000116500212/3110-Q2025Q3FALSEfalse7,1446,4620.010.0125,000,00025,000,00010,314,30510,182,5838,906,1528,904,9021,408,1521,277,6810.150.15http://fasb.org/us-gaap/2025#FairValueInputsLevel3Memberhttp://fasb.org/us-gaap/2025#FairValueInputsLevel12And3Member350,0005,398,100642,000

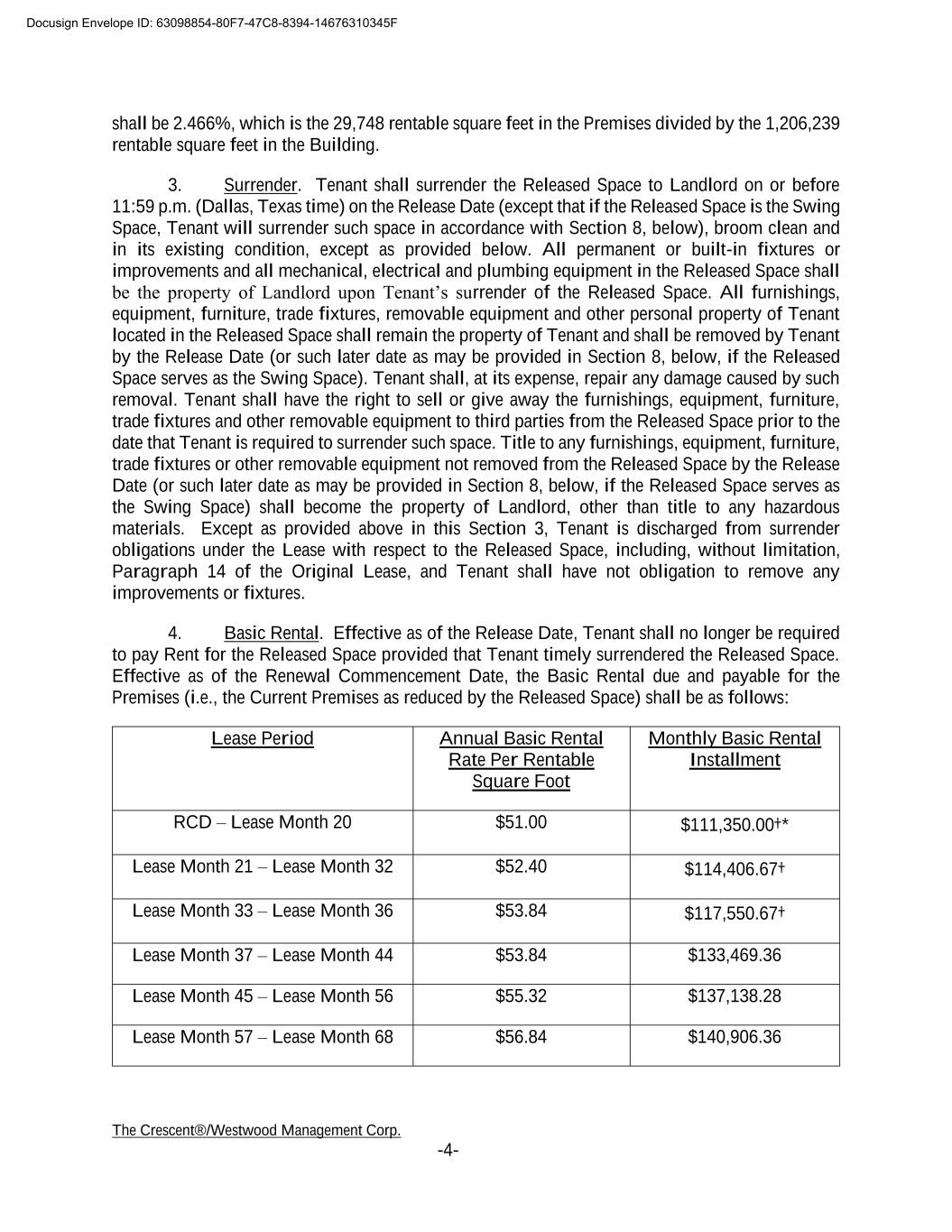

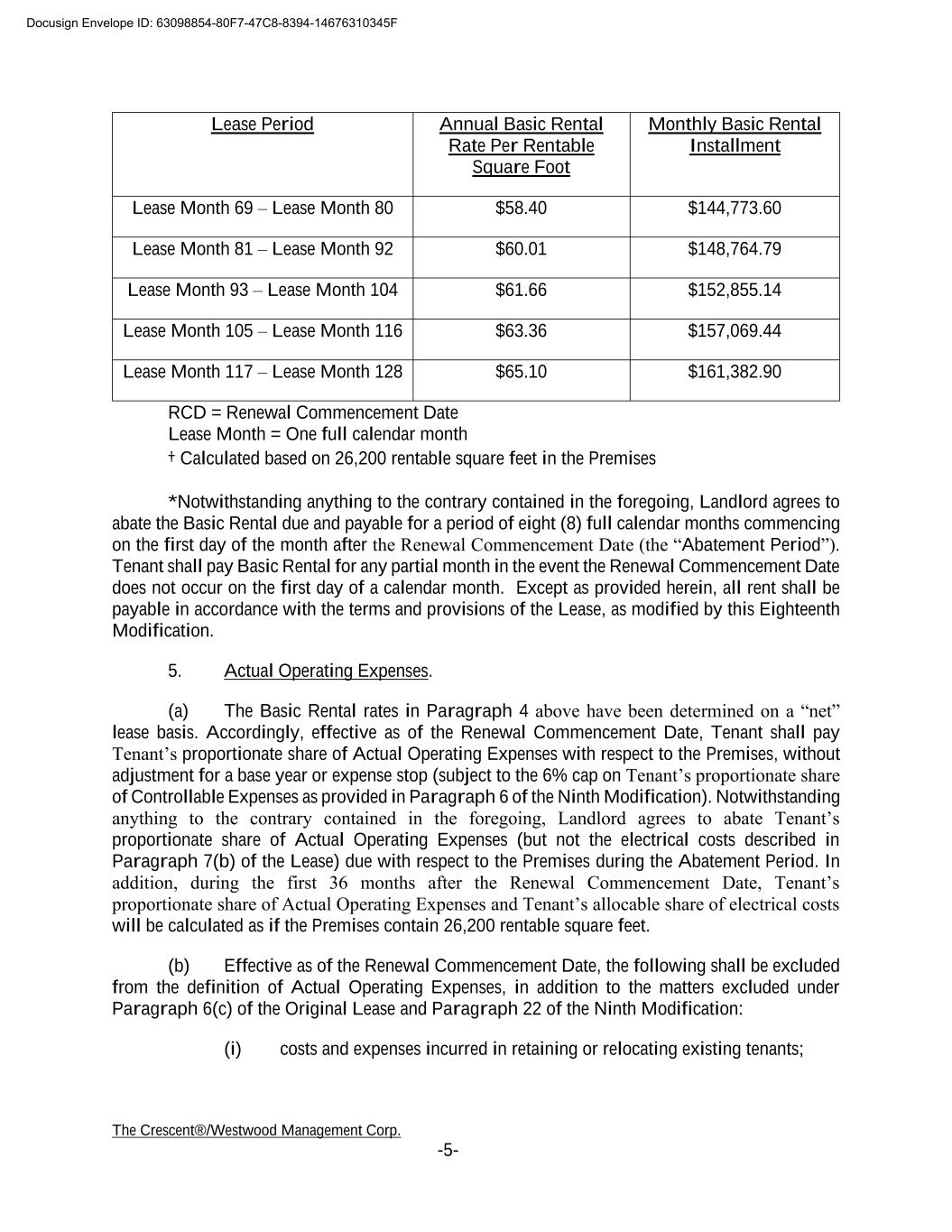

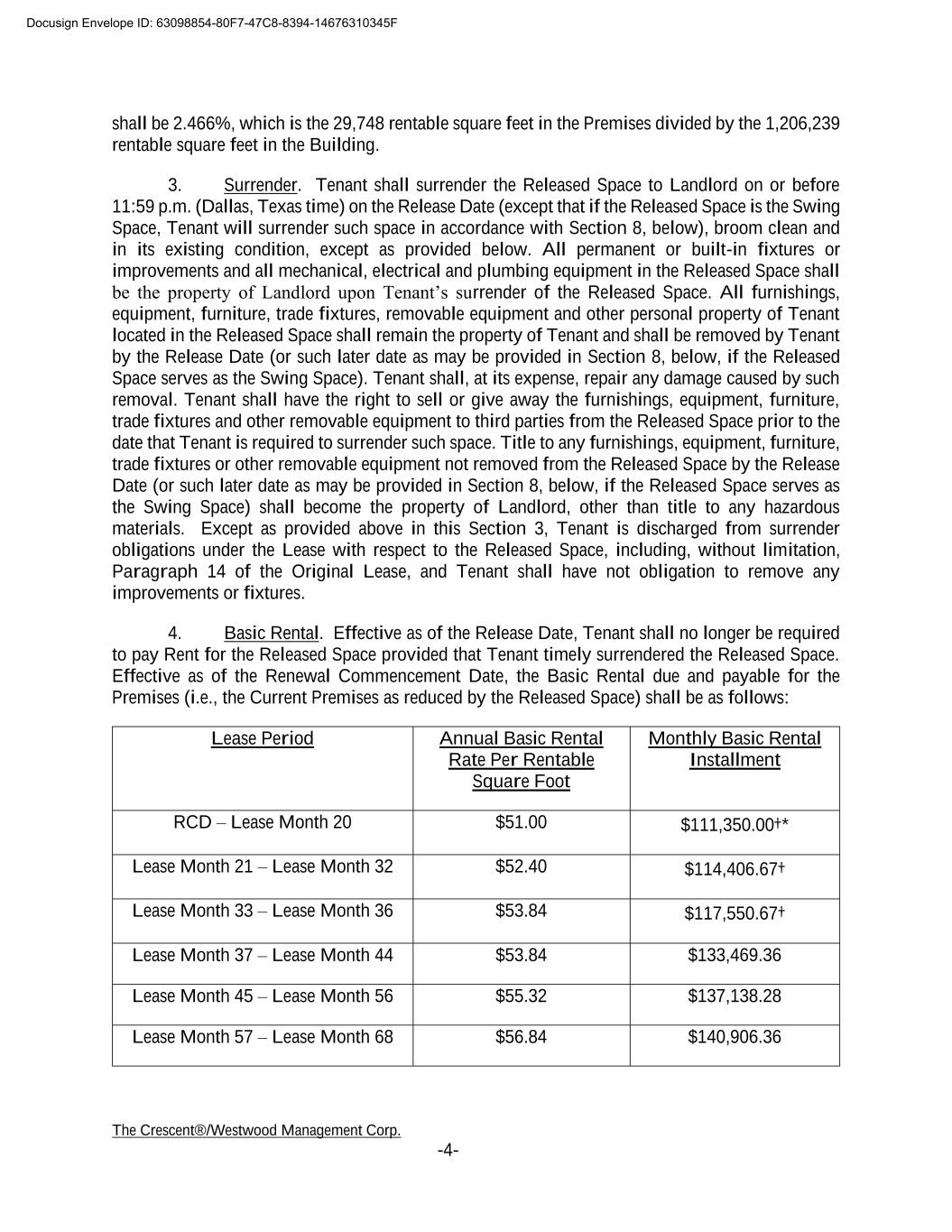

The following table presents the total stock-based compensation expense recorded for stock-based compensation arrangements for the periods indicated (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

2025 |

|

2024 |

|

|

|

|

| Service condition stock-based compensation expense |

|

|

$ |

1,283 |

|

|

|

|

|

| Performance condition stock-based compensation expense |

|

|

97 |

|

|

|

|

|

| Stock-based compensation expense under the Plan |

— |

|

|

1,380 |

|

|

|

|

|

