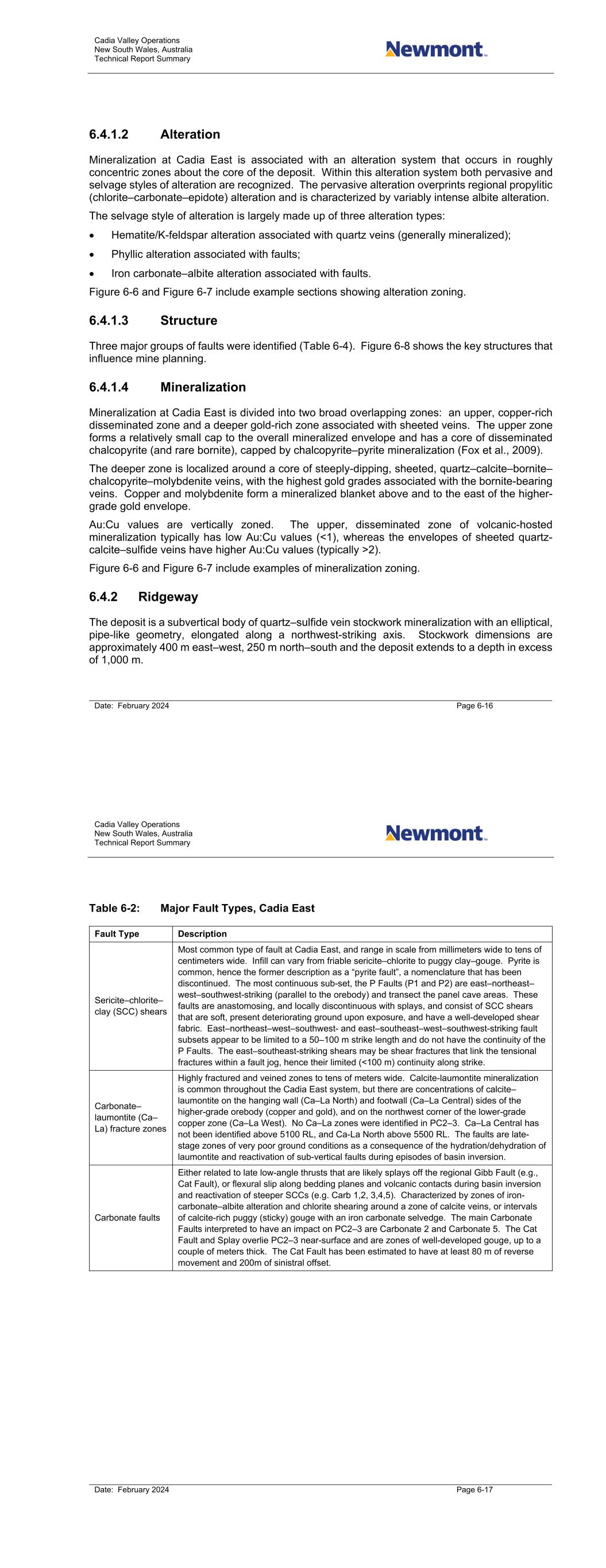

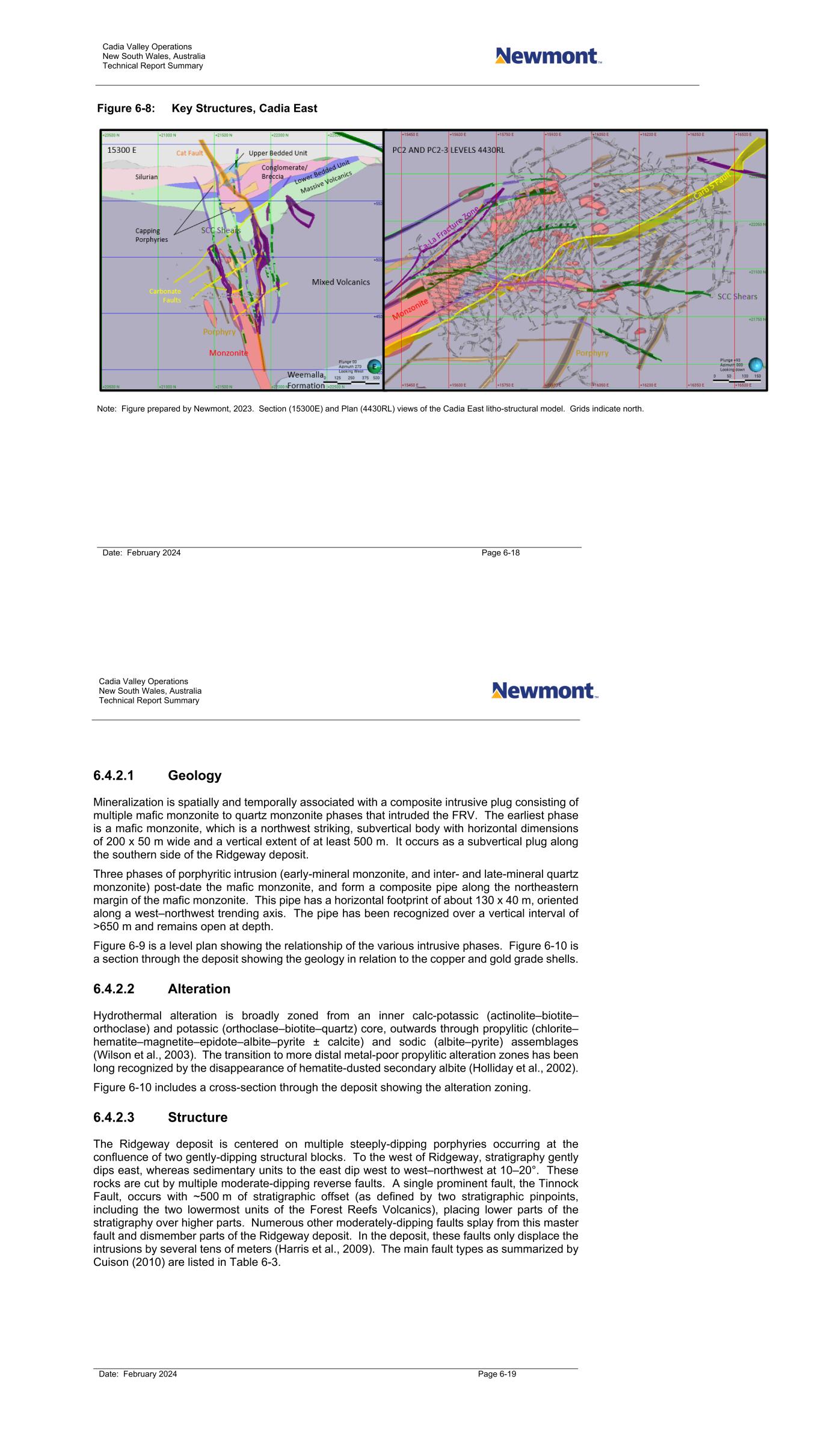

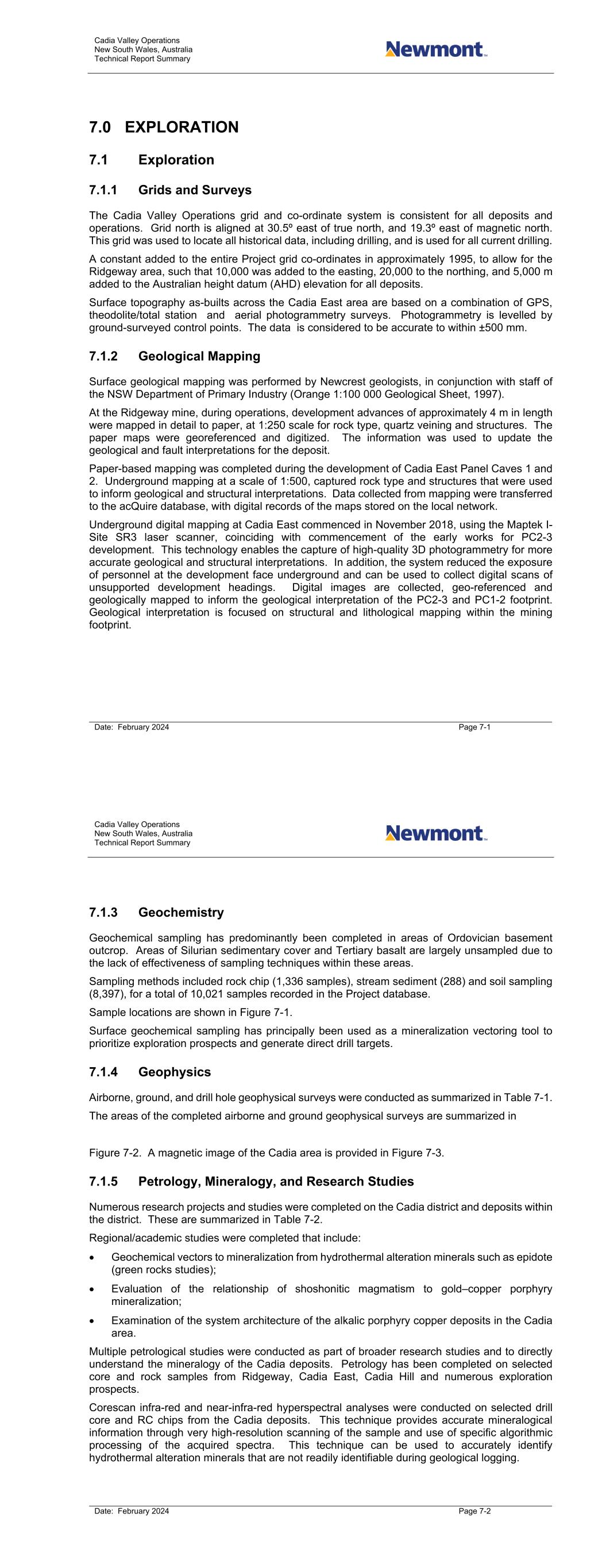

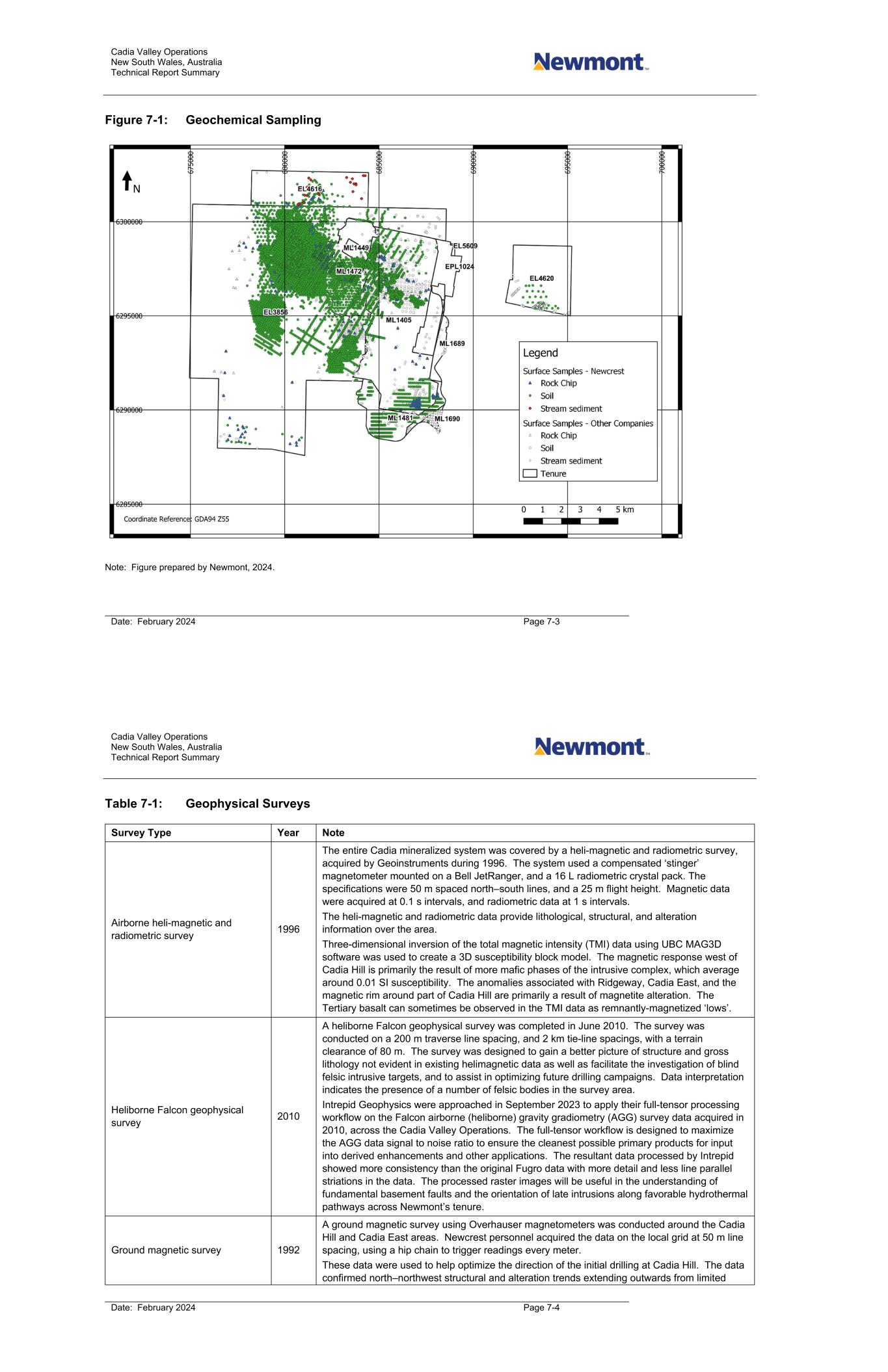

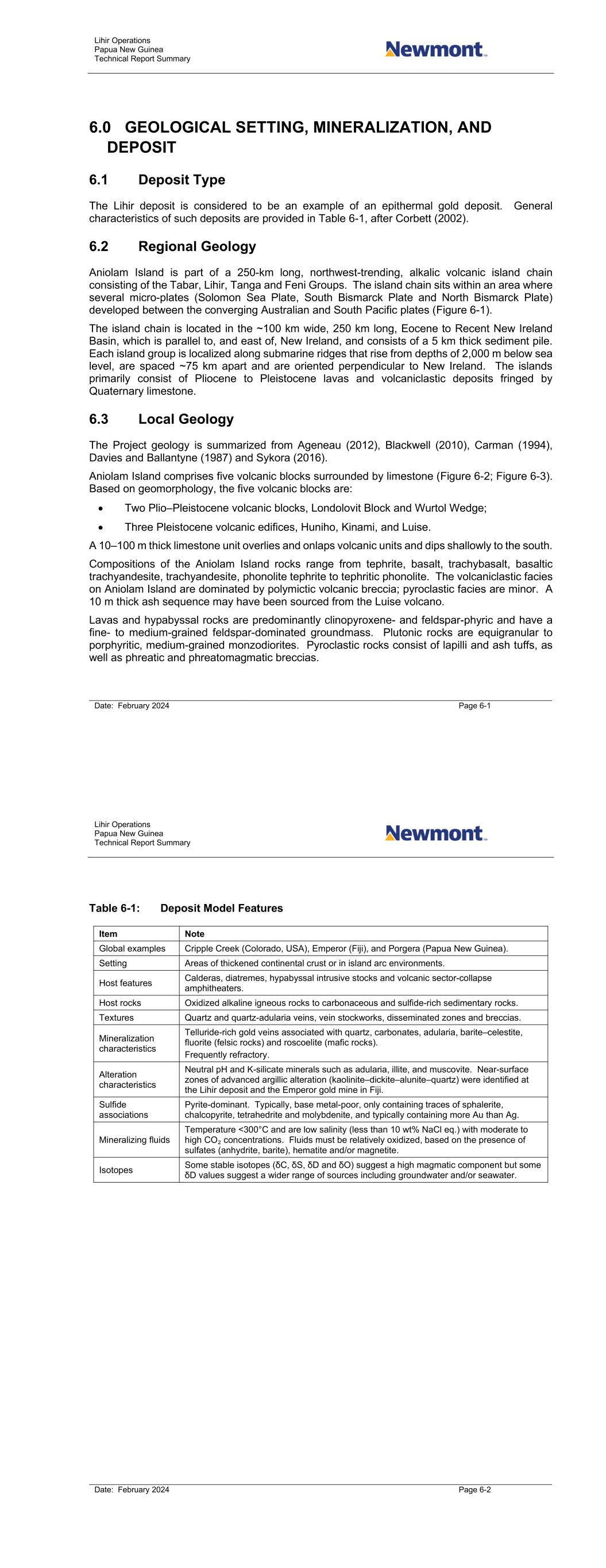

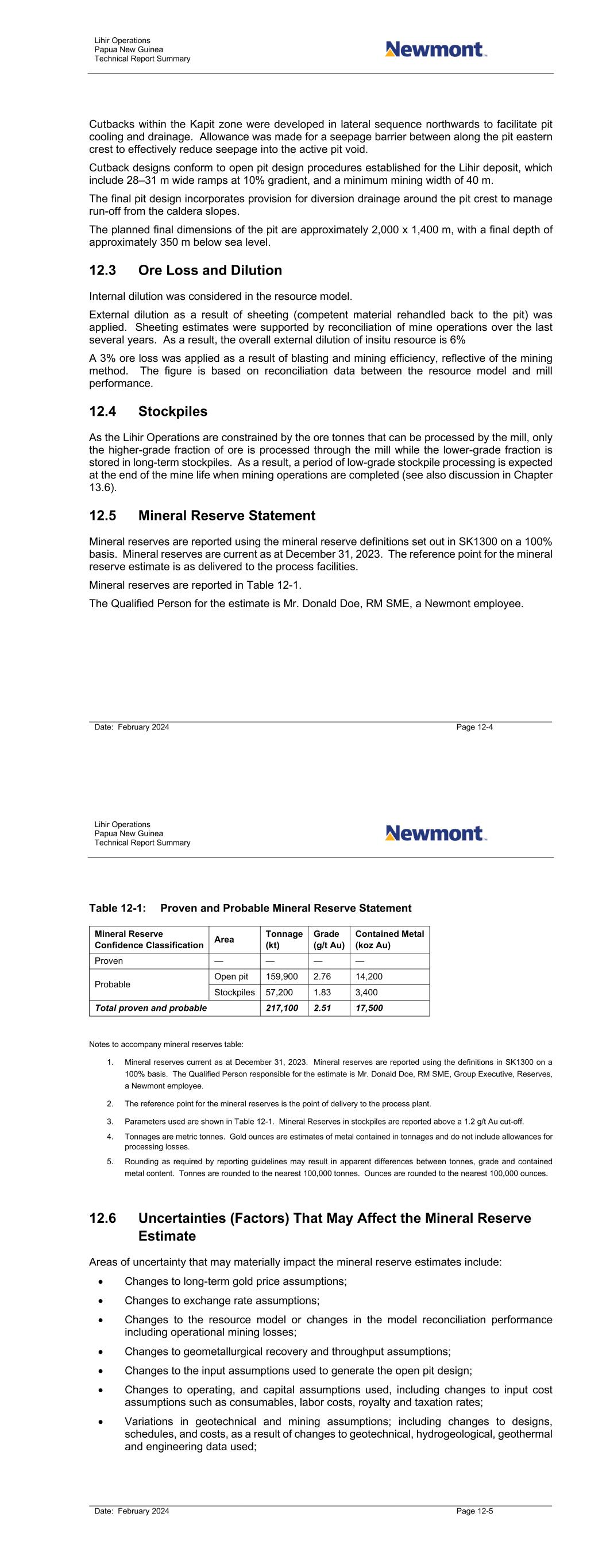

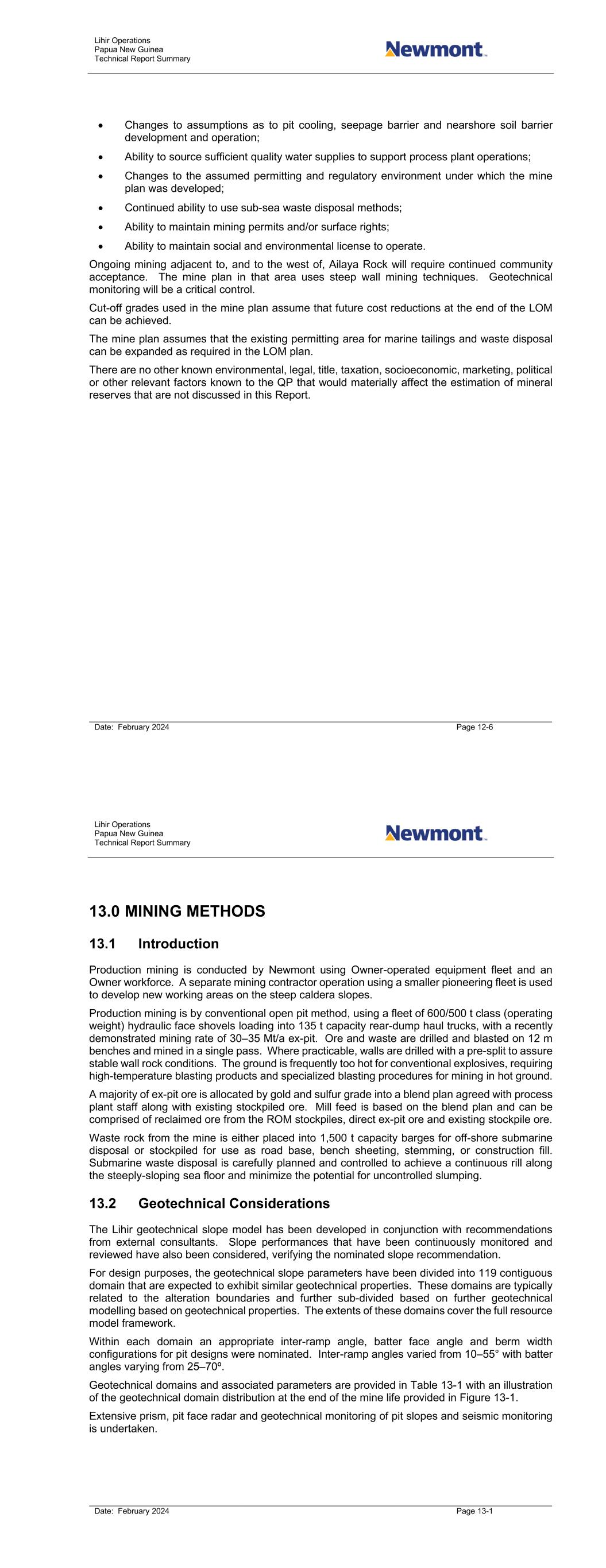

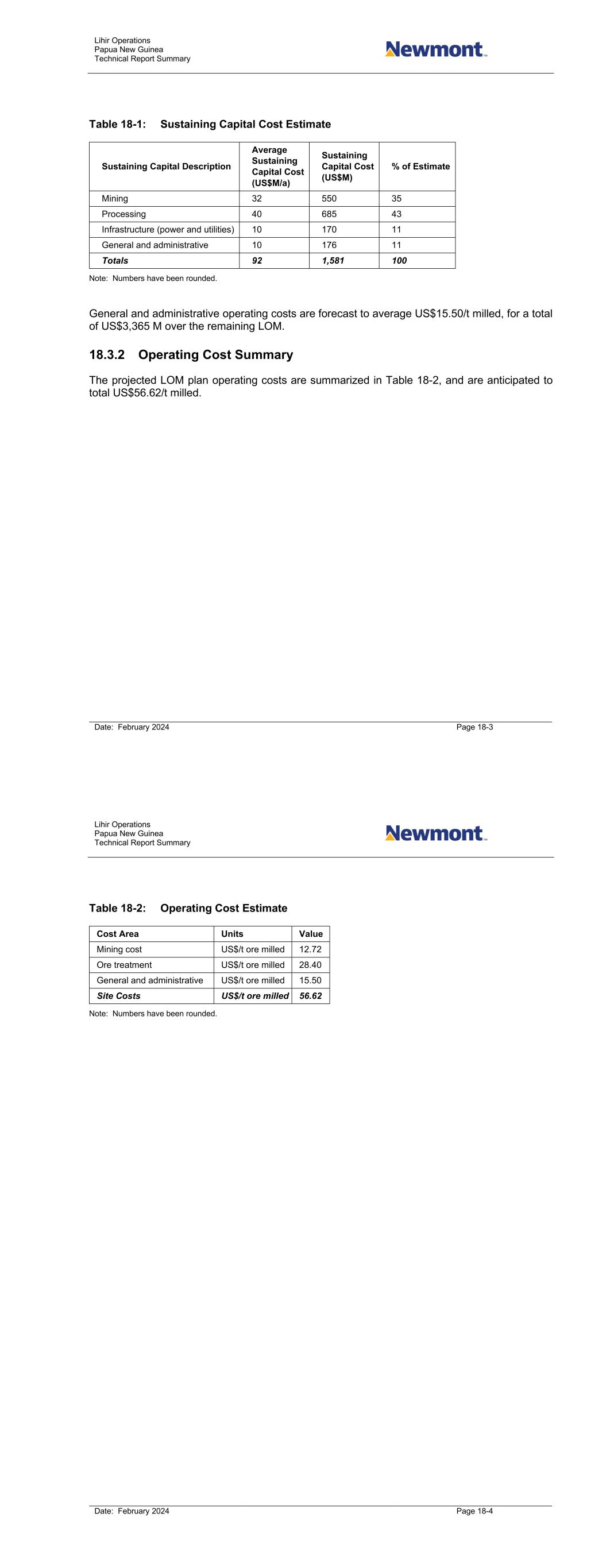

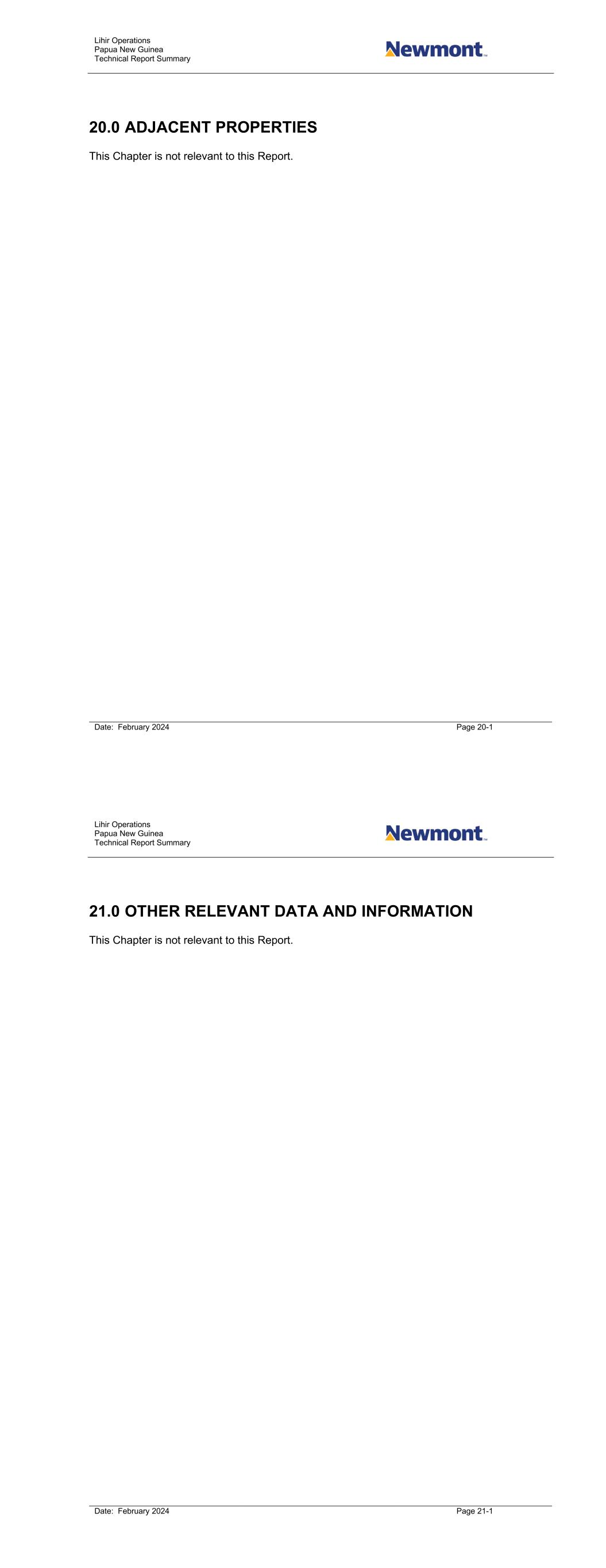

0001164727false2023FYhttp://fasb.org/us-gaap/2023#ImpairmentOfLongLivedAssetsToBeDisposedOfhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://www.newmont.com/20231231#LeaseAndOtherFinancingObligationsCurrenthttp://www.newmont.com/20231231#LeaseAndOtherFinancingObligationsCurrenthttp://www.newmont.com/20231231#LeaseAndOtherFinancingObligationsNoncurrenthttp://www.newmont.com/20231231#LeaseAndOtherFinancingObligationsNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrent http://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#IncomeLossFromDiscontinuedOperationsNetOfTaxhttp://fasb.org/us-gaap/2023#IncomeLossFromDiscontinuedOperationsNetOfTaxhttp://fasb.org/us-gaap/2023#CostOfGoodsAndServiceExcludingDepreciationDepletionAndAmortizationhttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#CostOfGoodsAndServiceExcludingDepreciationDepletionAndAmortization00011647272023-01-012023-12-3100011647272023-06-30iso4217:USD00011647272024-02-15xbrli:shares0001164727nem:PricewaterhouseCoopersLLPMember2023-01-012023-12-3100011647272022-01-012022-12-3100011647272021-01-012021-12-31iso4217:USDxbrli:shares00011647272023-12-3100011647272022-12-3100011647272021-12-3100011647272020-12-310001164727nem:GoldcorpMember2021-12-31xbrli:pure0001164727us-gaap:CommonStockMember2020-12-310001164727us-gaap:TreasuryStockCommonMember2020-12-310001164727us-gaap:AdditionalPaidInCapitalMember2020-12-310001164727us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001164727us-gaap:RetainedEarningsMember2020-12-310001164727us-gaap:NoncontrollingInterestMember2020-12-310001164727us-gaap:RetainedEarningsMember2021-01-012021-12-310001164727us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001164727us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001164727us-gaap:CommonStockMember2021-01-012021-12-310001164727us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001164727us-gaap:TreasuryStockCommonMember2021-01-012021-12-310001164727us-gaap:CommonStockMember2021-12-310001164727us-gaap:TreasuryStockCommonMember2021-12-310001164727us-gaap:AdditionalPaidInCapitalMember2021-12-310001164727us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001164727us-gaap:RetainedEarningsMember2021-12-310001164727us-gaap:NoncontrollingInterestMember2021-12-310001164727us-gaap:RetainedEarningsMember2022-01-012022-12-310001164727us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001164727us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001164727us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001164727us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001164727us-gaap:CommonStockMember2022-01-012022-12-310001164727us-gaap:CommonStockMember2022-12-310001164727us-gaap:TreasuryStockCommonMember2022-12-310001164727us-gaap:AdditionalPaidInCapitalMember2022-12-310001164727us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001164727us-gaap:RetainedEarningsMember2022-12-310001164727us-gaap:NoncontrollingInterestMember2022-12-310001164727us-gaap:RetainedEarningsMember2023-01-012023-12-310001164727us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001164727us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001164727us-gaap:CommonStockMember2023-01-012023-12-310001164727us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001164727us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001164727us-gaap:CommonStockMember2023-12-310001164727us-gaap:TreasuryStockCommonMember2023-12-310001164727us-gaap:AdditionalPaidInCapitalMember2023-12-310001164727us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001164727us-gaap:RetainedEarningsMember2023-12-310001164727us-gaap:NoncontrollingInterestMember2023-12-310001164727nem:SumitomoCorporationMember2021-12-310001164727nem:SummitGlobalManagementIiVBMembernem:MineraYanacochaMember2022-12-310001164727us-gaap:SubsequentEventMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMembernem:PortfolioOptimizationProgramMember2024-02-012024-02-29nem:asset0001164727us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMembernem:PortfolioOptimizationProgramMember2023-12-310001164727nem:NewcrestMiningLimitedMember2023-11-062023-11-06nem:plant0001164727nem:RedChrisMember2023-12-310001164727nem:NevadaGoldMinesMember2023-12-310001164727nem:CongaMillMemberus-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2021-09-300001164727nem:CongaMillMemberus-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2021-01-012021-12-310001164727nem:CongaMillMemberus-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2023-12-310001164727nem:GoldcorpMember2021-05-310001164727nem:GoldcorpMember2021-05-312021-05-310001164727nem:GoldcorpMember2021-04-300001164727nem:MerianGoldProjectMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-12-310001164727nem:MerianGoldProjectMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-12-310001164727nem:MerianGoldProjectMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-01-012021-12-310001164727nem:MineraYanacochaMember2021-12-310001164727nem:MineraYanacochaMembernem:CompaniaDeMinasBuenaventuraSAAMember2021-12-310001164727nem:MineraYanacochaMember2021-01-012021-12-310001164727nem:MineraYanacochaMembernem:SummitGlobalManagementIiVBMember2021-01-012021-12-310001164727nem:MineraYanacochaMember2022-06-012022-06-300001164727nem:MineraYanacochaMember2022-12-310001164727nem:MineraYanacochaMembernem:CompaniaDeMinasBuenaventuraSAAMember2022-12-310001164727nem:CompaniaDeMinasBuenaventuraSAAMembernem:MineraYanacochaMember2022-01-012022-03-310001164727nem:MineraLaZanjaMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-01-012021-12-310001164727nem:MineraLaZanjaMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-12-310001164727nem:MineraLaZanjaMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-03-310001164727nem:MineraYanacochaMember2022-01-012022-12-310001164727nem:MineraYanacochaMember2021-01-012021-12-310001164727nem:MineraYanacochaMember2023-12-310001164727us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-01-012023-12-310001164727us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-01-012022-12-310001164727us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2021-01-012021-12-310001164727nem:HoltPropertyRoyaltyMember2023-01-012023-12-310001164727nem:HoltPropertyRoyaltyMember2022-01-012022-12-310001164727nem:HoltPropertyRoyaltyMember2021-01-012021-12-310001164727nem:YanacochaMember2023-12-310001164727us-gaap:AssetUnderConstructionMembernem:YanacochaMember2023-12-310001164727nem:CongaMember2023-12-310001164727nem:CongaMember2022-12-310001164727nem:PenasquitoMembernem:UnionStrikeMember2023-10-130001164727srt:MinimumMember2023-01-012023-12-310001164727srt:MaximumMember2023-01-012023-12-310001164727nem:NewcrestMiningLimitedMember2023-11-060001164727nem:NewcrestMiningLimitedMember2023-12-310001164727nem:RedChrisMembernem:NewcrestMiningLimitedMember2023-12-310001164727nem:BrucejackMembernem:NewcrestMiningLimitedMember2023-12-310001164727nem:CadiaMembernem:NewcrestMiningLimitedMember2023-12-310001164727nem:LihirMembernem:NewcrestMiningLimitedMember2023-12-310001164727nem:NewcrestMiningLimitedMember2023-01-012023-12-310001164727nem:NewcrestMiningLimitedMember2022-01-012022-12-310001164727nem:CrippleCreekAndVictorMineMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CrippleCreekAndVictorMineMemberus-gaap:OperatingSegmentsMember2023-12-310001164727us-gaap:OperatingSegmentsMembernem:MusselwhiteMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:MusselwhiteMember2023-12-310001164727us-gaap:OperatingSegmentsMembernem:PorcupineMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:PorcupineMember2023-12-310001164727us-gaap:OperatingSegmentsMembernem:EleonoreMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:EleonoreMember2023-12-310001164727us-gaap:GoldMemberus-gaap:OperatingSegmentsMembernem:RedChrisMember2023-01-012023-12-310001164727nem:CopperMemberus-gaap:OperatingSegmentsMembernem:RedChrisMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:RedChrisMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