UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 6-K For the month of January 2025

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13

a

-16 OR 15

d

-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 1-15242

DEUTSCHE BANK CORPORATION

(Translation of Registrant’s Name Into English)

Deutsche Bank Aktiengesellschaft

Taunusanlage 12

60325 Frankfurt am Main

Germany

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐

Explanatory note and Exhibits

On January 30, 2025, Deutsche Bank AG published its Media Release, Analyst Conference Call Presentation and Financial Data Supplement, each of which relates to Deutsche Bank’s results for the quarter and year ended December 31, 2024.

For non-U.S. purposes, Deutsche Bank AG publishes such documents setting forth results prepared in accordance with International Financial Reporting Standards (IFRS) as endorsed by the European Union, including application of portfolio fair value hedge accounting for non-maturing deposits and fixed rate mortgages with pre-payment options (“EU IFRS”, using the “EU carve-out”). Fair value hedge accounting under the EU carve-out is employed to minimize the accounting exposure to both positive and negative moves in interest rates in each tenor bucket thereby reducing the volatility of reported revenue from Treasury activities. These documents prepared using EU IFRS are attached as Exhibits 99.1 through 99.3 hereto.

For U.S. reporting purposes, Deutsche Bank AG also prepares versions of its Media Release and Financial Data Supplement prepared in accordance with IFRS as issued by the International Accounting Standards Board (IASB), which does not permit use of the EU carve-out (“IASB IFRS”), but which is otherwise the same as EU IFRS. The Media Release and Financial Data Supplement prepared using IASB IFRS are attached as Exhibits 99.4 and 99.5 hereto. The impact of the EU carve out is described in the section “Basis of Accounting” on page 11 of Exhibit 99.4 hereto.

This Report on Form 6-K contains the following exhibits:

Exhibit 99.1: Deutsche Bank AG’s Media Release, dated January 30, 2025, announcing its preliminary results for the quarter and year ended December 31, 2024 (EU IFRS).

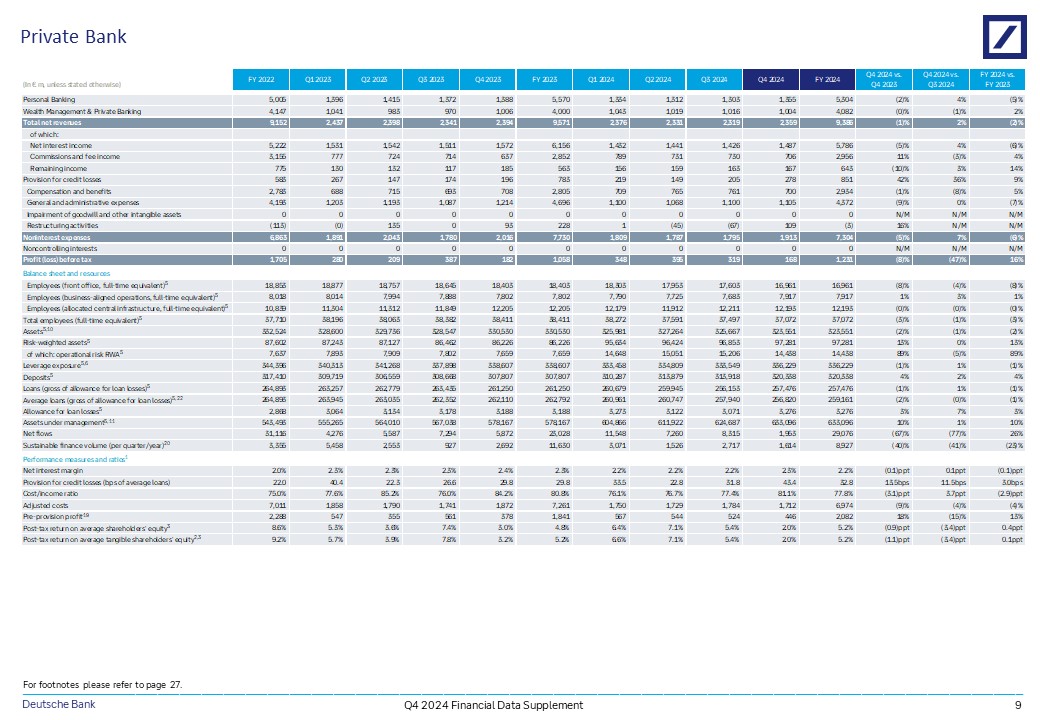

Exhibit 99.2: Financial Data Supplement 4Q 2024, providing details of the preliminary results (EU IFRS).

Exhibit 99.3: Presentation of Christian Sewing, Chief Executive Officer, and James von Moltke, Chief Financial Officer, given at Deutsche Bank AG’s Analyst Conference Call on January 30, 2025 (EU IFRS).

Exhibit 99.4: Deutsche Bank AG’s Media Release, dated January 30, 2025, announcing its preliminary results for the quarter and year ended December 31, 2024 (IASB IFRS).

Exhibit 99.5: Financial Data Supplement 4Q 2024, providing details of the preliminary results (IASB IFRS).

Exhibit 99.6: English translation of Articles of Association of Deutsche Bank Aktiengesellschaft in conformity with the resolution of the Supervisory Board on December 12, 2024.

This Report on Form 6-K and Exhibits 99.4 through 99.6 hereto are hereby incorporated by reference into Registration Statement No. 333-278331 of Deutsche Bank AG. Exhibits 99.1 through 99.3 are not so incorporated by reference.

The results provided hereby are presented under International Financial Reporting Standards (IFRS) and are preliminary and unaudited. Such results do not represent a full set of financial statements in accordance with IAS 1 and IFRS 1. Therefore, they may be subject to adjustments based on the preparation of the full set of financial statements for 2024.

Forward-looking statements contain risks

This report contains forward-looking statements. Forward-looking statements are statements that are not historical facts; they include statements about our beliefs and expectations. Any statement in this report that states our intentions, beliefs, expectations or predictions (and the assumptions underlying them) is a forward-looking statement. These statements are based on plans, estimates and projections as they are currently available to the management of Deutsche Bank. Forward-looking statements therefore speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events.

By their very nature, forward-looking statements involve risks and uncertainties. A number of important factors could therefore cause actual results to differ materially from those contained in any forward-looking statement. Such factors include the conditions in the financial markets in Germany, in Europe, in the United States and elsewhere from which we derive a substantial portion of our trading revenues, potential defaults of borrowers or trading counterparties, the implementation of our strategic initiatives, the reliability of our risk management policies, procedures and methods, and other risks referenced in our filings with the U.S. Securities and Exchange Commission. Such factors are described in detail in our 2023 Annual Report on Form 20-F filed with the SEC on March 14, 2024, in the section entitled “Risk Factors” on pages 11 through 41. Copies of this document are readily available upon request or can be downloaded from www.deutsche-bank.com/ir.

2

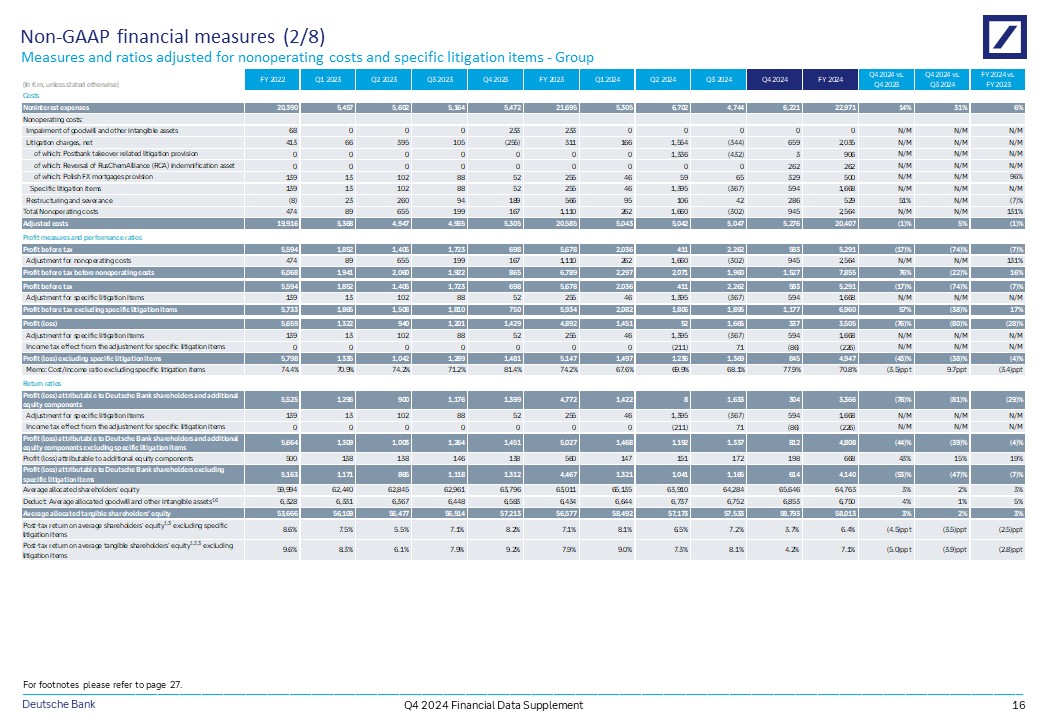

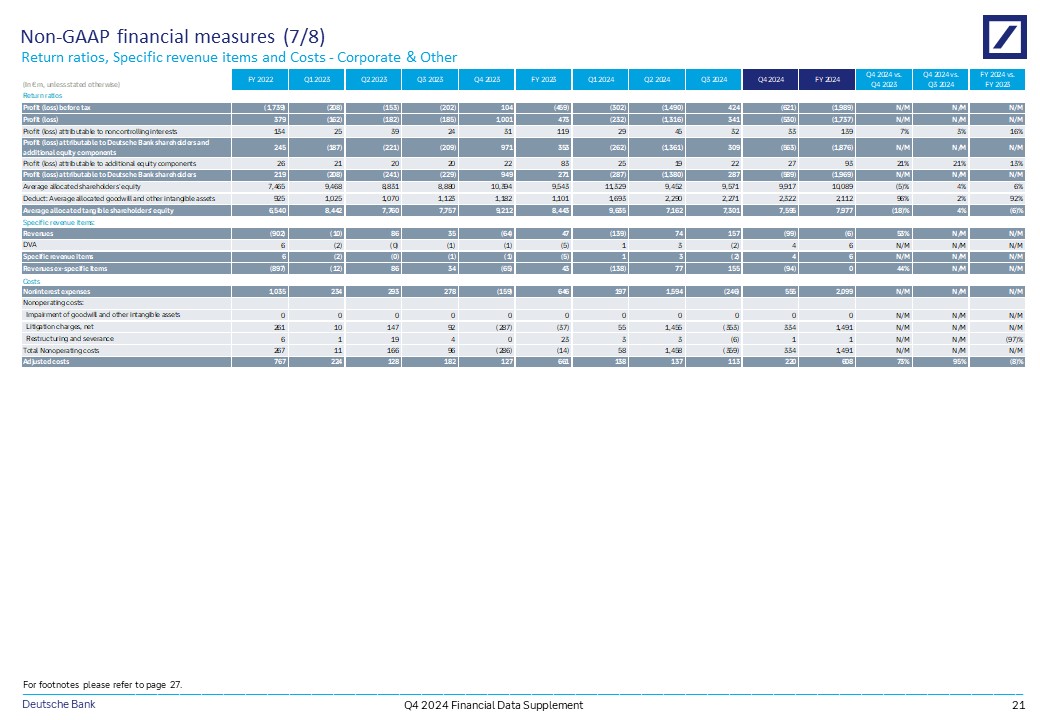

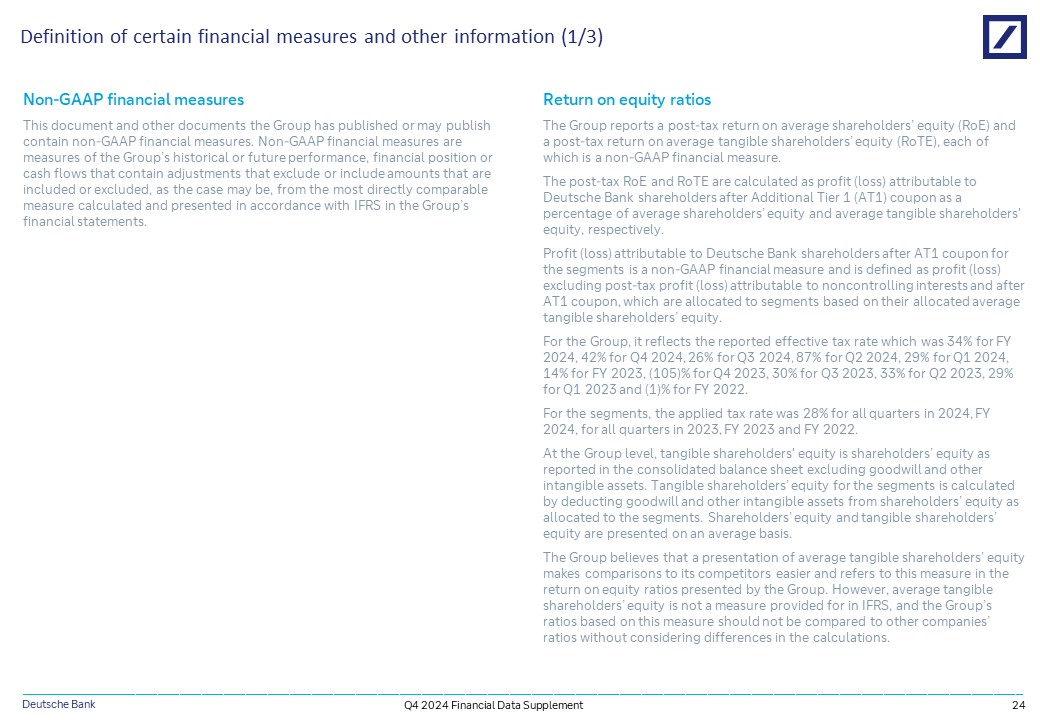

Use of Non-GAAP Financial Measures

This document and other documents we have published or may publish contain non-GAAP financial measures. Non-GAAP financial measures are measures of our historical or future performance, financial position or cash flows that contain adjustments that exclude or include amounts that are included or excluded, as the case may be, from the most directly comparable measure calculated and presented in accordance with IFRS in our financial statements. Examples of our non-GAAP financial measures, and the most directly comparable IFRS financial measures, are as follows:

|

Non-GAAP Financial Measure |

Most Directly Comparable IFRS Financial Measure |

|

|

Profit (loss) before tax before nonoperating costs, Profit (loss) before tax excluding specific litigation items, Pre-provision profit, Pre-provision profit on adjusted basis |

Profit (loss) before tax |

|

|

Profit (loss) attributable to Deutsche Bank shareholders for the segments, Profit (loss) attributable to Deutsche Bank shareholders and additional equity components for the segments, Profit (loss) excluding specific litigation items, Profit (loss) attributable to Deutsche Bank shareholders excluding specific litigation items |

Profit (loss) |

|

|

Revenues excluding specific items, Revenues on a currency-adjusted basis |

Net revenues |

|

|

Net interest income in the key banking book segments |

Net interest income |

|

|

Adjusted costs, Adjusted costs excluding exceptional Q4 2024 items, Costs on a currency-adjusted basis, Nonoperating costs, Specific litigation items |

Noninterest expenses |

|

|

Cost/income ratio excluding specific litigation items |

Cost/income ratio based on noninterest expenses |

|

|

Net assets (adjusted) |

Total assets |

|

|

Tangible shareholders’ equity, Average tangible shareholders’ equity, Tangible book value, Average tangible book value |

Total shareholders’ equity (book value) |

|

|

Post-tax return on average shareholders’ equity (based on Profit (loss) attributable to Deutsche Bank shareholders after AT1 coupon), Post-tax return on average tangible shareholders’ equity (based on Profit (loss) attributable to Deutsche Bank shareholders after AT1 coupon), Post-tax return on average shareholders' equity excluding specific litigation items, Post-tax return on average tangible shareholders’ equity excluding specific litigation items |

Post-tax return on average shareholders’ equity |

|

|

Book value per basic share outstanding, Tangible book value per basic share outstanding |

Book value per share outstanding |

3

For descriptions of these non-GAAP financial measures and the adjustments made to the most directly comparable financial measures under IFRS, please refer to (i) pages 7 through 11 and 15 through 27 of Exhibits 99.2 and 99.5 hereto and (ii) the section “Supplementary Information (Unaudited): Non-GAAP Financial Measures” on pages 430 to 438 of our 2023 Annual Report on Form 20-F.

