by itself and its counterparties. However, as of September 30, 2024 and December 31, 2023, the Company has assessed the significance of the impact of the credit valuation adjustments on the overall valuation of its derivative positions and has determined that the credit valuation adjustments are not significant to the overall valuation of its derivatives. As a result, the Company has determined that its derivative valuations in their entirety are classified in Level 2 of the fair value hierarchy.

Non-designated Hedges

The Company does not use derivatives for trading or speculative purposes and currently does not have any derivatives that are not designated as hedges. Changes in the fair value of derivatives not designated in hedging relationships would be recorded directly in earnings.

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

Credit-risk-related Contingent Features

The Company has agreements with each of its derivative counterparties that contain a provision where if the Company either defaults or is capable of being declared in default on any of its indebtedness, then the Company could also be declared in default on its derivative obligations. Specifically, the Company could be declared in default on its derivative obligations if repayment of the underlying indebtedness is accelerated by the lender due to the Company's default on the indebtedness.

As of September 30, 2024, the fair value of three of the eight interest rate swaps were in a net liability position. As of September 30, 2024, the Company has not posted any collateral related to these agreements. If the Company had breached any of these provisions at September 30, 2024, it could have been required to settle its obligations under the agreements at their termination value.

7. Common Stock

ATM Program

On February 27, 2024, the Company and the Operating Partnership entered into a distribution agreement with certain sales agents, forward sellers and forward purchasers, as applicable, pursuant to which the Company may issue and sell, from time to time, shares of its common stock, with aggregate gross proceeds not to exceed $200,000 through an “at-the-market” equity offering program (the “2024 $200 Million ATM Program”). The 2024 $200 Million ATM Program replaced the previous $200 million ATM program, which was entered into on February 28, 2023 (“2023 $200 Million ATM Program”).

For the nine months ended September 30, 2024, the Company did not issue any shares of its common stock under the 2024 $200 Million ATM Program or 2023 $200 Million ATM Program. The Company has approximately $200,000 available for issuance under the 2024 $200 Million ATM Program.

Common Stock Dividends

The following table sets forth the common stock dividends that were declared during the nine months ended September 30, 2024 and the year ended December 31, 2023.

Common stock - schedule of common stock dividends declared

| Cash Dividends Declared per Share |

Aggregate Amount |

|||||||

| 2024 | ||||||||

| First quarter | $ | 0.2400 | $ | 10,904 | ||||

| Second quarter | 0.2400 | 10,928 | ||||||

| Third quarter | 0.2400 | 10,927 | ||||||

| Total | $ | 0.7200 | $ | 32,759 | ||||

| 2023 | ||||||||

| First quarter | $ | 0.2250 | $ | 9,682 | ||||

| Second quarter | 0.2250 | 9,709 | ||||||

| Third quarter | 0.2250 | 10,193 | ||||||

| Fourth quarter | 0.2250 | 10,193 | ||||||

| Total | $ | 0.9000 | $ | 39,777 | ||||

8. Non-Controlling Interests

Operating Partnership Units

In connection with prior acquisitions of real estate property, the Company, through its Operating Partnership, issued Operating Partnership Units (“OP Units”) to the former owners as part of the acquisition consideration. The holders of the OP Units are entitled to receive distributions concurrent with the dividends paid on our common stock. The holders of the OP Units can also elect to tender their respective OP Units for redemption by the Company for cash or, at our election, for shares of our common stock on a 1-to-1 basis. Upon conversion, the Company adjusts the carrying value of non-controlling interest to reflect its modified share of the book value of the Operating Partnership. Such adjustments are recorded to additional paid-in capital as a reallocation of non-controlling interest on the accompanying condensed consolidated statements of changes in preferred stock and equity.

OP Units outstanding as of September 30, 2024 and December 31, 2023 was 490,299.

Plymouth Industrial REIT, Inc.

Notes to Condensed Consolidated Financial Statements

Unaudited

(all dollar amounts in thousands, except share and per share data)

The following table sets forth the OP Unit distributions that were declared during the nine months ended September 30, 2024 and the year ended December 31, 2023.

Non-controlling interest - schedule of redeemable non-controlling interest

| Cash Distributions Declared per OP Unit |

Aggregate Amount |

|||||||

| 2024 | ||||||||

| First quarter | $ | 0.2400 | $ | 118 | ||||

| Second quarter | 0.2400 | 118 | ||||||

| Third quarter | 0.2400 | 118 | ||||||

| Total | $ | 0.7200 | $ | 354 | ||||

| 2023 | ||||||||

| First quarter | $ | 0.2250 | $ | 110 | ||||

| Second quarter | 0.2250 | 110 | ||||||

| Third quarter | 0.2250 | 110 | ||||||

| Fourth quarter | 0.2250 | 110 | ||||||

| Total | $ | 0.9000 | $ | 440 | ||||

The proportionate share of the income (loss) attributed to the OP Units was ($170) and $114 for the three months ended September 30, 2024 and 2023, respectively, and ($88) and $46 for the nine months ended September 30, 2024 and 2023, respectively.

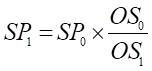

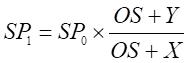

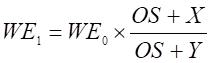

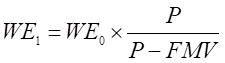

Redeemable Non-controlling Interest - Series C Preferred Units