| Canadian Plan stock-based compensation expense |

— |

|

|

— |

|

|

|

|

|

| Total stock-based compensation expense |

$ |

— |

|

|

$ |

1,380 |

|

|

|

|

|

1,28397—1,380———1,38013.22.5

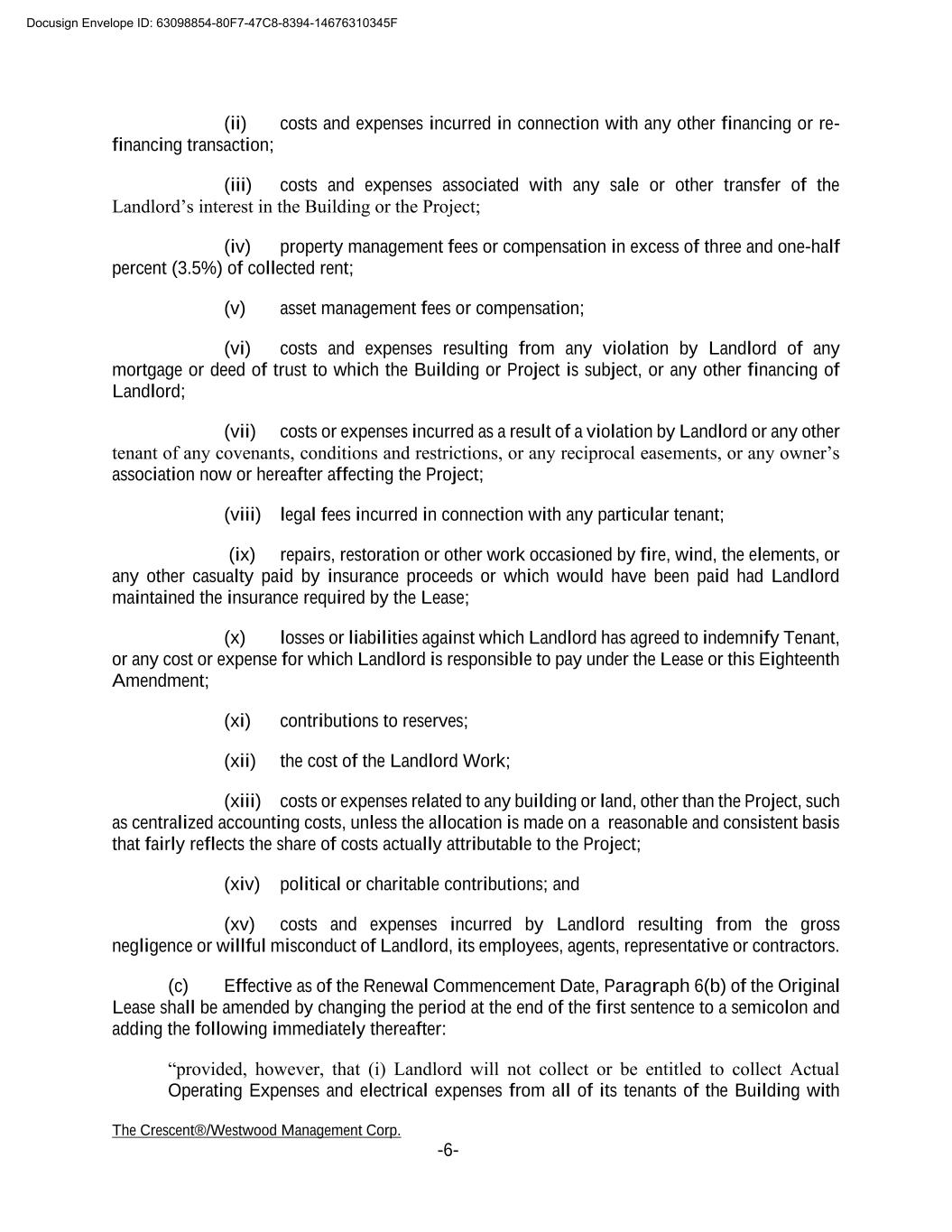

Restricted Stock Subject Only to a Service Condition

We calculate compensation cost for restricted stock grants by using the fair market value of our common stock at the date of grant, the number of shares issued and an adjustment for restrictions on dividends. This compensation cost is amortized on a straight-line basis over the applicable vesting period, with adjustments for forfeitures recorded as they occur.

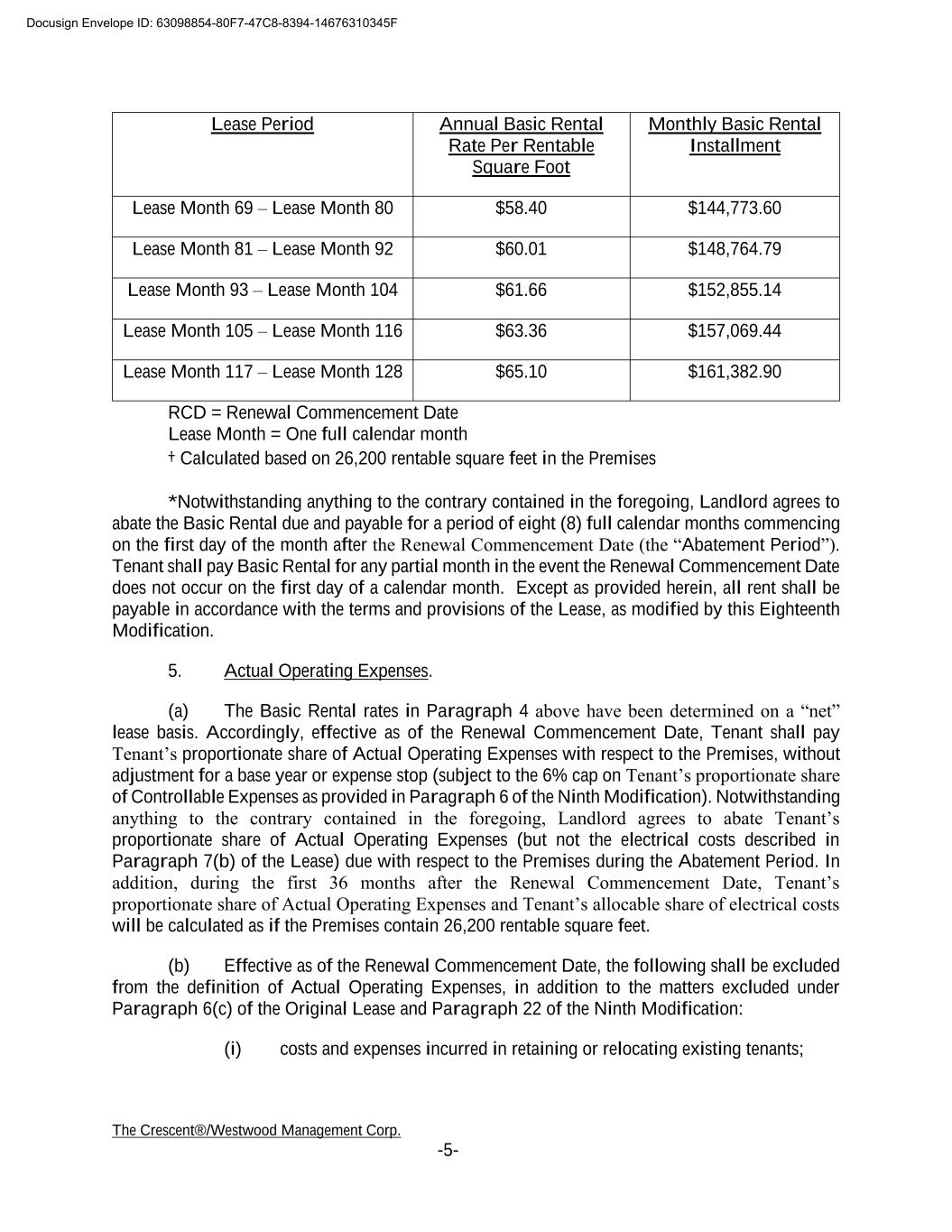

The following table details the status and changes in our restricted stock grants subject only to a service condition for the six months ended June 30, 2025:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

