1 EARNINGS CALL THIRD QUARTER 2023 David Burritt President and Chief Executive Officer Jessica Graziano SVP and Chief Financial Officer Rich Fruehauf SVP, Chief Strategy and Sustainability Officer Kevin Lewis VP, Finance

2 FORWARD-LOOKING STATEMENTS These slides are being provided to assist readers in understanding the results of operations, financial condition and cash flows of United States Steel Corporation as of and for the third quarter 2023. Financial results as of and for the periods ended September 30, 2023 provided herein are preliminary unaudited results based on current information available to management. They should be read in conjunction with the consolidated financial statements and Notes to the Consolidated Financial Statements contained in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. This presentation contains information that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,” "may" and similar expressions or by using future dates in connection with any discussion of, among other things, the construction or operation of new or existing facilities or operating capabilities, the timing, size and form of share repurchase transactions, operating or financial performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume changes, share of sales and earnings per share changes, anticipated cost savings, potential capital and operational cash improvements, changes in the global economic environment, including supply and demand conditions, inflation, interest rates, supply chain disruptions and changes in prices for our products, international trade duties and other aspects of international trade policy, statements regarding our future strategies, products and innovations, statements regarding our greenhouse gas emissions reduction goals, statements regarding existing or new regulations and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements include all statements that are not historical facts, but instead represent only the Company’s beliefs regarding goals, plans and expectations about our prospects for the future and other future events, many of which, by their nature, are inherently uncertain, qualified by important factors and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, whether the objectives of the Company’s previously announced strategic alternatives review process will be achieved; the terms, structure, timing, benefits and costs of any strategic transaction; and whether any such transaction will be consummated at all; the risk that the strategic alternatives review process and its announcement could have an adverse effect on the ability of the Company to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, shareholders and other business relationships and on its operating results and business generally; the risk that the strategic alternatives review process could divert the attention and time of the Company’s management, the risk of any unexpected costs or expenses resulting from the strategic alternatives review process; the risk of any litigation relating to the strategic alternatives review process; and the risks and uncertainties described in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and those described from time to time in our future reports filed with the Securities and Exchange Commission. References to (i) "U. S. Steel," "the Company," "we," "us," and "our" refer to United States Steel Corporation and its consolidated subsidiaries unless otherwise indicated by the context and (ii) “Big River Steel” refer to Big River Steel Holdings LLC and its direct and indirect subsidiaries unless otherwise indicated by the context.

3 EXPLANATION OF USE OF NON-GAAP MEASURES We present adjusted net earnings, earnings before interest, income taxes, depreciation and amortization (EBITDA), adjusted EBITDA and adjusted EBITDA margin, which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance. We believe that EBITDA, considered along with net earnings, is a relevant indicator of trends relating to our operating performance and provides management and investors with additional information for comparison of our operating results to the operating results of other companies. Adjusted net earnings is a non-GAAP measure that exclude the effects of items that include: debt extinguishment, asset impairment charges, restructuring and other charges, stock-based compensation expense, VEBA asset surplus adjustment, gains on assets sold and previously held investments, pension de-risking, United Steelworkers labor agreement signing bonus and related costs, environmental remediation charges, the Company's previously announced strategic alternatives review process, Granite City idling costs, other charges, net and tax impact of adjusted items (Adjustment Items). Adjusted EBITDA and adjusted EBITDA margin are also non-GAAP measures that exclude the effects of certain Adjustment Items. We present adjusted net earnings, adjusted EBITDA and adjusted EBITDA margin to enhance the understanding of our ongoing operating performance and established trends affecting our core operations by excluding the effects of events that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings, adjusted EBITDA and adjusted EBITDA margin as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings, adjusted EBITDA and adjusted EBITDA margin useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings, adjusted EBITDA and adjusted EBITDA margin provides insight into management’s view and assessment of the Company’s ongoing operating performance because management does not consider the Adjustment Items when evaluating the Company’s financial performance. Adjusted net earnings, adjusted EBITDA and adjusted EBITDA margin should not be considered a substitute for net earnings or other financial measures as computed in accordance with U.S. GAAP and is not necessarily comparable to similarly titled measures used by other companies. We also present free cash flow, a non-GAAP measure of cash generated from operations after any investing activity and investable free cash flow, a non-GAAP measure of cash generated from operations after any investing activity adjusted for strategic capital expenditures. We believe that free cash flow and investable free cash flow provides further insight into the Company's overall utilization of cash. We also present net debt, a non-GAAP measure calculated as total debt less cash and cash equivalents. We believe net debt is a useful measure in calculating enterprise value. A condensed consolidated statement of operations (unaudited), condensed consolidated cash flow statement (unaudited), condensed consolidated balance sheet (unaudited) and preliminary supplemental statistics (unaudited) for U. S. Steel are attached.

4 ADVANCING TOWARDS OUR BEST FOR ALL® FUTURE Current Landscape Enthusiasm for maximizing stockholder value Challenges Harnessing mega trends Solution Leverage our unique competitive advantages to capture mega trends in: • Deglobalization • Decarbonization • Digitization Path Forward Unlock stockholder value