When used with respect to future periods, non-GAAP financial measures we use are also forward-looking statements. We cannot predict or quantify the levels of the most directly comparable financial measures under IFRS that would correspond to these measures for future periods. This is because neither the magnitude of such IFRS financial measures, nor the magnitude of the adjustments to be used to calculate the related non-GAAP financial measures from such IFRS financial measures, can be predicted. Such adjustments, if any, will relate to specific, currently unknown, events and in most cases can be positive or negative, so that it is not possible to predict whether, for a future period, the non-GAAP financial measure will be greater than or less than the related IFRS financial measure.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Deutsche Bank Aktiengesellschaft

Date: January 30, 2025

|

By: |

_/s/ Andrea Schriber____________ |

|

Name: |

Andrea Schriber |

|

Title: |

Managing Director |

|

By: |

_/s/ Joseph C. Kopec___________ |

|

Name: |

Joseph C. Kopec |

|

Title: |

Managing Director and Senior Counsel |

4

Exhibit 99.1

Media Release

30 January 2025

Frankfurt am Main

Deutsche Bank reports 2024 profit before tax of € 5.3 billion and € 2.1 billion of proposed capital distributions to shareholders

Continued net revenue and business growth in 2024

Resolution of specific cost items

Resilient operating performance

€ 2.1 billion in capital distributions to shareholders announced for 2025 so far

|

Issued by the media relations department of Deutsche Bank AG

|

Internet: https://www.db.com/newsroom Email: db.media@db.com |

Fourth quarter of 2024: business growth and resolution of specific items

>10% RoTE target in 2025 and capital distribution goal reaffirmed, reflecting expectations of:

“2024 was a vital year for Deutsche Bank,” Christian Sewing, Chief Executive Officer, said. “Our strong and growing operating performance reflects the turnaround achieved in recent years. We delivered another year of revenue and business growth, maintained tight operating cost discipline, acted decisively to put significant legacy costs behind us and continued to invest in our platform. All of this – together with the strong start we have made this year – gives us firm confidence that we will deliver on our RoTE target of above 10% in 2025 and further increase distributions to shareholders. In addition, we are already working on measures to further increase returns in the coming years.”

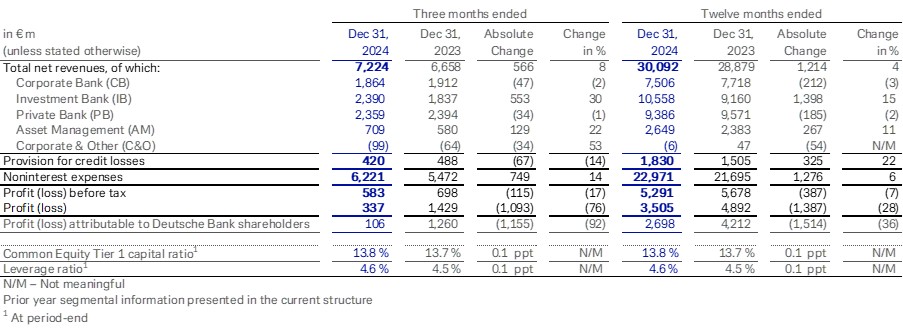

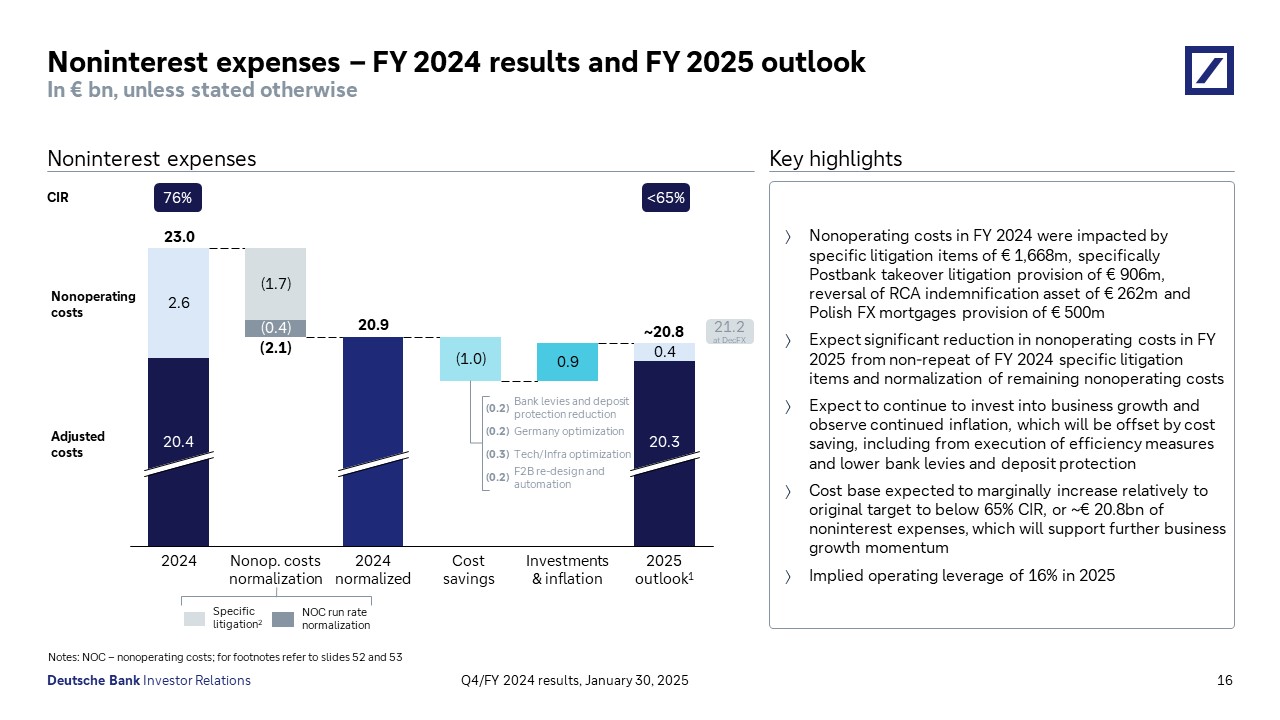

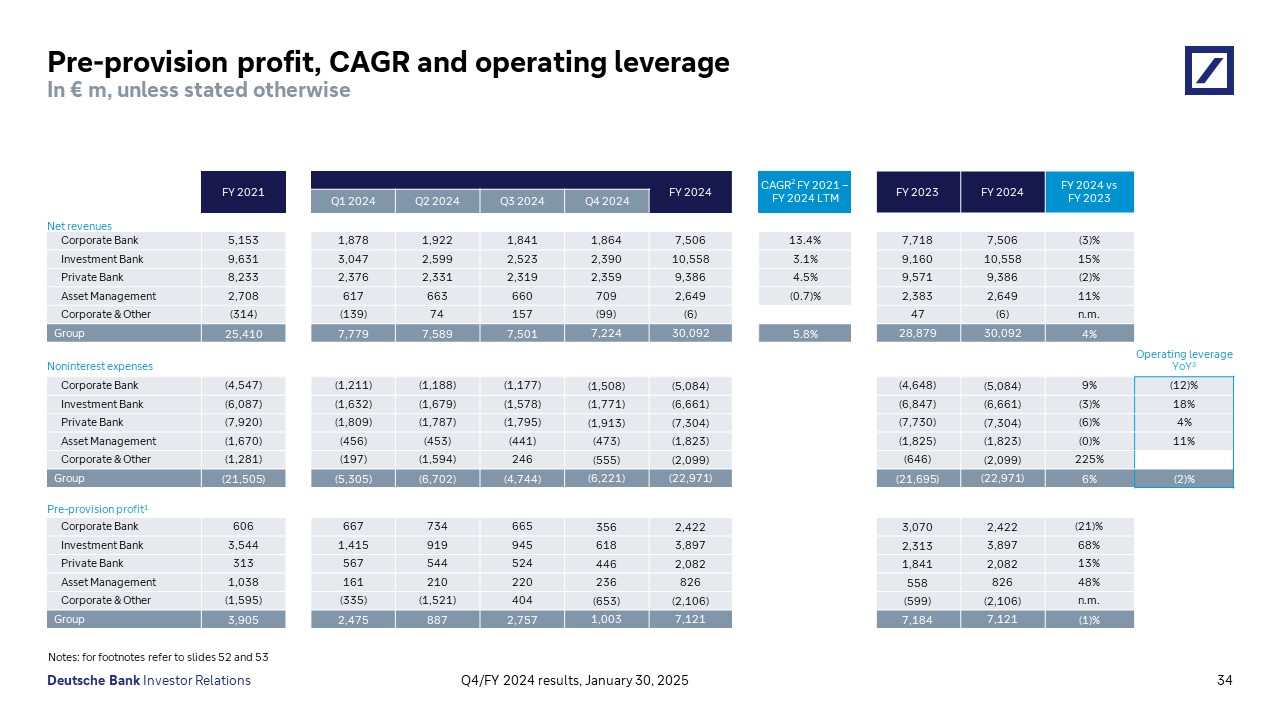

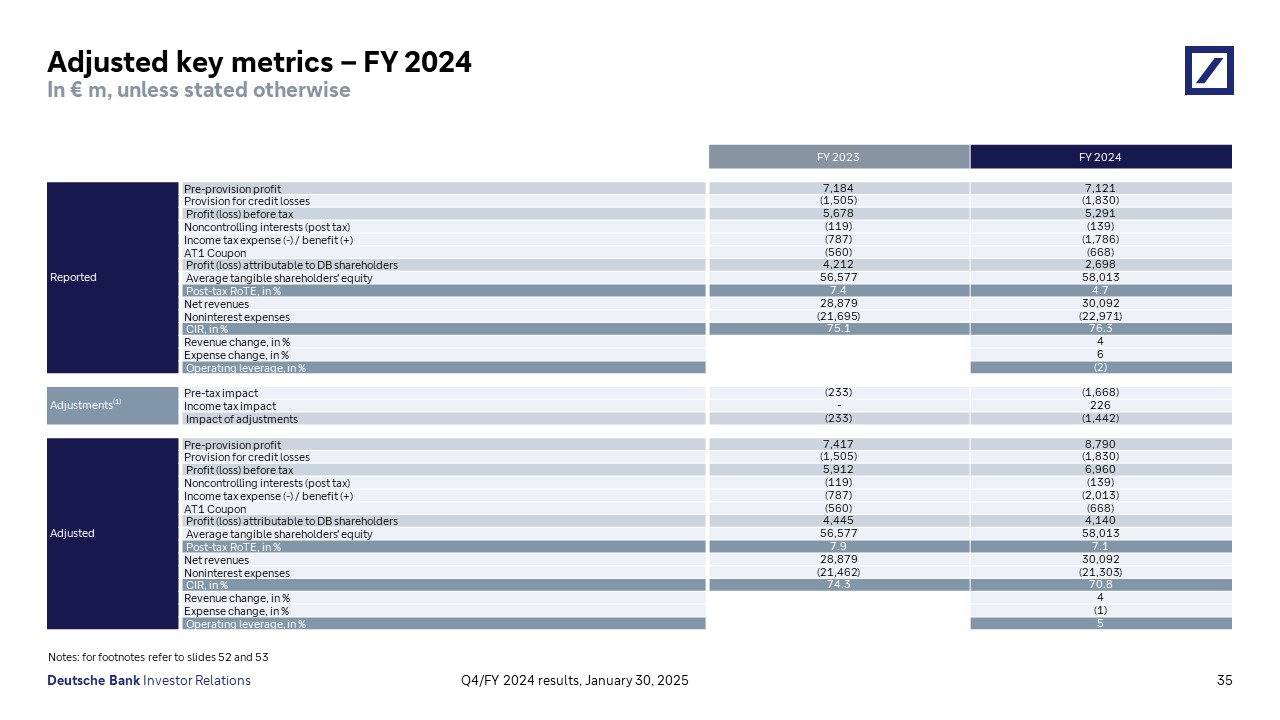

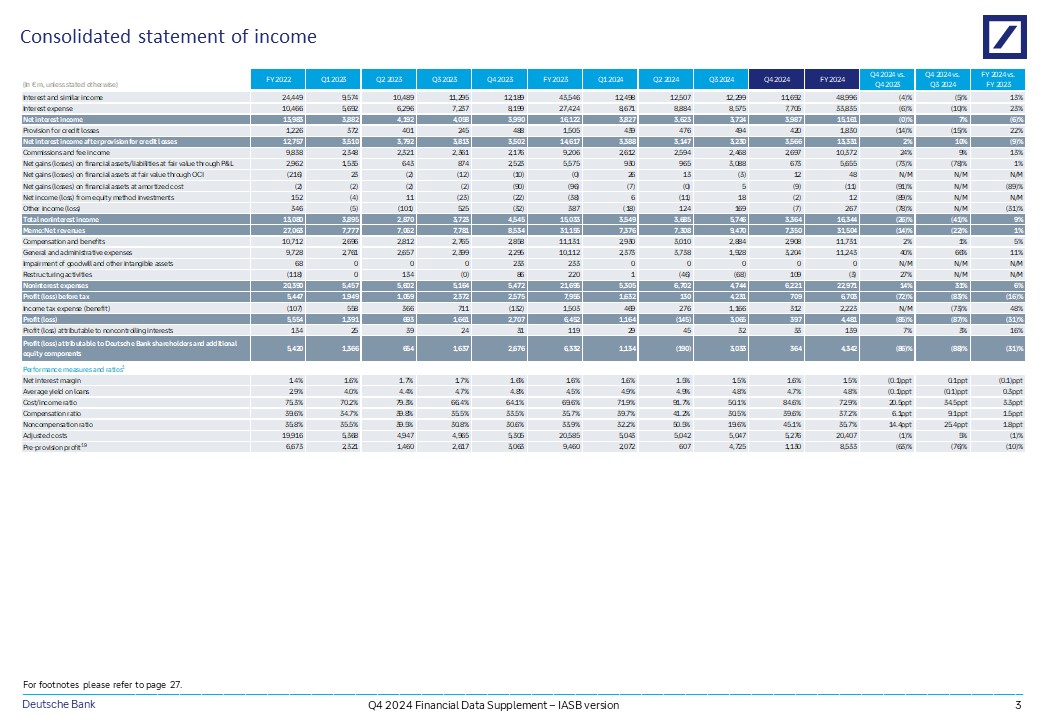

Deutsche Bank (XETRA: DBGn.DB / NYSE: DB) today announced profit before tax of € 5.3 billion for the full year 2024, down 7% compared to 2023. Revenues grew by 4% year on year to € 30.1 billion, in line with guidance. Noninterest expenses were € 23.0 billion, up 6%, and included € 1.7 billion relating to specific litigation items including settlements relating to the bank’s takeover of Postbank AG; adjusted for these items, profit before tax was € 7.0 billion. Adjusted costs, which exclude nonoperating items, were down 1% to € 20.4 billion, and included € 235 million in fourth quarter exceptional items consisting of real estate measures and true-up adjustments for UK bank levies.

Net profit was € 3.5 billion, down from € 4.9 billion in 2023. This year-on-year development reflected both costs relating to specific litigation items in 2024 and the non-recurrence in 2024 of € 1.0 billion in DTA valuation adjustments which positively impacted 2023.

2

Post-tax return on average tangible shareholders’ equity (RoTE 1 ) was 4.7% in 2024, compared to 7.4% in 2023. 2024 RoTE excluding specific litigation items 1 was 7.1%. Post-tax return on average shareholders’ equity (RoE) was 4.2%, compared to 6.7% in the prior year. The year-on-year development in both ratios reflects both the specific litigation items in 2024 and the non-recurrence of the DTA valuation adjustments which positively impacted 2023. The cost/income ratio was 76%, compared to 75% in 2023, and 71% excluding the aforementioned specific litigation items.

