| Exhibit No. | Description | |||||||

| Results for Announcement to the Market | ||||||||

| Earnings Release | ||||||||

| Management’s Analysis of Results | ||||||||

| Earnings Presentation | ||||||||

| Condensed Consolidated Financial Statements | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

| James Hardie Industries plc | ||||||||

Date: 19 February 2025 |

By: /s/ Aoife Rockett |

|||||||

Aoife Rockett |

||||||||

Company Secretary |

||||||||

| Exhibit No. | Description | |||||||

| Results for Announcement to the Market | ||||||||

| Earnings Release | ||||||||

| Management’s Analysis of Results | ||||||||

| Earnings Presentation | ||||||||

| Condensed Consolidated Financial Statements | ||||||||

| Change in substantial holding | ||||||||

| Change in substantial holding | ||||||||

|

James Hardie Industries plc

1st Floor, Block A

One Park Place

Upper Hatch Street, Dublin 2

D02 FD79, Ireland

T: +353 (0) 1 411 6924

F: +353 (0) 1 479 1128

|

|||||

| • | Earnings Release | ||||

| • | Management's Analysis of Results | ||||

| • | Earnings Presentation | ||||

| • | Condensed Consolidated Financial Statements | ||||

| Yours faithfully | ||

Joe Ahlersmeyer, CFA | ||

| Vice President, Investor Relations | ||

|

Earnings Release

February 19, 2025

|

|

||||

Earnings Release: James Hardie - Third Quarter Ended December 31, 2024 |

1 |

|||||||

|

Earnings Release

February 19, 2025

|

|

||||

Segment Business Update and Results | ||

Earnings Release: James Hardie - Third Quarter Ended December 31, 2024 |

2 |

|||||||

|

Earnings Release

February 19, 2025

|

|

||||

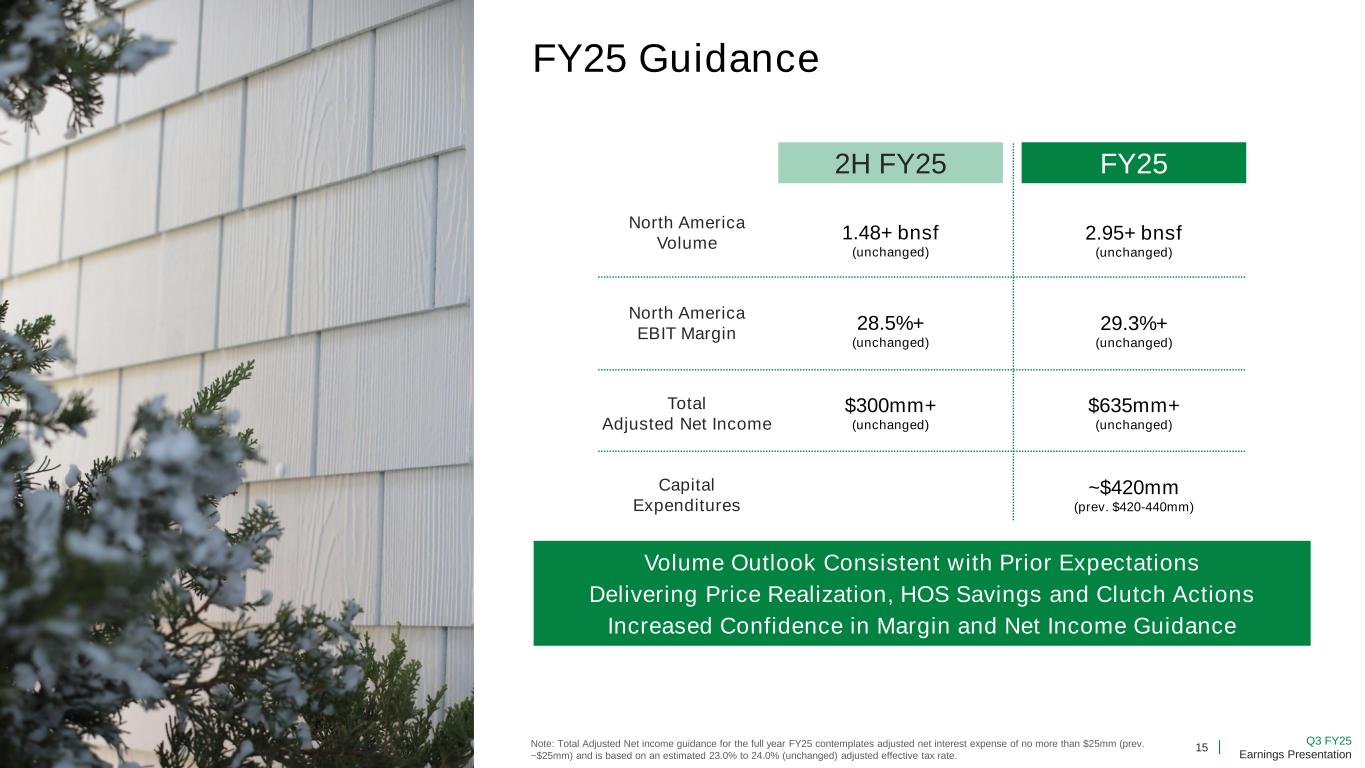

Market Outlook and Guidance, Planning Assumptions and Long-Term Aspirations | ||

Earnings Release: James Hardie - Third Quarter Ended December 31, 2024 |

3 |

|||||||

|

Earnings Release

February 19, 2025

|

|

||||

Cash Flow, Capital Investment & Allocation | ||

Earnings Release: James Hardie - Third Quarter Ended December 31, 2024 |

4 |

|||||||

|

Earnings Release

February 19, 2025

|

|

||||

Key Financial Information | ||

| Q3 FY25 | Q3 FY24 | Change | Q3 FY25 | Q3 FY24 | Change | ||||||||||||||||||||||||||||||

| Group | (US$ millions) | ||||||||||||||||||||||||||||||||||

| Net Sales | 953.3 | 978.3 | (3%) | ||||||||||||||||||||||||||||||||

| EBIT | 206.1 | 226.1 | (9%) | ||||||||||||||||||||||||||||||||

| Adjusted EBIT | 207.0 | 234.1 | (12%) | ||||||||||||||||||||||||||||||||

| EBIT Margin (%) | 21.6 | 23.1 | (1.5 pts) | ||||||||||||||||||||||||||||||||

| Adjusted EBIT Margin (%) | 21.7 | 23.9 | (2.2 pts) | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA | 262.1 | 280.4 | (7%) | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA Margin (%) | 27.5 | 28.7 | (1.2 pts) | ||||||||||||||||||||||||||||||||

| Net Income | 141.7 | 145.1 | (2%) | ||||||||||||||||||||||||||||||||

| Adjusted Net Income | 153.6 | 179.9 | (15%) | ||||||||||||||||||||||||||||||||

| Diluted EPS - US$ per share | 0.33 | 0.33 | —% | ||||||||||||||||||||||||||||||||

| Adjusted Diluted EPS - US$ per share | 0.36 | 0.41 | (13%) | ||||||||||||||||||||||||||||||||

| North America Fiber Cement | (US$ millions) | ||||||||||||||||||||||||||||||||||