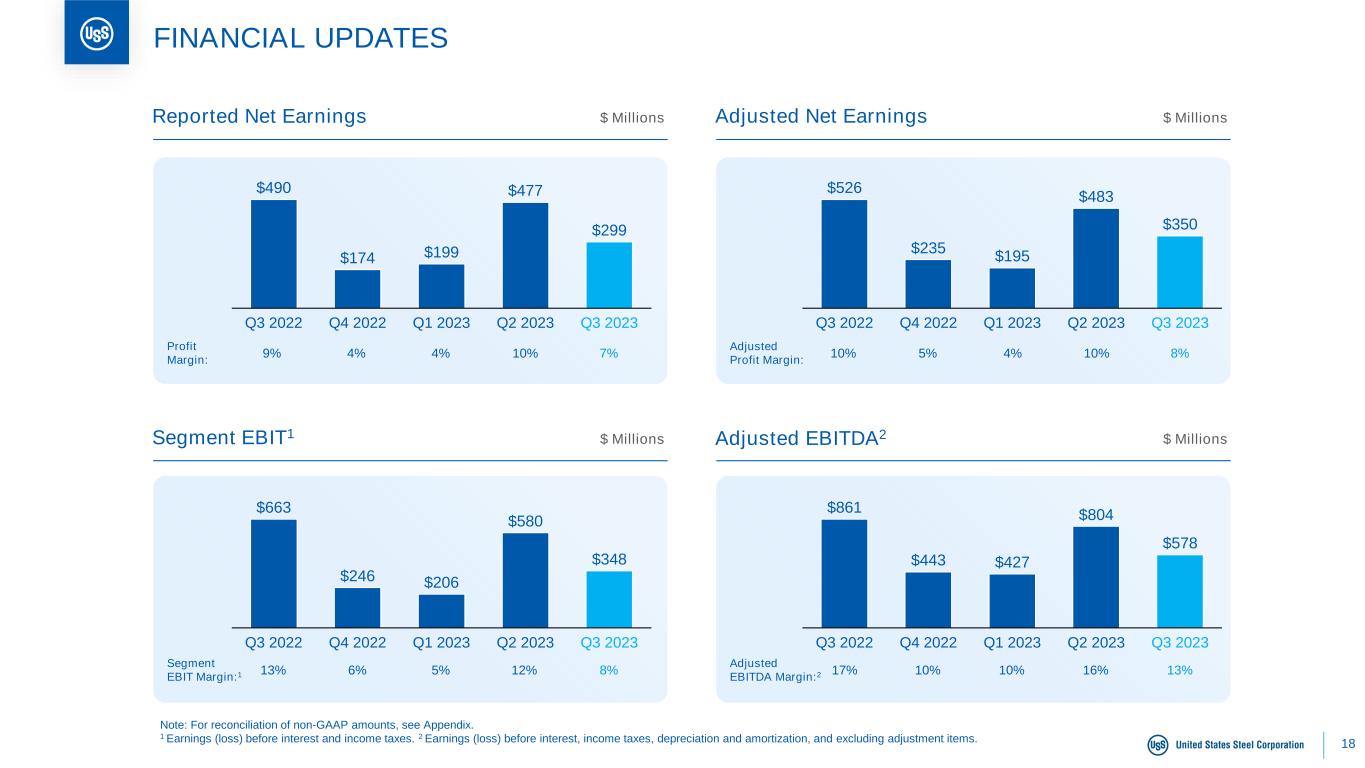

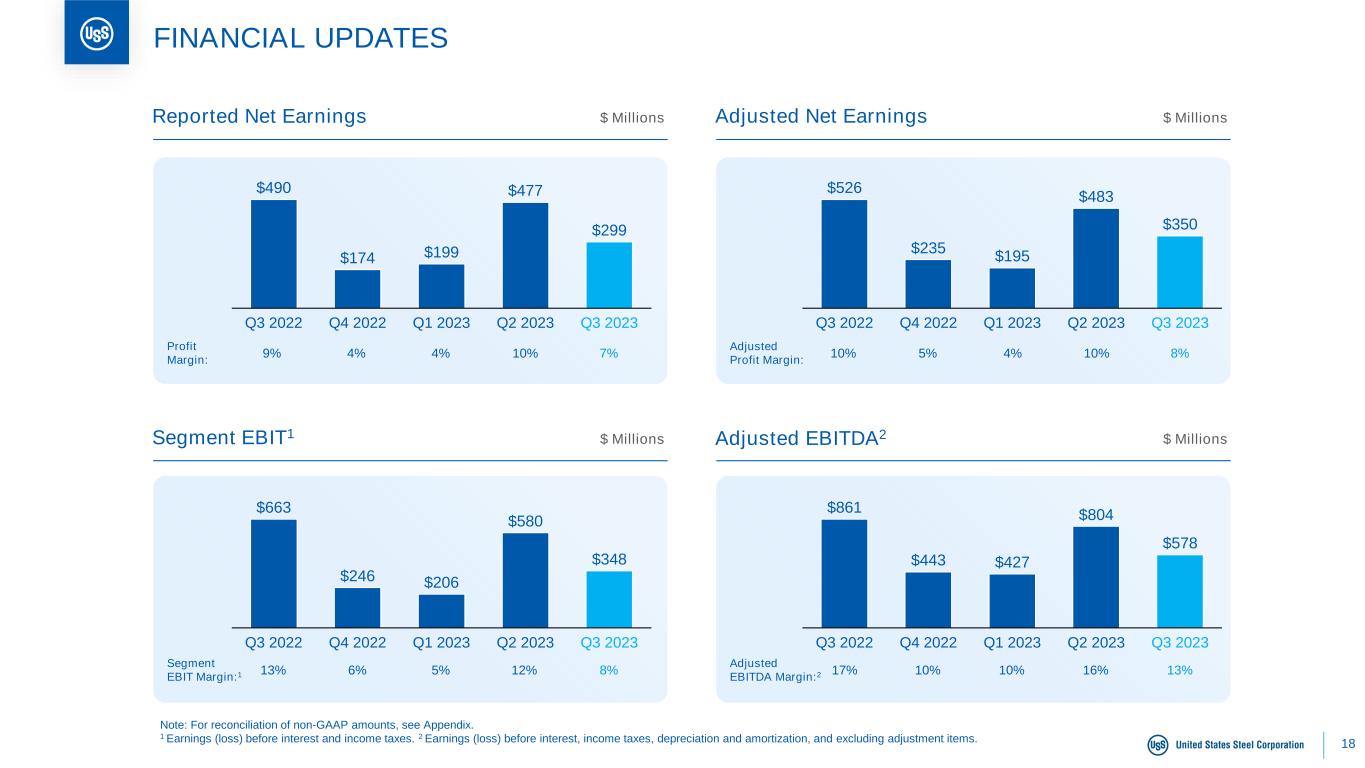

5 Q3 2023 FINANCIAL PERFORMANCE $578M Adjusted EBITDA Performance ~13% EBITDA margin Strong third quarter performance $299M Reported Net Earnings $1.20 per diluted share Note: For reconciliation of non-GAAP amounts, see Appendix. $232M Free Cash Flow $655M excluding strategic capex of $423M (provided for illustrative purposes) $350M Adjusted Net Earnings $1.40 per diluted share $5.5B Liquidity Including $3.2B cash

