| Exhibit No. | Description | |||||||

| Results for Announcement to the Market | ||||||||

| ASX Cover 30 September 2025 | ||||||||

| Earnings Release | ||||||||

| Management's Analysis of Results | ||||||||

| Earnings Presentation | ||||||||

| Condensed Consolidated Financial Statements | ||||||||

| Half Year Directors' Report | ||||||||

| James Hardie Industries plc | ||||||||

Date: 18 November 2025 |

By: /s/ Aoife Rockett |

|||||||

Aoife Rockett |

||||||||

Company Secretary |

||||||||

| Exhibit No. | Description | |||||||

| Results for Announcement to the Market | ||||||||

| ASX Cover 30 September 2025 | ||||||||

| Earnings Release | ||||||||

| Management's Analysis of Results | ||||||||

| Earnings Presentation | ||||||||

| Condensed Consolidated Financial Statements | ||||||||

| Half Year Directors' Report | ||||||||

|

James Hardie Industries plc

1st Floor, Block A

One Park Place

Upper Hatch Street, Dublin 2

D02 FD79, Ireland

T: +353 (0) 1 411 6924

F: +353 (0) 1 479 1128

|

|||||

| • | ASX Cover Sheet | ||||

| • | Earnings Release | ||||

| • | Management's Analysis of Results | ||||

| • | Earnings Presentation | ||||

| • | Condensed Consolidated Financial Statements | ||||

| • | Half-Yearly Directors' Report | ||||

| Yours faithfully | ||

Joe Ahlersmeyer, CFA | ||

| Vice President, Investor Relations | ||

| Appendix 4D – Half Year Report |  |

||||

Appendix 4D - Half Year Ended 30 September 2025 | ||||||||||||||

| Key Information (US$ Millions, except per share data) |

Half Year

FY 2026

|

Half Year

FY 2025

|

Movement | |||||||||||

| Net Sales From Ordinary Activities | 2,192.1 | 1,952.7 | Up | 12% | ||||||||||

| Profit From Ordinary Activities After Tax Attributable to Shareholders | 6.8 | 238.7 | Down | (97)% | ||||||||||

| Net Profit Attributable to Shareholders | 6.8 | 238.7 | Down | (97)% | ||||||||||

| Net Tangible (Liabilities) Assets per Ordinary Share | US$(3.53) | US$3.78 | Down | (193)% | ||||||||||

Appendix 4D: James Hardie - Half Year Ended 30 September 2025 |

1 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

1 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

| Q2 FY26 | Q2 FY25 | Change | 6 Months FY26 |

6 Months FY25 |

Change | ||||||||||||||||||||||||||||||

| Group | (US$ millions, except per share data) | ||||||||||||||||||||||||||||||||||

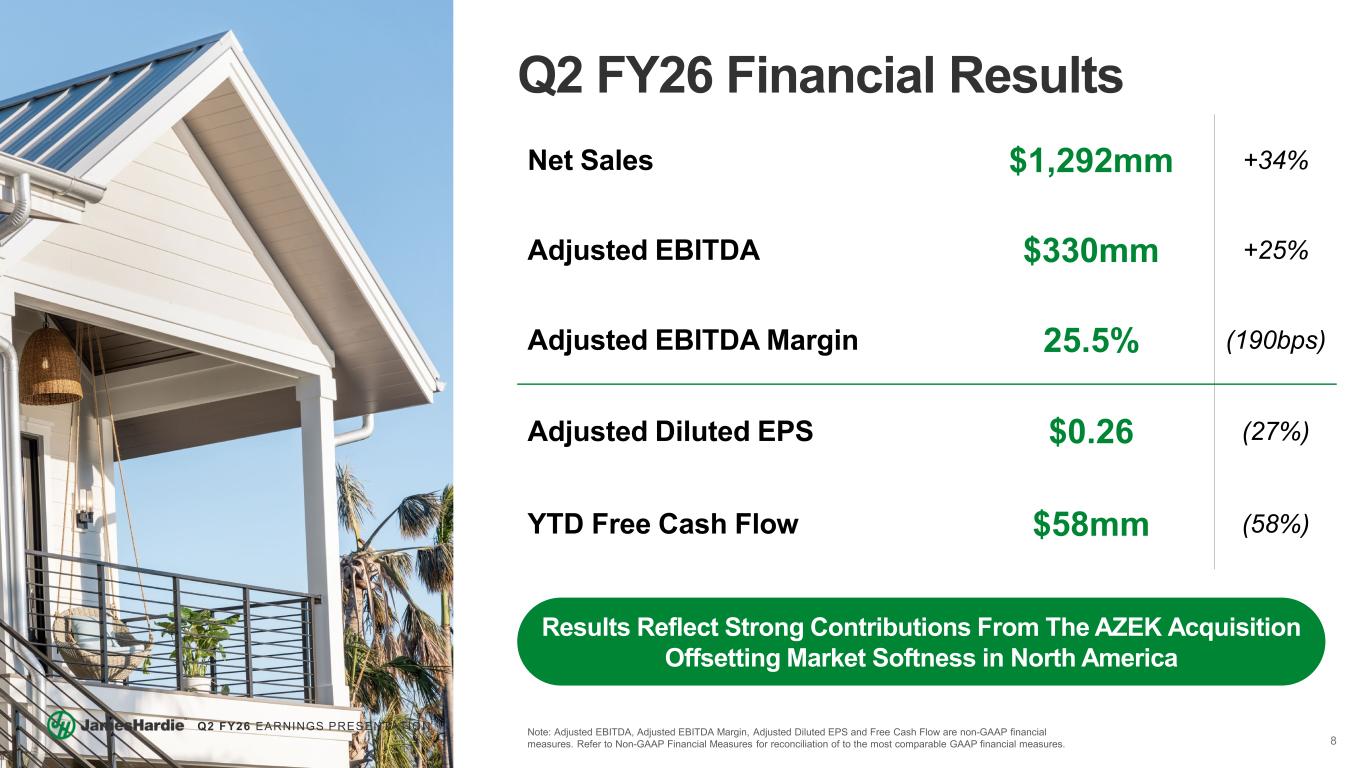

| Net Sales | 1,292.2 | 960.8 | +34% | 2,192.1 | 1,952.7 | +12% | |||||||||||||||||||||||||||||

| Operating Income | 24.0 | 152.3 | (84%) | 162.6 | 387.7 | (58%) | |||||||||||||||||||||||||||||

| Operating Income Margin | 1.9 | % | 15.9 | % | (1,400bps) | 7.4 | % | 19.9 | % | (1,250bps) | |||||||||||||||||||||||||

| Adjusted EBITDA | 329.5 | 262.9 | +25% | 555.0 | 548.7 | +1% | |||||||||||||||||||||||||||||

| Adjusted EBITDA Margin | 25.5 | % | 27.4 | % | (190bps) | 25.3 | % | 28.1 | % | (280bps) | |||||||||||||||||||||||||

| Net (Loss) Income | (55.8) | 83.4 | (167%) | 6.8 | 238.7 | (97%) | |||||||||||||||||||||||||||||

| Adjusted Net Income | 154.0 | 157.0 | (2%) | 280.9 | 334.6 | (16%) | |||||||||||||||||||||||||||||

| Diluted EPS - US$ per share | (0.10) | 0.19 | (150%) | 0.01 | 0.55 | (98%) | |||||||||||||||||||||||||||||

| Adjusted Diluted EPS - US$ per share | 0.26 | 0.36 | (27%) | 0.55 | 0.77 | (28%) | |||||||||||||||||||||||||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

2 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

Update to Reporting Segments | ||

Segment Business Update and Results | ||

| Q2 FY26 | Q2 FY25 | Change | 6 Months FY26 |

6 Months FY25 |

Change | ||||||||||||||||||||||||||||||

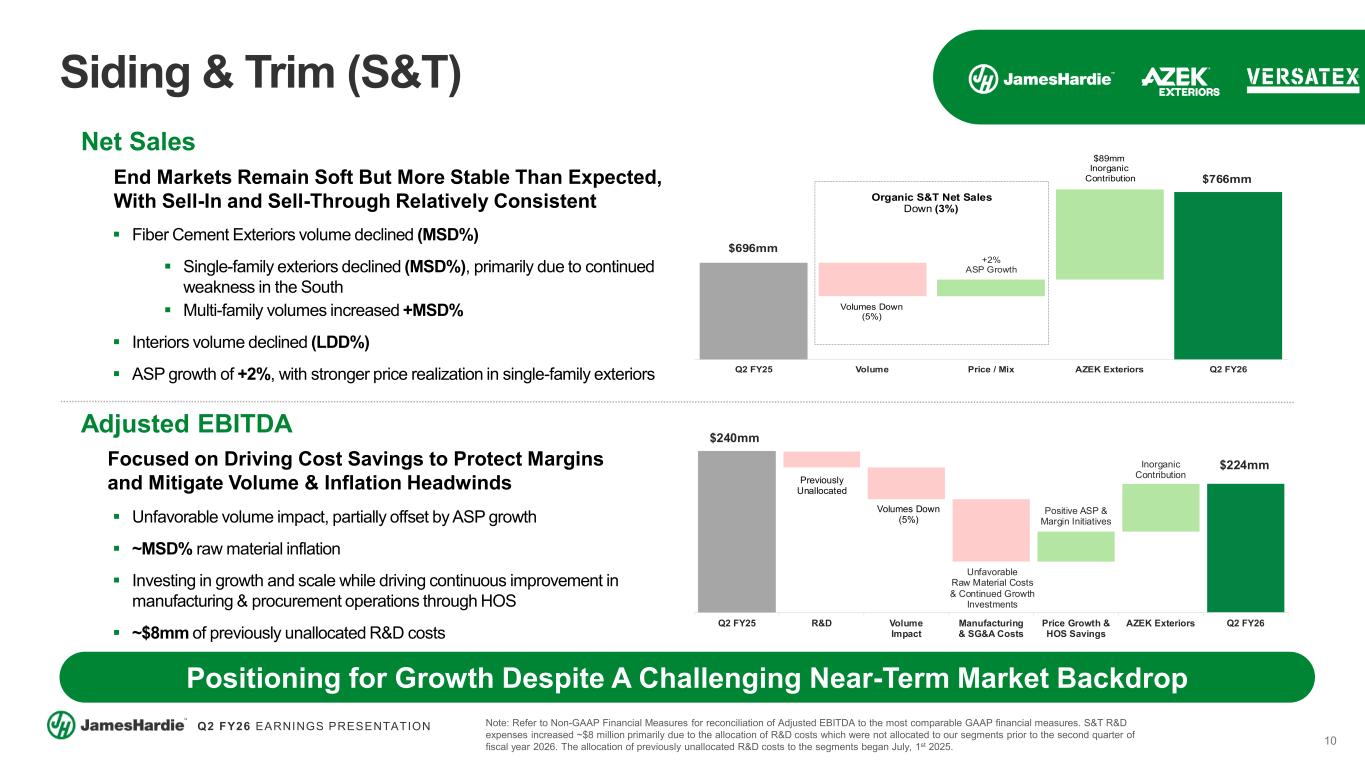

| Siding & Trim | (US$ millions) | ||||||||||||||||||||||||||||||||||

| Net Sales | 766.0 | 695.8 | +10% | 1,407.8 | 1,425.1 | (1%) | |||||||||||||||||||||||||||||

| Operating Income | 151.0 | 201.9 | (25%) | 312.2 | 429.2 | (27%) | |||||||||||||||||||||||||||||

| Operating Income Margin | 19.7 | % | 29.0 | % | (930bps) | 22.2 | % | 30.1 | % | (790bps) | |||||||||||||||||||||||||

| Adjusted EBITDA | 224.0 | 240.1 | (7%) | 429.8 | 503.5 | (15%) | |||||||||||||||||||||||||||||

| Adjusted EBITDA Margin | 29.2 | % | 34.5 | % | (530bps) | 30.5 | % | 35.3 | % | (480bps) | |||||||||||||||||||||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