:RedChrisMember2023-12-310001164727nem:BrucejackMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:BrucejackMemberus-gaap:OperatingSegmentsMember2023-12-310001164727nem:PenasquitoMemberus-gaap:GoldMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:SilverMembernem:PenasquitoMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:PenasquitoMembernem:LeadMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:PenasquitoMembernem:ZincMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMember2023-12-310001164727us-gaap:OperatingSegmentsMembernem:MerianGoldProjectMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:MerianGoldProjectMember2023-12-310001164727nem:CerroNegroMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CerroNegroMemberus-gaap:OperatingSegmentsMember2023-12-310001164727us-gaap:OperatingSegmentsMembernem:YanacochaMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:YanacochaMember2023-12-310001164727us-gaap:GoldMembernem:BoddingtonMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CopperMembernem:BoddingtonMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMember2023-12-310001164727us-gaap:OperatingSegmentsMembernem:TanamiMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:TanamiMember2023-12-310001164727nem:CadiaMemberus-gaap:GoldMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CopperMembernem:CadiaMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CadiaMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CadiaMemberus-gaap:OperatingSegmentsMember2023-12-310001164727us-gaap:GoldMembernem:TelferMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CopperMembernem:TelferMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:TelferMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:TelferMemberus-gaap:OperatingSegmentsMember2023-12-310001164727us-gaap:OperatingSegmentsMembernem:LihirMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:LihirMember2023-12-310001164727nem:AhafoMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:AhafoMemberus-gaap:OperatingSegmentsMember2023-12-310001164727us-gaap:OperatingSegmentsMembernem:AkyemMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:AkyemMember2023-12-310001164727us-gaap:OperatingSegmentsMembernem:NevadaGoldMinesMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:NevadaGoldMinesMember2023-12-310001164727us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001164727us-gaap:CorporateNonSegmentMember2023-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:UnionStrikeMember2023-01-012023-12-310001164727nem:CrippleCreekAndVictorMineMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:CrippleCreekAndVictorMineMemberus-gaap:OperatingSegmentsMember2022-12-310001164727us-gaap:OperatingSegmentsMembernem:MusselwhiteMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:MusselwhiteMember2022-12-310001164727us-gaap:OperatingSegmentsMembernem:PorcupineMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:PorcupineMember2022-12-310001164727us-gaap:OperatingSegmentsMembernem:EleonoreMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:EleonoreMember2022-12-310001164727nem:PenasquitoMemberus-gaap:GoldMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:SilverMembernem:PenasquitoMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:PenasquitoMembernem:LeadMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:PenasquitoMembernem:ZincMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMember2022-12-310001164727us-gaap:OperatingSegmentsMembernem:MerianGoldProjectMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:MerianGoldProjectMember2022-12-310001164727nem:CerroNegroMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:CerroNegroMemberus-gaap:OperatingSegmentsMember2022-12-310001164727us-gaap:OperatingSegmentsMembernem:YanacochaMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:YanacochaMember2022-12-310001164727us-gaap:GoldMembernem:BoddingtonMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:CopperMembernem:BoddingtonMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMember2022-12-310001164727us-gaap:OperatingSegmentsMembernem:TanamiMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:TanamiMember2022-12-310001164727nem:AhafoMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:AhafoMemberus-gaap:OperatingSegmentsMember2022-12-310001164727us-gaap:OperatingSegmentsMembernem:AkyemMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:AkyemMember2022-12-310001164727us-gaap:OperatingSegmentsMembernem:NevadaGoldMinesMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:NevadaGoldMinesMember2022-12-310001164727us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001164727us-gaap:CorporateNonSegmentMember2022-12-310001164727nem:PenasquitoMembernem:ProfitSharingAgreementMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001164727nem:CrippleCreekAndVictorMineMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:CrippleCreekAndVictorMineMemberus-gaap:OperatingSegmentsMember2021-12-310001164727us-gaap:OperatingSegmentsMembernem:MusselwhiteMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:MusselwhiteMember2021-12-310001164727us-gaap:OperatingSegmentsMembernem:PorcupineMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:PorcupineMember2021-12-310001164727us-gaap:OperatingSegmentsMembernem:EleonoreMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:EleonoreMember2021-12-310001164727nem:PenasquitoMemberus-gaap:GoldMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:SilverMembernem:PenasquitoMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:PenasquitoMembernem:LeadMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:PenasquitoMembernem:ZincMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMember2021-12-310001164727us-gaap:OperatingSegmentsMembernem:MerianGoldProjectMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:MerianGoldProjectMember2021-12-310001164727nem:CerroNegroMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:CerroNegroMemberus-gaap:OperatingSegmentsMember2021-12-310001164727us-gaap:OperatingSegmentsMembernem:YanacochaMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:YanacochaMember2021-12-310001164727us-gaap:GoldMembernem:BoddingtonMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:CopperMembernem:BoddingtonMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMember2021-12-310001164727us-gaap:OperatingSegmentsMembernem:TanamiMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:TanamiMember2021-12-310001164727nem:AhafoMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:AhafoMemberus-gaap:OperatingSegmentsMember2021-12-310001164727us-gaap:OperatingSegmentsMembernem:AkyemMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:AkyemMember2021-12-310001164727us-gaap:OperatingSegmentsMembernem:NevadaGoldMinesMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:NevadaGoldMinesMember2021-12-310001164727us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001164727us-gaap:CorporateNonSegmentMember2021-12-310001164727country:AU2023-12-310001164727country:AU2022-12-310001164727country:CA2023-12-310001164727country:CA2022-12-310001164727country:US2023-12-310001164727country:US2022-12-310001164727country:MX2023-12-310001164727country:MX2022-12-310001164727country:PG2023-12-310001164727country:PG2022-12-310001164727country:GH2023-12-310001164727country:GH2022-12-310001164727country:PE2023-12-310001164727country:PE2022-12-310001164727country:AR2023-12-310001164727country:AR2022-12-310001164727country:SR2023-12-310001164727country:SR2022-12-310001164727nem:OtherCountriesMember2023-12-310001164727nem:OtherCountriesMember2022-12-310001164727nem:CrippleCreekAndVictorMineMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CrippleCreekAndVictorMineMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:MusselwhiteMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:MusselwhiteMember2023-01-012023-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PorcupineMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:PorcupineMember2023-01-012023-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:EleonoreMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:EleonoreMember2023-01-012023-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:RedChrisGoldSubsegmentMembernem:RedChrisMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:RedChrisGoldSubsegmentMembernem:SalesFromConcentrateAndOtherProductionMembernem:RedChrisMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:RedChrisGoldSubsegmentMembernem:RedChrisMember2023-01-012023-12-310001164727nem:RedChrisCopperSubsegmentMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:RedChrisMember2023-01-012023-12-310001164727nem:RedChrisCopperSubsegmentMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:RedChrisMember2023-01-012023-12-310001164727nem:RedChrisCopperSubsegmentMemberus-gaap:OperatingSegmentsMembernem:RedChrisMember2023-01-012023-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:RedChrisMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:RedChrisMember2023-01-012023-12-310001164727nem:BrucejackMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:BrucejackMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PenasquitoGoldSubsegmentMember2023-01-012023-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoGoldSubsegmentMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoGoldSubsegmentMember2023-01-012023-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMember2023-01-012023-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMember2023-01-012023-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PenasquitoLeadSubsegmentMember2023-01-012023-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoLeadSubsegmentMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoLeadSubsegmentMember2023-01-012023-12-310001164727nem:PenasquitoMembernem:GoldDoreMembernem:PenasquitoZincSubsegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:PenasquitoMembernem:PenasquitoZincSubsegmentMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:PenasquitoMembernem:PenasquitoZincSubsegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:MerianGoldProjectMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:MerianGoldProjectMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:CerroNegroMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CerroNegroMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:YanacochaMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:YanacochaMember2023-01-012023-12-310001164727nem:BoddingtonMembernem:BoddingtonGoldSubsegmentMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:BoddingtonMembernem:BoddingtonGoldSubsegmentMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:BoddingtonMembernem:BoddingtonGoldSubsegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:BoddingtonMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:BoddingtonCopperSubsegmentMember2023-01-012023-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:BoddingtonCopperSubsegmentMember2023-01-012023-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMembernem:BoddingtonCopperSubsegmentMember2023-01-012023-12-310001164727nem:BoddingtonMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:TanamiMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:TanamiMember2023-01-012023-12-310001164727nem:CadiaMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:CadiaGoldSubsegmentMember2023-01-012023-12-310001164727nem:CadiaMemberus-gaap:OperatingSegmentsMembernem:CadiaGoldSubsegmentMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:CadiaMemberus-gaap:OperatingSegmentsMembernem:CadiaGoldSubsegmentMember2023-01-012023-12-310001164727nem:CadiaCopperSubsegmentMembernem:CadiaMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CadiaCopperSubsegmentMembernem:CadiaMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:CadiaCopperSubsegmentMembernem:CadiaMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CadiaMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:CadiaMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:TelferMembernem:TelferGoldSubsegmentMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:TelferMembernem:TelferGoldSubsegmentMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:TelferMembernem:TelferGoldSubsegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:TelferMembernem:TelferCopperSubsegmentMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:TelferMembernem:TelferCopperSubsegmentMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:TelferMembernem:TelferCopperSubsegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:TelferMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:TelferMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:LihirMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:LihirMember2023-01-012023-12-310001164727nem:AhafoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001164727nem:AhafoMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:AkyemMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:AkyemMember2023-01-012023-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:NevadaGoldMinesMember2023-01-012023-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:NevadaGoldMinesMember2023-01-012023-12-310001164727nem:GoldDoreMember2023-01-012023-12-310001164727nem:SalesFromConcentrateAndOtherProductionMember2023-01-012023-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMembernem:SilverStreamingAgreementMember2023-01-012023-12-310001164727srt:ConsolidationEliminationsMembernem:NevadaGoldMinesMember2023-01-012023-12-310001164727nem:CrippleCreekAndVictorMineMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:CrippleCreekAndVictorMineMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:MusselwhiteMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:MusselwhiteMember2022-01-012022-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PorcupineMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:PorcupineMember2022-01-012022-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:EleonoreMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:EleonoreMember2022-01-012022-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PenasquitoGoldSubsegmentMember2022-01-012022-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoGoldSubsegmentMembernem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoGoldSubsegmentMember2022-01-012022-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMember2022-01-012022-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMembernem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMember2022-01-012022-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PenasquitoLeadSubsegmentMember2022-01-012022-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoLeadSubsegmentMembernem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoLeadSubsegmentMember2022-01-012022-12-310001164727nem:PenasquitoMembernem:GoldDoreMembernem:PenasquitoZincSubsegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:PenasquitoMembernem:PenasquitoZincSubsegmentMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:PenasquitoMembernem:PenasquitoZincSubsegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:MerianGoldProjectMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:MerianGoldProjectMembernem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:CerroNegroMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:CerroNegroMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:YanacochaMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:YanacochaMember2022-01-012022-12-310001164727nem:BoddingtonMembernem:BoddingtonGoldSubsegmentMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:BoddingtonMembernem:BoddingtonGoldSubsegmentMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:BoddingtonMembernem:BoddingtonGoldSubsegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:BoddingtonMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:BoddingtonCopperSubsegmentMember2022-01-012022-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:BoddingtonCopperSubsegmentMember2022-01-012022-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMembernem:BoddingtonCopperSubsegmentMember2022-01-012022-12-310001164727nem:BoddingtonMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:TanamiMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:TanamiMember2022-01-012022-12-310001164727nem:AhafoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:AhafoMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:AkyemMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:AkyemMember2022-01-012022-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:NevadaGoldMinesMember2022-01-012022-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:NevadaGoldMinesMember2022-01-012022