| Exhibit No. | Description | |||||||

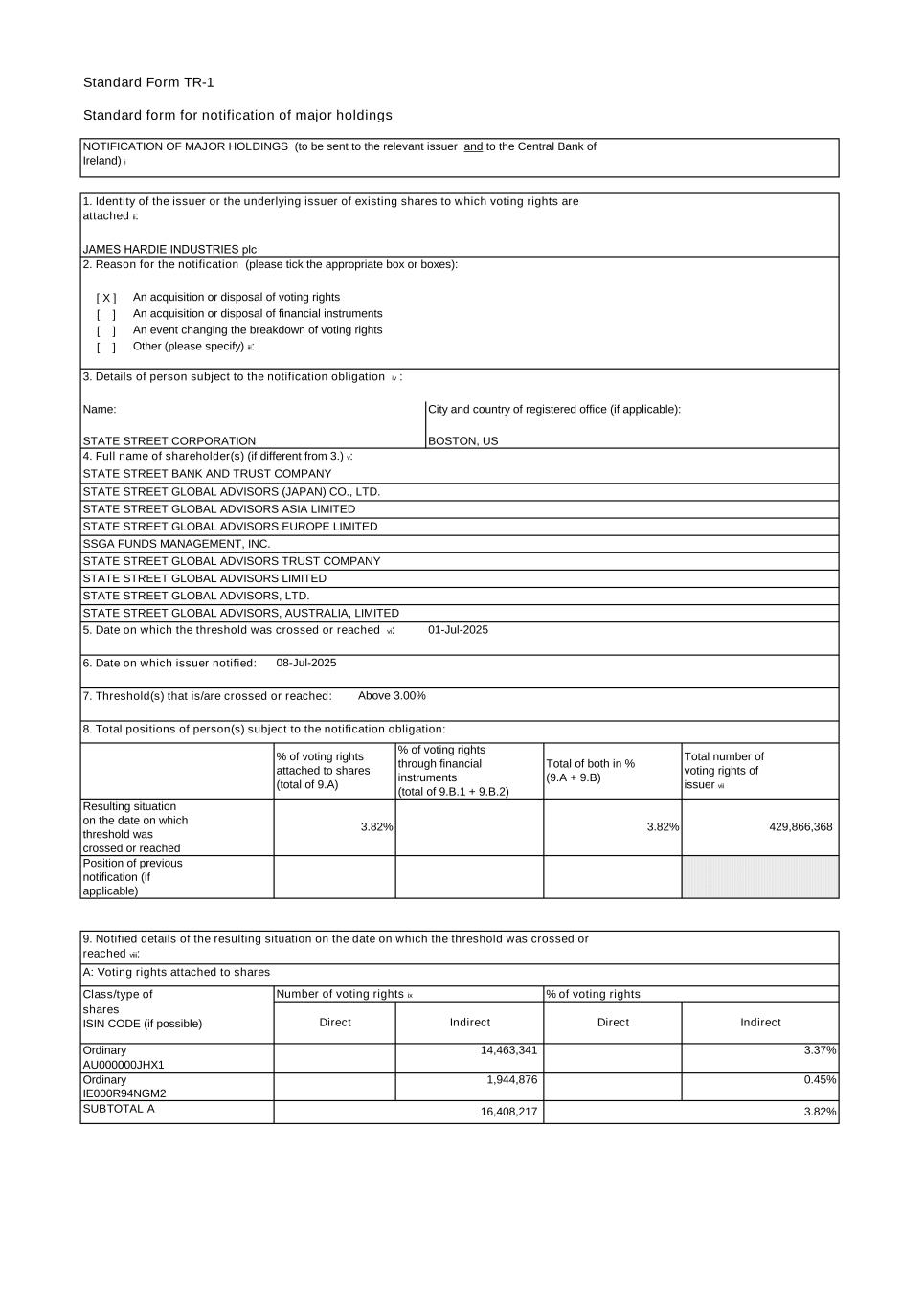

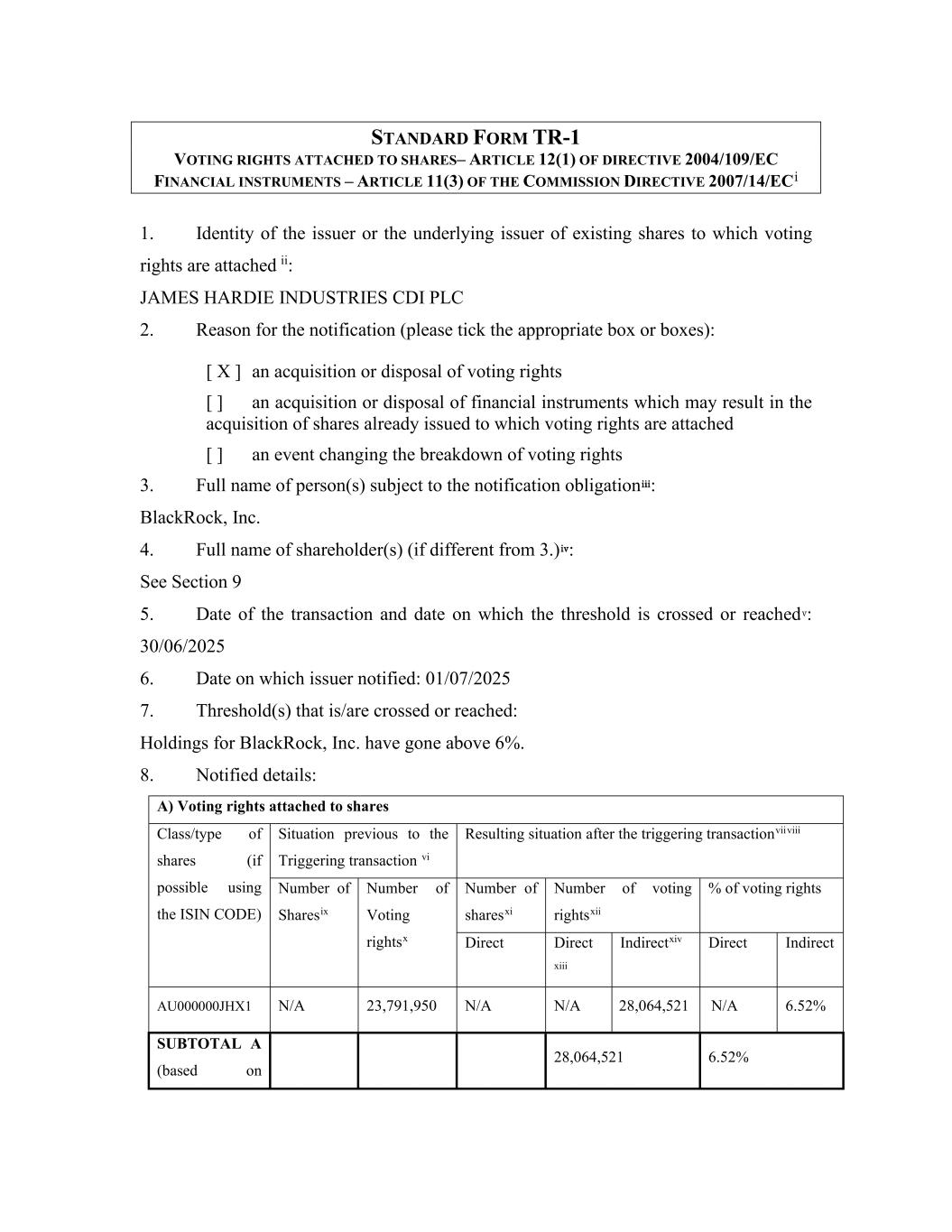

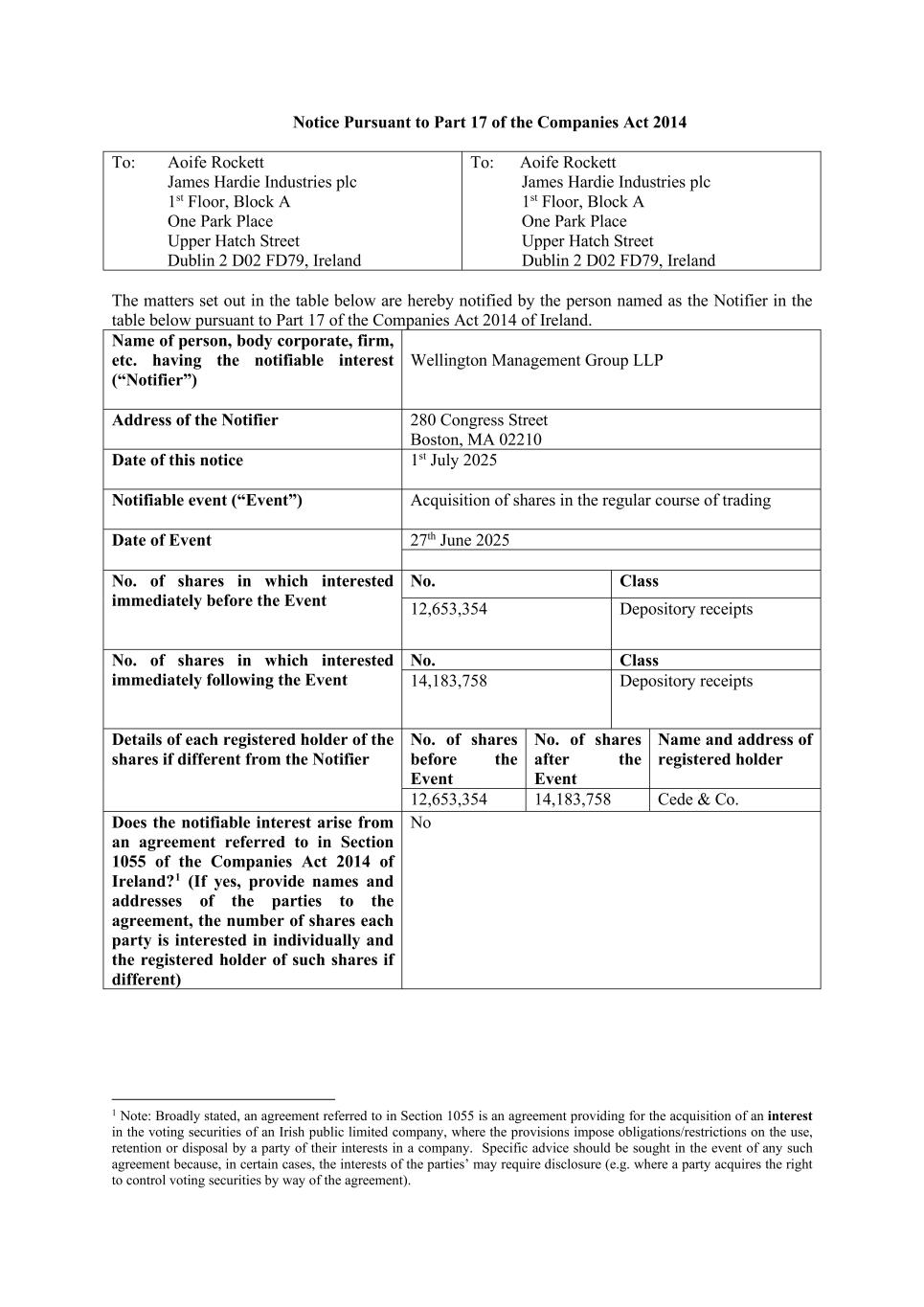

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Appendix 3Z - H WIENS | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Application for quotation of securities - JHX | ||||||||

| Initial Director's Interest Notice | ||||||||

| Initial Director's Interest Notice | ||||||||

| Initial Director's Interest Notice | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

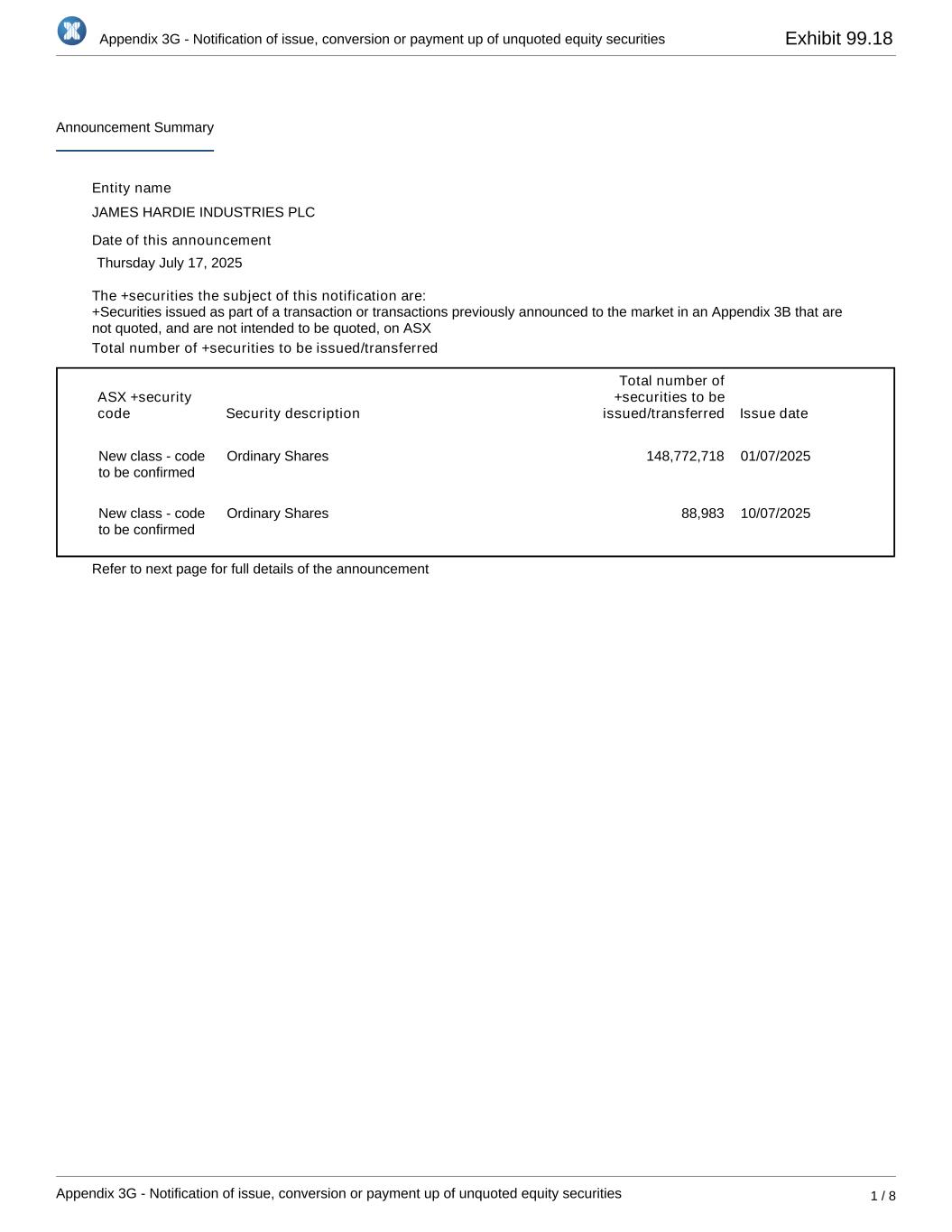

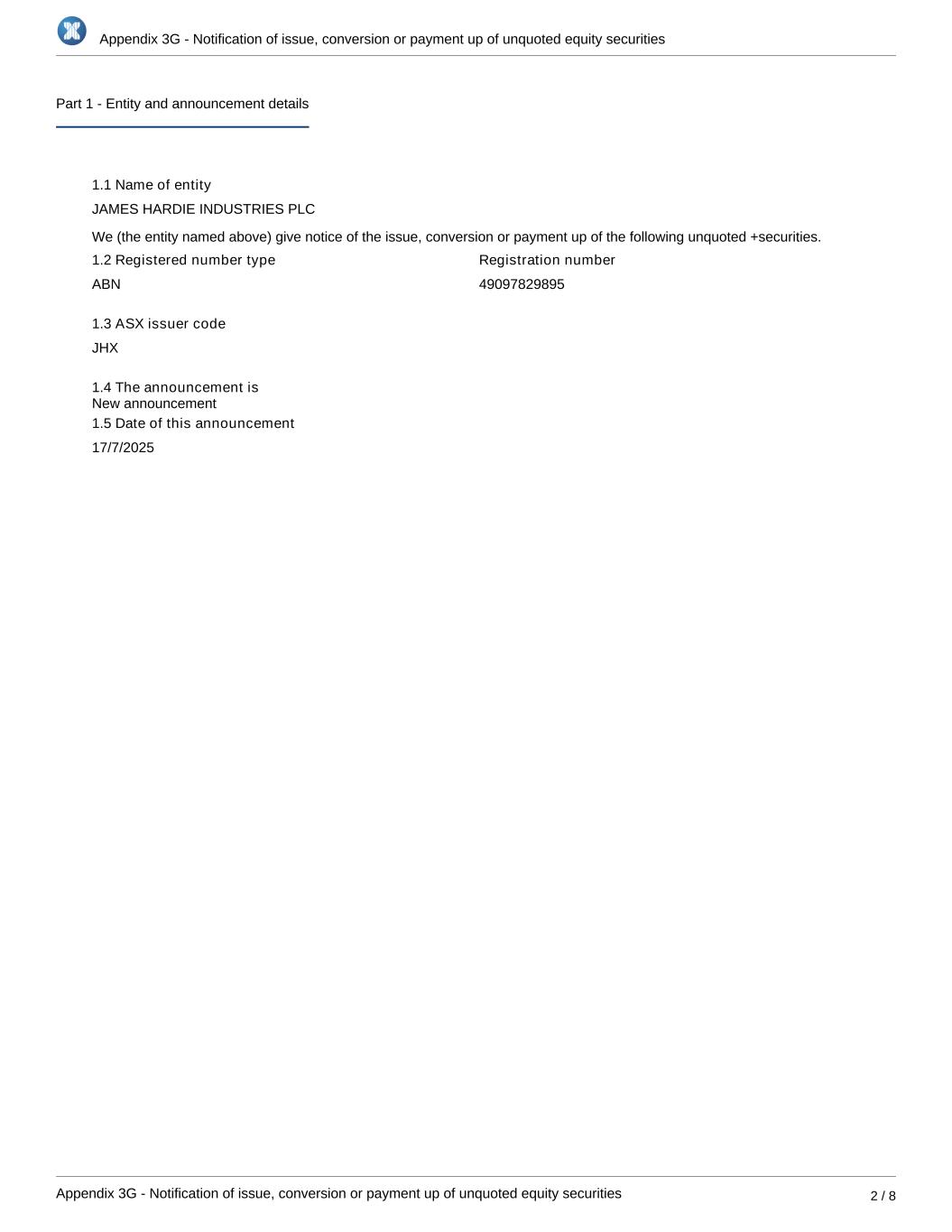

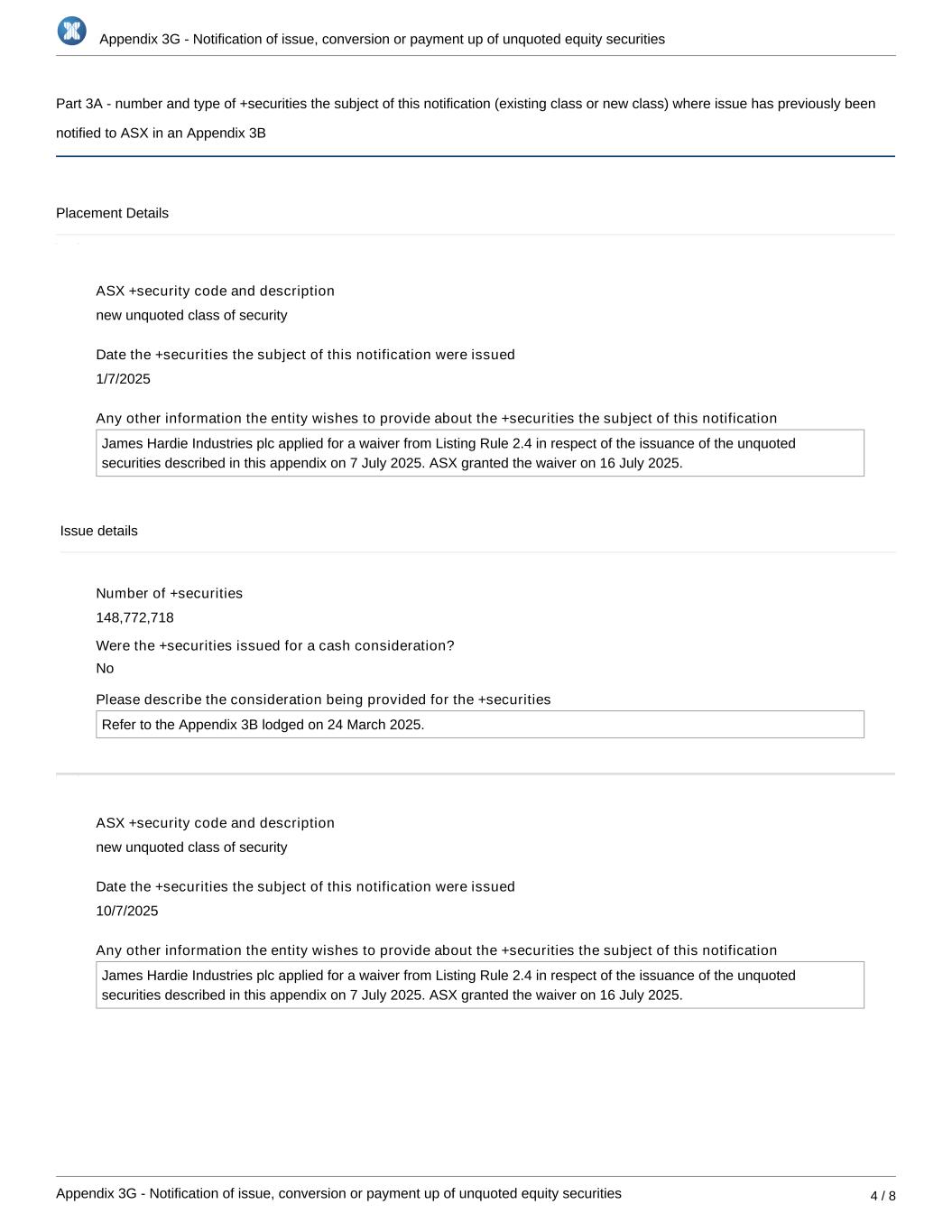

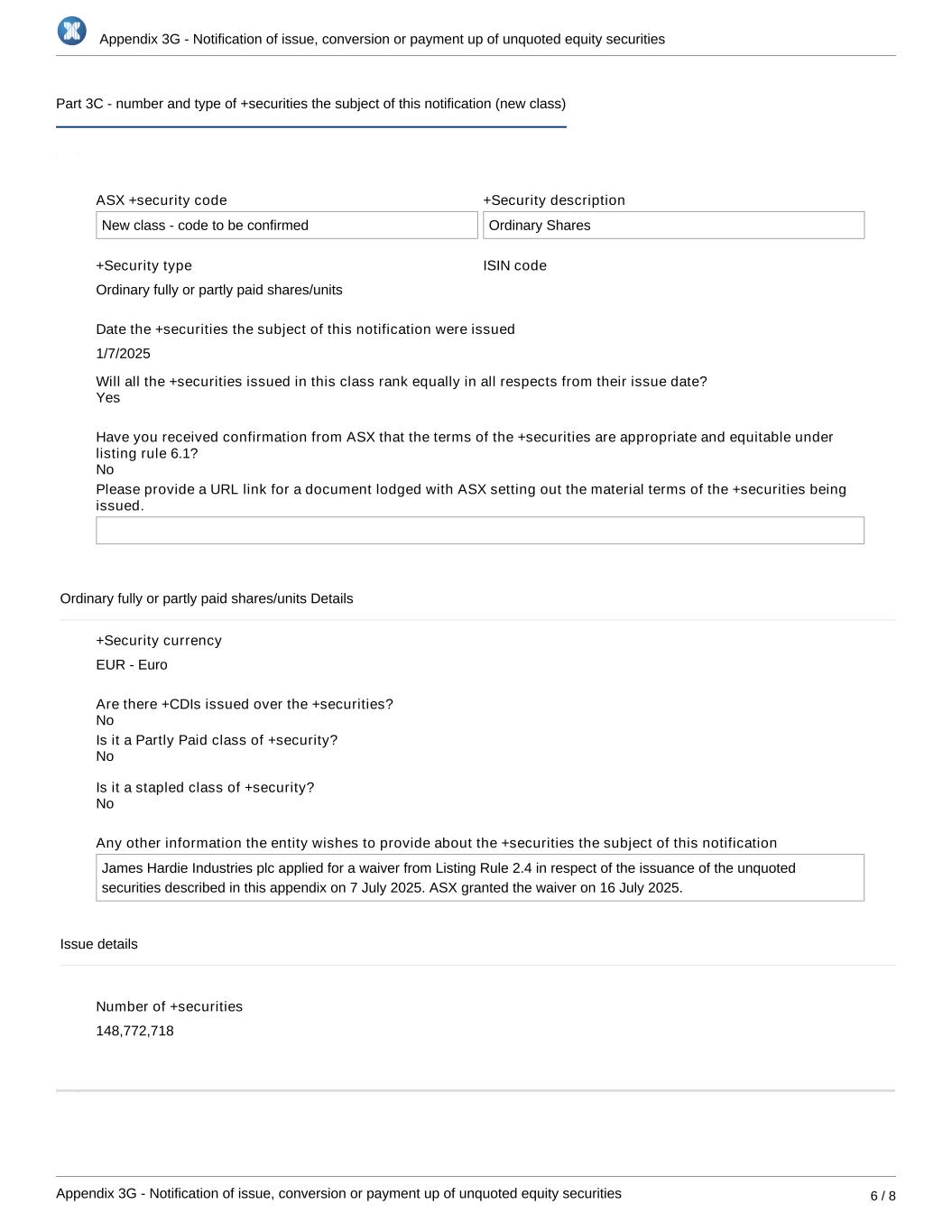