3 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

| Q2 FY26 | 6 Months FY26 |

|||||||||||||

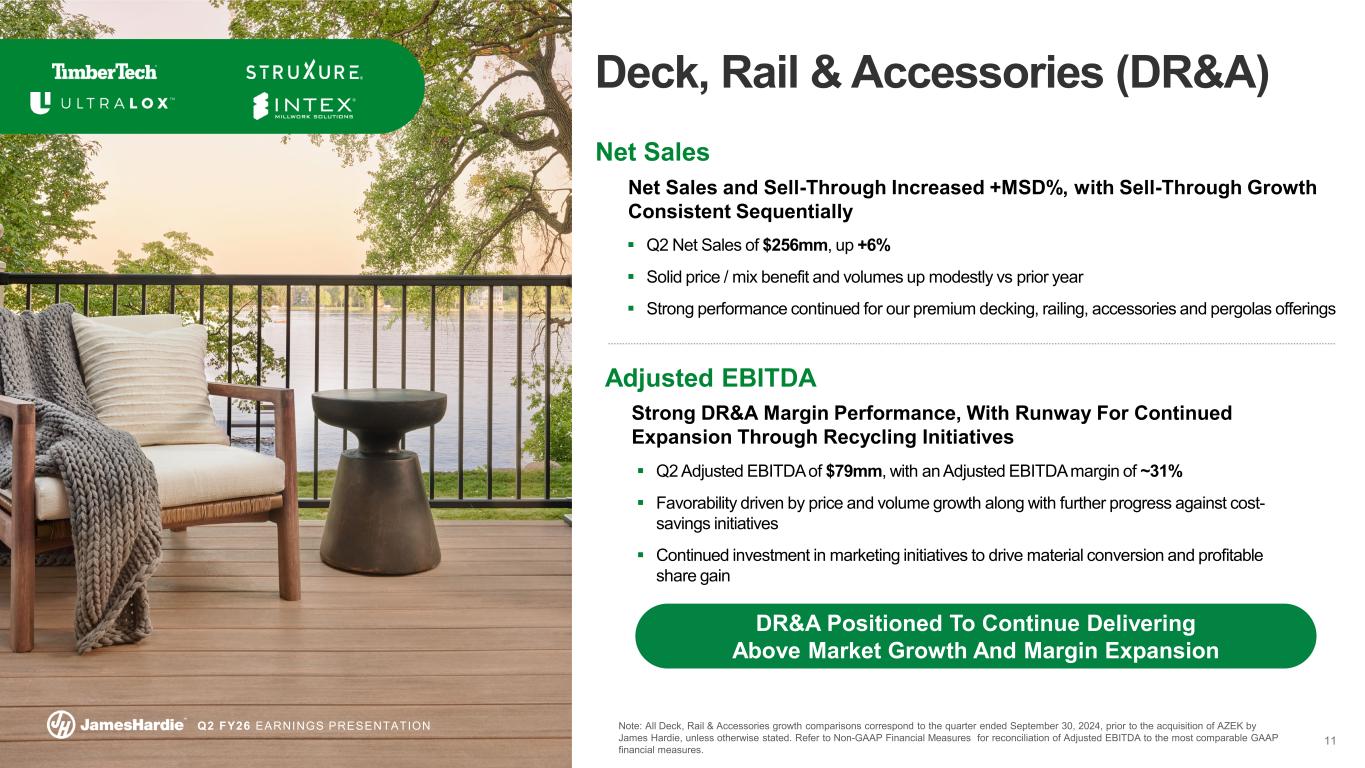

| Deck, Rail & Accessories | (US$ millions) | |||||||||||||

| Net Sales | 255.8 | 255.8 | ||||||||||||

| Operating Loss | (11.9) | (11.9) | ||||||||||||

| Operating Loss Margin | (4.7 | %) | (4.7 | %) | ||||||||||

| Adjusted EBITDA | 78.6 | 78.6 | ||||||||||||

| Adjusted EBITDA Margin | 30.7 | % | 30.7 | % | ||||||||||

| Q2 FY26 | Q2 FY25 | Change | 6 Months FY26 |

6 Months FY25 |

Change | ||||||||||||||||||||||||||||||

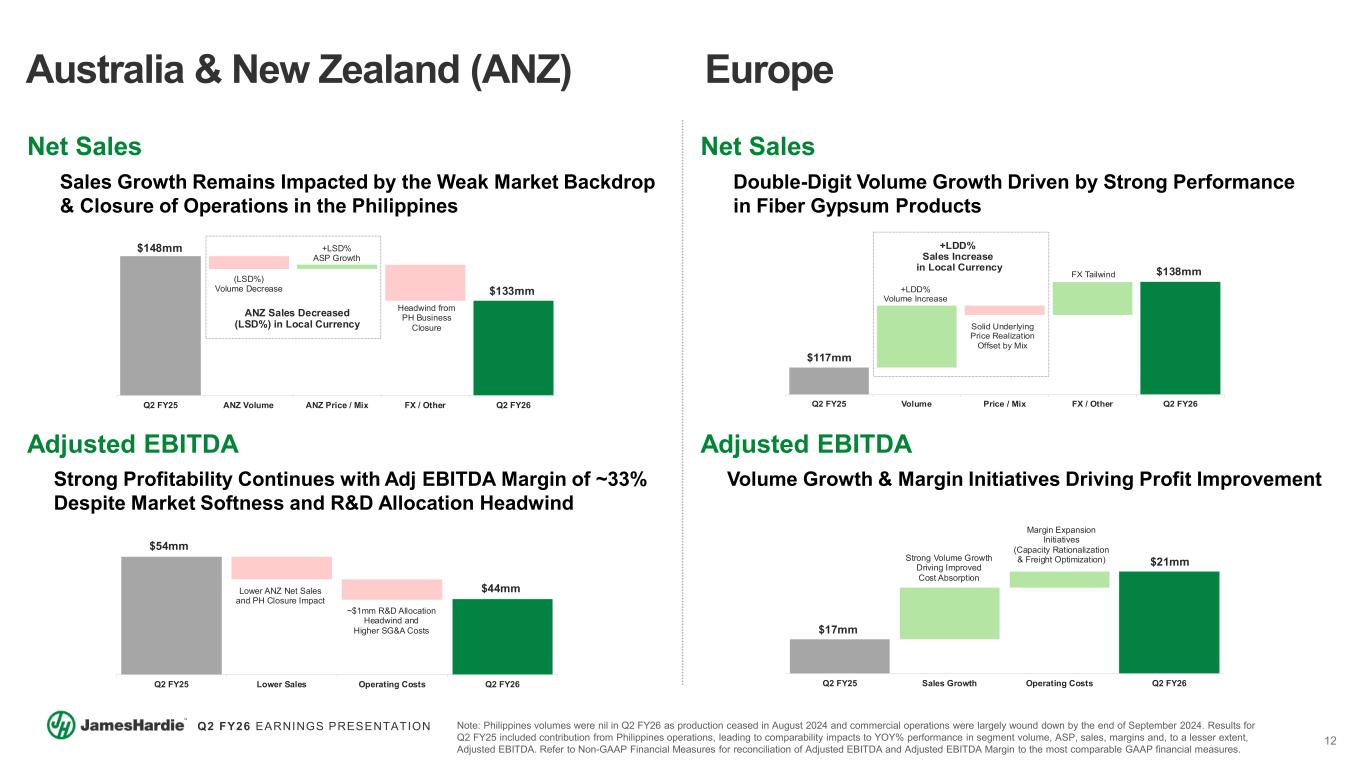

| Australia & New Zealand | (US$ millions, unless otherwise noted) | ||||||||||||||||||||||||||||||||||

| Net Sales | 132.9 | 148.4 | (10%) | 254.5 | 283.7 | (10%) | |||||||||||||||||||||||||||||

| Net Sales (A$) | 203.2 | 221.5 | (8%) | 392.7 | 426.8 | (8%) | |||||||||||||||||||||||||||||

| Operating Income (Loss) | 38.0 | (8.0) | +575% | 75.8 | 33.2 | +128% | |||||||||||||||||||||||||||||

| Operating Income (Loss) Margin | 28.6 | % | (5.0 | %) | +3,360bps | 29.8 | % | 12.1 | % | +1,770bps | |||||||||||||||||||||||||

| Adjusted EBITDA | 43.5 | 54.0 | (19%) | 86.5 | 100.0 | (14%) | |||||||||||||||||||||||||||||

| Adjusted EBITDA Margin | 32.7 | % | 36.5 | % | (380bps) | 34.0 | % | 35.3 | % | (130bps) | |||||||||||||||||||||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

4 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

| Q2 FY26 | Q2 FY25 | Change | 6 Months FY26 |

6 Months FY25 |

Change | ||||||||||||||||||||||||||||||

| Europe | (US$ millions, unless otherwise noted) | ||||||||||||||||||||||||||||||||||

| Net Sales | 137.5 | 116.6 | +18% | 274.0 | 243.9 | +12% | |||||||||||||||||||||||||||||

| Net Sales (€) | 117.7 | 106.1 | +11% | 238.0 | 224.3 | +6% | |||||||||||||||||||||||||||||

| Operating Income | 13.7 | 8.9 | +54% | 28.8 | 21.1 | +36% | |||||||||||||||||||||||||||||

| Operating Income Margin | 10.0 | % | 7.5 | % | +250bps | 10.5 | % | 8.6 | % | +190bps | |||||||||||||||||||||||||

| EBITDA | 21.0 | 17.0 | +24% | 42.9 | 36.7 | +17% | |||||||||||||||||||||||||||||

| EBITDA Margin | 15.3 | % | 14.5 | % | +80bps | 15.7% | 15.0% | +70bps | |||||||||||||||||||||||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

5 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

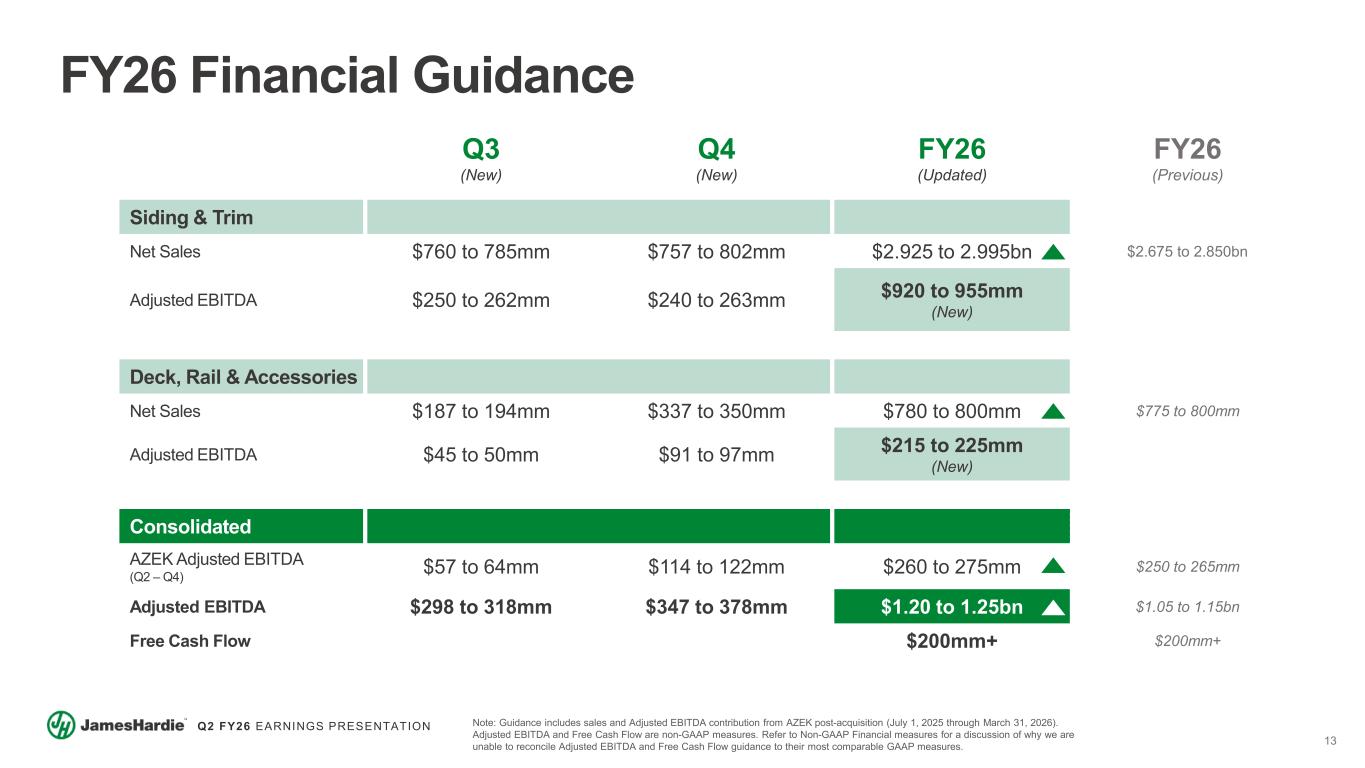

Outlook | ||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

6 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

Cash Flow, Capital Investment & Allocation | ||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

7 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

Reported Financial Results | ||

| (Millions of US dollars) | (Unaudited) September 30 2025 |

March 31

2025

|

|||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 566.7 | $ | 562.7 | |||||||

| Restricted cash and cash equivalents | 5.0 | 5.0 | |||||||||

| Restricted cash and cash equivalents - Asbestos | 15.3 | 37.9 | |||||||||

| Restricted short-term investments - Asbestos | 185.0 | 175.8 | |||||||||

| Accounts and other receivables, net | 359.7 | 391.8 | |||||||||

| Inventories | 638.0 | 347.1 | |||||||||

| Prepaid expenses and other current assets | 172.7 | 100.6 | |||||||||

| Assets held for sale | 76.1 | 73.1 | |||||||||

| Insurance receivable - Asbestos | 5.8 | 5.5 | |||||||||

| Workers’ compensation - Asbestos | 2.5 | 2.3 | |||||||||

| Total current assets | 2,026.8 | 1,701.8 | |||||||||

| Property, plant and equipment, net | 3,047.9 | 2,169.0 | |||||||||

| Operating lease right-of-use-assets | 109.5 | 70.4 | |||||||||

| Finance lease right-of-use-assets | 89.4 | 2.7 | |||||||||

| Goodwill | 5,102.8 | 193.7 | |||||||||

| Intangible assets, net | 3,265.9 | 145.6 | |||||||||

| Insurance receivable - Asbestos | 22.7 | 23.2 | |||||||||

| Workers’ compensation - Asbestos | 17.3 | 16.5 | |||||||||

| Deferred income taxes | 80.9 | 600.4 | |||||||||

| Deferred income taxes - Asbestos | 279.0 | 284.5 | |||||||||

| Other assets | 26.8 | 22.1 | |||||||||

| Total assets | $ | 14,069.0 | $ | 5,229.9 | |||||||

| Liabilities and Shareholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable and accrued liabilities | $ | 669.8 | $ | 446.4 | |||||||

| Accrued payroll and employee benefits | 181.6 | 133.3 | |||||||||

| Operating lease liabilities | 27.9 | 21.6 | |||||||||

| Finance lease liabilities | 5.3 | 1.1 | |||||||||

| Long-term debt, current portion | 43.8 | 9.4 | |||||||||

| Accrued product warranties | 10.6 | 7.3 | |||||||||

| Income taxes payable | 7.1 | 10.3 | |||||||||

| Asbestos liability | 125.7 | 119.4 | |||||||||

| Workers’ compensation - Asbestos | 2.5 | 2.3 | |||||||||

| Other liabilities | 55.9 | 59.1 | |||||||||

| Total current liabilities | 1,130.2 | 810.2 | |||||||||

| Long-term debt | 4,972.2 | 1,110.1 | |||||||||

| Deferred income taxes | 479.9 | 121.1 | |||||||||

| Operating lease liabilities | 98.3 | 63.9 | |||||||||

| Finance lease liabilities | 96.1 | 1.8 | |||||||||

| Accrued product warranties | 42.4 | 26.9 | |||||||||

| Asbestos liability | 847.0 | 864.2 | |||||||||

| Workers’ compensation - Asbestos | 17.3 | 16.5 | |||||||||

| Other liabilities | 63.5 | 53.7 | |||||||||

| Total liabilities | 7,746.9 | 3,068.4 | |||||||||

| Total shareholders’ equity | 6,322.1 | 2,161.5 | |||||||||

| Total liabilities and shareholders’ equity | $ | 14,069.0 | $ | 5,229.9 | |||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

8 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

| (Unaudited) Three Months Ended September 30 |

(Unaudited) Six Months Ended September 30 |

||||||||||||||||||||||

| (Millions of US dollars, except per share data) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Net sales | $ | 1,292.2 | $ | 960.8 | $ | 2,192.1 | $ | 1,952.7 | |||||||||||||||

| Cost of goods sold | 871.1 | 587.9 | 1,434.1 | 1,182.9 | |||||||||||||||||||

| Gross profit | 421.1 | 372.9 | 758.0 | 769.8 | |||||||||||||||||||

| Selling, general and administrative expenses | 250.8 | 149.9 | 406.9 | 299.7 | |||||||||||||||||||

| Research and development expenses | 15.8 | 12.8 | 27.9 | 24.6 | |||||||||||||||||||

| Restructuring expenses | — | 57.3 | — | 57.3 | |||||||||||||||||||

| Acquisition related expenses | 130.3 | — | 159.7 | — | |||||||||||||||||||

Asbestos adjustments |

0.2 | 0.6 | 0.9 | 0.5 | |||||||||||||||||||

| Operating income | 24.0 | 152.3 | 162.6 | 387.7 | |||||||||||||||||||

| Interest, net | 65.4 | 1.9 | 103.2 | 3.6 | |||||||||||||||||||

| Other (income) expense, net | (1.4) | — | 9.7 | (0.2) | |||||||||||||||||||

| (Loss) income before income taxes | (40.0) | 150.4 | 49.7 | 384.3 | |||||||||||||||||||

| Income tax expense | 15.8 | 67.0 | 42.9 | 145.6 | |||||||||||||||||||

| Net (loss) income | $ | (55.8) | $ | 83.4 | $ | 6.8 | $ | 238.7 | |||||||||||||||

| Income per share: | |||||||||||||||||||||||

| Basic | $ | (0.10) | $ | 0.19 | $ | 0.01 | $ | 0.55 | |||||||||||||||

| Diluted | $ | (0.10) | $ | 0.19 | $ | 0.01 | $ | 0.55 | |||||||||||||||

| Weighted average common shares outstanding (Millions): | |||||||||||||||||||||||

| Basic | 577.4 | 430.8 | 504.0 | 432.0 | |||||||||||||||||||

| Diluted | 577.4 | 432.3 | 508.6 | 433.4 | |||||||||||||||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