6 SAFELY DELIVERING STRONG PERFORMANCE ACROSS EACH SEGMENT Flat-Rolled Mini Mill USSE Tubular

7 STRATEGY EXECUTION LARGELY DE-RISKED Phase 1 Phase 2 Phase 3 Phase 4 Phase 5 3 5 DR PELLET STATUS 92% of spend committed 70% of execution completed BR2 STATUS 92% of spend committed 62% of execution completed CGL21 STATUS 89% of spend committed 50% of execution completed NGO COMPLETE 100% of spend committed 100% of execution completed GARY PIG COMPLETE 100% of spend committed 100% of execution completed 321 4 5 1 2 4 48% capex remaining33% capex remaining31% capex remaining 8% capex remaining2 0% capex remaining Note: “Capex remaining” is based on cash flows instead of liabilities. 1 CGL2 = Continuous galvanizing line. Also referred to as the dual coating line. 2 Timing of cash outlay.

8 PROGRESS UPDATE: BIG RIVER 2 Aerial View Big River 2 Endless Strip Production roughing & finishing mill PLTCM1 entry section 1 PLTCM = Pickle Line Tandem Cold Mill

9 APPROACHING CONSIDERABLE VALUE UNLOCK ~70% Completed Capex ~30% Remaining Capex Strategic Capital Expenditures (Capex) Progressing As-Expected % of strategic capex complete for in-flight projects Capital Expenditures by Year Manageable capex expected in future years ~$800M 2023E ~$1,800M ~$700M 2024E ~$800M ~$2,600M Expected Future State ~$1,500M ~$600 - $700M StrategicSustaining Significant free cash flow expected as strategic capex rolls off

10 EXPECTED 2024 EBITDA AT-A-GLANCE ~$0.2B Strategic Investments1 2023E All Other ~$0.1B Fixed Cost Reductions (~$0.3B) 2024E ~$2B ~$2B 1 Strategic project EBITDA contribution assumes a historical, through-cycle $616/nt HRC price environment. ✓ 2024 strategic project EBITDA contribution ✓ Run-rate contribution from Gary pig iron ✓ Partial contribution from Mini Mill projects ✓ Primarily in the N. American Flat- rolled segment ✓ Assumes lower ’24 steel prices in N. America and Europe ✓ Partially offset by lower raw material costs, including coal ✓ FX impact (EUR/USD) Additional details on the following slide

11 PROJECTING ~$155-$210M INCREMENTAL EBITDA IN ‘24 FROM STRATEGIC PROJECTS NGO Electrical Steel Dual Coating Line Gary Works Pig Iron Machine Big River 2 ✓ Monthly run-rate production already achieved ✓ Annual run-rate production = 500k tons ✓ ~100k tons; 50% of production expected in ‘24 ✓ ~$1,000/nt premium over HRC1 ✓ ~50 - 75k tons; ~15 - 23% of run-rate production, expected in ‘24 ✓ ~$400/nt premium over HRC1 ✓ ~750 – 900k tons; ~25 - 30% of run-rate production, expected in ‘24 ✓ ~$170/nt premium over HRC1 $20M $30M $30M $30M ’26E’23E ’24E ’25E +$10M $60M $120M $140M ’23E ’25E’24E ’26E $0M +$60M run-rate run-rate $55M $60M ’23E ’24E ’25E ’26E $0M $10 - $15M +$13M run-rate $625M $650M ’23E ’24E ’25E ’26E $0M $75 - $125M +$100M run-rate EBITDA Contribution EBITDA Contribution EBITDA Contribution EBITDA Contribution Note: Strategic project EBITDA contribution assumes a historical, through-cycle $616/nt HRC price environment. 1 Assumes run-rate EBITDA contribution and product mix in 2026.

12 NORTH AMERICAN FLAT-ROLLED MINI MILL U. S. STEEL EUROPE TUBULAR Segment EBITDA in billions Segment EBITDA in billions Segment EBITDA in billions Segment EBITDA in billions $0.1 $0.4 $0.7 $1.3 $0.7 ($0.1) $3.2 $2.5 $1.0 ’16’15 ’22’21’17 ’19 ’20’18 ’23E ’24E ~$1.0 Well-capitalized assets; beneficiary of asset revitalization program in ‘17-’20 Delivering world- class safety and reliability On-track for $1.3B EBITDA by ’26 after strategic investments ’22 / ‘23 impacted by raw material disruption from the Ukraine conflict Resilient performance through the cycle Insourced rounds production; EAF steelmaking Strategically located near customers in central EU STRUCTURALLY IMPROVED SEGMENT PERFORMANCE … ’15 – ’19 Avg: ~$0.6B or ~$60/nt $1.4 $0.6 $0.3 ’20 ’24E’19’18’15 ’22’16 ’17 ’21 ’23E ~$0.6 Mini Mill segment initiated in 2021 with the full acquisition of Big River Steel $0.2 $0.3 $0.4 $0.4 $0.0 $0.1 $1.1 $0.5 $0.1 $0.1 ’15 ’19’16 ’17 ’22’18 ’20 ’21 ’23E ’24E ($0.1) ($0.2) $0.0 $0.0 $0.0 ($0.1) $0.0 $0.6 $0.6 $0.3 ’17’15 ’16 ’22’21’18 ’19 ’20 ’23E ’24E Expanded proprietary connections for drillers 2024E: ~$120/nt 2024E: ~$190/nt1 2024E: ~$25/nt 2024E: ~$600/nt ’15 – ’19 Avg: $0.3B or ~$60/nt ’15 – ’19 Avg: ~(0.1B) or ~($180/nt) Note: For reconciliation of non-GAAP amounts, see Appendix. 2015 – 2019 average hot rolled coil (HRC) = $606/nt. 2024E HRC assumption = $750/nt. “Per ton” statistics excludes intersegment shipments. 1 Mini Mill segment EBITDA per ton based on third-party shipments only.

