false2024Q300011700102/290.500.50350,000,000350,000,000158,021,407158,079,033158,021,407158,079,0331,782,0871,614,924511,924507,20127.140000011700102023-03-012023-11-3000011700102024-01-03xbrli:shares0001170010kmx:UsedVehiclesMember2023-09-012023-11-30iso4217:USD0001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:UsedVehiclesMember2023-09-012023-11-30xbrli:pure0001170010kmx:UsedVehiclesMember2022-09-012022-11-300001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:UsedVehiclesMember2022-09-012022-11-300001170010kmx:UsedVehiclesMember2023-03-012023-11-300001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:UsedVehiclesMember2023-03-012023-11-300001170010kmx:UsedVehiclesMember2022-03-012022-11-300001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:UsedVehiclesMember2022-03-012022-11-300001170010kmx:WholesaleVehiclesMember2023-09-012023-11-300001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:WholesaleVehiclesMember2023-09-012023-11-300001170010kmx:WholesaleVehiclesMember2022-09-012022-11-300001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:WholesaleVehiclesMember2022-09-012022-11-300001170010kmx:WholesaleVehiclesMember2023-03-012023-11-300001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:WholesaleVehiclesMember2023-03-012023-11-300001170010kmx:WholesaleVehiclesMember2022-03-012022-11-300001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:WholesaleVehiclesMember2022-03-012022-11-300001170010kmx:OtherMember2023-09-012023-11-300001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:OtherMember2023-09-012023-11-300001170010kmx:OtherMember2022-09-012022-11-300001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:OtherMember2022-09-012022-11-300001170010kmx:OtherMember2023-03-012023-11-300001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:OtherMember2023-03-012023-11-300001170010kmx:OtherMember2022-03-012022-11-300001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:OtherMember2022-03-012022-11-3000011700102023-09-012023-11-300001170010kmx:NetSalesAndOperatingRevenuesMember2023-09-012023-11-3000011700102022-09-012022-11-300001170010kmx:NetSalesAndOperatingRevenuesMember2022-09-012022-11-300001170010kmx:NetSalesAndOperatingRevenuesMember2023-03-012023-11-3000011700102022-03-012022-11-300001170010kmx:NetSalesAndOperatingRevenuesMember2022-03-012022-11-300001170010us-gaap:CostOfSalesMemberkmx:UsedVehiclesMember2023-09-012023-11-300001170010us-gaap:CostOfSalesMemberkmx:UsedVehiclesMember2022-09-012022-11-300001170010us-gaap:CostOfSalesMemberkmx:UsedVehiclesMember2023-03-012023-11-300001170010us-gaap:CostOfSalesMemberkmx:UsedVehiclesMember2022-03-012022-11-300001170010us-gaap:CostOfSalesMemberkmx:WholesaleVehiclesMember2023-09-012023-11-300001170010us-gaap:CostOfSalesMemberkmx:WholesaleVehiclesMember2022-09-012022-11-300001170010us-gaap:CostOfSalesMemberkmx:WholesaleVehiclesMember2023-03-012023-11-300001170010us-gaap:CostOfSalesMemberkmx:WholesaleVehiclesMember2022-03-012022-11-300001170010us-gaap:CostOfSalesMemberkmx:OtherMember2023-09-012023-11-300001170010us-gaap:CostOfSalesMemberkmx:OtherMember2022-09-012022-11-300001170010us-gaap:CostOfSalesMemberkmx:OtherMember2023-03-012023-11-300001170010us-gaap:CostOfSalesMemberkmx:OtherMember2022-03-012022-11-300001170010us-gaap:CostOfSalesMember2023-09-012023-11-300001170010us-gaap:CostOfSalesMember2022-09-012022-11-300001170010us-gaap:CostOfSalesMember2023-03-012023-11-300001170010us-gaap:CostOfSalesMember2022-03-012022-11-300001170010kmx:GrossProfitMember2023-09-012023-11-300001170010kmx:GrossProfitMember2022-09-012022-11-300001170010kmx:GrossProfitMember2023-03-012023-11-300001170010kmx:GrossProfitMember2022-03-012022-11-300001170010kmx:NetIncomeLossFromFinancingMember2023-09-012023-11-300001170010kmx:NetIncomeLossFromFinancingMember2022-09-012022-11-300001170010kmx:NetIncomeLossFromFinancingMember2023-03-012023-11-300001170010kmx:NetIncomeLossFromFinancingMember2022-03-012022-11-300001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-09-012023-11-300001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-09-012022-11-300001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-03-012023-11-300001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-03-012022-11-300001170010kmx:DepreciationAndAmortizationMember2023-09-012023-11-300001170010kmx:DepreciationAndAmortizationMember2022-09-012022-11-300001170010kmx:DepreciationAndAmortizationMember2023-03-012023-11-300001170010kmx:DepreciationAndAmortizationMember2022-03-012022-11-300001170010us-gaap:InterestExpenseMember2023-09-012023-11-300001170010us-gaap:InterestExpenseMember2022-09-012022-11-300001170010us-gaap:InterestExpenseMember2023-03-012023-11-300001170010us-gaap:InterestExpenseMember2022-03-012022-11-300001170010us-gaap:NonoperatingIncomeExpenseMember2023-09-012023-11-300001170010us-gaap:NonoperatingIncomeExpenseMember2022-09-012022-11-300001170010us-gaap:NonoperatingIncomeExpenseMember2023-03-012023-11-300001170010us-gaap:NonoperatingIncomeExpenseMember2022-03-012022-11-300001170010kmx:EarningsBeforeIncomeTaxesMember2023-09-012023-11-300001170010kmx:EarningsBeforeIncomeTaxesMember2022-09-012022-11-300001170010kmx:EarningsBeforeIncomeTaxesMember2023-03-012023-11-300001170010kmx:EarningsBeforeIncomeTaxesMember2022-03-012022-11-300001170010kmx:IncomeTaxProvisionMember2023-09-012023-11-300001170010kmx:IncomeTaxProvisionMember2022-09-012022-11-300001170010kmx:IncomeTaxProvisionMember2023-03-012023-11-300001170010kmx:IncomeTaxProvisionMember2022-03-012022-11-300001170010kmx:NetEarningsMember2023-09-012023-11-300001170010kmx:NetEarningsMember2022-09-012022-11-300001170010kmx:NetEarningsMember2023-03-012023-11-300001170010kmx:NetEarningsMember2022-03-012022-11-30iso4217:USDxbrli:shares00011700102023-11-3000011700102023-02-2800011700102022-02-2800011700102022-11-300001170010us-gaap:CommonStockMember2023-02-280001170010us-gaap:AdditionalPaidInCapitalMember2023-02-280001170010us-gaap:RetainedEarningsMember2023-02-280001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-02-280001170010us-gaap:RetainedEarningsMember2023-03-012023-05-3100011700102023-03-012023-05-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-012023-05-310001170010us-gaap:AdditionalPaidInCapitalMember2023-03-012023-05-310001170010us-gaap:CommonStockMember2023-03-012023-05-310001170010us-gaap:CommonStockMember2023-05-310001170010us-gaap:AdditionalPaidInCapitalMember2023-05-310001170010us-gaap:RetainedEarningsMember2023-05-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-05-3100011700102023-05-310001170010us-gaap:RetainedEarningsMember2023-06-012023-08-3100011700102023-06-012023-08-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-012023-08-310001170010us-gaap:AdditionalPaidInCapitalMember2023-06-012023-08-310001170010us-gaap:CommonStockMember2023-06-012023-08-310001170010us-gaap:CommonStockMember2023-08-310001170010us-gaap:AdditionalPaidInCapitalMember2023-08-310001170010us-gaap:RetainedEarningsMember2023-08-