9 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

| (Unaudited) Six Months Ended September 30 |

|||||||||||

| (Millions of US dollars) | 2025 | 2024 | |||||||||

| Cash Flows From Operating Activities | |||||||||||

| Net income | $ | 6.8 | $ | 238.7 | |||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 182.9 | 101.7 | |||||||||

| Lease expense | 18.5 | 16.5 | |||||||||

| Deferred income taxes | 7.7 | 72.2 | |||||||||

| Stock-based compensation | 19.9 | 12.3 | |||||||||

Asbestos adjustments |

0.9 | 0.5 | |||||||||

| Non-cash restructuring expenses | — | 40.2 | |||||||||

| Non-cash interest expense | 4.3 | 1.0 | |||||||||

| Non-cash charge related to step up of inventory | 47.9 | — | |||||||||

| Other, net | 28.6 | 15.6 | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts and other receivables | 101.4 | 22.8 | |||||||||

| Inventories | (50.2) | (31.3) | |||||||||

| Operating lease assets and liabilities, net | (20.9) | (17.0) | |||||||||

| Prepaid expenses and other assets | (14.9) | (17.4) | |||||||||

| Insurance receivable - Asbestos | 1.7 | 2.1 | |||||||||

| Accounts payable and accrued liabilities | (9.1) | (8.7) | |||||||||

| Claims and handling costs paid - Asbestos | (61.0) | (60.4) | |||||||||

| Income taxes payable | (3.3) | (11.7) | |||||||||

| Other accrued liabilities | (6.9) | (12.8) | |||||||||

| Net cash provided by operating activities | $ | 254.3 | $ | 364.3 | |||||||

| Cash Flows From Investing Activities | |||||||||||

| Purchases of property, plant and equipment | $ | (195.9) | $ | (225.2) | |||||||

| Capitalized interest | (5.1) | (12.8) | |||||||||

| Cash consideration for The AZEK Company acquisition, net of cash acquired | (3,919.8) | — | |||||||||

| Purchase of restricted investments - Asbestos | (96.4) | (98.4) | |||||||||

| Proceeds from restricted investments - Asbestos | 96.4 | 94.6 | |||||||||

| Other | — | 0.4 | |||||||||

| Net cash used in investing activities | $ | (4,120.8) | $ | (241.4) | |||||||

| Cash Flows From Financing Activities | |||||||||||

| Proceeds from senior secured notes | $ | 1,700.0 | $ | — | |||||||

| Proceeds from term loans | 2,500.0 | — | |||||||||

| Repayments of term loans | (301.6) | (3.8) | |||||||||

| Debt issuance costs paid | (42.0) | — | |||||||||

| Repayment of finance lease obligations | (1.5) | (0.6) | |||||||||

| Shares repurchased | — | (149.9) | |||||||||

| Taxes paid related to net share settlement of equity awards | (6.3) | (2.2) | |||||||||

| Net cash provided by (used in) financing activities | $ | 3,848.6 | $ | (156.5) | |||||||

| Effects of exchange rate changes on cash and cash equivalents, restricted cash and restricted cash - Asbestos | $ | (0.7) | $ | 3.6 | |||||||

| Net decrease in cash and cash equivalents, restricted cash and restricted cash - Asbestos | (18.6) | (30.0) | |||||||||

| Cash and cash equivalents, restricted cash and restricted cash - Asbestos at beginning of period | 605.6 | 415.8 | |||||||||

| Cash and cash equivalents, restricted cash and restricted cash - Asbestos at end of period | $ | 587.0 | $ | 385.8 | |||||||

| Non-Cash Investing and Financing Activities | |||||||||||

| Capital expenditures incurred but not yet paid | $ | 35.5 | $ | 30.2 | |||||||

| Non-cash ROU assets obtained in exchange for new lease liabilities | $ | 13.6 | $ | 19.5 | |||||||

| Non-cash consideration for AZEK acquisition | $ | 4,136.1 | $ | — | |||||||

| Supplemental Disclosure of Cash Flow Activities | |||||||||||

| Cash paid to AICF | $ | 31.4 | $ | 24.8 | |||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

10 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

|

Further Information

| ||

Conference Call Details | ||

About James Hardie | ||

Investor and Media Contact | ||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

11 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

| Cautionary Note and Use of Non-GAAP Measures | ||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

12 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

Non-GAAP Financial Measures | ||

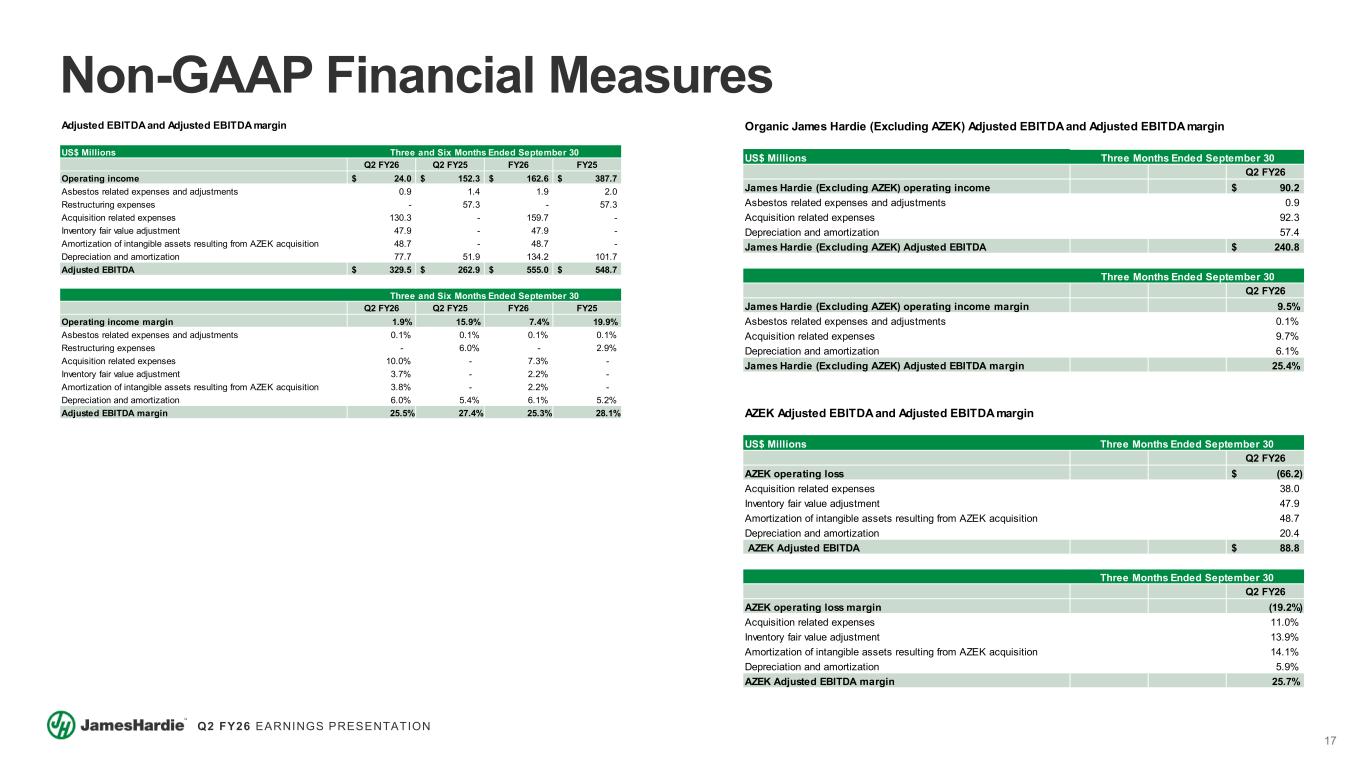

| US$ Millions | Three and Six Months Ended September 30 | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Operating income | $ | 24.0 | $ | 152.3 | $ | 162.6 | $ | 387.7 | ||||||||||||||||||

| Asbestos related expenses and adjustments | 0.9 | 1.4 | 1.9 | 2.0 | ||||||||||||||||||||||

| Restructuring expenses | — | 57.3 | — | 57.3 | ||||||||||||||||||||||

| Acquisition related expenses | 130.3 | — | 159.7 | — | ||||||||||||||||||||||

| Inventory fair value adjustment | 47.9 | — | 47.9 | — | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 48.7 | — | 48.7 | — | ||||||||||||||||||||||

| Depreciation and amortization | 77.7 | 51.9 | 134.2 | 101.7 | ||||||||||||||||||||||

| Adjusted EBITDA | $ | 329.5 | $ | 262.9 | $ | 555.0 | $ | 548.7 | ||||||||||||||||||

| Three and Six Months Ended September 30 | ||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Operating income margin | 1.9 | % | 15.9 | % | 7.4 | % | 19.9 | % | ||||||||||||||||||

| Asbestos related expenses and adjustments | 0.1 | % | 0.1 | % | 0.1 | % | 0.1 | % | ||||||||||||||||||

| Restructuring expenses | — | % | 6.0 | % | — | % | 2.9 | % | ||||||||||||||||||

| Acquisition related expenses | 10.0 | % | — | % | 7.3 | % | — | % | ||||||||||||||||||

| Inventory fair value adjustment | 3.7 | % | — | % | 2.2 | % | — | % | ||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 3.8 | % | — | % | 2.2 | % | — | % | ||||||||||||||||||

| Depreciation and amortization | 6.0 | % | 5.4 | % | 6.1 | % | 5.2 | % | ||||||||||||||||||

| Adjusted EBITDA margin | 25.5 | % | 27.4 | % | 25.3 | % | 28.1 | % | ||||||||||||||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

13 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

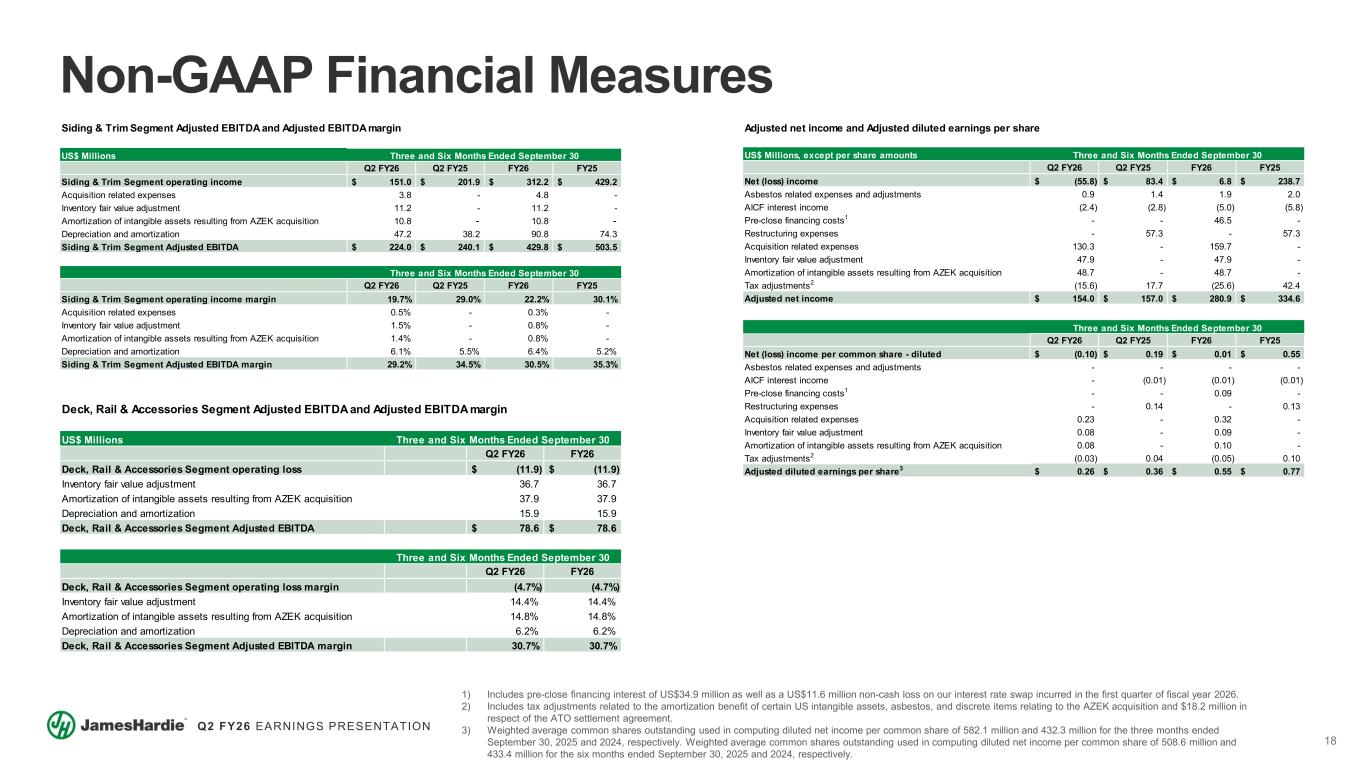

| US$ Millions, except per share amounts | Three and Six Months Ended September 30 | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Net (loss) income | $ | (55.8) | $ | 83.4 | $ | 6.8 | $ | 238.7 | ||||||||||||||||||

| Asbestos related expenses and adjustments | 0.9 | 1.4 | 1.9 | 2.0 | ||||||||||||||||||||||

| AICF interest income | (2.4) | (2.8) | (5.0) | (5.8) | ||||||||||||||||||||||

| Restructuring expenses | — | 57.3 | — | 57.3 | ||||||||||||||||||||||

Pre-close financing costs1 |

— | — | 46.5 | — | ||||||||||||||||||||||

| Acquisition related expenses | 130.3 | — | 159.7 | — | ||||||||||||||||||||||

| Inventory fair value adjustment | 47.9 | — | 47.9 | — | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 48.7 | — | 48.7 | — | ||||||||||||||||||||||

Tax adjustments2 |

(15.6) | 17.7 | (25.6) | 42.4 | ||||||||||||||||||||||

| Adjusted net income | $ | 154.0 | $ | 157.0 | $ | 280.9 | $ | 334.6 | ||||||||||||||||||

| Three and Six Months Ended September 30 | ||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Net (loss) income per common share - diluted | $ | (0.10) | $ | 0.19 | $ | 0.01 | $ | 0.55 | ||||||||||||||||||

| Asbestos related expenses and adjustments | — | — | — | — | ||||||||||||||||||||||

| AICF interest income | — | (0.01) | (0.01) | (0.01) | ||||||||||||||||||||||

| Restructuring expenses | — | 0.14 | — | 0.13 | ||||||||||||||||||||||

Pre-close financing costs1 |

— | — | 0.09 | — | ||||||||||||||||||||||

| Acquisition related expenses | 0.23 | — | 0.32 | — | ||||||||||||||||||||||

| Inventory fair value adjustment | 0.08 | — | 0.09 | — | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 0.08 | — | 0.10 | — | ||||||||||||||||||||||

Tax adjustments2 |

(0.03) | 0.04 | (0.05) | 0.10 | ||||||||||||||||||||||

Adjusted diluted earnings per share3 |

$ | 0.26 | $ | 0.36 | $ | 0.55 | $ | 0.77 | ||||||||||||||||||

|

1.Includes pre-close financing interest of $34.9 million as well as a $11.6 million non-cash loss on our interest rate swap incurred in the first quarter of fiscal year 2026.