13 … DELIVERING STRONG FREE CASH FLOW Strategic projects ramping up … Creating incremental EBITDA FREE CASH FLOW ($0.2) $0.4 $0.4 $0.0 ($1.3) ($0.4) $3.3 $1.8 $1.8 $1.2 ($0.8) $0.8 ’15 ’16 $0.1 ’19’18’17 ’20 ’21 $0.2 ’22 ’23E ’24E $3.5 $3.0 $1.0 $0.9 ’15 – ’19 Average FCF: ($0.1B) ’21 – ’24E Average Investable FCF: $2.1B ’21 – ’24E Average FCF: $1.1B Strategic Capex Free Cash Flow Completed strategic capex … Providing opportunity to increase direct returns Better capital intensity … $15/ton mini mill sustaining capex (vs. ~$30/nt for legacy assets) Note: For reconciliation of non-GAAP amounts, see Appendix. 2015 – 2019 HRC = $606/nt. 2024 assumption: HRC = $750/nt; assumes no change in working capital in 2024 vs. 2023. ---- Best for All® investment cycle ----

14 BALANCED CAPITAL ALLOCATION FRAMEWORK Safe, efficient and well- capitalized asset base Completed strategic projects1 Cash from Operations Strong balance sheet Advance strategic projects Maintain $0.05/sh dividend Excess Cash Transformed balance sheet Elevated cash balances to fund strategic investments; extended debt maturity profile (80% of debt due beyond ’29); generating significant cash from operations De-risked project execution Beyond peak investment cycle; delivering EBITDA benefits today; positive free cash flow expected in 2024 Increased optionality Approaching significant strategic value unlock; assessing options for excess cash, when appropriate Continuing to assess 1 Gary pig iron project completed in Q4 2022. Big River Steel non-grain oriented (NGO) electrical steel line completed in Q3 2023. Increase the dividend Buy back stock

15 Q&A

16 2023 T H I R D Q U A R T E R U P D A T E U. S. Steel and DuPont™ Launched COASTALUME™ Product, North America’s First GALVALUME® Solution Engineered and Warrantied for Coastal Environments

17 IMPROVING ON RECORD SAFETY PERFORMANCE 0.07 0.06 0.05 0.03 2020 2021 2022 YTD 2023 OSHA Days Away from Work 2 BLS - Iron & Steel: 0.90 Benchmark 1 : Multiple years of record-setting performance 1 Bureau of Labor Statistics – Iron & Steel 2021 data. 2 Occupational Safety and Health Administration (OSHA) Days Away from Work is defined as number of days away cases x 200,000 / hours worked. YTD as of October 26, 2023.

18 FINANCIAL UPDATES Reported Net Earnings Adjusted Net Earnings Segment EBIT1 Adjusted EBITDA2 Profit Margin: 9% 4% 4% 10% 7% $ Millions $ Millions $ Millions $ Millions 10% 5% 4% 10% 8% 13% 6% 5% 12% 8% Adjusted EBITDA Margin:2 17% 10% 10% 16% 13% Segment EBIT Margin:1 Note: For reconciliation of non-GAAP amounts, see Appendix. 1 Earnings (loss) before interest and income taxes. 2 Earnings (loss) before interest, income taxes, depreciation and amortization, and excluding adjustment items. Adjusted Profit Margin: $490 $174 $199 $477 $299 Q2 2023Q3 2022 Q4 2022 Q1 2023 Q3 2023 $526 $235 $195 $483 $350 Q3 2023Q3 2022 Q4 2022 Q1 2023 Q2 2023 $663 $246 $206 $580 $348 Q3 2022 Q1 2023Q4 2022 Q3 2023Q2 2023 $861 $443 $427 $804 $578 Q4 2022 Q1 2023Q3 2022 Q2 2023 Q3 2023

19 KEY OPERATING STATISTICS TRENDS BY SEGMENT Flat-Rolled Operating Statistics Mini Mill Operating Statistics U. S. Steel Europe (USSE) Operating Statistics Tubular Operating Statistics Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price $ / net ton Q3 2022 2,265 2,176 $1,232 Q4 2022 1,952 1,885 $1,086 Q1 2023 2,393 2,278 $1,012 Q2 2023 2,529 2,235 $1,088 Q3 2023 2,390 2,159 $1,036 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price $ / net ton Q3 2022 616 529 $1,096 Q4 2022 683 636 $786 Q1 2023 759 659 $794 Q2 2023 749 587 $1,011 Q3 2023 693 561 $901 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price $ / net ton Q3 2022 946 867 $1,021 Q4 2022 589 715 $957 Q1 2023 1,092 883 $909 Q2 2023 1,213 1,034 $965 Q3 2023 990 958 $852 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price $ / net ton Q3 2022 173 126 $3,217 Q4 2022 137 133 $3,616 Q1 2023 171 131 $3,757 Q2 2023 129 111 $3,493 Q3 2023 111 104 $2,927