Weighted Average

Grant Date Fair Value |

| Non-vested, January 1, 2020 |

|

396,598 |

|

|

$ |

48.31 |

|

| Granted |

|

262,373 |

|

|

$ |

27.39 |

|

| Vested |

|

(140,974) |

|

|

$ |

53.06 |

|

| Forfeited |

|

(26,372) |

|

|

$ |

39.72 |

|

Non-vested, June 30, 2025 |

|

491,625 |

|

|

$ |

36.25 |

|

396,59848.31262,37327.39140,97453.0626,37239.72491,62536.25

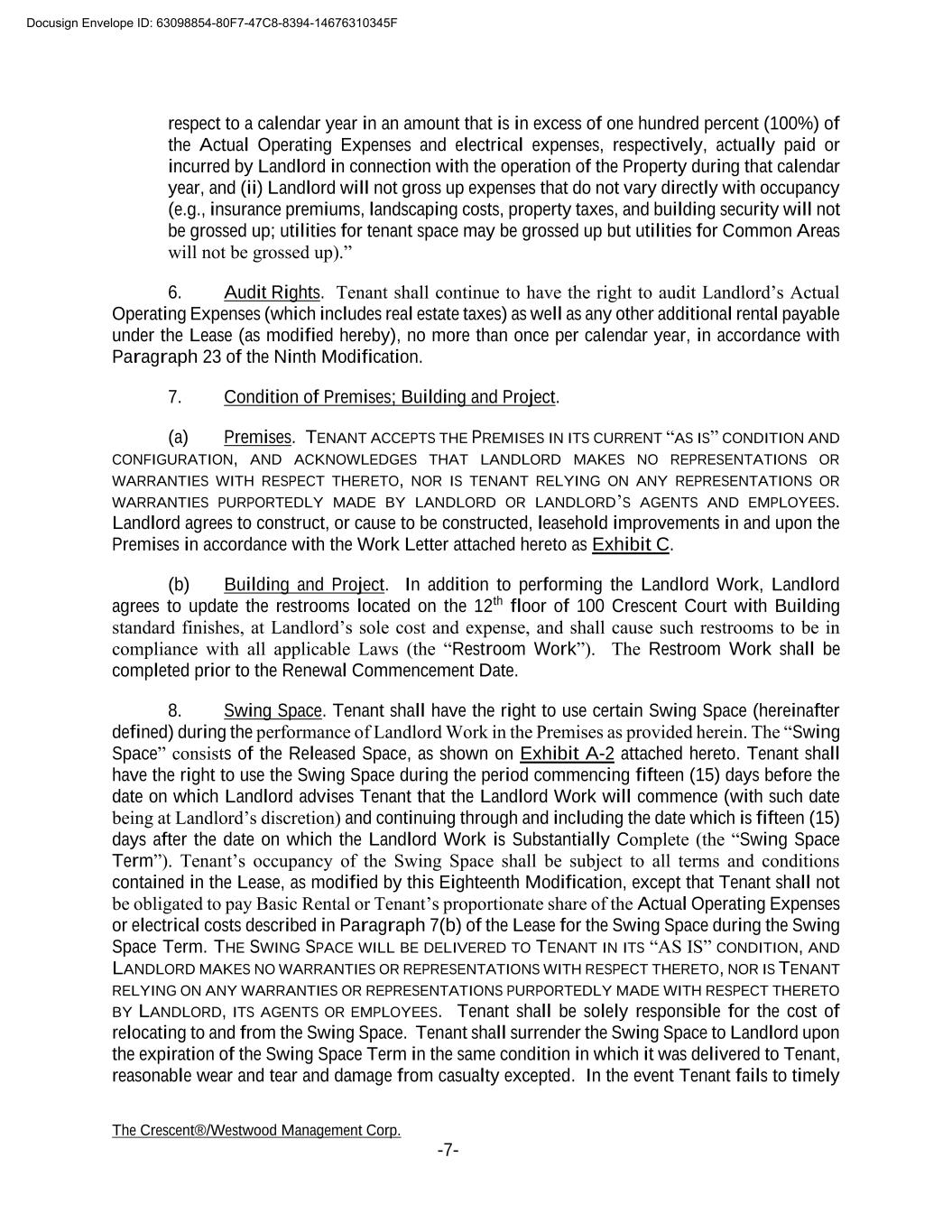

Restricted Stock Subject to Service and Performance Conditions

Under the Plan, certain key employees were provided agreements for grants of restricted shares that vest over multiple year periods subject to achieving annual performance goals established by the Compensation Committee of Westwood’s Board of Directors. Each year the Compensation Committee establishes specific goals for that year’s vesting of the restricted shares. The date that the Compensation Committee establishes annual goals is considered to be the grant date and the fair value measurement date to determine expense on the shares that are likely to vest. The vesting period ends when the Compensation Committee formally approves the performance-based restricted stock vesting based on the specific performance goals from the Company’s audited consolidated financial statements. If a portion of the performance-based restricted shares does not vest, no compensation expense is recognized for that portion and any previously recognized compensation expense related to shares that do not vest is reversed.

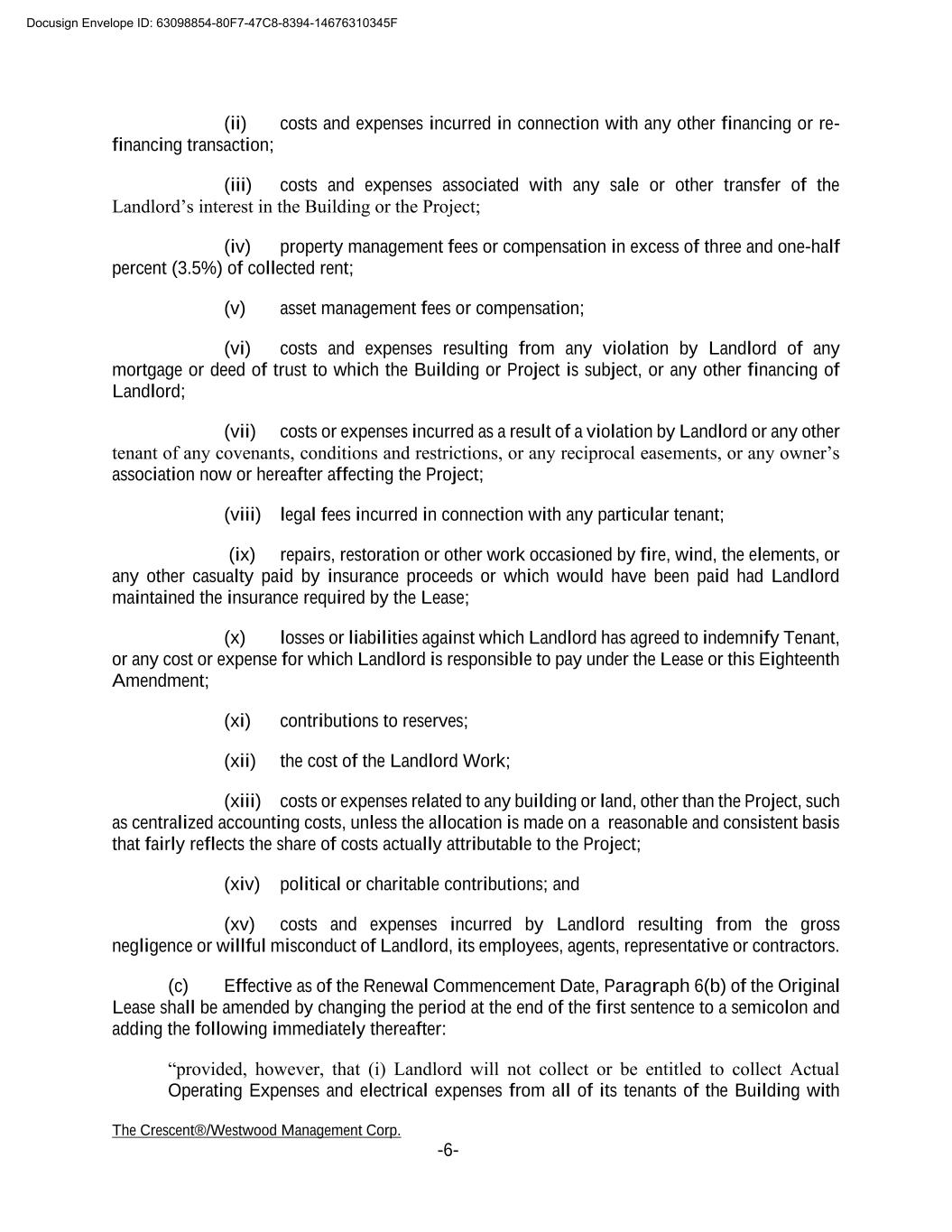

The following table details the status and changes in our restricted stock grants subject to service and performance conditions for the six months ended June 30, 2025:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