| Notification regarding unquoted securities - JHX | ||||||||

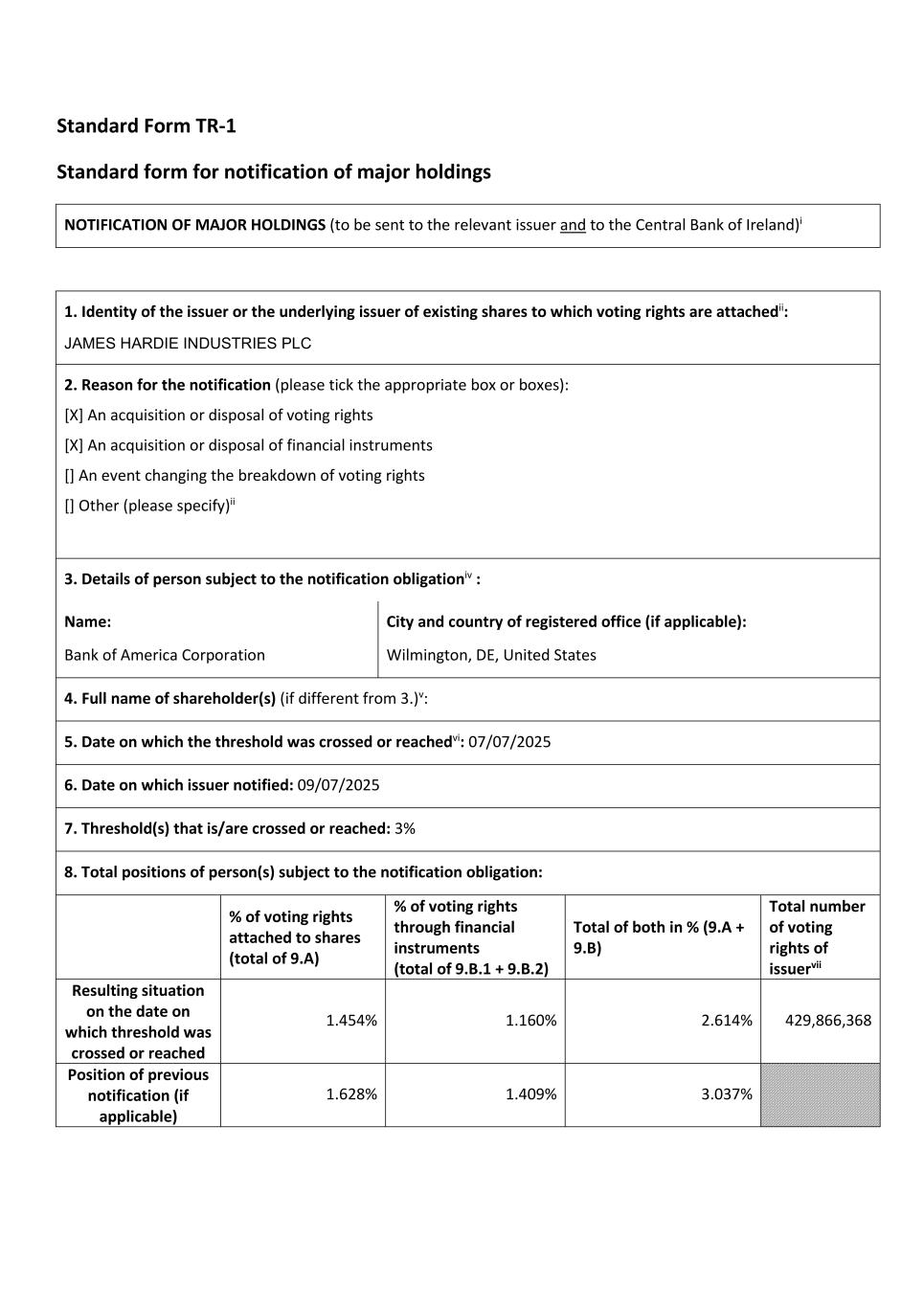

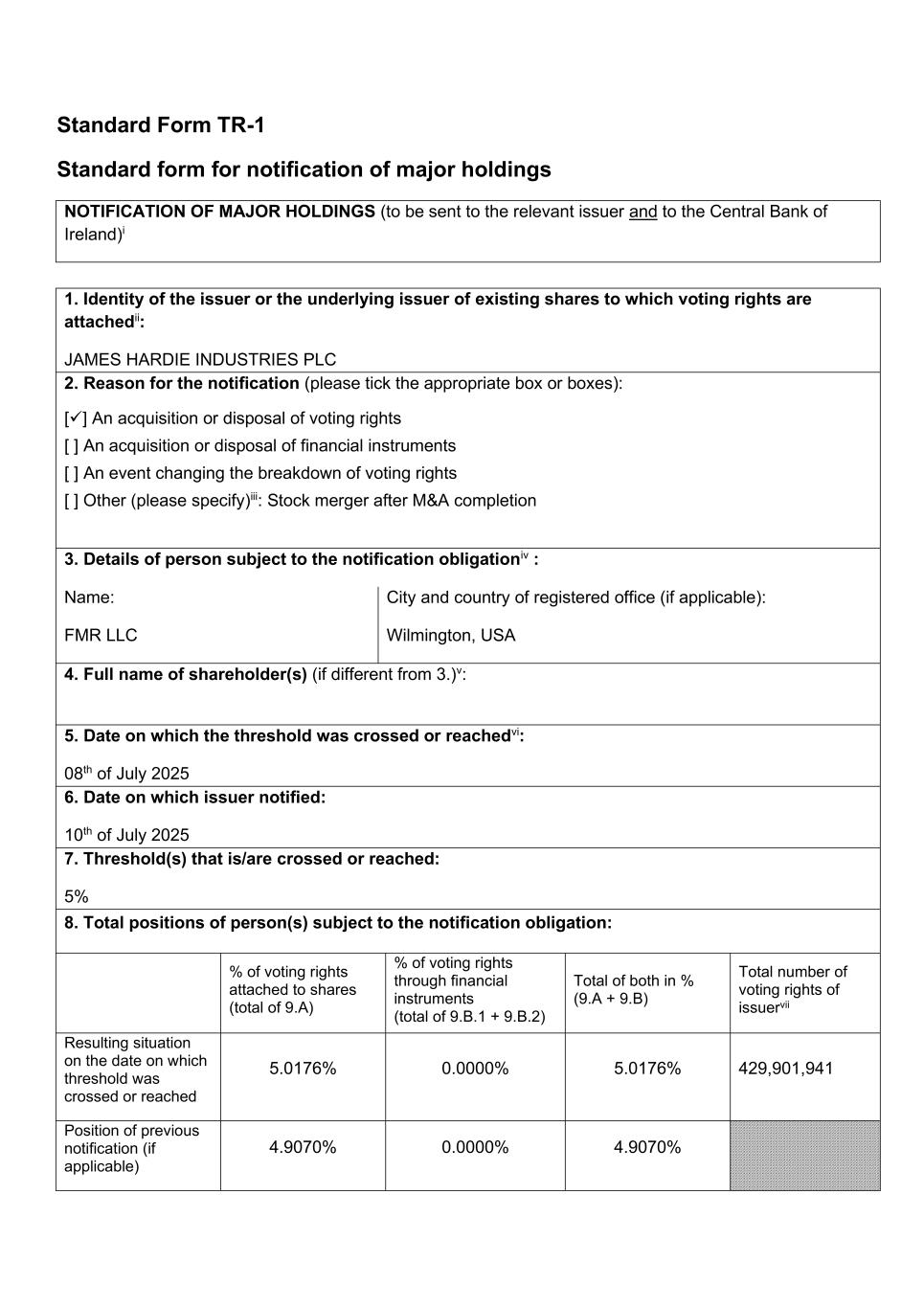

| James Hardie Industries plc | ||||||||