20 EBITDA TRENDS BY SEGMENT EBITDA Margin: 19% 11% 5% 12% 13% 6% (5%) 8% 22% 13% (1%) (7%) (1%) 9% 1% EBITDA Margin: 39% 44% 48% 42% 32% EBITDA Margin: Note: For reconciliation of non-GAAP amounts, see Appendix. 1 Q3 2023 Mini Mill segment EBITDA includes the impact of $17 million in construction and related start-up costs. EBITDA Margin: $644 $296 $140 $377 $378 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $40 ($28) $52 $173 $84 Q3 2022 Q1 2023Q4 2022 Q3 20231Q2 2023 ($12) ($48) ($12) $97 $10 Q3 2023Q2 2023Q3 2022 Q4 2022 Q1 2023 $167 $217 $244 $169 $99 Q2 2023Q3 2022 Q3 2023Q4 2022 Q1 2023 Flat-Rolled Segment EBITDA Mini Mill Segment EBITDA$ Millions $ Millions USSE Segment EBITDA Tubular Segment EBITDA$ Millions $ Millions

21 $ Millions, Q2 2023 vs. Q3 2023 FLAT-ROLLED SEGMENT EBITDA CHANGE ANALYSIS Commercial The unfavorable impact is primarily the result of lower average realized prices. Raw Materials The favorable impact is primarily the result of LIFO impacts and lower alloy costs partially offset by higher coal costs. Operating Costs The favorable impact is primarily the result of lower mining related costs, partially offset by increased costs for purchased products and services and higher labor costs. $644 $378 $77 $44 $48 OtherQ3 2022 ($435) Commercial Raw Materials Operating Costs Q3 2023 Other The favorable impact is primarily the result of lower variable compensation and lower energy costs partially offset by reduced joint venture income. Commercial The unfavorable impact is primarily the result of lower average realized prices and lower volumes. Raw Materials The favorable impact is primarily the result of LIFO impacts, lower outside purchased scrap costs and lower alloy costs. Operating Costs The change is not material. Other The favorable impact is primarily the result of derivative impacts. $ Millions, Q3 2022 vs. Q3 2023 $377 $378 $87 $57 Other ($139) Q2 2023 Commercial Raw Materials ($4) Q3 2023Operating Costs

22 $ Millions, Q2 2023 vs. Q3 2023 MINI MILL SEGMENT EBITDA CHANGE ANALYSIS Commercial The unfavorable impact is primarily the result of lower average realized prices partially offset by higher volumes. Raw Materials The favorable impact is primarily the result of lower metallics costs. Operating Costs The change is not material. $40 $84 $89 Q3 2022 $0 Commercial ($39) ($6) Raw Materials Operating Costs Other Q3 20231 Other The unfavorable impact is primarily the result of startup costs related to strategic projects. Commercial The unfavorable impact is primarily the result of lower average realized prices. Raw Materials The favorable impact is primarily the result of lower metallics costs. Operating Costs The change is not material. Other The change is not material. $ Millions, Q3 2022 vs. Q3 2023 $173 $84 $25 Q2 2023 ($112) Commercial Raw Materials ($2)$0 Operating Costs Other Q3 20231 1 Q3 2023 Mini Mill segment EBITDA includes the impact of $17 million in construction and related start-up costs.

23 $97 $10 $21 Q2 2023 $31 ($116) Commercial Operating Costs Raw Materials ($23) Other Q3 2023 $ Millions, Q2 2023 vs. Q3 2023 U. S. STEEL EUROPE SEGMENT EBITDA CHANGE ANALYSIS Commercial The unfavorable impact is primarily the result of lower average realized prices. Raw Materials The favorable impact is primarily the result of lower iron ore and coal costs. Operating Costs The change is not material. ($12) ($208) CommercialQ3 2022 $171 ($1) Raw Materials Operating Costs $60 Other $10 Q3 2023 Other The favorable impact is primarily the result of the strengthening of the Euro vs. the U.S. dollar and lower energy costs. Commercial The unfavorable impact is primarily the result of lower average realized prices. Raw Materials The favorable impact is primarily the result of lower coal cost, CO2 accruals and iron ore costs. Operating Costs The unfavorable impact is primarily the result of increased spending for planned maintenance outages. Other The favorable impact is primarily the result of lower energy costs and labor cost accruals. $ Millions, Q3 2022 vs. Q3 2023

24 $ Millions, Q2 2023 vs. Q3 2023 TUBULAR SEGMENT EBITDA CHANGE ANALYSIS Commercial The unfavorable impact is primarily the result of lower shipment volumes and lower average realized prices. Raw Materials The change is not material. Operating Costs The change is not material. $167 $99 $22 Commercial ($93) OtherQ3 2022 $2 Raw Materials $1 Operating Costs Q3 2023 Other The favorable impact is primarily the result of lower variable compensation. Commercial The unfavorable impact is primarily the result of lower average realized prices and shipment volumes. Raw Materials The change is not material. Operating Costs The change is not material. Other The favorable impact is primarily the result of lower variable compensation. $ Millions, Q3 2022 vs. Q3 2023 $169 $99 Q2 2023 OtherRaw Materials ($79) $1 Commercial $1 Operating Costs $7 Q3 2023

25 Minntac M I N I M I L L T U B U L A R Clairton Keetac BF #4 BF #6 BF #8 BF #14 BF ‘A’ BF ‘B’ N O R T H A M E R I C A N F L A T - R O L L E D BF #1 BF #3 EAF #1 EAF #2 BF #1 BF #3BF #2 Seamless Pipe #1 ERW #2 ERW EAF Steelmaking / Seamless Pipe Indefinitely IdledOperating 1 Raw steel capability, except at Minntac and Keetac (iron ore pellet capability), Clairton (coke capability), Gary pig (pig iron) Lorain, and Lone Star (pipe capability). All amounts shown are in millions. 22.4 3.6 7.5 2.8 2.9 - - - 2.8 - 0.90 0.38 0.79 - 0.38 0.79 5.0- 3.3- Iron Ore Pellets Cokemaking Gary Granite City Mon Valley Big River Steel Košice Lorain Lone Star Fairfield E U R O P E Idled Total Capability1 GLOBAL OPERATING FOOTPRINT Temporarily Idled GaryPig Iron - 0.5