2.Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and discrete items relating to the AZEK acquisition and $18.2 million in respect of the ATO settlement agreement.

3.Weighted average common shares outstanding used in computing diluted net income per common share of 582.1 million and 432.3 million for the three months ended September 30, 2025 and 2024, respectively. Weighted average common shares outstanding used in computing diluted net income per common share of 508.6 million and 433.4 million for the six months ended September 30, 2025 and 2024, respectively.

| ||||||||||||||||||||||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

14 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

| US$ Millions | Three and Six Months Ended September 30 | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Siding & Trim Segment operating income | $ | 151.0 | $ | 201.9 | $ | 312.2 | $ | 429.2 | ||||||||||||||||||

| Acquisition related expenses | 3.8 | — | 4.8 | — | ||||||||||||||||||||||

| Inventory fair value adjustment | 11.2 | — | 11.2 | — | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 10.8 | — | 10.8 | — | ||||||||||||||||||||||

| Depreciation and amortization | 47.2 | 38.2 | 90.8 | 74.3 | ||||||||||||||||||||||

| Siding & Trim Segment Adjusted EBITDA | $ | 224.0 | $ | 240.1 | $ | 429.8 | $ | 503.5 | ||||||||||||||||||

| Three and Six Months Ended September 30 | ||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Siding & Trim Segment operating income margin | 19.7 | % | 29.0 | % | 22.2 | % | 30.1 | % | ||||||||||||||||||

| Acquisition related expenses | 0.5 | % | — | % | 0.3 | % | — | % | ||||||||||||||||||

| Inventory fair value adjustment | 1.5 | % | — | % | 0.8 | % | — | % | ||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 1.4 | % | — | % | 0.8 | % | — | % | ||||||||||||||||||

| Depreciation and amortization | 6.1 | % | 5.5 | % | 6.4 | % | 5.2 | % | ||||||||||||||||||

| Siding & Trim Segment Adjusted EBITDA margin | 29.2 | % | 34.5 | % | 30.5 | % | 35.3 | % | ||||||||||||||||||

| US$ Millions | Three and Six Months Ended September 30 | |||||||||||||||||||

| Q2 FY26 | FY26 | |||||||||||||||||||

| Deck, Rail & Accessories Segment operating loss | $ | (11.9) | $ | (11.9) | ||||||||||||||||

| Inventory fair value adjustment | 36.7 | 36.7 | ||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 37.9 | 37.9 | ||||||||||||||||||

| Depreciation and amortization | 15.9 | 15.9 | ||||||||||||||||||

| Deck, Rail & Accessories Segment Adjusted EBITDA | $ | 78.6 | $ | 78.6 | ||||||||||||||||

| Three and Six Months Ended September 30 | ||||||||||||||||||||

| Q2 FY26 | FY26 | |||||||||||||||||||

| Deck, Rail & Accessories Segment operating loss margin | (4.7 | %) | (4.7 | %) | ||||||||||||||||

| Inventory fair value adjustment | 14.4 | % | 14.4 | % | ||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 14.8 | % | 14.8 | % | ||||||||||||||||

| Depreciation and amortization | 6.2 | % | 6.2 | % | ||||||||||||||||

| Deck, Rail & Accessories Segment Adjusted EBITDA margin | 30.7 | % | 30.7 | % | ||||||||||||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

15 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

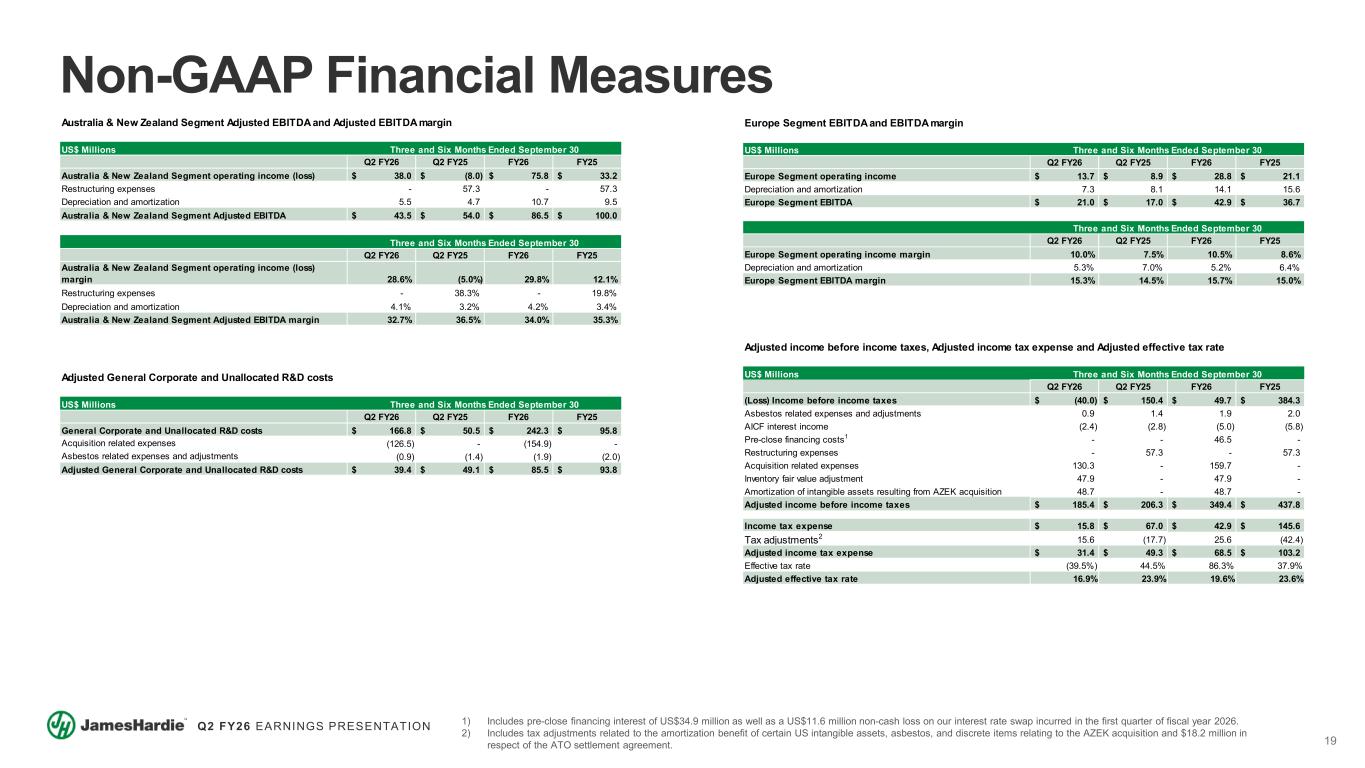

| US$ Millions | Three and Six Months Ended September 30 | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Australia & New Zealand Segment operating income (loss) | $ | 38.0 | $ | (8.0) | $ | 75.8 | $ | 33.2 | ||||||||||||||||||

| Restructuring expenses | — | 57.3 | — | 57.3 | ||||||||||||||||||||||

| Depreciation and amortization | 5.5 | 4.7 | 10.7 | 9.5 | ||||||||||||||||||||||

| Australia & New Zealand Segment Adjusted EBITDA | $ | 43.5 | $ | 54.0 | $ | 86.5 | $ | 100.0 | ||||||||||||||||||

| Three and Six Months Ended September 30 | ||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Australia & New Zealand Segment operating income (loss) margin | 28.6 | % | (5.0 | %) | 29.8 | % | 12.1 | % | ||||||||||||||||||

| Restructuring expenses | — | % | 38.3 | % | — | % | 19.8 | % | ||||||||||||||||||

| Depreciation and amortization | 4.1 | % | 3.2 | % | 4.2 | % | 3.4 | % | ||||||||||||||||||

| Australia & New Zealand Segment Adjusted EBITDA margin | 32.7 | % | 36.5 | % | 34.0 | % | 35.3 | % | ||||||||||||||||||

| US$ Millions | Three and Six Months Ended September 30 | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Europe Segment operating income | $ | 13.7 | $ | 8.9 | $ | 28.8 | $ | 21.1 | ||||||||||||||||||

| Depreciation and amortization | 7.3 | 8.1 | 14.1 | 15.6 | ||||||||||||||||||||||

| Europe Segment EBITDA | $ | 21.0 | $ | 17.0 | $ | 42.9 | $ | 36.7 | ||||||||||||||||||

| Three and Six Months Ended September 30 | ||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Europe Segment operating income margin | 10.0 | % | 7.5 | % | 10.5 | % | 8.6 | % | ||||||||||||||||||

| Depreciation and amortization | 5.3 | % | 7.0 | % | 5.2 | % | 6.4 | % | ||||||||||||||||||

| Europe Segment EBITDA margin | 15.3 | % | 14.5 | % | 15.7 | % | 15.0 | % | ||||||||||||||||||

| US$ Millions | Three and Six Months Ended September 30 | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| General Corporate and Unallocated R&D costs | $ | 166.8 | $ | 50.5 | $ | 242.3 | $ | 95.8 | ||||||||||||||||||

| Acquisition related expenses | (126.5) | — | (154.9) | — | ||||||||||||||||||||||

| Asbestos related expenses and adjustments | (0.9) | (1.4) | (1.9) | (2.0) | ||||||||||||||||||||||

| Adjusted General Corporate and Unallocated R&D costs | $ | 39.4 | $ | 49.1 | $ | 85.5 | $ | 93.8 | ||||||||||||||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

16 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

| US$ Millions | Three and Six Months Ended September 30 | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| (Loss) Income before income taxes | $ | (40.0) | $ | 150.4 | $ | 49.7 | $ | 384.3 | ||||||||||||||||||

| Asbestos related expenses and adjustments | 0.9 | 1.4 | 1.9 | 2.0 | ||||||||||||||||||||||

| AICF interest income | (2.4) | (2.8) | (5.0) | (5.8) | ||||||||||||||||||||||

| Restructuring expenses | — | 57.3 | — | 57.3 | ||||||||||||||||||||||

Pre-close financing costs1 |

— | — | 46.5 | — | ||||||||||||||||||||||

| Acquisition related expenses | 130.3 | — | 159.7 | — | ||||||||||||||||||||||

| Inventory fair value adjustment | 47.9 | — | 47.9 | — | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 48.7 | — | 48.7 | — | ||||||||||||||||||||||

| Adjusted income before income taxes | $ | 185.4 | $ | 206.3 | $ | 349.4 | $ | 437.8 | ||||||||||||||||||

| Income tax expense | $ | 15.8 | $ | 67.0 | $ | 42.9 | $ | 145.6 | ||||||||||||||||||

Tax adjustments2 |

15.6 | (17.7) | 25.6 | (42.4) | ||||||||||||||||||||||

| Adjusted income tax expense | $ | 31.4 | $ | 49.3 | $ | 68.5 | $ | 103.2 | ||||||||||||||||||

| Effective tax rate | (39.5 | %) | 44.5 | % | 86.3 | % | 37.9 | % | ||||||||||||||||||

| Adjusted effective tax rate | 16.9 | % | 23.9 | % | 19.6 | % | 23.6 | % | ||||||||||||||||||

|

1Includes pre-close financing interest of $34.9 million as well as a $11.6 million non-cash loss on our interest rate swap incurred in the first quarter of fiscal year 2026.

2Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and discrete items relating to the AZEK acquisition and $18.2 million in respect of the ATO settlement agreement.

| ||||||||||||||||||||||||||

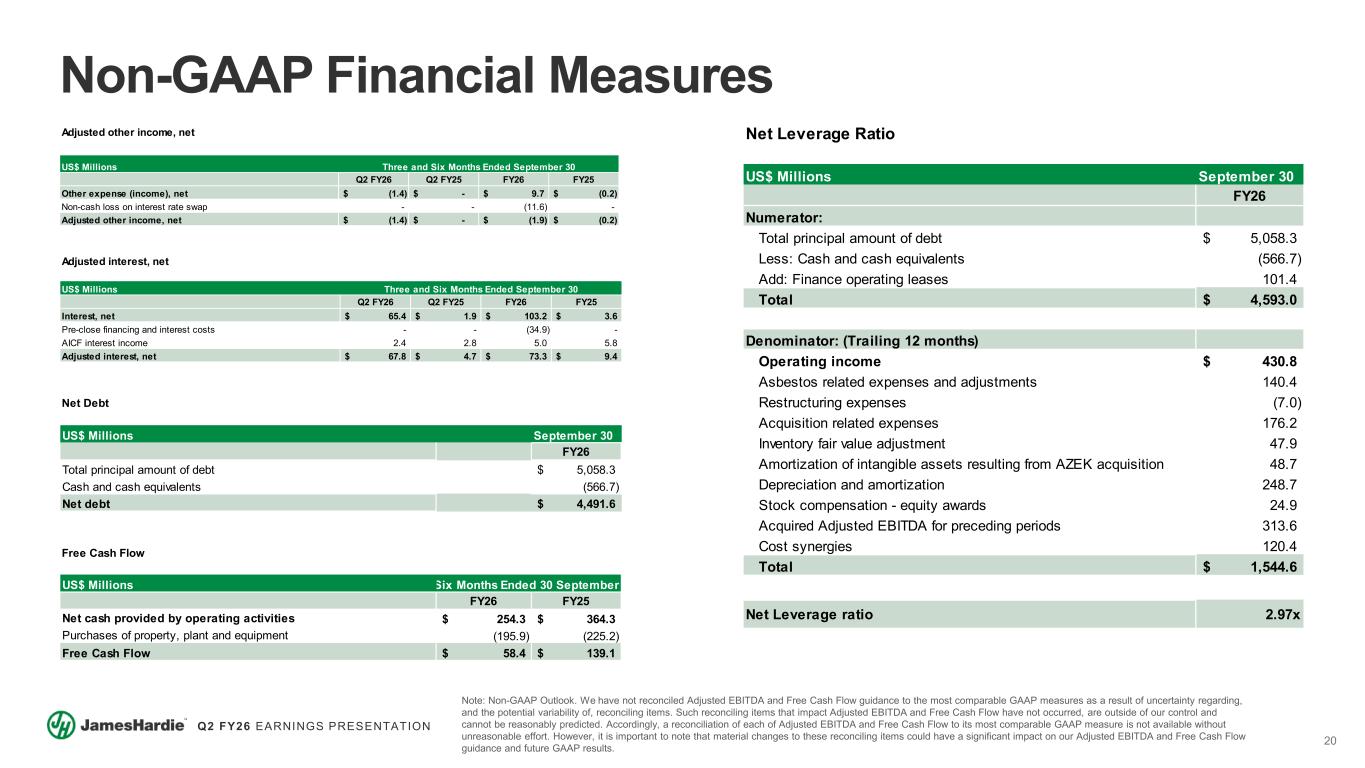

| US$ Millions | Three and Six Months Ended September 30 | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Interest, net | $ | 65.4 | $ | 1.9 | $ | 103.2 | $ | 3.6 | ||||||||||||||||||

| Pre-close financing and interest costs | — | — | (34.9) | — | ||||||||||||||||||||||

| AICF interest income | 2.4 | 2.8 | 5.0 | 5.8 | ||||||||||||||||||||||

| Adjusted interest, net | $ | 67.8 | $ | 4.7 | $ | 73.3 | $ | 9.4 | ||||||||||||||||||

| US$ Millions | Three and Six Months Ended September 30 | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Other (income) expense, net | $ | (1.4) | $ | — | $ | 9.7 | $ | (0.2) | ||||||||||||||||||

| Non-cash loss on interest rate swap | — | — | (11.6) | — | ||||||||||||||||||||||

| Adjusted other income, net | $ | (1.4) | $ | — | $ | (1.9) | $ | (0.2) | ||||||||||||||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