Deutsche Bank reaffirms its target for RoTE of above 10% in 2025. The bank reaffirms its 2025 revenue goal of around € 32 billion, not including further upside potential from exchange rate movements. The bank expects provision for credit losses to moderate from 2024 levels. The bank also expects to reduce noninterest expenses. Nonoperating costs are expected to normalize considerably, primarily through the non-recurrence of significant litigation items, while adjusted costs are expected to remain essentially flat compared to 2024, creating significant operating leverage. The bank is on track to achieve its target of € 2.5 billion euros in cost savings from its operational efficiency program, which offset additional investments to support further business growth and increased returns to shareholders beyond 2025. Reflecting both operational efficiencies and additional investments, the bank now targets a cost/income ratio of below 65% in 2025, slightly above its original target of below 62.5%.

Fourth-quarter pre-tax profit was € 583 million, down 17% from the fourth quarter of 2023. This development reflected charges for specific litigation items of € 594 million in the quarter, and the aforementioned exceptional items of € 235 million. These more than offset growth in revenues of 8% over the prior year quarter to € 7.2 billion. Net profit was € 337 million, additionally reflecting non-tax-deductible litigation items during the quarter, and the non-recurrence of € 1.0 billion in DTA valuation adjustments which positively impacted the prior year quarter.

A further € 2.1 billion in planned capital distributions to shareholders

Deutsche Bank today announced plans for € 2.1 billion in further capital distributions to shareholders in 2025. The bank has received supervisory authorization for further share repurchases of € 750 million so far in 2025 and plans to propose 2024 dividends of € 1.3 billion, or € 0.68 per share, at its Annual General Meeting in May 2025, up 50% from € 0.45 per share for 2023. These measures would increase cumulative capital distributions to shareholders to € 5.4 billion since 2022, in excess of the € 5 billion goal in the bank’s transformation program launched in 2019. The bank reaffirms its aim to exceed its capital distribution goal of € 8 billion in respect of the financial years 2021-25, paid in 2022-26.

3

James von Moltke, Chief Financial Officer, added: “Our performance in 2024 was impacted by significant nonoperating costs, particularly longstanding litigation items, and actions we took to accelerate the execution of our strategy. Having put these behind us, we look ahead to 2025 having decisively reduced our risk profile and with confidence that our operating strength will be clearly reflected in our financial results. We remain absolutely focused on achieving the full benefits of our operational efficiency program and expect credit provisions to normalize. This positions us to grow returns, boost organic capital generation and exceed our € 8 billion goal for capital distributions through 2026.”

Accelerating execution of the Global Hausbank strategy: further progress towards 2025 targets

Deutsche Bank made further progress on accelerating execution of its Global Hausbank strategy on all dimensions during 2024:

4

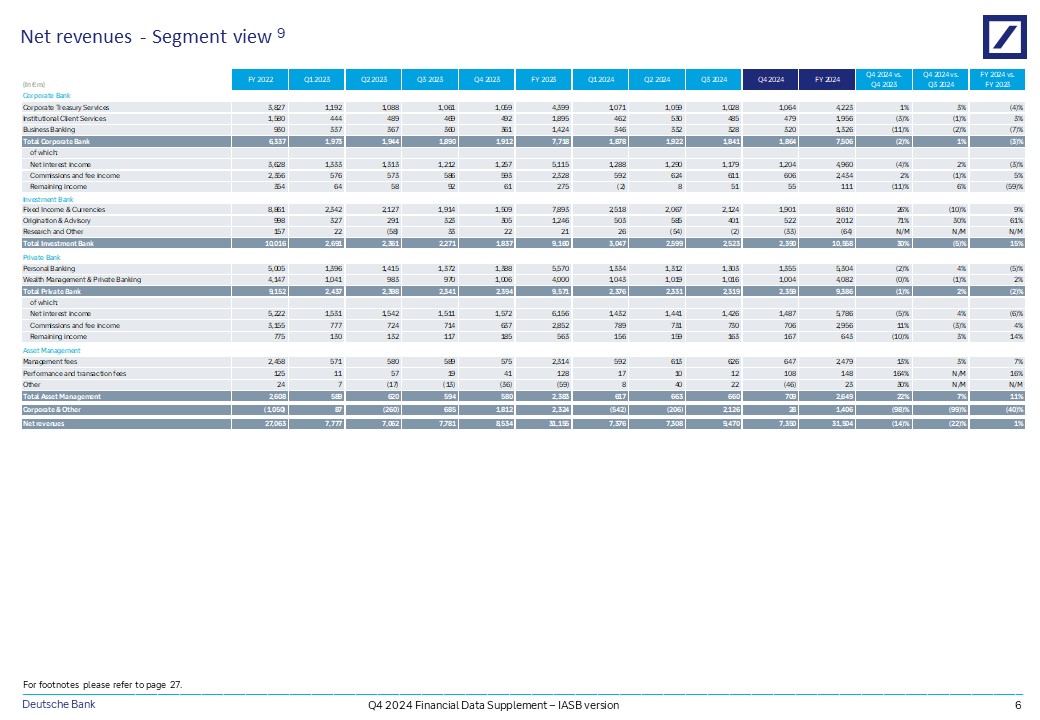

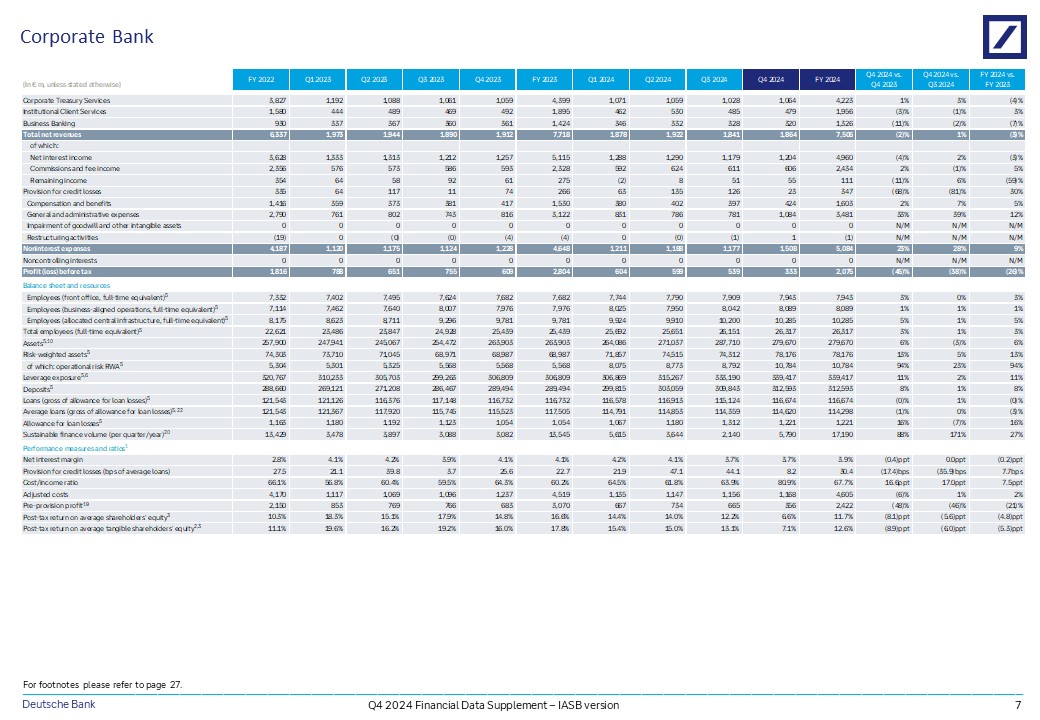

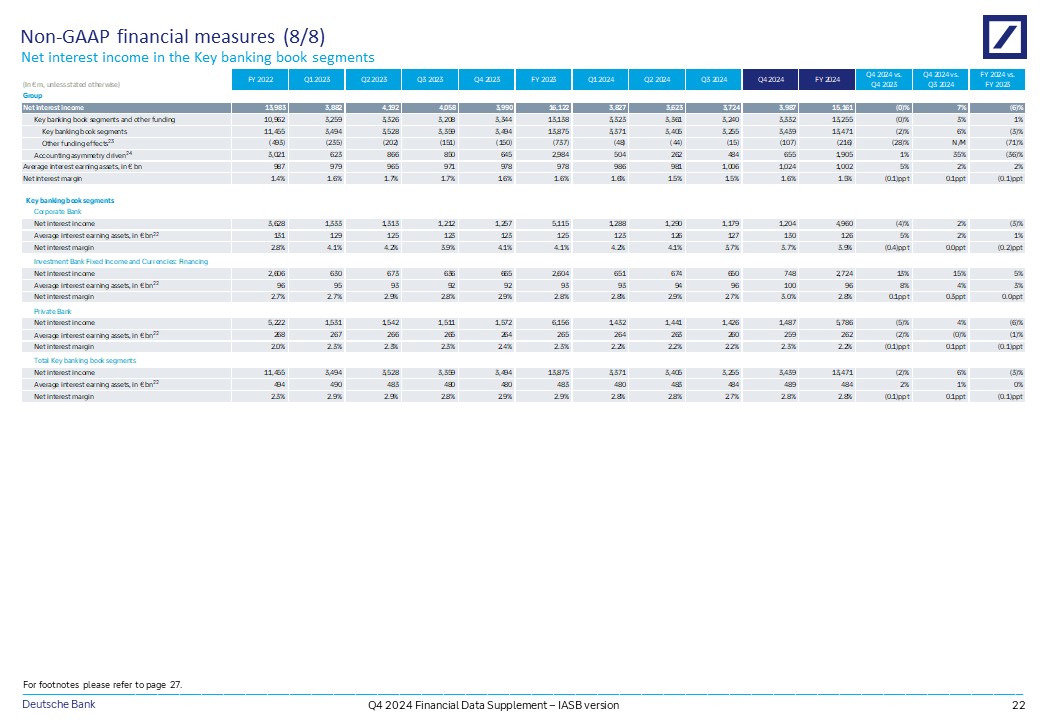

Revenues: fourth-quarter and full-year growth with market share gains and growing assets under management

Net revenues were € 30.1 billion in 2024, up 4% year on year, in line with full-year guidance of around € 30 billion and with the bank’s compound annual growth rate target. Commissions and fee income grew 13% to € 10.4 billion, while net interest income in key segments of the banking book remained resilient, reflecting higher deposit volumes and loan margin expansion . Fourth-quarter net revenues were € 7.2 billion, up 8% year on year and the bank’s highest fourth-quarter revenues for a decade. Deutsche Bank reaffirms its goal for revenues of around € 32 billion in 2025.

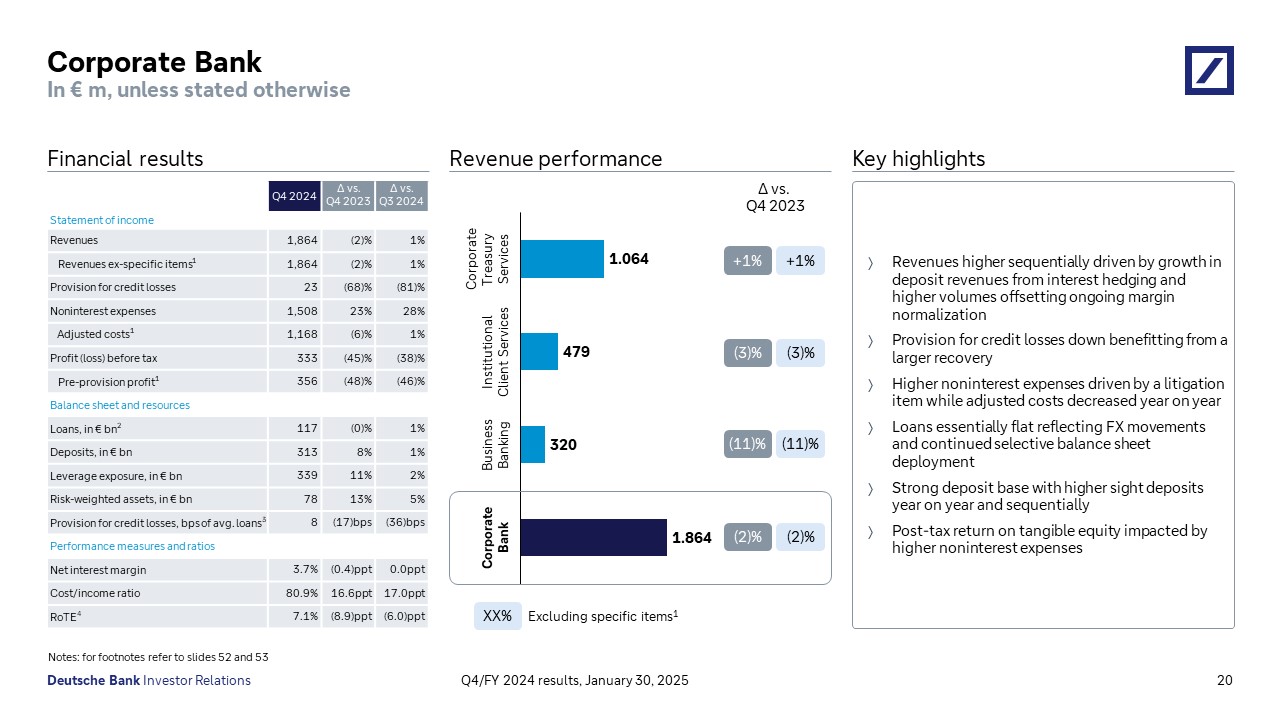

Revenue performance in the bank’s businesses in 2024 was as follows:

5

6

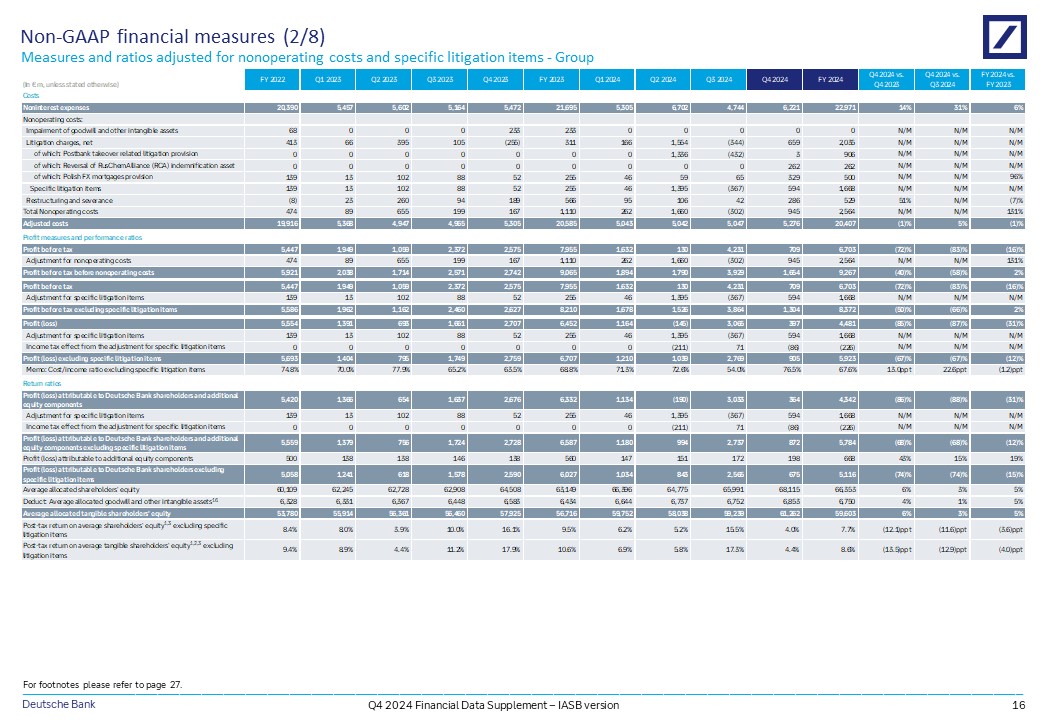

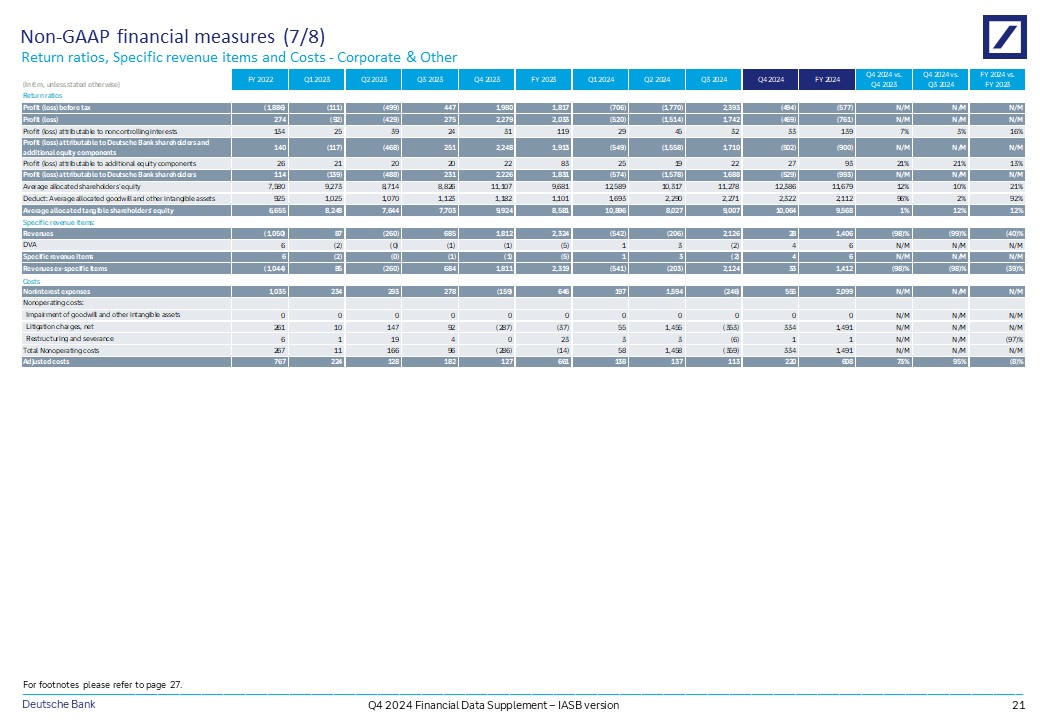

Noninterest expenses: operating cost discipline more than offset by impact of specific litigation items