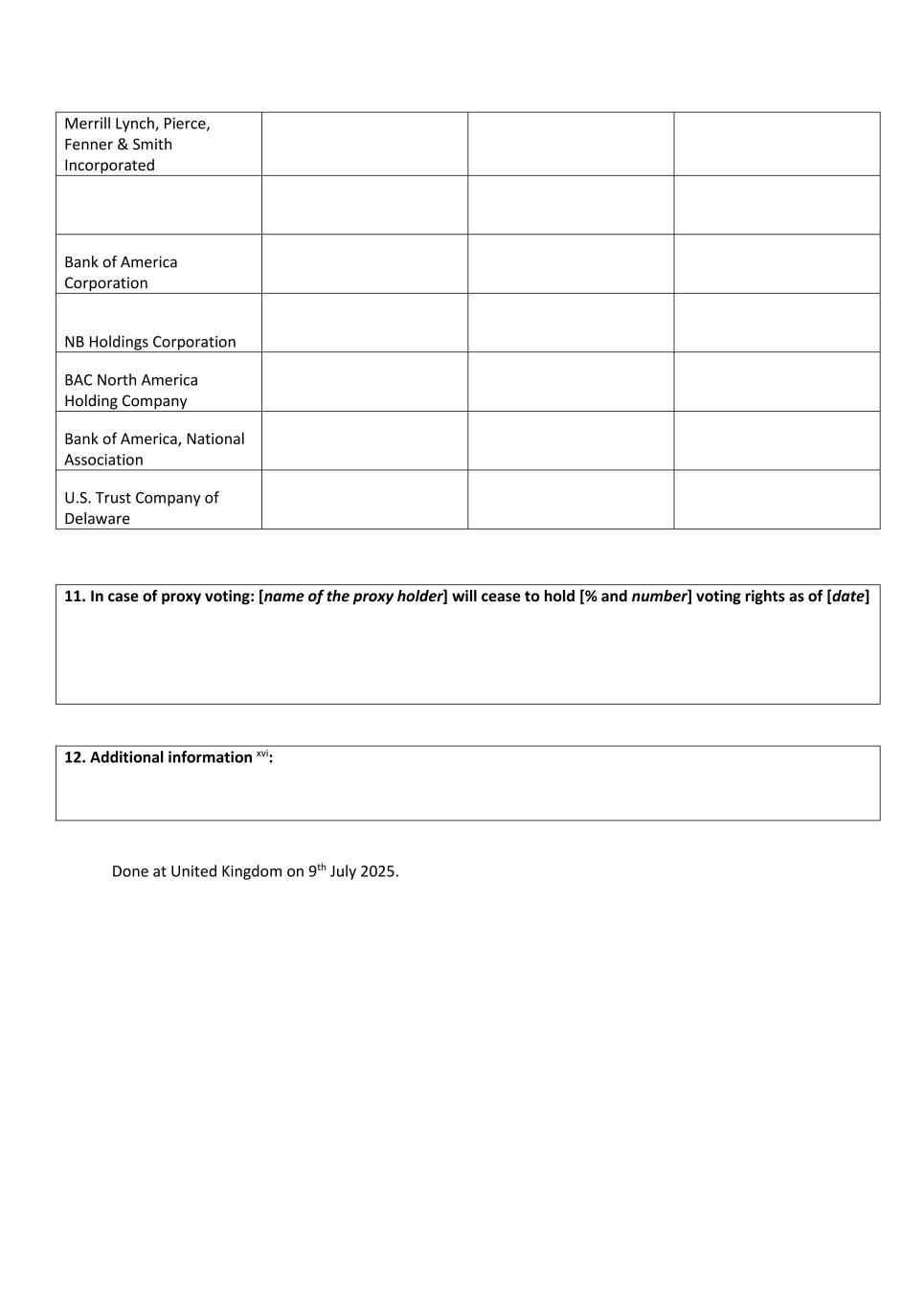

| Date: 18 July 2025 | By: /s/ Aoife Rockett |

|||||||

Aoife Rockett |

||||||||

Company Secretary |

||||||||

| Exhibit No. | Description | |||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Appendix 3Z - H WIENS | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Application for quotation of securities - JHX | ||||||||

| Initial Director's Interest Notice | ||||||||

| Initial Director's Interest Notice | ||||||||

| Initial Director's Interest Notice | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