| Net Sales | 719.3 | 727.0 | (1%) | ||||||||||||||||||||||||||||||||

| EBIT | 209.3 | 237.8 | (12%) | ||||||||||||||||||||||||||||||||

| EBIT Margin (%) | 29.1 | 32.7 | (3.6 pts) | ||||||||||||||||||||||||||||||||

| EBITDA | 250.5 | 271.3 | (8%) | ||||||||||||||||||||||||||||||||

| EBITDA Margin (%) | 34.8 | 37.3 | (2.5 pts) | ||||||||||||||||||||||||||||||||

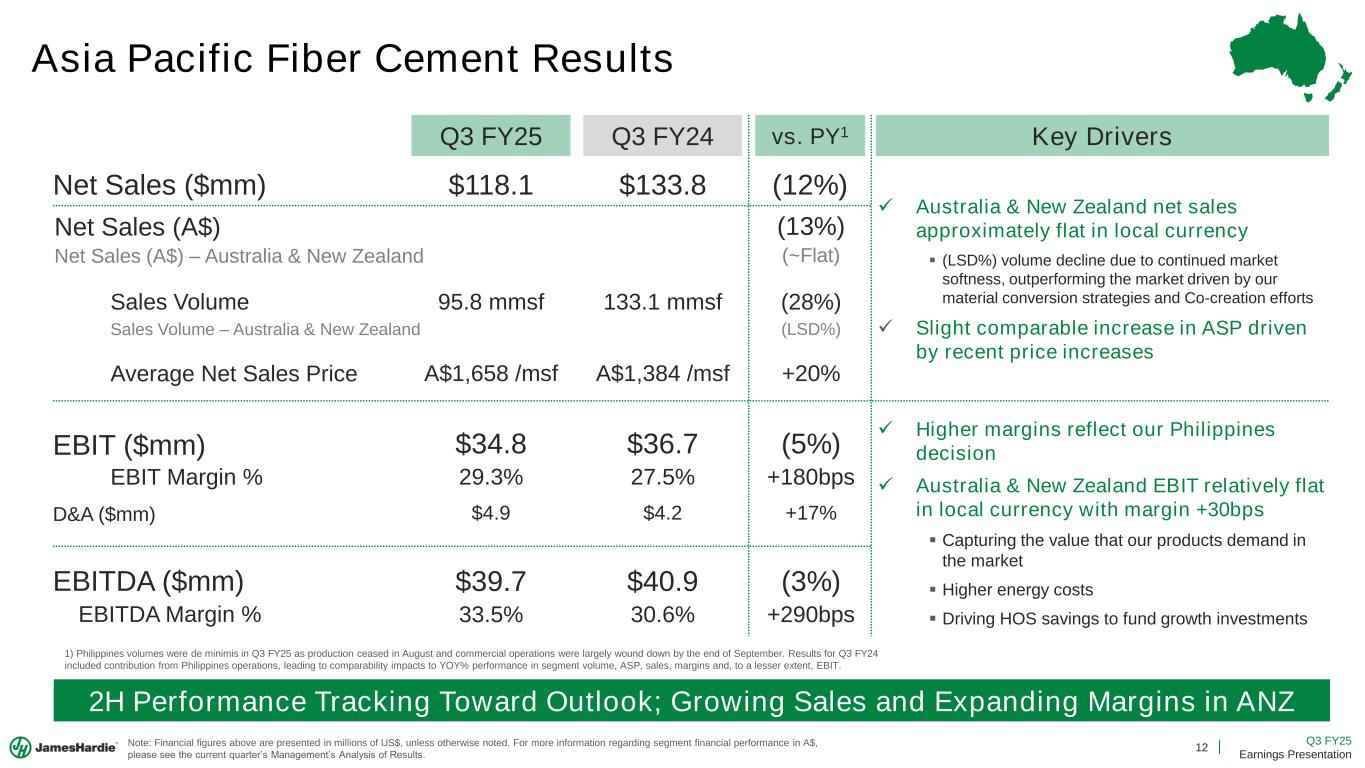

| Asia Pacific Fiber Cement | (US$ millions) | (A$ millions) | |||||||||||||||||||||||||||||||||

| Net Sales | 118.1 | 133.8 | (12%) | 180.1 | 206.3 | (13%) | |||||||||||||||||||||||||||||

| EBIT | 34.8 | 36.7 | (5%) | 52.8 | 56.7 | (7%) | |||||||||||||||||||||||||||||

| Adjusted EBIT | 34.8 | 36.7 | (5%) | 52.8 | 56.7 | (7%) | |||||||||||||||||||||||||||||

| EBIT Margin (%) | 29.3 | 27.5 | 1.8 pts | 29.3 | 27.5 | 1.8 pts | |||||||||||||||||||||||||||||

| Adjusted EBIT Margin (%) | 29.3 | 27.5 | 1.8 pts | 29.3 | 27.5 | 1.8 pts | |||||||||||||||||||||||||||||

| Adjusted EBITDA | 39.7 | 40.9 | (3%) | 60.3 | 63.2 | (5%) | |||||||||||||||||||||||||||||

| Adjusted EBITDA Margin (%) | 33.5 | 30.6 | 2.9 pts | 33.5 | 30.6 | 2.9 pts | |||||||||||||||||||||||||||||

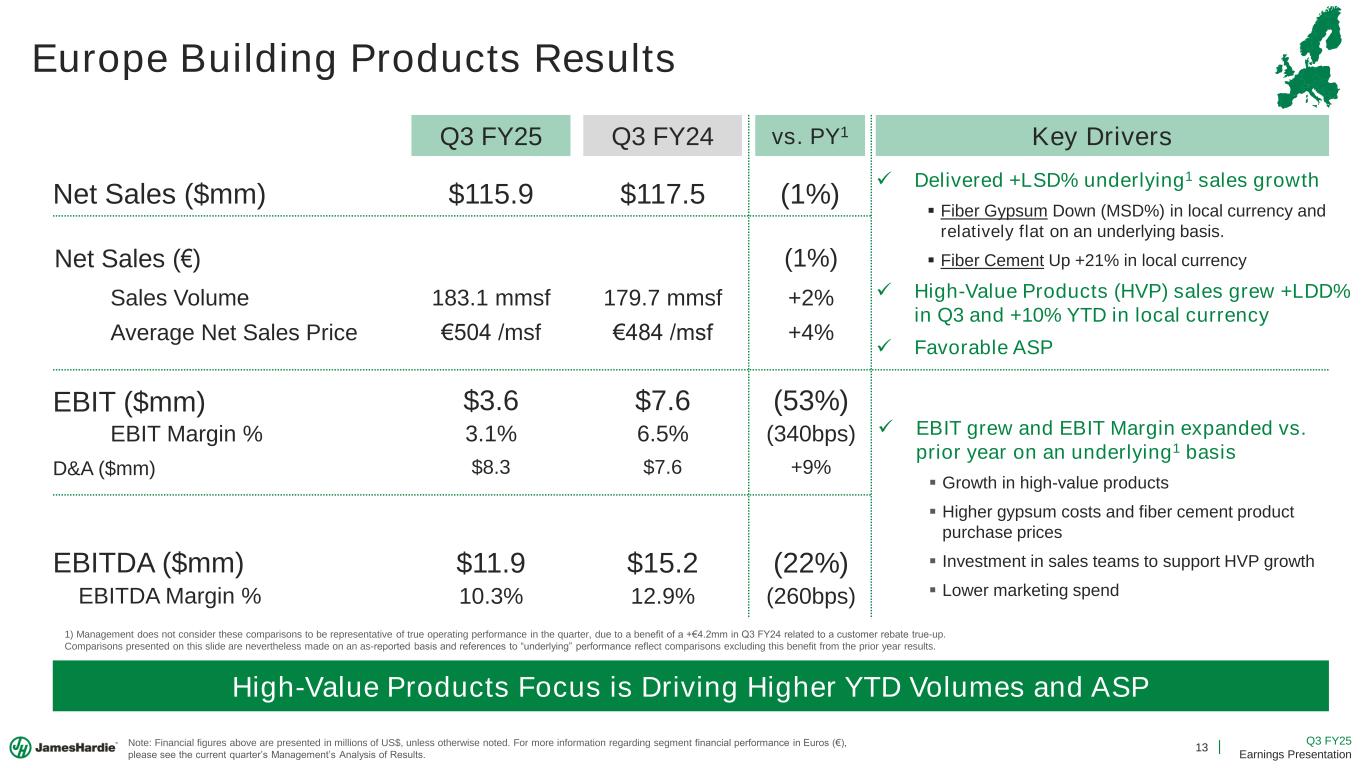

| Europe Building Products | (US$ millions) | (€ millions) | |||||||||||||||||||||||||||||||||

| Net Sales | 115.9 | 117.5 | (1%) | 108.6 | 109.3 | (1%) | |||||||||||||||||||||||||||||

| EBIT | 3.6 | 7.6 | (53%) | 3.4 | 7.1 | (52%) | |||||||||||||||||||||||||||||

| EBIT Margin (%) | 3.1 | 6.5 | (3.4 pts) | 3.1 | 6.5 | (3.4 pts) | |||||||||||||||||||||||||||||

| EBITDA | 11.9 | 15.2 | (22%) | 11.2 | 14.1 | (21%) | |||||||||||||||||||||||||||||

| EBITDA Margin (%) | 10.3 | 12.9 | (2.6 pts) | 10.3 | 12.9 | (2.6 pts) | |||||||||||||||||||||||||||||

Earnings Release: James Hardie - Third Quarter Ended December 31, 2024 |

5 |

|||||||

|

Earnings Release

February 19, 2025

|

|

||||

| 9 Months FY25 |

9 Months FY24 |

Change | 9 Months FY25 |

9 Months FY24 |

Change | ||||||||||||||||||||||||||||||

| Group | (US$ millions) | ||||||||||||||||||||||||||||||||||

| Net Sales | 2,906.0 | 2,931.4 | (1%) | ||||||||||||||||||||||||||||||||

| EBIT | 593.8 | 683.4 | (13%) | ||||||||||||||||||||||||||||||||

| Adjusted EBIT | 654.0 | 708.3 | (8%) | ||||||||||||||||||||||||||||||||

| EBIT Margin (%) | 20.4 | 23.3 | (2.9 pts) | ||||||||||||||||||||||||||||||||

| Adjusted EBIT Margin (%) | 22.5 | 24.2 | (1.7 pts) | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA | 810.8 | 845.0 | (4%) | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA Margin (%) | 27.9 | 28.8 | (0.9 pts) | ||||||||||||||||||||||||||||||||

| Net Income | 380.4 | 454.6 | (16%) | ||||||||||||||||||||||||||||||||

| Adjusted Net Income | 488.2 | 533.3 | (8%) | ||||||||||||||||||||||||||||||||

| Diluted EPS - US$ per share | 0.88 | 1.03 | (15%) | ||||||||||||||||||||||||||||||||

| Adjusted Diluted EPS - US$ per share | 1.13 | 1.21 | (7%) | ||||||||||||||||||||||||||||||||

| Operating Cash Flow | 657.4 | 749.5 | (12%) | ||||||||||||||||||||||||||||||||

| North America Fiber Cement | (US$ millions) | ||||||||||||||||||||||||||||||||||

| Net Sales | 2,144.4 | 2,156.2 | (1%) | ||||||||||||||||||||||||||||||||

| EBIT | 638.5 | 688.1 | (7%) | ||||||||||||||||||||||||||||||||

| EBIT Margin (%) | 29.8 | 31.9 | (2.1 pts) | ||||||||||||||||||||||||||||||||

| EBITDA | 754.0 | 787.7 | (4%) | ||||||||||||||||||||||||||||||||

| EBITDA Margin (%) | 35.2 | 36.5 | (1.3 pts) | ||||||||||||||||||||||||||||||||

| Asia Pacific Fiber Cement | (US$ millions) | (A$ millions) | |||||||||||||||||||||||||||||||||