Noninterest expenses were € 23.0 billion in 2024, up 6% year on year. Non-operating costs were € 2.6 billion, up from € 1.1 billion in 2023, and included € 1.7 billion in charges relating to specific litigation items, up from € 255 million in the prior year and including approximately € 900 million relating to the bank’s takeover of Postbank AG. Adjusted costs , which exclude nonoperating items, were € 20.4 billion, down 1% year on year and included € 235 million in real estate measures and true-up adjustments to UK bank levies. Higher compensation and benefit expenses were largely offset by lower technology and professional services costs during the year.

In the fourth quarter , noninterest expenses were € 6.2 billion, up 14% from the prior year quarter. Nonoperating costs were € 945 million, up from € 167 million in the prior year quarter, and including € 594 million relating to the aforementioned specific litigation items. Fourth quarter adjusted costs were € 5.3 billion, down 1%, from the prior year quarter and included the aforementioned € 235 million of exceptional items together with a negative year-on-year FX impact of € 65 million.

The workforce

was 89,753 FTEs at the end of 2024, a decrease of 483 FTEs during the fourth quarter and down 377 FTEs during the year. Investments in business growth, controls and technology, together with internalizations of external contract staff, were more than offset by leavers, including through operational efficiency measures, during the year.

7

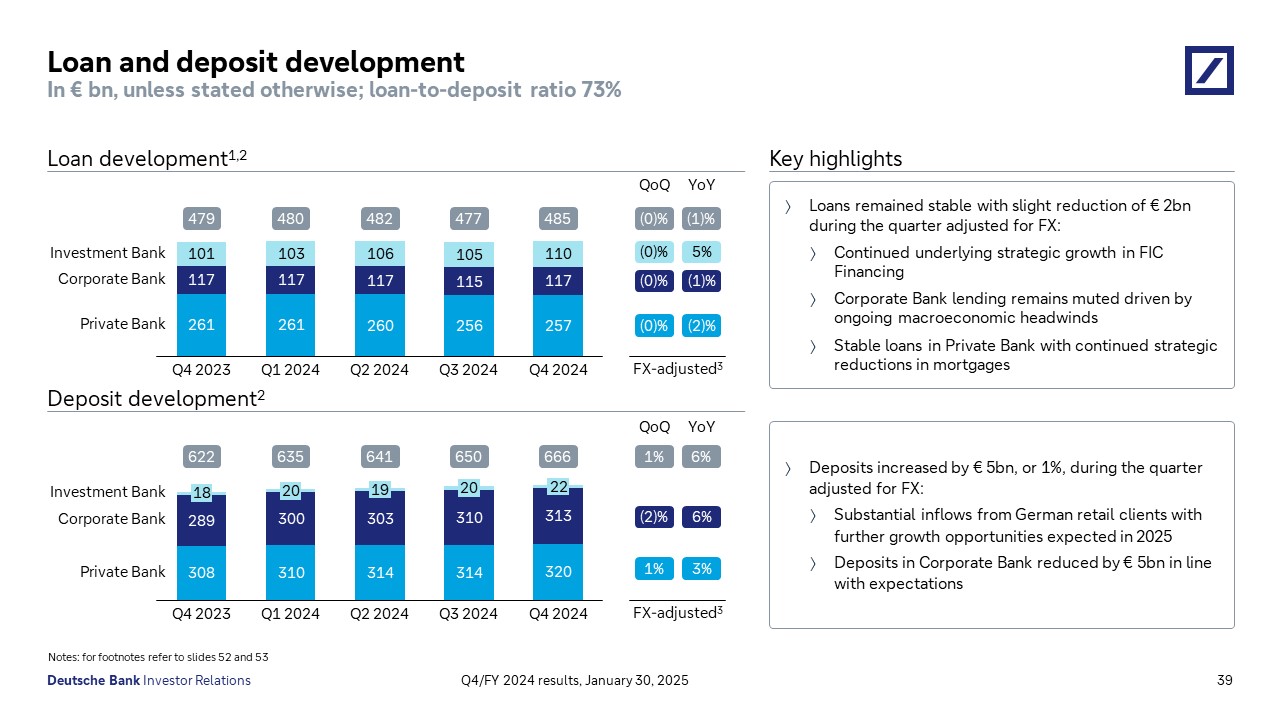

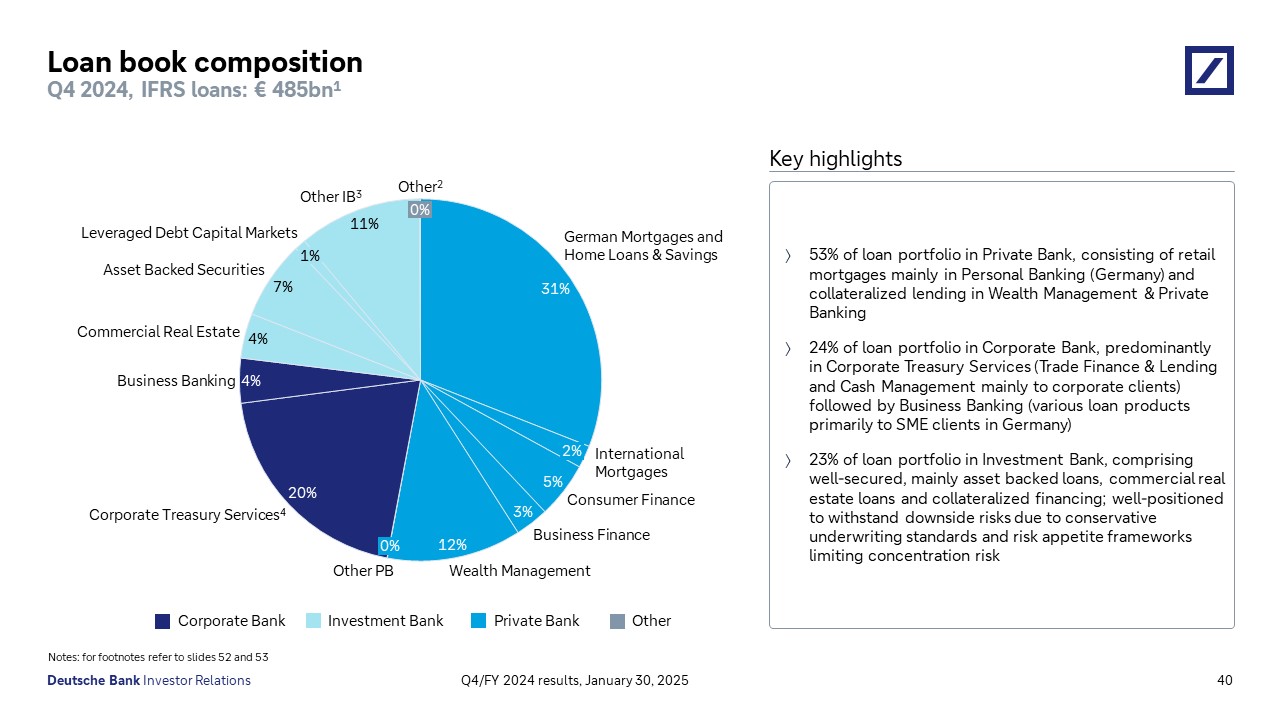

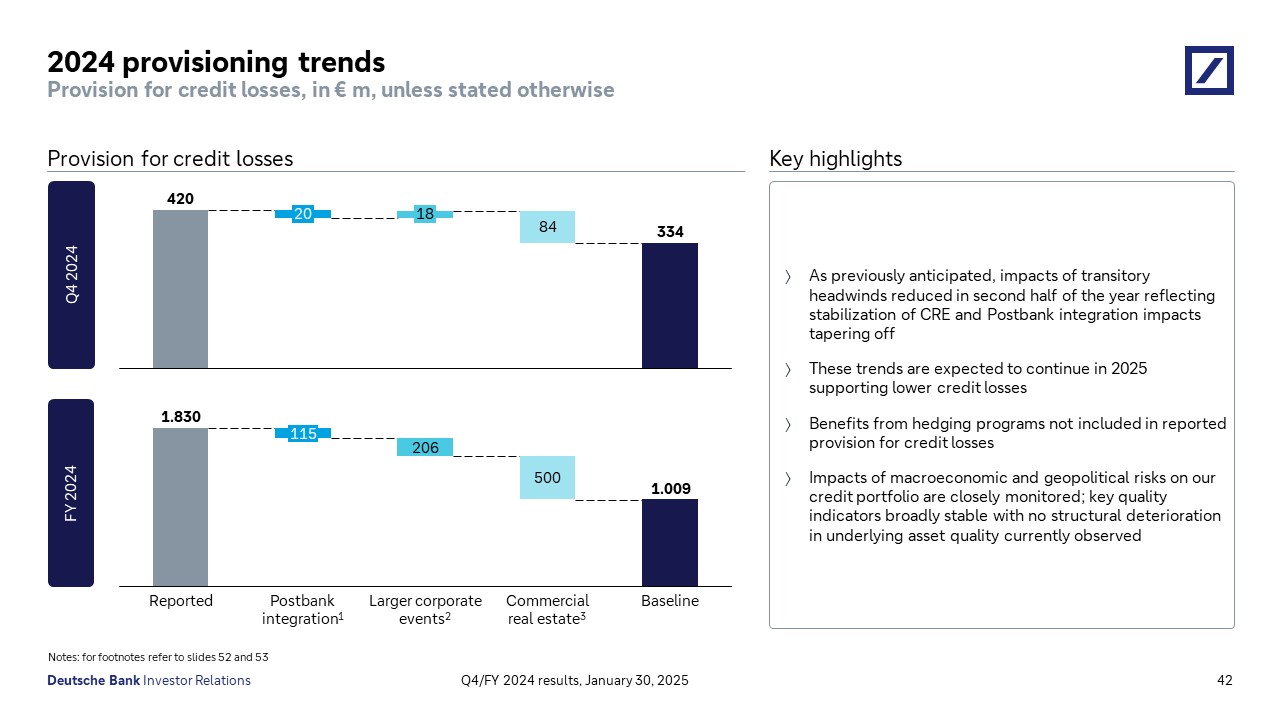

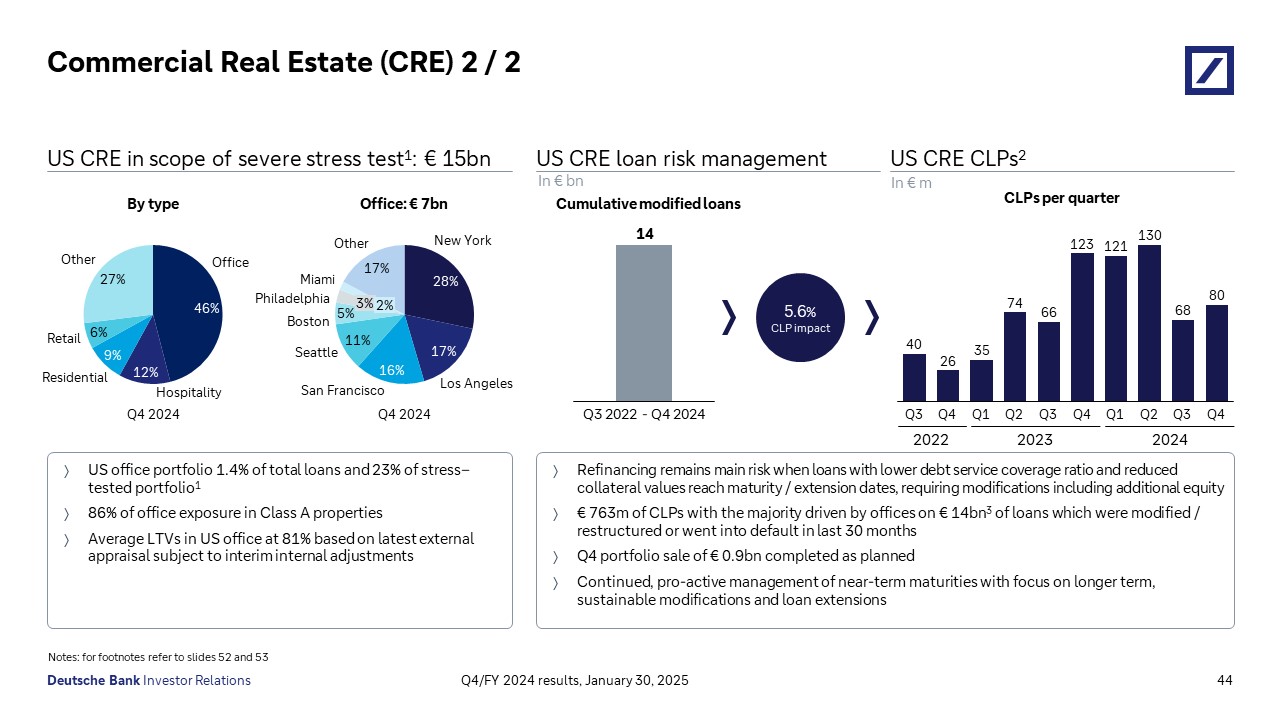

Credit provisions down 15% in the fourth quarter

Provision for credit losses was € 1.8 billion in 2024, up from € 1.5 billion in 2023 and 38 basis points (bps) of average loans, in line with the guidance the bank provided after the third quarter. The increase was driven by cyclical impacts from commercial real estate, a small number of corporate credit events and residual temporary impacts in the Private Bank following the Postbank integration. The wider portfolios performed broadly in line with expectations despite the challenging macroeconomic and interest rate environment.

In the fourth quarter, provision for credit losses was € 420 million and 35 bps of average loans, down 15% from € 494 million in the third quarter and down 14% from the prior year quarter. The quarter-on-quarter development primarily reflects a decline in provisions for non-performing loans (Stage 3) from € 482 million to € 415 million, driven by a larger recovery on a legacy case and a decline in commercial real estate provisions as expected. Provision for performing (Stage 1 and 2) loans was € 6 million; the effect of portfolio movements was largely offset by slightly improved macroeconomic forecasts and overlay recalculations. For 2025, the bank expects provision for credit losses to be around € 350-400 million per quarter on average.