17 |

|||||||

|

Earnings Release

November 18, 2025

|

|

||||

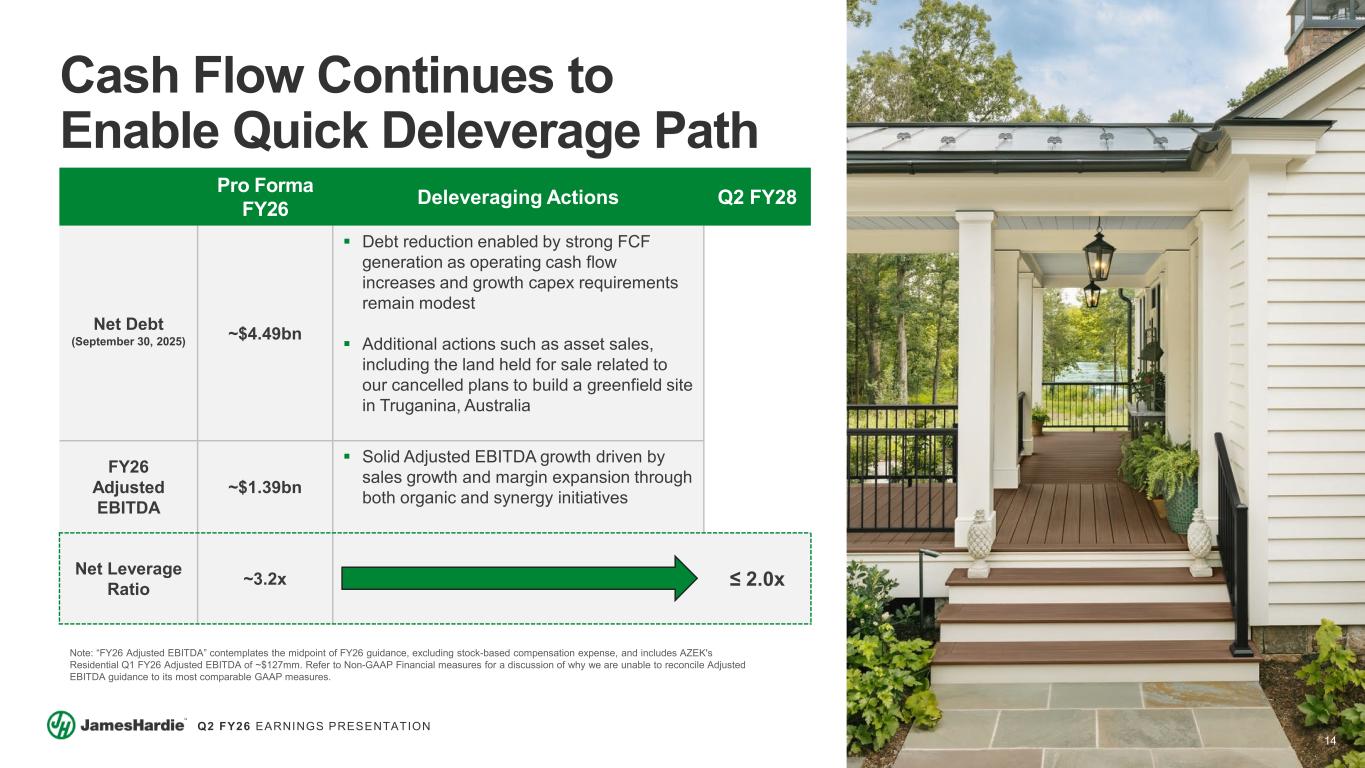

| US$ Millions | 30 September | ||||||||||

| FY26 | |||||||||||

| Total principal amount of debt | $ | 5,058.3 | |||||||||

| Cash and cash equivalents | (566.7) | ||||||||||

| Net debt | $ | 4,491.6 | |||||||||

| US$ Millions | Six Months Ended September 30 | |||||||||||||

| FY26 | FY25 | |||||||||||||

| Net cash provided by operating activities | $ | 254.3 | $ | 364.3 | ||||||||||

| Purchases of property, plant and equipment | (195.9) | (225.2) | ||||||||||||

| Free Cash Flow | $ | 58.4 | $ | 139.1 | ||||||||||

Earnings Release: James Hardie - Second Quarter Ended September 30, 2025 |

18 |

|||||||

| Fiscal Year 2026 Three and Six Months Ended 30 September 2025 |

|

||||

| Management’s Analysis of Results | ||

|

Telephone:

|

+1 773-970-1213 | |||||||

|

Email:

|

investors@jameshardie.com | |||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

1 |

|||||||

| CONSOLIDATED RESULTS |  |

||||

| Overview | ||

| Results of Operations | ||

| US$ Millions | Three Months Ended 30 September | |||||||||||||||||||

| FY26 | FY25 | Change | ||||||||||||||||||

| Net sales | $ | 1,292.2 | $ | 960.8 | 34% | |||||||||||||||

| Cost of goods sold | 871.1 | 587.9 | 48% | |||||||||||||||||

| Gross profit | 421.1 | 372.9 | 13% | |||||||||||||||||

| Gross margin (%) | 32.6 | 38.8 | (6.2 pts) | |||||||||||||||||

| Selling, general and administrative expenses | 250.8 | 149.9 | 67% | |||||||||||||||||

| Research and development expenses | 15.8 | 12.8 | 23% | |||||||||||||||||

| Restructuring expenses | — | 57.3 | (100%) | |||||||||||||||||

| Acquisition related expenses | 130.3 | — | 100% | |||||||||||||||||

Asbestos adjustments |

0.2 | 0.6 | (67%) | |||||||||||||||||

| Operating income | 24.0 | 152.3 | (84%) | |||||||||||||||||

| Operating income margin (%) | 1.9 | 15.9 | (14.0 pts) | |||||||||||||||||

| Interest, net | 65.4 | 1.9 | NM | |||||||||||||||||

| Other income, net | (1.4) | — | 100% | |||||||||||||||||

| Income tax expense | 15.8 | 67.0 | (76%) | |||||||||||||||||

| Net (loss) income | (55.8) | 83.4 | (167%) | |||||||||||||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

2 |

|||||||

| CONSOLIDATED RESULTS |  |

||||

| US$ Millions | Six Months Ended 30 September 2025 | |||||||||||||||||||

| FY26 | FY25 | Change | ||||||||||||||||||

| Net sales | $ | 2,192.1 | $ | 1,952.7 | 12% | |||||||||||||||

| Cost of goods sold | 1,434.1 | 1,182.9 | 21% | |||||||||||||||||

| Gross profit | 758.0 | 769.8 | (2%) | |||||||||||||||||

| Gross margin (%) | 34.6 | 39.4 | (4.8 pts) | |||||||||||||||||

| Selling, general and administrative expenses | 406.9 | 299.7 | 36% | |||||||||||||||||

| Research and development expenses | 27.9 | 24.6 | 13% | |||||||||||||||||

| Restructuring expenses | — | 57.3 | (100%) | |||||||||||||||||

| Acquisition related expenses | 159.7 | — | 100% | |||||||||||||||||

Asbestos adjustments |

0.9 | 0.5 | 80% | |||||||||||||||||

| Operating income | 162.6 | 387.7 | (58%) | |||||||||||||||||

| Operating income margin (%) | 7.4 | 19.9 | (12.5 pts) | |||||||||||||||||

| Interest, net | 103.2 | 3.6 | NM | |||||||||||||||||

| Other expense (income), net | 9.7 | (0.2) | NM | |||||||||||||||||

| Income tax expense | 42.9 | 145.6 | (71%) | |||||||||||||||||

| Net income | 6.8 | 238.7 | (97%) | |||||||||||||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

3 |

|||||||

| OPERATING RESULTS |  |

||||

| Segment Operating Results | ||

| Siding & Trim Segment | ||

| US$ Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | Change | FY26 | FY25 | Change | |||||||||||||||||||||||||||||||||

| Net sales | $ | 766.0 | $ | 695.8 | 10% | $ | 1,407.8 | $ | 1,425.1 | (1%) | ||||||||||||||||||||||||||||

| Cost of goods sold | 499.7 | 419.8 | 19% | 901.0 | 845.7 | 7% | ||||||||||||||||||||||||||||||||

| Gross profit | 266.3 | 276.0 | (4%) | 506.8 | 579.4 | (13%) | ||||||||||||||||||||||||||||||||

| Gross margin (%) | 34.8 | 39.7 | (4.9 pts) | 36.0 | 40.7 | (4.7 pts) | ||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 100.6 | 71.1 | 41% | 176.6 | 144.9 | 22% | ||||||||||||||||||||||||||||||||

| Research and development expenses | 10.9 | 3.0 | 263% | 13.2 | 5.3 | 149% | ||||||||||||||||||||||||||||||||

| Acquisition related expenses | 3.8 | — | 100% | 4.8 | — | 100% | ||||||||||||||||||||||||||||||||

| Operating income | 151.0 | 201.9 | (25%) | 312.2 | 429.2 | (27%) | ||||||||||||||||||||||||||||||||

| Operating income margin (%) | 19.7 | 29.0 | (9.3 pts) | 22.2 | 30.1 | (7.9 pts) | ||||||||||||||||||||||||||||||||

Adjusted operating income1 |

176.8 | 201.9 | (12%) | 339.0 | 429.2 | (21%) | ||||||||||||||||||||||||||||||||

Adjusted operating income margin (%)1 |

23.1 | 29.0 | (5.9 pts) | 24.1 | 30.1 | (6.0 pts) | ||||||||||||||||||||||||||||||||

1 See section titled "Non-GAAP Financial Measures" for a reconciliation to the equivalent GAAP measure |

||||||||||||||||||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

4 |

|||||||

| OPERATING RESULTS |  |

||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

5 |

|||||||

| OPERATING RESULTS |  |

||||

| Deck, Rail & Accessories Segment | ||

| US$ Millions | Three and Six Months Ended 30 September |

|||||||||||||

| Q2 FY26 | FY26 | |||||||||||||

| Net sales | $ | 255.8 | $ | 255.8 | ||||||||||

| Cost of goods sold | 200.0 | 200.0 | ||||||||||||

| Gross profit | 55.8 | 55.8 | ||||||||||||

| Gross margin (%) | 21.8 | 21.8 | ||||||||||||

| Selling, general and administrative expenses | 65.2 | 65.2 | ||||||||||||

| Research and development expenses | 2.5 | 2.5 | ||||||||||||

| Operating loss | (11.9) | (11.9) | ||||||||||||

| Operating loss margin (%) | (4.7) | (4.7) | ||||||||||||

Adjusted operating income1 |

62.7 | 62.7 | ||||||||||||

Adjusted operating income margin (%)1 |

24.5 | 24.5 | ||||||||||||

1 See section titled "Non-GAAP Financial Measures" for a reconciliation to the equivalent GAAP measure |

||||||||||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

6 |

|||||||

| OPERATING RESULTS |  |

||||

| Australia & New Zealand Segment | ||

| US$ Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | Change | FY26 | FY25 | Change | |||||||||||||||||||||||||||||||||

| Net sales | $ | 132.9 | $ | 148.4 | (10%) | $ | 254.5 | $ | 283.7 | (10%) | ||||||||||||||||||||||||||||

| Cost of goods sold | 76.3 | 84.7 | (10%) | 145.6 | 164.5 | (11%) | ||||||||||||||||||||||||||||||||

| Gross profit | 56.6 | 63.7 | (11%) | 108.9 | 119.2 | (9%) | ||||||||||||||||||||||||||||||||

| Gross margin (%) | 42.6 | 43.0 | (0.4 pts) | 42.8 | 42.0 | 0.8 pts | ||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 17.1 | 14.1 | 21% | 31.3 | 28.1 | 11% | ||||||||||||||||||||||||||||||||

| Restructuring expenses | — | 57.3 | (100%) | — | 57.3 | (100%) | ||||||||||||||||||||||||||||||||

| Research and development expenses | 1.5 | 0.3 | 400% | 1.8 | 0.6 | 200% | ||||||||||||||||||||||||||||||||

| Operating income (loss) | 38.0 | (8.0) | 575% | 75.8 | 33.2 | 128% | ||||||||||||||||||||||||||||||||

| Operating income (loss) margin (%) | 28.6 | (5.0) | 33.6 pts | 29.8 | 12.1 | 17.7 pts | ||||||||||||||||||||||||||||||||

Adjusted operating income1 |

38.0 | 49.3 | (23%) | 75.8 | 90.5 | (16%) | ||||||||||||||||||||||||||||||||

Adjusted operating income margin (%)1 |

28.6 | 33.3 | (4.7 pts) | 29.8 | 31.9 | (2.1 pts) | ||||||||||||||||||||||||||||||||

1 See section titled "Non-GAAP Financial Measures" for a reconciliation to the equivalent GAAP measure |

||||||||||||||||||||||||||||||||||||||

| A$ Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | Change | FY26 | FY25 | Change | |||||||||||||||||||||||||||||||||

| Net sales | A$ | 203.2 | A$ | 221.5 | (8%) | A$ | 392.7 | A$ | 426.8 | (8%) | ||||||||||||||||||||||||||||

| Cost of goods sold | 116.7 | 126.3 | (8%) | 224.7 | 247.5 | (9%) | ||||||||||||||||||||||||||||||||

| Gross profit | 86.5 | 95.2 | (9%) | 168.0 | 179.3 | (6%) | ||||||||||||||||||||||||||||||||

| Gross margin (%) | 42.6 | 43.0 | (0.4 pts) | 42.8 | 42.0 | 0.8 pts | ||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 26.2 | 21.0 | 25% | 48.3 | 42.2 | 14% | ||||||||||||||||||||||||||||||||

| Restructuring expenses | — | 84.7 | (100%) | — | 84.7 | (100%) | ||||||||||||||||||||||||||||||||

| Research and development expenses | 2.2 | 0.5 | 340% | 2.7 | 0.9 | 200% | ||||||||||||||||||||||||||||||||

| Operating income (loss) | 58.1 | (11.0) | 628% | 117.0 | 51.5 | 127% | ||||||||||||||||||||||||||||||||

| Operating income (loss) margin (%) | 28.6 | (5.0) | 33.6 pts | 29.8 | 12.1 | 17.7 pts | ||||||||||||||||||||||||||||||||