| Net Sales | 401.8 | 421.3 | (5%) | 606.9 | 641.1 | (5%) | |||||||||||||||||||||||||||||

| EBIT | 68.0 | 127.6 | (47%) | 104.3 | 194.1 | (46%) | |||||||||||||||||||||||||||||

| Adjusted EBIT | 125.3 | 127.6 | (2%) | 189.0 | 194.1 | (3%) | |||||||||||||||||||||||||||||

| EBIT Margin (%) | 17.2 | 30.3 | (13.1 pts) | 17.2 | 30.3 | (13.1 pts) | |||||||||||||||||||||||||||||

| Adjusted EBIT Margin (%) | 31.1 | 30.3 | 0.8 pts | 31.1 | 30.3 | 0.8 pts | |||||||||||||||||||||||||||||

| Adjusted EBITDA | 139.7 | 140.1 | —% | 210.8 | 213.1 | (1%) | |||||||||||||||||||||||||||||

| Adjusted EBITDA Margin (%) | 34.7 | 33.2 | 1.5 pts | 34.7 | 33.2 | 1.5 pts | |||||||||||||||||||||||||||||

| Europe Building Products | (US$ millions) | (€ millions) | |||||||||||||||||||||||||||||||||

| Net Sales | 359.8 | 353.9 | 2% | 332.9 | 326.5 | 2% | |||||||||||||||||||||||||||||

| EBIT | 24.7 | 31.9 | (23%) | 22.8 | 29.4 | (22%) | |||||||||||||||||||||||||||||

| EBIT Margin (%) | 6.8 | 9.0 | (2.2 pts) | 6.8 | 9.0 | (2.2 pts) | |||||||||||||||||||||||||||||

| EBITDA | 48.6 | 53.4 | (9%) | 44.9 | 49.2 | (9%) | |||||||||||||||||||||||||||||

| EBITDA Margin (%) | 13.5 | 15.1 | (1.6 pts) | 13.5 | 15.1 | (1.6 pts) | |||||||||||||||||||||||||||||

Earnings Release: James Hardie - Third Quarter Ended December 31, 2024 |

6 |

|||||||

|

Earnings Release

February 19, 2025

|

|

||||

|

Further Information

| ||

Conference Call Details | ||

About James Hardie | ||

Investor and Media Contact | ||

Earnings Release: James Hardie - Third Quarter Ended December 31, 2024 |

7 |

|||||||

|

Earnings Release

February 19, 2025

|

|

||||

| Cautionary Note and Use of Non-GAAP Measures | ||

Earnings Release: James Hardie - Third Quarter Ended December 31, 2024 |

8 |

|||||||

| Fiscal Year 2025 Three and Nine Months Ended 31 December 2024 |

|

||||

| Management’s Analysis of Results | ||

|

Telephone:

|

+1 773-970-1213 | |||||||

|

Email:

|

investors@jameshardie.com | |||||||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

1 |

|||||||

| CONSOLIDATED RESULTS |  |

||||

| Overview | ||

| 3rd Quarter Financial Highlights | ||

| US$ Millions (except per share data) | Three Months Ended 31 December | |||||||||||||||||||

| FY25 | FY24 | Change | ||||||||||||||||||

| Net sales | $ | 953.3 | $ | 978.3 | (3%) | |||||||||||||||

| Gross margin (%) | 38.0 | 41.0 | (3.0 pts) | |||||||||||||||||

| EBIT | 206.1 | 226.1 | (9%) | |||||||||||||||||

| EBIT margin (%) | 21.6 | 23.1 | (1.5 pts) | |||||||||||||||||

Adjusted EBIT1 |

207.0 | 234.1 | (12%) | |||||||||||||||||

Adjusted EBIT margin (%)1 |

21.7 | 23.9 | (2.2 pts) | |||||||||||||||||

| Net income | 141.7 | 145.1 | (2%) | |||||||||||||||||

Adjusted Net income1 |

153.6 | 179.9 | (15%) | |||||||||||||||||

| Diluted earnings per share | $ | 0.33 | $ | 0.33 | —% | |||||||||||||||

Adjusted diluted earnings per share1 |

$ | 0.36 | $ | 0.41 | (13%) | |||||||||||||||

1 See section titled “Non-GAAP Financial Measures" for a reconciliation to the equivalent GAAP measure |

||||||||||||||||||||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

2 |

|||||||

| OPERATING RESULTS |  |

||||

| North America Fiber Cement Segment | ||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | Change | 9 Months FY25 |

9 Months FY24 |

Change | |||||||||||||||||||||||||||||||||

| Volume (mmsf) | 744.0 | 766.5 | (3%) | 2,212.9 | 2,287.5 | (3%) | ||||||||||||||||||||||||||||||||

| Average net sales price per unit (per msf) | US$960 | US$943 | 2% | US$962 | US$937 | 3% | ||||||||||||||||||||||||||||||||

| Fiber cement net sales | 719.3 | 727.0 | (1%) | 2,144.4 | 2,156.2 | (1%) | ||||||||||||||||||||||||||||||||

| Gross profit | (10%) | (5%) | ||||||||||||||||||||||||||||||||||||

| Gross margin (%) | (3.8 pts) | (1.7 pts) | ||||||||||||||||||||||||||||||||||||

| EBIT | 209.3 | 237.8 | (12%) | 638.5 | 688.1 | (7%) | ||||||||||||||||||||||||||||||||

| EBIT margin (%) | 29.1 | 32.7 | (3.6 pts) | 29.8 | 31.9 | (2.1 pts) | ||||||||||||||||||||||||||||||||

| Higher average net sales price | 1.1 | pts | |||

| Higher production and distribution costs | (4.9 | pts) | |||

| Total percentage point change in gross margin | (3.8 | pts) | |||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

3 |

|||||||

| OPERATING RESULTS |  |

||||

| Higher average net sales price | 1.6 | pts | |||

| Higher production and distribution costs | (3.3 | pts) | |||

| Total percentage point change in gross margin | (1.7 | pts) | |||

| Asia Pacific Fiber Cement Segment | ||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | Change | 9 Months FY25 |

9 Months FY24 |

Change | |||||||||||||||||||||||||||||||||

| Volume (mmsf) | 95.8 | 133.1 | (28%) | 350.1 | 414.0 | (15%) | ||||||||||||||||||||||||||||||||

| Average net sales price per unit (per msf) | US$1,086 | US$898 | 21% | US$1,020 | US$908 | 12% | ||||||||||||||||||||||||||||||||

| Fiber cement net sales | 118.1 | 133.8 | (12%) | 401.8 | 421.3 | (5%) | ||||||||||||||||||||||||||||||||

| Gross profit | (7%) | (2%) | ||||||||||||||||||||||||||||||||||||

| Gross margin (%) | 2.1 pts | 1.3 pts | ||||||||||||||||||||||||||||||||||||

| Restructuring expenses | — | — | —% | 57.3 | — | 100% | ||||||||||||||||||||||||||||||||

| EBIT | 34.8 | 36.7 | (5%) | 68.0 | 127.6 | (47%) | ||||||||||||||||||||||||||||||||

| EBIT margin (%) | 29.3 | 27.5 | 1.8 pts | 17.2 | 30.3 | (13.1 pts) | ||||||||||||||||||||||||||||||||

| Adjusted EBIT | 34.8 | 36.7 | (5%) | 125.3 | 127.6 | (2%) | ||||||||||||||||||||||||||||||||

| Adjusted EBIT margin (%) | 29.3 | 27.5 | 1.8 pts | 31.1 | 30.3 | 0.8 pts | ||||||||||||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

4 |

|||||||

| OPERATING RESULTS |  |

||||

| A$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | Change | 9 Months FY25 |

9 Months FY24 |

Change | |||||||||||||||||||||||||||||||||

| Volume (mmsf) | 95.8 | 133.1 | (28%) | 350.1 | 414.0 | (15%) | ||||||||||||||||||||||||||||||||

| Average net sales price per unit (per msf) | A$1,658 | A$1,384 | 20% | A$1,541 | A$1,381 | 12% | ||||||||||||||||||||||||||||||||

| Fiber cement net sales | 180.1 | 206.3 | (13%) | 606.9 | 641.1 | (5%) | ||||||||||||||||||||||||||||||||

| Gross profit | (8%) | (2%) | ||||||||||||||||||||||||||||||||||||

| Gross margin (%) | 2.1 pts | 1.3 pts | ||||||||||||||||||||||||||||||||||||

| Restructuring expenses | — | — | —% | 84.7 | — | 100% | ||||||||||||||||||||||||||||||||

| EBIT | 52.8 | 56.7 | (7%) | 104.3 | 194.1 | (46%) | ||||||||||||||||||||||||||||||||

| EBIT margin (%) | 29.3 | 27.5 | 1.8 pts | 17.2 | 30.3 | (13.1 pts) | ||||||||||||||||||||||||||||||||

| Adjusted EBIT | 52.8 | 56.7 | (7%) | 189.0 | 194.1 | (3%) | ||||||||||||||||||||||||||||||||

| Adjusted EBIT margin (%) | 29.3 | 27.5 | 1.8 pts | 31.1 | 30.3 | 0.8 pts | ||||||||||||||||||||||||||||||||

| Higher average net sales price | 9.0 | pts | |||

| Higher production and distribution costs | (6.9 | pts) | |||

| Total percentage point change in gross margin | 2.1 | pts | |||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