Strong capital generation supports 50% year-on-year proposed dividend growth

The Common Equity Tier 1 (CET1) capital ratio was 13.8% at the end of 2024, up slightly compared to the end of 2023, as organic capital generation offset the combined impacts of dividends, share buybacks and business growth during the year. On a ‘pro forma’ basis, reflecting the introduction of the EU’s Capital Requirements Regulation 3 (CRR 3) on January 1, 2025, the CET1 ratio was 13.9%. Capital efficiency measures, part of Deutsche Bank’s accelerated execution of its Global Hausbank strategy, had delivered cumulative RWA equivalent reductions of € 24 billion by the end of 2024, close to the bank’s end-2025 target of € 25-30 billion. € 2.1 billion of capital distributions to shareholders are proposed or approved for execution in 2025, including € 1.3 billion in dividends of € 0.68 per share, up by 50% year on year, and approved share repurchases of € 750 million.

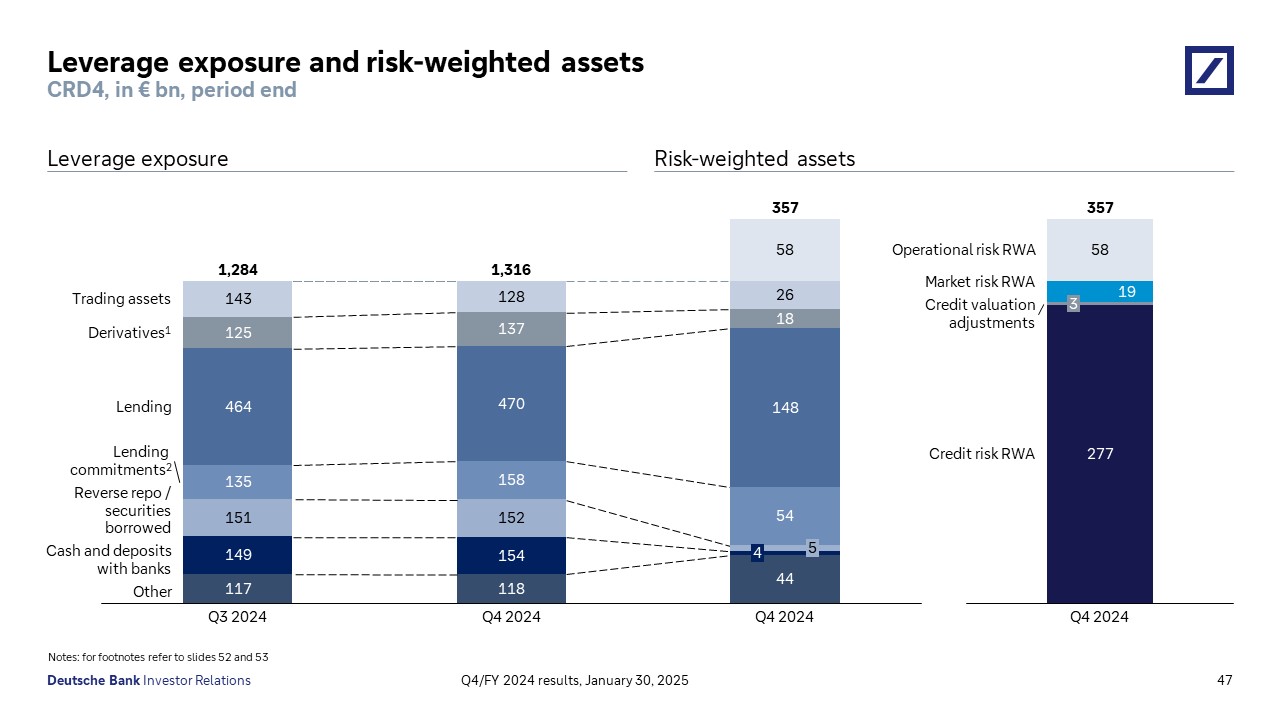

In the fourth quarter, the CET1 ratio was 13.8%, unchanged from the end of the third quarter. The CET1 ratio was impacted, as anticipated, by the deduction for the bank’s € 750 million share repurchase program announced today, largely offset by the positive impact of lower RWAs, principally due to lower market risk. As at the end of the fourth quarter, the bank had a CET1 capital buffer over requirements of € 9 billion.

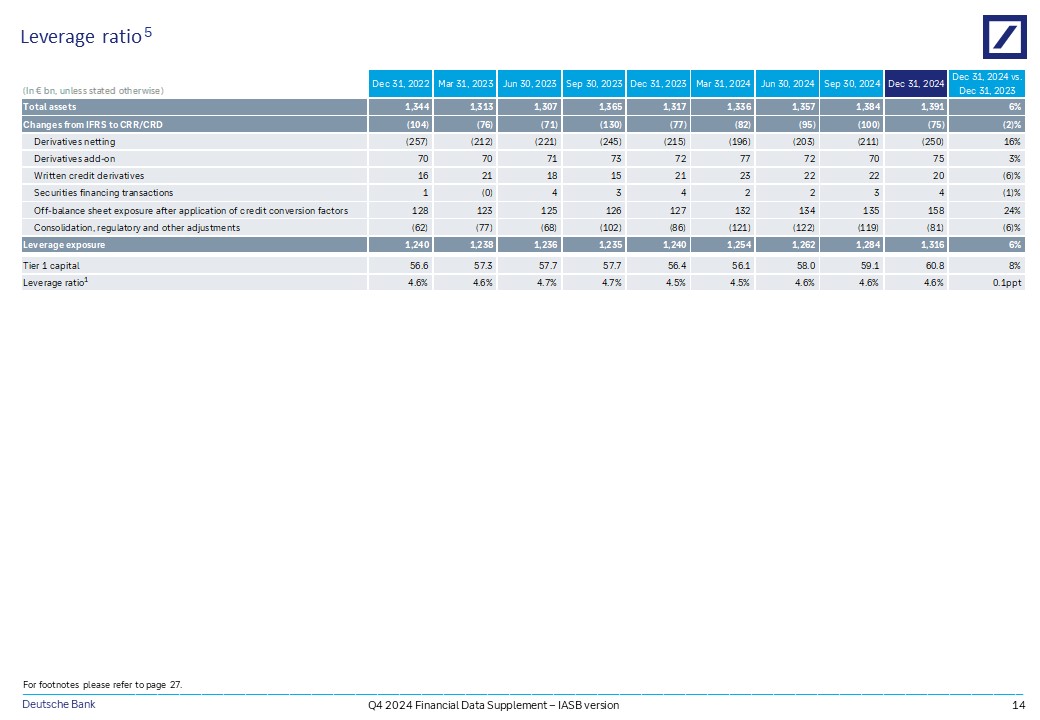

The Leverage ratio was 4.6% in the fourth quarter of 2024, unchanged versus the previous quarter. The bank’s € 1.5 billion AT1 issuance during the fourth quarter was partly offset by the aforementioned capital change relating to the upcoming share repurchase program.

8

Liquidity and funding strength

The Liquidity Coverage Ratio was 131%, above the regulatory requirement of 100%, representing a surplus of € 53 billion. The Net Stable Funding Ratio was 121%, slightly above the bank’s target range of 115-120% and representing a surplus of € 110 billion above required levels.

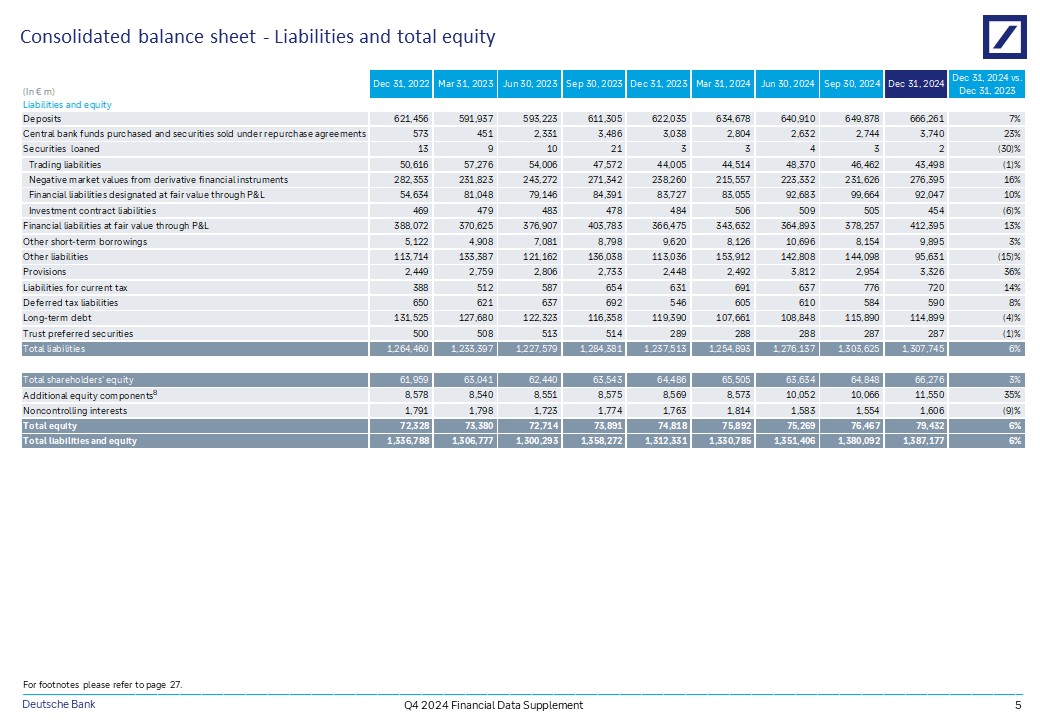

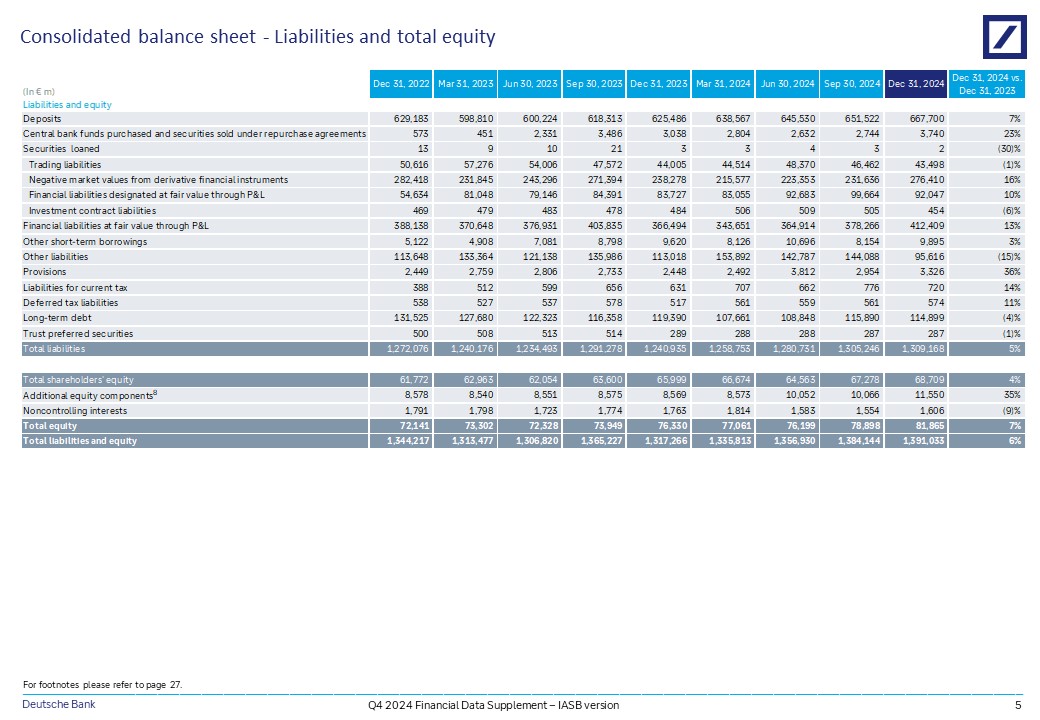

Deposits were € 666 billion at the end of 2024, up by € 44 billion from year-end 2023 and including a rise of € 16 billion during the fourth quarter of 2024.

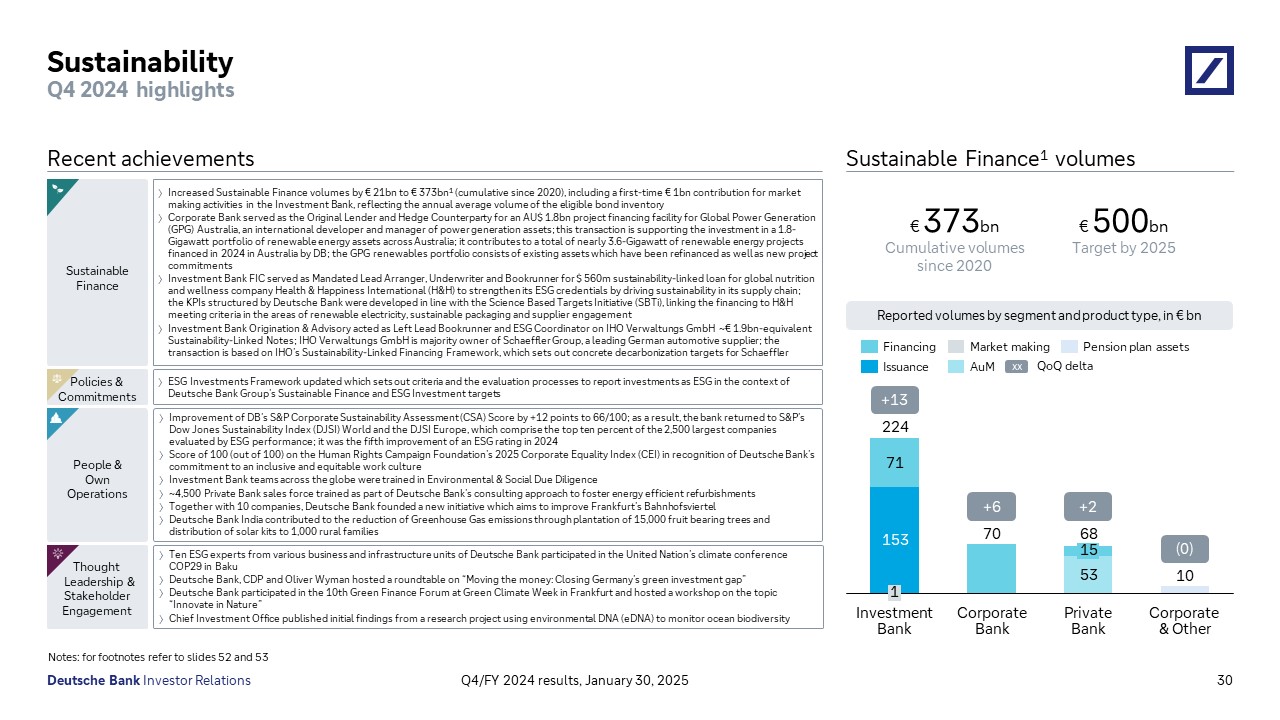

Sustainable Finance: volumes 2 reach € 373 billion in five years

Sustainable Financing and ESG investment volumes ex-DWS 2 were € 21 billion in the quarter, bringing the cumulative total since January 1, 2020 to € 373 billion and to € 93 billion in 2024, including a € 10 billion one-time contribution following the integration of ESG criteria into Deutsche Bank’s German pension plan. This was the second best since measurement began at the beginning of 2020 and an increase by almost half compared to 2023. Volumes in the fourth quarter included a first-time € 1 billion contribution for market making activities in the Investment Bank, reflecting the annual average volume of the eligible bond inventory.

At the end of the quarter, Deutsche Bank returned to the Dow Jones Sustainability Index (DJSI) with a score of 66 out of 100 in the annual Corporate Sustainability Assessment of S&P Global Sustainable1.

In the fourth quarter, Deutsche Bank’s businesses contributed as follows:

9

During the fourth quarter of 2024, notable transactions included:

10

Group results at a glance

1 For a description of this and other non-GAAP financial measures, see ‘Use of non-GAAP financial measures’ below, and on pp 15-22 of the fourth quarter 2024 Financial Data Supplement.

2 Cumulative ESG volumes include sustainable financing (flow) and ESG investments (stock) in the Corporate Bank, Investment Bank, Private Bank and Corporate & Other from January 1, 2020 to date. Products in scope include capital market issuance (bookrunner share only), market making activities (annual average volume of eligible bond inventory), sustainable financing, period-end assets under management and period-end pension plan assets (gross assets). Cumulative volumes and targets do not include ESG assets under management within DWS, which are reported separately by DWS.