Adjusted operating income1 |

58.1 | 73.7 | (21%) | 117.0 | 136.2 | (14%) | ||||||||||||||||||||||||||||||||

Adjusted operating income margin (%)1 |

28.6 | 33.3 | (4.7 pts) | 29.8 | 31.9 | (2.1 pts) | ||||||||||||||||||||||||||||||||

1 See section titled "Non-GAAP Financial Measures" for a reconciliation to the equivalent GAAP measure |

||||||||||||||||||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

7 |

|||||||

| OPERATING RESULTS |  |

||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

8 |

|||||||

| OPERATING RESULTS |  |

||||

| Europe Segment | ||

| US$ Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | Change | FY26 | FY25 | Change | |||||||||||||||||||||||||||||||||

| Net sales | $ | 137.5 | $ | 116.6 | 18% | $ | 274.0 | $ | 243.9 | 12% | ||||||||||||||||||||||||||||

| Cost of goods sold | 95.1 | 83.4 | 14% | 187.5 | 172.7 | 9% | ||||||||||||||||||||||||||||||||

| Gross profit | 42.4 | 33.2 | 28% | 86.5 | 71.2 | 21% | ||||||||||||||||||||||||||||||||

| Gross margin (%) | 30.8 | 28.4 | 2.4 pts | 31.6 | 29.2 | 2.4 pts | ||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 27.8 | 23.5 | 18% | 56.0 | 49.0 | 14% | ||||||||||||||||||||||||||||||||

| Research and development expenses | 0.9 | 0.8 | 13% | 1.7 | 1.1 | 55% | ||||||||||||||||||||||||||||||||

| Operating income | 13.7 | 8.9 | 54% | 28.8 | 21.1 | 36% | ||||||||||||||||||||||||||||||||

| Operating income margin (%) | 10.0 | 7.5 | 2.5 pts | 10.5 | 8.6 | 1.9 pts | ||||||||||||||||||||||||||||||||

| € Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | Change | FY26 | FY25 | Change | |||||||||||||||||||||||||||||||||

| Net sales | € | 117.7 | € | 106.1 | 11% | € | 238.0 | € | 224.3 | 6% | ||||||||||||||||||||||||||||

| Cost of goods sold | 81.4 | 76.0 | 7% | 162.8 | 158.9 | 2% | ||||||||||||||||||||||||||||||||

| Gross profit | 36.3 | 30.1 | 21% | 75.2 | 65.4 | 15% | ||||||||||||||||||||||||||||||||

| Gross margin (%) | 30.8 | 28.4 | 2.4 pts | 31.6 | 29.2 | 2.4 pts | ||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 23.8 | 21.4 | 11% | 48.7 | 45.0 | 8% | ||||||||||||||||||||||||||||||||

| Research and development expenses | 0.8 | 0.7 | 14% | 1.5 | 1.0 | 50% | ||||||||||||||||||||||||||||||||

| Operating income | 11.7 | 8.0 | 46% | 25.0 | 19.4 | 29% | ||||||||||||||||||||||||||||||||

| Operating income margin (%) | 10.0 | 7.5 | 2.5 pts | 10.5 | 8.6 | 1.9 pts | ||||||||||||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

9 |

|||||||

| OPERATING RESULTS |  |

||||

| General Corporate and Unallocated R&D costs | ||

| US$ Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | Change % | FY26 | FY25 | Change % | |||||||||||||||||||||||||||||||||

| General Corporate and Unallocated R&D costs | $ | 166.8 | $ | 50.5 | 230 | $ | 242.3 | $ | 95.8 | 153 | ||||||||||||||||||||||||||||

| Excluding: | ||||||||||||||||||||||||||||||||||||||

| Acquisition related expenses | (126.5) | — | 100 | (154.9) | — | 100 | ||||||||||||||||||||||||||||||||

| Asbestos related expenses and adjustments | (0.9) | (1.4) | (36) | (1.9) | (2.0) | (5) | ||||||||||||||||||||||||||||||||

| Adjusted General Corporate and Unallocated R&D costs | $ | 39.4 | $ | 49.1 | (20) | $ | 85.5 | $ | 93.8 | (9) | ||||||||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

10 |

|||||||

| OPERATING RESULTS |  |

||||

| Income Tax | ||

| US$ Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | Change | FY26 | FY25 | Change | |||||||||||||||||||||||||||||||||

| Income tax expense | $ | 15.8 | $ | 67.0 | (76%) | $ | 42.9 | $ | 145.6 | (71%) | ||||||||||||||||||||||||||||

| Effective tax rate (%) | (39.5) | 44.5 | (84.0 pts) | 86.3 | 37.9 | 48.4 pts | ||||||||||||||||||||||||||||||||

Adjusted income tax expense1 |

$ | 31.4 | $ | 49.3 | (36%) | $ | 68.5 | $ | 103.2 | (34%) | ||||||||||||||||||||||||||||

Adjusted effective tax rate1 (%) |

16.9 | 23.9 | (7.0 pts) | 19.6 | 23.6 | (4.0 pts) | ||||||||||||||||||||||||||||||||

1Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and discrete items relating to the AZEK acquisition, and US$18.2 million in respect of the ATO settlement agreement. See section titled "Non-GAAP Financial Measures" for a reconciliation to the equivalent GAAP measure. | ||||||||||||||||||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

11 |

|||||||

| OTHER INFORMATION |  |

||||

| Cash Flow | ||

| US$ Millions | Six Months Ended 30 September | |||||||||||||||||||||||||

| FY26 | FY25 | Change | Change % | |||||||||||||||||||||||

| Net cash provided by operating activities | $ | 254.3 | $ | 364.3 | $ | (110.0) | (30) | |||||||||||||||||||

| Net cash used in investing activities | 4,120.8 | 241.4 | 3,879.4 | NM | ||||||||||||||||||||||

| Net cash provided by (used in) financing activities | 3,848.6 | (156.5) | 4,005.1 | NM | ||||||||||||||||||||||

| Capacity Expansion | ||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

12 |

|||||||

| OTHER INFORMATION |  |

||||

| Liquidity | ||

| Capital Allocation | ||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

13 |

|||||||

| NON-GAAP FINANCIAL TERMS |  |

||||

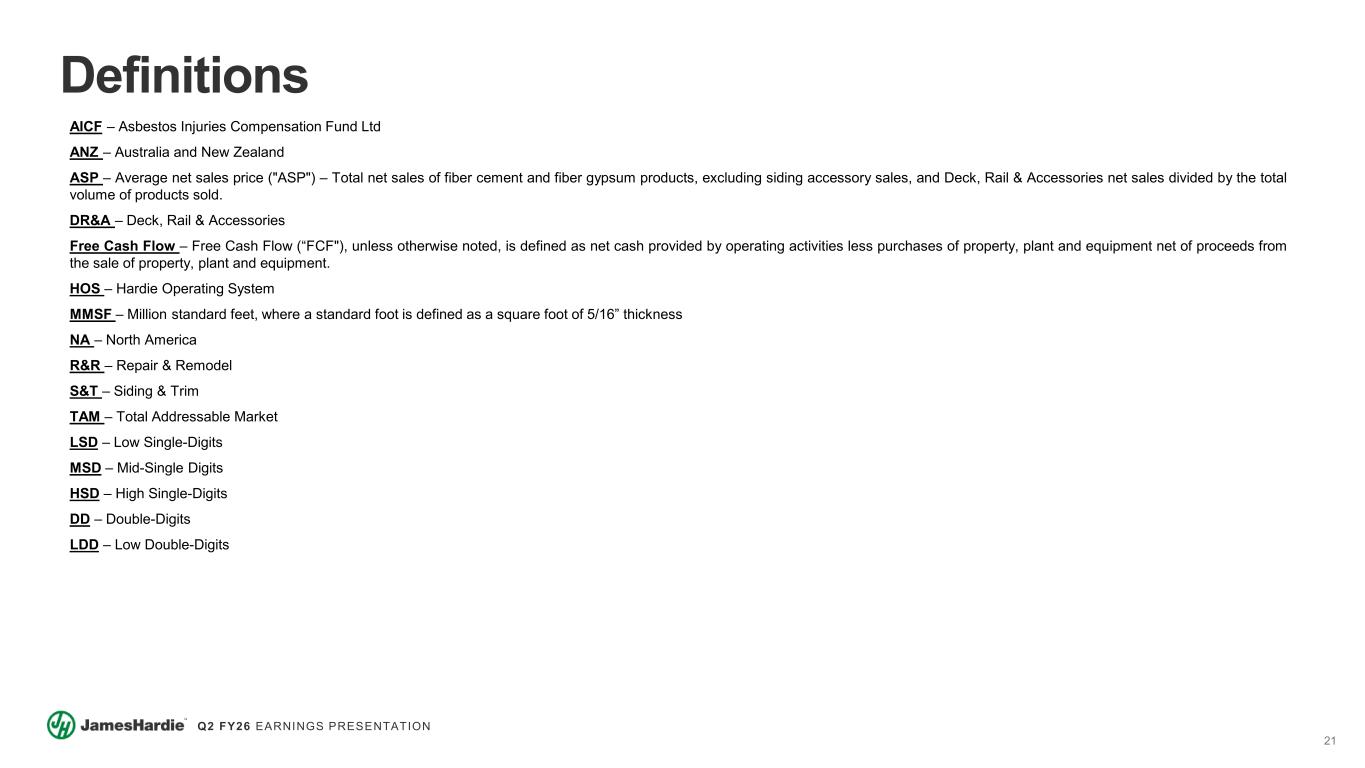

| Non GAAP Financial Terms | ||

| • | Adjusted operating income and adjusted operating income margin | • | Adjusted General Corporate and Unallocated R&D costs | ||||||||

| • | Siding & Trim Segment Adjusted operating income and adjusted operating income margin | • | Adjusted net income and Adjusted diluted earnings per share | ||||||||

| • | Deck, Rail & Accessories Segment Adjusted operating income and adjusted operating income margin | • | Adjusted income before income taxes, Adjusted income tax expense and Adjusted effective tax rate | ||||||||

| • | Australia & New Zealand Segment Adjusted operating income and adjusted operating income margin | • | Net debt | ||||||||

| Definitions | ||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

14 |

|||||||

| NON-GAAP FINANCIAL MEASURES |  |

||||

| Financial Measures - GAAP equivalents | ||

| US$ Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Operating income | $ | 24.0 | $ | 152.3 | $ | 162.6 | $ | 387.7 | ||||||||||||||||||

| Asbestos related expenses and adjustments | 0.9 | 1.4 | 1.9 | 2.0 | ||||||||||||||||||||||

| Restructuring expenses | — | 57.3 | — | 57.3 | ||||||||||||||||||||||

| Acquisition related expenses | 130.3 | — | 159.7 | — | ||||||||||||||||||||||

| Inventory fair value adjustment | 47.9 | — | 47.9 | — | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 48.7 | — | 48.7 | $ | — | |||||||||||||||||||||

| Adjusted operating income | $ | 251.8 | $ | 211.0 | $ | 420.8 | $ | 447.0 | ||||||||||||||||||

| Three and Six Months Ended 30 September | ||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Operating income margin | 1.9% | 15.9% | 7.4% | 19.9% | ||||||||||||||||||||||

| Asbestos related expenses and adjustments | 0.1% | 0.1% | 0.1% | 0.1% | ||||||||||||||||||||||

| Restructuring expenses | —% | 6.0% | —% | 2.9% | ||||||||||||||||||||||

| Acquisition related expenses | 10.0% | —% | 7.3% | —% | ||||||||||||||||||||||

| Inventory fair value adjustment | 3.7% | —% | 2.2% | —% | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 3.8% | —% | 2.2% | —% | ||||||||||||||||||||||

| Adjusted operating income margin | 19.5% | 22.0% | 19.2% | 22.9% | ||||||||||||||||||||||

| US$ Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Siding & Trim Segment operating income | $ | 151.0 | $ | 201.9 | $ | 312.2 | $ | 429.2 | ||||||||||||||||||

| Acquisition related expenses | 3.8 | — | 4.8 | — | ||||||||||||||||||||||

| Inventory fair value adjustment | 11.2 | — | 11.2 | — | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 10.8 | — | 10.8 | — | ||||||||||||||||||||||

| Siding & Trim Segment Adjusted operating income | $ | 176.8 | $ | 201.9 | $ | 339.0 | $ | 429.2 | ||||||||||||||||||

| Three and Six Months Ended 30 September | ||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Siding & Trim Segment operating income margin | 19.7% | 29.0% | 22.2% | 30.1% | ||||||||||||||||||||||

| Acquisition related expenses | 0.5% | —% | 0.3% | —% | ||||||||||||||||||||||

| Inventory fair value adjustment | 1.5% | —% | 0.8% | —% | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 1.4% | —% | 0.8% | —% | ||||||||||||||||||||||

| Siding & Trim Segment Adjusted operating income margin | 23.1% | 29.0% | 24.1% | 30.1% | ||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

15 |

|||||||

| NON-GAAP FINANCIAL MEASURES |  |

||||

| US$ Millions | Three and Six Months Ended 30 September | |||||||||||||

| Q2 FY26 | FY26 | |||||||||||||

| Deck, Rail & Accessories Segment operating income | $ | (11.9) | $ | (11.9) | ||||||||||

| Inventory fair value adjustment | 36.7 | 36.7 | ||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 37.9 | 37.9 | ||||||||||||

| Deck, Rail & Accessories Segment Adjusted operating income | $ | 62.7 | $ | 62.7 | ||||||||||

| Three and Six Months Ended 30 September | ||||||||||||||

| Q2 FY26 | FY26 | |||||||||||||

| Deck, Rail & Accessories Segment operating income margin | (4.7)% | (4.7)% | ||||||||||||

| Inventory fair value adjustment | 14.4% | 14.4% | ||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 14.8% | 14.8% | ||||||||||||

| Deck, Rail & Accessories Segment Adjusted operating income margin | 24.5% | 24.5% | ||||||||||||

| US$ Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Australia & New Zealand Segment operating income | $ | 38.0 | $ | (8.0) | $ | 75.8 | $ | 33.2 | ||||||||||||||||||

| Restructuring expenses | — | 57.3 | — | 57.3 | ||||||||||||||||||||||

| Australia & New Zealand Segment Adjusted operating income | $ | 38.0 | $ | 49.3 | $ | 75.8 | $ | 90.5 | ||||||||||||||||||

| Three and Six Months Ended 30 September | ||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Australia & New Zealand Segment operating income margin | 28.6% | (5.0)% | 29.8% | 12.1% | ||||||||||||||||||||||

| Restructuring expenses | —% | 38.3% | —% | 19.8% | ||||||||||||||||||||||

| Australia & New Zealand Segment Adjusted operating income margin | 28.6% | 33.3% | 29.8% | 31.9% | ||||||||||||||||||||||

| US$ Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| General Corporate and Unallocated R&D costs | $ | 166.8 | $ | 50.5 | $ | 242.3 | $ | 95.8 | ||||||||||||||||||

| Acquisition related expenses | (126.5) | — | (154.9) | — | ||||||||||||||||||||||

| Asbestos related expenses and adjustments | (0.9) | (1.4) | (1.9) | (2.0) | ||||||||||||||||||||||

| Adjusted General Corporate and Unallocated R&D costs | $ | 39.4 | $ | 49.1 | $ | 85.5 | $ | 93.8 | ||||||||||||||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