5 |

|||||||

| OPERATING RESULTS |  |

||||

| Higher average net sales price | 5.5 | pts | |||

| Higher production and distribution costs | (4.2 | pts) | |||

| Total percentage point change in gross margin | 1.3 | pts | |||

| Europe Building Products Segment | ||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | Change | 9 Months FY25 |

9 Months FY24 |

Change | |||||||||||||||||||||||||||||||||

| Volume (mmsf) | 183.1 | 179.7 | 2% | 555.9 | 541.7 | 3% | ||||||||||||||||||||||||||||||||

| Average net sales price per unit (per msf) | US$537 | US$520 | 3% | US$540 | US$523 | 3% | ||||||||||||||||||||||||||||||||

| Fiber cement net sales | 19.7 | 16.4 | 20% | 63.2 | 57.9 | 9% | ||||||||||||||||||||||||||||||||

Fiber gypsum net sales1 |

96.2 | 101.1 | (5%) | 296.6 | 296.0 | —% | ||||||||||||||||||||||||||||||||

| Net sales | 115.9 | 117.5 | (1%) | 359.8 | 353.9 | 2% | ||||||||||||||||||||||||||||||||

| Gross profit | (10%) | (1%) | ||||||||||||||||||||||||||||||||||||

| Gross margin (%) | (2.5 pts) | (1.0 pts) | ||||||||||||||||||||||||||||||||||||

| EBIT | 3.6 | 7.6 | (53%) | 24.7 | 31.9 | (23%) | ||||||||||||||||||||||||||||||||

| EBIT margin (%) | 3.1 | 6.5 | (3.4 pts) | 6.8 | 9.0 | (2.2 pts) | ||||||||||||||||||||||||||||||||

1Also includes cement bonded board net sales | ||||||||||||||||||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

6 |

|||||||

| OPERATING RESULTS |  |

||||

| € Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | Change | 9 Months FY25 |

9 Months FY24 |

Change | |||||||||||||||||||||||||||||||||

| Volume (mmsf) | 183.1 | 179.7 | 2% | 555.9 | 541.7 | 3% | ||||||||||||||||||||||||||||||||

| Average net sales price per unit (per msf) | €504 | €484 | 4% | €499 | €483 | 3% | ||||||||||||||||||||||||||||||||

| Fiber cement net sales | 18.5 | 15.3 | 21% | 58.5 | 53.5 | 9% | ||||||||||||||||||||||||||||||||

Fiber gypsum net sales1 |

90.1 | 94.0 | (4%) | 274.4 | 273.0 | 1% | ||||||||||||||||||||||||||||||||

| Net sales | 108.6 | 109.3 | (1%) | 332.9 | 326.5 | 2% | ||||||||||||||||||||||||||||||||

| Gross profit | (10%) | (1%) | ||||||||||||||||||||||||||||||||||||

| Gross margin (%) | (2.5 pts) | (1.0 pts) | ||||||||||||||||||||||||||||||||||||

| EBIT | 3.4 | 7.1 | (52%) | 22.8 | 29.4 | (22%) | ||||||||||||||||||||||||||||||||

| EBIT margin (%) | 3.1 | 6.5 | (3.4 pts) | 6.8 | 9.0 | (2.2 pts) | ||||||||||||||||||||||||||||||||

1Also includes cement bonded board net sales | ||||||||||||||||||||||||||||||||||||||

| Higher average net sales price | 2.6 | pts | |||

| Prior year favorable customer rebate true-up | (2.9 | pts) | |||

| Higher production and distribution costs | (2.2 | pts) | |||

| Total percentage point change in gross margin | (2.5 | pts) | |||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

7 |

|||||||

| OPERATING RESULTS |  |

||||

| Higher average net sales price | 2.0 | pts | |||

| Prior year favorable customer rebate true-up | (1.7 | pts) | |||

| Higher production and distribution costs | (1.3 | pts) | |||

| Total percentage point change in gross margin | (1.0 | pts) | |||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

8 |

|||||||

| OPERATING RESULTS |  |

||||

| General Corporate | ||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | Change % | 9 Months FY25 |

9 Months FY24 |

Change % | |||||||||||||||||||||||||||||||||

| General Corporate costs | $ | 31.8 | $ | 48.0 | (34) | $ | 108.8 | $ | 138.8 | (22) | ||||||||||||||||||||||||||||

| Less: | ||||||||||||||||||||||||||||||||||||||

| Restructuring expenses | — | — | — | — | (20.1) | (100) | ||||||||||||||||||||||||||||||||

| Asbestos related expenses and adjustments | (0.9) | (8.0) | (89) | (2.9) | (4.8) | (40) | ||||||||||||||||||||||||||||||||

| Adjusted General Corporate costs | $ | 30.9 | $ | 40.0 | (23) | $ | 105.9 | $ | 113.9 | (7) | ||||||||||||||||||||||||||||

| Interest, net | ||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | Change % | 9 Months FY25 |

9 Months FY24 |

Change % | |||||||||||||||||||||||||||||||||

| Interest expense | $ | 15.1 | $ | 14.7 | 3 | $ | 46.5 | $ | 40.2 | 16 | ||||||||||||||||||||||||||||

| Capitalized interest | (3.9) | (5.3) | (26) | (16.7) | (13.3) | 26 | ||||||||||||||||||||||||||||||||

| Interest income | (4.7) | (4.1) | 15 | (13.9) | (6.8) | 104 | ||||||||||||||||||||||||||||||||

| AICF interest income | (2.7) | (2.2) | 23 | (8.5) | (6.7) | 27 | ||||||||||||||||||||||||||||||||

| Interest, net | $ | 3.8 | $ | 3.1 | 23 | $ | 7.4 | $ | 13.4 | (45) | ||||||||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

9 |

|||||||

| OPERATING RESULTS |  |

||||

| Income Tax | ||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | Change | 9 Months FY25 |

9 Months FY24 |

Change | |||||||||||||||||||||||||||||||||

| Income tax expense | $ | 60.6 | $ | 78.5 | (23%) | $ | 206.2 | $ | 218.2 | (5%) | ||||||||||||||||||||||||||||

| Effective tax rate (%) | 30.0 | 35.1 | (5.1 pts) | 35.2 | 32.4 | 2.8 pts | ||||||||||||||||||||||||||||||||

Adjusted income tax expense1 |

$ | 46.9 | $ | 49.5 | (5%) | $ | 150.1 | $ | 157.7 | (5%) | ||||||||||||||||||||||||||||

Adjusted effective tax rate1 (%) |

23.4 | 21.6 | 1.8 pts | 23.5 | 22.8 | 0.7 pts | ||||||||||||||||||||||||||||||||

1Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments | ||||||||||||||||||||||||||||||||||||||

| Adjusted Net Income | ||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | Change % | 9 Months FY25 |

9 Months FY24 |

Change % | |||||||||||||||||||||||||||||||||

| North America Fiber Cement | $ | 209.3 | $ | 237.8 | (12) | $ | 638.5 | $ | 688.1 | (7) | ||||||||||||||||||||||||||||

Asia Pacific Fiber Cement1 |

34.8 | 36.7 | (5) | 125.3 | 127.6 | (2) | ||||||||||||||||||||||||||||||||

| Europe Building Products | 3.6 | 7.6 | (53) | 24.7 | 31.9 | (23) | ||||||||||||||||||||||||||||||||

| Research and Development | (9.8) | (8.0) | (23) | (28.6) | (25.4) | (13) | ||||||||||||||||||||||||||||||||

General Corporate2 |

(30.9) | (40.0) | 23 | (105.9) | (113.9) | 7 | ||||||||||||||||||||||||||||||||

| Adjusted EBIT | 207.0 | 234.1 | (12) | 654.0 | 708.3 | (8) | ||||||||||||||||||||||||||||||||

Adjusted interest, net3 |

6.5 | 5.3 | 23 | 15.9 | 20.1 | (21) | ||||||||||||||||||||||||||||||||

| Other income, net | — | (0.6) | (100) | (0.2) | (2.8) | (93) | ||||||||||||||||||||||||||||||||

Adjusted income tax expense4 |

46.9 | 49.5 | (5) | 150.1 | 157.7 | (5) | ||||||||||||||||||||||||||||||||

| Adjusted net income | $ | 153.6 | $ | 179.9 | (15) | $ | 488.2 | $ | 533.3 | (8) | ||||||||||||||||||||||||||||

|

1 Excludes restructuring expenses related to our decision to exit the Philippines

2 Excludes Asbestos-related expenses and adjustments and the Restructuring expense on the Truganina greenfield site in FY24