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-3100011700102023-08-310001170010us-gaap:RetainedEarningsMember2023-09-012023-11-300001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-012023-11-300001170010us-gaap:AdditionalPaidInCapitalMember2023-09-012023-11-300001170010us-gaap:CommonStockMember2023-09-012023-11-300001170010us-gaap:CommonStockMember2023-11-300001170010us-gaap:AdditionalPaidInCapitalMember2023-11-300001170010us-gaap:RetainedEarningsMember2023-11-300001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-11-300001170010us-gaap:CommonStockMember2022-02-280001170010us-gaap:AdditionalPaidInCapitalMember2022-02-280001170010us-gaap:RetainedEarningsMember2022-02-280001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-02-280001170010us-gaap:RetainedEarningsMember2022-03-012022-05-3100011700102022-03-012022-05-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-012022-05-310001170010us-gaap:AdditionalPaidInCapitalMember2022-03-012022-05-310001170010us-gaap:CommonStockMember2022-03-012022-05-310001170010us-gaap:CommonStockMember2022-05-310001170010us-gaap:AdditionalPaidInCapitalMember2022-05-310001170010us-gaap:RetainedEarningsMember2022-05-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-05-3100011700102022-05-310001170010us-gaap:RetainedEarningsMember2022-06-012022-08-3100011700102022-06-012022-08-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-012022-08-310001170010us-gaap:AdditionalPaidInCapitalMember2022-06-012022-08-310001170010us-gaap:CommonStockMember2022-06-012022-08-310001170010us-gaap:CommonStockMember2022-08-310001170010us-gaap:AdditionalPaidInCapitalMember2022-08-310001170010us-gaap:RetainedEarningsMember2022-08-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-3100011700102022-08-310001170010us-gaap:RetainedEarningsMember2022-09-012022-11-300001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-012022-11-300001170010us-gaap:AdditionalPaidInCapitalMember2022-09-012022-11-300001170010us-gaap:CommonStockMember2022-09-012022-11-300001170010us-gaap:CommonStockMember2022-11-300001170010us-gaap:AdditionalPaidInCapitalMember2022-11-300001170010us-gaap:RetainedEarningsMember2022-11-300001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-11-30kmx:segment0001170010kmx:UsedVehiclesMember2023-09-012023-11-300001170010kmx:UsedVehiclesMember2022-09-012022-11-300001170010kmx:UsedVehiclesMember2023-03-012023-11-300001170010kmx:UsedVehiclesMember2022-03-012022-11-300001170010kmx:WholesaleVehiclesMember2023-09-012023-11-300001170010kmx:WholesaleVehiclesMember2022-09-012022-11-300001170010kmx:WholesaleVehiclesMember2023-03-012023-11-300001170010kmx:WholesaleVehiclesMember2022-03-012022-11-300001170010kmx:ExtendedprotectionplanDomain2023-09-012023-11-300001170010kmx:ExtendedprotectionplanDomain2022-09-012022-11-300001170010kmx:ExtendedprotectionplanDomain2023-03-012023-11-300001170010kmx:ExtendedprotectionplanDomain2022-03-012022-11-300001170010kmx:ThirdpartyfinancefeesDomain2023-09-012023-11-300001170010kmx:ThirdpartyfinancefeesDomain2022-09-012022-11-300001170010kmx:ThirdpartyfinancefeesDomain2023-03-012023-11-300001170010kmx:ThirdpartyfinancefeesDomain2022-03-012022-11-300001170010kmx:AdvertisingSubscriptionRevenuesDomain2023-09-012023-11-300001170010kmx:AdvertisingSubscriptionRevenuesDomain2022-09-012022-11-300001170010kmx:AdvertisingSubscriptionRevenuesDomain2023-03-012023-11-300001170010kmx:AdvertisingSubscriptionRevenuesDomain2022-03-012022-11-300001170010kmx:ServiceDomain2023-09-012023-11-300001170010kmx:ServiceDomain2022-09-012022-11-300001170010kmx:ServiceDomain2023-03-012023-11-300001170010kmx:ServiceDomain2022-03-012022-11-300001170010kmx:OtherDomain2023-09-012023-11-300001170010kmx:OtherDomain2022-09-012022-11-300001170010kmx:OtherDomain2023-03-012023-11-300001170010kmx:OtherDomain2022-03-012022-11-300001170010kmx:OtherMember2023-09-012023-11-300001170010kmx:OtherMember2022-09-012022-11-300001170010kmx:OtherMember2023-03-012023-11-300001170010kmx:OtherMember2022-03-012022-11-300001170010kmx:InterestAndFeeIncomeMember2023-09-012023-11-300001170010kmx:InterestAndFeeIncomeMember2022-09-012022-11-300001170010kmx:InterestAndFeeIncomeMember2023-03-012023-11-300001170010kmx:InterestAndFeeIncomeMember2022-03-012022-11-300001170010kmx:InterestIncomeExpenseNetMember2023-09-012023-11-300001170010kmx:InterestIncomeExpenseNetMember2022-09-012022-11-300001170010kmx:InterestIncomeExpenseNetMember2023-03-012023-11-300001170010kmx:InterestIncomeExpenseNetMember2022-03-012022-11-300001170010kmx:ProvisionForLoanLossesMember2023-09-012023-11-300001170010kmx:ProvisionForLoanLossesMember2022-09-012022-11-300001170010kmx:ProvisionForLoanLossesMember2023-03-012023-11-300001170010kmx:ProvisionForLoanLossesMember2022-03-012022-11-300001170010kmx:TotalInterestMarginAfterProvisionForLoanLossesMember2023-09-012023-11-300001170010kmx:TotalInterestMarginAfterProvisionForLoanLossesMember2022-09-012022-11-300001170010kmx:TotalInterestMarginAfterProvisionForLoanLossesMember2023-03-012023-11-300001170010kmx:TotalInterestMarginAfterProvisionForLoanLossesMember2022-03-012022-11-300001170010kmx:PayrollAndFringeBenefitExpenseMember2023-09-012023-11-300001170010kmx:PayrollAndFringeBenefitExpenseMember2022-09-012022-11-300001170010kmx:PayrollAndFringeBenefitExpenseMember2023-03-012023-11-300001170010kmx:PayrollAndFringeBenefitExpenseMember2022-03-012022-11-300001170010kmx:OtherDirectExpensesMember2023-09-012023-11-300001170010kmx:OtherDirectExpensesMember2022-09-012022-11-300001170010kmx:OtherDirectExpensesMember2023-03-012023-11-300001170010kmx:OtherDirectExpensesMember2022-03-012022-11-300001170010kmx:TotalDirectExpensesMember2023-09-012023-11-300001170010kmx:TotalDirectExpensesMember2022-09-012022-11-300001170010kmx:TotalDirectExpensesMember2023-03-012023-11-300001170010kmx:TotalDirectExpensesMember2022-03-012022-11-300001170010kmx:CarmaxAutoFinanceIncomeMember2023-09-012023-11-300001170010kmx:CarmaxAutoFinanceIncomeMember2022-09-012022-11-300001170010kmx:CarmaxAutoFinanceIncomeMember2023-03-012023-11-300001170010kmx:CarmaxAutoFinanceIncomeMember2022-03-012022-11-300001170010kmx:TermSecuritizationsMember2023-11-300001170010kmx:TermSecuritizationsMember2023-02-280001170010kmx:WarehouseFacilitiesReceivablesMember2023-11-300001170010kmx:WarehouseFacilitiesReceivablesMember2023-02-280001170010kmx:ExcessCollateralMember2023-11-300001170010kmx:ExcessCollateralMember2023-02-280001170010kmx:OtherReceivablesMember2023-11-300001170010kmx:OtherReceivablesMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-11-300001170010kmx:CreditGradeBMemberkmx:CoreManagedReceivablesMember2023-11-300001170010kmx:CreditGradeCAndOtherMemberkmx:CoreManagedReceivablesMember2023-11-300001170010kmx:CoreManagedReceivablesMember2023-11-300001170010kmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2023-11-300001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-02-280001170010kmx:CreditGradeBMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2023-02-280001170010kmx