-12-310001164727nem:GoldDoreMember2022-01-012022-12-310001164727nem:SalesFromConcentrateAndOtherProductionMember2022-01-012022-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMembernem:SilverStreamingAgreementMember2022-01-012022-12-310001164727srt:ConsolidationEliminationsMembernem:NevadaGoldMinesMember2022-01-012022-12-310001164727nem:CrippleCreekAndVictorMineMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:CrippleCreekAndVictorMineMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:MusselwhiteMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:MusselwhiteMember2021-01-012021-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PorcupineMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:PorcupineMember2021-01-012021-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:EleonoreMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:EleonoreMember2021-01-012021-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PenasquitoGoldSubsegmentMember2021-01-012021-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoGoldSubsegmentMembernem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoGoldSubsegmentMember2021-01-012021-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMember2021-01-012021-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMembernem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMember2021-01-012021-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:PenasquitoLeadSubsegmentMember2021-01-012021-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoLeadSubsegmentMembernem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoLeadSubsegmentMember2021-01-012021-12-310001164727nem:PenasquitoMembernem:GoldDoreMembernem:PenasquitoZincSubsegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:PenasquitoMembernem:PenasquitoZincSubsegmentMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:PenasquitoMembernem:PenasquitoZincSubsegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:PenasquitoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:MerianGoldProjectMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:MerianGoldProjectMembernem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:CerroNegroMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:CerroNegroMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:YanacochaMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:YanacochaMember2021-01-012021-12-310001164727nem:BoddingtonMembernem:BoddingtonGoldSubsegmentMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:BoddingtonMembernem:BoddingtonGoldSubsegmentMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:BoddingtonMembernem:BoddingtonGoldSubsegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:BoddingtonMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:BoddingtonCopperSubsegmentMember2021-01-012021-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:BoddingtonCopperSubsegmentMember2021-01-012021-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMembernem:BoddingtonCopperSubsegmentMember2021-01-012021-12-310001164727nem:BoddingtonMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:BoddingtonMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:TanamiMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:TanamiMember2021-01-012021-12-310001164727nem:AhafoMembernem:GoldDoreMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:AhafoMemberus-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:AkyemMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:AkyemMember2021-01-012021-12-310001164727nem:GoldDoreMemberus-gaap:OperatingSegmentsMembernem:NevadaGoldMinesMember2021-01-012021-12-310001164727us-gaap:OperatingSegmentsMembernem:SalesFromConcentrateAndOtherProductionMembernem:NevadaGoldMinesMember2021-01-012021-12-310001164727nem:GoldDoreMember2021-01-012021-12-310001164727nem:SalesFromConcentrateAndOtherProductionMember2021-01-012021-12-310001164727nem:PenasquitoMemberus-gaap:OperatingSegmentsMembernem:PenasquitoSilverSubsegmentMembernem:SilverStreamingAgreementMember2021-01-012021-12-310001164727srt:ConsolidationEliminationsMembernem:NevadaGoldMinesMember2021-01-012021-12-310001164727us-gaap:GoldMember2023-12-31utr:oziso4217:USDutr:oz0001164727nem:CopperMember2023-12-31utr:lbiso4217:USDutr:lb0001164727nem:SilverMember2023-12-310001164727nem:LeadMember2023-12-310001164727nem:ZincMember2023-12-310001164727nem:MolybdenumMember2023-12-310001164727country:GB2023-01-012023-12-310001164727country:GB2022-01-012022-12-310001164727country:GB2021-01-012021-12-310001164727country:KR2023-01-012023-12-310001164727country:KR2022-01-012022-12-310001164727country:KR2021-01-012021-12-310001164727country:CH2023-01-012023-12-310001164727country:CH2022-01-012022-12-310001164727country:CH2021-01-012021-12-310001164727country:JP2023-01-012023-12-310001164727country:JP2022-01-012022-12-310001164727country:JP2021-01-012021-12-310001164727country:PH2023-01-012023-12-310001164727country:PH2022-01-012022-12-310001164727country:PH2021-01-012021-12-310001164727country:AU2023-01-012023-12-310001164727country:AU2022-01-012022-12-310001164727country:AU2021-01-012021-12-310001164727country:DE2023-01-012023-12-310001164727country:DE2022-01-012022-12-310001164727country:DE2021-01-012021-12-310001164727country:MX2023-01-012023-12-310001164727country:MX2022-01-012022-12-310001164727country:MX2021-01-012021-12-310001164727country:US2023-01-012023-12-310001164727country:US2022-01-012022-12-310001164727country:US2021-01-012021-12-310001164727nem:OtherCountriesMember2023-01-012023-12-310001164727nem:OtherCountriesMember2022-01-012022-12-310001164727nem:OtherCountriesMember2021-01-012021-12-310001164727us-gaap:CustomerConcentrationRiskMembernem:JpMorganChaseMemberus-gaap:GoldMemberus-gaap:RevenueFromContractWithCustomerProductAndServiceBenchmarkMember2023-01-012023-12-310001164727us-gaap:CustomerConcentrationRiskMemberus-gaap:GoldMemberus-gaap:RevenueFromContractWithCustomerProductAndServiceBenchmarkMembernem:RoyalBankOfCanadaMember2023-01-012023-12-310001164727us-gaap:CustomerConcentrationRiskMemberus-gaap:GoldMemberus-gaap:RevenueFromContractWithCustomerProductAndServiceBenchmarkMembernem:StandardCharteredMember2023-01-012023-12-310001164727us-gaap:CustomerConcentrationRiskMemberus-gaap:GoldMemberus-gaap:RevenueFromContractWithCustomerProductAndServiceBenchmarkMembernem:TorontoDominionBankMember2023-01-012023-12-310001164727us-gaap:CustomerConcentrationRiskMemberus-gaap:GoldMemberus-gaap:RevenueFromContractWithCustomerProductAndServiceBenchmarkMembernem:StandardCharteredMember2022-01-012022-12-310001164727us-gaap:CustomerConcentrationRiskMembernem:JpMorganChaseMemberus-gaap:GoldMemberus-gaap:RevenueFromContractWithCustomerProductAndServiceBenchmarkMember2022-01-012022-12-310001164727us-gaap:CustomerConcentrationRiskMemberus-gaap:GoldMemberus-gaap:RevenueFromContractWithCustomerProductAndServiceBenchmarkMembernem:StandardCharteredMember2021-01-012021-12-310001164727us-gaap:CustomerConcentrationRiskMembernem:JpMorganChaseMemberus-gaap:GoldMemberus-gaap:RevenueFromContractWithCustomerProductAndServiceBenchmarkMember2021-01-012021-12-310001164727us-gaap:EnvironmentalRemediationMember2023-01-012023-12-310001164727us-gaap:EnvironmentalRemediationMember2022-01-012022-12-310001164727us-gaap:EnvironmentalRemediationMember2021-01-012021-12-310001164727nem:YanacochaMember2023-01-012023-12-310001164727nem:YanacochaMember2022-01-012022-12-310001164727nem:PorcupineMember2022-01-012022-12-310001164727nem:YanacochaMember2021-01-012021-12-310001164727srt:MaximumMember2023-12-310001164727srt:MinimumMember2023-12-310001164727us-gaap:OtherNoncurrentAssetsMember2023-12-310001164727us-gaap:OtherNoncurrentAssetsMember2022-12-310001164727us-gaap:OtherNoncurrentAssetsMemberus-gaap:EquitySecuritiesMember2023-12-310001164727us-gaap:OtherNoncurrentAssetsMemberus-gaap:EquitySecuritiesMember2022-12-310001164727nem:TelferMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001164727nem:TelferMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001164727nem:PenasquitoMember2023-01-012023-12-310001164727nem:EleonoreMember2023-01-012023-12-310001164727nem:MusselwhiteMember2023-01-012023-12-310001164727us-gaap:IncomeApproachValuationTechniqueMembernem:MeasurementInputShortTermGoldPriceMember2023-12-310001164727nem:MeasurementInputLongTermGoldPriceMemberus-gaap:IncomeApproachValuationTechniqueMember2023-12-310001164727us