Weighted Average

Grant Date Fair Value |

| Non-vested, January 1, 2020 |

|

80,975 |

|

|

$ |

49.73 |

|

|

|

|

|

|

| Vested |

|

(35,275) |

|

|

$ |

55.11 |

|

Non-vested, June 30, 2025 |

|

45,700 |

|

|

$ |

45.58 |

|

80,97549.7335,27555.1145,70045.5827,4740.756,6251.3three years9,00012,00027,000100,00050,00079,000

xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureutr:sqft00011650022025-01-012025-06-3000011650022025-08-0100011650022025-06-3000011650022024-12-310001165002us-gaap:AssetManagement1Member2025-04-012025-06-300001165002us-gaap:AssetManagement1Member2024-04-012024-06-300001165002us-gaap:AssetManagement1Member2025-01-012025-06-300001165002us-gaap:AssetManagement1Member2024-01-012024-06-300001165002us-gaap:FiduciaryAndTrustMember2025-04-012025-06-300001165002us-gaap:FiduciaryAndTrustMember2024-04-012024-06-300001165002us-gaap:FiduciaryAndTrustMember2025-01-012025-06-300001165002us-gaap:FiduciaryAndTrustMember2024-01-012024-06-3000011650022025-04-012025-06-3000011650022024-04-012024-06-3000011650022024-01-012024-06-300001165002us-gaap:CommonStockMember2025-03-310001165002us-gaap:AdditionalPaidInCapitalMember2025-03-310001165002us-gaap:TreasuryStockMember2025-03-310001165002us-gaap:RetainedEarningsMember2025-03-310001165002us-gaap:RetainedEarningsMember2025-01-012025-03-3100011650022025-03-310001165002us-gaap:CommonStockMember2025-04-012025-06-300001165002us-gaap:AdditionalPaidInCapitalMember2025-04-012025-06-300001165002us-gaap:RetainedEarningsMember2025-04-012025-06-300001165002us-gaap:CommonStockMember2025-06-300001165002us-gaap:AdditionalPaidInCapitalMember2025-06-300001165002us-gaap:TreasuryStockMember2025-06-300001165002us-gaap:RetainedEarningsMember2025-06-300001165002us-gaap:NoncontrollingInterestMember2025-06-300001165002us-gaap:CommonStockMember2024-03-310001165002us-gaap:AdditionalPaidInCapitalMember2024-03-310001165002us-gaap:TreasuryStockMember2024-03-310001165002us-gaap:RetainedEarningsMember2024-03-310001165002us-gaap:RetainedEarningsMember2024-01-012024-06-3000011650022023-03-310001165002us-gaap:CommonStockMember2024-04-012024-06-300001165002us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001165002us-gaap:RetainedEarningsMember2024-04-012024-06-300001165002us-gaap:TreasuryStockMember2024-04-012024-06-300001165002us-gaap:CommonStockMember2024-06-300001165002us-gaap:AdditionalPaidInCapitalMember2024-06-300001165002us-gaap:TreasuryStockMember2024-06-300001165002us-gaap:RetainedEarningsMember2024-06-300001165002us-gaap:NoncontrollingInterestMember2024-06-3000011650022024-06-300001165002us-gaap:CommonStockMember2024-12-310001165002us-gaap:AdditionalPaidInCapitalMember2024-12-310001165002us-gaap:TreasuryStockMember2024-12-310001165002us-gaap:RetainedEarningsMember2024-12-310001165002us-gaap:RetainedEarningsMember2024-01-012024-12-310001165002us-gaap:CommonStockMember2025-01-012025-06-300001165002us-gaap:AdditionalPaidInCapitalMember2025-01-012025-06-300001165002us-gaap:RetainedEarningsMember2025-01-012025-06-300001165002us-gaap:TreasuryStockMember2025-01-012025-06-300001165002us-gaap:CommonStockMember2023-12-310001165002us-gaap:AdditionalPaidInCapitalMember2023-12-310001165002us-gaap:TreasuryStockMember2023-12-310001165002us-gaap:RetainedEarningsMember2023-12-310001165002us-gaap:RetainedEarningsMember2023-01-012023-06-3000011650022023-12-310001165002us-gaap:CommonStockMember2024-01-012024-06-300001165002us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001165002us-gaap:TreasuryStockMember2024-01-012024-06-300001165002whg:InvestmentAdvisoryServicesMemberwhg:AdvisoryMember2025-04-012025-06-300001165002whg:InvestmentAdvisoryServicesMemberwhg:AdvisoryMember2024-04-012024-06-300001165002whg:InvestmentAdvisoryServicesMemberwhg:AdvisoryMember2025-01-012025-09-300001165002whg:InvestmentAdvisoryServicesMemberwhg:AdvisoryMember2024-01-012024-06-300001165002whg:MutualFundAdvisoryMemberMemberwhg:AdvisoryMember2025-04-012025-06-300001165002whg:MutualFundAdvisoryMemberMemberwhg:AdvisoryMember2024-04-012024-06-300001165002whg:MutualFundAdvisoryMemberMemberwhg:AdvisoryMember2025-01-012025-06-300001165002whg:MutualFundAdvisoryMemberMemberwhg:AdvisoryMember2024-01-012024-06-300001165002whg:PrivateWealthAdvisoryMemberwhg:AdvisoryMember2025-04-012025-06-300001165002whg:PrivateWealthAdvisoryMemberwhg:AdvisoryMember2024-04-012024-06-300001165002whg:PrivateWealthAdvisoryMemberwhg:AdvisoryMember2025-01-012025-06-300001165002whg:PrivateWealthAdvisoryMemberwhg:AdvisoryMember2024-01-012024-06-300001165002whg:TrustFeeMemberwhg:TrustMember2025-04-012025-06-300001165002whg:TrustFeeMemberwhg:TrustMember2024-04-012024-06-300001165002whg:TrustFeeMemberwhg:TrustMember2025-01-012025-06-300001165002whg:TrustFeeMemberwhg:TrustMember2024-01-012024-06-300001165002whg:OtherRevenueMiscServicesMemberwhg:AdvisoryMember2025-04-012025-06-300001165002whg:OtherRevenueMiscServicesMemberwhg:AdvisoryMember2024-04-012024-06-300001165002whg:OtherRevenueMiscServicesMemberwhg:AdvisoryMember2025-01-012025-06-300001165002whg:OtherRevenueMiscServicesMemberwhg:AdvisoryMember2024-01-012024-06-300001165002whg:InvestmentAdvisoryServicesMembercountry:CA2025-04-012025-06-300001165002whg:TrustFeeMembercountry:CA2025-04-012025-06-300001165002whg:OtherRevenueMiscServicesMembercountry:CA2025-04-012025-06-300001165002country:CA2025-04-012025-06-300001165002whg:InvestmentAdvisoryServicesMembercountry:US2025-04-012025-06-300001165002whg:TrustFeeMembercountry:US2025-04-012025-06-300001165002whg:OtherRevenueMiscServicesMembercountry:US2025-04-012025-06-300001165002country:US2025-04-012025-06-300001165002whg:InvestmentAdvisoryServicesMember2025-04-012025-06-300001165002whg:TrustFeeMember2025-04-012025-06-300001165002whg:OtherRevenueMiscServicesMember2025-04-012025-06-300001165002whg:InvestmentAdvisoryServicesMembercountry:CA2024-04-012024-06-300001165002whg:TrustFeeMembercountry:CA2024-04-012024-06-300001165002whg:OtherRevenueMiscServicesMembercountry:CA2024-04-012024-06-300001165002country:CA2024-04-012024-06-300001165002whg:InvestmentAdvisoryServicesMembercountry:US2024-04-012024-06-300001165002whg:TrustFeeMembercountry:US2024-04-012024-06-300001165002whg:OtherRevenueMiscServicesMembercountry:US2024-04-012024-06-300001165002country:US2024-04-012024-06-300001165002whg:InvestmentAdvisoryServicesMember2024-04-012024-06-300001165002whg:TrustFeeMember2024-04-012024-06-300001165002whg:OtherRevenueMiscServicesMember2024-04-012024-06-300001165002whg:InvestmentAdvisoryServicesMembercountry:CA2025-01-012025-06-300001165002whg:TrustFeeMembercountry:CA2025-01-012025-06-300001165002whg:OtherRevenueMiscServicesMembercountry:CA2025-01-012025-06-300001165002country:CA2025-01-012025-06-300001165002whg:InvestmentAdvisoryServicesMembercountry:US2025-01-012025-06-300001165002whg:TrustFeeMembercountry:US2025-01-012025-06-300001165002whg:OtherRevenueMiscServicesMembercountry:US2025-01-012025-06-300001165002country:US2025-01-012025-06-300001165002whg:InvestmentAdvisoryServicesMember2025-01-012025-06-300001165002whg:TrustFeeMember2025-01-012025-06-300001165002whg:OtherRevenueMiscServicesMember2025-01-012025-06-300001165002whg:InvestmentAdvisoryServicesMembercountry:CA2024-01-012024-06-300001165002whg:TrustFeeMembercountry:CA2024-01-012024-06-300001165002whg:OtherRevenueMiscServicesMembercountry:CA2024-01-012024-06-300001165002country:CA2024-01