:CoreManagedReceivablesMember2023-08-310001170010kmx:OtherManagedReceivablesMember2023-08-310001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2023-08-310001170010kmx:CoreManagedReceivablesMember2023-09-012023-11-300001170010kmx:OtherManagedReceivablesMember2023-09-012023-11-300001170010kmx:OtherManagedReceivablesMember2023-11-300001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2023-11-300001170010kmx:CoreManagedReceivablesMember2022-08-310001170010kmx:OtherManagedReceivablesMember2022-08-310001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2022-08-310001170010kmx:CoreManagedReceivablesMember2022-09-012022-11-300001170010kmx:OtherManagedReceivablesMember2022-09-012022-11-300001170010kmx:CoreManagedReceivablesMember2022-11-300001170010kmx:OtherManagedReceivablesMember2022-11-300001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2022-11-300001170010kmx:OtherManagedReceivablesMember2023-02-280001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2023-02-280001170010kmx:CoreManagedReceivablesMember2023-03-012023-11-300001170010kmx:OtherManagedReceivablesMember2023-03-012023-11-300001170010kmx:CoreManagedReceivablesMember2022-02-280001170010kmx:OtherManagedReceivablesMember2022-02-280001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2022-02-280001170010kmx:CoreManagedReceivablesMember2022-03-012022-11-300001170010kmx:OtherManagedReceivablesMember2022-03-012022-11-300001170010kmx:OneToThirtyDaysPastDueMember2023-11-300001170010kmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-11-300001170010kmx:CreditGradeBMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-11-300001170010kmx:CreditGradeCAndOtherMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-11-300001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMember2023-11-300001170010kmx:CreditGradeCAndOtherMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:OtherManagedReceivablesMember2023-11-300001170010kmx:ThirtyOneToSixtyDaysPastDueMember2023-11-300001170010kmx:SixtyOneToNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-11-300001170010kmx:CreditGradeBMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-11-300001170010kmx:CreditGradeCAndOtherMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-11-300001170010kmx:SixtyOneToNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-11-300001170010kmx:CreditGradeCAndOtherMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:OtherManagedReceivablesMember2023-11-300001170010kmx:SixtyOneToNinetyDaysPastDueMember2023-11-300001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-11-300001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CreditGradeBMemberkmx:CoreManagedReceivablesMember2023-11-300001170010kmx:CreditGradeCAndOtherMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-11-300001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-11-300001170010kmx:CreditGradeCAndOtherMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:OtherManagedReceivablesMember2023-11-300001170010kmx:GreaterThanNinetyDaysPastDueMember2023-11-300001170010kmx:OneToThirtyDaysPastDueMember2023-02-280001170010kmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-02-280001170010kmx:CreditGradeBMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:OtherManagedReceivablesMember2023-02-280001170010kmx:ThirtyOneToSixtyDaysPastDueMember2023-02-280001170010kmx:SixtyOneToNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-02-280001170010kmx:CreditGradeBMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:SixtyOneToNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:OtherManagedReceivablesMember2023-02-280001170010kmx:SixtyOneToNinetyDaysPastDueMember2023-02-280001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-02-280001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CreditGradeBMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:OtherManagedReceivablesMember2023-02-280001170010kmx:GreaterThanNinetyDaysPastDueMember2023-02-280001170010us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2023-03-012023-11-300001170010us-gaap:NondesignatedMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2023-09-012023-11-300001170010us-gaap:NondesignatedMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2023-03-012023-11-300001170010us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2023-11-300001170010us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2023-02-280001170010us-gaap:NondesignatedMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2023-11-300001170010us-gaap:NondesignatedMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2023-02-280001170010us-gaap:FairValueInputsLevel1Member2023-11-300001170010us-gaap:FairValueInputsLevel2Member2023-11-300001170010us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel1Member2023-11-300001170010us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2023-11-300001170010us-gaap:DesignatedAsHedgingInstrumentMember2023-11-300001170010us-gaap:NondesignatedMemberus-gaap:FairValueInputsLevel1Member2023-11-300001170010us-gaap:NondesignatedMemberus-gaap:FairValueInputsLevel2Member2023-11-300001170010us-gaap:NondesignatedMember2023-11-300001170010us-gaap:FairValueInputsLevel1Member2023-02-280001170010us-gaap:FairValueInputsLevel2Member2023-02-280001170010us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel1Member2023-02-280001170010us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2023-02-280001170010us-gaap:DesignatedAsHedgingInstrumentMember2023-02-280001170010us-gaap:NondesignatedMemberus-gaap:FairValueInputsLevel1Member2023-02-280001170010us-gaap:NondesignatedMemberus-gaap:FairValueInputsLevel2Member2023-02-280001170010us-gaap:NondesignatedMember2023-02-280001170010us-gaap:RevolvingCreditFacilityMember2023-11-300001170010us-gaap:RevolvingCreditFacilityMember2023-02-280001170010kmx:TermLoanMember2023-11-300001170010kmx:TermLoanMember2023-02-280001170010kmx:October2021TermLoanMember2023-11-300001170010kmx:October2021TermLoanMember2023-02-280001170010kmx:A3.86seniornotesdues2023Member2023-11-300001170010kmx:A3.86seniornotesdues2023Member2023-02-280001170010kmx:A4.17seniornotesdue2026Member2023-11-300001170010kmx:A4.17seniornotesdue2026Member2023-02-280001170010kmx:A4.27seniornotesdue2028Member2023-11-300001170010kmx:A4.27seniornotesdue2028Member2023-02-280001170010us-gaap:LineOfCreditMember2023-11-300001170010kmx:TermLoanMember2023-11-300001170010kmx:October2021TermLoanMember2023-11-300001170010us-gaap:SeniorNotesMember2023-11-300001170010kmx:FinancingObligationMembersrt:MinimumMember2023-03-012023-11-300001170010kmx:FinancingObligationMembersrt:MaximumMember2023-03-012023-11-300001170010kmx:WarehouseFacilityOneMember2023-11-300001170010kmx:WarehouseFacilityThreeMember2023-11-300001170010kmx:WarehouseFacilityTwoMember2023-11-300001170010kmx:WarehouseFacilitiesMember2023-11-300001170010kmx:TermSecuritizationsDebtMember2023-11-300001170010kmx:ShareRepurchaseProgramMember2023-11-300001170010kmx:ShareRepurchaseProgramMember2023-09-012023-11-300001170010kmx:ShareRepurchaseProgramMember2022-09-012022-11-300001170010kmx:ShareRepurchaseProgramMember2023-03-012023-11-300001170010kmx:ShareRepurchaseProgramMember2022-03-012022-11-300001170010kmx:ShareRepurchaseProgramMember2022-11-300001170010us-gaap:CostOfSalesMember2023-09-012023-11-300001170010us-gaap:CostOfSalesMember2022-09-012022-11-300001170010us-gaap:CostOfSalesMember2023-03-012023-11-300001170010us-gaap:CostOfSalesMember2022-03-012022-11-300001170010kmx:CarmaxAutoFinanceIncomeMember2023-09-012023-11-300001170010kmx:CarmaxAutoFinanceIncomeMember2022-09-012022-11-300001170010kmx:CarmaxAutoFinanceIncomeMember2023-03-012023-11-300001170010kmx:CarmaxAutoFinanceIncomeMember2022-03-012022-11-300001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-09-012023-11-300001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-09-012022-11-300001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-03-012023-11-300001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-03-012022-11-300001170010us-gaap:EmployeeStockOptionMember2023-09-012023-11-300001170010us-gaap:EmployeeStockOptionMember2022-09-012022-11-300001170010us-gaap:EmployeeStockOptionMember2023-03-012023-11-300001170010us-gaap:EmployeeStockOptionMember2022-03-012022-11-300001170010kmx:CashSettledRestrictedStockUnitsMember2023-09-012023-11-300001170010kmx:CashSettledRestrictedStockUnitsMember2022-09-012022-11-300001170010kmx:CashSettledRestrictedStockUnitsMember2023-03-012023-11-300001170010kmx:CashSettledRestrictedStockUnitsMember2022-03-012022-11-300001170010kmx:StockSettledRestrictedStockUnitsMember2023-09-012023-11-300001170010kmx:StockSettledRestrictedStockUnitsMember2022-09-012022-11-300001170010kmx:StockSettledRestrictedStockUnitsMember2023-03-012023-11-300001170010kmx:StockSettledRestrictedStockUnitsMember2022-03-012022-11-300001170010us-gaap:PerformanceSharesMember2023-09-012023-11-300001170010us-gaap:PerformanceSharesMember2022-09-012022-11-300001170010us-gaap:PerformanceSharesMember2023-03-012023-11-300001170010us-gaap:PerformanceSharesMember2022-03-012022-11-300001170010us-gaap:RestrictedStockMember2023-09-012023-11-300001170010us-gaap:RestrictedStockMember2022-09-012022-11-300001170010us-gaap:RestrictedStockMember2023-03-012023-11-300001170010us-gaap:RestrictedStockMember2022-03-012022-11-300001170010kmx:DeferredStockUnitsMember2023-09-012023-11-300001170010kmx:DeferredStockUnitsMember2022-09-012022-11-300001170010kmx:DeferredStockUnitsMember2023-03-012023-11-300001170010kmx:DeferredStockUnitsMember2022-03-012022-11-300001170010us-gaap:EmployeeStockMember2023-09-012023-11-300001170010us-gaap:EmployeeStockMember2022-09-012022-11-300001170010us-gaap:EmployeeStockMember2023-03-012023-11-300001170010us-gaap:EmployeeStockMember2022-03-012022-11-300001170010kmx:OthersharebasedincentivesMember2023-09-012023-11-300001170010kmx:OthersharebasedincentivesMember2022-09-012022-11-300001170010kmx:OthersharebasedincentivesMember2023-03-012023-11-300001170010kmx:OthersharebasedincentivesMember2022-03-012022-11-300001170010kmx:StockSettledRestrictedStockUnitsMember2023-02-280001170010kmx:OthersharebasedincentivesMember2023-02-280001170010kmx:CashSettledRestrictedStockUnitsMember2023-02-280001170010kmx:StockSettledRestrictedStockUnitsMember2023-11-300001170010kmx:OthersharebasedincentivesMember2023-11-300001170010kmx:CashSettledRestrictedStockUnitsMember2023-11-300001170010us-gaap:EmployeeStockOptionMember2023-09-012023-11-300001170010us-gaap:EmployeeStockOptionMember2022-09-012022-11-300001170010us-gaap:EmployeeStockOptionMember2023-03-012023-11-300001170010us-gaap:EmployeeStockOptionMember2022-03-012022-11-300001170010kmx:StockSettledStockUnitsAndAwardsMember2023-09-012023-11-300001170010kmx:StockSettledStockUnitsAndAwardsMember2022-09-012022-11-300001170010kmx:StockSettledStockUnitsAndAwardsMember2023-03-012023-11-300001170010kmx:StockSettledStockUnitsAndAwardsMember2022-03-012022-11-300001170010kmx:UnrecognizedActuarialLossesMember2023-02-280001170010kmx:UnrecognizedHedgeLossesMember2023-02-280001170010kmx:UnrecognizedActuarialLossesMember2023-03-012023-11-300001170010kmx:UnrecognizedHedgeLossesMember2023-03-012023-11-300001170010kmx:UnrecognizedActuarialLossesMember2023-11-300001170010kmx:UnrecognizedHedgeLossesMember2023-11-300001170010kmx:CarmaxAutoFinanceMember2023-09-012023-11-300001170010kmx:CarmaxAutoFinanceMember2022-09-012022-11-300001170010kmx:CarmaxAutoFinanceMember2023-03-012023-11-300001170010kmx:CarmaxAutoFinanceMember2022-03-012022-11-300001170010srt:MinimumMember2023-03-012023-11-300001170010srt:MaximumMember2023-03-012023-11-30utr:Rate0001170010kmx:CarMaxSalesOperationsMember2023-09-012023-11-300001170010us-gaap:AllOtherSegmentsMember2023-09-012023-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2023-09-012023-11-300001170010us-gaap:IntersegmentEliminationMember2023-09-012023-11-300001170010us-gaap:OperatingSegmentsMemberkmx:CarMaxSalesOperationsMember2023-09-012023-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-09-012023-11-300001170010us-gaap:CostOfSalesMemberkmx:CarMaxSalesOperationsMember2023-09-012023-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:CostOfSalesMember2023-09-012023-11-300001170010kmx:CarMaxSalesOperationsMember2022-09-012022-11-300001170010us-gaap:AllOtherSegmentsMember2022-09-012022-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2022-09-012022-11-300001170010us-gaap:IntersegmentEliminationMember2022-09-012022-11-300001170010us-gaap:OperatingSegmentsMemberkmx:CarMaxSalesOperationsMember2022-09-012022-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-09-012022-11-300001170010us-gaap:CostOfSalesMemberkmx:CarMaxSalesOperationsMember2022-09-012022-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:CostOfSalesMember2022-09-012022-11-300001170010kmx:CarMaxSalesOperationsMember2023-03-012023-11-300001170010us-gaap:AllOtherSegmentsMember2023-03-012023-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2023-03-012023-11-300001170010us-gaap:IntersegmentEliminationMember2023-03-012023-11-300001170010us-gaap:OperatingSegmentsMemberkmx:CarMaxSalesOperationsMember2023-03-012023-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-03-012023-11-300001170010us-gaap:CostOfSalesMemberkmx:CarMaxSalesOperationsMember2023-03-012023-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:CostOfSalesMember2023-03-012023-11-300001170010kmx:CarMaxSalesOperationsMember2022-03-012022-11-300001170010us-gaap:AllOtherSegmentsMember2022-03-012022-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2022-03-012022-11-300001170010us-gaap:IntersegmentEliminationMember2022-03-012022-11-300001170010us-gaap:OperatingSegmentsMemberkmx:CarMaxSalesOperationsMember2022-03-012022-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-03-012022-11-300001170010us-gaap:CostOfSalesMemberkmx:CarMaxSalesOperationsMember2022-03-012022-11-300001170010us-gaap:AllOtherSegmentsMemberus-gaap:CostOfSalesMember2022-03-012022-11-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