ESG Classification

We defined our sustainable financing and ESG investment activities in the “Sustainable Financing Framework” and “Deutsche Bank ESG Investments Framework” which are available at investor-relations.db.com. Given the cumulative definition of our target, in cases where validation against the Framework cannot be completed before the end of the reporting quarter, volumes are reported upon completion of the validation in subsequent quarters. In Asset Management, for details on ESG product classification of DWS, please refer to the section “Our Responsibility – Sustainable Action – Our Product Suite” in DWS Annual Report 2023 .

11

For further information please contact:

Christian Streckert Eduard Stipic

Phone: +49 69 910 38079 Phone: +49 69 910 41864

Email: mailto:christian.streckert@db.com Email: eduard.stipic@db.com

Charlie Olivier

Phone: +44 20 7545 7866

Email: charlie.olivier@db.com

Investor Relations

+49 800 910-8000 (Frankfurt)

db.ir@db.com

Annual Media Conference

Deutsche Bank will host its Annual Media Conference at 09:00 CET today. Christian Sewing, Chief Executive Officer, and James von Moltke, Chief Financial Officer, will discuss the bank’s fourth quarter and full year 2024 financial results and provide an update on the bank’s strategy and outlook. This event can be followed live on the bank’s website from 09:00 to 11:00 CET.

Analyst call

An analyst call to discuss fourth quarter and full year 2024 financial results will take place at 11:00 CET today. The Financial Data Supplement (FDS), presentation and audio webcast for the analyst conference call are available at: http://www.db.com/quarterly-results

A fixed income investor call will take place on January 31, 2025, at 15:00 CET. This conference call will be transmitted via internet: http://www.db.com/quarterly-results

12

Annual Report

The figures in this release are preliminary and unaudited. Deutsche Bank will publish its 2024 Annual Report and Form 20-F on March 13, 2025.

About Deutsche Bank

Deutsche Bank provides retail and private banking, corporate and transaction banking, lending, asset and wealth management products and services as well as focused investment banking to private individuals, small and medium-sized companies, corporations, governments and institutional investors. Deutsche Bank is the leading bank in Germany with strong European roots and a global network.

Forward-looking statements

This release contains forward-looking statements. Forward-looking statements are statements that are not historical facts; they include statements about our beliefs and expectations and the assumptions underlying them. These statements are based on plans, estimates and projections as they are currently available to the management of Deutsche Bank. Forward-looking statements therefore speak only as of the date they are made, and we undertake no obligation to update publicly any of them in the light of new information or future events.

By their very nature, forward-looking statements involve risks and uncertainties. A number of important factors could therefore cause actual results to differ materially from those contained in any forward-looking statement.

Such factors include the conditions in the financial markets in Germany, in Europe, in the United States and elsewhere from which we derive a substantial portion of our revenues and in which we hold a substantial portion of our assets, the development of asset prices and market volatility, potential defaults of borrowers or trading counterparties, the implementation of our strategic initiatives, the reliability of our risk management policies, procedures and methods, and other risks referenced in our filings with the U.S. Securities and Exchange Commission. Such factors are described in detail in our SEC Form 20-F of March 14, 2024, under the heading “Risk Factors”. Copies of this document are readily available upon request or can be downloaded from http://www.db.com/ir .

Basis of Accounting

Results are prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (“IASB”) and endorsed by the European Union (“EU”), including, from 2020, application of portfolio fair value hedge accounting for non-maturing deposits and fixed rate mortgages with pre-payment options (the “EU carve-out”). Fair value hedge accounting under the EU carve-out is employed to minimise the accounting exposure to both positive and negative moves in interest rates in each tenor bucket thereby reducing the volatility of reported revenue from Treasury activities.

For the three-month period ended December 31, 2024, the application of the EU carve-out had a negative impact of € 127 million on profit before taxes and of € 60 million on profit. For the same time period in 2023, the application of the EU carve-out had a negative impact of € 1.9 billion on profit before taxes and of € 1.3 billion on profit. For the full year 2024, the application of the EU carve out had a negative impact of € 1.4 billion on profit before taxes and of € 976 million on profit. For the full year 2023, the application of the EU carve out had a negative impact of € 2.3 billion on profit before taxes and of € 1.6 billion on profit. The Group’s regulatory capital and ratios thereof are also reported on the basis of the EU carve-out version of IAS 39. As of December 31, 2024, the application of the EU carve-out had a negative impact on the CET1 capital ratio of about 68 basis points compared to a negative impact of about 43 basis points as of December 31, 2023. In any given period, the net effect of the EU carve-out can be positive or negative, depending on the fair market value changes in the positions being hedged and the hedging instruments.

13

Use of Non-GAAP Financial Measures

This report and other documents the bank has published or may publish contain non-GAAP financial measures. Non-GAAP financial measures are measures of our historical or future performance, financial position or cash flows that contain adjustments that exclude or include amounts that are included or excluded, as the case may be, from the most directly comparable measure calculated and presented in accordance with IFRS in our financial statements. Examples of our non-GAAP financial measures, and the most directly comparable IFRS financial measures, are as follows:

|

Non-GAAP Financial Measure |

|

Most Directly Comparable IFRS Financial Measure |

|

|

Profit (loss) before tax before nonoperating costs, Profit (loss) before tax excluding specific litigation items |

|

Profit (loss) before tax |

|

|

Profit (loss) attributable to Deutsche Bank shareholders for the segments, Profit (loss) attributable to Deutsche Bank shareholders and additional equity components for the segments, Profit (loss) excluding specific litigation items, Profit (loss) attributable to Deutsche Bank shareholders excluding specific litigation items |

|

Profit (loss) |

|

|

Revenues excluding specific items, Revenues on a currency-adjusted basis |

|

Net revenues |

|

|

Adjusted costs, Costs on a currency-adjusted basis, Nonoperating costs, Specific litigation items |

|

Noninterest expenses |

|

|

Cost/income ratio excluding specific litigation items |

|

Cost/income ratio based on noninterest expenses |

|

|

Net assets (adjusted) |

|

Total assets |

|

|

Tangible shareholders’ equity, Average tangible shareholders’ equity, Tangible book value, Average tangible book value |

|

Total shareholders’ equity (book value) |

|

|

Post-tax return on average shareholders’ equity (based on Profit (loss) attributable to Deutsche Bank shareholders after AT1 coupon), Post-tax return on average tangible shareholders’ equity (based on Profit (loss) attributable to Deutsche Bank shareholders after AT1 coupon), Post-tax return on average shareholders’ equity excluding specific litigation items, Post-tax return on average tangible shareholders’ equity excluding specific litigation items |

|

Post-tax return on average shareholders’ equity |

|

|

Tangible book value per basic share outstanding, Book value per basic share outstanding |

|

Book value per share outstanding |

|

14

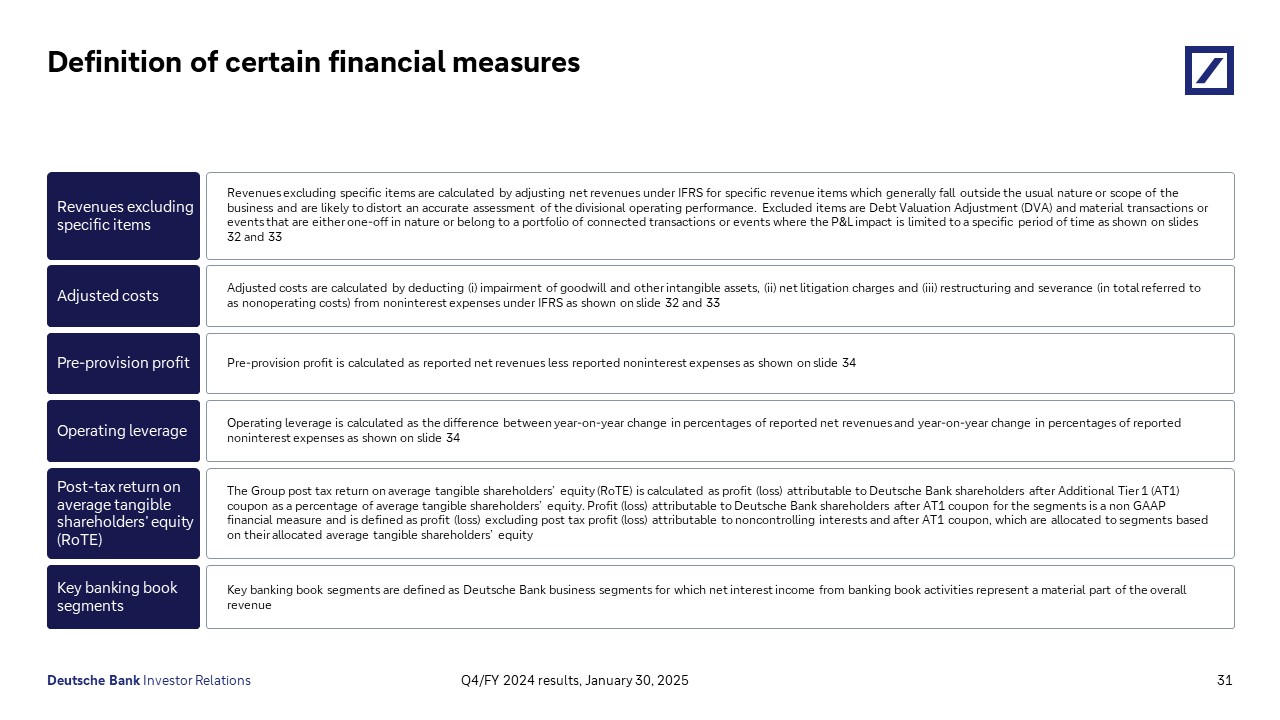

Revenues excluding specific items is calculated by adjusting net revenues under IFRS for specific revenue items which generally fall outside the usual nature or scope of the business and are likely to distort an accurate assessment of the divisional operating performance. Excluded items are debt valuation adjustment (DVA) and material transactions or events that are either one-off in nature or belong to a portfolio of connected transactions or events where the P&L impact is limited to a specific period of time.

Revenues and costs on a currency-adjusted basis are calculated by translating prior period revenues that were generated or incurred in non-euro currencies into euros at the foreign exchange rates that prevailed during the current period. These adjusted figures, and period-to-period percentage changes based thereon, are intended to provide information on the development of underlying business volumes.

Adjusted costs are calculated by deducting (i) impairment of goodwill and other intangible assets, (ii) net litigation charges and (iii) restructuring and severance, in total referred to as nonoperating costs , from noninterest expenses under IFRS.

Specific litigation items are costs relating to the bank’s provision for Postbank takeover litigation, the reversal of the bank’s RusChemAlliance (RCA) indemnification asset, and the bank’s provision relating to Polish FX mortgages.

Exceptional items consist of real estate measures and true-up adjustments for UK bank levies.

15

Exhibit 99.4

Media Release

30 January 2025

Frankfurt am Main

Deutsche Bank reports 2024 profit before tax of € 6.7 billion and € 2.1 billion of proposed capital distributions to shareholders

Revenue and business performance in 2024

Resolution of specific cost items

Operating performance

€ 2.1 billion in capital distributions to shareholders announced for 2025 so far

|

Issued by the media relations department of Deutsche Bank AG

|

Internet: https://www.db.com/newsroom Email: db.media@db.com |

Fourth quarter of 2024: Operating performance and resolution of specific items

>10% RoTE target in 2025 and capital distribution goal reaffirmed, reflecting expectations of:

“2024 was a vital year for Deutsche Bank,” Christian Sewing, Chief Executive Officer, said. “Our strong and growing operating performance reflects the turnaround achieved in recent years. We delivered another year with continued business momentum, maintained tight operating cost discipline, acted decisively to put significant legacy costs behind us and continued to invest in our platform. All of this – together with the strong start we have made this year – gives us firm confidence that we will deliver on our RoTE target of above 10% in 2025 and further increase distributions to shareholders. In addition, we are already working on measures to further increase returns in the coming years.”

The bank’s financial targets, goals and capital objectives are based on our financial results prepared in accordance with the International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and endorsed by the European Union (“EU”). For further details, please refer to the section ‘Basis of Accounting’ on page 12 hereof.

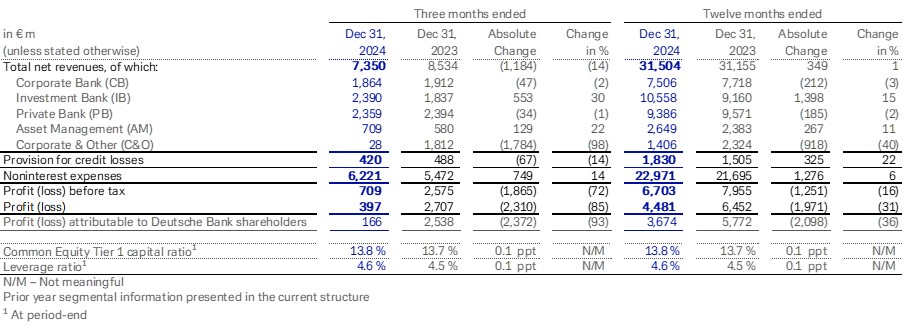

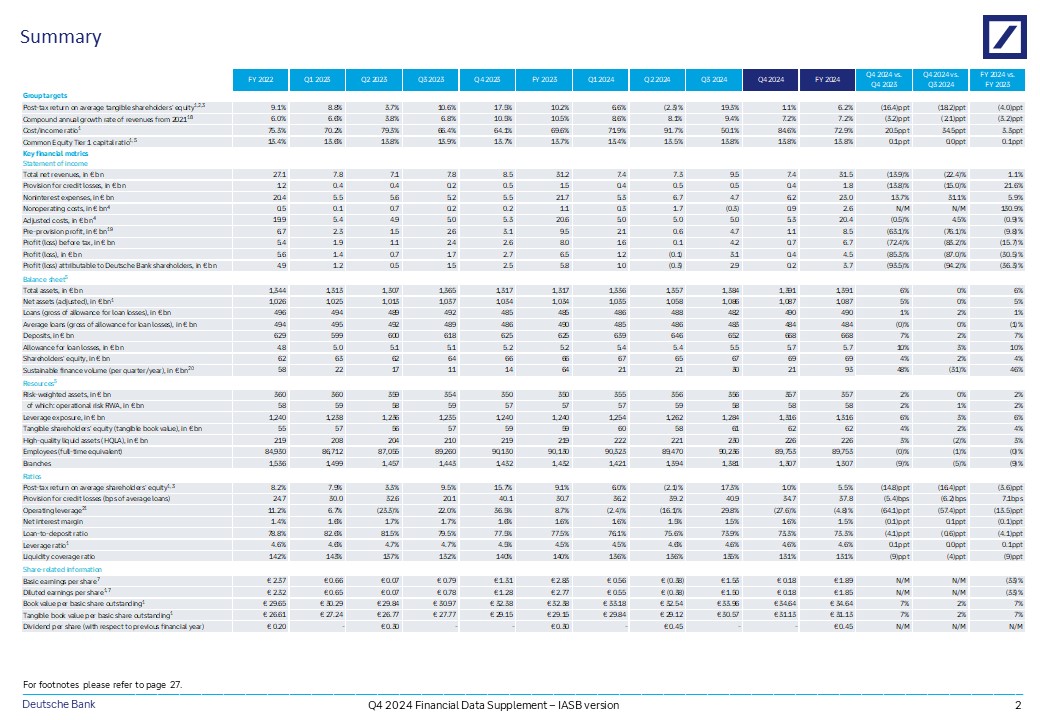

Deutsche Bank (XETRA: DBGn.DB / NYSE: DB) today announced profit before tax of € 6.7 billion for the full year 2024, down 16% compared to 2023. Revenues grew by 1% year on year to € 31.5 billion. Noninterest expenses were € 23.0 billion, up 6%, and included € 1.7 billion relating to specific litigation items including settlements relating to the bank’s takeover of Postbank AG; adjusted for these items, profit before tax was € 8.4 billion. Adjusted costs, which exclude nonoperating items, were down 1% to € 20.4 billion, and included € 235 million in fourth quarter exceptional items consisting of real estate measures and true-up adjustments for UK bank levies.

Net profit was € 4.5 billion, down from € 6.5 billion in 2023. This year-on-year development reflected both costs relating to specific litigation items in 2024 and the non-recurrence in 2024 of € 1.0 billion in DTA valuation adjustments which positively impacted 2023.