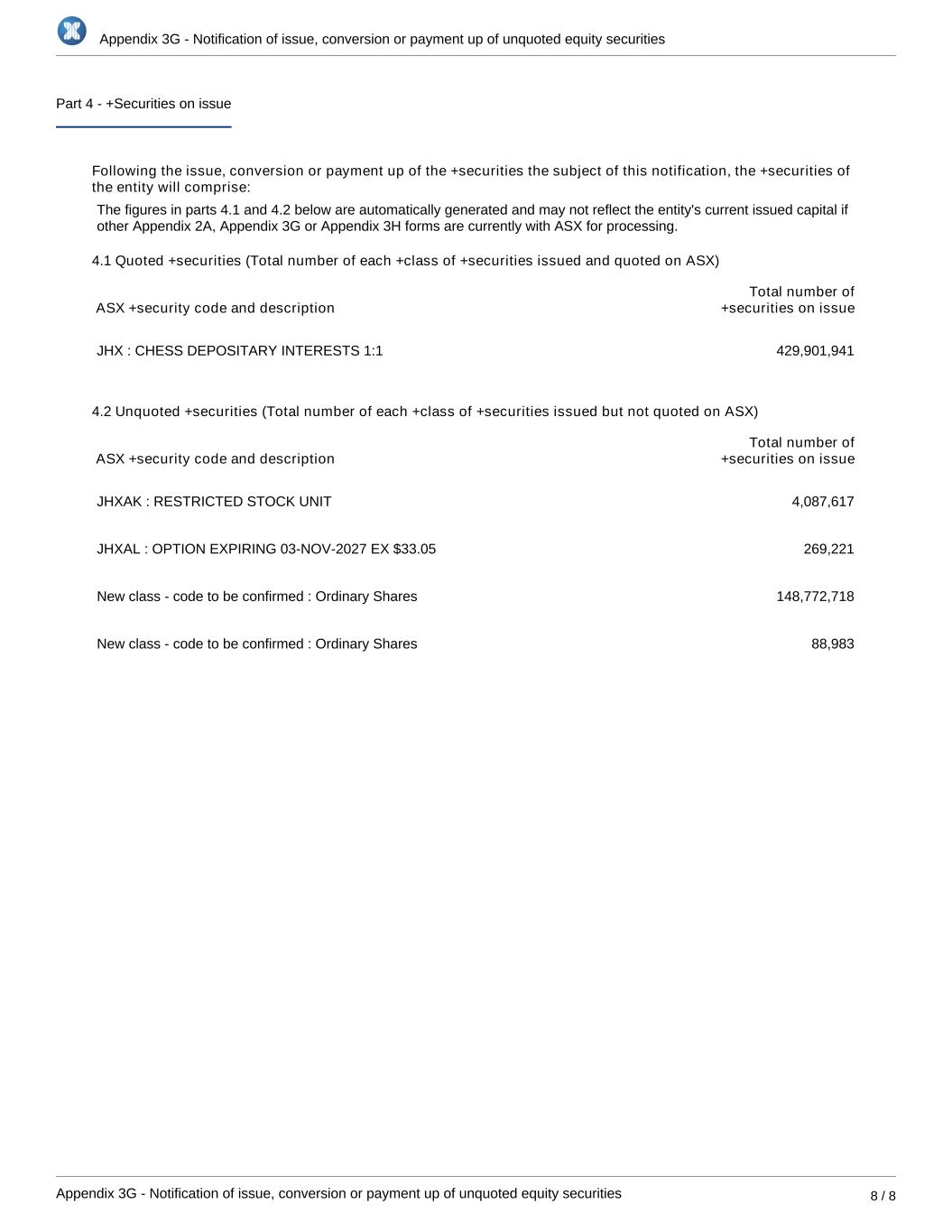

| Notification regarding unquoted securities - JHX | ||||||||

|

Exhibit 99.3

Appendix 3Z

Final Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc | ||||

ABN |

097 829 895 | ||||

| Name of director | Harold Wiens | ||||

| Date of last notice | 20 June 2025 | ||||

| Date that director ceased to be director | 1 July 2025 | ||||

|

Number & class of securities

•Direct interest in 11,674 ADRs, equivalent to a holding of 11,674 ordinary shares/CUFS.

| ||

'+ See chapter 19 for defined terms. | ||

|

Appendix 3Z

Final Director’s Interest Notice

| ||

|

Name of holder & nature of interest

Note: Provide details of the circumstances giving rise to the relevant interest

|

Number & class of securities

•Indirect interest in 7,370 ADRs, equivalent to a holding of 7,370 ordinary shares/CUFS. The registered holder is UBS Financial Services Inc. and they are held on account for the joint beneficial owners, Harold and Claudia Wiens.

|

||||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

| +See chapter 19 for defined terms. | ||

|

Exhibit 99.7

Appendix 3X

Initial Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc | ||||

ABN |

49 097 829 895 | ||||

| Name of Director | Gary Hendrickson | ||||

| Date of appointment | 1 July 2025 | ||||

|

Number & class of securities

260,166 fully paid ordinary shares

1,156,647 options exercisable at US$11.23 and expiring 16 June 2030

| ||

'+ See chapter 19 for defined terms. | ||

| Appendix 3X Initial Director’s Interest Notice | ||

|

Name of holder & nature of interest

Note: Provide details of the circumstances giving rise to the relevant interest.

The Hendrickson Family Trust, for which the Director’s spouse serves as trustee and for which the Director’s spouse has delegated investment control and management to the Director

|

Number & class of Securities

145,682 fully paid ordinary shares

|

||||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

| + See chapter 19 for defined terms. | ||

|

Exhibit 99.8

Appendix 3X

Initial Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc | ||||

ABN |

49 097 829 895 | ||||

| Name of Director | Howard Heckes | ||||

| Date of appointment | 1 July 2025 | ||||

|

Number & class of securities

22,261 fully paid ordinary shares

| ||

'+ See chapter 19 for defined terms. | ||

|

Appendix 3X

Initial Director’s Interest Notice

| ||

|

Name of holder & nature of interest

Note: Provide details of the circumstances giving rise to the relevant interest.

Howard C Heckes Trust for which the Director serves as trustee

|

Number & class of Securities

2,585 fully paid ordinary shares

|

||||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

'+ See chapter 19 for defined terms. | ||

|

Exhibit 99.9

Appendix 3X

Initial Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc | ||||

ABN |

49 097 829 895 | ||||

| Name of Director | Jesse Singh | ||||

| Date of appointment | 1 July 2025 | ||||

|

Number & class of securities

1,148,682 fully paid ordinary shares

1,964,149 options exercisable at US$11.23 and expiring 16 June 2030

113,265 options exercisable at US$16.73 and expiring 4 December 2030

86,830 options exercisable at US$20.12 and expiring 19 November 2031

190,835 options exercisable at US$9.85 and expiring 12 December 2032

107,728 options exercisable at US$18.62 and expiring 15 December 2033

71,474 options exercisable at US$26.12 and expiring 15 December 2034

| ||

| + See chapter 19 for defined terms. | ||

|

Appendix 3X

Initial Director’s Interest Notice

| ||

|

Name of holder & nature of interest

Note: Provide details of the circumstances giving rise to the relevant interest.

The Linda Singh Revocable Trust, Director and spouse as co-trustees

The Linda S.R. Singh Family Trust, Director as trustee

The Jesse Singh 2016 Irrevocable Trust, Director’s spouse as trustee

The Jesse Singh 2024 Trust, Director as grantor-trustee

The Jesse G. Singh Revocable Trust, Director and spouse as co-trustees

|

Number & class of Securities

116,022 fully paid ordinary shares

242,775 fully paid ordinary shares

240,616 fully paid ordinary shares

103,400 fully paid ordinary shares

9,798 fully paid ordinary shares

|

||||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

'+ See chapter 19 for defined terms. | ||