|

|

|

|

|

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended November 30, 2023

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-31420

CARMAX, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

Virginia |

|

54-1821055 |

(State or other jurisdiction of incorporation) |

|

(I.R.S. Employer Identification No.) |

|

|

12800 Tuckahoe Creek Parkway |

|

23238 |

Richmond, |

Virginia |

|

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(804) 747-0422

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

KMX |

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

|

|

|

|

|

|

|

|

| Class |

|

Outstanding as of January 3, 2024 |

| Common Stock, par value $0.50 |

|

157,921,209 |

CARMAX, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

| |

Page

No.

|

| PART I. |

FINANCIAL INFORMATION |

|

|

|

|

|

| |

Item 1. |

Financial Statements: |

|

|

|

|

|

| |

|

Consolidated Statements of Earnings (Unaudited) – |

|

| |

|

Three and Nine Months Ended November 30, 2023 and 2022 |

|

| |

|

|

|

| |

|

Consolidated Statements of Comprehensive Income (Unaudited) – |

|

| |

|

Three and Nine Months Ended November 30, 2023 and 2022 |

|

| |

|

|

|

| |

|

Consolidated Balance Sheets (Unaudited) – |

|

| |

|

November 30, 2023 and February 28, 2023 |

|

| |

|

|

|

| |

|

Consolidated Statements of Cash Flows (Unaudited) – |

|

| |

|

Nine Months Ended November 30, 2023 and 2022 |

|

| |

|

|

|

|

|

Consolidated Statements of Shareholders’ Equity (Unaudited) – |

|

|

|

Three and Nine Months Ended November 30, 2023 and 2022 |

|

|

|

|

|

| |

|

Notes to Consolidated Financial Statements (Unaudited) |

|

|

|

|

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and |

|

| |

|

Results of Operations |

|

|

|

|

|

| |

Item 3. |

Quantitative and Qualitative Disclosures About Market Risk |

|

|

|

|

|

| |

Item 4. |

Controls and Procedures |

|

|

|

|

|

| PART II. |

OTHER INFORMATION |

|

|

|

|

|

| |

Item 1. |

Legal Proceedings |

|

|

|

|

|

| |

Item 1A. |

Risk Factors |

|

|

|

|

|

| |

Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

|

|

|

|

|

| |

Item 6. |

Exhibits |

|

|

|

|

|

| SIGNATURES |

|

|

|

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Earnings

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended November 30 |

|

Nine Months Ended November 30 |

| (In thousands except per share data) |

2023 |

%(1) |

|

2022 |

%(1) |

|

2023 |

%(1) |

|

2022 |

%(1) |

| SALES AND OPERATING REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

| Used vehicle sales |

$ |

4,832,077 |

|

78.6 |

|

|

$ |

5,204,584 |

|

80.0 |

|

|

$ |

16,424,691 |

|

78.6 |

|

|

$ |

18,503,159 |

|

77.2 |

|

| Wholesale vehicle sales |

1,165,204 |

|

19.0 |

|

|

1,152,207 |

|

17.7 |

|

|

4,001,542 |

|

19.1 |

|

|

4,959,050 |

|

20.7 |

|

| Other sales and revenues |

151,257 |

|

2.5 |

|

|

149,165 |

|

2.3 |

|

|

483,204 |

|

2.3 |

|

|

500,171 |

|

2.1 |

|

| NET SALES AND OPERATING REVENUES |

6,148,538 |

|

100.0 |

|

|

6,505,956 |

|

100.0 |

|

|

20,909,437 |

|

100.0 |

|

|

23,962,380 |

|

100.0 |

|

| COST OF SALES: |

|

|

|

|

|

|

|

|

|

|

|

| Used vehicle cost of sales |

4,434,165 |

|

72.1 |

|

|

4,801,790 |

|

73.8 |

|

|

15,060,045 |

|

72.0 |

|

|

17,041,898 |

|

71.1 |

|

| Wholesale vehicle cost of sales |

1,042,303 |

|

17.0 |

|

|

1,037,534 |

|

15.9 |

|

|

3,574,200 |

|

17.1 |

|

|

4,512,053 |

|

18.8 |

|

| Other cost of sales |

59,207 |

|

1.0 |

|

|

89,944 |

|

1.4 |

|

|

148,174 |

|

0.7 |

|

|

219,205 |

|

0.9 |

|

| TOTAL COST OF SALES |

5,535,675 |

|

90.0 |

|

|

5,929,268 |

|

91.1 |

|

|

18,782,419 |

|

89.8 |

|

|

21,773,156 |

|

90.9 |

|

| GROSS PROFIT |

612,863 |

|

10.0 |

|

|

576,688 |

|

8.9 |

|

|

2,127,018 |

|

10.2 |

|

|

2,189,224 |

|

9.1 |

|

| CARMAX AUTO FINANCE INCOME |

148,659 |

|

2.4 |

|

|

152,196 |

|

2.3 |

|

|

421,004 |

|

2.0 |

|

|

539,538 |

|

2.3 |

|

| Selling, general and administrative expenses |

559,962 |

|

9.1 |

|

|

591,727 |

|

9.1 |

|

|

1,705,493 |

|

8.2 |

|

|

1,914,508 |

|

8.0 |

|

| Depreciation and amortization |

60,623 |

|

1.0 |

|

|

57,377 |

|

0.9 |

|

|

177,859 |

|

0.9 |

|

|

170,717 |

|

0.7 |

|

| Interest expense |

31,265 |

|

0.5 |

|

|

30,150 |

|

0.5 |

|

|

93,316 |

|

0.4 |

|

|

91,670 |

|

0.4 |

|

| Other income |

(886) |

|

— |

|

|

(363) |

|

— |

|

|

(4,730) |

|

— |

|

|

(2,303) |

|

— |

|

| Earnings before income taxes |

110,558 |

|

1.8 |

|

|

49,993 |

|

0.8 |

|

|

576,084 |

|

2.8 |

|

|

554,170 |

|

2.3 |

|

| Income tax provision |

28,555 |

|

0.5 |

|

|

12,413 |

|

0.2 |

|

|

147,148 |

|

0.7 |

|

|

138,420 |

|

0.6 |

|

| NET EARNINGS |

$ |

82,003 |

|

1.3 |

|

|

$ |

37,580 |

|

0.6 |

|

|

$ |

428,936 |

|

2.1 |

|

|

$ |

415,750 |

|

1.7 |

|

| WEIGHTED AVERAGE COMMON SHARES: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

158,446 |

|

|

|

158,003 |

|

|

|

158,347 |

|

|

|

159,044 |

|

|

| Diluted |

158,799 |

|

|

|

158,536 |

|

|

|

158,866 |

|

|

|

160,195 |

|

|

| NET EARNINGS PER SHARE: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.52 |

|

|

|

$ |

0.24 |

|

|

|

$ |

2.71 |

|

|

|

$ |

2.61 |

|

|

| Diluted |

$ |

0.52 |

|

|

|

$ |

0.24 |

|

|

|

$ |

2.70 |

|

|

|

$ |

2.60 |

|

|

(1) Percents are calculated as a percentage of net sales and operating revenues and may not total due to rounding.

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Comprehensive Income

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended November 30 |

|

Nine Months Ended November 30 |

| (In thousands) |

2023 |

|

2022 |

|

2023 |

|

2022 |

| NET EARNINGS |

$ |

82,003 |

|

|

$ |

37,580 |

|

|

$ |

428,936 |

|

|

$ |

415,750 |

|

| Other comprehensive (loss) income, net of taxes: |

|

|

|

|

|

|

|

| Net change in retirement benefit plan unrecognized actuarial losses |

98 |

|

|

482 |

|

|

294 |

|

|

1,444 |

|

| Net change in cash flow hedge unrecognized gains |

(18,028) |

|

|

24,939 |

|

|

(37,496) |

|

|

102,398 |

|

| Other comprehensive (loss) income, net of taxes |

(17,930) |

|

|

25,421 |

|

|

(37,202) |

|

|

103,842 |

|

| TOTAL COMPREHENSIVE INCOME |

$ |

64,073 |

|

|

$ |

63,001 |

|

|

$ |

391,734 |

|

|

$ |

519,592 |

|

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| |

As of November 30 |

|

As of February 28 |

| (In thousands except share data) |

2023 |

|

2023 |

| ASSETS |

|

|

|

| CURRENT ASSETS: |

|

|

|

| Cash and cash equivalents |

$ |

605,375 |

|

|

$ |

314,758 |

|

| Restricted cash from collections on auto loans receivable |

483,570 |

|

|

470,889 |

|

| Accounts receivable, net |

212,406 |

|

|

298,783 |

|

| Inventory |

3,638,946 |

|

|

3,726,142 |

|

| Other current assets |

169,653 |

|

|

230,795 |

|

| TOTAL CURRENT ASSETS |

5,109,950 |

|

|

5,041,367 |

|

| Auto loans receivable, net of allowance for loan losses of $511,924 and $507,201 as of November 30, 2023 and February 28, 2023, respectively |

17,081,891 |

|

|

16,341,791 |

|

| Property and equipment, net of accumulated depreciation of $1,782,087 and $1,614,924 as of November 30, 2023 and February 28, 2023, respectively |

3,623,697 |

|

|

3,430,914 |

|

| Deferred income taxes |

121,219 |

|

|

80,740 |

|

| Operating lease assets |

533,387 |

|

|

545,677 |

|

| Goodwill |

141,258 |

|

|

141,258 |

|

| Other assets |

561,848 |

|

|

600,989 |

|

| TOTAL ASSETS |

$ |

27,173,250 |

|

|

$ |

26,182,736 |

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

| CURRENT LIABILITIES: |

|

|

|

| Accounts payable |

$ |

762,594 |

|

|

$ |

826,592 |

|

| Accrued expenses and other current liabilities |

494,365 |

|

|

478,964 |

|

| Accrued income taxes |

10,581 |

|

|

— |

|

| Current portion of operating lease liabilities |

56,410 |

|

|

53,287 |

|

|

|

|

|

| Current portion of long-term debt |

312,744 |

|

|

111,859 |

|

| Current portion of non-recourse notes payable |

446,544 |

|

|

467,609 |

|

| TOTAL CURRENT LIABILITIES |

2,083,238 |

|

|

1,938,311 |

|

| Long-term debt, excluding current portion |

1,605,638 |

|

|

1,909,361 |

|

| Non-recourse notes payable, excluding current portion |

16,558,053 |

|

|

15,865,776 |

|

| Operating lease liabilities, excluding current portion |

509,141 |

|

|

523,828 |

|

| Other liabilities |

372,815 |

|

|

332,383 |

|

| TOTAL LIABILITIES |

21,128,885 |

|

|

20,569,659 |

|

|

|

|

|

| Commitments and contingent liabilities |

|

|

|

| SHAREHOLDERS’ EQUITY: |

|

|

|

| Common stock, $0.50 par value; 350,000,000 shares authorized; 158,021,407 and 158,079,033 shares issued and outstanding as of November 30, 2023 and February 28, 2023, respectively |