-012024-06-300001165002whg:InvestmentAdvisoryServicesMembercountry:US2024-01-012024-06-300001165002whg:TrustFeeMembercountry:US2024-01-012024-06-300001165002whg:OtherRevenueMiscServicesMembercountry:US2024-01-012024-06-300001165002country:US2024-01-012024-06-300001165002whg:InvestmentAdvisoryServicesMember2024-01-012024-06-300001165002whg:TrustFeeMember2024-01-012024-06-300001165002whg:OtherRevenueMiscServicesMember2024-01-012024-06-300001165002us-gaap:OperatingSegmentsMemberwhg:AdvisoryMember2025-04-012025-06-300001165002us-gaap:OperatingSegmentsMemberwhg:TrustMember2025-04-012025-06-300001165002us-gaap:CorporateNonSegmentMember2025-04-012025-06-300001165002us-gaap:IntersegmentEliminationMember2025-04-012025-06-300001165002us-gaap:OperatingSegmentsMemberwhg:AdvisoryMember2025-06-300001165002us-gaap:OperatingSegmentsMemberwhg:TrustMember2025-06-300001165002us-gaap:CorporateNonSegmentMember2025-06-300001165002us-gaap:IntersegmentEliminationMember2025-06-300001165002us-gaap:OperatingSegmentsMemberwhg:AdvisoryMember2025-01-012025-06-300001165002us-gaap:OperatingSegmentsMemberwhg:TrustMember2025-01-012025-06-300001165002us-gaap:CorporateNonSegmentMember2025-01-012025-06-300001165002us-gaap:IntersegmentEliminationMember2025-01-012025-06-300001165002us-gaap:OperatingSegmentsMemberwhg:AdvisoryMember2024-04-012024-06-300001165002us-gaap:OperatingSegmentsMemberwhg:TrustMember2024-04-012024-06-300001165002us-gaap:CorporateNonSegmentMember2024-04-012024-06-300001165002us-gaap:IntersegmentEliminationMember2024-04-012024-06-300001165002us-gaap:OperatingSegmentsMemberwhg:AdvisoryMember2024-06-300001165002us-gaap:OperatingSegmentsMemberwhg:TrustMember2024-06-300001165002us-gaap:CorporateNonSegmentMember2024-06-300001165002us-gaap:IntersegmentEliminationMember2024-06-300001165002us-gaap:OperatingSegmentsMemberwhg:AdvisoryMember2024-01-012024-06-300001165002us-gaap:OperatingSegmentsMemberwhg:TrustMember2024-01-012024-06-300001165002us-gaap:CorporateNonSegmentMember2024-01-012024-06-300001165002us-gaap:IntersegmentEliminationMember2024-01-012024-06-300001165002us-gaap:USTreasuryAndGovernmentMember2025-06-300001165002us-gaap:USTreasuryAndGovernmentMember2025-01-012025-06-300001165002us-gaap:MoneyMarketFundsMember2025-06-300001165002us-gaap:MoneyMarketFundsMember2025-01-012025-06-300001165002us-gaap:EquityFundsMember2025-06-300001165002us-gaap:EquityFundsMember2025-01-012025-06-300001165002us-gaap:EquitySecuritiesMember2025-06-300001165002us-gaap:EquitySecuritiesMember2025-01-012025-06-300001165002whg:UsGaap_EquitySecuritiesMemberMember2025-06-300001165002whg:UsGaap_EquitySecuritiesMemberMember2025-01-012025-06-300001165002us-gaap:PrivateEquityFundsMember2025-06-300001165002us-gaap:PrivateEquityFundsMember2025-01-012025-06-300001165002us-gaap:USTreasuryAndGovernmentMember2024-12-310001165002us-gaap:USTreasuryAndGovernmentMember2024-04-012024-06-300001165002us-gaap:MoneyMarketFundsMember2024-12-310001165002us-gaap:MoneyMarketFundsMember2024-04-012024-06-300001165002us-gaap:EquityFundsMember2024-12-310001165002us-gaap:EquityFundsMember2024-04-012024-06-300001165002us-gaap:EquitySecuritiesMember2024-12-310001165002us-gaap:EquitySecuritiesMember2024-04-012024-06-300001165002whg:UsGaap_EquitySecuritiesMemberMember2024-12-310001165002whg:UsGaap_EquitySecuritiesMemberMember2024-04-012024-06-300001165002us-gaap:PrivateEquityFundsMember2024-12-310001165002us-gaap:PrivateEquityFundsMember2024-04-012024-06-300001165002whg:ZarvonaEnergyFundGPLPDomain2025-06-300001165002whg:ZarvonaEnergyFundGPLPDomain2024-12-310001165002whg:ZarvonaEnergyFundIIALPDomain2025-06-300001165002whg:ZarvonaEnergyFundIIALPDomain2024-12-310001165002whg:SalientMLPTotalReturnFundLPDomain2025-06-300001165002whg:SalientMLPTotalReturnFundLPDomain2024-12-310001165002whg:SalientMLPTotalReturnTEFundLPDomain2025-06-300001165002whg:SalientMLPTotalReturnTEFundLPDomain2024-12-310001165002whg:TotalMember2025-06-300001165002whg:TotalMember2024-12-310001165002us-gaap:FairValueInputsLevel1Member2025-06-300001165002us-gaap:FairValueInputsLevel2Member2025-06-300001165002us-gaap:FairValueInputsLevel3Member2025-06-300001165002us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-06-300001165002us-gaap:PrivateEquityFundsMemberus-gaap:FairValueInputsLevel1Member2025-06-300001165002us-gaap:PrivateEquityFundsMemberus-gaap:FairValueInputsLevel2Member2025-06-300001165002us-gaap:PrivateEquityFundsMemberus-gaap:FairValueInputsLevel3Member2025-06-300001165002us-gaap:PrivateEquityFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-06-300001165002us-gaap:FairValueInputsLevel1Member2024-12-310001165002us-gaap:FairValueInputsLevel2Member2024-12-310001165002us-gaap:FairValueInputsLevel3Member2024-12-310001165002us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310001165002us-gaap:PrivateEquityFundsMemberus-gaap:FairValueInputsLevel1Member2024-12-310001165002us-gaap:PrivateEquityFundsMemberus-gaap:FairValueInputsLevel2Member2024-12-310001165002us-gaap:PrivateEquityFundsMemberus-gaap:FairValueInputsLevel3Member2024-12-310001165002us-gaap:PrivateEquityFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310001165002us-gaap:FairValueMeasurementsRecurringMember2024-12-310001165002us-gaap:RestrictedStockMember2025-04-012025-06-300001165002us-gaap:RestrictedStockMember2025-06-300001165002whg:DomesticEmployeeServiceAwardMember2025-04-012025-06-300001165002whg:DomesticEmployeeServiceAwardMember2024-04-012024-06-300001165002us-gaap:PerformanceSharesMember2025-04-012025-06-300001165002us-gaap:PerformanceSharesMember2024-04-012024-06-300001165002whg:DomesticServiceAndPerformanceAwardMember2025-04-012025-06-300001165002whg:DomesticServiceAndPerformanceAwardMember2024-04-012024-06-300001165002whg:CanadianEmployeeServiceAwardMember2025-04-012025-06-300001165002whg:CanadianEmployeeServiceAwardMember2024-04-012024-06-300001165002us-gaap:RestrictedStockMember2024-04-012024-06-300001165002whg:RestrictedStockSubjectOnlyToServiceConditionMember2025-01-012025-06-300001165002us-gaap:RestrictedStockMember2024-12-310001165002us-gaap:RestrictedStockMember2025-01-012025-06-300001165002whg:RestrictedSharesSubjectToServiceAndPerformanceConditionsMember2025-01-012025-06-300001165002whg:RestrictedSharesSubjectToServiceAndPerformanceConditionsMember2024-12-310001165002whg:RestrictedSharesSubjectToServiceAndPerformanceConditionsMember2025-06-300001165002whg:WestwoodInternationalAdvisorsIncMemberwhg:CanadianPlanMember2025-01-012025-06-300001165002whg:MutualFundShareIncentiveAwardsMember2025-01-012025-06-300001165002whg:MutualFundShareIncentiveAwardsMember2025-04-012025-06-300001165002whg:MutualFundShareIncentiveAwardsMember2024-04-012024-06-300001165002us-gaap:MutualFundMember2025-01-012025-06-300001165002us-gaap:MutualFundMember2024-01-012024-06-300001165002us-gaap:RestrictedStockMember2025-04-012025-06-300001165002us-gaap:RestrictedStockMember2024-04-012024-06-300001165002us-gaap:RestrictedStockMember2025-01-012025-06-300001165002us-gaap:RestrictedStockMember2024-01-012024-06-300001165002whg:WestwoodFundsMember2025-06-300001165002whg:CommonTrustFundsMember2025-06-300001165002whg:WestwoodHospitalityFundILLCMember2025-06-300001165002whg:PrivateEquityInvestmentsMember2025-06-300001165002whg:PrivateWealthMember2025-06-300001165002whg:InstitutionalMember2025-06-300001165002us-gaap:SubsequentEventMember2023-08-022023-08-02