2

Post-tax return on average shareholders’ equity (RoE) was 5.5%, compared to 9.1% in the prior year. Post-tax return on average tangible shareholders’ equity (RoTE 1 ) was 6.2% in 2024, compared to 10.2% in 2023. 2024 RoTE excluding specific litigation items 1 was 8.6%. The year-on-year development in both ratios reflects both the specific litigation items in 2024 and the non-recurrence of the DTA valuation adjustments which positively impacted 2023. The cost/income ratio was 73%, compared to 70% in 2023, and 68% excluding the aforementioned specific litigation items.

Deutsche Bank reaffirms its target for RoTE of above 10% in 2025. The bank reaffirms its 2025 revenue goal of around € 32 billion, not including further upside potential from exchange rate movements. The bank expects provision for credit losses to moderate from 2024 levels. The bank also expects to reduce noninterest expenses. Nonoperating costs are expected to normalize considerably, primarily through the non-recurrence of significant litigation items, while adjusted costs are expected to remain essentially flat compared to 2024, creating significant operating leverage. The bank is on track to achieve its target of € 2.5 billion euros in cost savings from its operational efficiency program, which offset additional investments to support further business growth and increased returns to shareholders beyond 2025. Reflecting both operational efficiencies and additional investments, the bank now targets a cost/income ratio of below 65% in 2025, slightly above its original target of below 62.5%.

Fourth-quarter pre-tax profit was € 709 million, down 72% from the fourth quarter of 2023. This development reflected lower revenues in the fourth quarter 2024, charges for specific litigation items of € 594 million in the quarter, as well as the aforementioned exceptional items of € 235 million. Net profit was € 397 million, additionally reflecting non-tax-deductible litigation items during the quarter, and the non-recurrence of € 1.0 billion in DTA valuation adjustments which positively impacted the prior year quarter.

A further € 2.1 billion in planned capital distributions to shareholders

Deutsche Bank today announced plans for € 2.1 billion in further capital distributions to shareholders in 2025. The bank has received supervisory authorization for further share repurchases of € 750 million so far in 2025 and plans to propose 2024 dividends of € 1.3 billion, or € 0.68 per share, at its Annual General Meeting in May 2025, up 50% from € 0.45 per share for 2023. These measures would increase cumulative capital distributions to shareholders to € 5.4 billion since 2022, in excess of the € 5 billion goal in the bank’s transformation program launched in 2019. The bank reaffirms its aim to exceed its capital distribution goal of € 8 billion in respect of the financial years 2021-25, paid in 2022-26.

3

James von Moltke, Chief Financial Officer, added: “Our performance in 2024 was impacted by significant nonoperating costs, particularly longstanding litigation items, and actions we took to accelerate the execution of our strategy. Having put these behind us, we look ahead to 2025 having decisively reduced our risk profile and with confidence that our operating strength will be clearly reflected in our financial results. We remain absolutely focused on achieving the full benefits of our operational efficiency program and expect credit provisions to normalize. This positions us to grow returns, boost organic capital generation and exceed our € 8 billion goal for capital distributions through 2026.”

Accelerating execution of the Global Hausbank strategy: further progress towards 2025 targets

Deutsche Bank made further progress on accelerating execution of its Global Hausbank strategy on all dimensions during 2024:

4

Revenues: fourth-quarter and full-year performance with market share gains and growing assets under management

Net revenues were € 31.5 billion in 2024, up 1% year on year. Commissions and fee income grew 13% to € 10.4 billion, while net interest income in key segments of the banking book remained resilient, reflecting higher deposit volumes and loan margin expansion . Fourth-quarter net revenues were € 7.4 billion, down 14% year on year. Deutsche Bank reaffirms its goal for revenues of around € 32 billion in 2025.

Revenue performance in the bank’s businesses in 2024 was as follows:

5

6

Noninterest expenses: operating cost discipline more than offset by impact of specific litigation items

Noninterest expenses were € 23.0 billion in 2024, up 6% year on year. Non-operating costs were € 2.6 billion, up from € 1.1 billion in 2023, and included € 1.7 billion in charges relating to specific litigation items, up from € 255 million in the prior year and including approximately € 900 million relating to the bank’s takeover of Postbank AG. Adjusted costs , which exclude nonoperating items, were € 20.4 billion, down 1% year on year and included € 235 million in real estate measures and true-up adjustments to UK bank levies. Higher compensation and benefit expenses were largely offset by lower technology and professional services costs during the year.

In the fourth quarter , noninterest expenses were € 6.2 billion, up 14% from the prior year quarter. Nonoperating costs were € 945 million, up from € 167 million in the prior year quarter, and including € 594 million relating to the aforementioned specific litigation items. Fourth quarter adjusted costs were € 5.3 billion, down 1%, from the prior year quarter and included the aforementioned € 235 million of exceptional items together with a negative year-on-year FX impact of € 65 million.

The workforce

was 89,753 FTEs at the end of 2024, a decrease of 483 FTEs during the fourth quarter and down 377 FTEs during the year. Investments in business growth, controls and technology, together with internalizations of external contract staff, were more than offset by leavers, including through operational efficiency measures, during the year.

7

Credit provisions down 15% in the fourth quarter

Provision for credit losses was € 1.8 billion in 2024, up from € 1.5 billion in 2023 and 38 basis points (bps) of average loans, in line with the guidance the bank provided after the third quarter. The increase was driven by cyclical impacts from commercial real estate, a small number of corporate credit events and residual temporary impacts in the Private Bank following the Postbank integration. The wider portfolios performed broadly in line with expectations despite the challenging macroeconomic and interest rate environment.

In the fourth quarter, provision for credit losses was € 420 million and 35 bps of average loans, down 15% from € 494 million in the third quarter and down 14% from the prior year quarter. The quarter-on-quarter development primarily reflects a decline in provisions for non-performing loans (Stage 3) from € 482 million to € 415 million, driven by a larger recovery on a legacy case and a decline in commercial real estate provisions as expected. Provision for performing (Stage 1 and 2) loans was € 6 million; the effect of portfolio movements was largely offset by slightly improved macroeconomic forecasts and overlay recalculations. For 2025, the bank expects provision for credit losses to be around € 350-400 million per quarter on average.

Strong capital generation supports 50% year-on-year proposed dividend growth

The Common Equity Tier 1 (CET1) capital ratio was 13.8% at the end of 2024, up slightly compared to the end of 2023, as organic capital generation offset the combined impacts of dividends, share buybacks and business growth during the year. On a ‘pro forma’ basis, reflecting the introduction of the EU’s Capital Requirements Regulation 3 (CRR 3) on January 1, 2025, the CET1 ratio was 13.9%. Capital efficiency measures, part of Deutsche Bank’s accelerated execution of its Global Hausbank strategy, had delivered cumulative RWA equivalent reductions of € 24 billion by the end of 2024, close to the bank’s end-2025 target of € 25-30 billion. € 2.1 billion of capital distributions to shareholders are proposed or approved for execution in 2025, including € 1.3 billion in dividends of € 0.68 per share, up by 50% year on year, and approved share repurchases of € 750 million.

In the fourth quarter, the CET1 ratio was 13.8%, unchanged from the end of the third quarter. The CET1 ratio was impacted, as anticipated, by the deduction for the bank’s € 750 million share repurchase program announced today, largely offset by the positive impact of lower RWAs, principally due to lower market risk. As at the end of the fourth quarter, the bank had a CET1 capital buffer over requirements of € 9 billion.

The Leverage ratio was 4.6% in the fourth quarter of 2024, unchanged versus the previous quarter. The bank’s € 1.5 billion AT1 issuance during the fourth quarter was partly offset by the aforementioned capital change relating to the upcoming share repurchase program.

8

Liquidity and funding strength

The Liquidity Coverage Ratio was 131%, above the regulatory requirement of 100%, representing a surplus of € 53 billion. The Net Stable Funding Ratio was 121%, slightly above the bank’s target range of 115-120% and representing a surplus of € 110 billion above required levels.

Deposits were € 668 billion at the end of 2024, up by € 42 billion from year-end 2023 and including a rise of € 16 billion during the fourth quarter of 2024.

Sustainable Finance: volumes 2 reach € 373 billion in five years

Sustainable Financing and ESG investment volumes ex-DWS 2 were € 21 billion in the quarter, bringing the cumulative total since January 1, 2020 to € 373 billion and to € 93 billion in 2024, including a € 10 billion one-time contribution following the integration of ESG criteria into Deutsche Bank’s German pension plan. This was the second best since measurement began at the beginning of 2020 and an increase by almost half compared to 2023. Volumes in the fourth quarter included a first-time € 1 billion contribution for market making activities in the Investment Bank, reflecting the annual average volume of the eligible bond inventory.

At the end of the quarter, Deutsche Bank returned to the Dow Jones Sustainability Index (DJSI) with a score of 66 out of 100 in the annual Corporate Sustainability Assessment of S&P Global Sustainable1.

In the fourth quarter, Deutsche Bank’s businesses contributed as follows:

9

During the fourth quarter of 2024, notable transactions included:

10

Group results at a glance

1 For a description of this and other non-GAAP financial measures, see ‘Use of non-GAAP financial measures’ below, and on pp 15-22 of the fourth quarter 2024 Financial Data Supplement.

2 Cumulative ESG volumes include sustainable financing (flow) and ESG investments (stock) in the Corporate Bank, Investment Bank, Private Bank and Corporate & Other from January 1, 2020 to date. Products in scope include capital market issuance (bookrunner share only), market making activities (annual average volume of eligible bond inventory), sustainable financing, period-end assets under management and period-end pension plan assets (gross assets). Cumulative volumes and targets do not include ESG assets under management within DWS, which are reported separately by DWS.

ESG Classification

We defined our sustainable financing and ESG investment activities in the “Sustainable Financing Framework” and “Deutsche Bank ESG Investments Framework” which are available at investor-relations.db.com. Given the cumulative definition of our target, in cases where validation against the Framework cannot be completed before the end of the reporting quarter, volumes are reported upon completion of the validation in subsequent quarters. In Asset Management, for details on ESG product classification of DWS, please refer to the section “Our Responsibility – Sustainable Action – Our Product Suite” in DWS Annual Report 2023 .

11

For further information please contact:

Christian Streckert Eduard Stipic

Phone: +49 69 910 38079 Phone: +49 69 910 41864

Email: mailto:christian.streckert@db.com Email: eduard.stipic@db.com

Charlie Olivier

Phone: +44 20 7545 7866

Email: charlie.olivier@db.com

Investor Relations

+49 800 910-8000 (Frankfurt)

db.ir@db.com

Annual Media Conference

Deutsche Bank will host its Annual Media Conference at 09:00 CET today. Christian Sewing, Chief Executive Officer, and James von Moltke, Chief Financial Officer, will discuss the bank’s fourth quarter and full year 2024 financial results and provide an update on the bank’s strategy and outlook. This event can be followed live on the bank’s website from 09:00 to 11:00 CET.

Analyst call

An analyst call to discuss fourth quarter and full year 2024 financial results will take place at 11:00 CET today. The Financial Data Supplement (FDS), presentation and audio webcast for the analyst conference call are available at: http://www.db.com/quarterly-results

A fixed income investor call will take place on January 31, 2025, at 15:00 CET. This conference call will be transmitted via internet: http://www.db.com/quarterly-results

12

Annual Report

The figures in this release are preliminary and unaudited. Deutsche Bank will publish its 2024 Annual Report and Form 20-F on March 13, 2025.

About Deutsche Bank

Deutsche Bank provides retail and private banking, corporate and transaction banking, lending, asset and wealth management products and services as well as focused investment banking to private individuals, small and medium-sized companies, corporations, governments and institutional investors. Deutsche Bank is the leading bank in Germany with strong European roots and a global network.

Forward-looking statements

This release contains forward-looking statements. Forward-looking statements are statements that are not historical facts; they include statements about our beliefs and expectations and the assumptions underlying them. These statements are based on plans, estimates and projections as they are currently available to the management of Deutsche Bank. Forward-looking statements therefore speak only as of the date they are made, and we undertake no obligation to update publicly any of them in the light of new information or future events.

By their very nature, forward-looking statements involve risks and uncertainties. A number of important factors could therefore cause actual results to differ materially from those contained in any forward-looking statement.

Such factors include the conditions in the financial markets in Germany, in Europe, in the United States and elsewhere from which we derive a substantial portion of our revenues and in which we hold a substantial portion of our assets, the development of asset prices and market volatility, potential defaults of borrowers or trading counterparties, the implementation of our strategic initiatives, the reliability of our risk management policies, procedures and methods, and other risks referenced in our filings with the U.S. Securities and Exchange Commission. Such factors are described in detail in our SEC Form 20-F of March 14, 2024, under the heading “Risk Factors”. Copies of this document are readily available upon request or can be downloaded from http://www.db.com/ir .

Basis of Accounting

The results set forth herein are intended for U.S. investors and are prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) (IASB IFRS). By contrast, the results that the Group publishes for non-U.S. purposes are prepared in accordance with IFRS as issued by the IASB and endorsed by the European Union (“EU”), including, from 2020, application of portfolio fair value hedge accounting for non-maturing deposits and fixed rate mortgages with pre-payment options (the “EU carve-out”). Fair value hedge accounting under the EU carve-out is employed to minimize the accounting exposure to both positive and negative moves in interest rates in each tenor bucket thereby reducing the volatility of reported revenue from Treasury activities.

For the three-month period ended December 31, 2024, the application of the EU carve-out had a negative impact of € 127 million on profit before taxes and of € 60 million on profit. For the same time period in 2023, the application of the EU carve-out had a negative impact of € 1.9 billion on profit before taxes and of € 1.3 billion on profit. For the full year 2024, the application of the EU carve-out had a negative impact of € 1.4 billion on profit before taxes and of € 976 million on profit. For the full year 2023, the application of the EU carve-out had a negative impact of € 2.3 billion on profit before taxes and of € 1.6 billion on profit. The Group’s regulatory capital and ratios thereof are also reported on the basis of the EU carve-out version of IAS 39. As of December 31, 2024, the application of the EU carve-out had a negative impact on the CET1 capital ratio of about 68 basis points compared to a negative impact of about 43 basis points as of December 31, 2023. In any given period, the net effect of the EU carve-out can be positive or negative, depending on the fair market value changes in the positions being hedged and the hedging instruments.

13

Use of Non-GAAP Financial Measures

This report and other documents the bank has published or may publish contain non-GAAP financial measures. Non-GAAP financial measures are measures of our historical or future performance, financial position or cash flows that contain adjustments that exclude or include amounts that are included or excluded, as the case may be, from the most directly comparable measure calculated and presented in accordance with IFRS in our financial statements. Examples of our non-GAAP financial measures, and the most directly comparable IFRS financial measures, are as follows:

|

Non-GAAP Financial Measure |

|

Most Directly Comparable IFRS Financial Measure |

|

|

Profit (loss) before tax before nonoperating costs, Profit (loss) before tax excluding specific litigation items |

|

Profit (loss) before tax |

|

|

Profit (loss) attributable to Deutsche Bank shareholders for the segments, Profit (loss) attributable to Deutsche Bank shareholders and additional equity components for the segments, Profit (loss) excluding specific litigation items, Profit (loss) attributable to Deutsche Bank shareholders excluding specific litigation items |

|

Profit (loss) |

|

|

Revenues excluding specific items, Revenues on a currency-adjusted basis |

|

Net revenues |

|

|

Adjusted costs, Costs on a currency-adjusted basis, Nonoperating costs, Specific litigation items |

|

Noninterest expenses |

|

|

Cost/income ratio excluding specific litigation items |

|

Cost/income ratio based on noninterest expenses |

|

|

Net assets (adjusted) |

|

Total assets |

|

|

Tangible shareholders’ equity, Average tangible shareholders’ equity, Tangible book value, Average tangible book value |

|

Total shareholders’ equity (book value) |

|

|

Post-tax return on average shareholders’ equity (based on Profit (loss) attributable to Deutsche Bank shareholders after AT1 coupon), Post-tax return on average tangible shareholders’ equity (based on Profit (loss) attributable to Deutsche Bank shareholders after AT1 coupon), Post-tax return on average shareholders’ equity excluding specific litigation items, Post-tax return on average tangible shareholders’ equity excluding specific litigation items |

|

Post-tax return on average shareholders’ equity |

|

|

Tangible book value per basic share outstanding, Book value per basic share outstanding |

|

Book value per share outstanding |

|

14

Revenues excluding specific items is calculated by adjusting net revenues under IFRS for specific revenue items which generally fall outside the usual nature or scope of the business and are likely to distort an accurate assessment of the divisional operating performance. Excluded items are debt valuation adjustment (DVA) and material transactions or events that are either one-off in nature or belong to a portfolio of connected transactions or events where the P&L impact is limited to a specific period of time.