79,011 |

|

|

79,040 |

|

| Capital in excess of par value |

1,786,924 |

|

|

1,713,074 |

|

| Accumulated other comprehensive income |

60,667 |

|

|

97,869 |

|

| Retained earnings |

4,117,763 |

|

|

3,723,094 |

|

| TOTAL SHAREHOLDERS’ EQUITY |

6,044,365 |

|

|

5,613,077 |

|

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ |

27,173,250 |

|

|

$ |

26,182,736 |

|

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| |

Nine Months Ended November 30 |

| (In thousands) |

2023 |

|

2022 |

| OPERATING ACTIVITIES: |

|

|

|

| Net earnings |

$ |

428,936 |

|

|

$ |

415,750 |

|

| Adjustments to reconcile net earnings to net cash provided by operating activities: |

|

|

|

| Depreciation and amortization |

193,528 |

|

|

202,655 |

|

| Share-based compensation expense |

90,479 |

|

|

64,974 |

|

| Provision for loan losses |

238,952 |

|

|

218,967 |

|

| Provision for cancellation reserves |

62,587 |

|

|

79,924 |

|

| Deferred income tax benefit |

(28,290) |

|

|

(2,178) |

|

| Other |

8,534 |

|

|

8,879 |

|

| Net decrease (increase) in: |

|

|

|

| Accounts receivable, net |

86,377 |

|

|

314,190 |

|

| Inventory |

87,196 |

|

|

1,709,632 |

|

| Other current assets |

91,793 |

|

|

149,777 |

|

| Auto loans receivable, net |

(979,052) |

|

|

(1,170,098) |

|

| Other assets |

(8,775) |

|

|

(43,502) |

|

| Net decrease in: |

|

|

|

| Accounts payable, accrued expenses and other |

|

|

|

| current liabilities and accrued income taxes |

(60,365) |

|

|

(195,154) |

|

| Other liabilities |

(62,921) |

|

|

(91,739) |

|

| NET CASH PROVIDED BY OPERATING ACTIVITIES |

148,979 |

|

|

1,662,077 |

|

| INVESTING ACTIVITIES: |

|

|

|

| Capital expenditures |

(355,442) |

|

|

(319,486) |

|

| Proceeds from disposal of property and equipment |

1,299 |

|

|

3,806 |

|

|

|

|

|

| Purchases of investments |

(4,641) |

|

|

(6,460) |

|

| Sales and returns of investments |

1,562 |

|

|

3,486 |

|

|

|

|

|

| NET CASH USED IN INVESTING ACTIVITIES |

(357,222) |

|

|

(318,654) |

|

| FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

| Proceeds from issuances of long-term debt |

134,600 |

|

|

2,863,500 |

|

| Payments on long-term debt |

(242,989) |

|

|

(4,116,775) |

|

| Cash paid for debt issuance costs |

(15,576) |

|

|

(13,987) |

|

| Payments on finance lease obligations |

(12,177) |

|

|

(10,056) |

|

| Issuances of non-recourse notes payable |

9,099,929 |

|

|

11,351,696 |

|

| Payments on non-recourse notes payable |

(8,430,615) |

|

|

(10,581,076) |

|

| Repurchase and retirement of common stock |

(44,287) |

|

|

(333,814) |

|

| Equity issuances |

28,430 |

|

|

13,504 |

|

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES |

517,315 |

|

|

(827,008) |

|

| Increase in cash, cash equivalents, and restricted cash |

309,072 |

|

|

516,415 |

|

| Cash, cash equivalents, and restricted cash at beginning of year |

951,004 |

|

|

803,618 |

|

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH AT END OF PERIOD |

$ |

1,260,076 |

|

|

$ |

1,320,033 |

|

|

|

|

|

| RECONCILIATION OF CASH, CASH EQUIVALENTS AND RESTRICTED CASH TO THE CONSOLIDATED BALANCE SHEETS: |

| Cash and cash equivalents |

$ |

605,375 |

|

|

$ |

688,618 |

|

| Restricted cash from collections on auto loans receivable |

483,570 |

|

|

466,525 |

|

| Restricted cash included in other assets |

171,131 |

|

|

164,890 |

|

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH AT END OF PERIOD |

$ |

1,260,076 |

|

|

$ |

1,320,033 |

|

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Shareholders’ Equity

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended November 30, 2023 |

| |

|

|

|

|

|

|

|

|

Accumulated |

|

|

| |

Common |

|

|

|

Capital in |

|

|

|

Other |

|

|

| |

Shares |

|

Common |

|

Excess of |

|

Retained |

|

Comprehensive |

|

|

| (In thousands) |

Outstanding |

|

Stock |

|

Par Value |

|

Earnings |

|

Income |

|

Total |

| Balance as of February 28, 2023 |

158,079 |

|

|

$ |

79,040 |

|

|

$ |

1,713,074 |

|

|

$ |

3,723,094 |

|

|

$ |

97,869 |

|

|

$ |

5,613,077 |

|

| Net earnings |

— |

|

|

— |

|

|

— |

|

|

228,298 |

|

|

— |

|

|

228,298 |

|

| Other comprehensive loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(36,539) |

|

|

(36,539) |

|

| Share-based compensation expense |

— |

|

|

— |

|

|

21,274 |

|

|

— |

|

|

— |

|

|

21,274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exercise of common stock options |

18 |

|

|

9 |

|

|

979 |

|

|

— |

|

|

— |

|

|

988 |

|

| Stock incentive plans, net shares issued |

112 |

|

|

56 |

|

|

(3,986) |

|

|

— |

|

|

— |

|

|

(3,930) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of May 31, 2023 |

158,209 |

|

|

$ |

79,105 |

|

|

$ |

1,731,341 |

|

|

$ |

3,951,392 |

|

|

$ |

61,330 |

|

|

$ |

5,823,168 |

|

| Net earnings |

— |

|

|

— |

|

|

— |

|

|

118,635 |

|

|

— |

|

|

118,635 |

|

| Other comprehensive income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

17,267 |

|

|

17,267 |

|

| Share-based compensation expense |

— |

|

|

— |

|

|

20,256 |

|

|

— |

|

|

— |

|

|

20,256 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exercise of common stock options |