16 |

|||||||

| NON-GAAP FINANCIAL MEASURES |  |

||||

| US$ Millions, except per share amounts | Three and Six Months Ended 30 September | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Net (loss) income | $ | (55.8) | $ | 83.4 | $ | 6.8 | $ | 238.7 | ||||||||||||||||||

| Asbestos related expenses and adjustments | 0.9 | 1.4 | 1.9 | 2.0 | ||||||||||||||||||||||

| AICF interest income | (2.4) | (2.8) | (5.0) | (5.8) | ||||||||||||||||||||||

| Restructuring expenses | — | 57.3 | — | 57.3 | ||||||||||||||||||||||

Pre-close financing costs1 |

— | — | 46.5 | — | ||||||||||||||||||||||

| Acquisition related expenses | 130.3 | — | 159.7 | — | ||||||||||||||||||||||

| Inventory fair value adjustment | 47.9 | — | 47.9 | — | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 48.7 | — | 48.7 | — | ||||||||||||||||||||||

Tax adjustments2 |

(15.6) | 17.7 | (25.6) | 42.4 | ||||||||||||||||||||||

| Adjusted net income | $ | 154.0 | $ | 157.0 | $ | 280.9 | $ | 334.6 | ||||||||||||||||||

| Three and Six Months Ended 30 September | ||||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| Net (loss) income per common share - diluted | $ | (0.10) | $ | 0.19 | $ | 0.01 | $ | 0.55 | ||||||||||||||||||

| Asbestos related expenses and adjustments | — | — | — | — | ||||||||||||||||||||||

| AICF interest income | — | (0.01) | (0.01) | (0.01) | ||||||||||||||||||||||

| Restructuring expenses | — | 0.14 | — | 0.13 | ||||||||||||||||||||||

Pre-close financing costs1 |

— | — | 0.09 | — | ||||||||||||||||||||||

| Acquisition related expenses | 0.23 | — | 0.32 | — | ||||||||||||||||||||||

| Inventory fair value adjustment | 0.08 | — | 0.09 | — | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 0.08 | — | 0.10 | — | ||||||||||||||||||||||

Tax adjustments2 |

(0.03) | 0.04 | (0.05) | 0.10 | ||||||||||||||||||||||

Adjusted diluted earnings per share3 |

$ | 0.26 | $ | 0.36 | $ | 0.55 | $ | 0.77 | ||||||||||||||||||

|

1 Includes pre-close financing interest of US$34.9 million as well as a US$11.6 million non-cash loss on our interest rate swap incurred in the first quarter of fiscal year 2026.

2 Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and discrete items relating to the AZEK acquisition, and US$18.2 million in respect of the ATO settlement agreement.

3 Weighted average common shares outstanding used in computing diluted net income per common share of 582.1 million and 432.3 million for the three months ended September 30, 2025 and 2024, respectively. Weighted average common shares outstanding used in computing diluted net income per common share of 508.6 million and 433.4 million for the six months ended September 30, 2025 and 2024, respectively.

| ||||||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

17 |

|||||||

| NON-GAAP FINANCIAL MEASURES |  |

||||

| US$ Millions | Three and Six Months Ended 30 September | |||||||||||||||||||||||||

| Q2 FY26 | Q2 FY25 | FY26 | FY25 | |||||||||||||||||||||||

| (Loss) Income before income taxes | $ | (40.0) | $ | 150.4 | $ | 49.7 | $ | 384.3 | ||||||||||||||||||

| Asbestos related expenses and adjustments | 0.9 | 1.4 | 1.9 | 2.0 | ||||||||||||||||||||||

| AICF interest income | (2.4) | (2.8) | (5.0) | (5.8) | ||||||||||||||||||||||

| Restructuring expenses | — | 57.3 | — | 57.3 | ||||||||||||||||||||||

Pre-close financing costs1 |

— | — | 46.5 | — | ||||||||||||||||||||||

| Acquisition related expenses | 130.3 | — | 159.7 | — | ||||||||||||||||||||||

| Inventory fair value adjustment | 47.9 | — | 47.9 | — | ||||||||||||||||||||||

| Amortization of intangible assets resulting from AZEK acquisition | 48.7 | — | 48.7 | — | ||||||||||||||||||||||

| Adjusted income before income taxes | $ | 185.4 | $ | 206.3 | $ | 349.4 | $ | 437.8 | ||||||||||||||||||

| Income tax expense | 15.8 | 67.0 | 42.9 | 145.6 | ||||||||||||||||||||||

Tax adjustments2 |

15.6 | (17.7) | 25.6 | (42.4) | ||||||||||||||||||||||

| Adjusted income tax expense | $ | 31.4 | $ | 49.3 | $ | 68.5 | $ | 103.2 | ||||||||||||||||||

| Effective tax rate | (39.5%) | 44.5% | 86.3% | 37.9% | ||||||||||||||||||||||

| Adjusted effective tax rate | 16.9% | 23.9% | 19.6% | 23.6% | ||||||||||||||||||||||

|

1Includes pre-close financing interest of US$34.9 million as well as a US$11.6 million non-cash loss on our interest rate swap incurred in the first quarter of fiscal year 2026.

2Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and discrete items relating to the AZEK acquisition, and US$18.2 million in respect of the ATO settlement agreement.

| ||||||||||||||||||||||||||

| US$ Millions | 30 September | ||||

| FY26 | |||||

| Total principal amount of debt | $ | 5,058.3 | |||

| Cash and cash equivalents | (566.7) | ||||

| Net debt | $ | 4,491.6 | |||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

18 |

|||||||

| FORWARD-LOOKING STATEMENTS |  |

||||

Management's Analysis of Results: James Hardie - 2nd Quarter Fiscal Year 2026 |

19 |

|||||||

| Page | |||||

| (Millions of US dollars) |

(Unaudited)

30 September

2025

|

31 March

2025

|

|||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 566.7 | $ | 562.7 | |||||||

| Restricted cash and cash equivalents | 5.0 | 5.0 | |||||||||

| Restricted cash and cash equivalents - Asbestos | 15.3 | 37.9 | |||||||||

| Restricted short-term investments - Asbestos | 185.0 | 175.8 | |||||||||

| Accounts and other receivables, net | 359.7 | 391.8 | |||||||||

| Inventories | 638.0 | 347.1 | |||||||||

| Prepaid expenses and other current assets | 172.7 | 100.6 | |||||||||

| Assets held for sale | 76.1 | 73.1 | |||||||||

| Insurance receivable - Asbestos | 5.8 | 5.5 | |||||||||

| Workers’ compensation - Asbestos | 2.5 | 2.3 | |||||||||

| Total current assets | 2,026.8 | 1,701.8 | |||||||||

| Property, plant and equipment, net | 3,047.9 | 2,169.0 | |||||||||

| Operating lease right-of-use-assets | 109.5 | 70.4 | |||||||||

| Finance lease right-of-use-assets | 89.4 | 2.7 | |||||||||

| Goodwill | 5,102.8 | 193.7 | |||||||||

| Intangible assets, net | 3,265.9 | 145.6 | |||||||||

| Insurance receivable - Asbestos | 22.7 | 23.2 | |||||||||

| Workers’ compensation - Asbestos | 17.3 | 16.5 | |||||||||

| Deferred income taxes | 80.9 | 600.4 | |||||||||

| Deferred income taxes - Asbestos | 279.0 | 284.5 | |||||||||

| Other assets | 26.8 | 22.1 | |||||||||

| Total assets | $ | 14,069.0 | $ | 5,229.9 | |||||||

| Liabilities and Shareholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable and accrued liabilities | $ | 669.8 | $ | 446.4 | |||||||

| Accrued payroll and employee benefits | 181.6 | 133.3 | |||||||||

| Operating lease liabilities | 27.9 | 21.6 | |||||||||

| Finance lease liabilities | 5.3 | 1.1 | |||||||||

| Long-term debt, current portion | 43.8 | 9.4 | |||||||||

| Accrued product warranties | 10.6 | 7.3 | |||||||||

| Income taxes payable | 7.1 | 10.3 | |||||||||

| Asbestos liability | 125.7 | 119.4 | |||||||||

| Workers’ compensation - Asbestos | 2.5 | 2.3 | |||||||||

| Other liabilities | 55.9 | 59.1 | |||||||||

| Total current liabilities | 1,130.2 | 810.2 | |||||||||

| Long-term debt | 4,972.2 | 1,110.1 | |||||||||

| Deferred income taxes | 479.9 | 121.1 | |||||||||

| Operating lease liabilities | 98.3 | 63.9 | |||||||||

| Finance lease liabilities | 96.1 | 1.8 | |||||||||

| Accrued product warranties | 42.4 | 26.9 | |||||||||

| Asbestos liability | 847.0 | 864.2 | |||||||||

| Workers’ compensation - Asbestos | 17.3 | 16.5 | |||||||||

| Other liabilities | 63.5 | 53.7 | |||||||||

| Total liabilities | 7,746.9 | 3,068.4 | |||||||||

| Commitments and contingencies (Note 10) | |||||||||||

| Shareholders’ equity: | |||||||||||

Common stock, Euro 0.59 par value, 2.0 billion shares authorized; 579,185,759 shares issued and outstanding at 30 September 2025 and 429,818,781 shares issued and outstanding at 31 March 2025 |

325.9 | 222.1 | |||||||||

| Additional paid-in capital | 4,303.6 | 271.9 | |||||||||

| Retained earnings | 1,732.5 | 1,725.7 | |||||||||

| Accumulated other comprehensive loss | (39.9) | (58.2) | |||||||||

| Total shareholders’ equity | 6,322.1 | 2,161.5 | |||||||||

| Total liabilities and shareholders’ equity | $ | 14,069.0 | $ | 5,229.9 | |||||||

| Three Months Ended 30 September |

Six Months Ended 30 September |

||||||||||||||||||||||

| (Millions of US dollars, except per share data) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Net sales | $ | 1,292.2 | $ | 960.8 | $ | 2,192.1 | $ | 1,952.7 | |||||||||||||||

| Cost of goods sold | 871.1 | 587.9 | 1,434.1 | 1,182.9 | |||||||||||||||||||

| Gross profit | 421.1 | 372.9 | 758.0 | 769.8 | |||||||||||||||||||

| Selling, general and administrative expenses | 250.8 | 149.9 | 406.9 | 299.7 | |||||||||||||||||||

| Research and development expenses | 15.8 | 12.8 | 27.9 | 24.6 | |||||||||||||||||||

| Restructuring expenses | — | 57.3 | — | 57.3 | |||||||||||||||||||

| Acquisition related expenses | 130.3 | — | 159.7 | — | |||||||||||||||||||

Asbestos adjustments |

0.2 | 0.6 | 0.9 | 0.5 | |||||||||||||||||||

| Operating income | 24.0 | 152.3 | 162.6 | 387.7 | |||||||||||||||||||

| Interest, net | 65.4 | 1.9 | 103.2 | 3.6 | |||||||||||||||||||

| Other (income) expense, net | (1.4) | — | 9.7 | (0.2) | |||||||||||||||||||

| (Loss) income before income taxes | (40.0) | 150.4 | 49.7 | 384.3 | |||||||||||||||||||

| Income tax expense | 15.8 | 67.0 | 42.9 | 145.6 | |||||||||||||||||||

| Net (loss) income | $ | (55.8) | $ | 83.4 | $ | 6.8 | $ | 238.7 | |||||||||||||||

| (Loss) income per share: | |||||||||||||||||||||||

| Basic | $ | (0.10) | $ | 0.19 | $ | 0.01 | $ | 0.55 | |||||||||||||||

| Diluted | $ | (0.10) | $ | 0.19 | $ | 0.01 | $ | 0.55 | |||||||||||||||

| Weighted average common shares outstanding (Millions): | |||||||||||||||||||||||

| Basic | 577.4 | 430.8 | 504.0 | 432.0 | |||||||||||||||||||

| Diluted | 577.4 | 432.3 | 508.6 | 433.4 | |||||||||||||||||||

| Comprehensive (loss) income, net of tax: | |||||||||||||||||||||||

| Net (loss) income | $ | (55.8) | $ | 83.4 | $ | 6.8 | $ | 238.7 | |||||||||||||||

| Currency translation adjustments | (4.8) | 16.7 | 19.5 | 10.3 | |||||||||||||||||||

| Cash flow hedges | (1.2) | — | (1.2) | (0.1) | |||||||||||||||||||

| Reclassification of other comprehensive income | — | 8.5 | — | 8.5 | |||||||||||||||||||

| Comprehensive (loss) income | $ | (61.8) | $ | 108.6 | $ | 25.1 | $ | 257.4 | |||||||||||||||

| Six Months Ended 30 September | |||||||||||

| (Millions of US dollars) | 2025 | 2024 | |||||||||

| Cash Flows From Operating Activities | |||||||||||

| Net income | $ | 6.8 | $ | 238.7 | |||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 182.9 | 101.7 | |||||||||

| Lease expense | 18.5 | 16.5 | |||||||||

| Deferred income taxes | 7.7 | 72.2 | |||||||||

| Stock-based compensation | 19.9 | 12.3 | |||||||||

Asbestos adjustments |

0.9 | 0.5 | |||||||||

| Non-cash restructuring expenses | — | 40.2 | |||||||||

| Non-cash interest expense | 4.3 | 1.0 | |||||||||

| Non-cash charge related to step up of inventory | 47.9 | — | |||||||||

| Other, net | 28.6 | 15.6 | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts and other receivables | 101.4 | 22.8 | |||||||||

| Inventories | (50.2) | (31.3) | |||||||||

| Operating lease assets and liabilities, net | (20.9) | (17.0) | |||||||||

| Prepaid expenses and other assets | (14.9) | (17.4) | |||||||||

| Insurance receivable - Asbestos | 1.7 | 2.1 | |||||||||

| Accounts payable and accrued liabilities | (9.1) | (8.7) | |||||||||

| Claims and handling costs paid - Asbestos | (61.0) | (60.4) | |||||||||

| Income taxes payable | (3.3) | (11.7) | |||||||||

| Other accrued liabilities and interest | (6.9) | (12.8) | |||||||||

| Net cash provided by operating activities | $ | 254.3 | $ | 364.3 | |||||||

| Cash Flows From Investing Activities | |||||||||||

| Purchases of property, plant and equipment | $ | (195.9) | $ | (225.2) | |||||||

| Capitalized interest | (5.1) | (12.8) | |||||||||

| Cash consideration for The AZEK Company acquisition, net of cash acquired | (3,919.8) | — | |||||||||