-gaap:MeasurementInputDiscountRateMemberus-gaap:IncomeApproachValuationTechniqueMembernem:MusselwhiteMember2023-12-310001164727us-gaap:MeasurementInputDiscountRateMemberus-gaap:IncomeApproachValuationTechniqueMembernem:EleonoreMember2023-12-310001164727us-gaap:MeasurementInputDiscountRateMembernem:PenasquitoMemberus-gaap:IncomeApproachValuationTechniqueMember2023-12-310001164727us-gaap:MeasurementInputDiscountRateMembernem:CerroNegroMemberus-gaap:IncomeApproachValuationTechniqueMember2022-12-310001164727us-gaap:IncomeApproachValuationTechniqueMembernem:MeasurementInputShortTermGoldPriceMember2022-12-310001164727nem:MeasurementInputLongTermGoldPriceMemberus-gaap:IncomeApproachValuationTechniqueMember2022-12-310001164727us-gaap:MeasurementInputDiscountRateMemberus-gaap:IncomeApproachValuationTechniqueMembercountry:CA2022-12-310001164727nem:LongCanyonMemberus-gaap:OperatingSegmentsMembernem:NevadaGoldMinesMember2023-01-012023-12-310001164727us-gaap:MeasurementInputDiscountRateMemberus-gaap:IncomeApproachValuationTechniqueMember2023-12-310001164727nem:NewcrestMiningLimitedMember2021-01-012021-12-310001164727us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-01-012023-12-310001164727us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-12-310001164727us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-01-012021-12-310001164727nem:TanamiMember2023-07-012023-09-300001164727nem:AhafoMember2023-07-012023-09-300001164727us-gaap:OtherNonoperatingIncomeExpenseMembernem:TanamiMember2023-07-012023-09-300001164727nem:AhafoMemberus-gaap:OtherNonoperatingIncomeExpenseMember2023-07-012023-09-300001164727us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembernem:PyriteLeachPlantMember2023-10-012023-12-310001164727nem:MaverixMember2023-01-012023-03-310001164727us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembernem:AlumbreraMineDisposalGroupMember2022-07-012022-09-300001164727nem:MARAInvestmentMember2022-09-300001164727us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembernem:AlumbreraMineDisposalGroupMember2022-09-300001164727nem:KalgoorlieDisposalGroupMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-10-012021-12-310001164727nem:LoneTreeMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-07-012021-09-300001164727nem:SouthArturoMembernem:NevadaGoldMinesLlcNgmMember2021-09-300001164727us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembernem:TMACMember2021-01-012021-03-310001164727us-gaap:MexicanTaxAuthorityMember2022-04-012022-06-3000011647272022-04-012022-06-300001164727nem:ExpirationYear2043Membercountry:CA2023-12-310001164727country:USnem:ExpirationYear2029Membernem:ForeignTaxCreditsMember2023-12-310001164727country:USnem:ExpirationYear2029Membernem:ForeignTaxCreditsMember2022-12-310001164727nem:ExpirationYear2045Membernem:SolarTaxCreditCarryforwardMember2023-12-310001164727nem:ExpirationYear2045Membernem:SolarTaxCreditCarryforwardMember2022-12-310001164727country:CAus-gaap:InvestmentCreditMember2023-12-310001164727country:CAus-gaap:InvestmentCreditMember2022-12-310001164727nem:ExpirationYear2043Membercountry:CAus-gaap:InvestmentCreditMember2023-12-310001164727country:CAus-gaap:InvestmentCreditMembernem:ExpirationYear2042Member2023-12-310001164727us-gaap:AustralianTaxationOfficeMember2017-10-012017-12-310001164727us-gaap:PensionPlansDefinedBenefitMember2022-12-310001164727us-gaap:PensionPlansDefinedBenefitMember2021-12-310001164727us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001164727us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-12-310001164727us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001164727us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001164727us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310001164727us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310001164727us-gaap:PensionPlansDefinedBenefitMember2023-12-310001164727us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001164727us-gaap:UnfundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001164727us-gaap:UnfundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001164727us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001164727us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310001164727us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310001164727us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310001164727us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310001164727us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-12-310001164727us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-03-250001164727us-gaap:PensionPlansDefinedBenefitMember2022-03-262022-12-310001164727srt:ScenarioForecastMemberus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-31nem:calculation0001164727us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2023-12-310001164727us-gaap:PensionPlansDefinedBenefitMembernem:WorldEquityFundMember2023-12-310001164727us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001164727us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310001164727us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2023-12-310001164727us-gaap:PensionPlansDefinedBenefitMembernem:HighYieldFixedIncomeInvestmentsMember2023-12-310001164727us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310001164727us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2022-12-310001164727us-gaap:PensionPlansDefinedBenefitMembernem:WorldEquityFundMember2022-12-310001164727us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001164727us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2022-12-310001164727us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2022-12-310001164727us-gaap:PensionPlansDefinedBenefitMembernem:HighYieldFixedIncomeInvestmentsMember2022-12-310001164727us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-310001164727us-gaap:QualifiedPlanMembercountry:US2023-01-012023-12-31nem:plan0001164727country:USus-gaap:NonqualifiedPlanMember2023-01-012023-12-310001164727us-gaap:RestrictedStockUnitsRSUMember2018-01-012018-01-310001164727us-gaap:RestrictedStockUnitsRSUMember2018-02-012018-02-280001164727us-gaap:PerformanceSharesMember2023-01-012023-12-310001164727nem:GoldcorpEmployeeStockOptionsMember2019-04-182019-04-180001164727nem:NewmontEmployeeStockOptionsMember2019-04-182019-04-180001164727nem:GoldcorpEmployeeStockOptionsMember2022-12-310001164727nem:GoldcorpEmployeeStockOptionsMember2023-01-012023-12-310001164727nem:GoldcorpEmployeeStockOptionsMember2023-12-310001164727us-gaap:RestrictedStockUnitsRSUMember2022-12-310001164727us-gaap:PerformanceSharesMember2022-12-310001164727us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001164727us-gaap:RestrictedStockUnitsRSUMember2023-12-310001164727us-gaap:PerformanceSharesMember2023-12-310001164727us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001164727us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001164727us-gaap:PerformanceSharesMember2022-01-012022-12-310001164727us-gaap:PerformanceSharesMember2021-01-012021-12-310001164727nem:OtherAwardsMember2023-01-012023-12-310001164727nem:OtherAwardsMember2022-01-012022-12-310001164727nem:OtherAwardsMember2021-01-012021-12-310001164727us-gaap:FairValueMeasurementsRecurringMember2023-12-310001164727us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001164727us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001164727us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001164727nem:ProvisionalCopperAndGoldConcentrateTradeReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001164727nem:ProvisionalCopperAndGoldConcentrateTradeReceivablesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001164727nem:ProvisionalCopperAndGoldConcentrateTradeReceivablesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001164727nem:ProvisionalCopperAndGoldConcentrateTradeReceivablesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001164727us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2023-12-310001164727us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2023-12-310001164727us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2023-12-310001164727us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2023-12-310001164727us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMember2023-12-310001164727us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMember2023-12-310001164727us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMember2023-12-310001164727us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMember2023-12-310001164727us-gaap:FairValueMeasurementsRecurringMember2022-12-310001164727us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001164727us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001164727us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001164727nem:ProvisionalCopperAndGoldConcentrateTradeReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001164727nem:ProvisionalCopperAndGoldConcentrateTradeReceivablesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001164727nem:ProvisionalCopperAndGoldConcentrateTradeReceivablesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001164727nem:ProvisionalCopperAndGoldConcentrateTradeReceivablesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001164727us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2022-12-310001164727us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2022-12-310001164727us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2022-12-310001164727us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2022-12-310001164727us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMember2022-12-310001164727us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMember2022-12-310001164727us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMember2022-12-310001164727us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMember2022-12-310001164727us-gaap:OtherAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001164727us-gaap:OtherAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001164727us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001164727us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001164727us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001164727us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001164727nem:MusselwhiteMember2023-12-310001164727nem:PenasquitoMember2023-12-310001164727nem:EleonoreMember2023-12-310001164727us-gaap:FairValueInputsLevel3Member2023-12-310001164727us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Member2023-12-310001164727us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMember2023-12-310001164727nem:MonteCarloMemberus-gaap:MeasurementInputDiscountRateMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Member2023-12-310001164727nem:MonteCarloMemberus-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMember2023-12-310001164727us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Membersrt:WeightedAverageMember2023-12-310001164727us-gaap:FairValueInputsLevel3Member2022-12-310001164727nem:MonteCarloMemberus-gaap:MeasurementInputDiscountRateMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Member2022-12-310001164727nem:MonteCarloMemberus-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMember2022-12-310001164727us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Member2022-12-310001164727us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMember2022-12-310001164727us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Membersrt:WeightedAverageMember2022-12-310001164727us-gaap:DerivativeMember2021-12-310001164727us-gaap:DerivativeMember2021-12-310001164727us-gaap:DerivativeMember2022-01-012022-12-310001164727us-gaap:DerivativeMember2022-01-012022-12-310001164727us-gaap:DerivativeMember2022-12-310001164727us-gaap:DerivativeMember2022-12-310001164727us-gaap:DerivativeMember2023-01-012023-12-310001164727us-gaap:DerivativeMember2023-01-012023-12-310001164727us-gaap:DerivativeMember2023-12-310001164727us-gaap:DerivativeMember2023-12-310001164727us-gaap:OtherNonoperatingIncomeExpenseMember2023-01-012023-12-310001164727nem:IncomeLossFromDiscontinuedOperationsMember2023-01-012023-12-310001164727us-gaap:OtherNonoperatingIncomeExpenseMember2022-01-012022-12-310001164727nem:IncomeLossFromDiscontinuedOperationsMember2022-01-012022-12-310001164727nem:NonContingentConsiderationDerivativeMemberus-gaap:NondesignatedMember2023-12-310001164727nem:NonContingentConsiderationDerivativeMemberus-gaap:NondesignatedMember2022-12-310001164727us-gaap:NondesignatedMembernem:ContingentConsiderationDerivativeMember2023-12-310001164727us-gaap:NondesignatedMembernem:ContingentConsiderationDerivativeMember2022-12-310001164727nem:NonContingentConsiderationDerivativeMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001164727nem:NonContingentConsiderationDerivativeMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001164727nem:GoldAndFuelHedgeProgramsMember2023-11-012023-11-300001164727nem:LundinGoldIncMember2023-12-310001164727nem:StreamCreditFacilityAgreementMember2023-12-310001164727us-gaap:GoldMembernem:StreamCreditFacilityAgreementMember2023-12-310001164727nem:SilverMembernem:StreamCreditFacilityAgreementMember2023-12-310001164727nem:StreamCreditFacilityAgreementMembernem:June302024Member2023-12-310001164727nem:StreamCreditFacilityAgreementMembernem:June302026Member2023-12-310001164727nem:StreamCreditFacilityAgreementMemberus-gaap:NondesignatedMember2023-12-310001164727us-gaap:OtherCurrentAssetsMembernem:StreamCreditFacilityAgreementMemberus-gaap:NondesignatedMember2023-12-310001164727nem:StreamCreditFacilityAgreementMemberus-gaap:NondesignatedMemberus-gaap:OtherNoncurrentAssetsMember2023-12-310001164727us-gaap:NondesignatedMembernem:CadiaPowerPurchaseAgreementMember2023-12-310001164727us-gaap:OtherCurrentAssetsMemberus-gaap:NondesignatedMembernem:CadiaPowerPurchaseAgreementMember2023-12-310001164727us-gaap:NondesignatedMemberus-gaap:OtherNoncurrentAssetsMembernem:CadiaPowerPurchaseAgreementMember2023-12-310001164727nem:BatuHijauAndElangMember2023-12-310001164727nem:BatuHijauAndElangMember2022-12-310001164727nem:RedLakeMember2023-12-310001164727nem:RedLakeMember2022-12-310001164727nem:CerroBlancoMember2023-12-310001164727nem:CerroBlancoMember2022-12-310001164727nem:MaerixMember2023-12-310001164727nem:MaerixMember2022-12-310001164727nem:OtherCounterpartyMember2023-12-310001164727nem:OtherCounterpartyMember2022-12-310001164727nem:NorteAbiertoMember2023-12-310001164727nem:NorteAbiertoMember2022-12-310001164727nem:RedChrisMember2023-12-310001164727nem:RedChrisMember2022-12-310001164727nem:GaloreCreekMember2023-12-310001164727nem:GaloreCreekMember2022-12-310001164727us-gaap:OtherCurrentAssetsMembernem:BatuHijauAndElangMember2023-12-310001164727us-gaap:OtherNoncurrentAssetsMembernem:BatuHijauAndElangMember2023-12-3100011647272023-05-31iso4217:CADiso4217:AUD00011647272022-10-310001164727us-gaap:OtherCurrentAssetsMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001164727us-gaap:OtherCurrentAssetsMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001164727us-gaap:OtherNoncurrentAssetsMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001164727us-gaap:OtherNoncurrentAssetsMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001164727us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001164727us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001164727us-gaap:ForeignExchangeContractMember2023-01-012023-12-310001164727us-gaap:ForeignExchangeContractMember2022-01-012022-12-310001164727us-gaap:ForeignExchangeContractMember2021-01-012021-12-310001164727us-gaap:InterestRateContractMember2023-01-012023-12-310001164727us-gaap:InterestRateContractMember2022-01-012022-12-310001164727us-gaap:InterestRateContractMember2021-01-012021-12-310001164727nem:OperatingCashFlowHedgingMember2023-01-012023-12-310001164727nem:OperatingCashFlowHedgingMember2022-01-012022-12-310001164727nem:OperatingCashFlowHedgingMember2021-01-012021-12-310001164727nem:InvestmentsCurrentMember2023-12-310001164727nem:InvestmentsCurrentMember2022-12-310001164727nem:InvestmentsNoncurrentMember2023-12-310001164727nem:InvestmentsNoncurrentMember2022-12-310001164727nem:PuebloViejoMineMember2023-12-310001164727nem:PuebloViejoMineMembernem:InvestmentsNoncurrentMember2023-12-310001164727nem:PuebloViejoMineMembernem:InvestmentsNoncurrentMember2022-12-310001164727nem:NuevaUnionProjectMember2023-12-310001164727nem:NuevaUnionProjectMembernem:InvestmentsNoncurrentMember2023-12-310001164727nem:NuevaUnionProjectMembernem:InvestmentsNoncurrentMember2022-12-310001164727nem:InvestmentsNoncurrentMembernem:LundinGoldIncMember2023-12-310001164727nem:InvestmentsNoncurrentMembernem:LundinGoldIncMember2022-12-310001164727nem:NorteAbiertoProjectMembernem:InvestmentsNoncurrentMember2023-12-310001164727nem:NorteAbiertoProjectMembernem:InvestmentsNoncurrentMember2022-12-310001164727nem:MaverixMember2023-12-310001164727nem:MaverixMember2022-12-310001164727nem:MaverixMembernem:InvestmentsNoncurrentMember2023-12-310001164727nem:MaverixMembernem:InvestmentsNoncurrentMember2022-12-310001164727nem:OtherEquityMethodInvestmentMembernem:InvestmentsNoncurrentMember2023-12-310001164727nem:OtherEquityMethodInvestmentMembernem:InvestmentsNoncurrentMember2022-12-310001164727us-gaap:DebtSecuritiesMember2023-12-310001164727us-gaap:DebtSecuritiesMember2022-12-310001164727us-gaap:OtherAssetsMember2023-12-310001164727us-gaap:OtherAssetsMember2022-12-310001164727nem:PuebloViejoMineMember2023-01-012023-12-310001164727nem:PuebloViejoMineMember2022-01-012022-12-310001164727nem:PuebloViejoMineMember2021-01-012021-12-310001164727nem:PuebloViejoMineMember2009-06-012009-06-300001164727nem:PuebloViejoMineMember2012-04-012012-04-300001164727nem:PuebloViejoMineMember2012-04-300001164727nem:PuebloViejoMineMember2009-06-300001164727nem:PuebloViejoMineMember2020-11-300001164727nem:PuebloViejoMineMember2020-11-012020-11-300001164727nem:PuebloViejoMineMembernem:InvestmentTrancheOneMember2020-11-300001164727nem:InvestmentTrancheTwoMembernem:PuebloViejoMineMember2020-11-300001164727nem:PuebloViejoMineMember2022-12-310001164727nem:PuebloViejoRevolvingFacilityMember2019-09-300001164727nem:PuebloViejoRevolvingFacilityMembernem:SecuredOvernightFinancingRateSOFRMember2023-12-310001164727nem:PuebloViejoRevolvingFacilityMember2023-12-310001164727nem:PuebloViejoRevolvingFacilityMember2022-12-310001164727nem:PuebloViejoMineMemberus-gaap:RelatedPartyMember2022-12-310001164727nem:PuebloViejoMineMemberus-gaap:RelatedPartyMember2023-12-3100011647272023-11-060001164727nem:LundinGoldIncMember2023-01-012023-12-310001164727nem:LundinGoldIncMemberus-gaap:RelatedPartyMember2023-12-310001164727nem:TeckResourcesMembernem:NuevaUnionProjectMember2023-12-310001164727nem:NorteAbiertoProjectMembernem:BarrickGoldCorporationMember2023-12-310001164727nem:NorteAbiertoProjectMemberus-gaap:OtherCurrentLiabilitiesMembernem:BarrickGoldCorporationMember2023-01-012023-12-310001164727us-gaap:OtherNoncurrentLiabilitiesMembernem:NorteAbiertoProjectMembernem:BarrickGoldCorporationMember2023-01-012023-12-310001164727nem:NorteAbiertoProjectMember2023-12-012023-12-310001164727nem:NorteAbiertoProjectMember2023-12-310001164727nem:NorteAbiertoProjectMemberus-gaap:OtherCurrentLiabilitiesMember2023-12-310001164727us-gaap:OtherNoncurrentLiabilitiesMembernem:NorteAbiertoProjectMember2023-12-310001164727nem:TripleFlagMember2023-01-310001164727nem:PorcupineMember2023-01-012023-12-310001164727nem:CerroNegroMember2023-01-012023-12-310001164727nem:BrucejackMember2023-01-012023-12-310001164727nem:TelferMember2023-01-012023-12-310001164727us-gaap:PublicUtilitiesInventorySuppliesMember2023-01-012023-12-310001164727us-gaap:PublicUtilitiesInventorySuppliesMembernem:NewcrestMiningLimitedMember2023-01-012023-12-310001164727nem:StockpilesMember2023-12-310001164727nem:OreOnLeachPadsMember2023-12-310001164727nem:StockpilesMember2022-12-310001164727nem:OreOnLeachPadsMember2022-12-310001164727us-gaap:CostOfSalesMembernem:StockpilesAndOreOnLeachPadsMember2023-01-012023-12-310001164727nem:DepreciationAndAmortizationMembernem:StockpilesAndOreOnLeachPadsMember2023-01-012023-12-310001164727nem:NevadaGoldMinesMembernem:StockpilesAndOreOnLeachPadsMember2023-01-012023-12-310001164727nem:PenasquitoMembernem:StockpilesAndOreOnLeachPadsMember2023-01-012023-12-310001164727nem:StockpilesAndOreOnLeachPadsMembernem:YanacochaMember2023-01-012023-12-310001164727nem:AkyemMembernem:StockpilesAndOreOnLeachPadsMember2023-01-012023-12-310001164727nem:EleonoreMembernem:StockpilesAndOreOnLeachPadsMember2023-01-012023-12-310001164727nem:TelferMembernem:StockpilesAndOreOnLeachPadsMember2023-01-012023-12-310001164727us-gaap:CostOfSalesMembernem:StockpilesAndOreOnLeachPadsMember2022-01-012022-12-310001164727nem:DepreciationAndAmortizationMembernem:StockpilesAndOreOnLeachPadsMember2022-01-012022-12-310001164727nem:NevadaGoldMinesMembernem:StockpilesAndOreOnLeachPadsMember2022-01-012022-12-310001164727nem:StockpilesAndOreOnLeachPadsMembernem:YanacochaMember2022-01-012022-12-310001164727nem:CrippleCreekAndVictorMineMembernem:StockpilesAndOreOnLeachPadsMember2022-01-012022-12-310001164727nem:AkyemMembernem:StockpilesAndOreOnLeachPadsMember2022-01-012022-12-310001164727nem:AhafoMembernem:StockpilesAndOreOnLeachPadsMember2022-01-012022-12-310001164727nem:MerianMineMembernem:StockpilesAndOreOnLeachPadsMember2022-01-012022-12-310001164727us-gaap:CostOfSalesMembernem:StockpilesAndOreOnLeachPadsMember2021-01-012021-12-310001164727nem:DepreciationAndAmortizationMembernem:StockpilesAndOreOnLeachPadsMember2021-01-012021-12-310001164727nem:StockpilesAndOreOnLeachPadsMembernem:YanacochaMember2021-01-012021-12-310001164727nem:CrippleCreekAndVictorMineMembernem:StockpilesAndOreOnLeachPadsMember2021-01-012021-12-310001164727nem:NevadaGoldMinesMembernem:StockpilesAndOreOnLeachPadsMember2021-01-012021-12-310001164727us-gaap:LandMember2023-12-310001164727us-gaap:LandMember2022-12-310001164727srt:MinimumMembernem:FacilitiesAndEquipmentMember2023-12-310001164727nem:FacilitiesAndEquipmentMembersrt:MaximumMember2023-12-310001164727nem:FacilitiesAndEquipmentMember2023-12-310001164727nem:FacilitiesAndEquipmentMember2022-12-310001164727us-gaap:MineDevelopmentMembersrt:MinimumMember2023-12-310001164727us-gaap:MineDevelopmentMembersrt:MaximumMember2023-12-310001164727us-gaap:MineDevelopmentMember2023-12-310001164727us-gaap:MineDevelopmentMember2022-12-310001164727srt:MinimumMemberus-gaap:MiningPropertiesAndMineralRightsMember2023-12-310001164727us-gaap:MiningPropertiesAndMineralRightsMembersrt:MaximumMember2023-12-310001164727us-gaap:MiningPropertiesAndMineralRightsMember2023-12-310001164727us-gaap:MiningPropertiesAndMineralRightsMember2022-12-310001164727us-gaap:ConstructionInProgressMember2023-12-310001164727us-gaap:ConstructionInProgressMember2022-12-310001164727nem:ProductionStageMember2023-12-310001164727nem:ProductionStageMember2022-12-310001164727nem:DevelopmentStageMember2023-12-310001164727nem:DevelopmentStageMember2022-12-310001164727nem:ExplorationStageMember2023-12-310001164727nem:ExplorationStageMember2022-12-310001164727us-gaap:OperatingSegmentsMembernem:RedChrisMember2022-12-310001164727nem:BrucejackMemberus-gaap:OperatingSegmentsMember2022-12-310001164727nem:CadiaMemberus-gaap:OperatingSegmentsMember2022-12-310001164727nem:TelferMemberus-gaap:OperatingSegmentsMember2022-12-310001164727us-gaap:OperatingSegmentsMembernem:LihirMember2022-12-310001164727nem:MusselwhiteMember2021-12-310001164727nem:MusselwhiteMember2022-01-012022-12-310001164727nem:MusselwhiteMember2022-12-310001164727nem:PorcupineMember2021-12-310001164727nem:PorcupineMember2022-01-012022-12-310001164727nem:PorcupineMember2022-12-310001164727nem:PorcupineMember2023-12-310001164727nem:EleonoreMember2021-12-310001164727nem:EleonoreMember2022-01-012022-12-310001164727nem:EleonoreMember2022-12-310001164727nem:RedChrisMember2021-12-310001164727nem:RedChrisMember2022-01-012022-12-310001164727nem:RedChrisMember2022-12-310001164727nem:RedChrisMember2023-01-012023-12-310001164727nem:RedChrisMember2023-12-310001164727nem:BrucejackMember2021-12-310001164727nem:BrucejackMember2022-01-012022-12-310001164727nem:BrucejackMember2022-12-310001164727nem:BrucejackMember2023-12-310001164727nem:PenasquitoMember2021-12-310001164727nem:PenasquitoMember2022-01-012022-12-310001164727nem:PenasquitoMember2022-12-310001164727nem:CerroNegroMember2021-12-310001164727nem:CerroNegroMember2022-01-012022-12-310001164727nem:CerroNegroMember2022-12-310001164727nem:CerroNegroMember2023-12-310001164727nem:CadiaMember2021-12-310001164727nem:CadiaMember2022-01-012022-12-310001164727nem:CadiaMember2022-12-310001164727nem:CadiaMember2023-01-012023-12-310001164727nem:CadiaMember2023-12-310001164727nem:LihirMember2021-12-310001164727nem:LihirMember2022-01-012022-12-310001164727nem:LihirMember2022-12-310001164727nem:LihirMember2023-01-012023-12-310001164727nem:LihirMember2023-12-310001164727nem:NevadaGoldMinesMember2021-12-310001164727nem:NevadaGoldMinesMember2022-01-012022-12-310001164727nem:NevadaGoldMinesMember2022-12-310001164727nem:NevadaGoldMinesMember2023-01-012023-12-310001164727nem:NevadaGoldMinesMember2023-12-310001164727srt:RestatementAdjustmentMember2023-12-310001164