3 Excludes AICF interest income

4 Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos and other tax adjustments

| ||||||||||||||||||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

10 |

|||||||

| OTHER INFORMATION |  |

||||

| Cash Flow | ||

| US$ Millions | Nine Months Ended 31 December | |||||||||||||||||||||||||

| FY25 | FY24 | Change | Change % | |||||||||||||||||||||||

| Net cash provided by operating activities | $ | 657.4 | $ | 749.5 | $ | (92.1) | (12) | |||||||||||||||||||

| Net cash used in investing activities | 353.1 | 350.0 | 3.1 | 1 | ||||||||||||||||||||||

| Net cash used in financing activities | 163.7 | 132.9 | 30.8 | 23 | ||||||||||||||||||||||

| Capacity Expansion | ||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

11 |

|||||||

| OTHER INFORMATION |  |

||||

| Liquidity | ||

| Capital Allocation | ||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

12 |

|||||||

| NON-GAAP FINANCIAL TERMS |  |

||||

| Financial Measures - GAAP equivalents | ||

| Non GAAP Financial Terms | ||

| • | Adjusted EBIT | • | Adjusted net income | ||||||||

| • | Adjusted EBIT margin | • | Adjusted diluted earnings per share | ||||||||

| • | Asia Pacific Fiber Cement Segment Adjusted EBIT | • | Adjusted income before income taxes | ||||||||

| • | Asia Pacific Fiber Cement Segment Adjusted EBIT margin | • | Adjusted income tax expense | ||||||||

| • | Adjusted General Corporate costs | • | Adjusted effective tax rate | ||||||||

| • | Adjusted interest, net | ||||||||||

| Definitions | ||

mmsf – million standard feet, where a standard foot is defined as a square foot of 5/16” thickness |

|||||

msf – thousand standard feet, where a standard foot is defined as a square foot of 5/16” thickness |

|||||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

13 |

|||||||

| NON-GAAP FINANCIAL MEASURES |  |

||||

| Financial Measures - GAAP equivalents | ||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | 9 Months FY25 |

9 Months FY24 |

|||||||||||||||||||||||

| EBIT | $ | 206.1 | $ | 226.1 | $ | 593.8 | $ | 683.4 | ||||||||||||||||||

| Restructuring expenses | — | — | 57.3 | 20.1 | ||||||||||||||||||||||

| Asbestos related expenses and adjustments | 0.9 | 8.0 | 2.9 | 4.8 | ||||||||||||||||||||||

| Adjusted EBIT | $ | 207.0 | $ | 234.1 | $ | 654.0 | $ | 708.3 | ||||||||||||||||||

| Net sales | 953.3 | 978.3 | 2,906.0 | 2,931.4 | ||||||||||||||||||||||

| Adjusted EBIT margin | 21.7% | 23.9% | 22.5% | 24.2% | ||||||||||||||||||||||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | 9 Months FY25 |

9 Months FY24 |

|||||||||||||||||||||||

| Asia Pacific Fiber Cement Segment EBIT | $ | 34.8 | $ | 36.7 | $ | 68.0 | $ | 127.6 | ||||||||||||||||||

| Restructuring expenses | — | — | 57.3 | — | ||||||||||||||||||||||

| Asia Pacific Fiber Cement Segment Adjusted EBIT | $ | 34.8 | $ | 36.7 | $ | 125.3 | $ | 127.6 | ||||||||||||||||||

| Asia Pacific Fiber Cement Segment Net sales | 118.1 | 133.8 | 401.8 | 421.3 | ||||||||||||||||||||||

| Asia Pacific Fiber Cement Segment Adjusted EBIT margin | 29.3% | 27.5% | 31.1% | 30.3% | ||||||||||||||||||||||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | 9 Months FY25 |

9 Months FY24 |

|||||||||||||||||||||||

| General Corporate costs | $ | 31.8 | $ | 48.0 | $ | 108.8 | $ | 138.8 | ||||||||||||||||||

| Less: | ||||||||||||||||||||||||||

| Restructuring expenses | — | — | — | (20.1) | ||||||||||||||||||||||

| Asbestos related expenses and adjustments | (0.9) | (8.0) | (2.9) | (4.8) | ||||||||||||||||||||||

| Adjusted General Corporate costs | $ | 30.9 | $ | 40.0 | $ | 105.9 | $ | 113.9 | ||||||||||||||||||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

14 |

|||||||

| NON-GAAP FINANCIAL MEASURES |  |

||||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | 9 Months FY25 |

9 Months FY24 |

|||||||||||||||||||||||

| Interest, net | $ | 3.8 | $ | 3.1 | $ | 7.4 | $ | 13.4 | ||||||||||||||||||

| AICF interest income | (2.7) | (2.2) | (8.5) | (6.7) | ||||||||||||||||||||||

| Adjusted interest, net | $ | 6.5 | $ | 5.3 | $ | 15.9 | $ | 20.1 | ||||||||||||||||||

| Three and Nine Months Ended 31 December | ||||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | 9 Months FY25 |

9 Months FY24 |

|||||||||||||||||||||||

| Net income | $ | 141.7 | $ | 145.1 | $ | 380.4 | $ | 454.6 | ||||||||||||||||||

| Asbestos related expenses and adjustments | 0.9 | 8.0 | 2.9 | 4.8 | ||||||||||||||||||||||

| AICF interest income | (2.7) | (2.2) | (8.5) | (6.7) | ||||||||||||||||||||||

| Restructuring expenses | — | — | 57.3 | 20.1 | ||||||||||||||||||||||

Tax adjustments1 |

13.7 | 29.0 | 56.1 | 60.5 | ||||||||||||||||||||||

| Adjusted net income | $ | 153.6 | $ | 179.9 | $ | 488.2 | $ | 533.3 | ||||||||||||||||||

1Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments | ||||||||||||||||||||||||||

| Three and Nine Months Ended 31 December | ||||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | 9 Months FY25 |

9 Months FY24 |

|||||||||||||||||||||||

| Adjusted net income (US$ millions) | $ | 153.6 | $ | 179.9 | $ | 488.2 | $ | 533.3 | ||||||||||||||||||

|

Weighted average common shares outstanding -

Diluted (millions)

|

430.9 | 438.3 | 432.6 | 440.6 | ||||||||||||||||||||||

| Adjusted diluted earnings per share | $ | 0.36 | $ | 0.41 | $ | 1.13 | $ | 1.21 | ||||||||||||||||||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

15 |

|||||||

| NON-GAAP FINANCIAL MEASURES |  |

||||

| US$ Millions | Three and Nine Months Ended 31 December | |||||||||||||||||||||||||

| Q3 FY25 | Q3 FY24 | 9 Months FY25 |

9 Months FY24 |

|||||||||||||||||||||||

| Income before income taxes | $ | 202.3 | $ | 223.6 | $ | 586.6 | $ | 672.8 | ||||||||||||||||||

| Asbestos related expenses and adjustments | 0.9 | 8.0 | 2.9 | 4.8 | ||||||||||||||||||||||

| AICF interest income | (2.7) | (2.2) | (8.5) | (6.7) | ||||||||||||||||||||||

| Restructuring expenses | — | — | 57.3 | 20.1 | ||||||||||||||||||||||

| Adjusted income before income taxes | $ | 200.5 | $ | 229.4 | $ | 638.3 | $ | 691.0 | ||||||||||||||||||

| Income tax expense | 60.6 | 78.5 | 206.2 | 218.2 | ||||||||||||||||||||||

Tax adjustments1 |

(13.7) | (29.0) | (56.1) | (60.5) | ||||||||||||||||||||||

| Adjusted income tax expense | $ | 46.9 | $ | 49.5 | $ | 150.1 | $ | 157.7 | ||||||||||||||||||

| Effective tax rate | 30.0% | 35.1% | 35.2% | 32.4% | ||||||||||||||||||||||

| Adjusted effective tax rate | 23.4% | 21.6% | 23.5% | 22.8% | ||||||||||||||||||||||

1Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments | ||||||||||||||||||||||||||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

16 |

|||||||

| FORWARD-LOOKING STATEMENTS |  |

||||

Management's Analysis of Results: James Hardie - 3rd Quarter Fiscal Year 2025 |

17 |

|||||||

| Page | |||||

| (Millions of US dollars) |

(Unaudited)

31 December

2024

|

31 March

2024

|

|||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 539.1 | $ | 365.0 | |||||||

| Restricted cash and cash equivalents | 5.0 | 5.0 | |||||||||

| Restricted cash and cash equivalents - Asbestos | 13.4 | 45.8 | |||||||||

| Restricted short-term investments - Asbestos | 174.1 | 178.4 | |||||||||

| Accounts and other receivables, net | 270.6 | 366.1 | |||||||||

| Inventories | 350.3 | 337.8 | |||||||||

| Prepaid expenses and other current assets | 70.5 | 68.2 | |||||||||

| Assets held for sale | 60.7 | 55.4 | |||||||||

| Insurance receivable - Asbestos | 4.9 | 5.1 | |||||||||

| Workers’ compensation - Asbestos | 1.5 | 1.6 | |||||||||

| Total current assets | 1,490.1 | 1,428.4 | |||||||||

| Property, plant and equipment, net | 2,108.3 | 2,037.8 | |||||||||

| Operating lease right-of-use-assets | 69.1 | 60.9 | |||||||||

| Goodwill | 186.0 | 192.6 | |||||||||

| Intangible assets, net | 141.1 | 149.2 | |||||||||

| Insurance receivable - Asbestos | 22.3 | 26.4 | |||||||||

| Workers’ compensation - Asbestos | 13.0 | 13.6 | |||||||||

| Deferred income taxes | 604.4 | 690.4 | |||||||||

| Deferred income taxes - Asbestos | 251.2 | 294.0 | |||||||||

| Other assets | 22.7 | 19.3 | |||||||||

| Total assets | $ | 4,908.2 | $ | 4,912.6 | |||||||

| Liabilities and Shareholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable and accrued liabilities | $ | 391.1 | $ | 463.3 | |||||||