____________________________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________________________________

FORM 10-Q

____________________________________________________________________________________________________

|

|

|

|

|

|

| ☒ |

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended June 30, 2025

OR

|

|

|

|

|

|

| ☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission file number 1-31234

____________________________________________________________________________________________________

WESTWOOD HOLDINGS GROUP, INC.

(Exact name of registrant as specified in its charter)

____________________________________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

75-2969997 |

| (State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

|

|

|

|

| 200 CRESCENT COURT, SUITE 1200 |

|

|

| DALLAS, |

Texas |

|

75201 |

| (Address of principal executive office) |

|

(Zip Code) |

(214) 756-6900

(Registrant’s telephone number, including area code)

____________________________________________________________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

| Common stock, par value $0.01 per share |

WHG |

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

| Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Shares of common stock, par value $0.01 per share, outstanding as of August 1, 2025: 9,408,130.

____________________________________________________________________________________________________

WESTWOOD HOLDINGS GROUP, INC.

INDEX

|

|

|

|

|

|

|

|

|

|

|

|

PART I |

|

FINANCIAL INFORMATION |

PAGE |

|

|

|

|

Item 1. |

|

Financial Statements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 2. |

|

|

|

|

|

|

|

Item 3. |

|

|

|

|

|

|

|

Item 4. |

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

Item 1. |

|

|

|

|

|

|

|

Item 1A. |

|

|

|

|

|

|

|

Item 2. |

|

|

|

|

|

|

|

| Item 6. |

|

|

|

|

|

|

|

|

|

WESTWOOD HOLDINGS GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except par value and share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2025 |

|

December 31, 2024 |

| ASSETS |

|

|

|

| Cash and cash equivalents |

$ |

15,403 |

|

|

$ |

18,847 |

|

| Accounts receivable |

15,331 |

|

|

14,453 |

|

| Investments, at fair value (amortized cost of $18,316 and $26,788) |

19,768 |

|

|

27,694 |

|

| Investments under measurement alternative |

11,747 |

|

|

10,747 |

|

| Equity method investments |

4,197 |

|

|

4,250 |

|

| Income taxes receivable |

167 |

|

|

295 |

|

| Other assets |

7,076 |

|

|

6,780 |

|

| Goodwill |

39,501 |

|

|

39,501 |

|

| Deferred income taxes |

2,356 |

|

|

2,244 |

|

| Operating lease right-of-use assets |

9,997 |

|

|

2,559 |

|

| Intangible assets, net |

20,035 |

|

|

21,668 |

|

| Property and equipment, net of accumulated depreciation of $8,716 and $8,424 |

701 |

|

|

951 |

|

| Total assets |

$ |

146,279 |

|

|

$ |

149,989 |

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Accounts payable and accrued liabilities |

$ |

5,304 |

|

|

$ |

6,413 |

|

|

|

|

|

| Dividends payable |

2,430 |

|

|

2,466 |

|

| Compensation and benefits payable |

5,719 |

|

|

10,924 |

|

| Operating lease liabilities |

10,468 |

|

|

3,197 |

|

|

|

|

|

|

|

|

|

| Contingent consideration |

— |

|

|

4,657 |

|

|

|

|

|

| Total liabilities |

23,921 |

|

|

27,657 |

|

| Commitments and contingencies (Note 10) |

|

|

|

| Stockholders' Equity: |

|

|

|

| Common stock, $0.01 par value, authorized 25,000,000 shares, issued 12,391,817 and 12,137,080, respectively and outstanding 9,408,125 and 9,234,575, respectively |

124 |

|

|

122 |

|

| Additional paid-in capital |

203,594 |

|

|

202,239 |

|

| Treasury stock, at cost – 2,983,692 and 2,902,505, respectively |

(89,612) |

|

|

(88,277) |

|

|

|

|

|

| Retained earnings |

6,200 |

|

|

6,207 |

|

| Total Westwood Holdings Group, Inc. stockholders’ equity |

120,306 |

|

|

120,291 |

|

| Noncontrolling interest in consolidated subsidiary |

2,052 |

|

|

2,041 |

|

| Total equity |

122,358 |

|

|

122,332 |

|

| Total liabilities and stockholders' equity |

$ |

146,279 |

|

|

$ |

149,989 |

|

See Notes to Condensed Consolidated Financial Statements.

1

WESTWOOD HOLDINGS GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data and share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| REVENUES: |

|

|

|

|

|

|

|

| Advisory fees: |

|

|

|

|

|

|

|

| Asset-based |

$ |

17,955 |

|

|

$ |

17,139 |

|

|

$ |

35,686 |

|

|

$ |

33,956 |

|

|

|

|

|

|

|

|

|

| Trust fees |

5,069 |

|

|

5,227 |

|

|

10,498 |

|

|

10,340 |

|

|

|

|

|

|

|

|

|

| Other, net |

96 |

|

|

322 |

|

|

188 |

|

|

1,124 |

|

| Total revenues |

23,120 |

|

|

22,688 |

|

|

46,372 |

|

|

45,420 |

|

| EXPENSES: |

|

|

|

|

|

|

|

| Employee compensation and benefits |

13,472 |

|

|

13,638 |

|

|

27,973 |

|

|

28,349 |

|

| Sales and marketing |

657 |

|

|

755 |

|

|

1,417 |

|

|

1,383 |

|

| Westwood mutual funds |

957 |

|

|

855 |

|

|

1,854 |

|

|

1,576 |

|

| Information technology |

2,704 |

|

|

2,350 |

|

|

5,371 |

|

|

4,640 |

|

| Professional services |

1,486 |

|

|

1,450 |

|

|

3,099 |

|

|

2,939 |

|

| General and administrative |

2,976 |

|

|

3,011 |

|

|

5,858 |

|

|

5,912 |

|

|

|

|

|

|

|

|

|

| Loss from change in fair value of contingent consideration |

— |

|

|

4,807 |

|

|

— |

|

|

1,858 |

|

|

|

|

|

|

|

|

|

| Total expenses |

22,252 |

|

|

26,866 |

|

|

45,572 |

|

|

46,657 |

|

| Net operating income (loss) |

868 |

|

|

(4,178) |

|

|

800 |

|

|

(1,237) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

343 |

|

|

548 |

|

|

726 |

|

|

1,003 |

|

| Other income |

257 |

|

|

224 |

|

|

534 |

|

|

409 |

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

1,468 |

|

|

(3,406) |

|

|

2,060 |

|

|

175 |

|

| Income tax provision |

437 |

|

|

(1,193) |

|

|

552 |

|

|

222 |

|

| Net income (loss) |

$ |

1,031 |

|

|

$ |

(2,213) |

|

|

$ |

1,508 |

|

|

$ |

(47) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: income (loss) attributable to noncontrolling interest |

12 |

|

|

30 |

|

|

11 |

|

|

(100) |

|

| Income (loss) attributable to Westwood Holdings Group, Inc. |

$ |

1,019 |

|

|

$ |

(2,243) |

|

|

$ |

1,497 |

|

|

$ |

53 |

|

| Earnings (loss) per share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.12 |

|

|

$ |

(0.27) |

|

|

$ |

0.18 |

|

|

$ |

0.01 |

|

| Diluted |

$ |

0.12 |

|

|

$ |

(0.27) |

|

|

$ |

0.17 |

|

|

$ |

0.01 |

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

8,404,859 |

|

|

8,218,596 |

|

|

8,329,803 |

|

|

8,158,812 |

|

| Diluted |

8,813,606 |

|

|

8,218,596 |

|

|

8,798,092 |

|

|

8,438,431 |

|

See Notes to Condensed Consolidated Financial Statements.

2

WESTWOOD HOLDINGS GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For the Three Months Ended June 30, 2025 and 2024

(In thousands, except share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, Par |

|

Additional Paid-In Capital |

|

Treasury Stock |

|

|

|

Retained Earnings |

|

Noncontrolling Interest |

|

Total |

|

Shares |

|

Amount |

|

|

|

|

|

|

| Balance, March 31, 2025 |

9,379,675 |

|

|

$ |

124 |

|

|

$ |

202,299 |

|

|

$ |

(89,612) |

|

|

|

|

$ |

6,535 |

|

|

$ |

2,040 |

|

|

$ |

121,386 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

1,019 |

|

|

12 |

|

|

1,031 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of restricted stock, net of forfeitures |

28,450 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

— |

|

| Dividends declared ($0.15 per share) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

(1,354) |

|

|

— |

|

|

(1,354) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

— |

|

|

— |

|

|

1,295 |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

1,295 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, June 30, 2025 |

9,408,125 |

|

|

$ |

124 |

|

|

$ |

203,594 |

|

|

$ |

(89,612) |

|

|

|

|

$ |

6,200 |

|

|

$ |

2,052 |

|

|

$ |

122,358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, Par |

|

Additional Paid-In Capital |

|

Treasury Stock |

|

Retained Earnings |

|

Noncontrolling Interest |

|

Total |

|

Shares |

|

Amount |

|

|

|

|

|

| Balance, March 31, 2024 |

9,330,762 |

|

|

$ |

122 |

|

|

$ |

201,899 |

|

|

$ |

(86,930) |

|

|

$ |

6,749 |

|

|

$ |

1,915 |

|

|

$ |

123,755 |

|

| Net income (loss) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,243) |

|

|

30 |

|

|

(2,213) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of restricted stock, net of forfeitures |

49,031 |

|

|

1 |

|

|

(1) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends declared ($0.15 per share) |

— |

|

|

— |

|

|

(1,231) |

|

|

— |

|

|

(167) |

|

|

— |

|

|

(1,398) |

|

Stock-based compensation expense |

— |

|

|

— |

|

|

1,397 |

|

|

— |

|

|

— |

|

|

— |

|

|

1,397 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of treasury stock |

(86,346) |

|

|

— |

|

|

— |

|

|

(1,075) |

|

|

— |

|

|

— |

|

|

(1,075) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, June 30, 2024 |

9,293,447 |

|

|

$ |

123 |

|

|

$ |

202,064 |

|

|

$ |

(88,005) |

|

|

$ |

4,339 |

|

|

$ |

1,945 |

|

|

$ |

120,466 |

|

See Notes to Condensed Consolidated Financial Statements.

3

WESTWOOD HOLDINGS GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For the Six Months Ended June 30, 2025 and 2024

(In thousands, except share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, Par |

|

Additional Paid-In Capital |

|

Treasury Stock |

|

|

|

Retained Earnings |

|

Noncontrolling Interest |

|

Total |

|

Shares |

|

Amount |

|

|

|

|

|

|

| Balance, December 31, 2024 |

9,234,575 |

|

|

$ |

122 |

|

|

$ |

202,239 |

|

|

$ |

(88,277) |

|

|

|

|

$ |

6,207 |

|

|

$ |

2,041 |

|

|

$ |

122,332 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

1,497 |

|

|

11 |

|

|

1,508 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of restricted stock, net of forfeitures |

254,737 |

|

|

2 |

|

|

(2) |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends declared ($0.30 per share) |

— |

|

|

— |

|

|

(1,265) |

|

|

— |

|

|

|

|

(1,504) |

|

|

— |

|

|

(2,769) |

|

Stock-based compensation expense |

— |

|

|

— |

|

|

2,622 |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

2,622 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restricted stock returned for payment of taxes |

(81,187) |

|

|

— |

|

|

— |

|

|

(1,335) |

|

|

|

|

— |

|

|

— |

|

|

(1,335) |

|

| Balance, June 30, 2025 |

9,408,125 |

|

|

$ |

124 |

|

|

$ |

203,594 |

|

|

$ |

(89,612) |

|

|

|

|

$ |

6,200 |

|

|

$ |

2,052 |

|

|

$ |

122,358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, Par |

|

Additional Paid-In Capital |

|

Treasury Stock |

|

Retained Earnings |

|

Noncontrolling Interest |

|

Total |

|

Shares |

|

Amount |

|

|

|

|

|

| Balance, December 31, 2023 |

9,140,760 |

|

|

$ |

119 |

|

|

$ |

201,622 |

|

|

$ |

(85,990) |

|

|

$ |

4,650 |

|

|

$ |

2,045 |

|

|

$ |

122,446 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

53 |

|

|

(100) |

|

|

(47) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of restricted stock, net of forfeitures |

317,336 |

|

|

4 |

|

|

(4) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends declared ($0.30 per share) |

— |

|

|

— |

|

|

(2,466) |

|

|

— |

|

|

(364) |

|

|

— |

|

|

(2,830) |

|

Stock-based compensation expense |

— |

|

|

— |

|

|

2,912 |

|

|

— |

|

|

— |

|

|

— |

|

|

2,912 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of treasury stock |

(86,346) |

|

|

— |

|

|

— |

|

|

(1,075) |

|

|

— |

|

|

— |

|

|

(1,075) |

|

Restricted stock returned for payment of taxes |

(78,303) |

|

|

— |

|

|

— |

|

|

(940) |

|

|

— |

|

|

— |

|

|

(940) |

|

| Balance, June 30, 2024 |

9,293,447 |

|

|

$ |

123 |

|

|

$ |

202,064 |

|

|

$ |

(88,005) |

|

|

$ |

4,339 |

|

|

$ |

1,945 |

|

|

$ |

120,466 |

|

See Notes to Condensed Consolidated Financial Statements.