26 CASH AND LIQUIDITY Note: For reconciliation of non-GAAP amounts, see Appendix. $682 $138 $4,090 $3,505 $1,711 FY 2021FY 2019 FY 2020 FY 2022 9M 2023 $749 $1,985 $2,522 $3,504 $3,222 FY 2020 9M 2023FY 2019 FY 2021 FY 2022 $2,284 $3,153 $4,971 $5,925 $5,493 FY 2021FY 2020FY 2019 9M 2023FY 2022 $2,892 $2,902 $1,369 $473 $1,005 9M 2023FY 2019 FY 2020 FY 2022FY 2021 Cash from Operations Cash and Cash Equivalents$ Millions $ Millions Total Estimated Liquidity Net Debt$ Millions $ Millions

27 APPENDIX

28 SUPPLEMENTAL INFORMATION HRC (30%) CRC (25%) Coated (40%) Tin (5%) HRC (70%) CRC (10%) Coated (20%) HRC (60%) CRC (10%) Coated (20%) Tin (10%) Seamless (100%) Flat-rolled Mini Mill1 U. S. Steel Europe Tubular 2022 Shipments by product mix Note: Product mix is rounded. Hot rolled coil (HRC) included semi-finished materials. Pro-Tec joint venture mix included in Flat-rolled detail. 1 Mini Mill segment product mix, once Big River 2 (BR2) is fully ramped by 2026, is expected to be 40% hot rolled coil (HRC) / 15% cold rolled coil (CRC) / 40% Coated / 5% Non-grain oriented electrical steel.

29 SUPPLEMENTAL INFORMATION HRC (19%) CRC (31%) Coated (36%) Other (13%) HRC (59%) CRC (13%) Coated (28%) HRC (45%) CRC (9%) Coated (38%) Tubular / Other (5%) Tubular Product (99%) Flat-rolled Mini Mill U. S. Steel Europe Tubular 2022 Revenue by product mix Semi-finished (1%) Semi-finished (3%) Other (1%)

30 SUPPLEMENTAL INFORMATION Service Centers (14%) Converters (29%) Auto (31%) Construction (11%) Oil & Gas (94%) Flat-rolled Mini Mill1 U. S. Steel Europe Tubular 2022 Shipments by major market Packaging (8%) Appliance & Electrical (5%) Other (2%) Service Centers (47%) Converters (34%) Auto (1%) Construction (13%) Packaging (1%) Appliance & Electrical (4%) Service Centers (22%) Converters (8%) Auto (16%) Construction (28%) Packaging (12%) Appliance & Electrical (6%) Other (8%) Construction (6%)

31 SUPPLEMENTAL INFORMATION Firm (25%) Cost based (5%) Market based quarterly (28%) Market based monthly (18%) Spot (24%) Firm (5%) Cost based (5%) Market based quarterly (4%) Market based monthly (47%) Spot (39%) Firm (38%) Cost based (2%) Market based quarterly (2%) Market based monthly (6%) Spot (52%) Program (78%) Spot (22%) Flat-rolled Mini Mill U. S. Steel Europe Tubular Growing program volume to serve strategic basins 2022 Contract / spot mix by segment Note: Excludes intersegment shipments.

32 SUPPLEMENTAL INFORMATION Cost structure: Blast furnace steelmaking illustrative Coke (~35%) Natural Gas (~5%) Scrap (~30%) Raw Material Costs1 Iron ore (~30%) Key Inputs Ratio1 Pricing Convention Iron ore 1.3 tons of pellets / ton of raw steel x raw steel volume (million tons) x iron ore price assumption ($/nt) NAFR: Vertically integrated USSE: Prices negotiated monthly or quarterly Coke Scrap Natural Gas2 1.4 tons of met coal / ton of coke x met coal price assumption ($/nt) + $75 - $100 / ton conversion cost x 0.3 ton of coke / ton of raw steel 0.3 tons of scrap / ton of raw steel x raw steel volume (million tons) x scrap price assumption ($/nt) 6 mmbtus of nat gas / ton of raw steel x raw steel volume (million tons) x nat gas price assumption ($/nt) Labor Union-represented workforce 2 hours labor / ton of raw steel x raw steel volume (million tons) x hourly labor rate ($/hr) Other Variable Costs ~$150 - $300 / ton dependent on level of raw steel pricing, product mix, and maintenance activity USSE: Includes CO2 costs Miscellaneous; includes maintenance and services, tool, other fuel and energy, and alloy costs NAFR: Annual met coal contracts USSE: Mix of quarterly and annual contracts and index-based pricing for met coal NAFR & USSE: 60% generated internally; 40% purchased at market prices NAFR: Hedged and spot purchases USSE: 48% purchased through fixed-price forward physical purchase contracts; remainder on quarterly / monthly basis 1 Raw material costs and ratios assume a blast furnace within the North American flat-rolled segment. 2 6 mmbtus per ton of raw steel production; 4 mmbtus per ton consumed for further process (primarily at the hot strip mill).