Revenues and costs on a currency-adjusted basis are calculated by translating prior period revenues that were generated or incurred in non-euro currencies into euros at the foreign exchange rates that prevailed during the current period. These adjusted figures, and period-to-period percentage changes based thereon, are intended to provide information on the development of underlying business volumes.

Adjusted costs are calculated by deducting (i) impairment of goodwill and other intangible assets, (ii) net litigation charges and (iii) restructuring and severance, in total referred to as nonoperating costs , from noninterest expenses under IFRS.

Specific litigation items are costs relating to the bank’s provision for Postbank takeover litigation, the reversal of the bank’s RusChemAlliance (RCA) indemnification asset, and the bank’s provision relating to Polish FX mortgages.

Exceptional items consist of real estate measures and true-up adjustments for UK bank levies.

15

Exhibit 99.6

Articles of Association of Deutsche Bank Aktiengesellschaft

In conformity with the resolution of the Supervisory Board on December 12, 2024

______________________________________________________________________________

– 2 –

I.

General Provisions

§ 1

The stock corporation bears the name

Deutsche Bank

Aktiengesellschaft

It is domiciled in Frankfurt am Main.

§ 2

(1)The object of the enterprise is the transaction of banking business of every kind, the provision of financial and other services, and the promotion of international economic relations. The Company may realize this object itself or through subsidiaries and affiliated companies.

(2)To the extent permitted by law, the Company is entitled to transact all business and take all steps which appear likely to promote the object of the Company, in particular to acquire and dispose of real estate, to establish branches at home and abroad, to acquire, administer and dispose of participations in other enterprises, and to conclude enterprise agreements.

§ 3

(1)The Company’s notices shall be published in the Federal Gazette [Bundesanzeiger].

(2)Information to the owners of admitted securities may also be communicated by way of remote data transmission.

II. Share Capital and Shares

§ 4

(1)The share capital is €4,987,527,385.60 .

It is divided into 1,948,252,885 no par value shares.

(2)The Company shall not obtain any lien pursuant to its General Business Conditions in respect of the shares it has issued except by special pledging agreements.

(3)(deleted)

______________________________________________________________________________

– 3 –

(4)The Management Board is authorized to increase the share capital on or before April 30, 2026, once or more than once, by up to a total of €512,000,000 through the issue of new shares against cash payments (Authorized Capital 2021/I). Shareholders are to be granted pre-emptive rights. However, the Management Board is authorized to except broken amounts from shareholders’ pre-emptive rights and to exclude pre-emptive rights insofar as is necessary to grant to the holders of option rights, convertible bonds and convertible participatory rights issued by the company and its affiliated companies pre-emptive rights to new shares to the extent that they would be entitled to such rights after exercising their option or conversion rights. The Management Board is also authorized to exclude the pre-emptive rights in full if the issue price of the new shares is not significantly lower than the quoted price of the shares already listed at the time of the final determination of the issue price and the total shares issued since the authorization in accordance with § 186 (3) sentence 4 Stock Corporation Act do not exceed 10% of the share capital at the time the authorization becomes effective – or if the value is lower – at the time the authorization is utilized. Shares that are issued or sold during the validity of this authorization with the exclusion of preemptive rights, in direct or analogous application of § 186 (3) sentence 4 Stock Corporation Act, are to be included in the maximum limit of 10% of the share capital. Also to be included are shares that are to be issued to service option and/or conversion rights from convertible bonds, bonds with warrants, convertible participatory rights or participatory rights, if these bonds or participatory rights are issued during the validity of this authorization with the exclusion of pre-emptive rights in corresponding application of § 186 (3) sentence 4 Stock Corporation Act. The Management Board may make use of the authorizations above to exclude preemptive rights only to the extent that the proportional amount of the newly issued shares with the exclusion of pre-emptive rights does not exceed 10% of the share capital. Decisive for calculating the 10% limit is the amount of share capital at the time this authorization becomes effective. Should the amount of share capital be lower at the time this authorization is exercised, this amount is decisive. If, during the period of this authorization until its utilization, use is made of other authorizations to issue company shares or to issue rights that enable or obligate the subscription of the company’s shares and pre-emptive rights are excluded in the process, this is to be counted towards the 10% limit specified above. Management Board resolutions to utilize authorized capital and to exclude pre-emptive rights require the Supervisory Board’s approval. The new shares may also be taken up by banks specified by the Management Board with the obligation to offer them to shareholders (indirect pre-emptive right).

(5)The Management Board is authorized to increase the share capital on or before April 30, 2026, once or more than once, by up to a total of €2,048,000,000 through the issue of new shares against cash payments (Authorized Capital 2021/II). Shareholders are to be granted pre-emptive rights. However, the Management Board is authorized to except broken amounts from shareholders’ pre-emptive rights and to exclude pre-emptive rights insofar as is necessary to grant to the holders of option rights, convertible bonds and convertible participatory rights issued by the company and its affiliated companies pre-emptive rights to new shares to the extent that they would be entitled to such rights after exercising their option or conversion rights. The Management Board may make use of the authorizations above to exclude pre-emptive rights only to the extent that the proportional amount of the newly issued shares with the exclusion of pre-emptive rights does not exceed 10% of the share capital. Decisive for calculating the 10% limit is the amount of share capital at the time this authorization becomes effective. Should the amount of share capital be lower at the time this authorization is exercised, this amount is decisive. If, during the period of this authorization until its utilization, use is made of other authorizations to issue company shares or to issue rights that enable or obligate the subscription of the company’s shares and preemptive rights are excluded in the process, this is to be counted towards the 10% limit specified above. Management Board resolutions to utilize authorized capital and to exclude pre-emptive rights require the Supervisory Board’s approval. The new shares may also be taken up by banks specified by the Management Board with the obligation to offer them to shareholders (indirect pre-emptive right).

______________________________________________________________________________

– 4 –

(6)(deleted)

§ 5

(1)The shares are registered shares. Shareholders must notify the Company, for registration in the share register, of the personal information specified in § 67 (1) Stock Corporation Act as well as the number of shares they hold.

(2)If, in the event of a capital increase, the resolution on the increase does not specify whether the new shares are to be made out to bearer or registered in a name, they shall be registered in a name.

(3)The form that shares and dividend and renewal coupons are to take shall be determined by the Management Board in agreement with the Supervisory Board. The same shall apply to bonds and interest coupons. Global certificates may be issued. The claim of shareholders to have their shares and any dividend and renewal coupons issued in individual certificate form is excluded unless such issue is required by the rules in force at a stock exchange where the shares are listed.

III. The Management Board

§ 6

(1)The Management Board shall consist of not less than three members.

(2)The Supervisory Board shall appoint the members of the Management Board and determine their number. The Supervisory Board may appoint deputy members of the Management Board.

§ 7

(1)The Company shall be legally represented by two members of the Management Board or by one member jointly with a holder of procuration [Prokurist].

(2)The deputy members of the Management Board shall rank equally with full members in respect of powers of representation.

§ 8

For the purpose of closer contact and business consultation with trade and industry, the Management Board may form Advisory Boards and Regional Advisory Councils, lay down rules of procedure for their business and establish the remuneration of their members. The Supervisory Board shall be informed once a year of any changes in the membership of the Advisory Boards and the Regional Advisory Councils.

______________________________________________________________________________

– 5 –

IV. The Supervisory Board

§ 9

(1)The Supervisory Board shall consist of 20 members. They are elected for the period until conclusion of the General Meeting which adopts the resolutions concerning the ratification of acts of management for the fourth financial year following the beginning of the term of office. Here, the financial year in which the term of office begins is not taken into account. For the election of shareholder representatives, the General Meeting may establish that the terms of office of individual members may begin or end on differing dates.

(2)In the election of shareholders’ representatives to the Supervisory Board and of any substitute members, the Chairman of the General Meeting shall be entitled to take a vote on a list of election proposals submitted by management or shareholders. If substitute members are elected on a list, they shall replace shareholders’ representatives prematurely leaving the Supervisory Board in the order in which they were named, unless resolved otherwise at the vote.

(3)If a Supervisory Board member is elected to replace an outgoing member, the new member’s term of office shall run for the remainder of the outgoing member’s term. In the event that a substitute member takes the place of an outgoing member, the substitute member’s term of office shall expire – if a new vote to replace the outgoing member is taken at the first or second General Meeting after the vacancy arises – at the end of the said General Meeting, otherwise at the end of the outgoing member’s residual term of office.

(4)Any member of the Supervisory Board may resign from office without being required to show cause subject to his giving one month’s notice by written declaration addressed to the Management Board.

§ 10

(1)Immediately following a General Meeting at the end of which the employee representatives depart from office through rotation, a meeting of the Supervisory Board shall take place, for which no special invitation is required. At this meeting, the Supervisory Board under the chairmanship of its oldest member in terms of age shall elect from among its members and for the duration of its term of office the Chairman of the Supervisory Board and his Deputy in accordance with § 27 of the German Co-determination Act [Mitbestimmungsgesetz] (first Deputy) as well as, possibly, a second Deputy. In the event of the Chairman of the Supervisory Board or the first Deputy leaving before completion of his term of office, the Supervisory Board shall elect a substitute without delay.

(2)A Deputy of the Chairman of the Supervisory Board has the legal and statutory rights and duties of the Chairman only if the latter is unable to exercise them. This is without prejudice to § 29 (2) sentence 3 and § 31 (4) sentence 3 of the German Co-determination Act.

§ 11

(1)Meetings of the Supervisory Board are convened by the Chairman or, if the latter is unable to do so, by one of his Deputies, whenever required by law or for business reasons.

______________________________________________________________________________

– 6 –

(2)The Supervisory Board shall be deemed to constitute a quorum if the members have been invited at their last given contact details in writing, by telephone or through electronic means and not less than half the total members which it is required to comprise take part in the voting directly or by submitting written votes. The chair shall be taken by the Chairman of the Supervisory Board or one of his Deputies. The Chairman of the meeting shall decide the manner of voting.

(3)Resolutions may also be taken without a meeting being called, by way of written, cabled, telephoned or electronic votes, if so ruled by the Chairman of the Supervisory Board or one of his Deputies. This also applies to second polls pursuant to § 29 (2) sentence 1 and § 31 (4) sentence 1 of the German Co-determination Act.

(4)Resolutions of the Supervisory Board are taken with the simple majority of the votes unless otherwise provided by law. If there is equality of votes, the Chairman shall have the casting vote pursuant to § 29 (2) and § 31 (4) of the German Co-determination Act; a second poll within the meaning of these provisions can be requested by any member of the Supervisory Board.

(5)If not all the members of the Supervisory Board are present to vote on a resolution and if absent members have not submitted written votes, the voting shall be postponed at the request of at least two members of the Supervisory Board who are present. In the event of such postponement, the new vote shall be taken at the next regular Supervisory Board meeting if no extraordinary meeting is called. At the new vote, a further minority call for postponement is not permitted.

(6)If the Chairman of the Supervisory Board is present at the meeting, or if a member of the Supervisory Board in attendance is in possession of his written vote, sub-paragraph 5 shall not apply if the same number of shareholders’ representatives and employees’ representatives are personally present or participate in the voting on the resolution by written vote, or if any inequality is balanced out by individual members of the Supervisory Board not participating in the voting.

§ 12

(1)The Supervisory Board may appoint a Presiding Committee and one or several other Committees from among its members; this is without prejudice to § 27 (3) of the German Co-determination Act. The functions and powers of the Committees and the relevant procedures to be adopted shall be determined by the Supervisory Board. To the extent permitted by law, decisive powers of the Supervisory Board may also be delegated to the Committees. For Committee resolutions, unless otherwise determined by mandatory legal regulations, § 11 (3) and (4) apply with the proviso that the casting vote of the Supervisory Board Chairman is replaced by that of the Committee Chairman; § 11 (5) and (6) do not apply.

(2)Declarations of intention on the part of the Supervisory Board and its Committees shall be made in the name of the Supervisory Board by the Chairman or one of his Deputies.

______________________________________________________________________________

– 7 –

§ 13

(1)The approval of the Supervisory Board is required for

a)the granting of general powers of attorney;

b)the acquisition and disposal of real estate in so far as the object involves more than €500,000,000;

c)the granting of credits, including the acquisition of participations in other companies, for which approval of a credit institution’s supervisory body is required under the German Banking Act;

d)the acquisition and disposal of other participations, in so far as the object involves more than €1 billion.

The Supervisory Board must be informed without delay of any acquisition or disposal of such participations involving more than €500,000,000.

(2)The approvals under sub-paragraphs 1 b) and d) are also required if the transaction concerned is carried out in a dependent company.

(3)The Supervisory Board may specify further transactions which require its approval.

§ 14

(1)The members of the Supervisory Board receive a fixed annual compensation (“Supervisory Board Compensation”). The amount of the annual base compensation for each Supervisory Board member is €300,000, for the Supervisory Board Chairman €950,000, and for each Deputy Chairperson €475,000.

(2)Chairs of the Committees of the Supervisory Board are paid additional fixed annual compensation as follows:

a)For the Chair of the Audit Committee, the Risk Committee, as well as the Technology, Data and Innovation Committee: €150,000

b)For the Chair of the Chairman’s Committee, the Nomination Committee, the Compensation Control Committee, the Regulatory Oversight Committee as well as the Strategy and Sustainability Committee: €100,000.

If a Supervisory Board member is chair of more than one committee, compensation is only paid for the committee entitled to the highest amount. The Chairman of the Supervisory Board does not receive any additional compensation for chairing of the committees. Members of the committees also do not receive additional compensation.

(3)If the amount of the Supervisory Board Compensation according to paragraphs 1 and 2 does not exceed the Supervisory Board Compensation previously paid in the individual case (calculated compensation for the 2023 financial year based on the previous regulation in the Articles of Association), a member of the Supervisory Board whose current term of office began before May 17, 2023, will receive a compensating payment in the form of a cash payment in the amount of the difference between the previously granted Supervisory Board Compensation and the Supervisory Board Compensation pursuant to paragraphs 1 and 2. In the event of a re-election as member of the Supervisory Board, the provisions of these Articles of Association apply.

Members of the Supervisory Board whose current term of office began before May 17, 2023, will receive the virtual shares cumulatively earned during the current term of office paid out in February 2024 on the basis of the average closing price during the last 10 trading days of the Frankfurt Stock Exchange (Xetra or successor system) of the preceding January.

______________________________________________________________________________

– 8 –

(4)The compensation determined according to paragraphs 1 and 2 will be paid to the respective member of the Supervisory Board by, at the latest, two months after submitting invoices and as a rule within the first three months of the following year.

(5)In case of a change in Supervisory Board membership during the year, compensation for the financial year will be paid on a pro rata basis, rounded up/down to full months.

(6)The company reimburses the Supervisory Board members for the cash expenses they incur in the performance of their office, including any value added tax (VAT) on their compensation and reimbursements of expenses. Furthermore, any employer contributions to social security schemes that may be applicable under foreign law to the performance of their Supervisory Board work shall be paid for each Supervisory Board member affected. Finally, the Supervisory Board Chairman will be reimbursed appropriately for travel expenses incurred in performing representative tasks due to his function and reimbursed for costs for the security measures required based on his function.

(7)In the interest of the company, the members of the Supervisory Board will be included in an appropriate amount in any financial liability insurance policy held by the company. The premiums for this are paid by the company. A deductible does not have to be specified for the members of the Supervisory Board.

(8)The new provisions become effective with the registration of the amendment to the Articles of Association in the Commercial Register retroactively from the end of the Annual General Meeting on May 17, 2023.

V. General Meeting

§ 15

The General Meeting called to adopt the resolutions concerning the ratification of acts of management of the Management Board and the Supervisory Board, the appropriation of profits, the appointment of the annual auditor and, as the case may be, the establishment of the annual financial statements (Ordinary General Meeting) shall be held within the first eight months of each financial year.

§ 16