4

WESTWOOD HOLDINGS GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

2025 |

|

2024 |

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

| Net income (loss) |

$ |

1,508 |

|

|

$ |

(47) |

|

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

| Depreciation |

257 |

|

|

326 |

|

| Amortization of intangible assets |

2,082 |

|

|

2,074 |

|

| Net change in unrealized (appreciation) depreciation on investments |

137 |

|

|

(1,004) |

|

|

|

|

|

| Stock-based compensation expense |

2,622 |

|

|

2,912 |

|

| Deferred income taxes |

(112) |

|

|

(47) |

|

| Non-cash lease expense |

694 |

|

|

546 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fair value change of contingent consideration |

— |

|

|

1,858 |

|

|

|

|

|

|

|

|

|

| Change in operating assets and liabilities: |

|

|

|

|

|

|

|

| Accounts receivable |

(878) |

|

|

70 |

|

| Other assets |

(296) |

|

|

2 |

|

| Accounts payable and accrued liabilities |

(1,139) |

|

|

(814) |

|

| Compensation and benefits payable |

(5,205) |

|

|

(4,217) |

|

| Income taxes receivable |

128 |

|

|

(740) |

|

| Other liabilities |

(795) |

|

|

(664) |

|

| Net sales of trading securities |

7,842 |

|

|

11,430 |

|

| Contingent consideration |

(4,442) |

|

|

— |

|

| Net cash provided by operating activities |

2,403 |

|

|

11,685 |

|

| CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of property and equipment |

(6) |

|

|

(24) |

|

| Purchase of investments |

(1,000) |

|

|

(1,500) |

|

|

|

|

|

| Additions to internally developed software |

(449) |

|

|

— |

|

| Net cash used in investing activities |

(1,455) |

|

|

(1,524) |

|

| CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

| Purchases of treasury stock |

— |

|

|

(1,075) |

|

|

|

|

|

| Restricted stock returned for payment of taxes |

(1,335) |

|

|

(940) |

|

| Payment of contingent consideration in acquisition |

(201) |

|

|

(1,815) |

|

| Cash dividends paid |

(2,856) |

|

|

(2,983) |

|

| Net cash used in financing activities |

(4,392) |

|

|

(6,813) |

|

|

|

|

|

| NET CHANGE IN CASH AND CASH EQUIVALENTS |

(3,444) |

|

|

3,348 |

|

| Cash and cash equivalents, beginning of period |

18,847 |

|

|

20,422 |

|

| Cash and cash equivalents, end of period |

$ |

15,403 |

|

|

$ |

23,770 |

|

|

|

|

|

| SUPPLEMENTAL CASH FLOW INFORMATION: |

|

|

|

| Cash paid during the period for income taxes |

$ |

535 |

|

|

$ |

1,008 |

|

| Accrued dividends |

$ |

2,430 |

|

|

$ |

2,176 |

|

|

|

|

|

| Operating lease assets obtained in exchange for operating lease liabilities |

$ |

8,133 |

|

|

$ |

— |

|

|

|

|

|

See Notes to Condensed Consolidated Financial Statements.

5

WESTWOOD HOLDINGS GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. DESCRIPTION OF THE BUSINESS

Westwood Holdings Group, Inc. (“Westwood”, “the Company”, “we”, “us” or “our”) was incorporated under the laws of the State of Delaware on December 12, 2001. Westwood manages investment assets and provides services for its clients through its subsidiaries, Westwood Management Corp., Westwood Advisors, L.L.C., Salient Advisors, L.P. and Broadmark Asset Management LLC, (referred to hereinafter together as “Westwood Management”), and Westwood Trust.

Westwood Management provides investment advisory services to institutional clients, a family of mutual funds called the Westwood Funds®, other mutual funds, individual investors and clients of Westwood Trust. Westwood Trust provides trust and custodial services and participation in self-sponsored common trust funds ("CTFs") to institutions and high net worth individuals. Revenue is largely dependent on the total value and composition of assets under management ("AUM") and assets under advisement ("AUA"), and fluctuations in financial markets and in the composition of AUM impact our revenues and results of operations.

Westwood Management is registered with the Securities and Exchange Commission ("SEC") as an investment adviser under the Investment Advisers Act of 1940, as amended. Westwood Trust is chartered and regulated by the Texas Department of Banking.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying Condensed Consolidated Financial Statements are unaudited and are presented in accordance with the requirements for quarterly reports on Form 10-Q and consequently do not include all of the information and footnote disclosures required by accounting principles generally accepted in the United States of America ("GAAP"). The Company’s Condensed Consolidated Financial Statements reflect all adjustments (consisting only of normal recurring adjustments) necessary to a fair statement of our interim financial position and results of operations and cash flows for the periods presented. The accompanying Condensed Consolidated Financial Statements are presented in accordance with GAAP and the rules and regulations of the SEC. The Condensed Consolidated Balance Sheets have been reclassified to unclassified balance sheets to better reflect the nature of the Company’s operations. Prior year amounts have been reclassified for consistency with the current year presentation.

The accompanying unaudited Condensed Consolidated Financial Statements should be read in conjunction with our Consolidated Financial Statements, and notes thereto, included in our Annual Report on Form 10-K for the year ended December 31, 2024. Operating results for the periods in these Condensed Consolidated Financial Statements are not necessarily indicative of results for any future period. The accompanying Condensed Consolidated Financial Statements include the accounts of Westwood and its subsidiaries. All intercompany accounts and transactions have been eliminated upon consolidation.

Recent Accounting Pronouncements

Income Taxes

On January 1, 2025, ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures ("ASU 2023-09"), became effective and requires, among other things, greater disaggregation of information in the rate reconciliation and for paid income taxes to be disaggregated by jurisdiction. ASU 2023-09 affects financial statement disclosure only, which is not required until year end 2025 and, as a result, does not affect our results of operations or financial condition.

Income Statement Reporting

In November 2024, The FASB issued ASU 2024-03, Income Statement-Reporting Comprehensive Income-Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses ("ASU 2024-03"). ASU 2024-03 requires public companies to disclose, in the notes to financial statements, specified information about certain costs and expenses at each interim and annual reporting period. The FASB further clarified the effective date in January 2025 with the issuance of ASU 2025-01, Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosures (Subtopic 220-40): Clarifying the Effective Date ("ASU 2025-01"). ASU 2024-03 is effective for annual periods beginning after December 15, 2026, and interim periods within annual reporting periods beginning after December 15, 2027, with early adoption permitted.

WESTWOOD HOLDINGS GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued), (Unaudited)

The requirements should be applied on a prospective basis while retrospective application is permitted. We are in the process of analyzing the impact of this ASU on our consolidated financial statements.

3. REVENUE

Revenue Recognition

Revenues are recognized when the performance obligation (the investment management and advisory or trust services provided to the client) defined by the investment advisory or sub-advisory agreement is satisfied. For each performance obligation, we determine at contract inception whether the revenue satisfies over time or at a point in time. We derive our revenues from investment advisory fees, trust fees and other sources of revenues such as gains and losses from our seed money investments into new investment strategies. The "Other, net” revenues on our Condensed Consolidated Statements of Operations are the unrealized gains and losses on our seed money investments, and our seed money investments are included in "Investments, at fair value" on our Condensed Consolidated Balance Sheets. Advisory and trust fees are calculated based on a percentage of AUM or AUA, as applicable, and the performance obligation is realized over the current calendar quarter. Once clients receive our investment advisory services we have an enforceable right to payment.

Advisory Fee Revenues

Our advisory fees are generated by Westwood Management for managing client accounts under investment advisory and sub-advisory agreements. Advisory fees are typically calculated based on a percentage of AUM and AUA and are paid in accordance with the terms of the agreements. Advisory fees are paid quarterly in advance based on AUM on the last day of the preceding quarter, quarterly in arrears based on AUM on the last day of the quarter just ended or are based on a daily or monthly analysis of AUM for the stated period. We recognize advisory fee revenues as services are rendered. Since our advance paying clients' billing periods coincide with the calendar quarter to which such payments relate, revenue is recognized within the quarter and our Condensed Consolidated Financial Statements contain no deferred advisory fee revenues. Advisory clients typically consist of institutional and mutual fund accounts.

Institutional investors include separate accounts of (i) corporate pension and profit sharing plans, public employee retirement funds, Taft-Hartley plans, endowments, foundations and individuals; (ii) sub-advisory relationships where Westwood provides investment management services for funds offered by other financial institutions; (iii) pooled investment vehicles, including collective investment trusts; and (iv) managed account relationships with brokerage firms and other registered investment advisors that offer Westwood products to their customers.