| Accrued payroll and employee benefits | 108.5 | 143.3 | |||||||||

| Operating lease liabilities | 20.7 | 19.0 | |||||||||

| Long-term debt, current portion | 7.5 | 7.5 | |||||||||

| Accrued product warranties | 6.7 | 7.3 | |||||||||

| Income taxes payable | 2.7 | 13.0 | |||||||||

| Asbestos liability | 111.4 | 116.7 | |||||||||

| Workers’ compensation - Asbestos | 1.5 | 1.6 | |||||||||

| Other liabilities | 34.4 | 26.0 | |||||||||

| Total current liabilities | 684.5 | 797.7 | |||||||||

| Long-term debt | 1,096.2 | 1,115.1 | |||||||||

| Deferred income taxes | 116.4 | 107.5 | |||||||||

| Operating lease liabilities | 63.7 | 59.4 | |||||||||

| Accrued product warranties | 27.7 | 28.9 | |||||||||

| Asbestos liability | 751.2 | 873.0 | |||||||||

| Workers’ compensation - Asbestos | 13.0 | 13.6 | |||||||||

| Other liabilities | 55.2 | 58.5 | |||||||||

| Total liabilities | 2,807.9 | 3,053.7 | |||||||||

| Commitments and contingencies (Note 8) | |||||||||||

| Shareholders’ equity: | |||||||||||

Common stock, Euro 0.59 par value, 2.0 billion shares authorized; 429,787,099 shares issued and outstanding at 31 December 2024 and 433,784,634 shares issued and outstanding at 31 March 2024 |

222.1 | 224.7 | |||||||||

| Additional paid-in capital | 265.7 | 256.5 | |||||||||

| Retained earnings | 1,682.1 | 1,446.0 | |||||||||

| Accumulated other comprehensive loss | (69.6) | (68.3) | |||||||||

| Total shareholders’ equity | 2,100.3 | 1,858.9 | |||||||||

| Total liabilities and shareholders’ equity | $ | 4,908.2 | $ | 4,912.6 | |||||||

| Three Months Ended 31 December |

Nine Months Ended 31 December |

||||||||||||||||||||||

| (Millions of US dollars, except per share data) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net sales | $ | 953.3 | $ | 978.3 | $ | 2,906.0 | $ | 2,931.4 | |||||||||||||||

| Cost of goods sold | 590.9 | 577.6 | 1,773.8 | 1,753.7 | |||||||||||||||||||

| Gross profit | 362.4 | 400.7 | 1,132.2 | 1,177.7 | |||||||||||||||||||

| Selling, general and administrative expenses | 144.7 | 156.3 | 444.4 | 438.0 | |||||||||||||||||||

| Research and development expenses | 11.5 | 10.7 | 36.1 | 32.5 | |||||||||||||||||||

| Restructuring expenses | — | — | 57.3 | 20.1 | |||||||||||||||||||

Asbestos adjustments |

0.1 | 7.6 | 0.6 | 3.7 | |||||||||||||||||||

| Operating income | 206.1 | 226.1 | 593.8 | 683.4 | |||||||||||||||||||

| Interest, net | 3.8 | 3.1 | 7.4 | 13.4 | |||||||||||||||||||

| Other income, net | — | (0.6) | (0.2) | (2.8) | |||||||||||||||||||

| Income before income taxes | 202.3 | 223.6 | 586.6 | 672.8 | |||||||||||||||||||

| Income tax expense | 60.6 | 78.5 | 206.2 | 218.2 | |||||||||||||||||||

| Net income | $ | 141.7 | $ | 145.1 | $ | 380.4 | $ | 454.6 | |||||||||||||||

| Income per share: | |||||||||||||||||||||||

| Basic | $ | 0.33 | $ | 0.33 | $ | 0.88 | $ | 1.03 | |||||||||||||||

| Diluted | $ | 0.33 | $ | 0.33 | $ | 0.88 | $ | 1.03 | |||||||||||||||

| Weighted average common shares outstanding (Millions): | |||||||||||||||||||||||

| Basic | 429.5 | 437.0 | 431.2 | 439.4 | |||||||||||||||||||

| Diluted | 430.9 | 438.3 | 432.6 | 440.6 | |||||||||||||||||||

| Comprehensive income, net of tax: | |||||||||||||||||||||||

| Net income | $ | 141.7 | $ | 145.1 | $ | 380.4 | $ | 454.6 | |||||||||||||||

| Currency translation adjustments | (20.0) | 32.4 | (9.7) | 9.6 | |||||||||||||||||||

| Cash flow hedges | — | — | (0.1) | — | |||||||||||||||||||

| Reclassification of other comprehensive income | — | — | 8.5 | — | |||||||||||||||||||

| Comprehensive income | $ | 121.7 | $ | 177.5 | $ | 379.1 | $ | 464.2 | |||||||||||||||

| Nine Months Ended 31 December | |||||||||||

| (Millions of US dollars) | 2024 | 2023 | |||||||||

| Cash Flows From Operating Activities | |||||||||||

| Net income | $ | 380.4 | $ | 454.6 | |||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 156.8 | 136.7 | |||||||||

| Lease expense | 24.6 | 19.6 | |||||||||

| Deferred income taxes | 94.8 | 69.4 | |||||||||

| Stock-based compensation | 17.7 | 20.5 | |||||||||

Asbestos adjustments |

0.6 | 3.7 | |||||||||

| Gain on sale of land | — | (2.0) | |||||||||

| Non-cash restructuring expenses | 40.2 | 20.1 | |||||||||

| Other, net | 18.5 | 26.3 | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts and other receivables | 86.4 | 39.5 | |||||||||

| Inventories | (20.5) | 24.5 | |||||||||

| Operating lease assets and liabilities, net | (25.8) | (20.2) | |||||||||

| Prepaid expenses and other assets | (8.6) | (30.3) | |||||||||

| Insurance receivable - Asbestos | 3.0 | 4.0 | |||||||||

| Accounts payable and accrued liabilities | (15.6) | 57.2 | |||||||||

| Claims and handling costs paid - Asbestos | (87.7) | (95.0) | |||||||||

| Income taxes payable | (10.2) | (5.6) | |||||||||

| Other accrued liabilities | 2.8 | 26.5 | |||||||||

| Net cash provided by operating activities | $ | 657.4 | $ | 749.5 | |||||||

| Cash Flows From Investing Activities | |||||||||||

| Purchases of property, plant and equipment | $ | (333.0) | $ | (328.2) | |||||||

| Proceeds from sale of property, plant and equipment | — | 4.1 | |||||||||

| Capitalized interest | (16.7) | (13.3) | |||||||||

| Purchase of restricted investments - Asbestos | (145.2) | (104.8) | |||||||||

| Proceeds from restricted investments - Asbestos | 141.4 | 92.2 | |||||||||

| Other | 0.4 | — | |||||||||

| Net cash used in investing activities | $ | (353.1) | $ | (350.0) | |||||||

| Cash Flows From Financing Activities | |||||||||||

| Shares repurchased | $ | (149.9) | $ | (196.3) | |||||||

| Proceeds from term loan | — | 300.0 | |||||||||

| Repayments of term loan | (5.6) | — | |||||||||

| Proceeds from revolving credit facility | — | 95.0 | |||||||||

| Repayments of revolving credit facility | — | (325.0) | |||||||||

| Debt issuance costs | — | (1.2) | |||||||||

| Proceeds from issuance of shares | — | 0.3 | |||||||||

| Repayment of finance lease obligations | (0.9) | (0.8) | |||||||||

| Taxes paid related to net share settlement of equity awards | (7.3) | (4.9) | |||||||||

| Net cash used in financing activities | $ | (163.7) | $ | (132.9) | |||||||

| Effects of exchange rate changes on cash and cash equivalents, restricted cash and restricted cash - Asbestos | $ | 1.1 | $ | (1.2) | |||||||

| Net increase in cash and cash equivalents, restricted cash and restricted cash - Asbestos | 141.7 | 265.4 | |||||||||

| Cash and cash equivalents, restricted cash and restricted cash - Asbestos at beginning of period | 415.8 | 185.6 | |||||||||

| Cash and cash equivalents, restricted cash and restricted cash - Asbestos at end of period | $ | 557.5 | $ | 451.0 | |||||||

| Non-Cash Investing and Financing Activities | |||||||||||

| Capital expenditures incurred but not yet paid | $ | 23.2 | $ | 38.1 | |||||||

| Supplemental Disclosure of Cash Flow Activities | |||||||||||

| Cash paid to AICF | $ | 49.6 | $ | 45.9 | |||||||

| Three Months Ended 31 December 2024 | |||||||||||||||||||||||||||||||||||

| (Millions of US dollars) | Common Stock |

Additional Paid-in Capital |

Retained Earnings |

Treasury Stock |

Accumulated Other Comprehensive Loss |

Total | |||||||||||||||||||||||||||||

Balances as of 30 September 2024 |

$ | 221.9 | $ | 264.1 | $ | 1,540.4 | $ | — | $ | (49.6) | $ | 1,976.8 | |||||||||||||||||||||||

| Net income | — | — | 141.7 | — | — | 141.7 | |||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | (20.0) | (20.0) | |||||||||||||||||||||||||||||

| Stock-based compensation | 0.2 | 0.1 | — | — | — | 0.3 | |||||||||||||||||||||||||||||

| Issuance of ordinary shares | — | 1.5 | — | — | — | 1.5 | |||||||||||||||||||||||||||||