446 |

|

|

223 |

|

|

26,323 |

|

|

— |

|

|

— |

|

|

26,546 |

|

| Stock incentive plans, net shares issued |

1 |

|

|

— |

|

|

(213) |

|

|

— |

|

|

— |

|

|

(213) |

|

| Balance as of August 31, 2023 |

158,656 |

|

|

$ |

79,328 |

|

|

$ |

1,777,707 |

|

|

$ |

4,070,027 |

|

|

$ |

78,597 |

|

|

$ |

6,005,659 |

|

| Net earnings |

— |

|

|

— |

|

|

— |

|

|

82,003 |

|

|

— |

|

|

82,003 |

|

| Other comprehensive loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(17,930) |

|

|

(17,930) |

|

| Share-based compensation expense |

— |

|

|

— |

|

|

15,728 |

|

|

— |

|

|

— |

|

|

15,728 |

|

| Repurchases of common stock |

(649) |

|

|

(324) |

|

|

(7,312) |

|

|

(34,267) |

|

|

— |

|

|

(41,903) |

|

| Exercise of common stock options |

12 |

|

|

6 |

|

|

890 |

|

|

— |

|

|

— |

|

|

896 |

|

| Stock incentive plans, net shares issued |

2 |

|

|

1 |

|

|

(89) |

|

|

— |

|

|

— |

|

|

(88) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of November 30, 2023 |

158,021 |

|

|

$ |

79,011 |

|

|

$ |

1,786,924 |

|

|

$ |

4,117,763 |

|

|

$ |

60,667 |

|

|

$ |

6,044,365 |

|

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Shareholders’ Equity

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended November 30, 2022 |

| |

|

|

|

|

|

|

|

|

Accumulated |

|

|

| |

Common |

|

|

|

Capital in |

|

|

|

Other |

|

|

| |

Shares |

|

Common |

|

Excess of |

|

Retained |

|

Comprehensive |

|

|

| (In thousands) |

Outstanding |

|

Stock |

|

Par Value |

|

Earnings |

|

Income (Loss) |

|

Total |

| Balance as of February 28, 2022 |

161,054 |

|

|

$ |

80,527 |

|

|

$ |

1,677,268 |

|

|

$ |

3,524,066 |

|

|

$ |

(46,422) |

|

|

$ |

5,235,439 |

|

| Net earnings |

— |

|

|

— |

|

|

— |

|

|

252,265 |

|

|

— |

|

|

252,265 |

|

| Other comprehensive income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

52,314 |

|

|

52,314 |

|

| Share-based compensation expense |

— |

|

|

— |

|

|

21,594 |

|

|

— |

|

|

— |

|

|

21,594 |

|

| Repurchases of common stock |

(1,644) |

|

|

(822) |

|

|

(17,207) |

|

|

(139,565) |

|

|

— |

|

|

(157,594) |

|

| Exercise of common stock options |

49 |

|

|

24 |

|

|

3,418 |

|

|

— |

|

|

— |

|

|

3,442 |

|

| Stock incentive plans, net shares issued |

155 |

|

|

78 |

|

|

(6,901) |

|

|

— |

|

|

— |

|

|

(6,823) |

|

| Balance as of May 31, 2022 |

159,614 |

|

|

$ |

79,807 |

|

|

$ |

1,678,172 |

|

|

$ |

3,636,766 |

|

|

$ |

5,892 |

|

|

$ |

5,400,637 |

|

| Net earnings |

— |

|

|

— |

|

|

— |

|

|

125,905 |

|

|

— |

|

|

125,905 |

|

| Other comprehensive income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

26,107 |

|

|

26,107 |

|

| Share-based compensation expense |

— |

|

|

— |

|

|

15,062 |

|

|

— |

|

|

— |

|

|

15,062 |

|

| Repurchases of common stock |

(1,730) |

|

|

(865) |

|

|

(18,279) |

|

|

(143,873) |

|

|

— |

|

|

(163,017) |

|

| Exercise of common stock options |

155 |

|

|

78 |

|

|

9,762 |

|

|

— |

|

|

— |

|

|

9,840 |

|

| Stock incentive plans, net shares issued |

5 |

|

|

2 |

|

|

(309) |

|

|

— |

|

|

— |

|

|

(307) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of August 31, 2022 |

158,044 |

|

|

$ |

79,022 |

|

|

$ |

1,684,408 |

|

|

$ |

3,618,798 |

|

|

$ |

31,999 |

|

|

$ |

5,414,227 |

|

| Net earnings |

— |

|

|

— |

|

|

— |

|

|

37,580 |

|

|

— |

|

|

37,580 |

|

| Other comprehensive income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

25,421 |

|

|

25,421 |

|

| Share-based compensation expense |

— |

|

|

— |

|

|

12,797 |

|

|

— |

|

|

— |

|

|

12,797 |

|

| Repurchases of common stock |

(30) |

|

|

(15) |

|

|

(320) |

|

|

(2,297) |

|

|

— |

|

|

(2,632) |

|

| Exercise of common stock options |

4 |

|

|

2 |

|

|

218 |

|

|

— |

|

|

— |

|

|

220 |

|

| Stock incentive plans, net shares issued |

1 |

|

|

1 |

|

|

(41) |

|

|

— |

|

|

— |

|

|

(40) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of November 30, 2022 |

158,019 |

|

|

$ |

79,010 |

|

|

$ |

1,697,062 |

|

|

$ |

3,654,081 |

|

|

$ |

57,420 |

|

|

$ |

5,487,573 |

|

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

1.Background

Business. CarMax, Inc. (“we,” “our,” “us,” “CarMax” and “the company”), including its wholly owned subsidiaries, is the nation’s largest retailer of used vehicles. We operate in two reportable segments: CarMax Sales Operations and CarMax Auto Finance (“CAF”). Our CarMax Sales Operations segment consists of all aspects of our auto merchandising and service operations, excluding financing provided by CAF. Our CAF segment consists solely of our own finance operation that provides financing to customers buying retail vehicles from CarMax. On June 1, 2021, we completed the acquisition of Edmunds Holding Company (“Edmunds”), which does not meet the quantitative thresholds to be considered a reportable segment. See Note 16 for additional information on our reportable segments.

We deliver an unrivaled customer experience by offering a broad selection of quality used vehicles and related products and services at competitive, no-haggle prices using a customer-friendly sales process. Our omni-channel platform, which gives us the largest addressable market in the used car industry, empowers our retail customers to buy a car on their terms – online, in-store or an integrated combination of both. We offer customers a range of related products and services, including the appraisal and purchase of vehicles directly from consumers; the financing of retail vehicle purchases through CAF and third-party finance providers; the sale of extended protection plan (“EPP”) products, which include extended service plans (“ESPs”) and guaranteed asset protection (“GAP”); and vehicle repair service. Vehicles purchased through the appraisal process that do not meet our retail standards are sold to licensed dealers through on-site or virtual wholesale auctions.

Basis of Presentation and Use of Estimates. The accompanying interim unaudited consolidated financial statements include the accounts of CarMax and our wholly owned subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation. These interim unaudited consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, such interim consolidated financial statements reflect all normal recurring adjustments considered necessary to present fairly the financial position and the results of operations and cash flows for the interim periods presented. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full fiscal year.

The accounting policies followed in the presentation of our interim financial results are consistent with those included in the company’s Annual Report on Form 10-K for the fiscal year ended February 28, 2023 (the “2023 Annual Report”), with the exception of those related to recent accounting pronouncements adopted in the current fiscal year. These interim unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements and footnotes included in our 2023 Annual Report.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and the disclosure of contingent assets and liabilities. Actual results could differ from those estimates. Certain prior year amounts have been reclassified to conform to the current year’s presentation. Amounts and percentages may not total due to rounding.

Recent Accounting Pronouncements.

Effective in Future Periods

In October 2023, the Financial Accounting Standards Board (“FASB”) issued an accounting pronouncement (ASU 2023-06) related to disclosure or presentation requirements for various subtopics in the FASB’s Accounting Standards Codification (“Codification”). The amendments in the update are intended to align the requirements in the Codification with the U.S. Securities and Exchange Commission's (“SEC”) regulations and facilitate the application of GAAP for all entities. The effective date for each amendment is the date on which the SEC removal of the related disclosure requirement from Regulation S-X or Regulation S-K becomes effective, or if the SEC has not removed the requirements by June 30, 2027, this amendment will be removed from the Codification and will not become effective for any entity. Early adoption is prohibited. We do not expect this update to have a material impact on our consolidated financial statements.

In November 2023, the FASB issued an accounting pronouncement (ASU 2023-07) related to the disclosure of incremental segment information on an annual and interim basis. This update is effective for annual periods beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, and requires retrospective application to all prior periods presented in the financial statements. We plan to adopt this pronouncement beginning with our fiscal year ended February 28, 2025, and we do not expect it to have a material effect on our consolidated financial statements.