Mutual funds include the Westwood Funds®, a family of mutual funds for which Westwood Management serves as advisor. These funds are available to individual investors, as well as offered as part of our suite of investment strategies for institutional investors and wealth management accounts.

Arrangements with Performance-Based Obligations

A limited number of our advisory clients have a contractual performance-based fee component in their contracts, which generates additional revenues if we outperform a specified index over a specific period of time, and a limited number of our mutual fund offerings have fees that generate additional revenues if we outperform specified indices over specific periods of time. Performance-based fees are paid after the performance obligation has been satisfied.

The revenue is based on future market performance and is subject to many factors outside our control. We cannot conclude that a significant reversal in the cumulative amount of revenue recognized will not occur during the measurement period, and therefore the revenue is recorded at the end of the measurement period when the performance obligation has been satisfied.

Trust Fee Revenues

Our trust fees are generated by Westwood Trust pursuant to trust or custodial agreements. Trust fees are separately negotiated with each client and are generally based on a percentage of AUM. Westwood Trust also provides trust services to a small number of clients on a fixed fee basis. The fees for most of our trust clients are calculated quarterly in arrears, based on a daily average of AUM for the quarter, or monthly, based on the month-end value of AUM. Since billing periods for most of Westwood Trust’s clients coincide with the calendar quarter, revenue is fully recognized within the quarter and our Condensed Consolidated Financial Statements contain no deferred fee revenues.

Revenue Disaggregated

WESTWOOD HOLDINGS GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued), (Unaudited)

The following table presents our revenue disaggregated by account type (in thousands).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Advisory Fees: |

|

|

|

|

|

|

|

| Institutional |

$ |

10,626 |

|

|

$ |

9,718 |

|

|

$ |

20,880 |

|

|

$ |

19,189 |

|

| Mutual Funds |

6,744 |

|

|

6,856 |

|

|

13,576 |

|

|

13,767 |

|

| Wealth Management |

585 |

|

|

565 |

|

|

1,230 |

|

|

1,000 |

|

|

|

|

|

|

|

|

|

| Trust Fees |

5,069 |

|

|

5,227 |

|

|

10,498 |

|

|

10,340 |

|

|

|

|

|

|

|

|

|

| Other, net |

96 |

|

|

322 |

|

|

188 |

|

|

1,124 |

|

| Total revenues |

$ |

23,120 |

|

|

$ |

22,688 |

|

|

$ |

46,372 |

|

|

$ |

45,420 |

|

The following table presents our revenue disaggregated by our clients' geographical locations (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended June 30, 2025 |

Advisory |

|

Trust |

|

|

|

Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canada |

$ |

222 |

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

$ |

222 |

|

|

|

|

|

|

|

|

|

|

|

| United States |

17,733 |

|

|

5,069 |

|

|

|

|

96 |

|

|

22,898 |

|

| Total |

$ |

17,955 |

|

|

$ |

5,069 |

|

|

|

|

$ |

96 |

|

|

$ |

23,120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended June 30, 2024 |

Advisory |

|

Trust |

|

|

|

Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canada |

$ |

260 |

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

$ |

260 |

|

|

|

|

|

|

|

|

|

|

|

| United States |

16,879 |

|

|

5,227 |

|

|

|

|

322 |

|

|

22,428 |

|

| Total |

$ |

17,139 |

|

|

$ |

5,227 |

|

|

|

|

$ |

322 |

|

|

$ |

22,688 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Six Months Ended June 30, 2025 |

Advisory |

|

Trust |

|

|

|

Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canada |

$ |

460 |

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

$ |

460 |

|

|

|

|

|

|

|

|

|

|

|

| United States |

35,226 |

|

|

10,498 |

|

|

|

|

188 |

|

|

45,912 |

|

| Total |

$ |

35,686 |

|

|

$ |

10,498 |

|

|

|

|

$ |

188 |

|

|

$ |

46,372 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Six Months Ended June 30, 2024 |

Advisory |

|

Trust |

|

|

|

Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canada |

$ |

517 |

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

$ |

517 |

|

|

|

|

|

|

|

|

|

|

|

| United States |

33,439 |

|

|

10,340 |

|

|

|

|

1,124 |

|

|

44,903 |

|

| Total |

$ |

33,956 |

|

|

$ |

10,340 |

|

|

|

|

$ |

1,124 |

|

|

$ |

45,420 |

|

4. SEGMENT REPORTING

We operate two segments: Advisory and Trust. These segments are managed separately based on the types of products and services offered and their related client bases. The Company’s segment information is prepared on the same basis that management uses to review the financial information for operational decision-making purposes.

The Company's Chief Operating Decision Maker ("CODM"), our Chief Executive Officer, evaluates the performance of our segments based primarily on revenues. The CODM does not evaluate the performance of our segments on segment expenses so those have not been disclosed.

Westwood Holdings Group, Inc., the parent company of Advisory and Trust, does not have revenues and is the entity in which we record typical holding company expenses including employee compensation and benefits for holding company employees, directors’ fees and investor relations costs. All segment accounting policies are the same as those described in the summary of significant accounting policies. Intersegment balances that eliminate in consolidation have been applied to the appropriate segment.

WESTWOOD HOLDINGS GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued), (Unaudited)

Advisory

Our Advisory segment provides investment advisory services to (i) corporate pension and profit sharing plans, public employee retirement funds, Taft-Hartley plans, endowments, foundations and individuals, (ii) sub-advisory relationships where Westwood provides investment management services to the Westwood Funds®, funds offered by other financial institutions and funds offered by our Trust segment and (iii) pooled investment vehicles, including collective investment trusts. Westwood Management provides investment advisory services to similar clients, which are included in our Advisory segment.

Trust

Westwood Trust provides trust and custodial services and participation in common trust funds that it sponsors to institutions and high net worth individuals. Westwood Trust is included in our Trust segment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

Advisory |

|

Trust |

|

Westwood

Holdings |

|

Eliminations |

|

Consolidated |

| Three Months Ended June 30, 2025 |

|

|

|

|

|

|

|

|

|

|

| Net fee revenues from external sources |

|

$ |

17,955 |

|

|

$ |

5,069 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

23,024 |

|

| Net intersegment revenues |

|

1,469 |

|

|

39 |

|

|

— |

|

|

(1,508) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

| Other, net |

|

96 |

|

|

— |

|

|

— |

|

|

— |

|

|

96 |

|

| Total revenues |

|

$ |

19,520 |

|

|

$ |

5,108 |

|

|

$ |

— |

|

|

$ |

(1,508) |

|

|

$ |

23,120 |

|

| Interest income |

|

$ |

122 |

|

|

$ |

137 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

259 |

|

| Net income (loss) |

|

$ |

4,023 |

|

|

$ |

576 |

|

|

$ |

(3,568) |

|

|

$ |

— |

|

|

$ |

1,031 |

|

| Segment assets |

|

$ |

315,096 |

|

|

$ |

45,201 |

|

|

$ |

22,780 |

|

|

$ |

(236,798) |

|

|

$ |

146,279 |

|

| Segment goodwill |

|

$ |

23,100 |

|

|

$ |

16,401 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

39,501 |

|

| Segment equity-method investments |

|

$ |

4,197 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

4,197 |

|

| Segment expenditures for long-lived assets |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

6 |

|

|

$ |

— |

|

|

$ |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended June 30, 2024 |

|

|

|

|

|

|

|

|

|

|

| Net fee revenues from external sources |

|

$ |

17,139 |

|

|

$ |

5,227 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

22,366 |

|

| Net intersegment revenues |

|

1,448 |

|

|

55 |

|

|

— |

|

|

(1,503) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

| Other, net |

|

322 |

|

|

— |

|

|

— |

|

|

— |

|

|

322 |

|

| Total revenues |

|

$ |

18,909 |

|

|

$ |

5,282 |

|

|

$ |

— |

|

|

$ |

(1,503) |

|

|

$ |

22,688 |

|

| Interest income |

|

$ |

306 |

|

|

$ |

171 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

477 |

|

| Net income (loss) |

|

$ |

(3,674) |

|

|

$ |

(682) |

|

|

$ |

2,143 |

|

|

$ |

— |

|

|

$ |

(2,213) |

|

| Segment assets |

|

$ |

286,921 |

|

|

$ |

46,553 |

|

|

$ |

13,465 |

|

|

$ |

(199,565) |

|

|

$ |

147,374 |

|

| Segment goodwill |

|

$ |

23,100 |

|

|

$ |

16,401 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

39,501 |

|

| Segment equity-method investments |

|

$ |

4,578 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

4,578 |

|

| Segment expenditures for long-lived assets |

|

$ |

1 |

|

|

$ |

1 |

|

|

$ |

22 |

|

|

$ |

— |

|

|

$ |

24 |

|

WESTWOOD HOLDINGS GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (Continued), (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

Advisory |

|

Trust |

|

Westwood Holdings |

|

Eliminations |

|

Consolidated |

| Six Months Ended June 30, 2025 |

|

|

|

|

|

|

|

|

|

|

| Net fee revenues from external sources |

|

$ |

35,686 |

|

|

$ |

10,498 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

46,184 |

|

| Net intersegment revenues |

|

3,045 |

|

|

78 |

|

|

— |

|

|

(3,123) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

| Other, net |

|

188 |

|

|

— |

|

|

— |

|

|

— |

|

|

188 |

|

| Total revenues |

|

$ |

38,919 |

|

|

$ |

10,576 |

|

|

$ |

— |

|

|

$ |

(3,123) |

|

|

$ |

46,372 |

|

|

|

|

|

|

|

|

|

|

|

|

| Six Months Ended June 30, 2024 |

|

|

|

|

|

|

|

|

|

|

| Net fee revenues from external sources |

|

$ |

33,956 |

|

|

$ |

10,340 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

44,296 |

|

| Net intersegment revenues |