727nem:BilateralBankDebtFacilitiesMember2023-12-310001164727nem:BilateralBankDebtFacilitiesMember2022-12-310001164727nem:October2029SeniorNotesMember2019-09-300001164727nem:October2029SeniorNotesMember2023-12-310001164727nem:October2029SeniorNotesMember2022-12-310001164727nem:May2030SeniorNotesMember2023-12-260001164727nem:May2030SeniorNotesMember2023-12-310001164727nem:May2030SeniorNotesMember2022-12-310001164727nem:October2030SeniorNotesMember2020-03-310001164727nem:October2030SeniorNotesMember2023-12-310001164727nem:October2030SeniorNotesMember2022-12-310001164727nem:July2032SeniorNotesMember2021-12-310001164727nem:July2032SeniorNotesMember2023-12-310001164727nem:July2032SeniorNotesMember2022-12-310001164727nem:April2035SeniorNotesMember2005-03-310001164727nem:April2035SeniorNotesMember2023-12-310001164727nem:April2035SeniorNotesMember2022-12-310001164727nem:October2039SeniorNotesMember2009-09-300001164727nem:October2039SeniorNotesMember2023-12-310001164727nem:October2039SeniorNotesMember2022-12-310001164727nem:November2041SeniorNotesMember2023-12-260001164727nem:November2041SeniorNotesMember2023-12-310001164727nem:November2041SeniorNotesMember2022-12-310001164727nem:March2042SeniorNotesMember2012-03-310001164727nem:March2042SeniorNotesMember2023-12-310001164727nem:March2042SeniorNotesMember2022-12-310001164727nem:June2044SeniorNotesMember2020-01-010001164727nem:June2044SeniorNotesMember2023-12-310001164727nem:June2044SeniorNotesMember2022-12-310001164727nem:May2050SeniorNotesMember2020-01-010001164727nem:May2050SeniorNotesMember2023-12-310001164727nem:May2050SeniorNotesMember2022-12-31nem:bank0001164727nem:BilateralBankFacilityDueFebruary2024Member2023-12-310001164727nem:BilateralBankFacilityDueMarch2024Member2023-12-310001164727nem:BilateralBankFacilityDueMarch2026Member2023-12-310001164727nem:CorporateRevolvingCreditFacilityMember2019-04-040001164727us-gaap:SubsequentEventMembernem:CorporateRevolvingCreditFacilityMember2024-02-150001164727us-gaap:SubsequentEventMembernem:BilateralBankDebtFacilitiesMember2024-02-212024-02-210001164727nem:CorporateRevolvingCreditFacilityMember2023-12-310001164727nem:CorporateRevolvingCreditFacilityMemberus-gaap:LetterOfCreditMember2023-12-310001164727nem:CorporateRevolvingCreditFacilityMemberus-gaap:LetterOfCreditMember2022-12-310001164727nem:GoldcorpMember2023-12-310001164727nem:GoldcorpMember2022-12-310001164727nem:SeniorNotesNetOfDiscount2022Member2021-12-310001164727nem:SeniorNotesNetOfDiscount2022Member2021-12-012021-12-310001164727nem:A2023NewNewmontSeniorNotesMember2021-12-310001164727nem:A2023GoldcorpSeniorNotesMember2021-12-310001164727nem:A2023NewNewmontSeniorNotesMember2022-01-310001164727nem:A2023NewNewmontSeniorNotesMember2022-01-012022-01-310001164727nem:A2023GoldcorpSeniorNotesMember2022-01-310001164727nem:A2023GoldcorpSeniorNotesMember2022-01-012022-01-310001164727nem:October2030SeniorNotesMemberus-gaap:SeniorNotesMember2020-03-012020-03-310001164727nem:May2030November2041AndMay2050SeniorNotesMember2023-12-260001164727nem:May2030SeniorNotesExcludingNewcrestNotesMember2023-12-260001164727nem:May2030NewcrestSeniorNotesMember2023-11-060001164727nem:November2041SeniorNotesExcludingNewcrestNotesMember2023-12-260001164727nem:November2041NewcrestSeniorNotesMember2023-11-060001164727nem:May2050SeniorNotesExcludingNewcrestNotesMember2023-12-260001164727nem:May2050NewcrestSeniorNotesMember2023-11-060001164727nem:July2032SeniorNotesMember2021-12-012021-12-310001164727nem:NevadaGoldMinesMember2023-12-310001164727nem:NevadaGoldMinesMember2022-12-310001164727nem:NevadaGoldMinesMembernem:BarrickGoldCorporationMember2022-12-310001164727nem:NevadaGoldMinesMembernem:BarrickGoldCorporationMember2023-12-310001164727us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001164727us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001164727us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001164727us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001164727us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-12-310001164727us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001164727us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001164727us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001164727us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001164727us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001164727us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001164727us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001164727us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-12-310001164727us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001164727us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001164727us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310001164727us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310001164727us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001164727us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001164727us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310001164727nem:AccumulatedDefinedBenefitPlansAdjustmentNetSettlementAttributableToParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001164727nem:AccumulatedDefinedBenefitPlansAdjustmentNetSettlementAttributableToParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001164727nem:AccumulatedDefinedBenefitPlansAdjustmentNetSettlementAttributableToParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001164727us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001164727us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001164727us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMembernem:ForeignCurrencyExchangeAndDieselFixedForwardContractsMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMembernem:ForeignCurrencyExchangeAndDieselFixedForwardContractsMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMembernem:ForeignCurrencyExchangeAndDieselFixedForwardContractsMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001164727us-gaap:CashFlowHedgingMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310001164727us-gaap:CashFlowHedgingMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001164727us-gaap:CashFlowHedgingMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001164727us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001164727nem:CrippleCreekAndVictorMineMember2023-12-310001164727nem:CrippleCreekAndVictorMineMember2022-12-310001164727nem:DawnMiningCompanyMember2023-12-310001164727nem:MidniteMineAndDawnMillSitesMember2023-12-310001164727nem:GoldcorpMember2023-12-310001164727nem:PorcupineMember2023-01-012023-12-310001164727nem:CadiaMember2023-12-310001164727nem:NewmontGhanaGoldLimitedAndNewmontGoldenRidgeLimitedMember2023-12-310001164727nem:HoltOptionMemberus-gaap:UseRightsMember2020-08-012020-08-310001164727nem:KirklandRoyaltyMatterMemberus-gaap:PendingLitigationMember2021-08-162021-08-160001164727nem:NewWestGoldCorporationMembernem:NWGInvestmentsIncMember2007-09-300001164727us-gaap:MajorityShareholderMembernem:NWGInvestmentsIncMember2007-09-300001164727nem:FronteerGoldIncMembernem:AuroraEnergyResourcesIncMember2007-09-300001164727stpr:CA-NLus-gaap:PendingLitigationMember2008-04-082008-04-080001164727nem:NwgSummonsAndComplaintNewYorkCaseMemberus-gaap:PendingLitigationMember2012-09-242012-09-240001164727nem:NwgLawsuitOntarioSuperiorCourtOfJusticeMemberus-gaap:PendingLitigationMember2014-02-262014-02-260001164727us-gaap:SubsequentEventMembernem:NwgLawsuitOntarioSuperiorCourtOfJusticeMember2024-01-092024-01-090001164727nem:GhanaParliamentCasesMember2018-12-242018-12-24nem:plaintiffnem:co-defendant0001164727nem:GaloreCreekMember2023-12-3100011647272023-10-012023-12-310001164727nem:MarkEbelMember2023-01-012023-12-310001164727nem:MarkEbelMember2023-10-012023-12-310001164727nem:MarkEbelMember2023-12-310001164727nem:TomPalmerMember2023-01-012023-12-310001164727nem:TomPalmerMember2023-10-012023-12-310001164727nem:TomPalmerMember2023-12-310001164727us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001164727us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001164727us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001164727us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001164727us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001164727us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310001164727us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-31