33 SUPPLEMENTAL INFORMATION Cost structure: Electric arc furnace steelmaking illustrative Prime Scrap (~30%) Pig Iron (~25%) HBI / DRI (~10%) Raw Material Costs Obsolete Scrap (~35%) Key Inputs Ratio Pricing Convention Scrap 0.8 tons of scrap / ton of raw steel x raw steel volume (million tons) x scrap price assumption ($/nt) Volumes secured annually; priced on a monthly or quarterly basis Pig Iron HBI Electricity 0.3 tons of pig iron / ton of raw steel x raw steel volume (million tons) x pig iron price assumption ($/nt) 0.1 tons of HBI / ton of raw steel x raw steel volume (million tons) x HBI price assumption ($/nt) 0.6 MKWH of electricity / ton of raw steel x raw steel volume (million tons) x electricity price assumption ($/nt) Internal pig iron transferred from the N. American Flat-rolled segment at a discounted market rate; 3rd party pig volumes secured annually; priced on a monthly or quarterly basis Volumes secured annually; priced on a monthly or quarterly basis based on a blended basket of external HBI production inputs and HBI/DRI substitutes Volume-discounted negotiated base price; adjusted quarterly based on regional electricity price fluctuations Labor Non-union workforce0.14 hours labor / ton of raw steel x raw steel volume (million tons) x hourly labor rate ($/hr)

34 RECONCILIATION TABLE Flat-Rolled ($ millions) Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Segment earnings (loss) before interest and income taxes $518 $171 ($7) $231 $225 Depreciation 126 125 147 146 153 Flat-Rolled Segment EBITDA $644 $296 $140 $377 $378 Segment EBIT Margin1 15% 6% (0%) 8% 8% Segment EBITDA Margin1 19% 11% 5% 12% 13% Tubular ($ millions) Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Segment earnings (loss) before interest and income taxes $155 $205 $232 $157 $87 Depreciation 12 12 12 12 12 Tubular Segment EBITDA $167 $217 $244 $169 $99 Segment EBIT Margin1 36% 41% 46% 39% 28% Segment EBITDA Margin1 39% 44% 48% 42% 32% Other ($ millions) Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Segment earnings (loss) before interest and income taxes $21 $6 $3 ($12) $7 Depreciation 1 0 0 0 0 Other Segment EBITDA $22 $6 $3 ($12) $7 Mini Mill ($ millions) Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Segment earnings (loss) before interest and income taxes $1 ($68) $12 $132 $42 Depreciation 39 40 40 41 42 Mini Mill Segment EBITDA $40 ($28) $52 $173 $84 Segment EBIT Margin1 0% (12%) 2% 17% 6% Segment EBITDA Margin1 6% (5%) 8% 22% 13% Segment EBITDA U. S. Steel Europe ($ millions) Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Segment earnings (loss) before interest and income taxes ($32) ($68) ($34) $72 ($13) Depreciation 20 20 22 25 23 U. S. Steel Europe Segment EBITDA ($12) ($48) ($12) $97 $10 Segment EBIT Margin1 (3%) (9%) (4%) 7% (2%) Segment EBITDA Margin1 (1%) (7%) (1%) 9% 1% 1 The segment EBIT and segment EBITDA margins represent EBIT or EBITDA divided by net sales

35 RECONCILIATION TABLE Flat-Rolled ($ millions) 2015 2016 2017 2018 2019 2020 2021 2022 Segment earnings (loss) before interest and income taxes ($249) $22 $375 $883 $196 ($596) $2,740 $2,008 Depreciation 392 349 352 367 456 496 491 499 Flat-Rolled Segment EBITDA $143 $371 $727 $1,250 $652 ($100) $3,231 $2,507 Tubular ($ millions) 2015 2016 2017 2018 2019 2020 2021 2022 Segment earnings (loss) before interest and income taxes ($181) ($303) ($99) ($58) ($67) ($179) $1 $544 Depreciation 64 68 51 47 46 39 47 48 Tubular Segment EBITDA ($117) ($235) ($48) ($11) ($21) ($140) $48 $592 Other ($ millions) 2015 2016 2017 2018 2019 2020 2021 2022 Segment earnings (loss) before interest and income taxes $33 $63 $44 $55 $23 ($39) ($11) $22 Depreciation 10 10 22 $20 22 11 4 1 Other Segment EBITDA $43 $73 $66 $75 $45 ($28) ($7) $23 Mini Mill ($ millions) 2015 2016 2017 2018 2019 2020 2021 2022 Segment earnings (loss) before interest and income taxes - - - - - - $1,206 $481 Depreciation - - - - - - 151 158 Mini Mill Segment EBITDA - - - - - - $1,357 $639 Annual Segment EBITDA U. S. Steel Europe ($ millions) 2015 2016 2017 2018 2019 2020 2021 2022 Segment earnings (loss) before interest and income taxes $81 $185 $327 $359 ($57) $9 $975 $444 Depreciation 81 80 76 87 92 97 98 85 U. S. Steel Europe Segment EBITDA $162 $265 $403 $446 $35 $106 $1,073 $529

36 SUPPLEMENTAL INFORMATION Big River Steel LLC1 Summary Table Customer Sales Intersegment Sales Net Sales EBIT2 $530M $140M $670M $50M Income Statement $ Millions Q3 2023 Cash and cash equivalents Total Assets 2029 Senior secured notes Environmental revenue bonds Financial leases and all other obligations Fair value step up3 Total Debt3 $290M $3,686M $720M $752M $23M $113M $1,608M Balance Sheet Depreciation and Amortization Capital Expenditures4 $37M $85M Cash Flow 1 Unless otherwise noted, amounts shown are reflected in Big River Steel LLC, the operating unit of the Big River Steel companies that reside within the Mini Mill segment. 2 Earnings before interest and income taxes. 3 The debt amounts reflect aggregate principal amounts. The fair value step up represents the excess of fair value over book value when Big River Steel was purchased. The fair value step-up is recorded in Big River Steel Holdings LLC. The fair value step up is shown as it is related to the debt amounts in Big River Steel LLC. 4 Excludes capital expenditures for BR2 and air separation unit.