Balances as of 31 December 2024 |

$ | 222.1 | $ | 265.7 | $ | 1,682.1 | $ | — | $ | (69.6) | $ | 2,100.3 | |||||||||||||||||||||||

| Nine Months Ended 31 December 2024 | |||||||||||||||||||||||||||||||||||

| (Millions of US dollars) | Common Stock |

Additional Paid-in Capital |

Retained Earnings |

Treasury Stock |

Accumulated Other Comprehensive Loss |

Total | |||||||||||||||||||||||||||||

Balances as of 31 March 2024 |

$ | 224.7 | $ | 256.5 | $ | 1,446.0 | $ | — | $ | (68.3) | $ | 1,858.9 | |||||||||||||||||||||||

| Net income | — | — | 380.4 | — | — | 380.4 | |||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | (1.3) | (1.3) | |||||||||||||||||||||||||||||

| Stock-based compensation | 0.3 | 10.1 | — | — | — | 10.4 | |||||||||||||||||||||||||||||

| Issuance of ordinary shares | — | 1.8 | — | — | 1.8 | ||||||||||||||||||||||||||||||

| Shares repurchased | — | — | — | (149.9) | — | (149.9) | |||||||||||||||||||||||||||||

| Shares cancelled | (2.9) | (2.7) | (144.3) | 149.9 | — | — | |||||||||||||||||||||||||||||

Balances as of 31 December 2024 |

$ | 222.1 | $ | 265.7 | $ | 1,682.1 | $ | — | $ | (69.6) | $ | 2,100.3 | |||||||||||||||||||||||

| Three Months Ended 31 December 2023 | |||||||||||||||||||||||||||||||||||

| (Millions of US dollars) | Common Stock |

Additional Paid-in Capital |

Retained Earnings |

Treasury Stock |

Accumulated Other Comprehensive Loss |

Total | |||||||||||||||||||||||||||||

Balances as of 30 September 2023 |

$ | 227.3 | $ | 246.5 | $ | 1,390.3 | $ | — | $ | (76.1) | $ | 1,788.0 | |||||||||||||||||||||||

| Net income | — | — | 145.1 | — | — | 145.1 | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | 32.4 | 32.4 | |||||||||||||||||||||||||||||

| Stock-based compensation | 0.1 | 4.5 | — | — | — | 4.6 | |||||||||||||||||||||||||||||

| Issuance of ordinary shares | — | 0.1 | — | — | — | 0.1 | |||||||||||||||||||||||||||||

| Shares repurchased | — | — | — | (75.0) | — | (75.0) | |||||||||||||||||||||||||||||

| Shares cancelled | (1.5) | (1.3) | (72.2) | 75.0 | — | — | |||||||||||||||||||||||||||||

Balances as of 31 December 2023 |

$ | 225.9 | $ | 249.8 | $ | 1,463.2 | $ | — | $ | (43.7) | $ | 1,895.2 | |||||||||||||||||||||||

| Nine Months Ended 31 December 2023 | |||||||||||||||||||||||||||||||||||

| (Millions of US dollars) | Common Stock |

Additional Paid-in Capital |

Retained Earnings |

Treasury Stock |

Accumulated Other Comprehensive Loss |

Total | |||||||||||||||||||||||||||||

Balances as of 31 March 2023 |

$ | 230.0 | $ | 237.9 | $ | 1,196.8 | $ | — | $ | (53.3) | $ | 1,611.4 | |||||||||||||||||||||||

| Net income | — | — | 454.6 | — | — | 454.6 | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | 9.6 | 9.6 | |||||||||||||||||||||||||||||

| Stock-based compensation | 0.2 | 15.4 | — | — | — | 15.6 | |||||||||||||||||||||||||||||

| Issuance of ordinary shares | — | 0.3 | — | — | — | 0.3 | |||||||||||||||||||||||||||||

| Shares repurchased | — | — | — | (196.3) | — | (196.3) | |||||||||||||||||||||||||||||

| Shares cancelled | (4.3) | (3.8) | (188.2) | 196.3 | — | — | |||||||||||||||||||||||||||||

Balances as of 31 December 2023 |

$ | 225.9 | $ | 249.8 | $ | 1,463.2 | $ | — | $ | (43.7) | $ | 1,895.2 | |||||||||||||||||||||||

| Three Months Ended 31 December |

Nine Months Ended 31 December |

||||||||||||||||||||||

| (Millions of shares) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Basic common shares outstanding | 429.5 | 437.0 | 431.2 | 439.4 | |||||||||||||||||||

| Dilutive effect of stock awards | 1.4 | 1.3 | 1.4 | 1.2 | |||||||||||||||||||

| Diluted common shares outstanding | 430.9 | 438.3 | 432.6 | 440.6 | |||||||||||||||||||

| Three Months Ended 31 December 2024 | |||||||||||||||||||||||

| (Millions of US dollars) | North America Fiber Cement |

Asia Pacific Fiber Cement |

Europe Building Products |

Consolidated | |||||||||||||||||||

| Fiber cement revenues | $ | 719.3 | $ | 118.1 | $ | 19.7 | $ | 857.1 | |||||||||||||||

| Fiber gypsum revenues | — | — | 96.2 | 96.2 | |||||||||||||||||||

| Total revenues | $ | 719.3 | $ | 118.1 | $ | 115.9 | $ | 953.3 | |||||||||||||||

| Three Months Ended 31 December 2023 | |||||||||||||||||||||||

| (Millions of US dollars) | North America Fiber Cement |

Asia Pacific Fiber Cement |

Europe Building Products |

Consolidated | |||||||||||||||||||

| Fiber cement revenues | $ | 727.0 | $ | 133.8 | $ | 16.4 | $ | 877.2 | |||||||||||||||

| Fiber gypsum revenues | — | — | 101.1 | 101.1 | |||||||||||||||||||

| Total revenues | $ | 727.0 | $ | 133.8 | $ | 117.5 | $ | 978.3 | |||||||||||||||

Nine Months Ended 31 December 2024 |

|||||||||||||||||||||||

| (Millions of US dollars) | North America Fiber Cement |

Asia Pacific Fiber Cement |

Europe Building Products |

Consolidated | |||||||||||||||||||

| Fiber cement revenues | $ | 2,144.4 | $ | 401.8 | $ | 63.2 | $ | 2,609.4 | |||||||||||||||

| Fiber gypsum revenues | — | — | 296.6 | 296.6 | |||||||||||||||||||

| Total revenues | $ | 2,144.4 | $ | 401.8 | $ | 359.8 | $ | 2,906.0 | |||||||||||||||

Nine Months Ended 31 December 2023 |

|||||||||||||||||||||||

| (Millions of US dollars) | North America Fiber Cement |

Asia Pacific Fiber Cement |

Europe Building Products |

Consolidated | |||||||||||||||||||

| Fiber cement revenues | $ | 2,156.2 | $ | 421.3 | $ | 57.9 | $ | 2,635.4 | |||||||||||||||

| Fiber gypsum revenues | — | — | 296.0 | 296.0 | |||||||||||||||||||

| Total revenues | $ | 2,156.2 | $ | 421.3 | $ | 353.9 | $ | 2,931.4 | |||||||||||||||

| 31 December | 31 March | ||||||||||

| (Millions of US dollars) | 2024 | 2024 | |||||||||

| Cash and cash equivalents | $ | 539.1 | $ | 365.0 | |||||||

| Restricted cash | 5.0 | 5.0 | |||||||||

| Restricted cash - Asbestos | 13.4 | 45.8 | |||||||||

| Total | $ | 557.5 | $ | 415.8 | |||||||

| 31 December | 31 March | ||||||||||

| (Millions of US dollars) | 2024 | 2024 | |||||||||

| Finished goods | $ | 248.5 | $ | 235.4 | |||||||

| Work-in-process | 25.5 | 25.1 | |||||||||

| Raw materials and supplies | 88.6 | 90.6 | |||||||||

| Provision for obsolete finished goods and raw materials | (12.3) | (13.3) | |||||||||

| Total | $ | 350.3 | $ | 337.8 | |||||||

| Restructuring Expenses | ||||||||||||||||||||||||||

| Three Months Ended 31 December |

Nine Months Ended 31 December |

|||||||||||||||||||||||||

| (Millions of US dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Equipment write offs, including disposal costs | $ | — | $ | — | $ | 31.1 | $ | — | ||||||||||||||||||

| Reclassification of foreign currency translation adjustments | — | — | 8.3 | — | ||||||||||||||||||||||

| Contract termination costs | — | — | 4.6 | — | ||||||||||||||||||||||

| Accounts receivable reserves | — | — | 3.4 | — | ||||||||||||||||||||||

| Other exit costs | — | — | 9.9 | — | ||||||||||||||||||||||

| Asia Pacific Fiber Cement segment | — | — | 57.3 | — | ||||||||||||||||||||||

| General Corporate | — | — | — | 20.1 | ||||||||||||||||||||||

| Total | $ | — | $ | — | $ | 57.3 | $ | 20.1 | ||||||||||||||||||

| 31 December | 31 March | ||||||||||

| (Millions of US dollars) | 2024 | 2024 | |||||||||

| Unsecured debt: | |||||||||||

3.625% Senior notes due 2026 (€400.0 million) |

$ | 416.2 | $ | 431.0 | |||||||

5.000% Senior notes due 2028 |

400.0 | 400.0 | |||||||||

| Term Loan | 292.5 | 298.1 | |||||||||

| Unamortized debt issuance costs | (5.0) | (6.5) | |||||||||

| Total debt | 1,103.7 | 1,122.6 | |||||||||

| Less current portion | (7.5) | (7.5) | |||||||||

| Total Long-term debt | $ | 1,096.2 | $ | 1,115.1 | |||||||

| Weighted average interest rate of total debt | 4.9 | % | 5.1 | % | |||||||

| Weighted average term of available total debt | 2.4 years | 3.2 years |

|||||||||

| Fair value of Senior unsecured notes (Level 1) | $ | 803.1 | $ | 811.5 | |||||||

| (Millions of US dollars) | Asbestos Liability |

Insurance Receivables |

Restricted Cash and Investments |

Other Assets and Liabilities |

Net Unfunded AFFA Liability | Deferred Tax Assets |

Income Tax Payable |

Net Unfunded AFFA Liability, net of tax | |||||||||||||||||||||||||||||||||||||||