In December 2023, the FASB issued an accounting pronouncement (ASU 2023-09) related to income tax disclosures. The amendments in this update are intended to enhance the transparency and decision usefulness of income tax disclosures primarily through changes to the rate reconciliation and income taxes paid information. This update is effective for annual periods beginning after December 15, 2024, though early adoption is permitted. We plan to adopt this pronouncement for our fiscal year beginning March 1, 2025, and we do not expect it to have a material effect on our consolidated financial statements.

2. Revenue

We recognize revenue when control of the good or service has been transferred to the customer, generally either at the time of sale or upon delivery to a customer. Our contracts have a fixed contract price and revenue is measured as the amount of consideration we expect to receive in exchange for transferring goods or providing services. We collect sales taxes and other taxes from customers on behalf of governmental authorities at the time of sale. These taxes are accounted for on a net basis and are not included in net sales and operating revenues or cost of sales. We generally expense sales commissions when incurred because the amortization period would have been less than one year. These costs are recorded within selling, general and administrative expenses. We do not have any significant payment terms as payment is received at or shortly after the point of sale.

Disaggregation of Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended November 30 |

|

Nine Months Ended November 30 |

| (In millions) |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Used vehicle sales |

$ |

4,832.1 |

|

|

$ |

5,204.6 |

|

|

$ |

16,424.7 |

|

|

$ |

18,503.2 |

|

| Wholesale vehicle sales |

1,165.2 |

|

|

1,152.2 |

|

|

4,001.5 |

|

|

4,959.1 |

|

| Other sales and revenues: |

|

|

|

|

|

|

|

| Extended protection plan revenues |

90.8 |

|

|

91.8 |

|

|

303.8 |

|

|

318.1 |

|

| Third-party finance (fees)/income, net |

(1.2) |

|

|

1.0 |

|

|

(2.4) |

|

|

7.1 |

|

Advertising & subscription revenues (1) |

36.7 |

|

|

33.3 |

|

|

101.6 |

|

|

101.9 |

|

| Service revenues |

20.3 |

|

|

19.6 |

|

|

63.8 |

|

|

60.8 |

|

| Other |

4.7 |

|

|

3.5 |

|

|

16.4 |

|

|

12.3 |

|

| Total other sales and revenues |

151.3 |

|

|

149.2 |

|

|

483.2 |

|

|

500.2 |

|

| Total net sales and operating revenues |

$ |

6,148.5 |

|

|

$ |

6,506.0 |

|

|

$ |

20,909.4 |

|

|

$ |

23,962.4 |

|

(1) Excludes intersegment sales and operating revenues that have been eliminated in consolidation. See Note 16 for further details.

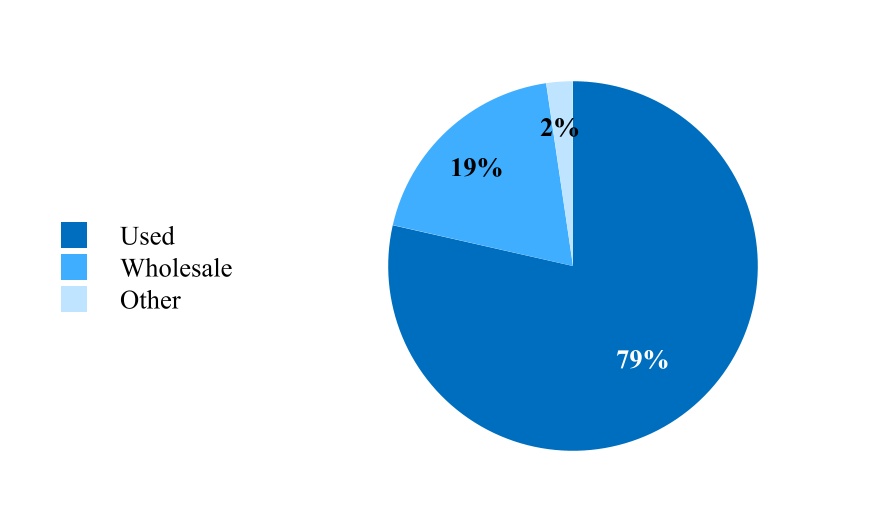

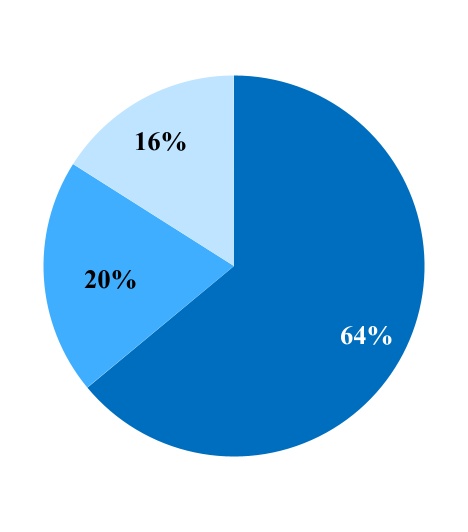

Used Vehicle Sales. Revenue from the sale of used vehicles is recognized upon transfer of control of the vehicle to the customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a 30-day/1,500 mile, money-back guarantee. We record a reserve for estimated returns based on historical experience and trends. The reserve for estimated returns is presented gross on the consolidated balance sheets, with a return asset recorded in other current assets and a refund liability recorded in accrued expenses and other current liabilities. We also guarantee the used vehicles we sell with a 90-day/4,000-mile limited warranty. These warranties are deemed assurance-type warranties and are accounted for as warranty obligations. See Note 15 for additional information on this warranty and its related obligation.

Wholesale Vehicle Sales. Wholesale vehicles are sold at our auctions, and revenue from the sale of these vehicles is recognized upon transfer of control of the vehicle to the customer. Dealers also pay a fee to us based on the sale price of the vehicles they purchase. This fee is recognized as revenue at the time of sale. While we provide condition disclosures on each wholesale vehicle sold, the vehicles are subject to a limited right of return. We record a reserve for estimated returns based on historical experience and trends. The reserve for estimated returns is presented gross on the consolidated balance sheets, with a return asset recorded in other current assets and a refund liability recorded in accrued expenses and other current liabilities.

EPP Revenues. We also sell ESP and GAP products on behalf of unrelated third parties, who are primarily responsible for fulfilling the contract, to customers who purchase a retail vehicle. The ESPs we currently offer on all used vehicles provide coverage up to 60 months (subject to mileage limitations), while GAP covers the customer for the term of their finance contract. We recognize revenue, on a net basis, at the time of sale. We also record a reserve, or refund liability, for estimated contract cancellations. The reserve for cancellations is evaluated for each product and is based on forecasted forward cancellation curves utilizing historical experience, recent trends and credit mix of the customer base. Our risk related to contract cancellations is limited to the revenue that we receive. Cancellations fluctuate depending on the volume of EPP sales, customer financing default or prepayment rates, and shifts in customer behavior, including those related to changes in the coverage or term of the product.

The current portion of estimated cancellation reserves is recognized as a component of accrued expenses and other current liabilities with the remaining amount recognized in other liabilities. See Note 7 for additional information on cancellation reserves.

We are contractually entitled to receive profit-sharing revenues based on the performance of the ESPs administered by third parties. These revenues are a form of variable consideration included in EPP revenues to the extent that it is probable that it will not result in a significant revenue reversal. An estimate of the amount to which we expect to be entitled is determined upon satisfying the performance obligation of selling the ESP. This estimate is subject to various constraints; primarily, factors that are outside of the company’s influence or control. We have determined that these constraints generally preclude any profit-sharing revenues from being recognized before they are paid. As of November 30, 2023 and February 28, 2023, no current or long-term contract asset was recognized related to cumulative profit-sharing payments to which we expect to be entitled. The estimate of the amount to which we expect to be entitled is reassessed each reporting period and any changes are reflected in other sales and revenues on our consolidated statements of earnings and other assets on our consolidated balance sheets.

Third-Party Finance (Fees)/Income. Customers applying for financing who are not approved or are conditionally approved by CAF are generally evaluated by other third-party finance providers. These providers generally either pay us or are paid a fixed, pre-negotiated fee per contract. We recognize these fees at the time of sale.