37 RECONCILIATION TABLE Short-term debt and current maturities of long-term debt Long-term debt, less unamortized discount and debt issuance costs Net Debt $ millions 9M 2023YE 2022YE 2021YE 2020 $14 $3,627 YE 2019 $192 $4,695 $28 $3,863 $63 $3,914 $98 $4,129 Total Debt $4,227$3,977$3,891$4,887$3,641 Less: Cash and cash equivalents 749 1,985 2,522 3,504 3,222 Net Debt $1,005$473$1,369$2,902$2,892 Net Debt

38 RECONCILIATION TABLE Net cash provided by operating activities Net cash used in investing activities Free Cash Flow / Investable Free Cash Flow $ millions Q2 2023 $713 (612) Free Cash Flow $101 Best for All Strategic capital expenditures 476 Investable Free Cash Flow $577 Free Cash Flow / Investable Free Cash Flow Q1 2023 $181 (738) ($557) 565 $8 9M 2023 $1,711 (1,935) ($224) 1,464 $1,240 Q3 2023 $817 (585) $232 423 $655

39 RECONCILIATION TABLE Net cash provided by operating activities Net cash used in investing activities Free Cash Flow / Investable Free Cash Flow $ millions 2020 $138 (563) Free Cash Flow ($425) Best for All Strategic capital expenditures - Investable Free Cash Flow ($425) Free Cash Flow / Investable Free Cash Flow 2019 $682 (1,958) ($1,276) - ($1,276) 2022 $1,826 1,175 $3,001 2021 $4,090 (840) $3,250 215 $3,465 2018 $938 (963) ($25) - ($25) 2017 $826 (389) $437 - $437 2016 $754 (318) $436 - $436 2015 $360 (510) ($150) - ($150) $3,505 (1,679) 9M 2023 ($224) 1,464 $1,240 $1,711 (1,935) Note: Best for All® strategic capex is expected to peak in 2023 at approximately $1,800M and is expected to reduce by 56% in 2024.

40 RECONCILIATION TABLE $ Millions Adjusted Net Earnings 3 The tax impact of adjusted items for the three months ended September 30, 2022 is calculated using a blended tax rate of 25% for domestic items and 21% for USSE items. The tax impact of adjusted items for the three months ended December 31, 2022, three months ended March 31, 2023, three months ended June 30, 2023 and three months ended September 30, 2023 was calculated using a blended tax rate of 24% for domestic items and 21% for USSE items. 2 The 2022 Labor Agreements include retroactive wage increases. A charge of $3 million pertaining to wages for the month of September 2022 was recognized during the three months ended December 31, 2022. This charge is included as an adjustment to net earnings for the three months ended December 31, 2022, however this amount is not included as an adjustment to net earnings for the year ended December 31, 2022. Q3 2023Q2 2023Q1 2023Q4 2022Q3 2022 $350$483$195$235$526 $490 (2) - 23 13 - - - - - - - 13 (11) Reported net earnings attributable to U. S. Steel Debt extinguishment Asset impairment charges Restructuring and other charges Stock-based compensation expense1 VEBA asset surplus adjustment Gains on assets sold and previously held investments Pension de-risking United Steelworkers labor agreement signing bonus and related costs2 Environmental remediation charges Strategic alternatives review process Granite City idling costs Other charges, net Tax impact of adjusted items3 $174 - 6 (9) 12 - (6) (3) 67 - - - 13 (19) $199 - 4 1 11 (22) - - - - - - 1 1 $477 - - 2 12 (8) - - - 2 - - - (2) $299 - - 18 14 (6) - - - 9 16 14 1 (15) Net Earnings 1 The prior year was retroactively adjusted to reflect the reclassification of stock-based compensation expense. The adjustment was $10 million and $9 million, net of taxes, for the three months ended September 30, 2022 and three months ended December 31, 2022, respectively. Net earnings margin4 Adjusted net earnings margin4 9% 10% 4% 5% 4% 4% 10% 10% 7% 8% 4 The net earnings and adjusted net earnings margins represent net earnings or adjusted net earnings divided by net sales

41 RECONCILIATION TABLE $ Millions Adjusted EBITDA Adjusted EBITDA Q3 2023Q2 2023Q1 2023Q4 2022Q3 2022 $578$804$427$443$861 $490 154 (30) $614 198 $812 - 23 - 13 - - - - 13 Reported net earnings attributable to U. S. Steel Income tax expense Net interest and other financial costs Reported earning before interest and income taxes Depreciation, depletion and amortization expense EBITDA Asset impairment charges Restructuring and other charges Losses (gains) on assets sold & previously held investments Stock-based compensation expense1 United Steelworkers labor agreement signing bonus and related costs2 Environmental remediation charges Strategic alternatives review process Granite City idling costs Other charges, net $174 51 (51) $174 197 $371 6 (9) (6) 12 67 - - - 2 $199 51 (61) $189 221 $410 4 1 - 11 - - - - 1 $477 144 (57) $564 224 $788 - 2 - 12 - 2 - - - $299 42 (64) $277 230 $507 - 18 - 14 - 9 16 14 - 2 The 2022 Labor Agreements include retroactive wage increases. A charge of $3 million pertaining to wages for the month of September 2022 was recognized during the three months ended December 31, 2022. This charge is included as an adjustment to net earnings for the three months ended December 31, 2022, however this amount is not included as an adjustment to net earnings for the year ended December 31, 2022. 1 The prior year was retroactively adjusted to reflect the reclassification of stock-based compensation expense. Net earnings margin3 Reported EBIT margin3 Adjusted EBITDA margin3 9% 12% 17% 4% 4% 10% 4% 4% 10% 10% 11% 16% 7% 6% 13% 3 The net earnings, adjusted EBIT and adjusted EBITDA margins represent net earnings or EBITDA divided by net sales

42 Emily Chieng Investor Relations Officer ecchieng@uss.com 412-618-9554 Eric Linn Director – Investor Relations eplinn@uss.com 412-433-2385 INVESTOR RELATIONS