Opening Balance - 31 March 2024 |

$ | (989.7) | $ | 31.5 | $ | 224.2 | $ | 1.5 | $ | (732.5) | $ | 294.0 | $ | 39.5 | $ | (399.0) | |||||||||||||||||||||||||||||||

| Asbestos claims paid | 86.9 | — | (86.9) | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Payment received in accordance with AFFA | — | — | 49.6 | — | 49.6 | — | — | 49.6 | |||||||||||||||||||||||||||||||||||||||

| AICF claims-handling costs incurred (paid) | 0.8 | — | (0.8) | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| AICF operating costs paid - non claims-handling | — | — | (2.3) | — | (2.3) | — | — | (2.3) | |||||||||||||||||||||||||||||||||||||||

| Insurance recoveries | — | (3.0) | 3.0 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Movement in income taxes | — | — | — | — | — | (29.6) | (10.4) | (40.0) | |||||||||||||||||||||||||||||||||||||||

| Other movements | — | — | 9.2 | (0.7) | 8.5 | (1.9) | — | 6.6 | |||||||||||||||||||||||||||||||||||||||

| Effect of foreign exchange | 39.4 | (1.3) | (8.5) | — | 29.6 | (11.3) | (1.3) | 17.0 | |||||||||||||||||||||||||||||||||||||||

Closing Balance - 31 December 2024 |

$ | (862.6) | $ | 27.2 | $ | 187.5 | $ | 0.8 | $ | (647.1) | $ | 251.2 | $ | 27.8 | $ | (368.1) | |||||||||||||||||||||||||||||||

| Nine Months | ||||||||||||||||||||

| Ended | For the Years Ended 31 March | |||||||||||||||||||

| 31 December 2024 | 2024 | 2023 | 2022 | 2021 | 2020 | |||||||||||||||

| Number of open claims at beginning of period | 379 | 359 | 365 | 360 | 393 | 332 | ||||||||||||||

| Number of new claims | ||||||||||||||||||||

| Direct claims | 329 | 410 | 403 | 411 | 392 | 449 | ||||||||||||||

| Cross claims | 169 | 154 | 152 | 144 | 153 | 208 | ||||||||||||||

| Number of closed claims | 455 | 544 | 561 | 550 | 578 | 596 | ||||||||||||||

| Number of open claims at end of period | 422 | 379 | 359 | 365 | 360 | 393 | ||||||||||||||

| Average settlement amount per settled claim | A$325,000 | A$289,000 | A$303,000 | A$314,000 | A$248,000 | A$277,000 | ||||||||||||||

Average settlement amount per case closed 1 |

A$285,000 | A$262,000 | A$271,000 | A$282,000 | A$225,000 | A$245,000 | ||||||||||||||

| Average settlement amount per settled claim | US$215,000 | US$190,000 | US$208,000 | US$232,000 | US$178,000 | US$189,000 | ||||||||||||||

Average settlement amount per case closed 1 |

US$188,000 | US$172,000 | US$186,000 | US$208,000 | US$162,000 | US$167,000 | ||||||||||||||

1 The average settlement amount per case closed includes nil settlements. |

||||||||||||||||||||

| Date Invested | Maturity Date | Interest Rate | A$ Millions | |||||||||||||||||

| October 2024 | 17 October 2025 | 4.94% | 70.0 | |||||||||||||||||

| July 2024 | 24 July 2025 | 5.25% | 60.0 | |||||||||||||||||

| April 2024 | 14 April 2025 | 5.12% | 36.0 | |||||||||||||||||

| April 2024 | 7 April 2025 | 5.08% | 54.0 | |||||||||||||||||

| January 2024 | 24 January 2025 | 5.20% | 60.0 | |||||||||||||||||

| Three Months Ended 31 December |

Nine Months Ended 31 December |

||||||||||||||||||||||

| (Millions of US dollars) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Liability Awards | $ | (0.4) | $ | 6.2 | $ | 3.0 | $ | 12.1 | |||||||||||||||

| Equity Awards | 5.4 | 8.2 | 17.7 | 20.5 | |||||||||||||||||||

| Total stock-based compensation expense | $ | 5.0 | $ | 14.4 | $ | 20.7 | $ | 32.6 | |||||||||||||||

| Net Sales | ||||||||||||||||||||||||||

| Three Months Ended 31 December |

Nine Months Ended 31 December |

|||||||||||||||||||||||||

| (Millions of US dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| North America Fiber Cement | $ | 719.3 | $ | 727.0 | $ | 2,144.4 | $ | 2,156.2 | ||||||||||||||||||

| Asia Pacific Fiber Cement | 118.1 | 133.8 | 401.8 | 421.3 | ||||||||||||||||||||||

| Europe Building Products | 115.9 | 117.5 | 359.8 | 353.9 | ||||||||||||||||||||||

| Total | $ | 953.3 | $ | 978.3 | $ | 2,906.0 | $ | 2,931.4 | ||||||||||||||||||

| Operating Income | ||||||||||||||||||||||||||

| Three Months Ended 31 December |

Nine Months Ended 31 December |

|||||||||||||||||||||||||

| (Millions of US dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| North America Fiber Cement | $ | 209.3 | $ | 237.8 | $ | 638.5 | $ | 688.1 | ||||||||||||||||||

| Asia Pacific Fiber Cement | 34.8 | 36.7 | 68.0 | 127.6 | ||||||||||||||||||||||

| Europe Building Products | 3.6 | 7.6 | 24.7 | 31.9 | ||||||||||||||||||||||

| Research and Development | (9.8) | (8.0) | (28.6) | (25.4) | ||||||||||||||||||||||

| Segments total | 237.9 | 274.1 | 702.6 | 822.2 | ||||||||||||||||||||||

| General Corporate | (31.8) | (48.0) | (108.8) | (138.8) | ||||||||||||||||||||||

| Total | $ | 206.1 | $ | 226.1 | $ | 593.8 | $ | 683.4 | ||||||||||||||||||

| Depreciation and Amortization | ||||||||||||||||||||||||||

| Three Months Ended 31 December |

Nine Months Ended 31 December |

|||||||||||||||||||||||||

| (Millions of US dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| North America Fiber Cement | $ | 41.2 | $ | 33.5 | $ | 115.5 | $ | 99.6 | ||||||||||||||||||

| Asia Pacific Fiber Cement | 4.9 | 4.2 | 14.4 | 12.5 | ||||||||||||||||||||||

| Europe Building Products | 8.3 | 7.6 | 23.9 | 21.5 | ||||||||||||||||||||||

| Research and Development | 0.5 | 0.5 | 1.9 | 1.5 | ||||||||||||||||||||||

| General Corporate | 0.2 | 0.5 | 1.1 | 1.6 | ||||||||||||||||||||||

| Total | $ | 55.1 | $ | 46.3 | $ | 156.8 | $ | 136.7 | ||||||||||||||||||

| Research and Development Expenses | ||||||||||||||||||||||||||

| Three Months Ended 31 December |

Nine Months Ended 31 December |

|||||||||||||||||||||||||

| (Millions of US dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| North America Fiber Cement | $ | 1.8 | $ | 2.1 | $ | 7.1 | $ | 5.9 | ||||||||||||||||||

| Asia Pacific Fiber Cement | 0.4 | 0.4 | 1.0 | 1.0 | ||||||||||||||||||||||

| Europe Building Products | 0.7 | 0.8 | 1.8 | 2.3 | ||||||||||||||||||||||

| Research and Development | 8.6 | 7.4 | 26.2 | 23.3 | ||||||||||||||||||||||

| Total | $ | 11.5 | $ | 10.7 | $ | 36.1 | $ | 32.5 | ||||||||||||||||||

| (Millions of US dollars) | Cash Flow Hedges |

Pension Actuarial Gain |

Foreign Currency Translation Adjustments |

Total | ||||||||||||||||||||||

Balance at 31 March 2024 |

$ | 0.2 | $ | 1.3 | $ | (69.8) | $ | (68.3) | ||||||||||||||||||

| Other comprehensive loss | (0.1) | — | (9.7) | (9.8) | ||||||||||||||||||||||

Reclassification to Restructuring expenses |

— | — | 8.3 | 8.3 | ||||||||||||||||||||||

Reclassification to Selling, general and administrative expenses |

— | — | 0.2 | 0.2 | ||||||||||||||||||||||

Balance at 31 December 2024 |

$ | 0.1 | $ | 1.3 | $ | (71.0) | $ | (69.6) | ||||||||||||||||||