| Purchase of restricted investments - Asbestos | (96.4) | (98.4) | |||||||||

| Proceeds from restricted investments - Asbestos | 96.4 | 94.6 | |||||||||

| Other | — | 0.4 | |||||||||

| Net cash used in investing activities | $ | (4,120.8) | $ | (241.4) | |||||||

| Cash Flows From Financing Activities | |||||||||||

| Proceeds from senior secured notes | $ | 1,700.0 | $ | — | |||||||

| Proceeds from term loans | 2,500.0 | — | |||||||||

| Repayments of term loans | (301.6) | (3.8) | |||||||||

| Debt issuance costs paid | (42.0) | — | |||||||||

| Repayment of finance lease obligations | (1.5) | (0.6) | |||||||||

| Shares repurchased | — | (149.9) | |||||||||

| Taxes paid related to net share settlement of equity awards | (6.3) | (2.2) | |||||||||

| Net cash provided by (used in) financing activities | $ | 3,848.6 | $ | (156.5) | |||||||

| Effects of exchange rate changes on cash and cash equivalents, restricted cash and restricted cash - Asbestos | $ | (0.7) | $ | 3.6 | |||||||

| Net decrease in cash and cash equivalents, restricted cash and restricted cash - Asbestos | (18.6) | (30.0) | |||||||||

| Cash and cash equivalents, restricted cash and restricted cash - Asbestos at beginning of period | 605.6 | 415.8 | |||||||||

| Cash and cash equivalents, restricted cash and restricted cash - Asbestos at end of period | $ | 587.0 | $ | 385.8 | |||||||

| Non-Cash Investing and Financing Activities | |||||||||||

| Capital expenditures incurred but not yet paid | $ | 35.5 | $ | 30.2 | |||||||

| Non-cash ROU assets obtained in exchange for new lease liabilities | $ | 13.6 | $ | 19.5 | |||||||

| Non-cash consideration for AZEK acquisition | $ | 4,143.6 | $ | — | |||||||

| Supplemental Disclosure of Cash Flow Activities | |||||||||||

| Cash paid to AICF | $ | 31.4 | $ | 24.8 | |||||||

| Three Months Ended 30 September 2025 | |||||||||||||||||||||||||||||

| (Millions of US dollars) | Common Stock |

Additional Paid-in Capital |

Retained Earnings |

Accumulated Other Comprehensive Loss |

Total | ||||||||||||||||||||||||

| Balances as of 30 June 2025 | $ | 222.1 | $ | 279.8 | $ | 1,788.3 | $ | (33.9) | $ | 2,256.3 | |||||||||||||||||||

| Net loss | — | — | (55.8) | — | (55.8) | ||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | (6.0) | (6.0) | ||||||||||||||||||||||||

| Stock-based compensation | — | 6.4 | — | — | 6.4 | ||||||||||||||||||||||||

| Issuance of ordinary shares | 0.3 | 1.1 | — | — | 1.4 | ||||||||||||||||||||||||

| Issuance of ordinary shares in connection with the acquisition of The AZEK Company | 103.5 | 3,889.0 | — | — | 3,992.5 | ||||||||||||||||||||||||

| Issuance of stock awards in connection with the acquisition of The AZEK Company | — | 127.3 | — | — | 127.3 | ||||||||||||||||||||||||

Balances as of 30 September 2025 |

$ | 325.9 | $ | 4,303.6 | $ | 1,732.5 | $ | (39.9) | $ | 6,322.1 | |||||||||||||||||||

| Six Months Ended 30 September 2025 | |||||||||||||||||||||||||||||

| (Millions of US dollars) | Common Stock |

Additional Paid-in Capital |

Retained Earnings |

Accumulated Other Comprehensive Loss |

Total | ||||||||||||||||||||||||

Balances as of 31 March 2025 |

$ | 222.1 | $ | 271.9 | $ | 1,725.7 | $ | (58.2) | $ | 2,161.5 | |||||||||||||||||||

| Net income | — | — | 6.8 | — | 6.8 | ||||||||||||||||||||||||

| Other comprehensive income | — | — | — | 18.3 | 18.3 | ||||||||||||||||||||||||

| Stock-based compensation | — | 13.3 | — | — | 13.3 | ||||||||||||||||||||||||

| Issuance of ordinary shares | 0.3 | 2.1 | — | — | 2.4 | ||||||||||||||||||||||||

| Issuance of ordinary shares in connection with the acquisition of The AZEK Company | 103.5 | 3,889.0 | — | — | 3,992.5 | ||||||||||||||||||||||||

| Issuance of stock awards in connection with the acquisition of The AZEK Company | — | 127.3 | — | — | 127.3 | ||||||||||||||||||||||||

Balances as of 30 September 2025 |

$ | 325.9 | $ | 4,303.6 | $ | 1,732.5 | $ | (39.9) | $ | 6,322.1 | |||||||||||||||||||

| Three Months Ended 30 September 2024 | |||||||||||||||||||||||||||||||||||

| (Millions of US dollars) | Common Stock |

Additional Paid-in Capital |

Retained Earnings |

Treasury Stock |

Accumulated Other Comprehensive Loss |

Total | |||||||||||||||||||||||||||||

| Balances as of 30 June 2024 | $ | 223.2 | $ | 259.4 | $ | 1,529.2 | $ | — | $ | (74.8) | $ | 1,937.0 | |||||||||||||||||||||||

| Net income | — | — | 83.4 | — | — | 83.4 | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | 25.2 | 25.2 | |||||||||||||||||||||||||||||

| Stock-based compensation | 0.1 | 5.9 | — | — | — | 6.0 | |||||||||||||||||||||||||||||

| Issuance of ordinary shares | — | 0.1 | — | — | — | 0.1 | |||||||||||||||||||||||||||||

| Shares repurchased | — | — | — | (74.9) | — | (74.9) | |||||||||||||||||||||||||||||

| Shares cancelled | (1.4) | (1.3) | (72.2) | 74.9 | — | — | |||||||||||||||||||||||||||||

Balances as of 30 September 2024 |

$ | 221.9 | $ | 264.1 | $ | 1,540.4 | $ | — | $ | (49.6) | $ | 1,976.8 | |||||||||||||||||||||||

| Six Months Ended 30 September 2024 | |||||||||||||||||||||||||||||||||||

| (Millions of US dollars) | Common Stock |

Additional Paid-in Capital |

Retained Earnings |

Treasury Stock |

Accumulated Other Comprehensive Loss |

Total | |||||||||||||||||||||||||||||

Balances as of 31 March 2024 |

$ | 224.7 | $ | 256.5 | $ | 1,446.0 | $ | — | $ | (68.3) | $ | 1,858.9 | |||||||||||||||||||||||

| Net income | — | — | 238.7 | — | — | 238.7 | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | 18.7 | 18.7 | |||||||||||||||||||||||||||||

| Stock-based compensation | 0.1 | 10.0 | — | — | — | 10.1 | |||||||||||||||||||||||||||||

| Issuance of ordinary shares | — | 0.3 | — | — | — | 0.3 | |||||||||||||||||||||||||||||

| Shares repurchased | — | — | — | (149.9) | — | (149.9) | |||||||||||||||||||||||||||||

| Shares cancelled | (2.9) | (2.7) | (144.3) | 149.9 | — | — | |||||||||||||||||||||||||||||

Balances as of 30 September 2024 |

$ | 221.9 | $ | 264.1 | $ | 1,540.4 | $ | — | $ | (49.6) | $ | 1,976.8 | |||||||||||||||||||||||

| 30 September | 31 March | ||||||||||

| (Millions of US dollars) | 2025 | 2025 | |||||||||

| Cash and cash equivalents | $ | 566.7 | $ | 562.7 | |||||||

| Restricted cash | 5.0 | 5.0 | |||||||||

| Restricted cash - Asbestos | 15.3 | 37.9 | |||||||||

| Total | $ | 587.0 | $ | 605.6 | |||||||

| Three Months Ended 30 September |

Six Months Ended 30 September |

||||||||||||||||||||||

| (Millions of shares) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Basic common shares outstanding | 577.4 | 430.8 | 504.0 | 432.0 | |||||||||||||||||||

| Dilutive effect of stock awards | — | 1.5 | 4.6 | 1.4 | |||||||||||||||||||

| Diluted common shares outstanding | 577.4 | 432.3 | 508.6 | 433.4 | |||||||||||||||||||

| (Millions of US dollars, except per share data) | Purchase Consideration | |||||||||||||

| Consideration Transferred: | ||||||||||||||

| Total shares of AZEK common stock acquired | 143,966,912 | |||||||||||||

| Cash consideration per share of AZEK common stock | $ | 26.45 | ||||||||||||

| Cash for AZEK common stock | 3,807.9 | |||||||||||||

| Cash settlement of certain stock options | 4.2 | |||||||||||||

| Cash consideration paid for common stock and stock options | $ | 3,812.1 | ||||||||||||

| AZEK debt repaid as of the acquisition date | 437.8 | |||||||||||||

| Total cash consideration paid | $ | 4,249.9 | ||||||||||||

| Total shares of AZEK common stock acquired | 143,966,912 | |||||||||||||

| Exchange ratio | 1.034 | |||||||||||||

| James Hardie Ordinary Shares issued | 148,861,787 | |||||||||||||

| Per share price of James Hardie ordinary shares on 1 July 2025 | $ | 26.82 | ||||||||||||

| Fair value of consideration of James Hardie ordinary shares | 3,992.5 | |||||||||||||

| Fair value of James Hardie equity awards to be issued in exchange for certain AZEK equity awards | 151.1 | |||||||||||||

| Total consideration transferred | $ | 8,393.5 | ||||||||||||

| (Millions of US dollars) | Assets Acquired and Liabilities Assumed |

|||||||

| Cash and cash equivalents | $ | 330.1 | ||||||

| Accounts and other receivables | 60.6 | |||||||

| Inventories | 280.0 | |||||||

| Prepaid expenses and other current assets | 59.8 | |||||||

| Property, plant and equipment | 790.6 | |||||||

| Intangible assets | 3,160.0 | |||||||

| Other assets - non-current | 124.6 | |||||||

| Total assets acquired | $ | 4,805.7 | ||||||

| Accounts payable and accrued liabilities | $ | 209.4 | ||||||

| Other liabilities - current | 73.8 | |||||||

| Deferred tax liabilities, net | 872.2 | |||||||

| Other liabilities - non-current | 149.9 | |||||||

| Total liabilities assumed | $ | 1,305.3 | ||||||

| Net assets acquired | $ | 3,500.4 | ||||||

| Amount of goodwill recognized | $ | 4,893.1 | ||||||

| Total consideration transferred | $ | 8,393.5 | ||||||

| Three Months Ended 30 September 2025 |

||||||||

| (Millions of US dollars) | (unaudited) | |||||||

| Revenue | $ | 345.1 | ||||||

| Net loss | $ | (50.7) | ||||||

| Six Months Ended 30 September | ||||||||||||||

| (Millions of US dollars) |

2025

(Unaudited)

|

2024

(Unaudited)

|

||||||||||||

| Revenue | $ | 2,624.4 | $ | 2,735.3 | ||||||||||

| Net income | $ | 18.8 | $ | 195.8 | ||||||||||

| Three Months Ended 30 September |

Six Months Ended 30 September |

|||||||||||||||||||||||||

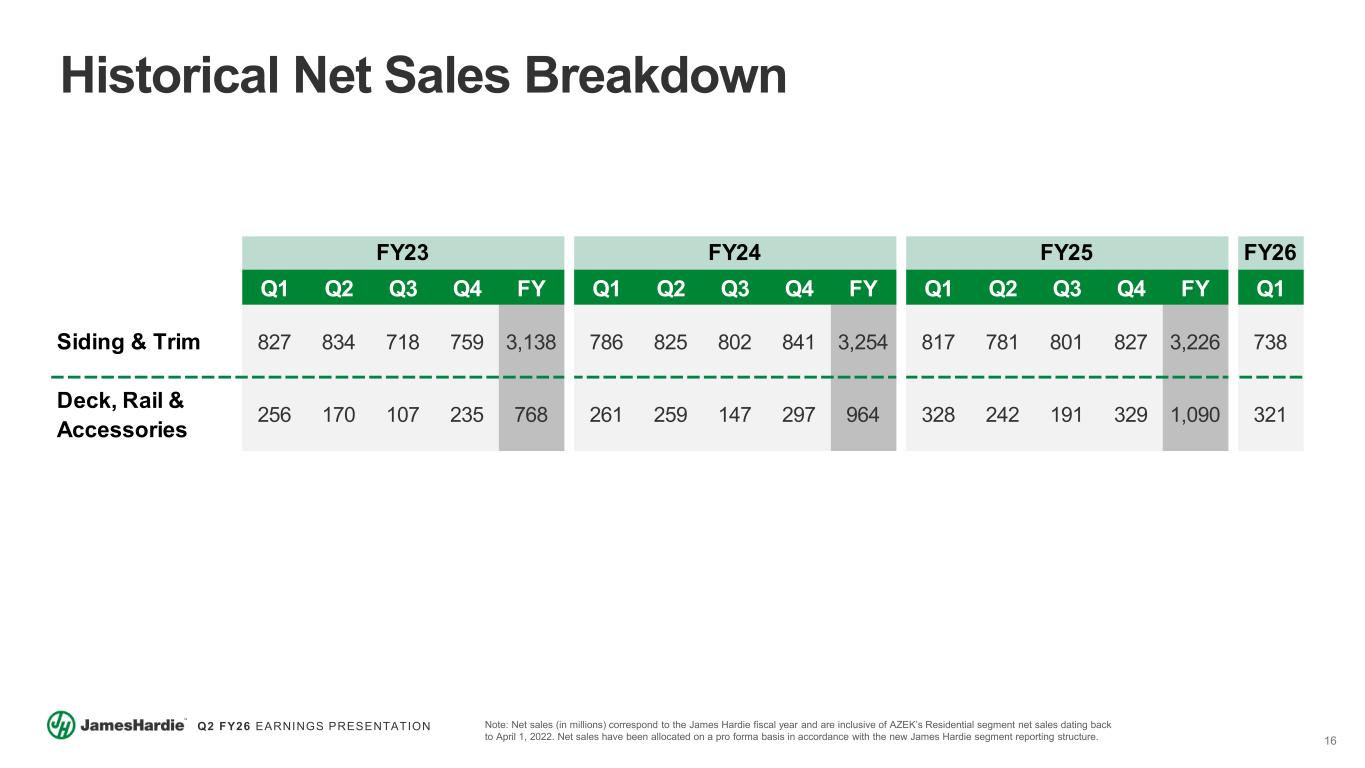

| (Millions of US dollars) | 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||

| Siding & Trim | $ | 766.0 | $ | 695.8 | $ | 1,407.8 | $ | 1,425.1 | ||||||||||||||||||

| Deck, Rail & Accessories | 255.8 | — | 255.8 | — | ||||||||||||||||||||||

| Australia & New Zealand | 132.9 | 148.4 | 254.5 | 283.7 | ||||||||||||||||||||||

| Europe | 137.5 | 116.6 | 274.0 | 243.9 | ||||||||||||||||||||||

| Total | $ | 1,292.2 | $ | 960.8 | $ | 2,192.1 | $ | 1,952.7 | ||||||||||||||||||

| 30 September | 31 March | ||||||||||

| (Millions of US dollars) | 2025 | 2025 | |||||||||

| Finished goods | $ | 468.0 | $ | 243.9 | |||||||

| Work-in-process | 46.3 | 26.5 | |||||||||

| Raw materials and supplies | 139.1 | 87.4 | |||||||||